Form 8-K Super Micro Computer, For: Sep 13

Medium-to-long horizontal (vertical) July 2020 version Medium-to-long Term Loan Agreement No.:231111000188 Customer name: SUPER MICRO COMPUTER, INC. TAIWAN Exhibit 10.1

Medium-to-long horizontal (vertical) July 2020 version 1 Medium-to-long Term Loan Agreement Mega International Commercial Bank Co., Ltd. (hereinafter referred to as "Party A") Parties to the Agreement SUPER MICRO COMPUTER, INC. TAIWAN (hereinafter referred to as "Party B") Whereas, Party B has applied for a loan from Party A due to its needs to operation turnover (hereinafter referred to as the "Loan"). Now, Therefore, Party B and the joint guarantor (hereinafter referred to as "Party C") have agreed to abide by the terms and conditions contained in the loan agreement (hereinafter referred to as the "Agreement") signed with Party A: General Terms and Conditions Section 1. General Provisions Article 1: Contents and terms of the loan (I) Intended use of the loan: Accelerate Investment Projects of Domestic Corporations (II) Loan amount: NT$1.2 billion, non-revolving loan. (III) Drawdown method and conditions: 1. From the first drawdown date until 113/12/31, and the first drawdown date may not be later than three months (110/08/06) after the bank faxes the approval of the loan amount (110/11/05). 2. Conditions precedent to drawdown: Party B shall prepare the "Qualification Approval Letter” of Root In Taiwan enterprise from the Ministry of Economic Affairs and apply for drawdown after Party A receives a fax from the bank approving the loan amount. 3. Drawdown method: (1) By presenting a loan drawdown form , and proof of payments (including but not limited to invoices and purchase orders), amount of each drawdown is limited to 80 percent of such payment; drawdown may be made by installments. (2) Proof of payment may be in the form of a list with photocopies of proof of payment for no less than three payments made on the list (for Party A’s inspection). If the proof of payment is denominated in foreign currency, appropriation may be made by using the exchange rate provided by Party B on the proof document. (3) The proof of payment list must declare there is no circumstances of reuse the proof , and all appropriations were utilized in compliance with material purchase purposes described in Party B’s investment project applied under the Directions for Loans to Accelerate Investment Projects of Domestic Corporations. (IV) Disbursement method: Present a loan drawdown form and relevant documents in the preceding paragraph. (V) Repayment deadline and method: 5 years (including 2-year grace period) from the first drawdown date, principal installments shall be paid on the 15th of each month after the grace period expires (if the grace period expires after the 15th, the first installment shall be paid on the 15th of the following month; if the grace period expires before the 15th, then the first installment shall be paid on the 15th of the current month). The expiration date of the grace period and maturity date of every drawdown shall be the same as the first drawdown. (VI) Calculation and payment of interest and fees: Paid on a monthly basis from the drawdown date. New Taiwan Dollar: Based on the floating interest rate for 2-year term deposits of less than NT$5 million at Chunghwa Post Co., Ltd. (hereinafter referred to as the "Benchmark Interest Rate", which was an annual interest rate of 0.845% at the time of contract signing), the margin of markdown is determined based on the cumulative loan amount registered by Party A at the NDF according to the table below. If the fees approved by the NDF is different from the table below, then markdown of the Benchmark Interest Rate must be adjusted according to the margin of fee adjustment (if the fee

