Form 8-K MCCORMICK & CO INC For: Mar 30

Exhibit 10(v) McCORMICK & COMPANY, INC. 2022 OMNIBUS INCENTIVE PLAN TERMS OF NON-QUALIFIED STOCK OPTION AWARD AGREEMENT The following terms and conditions apply to non-qualified stock options granted under the 2022 Omnibus Incentive Plan by McCORMICK & COMPANY, INC., a Maryland corporation, with its principal offices in Baltimore County, Maryland (hereinafter called the “Company”). RECITALS WHEREAS, the Board of Directors of the Company (the “Board”) believes that the interests of the Company and its stockholders will be advanced by encouraging its directors to become owners of common stock of the Company (“Shares”); and WHEREAS, the Board approved and adopted the Company’s 2022 Omnibus Incentive Plan (the “Plan”) on January 25, 2022, effective March 30, 2022, subject to the approval of the Company’s stockholders; and WHEREAS, the Company’s stockholders approved the Plan on March 30, 2022; and WHEREAS, one of the purposes of the Plan is to provide an inducement to the members of the Board (each a “Director”) to acquire Shares; and WHEREAS, the Board has authorized and approved the grant of an option to each non- employee member of the Board pursuant to the Plan, this Award Agreement and the terms described on the Screen (defined below); NOW THEREFORE, in consideration of the foregoing and of the covenants and agreements set forth below, the terms of this Award and this Award Agreement consist of the following: 1. Grant of Options Details of the Director’s non-qualified stock option, including the grant date, number of Shares, award price, and vesting schedule, are described on the screen captioned “Grants & Awards” in the Computershare website (the “Screen”). On the grant date specified on the Screen, the Company granted a non-qualified stock option to the Director to purchase the number of Shares identified as “Options Granted” at the price per Share specified under “Award Price” (this “Award” or this “option”). In order to exercise this option, the Director may (i) make a cash payment, (ii) surrender Shares owned by the Director having a market value equal to the Award Price and related taxes for the number of Shares to be purchased pursuant to the exercise of all or part of this option, or (iii) authorize the Company to withhold a sufficient number of Shares underlying this option, based on the market value of such Shares on the date of exercise, to pay the Award Price and related taxes and to issue the remaining number of such Shares to the Director (i.e., a net withholding exercise). The option granted hereunder shall be

2 exercisable, except as otherwise provided herein, in accordance with the vesting schedule provided on the Screen until this option expires on the date provided on the Screen (the “Expiration Date”). 2. Restrictions on Transfer of Options (a) Except as hereinafter provided, this option is not transferable by the Director and is exercisable during the Director’s lifetime only by the Director. This option may be transferred by the Director pursuant to a will or as otherwise permitted by the laws of descent and distribution. In addition, the Director may transfer all or any part of this option, “not for value” (as such phrase is defined in the Plan), to any Family Member. (b) Except as otherwise provided in Section 2(a), the option herein granted and the rights and privileges conferred hereby shall not be transferred, assigned, pledged, or hypothecated in any way (whether by operation of law or otherwise) and shall not be subject to execution, attachment, or similar process. Upon any attempt to transfer, assign, pledge, hypothecate, or otherwise dispose of said option or of any right or privilege conferred hereby contrary to the provisions hereof or upon the levy of any attachment or similar process upon the rights and privileges conferred hereby, this option and the rights and privileges conferred hereby shall immediately become null and void. 3. Vesting and Exercisability of Options (a) Post-Service Exercise Period Subject to the provisions of Section 3(b) (Death or Disability), Section 3(c) (Termination of Service After Age 75), and Section 3(d) (Change in Control Termination), all rights to exercise this option shall terminate thirty (30) days after the Director ceases to serve as a member of the Board. (b) Death or Disability If the Director ceases to serve as a member of the Board on account of death or Disability, any unvested portion of this option shall immediately become vested and the Director (or in the event of the Director’s death, the Director’s personal representative) may exercise this option, in full or in part, until the Expiration Date, regardless of the restrictions that might otherwise apply with respect to the Options Granted. (c) Termination of Service After Age 75 If the Director ceases to serve as a member of the Board on account of not being renominated to the Board after age 75, in accordance with the Corporate Governance Guidelines, the Director may exercise this option if the option has become vested as of the Director’s last day of Board service under the Vesting Schedule described in Section 1 (Grant of Options) until the Expiration Date, regardless of the restrictions that might otherwise apply with respect to the Options Granted.

3 In no event may this option, or any outstanding Options Granted and outstanding options previously granted (collectively, the “Outstanding Options”), be exercised after the Expiration Date. An exercise of this option with respect to a part of the Shares to which it relates shall not preclude a subsequent exercise as to any remaining part on or before the Expiration Date. (d) Change in Control Termination If the Director ceases to be a member of the Board in connection with a Change in Control: (i) any “in-the-money” Outstanding Options held by the Director immediately before such cessation of services in connection with a Change in Control (other than options granted after the Change in Control) shall, to the extent outstanding at the time of the cessation of services, immediately become 100% vested; and (ii) any Outstanding Options held by the Director immediately before such cessation of services in connection with a Change in Control that are not in-the-money will be canceled immediately. The Committee also may accord any Director a right to refuse any acceleration of exercisability, vesting or benefits, in such circumstances as the Committee may approve. For purposes of this Award Agreement, “in-the-money” means that the per Share fair market value of a Share immediately before the Change in Control exceeds the exercise price per Share of the applicable option. 4. Issuance of Shares The Company shall not be required to issue or deliver any certificate or certificates for Shares purchased upon the exercise of the option herein granted unless and until the offering and sale of the Shares represented thereby may legally be made under the Securities Act of 1933, as amended, and the applicable rules and regulations of the U.S. Securities and Exchange Commission. 5. Dividend, Voting and Other Rights The Director shall not have any of the rights or privileges of a stockholder of the Company in respect of any of the Shares issuable upon the exercise of the option herein granted unless and until such Shares have been issued and delivered. 6. Investment Purpose The Company may require the Director to agree that any Shares purchased upon the exercise of this option shall be acquired for investment and not for distribution and that each notice of the exercise of any portion of this option shall be accompanied by a written representation that the Shares are being acquired in good faith for investment and not for distribution.

4 7. Successor This Award shall be binding upon and inure to the benefit of any successor or successors of the Company. 8. Compliance with Law The Company shall make reasonable efforts to comply with all applicable federal and state securities laws. Notwithstanding any other provision of this Award Agreement, the Company shall not be obligated to issue any Shares pursuant to this Award Agreement if the issuance thereof would result in a violation of any law. 9. Withholding The Company shall, in its discretion, have the right to deduct or withhold from payments of any kind otherwise due to the Director, or require the Director to remit to the Company, an amount sufficient to satisfy taxes imposed under the laws of any country, state, province, city or other jurisdiction, including income taxes, capital gain taxes, transfer taxes, and social security contributions that are required by law to be withheld with respect to the Plan, the grant or exercise of stock options, the payment of Shares or cash under this Award Agreement, the sale of Shares acquired hereunder, and/or the payment of dividends on Shares acquired hereunder, as applicable. A sufficient number of Shares resulting from the exercise of this option may be retained by the Company to satisfy any tax withholding obligation. 10. No Right to Continue as Director Neither the Plan, this Award Agreement, the grant of stock options, the payment of Shares or cash under this Award Agreement, the sale of Shares acquired hereunder, and/or the payment of dividends on Shares acquired hereunder, as applicable, gives the Director any right to continue to be a director of the Company or limits, in any way, the right of the Company to change the Director’s compensation at any time for any reason not specifically prohibited by law. 11. Electronic Delivery The Company may, in its sole discretion, decide to deliver any documents related to current or future participation in the Plan by electronic means or request the Director’s consent to participate in the Plan by electronic means. The Director hereby consents to receive such documents by electronic delivery and agrees to participate in the Plan through an online or electronic system established and maintained by the Company or a third party designated by the Company. 12. Governing Law and Venue All disputes arising under or growing out of this option or the provisions of this Award Agreement shall be governed by and construed in accordance with the laws of the State of Maryland, United States of America, as provided in the Plan, without regard to such state’s conflict of laws rules. If any dispute arises directly or indirectly from the relationship of the

