Form 8-K PEOPLES BANCORP INC For: Jul 30

INVESTOR PRESENTATION 2ND QUARTER 2021

2 WORKING TOGETHER BUILDING SUCCESS TABLE OF CONTENTS PAGE 4 PROFILE, INVESTMENT RATIONALE, CULTURE AND STRATEGY PAGE 10 COVID-19 CREDIT IMPACT, CAPITAL & LIQUIDITY PAGE 25 Q2 & YTD 2021 FINANCIAL INSIGHTS PAGE 39 Q2 & YTD 2021 APPENDIX

WORKING TOGETHER BUILDING SUCCESS 3 Statements in this presentation which are not historical are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may include discussions of the strategic plans and objectives or anticipated future performance and events of Peoples Bancorp Inc. (“Peoples”). The information contained in this presentation should be read in conjunction with Peoples’ Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the “2020 Form 10-K”), and the Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, each of which is available on the Securities and Exchange Commission’s (“SEC”) website (www.sec.gov) or at Peoples’ website (www.peoplesbancorp.com). Investors are cautioned that forward-looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in Peoples’ 2020 Annual Report on Form 10-K filed with the SEC under the section, “Risk Factors” in Part I, Item 1A. As such, actual results could differ materially from those contemplated by forward-looking statements made in this presentation. Management believes that the expectations in these forward-looking statements are based upon reasonable assumptions within the bounds of management’s knowledge of Peoples’ business and operations. Peoples disclaims any responsibility to update these forward-looking statements to reflect events or circumstances after the date of this presentation. SAFE HARBOR STATEMENT

WORKING TOGETHER BUILDING SUCCESS PROFILE, INVESTMENT RATIONALE, CULTURE AND STRATEGY 4

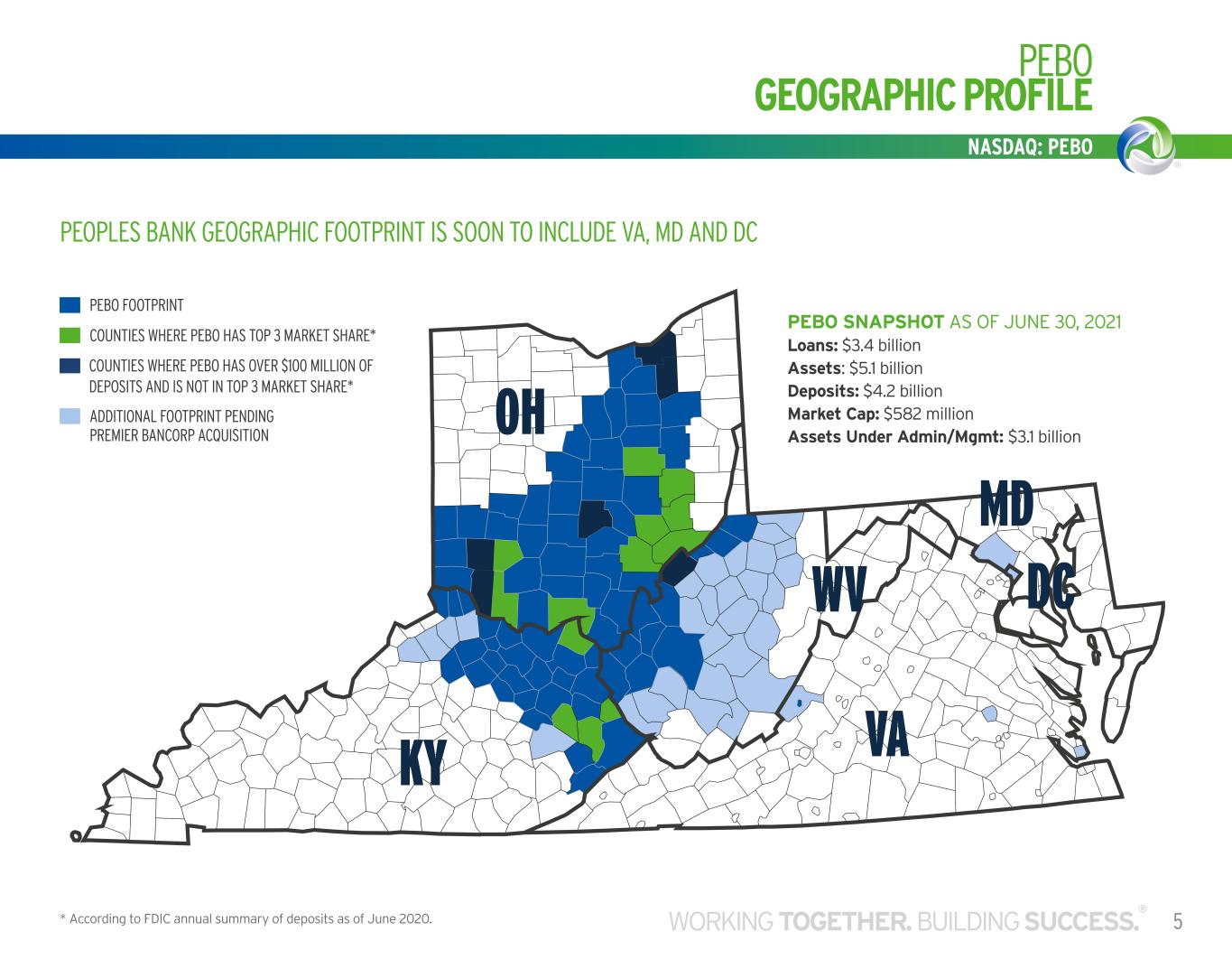

WORKING TOGETHER BUILDING SUCCESS PEBO GEOGRAPHIC PROFILE 5WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO WV VAKY OH MD DC OHIO WARREN COUNTY 49 CARLISLE 50 FRANKLIN 51 HAMILTON TOWNSHIP 52 LEBANON 53 MASON 54 SPRINGBORO 55 WAYNESVILLE HAMILTON COUNTY 56 MADEIRA 57 MONTGOMERY 58 CINCINNATI LPO EAST 59 CINCINNATI LPO WEST CLERMONT COUNTY 60 BATAVIA 61 MILFORD 62 MILFORD LPO 63 WILLIAMSBURG BROWN COUNTY 64 SARDINIA 65 GEORGETOWN OH 66 MOUNT ORAB 67 RIPLEY OH MAIN ST FAIRFIELD COUNTY 25 BALTIMORE 26 LANCASTER 27 LANCASTER - FAIR AVE ATHENS COUNTY 28 ATHENS - COURT STREET 29 ATHENS - MALL 30 NELSONVILLE MEIGS COUNTY 31 POMEROY 32 POMEROY DRIVE-THRU LAWRENCE COUNTY 34 PROCTORVILLE 35 IRONTON JACKSON COUNTY 36 JACKSON 37 WELLSTON SCIOTO COUNTY 38 PORTSMOUTH 39 PORTSMOUTH NORTH 40 SCIOTOVILLE 41 WHEELERSBURG PIKE COUNTY 42 WAVERLY GALIA COUNTY 33 GALLOPOLIS CLINTON COUNTY 44 BLANCHESTER 45 NEW VIENNA 46 SABINA 47 WILMINGTON MAIN 48 WILMINGTON PLAZA HIGHLAND COUNTY 43 HILLSBORO CUYAHOGA COUNTY 22 NEWARK 23 HEATH FRANKLIN COUNTY 24 WORTHINGTON WASHINGTON COUNTY 1 MARIETTA MAIN 2 FRONTIER 3 SECOND STREET 4 RENO 5 LOWEL 6 BELPRE SUMMIT COUNTY 16 NORTON 17 AKRON LPO 18 AKRON MAIN 19 CUYAHOGA FALLS 20 MUNROE FALLS GUERNSEY COUNTY 10 CAMBGIRDGE - WHEELING AVE 11 CAMBRIDGE - SIXTH STREET 12 BYESVILLE COSHOCTON COUNTY 13 COSHOCTON KNOX COUNTY 14 MOUNT VERNON STARK COUNTY 15 NORTH CANTON CUYAHOGA COUNTY 21 BEACHWOOD MORGAN COUNTY 8 MCONNESVILLE MUSKINGAM COUNTY 9 ZANESVILLE NOBLE COUNTY 7 CALDWELL GREENUP COUNTY 78 GREENUP 79 RUSSELL BOYD COUNTY 80 ASHLAND 81 SUMMIT MASON COUNTY 73 MAYSVILLE LEWIS COUNTY 74 VANCEBURG MAIN 75 VANCEBURG AA HWY 76 GARRISON 77 TOLLESBORO KENTON COUNTY 69 FORT WRIGHT CAMPBELL COUNTY 70 COLD SPRING BRACKEN COUNTY 71 BROOKSVILLE ROBERTSON COUNTY 72 MOUNT OLIVET BOONE COUNTY 68 FLORENCE UPSHUR COUNTY 115 BUCKHANNON BARBOUR COUNTY 116 PHILIPPI HARRISON COUNTY 117 BRIDGEPORT MARION COUNTY 118 FAIRMONT LPO CLAY COUNTY 123 CLAY KANAWAHA COUNTY 124 CHARLESTON 125 CHARLESTON PENN AVE ROANE COUNTY 126 SPENCER DRIVE THRU 127 SPENCER MAIN BRAXTON COUNTY 119 SUTTON 120 GASSAWAY 121 BURNSVILLE 122 FLATWOODS GREENBRIER COUNTY 111 WHITE SULPHUR SPRINGS 112 NORTH LEWISBURG 113 DOWNTOWN LEWISBURG 114 RONCEVERTE WOOD COUNTY 96 VIENNA 97 EMERSON 98 DIVISION 99 PETTYVILLE 100 MINERAL WELLS TYLER COUNTY 95 SISTERSVILLE JACKSON COUNTY 101 RAVENSWOOD 102 RIPLEY WV MILLER DR MASON COUNTY 103 POINT PLEASANT CABELL COUNTY 104 HUNTINGTON WEST 105 HUNTINGTON EAST 106 HUNTINGTON LPO LINCOLN COUNTY 107 WEST HAMLIN LOGAN COUNTY 108 LOGAN BOONE COUNTY 109 MADISON RALEIGH COUNTY 110 BECKLEY LPO WETZEL COUNTY 94 NEW MARTINSVILLE PIKE COUNTY 83 PIKEVILLE 84 PIKEVILLE - INSURANCE FLOYD COUNTY 85 MARTIN 86 PRESTONSBURG 87 NORTH SIDE JOHNSON COUNTY 88 PAINTSVILLE MAGOFFIN COUNTY 89 SALYERSVILLE MARTIN COUNTY 82 INEZ BREATHITT COUNTY 90 JACKSON KY MAIN 91 JACKSON KY HIGHWAY 15 SCOTT COUNTY 92 GEORGETOWN KY HENRY COUNTY 93 EMINENCE KENTUCKY WEST VIRGINIA 131 K STREET 132 DUPONT CIRCLE 133 CONNETICUT AVENUE DC MONTGOMERY COUNTY 134 CHEVY CHASE MARYLAND 128 COVINGTON 129 RICHMOND 130 HAMPTON VIRGINIA PEOPLES BANK GEOGRAPHIC FOOTPRINT IS SOON TO INCLUDE VA, MD AND DC COUNTIES WHERE PEBO HAS OVER $100 MILLION OF DEPOSITS AND IS NOT IN TOP 3 MARKET SHARE* COUNTIES WHERE PEBO HAS TOP 3 MARKET SHARE* PEBO FOOTPRINT PEBO SNAPSHOT AS OF JUNE 30, 2021 Loans: $3.4 billion Assets: $5.1 billion Deposits: $4.2 billion Market Cap: $582 million Assets Under Admin/Mgmt: $3.1 billion * According to FDIC annual summary of deposits as of June 2020. ADDITIONAL FOOTPRINT PENDING PREMIER BANCORP ACQUISITION

NASDAQ: PEBO 6 INVESTMENT RATIONALE UNIQUE COMMUNITY BANKING MODEL • Strongest deposit market share positions in more rural markets where we can affect pricing • Presence near larger cities puts us in a position to capture lending opportunities in more urban markets (e.g. Cincinnati, Cleveland & Columbus) • Greater revenue diversity (non-interest income, excluding gains and losses, as a percent of total revenue was 31% for first six months of 2021) than the average $1 - 10 billion bank • Strong community reputation and active involvement • 14 local market teams capable of out-maneuvering larger banks • More sophistication and product breadth than smaller banks (insurance, retirement plans, swaps, premium financing, etc.) • Nationwide insurance premium financing and equipment leasing businesses STRONG, DIVERSE BUSINESSES EARNING NON-INTEREST INCOME • 20th largest bank-owned insurance agency, with expertise in commercial, personal, life and health • Wealth management – $3.1 billion in assets under administration and management, including brokerage, trust and retirement planning CAPACITY TO GROW OUR FRANCHISE • Strong capital and fundamentals to support M&A strategy • Proven integration capabilities and scalable infrastructure COMMITTED TO DISCIPLINED EXECUTION • Strong, integrated enterprise risk management process • Dedicated to delivering positive operating leverage • Focused on business line performance and contribution, operating efficiency and credit quality • Disciplined credit practice as indicated by portfolio construction and portfolio data ATTRACTIVE DIVIDEND OPPORTUNITY • Targeting 40% to 50% payout ratio under normal operating environment • Dividend paid increased from $0.15 per share for Q1 2016 to $0.36 in the most recent quarter • Consistently evaluate dividend and adjust accordingly – annualized dividend yield at July 19, 2021 was 5.02%

