Form 8-K NATURAL ALTERNATIVES For: Sep 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): 09/17/2021

NATURAL ALTERNATIVES INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 000-15701

|

Delaware |

|

84-1007839 |

|

(State or other jurisdiction of |

|

(IRS Employer |

|

incorporation) |

|

Identification No.) |

1535 Faraday Avenue, Carlsbad, CA 92008

(Address of principal executive offices, including zip code)

760-736-7700

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common |

NAII |

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPONTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

5.02(b) Director Resignations

The Board of Directors (the "Board") of Natural Alternatives International, Inc. (the "Company") received letters of resignation tendered by Alan J. Lane and Lee G. Weldon two of its directors. Both letters of resignation stated their resignation would be effective September 18, 2021, and both letters of resignation stated they were not the result of any disagreement with the Board, the Company's management, its independent accountant or legal counsel. No new or modified compensatory arrangements were entered into by the Company with the departing directors.

5.02(d) Appointment of a Director

On September 17, 2021, the Board appointed a new director to a vacant seat on the Board resulting from the death of a director. The Board appointed Dr. Guru Ramanathan to complete the remaining term of the deceased director ending on the annual meeting of stockholders to elect directors in Class I currently scheduled to be held on December 3, 2021. The Board also accepted the recommendation of the Nominating Committee and resolved to nominate Dr. Ramanathan to be elected by the stockholders as a director in Class I at the annual stockholder meeting to be held on December 3, 2021. The only compensatory arrangement entered into between the Company and Dr. Ramanathan to be effective prior to his potential election as a director by the stockholders is to pay Dr. Ramanathan the same fees that are paid to other directors for attendance at Board and Committee meetings and to pay or reimburse the reasonable cost of traveling to and attending any such meetings.

In light of these changes in the composition of the Board and for related reasons, the Board also took the following actions.

Decrease in Board Size

In light of the size of the Company, and in order to meet currently applicable state statutory requirements regarding the composition of the Board of Directors and in doing so to avoid an otherwise required significant increase in the size of the Board which primarily due to cost and effectiveness the Board determined would not to be in the Company's best interest, the Board determined it would best provide for the efficient and effective governance of the Company to reduce the current size of the Board. Therefore, effective September 18, 2021, the Board approved a decrease in the size of the Board from 6 directors to 4 directors. As a result of the director resignations and the change in the size of the Board, the Board now has 4 members, three of whom are independent, and no vacancies.

Board Committee Appointments

On September 17, 2021, the Board of Directors appointed Alan G. Dunn, Laura Kay Matherly and Guru Ramanathan to the Nominating Committee of the Board of Directors and appointed Alan G. Dunn to serve as Chair of the Nominating Committee. On the same date, the Board appointed Laura Kay Matherly to be the Chair of the Human Resources Committee and also appointed Guru Ramanathan to the Audit Committee and the Human Resources Committee. As a result of the director resignations and the Committee appointments, all three Committees of the Board (Audit Committee, Human Resources Committee and Nominating Committee) are now comprised of directors Alan G. Dunn, Laura Kay Matherly and Guru Ramanathan.

ITEM 7.01 REGULATION FD DISCLOSURE.