5 parties evidenced by this Award and this Award Agreement, the parties hereby submit to and consent to the exclusive jurisdiction of the State of Maryland and agree that such litigation shall be conducted only in the courts of Baltimore County, Maryland, and no other courts, where the grant of this option is made and/or to be performed. 13. Severability The provisions of this Award Agreement are severable and if any one or more provisions are determined to be illegal or otherwise unenforceable, in whole or in part, the remaining provisions shall nevertheless be binding and enforceable. 14. Imposition of Other Requirements The Company reserves the right to impose other requirements on the Director’s participation in the Plan, on this option and on any Shares acquired under the Plan, to the extent the Company determines it is necessary or advisable to comply with local law or facilitate the administration of the Plan, and to require the Director to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing. 15. Relation to Plan This Award Agreement is subject to the terms and conditions of the Plan. In the event of any inconsistency or conflict between this Award Agreement and the Plan, the Plan shall govern. The Plan and this Award Agreement shall be administered by the Committee in accordance with the provisions of section 4 of the Plan. Except as expressly provided in this Award Agreement, capitalized terms used herein shall have the meanings ascribed to them in the Plan or on the Screen. 16. Acceptance of Award The Director shall be deemed to have accepted this Award unless the Director provides written notice to the Company, within thirty (30) business days following the Grant Date, stating that the Director does not wish to accept the Award. Notices should be directed to Investor Services at [email protected], or to McCormick & Company, Inc. Attn: Investor Services, 18 Loveton Circle, Sparks, Maryland 21152. By accepting this Award Agreement, the Director agrees to be bound by the terms and conditions set forth herein and acknowledges and agrees that: (a) The grant of this option and any future options under the Plan is entirely voluntary, and at the complete discretion of the Company. Neither the grant of this option, nor any future grant of an option by the Company, shall be deemed to create any obligation to grant any other options, whether or not such a reservation is explicitly stated at the time of any such grant. The Board has the right, at any time, to amend, suspend, discontinue or terminate the Plan, this Award, and/or this Award Agreement; provided, that the Director’s consent to such action shall be required unless the Administrator determines that the action, taking into account any related action, would not materially and adversely affect the Director’s rights under the Plan.

6 (b) Neither the Company nor any member of the Board or of the Committee shall have any liability of any kind to the Director for any action taken or not taken in good faith under the Plan; for any change, amendment, or cancellation of the Plan or this option; or for the failure of this option to realize intended tax consequences or to comply with any other law, compliance with which is not required on the part of the Company. (c) The Director has reviewed the Plan, this Award Agreement, and the Screen in their entirety, has had an opportunity to obtain the advice of counsel prior to accepting this Award Agreement, and fully understands all provisions of the Plan, this Award Agreement, and the Screen.

1 Exhibit 10(iv) McCORMICK & COMPANY, INC. 2022 OMNIBUS INCENTIVE PLAN TERMS OF NON-QUALIFIED STOCK OPTION AWARD AGREEMENT The following terms and conditions in this agreement (together with the Stock Option Covenants Addendum attached hereto, this “Award Agreement”) apply to non-qualified stock options granted under the 2022 Omnibus Incentive Plan by McCORMICK & COMPANY, INC., a Maryland corporation, with its principal offices in Baltimore County, Maryland (hereinafter called the “Company”). RECITALS WHEREAS, the Board of Directors of the Company (the “Board”) believes that the interests of the Company and its stockholders will be advanced and the Company’s overall managerial strength will be enhanced by encouraging its officers and other key employees to become owners of common stock of the Company (“Shares”); and WHEREAS, the Board approved and adopted the Company’s 2022 Omnibus Incentive Plan (the “Plan”) on January 25, 2022, effective March 30, 2022, subject to the approval of the Company’s stockholders; and WHEREAS, the Company’s stockholders approved the Plan on March 30, 2022; and WHEREAS, one of the purposes of the Plan is to provide an inducement to certain officers and other key employees of the Company and its affiliates to acquire Shares; and WHEREAS, the Board has authorized and approved the grant of an option to the employee or officer, as applicable (the “Optionholder”), pursuant to the Plan, this Award Agreement and the terms described on the Screen (defined below); and WHEREAS, this Award (defined below) and any options previously granted to the Optionholder (whether exercised or unexercised, and whether vested or unvested) are conditioned on and subject to the terms of the Plan and this Award Agreement. NOW THEREFORE, in consideration of the foregoing and of the covenants and agreements set forth below, the terms of this Award and this Award Agreement consist of the following: 1. Grant of Options Details of the Optionholder’s non-qualified stock option, including the grant date, number of Shares, award price, and vesting schedule, are described on the screen captioned “Grants & Awards” in the Computershare website (the “Screen”). On the grant date specified on the Screen, the Company granted a non-qualified stock option to the Optionholder to purchase the number of Shares identified as “Options Granted” at the price per Share specified under “Award Price” (this “Award” or this “option”). In order to exercise this option, the Optionholder may (i) make a

2 cash payment, (ii) surrender Shares owned by the Optionholder having a market value equal to the Award Price and related taxes for the number of Shares to be purchased pursuant to the exercise of all or part of this option, or (iii) authorize the Company to withhold a sufficient number of Shares underlying this option, based on the market value of such Shares on the date of exercise, to pay the Award Price and related taxes and to issue the remaining number of such Shares to the Optionholder (i.e., a net withholding exercise). The option granted hereunder shall be exercisable, except as otherwise provided herein, in accordance with the vesting schedule provided on the Screen until this option expires on the date provided on the Screen (the “Expiration Date”). 2. Restrictions on Transfer of Options (a) Except as hereinafter provided, this option is not transferable by the Optionholder and is exercisable during the Optionholder’s lifetime only by the Optionholder. This option may be transferred by the Optionholder pursuant to a will or as otherwise permitted by the laws of descent and distribution. In addition, the Optionholder may transfer all or any part of this option, “not for value” (as such phrase is defined in the Plan), to any Family Member. (b) Except as otherwise provided in Section 2(a), the option herein granted and the rights and privileges conferred hereby shall not be transferred, assigned, pledged, or hypothecated in any way (whether by operation of law or otherwise) and shall not be subject to execution, attachment, or similar process. Upon any attempt to transfer, assign, pledge, hypothecate, or otherwise dispose of said option or of any right or privilege conferred hereby contrary to the provisions hereof or upon the levy of any attachment or similar process upon the rights and privileges conferred hereby, this option and the rights and privileges conferred hereby shall immediately become null and void. 3. Vesting and Exercisability of Options (a) Post-Termination Exercise Period Subject to the provisions of Section 3(b) (Disability or Death), Section 3(c) (Retirement), Section 3(d) (Qualifying Termination), and Section 3(e) (Change in Control Termination), all rights to exercise this option shall terminate thirty (30) days after the Optionholder ceases to be an employee of the Company or of a subsidiary or affiliate of the Company. (b) Disability or Death If the Optionholder ceases to be an employee of the Company or of a subsidiary or an affiliate of the Company on account of Disability or death, any unvested portion of this option shall immediately become vested and the Optionholder (or in the event of the Optionholder’s death, the Optionholder’s personal representative) may exercise this option, in full or in part, until the Expiration Date, regardless of the restrictions that might otherwise apply with respect to the Options Granted.

3 (c) Retirement If the Optionholder ceases to be an employee of the Company or of a subsidiary or an affiliate of the Company on account of Retirement, any unvested portion of this option shall immediately become vested and the Optionholder may exercise this option, in full or in part, until the Expiration Date, regardless of the restrictions that might otherwise apply with respect to the Options Granted. For purposes of this Award Agreement, “Retirement” means termination of employment at or after age 55. (d) Qualifying Termination If the Optionholder has a Qualifying Termination (as such term is defined in the McCormick & Company, Incorporated Severance Plan for Executives (the “Severance Plan”)), any outstanding Options Granted and outstanding options previously granted (collectively, the “Outstanding Options”) that would have vested, in accordance with the applicable vesting schedule, during the 12-month (or 18-month if the Optionholder is the CEO) period following such Qualifying Termination, shall immediately vest and the Optionholder may exercise such options, in full or in part, until the earlier of the Expiration Date or the fifth anniversary of the date the Optionholder ceases to be an employee, regardless of the restrictions that might otherwise apply with respect to such options. If the Optionholder’s Qualifying Termination subsequently becomes a Change in Control Termination, the provisions of Section 3(e) (Change in Control Termination), shall be immediately applied to any Outstanding Options that were unvested after application of this Section 3(d) (Qualifying Termination). (e) Change in Control Termination If the Optionholder has a Change in Control Termination: (i) any “in-the-money” Outstanding Options held by the Optionholder immediately before such Change in Control Termination (other than options granted after the Change in Control) shall, to the extent outstanding at the time of the Change in Control Termination, immediately become 100% vested; and (ii) any Outstanding Options held by the Optionholder immediately before such Change in Control Termination that are not in-the-money will be canceled immediately. For purposes of this Award Agreement, “in-the-money” means that the per Share fair market value of a Share immediately before the Change in Control Termination exceeds the exercise price per Share of the applicable option. In no event may this option or the Outstanding Options be exercised after the Expiration Date. An exercise of this option with respect to a part of the Shares to which it relates shall not preclude a subsequent exercise as to any remaining part on or before the Expiration Date.

