Form 8-K Novelis Inc. For: May 12

UNITED STATES | ||

SECURITIES AND EXCHANGE COMMISSION | ||

Washington, D.C. 20549 | ||

FORM 8-K | ||

CURRENT REPORT | ||

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | ||

Date of Report (Date of earliest event reported): May 12, 2021 | ||

NOVELIS INC. | ||

(Exact name of registrant as specified in its charter) | ||

Canada | 001-32312 | 98-0442987 | ||||||

(State or Other Jurisdiction of Incorporation) | (Commission File No.) | (IRS Employer Identification No.) | ||||||

3560 Lenox Road, Suite 2000, Atlanta, Georgia 30326 | ||||||||||||||

(Address of Principal Executive Offices) | ||||||||||||||

| (404) 760-4000 | ||||||||||||||

| (Registrant's Telephone Number, Including Area Code) | ||||||||||||||

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | ||||||||||||||

| ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||||||||||||

| ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||||||||||||

| ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||||||||||||

| ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||||||||||||

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

The following information, including Exhibits 99.1 and 99.2, is furnished pursuant to Item 2.02, “Results of Operations and Financial Condition.” Consequently, it is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section. It may only be incorporated by reference in another filing under the Securities Exchange Act of 1934 or Securities Act of 1933 if such subsequent filing specifically references this Form 8-K.

On May 12, 2021, Novelis Inc. issued a press release reporting the company’s financial results for its fiscal quarter ended March 31, 2021. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein in its entirety. A copy of investor presentation materials relating to such financial results is attached hereto as Exhibit 99.2 and is incorporated by reference herein in its entirety. The presentation materials use the following non-GAAP financial measures: Adjusted EBITDA, Free Cash Flow and Free Cash Flow Before Capital Expenditures, Net Income From Continuing Operations Excluding Special Items and Liquidity.

Adjusted EBITDA. EBITDA consists of earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA further adjusts EBITDA by measures commonly used in the company’s industry. The company defines Adjusted EBITDA as: earnings before (a) “Depreciation and amortization”; (b) “Interest expense and amortization of debt issuance costs”; (c) interest income; (d) "Unrealized gains (losses) on change in fair value of derivative instruments, net", except for foreign currency remeasurement hedging activities, which are included in segment income; (e) impairment of goodwill; (f) gain or loss on extinguishment of debt; (g) noncontrolling interests' share; (h) adjustments to reconcile our proportional share of "Adjusted EBITDA" from non-consolidated affiliates to income as determined on the equity method of accounting; (i) “Restructuring and impairment, net”; (j) gains or losses on disposals of property, plant and equipment and businesses, net; (k) other costs, net; (l) litigation settlement, net of insurance recoveries; (m) sale transaction fees; (n) "income tax provision(benefit)"; (o) cumulative effect of accounting change, net of tax; (p) metal price lag; (q) business acquisition and other integration related costs, (r) purchase price accounting adjustments; (s) "income (loss) from discontinued operations, net of tax"; and (t) "loss on sale of discontinued operations, net of tax." The company presents Adjusted EBITDA to enhance investors’ understanding of the company’s operating performance. Novelis believes that Adjusted EBITDA is an operating performance measure, and not a liquidity measure, that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles and ages of related assets among otherwise comparable companies.

Adjusted EBITDA is not a measurement of financial performance under GAAP, and the company’s Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Adjusted EBITDA has important limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the company’s results as reported under GAAP. For example, Adjusted EBITDA:

•does not reflect the company’s cash expenditures or requirements for capital expenditures or capital commitments;

•does not reflect changes in, or cash requirements for, the company’s working capital needs; and

•does not reflect any costs related to the current or future replacement of assets being depreciated and amortized.

Management believes that investors’ understanding of the company’s performance is enhanced by including non-GAAP financial measures as a reasonable basis for comparing the company’s ongoing results of operations. Many investors are interested in understanding the performance of the company’s business by comparing its results from ongoing operations from one period to the next and would ordinarily add back items that are not part of normal day-to-day operations of the company’s business. By providing non-GAAP financial measures, together with reconciliations, the company believes it is enhancing investors’ understanding of its business and its results of operations, as well as assisting investors in evaluating how well it is executing strategic initiatives.

Additionally, the company’s senior secured credit facilities, 5.875% senior notes due 2026, 4.75% senior notes due 2030, and 3.375% senior notes due 2029 provide for adjustments to EBITDA, which may decrease or increase Adjusted EBITDA for purposes of compliance with certain covenants under such facilities and notes. The company also uses Adjusted EBITDA:

•as a measure of operating performance to assist the company in comparing its operating performance on a consistent basis because it removes the impact of items not directly resulting from the company’s core operations;

•for planning purposes, including the preparation of the company’s internal annual operating budgets and financial projections;

•to evaluate the performance and effectiveness of the company's operational strategies; and

•to calculate incentive compensation payments for the company’s key employees.

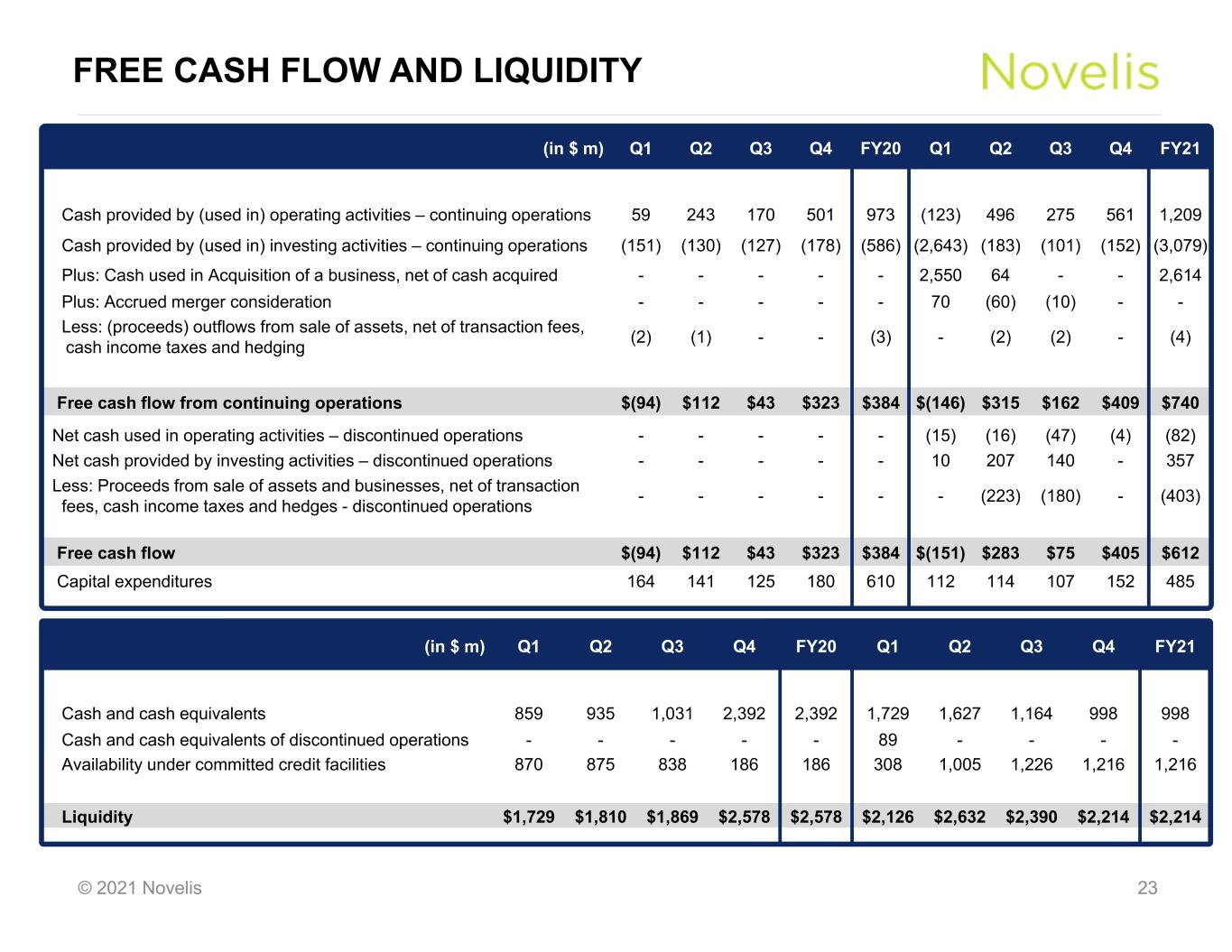

Free Cash Flow and Free Cash Flow Before Capital Expenditures. "Free cash flow" consists of: (a) "Net cash provided by (used in) operating activities - continuing operations," (b) plus "Net cash provided by (used in) investing activities - continuing operations," (c) plus "Net cash provided by (used in) operating activities - discontinued operations," (d) plus "Net cash provided by (used in) investing activities - discontinued operations," (e) plus cash used in the "Acquisition of assets under a capital lease," (f) plus cash used in the "Acquisition of business, net of cash and restricted cash acquired," (g) plus accrued merger consideration, (h) less "Proceeds from sales of assets and business, net of transaction fees, cash income taxes and hedging," and (i) less "Proceeds from sales of assets and business, net of transaction fees, cash income taxes and hedging - discontinued operations." Management believes "Free cash flow" is relevant to investors as it provides a measure of the cash generated internally that is available for debt service and other value creation opportunities. However, "Free cash flow" does not necessarily represent cash available for discretionary activities, as certain debt service obligations must be funded out of "Free cash flow." Our method of calculating "Free cash flow" may not be consistent with that of other companies.

Net Income From Continuing Operations Excluding Special Items. Net income from continuing operations excluding special items adjusts net income from continuing operations for restructuring and impairment charges, loss on extinguishment of debt, metal price lag, gains (losses) on sale of assets held for sale, gains (losses) on sale of a business, business acquisition and other integration related costs, purchase price accounting adjustments, charitable donation, and the tax effect of such items. We adjust for items which may recur in varying magnitude which affect the comparability of the operational results of our underlying business. Novelis believes that net income from continuing operations excluding special items enhances the overall understanding of the company's current financial performance. Specifically, management believes this non-GAAP financial measure provides useful information to investors by excluding or adjusting certain items, which impact the comparability of the company's core operating results. With respect to gains (losses) on sale of assets held for sale, gains (losses) on sale of a business, business acquisition and other integration related costs, purchase price accounting adjustments, charitable donations, and the tax effect of such special items, management believes these excluded items are not reflective of fixed costs that the company believes it will incur over the long term. Management also adjusts for loss on extinguishment of debt, metal price lag and restructuring and impairment charges to enhance the comparability of the company’s operating results between periods. However, the company has recorded similar charges in prior periods. The company may incur additional restructuring charges in connection with ongoing restructuring initiatives announced previously and may also incur additional restructuring and impairment charges in connection with future streamlining measures. The company may also incur additional impairment charges unrelated to restructuring initiatives. Net income from continuing operations excluding special items should be considered in addition to, and not as a substitute for or superior to, results prepared in accordance with US GAAP.

Liquidity. Liquidity consists of cash and cash equivalents plus availability under our committed credit facilities. In addition to presenting available cash and cash equivalents, management believes that presenting Liquidity enhances investors’ understanding of the liquidity that is actually available to the company. This financial measure should be considered in addition to, and not as a substitute for or superior to, results prepared in accordance with US GAAP.

All information in the news release and the presentation materials speak as of the date thereof, and Novelis does not assume any obligation to update said information in the future.

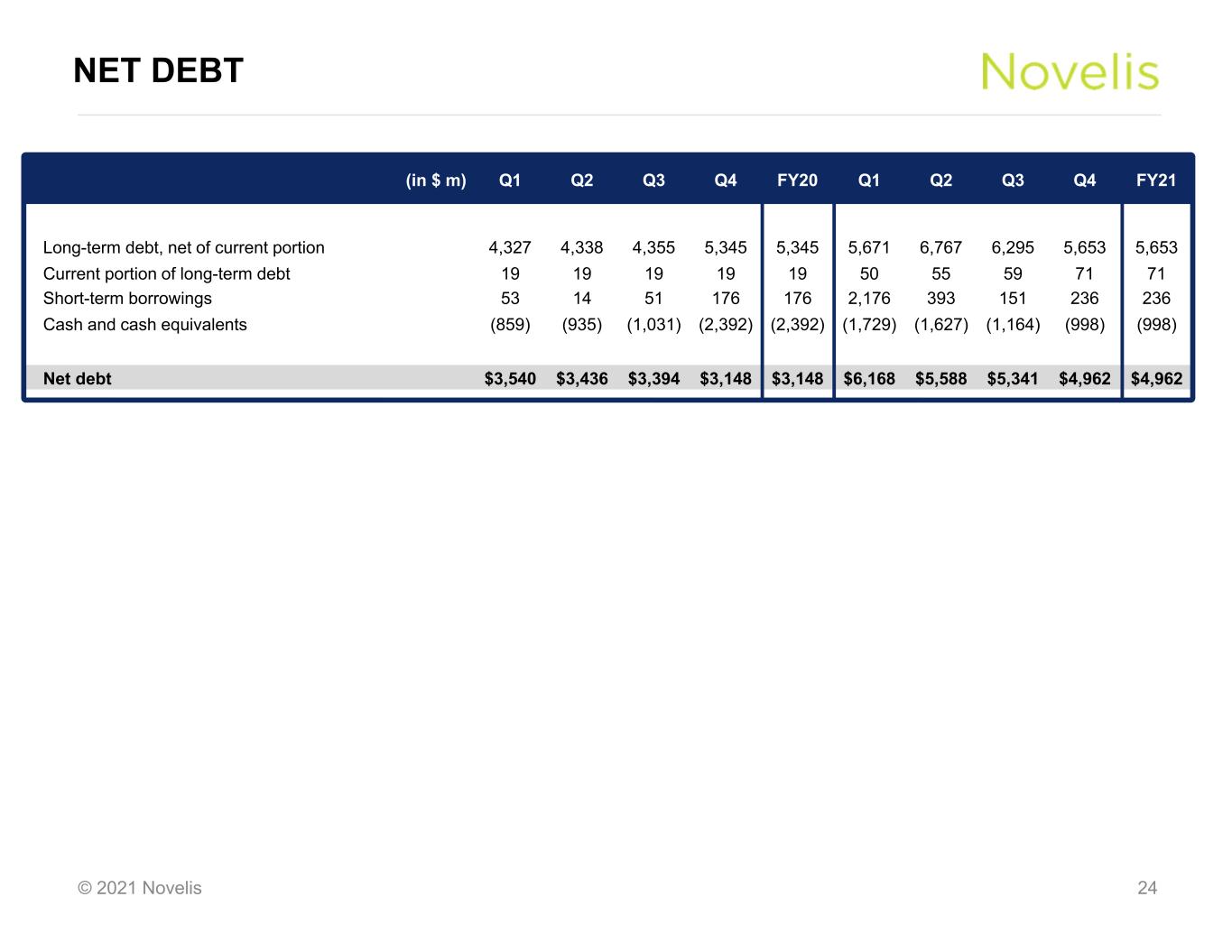

Net Leverage Ratio. Net Leverage Ratio is a financial measure that is used by management to assess the borrowing capacity of the company. The company defines its Net Leverage Ratio as (a) net debt (current portion of long-term debt plus short-term borrowings plus long-term debt, net of current portion less cash and cash equivalents) as of the balance sheet date divided by (b) Adjusted EBITDA for the trailing twelve month period. This financial measure should be considered in addition to, and not as a substitute for or superior to, results prepared in accordance with US GAAP.