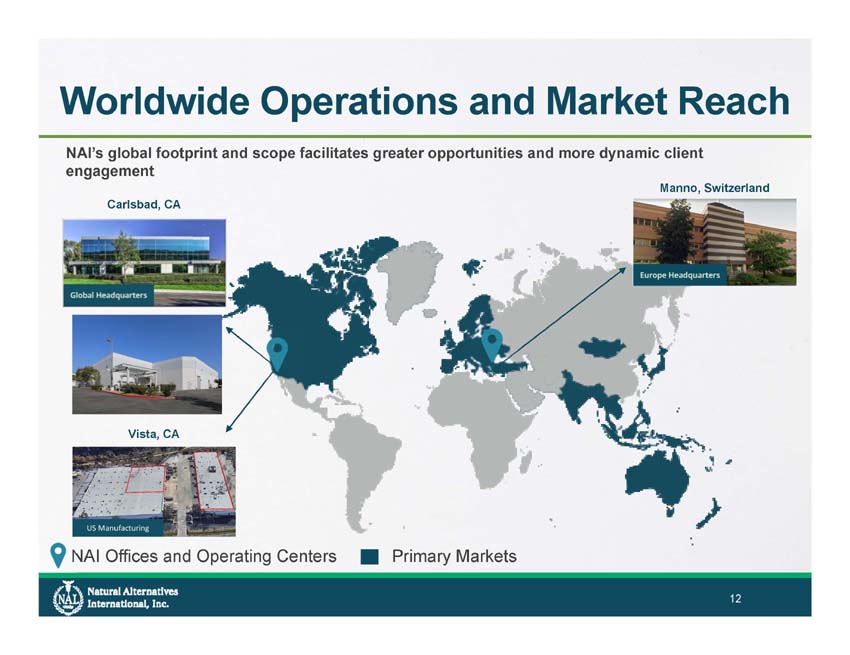

The Company has added an investor presentation to its website. The presentation can be found on the investor relations tab of the website at https://www.nai-online.com/our-company/investors/ . A copy of the Investor Presentation is attached hereto as Exhibit 99.1 and incorporated by reference herein.

On September 20, 2021, NAI issued a press release announcing its fourth quarter and annual financial results, the appointment of Dr. Guru Ramanathan to the Board of Directors, and the addition of a new investor presentation to its website. A copy of the press release is attached hereto as Exhibit 99.3 and incorporated by reference herein.

ITEM 8.01 OTHER EVENTS.

Determination of Director Independence and Audit Committee Financial Experts

On September 17, 2021, the Board, under advisement by legal counsel and the Nominating Committee, undertook an analysis regarding director independence and determined that each of Alan G. Dunn, Laura Kay Matherly and Guru Ramanathan are independent directors. On the same date the Board undertook an analysis of Audit Committee Financial Experts and determined Alan G. Dunn and Laura Kay Matherly are each an Audit Committee Financial Expert within the meaning of current SEC regulations.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

|

99.4 |

|

99.5 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Natural Alternatives International, Inc. a Delaware corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: September 20, 2021 |

By: |

/s/ Mike Fortin |

|

|

|

|

Mike Fortin, Chief Financial Officer |

|

Exhibit 99.4

Exhibit 99.5

Natural Alternatives International, Inc.

Announces 2021 Q4 and YTD Results

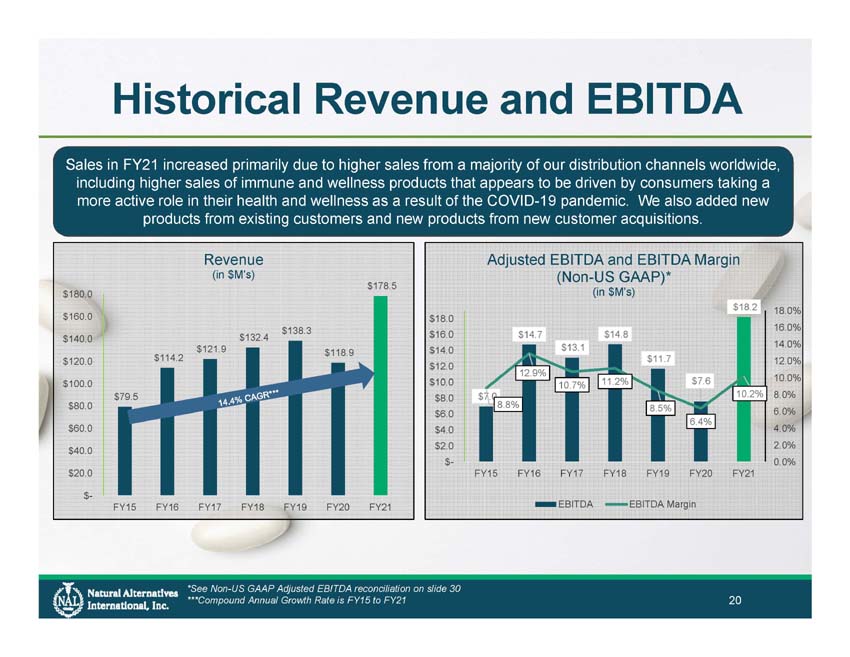

Record Level of Sales, Net Income, and Diluted EPS for the Fiscal Year 2021

|

● |

2021 Q4: $44.4 million Net Sales (+26.5%), $3.0 million Net Income, $0.47 diluted EPS |

|

● |

Fiscal Year 2021: $178.5 million Net Sales (+50.2%), $10.8 million Net Income, $1.69 diluted EPS |