4 4. Issuance of Shares The Company shall not be required to issue or deliver any certificate or certificates for Shares purchased upon the exercise of the option herein granted unless and until the offering and sale of the Shares represented thereby may legally be made under the Securities Act of 1933, as amended, and the applicable rules and regulations of the U.S. Securities and Exchange Commission. 5. Dividend, Voting and Other Rights The Optionholder shall not have any of the rights or privileges of a stockholder of the Company in respect of any of the Shares issuable upon the exercise of the option herein granted unless and until such Shares have been issued and delivered. 6. Investment Purpose The Company may require the Optionholder to agree that any Shares purchased upon the exercise of this option shall be acquired for investment and not for distribution and that each notice of the exercise of any portion of this option shall be accompanied by a written representation that the Shares are being acquired in good faith for investment and not for distribution. 7. Forfeiture of Outstanding Options and Gain on Any Option The Optionholder shall be required to forfeit to the Company (a) any unexercised Outstanding Options (whether or not vested) and (b) any gain realized on account of this option and all exercised options previously granted to the Optionholder (including any Shares received from the exercise of any such option) in the event the Optionholder takes any action in violation or breach of, or in conflict with this Award Agreement (including the Stock Option Covenants Addendum attached hereto), any employment agreement, non-competition agreement, any agreement prohibiting solicitation of employees or clients of the Company or any of its affiliates, or any confidentiality obligation with respect to the Company or any of its affiliates or otherwise in competition with the Company or any of its affiliates. The Company shall annul this Award if the Optionholder is an employee of the Company or any of its affiliates and is terminated for Cause or otherwise as required under the Plan. 8. Successor This Award shall be binding upon and inure to the benefit of any successor or successors of the Company. 9. Compliance with Law The Company shall make reasonable efforts to comply with all applicable federal and state securities laws. Notwithstanding any other provision of this Award Agreement, the Company shall not be obligated to issue any Shares pursuant to this Award Agreement if the issuance thereof would result in a violation of any law.

5 10. Withholding The Company (and/or the Optionholder’s local employer) shall, in its discretion, have the right to deduct or withhold from payments of any kind otherwise due to the Optionholder, or require the Optionholder to remit to the Company (and to his or her local employer), an amount sufficient to satisfy taxes imposed under the laws of any country, state, province, city or other jurisdiction, including income taxes, capital gain taxes, transfer taxes, and social security contributions that are required by law to be withheld with respect to the Plan, the grant or exercise of stock options, the payment of Shares or cash under this Award Agreement, the sale of Shares acquired hereunder, and/or the payment of dividends on Shares acquired hereunder, as applicable. A sufficient number of Shares resulting from the exercise of this option may be retained by the Company to satisfy any tax withholding obligation. 11. No Right to Continued Employment Neither the Plan, this Award Agreement, the grant of stock options, the payment of Shares or cash under this Award Agreement, the sale of Shares acquired hereunder, and/or the payment of dividends on Shares acquired hereunder, as applicable, gives the Optionholder any right to continue to be employed by the Company (or the Optionholder’s local employer), or limits, in any way, the right of the Company (or the Optionholder’s local employer) to change the Optionholder’s compensation or other benefits or to terminate the Optionholder’s employment at any time for any reason not specifically prohibited by law. 12. Electronic Delivery The Company may, in its sole discretion, decide to deliver any documents related to current or future participation in the Plan by electronic means or request the Optionholder’s consent to participate in the Plan by electronic means. The Optionholder hereby consents to receive such documents by electronic delivery and agrees to participate in the Plan through an online or electronic system established and maintained by the Company or a third party designated by the Company. 13. Governing Law and Venue All disputes arising under or growing out of this option or the provisions of this Award Agreement shall be governed by and construed in accordance with the laws of the State of Maryland, United States of America, as provided in the Plan, without regard to such state’s conflict of laws rules. If any dispute arises directly or indirectly from the relationship of the parties evidenced by this Award and this Award Agreement, the parties hereby submit to and consent to the exclusive jurisdiction of the State of Maryland and agree that such litigation shall be conducted only in the courts of Baltimore County, Maryland, and no other courts, where the grant of this option is made and/or to be performed. 14. Severability The provisions of this Award Agreement are severable and if any one or more provisions are determined to be illegal or otherwise unenforceable, in whole or in part, the remaining provisions shall nevertheless be binding and enforceable.

6 15. Imposition of Other Requirements The Company reserves the right to impose other requirements on the Optionholder’s participation in the Plan, on this option and on any Shares acquired under the Plan, to the extent the Company determines it is necessary or advisable to comply with local law or facilitate the administration of the Plan, and to require the Optionholder to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing. 16. Relation to Plan This Award Agreement is subject to the terms and conditions of the Plan. In the event of any inconsistency or conflict between this Award Agreement and the Plan, the Plan shall govern. The Plan and this Award Agreement shall be administered by the Committee in accordance with the provisions of section 4 of the Plan. Except as expressly provided in this Award Agreement, capitalized terms used herein shall have the meanings ascribed to them in the Plan or on the Screen. 17. Acceptance of Award In consideration for this option and by accepting this Award Agreement, the Optionholder agrees and acknowledges that: (a) All unexercised options previously granted to the Optionholder and all Options Granted under this Award Agreement are subject to the Stock Option Covenants Addendum attached hereto, the terms of which are fully incorporated herein. (b) The grant of this option and any future options under the Plan is entirely voluntary, and at the complete discretion of the Company. Neither the grant of this option, nor any future grant of an option by the Company, shall be deemed to create any obligation to grant any other options, whether or not such a reservation is explicitly stated at the time of any such grant. The Board has the right, at any time, to amend, suspend, discontinue or terminate the Plan, this Award, and/or this Award Agreement; provided, that the Optionholder’s consent to such action shall be required unless the Administrator determines that the action, taking into account any related action, would not materially and adversely affect the Optionholder’s rights under the Plan. (c) Neither the Company, the Optionholder’s local employer, nor any member of the Board or of the Committee shall have any liability of any kind to the Optionholder for any action taken or not taken in good faith under the Plan; for any change, amendment, or cancellation of the Plan or this option; or for the failure of this option to realize intended tax consequences or to comply with any other law, compliance with which is not required on the part of the Company. (d) The Optionholder has reviewed the Plan, this Award Agreement, and the Screen in their entirety, has had an opportunity to obtain the advice of counsel prior to accepting this Award Agreement, and fully understands all provisions of the Plan, this Award Agreement, and the Screen. **ADDENDUM APPEARS ON THE FOLLOWING PAGE**

