Form 8-K Howard Hughes Corp For: Aug 03

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 03, 2022

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||||||||||||

(Address of principal executive offices)

Registrant’s telephone number, including area code: (281) 719-6100

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol(s) | Name of each exchange on which registered: | |||||||||||||||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 3, 2022, The Howard Hughes Corporation (the “Company”) issued a press release announcing the Company’s financial results for the second quarter ended June 30, 2022. A copy of this press release is attached hereto as Exhibit 99.1.

The information contained in this Current Report on Form 8-K pursuant to this “Item 2.02 Results of Operations and Financial Condition” is being furnished. This information shall not be deemed to be filed for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section or shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, unless specifically identified therein as being incorporated by reference.

Item 7.01 Regulation FD Disclosure.

On August 3, 2022, the Company issued supplemental information for the second quarter ended June 30, 2022. The supplemental information contains key information about the Company. The supplemental information is attached hereto as Exhibit 99.2 and has been posted on our website at www.howardhughes.com under the “Investors” tab.

The information contained in this Current Report on Form 8-K pursuant to this “Item 7.01 Regulation FD Disclosure” is being furnished. This information shall not be deemed to be filed for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section or shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, unless specifically identified therein as being incorporated by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| THE HOWARD HUGHES CORPORATION | |||||||||||

| By: | /s/ Peter F. Riley | ||||||||||

| Peter F. Riley | |||||||||||

| Senior Executive Vice President, Secretary and General Counsel | |||||||||||

Date: August 3, 2022

Exhibit 99.1

The Howard Hughes Corporation® Reports Second Quarter 2022 Results

HHC reports strong financial results despite macroeconomic headwinds, driven by robust land sales, increased Operating Asset NOI, and continued momentum in condo sales

HOUSTON, August 3, 2022 – The Howard Hughes Corporation® (NYSE: HHC) (the “Company,” “HHC” or “we”) today announced operating results for the second quarter ended June 30, 2022. The financial statements, exhibits and reconciliations of non-GAAP measures in the attached Appendix and the Supplemental Information at Exhibit 99.2 provide further detail of these results.

Second Quarter 2022 Highlights Include:

–Second quarter net income of $21.6 million, or $0.42 per diluted share, compared to net income of $4.8 million, or $0.09 per diluted share, in the prior-year period.

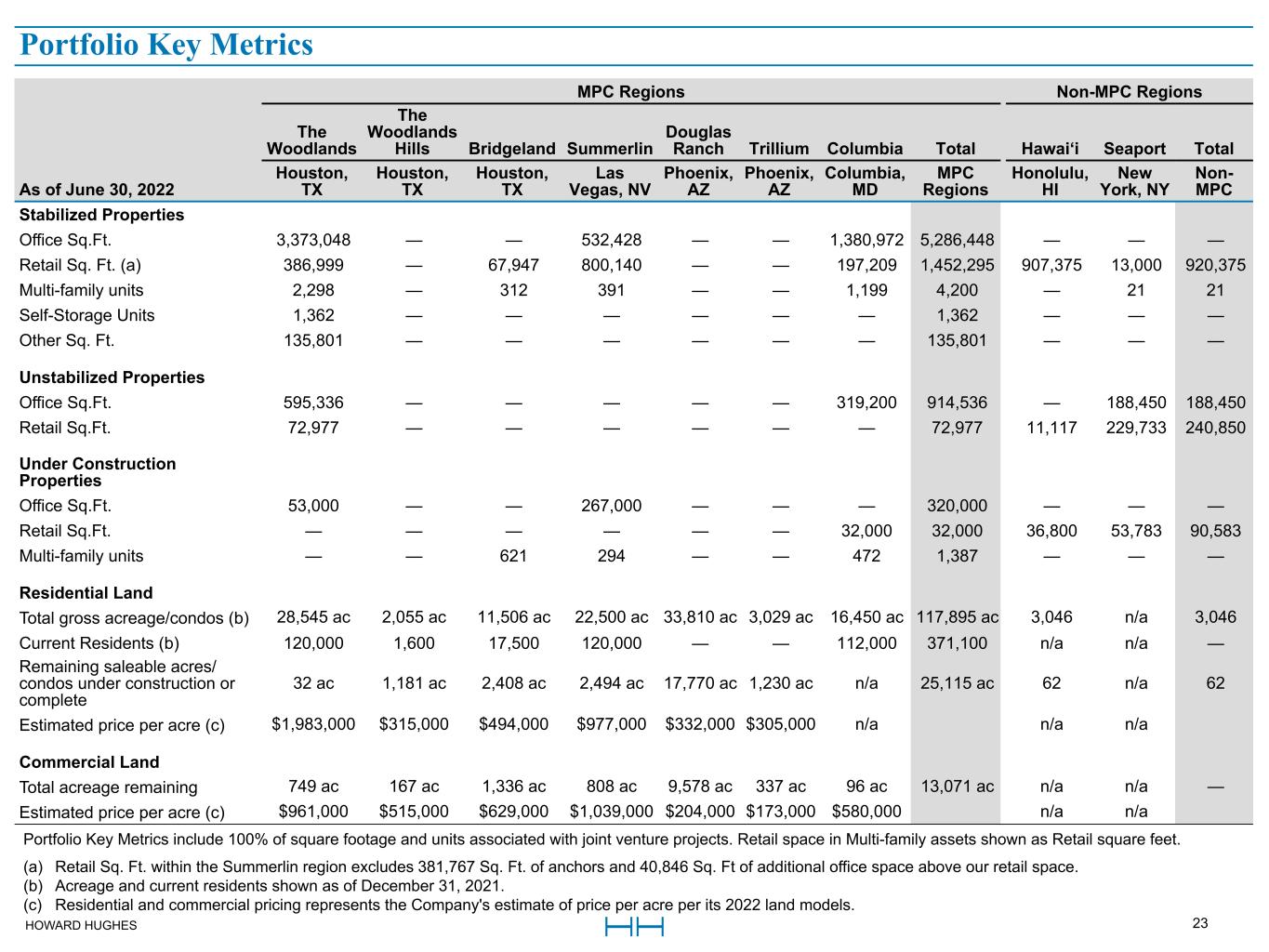

–Total Operating Assets net operating income (NOI) totaled $66.3 million in the quarter, a 14.6% increase over the prior-year period. The strong performance of our Operating Asset portfolio was attributable to the strong rent growth and leasing momentum of our latest multi-family assets, with quarterly NOI from this property type rising 59.8% year-over-year, as well as continued improvements in office assets and strong attendance at the Las Vegas Ballpark®.

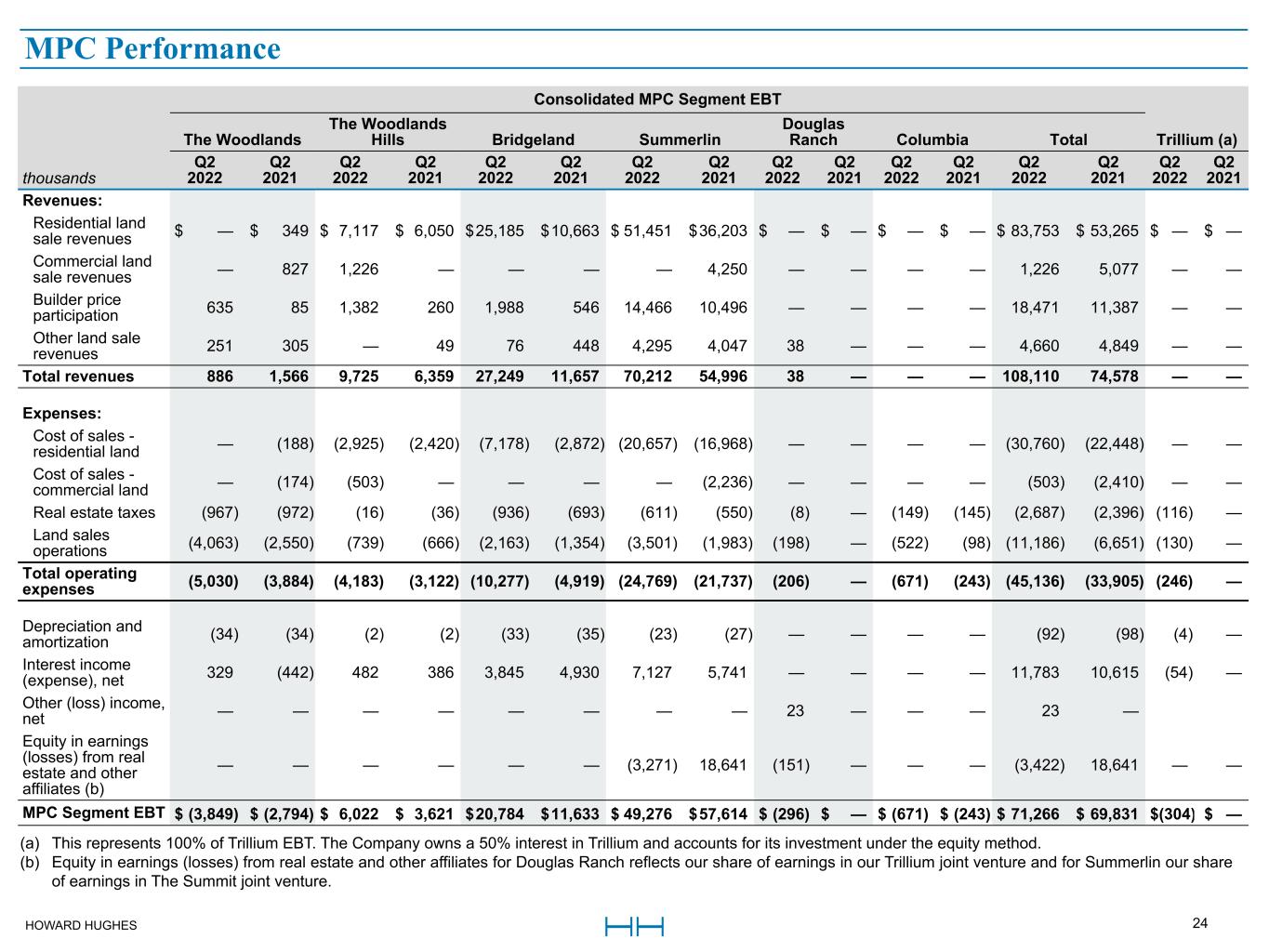

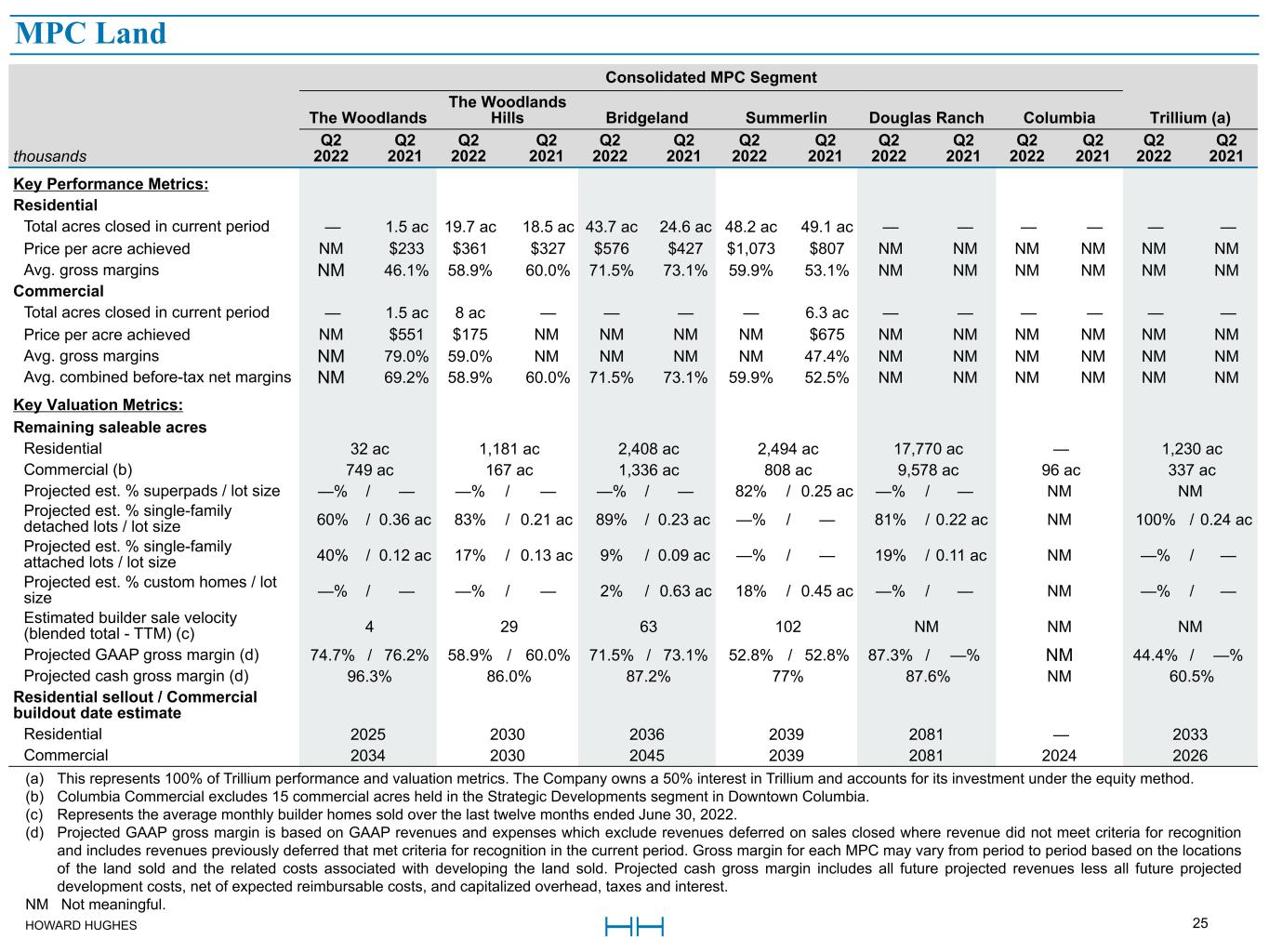

–Master Planned Community (MPC) earnings before taxes (EBT) totaled $71.3 million in the quarter—a 2.1% increase over the prior-year quarter—with land price appreciation and higher builder price participation revenue, signifying that housing demand remains outsized relative to supply in Las Vegas and Houston. Excluding equity earnings from The Summit, MPC EBT was up $23.3 million or 45.6%.

–Subsequent to quarter end, HHC reached an agreement with Discovery Land to expand our joint venture at The Summit to capture the heightened demand of those seeking an ultra-luxury residence in Summerlin®.