CLIENTS FIRST INTEGRITY ALWAYS RESPECT FOR ALL EXCELLENCE IN EVERYTHING LEAD THE WAY COMMITMENT TO COMMUNITY PEBO Promise CIRCLE CIRCLE OUR VALUES Our promise CIRCLE embodies values that strengthen relationships. 15 19-PEO-132 Employee Culture Notebook vf.indd 16-17 11/13/2019 5:30:49 PM CORPORATE CULTURE 7WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO OUR VISION Our vision is to be the BEST COMMUNITY BANK IN AMERICA ENVIRONMENTAL, SOCIAL AND GOVERNANCE (“ESG”) MATTERS Peoples is committed to conducting its business in a manner that aligns with the core values represented by the Promise Circle. This includes how we approach Enviromental, Social and Governance (“ESG”) matters. Whether it is instituting a $15 minimum wage for our associates, creating a culture of coaching each other for continuous improvement, donating over $1 million to charities serving our communities in 2020, or leading the way with making Paycheck Protection Program (“PPP”) loans to help small businesses during COVID-19, our actions are guided by these core values. We believe that this is key to the sustainability of our business and the long-term success of Peoples. More about our ESG practices can be found on our website at: peoplesbancorp.com/about-us/about-peoples PROMISE CIRCLE Peoples’ core values are represented by our Promise Circle, which represents how we do business and our never-ending pursuit of creating value for our clients, our associates, our communities and our shareholders. OUR VALUES

Peoples Bank has won TOP workplace recognition in Cleveland for three straight years NASDAQ: PEBO 8 2021 EXTERNAL RECOGNITION Peoples Bank was one of only 16 banks nationally to make Forbes list of Best-In-State Banks in 2 or more states. FLOYD COUNTY, KY JOHNSON COUNTY, KY PIKE COUNTY, KY MID-OHIO VALLEY

NASDAQ: PEBO STRATEGIC ROAD MAP 9WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO Peoples Bank has won TOP workplace recognition in Cleveland for three straight years Peoples Bank was one of only 16 banks nationally to make Forbes list of Best-In-State Banks in 2 or more states. STRATEGIC ROAD MAP FOR BEST COMMUNITY BANK IN AMERICA • Commitment to Superior Shareholder Returns • Clients’ 1st Choice for Banking, Investing and Insurance • Great Place to Work • Meaningful Impact on Our Communities • Embrace Risk Management • Know the Risks: Strategic, Reputation, Credit, Market, Liquidity, Operational, Compliance • Do Things Right the First Time • Raise Your Hand • Discover the Root Cause • Excel at Change Management • Delight the Client • Deliver Expert Advice and Solutions • Provide a Consistent Client Experience • Lead Meaningful Client Reviews • Evolve the Mobile Experience • DWYSYWD • Acquire, Grow and Retain Clients • Earn Client Referrals • Understand Client Needs and Concerns • Live the Sales and Service Processes • Value Our Skills and Expertise • Operate Efficiently • Execute Thoughtful Mergers and Acquisitions • Hire for Values • Strive for Excellence • Invest in Each Other • Promote a Culture of Learning • Coach in Every Direction • Recognize and Reward Performance • Balance Work and Life • Cultivate Diversity • Spread Goodness RESPONSIBLE RISK MANAGEMENT EXTRAORDINARY CLIENT EXPERIENCE PROFITABLE REVENUE GROWTH FIRST CLASS WORKPLACE

WORKING TOGETHER BUILDING SUCCESS COVID-19 CREDIT IMPACT, CAPITAL & LIQUIDITY 10

NASDAQ: PEBO OUR RESPONSE TO COVID-19 11WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO WORKING TOGETHER BUILDING SUCCESS COVID-19 CREDIT IMPACT, CAPITAL & LIQUIDITY THE CHANGES THAT THE PANDEMIC HAS HAD ON OUR INDUSTRY HAVE BEEN WIDESPREAD AND SWEEPING. CLIENTS • COVID-19 changed the way we provide our products and services, which is now more digital • Redesigned lobbies to enable social distancing • One of two banks to partner with JobsOhio to allow clients to obtain up to $200,000 in additional financing on terms that were favorable to the clients, subject to certain eligibility requirements • Highest PPP loan production in phase 1 for all banks in Ohio, Kentucky and West Virginia* • Peak of COVID-19 related loan payment deferrals of $528 million at the end of June 2020. At the end of June 2021, total loan payment deferrals were down to $17.5 million. ASSOCIATES • Created assistance programs for associates including paying for unexpected childcare and/or elder care • Made donation of $100,000 to our employee assistance program • Enabled remote work capabilities as appropriate COMMUNITIES • Peoples Bank Foundation made the most annual donations since its inception at almost $750,000 in 2020. One of 3 initial corporate sponsors (Kroger, Bose) of Joe Burrow Hunger Relief Fund. • Associates donated an additional $182,747 to local food banks and pantries as of June 30, 2021 * As a percentage of total loan balances through April 16, 2020 $182,747 AMOUNT RAISED BY ASSOCIATE DONATIONS TO LOCAL FOOD BANKS DURING PANDEMIC

NASDAQ: PEBO 12 CREDIT RISK MANAGEMENT PROCESS LOANS & LEASES* PORTFOLIO COMPOSITION • Robust concentration management process focused on portfolio risk diversification • Relationship based lending • Commercial Real Estate (CRE) and Commercial & Industrial (C&I) are balanced with Consumer • CRE financing for "A" tier developers only • CRE is 125% of risk based capital at 3/31/2021 • Very limited out of market lending • Growing consumer portfolios organically and through acquisitions • $5.1 billion bank with $25mm guideline for maximum loan exposure per relationship POLICY / UNDERWRITING STANDARDS • Experienced, independent commercial and consumer underwriters • Comprehensive commercial underwriting package includes standardized loan covenant language, sensitivity analysis, and industry research • Risk appropriate CRE policy standards that vary by asset class • Established limits on policy exceptions; volume and trends monitored monthly • Use of government guarantee programs when appropriate • Abbreviated approval process for loan exposures < $1.0mm • Use of automated underwriting systems to evaluate all residential loan requests (e.g. Fannie Mae Desktop Underwriter) MANAGEMENT & MONITORING • Clear segregation of duties between sales & credit functions • Signature approval process with Credit Administration representation • Centralized risk rating, borrowing base monitoring, covenant tracking and testing • Consistent documentation and loan funding process centrally managed by Credit Administration with second review • Experienced workout team dedicated to proactive rehabilitation or exit • Construction loan monitoring and funding process independently managed by Credit Administration staff OVERSIGHT • Board approval required for loan relationships > $30mm • External loan review by large accounting and advisory firm • Quarterly Criticized Asset Review (CAR) meetings for loans > $500m • Quarterly review of Systemically Important Relationships (SIRs) • Monthly Loan Quality Committee meetings *Also referred to throughout this document as “total loans” and “loans held for investment”

NASDAQ: PEBO ASSET QUALITY 13WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO 0.000% 0.125% 0.250% 0.375% 6-30-213-31-212020201920182017 Charge Offs Annualized Percentage of Net Charge-Offs to Average Loans Annualized 90% 95% 100% 6-30-213-31-2112-31-2012-31-1912-31-1812-31-17 Percentage of Loans considered Current Percentage of Loans Considered “Current” OUR DELINQUENCY AND NET CHARGE-OFF TRENDS HAVE REMAINED STABLE TO IMPROVING FOR FIVE YEARS. 98.6% 98.5% 98.5% 98.8% 0.15% 0.15% 0.04% 0.05% 99.0% 0.13% 0.09% 99.1%

NASDAQ: PEBO 14 ASSET QUALITY 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% Q2-21Q1-21Q4-20Q3-20Q2-20Q1-20Q4-19Q3-19Q2-19Q1-19Q4-18Q3-18Q2-18Q1-18Q4-17Q3-17Q2-17 Asset Quality - NPAs/Assets NPAS AS A PERCENTAGE OF TOTAL ASSETS HAVE CONSISTENTLY BEEN SUPERIOR TO MIDWEST BANKS WITH $1 TO $10 BILLION IN TOTAL ASSETS. The accounting for purchased credit deteriorated loans under ASU 2016-13 resulted in the movement of $3.9 million of loans from the 90+ days past due and accruing category to the nonaccrual category on March 31, 2020. As of December 31, 2019, these loans were presented as 90+ days past due and accruing, although they were not accruing interest income, because they were accreting income from the discount that was recognized due to acquisition accounting. Source: S&P Global Market Intelligence. Nonperforming assets include loans 90+ days past due and accruing, renegotiated loans, nonaccrual loans, and other real estate owned. PEBO$1 TO $10 BILLION MIDWEST BANKS N PA S / A S S E TS 0.57% 0.56% 0.49% 0.48% 0.46% 0.46% 0.49% 0.45% 0.48%0.47% 0.50% 0.88% 0.54% 0.50% 0.84% 0.51% 0.53%

NASDAQ: PEBO ASSET QUALITY 15WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO NPAS AT 6/30/21 WERE PRIMARILY COMPOSED OF WELL-COLLATERALIZED COMMERCIAL REAL ESTATE AND RESIDENTIAL REAL ESTATE LOANS. DECREASE DURING Q2 2021 WAS MAINLY DUE TO C&I & RESIDENTIAL.* C&IRESIDENTIALCRE HELOC CONSUMER $ M IL LI O N S $0 $5 $10 $15 $20 $25 $30 Q2-21Q1-21Q4-20Q3-20Q2-20Q1-20Q4-19Q3-19Q2-19Q1-19Q4-18Q3-18Q2-18Q1-18Q4-17Q3-17Q2-17Q1-17 NPA Composition * The accounting for purchased credit deteriorated loans under ASU 2016-13 resulted in the movement of $3.9 million of loans from the 90+ days past due and accruing category to the nonaccrual category on March 31, 2020. As of December 31, 2019, these loans were presented as 90+ days past due and accruing, although they were not accruing interest income, because they were accreting income from the discount that was recognized due to acquisition accounting. $0 $5 $10 $15 $20 $25 $30 Q4-20Q3- 0Q2-2Q1-20Q4-193-19Q2-19Q1-19Q4-18Q3Q2-18Q1-18Q4-17Q3-17Q2-17Q1-174 16Q3-16Q2-16Q1- 6 NPA Composition

NASDAQ: PEBO 16 ASSET QUALITY Asset Quality 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Q2-21Q1-21Q4-20Q3-20Q2-20Q1-20FY-19FY-18FY-17 CLASSIFIED AND CRITICIZED LOANS AS A PERCENTAGE OF TIER 1 CAPITAL ARE WELL MANAGED. *In accordance with SEC reporting methodologies. Criticized loans includes loans categorized as special mention, substandard or doubtful. Classified loans includes loans categorized as substandard or doubtful. CLASSIFIED LOANS / TIER 1 CAPITAL + ALLL * CRITICIZED LOANS / TIER 1 CAPITAL + ALLL * 25.61% 28.10% 10.78% 13.14% 21.22% 14.49% 19.58% 14.82% 22.42% 14.15% 26.54% 16.37% 27.09% 15.52% 16.17% 24.74% 15.70% 25.83% • Exposure levels also compare favorably to peer institution concentration levels.

206% 125% 0% 50% 100% 150% 200% 250% 300% 350% 400% PFC TSC FCF TMP SYBT CCNE Universe $1-$10 B CHCO LKFN FISI SMMF FRME GABC HBNC CTBI NWBI FMNB PEBO PRK THFF SRCE Peer Bank Subs - CRE Loans / Risk-Based Capital NASDAQ: PEBO CRE CONCENTRATION ANALYSIS 17WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO • Exposure levels also compare favorably to peer institution concentration levels. CRE EXPOSURE IS WELL BELOW SUPERVISORY CRITERIA ESTABLISHED TO IDENTIFY INSTITUTIONS WITH HEIGHTENED CRE CONCENTRATION RISK. PEER BANK SUBS – CRE LOANS / RISK-BASED CAPITAL Source: S&P Global Market Intelligence, Commercial Bank Call Report Data as of 3/31/21. Per April 2013 OCC-FRB Guidance. CLD Loans defined as total loans for construction, land and land development. CRE Loans defined as total non-owner-occupied CRE loans (including CLD). The Proxy Peer Group is used above for comparative purposes. Note: For the following peers, 3/31/21 data was not required to be reported for banks less than $3.0 billion, so the data above represents the most recent that is available for these peers: SMMF, FMNB. 300% IS THE LEVEL CONSIDERED HEIGHTENED CRE CONCENTRATION RISK PER SUPERVISORY GUIDANCE

