Form 8-K Santander Holdings USA, For: Aug 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 5, 2022

(Exact name of registrant as specified in its charter)

| (State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||||||||

Registrant's telephone number, including area code: (617 ) 346-7200

| N/A | ||

| (Former name or former address if changed since last report.) | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbols | Name of each exchange on which registered | ||||||

| Not applicable | ||||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 2.02 Results of Operations and Financial Condition

Item 7.01 Regulation FD Disclosure

Santander Holdings USA, Inc. (the “Company”) is furnishing copies of slides which will be used in connection with presentations on one or more occasions. The presentation materials are attached hereto as Exhibit 99.1 and incorporated herein solely for purposes of Items 2.02 and 7.01.

The information contained in the attached presentation materials is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission filings and other public announcements. The Company undertakes no duty or obligation to publicly update or revise this information, although it may do so from time to time.

The information in Items 2.02 and 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities under that Section. Further, the information in Items 2.02 and 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933. Item 7.01 of this Current Report on Form 8-K will not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 104 | Cover page formatted as Inline XBRL and contained in Exhibit 101 | |||||||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 5, 2022 | SANTANDER HOLDINGS USA, INC. By:/s/ Gerard A. Chamberlain Name: Gerard A. Chamberlain Title: Senior Deputy General Counsel and Executive Vice President | ||||

1 August 5, 2022 SANTANDER HOLDINGS USA, INC. Second Quarter 2022 Fixed Income Investor Presentation

2 Important Information This presentation of Santander Holdings USA, Inc. (“SHUSA”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and future performance of SHUSA. Words such as “may,” “could,” “should,” “will,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “goal” or similar expressions are intended to indicate forward-looking statements. In this presentation, we may sometimes refer to certain non-GAAP figures or financial ratios to help illustrate certain concepts. These ratios, each of which is defined in this document, if utilized, may include Pre- Tax Pre- Provision Income, the Tangible Common Equity to Tangible Assets Ratio, and the Texas Ratio. This information supplements our results as reported in accordance with generally accepted accounting principles (“GAAP”) and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this additional information and the reconciliations we provide may be useful to investors, analysts, regulators and others as they evaluate the impact of these items on our results for the periods presented due to the extent to which the items are indicative of our ongoing operations. Where applicable, we provide GAAP reconciliations for such additional information. SHUSA’s subsidiaries include Banco Santander International (“BSI”), Santander Investment Securities Inc. (“SIS”), Santander Securities LLC (“SSLLC”), Amherst Pierpont Securities, LLC (“APS”), Santander Financial Services, Inc. (“SFS”), and Santander Asset Management, LLC, as well as several other subsidiaries. Although SHUSA believes that the expectations reflected in these forward-looking statements are reasonable as of the date on which the statements are made, these statements are not guarantees of future performance and involve risks and uncertainties based on various factors and assumptions, many of which are beyond SHUSA’s control. Among the factors that could cause SHUSA’s financial performance to differ materially from that suggested by forward-looking statements are: (1) the effects of regulation, actions and/or policies of the Board of Governors of the Federal Reserve System (“Federal Reserve”), the Federal Deposit Insurance Corporation (the "FDIC"), the Office of the Comptroller of the Currency and the Consumer Financial Protection Bureau, and other changes in monetary and fiscal policies and regulations, including policies that affect market interest rates and money supply as well as in the impact of changes in and interpretations of GAAP, the failure to adhere to which could subject SHUSA and/or its subsidiaries to formal or informal regulatory compliance and enforcement actions and result in fines, penalties, restitution and other costs and expenses, changes in our business practice, and reputational harm; (2) SHUSA’s ability to manage credit risk may increase to the extent our loans are concentrated by loan type, industry segment, borrower type or location of the borrower or collateral, and changes in the credit quality of SHUSA’s customers and counterparties; (3) adverse economic conditions in the United States and worldwide, including the extent of recessionary conditions in the U.S. related to COVID-19 and the strength of the U.S. economy in general and regional and local economies in which SHUSA conducts operations in particular, which may affect, among other things, the level of non-performing assets, charge-offs, and credit loss expense; (4) inflation, interest rate, market and monetary fluctuations, including effects from the discontinuation of the London Interbank Offered Rate (“LIBOR”) as an interest rate benchmark, may, among other things, reduce net interest