|

● |

Appointment of Dr. Guru Ramanathan as a new independent Director |

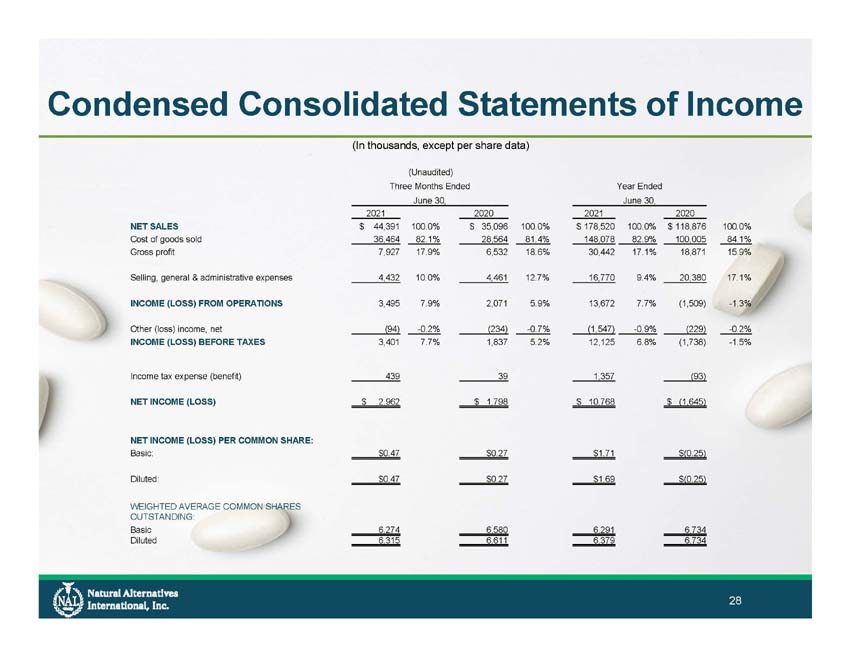

CARLSBAD, CALIF, September 20, 2021 /PRNewswire/ --Natural Alternatives International, Inc. ("NAI") (Nasdaq: NAII), a leading formulator, manufacturer and marketer of customized nutritional supplements, today announced net income of $3.0 million, or $0.47 per diluted share, on net sales of $44.4 million for the fourth quarter of fiscal year 2021 compared to net income of $1.8 million, or $0.27 per diluted share, in the fourth quarter of the prior fiscal year.