Item 9.01. Financial Statements and Exhibits.

| 99.1 | |||||

| 99.2 | |||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

NOVELIS INC. | ||||||||||||||

Date: May 12, 2021 | By: | /s/ Christopher Courts | ||||||||||||

Christopher Courts | ||||||||||||||

General Counsel, Corporate Secretary and Compliance Officer | ||||||||||||||

Exhibit 99.1

News Release

Novelis Reports Fourth Quarter and Full Fiscal Year 2021 Results

Strong operational performance and ongoing successful Aleris integration drive record fiscal year

Q4 and Fiscal Year 2021 Highlights

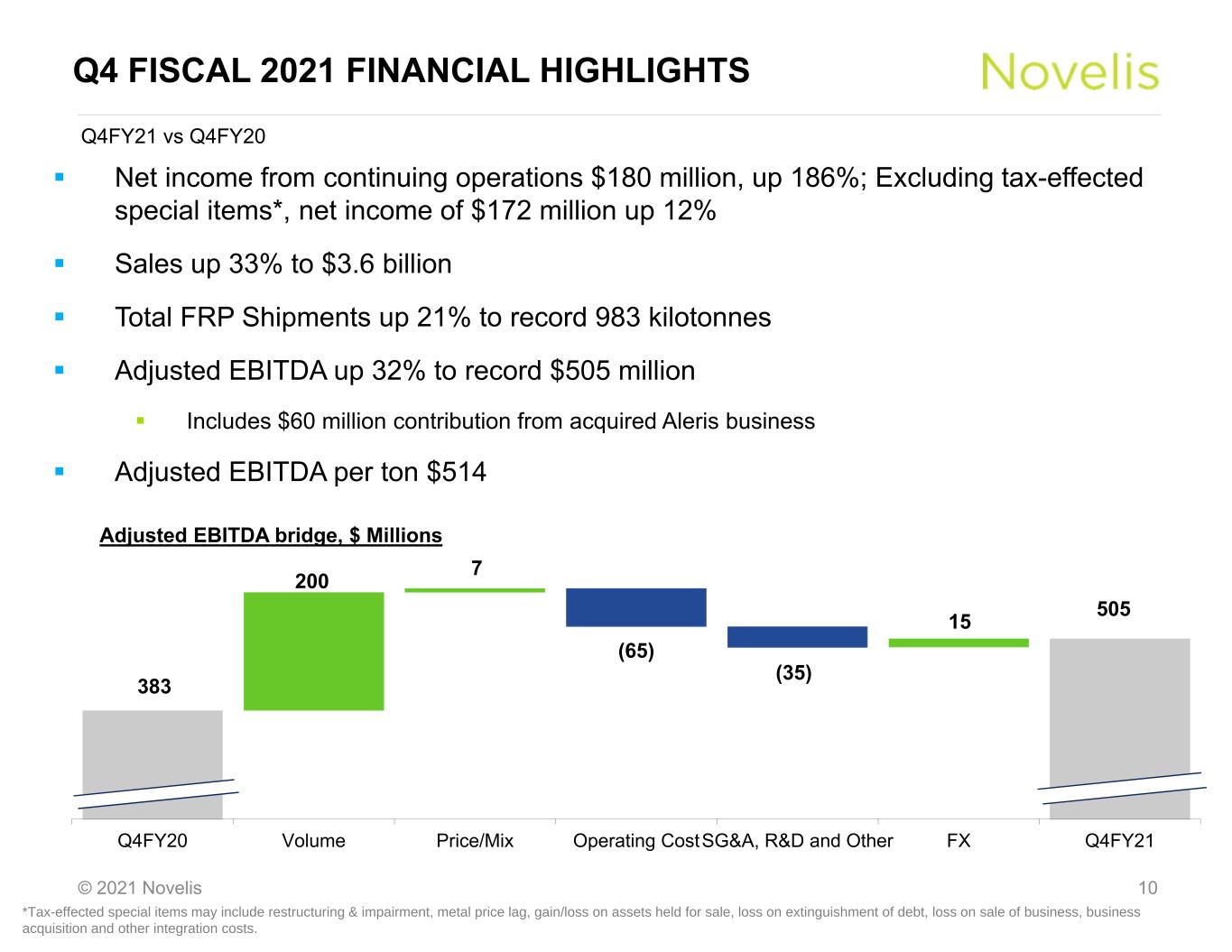

•Q4 net income from continuing operations of $180 million, up 186% YoY; Q4 net income from continuing operations excluding special items of $172 million, up 12% YoY

•Q4 shipments of 983 kilotonnes, up 21% YoY

•Q4 Adjusted EBITDA of $505 million, up 32% YoY; Q4 Adjusted EBITDA per ton shipped of $514, up 9% YoY

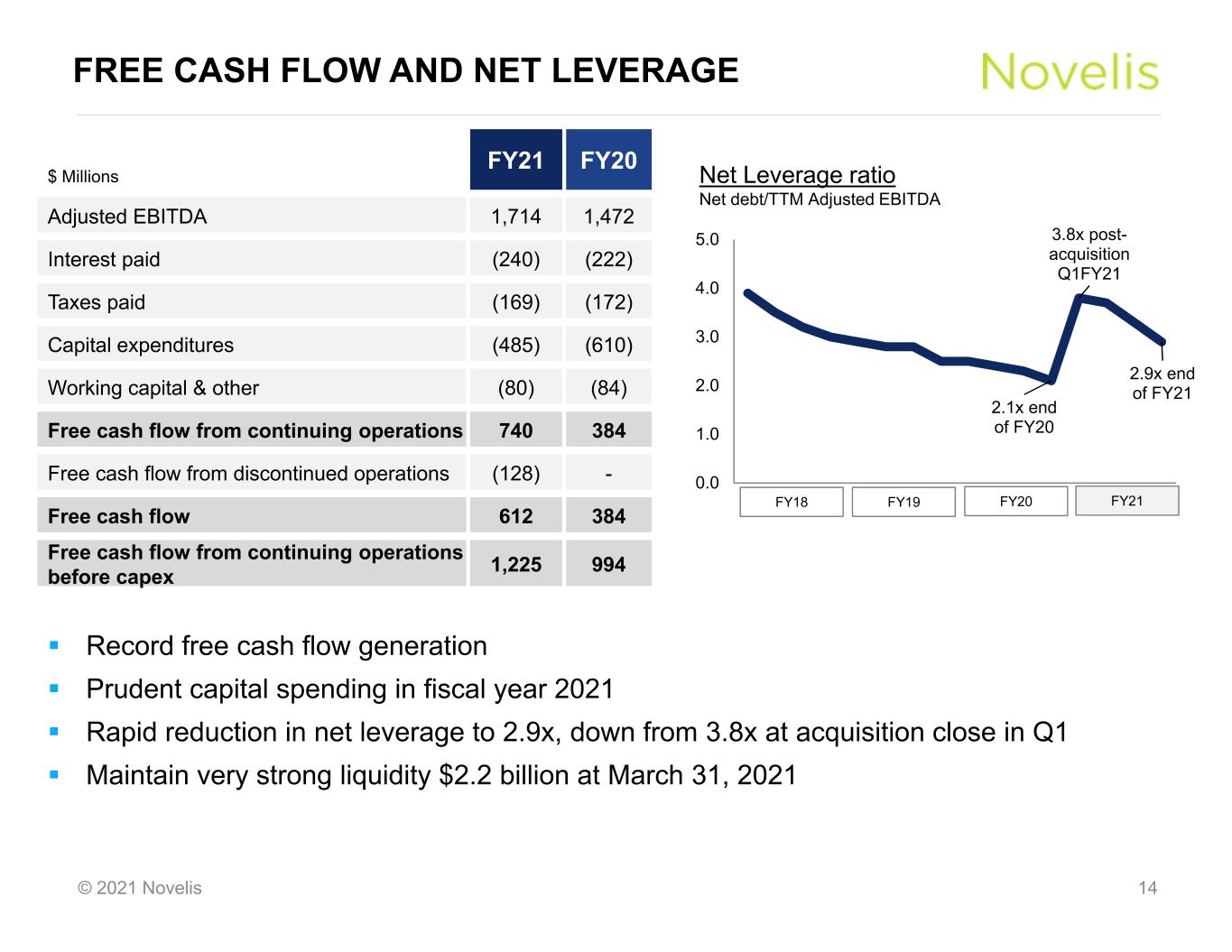

•Full year free cash flow from continuing operations of $740 million, up 93% YoY

•Rapid reduction in net leverage ratio to 2.9x, from 3.8x at acquisition close in Q1FY21

ATLANTA, May 12, 2021 – Novelis Inc., the world leader in aluminum rolling and recycling, today reported net income attributable to its common shareholder of $176 million in the fourth quarter of fiscal year 2021, and net income from continuing operations of $180 million, up 179 percent and 186 percent, respectively, versus the prior year. Net income attributable to its common shareholder was $236 million for the full fiscal year 2021, and net income from continuing operations was $458 million, down 44 percent and up nine percent, respectively, versus the prior year.

Excluding special items in both years, fourth quarter fiscal 2021 net income from continuing operations was $172 million, up 12 percent versus the prior year driven mainly by higher after-tax Adjusted EBITDA partially offset by higher depreciation and amortization associated with the acquired Aleris business. For the full fiscal year, net income excluding special items decreased five percent versus the prior year to $561 million affected by pandemic-related impacts on first quarter profitability.

”Guided by our purpose and driven by the resilience of our people and the strength of our partnerships, we safely navigated this extraordinary year to achieve outstanding results," said Steve Fisher, President and CEO, Novelis Inc. "With the ongoing successful integration of Aleris, a diverse and innovative product portfolio, and unmatched geographic footprint, we have proven our ability to deliver sustainable aluminum solutions to customers in a way that resulted in record financial performance. Looking forward we will continue to pursue growth opportunities through organic investment, while working towards creating a more sustainable and circular future for our business, industry, and society."

Key achievements in fiscal 2021 include:

