Form 8-K PULTEGROUP INC/MI/ For: Jul 28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 28, 2022

(Exact name of registrant as specified in its Charter)

| (State or other jurisdiction | (Commission | (IRS Employer | ||||||

| of incorporation) | File Number) | Identification No.) | ||||||

(Address of principal executive offices) (Zip Code) | ||||||||

| Registrant's telephone number, including area code: | ||||||||

____________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On July 28, 2022 , Pulte Mortgage LLC (“Pulte Mortgage”), a wholly-owned subsidiary of PulteGroup, Inc. ("PulteGroup"), entered into a Fourth Amended and Restated Master Repurchase Agreement (the “Repurchase Agreement”) with Comerica Bank, as Agent and representative of itself as a Buyer and the other Buyers ("Agent"), and the other Buyers listed therein. The purpose of the Repurchase Agreement is to finance the origination of mortgage loans by Pulte Mortgage in replacement of a similar agreement that expired on July 28, 2022. The Repurchase Agreement expires on the earlier of (i) July 27, 2023, or (ii) the date when the Buyers’ commitments are terminated pursuant to the Repurchase Agreement, by order of any governmental authority, or by operation of law.

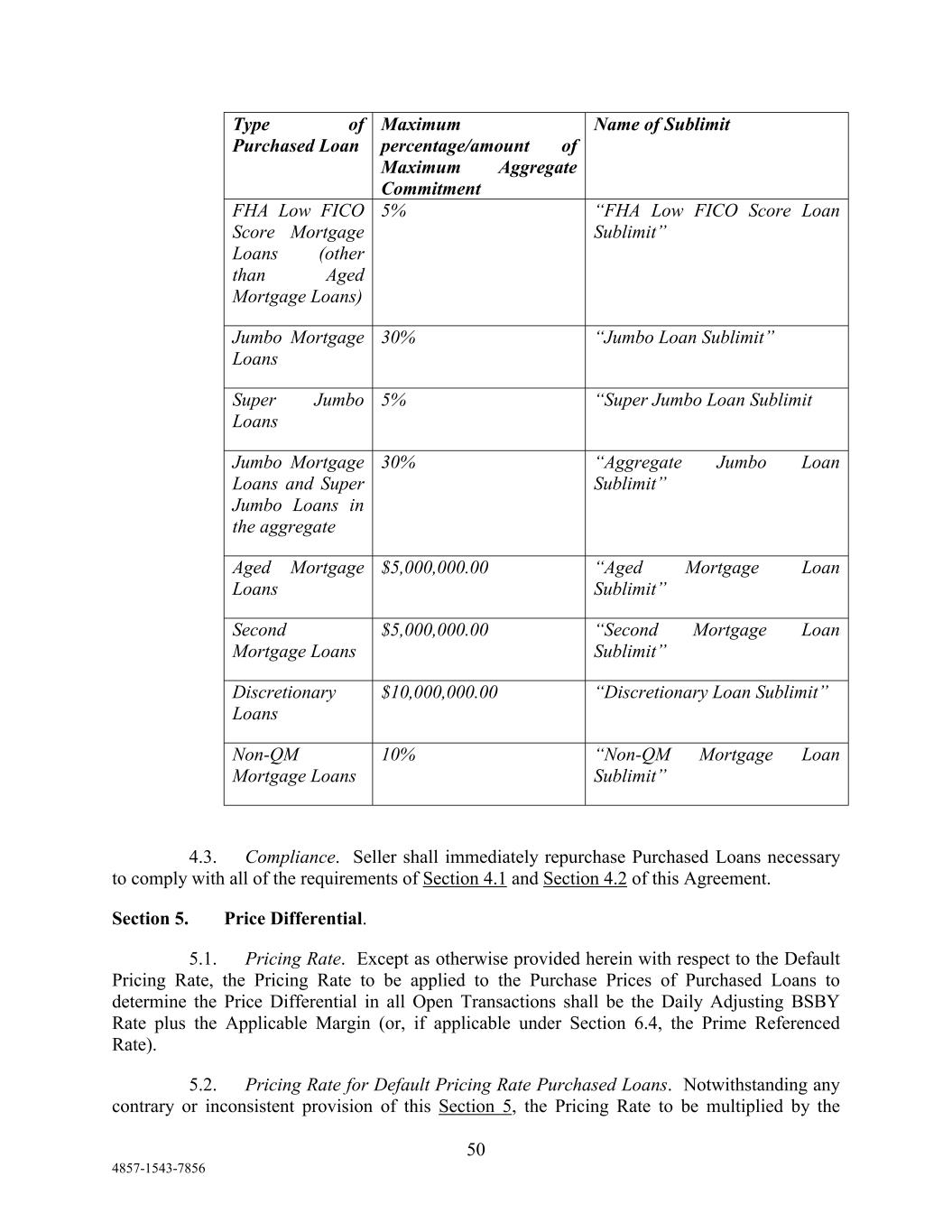

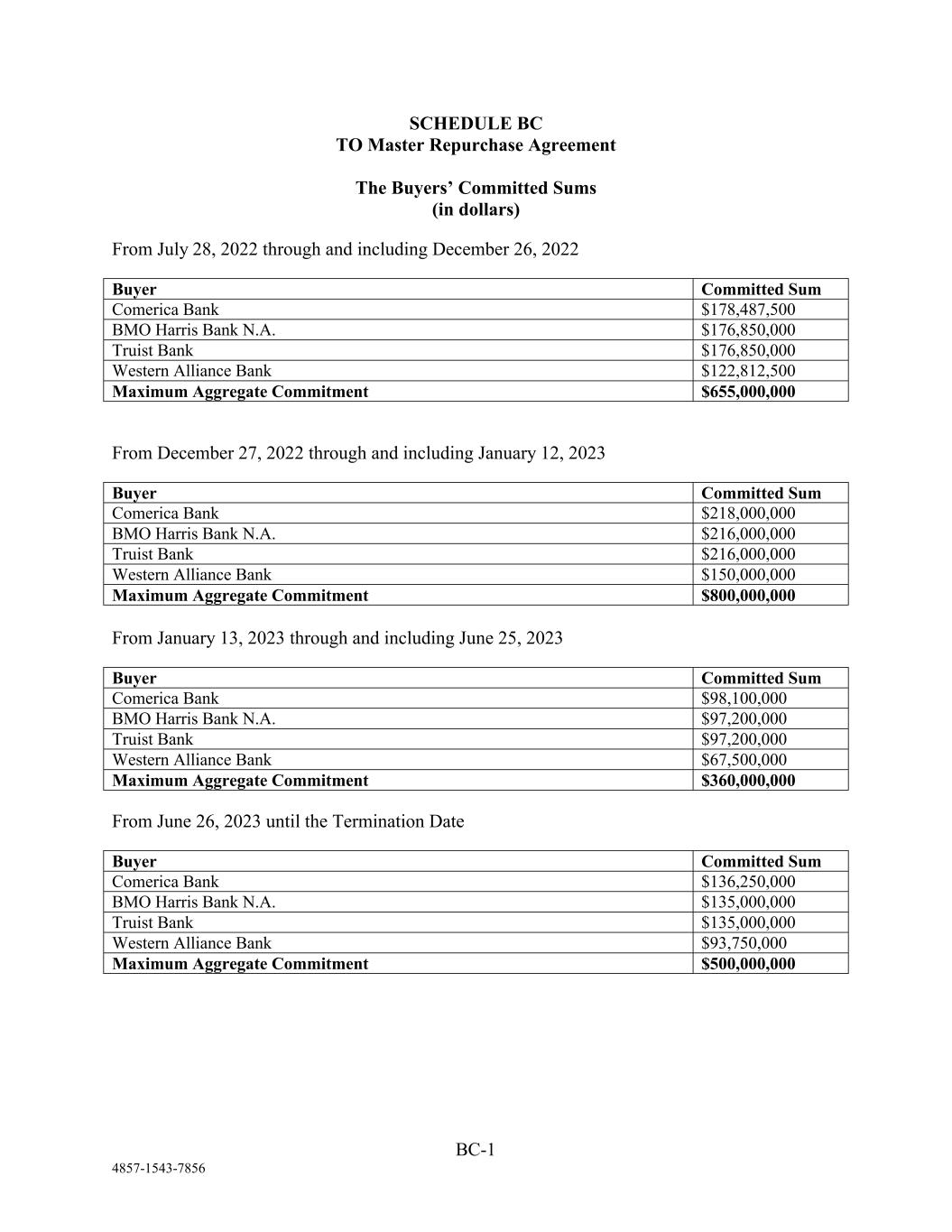

The Repurchase Agreement provides for a maximum aggregate commitment of $800 million, subject to certain sublimits, and contains an accordion feature that could increase the maximum aggregate commitment to $850 million based on the Agent obtaining increased committed sums from existing Buyers. The maximum aggregate commitment is initially set at $655 million but contains a series of increases and decreases in order to adjust the borrowing capacity based on seasonal fluctuations in volume. The maximum aggregate commitment is increased to $800 million on December 27, 2022, reduced to $360 million on January 13, 2023, and increased to $500 million on June 26, 2023.

Advances under the Repurchase Agreement carry a Pricing Rate based on the Daily Adjusting Bloomberg Short Term Bank Yield Rate plus the Applicable Margin, as defined in the Repurchase Agreement, or the Default Pricing Rate, as defined in the Repurchase Agreement. Amounts outstanding under the Repurchase Agreement are not guaranteed by PulteGroup or any of its subsidiaries that guarantee PulteGroup's senior notes.

