Form 8-K Prestige Consumer Health For: May 06

Exhibit 99.1

Prestige Consumer Healthcare Inc. Reports Fiscal 2021 Fourth Quarter and Record Full-Year Results

•Company Exceeds Full Year 2021 Guidance for Revenue, Adjusted EPS and Free Cash Flow

•Revenue was $237.8 Million in Q4 and $943.4 in Full-Year Fiscal 2021

•Record Diluted EPS of $3.25 for Full-Year Fiscal 2021

•Net Cash Provided by Operating Activities for Fiscal 2021 of $235.6 million and Record Adjusted Free Cash Flow of $213.4 Million in Full-Year Fiscal 2021

•Provides Full-Year Fiscal 2022 Outlook for Revenue and Earnings Per Share of $957 to $962 Million and $3.58 or More, Respectively

TARRYTOWN, N.Y.--(GLOBE NEWSWIRE)-May 6, 2021-- Prestige Consumer Healthcare Inc. (NYSE:PBH) today reported financial results for its fourth quarter and fiscal year ended March 31, 2021.

“We exceeded full year 2021 guidance by generating solid earnings and cash flow growth along with market share gains. This performance is a testament to our proven business strategy and the benefits of our leading and diverse portfolio of brands, especially against the backdrop of the unique pandemic business environment that disrupted several of our categories in fiscal 2021. We expect our business attributes to continue to create value in the upcoming fiscal year as we anticipate returning to sales growth and continue to leverage our strong free cash flow to execute our capital allocation strategy,” said Ron Lombardi, Chief Executive Officer of Prestige Consumer Healthcare.

Fourth Fiscal Quarter Ended March 31, 2021

Reported revenues in the fourth quarter of fiscal 2021 decreased 5.4% to $237.8 million versus $251.2 million in the fourth quarter of fiscal 2020. Revenues decreased 6.6% excluding the impact of foreign currency. The revenue performance for the quarter was driven by strong performance across the majority of the Company’s key brands versus their respective categories, but was more than offset by reduced consumption for certain brands where the category has been disrupted by the COVID-19 virus, including the comparison against a sharp rise in consumption during the fourth quarter fiscal 2020 as consumers “stocked up” on products as a result of the COVID-19 virus.

Reported net income for the fourth quarter of fiscal 2021 totaled $35.5 million, compared to the prior year quarter’s net income of $37.0 million. Non-GAAP adjusted net income of $39.9 million in the fourth quarter fiscal 2021 compared to the prior year quarter’s adjusted net income of $41.9 million. Diluted earnings per share of $0.70 for the fourth quarter of fiscal 2021 compared to $0.73 in the prior year comparable period. Non-GAAP adjusted earnings per share were $0.79 per share for fourth quarter fiscal 2021, compared to $0.82 per share in fourth quarter fiscal 2020.

The adjustment of net income in the fourth quarter fiscal 2021 includes a loss on extinguishment of debt and the related income tax effects. Adjustments to net income in the fourth quarter of fiscal 2020 included costs associated with a new logistics provider and location and the related income tax effects of the adjustment.

Fiscal Year Ended March 31, 2021

Reported revenues for fiscal 2021 totaled $943.4 million, a decrease of 2.0%, compared to revenues of $963.0 million in fiscal 2020. The revenue performance for fiscal 2021 was driven by solid consumption across the majority of the Company’s portfolio and a benefit associated with higher retailer order patterns to refill customer’s supply chains, offset by reduced consumption for certain brands where the category has been impacted by the COVID-19 virus.

Reported net income for fiscal 2021 totaled $164.7 million versus the prior year net income of $142.3 million. Non-GAAP adjusted net income for fiscal 2021 was $164.0 million, versus the prior year adjusted net income of $151.3 million. Diluted earnings per share were $3.25 for fiscal 2021 compared to $2.78 per share in the prior year. Non-GAAP adjusted earnings per share were $3.24 per share for fiscal 2021 compared to $2.96 in the prior fiscal year.

The adjustments to net income in fiscal 2021 related to the final regulations issued during the second fiscal quarter for certain tax elements imposed under the domestic Tax Cuts and Jobs Act, which resulted in a one-time discrete benefit associated with the utilization of foreign tax credits, as well as a loss on extinguishment of debt and the related income tax effects of the adjustments.

Adjustments to net income in fiscal 2020 included costs associated with a new logistics provider and location as well as a loss on extinguishment of debt, and the related income tax effects of each adjustment.

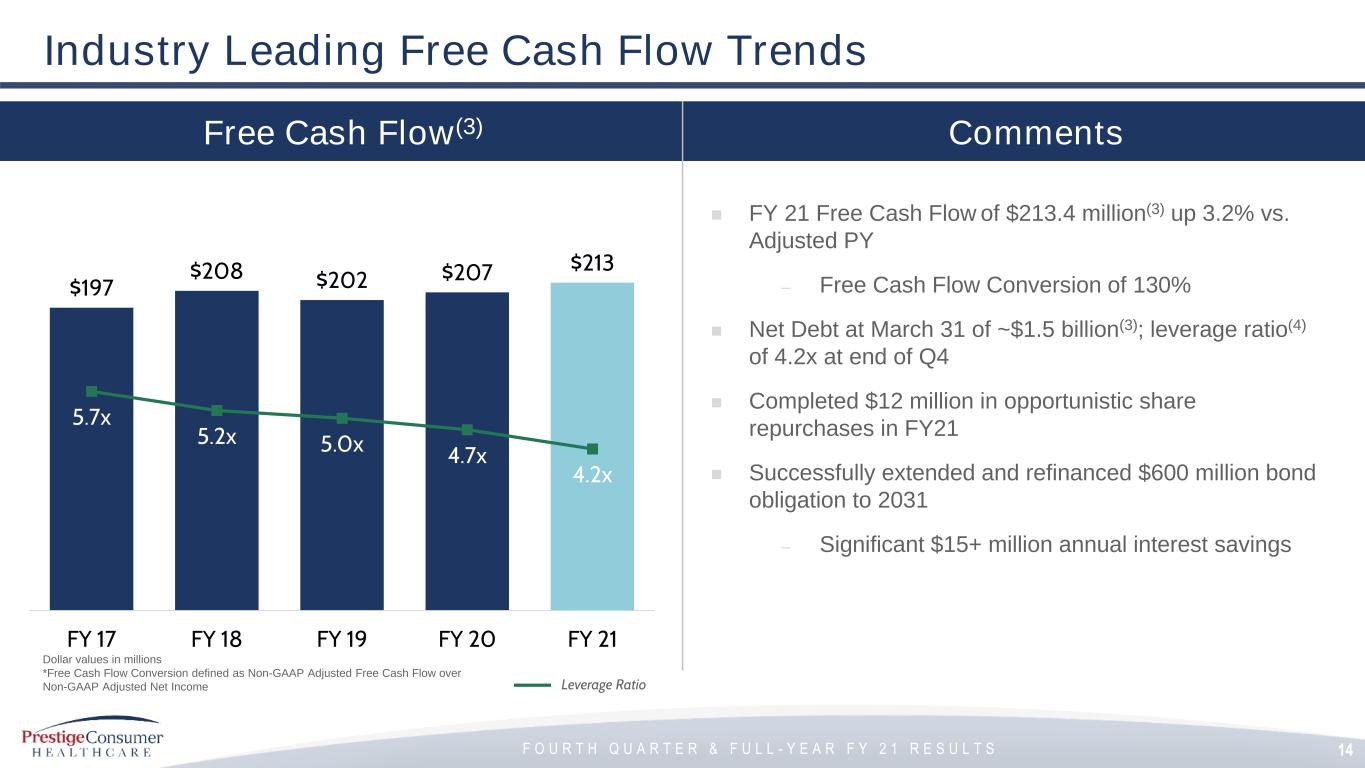

Free Cash Flow and Balance Sheet

The Company's net cash provided by operating activities for fourth quarter fiscal 2021 was $59.1 million, compared to $56.1 million during the prior year comparable period. Non-GAAP adjusted free cash flow in the fourth quarter of fiscal 2021 was $54.2 million compared to $52.5 million in the prior year. The Company's net cash provided by operating activities for fiscal 2021 was $235.6 million, an increase compared to $217.1 million during the prior year. Non-GAAP adjusted free cash flow in fiscal 2021 was $213.4 million compared to $206.8 million in the prior year. The change in free cash flow versus the prior year was attributable to higher operating income and lower interest costs.

The Company's net debt position as of March 31, 2021 was approximately $1.5 billion and the Company's covenant-defined leverage ratio was 4.2x. During the fourth quarter the Company reduced debt outstanding by $65 million and repurchased approximately $2 million in stock as authorized in the Company’s share repurchase program. For the full year, the Company repurchased approximately $12 million in stock as authorized in the Company’s share repurchase program. On March 1st, 2021 the Company issued $600 million of new senior notes which replaced the same principal of senior notes previously due in fiscal 2024. The new notes extend the maturity of the amount to April 1, 2031 with over $15 million in annual interest savings.

Segment Review

North American OTC Healthcare: Segment revenues of $211.5 million for the fourth quarter of fiscal 2021 compared to the prior year comparable quarter's revenues of $219.8 million. The fourth quarter fiscal 2021 revenue performance was driven by strong performance across a majority of the Company’s key brands versus their respective categories, but was more than offset by reduced consumption for certain brands where the category has been disrupted by the COVID-19 virus and the comparison against a sharp rise in consumption during the year earlier as consumers “stocked up” on products as a result of the COVID-19 virus.

For fiscal year 2021, reported revenues for the North American OTC Healthcare segment of $849.3 million compared to $859.4 million in the prior fiscal year. The modest decrease in revenue versus the prior year comparable period benefited from an increase in consumption levels for the majority of the Company’s core brand portfolio as well as a benefit in the first quarter 2021 associated with higher retailer order patterns to refill customer’s supply chains, offset primarily by a reduction in consumption for certain brands where the category consumption levels have been impacted by the COVID-19 virus.

International OTC Healthcare: Segment fiscal fourth quarter 2021 revenues totaled $26.3 million, compared to $31.4 million reported in the prior year comparable period. The revenue decrease versus the prior year related primarily to the comparison against a sharp rise in consumption during the fourth quarter fiscal 2020 as consumers “stocked up” on certain products such as Hydralyte as a result of the COVID-19 virus, partially offset by a foreign currency benefit of approximately $3 million.

