Form 8-K REGIONS FINANCIAL CORP For: Aug 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 10, 2022

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (800 ) 734-4667

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Depositary Shares, each representing a 1/40th Interest in a Share of | ||||||||||||||

| Depositary Shares, each representing a 1/40th Interest in a Share of | ||||||||||||||

| Depositary Shares, each representing a 1/40th Interest in a Share of | ||||||||||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

Regions Financial Corporation (“Regions” or the “Company”) executives will make various presentations regarding, among other things, the Company’s operations and performance, to institutional investors at various meetings and events during the months of August and September 2022.

A copy of the materials to be used at these various meetings and events (the “Presentation Materials”) is being furnished as Exhibit 99.1 to this report, substantially in the form intended to be used. Exhibit 99.1 is incorporated by reference under this Item 7.01. Such Presentation Materials are also available on Regions’ website at www.regions.com.

In accordance with general instruction B.2 of Form 8-K, this information is being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Number | Description of Exhibit | |||||||

| 99.1 | Copy of Presentation Materials that Regions Financial Corporation intends to provide to institutional investors at various meetings during the months of August and September 2022. | |||||||

| 104 | Cover Page Interactive Data (embedded within the Inline XBRL document). | |||||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| REGIONS FINANCIAL CORPORATION | ||||||||

| By: | /s/ Karin K. Allen | |||||||

| Name: | Karin K. Allen | |||||||

| Title: | Executive Vice President and Assistant Controller (Chief Accounting Officer and Authorized Officer) | |||||||

Date: August 10, 2022

Investor Information August - September 2022 Exhibit 99.1

2 Table of contents Topic Page # Profile and Strategy 3-10 Income Statement 11-26 Business Segment Highlights 27-31 Balance Sheet 32-38 Capital, Debt & Liquidity 39 Technology & Continuous Improvement 40-45 Credit 46-51 Near-Term Expectations 52 Environmental, Social & Governance 53-54 LIBOR Transition 55 Bolt-on Acquisitions 56 Appendix & Forward Looking Statements 57-68

3 Line of business coverage Alabama – 190 Georgia – 115 Iowa – 5 Mississippi – 101 South Carolina – 20 Arkansas – 59 Illinois – 41 Kentucky – 11 Missouri – 51 Tennessee – 200 Florida – 277 Indiana – 42 Louisiana – 83 North Carolina – 7 Texas – 91 Ranked 18th in the U.S. in total deposits(1) Branch locations by state(2) Our banking franchise Birmingham, Alabama (1) Source: S&P Capital IQ as of 6/30/2021; pro-forma for announced M&A transactions as of 07/29/2022. The green shaded states represent Regions' 15-state branch footprint. (2) Total branches as of 3/31/2022. First Sterling Ascentium Business Capital Capital Markets Commercial Banking Corporate Banking Equipment Finance Government/Institutional Institutional Services Private Wealth Real Estate Specialized Industries EnerBank

4 CCAR Loan Loss Rate Profile evolution Improved Credit Risk Profile Continuous Improvement Proactive Interest Rate Hedging Exited Non-Core Business Strategic M&A Top Quartile Profitability $24 $7 2008 2021 Investor CRE ($ in billions) 8.1% 6.5% 2012 2021 Customer Journeys Organization Simplification Revenue Growth Efficiency Improvements 460 bps Improvement in efficiency ratio 2017 to 2021 • Hedge program introduced in 2017/2018 to protect NIM against falling interest rates ◦ Highly effective; cumulative NII through 6/30/22 of ~$900M • New actions taken in 2022 to realize upside while locking in NIM if rates decrease 9.0% 21.4% 2015 RF ROATCE Indirect Auto 2012 2018 2019 2019 2021 Peers(1) Bottom Quartile Median Top Quartile 15.4% 16.5% 17.4% (1) Source: S&P Capital IQ; peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, TFC, USB, ZION.

5 Top market share plays a valuable role in the competitive landscape (1) Based on MSA and non-MSA counties using FDIC deposit data as of 6/30/2021; pro-forma for announced M&A transactions as of 07/29/2022. (2) Significant money center bank presence (JPM, BAC, C, WFC) defined as combined market share using 6/30/2021 FDIC deposit data of 20% or more. Markets with top 5 market share(1) MSAs Non-MSA counties • Ranked 18th in the U.S. in total deposits(1) • 86% of deposits in 7 states: Alabama, Tennessee, Florida, Louisiana, Mississippi, Georgia, Arkansas • Top 5 or better market share in ~70% of MSAs across 15-state footprint(1) • ~70% of deposits in markets without a significant money center bank presence(2) • High growth markets benefiting from population and business growth: • Florida • Georgia • Texas • Tennessee

6 Strong in-market migration has converted legacy core markets into growth markets Top Faster Growing MSAs Deposits Market Rank(1) Birmingham, Alabama $14.9 2 Nashville, Tennessee $10.8 3 Tampa, Florida $7.2 4 Miami, Florida $5.9 10 Atlanta, Georgia $5.5 7 Mobile, Alabama $3.2 1 Orlando, Florida $3.0 6 Knoxville, Tennessee $2.9 3 Huntsville, Alabama $2.4 1 Montgomery, Alabama $2.3 1 Dallas/Ft Worth, Texas $2.1 21 Indianapolis, Indiana $1.9 12 Houston, Texas $1.8 16 Chattanooga, Tennessee $1.7 3 Pensacola, Florida $1.6 1 National average: 3.2% '22-'27 Population Growth(1) 19 of Regions' top 25(1) MSAs are projected to grow faster than the U.S. national average 1) Source: S&P Capital IQ. Top 25 markets as defined by deposit dollars - FDIC 6/30/2021. Pro-forma for announced M&A transactions as of 7/29/2022. S&P's demographic data is provided by Claritas based primarily on U.S. Census data. (2) Source: U.S. Postal Service (for moves from January 2021 - June 2022). (3) Peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, TFC, USB, ZION. (4) Source: U.S. Bureau of Labor Statistics. 18 of top 25 U.S. markets with net migration inflows are within Regions' footprint(2) Regions' deposit weighted population growth by MSA for 2022-2027 is 3.6% vs. peer median of 3.0%(3) Unemployment rates in 6 of our top 8 deposit states are essentially at all time lows(4)

7 Regions Bank Awarded Silver Military Friendly Employer Award Eight Years Strong: Regions Bank Again Named Gallup Exceptional Workplace Award Winner in 2022 Regions Bank earned the Great Place to Work-Certified™ Company designation based on what current associates say about their experience working here. Regions Bank Ranked Highest in Customer Satisfaction in J.D. Power 2022 U.S. Online Banking Satisfaction Study Among Regional Banks for the third year in a row Regions Bank named a Best Place to Work for LGBTQ+ Equality by Human Rights Campaign Foundation Regions Bank named a Best Place to Work for Disability Inclusion by the American Association for People with Disabilities and Disability:IN Regions receives top honors For the second year, Regions earned Gallup's Don Clifton Strengths-Based Culture Award, which recognized organizations in 2022 with workplace cultures that put the strengths of all associates at the core of how they collaborate, make decisions and work every day.

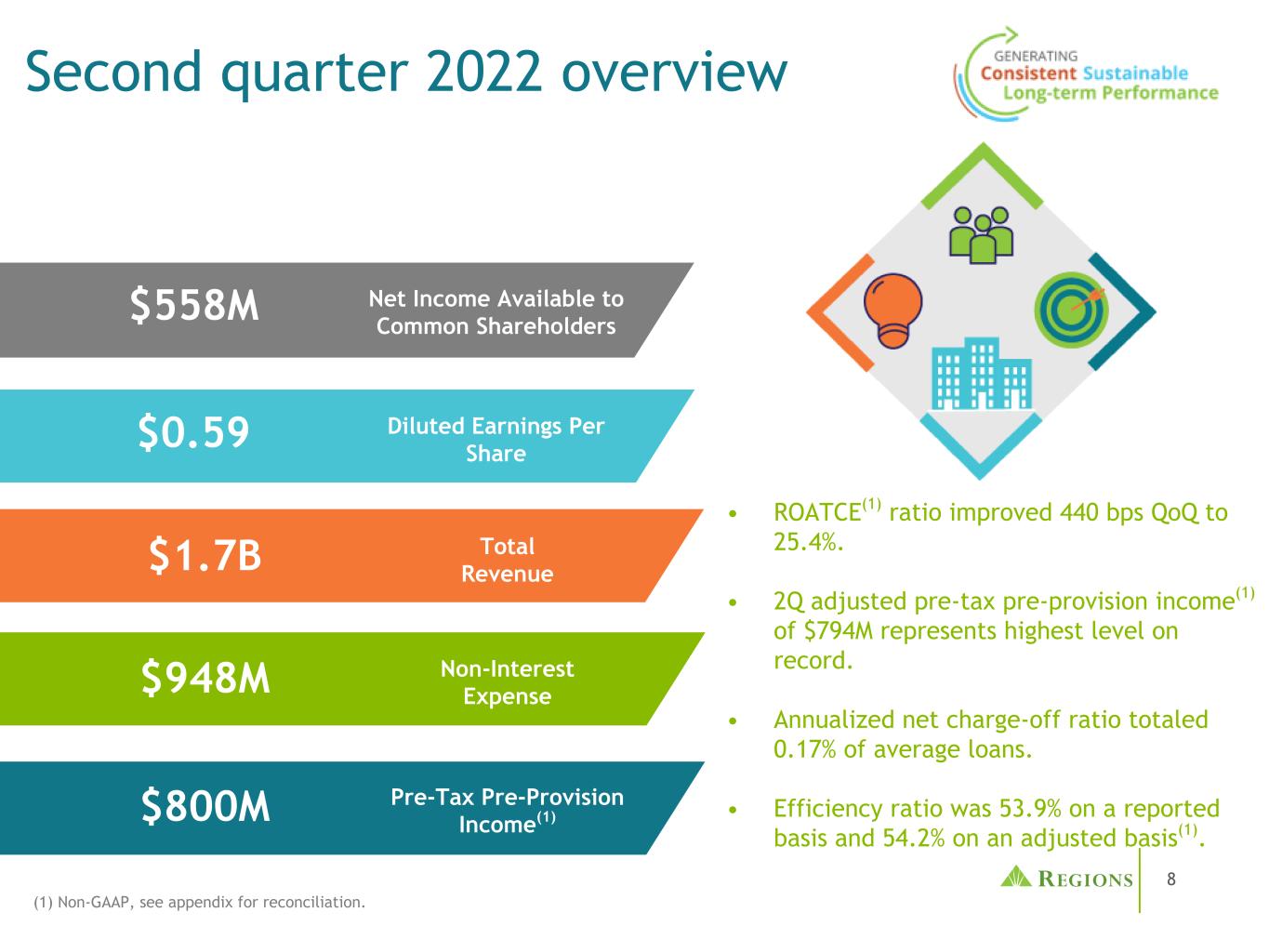

8 Second quarter 2022 overview (1) Non-GAAP, see appendix for reconciliation. Pre-Tax Pre-Provision Income(1) Diluted Earnings Per Share Total Revenue Non-Interest Expense Net Income Available to Common Shareholders $0.59 $558M • ROATCE(1) ratio improved 440 bps QoQ to 25.4%. • 2Q adjusted pre-tax pre-provision income(1) of $794M represents highest level on record. • Annualized net charge-off ratio totaled 0.17% of average loans. • Efficiency ratio was 53.9% on a reported basis and 54.2% on an adjusted basis(1). $800M $1.7B $948M

9 Regions' consistent outperformance Adjusted PPI(1) Less Net Charge-offs to RWA(2) Regions' earnings, including credit costs, have been top quartile for 8 straight quarters 1.70 2.16 2.33 2.29 2.33 2.44 2.23 2.19 2.54 1.74 1.73 1.74 1.86 1.97 1.91 1.78 1.63 1.89 RF Peer Median 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 (1) Non-GAAP; see Appendix for reconciliation. (2) Source: S&P Capital IQ. Risk-weighted Assets (RWA) used in the analysis represents the simple average of 2Q22 and 1Q22 disclosed amounts (same process for prior quarters); estimates of 2Q22 RWA used for MTB and HWC. Peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, TFC, USB, ZION.

10 ROATCE: Top of peer group 9.0% 9.7% 11.0% 17.6% 14.9% 9.2% 21.4% 21.0% 25.4% 12.0% 11.0% 12.0% 17.0% 14.7% 8.5% 16.5% 14.0% 18.3% RF Peer Median 2015 2016 2017 2018 2019 2020 2021 1Q22 2Q22 ROATCE Performance Trend vs. Peers(1) (1) Non-GAAP; see Appendix for reconciliation. Peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, TFC, USB, ZION. The 2018 ROATCE for Regions was 15.6% excluding a $191M after-tax benefit from discontinued operations primarily related to a gain from the sale of Regions Insurance Group. Other historical periods were also impacted by discontinued operations but to an immaterial extent.

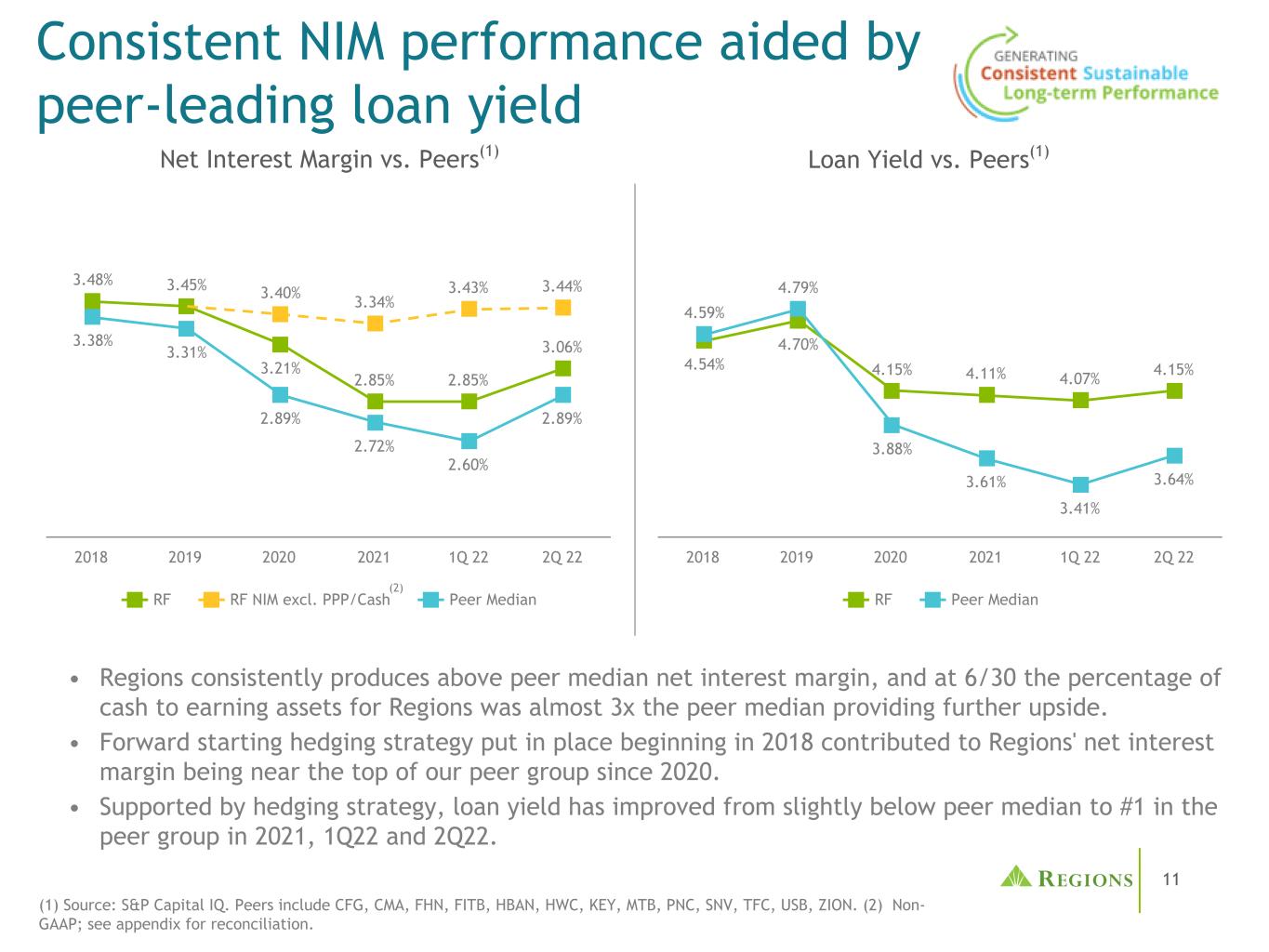

11 Consistent NIM performance aided by peer-leading loan yield (1) Source: S&P Capital IQ. Peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, TFC, USB, ZION. (2) Non- GAAP; see appendix for reconciliation. Net Interest Margin vs. Peers(1) 3.48% 3.45% 3.21% 2.85% 2.85% 3.06% 3.40% 3.34% 3.43% 3.44% 3.38% 3.31% 2.89% 2.72% 2.60% 2.89% RF RF NIM excl. PPP/Cash Peer Median 2018 2019 2020 2021 1Q 22 2Q 22 Loan Yield vs. Peers(1) 4.54% 4.70% 4.15% 4.11% 4.07% 4.15% 4.59% 4.79% 3.88% 3.61% 3.41% 3.64% RF Peer Median 2018 2019 2020 2021 1Q 22 2Q 22 (2) • Regions consistently produces above peer median net interest margin, and at 6/30 the percentage of cash to earning assets for Regions was almost 3x the peer median providing further upside. • Forward starting hedging strategy put in place beginning in 2018 contributed to Regions' net interest margin being near the top of our peer group since 2020. • Supported by hedging strategy, loan yield has improved from slightly below peer median to #1 in the peer group in 2021, 1Q22 and 2Q22.