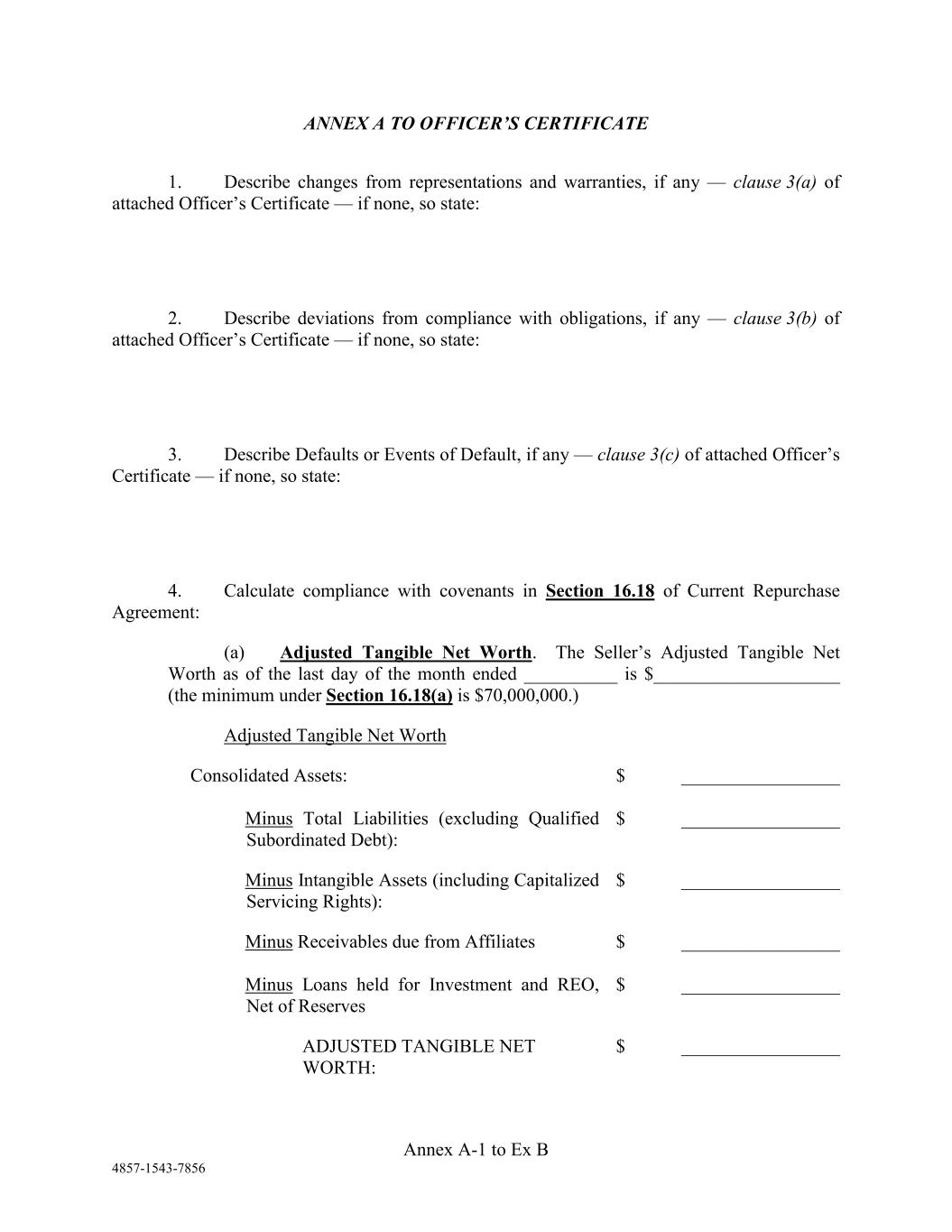

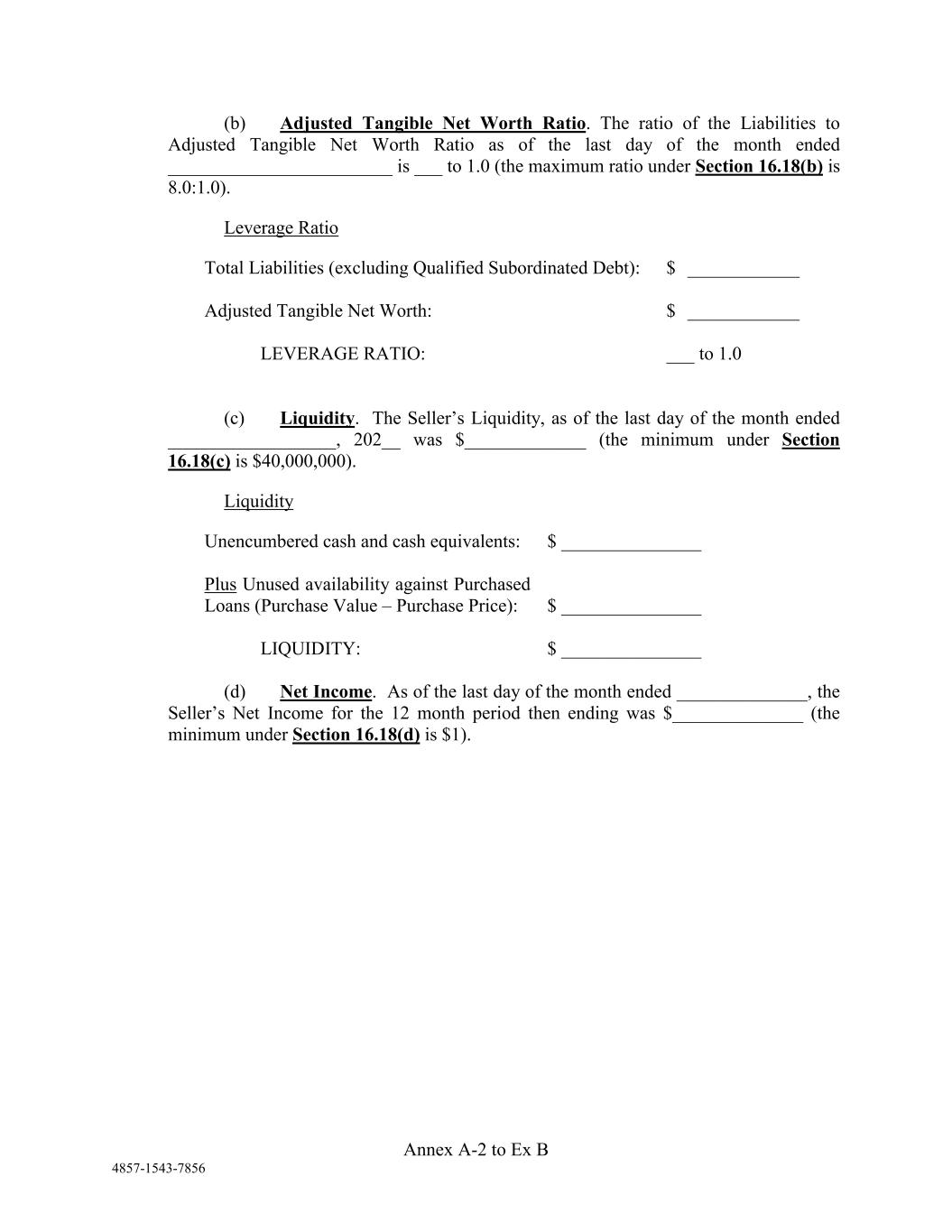

The Repurchase Agreement contains various affirmative and negative covenants applicable to Pulte Mortgage. The negative covenants include, among others, certain limitations on transactions involving acquisitions, mergers, the incurrence of debt, sale of assets, and creation of liens upon any of its mortgage notes or mortgages subject to the Repurchase Agreement. Additional covenants include quantitative thresholds related to: (i) Adjusted Tangible Net Worth, (ii) Adjusted Tangible Net Worth Ratio, (iii) Liquidity, and (iv) Net Income, each of which is defined in the Repurchase Agreement.

A copy of the Repurchase Agreement is attached as Exhibit 10.1 hereto and is herein incorporated by reference. The above referenced summary of the material terms of the Repurchase Agreement is qualified in its entirety by reference to Exhibit 10.1.

ITEM 2.03 CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT

All the information set forth above under Item 1.01 is hereby incorporated by reference into this Item 2.03.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

10.1 Fourth Amended and Restated Master Repurchase Agreement dated as of July 28, 2022, among Comerica Bank, as Agent, Lead Arranger and a Buyer, the other Buyers party hereto and Pulte Mortgage LLC, as Seller

104 Cover Page Interactive Data File (formatted in Inline XBRL)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PULTEGROUP, INC. | |||||||||||||||||

| Date: | July 29, 2022 | By: | /s/ Todd N. Sheldon | ||||||||||||||

| Name: | Todd N. Sheldon | ||||||||||||||||

| Title: | Executive Vice President, General Counsel and Corporate Secretary | ||||||||||||||||

4857-1543-7856 FOURTH AMENDED AND RESTATED MASTER REPURCHASE AGREEMENT (for Pulte Mortgage LLC) dated as of July 28, 2022 among COMERICA BANK, as Agent, Lead Arranger and a Buyer, THE OTHER BUYERS PARTY HERETO and PULTE MORTGAGE LLC, as Seller - 43-7856 RTH ENDED D S TED ASTER CHASE EE ENT r ulte ortgage C) ted s f ly 8, 22 ong ERICA NK, s gent, ead rranger d uyer, E ER ERS TY ETO d LTE ORTGAGE C, s l

TABLE OF CONTENTS FOURTH AMENDED AND RESTATED MASTER REPURCHASE AGREEMENT................... 1 SECTION 1. APPLICABILITY AND DEFINED TERMS......ccoooiieiiiieieeeeeee eee 1 Ll. APPHCADIIILY convicts eee sates saeebee sate e nae e sane ensaens 1 1.2. Defined TEINS ..cccueiiiiiiiiiiieiie eeee steer eesateebeesiaee ee ns 2 L.3. RABIES. eee steers 35 SECTION 2. THE BUYERS’ COMMITMENTS ......cctiitiieieieeeeee eects ease 36 2.1. The Buyers’ Commitments to PUrchase ...........ccecceeviieiiiiniiiiienieeiieeie e 36 2.2. Expiration or Termination of the Commitments............ccccveereurreriiieeniieeenieeenneenns 37 2.3. Disbursement of Purchase PriCes.........cccoovuirriieniiiiiiiniieiiecie cites e e 37 2.4. SWING LINE FaCIIY ...ccoiiiiiiiieiie ects eee eevee eevee ean 37 2.5. Swing Line Transactions. ........c.cecueeruieeriierieeiienieeiieesiteeieesereeseessaeesseessseenseessseenne 37 2.6. Optional Termination, Reduction and Increase of Buyers’ Commitments............ 40 SECTION 3. INITIATION; TERMINATION. ......oootiiitiiiniieniieieniienieeie stents ene 41 3.1. Seller Request; Agent Confirmation ............cccueeerieeeiieeeiieeeiiee seers eeve eevee e ns 41 3.2. Request/Confirmation..........ccccecueeriieriieniienieeiie si iee eee eiee ste ebee sere esee ase esseennnes 41 3.3. Transaction Termination; Purchase Price Decrease ..........cccovvuvvvveveeeiviivinvvennnnnnn. 42 3.4. Place for Payments of Repurchase Prices..........ccocceevieriiinieniieniienieeieeeie e e 43 3.5. Withdrawals from and Credits to Operating Account .............cceeveereveeercreeenveeenne. 43 3.6. [RESEIVEA]. .eiiiiiiiiiiie cite eects eee ects eerste este esta ee saaa ee sare eee areeenaree enn 43 3.7. Disbursements from Repurchase Settlement Account.............ccecveevciveeniieennennne. 43 3.8. Delivery of Additional Mortgage Loans............ccccueeruieriieniieniieniienieeiee e 43 3.9. Application of Purchase Price Decreases ..........ccceevvreeriieriieeniiieeeiee eerie 44 3.10. Defaulting BUYETS ......cccuiiiiieiieiiieiieeie eee estes esate sabe ebe nena 44 3.11. eMortgage Loan TranSactions..........cccveerueeerieeerieeeiiee eeri si es sree esses esse esssee ens 46 SECTION 4. TRANSACTION LIMITS AND SUBLIMITS ......cociiiiiiiiiinieienieneeeseeneeee 48 4.1. Transaction LAMIES ......cocueiiiiiiiiiiiieiie ieee sees sites sae 48 4.2. Transaction SUDIIMILS ......cccerieriieiiirienieiierteteete eects e e eee esas 49 4.3. COMPLIANCE ...eeiiiieeiiiieeiieeeieeeeiee este este essere a estae setae eessaeesss eessse essseeesss eessse ensseenns 50 SECTION 5. PRICE DIFFERENTIAL ......cooiiiiiiiiieeieteeeteeteteee steiner 50 TR I 0 [031 Fe 1 TSS 50 5.2. Pricing Rate for Default Pricing Rate Purchased Loans.........c.cccoceevevienenniennenne. 50 5.3. Price Differential Payment Due Dates.........cccceeviieeiiieeiiieeieeeieeeee 51 5.4. Adjustments to Buyer’s Price Differential based on Qualifying Balances............ 51 SECTION 6. MARGIN MAINTENANCE .....ccoooiiiieiteeeeeee eerie 51 6.1. Margin DETICIt....ccueeiiieiieiiieiieeie etc tera st erer ete abeebe nnnas 51 6.2. Margin Call Deadline..........ccccuvieeiiiiiiiiieciie eee eects eee ese re ee seae eee 52 6.3. Application Of Cash ........cccuieiiiiiiiiiiiiiieee eee eee ees 52 6.4. Inability to Determine Rates. .........ccccvuiieiiiieiiiieiie cece 52 6.5. BSBY Unavailability; Successor Rate Determination.............cccceevveenivenieeneennen. 53 -i- 4857-1543-7856 -i- BLE F TENTS RTH ENDED D TED ASTER CHASE GR EMENT. . . . . . .. TI N . PLI ABILITY D FI ED RMS. ........................................................ 1.1. pplicability ............................................................................................................ . . efi ed erms ........................................................................................................ 1. . ates. ..................................................................................................................... 5 TI N . E YERS’ MITMENTS . .. ................................................................ .1. he uyers’ mitments urchase . .. .. .. . ................................................ .2. xpirati n r er ination f e o itments.. ............................................... .3. is urs ent f rchase ces. .... . . .... ........................................................... .4. wing ine cility ............................................................................................... .5. ing i e ransactions ....... . ............................................................................. .6. ptional er ination, eduction d r ase f uyers’ o itments . .. .. .. 0 TI N . TI N; INATION. ..................................................................... 1 . . e ler equest; gent onfir ation . . .... . . .. . . ................................................. 1 . . st/Confirmation ....... ...... . . . ...... ................................................................ 1 . . r nsaction er ination; rchase ri e ecrease ............................................ 2 . . l ce r ents f epurchase ri es . .. .. .................................................... 3 . . ithdrawals d redits perating count ..................................... 3 . . eserved]. ............................................................................................................ 3 . . is urse ents epurchase t ent count. .. .............................. .. 3 . . eli ery f ditional ortgage oans .. .. .. . .................................................. 3 . . plication f rchase ri e ecreases .... ................................................... 4 . 0. efaulting uyers ...... .. .. .................................................................................... 4 . 1. ortgage oan nsactions..... . . . . . . . ............................................................ 6 TI N . SACTION I ITS D LI ITS .. .. ............................................. 8 .1. r nsaction imits ............................................................................................... 8 .2. r nsaction ublimits .. . .... ................................................................................. 9 .3. ompliance ... .. .................................................................................................... TI N . I E I NTIAL . .. ................................................................................ 5.1. Pricing Rate............................................................................................................ . . ri i g ate r efault ri i g ate rchased oans.. ... ............................ .. . . rice i ferential ent ue ates .. . .. . .. ...................................................... 1 . . djust ents uyer’s ri e i ferential sed ualifying alances... ... .. 1 TI N . ARGIN AI TE ANCE ...... .. .. ................................................................... 1 . . argin eficit................ .. .................................................................................... 1 . . argin all dline...... .... .... .... .. . .. ............................................................... . . plication of ash .. .. ..................................................................................... . . bility eter ine ates. ...... ....................................................................... . . Y navailab lity; cce sor ate etermination.. ... ............................... .. 3

6.6. 6.7. 6.8. 6.9. 6.10. SECTION 7. 7.1. 7.2. 7.3. 7.4. 7.5. 7.6. 7.7. 7.8. SECTION 8. 8.1. 8.2. 8.3. SECTION 9. 9.1. 9.2. SECTION 10. 10.1. 10.2. SECTION 11. 11.1. 11.2. SECTION 12. 12.1. 12.2. 12.3. 12.4. 12.5. SECTION 13. SECTION 14. 14.1. 14.2. SECTION 15. 4857-1543-7856 THL@EALIEY.. ceeeeeeeiieeeee eee e estes saree eabaeesnbeeeesbeeennseeenree ens 55 INCIEASEA COST... 55 Capital REQUITEMENTS.........ueeeiiieeiiieeiie eee eres etree etre sree e sree esses esasee enn 56 Certificates for Reimbursement. ............ceevveriieiiieniiienieeieeieeeie e e e ns 56 Market Valuations for Purchase Values ..........ccooeiiiiiiiiiiiniiiceeceeee, 56 TAXES. c e eee eee testes sbeebs ae 56 Payments to be Free of Taxes; Withholding.............ccccuvevviiiniiiiniiiicieeee e 56 ONT TAXES ...veeuveriieiieieeiie sitesi teste ees ete ste te sate sheet eate sae e been ae 57 Taxes INACIMNILY ......ccccvieiiiieeiiee cies eee e e etree etree eae e este ee sareeesareeesnsee enn 57 RECEIPL e ete e eat este esate enbae sabe enbee nanan 57 NON-EXEMPE BUYET ...eeiiiiiiiiiiiiee ects eee eee ee eaee eens 57 If Buyer Fails to Provide FOrm ........cccoooiiiiiiiiiiiiiciee eee 59 RETUNAS «ce eee ste eaees 60 SUIVIVAL . 60 INCOME AND ESCROW PAYMENTS; CONTROL......ccoceeiiirieieieeieieenee 60 Income and ESCrow Payments ..........cccceeouieriiiiiieniieiienie ee 60 Income and ESCIOW ACCOUNES........c.eeiuiiiiiiiiiiiiieiie etcetera 60 Income and Escrow Accounts after Default ............cccoooeiiiiiiniiiiniiniieieieeeeee, 61 FACILITY FEE; AGENT ’S FEE ....cuiiiiieeeeee eee 61 FaCIIItY FEE...eouiiiiiiieiieeeee e eee eee este etter eee sateen 61 AGENT'S FEES ..eiiiiiiiiiieeieee eee eee eee eee eee ease eee esate ease eee enraee eens 61 SECURITY INTEREST; LICENSE......cccioitiitiiinitiienieieeeeteneee e 61 Intent of the Parties ........cooeoiiiiiiii eee 61 REMEAICS cout eeeeeeeeteetest ee te sb eeb ee tesbee nb eeaeeae 64 SUBSTITUTION .....ooiiiiiiieteee eects eerie sees eee staat e sae eae ene es 65 Seller May Substitute Other Mortgage Loans with Notice to and Approval 0) BN 0 1 | SSR 65 Payment to Accompany SUbSHITULION. ........ccueeriierieeriienie ee e sai 65 PAYMENT AND TRANSFER .....c.ooiiiiiieeeee eee 65 Immediately Available Funds; Notice to Custodian............cceceevuereeneerienieniennene 65 Payments tO the AGENT .......c.eeeeiiiiiiieeiee c ce ects eres er s sre saree 65 If Payment Not Made When DUe..........ccccoeviiiiiiniiiiieieeeeee eee 66 Payments Valid and EffectiVe........cooooiiiiiiiieiiieceeeeeeeeee eee 66 Pro Rata Distribution of Payments ...........ccccceevieriiiiiieniiiniienieeeeeee eee 66 SEGREGATION OF DOCUMENTS RELATING TO PURCHASED LOANS .66 CONDITIONS PRECEDENT ... oii, 67 TNIEIAL PUTCRASE eee eee eee eee eee eee eee eee eee eee eee eee eee eee earaaa eee 67 BACH PUICRASE c eee eee e eee ee er eee eee eeeeeeeeeeeeeees 68 REPRESENTATIONS, WARRANTIES AND COVENANTS ...cooeviviieieeeeenn. 70 -ii--ii- - 43-7856 . . Illegality.. ............................................................................................................... 5 . . ncreased ost ................................................ ............. ............. ........................... 5 . . apital equirements............. .. .. .. .. .. .. .. .......................................................... . . ertifi ates r ei bursement. . . .. . .. . .. . ........................................................ . 0. arket aluations r rchase alues . .. .. . .. .................................................. TI N . XES................................................................................................................... . . ents e ree f axes; it holding . .. .. .. ............................................. . . ther axes ........................................................................................................... . . axes ndemnity ............ ... ... ............................................................................... . . eceipt ................................................................................................................... . . on- xempt uyer ............................................................................................... . . uyer ails r vide or .. .. .................................................................... . . efunds .................................................................................................................. . . urvival ......................................................... ........................................................ TI N . N E D MENTS; ONTROL......................................... . . e d scr ents ....................................................................... . . e d scrow ccounts. ............................................................................ . . e d s r counts ft r efault .. .. ............................................. 1 TI N . CILI Y E; ’ E ......................................................................... 1 . . acility e ............................................................................................................. 1 . . gent’s ees.. ........................................................................................................ 1 TI N . RITY REST; I ENSE . . ................................................................. 1 .1. t nt f e arties . . . . .................................................................................... 1 .2. emedies................................................................................................................ ECTION 1. STI TI N .. ............................................................................................. 5 .1. e ler ay bstitute ther ortgage oans ith otice d proval of Agent ................................................................................................................. 5 .2. ent cc pany ubstitution .... .... . .... ................................................... 5 TI N . ENT D NSFER . .. .. .................................................................... 5 .1. ediately vailable unds; otice ustodian.. .. ..................................... 5 .2. ents o e gent ... .. ... .. ...... ...... .............................................................. 5 .3. ent ot ade hen ue .. .. ................................................................. .4. ents alid d ffective. .. .. ....................................................................... .5. ro ata istri uti n f ents .... .............................................................. TI N . ATION F MENTS TI G ASED NS TI N . NDITI NS ENT ............................................................................. .1. Initial urchase....................................................................................................... .2. Each urchase ........................................................................................................ TI N . ESENTATIONS, A RANTIES D ENANTS ..........................