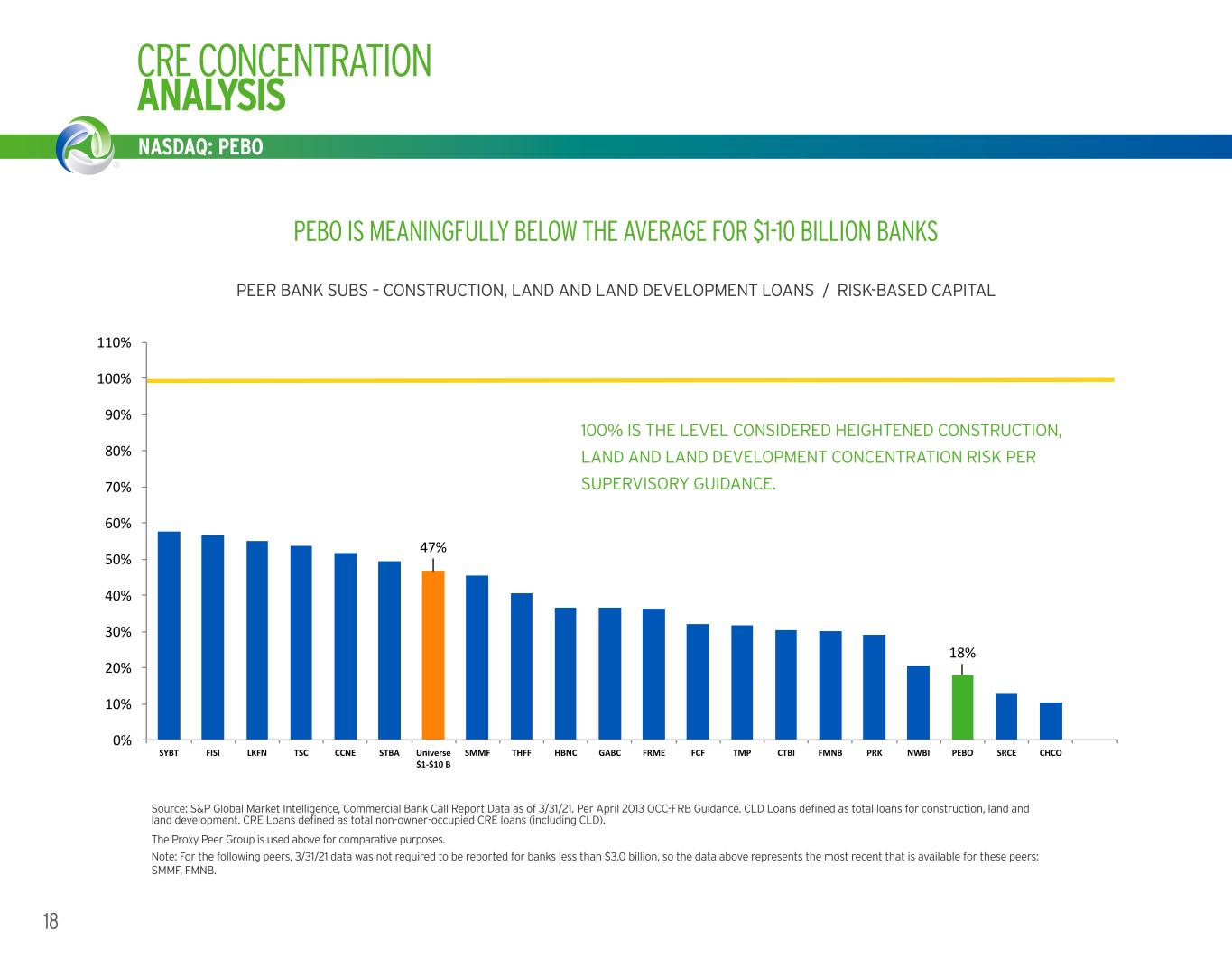

NASDAQ: PEBO 18 CRE CONCENTRATION ANALYSIS 47% 18% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 110% SYBT FISI LKFN TSC CCNE STBA Universe $1-$10 B SMMF THFF HBNC GABC FRME FCF TMP CTBI FMNB PRK NWBI PEBO SRCE CHCO Peer Bank Subs -- Construc�on, Land, and Land Development Loans / Risk-Based Capital Source: S&P Global Market Intelligence, Commercial Bank Call Report Data as of 3/31/21. Per April 2013 OCC-FRB Guidance. CLD Loans defined as total loans for construction, land and land development. CRE Loans defined as total non-owner-occupied CRE loans (including CLD). The Proxy Peer Group is used above for comparative purposes. Note: For the following peers, 3/31/21 data was not required to be reported for banks less than $3.0 billion, so the data above represents the most recent that is available for these peers: SMMF, FMNB. 100% IS THE LEVEL CONSIDERED HEIGHTENED CONSTRUCTION, LAND AND LAND DEVELOPMENT CONCENTRATION RISK PER SUPERVISORY GUIDANCE. PEBO IS MEANINGFULLY BELOW THE AVERAGE FOR $1-10 BILLION BANKS PEER BANK SUBS – CONSTRUCTION, LAND AND LAND DEVELOPMENT LOANS / RISK-BASED CAPITAL

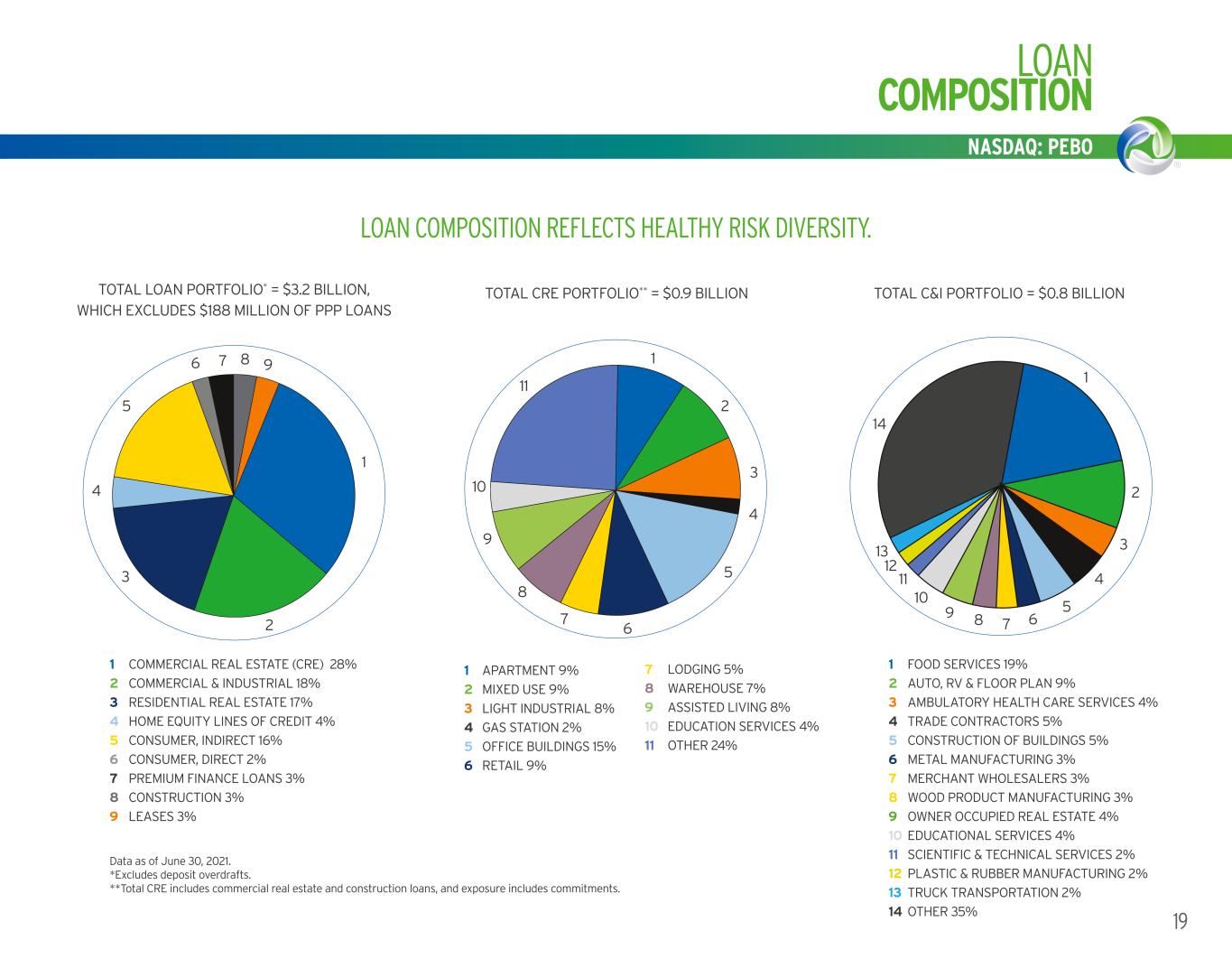

NASDAQ: PEBO LOAN COMPOSITION 19 NASDAQ: PEBO TOTAL LOAN PORTFOLIO* = $3.2 BILLION, WHICH EXCLUDES $188 MILLION OF PPP LOANS Data as of June 30, 2021. *Excludes deposit overdrafts. **Total CRE includes commercial real estate and construction loans, and exposure includes commitments. LOAN COMPOSITION REFLECTS HEALTHY RISK DIVERSITY. COMMERCIAL REAL ESTATE (CRE) 28% COMMERCIAL & INDUSTRIAL 18% RESIDENTIAL REAL ESTATE 17% HOME EQUITY LINES OF CREDIT 4% CONSUMER, INDIRECT 16% CONSUMER, DIRECT 2% PREMIUM FINANCE LOANS 3% CONSTRUCTION 3% LEASES 3% Loan Composition Commercial Real Estate PortfolioLoan Portfolio (Excluding Deposit Overdrafts) 1 2 3 4 5 6 7 8 9 TOTAL CRE PORTFOLIO** = $0.9 BILLION APARTMENT 9% MIXED USE 9% LIGHT INDUSTRIAL 8% GAS STATION 2% OFFICE BUILDINGS 15% RETAIL 9% LODGING 5% WAREHOUSE 7% ASSISTED LIVING 8% EDUCATION SERVICES 4% OTHER 24% 1 2 3 4 5 6 7 8 9 10 11 3 2 5 1 6 7 8 9 10 11 2 3 1 4 5 7 86 C & I Chart 2 1 3 4 5 6789 13 14 TOTAL C&I PORTFOLIO = $0.8 BILLION FOOD SERVICES 19% AUTO, RV & FLOOR PLAN 9% AMBULATORY HEALTH CARE SERVICES 4% TRADE CONTRACTORS 5% CONSTRUCTION OF BUILDINGS 5% METAL MANUFACTURING 3% MERCHANT WHOLESALERS 3% WOOD PRODUCT MANUFACTURING 3% OWNER OCCUPIED REAL ESTATE 4% EDUCATIONAL SERVICES 4% SCIENTIFIC & TECHNICAL SERVICES 2% PLASTIC & RUBBER MANUFACTURING 2% TRUCK TRANSPORTATION 2% OTHER 35% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 4 Commercial Real Estate Portfolio 10 11 12 9 PEER BANK SUBS – CONSTRUCTION, LAND AND LAND DEVELOPMENT LOANS / RISK-BASED CAPITAL

NASDAQ: PEBO 20 CURRENT EXPECTED CREDIT LOSSES SUMMARY ECONOMIC FORECAST – KEY DRIVERS AT JUNE 30, 2021 0% 6% 12% Q2-22Q1-22Q4-21Q3-21 Percentage of Loans considered Current US Unemployment Ohio Unemployment 5.16% 4.46% 4.01% 3.74% 0% 6% 12% Q2-22Q1-22Q4-21Q3-21 Percentage of Loans considered Current 6.50% 6.73% 6.61% 4.97% PERTINENT CREDIT STATS AS OF JUNE 30, 2021 • Allowance for credit losses was $47.9 million, up from $44.9 million as of March 31, 2021 due to the North Star Leasing acquisition • Allowance for credit losses as a percentage of total loans was 1.42%, and was up from 1.32% as of March 31, 2021* • Nonperforming assets as a percentage of total loans was 0.80% • Allowance for credit losses as a percent of nonperforming loans was 179% Ohio GDP 0% 6% 12% Q2-22Q1-22Q4-21Q3-21 Percentage of Loans considered Current 3.92% 3.30% 2.85%2.97% CECL KEY ASSUMPTIONS Day 1 CECL adoption resulted in a $5.8 million pre-tax increase to the allowance, driven by: • Estimated life of loans • 1 Year economic forecast as of 1.1.20 • Mix of acquired and organic loans • 1 Year straight-line reversion • Discounted Cash Flow (DCF) methodology *The allowance for credit losses as a percentage of total loans would increase to 1.51% as of June 30, 2021 and 1.47% as of March 31, 2021, if PPP loans were excluded from each ratio.

NASDAQ: PEBO RESERVES TO ASSETS 21WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO Source: S&P Global Market Intelligence, Commercial Bank Call Report Data as of 3/31/2021. Peer TMP data was not available as of 3/31/2021, therfore 12/31/20 is presented. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Proxy Peer Group”. The parent holding companies of these financial institutions did not comprise the peer group of financial institution holding companies used by Peoples’ Compensation Committee in analyzing and setting executive compensation for 2021. RESERVES AS A % OF LOANS* PEBO IS IN LINE WITH PEERS AS OF MARCH 31, 2021 1.42 Average, 1.19 Median, 1.23 0 0.5 1 1.5 2 2.5 3 Re se rv e as a % o f L oa ns 1Q21 eserves as a % of Loans CECL KEY ASSUMPTIONS Day 1 CECL adoption resulted in a $5.8 million pre-tax increase to the allowance, driven by: • Estimated life of loans • 1 Year economic forecast as of 1.1.20 • Mix of acquired and organic loans • 1 Year straight-line reversion • Discounted Cash Flow (DCF) methodology *The allowance for credit losses as a percentage of total loans would increase to 1.51% as of June 30, 2021 and 1.47% as of March 31, 2021, if PPP loans were excluded from each ratio.