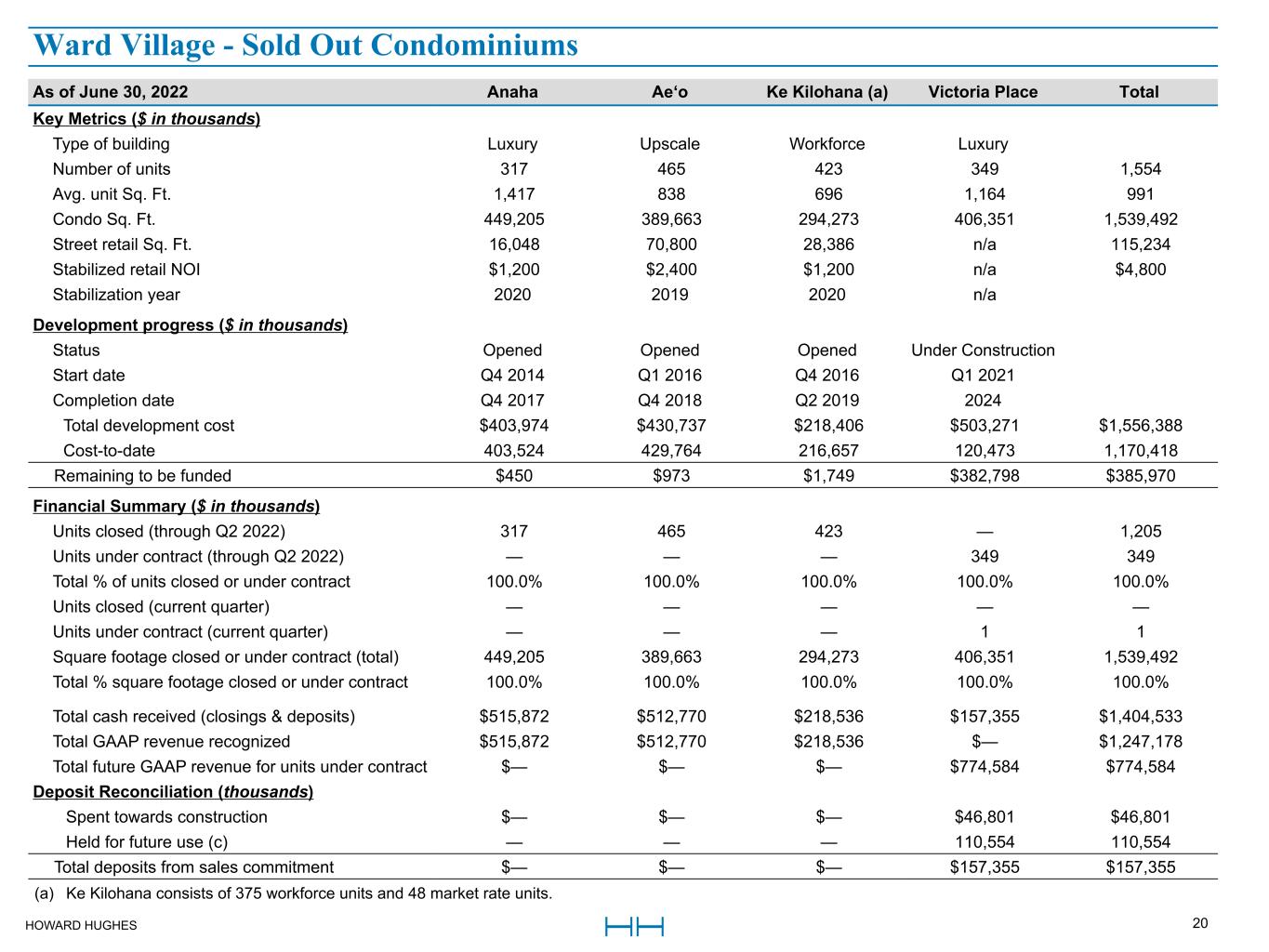

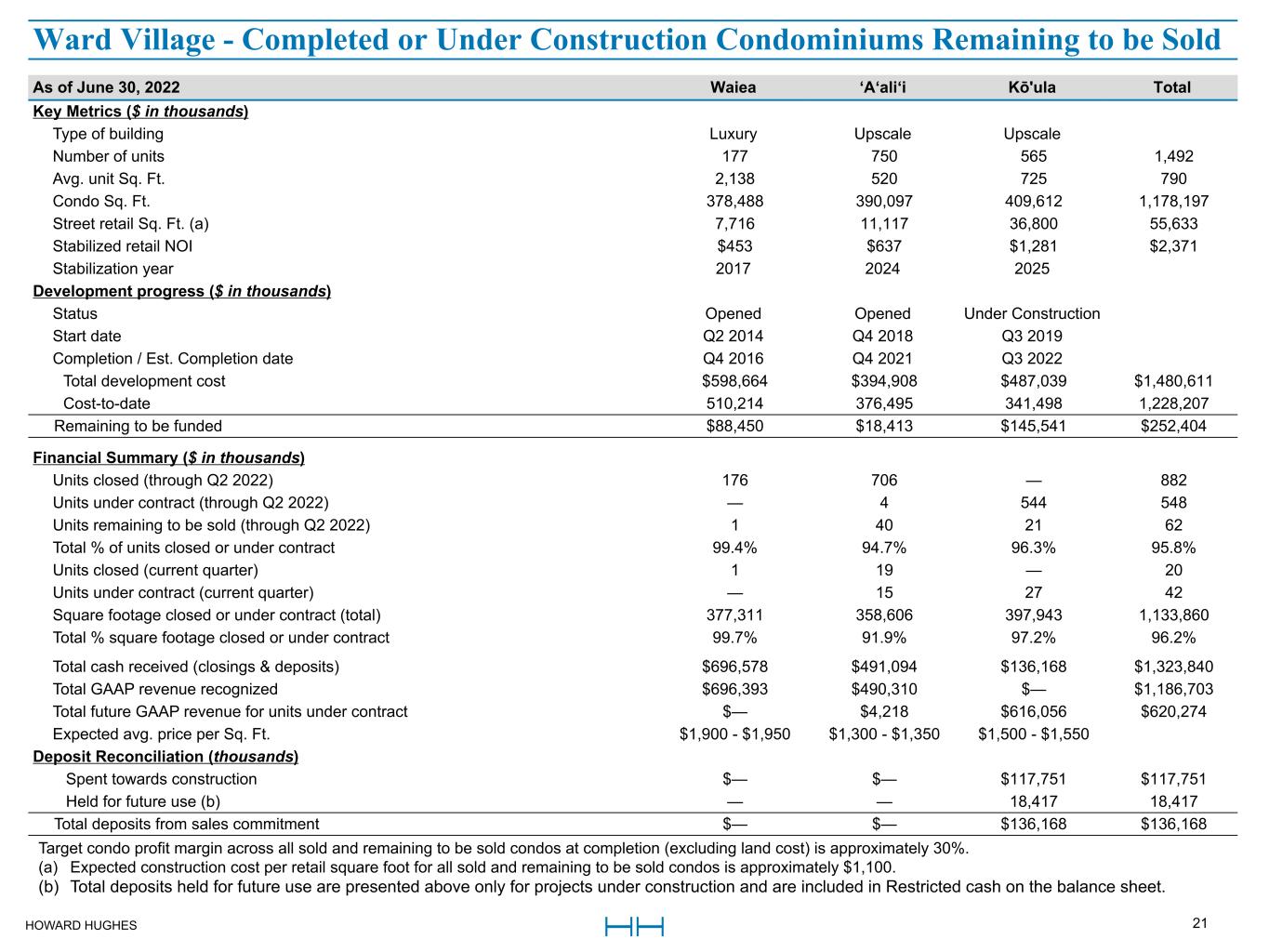

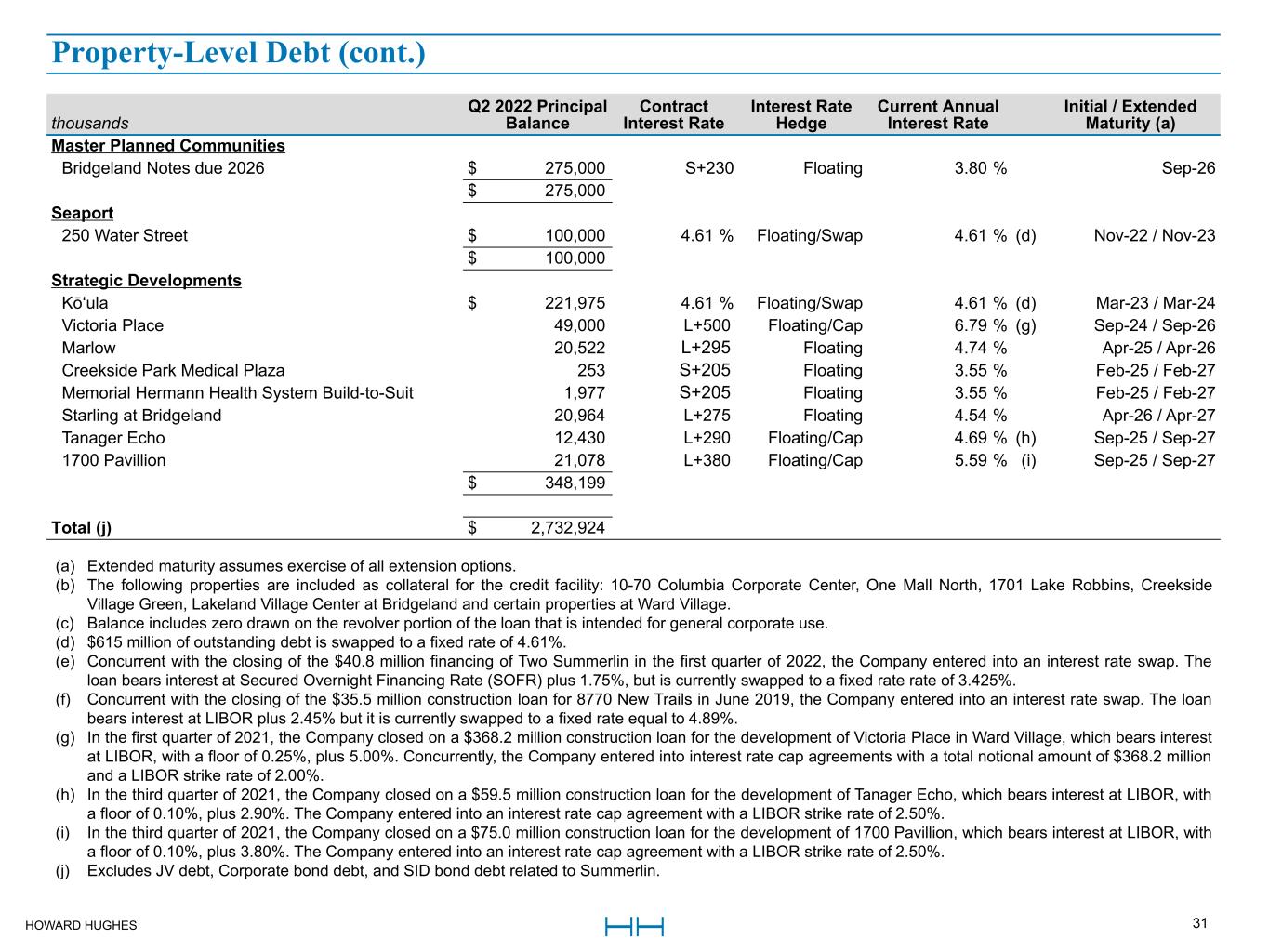

–Closed on 20 condo units in the quarter, 19 of which closed at ‘A‘ali‘i®—the latest completed tower at Ward Village®—generating $17.4 million in condo sales revenue. ‘A‘ali‘i ended the quarter 94.7% sold. Pre-sales at our two towers under construction were strong with Kō‘ula now 96.3% pre-sold and Victoria Place fully sold out.

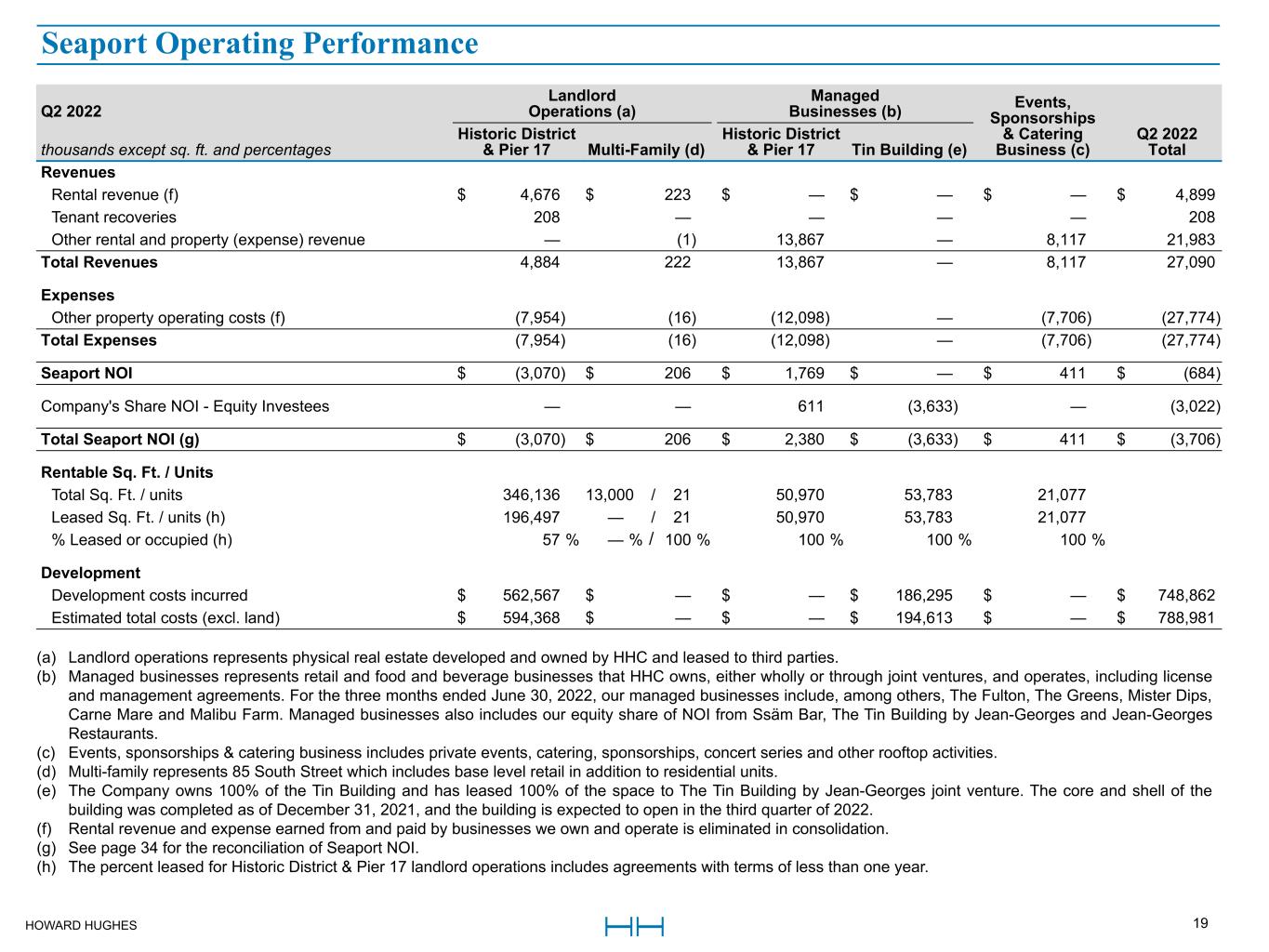

–The Seaport in New York City had one of its best quarters in its history, generating $27.1 million of revenue. The quarter’s results benefited from several concerts and private events on The Rooftop at Pier 17®, driving up foot traffic and increasing revenues at our managed restaurants.

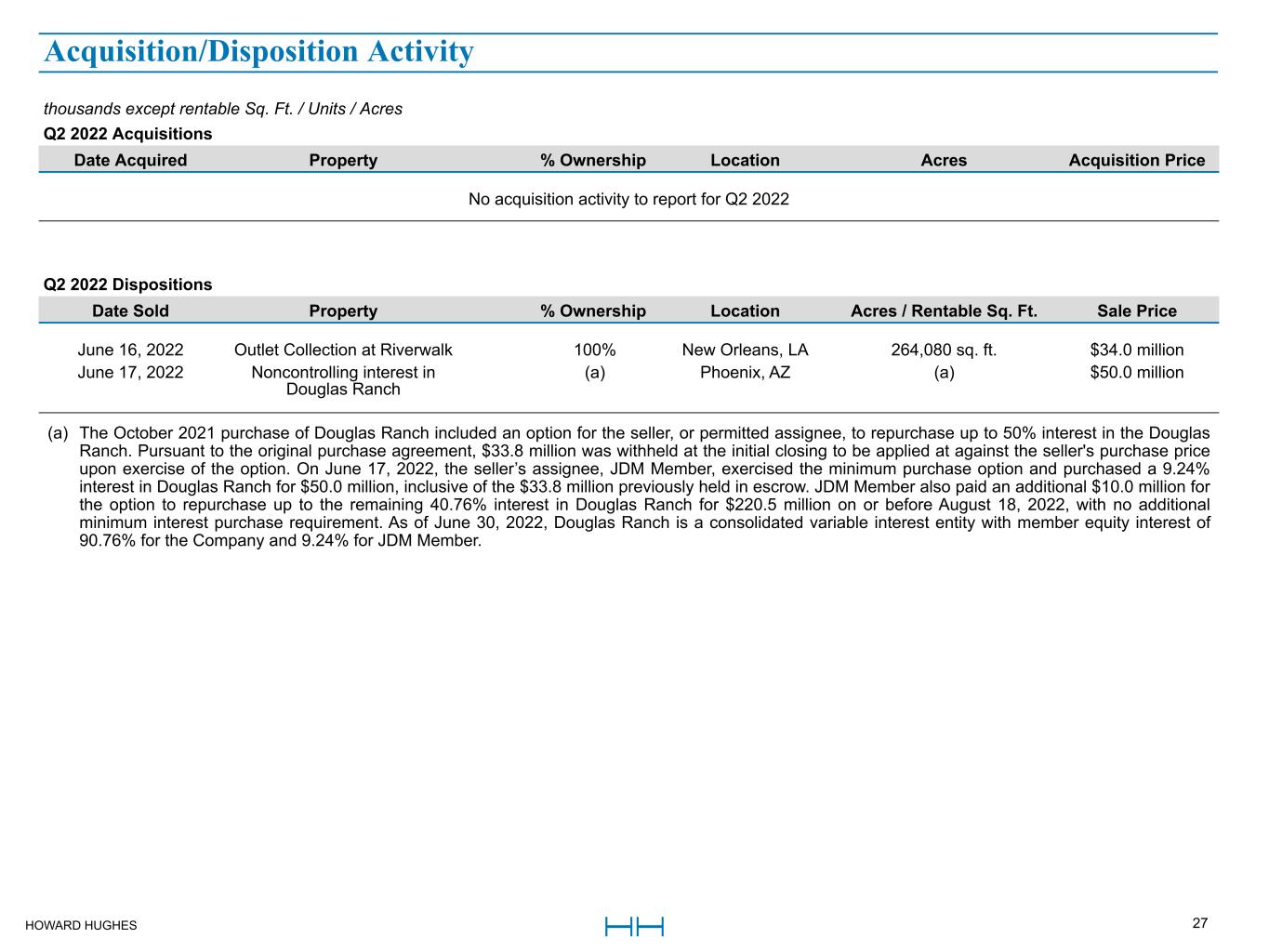

–Sold The Outlet Collection at Riverwalk®—an approximately 264,000-square-foot retail outlet center in New Orleans—for $34 million, generating net proceeds of $8.2 million. This transaction marked the disposition of the Company’s last remaining non-core asset located outside of its core regions.

–JDM Partners exercised its first option on Douglas Ranch, repurchasing a 9.24% ownership interest for $50 million. HHC also received a $10 million non-refundable deposit to secure a second option to reacquire up to an additional 40.76% stake in Douglas Ranch, which expires on August 18, 2022.

–Repurchased 2,164,400 shares of common stock funded with $192.3 million of cash on hand at an average price of $88.83 per share. Subsequent to quarter end, HHC repurchased an additional 368,806 shares of common stock for $25.4 million at an average price of $68.98 per share.

“In a quarter that has been headlined by an economic downturn, rising inflation, and recessionary concerns, we performed exceptionally well,” commented David R. O’Reilly, Chief Executive Officer of The Howard Hughes Corporation. “The strength of HHC’s unique business model and our continued commitment to developing exceptional communities where people want to live, work, and play continued to drive strong results across all of our operating segments.

1

“In our MPCs, our Houston and Las Vegas communities continued to outperform with strong land sales fueled by substantial increases in price per acre of land sold. Our Operating Assets segment delivered sizeable NOI growth, driven by continued outpeformance of our multi-family portfolio, improvements in office, and a successful start to the baseball season at the Las Vegas Ballpark, where league-leading attendance added to our strong results. Condo sales at Ward Village remained elevated, with limited remaining unit inventory at our towers under construction and in pre-sales. Finally, at the Seaport, we had a tremendous quarter with a significant increase in visitors for our summer concert series, a complete takeover of The Rooftop at Pier 17 for Ape Fest, and numerous other private events, quickly solidifying the Seaport as a top entertainment and dining venue in New York City. Looking forward, we expect the strong momentum across our segments to continue into the second half of the year.

“As we anticipated—due to rising mortgage rates, inflation, and the surge in sales during 2020 and 2021—the second quarter’s new home sales reflected a year-over-year decline, with Summerlin and our Houston MPCs showing a 37% decrease from the previous year. However, home sales remained solid relative to the levels seen prior to the pandemic-driven sales surge. Overall, demand for land in our core markets of Houston, Las Vegas, and Phoenix remains favorable, as lot inventories in these markets are at all-time lows, and homebuilders continue to replenish their available acreage to meet current demand. The continued demand for HHC's land during different market conditions is a testament to the strength of our MPC assets, continued migration trends, and our communities’ market-leading quality of life and cost of living. As a result, we expect to see continued strong demand for land sales in our MPCs for the duration of the year.

“With our shares trading significantly below the underlying net asset value of the Company, we continued to buy back shares throughout the quarter, affirming our commitment to unlocking shareholder value. In total, we repurchased nearly 2.2 million shares at an average price of $88.83 per share for approximately $192.3 million. Subsequent to the end of the second quarter, we repurchased approximately 369,000 additional shares at an average price of $68.98 per share for approximately $25.4 million. This brings total share repurchases under our current $250 million authorization to approximately $235 million.”

Second Quarter 2022 Highlights

Total Company

–Net income increased to $21.6 million or $0.42 per diluted share in the quarter, compared to net income of $4.8 million or $0.09 per diluted share in the prior-year period due to strong land sales, increased Operating Asset NOI, and reduced losses at the Seaport.

–This positive year-over-year performance included Operating Asset NOI of $66.3 million, an $8.5 million increase, and MPC EBT of $71.3 million, a $1.4 million increase. Excluding equity earnings from The Summit, MPC EBT increased $23.3 million.

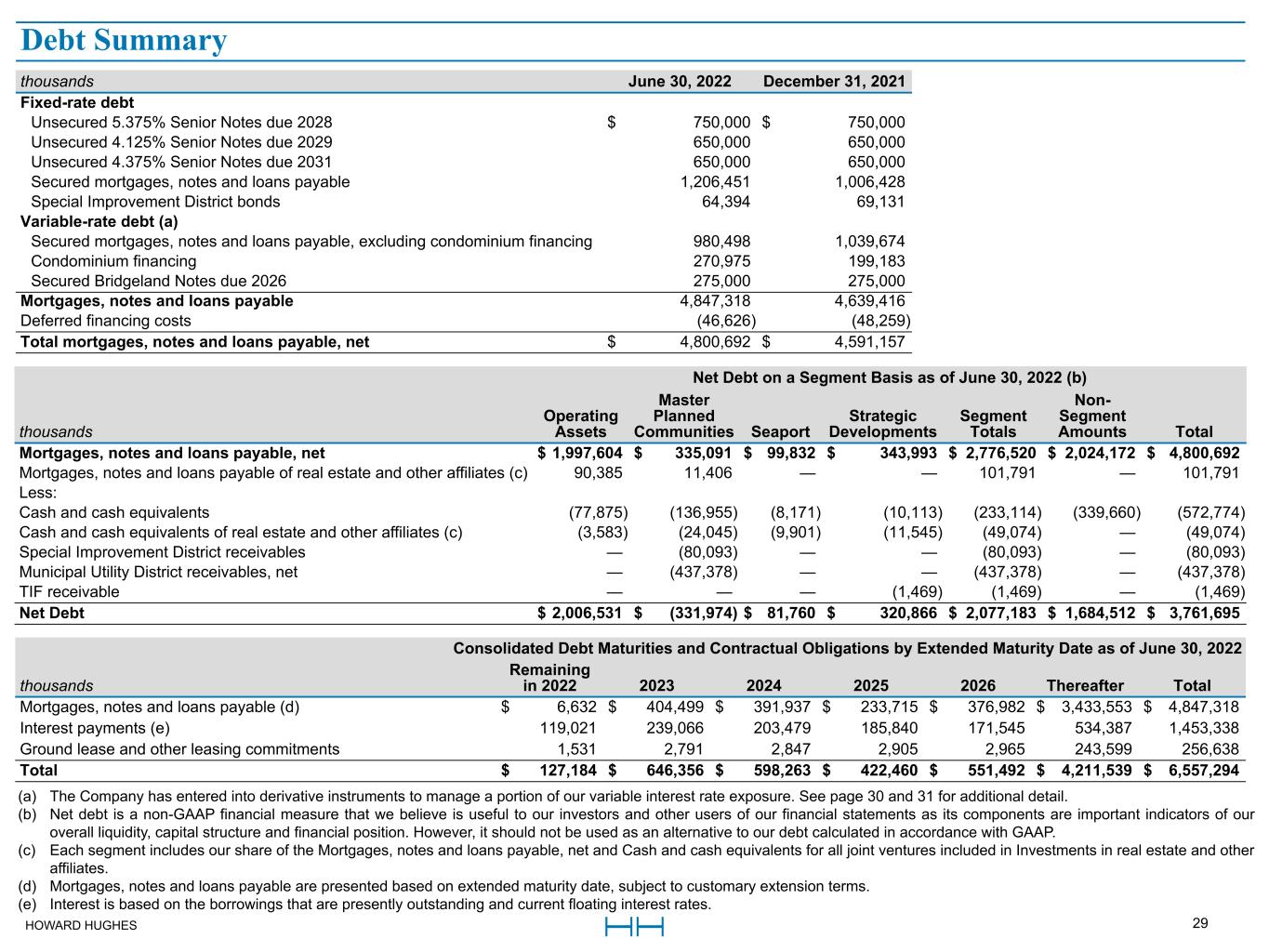

–Ended the second quarter with $572.8 million of cash on the balance sheet and total debt of $4.8 billion, with 79% of the balance maturing in 2026 or later.

Operating Assets

–Total Operating Assets NOI totaled $66.3 million in the quarter, a 14.6% increase compared to $57.9 million in the prior-year period. This is an impressive year-over-year performance, especially considering the $3.8 million of NOI delivered in the second quarter of 2021 by assets that have since been sold including The Outlet Collection at Riverwalk and HHC’s former hospitality portfolio.

