Form 8-K Healthcare Business Reso For: Jun 11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

Report (Date of earliest event reported): June 11,

2021

|

Healthcare Business Resources Inc.

|

|

(Exact

name of registrant as specified in its charter)

|

|

Delaware

|

000-56214

|

84-3639946

|

|

(State

or other jurisdiction ofIncorporation or Organization)

|

(Commission

File Number)

|

(I.R.S.

EmployerIdentification No.)

|

|

|

|

|

|

718 Thompson Lane, Suite 108-273 Nashville, TN

|

|

37204

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant's

telephone number, including area code: 615-856-5542

|

|

|

(Former

name or former address, if changed since last report)

|

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

None

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this

chapter).

|

Emerging

growth company ☑

|

|

If an

emerging growth company, indicate by checkmark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange

Act. ☐

Cautionary Note Regarding Forward-Looking Statements

Statements in this Current Report on Form 8-K,

including those regarding the Agreement and Plan of Merger (as

defined), future financial and operating results, and any other

statements about Healthcare Business Resources,

Inc.’s future expectations,

beliefs, goals, plans or prospects, constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements can be identified by

the use of words such as anticipate, intend, believe, estimate,

plan, seek, project or expect, may, will, would, could or should,

the negative of these terms or other comparable terminology. There

are a number of important factors that could cause actual results

or events to differ materially from those indicated by such

forward-looking statements, including; difficulties in integration

or a failure to attain anticipated operating results or synergies,

each of which could affect the accretiveness of the acquisition,

and the other factors described in Healthcare Business

Resources, Inc.’s periodic

reports filed with the Securities and Exchange Commission.

Healthcare Business Resources, Inc. undertakes no obligation to update forward looking

statements to reflect changed assumptions, the occurrence of

unanticipated events, or changes in future operating results,

financial condition or business over time. You are further advised

to review the Risk Factors set forth in Healthcare Business

Resources, Inc.’s Annual Report

on Form 10-K, which further detail and supplement the factors

described in this paragraph.