NASDAQ: PEBO 22 PRUDENT USE OF CAPITAL ACQUISITIONS • Bank acquisitions completed in 2014 (3), 2015 (1), 2018 (1), 2019 (1) and one planned in Q3 2021 • Insurance acquisitions completed in 2014 (1), 2015 (1), 2017 (2), 2020 (1), and 2021 (1) • One investment acquisition was completed in 2016 • One premium finance acquisition effective June 30, 2020 • One equipment leasing acquisition effective March 31, 2021 CAPITAL PRIORITIES • Organic growth • Dividends • Acquisition activities • Share repurchases DIVIDENDS • Dividend paid increased from $0.15 per share for Q1 2016 to $0.36 in the most recent quarter • Consistently evaluate dividend and adjust accordingly – annualized dividend yield at July 19, 2021 was 5.02% SHARE REPURCHASES • Prudent repurchase of shares • Repurchased shares in all four quarters of 2020

79.22% 70% 75% 80% 85% 90% 95% Loans / Deposits - Peer Group NASDAQ: PEBO DEPOSIT FRANCHISE IN A COVID-19 ENVIRONMENT 23WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO AS OF MARCH 31, 2021, OUR LOAN-TO-DEPOSIT RATIO WAS LOW COMPARED TO PEER GROUP, WHICH POSITIONS US WELL FROM A LIQUIDITY PERSPECTIVE. N O T T O S C A LE Source: S&P Global Market Intelligence Data as of December 31, 2020 UNIV. $1- $10 B AVERAGE: 83.03% Source: S&P Global Market Intelligence, as of 3/31/2021. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Proxy Peer Group”. The parent holding companies of these financial institutions did not comprise the peer group of financial institution holding companies used by Peoples’ Compensation Committee in analyzing and setting executive compensation for 2021. LOANS / DEPOSITS - PEER GROUP

0.32 0.28 0.10 0.15 0.20 0.25 0.30 0.35 0.40 0.45 0.50 0.55 Total Deposit Cost (%) WORKING TOGETHER BUILDING SUCCESS NASDAQ: PEBO 24 COST OF DEPOSITS PEBO IS BELOW THE $1 - $10 BILLION BANK UNIVERSE IN TERMS OF COST OF DEPOSITS AS OF MARCH 31, 2021. TOTAL DEPOSIT COST (%) N O T T O S C A LE * Includes seven basis points related to cash flow hedges. *

WORKING TOGETHER BUILDING SUCCESS Q2 & YTD 2021 FINANCIAL INSIGHTS 25

NASDAQ: PEBO 26 ACQUISITION OF NORTH STAR LEASING ACQUISITION EFFECTIVE MARCH 31, 2021 • Founded in 1979 and headquartered in Burlington, VT, North Star Leasing (NSL) leases a broad range of essential equipment used by small-and medium-sized businesses across the U.S. • NSL is an integrated originations, underwriting and servicing platform serving over 1,250 active vendors (80% of originations) and brokers (20%) • Originations have grown 18% annually from 2014 to 2020 SECOND QUARTER 2021 HIGHLIGHTS • Added over $12 million to lease balances since acquisition, resulting in annualized growth of 59% for the quarter • Provided over $4 million in interest income and added 29 basis points to net interest margin for the second quarter of 2021 ORIGINATIONS ($000) EQUIPMENT TYPE* A DIVISION OF PEOPLES BANK L E A S I N G SM *As of June 30, 2021 2014 2015 2016 2017 2018 2019 2020 YTD 2021 $46,303 $69,674$68,914 $49,615 $38,706 $36,383 $35,482 $25,806 Heavy Equipment 9% Titled Vocational 5% Medical 4% Landscaping 3% Manufacturing 33% Restaurant 20% Other 27%

NASDAQ: PEBO OVERVIEW OF PREMIER FINANCIAL BANCORP, INC. 27WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO • Holding company for Citizens Deposit Bank and Trust, Inc. and Premier Bank, Inc. • Operates 48 branches across five states and Washington, D.C. • Proven track record of profitability and capital generation • Planned acquisition for late in the third quarter of 2021 57.2% 22.5% 7.3% 6.2% 5.4% 1.4% West Virginia Kentucky Ohio Washington D.C. Virginia Maryland West Virginia Deposit Market Share Deposits Market Rank Institution Branches ($000) Share 1 Truist Financial Corp. 52 6,177,770 15.9% 2 United Bankshares Inc. 51 5,310,568 13.7% 3 WesBanco Inc. 44 3,316,050 8.5% 4 City Holding Co. 58 2,906,071 7.5% 5 Huntington Bancshares Inc. 28 2,262,262 5.8% 6 JPMorgan Chase & Co. 17 2,129,178 5.5% 7 Summit Financial Group Inc. 29 1,922,198 4.9% 8 MVB Financial Corp 12 1,542,394 4.0% Combined Company 33 1,362,392 3.5% 9 First Community Bankshares Inc 22 1,048,879 2.7% 10 Premier Financial Bancorp Inc. 25 927,938 2.4% Source: S&P Global Market Intelligence Note: MRQ is as of March 31, 2021. Deposit market share data as of June 30, 2020. DEPOSIT FRANCHISE BY STATE Company Overview Company Name Premier Financial Bancorp, Inc. Headquarters Huntington,WV Ticker PFBI Most Recent Quarter (“MRQ”) Balance Sheet Total Assets ($000) 2,037,788 Total Loans ($000) 1,261,908 Total Deposits ($000) 1,696,439 Tangible Common Equity ($000) 193,837 Loans/Deposits (%) 74.4% TCE/TA (%) 9.8% MRQ Profitability Net income ($000) 6.550 ROAA (%) 1.35% ROAE (%) 10.30% Net Interest Margin (%) 3.59% Efficiency Ratio (%) 49.8%

NASDAQ: PEBO 28 POWERFUL PRO FORMA FRANCHISE • Attractively valued opportunities to expand the Peoples franchise • Track record of acquisitions makes for efficient integration • Positions Peoples well to capitalize on strengthening economic prospects (1) Shown as of March 31, 2021; Excludes purchase accounting adjustments (2) North Star Leasing transaction closed at the end of business on March 31, 2021 and PFBI transaction is expected to close in September 2021. Note: Map locations above do not include Peoples Premium Finance (Lee’s Summit, MO) and North Star Leasing (Burlington, VT) PRO FORMA SNAPSHOT (1) PRODUCTS & SERVICES FINANCIALS (2) $7.2B+ Assets $6.0B+ Deposits $4.6B+ Loans 137 Locations Banking Insurance Wealth Management Equipment Leasing Premium Finance $0.75 - $0.80 Accretion to 2022 EPS ~8.0% TCE/TA

NASDAQ: PEBO Q2 & YTD 2021 HIGHLIGHTS & KEY IMPACTS 29WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO FINANCIAL: • Net income of $10.1 million for the second quarter of 2021, representing earnings per diluted common share of $0.51. • Net interest income increased $4.1 million, or 11%, compared to the first quarter of 2021 and increased $4.8 million, or 14%, compared to the second quarter of 2020. • Net interest margin increased 19 basis points to 3.45% for the second quarter of 2021, compared to 3.26% for the first quarter of 2021. • Total non-interest income, excluding net gains and losses, increased $1.4 million, or 10%, compared to the second quarter of 2020. • Fee-based income comprised 31% of total revenue for the first six months of 2021. • Asset quality metrics were generally stable during the second quarter of 2021. • Delinquency trends improved as loans considered current comprised 99.1% of the loan portfolio at June 30, 2021, compared to 99.0% at March 31, 2021. • Loan growth of 4% annualized compared to March 31, 2021, excluding PPP payoffs and leases acquired from North Star Leasing. • Period-end total deposit balances at June 30, 2021 decreased $71.6 million, or 2%, compared to March 31, 2021. 1 Peoples Bank is in the top third of peer group for social media followers Social media data as of July 1, 2021 for proxy peer group (based on Nasdaq symbol): STBA, FCF, GABC, HBNC, FRME, THFF, NWBI, PEBO, CCNE, SRCE, SMMF, CHCO, TMP, PRK, FMNB, LKFN, SYBT, FISI, PFC, CTBI, TSC #2 #3 #7#5 OUT OF PROXY PEER GROUP (21 BANKS)

NASDAQ: PEBO 30 Q2 & YTD 2021 HIGHLIGHTS & KEY IMPACTS PEOPLES BANK CONTINUES TO ADD TECHNOLOGY THAT CLIENTS CARE ABOUT • Contactless debit cards • Cardless cash (ability to use ATM via mobile app without debit card) • Card Controls (ability to lock/unlock debit card) • Transaction alerts • Ability to setup PayPal & Apple Pay using debit card • Zelle® - (Send & Receive money) • Mobile check deposit • Personal Financial Management tool (MX) available on online and mobile app • Reset password on mobile app or online • Stand alone Insurance App • Stand alone Retirement App 7% Increase in mobile banking users (June 2020 vs. June 2021) 32% Increase in card control active users (June 2020 vs. June 2021) 51% Increase in active Zelle© users (June 2020 vs. June 2021)10% Increase in mobile deposit monthly users (June 2020 vs. June 2021)

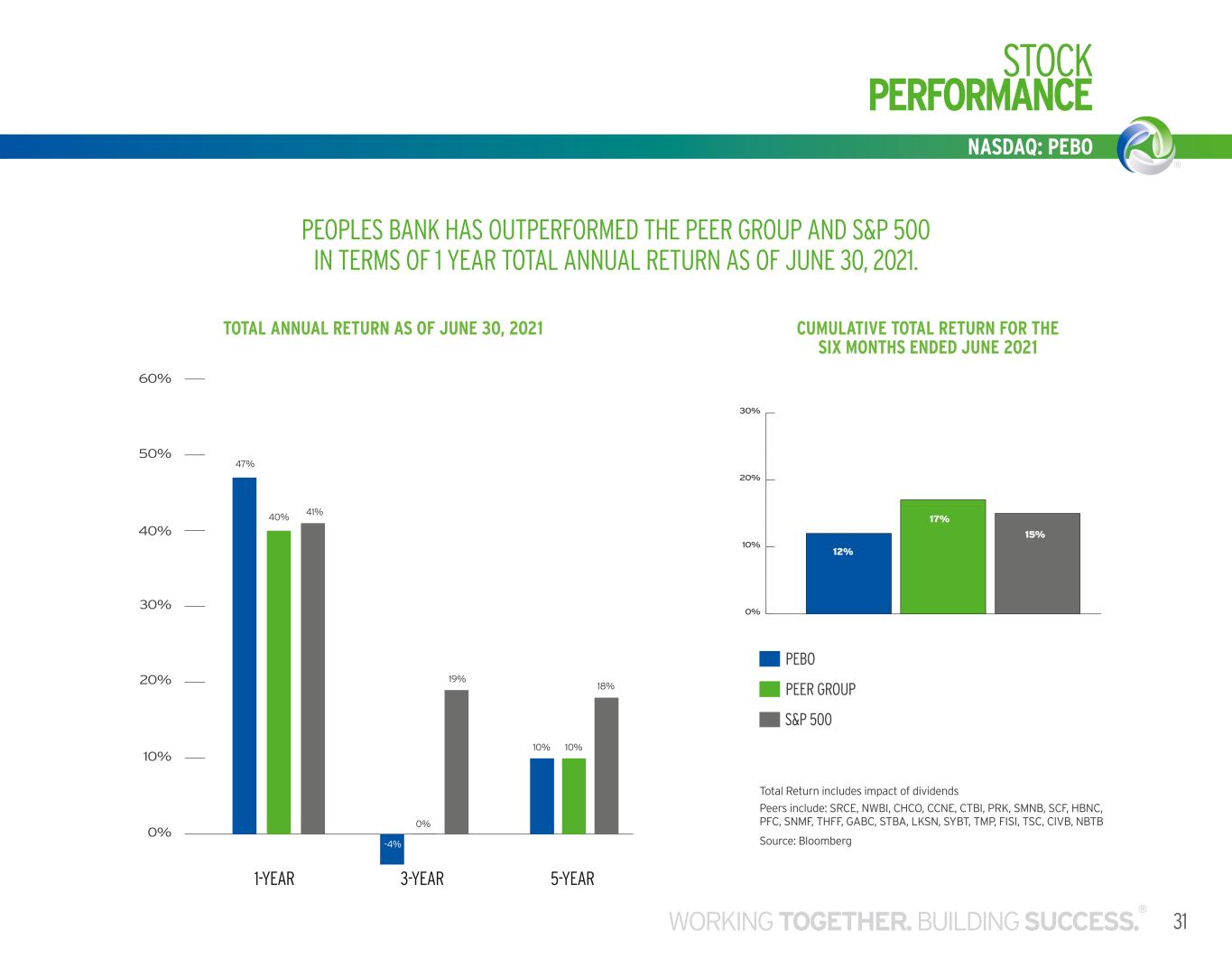

NASDAQ: PEBO STOCK PERFORMANCE 31WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO 0% 10% 20% 30% S&P 500 PEER GROUP PEBO S&P 500 0% 10% 20% 30% 40% 50% 60% Total Return includes impact of dividends Peers include: SRCE, NWBI, CHCO, CCNE, CTBI, PRK, SMNB, SCF, HBNC, PFC, SNMF, THFF, GABC, STBA, LKSN, SYBT, TMP, FISI, TSC, CIVB, NBTB Source: Bloomberg PEOPLES BANK HAS OUTPERFORMED THE PEER GROUP AND S&P 500 IN TERMS OF 1 YEAR TOTAL ANNUAL RETURN AS OF JUNE 30, 2021. CUMULATIVE TOTAL RETURN FOR THE SIX MONTHS ENDED JUNE 2021 12% 1-YEAR 3-YEAR 5-YEAR 47% 41% -4% 0% 10% 10% 40% 19% 18% 17% 15% TOTAL ANNUAL RETURN AS OF JUNE 30, 2021

NASDAQ: PEBO 32 TOTAL REVENUE $0 $50,000 $100,000 $150,000 $200,000 $250,000 YTD-21FY-20FY-19FY-18FY-17FY-16FY-15 Lorem ipsum TOTAL REVENUE OF $109 MILLION FOR FIRST SIX MONTHS OF 2021. $51,070 $52,653 $57,234 $64,892 $47,441 $97,612 $104,865 $113,377 $129,612 $140,838 NON-INTEREST INCOME, EXCLUDING GAINS AND LOSSESNET INTEREST INCOME ($ T H O U SA N D S) Beginning in the second quarter of 2018, Peoples benefited from the acquisition of ASB Financial Corp. Additionally, beginning in the second quarter of 2019, Peoples benefited from the acquisition of First Prestonsburg Bancshares Inc., in the third quarter of 2020 Peoples benefited from the acquisition of Triumph Premium Finance, and in the second quarter of 2021, Peoples benefited from the acquisition of North Star Leasing. $64,330 $138,923 $33,413 $75,238

NASDAQ: PEBO INSURANCE & INVESTMENT INCOME COMPOSITION 33WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO 1 FIDUCIARY 50% 2 BROKERAGE 35% 3 EMPLOYEE BENEFITS 15% Insurance and Investment Income Composition Insurance Revenue*Investment Revenue* 1 3 2 TOTAL INSURANCE REVENUE YTD 2021 $8.6 MILLION TOTAL INVESTMENT REVENUE YTD 2021 $8.1 MILLION 1 P&C COMMERCIAL LINES 50% 2 PERFORMANCE BASED 23% 3 P&C PERSONAL LINES 15% 4 LIFE & HEALTH 10% 5 OTHER 2% In su ra nc e an d In ve st m en t I nc om e Co m po si tio n In su ra nc e Re ve nu e* In ve st m en t R ev en ue * 1 3 2 4 5 TOTAL INSURANCE REVENUE INCREASED 17% COMPARED TO FIRST SIX MONTHS OF 2020 AND TOTAL INVESTMENT REVENUE INCREASED 23% COMPARED TO FIRST SIX MONTHS OF 2020.