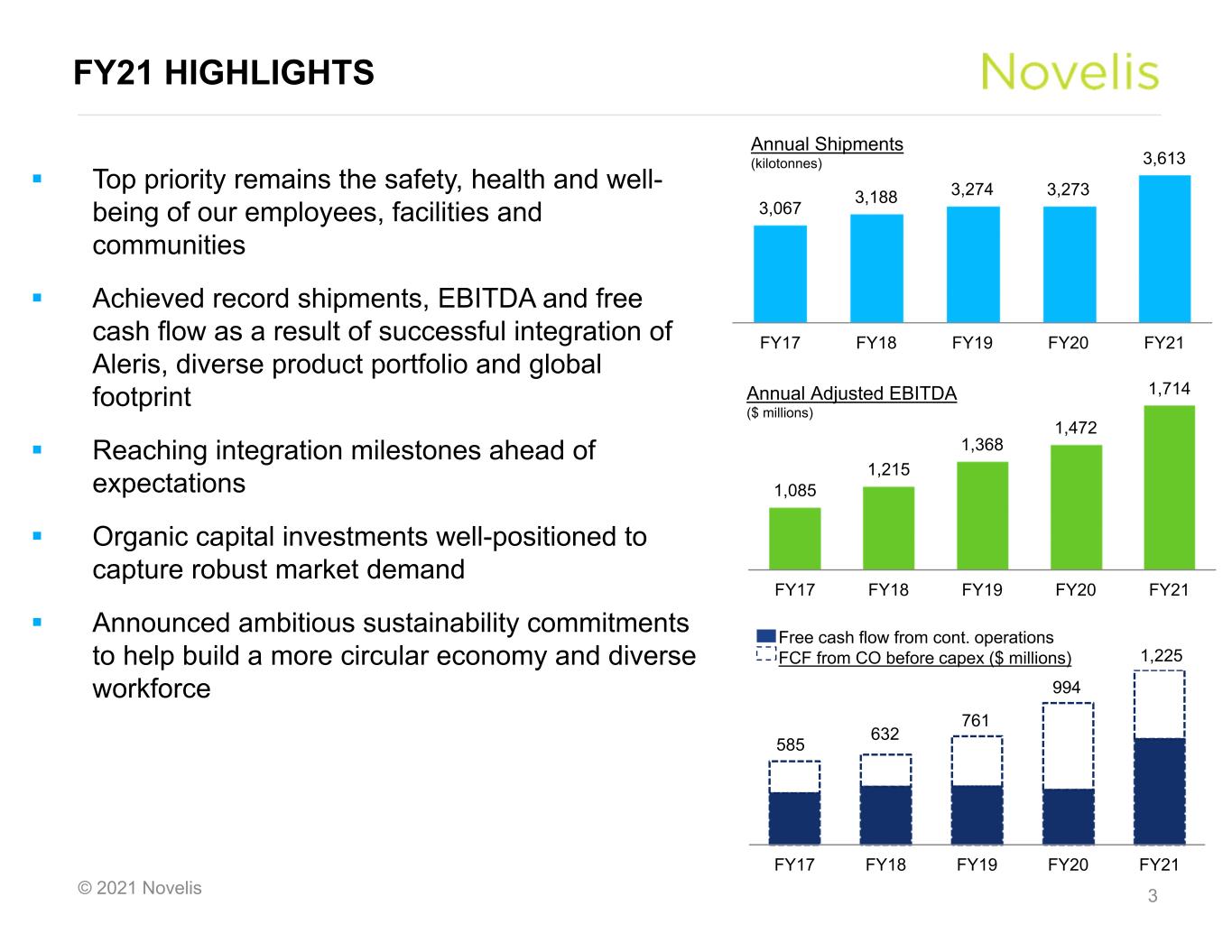

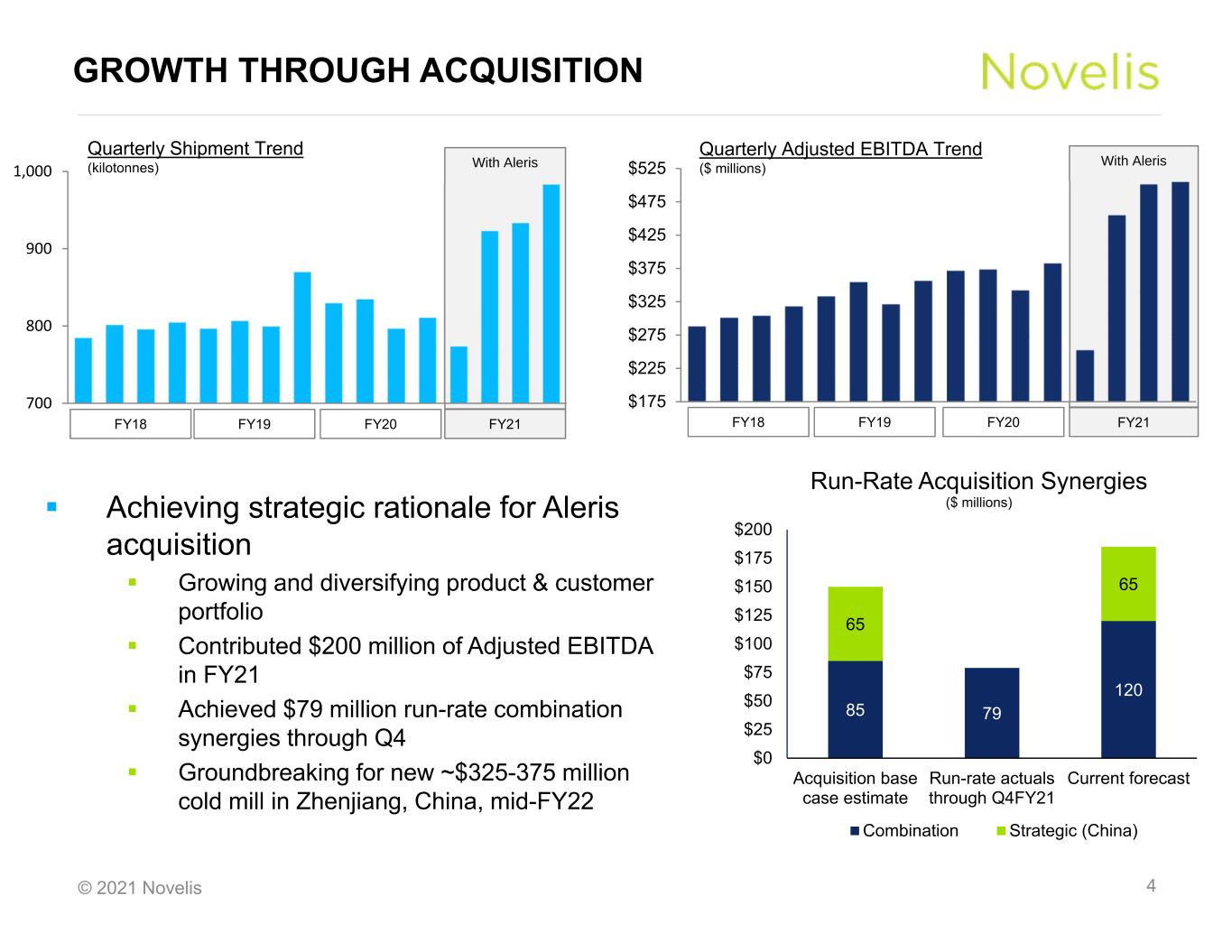

•Completed the acquisition of Aleris, generating initial run-rate integration cost synergies of $79 million and contributing to record full year shipments of 3.6 million tonnes, Adjusted EBITDA of $1.7 billion, net income from continuing operations of $458 million, and free cash flow from continuing operations of $740 million;

•Expanded our sustainability platform by committing to reduce our carbon footprint 30 percent by 2026 and become a net carbon-neutral company by 2050 or sooner;

•Committed to becoming a more diverse and inclusive workplace by increasing representation of women in leadership to 30 percent and to 15 percent in senior technical roles by 2024;

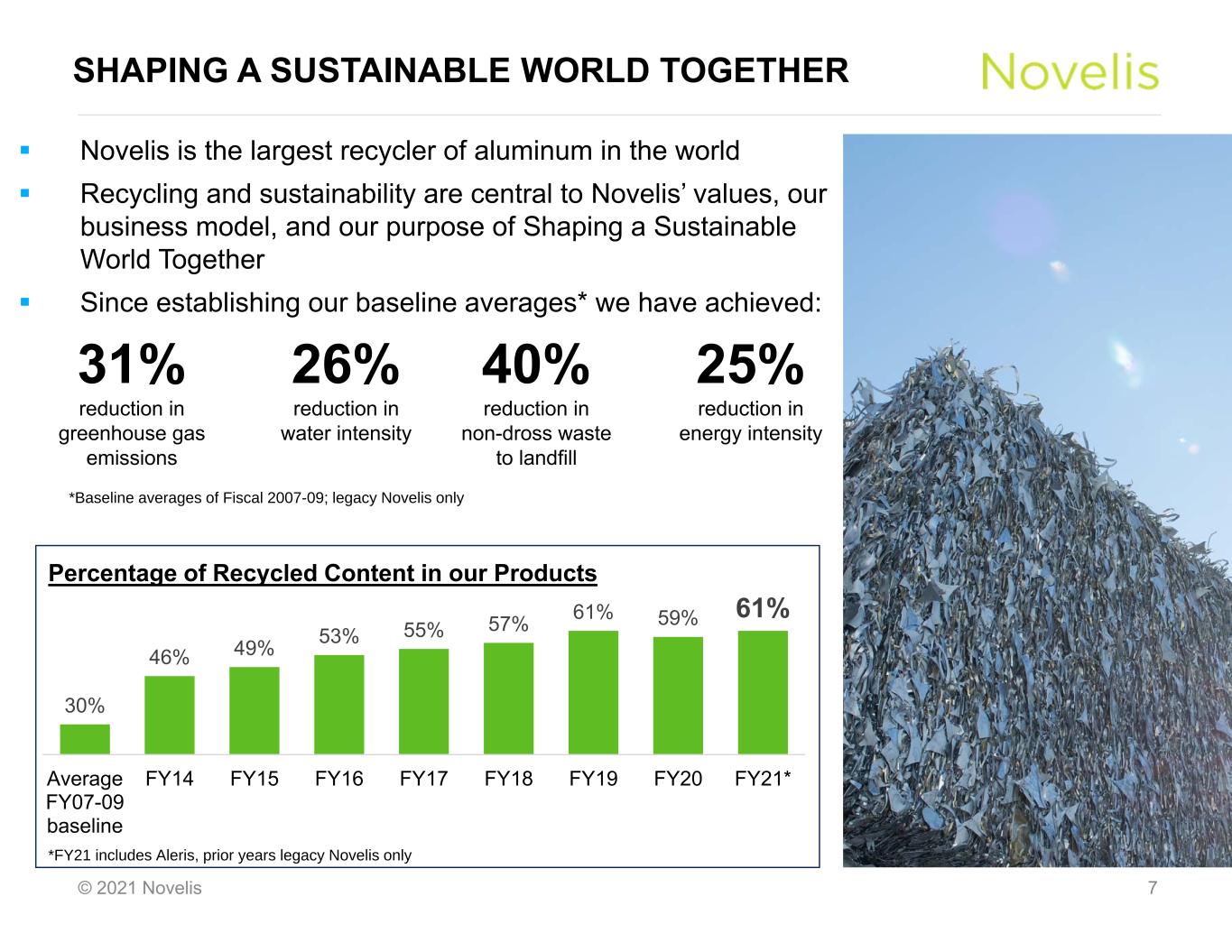

•Increased recycled content in our products to 61 percent in fiscal 2021;

•Strengthened our industry-leading automotive business with the commissioning of new auto finishing capacity in the U.S. and China, co-founding the innovative Alumobility ecosystem and offering an ultra-high-strength 7-series aluminum alloy to advance the continued adoption of aluminum in vehicles;

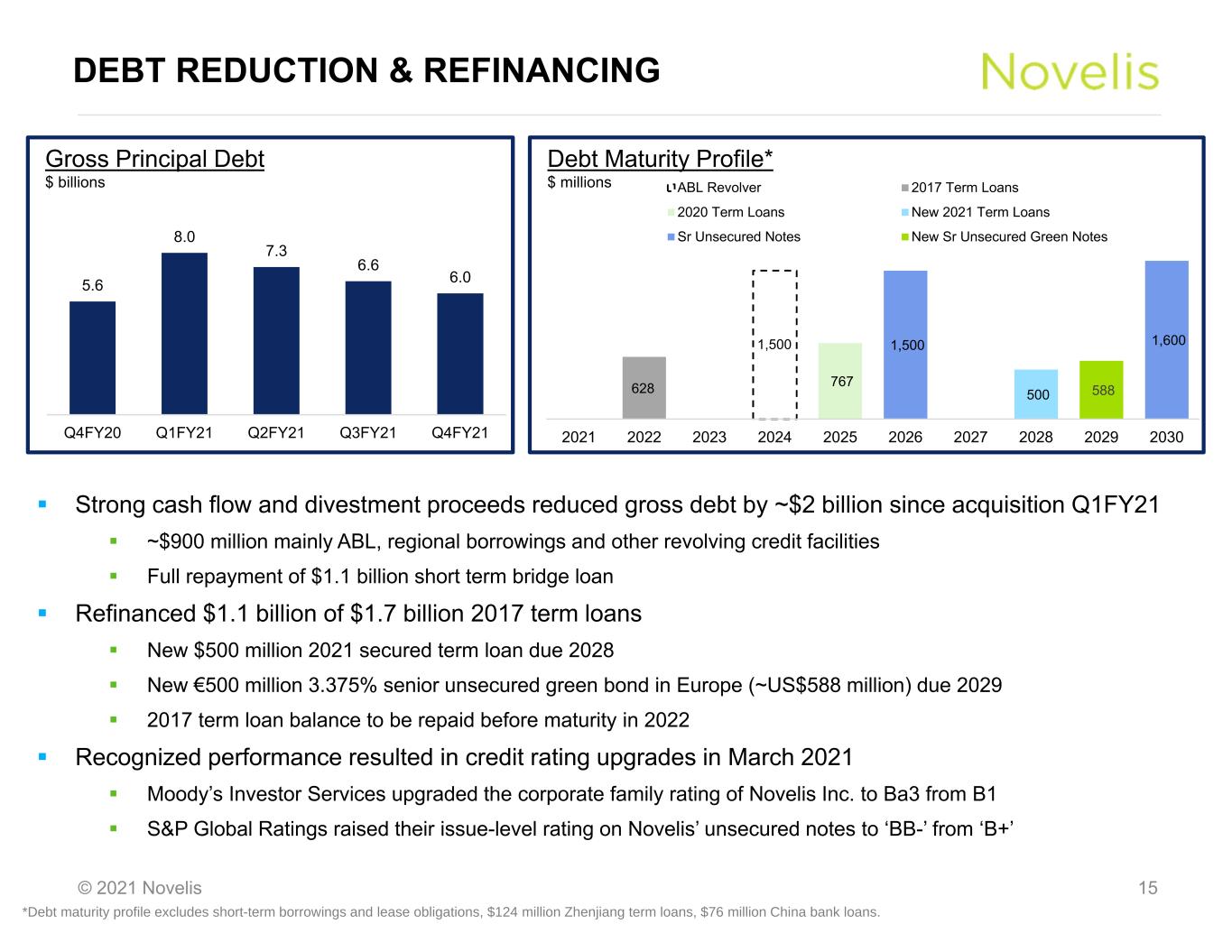

•Restructured long-term debt profile, reducing total debt by $2 billion since Aleris acquisition close in Q1 and refinancing approximately $1.1 billion of term loans through a €500 million eight-year senior unsecured green bond issuance in Europe, and a new $500 million secured term loan due 2028;

•Received credit ratings upgrades on Novelis unsecured notes by both S&P Global Ratings and Moody's Investor Services in March 2021.

