Form 8-K SEACOAST BANKING CORP For: May 24

First Quarter 2022 INVESTOR PRESENTATION 20 22

This presentation contains “forward‐looking statements” within the meaning, and protections, of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including, without limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal conditions in the Company’s markets, and improvements to reported earnings that may be realized from cost controls, tax law changes, new initiatives and for integration of banks that the Company has acquired, or expects to acquire, including Apollo Bancshares, Inc., as well as statements with respect to Seacoast's objectives, strategic plans, expectations and intentions and other statements that are not historical facts, any of which may be impacted by the COVID‐19 pandemic and any variants thereof and related effects on the U.S. economy. Actual results may differ from those set forth in the forward‐looking statements. Forward‐looking statements include statements with respect to the Company’s beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond the Company’s control, and which may cause the actual results, performance or achievements of Seacoast to be materially different from future results, performance or achievements expressed or implied by such forward‐looking statements. You should not expect the Company to update any forward‐looking statements. All statements other than statements of historical fact could be forward‐looking statements. You can identify these forward‐ looking statements through the use of words such as “may”, “will”, “anticipate”, “assume”, “should”, “support”, “indicate”, “would”, “believe”, “contemplate”, “expect”, “estimate”, “continue”, “further”, “plan”, “point to”, “project”, “could”, “intend”, “target” or other similar words and expressions of the future. These forward‐looking statements may not be realized due to a variety of factors, including, without limitation: the effects of future economic and market conditions, including seasonality; the adverse impact of COVID‐19 (economic and otherwise) on the Company and its customers, counterparties, employees, and third‐ party service providers, and the adverse impacts to our business, financial position, results of operations and prospects; government or regulatory responses to the COVID‐19 pandemic; governmental monetary and fiscal policies, including interest rate policies of the Board of Governors of the Federal Reserve, as well as legislative, tax and regulatory changes, including those that impact the money supply and inflation; changes in accounting policies, rules and practices, including the impact of the adoption of the current expected credit losses (“CECL”) methodology; the risks of changes in interest rates on the level and composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest rate sensitive assets and liabilities; interest rate risks, sensitivities and the shape of the yield curve; uncertainty related to the impact of LIBOR calculations on securities, loans and debt; changes in borrower credit risks and payment behaviors including as a result of the financial impact of COVID‐19; changes in retail distribution strategies, customer preferences and behavior (including as a result of economic factors); changes in the availability and cost of credit and capital in the financial markets; changes in the prices, values and sales volumes of residential and commercial real estate; our ability to comply with any regulatory requirements; the effects of problems encountered by other financial institutions that adversely affect Seacoast or the banking industry; the Company’s concentration in commercial real estate loans and in real estate collateral in Florida; inaccuracies or other failures from the use of models, including the failure of assumptions and estimates, as well as differences in, and changes to, economic, market and credit conditions; the impact on the valuation of Seacoast’s investments due to market volatility or counterparty payment risk; statutory and regulatory dividend restrictions; increases in regulatory capital requirements for banking organizations generally; the risks of mergers, acquisitions and divestitures, including Seacoast’s ability to continue to identify acquisition targets, successfully acquire and integrate desirable financial institutions and realize expected revenues and revenue synergies; changes in technology or products 2FIRST QUARTER 2022 INVESTOR PRESENTATION Cautionary Notice Regarding Forward‐Looking Statements that may be more difficult, costly, or less effective than anticipated; the Company’s ability to identify and address increased cybersecurity risks, including as a result of employees working remotely; inability of Seacoast’s risk management framework to manage risks associated with the Company’s business; dependence on key suppliers or vendors to obtain equipment or services for the business on acceptable terms, including the impact of supply chain disruptions; reduction in or the termination of Seacoast’s ability to use the online‐ or mobile‐based platform that is critical to the Company’s business growth strategy; the effects of war or other conflicts including the impacts related to or resulting from Russia’s military action in Ukraine, acts of terrorism, natural disasters, health emergencies, epidemics or pandemics, or other catastrophic events that may affect general economic conditions; unexpected outcomes of and the costs associated with, existing or new litigation involving the Company, including as a result of the Company’s participation in the Paycheck Protection Program (“PPP”); Seacoast’s ability to maintain adequate internal controls over financial reporting; potential claims, damages, penalties, fines and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the risks that deferred tax assets could be reduced if estimates of future taxable income from the Company’s operations and tax planning strategies are less than currently estimated and sales of capital stock could trigger a reduction in the amount of net operating loss carryforwards that the Company may be able to utilize for income tax purposes; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, non‐bank financial technology providers, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions operating in the Company’s market areas and elsewhere, including institutions operating regionally, nationally and internationally, together with such competitors offering banking products and services by mail, telephone, computer and the Internet; the failure of assumptions underlying the establishment of reserves for possible credit losses. The risks relating to the proposed Apollo Bancshares, Inc. and Drummond Banking Company mergers include, without limitation, failure to obtain the approval of shareholders of Apollo Bancshares, Inc. and Apollo Bank and Drummond Banking Company and Drummond Community Bank in connection with the mergers; the timing to consummate the proposed mergers; the risk that a condition to the closing of the proposed mergers may not be satisfied; the risk that a regulatory approval that may be required for the proposed mergers is not obtained or is obtained subject to conditions that are not anticipated; the parties' ability to achieve the synergies and value creation contemplated by the proposed mergers; the parties' ability to promptly and effectively integrate the businesses of Seacoast and Apollo Bancshares, Inc., and Seacoast and Drummond Banking Company, including unexpected transaction costs, the costs of integrating operations, severance, professional fees and other expenses; the diversion of management time on issues related to the mergers; the failure to consummate or any delay in consummating the mergers for other reasons; changes in laws or regulations; the risks of customer and employee loss and business disruption, including, without limitation, as the result of difficulties in maintaining relationships with employees; increased competitive pressures and solicitations of customers and employees by competitors; and the difficulties and risks inherent with entering new markets. All written or oral forward‐looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in the Company’s annual report on Form 10‐K for the year ended December 31, 2021 and the quarterly report on Form 10‐Q for the quarter ended March 31, 2022 under "Special Cautionary Notice Regarding Forward‐Looking Statements" and "Risk Factors", and otherwise in the Company’s SEC reports and filings. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC's Internet website at www.sec.gov.

AGENDA 01 ABOUT SEACOAST BANK 02 OUTLOOK 03 COMPANY PERFORMANCE 04 APPENDIX

ABOUT SEACOAST BANK AGENDA 01

5FIRST QUARTER 2022 INVESTOR PRESENTATION • $10.9 billion in assets as of March 31, 2022, operating in the nation’s third‐most populous state • Strong presence in Florida’s most attractive markets ▪ #1 Florida‐based bank in Orlando MSA ▪ #1 market share in Port Saint Lucie MSA ▪ #2 Florida‐based bank in West Palm Beach/Fort Lauderdale ▪ #2 Florida‐based bank in St. Petersburg • Among the largest publicly traded community banks headquartered in Florida • Market Cap: $2.1 billion as of March 31, 2022 • Highly disciplined credit portfolio • Strong liquidity position • Prudent capital position to support further organic growth and opportunistic acquisitions • Unique customer analytics capabilities drive value creation with new, acquired, and existing customers Jacksonville MSA West Palm Beach Fort Lauderdale Miami MSA Port St. Lucie MSA Orlando MSA Tampa St. Petersburg MSA Naples Fort Myers MSA Valuable Florida Franchise, Well‐Positioned for Growth with Strong Capital, Liquidity and Disciplined Credit Culture SEACOAST BANK FOOTPRINT