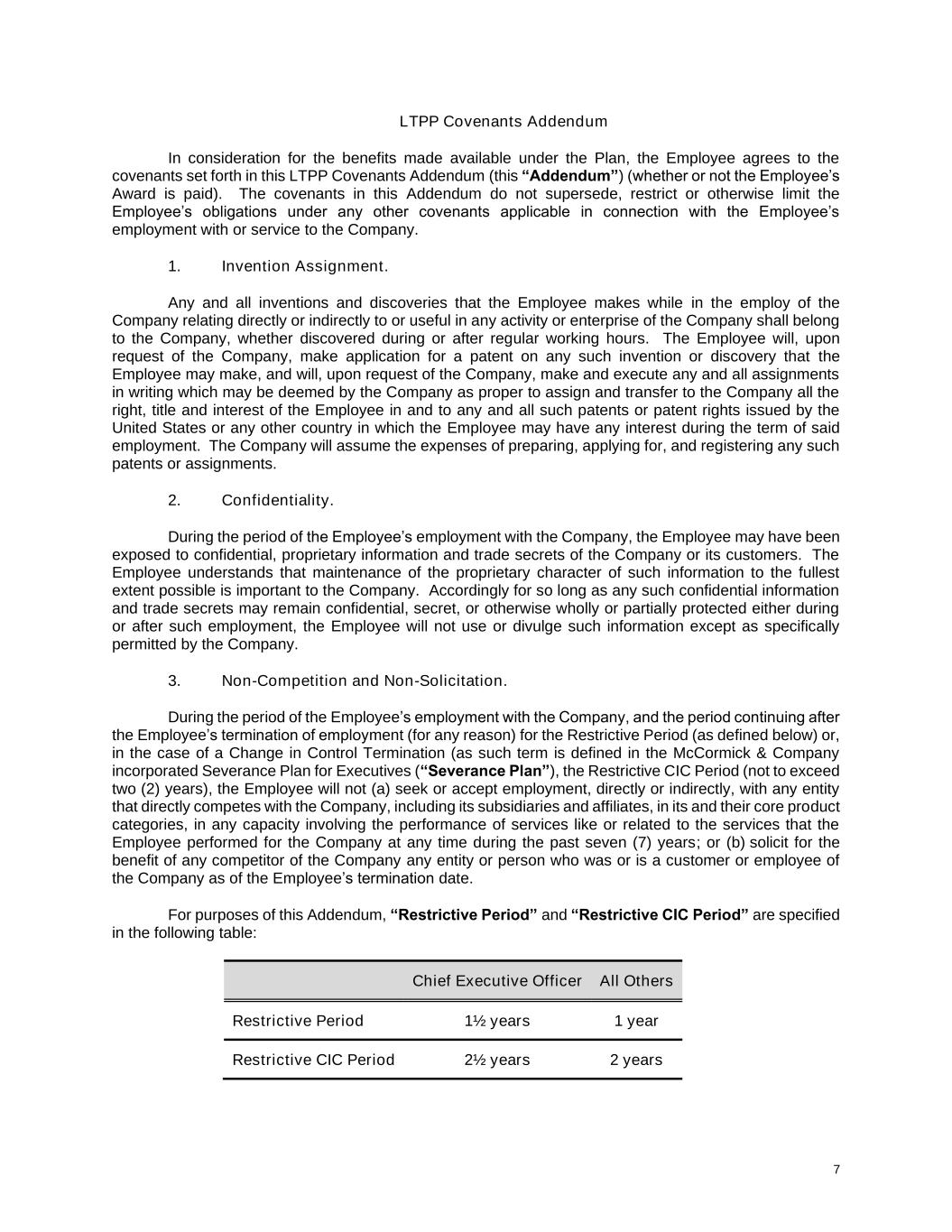

7 STOCK OPTION COVENANTS ADDENDUM In consideration for the benefits made available under the Plan, the Optionholder agrees to the covenants set forth in this Stock Option Covenants Addendum (this “Addendum”) (whether or not the Optionholder’s options vest or the Optionholder exercises such vested options). The covenants in this Addendum do not supersede, restrict or otherwise limit the Optionholder’s obligations under any other covenants applicable in connection with the Optionholder’s employment with or service to the Company. 1. Invention Assignment Any and all inventions and discoveries that the Optionholder makes while he or she is in the employ of the Company relating directly or indirectly to or useful in any activity or enterprise of the Company shall belong to the Company, whether discovered during or after regular working hours. The Optionholder will, upon request of the Company, make application for a patent on any such invention or discovery that he or she may make, and will, upon request of the Company, make and execute any and all assignments in writing which may be deemed by the Company as proper to assign and transfer to the Company all the right, title and interest of the Optionholder in and to any and all such patents or patent rights issued by the United States or any other country in which the Optionholder may have any interest during the term of his or her said employment. The Company will assume the expenses of preparing, applying for, and registering any such patents or assignments. 2. Confidentiality During the period of the Optionholder’s employment with the Company, the Optionholder may have been exposed to confidential, proprietary information and trade secrets of the Company or its customers. The Optionholder understands that maintenance of the proprietary character of such information to the fullest extent possible is important to the Company. Accordingly for so long as any such confidential information and trade secrets may remain confidential, secret, or otherwise wholly or partially protected either during or after such employment, the Optionholder will not use or divulge such information except as specifically permitted by the Company. 3. Non-Competition and Non-Solicitation During the period of the Optionholder’s employment with the Company, and the period continuing after the Optionholder’s termination of employment (for any reason) for the Restrictive Period (as defined below) or, in the case of a Change in Control Termination, the Restrictive CIC Period (not to exceed two (2) years), the Optionholder will not (a) seek or accept employment, directly or indirectly, with any entity that directly competes with the Company, including its subsidiaries and affiliates, in its and their core product categories, in any capacity involving the performance of services like or related to the services that the Optionholder performed for the Company at any time during the past seven (7) years or (b) solicit, for the benefit of any competitor of the Company, any entity or person who was or is a customer or employee of the Company as of the Optionholder’s termination date.