–Multi-family NOI increased 59.8% to $11.8 million compared to the second quarter of 2021 due to continued rent growth across the portfolio and strength in the lease-up of our latest multi-family developments that are all at or near full occupancy.

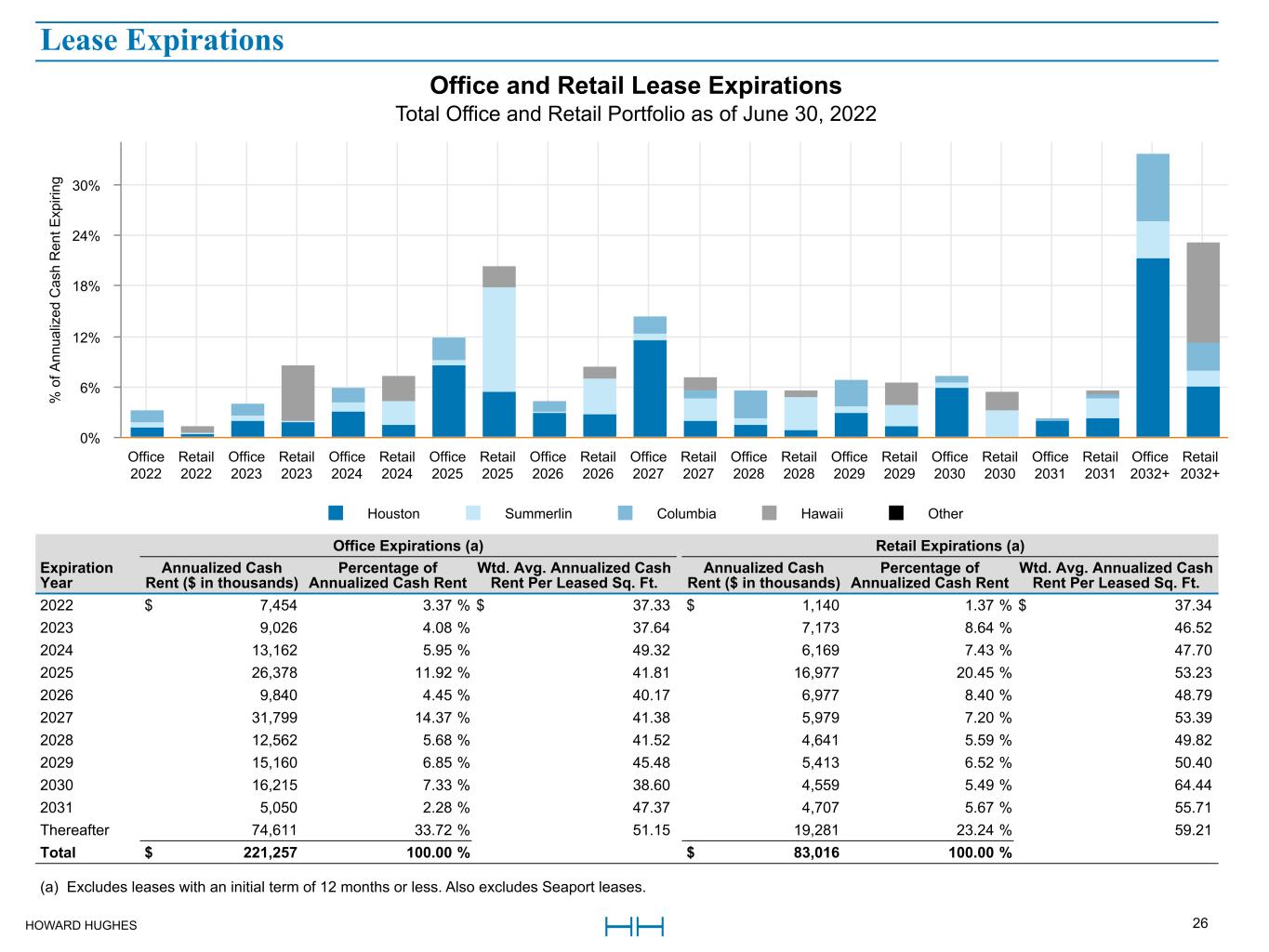

–Office NOI increased 12.9% to $29.7 million compared to the prior-year period largely due to improved leasing activity at our class-A properties, particularly in The Woodlands® and Downtown Columbia®, as companies recover from the pandemic and employees return to work. During the second quarter, the Company signed an 80,000 square-foot lease with CareFirst at 6100 Merriweather in Downtown Columbia, bringing this asset to 93.5% leased.

–The Las Vegas Ballpark generated $5.4 million of NOI during the quarter compared to $3.1 million in the prior year period driven by strong fan attendance for the Las Vegas Aviators®, HHC’s Triple-A minor league baseball team. This is in comparison to the second quarter of 2021 where the first several games of the season were limited to 50% seating capacity to comply with local COVID restrictions.

2

MPC

–MPC EBT totaled $71.3 million in the quarter, a 2.1% increase compared to $69.8 million in the prior-year period.

–MPC land sales revenue of $85.0 million was 45.7% higher compared to the prior-year period. This increase was primarily driven by increased land sales in Bridgeland® which contributed to a 18.7% increase in residential acres sold across our communities. The price per acre of land sold also increased to approximately $753,000 per acre during the quarter which compares to approximately $603,000 per acre in the prior-year period.

–Builder price participation revenue rose to $18.5 million during the quarter—an increase of 62.2% from the prior-year period as home prices in our communities continue to escalate.

–Equity earnings at The Summit decreased $21.9 million year-over-year due to no unit closings in the second quarter compared to 16 in the same period last year as this private Summerlin community moves closer to selling out its remaining inventory.

–With limited remaining lots and condos to sell at The Summit, we reached an agreement with Discovery Land subsequent to quarter end to expand this community with a second phase of development which is expected to drive tremendous cash proceeds to HHC over the life of the project. The Company contributed an additional 54 acres which will be used to develop 27 custom home sites.

–A total of 435 new homes were sold in HHC’s MPCs during the quarter, a 36.7% decline compared to the prior-year period as home sales in the second quarter of 2021 surged with the economy emerging from the pandemic and historically low mortgage interest rates. Sequentially, new home sales declined 28.0% compared to 604 new homes sold during the first quarter of 2022.

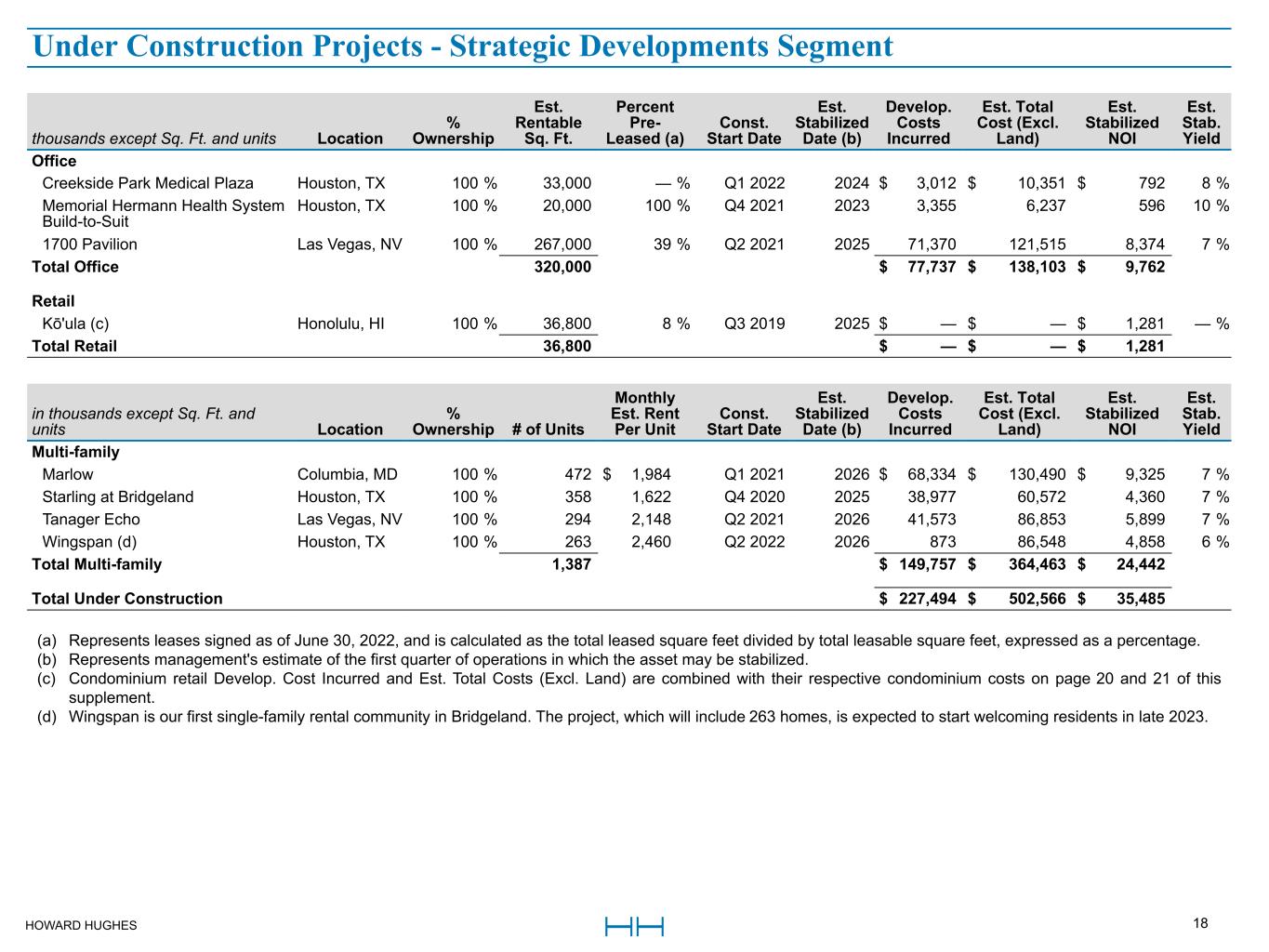

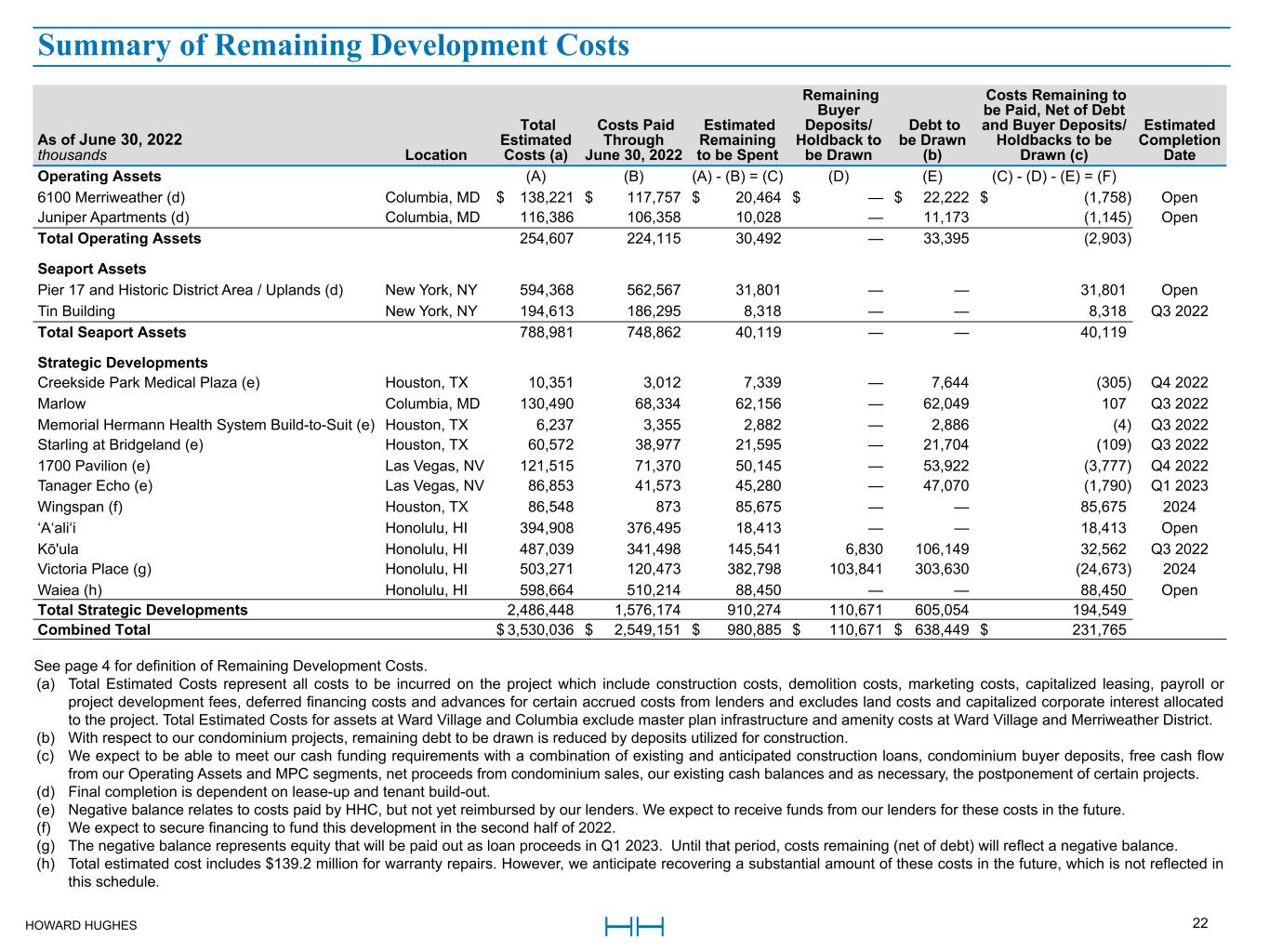

Strategic Developments

–We sold 20 condominium units at Ward Village during the second quarter, including 19 units at ‘A‘ali‘i, generating $17.4 million in net revenue, and one unit at Waiea®, generating $4.0 million in net revenue. As of the end of the second quarter, ‘A‘ali‘i was 94.7% sold and Waiea was 99.4% sold with just one unit remaining.

–Contracted to sell 28 units at our two towers under construction. Kō'ula—which is expected to deliver in the third quarter—ended the quarter 96.3% pre-sold. Victoria Place—which is expected to be completed in 2024—is now sold out.

–The Park Ward Village contracted 11 units during the second quarter and is now 90.6% pre-sold with construction expected to begin in the second half of 2022.

–Contracted on 627 units at Ulana—Ward Village’s ninth condo tower—which will be fully dedicated to workforce housing and ended the quarter 90.1% pre-sold.

–Commenced construction on our first single-family build-to-rent project, Wingspan, in Bridgeland. This project, which will include 263 homes, is expected to start welcoming its first residents in late 2023.

Seaport

–The Seaport generated negative NOI of $3.7 million in the quarter, a $0.7 million improvement compared to a $4.4 million loss in the prior-year period.

–Seaport revenue of $27.1 million rose 165.5% compared to revenue of $10.2 million during the second quarter of 2021 driven by the start of the summer concert series on The Rooftop at Pier 17, including a takeover of Pier 17 for Ape Fest, and increased demand at our managed restaurants.

–Construction at the Tin Building by Jean-Georges is substantially complete. Hiring and training of new employees has been challenging due to labor shortages, but onboarding is progressing and the Company expects the grand opening to be held in the third quarter.

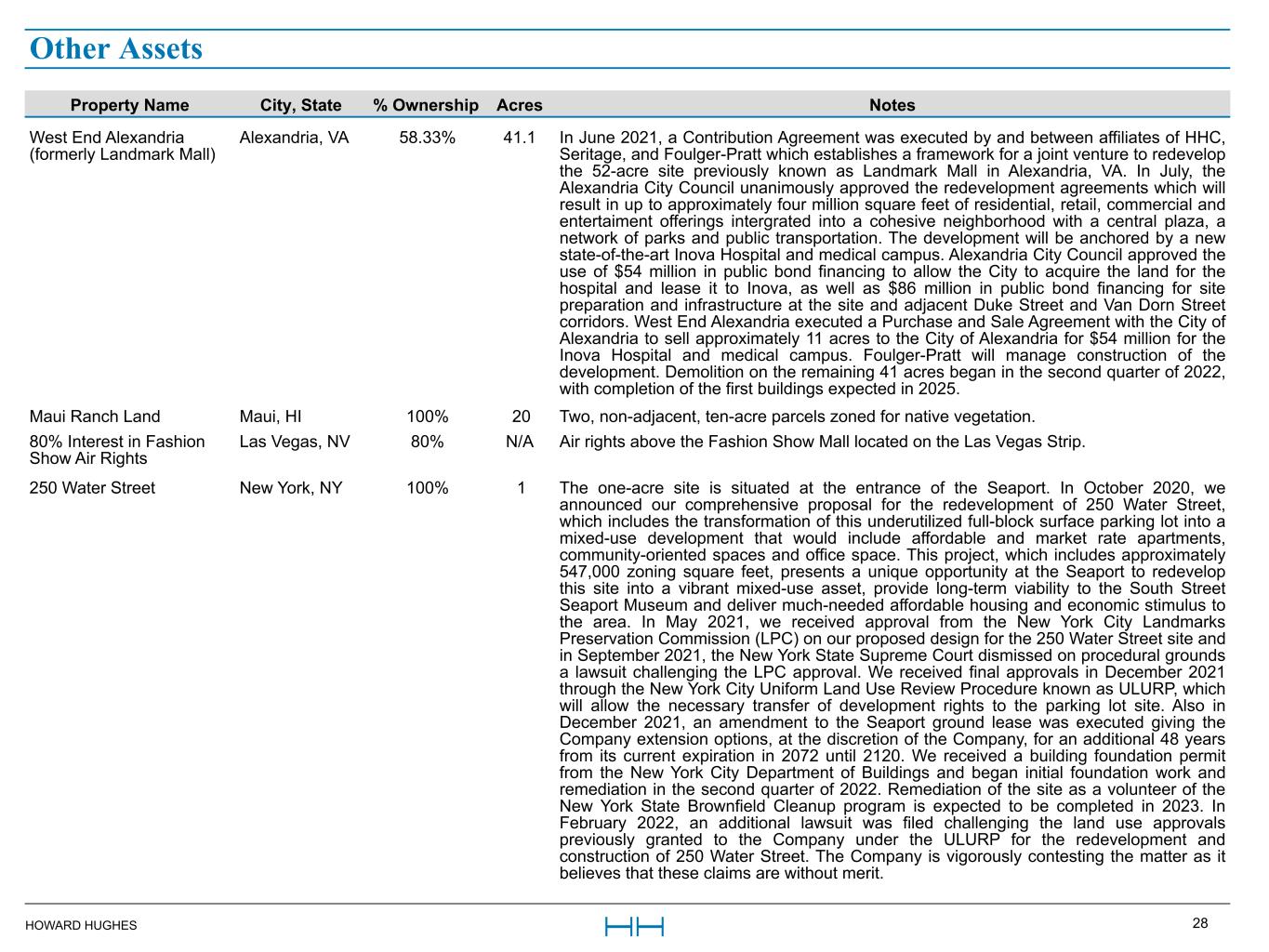

–Began site preparation work at 250 Water Street during the second quarter of 2022 following the approval by the City of New York in December 2021 for the transformation of this one-acre parking lot into a mixed-use multi-family and office development.

–Leading fashion designer Alexander Wang selected the Seaport for its new global headquarters and showroom in New York City, signing a 15-year lease for approximately 46,000 square feet, inclusive of 5,000 square feet of outdoor space, at the Fulton Market Building. The lease brings the building to 100% leased.

