Form 8-K KAMAN Corp For: May 21

[EXECUTION VERSION]

ASSET PURCHASE AGREEMENT

BY AND BETWEEN

PARKER-HANNIFIN CORPORATION,

KAMAN NEWCO, LLC

AND

KAMAN AEROSPACE GROUP, INC.

DATED AS OF

MAY 21, 2022

TABLE OF CONTENTS

Page

ARTICLE I DEFINITIONS | 1 | ||||

1.1 Certain Defined Terms | 1 | ||||

1.2 Other Defined Terms | 11 | ||||

1.3 Certain Interpretive Matters. | 12 | ||||

ARTICLE II PURCHASE AND SALE | 14 | ||||

2.1 Purchase and Sale of the Sold Assets | 14 | ||||

2.2 Excluded Assets | 16 | ||||

2.3 Assumption of Liabilities; Retained Liabilities. | 18 | ||||

2.4 Purchase Price | 18 | ||||

2.5 Purchase Price Adjustment | 19 | ||||

2.6 Allocation of Total Consideration | 22 | ||||

2.7 Prorations | 23 | ||||

2.8 The Closing | 23 | ||||

2.9 Deliveries at the Closing | 23 | ||||

2.10 Further Assurances. | 24 | ||||

ARTICLE III REPRESENTATIONS AND WARRANTIES OF THE Seller | 24 | ||||

3.1 Organization | 25 | ||||

3.2 Authorization; Enforceability | 25 | ||||

3.3 Financial Information; No Undisclosed Liabilities | 25 | ||||

3.4 Sufficiency of the Assets | 25 | ||||

3.5 No Approvals or Conflicts | 26 | ||||

3.6 Compliance with Law; Permits | 26 | ||||

3.7 Proceedings | 27 | ||||

3.8 Absence of Certain Changes | 27 | ||||

3.9 Tax Matters. | 27 | ||||

3.10 Employee Benefits | 28 | ||||

3.11 Business Employees and Labor Relations | 28 | ||||

3.12 Intellectual Property; Privacy and Data Security | 29 | ||||

3.13 Contracts | 30 | ||||

3.14 Environmental Matters | 31 | ||||

3.15 Insurance | 32 | ||||

3.16 Personal Property Assets | 32 | ||||

i

NAI-1530851850v2 | ||

TABLE OF CONTENTS

(continued)

Page

3.17 Real Property. | 32 | ||||

3.18 Customers and Suppliers. | 33 | ||||

3.19 Government Contracts | 33 | ||||

3.20 Affiliate Transactions | 34 | ||||

3.21 No Brokers’ or Other Fees | 34 | ||||

3.22 Anticorruption | 34 | ||||

3.23 Sanctions and Export Control | 34 | ||||

3.24 No Other Representations or Warranties | 34 | ||||

ARTICLE IV REPRESENTATIONS AND WARRANTIES OF THE BUYER | 35 | ||||

4.1 Organization | 35 | ||||

4.2 Authorization; Enforceability | 35 | ||||

4.3 No Approvals or Conflicts | 35 | ||||

4.4 Proceedings | 36 | ||||

4.5 Compliance with Laws; Permits | 36 | ||||

4.6 Financial Capacity | 36 | ||||

4.7 No Brokers’ or Other Fees | 36 | ||||

4.8 No Other Representations or Warranties | 36 | ||||

4.9 Solvency. | 37 | ||||

4.10 No Knowledge of Misrepresentations or Omissions | 37 | ||||

ARTICLE V COVENANTS AND AGREEMENTS | 37 | ||||

5.1 Conduct of Business Prior to the Closing | 37 | ||||

5.2 Access to Books and Records | 39 | ||||

5.3 Cooperation; Regulatory Matters | 40 | ||||

5.4 Tax Matters. | 43 | ||||

5.5 Employees; Employment Matters | 44 | ||||

5.6 Labor Matters | 47 | ||||

5.7 Contact with Customers and Suppliers | 48 | ||||

5.8 Non-Solicitation | 48 | ||||

5.9 Further Actions | 48 | ||||

5.10 Bulk Transfer Laws | 52 | ||||

5.11 Confidentiality | 52 | ||||

5.12 Use of Names Following Closing and Other Intellectual Property | 53 | ||||

5.13 Notification of Certain Matters | 55 | ||||

5.14 Intercompany Obligations | 55 | ||||

5.15 Shared Contracts | 55 | ||||

-ii-

TABLE OF CONTENTS

(continued)

Page

5.16 Release | 56 | ||||

5.17 Insurance | 57 | ||||

5.18 Novation. | 57 | ||||

5.19 Certain Research and Development Matters | 59 | ||||

ARTICLE VI CONDITIONS TO THE SELLER’S OBLIGATIONS | 59 | ||||

6.1 Competition/Foreign Investment Laws | 60 | ||||

6.2 Buyer Approval | 60 | ||||

6.3 Governmental Orders | 60 | ||||

6.4 Acquisition | 60 | ||||

ARTICLE VII CONDITIONS TO THE BUYER’S OBLIGATIONS | 60 | ||||

7.1 Competition/Foreign Investment Law | 60 | ||||

7.2 Governmental Orders | 60 | ||||

ARTICLE VIII TERMINATION | 60 | ||||

8.1 Termination | 60 | ||||

8.2 Procedure and Effect of Termination | 61 | ||||

ARTICLE IX INDEMNIFICATION | 62 | ||||

9.1 Survival | 62 | ||||

9.2 Indemnification by the Seller | 62 | ||||

9.3 Indemnification by the Buyer | 62 | ||||

9.4 Indemnification as Exclusive Remedy | 63 | ||||

9.5 Indemnification Calculations | 63 | ||||

9.6 Notice and Opportunity to Defend | 64 | ||||

9.7 Additional Limitations | 64 | ||||

9.8 Certain Acknowledgements | 65 | ||||

9.9 R&W Insurance Policy | 65 | ||||

ARTICLE X MISCELLANEOUS | 66 | ||||

10.1 Fees and Expenses | 66 | ||||

10.2 Governing Law | 66 | ||||

10.3 Further Acknowledgements | 66 | ||||

10.4 Amendment | 68 | ||||

10.5 No Assignment | 68 | ||||

10.6 Waiver | 69 | ||||

10.7 Notices | 69 | ||||

10.8 Complete Agreement | 70 | ||||

10.9 Counterparts | 70 | ||||

10.10 Publicity | 70 | ||||

-iii-

TABLE OF CONTENTS

(continued)

Page

10.11 Severability | 71 | ||||

10.12 Third Parties | 71 | ||||

10.13 Non-Recourse | 71 | ||||

10.14 Jurisdiction | 71 | ||||

10.15 Specific Performance | 72 | ||||

10.16 Waiver of Jury Trial | 72 | ||||

10.17 Privileged Communications | 72 | ||||

10.18 Guarantee | 72 | ||||

10.19 Financing Parties | 74 | ||||

-iv-

EXHIBITS

Exhibit A – Assumption Agreement

Exhibit B – Bill of Sale

Exhibit C – Illustrative Calculation of Working Capital

Exhibit D – Deed

Exhibit E – Patent Assignment Agreement

Exhibit F – Pre-Novation Subcontract Agreement

Exhibit G – Transition Services Agreement

-v-

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (this “Agreement”), dated as of May 21, 2022, is made and entered into by and between Parker-Hannifin Corporation, an Ohio corporation (the “Seller”), Kaman Newco, LLC, a Delaware limited liability company (the “Buyer”) and, solely for purposes of Section 10.18, Kaman Aerospace Group, Inc., a Connecticut corporation (the “Guarantor”). The Seller and the Buyer are each a “Party” and collectively, the “Parties.”

RECITALS

WHEREAS, the Seller, through its Aircraft Wheel and Brake Division, is and has been engaged in the design, development, manufacturing, testing, marketing, sale, distribution or service of wheel and brake technology and solutions for fixed-wing aircraft and rotorcraft (the “Business”);

WHEREAS, the Seller has announced, pursuant to Rule 2.7 of the United Kingdom City Code on Takeovers and Mergers, the terms of its offer (the “Offer”) to acquire (the “Acquisition”) Meggitt plc (“Meggitt”), which is intended to be implemented by means of a court-sanctioned scheme of arrangement under Part 26 of the UK Companies Act 2006;

WHEREAS, the Acquisition is conditional on, among other things, receipt of certain regulatory approvals;

WHEREAS, for purposes of obtaining certain regulatory approvals in connection with the consummation of the Acquisition, the Seller desires to sell the Sold Assets and transfer the Assumed Liabilities to the Buyer upon the terms and conditions contained in this Agreement; and

WHEREAS, the Buyer desires to purchase the Sold Assets and assume the Assumed Liabilities from the Seller upon the terms and conditions contained in this Agreement.