12 $975 $1,026 $1,119 2.81% 2.85% 3.06% 3.31% 3.43% 3.44% 2Q21 1Q22 2Q22 NII NII & margin performance NII and NIM(1) ($ in millions) (1) Net interest income (NII) and net interest margin (NIM) are reflected on a fully taxable-equivalent basis. (2) Non-GAAP; see appendix for reconciliation. NIM NIM excl. PPP/Cash(2) • In 2Q, deposit and cash balances remained elevated. • PPP and cash account for -38 bps NIM and $48M NII within the quarter (+20 bps / +$33M QoQ) ◦ PPP loans account for +1 bps NIM and $8M NII within the quarter (-1 bps / -$4M QoQ) ◦ Excess cash accounts for -39 bps NIM and $40M NII (+21 bps / +$37M QoQ)

13 • Avg. loans grew ~$3.0B in 2Q • $1.2B securities purchases for hedging • Higher short-term rates now benefiting NII ◦ Contractual loan and cash repricing ◦ Hedging benefit of $78M NII in 2Q ◦ Stable deposit pricing; 2Q deposit yield = 6bps / interest-bearing deposit yield = 10bps (5% beta) • Higher long-term rates increase fixed rate asset yields and reduce securities premium amortization(2) • Negative other items mostly from seasonal HR asset dividends (1Q) and PPP; lower cash accretive to NIM Loan Bals/MixOther(1) (1) Other items include 1Q seasonal HR asset dividends, 2Q loan yield adjustment, PPP, and lower cash balances. (2) Market rate impacts include contractual loan, cash, hedge and borrowings repricing; fixed asset turnover at higher market rates; and lower securities premium amort. from $41M to $38M. (3) All guidance assumes 7/1/2022 forward rates; 75bps hike in July, 50bps in Sept., Fed Funds end 2022 at 3.5% $1,015 $1,108 NII Attribution Drivers of NII and NIM 2Q22 1Q22 -2bps -3bps +19bps+8bps +$6M +$12M +$70M-$7M Expectations for 3Q22 and Beyond NII NIM Positioned well for continued market rate increases and balance sheet expansion NII & margin - core drivers Market Rates(2)Days Securities Bals +$12M -1bps • NII expected to grow approximately 8-10% in 3Q ◦ Asset growth: Near-term environment conducive for continued loan growth; $1.2B securities additions in 2Q (~3.30% yield); No additional securities purchases included in guidance ◦ Market rates: Meaningful short and long-term rate leverage as illustrated on following page ◦ 1 additional day adds ~0.5% NII • Longer-term NII growth from organic and strategic asset growth, and higher rates; 2022 NII growth expected to be +16-18%, excl. PPP +19-21%; expect 4Q22 NII to be ~23-25% higher than 1Q22(3)

14 (1) Adj. NIM excludes PPP and excess cash over $750M. Adjusted NIM is non-GAAP; see appendix for historical reconciliations. (2) Short- term rate NII guidance assumes 25%-35% incremental beta in a Fed Funds range of 1.75%-3.50%. 25bps rate hike adds +$40-60M of NII over 12 months(2) • ~$17B annual fixed rate loan production and securities reinvestment; mostly exposed to middle tenor rates • Reduced premium amortization from lower prepay speeds; expect to stabilize in mid/low-$30M per quarter Asset sensitive balance sheet Well positioned for rising short-term and/or long-term interest rates Short-term Rate Sensitivity Drivers • ~50% floating rate loans excl. hedges • Hedge maturities beginning in 3Q22 ◦ Recent decisions to shorten our hedge protection allows our sensitivity levels to increase throughout 2022 and beyond • Large, stable deposit funding base and historically low betas ◦ Stable deposit portfolio has grown by ~$15B over the pandemic ◦ 2/3 of pandemic growth likely more rate sensitive (~70% beta) • Large cash balance well positioned as rates rise Long-term Rate Sensitivity Drivers Upper End of Fed Funds Range 3.65% 3.80% 3.85% 3.90% 3.58% 3.70% 3.75% 3.80% 3.50% 3.60% 3.65% 3.70% 0.25% 1.00% 2.00% 2.50% 3.00% Longer-Term Adjusted(1) NIM Expectations Assumptions: • Base case deposit betas on stable balances consistent with the prior rate cycle; Surge deposit beta repricing/runoff of ~70% • Upper-end: Lower deposit beta and steeper yield curve • Lower-end: Higher deposit beta and flat to inverted yield curve • Opportunity for outperformance from surge deposit repricing / retention Assuming rates stabilize at higher levels and deposit betas follow historically-based expectations, Regions' NIM can achieve 3.80% over time Lower Beta/Steeper Curve Higher Beta/Flatter Curve 3.38% 3.40% 3.35%

15 Floating 60% Fixed 40% Deposits 96% Borrowings 2% Other 2% • Balance sheet position naturally benefits from higher interest rates (i.e. asset sensitive), supported by: ◦ large floating rate loan and cash mix ◦ large, stable deposit base and low reliance on wholesale borrowings • Stability of deposit funding evidenced over time ◦ High concentration of non-interest bearing (42% vs. peer median 35%) ◦ Regions' rising rate deposit betas have outperformed the industry (e.g. RF 29%, Peer Median 35% 3Q15-2Q19) • Have retained elevated cash balances to maximize flexibility and rate benefit ◦ Support profitable loan/securities growth ◦ Allow for potential surge deposit runoff ◦ No wholesale bank funding needs expected in the near term IB 54% NIB 42% Time 4% Loans 58% Securities 20% Cash 11% Other 11% Floating 30% Fixed (ex Hedges) 48% Fixed Hedges 22% $138B Loans(2)(3)(4) $93B Balance sheet profile (as of June 30, 2022) Portfolio Compositions $161B Assets(1) Liabilities $144B Wholesale Borrowings(2) $2B Deposits (1) Securities includes AFS, the unrealized AFS loss, and HTM securities; cash represents interest-bearing deposits held with the Federal Reserve. (2) Including spot starting balance sheet hedges as of 6/30/22; forward starting derivatives excluded. (3) ARM mortgage loans are included as floating rate loans. (4) Composition of floating rate loans: 52% LIBOR, 14% Prime, 24% SOFR, 6% BSBY, 4% Other.

16 Balance sheet positioning advantage Strong deposit franchise and cash position provide an opportunity for flexibility and outperformance in a monetary tightening environment (1) Rate cycle measured from 4Q21 to 2Q22. Source: SEC reporting. Peer banks include: CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, SNV, PNC, TFC, USB, and ZION. Cash / Earning Assets 18% 13%12% 7% 7% 6% 4% 4% 4% 3% 3% 2% 1% 1% 2Q22 EOP Cash / EA 1Q22 EOP Cash / EA Peer Median Pe er 1 Pe er 2 RF Pe er 3 Pe er 4 Pe er 5 Pe er 6 Pe er 7 Pe er 8 Pe er 9 Pe er 1 0 Pe er 1 1 Pe er 1 2 Pe er 1 3 —% 10% 20% 30% Loan-to-Deposit Ratio 87% 84% 80% 80% 77% 75% 74% 73% 72% 71% 71% 68% 68% 66% 2Q22 EOP Loan-to-Deposit Ratio Peer Median Pe er 1 Pe er 2 Pe er 3 Pe er 4 Pe er 5 Pe er 6 Pe er 7 Pe er 8 Pe er 9 Pe er 1 0 Pe er 1 1 Pe er 1 2 RF Pe er 1 3 Borrowings / Earning Assets 13% 10% 10% 9% 9% 8% 7% 5% 4% 3% 3% 2% 2% 2% 2Q22 EOP Borrowings / EA 1Q22 EOP Borrowings / EA Peer Median Pe er 1 Pe er 2 Pe er 3 Pe er 4 Pe er 5 Pe er 6 Pe er 7 Pe er 8 Pe er 9 Pe er 1 0 Pe er 1 1 Pe er 1 2 Pe er 1 3 RF —% 5% 10% 15% Rate Cycle Deposit Beta 16% 13% 11% 10% 8% 7% 7% 7% 7% 4% 3% 1% 1% —% 2Q22 YTD Peer Median Pe er 1 Pe er 2 Pe er 3 Pe er 4 Pe er 5 Pe er 6 Pe er 7 Pe er 8 Pe er 9 RF Pe er 1 0 Pe er 1 1 Pe er 1 2 Pe er 1 3 Peer Median:4% Peer Median:74% Peer Median:7% Peer Median:7% (1)

17 Hedges protected NII while rates were low; unwound hedges additive to NII in coming years While not included in the outlook, opportunities exist if surge deposits are retained with lower betas (assume ~70% through-the-cycle deposit beta), or if additional excess cash is able to be deployed into loans/ securities NII is positioned to benefit from higher rates, as well as natural loan growth and strategic opportunities. Hedge proceeds and the capital generated has been invested into strategically important businesses, such as Ascentium and EnerBank. 2021 2022 2023 NII Drivers - Current Support Relative Impact of Future NII Drivers(1) NII Drivers - Future Growth Expecte d NII g rowth of 1 3-15% CAGR Hedge Income Forward Rates EnerBank PPP Organic Growth Regions' asset sensitive position will benefit meaningfully as rates continue to rise The EnerBank acquisition closed in 4Q 2021, with additional growth opportunities expected PPP supported earnings through the pandemic but will mostly subside after 2021 Regions is well positioned to grow loans as the economic recovery continues NII Drivers - Additional Opportunity (1) Based on market forward rate projections from BlackRock as of 07/01/2022: 2021: Avg 1m LIBOR 10bps, Avg 10yr UST 1.46%; 2022: Avg 1m LIBOR 1.69%, Avg 10yr UST 2.61%; 2023: Avg 1m LIBOR 3.22%, Avg 10yr UST 2.96%. Future NII drivers

18 • Our legacy hedging program has performed as designed, limiting NII and NIM downside under the low-rate environment • The hedge repositioning in 2021 purposely created more rate exposure in the period where the balance of risk had shifted to rising rates • Today, forward rate expectations have been supportive of our longer-term margin goals; therefore, we have continued to add protection against a lower rate environment ◦ Year to date, we have added ~$15B of interest rate protection via swaps and securities for the next cycle ◦ Expect ~$5B additional hedging to finish program to protect 3.60% NIM in an environment where Fed Funds falls to 0.75% Net Receive Hedge Notional(1) (2) (1) Net receive hedge notional reflects receive-fixed asset hedges minus pay-fixed hedges. An immaterial amount of hedges remain in place beyond 2028. (2) Includes all active swaps entered into prior to 07/02/2022. (3) 2022 swap additions primarily receive fixed, pay SOFR; $1.5B receive fixed, pay LIBOR. (4) 1Q22 1mL equivalent yield: 2.33%; 2Q22 1mL equivalent yield: 3.10%. Hedging strategy update 2022 Swap Additions Legacy Swap Notional (Quarterly Avg) 1 2 3 4 5 61 2 3 4 5 6 72Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Legacy Swap Notional $20.7B $17.0B $11.7B $9.4B $9.4B $9.4B $9.3B 2022 Swap Additions $0B $0B $0B $0B $0B $6.4B $9.4B Total Hedge Notional $20.7B $17.0B $11.7B $9.4B $9.4B $15.7B $18.7B 2023 2024 2025 2026 2027 2028 $9.3B $6.5B $1.4B $0B $0B $0B $4.0B $12.5B $12.5B $8.8B $4.0B $1.6B $13.3B $18.9B $13.9B $8.8B $4.0B $1.6B 2022 Swap Additions Receive Rate (vs SOFR) - - - - - 2.93% 2.91% Receive Rate (LIBOR Equivalent) - - - - - 3.04% 3.03% 2.92% 2.74% 2.74% 2.60% 2.24% 2.24% 3.03% 2.84% 2.84% 2.69% 2.31% 2.25% (Annual Avg) 1Q22 Hedging Actions • Added $4.2 billion of forward starting (late ’23/ early ‘24) receive fix swaps (2.26%) • Added ~$1.3 billion of spot starting securities (2.80%) 2Q22 Hedging Actions • Added $8.25 billion of forward starting (mid/late ‘23) receive fix swaps (2.99%) • Added $1.2 billion of spot starting securities (3.30%) (4) (4) (3) (3)

19 • Portfolio constructed to protect against changes in market rates ◦ Duration of approximately 5 years provides offset to long-duration deposit book ◦ ~30% of the securities in the portfolio are bullet-like (CMBS, corporate bonds, and USTs) ◦ Purchase MBS with loan characteristics that offer prepayment protection: lower loan balances, seasoning, and state-specific geographic concentrations • Continue to reinvest monthly paydowns at ~1.00% above runoff yield • Added $1.2B to the securities portfolio in 2Q as rates increased and spreads widened to bolster NII and add downside protection in the form of bullet- like duration • MBS-related book premium $532M as of 6/30/2022; higher market interest rates and prepayment protection should reduce amortization volatility ◦ 2Q22 premium amortization was $38M; expect mid/low-$30M per quarter run-rate Agency/UST 6% Agency MBS 65% Agency CMBS 24% Non-Agency CMBS 1% Corporate Bonds 4% Securities portfolio used to add down- side rate protection Securities portfolio composition(1) $29.9B (1) Includes AFS, the unrealized AFS loss, and HTM securities as of 6/30/2022.

20 Adj. Non-Interest Income $600 $583 $640 2Q21 1Q22 2Q22 Change vs ($ in millions) 2Q22 1Q22 2Q21 Service charges $165 (1.8)% 1.2% Card and ATM fees 133 7.3% 3.9% Capital markets (Ex CVA/DVA) 92 37.3% 41.5% Capital Markets - CVA/DVA 20 233.3% NM Wealth management income 102 1.0% 6.3% Mortgage income 47 (2.1)% (11.3)% Non-interest income NM - Not Meaningful (1) Non-GAAP; see appendix for reconciliation. QoQ outlook Total Revenue outlook • Expect 2022 adjusted total revenue to be up 7.5-8.5% compared to 2021. • Announced NSF/OD policy changes are expected to result in FY22 service charges of ~$600M and FY23 service charges of ~$550M. • Expect capital markets to generate quarterly revenue in $90-$110M range, ex.CVA/DVA; 3Q expected to be on the lower end of the range. • Mortgage is expected to be lower in 2022 vs. 2021, but remains a key component to fee revenue. • Wealth management continues to perform well despite market declines, and incremental YoY growth is expected. Non-Interest Income $619 $584 $640 2Q21 1Q22 2Q22 ($ in millions) ($ in millions) (1)

21 Consumer 48% Wealth Management 16% Corporate 36% 2Q22 fee revenue by segment(1) Diversified non-interest income ($ in millions) • Consumer fee income categories include service charges on deposit accounts, card and ATM fees, and mortgage income generated through origination and servicing of residential mortgages. Consumer Wealth Management • Wealth Management offers individuals, businesses, governmental institutions and non-profit entities a wide range of solutions to help protect, grow and transfer wealth. • Fee offerings include trust and investment management, asset management, retirement and savings solutions and estate planning. Corporate • Corporate fee income categories include capital markets and treasury management activities. • Capital markets activities include capital raising, advisory and M&A services and mitigating risk with rate, commodity and foreign exchange products. • Treasury management activities focus on delivering traditional cash management services, commercial card, and global trade products to clients. $640M (1) Pie %'s exclude the non-interest income from the Other Segment totaling $(11) million.