NASDAQ: PEBO 34 EXPENSE & EFFICIENCY RATIO THE RECENT ESCALATION IN EXPENSES WAS DUE TO ACQUISITIONS, AND AN INCREASE IN FTE’S FOR GROWTH AND TECHNOLOGY INVESTMENTS. CORE NON-INTEREST EXPENSE Efficiency Ratio Adjusted for Non-Core Items* 55% 57% 59% 61% 63% 65% 67% 69% 71% 73% 75% YTD-21FY-20FY-19FY-18FY-17 $50000 $64000 $78000 $92000 $106000 $120000 YTD-19**FY-18**FY-17FY-16FY-15FY-14 61.85% 61.32% 61.09% N O T T O S C A LE 61.94% 64.56% EFFICIENCY RATIO ADJUSTED FOR NON-CORE ITEMS Core Non-Interest Expense* $25,000 $50,000 $75,000 $100,000 $125,000 $150,000 YTD-21FY-20FY-19FY-18FY-17 NON-CORE EXPENSES CORE NON-INTEREST EXPENSES ($ T H O U SA N D S) N O T T O S C A LE Non-US GAAP financial measure. See Appendix. COVID-19 AND REDUCED NET INTEREST INCOME IMPACTED THE EFFICIENCY RATIO IN 2020 & 2021.

IMPROVEMENT IN KEY METRICS 35WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO 0.0% 0.5% 1.0% 1.5% 2.0% YTD-21FY-20FY-19FY-18FY-17FY-16FY-15 Improvement In Key Metrics Return on Average Assets Adjusted for Non-Core Items Return on Average Tangible Stockholders’ Equity Adjusted for Non-Core Items 0% 3% 6% 9% 12% 15% YTD-21FY-20FY-19FY-18FY-17FY-16 $14 $15 $16 $17 $18 $19 $20 $21 YTD-21FY-20FY-19FY-18FY-17FY-16FY-15 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 YTD-21FY-20FY-19FY-18FY-17FY-16 1.25% 1.50% 1.75% 2.00% 2.25% FY-15 Tangible Book Value Per Share FY-15 0.0% 0.5% 1.0% 1.5% 2.0% YTD-21FY-20FY-19FY-18FY-17FY-16FY-15 Improvement In Key Metrics Return on Average Assets Adjusted for Non-Core Items Return on Average Tangible Stockholders’ Equity Adjusted for Non-Core Items 0% 3% 6% 9% 12% 15% YTD-21FY-20FY-19FY-18FY-17FY-16 $14 $15 $16 $17 $18 $19 $20 $21 YTD-21FY-20FY-19FY-18FY-17FY-16FY-15 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 YTD-21FY-20FY-19FY-18FY-17FY-16 1.25% 1.50% 1.75% 2.00% 2.25% FY-15 Tangible Book Value Per Share FY-15 0.0% 0.5% 1.0% 1.5% 2.0% YTD-21FY-20FY-19FY-18FY-17FY-16FY-15 Improvement In Key Metrics Return on Average Assets Adjusted for Non-Core Items Return on Average Tangible Stockholders’ Equity Adjusted for Non-Core Items 0% 3% 6% 9% 12% 15% YTD-21F -20FY-19FY-18FY-17FY-16 $14 $15 $16 $17 $18 $19 $20 $21 YTD-21FY-20FY-19FY-18FY-17FY-16FY-15 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 YTD-21FY-20FY-19FY-18FY-17FY-16 1.25% 1.50% 1.75% 2.00% 2.25% FY-15 Tangible Book Value Per Share -15 WE HAVE MADE STEADY PROGRESS ON THESE METRICS OVER THE RECENT YEARS. THE PROVISION FOR CREDIT LOSSES, INTEREST RATE ENVIRONMENT, AND OTHER ECONOMIC IMPACTS OF COVID-19 SIGNIFICANTLY IMPACTED THESE METRICS IN 2020 AND 2021. 0.97% RETURN ON AVERAGE ASSETS ADJUSTED FOR NON-CORE ITEMS1,2 TANGIBLE BOOK VALUE PER SHARE1 PPNR ADJUSTED FOR NON-CORE ITEMS1,2 PPNR TO TOTAL AVERAGE ASSETS ADJUSTED FOR NON-CORE ITEMS1,2 RETURN ON AVERAGE TA GIBLE STOCKHOLDERS’ EQUITY ADJUSTED FOR NO -CORE ITEMS1,2 0.0% 0.5% 1.0% 1.5% 2.0% YTD-21FY-20FY-19FY-18FY-17FY-16FY-15 Improvement In Key Metrics Return on Average Assets Adjusted for Non-Core Items Return on Average Tangible Stockholders’ Equity Adjusted for Non-Core Items 0% 3% 6% 9% 12% 15% YTD-21FY-20FY-19FY-18FY-17FY-16 $14 $15 $16 $17 $18 $19 $20 $21 YTD-21FY-20FY-19FY-18FY-17FY-16FY-15 $10,000 $20, $30,000 $40, $50, $60, $70, $80,000 YTD-21FY-20FY-19FY-18FY-17FY-16 1.25% 1.50% 1.75% 2.00% 2.25% FY-15 Tangible Book Value Per Share FY-15 1.08% 1.32% 1.42% 11.30% 11.40% 15.48% 15.32% $15.89 $17.17 $18.30 $41.6 ($ M IL LI O N S) N O T T O S C A LE N O T T O S C A LE N O T T O S C A LE $20.14 $58.6 $68.4 $50.4 $76.0 1.52% 1.67% 1.77% 1.80% 1.34% 7.32% 0.62% $14.68 $19.99 0.85% 9.75% $74.5 1.57% 1.21% 16.27% $18.51 1.44% $36.1 1 Non-US GAAP financial measure. See Appendix. 2 Presented on annualized basis.

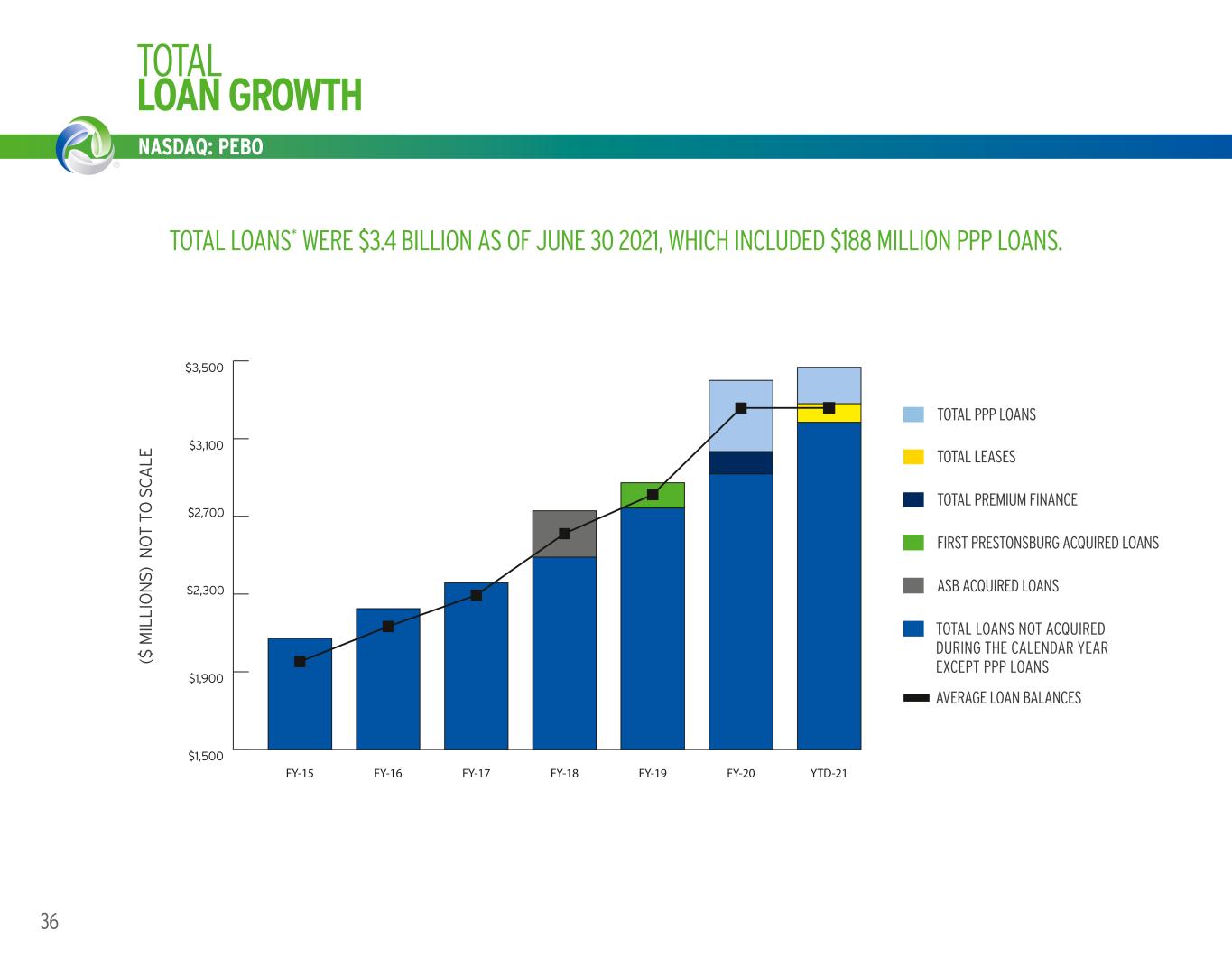

NASDAQ: PEBO 36 TOTAL LOAN GROWTH ($ M IL LI O N S) N O T T O S C A LE ASB ACQUIRED LOANS TOTAL LOANS NOT ACQUIRED DURING THE CALENDAR YEAR EXCEPT PPP LOANS AVERAGE LOAN BALANCES FIRST PRESTONSBURG ACQUIRED LOANS $1,500 $1,900 $2,300 $2,700 $3,100 $3,500 YTD-21FY-20FY-19FY-18FY-17FY-16FY-15 Total Loan Growth TOTAL LOANS* WERE $3.4 BILLION AS OF JUNE 30 2021, WHICH INCLUDED $188 MILLION PPP LOANS. TOTAL PREMIUM FINANCE TOTAL LEASES IN 2020, THE INCREASE IN TOTAL LOANS AS A PERCENTAGE OF EARNING ASSETS WAS DUE TO PPP LOANS. TOTAL PPP LOANS

EARNING ASSET MIX 37WORKING TOGETHER. BUILDING SUCCESS. ® IN 2020, THE INCREASE IN TOTAL LOANS AS A PERCENTAGE OF EARNING ASSETS WAS DUE TO PPP LOANS. TO TA L E A R N IN G A S S E TS (I N $ B IL LI O N S) P E R C E N TA G E O F TO TA L E A R N IN G A S S E TS Earning Asset Mix $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 YTD-21FY-20FY-19FY-18FY-17 20% 30% 40% 50% 60% 70% 80% LOANSINVESTMENTS INVESTMENTS % LOANS % 73% 76% 74% 27% 24% 26% 78% 80% 20% 76% 20% 24% NASDAQ: PEBO

DDAs* NASDAQ: PEBO DEPOSIT GROWTH DEPOSIT BALANCES BENEFITED FROM PPP LOAN PROCEEDS AND FISCAL STIMULUS FOR CONSUMERS AND COMMERCIAL CLIENTS. *DDAs stands for demand deposit accounts and represents interest-bearing and non-interest bearing transaction accounts. Deposit Growth $100 $750 $1,400 $2,050 $2,700 $3,350 $4,000 YTD-21FY-20FY-19FY-18FY-17 $2,730 $2,955 $3,291 ($ M IL LI O N S) N O T T O S C A LE BROKERED CERTIFICATES OF DEPOSIT GOVERNMENTAL DEPOSIT ACCOUNTS MONEY MARKET DEPOSIT ACCOUNTS RETAIL CERTIFICATES OF DEPOSIT SAVINGS ACCOUNTS INTEREST-BEARING DDAs* NON-INTEREST-BEARING DDAs* $3,910 $4,233 38 WORKING TOGETHER BUILDING SUCCESS 45%