NOW, THEREFORE, in consideration of the foregoing and the representations, warranties, covenants and agreements herein contained, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, and intending to be legally bound hereby, the Parties hereby agree as follows:

ARTICLE I

DEFINITIONS

1.1Certain Defined Terms. As used in this Agreement, the following terms shall have the following meanings:

“Accounting Methods” shall mean the accounting principles and practices set forth on Schedule 1.1(a).

“Acquisition Longstop Date” means the Longstop Date as defined in the Cooperation Agreement dated August 2, 2021, between the Seller and Meggitt, which is “2 February 2023 or such later date as may be agreed in writing by the Seller and Meggitt (where required by the Panel or with the Panel’s consent and as the Court may approve (if such consent(s) or approval(s) is/are required)).”

“Affiliate” shall mean, with respect to any Person, any Family Member of such Person and any other Person controlling, controlled by or under common control with such Person as of the date on which, or at any time during the period for which, the determination of affiliation is being made.

“Ancillary Agreements” shall mean (a) the Assumption Agreement, (b) the Bill of Sale, (c) the Deed, (d) the Patent Assignment Agreement, (e) the Pre-Novation Subcontract Agreement and (f) the Transition Services Agreement.

“Assumption Agreement” shall mean the assumption agreement substantially in the form of Exhibit A.

“Authorized Leave” shall mean a Business Employee’s absence from work covered under (a) a written long-term or short-term disability Seller Benefit Plan, or (b) any workers compensation leave program, military leave program or other Seller authorized leave of absence other than the use of vacation time or paid time off.

“Bill of Sale” shall mean the bill of sale substantially in the form of Exhibit B.

“Business Day” shall mean any day that is not a Saturday, a Sunday or other day on which banks are required or authorized by Law to be closed in the city of Cleveland, Ohio.

“Business Employee” shall mean the employees of the Seller or its Affiliates who are listed on Schedule 1.1(b).

“Business Material Adverse Effect” shall mean any change, effect, event, occurrence, state of facts or development (“Effect”) that has a material adverse effect on the business, results of operations or financial condition of the Business, taken as a whole, but none of the following shall be deemed either alone or in combination to constitute, and none of the following shall be taken into account in determining whether there has been a Business Material Adverse Effect: (a) any adverse Effect affecting generally companies in the industries in which the Seller operates the Business or (b) any adverse Effect caused by or resulting from (i) any national, international, foreign, domestic or regional economic, financial, social or political conditions (including changes therein), including (A) hostilities, acts of war, protests, riots, unrest, sabotage, terrorism, cyberterrorism or cybercrime or military actions and any escalation or worsening of the same; (B) changes in any financial, debt, credit, capital or banking markets or conditions; and (C) changes in interest, currency or exchange rates or tariffs or any trade wars; (ii) any act of God, hurricane, flood, tornado, fire, explosion, weather event, earthquake, landslide, other natural disaster, epidemic, pandemic (including

2

COVID-19), plague, other outbreak of illness or public health event (whether human or animal); (iii) changes in legal or regulatory conditions, including changes or proposed changes in Law or interpretations thereof (whether or not related to the COVID-19 pandemic or other pandemics, epidemics or public health emergencies); (iv) compliance by the Seller with its covenants and agreements contained in this Agreement; (v) the failure of the financial or operating performance of the Business to meet internal projections or budgets for any period prior to, on or after the date of this Agreement (it being understood that any underlying facts giving rise or contributing to such failure that are not otherwise excluded from the definition of “Business Material Adverse Effect” may be taken into account in determining whether there has been a Business Material Adverse Effect); (vi) the announcement or performance of this Agreement or the transactions contemplated hereby, including any losses of employees, cancelations of or delays in customer orders, any reduction in sales, any disruption in supplier, customer, distributor and similar relationships or the failure to obtain any supplier, customer or distributor consents; (vii) any matter or other item disclosed on the Disclosure Schedules or any fact known by the Buyer as of the date hereof; (viii) any changes in applicable accounting rules; (ix) any actions required under this Agreement to obtain any approval, waiver or consent from any Person; (x) any act or omission taken or not taken with the Buyer’s consent, whether or not required under this Agreement; or (xi) any material breach by the Buyer of its obligations under this Agreement; provided that, to the extent that any Effect in clauses (a), (b)(i), (b)(ii) or (b)(iii) materially and disproportionately has a greater adverse impact on the Business, taken as a whole, as compared to the adverse impact such Effect has on other Persons that are similarly situated and operating in the same industries as the Business operates, then only the incremental material and disproportionate impact of such Effect on the Business, taken as a whole, shall be taken into account in determining whether a Business Material Adverse Effect has occurred.

“Closing Working Capital” shall mean the Working Capital as of the Closing.

“Code” shall mean the Internal Revenue Code of 1986, as amended.

“Commitment Letter” means that certain Commitment Letter dated as of May 21, 2022, by and among Kaman Corporation, a Connecticut corporation, and JPMorgan Chase Bank, N.A.

“Competition/Foreign Investment Law” shall mean the HSR Act and any other Law that prohibits, restricts or regulates competition, foreign investment, national security, antitrust, monopolization or restraint of trade.

“Confidentiality Agreement” shall mean the confidentiality agreement dated March 22, 2022 between the Buyer and the Seller.

“control” (including the terms “controlled by” and “under common control with”), with respect to the relationship between or among two or more Persons, shall mean the possession, directly or indirectly, of the power to direct or cause the direction of the affairs or management of a Person, whether through the ownership of voting securities,

3

by contract or otherwise, including the ownership, directly or indirectly, of securities having the power to elect a majority of the board of directors or similar body governing the affairs of such Person.

“Court” means the High Court of Justice in England and Wales.

“COVID-19” shall mean SARS-Co-V-2 or COVID-19, and any variants, evolutions or mutations thereof or related or associated epidemics, pandemics, disease outbreaks or public health emergencies.

“COVID-19 Measures” shall mean any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut down, closure, sequester, safety or similar Law, directives, guidelines or recommendations promulgated by any Governmental Authority, including the Centers for Disease Control and Prevention and the World Health Organization, in each case with respect to or in response to COVID-19 (or any worsening or escalation thereof), including the CARES Act and the Families First Act.

“Current Assets” shall mean the current assets of the Business included in the line items of the Illustrative Calculation of Working Capital set forth in Exhibit C.

“Current Liabilities” shall mean the current liabilities of the Business included in the line items of the Illustrative Calculation of Working Capital set forth in Exhibit C.

“Debt Obligations” shall mean, with respect to any Person as of any date without duplication, (a) the principal of and accreted value and accrued but unpaid interest in respect of (i) indebtedness for borrowed money of such Person, and (ii) indebtedness evidenced by notes, bonds, debentures or other similar instruments, the payment of which is such Person’s responsibility or liability, (b) all obligations of such Person for the deferred purchase price of goods or services (other than trade payables incurred in the ordinary course of business), (c) all indebtedness or obligations of any other Person of the types referred to in the preceding clauses (a) and (b) secured by any Encumbrance on any assets of such Person, and (d) guarantees of obligations of any other Person of the types described in clauses (a) and (b) above by such Person.

“Deed” shall mean the limited warranty deed conveying the Sold Real Property substantially in the form of Exhibit D.

“Disclosure Schedules” shall mean the Schedules delivered by the Seller concurrently with the execution and delivery of this Agreement.

“Encumbrance” shall mean any security interest, pledge, mortgage, lien, transfer restriction, charge, option, easement, adverse claim or right of first refusal.

“Environment” shall mean soil, surface water, groundwater, stream sediment, surface or subsurface strata and ambient air.

4

“Environmental Claim” shall mean any written notice, claim, demand, action, suit, complaint or proceeding by any Person alleging any actual or potential liability or violation under any Environmental Law.

“Environmental Law” shall mean any Law concerning pollution or protection of the Environment, or the management or Release of Hazardous Materials, that is in force and applicable to the operation of the Business.

“ERISA” shall mean the Employee Retirement Income Security Act of 1974, as amended, and the rules and regulations promulgated thereunder.

“Exchange Act” shall mean the U.S. Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Excluded Business” shall mean all of the businesses of the Seller and its Affiliates other than the Business.

“Existing Credit Agreement” shall mean the Second Amended and Restated Credit and Guaranty Agreement dated as of December 13, 2019 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time), by and among Kaman Corporation, a Connecticut corporation, RWG Germany GmbH, a company organized under the laws of Germany, Kaman Lux Holdings S.à r.l., a private limited liability company (société à responsabilité limitée) organized under the laws of the Grand Duchy of Luxembourg, having its registered office at 5, rue de Bonnevoie, L-1260 Luxembourg and registered with the Luxembourg register under number B200.366, the other subsidiary borrowers from time to time party thereto, the guarantor subsidiaries from time to time party thereto, the lenders and other parties from time to time party thereto and JPMorgan Chase Bank, N.A., as administrative agent and collateral agent.