Item 1.01

Entry into a Material Definitive Agreement

Agreement and Plan of Merger

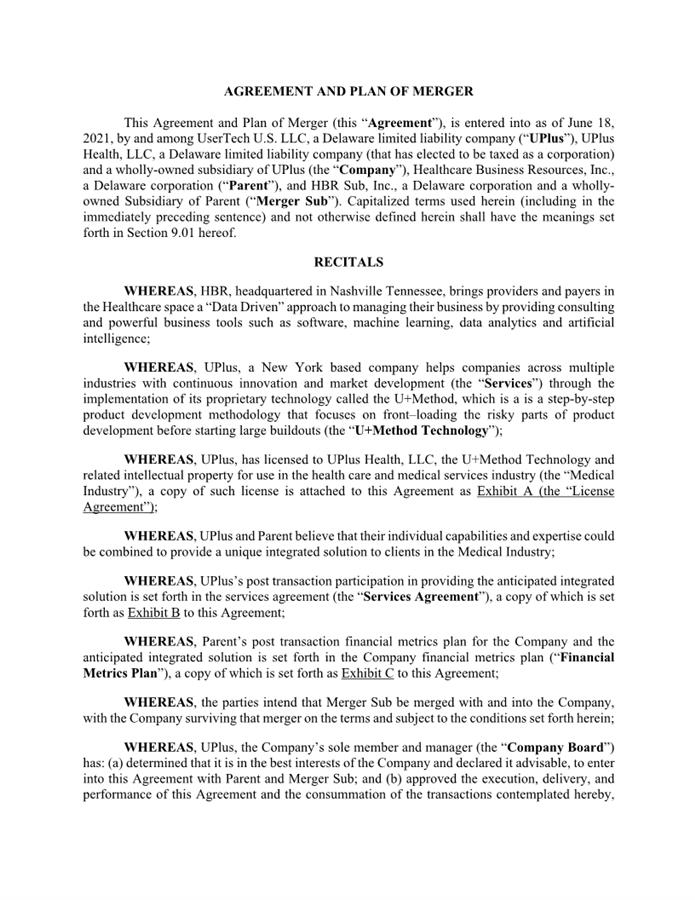

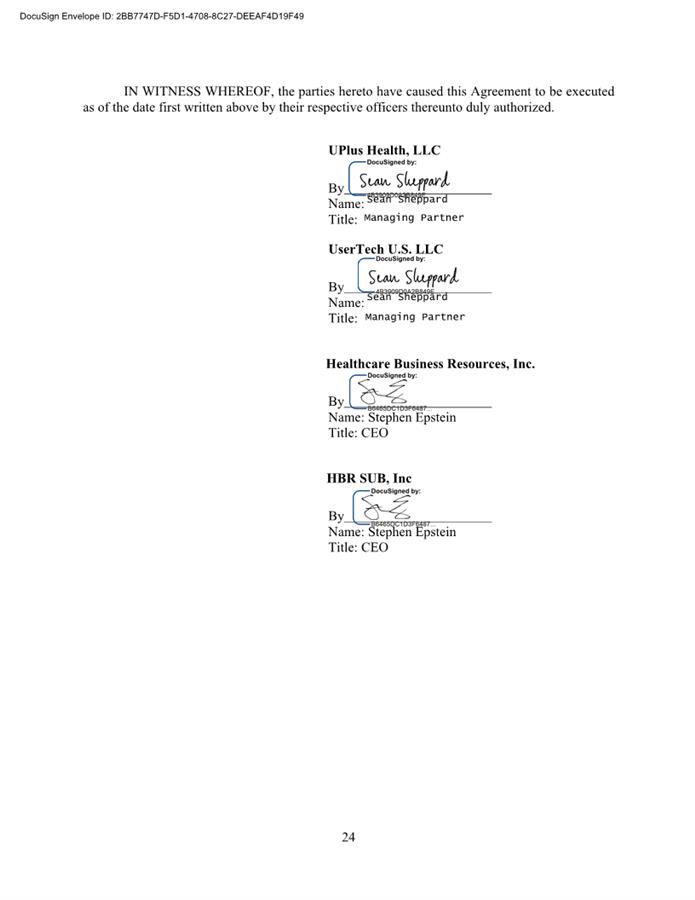

On June

18, 2021, the registrant, Healthcare Business Resources, Inc., a

Delaware corporation (“HBR”), and HBR Sub, Inc., a

Delaware corporation and a wholly owned Subsidiary of HBR

(“Merger Sub”)

entered into and closed an Agreement and Plan of Merger (the

