Form 8-K General Motors Co For: Oct 27

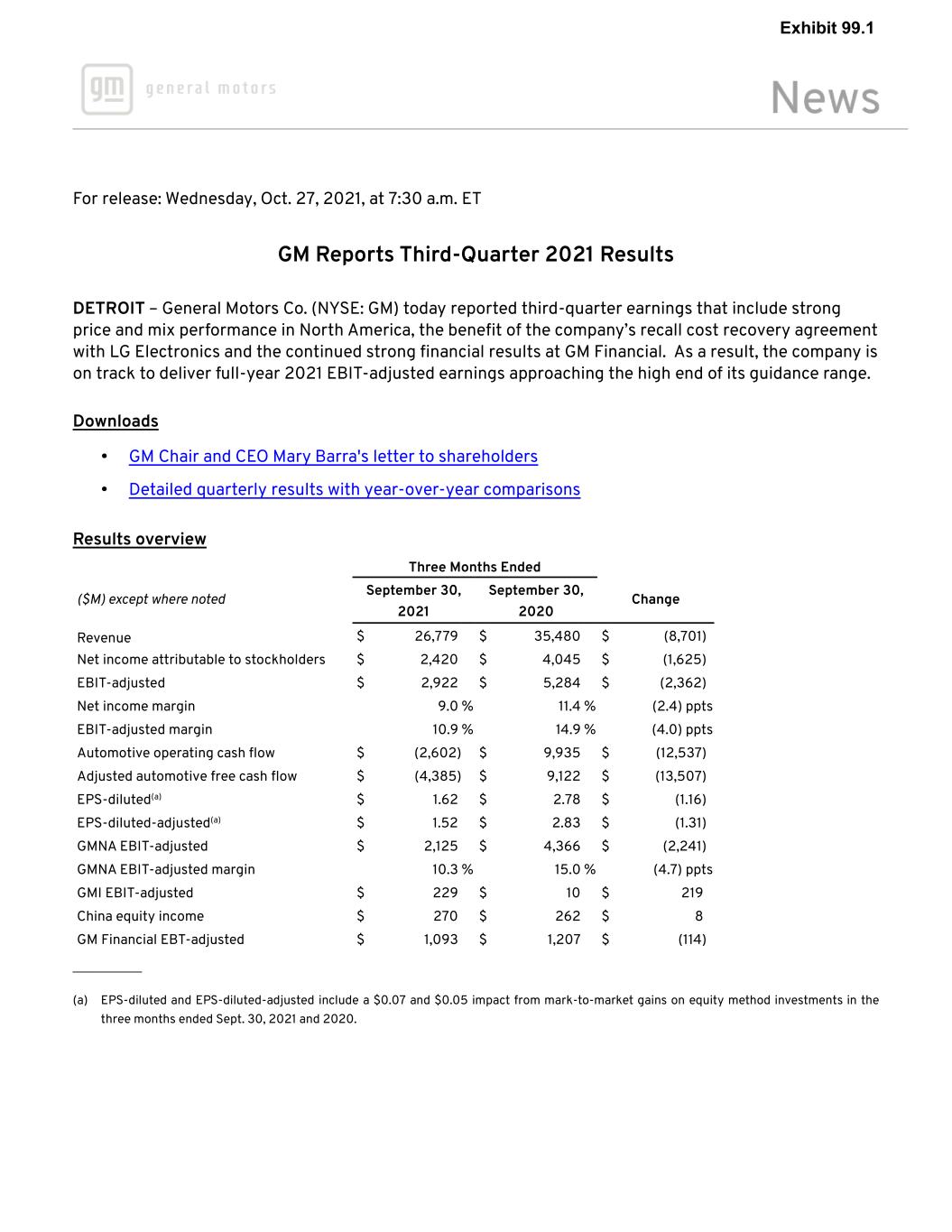

For release: Wednesday, Oct. 27, 2021, at 7:30 a.m. ET GM Reports Third-Quarter 2021 Results DETROIT – General Motors Co. (NYSE: GM) today reported third-quarter earnings that include strong price and mix performance in North America, the benefit of the company’s recall cost recovery agreement with LG Electronics and the continued strong financial results at GM Financial. As a result, the company is on track to deliver full-year 2021 EBIT-adjusted earnings approaching the high end of its guidance range. Downloads • GM Chair and CEO Mary Barra's letter to shareholders • Detailed quarterly results with year-over-year comparisons Results overview Three Months Ended ($M) except where noted September 30, 2021 September 30, 2020 Change Revenue $ 26,779 $ 35,480 $ (8,701) Net income attributable to stockholders $ 2,420 $ 4,045 $ (1,625) EBIT-adjusted $ 2,922 $ 5,284 $ (2,362) Net income margin 9.0 % 11.4 % (2.4) ppts EBIT-adjusted margin 10.9 % 14.9 % (4.0) ppts Automotive operating cash flow $ (2,602) $ 9,935 $ (12,537) Adjusted automotive free cash flow $ (4,385) $ 9,122 $ (13,507) EPS-diluted(a) $ 1.62 $ 2.78 $ (1.16) EPS-diluted-adjusted(a) $ 1.52 $ 2.83 $ (1.31) GMNA EBIT-adjusted $ 2,125 $ 4,366 $ (2,241) GMNA EBIT-adjusted margin 10.3 % 15.0 % (4.7) ppts GMI EBIT-adjusted $ 229 $ 10 $ 219 China equity income $ 270 $ 262 $ 8 GM Financial EBT-adjusted $ 1,093 $ 1,207 $ (114) __________ (a) EPS-diluted and EPS-diluted-adjusted include a $0.07 and $0.05 impact from mark-to-market gains on equity method investments in the three months ended Sept. 30, 2021 and 2020. Exhibit 99.1