“Family Member” shall mean, with respect to any Person, any child, stepchild, grandchild, parent, stepparent, grandparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law or sister-in-law, including adoptive relationships, of such Person.

“Financing” shall mean, collectively, (a) any financing committed to by the commitment parties under the Commitment Letter and (b) any financing made available or to be made available under the Existing Credit Agreement.

“Financing Entities” shall have the meaning set forth in the definition of “Financing Parties”.

“Financing Parties” shall mean the entities that have committed to provide or otherwise entered into agreements in connection with the Financing, including the parties to the Commitment Letter (and any credit agreements or other loan documentation relating thereto) and/or the Existing Credit Agreement (collectively, the “Financing Entities”) and, in each case, their respective Affiliates and their and their

5

respective Affiliates’ Representatives, stockholders, limited partners or members and their respective successors and assigns; provided that neither Buyer nor any Affiliate of Buyer shall be a Financing Party.

“Fraud” shall mean a knowing and intentional fraud in the making of a representation or warranty expressly stated in ARTICLE III or ARTICLE IV of this Agreement; provided that (a) such representation or warranty was materially false or materially inaccurate at the time such representation or warranty was made, (b) such representation or warranty was made with actual knowledge (and not imputed or constructive knowledge), without any duty of inquiry or investigation, that such representation or warranty was materially false or materially inaccurate, (c) such Party had the specific intent to deceive another Party and induce such Party to enter into this Agreement, and (d) such other Party reasonably relied on such materially false or materially inaccurate representation or warranty in entering into this Agreement. For the avoidance of doubt, “Fraud” shall not include equitable fraud, promissory fraud, unfair dealings fraud or any torts (including fraud), based on constructive or imputed knowledge, negligence or recklessness.

“GAAP” shall mean United States generally accepted accounting principles and practices.

“Government Bid” means any offer or proposal made by the Seller or any of its Affiliates which, if accepted, would result in a Government Contract.

“Government Contract” shall mean any (a) Government Prime Contract or (b) any subcontract under any such contract described in (a) to which the Seller or an Affiliate is a party and which is primarily related to the operation of the Business. A task, purchase or delivery order under a Government Contract will not constitute a separate Government Contract for purposes of this definition, but will be part of the Government Contract to which it relates, unless there is no such Government Contract under which such task, purchase or delivery order was delivered or to which it relates.

“Government Prime Contract” means any prime contract, grant agreement, cooperative agreement or other type of contract with a Governmental Authority to which the Seller or an Affiliate is a party and which is primarily related to the operation of the Business.

“Governmental Authority” shall mean any federal, state, local or foreign government, governmental, regulatory or administrative authority, agency or commission, or instrumentality of government, including state-owned or stated-controlled commercial entities, or any court, tribunal, judicial body or arbitrator (public or private) or any designee of a Governmental Authority, including any monitoring trustee appointed by the European Commission, the U.K. Competition and Markets Authority and/or the U.K. Secretary of State.

“Governmental Authority Settlement Documents” shall mean any and all agreement(s) or commitment(s) between (a) the Seller or the Buyer and (b) any

6

Governmental Authority, related to the approval process under applicable Competition/Foreign Investment Laws for the Acquisition.

“Governmental Order” shall mean any order, writ, injunction, decree, judgment, assessment or arbitration award of a Governmental Authority.

“Hazardous Material” shall mean any material that is listed or defined as a “hazardous substance,” “hazardous waste,” “hazardous material,” “toxic substance,” “pollutant,” “contaminant,” or any other term of similar import under, or any other material regulated due to its potentially harmful or deleterious properties under, any Environmental Law, including petroleum, asbestos, per- and polyfluoroalkyl substances and polychlorinated biphenyls.

“HSR Act” shall mean the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder.

“Intellectual Property” shall mean any and all: (a) patents, (b) trademarks, trade names, brand names, logos and Internet domain or social media names or addresses and their associated goodwill, (c) copyrights and copyrightable works (including Software, databases and related items), (d) inventions, processes, formulae, technology, discoveries, know-how, trade secrets, specifications, designs, plans, manuals, drawings, research and all other confidential or proprietary information, (e) all other intellectual property rights, and all registrations and applications for any of the foregoing and (f) the right to all past and future income, royalties, damages, and payments due with respect to the foregoing, including rights to damages and payments for past, present, or future infringements, misappropriations, or other violations thereof.

“Intercompany Obligations” shall mean all intercompany notes, cash advances and payables between the Seller or its Affiliates (other than the Business), on the one hand, and the Business, on the other hand, including those set forth on Schedule 1.1(c).

“Key Personnel” shall mean the individuals listed on Schedule 1.1(d).

“Knowledge of the Buyer” shall mean the actual knowledge (without inquiry) of the individuals listed on Schedule 1.1(e).

“Knowledge of the Seller” shall mean the actual knowledge (without inquiry) of the individuals listed on Schedule 1.1(f).

“Law” shall mean any statute, law, ordinance, regulation, or rule of any Governmental Authority.

“Liabilities” shall mean any debt, liability or obligation (whether direct or indirect, absolute or contingent, accrued or unaccrued, liquidated or unliquidated, or due or to become due), including all costs and expenses relating thereto.

“Panel” means the UK Panel on Takeovers and Mergers.

7

“Patent Assignment Agreement” shall mean the patent assignment agreement, dated as of the Closing Date, to be entered into between the Seller and the Buyer substantially in the form of Exhibit E.

“Permits” shall mean any permits, concessions, licenses, certificates, registrations, exemptions, approvals and authorizations of any Governmental Authority.

“Permitted Encumbrances” shall mean (a) statutory Encumbrances for Taxes, assessments and other charges of Governmental Authorities not yet due and payable or being contested in good faith, (b) Encumbrances in respect of property or assets imposed by Law or by agreement that were incurred in the ordinary course of business, such as carriers’, warehousemen’s, materialmen’s, mechanics’ and landlord’s liens and other similar liens, and retention of title rights, (c) pledges or deposits made in the ordinary course of business to secure obligations under workers’ compensation laws or similar legislation, (d) any matter that would be revealed by an accurate survey of any real property except as would not, individually or in the aggregate, materially impair the value or continued use and operation of the property to which it relates in the Business as presently conducted, (e) any easements, restrictions, covenants or similar matters relating to real property except as would not, individually or in the aggregate, materially impair the value or continued use and operation of the property to which it relates in the Business as presently conducted, (f) purchase money liens, and (g) non-exclusive licenses in Intellectual Property granted in the ordinary course of business.

“Person” shall mean any individual, partnership, firm, corporation, association, trust, unincorporated organization, joint venture, limited liability company, Governmental Authority or other entity.

“Personal Information” means any information that identifies or, alone or in combination with any other information, could reasonably be used to identify, locate, or contact a natural Person, including name, street address, telephone number, email address, identification number issued by a Governmental Body, credit card number, bank information, customer or account number, online identifier, device identifier, IP address, browsing history, search history, or other website, application, or online activity or usage date, location data, biometric data, medical or health information, or any other information that is considered “personally identifiable information,” “personal information,” or “personal data” under applicable Law.

“Pre-Novation Subcontract Agreement” shall mean the pre-novation subcontract agreement, dated as of the Closing Date, to be entered into by the Seller (or its Affiliate) and the Buyer (or its designated direct or indirect wholly owned subsidiary), substantially in the form of Exhibit F.

“Proceeding” shall mean any judicial, administrative or arbitral actions, suits, claims or counterclaims, litigation, investigation (for which a Governmental Authority has provided notice), criminal prosecution or proceedings (public or private) by or before any Governmental Authority.

8

“Release” shall have the meaning provided in 42 U.S.C. Section 9601(22).

“Retained Names and Marks” shall mean “Parker”, “Hannifin” and “Parker-Hannifin”, the “Parker” logo and the Parker “P” logo, alone or in combination with any other names or works, and together with all non-English equivalents thereof, all variations, derivations and abbreviations thereof, all confusingly or dilutively similar names and marks, any trademarks, trade names, brand marks, brand names, trade dress, logos, URLs, websites and domain and social media names and addresses relating to such names or works and any other identifiers of source containing, in combination with or incorporating the foregoing.

“Sanctioned Country” means a country or territory that is the subject of comprehensive sanctions pursuant to any Sanctions and Export Control Laws.

“Sanctioned Person” means any Person (a) designated on any list maintained pursuant to Sanctions and Export Control Laws, (b) majority-owned by a Person or Persons designated on any such list, or (c) organized or resident in a Sanctioned Country.

