Form 8-K Hyatt Hotels Corp For: Aug 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 9, 2022

(Exact Name of Registrant as Specified in Charter)

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

| | ||||||||||||||||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||||||||||||||

Registrant’s telephone number, including area code: (312 ) 750-1234

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Former Name or Former Address, if Changed Since Last Report: Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 | |||||

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |||||

| Emerging growth company | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for | |||||

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | ||||

Item 2.02. Results of Operations and Financial Condition.

On August 9, 2022, Hyatt Hotels Corporation (the "Company") issued a press release announcing its results for its quarter ended June 30, 2022. The full text of the press release is attached as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

The information in this Form 8-K and Exhibit 99.1 attached hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

On August 9, 2022, the Company published a supplemental investor presentation which may be accessed through the Company’s investor relations website. A copy of the supplemental presentation is furnished herewith as Exhibit 99.2 and is incorporated herein by reference.

The information furnished under Item 7.01 and Exhibit 99.2 in this Form 8-K shall not be deemed "filed" for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act or the Exchange Act, except as set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| 99.1 | ||||||||

| 99.2 | ||||||||

| 101 | Interactive Data File - XBRL tags are embedded within the Inline XBRL document | |||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Hyatt Hotels Corporation | |||||||||||

Date: August 9, 2022 | By: | /s/ Joan Bottarini | |||||||||

| Joan Bottarini | |||||||||||

| Executive Vice President, Chief Financial Officer | |||||||||||

Exhibit 99.1

| Investor Contact: | Media Contact: | |||||||

Noah Hoppe, 312.780.5991 | Franziska Weber, 312.780.6106 | |||||||

noah.hoppe@hyatt.com | franziska.weber@hyatt.com | |||||||

HYATT REPORTS SECOND QUARTER 2022 RESULTS

Total Fee Revenue More than Doubles from Last Year; Reaches Record Level

System-wide RevPAR, Excluding Greater China, Above 2019

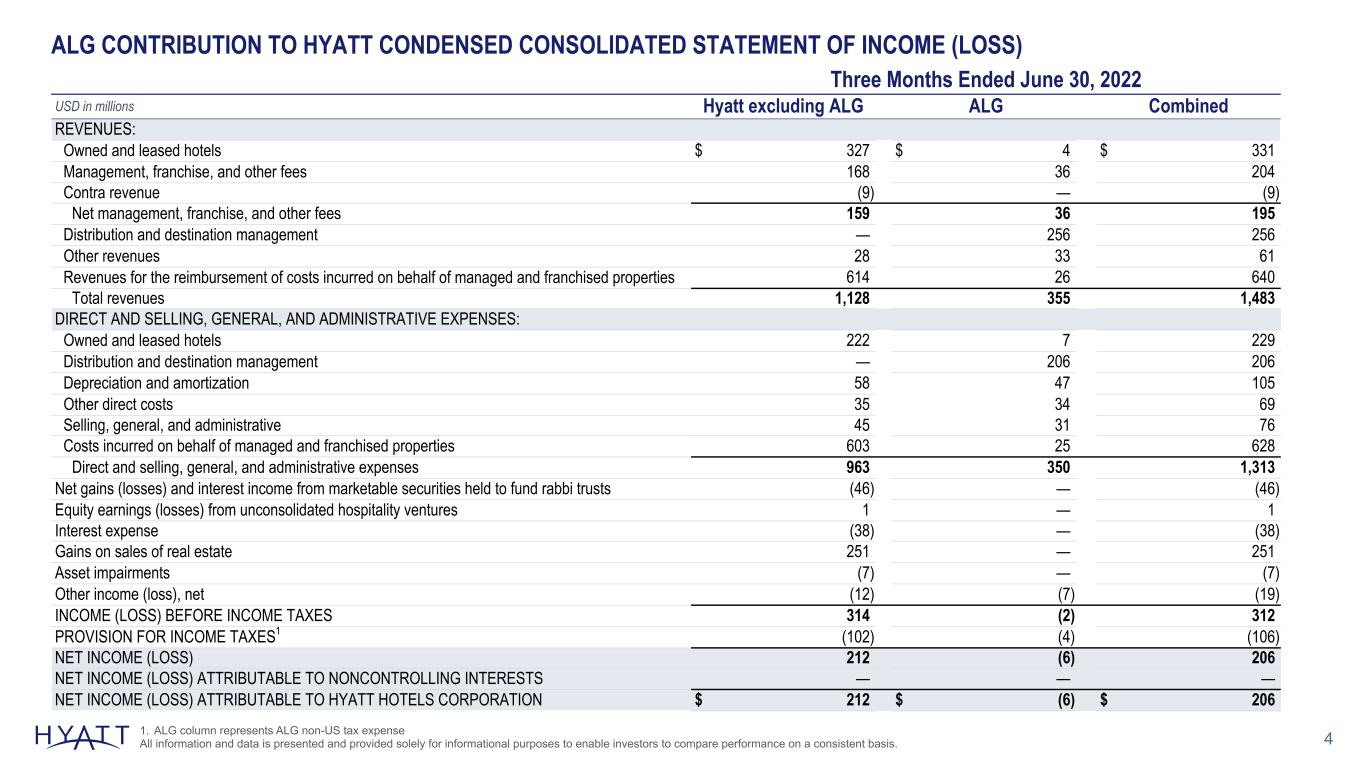

CHICAGO (August 9, 2022) - Hyatt Hotels Corporation ("Hyatt" or the "Company") (NYSE: H) today reported second quarter 2022 financial results. Net income attributable to Hyatt was $206 million, or $1.85 per diluted share, in the second quarter of 2022, compared to a net loss attributable to Hyatt of $9 million, or $0.08 per diluted share, in the second quarter of 2021. Adjusted net income attributable to Hyatt was $51 million, or $0.46 per diluted share, in the second quarter of 2022, compared to Adjusted net loss attributable to Hyatt of $117 million, or $1.15 per diluted share, in the second quarter of 2021. Refer to the table on page 14 of the schedules for a summary of special items impacting Adjusted net income (loss) and Adjusted earnings (losses) per diluted share for the three months ended June 30, 2022 and June 30, 2021.

"Our second quarter results serve as clear evidence of the earnings power of Hyatt as we continue to transform our business. Total fee revenue exceeded $200 million and was 27% higher than any other quarter in the Company’s history driven by a record level of leisure transient revenue and rapidly improving group and business transient demand," said Mark S. Hoplamazian, President and Chief Executive Officer of Hyatt Hotels Corporation. "Demand broadened both geographically and by segment, with RevPAR in most of our key geographies exceeding the same period in 2019. Our outlook remains optimistic with strong actualized results and booking trends for future periods continuing in July."

Second quarter 2022 financial results as compared to the second quarter 2021 are as follows:

•Net income increased to $206 million from a loss of $9 million.

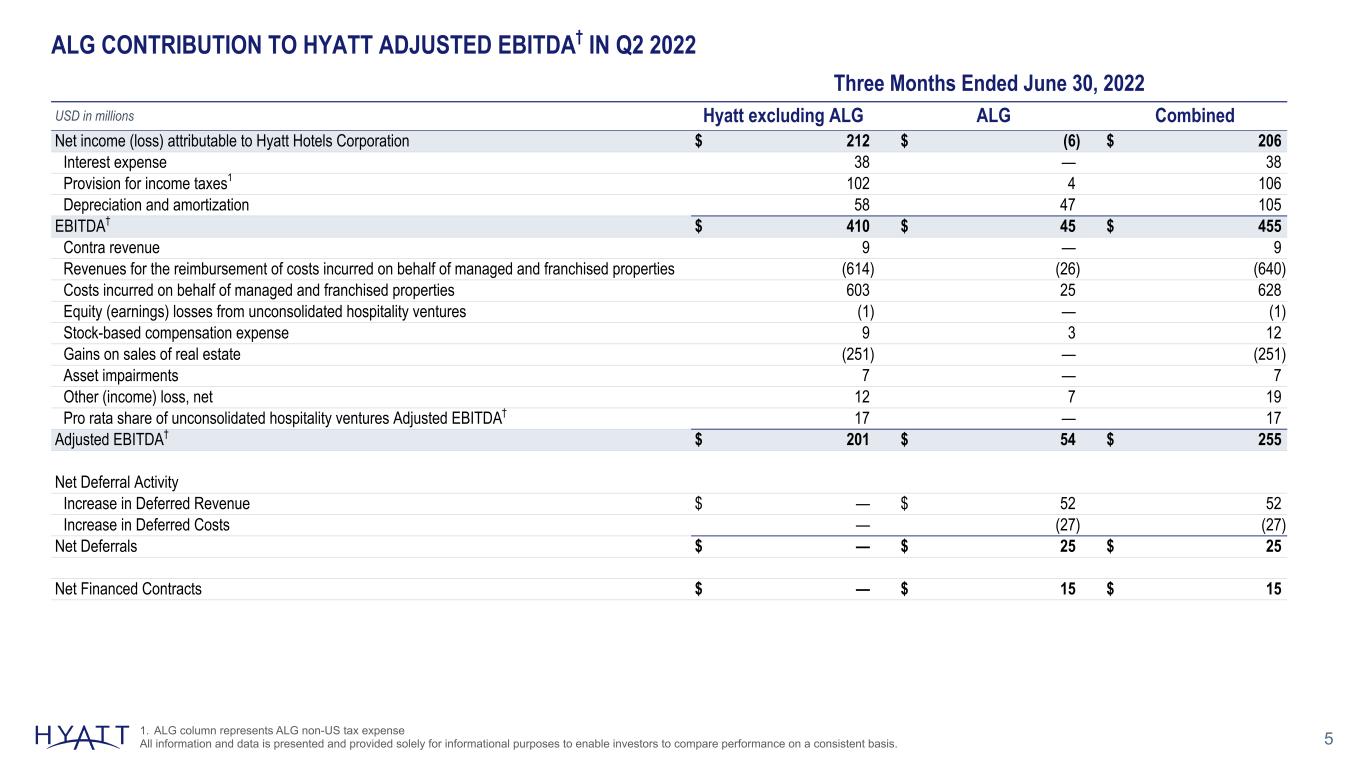

•Adjusted EBITDA increased to $255 million from $55 million.