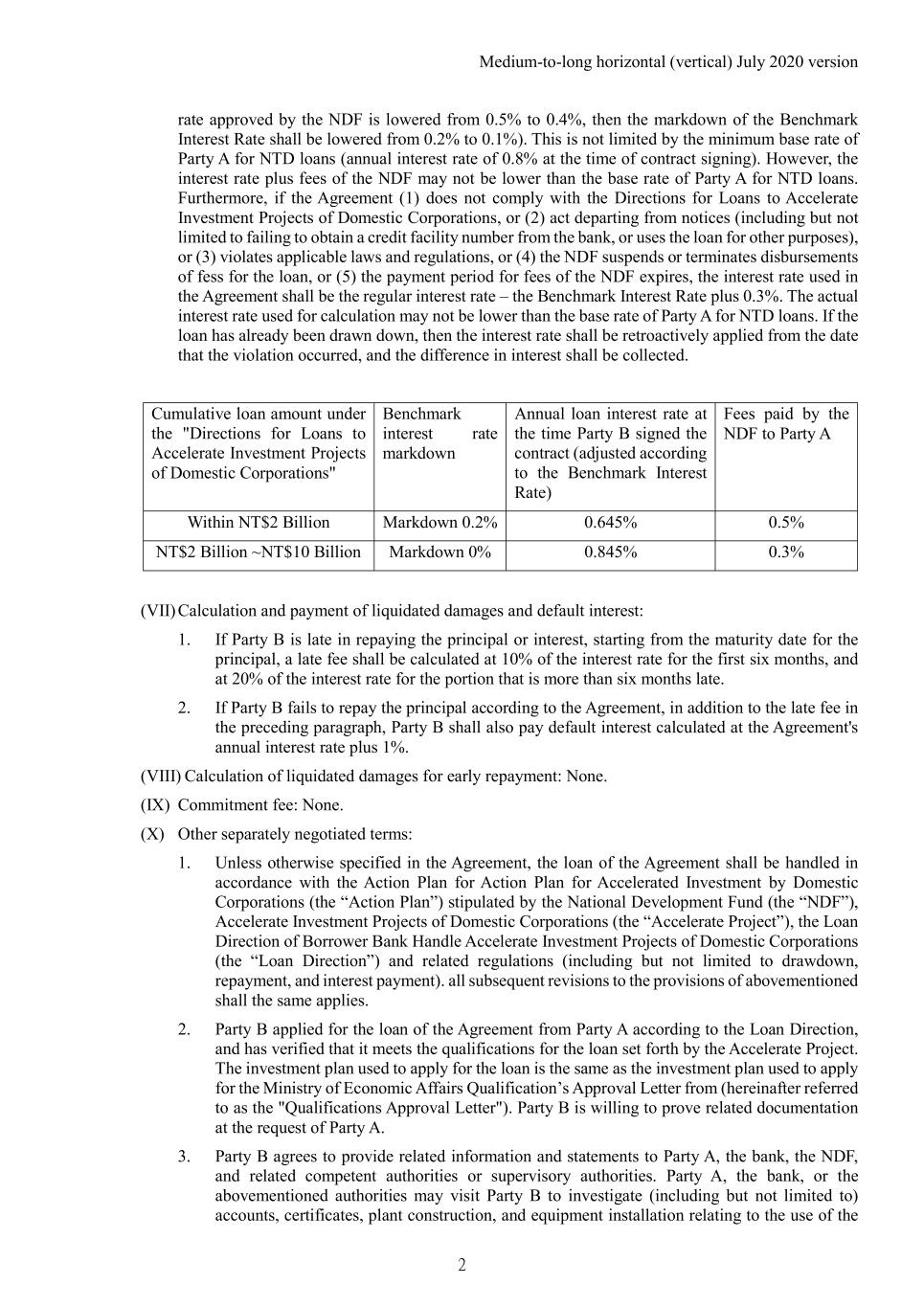

Medium-to-long horizontal (vertical) July 2020 version 2 rate approved by the NDF is lowered from 0.5% to 0.4%, then the markdown of the Benchmark Interest Rate shall be lowered from 0.2% to 0.1%). This is not limited by the minimum base rate of Party A for NTD loans (annual interest rate of 0.8% at the time of contract signing). However, the interest rate plus fees of the NDF may not be lower than the base rate of Party A for NTD loans. Furthermore, if the Agreement (1) does not comply with the Directions for Loans to Accelerate Investment Projects of Domestic Corporations, or (2) act departing from notices (including but not limited to failing to obtain a credit facility number from the bank, or uses the loan for other purposes), or (3) violates applicable laws and regulations, or (4) the NDF suspends or terminates disbursements of fess for the loan, or (5) the payment period for fees of the NDF expires, the interest rate used in the Agreement shall be the regular interest rate – the Benchmark Interest Rate plus 0.3%. The actual interest rate used for calculation may not be lower than the base rate of Party A for NTD loans. If the loan has already been drawn down, then the interest rate shall be retroactively applied from the date that the violation occurred, and the difference in interest shall be collected. Cumulative loan amount under the "Directions for Loans to Accelerate Investment Projects of Domestic Corporations" Benchmark interest rate markdown Annual loan interest rate at the time Party B signed the contract (adjusted according to the Benchmark Interest Rate) Fees paid by the NDF to Party A Within NT$2 Billion Markdown 0.2% 0.645% 0.5% NT$2 Billion ~NT$10 Billion Markdown 0% 0.845% 0.3% (VII) Calculation and payment of liquidated damages and default interest: 1. If Party B is late in repaying the principal or interest, starting from the maturity date for the principal, a late fee shall be calculated at 10% of the interest rate for the first six months, and at 20% of the interest rate for the portion that is more than six months late. 2. If Party B fails to repay the principal according to the Agreement, in addition to the late fee in the preceding paragraph, Party B shall also pay default interest calculated at the Agreement's annual interest rate plus 1%. (VIII) Calculation of liquidated damages for early repayment: None. (IX) Commitment fee: None. (X) Other separately negotiated terms: 1. Unless otherwise specified in the Agreement, the loan of the Agreement shall be handled in accordance with the Action Plan for Action Plan for Accelerated Investment by Domestic Corporations (the “Action Plan”) stipulated by the National Development Fund (the “NDF”), Accelerate Investment Projects of Domestic Corporations (the “Accelerate Project”), the Loan Direction of Borrower Bank Handle Accelerate Investment Projects of Domestic Corporations (the “Loan Direction”) and related regulations (including but not limited to drawdown, repayment, and interest payment). all subsequent revisions to the provisions of abovementioned shall the same applies. 2. Party B applied for the loan of the Agreement from Party A according to the Loan Direction, and has verified that it meets the qualifications for the loan set forth by the Accelerate Project. The investment plan used to apply for the loan is the same as the investment plan used to apply for the Ministry of Economic Affairs Qualification’s Approval Letter from (hereinafter referred to as the "Qualifications Approval Letter"). Party B is willing to prove related documentation at the request of Party A. 3. Party B agrees to provide related information and statements to Party A, the bank, the NDF, and related competent authorities or supervisory authorities. Party A, the bank, or the abovementioned authorities may visit Party B to investigate (including but not limited to) accounts, certificates, plant construction, and equipment installation relating to the use of the