“Sanctions and Export Control Laws” means any applicable economic sanctions, trade restrictions or Laws regulating or restricting the import, export or re-export of goods, services, software or technology administered or enforced by the U.S. Government, United Nations, the European Union or the United Kingdom, including the U.S. Office of Foreign Assets Control of the U.S. Department of the Treasury, the U.S. Department of State, U.S. Customs and Border Protection, and the Bureau of Industry and Security of the U.S. Department of Commerce), the United Nations Security Council, the European Union, or Her Majesty’s Treasury.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Laws” means (i) the U.S. Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder, (ii) the Exchange Act, (iii) all other rules and regulations of the SEC, including Regulation S-X, and (iv) the listing rules of the New York Stock Exchange.

“Seller Material Adverse Effect” shall mean a material adverse effect on the ability of the Seller to consummate the transactions contemplated by this Agreement.

“Shared Contract” means the contracts set forth on Schedule 1.1(g) to which the Seller or its Affiliates is a party, which is not primarily related to, used or held for use in the Business, but otherwise relates in part to the Business (and which is not otherwise a Sold Asset).

“Shared Contractual Liabilities” means any Liabilities in respect of Shared Contracts.

“Shared Intellectual Property” means any Intellectual Property, other than the Sold Intellectual Property, the Retained Names and Marks and the Seller’s information

9

technology resources or systems owned or controlled by the Seller or its subsidiaries, which is used non-exclusively by the Business immediately prior to the Closing and as to which the Seller or its Affiliates own or otherwise have the right to grant to the Buyer the rights granted to the Buyer hereunder.

“Shared Seller Policies” means any occurrence-based Business Insurance Policies held in the name of the Seller or any of its Affiliates that are in effect at or prior to the Closing.

“Software” means any and all (a) computer programs, including any and all software implementations of algorithms, models, methodologies, firmware, tools, data files, graphics, schematics,, whether in source code or object code, (b) databases and compilations, including any and all data and collections of data, whether machine readable or otherwise, and (c) all documentation, including user manuals and other training documentation, related to any of the foregoing.

“subsidiaries” shall mean, with respect to any Person, any other Person 50% or more of the voting equity of which is owned, directly or indirectly, by such first Person or by one or more subsidiaries of such first Person or a combination thereof.

“Target Working Capital” shall mean $6,750,000.

“Tax” or “Taxes” shall mean any taxes of any kind, including those on or measured by or referred to as income, gross receipts, capital, sales, use, ad valorem, franchise, profits, license, goods and services, withholding, payroll, employment, excise, severance, stamp, occupation, premium, real property transfer, real property transfer gains, value added, property or windfall profits taxes, customs, duties or similar fees, similar assessments or similar charges, together with any related interest, penalties, additions to tax or additional amounts imposed by any Governmental Authority.

“Tax Return” shall mean any return, form, report or statement required to be filed with any Governmental Authority with respect to Taxes, including any schedule or attachment thereto or amendment thereof.

“Taxing Authority” shall mean, with respect to any Tax, the Governmental Authority that imposes such Tax and the agency (if any) charged with the collection of such Tax for such Governmental Authority.

“Transition Services Agreement” shall mean the transition services agreement, dated as of the Closing Date, to be entered into by the Seller and the Buyer, substantially in the form of Exhibit G.

“Treasury Regulations” shall mean the Treasury Regulations promulgated under the Code.

“Willful Breach” shall mean an action or failure to act by one of the Parties that constitutes a material breach or material violation of any covenant or agreement set forth in this Agreement, and such action was taken or such failure occurred with such

10

Party’s knowledge or intention that such action or failure to act constituted or would cause a material breach or material violation of such covenant or agreement set forth in this Agreement.

“Working Capital” shall mean, as of the date of computation, (a) the Current Assets, minus (b) the Current Liabilities, each computed consistently in accordance with the Accounting Methods.

1.2Other Defined Terms. The following terms shall have the meanings defined for such terms in the Sections set forth below:

| Term | Section | ||||

| Accounting Firm | 5.9(f) | ||||

| Acquisition | Recitals | ||||

| Additional Business Financial Statements | 5.9(f) | ||||

| Agreement | Preamble | ||||

| Assumed Liabilities | 2.3(a) | ||||

| Balance Sheet | 3.3 | ||||

| Balance Sheet Date | 3.3 | ||||

| Business | Recitals | ||||

| Business Financial Statements | 5.9(f) | ||||

| Business Insurance Policies | 3.15 | ||||

| Buyer | Preamble | ||||

| Buyer Indemnified Persons | 9.2 | ||||

Buyer Releasing Parties Buyer’s Flexible Account Plan | 5.16 5.5(h) | ||||

| Buyer’s Welfare Plans | 5.5(e) | ||||

| Closing | 2.8 | ||||

| Closing Balance Sheet | 2.5(b) | ||||

| Closing Date | 2.8 | ||||

| Closing Purchase Price | 2.4 | ||||

| Consent End Date | 5.9(b) | ||||

| CPA Firm | 2.5(c) | ||||

| Effect | Definition of “Business Material Adverse Effect” | ||||

| End Date | 8.1(b) | ||||

| Estimated Balance Sheet | 2.5(a) | ||||

| Estimated Working Capital | 2.5(a) | ||||

| Excluded Assets | 2.2 | ||||

| FAR | 5.18(a) | ||||

| Final Statement | 2.5(c) | ||||

| Final Working Capital | 2.5(b) | ||||

| Flex Plan Amount | 5.5(h) | ||||

| General Enforceability Exceptions | 3.2 | ||||

| Guarantor | Preamble | ||||

| Indemnified Party | 9.6 | ||||

11

| Term | Section | ||||

| Indemnifying Party | 9.6 | ||||

| Interim Business Financial Statements | 5.9(f) | ||||

| Losses | 9.2 | ||||

| Material Contracts | 3.13(a) | ||||

| Meggitt | Recitals | ||||

| Novation Agreement | 5.18(a) | ||||

| Offer | Recitals | ||||

| Other Advisors | 5.9(f) | ||||

| Parker Marks | 5.12(a) | ||||

| Party/Parties | Preamble | ||||

| Post-Closing Statement | 2.5(b) | ||||

| Post-Closing Statement Objection | 2.5(c) | ||||

| Pre-Closing Appeals | 5.4(c) | ||||

Pre-Closing Statement Pre-Novation Period | 2.5(a) 5.18(b) | ||||

| Privileged Communications | 10.17 | ||||

| Purchase Price | 2.4 | ||||

R&W Insurance Policy Retained Liabilities | 9.9 2.3(b) | ||||

| Seller | Preamble | ||||

| Seller Benefit Plans | 3.10(a) | ||||

| Seller Indemnified Persons | 9.3 | ||||

| Seller Released Parties | 5.16 | ||||

| Seller’s Flexible Account Plan | 5.5(h) | ||||

| Seller’s Welfare Plans | 5.5(e) | ||||

| Sold Assets | 2.1 | ||||

| Sold Contracts | 2.1(c) | ||||

| Sold Intellectual Property | 2.1(e) | ||||

| Sold Real Property | 2.1(k) | ||||

| Specified Claims | 5.16 | ||||

| Third Party Claim | 9.6 | ||||

| Total Consideration | 2.4 | ||||

| Transfer Taxes | 5.4(d) | ||||

| Transferred Employees | 5.5(a) | ||||

| Transition | 5.15(a) | ||||

| Year-end Financial Information | 3.3 | ||||

1.3Certain Interpretive Matters.

(a)The words “hereof,” “herein,” “hereby,” “hereinafter” and “hereunder” and words of similar import, when used in this Agreement, the Ancillary Agreements or the Exhibits or Disclosure Schedules hereto, refer to this Agreement, the Ancillary Agreement or the Exhibit or Disclosure Schedule in which any such word is used and not to any particular provision of this Agreement, the Ancillary Agreements or the Exhibits or Disclosure Schedules in which any such word is used. References to any Article, Section, Disclosure Schedule and Exhibit refer to an Article or Section of, or

12

a Disclosure Schedule or Exhibit to, this Agreement unless otherwise expressly specified.

(b)In this Agreement, the Ancillary Agreements and the Exhibits and Disclosure Schedules hereto, (i) the meaning of defined terms shall be equally applicable to the singular and plural forms of the defined terms; (ii) any pronoun or pronouns shall be deemed to include both the singular and the plural; (iii) the term “or” is disjunctive but, depending on the context, not necessarily exclusive; (iv) the words “include,” “includes” or “including” shall be deemed to be followed by the words “without limitation,” whether or not they are in fact followed by those words or words of like import; (v) the word “extent” in the phrase “to the extent” shall mean the degree to which a subject or other thing extends, and such phrase shall not simply mean “if”; (vi) references to agreements and other documents shall be deemed to include all subsequent amendments and other modifications thereto; (vii) any reference to any Law shall be deemed also to refer to all rules and regulations promulgated under such Law, unless the context expressly requires otherwise; (viii) references to dollars or “$” shall mean U.S. dollars; (ix) the words “writing,” “written” and comparable terms refer to printing, typing and other means of reproducing words (including electronic media); and (x) any reference to gender shall include all genders.