15.1. 15.2. 15.3. 15.4. 15.5. 15.6. SECTION 16. 16.1. 16.2. 16.3. 16.4. 16.5. 16.6. 16.7. 16.8. 16.9. 16.10. 16.11. 16.12. 16.13. 16.14. 16.15. 16.16. 16.17. 16.18. SECTION 17. 17.1. 17.2. 17.3. 17.4. 17.5. 17.6. 17.7. 17.8. 17.9. 17.10. 17.11. 17.12. 17.13. SECTION 18. 18.1. 18.2. 18.3. 4857-1543-7856 Buyers, Agent and Seller Representations............cueeeeveeeiieeniiieesiieeeeiee eeve sev ns 70 Additional Seller Representations. ...........c.eecueerieeieeniieeieenieeieeniee e e e see eee ens 70 Special Representations Relating to the Purchased Loans ...........ccccceeeevveeenennnen. 75 Representations and Warranties Relating to Specific Transactions ...................... 75 Buyers’ Representations and Certain Other Obligations. ..........ccccceeeecvveerveeennnenns 76 SUIVIVAL c. 76 AFFIRMATIVE COVENANTS oot 77 Office of Foreign Assets Control and USA Patriot ACt........ccccecveveevieriienienennene 77 Financial Statements .......cc.eeeueeriiiiiieiie ieee eee eee eee sees 77 Financial Statements Will Be ACCUTIate ..........cceeviieiieniiiiienieeieeeie eee 78 (01113 J 3 10) JSS 79 Maintain Existence and Statuses; Conduct of BUSINESS .......ccocvvvveveiiiiiiiinneenennnn. 80 Compliance with Applicable Laws.........cccceeeiiieriieeiiieeieeeeeeee eee 80 Inspection of Properties and Books; Protection of Seller’s Proprietary Information; Buyers’ Due Diligence of Seller...........cccvevvieeniiiiniiiiniieeeieeiee 80 INOLICE OF SUIS, ELC. evvvviiiiiiiiiiieieieeee eee eee eee essere ee sees senaaaas 82 Payment of Taxes, ELC. ...ooouiiiiiiieiie ects eee eee eevee eee 83 Insurance; Fidelity Bond...........ccoooiiiiiiiiiiiiiiieeeee eee 83 EMOTEZAZE [LOANS ..eeiiiiiiiieieiiiie eee eee eee eee ee eee eee e eer e eee eee eennees 83 Subordination of Certain Indebtedness.............ccceevieeiienieeiiienieeieeie 84 Certain Debt to Remain Unsecured .............oooueeiiieniiiiiiniiiiienieeeeseeeiee 84 Promptly Correct Escrow Imbalances .............cceeveeiieniiiniieniieiieeieeieeeieeeee 84 MERS COVENANLS.......ooiiiiiiiiiiiiiieeiiee eects e sane 84 Special Affirmative Covenants Concerning Purchased Loans ..............cccecuvenneene. 85 Coordination with Other Lenders/Repo Purchasers and Their Custodians ........... 86 Financial CoOVENAntS...........ccueeiiriiriiriiniieieeiesie eesti eee eee 86 NEGATIVE COVENANTS coisas site see sae eee 87 INO METEET netic eee eee ete estes e sate e sate e sabe eesabeeesabeeennbeesnneas 87 Limitation on Debt and Contingent Indebtedness ............ccceeveuveerciieenciieencieeenieenns 87 BUSINESS ...envtenteeiieieeteeeteeeeeeeteeeeetesteetesatesbeeteebtes bee atesbee be s nb esate ae 88 Liquidations, Dispositions of Substantial ASSEtS.........ccceeeveeririeeriieeriiieerieeenieenns 88 Loans, Advances, and INVESTMENTS ........uuviiieiiiiiiiiiiiiiieeeeeeeeeeeieeeee ases eaaeee e eas 88 USE Of PTOCEEAS. .....eoutieiiieiiieiie eeeee eee eee saan 89 Transactions With AffIHALES ........cccuieriiiiiiiieeieeee eee e 89 LIIIS e eee eee eee ete at ee beeeaeas 89 ERISA PLANS «oiie te e te ete steer eebeetesiee sb eeaeeae 89 Change of Principal Office ........coovieeiiieiiiieeiieeee eee e e 89 DISEITDULIONS sbe estes ae 90 Limitations on Payments of Certain Debt...........ccccuveeviiiiiiiiniieecieeeee e 90 No Changes in Accounting Practices or Fiscal Year.......c.cccccevvveninviniinennennene. 90 EVENTS OF DEFAULT; EVENT OF TERMINATION.........ccceeoiirieiieieieenee. 90 Events of Default .......cocoooiiiiiiiiii eee 90 Transaction TermMINAtION ........ccc.eeiiiiiuieriiiiie nicest etcet ra sateen 92 Termination by the AGent ...........cocuieiiiiiiiiieiiieee eee eee eae 93 -1ii-i - 43-7856 .1. uyers, gent d e ler epresen ations. .. .. .. .. ............................................... .2. ditional e ler epresen ations . .. . . .. . ......................................................... .3. ecial epresentations elati g e r hased oans ......... ........................ 5 .4. epresentations d arranties elati g ecific r nsactions ... . 5 .5. uyers’ epresentations d ertain ther bligations. .................................... .6. urvival ......................................................... ........................................................ TI N . I ATIVE ENANTS ........................................................................... .1. fice f rei n sets ontrol d SA atriot ct ... .................................. .2. i ancial t ents ......... ................................................................................... .3. i ancial t ents ill e ccurate ... ....................................................... .4. Other Reports ......................................................................................................... .5. aintain xist nce d t t ses; onduct f usiness ....................................... .6. ompliance ith plicable aws .. .. ................................................................ .7. ecti n f r perties d oks; r tecti n f e ler’s r prietary r ation; uyers’ ue ili nce f e ler. .. .. ........................................... .8. Notice of uits, tc. ............................................................................................... .9. ent f axes, tc. ......................................................................................... . 0. rance; i elity ond .. . .. ............................................................................. . 1. e ortgage Loans ................................................................................................. . 2. bordination f ertain tedne s. .. . . .. .. . ................................................ . 3. ertain ebt e ain nsecured .. .. .. . .. ..................................................... . 4. r ptly o rect s r balances .. .. .. ................................................... . 5. ERS ovenants .................................................................................................. . 6. ecial fi ative ovenants oncerning r hased oans .............. . . 7. oordination ith ther enders/ epo rchasers d heir ustodians .. . . 8. i ancial ove ants ... ....................................................................................... TI N . ATIVE ENANTS .................................................................................. .1. No erger.............................................................................................................. .2. i itati n ebt d ontingent t dne s ..................................... .3. usiness . . ............................................................................................................ .4. i uidations, ispositi ns f bstantial ssets. ............................................. .5. oans, dvances, d nvestments . .. .. .. ............................................................ .6. se of roceeds. ................................................................................................ .7. r nsactions with filiates .. .... .. .... .. ............................................................... .8. iens....................................................................................................................... .9. I A lans .......................................................................................................... . 0. hange f ri cipal fice .. .... .. .... ................................................................... . 1. istributions........................................................................................................... . 2. i itations ents f ertain ebt .. .. .. . . ............................................... . 3. o hanges counting ractices r iscal ear ... ..................................... .. TI N . ENTS F FAULT; ENT F ERMINATION ................................. .. .1. vents f efault . . ...... ....................................................................................... .2. r nsaction er ination .. .. .. .. .. .. .. .................................................................. .3. er ination y e gent .. .. .. ........................................................................ 3

18.4. 18.5. 18.6. 18.7. 18.8. 18.9. 18.10. SECTION 19. 19.1. 19.2. 19.3. 19.4. 19.5. 19.6. 19.7. 19.8. 19.9. 19.10. 19.11. SECTION 20. 20.1. 20.2. SECTION 21. SECTION 22. 22.1. 22.2. 22.3. 22.4. 22.5. 22.6. 22.7. 22.8. 22.9. 22.10. 22.11. 22.12. 22.13. 22.14. 22.15. 22.16. 22.17. 22.18. 22.19. 4857-1543-7856 REIMIEAIES cee eee eee eee eee eee eee eee eee eee eee eee e eee ee eee eer a aaa ee ee ee earaaaa eens 93 Liability for Expenses and Damages ...........ccccceerieeriieniieniienieeieeeie ee 94 Liability fOr INTETEST ......vvieeiiieeiie cetera este e eee eesareeeanee ens 94 Other RIZIES ....eeiiieiieeiiieiieee eects e e ete esibe ete e sate e ns e sane essen 94 Seller’s Repurchase RIGhtS .........c.coooiiiiiiiiiiiiecieecee cece 94 Sale of Purchased Loans ..........cccouereriiiriinieiienienieeieseeieee sess 94 SEEOTT e eee estes eee 95 SERVICING OF THE PURCHASED LOANS ......ooiiiiiieienieneeeeeeeee e 95 Servicing Released Basis ........ececvieeiiieeiiieeiieecee cts 95 Servicing and SUDSEIVICING........ccuieiiieiiieiieie cites ete eee eee seen 95 ESCIOW PAYMENTS ....coiiiiiiiiiiiiiiee c seee eset eee ee eee eee enaaeeeenns 96 Escrow and Income after Event of Default...........ccccccooviiiiiiniiiniiieeeeeee, 96 Servicing RECOTAS ....uviiiiiiiiiie cies ee e esa e sane 96 Subservicer Instruction Letter. ........coeevuiriiriiiiinienieeierieieeieeeeseee e 96 Termination Of SEIVICING .....cccuvieeiiieeiieeeiee cet ris tr ss s etree sr e sses esare enn 96 NOHICE FIOM SELLET cui 97 Seller Remains Liable .......cc..oouiiiiiiiiiiiiiie eee 97 BACKUP SEIVICET ....eouiiiiiiiiiieeiiee eee teeta sree steer e eens 98 SUCCESSOT SEIVICET cunt etter b tesa e eae e sae e eae e sateen 98 PAYMENT OF EXPENSES; INDEMNITY .....coootiiiiiiiiiiiienieeieeeee eee 99 EXPENSES nitieseee eee eee ee eset eee enna e eee nnbaae ee enraeee enn 99 INACIMNILY c.etiiiieieeeeeeeeeeeeeeeeeeeeeeteeetteeteeeteebee sat en e sabe enbee nanan 99 SINGLE AGREEMENT ......oouiiiiiiiiieeee cetera eases sees 100 RELATIONSHIPS AMONG THE AGENT AND THE BUYERS. .................... 100 APPOINTMENT OF AGENT ...eieiiiieiiieeeiie eee etcetera e rie ee r eesreeesareeenaneas 100 Scope Of AGENt’s DULIES ....c.veeruiieiieiieeiieeiie cites ett r 101 Limitation on Duty to DISCIOSE........eeeriiieiiiieiiieeiee c ter eee eee eevee e s 102 Authority of Agent to Enforce this Agreement............cccoceeverieneeneniienienennne 102 Agent in its Individual Capacity .......ccccveeeriieeiiieeiiee circa 102 Actions Requiring All Buyers” CONSent ...........cceeveerieerieeniienieenieenieeieesve inen 102 Actions Requiring Required Buyers’ Consent............ccceeeeuveeecieeenirieenireeenveeennen. 103 Agent’s DiSCTetionary ACHONS. ......ccueeruieeriierieeiieniieeieeseeetee sere ete sa e e sna ese ns 103 Buyers” COOPETatioN ........cccuvieeiieeiiieeiiieeiieeeeiieeeteeeeteeesaeeesaeeesseeessseeessseeenssens 104 Buyers’ Sharing Arrangement ...........ccceecueeruierieeniienieeniienie e e see eiee sre esee seen 105 Buyers’ Acknowledgment ............cceeeriiieiiieeiiieeiee cece eee eee eee e s 105 Agent Market Value Determinations ............c.eecueerieeriienieeniienieenieesie e e sve eeeens 106 Agent’s Duty of Care, Express Negligence Waiver and Release ........................ 106 Calculations of Shares of Principal and Other Sums...........cccoevveviienieniieneennen. 107 SUCCESSOT AGENT ...eiiiiiiiieiiiiiiee erie eee eee eee e eee tee eee eateeeeesntaeeeeenraeee s ns s 107 Merger Of the AGENt.......cccieiiiiiiiiieeieee eerste eee sree seen 108 Participation; Assignment by BUYETS.......cccceeviieeiiieiiiieeieeeee eee 108 The Agent and the Buyers are the only Beneficiaries of this Section ................. 111 Knowledge of Default...........coouiiiiiiieiiieeeeeee eects eee eee ee e s 111 -iv--i - - 43-7856 .4. emedies................................................................................................................ 3 .5. iability r xpenses d a ages . . .. .. .. ...................................................... .6. iability or nterest ............................................................................................ .7. ther ights .... ... ................................................................................................. .8. e ler’s epurchase ights ... .......................................................................... .9. ale f rchased oans .. .. ............................................................................ . 0. etoff...................................................................................................................... 5 TI N . I I G F E ASED NS . .. . ............................................ 5 .1. r ici g eleased asis ... .............................................................................. 5 .2. r ici g d ubservicing.. ................................................................................ 5 .3. scrow ayments .................................................................................................. .4. s r d e t r vent f efault. .. .. .. ............................................... .5. r ici g ecords ... ............................................................................................. .6. bservicer t cti n etter . .. . .. ..................................................................... .7. er ination of ervicing ...... .. .. ......................................................................... .8. otice from eller.................................................................................................. .9. e ler e ains i ble .. ..... ................................................................................ . 0. ackup ervicer ................................................................................................... . 1. uccessor ervicer ................................................................................................. TI N 0. ENT F PENSES; N NITY ...................................................... .1. xpenses ................................................................................................................ .2. ndemnity ............................................................................................................... TI N 1. LE EE ENT ... ............................................................................... 0 TI N 2. TIONSHIPS ONG E ENT D E YERS ... . 0 .1. ppointment of gent ........ ............................................................................... 0 .2. pe of gent’s uties .. .. .. ..... ...................................................................... 1 .3. i itati n uty isclose..... . .... .... . ........................................................ 2 .4. uthority f gent nforce is gre ment. .. .. .......................................... 2 .5. gent i i ual apacity ......................................................................... 2 .6. ctions equiring ll uyers’ onsent .. .. ... ................................................ 2 .7. ctions equiring equired uyers’ onsent .... ............................................. 3 .8. gent’s iscreti ary ctions . . .... ................................................................... 3 .9. uyers’ ooperation .... ................................................................................... 4 .10. uyers’ ari g rr e ent . . .. . . .. . ............................................................ 5 . 1. uyers’ cknowledgment .... . .... . . .... . ........................................................... 5 .12. gent arket alue eter inations .. .. .. .. ... ................................................ 6 .13. gent’s uty f are, xpre s egli ence aiver d elease ..... . 6 .14. alculati ns f ares f ri cipal d ther ums .. ... ............................... .. 7 .15. uccessor gent ................................................................................................ 7 .16. erger of e gent. .. ....................................................................................... 8 .17. arti i ation; ssi ent y uyers.. .............................................................. 8 .18. he gent d e uyers re e ly eneficiaries f is cti n ... . 1 .19. nowledge f ault..... .. . .. . .... .... .... ........................................................... 1