3

Financing Activity

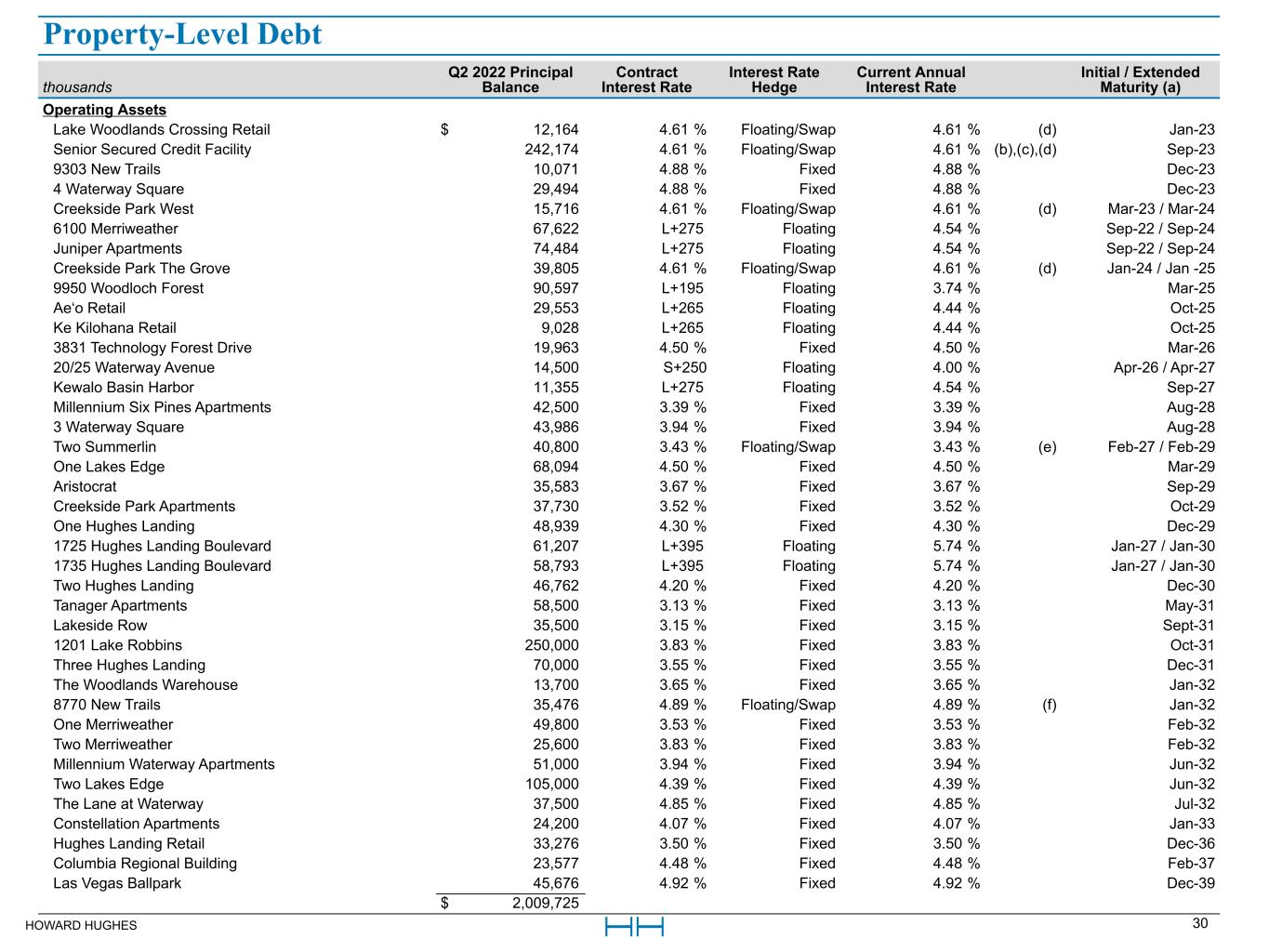

–In April 2022, the Company closed on a $19.5 million financing of 20/25 Waterway Avenue, replacing the existing loan, with $4.2 million withheld until the release of upcoming tenant expirations. The loan matures in April 2026 with a one-year extension option and bears interest at SOFR plus 2.50% and is interest-only for the first three years with 25-year amortization thereafter.

–In May 2022, the Company closed on a $51.0 million interest-only refinancing of Millennium Waterway Apartments. The loan bears interest at 3.94% with maturity in June 2032.

–In May 2022, the Company closed on a $105.0 million interest-only refinancing of Two Lakes Edge. The loan bears interest at 4.39% with maturity in June 2032.

–In June 2022, the Company closed on a $37.5 million interest-only refinancing of The Lane at Waterway. The loan bears interest at 4.85% with maturity in July 2032.

Full-Year 2022 Guidance

–Full-year 2022 guidance remains unchanged from the prior reporting period.

–Operating Asset NOI is projected to experience strong leasing activity at our latest multi-family developments, offset by no hospitality NOI in 2022 as a result of the sale of our hotel portfolio, as well as reduced non-recurring COVID-related rent recoveries related to certain retail tenants during 2021. We expect 2022 Operating Asset NOI to decline 0% to 2% year-over-year.

–MPC EBT range is projected to remain higher compared to the earnings we generated on average over 2017 to 2020. In 2021, we experienced outsized land sales, largely due to the closing of a 216-acre superpad in Summerlin. Superpad sales of this size do not occur every year, which is reflective of the projected EBT decline in 2022. We expect 2022 MPC EBT to decline 25% to 30% year-over-year.

–Condo sales are projected to range between $650 million to $700 million, with gross margins between 26.5% to 27.5%. Projected condo sales are driven by the anticipated closing of units at Kō‘ula during the third quarter of 2022 and additional closings at ‘A‘ali‘i.

–Cash G&A is projected to range between $75 million to $80 million, which excludes anticipated non-cash stock compensation of $10 million to $15 million.

4

Conference Call & Webcast Information

The Howard Hughes Corporation will host its investor conference call on Thursday, August 4, 2022, at 9:00 a.m. Central Daylight Time (10:00 a.m. Eastern Daylight Time) to discuss second quarter 2022 results. To participate, please dial 1-877-883-0383 within the U.S., 1-866-605-3850 within Canada, or 1-412-902-6506 when dialing internationally. All participants should dial in at least five minutes prior to the scheduled start time, using 5181383 as the passcode. A live audio webcast and Quarterly Spotlight will also be available on the Company's website (www.howardhughes.com). In addition to dial-in options, institutional and retail shareholders can participate by going to app.saytechnologies.com/howardhughes. Shareholders can email hello@saytechnologies.com for any support inquiries.

5

We are primarily focused on creating shareholder value by increasing our per-share net asset value. Often, the nature of our business results in short-term volatility in our net income due to the timing of MPC land sales, recognition of condominium revenue and operating business pre-opening expenses, and, as such, we believe the following metrics summarized below are most useful in tracking our progress towards net asset value creation.

| Six Months Ended June 30, | Three Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||||

| $ in thousands | 2022 | 2021 | $ Change | % Change | 2022 | 2021 | $ Change | % Change | |||||||||||||||||||||||||||||||||

Operating Assets NOI (1) | |||||||||||||||||||||||||||||||||||||||||

| Office | $ | 54,798 | $ | 52,115 | $ | 2,683 | 5 | % | $ | 29,680 | $ | 26,283 | $ | 3,397 | 13 | % | |||||||||||||||||||||||||

| Retail | 27,957 | 25,312 | 2,645 | 10 | % | 14,932 | 13,762 | 1,170 | 9 | % | |||||||||||||||||||||||||||||||

| Multi-family | 22,985 | 13,145 | 9,840 | 75 | % | 11,843 | 7,410 | 4,433 | 60 | % | |||||||||||||||||||||||||||||||

| Other | 8,107 | 5,791 | 2,316 | 40 | % | 7,318 | 4,975 | 2,343 | 47 | % | |||||||||||||||||||||||||||||||

| Dispositions | 628 | 3,964 | (3,336) | (84) | % | 188 | 3,758 | (3,570) | (95) | % | |||||||||||||||||||||||||||||||

| Operating Assets NOI | 114,475 | 100,327 | 14,148 | 14 | % | 63,961 | 56,188 | 7,773 | 14 | % | |||||||||||||||||||||||||||||||

| Company's share NOI (a) | 9,140 | 5,830 | 3,310 | 57 | % | 2,386 | 1,690 | 696 | 41 | % | |||||||||||||||||||||||||||||||

| Total Operating Assets NOI | $ | 123,615 | $ | 106,157 | $ | 17,458 | 16 | % | $ | 66,347 | $ | 57,878 | $ | 8,469 | 15 | % | |||||||||||||||||||||||||

| Projected stabilized NOI Operating Assets ($ in millions) | $ | 356.5 | $ | 395.2 | $ | (38.7) | (10) | % | |||||||||||||||||||||||||||||||||

| MPC | |||||||||||||||||||||||||||||||||||||||||

| Acres Sold - Residential | 156 | 148 | 8 | 5 | % | 112 | 94 | 18 | 19 | % | |||||||||||||||||||||||||||||||

| Acres Sold - Commercial | 34 | 26 | 8 | 32 | % | 8 | 8 | — | — | % | |||||||||||||||||||||||||||||||

| Price Per Acre - Residential | $ | 698 | $ | 618 | $ | 80 | 13 | % | $ | 753 | $ | 603 | $ | 150 | 25 | % | |||||||||||||||||||||||||

| Price Per Acre - Commercial | $ | 871 | $ | 288 | $ | 583 | 203 | % | $ | 175 | $ | 651 | $ | (477) | (73) | % | |||||||||||||||||||||||||

MPC EBT (1) | $ | 130,944 | $ | 133,186 | $ | (2,242) | (2) | % | $ | 71,266 | $ | 69,831 | $ | 1,435 | 2 | % | |||||||||||||||||||||||||

Seaport NOI (1) | |||||||||||||||||||||||||||||||||||||||||

| Landlord Operations - Historic District & Pier 17 | $ | (5,925) | $ | (7,074) | $ | 1,149 | 16 | % | $ | (3,070) | $ | (3,834) | $ | 764 | 20 | % | |||||||||||||||||||||||||

| Multi-family | 74 | 136 | (62) | (46) | % | 206 | 44 | 162 | NM | ||||||||||||||||||||||||||||||||

| Managed Businesses - Historic District & Pier 17 | (861) | (916) | 55 | 6 | % | 1,769 | (256) | 2,025 | NM | ||||||||||||||||||||||||||||||||

| Events, Sponsorships & Catering Business | 286 | (665) | 951 | 143 | % | 411 | (229) | 640 | NM | ||||||||||||||||||||||||||||||||

| Seaport NOI | (6,426) | (8,519) | 2,093 | 25 | % | (684) | (4,275) | 3,591 | 84 | % | |||||||||||||||||||||||||||||||

| Company's share NOI (a) | (5,597) | (282) | (5,315) | NM | (3,022) | (147) | (2,875) | NM | |||||||||||||||||||||||||||||||||

| Total Seaport NOI | $ | (12,023) | $ | (8,801) | $ | (3,222) | (37) | % | $ | (3,706) | $ | (4,422) | $ | 716 | 16 | % | |||||||||||||||||||||||||

| Strategic Developments | |||||||||||||||||||||||||||||||||||||||||

| Condominium units contracted to sell (b) | 80 | 91 | (11) | (12) | % | 43 | 45 | (2) | (4) | % | |||||||||||||||||||||||||||||||

(a)Includes Company’s share of NOI from non-consolidated assets

(b)Includes units at our buildings that are open or under construction as of June 30, 2022

NM - Not Meaningful

Financial Data

(1)See the accompanying appendix for a reconciliation of GAAP to non-GAAP financial measures and a statement indicating why management believes the non-GAAP financial measure provides useful information for investors.

6

About The Howard Hughes Corporation®

The Howard Hughes Corporation owns, manages and develops commercial, residential and mixed-use real estate throughout the U.S. Its award-winning assets include the country’s preeminent portfolio of master planned communities, as well as operating properties and development opportunities including: the Seaport in New York City; Downtown Columbia®, Maryland; The Woodlands®, The Woodlands Hills®, and Bridgeland® in the Greater Houston, Texas area; Summerlin®, Las Vegas; Ward Village® in Honolulu, Hawai‘i; and Douglas Ranch in Phoenix. The Howard Hughes Corporation’s portfolio is strategically positioned to meet and accelerate development based on market demand, resulting in one of the strongest real estate platforms in the country. Dedicated to innovative place making, the Company is recognized for its ongoing commitment to design excellence and to the cultural life of its communities. The Howard Hughes Corporation is traded on the New York Stock Exchange as HHC. For additional information visit www.howardhughes.com.

The Howard Hughes Corporation has partnered with Say, the fintech startup reimagining shareholder communications, to allow investors to submit and upvote questions they would like to see addressed on the Company’s second quarter earnings call. Say verifies all shareholder positions and provides permission to participate on the August 4, 2022 call, during which the Company’s leadership will be answering top questions. Utilizing the Say platform, The Howard Hughes Corporation elevates its capabilities for responding to Company shareholders, making its investor relations Q&A more transparent and engaging.

Safe Harbor Statement

Certain statements contained in this press release may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical facts, including, among others, statements regarding the Company’s future financial position, results or performance, are forward-looking statements. Those statements include statements regarding the intent, belief, or current expectations of the Company, members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “plan,” “project,” “realize,” “should,” “transform,” “will,” “would,” and other statements of similar expression. Forward-looking statements are not a guaranty of future performance and involve risks and uncertainties that actual results may differ materially from those contemplated by such forward-looking statements. Many of these factors are beyond the Company’s abilities to control or predict. Some of the risks, uncertainties and other important factors that may affect future results or cause actual results to differ materially from those expressed or implied by forward-looking statements include: (i) the impact of the COVID-19 pandemic on the Company’s business, tenants and the economy in general, including the measures taken by governmental authorities to address it; (ii) general adverse economic and local real estate conditions; (iii) potential changes in the financial markets and interest rates; (iv) the inability of major tenants to continue paying their rent obligations due to bankruptcy, insolvency or a general downturn in their business; (v) financing risks, such as the inability to obtain equity, debt or other sources of financing or refinancing on favorable terms, if at all; (vi) ability to compete effectively, including the potential impact of heightened competition for tenants and potential decreases in occupancy at our properties; (vii) ability to successfully dispose of non-core assets on favorable terms, if at all; (viii) ability to successfully identify, acquire, develop and/or manage properties on favorable terms and in accordance with applicable zoning and permitting laws; (ix) changes in governmental laws and regulations; (x) increases in operating costs, including construction cost increases as the result of trade disputes and tariffs on goods imported in the United States; (xi) lack of control over certain of the Company’s properties due to the joint ownership of such property; (xii) impairment charges; (xiii) the effects of geopolitical instability and risks such as terrorist attacks and trade wars; (xiv) the effects of natural disasters, including floods, droughts, wind, tornadoes and hurricanes; (xv) the inherent risks related to disruption of information technology networks and related systems, including cyber security attacks; and (xvi) the ability to attract and retain key employees. The Company refers you to the section entitled “Risk Factors” contained in the Company's Annual Report on Form 10-K for the year ended December 31, 2021. Additional information concerning factors that could cause actual results to differ materially from those forward-looking statements is contained from time to time in the Company's filings with the Securities and Exchange Commission. Copies of each filing may be obtained from the Company or the Securities and Exchange Commission. The risks included here are not exhaustive and undue reliance should not be placed on any forward-looking statements, which are based on current expectations. All written and oral forward-looking statements attributable to the Company, its management, or persons acting on their behalf are qualified in their entirety by these cautionary statements. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to

7

update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time unless otherwise required by law.

Financial Presentation

As discussed throughout this release, we use certain non-GAAP performance measures, in addition to the required GAAP presentations, as we believe these measures improve the understanding of our operational results and make comparisons of operating results among peer companies more meaningful. We continually evaluate the usefulness, relevance, limitations and calculation of our reported non-GAAP performance measures to determine how best to provide relevant information to the public, and thus such reported measures could change. A non-GAAP financial measure used throughout this release is net operating income (NOI). We provide a more detailed discussion about this non-GAAP measure in our reconciliation of non-GAAP measures provided in the appendix in this earnings release.

Media Contact

The Howard Hughes Corporation

Cristina Carlson, 646-822-6910

Senior Vice President, Head of Corporate Communications

cristina.carlson@howardhughes.com

Investor Relations Contact

The Howard Hughes Corporation

Eric Holcomb, 281-475-2144

Senior Vice President, Investor Relations

eric.holcomb@howardhughes.com

8

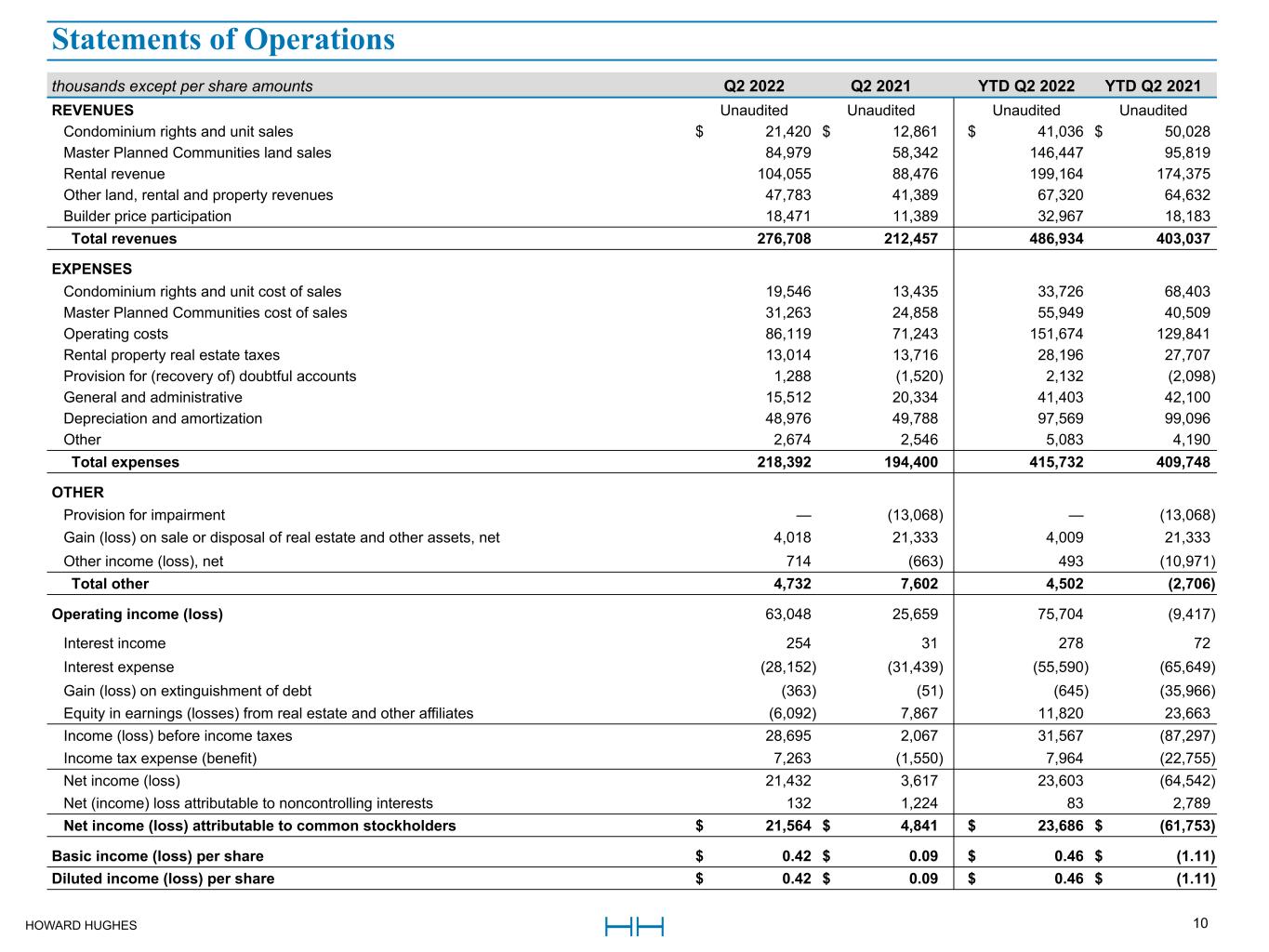

THE HOWARD HUGHES CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

UNAUDITED

| Six Months Ended June 30, | Three Months Ended June 30, | ||||||||||||||||||||||

| thousands except per share amounts | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| REVENUES | |||||||||||||||||||||||

| Condominium rights and unit sales | $ | 41,036 | $ | 50,028 | $ | 21,420 | $ | 12,861 | |||||||||||||||

| Master Planned Communities land sales | 146,447 | 95,819 | 84,979 | 58,342 | |||||||||||||||||||

| Rental revenue | 199,164 | 174,375 | 104,055 | 88,476 | |||||||||||||||||||

| Other land, rental and property revenues | 67,320 | 64,632 | 47,783 | 41,389 | |||||||||||||||||||

| Builder price participation | 32,967 | 18,183 | 18,471 | 11,389 | |||||||||||||||||||

| Total revenues | 486,934 | 403,037 | 276,708 | 212,457 | |||||||||||||||||||

| EXPENSES | |||||||||||||||||||||||

| Condominium rights and unit cost of sales | 33,726 | 68,403 | 19,546 | 13,435 | |||||||||||||||||||

| Master Planned Communities cost of sales | 55,949 | 40,509 | 31,263 | 24,858 | |||||||||||||||||||

| Operating costs | 151,674 | 129,841 | 86,119 | 71,243 | |||||||||||||||||||

| Rental property real estate taxes | 28,196 | 27,707 | 13,014 | 13,716 | |||||||||||||||||||

| Provision for (recovery of) doubtful accounts | 2,132 | (2,098) | 1,288 | (1,520) | |||||||||||||||||||

| General and administrative | 41,403 | 42,100 | 15,512 | 20,334 | |||||||||||||||||||

| Depreciation and amortization | 97,569 | 99,096 | 48,976 | 49,788 | |||||||||||||||||||

| Other | 5,083 | 4,190 | 2,674 | 2,546 | |||||||||||||||||||

| Total expenses | 415,732 | 409,748 | 218,392 | 194,400 | |||||||||||||||||||

| OTHER | |||||||||||||||||||||||

| Provision for impairment | — | (13,068) | — | (13,068) | |||||||||||||||||||

| Gain (loss) on sale or disposal of real estate and other assets, net | 4,009 | 21,333 | 4,018 | 21,333 | |||||||||||||||||||

| Other income (loss), net | 493 | (10,971) | 714 | (663) | |||||||||||||||||||

| Total other | 4,502 | (2,706) | 4,732 | 7,602 | |||||||||||||||||||

| Operating income (loss) | 75,704 | (9,417) | 63,048 | 25,659 | |||||||||||||||||||

| Interest income | 278 | 72 | 254 | 31 | |||||||||||||||||||

| Interest expense | (55,590) | (65,649) | (28,152) | (31,439) | |||||||||||||||||||

| Gain (loss) on extinguishment of debt | (645) | (35,966) | (363) | (51) | |||||||||||||||||||

| Equity in earnings (losses) from real estate and other affiliates | 11,820 | 23,663 | (6,092) | 7,867 | |||||||||||||||||||

| Income (loss) before income taxes | 31,567 | (87,297) | 28,695 | 2,067 | |||||||||||||||||||

| Income tax expense (benefit) | 7,964 | (22,755) | 7,263 | (1,550) | |||||||||||||||||||

| Net income (loss) | 23,603 | (64,542) | 21,432 | 3,617 | |||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | 83 | 2,789 | 132 | 1,224 | |||||||||||||||||||

| Net income (loss) attributable to common stockholders | $ | 23,686 | $ | (61,753) | $ | 21,564 | $ | 4,841 | |||||||||||||||

| Basic income (loss) per share | $ | 0.46 | $ | (1.11) | $ | 0.42 | $ | 0.09 | |||||||||||||||

| Diluted income (loss) per share | $ | 0.46 | $ | (1.11) | $ | 0.42 | $ | 0.09 | |||||||||||||||