For fiscal year 2021, reported revenues for the International OTC Healthcare segment were $94.0 million versus the prior year revenues of $103.6 million, driven by reduced consumption for certain brands impacted by the COVID-19 virus, such as Hydralyte as well as a foreign currency benefit of approximately $4 million.

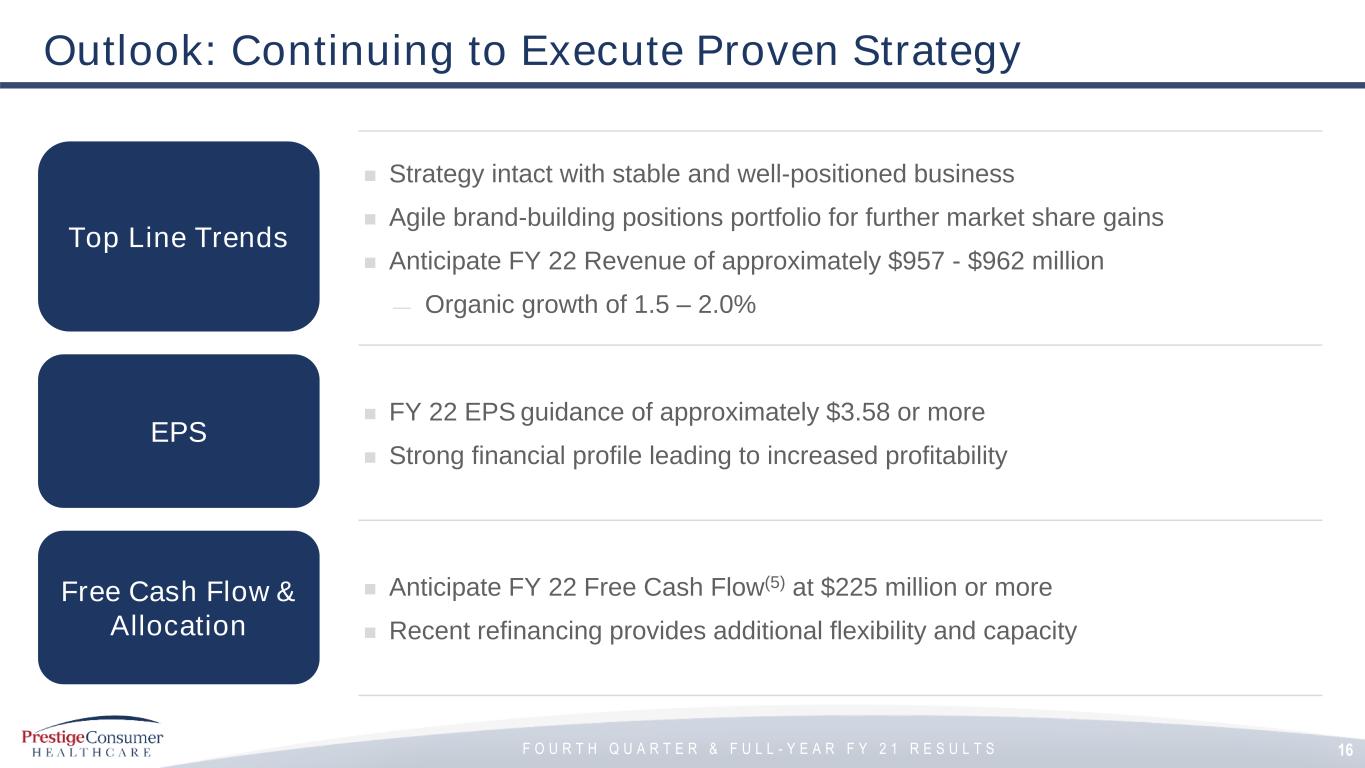

Commentary and Outlook for Fiscal 2022

Ron Lombardi, Chief Executive Officer, stated, “A year ago, we entered fiscal 2021 with a backdrop of uncertainty prevalent across the economy due to many factors resulting from COVID-19. Our time-tested business attributes and strategy worked to our favor: leading #1 market share brand positions, agile marketing ability, a diversified brand portfolio, and a robust eCommerce strategy, among many others – all helping to generate continued market share gains. This enabled solid fiscal year financial results and we expect to benefit once again from these attributes in fiscal 2022 and beyond.”

He continued, “In fiscal 2022, we expect organic growth to track in-line with our long-term expectations for our leading brand portfolio, except for certain COVID-disrupted categories, where we anticipate stable performance versus FY21 levels. Meanwhile, we anticipate our solid financial profile to enable cash flow growth in fiscal ’22 and strong low-double-digit earnings growth. This financial outlook will continue to fuel our disciplined capital allocation strategy of continued debt reduction, enabling us to focus on long-term top- and bottom-line growth prospects,” Mr. Lombardi concluded.

Fiscal 2022 Full-Year Outlook

Revenue $957 to 962 million

Organic Growth 1.5% to 2.0%

Adjusted E.P.S. $3.58 or more

Free Cash Flow $225 million or more

Fiscal Fourth Quarter and Full-Year 2021 Conference Call, Accompanying Slide Presentation and Replay

The Company will host a conference call to review its fourth quarter and full-year results today, May 6, 2021 at 8:30 a.m. ET. The toll-free dial-in numbers are 844-233-9440 for the U.S. & Canada and 574-990-1016 internationally. The conference ID number is 5996287. The Company provides a live

Internet webcast, a slide presentation to accompany the call, as well as an archived replay, all of which can be accessed from the Investor Relations page of the Company's website at www.prestigeconsumerhealthcare.com. The slide presentation can be accessed from the Investor Relations page of the website by clicking on Webcasts and Presentations.

Telephonic replays will be available for approximately one week following the completion of the call and can be accessed at 855-859-2056 within North America and at 404-537-3406 from outside North America. The conference ID is 5996287.

Non-GAAP and Other Financial Information

In addition to financial results reported in accordance with generally accepted accounting principles (GAAP), we have provided certain non-GAAP financial information in this release to aid investors in understanding the Company's performance. Each non-GAAP financial measure is defined and reconciled to its most closely related GAAP financial measure in the “About Non-GAAP Financial Measures” section at the end of this earnings release.

Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of the federal securities laws that are intended to qualify for the Safe Harbor from liability established by the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" generally can be identified by the use of forward-looking terminology such as "guidance," "strategy," "outlook," "projection," "may," "will," "would," "expect," "anticipate," "believe”, "enables," or "continue" (or the negative or other derivatives of each of these terms) or similar terminology. The "forward-looking statements" include, without limitation, statements regarding the Company's future operating results including revenues, organic growth, adjusted earnings per share, and free cash flow, the Company’s ability to execute on its capital allocation strategy and reduce debt, and the Company’s ability to create long-term value for stakeholders. These statements are based on management's estimates and assumptions with respect to future events and financial performance and are believed to be reasonable, though are inherently uncertain and difficult to predict. Actual results could differ materially from those expected as a result of a variety of factors, including the impact of the COVID-19 pandemic and business and economic conditions, consumer trends, the impact of the Company’s advertising and promotional and new product development initiatives, customer inventory management initiatives, fluctuating foreign exchange rates, competitive pressures, and the ability of the Company’s third party manufacturers and logistics providers and suppliers to meet demand for its products and to reduce costs. A discussion of other factors that could cause results to vary is included in the Company's Annual Report on Form 10-K for the year ended March 31, 2020 and other periodic reports filed with the Securities and Exchange Commission.

About Prestige Consumer Healthcare Inc.

Prestige Consumer Healthcare markets, sells, manufactures and distributes consumer healthcare products to retail outlets throughout the U.S. and Canada, Australia, and in certain other international markets. The Company’s diverse portfolio of brands include Monistat® and Summer’s Eve® women's health products, BC® and Goody's® pain relievers, Clear Eyes® eye care products, DenTek® specialty oral care products, Dramamine® motion sickness treatments, Fleet® enemas and glycerin suppositories, Chloraseptic® and Luden's® sore throat treatments and drops, Compound W® wart treatments, Little Remedies® pediatric over-the-counter products, Boudreaux’s Butt Paste® diaper rash ointments, Nix® lice treatment, Debrox® earwax remover, Gaviscon® antacid in Canada, and Hydralyte® rehydration products and the Fess® line of nasal and sinus care products in Australia. Visit the Company's website at www.prestigeconsumerhealthcare.com.

Prestige Consumer Healthcare Inc.

Consolidated Statement of Income and Comprehensive Income

(Unaudited)

| Three Months Ended March 31, | Year Ended March 31, | |||||||||||||||||||||||||

| (In thousands, except per share data) | 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||

| Total Revenues | 237,761 | 251,235 | 943,365 | 963,010 | ||||||||||||||||||||||

| Cost of Sales | ||||||||||||||||||||||||||

| Cost of sales excluding depreciation | 99,047 | 106,236 | 389,670 | 406,554 | ||||||||||||||||||||||

| Cost of sales depreciation | 1,658 | 1,089 | 6,223 | 4,233 | ||||||||||||||||||||||

| Cost of sales | 100,705 | 107,325 | 395,893 | 410,787 | ||||||||||||||||||||||

| Gross profit | 137,056 | 143,910 | 547,472 | 552,223 | ||||||||||||||||||||||

| Operating Expenses | ||||||||||||||||||||||||||

| Advertising and marketing | 36,417 | 40,167 | 140,589 | 147,194 | ||||||||||||||||||||||

| General and administrative | 23,823 | 23,584 | 85,540 | 89,112 | ||||||||||||||||||||||

| Depreciation and amortization | 5,879 | 6,242 | 23,941 | 24,762 | ||||||||||||||||||||||

| Total operating expenses | 66,119 | 69,993 | 250,070 | 261,068 | ||||||||||||||||||||||

| Operating income | 70,937 | 73,917 | 297,402 | 291,155 | ||||||||||||||||||||||

| Other (income) expense | ||||||||||||||||||||||||||

| Interest expense, net | 18,983 | 22,452 | 82,328 | 96,224 | ||||||||||||||||||||||

| Loss on extinguishment of debt | 12,327 | — | 12,327 | 2,155 | ||||||||||||||||||||||

| Other (income) expense, net | (746) | 930 | (1,366) | 1,625 | ||||||||||||||||||||||

| Total other expense, net | 30,564 | 23,382 | 93,289 | 100,004 | ||||||||||||||||||||||

