Form 8-K MIMEDX GROUP, INC. For: Jun 23

Exhibit 99.1 ADVANCING REGENERATIVE MEDICINE TREATMENT THROUGH PLACENTAL SCIENCE Raymond James Human Health Innovation Conference June 23, 2021 1Exhibit 99.1 ADVANCING REGENERATIVE MEDICINE TREATMENT THROUGH PLACENTAL SCIENCE Raymond James Human Health Innovation Conference June 23, 2021 1

DISCLAIMER & CAUTIONARY STATEMENTS Important Cautionary Statement This presentation includes forward-looking statements. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward- looking statements. Such forward-looking statements include statements regarding: • expectations regarding the timing and results of clinical trials, the timing and results of future regulatory filings, the potential to receive revenue from future products, and the timing and magnitude of such revenue; the results of a clinical trial or trials may have little or no statistical value, or may fail to demonstrate that the product is safe or effective; the Company may change its plans due to unforeseen circumstances, to conduct additional analyses, or for other reasons, and delay or alter the timeline for future trials, analyses, or public announcements; the future market for such products depends on regulatory approval of such products, which might not occur at all or when expected, and is based in part on assumptions regarding the number of patients who elect less acute and more acute treatment than the Company’s products, market acceptance of the Company’s products, and adequate reimbursement for such therapies; • plans for expansion outside of the U.S.; the process of obtaining regulatory clearances or approvals to market a biological product or medical device from the FDA or similar regulatory authorities outside of the U.S. is costly and time consuming, and such clearances or approvals may not be granted on a timely basis, or at all, and the ability to obtain adequate reimbursement for the use of such products may not be obtained on a timely basis or at all; • the effectiveness of amniotic tissue as a therapy for any particular indication or condition or as a platform for regenerative medicine; the results of a clinical trial or trials may have little or no statistical value, or may fail to demonstrate that the product is safe or effective; and • expectations regarding trends and growth, including expectations for growth in the wound care business, and the future growth potential and structure of the business; such expectations depend upon most or all of the above factors. Additional forward-looking statements may be identified by words such as believe, expect, may, plan, potential, will, preliminary, and similar expressions, and are based on management's current beliefs and expectations. The Company describes additional risks and uncertainties in the Risk Factors section of its most recent annual report and quarterly reports filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this presentation or report and the Company assumes no obligation to update any forward-looking statement. 2DISCLAIMER & CAUTIONARY STATEMENTS Important Cautionary Statement This presentation includes forward-looking statements. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward- looking statements. Such forward-looking statements include statements regarding: • expectations regarding the timing and results of clinical trials, the timing and results of future regulatory filings, the potential to receive revenue from future products, and the timing and magnitude of such revenue; the results of a clinical trial or trials may have little or no statistical value, or may fail to demonstrate that the product is safe or effective; the Company may change its plans due to unforeseen circumstances, to conduct additional analyses, or for other reasons, and delay or alter the timeline for future trials, analyses, or public announcements; the future market for such products depends on regulatory approval of such products, which might not occur at all or when expected, and is based in part on assumptions regarding the number of patients who elect less acute and more acute treatment than the Company’s products, market acceptance of the Company’s products, and adequate reimbursement for such therapies; • plans for expansion outside of the U.S.; the process of obtaining regulatory clearances or approvals to market a biological product or medical device from the FDA or similar regulatory authorities outside of the U.S. is costly and time consuming, and such clearances or approvals may not be granted on a timely basis, or at all, and the ability to obtain adequate reimbursement for the use of such products may not be obtained on a timely basis or at all; • the effectiveness of amniotic tissue as a therapy for any particular indication or condition or as a platform for regenerative medicine; the results of a clinical trial or trials may have little or no statistical value, or may fail to demonstrate that the product is safe or effective; and • expectations regarding trends and growth, including expectations for growth in the wound care business, and the future growth potential and structure of the business; such expectations depend upon most or all of the above factors. Additional forward-looking statements may be identified by words such as believe, expect, may, plan, potential, will, preliminary, and similar expressions, and are based on management's current beliefs and expectations. The Company describes additional risks and uncertainties in the Risk Factors section of its most recent annual report and quarterly reports filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this presentation or report and the Company assumes no obligation to update any forward-looking statement. 2

INDUSTRY LEADER IN UTILIZING AMNIOTIC TISSUE AS A PLATFORM FOR REGENERATIVE MEDICINE Promising Late- Base Business Stage Pipeline Advanced Wound Care Musculoskeletal Distinct drivers of significant shareholder value with current and future growth potential 3INDUSTRY LEADER IN UTILIZING AMNIOTIC TISSUE AS A PLATFORM FOR REGENERATIVE MEDICINE Promising Late- Base Business Stage Pipeline Advanced Wound Care Musculoskeletal Distinct drivers of significant shareholder value with current and future growth potential 3

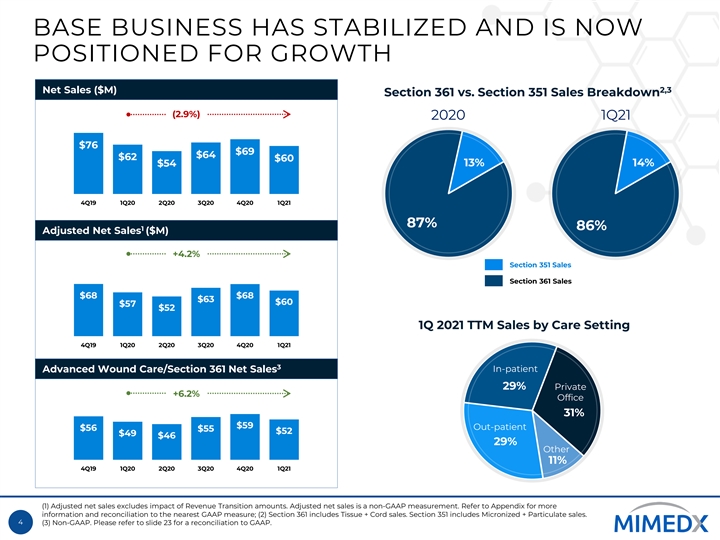

BASE BUSINESS HAS STABILIZED AND IS NOW POSITIONED FOR GROWTH Net Sales ($M) 2,3 Section 361 vs. Section 351 Sales Breakdown (2.9%) 2020 1Q21 $76 $69 $64 $62 $60 13% 14% $54 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 87% 86% 1 Adjusted Net Sales ($M) +4.2% Section 351 Sales Section 361 Sales $68 $68 $63 $60 $57 $52 1Q 2021 TTM Sales by Care Setting 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 3 In-patient Advanced Wound Care/Section 361 Net Sales 29% Private +6.2% Office 31% $59 Out-patient $56 $55 $52 $49 $46 29% Other 11% 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 (1) Adjusted net sales excludes impact of Revenue Transition amounts. Adjusted net sales is a non-GAAP measurement. Refer to Appendix for more information and reconciliation to the nearest GAAP measure; (2) Section 361 includes Tissue + Cord sales. Section 351 includes Micronized + Particulate sales. 4 (3) Non-GAAP. Please refer to slide 23 for a reconciliation to GAAP.BASE BUSINESS HAS STABILIZED AND IS NOW POSITIONED FOR GROWTH Net Sales ($M) 2,3 Section 361 vs. Section 351 Sales Breakdown (2.9%) 2020 1Q21 $76 $69 $64 $62 $60 13% 14% $54 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 87% 86% 1 Adjusted Net Sales ($M) +4.2% Section 351 Sales Section 361 Sales $68 $68 $63 $60 $57 $52 1Q 2021 TTM Sales by Care Setting 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 3 In-patient Advanced Wound Care/Section 361 Net Sales 29% Private +6.2% Office 31% $59 Out-patient $56 $55 $52 $49 $46 29% Other 11% 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 (1) Adjusted net sales excludes impact of Revenue Transition amounts. Adjusted net sales is a non-GAAP measurement. Refer to Appendix for more information and reconciliation to the nearest GAAP measure; (2) Section 361 includes Tissue + Cord sales. Section 351 includes Micronized + Particulate sales. 4 (3) Non-GAAP. Please refer to slide 23 for a reconciliation to GAAP.