“Agreement”),

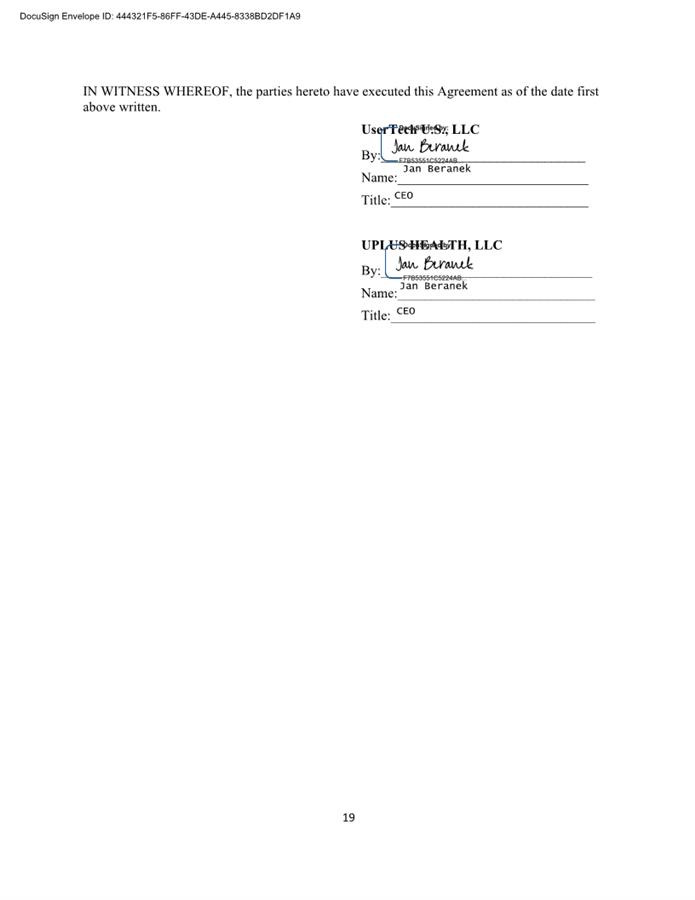

with UserTech U.S. LLC, a Delaware limited liability company

(“UPlus”) and

UPlus Health, LLC, a Delaware limited liability company and a

wholly-owned subsidiary of UPlus (“UPlus Health”). Capitalized terms

used herein (including in the immediately preceding sentence) and

not otherwise defined herein shall have the meanings set forth in

the Agreement.