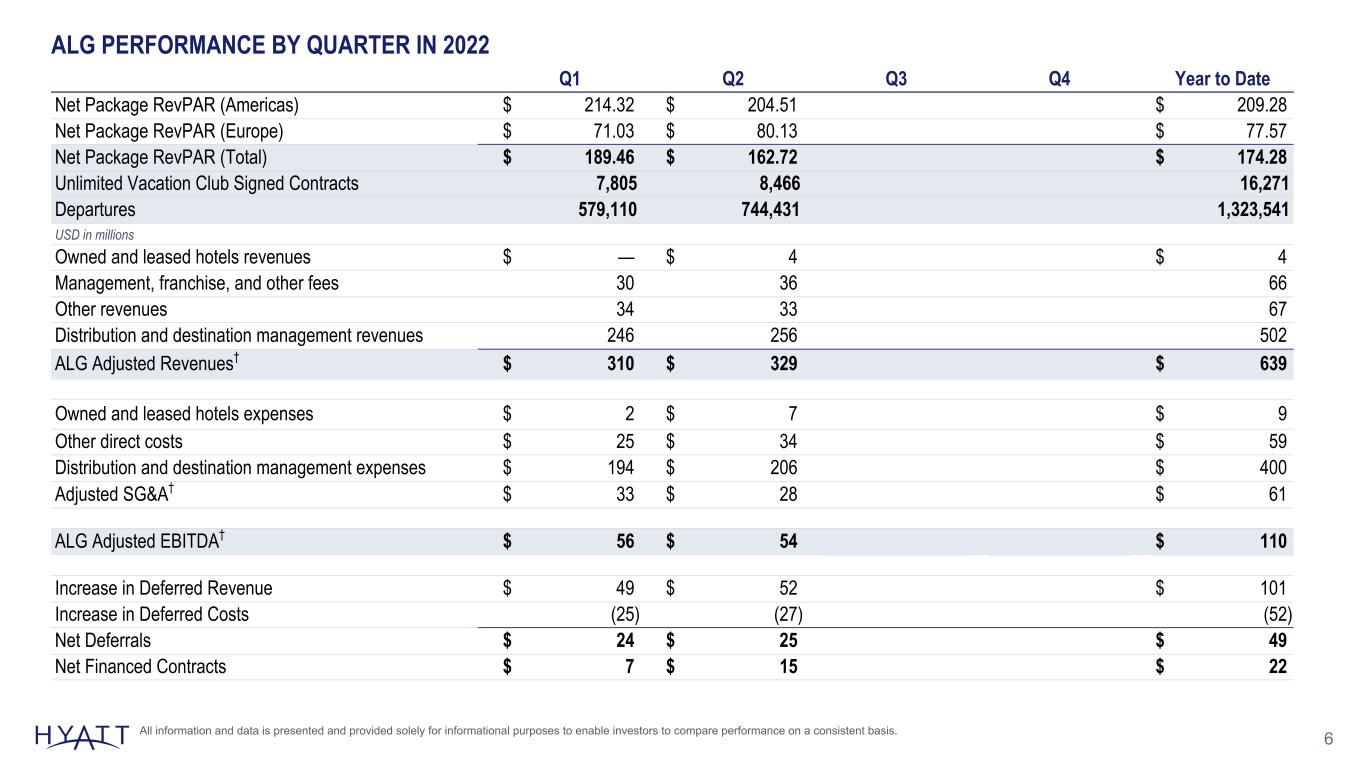

◦Apple Leisure Group ("ALG") contributed $54 million of Adjusted EBITDA.

◦Adjusted EBITDA does not include ALG's Net Deferrals of $25 million and Net Financed Contracts of $15 million.

•Comparable system-wide RevPAR increased 82% to $130.16 and comparable U.S. hotel RevPAR increased 85% to $150.52 in the second quarter of 2022.

•Comparable owned and leased hotels RevPAR increased 140% to $186.34 and comparable owned and leased hotels operating margin improved to 31.9% in the second quarter of 2022.

•All-inclusive Net Package RevPAR was $182.10 with an Average Daily Rate of $255.30.

•System-wide Net Rooms Growth was 19.0% in the second quarter of 2022. Excluding ALG, Net Rooms Growth was 4.6%.

•Pipeline of executed management or franchise contracts was approximately 113,000 rooms. Excluding ALG, the pipeline was approximately 106,000 rooms.

Mr. Hoplamazian continued, "We had a strong second quarter of gross rooms expansion through the opening of approximately 5,500 rooms during the quarter. While there have been delays in the timing of openings across the industry, we are particularly encouraged by the volume of conversion opportunities driven by the compelling value of our brands, and expect Net Rooms Growth for the full year to be greater than 6%."

Note: All RevPAR and ADR percentage changes are in constant dollars. This release includes references to non-GAAP financial measures. Refer to the non-GAAP reconciliations included in the schedules and the definitions of the non-GAAP measures presented beginning on page 12.

Page 2

OPERATIONAL UPDATE

Comparable system-wide RevPAR experienced rapid improvement in the second quarter and into the third quarter. Comparable system-wide RevPAR was down 5% to 2019 in the second quarter, improving from down 9% to 2019 in April to down 1% to 2019 in June. In July, comparable system-wide RevPAR was up 5% to 2019, marking one of the strongest individual months in Hyatt’s history powered by growth in luxury branded hotels, which were up 28% to 2019 in the Americas and EAME/SW Asia regions combined.

The results in July and favorable forward booking trends reflect continued strength. System-wide comparable transient revenue on the books for the remainder of the year is pacing 1% ahead of the same period in 2019 or 4% ahead when excluding Greater China. Additionally, short-term demand for group business continues to trend significantly ahead of 2019. Gross group room revenue booked in July for stay dates in 2022 for comparable Americas Full Service Managed properties was approximately 40% above July 2019 and group pace for the remainder of the year, from August through December, is approximately 7% below 2019 reflecting steady improvement as a result of strong short-term bookings.

Our all-inclusive portfolio also continues to experience strong growth. Based on preliminary results, net package RevPAR in July for ALG resorts in the Americas is approximately 24% higher in comparison with the same properties managed by ALG in July of 2019. Additionally, total package revenue for the entire ALG portfolio is approximately 74% higher than July of 2019, reflecting the impact of net rooms growth. Looking ahead, gross package revenue for ALG resorts in the Americas is pacing more than 44% above 2019 over the months of August through December for the same set of properties.

SECOND QUARTER RESULTS

Second quarter of 2022 financial results as compared to the second quarter of 2021 are as follows:

Management, Franchise, and Other Fees

Total management, franchise, and other fee revenues increased to $204 million in the second quarter of 2022 compared to $93 million reported in the second quarter of 2021 and reflected a sequential improvement from $154 million reported in the first quarter of 2022. Base management fees increased to $79 million, incentive management fees increased to $45 million, and franchise fees increased to $52 million during the quarter. Other fee revenues increased to $28 million during the quarter.

Americas Management and Franchising Segment

Americas management and franchising segment Adjusted EBITDA increased to $117 million in the second quarter of 2022 compared to $54 million reported in the second quarter of 2021. Results were led by the continuation of strong leisure demand and building momentum in group and business transient, resulting in increases in base and franchise fees with total franchise fees exceeding 2019 levels by 35% on a reported basis.

Americas net rooms increased 3.5% compared to the second quarter of 2021.

Southeast Asia, Greater China, Australia, New Zealand, South Korea, Japan and Micronesia (ASPAC) Management and Franchising Segment

ASPAC management and franchising segment Adjusted EBITDA decreased to $6 million in the second quarter of 2022 compared to $10 million reported in the second quarter of 2021. Results reflect lower demand in Greater China while the remainder of the region showed steady improvement led by the easing of travel restrictions as well as increased airlift to meet pent up demand.

ASPAC net rooms increased 6.1% compared to the second quarter of 2021.

Note: All RevPAR and ADR percentage changes are in constant dollars. This release includes references to non-GAAP financial measures. Refer to the non-GAAP reconciliations included in the schedules and the definitions of the non-GAAP measures presented beginning on page 12.

Page 3

Europe, Africa, Middle East and Southwest Asia (EAME/SW Asia) Management and Franchising Segment

EAME/SW Asia management and franchising segment Adjusted EBITDA increased to $13 million in the second quarter of 2022 compared to a loss of $1 million reported in the second quarter of 2021. In the second quarter of 2022, results across the region were led by Europe and the Middle East as travel restrictions eased, cross-border travel strengthened, and airlift improved.

EAME/SW Asia net rooms increased 7.9% compared to the second quarter of 2021.

Apple Leisure Group Segment

ALG segment Adjusted EBITDA was $54 million in the second quarter of 2022. Adjusted EBITDA does not include ALG's Net Deferrals of $25 million and Net Financed Contracts of $15 million. Results reflect strong demand for leisure destinations, increased airlift capacity, and favorable pricing environment.

During the second quarter of 2022, ALG added 10 resorts (or 2,502 rooms).

Refer to the table on page 3 of the schedules for further details on revenue recognition, deferrals, and financed contracts relating to the Unlimited Vacation Club.

Owned and Leased Hotels Segment

Owned and leased hotels segment Adjusted EBITDA increased to $99 million in the second quarter of 2022 compared to $12 million reported in the second quarter of 2021. Owned and leased hotels segment comparable operating margins improved to 31.9% from the second quarter 2021 as reported, reflecting strong operational execution and growth in average daily rates.

Refer to the tables starting on page 11 of the schedules for a detailed list of portfolio changes and the year-over-year net impact to total owned and leased hotels segment Adjusted EBITDA.

Corporate and Other

Corporate and other Adjusted EBITDA decreased to $(34) million in the second quarter of 2022 compared to $(21) million reported in the second quarter of 2021. The decrease to the second quarter of 2021 is driven by increases in certain selling, general, and administrative expenses, including $4 million of integration-related costs associated with the acquisition of ALG, and increases in payroll and related costs.