22.20. No Reliance on Agent’s Customer Identification Program ..........c..ccccceeevveennen. 111 22.21. Other TILES ..ueeeueeiieiieiieiieeieete tetera sae eae 111 22.22. Other AGIEEMENLS ......ccuvieeiiieiiiieeiieeeeieeeeiee este a etae ereeesaeeesseeessseeessse esssee esses 112 22.23. Erroneous Payments. ........ccccceeriiiiiiiiiiiieiiiieeiieeeiiee s tes estes 112 SECTION 23. NOTICES AND OTHER COMMUNICATIONS; ELECTRONIC TRANSMISSIONS 113 SECTION 24. MISCELLANEOUS .....ooiiieeeeeee eee ete eee sees saat ns 115 24.1. FUIther ASSUIANCES....cc.ueruieriiriieriietieiienttete s tesi atest e ste ete sate sbe ete eate sae e nae sat saeennens 115 24.2. Agent as Attorney in FaCt........ccooviiiiiiiiiiiieeeeeeeee eee ee e s 115 24.3. WILES 10 SCIICT....euiiiiiiiiiieieeetee e 116 24.4. WITES 10 AZENL ...oiiiiiieeiiieeiee eee eee ete eeete eerie esate ee taeesaeeessseeessseeessseeenssee e ses 116 24.5. Receipt; Available FUNAS.........cccccooiiiiiiiiiiiiieeeee eee 116 24.6. Privacy of Customer Information ...........cccceeeeveeeiiieeiieeeiieeeee ee ee e e ees 116 SECTION 25. ENTIRE AGREEMENT; SEVERABILITY ...cc.coviiiiiiiiiieieeieeee eee 117 SECTION 26. NON-ASSIGNABILITY; TERMINATION; REPLACEMENT OF BUYERS .117 26.1. Limited ASSIGNMENT. ....cc.eeiiiieriieriieiierieerieeeieetee sre etee see es essseensaessseese ssseenseens 117 26.2. Remedies EXCOPLION.......ciiiiiieiiieeiiie cite eect eee estes tree sree siree esa eeearee nneas 117 26.3. Agreement Termination .........ccueecuieruieriieriienieeniieeieeiee see eiee sre sseesnae seeseneese ns 117 26.4. Replacement of BUYETS. .....c.ccooiiiiiiiiiiiieeiee cece eerste eevee evee eevee ens 117 SECTION 27. COUNTERPARTS ....cooiiiiieeeeeetee eee sess 118 SECTION 28. GOVERNING LAW, JURISDICTION AND VENUE .......cccooiiiiiiiieieenee. 118 SECTION 29. WAIVER OF JURY TRIAL.....ccceiiiiiiiiiiiieeieneeeeeeee sess 119 SECTION 30. RELATIONSHIP OF THE PARTIES ......c.oooiiiiieeeeeeeee eee 119 SECTION 31. NO WAIVERS, ETC ....ooiiiiiiiiiieiteeeetee eesti eesti esis 120 SECTION 32. USE OF EMPLOYEE PLAN ASSETS ......ooiieeeeeeee eee 120 32.1. Prohibited TranSaCtions ...........ccceerieerieeiiienieeieeniieeieeniee er esieesseensee esse nseesns enne 120 32.2. Audited Financial Statements Required............cccceeeviiieiiieniieenieeeiee e 120 32.3. REPIESENIATIONS ....vieiiieiiieiieeiiieiie ete esite atte stee ete estee ete e tee ssbeesee sabe ense esse enseesnseenns 120 SECTION 33. INTENT «cotton e sate t eee e sae ense este sseenseenee nes 120 33.1. Transactions are Repurchase Agreements and Securities Contracts .................. 120 33.2. Contractual Rights, ELC. .....ccoiiiiiiiiiiiiieeie eects eee 121 33.3. FDA eee ete sateen ae 121 33.4. Master Netting AGIrEEMENL.........cccuvieriureeriieerieeerireeerreeesrreesreeesseeesseeesseeesseenns 121 SECTION 34. DISCLOSURE RELATING TO CERTAIN FEDERAL PROTECTIONS. ........ 121 34.1. Parties not Protected by SIPA or Insured by FDIC or NCUSIF...........cccceeune.. 121 -V- 4857-1543-7856 -v- .20. o eli nce gent’s ust er ntifi ti n r r ........ . ................... 1 .21. ther itles ......................................................................................................... 1 . 2. ther greements .. .... .... .................................................................................. 2 .23. rr eous ayments . .......................................................................................... 2 TI N 3. TICES D ER MUNICATIONS; TRONIC NSMI SIONS 3 TI N 4. I NEOUS ........................................................................................... 5 .1. urther ssurances...... . .... ...... .......................................................................... 5 .2. gent s t r ey ct .. . .... . .... . ................................................................. 5 .3. ires to eller.. ................................................................................................... 6 .4. ires to gent .................................................................................................... 6 .5. eceipt; vailable unds.. .. .. . .......................................................................... 6 .6. ri cy f ust er ation . . .. . . .. . . ..................................................... 6 TI N 5. TIRE REEMENT; RABILITY ..... ................................................ 7 TI N 6. N-A SIGNAB LITY; INATION; ENT F YERS 7 .1. i ited ssignment .... . ...... .............................................................................. 7 .2. e edies xception............. .. .. .. ...... .. ............................................................ 7 .3. gree ent er ination . . . . . .... ....................................................................... 7 .4. epl e ent f uyers. .. .. .. .. ..... .................................................................... 7 TI N 7. NTERPARTS ........ ... ................................................................................ 8 TI N 8. ERNING W, I I TI N D UE .. .. .......................... .. 8 TI N 9. AIVER F Y IAL.. ............................................................................. 9 TI N 0. TIONSHIP F E RTIES. .. .. .. ...................................................... 9 TI N 1. O AIVERS, C . ....................................................................................... 0 TI N 2. SE F PLOY E N SSETS . . . . . .................................................... 0 .1. r hibited r nsactions . . . .. . . . .. .................................................................... 0 .2. udited i ancial t ents equired. .. .. .. . . ............................................... 0 .3. epresentations ... ... ........................................................................................... 0 TI N 3. T ............................................................................................................... 0 .1. r nsactions re epurchase gree ents d curities ontracts ... . 0 .2. ontractual ights, tc. ... ................................................................................. 1 .3. IA .................................................................................................................... 1 .4. aster e ti g greement ............................................................................... 1 TI N 4. I SURE TI G TAIN RAL TECTIONS . . 1 .1. arties ot r t cted y r red IC r CUSIF. .. . .............. .. 1

34.2. 34.3. SECTION 35. SECTION 36. SECTION 37. 4857-1543-7856 SIPA Does Not Protect Government Securities Broker or Dealer COUNLETPATTY ...vveeeniiieeiiie cite site e siete site e ste ee site eetbee sate esstaeesabteesabteesaseeenaseesnnseeens 121 Transaction Funds Are Not Insured Deposits........c.ceeeveeeeiieeriiieenirieeniie eeri eee. 121 USA PATRIOT ACT NOTIFICATION eee 122 WAIVER OF FEES, COSTS AND EXPENSES .....oooiiiiiiieeeeeeeeee eee 122 AMENDED AND RESTATED eee 122 -Vi--vi- - 43-7856 .2. oes ot r tect overnment curities roker r ealer ounterparty ..................................................................................................... 1 .3. r nsaction nds re ot red eposits . .. .. ........................................... 1 TI N 5. SA TRIOT CT TIFI TI N ............................................................. 2 TI N 6. AIVER F ES, STS D PENSES . .. .......................................... 2 TI N 7. ENDED D TED .......................................................................... 2

