Form 8-K Soaring Eagle Acquisitio For: May 11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 11, 2021

SOARING EAGLE ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Cayman Islands |

001-40097 |

N/A | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

955 Fifth Avenue

New York, NY 10075

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (310) 209-7280

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Units, each consisting of one Class A ordinary share and one-fifth of one redeemable warrant | SRNGU | The Nasdaq Stock Market LLC | ||

| Class A ordinary share, par value $0.0001 per share | SRNG | The Nasdaq Stock Market LLC | ||

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share | SRNGW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Merger Agreement

On May 11, 2021, Soaring Eagle Acquisition Corp., a Cayman Islands exempted company limited by shares (“SRNG” or the “Company”), entered into an agreement and plan of merger by and among SRNG, SEAC Merger Sub Inc., a wholly owned subsidiary of SRNG (“Merger Sub”), and Ginkgo Bioworks, Inc. (“Ginkgo”) (as it may be amended, restated, supplemented or otherwise modified from time to time, the “Merger Agreement”). The merger was approved by SRNG’s board of directors on May 7, 2021. If the Merger Agreement is approved by SRNG’s and Ginkgo’s stockholders, and the closing conditions contemplated by the Merger Agreement are satisfied, then, among other things, (i) prior to the closing of the Business Combination, SRNG shall domesticate as a Delaware corporation in accordance with Section 388 of the Delaware General Corporation Law, as amended (“DGCL”), and the Cayman Islands Companies Act (As Revised) (the “Domestication”) and (ii) upon the terms and subject to the conditions of the Merger Agreement, in accordance with the DGCL, Merger Sub will merge with and into Ginkgo, with Ginkgo surviving the merger as a wholly owned subsidiary of SRNG (the “Business Combination”). In addition, in connection with the consummation of the Business Combination, SRNG will be renamed “Ginkgo Bioworks Holdings, Inc.” and is referred to herein as “New Ginkgo” as of the time following such change of name.

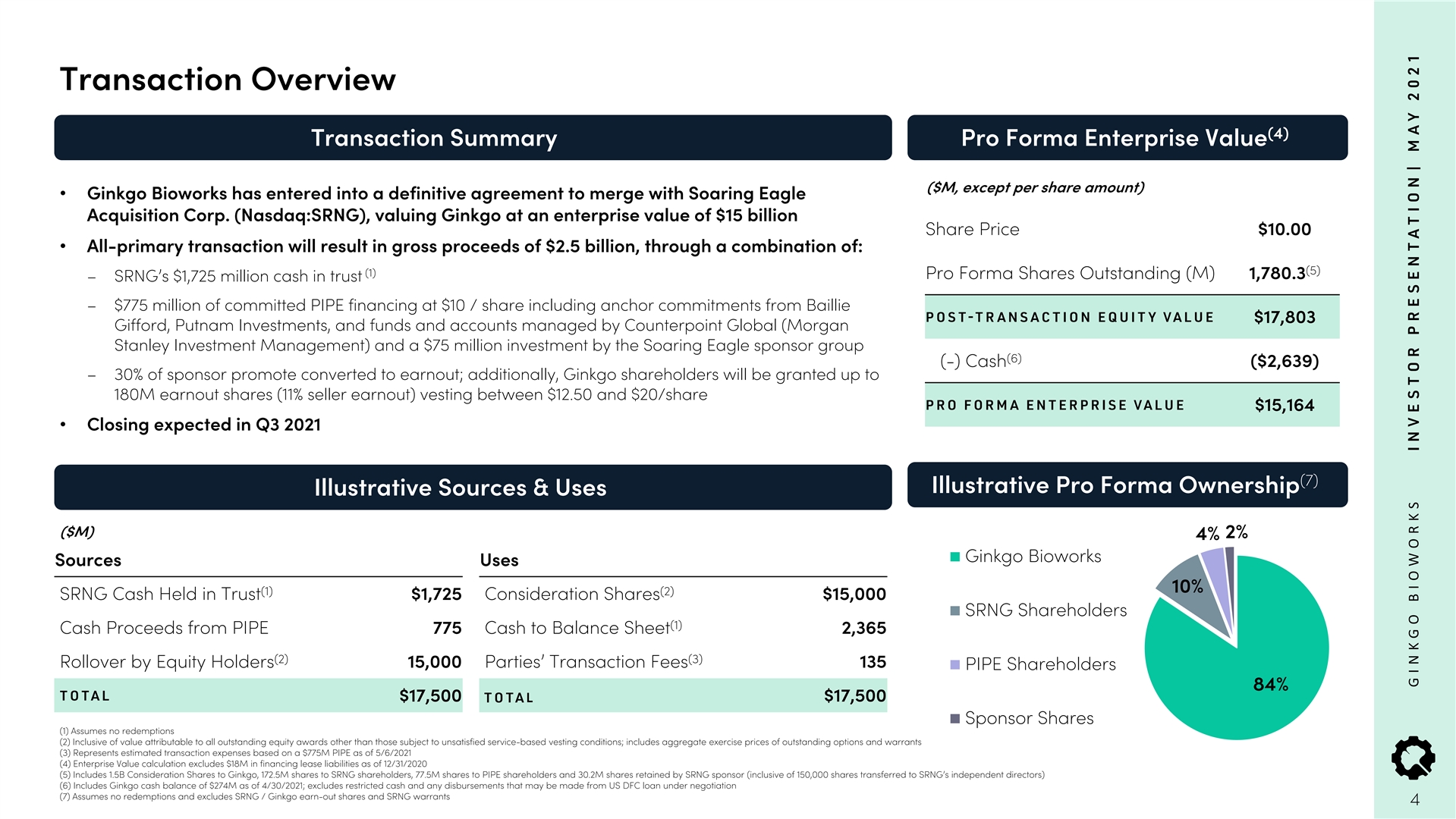

Under the Merger Agreement, SRNG has agreed to acquire all of the outstanding equity interests in Ginkgo for approximately $15 billion in aggregate base equity consideration in the form of New Ginkgo common stock (at $10 per share) to be paid at the effective time of the Business Combination, plus approximately 180,000,000 earn-out shares of New Ginkgo common stock, which are subject to forfeiture to the extent that the vesting conditions described below are not satisfied on or before the fifth anniversary of the closing.

The base equity consideration will be allocated among Ginkgo’s equityholders as follows: (i) each stockholder of Ginkgo holding shares of Class A common stock or Class B common stock of Ginkgo immediately prior to the effective time of the Business Combination (including as a result of the automatic exercise of Ginkgo Preferred Warrants (defined below) by virtue of the occurrence of the Business Combination pursuant to the terms of such warrants) will receive, with respect to each share of Class A common stock or Class B common stock of Ginkgo such person holds, a number of shares of Class A common stock or Class B common stock, as applicable, of New Ginkgo calculated, in each case, based on the equity value exchange ratio as set forth in the Merger Agreement, (ii) each option exercisable for Class A common stock or Class B common stock of Ginkgo that is outstanding immediately prior to the effective time of the Business Combination will be assumed and converted into a newly issued option exercisable for shares of Class A common stock or Class B common stock, as applicable, of New Ginkgo (subject to the same terms and conditions as the original Ginkgo option and with appropriate adjustments to the number of shares for which such option is exercisable and the exercise price thereof), (iii) each award of restricted common stock of Ginkgo under Ginkgo’s stock incentive plans (a “Ginkgo Restricted Stock Award”) that is outstanding immediately prior to the effective time of the Business Combination will be converted into the right to receive restricted common stock of New Ginkgo on the same terms and conditions as applicable to such Ginkgo Restricted Stock Award, (iv) each award of restricted stock units of Ginkgo under Ginkgo’s stock incentive plans (a “Ginkgo Restricted Stock Unit Award”) that is outstanding immediately prior to the effective time of the Business Combination will be converted into the right to receive restricted stock units based on common stock of New Ginkgo on the same terms and conditions as applicable to such Ginkgo Restricted Stock Unit Award and with appropriate adjustments to the number of shares to which each such restricted stock unit relates, and (v) each preferred warrant to purchase shares of Ginkgo capital stock (a “Ginkgo Preferred Warrant”) that is outstanding and unexercised immediately prior to the effective time of the Business Combination that is not automatically exercised in full in accordance with its terms by virtue of the occurrence of the Business Combination will be assumed and converted into a warrant exercisable for Class A common stock of New Ginkgo on the same terms and conditions as applicable to such Ginkgo Preferred Warrant immediately prior to the effective time of the Business Combination, with appropriate adjustments to the number of shares for which such preferred warrant is exercisable and the exercise price thereof.

As described above, the Merger Agreement also contemplates that the holders of Ginkgo common stock, Ginkgo options, Ginkgo Restricted Stock Awards, Ginkgo Restricted Stock Unit Awards, and Ginkgo preferred warrants outstanding immediately prior to the effective time of the Business Combination will collectively be entitled

to receive up to approximately 180,000,000 earn-out shares of New Ginkgo common stock (the “Seller Earn-out Shares”), which are divided into four equal tranches subject to the below vesting terms during the five-year period following the closing date of the Business Combination (the “Earn-out Period”):

| • | If the trading price per share of New Ginkgo Class A common stock at any point during the trading hours of a trading day is greater than or equal to $12.50 for any 20 trading days within any period of 30 consecutive trading days during the Earn-out Period, 25% of the Seller Earn-out Shares will immediately vest; |

| • | If the trading price per share of New Ginkgo Class A common stock at any point during the trading hours of a trading day is greater than or equal to $15.00 for any 20 trading days within any period of 30 consecutive trading days during the Earn-out Period, an additional 25% of the Seller Earn-out Shares will immediately vest; |

| • | If the trading price per share of New Ginkgo Class A common stock at any point during the trading hours of a trading day is greater than or equal to $17.50 for any 20 trading days within any period of 30 consecutive trading days, an additional 25% of the Seller Earn-out Shares will immediately vest; and |

| • | If the trading price per share of New Ginkgo Class A common stock at any point during the trading hours of a trading day is greater than or equal to $20.00 for any 20 trading days within any period of 30 consecutive trading days, the remaining 25% of the Seller Earn-out Shares will immediately vest. |

The shares of Class B common stock of New Ginkgo will have the same economic terms as the shares of Class A common stock of New Ginkgo, but the shares of Class A common stock of New Ginkgo will have 1 vote per share and the Class B common stock of New Ginkgo will have 10 votes per share. Generally, the outstanding shares of Class B common stock of New Ginkgo will convert to shares of Class A common stock when the holder thereof ceases to be a director or employee of New Ginkgo or upon transfer to a person who is not a director or employee of New Ginkgo.