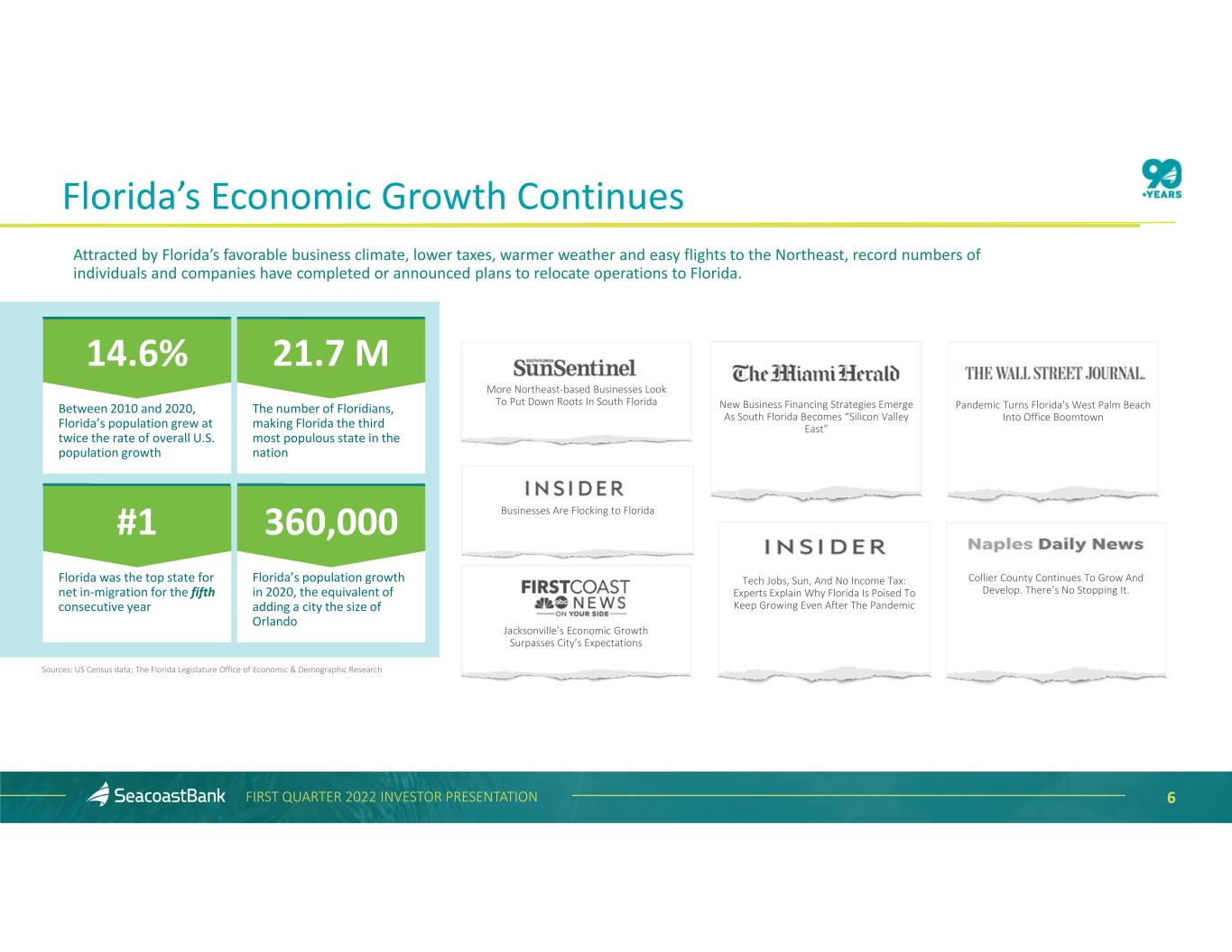

6FIRST QUARTER 2022 INVESTOR PRESENTATION Attracted by Florida’s favorable business climate, lower taxes, warmer weather and easy flights to the Northeast, record numbers of individuals and companies have completed or announced plans to relocate operations to Florida. Sources: US Census data; The Florida Legislature Office of Economic & Demographic Research Florida’s Economic Growth Continues More Northeast‐based Businesses Look To Put Down Roots In South Florida Jacksonville’s Economic Growth Surpasses City’s Expectations New Business Financing Strategies Emerge As South Florida Becomes “Silicon Valley East” Tech Jobs, Sun, And No Income Tax: Experts Explain Why Florida Is Poised To Keep Growing Even After The Pandemic Pandemic Turns Florida's West Palm Beach Into Office Boomtown Collier County Continues To Grow And Develop. There’s No Stopping It. The number of Floridians, making Florida the third most populous state in the nation 21.7 M Between 2010 and 2020, Florida’s population grew at twice the rate of overall U.S. population growth 14.6% Florida’s population growth in 2020, the equivalent of adding a city the size of Orlando 360,000 Florida was the top state for net in‐migration for the fifth consecutive year #1 Businesses Are Flocking to Florida

2.2 2.3 3.1 3.5 4.7 5.8 6.7 7.1 8.3 10.3 13.0 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Pro Forma Total Shareholder Returns PROVEN TRACK RECORD OF SUCCESSFUL AND VALUE ‐ADDED I NTEGRAT IONS M&A Strategy Delivering Consistent Growth and Long‐Term Value Creation 7 As se ts ($ B ) 1 2 1. Acquisitions of Sabal Palm Bank and Florida Business Bank closed January 3, 2022 2. Pro forma as of March 31, 2022 does not include fair value / purchase accounting adjustments Note: Total shareholder returns data as of May 3, 2022; Source: S&P Capital IQ Pro 1 FIRST QUARTER 2022 INVESTOR PRESENTATION

Meeting the $10 Billion Asset Threshold Challenge WELL ‐PREPARED TO CROSS $10 B I L L ION AND HAVE OFFSET I NCREMENTAL COSTS THROUGH ACQU I S I T IONS Crossing $10 Billion Asset Threshold Seacoast estimates that the aggregate after‐tax cost of crossing $10 billion in 2023will be ~$7.6million: – ~$4.5million from theDurbin Amendment impact on Seacoast, impacting the second half of 2023 – ~$1.1 million from the Durbin Amendment impact on Apollo and Drummond, impacting the second half of 2023 – ~$2.0 million from higher FDIC expense and reduction of Federal Reserve dividend, impacting the full year 2023 FIRST QUARTER 2022 INVESTOR PRESENTATION 8 Acquisitions of Sabal Palm Bank, Florida Business Bank, and Apollo Bank fully offset the EPS dilution expected from the impact of crossing $10 billion in assets

Stratification of Florida Headquartered Banks 1 Total Asset Parameters Number of Institutions Assets ($B) >$10B 3 $91.4 $5B ‐ $10B 1 $7.8 $1B ‐ $5B 16 $28.0 <$1B 59 $17.2 Acquisition Opportunities Remain Across Florida 1. Source: S&P Global Market Intelligence; represents most recent quarter assets available FIRST QUARTER 2022 INVESTOR PRESENTATION 9 The Florida banking landscape continues to provide numerous low‐risk, high‐value acquisition opportunities

OUTLOOK AGENDA 02

Primary driver of growth will be strong performance from business units growing organically in robust Florida markets 1 Goal is to deliver profitability and growth to the maximum level while maintaining our conservative risk posture Acquisitions will be evaluated opportunistically when additive to profitability and efficiency metrics. We will remain disciplined in our approach Focused on Shareholder Returns – As Seacoast crosses $10 billion, the focus remains on delivering shareholder returns as we continue to scale the franchise across Florida 2 3 4 Key Principles to Driving Long‐Term Shareholder Value FIRST QUARTER 2022 INVESTOR PRESENTATION 11

Positioned To Be Highly Competitive Post Pandemic • Organic Growth Levers • Focused on outperforming in the Commercial Banking space, leveraging talent and technology • Continuing to evolve Retail Banking by further integrating digital to deliver an outstanding experience for our customers • Executing a high‐performance culture • Inorganic Growth Levers • Leveraging our proven M&A capabilities to expand geographically in Florida’s most attractive MSAs • Unlocking additional value from acquired customer sets via our broad product set and proven analytics platform Priorities for 2022 and Beyond – Executing Balanced Growth Strategy FIRST QUARTER 2022 INVESTOR PRESENTATION 12