margins, and impact funding sources, revenue and expenses, the value of assets and obligations, and the ability to originate and distribute financial products in the primary and secondary markets; (5) the adverse impact of COVID-19 on our business, financial condition, liquidity, reputation and results of operations; (6) natural or man-made disasters, including pandemics and other significant public health emergencies, outbreaks of hostilities or effects of climate change, and SHUSA’s ability to deal with disruptions caused by such disasters and emergencies; (7) the pursuit of protectionist trade or other related policies, including tariffs and sanctions by the U.S., its global trading partners, and/or other countries, and/or trade disputes generally; (8) adverse movements and volatility in debt and equity capital markets and adverse changes in the securities markets, including those related to the financial condition of significant issuers in SHUSA’s investment portfolio; (9) risks SHUSA faces implementing its growth strategy, including SHUSA's ability to grow revenue, manage expenses, attract and retain highly-skilled people and raise capital necessary to achieve its business goals and comply with regulatory requirements; (10) SHUSA’s ability to effectively manage its capital and liquidity, including approval of its capital plans by its regulators and its subsidiaries’ ability to continue to pay dividends to it; (11) reduction in SHUSA’s access to funding or increases in the cost of its funding, such as in connection with changes in credit ratings assigned to SHUSA or its subsidiaries, or a significant reduction in customer deposits; (12) the ability to manage risks inherent in our businesses, including through effective use of systems and controls, insurance, derivatives and capital management; (13) SHUSA’s ability to timely develop competitive new products and services in a changing environment that are responsive to the needs of SHUSA's customers and are profitable to SHUSA, the success of our marketing efforts to customers, and the potential for new products and services to impose additional unexpected costs, losses or other liabilities not anticipated at their initiation, and expose SHUSA to increased operational risk; (14) competitors of SHUSA may have greater financial resources or lower costs, or be subject to different regulatory requirements than SHUSA, may innovate more effectively, or may develop products and technology that enable those competitors to compete more successfully than SHUSA and cause SHUSA to lose business or market share and impact our net income adversely; (15) Santander Consumer USA Inc.’s (“SC’s”) agreement with FCA US LLC (“Stellantis”) may not result in currently anticipated levels of growth; (16) changes in customer spending, investment or savings behavior; (17) the ability of SHUSA and its third-party vendors to convert, maintain and upgrade, as necessary, SHUSA’s data processing and other information technology infrastructure on a timely and acceptable basis, within projected cost estimates and without significant disruption to our business; (18) SHUSA’s ability to control operational risks, data security breach risks and outsourcing risks, and the possibility of errors in quantitative models and software SHUSA uses in its business, including as a result of cyber-attacks, technological failure, human error, fraud or malice by internal or external parties, and the possibility that SHUSA’s controls will prove insufficient, fail or be circumvented; (19) changing federal, state, and local tax laws and regulations, which may include tax rates changes that could materially adversely affect our business, including changes to tax laws and regulations and the outcome of ongoing tax audits by federal, state and local income tax authorities that may require SHUSA to pay additional taxes or recover fewer overpayments compared to what has been accrued or paid as of period-end; (20) the costs and effects of regulatory or judicial actions or proceedings, including possible business restrictions resulting from such actions or proceedings; and (21) adverse publicity and negative public opinion, whether specific to SHUSA or regarding other industry participants or industry-wide factors, or other reputational harm; and (22) acts of terrorism or domestic or foreign military conflicts. In this regard, during the first quarter SHUSA assessed its exposure to clients in Russia and Belarus and does not believe it has any significant risk with respect to these clients; and (23) the other factors that are described in Part I, Item IA – Risk Factors of SHUSA’s Annual Report on Form 10-K for 2021. Because this information is intended only to assist investors, it does not constitute investment advice or an offer to invest, and in making this presentation available, SHUSA gives no advice and makes no recommendation to buy, sell, or otherwise deal in shares or other securities of Banco Santander, S.A. (“Santander”), SHUSA, Santander Bank, N.A. (“SBNA”), SC or any other securities or investments. It is not our intention to state, indicate, or imply in any manner that current or past results are indicative of future results or expectations. As with all investments, there are associated risks, and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal, evaluate independently the risks, consequences, and suitability of that investment. No offering of securities shall be made in the United States except pursuant to registration under the Securities Act of 1933, as amended, or an exemption therefrom.