22 Capital Markets Growing products and services that our clients value Our associates delivered results • Capital Markets revenue is up 15% YTD • 2021 vs. 2020 revenue driven by loan syndications, securities underwriting and placement, M&A advisory services, and placement of real estate permanent financing • 2022 growth drivers focused on organic growth, Sabal Capital Partners and Clearsight Advisors • Expect capital markets to generate quarterly revenue in $90-$110M range in 2022, excl. impact of CVA/DVA • Real estate capital markets contributed $17M in 2014 growing to $86M in 2021 and is expected to increase with the addition of Sabal Capital Partners Capital markets is an umbrella over capital raising, risk management, and advisory services. Capital Markets Product Solutions Real Estate • Multifamily loan origination & distribution ◦ Fannie Mae ◦ Freddie Mac ◦ HUD • All property types loan origination & distribution ◦ CMBS • Real Estate loan syndications • Low income housing tax credit distribution Financial Risk Management • Interest Rate Derivatives • Commodity Derivatives • Foreign Exchange Debt & Capital • Loan syndication • Sponsor coverage • Loan sales & trading • Public and private capital raising Structured Products • Asset backed loan warehousing & fixed income underwriting • Private equity subscription lines Client Coverage Areas • Corporate Banking • Commercial Banking • Commercial Real Estate • Specialized Industries • Wealth Management Capital Markets Annual Revenue(1)(2) Mergers & Acquisitions • M&A Advisory Services (1) Prior to 2018, Capital Markets Fee income was labeled as "Capital Markets Fee Income and Other". (2) Decline in 2019 revenue was due to market conditions impacting M&A, Derivatives and CVA/DVA. ($ in millions) $73 $104 $152 $161 $202 $178 $275 $331 2014 2015 2016 2017 2018 2019 2020 2021

23 Treasury Management Enabling our clients to optimize cash flow and manage risk with a comprehensive & competitive suite of Treasury Management solutions Strategic Investments in Technology & Talent Excellence in Global Trade Finance • Export Working Capital Preferred Lender • #1 SBA Export Lender for 4 Consecutive Years • Export Working Capital Lender of the Year • Highest Delegated Lender Authority • Lender of the Year • EX-IM Medium Term Note Financing (1) May 2022 - YoY Growth Steadily Growing our Treasury Management Business(1) • Delivering capabilities in line with our "Build/Partner/Invest" strategy • Expanding client access via enhanced digital solutions and expanded self-service capabilities • Launching new cash flow analysis tools, open banking APIs, and Real Time Payment - Send functionality • Enhancing fraud mitigation resources • Providing additional online and mobile functionality • Adding Treasury Management sales talent in core & expansion markets and product & support functions

24 Regions has made significant changes and upgrades while continuing to provide clients with resources needed to succeed in managing their finances. Details of Regions' Announcement(2): 1Q22-Eliminate overdraft protection transfer fees 2Q22-Reduce daily cap for overdraft occurrences to 3 2Q22-Eliminate all NSF fees • By end of 3Q22-Early access to direct deposit • By end of 3Q22-Small dollar LOC available for qualifying customers Deposit account policy changes Providing customers capabilities to be more financially sound Updated NSF/OD Policies $2,109 $2,498 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Adjusted Non-Interest Income(1) • NSF/OD fees have declined over $175M since 2011 while total adjusted NIR increased ~$400M over that same time period by growing & diversifying revenue through expanded fee-based services including: ◦ Mortgage ◦ Capital markets ◦ Wealth management ◦ Card & ATM • Regulation E and debit interchange legislation had a combined $300M negative impact on Regions' fee income • Track record of consistent non-interest income growth Regions is committed to making banking easier for our customers. • Bank On certified Now Checking account • Simplified transaction posting order • Reduced fees • Customer education tools • Expansion of alert capabilities • Enhanced available balance views in digital channels • Intraday visibility of checks cleared Enhancements Product Features (1) Non-GAAP; see appendix for reconciliation. (2) For specific account details and eligibility requirements see "Regions Bank Announces New Steps to Reduce Overdraft Charges, Eliminate Non-Sufficient Funds Fees" press release dated January 19, 2022. ($ in millions) Future Enhancements - Expect to roll out a grace period feature sometime in 2023

25 Purchase volume expected to remain stable in 2022 driven by the housing market(1), while refinances have slowed due to rising rates Closed mortgages expected to be over $675B in 2Q 2022 across the US(1) Enhancing MLO execution to drive customer experience and improve cycle time Continuing to focus on growing Servicing through acquiring new MSRs 755 Avg. FICO 52% current LTV Exceeds market in percentage of purchase production volume at 83% in 2Q vs 70% for the industry(1) Mortgage remains a key component of fee revenue Investing For Growth Prime Portfolio Delivery Efficiency Mortgage Servicing Market Strength 23% lower origination and fulfillment cost than industry average(2) Omnichannel capabilities and partnership with retail bank create competitive advantage Servicing expense lower than peer average(2) $72B servicing portfolio(3) with capacity to grow to $95B (1) Mortgage Bankers Association – July 2022 Forecast. (2) MBA Stratmor (Spring 2022). (3) Includes residential owned portfolio and serviced for others.

26 $898 $933 $948 56.4% 57.9% 53.9% Non-interest expense Efficiency ratio 2Q21 1Q22 2Q22 • Non-interest expense increased ~2% on both a reported and adjusted basis(1). ◦ Salaries and benefits increased 5% due to annual merit increases, higher variable- based and incentive compensation, and one additional work day. Offset by a decrease in payroll taxes, higher loan cost deferrals associated with increased production, and lower HR asset valuations. • Expect 2022 adjusted non-interest expenses to be up 4.5-5.5% compared to 2021. • Expect to generate ~3% adjusted operating leverage in 2022. $895 $932 $954 56.9% 57.9% 54.2% Adjusted non-interest expense Adjusted efficiency ratio 2Q21 1Q22 2Q22 $3,387 $3,419 $3,434 $3,443 $3,541 $3,698 2016 2017 2018 2019 2020 2021 Non-interest expense QoQ highlights & outlookAdj. Non-Interest Expense(1) ($ in millions) 1.8% CAGR (3) (4) (2) (1) (2) (1) Non-GAAP; see appendix for reconciliation. (2) Includes the incremental increase of core operating expenses associated with the EnerBank, Sabal Capital Partners, and ClearSight Advisors acquisitions closed during 4Q21. (3) 2020 adjusted NIE includes expenses associated with the Ascentium acquisition that closed 4/1/2020. (4) 2021 adjusted NIE includes expenses associated with 3 additional months for Ascentium, as well as the 4Q21 EnerBank, Sabal Capital Partners, and Clearsight Advisors acquisitions. (1) Non-Interest Expense (2) (2) ($ in millions) Adj. Non-Interest Expense(1) ($ in millions)

27 51%43% 6% 63% 35% 2% 30% 61% 7% 2% $800M $91B $140B 2Q22 Pre-tax pre- provision income(1) 2Q22 Average deposits 2Q22 Average loans (1) Pie %'s exclude the pre-tax pre-provision income from the Other Segment totaling $(6) million. Business segments Consumer Corporate Wealth Management Other

28(1) May 2022 vs 2021. (2) Represents penetration of Corporate Banking Group segment. (3) Since 2019. (4) Includes accounts for Investment Services, Institutional Services, Highland Associates, and Private Wealth Management. (5) Quality relationships defined as having a cumulative $500K in deposits, loans and IM&T accounts, revenue per quality relationship measured over TTM. Investments in our businesses Increased number of Treasury Management clients 14% YoY(1); penetration rate improved 370bps(1)(2) Clearsight has robust pipeline for 2H22 & on track to exceed FY expectations CORPORATE CONSUMER WEALTH We are investing in talent, technology, and strategic acquisitions; the investments we are making across all three of our businesses are paying off. Mobile users increased 8% YoY 44 new revenue generating staff positions(3) in Private WM & Investment Services Sabal closed $500M in Loans YTD; anticipate increasing FY volume by 11% Launched a new digital investing tool in 2Q combining ease of self- service with support of financial advisor Investments contributed to YTD growth in total relationships(4) of 5% and revenue per quality relationship(5) of 7% Significantly improved closing time on home equity products Contributed to YTD non-interest income growth of 9% Ascentium 1H22 production up 31% YoY; pipelines remain strong Completed YTD bulk purchases of MSR totaling $13B UPB & continue to purchase MSR on a flow basis Upgraded mortgage contact relationship management platform SBA lending on target to grow FY production by 45% vs pre- pandemic levels EnerBank acquisition performing as expected generating high quality loans; synergy work ongoing

29 (1) Consumer Bank – LOB Average Deposits. (2) From 1/1/2014 to 6/30/2022. Consumer Banking Group Driving growth and customer engagement through strategic investments Continuing to Deliver Strong Results Strong Banker Talent in branches to provide effective consumer banking services to customers Delivered ~1MM Greenprint personalized financial plans in 2021 ◦ 2nd most financial health scores globally Consumer Deposit Growth of +50% (2014-2022)(1) Premier Lender to Homeowners Home Equity Modernization Top-decile customer satisfaction & loyalty ~3,000 FTE (~30%) reduction through efficiencies, improved sales production while creating customer value through advice, guidance, and education >500 branch consolidations; ~80 De Novos openings(2) ◦ Re-shaped branch network by consolidating ~30% of branches since 2014 while increasing bankable prospects ◦ De Novo branches drive substantial net checking performance in growth markets Strong Expense Management and credit performance Successful integration of EnerBank Creating Efficiencies Through an Optimized Branch Network Strategic Investments Across The Business Upgraded mortgage contact relationship management platform

30 Corporate Banking Group Strong alignment across the businesses, risk partners, and product groups Strategic Investments Expanded Expertise Solid Credit Quality with YTD Charge offs of 5bps, a 13bps improvement vs the prior year Ascentium Capital exceeding expectations Integrated Clearsight Advisors, Sabal on schedule Continue to Deliver Outstanding Performance Invested in Talent & Enablement Enhancing Treasury Management capabilities to include Real Time Payments, fraud mitigation, open banking APIs, and cash flow analysis tools Delivering Another Record Year for Revenue & Profit with Revenue +7% vs the prior year and Profit +11.3% vs the prior year Grew Deposit Balances to $42.2B in 2022, a 1.4% increase vs the prior year Expanded Small Business Capabilities in SBA, Franchise, & executed the Outbound Business Development model Remain focused on top performing banker retention & providing resources to build best in class RMs Continue to attract top talent to provide leadership for strategic initiatives Delivered advanced data and analytics to deepen our Relationship Managers' understanding of client needs Broad Based Loan Growth of +3.9% YTD vs the prior year, with 83% of new commitments coming from existing clients 17 Strategic Initiatives focused on expanding client solutions

31 Launch of hybrid robo-advice solution, Regions InvestPath®, on June 7, 2022(2) (1) Represents June YTD Numbers. (2) Through Regions Investment Solutions. See additional information on slide 68. Wealth Management Group Focus on execution & investments to optimize the client and associate experience Customer Experience & Communication Maintained strong momentum in growth markets and protected business through continued engagement and solid partnerships with Consumer Banking and Corporate Banking Continued enhancement of existing business intelligence dashboards to aid in client management and identification of trends Strong NIR Growth NIR growth of $15.2M or 8% YoY driven by increased IM&T sales, NRRE non- recurring revenue, and Money Market Mutual Fund fees Delivered Strong Results(1) Strategic Technology Investments & Data Analytics Managed Assets grew 4% YoY in volatile environment Grew Total Investment Services Assets +$0.2B or 2% YoY Continued lead management in Regions Investments with use of Bridge, the Salesforce CRM solution Investing in enhancements to RWP to improve retention and deliver future recurring non-interest revenue Focused on automation efforts to increase operational efficiency, reduce risk, and enhance client experience Exceeded client retention goal at 93.2% with $1.4M revenue impact for 2022 through Wealth Client IQ which provides insights for Private Wealth clients Grew Average Deposits +$0.9B or 9% YoY Client communications including weekly market update client calls with Asset Management; over 16,125 Regions Wealth Podcast downloads; Regions Asset Management provided commentary on ESG, crypto, and nonprofit RFPs Enhanced Guided Discovery for investment, retirement and wealth planning objectives for referral to Wealth or Financial Advisors for needs-based conversations

