Form 8-K STARBOARD VALUE ACQUISIT For: May 25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 25, 2021

STARBOARD VALUE ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 001- 39496 | 84-3743013 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

|

777 Third Avenue, 18th Floor New York, NY |

10017 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (212) 845-7977

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||

| Units, each consisting of one share of Class A Common Stock and one-sixth of one Warrant to purchase one share of Class A Common Stock |

SVACU | The Nasdaq Stock Market LLC | ||

| Class A Common Stock, par value $0.0001 per share |

SVAC | The Nasdaq Stock Market LLC | ||

| Redeemable Warrants, exercisable for one share of Class A Common Stock for $11.50 per share |

SVACW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

As previously disclosed, on February 21, 2021, Starboard Value Acquisition Corp., a Delaware corporation (“SVAC”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Cyxtera Technologies, Inc., a Delaware corporation (“Cyxtera”), and the other parties thereto, pursuant to which Cyxtera and the various operating subsidiaries of Cyxtera will become subsidiaries of SVAC, with the Cyxtera stockholder becoming a stockholder of SVAC (the transactions contemplated by the Merger Agreement, the “Transactions”).

On May 26, 2021, Cyxtera issued a press release reporting its first quarter 2021 financial highlights, which is attached as Exhibit 99.1 hereto and incorporated by reference into this Item 7.01.

Separately on May 25, 2021, Cyxtera provided its lenders with materials in connection with the requirements under its credit facilities to provide certain financial information and hold an earnings call. The information provided to the lenders included: (i) Cyxtera’s Unaudited Condensed Consolidated Financial Statements as of March 31, 2021 and December 31, 2020 and for the three months ended March 31, 2021 and 2020 (the “Unaudited Financial Statements”); (ii) Cyxtera’s Unaudited Selected Financial Data for the three months ended March 31, 2021 and March 31, 2020 and the twelve months ended March 31, 2021 and December 31, 2020 (the “Unaudited Selected Financial Data”); and (iii) a presentation reviewing Cyxtera’s first quarter 2021 results (the “Earnings Call Presentation”).

A copy of the Unaudited Financial Statements, Unaudited Selected Financial Data and Earnings Call Presentation are furnished with this Report as Exhibits 99.2, 99.3 and 99.4, respectively, and are incorporated herein by reference.

The exhibits and the information set forth therein shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall they be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 8.01 Other Events.

Item 7.01 is incorporated herein by reference.

Additional Information and Where to Find It

In connection with the Transactions, SVAC filed a proxy statement (the “Proxy Statement”) with the Securities and Exchange Commission (the “SEC”), which will be distributed to holders of SVAC’s common stock in connection with SVAC’s solicitation of proxies for the vote by the SVAC stockholders with respect to the Transactions and other matters as described in the Proxy Statement. SVAC urges its stockholders and other interested persons to read the Proxy Statement and amendments thereto and documents incorporated by reference therein, as well as other documents filed with the SEC in connection with the Transactions, as these materials will contain important information about SVAC, Cyxtera and the Transactions. When available, the definitive Proxy Statement will be mailed to SVAC’s stockholders. Stockholders will also be able to obtain copies of such documents, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: Starboard Value Acquisition Corp., 777 Third Avenue, 18th Floor, New York, NY 10017.

Participants in Solicitation

SVAC and its directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of SVAC’s stockholders in connection with the Transactions. Stockholders of SVAC may obtain more detailed information regarding the names, affiliations and interests of SVAC’s directors and executive officers in SVAC’s final prospectus for its initial public offering filed with the SEC on September 11, 2020 and in the Proxy Statement relating to the Transactions. Information concerning the interests of SVAC’s participants in the solicitation, which may, in some cases, be different than those of SVAC’s stockholders generally, is set forth in the Proxy Statement relating to the Transactions.

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of the federal securities laws. These forward-looking statements generally are identified by the words “expects,” “will,” “projected,” “continue,” “increase,” and/or similar expressions that concern Cyxtera’s or SVAC’s strategy, plans or intentions, but the absence of these words does not mean that a statement is not forward-looking. Such statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are based on management’s belief or interpretation of information currently available. Because forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of Cyxtera’s or SVAC’s control. Actual results and condition (financial or otherwise) may differ materially from those indicated in the forward-looking statements.

These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results and conditions to differ materially from those indicated in the forward-looking statements, including, but not limited to, changes in domestic and foreign business, market, financial, political and legal conditions; the ability of the parties to successfully or timely consummate the Transactions, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Transactions, the risk that legal or regulatory developments (such as the SEC’s recently released statement on accounting and reporting considerations for warrants in SPACs) could cause unforeseen delays in the timing of the Transactions and negatively impact the trading price of SVAC’s securities and the attractiveness of the Transactions to investors, or that the required stockholder approval may not be obtained; failure to realize the anticipated benefits of the Transactions; the risk that the market price of the combined company’s securities may decline following the consummation of the Transactions if the Transaction’s benefits do not meet the expectations of investors or securities analysts; risks relating to the uncertainty of Cyxtera’s projected operating and financial information; the impact of Cyxtera’s substantial debt on its future cash flows and its ability to raise additional capital in the future; adverse global economic conditions and credit market uncertainty; the regulatory, currency, legal, tax and other risks related to Cyxtera’s international operations; the United Kingdom’s withdrawal from the European Union and the potential negative effect on global economic conditions, financial markets and Cyxtera’s business; the effects of the COVID-19 pandemic on Cyxtera’s business or future results; the ability to access external sources of capital on favorable terms or at all, which could limit Cyxtera’s ability to execute its business and growth strategies; fluctuations in foreign currency exchange rates in the markets in which Cyxtera operates internationally; physical and electronic security breaches and cyber-attacks which could disrupt Cyxtera’s operations; Cyxtera’s dependence upon the demand for data centers; Cyxtera’s products and services having a long sales cycle that may harm its revenues and operating results; any failure of Cyxtera’s physical infrastructure or negative impact on its ability to provide its services, or damage to customer infrastructure within its data centers, which could lead to significant costs and disruptions that could reduce Cyxtera’s revenue and harm its business reputation and financial results; inadequate or inaccurate external and internal information, including budget and planning data, which could lead to inaccurate financial forecasts and inappropriate financial decisions; maintaining sufficient insurance coverage; environmental regulations and related new or unexpected costs; climate change and responses to it; prolonged power outages, shortages or capacity constraints; the combined company’s ability to recruit or retain key executives and qualified personnel; the ability to compete successfully against current and future competitors; Cyxtera’s fluctuating operating results; incurring substantial losses, as Cyxtera has previously; Cyxtera’s ability to renew its long-term data center leases on acceptable terms, or at all; Cyxtera’s government contracts, which are subject to early termination, audits, investigations, sanctions and penalties; failure to attract, grow and retain a diverse and balanced customer base; future consolidation and competition in Cyxtera’s customers’ industries, which could reduce the number of Cyxtera’s existing and potential customers and make it dependent on a more limited number of customers; Cyxtera’s reliance on third parties to provide internet connectivity to its data centers; disruption or termination of connectivity; government regulation; the non-realization of the financial or strategic goals related to acquisitions that were contemplated at the time of any transaction; Cyxtera’s ability to protect its intellectual property rights; Cyxtera’s ability to continue to develop, acquire, market and provide new offerings or enhancements to existing offerings that meet customer requirements and differentiate it from its competitors; disruptions associated with events beyond its control, such as war, acts of terror, political unrest, public health concerns, labor disputes or natural disasters; sales or issuances of shares of the combined company’s common stock may adversely affect the market price of the combined company’s common stock; the requirements of being a public company, including maintaining adequate internal control over financial and management systems; risks related to corporate social responsibility; Cyxtera’s ability to lease available space to existing or new customers, which could be constrained by its ability to provide sufficient electrical power; Cyxtera’s ability to adapt to changing technologies and customer requirements; Cyxtera’s ability to manage its growth; risks related to litigation, securities class action or threatened litigation which may divert management time and attention, require Cyxtera to pay damages and expenses or restrict the operation of its business; the volatility of the market price of the combined company’s stock; the incurrence of goodwill and other intangible asset impairment charges, or impairment charges to Cyxtera’s property, plant and equipment, which could result in a significant reduction to its earnings; U.S. and foreign tax legislation and future changes to applicable U.S. or foreign tax laws and regulations and/or their interpretation may have an adverse effect on Cyxtera’s business, financial condition and results of operations and tax rules and regulations are subject to interpretation and require judgment by Cyxtera that may be successfully challenged by the applicable taxation authorities upon audit, which could result in additional tax liabilities; and Cyxtera’s ability to use its United States federal and state net operating losses to offset future United States federal and applicable state taxable income may be subject to certain limitations which could accelerate or permanently increase taxes owed. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of SVAC’s final prospectus related to its initial public offering, SVAC’s Annual Report on Form 10-K/A for the year ended December 31, 2020, the Proxy Statement discussed above under the heading “Additional Information and Where to Find It” and other documents filed by SVAC from time to time with the SEC. There may be additional risks that Cyxtera and SVAC do not presently know or that they currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Cyxtera’s and SVAC’s expectations, plans or forecasts of future events and views as of the date of this Current Report on Form 8-K. Accordingly, you should not place undue reliance upon any such forward-looking statements in this Current Report on Form 8-K. Neither Cyxtera, SVAC nor any of their affiliates assume any obligation to update this Current Report on Form 8-K, except as required by law.

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Transactions and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of SVAC or Cyxtera nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Starboard Value Acquisition Corp. | |||

| Dated: May 26, 2021 | |||

| By: | /s/ Martin D. McNulty, Jr. | ||

| Name: | Martin D. McNulty, Jr. | ||

| Title: | Chief Executive Officer | ||

Exhibit 99.1

Cyxtera Announces First Quarter 2021 Results

Miami, FL May 26, 2021 – Cyxtera, a global leader in data center colocation and interconnection services, today released financial results for the quarter ended March 31, 2021.