(c)The provision of a Table of Contents and the division of this Agreement, the Ancillary Agreements or the Exhibits and Disclosure Schedules hereto into Articles, Sections and other subdivisions and the insertion of headings herein and therein are for convenience of reference only and shall not affect or be utilized in construing or interpreting this Agreement, the Ancillary Agreements or the Exhibits and Disclosure Schedules hereto, as the case may be. All references in this Agreement to any “Section” are to the corresponding Section of this Agreement unless otherwise specified. All references to any “Section” in any Ancillary Agreement, Exhibit or Disclosure Schedule hereto are to the corresponding Section of such Ancillary Agreement, Exhibit or Disclosure Schedule in which such reference appears, unless otherwise specified.

(d)The Parties have participated jointly in the negotiation and drafting of this Agreement, the Ancillary Agreements and the Exhibits and Disclosure Schedules hereto. In the event an ambiguity or question of intent or interpretation arises, this Agreement, the Ancillary Agreements and the Exhibits and Disclosure Schedules hereto must be construed as if drafted jointly by the Parties, and no presumption or burden of proof will arise favoring or disfavoring any Party by virtue of the authorship of any of the provisions of this Agreement, the Ancillary Agreements or the Exhibits or Disclosure Schedules hereto.

(e)When calculating the period of time before which, within which or following which, any act is to be done or step taken pursuant to this Agreement, the Ancillary Agreements or any Exhibit or Disclosure Schedule hereto, the date that is the reference date in calculating such period shall be excluded. If the last day of such period is a non-Business Day, the period in question shall end on the next succeeding Business Day.

13

(f)The Exhibits and Disclosure Schedules to this Agreement are hereby incorporated and made a part hereof and are an integral part of this Agreement. All Exhibits and Disclosure Schedules annexed hereto or referred to herein are hereby incorporated into and made a part of this Agreement as if set forth in full herein. Any matter or item disclosed on one Disclosure Schedule shall be deemed to have been disclosed and incorporated by reference in each other Disclosure Schedule, but only to the extent that the relevance of such matter or item to such other Disclosure Schedule is reasonably apparent on its face. No disclosure on a Disclosure Schedule relating to a possible breach or violation of any contract, Law or Governmental Order shall be construed as an admission or indication that such breach or violation exists or has actually occurred. Information, matters and items disclosed or reflected in the Disclosure Schedules are not necessarily limited to information, matters and items that are required by this Agreement to be disclosed in the Disclosure Schedules. The disclosure of any information, matter or item in any Disclosure Schedule shall not be deemed to constitute an acknowledgement that any such information, matter or item (or any non-disclosed information, matter or item of comparable or greater significance) is required to be disclosed or is otherwise material. Any capitalized terms used in any Disclosure Schedule or Exhibit but not otherwise defined therein shall be defined as set forth in this Agreement. Any disclosure in the Disclosure Schedules that refers to a document is qualified in its entirety by reference to the text of such document, including all amendments, exhibits, schedules and other attachments thereto.

(g)In respect of ARTICLE III and ARTICLE IV, any document or item will be deemed “delivered,” “provided,” “disclosed” or “made available” (or any other words of similar import) by the Seller or its Affiliates, as applicable, within the meaning of this Agreement if such document or item is included in the Project Condor electronic data room maintained by Merrill Datasite on behalf of the Seller made available to the Buyer.

(h)A contract, asset or right shall be deemed to be “primarily related to” or “primarily used or held for use in” the Business only if, as of the date of this Agreement or the Closing, such contract, asset or right is used in connection with the Business more than it is used in connection with the Excluded Business.

(i)For purposes of this Agreement, the Ancillary Agreements or any Exhibit or Disclosure Schedule hereto, the term “commercially reasonable efforts” or “reasonable best efforts” shall not be deemed to require any Person to give any guarantee or other consideration of any nature, including in connection with obtaining any consent or waiver, or to consent to any change in the terms of any agreement or arrangement.

ARTICLE II

PURCHASE AND SALE

PURCHASE AND SALE

2.1Purchase and Sale of the Sold Assets. On the Closing Date and subject to the terms and conditions set forth in this Agreement, the Seller shall sell, assign, transfer, convey and deliver to the Buyer, and the Buyer shall purchase and acquire from the Seller, free and clear of all Encumbrances, other than Permitted

14

Encumbrances, all of the Seller’s right, title and interest in, to and under the Sold Assets. The term “Sold Assets” shall mean all of the Seller’s right, title and interest in and to all assets (other than the Excluded Assets) of whatever kind and nature, real and personal, tangible or intangible, that are owned, leased or licensed by the Seller on the Closing Date primarily relating to or primarily used or held for use in connection with the Business, including all right, title and interest of Seller in, to and under the following:

(a)all machinery, equipment, computer hardware, tools, tooling, office and design and development equipment, test equipment, business machines, furniture, furnishings and other tangible personal property located at the Sold Real Property, including those described or listed on Schedule 2.1(a);

(b)all inventory of raw materials, finished goods and work-in-process, packaging, supplies, parts and other inventories located at the Sold Real Property, including those described or listed on Schedule 2.1(b);

(c)subject to Section 5.15 with respect to Shared Contracts, and Section 5.18 with respect to Government Prime Contracts, (i) the contracts set forth on Schedule 2.1(c), (ii) all open sales orders with customers and all open purchase orders with suppliers, in each case, arising primarily from the operation of the Business, and (iii) any other contract (including sales orders and purchase orders) entered into by the Seller in the ordinary course of business after the date of this Agreement that relates primarily to the operation of the Business and entered into in accordance with the terms of this Agreement, whether or not set forth on Schedule 2.1(c) (collectively, the “Sold Contracts”);

(d)all books and records, customer and supplier lists and other customer and supplier information, research and development files (including, for the avoidance of doubt, those files related to electric brakes, carbon brakes, brake health monitoring systems and initial research into additive manufacturing), testing and qualification documents and files, product files, equipment logs, operating guides and manuals, personnel and employment records relating to Transferred Employees to the extent not prohibited by Law and subject to the consent of such Transferred Employees where required by Law, websites, domain names, internet and social media addresses, phone numbers and other lists and documents primarily related to the Business (other than Tax records, litigation files and books, records, lists or documents related to Excluded Assets or the Retained Liabilities), except that Seller is entitled to retain copies of any such materials that are necessary in its reasonable judgment for Tax, accounting, personnel or legal purposes (including Exchange Act reporting);

(e)all Intellectual Property set forth on Schedule 2.1(e) (collectively, the “Sold Intellectual Property”);

(f)all Permits listed on Schedule 2.1(f), but only to the extent such Permits may be transferred under applicable Law or their applicable terms;

15

(g)all rights, claims, causes of action and credits, including all guarantees, warranties, indemnities, refunds, set-offs and similar rights, in favor of the Seller to the extent primarily relating to any other Sold Asset, the Buyer’s portion of Shared Contracts or to any Assumed Liability;

(h)all accounts receivable primarily related to the Business;

(i)all credits, prepaid expenses, advance payments, security deposits, escrows, deferred charges and prepaid items of the Seller that are primarily owned or primarily used, primarily held for use or that primarily arise out of the operation or conduct of the Business or the ownership or use of the Sold Assets;

(j)all causes of action, claims, credits, demands or rights of set-off of any nature, to the extent primarily related to the Business, the Sold Assets or the Assumed Liabilities, whether arising by way of counterclaim or otherwise;

(k)the real estate parcels that are specifically listed or described in Schedule 2.1(k), together with the buildings and improvements thereon, fixtures related thereto, and any rights or easements appurtenant thereto (collectively, the “Sold Real Property”); and

(l)the properties and assets set forth on Schedule 2.1(l).