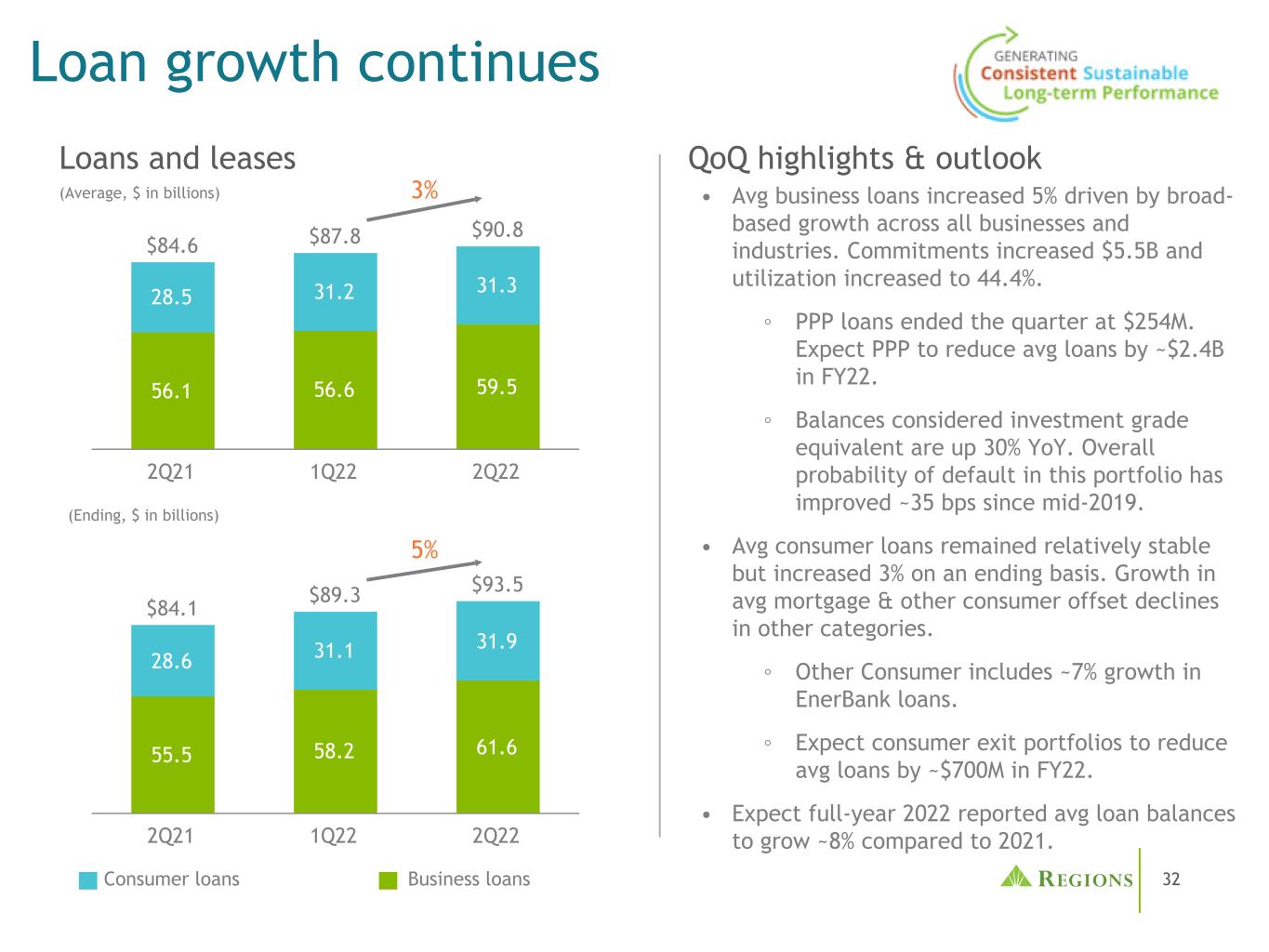

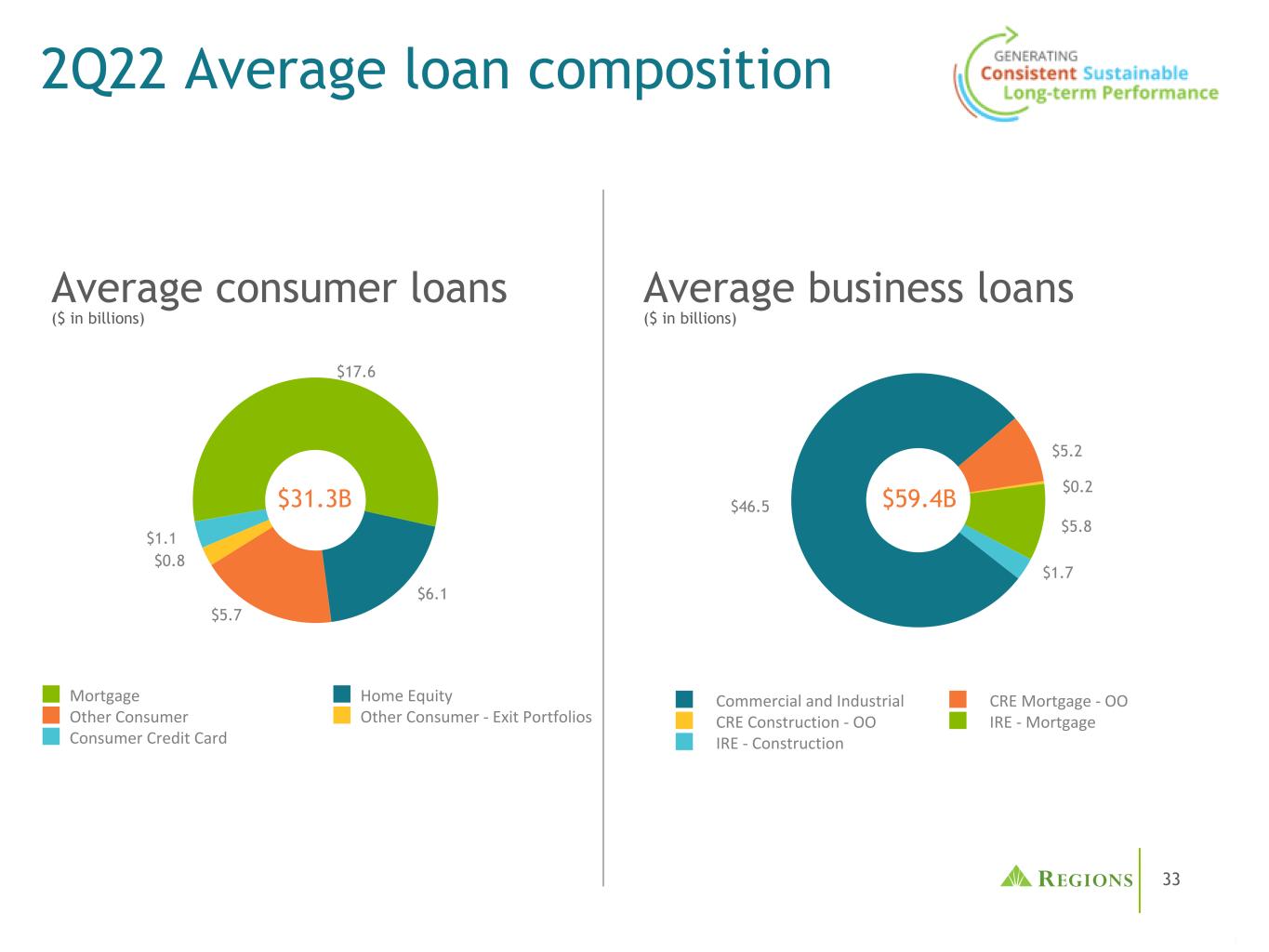

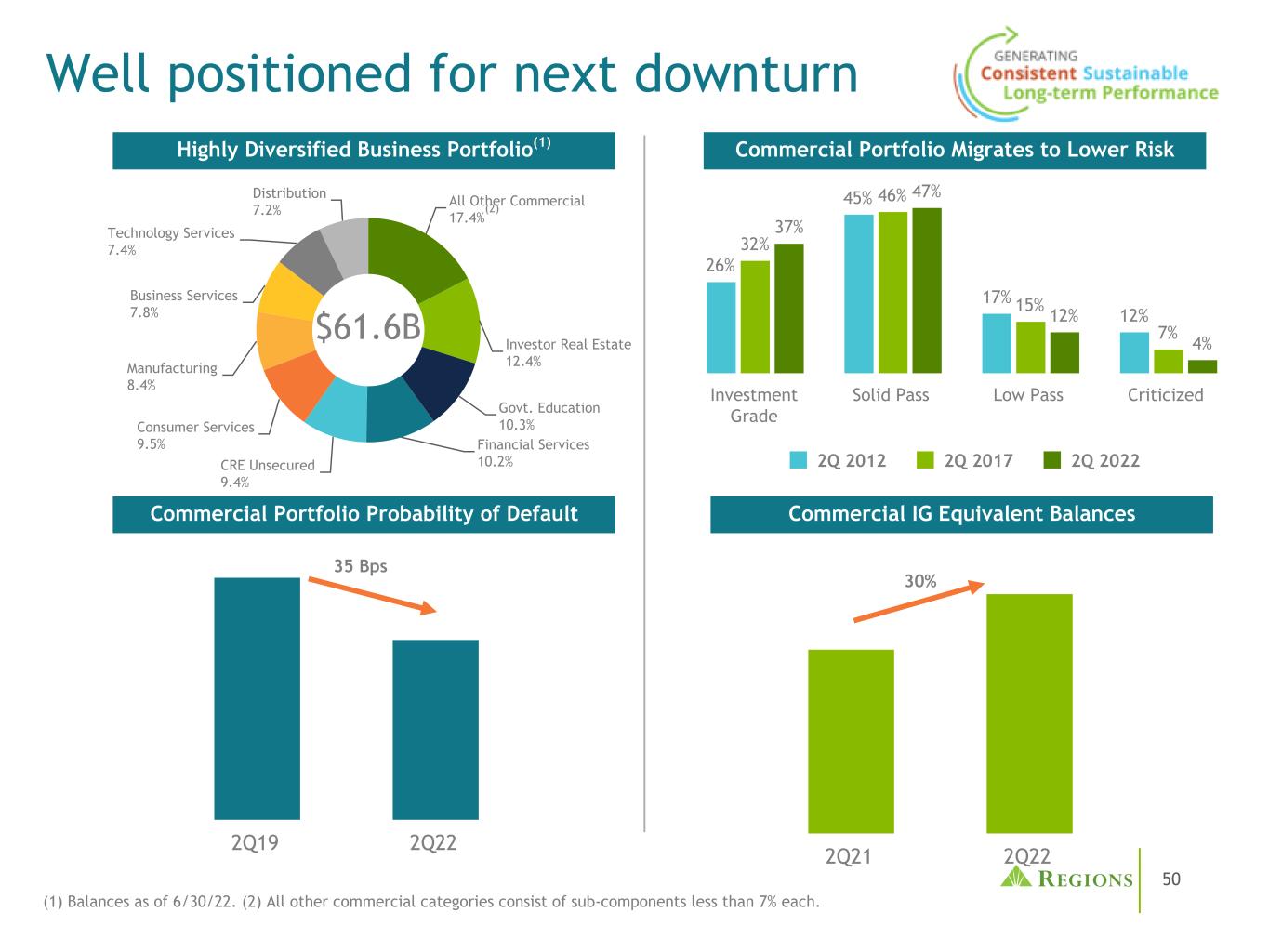

32 • Avg business loans increased 5% driven by broad- based growth across all businesses and industries. Commitments increased $5.5B and utilization increased to 44.4%. ◦ PPP loans ended the quarter at $254M. Expect PPP to reduce avg loans by ~$2.4B in FY22. ◦ Balances considered investment grade equivalent are up 30% YoY. Overall probability of default in this portfolio has improved ~35 bps since mid-2019. • Avg consumer loans remained relatively stable but increased 3% on an ending basis. Growth in avg mortgage & other consumer offset declines in other categories. ◦ Other Consumer includes ~7% growth in EnerBank loans. ◦ Expect consumer exit portfolios to reduce avg loans by ~$700M in FY22. • Expect full-year 2022 reported avg loan balances to grow ~8% compared to 2021. Loan growth continues $84.1 $89.3 $93.5 55.5 58.2 61.6 28.6 31.1 31.9 2Q21 1Q22 2Q22 (Ending, $ in billions) $84.6 $87.8 $90.8 56.1 56.6 59.5 28.5 31.2 31.3 2Q21 1Q22 2Q22 Loans and leases (Average, $ in billions) Business loansConsumer loans QoQ highlights & outlook 3% 5%

33 $46.5 $5.2 $0.2 $5.8 $1.7 Commercial and Industrial CRE Mortgage - OO CRE Construction - OO IRE - Mortgage IRE - Construction 2Q22 Average loan composition $17.6 $6.1 $5.7 $0.8 $1.1 Mortgage Home Equity Other Consumer Other Consumer - Exit Portfolios Consumer Credit Card Average consumer loans $31.3B Average business loans $59.4B ($ in billions)($ in billions)

34 Commercial & IRE loans As of 6/30/22 ($ in millions) Total Commitments Outstanding Balances % Utilization Administrative, Support, Waste & Repair $2,524 $1,518 60% Agriculture 575 335 58% Educational Services 4,377 3,299 75% Energy - Oil, Gas & Coal 4,498 1,519 34% Financial Services 13,190 6,279 48% Government & Public Sector 3,540 3,052 86% Healthcare 6,333 3,881 61% Information 3,673 2,188 60% Professional, Scientific & Technical Services 3,830 2,400 63% Real Estate 16,446 8,283 50% Religious, Leisure, Personal & Non-Profit Services 2,317 1,623 70% Restaurant, Accommodation & Lodging 1,800 1,447 80% Retail Trade 4,848 2,751 57% Transportation & Warehousing 4,834 3,255 67% Utilities 5,387 2,332 43% Wholesale 7,545 4,438 59% Manufacturing 9,468 5,166 55% Other(1) 1,027 210 N/A Total Commercial $96,212 $53,976 56% Land $123 $96 78% Single-Family/Condo 1,277 648 51% Hotel 271 262 97% Industrial 1,049 580 55% Office 1,882 1,785 95% Retail 584 559 96% Multi-Family 4,511 2,689 60% Other(1) 1,416 993 N/A Total Investor Real Estate $11,113 $7,612 68% •The outstanding balance for Real Estate within the Commercial section reflects $2,508M of Real Estate Services & Construction loans as well as $5,775M of combined CRE-Unsecured which includes REITs: ◦ Hotel REITs total $418M in balances with $654M in commitments ◦ Retail REITs total $1,075M in balances with $2,411M in commitments •Commitments to make commitments are not included •Utilization % presented incorporates all loan structures in the portfolio; utilization on revolving line structures was 44.4% at 6/30/2022 (1) Contains balances related to non-classifiable and invalid business industry codes offset by payments in process and fee accounts that are not available at the loan level.

35 $131.1 $138.7 $139.6 78.2 83.1 85.2 43.0 42.6 41.9 9.5 10.4 10.00.4 2.7 2.4 2Q21 1Q22 2Q22 Deposit growth continues (1) Other deposits represent non-customer balances primarily consisting of EnerBank brokered deposits. (2) See next slide for an analysis of surge deposit components, as well as underlying deposit beta assumptions. Wealth Mgt Other(1) Consumer Bank Corporate Bank QoQ highlights & outlook • Deposit balances acquired throughout the pandemic remained mostly stable. • Ending balances reflect the return of pre- pandemic seasonal patterns related to income tax payments during the quarter, as well as certain commercial and wealth clients reducing excess balances. • 2/3 of pandemic-related deposit growth assumed to have a ~70% deposit beta which includes ~$5-$10B of total deposit balance reduction in FY 2022.(2) • Legacy deposit base and the more stable component of surge deposits(2) represent a significant opportunity as rates continue to increase. (Ending, $ in billions) Deposits by Segment (Average, $ in billions) $131.5 $141.0 $138.3 78.4 85.2 85.0 43.1 42.8 41.5 9.5 10.4 9.50.4 2.5 2.3 2Q21 1Q22 2Q22

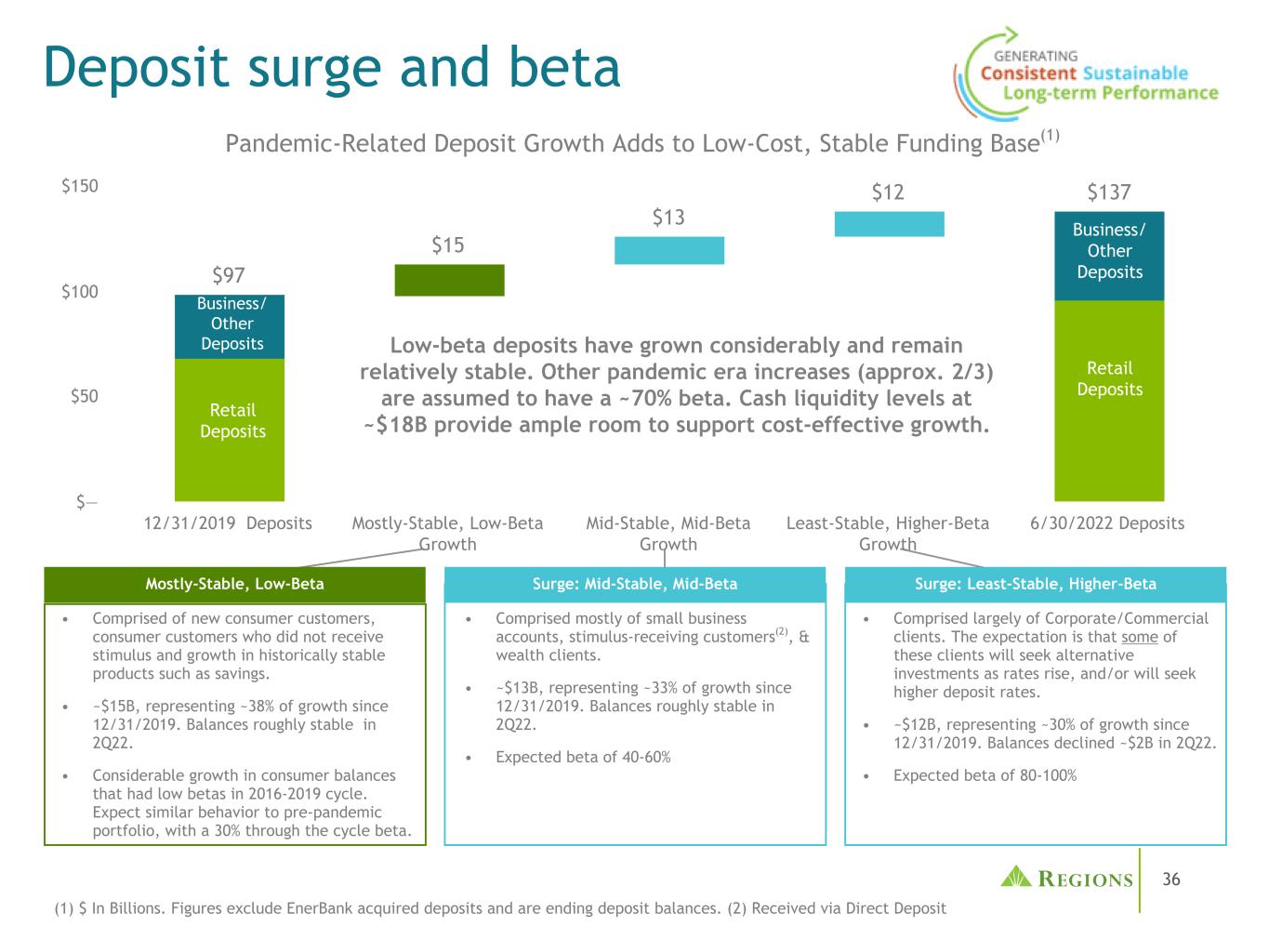

36 • Comprised of new consumer customers, consumer customers who did not receive stimulus and growth in historically stable products such as savings. • ~$15B, representing ~38% of growth since 12/31/2019. Balances roughly stable in 2Q22. • Considerable growth in consumer balances that had low betas in 2016-2019 cycle. Expect similar behavior to pre-pandemic portfolio, with a 30% through the cycle beta. $97 $15 $13 $12 $137 12/31/2019 Deposits Most-Stable, Low-Beta Growth Mid-Stable, Mid-Beta Growth Least Stable, Higher-Beta Growth 6/30/2022 Deposits $— $50 $100 $150 i Mostly-Stable, Low-Beta i l i - l i i Deposit surge and beta • Comprised mostly of small business accounts, stimulus-receiving customers(2), & wealth clients. • ~$13B, representing ~33% of growth since 12/31/2019. Balances roughly stable in 2Q22. • Expected beta of 40-60% • Comprised largely of Corporate/Commercial clients. The expectation is that some of these clients will seek alternative investments as rates rise, and/or will seek higher deposit rates. • ~$12B, representing ~30% of growth since 12/31/2019. Balances declined ~$2B in 2Q22. • Expected beta of 80-100% Low-beta deposits have grown considerably and remain relatively stable. Other pandemic era increases (approx. 2/3) are assumed to have a ~70% beta. Cash liquidity levels at ~$18B provide ample room to support cost-effective growth. Mostly-Stable, Low-Beta Surge: Mid-Stable, Mid-Beta Surge: Least-Stable, Higher-Beta (1) $ In Billions. Figures exclude EnerBank acquired deposits and are ending deposit balances. (2) Received via Direct Deposit Pandemic-Related Deposit Growth Adds to Low-Cost, Stable Funding Base(1) Business/ Other Deposits Business/ Other Deposits Retail Deposits Retail Deposits