The parties to the Merger Agreement have made customary representations, warranties and covenants in the Merger Agreement, including, among others, covenants with respect to the conduct of SRNG, Merger Sub, Ginkgo and its subsidiaries prior to the closing of the Business Combination.

The closing of the Business Combination is subject to certain customary conditions, including, among other things, the following mutual closing conditions: (i) approval by SRNG’s stockholders and Ginkgo’s stockholders of the Merger Agreement, the Business Combination and certain other actions related thereto; (ii) the expiration or termination of the waiting period (or any extension thereof) applicable under the Hart-Scott-Rodino Antitrust Improvements Act of 1976; and (iii) the shares of Class A common stock of New Ginkgo to be issued in connection with the Business Combination having been approved for listing on the Nasdaq Capital Market or the New York Stock Exchange (as determined by Ginkgo), subject only to official notice of issuance thereof. Ginkgo also has a closing condition (among others) that requires SRNG to have at least $1.25 billion of cash at the closing of the Business Combination, consisting of (A) cash held in its trust account after giving effect to redemptions of public shares, if any, but before giving effect to the payment of Ginkgo’s and SRNG’s outstanding transaction expenses, (B) the aggregate gross purchase price received by the Company pursuant to the Subscription Agreements (as defined below) and (C) subject to certain limitations, the amount of any equity investments in Ginkgo or SRNG between the date of the Merger Agreement and the closing of the Business Combination (other than the PIPE investments committed pursuant to the Subscription Agreements).

The Merger Agreement may be terminated by SRNG or Ginkgo under certain circumstances, including, among others, (i) by mutual written consent of SRNG and Ginkgo, (ii) subject to certain conditions and exceptions, by either SRNG or Ginkgo if the closing of the Business Combination has not occurred on or before November 11, 2021 (subject to extension under the circumstances specified in the Merger Agreement), and (iii) by SRNG or Ginkgo if SRNG has not obtained the required approval of its shareholders.

The foregoing description of the Merger Agreement and the Business Combination does not purport to be complete and is qualified in its entirety by the terms and conditions of the Merger Agreement, a copy of which is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The Merger Agreement contains representations, warranties and covenants that the parties to the Merger Agreement made to each other as of the date of the Merger Agreement or other specific dates as expressly set forth therein. The assertions embodied in those representations, warranties and covenants were made for purposes of the contract among the parties and are subject to important qualifications and limitations agreed to by the parties in connection with negotiating the Merger Agreement. The Merger Agreement has been attached to provide investors with information regarding its terms and is not intended to provide

any other factual information about SRNG, Ginkgo, Merger Sub or any other person. In particular, the representations, warranties, covenants and agreements contained in the Merger Agreement, which were made only for purposes of the Merger Agreement and as of specific dates as expressly set forth therein, were solely for the benefit of the parties to the Merger Agreement, may be subject to limitations agreed upon by the contracting parties (including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts) and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors and reports and documents filed with the U.S. Securities and Exchange Commission (the “SEC”). Investors should not rely on the representations, warranties, covenants and agreements, or any descriptions thereof, as characterizations of the actual state of facts or condition of any party to the Merger Agreement. In addition, the representations, warranties, covenants and agreements and other terms of the Merger Agreement may be subject to subsequent waiver or modification. Moreover, information concerning the subject matter of the representations and warranties and other terms may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

Subscription Agreements

The Company entered into subscription agreements (the “Subscription Agreements”), each dated as of May 11, 2021, with certain accredited investors, including an affiliate of Eagle Equity Partners III, LLC (the “Sponsor”) (collectively, the “Investors”), pursuant to which, among other things, the Company agreed to issue and sell, in private placements to close immediately prior to the closing of the Business Combination, an aggregate of 77,500,000 Class A common shares for $10.00 per share (the “PIPE Investment”) to the Investors (including 7,500,000 Class A common shares to an affiliate of the Sponsor). The Sponsor currently owns approximately 20% of the Company’s outstanding shares and certain members of the Company’s management are members of the Sponsor and its affiliate.

The foregoing description of the Subscription Agreements does not purport to be complete and is qualified in its entirety by the terms and conditions of the form of Subscription Agreement, a copy of which is filed as Exhibit 10.1 hereto and is incorporated by reference herein.

Registration Rights Agreement

The Company and SRNG have agreed to a form amended and restated registration rights agreement (the “Registration Rights Agreement”) that the Company, the Sponsor, Ginkgo and certain stockholders of Ginkgo (“Ginkgo Holders”, and collectively with the Sponsor, the “Holders”) will enter into at the closing of the Business Combination. Pursuant to the Registration Rights Agreement, New Ginkgo will be required to register for resale securities held by the stockholder of New Ginkgo (“New Ginkgo Holders”). In the event that any New Ginkgo Holder holds registrable securities that are no registered for resale, New Ginkgo shall only be required to update the registration statement at the request of the Sponsor or a New Ginkgo Holder twice per calendar year for each of the Sponsor and New Ginkgo Holders. In addition, the holders have certain “piggyback” registration rights with respect to registrations initiated by New Ginkgo. New Ginkgo will bear the expenses incurred in connection with the filing of any registration statements pursuant to the Registration Rights Agreement.

The foregoing description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Registration Rights Agreement filed as Exhibit 10.2 hereto and is incorporated by reference herein.

Company Stockholder Support Agreements

In connection with and following the execution of the Merger Agreement, certain Ginkgo stockholders (the “Ginkgo Supporting Stockholders”) entered into Ginkgo stockholder support agreement with SRNG and Merger Sub (the “Ginkgo Stockholder Support Agreements”). Under the Ginkgo Stockholder Support Agreements, each Ginkgo Supporting Stockholder agreed, within two business days after receiving notice from SRNG or Ginkgo that the SEC has declared the registration statement effective, to execute and deliver a written consent with respect to the outstanding shares of Ginkgo common stock and preferred stock held by such Ginkgo Supporting Stockholder adopting the Merger Agreement and approving the Business Combination and the recapitalization transaction in

connection with the Business Combination. The shares of Ginkgo common stock and preferred stock that are owned by the Ginkgo Supporting Stockholders and subject to the Ginkgo Stockholder Support Agreements represent approximately 90% of the outstanding voting power of Ginkgo common stock and preferred stock (on an as converted basis) and represent the requisite votes required to adopt the Merger Agreement and approve the Business Combination and the recapitalization transaction in connection with the Business Combination. In addition, the Ginkgo Stockholder Support Agreements prohibit the Ginkgo Supporting Stockholders from engaging in activities that have the effect of soliciting a competing acquisition proposal.

The foregoing description of the Support Agreements does not purport to be complete and is qualified in its entirety by the terms and conditions of the Ginkgo Stockholder Support Agreements filed as Exhibit 10.3 hereto and incorporated by reference herein.

Sponsor Support Agreement

In connection with the execution of the Merger Agreement, the Sponsor and certain principals of the Sponsor (solely with respect to certain specified provisions) entered into an Agreement (the “Sponsor Support Agreement”) with Ginkgo and SRNG, pursuant to which the Sponsor agreed to vote all SRNG ordinary shares beneficially owned by the Sponsor in favor of each of the transaction proposals in connection with the Business Combination at any SRNG shareholder meeting, to use such Person’s commercially reasonable efforts to take all actions reasonably necessary to consummate the Business Combination and not to take any action that would reasonably be expected to materially delay or prevent the satisfaction of the conditions to the Business Combination set forth in the Merger Agreement.

The Sponsor Support Agreement provides that the Sponsor will not redeem any SRNG ordinary shares and will not commence or participate in, and will take all actions necessary to opt out of any class in any class action with respect to or against SRNG, Ginkgo, any of their respective related persons, relating to the negotiation, execution or delivery of the Merger Agreement or any of the transactions contemplated in the Merger Agreement.

If the SRNG shareholders’ redemption of SRNG Class A ordinary shares in connection with the Business Combination (“Shareholder Redemption”) is in the amount of no greater than $387.5 million, the Sponsor will initially receive a number of shares of Class A common stock of New Ginkgo equal to 70% of the SRNG Class B ordinary shares it owns prior to the Closing, or 30,082,500 shares (the “Upfront Shares”). If the Shareholder Redemption is in an amount greater than $387.5 million, the Upfront Shares initially received by the Sponsor in connection with the Business Combination will be further reduced by a “Restructured Amount,” which is equal to 42,975,000 Class B ordinary shares held by the Sponsor immediately prior to the Closing multiplied by a percentage, the numerator of which is the dollar amount of the Shareholder Redemption, as offset by the amount of any incremental proceeds raised by SRNG outside of the PIPE Investment, and the denominator of which is the sum of SRNG’s trust account balance (before giving effect to the Shareholder Redemption) and the PIPE Investment amount of $775 million.

In connection with the Business Combination, the Sponsor will, subject to certain vesting conditions, be entitled receive a number of earn-out shares (the “Sponsor Earn-out Shares”) up to the difference between 30% of the number of Class B ordinary shares held by the Sponsor prior the Closing (or 12,892,500 shares), minus the excess (if any) of the Restructured Amount over the Upfront Shares, plus 25% of the Restructured Amount. The Sponsor Earn-out Shares are divided into four equal tranches that will vest in accordance with the same milestones applicable to the Seller Earn-out Shares described above under the section “Merger Agreement.”

The Sponsor also agreed that, at the Closing, it will forfeit 10% of the private place warrants it holds immediately prior to the Closing and that, contingent upon the Closing, it will waive any anti-dilution right pursuant to the organizational documents of SRNG.