“In the first quarter of 2021 our team was able to continue the momentum we built in 2020 to deliver solid results,” said Nelson Fonseca, Cyxtera’s Chief Executive Officer. “Based on the ongoing positive trends we’re seeing across our business, we believe that we are well positioned to continue our growth trajectory and deliver strong results in line with our previously disclosed targets.”

Q1 2021 Financial Highlights

| · | Total Revenue increased slightly in Q1 2021 versus Q1 2020, in line with expectations. |

| · | Core Revenue increased approximately 6% over the same quarter last year. |

| · | Transaction Adjusted EBITDA increased by 3% year-over-year, or $1.5 million, to $56.1 million, principally due to higher revenue and improvements in cost of revenue. |

Q1 2021 Business Highlights

| · | Continued positive sales momentum driven by enhanced customer engagement and strong pipeline growth. |

| · | Core bookings increased by approximately 40% over the same quarter last year, propelled by continued growth in channel partner activity. |

| · | Channel bookings increased year over year. |

| · | Churn remained flat, and in line with expectations. |

Cyxtera and Starboard Value Acquisition Corp. (NASDAQ: SVAC), a publicly traded special purpose acquisition company, previously announced the signing of an agreement and plan of merger. The merger implies an enterprise value of approximately $3.4 billion and the proposed business combination has been unanimously approved by the boards of directors of both SVAC and Cyxtera. It is expected to close in mid 2021, subject to customary closing conditions, including the receipt of regulatory approvals and approval by SVAC’s stockholders. Upon closing of the proposed business combination, the name of Starboard Value Acquisition Corp. will be changed to Cyxtera Technologies, Inc.

About Cyxtera

Cyxtera is a global leader in data center colocation and interconnection services. The company operates a footprint of 61 data centers in 29 markets around the world, providing services to more than 2,300 leading enterprises and U.S. federal government agencies. Cyxtera brings proven operational excellence, global scale, flexibility and customer-focused innovation together to provide a comprehensive portfolio of data center and interconnection services. For more information, please visit www.cyxtera.com.

About SVAC

Starboard Value Acquisition Corp. is a blank check company whose business purpose is to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. SVAC’s sponsor, SVAC Sponsor LLC, is an affiliate of Starboard Value LP. For more information, please go to StarboardSVAC.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the federal securities laws, opinions and projections prepared by the Cyxtera and SVAC’s management. These forward-looking statements generally are identified by the words “expects,” “will,” “projected,” “continue,” “ increase,” and/or similar expressions that concern Cyxtera’s or SVAC’s strategy, plans or intentions, but the absence of these words does not mean that a statement is not forward-looking. Such statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are based on management’s belief or interpretation of information currently available. Because forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of Cyxtera’s or SVAC’s control. Actual results and condition (financial or otherwise) may differ materially from those indicated in the forward-looking statements. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results and conditions to differ materially from those indicated in the forward-looking statements, including, but not limited to, changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the proposed transactions, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed transactions or that the required stockholder approval is not obtained; failure to realize the anticipated benefits of the proposed transactions; the risk that the market price of the combined company’s securities may decline following the consummation of the proposed transactions if the proposed transaction’s benefits do not meet the expectations of investors or securities analysts; risks relating to the uncertainty of Cyxtera’s projected operating and financial information; the impact of Cyxtera’s substantial debt on its future cash flows and its ability to raise additional capital in the future; adverse global economic conditions and credit market uncertainty; the regulatory, currency, legal, tax and other risks related to Cyxtera’s international operations; the United Kingdom’s withdrawal from the European Union and the potential negative effect on global economic conditions, financial markets and Cyxtera’s business; the effects of the COVID-19 pandemic on Cyxtera’s business or future results; the ability to access external sources of capital on favorable terms or at all, which could limit Cyxtera’s ability to execute its business and growth strategies; fluctuations in foreign currency exchange rates in the markets in which Cyxtera operates internationally; physical and electronic security breaches and cyber-attacks which could disrupt Cyxtera’s operations; Cyxtera’s dependence upon the demand for data centers; Cyxtera’s products and services having a long sales cycle that may harm its revenues and operating results; any failure of Cyxtera’s physical infrastructure or negative impact on its ability to provide its services, or damage to customer infrastructure within its data centers, which could lead to significant costs and disruptions that could reduce Cyxtera’s revenue and harm its business reputation and financial results; inadequate or inaccurate external and internal information, including budget and planning data, which could lead to inaccurate financial forecasts and inappropriate financial decisions; maintaining sufficient insurance coverage; environmental regulations and related new or unexpected costs; climate change and responses to it; prolonged power outages, shortages or capacity constraints; the combined company’s inability to recruit or retain key executives and qualified personnel; the ability to compete successfully against current and future competitors; Cyxtera’s fluctuating operating results; incurring substantial losses, as Cyxtera has previously; Cyxtera’s ability to renew its long-term data center leases on acceptable terms, or at all; Cyxtera’s government contracts, which are subject to early termination, audits, investigations, sanctions and penalties; failure to attract, grow and retain a diverse and balanced customer base, including key magnet customers; future consolidation and competition in Cyxtera’s customers’ industries, which could reduce the number of Cyxtera’s existing and potential customers and make it dependent on a more limited number of customers; Cyxtera’s reliance on third parties to provide internet connectivity to its data centers; disruption or termination of connectivity; government regulation; the non-realization of the financial or strategic goals related to acquisitions that were contemplated at the time of any transaction; Cyxtera’s ability to protect its intellectual property rights; Cyxtera’s ability to continue to develop, acquire, market and provide new offerings or enhancements to existing offerings that meet customer requirements and differentiate it from its competitors; disruptions associated with events beyond its control, such as war, acts of terror, political unrest, public health concerns, labor disputes or natural disasters; sales or issuances of shares of the combined company’s common stock may adversely affect the market price of the combined company’s common stock; the requirements of being a public company, including maintaining adequate internal control over financial and management systems; risks related to corporate social responsibility; Cyxtera’s ability to lease available space to existing or new customers, which could be constrained by its ability to provide sufficient electrical power; Cyxtera’s ability to adapt to changing technologies and customer requirements; Cyxtera’s ability to manage its growth; risks related to litigation, securities class action or threatened litigation which may divert management time and attention, require Cyxtera to pay damages and expenses or restrict the operation of its business; the volatility of the market price of the combined company’s stock; the incurrence of goodwill and other intangible asset impairment charges, or impairment charges to Cyxtera’s property, plant and equipment, which could result in a significant reduction to its earnings; U.S. and foreign tax legislation and future changes to applicable U.S. or foreign tax laws and regulations and/or their interpretation may have an adverse effect on Cyxtera’s business, financial condition and results of operations and tax rules and regulations are subject to interpretation and require judgment by Cyxtera that may be successfully challenged by the applicable taxation authorities upon audit, which could result in additional tax liabilities; and Cyxtera’s ability to use its United States federal and state net operating losses to offset future United States federal and applicable state taxable income may be subject to certain limitations which could accelerate or permanently increase taxes owed. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of SVAC’s final prospectus related to its initial public offering, the proxy statement discussed below and other documents filed by SVAC from time to time with the SEC. There may be additional risks that Cyxtera and SVAC do not presently know or that they currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Cyxtera’s and SVAC’s expectations, plans or forecasts of future events and views as of the date of this press release. Accordingly, you should not place undue reliance upon any such forward-looking statements in this press release. Neither Cyxtera, SVAC nor any of their affiliates assume any obligation to update this press release, except as required by law.

Additional Information and Where to Find It

In connection with the merger, SVAC has filed a proxy statement (the “Proxy Statement”) with the SEC, which will be distributed to holders of SVAC’s common stock in connection with SVAC’s solicitation of proxies for the vote by the SVAC stockholders with respect to the merger and other matters as described in the Proxy Statement. SVAC urges its stockholders and other interested persons to read the Proxy Statement and amendments thereto and documents incorporated by reference therein, as well as other documents filed with the SEC in connection with the merger, as these materials contain important information about SVAC, Cyxtera and the merger. When available, the definitive Proxy Statement will be mailed to SVAC’s stockholders. Stockholders will also be able to obtain copies of such documents, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: Starboard Value Acquisition Corp., 777 Third Avenue, 18th Floor, New York, NY 10017.

Participants in Solicitation

SVAC and its directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of SVAC’s stockholders in connection with the merger. Stockholders of SVAC may obtain more detailed information regarding the names, affiliations and interests of SVAC’s directors and executive officers in SVAC’s final prospectus for its initial public offering filed with the SEC on September 11, 2020 and in the Proxy Statement. Information concerning the interests of SVAC’s participants in the solicitation, which may, in some cases, be different than those of SVAC’s stockholders generally, will be set forth in the Proxy Statement relating to the merger when it becomes available.

No Offer or Solicitation

This press release is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Cyxtera or SVAC nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

Statement Regarding Non-GAAP Financial Measures

This press release includes Transaction Adjusted EBITDA, which is a supplemental measure that is not required by, or presented in accordance with, accounting principles generally accepted in the United States (“GAAP”). Cyxtera defines Transaction Adjusted EBITDA as net income (loss) before the following items: depreciation and amortization, impairment on note and other receivables from affiliate, interest and other expenses, net, income tax benefit, equity-based compensation, straight line rent adjustment, amortization of unfavorable interest and accretion expense, stand up, separation and out of period adjustments, and restructuring costs. As a Non-GAAP financial measure, Transaction Adjusted EBITDA excludes items that are significant in understanding and assessing Cyxtera’s financial results or position. Therefore, this measure should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that Cyxtera’s presentation of this measure may not be comparable to similarly-titled measures used by other companies. You should review Cyxtera’s audited financial statements and the reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measures provided in this release and not rely on any single financial measure to evaluate Cyxtera’s business.

