Form 8-K STERLING CONSTRUCTION For: Jan 05

Exhibit 99.1

NEWS RELEASE

For Immediate Release:

January 5, 2022

Sterling Acquires Petillo, an Industry Leading Specialty Site Development Company

•One of the largest specialty site development companies in the Northeast

•Expansion of geographic footprint to cover blue chip e-commerce customers in all major East Coast markets

•Positions Sterling to be an industry leader on E-infrastructure specialty site development

•Strong Cultural Alignment

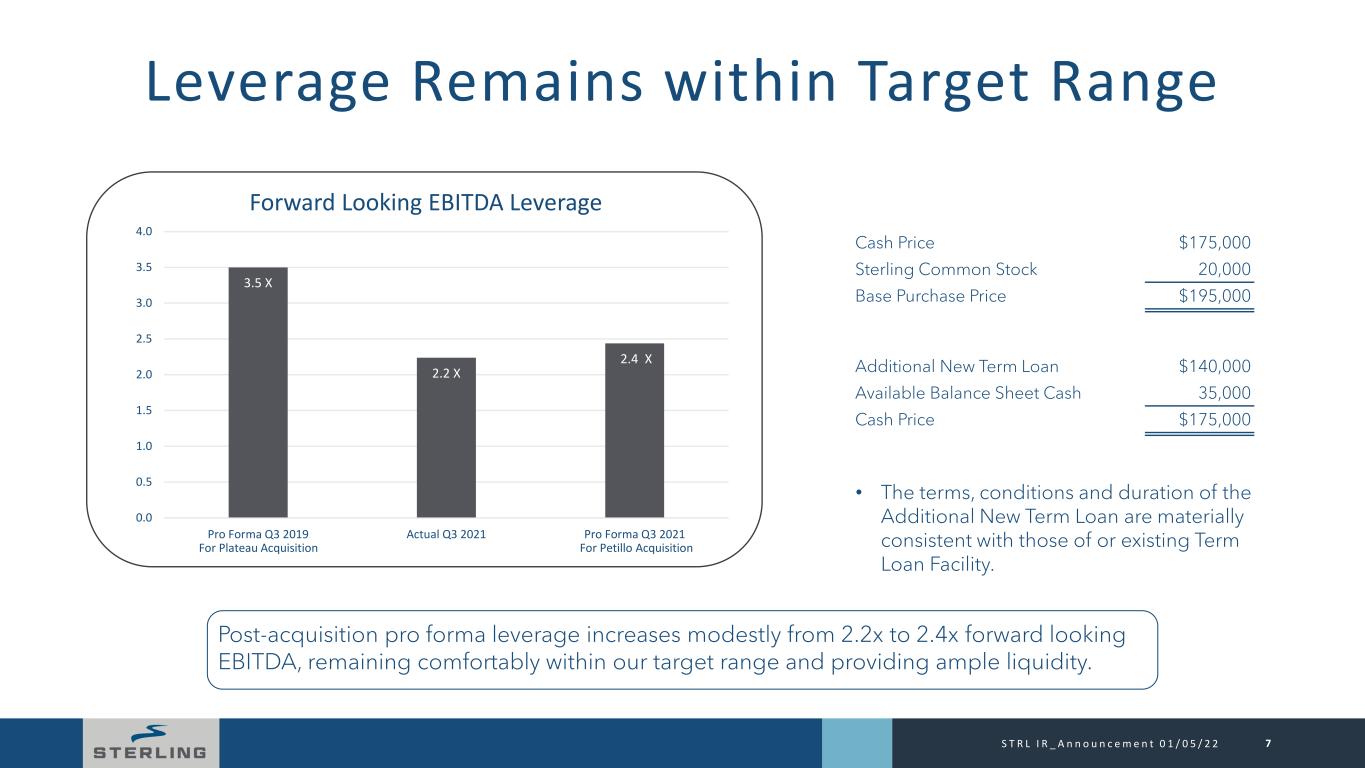

•Pro forma Total Leverage Ratio increases modestly from 2.14 to 2.35 times, remaining comfortably within our target range and providing ample liquidity

•Accretive day one

Conference Call with Accompanying Slide Deck, Thursday, January 6, 2022 at 9:00 am ET

THE WOODLANDS, TX – January 5, 2022 – Sterling Construction Company, Inc. (NasdaqGS: STRL) (“Sterling” or “the Company”) entered into a Stock Purchase Agreement and closed on the acquisition of Petillo Incorporated and its related operating entities (collectively “Petillo”), on December 30, 2021. Petillo is a leading specialty site development solution provider in the Northeast and Mid-Atlantic. Founded in 1994 by owner and CEO Michael Petillo, Petillo has seen compound revenue growth from 2017 to 2021 of 29% through continued expansion of its geographic footprint, customer base and service offerings. Petillo’s 2021 revenues and income from operations are expected to be approximately $212 million and $29 million, respectively.