3 1 At a Glance 2 Summary 3 Results 4 Appendix Index

4 Europe: 31% USA: 18% Mexico: 9% South America: 33% Digital Consumer Bank: 10% Europe: 58% USA: 11% Mexico: 4% South America : 15% Digital Consumer Bank: 12% Santander Group The United States is a core market for Santander, contributing 18% to 1H 2022 underlying attributable profit, down from record high levels 24% in 1H 2021. 1H 2022 loans & advances to customers1 Contribution to 1H 2022 underlying attributable profit2 Santander is a leading retail and commercial bank headquartered in Spain. It has a meaningful presence in 10 core markets in Europe and the Americas. €4.9B* Underlying Attributable Profit €1,015B* Total Gross Loans 3 1 2 Loans and advances to customers excluding reverse repurchase agreements As a % of operating areas. Excludes corporate center. Source: Santander’s 1H 2022 earnings presentation 3 Excludes other North America expenses * Figures in International Financial Reporting Standards (“IFRS”) 3 3

5 Q2 2022 Highlights Credit Performance Deposits & Originations Liquidity Reserves & Capital ► Deposits of $74B, down 6% QoQ ► Auto originations of $8.2B, up 9% QoQ ($2.6B in loans and leases through SBNA) ► Allowance ratio of 7.2%, stable QoQ ► Common equity Tier 1 (“CET1”) ratio of 16.9%, down 160 bps QoQ ► For the 2022 Supervisory Stress Test, SHUSA's minimum capital ratios under the Federal Reserve Board severely adverse scenario and ranked in the top quartile among participating banks ► Demonstrated continued market access during volatility; Issued $2.7B in ABS3, ~$500M prime auto loan credit-linked note (“CLN”), $500M 3nc2 public senior unsecured transaction and $434M of a privately placed 4nc3 senior unsecured transaction ► Met the Federal Reserve’s total loss absorbing capacity (“TLAC”) and long-term debt (“LTD”) requirements, with 23.5% TLAC, 6.6% eligible LTD ► Credit performance continues to normalize, but remains below pre-pandemic levels ► Consolidated net charge-off ratio stable QoQ ► In April, SC announced the amendment and extension of its agreement with Stellantis through 2025 ► In April, SHUSA acquired APS, a market-leading, independent fixed-income broker dealer, enhancing US fixed-income capital markets capabilities ► In June, SBNA announced the new Chief Consumer and Digital Transformation Officer role which will expand digital capabilities and enhance the experience for customers across the United States ► In June, San US Auto and Mitsubishi1 preferred financing partnership commenced Strategy Profitability ► Q2 profitability impacted by credit performance normalization and increased provisions ► Net income of $439M and PPNR2 of $950M, down 29% and 5% QoQ, respectively ► SHUSA paid $1.25B in dividend to Santander Group 1 2 3 Mitsubishi Motors North America, Inc. Pre-provision net revenue (“PPNR”) Asset-backed securities (“ABS”), Q2’22 transactions include one Santander Drive Auto Receivables Trust and one Santander Retail Auto Lease Trust transactions

6 1 At a Glance 2 Summary 3 Results 4 Appendix Index

7 SHUSA SHUSA Highlights 1 ~15,000 employees ~5M customers $165B in assets7 major locations SHUSA is the intermediate holding company (“IHC”) for Santander US entities, is SEC-registered and issues under the ticker symbol “SANUSA” SHUSA 2 SBNA – Retail Bank ~$94B Assets SC – Auto Finance ~$44B Assets BSI – Private Banking ~$8B Assets SIS – Broker Dealer ~$4B Assets Products include: • Commercial and industrial (“C&I”) • Commercial Real Estate (“CRE”) • Multi-family • Auto and dealer floorplan financing • Leading auto loan & lease originator & servicer • #1 retail auto ABS issuer 2021 in US • Private wealth management for high net worth (“HNW”) and ultra-high net worth clients Investment banking services include: • Global markets • Global transaction banking • Global debt financing • Corporate finance 1 Data as of June 30, 2022 2 Includes SSLLC, which offers personal investment & financial planning services to clients Santander Market-leading fixed-income broker dealer with capabilities including: • US fixed-income capital markets market making • Self-clearing of fixed-income securities globally • Expands the structuring and advisory capabilities for asset originators APS – Broker Dealer ~$15B Assets

8 Strategic focus Strategic focus CIB Consumer Commercial CIB Wealth Management Market-leading full spectrum auto lender and consumer finance franchise, funded by attractive consumer deposits Top 10 CRE and Multifamily lender Global hub for capital markets and investment banking Leading brand in LatAm HNW leveraging connectivity with Santander Assets ($BN) Income before tax ($MM) $48 $522 $4 1 Client assets and liabilities represents customer deposits and securities and loans and letters of credit. SHUSA Overview Q2 2022 $75 Income before tax ($MM) $84 $1,246 $16 $172 YTD $47 1 $75 $29 $25

9 Noninterest- bearing Demand, 12% Interest-bearing Demand, 8% Savings, 3% Money Market, 20% CDs, 1% Secured Structured Financing, 15% Other Borrowings, 10% Other Liabilities, 15% Equity, 13% Trading Liabilities, 1% Revolving Credit Facilities, 2% Auto Loans, 27% Auto Leases , 9% CRE, 10% C&I, 13% Residential, 5% Other Consumer Loans, 2% Investments, 14% Cash, 6% Goodwill and Other Intangibles, 2% Other Assets, 12% Balance Sheet Overview 1 Includes restricted cash and federal funds sold and securities purchased under resale agreements or similar arrangements 2 Operating leases 3 Includes federal funds purchased and securities loaned or sold under repurchase agreements 4 Includes Federal Home Loan Bank (“FHLB”) borrowings 5 Certificates of deposit $165B Assets $144B Liabilities $21B Equity 2 1 5 3 4