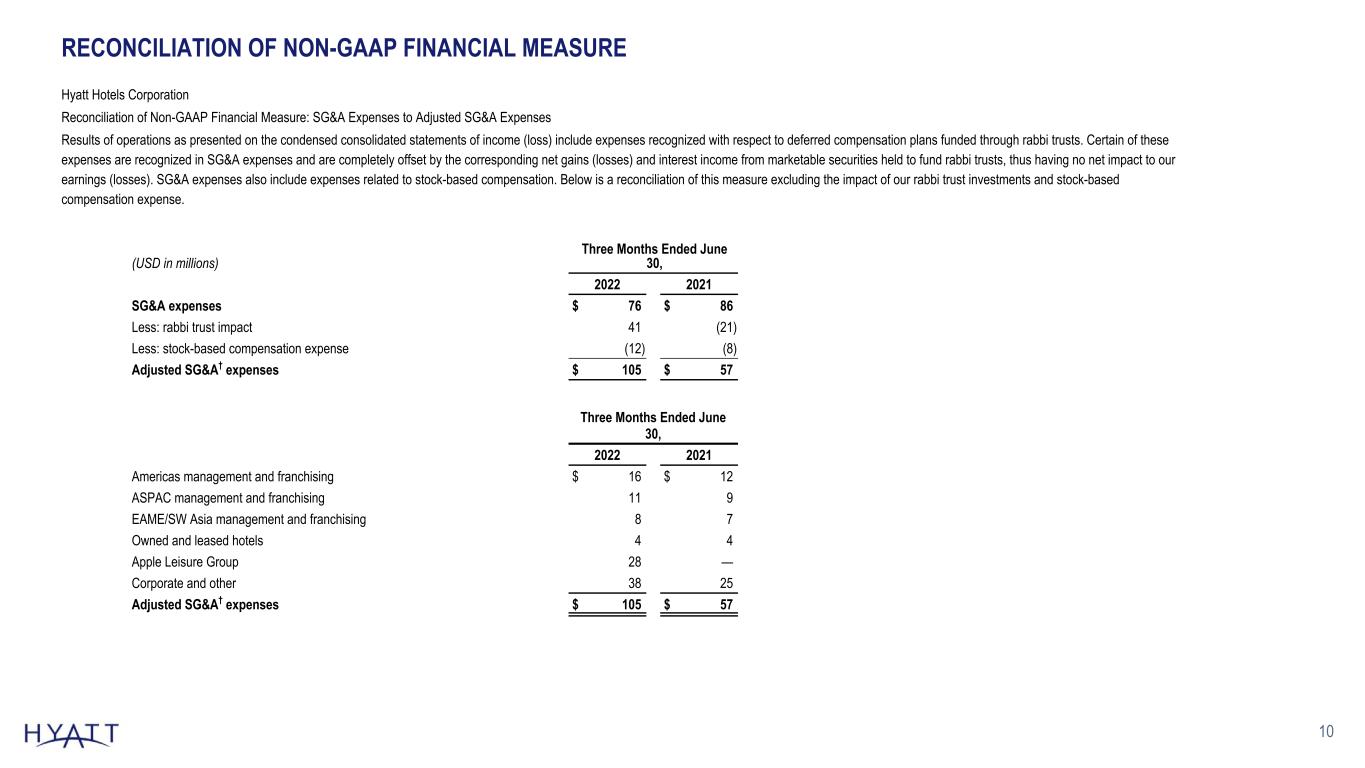

Selling, General, and Administrative Expenses

Selling, general, and administrative expenses decreased 11.4% inclusive of rabbi trust impacts and stock-based compensation. Adjusted selling, general, and administrative expenses increased $48 million, primarily due to the addition of ALG's Adjusted selling, general, and administrative expenses which were $28 million in the second quarter of 2022 and an increase in Corporate Adjusted selling, general, and administrative expenses of $13 million compared to second quarter of 2021.

Refer to the table on page 16 of the schedules for a reconciliation of selling, general, and administrative expenses to Adjusted selling, general, and administrative expenses.

OPENINGS AND FUTURE EXPANSION

In the second quarter of 2022, 28 new hotels (or 5,510 rooms) joined Hyatt's system.

As of June 30, 2022, the Company had a pipeline of executed management or franchise contracts for approximately 550 hotels (approximately 113,000 rooms), inclusive of ALG's pipeline contribution of approximately 20 hotels (or approximately 7,000 rooms).

Note: All RevPAR and ADR percentage changes are in constant dollars. This release includes references to non-GAAP financial measures. Refer to the non-GAAP reconciliations included in the schedules and the definitions of the non-GAAP measures presented beginning on page 12.

Page 4

TRANSACTION / CAPITAL STRATEGY

During the second quarter, the Company completed the following asset sales related to its owned and leased portfolio, resulting in gross proceeds of $812 million at an aggregate multiple of 15.7x 2019 EBITDA:

•Hyatt Regency Indian Wells Resort & Spa — The Company sold the 530-room Hyatt Regency Indian Wells Resort & Spa, located in Palm Springs, CA, for approximately $145 million (approximately $136 million, net of closing costs and proration adjustments) to an unrelated third party and entered into a long-term management agreement.

•Grand Hyatt San Antonio River Walk — The Company sold the 1,003-room Grand Hyatt San Antonio River Walk, located in San Antonio, TX, for approximately $310 million (approximately $127 million, net of closing costs, proration adjustments, restricted cash returned, and after legal defeasance of $166 million of bonds) to an unrelated third party and entered into a long-term management agreement.

•The Driskill — The Company sold the 189-room The Driskill, located in Austin, TX, for approximately $125 million (approximately $119 million, net of closing costs and proration adjustments) to an unrelated third party and entered into a long-term management agreement.

•The Confidante Miami Beach — The Company sold the 339-room The Confidante Miami Beach, located in Miami Beach, FL, for approximately $232 million (approximately $227 million, net of closing costs and proration adjustments) to an unrelated third party and entered into a long-term management agreement.

On August 3, 2022, the Company acquired the following asset:

•Hotel Irvine — The Company acquired the 541-room Hotel Irvine, located in Irvine, CA, for approximately $135 million from an unrelated third party.

The Company is currently marketing two hotels for sale and intends to successfully execute plans to realize approximately $2 billion of gross proceeds from the sales of real estate, net of acquisitions, by the end of 2024 as part of its expanded asset-disposition commitment announced in August 2021.

BALANCE SHEET / LIQUIDITY

As of June 30, 2022, the Company reported the following:

•Total debt of $3,804 million, reflecting a reduction of approximately $180 million during the quarter through the repurchase of senior notes and the legal defeasance of bonds related to Grand Hyatt San Antonio River Walk.

•Pro rata share of unconsolidated hospitality venture debt of $589 million, substantially all of which is non-recourse to Hyatt and a portion of which Hyatt guarantees pursuant to separate agreements.

•Total liquidity of approximately $3.5 billion with $1,955 million of cash and cash equivalents and short-term investments, and borrowing availability of $1,496 million under Hyatt's revolving credit facility, net of letters of credit outstanding.

SHARE REPURCHASE / DIVIDEND

During the second quarter of 2022, the Company repurchased Class A common shares for approximately $101 million. There were no Class B shares repurchases or any Class A or Class B quarterly dividend payments during the second quarter of 2022. The Company ended the second quarter with 50,096,332 Class A and 59,017,749 Class B shares issued and outstanding.

Note: All RevPAR and ADR percentage changes are in constant dollars. This release includes references to non-GAAP financial measures. Refer to the non-GAAP reconciliations included in the schedules and the definitions of the non-GAAP measures presented beginning on page 12.

Page 5

2022 OUTLOOK

The Company is providing the following information for the 2022 fiscal year:

•Comparable system-wide constant dollar RevPAR is expected to be greater than 2021 by a range of 55% to 60%, and system-wide constant dollar RevPAR is expected to be less than 2019 by a range of 4% to 9% for hotels that were comparable in both years.

•Capital expenditures are expected to be approximately $210 million.

◦Hyatt capital expenditures, excluding ALG, are expected to be approximately $185 million.

◦ALG capital expenditures are expected to be approximately $25 million.

•Adjusted selling, general, and administrative expenses are expected to be approximately $460 million to $465 million. This includes selling, general, and administrative expenses associated with the acquisition of ALG, of which $25 million to $30 million is related to one-time integration costs in 2022. Refer to the table on page 16 of the schedules for a reconciliation of selling, general, and administrative expenses to Adjusted selling, general, and administrative expenses.

◦Excluding ALG, Adjusted selling, general, and administrative expenses are expected to be approximately $300 million to $305 million, and include $25 million to $30 million related to one-time integration costs in 2022.

◦ALG Adjusted selling, general, and administrative expenses are expected to be approximately $160 million.

•The Company expects to grow net rooms by greater than 6.0%.

No disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2022 Outlook. The Company's 2022 Outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that Hyatt will achieve these results.

Note: All RevPAR and ADR percentage changes are in constant dollars. This release includes references to non-GAAP financial measures. Refer to the non-GAAP reconciliations included in the schedules and the definitions of the non-GAAP measures presented beginning on page 12.

Page 6

CONFERENCE CALL INFORMATION

The Company will hold an investor conference call this morning, August 9, 2022, at 8:00 a.m. CT.

Participants are encouraged to listen to a simultaneous webcast of the conference call, which may be accessed through the Company’s website at investors.hyatt.com. Alternatively, participants may access the live call by dialing: 888-412-4131 (U.S. Toll-Free) or 646-960-0134 (International Toll Number) using conference ID# 9019679 approximately 15 minutes prior to the scheduled start time.

A replay of the call will be available for one week beginning on Tuesday, August 9, 2022 at 11:00 a.m. CT by dialing: 800-770-2030 (U.S. Toll-Free) or 647-362-9199 (International Toll Number) using conference ID# 9019679. An archive of the webcast will be available on the Company’s website for 90 days.

FORWARD-LOOKING STATEMENTS

Forward-Looking Statements in this press release, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements about our plans, strategies, outlook, occupancy, the impact of the COVID-19 pandemic and pace of recovery, the amount by which the Company intends to reduce its real estate asset base and the anticipated timeframe for such asset dispositions, the number of properties we expect to open in the future, booking trends, RevPAR trends, our expected Adjusted SG&A expense, our expected capital expenditures, our expected net rooms growth, financial performance, prospects or future events and involve known and unknown risks that are difficult to predict. As a result, our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "continue," "likely," "will," "would" and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: risks associated with the acquisition of ALG; our ability to realize the anticipated benefits of the acquisition of ALG as rapidly or to the extent anticipated, including successful integration of the ALG business; the duration and severity of the COVID-19 pandemic and the pace of recovery following the pandemic, any additional resurgence, or COVID-19 variants; the short and long-term effects of the COVID-19 pandemic, including on the demand for travel, transient and group business, and levels of consumer confidence; the impact of the COVID-19 pandemic, any additional resurgence, or COVID-19 variants, and the impact of actions that governments, businesses, and individuals take in response, on global and regional economies, travel limitations or bans, and economic activity, including the duration and magnitude of its impact on unemployment rates and consumer discretionary spending; the broad distribution and efficacy of COVID-19 vaccines and treatments, wide acceptance by the general population of such vaccines, and the availability, use, and effectiveness of COVID-19 testing, including at-home testing kits; the ability of third-party owners, franchisees, or hospitality venture partners to successfully navigate the impacts of the COVID-19 pandemic, any additional resurgence, or COVID-19 variants; general economic uncertainty in key global markets and a worsening of global economic conditions or low levels of economic growth; the rate and the pace of economic recovery following economic downturns; global supply chain constraints and interruptions, rising costs of construction-related labor and materials, and increases in costs due to inflation or other factors that may not be fully offset by increases in revenues in our business; risks affecting the luxury, resort, and all-inclusive lodging segments; levels of spending in business, leisure, and group segments as well as consumer confidence; declines in occupancy and average daily rate; limited visibility with respect to future bookings; loss of key personnel; domestic and international political and geo-political conditions, including political or civil unrest or changes in trade policy; hostilities, or fear of hostilities, including future terrorist attacks, that affect travel; travel-related accidents; natural or man-made disasters such as earthquakes, tsunamis, tornadoes, hurricanes, floods, wildfires, oil spills, nuclear incidents, and global outbreaks of pandemics or contagious diseases, or fear of such outbreaks; our ability to successfully achieve certain levels of operating profits at hotels that have performance tests or guarantees in favor of our third-party owners; the impact of hotel renovations and redevelopments; risks associated with our capital allocation plans, share repurchase program, and dividend payments, including a reduction in, or elimination or suspension of, repurchase activity or dividend payments; the seasonal and cyclical nature of the real estate and hospitality businesses; changes in distribution arrangements, such as through internet travel intermediaries; changes in the tastes and preferences of our customers; relationships with colleagues and labor unions and changes in labor laws; the financial condition of, and our relationships with, third-party property owners, franchisees, and hospitality venture partners; the possible inability of third-party owners, franchisees, or development partners to access capital necessary to fund current operations or implement our plans for growth; risks associated with potential acquisitions and dispositions and the introduction of new brand concepts; the timing of acquisitions and dispositions and our ability to successfully integrate completed acquisitions with existing operations; failure to successfully complete proposed transactions (including the failure to satisfy closing conditions or obtain required approvals); our ability to successfully execute on our strategy to expand our management and franchising business while at the same time reducing our real estate asset base within targeted timeframes and at expected values; declines in the value of our real estate assets; unforeseen terminations of our management or franchise agreements; changes in federal, state, local, or foreign tax law; increases in interest rates, wages, and other operating costs; foreign exchange rate fluctuations or currency restructurings; lack of acceptance of new brands or innovation; general volatility of the capital markets and our ability to access such markets; changes in the competitive environment in our industry, including as a result of the COVID-19 pandemic, industry consolidation, and the markets where we operate; our ability to successfully grow the World of Hyatt loyalty program and Unlimited Vacation Club paid membership program; cyber incidents and information technology failures; outcomes of legal or

Note: All RevPAR and ADR percentage changes are in constant dollars. This release includes references to non-GAAP financial measures. Refer to the non-GAAP reconciliations included in the schedules and the definitions of the non-GAAP measures presented beginning on page 12.