| Income before income taxes | 40,373 | 50,535 | 204,113 | 191,151 | ||||||||||||||||||||||

| Provision for income taxes | 4,859 | 13,489 | 39,431 | 48,870 | ||||||||||||||||||||||

| Net income | $ | 35,514 | $ | 37,046 | $ | 164,682 | $ | 142,281 | ||||||||||||||||||

| Earnings per share: | ||||||||||||||||||||||||||

| Basic | $ | 0.71 | $ | 0.74 | $ | 3.28 | $ | 2.81 | ||||||||||||||||||

| Diluted | $ | 0.70 | $ | 0.73 | $ | 3.25 | $ | 2.78 | ||||||||||||||||||

| Weighted average shares outstanding: | ||||||||||||||||||||||||||

| Basic | 50,031 | 50,367 | 50,210 | 50,723 | ||||||||||||||||||||||

| Diluted | 50,512 | 50,878 | 50,605 | 51,140 | ||||||||||||||||||||||

| Comprehensive income, net of tax: | ||||||||||||||||||||||||||

| Currency translation adjustments | (2,106) | (12,052) | 20,333 | (12,363) | ||||||||||||||||||||||

| Unrealized gain (loss) on interest rate swaps | 698 | (4,864) | 3,045 | (4,864) | ||||||||||||||||||||||

| Unrecognized net (loss) gain on pension plans | (1,162) | (1,187) | 1,172 | (1,187) | ||||||||||||||||||||||

| Net gain on pension distribution reclassified to net income | — | — | (190) | — | ||||||||||||||||||||||

| Total other comprehensive (loss) income | (2,570) | (18,103) | 24,360 | (18,414) | ||||||||||||||||||||||

| Comprehensive income | $ | 32,944 | $ | 18,943 | $ | 189,042 | $ | 123,867 | ||||||||||||||||||

Prestige Consumer Healthcare Inc.

Consolidated Balance Sheet

(Unaudited)

| (In thousands) | March 31, | ||||||||||

| 2021 | 2020 | ||||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | 32,302 | $ | 94,760 | |||||||

| Accounts receivable, net of allowance of $16,457 and $20,194, respectively | 114,671 | 150,517 | |||||||||

| Inventories | 114,959 | 116,026 | |||||||||

| Prepaid expenses and other current assets | 7,903 | 4,351 | |||||||||

| Total current assets | 269,835 | 365,654 | |||||||||

| Property, plant and equipment, net | 70,059 | 55,988 | |||||||||

| Operating lease right-of-use assets | 23,722 | 28,888 | |||||||||

| Finance lease right-of-use assets, net | 8,986 | 5,842 | |||||||||

| Goodwill | 578,079 | 575,179 | |||||||||

| Intangible assets, net | 2,475,729 | 2,479,391 | |||||||||

| Other long-term assets | 2,863 | 2,963 | |||||||||

| Total Assets | $ | 3,429,273 | $ | 3,513,905 | |||||||

| Liabilities and Stockholders' Equity | |||||||||||

| Current liabilities | |||||||||||

| Accounts payable | $ | 45,978 | $ | 62,375 | |||||||

| Accrued interest payable | 6,312 | 9,911 | |||||||||

| Operating lease liabilities, current portion | 5,858 | 5,612 | |||||||||

| Finance lease liabilities, current portion | 2,588 | 1,220 | |||||||||

| Other accrued liabilities | 61,402 | 70,763 | |||||||||

| Total current liabilities | 122,138 | 149,881 | |||||||||

| Long-term debt, net | 1,479,653 | 1,730,300 | |||||||||

| Deferred income tax liabilities | 434,050 | 407,812 | |||||||||

| Long-term operating lease liabilities, net of current portion | 19,706 | 24,877 | |||||||||

| Long-term finance lease liabilities, net of current portion | 6,816 | 4,626 | |||||||||

| Other long-term liabilities | 8,612 | 25,438 | |||||||||

| Total Liabilities | 2,070,975 | 2,342,934 | |||||||||

| Stockholders' Equity | |||||||||||

| Preferred stock - $0.01 par value | |||||||||||

| Authorized - 5,000 shares | |||||||||||

| Issued and outstanding - None | — | — | |||||||||

| Common stock - $0.01 par value | |||||||||||

| Authorized - 250,000 shares | |||||||||||

| Issued – 53,999 shares at March 31, 2021 and 53,805 shares at March 31, 2020 | 540 | 538 | |||||||||

| Additional paid-in capital | 499,508 | 488,116 | |||||||||

| Treasury stock, at cost – 4,088 shares at March 31, 2021 and 3,719 at March 31, 2020 | (130,732) | (117,623) | |||||||||

| Accumulated other comprehensive loss, net of tax | (19,801) | (44,161) | |||||||||

| Retained earnings | 1,008,783 | 844,101 | |||||||||

| Total Stockholders' Equity | 1,358,298 | 1,170,971 | |||||||||

| Total Liabilities and Stockholders' Equity | $ | 3,429,273 | $ | 3,513,905 | |||||||

Prestige Consumer Healthcare Inc.

Consolidated Statement of Cash Flows

(Unaudited)

| Year Ended March 31, | |||||||||||

| (In thousands) | 2021 | 2020 | |||||||||

| Operating Activities | |||||||||||

| Net income | $ | 164,682 | $ | 142,281 | |||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 30,164 | 28,995 | |||||||||

| Loss on sale or disposal of property and equipment | 220 | 713 | |||||||||

| Deferred income taxes | 18,628 | 13,852 | |||||||||

| Amortization of debt origination costs | 4,979 | 3,812 | |||||||||

| Stock-based compensation costs | 8,543 | 7,644 | |||||||||

| Loss on extinguishment of debt | 12,327 | 2,155 | |||||||||

| Non-cash operating lease cost | 7,082 | 8,786 | |||||||||

| Impairment loss | 2,434 | — | |||||||||

| Other | (7,854) | 84 | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable | 36,872 | (2,849) | |||||||||

| Inventories | 2,972 | 2,930 | |||||||||

| Prepaid expenses and other current assets | (3,227) | 687 | |||||||||

| Accounts payable | (17,342) | 6,210 | |||||||||

| Accrued liabilities | (14,912) | 12,096 | |||||||||

| Operating lease liabilities | (6,718) | (8,824) | |||||||||

| Other | (3,243) | (1,448) | |||||||||

| Net cash provided by operating activities | 235,607 | 217,124 | |||||||||

| Investing Activities | |||||||||||

| Purchases of property, plant and equipment | (22,243) | (14,560) | |||||||||

| Escrow receipt | — | 750 | |||||||||

| Acquisition of tradename | — | (2,760) | |||||||||

| Net cash used in investing activities | (22,243) | (16,570) | |||||||||

| Financing Activities | |||||||||||

| Proceeds from issuance of senior notes | 600,000 | 400,000 | |||||||||

| Repayment of senior notes | (600,000) | (400,000) | |||||||||

| Term Loan repayments | (195,000) | (48,000) | |||||||||

| Borrowings under revolving credit agreement | 15,000 | 100,000 | |||||||||

| Repayments under revolving credit agreement | (70,000) | (120,000) | |||||||||

| Payment of debt costs | (17,718) | (6,584) | |||||||||

| Payments of finance leases | (1,443) | (476) | |||||||||

| Proceeds from exercise of stock options | 2,851 | 1,324 | |||||||||

| Fair value of shares surrendered as payment of tax withholding | (1,242) | (974) | |||||||||

| Repurchase of common stock | (11,867) | (56,721) | |||||||||

| Net cash used in financing activities | (279,419) | (131,431) | |||||||||

| Effects of exchange rate changes on cash and cash equivalents | 3,597 | (1,893) | |||||||||

| (Decrease) increase in cash and cash equivalents | (62,458) | 67,230 | |||||||||

| Cash and cash equivalents - beginning of year | 94,760 | 27,530 | |||||||||

| Cash and cash equivalents - end of year | $ | 32,302 | $ | 94,760 | |||||||

| Interest paid | $ | 80,290 | $ | 92,166 | |||||||

| Income taxes paid | $ | 34,381 | $ | 30,602 | |||||||

Prestige Consumer Healthcare Inc.

Consolidated Statement of Income

Business Segments

(Unaudited)

| Three Months Ended March 31, 2021 | |||||||||||||||||

| (In thousands) | North American OTC Healthcare | International OTC Healthcare | Consolidated | ||||||||||||||

| Total segment revenues* | $ | 211,468 | $ | 26,293 | $ | 237,761 | |||||||||||

| Cost of sales | 91,321 | 9,384 | 100,705 | ||||||||||||||

| Gross profit | 120,147 | 16,909 | 137,056 | ||||||||||||||

| Advertising and marketing | 31,304 | 5,113 | 36,417 | ||||||||||||||

| Contribution margin | $ | 88,843 | $ | 11,796 | 100,639 | ||||||||||||

| Other operating expenses | 29,702 | ||||||||||||||||

| Operating income | $ | 70,937 | |||||||||||||||

*Intersegment revenues of $0.8 million were eliminated from the North American OTC Healthcare segment.

| Year Ended March 31, 2021 | |||||||||||||||||

| (In thousands) | North American OTC Healthcare | International OTC Healthcare | Consolidated | ||||||||||||||

| Total segment revenues* | $ | 849,319 | $ | 94,046 | $ | 943,365 | |||||||||||

| Cost of sales | 359,100 | 36,793 | 395,893 | ||||||||||||||

| Gross profit | 490,219 | 57,253 | 547,472 | ||||||||||||||

| Advertising and marketing | 122,857 | 17,732 | 140,589 | ||||||||||||||

| Contribution margin | $ | 367,362 | $ | 39,521 | 406,883 | ||||||||||||

| Other operating expenses | 109,481 | ||||||||||||||||

| Operating income | $ | 297,402 | |||||||||||||||

*Intersegment revenues of $3.2 million were eliminated from the North American OTC Healthcare segment.

| Three Months Ended March 31, 2020 | |||||||||||||||||

| (In thousands) | North American OTC Healthcare | International OTC Healthcare | Consolidated | ||||||||||||||

| Total segment revenues* | $ | 219,814 | $ | 31,421 | $ | 251,235 | |||||||||||

| Cost of sales | 96,454 | 10,871 | 107,325 | ||||||||||||||

| Gross profit | 123,360 | 20,550 | 143,910 | ||||||||||||||

| Advertising and marketing | 33,338 | 6,829 | 40,167 | ||||||||||||||

| Contribution margin | $ | 90,022 | $ | 13,721 | 103,743 | ||||||||||||

| Other operating expenses | 29,826 | ||||||||||||||||

| Operating income | $ | 73,917 | |||||||||||||||

*Intersegment revenues of $1.4 million were eliminated from the North American OTC Healthcare segment.

| Year Ended March 31, 2020 | |||||||||||||||||

| (In thousands) | North American OTC Healthcare | International OTC Healthcare | Consolidated | ||||||||||||||

| Total segment revenues* | $ | 859,368 | $ | 103,642 | $ | 963,010 | |||||||||||

| Cost of sales | 372,133 | 38,654 | 410,787 | ||||||||||||||

| Gross profit | 487,235 | 64,988 | 552,223 | ||||||||||||||

| Advertising and marketing | 127,972 | 19,222 | 147,194 | ||||||||||||||

| Contribution margin | $ | 359,263 | $ | 45,766 | 405,029 | ||||||||||||

| Other operating expenses | 113,874 | ||||||||||||||||

| Operating income | $ | 291,155 | |||||||||||||||

* Intersegment revenues of $3.5 million were eliminated from the North American OTC Healthcare segment.