2.2Excluded Assets. Other than the Sold Assets subject to Section 2.1, the Buyer acknowledges and agrees that it is not purchasing or acquiring, and the Seller is not selling, assigning, transferring, conveying or delivering any other assets or properties, and all such other assets and properties of the Seller shall be excluded from the Sold Assets (collectively, the “Excluded Assets”). The term “Excluded Assets” shall include each of the following assets:

(a)any cash or cash equivalents owned by the Seller;

(b)the organizational documents, taxpayer and other identification numbers, minute and record books of the Seller;

(c)all real property owned by the Seller other than the Sold Real Property;

(d)any assets and properties used in the Business that have been disposed of in the ordinary course, consistent with past practice, since the date of this Agreement;

(e)except to the extent provided in Section 5.17, any rights to the Seller’s insurance policies, premiums or proceeds from insurance coverages, and any other recovery by Seller from any Person;

(f)any rights to any refunds, credits, prepayments, overpayments and deposits of the Seller with any Governmental Authority, in each case relating to Taxes;

16

(g)all Tax Returns and financial statements of the Seller and the Business and all records (including working papers) related thereto;

(h)all of the Seller’s causes of action, claims, credits, demands or rights of set-off against third parties, to the extent solely related to any other Excluded Asset, including any books, records and privileged information to the extent relating solely thereto;

(i)all Intellectual Property that is not Sold Intellectual Property, including the Retained Names and Marks and the Shared Intellectual Property;

(j)all rights that accrue to the Seller under this Agreement or any Ancillary Agreement;

(k)all assets used in providing the services under the Transition Services Agreement and, except as provided pursuant to the Transition Services Agreement, the right of the Business to receive such services;

(l)all rights of the Seller under, all funds and property held in trust or any other funding vehicle pursuant to, and all insurance contracts providing funding for, any Seller Benefit Plans;

(m)all assets primarily used or held for use in connection with the Excluded Business; and

(n)personnel or employment records of employees that are not Transferred Employees, and personnel or employment records of any Transferred Employees where prohibited by Law or whose consent to such transfer is required by applicable Law to the extent such Transferred Employee has not consented to such transfer; and

(o)the properties and assets set forth on Schedule 2.2(o).

Notwithstanding anything to the contrary contained in this Agreement or any of the Ancillary Agreements, the Buyer acknowledges and agrees that all of the following shall remain the property of the Seller, and neither the Buyer nor any of its Affiliates shall have any interest therein: (w) all records and reports prepared or received by the Seller or any of its Affiliates in connection with the sale of the Business and the transactions contemplated hereby, including all analyses relating to the Business or the Buyer so prepared or received; (x) all confidentiality agreements entered into with prospective purchasers of the Business or any portion thereof; (y) all bids and expressions of interest received from third parties with respect thereto; and (z) all privileged materials, documents and records in the possession of the Seller or its Affiliates, to the extent such materials, documents and records are (i) not related to the Business or (ii) related to any Excluded Asset or Retained Liability.

17

2.3Assumption of Liabilities; Retained Liabilities.

(a)Assumed Liabilities. On the terms and subject to the conditions set forth in this Agreement, at the Closing, the Buyer shall assume effective as of the Closing, and shall thereafter pay, perform, be responsible for and discharge as and when due any and all Liabilities of the Seller to the extent relating to, resulting from, or arising out of, the past, present or future operation or conduct of the Business or ownership or use of the Sold Assets (other than the Retained Liabilities), whether arising prior to, on or after the Closing, and whether accrued or unaccrued, fixed or variable, known or unknown, absolute or contingent, matured or unmatured or determined or determinable as of the Closing (collectively, the “Assumed Liabilities”). Buyer’s obligations under this Section 2.3(a) will not be subject to offset or reduction by reason of any actual or alleged breach of any representation, warranty, covenant or agreement contained in this Agreement or the Ancillary Agreements or any closing or other document contemplated by this Agreement or the Ancillary Agreements, any right or alleged right of indemnification hereunder or for any other reason.

(b)Retained Liabilities. The Seller shall retain and be responsible only for the following Liabilities relating to the Business following the Closing (the “Retained Liabilities”):

(i)Liabilities for which the Seller expressly has responsibility pursuant to the terms of this Agreement or any Ancillary Agreement;

(ii)Liabilities of Seller solely and to the extent related to or arising out of the Excluded Assets;

(iii)Liabilities for any transaction expenses incurred and payable by the Seller in connection with the transactions contemplated by this Agreement;

(iv)Liabilities for Taxes imposed on (A) Seller or its Affiliates for any tax period and (B) with respect to the Sold Assets for any taxable period (or portion thereof) ending on or prior to the Closing Date pursuant to Section 5.4(b);

(v)except as otherwise provided in Section 5.5, all Liabilities under or with respect to, or related to the sponsorship of, any Seller Benefit Plan;

(vi)all Liabilities arising out of any Debt Obligations of the Seller; and

(vii)Liabilities to the extent related to or arising out of the matters set forth on Schedule 2.3(b)(vii).

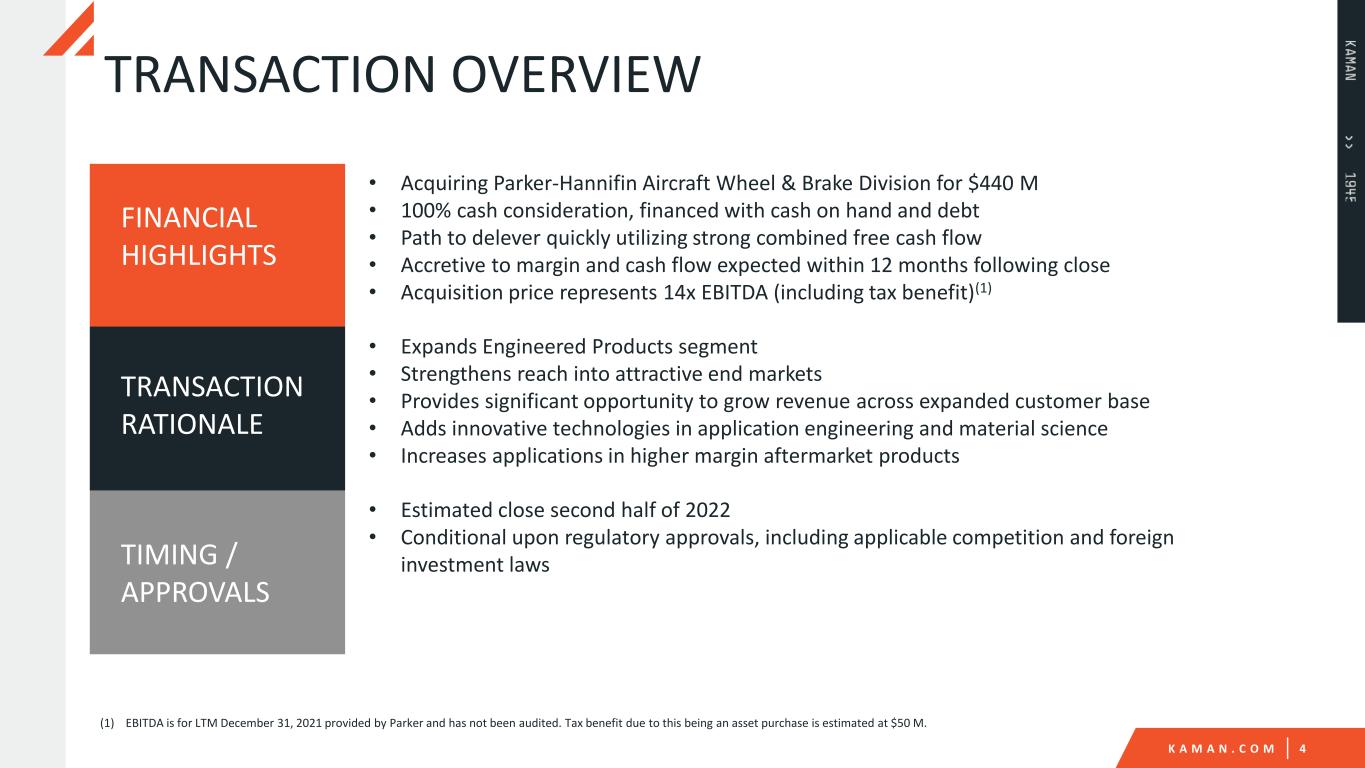

2.4Purchase Price. On the Closing Date and subject to the terms and conditions set forth in this Agreement, in consideration of the sale, assignment, transfer, conveyance and delivery of the Sold Assets, the Buyer shall (a) pay to the Seller an aggregate amount equal to $440,000,000 (the “Closing Purchase Price”), as adjusted pursuant to Section 2.5(a), by wire transfer of immediately available funds in U.S. dollars to one or more accounts of the Seller designated at least two Business Days prior to the Closing Date, and (b) assume the Assumed Liabilities (collectively, the “Total Consideration”). The Closing Purchase Price shall be adjusted prior to the Closing Date pursuant to Section 2.5(a). After the Closing Date, the Closing Purchase Price shall be

18

adjusted pursuant to Sections 2.5(b)-(e). The Closing Purchase Price, plus or minus the adjustment amount determined pursuant to Section 2.5(b)-(e), shall be the “Purchase Price.” For the avoidance of doubt, the Purchase Price and Total Consideration specified in this Section 2.4 do not include any Transfer Taxes. The Buyer shall pay such Transfer Taxes in accordance with Section 5.4(d) of this Agreement in addition to the Purchase Price and Total Consideration specified in this Section 2.4.

2.5Purchase Price Adjustment.