10 Balance Sheet Trends LOANS & LEASES ($B) LIABILITIES & EQUITY ($B)ASSETS ($B) DEPOSITS ($B) Deposits of $74B, down 9% YoY; loans and leases down 2% YoY 1 Other assets includes securities purchased under repurchase agreements 2 Other liabilities includes securities sold under repurchase agreements * ** Non-interest-bearing deposits Interest-bearing deposits * ** 1 2 s 43 43 43 43 44 24 23 23 22 21 16 16 15 15 15 16 15 15 15 16 10 9 9 9 9 2 2 2 3 4 $111 $108 $107 $107 $109 2Q21 3Q21 4Q21 1Q22 2Q22 Auto C&I Leases CRE Res. Mtg Other 35 33 34 35 32 25 24 23 22 20 13 13 16 13 14 5 6 6 6 6 3 3 3 3 2 $81 $79 $82 $79 $74 2Q21 3Q21 4Q21 1Q22 2Q22 Money Market NIB Deposits IB Deposits Savings CD 94 92 92 92 93 19 18 19 19 24 16 16 15 15 15 17 19 19 14 10 9 11 14 14 23 $155 $156 $159 $154 2Q21 3Q21 4Q21 1Q22 2Q22 Gross Loans Investments Leases Short-Term Funds Other Assets $165 56 55 59 57 54 43 44 41 40 43 25 24 23 22 20 23 24 24 22 21 8 9 12 13 27 $155 $156 $159 $154 2Q21 3Q21 4Q21 1Q22 2Q22 IB Deposits Borrowed Funds NIB Deposits Equity Other Liabilities $165

11 Quarterly Profitability NET INTEREST INCOME ($M) PRE-TAX INCOME ($M) NET INCOME ATTRIBUTABLE TO SHUSA1,2 ($M) PPNR ($M) 1 Net income includes noncontrolling interest (“NCI”). 2 See Appendix for the consolidating income statement. Profitability impacted by credit performance normalization leading to increased provisions, lower leased vehicle income due to shifts in the mix of lease vehicle dispositions and the SafetyNet initiative, which reduced client overdraft fees $1,532 $1,534 $1,505 $1,480 $1,533 2Q21 3Q21 4Q21 1Q22 2Q22 $1,222 $1,104 $917 $995 $950 2Q21 3Q21 4Q21 1Q22 2Q22 $1,539 $1,084 $903 $778 $546 2Q21 3Q21 4Q21 1Q22 2Q22 $959 $707 $570 $616 $439 2Q21 3Q21 4Q21 1Q22 2Q22

12 Net Interest Margin & Interest Rate Risk Sensitivity NII increased QoQ, however, Net interest margin (“NIM”) declined due to inclusion of APS and associated short term market balances SHUSA NIM Down 100bps Up 100bps INTEREST RATE RISK SENSITIVITY (Change in annual net interest income for parallel rate movements) 1 -2.0% -1.7% -2.6% -3.5% -2.6% 4.7% 4.7% 4.3% 3.6% 2.2% 2Q21 3Q21 4Q21 1Q22 2Q22 5.0% 4.8% 4.6% 4.5% 4.3% 2Q21 3Q21 4Q21 1Q22 2Q22

13 Further embedding ESG to build a more responsible bank Environmental: supporting the green transition Social: building a more inclusive society ~497,243 financially empowered people through 2022 Governance: doing business the right way 24% women in senior positions Note: 2021 data, unless otherwise stated (1) Cultivate Small Business program began in 2017 (2) Inclusive Communities Plan was a public commitment 2017-2021 48% electricity from renewable sources ~270+ entrepreneurs participated in Cultivate Small Business program1 USD 1.24B share of auto portfolio in plug-in hybrid vehicles through 2022 Carbon neutral in operations USD 1.9B renewable projects financed 100% single-use plastics free USD 501M invested in affordable housing in 2021 USD 14.1B invested through the Inclusive Communities Plan2 58% independent directors 16.7% women on Board Risk Culture focuses on consumer protection, cyber awareness, privacy Diversity, Equity and Inclusion framework

14 1 At a Glance 2 Summary 3 Results 4 Appendix Index

15 Auto Originations 1 Approximate FICO scores 2 Includes nominal capital lease originations 3 Includes SBNA loan originations of $1.2 billion and lease originations of $1.4 billion for Q2 2022 Q2 auto originations of $8.2B are up 9% QoQ, but down 22% YoY Penetration rate of 25% with Stellantis, down from 34% in Q2 2021 due to lower supply and exclusive incentives YoY Three Months Ended Originations Q2 2022 Q1 2022 Q2 2021($ in Millions) QoQ YoY % Variance Total Core Retail Auto 3,695$ 3,193$ 3,812$ Chrysler Capital Loans (<640)1 1,321 1,212 1,597 Chrysler Capital Loans (≥640)1 1,455 1,365 3,021 Total Chrysler Capital Retail 2,776 2,577 4,618 Total Leases2 1,701 1,744 2,070 Total Auto Originations3 8,171$ 7,514$ 10,500$ 16% (3%) 9% (17%) 7% (52%) 8% (41%) (2%) (18%) 9% (22%)

16 Asset Quality NCO and NPL ratios continue to normalize but remain below pre-pandemic levels NET CHARGE-OFF RATIO ALLOWANCE COVERAGE (ACL/LHFI) RESERVE COVERAGE (ALLL/NPL) NONPERFORMING LOAN (“NPL”) RATIO 0.5% 0.6% 0.8% 1.2% 1.2% 2Q21 3Q21 4Q21 1Q22 2Q22 1.6% 1.9% 2.1% 1.8% 2.0% 2Q21 3Q21 4Q21 1Q22 2Q22 7.5% 7.5% 7.1% 7.1% 7.2% 2Q21 3Q21 4Q21 1Q22 2Q22 461.4% 380.9% 340.5% 394.8% 350.4% 2Q21 3Q21 4Q21 1Q22 2Q22