Medium-to-long horizontal (vertical) July 2020 version 3 loan. 4. The loan of the Agreement may not be rolled over or used on a revolving basis. 5. In the event of any one of the following situations, Party B agrees that interest on the loan of the Agreement will be accrued at the Benchmark Interest Rate plus 0.3% from the date of occurrence (the date that the NDF decides to stop disbursement of fees to Party A for the Agreement, same below): (1) Party B does not provide information or cooperate with investigation according to Subparagraphs 2 and 3 above. (2) Party B violates the "Action plan" or "Loan Directions" or related regulations. (3) Party B divert the loan for other use. (4) Party B fails to draw down the loan within 3 months of the approved date (110/08/06) loan amount approval date, resulting in the loan amount being canceled by the NDF. (5) Party B fails to meet the conditions set forth in the "Action Plan" or the investment plan and plant construction were not completed within the time limit specified on the Qualifications Approval Letter, the plant did not obtain a building use permit and begin use, or other requirements specified in the Qualifications Approval Letter were not met. (6) Contents of the "Action Plan" is announced to violate the law, the budget was frozen by the Legislative Yuan, the policy was changed, funding requirements, or other reasons not attributable to the NDF resulting in the suspending payment of fees to Party A. (7) Other situations that cause the NDF to no longer be able to make payments or suspend payments of fees to Party A (including but not limited to expiration of the period approved by the NDF for fee payment). 6. If Party B has any one of the situations in Item (1), (2), or (3) of the preceding subparagraph, Party B agrees to pay Party A fees of the NDF according to the Loan Direction, as well as interest accrued at the Benchmark Interest Rate from the date that the default occurred. 7. If the NDF suspends payment of fees to Party A due to late repayment by Party B, Party B agrees that interest on the overdue balance shall be accrued at the Benchmark Interest Rate plus 0.3% from the date that disbursement is suspended. 8. During the loan period of the Agreement, Party B's parent company SUPER MICRO COMPUTER, INC. shall maintain 100% direct (indirect) shareholding of Party B. However, this does not apply if Party B is a public company. 9. Party B agrees to maintain an average demand deposit balance equal to 10% of the total loan amount during the loan period of the Agreement, subject to inspection once a year. 10. Party B agrees to implement its investment plan according to the contents of the approved "Action Plan." 11. Party B agrees that it may not refuse and must cooperate with requests from Party A to provide documents related to the "Action Plan" or visits by the NDF, bank, and Party A to investigate loan use. Article 2: Foreign currency debt of Party B under the Agreement may be repaid in foreign currency or the equivalent amount in NTD. If repaid in an equivalent amount in NTD, Party B agrees that Party A may use Party A's spot exchange rate on the maturity date or repayment date for conversion. Party B must obtain the approval of Party A for early repayment.