(a)Pre-Closing Statement. No later than five Business Days prior to the Closing Date, the Seller shall prepare and deliver to the Buyer a written statement together with any relevant supporting materials (the “Pre-Closing Statement”) setting forth (i) a balance sheet of the Business as of the Closing (the “Estimated Balance Sheet”) and (ii) the Seller’s calculation of a good-faith estimate of (A) the Closing Working Capital as derived therefrom (the “Estimated Working Capital”), and (B) the Closing Purchase Price as adjusted as provided below to give effect to the Estimated Working Capital. The Estimated Balance Sheet (and the Estimated Working Capital derived therefrom) shall be prepared in accordance with the Accounting Methods. The Seller shall consider in good faith any comments or objections to any amounts set forth in the Pre-Closing Statement notified to it by the Buyer prior to the Closing, and if, prior to the Closing, the Seller and the Buyer agree to make any modification to the Pre-Closing Statement, then the Pre-Closing Statement as so modified shall be deemed to be the Pre-Closing Statement for purposes of calculating the Closing Purchase Price; provided that (x) the Seller shall be under no obligation to accept any proposed modifications that the Seller determines in good faith are not appropriate and (y) it is hereby acknowledged that the acceptance of any such proposed modifications shall not constitute a condition to the Buyer’s obligations to consummate the transactions contemplated by this Agreement. If the Seller and the Buyer fail to agree upon the amounts set forth in the Pre-Closing Statement at least two days prior to the Closing Date, then the Pre-Closing Statement as provided by the Seller shall be used for purposes of calculating the Closing Purchase Price without prejudice to the Buyer’s rights to assert such objections thereto pursuant to Section 2.5(c), and such failure of the Seller and the Buyer to agree shall have no effect on the Parties’ respective obligation to consummate the transactions contemplated by this Agreement or require that the contemplated Closing Date be postponed or otherwise delayed. No failure by the Buyer to raise any objection or dispute pursuant to this Section 2.5(a) shall prejudice the Buyer’s right to raise any matter pursuant to Section 2.5(c). If the Estimated Working Capital (as set forth in the Pre-Closing Statement) is less than the Target Working Capital, then the Closing Purchase Price shall be adjusted downward by an amount equal to the amount of the deficiency between the Target Working Capital and the Estimated Working Capital. If the Estimated Working Capital (as set forth in the Pre-Closing Statement) is greater than the Target Working Capital, then the Closing Purchase Price shall be adjusted upward by an amount equal to the amount of the excess between the Estimated Working Capital and the Target Working Capital. If the Estimated Working Capital is equal to the Target Working Capital, then no adjustment shall be made to the Closing Purchase Price with respect to the Estimated Working Capital.

19

(b)Post-Closing Statement. Within 90 days after the Closing Date, the Buyer shall cause to be prepared and delivered to the Seller a written statement together with any relevant supporting materials (the “Post-Closing Statement”) setting forth (i) a balance sheet of the Business as of the Closing (the “Closing Balance Sheet”) and (ii) the Buyer’s calculation of (A) the Closing Working Capital as derived therefrom (“Final Working Capital”), and (B) the Closing Purchase Price to give effect to the Final Working Capital. The Closing Balance Sheet (and the Final Working Capital derived therefrom) shall be prepared in accordance with the Accounting Methods.

(c)Dispute. Within 30 days following receipt by the Seller of the Post-Closing Statement, the Seller shall deliver written notice to the Buyer of any dispute it has with respect to the Post-Closing Statement (the “Post-Closing Statement Objection”) setting forth a specific description of the basis of the Post-Closing Statement Objection, the adjustments to the Post-Closing Statement which the Seller believes should be made, and the Seller’s calculation of the Final Working Capital and the Closing Purchase Price as adjusted thereby. The Seller shall be deemed to have accepted any items not specifically disputed in the Post-Closing Statement Objection. Failure to so notify the Buyer within such 30-day period shall constitute acceptance and approval of the Buyer’s calculation of the Final Working Capital and the Closing Purchase Price set forth in the Post-Closing Statement. During such 30-day period, the Buyer shall, at the request of the Seller, on reasonable prior notice from the Seller and during normal business hours, afford the Seller reasonable access to the books and records with respect to the Business (to the extent relevant to the determination of the Final Working Capital) and otherwise reasonably cooperate with the Seller in connection with its preparation of the Post-Closing Statement Objection. The Buyer shall have 30 days following the date it receives the Post-Closing Statement Objection to review and respond to the Post-Closing Statement Objection. If the Seller and the Buyer are unable to resolve all of their disagreements with respect to the determination of the foregoing items by the 30th day following the Buyer’s response to the Post-Closing Statement Objection, after having used their good-faith efforts to reach a resolution, either the Seller or the Buyer shall refer their remaining differences to Ernst & Young or, if such firm refuses to accept such engagement, another nationally recognized firm of independent public accountants as to which the Seller and the Buyer mutually agree acting promptly and in good faith (in either case, the “CPA Firm”) to resolve their dispute. The CPA Firm will act as an expert, not an arbitrator. As promptly as practicable, and in any event not more than 15 days after the CPA Firm is engaged, the Seller and the Buyer shall each prepare and submit a written presentation detailing each Party’s complete statement of proposed resolution of the dispute to the CPA Firm. As soon as practicable thereafter, the Seller and the Buyer shall cause the CPA Firm to choose either the Seller’s or the Buyer’s positions based solely upon the written presentations of the Seller and the Buyer. The CPA Firm shall make such determination with respect to the Final Working Capital in accordance with the Accounting Methods on a basis consistent with the Estimated Working Capital, and, in each case, only with respect to the specific remaining accounting-related differences so submitted in such written presentations. In resolving any such unresolved disputed item, the CPA Firm will not assign a value to any item greater than the greatest value claimed for such item by either Party or lower than the lowest value claimed for such item by either Party in the

20

Post-Closing Statement and the Post-Closing Statement Objection. The Party whose position is not accepted by the CPA Firm shall be responsible for and pay all of the fees and expenses of the CPA Firm. The Buyer and the Seller each agree to execute, if requested by the CPA Firm, a reasonable engagement letter. The Seller and the Buyer shall request that the CPA Firm use its best efforts to render its determination within 45 days after referral. All determinations made by the CPA Firm will be limited to the matters submitted to the CPA Firm by the Buyer and the Seller and shall be final, conclusive and binding on the Parties, and none of the Buyer, the Seller or any of their respective Affiliates shall seek further recourse from Governmental Authorities, other than to enforce the CPA Firm’s determination. Judgment may be entered to enforce such determination in any court of competent jurisdiction. The Seller and the Buyer shall make reasonably available to the CPA Firm all relevant books and records, any work papers (including those of the Parties’ respective accountants) and supporting documentation relating to the Post-Closing Statement and all other items reasonably requested by the CPA Firm. The “Final Statement” shall be (i) the Post-Closing Statement in the event that (A) no Post-Closing Statement Objection is delivered to the Buyer during the initial 30-day period specified above or (B) the Seller and the Buyer so agree in writing, (ii) the Post-Closing Statement, adjusted in accordance with the Post-Closing Statement Objection, in the event that (A) the Buyer does not respond to the Post-Closing Statement Objection during the 30-day period specified above following receipt by the Buyer of the Post-Closing Statement Objection or (B) the Seller and the Buyer so agree in writing or (iii) the Post-Closing Statement, as adjusted pursuant to the agreement of the Buyer and the Seller or as determined by the CPA Firm together with any other modifications to the Post-Closing Statement agreed upon in writing by the Seller and the Buyer prior to the determination by the CPA Firm. Any adjustment or non-adjustment to the Purchase Price shall not form the basis for any claim for damages pursuant to this Agreement. The Parties’ payment obligations under this Section 2.5 will not be subject to offset or reduction by reason of any actual or alleged breach of, or inaccuracy in, any representation, warranty, covenant or agreement contained in this Agreement or the Ancillary Agreements, and any right or alleged right of indemnification hereunder or for any other reason. The process set forth in this Section 2.5(c) shall be the sole and exclusive remedy of the Parties and their respective Affiliates for any disputes related to the Closing Purchase Price or the Purchase Price and the calculations and amounts on which they are based or set forth in the related statements and notices delivered in connection therewith. For the avoidance of doubt, the Parties acknowledge and agree that the calculations to be made pursuant to this Section 2.5 are not intended to be used to adjust for errors or omissions, under GAAP or otherwise, that may be found in the Year-end Financial Information or the Target Working Capital. No event, act, change in circumstances or similar development, including any market or business development or changes in GAAP or applicable Law, arising or occurring after the Closing, shall be taken into consideration in the calculations to be made pursuant to this Section 2.5 (even if GAAP would require such matter to be taken into consideration in such calculations).

(d)Downward Adjustment. If the Closing Purchase Price set forth on the Final Statement is less than the Closing Purchase Price paid at Closing, then the

21

Closing Purchase Price shall be adjusted downward by an amount equal to the amount of the deficiency between the Closing Purchase Price as set forth in the Final Statement and Closing Purchase Price paid at Closing, and the Seller shall pay or cause to be paid such amount by wire transfer of immediately available funds in U.S. dollars to an account designated by the Buyer. Such payment shall be made within three Business Days after the later of the date on which the Final Statement is determined and the date when the Buyer designates to the Seller the payment account details.