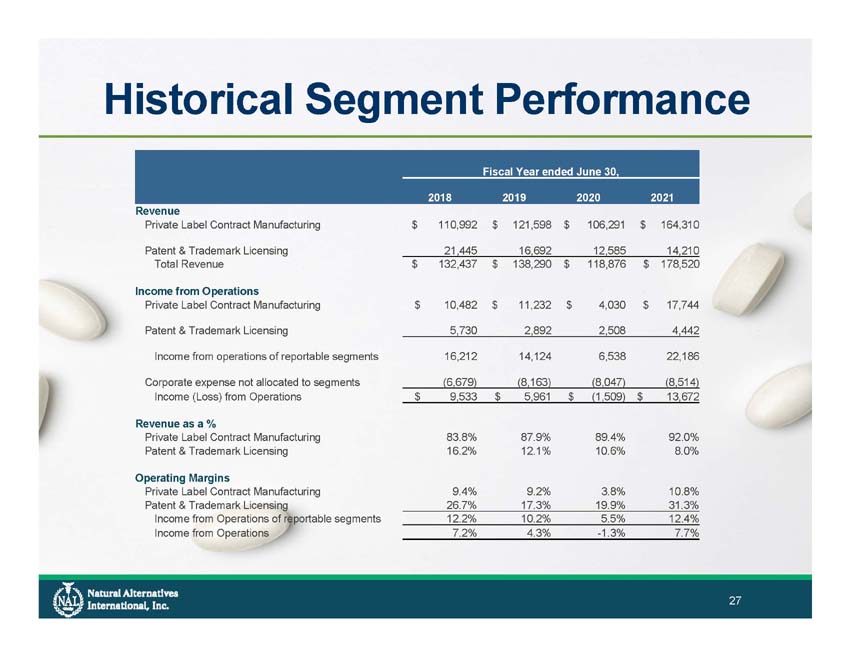

Net sales during the three months ended June 30, 2021 increased $9.3 million, or 26.5%, to $44.4 million as compared to $35.1 million recorded in the comparable prior year period. During the same period, private-label contract manufacturing sales increased to $39.8 million, a 21.2% increase from the comparable quarter last year. In both the fiscal year and fourth quarter, private-label contract manufacturing sales increased primarily due to higher sales from a majority of our distribution channels worldwide. A significant portion of our increased contract manufacturing sales related to higher sales of immune and wellness products which is in line with the trend we find being experienced by the dietary supplement industry that appears to be driven by consumers taking a more active role in their health and wellness as a result of the COVID-19 pandemic. Our contract manufacturing sales also increased due to sales of newly awarded products from new and existing customers. CarnoSyn® beta-alanine royalty, licensing and raw material sales revenue increased 102.6% to $4.7 million during the fourth quarter of fiscal year 2021, as compared to $2.3 million for the fourth quarter of fiscal year 2020. In both the fiscal year and fourth quarter, CarnoSyn® sales increased primarily due to an increase in material shipments resulting from higher sales to existing customers. We believe the higher sales were influenced by an increase in activity as gyms and athletic facilities began to reopen in accordance with easing COVID-19 guidelines in various cities and states across the U.S.

Net income for the year ended June 30, 2021 was $10.8 million, or $1.69 per diluted share, compared to a net loss of $1.6 million, or $0.25 per diluted share, for the year ended June 30, 2020.

Net sales during the year ended June 30, 2021 increased 50.2% to $178.5 million as compared to $118.9 million recorded in the comparable prior year period. For the year ended June 30, 2021, private-label contract manufacturing sales increased 54.6% to $164.3 million as compared to $106.3 million during the comparable period last year. CarnoSyn® beta-alanine royalty, licensing and raw material sales revenue increased 12.9% to $14.2 million during the year ended June 30, 2021, as compared to $12.6 million for the year ended June 30, 2020.