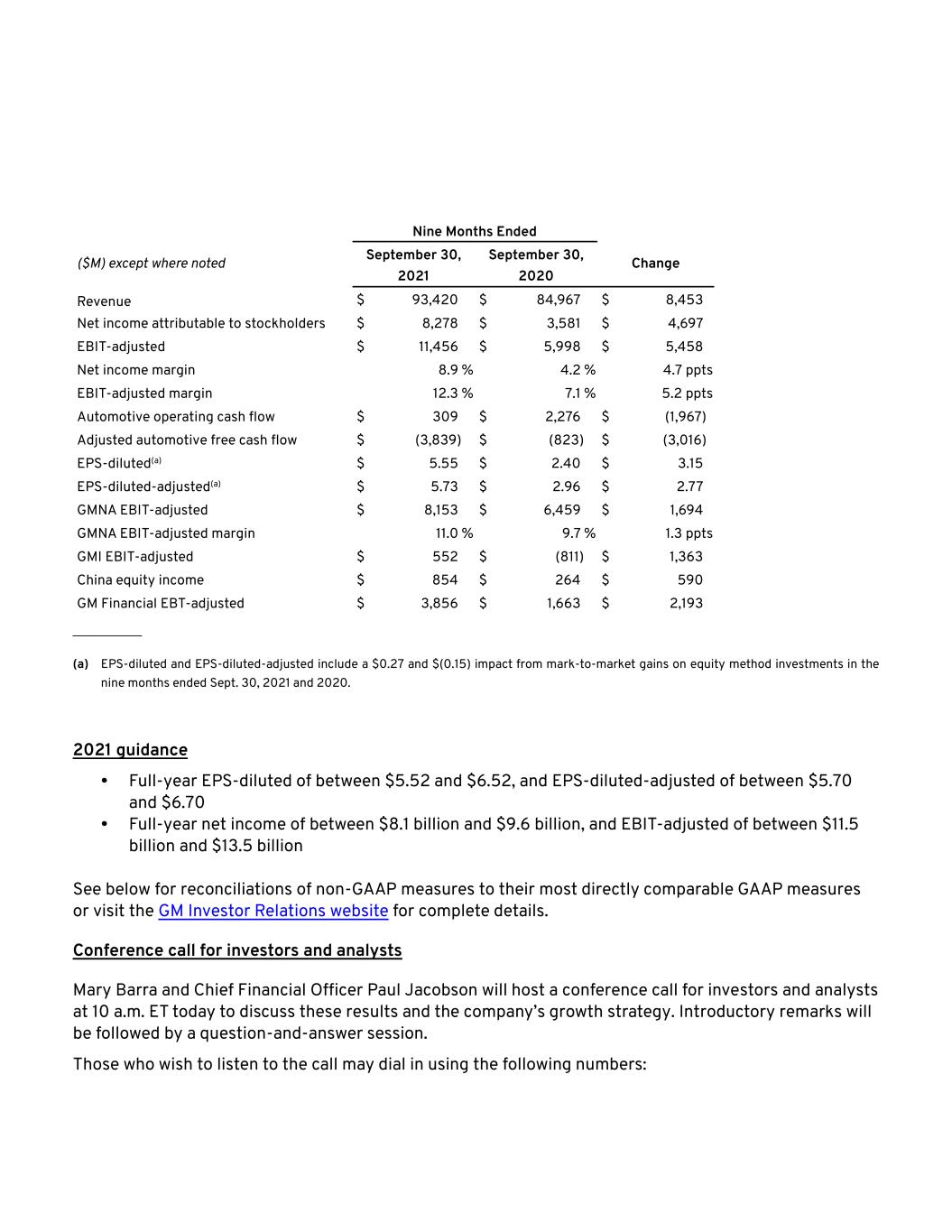

Nine Months Ended ($M) except where noted September 30, 2021 September 30, 2020 Change Revenue $ 93,420 $ 84,967 $ 8,453 Net income attributable to stockholders $ 8,278 $ 3,581 $ 4,697 EBIT-adjusted $ 11,456 $ 5,998 $ 5,458 Net income margin 8.9 % 4.2 % 4.7 ppts EBIT-adjusted margin 12.3 % 7.1 % 5.2 ppts Automotive operating cash flow $ 309 $ 2,276 $ (1,967) Adjusted automotive free cash flow $ (3,839) $ (823) $ (3,016) EPS-diluted(a) $ 5.55 $ 2.40 $ 3.15 EPS-diluted-adjusted(a) $ 5.73 $ 2.96 $ 2.77 GMNA EBIT-adjusted $ 8,153 $ 6,459 $ 1,694 GMNA EBIT-adjusted margin 11.0 % 9.7 % 1.3 ppts GMI EBIT-adjusted $ 552 $ (811) $ 1,363 China equity income $ 854 $ 264 $ 590 GM Financial EBT-adjusted $ 3,856 $ 1,663 $ 2,193 __________ (a) EPS-diluted and EPS-diluted-adjusted include a $0.27 and $(0.15) impact from mark-to-market gains on equity method investments in the nine months ended Sept. 30, 2021 and 2020. 2021 guidance • Full-year EPS-diluted of between $5.52 and $6.52, and EPS-diluted-adjusted of between $5.70 and $6.70 • Full-year net income of between $8.1 billion and $9.6 billion, and EBIT-adjusted of between $11.5 billion and $13.5 billion See below for reconciliations of non-GAAP measures to their most directly comparable GAAP measures or visit the GM Investor Relations website for complete details. Conference call for investors and analysts Mary Barra and Chief Financial Officer Paul Jacobson will host a conference call for investors and analysts at 10 a.m. ET today to discuss these results and the company’s growth strategy. Introductory remarks will be followed by a question-and-answer session. Those who wish to listen to the call may dial in using the following numbers:

• United States: 1-888-808-8618 • International: +1-949-484-0645 • Name of call: GM Earnings Call General Motors (NYSE: GM) is a global company focused on advancing an all-electric future that is inclusive and accessible to all. At the heart of this strategy is the Ultium battery platform, which powers everything from mass- market to high-performance vehicles. General Motors, its subsidiaries and its joint venture entities sell vehicles under the Chevrolet, Buick, GMC, Cadillac, Baojun and Wuling brands. More information on the company and its subsidiaries, including OnStar, a global leader in vehicle safety and security services, can be found at https://www.gm.com. ### CONTACTS: Jim Cain GM Communications 313-407-2843 [email protected] Michael Heifler GM Investor Relations 313-418-0220 [email protected] Lauren Langille GM Communications 931-398-8191 [email protected] Cautionary Note on Forward-Looking Statements: This press release and related comments by management may include “forward- looking statements” within the meaning of the U.S. federal securities laws. Forward-looking statements are any statements other than statements of historical fact. Forward-looking statements represent our current judgement about possible future events and are often identified by words such as “anticipate,” “appears,” “approximately,” “believe,” “continue,” “could,” “designed,” “effect,” “estimate,” “evaluate,” “expect,” “forecast,” “goal,” “initiative,” “intend,” “may,” “objective,” “outlook,” “plan,” “potential,” “priorities,” “project,” “pursue,” “seek,” “should,” “target,” “when,” “will,” “would,” or the negative of any of those words or similar expressions. In making these statements, we rely upon assumptions and analysis based on our experience and perception of historical trends, current conditions, and expected future developments, as well as other factors we consider appropriate under the circumstances. We believe these judgements are reasonable, but these statements are not guarantees of any future events or financial results, and our actual results may differ materially due to a variety of factors, many of which are described in our most recent Annual Report on Form 10-K and our other filings with the U.S. Securities and Exchange Commission. We caution readers not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events, or other factors that affect the subject of these statements, except where we are expressly required to do so by law.