About Non-GAAP Financial Measures

In addition to financial results reported in accordance with GAAP, we disclose certain Non-GAAP financial measures ("NGFMs"), including, but not limited to, Non-GAAP Organic Revenues, Non-GAAP Organic Revenue Change Percentage, Non-GAAP Adjusted Gross Margin, Non-GAAP Adjusted Gross Margin Percentage, Non-GAAP EBITDA, Non-GAAP EBITDA Margin, Non-GAAP Adjusted EBITDA, Non-GAAP Adjusted EBITDA Margin, Non-GAAP Adjusted Net Income, Non-GAAP Adjusted EPS, Non-GAAP Free Cash Flow, Non-GAAP Adjusted Free Cash Flow and Net Debt. We use these NGFMs internally, along with GAAP information, in evaluating our operating performance and in making financial and operational decisions. We believe that the presentation of these NGFMs provides investors with greater transparency, and provides a more complete understanding of our business than could be obtained absent these disclosures, because the supplemental data relating to our financial condition and results of operations provides additional ways to view our operation when considered with both our GAAP results and the reconciliations below. In addition, we believe that the presentation of each of these NGFMs is useful to investors for period-to-period comparisons of results in assessing shareholder value, and we use these NGFMs internally to evaluate the performance of our personnel and also to evaluate our operating performance and compare our performance to that of our competitors.

These NGFMs are not in accordance with GAAP, should not be considered as a measure of profitability or liquidity, and may not be directly comparable to similarly titled NGFMs reported by other companies. These NGFMs have limitations and they should not be considered in isolation from or as an alternative to their most closely related GAAP measures reconciled below. Investors should not rely on any single financial measure when evaluating our business. We recommend investors review the GAAP financial measures included in this earnings release. When viewed in conjunction with our GAAP results and the reconciliations below, we believe these NGFMs provide greater transparency and a more complete understanding of factors affecting our business than GAAP measures alone.

NGFMs Defined

We define our NGFMs presented herein as follows:

•Non-GAAP Organic Revenues: GAAP Total Revenues excluding impact of foreign currency exchange rates in the periods presented.

•Non-GAAP Organic Revenue Change Percentage: Calculated as the change in Non-GAAP Organic Revenues from prior year divided by prior year Non-GAAP Organic Revenues.

•Non-GAAP Adjusted Gross Margin: GAAP Gross Profit minus certain transition and other costs associated with new warehouse.

•Non-GAAP Adjusted Gross Margin Percentage: Calculated as Non-GAAP Adjusted Gross Margin divided by GAAP Total Revenues.

•Non-GAAP EBITDA: GAAP Net Income before interest expense, net, income taxes provision, and depreciation and amortization.

•Non-GAAP EBITDA Margin: Calculated as Non-GAAP EBITDA divided by GAAP Total Revenues.

•Non-GAAP Adjusted EBITDA: Non-GAAP EBITDA less certain transition and other costs associated with new warehouse, loss on disposal of assets and loss on extinguishment of debt.

•Non-GAAP Adjusted EBITDA Margin: Calculated as Non-GAAP Adjusted EBITDA divided by GAAP Total Revenues.

•Non-GAAP Adjusted Net Income: GAAP Net Income before certain transition and other costs associated with new warehouse, loss on disposal of assets, loss on extinguishment of debt, tax impact of adjustments, and normalized tax rate adjustment.

•Non-GAAP Adjusted EPS: Calculated as Non-GAAP Adjusted Net Income, divided by the weighted average number of common and potential common shares outstanding during the period.

•Non-GAAP Free Cash Flow: GAAP Net cash provided by operating activities less cash paid for capital expenditures.

•Non-GAAP Adjusted Free Cash Flow: Non-GAAP Free Cash Flow plus cash payments made for transition and other costs associated with new warehouse.

•Net Debt: Calculated as total principal amount of debt outstanding ($1,495,000 at March 31, 2021 and $1,745,000 at March 31, 2020) less cash and cash equivalents ($32,302 at March 31, 2021 and $94,760 at March 31, 2020). Amounts in thousands.

The following tables set forth the reconciliations of each of our NGFMs to their most directly comparable financial measures presented in accordance with GAAP.

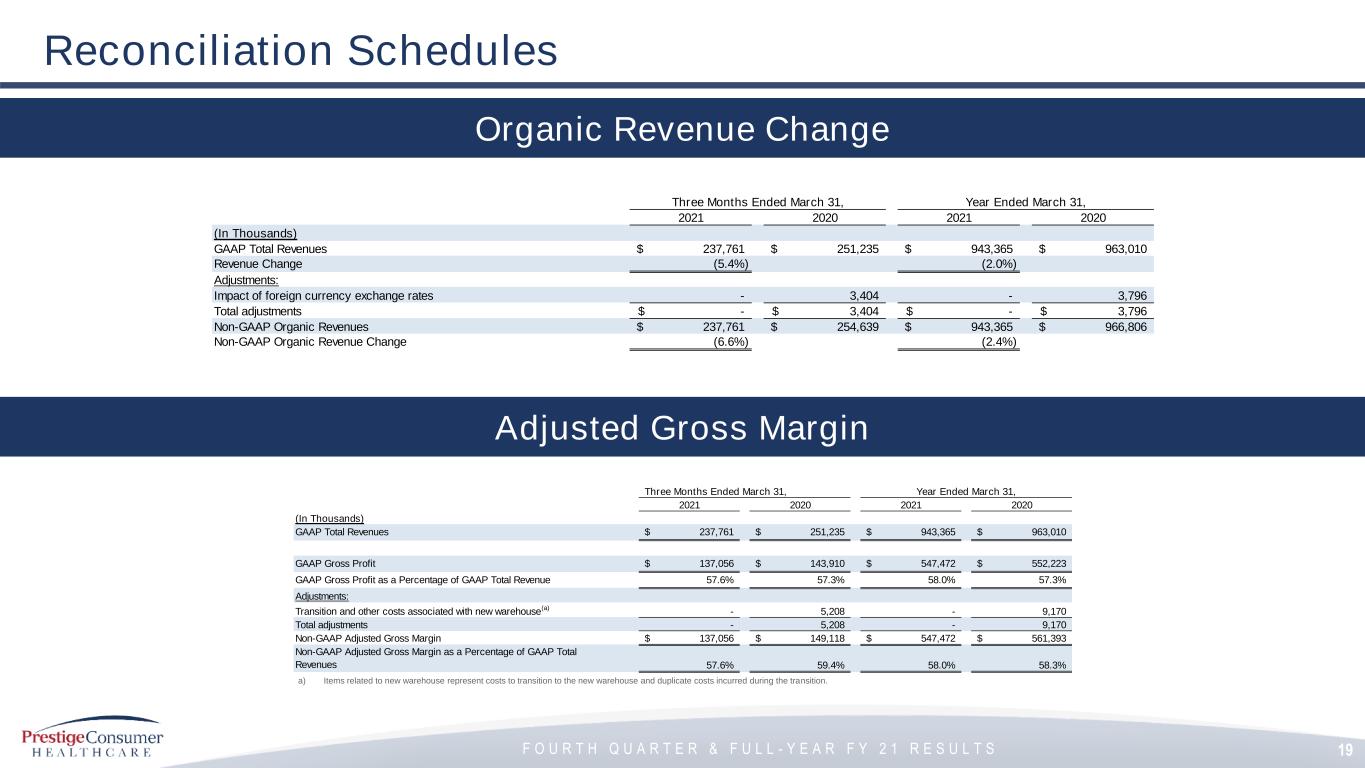

Reconciliation of GAAP Total Revenues to Non-GAAP Organic Revenues and related Non-GAAP Organic Revenue Change percentage:

| Three Months Ended March 31, | Year Ended March 31, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (In thousands) | |||||||||||||||||||||||

| GAAP Total Revenues | $ | 237,761 | $ | 251,235 | $ | 943,365 | $ | 963,010 | |||||||||||||||

| Revenue Change | (5.4) | % | (2.0) | % | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Impact of foreign currency exchange rates | — | 3,404 | — | 3,796 | |||||||||||||||||||

| Total adjustments | — | 3,404 | — | 3,796 | |||||||||||||||||||

| Non-GAAP Organic Revenues | $237,761 | $254,639 | $943,365 | $966,806 | |||||||||||||||||||

| Non-GAAP Organic Revenue Change | (6.6) | % | (2.4) | % | |||||||||||||||||||

Reconciliation of GAAP Gross Profit to Non-GAAP Adjusted Gross Margin and related Non-GAAP Adjusted Gross Margin percentage:

| Three Months Ended March 31, | Year Ended March 31, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (In thousands) | |||||||||||||||||||||||

| GAAP Total Revenues | $ | 237,761 | $ | 251,235 | $ | 943,365 | $ | 963,010 | |||||||||||||||

| GAAP Gross Profit | $ | 137,056 | $ | 143,910 | $ | 547,472 | $ | 552,223 | |||||||||||||||

| GAAP Gross Profit as a Percentage of GAAP Total Revenue | 57.6 | % | 57.3 | % | 58.0 | % | 57.3 | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

Transition and other costs associated with new warehouse(1) | — | 5,208 | — | 9,170 | |||||||||||||||||||

| Total adjustments | — | 5,208 | — | 9,170 | |||||||||||||||||||

| Non-GAAP Adjusted Gross Margin | $ | 137,056 | $ | 149,118 | $ | 547,472 | $ | 561,393 | |||||||||||||||

| Non-GAAP Adjusted Gross Margin as a Percentage of GAAP Total Revenues | 57.6 | % | 59.4 | % | 58.0 | % | 58.3 | % | |||||||||||||||

(1) Items related to new warehouse represent costs to transition to the new warehouse and duplicate costs incurred during the transition.