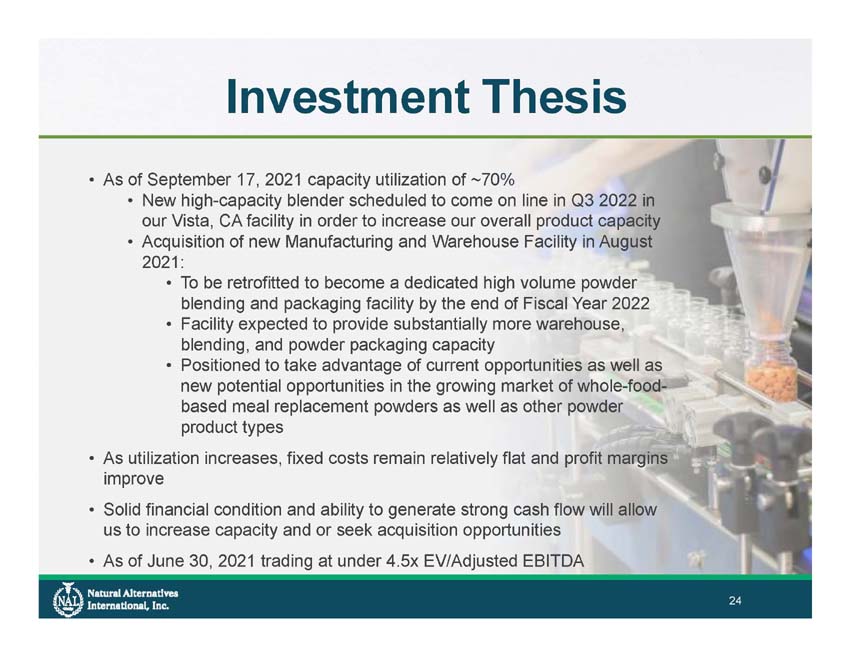

Based on our current sales order volumes, and forecasts we have received from our customers, we anticipate our fiscal year 2022 consolidated net sales will increase between 5.0% and 10.0% as compared to fiscal year 2021. We also anticipate we will generate operating income between 7.0% and 9.0% of net sales for our fiscal year ending June 30, 2022. Sales and profitability during the first half of fiscal year 2022 are anticipated to decline when compared to the same period of fiscal 2021. Our expectations for the first half of fiscal year 2022 are being driven by continuing supply chain, labor and logistical constraints, all of which are expected to result in a backlog of existing orders that may not be delivered until the second half of fiscal year 2022. We currently anticipate these manufacturing challenges will be substantially resolved during the second half of fiscal year 2022. As a result, we expect sales and profitability in the second half of fiscal 2022 to exceed the comparable period in fiscal year 2021, with the overall fiscal year 2022 results reflecting an increase in both sales and profitability on a full year basis.

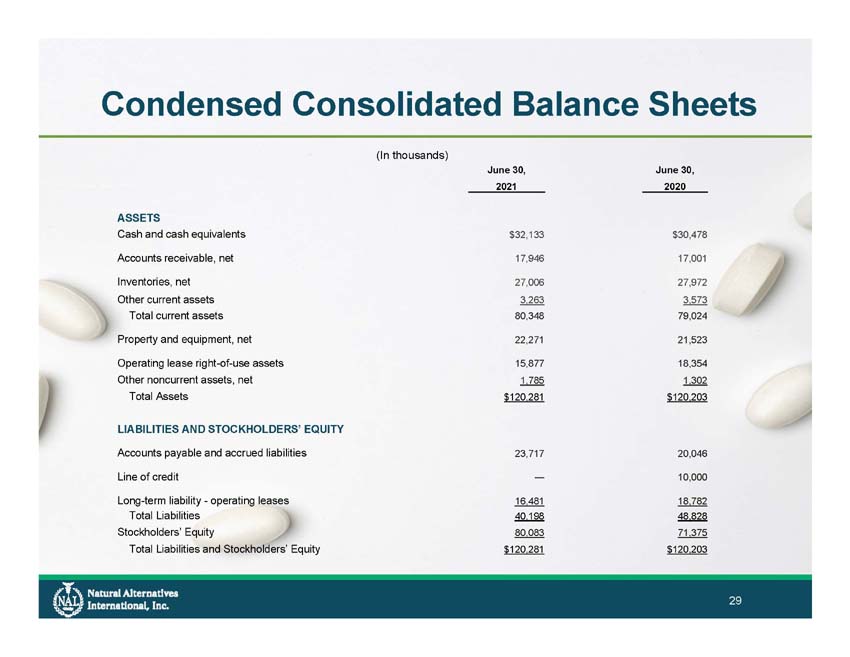

As of June 30, 2021, we had cash of $32.1 million and working capital of $58.3 million compared to $30.5 million and $51.2 million respectively, as of June 30, 2020. As of June 30, 2021, we had $20.0 million available under our line of credit agreement.

Additionally, on September 17, 2021, the Board of Directors appointed Dr. Guru Ramanathan to the Board of Directors seat vacated by the unexpected death of a director this past spring. Dr. Ramanathan joins NAI’s board with extensive experience in the dietary supplement industry including recently as Chief Innovation Officer with General Nutrition Corporation (GNC), and a founding member and current Chairman of the Supplement Safety & Compliance Initiative (SSCI). Dr. Ramanathan holds a Ph.D. from Tufts University in Healthcare Innovation Management, and an MBA from Duke University’s Fuqua School of Business.