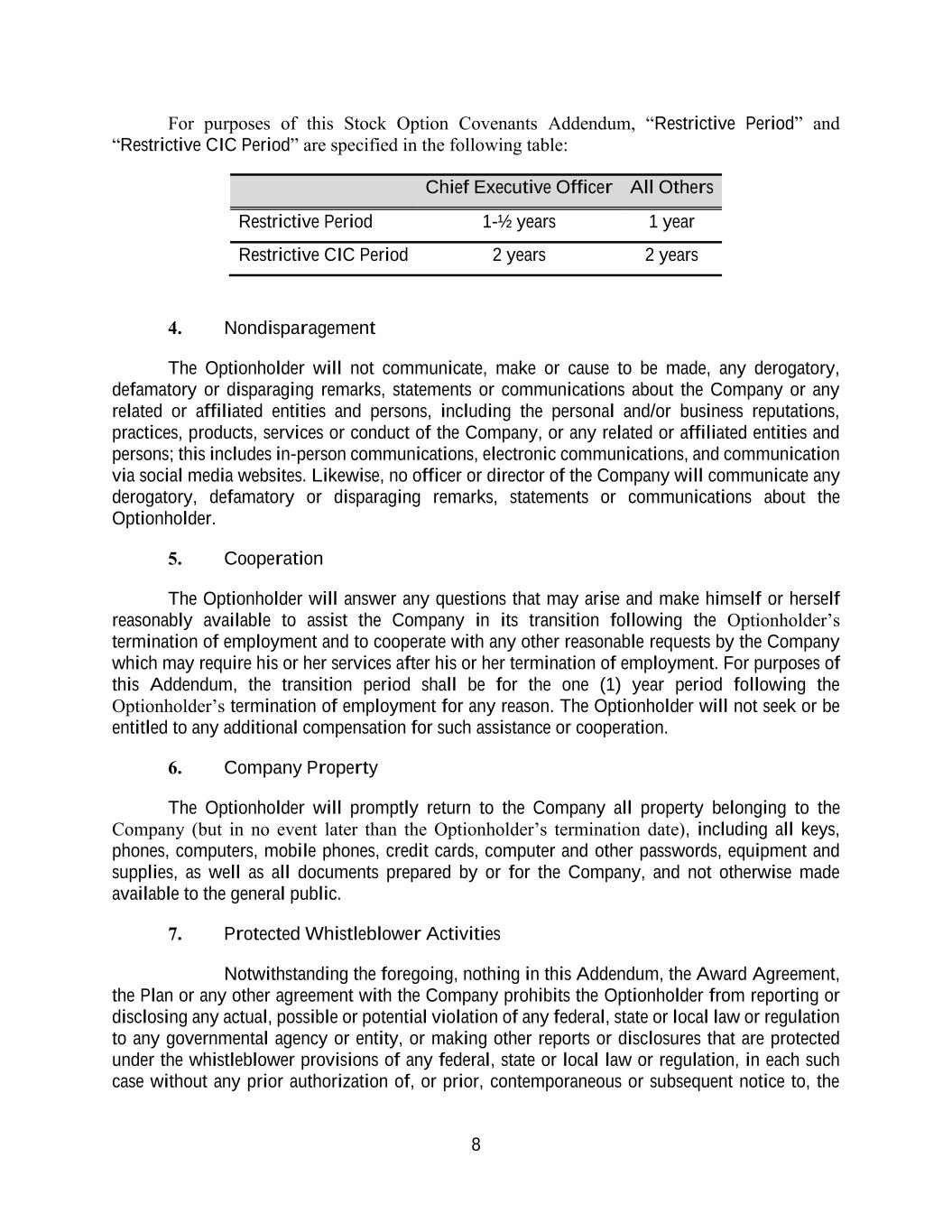

8 For purposes of this Stock Option Covenants Addendum, “Restrictive Period” and “Restrictive CIC Period” are specified in the following table: Chief Executive Officer All Others Restrictive Period 1-½ years 1 year Restrictive CIC Period 2 years 2 years 4. Nondisparagement The Optionholder will not communicate, make or cause to be made, any derogatory, defamatory or disparaging remarks, statements or communications about the Company or any related or affiliated entities and persons, including the personal and/or business reputations, practices, products, services or conduct of the Company, or any related or affiliated entities and persons; this includes in-person communications, electronic communications, and communication via social media websites. Likewise, no officer or director of the Company will communicate any derogatory, defamatory or disparaging remarks, statements or communications about the Optionholder. 5. Cooperation The Optionholder will answer any questions that may arise and make himself or herself reasonably available to assist the Company in its transition following the Optionholder’s termination of employment and to cooperate with any other reasonable requests by the Company which may require his or her services after his or her termination of employment. For purposes of this Addendum, the transition period shall be for the one (1) year period following the Optionholder’s termination of employment for any reason. The Optionholder will not seek or be entitled to any additional compensation for such assistance or cooperation. 6. Company Property The Optionholder will promptly return to the Company all property belonging to the Company (but in no event later than the Optionholder’s termination date), including all keys, phones, computers, mobile phones, credit cards, computer and other passwords, equipment and supplies, as well as all documents prepared by or for the Company, and not otherwise made available to the general public. 7. Protected Whistleblower Activities Notwithstanding the foregoing, nothing in this Addendum, the Award Agreement, the Plan or any other agreement with the Company prohibits the Optionholder from reporting or disclosing any actual, possible or potential violation of any federal, state or local law or regulation to any governmental agency or entity, or making other reports or disclosures that are protected under the whistleblower provisions of any federal, state or local law or regulation, in each such case without any prior authorization of, or prior, contemporaneous or subsequent notice to, the

9 Company. Under the Defend Trade Secrets Act, 18 U.S.C. § 1833(b), the Optionholder may be entitled to immunity for certain disclosures to his or her attorney or government officials.

Exhibit 10(iii) McCORMICK & COMPANY, INC. 2022 OMNIBUS INCENTIVE PLAN TERMS OF RESTRICTED STOCK UNITS AWARD AGREEMENT The following terms and conditions apply to restricted stock units granted under the 2022 Omnibus Incentive Plan by McCORMICK & COMPANY, INC., a Maryland corporation, with its principal offices in Baltimore County, Maryland (hereinafter called the “Company”). RECITALS WHEREAS, the Board of Directors of the Company (the “Board”) believes that the interests of the Company and its stockholders will be advanced by encouraging its directors to become owners of common stock of the Company (“Shares”); and WHEREAS, the Board approved and adopted the Company’s 2022 Omnibus Incentive Plan (the “Plan”) on January 25, 2022, effective March 30, 2022, subject to the approval of the Company’s stockholders; and WHEREAS, the Company’s stockholders approved the Plan on March 30, 2022; and WHEREAS, one of the purposes of the Plan is to provide an inducement to the members of the Board (each a “Director”) to acquire Shares; and WHEREAS, the Board has authorized and approved the grant of this Award (defined below) pursuant to the Plan, this Award Agreement and the terms described on the Screen (defined below). NOW THEREFORE, in consideration of the foregoing and of the covenants and agreements set forth below, the terms of this Award and this Award Agreement consist of the following: 1. Grant of Restricted Stock Units Details of the Director’s Award are described on the screen captioned “Grants & Awards” in the Computershare website (the “Screen”). On the grant date specified on the Screen (the “Grant Date”), the Company granted restricted common stock units (“Restricted Stock Units”) to the Director for the number of Shares identified as granted on the Screen (the “Award”). The Restricted Stock Units shall become vested in accordance with the vesting schedule described in Section 3 (Vesting of Restricted Stock Units). Each Restricted Stock Unit shall represent one hypothetical Share, without par value. Each Restricted Stock Unit shall at all times be equal in value to one Share. The Company shall credit each Restricted Stock Unit to a bookkeeping account that the Company shall maintain for the Director until the Company issues Shares with respect to such Restricted Stock Unit in accordance with Section 4 (Issuance of Shares) or such Restricted Stock Unit is forfeited in accordance with Section 3 (Vesting of Restricted Stock Units).

2 2. Restrictions on Transfer of Restricted Stock Units The Restricted Stock Units herein granted and the rights and privileges conferred hereby shall not be transferred, assigned, pledged, or hypothecated in any way (whether by operation of law or otherwise) and shall not be subject to execution, attachment, or similar process. Upon any attempt to transfer, assign, pledge, hypothecate, or otherwise dispose of said Restricted Stock Units or of any right or privilege conferred hereby contrary to the provisions hereof or upon the levy of any attachment or similar process upon the rights and privileges conferred hereby, these Restricted Stock Units and the rights and privileges conferred hereby shall immediately become null and void. 3. Vesting of Restricted Stock Units (a) The Restricted Stock Units shall become vested and non-forfeitable on March 15 in the year immediately following the Grant Date (the “Vesting Date”); provided, that the Director continues to serve as a member of the Board from the Grant Date until the Vesting Date. Except as provided in Section 3(b), if the Director ceases to serve as a member of the Board on account of not being renominated to the Board after age 75, in accordance with the Corporate Governance Guidelines, prior to the Vesting Date, the Restricted Stock Units shall be immediately forfeited. (b) Notwithstanding the provisions of Section 3(a), any outstanding Restricted Stock Units shall immediately become vested and non-forfeitable in the event of the Director’s death, Disability, or in the event the Director ceases to serve as a member of the Board in connection with a Change in Control of the Company. If such Restricted Stock Units become vested and non-forfeitable pursuant to this Section 3(b), the date of the Director’s death or Disability or the date the Director ceases to serve as a member of the Board in connection with the Change in Control, whichever applies, shall be treated as the Vesting Date for purposes of this Award Agreement. 4. Issuance of Shares (a) The Company shall issue to the Director (or, in the event of the Director’s death, to the Director’s personal representative) Shares corresponding to vested Restricted Stock Units, net of any applicable withholding taxes, as soon as practicable following the Vesting Date and in no event later than March 15th of the year following the Vesting Date. (b) No Shares shall be issued to the Director under this Award Agreement before the Vesting Date. (c) The Company’s obligations to the Director with respect to the Restricted Stock Units shall be satisfied in full upon the issuance of Shares with respect to the Restricted Stock Units that vest in accordance with Section 3 (Vesting of Restricted Stock Units), net of any applicable withholding taxes, or upon the forfeiture of such Restricted Stock Units in accordance with Section 3 (Vesting of Restricted Stock Units).

3 5. Dividend, Voting and Other Rights. (a) The Restricted Stock Units are not Shares, and the Director shall therefore have no voting, dividend, or other shareholder rights by reason of receiving or being credited with Restricted Stock Units pursuant to this Award Agreement unless and until Shares are issued to the Director pursuant to Section 4 (Issuance of Shares). (b) This Award Agreement represents only an unfunded and unsecured promise by the Company. The Director’s rights under this Award Agreement shall be limited to those of an unsecured general creditor of the Company. 6. Successor This Award shall be binding upon and inure to the benefit of any successor or successors of the Company. 7. Compliance with Law The Company shall make reasonable efforts to comply with all applicable federal and state securities laws. Notwithstanding any other provision of this Award Agreement, the Company shall not be obligated to issue any Shares pursuant to this Award Agreement if the issuance thereof would result in a violation of any law. 8. Section 409A of the Internal Revenue Code It is intended that the Restricted Stock Units and this Award Agreement shall qualify as a short-term deferral arrangement described in Treas. Reg. § 1.409A-1(b)(4), and any successor thereto, and that, as a result, the Restricted Stock Units and this Award Agreement shall not be subject to the provisions of Section 409A of the Code (“Section 409A”). This Award Agreement and the Plan shall be administered in a manner consistent with the foregoing intent, and any provision that would cause such Restricted Stock Units or this Award Agreement to be subject to Section 409A shall have no force or effect until this Award Agreement is amended to avoid the application of Section 409A (which amendment may be retroactive to the extent permitted by Section 409A and may be made by the Company without the Director’s consent). 9. Withholding The Company shall, in its discretion, have the right to deduct or withhold from payments of any kind otherwise due to the Director, or require the Director to remit to the Company, an amount sufficient to satisfy taxes imposed under the laws of any country, state, province, city or other jurisdiction, including income taxes, capital gain taxes, transfer taxes, and social security contributions that are required by law to be withheld with respect to the Plan, the grant of restricted stock units, the payment of Shares or cash under this Award Agreement, the sale of Shares acquired hereunder, and/or the payment of dividends on Shares acquired hereunder, as applicable. A sufficient number of Shares resulting from payout of this Award at vesting may be retained by the Company to satisfy any tax withholding obligation.