(e)Upward Adjustments. If the Closing Purchase Price set forth on the Final Statement is greater than the Closing Purchase Price paid at Closing, then the Closing Purchase Price shall be adjusted upward by an amount equal to the amount of the excess between the Closing Purchase Price set forth on the Final Statement and the Closing Purchase Price paid at Closing, and the Buyer shall pay or cause to be paid such amount by wire transfer of immediately available funds in U.S. dollars to an account designated by the Seller. Such payment shall be made within three Business Days after the later of the date on which the Final Statement is determined and the date when the Seller designates to the Buyer the payment account details.

(f)Payments. Any amount required to be paid by the Buyer or the Seller under this Agreement that is not paid within the period specified for such payment shall bear interest on a daily basis, from and including the date such payment was required to be made hereunder, to but excluding the date of payment, at a rate per annum equal to 200 basis points plus the rate of interest publicly announced by JPMorgan Chase Bank from time to time as its prime rate in effect at its office located at 270 Park Avenue, New York, New York, in effect from time to time during the period from the date such payment was required to be made hereunder, to the date of payment. Such interest shall be payable at the same time as the payment to which it relates and shall be calculated on the basis of a year of three hundred sixty-five days and the actual number of days elapsed.

2.6Allocation of Total Consideration. The Total Consideration, including any adjustments thereto, shall be allocated among the Sold Assets using the methodology set forth on Schedule 2.6. The Buyer shall deliver to the Seller a proposed allocation of the amount allocated among the Sold Assets no later than 60 days after the Closing Date, and the Seller will provide any comments, questions or objections with respect thereto no later than 30 days after the delivery of the proposed allocation by the Buyer. The Parties agree that the allocation of the Total Consideration pursuant to Schedule 2.6 is in accordance with the fair market value of such Sold Assets and Section 1060 of the Code and, to the extent not inconsistent therewith, any other applicable Tax Law. The Parties shall cooperate to comply with all substantive and procedural requirements of Section 1060 of the Code and any regulations thereunder and, to the extent not inconsistent therewith, any other applicable Tax Law, and the allocations shall be adjusted and/or supplemented if, and to the extent, necessary to comply with the requirements of Section 1060 of the Code and, to the extent not inconsistent therewith, any other applicable Tax Law. Neither the Buyer nor the Seller will take, nor permit any Affiliate to take, any position inconsistent with the allocations set forth on Schedule 2.6 or, if applicable, such adjusted or supplemental allocation.

22

Each of the Seller and the Buyer agrees that it shall attach to its Tax Returns for the tax year in which the Closing shall occur an information statement on Form 8594, which shall be completed in accordance with the allocations set forth on Schedule 2.6, and shall, and shall cause their respective Affiliates to, cooperate with each other in preparing and filing any supplements to such form as may be required under Section 1060 of the Code and any other applicable Tax Law. The Parties agree to notify each other with respect to the initiation of any inquiry, claim, assessment, audit or Proceeding by any Taxing Authority relating to the allocations and agree to consult with each other with respect to any such inquiry, claim, assessment, audit or Proceeding by any Taxing Authority.

2.7Prorations. On the Closing Date, all utility charges and other similar periodic obligations (other than Taxes, which will be allocated as provided in Section 5.4), related to the Sold Real Property will be prorated as of the Closing Date. Whenever possible, such prorations will be based on actual, current payments by the Seller, and to the extent such actual amounts are not available, such prorations will be estimated as of the Closing Date based on actual amounts for the most recent comparable billing period. When the actual amounts become known, such prorations will be recalculated by the Buyer and the Seller, and the Buyer or the Seller, as the case may be, promptly (but not later than five Business Days after notice of payment due) will make any additional payment or refund so that the correct prorated amount is paid by each of the Buyer and the Seller.

2.8The Closing. Unless this Agreement shall have been terminated pursuant to ARTICLE VIII, subject to ARTICLE VI and ARTICLE VII, the closing (the “Closing”) of the transactions contemplated by this Agreement shall take place at the offices of Jones Day, 901 Lakeside Avenue, Cleveland, Ohio 44114, on the third Business Day following the satisfaction or waiver (to the extent legally permitted) of all of the conditions set forth in ARTICLE VI and ARTICLE VII (other than those conditions that are to be satisfied at the Closing, but subject to the satisfaction or waiver of those conditions), or at such other place and time as may be agreed upon by the Parties (including remotely via the exchange of executed documents and other deliverables through electronic transmission of portable document format). The date on which the Closing actually takes place is referred to as the “Closing Date”. All proceedings to be taken and all documents to be executed and delivered by all Parties at the Closing shall be deemed to have been taken and executed and delivered simultaneously, and no proceedings shall be deemed to have been taken nor documents executed or delivered until all have been taken, executed and delivered. Legal title, equitable title and risk of loss with respect to the Sold Assets will be deemed transferred to or vested in the Buyer, and the transactions contemplated by this Agreement will be deemed effective for Tax, accounting and other computational purposes, and the Parties will treat the Closing as if it had occurred, as of 12:01 a.m. (Eastern Time) on the Closing Date. Notwithstanding the foregoing, the Closing Date will not be earlier than July 1, 2022.

2.9Deliveries at the Closing.

(a)Deliveries by the Seller. At or prior to the Closing, the Seller shall deliver or cause to be delivered to the Buyer the following:

23

(i)the Ancillary Agreements to which the Seller or any of its Affiliates is a party, duly executed by the Seller or such Affiliate;

(ii)a certificate of good standing of the Seller, issued by the Secretary of State of the State of Ohio, dated as of the most recent practicable date;

(iii)certified copies of resolutions duly adopted by the board of directors of the Seller evidencing the taking of all corporate action necessary to authorize the execution, delivery and performance of this Agreement and the Ancillary Agreements to which it is a party and the consummation of the transactions contemplated hereby and thereby; and

(iv)a certificate, to the extent applicable, from the Seller certifying, pursuant to Treasury Regulations Section 1.1445-2(b)(2), the Seller is not a foreign person within the meaning of Section 1445 of the Code.

(b)Deliveries by the Buyer. At or prior to the Closing, the Buyer shall deliver or cause to be delivered to the Seller the following:

(i)the Closing Purchase Price by wire transfer of immediately available funds in U.S. dollars to an account or accounts designated by the Seller;

(ii)the Ancillary Agreements to which the Buyer or any of its Affiliates is a party, duly executed by the Buyer or such Affiliate;

(iii)a certificate of good standing of the Buyer, issued by the Secretary of State of the State of Delaware, dated as of the most recent practicable date; and

(iv)certified copies of resolutions duly adopted by the board of directors of the Buyer evidencing the taking of all corporate or other action necessary to authorize the execution, delivery and performance of this Agreement and the Ancillary Agreements to which it is a party and the consummation of the transactions contemplated hereby and thereby.

2.10Further Assurances. Each Party covenants that it will do, execute and deliver, or will cause to be done, executed and delivered, all such further acts and instruments that the other Parties or any of their respective successors or permitted assigns may reasonably request in order to more fully evidence the assumption of the Assumed Liabilities provided for in Section 2.3 and the sale and transfer of the Sold Assets.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF THE SELLER

REPRESENTATIONS AND WARRANTIES OF THE SELLER

Except as set forth in the Disclosure Schedules, the Seller hereby represents and warrants to the Buyer as follows:

24

3.1Organization. The Seller is a corporation duly incorporated, validly existing and in good standing under the Laws of the State of Ohio. The Seller has all requisite power and authority to own, lease and operate its assets and to carry on its business as now being conducted and is duly qualified or licensed to do business and (to the extent any such jurisdiction recognizes the concept of good standing) is in good standing in the jurisdictions in which the ownership of its property or the conduct of its business requires such qualification or license, except where the failure to be so qualified or licensed would not have a Business Material Adverse Effect or a Seller Material Adverse Effect.

3.2Authorization; Enforceability. The Seller has the corporate power and authority to execute and deliver this Agreement and each Ancillary Agreement to which it is a party and to perform its obligations hereunder and thereunder. The execution and delivery of this Agreement and the Ancillary Agreements by the Seller and the performance of its obligations hereunder and thereunder have been duly authorized by all necessary action on the part of the Seller. This Agreement has been duly executed and delivered by the Seller and, assuming due authorization, execution and delivery by the Buyer, constitutes a valid and binding agreement of the Seller, enforceable against it in accordance with its terms, subject to the effects of bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium and other similar Laws relating to or affecting creditors’ rights generally and general equitable principles (whether considered in a proceeding in equity or at Law) (collectively, the “General Enforceability Exceptions”).