9

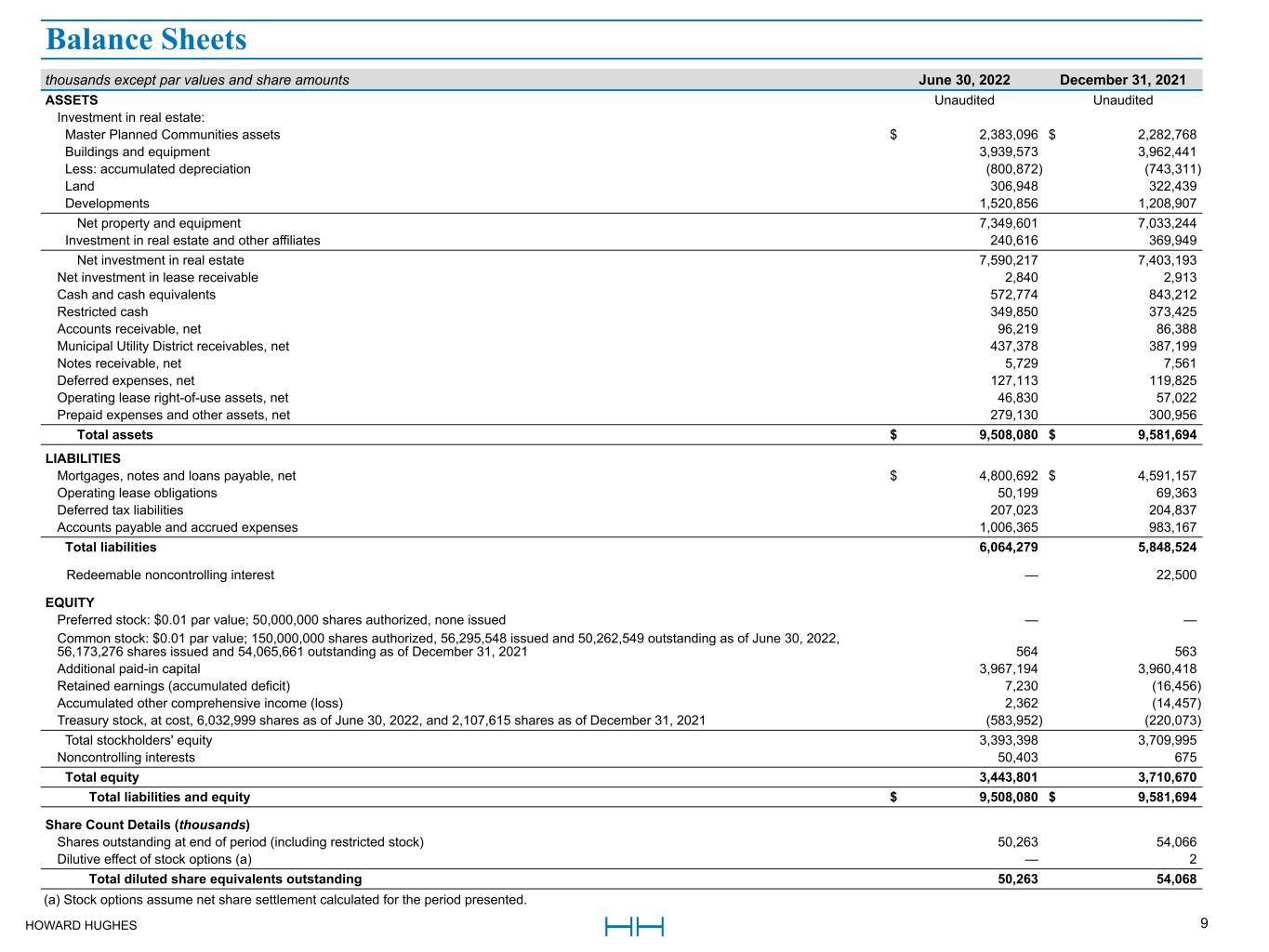

THE HOWARD HUGHES CORPORATION

CONSOLIDATED BALANCE SHEETS

UNAUDITED

| thousands except par values and share amounts | June 30, 2022 | December 31, 2021 | |||||||||

| ASSETS | |||||||||||

| Investment in real estate: | |||||||||||

| Master Planned Communities assets | $ | 2,383,096 | $ | 2,282,768 | |||||||

| Buildings and equipment | 3,939,573 | 3,962,441 | |||||||||

| Less: accumulated depreciation | (800,872) | (743,311) | |||||||||

| Land | 306,948 | 322,439 | |||||||||

| Developments | 1,520,856 | 1,208,907 | |||||||||

| Net property and equipment | 7,349,601 | 7,033,244 | |||||||||

| Investment in real estate and other affiliates | 240,616 | 369,949 | |||||||||

| Net investment in real estate | 7,590,217 | 7,403,193 | |||||||||

| Net investment in lease receivable | 2,840 | 2,913 | |||||||||

| Cash and cash equivalents | 572,774 | 843,212 | |||||||||

| Restricted cash | 349,850 | 373,425 | |||||||||

| Accounts receivable, net | 96,219 | 86,388 | |||||||||

| Municipal Utility District receivables, net | 437,378 | 387,199 | |||||||||

| Notes receivable, net | 5,729 | 7,561 | |||||||||

| Deferred expenses, net | 127,113 | 119,825 | |||||||||

| Operating lease right-of-use assets, net | 46,830 | 57,022 | |||||||||

| Prepaid expenses and other assets, net | 279,130 | 300,956 | |||||||||

| Total assets | $ | 9,508,080 | $ | 9,581,694 | |||||||

| LIABILITIES | |||||||||||

| Mortgages, notes and loans payable, net | $ | 4,800,692 | $ | 4,591,157 | |||||||

| Operating lease obligations | 50,199 | 69,363 | |||||||||

| Deferred tax liabilities | 207,023 | 204,837 | |||||||||

| Accounts payable and accrued expenses | 1,006,365 | 983,167 | |||||||||

| Total liabilities | 6,064,279 | 5,848,524 | |||||||||

| Redeemable noncontrolling interest | — | 22,500 | |||||||||

| EQUITY | |||||||||||

| Preferred stock: $0.01 par value; 50,000,000 shares authorized, none issued | — | — | |||||||||

| Common stock: $0.01 par value; 150,000,000 shares authorized, 56,295,548 issued and 50,262,549 outstanding as of June 30, 2022, 56,173,276 shares issued and 54,065,661 outstanding as of December 31, 2021 | 564 | 563 | |||||||||

| Additional paid-in capital | 3,967,194 | 3,960,418 | |||||||||

| Retained earnings (accumulated deficit) | 7,230 | (16,456) | |||||||||

| Accumulated other comprehensive income (loss) | 2,362 | (14,457) | |||||||||

| Treasury stock, at cost, 6,032,999 shares as of June 30, 2022, and 2,107,615 shares as of December 31, 2021 | (583,952) | (220,073) | |||||||||

| Total stockholders' equity | 3,393,398 | 3,709,995 | |||||||||

| Noncontrolling interests | 50,403 | 675 | |||||||||

| Total equity | 3,443,801 | 3,710,670 | |||||||||

| Total liabilities and equity | $ | 9,508,080 | $ | 9,581,694 | |||||||

10

Appendix – Reconciliation of Non-GAAP Measures

Below are GAAP to non-GAAP reconciliations of certain financial measures, as required under Regulation G of the Securities Exchange Act of 1934. Non-GAAP information should be considered by the reader in addition to, but not instead of, the financial statements prepared in accordance with GAAP. The non-GAAP financial information presented may be determined or calculated differently by other companies and may not be comparable to similarly titled measures.

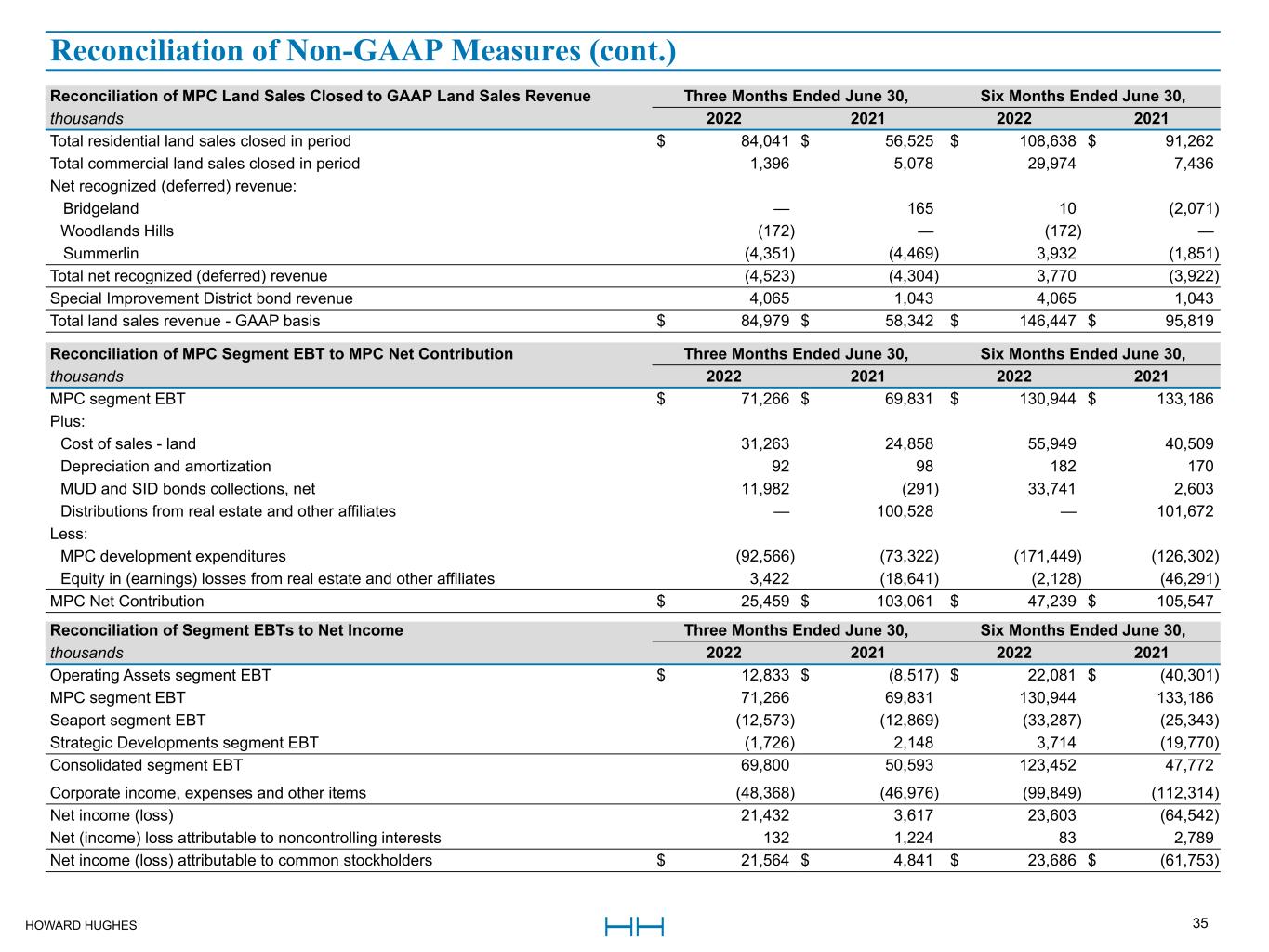

As a result of our four segments—Operating Assets, Master Planned Communities (MPC), Seaport and Strategic Developments—being managed separately, we use different operating measures to assess operating results and allocate resources among these four segments. The one common operating measure used to assess operating results for our business segments is earnings before tax (EBT). EBT, as it relates to each business segment, represents the revenues less expenses of each segment, including interest income, interest expense and equity in earnings of real estate and other affiliates. EBT excludes corporate expenses and other items that are not allocable to the segments. We present EBT because we use this measure, among others, internally to assess the core operating performance of our assets. However, segment EBT should not be considered as an alternative to GAAP net income.

| Six Months Ended June 30, | Three Months Ended June 30, | ||||||||||||||||||||||||||||||||||

| thousands | 2022 | 2021 | $ Change | 2022 | 2021 | $ Change | |||||||||||||||||||||||||||||

| Operating Assets Segment EBT | |||||||||||||||||||||||||||||||||||

| Total revenues (a) | $ | 218,249 | $ | 209,861 | $ | 8,388 | $ | 118,562 | $ | 113,422 | $ | 5,140 | |||||||||||||||||||||||

| Total operating expenses (a) | (97,964) | (100,425) | 2,461 | (51,349) | (53,191) | 1,842 | |||||||||||||||||||||||||||||

| Segment operating income (loss) | 120,285 | 109,436 | 10,849 | 67,213 | 60,231 | 6,982 | |||||||||||||||||||||||||||||

| Depreciation and amortization | (77,429) | (79,626) | 2,197 | (38,999) | (39,975) | 976 | |||||||||||||||||||||||||||||

| Interest income (expense), net | (41,436) | (37,152) | (4,284) | (21,318) | (18,152) | (3,166) | |||||||||||||||||||||||||||||

| Other income (loss), net | (478) | (10,254) | 9,776 | (309) | (156) | (153) | |||||||||||||||||||||||||||||

| Equity in earnings (losses) from real estate and other affiliates | 17,766 | (21,823) | 39,589 | 2,591 | (10,419) | 13,010 | |||||||||||||||||||||||||||||

| Gain (loss) on sale or disposal of real estate and other assets, net | 4,018 | — | 4,018 | 4,018 | — | 4,018 | |||||||||||||||||||||||||||||

| Gain (loss) on extinguishment of debt | (645) | (882) | 237 | (363) | (46) | (317) | |||||||||||||||||||||||||||||

| Operating Assets segment EBT | 22,081 | (40,301) | 62,382 | 12,833 | (8,517) | 21,350 | |||||||||||||||||||||||||||||

| Master Planned Communities Segment EBT | |||||||||||||||||||||||||||||||||||

| Total revenues | 188,802 | 122,865 | 65,937 | 108,110 | 74,578 | 33,532 | |||||||||||||||||||||||||||||

| Total operating expenses | (82,032) | (57,172) | (24,860) | (45,136) | (33,905) | (11,231) | |||||||||||||||||||||||||||||

| Segment operating income (loss) | 106,770 | 65,693 | 41,077 | 62,974 | 40,673 | 22,301 | |||||||||||||||||||||||||||||

| Depreciation and amortization | (182) | (170) | (12) | (92) | (98) | 6 | |||||||||||||||||||||||||||||

| Interest income (expense), net | 22,205 | 21,372 | 833 | 11,783 | 10,615 | 1,168 | |||||||||||||||||||||||||||||

| Other income (loss), net | 23 | — | 23 | 23 | — | 23 | |||||||||||||||||||||||||||||

| Equity in earnings (losses) from real estate and other affiliates | 2,128 | 46,291 | (44,163) | (3,422) | 18,641 | (22,063) | |||||||||||||||||||||||||||||

| MPC segment EBT | 130,944 | 133,186 | (2,242) | 71,266 | 69,831 | 1,435 | |||||||||||||||||||||||||||||

Seaport Segment EBT | |||||||||||||||||||||||||||||||||||

| Total revenues | 37,552 | 18,351 | 19,201 | 28,176 | 10,898 | 17,278 | |||||||||||||||||||||||||||||

| Total operating expenses | (47,925) | (28,502) | (19,423) | (29,066) | (15,996) | (13,070) | |||||||||||||||||||||||||||||

| Segment operating income (loss) | (10,373) | (10,151) | (222) | (890) | (5,098) | 4,208 | |||||||||||||||||||||||||||||

| Depreciation and amortization | (15,543) | (13,839) | (1,704) | (7,720) | (7,004) | (716) | |||||||||||||||||||||||||||||

| Interest income (expense), net | 1,272 | 289 | 983 | 1,319 | 187 | 1,132 | |||||||||||||||||||||||||||||

| Other income (loss), net | 307 | (954) | 1,261 | (43) | (618) | 575 | |||||||||||||||||||||||||||||

| Equity in earnings (losses) from real estate and other affiliates | (8,950) | (688) | (8,262) | (5,239) | (336) | (4,903) | |||||||||||||||||||||||||||||

| Seaport segment EBT | (33,287) | (25,343) | (7,944) | (12,573) | (12,869) | 296 | |||||||||||||||||||||||||||||

11

| Six Months Ended June 30, | Three Months Ended June 30, | ||||||||||||||||||||||||||||||||||

| thousands | 2022 | 2021 | $ Change | 2022 | 2021 | $ Change | |||||||||||||||||||||||||||||

| Strategic Developments Segment EBT | |||||||||||||||||||||||||||||||||||

| Total revenues | 42,302 | 51,766 | (9,464) | 21,846 | 13,466 | 8,380 | |||||||||||||||||||||||||||||

| Total operating expenses | (43,756) | (78,263) | 34,507 | (25,679) | (18,640) | (7,039) | |||||||||||||||||||||||||||||

| Segment operating income (loss) | (1,454) | (26,497) | 25,043 | (3,833) | (5,174) | 1,341 | |||||||||||||||||||||||||||||

| Depreciation and amortization | (2,677) | (3,195) | 518 | (1,345) | (1,597) | 252 | |||||||||||||||||||||||||||||

| Interest income (expense), net | 6,517 | 1,760 | 4,757 | 2,528 | 659 | 1,869 | |||||||||||||||||||||||||||||

| Other income (loss), net | 461 | 14 | 447 | 946 | 14 | 932 | |||||||||||||||||||||||||||||

| Equity in earnings (losses) from real estate and other affiliates | 876 | (117) | 993 | (22) | (19) | (3) | |||||||||||||||||||||||||||||

| Gain (loss) on sale or disposal of real estate and other assets, net | (9) | 21,333 | (21,342) | — | 21,333 | (21,333) | |||||||||||||||||||||||||||||

| Provision for impairment | — | (13,068) | 13,068 | — | (13,068) | 13,068 | |||||||||||||||||||||||||||||

| Strategic Developments segment EBT | 3,714 | (19,770) | 23,484 | (1,726) | 2,148 | (3,874) | |||||||||||||||||||||||||||||

| Consolidated Segment EBT | |||||||||||||||||||||||||||||||||||

| Total revenues | 486,905 | 402,843 | 84,062 | 276,694 | 212,364 | 64,330 | |||||||||||||||||||||||||||||

| Total operating expenses | (271,677) | (264,362) | (7,315) | (151,230) | (121,732) | (29,498) | |||||||||||||||||||||||||||||

| Segment operating income (loss) | 215,228 | 138,481 | 76,747 | 125,464 | 90,632 | 34,832 | |||||||||||||||||||||||||||||

| Depreciation and amortization | (95,831) | (96,830) | 999 | (48,156) | (48,674) | 518 | |||||||||||||||||||||||||||||

| Interest income (expense), net | (11,442) | (13,731) | 2,289 | (5,688) | (6,691) | 1,003 | |||||||||||||||||||||||||||||

| Other income (loss), net | 313 | (11,194) | 11,507 | 617 | (760) | 1,377 | |||||||||||||||||||||||||||||

| Equity in earnings (losses) from real estate and other affiliates | 11,820 | 23,663 | (11,843) | (6,092) | 7,867 | (13,959) | |||||||||||||||||||||||||||||

| Gain (loss) on sale or disposal of real estate and other assets, net | 4,009 | 21,333 | (17,324) | 4,018 | 21,333 | (17,315) | |||||||||||||||||||||||||||||

| Gain (loss) on extinguishment of debt | (645) | (882) | 237 | (363) | (46) | (317) | |||||||||||||||||||||||||||||

| Provision for impairment | — | (13,068) | 13,068 | — | (13,068) | 13,068 | |||||||||||||||||||||||||||||

| Consolidated segment EBT | 123,452 | 47,772 | 75,680 | 69,800 | 50,593 | 19,207 | |||||||||||||||||||||||||||||

| Corporate income, expenses and other items | (99,849) | (112,314) | 12,465 | (48,368) | (46,976) | (1,392) | |||||||||||||||||||||||||||||

| Net income (loss) | 23,603 | (64,542) | 88,145 | 21,432 | 3,617 | 17,815 | |||||||||||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | 83 | 2,789 | (2,706) | 132 | 1,224 | (1,092) | |||||||||||||||||||||||||||||

| Net income (loss) attributable to common stockholders | $ | 23,686 | $ | (61,753) | $ | 85,439 | $ | 21,564 | $ | 4,841 | $ | 16,723 | |||||||||||||||||||||||

(a)Total revenues includes hospitality revenues of $21.6 million for the six months ended June 30, 2021, and $13.9 million for the three months ended June 30, 2021. Total operating expenses includes hospitality operating costs of $18.9 million for the six months ended June 30, 2021, and $11.0 million for the three months ended June 30, 2021. In September 2021, the Company completed the sale of its three hospitality properties.