COMPANY PERFORMANCE AGENDA 03

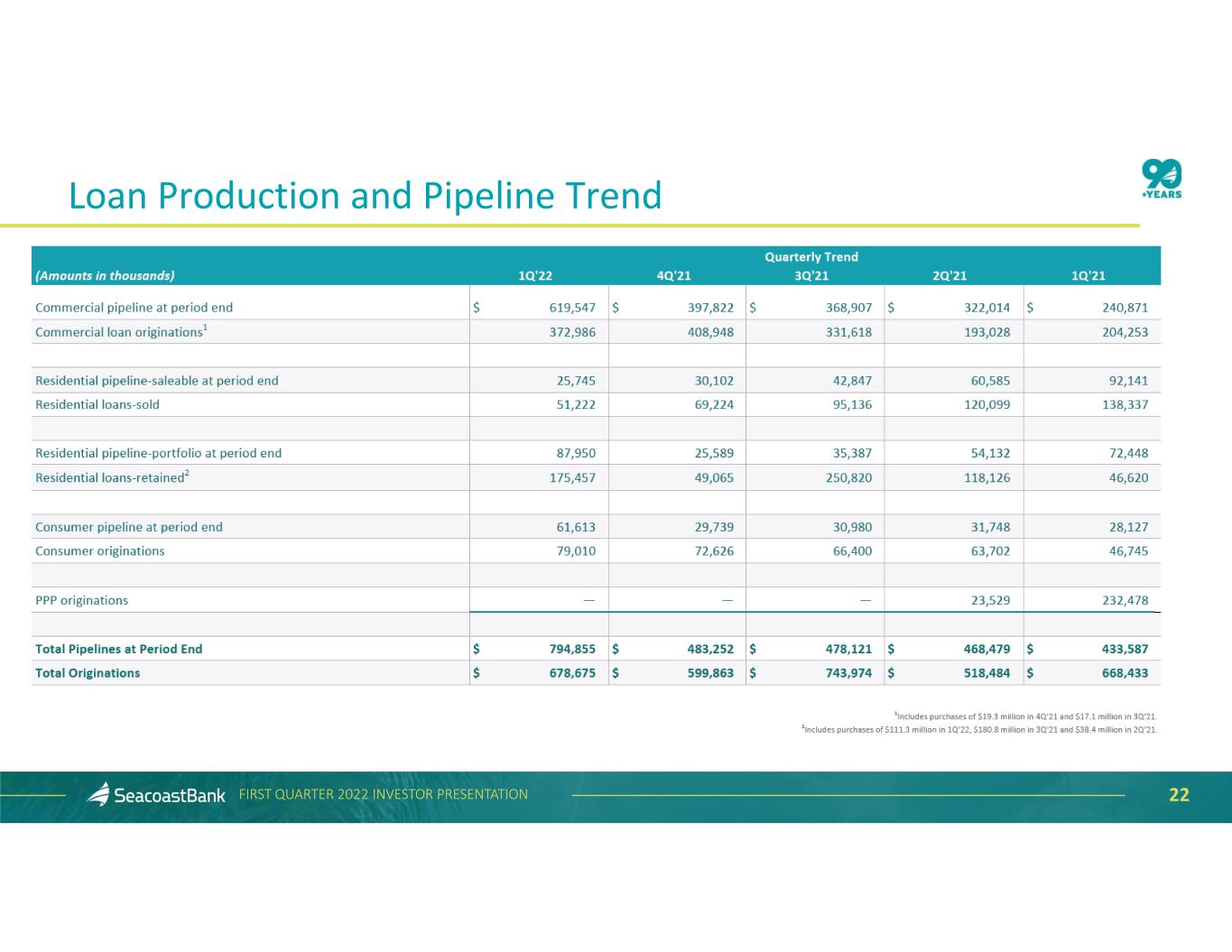

• Continued strong asset quality trends, with nonperforming loans declining to 0.41% of total loans. $5.1 million of provision build upon closing of two acquisitions. • Strong deposit growth, with organic deposits increasing 25% on an annualized basis. • Building long‐term shareholder value through long‐term growth in tangible book value per share, ending the period at $17.12, an increase of 3% over the prior year. Excluding the decrease in fair value of AFS debt securities, tangible book value per share would have been $18.19, or an increase of 9% year‐over‐year. • Established market presence in Naples, Sarasota, and Jacksonville, and announced the upcoming acquisition of Apollo Bancshares, Inc., which brings five locations in Miami‐Dade County. This expansion across some of the best banking markets in the United States will lead to strong franchise value creation in the coming years. • Increased quarterly dividend from $0.13 to $0.17 given balance sheet strength and continued strong outlook for capital generation. • Net interest margin expanded nine basis points to 3.25%. Excluding the effect of PPP and accretion on acquired loans, net interest margin expanded 14 basis points to 3.05%. • Asset sensitive balance sheet and ample liquidity support the opportunity for continued expansion of NIM in future periods. • Yield on securities expanded 11 basis points to 1.68% and yield on non‐PPP loans expanded six basis points to 4.24%. • Cost of deposits remained flat at six basis points. • Investment in commercial banking talent over the prior year supported disciplined organic loan growth of 7% on an annualized basis. • Commercial loan originations increased 83% from the first quarter of 2021 to $373 million. The late stage pipeline exiting the quarter is $620 million, setting the stage for continued growth in the coming quarter. First Quarter 2022 Highlights 14FIRST QUARTER 2022 INVESTOR PRESENTATION

Net Interest Income and Margin $65,933 $71,455 $71,455 $72,412 • Net interest income1 totaled $76.6 million, an increase of $4.2 million, or 6%, from the prior quarter. • Net interest margin expanded nine basis points to 3.25% and, excluding the effect of PPP and accretion on acquired loans, net interest margin increased 14 basis points to 3.05%. • Securities yields expanded eleven basis points to 1.68%, reflecting the addition of higher yielding securities during the quarter. Non‐ PPP loan yields expanded six basis points to 4.24%, benefiting from $678.7 million in loan originations during the first quarter of 2022. • Cost of deposits remained flat quarter‐over‐quarter at six basis points. 1Calculated on a fully taxable equivalent basis using amortized cost. 15FIRST QUARTER 2022 INVESTOR PRESENTATION

Continued Strength in Noninterest Income $2,423 $4,131 $4,135 $2,495 $2,606 $2,562 $2,356 $3,646 $1,949 $812 $2,550 $200 $2,030 $2,332 $113 $5,708 $1,128 Noninterest income declined $3.3 million from the prior quarter to $15.4 million, and adjusted noninterest income1 declined $2.5 million to $15.8 million. Changes on an adjusted basis include: • Wealth management income was $2.7 million in the first quarter, an increase of $0.3 million compared to the prior quarter, reflecting continued success at winning new relationships. • Mortgage banking fees were $1.7 million, compared to $2.0 million in the prior quarter, the result of lower saleable production due to low housing inventory and slowing refinance demand. • Other income decreased by $2.7 million in the first quarter of 2022, reflecting lower income on SBIC investments and the fourth quarter of 2021 gain on sale of a website domain name, partially offset by higher loan swap‐related income. 1Non‐GAAP measure, see “Explanation of Certain Unaudited Non‐GAAP Financial Measures" for more information and a reconciliation to GAAP. 2Other Income includes income and gains on SBIC investments, SBA gains, marine finance fees, a gain on the sale of a website domain name obtained in a prior bank acquisition, and other fees related to customer activity as well as securities losses of $55 thousand in 1Q’21, $379 thousand in 4Q'21 and $452 thousand in 1Q'22. 3Other Income on an adjusted basis includes income and gains on SBIC investments, SBA gains, marine finance fees, and other fees related to customer activity. 16FIRST QUARTER 2022 INVESTOR PRESENTATION Noninterest Income ($ in thousands) Adjusted Noninterest Income1 ($ in thousands) 2 3

Continued Focus on Disciplined Expense Control Noninterest expense increased $8.7 million, which includes a $6.2 million increase in merger‐related expenses, and adjusted noninterest expense1 increased $2.4 million sequentially. Changes quarter‐over‐quarter on an adjusted basis include: • Salaries and benefits increased $0.9 million, primarily reflecting the impact of higher seasonal payroll taxes and 401(k) contributions and an expanded footprint. • Data processing costs increased by $0.4 million, which includes expenses incurred for the launch of the Company’s enhanced online and mobile banking platform in the first quarter of 2022. • Occupancy and telephone increased by $0.5 million, reflecting our expansion into the Naples, Sarasota, and Jacksonville markets. 1Non‐GAAP measure, see “Explanation of Certain Unaudited Non‐GAAP Financial Measures" for more information and a reconciliation to GAAP. 2Other Expense includes marketing expenses, provision for credit losses on unfunded commitments, foreclosed property expense and net loss/(gain) on sale, and other expenses associated with ongoing business operations. 17FIRST QUARTER 2022 INVESTOR PRESENTATION Noninterest Expense ($ in thousands) Adjusted Noninterest Expense1 ($ in thousands) 2 2