1

Fourth Quarter Fiscal 2021 Highlights

Net sales increased 33 percent over the prior year to $3.6 billion for the fourth quarter of fiscal 2021, primarily driven by a 21 percent increase in shipments, favorable product mix and higher average aluminum prices. Total flat rolled product shipments increased to 983 kilotonnes, mainly reflecting the addition of the acquired Aleris business and record automotive and beverage can shipments, as well as continued strong demand for building and construction and other specialty flat rolled aluminum products.

Adjusted EBITDA increased 32 percent to $505 million in the fourth quarter of fiscal 2021 compared to $383 million in the prior year period. The increase in Adjusted EBITDA is due to higher organic volume, favorable metal benefits, and a $60 million positive EBITDA contribution from the acquired Aleris business. On a consolidated basis, Novelis achieved an Adjusted EBITDA per ton shipped of $514 in the fourth quarter, compared to $472 in the prior year.

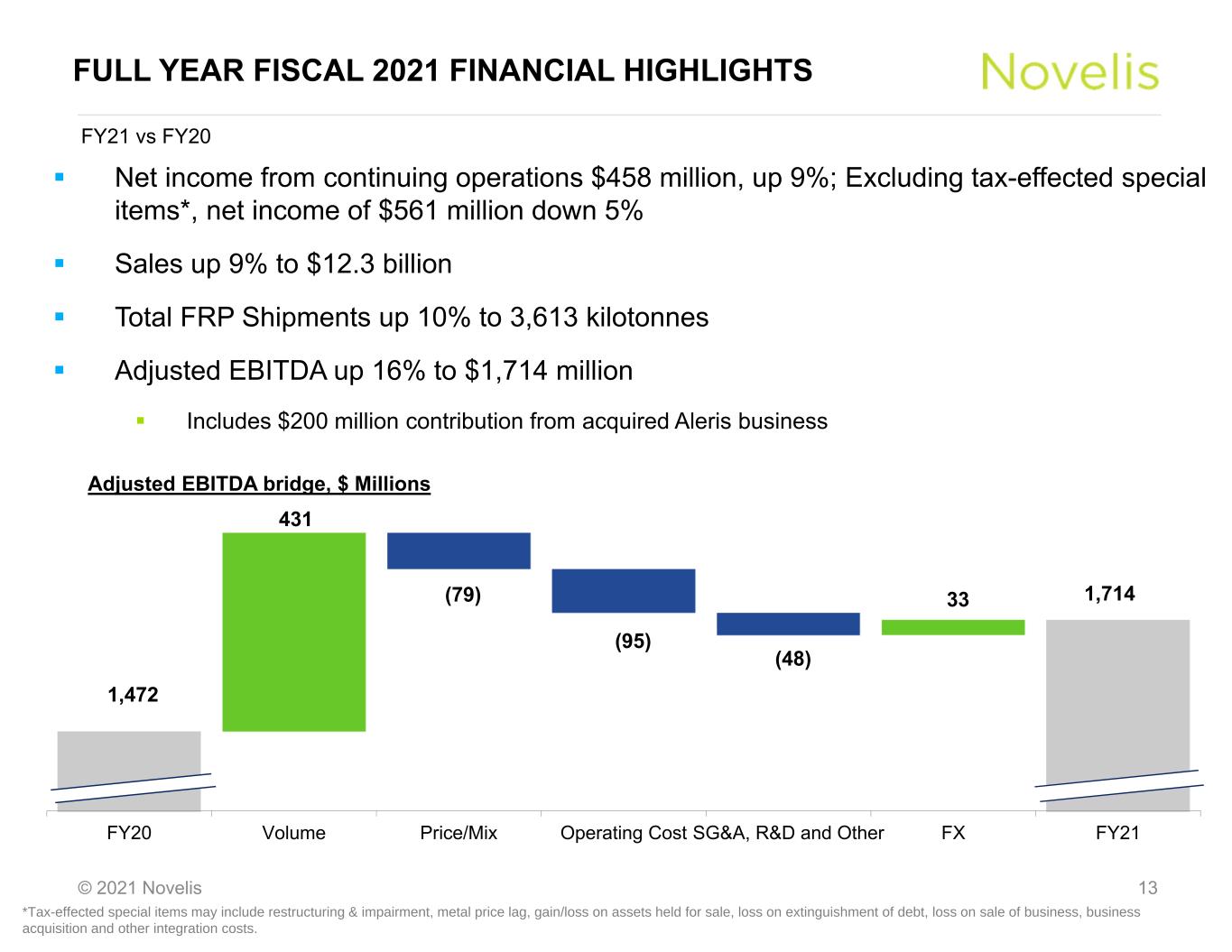

Full Year Fiscal 2021 Highlights

Net sales increased nine percent versus the prior year to $12.3 billion in fiscal 2021, primarily driven by a ten percent increase in total shipments. Total flat rolled product shipments increased to 3,613 kilotonnes, mainly reflecting the addition of the acquired Aleris business, resilient beverage can demand, and a rapid recovery in demand for automotive and specialty products following a challenging first quarter impacted by the pandemic.

Adjusted EBITDA increased 16 percent to $1.7 billion in fiscal 2021 compared to $1.5 billion in fiscal 2020. The increase in Adjusted EBITDA is mainly due to a $200 million positive EBITDA contribution from the acquired Aleris business, favorable metal benefits, and good cost control, partially offset by unfavorable volume and product mix from lower automotive shipments in early fiscal year 2021.

Fiscal 2021 free cash flow from continuing operations nearly doubled to $740 million compared to $384 million in the prior year, driven primarily by higher Adjusted EBITDA, favorable working capital and lower capital expenditures.

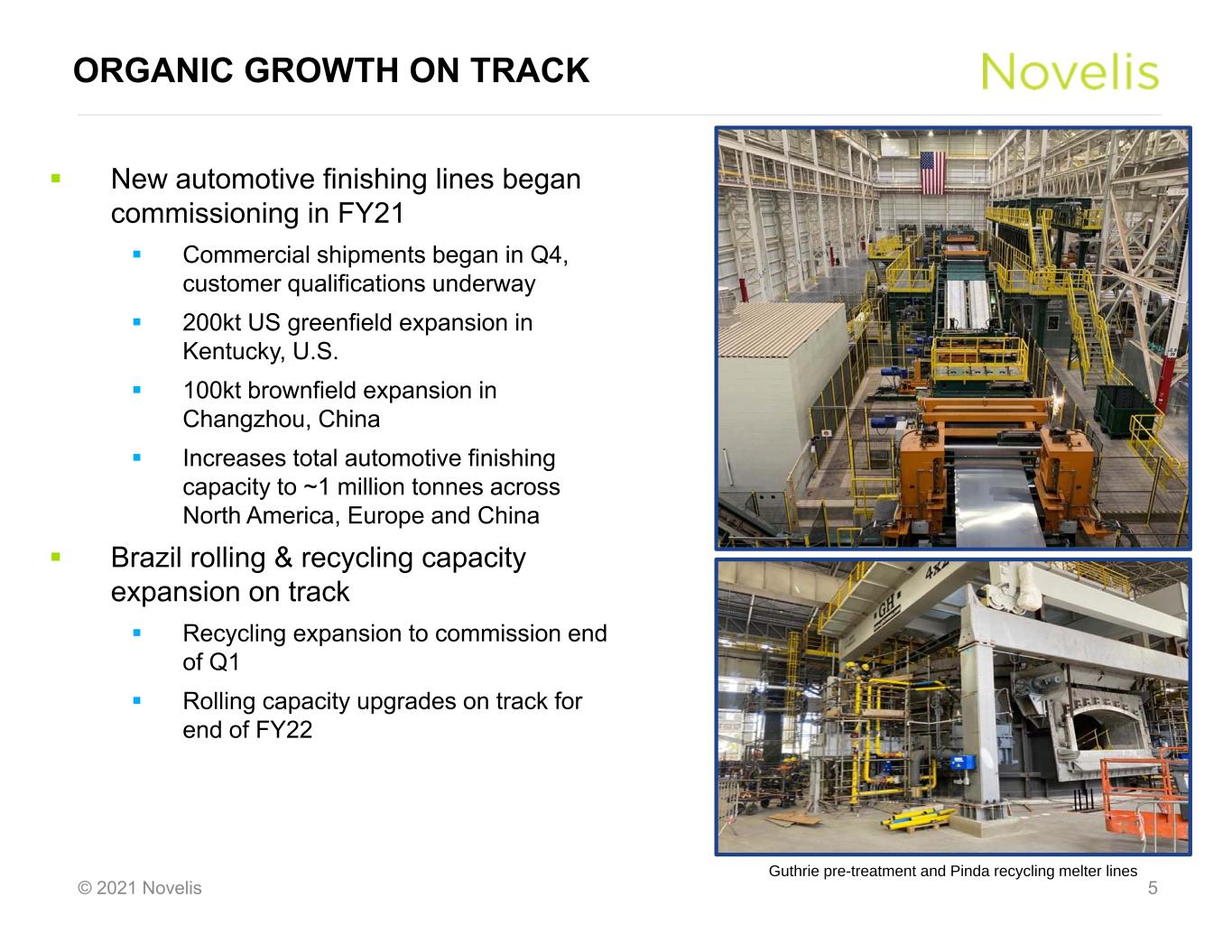

The greenfield Guthrie, Kentucky, automotive finishing plant in the U.S. and the new automotive finishing line in Changzhou, China, were both commissioned in the second half of fiscal 2021. Customer qualification continues to ramp up at both facilities to meet strong demand for lightweight, automotive aluminum sheet. The recycling, casting and rolling expansion in Brazil also remains on track to commission in the middle of fiscal year 2022.

Fiscal Year Ended March 31, | |||||||||||

| (in $ millions, non-GAAP measures) | 2021 | 2020 | |||||||||

| Free cash flow from continuing operations | $ | 740 | $ | 384 | |||||||

| Capital expenditures | 485 | 610 | |||||||||

| Free cash flow from continuing operations before capital expenditures | $ | 1,225 | $ | 994 | |||||||

Net leverage (net debt / LTM Adjusted EBITDA) improved to 2.9x at fiscal year end, well ahead of the company's initial guidance to be below 3x by the end of fiscal 2022. The rapid deleveraging from 3.8x at the close of the Aleris acquisition in the first quarter of fiscal 2021 is a factor of strong free cash flow generation driven by higher Adjusted EBITDA. Over the last three quarters, Novelis has reduced its gross debt by approximately $2 billion and has committed to repaying another $600 million by the end of fiscal 2022.

"Our strong operational performance and the ongoing successful integration of Aleris have allowed us to nearly double cash flow generation over the prior year, enabling us to reduce net leverage while continuing to invest in organic growth projects that meet our customers’ evolving needs," said Devinder Ahuja, Senior Vice President and Chief Financial Officer, Novelis Inc.

The company continues to maintain a strong total liquidity position of $2.2 billion as of March 31, 2021.

COVID-19 Response

Novelis’ primary focus remains the health and well-being of its employees. The company continues to closely monitor the changing landscape with respect to the COVID-19 pandemic and is taking actions to manage its business and support customers. Novelis has bolstered its Environmental Health and Safety protocols to align with guidance from global health authorities and government agencies across company operations to help ensure the safety of its employees, customers, suppliers, communities and other stakeholders. Customer demand has recovered to pre-COVID levels in most end markets, and Novelis will continue to work closely with customers to leverage its global manufacturing footprint and adjust production levels to meet their needs.

2

Update on Aleris Acquisition and Integration

On April 14, 2020, Novelis closed its acquisition of Aleris Corporation. The results from continuing operations reported today for the quarter and fiscal year ending March 31, 2021 include results of the acquired business from the date of closing. Results related to the Duffel and Lewisport plants, divested in mid-fiscal 2021, are reflected as results from discontinued operations. The company filed a form 8-K/A with the Securities and Exchange Commission on June 30, 2020, providing historical and pro forma financial information related to the acquisition.

Novelis is focused on the safe integration of Aleris' continuing operations to drive a number of strategic benefits, including more than $180 million in potential run-rate synergies that have been identified. In the period between closing and the end of fiscal 2021, we achieved $79 million of run-rate cost synergies. Novelis’ acquisition of Aleris is expected to provide a strong pro-forma financial profile, many strategic benefits including securing an integrated manufacturing footprint in China, further portfolio diversification with the addition of aerospace and building and construction, as well as new technology and operational capabilities.

Fourth Quarter and Full Fiscal Year 2021 Earnings Conference Call

Novelis will discuss its fourth quarter and full fiscal year 2021 results via a live webcast and conference call for investors at 7:00 a.m. ET on Wednesday, May 12, 2021. To view slides and listen only, visit https://cc.callinfo.com/r/18hl8ptvxsazi&eom. To join by telephone, dial toll-free in North America at 800-709-0218, India toll-free at 18002660834 or the international toll line at +1-303-223-0118. Presentation materials and access information may also be found at novelis.com/investors.

About Novelis

Novelis Inc. is driven by its purpose to shape a sustainable world together. As a global leader in innovative products and services and the world's largest recycler of aluminum, we partner with customers in the aerospace, automotive, beverage can and specialties industries to deliver solutions that maximize the benefits of lightweight aluminum throughout North America, Europe, Asia and South America. Novelis is a subsidiary of Hindalco Industries Limited, an industry leader in aluminum and copper, and the metals flagship company of the Aditya Birla Group, a multinational conglomerate based in Mumbai, India. For more information, visit novelis.com.

Non-GAAP Financial Measures

This news release and the presentation slides for the earnings call contain non-GAAP financial measures as defined by SEC rules. We believe these measures are helpful to investors in measuring our financial performance and liquidity and comparing our performance to our peers. However, our non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures used by other companies. These non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for GAAP financial measures. To the extent we discuss any non-GAAP financial measures on the earnings call, a reconciliation of each measure to the most directly comparable GAAP measure will be available in the presentation slides filed as Exhibit 99.2 to our Current Report on Form 8-K furnished to the SEC concurrently with the issuance of this news release. In addition, the Form 8-K includes a more detailed description of each of these non-GAAP financial measures, together with a discussion of the usefulness and purpose of such measures.