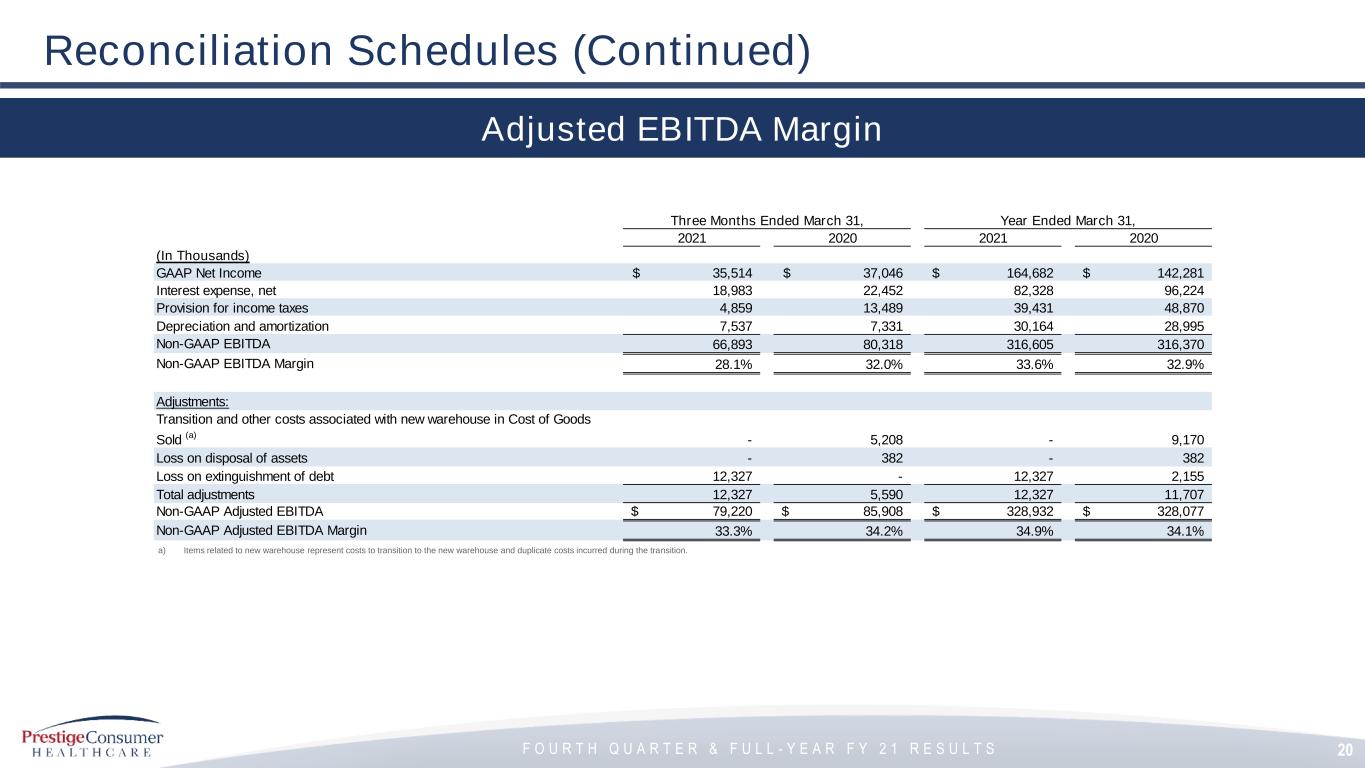

Reconciliation of GAAP Net Income to Non-GAAP EBITDA and related Non-GAAP EBITDA Margin, Non-GAAP Adjusted EBITDA and related Non-GAAP Adjusted EBITDA Margin:

| Three Months Ended March 31, | Year Ended March 31, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (In thousands) | |||||||||||||||||||||||

| GAAP Net Income | $ | 35,514 | $ | 37,046 | $ | 164,682 | $ | 142,281 | |||||||||||||||

| Interest expense, net | 18,983 | 22,452 | 82,328 | 96,224 | |||||||||||||||||||

| Provision for income taxes | 4,859 | 13,489 | 39,431 | 48,870 | |||||||||||||||||||

| Depreciation and amortization | 7,537 | 7,331 | 30,164 | 28,995 | |||||||||||||||||||

| Non-GAAP EBITDA | 66,893 | 80,318 | 316,605 | 316,370 | |||||||||||||||||||

| Non-GAAP EBITDA Margin | 28.1 | % | 32.0 | % | 33.6 | % | 32.9 | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

Transition and other costs associated with new warehouse in Cost of Goods Sold(1) | — | 5,208 | — | 9,170 | |||||||||||||||||||

| Loss on disposal of assets | — | 382 | — | 382 | |||||||||||||||||||

| Loss on extinguishment of debt | 12,327 | — | 12,327 | 2,155 | |||||||||||||||||||

| Total adjustments | 12,327 | 5,590 | 12,327 | 11,707 | |||||||||||||||||||

| Non-GAAP Adjusted EBITDA | $ | 79,220 | $ | 85,908 | $ | 328,932 | $ | 328,077 | |||||||||||||||

| Non-GAAP Adjusted EBITDA Margin | 33.3 | % | 34.2 | % | 34.9 | % | 34.1 | % | |||||||||||||||

(1) Items related to new warehouse represent costs to transition to the new warehouse and duplicate costs incurred during the transition.

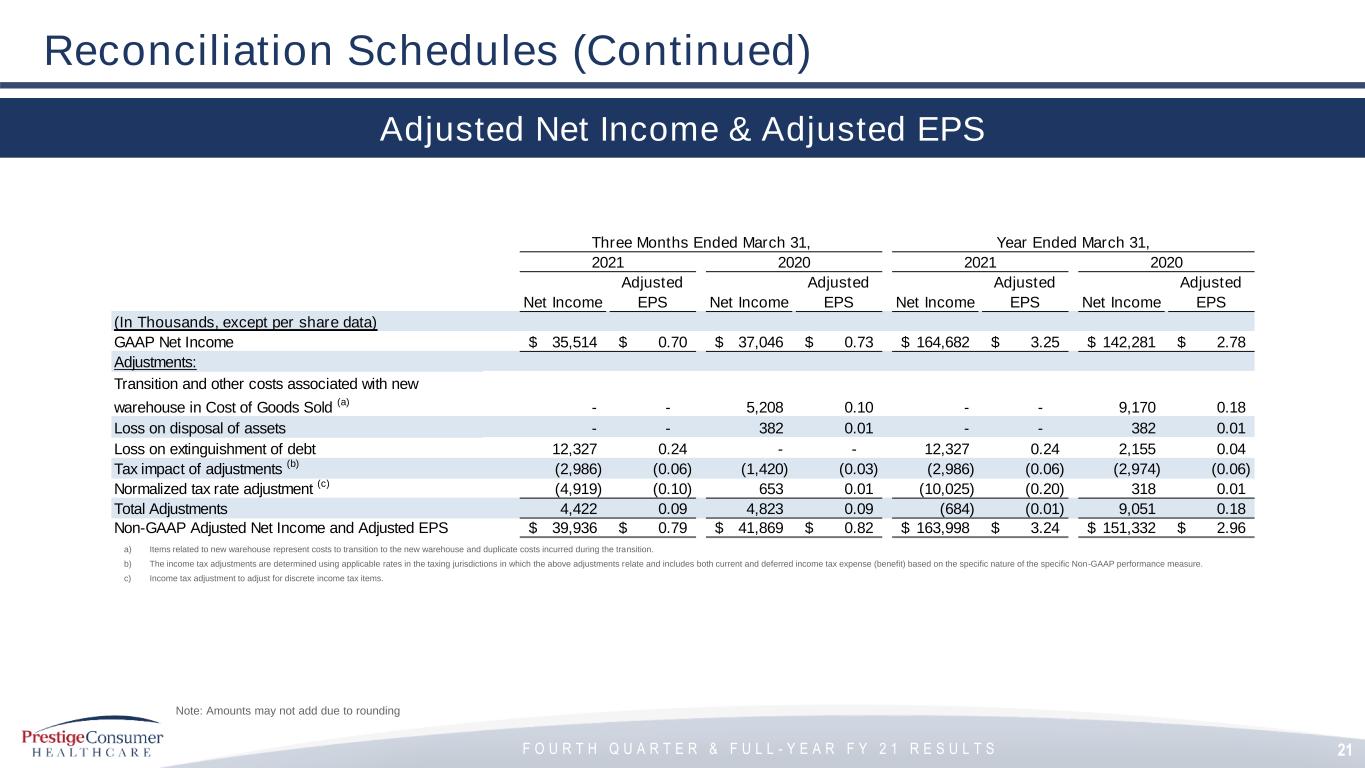

Reconciliation of GAAP Net Income and GAAP Diluted Earnings Per Share to Non-GAAP Adjusted Net Income and related Non-GAAP Adjusted Earnings Per Share:

| Three Months Ended March 31, | Year Ended March 31, | ||||||||||||||||||||||||||||||||||

| 2021 | 2021 Adjusted EPS | 2020 | 2020 Adjusted EPS | 2021 | 2021 Adjusted EPS | 2020 | 2020 Adjusted EPS | ||||||||||||||||||||||||||||

| (In thousands, except per share data) | |||||||||||||||||||||||||||||||||||

| GAAP Net Income and Diluted EPS | $ | 35,514 | $ | 0.70 | $ | 37,046 | $ | 0.73 | $ | 164,682 | $ | 3.25 | $ | 142,281 | $ | 2.78 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||

Transition and other costs associated with new warehouse in Cost of Goods Sold(1) | — | — | 5,208 | 0.10 | — | — | 9,170 | 0.18 | |||||||||||||||||||||||||||

| Loss on disposal of assets | — | — | 382 | 0.01 | — | — | 382 | 0.01 | |||||||||||||||||||||||||||

| Loss on extinguishment of debt | 12,327 | 0.24 | — | — | 12,327 | 0.24 | 2,155 | 0.04 | |||||||||||||||||||||||||||

Tax impact of adjustments(2) | (2,986) | (0.06) | (1,420) | (0.03) | (2,986) | (0.06) | (2,974) | (0.06) | |||||||||||||||||||||||||||

Normalized tax rate adjustment(3) | (4,919) | (0.10) | 653 | 0.01 | (10,025) | (0.20) | 318 | 0.01 | |||||||||||||||||||||||||||

| Total adjustments | 4,422 | 0.09 | 4,823 | 0.09 | (684) | (0.01) | 9,051 | 0.18 | |||||||||||||||||||||||||||

| Non-GAAP Adjusted Net Income and Adjusted EPS | $ | 39,936 | $ | 0.79 | $ | 41,869 | $ | 0.82 | $ | 163,998 | $ | 3.24 | $ | 151,332 | $ | 2.96 | |||||||||||||||||||

Note: Amounts may not add due to rounding.