12

NOI

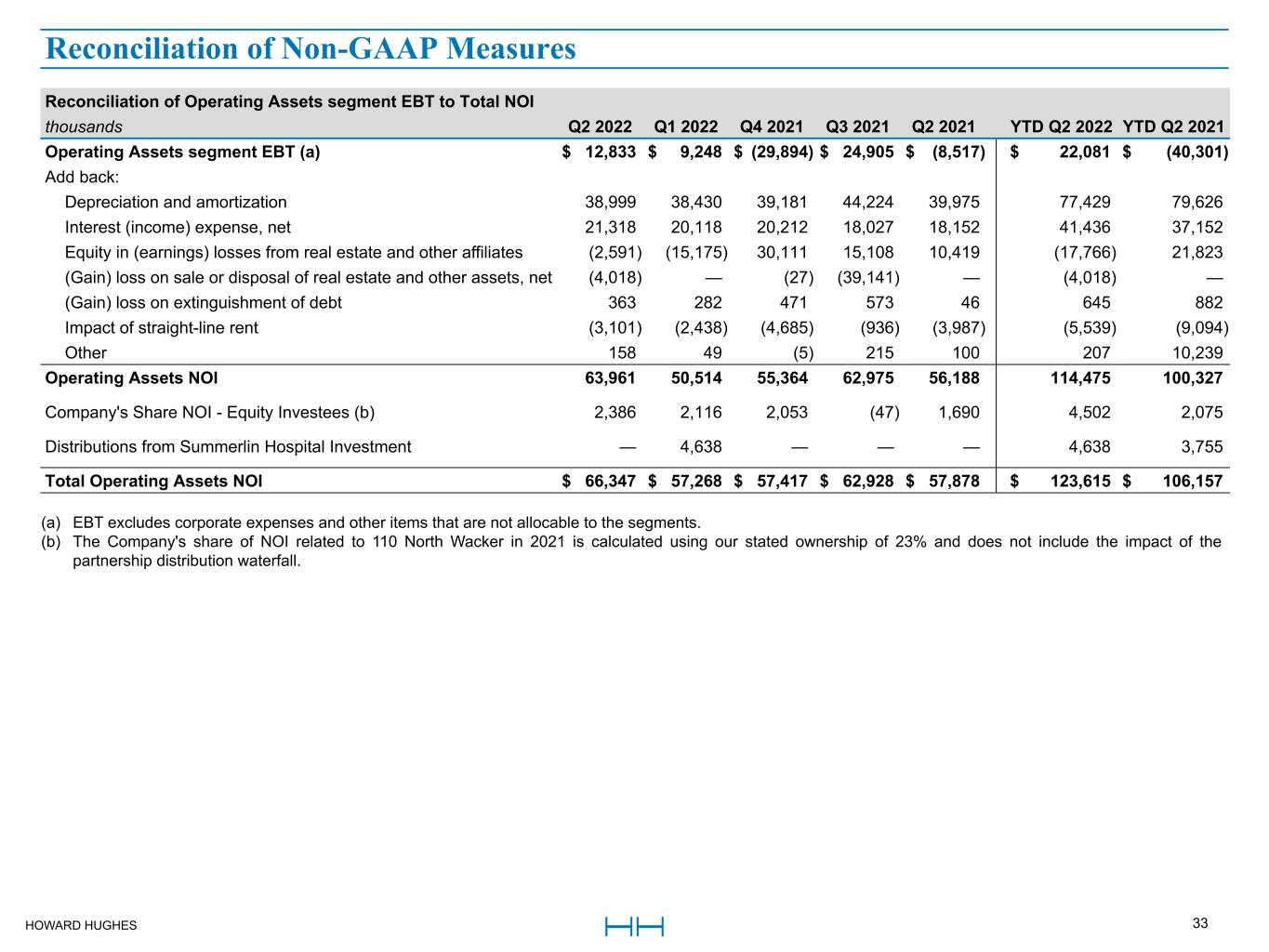

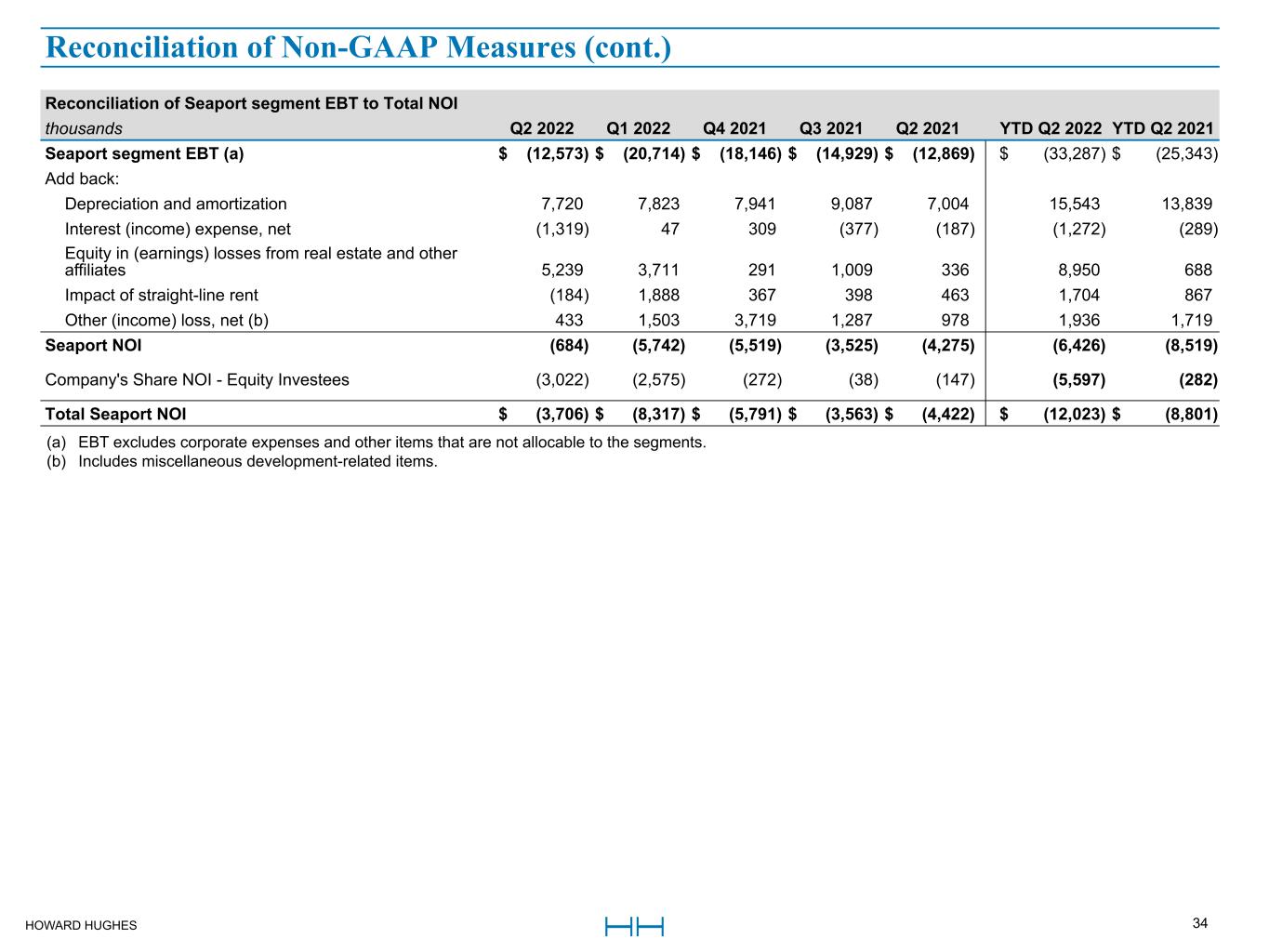

We believe that NOI is a useful supplemental measure of the performance of our Operating Assets and Seaport portfolio because it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating real estate properties and the impact on operations from trends in rental and occupancy rates and operating costs. We define NOI as operating revenues (rental income, tenant recoveries and other revenue) less operating expenses (real estate taxes, repairs and maintenance, marketing and other property expenses, including our share of NOI from equity investees). NOI excludes straight-line rents and amortization of tenant incentives, net; interest expense, net; ground rent amortization, demolition costs; other income (loss); amortization; depreciation; development-related marketing cost; gain on sale or disposal of real estate and other assets, net; provision for impairment and equity in earnings from real estate and other affiliates. All management fees have been eliminated for all internally-managed properties. We use NOI to evaluate our operating performance on a property-by-property basis because NOI allows us to evaluate the impact that property-specific factors such as lease structure, lease rates and tenant base have on our operating results, gross margins and investment returns. Variances between years in NOI typically result from changes in rental rates, occupancy, tenant mix and operating expenses. Although we believe that NOI provides useful information to investors about the performance of our Operating Assets and Seaport assets, due to the exclusions noted above, NOI should only be used as an additional measure of the financial performance of the assets of this segment of our business and not as an alternative to GAAP Net income (loss). For reference, and as an aid in understanding our computation of NOI, a reconciliation of segment EBT to NOI for Operating Assets and Seaport has been presented in the tables below.

| Six Months Ended June 30, | Three Months Ended June 30, | ||||||||||||||||||||||

| thousands | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Operating Assets segment EBT (a) | $ | 22,081 | $ | (40,301) | $ | 12,833 | $ | (8,517) | |||||||||||||||

| Add back: | |||||||||||||||||||||||

| Depreciation and amortization | 77,429 | 79,626 | 38,999 | 39,975 | |||||||||||||||||||

| Interest (income) expense, net | 41,436 | 37,152 | 21,318 | 18,152 | |||||||||||||||||||

| Equity in (earnings) losses from real estate and other affiliates | (17,766) | 21,823 | (2,591) | 10,419 | |||||||||||||||||||

| (Gain) loss on sale or disposal of real estate and other assets, net | (4,018) | — | (4,018) | — | |||||||||||||||||||

| (Gain) loss on extinguishment of debt | 645 | 882 | 363 | 46 | |||||||||||||||||||

| Impact of straight-line rent | (5,539) | (9,094) | (3,101) | (3,987) | |||||||||||||||||||

| Other | 207 | 10,239 | 158 | 100 | |||||||||||||||||||

| Operating Assets NOI | 114,475 | 100,327 | 63,961 | 56,188 | |||||||||||||||||||

| Company's Share NOI - Equity Investees (b) | 4,502 | 2,075 | 2,386 | 1,690 | |||||||||||||||||||

| Distributions from Summerlin Hospital Investment | 4,638 | 3,755 | — | — | |||||||||||||||||||

| Total Operating Assets NOI | $ | 123,615 | $ | 106,157 | $ | 66,347 | $ | 57,878 | |||||||||||||||

| Seaport segment EBT (a) | $ | (33,287) | $ | (25,343) | $ | (12,573) | $ | (12,869) | |||||||||||||||

| Add back: | |||||||||||||||||||||||

| Depreciation and amortization | 15,543 | 13,839 | 7,720 | 7,004 | |||||||||||||||||||

| Interest (income) expense, net | (1,272) | (289) | (1,319) | (187) | |||||||||||||||||||

| Equity in (earnings) losses from real estate and other affiliates | 8,950 | 688 | 5,239 | 336 | |||||||||||||||||||

| Impact of straight-line rent | 1,704 | 867 | (184) | 463 | |||||||||||||||||||

| Other (income) loss, net | 1,936 | 1,719 | 433 | 978 | |||||||||||||||||||

| Seaport NOI | (6,426) | (8,519) | (684) | (4,275) | |||||||||||||||||||

| Company's Share NOI - Equity Investees | (5,597) | (282) | (3,022) | (147) | |||||||||||||||||||

| Total Seaport NOI | $ | (12,023) | $ | (8,801) | $ | (3,706) | $ | (4,422) | |||||||||||||||

(a)Segment EBT excludes corporate expenses and other items that are not allocable to the segments.

(b)The Company's share of NOI related to 110 North Wacker Drive in 2021 is calculated using our stated ownership of 23% and does not include the impact of the partnership distribution waterfall.

13

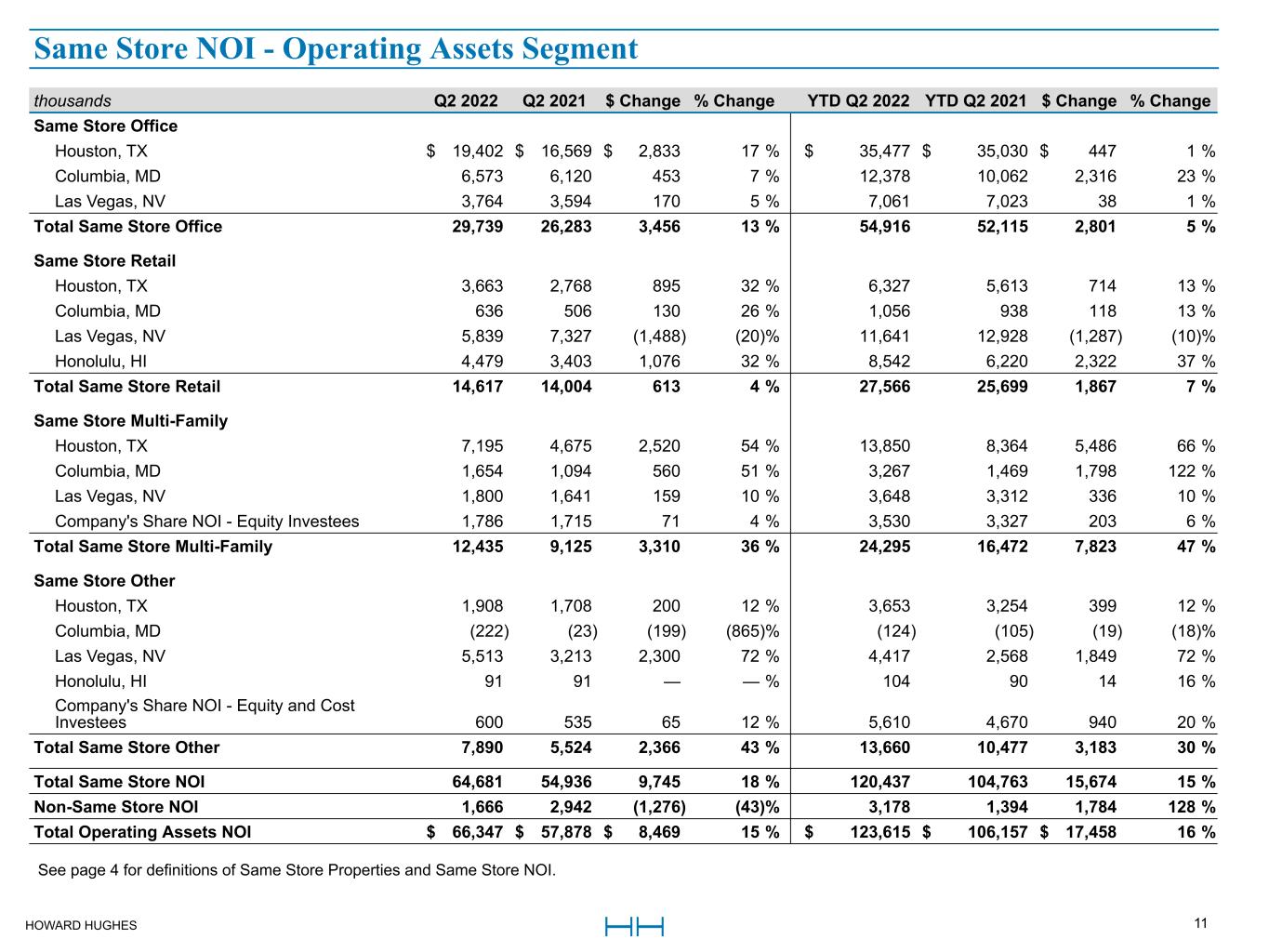

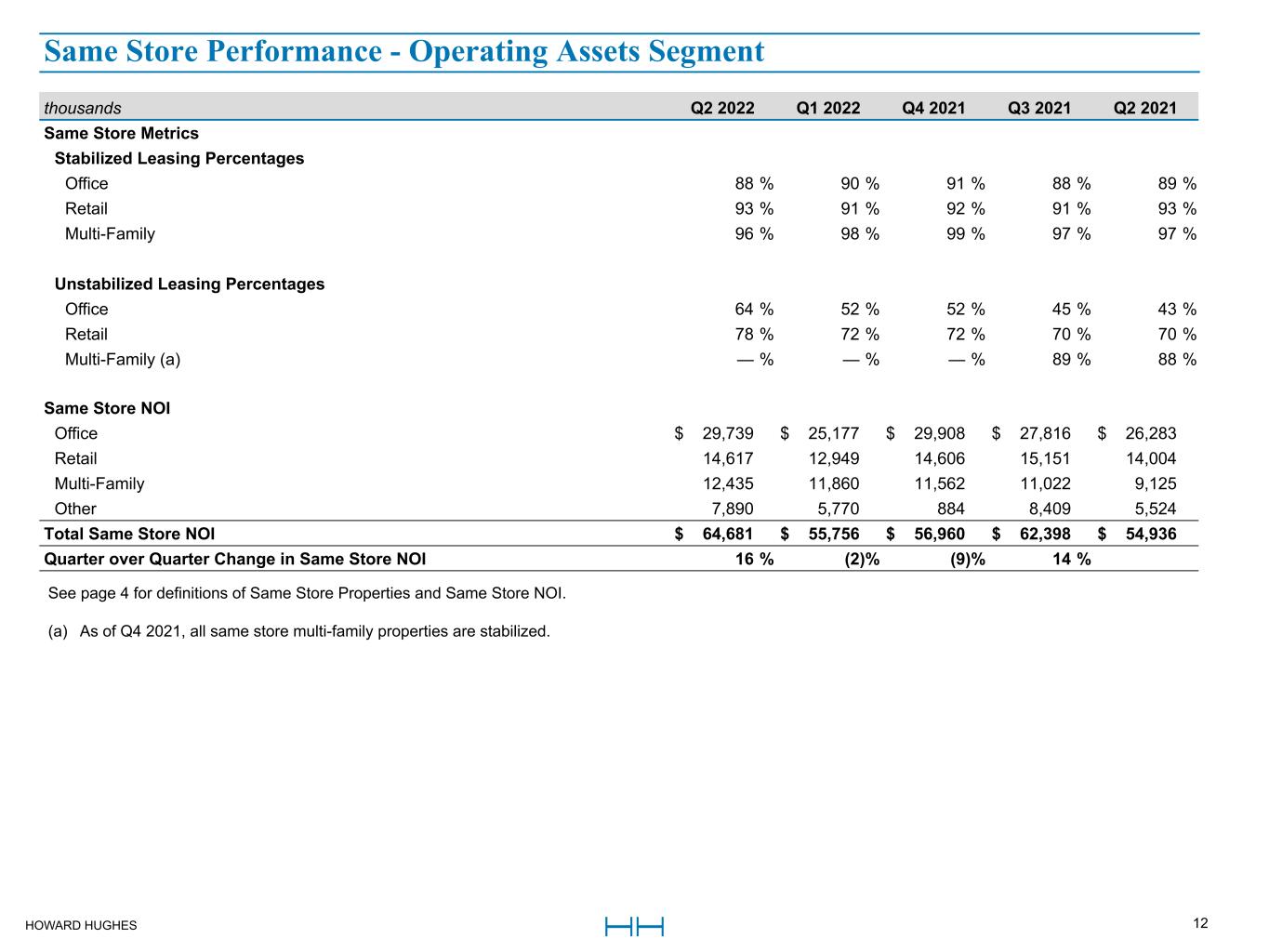

Same Store NOI - Operating Assets Segment

The Company defines Same Store Properties as consolidated and unconsolidated properties that are acquired or placed in-service prior to the beginning of the earliest period presented and owned by the Company through the end of the latest period presented. Same Store Properties exclude properties placed in-service, acquired, repositioned or in development or redevelopment after the beginning of the earliest period presented or disposed of prior to the end of the latest period presented. Accordingly, it takes at least one year and one quarter after a property is acquired or treated as in-service for that property to be included in Same Store Properties.