Attached to this news release are tables showing the Condensed Consolidated Statements of Operations, Condensed Consolidated Balance Sheets, Condensed Consolidated Statements of Cash Flows, Reconciliation of Adjusted EBITDA, Free Cash Flow, Liquidity, Net Income from continuing operations excluding Special Items, and Segment Information.

3

Forward-Looking Statements

Statements made in this news release which describe Novelis' intentions, expectations, beliefs or predictions may be forward-looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward looking statements in this news release are statements about our ability to reduce net leverage and total debt, adjustments to production to meet customer needs, expected start dates of new facilities, sustainability targets, commitments to improve diversity, and potential acquisition synergies from our acquisition of Aleris. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing including in connection with potential acquisitions and investments; risks arising out of our acquisition of Aleris Corporation, including uncertainties inherent in the acquisition method of accounting; disruption to our global aluminum production and supply chain as a result of COVID-19; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, breakdown of equipment and other events; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions including deterioration in the global economy; the risks of pandemics or other public health emergencies, including the continued spread and impact of, and the governmental and third party response to, the ongoing COVID-19 outbreak; changes in government regulations, particularly those affecting taxes, derivative instruments, environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our credit facilities and other financing agreements; and our ability to generate cash. The above list of factors is not exhaustive. Other important risk factors are included under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended March 31, 2021.

| Media Contact: | Investor Contact: | |||||||

| Michael Touhill | Megan Cochard | |||||||

| +1 404 580 5234 | +1 404 760 4170 | |||||||

| michael.touhill@novelis.adityabirla.com | megan.cochard@novelis.adityabirla.com | |||||||

4

Novelis Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

Three Months Ended March 31, | Fiscal Year Ended March 31, | ||||||||||||||||||||||

| (in millions) | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||

| Net sales | $ | 3,631 | $ | 2,726 | $ | 12,276 | $ | 11,217 | |||||||||||||||

| Cost of goods sold (exclusive of depreciation and amortization) | 2,917 | 2,230 | 9,980 | 9,231 | |||||||||||||||||||

| Selling, general and administrative expenses | 151 | 118 | 551 | 498 | |||||||||||||||||||

| Depreciation and amortization | 147 | 94 | 543 | 361 | |||||||||||||||||||

| Interest expense and amortization of debt issuance costs | 61 | 63 | 267 | 248 | |||||||||||||||||||

| Research and development expenses | 26 | 26 | 83 | 84 | |||||||||||||||||||

| Loss on extinguishment of debt | 14 | 71 | 14 | 71 | |||||||||||||||||||

| Restructuring and impairment, net | 1 | 7 | 29 | 43 | |||||||||||||||||||

| Equity in net (income) loss of non-consolidated affiliates | (2) | 1 | (1) | 2 | |||||||||||||||||||

| Business acquisition and other integration related costs | — | 17 | 11 | 63 | |||||||||||||||||||

| Other expenses, net | 17 | 15 | 103 | 18 | |||||||||||||||||||

| $ | 3,332 | $ | 2,642 | $ | 11,580 | $ | 10,619 | ||||||||||||||||

| Income from continuing operations before income tax provision | 299 | 84 | 696 | 598 | |||||||||||||||||||

| Income tax provision | 119 | 21 | 238 | 178 | |||||||||||||||||||

| Net income from continuing operations | $ | 180 | $ | 63 | $ | 458 | $ | 420 | |||||||||||||||

| Loss from discontinued operations, net of tax | (4) | — | (51) | — | |||||||||||||||||||

| Loss on sale of discontinued operations, net of tax | — | — | (170) | — | |||||||||||||||||||

| Net loss from discontinued operations | (4) | — | (221) | — | |||||||||||||||||||

| Net income | $ | 176 | $ | 63 | $ | 237 | $ | 420 | |||||||||||||||

| Net income attributable to noncontrolling interest | — | — | 1 | — | |||||||||||||||||||

| Net income attributable to our common shareholder | $ | 176 | $ | 63 | $ | 236 | $ | 420 | |||||||||||||||

5

Novelis Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited)

| (in millions, except number of shares) | March 31, 2021 | March 31, 2020 | |||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 998 | $ | 2,392 | |||||||

| Accounts receivable, net | |||||||||||

— third parties (net of allowance for uncollectible accounts of $5 and $8 as of March 31, 2021 and March 31, 2020, respectively) | 1,687 | 1,067 | |||||||||

| — related parties | 166 | 164 | |||||||||

| Inventories | 1,928 | 1,409 | |||||||||

| Prepaid expenses and other current assets | 198 | 145 | |||||||||

| Fair value of derivative instruments | 137 | 202 | |||||||||

| Assets held for sale | 5 | 5 | |||||||||

| Current assets of discontinued operations | 15 | — | |||||||||

| Total current assets | $ | 5,134 | $ | 5,384 | |||||||

| Property, plant and equipment, net | 4,687 | 3,580 | |||||||||

| Goodwill | 1,083 | 607 | |||||||||

| Intangible assets, net | 696 | 299 | |||||||||

| Investment in and advances to non–consolidated affiliates | 838 | 760 | |||||||||

| Deferred income tax assets | 130 | 140 | |||||||||

| Other long–term assets | |||||||||||

| — third parties | 316 | 219 | |||||||||

| — related parties | 1 | — | |||||||||

| Total assets | $ | 12,885 | $ | 10,989 | |||||||

| LIABILITIES AND SHAREHOLDER’S EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Current portion of long–term debt | $ | 71 | $ | 19 | |||||||

| Short–term borrowings | 236 | 176 | |||||||||

| Accounts payable | |||||||||||

| — third parties | 2,498 | 1,732 | |||||||||

| — related parties | 230 | 176 | |||||||||

| Fair value of derivative instruments | 280 | 214 | |||||||||

| Accrued expenses and other current liabilities | 670 | 613 | |||||||||

| Current liabilities of discontinued operations | 16 | — | |||||||||

| Total current liabilities | $ | 4,001 | $ | 2,930 | |||||||

| Long–term debt, net of current portion | 5,653 | 5,345 | |||||||||

| Deferred income tax liabilities | 162 | 194 | |||||||||

| Accrued postretirement benefits | 878 | 930 | |||||||||

| Other long–term liabilities | 305 | 229 | |||||||||

| Total liabilities | $ | 10,999 | $ | 9,628 | |||||||

| Commitments and contingencies | |||||||||||

| Shareholder’s equity | |||||||||||

Common stock, no par value; unlimited number of shares authorized; 1,000 shares issued and outstanding as of March 31, 2021 and March 31, 2020 | — | — | |||||||||

| Additional paid–in capital | 1,404 | 1,404 | |||||||||

| Retained earnings | 864 | 628 | |||||||||

| Accumulated other comprehensive loss | (366) | (620) | |||||||||

| Total equity of our common shareholder | $ | 1,902 | $ | 1,412 | |||||||

| Noncontrolling interest | (16) | (51) | |||||||||

| Total equity | $ | 1,886 | $ | 1,361 | |||||||

| Total liabilities and equity | $ | 12,885 | $ | 10,989 | |||||||

6

Novelis Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited)

Fiscal Year Ended March 31, | |||||||||||

| (in millions) | 2021 | 2020 | |||||||||

| OPERATING ACTIVITIES | |||||||||||

| Net income | 237 | $ | 420 | ||||||||

| Net loss from discontinued operations | (221) | — | |||||||||

| Net income from continuing operations | $ | 458 | $ | 420 | |||||||

| Adjustments to determine net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 543 | 361 | |||||||||

Loss (gain) on unrealized derivatives and other realized derivatives in investing activities, net | 1 | (4) | |||||||||

Loss on sale of assets | 1 | 1 | |||||||||

| Impairment charges | 1 | 18 | |||||||||

Loss on extinguishment of debt | 14 | 71 | |||||||||

| Deferred income taxes, net | 49 | — | |||||||||

Equity in net (income) loss of non-consolidated affiliates | (1) | 2 | |||||||||

| Gain on foreign exchange remeasurement of debt | (3) | — | |||||||||

| Amortization of debt issuance costs and carrying value adjustments | 28 | 17 | |||||||||

| Other, net | — | 2 | |||||||||

| Changes in assets and liabilities including assets and liabilities held for sale (net of effects from divestitures): | |||||||||||

| Accounts receivable | (323) | 304 | |||||||||

| Inventories | (94) | 23 | |||||||||

| Accounts payable | 569 | (171) | |||||||||

| Other assets | 91 | (62) | |||||||||

| Other liabilities | (125) | (9) | |||||||||

Net cash provided by operating activities - continuing operations | 1,209 | 973 | |||||||||

Net cash used in operating activities - discontinued operations | (82) | — | |||||||||

Net cash provided by operating activities | $ | 1,127 | $ | 973 | |||||||

| INVESTING ACTIVITIES | |||||||||||

| Capital expenditures | (485) | (610) | |||||||||

| Acquisition of business, net of cash acquired | (2,614) | — | |||||||||

| Proceeds from sales of assets, third party, net of transaction fees and hedging | 4 | 3 | |||||||||

Proceeds from investment in and advances to non-consolidated affiliates, net | 9 | 3 | |||||||||

(Outflows) proceeds from the settlement of derivative instruments, net | (5) | 5 | |||||||||

| Other | 12 | 13 | |||||||||

Net cash used in investing activities - continuing operations | (3,079) | (586) | |||||||||

Net cash provided by investing activities - discontinued operations | 357 | — | |||||||||

Net cash used in investing activities | $ | (2,722) | $ | (586) | |||||||

| FINANCING ACTIVITIES | |||||||||||

| Proceeds from issuance of long-term and short-term borrowings | 3,042 | 1,696 | |||||||||

| Principal payments of long-term and short-term borrowings | (2,301) | (1,225) | |||||||||

| Revolving credit facilities and other, net | (506) | 633 | |||||||||

| Debt issuance costs | (44) | (40) | |||||||||

| Contingent consideration paid in acquisition of business | (9) | — | |||||||||

Net cash provided by financing activities - continuing operations | 182 | 1,064 | |||||||||

Net cash used in financing activities - discontinued operations | (2) | — | |||||||||

Net cash provided by financing activities | $ | 180 | $ | 1,064 | |||||||

Net (decrease) increase in cash, cash equivalents and restricted cash | (1,415) | 1,451 | |||||||||

| Effect of exchange rate changes on cash | 40 | (9) | |||||||||

| Cash, cash equivalents and restricted cash — beginning of period | 2,402 | 960 | |||||||||

| Cash, cash equivalents and restricted cash — end of period | $ | 1,027 | $ | 2,402 | |||||||

| Cash and cash equivalents | $ | 998 | $ | 2,392 | |||||||

| Restricted cash (Included in "Other long-term assets") | 15 | 10 | |||||||||

| Restricted cash (Included in "Prepaid expenses and other current assets") | 14 | — | |||||||||

| Cash and cash equivalents of discontinued operations | — | — | |||||||||

| Cash, cash equivalents and restricted cash — end of period | $ | 1,027 | $ | 2,402 | |||||||

7

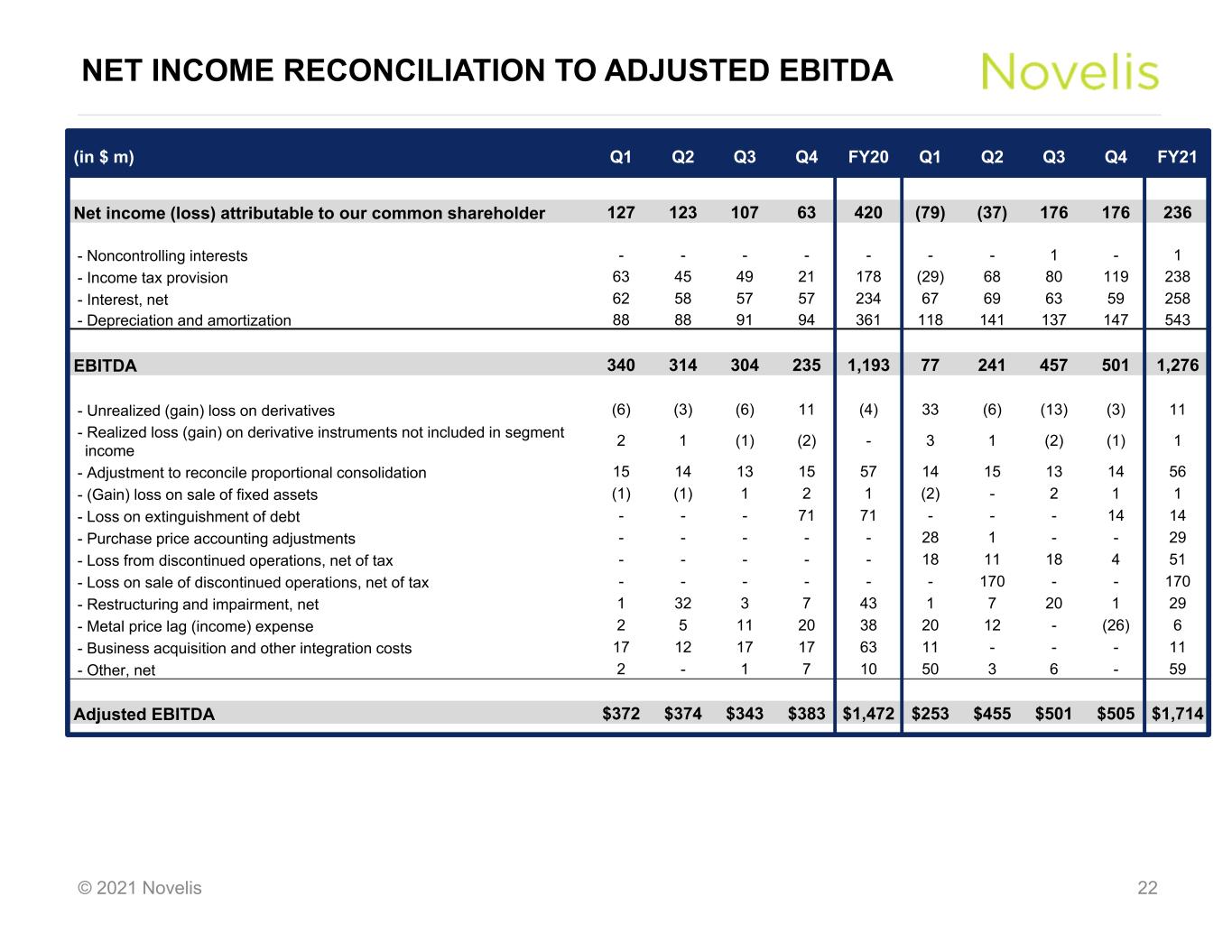

Reconciliation of Adjusted EBITDA (unaudited) to Net income attributable to our common shareholder

The following table reconciles Adjusted EBITDA, a non-GAAP financial measure, to Net income attributable to our common shareholder.