(1) Items related to new warehouse represent costs to transition to the new warehouse and duplicate costs incurred during the transition.

(2) The income tax adjustments are determined using applicable rates in the taxing jurisdictions in which the above adjustments relate and includes both current and deferred income tax expense (benefit) based on the specific nature of the specific Non-GAAP performance measure.

(3) Income tax adjustment to adjust for discrete income tax items.

Reconciliation of GAAP Net Income to Non-GAAP Free Cash Flow and Non-GAAP Adjusted Free Cash Flow:

| Three Months Ended March 31, | Year Ended March 31, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (In thousands) | |||||||||||||||||||||||

| GAAP Net Income | $ | 35,514 | $ | 37,046 | $ | 164,682 | $ | 142,281 | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities as shown in the Statement of Cash Flows | 29,904 | 20,056 | 76,523 | 66,041 | |||||||||||||||||||

| Changes in operating assets and liabilities as shown in the Statement of Cash Flows | (6,331) | (976) | (5,598) | 8,802 | |||||||||||||||||||

| Total adjustments | 23,573 | 19,080 | 70,925 | 74,843 | |||||||||||||||||||

| GAAP Net cash provided by operating activities | 59,087 | 56,126 | 235,607 | 217,124 | |||||||||||||||||||

| Purchases of property and equipment | (4,896) | (5,505) | (22,243) | (14,560) | |||||||||||||||||||

| Non-GAAP Free Cash Flow | 54,191 | 50,621 | 213,364 | 202,564 | |||||||||||||||||||

Transition and other payments associated with new warehouse(1) | — | 1,876 | — | 4,203 | |||||||||||||||||||

| Non-GAAP Adjusted Free Cash Flow | $ | 54,191 | $ | 52,497 | $ | 213,364 | $ | 206,767 | |||||||||||||||

(1) Payments related to new warehouse represent costs to transition to the new warehouse and duplicate costs incurred during the transition.

Outlook for Fiscal Year 2022:

Reconciliation of Projected GAAP Net cash provided by operating activities to Projected Non-GAAP Free Cash Flow:

| (In millions) | |||||

| Projected FY'22 GAAP Net cash provided by operating activities | $ | 240 | |||

| Additions to property and equipment for cash | (15) | ||||

| Projected Non-GAAP Free Cash Flow | $ | 225 | |||

Fourth Quarter & Full-Year FY 2021 Results May 6th, 2021 Exhibit 99.2

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements regarding the Company’s expected financial performance, including revenues, EPS, free cash flow, and organic revenue growth; the Company’s ability to perform well in the currently evolving environment and execute on its brand-building strategy; the Company’s ability to reduce debt and increase profitability; the expected market share and consumption trends for the Company’s brands; and the Company’s disciplined capital allocation strategy. Words such as “trend,” “continue,” “will,” “expect,” “project,” “anticipate,” “focus,” “may,” “should,” “could,” “would,” and similar expressions identify forward-looking statements. Such forward-looking statements represent the Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include, among others, the impact of the COVID-19 pandemic, including on economic and business conditions, government actions, consumer trends, retail management initiatives, and disruptions to the distribution and supply chain; competitive pressures; the impact of the Company’s advertising and promotional and new product development initiatives; customer inventory management initiatives; fluctuating foreign exchange rates; and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K for the year ended March 31, 2020. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this presentation. Except to the extent required by applicable law, the Company undertakes no obligation to update any forward- looking statement contained in this presentation, whether as a result of new information, future events, or otherwise. All adjusted GAAP numbers presented are footnoted and reconciled to their closest GAAP measurement in the attached reconciliation schedule or in our May 6, 2021 earnings release in the “About Non-GAAP Financial Measures” section. Safe Harbor Disclosure 2

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Agenda for Today’s Discussion I. FY 21 Recap II. Financial Overview III. FY 22 Outlook and The Road Ahead 3

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S I. FY 2021 Recap

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Long-Term Strategy ◼ Brand-building designed to grow categories and connect with consumers ◼ Strategy and tactics performing well in an evolving environment Diverse Portfolio ◼ Capitalizing on current opportunities while investing for the long-term ◼ Investments in most relevant channels and media to drive consumer engagement Agile Marketing Financial Profile & Cash Flow ◼ Leading financial profile and cash flow generation ◼ Continued focus on optimizing capital allocation optionality 5 ◼ Portfolio of leading brands well-positioned in dynamic environment ◼ Trusted consumer brands driving market share growth Strategy and Execution Delivered Results

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Revenue of $943.4 million, down 2.4%(1) versus PY in constant currency Gross Margin of 58.0%, approximate with Adjusted PY(3) in-line with expectations Strong cash flow generation of $213.4 million(3) enabled by leading financial profile Consumption performance included market share gains led by strong brand-building Adjusted EPS of $3.24(3), up 9.5% versus PY Strong Fiscal 2021 Performance in a Difficult Backdrop 6

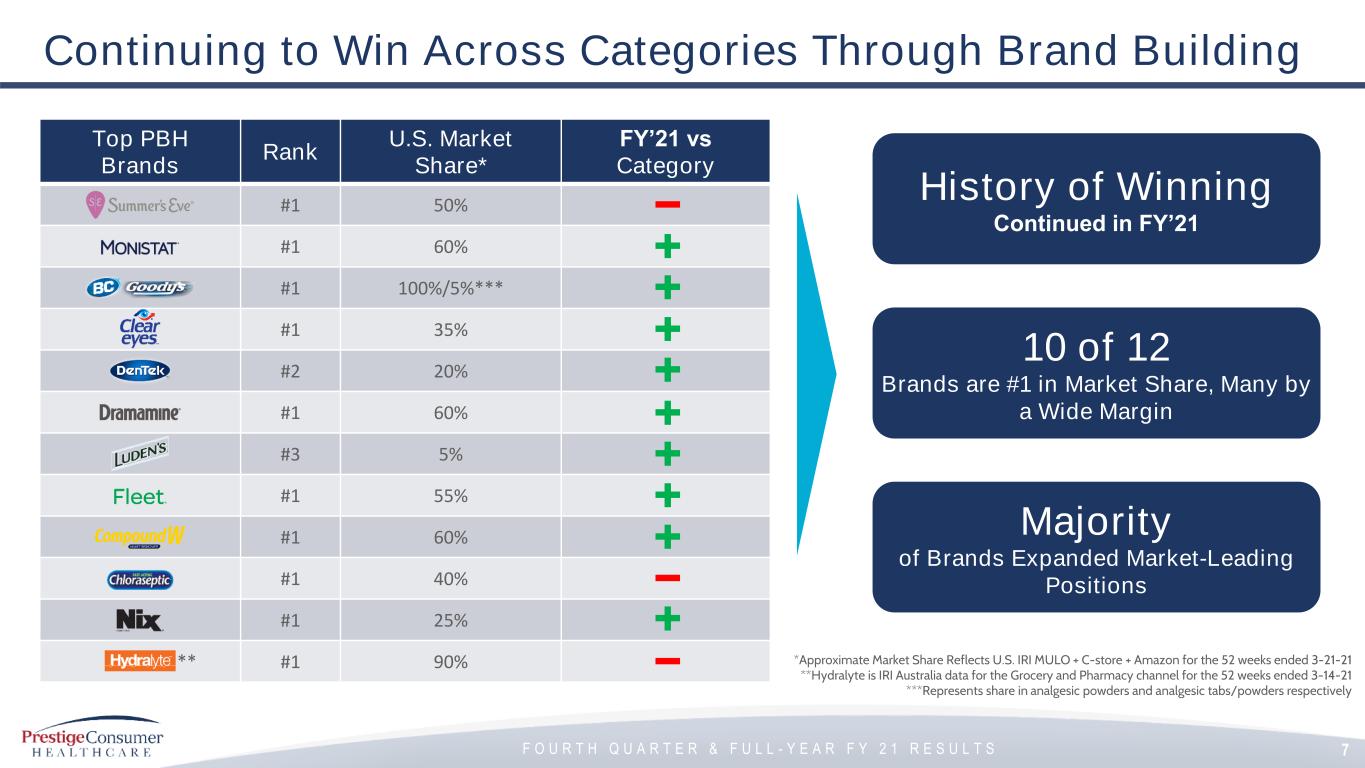

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Top PBH Brands Rank U.S. Market Share* FY’21 vs Category #1 50% #1 60% #1 100%/5%*** #1 35% #2 20% #1 60% #3 5% #1 55% #1 60% #1 40% #1 25% ** #1 90% *Approximate Market Share Reflects U.S. IRI MULO + C-store + Amazon for the 52 weeks ended 3-21-21 **Hydralyte is IRI Australia data for the Grocery and Pharmacy channel for the 52 weeks ended 3-14-21 ***Represents share in analgesic powders and analgesic tabs/powders respectively Majority of Brands Expanded Market-Leading Positions 10 of 12 Brands are #1 in Market Share, Many by a Wide Margin History of Winning Continued in FY’21 Continuing to Win Across Categories Through Brand Building 7

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Nimble Marketing Approach Paid Off ◼ “Thank you” essential worker donations ◼ Consumer brand promise: Brighter, whiter, and more comfortable ◼ New campaign across all key touchpoints: TV, Social, YouTube, Web ◼ Leading innovation for the consumer in warts ◼ 70% of consumers who click are new to the brand ◼ Successfully shifted media mix towards digital, addressable TV ◼ Reaching consumers at home with relevant messaging during COVID-19 8 +7% vs. Category(2)+15% vs. Category(2)+5% vs. Category(2) Ship Your Cure to Your Door