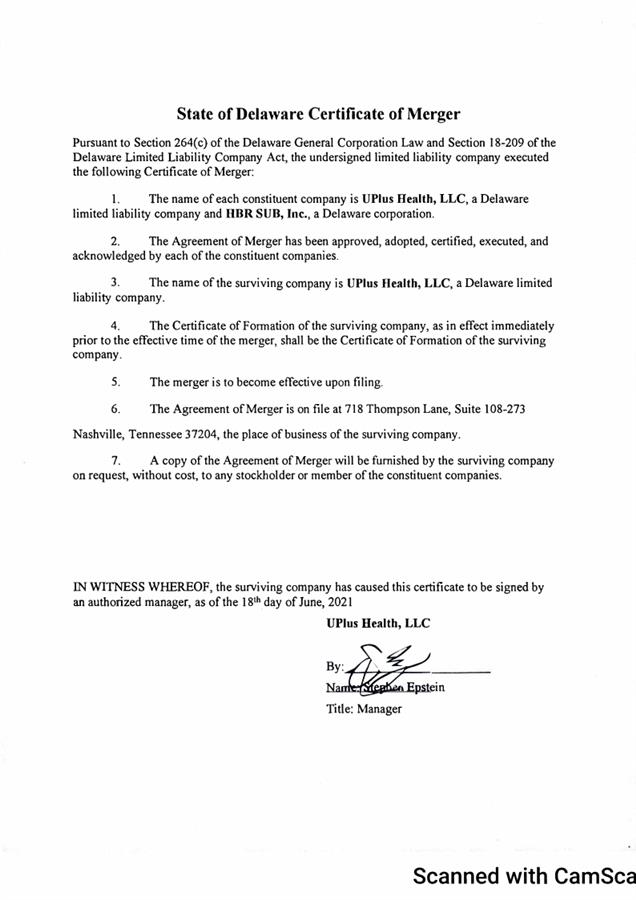

Pursuant to the Agreement, and subject to the

terms and conditions contained therein, Merger Sub was

merged with and into UPlus Health, with UPlus Health surviving the

merger on the terms and subject to the conditions set forth in the

Agreement and certain ancillary agreements. UPlus Health is now a

wholly owned subsidiary of HBR. The consideration for the merger

consisted of HBR’s issuance to UPlus of 1,000,000 shares of

HBR Common Stock and a three-year warrant to purchase 1,400,000

shares of HBR’s Common Stock for $0.50 per share, subject to

the Special Adjustments described in the Agreement, which includes

UPlus’ right to unwind the merger in the event HBR fails to

meet the Financial Metrics Plan described in the

Agreement.

UPlus

helps companies across multiple industries with continuous

innovation and market development through the implementation of its

proprietary technology called the U+Method, which is a is a

step-by-step product development methodology that focuses on

front–loading the risky parts of product development before

starting large buildouts (the “U+Method Technology”). UPlus has

licensed to UPlus Health the U+Method Technology and related

intellectual property for use in the health care and medical

services industry (the “Medical Industry”), pursuant to

the license attached to the Agreement as Exhibit A (the

“License

Agreement”). UPlus and HBR believe that their

individual capabilities and expertise could be combined to provide

a unique integrated solution to clients in the Medical Industry;