39 WORKING TOGETHER BUILDING SUCCESS Q2 & YTD 2021 APPENDIX 39

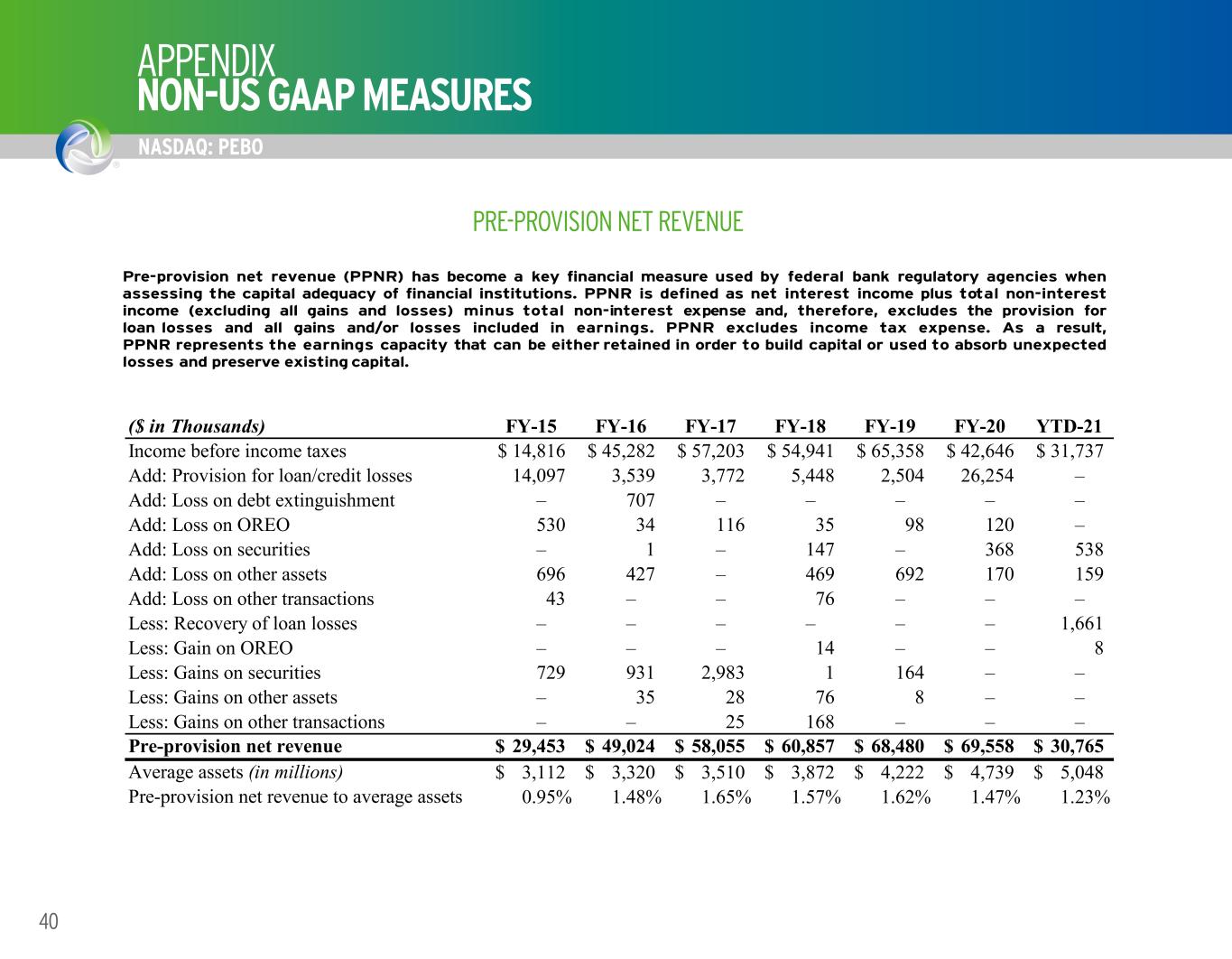

NASDAQ: PEBO APPENDIX NON-US GAAP MEASURES 40 PRE-PROVISION NET REVENUE Pre-provision net revenue (PPNR) has become a key financial measure used by federal bank regulatory agencies when assessing the capital adequacy of financial institutions. PPNR is defined as net interest income plus total non-interest income (excluding all gains and losses) minus total non-interest expense and, therefore, excludes the provision for loan losses and all gains and/or losses included in earnings. PPNR excludes income tax expense. As a result, PPNR represents the earnings capacity that can be either retained in order to build capital or used to absorb unexpected losses and preserve existing capital. (a) Presented on an annualized basis PRE-PROVISION NET REVENUE C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Q2 2021 Spreadsheet data for investor deck Appendix 1 ($ in Thousands) FY-15 FY-16 FY-17 FY-18 FY-19 FY-20 YTD-21 Income before income taxes 14,816$ 45,282$ 57,203$ 54,941$ 65,358$ 42,646$ 31,737$ Add: Provision for loan/credit losses 14,097 3,539 3,772 5,448 2,504 26,254 – Add: Loss on debt extinguishment – 707 – – – – – Add: Loss on OREO 530 34 116 35 98 120 – Add: Loss on securities – 1 – 147 – 368 538 Add: Loss on other assets 696 427 – 469 692 170 159 Add: Loss on other transactions 43 – – 76 – – – Less: Recovery of loan losses – – – – – – 1,661 Less: Gain on OREO – – – 14 – – 8 Less: Gains on securities 729 931 2,983 1 164 – – Less: Gains on other assets – 35 28 76 8 – – Less: Gains on other transactions – – 25 168 – – – Pre-provision net revenue 29,453$ 49,024$ 58,055$ 60,857$ 68,480$ 69,558$ 30,765$ Average assets (in millions) 3,112$ 3,320$ 3,510$ 3,872$ 4,222$ 4,739$ 5,048$ Pre-provision net revenue to average assets 0.95% 1.48% 1.65% 1.57% 1.62% 1.47% 1.23%

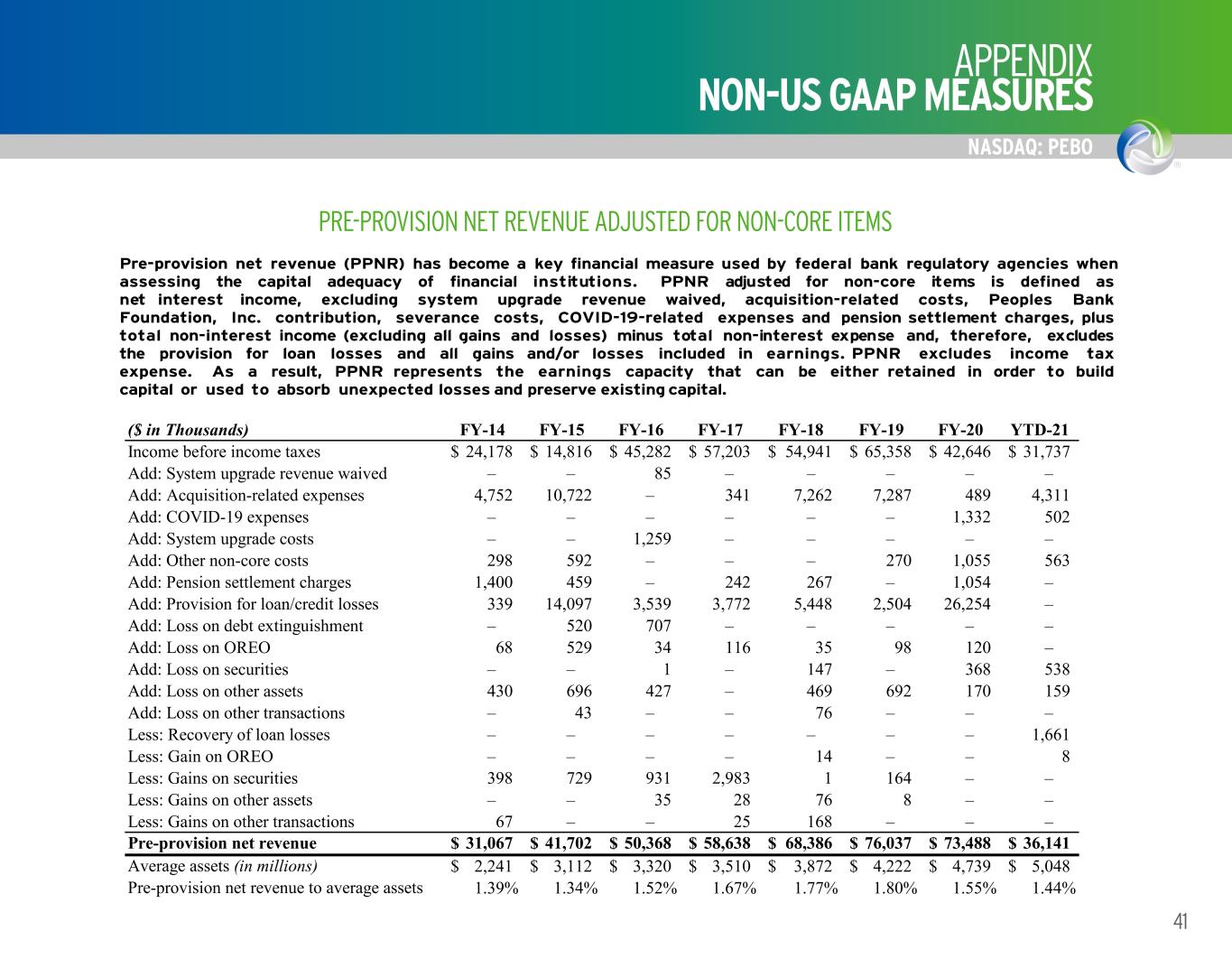

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO 41 PRE-PROVISION NET REVENUE ADJUSTED FOR NON-CORE ITEMS Pre-provision net revenue (PPNR) has become a key financial measure used by federal bank regulatory agencies when assessing the capital adequacy of financial institutions. PPNR adjusted for non-core items is defined as net interest income, excluding system upgrade revenue waived, acquisition-related costs, Peoples Bank Foundation, Inc. contribution, severance costs, COVID-19-related expenses and pension settlement charges, plus total non-interest income (excluding all gains and losses) minus total non-interest expense and, therefore, excludes the provision for loan losses and all gains and/or losses included in earnings. PPNR excludes income tax expense. As a result, PPNR represents the earnings capacity that can be either retained in order to build capital or used to absorb unexpected losses and preserve existing capital. (a) Presented on an annualized basis PRE-PROVISION NET REVENUE ADJUSTED FOR NON-CORE ITEMS C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Q2 2021 Spreadsheet data for investor deck Appendix 2 ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 FY-20 YTD-21 Income before income taxes 24,178$ 14,816$ 45,282$ 57,203$ 54,941$ 65,358$ 42,646$ 31,737$ Add: System upgrade revenue waived – – 85 – – – – – Add: Acquisition-related expenses 4,752 10,722 – 341 7,262 7,287 489 4,311 Add: COVID-19 expenses – – – – – – 1,332 502 Add: System upgrade costs – – 1,259 – – – – – Add: Other non-core costs 298 592 – – – 270 1,055 563 Add: Pension settlement charges 1,400 459 – 242 267 – 1,054 – Add: Provision for loan/credit losses 339 14,097 3,539 3,772 5,448 2,504 26,254 – Add: Loss on debt extinguishment – 520 707 – – – – – Add: Loss on OREO 68 529 34 116 35 98 120 – Add: Loss on securities – – 1 – 147 – 368 538 Add: Loss on other assets 430 696 427 – 469 692 170 159 Add: Loss on other transactions – 43 – – 76 – – – Less: Recovery of loan losses – – – – – – – 1,661 Less: Gain on OREO – – – – 14 – – 8 Less: Gains on securities 398 729 931 2,983 1 164 – – Less: Gains on other assets – – 35 28 76 8 – – Less: Gains on other transactions 67 – – 25 168 – – – Pre-provision net revenue 31,067$ 41,702$ 50,368$ 58,638$ 68,386$ 76,037$ 73,488$ 36,141$ Average assets (in millions) 2,241$ 3,112$ 3,320$ 3,510$ 3,872$ 4,222$ 4,739$ 5,048$ Pre-provision net revenue to average assets 1.39% 1.34% 1.52% 1.67% 1.77% 1.80% 1.55% 1.44%