CYXTERA TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Balance Sheets

(in millions, except share information)

(unaudited)

| March 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Assets: | ||||||||

| Current assets: | ||||||||

| Cash | $ | 113.6 | $ | 120.7 | ||||

| Accounts receivable, net of allowance of $1.2 and $1.4 | 12.6 | 33.5 | ||||||

| Prepaid and other current assets | 38.9 | 41.9 | ||||||

| Due from affiliates | - | 117.1 | ||||||

| Total current assets | 165.1 | 313.2 | ||||||

| Property, plant and equipment, net | 1,554.0 | 1,580.7 | ||||||

| Goodwill | 763.0 | 762.2 | ||||||

| Intangible assets, net | 569.7 | 586.3 | ||||||

| Other assets | 24.0 | 23.7 | ||||||

| Total assets | $ | 3,075.8 | $ | 3,266.1 | ||||

| Liabilities and shareholder's equity: | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 48.2 | $ | 48.9 | ||||

| Accrued expenses | 91.0 | 88.4 | ||||||

| Due to affiliates | - | 22.7 | ||||||

| Current portion of long-term debt, capital leases and other financing obligations | 58.1 | 65.0 | ||||||

| Deferred revenue | 59.9 | 60.2 | ||||||

| Other current liabilities | 7.0 | 6.8 | ||||||

| Total current liabilities | 264.2 | 292.0 | ||||||

| Long-term debt, net of current portion | 1,310.4 | 1,311.5 | ||||||

| Capital leases and other financing obligations, net of current portion | 927.3 | 933.1 | ||||||

| Deferred income taxes | 64.9 | 77.8 | ||||||

| Other liabilities | 99.6 | 93.9 | ||||||

| Total liabilities | 2,666.4 | 2,708.3 | ||||||

| Commitments and contingencies | ||||||||

| Shareholder's equity: | ||||||||

| Common shares, $0.01 par value; 1,000 shares authorized; 0.88 of a share and 0.96 of a share issued and outstanding as of March 31, 2021 and December 31, 2020, respectively | - | - | ||||||

| Additional paid-in capital | 1,408.6 | 1,504.6 | ||||||

| Accumulated other comprehensive income | 16.9 | 16.7 | ||||||

| Accumulated deficit | (1,016.1 | ) | (963.5 | ) | ||||

| Total shareholder's equity | 409.4 | 557.8 | ||||||

| Total liabilities and shareholder's equity | $ | 3,075.8 | $ | 3,266.1 | ||||

CYXTERA TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Statements of Operations

(in millions)

(unaudited)

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Revenues | $ | 172.9 | $ | 172.5 | ||||

| Operating costs and expenses: | ||||||||

| Cost of revenues, excluding depreciation and amortization | 98.4 | 95.9 | ||||||

| Selling, general and administrative expenses | 27.6 | 31.1 | ||||||

| Depreciation and amortization | 60.6 | 57.0 | ||||||

| Restructuring, impairment, site closures and related costs | 8.1 | - | ||||||

| Impairment of notes receivable and other amounts due from affiliate | - | 6.7 | ||||||

| Total operating costs and expenses | 194.7 | 190.7 | ||||||

| Loss from operations | (21.8 | ) | (18.2 | ) | ||||

| Interest expense, net | (43.2 | ) | (43.3 | ) | ||||

| Other expenses, net | (0.5 | ) | (0.3 | ) | ||||

| Loss from operations before income taxes | (65.5 | ) | (61.8 | ) | ||||

| Income tax benefit | 12.9 | 14.4 | ||||||

| Net loss | $ | (52.6 | ) | $ | (47.4 | ) | ||

CYXTERA TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Statements of Comprehensive Loss

(in millions)

(unaudited)

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Net loss | $ | (52.6 | ) | $ | (47.4 | ) | ||

| Other comprehensive income (loss): | ||||||||

| Foreign currency translation adjustment | 0.2 | (17.4 | ) | |||||

| Other comprehensive income (loss) | 0.2 | (17.4 | ) | |||||

| Comprehensive loss | $ | (52.4 | ) | $ | (64.8 | ) | ||

CYXTERA TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Statements of Cash Flows

(in millions)

(unaudtied)

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Net loss | $ | (52.6 | ) | $ | (47.4 | ) | ||

| Cash flows from operating activities: | ||||||||

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | ||||||||

| Depreciation and amortization | 60.6 | 57.0 | ||||||

| Restructuring, impairment, site closures and related costs | 2.0 | - | ||||||

| Amortization of favorable/unfavorable leasehold interests, net | 1.1 | 0.8 | ||||||

| Amortization of debt issuance costs and fees, net | 1.4 | 1.4 | ||||||

| Impairment of notes receivable and other amounts due from affiliate | - | 6.7 | ||||||

| Equity-based compensation | 1.9 | 2.2 | ||||||

| Bad debt expense (recoveries), net | (0.2 | ) | 0.6 | |||||

| Deferred income taxes | (12.9 | ) | (14.4 | ) | ||||

| Non-cash interest expense, net | 2.4 | 4.6 | ||||||

| Changes in operating assets and liabilities, excluding impact of acquisitions and dispositions: | ||||||||

| Accounts receivable | 21.0 | (19.4 | ) | |||||

| Prepaid and other current assets | 2.8 | 2.3 | ||||||

| Due from affiliates | - | 1.2 | ||||||

| Other assets | (0.5 | ) | 2.3 | |||||

| Accounts payable | (3.1 | ) | 0.7 | |||||

| Accrued expenses | 2.6 | (2.6 | ) | |||||

| Due to affiliates | (22.7 | ) | - | |||||

| Other liabilities | 4.3 | 3.2 | ||||||

| Net cash provided by (used in) operating activities | 8.1 | (0.8 | ) | |||||

| Cash flows from investing activities: | ||||||||

| Purchases of property and equipment | (13.7 | ) | (37.9 | ) | ||||

| Amounts received from (advanced to) affiliate | 117.1 | (5.3 | ) | |||||

| Net cash provided by (used in) investing activities | 103.4 | (43.2 | ) | |||||

| Cash flows from financing activities: | ||||||||

| Proceeds from issuance of long-term debt and other financing obligations | - | 91.0 | ||||||

| Repayment of long-term debt | (2.3 | ) | - | |||||

| Repayment of capital leases and other financing obligations | (17.1 | ) | (2.2 | ) | ||||

| Capital redemption | (97.9 | ) | - | |||||

| Net cash (used in) provided by financing activities | (117.3 | ) | 88.8 | |||||

| Effect of foreign currency exchange rates on cash | (1.3 | ) | (3.6 | ) | ||||

| Net (decrease) increase in cash | (7.1 | ) | 41.2 | |||||

| Cash at beginning of period | 120.7 | 13.0 | ||||||

| Cash at end of period | $ | 113.6 | $ | 54.2 | ||||

| Supplemental cash flow information: | ||||||||

| Cash paid for income taxes, net of refunds | $ | 0.3 | $ | 0.4 | ||||

| Cash paid for interest | $ | 25.6 | $ | 24.7 | ||||

| Non-cash purchases of property, plant and equipment | $ | 9.7 | $ | 29.7 | ||||

CYXTERA TECHNOLOGIES, INC.

RECONCILIATION OF GAAP TO NON-GAAP RESULTS

(in millions)

(unaudited)

| Three Months Ended | Three Months Ended | |||||||

| March 31, 2021 | March 31, 2020 | |||||||

| Net Loss to Transaction Adj. EBITDA Reconciliation: | ||||||||

| Net loss | $ | (52.6 | ) | $ | (47.4 | ) | ||

| Depreciation and amortization | 60.6 | 57.0 | ||||||

| Impairment of note and other receivables from affiliate | - | 6.7 | ||||||

| Interest and other expenses, net | 43.7 | 43.6 | ||||||

| Income tax benefit | (12.9 | ) | (14.4 | ) | ||||

| EBITDA | 38.9 | 45.5 | ||||||

| Transaction Adjustments | ||||||||

| Equity-based compensation | 1.8 | 2.0 | ||||||

| Straight-line rent adjustment | 1.1 | 0.8 | ||||||

| Amort of Un/Fav Int. & Accretion Exp. | 0.9 | 0.9 | ||||||

| Stand-up, separation & out-of-period adjustments | 3.1 | 2.8 | ||||||

| Restructuring costs | 10.3 | 2.6 | ||||||

| Transaction Adjusted EBITDA | $ | 56.1 | $ | 54.6 | ||||

IR Contact:

Nathan Berlinski

Cyxtera

Press Contact:

Xavier Gonzalez

Cyxtera

Exhibit 99.2

CYXTERA TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Financial Statements