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Behavior Changes Began to be Lapped at Year-End CommentaryFY 21 Organic Revenue Breakdown (2.4%) 3.5% Total Excl. Impacted Brands Impacted Brands 9 Five brands drove significant impact to FY 21 revenue performance Affected brands continued to grow market share in aggregate Effects were partially offset by the diversity of leading brand portfolio FY 22 anticipates stable levels for category

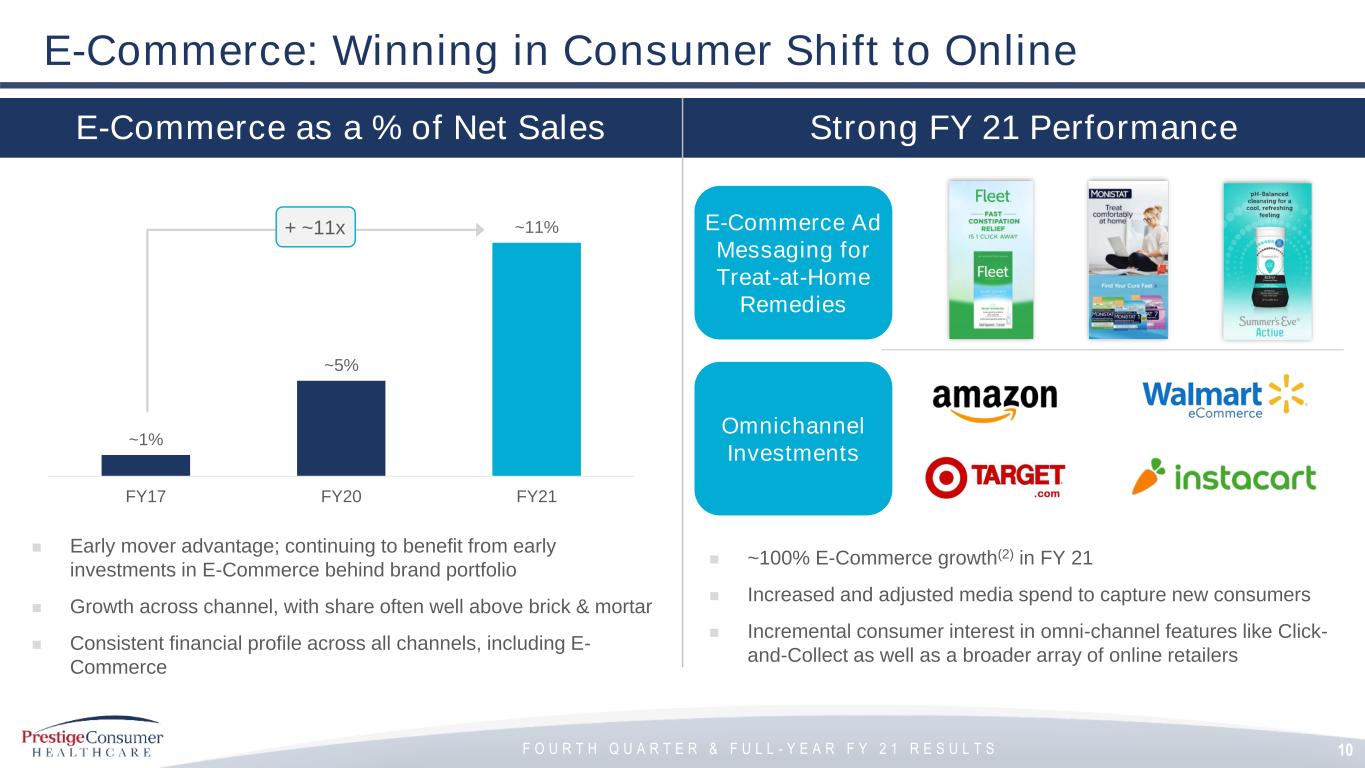

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S E-Commerce: Winning in Consumer Shift to Online Strong FY 21 PerformanceE-Commerce as a % of Net Sales ◼ ~100% E-Commerce growth(2) in FY 21 ◼ Increased and adjusted media spend to capture new consumers ◼ Incremental consumer interest in omni-channel features like Click- and-Collect as well as a broader array of online retailers ~1% ~5% ~11% FY17 FY20 FY21 ◼ Early mover advantage; continuing to benefit from early investments in E-Commerce behind brand portfolio ◼ Growth across channel, with share often well above brick & mortar ◼ Consistent financial profile across all channels, including E- Commerce + ~11x E-Commerce Ad Messaging for Treat-at-Home Remedies Omnichannel Investments 10

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S II. Financial Overview

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Key Financial Results for Fourth Quarter and FY 21 Performance FY 21 FY 20 Dollar values in millions, except per share data. $237.8 $ 79.2 $0.79 $251.2 $85.9 $0.82 Revenue Adjusted EBITDA Adjusted EPS (5.4%) (7.8%) (3.9%) 12 Q 4 $943.4 $328.9 $3.24 $963.0 $328.1 $2.96 Revenue Adjusted EBITDA Adjusted EPS (2.0%) 0.3% 9.5% (3) Revenue of $237.8 million, down versus unusual PY Q4 Adjusted EPS(3) of $0.79 down slightly versus PY Q4 Q4 Adj. EBITDA(3) of $79.2 and 33.3% margin, consistent with long-term expectations F Y 2 1 (3) 12 (3) (3)

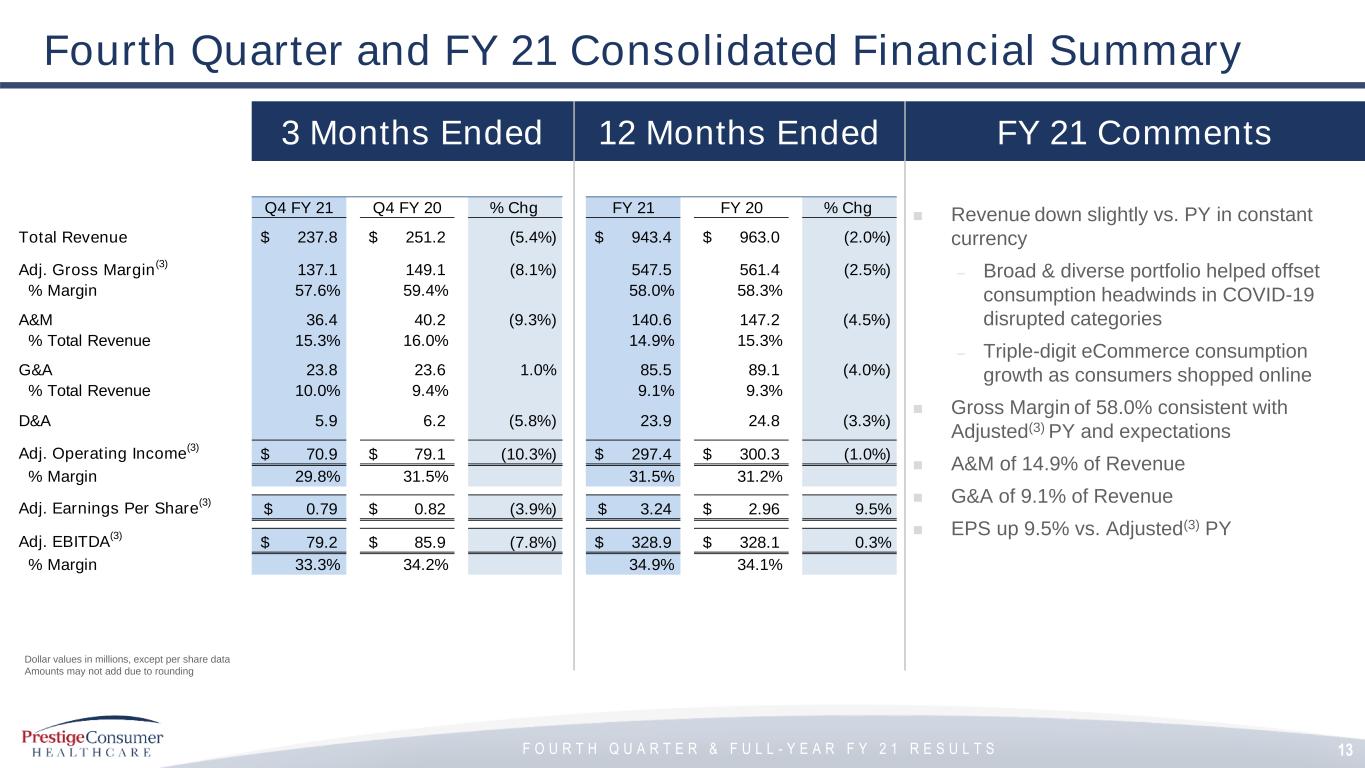

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Q4 FY 21 Q4 FY 20 % Chg FY 21 FY 20 % Chg Total Revenue 237.8$ 251.2$ (5.4%) 943.4$ 963.0$ (2.0%) Adj. Gross Margin (3) 137.1 149.1 (8.1%) 547.5 561.4 (2.5%) % Margin 57.6% 59.4% 58.0% 58.3% A&M 36.4 40.2 (9.3%) 140.6 147.2 (4.5%) % Total Revenue 15.3% 16.0% 14.9% 15.3% G&A 23.8 23.6 1.0% 85.5 89.1 (4.0%) % Total Revenue 10.0% 9.4% 9.1% 9.3% D&A 5.9 6.2 (5.8%) 23.9 24.8 (3.3%) Adj. Operating Income (3) 70.9$ 79.1$ (10.3%) 297.4$ 300.3$ (1.0%) % Margin 29.8% 31.5% 31.5% 31.2% Adj. Earnings Per Share (3) 0.79$ 0.82$ (3.9%) 3.24$ 2.96$ 9.5% Adj. EBITDA (3) 79.2$ 85.9$ (7.8%) 328.9$ 328.1$ 0.3% % Margin 33.3% 34.2% 34.9% 34.1% 3 Months Ended FY 21 Comments Fourth Quarter and FY 21 Consolidated Financial Summary ◼ Revenue down slightly vs. PY in constant currency – Broad & diverse portfolio helped offset consumption headwinds in COVID-19 disrupted categories – Triple-digit eCommerce consumption growth as consumers shopped online ◼ Gross Margin of 58.0% consistent with Adjusted(3) PY and expectations ◼ A&M of 14.9% of Revenue ◼ G&A of 9.1% of Revenue ◼ EPS up 9.5% vs. Adjusted(3) PY Dollar values in millions, except per share data Amounts may not add due to rounding 13 12 Months Ended