and UPlus’ post transaction participation in providing the

anticipated integrated solution is set forth in the services

agreement (the “Services

Agreement”), a copy of which is set forth as Exhibit B

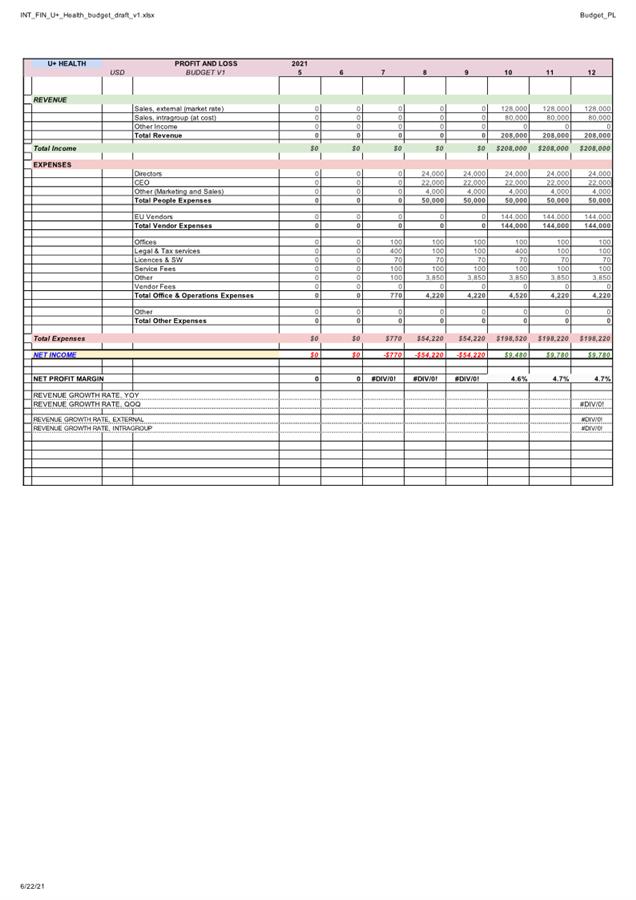

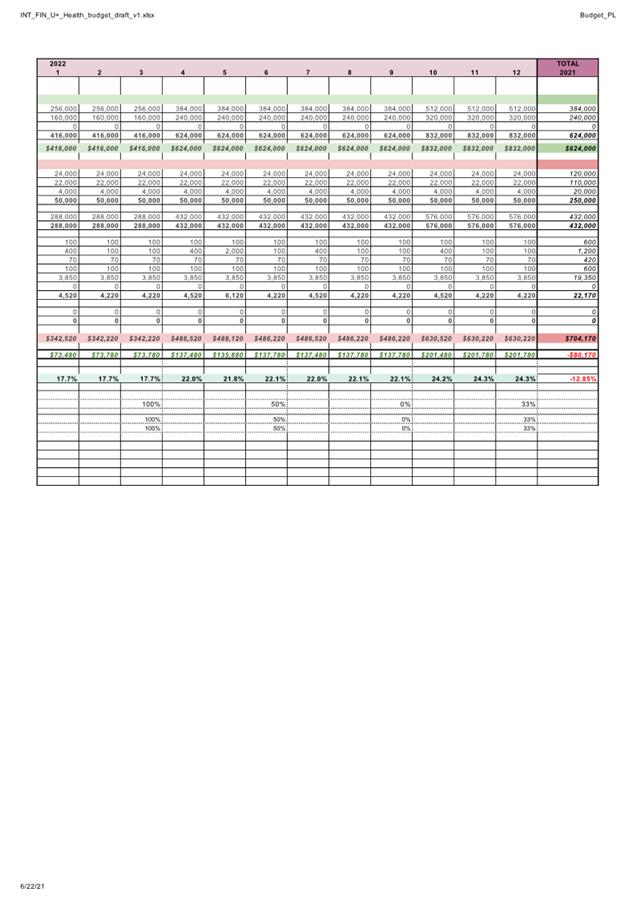

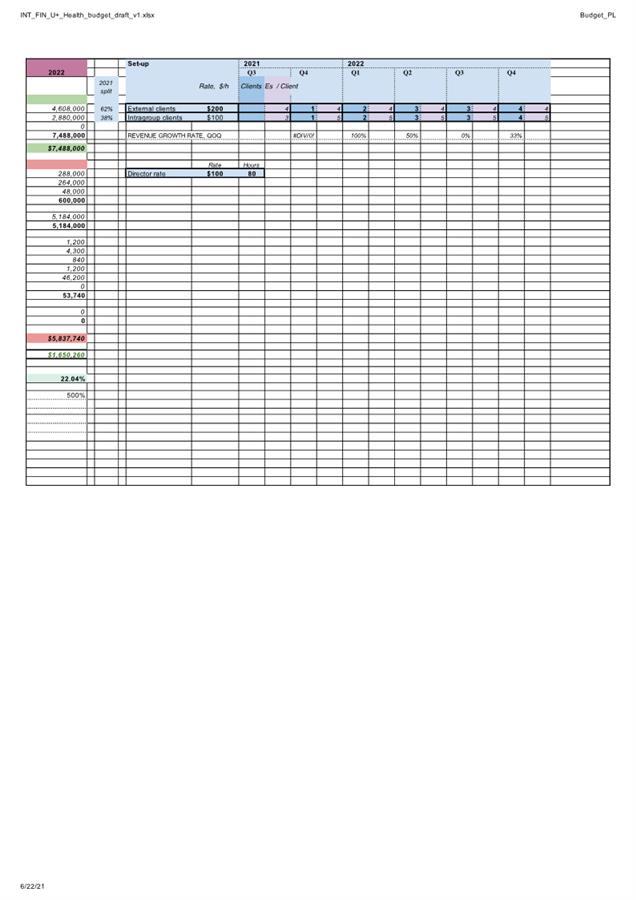

to the Agreement. HBR’s post transaction financial metrics

plan for Uplus Health and the anticipated integrated solution is

set forth in UPlus Health’s financial metrics plan

(“Financial Metrics

Plan”), a copy of which is set forth as Exhibit C to

the Agreement. UPlus Health will be managed by HBR’s current

management team.

The Agreement includes customary representations,

warranties and covenants by the parties. A copy of the Agreement is

attached hereto as Exhibit 2.1

and is incorporated herein by

reference.