After the Closing and through New Ginkgo’s first annual meeting of stockholders, New Ginkgo will nominate, and will use its reasonable best efforts to have elected or appointed to the board of directors of New Ginkgo (the “New Ginkgo Board”) at least one of the Sponsor’s designee to the initial New Ginkgo Board.

The foregoing description of the Sponsor Support Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Sponsor Support Agreement filed as Exhibit 10.4 hereto and incorporated by reference herein.

Item 3.02. Unregistered Sales of Equity Securities.

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K with respect to the issuance of shares of SRNG common stock is incorporated by reference herein. The shares of SRNG common stock issuable in connection with the PIPE Investment will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder.

Item 7.01. Regulation FD Disclosure.

On May 11, 2021, the Company issued a press release announcing the execution of the Merger Agreement. The press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

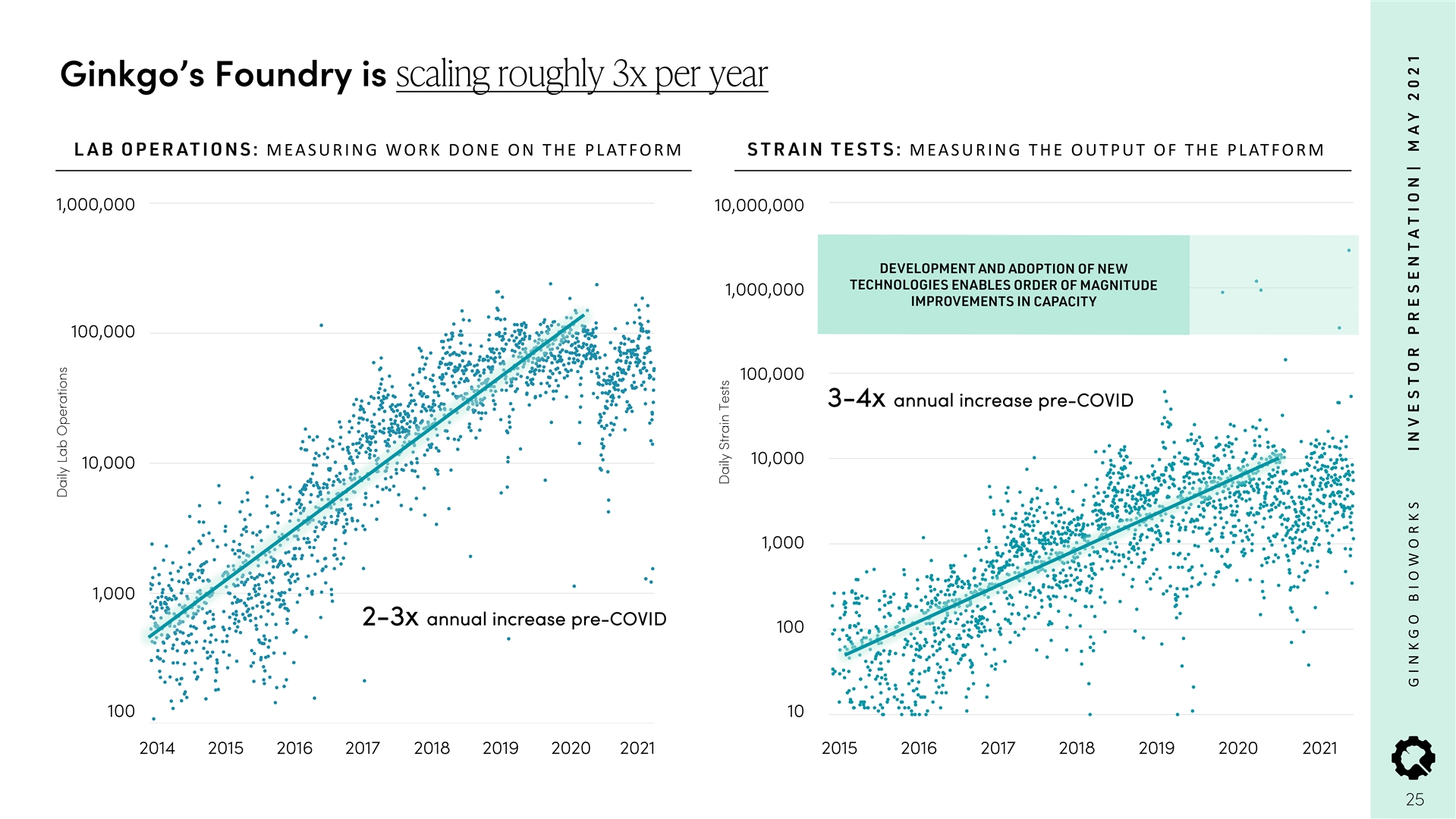

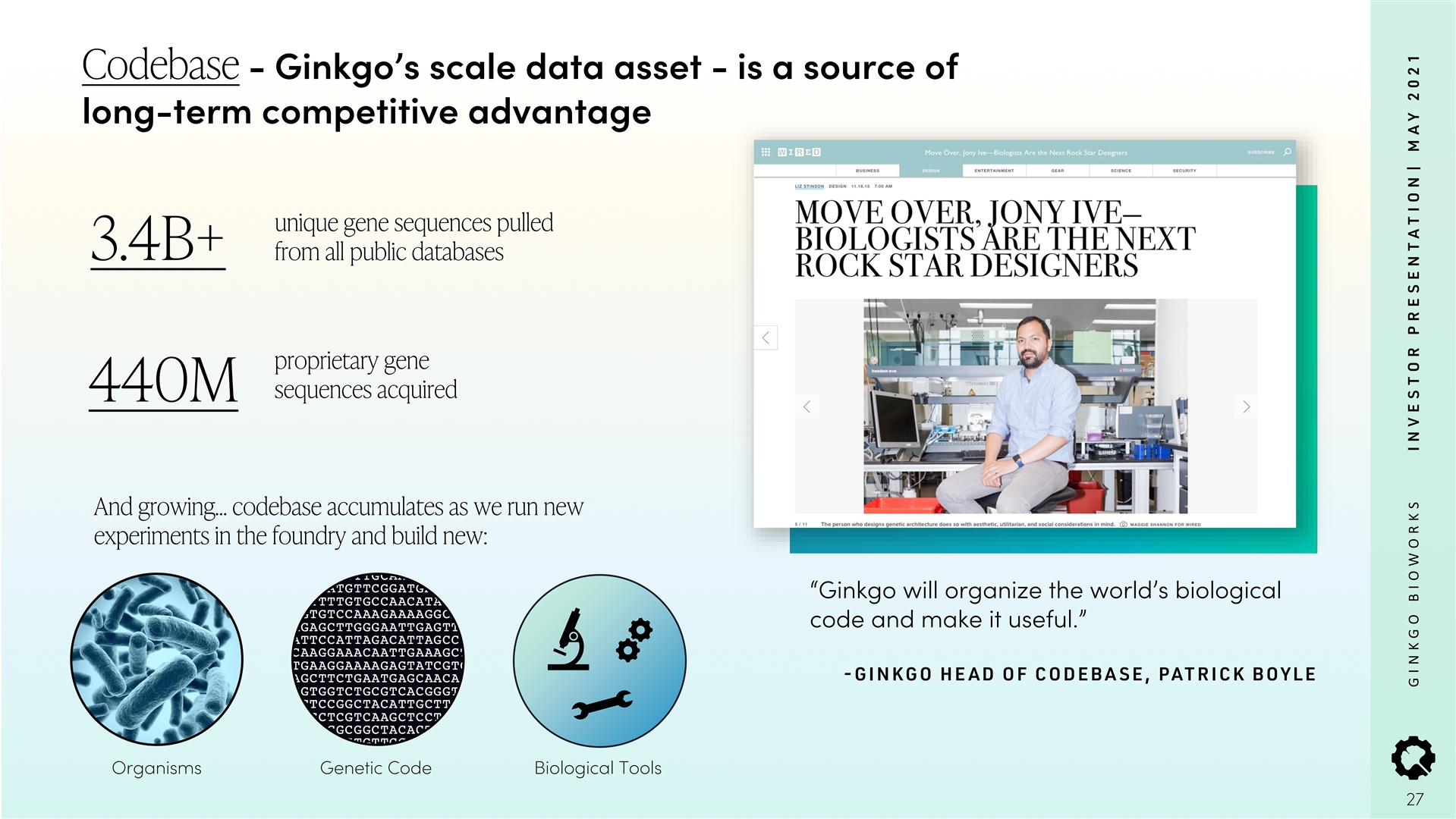

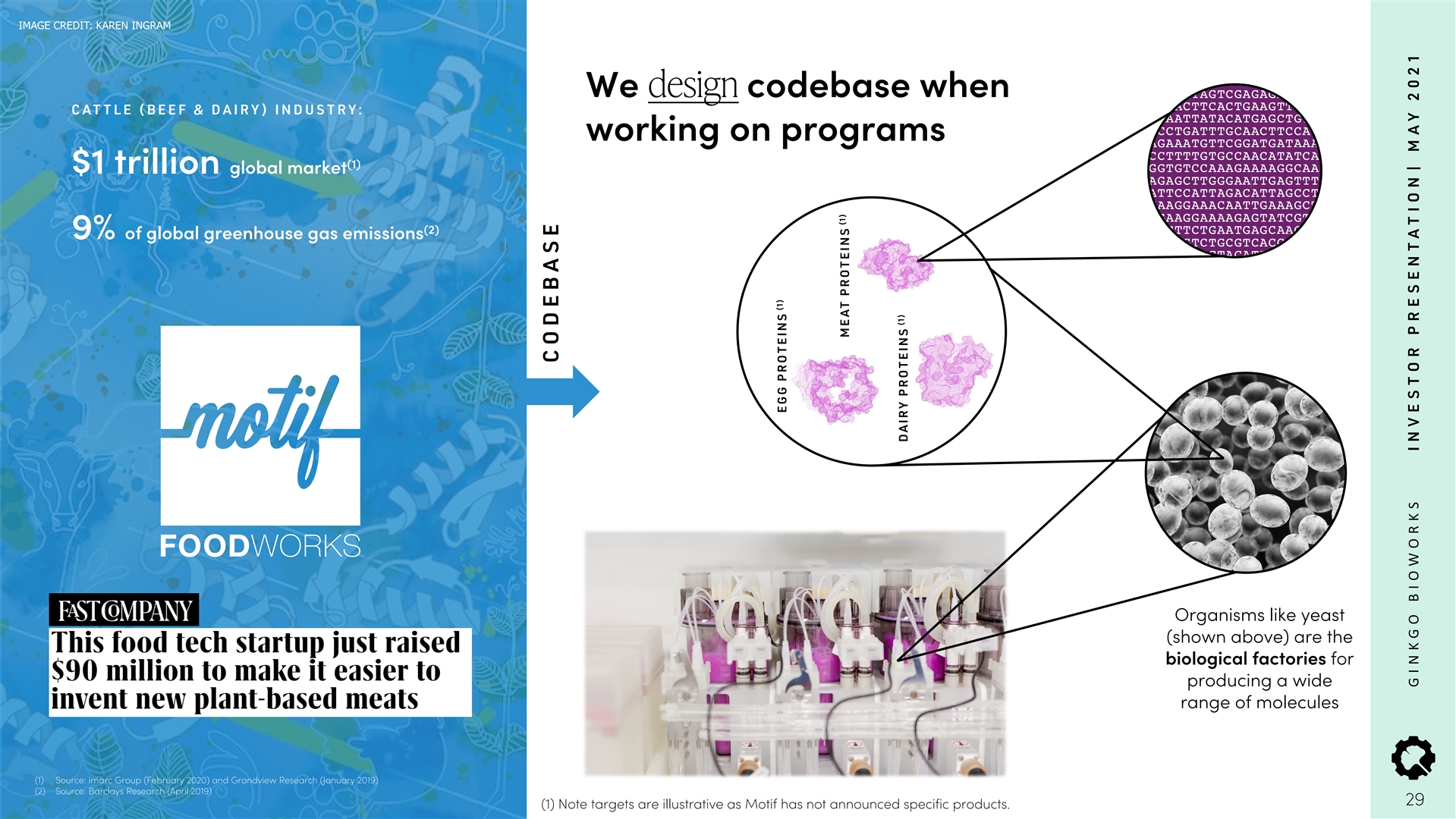

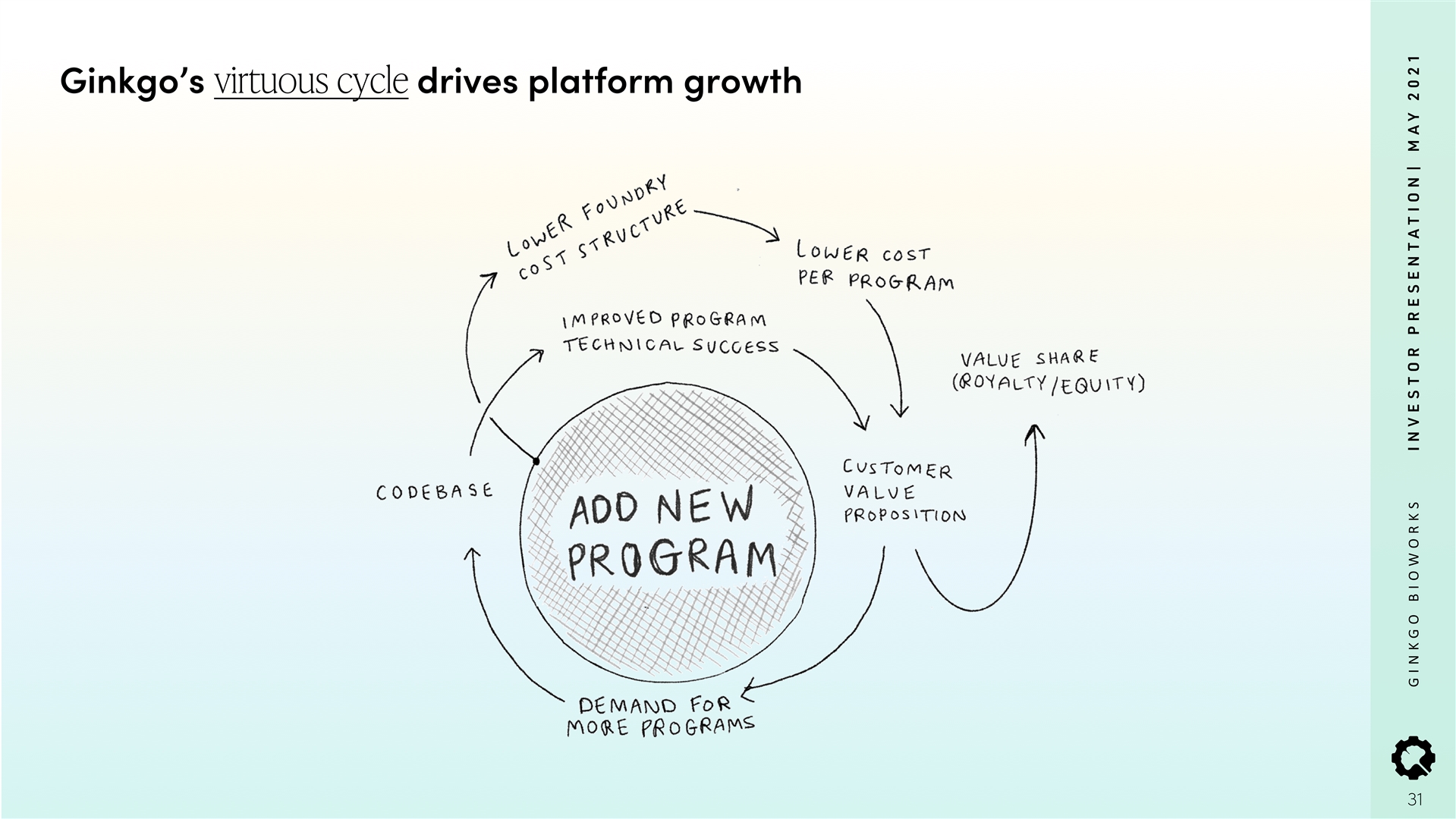

Attached as Exhibit 99.2 hereto and incorporated by reference herein is the investor presentation dated May 2021, which will be used by the Company with respect to the Business Combination.

Attached as Exhibit 99.3 and incorporated herein by reference is a summary of certain risk factors that are applicable to the Business Combination and the business of Ginkgo, made available to potential investors in the PIPE Investment.

The information in this Item 7.01, including Exhibits 99.1, 99.2 and 99.3, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information of the information in this Item 7.01, including Exhibits 99.1, 99.2 and 99.3.

Important Information About the Business Combination and Where to Find It

In connection with the proposed Business Combination, the Company intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”), which will include a proxy statement/prospectus, and certain other related documents, which will be both the proxy statement to be distributed to holders of the Company’s ordinary shares in connection with the Company’s solicitation of proxies for the vote by the Company’s shareholders with respect to the Business Combination and other matters as may be described in the Registration Statement, as well as the prospectus relating to the offer and sale of the securities of the Company to be issued in the Business Combination. The Company’s shareholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus included in the Registration Statement and the amendments thereto and the definitive proxy statement/prospectus, as these materials will contain important information about the parties to the Merger Agreement, the Company and the Business Combination. After the Registration Statement is declared effective, the definitive proxy statement/prospectus will be mailed to shareholders of the Company as of a record date to be established for voting on the Business Combination and other matters as may be described in the Registration Statement. Shareholders will also be able to obtain copies of the proxy statement/prospectus and other documents filed with the SEC that will be incorporated by reference in the proxy statement/prospectus, without charge, once available, at the SEC’s web site at www.sec.gov, or by directing a request to: Soaring Eagle Acquisition Corp., 955 Fifth Avenue, New York, NY 10075, Attention: Eli Baker, Chief Financial Officer, (310) 209-7280.