CLEAR STRATEGY FOR VALUE CREATION Industry leading base business with high gross margins provides foundation for long-term, stable growth, fueling late-stage pipeline • Targeting 10%+ growth in base advanced wound care business • Japan approval received June 2021, providing foundation for further international expansion • Contribution from late-stage pipeline anticipated in 2023; Potential blockbuster drug reaching the market in 2025 / 2026 • Long-term view anticipates additional large-scale markets leveraging platform technology Knee OA Base Business International Outside US Outside US Pipeline Plantar Fasciitis Plantar Fasciitis Plantar Fasciitis Japan Japan Japan Japan Base Business Base Business Base Business Base Business Base Business 2021 2022 2023 2024 2025+ OUS = Outside United States. Timeline represents current plans and estimates only. Actual results and timing may differ materially. There can be no assurance that clinical trials are conducted or completed on schedule, that trial results are favorable, or that we obtain regulatory approval for our products and indications. 5CLEAR STRATEGY FOR VALUE CREATION Industry leading base business with high gross margins provides foundation for long-term, stable growth, fueling late-stage pipeline • Targeting 10%+ growth in base advanced wound care business • Japan approval received June 2021, providing foundation for further international expansion • Contribution from late-stage pipeline anticipated in 2023; Potential blockbuster drug reaching the market in 2025 / 2026 • Long-term view anticipates additional large-scale markets leveraging platform technology Knee OA Base Business International Outside US Outside US Pipeline Plantar Fasciitis Plantar Fasciitis Plantar Fasciitis Japan Japan Japan Japan Base Business Base Business Base Business Base Business Base Business 2021 2022 2023 2024 2025+ OUS = Outside United States. Timeline represents current plans and estimates only. Actual results and timing may differ materially. There can be no assurance that clinical trials are conducted or completed on schedule, that trial results are favorable, or that we obtain regulatory approval for our products and indications. 5

THE PLACENTA IS A SOPHISTICATED BIOLOGICAL SYSTEM THAT SUPPORTS GROWTH AND HEALING 1 Known Properties of Amniotic Tissue 2 • Regulator of angiogenesis • Modulates inflammation • Barrier membrane • Inhibitor of fibrosis and scars 3 • Promoter of epithelialization • Non-immunogenic material Our library of peer-reviewed literature provides MIMEDX with a critical advantage for the future development of novel therapeutics (1) N. G. Fairbairn, M. A. Randolph, R. W. Redmond, J Plast Reconstr Aesthet Surg. 2014 May; 67(5): 662–675. Published online 2014 Jan 31. doi: 10.1016/j.bjps.2014.01.031; (2) Angiogenesis is the formation of new blood vessels. This process involves the migration, growth, and differentiation of 6 endothelial cells, which line the inside wall of blood vessels; (3) Epithelialization is an essential component of wound healing used as a defining parameter of a successful wound closure.THE PLACENTA IS A SOPHISTICATED BIOLOGICAL SYSTEM THAT SUPPORTS GROWTH AND HEALING 1 Known Properties of Amniotic Tissue 2 • Regulator of angiogenesis • Modulates inflammation • Barrier membrane • Inhibitor of fibrosis and scars 3 • Promoter of epithelialization • Non-immunogenic material Our library of peer-reviewed literature provides MIMEDX with a critical advantage for the future development of novel therapeutics (1) N. G. Fairbairn, M. A. Randolph, R. W. Redmond, J Plast Reconstr Aesthet Surg. 2014 May; 67(5): 662–675. Published online 2014 Jan 31. doi: 10.1016/j.bjps.2014.01.031; (2) Angiogenesis is the formation of new blood vessels. This process involves the migration, growth, and differentiation of 6 endothelial cells, which line the inside wall of blood vessels; (3) Epithelialization is an essential component of wound healing used as a defining parameter of a successful wound closure.

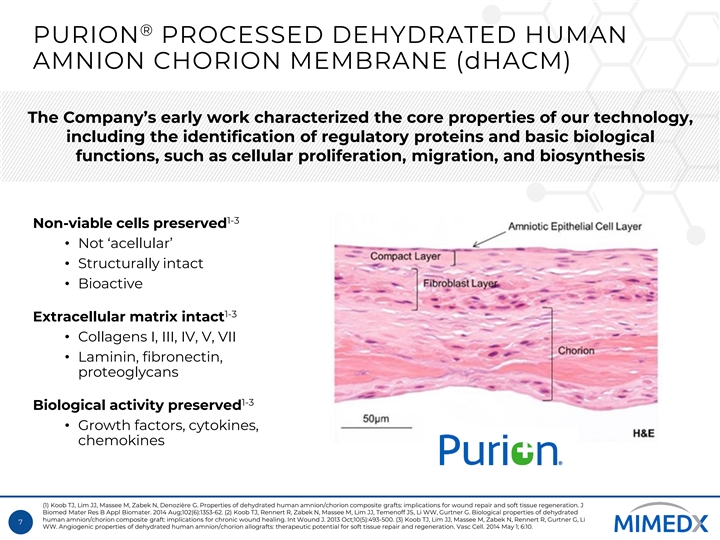

® PURION PROCESSED DEHYDRATED HUMAN AMNION CHORION MEMBRANE (dHACM) The Company’s early work characterized the core properties of our technology, including the identification of regulatory proteins and basic biological functions, such as cellular proliferation, migration, and biosynthesis 1-3 Non-viable cells preserved • Not ‘acellular’ • Structurally intact • Bioactive 1-3 Extracellular matrix intact • Collagens I, III, IV, V, VII • Laminin, fibronectin, proteoglycans 1-3 Biological activity preserved • Growth factors, cytokines, chemokines (1) Koob TJ, Lim JJ, Massee M, Zabek N, Denozière G. Properties of dehydrated human amnion/chorion composite grafts: implications for wound repair and soft tissue regeneration. J Biomed Mater Res B Appl Biomater. 2014 Aug;102(6):1353-62. (2) Koob TJ, Rennert R, Zabek N, Massee M, Lim JJ, Temenoff JS, Li WW, Gurtner G. Biological properties of dehydrated human amnion/chorion composite graft: implications for chronic wound healing. Int Wound J. 2013 Oct;10(5):493-500. (3) Koob TJ, Lim JJ, Massee M, Zabek N, Rennert R, Gurtner G, Li 7 WW. Angiogenic properties of dehydrated human amnion/chorion allografts: therapeutic potential for soft tissue repair and regeneration. Vasc Cell. 2014 May 1; 6:10.® PURION PROCESSED DEHYDRATED HUMAN AMNION CHORION MEMBRANE (dHACM) The Company’s early work characterized the core properties of our technology, including the identification of regulatory proteins and basic biological functions, such as cellular proliferation, migration, and biosynthesis 1-3 Non-viable cells preserved • Not ‘acellular’ • Structurally intact • Bioactive 1-3 Extracellular matrix intact • Collagens I, III, IV, V, VII • Laminin, fibronectin, proteoglycans 1-3 Biological activity preserved • Growth factors, cytokines, chemokines (1) Koob TJ, Lim JJ, Massee M, Zabek N, Denozière G. Properties of dehydrated human amnion/chorion composite grafts: implications for wound repair and soft tissue regeneration. J Biomed Mater Res B Appl Biomater. 2014 Aug;102(6):1353-62. (2) Koob TJ, Rennert R, Zabek N, Massee M, Lim JJ, Temenoff JS, Li WW, Gurtner G. Biological properties of dehydrated human amnion/chorion composite graft: implications for chronic wound healing. Int Wound J. 2013 Oct;10(5):493-500. (3) Koob TJ, Lim JJ, Massee M, Zabek N, Rennert R, Gurtner G, Li 7 WW. Angiogenic properties of dehydrated human amnion/chorion allografts: therapeutic potential for soft tissue repair and regeneration. Vasc Cell. 2014 May 1; 6:10.