17 Allowance For Credit Losses (“ACL”) Under the Federal Reserve’s April 2022 stress test (Severely Adverse Scenario): ►Q2 2022 ending ACL represents ~69% of stress test losses ►SHUSA’s stressed capital ratio2 of 18.7% ranked in the top quartile among participating banks ►PPNR3 of $7.3B (4.6% of average assets) ranked in the top quartile among participating banks 1 Includes ACL for unfunded commitments 2 Projected minimum CET1 ratio (minimum and ending) under the severely adverse scenario over the nine-quarter projection horizon, 2022:Q1–2024:Q1 3 Projected PPNR under the severely adverse scenario through the nine-quarter projection horizon, 2022:Q1–2024:Q1 Allowance ratio stable QoQ Allowance Ratios June 30, 2022 December 31, 2021 June 30, 2021 (Dollars in Millions) (Unaudited) (Audited) (Unaudited) Total loans held for investment (“LHFI”) $92,762 $92,076 $93,131 Total ACL 1 $6,641 $6,566 $7,014 Total Allowance Ratio 7.2% 7.1% 7.5%

18 Borrowed Funds Profile Total Funding ($ in billions) Total funding of $43B in Q2, up 7% QoQ ►Increased in FHLB advances QoQ driven by deposit decrease ►Third-party secured funding increasing as public securitization size normalize 2Q22 1Q22 2Q21 QoQ (%) YoY (%) Senior Unsecured Debt 10.4 9.9 10.1 4.9 2.6 FHLB & CLN 3.5 0.5 0.9 583.2 308.1 Third-Party Secured Funding 3.3 0.0 0.8 32818.0 332.5 Amortizing Notes 2.0 2.6 5.2 (23.7) (61.9) Securitizations 22.0 23.2 22.0 (5.2) (0.0) Intragroup 2.0 4.0 4.0 (50.0) (50.0) Total SHUSA Funding 43.2 40.2 42.9 7.3 0.5

19 Debt & Total Loss-Absorbing Capacity 1 SHUSA’s requirement is 20.5% for TLAC and 6.0% for LTD as a percentage of risk weighted assets 2 Senior debt issuance. Data as of June 30, 2022 * 3-Month LIBOR Debt Maturity Schedule2 ($ In billions) As of Q2 2022, SHUSA met the Federal Reserve’s TLAC and LTD requirements 1 with 23.5% TLAC, 6.6% eligible LTD and a CET1 ratio of 16.9% ►In January 2022, SHUSA issued a $1.0B, 6nc5 Senior Unsecured transaction at 2.49% ►In April 2022, privately placed $434M of senior notes at SOFR +135bps ►In June 2022, public issuance of $500M of senior notes at 4.26% $1.2 3ML+110bps $0.5 4.26% $1.1 4.50% $0.4 SOFR+135bps $1.0 3.40% $1.0 3.50% $1.0 3.45% $1.0 3.24% 4.40% 2.49% $0.8 2.88% 2.88% $2.2 $1.8 $2.6 $1.4 $1.0 $1.0 $0.5 2023 2024 2025 2026 2027 2028 2031 Private placement Public issuance Internal TLAC

20 Capital Ratios CET1 TIER 1 RISK-BASED CAPITAL RATIO TOTAL RISK-BASED CAPITAL RATIO TIER 1 LEVERAGE RATIO CET1 decreased 160bps QoQ due to the SHUSA dividend of $1.25B paid to BSSA and the acquisition of APS 17.6% 18.4% 18.8% 18.5% 16.9% 2Q21 3Q21 4Q21 1Q22 2Q22 14.8% 14.9% 15.0% 13.6% 11.8% 2Q21 3Q21 4Q21 1Q22 2Q22 19.3% 20.2% 20.7% 18.8% 17.2% 2Q21 3Q21 4Q21 1Q22 2Q22 20.7% 21.6% 22.7% 20.6% 18.9% 2Q21 3Q21 4Q21 1Q22 2Q22

21 Rating Agencies Santander1 A2/Baa1 SHUSA Baa3 SBNA2 Baa1 Santander1 A+/A- SHUSA BBB+ SBNA A- Stable outlook (June 14, 2022) SHUSA and SBNA ratings outlook remained “stable” SR. DEBT RATINGS BY SANTANDER ENTITY Santander1 A/A- SHUSA BBB+ SBNA BBB+ Stable outlook (June 25, 2021) Stable outlook (March 18, 2022) 1 Senior Debt / Senior non preferred 2 SBNA Long-term issuer rating