Three Months Ended March 31, | Fiscal Year Ended March 31, | ||||||||||||||||||||||

| (in millions) | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||

| Net income attributable to our common shareholder | 176 | 63 | 236 | 420 | |||||||||||||||||||

| Net income attributable to noncontrolling interests | — | — | 1 | — | |||||||||||||||||||

| Income tax provision | 119 | 21 | 238 | 178 | |||||||||||||||||||

| Interest, net | 59 | 57 | 258 | 234 | |||||||||||||||||||

| Depreciation and amortization | 147 | 94 | 543 | 361 | |||||||||||||||||||

| EBITDA | $ | 501 | $ | 235 | $ | 1,276 | $ | 1,193 | |||||||||||||||

| Adjustment to reconcile proportional consolidation | 14 | 15 | 56 | 57 | |||||||||||||||||||

| Unrealized (gains) losses on change in fair value of derivative instruments, net | (3) | 11 | 11 | (4) | |||||||||||||||||||

| Realized (gains) losses on derivative instruments not included in segment income | (1) | (2) | 1 | — | |||||||||||||||||||

| Loss on extinguishment of debt | 14 | 71 | 14 | 71 | |||||||||||||||||||

| Restructuring and impairment, net | 1 | 7 | 29 | 43 | |||||||||||||||||||

| Loss on sale of fixed assets | 1 | 2 | 1 | 1 | |||||||||||||||||||

| Purchase price accounting adjustments | — | — | 29 | — | |||||||||||||||||||

| Loss from discontinued operations, net of tax | 4 | — | 51 | — | |||||||||||||||||||

| Loss on sale of discontinued operations, net of tax | — | — | 170 | — | |||||||||||||||||||

| Metal price lag | (26) | 20 | 6 | 38 | |||||||||||||||||||

| Business acquisition and other integration related costs | — | 17 | 11 | 63 | |||||||||||||||||||

| Other, net | — | 7 | 59 | 10 | |||||||||||||||||||

| Adjusted EBITDA | $ | 505 | $ | 383 | $ | 1,714 | $ | 1,472 | |||||||||||||||

8

Free Cash Flow (unaudited)

The following table reconciles Free cash flow and Free cash flow from continuing operations, non-GAAP financial measures, to Net cash provided by operating activities - continuing operations.

Fiscal Year Ended March 31, | |||||||||||

| (in millions) | 2021 | 2020 | |||||||||

Net cash provided by operating activities - continuing operations | $ | 1,209 | $ | 973 | |||||||

Net cash used in investing activities - continuing operations | (3,079) | (586) | |||||||||

| Plus: Cash used in the acquisition of business, net of cash and restricted cash acquired | 2,614 | — | |||||||||

| Less: Proceeds from sales of assets and business, net of transaction fees, cash income taxes and hedging | (4) | (3) | |||||||||

| Free cash flow from continuing operations | 740 | 384 | |||||||||

Net cash used in operating activities - discontinued operations | (82) | — | |||||||||

| Net cash provided by investing activities - discontinued operations | 357 | — | |||||||||

| Less: Proceeds from sales of assets and business, net of transaction fees, cash income taxes and hedging - discontinued operations | (403) | — | |||||||||

| Free cash flow | $ | 612 | $ | 384 | |||||||

Cash and Cash Equivalents and Total Liquidity (unaudited)

The following table reconciles Total liquidity to the ending balances of cash and cash equivalents.

| (in millions) | March 31, 2021 | March 31, 2020 | |||||||||

| Cash and cash equivalents | $ | 998 | $ | 2,392 | |||||||

| Availability under committed credit facilities | 1,223 | 186 | |||||||||

| Total liquidity | $ | 2,221 | $ | 2,578 | |||||||

Reconciliation of Net income from continuing operations, excluding special items (unaudited) to Net income from continuing operations

The following table presents Net income from continuing operations excluding special items. We adjust for items which may recur in varying magnitude which affect the comparability of the operational results of our underlying business.

Three Months Ended March 31, | Fiscal Year Ended March 31, | ||||||||||||||||||||||

| (in millions) | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||

| Net income from continuing operations | 180 | 63 | 458 | 420 | |||||||||||||||||||

Special Items: | |||||||||||||||||||||||

| Business acquisition and other integration related costs | — | 17 | 11 | 63 | |||||||||||||||||||

| Loss on extinguishment of debt | 14 | 71 | 14 | 71 | |||||||||||||||||||

| Metal price lag | (26) | 20 | 6 | 38 | |||||||||||||||||||

| Restructuring and impairment, net | 1 | 7 | 29 | 43 | |||||||||||||||||||

| Charitable donation | — | — | 50 | — | |||||||||||||||||||

| Purchase price accounting adjustment | — | — | 29 | — | |||||||||||||||||||

Tax effect on special items | 3 | (25) | (36) | (45) | |||||||||||||||||||

| Net income from continuing operations, excluding special items | $ | 172 | $ | 153 | $ | 561 | $ | 590 | |||||||||||||||

9

Segment Information (unaudited)

The following table presents selected segment financial information (in millions, except shipments which are in kilotonnes).

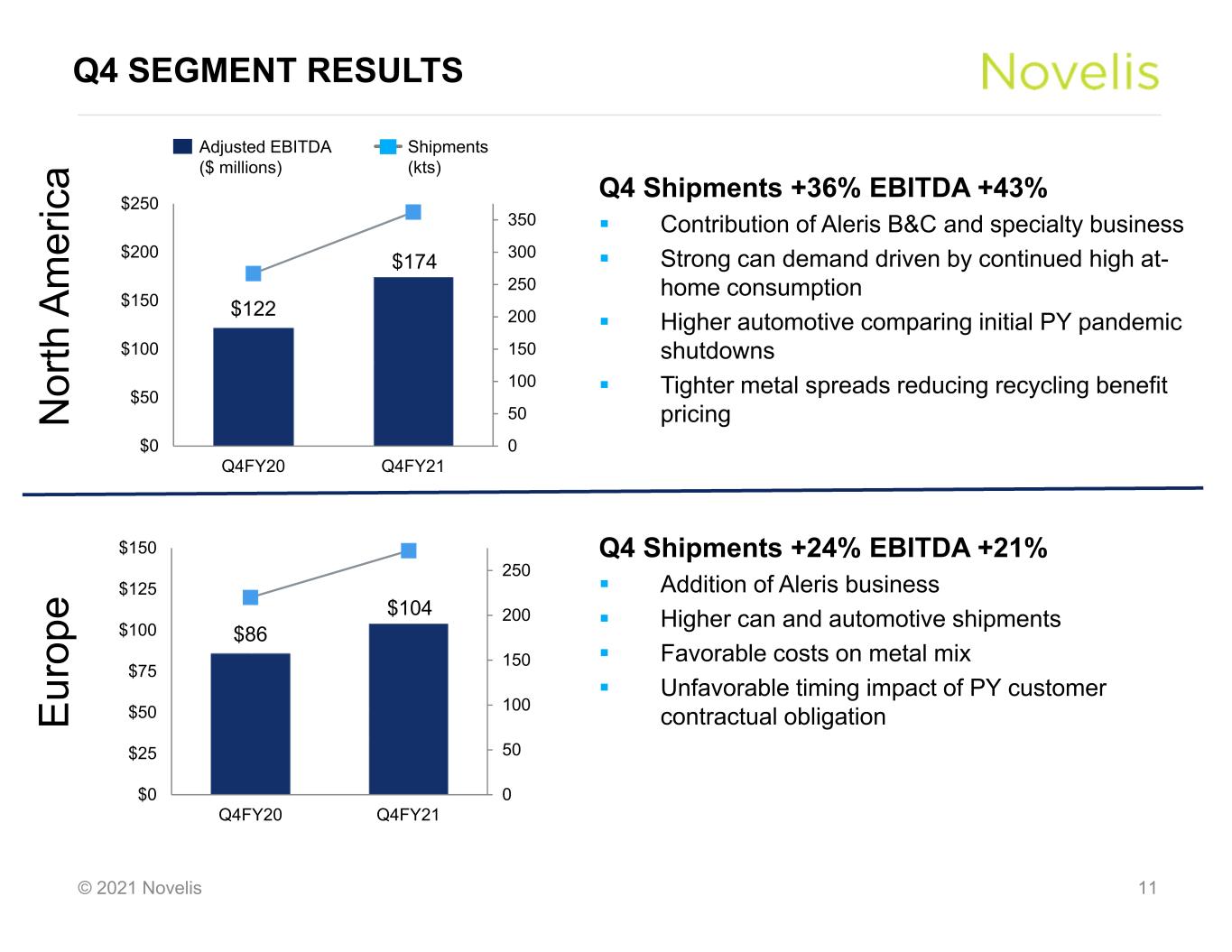

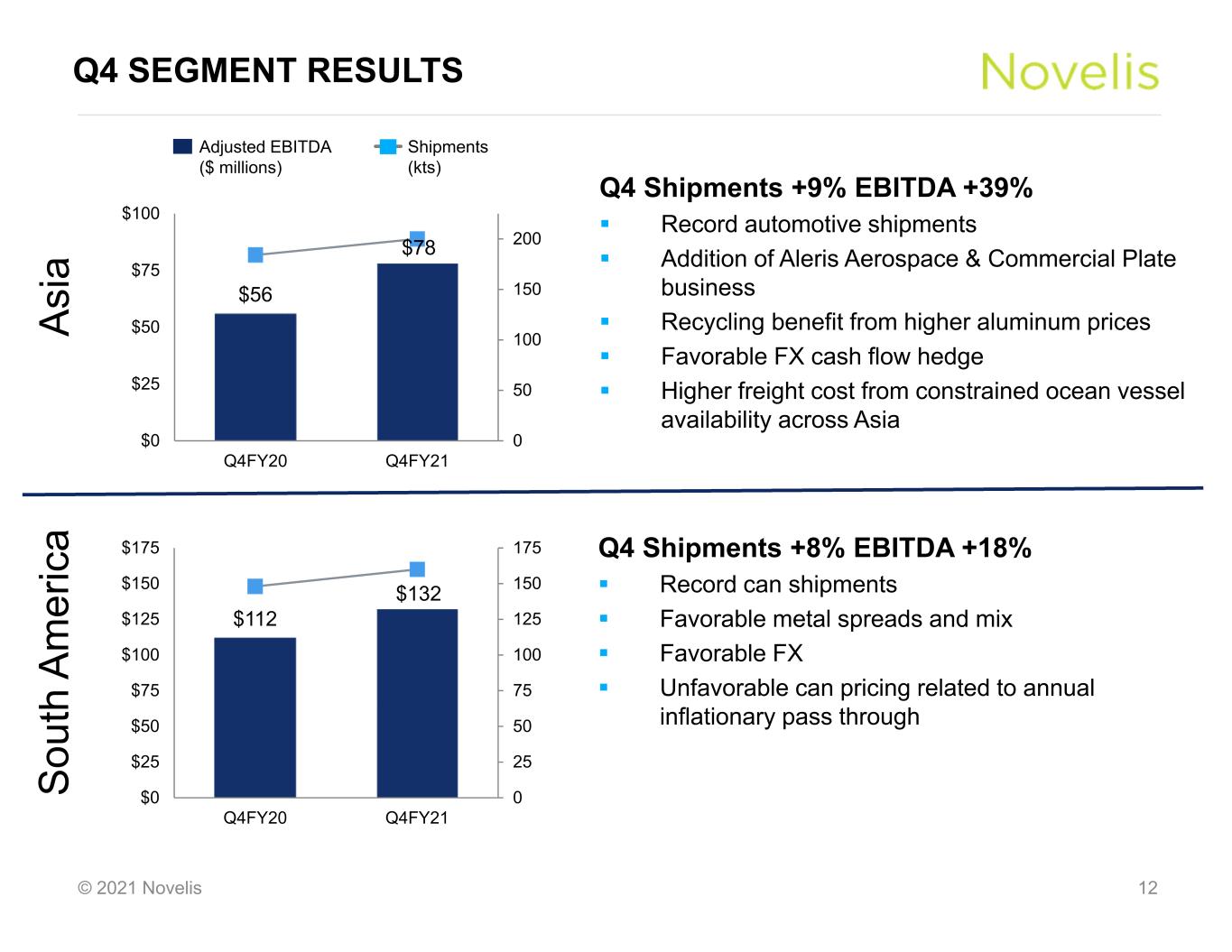

Selected Operating Results Three Months Ended March 31, 2021 | North America | Europe | Asia | South America | Eliminations and Other | Total | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 174 | $ | 104 | $ | 78 | $ | 132 | $ | 17 | $ | 505 | ||||||||||||||||||||||||||

| Shipments (in kt) | ||||||||||||||||||||||||||||||||||||||

| Rolled products - third party | 362 | 262 | 199 | 160 | — | 983 | ||||||||||||||||||||||||||||||||

| Rolled products - intersegment | — | 10 | 1 | — | (11) | — | ||||||||||||||||||||||||||||||||

| Total rolled products | 362 | 272 | 200 | 160 | (11) | 983 | ||||||||||||||||||||||||||||||||