Medium-to-long horizontal (vertical) July 2020 version 4 Article 3: After the Agreement is signed, if Party A has difficulty obtaining capital or loan disbursement will put Party A at risk of violating the law, Party A may adjust the disbursement date and amount. However, if Party A does not disburse the loan after collecting a commitment fee, it shall return a part of the commitment fee to Party B according to the ratio of the loan amount not disbursed. Article 4: When any repayment requests or notices issued by Party A to Party B and Party C under the Agreement are delivered to the last address provided by the recipient or his/her agent, Party A shall be deemed as having given sufficient notice. If the recipient or his/her agent both fail to notify Party A that he/she has moved from the last address that was provided, or Party A is unable to deliver the request or notice to the last address that was provided due to other situations, the request or notice shall be deemed delivered to the recipient after the normal mailing time once it is mailed by Party A to the last address that was provided by the recipient or his/her agent. Article 5: Party B shall complete repayment of the principal and payment of interest and other expenses at a business location of Party A during business hours on the maturity date. Article 6: If the interest rate under the Agreement is adjusted according to the bank's base rate during contract signing (the base rate was an annual interest rate of 2.5% when the Agreement was signed), Party B agrees that adjustments may be made according to the adjusted base rate from the date the base rate is adjusted by Party A. If the base rate is adjusted after the Agreement is signed, Party B agrees to be bound by the contents announced by Party A at its business locations. Section 2. Creditor Protection Clause Article 7: If Party B changes its business or company organization; enters into, amends, or terminates any contract with a third party for lease of the company's business, outsourcing, or joint operations; transfers the whole or any essential part of its business or assets to others, or receives whole businesses or assets from others that have a material impact on the company's operations, it must obtain prior written approval from Party A. Article 8: Party B agrees to accept any supervision from Party A over the intended use of the loan, audits of business performance and/or financial position, inspection and supervision of collateral, and review of relevant accounts, books, statements (including the consolidated financial statements of any affiliates), receipts, and documents. Party A may, as it deems necessary, request that Party B prepare and provide the aforesaid credit investigation data periodically or furnish any financial statements audited by a certified public accountant approved by Party A and, in addition thereto, request the said certified public accountant to provide a copy of his/her work, submit a duplicate copy of the financial statements to the Joint Credit Information Center, and notify Party A. If Party A believes that the financial statements or other documents submitted by Party B contains false information, Party B shall be deemed in violation of the Agreement after being notified by Party A. However, Party A is not obligated to supervise, audit, inspect, and review the financial statements or documents. If Party A believes that Party B's financial structure requires improvement, Party A may require Party B to take action to improve its financial structure. Party B and Party C agree that Party A may provide Party B and Party C's credit investigation reports and credit information (including late payment, collection, and bad debt records); Party B and Party C's financial data, note credit information, personal credit information, credit card (including IC card and magnetic stripe) credit information, and licensed store credit information, as well as other data relating to credit transactions, to Party A, the Small & Medium Enterprise Credit Guarantee Fund of Taiwan (Taiwan SMEG), and institutions entrusted by Taiwan SMEG for collection, processing, use, and international transmission, and may be provided to the Joint Credit Information Center for filing. Party B and Party C agree that the Joint Credit Information Center may provide data on file to its member financial institutions.