Efficiency Ratio Trend • The efficiency ratio was 62.3% for the first quarter of 2022 compared to 53.7% in the prior quarter and 53.2% in the first quarter of 2021. Increases in the first quarter of 2022 reflect higher expenses from the acquisitions of BBFC and Sabal Palm. • The adjusted efficiency ratio1 was 54.9% for the first quarter of 2022 compared to 53.4% in the prior quarter and 52.0% in the first quarter of 2021. 1Non‐GAAPmeasure, see “Explanation of Certain Unaudited Non‐GAAP Financial Measures" for more information and a reconciliation to GAAP. 18FIRST QUARTER 2022 INVESTOR PRESENTATION GAAP ‐ Efficiency First Bank of the Palm Beaches Freedom Bank Legacy Bank of Florida Sabal Palm Bank and Florida Business Bank Adjusted ‐ Efficiency1

19FIRST QUARTER 2022 INVESTOR PRESENTATION Building Florida’s Leading Commercial Bank Ron York joins as Treasury Management Executive Previously with First Horizon Chris Rolle joins as West FL Regional Market President, formerly Director of Middle Market Banking at Synovus and Central FL Market President at BB&T Dan Hilken joins as Central FL Regional Market President with a 30‐year career, most recently with Wells Fargo Austen Carroll joins as Chief Lending Officer Previously Chief Banking Officer at Ameris James Norton joins as CRE Director, formerly Executive Director of Real Estate Banking at JPMorgan Chase Brannon Fitch formerly of BB&T, joins as Northeast FL Market President leading strategic geographic expansion Growth continues in Central FL Four bankers join in Orlando and Lakeland (JPMorgan Chase, Regions, TD Bank, Wells Fargo) South Florida expansion continues Six bankers join in Palm Beach and Broward counties (TD Bank and Legacy Bank) James Stallings joins as Chief Credit Officer after almost 25 years with BB&T 4Q 20203Q 2020 1Q 2021 2Q 2021 3Q 2021 1Q 20224Q 2021 West and North Florida expansion continues 14 bankers join YTD in Jacksonville, Naples, St. Petersburg TOTAL COMMERCIAL PIPELINE OF $620MM In the first quarter of 2022, Seacoast expanded the footprint in Naples/Southwest Florida and Jacksonville/Northeast Florida with key additions to our commercial banking leadership and the addition of 14 experienced bankers in the state’s most dynamic and fastest growing markets. Co m m er ci al P ip el in e ($ in m ill io ns )

Seacoast's Lending Strategy Produced and Sustains a Diverse Loan Portfolio The Company remains focused and committed to its strict credit underwriting standards. Construction and land development and commercial real estate loans, as defined in regulatory guidance, represent 20% and 172%, respectively, of total consolidated risk based capital. Portfolio diversification in terms of asset mix, industry, and loan type, has been a critical element of the Company’s lending strategy. Exposure across industries and collateral types is broadly distributed. Seacoast’s average commercial loan size is $524 thousand. 20FIRST QUARTER 2022 INVESTOR PRESENTATION Commercial Real Estate ‐ Owner Occupied $1,284,515 20% Construction and Land Development $259,421 4% Paycheck Protection Program $39,256 1% Consumer $169,724 3% Commercial & Financial $1,132,506 17% Commercial Real Estate ‐ Non‐Owner Occupied $1,966,150 30% Residential Real Estate $1,599,645 25% At March 31, 2022 ($ in thousands)

Disciplined Approach to Lending in an Expanding Florida Economy Loans outstanding, excluding PPP and excluding the impact of acquired banks and purchases, increased $104 million, or 7% annualized. Total loan originations were $678.7 million, and the commercial pipeline increased 56% to a record $619.5 million. Loan yields excluding PPP and accretion on acquired loans expanded to 4.00% from 3.94%. Growth occurred across all loan types, building diversity in the portfolio. 21FIRST QUARTER 2022 INVESTOR PRESENTATION Total Loans Outstanding ($ in millions) 1 1Total loans outstanding as of 1Q’22 includes $39 million in PPP loans.

22FIRST QUARTER 2022 INVESTOR PRESENTATION Loan Production and Pipeline Trend

Investment Securities Performance and Composition • Portfolio yield increased 11 basis points to 1.68% from 1.57% in the prior quarter. • AFS securities ended the quarter with a net unrealized loss of $95.9 million compared to an unrealized loss of $9.3 million at December 31, 2021, largely due to the rise in short and medium term interest rates during the first quarter. • High quality portfolio consisting of 82% agency backed, with the remainder being high quality investment grade bonds. CLO portfolio is 61% AAA and 39% AA. • AFS portfolio duration of 3.19. 23FIRST QUARTER 2022 INVESTOR PRESENTATION

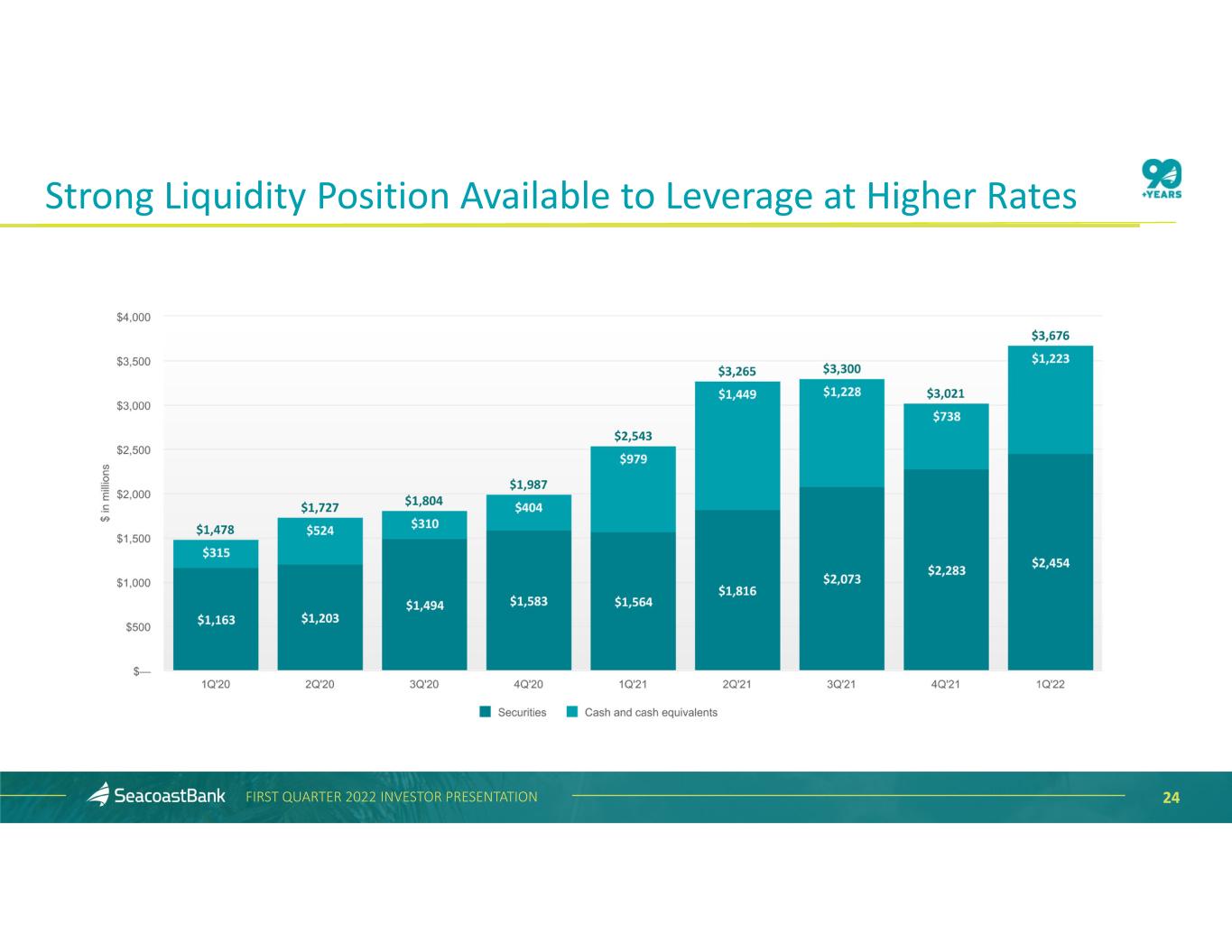

24FIRST QUARTER 2022 INVESTOR PRESENTATION Strong Liquidity Position Available to Leverage at Higher Rates