Page 7

administrative proceedings; violations of regulations or laws related to our franchising business; and other risks discussed in the Company's filings with the SEC, including our annual report on Form 10-K, which filings are available from the SEC. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. We caution you not to place undue reliance on any forward-looking statements, which are made only as of the date of this press release. We do not undertake or assume any obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

NON-GAAP FINANCIAL MEASURES

The Company refers to certain financial measures that are not recognized under U.S. generally accepted accounting principles (GAAP) in this press release, including: net income (loss), adjusted for special items; diluted earnings (losses) per share, adjusted for special items; Adjusted EBITDA; Adjusted EBITDA margin; and Adjusted SG&A. See the schedules to this earnings release, including the "Definitions" section, for additional information and reconciliations of such non-GAAP financial measures.

AVAILABILITY OF INFORMATION ON HYATT'S WEBSITE AND SOCIAL MEDIA CHANNELS

Investors and others should note that Hyatt routinely announces material information to investors and the marketplace using U.S. Securities and Exchange Commission (SEC) filings, press releases, public conference calls, webcasts and the Hyatt Investor Relations website. The Company uses these channels as well as social media channels (e.g., the Hyatt Facebook account (facebook.com/hyatt); the Hyatt Instagram account (instagram.com/hyatt/); the Hyatt Twitter account (twitter.com/hyatt); the Hyatt LinkedIn account (linkedin.com/company/hyatt/); and the Hyatt YouTube account (youtube.com/user/hyatt)) as a means of disclosing information about the Company's business to our guests, customers, colleagues, investors, and the public. While not all of the information that the Company posts to the Hyatt Investor Relations website or on the Company's social media channels is of a material nature, some information could be deemed to be material. Accordingly, the Company encourages investors, the media, and others interested in Hyatt to review the information that it shares at the Investor Relations link located at the bottom of the page on hyatt.com and on the Company's social media channels. Users may automatically receive email alerts and other information about the Company when enrolling an email address by visiting "Sign up for Email Alerts" in the "Investor Resources" section of Hyatt's website at investors.hyatt.com.

ABOUT HYATT HOTELS CORPORATION

Hyatt Hotels Corporation, headquartered in Chicago, is a leading global hospitality company guided by its purpose – to care for people so they can be their best. As of June 30, 2022, the Company’s portfolio included more than 1,150 hotels and all-inclusive properties in 72 countries across six continents. The Company's offering includes brands in the Timeless Collection, including Park Hyatt®, Grand Hyatt®, Hyatt Regency®, Hyatt®, Hyatt Residence Club®, Hyatt Place®, Hyatt House®, and UrCove; the Boundless Collection, including Miraval®, Alila®, Andaz®, Thompson Hotels®, Hyatt Centric®, and Caption by Hyatt; the Independent Collection, including The Unbound Collection by Hyatt®, Destination by Hyatt™, and JdV by Hyatt™; and the Inclusive Collection, including Hyatt Ziva®, Hyatt Zilara®, Zoëtry® Wellness & Spa Resorts, Secrets® Resorts & Spas, Breathless Resorts & Spas®, Dreams® Resorts & Spas, Vivid Hotels & Resorts®, Alua Hotels & Resorts®, and Sunscape® Resorts & Spas. Subsidiaries of the Company operate the World of Hyatt® loyalty program, ALG Vacations®, Unlimited Vacation Club®, Amstar DMC destination management services, and Trisept Solutions® technology services. For more information, please visit www.hyatt.com.

Note: All RevPAR and ADR percentage changes are in constant dollars. This release includes references to non-GAAP financial measures. Refer to the non-GAAP reconciliations included in the schedules and the definitions of the non-GAAP measures presented beginning on page 12.

Hyatt Hotels Corporation

Table of Contents

Financial Information (unaudited)

| 1. | |||||

| 2. | |||||

| 3. | |||||

| 4. | |||||

| 5. | |||||

| 6. | |||||

| 7. | |||||

| 8. - 9. | |||||

| 10. | |||||

| 11. | |||||

| 12. - 18. | |||||

| a. | |||||

| b. | |||||

| c. | |||||

| d. | Earnings (Losses) per Diluted Share and Net Income (Loss) Attributable to Hyatt Hotels Corporation, to Earnings (Losses) per Diluted Share, Adjusted for Special Items and Adjusted Net Income (Loss) Attributable to Hyatt Hotels Corporation - Six Months Ended June 30, 2022 and June 30, 2021 | ||||

| e. | |||||

| f. | |||||

| g. | |||||

| 19. - 23. | |||||

Percentages on the following schedules may not recompute due to rounding. Not meaningful percentage changes are presented as "NM".

Hyatt Hotels Corporation

Condensed Consolidated Statements of Income (Loss)

(in millions, except per share amounts)

(unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||

| REVENUES: | ||||||||||||||||||||||||||

| Owned and leased hotels | $ | 331 | $ | 191 | $ | 602 | $ | 295 | ||||||||||||||||||

| Management, franchise, and other fees | 204 | 93 | 358 | 156 | ||||||||||||||||||||||

| Contra revenue | (9) | (9) | (18) | (17) | ||||||||||||||||||||||

| Net management, franchise, and other fees | 195 | 84 | 340 | 139 | ||||||||||||||||||||||

| Distribution and destination management | 256 | — | 502 | — | ||||||||||||||||||||||

| Other revenues | 61 | 22 | 138 | 41 | ||||||||||||||||||||||

| Revenues for the reimbursement of costs incurred on behalf of managed and franchised properties | 640 | 366 | 1,180 | 626 | ||||||||||||||||||||||

| Total revenues | 1,483 | 663 | 2,762 | 1,101 | ||||||||||||||||||||||

| DIRECT AND SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES: | ||||||||||||||||||||||||||

| Owned and leased hotels | 229 | 174 | 439 | 298 | ||||||||||||||||||||||

| Distribution and destination management | 206 | — | 400 | — | ||||||||||||||||||||||

| Depreciation and amortization | 105 | 74 | 224 | 148 | ||||||||||||||||||||||

| Other direct costs | 69 | 24 | 136 | 47 | ||||||||||||||||||||||

| Selling, general, and administrative | 76 | 86 | 187 | 181 | ||||||||||||||||||||||

| Costs incurred on behalf of managed and franchised properties | 628 | 375 | 1,184 | 652 | ||||||||||||||||||||||

| Direct and selling, general, and administrative expenses | 1,313 | 733 | 2,570 | 1,326 | ||||||||||||||||||||||

| Net gains (losses) and interest income from marketable securities held to fund rabbi trusts | (46) | 24 | (77) | 36 | ||||||||||||||||||||||

| Equity earnings (losses) from unconsolidated hospitality ventures | 1 | (34) | (8) | 20 | ||||||||||||||||||||||

| Interest expense | (38) | (42) | (78) | (83) | ||||||||||||||||||||||

| Gains on sales of real estate | 251 | 105 | 251 | 105 | ||||||||||||||||||||||

| Asset impairments | (7) | (2) | (10) | (2) | ||||||||||||||||||||||

| Other income (loss), net | (19) | 25 | (29) | 37 | ||||||||||||||||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | 312 | 6 | 241 | (112) | ||||||||||||||||||||||

| PROVISION FOR INCOME TAXES | (106) | (15) | (108) | (201) | ||||||||||||||||||||||

| NET INCOME (LOSS) | 206 | (9) | 133 | (313) | ||||||||||||||||||||||

| NET INCOME (LOSS) ATTRIBUTABLE TO NONCONTROLLING INTERESTS | — | — | — | — | ||||||||||||||||||||||

| NET INCOME (LOSS) ATTRIBUTABLE TO HYATT HOTELS CORPORATION | $ | 206 | $ | (9) | $ | 133 | $ | (313) | ||||||||||||||||||

| EARNINGS (LOSSES) PER SHARE—Basic | ||||||||||||||||||||||||||

| Net income (loss) | $ | 1.88 | $ | (0.08) | $ | 1.21 | $ | (3.07) | ||||||||||||||||||

| Net income (loss) attributable to Hyatt Hotels Corporation | $ | 1.88 | $ | (0.08) | $ | 1.21 | $ | (3.07) | ||||||||||||||||||

| EARNINGS (LOSSES) PER SHARE—Diluted | ||||||||||||||||||||||||||

| Net income (loss) | $ | 1.85 | $ | (0.08) | $ | 1.19 | $ | (3.07) | ||||||||||||||||||

| Net income (loss) attributable to Hyatt Hotels Corporation | $ | 1.85 | $ | (0.08) | $ | 1.19 | $ | (3.07) | ||||||||||||||||||