37 State of the consumer Regions' exposure to low-FICO borrowers remains negligible; customers with historically low deposit balances still have significant cushion Retail Deposits Business/ Other Deposits Retail Deposits Regions' consumer borrowers are in a strong position relative to pre-pandemic $378 $2,359 12/31/19 06/30/22 Balances up ~6x vs pre- pandemic • Exposure to customers with FICO scores less than 620 is less than 4% of consumer loan book(1) (primarily secured) • Average deposit balances among Regions consumer borrowers are 43% higher versus pre-pandemic levels • Delinquencies are at record lows with 30 day past due volumes 35% lower than pre-pandemic levels Average Customer Balances: Balance Footing <$1K Pre-pandemic(3) More broadly, Regions' lower-deposit-balance customers pre-pandemic still maintain substantial savings cushion 3.32% 3.30% 2.90% 2.38% 2.08% 2.02% 2.10% 1.73% 1.67% 1.64% 1.26% 1.08% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2Q22 (1) As of 5/31/2022. (2) End of period (excludes non-performing loans and small business loans). (3) Includes Consumer and Private Wealth deposit customers (regardless of whether they have an outstanding Regions' borrowing or not); fixed group of customers with at least one deposit open account in both periods. 30 Days Past Due(2) Consumer Loans

38 4Q17 2Q22 Deposit advantage (1) "Other" category includes EnerBank deposits and are average deposit balances. (2) Source - Bank Call Report data as of 3/31/2022. (3) 2Q22 Average NIB/IB split by Business: Consumer 37%/63%, Corporate 61%/39%, Wealth 14%/86%. Funding Mix(1) - Current vs. Prior Rising Rate Cycle • Regions holds a larger proportion of smaller deposit balance accounts when compared to the industry • The increase in consumer deposits has been largely with existing long-tenure customers, whose low rate sensitivity is likely to persist into the next rate cycle % of Total Deposits Balance in Accounts Less than $250k(2) Business Deposit Mix(1) 2Q 2022 Average Consumer $85 Corporate $42 Wealth Mgt $10 Other $2 Product Mix Deposit Granularity • Historically, Regions' deposit pricing has outperformed peer banks in rising rate environment; in last rising interest rate cycle, Regions' total interest bearing deposit betas of 29% (retail 14%; commercial 67%); outperformed the peer median of 35%. In the consumer deposit portfolio, less than 5% of balances are associated with customers that had deposit rates over 100 bps in 2019, the peak of the last rate cycle. • The funding mix has become more granular and less reliant on wholesale borrowings, positioning the balance sheet well for a potential rising rate environment • Balance sheet primarily deposit funded; 96% of liabilities; 6% higher than at the outset of the last up-rate cycle • 42% of deposit balances in non-interest bearing accounts(3) • Retail deposits consist of consumer and wealth accounts and represent 67% of total deposits Well Positioned for Rising Rates 30% 67% 63% 27% 10% 3% $105 $142 Retail Commercial ($ in billions) ($ in billions) Borrowings/ Other(1) 60% 51% 47% 44% 44% 44% 39% 39% 38% 38% 37% 33% 28% 27% Peer 1 RF Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13

39 10.36% 9.39% 9.25% 2Q21 1Q22 2Q22 • Stress Capital Buffer requirement for 4Q22 through 3Q23 will remain at 2.5%. • Common Equity Tier 1 (CET1) ratio decreased 14 bps to 9.25%, reflecting strong loan growth. • Expect to maintain CET1 near the mid-point of 9.25-9.75% operating range over time. • In 2Q, Regions repurchased $15M of common stock and declared $159M in common dividends. • On 7/20/2022, our Board of Directors declared a quarterly common stock dividend of $0.20 per share, an 18% increase over the prior quarter. QoQ Highlights & Outlook Capital and liquidity (1) Current quarter ratios are estimated. (2) Based on ending balances. 11.90% 10.82% 10.61% 2Q21 1Q22 2Q22 Tier 1 capital ratio(1) Loan-to-deposit ratio(2) 64% 63% 68% 2Q21 1Q22 2Q22 Common equity Tier 1 ratio(1)

40 Investing for growth while maintaining focus on capital optimization Acquisition of HUD (MAP) License 2014 2015 2016 2019 2020 2018 2021 Acquisition of Fannie Mae DUS License Third-party originated auto portfolio ~$2.0B moved to runoff Entered into MSR flow-deal arrangement Sold Regions Insurance Group; redeployed capital generated to shareholders Greensky unsecured consumer loans ~$2.0B moved to runoff Dealer Financial Services auto portfolio ~$2.4B moved to runoff Entered into second MSR flow-deal arrangement Return optimization of commercial, OORE and IRE loans began through Capital Commitments Working Group Acquisition of Freddie Mac License 2022 YTD Purchased $13B of bulk MSR

41 ® Efforts Omnichannel view of customers for a “You Know Me & Value Me” experience Regions Client IQ (RCLIQ) and Wealth Client IQ delivering ‘needs based’ engagement resulting in significant corporate and wealth management revenue ROSIE Personalized offering of products and services to anticipate customer needs Accelerating digital transformation through customer feedback Expanding Influence of Data & Personalization Platform Modernization Regions 2.0 Next Generation of Customer Experience and Core Banking Platforms New Fulfillment & Servicing Platforms for Real Estate Loans Path to omnichannel experience Enhanced Fraud Analytics Machine learning models to detect and prevent fraud and enable analytics for proactive customer protection Continuous Improvement on Data Governance Unification of data architecture, data assets, and data catalog BSA/AML Enhanced Due Diligence Delivering graph-based network visualization capabilities for Anti-Money Laundering customer entities Cloud Center of Excellence Enabling new services, cloud native development, and disaster recovery as a service Modernizing Technology Practices Shift to DevSecOps and increasing usage of Agile principles Empowered by innovation & data Centralization of Data/Modernization Leveraging modern Big Data Platforms to accelerate our data driven decision-making processes Completion of Expansion for Relationship Platform Regions Bridge successfully rolled out and adoption of the system is the key focus for Mortgage business lines Enhanced Data for Incentive Offers Offer Tracker combines data from multiple sources to enhance and automate the fulfillment processes Centralizing Corporate Banking Group Lending Origination Platform Expanding nCino to three additional lines of business to finalize centralization of a single lending origination platform reducing re- keying and data duplication Data Recovery Enhancing cyber resilience protection

42 Digital Acceleration Digital Enhancements iTreasury Upgrade, Regions InvestPath® digital investment solutions tool(1), Auto-Draft Reminder Alerts, Text Banking Enhancements, New HELOC customer application portal . 31% increase in Zelle transactions in Q2 2022 compared to Q2 2021 Innovating Operations Authentication Improvements Enhance Risk-Based Authentication in Mobile Banking and Digital Corporate Banking, New Identity Platform for Digital Corporate Banking, Launched Customer Authentication framework Expansion of Customer Interaction Points Secure Messaging through web/mobile monthly volume has grown 233% Q2 ’22 vs Q2 ’21, now representing 11.7% of daily customer contacts (up from 4.9% June ’21). eSignature Expansion Over 4.5 million transactions have been initiated through eSignature since launch and utilized by 37 groups across the bank. #1 in Online Banking for 2 consecutive years, 2020 & 2021 Expanded Regions Secure Messaging Increased usage by 138% June 2022 MTD versus June 2021 Automated Non-Agent Interactions 86% average interaction resolution rate Collections Self-Service Portal Enabling an improved customer experience with $735k collected in Q2 2022, a 10% increase from Q1 2022Customer Transactions 70% of Q2 2022 transactions initiated in Digital, 3% growth year over year Differentiating through customer experience Faster & More Transparent Transactions Real Time Payments increased 5.5% from 1.087MM to 1.147MM in Q2, 22 vs. Q2, 21; dollars received increased 17.6% in the same time period to $361.6MM. Adoption 8% increase in Mobile users in Q2 2022 compared to Q2 2021 #1 in Customer Satisfaction with Online Banking among Regional Banks for the 3rd year in a row per the J.D. Power 2022 U.S. Banking Online Satisfaction Study #1 in Customer Satisfaction for Consumer Banking in Florida in the J.D. Power 2022 U.S. Retail Banking Satisfaction Study Best In Class Mobile App* *iOS Mobile App Store (1) Through Regions Investment Solutions. See additional information on slide 68.

43 System Maintenance New Technology Cybersecurity / Risk Management Continue to invest for the future • Regions remains competitive by reserving ~10-11% of revenue for Technology Spend. • Past investment on innovation and strategy provided a firm, resilient foundation for addressing changes in customer needs. • Investments over the last 4 years to modernize the customer experience and transform the technology operating model allow system modernization to be prioritized for new technology spend. • Along with continuous innovation, we are making investments into modernizing our infrastructure and data. As we start taking advantage of AI and the scale modern technologies have to offer, our technology spend will be linear or proportional to revenue growth. • Regions 2.0 (platform modernization) will take a staggered approach to the transformation. Modernization efforts began in 2021 with runway through 2027 to complete the overall program.

44 2.0 2.2 2.4 2Q20 2Q21 2Q22 1.31 2.28 2.99 2Q20 2Q21 2Q22 147 159 159 2Q20 2Q21 2Q22 2.8 3.1 3.3 2Q20 2Q21 2Q22 19.4% 21.4% 22.2% 31.7% 32.2% 32.2% 48.9% 46.4% 45.6% 2Q20 2Q21 2Q22 70.7 87.2 82.2 61.0 73.9 65.4 9.7 13.3 16.8 Deposits Lending 2Q20 2Q21 2Q22 66% 68% 70% 34% 32% 30% 2Q20 2Q21 2Q22 Growth in digital Mobile Banking Log-Ins (Millions) Customer Transactions(2)(3) Deposit Transactions by Channel +16% Active Users (Millions) +21% Digital Sales (Accounts in Thousands)(1) Digital Banking Digital Non-Digital Mobile ATMBranch (1) Digital sales represent deposit accounts opened and loans booked. (2) Digital transactions represent online and mobile only; Non-digital transactions represent branches, contact centers and ATMs. (3) Transactions represent Consumer customer deposits, transfers, mobile deposits, fee refunds, withdrawals, payments, official checks, bill payments, and Western Union. Excludes ACH and Debit Card purchases/refunds.(4) Includes cross-channel sales capabilities through digital banker dashboard applications launched across our footprint at the end of 2Q21. +129% +8% 21% 22% 21% 73% 76% 77% 6% 2% 2% 2Q20 2Q21 2Q22 Digital BranchContact Center Consumer Checking Sales by Channel(4) Mobile Banking Mobile App Rating Zelle Transactions (Millions)Sales and TransactionsDigital Usage +16%

45 Continuous improvement framework • Making Banking Easier – Be intensely responsive to customer needs • Revenue Growth – Improve effectiveness in generating prudent, profitable, sustainable growth • Efficiency Improvements – Continuously leverage people and technology to improve processes, reduce costs and drive growth • Innovation – Focus on data & analytics, omnichannel delivery, protection & security, advice & guidance Simplify & Grow established a culture of Continuous Improvement. Now that Continuous Improvement is embedded in our DNA, initiatives are no longer centrally tracked, and groups manage the development and execution of their programs with regular updates to the Steering and Integration Teams. • Established processes to maintain a Continuous Improvement culture through Simplify & Grow. • Independently manages and reports Continuous Improvement program performance regularly at Integration and Steering Team meetings. • Includes senior leaders from business and support segments across the bank. • Sponsors, promotes and provides executive direction of the Continuous Improvement program. Reviews segment programs and ensures accountability to promote a Continuous Improvement culture. • Includes strategic leaders from business and support segments across the bank. • Provides effective challenge, offers support when needed, looks for opportunities that can be leveraged in other areas and offers insights and ideates across groups. Continuous Improvement Key Pillars Steering Team Integration Team Business and Support Groups

46 • 2Q annualized NCOs at 17bps, decreased 4bps QoQ. • In consumer - residential mortgage and home equity experienced net recoveries in 2Q. • 2Q NPLs increased modestly while criticized business loans and total delinquencies continued to improve. • 2Q ACL increased modestly while the ACL ratio declined, both attributable to strong loan growth. • Expect full-year 2022 NCOs to be toward the lower end of 20-30 bps range. 1.71% 2.00% 1.67% 1.62% ACL/Loans Day 1 2Q21 1Q22 2Q22 $47 $46 $38 24 33 30 23 13 8 0.23% 0.21% 0.17% 2Q21 1Q22 2Q22 $666 $335 $369 253% 446% 410% 2Q21 1Q22 2Q22 NPLs and ACL coverage ratio Asset quality improvement continues ($ in millions) ($ in millions) ($ in millions) Net charge-offs and ratio NPLs - excluding LHFS ACL/NPLs Consumer net charge-offs Business services net charge-offs Net charge-offs ratio (1) CECL Day 1 ratio is as of January 1, 2020. ACL to loans ratio (1)

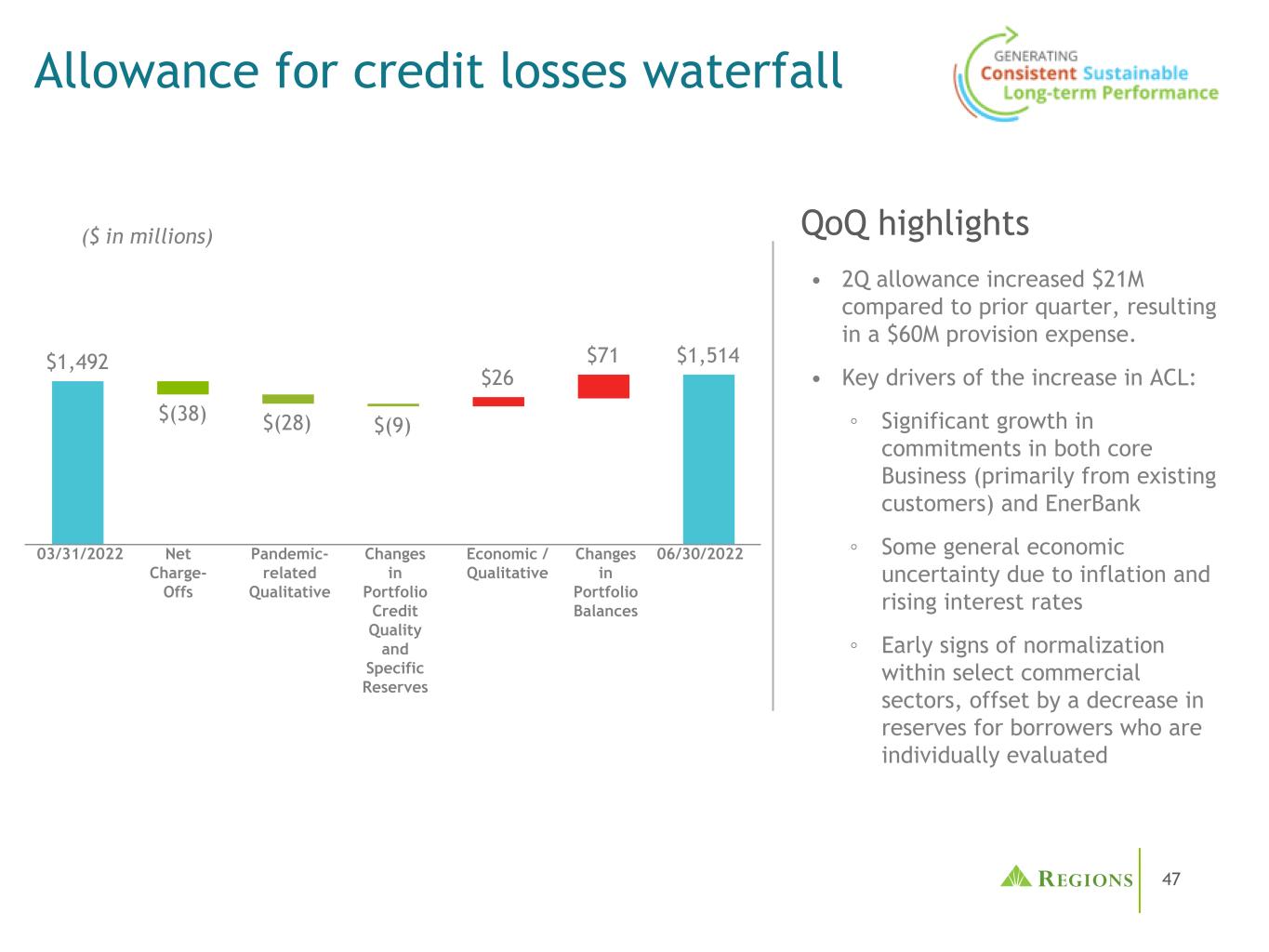

47 Economic / Qualitative $1,492 $(38) $(28) $(9) $26 $71 $1,514 Allowance for credit losses waterfall Pandemic- related Qualitative Net Charge- Offs 06/30/2022 • 2Q allowance increased $21M compared to prior quarter, resulting in a $60M provision expense. • Key drivers of the increase in ACL: ◦ Significant growth in commitments in both core Business (primarily from existing customers) and EnerBank ◦ Some general economic uncertainty due to inflation and rising interest rates ◦ Early signs of normalization within select commercial sectors, offset by a decrease in reserves for borrowers who are individually evaluated QoQ highlights($ in millions) 03/31/2022 Changes in Portfolio Balances Changes in Portfolio Credit Quality and Specific Reserves