VERSATILE PLATFORM WITH BROAD POTENTIAL ACROSS MULTIPLE APPLICATIONS Placental Tissue Injectable Amnion/Chorion Umbilical Cord Matrix Amnion/Chorion 1 1 2 2 Applications : Applications : Indications : Indications : • Acute & Chronic • Acute & Chronic • Soft Tissue Defects • Musculoskeletal & Wounds Wounds Sports Medicine: – Knee Osteoarthritis • Diabetic Foot Ulcers • Diabetic Foot Ulcers – Plantar Fasciitis • Venous Leg Ulcers • Venous Leg Ulcers • Advanced Wound Care: – Chronic Wounds – Surgical Incisions (1) 361 HCT/Ps (Human Cell Tissue/ Products) for homologous use only; HCT/P is intended for homologous use only, as reflected by the labeling, advertising, or other indications of the manufacturer’s objective intent. As defined in 21 CFR 1271.3(c), homologous use means the repair, reconstruction, replacement, or supplementation of a recipient’s cells or tissues with an HCT/P that performs the same basic function or functions in the recipient as in the donor. (2) Clinical trials in planning or underway; Final indication for use to be confirmed at FDA product 8 approval.VERSATILE PLATFORM WITH BROAD POTENTIAL ACROSS MULTIPLE APPLICATIONS Placental Tissue Injectable Amnion/Chorion Umbilical Cord Matrix Amnion/Chorion 1 1 2 2 Applications : Applications : Indications : Indications : • Acute & Chronic • Acute & Chronic • Soft Tissue Defects • Musculoskeletal & Wounds Wounds Sports Medicine: – Knee Osteoarthritis • Diabetic Foot Ulcers • Diabetic Foot Ulcers – Plantar Fasciitis • Venous Leg Ulcers • Venous Leg Ulcers • Advanced Wound Care: – Chronic Wounds – Surgical Incisions (1) 361 HCT/Ps (Human Cell Tissue/ Products) for homologous use only; HCT/P is intended for homologous use only, as reflected by the labeling, advertising, or other indications of the manufacturer’s objective intent. As defined in 21 CFR 1271.3(c), homologous use means the repair, reconstruction, replacement, or supplementation of a recipient’s cells or tissues with an HCT/P that performs the same basic function or functions in the recipient as in the donor. (2) Clinical trials in planning or underway; Final indication for use to be confirmed at FDA product 8 approval.

INVESTING HEAVILY IN PROMISING LATE-STAGE PIPELINE WITH SIGNIFICANT GROWTH OPPORTUNITIES MUSCULOSKELETAL/SPORTS MEDICINE 1H 2022 PHASE 3 Plantar Fasciitis (PF) Est. BLA filing PHASE 3 Achilles Tendonitis (AT) * 2H 2024 / 1H2025 PHASE 2B Knee Osteoarthritis (OA) Est. BLA filing ADVANCED WOUND CARE Chronic Cutaneous 1H 2021 P R E - CL IN IC A L Ulcers IND allowed to proceed 1H 2021 Surgical Incisions P R E - CL IN IC A L IND allowed to proceed 1H 2021 P R E - CL IN IC A L Soft Tissue Defects Est. IND/IDE filing * The Company does not anticipate pursuing a BLA for Achilles Tendonitis at this time; Anticipate safety data can be used from the trial to supplement the data package for other clinical indications underway and inform future clinical indications under consideration IDE= Investigational Device Exemption; According to recently updated FDA guidance, FDA generally intends to exercise enforcement discretion through May 31, 2021, with respect to the IND and the premarket approval requirements for certain HCT/Ps, provided that use of the HCT/P does not raise reported safety concerns or potential significant safety concerns.; Timeline represents current plans and estimates only. Actual results and timing may differ materially. There can be no assurance that clinical trials are conducted or completed on schedule, that trial 9 results are favorable, or that we obtain regulatory approval for our products and indications. INVESTING HEAVILY IN PROMISING LATE-STAGE PIPELINE WITH SIGNIFICANT GROWTH OPPORTUNITIES MUSCULOSKELETAL/SPORTS MEDICINE 1H 2022 PHASE 3 Plantar Fasciitis (PF) Est. BLA filing PHASE 3 Achilles Tendonitis (AT) * 2H 2024 / 1H2025 PHASE 2B Knee Osteoarthritis (OA) Est. BLA filing ADVANCED WOUND CARE Chronic Cutaneous 1H 2021 P R E - CL IN IC A L Ulcers IND allowed to proceed 1H 2021 Surgical Incisions P R E - CL IN IC A L IND allowed to proceed 1H 2021 P R E - CL IN IC A L Soft Tissue Defects Est. IND/IDE filing * The Company does not anticipate pursuing a BLA for Achilles Tendonitis at this time; Anticipate safety data can be used from the trial to supplement the data package for other clinical indications underway and inform future clinical indications under consideration IDE= Investigational Device Exemption; According to recently updated FDA guidance, FDA generally intends to exercise enforcement discretion through May 31, 2021, with respect to the IND and the premarket approval requirements for certain HCT/Ps, provided that use of the HCT/P does not raise reported safety concerns or potential significant safety concerns.; Timeline represents current plans and estimates only. Actual results and timing may differ materially. There can be no assurance that clinical trials are conducted or completed on schedule, that trial 9 results are favorable, or that we obtain regulatory approval for our products and indications.

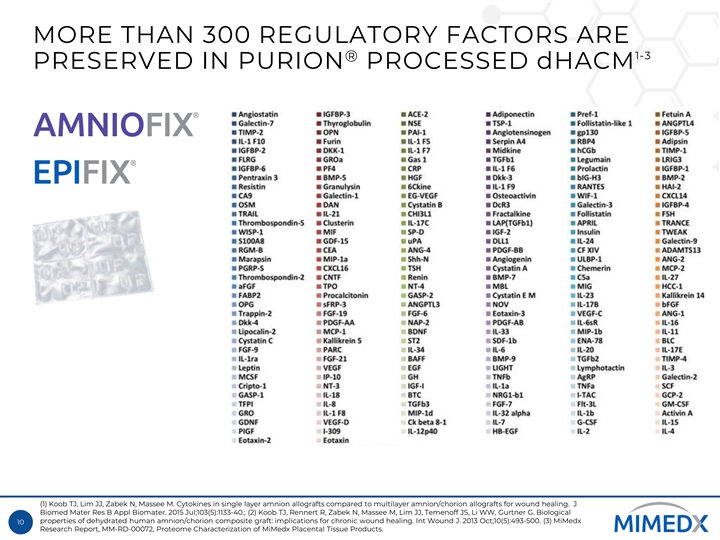

MORE THAN 300 REGULATORY FACTORS ARE 1-3 ® PRESERVED IN PURION PROCESSED dHACM (1) Koob TJ, Lim JJ, Zabek N, Massee M. Cytokines in single layer amnion allografts compared to multilayer amnion/chorion allografts for wound healing. J Biomed Mater Res B Appl Biomater. 2015 Jul;103(5):1133-40.; (2) Koob TJ, Rennert R, Zabek N, Massee M, Lim JJ, Temenoff JS, Li WW, Gurtner G. Biological properties of dehydrated human amnion/chorion composite graft: implications for chronic wound healing. Int Wound J. 2013 Oct;10(5):493-500. (3) MiMedx 10 Research Report, MM-RD-00072, Proteome Characterization of MiMedx Placental Tissue Products.MORE THAN 300 REGULATORY FACTORS ARE 1-3 ® PRESERVED IN PURION PROCESSED dHACM (1) Koob TJ, Lim JJ, Zabek N, Massee M. Cytokines in single layer amnion allografts compared to multilayer amnion/chorion allografts for wound healing. J Biomed Mater Res B Appl Biomater. 2015 Jul;103(5):1133-40.; (2) Koob TJ, Rennert R, Zabek N, Massee M, Lim JJ, Temenoff JS, Li WW, Gurtner G. Biological properties of dehydrated human amnion/chorion composite graft: implications for chronic wound healing. Int Wound J. 2013 Oct;10(5):493-500. (3) MiMedx 10 Research Report, MM-RD-00072, Proteome Characterization of MiMedx Placental Tissue Products.