25FIRST QUARTER 2022 INVESTOR PRESENTATION Low Historical Deposit Beta Coupled with Favorable Deposit Composition 1Beta is calculated as the change in deposit costs divided by the change in Fed Funds Rate Total 3Q15 to 2Q19 Deposit Beta1 equal to 28% Favorable deposit composition compared to prior start of rate cycle. Deposit Mix

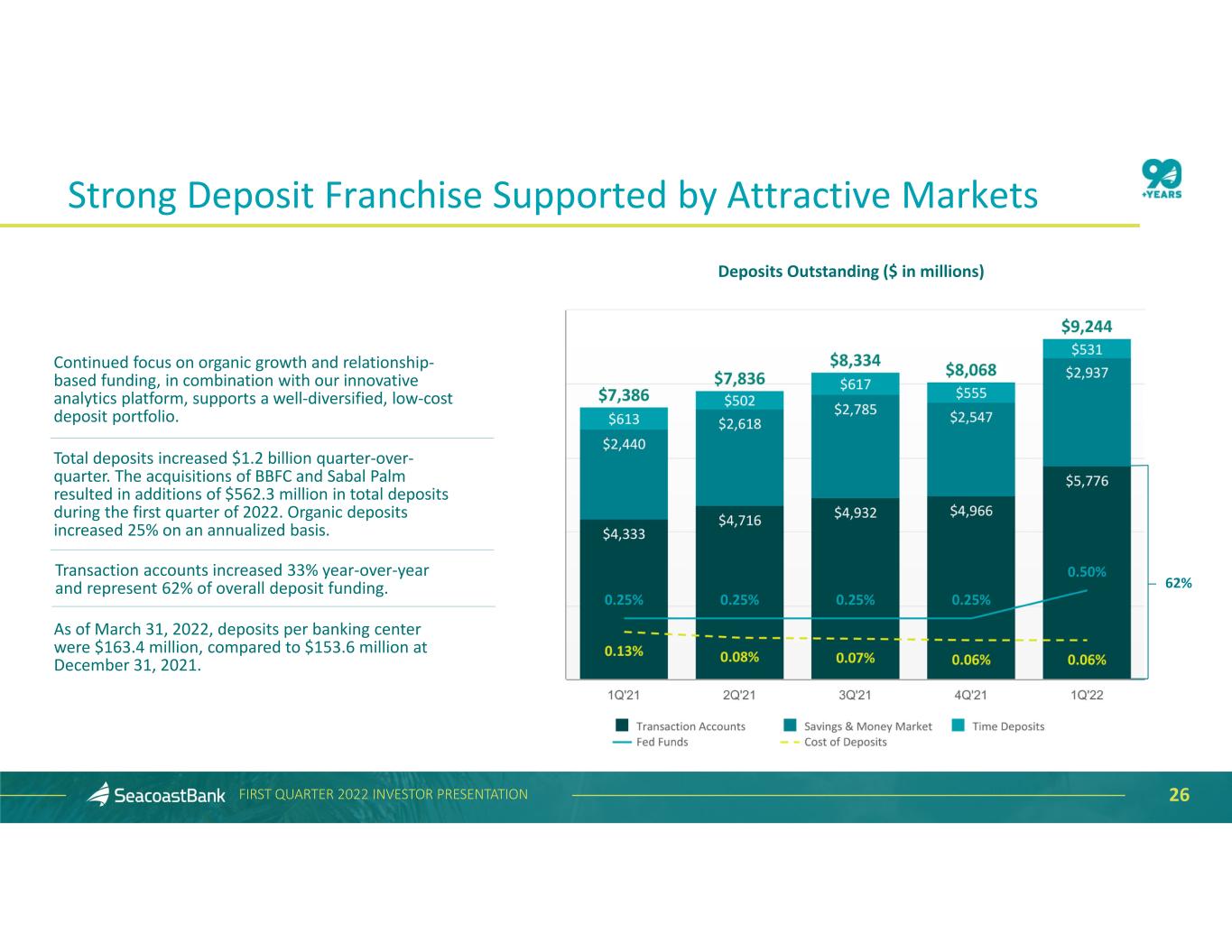

62% Strong Deposit Franchise Supported by Attractive Markets Continued focus on organic growth and relationship‐ based funding, in combination with our innovative analytics platform, supports a well‐diversified, low‐cost deposit portfolio. Total deposits increased $1.2 billion quarter‐over‐ quarter. The acquisitions of BBFC and Sabal Palm resulted in additions of $562.3 million in total deposits during the first quarter of 2022. Organic deposits increased 25% on an annualized basis. Transaction accounts increased 33% year‐over‐year and represent 62% of overall deposit funding. 26FIRST QUARTER 2022 INVESTOR PRESENTATION As of March 31, 2022, deposits per banking center were $163.4 million, compared to $153.6 million at December 31, 2021. Deposits Outstanding ($ in millions)

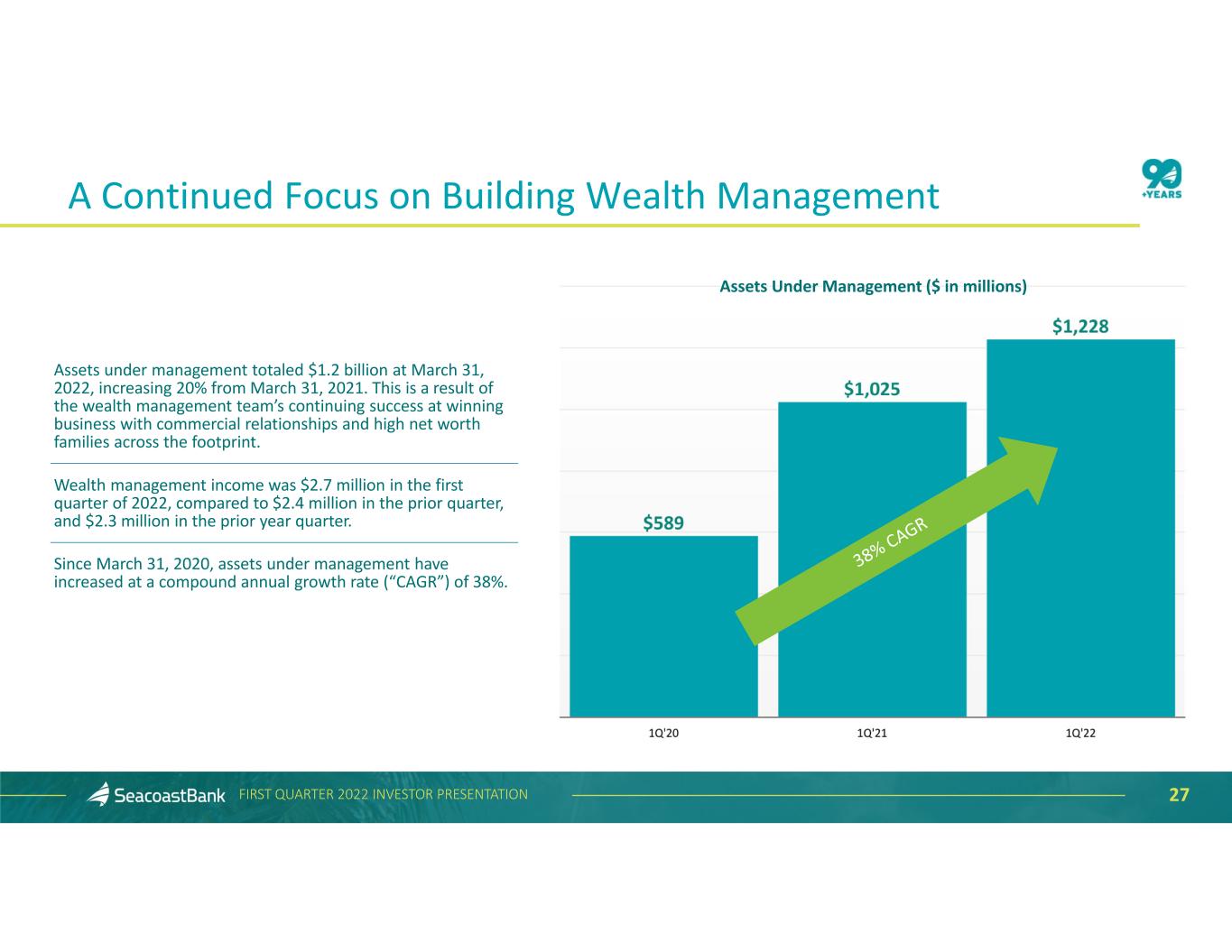

A Continued Focus on Building Wealth Management Assets under management totaled $1.2 billion at March 31, 2022, increasing 20% from March 31, 2021. This is a result of the wealth management team’s continuing success at winning business with commercial relationships and high net worth families across the footprint. Wealth management income was $2.7 million in the first quarter of 2022, compared to $2.4 million in the prior quarter, and $2.3 million in the prior year quarter. Since March 31, 2020, assets under management have increased at a compound annual growth rate (“CAGR”) of 38%. 27FIRST QUARTER 2022 INVESTOR PRESENTATION Assets Under Management ($ in millions)