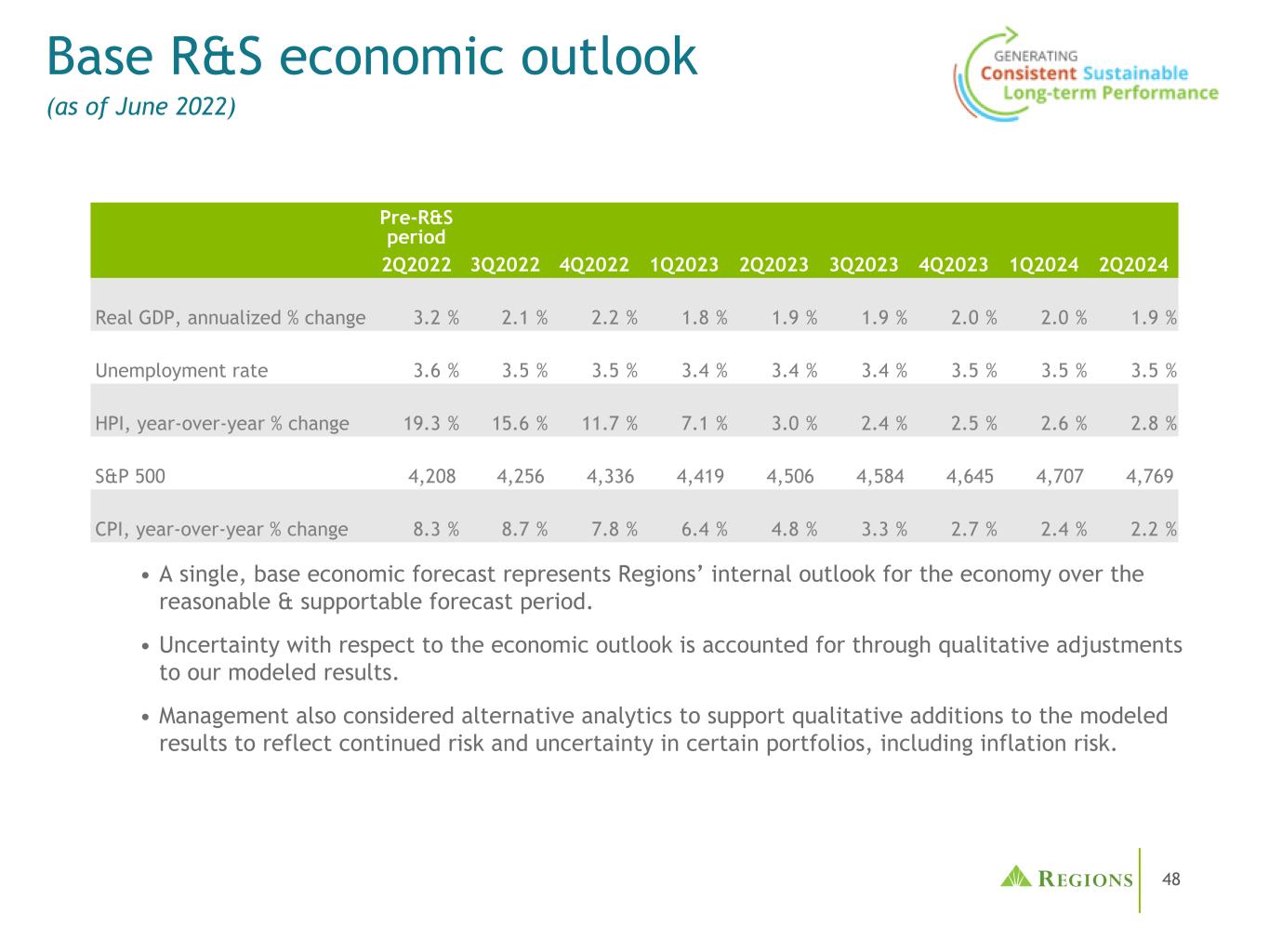

48 Pre-R&S period 2Q2022 3Q2022 4Q2022 1Q2023 2Q2023 3Q2023 4Q2023 1Q2024 2Q2024 Real GDP, annualized % change 3.2 % 2.1 % 2.2 % 1.8 % 1.9 % 1.9 % 2.0 % 2.0 % 1.9 % Unemployment rate 3.6 % 3.5 % 3.5 % 3.4 % 3.4 % 3.4 % 3.5 % 3.5 % 3.5 % HPI, year-over-year % change 19.3 % 15.6 % 11.7 % 7.1 % 3.0 % 2.4 % 2.5 % 2.6 % 2.8 % S&P 500 4,208 4,256 4,336 4,419 4,506 4,584 4,645 4,707 4,769 CPI, year-over-year % change 8.3 % 8.7 % 7.8 % 6.4 % 4.8 % 3.3 % 2.7 % 2.4 % 2.2 % Base R&S economic outlook (as of June 2022) • A single, base economic forecast represents Regions’ internal outlook for the economy over the reasonable & supportable forecast period. • Uncertainty with respect to the economic outlook is accounted for through qualitative adjustments to our modeled results. • Management also considered alternative analytics to support qualitative additions to the modeled results to reflect continued risk and uncertainty in certain portfolios, including inflation risk.

49 As of 6/30/2022 As of 12/31/2021 (in millions) Loan Balance ACL ACL/Loans Loan Balance ACL ACL/Loans C&I $48,492 548 1.13 % $43,758 $613 1.40 % CRE-OO mortgage 5,218 100 1.92 % 5,287 118 2.23 % CRE-OO construction 266 6 2.40 % 264 9 3.53 % Total commercial $53,976 $654 1.21 % $49,309 $740 1.50 % IRE mortgage 5,892 90 1.53 % 5,441 77 1.41 % IRE construction 1,720 11 0.61 % 1,586 10 0.61 % Total IRE $7,612 $101 1.33 % $7,027 $87 1.23 % Residential first mortgage 17,892 120 0.67 % 17,512 122 0.70 % Home equity lines 3,550 72 2.02 % 3,744 83 2.23 % Home equity loans 2,524 27 1.06 % 2,510 28 1.13 % Consumer credit card 1,172 127 10.86 % 1,184 120 10.15 % Other consumer- exit portfolios 775 55 7.09 % 1,071 64 6.00 % Other consumer 5,957 358 6.01 % 5,427 330 6.07 % Total consumer $31,870 $759 2.38 % $31,448 $747 2.38 % Total $93,458 $1,514 1.62 % $87,784 $1,574 1.79 % Allowance allocation

50 2Q19 2Q22 Commercial Portfolio Migrates to Lower Risk 35 Bps Commercial Portfolio Probability of Default All Other Commercial 17.4% Investor Real Estate 12.4% Govt. Education 10.3% Financial Services 10.2%CRE Unsecured 9.4% Consumer Services 9.5% Manufacturing 8.4% Business Services 7.8% Technology Services 7.4% Distribution 7.2% 2Q21 2Q22 Well positioned for next downturn $61.6B 30% Commercial IG Equivalent Balances Highly Diversified Business Portfolio(1) 26% 45% 17% 12% 32% 46% 15% 7% 37% 47% 12% 4% 2Q 2012 2Q 2017 2Q 2022 Investment Grade Solid Pass Low Pass Criticized (1) Balances as of 6/30/22. (2) All other commercial categories consist of sub-components less than 7% each. (2)

51 Consumer lending portfolio statistics • Avg. origination FICO 760 • Current LTV 52% • 98% owner occupied • Avg. origination FICO 778 • Current LTV 34% • 71% of portfolio is 1st lien • Avg. loan size $36,270 • $63M to convert to amortizing or balloon during 2022 • Avg. origination FICO 761 • Avg. new loan $18,003 • Avg. origination FICO 754 • 2Q22 Yield 5.93% • 2Q22 QTD NCO 0.80% • Avg. origination FICO 750 • Avg. new line $6,243 • 2Q22 Yield 12.38% • 2Q22 QTD NCO 2.70% 3% 4% 4%5% 11% 7% 9% 17% 10% 81% 64% 76% 2% 4% 3% Cons R/E secured Cons non-R/E secured Total consumer Not Available Above 720 620-680 Below 620 681-720 Consumer FICO Scores(1) (1) Refreshed FICO scores as of 6/30/2022. (2) Other Consumer Unsecured consists of Direct, SoFi, and EnerBank portfolios. Residential Mortgage Consumer - Exit Portfolios Consumer Credit Card Home Equity Other Consumer Unsecured(2)

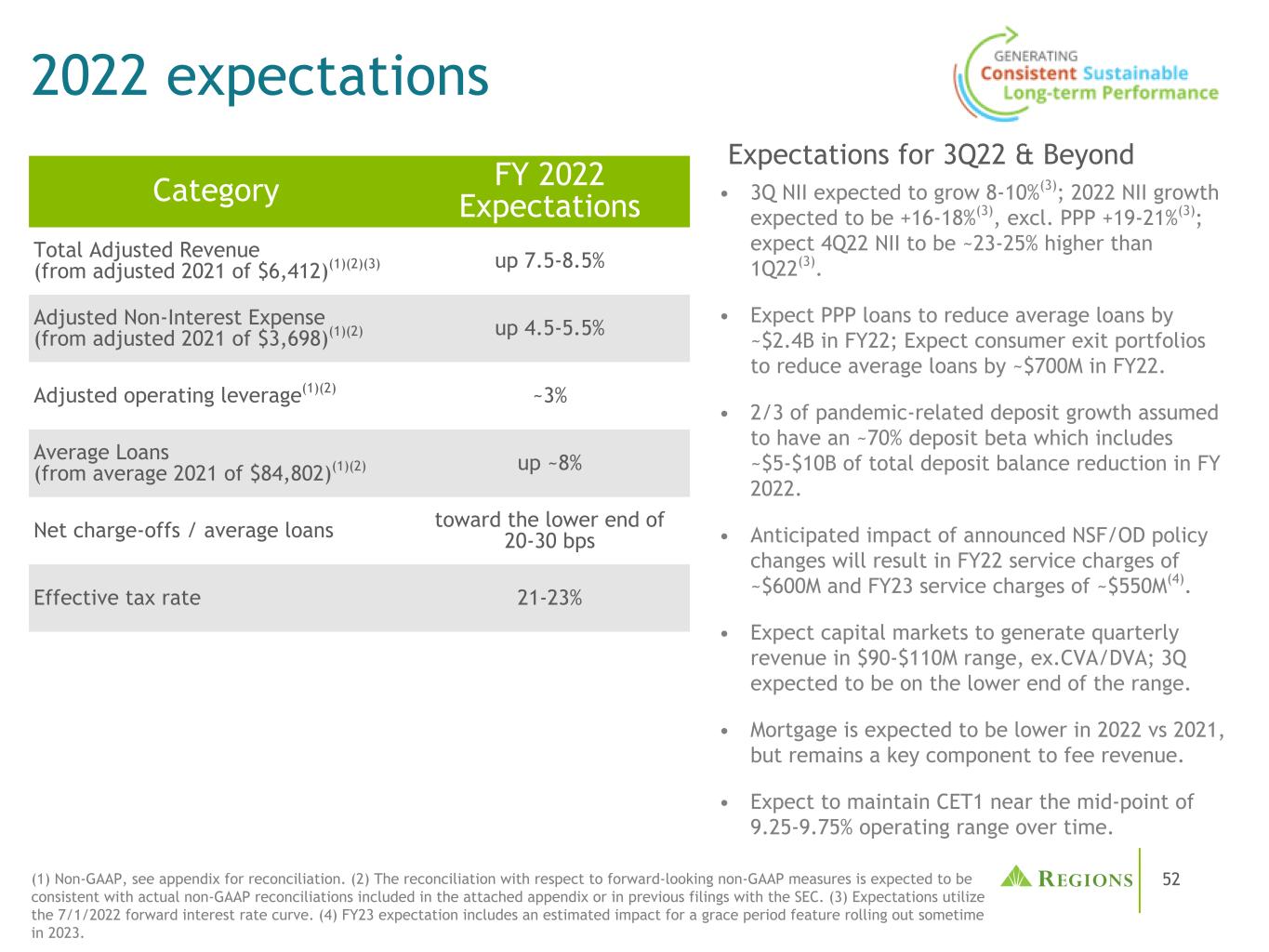

52 2022 expectations (1) Non-GAAP, see appendix for reconciliation. (2) The reconciliation with respect to forward-looking non-GAAP measures is expected to be consistent with actual non-GAAP reconciliations included in the attached appendix or in previous filings with the SEC. (3) Expectations utilize the 7/1/2022 forward interest rate curve. (4) FY23 expectation includes an estimated impact for a grace period feature rolling out sometime in 2023. Category FY 2022 Expectations Total Adjusted Revenue (from adjusted 2021 of $6,412)(1)(2)(3) up 7.5-8.5% Adjusted Non-Interest Expense (from adjusted 2021 of $3,698)(1)(2) up 4.5-5.5% Adjusted operating leverage(1)(2) ~3% Average Loans (from average 2021 of $84,802)(1)(2) up ~8% Net charge-offs / average loans toward the lower end of 20-30 bps Effective tax rate 21-23% Expectations for 3Q22 & Beyond • 3Q NII expected to grow 8-10%(3); 2022 NII growth expected to be +16-18%(3), excl. PPP +19-21%(3); expect 4Q22 NII to be ~23-25% higher than 1Q22(3). • Expect PPP loans to reduce average loans by ~$2.4B in FY22; Expect consumer exit portfolios to reduce average loans by ~$700M in FY22. • 2/3 of pandemic-related deposit growth assumed to have an ~70% deposit beta which includes ~$5-$10B of total deposit balance reduction in FY 2022. • Anticipated impact of announced NSF/OD policy changes will result in FY22 service charges of ~$600M and FY23 service charges of ~$550M(4). • Expect capital markets to generate quarterly revenue in $90-$110M range, ex.CVA/DVA; 3Q expected to be on the lower end of the range. • Mortgage is expected to be lower in 2022 vs 2021, but remains a key component to fee revenue. • Expect to maintain CET1 near the mid-point of 9.25-9.75% operating range over time.