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed participants in the solicitation of proxies from the Company’s shareholders with respect to the Business Combination. A list of the names of those directors and executive officers and a description of their interests in the Company is contained in the Company’s registration statement on Form S-1, which was initially filed with the SEC on December 23, 2020, and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to Soaring Eagle Acquisition Corp., 955 Fifth Avenue, New York, NY 10075, Attention: Eli Baker, Chief Financial Officer, (310) 209-7280. Additional information regarding the interests of such participants will be contained in the Registration Statement when available.

Ginkgo and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of the Company in connection with the Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination will be contained in the Registration Statement when available.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Ginkgo and the Company, including statements regarding the benefits of the transaction, the anticipated timing of the transaction, the services offered by Ginkgo and the markets in which it operates, and Ginkgo’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of the Company’s securities, (ii) the risk that the transaction may not be completed by the Company’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by the Company, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the adoption of the agreement and plan of merger by the shareholders of the Company and Ginkgo, the satisfaction of the minimum trust account amount following redemptions by the Company’s public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the agreement and plan of merger, (vi) the effect of the announcement or pendency of the transaction on Ginkgo’s business relationships, performance, and business generally, (vii) risks that the proposed transaction disrupts current plans of Ginkgo and potential difficulties in Ginkgo employee retention as a result of the proposed transaction, (viii) the outcome of any legal proceedings that may be instituted against Ginkgo or against the Company related to the agreement and plan of merger or the proposed transaction, (ix) the ability to maintain the listing of the Company’s securities on Nasdaq, (x) volatility in the price of the Company’s securities due to a variety of factors, including changes in the competitive and highly regulated industries in which Ginkgo plans to operate, variations in performance across competitors, changes in laws and regulations affecting Ginkgo’s business and changes in the combined capital structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, and (xii) the risk of downturns in demand for products using synthetic biology. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Company’s proxy statement/prospectus relating to the Business Combination, and in the Company’s other filings with the SEC. The Company cautions that the foregoing list of factors is not exclusive. The Company cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination. This Current Report on Form 8-K shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of

securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| † | Certain of the exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5). The Registrant agrees to furnish a copy of all omitted exhibits and schedules to the SEC upon its request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SOARING EAGLE ACQUISITION CORP. | ||

| By: | /s/ Eli Baker | |

| Name: | Eli Baker | |

| Title: | Chief Financial Officer | |

Date: May 11, 2021

Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

by and among

SOARING EAGLE ACQUISITION CORP.,

SEAC MERGER SUB INC.,

and

GINKGO BIOWORKS, INC.