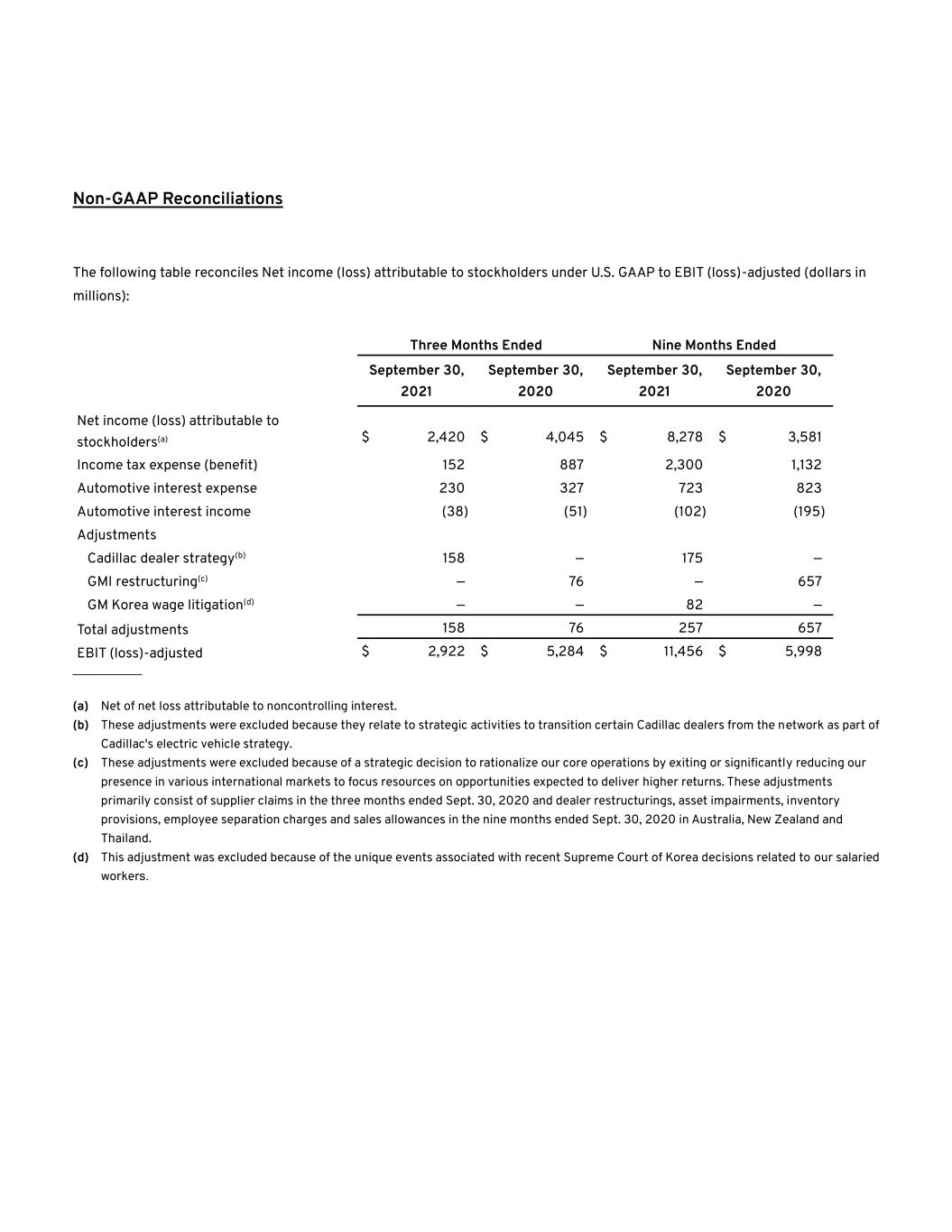

Non-GAAP Reconciliations The following table reconciles Net income (loss) attributable to stockholders under U.S. GAAP to EBIT (loss)-adjusted (dollars in millions): Three Months Ended Nine Months Ended September 30, 2021 September 30, 2020 September 30, 2021 September 30, 2020 Net income (loss) attributable to stockholders(a) $ 2,420 $ 4,045 $ 8,278 $ 3,581 Income tax expense (benefit) 152 887 2,300 1,132 Automotive interest expense 230 327 723 823 Automotive interest income (38) (51) (102) (195) Adjustments Cadillac dealer strategy(b) 158 — 175 — GMI restructuring(c) — 76 — 657 GM Korea wage litigation(d) — — 82 — Total adjustments 158 76 257 657 EBIT (loss)-adjusted $ 2,922 $ 5,284 $ 11,456 $ 5,998 __________ (a) Net of net loss attributable to noncontrolling interest. (b) These adjustments were excluded because they relate to strategic activities to transition certain Cadillac dealers from the network as part of Cadillac's electric vehicle strategy. (c) These adjustments were excluded because of a strategic decision to rationalize our core operations by exiting or significantly reducing our presence in various international markets to focus resources on opportunities expected to deliver higher returns. These adjustments primarily consist of supplier claims in the three months ended Sept. 30, 2020 and dealer restructurings, asset impairments, inventory provisions, employee separation charges and sales allowances in the nine months ended Sept. 30, 2020 in Australia, New Zealand and Thailand. (d) This adjustment was excluded because of the unique events associated with recent Supreme Court of Korea decisions related to our salaried workers.