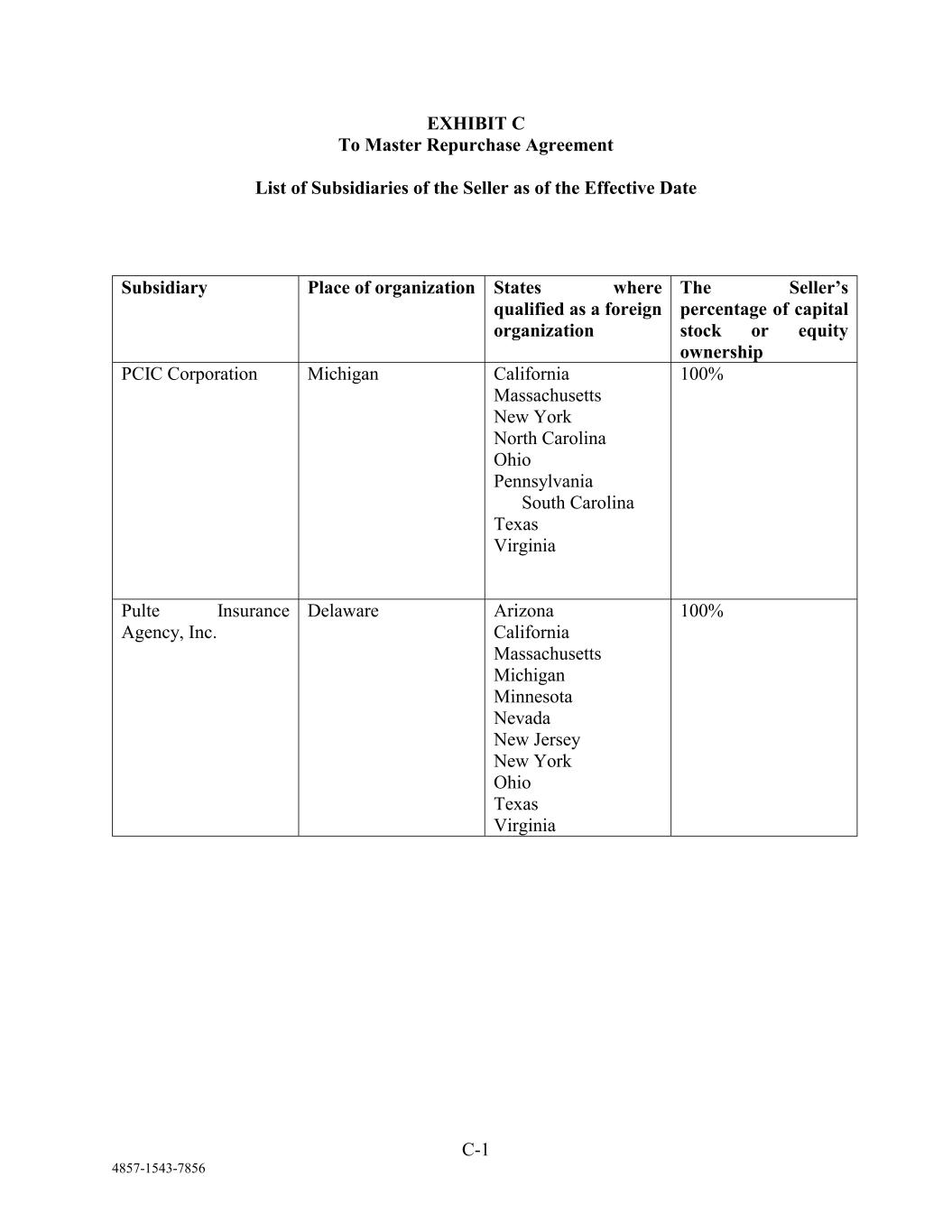

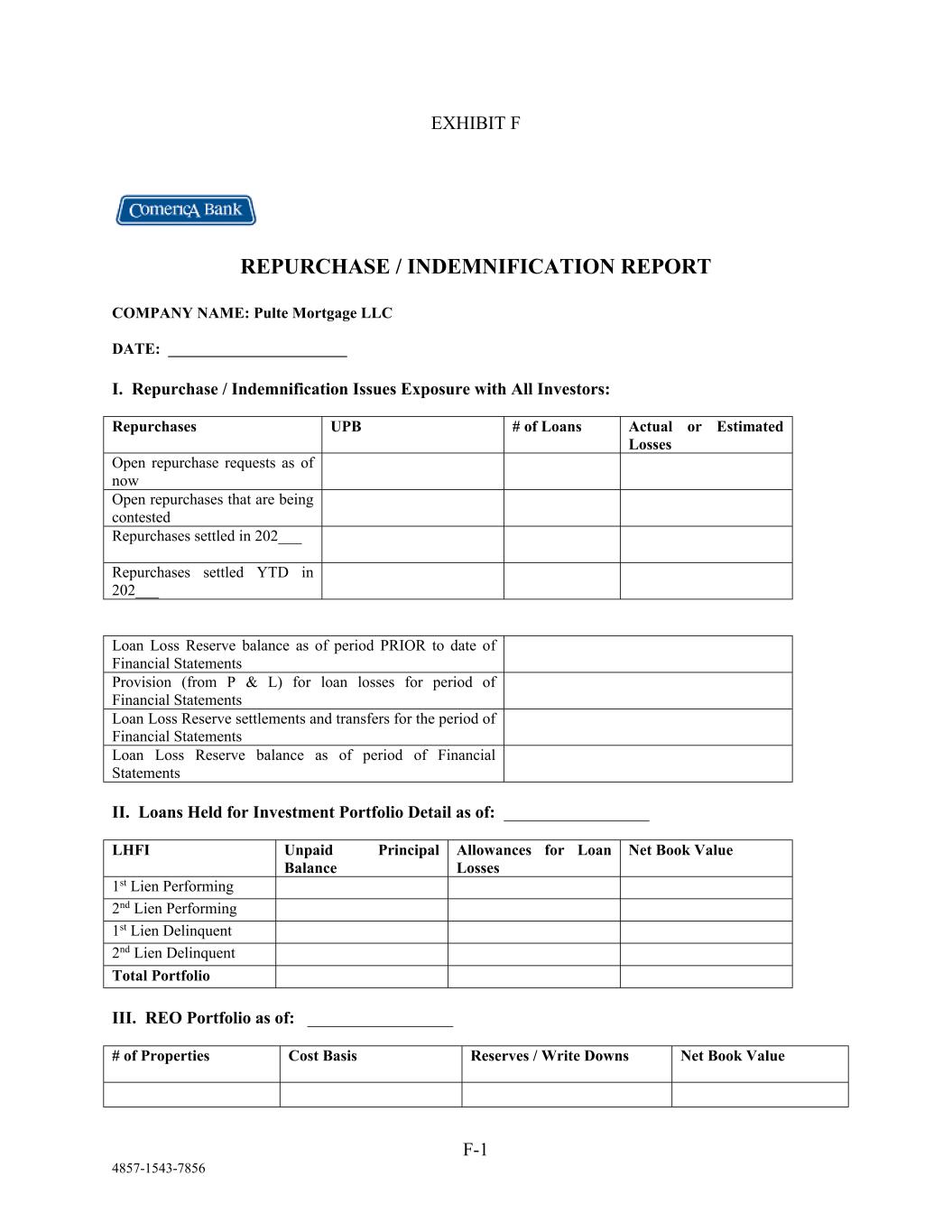

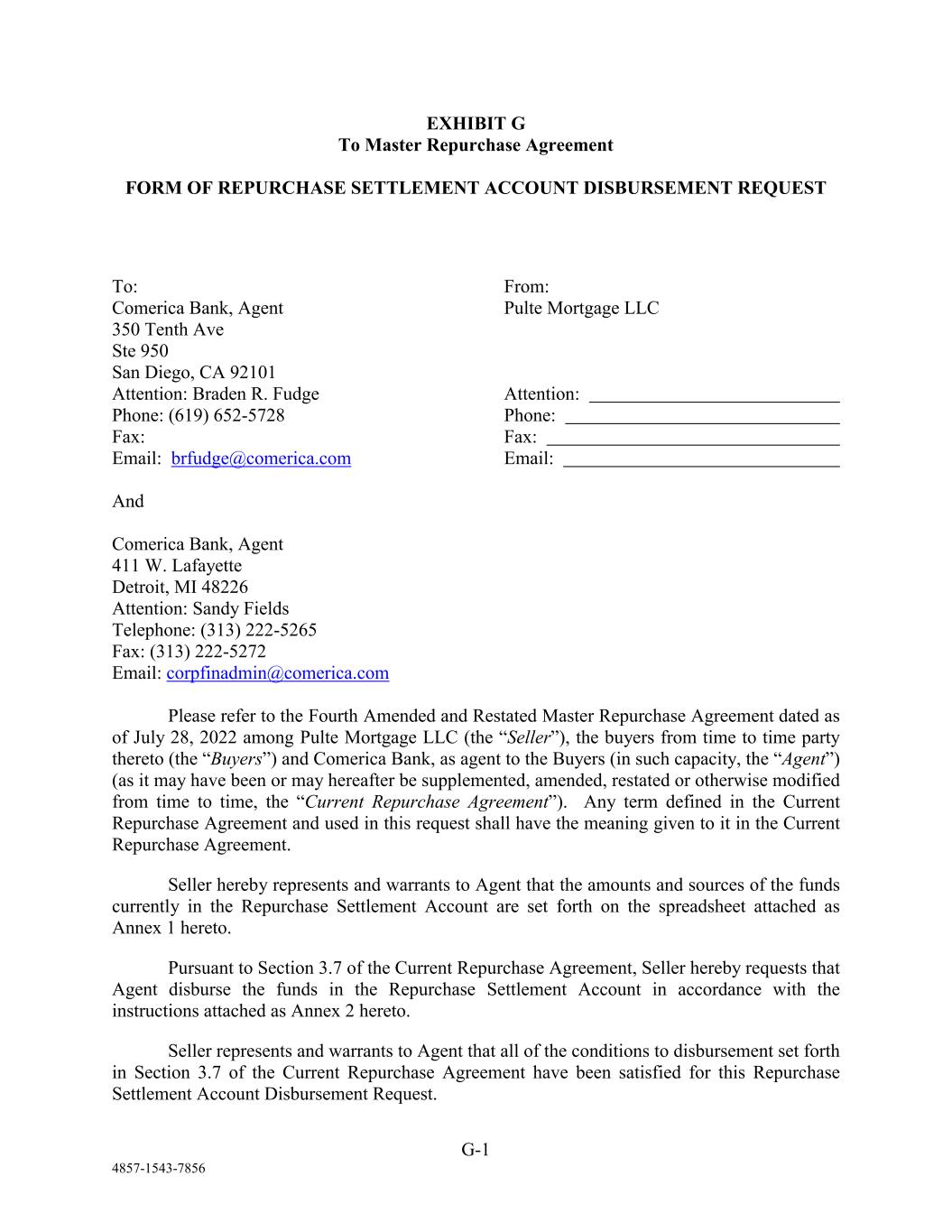

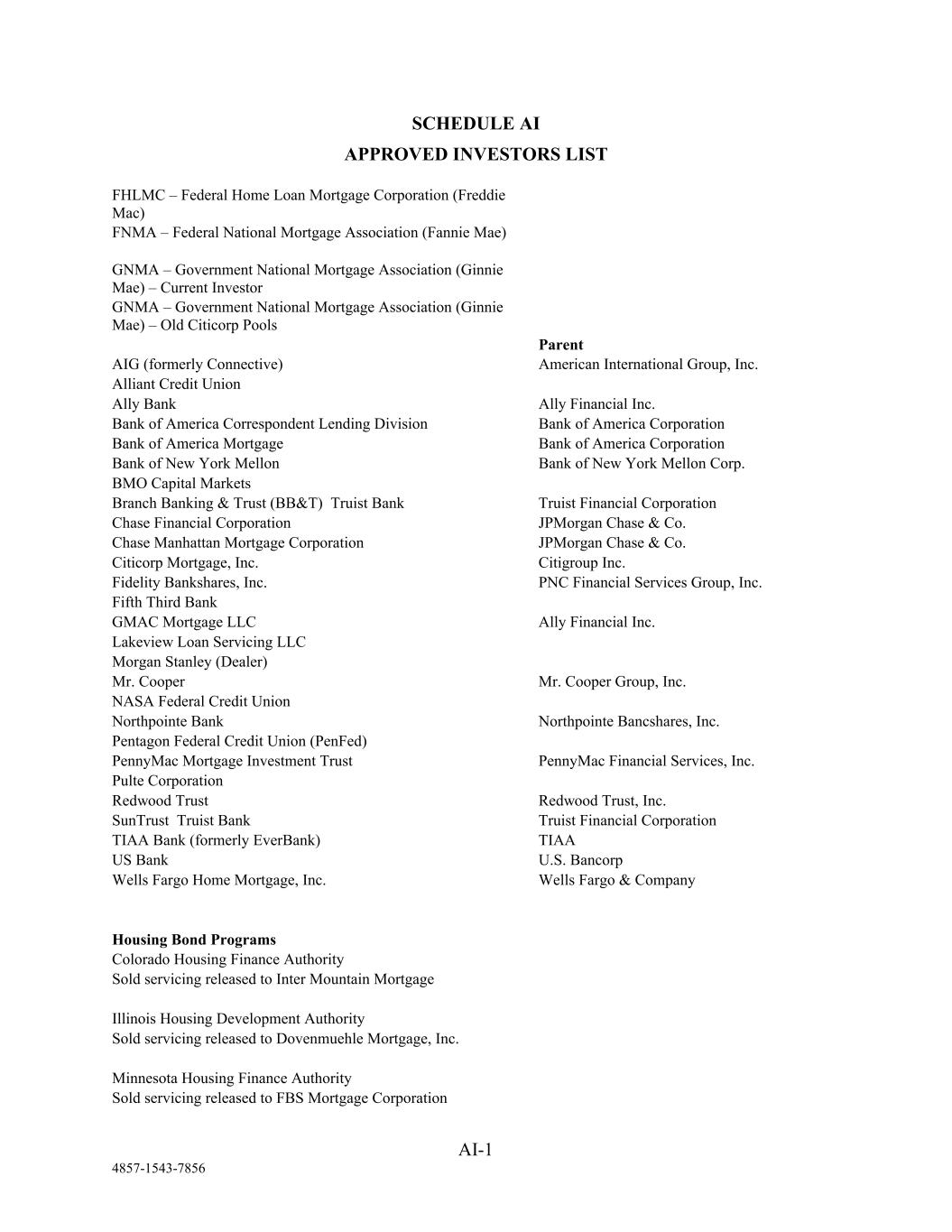

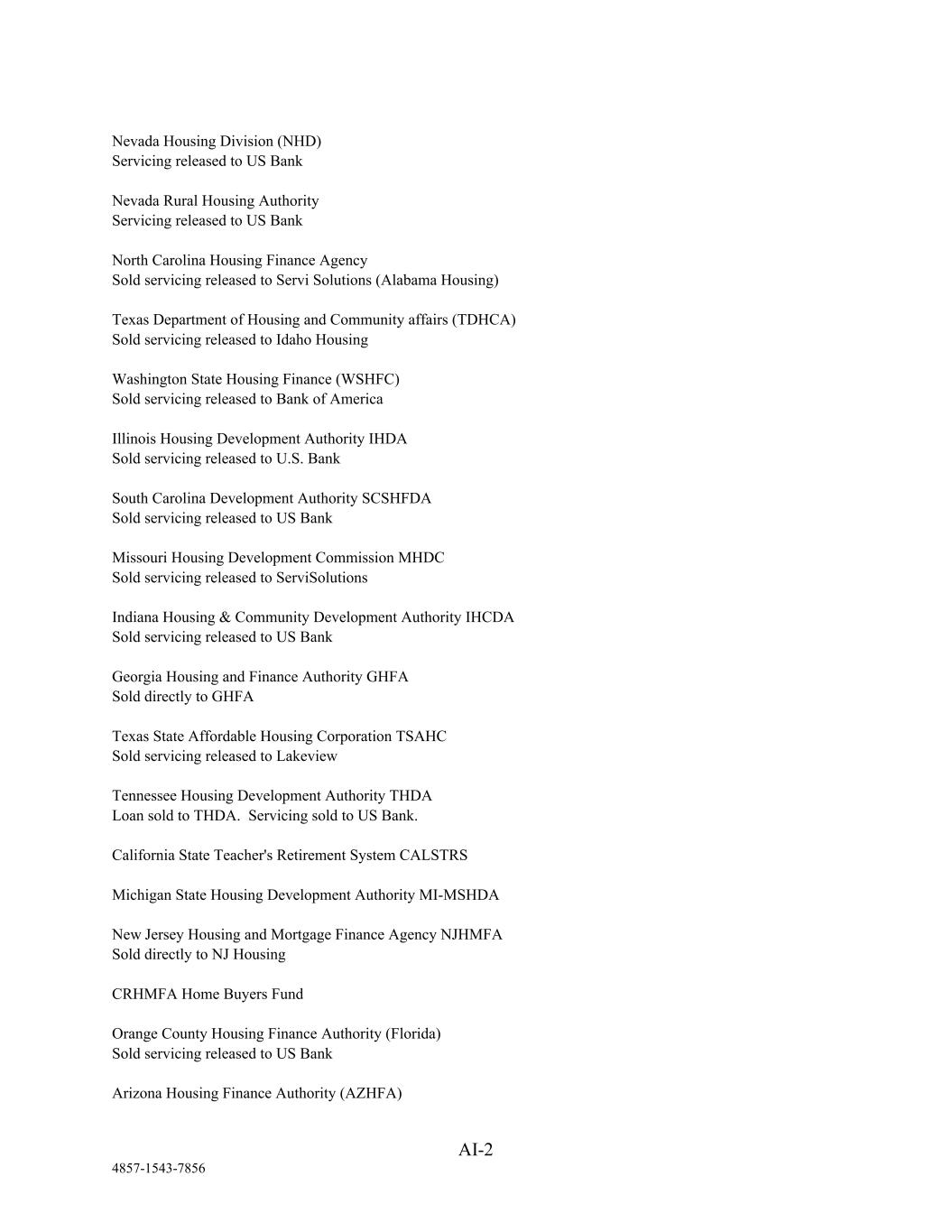

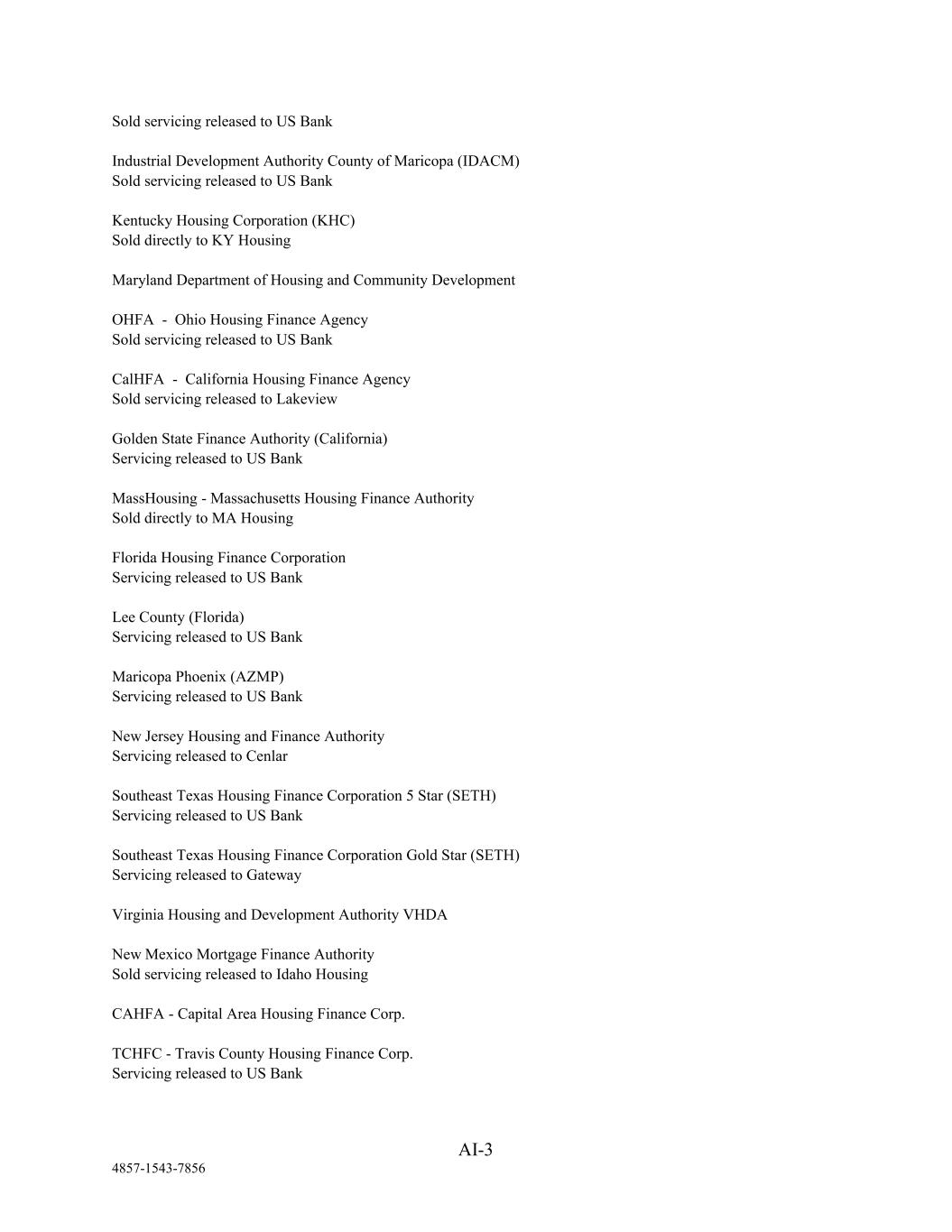

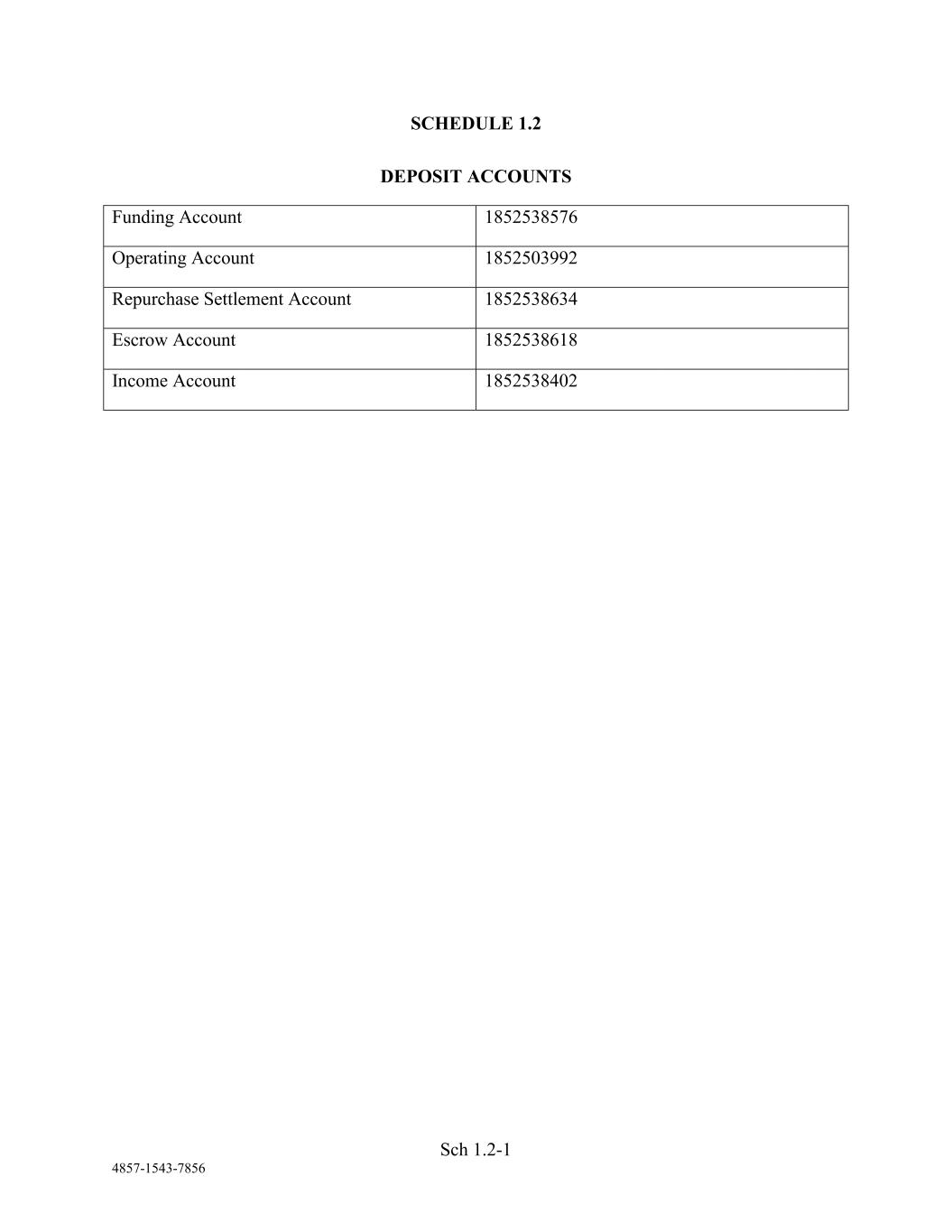

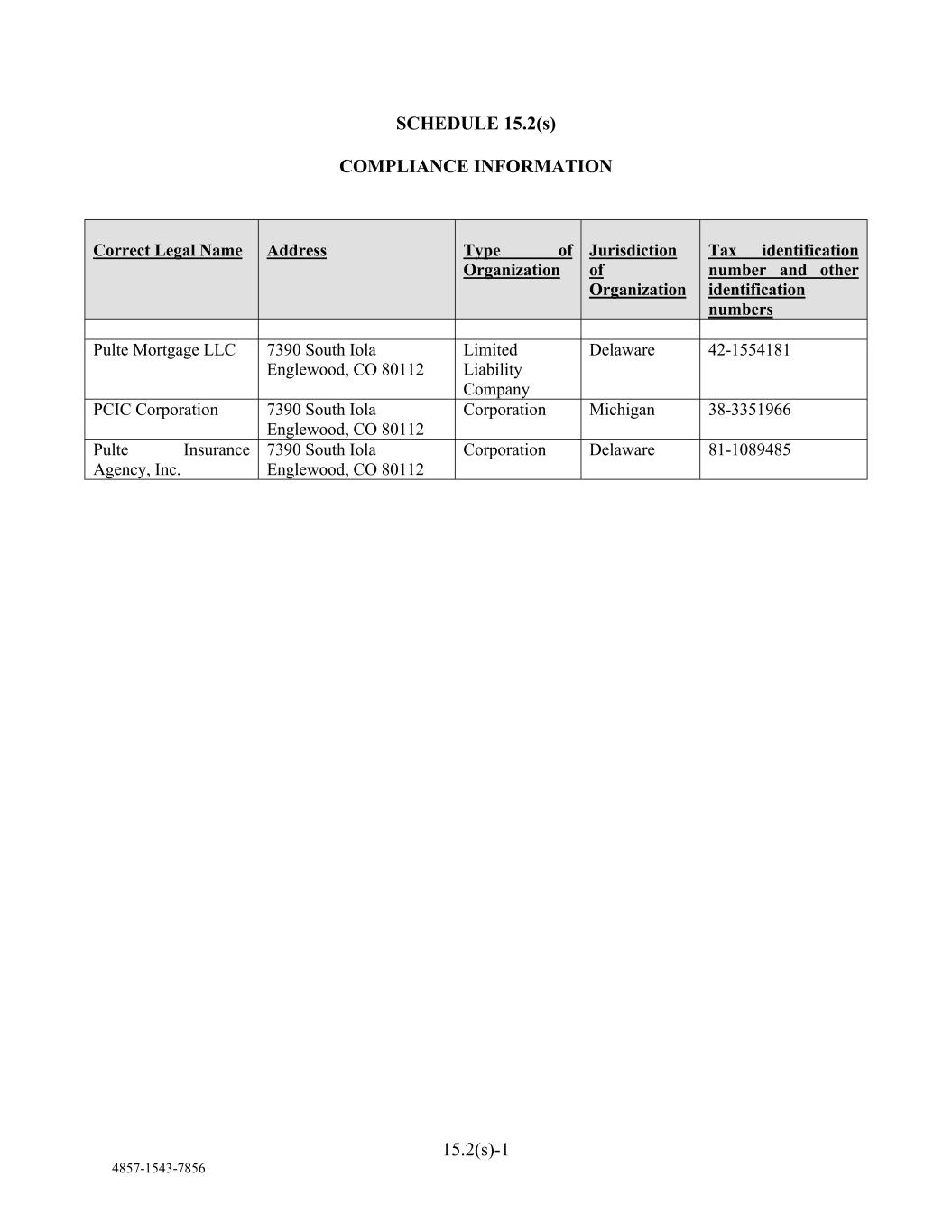

EXHIBITS AND SCHEDULES Exhibit A Form of Request/Confirmation Exhibit B Form of Compliance Certificate Exhibit C List of Subsidiaries of the Seller as of the Effective Date Exhibit D Form of Corporation Tax Treatment Certificate Exhibit E Form of Assignment and Assumption Exhibit F Form of Repurchase and Indemnification Report Exhibit G Form of Repurchase Settlement Account Disbursement Request Schedule Al Approved Investors Schedule AR Authorized Seller Representatives List Effective as of July 28, 2022 Schedule BC The Buyers’ Committed Sums Schedule BP List of Basic Papers Schedule DQ Disqualifiers Schedule EL Eligible Loans Schedule 1.2 Deposit Accounts Schedule 15.2(f) Material Adverse Changes and Contingent Liabilities Schedule 15.2(g) Pending Litigation Schedule 15.2(n) Existing Liens Schedule 15.2(s) Compliance Information Schedule 15.3 Special Representations and Warranties with Respect to each Purchased Loan Schedule 23 Buyers’ Addresses for Notice as of July 28, 2022 -vii- 4857-1543-7856 i- HIBITS D ULES xhibit r f equest/ onfir ation xhibit r f ompliance ertifi ate xhibit ist f bsidiaries f e e ler s f e ffective ate xhibit r f orporation ax r t ent ertificate xhibit r f ssi ent d ssu ption xhibit r f epurchase d nification eport xhibit r f epurchase t ent count i urs ent equest edule I pproved estors edule R uthorized e ler epresentatives ist ffecti e s f ly 8, 22 edule C he uyers’ o mitted s edule P ist f asic apers edule isqualifiers edule li ible oans edule . eposit counts edule . (f) aterial dverse hanges d ontingent iabilities edule . (g) nding it ti n edule . (n) xisti g i ns edule . (s) ompliance ation edule .3 ecial epresentations d arranties ith espect h r hased oan edule 3 uyers’ dre ses r otice s f ly 8, 22