28FIRST QUARTER 2022 INVESTOR PRESENTATION Successful Online and Mobile Upgrade Deliver an Improved Customer Experience Seacoast Bank successfully upgraded its online and mobile banking platform in Q1 for consumers, small businesses, and commercial customers. New features and functionality enabled by best‐in‐class technology now deliver an improved user experience consistent across devices. Migrate over 100,000+ end users Drive adoption of new features with the goal of improving customer satisfaction 10 new features, 400+ functions in total GOALS 10K+ 60,000+ customers began using the system in the first week Personal Financial Management (PFM) users prior P2P providervs. 30%+ adoption rate in first week over expected benchmark 75% of customers logged in through 3/31/2022. This app is fantastic and made me change banks. You can add your credit accounts and other bank accounts to it. One app that can hold on your financial institution in one!! 3x Zelle® volume Customer Adoption New feature adoption outpaced expectations with: APP STORE CUSTOMER

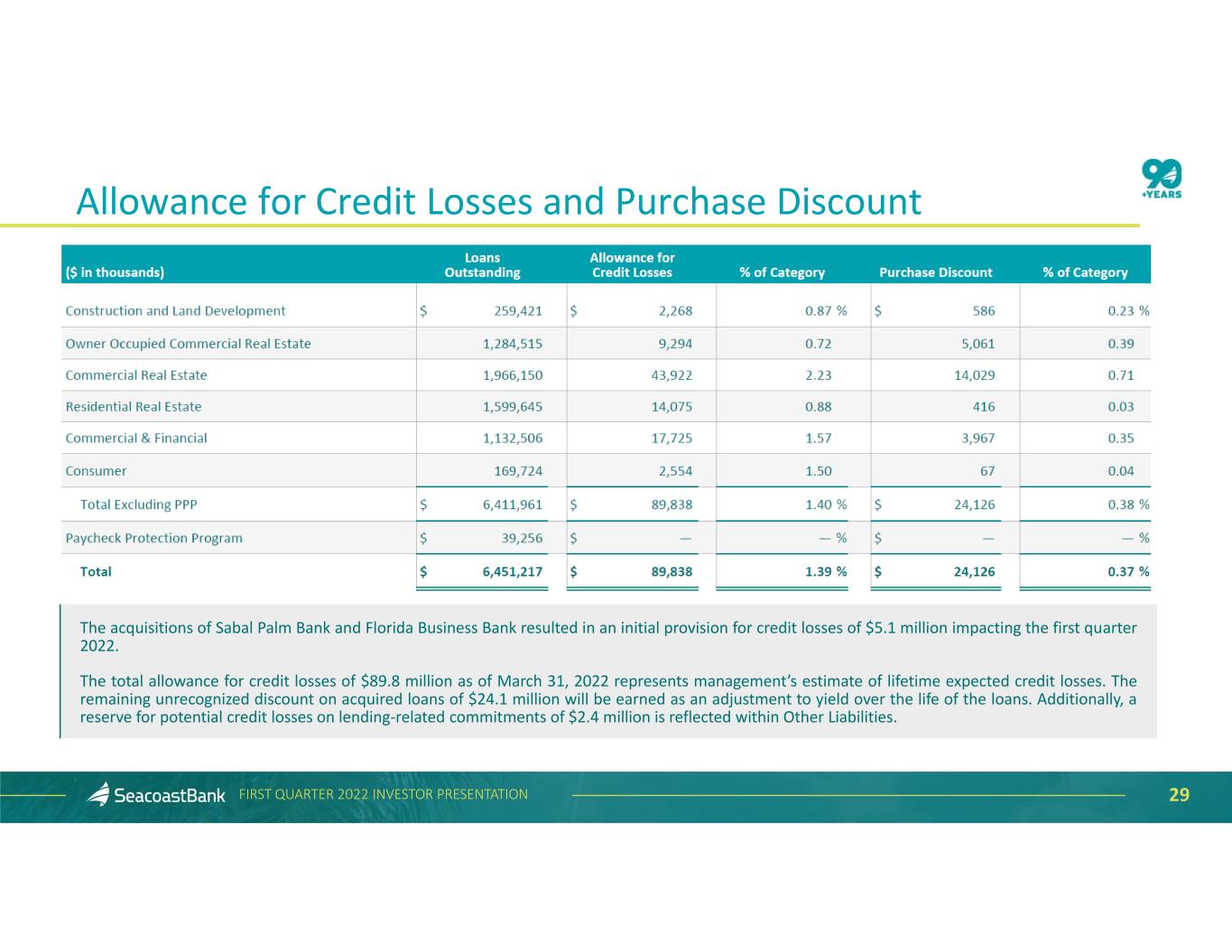

The acquisitions of Sabal Palm Bank and Florida Business Bank resulted in an initial provision for credit losses of $5.1 million impacting the first quarter 2022. Allowance for Credit Losses and Purchase Discount 29FIRST QUARTER 2022 INVESTOR PRESENTATION The total allowance for credit losses of $89.8 million as of March 31, 2022 represents management’s estimate of lifetime expected credit losses. The remaining unrecognized discount on acquired loans of $24.1 million will be earned as an adjustment to yield over the life of the loans. Additionally, a reserve for potential credit losses on lending‐related commitments of $2.4 million is reflected within Other Liabilities.

Continued Strong Asset Quality Trends 30FIRST QUARTER 2022 INVESTOR PRESENTATION ($ in thousands) Allowance for Credit Losses Criticized Loans as a % of Risk‐Based Capital

Strong Capital Supporting a Fortress Balance Sheet 31FIRST QUARTER 2022 INVESTOR PRESENTATION 1Non‐GAAP measure, see “Explanation of Certain Unaudited Non‐GAAP Financial Measures" for more information and a reconciliation to GAAP. 2FDICIA defines well capitalized as 10.0% for total risk based capital and 8.0% for Tier 1 ratio at a total Bank level. Tangible Book Value and Book Value Per Share Tangible Common Equity / Tangible Assets Total Risk Based and Tier 1 CapitalReturn on Tangible Common Equity 10.0%2 8.0%2 1