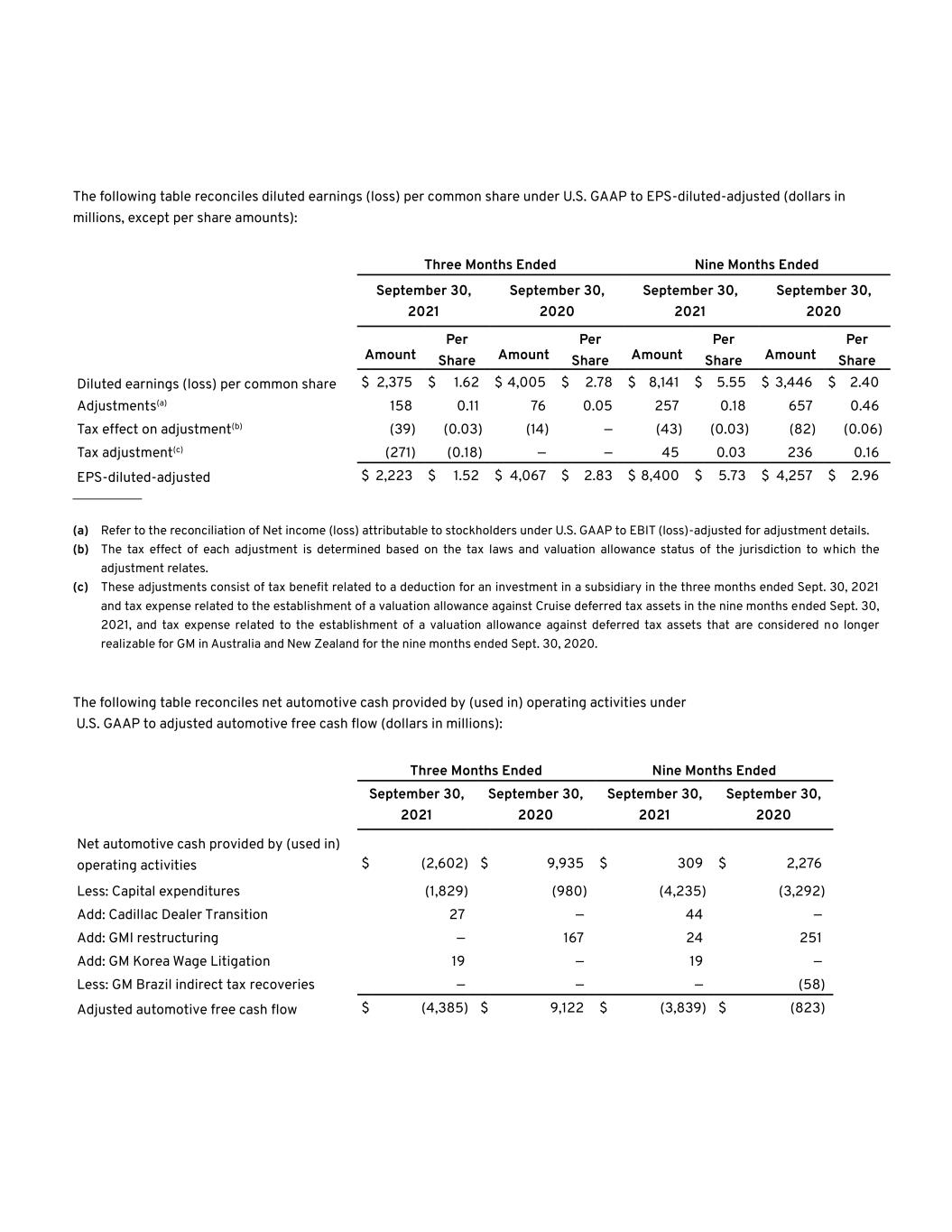

The following table reconciles diluted earnings (loss) per common share under U.S. GAAP to EPS-diluted-adjusted (dollars in millions, except per share amounts): Three Months Ended Nine Months Ended September 30, 2021 September 30, 2020 September 30, 2021 September 30, 2020 Amount Per Share Amount Per Share Amount Per Share Amount Per Share Diluted earnings (loss) per common share $ 2,375 $ 1.62 $ 4,005 $ 2.78 $ 8,141 $ 5.55 $ 3,446 $ 2.40 Adjustments(a) 158 0.11 76 0.05 257 0.18 657 0.46 Tax effect on adjustment(b) (39) (0.03) (14) — (43) (0.03) (82) (0.06) Tax adjustment(c) (271) (0.18) — — 45 0.03 236 0.16 EPS-diluted-adjusted $ 2,223 $ 1.52 $ 4,067 $ 2.83 $ 8,400 $ 5.73 $ 4,257 $ 2.96 __________ (a) Refer to the reconciliation of Net income (loss) attributable to stockholders under U.S. GAAP to EBIT (loss)-adjusted for adjustment details. (b) The tax effect of each adjustment is determined based on the tax laws and valuation allowance status of the jurisdiction to which the adjustment relates. (c) These adjustments consist of tax benefit related to a deduction for an investment in a subsidiary in the three months ended Sept. 30, 2021 and tax expense related to the establishment of a valuation allowance against Cruise deferred tax assets in the nine months ended Sept. 30, 2021, and tax expense related to the establishment of a valuation allowance against deferred tax assets that are considered no longer realizable for GM in Australia and New Zealand for the nine months ended Sept. 30, 2020. The following table reconciles net automotive cash provided by (used in) operating activities under U.S. GAAP to adjusted automotive free cash flow (dollars in millions): Three Months Ended Nine Months Ended September 30, 2021 September 30, 2020 September 30, 2021 September 30, 2020 Net automotive cash provided by (used in) operating activities $ (2,602) $ 9,935 $ 309 $ 2,276 Less: Capital expenditures (1,829) (980) (4,235) (3,292) Add: Cadillac Dealer Transition 27 — 44 — Add: GMI restructuring — 167 24 251 Add: GM Korea Wage Litigation 19 — 19 — Less: GM Brazil indirect tax recoveries — — — (58) Adjusted automotive free cash flow $ (4,385) $ 9,122 $ (3,839) $ (823)