Selected Operating Results Three Months Ended March 31, 2020 | North America | Europe | Asia | South America | Eliminations and Other | Total | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 122 | $ | 86 | $ | 56 | $ | 112 | $ | 7 | $ | 383 | ||||||||||||||||||||||||||

| Shipments (in kt) | ||||||||||||||||||||||||||||||||||||||

| Rolled products - third party | 267 | 214 | 182 | 148 | — | 811 | ||||||||||||||||||||||||||||||||

| Rolled products - intersegment | — | 6 | 2 | — | (8) | — | ||||||||||||||||||||||||||||||||

| Total rolled products | 267 | 220 | 184 | 148 | (8) | 811 | ||||||||||||||||||||||||||||||||

Selected Operating Results Fiscal Year Ended March 31, 2021 | North America | Europe | Asia | South America | Eliminations and Other | Total | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 663 | $ | 285 | $ | 305 | $ | 449 | $ | 12 | $ | 1,714 | ||||||||||||||||||||||||||

| Shipments (in kt) | ||||||||||||||||||||||||||||||||||||||

| Rolled products - third party | 1,348 | 947 | 740 | 578 | — | 3,613 | ||||||||||||||||||||||||||||||||

| Rolled products - intersegment | — | 30 | 6 | 1 | (37) | — | ||||||||||||||||||||||||||||||||

| Total rolled products | 1,348 | 977 | 746 | 579 | (37) | 3,613 | ||||||||||||||||||||||||||||||||

Selected Operating Results Fiscal Year Ended March 31, 2020 | North America | Europe | Asia | South America | Eliminations and Other | Total | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 590 | $ | 246 | $ | 210 | $ | 421 | $ | 5 | $ | 1,472 | ||||||||||||||||||||||||||

| Shipments (in kt) | ||||||||||||||||||||||||||||||||||||||

| Rolled products - third party | 1,111 | 892 | 711 | 559 | — | 3,273 | ||||||||||||||||||||||||||||||||

| Rolled products - intersegment | — | 31 | 7 | 15 | (53) | — | ||||||||||||||||||||||||||||||||

| Total rolled products | 1,111 | 923 | 718 | 574 | (53) | 3,273 | ||||||||||||||||||||||||||||||||

10

© 2021 Novelis NOVELIS Q4 AND FULL FISCAL YEAR 2021 EARNINGS CONFERENCE CALL May 12, 2021 Steve Fisher President and Chief Executive Officer Dev Ahuja Senior Vice President and Chief Financial Officer Exhibit 99.2

© 2021 Novelis SAFE HARBOR STATEMENT Forward-looking statements Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward- looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward looking statements in this presentation are statements about our expectations that impacts of the semi-conductor shortage on OEM production will be short-term. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing including in connection with potential acquisitions and investments; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations and negotiations; breakdown of equipment and other events; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions including deterioration in the global economy; the risks of pandemics or other public health emergencies, including the continued spread and impact of, and the governmental and third- party responses to the ongoing COVID-19 outbreak; risks arising out of our acquisition of Aleris Corporation including risks inherent in the acquisition method of accounting; disruption to our global aluminum production and supply chain as a result of COVID-19; changes in government regulations, particularly those affecting taxes, derivative instruments, environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our credit facilities and other financing agreements; and our ability to generate cash. The above list of factors is not exhaustive. Other important risk factors are included under the caption "Risk Factors" in our upcoming Annual Report on Form 10-K for the fiscal year ended March 31, 2021. 2

© 2021 Novelis 3,067 3,188 3,274 3,273 3,613 FY17 FY18 FY19 FY20 FY21 1,085 1,215 1,368 1,472 1,714 FY17 FY18 FY19 FY20 FY21 FY21 HIGHLIGHTS Top priority remains the safety, health and well- being of our employees, facilities and communities Achieved record shipments, EBITDA and free cash flow as a result of successful integration of Aleris, diverse product portfolio and global footprint Reaching integration milestones ahead of expectations Organic capital investments well-positioned to capture robust market demand Announced ambitious sustainability commitments to help build a more circular economy and diverse workforce 3 Annual Adjusted EBITDA ($ millions) Annual Shipments (kilotonnes) FY17 FY18 FY19 FY20 FY21 Free cash flow from cont. operations FCF from CO before capex ($ millions) 632 1,225 585 761 994

© 2021 Novelis With AlerisWith Aleris GROWTH THROUGH ACQUISITION 4 $175 $225 $275 $325 $375 $425 $475 $525 Q1FY18 Q2FY18 Q3FY18 FY18 Q1FY19 Q2FY19 Q3FY19 FY19 Q1FY20 Q2FY20 Q3FY20 Q4FY20 Q1FY21 Q2FY21 Q3FY21 Q4FY21700 800 900 1,000 Q1FY18 Q2FY18 Q3FY18 FY18 Q1FY19 Q2FY19 Q3FY19 FY19 Q1FY20 Q2FY20 Q3FY20 Q4FY21 Q1FY21 Q2FY21 Q3FY21 Q4FY21 Quarterly Adjusted EBITDA Trend ($ millions) Quarterly Shipment Trend (kilotonnes) FY18 FY19 FY20 FY21 FY18 FY19 FY20 FY21 Achieving strategic rationale for Aleris acquisition Growing and diversifying product & customer portfolio Contributed $200 million of Adjusted EBITDA in FY21 Achieved $79 million run-rate combination synergies through Q4 Groundbreaking for new ~$325-375 million cold mill in Zhenjiang, China, mid-FY22 85 79 120 65 65 $0 $25 $50 $75 $100 $125 $150 $175 $200 Acquisition base case estimate Run-rate actuals through Q4FY21 Current forecast Run-Rate Acquisition Synergies ($ millions) Combination Strategic (China)

© 2021 Novelis ORGANIC GROWTH ON TRACK New automotive finishing lines began commissioning in FY21 Commercial shipments began in Q4, customer qualifications underway 200kt US greenfield expansion in Kentucky, U.S. 100kt brownfield expansion in Changzhou, China Increases total automotive finishing capacity to ~1 million tonnes across North America, Europe and China Brazil rolling & recycling capacity expansion on track Recycling expansion to commission end of Q1 Rolling capacity upgrades on track for end of FY22 5 Guthrie pre-treatment and Pinda recycling melter lines

© 2021 Novelis FOCUSED APPROACH DRIVING RESULTS 6 Continuous improvement mindset Balanced approach to key fundamentals that drive business performance ROCE will be the outcome, enabling reinvestment for further growth Legacy Novelis plants achieved significant improvement over past five years Customer satisfaction ratings consistently at or above 90% over last three years Reduced unplanned downtime and PPM defects Released over 100kt of capacity through improved recovery rates

© 2021 Novelis SHAPING A SUSTAINABLE WORLD TOGETHER 7 30% 46% 49% 53% 55% 57% 61% 59% 61% Average FY07-09 baseline FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21* Percentage of Recycled Content in our Products Novelis is the largest recycler of aluminum in the world Recycling and sustainability are central to Novelis’ values, our business model, and our purpose of Shaping a Sustainable World Together Since establishing our baseline averages* we have achieved: 31% reduction in greenhouse gas emissions 26% reduction in water intensity *Baseline averages of Fiscal 2007-09; legacy Novelis only 40% reduction in non-dross waste to landfill 25% reduction in energy intensity *FY21 includes Aleris, prior years legacy Novelis only

© 2021 Novelis OUR COMMITMENTS & GOALS 8 10% Reduction in Energy use by 2026 10% Reduction in Water use by 2026 20% Reduction in Waste to landfill by 2026 * Net Carbon Neutral by 2050 30% reduction in C02 footprint by 2026 * *Includes Scopes 1-3 Greenhouse Gas Emissions and Waste based on Fiscal Year 2016 Baseline Increase representation of women to: 30% in leadership roles by 2024 15% in senior technical roles by 2024

© 2021 Novelis FINANCIAL HIGHLIGHTS

© 2021 Novelis Q4 FISCAL 2021 FINANCIAL HIGHLIGHTS Net income from continuing operations $180 million, up 186%; Excluding tax-effected special items*, net income of $172 million up 12% Sales up 33% to $3.6 billion Total FRP Shipments up 21% to record 983 kilotonnes Adjusted EBITDA up 32% to record $505 million Includes $60 million contribution from acquired Aleris business Adjusted EBITDA per ton $514 10 Q4FY21 vs Q4FY20 *Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss on sale of business, business acquisition and other integration costs. Adjusted EBITDA bridge, $ Millions 383 200 7 (65) (35) 15 505 Q4FY20 Volume Price/Mix Operating CostSG&A, R&D and Other FX Q4FY21

© 2021 Novelis Q4 SEGMENT RESULTS 11 Q4 Shipments +36% EBITDA +43% Contribution of Aleris B&C and specialty business Strong can demand driven by continued high at- home consumption Higher automotive comparing initial PY pandemic shutdowns Tighter metal spreads reducing recycling benefit pricing $122 $174 0 50 100 150 200 250 300 350 $0 $50 $100 $150 $200 $250 Q4FY20 Q4FY21 Shipments (kts) Adjusted EBITDA ($ millions) N or th A m er ic a E ur op e Q4 Shipments +24% EBITDA +21% Addition of Aleris business Higher can and automotive shipments Favorable costs on metal mix Unfavorable timing impact of PY customer contractual obligation $86 $104 0 50 100 150 200 250 $0 $25 $50 $75 $100 $125 $150 Q4FY20 Q4FY21

© 2021 Novelis Q4 Shipments +8% EBITDA +18% Record can shipments Favorable metal spreads and mix Favorable FX Unfavorable can pricing related to annual inflationary pass through Q4 Shipments +9% EBITDA +39% Record automotive shipments Addition of Aleris Aerospace & Commercial Plate business Recycling benefit from higher aluminum prices Favorable FX cash flow hedge Higher freight cost from constrained ocean vessel availability across Asia Q4 SEGMENT RESULTS 12 $56 $78 0 50 100 150 200 $0 $25 $50 $75 $100 Q4FY20 Q4FY21 A si a S ou th A m er ic a Shipments (kts) Adjusted EBITDA ($ millions) $112 $132 0 25 50 75 100 125 150 175 $0 $25 $50 $75 $100 $125 $150 $175 Q4FY20 Q4FY21

© 2021 Novelis FULL YEAR FISCAL 2021 FINANCIAL HIGHLIGHTS Net income from continuing operations $458 million, up 9%; Excluding tax-effected special items*, net income of $561 million down 5% Sales up 9% to $12.3 billion Total FRP Shipments up 10% to 3,613 kilotonnes Adjusted EBITDA up 16% to $1,714 million Includes $200 million contribution from acquired Aleris business 13 FY21 vs FY20 *Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss on sale of business, business acquisition and other integration costs. Adjusted EBITDA bridge, $ Millions 1,472 431 (79) (95) (48) 33 1,714 FY20 Volume Price/Mix Operating Cost SG&A, R&D and Other FX FY21

© 2021 Novelis FREE CASH FLOW AND NET LEVERAGE 14 FY21 FY20 Adjusted EBITDA 1,714 1,472 Interest paid (240) (222) Taxes paid (169) (172) Capital expenditures (485) (610) Working capital & other (80) (84) Free cash flow from continuing operations 740 384 Free cash flow from discontinued operations (128) - Free cash flow 612 384 Free cash flow from continuing operations before capex 1,225 994 $ Millions Record free cash flow generation Prudent capital spending in fiscal year 2021 Rapid reduction in net leverage to 2.9x, down from 3.8x at acquisition close in Q1 Maintain very strong liquidity $2.2 billion at March 31, 2021 Net Leverage ratio Net debt/TTM Adjusted EBITDA 2.1x end of FY20 3.8x post- acquisition Q1FY21 2.9x end of FY21 0.0 1.0 2.0 3.0 4.0 5.0 FY18 FY19 FY20 FY21 FY18 FY19 FY20 FY21

© 2021 Novelis DEBT REDUCTION & REFINANCING 15 Strong cash flow and divestment proceeds reduced gross debt by ~$2 billion since acquisition Q1FY21 ~$900 million mainly ABL, regional borrowings and other revolving credit facilities Full repayment of $1.1 billion short term bridge loan Refinanced $1.1 billion of $1.7 billion 2017 term loans New $500 million 2021 secured term loan due 2028 New €500 million 3.375% senior unsecured green bond in Europe (~US$588 million) due 2029 2017 term loan balance to be repaid before maturity in 2022 Recognized performance resulted in credit rating upgrades in March 2021 Moody’s Investor Services upgraded the corporate family rating of Novelis Inc. to Ba3 from B1 S&P Global Ratings raised their issue-level rating on Novelis’ unsecured notes to ‘BB-’ from ‘B+’ 5.6 8.0 7.3 6.6 6.0 Q4FY20 Q1FY21 Q2FY21 Q3FY21 Q4FY21 Gross Principal Debt $ billions Debt Maturity Profile* $ millions 1,500 628 767 500 1,500 1,600 588 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 ABL Revolver 2017 Term Loans 2020 Term Loans New 2021 Term Loans Sr Unsecured Notes New Sr Unsecured Green Notes *Debt maturity profile excludes short-term borrowings and lease obligations, $124 million Zhenjiang term loans, $76 million China bank loans.