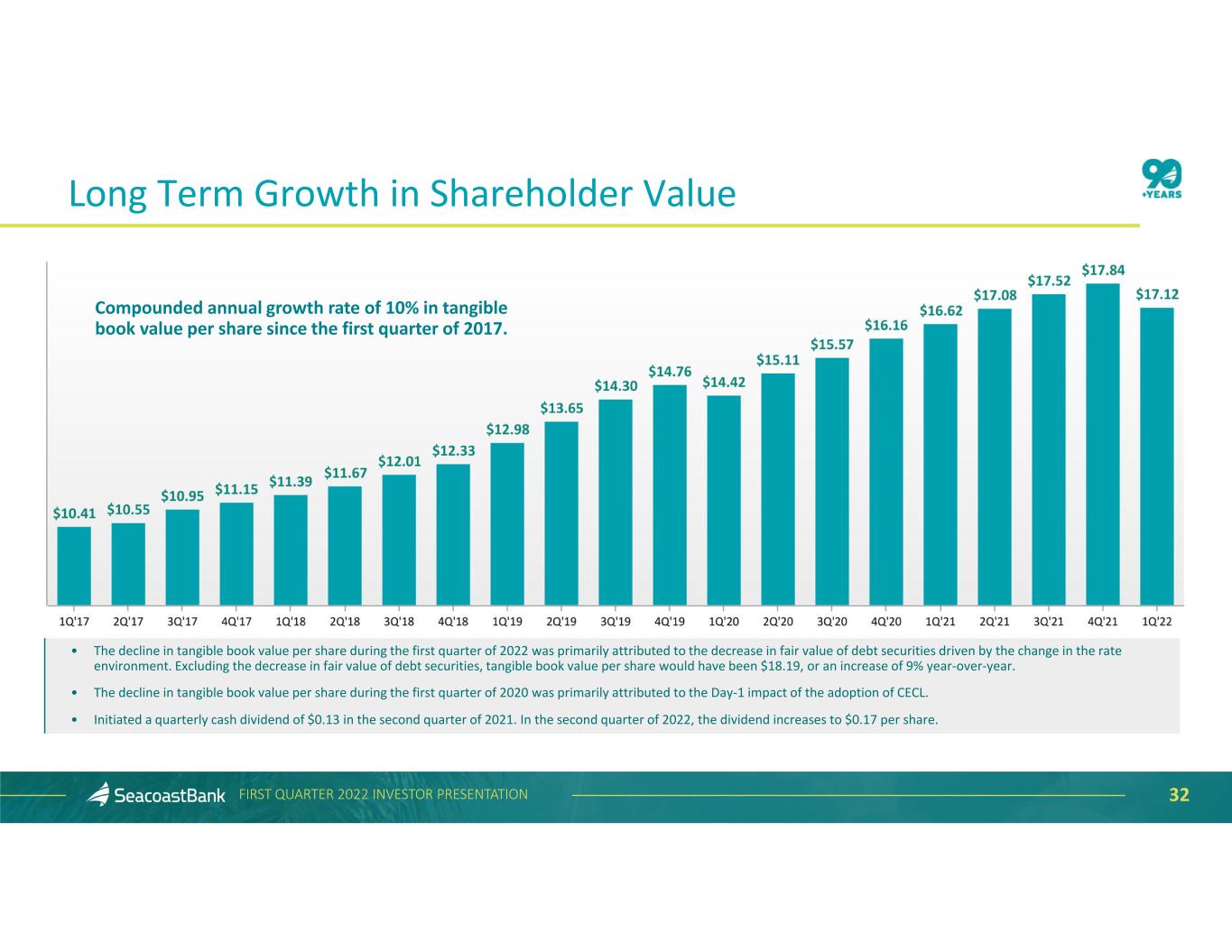

Long Term Growth in Shareholder Value 32FIRST QUARTER 2022 INVESTOR PRESENTATION • The decline in tangible book value per share during the first quarter of 2022 was primarily attributed to the decrease in fair value of debt securities driven by the change in the rate environment. Excluding the decrease in fair value of debt securities, tangible book value per share would have been $18.19, or an increase of 9% year‐over‐year. • The decline in tangible book value per share during the first quarter of 2020 was primarily attributed to the Day‐1 impact of the adoption of CECL. • Initiated a quarterly cash dividend of $0.13 in the second quarter of 2021. In the second quarter of 2022, the dividend increases to $0.17 per share. Compounded annual growth rate of 10% in tangible book value per share since the first quarter of 2017.

I N V E S TO R R E L AT I O N S www. S e a c o a s t B a n k i n g . c om N A S DAQ : S B C F Seacoast Banking Corporation of Florida THANK YOU. TRAC E Y L . D E X T E R E x e c u t i v e V i c e P r e s i d e n t C h i e f F i n a n c i a l O f f i c e r ( 7 7 2 ) 4 0 3 ‐ 0 4 6 1