Medium-to-long horizontal (vertical) July 2020 version 5 Article 9: If Party A holds notes issued, guaranteed, or endorsed by Party B or Party C due to the credit business, and Party A is unaware of Party B or Party C's seal being stolen, or if Party B or Party C's seal was forged and Party A has already fulfilled its duty of care: Party B and Party C are willing to bear all responsibility for damages sustained by Party A. If Party A holds an IOU, guarantee, or other document issued by Party B and Party C due to the credit business, and Party A proves that it has already delivered the loan to Party B or issued a guarantee to the beneficiary according to the loan agreement, Party B and Party C may not deny the existence of the loan by claiming that the seal affixed on the documents above was stolen or forged. Party B and Party C shall notify Party A in writing of changes to its name, organizational changes, changes to the Articles of Incorporation, changes to the person-in-charge, or other changes that have a material effect on company operations, and submit an application to Party A to change or cancel the specimen seal. Party B and Party C are willing to bear all responsibility for transactions with Party A before notifying Party A of the changes. The specimen seal registered by Party B and Party C at Party A shall remain effective until Party A approves and completes specimen seal change or cancellation procedures. Party B and Party C shall be responsible for all transactions with Party A using the original specimen seal. However, if the original specimen seal was stolen or forged, the damages resulting from the theft or forgery shall be handled according to the preceding paragraph. Article 10: If notes and IOUs that were issued, endorsed, accepted, or guaranteed by Party B, and other proof of debt owed by Party B to Party A are damaged or lost due to incidents, force majeure, or reasons not attributable to Party A, or if the notes or IOUs were forged and not the result of gross negligence by Party A, except for accounts, vouchers, documents prepared on computer, photocopies of correspondence, or microfilm records of Party A that are proven by Party B to be incorrect and must be corrected by Party A, Party B is willing to acknowledge the records on the books and documents above, and immediately repay fees, liquidated damages, principal, and interest when the debt matures. Article 11: 1. Where the debt owed by Party B to Party A has any one of the following circumstances, Party A may, without prior notices or reminders and at any time, reduce the credit limit granted to Party B or shorten the term for loan repayment, or declare all of its liabilities due: (1) Failure to fully repay any debt. (2) Application for mediation, bankruptcy, or company reorganization under the Bankruptcy Law, or notified by the Taiwan Payments Clearance System of rejection of processing, termination of business operations, or repayment of debt. (3) Failure to fulfill its duty of providing collateral in accordance with the agreement. (4) Occurrence of death and its successors declare limited or waived succession. (5) Confiscation of its main assets as a result of criminal offenses. 2. Where the debt owed by Party B to Party A has any one of the following circumstances, Party A may, after prior notice or reminder, reduce the credit limit granted to Party B or shorten the term for loan repayment, or declare all of its liabilities due: (1) Interest for any single loan is not duly paid. (2) The collateral has been seized or lost, or its value impaired or is insufficient to cover the liability. (3) The actual funds in debts owed by Party B to Party A are used for a purpose other than that approved by Party A. (4) Party B is subject to compulsory enforcement or provisional seizure, provisional injunction or other injunction measures such that there is a risk of Party A not being repaid. Article 12: In the event of default by Party B or Party C, regardless of the loan period, Party A has the right to use deposits of Party B and Party C and all early repayment of debts owed to Party A (excluding check deposits) to directly offset all debts owed by Party B and Party C to Party A. Party B and Party C understand and agree that: In the event Party B and Party C default on any contract signed with Party A and Party A reduces the credit limit, shortens the term for repayment, or declares all

Medium-to-long horizontal (vertical) July 2020 version 6 of the liabilities due, the check deposit (account) agreement signed by Party B and Party C with Party A naturally becomes invalid. Party A shall immediately return the balance in the check deposit and directly use the funds returned to offset all debts owed by Party B and Party C to Party A. Offset in the preceding two paragraphs becomes effective when Party A carries out book deduction. At the same time, all deposit notes, passbooks or other proofs of deposits issued by the Bank to the Guarantor shall, insofar as they are involved in such deduction for offset, become invalid. Article 13: Where Party B owes several debts to Party A, if the payment is insufficient to repay all debts, the method and order in which debts are repaid shall be in accordance with the Civil Code. However, payment of liquidated damages shall be after expenses and before interest. Article 14: In the event of litigation arising out of Party B and Party C's non-performance of obligations, the credit investigation expenses, storage expenses, transportation expenses, and attorney fees (limited to the amount where an attorney must be appointed because Party A is indeed unable to handle the litigation) of Party A to exercise or protect its creditors' rights shall be jointly borne by Party B and Party C. However, this does not apply if the court rules that Party B and Party C do not owe any debt to Party A. Section 3. Collateral Article 15: The collateral provided by Party B and (or) the collateral provider according to this agreement is not only provided for all debts under this agreement, but also current (including past loans that have not yet been fully repaid) and future debts (including various loans, overdraft, discount, entrusted guarantees, entrusted acceptances, entrusted guaranteed commercial papers, issuance of letters of credit, export bills advances, and all liabilities and advances derived from other credit) of Party B and (or) the collateral provider within the limit specified in the mortgage or pledge agreement with Party A, the principal and interest of notes and liability on guarantees, default interest, liquidated damages, expenses for exercising mortgage right, insurance premiums advanced by the mortgagee, litigation expenses, and compensation for damages arising out of non-performance of obligation. Article 16: (I) If the collateral can be insured, Party A shall submit an application as the mortgagee to the insurance company to add a special clause on mortgage rights on the insurance policy. When purchasing suitable fire insurance or other insurance required by Party A, the insured amount and terms and conditions must be approved by Party A. Insurance premiums and other expenses shall be jointly borne by Party B and the collateral provider. Insurance policies and receipts for premium payments shall be retained by Party A. If Party B and collateral provider fail to purchase or renew insurance, Party A may directly use the Agreement as a power of attorney to purchase insurance on their behalf. Party B shall immediately repay Party A for any insurance premiums advanced by Party A. If Party B fails to immediately repay Party A, Party A may include the amount of premiums in the amount owed by Party B, and interest will be accrued according to the interest rate of the Agreement. However, Party A is not obligated to purchase insurance or pay premiums on behalf of Party B. If the collateral sustains any damages and the insurance company refuses or delays payment of insurance benefits for any reason, Party A may require Party B provide collateral approved by Party A with value equal to the diminished value within a prescribed time limit: If Party B fails to provide collateral within the prescribed time limit, Party A may require Party B to immediately repay all debts. (II) Collateral provided by Party B and Party C to Party A are all used as collateral for the loan, regardless of the order they were provided in, and the Agreement is proof of the provision of collateral.