As of March 31, 2021 and December 31, 2020 and for the

Three Months Ended March 31, 2021 and 2020

CYXTERA TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Balance Sheets

(in millions, except share information)

| March 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Assets: | ||||||||

| Current assets: | ||||||||

| Cash | $ | 113.6 | $ | 120.7 | ||||

| Accounts receivable, net of allowance of $1.2 and $1.4 | 12.6 | 33.5 | ||||||

| Prepaid and other current assets | 38.9 | 41.9 | ||||||

| Due from affiliates | - | 117.1 | ||||||

| Total current assets | 165.1 | 313.2 | ||||||

| Property, plant and equipment, net | 1,554.0 | 1,580.7 | ||||||

| Goodwill | 763.0 | 762.2 | ||||||

| Intangible assets, net | 569.7 | 586.3 | ||||||

| Other assets | 24.0 | 23.7 | ||||||

| Total assets | $ | 3,075.8 | $ | 3,266.1 | ||||

| Liabilities and shareholder's equity: | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 48.2 | $ | 48.9 | ||||

| Accrued expenses | 91.0 | 88.4 | ||||||

| Due to affiliates | - | 22.7 | ||||||

| Current portion of long-term debt, capital leases and other financing obligations | 58.1 | 65.0 | ||||||

| Deferred revenue | 59.9 | 60.2 | ||||||

| Other current liabilities | 7.0 | 6.8 | ||||||

| Total current liabilities | 264.2 | 292.0 | ||||||

| Long-term debt, net of current portion | 1,310.4 | 1,311.5 | ||||||

| Capital leases and other financing obligations, net of current portion | 927.3 | 933.1 | ||||||

| Deferred income taxes | 64.9 | 77.8 | ||||||

| Other liabilities | 99.6 | 93.9 | ||||||

| Total liabilities | 2,666.4 | 2,708.3 | ||||||

| Commitments and contingencies | ||||||||

| Shareholder's equity: | ||||||||

| Common shares, $0.01 par value; 1,000 shares authorized; 0.88 of a share and 0.96 of a share issued and outstanding as of March 31, 2021 and | ||||||||

| December 31, 2020, respectively | - | - | ||||||

| Additional paid-in capital | 1,408.6 | 1,504.6 | ||||||

| Accumulated other comprehensive income | 16.9 | 16.7 | ||||||

| Accumulated deficit | (1,016.1 | ) | (963.5 | ) | ||||

| Total shareholder's equity | 409.4 | 557.8 | ||||||

| Total liabilities and shareholder's equity | $ | 3,075.8 | $ | 3,266.1 | ||||

2

CYXTERA TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Statements of Operations

(in millions)

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Revenues | $ | 172.9 | $ | 172.5 | ||||

| Operating costs and expenses: | ||||||||

| Cost of revenues, excluding depreciation and amortization | 98.4 | 95.9 | ||||||

| Selling, general and administrative expenses | 27.6 | 31.1 | ||||||

| Depreciation and amortization | 60.6 | 57.0 | ||||||

| Restructuring, impairment, site closures and related costs | 8.1 | - | ||||||

| Impairment of notes receivable and other amounts due from affiliate | - | 6.7 | ||||||

| Total operating costs and expenses | 194.7 | 190.7 | ||||||

| Loss from operations | (21.8 | ) | (18.2 | ) | ||||

| Interest expense, net | (43.2 | ) | (43.3 | ) | ||||

| Other expenses, net | (0.5 | ) | (0.3 | ) | ||||

| Loss from operations before income taxes | (65.5 | ) | (61.8 | ) | ||||

| Income tax benefit | 12.9 | 14.4 | ||||||

| Net loss | $ | (52.6 | ) | $ | (47.4 | ) | ||

3

CYXTERA TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Statements of Comprehensive Loss

(in millions)

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Net loss | $ | (52.6 | ) | $ | (47.4 | ) | ||

| Other comprehensive income (loss): | ||||||||

| Foreign currency translation adjustment | 0.2 | (17.4 | ) | |||||

| Other comprehensive income (loss) | 0.2 | (17.4 | ) | |||||

| Comprehensive loss | $ | (52.4 | ) | $ | (64.8 | ) | ||

4

CYXTERA TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Statements of Changes in Shareholder’s Equity

(in millions, except share information)

| Accumulated | ||||||||||||||||||||||||

| Additional | other | Total | ||||||||||||||||||||||

| Common shares | paid-in | comprehensive | Accumulated | shareholder's | ||||||||||||||||||||

| Share | Amount | capital | income (loss) | deficit | equity | |||||||||||||||||||

| Balance as of December 31, 2020 | 0.96 | $ | 0.01 | $ | 1,504.6 | $ | 16.7 | $ | (963.5 | ) | $ | 557.8 | ||||||||||||

| Equity-based compensation | - | - | 1.9 | - | - | 1.9 | ||||||||||||||||||

| Capital redemption | (0.08 | ) | - | (97.9 | ) | - | - | (97.9 | ) | |||||||||||||||

| Net loss | - | - | - | - | (52.6 | ) | (52.6 | ) | ||||||||||||||||

| Other comprehensive income | - | - | - | 0.2 | - | 0.2 | ||||||||||||||||||

| Balance as of March 31, 2021 | 0.88 | $ | 0.01 | $ | 1,408.6 | $ | 16.9 | $ | (1,016.1 | ) | $ | 409.4 | ||||||||||||

| Balance as of December 31, 2019 | 0.96 | $ | 0.01 | $ | 1,494.9 | $ | 8.0 | $ | (840.7 | ) | $ | 662.2 | ||||||||||||

| Equity-based compensation | - | - | 2.2 | - | - | 2.2 | ||||||||||||||||||

| Net loss | - | - | - | - | (47.4 | ) | (47.4 | ) | ||||||||||||||||

| Other comprehensive income | - | - | - | (17.4 | ) | - | (17.4 | ) | ||||||||||||||||

| Balance as of March 31, 2020 | 0.96 | $ | 0.01 | $ | 1,497.1 | $ | (9.4 | ) | $ | (888.1 | ) | $ | 599.6 | |||||||||||

5

CYXTERA TECHNOLOGIES, INC.

Unaudited

Condensed Consolidated Statements of Cash Flows

(in millions)

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Net loss | $ | (52.6 | ) | $ | (47.4 | ) | ||

| Cash flows from operating activities: | ||||||||

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | ||||||||

| Depreciation and amortization | 60.6 | 57.0 | ||||||

| Restructuring, impairment, site closures and related costs | 2.0 | - | ||||||

| Amortization of favorable/unfavorable leasehold interests, net | 1.1 | 0.8 | ||||||

| Amortization of debt issuance costs and fees, net | 1.4 | 1.4 | ||||||

| Impairment of notes receivable and other amounts due from affiliate | - | 6.7 | ||||||

| Equity-based compensation | 1.9 | 2.2 | ||||||

| Bad debt expense (recoveries), net | (0.2 | ) | 0.6 | |||||

| Deferred income taxes | (12.9 | ) | (14.4 | ) | ||||

| Non-cash interest expense, net | 2.4 | 4.6 | ||||||

| Changes in operating assets and liabilities, excluding impact of acquisitions and dispositions: | ||||||||

| Accounts receivable | 21.0 | (19.4 | ) | |||||

| Prepaid and other current assets | 2.8 | 2.3 | ||||||

| Due from affiliates | - | 1.2 | ||||||

| Other assets | (0.5 | ) | 2.3 | |||||

| Accounts payable | (3.1 | ) | 0.7 | |||||

| Accrued expenses | 2.6 | (2.6 | ) | |||||

| Due to affiliates | (22.7 | ) | - | |||||

| Other liabilities | 4.3 | 3.2 | ||||||

| Net cash provided by (used in) operating activities | 8.1 | (0.8 | ) | |||||

| Cash flows from investing activities: | ||||||||

| Purchases of property, plant and equipment | (13.7 | ) | (37.9 | ) | ||||

| Amounts received from (advanced to) affiliate | 117.1 | (5.3 | ) | |||||

| Net cash provided by (used in) investing activities | 103.4 | (43.2 | ) | |||||

| Cash flows from financing activities: | ||||||||

| Proceeds from issuance of long-term debt and other financing obligations | - | 91.0 | ||||||

| Repayment of long-term debt | (2.3 | ) | - | |||||

| Repayment of capital leases and other financing obligations | (17.1 | ) | (2.2 | ) | ||||

| Capital redemption | (97.9 | ) | - | |||||

| Net cash (used in) provided by financing activities | (117.3 | ) | 88.8 | |||||

| Effect of foreign currency exchange rates on cash | (1.3 | ) | (3.6 | ) | ||||

| Net (decrease) increase in cash | (7.1 | ) | 41.2 | |||||

| Cash at beginning of period | 120.7 | 13.0 | ||||||

| Cash at end of period | $ | 113.6 | $ | 54.2 | ||||

| Supplemental cash flow information: | ||||||||

| Cash paid for income taxes, net of refunds | $ | 0.3 | $ | 0.4 | ||||

| Cash paid for interest | $ | 25.6 | $ | 24.7 | ||||

| Non-cash purchases of property, plant and equipment | $ | 9.7 | $ | 29.7 | ||||

6

CYXTERA TECHNOLOGIES, INC.

SUPPLEMENTARY INFORMATION

The following supplemental consolidating information of Cyxtera DC Holdings, Inc. and its subsidiaries (“DC Holdings”), and all other subsidiaries of the Company, including its parent Cyxtera Technologies, Inc. (“Other”) as of March 31, 2021 and December 31, 2020, and the results of its operations, comprehensive income, changes in shareholder’s equity and other comprehensive income (loss), and cash flows for the three months ended March 31, 2021 and 2020. DC Holdings is a wholly owned subsidiary of the Company.

7

CYXTERA TECHNOLOGIES, INC.