dHACM CONTAINS A COMPLEX VARIETY OF MATRIX COMPONENTS AND REGULATORY 1 PROTEINS MMP = matrix metalloproteinase TIMPs = Tissue Inhibitors of matrix metalloproteinase (1) Lei J, Priddy LB, Lim JJ, Massee M, Koob TJ. Identification of extracellular matrix components and biological factors in micronized dehydrated human amnion/chorion membrane. Adv Wound Care. 2017;6(2):43-53. 11dHACM CONTAINS A COMPLEX VARIETY OF MATRIX COMPONENTS AND REGULATORY 1 PROTEINS MMP = matrix metalloproteinase TIMPs = Tissue Inhibitors of matrix metalloproteinase (1) Lei J, Priddy LB, Lim JJ, Massee M, Koob TJ. Identification of extracellular matrix components and biological factors in micronized dehydrated human amnion/chorion membrane. Adv Wound Care. 2017;6(2):43-53. 11

GROWTH FACTORS CONTAINED WITHIN 1 dHACM ARE RELEASED OVER TIME Method Combine Incubate Centrifuge Analyze dHACM Soluble 24 Hours growth factors Growth factors Saline bound in the matrix Solution @ 4C° Results Determined by ELISA Assay (N=5) PDGF-AA 13% 87% PDGF-BB 4% 96% bFGF 44% 56% TGF-ß1 24% 76% EGF 63% 37% (1) Koob TJ, Rennert R, Zabek N, Massee M, Lim JJ, Temenoff JS, Li WW, Gurtner G. Biological properties of dehydrated human amnion/chorion composite graft: implications for chronic wound healing. Int Wound J. 2013 Oct;10(5):493-500. 12GROWTH FACTORS CONTAINED WITHIN 1 dHACM ARE RELEASED OVER TIME Method Combine Incubate Centrifuge Analyze dHACM Soluble 24 Hours growth factors Growth factors Saline bound in the matrix Solution @ 4C° Results Determined by ELISA Assay (N=5) PDGF-AA 13% 87% PDGF-BB 4% 96% bFGF 44% 56% TGF-ß1 24% 76% EGF 63% 37% (1) Koob TJ, Rennert R, Zabek N, Massee M, Lim JJ, Temenoff JS, Li WW, Gurtner G. Biological properties of dehydrated human amnion/chorion composite graft: implications for chronic wound healing. Int Wound J. 2013 Oct;10(5):493-500. 12

dHACM SUPPORTS THE RECRUITMENT & PROLIFERATION OF MULTIPLE REPARATIVE CELL TYPES Fibroblasts Endothelial Cells Migration Epithelial Cells Proliferation dHACM HSCs Biosynthesis bmMSCs ADSCs Healthy & Diabetic Type I, II 1-8 • Signals released from dHACM create a chemotactic gradient to recruit cells to the allograft • Growth factors released from dHACM promote increases in cell number to amplify the response; 1-8 Regulatory proteins direct the function of these cells to promote healing 1-8 • These observations were made in both normal and diseased cells in vitro (1) Koob TJ, Rennert R, Zabek N, Massee M, Lim JJ, Temenoff JS, Li WW, Gurtner G. Biological properties of dehydrated human amnion/chorion composite graft: implications for chronic wound healing. Int Wound J. 2013 Oct;10(5):493-500. (2) Koob TJ, Lim JJ, Massee M, Zabek N, Rennert R, Gurtner G, Li WW. Angiogenic properties of dehydrated human amnion/chorion allografts: therapeutic potential for soft tissue repair and regeneration. Vasc Cell. 2014 May 1;6:10. (3) Maan ZN, Rennert RC, Koob TJ, Januszyk M, Li WW, Gurtner GC. Cell recruitment by amnion chorion grafts promotes neovascularization. J Surg Res. 2015 Feb; 193(2):953-62. (4) Koob TJ, Lim JJ, Massee M, Zabek N, Denozière G. Properties of dehydrated human amnion/chorion composite grafts: Implications for wound repair and soft tissue regeneration. J Biomed Mater Res B Appl Biomater. 2014 Aug;102(6):1353-62. (5) Koob TJ, Lim JJ, Zabek N, Massee M. Cytokines in single layer amnion allografts compared to multilayer amnion/chorion allografts for wound healing. J Biomed Mater Res B Appl Biomater. 2015 Jul;103(5):1133-40. (6) Willett NJ, Thote T, Lin AS, Moran S, Raji Y, Sridaran S, Stevens HY, Guldberg RE. Intra‐articular injection of micronized dehydrated human amnion/chorion membrane attenuates osteoarthritis development. Arthritis Res Ther. 2014 Feb 6;16(1):R47. (7) Massee M, Chinn K, Lei J, Lim JJ, Young CS, 13 Koob TJ. Dehydrated human amnion/chorion membrane regulates stem cell activity in vitro. J Biomed Mater Res B Appl Biomater. 2016 Oct;104(7):1495-503. (8) Massee M, Chinn K, Lim JJ, Godwin L, Young CS, Koob TJ. Type I and II Diabetic Adipose-Derived Stem Cells Respond In Vitro to Dehydrated Human Amnion/Chorion Membrane Allograft Treatment by Increasing Proliferation, Migration, and Altering Cytokine Secretion. Adv Wound Care (New Rochelle). 2016 Feb 1;5(2):43-54.dHACM SUPPORTS THE RECRUITMENT & PROLIFERATION OF MULTIPLE REPARATIVE CELL TYPES Fibroblasts Endothelial Cells Migration Epithelial Cells Proliferation dHACM HSCs Biosynthesis bmMSCs ADSCs Healthy & Diabetic Type I, II 1-8 • Signals released from dHACM create a chemotactic gradient to recruit cells to the allograft • Growth factors released from dHACM promote increases in cell number to amplify the response; 1-8 Regulatory proteins direct the function of these cells to promote healing 1-8 • These observations were made in both normal and diseased cells in vitro (1) Koob TJ, Rennert R, Zabek N, Massee M, Lim JJ, Temenoff JS, Li WW, Gurtner G. Biological properties of dehydrated human amnion/chorion composite graft: implications for chronic wound healing. Int Wound J. 2013 Oct;10(5):493-500. (2) Koob TJ, Lim JJ, Massee M, Zabek N, Rennert R, Gurtner G, Li WW. Angiogenic properties of dehydrated human amnion/chorion allografts: therapeutic potential for soft tissue repair and regeneration. Vasc Cell. 2014 May 1;6:10. (3) Maan ZN, Rennert RC, Koob TJ, Januszyk M, Li WW, Gurtner GC. Cell recruitment by amnion chorion grafts promotes neovascularization. J Surg Res. 2015 Feb; 193(2):953-62. (4) Koob TJ, Lim JJ, Massee M, Zabek N, Denozière G. Properties of dehydrated human amnion/chorion composite grafts: Implications for wound repair and soft tissue regeneration. J Biomed Mater Res B Appl Biomater. 2014 Aug;102(6):1353-62. (5) Koob TJ, Lim JJ, Zabek N, Massee M. Cytokines in single layer amnion allografts compared to multilayer amnion/chorion allografts for wound healing. J Biomed Mater Res B Appl Biomater. 2015 Jul;103(5):1133-40. (6) Willett NJ, Thote T, Lin AS, Moran S, Raji Y, Sridaran S, Stevens HY, Guldberg RE. Intra‐articular injection of micronized dehydrated human amnion/chorion membrane attenuates osteoarthritis development. Arthritis Res Ther. 2014 Feb 6;16(1):R47. (7) Massee M, Chinn K, Lei J, Lim JJ, Young CS, 13 Koob TJ. Dehydrated human amnion/chorion membrane regulates stem cell activity in vitro. J Biomed Mater Res B Appl Biomater. 2016 Oct;104(7):1495-503. (8) Massee M, Chinn K, Lim JJ, Godwin L, Young CS, Koob TJ. Type I and II Diabetic Adipose-Derived Stem Cells Respond In Vitro to Dehydrated Human Amnion/Chorion Membrane Allograft Treatment by Increasing Proliferation, Migration, and Altering Cytokine Secretion. Adv Wound Care (New Rochelle). 2016 Feb 1;5(2):43-54.