4 10. No Right to Continue as Director Neither the Plan, this Award Agreement, the grant of Restricted Stock Units, the payment of Shares or cash under this Award Agreement, the sale of Shares acquired hereunder, and/or the payment of dividends on Shares acquired hereunder, as applicable, gives the Director any right to continue to be a director of the Company or limits, in any way, the right of the Company to change the Director’s compensation at any time for any reason not specifically prohibited by law. 11. Electronic Delivery The Company may, in its sole discretion, decide to deliver any documents related to current or future participation in the Plan by electronic means or request the Director’s consent to participate in the Plan by electronic means. The Director hereby consents to receive such documents by electronic delivery and agrees to participate in the Plan through an online or electronic system established and maintained by the Company or a third party designated by the Company. 12. Governing Law and Venue All disputes arising under or growing out of the Restricted Stock Units or the provisions of this Award Agreement shall be governed by and construed in accordance with the laws of the State of Maryland, United States of America, as provided in the Plan, without regard to such state’s conflict of laws rules. If any dispute arises directly or indirectly from the relationship of the parties evidenced by this Award and this Award Agreement, the parties hereby submit to and consent to the exclusive jurisdiction of the State of Maryland and agree that such litigation shall be conducted only in the courts of Baltimore County, Maryland, and no other courts, where the grant of the Restricted Stock Units are made and/or to be performed. 13. Severability The provisions of this Award Agreement are severable and if any one or more provisions are determined to be illegal or otherwise unenforceable, in whole or in part, the remaining provisions shall nevertheless be binding and enforceable. 14. Imposition of Other Requirements The Company reserves the right to impose other requirements on the Director’s participation in the Plan, on the Restricted Stock Units and on any Shares acquired under the Plan, to the extent the Company determines it is necessary or advisable to comply with local law or facilitate the administration of the Plan, and to require the Director to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing. 15. Relation to Plan This Award Agreement is subject to the terms and conditions of the Plan. In the event of any inconsistency or conflict between this Award Agreement and the Plan, the Plan shall govern. The Plan and this Award Agreement shall be administered by the Committee in accordance with

5 the provisions of section 4 of the Plan. Except as expressly provided in this Award Agreement, capitalized terms used herein shall have the meanings ascribed to them in the Plan or on the Screen. 16. Acceptance of Award The Director shall be deemed to have accepted this Award unless the Director provides written notice to the Company within thirty (30) business days following the Grant Date, stating that the Director does not wish to accept the Award. Notices should be directed to Investor Services at [email protected], or to McCormick & Company, Inc. Attn: Investor Services, 18 Loveton Circle, Sparks, Maryland 21152. By accepting this Award Agreement, the Director agrees to be bound by the terms and conditions set forth herein and acknowledges and agrees that: (a) The award of Restricted Stock Units hereunder and any future awards under the Plan are entirely voluntary, and at the complete discretion of the Company. Neither the award of Restricted Stock Units hereunder, nor any future awards by the Company, shall be deemed to create any obligation to grant any other awards, whether or not such a reservation is explicitly stated at the time of any such award. The Board has the right, at any time, to amend, suspend, discontinue or terminate the Plan, this Award, and/or this Award Agreement; provided, that the Director’s consent to such action shall be required unless the Administrator determines that the action, taking into account any related action, would not materially and adversely affect the Director’s rights under the Plan. (b) Neither the Company nor any member of the Board or of the Committee shall have any liability of any kind to the Director for any action taken or not taken in good faith under the Plan; for any change, amendment, or cancellation of the Plan or this Award; or for the failure of this Award to realize intended tax consequences or to comply with any other law, compliance with which is not required on the part of the Company. (c) The Director has reviewed the Plan, this Award Agreement, and the Screen in their entirety, has had an opportunity to obtain the advice of counsel prior to accepting this Award Agreement, and fully understands all provisions of the Plan, this Award Agreement, and the Screen.

Exhibit 10(ii) McCORMICK & COMPANY, INC. 2022 OMNIBUS INCENTIVE PLAN TERMS OF RESTRICTED STOCK UNITS AWARD AGREEMENT The following terms and conditions in this agreement (together with the RSU Covenants Addendum attached hereto, this “Award Agreement”) apply to restricted stock units granted under the 2022 Omnibus Incentive Plan by McCORMICK & COMPANY, INC., a Maryland corporation, with its principal offices in Baltimore County, Maryland (hereinafter called the “Company”). RECITALS WHEREAS, the Board of Directors of the Company (the “Board”) believes that the interests of the Company and its stockholders will be advanced and the Company’s overall managerial strength will be enhanced by encouraging its officers and other key employees to become owners of common stock of the Company (“Shares”); and WHEREAS, the Board approved and adopted the Company’s 2022 Omnibus Incentive Plan (the “Plan”) on January 25, 2022, effective March 30, 2022, subject to the approval of the Company’s stockholders; and WHEREAS, the Company’s stockholders approved the Plan on March 30, 2022; and WHEREAS, one of the purposes of the Plan is to provide an inducement to certain officers and other key employees of the Company and its affiliates (each a “Grantee”) to acquire Shares; and WHEREAS, the Board has authorized and approved the grant of this Award (defined below) pursuant to the Plan, this Award Agreement and the terms described on the Screen (defined below); and WHEREAS, this Award and any restricted stock units previously granted to the Grantee (whether vested or unvested) are conditioned on and subject to the terms of the Plan and this Award Agreement. NOW THEREFORE, in consideration of the foregoing and of the covenants and agreements set forth below, the terms of this Award and this Award Agreement consist of the following: 1. Grant of Restricted Stock Units Details of the Grantee’s Award are described on the screen captioned “Grants & Awards” in the Computershare website (the “Screen”). On the grant date specified on the Screen (the “Grant Date”), the Company granted restricted common stock units (“Restricted Stock Units”) to the Grantee for the number of Shares identified as granted on the Screen (the “Award”). The Restricted Stock Units shall become vested in accordance with the vesting

2 schedule described in Section 3 (Vesting of Restricted Stock Units). Each Restricted Stock Unit shall represent one hypothetical Share, without par value. Each Restricted Stock Unit shall at all times be equal in value to one Share. The Company shall credit each Restricted Stock Unit to a bookkeeping account that the Company shall maintain for the Grantee until the Company issues Shares with respect to such Restricted Stock Unit in accordance with Section 4 (Issuance of Shares) or such Restricted Stock Unit is forfeited in accordance with Section 3 (Vesting of Restricted Stock Units). 2. Restrictions on Transfer of Restricted Stock Units The Restricted Stock Units herein granted and the rights and privileges conferred hereby shall not be transferred, assigned, pledged, or hypothecated in any way (whether by operation of law or otherwise) and shall not be subject to execution, attachment, or similar process. Upon any attempt to transfer, assign, pledge, hypothecate, or otherwise dispose of said Restricted Stock Units or of any right or privilege conferred hereby contrary to the provisions hereof or upon the levy of any attachment or similar process upon the rights and privileges conferred hereby, these Restricted Stock Units and the rights and privileges conferred hereby shall immediately become null and void. 3. Vesting of Restricted Stock Units (a) The Restricted Stock Units shall vest over a period of three years as follows: 33-1/3% of the Restricted Stock Units, rounded down to the closest whole number, shall become vested and non-forfeitable on March 15th of each of the first and second year following the Grant Date, and the remaining Restricted Stock Units shall become vested and non- forfeitable on March 15th of the third year following the Grant Date (hereinafter referred to collectively as the “Vesting Dates”); provided, that the Grantee continues in the employ of the Company from the Grant Date until the applicable Vesting Date. Except as provided in the remainder of this Section 3 (Vesting of Restricted Stock Units), if the Grantee ceases to be an employee of the Company prior to a Vesting Date, the Restricted Stock Units that would otherwise vest on such Vesting Date and any subsequent Vesting Date shall be immediately forfeited. (b) Notwithstanding the provisions of Section 3(a), any outstanding Restricted Stock Units shall immediately become vested and non-forfeitable if the Grantee ceases to be an employee of the Company on account of Disability, death, Retirement, or a Change in Control Termination. If such Restricted Stock Units become vested and non-forfeitable pursuant to this Section 3(b), the date of the Grantee’s Disability, death, Retirement, or the date of the Change in Control Termination (or, if later, the Grant Date), whichever applies, shall be treated as the Vesting Date for purposes of this Award Agreement. (c) Notwithstanding the provisions of Section 3(a), if the Grantee has a Qualifying Termination (as such term is defined in the McCormick & Company, Incorporated Severance Plan for Senior Employees (the “Severance Plan”)), any outstanding Restricted Stock Units and outstanding restricted stock units previously granted (collectively, the “Outstanding RSUs”) that would have vested, in accordance with the applicable vesting schedule, during the 12-month period following such Qualifying Termination, shall immediately vest. If the Grantee’s