Medium-to-long horizontal (vertical) July 2020 version 7 Article 17: If the collateral is damaged, destroyed, or its value diminishes due natural disasters, incidents, or actions of a third party not attributable to the parties, Party B shall immediately notify Party A and Party A may specify a time limit for Party B provide collateral with value equal to the diminished value. If Party B fails to provide collateral within the prescribed time limit, Party A may require Party B to repay all debts. If the collateral is pledged property that sustains damages due to the reason above, Party A is not liable for returning the pledged property or compensating Party B for damages. Article 18: If the collateral is cargo, rent for storage space, taxes, relocation expenses, and other expenses shall be borne by the collateral provider and Party B. Where Party A lawfully occupies the collateral, Party A shall not be liable for damages resulting from the decision to relocate or not, unless the damages were caused by reasons attributable to Party A. Section 4. Joint Guarantor Clause Article 19: Party C is willing to bear joint liability for repaying all debts of Party B under the Agreement until all debts are repaid, and also agrees to the following terms and conditions: (I) Party A is not required to seek indemnity by way of the collateral before seeking indemnity from Party C. (II) After Party C repays all debts on behalf of Party B and lawfully requests that Party A transfer the collateral, no objections shall be raised with respect to any defects in the collateral. Article 20: Party C agrees that before the main debt is fully repaid, if Party C repays the debt on behalf of Party B, Party C's right of claim and right of subrogation shall be subordinate to Party A's right of residual claim against Party B within the scope of such repayment. However, this is limited to obligations guaranteed by Party C. Article 21: Party A may notify Party B to add or replace the joint guarantor if Party A deems it necessary based on the facts, and Party B shall immediately cooperate. Section 5. Other terms Article 22: The elements, effect, and legal actions taken by Party B and Party C relating to the debts under the Agreement shall be in accordance with the laws of the Republic of China. Article 23: The parties agree that Taiwan New Taipei District Court or Taiwan Taipei District Court shall be the court of first instance for all debts of owed by Party B and Party C to Party A. However, where the law contains special provisions on exclusive jurisdiction, the provisions shall prevail. Article 24: The Agreement is terminated when Party B fully repays all principle, interest, default interest, liquidated damages, fees, charges, insurance premiums, and all related debts payable to Party A, and the parties have completed all requirements according to the Agreement and subsequent supplementary contracts. Article 25: Party B and Party C agree that Party A may outsource operations to other institutions in accordance with regulations of the competent authority due to business needs, and may provide date to the entrusted institution. However, the entrusted institutions shall comply with laws and regulations and maintain confidentiality when processing and using data of Party B and Party C. Party B and Party C may inquire Party A about the type of information disclosed to the entrusted institution and the name of the entrusted institution. Article 26: If either party deems it necessary to revise, add, or delete any provisions in the Agreement, it shall notify the other party and any changes must be agreed to by the parties. Any matters not specified herein, unless otherwise stipulated by the law, shall be handled according to an agreement between the parties.