dHACM EFFECTIVELY DEMONSTRATED PREFERENTIAL RECRUITMENT OF STEM CELLS 1 IN A MOUSE PARABIOSIS MODEL GFP+ cells travel through Surgically join skin so mice All cells in GFP mouse circulation to normal mouse, fluoresce green share blood circulation = exit blood and migrate “parabiosis” toward chemotactic implants Data support previous in vitro evidence that dHACM actively recruits cells to the site of application (1) Maan ZN, Rennert RC, Koob TJ, Januszyk M, Li WW, Gurtner GC. Cell recruitment by amnion chorion grafts promotes neovascularization. J Surg Res. 2015 Feb; 193(2):953-62. 14dHACM EFFECTIVELY DEMONSTRATED PREFERENTIAL RECRUITMENT OF STEM CELLS 1 IN A MOUSE PARABIOSIS MODEL GFP+ cells travel through Surgically join skin so mice All cells in GFP mouse circulation to normal mouse, fluoresce green share blood circulation = exit blood and migrate “parabiosis” toward chemotactic implants Data support previous in vitro evidence that dHACM actively recruits cells to the site of application (1) Maan ZN, Rennert RC, Koob TJ, Januszyk M, Li WW, Gurtner GC. Cell recruitment by amnion chorion grafts promotes neovascularization. J Surg Res. 2015 Feb; 193(2):953-62. 14

dHACM PROMOTES PRODUCTION OF HYALURONIC ACID (HA) BY HUMAN SYNOVIOCYTES ACROSS 1 NORMAL, OA AND RA CELL TYPES Deficient cells respond to dHACM by stimulating production of necessary components (HA) Purion processed dHACM could be potentially effective for treatment of joint diseases due to the multitude of bioactive growth factors and inhibitors retained within the tissue (1) Lei J, Priddy LB, Lim JJ, Koob TJ. Dehydrated Human Amnion/Chorion Membrane (dHACM) Allografts as a Therapy for Orthopedic Tissue Repair. Techniques in Orthopaedics. 2017. DOI: 10.1097/BTO.0000000000000229. 15dHACM PROMOTES PRODUCTION OF HYALURONIC ACID (HA) BY HUMAN SYNOVIOCYTES ACROSS 1 NORMAL, OA AND RA CELL TYPES Deficient cells respond to dHACM by stimulating production of necessary components (HA) Purion processed dHACM could be potentially effective for treatment of joint diseases due to the multitude of bioactive growth factors and inhibitors retained within the tissue (1) Lei J, Priddy LB, Lim JJ, Koob TJ. Dehydrated Human Amnion/Chorion Membrane (dHACM) Allografts as a Therapy for Orthopedic Tissue Repair. Techniques in Orthopaedics. 2017. DOI: 10.1097/BTO.0000000000000229. 15

mdHACM PROTECTS CARTILAGE DEGRADATION IN VIVO FOLLOWING INTRA-ARTICULAR 1 INJECTION Medial Meniscal Transection Model to Induce OA mdHACM Injected into Joints with Induced OA • Confirmed OA in saline-treated joints • Histology confirmed presence of particles at day 3 and 21 • No differences in cartilage observed at day 3 • Micronized injections significantly reduced erosions and prevented lesion formation at day 21 Data suggest that intra-articular delivery of mdHACM may have a therapeutic effect on OA development (1) Willett NJ, Thote T, Lin ASP, Moran S, Raji Y, Sridaran S, Stevens HY, Guldberg RE. Intra-articular injection of micronized dehydrated human amnion/chorion membrane attenuates osteoarthritis development. Arthritis Research & Therapy. 2014;16(1):R47. 16mdHACM PROTECTS CARTILAGE DEGRADATION IN VIVO FOLLOWING INTRA-ARTICULAR 1 INJECTION Medial Meniscal Transection Model to Induce OA mdHACM Injected into Joints with Induced OA • Confirmed OA in saline-treated joints • Histology confirmed presence of particles at day 3 and 21 • No differences in cartilage observed at day 3 • Micronized injections significantly reduced erosions and prevented lesion formation at day 21 Data suggest that intra-articular delivery of mdHACM may have a therapeutic effect on OA development (1) Willett NJ, Thote T, Lin ASP, Moran S, Raji Y, Sridaran S, Stevens HY, Guldberg RE. Intra-articular injection of micronized dehydrated human amnion/chorion membrane attenuates osteoarthritis development. Arthritis Research & Therapy. 2014;16(1):R47. 16

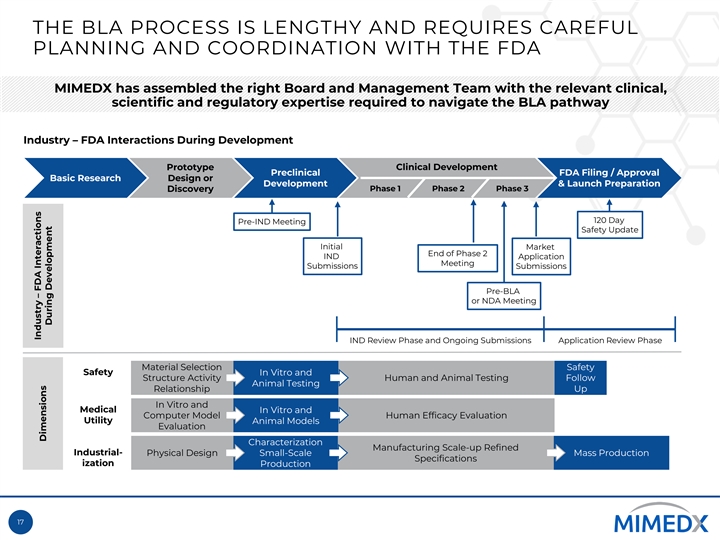

THE BLA PROCESS IS LENGTHY AND REQUIRES CAREFUL PLANNING AND COORDINATION WITH THE FDA MIMEDX has assembled the right Board and Management Team with the relevant clinical, scientific and regulatory expertise required to navigate the BLA pathway Industry – FDA Interactions During Development Prototype Clinical Development Preclinical FDA Filing / Approval Basic Research Design or Development & Launch Preparation Phase 1 Phase 2 Phase 3 Discovery 120 Day Pre-IND Meeting Safety Update Initial Market End of Phase 2 IND Application Meeting Submissions Submissions Pre-BLA or NDA Meeting IND Review Phase and Ongoing Submissions Application Review Phase Material Selection Safety Safety In Vitro and Structure Activity Human and Animal Testing Follow Animal Testing Relationship Up In Vitro and Medical In Vitro and Computer Model Human Efficacy Evaluation Utility Animal Models Evaluation Characterization Manufacturing Scale-up Refined Industrial- Physical Design Small-Scale Mass Production Specifications ization Production 17 Industry – FDA Interactions Dimensions During DevelopmentTHE BLA PROCESS IS LENGTHY AND REQUIRES CAREFUL PLANNING AND COORDINATION WITH THE FDA MIMEDX has assembled the right Board and Management Team with the relevant clinical, scientific and regulatory expertise required to navigate the BLA pathway Industry – FDA Interactions During Development Prototype Clinical Development Preclinical FDA Filing / Approval Basic Research Design or Development & Launch Preparation Phase 1 Phase 2 Phase 3 Discovery 120 Day Pre-IND Meeting Safety Update Initial Market End of Phase 2 IND Application Meeting Submissions Submissions Pre-BLA or NDA Meeting IND Review Phase and Ongoing Submissions Application Review Phase Material Selection Safety Safety In Vitro and Structure Activity Human and Animal Testing Follow Animal Testing Relationship Up In Vitro and Medical In Vitro and Computer Model Human Efficacy Evaluation Utility Animal Models Evaluation Characterization Manufacturing Scale-up Refined Industrial- Physical Design Small-Scale Mass Production Specifications ization Production 17 Industry – FDA Interactions Dimensions During Development

INDUSTRY LEADER IN UTILIZING AMNIOTIC TISSUE AS A PLATFORM FOR REGENERATIVE MEDICINE Promising Late- Base Business Stage Pipeline Advanced Wound Care Musculoskeletal Distinct drivers of significant shareholder value with current and future growth potential 18INDUSTRY LEADER IN UTILIZING AMNIOTIC TISSUE AS A PLATFORM FOR REGENERATIVE MEDICINE Promising Late- Base Business Stage Pipeline Advanced Wound Care Musculoskeletal Distinct drivers of significant shareholder value with current and future growth potential 18