3 Qualifying Termination subsequently becomes a Change in Control Termination, the provisions of Section 3(b) shall be immediately applied to any Outstanding RSUs that were unvested after application of this Section 3(c). For purposes of this Award Agreement, “Retirement” means termination of employment at or after age 55. 4. Issuance of Shares (a) The Company shall issue to the Grantee (or, in the event of the Grantee’s death, to the Grantee’s personal representative) Shares corresponding to vested Restricted Stock Units, net of any applicable withholding taxes, as soon as practicable following the Vesting Date and in no event later than March 15th of the year following the Vesting Date, except as provided in the next sentence. If the Vesting Date occurs by reason of the Grantee’s Retirement, payment shall be made during the 90-day period immediately following the earliest of: (i) (A) March 15th of the year immediately following the Grant Date with respect to the Restricted Stock Units that would otherwise vest on that date, (B) March 15th of the second year following the Grant Date with respect to the Restricted Stock Units that would otherwise vest on that date, and (C) March 15th of the third year following the Grant Date with respect to the remaining Restricted Stock Units; (ii) the date of the Grantee’s death; (iii) the date of the Grantee’s Disability; provided, that such Disability constitutes a “disability” within the meaning of Treas. Reg. § 1.409A-3(i)(4); (iv) the date of a Qualifying Termination; or (v) the date of a Change in Control Termination. (b) No Shares shall be issued to the Grantee under this Award Agreement before the applicable Vesting Date. (c) The Company’s obligations to the Grantee with respect to the Restricted Stock Units shall be satisfied in full upon the issuance of Shares with respect to the Restricted Stock Units that vest in accordance with Section 3 (Vesting of Restricted Stock Units), net of any applicable withholding taxes, or upon the forfeiture of such Restricted Stock Units in accordance with Section 3 (Vesting of Restricted Stock Units). 5. Dividend, Voting and Other Rights (a) The Restricted Stock Units are not Shares, and the Grantee shall therefore have no voting, dividend, or other shareholder rights by reason of receiving or being credited with Restricted Stock Units pursuant to this Award Agreement unless and until Shares are issued to the Grantee pursuant to Section 4 (Issuance of Shares).

4 (b) This Award Agreement represents only an unfunded and unsecured promise by the Company. The Grantee’s rights under this Award Agreement shall be limited to those of an unsecured general creditor of the Company. 6. Forfeiture of Outstanding RSUs and Gain on Any Outstanding RSUs The Grantee shall be required to forfeit to the Company (a) any Outstanding RSUs and (b) any gain realized on account of any Outstanding RSUs (including any Shares issued to the Grantee in connection with the vesting of such awards) in the event the Grantee takes any action in violation or breach of, or in conflict with, this Award Agreement (including the RSU Covenants Addendum attached hereto), any employment agreement, non-competition agreement, any agreement prohibiting solicitation of employees or clients of the Company or any of its affiliates, or any confidentiality obligation with respect to the Company or any of its affiliates or otherwise in competition with the Company or any of its affiliates. The Company shall annul this Award if the Grantee is an employee of the Company or any of its affiliates and is terminated for Cause or otherwise as required under the Plan. 7. Successor This Award shall be binding upon and inure to the benefit of any successor or successors of the Company. 8. Compliance with Law The Company shall make reasonable efforts to comply with all applicable federal and state securities laws. Notwithstanding any other provision of this Award Agreement, the Company shall not be obligated to issue any Shares pursuant to this Award Agreement if the issuance thereof would result in a violation of any law. 9. Section 409A of the Internal Revenue Code (a) Except as provided in Section 9(b), it is intended that the Restricted Stock Units and this Award Agreement shall qualify as a short-term deferral arrangement described in Treas. Reg. § 1.409A-1(b)(4), and any successor thereto, and that, as a result, the Restricted Stock Units and this Award Agreement shall not be subject to the provisions of Section 409A of the Code (“Section 409A”). This Award Agreement and the Plan shall be administered in a manner consistent with the foregoing intent, and, except as provided in Section 9(b), any provision that would cause such Restricted Stock Units or this Award Agreement to be subject to Section 409A shall have no force or effect until this Award Agreement is amended to avoid the application of Section 409A (which amendment may be retroactive to the extent permitted by Section 409A and may be made by the Company without the Grantee’s consent). However, should this Award be subject to Section 409A and if the Grantee is a “Specified Employee” (within the meaning set forth Section 409A(a)(2)(B)(i) of the Code) as of the date of his or her separation from service (within the meaning of Treas. Reg. § 1.409A-1(h)), then the issuance of any Shares that would otherwise be made upon the date of the separation from service or within the first six months thereafter will not be made on the originally scheduled date(s) and will instead be issued in a lump sum on the date that is six months and one day after the date of the separation from service, with the balance of the Shares issued thereafter in accordance with the

5 original vesting and issuance schedule, but if and only if such delay in the issuance of the Shares is necessary to avoid the imposition of taxation on the Grantee in respect of the Shares under Section 409A. Each installment of Restricted Stock Units that vests is a “separate payment” for purposes of Treas. Reg. § 1.409A-2(b)(2). (b) Notwithstanding Section 9(a), the parties recognize that if the Grantee is eligible to retire before the applicable Vesting Date, all or a portion of the Restricted Stock Units will likely no longer be subject to a “substantial risk of forfeiture,” within the meaning of Treas. Reg. § 1.409A-1(d), on the date on which the Grantee becomes eligible to retire (or, if later, the Grant Date). Any such Restricted Stock Units will likely be subject to, rather than exempt from, Section 409A, but shall comply with Section 409A because they are payable on a permissible payment event within the meaning of Treas. Reg. § 1.409A-3(b). 10. Withholding The Company (and/or the Grantee’s local employer) shall, in its discretion, have the right to deduct or withhold from payments of any kind otherwise due to the Grantee, or require the Grantee to remit to the Company (and to his or her local employer), an amount sufficient to satisfy taxes imposed under the laws of any country, state, province, city, or other jurisdiction, including income taxes, capital gain taxes, transfer taxes, and social security contributions that are required by law to be withheld with respect to the Plan, the grant of restricted stock units, the payment of Shares or cash under this Award Agreement, the sale of Shares acquired hereunder, and/or the payment of dividends on Shares acquired hereunder, as applicable. A sufficient number of Shares resulting from payout of this Award at vesting may be retained by the Company to satisfy any tax withholding obligation. 11. No Right to Continued Employment Neither the Plan, this Award Agreement, the grant of Restricted Stock Units, the payment of Shares or cash under this Award Agreement, the sale of Shares acquired hereunder, and/or the payment of dividends on Shares acquired hereunder, as applicable, gives the Grantee any right to continue to be employed by the Company (or the Grantee’s local employer), or limits, in any way, the right of the Company (or the Grantee’s local employer) to change the Grantee’s compensation or other benefits or to terminate the Grantee’s employment at any time for any reason not specifically prohibited by law. 12. Electronic Delivery The Company may, in its sole discretion, decide to deliver any documents related to current or future participation in the Plan by electronic means or request the Grantee’s consent to participate in the Plan by electronic means. The Grantee hereby consents to receive such documents by electronic delivery and agrees to participate in the Plan through an online or electronic system established and maintained by the Company or a third party designated by the Company.