dated as of May 11, 2021

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I CERTAIN DEFINITIONS | 4 | |||||

| Section 1.1. |

Definitions |

4 | ||||

| Section 1.2. |

Construction |

22 | ||||

| Section 1.3. |

Knowledge |

23 | ||||

| Section 1.4. |

Equitable Adjustments |

23 | ||||

| ARTICLE II THE TRANSACTIONS | 24 | |||||

| Section 2.1. |

Domestication |

24 | ||||

| Section 2.2. |

Pre-Closing Recapitalization |

25 | ||||

| Section 2.3. |

The Merger |

25 | ||||

| Section 2.4. |

Merger Effective Time |

25 | ||||

| Section 2.5. |

Effect of the Merger |

25 | ||||

| Section 2.6. |

Governing Documents |

26 | ||||

| Section 2.7. |

Directors and Officers |

26 | ||||

| Section 2.8. |

Reorganization Tax Matters |

26 | ||||

| ARTICLE III CLOSING OF THE TRANSACTIONS | 27 | |||||

| Section 3.1. |

Closing |

27 | ||||

| Section 3.2. |

Pre-Closing Deliverables |

27 | ||||

| Section 3.3. |

FIRPTA Certificate |

27 | ||||

| Section 3.4. |

Closing Payments |

27 | ||||

| Section 3.5. |

Further Assurances |

28 | ||||

| ARTICLE IV MERGER CONSIDERATION; CONVERSION OF SECURITIES | 28 | |||||

| Section 4.1. |

Merger Consideration. |

28 | ||||

| Section 4.2. |

Conversion of Company Common Shares in the Merger. |

28 | ||||

| Section 4.3. |

Exchange Procedures |

29 | ||||

| Section 4.4. |

Treatment of Company Preferred Warrants |

31 | ||||

| Section 4.5. |

Treatment of Company Equity Awards |

32 | ||||

| Section 4.6. |

Earn-out. |

33 | ||||

| Section 4.7. |

Withholding |

35 | ||||

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 36 | |||||

| Section 5.1. |

Company Organization |

36 | ||||

| Section 5.2. |

Subsidiaries |

36 | ||||

| Section 5.3. |

Due Authorization. |

36 | ||||

| Section 5.4. |

No Conflict |

37 | ||||

| Section 5.5. |

Governmental Authorities; Consents |

38 | ||||

| Section 5.6. |

Capitalization of the Company. |

38 | ||||

| Section 5.7. |

Capitalization of Subsidiaries. |

39 | ||||

-i-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| Section 5.8. |

Financial Statements |

40 | ||||

| Section 5.9. |

Undisclosed Liabilities |

40 | ||||

| Section 5.10. |

Absence of Changes |

41 | ||||

| Section 5.11. |

Litigation and Proceedings |

41 | ||||

| Section 5.12. |

Legal Compliance |

41 | ||||

| Section 5.13. |

Contracts; No Defaults. |

41 | ||||

| Section 5.14. |

Company Benefit Plans. |

43 | ||||

| Section 5.15. |

Labor Relations; Employees. |

45 | ||||

| Section 5.16. |

Taxes |

46 | ||||

| Section 5.17. |

Brokers’ Fees |

48 | ||||

| Section 5.18. |

Insurance |

48 | ||||

| Section 5.19. |

Licenses |

48 | ||||

| Section 5.20. |

Equipment and Other Tangible Property |

48 | ||||

| Section 5.21. |

Real Property. |

50 | ||||

| Section 5.22. |

Intellectual Property. |

50 | ||||

| Section 5.23. |

Privacy and Cybersecurity. |

51 | ||||

| Section 5.24. |

Environmental Matters |

52 | ||||

| Section 5.25. |

Anti-Corruption and Anti-Money Laundering Compliance. |

52 | ||||

| Section 5.26. |

Sanctions and International Trade Compliance. |

53 | ||||

| Section 5.27. |

Information Supplied |

53 | ||||

| Section 5.28. |

Customers. |

53 | ||||

| Section 5.29. |

Vendors. |

54 | ||||

| Section 5.30. |

Sufficiency of Assets |

54 | ||||

| Section 5.31. |

Related Party Transactions |

54 | ||||

| Section 5.32. |

Investment Company Act |

54 | ||||

| Section 5.33. |

No Additional Representation or Warranties |

54 | ||||

| ARTICLE VI REPRESENTATIONS AND WARRANTIES OF ACQUIROR AND MERGER SUB | 55 | |||||

| Section 6.1. |

Company Organization |

55 | ||||

| Section 6.2. |

Due Authorization. |

55 | ||||

| Section 6.3. |

No Conflict |

57 | ||||

| Section 6.4. |

Governmental Authorities; Consents |

57 | ||||

| Section 6.5. |

Litigation and Proceedings |

57 | ||||

| Section 6.6. |

SEC Filings |

58 | ||||

| Section 6.7. |

Internal Controls; Listing; Financial Statements. |

58 | ||||

| Section 6.8. |

Undisclosed Liabilities |

59 | ||||

| Section 6.9. |

Absence of Changes |

59 | ||||

| Section 6.10. |

Trust Account |

59 | ||||

| Section 6.11. |

Investment Company Act; JOBS Act |

60 | ||||

| Section 6.12. |

Capitalization of Acquiror. |

60 | ||||

| Section 6.13. |

PIPE Investment |

61 | ||||

| Section 6.14. |

Brokers’ Fees |

62 | ||||

| Section 6.15. |

Indebtedness; SPAC Expenses |

62 | ||||

| Section 6.16. |

Taxes |

62 | ||||

| Section 6.17. |

Business Activities |

64 | ||||

-ii-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| Section 6.18. |

Nasdaq Stock Market Quotation |

65 | ||||

| Section 6.19. |

Registration Statement, Proxy Statement and Proxy Statement/Registration Statement |

65 | ||||

| Section 6.20. |

No Additional Representation or Warranties |

65 | ||||

| ARTICLE VII COVENANTS OF THE COMPANY | 66 | |||||

| Section 7.1. |

Conduct of Business |

66 | ||||

| Section 7.2. |

Inspection |

68 | ||||

| Section 7.3. |

Preparation and Delivery of Additional Company Financial Statements |

69 | ||||

| Section 7.4. |

Affiliate Agreements |

69 | ||||

| Section 7.5. |

Acquisition Proposals |

69 | ||||

| ARTICLE VIII COVENANTS OF ACQUIROR | 70 | |||||

| Section 8.1. |

Employee Matters |

70 | ||||

| Section 8.2. |

Trust Account Proceeds and Related Available Equity |

71 | ||||

| Section 8.3. |

Listing Matters |

71 | ||||

| Section 8.4. |

No Solicitation by Acquiror |

71 | ||||

| Section 8.5. |

Acquiror Conduct of Business |

72 | ||||

| Section 8.6. |

Post-Closing Directors and Officers of Acquiror |

73 | ||||

| Section 8.7. |

Indemnification and Insurance |

73 | ||||

| Section 8.8. |

Acquiror Public Filings |

75 | ||||

| Section 8.9. |

PIPE Subscriptions |

75 | ||||

| ARTICLE IX JOINT COVENANTS | 75 | |||||

| Section 9.1. |

HSR Act; Other Filings |

75 | ||||

| Section 9.2. |

Preparation of Proxy Statement/Registration Statement; Shareholders’ Meeting and Approvals |

76 | ||||

| Section 9.3. |

Support of Transaction |

79 | ||||

| Section 9.4. |

Tax Matters |

80 | ||||

| Section 9.5. |

Section 16 Matters |

80 | ||||

| Section 9.6. |

Cooperation; Consultation |

80 | ||||

| Section 9.7. |

Transaction Litigation |

80 | ||||

| ARTICLE X CONDITIONS TO OBLIGATIONS | 81 | |||||

| Section 10.1. |

Conditions to Obligations of Acquiror, Merger Sub, and the Company |

81 | ||||

| Section 10.2. |

Conditions to Obligations of Acquiror and Merger Sub |

81 | ||||

| Section 10.3. |

Conditions to Obligation of the Company |

83 | ||||

| Section 10.4. |

Frustration of Conditions |

83 | ||||

| ARTICLE XI TERMINATION/EFFECTIVENESS | 83 | |||||

| Section 11.1. |

Termination |

83 | ||||

| Section 11.2. |

Effect of Termination |

85 | ||||

-iii-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| ARTICLE XII MISCELLANEOUS | 85 | |||||

| Section 12.1. |

Trust Account Waiver |

85 | ||||

| Section 12.2. |

Notices |

86 | ||||

| Section 12.3. |

Assignment |

87 | ||||

| Section 12.4. |

Rights of Third Parties |

87 | ||||

| Section 12.5. |

Expenses |

87 | ||||

| Section 12.6. |

Governing Law |

87 | ||||

| Section 12.7. |

Counterparts |

87 | ||||

| Section 12.8. |

Company and Acquiror Disclosure Letters |

87 | ||||

| Section 12.9. |

Entire Agreement |

87 | ||||

| Section 12.10. |

Amendments |

88 | ||||

| Section 12.11. |

Waivers |

88 | ||||

| Section 12.12. |

Confidentiality; Publicity. |

88 | ||||

| Section 12.13. |

Severability |

89 | ||||

| Section 12.14. |

Jurisdiction; Waiver of Jury Trial. |

89 | ||||

| Section 12.15. |

Enforcement |

89 | ||||

| Section 12.16. |

Non-Recourse |

89 | ||||

| Section 12.17. |

Non-Survival of Representations, Warranties and Covenants |

90 | ||||

| Section 12.18. |

Conflicts and Privilege |

90 | ||||

EXHIBITS

| Exhibit A | Form of Certificate of Incorporation of Acquiror upon Domestication | |

| Exhibit B | Form of Bylaws of Acquiror upon Domestication | |

| Exhibit C | Form of Company Stockholder Support Agreement | |

| Exhibit D | Sponsor Support Agreement | |

| Exhibit E | Form of Registration Rights Agreement | |

| Exhibit F | Form of Certificate of Merger | |

| Exhibit G | Form of Certificate of Incorporation of Surviving Company | |

| Exhibit H | Form of Bylaws of Surviving Company |

-iv-

AGREEMENT AND PLAN OF MERGER

This Agreement and Plan of Merger, dated as of May 11, 2021 (this “Agreement”), is made and entered into by and among Soaring Eagle Acquisition Corp., a Cayman Islands exempted company limited by shares (which shall domesticate as a Delaware corporation in connection with the consummation of the transactions contemplated hereby) (together with its successor, “Acquiror”), SEAC Merger Sub Inc., a Delaware corporation and a direct, wholly owned subsidiary of Acquiror (“Merger Sub”), and Ginkgo Bioworks, Inc., a Delaware corporation (the “Company”). Acquiror, Merger Sub and the Company are sometimes collectively referred to herein as the “Parties”, and each of them is sometimes individually referred to herein as a “Party”. Certain terms used in this Agreement have the respective meanings ascribed to them in Section 1.1.