SUPPLEMENTARY INFORMATION

Schedule 1 – Unaudited Condensed Consolidating Balance Sheet Information (in millions)

| As of March 31, 2021 | ||||||||||||

| DC Holdings | Other | Total | ||||||||||

| Assets: | ||||||||||||

| Current assets: | ||||||||||||

| Cash | $ | 110.4 | $ | 3.2 | $ | 113.6 | ||||||

| Accounts receivable, net of allowance | 12.4 | 0.2 | 12.6 | |||||||||

| Prepaid and other current assets | 34.3 | 4.6 | 38.9 | |||||||||

| Due from affiliates | 66.0 | (66.0 | ) | - | ||||||||

| Total current assets | 223.1 | (58.0 | ) | 165.1 | ||||||||

| Property, plant and equipment, net | 1,546.2 | 7.8 | 1,554.0 | |||||||||

| Goodwill | 763.0 | - | 763.0 | |||||||||

| Intangible assets, net | 569.7 | - | 569.7 | |||||||||

| Other assets | 18.5 | 5.5 | 24.0 | |||||||||

| Total assets | $ | 3,120.5 | $ | (44.7 | ) | $ | 3,075.8 | |||||

| Liabilities and shareholder's equity: | ||||||||||||

| Current liabilities: | ||||||||||||

| Accounts payable | $ | 44.2 | $ | 4.0 | $ | 48.2 | ||||||

| Accrued expenses | 71.1 | 19.9 | 91.0 | |||||||||

| Current portion of long-term debt, capital leases and other financing obligations | 57.0 | 1.1 | 58.1 | |||||||||

| Deferred revenue | 59.6 | 0.3 | 59.9 | |||||||||

| Other current liabilities | 6.6 | 0.4 | 7.0 | |||||||||

| Total current liabilities | 238.5 | 25.7 | 264.2 | |||||||||

| Long-term debt, net of current portion | 1,310.4 | - | 1,310.4 | |||||||||

| Capital leases and other financing obligations, net of current portion | 927.3 | - | 927.3 | |||||||||

| Deferred income taxes | 64.6 | 0.3 | 64.9 | |||||||||

| Other liabilities | 94.9 | 4.7 | 99.6 | |||||||||

| Total liabilities | 2,635.7 | 30.7 | 2,666.4 | |||||||||

| Shareholder's equity: | ||||||||||||

| Common shares | - | - | - | |||||||||

| Additional paid-in capital | 1,053.2 | 355.4 | 1,408.6 | |||||||||

| Accumulated other comprehensive income (loss) | 17.5 | (0.6 | ) | 16.9 | ||||||||

| Accumulated deficit | (585.9 | ) | (430.2 | ) | (1,016.1 | ) | ||||||

| Total shareholder's equity | 484.8 | (75.4 | ) | 409.4 | ||||||||

| Total liabilities and shareholder's equity | $ | 3,120.5 | $ | (44.7 | ) | $ | 3,075.8 | |||||

8

CYXTERA TECHNOLOGIES, INC.

SUPPLEMENTARY INFORMATION

Schedule 1 – Unaudited Condensed Consolidating Balance Sheet Information (in millions, continued)

| As of December 31, 2020 | ||||||||||||||||

| DC Holdings | Other | Eliminations | Total | |||||||||||||

| Assets: | ||||||||||||||||

| Current assets: | ||||||||||||||||

| Cash | $ | 120.3 | $ | 0.4 | $ | - | $ | 120.7 | ||||||||

| Accounts receivable, net of allowance | 29.3 | 4.2 | - | 33.5 | ||||||||||||

| Prepaid and other current assets | 36.6 | 5.3 | - | 41.9 | ||||||||||||

| Total current assets | 259.5 | 127.0 | (73.3 | ) | 313.2 | |||||||||||

| Property, plant and equipment, net | 1,570.1 | 10.6 | - | 1,580.7 | ||||||||||||

| Goodwill | 762.2 | - | - | 762.2 | ||||||||||||

| Intangible assets, net | 586.3 | - | - | 586.3 | ||||||||||||

| Other assets | 21.4 | 2.3 | - | 23.7 | ||||||||||||

| Total assets | $ | 3,199.5 | $ | 139.9 | $ | (73.3 | ) | $ | 3,266.1 | |||||||

| Liabilities and shareholder's equity: | ||||||||||||||||

| Current liabilities: | ||||||||||||||||

| Accounts payable | $ | 46.0 | $ | 2.9 | $ | - | $ | 48.9 | ||||||||

| Accrued expenses | 73.0 | 15.4 | - | 88.4 | ||||||||||||

| Due to affiliates | - | 96.0 | (73.3 | ) | 22.7 | |||||||||||

| Current portion of long-term debt, capital leases and other financing obligations | 62.5 | 2.5 | - | 65.0 | ||||||||||||

| Deferred revenue | 60.2 | - | - | 60.2 | ||||||||||||

| Other current liabilities | 6.8 | - | - | 6.8 | ||||||||||||

| Total current liabilities | 248.5 | 116.8 | (73.3 | ) | 292.0 | |||||||||||

| Long-term debt, net of current portion | 1,311.5 | - | - | 1,311.5 | ||||||||||||

| Capital leases and other financing obligations, net of current portion | 933.1 | - | - | 933.1 | ||||||||||||

| Deferred income taxes | 77.1 | 0.7 | - | 77.8 | ||||||||||||

| Other liabilities | 93.9 | - | - | 93.9 | ||||||||||||

| Total liabilities | 2,664.1 | 117.5 | (73.3 | ) | 2,708.3 | |||||||||||

| Shareholder's equity: | ||||||||||||||||

| Common shares | - | - | - | - | ||||||||||||

| Additional paid-in capital | 1,052.8 | 451.8 | - | 1,504.6 | ||||||||||||

| Accumulated other comprehensive income (loss) | 17.3 | (0.6 | ) | - | 16.7 | |||||||||||

| Accumulated deficit | (534.7 | ) | (428.8 | ) | - | (963.5 | ) | |||||||||

| Total shareholder's equity | 535.4 | 22.4 | - | 557.8 | ||||||||||||

| Total liabilities and shareholder's equity | $ | 3,199.5 | $ | 139.9 | $ | (73.3 | ) | $ | 3,266.1 | |||||||

9

CYXTERA TECHNOLOGIES, INC.

SUPPLEMENTARY INFORMATION

Schedule 2 – Unaudited Condensed Consolidating Statements of Operations Information (in millions)

| Three Months Ended March 31, 2021 | ||||||||||||

| DC Holdings | Other | Total | ||||||||||

| Revenues | $ | 167.9 | $ | 5.0 | $ | 172.9 | ||||||

| Operating costs and expenses: | ||||||||||||

| Cost of revenues, excluding depreciation and amortization | 95.7 | 2.7 | 98.4 | |||||||||

| Selling, general and administrative expenses | 25.9 | 1.7 | 27.6 | |||||||||

| Depreciation and amortization | 58.8 | 1.8 | 60.6 | |||||||||

| Restructuring, impairment, site closures and related costs | 8.1 | - | 8.1 | |||||||||

| Total operating costs and expenses | 188.5 | 6.2 | 194.7 | |||||||||

| (Loss) Income from operations | (20.6 | ) | (1.2 | ) | (21.8 | ) | ||||||

| Interest expense, net | (42.8 | ) | (0.4 | ) | (43.2 | ) | ||||||

| Other expenses, net | (0.4 | ) | (0.1 | ) | (0.5 | ) | ||||||

| (Loss) Income from operations before income taxes | (63.8 | ) | (1.7 | ) | (65.5 | ) | ||||||

| Income tax benefit (expense) | 12.6 | 0.3 | 12.9 | |||||||||

| Net (loss) income | $ | (51.2 | ) | $ | (1.4 | ) | $ | (52.6 | ) | |||

| Three Months Ended March 31, 2020 | ||||||||||||

| DC Holdings | Other | Total | ||||||||||

| Revenues | $ | 172.5 | $ | - | $ | 172.5 | ||||||

| Operating costs and expenses: | ||||||||||||

| Cost of revenues, excluding depreciation and amortization | 95.9 | - | 95.9 | |||||||||

| Selling, general and administrative expenses | 30.6 | 0.5 | 31.1 | |||||||||

| Depreciation and amortization | 57.0 | - | 57.0 | |||||||||

| Impairment (recovery) of notes receivable and other amounts due from affiliate | 7.7 | (1.0 | ) | 6.7 | ||||||||

| Total operating costs and expenses | 191.2 | (0.5 | ) | 190.7 | ||||||||

| (Loss) Income from operations | (18.7 | ) | 0.5 | (18.2 | ) | |||||||

| Interest expense, net | (43.3 | ) | - | (43.3 | ) | |||||||

| Other expenses, net | (0.2 | ) | (0.1 | ) | (0.3 | ) | ||||||

| (Loss) Income from operations before income taxes | (62.2 | ) | 0.4 | (61.8 | ) | |||||||

| Income tax benefit (expense) | 14.7 | (0.3 | ) | 14.4 | ||||||||

| Net (loss) income | $ | (47.5 | ) | $ | 0.1 | $ | (47.4 | ) | ||||

10

CYXTERA TECHNOLOGIES, INC.

SUPPLEMENTARY INFORMATION

Schedule 3 – Unaudited Condensed Consolidating Statements of Comprehensive Income Information (in millions)

| Three Months Ended March 31, 2021 | ||||||||||||

| DC Holdings | Other | Total | ||||||||||

| Net loss | $ | (51.2 | ) | $ | (1.4 | ) | $ | (52.6 | ) | |||

| Other comprehensive loss: | ||||||||||||

| Foreign currency translation adjustment | 0.2 | - | 0.2 | |||||||||

| Other comprehensive loss | 0.2 | - | 0.2 | |||||||||

| Comprehensive loss | $ | (51.0 | ) | $ | (1.4 | ) | $ | (52.4 | ) | |||

Three Months Ended March 31, 2020 | ||||||||||||

| DC Holdings | Other | Total | ||||||||||

| Net (loss) income | $ | (47.5 | ) | $ | 0.1 | $ | (47.4 | ) | ||||

| Other comprehensive loss: | ||||||||||||

| Foreign currency translation adjustment | (17.3 | ) | (0.1 | ) | (17.4 | ) | ||||||

| Other comprehensive loss | (17.3 | ) | (0.1 | ) | (17.4 | ) | ||||||

| Comprehensive (loss) income | $ | (64.8 | ) | $ | - | $ | (64.8 | ) | ||||

11

CYXTERA TECHNOLOGIES, INC.