Mark A. Le Doux, Chairman and Chief Executive Officer of NAI stated, “We are extremely proud of the fiscal year just concluded including record sales and profitability. With the recent acquisition of a new manufacturing and warehouse facility and the pending addition of a new blender in our current facility, we believe we are poised to take advantage of new opportunities that are at hand as well as future growth. Our balance sheet remains the envy of our industry and we are taking steps to continue leading by example in deploying production efficiencies, as well as securing essential raw materials and packaging components as they become available in a constrained supply environment.”

“Our recent acquisition of the new manufacturing facility in Carlsbad, California is being retrofitted to generate significant output of the highest quality whole-food-based meal replacement powders in various packaging configurations and other products envisioned for production in what will be a state-of-the-art cGMP facility. While it will likely be mid calendar 2022 or later before the facility is in full production, we anticipate this facility will allow us to significantly expand our product offerings across various industries and sales channels.”

“Our industry, like many, are dealing with the ongoing challenges of the COVID-19 pandemic, including supply chain and staffing, but we are fortunate that our industry has also benefited from consumers becoming more educated and interested in taking care of their health and well-being. We believe this bodes well for our growth objectives for the future. While we anticipate some challenges related to supply chain and staffing in the first half of this fiscal year, we believe we are well positioned to navigate these waters and we have made the appropriate investments in our business to ensure we are ready once those challenges clear.”

“We are extremely pleased to welcome Dr. Ramanathan to our board of directors. I have worked closely with Dr. Ramanathan for many years on various industry initiatives, including efforts by the Natural Products Association in Washington D.C. to facilitate the creation and launch of the retailer driven Supplement Safety Compliance Initiative (SSCI). Guru has a significant level of experience in dealing with mass market product positioning on a global basis. I believe he will be a valuable addition to our board and will provide a firsthand perspective with his extensive experience working on the branded side of our industry.”

An updated investor presentation will be posted to the investor relations page on our website later today (https://www.nai-online.com/our-company/investors/).

NAI, headquartered in Carlsbad, California, is a leading formulator, manufacturer and marketer of nutritional supplements and provides strategic partnering services to its customers. Our comprehensive partnership approach offers a wide range of innovative nutritional products and services to our clients including scientific research, clinical studies, proprietary ingredients, customer-specific nutritional product formulation, product testing and evaluation, marketing management and support, packaging and delivery system design, regulatory review and international product registration assistance. For more information about NAI, please see our website at http://www.nai-online.com.

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 that are not historical facts and information. These statements represent our intentions, expectations and beliefs concerning future events, including, among other things, COVID-19 and related impacts on the availability of raw materials, and staffing, our future revenue profits and financial condition, our ability to develop, maintain or increase sales to new and existing customers, as well as future economic conditions and the impact of such conditions on our business. We wish to caution readers these statements involve risks and uncertainties that could cause actual results and outcomes for future periods to differ materially from any forward-looking statement or views expressed herein. NAI's financial performance and the forward-looking statements contained herein are further qualified by other risks, including those set forth from time to time in the documents filed by us with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K.

SOURCE - Natural Alternatives International, Inc.

CONTACT – Michael Fortin, Chief Financial Officer, Natural Alternatives International, Inc., at 760-736-7700 or [email protected].

Web site: http://www.nai-online.com

|

NATURAL ALTERNATIVES INTERNATIONAL, INC. |

|||||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

|||||||||||||||

|

(In thousands, except per share data) |

|

(Unaudited) |

||||||||||||||||||||||||||||||||

|

Three Months Ended |

Year Ended |

|||||||||||||||||||||||||||||||

|

June 30, |

June 30, |

|||||||||||||||||||||||||||||||

|

2021 |

2020 |

2021 |

2020 |

|||||||||||||||||||||||||||||

|

NET SALES |

$ | 44,391 | 100.0 | % | $ | 35,096 | 100.0 | % | $ | 178,520 | 100.0 | % | $ | 118,876 | 100.0 | % | ||||||||||||||||