RECITALS

WHEREAS, Acquiror is a blank check company incorporated for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses;

WHEREAS, Merger Sub is a newly formed, direct, wholly owned subsidiary of Acquiror incorporated for the purpose of effecting the Merger;

WHEREAS, subject to the conditions set forth in this Agreement, prior to the Closing, Acquiror will change its jurisdiction of incorporation from the Cayman Islands to the State of Delaware by effecting the Domestication in accordance with the applicable provisions of the Delaware General Corporation Law (the “DGCL”) and the Cayman Islands Companies Act (the “Companies Act”);

WHEREAS, in connection with the Domestication, Acquiror will amend and restate its Governing Documents by (a) adopting and filing with the Delaware Secretary of State a certificate of incorporation substantially in the form attached to this Agreement as Exhibit A (the “Acquiror Delaware Charter”), which will, among other things, implement a dual-class stock structure wherein Acquiror’s common stock will consist of Acquiror Delaware Class A Shares, which will entitle the holders thereof to one vote per share on all voting matters, and Acquiror Delaware Class B Shares, which will carry economic rights (including dividend and liquidation rights) identical to those carried by the Acquiror Delaware Class A Shares but will entitle the holders thereof to ten votes per share on all voting matters (the “Dual-Class Stock Structure”), and (b) adopting bylaws substantially in the form attached to this Agreement as Exhibit B (the “Acquiror Delaware Bylaws”);

WHEREAS, at the Domestication Effective Time, by virtue of the Domestication, (a) each Acquiror Cayman Class B Share that is issued and outstanding immediately prior to the Domestication Effective Time will convert automatically, on a one-for-one basis, into an Acquiror Cayman Class A Share, (b) immediately following the conversion described in the preceding clause (a), each Acquiror Cayman Class A Share that is then issued and outstanding will convert automatically, on a one-for-one basis, into an Acquiror Delaware Class A Share, (c) each Acquiror Cayman Warrant that is issued and outstanding immediately prior to the Domestication Effective Time will convert automatically, on a one-for-one basis, into an Acquiror Delaware Warrant and (d) each Acquiror Cayman Unit that is issued and outstanding immediately prior to the Domestication Effective Time will convert automatically into one Acquiror Delaware Class A Share and one-fifth of one Acquiror Delaware Warrant;

WHEREAS, prior to the Closing, in order to facilitate the consummation of the transactions contemplated hereby (including the Merger and the implementation of the Dual-Class Stock Structure), the Company will be recapitalized such that, immediately prior to the Merger Effective Time, the Company’s authorized capital stock shall consist solely of Company Class A Shares and Company Class B Shares (the “Company Recapitalization”);

WHEREAS, after the Domestication Effective Time and prior to the Merger Effective Time, on the terms and subject to the conditions set forth in the Subscription Agreements, the PIPE Investors will purchase from Acquiror in a private placement certain Acquiror Delaware Class A Shares for an aggregate purchase price equal to the PIPE Investment Amount (the “PIPE Investment”);

WHEREAS, at the Merger Effective Time, on the terms and subject to the conditions set forth in this Agreement and in accordance with the applicable provisions of the DGCL, Merger Sub will be merged with and into the Company (the “Merger”), whereupon the separate corporate existence of Merger Sub will cease and the Company will continue as the surviving corporation in the Merger (the “Surviving Corporation”) and will be a wholly owned subsidiary of Acquiror;

WHEREAS, at the Merger Effective Time, by virtue of the Merger, (a) each Company Class A Share that is issued and outstanding immediately prior to the Merger Effective Time will be converted into the right to receive, on the terms and subject to the conditions set forth in this Agreement, the Standard Per Share Equity Value Consideration and, subject to the vesting and forfeiture conditions specified in Section 4.6, the Standard Per Share Earn-out Consideration and (b) each Company Class B Share that is issued and outstanding immediately prior to the Merger Effective Time will be converted into the right to receive, on the terms and subject to the conditions set forth in this Agreement, the Employee Per Share Equity Value Consideration and, subject to the vesting and forfeiture conditions specified in Section 4.6, the Employee Per Share Earn-out Consideration;

WHEREAS, each of the Parties intends that, for U.S. federal income tax purposes, the Merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Code and the Treasury Regulations, to which each of Acquiror, Merger Sub and the Company are to be parties under Section 368(b) of the Code, this Agreement is intended to constitute a “plan of reorganization” within the meaning of Section 368 of the Code and the Treasury Regulations and the Merger and the PIPE Investment, taken together, shall constitute a transaction that qualifies under Section 351 of the Code;

WHEREAS, the board of directors of the Company (the “Company Board”) has (a) determined that it is in the best interests of the Company and the Company Stockholders, and declared it advisable, for the Company to enter into this Agreement and each Ancillary Agreement to which the Company is, or is contemplated to be, a party, (b) approved the Company’s execution and delivery of, and performance of its obligations under, this Agreement and each Ancillary Agreement to which the Company is, or is contemplated to be, a party and the transactions contemplated hereby and thereby (including the Company Recapitalization and the Merger), on the terms and subject to the conditions set forth herein and therein, and (c) adopted a resolution recommending the approval and (as applicable) adoption of this Agreement and each Ancillary Agreement to which the Company is, or is contemplated to be, a party and the transactions contemplated hereby and thereby (including the Company Recapitalization and the Merger), on the terms and subject to the conditions set forth herein and therein, by the Company Stockholders (the determinations, approvals and other actions described in each of the foregoing clauses (a), (b) and (c), the “Company Board Actions”);

WHEREAS, the board of directors of Acquiror (the “Acquiror Board”) has (a) determined that it is in the best interests of Acquiror and the Acquiror Shareholders, and declared it advisable, for Acquiror to enter into this Agreement and each Ancillary Agreement to which Acquiror is, or is contemplated to be, a party, (b) approved the transactions contemplated hereby as a Business Combination and approved Acquiror’s execution and delivery of, and performance of its obligations under, this Agreement and each Ancillary Agreement to which Acquiror is, or is contemplated to be, a party and the transactions

2

contemplated hereby and thereby (including the Domestication and the Merger), on the terms and subject to the conditions set forth herein and therein, and (c) adopted a resolution recommending the approval and (as applicable) adoption of this Agreement and each Ancillary Agreement to which Acquiror is, or is contemplated to be, a party and the transactions contemplated hereby and thereby (including the Domestication, the PIPE Investment and the Merger), on the terms and subject to the conditions set forth herein and therein, by the Acquiror Shareholders (the determinations, approvals and other actions described in each of the foregoing clauses (a), (b) and (c), the “Acquiror Board Actions”);

WHEREAS, the board of directors of Merger Sub has (a) determined that it is in the best interests of Merger Sub and its sole stockholder, and declared it advisable, for Merger Sub to enter into this Agreement and each Ancillary Agreement to which Merger Sub is, or is contemplated to be, a party, (b) approved Merger Sub’s execution and delivery of, and performance of its obligations under, this Agreement and each Ancillary Agreement to which Merger Sub is, or is contemplated to be, a party and the transactions contemplated hereby and thereby (including the Merger), on the terms and subject to the conditions set forth herein and therein, and (c) adopted a resolution recommending the approval and (to the extent applicable) adoption of this Agreement and each Ancillary Agreement to which Merger Sub is, or is contemplated to be, a party and the transactions contemplated hereby and thereby (including the Merger), on the terms and subject to the conditions set forth herein and therein, by Merger Sub’s sole stockholder;

WHEREAS, concurrently with the Parties’ execution and delivery of this Agreement, and as a condition and inducement to Acquiror’s willingness to enter into this Agreement, each of the Supporting Company Stockholders has entered into a support agreement substantially in the form attached to this Agreement as Exhibit C (each, a “Company Stockholder Support Agreement”) with the Company, pursuant to which, among other things, such Supporting Company Stockholder has agreed, on the terms and subject to the conditions set forth therein, to vote all of its Company Shares, promptly after the Registration Statement is declared effective under the Securities Act, in favor of the approval and (to the extent applicable) adoption of this Agreement, each applicable Ancillary Agreement, the transactions contemplated hereby and thereby (including the Merger) and each other matter required to be approved or adopted by the Company Stockholders in order to effect the Merger and the other transactions contemplated hereby;

WHEREAS, Acquiror, as the sole stockholder of Merger Sub, has approved and adopted this Agreement and each applicable Ancillary Agreement and has approved the consummation of the transactions contemplated hereby and thereby;

WHEREAS, concurrently with the Parties’ execution and delivery of this Agreement, and as a condition and inducement to the Company’s willingness to enter into this Agreement, the Sponsor, which is the record holder of the issued and outstanding Acquiror Cayman Class B Shares, and certain principals thereof have entered into the support agreement attached to this Agreement as Exhibit D (the “Sponsor Support Agreement”) with Acquiror and the Company, pursuant to which, among other things, the Sponsor and such principals have agreed, on the terms and subject to the conditions set forth therein, (a) to vote all of their Acquiror Shares in favor of the approval and (to the extent applicable) adoption of this Agreement, each applicable Ancillary Agreement, the transactions contemplated hereby and thereby (including the Domestication and the Merger) and each other matter required to be approved or adopted by the Acquiror Shareholders in order to effect the Merger and the other transactions contemplated hereby, (b) to irrevocably waive any anti-dilution right or other protection with respect to the Acquiror Cayman Class B Shares that would result in the Acquiror Cayman Class B Shares converting into other Acquiror Shares in connection with any of the transactions contemplated by this Agreement at a ratio greater than one-for-one, (c) to forfeit a specified portion of the aggregate number of Acquiror Shares into which the Acquiror Cayman Class B Shares otherwise would automatically convert in connection with the consummation of the transactions contemplated by this Agreement in the event that the Acquiror Share Redemption Amount exceeds a specified threshold and (d) to subject a portion of their Equity Securities of Acquiror to certain vesting and forfeiture conditions;

3

WHEREAS, in connection with obtaining the Acquiror Shareholder Approval, each eligible Acquiror Shareholder will be entitled to request that Acquiror redeem all or a portion of such eligible Acquiror Shareholder’s Acquiror Cayman Class A Shares for a pro rata portion of the amount on deposit in the Trust Account; and

WHEREAS, at the Closing, Acquiror and certain stockholders of Acquiror (after giving effect to the Domestication and the Merger) will enter into a registration rights agreement substantially in the form attached to this Agreement as Exhibit E (the “Registration Rights Agreement”), which shall be effective as of the Closing.