FOURTH AMENDED AND RESTATED MASTER REPURCHASE AGREEMENT THIS FOURTH AMENDED AND RESTATED MASTER REPURCHASE AGREEMENT is made and entered into as of July 28, 2022, between and among Pulte Mortgage LLC, a Delaware limited liability company (the “Seller”), and Comerica Bank, as Agent and representative of itself as a Buyer and the other Buyers (the “Agent” and sometimes “Comerica Bank”), and the other Buyers, as defined in Section 1.2. RECITALS Section 1. Applicability and Defined Terms. 1.1. Applicability. From time to time the parties hereto may enter into transactions in which the Seller agrees to transfer to the Agent on behalf of the Buyers, Eligible Loans on a servicing released basis against the transfer of funds by the Buyers, with a simultaneous agreement by the Buyers to transfer to the Seller such Eligible Loans at a date certain or on demand in the event of termination pursuant to Section 18.2 hereof, or if no demand is sooner made, on the Termination Date, against the transfer of funds by the Seller. Each such transaction shall be referred to herein as a “Transaction” and shall be governed by this Agreement, as hereinafter defined. Comerica Bank has also agreed to provide a separate revolving swing line repurchase facility to initially and temporarily purchase Eligible Loans pending their purchase by all of the Buyers pursuant to this Agreement. The parties hereby specifically declare that it is their intention that this Fourth Amended and Restated Master Repurchase Agreement (as amended, restated, supplemented or otherwise modified from time to time, the “Agreement,” which term includes the preamble above) and the purchases of Eligible Loans made pursuant to it (under both its regular and swing line provisions) are to be treated as repurchase transactions under the Title 11 of the United States Code, as amended (the “Bankruptcy Code’), including all rights that accrue to the Buyers by virtue of sections 559, 561 and 562 of the Bankruptcy Code. This Agreement also contains lien provisions with respect to the Purchased Loans so that if, contrary to the intent of the parties, any court of competent jurisdiction characterizes any Transaction as a financing, rather than a purchase, under applicable law, including the applicable provisions of the Bankruptcy Code, the Agent is deemed to have a first priority perfected security interest in and to the Purchased Loans to secure the payment and performance of all of the Seller’s Obligations under this Agreement and the other Repurchase Documents. The Buyers’ agreement to establish and continue the revolving repurchase facilities, and Comerica Bank’s agreement to establish and continue such revolving swing line repurchase facility, are each made upon and subject to the terms and conditions of this Agreement. If there is any conflict or inconsistency between any of the terms or provisions of this Agreement and any of the other Repurchase Documents, this Agreement shall govern and control. If there is any conflict between any provision of this Agreement and any later supplement, amendment, restatement or replacement of it, then the latter shall govern and control. 4857-1543-7856 RTH ENDED D TED ASTER CHASE EE ENT IS RTH ENDED D TED ASTER CHASE EE ENT ade d t r d t s f ly 8, 2, t en d ong ulte ortgage C, ela are i it d ilit pany e e ler”), d omerica ank, s gent d r sentative f lf s uyer d e t er uyers e gent” d eti es omerica ank”), d e t er uyers, s fi ed cti n . . CITALS cti n . plicab lity d efi ed er s. . . plicab lity. e e e arties reto ay ter t cti ns hich e e ler rees sfer e gent half f e uyers, li ible oans i i g d asis ainst e sfer f ds y e uyers, ith ult eous ent y e uyers sfer e e ler h li ible oans t ate rt in r and e ent f inati n rsuant cti n .2 ereof, r o and ner ade, e er ination ate, ainst e sfer f ds e e ler. ach h cti n a l e rr d rein s ransacti n” d a l e erned y is gr ement, s reinafter fi ed. omerica ank as l r ed r vide arate l i g ing e r hase ilit it ll d porarily rchase li ible oans ding eir rchase y l f e uyers rsuant is gr ement. he arties r y ecifica ly clare at eir ti n at is urth ended d estated aster epurchase gree ent s ended, t ted, l ented r r ise odified e e, e greement,” hich l es e ble ve) d e rchases f li ible oans ade rsuant der th ular d ing e r visions) re e t d s rchase cti ns der e itle f e nited t tes ode, s ended e ankruptcy ode”), i g l ts at rue e uyers y i t e f ti ns 9, 1 d 2 f e ankruptcy ode. his gree ent l ntains r visi ns ith ect e r hased oans at , ntrary e t nt f e arties, y urt f petent ri i ti n aracterizes y r nsaction s cing, t er n rchase, der li able , i g e pli able r visi ns f e ankruptcy ode, e gent ed ve t ri rity rf cted urity t rest d e r hased oans ure e ent d r ance f l f e e ler’s bligations der is gree ent d e t er epurchase ocuments. he uyers’ ent t lish d ti ue e l i g rchase ilities, d omerica ank’s ent t lish d ti ue h l i g ing e r hase ility, re h ade on d ject e s d nditi ns f is gr ement. re y nflict r sist cy t en y f e s r r visi ns f is gree ent d y f e t er epurchase ocuments, is gree ent a l vern d ntrol. re y nflict t en y r visi n f is gree ent d y t r l ent, endment, ent r ent f , n e tt r a l vern d ntrol.

1.2. Defined Terms. Except where otherwise specifically stated, capitalized terms used in this Agreement and the other Repurchase Documents have the meanings assigned to them below or elsewhere in this Agreement. “Accepted Servicing Practices” means, with respect to any Mortgage Loan, (a) those mortgage loan servicing standards and procedures in accordance with all applicable state, local and federal laws, rules and regulations and (b)(i) the mortgage loan servicing standards and procedures prescribed by Fannie Mae and Freddie Mac, in each case as set forth in the Fannie Mae Servicing Guide or Freddie Mac Servicing Guide, as applicable, and in the directives or applicable publications of such agencies, as such may be amended or supplemented from time to time, or (ii) with respect to any Mortgage Loans and any matters or circumstances as to which no such standard or procedure applies, the servicing standards, procedures and practices the Seller uses with respect to its own assets as of the date of this Agreement, subject to reasonable changes. “Additional Purchased Loans” means Eligible Loans transferred by the Seller to the Buyers pursuant to, and as defined in, Section 6.1(a). “Adjusted Tangible Net Worth” means, as of any date, the sum of (a) all assets of the Seller and the Subsidiaries on a Consolidated basis, minus (b) the sum of (i) Total Liabilities (excluding Qualified Subordinated Debt), (ii) all assets of the Seller and the Subsidiaries that would be classified as intangible assets under GAAP, including, but not limited to, subscribed stock, goodwill (whether representing the excess of cost over book value of assets acquired or otherwise), patents, trademarks, trade names, copyrights, franchises, licenses and (iii) unsecured notes and accounts receivable due from stockholders, directors, officers, members, employees, Affiliates or other related Persons (other than Parent and Subsidiaries), and (iv) loans held for investment and real estate acquired by foreclosure or deed in lieu of foreclosure, net of reserves. “Affected Tenor” is defined in Section 6.4 hereof. “Affiliate” means and includes, with respect to a specified Person, any other Person: (a) that directly or indirectly through one or more intermediaries Controls, is Controlled by or is under common Control with the specified Person (in this definition only, the term “Control” means having the power to set or direct management policies, directly or indirectly); (b) that is a director, trustee, partner, member or executive officer of the specified Person or serves in a similar capacity in respect of the specified Person; (©) of which the specified Person is a director, trustee, partner, member or executive officer or with respect to which the specified Person serves in a similar capacity and over whom the specified Person, either alone or together with one or more other Persons similarly situated, has Control; (d) that, directly or indirectly through one or more intermediaries, is the beneficial owner of ten percent (10%) or more of any class of equity securities — which does not include any MBS — of the specified Person; or 2 4857-1543-7856 . . efi ed r s. xcept here r ise cifica ly t d, it li d s sed is gree ent d e t er epurchase ocuments ve e eanings ed l r here is gr ement. ccepted rvi i g ractices” eans, ith ect y ortgage oan, ) se ortgage n i i g ards d r cedures r ance ith l pli able te, al d eral s, les d lati ns d )(i) e ortgage n i i g ards d edures r scri ed y nnie ae d r ddie ac, h se s t rt e annie ae r ici g uide r r ddie ac r ici g uide, s plicable, d e i ti es r pli able blicati ns f h encies, s h ay e ended r l ented e e, r i) ith ect y ortgage oans d y atters r rc stances s hich o h ard r r cedure plies, e i i g ards, edures d r ctices e e ler ses ith ect n sets s f e te f is gr ement, ject able anges. diti nal urchased oans” eans li ible oans f rr d y e e ler e uyers rsuant , d s fi ed , cti n . (a). djusted ngible et orth” eans, s f y ate, e f ) l sets f e e ler d e bsidiaries onsolidated asis, inus ) e f ) otal iabilities l i g ualified bordinated ebt), i) l sets f e e ler d e bsidiaries at ould e sifi d s gible sets der AP, l ing, ut ot i it d , scri ed ck, odwill hether r senti g e ce s f st er ok l e f sets uired r t r ise), atents, ra arks, e es, pyrights, chises, ic ses d i) secured tes d unts i able e holders, i ctors, ffi ers, embers, ploy es, filiates r t er l t d ersons t er n arent d bsidiaries), d ) ns ld r t ent d al t te uired y l sure r ed f l sure, et f rves. ff ct d or” fi ed cti n . reof. fili te” eans d l des, ith ect cifi d erson, y t er erson: ) at i ctly r ir ctly gh e r ore ediaries ontrols, ontro led y r der on ontrol ith e cifi d erson is fi iti n ly, e ontrol” eans i g e er t r i ct anagement olicies, i ctly r irectly); ) at i ctor, st e, artner, ember r ecutive ffi er f e cifi d ers n r es ilar acity ect f e cifi d erson; c) f hich e cifi d erson i ctor, st e, artner, ember r ecutive ffi er r ith ect hich e cifi d ers n es ilar acity d er ho e cifi d erson, i er e r et er ith e r ore t er ersons ilarly ted, as ontrol; ) at, i ctly r ir ctly gh e r ore ediaries, e neficial ner f rcent ) r ore f y l s f uity urities hich es ot l e y BS f e cifi d erson; r

(e) of which the specified Person is directly or indirectly the owner of ten percent (10%) or more of any class of equity securities of the specified Person. “Aged Mortgage Loan” means a Mortgage Loan that is an Eligible Loan, and with respect to which each of the following statements shall be accurate and complete (and Seller by including such Mortgage Loan in any computation of the Sublimits shall be deemed to so represent and warrant to the Agent as of the date of such computation): (a) Such Mortgage Loan was originally funded in a Transaction under the Conforming Loan Sublimit or the FHA Low FICO Score Loan Sublimit; (b) Immediately prior to becoming an Aged Mortgage Loan, such Mortgage Loan was included in the Conforming Mortgage Loan Sublimit or the FHA Low FICO Score Loan Sublimit; and (c) Except for the expiration of the Repurchase Date applicable to such Mortgage Loan prior to the transfer of such Mortgage Loan to the Aged Mortgage Loan Sublimit from the Conforming Mortgage Loan Sublimit or the FHA Low FICO Score Loan Sublimit, as applicable, such Mortgage Loan would continue to be eligible under this Agreement as a Conforming Mortgage Loan or an FHA Low FICO Score Mortgage Loan, as applicable. “Aged Mortgage Loan Sublimit’ is defined in the table set forth in Section 4.2(c). “Agency” means Ginnie Mae, Fannie Mae or Freddie Mac. “Agency MBS” means MBS issued or guaranteed as to timely payment of principal and interest by Ginnie Mae, Fannie Mae or Freddie Mac. “Agency-Required eNote Legend’ means the legend or paragraph required by Fannie Mae or Freddie Mac, as applicable, to be set forth in the text of an eNote, as may be amended from time to time by Fannie Mae or Freddie Mac, as applicable. “Agent” is defined above. “Agent’s Fees” is defined in Section 9.2. “Aggregate Jumbo Loan Sublimit” is defined in Section 4.2(c). “Aggregate Outstanding Purchase Price” means as of any Determination Date, an amount equal to the sum of the Purchase Prices for all Purchased Loans included in all Open Transactions. “Agreement” is defined in the Recitals. “Applicable Floor” shall mean, as such term is used in the definitions of “Daily Adjusting BSBY Rate” or “Successor Rate” (as defined in Section 6.5), five tenths of one percent (0.5%) per annum. 4857-1543-7856 3 ) f hich e cifi d erson i ctly r ir ctly e ner f rcent ) r ore f y l s f uity urities f e cifi d erson. “ ed ortgage an” eans ortgage oan at li ible oan, d ith ect hich h f e o ing e ents a l e urate d plete d e ler y i g h ortgage oan y putation f e bli its a l e ed r sent d a rant e gent s f e te f h pu ation): ) ch ortgage oan as ri i a ly ed r nsaction der e onfor ing oan bli it r e A ore oan bli it; ) ediately ri r ing ged ortgage oan, h ortgage oan as ed e onfor ing ortgage an bli it r e A ore oan bli it; d ) xcept r e pirati n f e epurchase ate pli able h ortgage oan ri r e sfer f h ortgage oan e ged ortgage oan bli it e onfor ing ortgage oan bli it r e A ore oan blimit, s plicable, h ortgage oan ould ti ue e i le der is gree ent s onfor ing ortgage oan r A I ore ortgage oan, s plicable. ged ortgage oan blimit’ fi ed e le t rt cti n . (c). gency” eans innie ae, annie ae r r ddie ac. gency BS” eans BS d r aranteed s i ely ent f ri cipal d t rest innie ae, annie ae r r ddie ac. ency- equired ote egend” eans e d r r raph ired y a nie ae r r ddie ac, s plicable, e t rt e t f ote, s ay e ended e e y annie ae r r ddie ac, s plicable. gent” fi ed ove. gent’s es” fi ed cti n . . ggregate bo oan bli it” fi ed cti n . (c). ggregate utst ding urchase rice” eans s f y eter ination ate, ount ual e f e rchase ri es r l r hased oans ed l pen ransactions. ree ent” fi ed e ecitals. “ pplicable l or” a l ean, s h sed e fi iti ns f aily djusting Y ate” r ce sor ate” s fi ed cti n . ), e t s f e rcent ) er um.