22 1 At a Glance 2 Summary 3 Results 4 Appendix Index

23 Consumer Activities ($ in 000's) Auto CBB Total Consumer Activities Auto CBB Total Consumer Activities Dollar Increase / (Decrease) Percentage Net interest income 2,072,601$ 633,387$ 2,705,988$ 2,169,118$ 703,754$ 2,872,872$ (166,884)$ -5.8% Non-interest income 1,403,036 157,038 1,560,074 1,846,438 153,120 1,999,558 (439,484) -22.0% Credit losses expense / (benefit) 554,707 65,343 620,050 (150,327) (17,236) (167,563) 787,613 470.0% Total expenses 1,632,156 767,436 2,399,592 1,745,835 775,249 2,521,084 (121,492) -4.8% Income/(loss) before income taxes 1,288,774$ (42,354)$ 1,246,420$ 2,420,048$ 98,861$ 2,518,909$ (1,272,489)$ -50.5% Total assets 61,804,866 12,880,656 74,685,522 62,017,708 12,765,546 74,783,254 (97,732) -0.1% Total Consumer ActivitiesYear-To-Date Ended June 30, 2022 2022 2021 ($ in 000's) Auto CBB Total Consumer Activities Auto CBB Total Consumer Activities Dollar Increase / (Decrease) Percentage Net interest income 1,021,335$ 331,432$ 1,352,767$ 1,096,871$ 301,416$ 1,398,287$ (45,520)$ -3.3% Non-interest income 696,522 78,885 775,407 928,581 85,911 1,014,492 (239,085) -23.6% Credit losses expense / (benefit) 334,181 58,299 392,480 (271,712) (12,915) (284,627) 677,107 237.9% Total expenses 830,072 383,486 1,213,558 855,243 372,913 1,228,156 (14,598) -1.2% Income/(loss) before income taxes 553,604$ (31,468)$ 522,136$ 1,441,921$ 27,329$ 1,469,250$ (947,114)$ -64.5% Total Consumer ActivitiesQuarter-To-Date Ended June 30, 2022 2022 2021

24 Commercial Activities ($ in 000's) C&I CRE Total Commercial Activities C&I CRE Total Commercial Activities Dollar Increase / (Decrease) Percentage Net interest income 143,457$ 163,182$ 306,639$ 146,266$ 168,066$ 314,332$ (7,693)$ -2.4% Non-interest income 30,257 23,031 53,288 35,019 20,777 55,796 (2,508) -4.5% Credit losses expense / (benefit) 12,256 (14,788) (2,532) (52,062) 4,349 (47,713) 45,181 94.7% Total expenses 132,187 58,609 190,796 126,163 57,163 183,326 7,470 4.1% Income/(loss) before income taxes 29,271$ 142,392$ 171,663$ 107,184$ 127,331$ 234,515$ (62,852)$ -26.8% Total assets 6,661,483 18,481,532 25,143,015 7,470,239 17,792,008 25,262,247 (119,232) -0.5% Year-To-Date Ended June 30, 2022 2022 2021 Total Commercial Activities ($ in 000's) C&I CRE Total Commercial Activities C&I CRE Total Commercial Activities Dollar Increase / (Decrease) Percentage Net interest income 75,795$ 84,747$ 160,542$ 72,491$ 82,783$ 155,274$ 5,268$ 3.4% Non-interest income 14,317 7,691 22,008 18,617 15,161 33,778 (11,770) -34.8% Credit losses expense / (benefit) 8,622 4,550 13,172 (20,721) 2,573 (18,148) 31,320 172.6% Total expenses 64,700 29,410 94,110 62,903 29,138 92,041 2,069 2.2% Income/(loss) before income taxes 16,790$ 58,478$ 75,268$ 48,926$ 66,233$ 115,159$ (39,891)$ -34.6% Quarter-To-Date Ended June 30, 2022 2022 2021 Total Commercial Activities

25 CIB CIB ($ in 000's) 2022 2021 Dollar Increase / (Decrease) Percentage Net interest income 74,250$ 57,655$ 16,595$ 28.8% Non-interest income 137,919 132,078 5,841 4.4% Credit losses expense / (benefit) 3,390 (22,327) 25,717 115.2% Total expenses 192,647 130,109 62,538 48.1% Income/(loss) before income taxes 16,132$ 81,951$ (65,819)$ -80.3% Total assets 28,747,499 11,788,210 16,959,289 143.9% Year-To-Date Ended June 30, 2022 YTD Change CIB ($ in 000's) 2022 2021 Dollar Increase / (Decrease) Percentage Net interest income 48,361$ 30,244$ 18,117$ 59.9% Non-interest income 70,077 54,529 15,548 28.5% Credit losses expense / (benefit) (3,003) (13,633) 10,630 78.0% Total expenses 117,092 62,779 54,313 86.5% Income/(loss) before income taxes 4,349$ 35,627$ (31,278)$ -87.8% Quarter-To-Date Ended June 30, 2022 QTD Change