|

Cost of goods sold |

36,464 | 82.1 | % | 28,564 | 81.4 | % | 148,078 | 82.9 | % | 100,005 | 84.1 | % | ||||||||||||||||||||

|

Gross profit |

7,927 | 17.9 | % | 6,532 | 18.6 | % | 30,442 | 17.1 | % | 18,871 | 15.9 | % | ||||||||||||||||||||

|

Selling, general & administrative expenses |

4,432 | 10.0 | % | 4,461 | 12.7 | % | 16,770 | 9.4 | % | 20,380 | 17.1 | % | ||||||||||||||||||||

|

INCOME (LOSS) FROM OPERATIONS |

3,495 | 7.9 | % | 2,071 | 5.9 | % | 13,672 | 7.7 | % | (1,509 | ) | -1.3 | % | |||||||||||||||||||

|

Other loss, net |

(94 | ) | -0.2 | % | (234 | ) | -0.7 | % | (1,547 | ) | -0.9 | % | (229 | ) | -0.2 | % | ||||||||||||||||

|

INCOME (LOSS) BEFORE TAXES |

3,401 | 7.7 | % | 1,837 | 5.2 | % | 12,125 | 6.8 | % | (1,738 | ) | -1.5 | % | |||||||||||||||||||

|

Income tax expense (benefit) |

439 | 39 | 1,357 | (93 | ) | |||||||||||||||||||||||||||

|

NET INCOME (LOSS) |

$ | 2,962 | $ | 1,798 | $ | 10,768 | $ | (1,645 | ) | |||||||||||||||||||||||

|

NET INCOME (LOSS) PER COMMON SHARE: |

||||||||||||||||||||||||||||||||

|

Basic: |

$ | 0.47 | $ | 0.27 | $ | 1.71 | $ | (0.25 | ) | |||||||||||||||||||||||

|

Diluted: |

$ | 0.47 | $ | 0.27 | $ | 1.69 | $ | (0.25 | ) | |||||||||||||||||||||||

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: |

||||||||||||||||||||||||||||||||

|

Basic |

6,274 | 6,580 | 6,291 | 6,695 | ||||||||||||||||||||||||||||

|

Diluted |

6,315 | 6,611 | 6,379 | 6,695 | ||||||||||||||||||||||||||||

|

NATURAL ALTERNATIVES INTERNATIONAL, INC. |

|||

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|||

|

(In thousands) |

|

June 30, |

June 30, |

|||||||

|

2021 |

2020 |

|||||||

|

ASSETS |

||||||||

|

Cash and cash equivalents |

$ | 32,133 | $ | 30,478 | ||||

|

Accounts receivable, net |

17,946 | 17,001 | ||||||

|

Inventories, net |

27,006 | 27,972 | ||||||

|

Other current assets |

3,263 | 3,573 | ||||||

|

Total current assets |

80,348 | 79,024 | ||||||

|

Property and equipment, net |

22,271 | 21,523 | ||||||

|

Operating lease right-of-use assets |

15,877 | 18,354 | ||||||

|

Other noncurrent assets, net |

1,785 | 1,302 | ||||||

|

Total Assets |

$ | 120,281 | $ | 120,203 | ||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

|

Accounts payable and accrued liabilities |

23,717 | 20,046 | ||||||

|

Line of credit |

- | 10,000 | ||||||

|

Long-term liability - operating leases |

16,481 | 18,782 | ||||||

|

Total Liabilities |

40,198 | 48,828 | ||||||

|

Stockholders’ Equity |

80,083 | 71,375 | ||||||

|

Total Liabilities and Stockholders’ Equity |

$ | 120,281 | $ | 120,203 | ||||

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Amerant Reports First Quarter 2024 Results

- Gran Tierra Energy Inc. Provides Release Date for its 2024 First Quarter Results and Details of Annual Meeting of Stockholders

- Leading Industry Publication: Black & Veatch Remains Among Global Critical Infrastructure Leaders as Sustainability, Decarbonization Solutions Drive Growth

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share