| Basic share counts | 110.0 | 101.9 | 110.1 | 101.7 | ||||||||||||||||||||||

| Diluted share counts | 111.9 | 101.9 | 112.2 | 101.7 | ||||||||||||||||||||||

Page 1

Hyatt Hotels Corporation

Segment Financial Summary

(in millions)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change ($) | Change (%) | Change in Constant $ | Change in Constant $ (%) | 2022 | 2021 | Change ($) | Change (%) | Change in Constant $ | Change in Constant $ (%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Owned and leased hotels | $ | 335 | $ | 194 | $ | 141 | 71.9 | % | $ | 142 | 72.8 | % | $ | 612 | $ | 301 | $ | 311 | 103.0 | % | $ | 312 | 103.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Americas management and franchising | 157 | 85 | 72 | 86.9 | % | 72 | 87.0 | % | 290 | 140 | 150 | 107.0 | % | 150 | 107.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ASPAC management and franchising | 18 | 20 | (2) | (12.1) | % | (1) | (9.3) | % | 32 | 35 | (3) | (7.5) | % | (2) | (5.7) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EAME/SW Asia management and franchising | 21 | 6 | 15 | 222.5 | % | 16 | 233.1 | % | 36 | 13 | 23 | 173.9 | % | 24 | 183.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Apple Leisure Group | 329 | — | 329 | NM | 329 | NM | 639 | — | 639 | NM | 639 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate and other | 13 | 11 | 2 | 21.5 | % | 2 | 21.5 | % | 27 | 19 | 8 | 40.9 | % | 8 | 40.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliminations (a) | (21) | (10) | (11) | (112.4) | % | (11) | (112.6) | % | (36) | (16) | (20) | (127.8) | % | (20) | (127.9) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted revenues | $ | 852 | $ | 306 | $ | 546 | 178.1 | % | $ | 549 | 179.7 | % | $ | 1,600 | $ | 492 | $ | 1,108 | 224.8 | % | $ | 1,111 | 226.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Owned and leased hotels | $ | 82 | $ | 11 | $ | 71 | 687.5 | % | $ | 70 | 658.6 | % | $ | 130 | $ | (14) | $ | 144 | 998.3 | % | $ | 143 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Pro rata share of unconsolidated hospitality ventures | 17 | 1 | 16 | NM | 16 | NM | 23 | (3) | 26 | NM | 26 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total owned and leased hotels | 99 | 12 | 87 | 752.4 | % | 86 | 719.9 | % | 153 | (17) | 170 | NM | 169 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Americas management and franchising | 117 | 54 | 63 | 115.3 | % | 63 | 115.6 | % | 202 | 82 | 120 | 145.8 | % | 120 | 146.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ASPAC management and franchising | 6 | 10 | (4) | (40.5) | % | (3) | (38.0) | % | 11 | 15 | (4) | (28.6) | % | (3) | (26.4) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EAME/SW Asia management and franchising | 13 | (1) | 14 | NM | 14 | NM | 19 | (1) | 20 | NM | 20 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Apple Leisure Group | 54 | — | 54 | NM | 54 | NM | 110 | — | 110 | NM | 110 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate and other | (34) | (21) | (13) | (62.2) | % | (13) | (62.7) | % | (72) | (45) | (27) | (57.9) | % | (27) | (58.1) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliminations | — | 1 | (1) | (39.7) | % | (1) | (39.7) | % | 1 | 1 | — | 24.9 | % | — | 24.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 255 | $ | 55 | $ | 200 | 365.4 | % | $ | 200 | 364.0 | % | $ | 424 | $ | 35 | $ | 389 | NM | $ | 389 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change $ | Change (%) | 2022 | 2021 | Change $ | Change (%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 255 | $ | 55 | $ | 200 | 365.4 | % | $ | 424 | $ | 35 | $ | 389 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Deferral activity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Increase in deferred revenue | $ | 52 | $ | — | $ | 52 | NM | $ | 101 | $ | — | $ | 101 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Increase in deferred costs | (27) | — | (27) | NM | (52) | — | (52) | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Deferrals | $ | 25 | $ | — | $ | 25 | NM | $ | 49 | $ | — | $ | 49 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Increase in Net Financed Contracts | $ | 15 | $ | — | $ | 15 | NM | $ | 22 | $ | — | $ | 22 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a)These intersegment eliminations represent management fee revenues and expenses related to our owned and leased hotels and promotional award redemption revenues and expenses related to our co-branded credit card program at our owned and leased hotels.

Page 2

Hyatt Hotels Corporation

Reconciliation of Unlimited Vacation Club Net Deferrals

(in millions)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change $ | Change (%) | 2022 | 2021 | Change ($) | Change (%) | ||||||||||||||||||||||||||||||||||||||||||||||

| Sales of membership club contracts deferrals | $ | 91 | $ | — | $ | 91 | NM | $ | 179 | $ | — | $ | 179 | NM | |||||||||||||||||||||||||||||||||||||||

| Membership club revenue recognized | (39) | — | (39) | NM | (78) | — | (78) | NM | |||||||||||||||||||||||||||||||||||||||||||||

| Increase in deferred revenue from membership club contract sales | 52 | — | 52 | NM | 101 | — | 101 | NM | |||||||||||||||||||||||||||||||||||||||||||||

| Costs of memberships club contracts deferrals | (29) | — | (29) | NM | (56) | — | (56) | NM | |||||||||||||||||||||||||||||||||||||||||||||

| Membership club costs recognized | 2 | — | 2 | NM | 4 | — | 4 | NM | |||||||||||||||||||||||||||||||||||||||||||||

| Increase in deferred costs from membership club contract costs | (27) | — | (27) | NM | (52) | — | (52) | NM | |||||||||||||||||||||||||||||||||||||||||||||

| Net Deferrals | $ | 25 | $ | — | $ | 25 | NM | $ | 49 | $ | — | $ | 49 | NM | |||||||||||||||||||||||||||||||||||||||

| Increase in Net Financed Contracts | $ | 15 | $ | — | $ | 15 | NM | $ | 22 | $ | — | $ | 22 | NM | |||||||||||||||||||||||||||||||||||||||

Page 3

Hyatt Hotels Corporation

Hotel Chain Statistics

Comparable Hotels

In Constant $

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| RevPAR | Occupancy | ADR | RevPAR | Occupancy | ADR | ||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | vs. 2021 | 2022 | vs. 2021 | 2022 | vs. 2021 | 2022 | vs. 2021 | 2022 | vs. 2021 | 2022 | vs. 2021 | ||||||||||||||||||||||||||||||||||||||||||

| Owned and leased hotels (# of hotels) (a) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Owned and leased hotels (26) | $ | 186.34 | 140.1 | % | 70.4 | % | 30.8% pts | $ | 264.74 | 35.2 | % | $ | 160.94 | 180.4 | % | 61.7 | % | 30.9% pts | $ | 260.78 | 39.8 | % | |||||||||||||||||||||||||||||||

| Managed and franchised hotels (# of hotels) (b) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| System-wide hotels (922) | $ | 130.16 | 81.7 | % | 65.5 | % | 17.8% pts | $ | 198.78 | 32.4 | % | $ | 112.32 | 91.9 | % | 58.4 | % | 16.9% pts | $ | 192.31 | 36.2 | % | |||||||||||||||||||||||||||||||

| Americas | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full service hotels (217) | $ | 175.14 | 112.0 | % | 70.2 | % | 27.7% pts | $ | 249.52 | 28.5 | % | $ | 149.68 | 136.1 | % | 61.0 | % | 26.5% pts | $ | 245.46 | 33.5 | % | |||||||||||||||||||||||||||||||

| Select service hotels (435) | $ | 116.77 | 55.2 | % | 74.6 | % | 11.6% pts | $ | 156.63 | 31.3 | % | $ | 100.05 | 62.6 | % | 68.1 | % | 12.7% pts | $ | 147.01 | 32.5 | % | |||||||||||||||||||||||||||||||

| ASPAC | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full service hotels (120) | $ | 70.64 | 0.8 | % | 43.9 | % | (2.3)% pts | $ | 161.06 | 6.2 | % | $ | 66.86 | 7.4 | % | 40.6 | % | (0.4)% pts | $ | 164.84 | 8.6 | % | |||||||||||||||||||||||||||||||

| Select service hotels (31) | $ | 33.03 | (22.6) | % | 49.9 | % | (11.6)% pts | $ | 66.22 | (4.5) | % | $ | 32.27 | (16.1) | % | 47.5 | % | (9.1)% pts | $ | 67.95 | 0.0 | % | |||||||||||||||||||||||||||||||

| EAME/SW Asia | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full service hotels (99) | $ | 135.48 | 239.9 | % | 65.2 | % | 36.6% pts | $ | 207.90 | 49.3 | % | $ | 112.77 | 204.5 | % | 57.0 | % | 28.1% pts | $ | 197.77 | 54.5 | % | |||||||||||||||||||||||||||||||

| Select service hotels (20) | $ | 62.40 | 148.2 | % | 71.9 | % | 32.1% pts | $ | 86.82 | 37.4 | % | $ | 57.15 | 119.2 | % | 64.0 | % | 22.4% pts | $ | 89.36 | 42.5 | % | |||||||||||||||||||||||||||||||

(a) Owned and leased hotels figures do not include unconsolidated hospitality ventures.

(b) Managed and franchised hotels figures include owned and leased hotels.

Page 4

Hyatt Hotels Corporation

Hotel Brand Statistics

Comparable System-wide Managed and Franchised Hotels (a)

In Constant $

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RevPAR | Occupancy | ADR | RevPAR | Occupancy | ADR | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | vs. 2021 | 2022 | vs. 2021 | 2022 | vs. 2021 | 2022 | vs. 2021 | 2022 | vs. 2021 | 2022 | vs. 2021 | |||||||||||||||||||||||||||||||||||||||||||||

| Brand (# of hotels) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Park Hyatt (39) | $ | 205.11 | 64.3 | % | 53.1 | % | 11.9 pts | $ | 386.53 | 27.5 | % | $ | 193.27 | 67.9 | % | 49.0 | % | 10.5 pts | $ | 394.15 | 31.8 | % | ||||||||||||||||||||||||||||||||||

| Grand Hyatt (57) | $ | 132.65 | 79.1 | % | 57.3 | % | 15.3 pts | $ | 231.68 | 31.4 | % | $ | 122.20 | 96.7 | % | 52.5 | % | 15.6 pts | $ | 232.79 | 38.4 | % | ||||||||||||||||||||||||||||||||||

| Andaz (23) | $ | 214.22 | 70.1 | % | 65.2 | % | 18.4 pts | $ | 328.78 | 22.3 | % | $ | 192.41 | 84.7 | % | 57.4 | % | 16.5 pts | $ | 335.35 | 31.6 | % | ||||||||||||||||||||||||||||||||||

| Unbound (21) | $ | 226.19 | 111.8 | % | 62.2 | % | 17.5 pts | $ | 363.55 | 52.1 | % | $ | 180.73 | 125.9 | % | 54.0 | % | 18.2 pts | $ | 334.53 | 49.7 | % | ||||||||||||||||||||||||||||||||||

Composite Luxury1 | $ | 165.91 | 76.9 | % | 58.6 | % | 16.0 pts | $ | 283.33 | 28.7 | % | $ | 149.59 | 90.6 | % | 53.0 | % | 15.7 pts | $ | 282.02 | 34.1 | % | ||||||||||||||||||||||||||||||||||

| Hyatt Regency (204) | $ | 124.44 | 105.0 | % | 63.3 | % | 23.0 pts | $ | 196.70 | 30.6 | % | $ | 104.71 | 118.3 | % | 55.0 | % | 21.1 pts | $ | 190.29 | 34.4 | % | ||||||||||||||||||||||||||||||||||

| Hyatt Centric (37) | $ | 149.86 | 126.5 | % | 71.0 | % | 27.7 pts | $ | 211.14 | 38.4 | % | $ | 126.00 | 120.5 | % | 61.4 | % | 22.7 pts | $ | 205.29 | 39.1 | % | ||||||||||||||||||||||||||||||||||

Composite Upper-Upscale2 | $ | 127.46 | 108.6 | % | 64.2 | % | 23.6 pts | $ | 198.38 | 31.8 | % | $ | 106.74 | 119.8 | % | 55.8 | % | 21.5 pts | $ | 191.34 | 35.1 | % | ||||||||||||||||||||||||||||||||||

| Hyatt Place (372) | $ | 103.04 | 51.1 | % | 71.5 | % | 10.7 pts | $ | 144.17 | 28.5 | % | $ | 88.87 | 58.1 | % | 65.2 | % | 11.1 pts | $ | 136.31 | 31.1 | % | ||||||||||||||||||||||||||||||||||

| Hyatt House (109) | $ | 126.10 | 61.7 | % | 76.0 | % | 11.8 pts | $ | 165.99 | 36.7 | % | $ | 108.17 | 67.2 | % | 70.0 | % | 13.3 pts | $ | 154.59 | 35.5 | % | ||||||||||||||||||||||||||||||||||

Composite Upscale3 | $ | 108.39 | 53.9 | % | 72.5 | % | 10.9 pts | $ | 149.47 | 30.6 | % | $ | 93.35 | 60.4 | % | 66.3 | % | 11.6 pts | $ | 140.78 | 32.3 | % | ||||||||||||||||||||||||||||||||||

(a) Managed and franchised hotels figures include owned and leased hotels.