APPENDIX 19APPENDIX 19

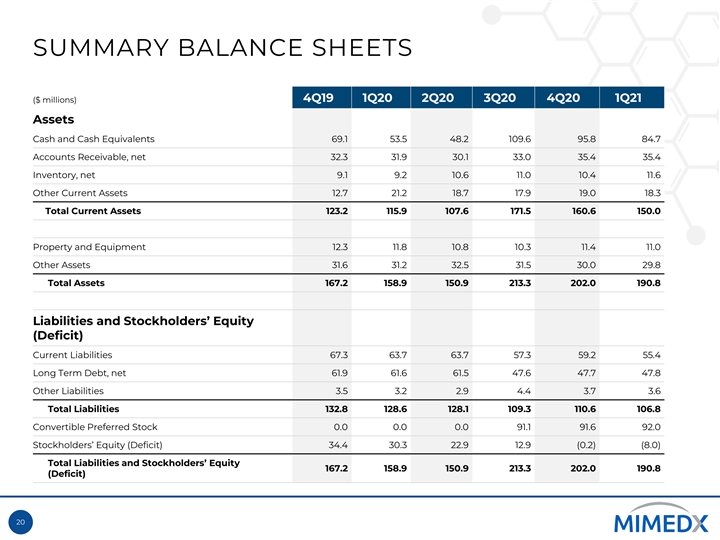

SUMMARY BALANCE SHEETS 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 ($ millions) Assets Cash and Cash Equivalents 69.1 53.5 48.2 109.6 95.8 84.7 Accounts Receivable, net 32.3 31.9 30.1 33.0 35.4 35.4 Inventory, net 9.1 9.2 10.6 11.0 10.4 11.6 Other Current Assets 12.7 21.2 18.7 17.9 19.0 18.3 Total Current Assets 123.2 115.9 107.6 171.5 160.6 150.0 Property and Equipment 12.3 11.8 10.8 10.3 11.4 11.0 Other Assets 31.6 31.2 32.5 31.5 30.0 29.8 Total Assets 167.2 158.9 150.9 213.3 202.0 190.8 Liabilities and Stockholders’ Equity (Deficit) Current Liabilities 67.3 63.7 63.7 57.3 59.2 55.4 Long Term Debt, net 61.9 61.6 61.5 47.6 47.7 47.8 Other Liabilities 3.5 3.2 2.9 4.4 3.7 3.6 Total Liabilities 132.8 128.6 128.1 109.3 110.6 106.8 Convertible Preferred Stock 0.0 0.0 0.0 91.1 91.6 92.0 Stockholders’ Equity (Deficit) 34.4 30.3 22.9 12.9 (0.2) (8.0) Total Liabilities and Stockholders’ Equity 167.2 158.9 150.9 213.3 202.0 190.8 (Deficit) 20SUMMARY BALANCE SHEETS 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 ($ millions) Assets Cash and Cash Equivalents 69.1 53.5 48.2 109.6 95.8 84.7 Accounts Receivable, net 32.3 31.9 30.1 33.0 35.4 35.4 Inventory, net 9.1 9.2 10.6 11.0 10.4 11.6 Other Current Assets 12.7 21.2 18.7 17.9 19.0 18.3 Total Current Assets 123.2 115.9 107.6 171.5 160.6 150.0 Property and Equipment 12.3 11.8 10.8 10.3 11.4 11.0 Other Assets 31.6 31.2 32.5 31.5 30.0 29.8 Total Assets 167.2 158.9 150.9 213.3 202.0 190.8 Liabilities and Stockholders’ Equity (Deficit) Current Liabilities 67.3 63.7 63.7 57.3 59.2 55.4 Long Term Debt, net 61.9 61.6 61.5 47.6 47.7 47.8 Other Liabilities 3.5 3.2 2.9 4.4 3.7 3.6 Total Liabilities 132.8 128.6 128.1 109.3 110.6 106.8 Convertible Preferred Stock 0.0 0.0 0.0 91.1 91.6 92.0 Stockholders’ Equity (Deficit) 34.4 30.3 22.9 12.9 (0.2) (8.0) Total Liabilities and Stockholders’ Equity 167.2 158.9 150.9 213.3 202.0 190.8 (Deficit) 20

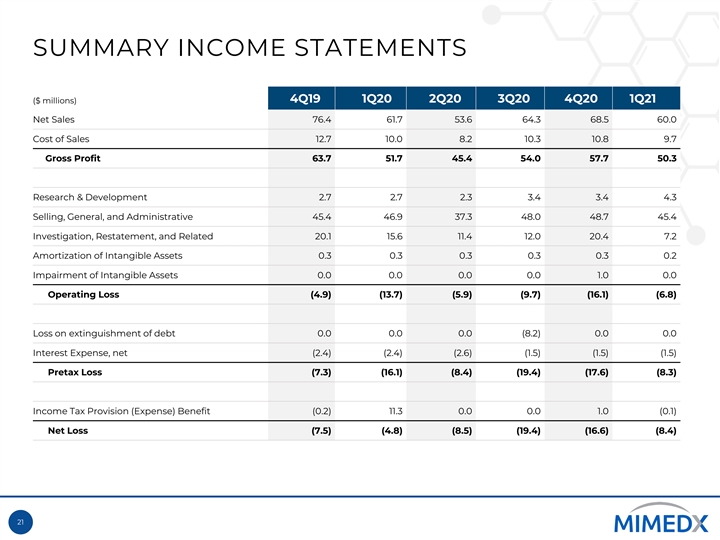

SUMMARY INCOME STATEMENTS 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 ($ millions) Net Sales 76.4 61.7 53.6 64.3 68.5 60.0 Cost of Sales 12.7 10.0 8.2 10.3 10.8 9.7 Gross Profit 63.7 51.7 45.4 54.0 57.7 50.3 Research & Development 2.7 2.7 2.3 3.4 3.4 4.3 Selling, General, and Administrative 45.4 46.9 37.3 48.0 48.7 45.4 Investigation, Restatement, and Related 20.1 15.6 11.4 12.0 20.4 7.2 Amortization of Intangible Assets 0.3 0.3 0.3 0.3 0.3 0.2 Impairment of Intangible Assets 0.0 0.0 0.0 0.0 1.0 0.0 Operating Loss (4.9) (13.7) (5.9) (9.7) (16.1) (6.8) Loss on extinguishment of debt 0.0 0.0 0.0 (8.2) 0.0 0.0 Interest Expense, net (2.4) (2.4) (2.6) (1.5) (1.5) (1.5) Pretax Loss (7.3) (16.1) (8.4) (19.4) (17.6) (8.3) Income Tax Provision (Expense) Benefit (0.2) 11.3 0.0 0.0 1.0 (0.1) Net Loss (7.5) (4.8) (8.5) (19.4) (16.6) (8.4) 21SUMMARY INCOME STATEMENTS 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 ($ millions) Net Sales 76.4 61.7 53.6 64.3 68.5 60.0 Cost of Sales 12.7 10.0 8.2 10.3 10.8 9.7 Gross Profit 63.7 51.7 45.4 54.0 57.7 50.3 Research & Development 2.7 2.7 2.3 3.4 3.4 4.3 Selling, General, and Administrative 45.4 46.9 37.3 48.0 48.7 45.4 Investigation, Restatement, and Related 20.1 15.6 11.4 12.0 20.4 7.2 Amortization of Intangible Assets 0.3 0.3 0.3 0.3 0.3 0.2 Impairment of Intangible Assets 0.0 0.0 0.0 0.0 1.0 0.0 Operating Loss (4.9) (13.7) (5.9) (9.7) (16.1) (6.8) Loss on extinguishment of debt 0.0 0.0 0.0 (8.2) 0.0 0.0 Interest Expense, net (2.4) (2.4) (2.6) (1.5) (1.5) (1.5) Pretax Loss (7.3) (16.1) (8.4) (19.4) (17.6) (8.3) Income Tax Provision (Expense) Benefit (0.2) 11.3 0.0 0.0 1.0 (0.1) Net Loss (7.5) (4.8) (8.5) (19.4) (16.6) (8.4) 21