APPENDIX AGENDA 04

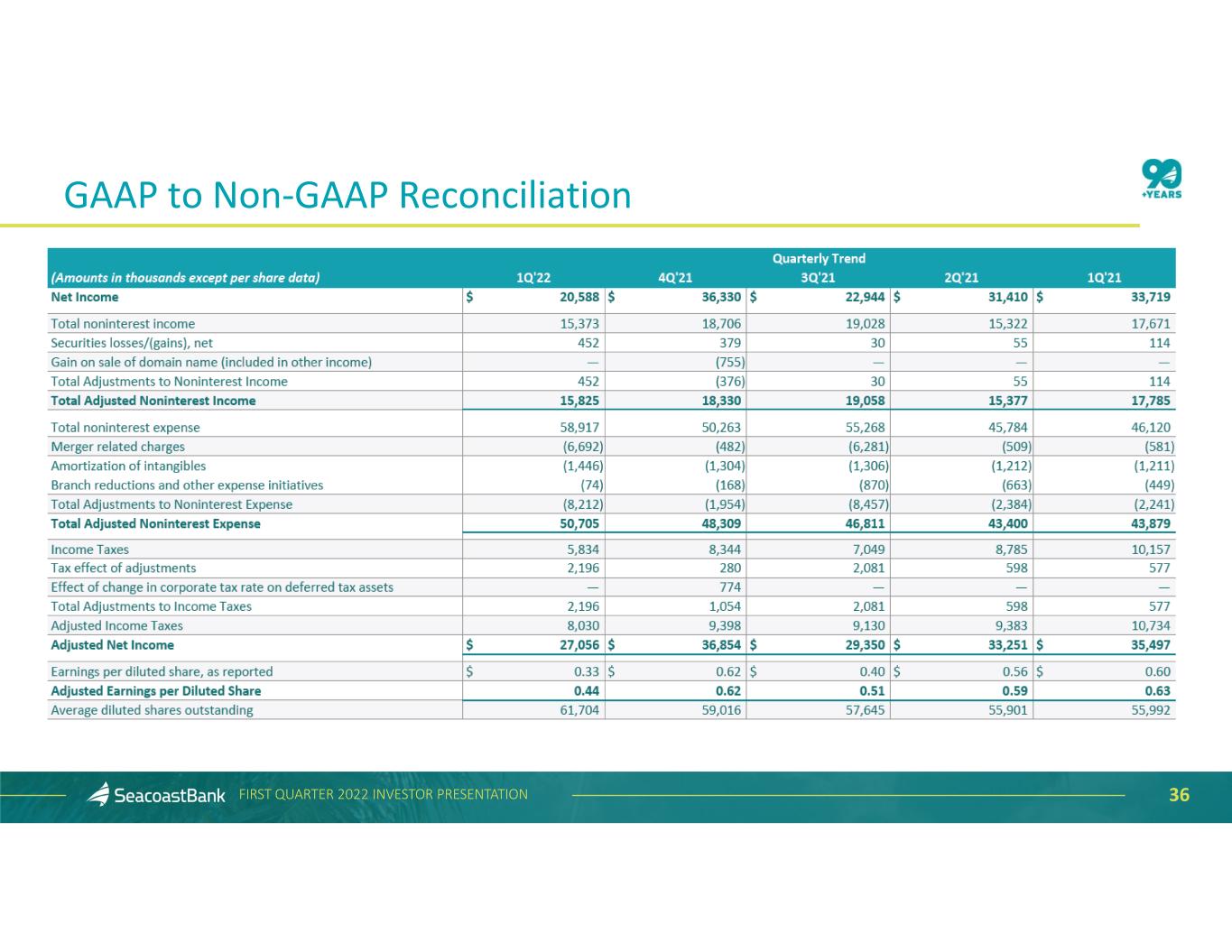

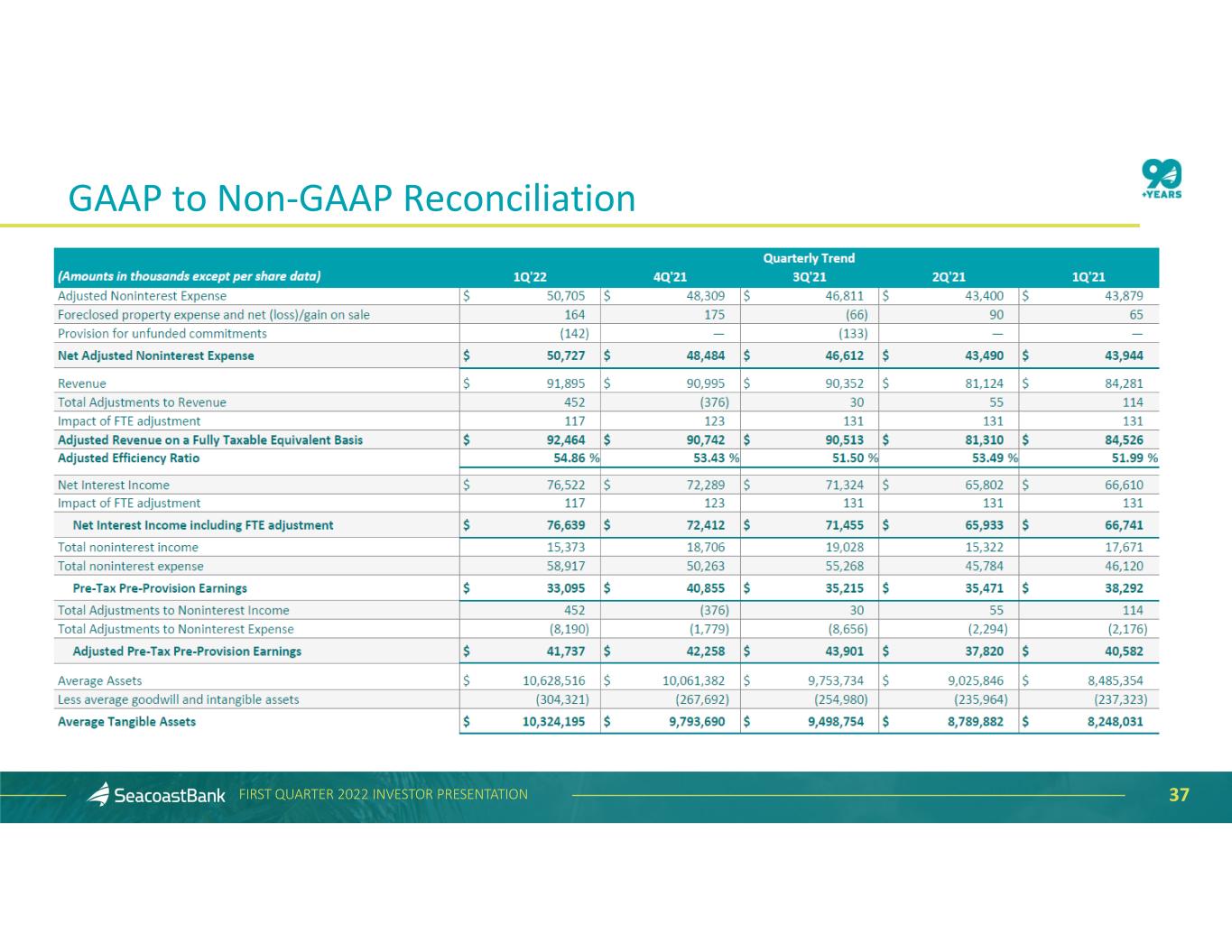

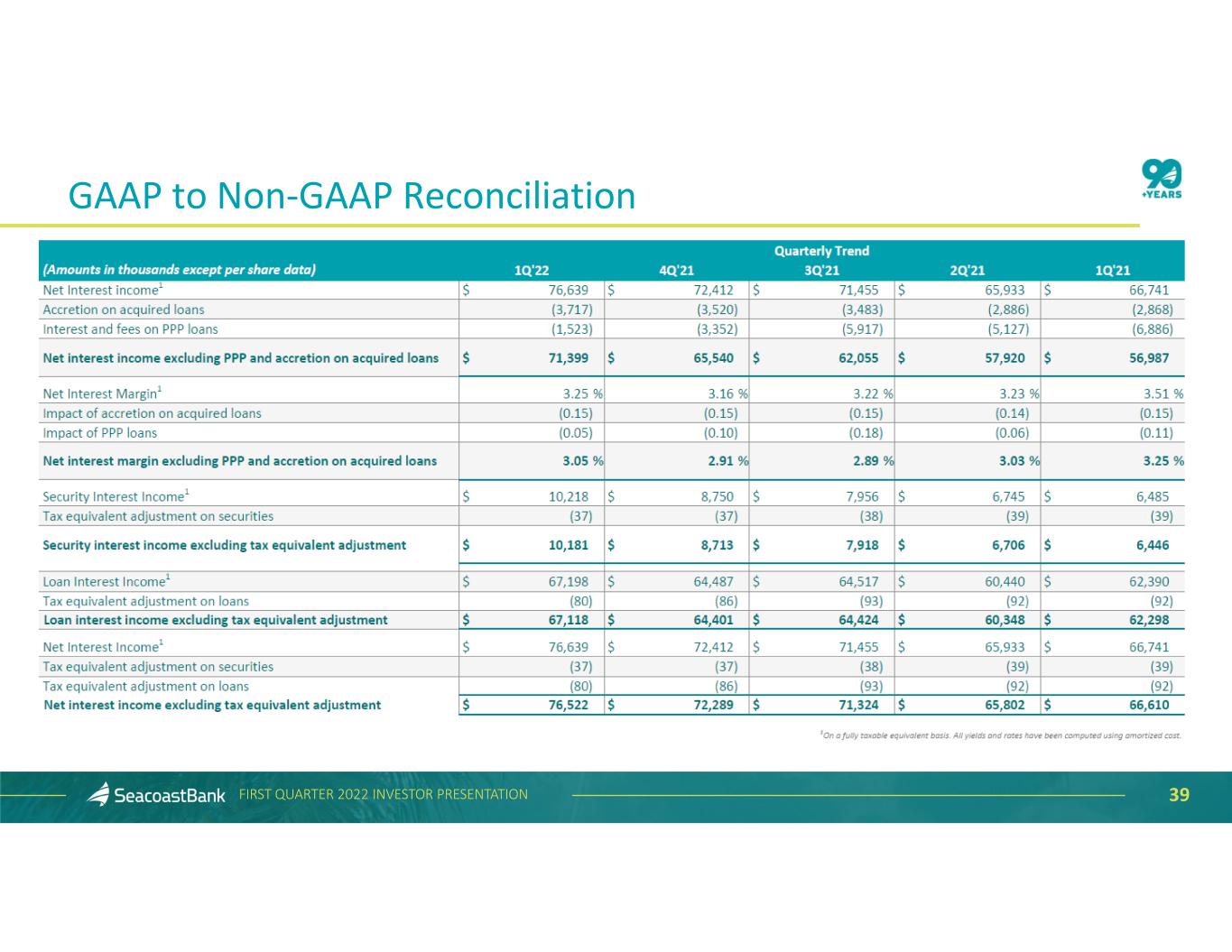

Explanation of Certain Unaudited Non‐GAAP Financial Measures 35FIRST QUARTER 2022 INVESTOR PRESENTATION This presentation contains financial information determined by methods other than Generally Accepted Accounting Principles (“GAAP”). The financial highlights provide reconciliations between GAAP and adjusted financial measures including net income, noninterest income, noninterest expense, tax adjustments and other financial ratios. Management uses these non‐GAAP financial measures in its analysis of the Company’s performance and believes these presentations provide useful supplemental information, and a clearer understanding of the Company’s performance. The Company believes the non‐GAAP measures enhance investors’ understanding of the Company’s business and performance and if not provided would be requested by the investor community. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. The limitations associated with operating measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might define or calculate these measures differently. The Company provides reconciliations between GAAP and these non‐GAAP measures. These disclosures should not be considered an alternative to GAAP.

GAAP to Non‐GAAP Reconciliation 36FIRST QUARTER 2022 INVESTOR PRESENTATION Quarterly Trend Twelve Months Ended

GAAP to Non‐GAAP Reconciliation 37FIRST QUARTER 2022 INVESTOR PRESENTATION

GAAP to Non‐GAAP Reconciliation 38FIRST QUARTER 2022 INVESTOR PRESENTATION

39FIRST QUARTER 2022 INVESTOR PRESENTATION GAAP to Non‐GAAP Reconciliation

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Seacoast Banking Corporation of Florida Declares Quarterly Dividend on Common Stock

- Property Management and Real Estate Investment Firm Ginkgo Residential Names New Director of Investor Relations

- Taro Pharmaceutical Board Relies on Flawed Analysis to Shortchange Minority Shareholders

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share