1 Includes Park Hyatt, Miraval, Grand Hyatt, Alila, Andaz, The Unbound Collection by Hyatt, Destination by Hyatt, and Thompson Hotels.

2 Includes Hyatt Regency, Hyatt, Hyatt Centric, and JdV by Hyatt.

3 Includes Hyatt Place and Hyatt House.

Page 5

Hyatt Hotels Corporation

All-inclusive Brand Statistics

All Properties (Comparable and Non-Comparable) Managed and Franchised Hotels (a)

In Constant $

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Package RevPAR | Occupancy | Net Package ADR | Net Package RevPAR | Occupancy | Net Package ADR | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | vs. 2021 | 2022 | vs. 2021 | 2022 | vs. 2021 | 2022 | vs. 2021 | 2022 | vs. 2021 | 2022 | vs. 2021 | |||||||||||||||||||||||||||||||||||||||||||||

| Brand (# of hotels) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ALG resorts Americas (62) | $ | 204.51 | NM | 72.6 | % | NM | $ | 281.64 | NM | $ | 209.28 | NM | 70.9 | % | NM | $ | 294.98 | NM | ||||||||||||||||||||||||||||||||||||||

| ALG resorts Europe (50) (b) | $ | 80.13 | NM | 68.7 | % | NM | $ | 116.70 | NM | $ | 77.57 | NM | 64.9 | % | NM | $ | 119.56 | NM | ||||||||||||||||||||||||||||||||||||||

Composite all-inclusive1 (b) | $ | 182.10 | NM | 71.3 | % | NM | $ | 255.30 | NM | $ | 192.01 | NM | 69.0 | % | NM | $ | 278.25 | NM | ||||||||||||||||||||||||||||||||||||||

(a) Managed and franchised hotels figures include owned and leased hotels.

(b) Certain resorts in Europe operate under a hybrid all-inclusive model, which includes various all-inclusive package options as well as rooms-only options.

1 Includes ALG resorts, Hyatt Ziva and Hyatt Zilara.

Page 6

Hyatt Hotels Corporation

Fee Summary

(in millions)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change ($) | Change (%) | 2022 | 2021 | Change ($) | Change (%) | |||||||||||||||||||||||||||||||||||||||||||

| Base management fees | $ | 79 | $ | 36 | $ | 43 | 119.2 | % | $ | 139 | $ | 60 | $ | 79 | 131.5 | % | ||||||||||||||||||||||||||||||||||

| Incentive management fees | 45 | 12 | 33 | 264.6 | % | 85 | 20 | 65 | 324.4 | % | ||||||||||||||||||||||||||||||||||||||||

| Franchise fees | 52 | 29 | 23 | 83.4 | % | 87 | 46 | 41 | 91.9 | % | ||||||||||||||||||||||||||||||||||||||||

| Management and franchise fees | 176 | 77 | 99 | 129.4 | % | 311 | 126 | 185 | 147.9 | % | ||||||||||||||||||||||||||||||||||||||||

| Other fee revenues | 28 | 16 | 12 | 68.6 | % | 47 | 30 | 17 | 53.7 | % | ||||||||||||||||||||||||||||||||||||||||

| Management, franchise, and other fees | $ | 204 | $ | 93 | $ | 111 | 118.3 | % | $ | 358 | $ | 156 | $ | 202 | 129.3 | % | ||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change ($) | Change (%) | 2022 | 2021 | Change ($) | Change (%) | |||||||||||||||||||||||||||||||||||||||||||

| Management, franchise, and other fees | $ | 204 | $ | 93 | $ | 111 | 118.3 | % | $ | 358 | $ | 156 | $ | 202 | 129.3 | % | ||||||||||||||||||||||||||||||||||

| Contra revenue from management agreements | (6) | (6) | — | (1.6) | % | (11) | (11) | — | 1.6 | % | ||||||||||||||||||||||||||||||||||||||||

| Contra revenue from franchise agreements | (3) | (3) | — | (22.0) | % | (7) | (6) | (1) | (27.4) | % | ||||||||||||||||||||||||||||||||||||||||

| Net management, franchise, and other fees | $ | 195 | $ | 84 | $ | 111 | 129.8 | % | $ | 340 | $ | 139 | $ | 201 | 144.1 | % | ||||||||||||||||||||||||||||||||||

Page 7

Hyatt Hotels Corporation

Properties and Rooms by Geography

Owned and leased hotels

| June 30, 2022 | June 30, 2021 | Change | |||||||||||||||||||||||||||||||||||||||||||||

| Properties | Rooms | Properties | Rooms | Properties | Rooms | ||||||||||||||||||||||||||||||||||||||||||

| Full service hotels | |||||||||||||||||||||||||||||||||||||||||||||||

| United States (a) | 17 | 8,964 | 25 | 12,167 | (8) | (3,203) | |||||||||||||||||||||||||||||||||||||||||

| Other Americas | 3 | 1,262 | 3 | 1,262 | — | — | |||||||||||||||||||||||||||||||||||||||||

| EAME/SW Asia | 5 | 1,135 | 7 | 1,435 | (2) | (300) | |||||||||||||||||||||||||||||||||||||||||

| Select service hotels | |||||||||||||||||||||||||||||||||||||||||||||||

| United States | 1 | 171 | 1 | 171 | — | — | |||||||||||||||||||||||||||||||||||||||||

| Other Americas | 2 | 293 | 2 | 293 | — | — | |||||||||||||||||||||||||||||||||||||||||

| EAME/SW Asia | 1 | 330 | 1 | 330 | — | — | |||||||||||||||||||||||||||||||||||||||||

| Total full service and select service hotels | 29 | 12,155 | 39 | 15,658 | (10) | (3,503) | |||||||||||||||||||||||||||||||||||||||||

| All-inclusive hotels (b) | 6 | 1,279 | — | — | 6 | 1,279 | |||||||||||||||||||||||||||||||||||||||||

| Total owned and leased hotels (c) | 35 | 13,434 | 39 | 15,658 | (4) | (2,224) | |||||||||||||||||||||||||||||||||||||||||

(a) Includes one hotel that was rebranded and combined with an existing property during the three months ended June 30, 2022.

(b) Certain resorts in Europe operate under a hybrid all-inclusive model, which includes various all-inclusive package options as well as rooms-only options.

(c) Figures do not include unconsolidated hospitality ventures.

Page 8

Hyatt Hotels Corporation

Properties and Rooms by Geography

Managed and franchised properties (includes owned and leased properties)

| June 30, 2022 | June 30, 2021 | Change | |||||||||||||||||||||||||||||||||||||||||||||

| Properties | Rooms | Properties | Rooms | Properties | Rooms | ||||||||||||||||||||||||||||||||||||||||||

| Americas | |||||||||||||||||||||||||||||||||||||||||||||||

| Full service hotels | |||||||||||||||||||||||||||||||||||||||||||||||

| United States managed | 147 | 64,102 | 145 | 64,000 | 2 | 102 | |||||||||||||||||||||||||||||||||||||||||

| Other Americas managed | 25 | 8,957 | 24 | 8,741 | 1 | 216 | |||||||||||||||||||||||||||||||||||||||||

| United States franchised | 77 | 22,631 | 68 | 20,675 | 9 | 1,956 | |||||||||||||||||||||||||||||||||||||||||

| Other Americas franchised | 11 | 2,019 | 8 | 1,307 | 3 | 712 | |||||||||||||||||||||||||||||||||||||||||

| Subtotal | 260 | 97,709 | 245 | 94,723 | 15 | 2,986 | |||||||||||||||||||||||||||||||||||||||||

| Select service hotels | |||||||||||||||||||||||||||||||||||||||||||||||

| United States managed | 34 | 5,075 | 37 | 5,658 | (3) | (583) | |||||||||||||||||||||||||||||||||||||||||

| Other Americas managed | 13 | 1,857 | 13 | 1,857 | — | — | |||||||||||||||||||||||||||||||||||||||||

| United States franchised | 410 | 57,205 | 400 | 55,186 | 10 | 2,019 | |||||||||||||||||||||||||||||||||||||||||

| Other Americas franchised | 18 | 2,651 | 13 | 1,761 | 5 | 890 | |||||||||||||||||||||||||||||||||||||||||

| Subtotal | 475 | 66,788 | 463 | 64,462 | 12 | 2,326 | |||||||||||||||||||||||||||||||||||||||||

| ASPAC | |||||||||||||||||||||||||||||||||||||||||||||||

| Full service hotels | |||||||||||||||||||||||||||||||||||||||||||||||

| ASPAC managed | 127 | 41,770 | 121 | 40,661 | 6 | 1,109 | |||||||||||||||||||||||||||||||||||||||||

| ASPAC franchised | 11 | 3,275 | 9 | 2,803 | 2 | 472 | |||||||||||||||||||||||||||||||||||||||||

| Subtotal | 138 | 45,045 | 130 | 43,464 | 8 | 1,581 | |||||||||||||||||||||||||||||||||||||||||

| Select service hotels | |||||||||||||||||||||||||||||||||||||||||||||||

| ASPAC managed | 29 | 5,065 | 28 | 5,134 | 1 | (69) | |||||||||||||||||||||||||||||||||||||||||

| ASPAC franchised | 15 | 2,703 | 6 | 1,169 | 9 | 1,534 | |||||||||||||||||||||||||||||||||||||||||

| Subtotal | 44 | 7,768 | 34 | 6,303 | 10 | 1,465 | |||||||||||||||||||||||||||||||||||||||||

| EAME/SW Asia | |||||||||||||||||||||||||||||||||||||||||||||||

| Full service hotels | |||||||||||||||||||||||||||||||||||||||||||||||

| EAME/SW Asia managed | 105 | 26,176 | 101 | 25,494 | 4 | 682 | |||||||||||||||||||||||||||||||||||||||||