SUMMARY CASH FLOW STATEMENTS 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 ($ millions) Net Loss (7.5) (4.8) (8.5) (19.4) (16.6) (8.4) Share-Based Compensation 2.9 3.3 4.4 3.7 3.9 3.2 Depreciation 1.6 1.5 1.4 1.5 1.3 1.2 Other Non-Cash Effects 1.2 1.2 1.3 9.5 1.7 1.1 Changes in Assets (14.2) (8.2) 2.9 (1.8) (6.2) 0.1 Changes in Liabilities (7.0) (5.3) (4.7) 1.9 5.5 (3.9) Net Cash Flows Used in (23.1) (12.3) (3.1) (4.6) (10.4) (6.7) Operating Activities Purchases of Property and Equipment (0.7) (1.0) (0.4) (0.7) (2.2) (1.9) Patent Application Costs (0.1) (0.1) (0.1) 0.0 (0.1) (0.2) Net Cash Flows Used in (0.8) (1.1) (0.5) (0.7) (2.3) (2.1) Investing Activities Preferred Stock Net Proceeds 0.0 0.0 0.0 93.4 (0.8) 0.0 Proceeds from Term Loan 0.0 0.0 10.0 49.5 0.0 0.0 Repayment of Term Loan (0.9) (0.9) (10.9) (72.0) 0.0 0.0 Prepayment Premium on Term Loan 0.0 0.0 0.0 (1.4) 0.0 0.0 Deferred Financing Cost 0.0 0.0 0.0 (2.8) (0.3) 0.0 Stock Repurchased for Tax Withholdings on Vesting of (0.2) (1.5) (0.8) (0.1) 0.0 (3.2) Restricted Stock Proceeds from Exercise of Stock Options 0.0 0.3 0.0 0.1 0.0 0.9 Net Cash Flows (Used in) Provided By (1.1) (2.2) (1.8) 66.7 (1.1) (2.3) Financing Activities Beginning Cash Balance 94.1 69.1 53.5 48.2 109.6 95.8 Change in Cash (25.1) (15.5) (5.3) 61.4 (13.8) (11.1) Ending Cash Balance 69.1 53.5 48.2 109.6 95.8 84.7 22SUMMARY CASH FLOW STATEMENTS 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 ($ millions) Net Loss (7.5) (4.8) (8.5) (19.4) (16.6) (8.4) Share-Based Compensation 2.9 3.3 4.4 3.7 3.9 3.2 Depreciation 1.6 1.5 1.4 1.5 1.3 1.2 Other Non-Cash Effects 1.2 1.2 1.3 9.5 1.7 1.1 Changes in Assets (14.2) (8.2) 2.9 (1.8) (6.2) 0.1 Changes in Liabilities (7.0) (5.3) (4.7) 1.9 5.5 (3.9) Net Cash Flows Used in (23.1) (12.3) (3.1) (4.6) (10.4) (6.7) Operating Activities Purchases of Property and Equipment (0.7) (1.0) (0.4) (0.7) (2.2) (1.9) Patent Application Costs (0.1) (0.1) (0.1) 0.0 (0.1) (0.2) Net Cash Flows Used in (0.8) (1.1) (0.5) (0.7) (2.3) (2.1) Investing Activities Preferred Stock Net Proceeds 0.0 0.0 0.0 93.4 (0.8) 0.0 Proceeds from Term Loan 0.0 0.0 10.0 49.5 0.0 0.0 Repayment of Term Loan (0.9) (0.9) (10.9) (72.0) 0.0 0.0 Prepayment Premium on Term Loan 0.0 0.0 0.0 (1.4) 0.0 0.0 Deferred Financing Cost 0.0 0.0 0.0 (2.8) (0.3) 0.0 Stock Repurchased for Tax Withholdings on Vesting of (0.2) (1.5) (0.8) (0.1) 0.0 (3.2) Restricted Stock Proceeds from Exercise of Stock Options 0.0 0.3 0.0 0.1 0.0 0.9 Net Cash Flows (Used in) Provided By (1.1) (2.2) (1.8) 66.7 (1.1) (2.3) Financing Activities Beginning Cash Balance 94.1 69.1 53.5 48.2 109.6 95.8 Change in Cash (25.1) (15.5) (5.3) 61.4 (13.8) (11.1) Ending Cash Balance 69.1 53.5 48.2 109.6 95.8 84.7 22

REVENUE DETAIL QUARTER TRAILING 12 MONTHS ($ millions) 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 3Q20 4Q20 1Q21 Advanced Wound Care 56.2 48.5 45.8 55.1 59.3 51.5 205.6 208.7 211.7 1 /Section 361 1 Section 351 12.0 8.7 6.1 8.2 8.7 8.2 35.0 31.7 31.2 2 Adjusted Net Sales 68.2 57.2 51.9 63.3 68.0 59.7 240.6 240.4 242.9 Revenue Transition 8.2 4.5 1.7 1.0 0.5 0.3 15.4 7.7 3.5 3 Impact Net Sales $76.4 $61.7 $53.6 $64.3 $68.5 $60.0 $256.0 $248.1 $246.4 (1) Section 361 includes Tissue + Cord sales. Section 351 includes Micronized + Particulate sales. Advanced Wound Care/Section 361 and Section 351 Sales are Non-GAAP metrics. These two metrics allow investors to better understand the trend in sales between the two different product groups. (2) Adjusted net sales excludes impact of Revenue Transition amounts. Adjusted net sales is a non-GAAP measurement. Our reported net sales, specifically those reported prior to and after the Transition, led to situations where we included revenue recognized on the cash basis and “as-shipped” basis in the same period. Management uses Adjusted Net Sales to provide comparative assessments and understand the trend in the Company’s sales across periods exclusive of effects related to the Company’s transition to revenue recognition at the point of shipment. (3) Impact of revenue 23 transition includes cash collected related to the remaining contracts. For a discussion of the revenue transition and the defined terms, refer to Item 8, Notes to the Consolidated Financial Statements in the MiMedx Group, Inc. Form 10-K for the years ended December 31, 2019 and 2020, and the respective Form 10-Qs for the noted quarterly periods.REVENUE DETAIL QUARTER TRAILING 12 MONTHS ($ millions) 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 3Q20 4Q20 1Q21 Advanced Wound Care 56.2 48.5 45.8 55.1 59.3 51.5 205.6 208.7 211.7 1 /Section 361 1 Section 351 12.0 8.7 6.1 8.2 8.7 8.2 35.0 31.7 31.2 2 Adjusted Net Sales 68.2 57.2 51.9 63.3 68.0 59.7 240.6 240.4 242.9 Revenue Transition 8.2 4.5 1.7 1.0 0.5 0.3 15.4 7.7 3.5 3 Impact Net Sales $76.4 $61.7 $53.6 $64.3 $68.5 $60.0 $256.0 $248.1 $246.4 (1) Section 361 includes Tissue + Cord sales. Section 351 includes Micronized + Particulate sales. Advanced Wound Care/Section 361 and Section 351 Sales are Non-GAAP metrics. These two metrics allow investors to better understand the trend in sales between the two different product groups. (2) Adjusted net sales excludes impact of Revenue Transition amounts. Adjusted net sales is a non-GAAP measurement. Our reported net sales, specifically those reported prior to and after the Transition, led to situations where we included revenue recognized on the cash basis and “as-shipped” basis in the same period. Management uses Adjusted Net Sales to provide comparative assessments and understand the trend in the Company’s sales across periods exclusive of effects related to the Company’s transition to revenue recognition at the point of shipment. (3) Impact of revenue 23 transition includes cash collected related to the remaining contracts. For a discussion of the revenue transition and the defined terms, refer to Item 8, Notes to the Consolidated Financial Statements in the MiMedx Group, Inc. Form 10-K for the years ended December 31, 2019 and 2020, and the respective Form 10-Qs for the noted quarterly periods.