“We are excited to welcome the Petillo team, its culture and capabilities into our E-infrastructure solutions sector,” said Joe Cutillo, Sterling’s Chief Executive Officer. “Their entrepreneurial spirit focused on delivering customer-centric solutions coupled with their geographic footprint will enable us to service our key blue-chip e-commerce customers up and down the entire East Coast with even more offerings than we had before. Petillo’s capabilities along with our current Plateau capabilities will not only create one of the largest specialty site development companies in the U.S. but will also add broader capabilities and service offerings to both end markets.”

The aggregate consideration of $195 million paid on the Closing Date (the “Base Purchase Price”) consisted of $175 million of cash and 759,447 shares of Sterling common shares valued at $20 million. Additionally, under the purchase agreement, upon the satisfaction of achieving the specified annual operating income growth thresholds, and certain other conditions, the sellers are entitled to earn-out payments not to exceed $20 million over the next five years. The Company also entered into a five-year employment agreement with Michael Petillo, which provides for five equal annual retention payments totaling $15 million.

Effective December 29, 2021, Sterling entered into a Third Amendment to Credit Agreement (the “Amendment”) which, among other provisions, increased the Company’s Existing Term Loans through a new incremental $140 million term loan with the same maturity as the Existing Term Loans to fund a portion of the Petillo acquisition. The Amendment was led by BMO Capital Markets Corp, as Joint Lead Arranger and Joint Book Runner, and BMO Harris Bank N.A., as Administrative Agent. The balance of the Base Purchase Price, together with acquisition related costs, was funded from Sterling’s cash balance.

Stifel served as exclusive financial advisor and Jones Walker LLP served as legal advisor to Sterling on this transaction.

Conference Call

Sterling’s management will hold a conference call to discuss this transaction on Thursday, January 6th at 9:00 a.m. ET/8:00 a.m. CT. Interested parties may participate in the call by dialing (201) 493-6744 or (877) 445-9755. Please call in ten minutes before the conference call is scheduled to begin and ask for the Sterling call. Following management’s opening remarks, there will be a question and answer session. Additionally, a slide presentation that will accompany management’s comments has been posted to the Investor Relations section of the Company’s website, which can be found at www.strlco.com, where a simultaneous webcast of the call will be available as well. If you are unable to listen live, the conference call webcast will be archived on the Company’s website for thirty days.

About Sterling

Sterling Construction Company, Inc. operates through a variety of subsidiaries within three segments specializing in Heavy Civil, Specialty Services and Residential projects in the United States (the “U.S.”), primarily across the southern U.S., the Rocky Mountain States, California and Hawaii, as well as other areas with strategic construction opportunities. Heavy Civil includes infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, light rail, water, wastewater and storm drainage systems. Specialty Services projects include e-infrastructure site development activities, foundations for multi-family homes, parking structures and other commercial concrete projects. Residential projects include concrete foundations for single-family homes. From strategy to operations, we are committed to sustainability by operating responsibly to safeguard and improve society’s quality of life. Caring for our people and communities, our customers and our investors – that is The Sterling Way.

Joe Cutillo, CEO, “We build and service the infrastructure that enables our economy to run, our people to move and our country to grow.”

Important Information for Investors and Stockholders

Cautionary Statement Regarding Forward-Looking Statements

This press release contains statements that are considered forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about: our projections or expectations relating to synergies and other benefits from the transaction; our business strategy; our financial strategy; our industry outlook; and our plans, objectives, expectations, forecasts, outlook and intentions. All of these types of statements, other than statements of historical fact included in this press release, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such

terms or other comparable terminology. The forward-looking statements contained in this press release are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in this press release are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward-looking events and circumstances will occur. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control, including the possibility that the anticipated benefits from the transaction cannot be fully realized or may take longer to realize than expected, the possibility that the costs or difficulties of integration of the Petillo business will be greater than expected and our ability to hire and retain the Petillo employees. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to such factors as well as the other factors included in the “Risk Factors” section in our filings with the U.S. Securities and Exchange Commission and elsewhere in those filings. Additional factors or risks that we currently deem immaterial, that are not presently known to us or that arise in the future could also cause our actual results to differ materially from our expected results. Given these uncertainties, investors are cautioned that many of the assumptions upon which our forward-looking statements are based are likely to change after the date the forward-looking statements are made. The forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements for any reason, whether as a result of new information, future events or developments, changed circumstances or otherwise, notwithstanding any changes in our assumptions, changes in business plans, actual experience or other changes. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