We calculate Same Store Net Operating Income (Same Store NOI) as Operating Assets NOI applicable to Same Store Properties. Same Store NOI also includes the Company's share of NOI of unconsolidated properties and the annual distribution from a cost basis investment. Same Store NOI is a non-GAAP financial measure and should not be viewed as an alternative to net income calculated in accordance with GAAP as a measurement of our operating performance. We believe that Same Store NOI is helpful to investors as a supplemental comparative performance measure of the income generated from the same group of properties from one period to the next. Other companies may not define Same Store NOI in the same manner as we do; therefore, our computation of Same Store NOI may not be comparable to that of other companies. Additionally, we do not control investments in unconsolidated properties and while we consider disclosures of our share of NOI to be useful, they may not accurately depict the legal and economic implications of our investment arrangements.

| Six Months Ended June 30, | Three Months Ended June 30, | ||||||||||||||||||||||||||||||||||

| thousands | 2022 | 2021 | $ Change | 2022 | 2021 | $ Change | |||||||||||||||||||||||||||||

| Same Store Office | |||||||||||||||||||||||||||||||||||

| Houston, TX | $ | 35,477 | $ | 35,030 | $ | 447 | $ | 19,402 | $ | 16,569 | $ | 2,833 | |||||||||||||||||||||||

| Columbia, MD | 12,378 | 10,062 | 2,316 | 6,573 | 6,120 | 453 | |||||||||||||||||||||||||||||

| Las Vegas, NV | 7,061 | 7,023 | 38 | 3,764 | 3,594 | 170 | |||||||||||||||||||||||||||||

| Total Same Store Office | 54,916 | 52,115 | 2,801 | 29,739 | 26,283 | 3,456 | |||||||||||||||||||||||||||||

| Same Store Retail | |||||||||||||||||||||||||||||||||||

| Houston, TX | 6,327 | 5,613 | 714 | 3,663 | 2,768 | 895 | |||||||||||||||||||||||||||||

| Columbia, MD | 1,056 | 938 | 118 | 636 | 506 | 130 | |||||||||||||||||||||||||||||

| Las Vegas, NV | 11,641 | 12,928 | (1,287) | 5,839 | 7,327 | (1,488) | |||||||||||||||||||||||||||||

| Honolulu, HI | 8,542 | 6,220 | 2,322 | 4,479 | 3,403 | 1,076 | |||||||||||||||||||||||||||||

| Total Same Store Retail | 27,566 | 25,699 | 1,867 | 14,617 | 14,004 | 613 | |||||||||||||||||||||||||||||

| Same Store Multi-Family | |||||||||||||||||||||||||||||||||||

| Houston, TX | 13,850 | 8,364 | 5,486 | 7,195 | 4,675 | 2,520 | |||||||||||||||||||||||||||||

| Columbia, MD | 3,267 | 1,469 | 1,798 | 1,654 | 1,094 | 560 | |||||||||||||||||||||||||||||

| Las Vegas, NV | 3,648 | 3,312 | 336 | 1,800 | 1,641 | 159 | |||||||||||||||||||||||||||||

| Company's Share NOI - Equity Investees | 3,530 | 3,327 | 203 | 1,786 | 1,715 | 71 | |||||||||||||||||||||||||||||

| Total Same Store Multi-Family | 24,295 | 16,472 | 7,823 | 12,435 | 9,125 | 3,310 | |||||||||||||||||||||||||||||

| Same Store Other | |||||||||||||||||||||||||||||||||||

| Houston, TX | 3,653 | 3,254 | 399 | 1,908 | 1,708 | 200 | |||||||||||||||||||||||||||||

| Columbia, MD | (124) | (105) | (19) | (222) | (23) | (199) | |||||||||||||||||||||||||||||

| Las Vegas, NV | 4,417 | 2,568 | 1,849 | 5,513 | 3,213 | 2,300 | |||||||||||||||||||||||||||||

| Honolulu, HI | 104 | 90 | 14 | 91 | 91 | — | |||||||||||||||||||||||||||||

| Company's Share NOI - Equity and Cost Investees | 5,610 | 4,670 | 940 | 600 | 535 | 65 | |||||||||||||||||||||||||||||

| Total Same Store Other | 13,660 | 10,477 | 3,183 | 7,890 | 5,524 | 2,366 | |||||||||||||||||||||||||||||

| Total Same Store NOI | 120,437 | 104,763 | 15,674 | 64,681 | 54,936 | 9,745 | |||||||||||||||||||||||||||||

| Non-Same Store NOI | 3,178 | 1,394 | 1,784 | 1,666 | 2,942 | (1,276) | |||||||||||||||||||||||||||||

| Total Operating Assets NOI | $ | 123,615 | $ | 106,157 | $ | 17,458 | $ | 66,347 | $ | 57,878 | $ | 8,469 | |||||||||||||||||||||||

14

Cash G&A

The Company defines Cash G&A as General and administrative expense less non-cash stock compensation expense. Cash G&A is a non-GAAP financial measure that we believe is useful to our investors and other users of our financial statements as an indicator of overhead efficiency without regard to non-cash expenses associated with stock compensation. However, it should not be used as an alternative to general and administrative expenses in accordance with GAAP.

| Six Months Ended June 30, | Three Months Ended June 30, | ||||||||||||||||||||||||||||||||||

| thousands | 2022 | 2021 | $ Change | 2022 | 2021 | $ Change | |||||||||||||||||||||||||||||

| General and Administrative | |||||||||||||||||||||||||||||||||||

| General and administrative (G&A) | $ | 41,403 | $ | 42,100 | $ | (697) | $ | 15,512 | $ | 20,334 | $ | (4,822) | |||||||||||||||||||||||

| Less: Non-cash stock compensation | (2,691) | (4,781) | 2,090 | (1,254) | (2,248) | 994 | |||||||||||||||||||||||||||||

| Cash G&A (a) | $ | 38,712 | $ | 37,319 | $ | 1,393 | $ | 14,258 | $ | 18,086 | $ | (3,828) | |||||||||||||||||||||||

(a)The first quarter of 2022 includes $2.3 million of severance and bonus costs related to our former Chief Financial Officer.

15

The Howard Hughes Corporation Supplemental Information Three Months Ended June 30, 2022 NYSE: HHC Exhibit 99.2

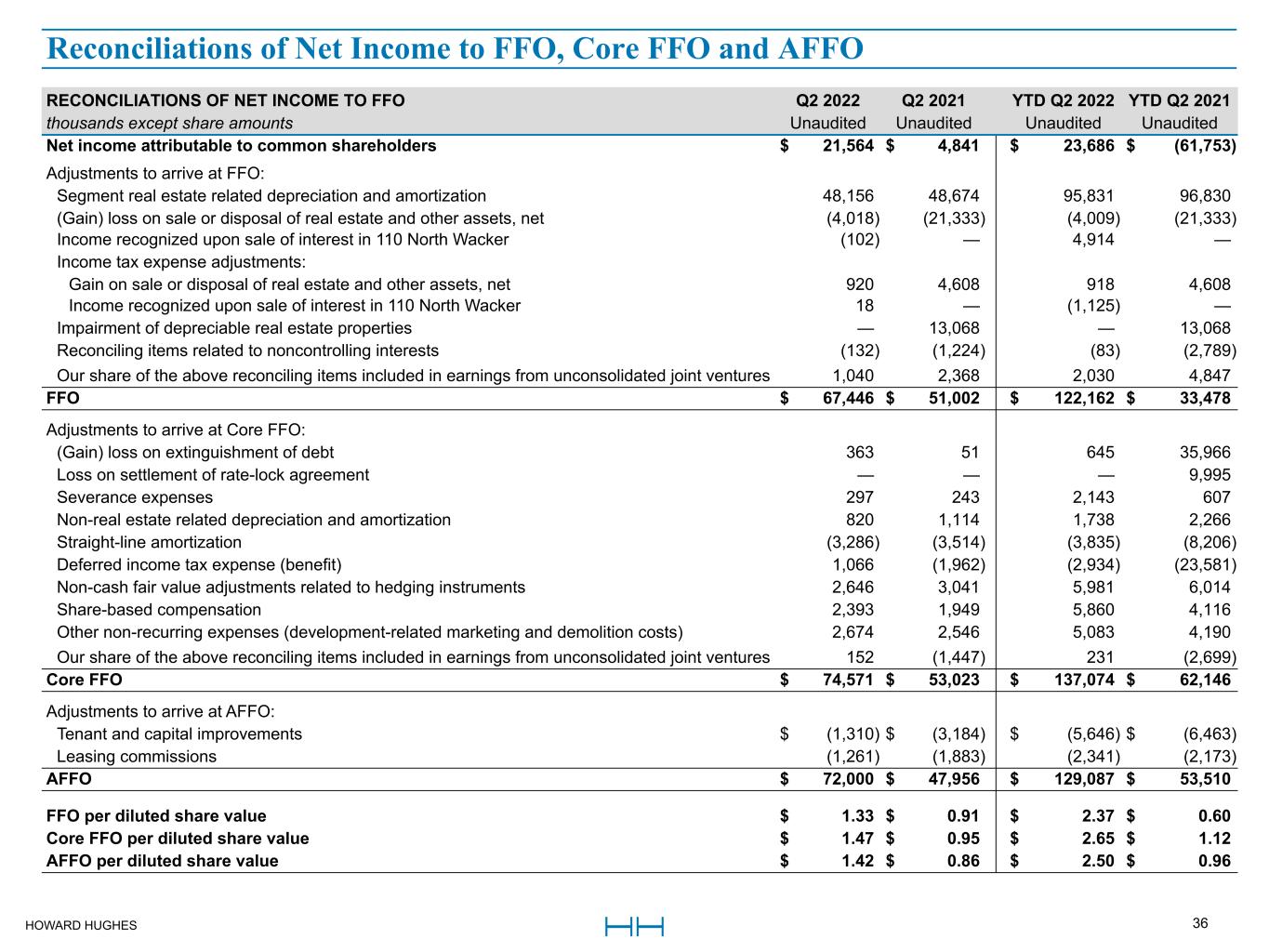

HOWARD HUGHES 2 Cautionary StatementsCautionary Statements Forward Looking Statements This presentation includes forward-looking statements. Forward-looking statements give our current expectations relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to current or historical facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “forecast,” “plan,” “intend,” "believe," “likely,” “may,” “realize,” “should,” “transform,” “would” and other statements of similar expression. Forward-looking statements give our expectations about the future and are not guarantees. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements to materially differ from any future results, performance and achievements expressed or implied by such forward-looking statements. We caution you not to rely on these forward-looking statements. For a discussion of the risk factors that could have an impact on these forward-looking statements, see our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as filed with the Securities and Exchange Commission (SEC) on February 28, 2022. The statements made herein speak only as of the date of this presentation, and we do not undertake to update this information except as required by law. Past performance does not guarantee future results. Performance during time periods shown is limited and may not reflect the performance for the full year or future years, or in different economic and market cycles. Non-GAAP Financial Measures Our financial statements have been prepared in accordance with accounting principles generally accepted in the United States (GAAP); however, we use certain non-GAAP performance measures in this presentation, in addition to GAAP measures, as we believe these measures improve the understanding of our operational results and make comparisons of operating results among peer companies more meaningful. Management continually evaluates the usefulness, relevance, limitations and calculation of our reported non-GAAP performance measures to determine how best to provide relevant information to the public, and thus such reported measures could change. The non-GAAP financial measures used in this presentation are funds from operations (FFO), core funds from operations (Core FFO), adjusted funds from operations (AFFO) and net operating income (NOI). FFO is defined by the National Association of Real Estate Investment Trusts (NAREIT) as net income calculated in accordance with GAAP, excluding gains or losses from real estate dispositions, plus real estate depreciation and amortization and impairment charges (which we believe are not indicative of the performance of our operating portfolio). We calculate FFO in accordance with NAREIT’s definition. Since FFO excludes depreciation and amortization, gains and losses from depreciable property dispositions, and impairments, it can provide a performance measure that, when compared year over year, reflects the impact on operations from trends in occupancy rates, rental rates, operating costs, acquisition, development activities and financing costs. This provides a perspective of our financial performance not immediately apparent from net income determined in accordance with GAAP. Core FFO is calculated by adjusting FFO to exclude the impact of certain non-cash and/or nonrecurring income and expense items, as set forth in the calculation herein. These items can vary greatly from period to period, depending upon the volume of our acquisition activity and debt retirements, among other factors. We believe that by excluding these items, Core FFO serves as a useful, supplementary measure of the ongoing operating performance of the core operations across all segments, and we believe it is used by investors in a similar manner. Finally, AFFO adjusts our Core FFO operating measure to deduct cash expended on recurring tenant improvements and capital expenditures of a routine nature to present an adjusted measure of Core FFO. Core FFO and AFFO are non-GAAP and non-standardized measures and may be calculated differently by other peer companies. We define NOI as operating revenues (rental income, tenant recoveries and other revenue) less operating expenses (real estate taxes, repairs and maintenance, marketing and other property expenses,), plus our share of NOI from equity investees. NOI excludes straight-line rents and amortization of tenant incentives, net interest expense, ground rent amortization, demolition costs, amortization, depreciation, development-related marketing costs, gain on sale or disposal of real estate and other assets, net, provision for impairment, and Equity in earnings from real estate and other affiliates. We use NOI to evaluate our operating performance on a property-by- property basis because NOI allows us to evaluate the impact that factors which vary by property, such as lease structure, lease rates and tenant bases, have on our operating results, gross margins and investment returns. We believe that NOI is a useful supplemental measure of the performance of our Operating Assets and Seaport segments because it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating real estate properties and the impact on operations from trends in rental and occupancy rates and operating costs. While FFO, Core FFO, AFFO and NOI are relevant and widely used measures of operating performance of real estate companies, they do not represent cash flows from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating our liquidity or operating performance. FFO, Core FFO, AFFO and NOI do not purport to be indicative of cash available to fund our future cash requirements. Further, our computations of FFO, Core FFO, AFFO and NOI may not be comparable to FFO, Core FFO, AFFO and NOI reported by other real estate companies. We have included in this presentation a reconciliation from GAAP net income to FFO, Core FFO and AFFO, as well as reconciliations of our GAAP Operating Assets segment earnings before taxes (EBT) to NOI and Seaport segment EBT to NOI. Non-GAAP financial measures should not be considered independently, or as a substitute, for financial information presented in accordance with GAAP. Additional Information Our website address is www.howardhughes.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other publicly filed or furnished documents are available and may be accessed free of charge through the “Investors” section of our website under the "SEC Filings" subsection, as soon as reasonably practicable after those documents are filed with, or furnished to, the SEC. Also available through the Investors section of our website are beneficial ownership reports filed by our directors, officers and certain shareholders on Forms 3, 4 and 5.

3 Table of Contents Table of Contents FINANCIAL OVERVIEW Definitions 4 Company Profile 5 Financial Summary 7 Balance Sheets 9 Statements of Operations 10 OPERATING PORTFOLIO PERFORMANCE Same Store Metrics 11 NOI by Region 13 Stabilized Properties 15 Unstabilized Properties 17 Under Construction Properties 18 Seaport Operating Performance 19 OTHER PORTFOLIO METRICS Ward Village - Sold Out Condominiums 20 Ward Village - Completed or Under Construction Condominiums to be Sold 21 Summary of Remaining Development Costs 22 Portfolio Key Metrics 23 MPC Performance 24 MPC Land 25 Lease Expirations 26 Acquisition / Disposition Activity 27 Other/Non-core Assets 28 Debt Summary 29 Property-Level Debt 30 Ground Leases 32 Reconciliations of Non-GAAP Measures 33

HOWARD HUGHES 4 Stabilized - Properties in the Operating Assets and Seaport segments that have been in service for more than 36 months or have reached 90% occupancy, whichever occurs first. If an office, retail or multi-family property has been in service for more than 36 months but does not exceed 90% occupancy, the asset is considered underperforming. Unstabilized - Properties in the Operating Assets and Seaport segments that have been in service for less than 36 months and do not exceed 90% occupancy. Under Construction - Projects in the Strategic Developments and Seaport segments for which construction has commenced as of June 30, 2022, unless otherwise noted. This excludes MPC and condominium development. Net Operating Income (NOI) - We define net operating income (NOI) as operating cash revenues (rental income, tenant recoveries and other revenue) less operating cash expenses (real estate taxes, repairs and maintenance, marketing and other property expenses), including our share of NOI from equity investees. NOI excludes straight-line rents and amortization of tenant incentives, net interest expense, ground rent amortization, demolition costs, amortization, other (loss) income, depreciation, development-related marketing costs, gain on sale or disposal of real estate and other assets, net, provision for impairment and, unless otherwise indicated, equity in earnings from real estate and other affiliates. We use NOI to evaluate our operating performance on a property-by-property basis because NOI allows us to evaluate the impact that factors which vary by property, such as lease structure, lease rates and tenant bases, have on our operating results, gross margins and investment returns. We believe that NOI is a useful supplemental measure of the performance of our Operating Assets and Seaport segments because it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating real estate properties and the impact on operations from trends in rental and occupancy rates and operating costs. Estimated Stabilized NOI - Stabilized NOI is initially projected prior to the development of the asset based on market assumptions and is revised over the life of the asset as market conditions evolve. On a quarterly basis, each asset’s Annualized NOI is compared to its projected Stabilized NOI in conjunction with forecast data to determine if an adjustment is needed. Adjustments to Stabilized NOI are made when changes to the asset's long-term performance are thought to be more than likely and permanent. Remaining Development Costs - Development costs and related debt held for projects that are under construction or substantially complete and in service in the Operating Assets or the Seaport segment but have not reached stabilized occupancy status are disclosed on the Summary of Remaining Development Costs slide if the project has more than $1.0 million of estimated costs remaining to be incurred. The total estimated costs and costs paid are prepared on a cash basis to reflect the total anticipated cash requirements for the projects. Projects not yet under construction are not included. Same Store Properties - The Company defines Same Store Properties as consolidated and unconsolidated properties that are acquired or placed in-service prior to the beginning of the earliest period presented and owned by the Company through the end of the latest period presented. Same Store Properties exclude properties placed in- service, acquired, repositioned or in development or redevelopment after the beginning of the earliest period presented or disposed of prior to the end of the latest period presented. Accordingly, it takes at least one year and one quarter after a property is acquired or treated as in-service for that property to be included in Same Store Properties. Same Store NOI - We calculate Same Store Net Operating Income (Same Store NOI) as Operating Assets NOI applicable to consolidated properties acquired or placed in-service prior to the beginning of the earliest period presented and owned by the Company through the end of the latest period presented. Same Store NOI also includes the Company's share of NOI of unconsolidated properties and the annual distribution from a cost basis investment. Same Store NOI is a non-GAAP financial measure and should not be viewed as an alternative to net income calculated in accordance with GAAP as a measurement of our operating performance. We believe that Same Store NOI is helpful to investors as a supplemental comparative performance measure of the income generated from the same group of properties from one period to the next. Other companies may not define Same Store NOI in the same manner as we do; therefore, our computation of Same Store NOI may not be comparable to that of other companies. Additionally, we do not control investments in unconsolidated properties and while we consider disclosures of our share of NOI to be useful, they may not accurately depict the legal and economic implications of our investment arrangements. DefinitionsDefinitions