26 Wealth Management Wealth Management ($ in 000's) 2022 2021 Dollar Increase / (Decrease) Percentage Net interest income 64,370$ 46,851$ 17,519$ 37.4% Non-interest income 140,237 126,242 13,995 11.1% Credit losses expense / (benefit) - (170) 170 100.0% Total expenses 121,032 103,317 17,715 17.1% Income/(loss) before income taxes 83,575$ 69,946$ 13,629$ 19.5% Total assets 8,304,682 8,149,788 154,894 1.9% Year-To-Date Ended June 30, 2022 YTD Change Wealth Management ($ in 000's) 2022 2021 Dollar Increase / (Decrease) Percentage Net interest income 45,227$ 23,171$ 22,056$ 95.2% Non-interest income 62,587 62,996 (409) -0.6% Credit losses expense / (benefit) - (97) 97 100.0% Total expenses 59,375 52,755 6,620 12.5% Income/(loss) before income taxes 48,439$ 33,509$ 14,930$ 44.6% Quarter-To-Date Ended June 30, 2022 QTD Change

27 Other * Other includes the results of immaterial entities, earnings from non-strategic assets, the investment portfolio, interest expense on SBNA’s and SHUSA's borrowings and other debt obligations, amortization of intangible .assets and certain unallocated corporate income and indirect expenses. Other ($ in 000's) 2022 2021 Dollar Increase / (Decrease) Percentage Net interest income (137,830)$ (140,543)$ 2,713$ 1.9% Non-interest income 39,137 53,108 (13,971) -26.3% Credit losses expense / (benefit) 101 (3,443) 3,544 102.9% Total expenses 95,695 103,474 (7,779) -7.5% Income/(loss) before income taxes (194,489)$ (187,466)$ (7,023)$ -3.7% Total assets 28,443,114 35,202,144 (6,759,030) -19.2% Year-To-Date Ended June 30, 2022 YTD Change Other ($ in 000's) 2022 2021 Dollar Increase / (Decrease) Percentage Net interest income (73,485)$ (75,141)$ 1,656$ 2.2% Non-interest income 19,319 16,492 2,827 17.1% Credit losses expense / (benefit) 1,551 (777) 2,328 299.6% Total expenses 48,937 57,151 (8,214) -14.4% Income/(loss) before income taxes (104,654)$ (115,023)$ 10,369$ 9.0% Quarter-To-Date Ended June 30, 2022 QTD Change