Company Contact: Sterling Construction Company, Inc. Ron Ballschmiede, Chief Financial Officer (281) 214-0777 | Investor Relations Contact: The Equity Group Inc. Jeremy Hellman, CFA (212) 836-9626 | ||||

We build and service the infrastructure that enables our economy to run, our people to move and our country to grow. STERLING ACQUIRES PETILLO, AN INDUSTRY LEADING SPECIALTY SITE DEVELOPMENT COMPANY January 6, 2022

2 DISCLOSURE: Forward-Looking Statements This presentation contains statements that are considered forward-looking statements within the meaning of the federal securities laws. These forward- looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about: our projections or expectations relating to synergies and other benefits from the transaction; our business strategy; our financial strategy; our industry outlook; and our plans, objectives, expectations, forecasts, outlook and intentions. All of these types of statements, other than statements of historical fact included in this press release, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this press release are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in this press release are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward-looking events and circumstances will occur. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control, including the possibility that the anticipated benefits from the transaction cannot be fully realized or may take longer to realize than expected, the possibility that the costs or difficulties of integration of the Petillo business will be greater than expected and our ability to hire and retain the Petillo employees. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to such factors as well as the other factors included in the “Risk Factors” section in our filings with the U.S. Securities and Exchange Commission and elsewhere in those filings. Additional factors or risks that we currently deem immaterial, that are not presently known to us or that arise in the future could also cause our actual results to differ materially from our expected results. Given these uncertainties, investors are cautioned that many of the assumptions upon which our forward-looking statements are based are likely to change after the date the forward-looking statements are made. The forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements for any reason, whether as a result of new information, future events or developments, changed circumstances, or otherwise, notwithstanding any changes in our assumptions, changes in business plans, actual experience or other changes. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf. S T R L I R _ A n n o u n c e m e n t 0 1 / 0 5 / 2 2

3S T R L I R _ A n n o u n c e m e n t 0 1 / 0 5 / 2 2 Continuing Our Strategic Vision Focused & Moving Forward • Executing our strategic vision: Solidify the Base Grow High-Margin Products Expansion into Adjacent Markets • Continuing our key objectives: Bottom-line Growth Risk Reduction Exceed Peer Performance Strategic Acquisition - Benefits • Positions Sterling to be an industry leader on e-infrastructure site development • Geographic expansion in a high growth sector in which we generate our highest margins • Expands our geographic presence in many of the leading markets with Petillo in the North East/Mid Atlantic supplementing Plateau’s established footprint in the Southeast • Provides a vertical integration for our specialty infrastructure services adding capacity, assets, capabilities, customers and people • Petillo transaction is expected to be immediately accretive to Net Income and EPS • Post acquisition leverage remains comfortably within our target range with ample liquidity

Petillo Overview Transaction Summary Leading specialty site development solution provider in the Northeast and Mid-Atlantic regions focused on e- infrastructure projects Revenue ~$212 million ’17–’21E Rev CAGR ~29% Operating Margin ~14% Field Employees 300+ Service Profile Expansion of geographic footprint to cover blue-chip customers in all major East Coast markets Positions Sterling to be an industry leader of e- infrastructure specialty site development services Strong cultural alignment with an abundance of entrepreneurial spirit Enables cross-selling of broader capabilities and adjacent service offerings across geographies Utilities Contractor Site Excavation Environmental Remediation Erosion Control & Retaining Walls Water Management & Distribution Concrete Installation & Repair 4S T R L I R A n n o u n c e m e n t 0 1 / 0 5 / 2 2 Investment Highlights