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Free Cash Flow(3) Comments ◼ FY 21 Free Cash Flow of $213.4 million(3) up 3.2% vs. Adjusted PY – Free Cash Flow Conversion of 130% ◼ Net Debt at March 31 of ~$1.5 billion(3); leverage ratio(4) of 4.2x at end of Q4 ◼ Completed $12 million in opportunistic share repurchases in FY21 ◼ Successfully extended and refinanced $600 million bond obligation to 2031 – Significant $15+ million annual interest savings Industry Leading Free Cash Flow Trends Dollar values in millions *Free Cash Flow Conversion defined as Non-GAAP Adjusted Free Cash Flow over Non-GAAP Adjusted Net Income 14 $197 $208 $202 $207 $213 5.7x 5.2x 5.0x 4.7x 4.2x FY 17 FY 18 FY 19 FY 20 FY 21 Leverage Ratio

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S III. FY 21 Outlook

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Outlook: Continuing to Execute Proven Strategy ◼ Strategy intact with stable and well-positioned business ◼ Agile brand-building positions portfolio for further market share gains ◼ Anticipate FY 22 Revenue of approximately $957 - $962 million — Organic growth of 1.5 – 2.0% ◼ FY 22 EPS guidance of approximately $3.58 or more ◼ Strong financial profile leading to increased profitability ◼ Anticipate FY 22 Free Cash Flow(5) at $225 million or more ◼ Recent refinancing provides additional flexibility and capacity Top Line Trends Free Cash Flow & Allocation EPS 16

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Q&A

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Appendix (1) Organic Revenue is a Non-GAAP financial measure and is reconciled to the most closely related GAAP financial measure in the attached Reconciliation Schedules and / or our earnings release dated May 6, 2021 in the “About Non-GAAP Financial Measures” section. (2) Company consumption includes data sourced from domestic IRI multi-outlet + C-Store retail sales for the period ending March 21, 2021, retail sales from other 3rd parties for certain untracked channels in North America for leading retailers, Australia consumption based on IMS data, and other international net revenues as a proxy for consumption. (3) Adjusted EPS, Adjusted Gross Margin, Adjusted Operating Income, EBITDA, EBITDA Margin, Free Cash Flow and Net Debt are Non-GAAP financial measures and are reconciled to their most closely related GAAP financial measures in the attached Reconciliation Schedules and / or in our earnings release dated May 6, 2021 in the “About Non-GAAP Financial Measures” section. (4) Leverage ratio reflects net debt / covenant defined EBITDA. (5) Adjusted Free Cash Flow for FY 22 is a projected Non-GAAP financial measure, is reconciled to projected GAAP Net Cash Provided by Operating Activities in the attached Reconciliation Schedules and / or in our earnings release in the “About Non-GAAP Financial Measures” section and is calculated based on projected Net Cash Provided by Operating Activities less projected capital expenditures. 18

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Adjusted Gross Margin 19 Reconciliation Schedules Organic Revenue Change a) Items related to new warehouse represent costs to transition to the new warehouse and duplicate costs incurred during the transition. Three Months Ended March 31, Year Ended March 31, 2021 2020 2021 2020 (In Thousands) GAAP Total Revenues 237,761$ 251,235$ 943,365$ 963,010$ Revenue Change (5.4%) (2.0%) Adjustments: Impact of foreign currency exchange rates - 3,404 - 3,796 Total adjustments -$ 3,404$ -$ 3,796$ Non-GAAP Organic Revenues 237,761$ 254,639$ 943,365$ 966,806$ Non-GAAP Organic Revenue Change (6.6%) (2.4%) Three Months Ended March 31, Year Ended March 31, 2021 2020 2021 2020 (In Thousands) GAAP Total Revenues 237,761$ 251,235$ 943,365$ 963,010$ GAAP Gross Profit 137,056$ 143,910$ 547,472$ 552,223$ GAAP Gross Profit as a Percentage of GAAP Total Revenue 57.6% 57.3% 58.0% 57.3% Adjustments: Transition and other costs associated with new warehouse (a) - 5,208 - 9,170 Total adjustments - 5,208 - 9,170 Non-GAAP Adjusted Gross Margin 137,056$ 149,118$ 547,472$ 561,393$ Non-GAAP Adjusted Gross Margin as a Percentage of GAAP Total Revenues 57.6% 59.4% 58.0% 58.3%

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S 20 Reconciliation Schedules (Continued) Adjusted EBITDA Margin a) Items related to new warehouse represent costs to transition to the new warehouse and duplicate costs incurred during the transition. Three Months Ended March 31, Year Ended March 31, 2021 2020 2021 2020 (In Thousands) GAAP Net Income 35,514$ 37,046$ 164,682$ 142,281$ Interest expense, net 18,983 22,452 82,328 96,224 Provision for income taxes 4,859 13,489 39,431 48,870 Depreciation and amortization 7,537 7,331 30,164 28,995 Non-GAAP EBITDA 66,893 80,318 316,605 316,370 Non-GAAP EBITDA Margin 28.1% 32.0% 33.6% 32.9% Adjustments: Transition and other costs associated with new warehouse in Cost of Goods Sold (a) - 5,208 - 9,170 Loss on disposal of assets - 382 - 382 Loss on extinguishment of debt 12,327 - 12,327 2,155 Total adjustments 12,327 5,590 12,327 11,707 Non-GAAP Adjusted EBITDA 79,220$ 85,908$ 328,932$ 328,077$ Non-GAAP Adjusted EBITDA Margin 33.3% 34.2% 34.9% 34.1%

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S Three Months Ended March 31, Year Ended March 31, 2021 2020 2021 2020 Net Income Adjusted EPS Net Income Adjusted EPS Net Income Adjusted EPS Net Income Adjusted EPS (In Thousands, except per share data) GAAP Net Income 35,514$ 0.70$ 37,046$ 0.73$ 164,682$ 3.25$ 142,281$ 2.78$ Adjustments: Transition and other costs associated with new warehouse in Cost of Goods Sold (a) - - 5,208 0.10 - - 9,170 0.18 Loss on disposal of assets - - 382 0.01 - - 382 0.01 Loss on extinguishment of debt 12,327 0.24 - - 12,327 0.24 2,155 0.04 Tax impact of adjustments (b) (2,986) (0.06) (1,420) (0.03) (2,986) (0.06) (2,974) (0.06) Normalized tax rate adjustment (c) (4,919) (0.10) 653 0.01 (10,025) (0.20) 318 0.01 Total Adjustments 4,422 0.09 4,823 0.09 (684) (0.01) 9,051 0.18 Non-GAAP Adjusted Net Income and Adjusted EPS 39,936$ 0.79$ 41,869$ 0.82$ 163,998$ 3.24$ 151,332$ 2.96$ 21 Reconciliation Schedules (Continued) Adjusted Net Income & Adjusted EPS a) Items related to new warehouse represent costs to transition to the new warehouse and duplicate costs incurred during the transition. b) The income tax adjustments are determined using applicable rates in the taxing jurisdictions in which the above adjustments relate and includes both current and deferred income tax expense (benefit) based on the specific nature of the specific Non-GAAP performance measure. c) Income tax adjustment to adjust for discrete income tax items. Note: Amounts may not add due to rounding

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S 22 Reconciliation Schedules (Continued) Adjusted Free Cash Flow a) Payments related to new warehouse represent costs to transition to the new warehouse and duplicate costs incurred during transition. Three Months Ended March 31, Year Ended March 31, 2021 2020 2021 2020 (In Thousands) GAAP Net Income 35,514$ 37,046$ 164,682$ 142,281$ Adjustments: Adjustments to reconcile net income to net cash provided by operating activities as shown in the Statement of Cash Flows 29,904 20,056 76,523 66,041 Changes in operating assets and liabilities as shown in the Statement of Cash Flows (6,331) (976) (5,598) 8,802 Total adjustments 23,573 19,080 70,925 74,843 GAAP Net cash provided by operating activities 59,087 56,126 235,607 217,124 Purchase of property and equipment (4,896) (5,505) (22,243) (14,560) Non-GAAP Free Cash Flow 54,191 50,621 213,364 202,564 Transition and other payments associated with new warehouse (a) - 1,876 - 4,203 Non-GAAP Adjusted Free Cash Flow 54,191$ 52,497$ 213,364$ 206,767$

F O U R T H Q U A R T E R & F U L L - Y E A R F Y 2 1 R E S U L T S 23 Reconciliation Schedules (Continued) Adjusted Free Cash Flow Projected Free Cash Flow (In millions) Projected FY'22 GAAP Net Cash provided by operating activities 240$ Additions to property and equipment for cash (15) Projected Non-GAAP Adjusted Free Cash Flow 225$ 2017 2018 2019 (In Thousands) GAAP Net Income (Loss) 69,395$ 339,570$ (35,800)$ Adjustments Adjustments to reconcile net income to net cash provided by operating activities as shown in the statement of cash flows 92,613 (113,698) 233,400 Changes in operating assets and liabilities, net of effects from acquisitions as shown in the statement of cash flows (13,336) (15,762) (8,316) Total adjustments 79,277 (129,460) 225,084 GAAP Net cash provided by operating activities 148,672 210,110 189,284 Purchases of property and equipment (2,977) (12,532) (10,480) Non-GAAP Free Cash Flow 145,695 197,578 178,804 Additional expense as a result of debt refinancing 9,184 182 - Integration, transition and other payments associated with acquisitions & divestitures 10,448 10,358 10,902 Pension contribution 6,000 - - Additional income tax payments associated with divestitures 25,545 - 12,656 Total adjustments 51,177 10,540 23,558 Non-GAAP Adjusted Free Cash Flow 196,872$ 208,118$ 202,362$

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Vertical Farming Market to Reach USD 30 Billion by 2031 Driven by Rising Demand for Sustainable Agriculture Solutions

- MONDAY DEADLINE ALERT: The Schall Law Firm Encourages Investors in Nextdoor Holdings, Inc. with Losses to Contact the Firm

- Integrated Biosciences Partners with Project 8p Foundation to Pioneer a New Path to Groundbreaking Treatments for Chromosomal Disorders

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share