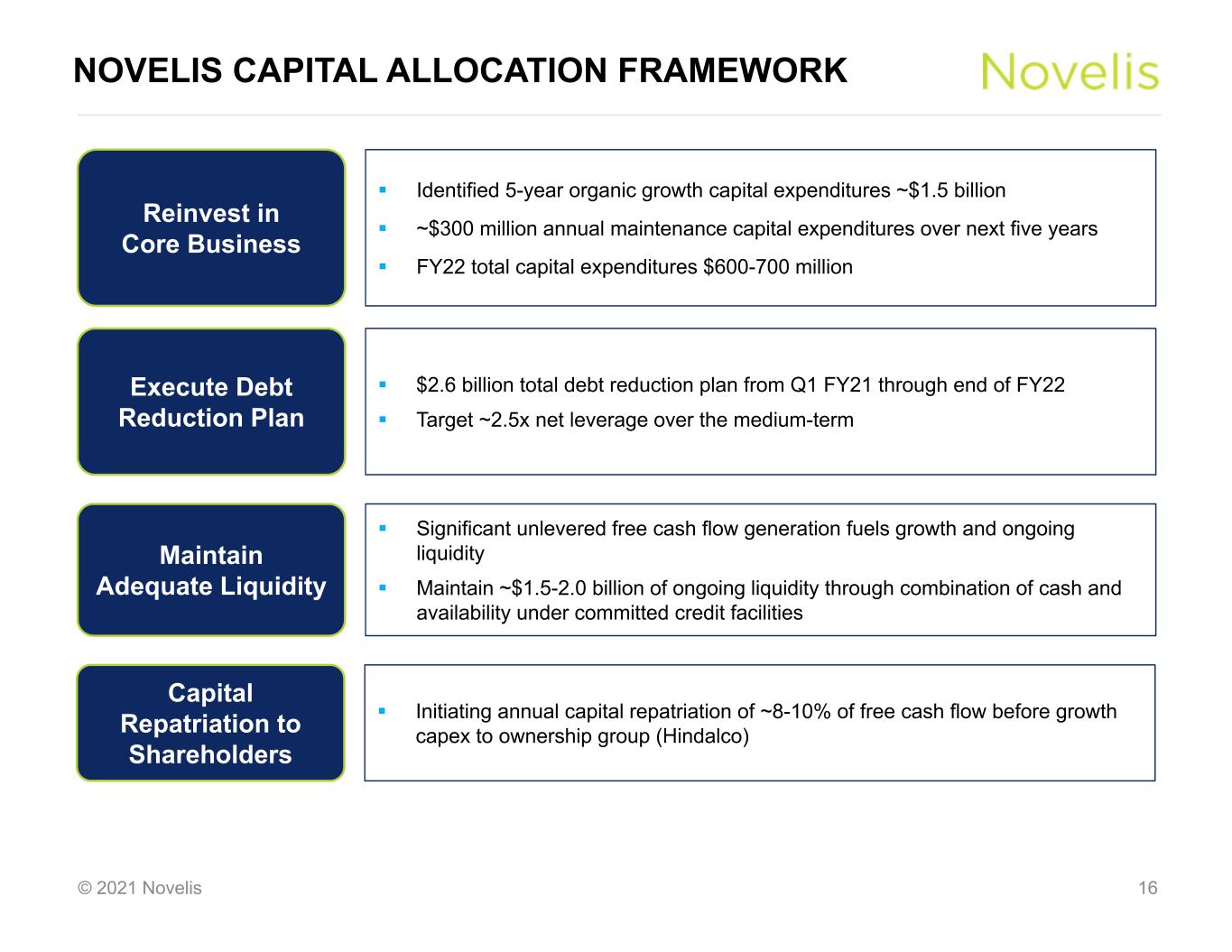

© 2021 Novelis NOVELIS CAPITAL ALLOCATION FRAMEWORK 16 Execute Debt Reduction Plan $2.6 billion total debt reduction plan from Q1 FY21 through end of FY22 Target ~2.5x net leverage over the medium-term Reinvest in Core Business Identified 5-year organic growth capital expenditures ~$1.5 billion ~$300 million annual maintenance capital expenditures over next five years FY22 total capital expenditures $600-700 million Maintain Adequate Liquidity Significant unlevered free cash flow generation fuels growth and ongoing liquidity Maintain ~$1.5-2.0 billion of ongoing liquidity through combination of cash and availability under committed credit facilities Capital Repatriation to Shareholders Initiating annual capital repatriation of ~8-10% of free cash flow before growth capex to ownership group (Hindalco)

© 2021 Novelis OUTLOOK & SUMMARY

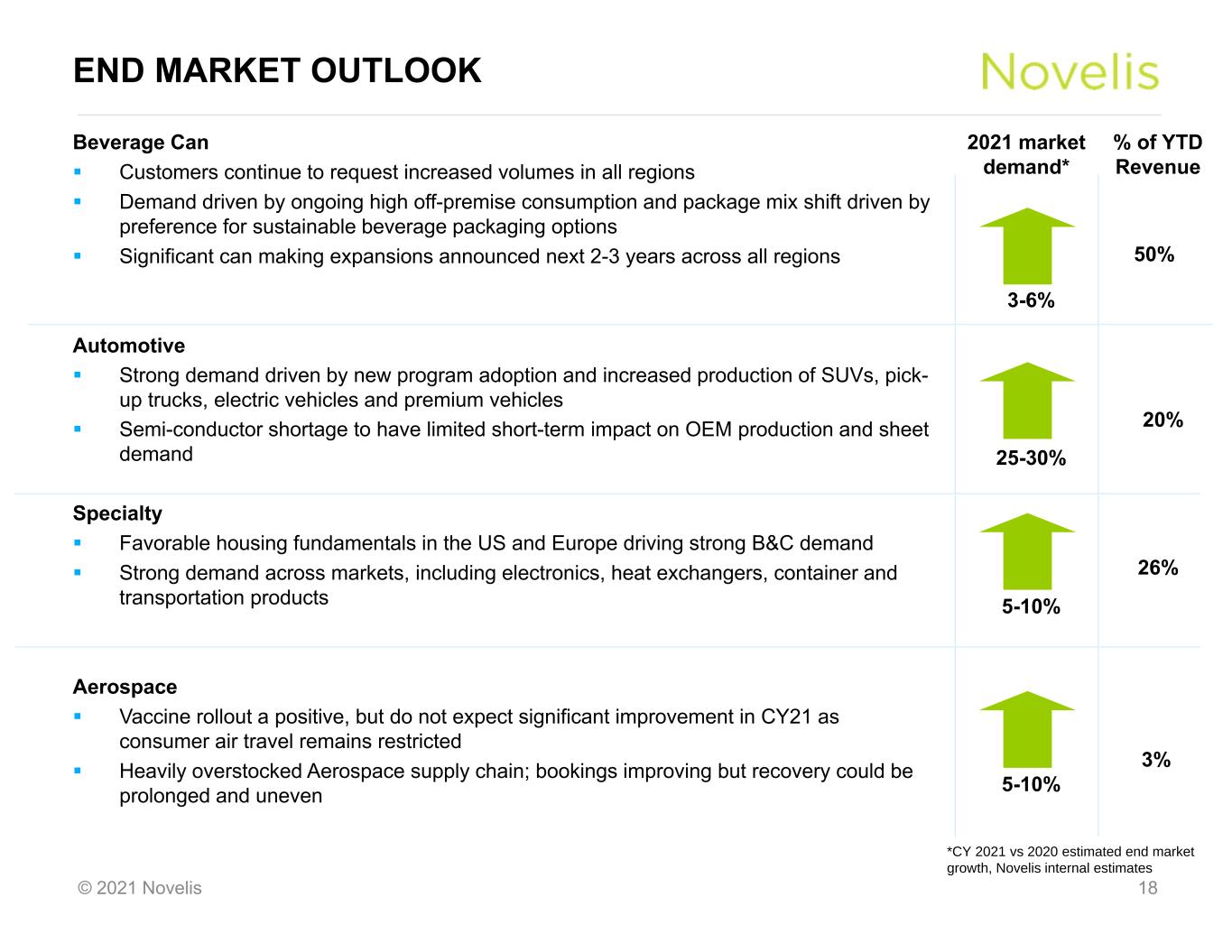

© 2021 Novelis END MARKET OUTLOOK 18 Beverage Can Customers continue to request increased volumes in all regions Demand driven by ongoing high off-premise consumption and package mix shift driven by preference for sustainable beverage packaging options Significant can making expansions announced next 2-3 years across all regions Automotive Strong demand driven by new program adoption and increased production of SUVs, pick- up trucks, electric vehicles and premium vehicles Semi-conductor shortage to have limited short-term impact on OEM production and sheet demand Specialty Favorable housing fundamentals in the US and Europe driving strong B&C demand Strong demand across markets, including electronics, heat exchangers, container and transportation products Aerospace Vaccine rollout a positive, but do not expect significant improvement in CY21 as consumer air travel remains restricted Heavily overstocked Aerospace supply chain; bookings improving but recovery could be prolonged and uneven 2021 market demand* % of YTD Revenue 50% 26% 20% 3% *CY 2021 vs 2020 estimated end market growth, Novelis internal estimates 3-6% 5-10% 5-10% 25-30%

© 2021 Novelis SUMMARY 19 Exceptional performance driven by diversified product portfolio, operational excellence, and expanded global presence Favorable demand trends for aluminum FRP across most end markets continue Integration of Aleris driving synergies and value capture Significant cash flow generation to allow organic investment for continued growth Working across the value chain to enhance the sustainability of our products

© 2021 Novelis THANK YOU QUESTIONS?

© 2021 Novelis APPENDIX

© 2021 Novelis (in $ m) Q1 Q2 Q3 Q4 FY20 Q1 Q2 Q3 Q4 FY21 Net income (loss) attributable to our common shareholder 127 123 107 63 420 (79) (37) 176 176 236 - Noncontrolling interests - - - - - - - 1 - 1 - Income tax provision 63 45 49 21 178 (29) 68 80 119 238 - Interest, net 62 58 57 57 234 67 69 63 59 258 - Depreciation and amortization 88 88 91 94 361 118 141 137 147 543 EBITDA 340 314 304 235 1,193 77 241 457 501 1,276 - Unrealized (gain) loss on derivatives (6) (3) (6) 11 (4) 33 (6) (13) (3) 11 - Realized loss (gain) on derivative instruments not included in segment income 2 1 (1) (2) - 3 1 (2) (1) 1 - Adjustment to reconcile proportional consolidation 15 14 13 15 57 14 15 13 14 56 - (Gain) loss on sale of fixed assets (1) (1) 1 2 1 (2) - 2 1 1 - Loss on extinguishment of debt - - - 71 71 - - - 14 14 - Purchase price accounting adjustments - - - - - 28 1 - - 29 - Loss from discontinued operations, net of tax - - - - - 18 11 18 4 51 - Loss on sale of discontinued operations, net of tax - - - - - - 170 - - 170 - Restructuring and impairment, net 1 32 3 7 43 1 7 20 1 29 - Metal price lag (income) expense 2 5 11 20 38 20 12 - (26) 6 - Business acquisition and other integration costs 17 12 17 17 63 11 - - - 11 - Other, net 2 - 1 7 10 50 3 6 - 59 Adjusted EBITDA $372 $374 $343 $383 $1,472 $253 $455 $501 $505 $1,714 NET INCOME RECONCILIATION TO ADJUSTED EBITDA 22

© 2021 Novelis FREE CASH FLOW AND LIQUIDITY 23 (in $ m) Q1 Q2 Q3 Q4 FY20 Q1 Q2 Q3 Q4 FY21 Cash provided by (used in) operating activities – continuing operations 59 243 170 501 973 (123) 496 275 561 1,209 Cash provided by (used in) investing activities – continuing operations (151) (130) (127) (178) (586) (2,643) (183) (101) (152) (3,079) Plus: Cash used in Acquisition of a business, net of cash acquired - - - - - 2,550 64 - - 2,614 Plus: Accrued merger consideration - - - - - 70 (60) (10) - - Less: (proceeds) outflows from sale of assets, net of transaction fees, cash income taxes and hedging (2) (1) - - (3) - (2) (2) - (4) Free cash flow from continuing operations $(94) $112 $43 $323 $384 $(146) $315 $162 $409 $740 Net cash used in operating activities – discontinued operations - - - - - (15) (16) (47) (4) (82) Net cash provided by investing activities – discontinued operations - - - - - 10 207 140 - 357 Less: Proceeds from sale of assets and businesses, net of transaction fees, cash income taxes and hedges - discontinued operations - - - - - - (223) (180) - (403) Free cash flow $(94) $112 $43 $323 $384 $(151) $283 $75 $405 $612 Capital expenditures 164 141 125 180 610 112 114 107 152 485 (in $ m) Q1 Q2 Q3 Q4 FY20 Q1 Q2 Q3 Q4 FY21 Cash and cash equivalents 859 935 1,031 2,392 2,392 1,729 1,627 1,164 998 998 Cash and cash equivalents of discontinued operations - - - - - 89 - - - - Availability under committed credit facilities 870 875 838 186 186 308 1,005 1,226 1,216 1,216 Liquidity $1,729 $1,810 $1,869 $2,578 $2,578 $2,126 $2,632 $2,390 $2,214 $2,214

© 2021 Novelis NET DEBT 24 (in $ m) Q1 Q2 Q3 Q4 FY20 Q1 Q2 Q3 Q4 FY21 Long-term debt, net of current portion 4,327 4,338 4,355 5,345 5,345 5,671 6,767 6,295 5,653 5,653 Current portion of long-term debt 19 19 19 19 19 50 55 59 71 71 Short-term borrowings 53 14 51 176 176 2,176 393 151 236 236 Cash and cash equivalents (859) (935) (1,031) (2,392) (2,392) (1,729) (1,627) (1,164) (998) (998) Net debt $3,540 $3,436 $3,394 $3,148 $3,148 $6,168 $5,588 $5,341 $4,962 $4,962

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- INVESTOR ACTION ALERT: The Schall Law Firm Encourages Investors in SSR Mining Inc. with Losses of $100,000 to Contact the Firm

- Inszone Insurance Services Acquires James Kelly Insurance, Expanding Its Presence in California

- InventHelp Inventor Develops Newly Formulated Snack Item (PDK-409)

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share