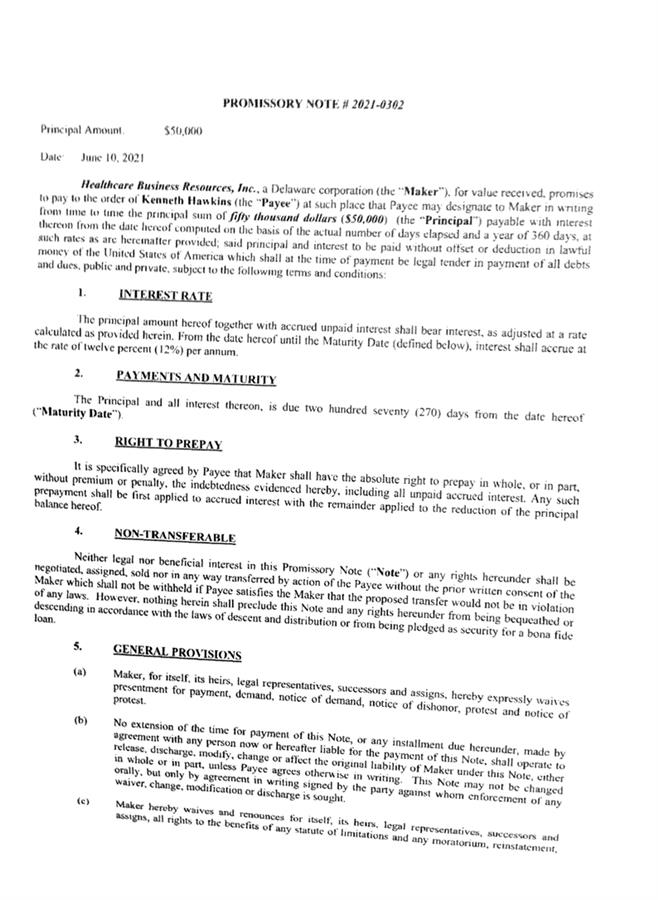

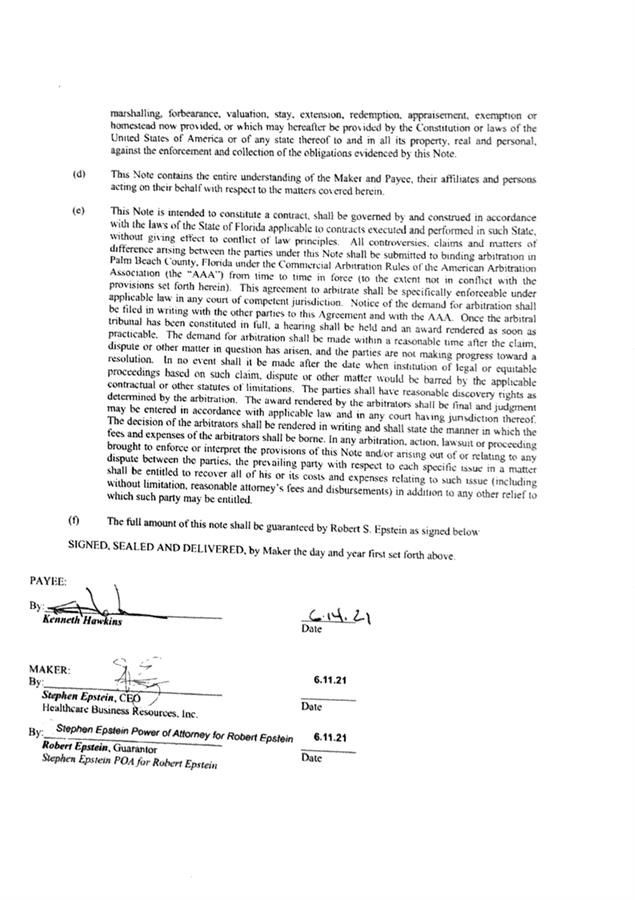

Promissory Note - $50,000

On June 10, 2021, HBR issued to Kenneth

Hawkins, a member of HBR’s board of directors,

a Promissory Note in the aggregate principal amount of $50,000

(the “50,000 Promissory

Note”). The principal

amount of $50,000 plus all interest under the $50,000 Promissory

Note will be due and payable two hundred seventy (270) days

from June 10, 2021. Interest on the Note will accrue at a rate

of 12.0% per annum, beginning on June 10, 2021 until the principal

amount and all accrued but unpaid interest shall have been paid.

The $50,000 Promissory Note is an unsecured debt obligation of the

Company.

The

foregoing description of the $50,000 Promissory Note is not

intended to be complete and is qualified in its entirety by the

full text of the $50,000 Promissory Note, a copy of which is

attached hereto as Exhibit 10.1 and incorporated herein by

reference.