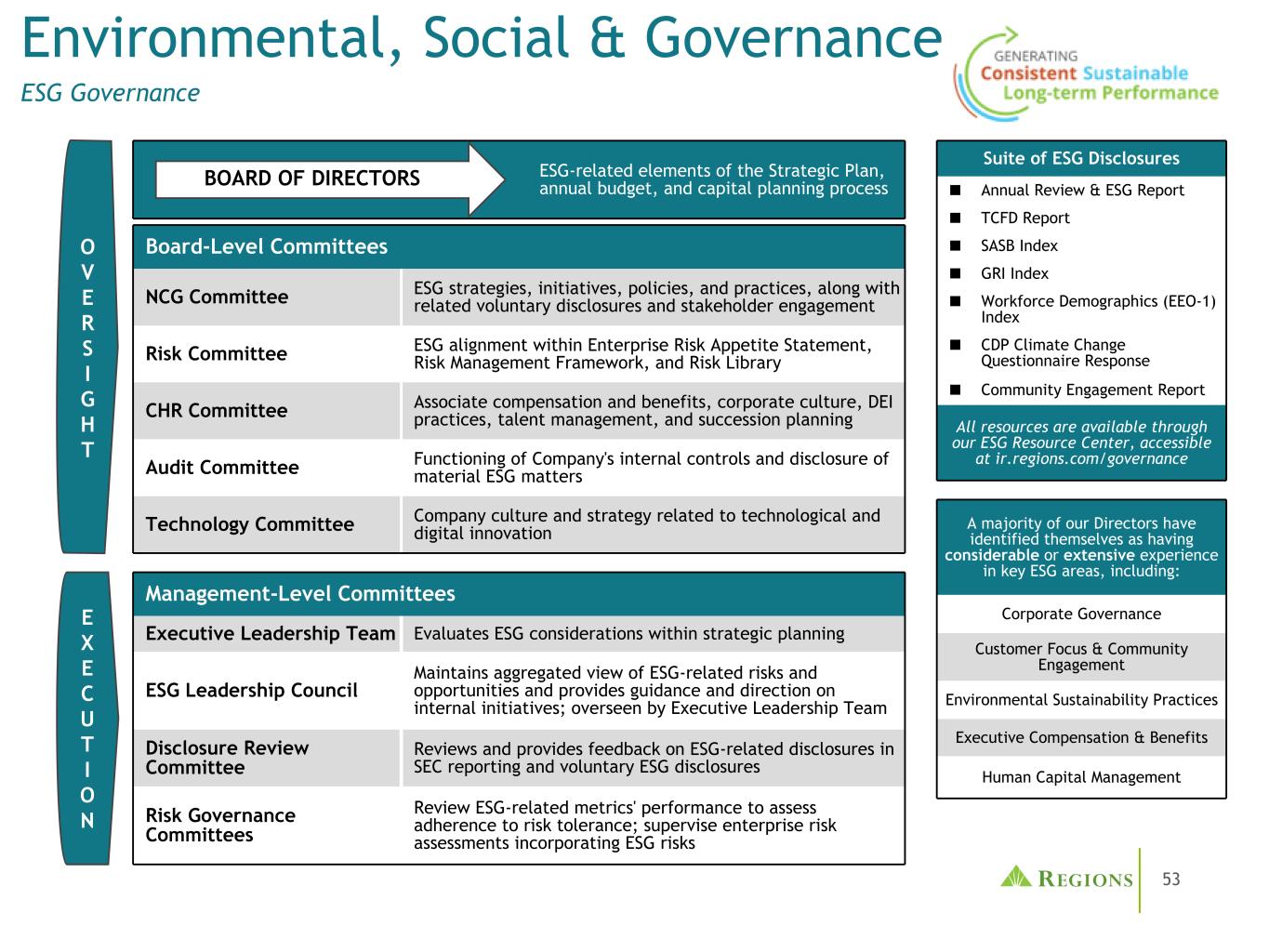

53 Environmental, Social & Governance ESG Governance ESG-related elements of the Strategic Plan, annual budget, and capital planning processBOARD OF DIRECTORS Board-Level Committees NCG Committee ESG strategies, initiatives, policies, and practices, along with related voluntary disclosures and stakeholder engagement Risk Committee ESG alignment within Enterprise Risk Appetite Statement, Risk Management Framework, and Risk Library CHR Committee Associate compensation and benefits, corporate culture, DEI practices, talent management, and succession planning Audit Committee Functioning of Company's internal controls and disclosure of material ESG matters Technology Committee Company culture and strategy related to technological and digital innovation Management-Level Committees Executive Leadership Team Evaluates ESG considerations within strategic planning ESG Leadership Council Maintains aggregated view of ESG-related risks and opportunities and provides guidance and direction on internal initiatives; overseen by Executive Leadership Team Disclosure Review Committee Reviews and provides feedback on ESG-related disclosures in SEC reporting and voluntary ESG disclosures Risk Governance Committees Review ESG-related metrics' performance to assess adherence to risk tolerance; supervise enterprise risk assessments incorporating ESG risks O V E R S I G H T E X E C U T I O N Suite of ESG Disclosures ■ Annual Review & ESG Report ■ TCFD Report ■ SASB Index ■ GRI Index ■ Workforce Demographics (EEO-1) Index ■ CDP Climate Change Questionnaire Response ■ Community Engagement Report All resources are available through our ESG Resource Center, accessible at ir.regions.com/governance A majority of our Directors have identified themselves as having considerable or extensive experience in key ESG areas, including: Corporate Governance Customer Focus & Community Engagement Environmental Sustainability Practices Executive Compensation & Benefits Human Capital Management

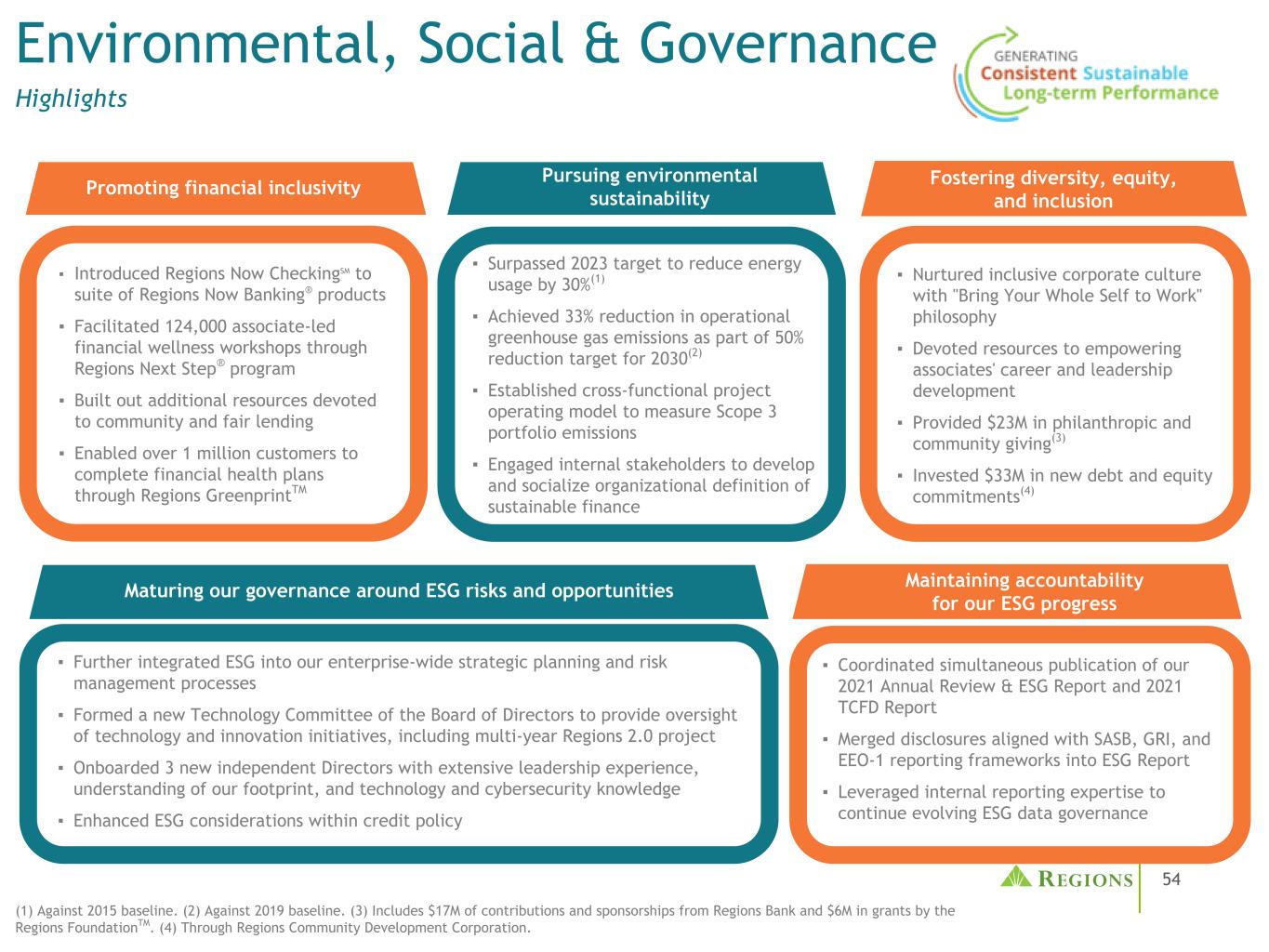

54 Environmental, Social & Governance Highlights Promoting financial inclusivity Pursuing environmental sustainability Maintaining accountability for our ESG progress ▪ Further integrated ESG into our enterprise-wide strategic planning and risk management processes ▪ Formed a new Technology Committee of the Board of Directors to provide oversight of technology and innovation initiatives, including multi-year Regions 2.0 project ▪ Onboarded 3 new independent Directors with extensive leadership experience, understanding of our footprint, and technology and cybersecurity knowledge ▪ Enhanced ESG considerations within credit policy ▪ Introduced Regions Now CheckingSM to suite of Regions Now Banking® products ▪ Facilitated 124,000 associate-led financial wellness workshops through Regions Next Step® program ▪ Built out additional resources devoted to community and fair lending ▪ Enabled over 1 million customers to complete financial health plans through Regions GreenprintTM ▪ Surpassed 2023 target to reduce energy usage by 30%(1) ▪ Achieved 33% reduction in operational greenhouse gas emissions as part of 50% reduction target for 2030(2) ▪ Established cross-functional project operating model to measure Scope 3 portfolio emissions ▪ Engaged internal stakeholders to develop and socialize organizational definition of sustainable finance ▪ Coordinated simultaneous publication of our 2021 Annual Review & ESG Report and 2021 TCFD Report ▪ Merged disclosures aligned with SASB, GRI, and EEO-1 reporting frameworks into ESG Report ▪ Leveraged internal reporting expertise to continue evolving ESG data governance Fostering diversity, equity, and inclusion Maturing our governance around ESG risks and opportunities ▪ Nurtured inclusive corporate culture with "Bring Your Whole Self to Work" philosophy ▪ Devoted resources to empowering associates' career and leadership development ▪ Provided $23M in philanthropic and community giving(3) ▪ Invested $33M in new debt and equity commitments(4) (1) Against 2015 baseline. (2) Against 2019 baseline. (3) Includes $17M of contributions and sponsorships from Regions Bank and $6M in grants by the Regions FoundationTM. (4) Through Regions Community Development Corporation.

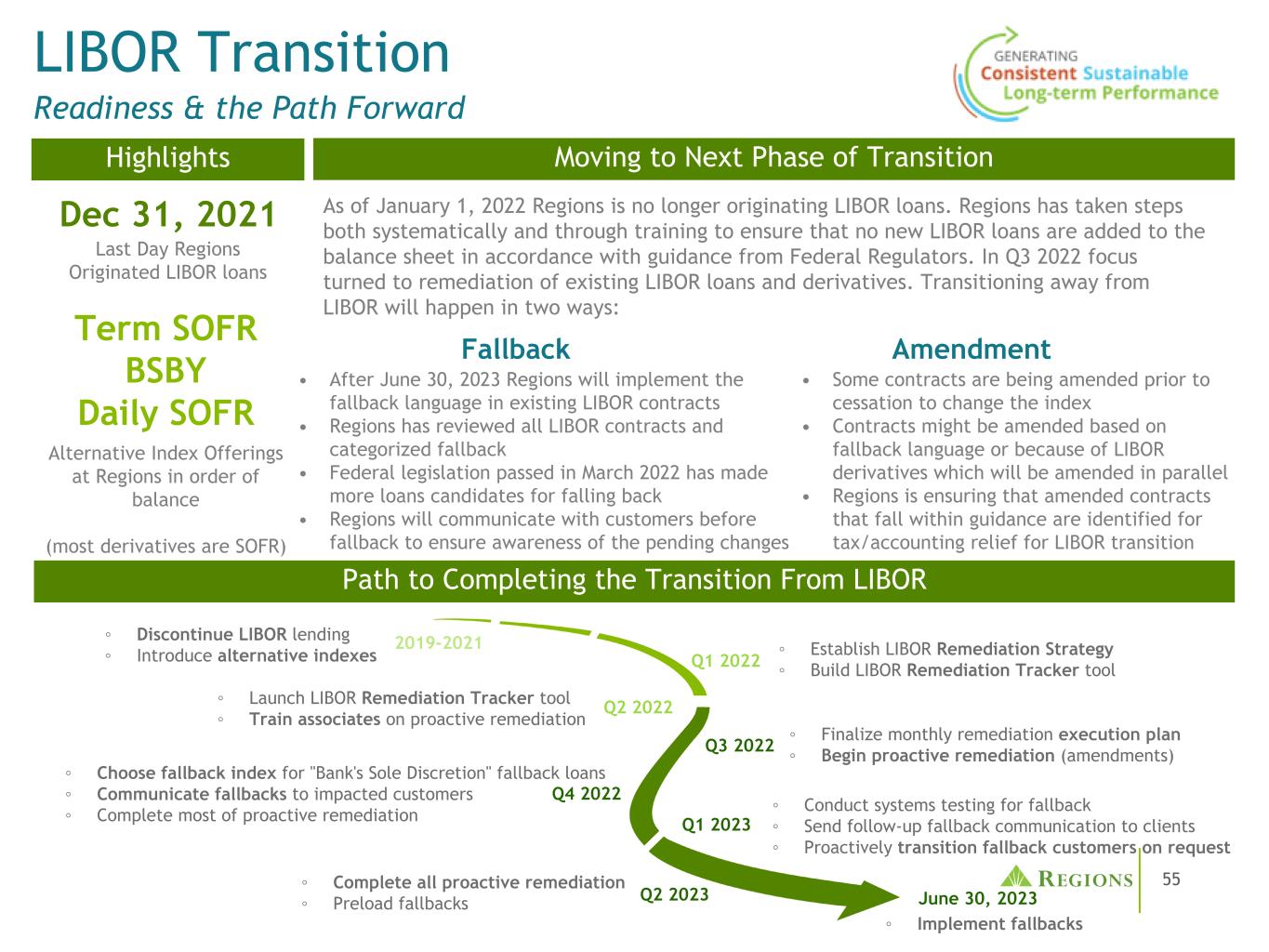

55 LIBOR Transition Readiness & the Path Forward Moving to Next Phase of Transition Path to Completing the Transition From LIBOR As of January 1, 2022 Regions is no longer originating LIBOR loans. Regions has taken steps both systematically and through training to ensure that no new LIBOR loans are added to the balance sheet in accordance with guidance from Federal Regulators. In Q3 2022 focus turned to remediation of existing LIBOR loans and derivatives. Transitioning away from LIBOR will happen in two ways: Highlights Dec 31, 2021 Last Day Regions Originated LIBOR loans Term SOFR BSBY Daily SOFR Alternative Index Offerings at Regions in order of balance (most derivatives are SOFR) Fallback Amendment • After June 30, 2023 Regions will implement the fallback language in existing LIBOR contracts • Regions has reviewed all LIBOR contracts and categorized fallback • Federal legislation passed in March 2022 has made more loans candidates for falling back • Regions will communicate with customers before fallback to ensure awareness of the pending changes • Some contracts are being amended prior to cessation to change the index • Contracts might be amended based on fallback language or because of LIBOR derivatives which will be amended in parallel • Regions is ensuring that amended contracts that fall within guidance are identified for tax/accounting relief for LIBOR transition ◦ Discontinue LIBOR lending ◦ Introduce alternative indexes ◦ Launch LIBOR Remediation Tracker tool ◦ Train associates on proactive remediation ◦ Choose fallback index for "Bank's Sole Discretion" fallback loans ◦ Communicate fallbacks to impacted customers ◦ Complete most of proactive remediation ◦ Complete all proactive remediation ◦ Preload fallbacks ◦ Establish LIBOR Remediation Strategy ◦ Build LIBOR Remediation Tracker tool ◦ Finalize monthly remediation execution plan ◦ Begin proactive remediation (amendments) ◦ Conduct systems testing for fallback ◦ Send follow-up fallback communication to clients ◦ Proactively transition fallback customers on request ◦ Implement fallbacks 2019-2021 Q2 2022 Q1 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 June 30, 2023

56 Acquisitions exceeding expectations Ascentium(1) EnerBank(2) April 1, 2022 marked the second anniversary of Ascentium Capital’s ownership by Regions Bank and the integration has been successful to date Ascentium Capital origination growth in 2Q22 and 1H22 has exceeded expectations, up 30% and 21% respectively from the prior year Contributing to growth are transactions originated through cross-marketing relationships with Commercial and Small Business Banking with the full rollout to all of Regions Branches during 4Q21 Ascentium net losses in 2Q22 and 1H22 continue to be at multi-year lows, as charge-offs have been low while recoveries have been strong Pursuing merger of Ascentium legal entities into Regions Bank Successful integration of EnerBank has led to a continued focus on growth and synergy opportunities EnerBank 2Q22 production exceeded expectations, up 43% from prior quarter, due in part to seasonally higher loan production EnerBank outperformed 2Q22 pretax income expectations • 2Q22 average balances grew ~7% linked quarter New contractor pipeline opportunities remain strong with key opportunities across Solar, HVAC, Windows, and Roofing contracts Prime/Super-prime focus has resulted in strong credit performance; average FICO of 764 in 2Q22 • Through the cycle loss rate is ~1.5% with current trends well below those levels • Credit losses peaked at 2.19% during the 2008 financial crisis (1) Key portfolio metrics were provided with the company's original acquisition announcement on Form 8-K dated February 27, 2020. (2) Key portfolio metrics were provided with the company's original acquisition announcement on Form 8-K dated June 8, 2021.