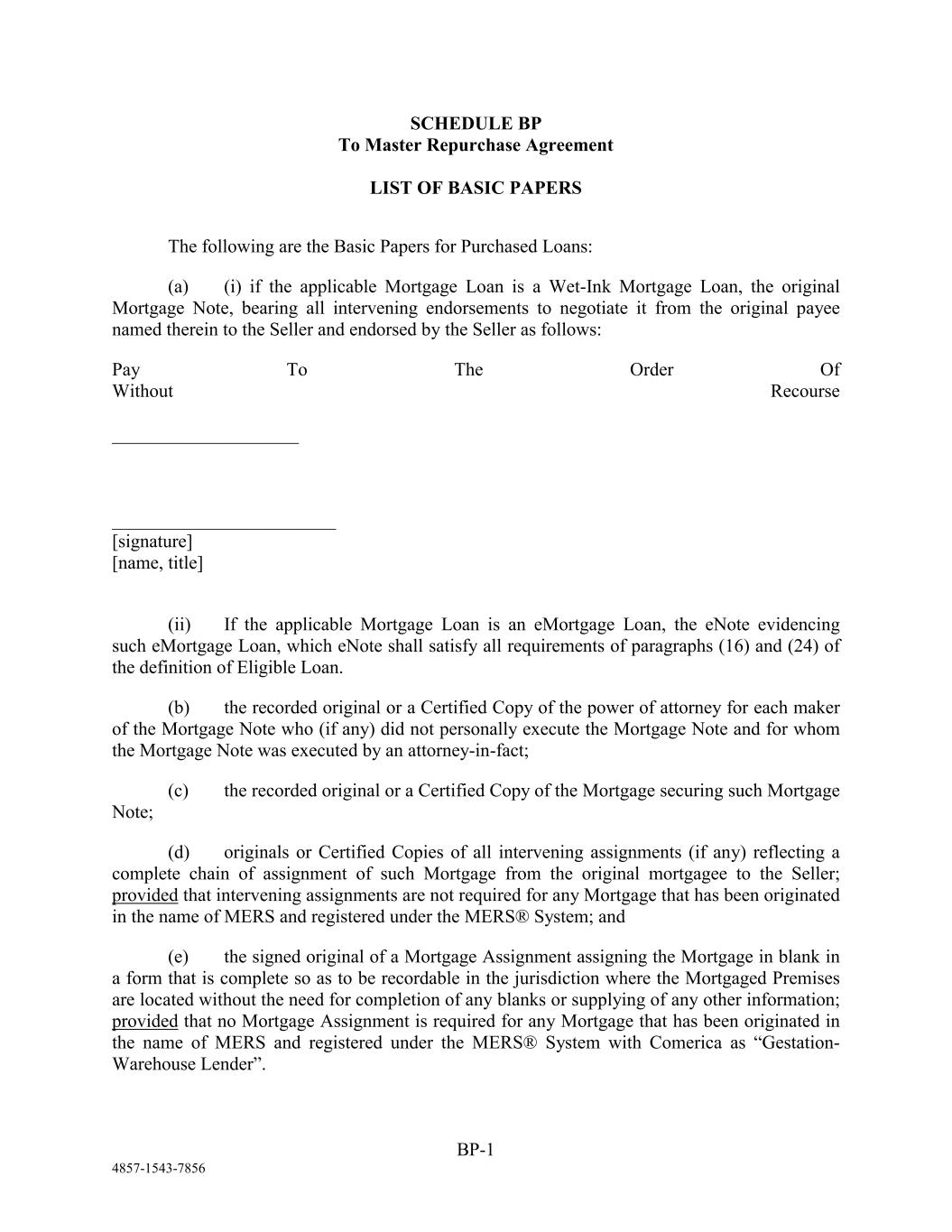

“Applicable Margin” means, (a) for the Daily Adjusting BSBY Rate, one and six tenths of one percent (1.6%) per annum, and (b) for the Prime Referenced Rate, zero percent (0%) per annum. “Applicable Reference Date” means any date of determination (or, if such date is not a Business Day, the preceding Business Day). “Approved Investor” means Ginnie Mae, Fannie Mae, Freddie Mac and any of the Persons listed on Schedule Al, as it may be supplemented or amended from time to time by agreement of the Seller and the Agent; provided, that (a) persons listed on Schedule Al shall be Approved Investors only with respect to the type(s) of Mortgage Loans for which they are specified as an “Approved Investor” on Schedule Al, and (b) if the Agent shall give notice to the Seller of the Agent’s reasonable disapproval of any Approved Investor(s) named in the notice, the Approved Investor(s) so named shall no longer be (an) Approved Investor(s) from and after the time when the Agent sends that notice to the Seller or such later date as may be specified by the Agent in its sole discretion. “Approved Investor Agreement” shall have the meaning given the term in the Custody Agreement. “Approved MBS Custodian” is defined in Section 1.1 of the Custody Agreement. “Approved MBS Custodian Account” is defined in Section 1.1 of the Custody Agreement. “Authoritative Copy” means, with respect to an eNote, the single authoritative copy of such eNote within the meaning of 15 U.S.C. § 7021(c) (being Section 7021(c) of E-SIGN) or Section 16(c) of UETA, as applicable, which eNote is within the Control of the Controller. “Authorized Seller Representative” means a representative of the Seller duly designated by all requisite corporate action to execute any certificate, schedule or other document contemplated or required by this Agreement or the Custody Agreement on behalf of the Seller and as its act and deed. A list of Authorized Seller Representatives current as of the Effective Date is attached as Schedule AR. The Seller will provide an updated list of Authorized Seller Representatives to the Agent and the Custodian promptly following each addition to or subtraction from such list, and the Agent, the Buyers and the Custodian shall be entitled to rely on each such list until such an updated list is received by the Agent and the Custodian. “Backup Servicer” means any Person designated by the Agent, in its sole discretion, to act as a backup servicer of the Purchased Loans in accordance with Section 19.10. “Bankruptcy Code” is defined in the Recitals. “Basic Papers” means all of the Loan Papers that must be delivered to the Custodian (in the case of Dry Loans, prior to the related Purchase Date and, in the case of Wet Loans, on or before the seventh (7th) Business Day after the related Purchase Date) in order for any particular Purchased Loan to continue to have Market Value. Schedule BP lists the Basic Papers. 4857-1543-7856 4 “ pplicable argin” eans, ) r e aily djusting Y ate, e d t s f e rcent ) er u , d ) r e ri e efer nced ate, ro rcent ) er um. “ pplicable eference ate” eans y te f t ination r, h te ot usine s ay, e eding usine s ay). proved estor” eans innie ae, a nie ae, r ddie ac d y f e ersons edule I, s ay e l ented r ended e e y ent f e e ler d e gent; r vided, at ) rs ns edule I a l e pproved estors ly ith ect e e(s) f ortgage oans r hich y e cifi d s pproved estor” edule I, d ) e gent a l i e tice e e ler f e gent’s able roval f y pproved estor(s) ed e tice, e pproved estor(s) ed a l o er e ) pproved estor(s) d t r e e hen e gent ds at tice e e ler r h t r ate s ay e cifi d y e gent le i retion. proved estor greement” a l ve e eaning i en e e ust dy gr ement. proved BS ust dian” fi ed cti n . f e ust dy gr ement. proved BS ust dian ccount” fi ed cti n . f e ust dy gr ement. uthoritative opy” eans, ith ect ote, e le t oritati e y f h ote ithin e eaning f .S.C. 21(c) i g cti n 21(c) f - I N) r cti n (c) f ETA, s plicable, hich ote ithin e ontrol f e ontroller. uthorized e ler epresentative” eans r sentative f e e ler ly si ated y l uisite r orate ti n ecute y rtifi ate, dule r t er ent t plated r ired y is gree ent r e ust dy gree ent half f e e ler d s t d ed. t f uthorized e ler epresentatives rrent s f e ffecti e ate ed s edule R. he e ler i l r vide dated t f uthorized e ler epresentatives e gent d e ustodian ptly o i g h diti n r tr cti n h t, d e gent, e uyers d e ustodian a l e titl d l h h t ntil h dated t i ed y e gent d e ustodian. ackup rvicer” eans y erson si ated y e gent, le i retion, t s up icer f e r hased oans r ance ith cti n . 0. ankruptcy ode” fi ed e ecitals. asic apers” eans l f e an apers at ust e l red e ustodian e se f ry oans, ri r e l t d rchase ate d, e se f et oans, r fore e enth t ) usine s ay t r e t d rchase ate) r er r y arti ular r hased oan ti ue ve arket alue. edule P ts e asic apers.

“Benchmark” shall mean, initially, the BSBY Screen Rate; provided that if the BSBY Screen Rate or any successor thereof is subsequently replaced by a Successor Rate in accordance with Section 6.5, then “Benchmark” shall mean the applicable Successor Rate then in effect. “Beneficial Ownership Certification” means a certification regarding beneficial ownership as required by the Beneficial Ownership Regulation. “Beneficial Ownership Regulation” means 31 C.F.R. § 1010.230, as amended from time to time. “BSBY” shall mean the Bloomberg Short-Term Bank Yield Index rate. “BSBY Administrator” shall mean the Bloomberg Index Services Limited (or any successor administrator of BSBY). “BSBY Screen Rate” means BSBY, as administered by the BSBY Administrator and published on the applicable Reuters screen page (or such other commercially available source providing such rate as may be designated by Agent from time to time). “Business Day” means any day, other than a Saturday, Sunday or any other day designated as a holiday under Federal or applicable State statute or regulation, on which Agent is open for all or substantially all of its domestic and international business (including dealings in foreign exchange) in Detroit, Michigan. “Buyer” means Comerica Bank and such other Person from time to time party to this agreement as a “Buyer.” Persons who are currently Buyers on any day shall be listed as Buyers in Schedule BC in effect for that day. “Buyer Affiliate” means (a) with respect to any Buyer, (i) an Affiliate of such Buyer or (ii) any entity (whether a corporation, partnership, trust or otherwise) that is engaged in making, purchasing, holding or otherwise investing in securities and mortgage reverse repurchase agreements, bank loans and similar financial arrangements in the ordinary course of its business and is administered or managed by such Buyer or an Affiliate of such Buyer and (b) with respect to any Buyer that is a fund which invests in securities and mortgage reverse repurchase agreements, bank loans and similar financial arrangements, any other fund that invests in securities and mortgage reverse repurchase agreements, bank loans and similar financial arrangements and is managed by the same investment advisor as such Buyer or by an Affiliate of such investment advisor. “Buyers” Margin Percentage” means: (a) for Conforming Mortgage Loans (other than Aged Mortgage Loans), ninety-seven percent (97%); (b) for FHA Low FICO Score Mortgage Loans (other than Aged Mortgage Loans), ninety-seven percent (97%); (©) for Jumbo Mortgage Loans, ninety-seven percent (97%); 4857-1543-7856 5 c ark” a l ean, iti ly, e Y r en ate; r i ed at e Y r en ate r y e sor r f s quently l ed y cce sor ate r ance ith cti n . , n e ch ark” a l ean e pli able cce sor ate n fect. eneficial wnership ertif ti n” eans rti ti n r i g neficial nership s ired y e eneficial wnership egulation. eneficial wnership egulation” eans 1 . .R. 0.230, s ended e e. SBY” a l ean e l berg rt r ank ield ex te. Y dministrator” a l ean e l berg ex rvices i ited r y ce sor inistrator f SBY). Y reen ate” eans BY, s inistered y e Y dm nistrator d bli ed e pli able euters n ge r h t er mercially ail ble rce r viding h te s ay e si ated gent e e). usine s ay” eans y ay, t er n t rday, day r y t er y si ated s li ay der ederal r pli able t te t te r ulation, hich gent en r l r stantia ly l f estic d ati nal sine s i g ali gs i n ange) etroit, ichigan. uyer” eans omerica ank d h t er ers n e e arty is ent s uyer.” ersons ho re rrently uyers y y a l e s uyers edule ct r at ay. uyer fili te” eans ) ith ect y uyer, ) filiate f h uyer r i) y tit hether r oration, art ership, st r t r ise) at aged aking, rchasing, l i g r r ise esti g urities d ortgage erse rchase r ents, k s d ilar cial a ents e i ary urse f sine s d inistered r anaged y h uyer r filiate f h uyer d ) ith ect y uyer at d hich ests urities d ortgage erse r hase r ents, k s d ilar cial ents, y t er d at ests urities d ortgage erse rchase r ents, k ns d ilar cial a ents d anaged e e t ent visor s h uyer r y filiate f h t ent visor. “ uyers’ argin ercent ge” eans: ) r onfor ing ortgage oans t er n ged ortgage oans), i t - en rcent ); ) r A ore ortgage oans t er n ged ortgage oans), i t - en rcent ); c) r bo ortgage oans, i t - en rcent );

(d) for Super Jumbo Mortgage Loans, ninety-seven percent (97%); (e) for Aged Mortgage Loans, ninety-seven percent (97%); ® for Second Mortgage Loans, fifty percent (50%); (2) for Non-QM Mortgage Loans, ninety percent (90%); (h) for Discretionary Loans, the Buyer’s Margin Percentage for the underlying type of Purchased Loan which would apply if such Mortgage Loan met the requirements waived by Agent under Section 22.8; and (1) for Wet Loans, the Buyer’s Margin Percentage for the underlying type of Purchased Loan which would apply if such Purchased Loan were a Dry Loan. “Cash Equivalents” means and includes, on any day: (a) any evidence of debt issued by the United States government or any agency thereof, or guaranteed as to the timely payment of principal and interest by the United States government, and maturing ninety (90) days or less after that day; and (b) any demand deposit, time deposit, certificate of deposit or banker’s acceptance maturing not more than ninety (90) days after that day and issued by a commercial bank that either (i) is insured by the Federal Deposit Insurance Corporation or (ii) is a member of the Federal Reserve System and has a combined unimpaired capital and surplus and unimpaired undivided profits of not less than Two Hundred Fifty Million Dollars ($250,000,000); and (©) money market and cash accounts and money market funds which are invested in investments of the types described above or in commercial paper maturing no more than 90 days from the date of creation thereof and which is rated at least “A-1" by Standard & Poor’s Corporation or at least “P-1" by Moody’s Investors Service, Inc. “Central Elements” means and includes the value of a substantial part of the Purchased Loans; the prospects for payment of each portion of the Repurchase Price, both Purchase Price and Price Differential, when due; the validity or enforceability of this Agreement and the other Repurchase Documents and, as to any Person referred to in any reference to the Central Elements, such Person’s property, business operations, financial condition and ability to fulfill and perform its obligations under this Agreement and the other Repurchase Documents to which it is a party, each taken as a whole, and such Person’s prospects of continuing in business as a going concern. “Certified Copy” means a copy of an original Basic Paper or Supplemental Paper accompanied by (or on which there is stamped) a certification by an officer of either a title insurer or an agent of a title insurer (whether a title agency or a closing attorney) or, except where otherwise specified below, by an Authorized Seller Representative or an officer of the Servicer (if other than the Seller) or subservicer of the relevant Mortgage Loan, that such copy is 4857-1543-7856 6 ) r per bo ortgage oans, i t - en rcent ); ) r ged ortgage oans, i t - en rcent ); (f) r nd ortgage oans, rcent ); g) r on- ortgage oans, i ety rcent ); ) r iscreti ary oans, e uyer’s argin r entage r e derlying e f r hased oan hich ould ply h ortgage oan et e i ents aived y gent der cti n .8; d i) r et oans, e uyer’s argin er entage r e derlying e f r hased oan hich ould ply h r hased oan ere ry oan. ash quivalents” eans d l des, y y: ) y i nce f bt d y e nited t tes er ent r y cy reof, r aranteed s e i ely ent f ri cipal d t rest y e nited t tes ernment, d aturing i ety ) ys r s ft r at y; d ) y and posit, e posit, rti i ate f posit r nker’s tance aturing ot ore n i ety ) ys ft r at y d d y mercial k at i er ) r d y e ederal eposit r nce orporation r i) ember f e ederal eserve st d as bined i paired pital d r lus d i paired divi ed rofits f ot s n o undred ift i li n ollars 0, 0, 0); d c) oney arket d sh unts d oney arket ds hich re st d t ents f e es scri ed ve r mercial per aturing o ore n ys e te f ti n f d hich t d t st -1” y t ard oor’s orporation r t st -1” y ody’s estors ervice, c. entral l ents” eans d l es e l e f stantial art f e r hased oans; e r spects r ent f h rti n f e epurchase rice, th rchase rice d ri e i ferential, hen e; e ali ity r f rceability f is gree ent d e t er epurchase ocuments d, s y ers n rr d y ce e entral l ents, h erson’s r perty, sine s erations, cial nditi n d ilit lfi l d r li ati ns der is gree ent d e t er epurchase ocuments hich arty, h n s hole, d h erson’s r spects f ti ing sine s s i g ncern. ertifi d opy” eans y f ri i al asic aper r ple ental aper panied y r hich re a ped) rti ti n y ffi er f er rer r ent f rer hether cy r i g ey) r, cept here r ise cifi d l , y uthorized e ler epresentative r ffi er f e rvicer t er n e e ler) r servicer f e ant ortgage oan, at h y