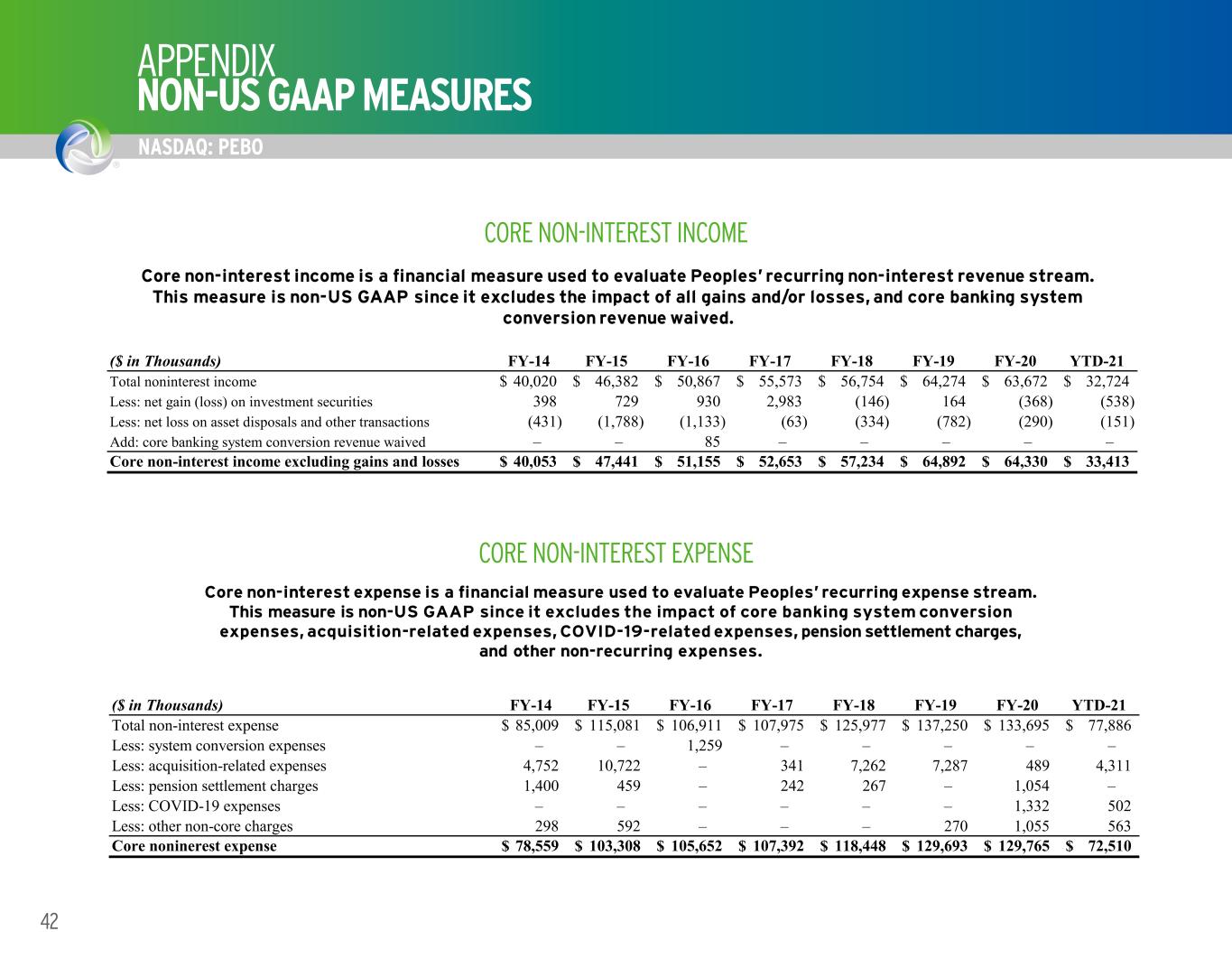

NASDAQ: PEBO APPENDIX NON-US GAAP MEASURES 42 CORE NON-INTEREST INCOME Core non-interest income is a financial measure used to evaluate Peoples’ recurring non-interest revenue stream. This measure is non-US GAAP since it excludes the impact of all gains and/or losses, and core banking system conversion revenue waived. CORE NON-INTEREST EXPENSE Core non-interest expense is a financial measure used to evaluate Peoples’ recurring expense stream. This measure is non-US GAAP since it excludes the impact of core banking system conversion expenses, acquisition-related expenses, COVID-19-related expenses, pension settlement charges, and other non-recurring expenses. CORE NON-INTEREST INCOME Core non-interest income is a financial measure used to evaluate Peoples’ recurring non-interest revenue stream. This measure is non-US GAAP since it excludes the impact of all gains and/or losses, and core banking system conversion revenue waived. CORE NON-INTEREST EXPENSE Core non-interest expense is a financial measure used to evaluate Peoples’ recurring expense stream. This measure is non-US GAAP since it excludes the impact of core banking system conversion expenses, acquisition-related expenses, COVID-19-related expenses, pension settlement charges, and other non-recurring expenses. CORE NON-I TE EST INCOME CORE NON-I EST EXPENSE C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Q2 2021 Spreadsheet data for investor deck Appendix 3 ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 FY-20 YTD-21 Total noninterest income 40,020$ 46,382$ 50,867$ 55,573$ 56,754$ 64,274$ 63,672$ 32,724$ Less: net gain (loss) on investment securities 398 729 930 2,983 (146) 164 (368) (538) Less: net loss on asset disposals and other transactions (431) (1,788) (1,133) (63) (334) (782) (290) (151) Add: core banking system conversion revenue waived – – 85 – – – – – Core non-interest income excluding gains and losses 40,053$ 47,441$ 51,155$ 52,653$ 57,234$ 64,892$ 64,330$ 33,413$ ($ in Thousa ds) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 FY-20 YTD-21 Total non-interest expense 85,009$ 115,081$ 106,911$ 107,975$ 125,977$ 137,250$ 133,695$ 77,886$ Less: system conversion expenses – – 1,259 – – – – – Less: acquisition-related expenses 4,752 10,722 – 341 7,262 7,287 489 4,311 Less: pension settlement charges 1,400 459 – 242 267 – 1,054 – Less: COVID-19 expenses – – – – – – 1,332 502 Less: other non-core charges 298 592 – – – 270 1,055 563 Core noninerest expense 78,559$ 103,308$ 105,652$ 107,392$ 118,448$ 129,693$ 129,765$ 72,510$ C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Q2 2021 Spreadsheet data for investor deck Appendix 3 ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 FY-20 YTD-21 Total noninterest income 40,020$ 46,382$ 50,867$ 55,573$ 56,754$ 64,274$ 63,672$ 32,724$ Less: net gain (loss) on investment securities 398 729 930 2,983 (146) 164 (368) (538) Less: net loss on asset disposals and other transactions (431) (1,788) (1,133) (63) (334) (782) (290) (151) Add: core banking system conversion revenue waived – – 85 – – – – – Core non-interest income excluding gains and losses 40,053$ 47,441$ 51,155$ 52,653$ 57,234$ 64,892$ 64,330$ 33,413$ ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 FY-20 YTD-21 Total non-interest expense 85,009$ 115,081$ 106,911$ 107,975$ 125,977$ 137,250$ 133,695$ 77,886$ Less: system conversion expenses – – 1,259 – – – – – Less: acquisition-related expenses 4,752 10,722 – 341 7,262 7,287 489 4,311 Less: pension settlement charges 1,400 459 – 242 267 – 1,054 – Less: COVID-19 expenses – – – – – – 1,332 502 Less: other non-core charges 298 592 – – – 270 1,055 563 Core noninerest expense 78,559$ 103,308$ 105,652$ 107,392$ 118,448$ 129,693$ 129,765$ 72,510$

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO 43 EFFICIENCY RATIO The efficiency ratio is a key financial measure used to monitor performance. The efficiency ratio is calculated as total non-interest expense (less amortization of other intangible assets) as a percentage of fully tax-equivalent net interest income plus total non-interest income excluding all gains and all losses. This measure is non-US GAAP since it excludes amortization of other intangible assets, and all gains and/or losses included in earnings, and uses fully tax-equivalent net interest income. The efficiency ratio adjusted for non-core items is non-US GAAP since it excludes amortization of other intangible assets, non-core expenses, system upgrade revenue waived and all gains and/or losses included in earnings, and uses fully tax-equivalent net interest income. CORE NON-INTEREST EXPENSE EFFICIENCY RATIO AND ADJUSTED FOR NON-CORE ITEMS C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Slide 43 Appendix 4 ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 FY-20 YTD-21 Total noninterest expense 85,009$ 115,081$ 106,911$ 107,975$ 125,977$ 137,250$ 133,695$ 77,886$ Less: amortization on other intangible assets 1,428 4,077 4,030 3,516 3,338 3,359 3,223 1,988 Adjusted total non-interest expense 83,581 111,004 102,881 104,459 122,639 133,891 130,472 75,898 Total non-interest income excluding net gains and losses 40,053 47,441 51,070 52,653 57,234 64,892 64,330 33,413 Net interest income 69,506 97,612 104,865 113,377 129,612 140,838 138,923 75,238 Add: fully taxable equivalent adjustment 1,335 1,978 2,027 1,912 881 1,068 1,054 578 Net interest income on a fully taxable equivalent basis 70,841 99,590 106,892 115,289 130,493 141,906 139,977 75,816 Adjusted revenue 110,894$ 147,031$ 157,962$ 167,942$ 187,727$ 206,798$ 204,307$ 109,229$ Efficiency ratio 75.37% 75.50% 65.13% 62.20% 65.33% 64.74% 63.86% 69.49% Core non-interest expense 78,559$ 103,308$ 105,652$ 107,392$ 118,448$ 129,693$ 129,765$ 72,510$ Less: amortization on other intangible assets 1,428 4,077 4,030 3,516 3,338 3,359 3,223 1,988 77,131 99,231 101,622 103,876 115,110 126,334 126,542 70,522 Core non-interest income excluding gains and losses 40,053 47,441 51,070 52,653 57,234 64,892 64,330 33,413 Net interest income on a fully taxable equivalent basis 70,841 99,590 106,892 115,289 130,493 141,906 139,977 75,816 Adjusted core revenue 110,894 147,031 157,962 167,942 187,727 206,798 204,307 109,229 Efficiency ratio adjusted for non-core items 69.55% 67.49% 64.33% 61.85% 61.32% 61.09% 61.94% 64.56%

NASDAQ: PEBO APPENDIX NON-US GAAP MEASURES 44 TANGIBLE EQUITY TO TANGIBLE ASSETS AND TANGIBLE BOOK VALUE PER SHARE Peoples uses tangible capital measures to evaluate the adequacy of Peoples’ stockholders’ equity. Such ratios represent non-US GAAP financial measures since the calculation removes the impact of goodwill and other intangible assets acquired through acquisitions on both total stockholders' equity and total assets. Management believes this information is useful to investors since it facilitates the comparison of Peoples’ operating performance, financial condition and trends to peers, especially those without a level of intangible assets similar to that of Peoples. The following table reconciles the calculation of these non-US GAAP financial measures to amounts reported in Peoples’ consolidated financial statements. TANGIBLE EQUITY TO TANGIBLE ASSETS AND TANGIBLE BOOK VALUE PER SHARE C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Q2 2021 Spreadsheet data for investor deck Appendix 5 ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 FY-20 YTD-21 Total stockholders equity 340,118$ 419,789$ 435,261$ 458,592$ 520,140$ 594,393$ 575,673$ 585,505$ Less: goodwill and other intangible assets 109,158 149,617 146,018 144,576 162,085 177,503 184,597 221,576 Tangible equity 230,960 270,172 289,243 314,016 358,055 416,890 391,076 363,929 Total assets 2,567,769$ 3,258,970$ 3,432,348$ 3,581,686$ 3,991,454$ 4,354,165$ 4,760,764$ 5,067,634$ Less: goodwill and other intangible assets 109,158 149,617 146,018 144,576 162,085 177,503 184,597 221,576 Tangible assets 2,458,611 3,109,353 3,286,330 3,437,110 3,829,369 4,176,662 4,576,167 4,846,058 Tangible equity to tangible assets 9.39% 8.69% 8.80% 9.14% 9.35% 9.98% 8.55% 7.51% Tangible equity 230,960$ 270,172$ 289,243$ 314,016$ 358,055$ 416,890$ 391,076$ 363,929$ Common shares outstanding 14,836,727 18,404,864 18,200,067 18,287,449 19,565,029 20,698,941 19,563,979 19,660,877 Tangible book value per share 15.57$ 14.68$ 15.89$ 17.17$ 18.30$ 20.14$ 19.99$ 18.51$