57 APPENDIX

58 Selected items impact Second quarter 2022 highlights (1) Non-GAAP, see appendix for reconciliation. (2) Based on income taxes at an approximate 25% incremental rate. (3) Items impacting results or trends during the period, but are not considered non-GAAP adjustments. These items generally include market-related measures, impacts of new accounting guidance, or event driven actions. NM - Not Meaningful ($ amounts in millions, except per share data) 2Q22 QoQ Change YoY Change Net interest income $ 1,108 9.2% 15.1% Provision for (benefit from) credit losses 60 (266.7)% (117.8)% Non-interest income 640 9.6% 3.4% Non-interest expense 948 1.6% 5.6% Income before income taxes 740 5.4% (27.5)% Income tax expense 157 1.9% (32.0)% Net income 583 6.4% (26.2)% Preferred dividends 25 4.2% (40.5)% Net income available to common shareholders $ 558 6.5% (25.4)% Diluted EPS $ 0.59 7.3% (23.4)% Summary of second quarter results (amounts in millions, except per share data) 2Q22 Pre-tax adjusted items(1): Branch consolidation, property and equipment charges $ 6 Total pre-tax adjusted items(1) $ 6 Diluted EPS impact(2) $ — Additional selected items(3): CECL provision (in excess of) less than net charge-offs $ (22) Capital markets income - CVA/DVA 20 Residential MSR net hedge performance 11 PPP loan interest/fee income 8

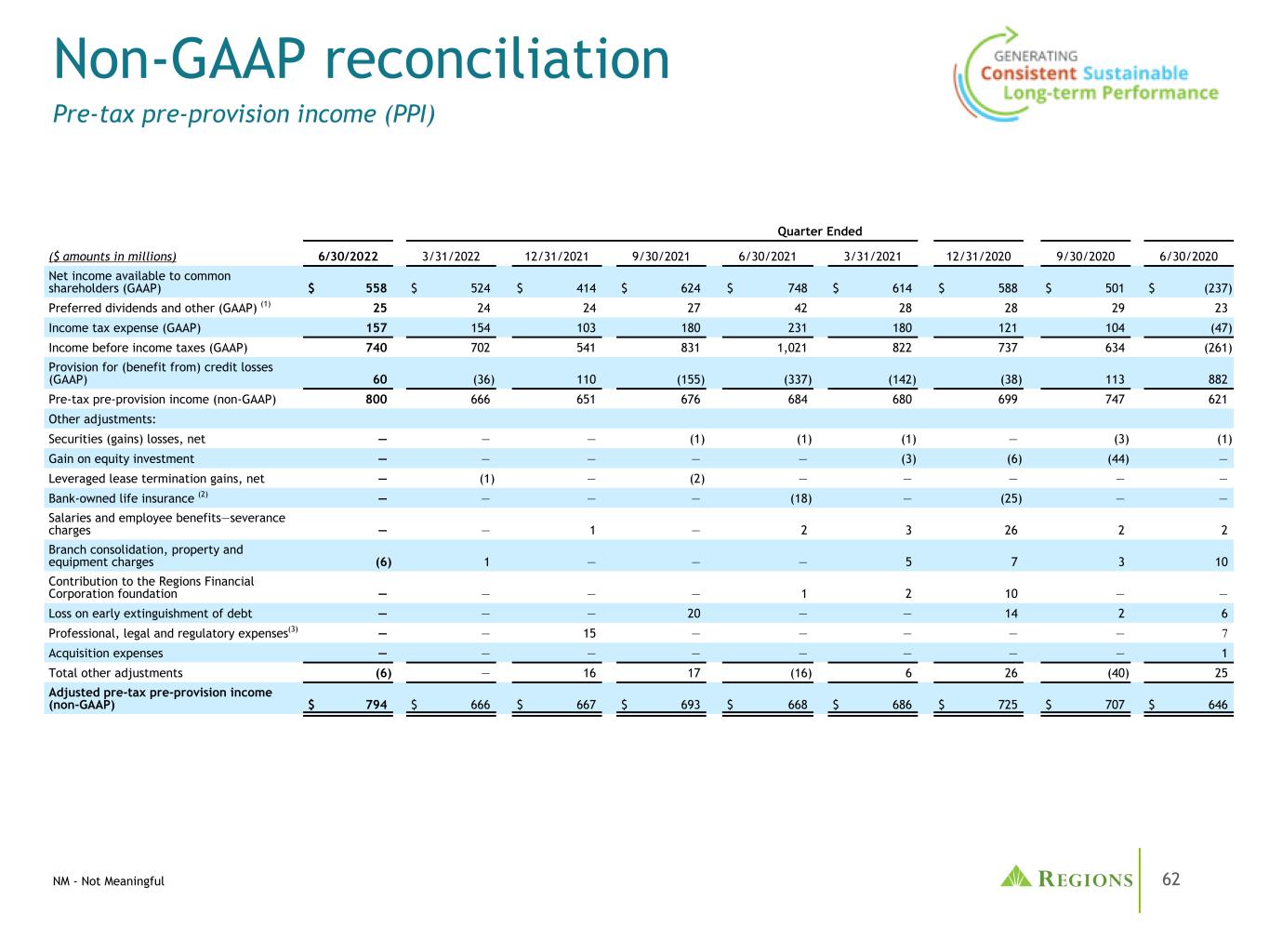

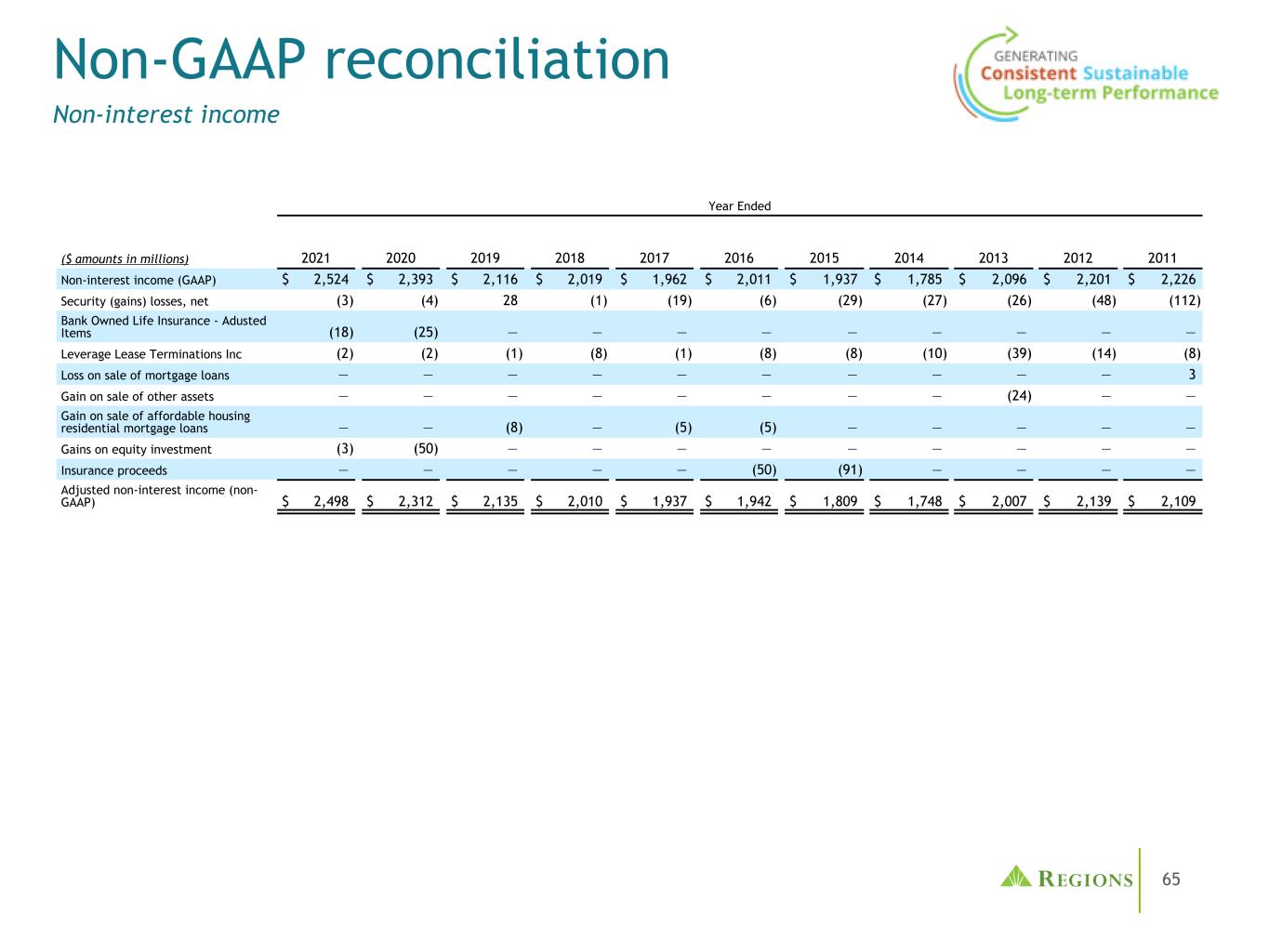

59 Management uses pre-tax pre-provision income (non-GAAP) and adjusted pre-tax pre-provision income (non-GAAP), as well as the adjusted efficiency ratio (non-GAAP) and the adjusted fee income ratio (non-GAAP) to monitor performance and believes these measures provide meaningful information to investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which is the numerator for the adjusted efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non-GAAP), which is the numerator for the adjusted fee income ratio. Adjusted non-interest income (non-GAAP) and adjusted non- interest expense (non-GAAP) are used to determine adjusted pre-tax pre-provision income (non-GAAP). Net interest income (GAAP) on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable-equivalent basis (non-GAAP), which is the denominator for the adjusted fee income and efficiency ratios. Regions believes that the exclusion of these adjustments provides a meaningful basis for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Tangible common stockholders’ equity ratios have become a focus of some investors and management believes they may assist investors in analyzing the capital position of the Company absent the effects of intangible assets and preferred stock. Analysts and banking regulators have assessed Regions’ capital adequacy using the tangible common stockholders’ equity measure. Because tangible common stockholders’ equity is not formally defined by GAAP or prescribed in any amount by federal banking regulations it is currently considered to be a non- GAAP financial measure and other entities may calculate it differently than Regions’ disclosed calculations. Since analysts and banking regulators may assess Regions’ capital adequacy using tangible common stockholders’ equity, management believes that it is useful to provide investors the ability to assess Regions’ capital adequacy on this same basis. Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. In particular, a measure of earnings that excludes selected items does not represent the amount that effectively accrues directly to stockholders. Management and the Board of Directors utilize non-GAAP measures as follows: • Preparation of Regions' operating budgets • Monthly financial performance reporting • Monthly close-out reporting of consolidated results (management only) • Presentation to investors of company performance • Metrics for incentive compensation Non-GAAP information

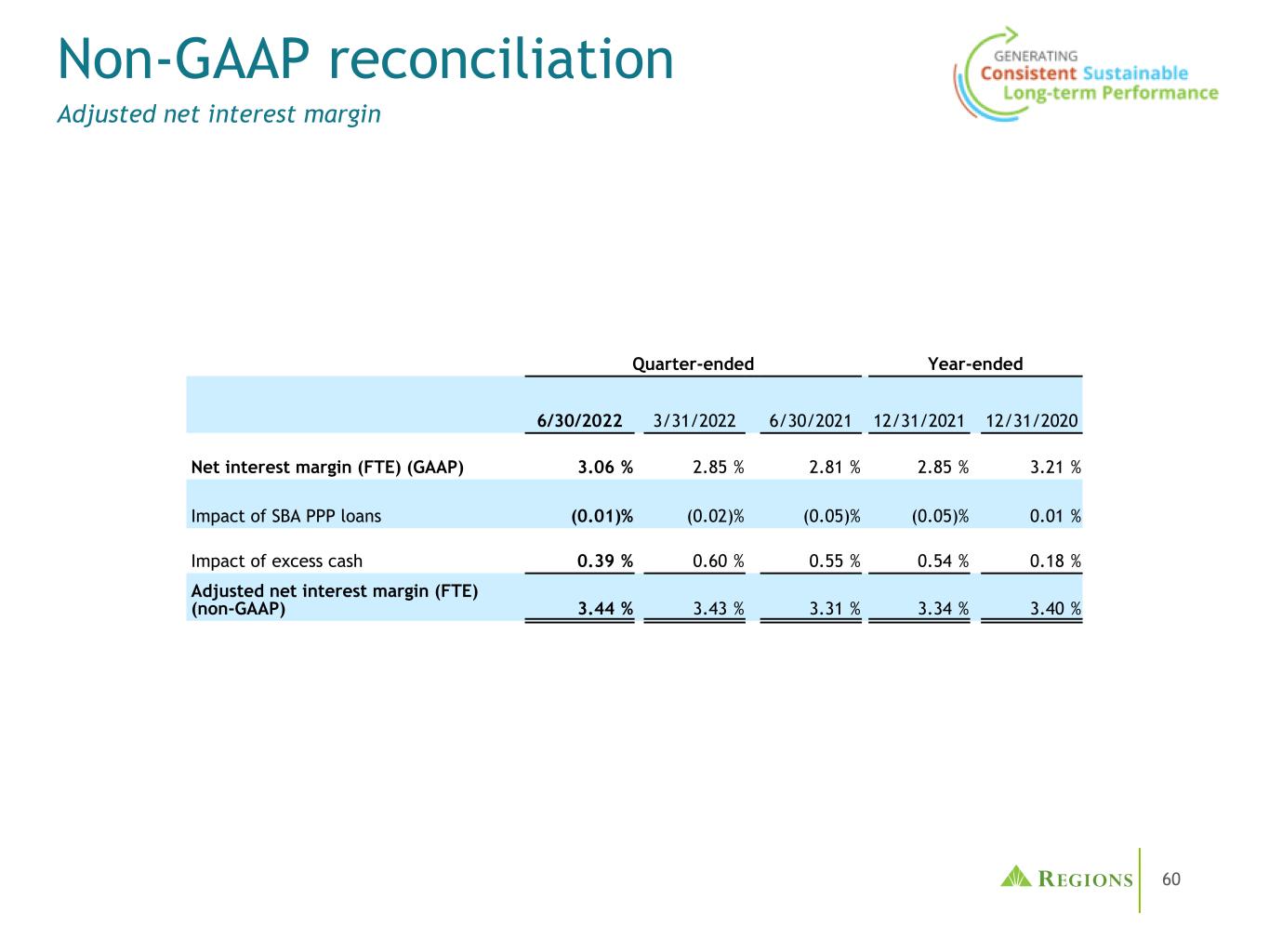

60 Non-GAAP reconciliation Adjusted net interest margin Quarter-ended Year-ended 6/30/2022 3/31/2022 6/30/2021 12/31/2021 12/31/2020 Net interest margin (FTE) (GAAP) 3.06 % 2.85 % 2.81 % 2.85 % 3.21 % Impact of SBA PPP loans (0.01) % (0.02) % (0.05) % (0.05) % 0.01 % Impact of excess cash 0.39 % 0.60 % 0.55 % 0.54 % 0.18 % Adjusted net interest margin (FTE) (non-GAAP) 3.44 % 3.43 % 3.31 % 3.34 % 3.40 %

61 Non-GAAP reconciliation Non-interest expense Year Ended December 31 ($ amounts in millions) 2021 2020 2019 2018 2017 2016 Non-interest expense (GAAP) $ 3,747 $ 3,643 $ 3,489 $ 3,570 $ 3,491 $ 3,483 Adjustments: Contribution to Regions Financial Corporation foundation (3) (10) — (60) (40) — Professional, legal and regulatory expenses (15) (7) — — — (3) Branch consolidation, property and equipment charges (5) (31) (25) (11) (22) (58) Expenses associated with residential mortgage loan sale — — — (4) — — Loss on early extinguishment of debt (20) (22) (16) — — (14) Salary and employee benefits—severance charges (6) (31) (5) (61) (10) (21) Acquisition Expense — (1) — — — — Adjusted non-interest expense (non-GAAP) $ 3,698 $ 3,541 $ 3,443 $ 3,434 $ 3,419 $ 3,387