Medium-to-long horizontal (vertical) July 2020 version 8 Article 27: The Agreement is drawn out in 2 originals with 1 original retained by Party A and 1 original retained by Party B. Special Clauses: Article 28: If Party B fails to perform obligations that are guaranteed by Party C, and Party A deems it necessary to extend the deadline for repayment or allow repayment in installments based on an application from Party B, Party A shall immediately notify Party C in writing, and Party C consents to continue to guarantee all debts when the written notification from Party A is delivered or deemed delivered. Article 29: Where the debt owed by Party B to Party A has any one of the following circumstances, Party A may, without prior notices or reminders and at any time, reduce the credit limit granted to Party B or shorten the term for loan repayment, or declare all of its liabilities due: 1. Party B provided false financial statements or data that resulted in incorrect assessment by Party A, or intentionally concealed or falsified material facts during interactions with Party A that caused Party A to make an incorrect judgment before approving the loan to Party B. 2. Party B's license for the intended use of the loan approved by Party A was suspended or revoked. 3. The funds approved by the bank were flowed to China. Article 30: Where the debt owed by Party B to Party A has any one of the following circumstances, Party A may, after notice or reminder a reasonable amount of time in advance, reduce the credit limit granted to Party B or shorten the term for loan repayment, or declare all of its liabilities due: 1. Party B or its person-in-charge has previous records of its bills not being honored. 2. The indemnity notes provided by Party B were not honored at the maturity date. 3. Party B has overdue loans from financial institutions. 4. If movable property is provided as collateral for the loan, and Party A may take possession of the collateral according to the chattel mortgage agreement. 5. Party B establishes a trust of its assets with a third party as beneficiary without obtaining Party A's consent. 6. Party B fails to purchase or renew suitable fire insurance (including earthquake insurance) for the collateral. 7. Party B is merged, spin-off, or reduces capital. 8. Party B violates or fails to perform any provisions in the Agreement. Article 31: Party B and Party C consent that when Party A establishes a trust or transfers Party B's debts (including collateral for the debt and other accessory rights) to a third party in accordance with the Financial Asset Securitization Act, Party A may make an announcement according to the Financial Asset Securitization Act instead of issuing a debt transfer notification. Article 32: Party B and Party C consent that Party A may provide data relating to the debt of Party B and Party C to the transferee and appraiser for the specific purpose of transferring the debt. However, Party A shall urge the data user to comply with confidentiality requirements set forth in the Banking Act, Personal Data Protection Act, and other applicable laws and regulations, and may not leak the data to any third party. Article 33: Party B and Party C □ consent □ do not consent to let Party A disclose or transfer, under the customer data confidentiality measures of the financial holding corporation that Party A is subordinate to and other subsidiaries, basic personal information other than the name and address of Party B and Party C and account, credit, investment or insurance information held on file by Party A to the financial holdings corporation that Party A is subordinate to and other subsidiaries, for the purpose of promotion, marketing, or providing services. Mega Securities Co., Ltd. Chung Kuo Insurance Co., Ltd. Mega Bills Finance Co., Ltd.

Medium-to-long horizontal (vertical) July 2020 version 9 Mega International Investment Trust Co., Ltd. Mega Asset Management Corp. Mega Venture Capital Co., Ltd. Yung Shing Industries Co., Ltd. Mega Futures Co., Ltd. Mega International Investment Consulting Co., Ltd. Yin Kai Co., Ltd. Party B and Party C consent that even if they consent to the preceding paragraph, if they no longer consent with the clause in the future, they may notify Party A via phone, the Internet, in writing, or in person at a business location of Party A, and Party A will notify the financial holding company that it is subordinate to and all subsidiaries to stop sending related data and stop using the data of Party B and Party C above. However, if Party B and Party C clearly express their wishes for only the financial holding company that Party A is subordinate to and other subsidiaries to stop using their data, Party A may handle the matter according to their wishes. Party B and Party C _______________________________________________________________________________ (Signature and seal) Note 1: Signature and seal not required if consent is not given. Note 2: If "consent" is not selected or the signature and seal column is empty, is shall be construed as "do notconsent." Note 3: If the subsidiaries in this paragraph are added or deleted due to organizational changes of the financial holding company that Party A is subordinate to, the change shall be announced on the website of the financial holding company and its subsidiaries. Article 34: The signature and seal of Party B and Party C on the Agreement were signed and affixed by Party B and Party C in person. Any subsequent loans from Party A to Party B and Party C shall be effective with either the signature or seal. Article 35: Party B and Party C agree that, for the purpose of evaluating whether to repay the debt owed by Party B to Party A on behalf of Party B, Party A may provide the total amount of Party B's debt or the balance of the principal, interest, liquidated damages, and fees payable for each type of debt owed by Party B to a third party that is an interested party with respect to the performance of the debt. Party B Signature and Seal