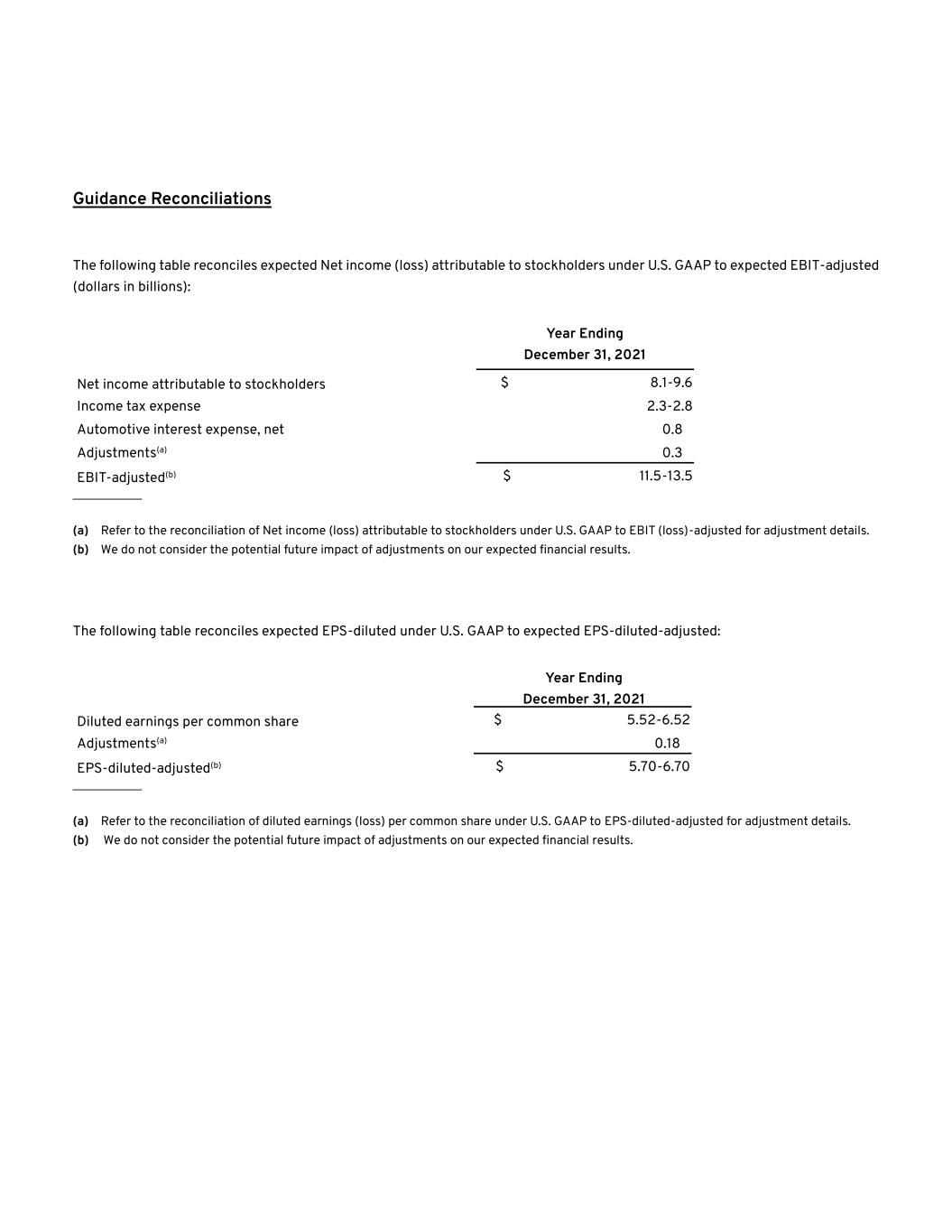

Guidance Reconciliations The following table reconciles expected Net income (loss) attributable to stockholders under U.S. GAAP to expected EBIT-adjusted (dollars in billions): Year Ending December 31, 2021 Net income attributable to stockholders $ 8.1-9.6 Income tax expense 2.3-2.8 Automotive interest expense, net 0.8 Adjustments(a) 0.3 EBIT-adjusted(b) $ 11.5-13.5 __________ (a) Refer to the reconciliation of Net income (loss) attributable to stockholders under U.S. GAAP to EBIT (loss)-adjusted for adjustment details. (b) We do not consider the potential future impact of adjustments on our expected financial results. The following table reconciles expected EPS-diluted under U.S. GAAP to expected EPS-diluted-adjusted: Year Ending December 31, 2021 Diluted earnings per common share $ 5.52-6.52 Adjustments(a) 0.18 EPS-diluted-adjusted(b) $ 5.70-6.70 __________ (a) Refer to the reconciliation of diluted earnings (loss) per common share under U.S. GAAP to EPS-diluted-adjusted for adjustment details. (b) We do not consider the potential future impact of adjustments on our expected financial results.

Exhibit 99.2

General Motors Company and Subsidiaries

Supplemental Material

(Unaudited)

General Motors Company's (GM) non-GAAP measures include: earnings before interest and taxes (EBIT)-adjusted, presented net of noncontrolling interests; earnings before income taxes (EBT)-adjusted for our General Motors Financial Company, Inc. (GM Financial) segment; earnings per share (EPS)-diluted-adjusted; effective tax rate-adjusted (ETR-adjusted); return on invested capital-adjusted (ROIC-adjusted) and adjusted automotive free cash flow. GM's calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related U.S. GAAP measures.

These non-GAAP measures allow management and investors to view operating trends, perform analytical comparisons and benchmark performance between periods and among geographic regions to understand operating performance without regard to items we do not consider a component of our core operating performance. Furthermore, these non-GAAP measures allow investors the opportunity to measure and monitor our performance against our externally communicated targets and evaluate the investment decisions being made by management to improve ROIC-adjusted. Management uses these measures in its financial, investment and operational decision-making processes, for internal reporting and as part of its forecasting and budgeting processes. Further, our Board of Directors uses certain of these and other measures as key metrics to determine management performance under our performance-based compensation plans. For these reasons, we believe these non-GAAP measures are useful for our investors.

EBIT-adjusted EBIT-adjusted is presented net of noncontrolling interests and is used by management and can be used by investors to review our consolidated operating results because it excludes automotive interest income, automotive interest expense and income taxes as well as certain additional adjustments that are not considered part of our core operations. Examples of adjustments to EBIT include, but are not limited to, impairment charges on long-lived assets and other exit costs resulting from strategic shifts in our operations or discrete market and business conditions; costs arising from the ignition switch recall and related legal matters; and certain currency devaluations associated with hyperinflationary economies. For EBIT-adjusted and our other non-GAAP measures, once we have made an adjustment in the current period for an item, we will also adjust the related non-GAAP measure in any future periods in which there is an impact from the item. Our corresponding measure for our GM Financial segment is EBT-adjusted because interest income and interest expense are part of operating results when assessing and measuring the operational and financial performance of the segment.

EPS-diluted-adjusted EPS-diluted-adjusted is used by management and can be used by investors to review our consolidated diluted EPS results on a consistent basis. EPS-diluted-adjusted is calculated as net income attributable to common stockholders-diluted less adjustments noted above for EBIT-adjusted and certain income tax adjustments divided by weighted-average common shares outstanding-diluted. Examples of income tax adjustments include the establishment or reversal of significant deferred tax asset valuation allowances.

ETR-adjusted ETR-adjusted is used by management and can be used by investors to review the consolidated effective tax rate for our core operations on a consistent basis. ETR-adjusted is calculated as Income tax expense less the income tax related to the adjustments noted above for EBIT-adjusted and the income tax adjustments noted above for EPS-diluted-adjusted divided by Income before income taxes less adjustments. When we provide an expected adjusted effective tax rate, we do not provide an expected effective tax rate because the U.S. GAAP measure may include significant adjustments that are difficult to predict.

ROIC-adjusted ROIC-adjusted is used by management and can be used by investors to review our investment and capital allocation decisions. We define ROIC-adjusted as EBIT-adjusted for the trailing four quarters divided by ROIC-adjusted average net assets, which is considered to be the average equity balances adjusted for average automotive debt and interest liabilities, exclusive of finance leases; average automotive net pension and other postretirement benefits (OPEB) liabilities; and average automotive net income tax assets during the same period.