5S T R L I R _ A n n o u n c e m e n t 0 1 / 0 5 / 2 2 Expanding our geographic footprint into: New Jersey Maryland New York Pennsylvania STRL’s 2021 Footprint: Alabama Florida Georgia Kentucky Mississippi North Carolina South Carolina Tennessee Virginia West Virginia 3-Year Strategy: Solidify the Base, Grow High-Margin Products, Expansion into Adjacent Markets Our acquisition standards have always been centered on specific strategic, financial and cultural considerations including a shift toward higher-margin, lower-risk work, with increased emphasis on e-infrastructure solutions, building solutions and transportation solutions. AND this transaction aligns with our strategy Expanding our E-Infrastructure Solutions Growing Roster of Top End-Customers:

6S T R L I R _ A n n o u n c e m e n t 0 1 / 0 5 / 2 2 Highly Attractive Financial Profile at an Accretive Price ( 1 ) T h e C o m p a n y d e f i n e s E B I T D A a s G A A P n e t i n c o m e , a d j u s t e d f o r d e p r e c i a t i o n a n d a m o r t i z a t i o n , n e t i n t e r e s t e x p e n s e , t a x e s , a n d g a i n o r l o s s o n e x t i n g u i s h m e n t o f d e b t , n e t . S e e t h e “ E B I T D A R e c o n c i l i a t i o n ” s l i d e 1 3 f o r m o r e i n f o r m a t i o n . ($ in millions) Sterling Historical Petillo Historical Combined Pro Forma Sterling Historical Petillo Historical Combined Pro Forma Revenues $ 1,180.4 $ 143.3 $ 1,323.7 $ 1,427.4 $ 222.7 $ 1,650.1 Gross Margin 13.4% 16.5% 13.8% 13.4% 18.7% 14.1% Income from Operations Margin 6.8% 13.9% 7.7% 6.6% 15.7% 7.4% Net Income $ 51.7 $ 23.7 $ 59.8 $ 42.3 $ 33.3 $ 59.1 EBITDA (1) $ 110.9 $ 27.1 $ 136.9 $ 127.1 $ 45.1 $ 169.2 EBITDA Margin 9.4% 18.9% 10.3% 8.9% 20.3% 10.3% Nine Months Ended September 30, 2021 Twelve Months Ended December 31, 2020

Leverage Remains within Target Range 7S T R L I R _ A n n o u n c e m e n t 0 1 / 0 5 / 2 2 Cash Price $175,000 Sterling Common Stock 20,000 Base Purchase Price $195,000 Additional New Term Loan $140,000 Available Balance Sheet Cash 35,000 Cash Price $175,000 Post-acquisition pro forma leverage increases modestly from 2.2x to 2.4x forward looking EBITDA, remaining comfortably within our target range and providing ample liquidity. • The terms, conditions and duration of the Additional New Term Loan are materially consistent with those of or existing Term Loan Facility. 3.5 X 2.2 X 2.4 X 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 Pro Forma Q3 2019 Actual Q3 2021 Pro Forma Q3 2021 Forward Looking EBITDA Leverage For Plateau Acquisition For Petillo Acquisition

8 Sterling’s Evolution Continues S T R L I R _ A n n o u n c e m e n t 0 1 / 0 5 / 2 2 Diversified, customer-centric, market-focused portfolio of specialty infrastructure services. Platform for strong growth of higher-margin lower-risk work Execution on strategic plan of solidifying the base, growing high-margin products, and expanding into adjacent markets Geographically positioned in the strongest markets Serving the nation’s leading customers in each of our sectors Specialty site development provider able to handle the largest and most complex site development projects

Sterling Ron Ballschmiede, Chief Financial Officer Mary Morley, Investor Relations Sterling Construction Company, Inc. Tel: (281) 214-0777 The Equity Group Inc. Jeremy Hellman Tel: (212) 836-9626 [email protected] 9 Contact Us S T R L I R _ A n n o u n c e m e n t 0 1 / 0 5 / 2 2

We build and service the infrastructure that enables our economy to run, our people to move and our country to grow. + 10S T R L I R _ A n n o u n c e m e n t 0 1 / 0 5 / 2 2 Appendix