| EAME/SW Asia franchised | 22 | 3,799 | 17 | 2,895 | 5 | 904 | |||||||||||||||||||||||||||||||||||||||||

| Subtotal | 127 | 29,975 | 118 | 28,389 | 9 | 1,586 | |||||||||||||||||||||||||||||||||||||||||

| Select service hotels | |||||||||||||||||||||||||||||||||||||||||||||||

| EAME/SW Asia managed | 24 | 3,978 | 16 | 2,651 | 8 | 1,327 | |||||||||||||||||||||||||||||||||||||||||

| EAME/SW Asia franchised | 5 | 1,070 | 6 | 1,411 | (1) | (341) | |||||||||||||||||||||||||||||||||||||||||

| Subtotal | 29 | 5,048 | 22 | 4,062 | 7 | 986 | |||||||||||||||||||||||||||||||||||||||||

| Total full service and select service hotels | 1,073 | 252,333 | 1,012 | 241,403 | 61 | 10,930 | |||||||||||||||||||||||||||||||||||||||||

| Americas | |||||||||||||||||||||||||||||||||||||||||||||||

| All-inclusive | |||||||||||||||||||||||||||||||||||||||||||||||

| Other Americas | 71 | 25,721 | 8 | 3,153 | 63 | 22,568 | |||||||||||||||||||||||||||||||||||||||||

| Subtotal | 71 | 25,721 | 8 | 3,153 | 63 | 22,568 | |||||||||||||||||||||||||||||||||||||||||

| EAME/SW Asia (a) | |||||||||||||||||||||||||||||||||||||||||||||||

| All-inclusive | |||||||||||||||||||||||||||||||||||||||||||||||

| EAME/SW Asia | 50 | 12,933 | — | — | 50 | 12,933 | |||||||||||||||||||||||||||||||||||||||||

| Subtotal | 50 | 12,933 | — | — | 50 | 12,933 | |||||||||||||||||||||||||||||||||||||||||

| Total all-inclusive hotels | 121 | 38,654 | 8 | 3,153 | 113 | 35,501 | |||||||||||||||||||||||||||||||||||||||||

| Total managed and franchised (b) | 1,194 | 290,987 | 1,020 | 244,556 | 174 | 46,431 | |||||||||||||||||||||||||||||||||||||||||

| Vacation ownership | 22 | 16 | 6 | ||||||||||||||||||||||||||||||||||||||||||||

| Residential | 37 | 36 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| Condominium ownership | 39 | 36 | 3 | ||||||||||||||||||||||||||||||||||||||||||||

(a) Certain resorts in Europe operate under a hybrid all-inclusive model, which includes various all-inclusive package options as well as rooms-only options.

(b) Figures do not include vacation ownership, residential, or condominium ownership units.

Page 9

Hyatt Hotels Corporation

Properties and Rooms by Brand

| June 30, 2022 | June 30, 2021 | Change | |||||||||||||||||||||||||||||||||

| Brand | Properties | Rooms | Properties | Rooms | Properties | Rooms | |||||||||||||||||||||||||||||

| Park Hyatt | 45 | 8,398 | 44 | 8,191 | 1 | 207 | |||||||||||||||||||||||||||||

| Miraval (a) | 3 | 383 | 3 | 362 | — | 21 | |||||||||||||||||||||||||||||

| Grand Hyatt | 58 | 31,110 | 59 | 32,489 | (1) | (1,379) | |||||||||||||||||||||||||||||

| Alila | 16 | 1,765 | 15 | 1,681 | 1 | 84 | |||||||||||||||||||||||||||||

| Andaz | 25 | 5,623 | 25 | 5,698 | — | (75) | |||||||||||||||||||||||||||||

| The Unbound Collection by Hyatt | 30 | 5,898 | 26 | 5,401 | 4 | 497 | |||||||||||||||||||||||||||||

| Thompson Hotels | 17 | 3,592 | 12 | 2,705 | 5 | 887 | |||||||||||||||||||||||||||||

| Destination by Hyatt (a) | 15 | 3,447 | 17 | 3,852 | (2) | (405) | |||||||||||||||||||||||||||||

| Hyatt Regency (b) | 228 | 94,336 | 219 | 92,107 | 9 | 2,229 | |||||||||||||||||||||||||||||

| Hyatt | 13 | 3,354 | 12 | 2,056 | 1 | 1,298 | |||||||||||||||||||||||||||||

| Hyatt Centric | 51 | 10,703 | 40 | 8,333 | 11 | 2,370 | |||||||||||||||||||||||||||||

| JdV by Hyatt | 23 | 3,320 | 20 | 2,901 | 3 | 419 | |||||||||||||||||||||||||||||

| Caption by Hyatt | 1 | 136 | — | — | 1 | 136 | |||||||||||||||||||||||||||||

| Hyatt Place | 406 | 58,885 | 393 | 56,289 | 13 | 2,596 | |||||||||||||||||||||||||||||

| Hyatt House | 128 | 18,273 | 121 | 17,523 | 7 | 750 | |||||||||||||||||||||||||||||

| UrCove | 13 | 2,310 | 5 | 1,015 | 8 | 1,295 | |||||||||||||||||||||||||||||

| Other | 1 | 800 | 1 | 800 | — | — | |||||||||||||||||||||||||||||

| Total full service and select service hotels (c) | 1,073 | 252,333 | 1,012 | 241,403 | 61 | 10,930 | |||||||||||||||||||||||||||||

| ALG resorts (d)(e) | 112 | 35,063 | — | — | 112 | 35,063 | |||||||||||||||||||||||||||||

| Hyatt Ziva | 6 | 2,672 | 5 | 2,234 | 1 | 438 | |||||||||||||||||||||||||||||

| Hyatt Zilara | 3 | 919 | 3 | 919 | — | — | |||||||||||||||||||||||||||||

| Total all-inclusive hotels | 121 | 38,654 | 8 | 3,153 | 113 | 35,501 | |||||||||||||||||||||||||||||

| Total managed and franchised properties and rooms (c) | 1,194 | 290,987 | 1,020 | 244,556 | 174 | 46,431 | |||||||||||||||||||||||||||||

| Hyatt Residence Club (f) | 22 | 16 | 6 | ||||||||||||||||||||||||||||||||

(a) Includes one Destination by Hyatt property that was rebranded and combined with a Miraval property during the three months ended June 30, 2022.

(b) Includes one property that we will rebrand under the respective brand in 2022.

(c) Figures do not include vacation ownership, residential, or condominium ownership units.

(d) Includes nine non-branded properties managed by ALG.

(e) Certain resorts in Europe operate under a hybrid all-inclusive model, which includes various all-inclusive package options as well as rooms-only options.

(f) Includes eight properties that we will rebrand under the respective brand in 2023.

Page 10

Hyatt Hotels Corporation

Year-over-Year Net Impact of Portfolio Changes to Owned and Leased Hotels Segment Adjusted EBITDA

(in millions)

| Rooms | Transaction / Opening Date | Three Months Ended June 30, 2022 Adjusted EBITDA Impact | ||||||||||||||||||

| Dispositions | ||||||||||||||||||||

| Owned and Leased Hotels | ||||||||||||||||||||

| Hyatt Regency Lost Pines Resort and Spa | 490 | 2Q21 | ||||||||||||||||||

| Hyatt Regency Lake Tahoe Resort, Spa and Casino | 422 | 3Q21 | ||||||||||||||||||

| Alila Ventana Big Sur (a) | 50 | 3Q21 | ||||||||||||||||||

| Hyatt Regency Miami | 615 | 4Q21 | ||||||||||||||||||

| Hyatt Regency Bishkek | 178 | 4Q21 | ||||||||||||||||||

| Hyatt Regency Indian Wells Resort & Spa | 530 | 2Q22 | ||||||||||||||||||

| Grand Hyatt San Antonio River Walk | 1,003 | 2Q22 | ||||||||||||||||||

| The Driskill | 189 | 2Q22 | ||||||||||||||||||

| The Confidante Miami Beach | 339 | 2Q22 | ||||||||||||||||||

| Total Owned and Leased Hotels Dispositions (b) | $ | (13) | ||||||||||||||||||

| Unconsolidated Hospitality Venture Hotels | ||||||||||||||||||||

| Hyatt Place Celaya | 145 | 2Q21 | ||||||||||||||||||

| Hyatt Place Los Cabos | 157 | 2Q21 | ||||||||||||||||||

| Hyatt Place Tijuana | 145 | 2Q21 | ||||||||||||||||||

| Hyatt Centric Beale Street Memphis | 227 | 2Q21 | ||||||||||||||||||

| Hyatt Place Glendale / Los Angeles | 179 | 4Q21 | ||||||||||||||||||

| Hyatt Place San Jose Airport | 190 | 4Q21 | ||||||||||||||||||

| Hyatt House San Jose Airport | 165 | 4Q21 | ||||||||||||||||||

| Hyatt Centric Downtown Portland | 220 | 4Q21 | ||||||||||||||||||

| Hyatt House Nashville at Vanderbilt | 201 | 4Q21 | ||||||||||||||||||

| Hyatt Regency Andares Guadalajara | 257 | 2Q22 | ||||||||||||||||||

| Total Unconsolidated Hospitality Venture Hotels Dispositions (c) (d) (e) | $ | (1) | ||||||||||||||||||

| Year-over-Year Net Impact of Dispositions to Owned and Leased Hotels Segment Adjusted EBITDA | $ | (14) | ||||||||||||||||||

| Acquisitions or Openings | ||||||||||||||||||||

| Owned and Leased Hotels | ||||||||||||||||||||

| Total Owned and Leased Hotels Acquisitions or Openings | $ | — | ||||||||||||||||||

| Unconsolidated Hospitality Venture Hotels | ||||||||||||||||||||

| Hyatt Centric Downtown Nashville | 252 | 3Q21 | ||||||||||||||||||

| Hyatt Centric Buckhead Atlanta | 218 | 4Q21 | ||||||||||||||||||

| Hyatt Regency Miami | 615 | 4Q21 | ||||||||||||||||||

| Caption by Hyatt Beale Street Memphis | 136 | 2Q22 | ||||||||||||||||||

| Total Unconsolidated Hospitality Venture Hotels Acquisitions or Openings (c) (e) (f) | $ | 1 | ||||||||||||||||||

| Year-over-Year Net Impact of Acquisitions and Openings to Owned and Leased Hotels Segment Adjusted EBITDA | $ | 1 | ||||||||||||||||||

| Year-over-Year Net Impact of Portfolio Changes to Owned and Leased Hotels Segment Adjusted EBITDA | $ | (13) | ||||||||||||||||||

(a) Total inventory of 59 rooms; 50 rooms available for sale with 9 rooms out of service. Hotel was acquired and subsequently sold during the year ended December 31, 2021.

(b) Includes the year-over-year impact of one property that converted from leased to managed during the three months ended December 31, 2021.

(c) Reflects Hyatt's pro rata share of unconsolidated hospitality ventures' Adjusted EBITDA.

(d) Includes the sale of the hotel by the venture, the Company's sale of our equity interest in the venture, or the Company's equity interest no longer qualifying for the equity method of accounting.