SUPPLEMENTARY INFORMATION

Schedule

4 – Unaudited Condensed Consolidating Statements of Shareholder’s Equity and Other Comprehensive

(Loss) Income Information (in millions)

| Accumulated | ||||||||||||||||||||||||

| Additional | other | Total | ||||||||||||||||||||||

| Common shares | paid-in | comprehensive | Accumulated | shareholder's | ||||||||||||||||||||

| Share | Amount | capital | (loss) income | deficit | equity | |||||||||||||||||||

| DC Holdings | ||||||||||||||||||||||||

| Balance as of December 31, 2020 | 1 | $ | 0.01 | $ | 1,052.8 | $ | 17.3 | $ | (534.7 | ) | $ | 535.4 | ||||||||||||

| Equity-based compensation, net | - | - | 0.4 | - | - | 0.4 | ||||||||||||||||||

| Net loss | - | - | - | - | (51.2 | ) | (51.2 | ) | ||||||||||||||||

| Other comprehensive loss | - | - | - | 0.2 | - | 0.2 | ||||||||||||||||||

| Balance as of March 31, 2021 | 1 | $ | 0.01 | $ | 1,053.2 | $ | 17.5 | $ | (585.9 | ) | $ | 484.8 | ||||||||||||

| Balance as of December 31, 2019 | 1.00 | $ | 0.01 | $ | 1,051.0 | $ | 8.5 | $ | (385.2 | ) | $ | 674.3 | ||||||||||||

| Equity-based compensation, net | - | - | 0.4 | - | - | 0.4 | ||||||||||||||||||

| Net loss | - | - | - | - | (47.5 | ) | (47.5 | ) | ||||||||||||||||

| Other comprehensive income | - | - | - | (17.3 | ) | - | (17.3 | ) | ||||||||||||||||

| Balance as of March 31, 2020 | 1 | $ | 0.01 | $ | 1,051.4 | $ | (8.8 | ) | $ | (432.7 | ) | $ | 609.9 | |||||||||||

| Other | ||||||||||||||||||||||||

| Balance as of December 31, 2020 | 1 | $ | 0.01 | $ | 451.8 | $ | (0.6 | ) | $ | (428.8 | ) | $ | 22.4 | |||||||||||

| Equity-based compensation, net | - | - | 1.5 | - | - | 1.5 | ||||||||||||||||||

| Capital redemption | (0.95 | ) | - | (97.9 | ) | - | - | (97.9 | ) | |||||||||||||||

| Net loss | - | - | - | - | (1.4 | ) | (1.4 | ) | ||||||||||||||||

| Other comprehensive loss | - | - | - | - | - | - | ||||||||||||||||||

| Balance as of March 31, 2021 | 0.05 | $ | 0.01 | $ | 355.4 | $ | (0.6 | ) | $ | (430.2 | ) | $ | (75.4 | ) | ||||||||||

| Balance as of December 31, 2019 | 1.00 | $ | 0.01 | $ | 1,051.0 | $ | 8.5 | $ | (385.2 | ) | $ | 674.3 | ||||||||||||

| Equity-based compensation, net | - | - | 1.8 | - | - | 1.8 | ||||||||||||||||||

| Net loss | - | - | - | - | 0.1 | 0.1 | ||||||||||||||||||

| Other comprehensive income | - | - | - | (0.1 | ) | - | (0.1 | ) | ||||||||||||||||

| Balance as of March 31, 2020 | 1 | $ | 0.01 | $ | 1,052.8 | $ | 8.4 | $ | (385.1 | ) | $ | 676.1 | ||||||||||||

| Total | ||||||||||||||||||||||||

| Balance as of December 31, 2020 | 0.96 | $ | 0.01 | $ | 1,504.6 | $ | 16.7 | $ | (963.5 | ) | $ | 557.8 | ||||||||||||

| Equity-based compensation, net | - | - | 1.9 | - | - | 1.9 | ||||||||||||||||||

| Capital redemption | (0.08 | ) | - | (97.9 | ) | - | - | (97.9 | ) | |||||||||||||||

| Net loss | - | - | - | - | (52.6 | ) | (52.6 | ) | ||||||||||||||||

| Other comprehensive loss | - | - | - | 0.2 | - | 0.2 | ||||||||||||||||||

| Balance as of March 31, 2021 | 0.88 | $ | 0.01 | $ | 1,408.6 | $ | 16.9 | $ | (1,016.1 | ) | $ | 409.4 | ||||||||||||

| Balance as of December 31, 2019 | 0.96 | $ | 0.01 | $ | 1,494.9 | $ | 8.0 | $ | (840.7 | ) | $ | 662.2 | ||||||||||||

| Equity-based compensation, net | - | - | 2.2 | - | - | 2.2 | ||||||||||||||||||

| Net loss | - | - | - | - | (47.4 | ) | (47.4 | ) | ||||||||||||||||

| Other comprehensive income | - | - | - | (17.4 | ) | - | (17.4 | ) | ||||||||||||||||

| Balance as of March 31, 2020 | 0.96 | $ | 0.01 | $ | 1,497.1 | $ | (9.4 | ) | $ | (888.1 | ) | $ | 599.6 | |||||||||||

12

CYXTERA TECHNOLOGIES, INC.

SUPPLEMENTARY INFORMATION

Schedule 5 – Unaudited Condensed Consolidating Statements of Cash Flows Information (in millions)

| Three Months Ended March 31, 2021 | ||||||||||||

| DC Holdings | Other | Total | ||||||||||

| Net loss | $ | (51.2 | ) | $ | (1.4 | ) | $ | (52.6 | ) | |||

| Cash flows from operating activities: | ||||||||||||

| Adjustments to reconcile net loss to net cash provided by (used in) operating | ||||||||||||

| activities: | ||||||||||||

| Depreciation and amortization | 58.8 | 1.8 | 60.6 | |||||||||

| Restructuring, impairment, site closures and related costs | 2.0 | - | 2.0 | |||||||||

| Amortization of favorable/unfavorable leasehold interests, net | 1.1 | - | 1.1 | |||||||||

| Amortization of debt issuance costs and fees, net | 1.4 | - | 1.4 | |||||||||

| Equity-based compensation, net | 1.9 | - | 1.9 | |||||||||

| Bad debt expense (recoveries), net | (0.2 | ) | - | (0.2 | ) | |||||||

| Deferred income taxes | (12.6 | ) | (0.3 | ) | (12.9 | ) | ||||||

| Non-cash interest expense | 2.4 | - | 2.4 | |||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Accounts receivable | 17.0 | 4.0 | 21.0 | |||||||||

| Prepaid and other assets | 2.2 | 0.6 | 2.8 | |||||||||

| Due from affiliates | 6.4 | (6.4 | ) | - | ||||||||

| Other assets | 2.6 | (3.1 | ) | (0.5 | ) | |||||||

| Accounts payable | (4.5 | ) | 1.4 | (3.1 | ) | |||||||

| Accrued expenses | (1.9 | ) | 4.5 | 2.6 | ||||||||

| Due to affiliates | (1.5 | ) | (21.2 | ) | (22.7 | ) | ||||||

| Other liabilities | (0.9 | ) | 5.2 | 4.3 | ||||||||

| Net cash provided by (used in) continuing operating activities | 23.0 | (14.9 | ) | 8.1 | ||||||||

| Cash flows from investing activities: | ||||||||||||

| Purchases of property, plant and equipment | (13.2 | ) | (0.5 | ) | (13.7 | ) | ||||||

| Amounts received from affiliate | - | 117.1 | 117.1 | |||||||||

| Net cash (used in) provided by investing activities | (13.2 | ) | 116.6 | 103.4 | ||||||||

| Cash flows from financing activities: | ||||||||||||

| (Repayment of) proceeds from Promissory Notes | - | - | - | |||||||||

| Repayment of long-term debt | (2.3 | ) | - | (2.3 | ) | |||||||

| Repayment of capital leases and other financing obligations | (15.8 | ) | (1.3 | ) | (17.1 | ) | ||||||

| Capital redemption | - | (97.9 | ) | (97.9 | ) | |||||||

| Net cash (used in) provided by financing activities | (18.1 | ) | (99.2 | ) | (117.3 | ) | ||||||

| Effect of foreign currency exchange rates on cash | (1.6 | ) | 0.3 | (1.3 | ) | |||||||

| Net decrease in cash and restricted cash | (9.9 | ) | 2.8 | (7.1 | ) | |||||||

| Cash at beginning of period | 120.3 | 0.4 | 120.7 | |||||||||

| Cash at end of period | $ | 110.4 | $ | 3.2 | $ | 113.6 | ||||||

13

CYXTERA TECHNOLOGIES, INC.