NON-GAAP METRICS RECONCILIATION ($ millions) 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 Net Sales – Reported $ 76.4 $ 61.7 $ 53.6 $ 64.3 $ 68.5 $ 60.0 1 Less: Revenue Transition Impact 8.2 4.5 1.7 1.0 0.5 0.3 Adjusted Net Sales $ 68.2 $ 57.2 $ 51.9 $ 63.3 $ 68.0 $ 59.7 $ 63.7 $ 51.7 $ 45.4 $ 54.0 $ 57.7 $ 50.3 Gross Profit 1 Less: Revenue Transition Impact 7.1 3.9 1.5 0.9 0.4 0.2 Adjusted Gross Profit $ 56.6 $ 47.8 $ 44.0 $ 53.1 $ 57.3 $ 50.1 Adjusted Gross Margin 83.0% 83.6% 84.8% 83.9% 84.2% 83.9% Adjusted EBITDA $ 14.1 $ 3.1 $ 10.2 $ 6.9 $ 10.3 $ 4.7 Less: Capital Expenditures (0.7) (1.0) (0.4) (0.7) (2.2) (1.9) Less: Patent Application Costs (0.1) (0.1) (0.1) 0.0 (0.1) (0.2) Adjusted Free Cash Flow $ 13.3 $ 2.0 $ 9.7 $ 6.2 $ 8.0 $ 2.6 (1) Impact of revenue transition includes cash collected related to the remaining contracts. For a discussion of the revenue transition and the defined terms, refer to Item 8, Notes to the Consolidated Financial Statements in the MiMedx Group, Inc. Form 10-K for the years ended December 31, 2019 and 2020, and the respective Form 10-Qs for the noted quarterly periods. 24NON-GAAP METRICS RECONCILIATION ($ millions) 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 Net Sales – Reported $ 76.4 $ 61.7 $ 53.6 $ 64.3 $ 68.5 $ 60.0 1 Less: Revenue Transition Impact 8.2 4.5 1.7 1.0 0.5 0.3 Adjusted Net Sales $ 68.2 $ 57.2 $ 51.9 $ 63.3 $ 68.0 $ 59.7 $ 63.7 $ 51.7 $ 45.4 $ 54.0 $ 57.7 $ 50.3 Gross Profit 1 Less: Revenue Transition Impact 7.1 3.9 1.5 0.9 0.4 0.2 Adjusted Gross Profit $ 56.6 $ 47.8 $ 44.0 $ 53.1 $ 57.3 $ 50.1 Adjusted Gross Margin 83.0% 83.6% 84.8% 83.9% 84.2% 83.9% Adjusted EBITDA $ 14.1 $ 3.1 $ 10.2 $ 6.9 $ 10.3 $ 4.7 Less: Capital Expenditures (0.7) (1.0) (0.4) (0.7) (2.2) (1.9) Less: Patent Application Costs (0.1) (0.1) (0.1) 0.0 (0.1) (0.2) Adjusted Free Cash Flow $ 13.3 $ 2.0 $ 9.7 $ 6.2 $ 8.0 $ 2.6 (1) Impact of revenue transition includes cash collected related to the remaining contracts. For a discussion of the revenue transition and the defined terms, refer to Item 8, Notes to the Consolidated Financial Statements in the MiMedx Group, Inc. Form 10-K for the years ended December 31, 2019 and 2020, and the respective Form 10-Qs for the noted quarterly periods. 24

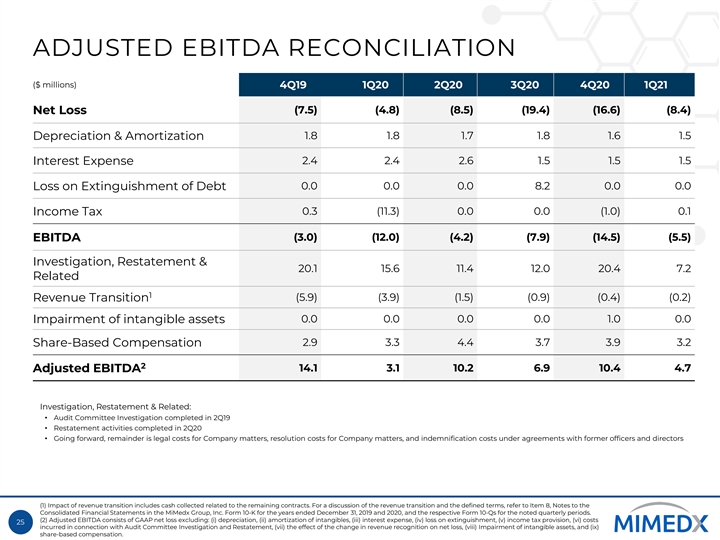

ADJUSTED EBITDA RECONCILIATION ($ millions) 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 Net Loss (7.5) (4.8) (8.5) (19.4) (16.6) (8.4) 1.8 1.8 1.7 1.8 1.6 1.5 Depreciation & Amortization 2.4 2.4 2.6 1.5 1.5 1.5 Interest Expense Loss on Extinguishment of Debt 0.0 0.0 0.0 8.2 0.0 0.0 0.3 (11.3) 0.0 0.0 (1.0) 0.1 Income Tax (3.0) (12.0) (4.2) (7.9) (14.5) (5.5) EBITDA Investigation, Restatement & 20.1 15.6 11.4 12.0 20.4 7.2 Related 1 (5.9) (3.9) (1.5) (0.9) (0.4) (0.2) Revenue Transition Impairment of intangible assets 0.0 0.0 0.0 0.0 1.0 0.0 2.9 3.3 4.4 3.7 3.9 3.2 Share-Based Compensation 2 Adjusted EBITDA 14.1 3.1 10.2 6.9 10.4 4.7 Investigation, Restatement & Related: • Audit Committee Investigation completed in 2Q19 • Restatement activities completed in 2Q20 • Going forward, remainder is legal costs for Company matters, resolution costs for Company matters, and indemnification costs under agreements with former officers and directors (1) Impact of revenue transition includes cash collected related to the remaining contracts. For a discussion of the revenue transition and the defined terms, refer to Item 8, Notes to the Consolidated Financial Statements in the MiMedx Group, Inc. Form 10-K for the years ended December 31, 2019 and 2020, and the respective Form 10-Qs for the noted quarterly periods. (2) Adjusted EBITDA consists of GAAP net loss excluding: (i) depreciation, (ii) amortization of intangibles, (iii) interest expense, (iv) loss on extinguishment, (v) income tax provision, (vi) costs 25 incurred in connection with Audit Committee Investigation and Restatement, (vii) the effect of the change in revenue recognition on net loss, (viii) Impairment of intangible assets, and (ix) share-based compensation.ADJUSTED EBITDA RECONCILIATION ($ millions) 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 Net Loss (7.5) (4.8) (8.5) (19.4) (16.6) (8.4) 1.8 1.8 1.7 1.8 1.6 1.5 Depreciation & Amortization 2.4 2.4 2.6 1.5 1.5 1.5 Interest Expense Loss on Extinguishment of Debt 0.0 0.0 0.0 8.2 0.0 0.0 0.3 (11.3) 0.0 0.0 (1.0) 0.1 Income Tax (3.0) (12.0) (4.2) (7.9) (14.5) (5.5) EBITDA Investigation, Restatement & 20.1 15.6 11.4 12.0 20.4 7.2 Related 1 (5.9) (3.9) (1.5) (0.9) (0.4) (0.2) Revenue Transition Impairment of intangible assets 0.0 0.0 0.0 0.0 1.0 0.0 2.9 3.3 4.4 3.7 3.9 3.2 Share-Based Compensation 2 Adjusted EBITDA 14.1 3.1 10.2 6.9 10.4 4.7 Investigation, Restatement & Related: • Audit Committee Investigation completed in 2Q19 • Restatement activities completed in 2Q20 • Going forward, remainder is legal costs for Company matters, resolution costs for Company matters, and indemnification costs under agreements with former officers and directors (1) Impact of revenue transition includes cash collected related to the remaining contracts. For a discussion of the revenue transition and the defined terms, refer to Item 8, Notes to the Consolidated Financial Statements in the MiMedx Group, Inc. Form 10-K for the years ended December 31, 2019 and 2020, and the respective Form 10-Qs for the noted quarterly periods. (2) Adjusted EBITDA consists of GAAP net loss excluding: (i) depreciation, (ii) amortization of intangibles, (iii) interest expense, (iv) loss on extinguishment, (v) income tax provision, (vi) costs 25 incurred in connection with Audit Committee Investigation and Restatement, (vii) the effect of the change in revenue recognition on net loss, (viii) Impairment of intangible assets, and (ix) share-based compensation.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- MiMedx Group (MDXG) May 7.5 puts active

- AM Best Maintains Under Review with Negative Implications Status for Credit Ratings of RF&G Insurance Company Limited

- Forbes Ranks Subaru as a Best Brand for Social Impact for the Second Year in a Row

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share