6 13. Governing Law and Venue All disputes arising under or growing out of the Restricted Stock Units or the provisions of this Award Agreement shall be governed by and construed in accordance with the laws of the State of Maryland, United States of America, as provided in the Plan, without regard to such state’s conflict of laws rules. If any dispute arises directly or indirectly from the relationship of the parties evidenced by this Award and this Award Agreement, the parties hereby submit to and consent to the exclusive jurisdiction of the State of Maryland and agree that such litigation shall be conducted only in the courts of Baltimore County, Maryland, and no other courts, where the grant of the Restricted Stock Units are made and/or to be performed. 14. Severability The provisions of this Award Agreement are severable and if any one or more provisions are determined to be illegal or otherwise unenforceable, in whole or in part, the remaining provisions shall nevertheless be binding and enforceable. 15. Imposition of Other Requirements The Company reserves the right to impose other requirements on the Grantee’s participation in the Plan, on the Restricted Stock Units and on any Shares acquired under the Plan, to the extent the Company determines it is necessary or advisable to comply with local law or facilitate the administration of the Plan, and to require the Grantee to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing. 16. Relation to Plan This Award Agreement is subject to the terms and conditions of the Plan. In the event of any inconsistency or conflict between this Award Agreement and the Plan, the Plan shall govern. The Plan and this Award Agreement shall be administered by the Committee in accordance with the provisions of section 4 of the Plan. Except as expressly provided in this Award Agreement, capitalized terms used herein shall have the meanings ascribed to them in the Plan or on the Screen. 17. Acceptance of Award In consideration for the Restricted Stock Units and by accepting this Award Agreement, the Grantee agrees and acknowledges that: (a) All restricted stock units previously granted to the Grantee and all Restricted Stock Units granted under this Award Agreement are subject to the RSU Covenants Addendum attached hereto, the terms of which are fully incorporated herein. (b) The award of Restricted Stock Units hereunder and any future awards under the Plan are entirely voluntary, and at the complete discretion of the Company. Neither the award of Restricted Stock Units hereunder, nor any future awards by the Company, shall be deemed to create any obligation to grant any other awards, whether or not such a reservation is explicitly stated at the time of any such award. The Board has the right, at any time, to amend,

7 suspend, discontinue or terminate the Plan, this Award, and/or this Award Agreement; provided, that the Grantee’s consent to such action shall be required unless the Administrator determines that the action, taking into account any related action, would not materially and adversely affect the Grantee’s rights under the Plan. (c) Neither the Company, the Grantee’s local employer, nor any member of the Board or of the Committee shall have any liability of any kind to the Grantee for any action taken or not taken in good faith under the Plan; for any change, amendment, or cancellation of the Plan or this Award; or for the failure of this Award to realize intended tax consequences or to comply with any other law, compliance with which is not required on the part of the Company. (d) The Grantee has reviewed the Plan, this Award Agreement, and the Screen in their entirety, has had an opportunity to obtain the advice of counsel prior to accepting this Award Agreement, and fully understands all provisions of the Plan, this Award Agreement, and the Screen. **ADDENDUM APPEARS ON THE FOLLOWING PAGE**

RSU COVENANTS ADDENDUM In consideration for the benefits made available under the Plan, the Grantee agrees to the covenants set forth in this RSU Covenants Addendum (this “Addendum”) (whether or not the Grantee’s Restricted Stock Units vest). The covenants in this Addendum do not supersede, restrict, or otherwise limit the Grantee’s obligations under any other covenants applicable in connection with the Grantee’s employment with or service to the Company. 1. Invention Assignment Any and all inventions and discoveries that the Grantee makes while he or she is in the employ of the Company relating directly or indirectly to or useful in any activity or enterprise of the Company shall belong to the Company, whether discovered during or after regular working hours. The Grantee will, upon request of the Company, make application for a patent on any such invention or discovery that he or she may make, and will, upon request of the Company, make and execute any and all assignments in writing which may be deemed by the Company as proper to assign and transfer to the Company all the right, title and interest of the Grantee in and to any and all such patents or patent rights issued by the United States or any other country in which the Grantee may have any interest during the term of his or her said employment. The Company will assume the expenses of preparing, applying for, and registering any such patents or assignments. 2. Confidentiality During the period of the Grantee’s employment with the Company, the Grantee may have been exposed to confidential, proprietary information and trade secrets of the Company or its customers. The Grantee understands that maintenance of the proprietary character of such information to the fullest extent possible is important to the Company. Accordingly for so long as any such confidential information and trade secrets may remain confidential, secret, or otherwise wholly or partially protected either during or after such employment, the Grantee will not use or divulge such information except as specifically permitted by the Company. 3. Non-Competition and Non-Solicitation During the period of the Grantee’s employment with the Company and for the twelve (12) month period continuing after the Grantee’s termination of employment for any reason, the Grantee will not (a) seek or accept employment, directly or indirectly, with any entity that directly competes with the Company, including its subsidiaries and affiliates, in its and their core product categories, in any capacity involving the performance of services like or related to the services that the Grantee performed for the Company at any time during the past seven (7) years or (b) solicit, for the benefit of any competitor of the Company, any entity or person who was or is a customer or employee of the Company as of the Grantee’s termination date. 4. Nondisparagement The Grantee will not communicate, make or cause to be made, any derogatory, defamatory or disparaging remarks, statements or communications about the Company or any related or affiliated entities and persons, including the personal and/or business reputations,

9 practices, products, services or conduct of the Company, or any related or affiliated entities and persons; this includes in-person communications, electronic communications, and communication via social media websites. Likewise, no officer or director of the Company will communicate any derogatory, defamatory or disparaging remarks, statements or communications about the Grantee. 5. Cooperation The Grantee will answer any questions that may arise and make himself or herself reasonably available to assist the Company in its transition following the Grantee’s termination of employment and to cooperate with any other reasonable requests by the Company which may require his or her services after his or her termination of employment. For purposes of this Addendum, the transition period shall be for the one (1) year period following the Grantee’s termination of employment for any reason. The Grantee will not seek or be entitled to any additional compensation for such assistance or cooperation. 6. Company Property The Grantee will promptly return to the Company all property belonging to the Company (but in no event later than the Grantee’s termination date), including all keys, phones, computers, mobile phones, credit cards, computer and other passwords, equipment and supplies, as well as all documents prepared by or for the Company, and not otherwise made available to the general public. 7. Protected Whistleblower Activities Notwithstanding the foregoing, nothing in this Addendum, the Award Agreement, the Plan or any other agreement with the Company prohibits the Grantee from reporting or disclosing any actual, possible or potential violation of any federal, state or local law or regulation to any governmental agency or entity, or making other reports or disclosures that are protected under the whistleblower provisions of any federal, state or local law or regulation, in each such case without any prior authorization of, or prior, contemporaneous or subsequent notice to, the Company. Under the Defend Trade Secrets Act, 18 U.S.C. § 1833(b), the Grantee may be entitled to immunity for certain disclosures to his or her attorney or government officials.

Exhibit 10(i) 1 DC: 6300319-4 McCORMICK & COMPANY, INC. 2022 OMNIBUS INCENTIVE PLAN LONG-TERM PERFORMANCE PLAN AGREEMENT Performance Cycle ___ The following terms and conditions in this agreement (together with the LTPP Covenants Addendum attached hereto, this “Agreement”) apply to Long-Term Performance Plan awards granted under the 2022 Omnibus Incentive Plan by McCORMICK & COMPANY, INC., a Maryland corporation, with its principal offices in Baltimore County, Maryland (hereinafter called the “Company”). RECITALS WHEREAS, the Board of Directors of the Company (the “Board”) believes that the interests of the Company and its stockholders will be advanced by providing an incentive to senior management to cause the Company to achieve certain of its financial goals and strategic objectives over a period of years; and WHEREAS, the Board approved and adopted the Company’s 2022 Omnibus Incentive Plan (the “Plan”) on January 25, 2022, effective March 30, 2022, subject to the approval of the Company’s stockholders; and WHEREAS, the Company’s stockholders approved the Plan on March 30, 2022; and WHEREAS, the Plan permits the Company to grant cash-based incentive awards to reward employees and others for the achievement of performance goals, as well as the grant of restricted stock units, options and other equity-based awards to align the interests of its employees, directors and others with the interests of its stockholders; and WHEREAS, pursuant to the Plan, the Compensation Committee of the Board (with respect to participating employees that are executive officers) and the Management Committee of the Company (with respect to all other participating employees) (the Compensation Committee and the Management Committee being referred to herein as the “Committee” as applicable) have established a Long-Term Performance Plan, which is intended to provide an inducement to certain senior executives of the Company to cause the Company to achieve specified financial goals over a period of three years; and WHEREAS, the Committee has designated the employee (the “Employee”) receiving this award as a participant in the Long-Term Performance Plan and has established performance goals and measures, and an incentive award target, for the three year performance cycle beginning on _______, and ending on _______; and NOW THEREFORE, in consideration of the foregoing and of the covenants and agreements set forth below, the parties hereby agree as follows: 1. Grant of Participation Right. Details of the Employee’s Long-Term Performance Plan award, including the value of the Employee’s target stock award (in Shares, subject to adjustment based upon the achievement of pre-established performance goals), for sales and total shareholder return for the Company are described on the screen captioned “Grants & Awards” in the Computershare website (the “Screen”). The award (the “Award”) is for the performance cycle beginning on ________, and ending on _______ (the “Performance Cycle”). No award will be paid to the Employee unless the Company achieves cumulative sales growth of at least __% at the end of the performance cycle. 2. Performance Goals. The total number of Shares that will be payable pursuant to this Award will be determined by calculating the percentage of the target Award that is earned based on growth