(e) Includes the year-over-year financial impact of pre-opening activity.

(f) Includes the opening of a hotel by the venture.

Page 11

Hyatt Hotels Corporation

Reconciliation of Non-GAAP Measure: Reconciliation of Net Income (Loss) Attributable to Hyatt Hotels Corporation to EBITDA and EBITDA to Adjusted EBITDA

(in millions)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change ($) | Change (%) | 2022 | 2021 | Change ($) | Change (%) | ||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) attributable to Hyatt Hotels Corporation | $ | 206 | $ | (9) | $ | 215 | NM | $ | 133 | $ | (313) | $ | 446 | 142.6 | % | ||||||||||||||||||||||||||||||||||||||

| Interest expense | 38 | 42 | (4) | (7.7) | % | 78 | 83 | (5) | (5.7) | % | |||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 106 | 15 | 91 | 578.5 | % | 108 | 201 | (93) | (46.4) | % | |||||||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 105 | 74 | 31 | 40.7 | % | 224 | 148 | 76 | 51.3 | % | |||||||||||||||||||||||||||||||||||||||||||

| EBITDA | 455 | 122 | 333 | 270.8 | % | 543 | 119 | 424 | 356.2 | % | |||||||||||||||||||||||||||||||||||||||||||

| Contra revenue | 9 | 9 | — | 8.0 | % | 18 | 17 | 1 | 7.6 | % | |||||||||||||||||||||||||||||||||||||||||||

| Revenues for the reimbursement of costs incurred on behalf of managed and franchised properties | (640) | (366) | (274) | (75.1) | % | (1,180) | (626) | (554) | (88.7) | % | |||||||||||||||||||||||||||||||||||||||||||

| Costs incurred on behalf of managed and franchised properties | 628 | 375 | 253 | 67.6 | % | 1,184 | 652 | 532 | 81.7 | % | |||||||||||||||||||||||||||||||||||||||||||

| Equity (earnings) losses from unconsolidated hospitality ventures | (1) | 34 | (35) | (104.1) | % | 8 | (20) | 28 | 141.2 | % | |||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | 12 | 8 | 4 | 71.6 | % | 40 | 36 | 4 | 12.3 | % | |||||||||||||||||||||||||||||||||||||||||||

| Gains on sales of real estate | (251) | (105) | (146) | (138.2) | % | (251) | (105) | (146) | (138.2) | % | |||||||||||||||||||||||||||||||||||||||||||

| Asset impairments | 7 | 2 | 5 | 177.5 | % | 10 | 2 | 8 | 317.1 | % | |||||||||||||||||||||||||||||||||||||||||||

| Other (income) loss, net | 19 | (25) | 44 | 175.3 | % | 29 | (37) | 66 | 176.7 | % | |||||||||||||||||||||||||||||||||||||||||||

| Pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA | 17 | 1 | 16 | NM | 23 | (3) | 26 | NM | |||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 255 | $ | 55 | $ | 200 | 365.4 | % | $ | 424 | $ | 35 | $ | 389 | NM | ||||||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change $ | Change (%) | 2022 | 2021 | Change ($) | Change (%) | ||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 255 | $ | 55 | $ | 200 | 365.4 | % | $ | 424 | $ | 35 | $ | 389 | NM | ||||||||||||||||||||||||||||||||||||||

| Net Deferral activity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Increase in deferred revenue | $ | 52 | $ | — | $ | 52 | NM | $ | 101 | $ | — | $ | 101 | NM | |||||||||||||||||||||||||||||||||||||||

| Increase in deferred costs | (27) | — | (27) | NM | (52) | — | (52) | NM | |||||||||||||||||||||||||||||||||||||||||||||

| Net Deferrals | $ | 25 | $ | — | $ | 25 | NM | $ | 49 | $ | — | $ | 49 | NM | |||||||||||||||||||||||||||||||||||||||

| Increase in Net Financed Contracts | $ | 15 | $ | — | $ | 15 | NM | $ | 22 | $ | — | $ | 22 | NM | |||||||||||||||||||||||||||||||||||||||

Page 12

Hyatt Hotels Corporation

Reconciliation of Non-GAAP Measure: Reconciliation of Total Revenues to Adjusted Revenues

(in millions)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change ($) | Change (%) | 2022 | 2021 | Change ($) | Change (%) | ||||||||||||||||||||||||||||||||||||||||||||||

| Total revenues | $ | 1,483 | $ | 663 | $ | 820 | 123.6 | % | $ | 2,762 | $ | 1,101 | $ | 1,661 | 150.8 | % | |||||||||||||||||||||||||||||||||||||

| Add: Contra revenue | 9 | 9 | — | 8.0 | % | 18 | 17 | 1 | 7.6 | % | |||||||||||||||||||||||||||||||||||||||||||

| Less: Revenues for the reimbursement of costs incurred on behalf of managed and franchised properties | (640) | (366) | (274) | (75.1) | % | (1,180) | (626) | (554) | (88.7) | % | |||||||||||||||||||||||||||||||||||||||||||

| Adjusted revenues | $ | 852 | $ | 306 | $ | 546 | 178.1 | % | $ | 1,600 | $ | 492 | $ | 1,108 | 224.8 | % | |||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA Margin % | 30.0 | % | 17.9 | % | 12.1 | % | 26.5 | % | 7.1 | % | 19.4 | % | |||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA Margin % Change in Constant Currency | 11.9 | % | 19.3 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

Page 13

Hyatt Hotels Corporation

Reconciliation of Non-GAAP Measure: Earnings (Losses) per Diluted Share and Net Income (Loss) Attributable to Hyatt Hotels Corporation, to Earnings (Losses) per Diluted Share, Adjusted for Special Items and Adjusted Net Income (Loss) Attributable to Hyatt Hotels Corporation - Three Months Ended June 30, 2022 and June 30, 2021.

(in millions, except per share amounts)

| Location on Condensed Consolidated Statements of Income (Loss) | Three Months Ended June 30, | |||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||

| Net income (loss) attributable to Hyatt Hotels Corporation | $ | 206 | $ | (9) | ||||||||||||||||

| Earnings (losses) per diluted share | $ | 1.85 | $ | (0.08) | ||||||||||||||||

| Special items | ||||||||||||||||||||

| Gains on sales of real estate (a) | Gains on sales of real estate | (251) | (105) | |||||||||||||||||

| Fund (surpluses) deficits (b) | Revenues for the reimbursement of costs incurred and costs incurred on behalf of managed and franchised properties; other income (loss), net | (15) | 7 | |||||||||||||||||

| Unconsolidated hospitality ventures (c) | Equity earnings (losses) from unconsolidated hospitality ventures | (4) | 1 | |||||||||||||||||

| Unrealized losses (gains) (d) | Other income (loss), net | 34 | (5) | |||||||||||||||||

| Loss on extinguishment of debt (e) | Other income (loss), net | 8 | — | |||||||||||||||||

| Asset impairments (f) | Asset impairments | 7 | 2 | |||||||||||||||||

| Utilization of Avendra proceeds (g) | Costs incurred on behalf of managed and franchised properties; depreciation and amortization | 3 | 3 | |||||||||||||||||

| Other | Other income (loss), net | 4 | — | |||||||||||||||||

| Special items - pre-tax | (214) | (97) | ||||||||||||||||||

| Income tax benefit (provision) for special items | Provision for income taxes | 59 | (11) | |||||||||||||||||

| Total special items - after-tax | $ | (155) | $ | (108) | ||||||||||||||||

| Special items impact per diluted share | $ | (1.39) | $ | (1.07) | ||||||||||||||||

| Adjusted net income (loss) attributable to Hyatt Hotels Corporation | $ | 51 | $ | (117) | ||||||||||||||||

| Earnings (losses) per diluted share, adjusted for special items | $ | 0.46 | $ | (1.15) | ||||||||||||||||

(a) Gains on sales of real estate - During the three months ended June 30, 2022 (Q2 2022), we recognized $251 million pre-tax gains on sales of real estate related to the sale of Grand Hyatt San Antonio River Walk ($137 million), The Driskill ($51 million), Hyatt Regency Indian Wells Resort & Spa ($40 million), and The Confidante Miami Beach ($24 million). During the three months ended June 30, 2021 (Q2 2021), we recognized a $104 million pre-tax gain related to the sale of Hyatt Regency Lost Pines Resort and Spa.

(b) Fund (surpluses) deficits - During Q2 2022 and Q2 2021, we recognized surpluses and deficits, respectively, on certain funds, due to the timing of revenue and expense recognition. We intend to recover any deficits recognized in future periods.

(c) Unconsolidated hospitality ventures - During Q2 2022, we recognized a $4 million pre-tax gain on the sale of our ownership interest in an equity method investment.

(d) Unrealized losses (gains) - During Q2 2022 and Q2 2021, we recognized unrealized losses and gains, respectively, due to the change in fair value of our marketable securities.

(e) Loss on extinguishment of debt - During Q2 2022, we recognized an $8 million loss on extinguishment of debt for the bonds that were legally defeased in conjunction with the sale of Grand Hyatt San Antonio River Walk.

(f) Asset impairments - During Q2 2022, we recognized a $7 million goodwill impairment charge in connection with the sale of Grand Hyatt San Antonio River Walk.

(g) Utilization of Avendra proceeds - During Q2 2022 and Q2 2021, we recognized expenses related to the partial utilization of the Avendra LLC sale proceeds for the benefit of our hotels. The gain recognized in conjunction with the sale of Avendra LLC was included as a special item during the year ended December 31, 2017.

Page 14

Hyatt Hotels Corporation

Reconciliation of Non-GAAP Measure: Earnings (Losses) per Diluted Share and Net Income (Loss) Attributable to Hyatt Hotels Corporation, to Earnings (Losses) per Diluted Share, Adjusted for Special Items and Adjusted Net Income (Loss) Attributable to Hyatt Hotels Corporation - Six Months Ended June 30, 2022 and June 30, 2021.

(in millions, except per share amounts)

| Location on Condensed Consolidated Statements of Income (Loss) | Six Months Ended June 30, | |||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||

| Net income (loss) attributable to Hyatt Hotels Corporation | $ | 133 | $ | (313) | ||||||||||||||||

| Earnings (losses) per diluted share | $ | 1.19 | $ | (3.07) | ||||||||||||||||

| Special items | ||||||||||||||||||||

| Gains on sales of real estate (a) | Gains on sales of real estate | (251) | (105) | |||||||||||||||||

| Unconsolidated hospitality ventures (b) | Equity earnings (losses) from unconsolidated hospitality ventures | (4) | (68) | |||||||||||||||||

| Fund (surpluses) deficits (c) | Revenues for the reimbursement of costs incurred and costs incurred on behalf of managed and franchised properties; other income (loss), net | (2) | 21 | |||||||||||||||||

| Unrealized losses (gains) (d) | Other income (loss), net | 44 | (13) | |||||||||||||||||

| Asset impairments (e) | Asset impairments | 10 | 2 | |||||||||||||||||