SUPPLEMENTARY INFORMATION

Schedule 5 – Unaudited Condensed Consolidating Statements of Cash Flows Information (in millions, continued)

| Three Months Ended March 31, 2020 | ||||||||||||||||

| DC Holdings | Other | Eliminations | Total | |||||||||||||

| Net loss | $ | (47.5 | ) | $ | 0.1 | $ | - | $ | (47.4 | ) | ||||||

| Cash flows from operating activities: | ||||||||||||||||

| Adjustments to reconcile net loss to net cash (used in) provided by operating | ||||||||||||||||

| activities: | ||||||||||||||||

| Depreciation and amortization | 57.0 | - | - | 57.0 | ||||||||||||

| Amortization of favorable/unfavorable leasehold interests, net | 0.8 | - | - | 0.8 | ||||||||||||

| Amortization of debt issuance costs and fees, net | 1.4 | - | - | 1.4 | ||||||||||||

| Impairment of (recovery of) note receivable from affiliate | 7.7 | (1.0 | ) | - | 6.7 | |||||||||||

| Equity-based compensation, net | 0.4 | 1.8 | - | 2.2 | ||||||||||||

| Bad debt expense (recoveries), net | 0.6 | - | - | 0.6 | ||||||||||||

| Deferred income taxes | (14.4 | ) | - | - | (14.4 | ) | ||||||||||

| Non-cash interest expense | 4.6 | - | - | 4.6 | ||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||||||

| Accounts receivable | (19.4 | ) | - | - | (19.4 | ) | ||||||||||

| Prepaid and other assets | 1.2 | 1.1 | - | 2.3 | ||||||||||||

| Due from affiliates | - | 1.2 | - | 1.2 | ||||||||||||

| Other assets | 2.2 | 0.1 | - | 2.3 | ||||||||||||

| Accounts payable | 1.8 | (1.1 | ) | - | 0.7 | |||||||||||

| Accrued expenses | (1.2 | ) | (1.4 | ) | - | (2.6 | ) | |||||||||

| Due to affiliates | - | - | - | - | ||||||||||||

| Other liabilities | 3.6 | (0.4 | ) | - | 3.2 | |||||||||||

| Net cash (used in) provided by operating activities | (1.2 | ) | 0.4 | - | (0.8 | ) | ||||||||||

| Cash flows from investing activities: | ||||||||||||||||

| Purchases of property, plant and equipment | (37.9 | ) | - | - | (37.9 | ) | ||||||||||

| (Advances to) amounts received from affiliate | (5.3 | ) | (5.3 | ) | 5.3 | (5.3 | ) | |||||||||

| Net cash (used in) provided by investing activities | (43.2 | ) | (5.3 | ) | 5.3 | (43.2 | ) | |||||||||

| Cash flows from financing activities: | ||||||||||||||||

| Proceeds from issuance of long-term debt and other financing obligations | 91.0 | - | - | 91.0 | ||||||||||||

| Proceeds from (repayment of) Promissory Notes | - | 5.3 | (5.3 | ) | - | |||||||||||

| Repayment of capital leases and other financing obligations | (2.2 | ) | - | - | (2.2 | ) | ||||||||||

| Net cash provided by (used in) financing activities | 88.8 | 5.3 | (5.3 | ) | 88.8 | |||||||||||

| Effect of foreign currency exchange rates on cash | (3.2 | ) | (0.4 | ) | - | (3.6 | ) | |||||||||

| Net decrease in cash | 41.2 | - | - | 41.2 | ||||||||||||

| Cash at beginning of period | 12.8 | 0.2 | - | 13.0 | ||||||||||||

| Cash at end of period | $ | 54.0 | $ | 0.2 | $ | - | $ | 54.2 | ||||||||

14

Exhibit 99.3

CYXTERA TECHNOLOGIES, INC.

UNAUDITED SELECTED FINANCIAL DATA

(In millions, except percentages)

| Three Months Ended | Twelve Months Ended | Three Months Ended | Twelve Months Ended | |||||||||||||

| March 31, 2021 | March 31, 2021 | March 31, 2020 | December 31, 2020 | |||||||||||||

| Financial Position: | ||||||||||||||||

| Cash and cash equivalents | $ | 113.6 | $ | 113.6 | $ | 54.2 | $ | 120.7 | ||||||||

| Debt | ||||||||||||||||

| 1st Lien term loan, net | $ | 872.5 | $ | 872.5 | $ | 880.3 | $ | 874.0 | ||||||||

| 2nd Lien term loan, net | 304.2 | 304.2 | 302.9 | 303.9 | ||||||||||||

| Revolving loans | 142.6 | 142.6 | 143.0 | 142.6 | ||||||||||||

| Capital leases and other financing obligations (1) | 976.4 | 976.4 | 957.6 | 989.2 | ||||||||||||

| $ | 2,295.8 | $ | 2,295.8 | $ | 2,283.8 | $ | 2,309.6 | |||||||||

| Financial Data and Metrics: | ||||||||||||||||

| Revenue | $ | 172.9 | $ | 690.8 | $ | 172.5 | $ | 690.5 | ||||||||

| Adjusted gross margin (2) | 43.3 | % | 44.2 | % | 44.5 | % | 43.5 | % | ||||||||

| Exit MRR | $ | 52.6 | $ | 52.6 | $ | 53.4 | $ | 52.9 | ||||||||

| Credit Agreement Adjusted EBITDA (3) | $ | 61.8 | $ | 232.9 | $ | 60.6 | $ | 231.7 | ||||||||

| Credit Agreement Adjusted EBITDA % (3) | 35.8 | % | 33.7 | % | 35.1 | % | 33.6 | % | ||||||||

| Utilization | 67.2 | % | 67.2 | % | 67.5 | % | 67.2 | % | ||||||||

| Capital expenditures (accrual basis) | $ | 13.2 | $ | 56.2 | $ | 11.7 | $ | 54.7 | ||||||||

| Net Loss to EBITDA Reconciliation: | ||||||||||||||||

| Net loss | $ | (52.6 | ) | $ | (128.0 | ) | $ | (47.4 | ) | $ | (122.8 | ) | ||||

| Depreciation and amortization | 60.6 | 235.4 | 57.0 | 231.8 | ||||||||||||

| Impairment of note and other receivables from affiliate | - | (104.4 | ) | 6.7 | (97.7 | ) | ||||||||||

| Interest and other expenses, net | 43.7 | 169.8 | 43.6 | 169.7 | ||||||||||||

| Income tax benefit | (12.9 | ) | 5.0 | (14.4 | ) | 3.5 | ||||||||||

| EBITDA | 38.9 | 177.9 | 45.5 | 184.5 | ||||||||||||

| Credit Agreement Adjustments | 22.9 | 55.0 | 15.1 | 47.2 | ||||||||||||

| Credit Agreement Adjusted EBITDA (3) | $ | 61.8 | $ | 232.9 | $ | 60.6 | $ | 231.7 | ||||||||

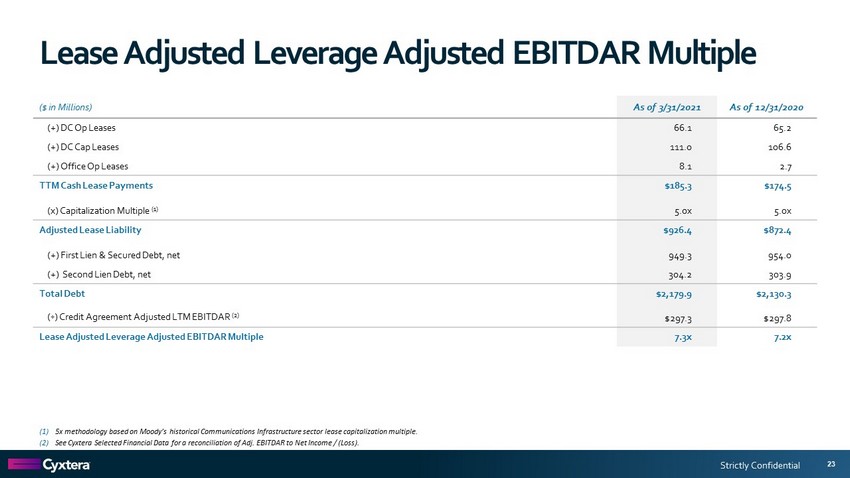

| Rent (net of Adjustments) | 14.6 | 64.4 | 16.4 | 66.1 | ||||||||||||

| Credit Agreement Adjusted EBITDAR | $ | 76.5 | $ | 297.3 | $ | 77.0 | $ | 297.8 | ||||||||

| Credit Agreement EBITDA adjustments: | ||||||||||||||||

| Recurring: | ||||||||||||||||

| Bonus on a cash basis adjustment | $ | - | $ | 1.7 | $ | 0.5 | $ | 2.3 | ||||||||

| Straight-line rent adjustment | 1.1 | 3.3 | 0.8 | 2.9 | ||||||||||||

| ASC 606 impact on costs: | ||||||||||||||||

| Sales commissions | 1.4 | (1.4 | ) | 0.5 | (2.3 | ) | ||||||||||

| Capitalized labor for Installations | 0.3 | 0.9 | (0.1 | ) | 0.5 | |||||||||||

| Equity-based compensation | 1.8 | 7.2 | 2.0 | 7.4 | ||||||||||||

| Other | 0.9 | 4.4 | 1.3 | 4.8 | ||||||||||||

| 5.6 | 16.1 | 5.0 | 15.5 | |||||||||||||

| Standup, separation, and out of period adjustments | 3.5 | 11.3 | 3.3 | 11.1 | ||||||||||||

| Restructuring, cost savings and growth initiatives | 13.9 | 27.6 | 6.8 | 20.6 | ||||||||||||

| $ | 22.9 | $ | 55.0 | $ | 15.1 | $ | 47.2 | |||||||||

Notes:

| 1) | Other financing obligations includes a $0.2M Promissory Note related to equipment financing. |

| 2) | Adjusted gross margin excludes equity-based compensation. |

| 3) | As defined by our 1st and 2nd lien term loan agreements under "Consolidated EBITDA". |