Adjusted automotive free cash flow Adjusted automotive free cash flow is used by management and can be used by investors to review the liquidity of our automotive operations and to measure and monitor our performance against our capital allocation program and evaluate our automotive liquidity against the substantial cash requirements of our automotive operations. We measure adjusted automotive free cash flow as automotive operating cash flow from operations less capital expenditures adjusted for management actions. Management actions can include voluntary events such as discretionary contributions to employee benefit plans or nonrecurring specific events such as a closure of a facility that are considered special for EBIT-adjusted purposes.

1

General Motors Company and Subsidiaries

Supplemental Material

(Unaudited)

The following table reconciles Net income (loss) attributable to stockholders under U.S. GAAP to segment profit (loss) (dollars in millions):

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | ||||||||||||||||||||

| Net income (loss) attributable to stockholders(a) | $ | 2,420 | $ | 4,045 | $ | 8,278 | $ | 3,581 | |||||||||||||||

| Income tax expense (benefit) | 152 | 887 | 2,300 | 1,132 | |||||||||||||||||||

| Automotive interest expense | 230 | 327 | 723 | 823 | |||||||||||||||||||

| Automotive interest income | (38) | (51) | (102) | (195) | |||||||||||||||||||

| Adjustments | |||||||||||||||||||||||

| Cadillac dealer strategy(b) | 158 | — | 175 | — | |||||||||||||||||||

| GMI restructuring(c) | — | 76 | — | 657 | |||||||||||||||||||

| GM Korea wage litigation(d) | — | — | 82 | — | |||||||||||||||||||

| Total adjustments | 158 | 76 | 257 | 657 | |||||||||||||||||||

| EBIT(loss)-adjusted | 2,922 | 5,284 | 11,456 | 5,998 | |||||||||||||||||||

| Operating segments | |||||||||||||||||||||||

| GM North America (GMNA) | 2,125 | 4,366 | 8,153 | 6,459 | |||||||||||||||||||

| GM International (GMI) | 229 | 10 | 552 | (811) | |||||||||||||||||||

| Cruise | (286) | (204) | (847) | (627) | |||||||||||||||||||

| GM Financial(e) | 1,093 | 1,207 | 3,856 | 1,663 | |||||||||||||||||||

| Total operating segments | 3,161 | 5,379 | 11,714 | 6,684 | |||||||||||||||||||

| Corporate and eliminations(f) | (239) | (95) | (258) | (686) | |||||||||||||||||||

| EBIT(loss)-adjusted | $ | 2,922 | $ | 5,284 | $ | 11,456 | $ | 5,998 | |||||||||||||||

__________

(a)Net of net loss attributable to noncontrolling interests.

(b)These adjustments were excluded because they relate to strategic activities to transition certain Cadillac dealers from the network as part of Cadillac's electric vehicle strategy.

(c)These adjustments were excluded because of a strategic decision to rationalize our core operations by exiting or significantly reducing our presence in various international markets to focus resources on opportunities expected to deliver higher returns. These adjustments primarily consist of supplier claims in the three months ended September 30, 2020 and dealer restructurings, asset impairments, inventory provisions, employee separation charges and sales allowances in the nine months ended September 30, 2020 in Australia, New Zealand and Thailand.

(d)This adjustment was excluded because of the unique events associated with recent Supreme Court of Korea decisions related to our salaried workers.

(e)GM Financial amounts represent EBT-adjusted.

(f)GM's automotive interest income and interest expense, legacy costs from the Opel and Vauxhall businesses and certain other assets in Europe, which are primarily pension costs, corporate expenditures and certain nonsegment-specific revenues and expenses are recorded centrally in Corporate.

2

General Motors Company and Subsidiaries

Supplemental Material

(Unaudited)

The following table reconciles Net income (loss) attributable to stockholders under U.S. GAAP to EBIT (loss)-adjusted (dollars in millions):

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | ||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | 2020 | 2019 | ||||||||||||||||||||||||||||||||||||||||

| Net income (loss) attributable to stockholders | $ | 2,420 | $ | 4,045 | $ | 2,836 | $ | (758) | $ | 3,022 | $ | 294 | $ | 2,846 | $ | (194) | |||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 152 | 887 | 971 | (112) | 1,177 | 357 | 642 | (163) | |||||||||||||||||||||||||||||||||||||||

| Automotive interest expense | 230 | 327 | 243 | 303 | 250 | 193 | 275 | 200 | |||||||||||||||||||||||||||||||||||||||

| Automotive interest income | (38) | (51) | (32) | (61) | (32) | (83) | (46) | (96) | |||||||||||||||||||||||||||||||||||||||

| Adjustments | |||||||||||||||||||||||||||||||||||||||||||||||

| Cadillac dealer strategy(a) | 158 | — | 17 | — | — | — | 99 | — | |||||||||||||||||||||||||||||||||||||||

| GMI restructuring(b) | — | 76 | — | 92 | — | 489 | 26 | — | |||||||||||||||||||||||||||||||||||||||

| GM Korea Wage Litigation(c) | — | — | 82 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Ignition switch recall and related legal matters(d) | — | — | — | — | — | — | (130) | — | |||||||||||||||||||||||||||||||||||||||

| Transformation activities(e) | — | — | — | — | — | — | — | 194 | |||||||||||||||||||||||||||||||||||||||

| FAW-GM divestiture(f) | — | — | — | — | — | — | — | 164 | |||||||||||||||||||||||||||||||||||||||

| Total adjustments | 158 | 76 | 99 | 92 | — | 489 | (5) | 358 | |||||||||||||||||||||||||||||||||||||||

| EBIT (loss)-adjusted | $ | 2,922 | $ | 5,284 | $ | 4,117 | $ | (536) | $ | 4,417 | $ | 1,250 | $ | 3,712 | $ | 105 | |||||||||||||||||||||||||||||||

________

(a)These adjustments were excluded because they relate to strategic activities to transition certain Cadillac dealers from the network as part of Cadillac's electric vehicle strategy.

(b)These adjustments were excluded because of a strategic decision to rationalize our core operations by exiting or significantly reducing our presence in various international markets to focus resources on opportunities expected to deliver higher returns. These adjustments primarily consist of supplier claims in the three months ended September 30, 2020, inventory provisions in the three months ended June 30, 2020, asset impairments, dealer restructurings, employee separation charges and sales allowances in Australia, New Zealand and Thailand in the three months ended March 31, 2020, and employee separation charges in the three months ended December 31, 2020.