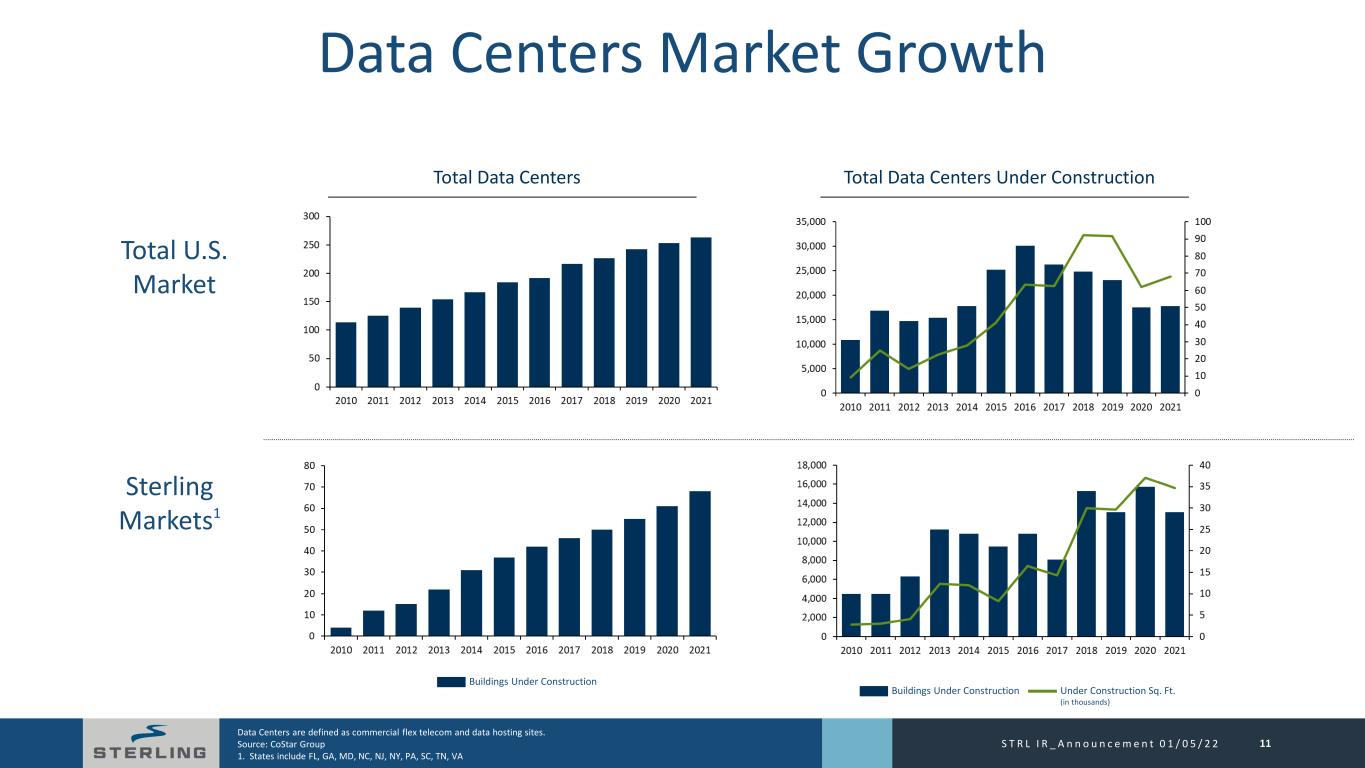

Data Centers Market Growth Data Centers are defined as commercial flex telecom and data hosting sites. Source: CoStar Group 1. States include FL, GA, MD, NC, NJ, NY, PA, SC, TN, VA Total Data Centers Total U.S. Market Total Data Centers Under Construction S T R L I R _ A n n o u n c e m e n t 0 1 / 0 5 / 2 2 11 Buildings Under Construction Under Construction Sq. Ft. (in thousands) Buildings Under Construction Sterling Markets1