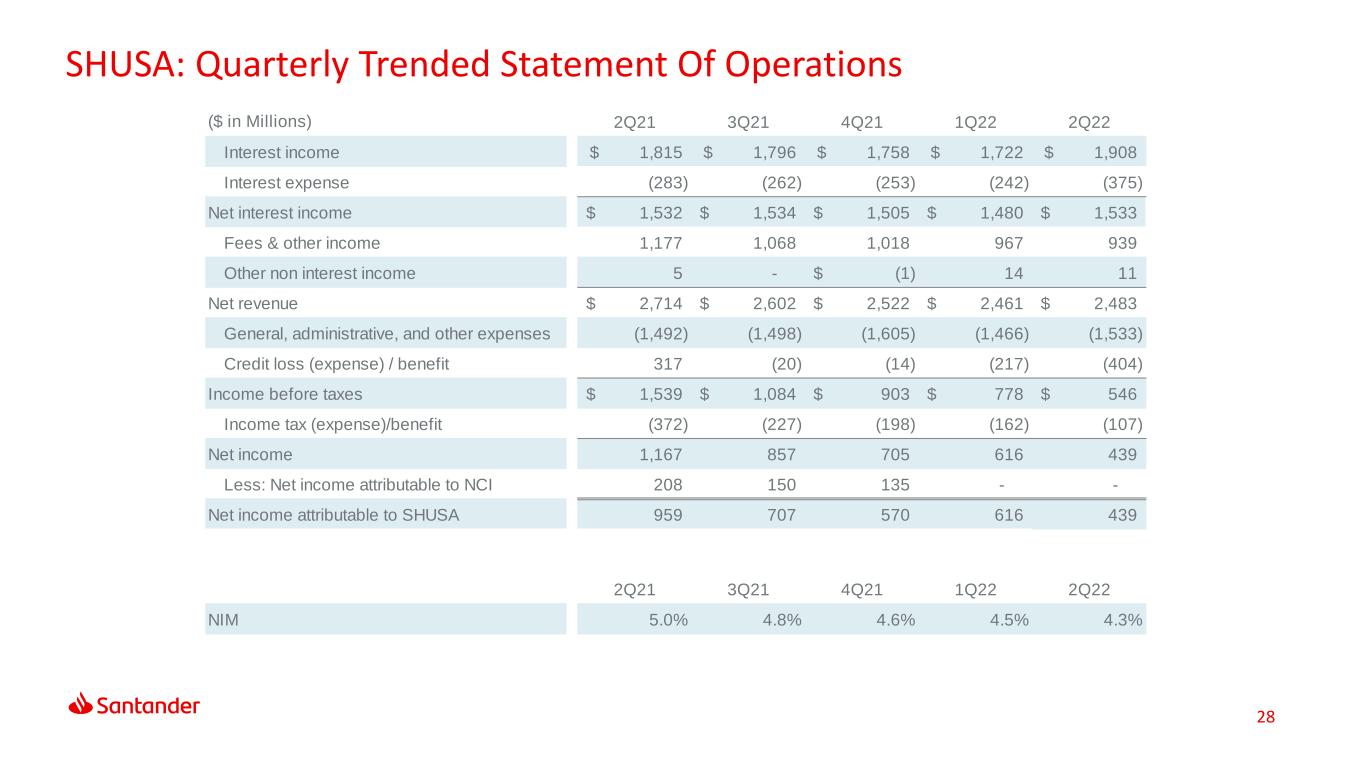

28 SHUSA: Quarterly Trended Statement Of Operations ($ in Millions) 2Q21 3Q21 4Q21 1Q22 2Q22 Interest income 1,815$ 1,796$ 1,758$ 1,722$ 1,908$ Interest expense (283) (262) (253) (242) (375) Net interest income 1,532$ 1,534$ 1,505$ 1,480$ 1,533$ Fees & other income 1,177 1,068 1,018 967 939 Other non interest income 5 - (1)$ 14 11 Net revenue 2,714$ 2,602$ 2,522$ 2,461$ 2,483$ General, administrative, and other expenses (1,492) (1,498) (1,605) (1,466) (1,533) Credit loss (expense) / benefit 317 (20) (14) (217) (404) Income before taxes 1,539$ 1,084$ 903$ 778$ 546$ Income tax (expense)/benefit (372) (227) (198) (162) (107) Net income 1,167 857 705 616 439 Less: Net income attributable to NCI 208 150 135 - - Net income attributable to SHUSA 959 707 570 616 439 2Q21 3Q21 4Q21 1Q22 2Q22 NIM 5.0% 4.8% 4.6% 4.5% 4.3%

29 SHUSA: Non-GAAP Reconciliations ($ in Millions) 2Q21 3Q21 4Q21 1Q22 2Q22 SHUSA pre-tax pre-provision income Pre-tax income, as reported 1,539$ 1,084$ 903$ 778$ 546$ (Release of)/provision for credit losses (317) 20 14 217 404 Pre-tax pre-provision Income 1,222 1,104 917 995 950 CET1 to risk-weighted assets CET1 capital 19,895$ 20,573 21,068 20,576 19,565 Risk-weighted assets 113,295 112,068 111,820 111,181 115,655 Ratio 17.6% 18.4% 18.8% 18.5% 16.9% Tier 1 leverage Tier 1 capital 21,868$ 22,631 23,175 20,921 19,910 Avg total assets, leverage capital purposes 148,072 152,058 154,429 154,305 168,042 Ratio 14.8% 14.9% 15.0% 13.6% 11.8% Tier 1 risk-based Tier 1 capital 21,868$ 22,631$ 23,175$ 20,921$ 19,910$ Risk-weighted assets 113,295 112,068 111,820 111,181 115,655 Ratio 19.3% 20.2% 20.7% 18.8% 17.2% Total risk-based Risk-based capital 23,446$ 24,192$ 25,333$ 22,848$ 21,896$ Risk-weighted assets 113,295 112,068 111,820 111,181 115,655 Ratio 20.7% 21.6% 22.7% 20.6% 18.9%

30 10.3% 10.6% 8.3% 7.7% 6.0% 0.6% 3.5% 3.0% -1.0% 2.0% 3.3% 3.4% 2.9% Q4 2017 Q4 2018 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 4Q 2021 Q1 2022 Q2 2022 46.3% 47.3% 52.2% 50.1% 45.7% 91.4% 64.2% 69.1% 114.9% 74.4% 65.7% 67.8% 69.1% 6.3% 6.0% 5.1% 4.6% 2.4% 2.4% 3.1% 2.2% 2.4% 3.3% 4.1% 3.4% 4.1% 19.2% 20.2% 17.3% 15.5% 11.1% 6.8% 9.9% 9.7% 6.6% 7.7% 9.6% 10.4% 9.5% SC Delinquency And Loss (Quarterly) SC Recovery Rates1 (% of Gross Loss) Net Charge-off Rates2 Delinquency Ratios: >59 Days Delinquent, RICs, HFI Gross Charge-off Rates Late stage delinquencies increased 170 bps YoY Gross charge-off rate increased 290 bps YoY SC’s Q2 recovery rate of 69% beginning to normalize but remains elevated due to low gross losses and continued strength in wholesale auction prices Net charge-off rate increased 390 bps YoY Early stage delinquencies increased 250 bps YoY Delinquencies and charge-offs remain low and are beginning to normalize Delinquency Ratios: 30-59 Days Delinquent, Retail Installment Contracts (“RICs”), Held For Investment (“HFI”) 1 Recovery rate – Includes insurance proceeds, bankruptcy/deficiency sales, and timing impacts 2 Net charge-off rates on RICs, HFI 11.4% 11.0% 9.7% 8.3% 4.3% 5.0% 6.0% 4.4% 5.5% 6.8% 7.4% 7.3% 8.0%

Thank You. Our purpose is to help people and businesses prosper. Our culture is based on believing that everything we do should be:

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- 4Sight Labs Introduces OverWatch Biometric Monitoring Solution

- Argo Blockchain PLC Announces Notice of Results

- deepull appoints Kimberle Chapin, MD, as Chief Medical Officer and Wade Stevenson as Chief Marketing and Sales Officer

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share