PRIVATE AND CONFIDENTIAL

Exhibit 99.4

Earnings Conference Call Review of Cyxtera Technologies, Inc. Q1 2021 Results

Strictly Confidential Disclaimer 2 Cyxtera Technologies, Inc . (“Cyxtera” or the “Company”) is pleased to present its first lien lenders and second lien lenders (collectively, “you”) the following financial information for your review and consideration . This presentation and the information contained herein is being provided on a voluntary basis to assist you with your ongoing independent evaluation of the Company . We are not required to provide this presentation or any of the information contained herein by the terms of any agreement we have with you . As such, we make no representation or warranty with respect to such information, and by receipt of this presentation (and as a condition to your receipt of this presentation) you acknowledge and agree that no such representation or warranty is being made and release us from any liability with respect thereto . You further acknowledge and agree that you will not rely on any information contained herein, you need to conduct your own thorough ongoing investigation of our business and to exercise your own independent due diligence with respect to our business and the statements set forth herein ; We shall be fully exculpated with respect to any liability related to the use and the content of this presentation and you agree (as a condition to its receipt) not to assert any claim with respect thereto . Some of the statements herein constitute "forward - looking statements" that do not directly or exclusively relate to historical facts . These forward - looking statements reflect our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks (including regulatory risks), uncertainties and other factors, many of which are outside of our control . Important factors that could cause actual results to differ materially from the expectations expressed or implied in the forward - looking statements include known and unknown risks . Because actual results could differ materially from our intentions, plans, expectations, assumptions and beliefs about the future, you are urged to view all forward - looking statements contained herein with caution . We do not undertake any obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise . Note : References to Adjusted EBITDA throughout this presentation refer to Credit Agreement Adjusted EBITDA . See Cyxtera Selected Financial Data for a reconciliation of Adj . EBTIDA and Adj . EBITDAR to Net Income / (Loss) . Cyxtera Contacts Carlos Sagasta Chief Financial Officer [email protected] (305) 537 - 9500 Nathan Berlinski VP of Corporate Development [email protected] (305) 537 - 9500

Strictly Confidential Presenters 3 Nelson Fonseca – Chief Executive Officer ▪ Assumed the CEO role in January 2020 ▪ Promoted from President & COO of Cyxtera, a position he had held for almost two years ▪ Previously served in positions of increasing seniority at Terremark, most recently as President ▪ Over 20 years of executive experience in the IT/Telecommunications sector Carlos Sagasta – Chief Financial Officer ▪ Assumed the CFO role in February 2020 ▪ Most recently served as CFO at Diversey Inc., where he completed the carve out of the business from Sealed Air and streamline d t he finance function ▪ Previously served at CompuCom as part of the management team that led the successful turnaround and exit by Thomas H Lee Part ner s ▪ Over 25 years of experience as a finance executive in the IT/Telecommunications industry

Strategic Review & Highlights

Strictly Confidential Executive Summary 5 ▪ Continued momentum in key performance indicators − Core Bookings up ~40% year - over - year, propelled by enhanced customer engagement and increased channel partner activity. Core Ch urn as a percentage of MRR increased ~20 basis points year - over - year, but is still within target range. Net Core Bookings, defined as Core Bookings minus Core Churn, increased ~33% over the prior year − Core Revenue grew ~6% year - over - year, offsetting a commensurate decline in Lumen Revenue, leading to relatively flat Total Reven ue over the prior year − Operating and SG&A expenses were impacted by Winter Storm Uri and certain non - cash charges during the quarter. Adjusting for th is, EBITDA and Credit Agreement Adjusted EBITDA grew ~10% and ~2%, respectively, over the comparison period ▪ Ongoing liquidity and working capital management initiatives further bolstering the balance sheet − Secured new Factoring facility with Nomura, accelerating cash conversion − Extended ~94% of $150MM Revolver commitments from May 2022 to November 2023 and reduced said commitments by 15% ▪ Sustained improvement in commercial execution − Sales force continues to perform well across markets with five consecutive quarters of Bookings growth − Channel Partner Bookings up ~66% year - over - year − Continued momentum in differentiated CXD and Bare Metal offerings

Financial Overview

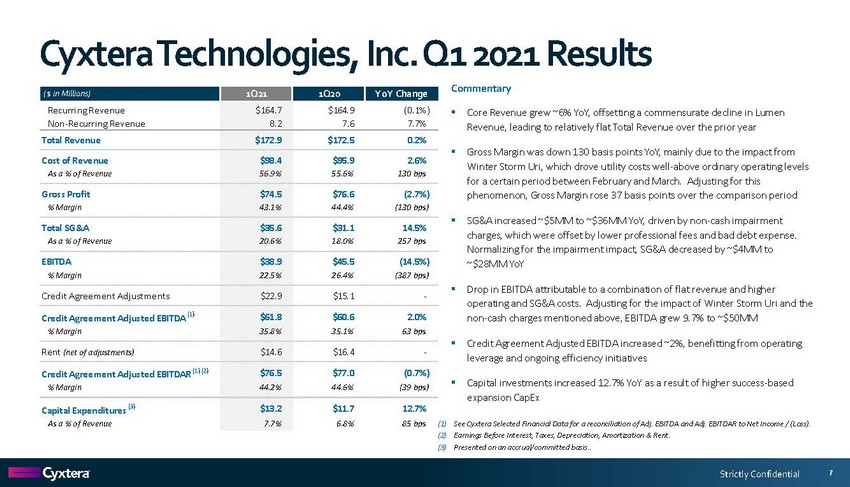

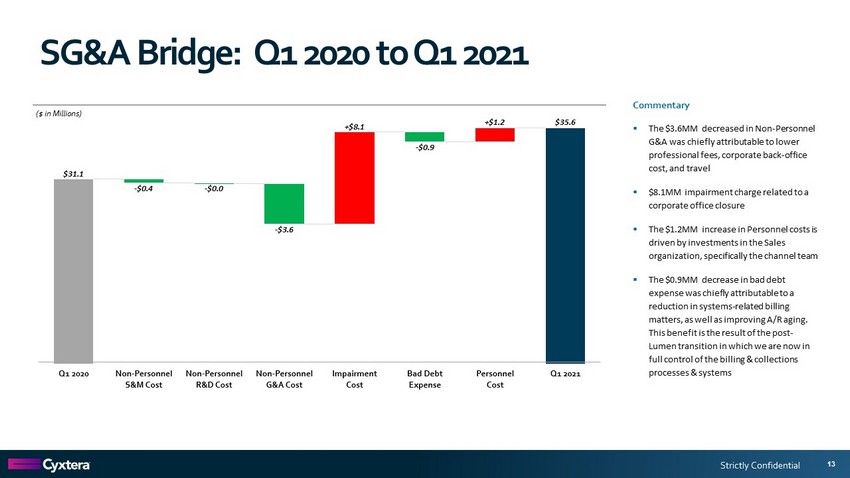

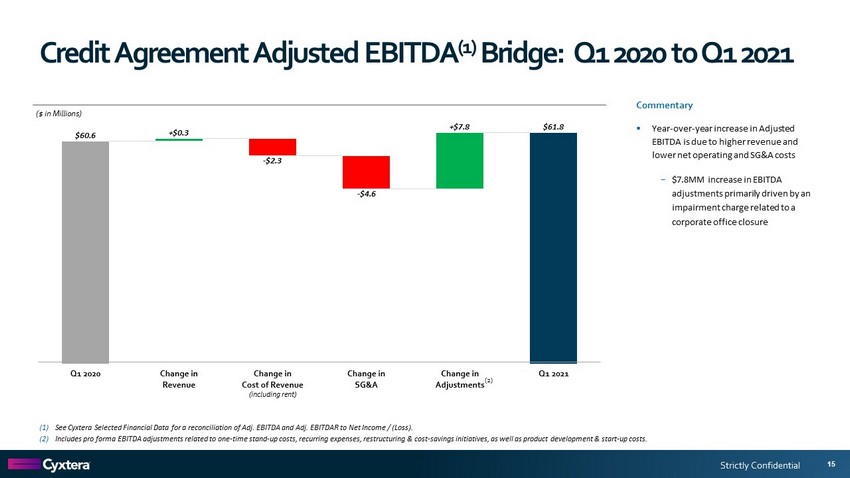

Strictly Confidential Cyxtera Technologies, Inc. Q1 2021 Results 7 Commentary Core Revenue grew ~6% YoY, offsetting a commensurate decline in Lumen Revenue, leading to relatively flat Total Revenue over the prior year Gross Margin was down 130 basis points YoY, mainly due to the impact from Winter Storm Uri, which drove utility costs well above ordinary operating levels for a certain period between February and March. Adjusting for this phenomenon, Gross Margin rose 37 basis points over the comparison period SG&A increased ~$5MM to ~$36MM YoY, driven by non cash impairment charges, which were offset by lower professional fees and bad debt expense. Normalizing for the impairment impact, SG&A decreased by ~$4MM to ~$28MM YoY Drop in EBITDA attributable to a combination of flat revenue and higher operating and SG&A costs. Adjusting for the impact of Winter Storm Uri and the non cash charges mentioned above, EBITDA grew 9.7% to ~$50MM Credit Agreement Adjusted EBITDA increased ~2%, benefitting from operating leverage and ongoing efficiency initiatives Capital investments increased 12.7% YoY as a result of higher success based expansion CapEx (1) See Cyxtera Selected Financial Data for a reconciliation of Adj. EBITDA and Adj. EBITDAR to Net Income / (Loss). (2) Earnings Before Interest, Taxes, Depreciation, Amortization & Rent. (3) Presented on an accrual/committed basis. ($ in Millions)1Q211Q20YoY ChangeRecurring Revenue$164.7$164.9(0.1%)Non-Recurring Revenue8.27.67.7%Total Revenue$172.9$172.50.2%Cost of Revenue$98.4$95.92.6%As a % of Revenue56.9%55.6%130 bpsGross Profit$74.5$76.6(2.7%)% Margin43.1%44.4%(130 bps)Total SG&A$35.6$31.114.5%As a % of Revenue20.6%18.0%257 bpsEBITDA$38.9$45.5(14.5%)% Margin22.5%26.4%(387 bps)Credit Agreement Adjustments$22.9$15.1-Credit Agreement Adjusted EBITDA (1)$61.8$60.62.0%% Margin35.8%35.1%63 bpsRent (net of adjustments)$14.6$16.4-Credit Agreement Adjusted EBITDAR (1) (2)$76.5$77.0(0.7%)% Margin44.2%44.6%(39 bps)Capital Expenditures (3)$13.2$11.712.7%As a % of Revenue7.7%6.8%85 bps