(c)This adjustment was excluded because of the unique events associated with recent Supreme Court of Korea decisions related to our salaried workers.

(d)This adjustment was excluded because of the unique events associated with the ignition switch recall, which included various investigations, inquiries and complaints from constituents.

(e)This adjustment was excluded because of a strategic decision to accelerate our transformation for the future to strengthen our core business, capitalize on the future of personal mobility and drive significant cost efficiencies. The adjustments primarily consist of accelerated depreciation and employee separation charges in the three months ended December 31, 2019.

(f)This adjustment was excluded because we divested our joint venture FAW-GM Light Duty Commercial Vehicle Co., Ltd. (FAW-GM), as a result of a strategic decision by both shareholders, allowing us to focus our resources on opportunities expected to deliver higher returns.

3

General Motors Company and Subsidiaries

Supplemental Material

(Unaudited)

The following table reconciles diluted earnings (loss) per common share under U.S. GAAP to EPS-diluted-adjusted (dollars in millions, except per share amounts):

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | ||||||||||||||||||||||||||||||||||||||||||||

| Amount | Per Share | Amount | Per Share | Amount | Per Share | Amount | Per Share | ||||||||||||||||||||||||||||||||||||||||

| Diluted earnings per common share | $ | 2,375 | $ | 1.62 | $ | 4,005 | $ | 2.78 | $ | 8,141 | $ | 5.55 | $ | 3,446 | $ | 2.40 | |||||||||||||||||||||||||||||||

| Adjustments(a) | 158 | 0.11 | 76 | 0.05 | 257 | 0.18 | 657 | 0.46 | |||||||||||||||||||||||||||||||||||||||

| Tax effect on adjustment(b) | (39) | (0.03) | (14) | — | (43) | (0.03) | (82) | (0.06) | |||||||||||||||||||||||||||||||||||||||

| Tax adjustment(c) | (271) | (0.18) | — | — | 45 | 0.03 | 236 | 0.16 | |||||||||||||||||||||||||||||||||||||||

| EPS-diluted-adjusted | $ | 2,223 | $ | 1.52 | $ | 4,067 | $ | 2.83 | $ | 8,400 | $ | 5.73 | $ | 4,257 | $ | 2.96 | |||||||||||||||||||||||||||||||

________

(a)Refer to the reconciliation of Net income (loss) attributable to stockholders under U.S. GAAP to segment profit (loss) for adjustment details.

(b)The tax effect of each adjustment is determined based on the tax laws and valuation allowance status of the jurisdiction to which the adjustment relates.

(c)These adjustments consist of tax benefit related to a deduction for an investment in a subsidiary in the three months ended September 30, 2021 and tax expense related to the establishment of a valuation allowance against Cruise deferred tax assets in the nine months ended September 30, 2021, and tax expense related to the establishment of a valuation allowance against deferred tax assets that are considered no longer realizable for GM in Australia and New Zealand for the nine months ended September 30, 2020.

The following table reconciles our effective tax rate under U.S. GAAP to ETR-adjusted (dollars in millions):

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income taxes | Income tax expense | Effective tax rate | Income before income taxes | Income tax expense | Effective tax rate | Income before income taxes | Income tax expense | Effective tax rate | Income before income taxes | Income tax expense | Effective tax rate | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Effective tax rate | $ | 2,538 | $ | 152 | 6.0 | % | $ | 4,905 | $ | 887 | 18.1 | % | $ | 10,479 | $ | 2,300 | 21.9 | % | $ | 4,656 | $ | 1,132 | 24.3 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Adjustments(a) | 158 | 39 | 76 | 14 | 282 | 43 | 657 | 82 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tax adjustment(b) | 271 | (45) | (236) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ETR-adjusted | $ | 2,696 | $ | 462 | 17.1 | % | $ | 4,981 | $ | 901 | 18.1 | % | $ | 10,761 | $ | 2,298 | 21.4 | % | $ | 5,313 | $ | 978 | 18.4 | % | |||||||||||||||||||||||||||||||||||||||||||||||

________

(a)Refer to the reconciliation of Net income (loss) attributable to stockholders under U.S. GAAP to segment profit (loss) for adjustment details. These adjustments include Net income attributable to noncontrolling interests where applicable. The tax effect of each adjustment is determined based on the tax laws and valuation allowance status of the jurisdiction to which the adjustment relates.

(b)Refer to the reconciliation of diluted earnings per common share under U.S. GAAP to EPS-diluted-adjusted within the previous section for adjustment details.

We define return on equity (ROE) as Net income (loss) attributable to stockholders for the trailing four quarters divided by average equity for the same period. Management uses average equity to provide comparable amounts in the calculation of ROE. The following table summarizes the calculation of ROE (dollars in billions):

| Four Quarters Ended | |||||||||||

| September 30, 2021 | September 30, 2020 | ||||||||||

| Net income (loss) attributable to stockholders | $ | 11.1 | $ | 3.4 | |||||||

| Average equity(a) | $ | 52.4 | $ | 42.5 | |||||||

| ROE | 21.2 | % | 8.0 | % | |||||||

________

(a)Includes equity of noncontrolling interests where the corresponding earnings (loss) are included in Net income (loss) attributable to stockholders.

4

General Motors Company and Subsidiaries

Supplemental Material

(Unaudited)

The following table summarizes the calculation of ROIC-adjusted (dollars in billions):

| Four Quarters Ended | |||||||||||

| September 30, 2021 | September 30, 2020 | ||||||||||

| EBIT (loss)-adjusted(a) | $ | 15.2 | $ | 6.1 | |||||||

| Average equity(b) | $ | 52.4 | $ | 42.5 | |||||||

| Add: Average automotive debt and interest liabilities (excluding finance leases) | 17.3 | 27.0 | |||||||||

| Add: Average automotive net pension & OPEB liability | 17.7 | 17.4 | |||||||||

| Less: Average automotive and other net income tax asset | (22.8) | (24.1) | |||||||||

| ROIC-adjusted average net assets | $ | 64.6 | $ | 62.8 | |||||||

| ROIC-adjusted | 23.5 | % | 9.7 | % | |||||||

________

(a)Refer to the reconciliation of Net income (loss) attributable to stockholders under U.S. GAAP to EBIT (loss)-adjusted for adjustment details.

(b)Includes equity of noncontrolling interests where the corresponding earnings (loss) are included in EBIT (loss)-adjusted.