NOW, THEREFORE, in consideration of the foregoing and the representations, warranties, covenants and agreements set forth in this Agreement, the Parties, intending to be legally bound, agree as follows:

ARTICLE I

CERTAIN DEFINITIONS

Section 1.1. Definitions. As used in this Agreement, the following terms shall have the following meanings:

“2019 Audited Financial Statements” has the meaning specified in Section 5.8(a).

“2020 Audited Financial Statements” has the meaning specified in Section 7.3.

“2020 Unaudited Financial Statements” has the meaning specified in Section 5.8(a).

“Acquiror” has the meaning specified in the Preamble hereto.

“Acquiror Board” has the meaning specified in the Recitals hereto.

“Acquiror Board Actions” has the meaning specified in the Recitals hereto.

“Acquiror Cayman Class A Share” means a Class A ordinary share, par value $0.0001 per share, of Acquiror prior to the Domestication Effective Time.

“Acquiror Cayman Class B Share” means a Class B ordinary share, par value $0.0001 per share, of Acquiror prior to the Domestication Effective Time.

“Acquiror Cayman Ordinary Share” means any Acquiror Cayman Class A Share or the Acquiror Cayman Class B Share.

“Acquiror Cayman Share” means any Acquiror Cayman Class A Share, Acquiror Cayman Class B Share or share of any other class or series of capital stock of Acquiror prior to the Domestication Effective Time.

“Acquiror Cayman Unit” means a unit of Acquiror prior to the Domestication Effective Time, consisting of one Acquiror Cayman Class A Share and one-fifth of one Acquiror Cayman Warrant.

4

“Acquiror Cayman Warrant” means a warrant to purchase one Acquiror Cayman Class A Share at an exercise price of $11.50 per share (subject to adjustment as provided in the Warrant Agreement).

“Acquiror Closing Cash Amount” means an amount, calculated as of the Closing, equal to the sum of (a) the amount of cash available in the Trust Account after deducting the Acquiror Share Redemption Amount (but prior to payment of any Acquiror Transaction Expenses or Company Transaction Expenses), plus (b) the PIPE Investment Amount, to the extent actually received by Acquiror, the Company or any of their respective Subsidiaries substantially concurrently with the Closing and held by Acquiror as of the Closing plus (c) the portion of the Net Ancillary Investment Amount, if any, resulting from Ancillary Investments arranged solely by Acquiror or any of its Representatives acting on its behalf (and not arranged by the Company or any of its Representatives acting on its behalf).

“Acquiror Delaware Bylaws” has the meaning specified in the Recitals hereto.

“Acquiror Delaware Charter” has the meaning specified in the Recitals hereto.

“Acquiror Delaware Class A Share” means a share of Class A common stock, par value $0.0001 per share, of Acquiror at or after the Domestication Effective Time, which, as of immediately after the Domestication Effective Time and as of immediately after the Merger Effective Time, will entitle the holder thereof to one vote per share on all voting matters.

“Acquiror Delaware Class B Share” means a share of Class B common stock, par value $0.0001 per share, of Acquiror at or after the Domestication Effective Time, which, as of immediately after the Domestication Effective Time and as of immediately after the Merger Effective Time, will entitle the holder thereof to ten votes per share on all voting matters.

“Acquiror Delaware Common Share” means any Acquiror Delaware Class A Share, Acquiror Delaware Class B Share or share of any other class or series of common stock of Acquiror at or after the Domestication Effective Time.

“Acquiror Delaware Share” means any Acquiror Delaware Common Share or share of any other class or series of capital stock of Acquiror at or after the Domestication Effective Time.

“Acquiror Delaware Warrant” means a warrant to purchase one Acquiror Delaware Class A Share at an exercise price of $11.50 per share (subject to adjustment as provided in the Warrant Agreement).

“Acquiror Disclosure Letter” has the meaning specified in the introduction to Article VI.

“Acquiror Financial Statements” has the meaning specified in Section 6.7(d).

“Acquiror Indemnified Parties” has the meaning specified in Section 8.7(a).

“Acquiror Inception Date” means October 22, 2020.

“Acquiror Insider” means (a) the Sponsor, (b) any Related Person of the Sponsor or (c) prior to the Merger Effective Time, (i) any Affiliate of Acquiror or (ii) any director or officer of Acquiror or any of its Affiliates.

“Acquiror IPO Date” means February 26, 2021.

“Acquiror Option” has the meaning specified in Section 4.5(a).

5

“Acquiror Private Placement Warrant” means an Acquiror Cayman Warrant issued to the Sponsor substantially concurrently with Acquiror’s initial public offering or any Acquiror Delaware Warrant into which such Acquiror Cayman Warrant has been converted or for which such Acquiror Cayman Warrant has been exchanged.

“Acquiror Public Warrant” means any Acquiror Warrant other than an Acquiror Private Placement Warrant.

“Acquiror Restricted Stock Award” has the meaning specified in Section 4.5(b).

“Acquiror Restricted Stock Unit Award” has the meaning specified in Section 4.5(b).

“Acquiror Sale” means (a) any transaction or series of related transactions (whether by merger, consolidation, tender offer, exchange offer, stock transfer or otherwise) that results in any Third-Party Purchaser acquiring beneficial ownership of Equity Securities of Acquiror that represent more than 50% of (i) the issued and outstanding Acquiror Delaware Class A Shares or (ii) the combined voting power of the then-outstanding voting Equity Securities of Acquiror or (b) any sale, transfer or other disposition to a Third-Party Purchaser of all or more than 50% of the assets (by value), or assets generating at least 50% of the gross revenues or net income, of Acquiror and its Subsidiaries on a consolidated basis (other than any sale, transfer or other disposition of property or assets in the ordinary course of business). For clarity, the preceding clause (a) shall include any merger or consolidation of Acquiror with any Person if immediately after the consummation of such merger or consolidation, the Acquiror Delaware Class A Shares outstanding immediately prior to such merger or consolidation do not continue to represent, or are not converted into, voting securities representing in the aggregate more than 50% of the combined voting power of all of the outstanding voting securities (other than the successor security to Acquiror Delaware Class B Shares) of the Person resulting from such merger or consolidation or, if the surviving company is a subsidiary, the ultimate parent company thereof.

“Acquiror Sale Price” means the price per Acquiror Delaware Class A Share paid or payable to the holders of outstanding Acquiror Common Shares (determined without giving effect to the vesting contemplated by Section 4.6(g)) in an Acquiror Sale, inclusive of any escrows, holdbacks or fixed deferred purchase price, but exclusive of any contingent deferred purchase price, earnouts or the like; provided that, if and to the extent such price is payable in whole or in part in the form of consideration other than cash, the price for such non-cash consideration shall be (a) with respect to any securities, (i) the average of the closing prices of the sales of such securities on all securities exchanges on which such securities are then listed, averaged over a period of 21 days consisting of the day as of which such value is being determined and the 20 consecutive Business Days preceding such day, or (ii) if the information contemplated by the preceding clause (i) is not practically available, then the fair value of such securities as of the date of valuation as determined in accordance with the succeeding clause (b), and (b) with respect to any other non-cash assets, the fair value thereof as of the date of valuation, as determined by an independent, nationally recognized investment banking firm mutually selected by Acquiror and the holders of a majority of the Acquiror Delaware Class B Shares, on the basis of an orderly sale to a willing, unaffiliated buyer in an arm’s-length transaction, taking into account all factors determinative of value as the investment banking firm determines relevant (and giving effect to any transfer Taxes payable in connection with such sale).

“Acquiror SEC Filings” has the meaning specified in Section 6.6.

“Acquiror Share” means any Acquiror Cayman Share or any Acquiror Delaware Share.

6

“Acquiror Share Redemption” means the election, in connection with the Acquiror Shareholder Approval, of an eligible (as determined in accordance with Article 51.5 of Acquiror’s Governing Documents as in effect on the date hereof) Acquiror Shareholder to have all or a portion of the Acquiror Cayman Class A Shares or Acquiror Delaware Class A Shares, as the case may be, held by such Acquiror Shareholder redeemed by Acquiror, on the terms and subject to the limitations and conditions set forth in Acquiror’s Governing Documents, at a per-share price, payable in cash, equal to the quotient of (a) the aggregate amount on deposit in the Trust Account (including interest earned on funds held in the Trust Account and not previously released to Acquiror to pay taxes) calculated as of two Business Days prior to the Closing Date divided by (b) the aggregate number of Acquiror Cayman Class A Shares or Acquiror Delaware Class A Shares, as the case may be, then issued.

“Acquiror Share Redemption Amount” means the aggregate amount paid or payable in connection with all Acquiror Share Redemptions.

“Acquiror Shareholder” means any shareholder of Acquiror prior to the Merger Effective Time.