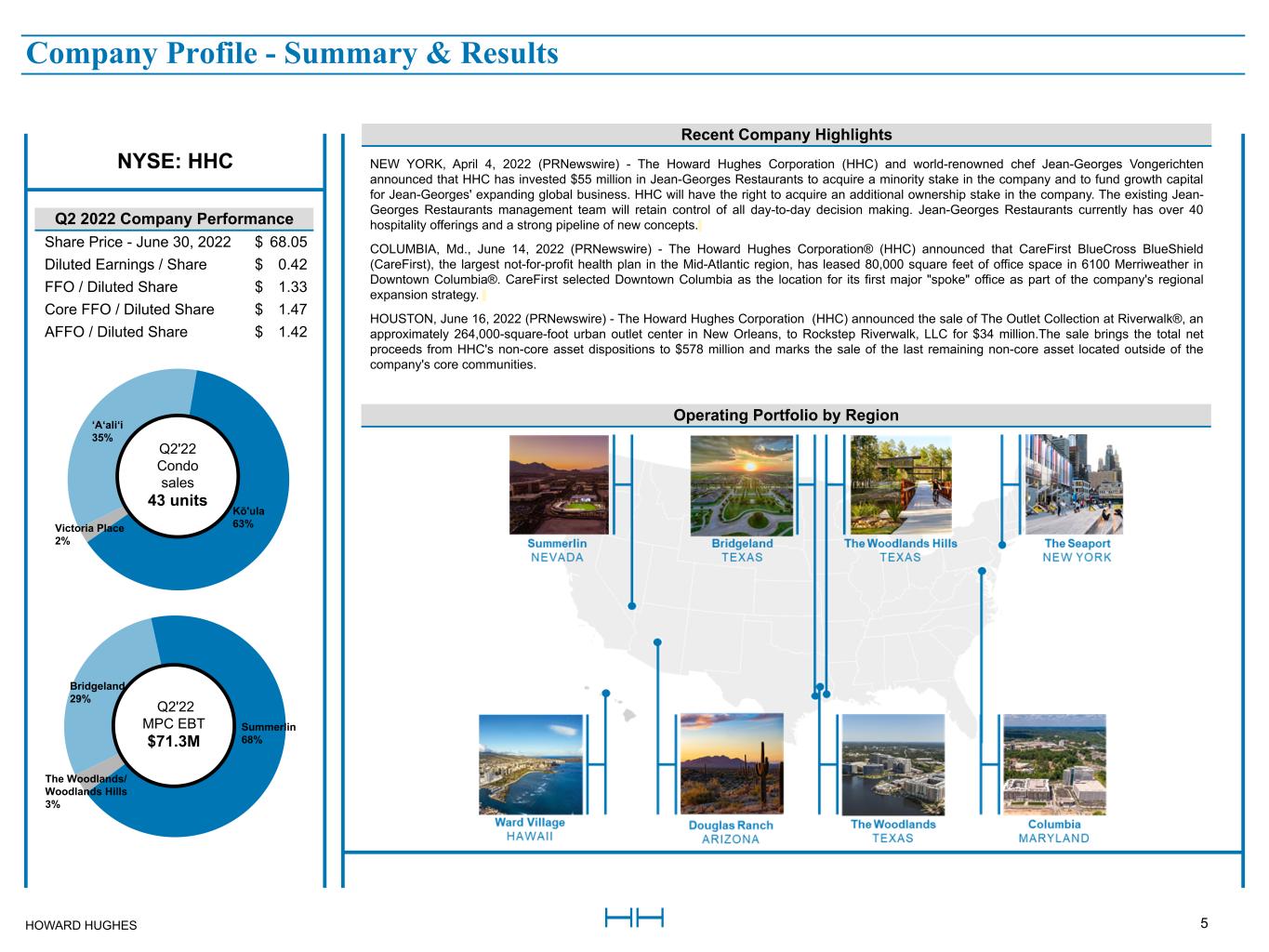

HOWARD HUGHES 5 ‘A‘ali‘i 35% Kō'ula 63%Victoria Place 2% Bridgeland 29% Summerlin 68% The Woodlands/ Woodlands Hills 3% Recent Company Highlights NEW YORK, April 4, 2022 (PRNewswire) - The Howard Hughes Corporation (HHC) and world-renowned chef Jean-Georges Vongerichten announced that HHC has invested $55 million in Jean-Georges Restaurants to acquire a minority stake in the company and to fund growth capital for Jean-Georges' expanding global business. HHC will have the right to acquire an additional ownership stake in the company. The existing Jean- Georges Restaurants management team will retain control of all day-to-day decision making. Jean-Georges Restaurants currently has over 40 hospitality offerings and a strong pipeline of new concepts. COLUMBIA, Md., June 14, 2022 (PRNewswire) - The Howard Hughes Corporation® (HHC) announced that CareFirst BlueCross BlueShield (CareFirst), the largest not-for-profit health plan in the Mid-Atlantic region, has leased 80,000 square feet of office space in 6100 Merriweather in Downtown Columbia®. CareFirst selected Downtown Columbia as the location for its first major "spoke" office as part of the company's regional expansion strategy. HOUSTON, June 16, 2022 (PRNewswire) - The Howard Hughes Corporation (HHC) announced the sale of The Outlet Collection at Riverwalk®, an approximately 264,000-square-foot urban outlet center in New Orleans, to Rockstep Riverwalk, LLC for $34 million.The sale brings the total net proceeds from HHC's non-core asset dispositions to $578 million and marks the sale of the last remaining non-core asset located outside of the company's core communities. Q2 2022 Company Performance Share Price - June 30, 2022 $ 68.05 Diluted Earnings / Share $ 0.42 FFO / Diluted Share $ 1.33 Core FFO / Diluted Share $ 1.47 AFFO / Diluted Share $ 1.42 Company Profile - Summary & Results Operating Portfolio by Region Q2'22 MPC EBT $71.3M Q2'22 Condo sales 43 units NYSE: HHC Company Profile - Summary & Results

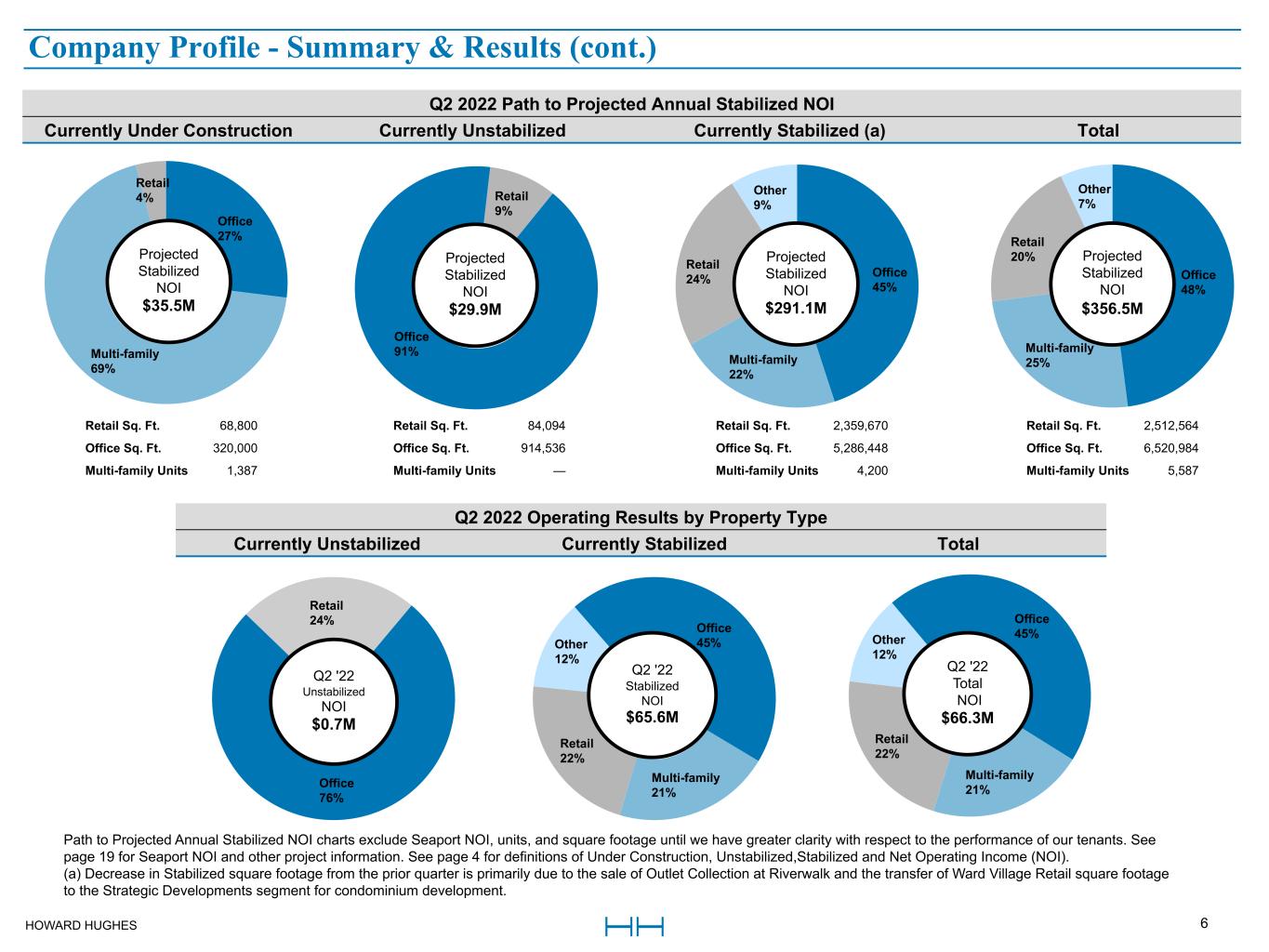

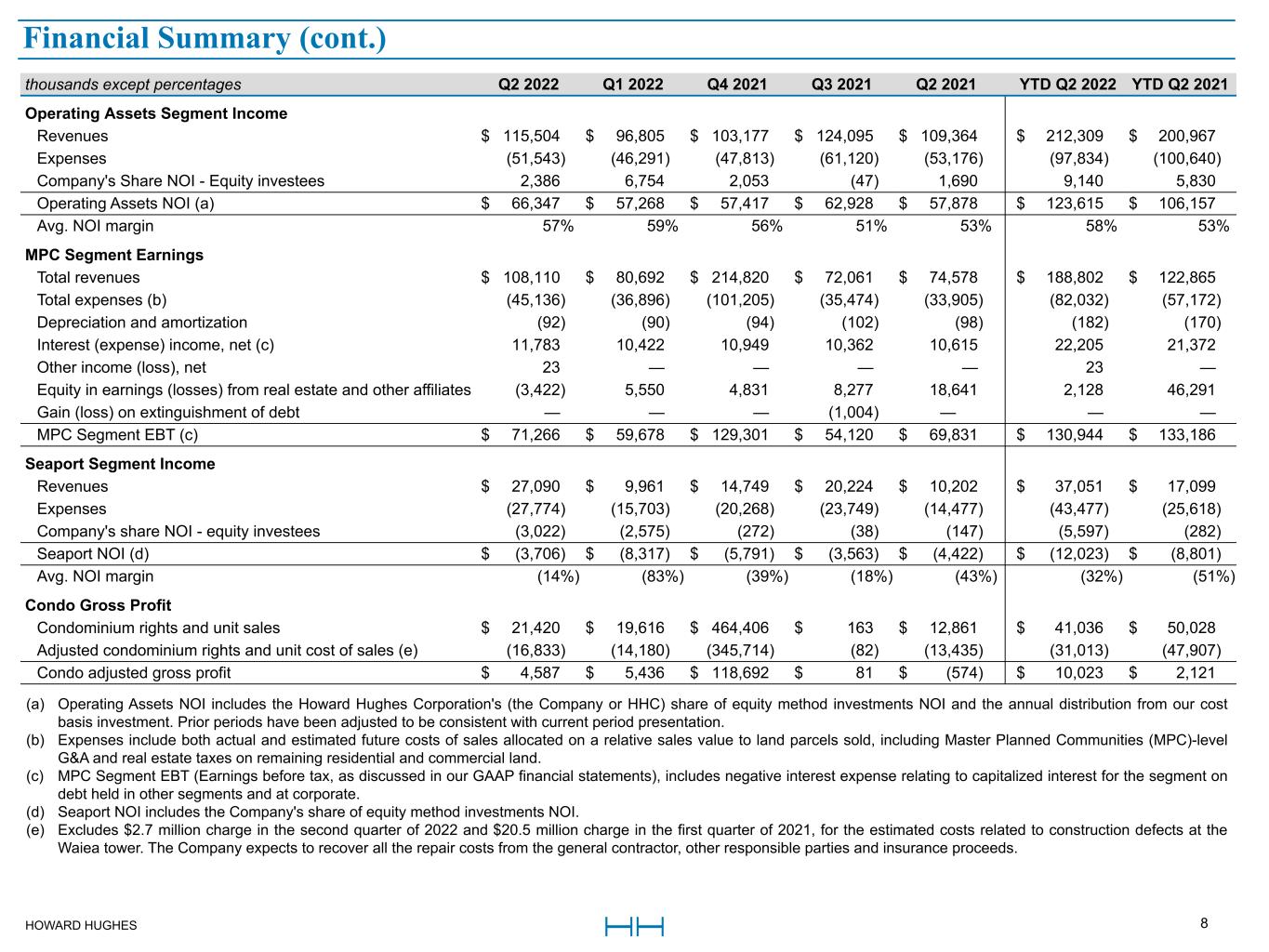

HOWARD HUGHES 6 Office 27% Multi-family 69% Retail 4% Office 76% Retail 24% Office 48% Multi-family 25% Retail 20% Other 7% Office 45% Multi-family 22% Retail 24% Other 9% Office 91% Retail 9% Q2 2022 Path to Projected Annual Stabilized NOI Currently Under Construction Currently Unstabilized Currently Stabilized (a) Total Projected Stabilized NOI $29.9M Projected Stabilized NOI $291.1M Projected Stabilized NOI $356.5M Office 45% Multi-family 21% Retail 22% Other 12% Office 45% Multi-family 21% Retail 22% Other 12% Path to Projected Annual Stabilized NOI charts exclude Seaport NOI, units, and square footage until we have greater clarity with respect to the performance of our tenants. See page 19 for Seaport NOI and other project information. See page 4 for definitions of Under Construction, Unstabilized,Stabilized and Net Operating Income (NOI). (a) Decrease in Stabilized square footage from the prior quarter is primarily due to the sale of Outlet Collection at Riverwalk and the transfer of Ward Village Retail square footage to the Strategic Developments segment for condominium development. Q2 '22 Stabilized NOI $65.6M Q2 '22 Unstabilized NOI $0.7M Q2 '22 Total NOI $66.3M Projected Stabilized NOI $35.5M Retail Sq. Ft. 68,800 Retail Sq. Ft. 84,094 Retail Sq. Ft. 2,359,670 Retail Sq. Ft. 2,512,564 Office Sq. Ft. 320,000 Office Sq. Ft. 914,536 Office Sq. Ft. 5,286,448 Office Sq. Ft. 6,520,984 Multi-family Units 1,387 Multi-family Units — Multi-family Units 4,200 Multi-family Units 5,587 Q2 2022 Operating Results by Property Type Currently Unstabilized Currently Stabilized Total Company Profile - Summary & Results (cont.)

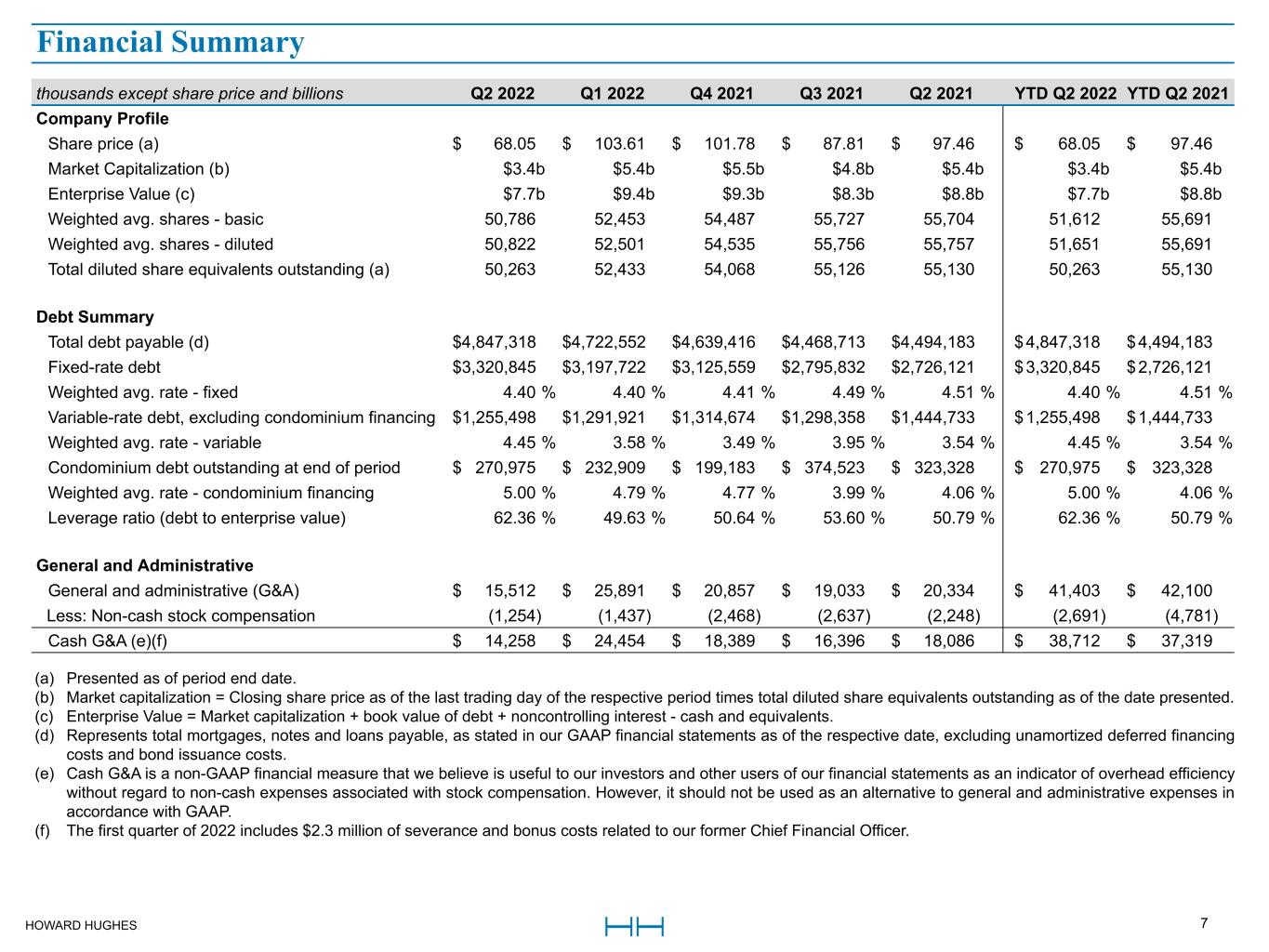

HOWARD HUGHES 7 thousands except share price and billions Q2 2022 Q1 2022 Q4 2021 Q3 2021 Q2 2021 YTD Q2 2022 YTD Q2 2021 Company Profile Share price (a) $ 68.05 $ 103.61 $ 101.78 $ 87.81 $ 97.46 $ 68.05 $ 97.46 Market Capitalization (b) $3.4b $5.4b $5.5b $4.8b $5.4b $3.4b $5.4b Enterprise Value (c) $7.7b $9.4b $9.3b $8.3b $8.8b $7.7b $8.8b Weighted avg. shares - basic 50,786 52,453 54,487 55,727 55,704 51,612 55,691 Weighted avg. shares - diluted 50,822 52,501 54,535 55,756 55,757 51,651 55,691 Total diluted share equivalents outstanding (a) 50,263 52,433 54,068 55,126 55,130 50,263 55,130 Debt Summary Total debt payable (d) $ 4,847,318 $ 4,722,552 $ 4,639,416 $ 4,468,713 $ 4,494,183 $ 4,847,318 $ 4,494,183 Fixed-rate debt $ 3,320,845 $ 3,197,722 $ 3,125,559 $ 2,795,832 $ 2,726,121 $ 3,320,845 $ 2,726,121 Weighted avg. rate - fixed 4.40 % 4.40 % 4.41 % 4.49 % 4.51 % 4.40 % 4.51 % Variable-rate debt, excluding condominium financing $ 1,255,498 $ 1,291,921 $ 1,314,674 $ 1,298,358 $ 1,444,733 $ 1,255,498 $ 1,444,733 Weighted avg. rate - variable 4.45 % 3.58 % 3.49 % 3.95 % 3.54 % 4.45 % 3.54 % Condominium debt outstanding at end of period $ 270,975 $ 232,909 $ 199,183 $ 374,523 $ 323,328 $ 270,975 $ 323,328 Weighted avg. rate - condominium financing 5.00 % 4.79 % 4.77 % 3.99 % 4.06 % 5.00 % 4.06 % Leverage ratio (debt to enterprise value) 62.36 % 49.63 % 50.64 % 53.60 % 50.79 % 62.36 % 50.79 % General and Administrative General and administrative (G&A) $ 15,512 $ 25,891 $ 20,857 $ 19,033 $ 20,334 $ 41,403 $ 42,100 Less: Non-cash stock compensation (1,254) (1,437) (2,468) (2,637) (2,248) (2,691) (4,781) Cash G&A (e)(f) $ 14,258 $ 24,454 $ 18,389 $ 16,396 $ 18,086 $ 38,712 $ 37,319 Financial Summary (a) Presented as of period end date. (b) Market capitalization = Closing share price as of the last trading day of the respective period times total diluted share equivalents outstanding as of the date presented. (c) Enterprise Value = Market capitalization + book value of debt + noncontrolling interest - cash and equivalents. (d) Represents total mortgages, notes and loans payable, as stated in our GAAP financial statements as of the respective date, excluding unamortized deferred financing costs and bond issuance costs. (e) Cash G&A is a non-GAAP financial measure that we believe is useful to our investors and other users of our financial statements as an indicator of overhead efficiency without regard to non-cash expenses associated with stock compensation. However, it should not be used as an alternative to general and administrative expenses in accordance with GAAP. (f) The first quarter of 2022 includes $2.3 million of severance and bonus costs related to our former Chief Financial Officer. Financial Summary