Medium-to-long horizontal (vertical) July 2020 version 10 Party C Signature and Seal Other terms: Article 36: If the loan of the Agreement is a participation loan, Party B hereby declares that each co-borrower is liable for repaying all debts owed to Party A under the Agreement. Article 37: If Party C was a director or supervisor of Party B when providing guarantee for the Agreement and resigned or was relieved from the position due to other legal reasons, Party A may, without prior notice or reminder, reduce Party B's credit limit or suspend drawdowns at any time. Party B shall immediately notify Party A when Party C is relieved from the position, and shall be liable for compensating any damages sustained by Party A in the event of a violation. Article 38: Party C hereby declares that he/she provides guarantee for Party B under the Agreement in a private capacity. If Party C held the position of Party B's director or supervisor when providing guarantee under the Agreement, Party C agrees to continue to provide guarantee under the Agreement in a private capacity after being relieved from the position. Article 39: If Party C was a director or supervisor of Party B when providing guarantee for the Agreement and resigned or was relieved from the position due to other legal reasons, Party C agrees to immediately notify Party A in writing when Party C is relieved from the position, and shall be liable for compensating any damages sustained by Party A in the event of a violation. Article 40: If Party A or Party B becomes aware of any personnel who accepted commission, kickbacks, or other improper benefits, the party shall immediately notify the other party of the person's identity, how it was provided, committed, demanded, or accepted, the amount, or other improper benefits, and also provide evidence and cooperate with the other party's investigation. If either party sustains any damages as a result, the party may seek compensation from the other party. If Party A or Party B engage in unethical conduct during business activities, the other party may unconditionally terminate the Agreement at any time. Article 41: If Party B has any one of the following circumstances, the Bank may directly suspend disbursement or terminate the Agreement to comply with laws and regulations relating to anti-money laundering and countering the financing of terrorism (AML/CFT): 1. Party B does not cooperate with the Bank's periodic review, refuses to provide information on its beneficial owner or controlling person, or is unwilling to explain the nature or purpose of transactions or source of funds. 2. Party B is a terrorist or terrorist organization under economic sanctions or identified or investigated by a foreign government or international anti-money laundering organization, or announced by the Ministry of Justice in accordance with the Counter-Terrorism Financing Act. Article 42: Party B and Party C hereby declare that they have read all clauses within a reasonable period and fully understood the contents before personally signing and affixing their seal.

Medium-to-long horizontal (vertical) July 2020 version 11 Parties to the Agreement: Party A: Mega International Commercial Bank Co., Ltd. Legal Representative: Vice President & General Manager of North Taipei Branch Choun-Chau Tsai Address: No.156-1, Sung-chiang Rd., Taipei City 10459, Taiwan Party B: SUPER MICRO COMPUTER, INC. TAIWAN /s/ Super Micro Incorporation, Taiwan Company stamp Date: September 13, 2021 /s/ CHUN-LAI HSU stamp Personal stamp Date: September 13, 2021 Legal Representative: CHUN-LAI HSU /s/ CHUN-LAI HSU Chairman of BOD Date: September 13, 2021 Address: 3F., No.150, Jian 1st Rd., Zhonghe Dist., New Taipei City 23511, Taiwan (R.O.C.) Unified Business No.:12729477 Party C: Joint Guarantor: ID No.: Address: (yyyy) (mm) (dd) Party B Joint Guarantor Joint Guarantor Date of witness 2021.9.13 Signature and Seal /s/ Super Micro Incorporation, Taiwan Company stamp /s/ CHUN-LAI HSU CHUN-LAI HSU personal stamp /s/ CHUN-LAI HSU CHUN-LAI HSU Chairman of BOD Date: September 13, 2021 Place of Guarantee 980 Rock Avenue, San Jose, CA 95131, USA Witness /s/ Chung-Chang, Wu Chung-Chang, Wu stamp Assistant Manager of Mega Bank Date: September 13, 2021

Exhibit 10.2

Exhibit 10.3

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- KeyBanc Starts Super Micro Computer (SMCI) at Sector Weight, 'shares currently trading relatively inline with its infrastructure peer group'

- Dow reports first quarter 2024 results

- Popular stocks with increasing volume: SMCI ARM BAC TSM MU AMC PLTR SNAP COIN

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share