“Acquiror Shareholder Approval” means the approval of (a) the Transaction Proposal identified in clause (A) of Section 9.2(c) by an affirmative vote of the holders of at least two-thirds of the outstanding Acquiror Cayman Class B Shares entitled to vote, who attend and vote thereupon (as determined in accordance with Acquiror’s Governing Documents) at a shareholders’ meeting duly called by the Board of Directors of Acquiror and held for such purpose, (b) those Transaction Proposals identified in clauses (B) and (C) of Section 9.2(c), in each case, by an affirmative vote of the holders of at least two-thirds of the outstanding Acquiror Cayman Ordinary Shares entitled to vote, who attend and vote thereupon (as determined in accordance with Acquiror’s Governing Documents) at a shareholders’ meeting duly called by the Board of Directors of Acquiror and held for such purpose and (c) those Transaction Proposals identified in clauses (D), (E), (F), (G), (H), (I), (J), and (K) of Section 9.2(c), in each case, by an affirmative vote of the holders of at least a majority of the outstanding Acquiror Cayman Ordinary Shares entitled to vote, who attend and vote thereupon (as determined in accordance with Acquiror’s Governing Documents), in each case, at an Acquiror Shareholders’ Meeting duly called by the Board of Directors of Acquiror and held for such purpose.

“Acquiror Shareholders’ Meeting” has the meaning specified in Section 9.2(c).

“Acquiror Trading Price” means, at any given time, the trading price per share of Acquiror Delaware Class A Common Shares as reported by Bloomberg or, if not available on Bloomberg, as reported by Morningstar.

“Acquiror Transaction Expenses” means the following out-of-pocket fees and expenses paid or payable by Acquiror (whether or not billed or accrued for) as a result of or in connection with its initial public offering or the negotiation, documentation and consummation of the transactions contemplated hereby: (a) all fees, costs, expenses, brokerage fees, commissions, finders’ fees and disbursements of financial advisors, investment banks, data room administrators, attorneys, accountants and other advisors and service providers, (b) 50% of all the filing fees incurred in connection with making any filings under Section 9.1, (c) all fees and expenses incurred in connection with effecting the Domestication, preparing and filing the Registration Statement, the Proxy Statement or the Proxy Statement/Registration Statement under Section 9.2, obtaining approval of Nasdaq or NYSE, as applicable, under Section 8.3(b) and obtaining the Acquiror Shareholder Approval, (d) obligations under any Working Capital Loans and (e) any deferred underwriting commissions and other fees and expenses relating to Acquiror’s initial public offering.

“Acquiror Warrant” means an Acquiror Cayman Warrant or an Acquiror Delaware Warrant (including any Acquiror Private Placement Warrant or Acquiror Public Warrant).

7

“Acquiror Warrantholder Approval” means the approval of the Acquiror Warrant Proposal by an affirmative vote of the holders of (a) at least 50% of the outstanding Acquiror Public Warrants and (b) at least 50% of the outstanding Acquiror Private Placement Warrants.

“Acquiror Warrant Proposal” has the meaning specified in Section 9.2(b).

“Acquisition Proposal” means (a) any offer, inquiry, proposal or indication of interest (whether written or oral, and whether binding or non-binding), other than with respect to the transactions contemplated by this Agreement (including the Company Recapitalization and the Merger), and other than with respect to any acquisition or disposition of property or assets in the ordinary course of business, relating to (i) any acquisition, issuance or purchase, direct or indirect, of (A) 15% or more of the consolidated assets (by value), or assets generating 15% or more of the consolidated revenues or net income, of the Company and its Subsidiaries or (B) 15% or more of any class or series of Equity Securities of (x) the Company or (y) any Subsidiary of the Company holding assets constituting, individually or in the aggregate, 15% or more of the consolidated assets (by value), or assets generating 15% or more of the consolidated revenues or net income, of the Company and its Subsidiaries, (ii) any tender offer or exchange offer that, if consummated, would result in any Person or group beneficially owning (within the meaning of Rule 13d-3 promulgated under the Exchange Act) 15% or more of any class of Equity Securities or voting securities of (A) the Company or (B) any Subsidiary of the Company holding assets constituting, individually or in the aggregate, 15% or more of the consolidated assets (by value), or assets generating 15% or more of the consolidated revenues or net income, of the Company and its Subsidiaries or (iii) a merger, consolidation, share exchange, business combination, sale of substantially all the assets, reorganization, recapitalization, liquidation, dissolution or other similar transaction involving (A) the Company or (B) any Subsidiary of the Company holding assets constituting, individually or in the aggregate, 15% or more of the consolidated assets (by value), or assets generating 15% or more of the consolidated revenues or net income, of the Company and its Subsidiaries, and of which the Company or its applicable Subsidiary is not the surviving entity or (b) any initial public offering or direct listing of the Company on any stock exchange.

“Action” means any claim, action, suit, audit, examination, assessment, arbitration, mediation or inquiry, or any proceeding or investigation, by or before any Governmental Authority.

“Affiliate” means, with respect to any specified Person, any other Person that, directly or indirectly, controls, is controlled by, or is under common control with, such specified Person, whether through one or more intermediaries or otherwise. The term “control” (including the terms “controlling”, “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by Contract or otherwise.

“Affiliate Agreements” has the meaning specified in Section 5.13(a)(vii).

“Aggregate Assumed Warrant Exercise Price” means the aggregate exercise price that would be paid to the Company in respect of all Assumed Warrants if all such Assumed Warrants were exercised in full on a cash basis immediately prior to the Merger Effective Time (without giving effect to any net exercise or similar concept).

“Aggregate Company Option Exercise Price” means the aggregate exercise price that would be paid to the Company in respect of all in-the-money Company Options that are Included Company Equity Awards if all such Company Options were exercised in full on a cash basis immediately prior to the Merger Effective Time (without giving effect to any net exercise or similar concept).

8

“Aggregate Equity Value” means an amount equal to the sum of (a) the Base Equity Value plus (b) the Aggregate Company Option Exercise Price plus (c) the Aggregate Assumed Warrant Exercise Price plus (d) the Excess Acquiror Transaction Expenses Amount.

“Aggregate Equity Value Consideration” means a number of Acquiror Delaware Common Shares equal to the quotient of (a) the Aggregate Equity Value divided by (b) $10.00.

“Aggregate Earn-out Consideration” means 180,000,000 restricted Acquiror Delaware Common Shares.

“Agreement” has the meaning specified in the Preamble hereto.

“Ancillary Agreements” means the Sponsor Support Agreement, the Company Stockholder Support Agreements, the Acquiror Delaware Charter, the Acquiror Delaware Bylaws, and the Registration Rights Agreement.

“Ancillary Investment” has the meaning ascribed to such term in the Sponsor Support Agreement.

“Anti-Bribery Laws” means the anti-bribery provisions of the Foreign Corrupt Practices Act of 1977 and all other applicable anti-corruption and bribery Laws (including the U.K. Bribery Act 2010, and any rules or regulations promulgated thereunder or other Laws of other countries implementing the OECD Convention on Combating Bribery of Foreign Officials).

“Anti-Money Laundering Laws” means all applicable Laws related to the prevention of money laundering, including the U.S. Money Laundering Control Act of 1986, the U.S. Currency and Foreign Transactions Reporting Act of 1970 (commonly referred to as the “U.S. Bank Secrecy Act”) and similar Laws in other applicable jurisdictions.

“Antitrust Authorities” means the Antitrust Division of the U.S. Department of Justice, the U.S. Federal Trade Commission or the antitrust or competition Law authorities of any other jurisdiction (whether United States, foreign or multinational).

“Antitrust Information or Document Request” means any request or demand for the production, delivery or disclosure of documents or other evidence, or any request or demand for the production of witnesses for interviews or depositions or other oral or written testimony, by any Antitrust Authority relating to the transactions contemplated hereby.

“Applicable Earn-out Consideration” means (a) the Standard Per Share Earn-out Consideration, (b) the Employee Per Share Earn-out Consideration, (c) the Option Earn-out Shares and/or (d) the RSU Earn-out Shares, as applicable.

“Applicable Earn-out Recipient” means any Person entitled to any Applicable Earn-out Consideration.

“Base Equity Value” means $15,000,000,000.

“Business Combination” has the meaning set forth in Article 1.1 of Acquiror’s Governing Documents as in effect on the date hereof.

“Business Combination Deadline Date” means August 26, 2023, the deadline for consummating Acquiror’s initial Business Combination pursuant to Acquiror’s Governing Documents.

9

“Business Combination Proposal” means any offer, inquiry, proposal or indication of interest (whether written or oral, and whether binding or non-binding), other than with respect to the transactions contemplated hereby, relating to a Business Combination.

“Business Day” means any day other than a Saturday, a Sunday or another day on which commercial banks in New York, New York are authorized or required by Law to close.

“Cayman Registrar” means the Register of Companies in the Cayman Islands.

“Certificate of Domestication” has the meaning specified in Section 2.1(a).

“Certificate of Merger” has the meaning specified in Section 2.4.

“Closing” has the meaning specified in Section 3.1.

“Closing Company Financial Statements” has the meaning specified in Section 7.3.

“Closing Date” has the meaning specified in Section 3.1.

“Code” means the Internal Revenue Code of 1986.

“Companies Act” has the meaning specified in the Recitals hereto.

“Company” has the meaning specified in the Preamble hereto.

“Company Benefit Plan” has the meaning specified in Section 5.14(a).

“Company Board” has the meaning specified in the Recitals hereto.

“Company Board Actions” has the meaning specified in the Recitals hereto.

“Company Class A Share” means a share of Class A common stock, par value $0.0001 per share, of the Company, which, as of immediately after the Company Recapitalization, will entitle the holder thereof to one vote per share on all voting matters.

“Company Class B Share” means a share of Class B common stock, par value $0.0001 per share, of the Company, which, as of immediately after the Company Recapitalization, will entitle the holder thereof to ten votes per share on all voting matters.

“Company Common Share” means any share of any class or series of common stock of the Company, including, after the Company Recapitalization, any Company Class A Share or Company Class B Share.

“Company Disclosure Letter” has the meaning specified in the introduction to Article V.