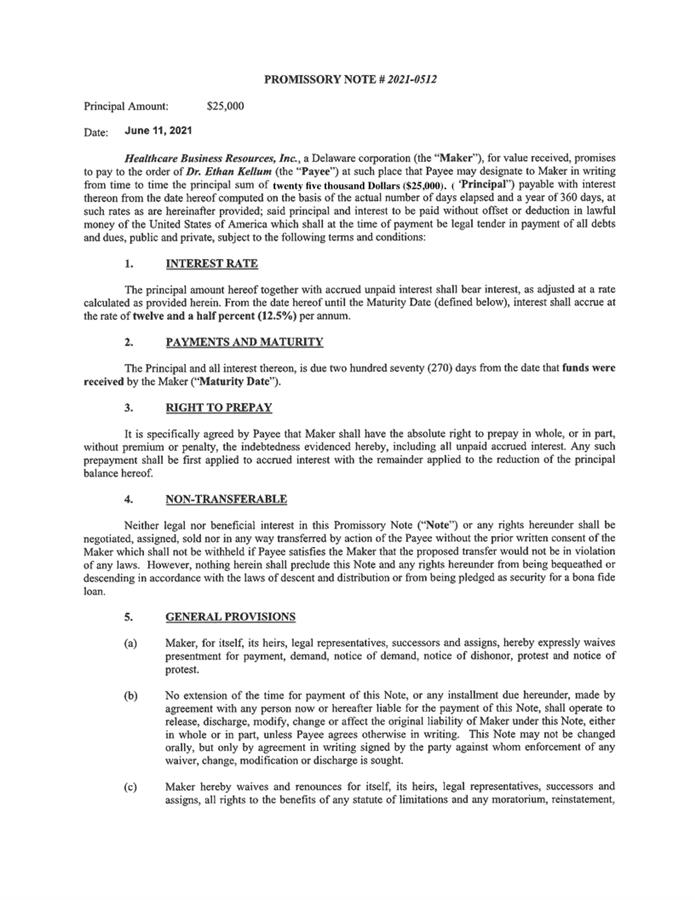

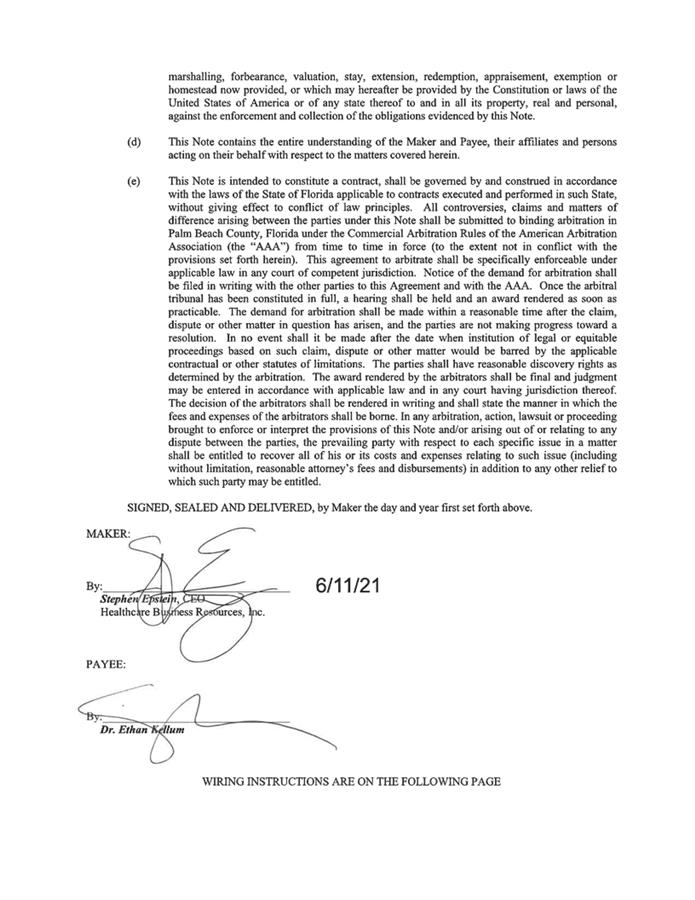

Promissory Note - $25,000

On June 11, 2021, HBR issued to Ethan

Kellum a Promissory Note in the aggregate principal amount of

$25,000 (the “25,000 Promissory

Note”). The principal

amount of $25,000 plus all interest under the $25,000 Promissory

Note will be due and payable two hundred seventy (270) days

from the date the principal amount is received by HBR.

Interest on the Note will accrue at a rate of 12.5% per annum,

beginning on the date the principal amount is received by HBR until

the principal amount and all accrued but unpaid interest shall have

been paid. The $25,000 Promissory Note is an unsecured debt

obligation of the Company.

The

foregoing description of the $25,000 Promissory Note is not

intended to be complete and is qualified in its entirety by the

full text of the $25,000 Promissory Note, a copy of which is

attached hereto as Exhibit 10.2 and incorporated herein by

reference.

Item 2.01

Completion of Acquisition or Disposition of Assets

The

information contained in Item 1.01 herein is hereby incorporated

into this Item 2.01 by reference.

Item 2.03

Creation of a Direct Financial Obligation or an Obligation under an

Off-Balance Sheet Arrangement of the Registrant

The

information set forth above under Item 1.01 is incorporated by

reference in this Item 2.03.

The

information set forth above under Item 2.01 is incorporated by

reference in this Item 2.03.

Item

3.02

Unregistered

Sales of Equity Securities

The

information set forth above under Item 1.01 is incorporated by

reference in this Item 2.03.

Item 9.01

Financial Statements and Exhibits

(d) Exhibits:

|

Exhibit No.

|

|

Description

|

|

|

Agreement

and Plan of Merger

|

|

|

|

Promissory

Note - $50,000

|

|

|

|

Promissory

Note - $25,000

|

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

HEALTHCARE

BUSINESS RESOURCES INC.

|

|

|

|

|

|

By:

|

/s/

Stephen Epstein

|

|

Name:

|

Stephen Epstein

|

|

Title:

|

Chief Executive Officer and Chief Financial Officer

|

Dated:

June 23, 2021

Exhibit

2.1

Exhibit

10.1

Exhibit

10.2

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Dicello Levitt LLP Announces Investor Class Action Lawsuit Filed Against QuidelOrtho Corp. f/k/a Quidel Corp. (NASDAQ: QDEL) And Lead Plaintiff Deadline

- RUM Reports Annual Financial Results with Increased Net Comprehensive Income for the Year Ended December 31, 2023

- DiCello Levitt LLP Announces Investor Class Action Lawsuit Filed Against Perion Network Ltd. (Nasdaq: Peri) and Lead Plaintiff Deadline

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share