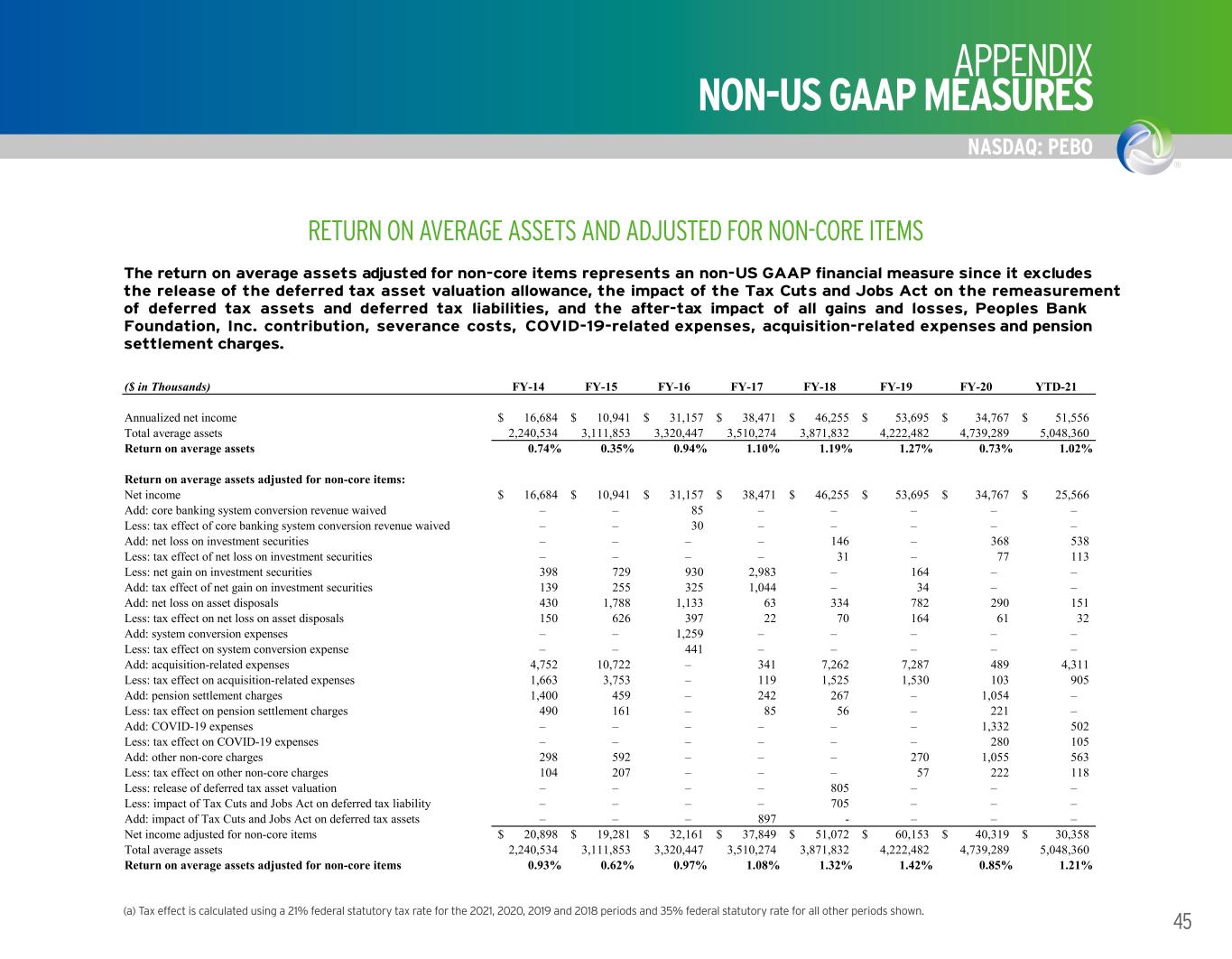

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO 45 RETURN ON AVERAGE ASSETS ADJUSTED FOR NON-CORE ITEMS The return on average assets adjusted for non-core items represents an non-US GAAP financial measure since it excludes the release of the deferred tax asset valuation allowance, the impact of the Tax Cuts and Jobs Act on the remeasurement of deferred tax assets and deferred tax liabilities, and the after-tax impact of all gains and losses, Peoples Bank Foundation, Inc. contribution, severance costs, COVID-19-related expenses, acquisition-related expenses and pension settlement charges. (a) Tax effect is calculated using a 21% federal statutory tax rate for the 2018 periods and 35% for the 2017 period. (a) Tax effect is calculated using a 21% federal statutory tax rate for the 2021, 2020, 2019 and 2018 periods and 35% federal statutory rate for all other periods shown. TANGIBLE EQUITY TO TANGIBLE ASSETS AND TANGIBLE BOOK VALUE PER SHARE RETURN ON AVERAGE ASSETS AND ADJUSTED FOR NON-CORE ITEMS C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Q2 2021 Spreadsheet data for investor deck Appendix 6 ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 FY-20 YTD-21 Annualized net income 16,684$ 10,941$ 31,157$ 38,471$ 46,255$ 53,695$ 34,767$ 51,556$ Total average assets 2,240,534 3,111,853 3,320,447 3,510,274 3,871,832 4,222,482 4,739,289 5,048,360 Return on average assets 0.74% 0.35% 0.94% 1.10% 1.19% 1.27% 0.73% 1.02% Return on average assets adjusted for non-core items: Net income 16,684$ 10,941$ 31,157$ 38,471$ 46,255$ 53,695$ 34,767$ 25,566$ Add: core banking system conversion revenue waived – – 85 – – – – – Less: tax effect of core banking system conversion revenue waived – – 30 – – – – – Add: net loss on investment securities – – – – 146 – 368 538 Less: tax effect of net loss on investment securities – – – – 31 – 77 113 Less: net gain on investment securities 398 729 930 2,983 – 164 – – Add: tax effect of net gain on investment securities 139 255 325 1,044 – 34 – – Add: net loss on asset disposals 430 1,788 1,133 63 334 782 290 151 Less: tax effect on net loss on asset disposals 150 626 397 22 70 164 61 32 Add: system conversion expenses – – 1,259 – – – – – Less: tax effect on system conversion expense – – 441 – – – – – Add: acquisition-related expenses 4,752 10,722 – 341 7,262 7,287 489 4,311 Less: tax effect on acquisition-related expenses 1,663 3,753 – 119 1,525 1,530 103 905 Add: pension settlement charges 1,400 459 – 242 267 – 1,054 – Less: tax effect on pension settlement charges 490 161 – 85 56 – 221 – Add: COVID-19 expenses – – – – – – 1,332 502 Less: tax effect on COVID-19 expenses – – – – – – 280 105 Add: other non-core charges 298 592 – – – 270 1,055 563 Less: tax effect on other non-core charges 104 207 – – – 57 222 118 Less: release of deferred tax asset valuation – – – – 805 – – – Less: impact of Tax Cuts and Jobs Act on deferred tax liability – – – – 705 – – – Add: impact of Tax Cuts and Jobs Act on deferred tax assets – – – 897 - – – – Net income djust d for non-core items 20,898$ 19,281$ 32,161$ 37,849$ 51,072$ 60,153$ 40,319$ 30,358$ Total average assets 2,240,534 3,111,853 3,320,447 3,510,274 3,871,832 4,222,482 4,739,289 5,048,360 Return on average assets adjusted for non-core items 0.93% 0.62% 0.97% 1.08% 1.32% 1.42% 0.85% 1.21%

NASDAQ: PEBO APPENDIX NON-US GAAP MEASURES 46 RETURN ON AVERAGE TANGIBLE STOCKHOLDERS’ EQUITY The return on average tangible stockholders' equity ratio is a key financial measure used to monitor performance. It is calculated as net income (less after-tax impact of amortization of other intangible assets) divided by average tangible stockholders' equity. This measure is non-US GAAP since it excludes the after-tax impact of amortization of other intangible assets from earnings and the impact of goodwill and other intangible assets acquired through acquisitions on total stockholders' equity. (a) T ax effect is calculated using a 21% federal statutory tax rate for the 2019 and 2018 periods, and a 35% federal statutory tax rate for all other periods shown. (a) Tax effect is calculated using a 21% federal statutory tax rate for the 2021, 2020, 2019 and 2018 periods and 35% federal statutory rate for all other periods shown. RETURN ON AVERAGE TANGIBLE STOCKHOLDERS’ EQUITY C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Q2 2021 Spreadsheet data for investor deck Appendix 7 ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 YTD-20 YTD-21 Annualized net income 16,684$ 10,941$ 31,157$ 38,471$ 46,255$ 53,695$ 34,767$ 51,556$ Add: amortization of other intangible assets 1,428 4,077 4,030 3,516 3,338 3,359 3,223 4,009 Less: tax effect of amortization of other intangible assets (a) 500 1,427 1,411 1,231 701 705 677 842 Annualized net income excluding the amortization of intangible assets 17,612 13,591 33,776 40,756 48,892 56,349 37,313 54,723 Total average equity 270,689 407,296 432,666 450,379 488,139 566,123 575,386 579,721 Less: average goodwill and other intangible assets 87,821 144,013 147,981 144,696 158,115 173,529 181,526 203,509 Average tangible equity 182,868 263,283 284,685 305,683 330,024 392,594 393,860 376,212 Annualized net income 16,684$ 10,941$ 31,157$ 38,471$ 46,255$ 53,695$ 34,767$ 51,556$ Total average equity 270,689 407,296 432,666 450,379 488,139 566,123 575,386 579,721 Return on average equity 6.16% 2.69% 7.20% 8.54% 9.48% 9.48% 6.04% 8.89% Annualized net income excluding the amortization of intangible assets 17,612$ 13,591$ 33,776$ 40,756$ 48,892$ 56,349$ 37,313$ 54,723$ Average tangible equity 182,868 263,283 284,685 305,683 330,024 392,594 393,860 376,212 Return on average tangible equity 9.63% 5.16% 11.86% 13.33% 14.81% 14.35% 9.47% 14.55% ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 FY-20 YTD-21 Return on average equity adjusted for non-core items: Net income 16,684$ 10,941$ 31,157$ 38,471$ 46,255$ 53,695$ 34,767$ 25,566$ Add: core banking system conversion revenue waived – – 85 – – – – – Less: tax effect of core banking system conversion revenue waived (a) – – 30 – – – – – Add: net loss on investment securities – – – – 146 – 368 538 Less: tax effect of net loss on investment securities (a) – – – – 31 – 77 113 Less: net gain on investment securities 398 729 930 2,983 – 164 – – Add: tax effect of net gain on investment securities (a) 139 255 325 1,044 – 34 – – Add: net loss on asset disposals 430 1,788 1,133 63 334 782 290 151 Less: tax effect on net loss on asset disposals (a) 150 626 397 22 70 164 61 32 Add: system conversion expenses – – 1,259 – – – – – Less: tax effect on system conversion expense (a) – – 441 – – – – – Add: acquisition-related expenses 4,752 10,722 – 341 7,262 7,287 489 4,311 Less: tax effect on acquisition-related expenses (a) 1,663 3,753 – 119 1,525 1,530 103 905 Add: pension settlement charges 1,400 459 – 242 267 – 1,054 – Less: tax effect on pension settlement charges (a) 490 161 – 85 56 – 221 – Add: COVID-19 expenses – – – – – – 1,332 502 Less: tax effect on COVID-19 expenses (a) – – – – – – 280 105 Add: other non-core charges 298 592 – – – 270 1,055 563 Less: tax effect on other non-core charges (a) 104 207 – – – 57 222 118 Less: release of deferred tax asset valuation – – – – 805 – – – Less: impact of Tax Cuts and Jobs Act on deferred tax liability – – – – 705 – – – Add: impact of Tax Cuts and Jobs Act on deferred tax assets – – – 897 – – – – Net income adjusted for non-core items 20,898$ 19,281$ 32,161$ 37,849$ 51,072$ 60,153$ 38,391$ 30,358$ Average tangible equity 270,689 407,296 432,666 450,379 488,139 566,123 575,386 579,721 Return on average equity adjusted for non-core items 7.72% 4.73% 7.43% 8.40% 10.46% 10.63% 6.67% 10.56% Net income adjusted for non-core items 20,898$ 19,281$ 32,161$ 37,849$ 51,072$ 60,153$ 38,391$ 30,358$ Average tangible equity 182,868 263,283 284,685 305,683 330,024 392,594 393,860 376,212 Return on average tangible equity adjusted for non-core items 11.43% 7.32% 11.30% 12.38% 15.48% 15.32% 9.75% 16.27%

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO 47 The return on average stockholders’ equity adjusted for non-core items represents an non-US GAAP financial measure since it excludes the release of the deferred tax asset valuation allowance, the impact of the Tax Cuts and Jobs Act on the remeasurement of deferred tax assets and deferred tax liabilities, and the after-tax impact of all gains and losses, other non-core charges, Peoples Bank Foundation, Inc. contribution, severance costs, COVID-19-related expenses, acquisition-related expenses and pension settlement charges. (a) Tax effect is calculated using a 21% federal statutory tax rate for the 2019and 2018 periods and 35% for the 2017 period. RETURN ON AVERAGE STOCKHOLDERS’ EQUITY ADJUSTED FOR NON-CORE ITEMS C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Q2 2021 Spreadsheet data for investor deck Appendix 7 ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 YTD-20 YTD-21 Annualized net income 16,684$ 10,941$ 31,157$ 38,471$ 46,255$ 53,695$ 34,767$ 51,556$ Add: amortization of other intangible assets 1,428 4,077 4,030 3,516 3,338 3,359 3,223 4,009 Less: tax effect of amortization of other intangible assets (a) 500 1,427 1,411 1,231 701 705 677 842 Annualized net income excluding the amortization of intangible assets 17,612 13,591 33,776 40,756 48,892 56,349 37,313 54,723 Total average equity 270,689 407,296 432,666 450,379 488,139 566,123 575,386 579,721 Less: average goodwill and other intangible assets 87,821 144,013 147,981 144,696 158,115 173,529 181,526 203,509 Average tangible equity 182,868 263,283 284,685 305,683 330,024 392,594 393,860 376,212 Annualized net income 16,684$ 10,941$ 31,157$ 38,471$ 46,255$ 53,695$ 34,767$ 51,556$ Total average equity 270,689 407,296 432,666 450,379 488,139 566,123 575,386 579,721 Return on average equity 6.16% 2.69% 7.20% 8.54% 9.48% 9.48% 6.04% 8.89% Annualized net inco e excluding th amortization of intangible assets 17,612$ 13,591$ 33,776$ 40,756$ 48,892$ 56,349$ 37,313$ 54,723$ Average tangible equity 182,868 263,283 284,685 305,683 330,024 392,594 393,860 376,212 Return on average tangible equity 9.63% 5.16% 11.86% 13.33% 14.81% 14.35% 9.47% 14.55% ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 FY-20 YTD-21 Return on average equity adjusted for non-core items: Net income 16,684$ 10,941$ 31,157$ 38,471$ 46,255$ 53,695$ 34,767$ 25,566$ Add: core banking system conversion revenue waived – – 85 – – – – – Less: tax effect of core banking system conversion revenue waived (a) – – 30 – – – – – Add: net loss on investment securities – – – – 146 – 368 538 Less: tax effect of net loss on investment securities (a) – – – – 31 – 77 113 Less: net gain on investment securities 398 729 930 2,983 – 164 – – Add: tax effect of net gain on investment securities (a) 139 255 325 1,044 – 34 – – Add: net loss on asset disposals 430 1,788 1,133 63 334 782 290 151 Less: tax effect on net loss on asset disposals (a) 150 626 397 22 70 164 61 32 Add: system conversion expenses – – 1,259 – – – – – Less: tax effect on system conversion expense (a) – – 441 – – – – – Add: acquisition-related expenses 4,752 10,722 – 341 7,262 7,287 489 4,311 Less: tax effect on acquisition-related expenses (a) 1,663 3,753 – 119 1,525 1,530 103 905 Add: pension settlement charges 1,400 459 – 242 267 – 1,054 – Less: tax effect on pension settlement charges (a) 490 161 – 85 56 – 221 – Add: COVID-19 expenses – – – – – – 1,332 502 Less: tax effect on COVID-19 expenses (a) – – – – – – 280 105 Add: other non-core charges 298 592 – – – 270 1,055 563 Less: tax effect on other non-core charges (a) 104 207 – – – 57 222 118 Less: release of deferred tax asset valuation – – – – 805 – – – Less: impact of Tax Cuts and Jobs Act on deferred tax liability – – – – 705 – – – Add: impact of Tax Cuts and Jobs Act on deferred tax assets – – – 897 – – – – Net income adjusted for non-core items 20,898$ 19,281$ 32,161$ 37,849$ 51,072$ 60,153$ 38,391$ 30,358$ Average tangible equity 270,689 407,296 432,666 450,379 488,139 566,123 575,386 579,721 Return on average equity adjusted for non-core items 7.72% 4.73% 7.43% 8.40% 10.46% 10.63% 6.67% 10.56% Net income adjusted for non-core items 20,898$ 19,281$ 32,161$ 37,849$ 51,072$ 60,153$ 38,391$ 30,358$ Average tangible equity 182,868 263,283 284,685 305,683 330,024 392,594 393,860 376,212 Return on average tangible equity adjusted for non-core items 11.43% 7.32% 11.30% 12.38% 15.48% 15.32% 9.75% 16.27% (a) Tax effect is calculated using a 21% federal statutory tax rate for the 2021, 2020, 2019 and 2018 periods and 35% federal statutory rate for all other periods shown.

peoplesbancorp.com Peoples Bancorp® is a federally registered service mark of Peoples Bancorp Inc. The three arched ribbons logo and Working Together. Building Success.® are federally registered services marks of Peoples Bank. CHUCK SULERZYSKI President and Chief Executive Officer P: 740.374.6163 [email protected] KATIE BAILEY Executive Vice President Chief Financial Officer and Treasurer P: 740.376.7138 [email protected]

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Peoples Bancorp (PEBO) PT Lowered to $37 at DA Davidson

- ROSEN, THE FIRST FILING FIRM, Encourages Luna Innovations Incorporated Investors to Secure Counsel Before Important Deadline in Securities Class Action First Filed by the Firm – LUNA

- FLYHT Reports Fourth Quarter and Full Year 2023 Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share