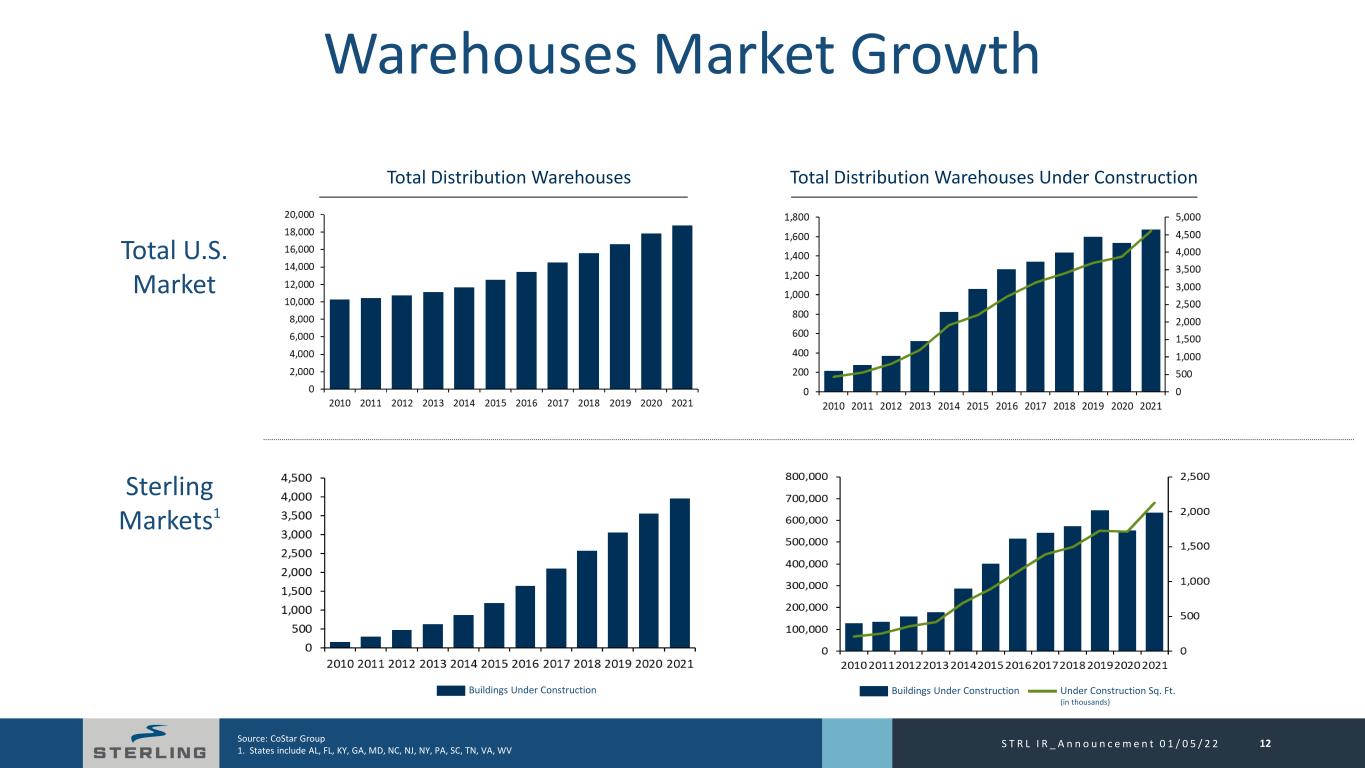

Warehouses Market Growth Source: CoStar Group 1. States include AL, FL, KY, GA, MD, NC, NJ, NY, PA, SC, TN, VA, WV Total Distribution Warehouses Total Distribution Warehouses Under Construction Buildings Under Construction Under Construction Sq. Ft. (in thousands) S T R L I R _ A n n o u n c e m e n t 0 1 / 0 5 / 2 2 12 Total U.S. Market Sterling Markets1 Buildings Under Construction

EBITDA Reconciliation 13S T R L I R _ A n n o u n c e m e n t 0 1 / 0 5 / 2 2 ( 1 ) T h e C o m p a n y d e f i n e s E B I T D A a s G A A P n e t i n c o m e , a d j u s t e d f o r d e p r e c i a t i o n a n d a m o r t i z a t i o n , n e t i n t e r e s t e x p e n s e , t a x e s , a n d g a i n o r l o s s o n e x t i n g u i s h m e n t o f d e b t , n e t . ($ in millions) Sterling Historical Petillo Historical Combined Pro Forma Sterling Historical Petillo Historical Combined Pro Forma Net income $ 51.7 $ 23.7 $ 59.8 $ 42.3 $ 33.3 $ 59.1 Depreciation and amortization 25.3 8.2 36.6 32.8 10.1 47.0 Net interest expense 15.6 - 19.1 29.2 - 33.8 Income tax expense 20.3 1.9 23.4 22.5 1.7 29.0 (Gain) loss on extinguishment of debt (2.0) (6.7) (2.0) 0.3 - 0.3 EBITDA (1) $ 110.9 $ 27.1 $ 136.9 $ 127.1 $ 45.1 $ 169.2 Nine Months Ended September 30, 2021 Twelve Months Ended December 31, 2020

We build and service the infrastructure that enables our economy to run, our people to move and our country to grow. THANK YOU

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Sterling Schedules 2024 First Quarter Release and Conference Call

- Komprise Receives Prestigious Stevie Gold Award for Data Platforms

- Publication Annual Report 2023 and convocation of the Ordinary General Meeting on May 29 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share