5

General Motors Company and Subsidiaries

Supplemental Material

(Unaudited)

The following table reconciles Net automotive cash provided by (used in) operating activities under U.S. GAAP to adjusted automotive free cash flow (dollars in millions):

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | ||||||||||||||||||||

| Net automotive cash provided by (used in) operating activities | $ | (2,602) | $ | 9,935 | $ | 309 | $ | 2,276 | |||||||||||||||

| Less: Capital expenditures | (1,829) | (980) | (4,235) | (3,292) | |||||||||||||||||||

| Add: Cadillac dealer strategy | 27 | — | 44 | — | |||||||||||||||||||

| Add: GMI restructuring | — | 167 | 24 | 251 | |||||||||||||||||||

| Add: GM Korea Wage Litigation | 19 | — | 19 | — | |||||||||||||||||||

| Less: GM Brazil indirect tax recoveries | — | — | — | (58) | |||||||||||||||||||

| Adjusted automotive free cash flow | $ | (4,385) | $ | 9,122 | $ | (3,839) | $ | (823) | |||||||||||||||

The following tables summarize key financial information by segment (dollars in millions):

| GMNA | GMI | Corporate | Eliminations | Total Automotive | Cruise | GM Financial | Reclassifications/Eliminations | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales and revenue | $ | 20,554 | $ | 2,843 | $ | 27 | $ | 23,424 | $ | 26 | $ | 3,354 | $ | (25) | $ | 26,779 | |||||||||||||||||||||||||||||||||||||

| Expenditures for property | $ | 1,684 | $ | 142 | $ | 3 | $ | — | $ | 1,829 | $ | 23 | $ | 7 | $ | — | $ | 1,859 | |||||||||||||||||||||||||||||||||||

| Depreciation and amortization | $ | 1,370 | $ | 138 | $ | 6 | $ | — | $ | 1,514 | $ | 13 | $ | 1,554 | $ | — | $ | 3,081 | |||||||||||||||||||||||||||||||||||

| Impairment charges | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||||||||||||||||||||

| Equity income(a) | $ | 1 | $ | 269 | $ | — | $ | — | $ | 270 | $ | — | $ | 53 | $ | — | $ | 323 | |||||||||||||||||||||||||||||||||||

| GMNA | GMI | Corporate | Eliminations | Total Automotive | Cruise | GM Financial | Reclassifications/Eliminations | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales and revenue | $ | 29,128 | $ | 2,735 | $ | 203 | $ | 32,066 | $ | 26 | $ | 3,421 | $ | (33) | $ | 35,480 | |||||||||||||||||||||||||||||||||||||

| Expenditures for property | $ | 841 | $ | 138 | $ | 1 | $ | — | $ | 980 | $ | 4 | $ | 8 | $ | — | $ | 992 | |||||||||||||||||||||||||||||||||||

| Depreciation and amortization | $ | 1,182 | $ | 146 | $ | 5 | $ | — | $ | 1,333 | $ | 11 | $ | 1,814 | $ | — | $ | 3,158 | |||||||||||||||||||||||||||||||||||

| Impairment charges | $ | — | $ | 4 | $ | — | $ | — | $ | 4 | $ | — | $ | — | $ | — | $ | 4 | |||||||||||||||||||||||||||||||||||

| Equity income (a) | $ | 4 | $ | 259 | $ | — | $ | — | $ | 263 | $ | — | $ | 46 | $ | — | $ | 309 | |||||||||||||||||||||||||||||||||||

| GMNA | GMI | Corporate | Eliminations | Total Automotive | Cruise | GM Financial | Reclassifications/Eliminations | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales and revenue | $ | 74,443 | $ | 8,721 | $ | 67 | $ | 83,231 | $ | 81 | $ | 10,187 | $ | (79) | $ | 93,420 | |||||||||||||||||||||||||||||||||||||

| Expenditures for property | $ | 3,860 | $ | 362 | $ | 13 | $ | — | $ | 4,235 | $ | 55 | $ | 20 | $ | — | $ | 4,310 | |||||||||||||||||||||||||||||||||||

| Depreciation and amortization | $ | 3,849 | $ | 407 | $ | 16 | $ | — | $ | 4,272 | $ | 37 | $ | 4,801 | $ | — | $ | 9,110 | |||||||||||||||||||||||||||||||||||

| Impairment charges | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 4 | $ | — | $ | — | $ | 4 | |||||||||||||||||||||||||||||||||||

| Equity income(a) | $ | 8 | $ | 850 | $ | — | $ | — | $ | 858 | $ | — | $ | 157 | $ | — | $ | 1,015 | |||||||||||||||||||||||||||||||||||

| GMNA | GMI | Corporate | Eliminations | Total Automotive | Cruise | GM Financial | Reclassifications/Eliminations | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales and revenue | $ | 66,563 | $ | 7,692 | $ | 321 | $ | 74,576 | $ | 79 | $ | 10,405 | $ | (93) | $ | 84,967 | |||||||||||||||||||||||||||||||||||||

| Expenditures for property | $ | 2,703 | $ | 574 | $ | 15 | $ | — | $ | 3,292 | $ | 10 | $ | 26 | $ | — | $ | 3,328 | |||||||||||||||||||||||||||||||||||

| Depreciation and amortization | $ | 3,536 | $ | 461 | $ | 20 | $ | — | $ | 4,017 | $ | 30 | $ | 5,567 | $ | — | $ | 9,614 | |||||||||||||||||||||||||||||||||||

| Impairment charges | $ | 20 | $ | 101 | $ | — | $ | — | $ | 121 | $ | — | $ | — | $ | — | $ | 121 | |||||||||||||||||||||||||||||||||||

| Equity income (a) | $ | 15 | $ | 261 | $ | — | $ | — | $ | 276 | $ | — | $ | 113 | $ | — | $ | 389 | |||||||||||||||||||||||||||||||||||

________

(a)Includes Automotive China equity income of $270 million and $262 million in the three months ended September 30, 2021 and 2020 and $854 million and $264 million in the nine months ended September 30, 2021 and 2020.

6

General Motors Company and Subsidiaries

Supplemental Material

(Unaudited)

Vehicle Sales

GM presents both wholesale and total vehicle sales data to assist in the analysis of our revenue and our market share. Cuba, Iran, North Korea, Sudan and Syria are subject to broad economic sanctions. Accordingly, these countries are excluded from industry sales data and the corresponding calculation of GM's market share.

Wholesale vehicle sales data consists of sales to GM's dealers and distributors as well as sales to the U.S. Government and excludes vehicles sold by our joint ventures. Wholesale vehicle sales data correlates to GM's revenue recognized from the sale of vehicles, which is the largest component of Automotive net sales and revenue. In the nine months ended September 30, 2021, 29.1% of our wholesale vehicle sales volume was generated outside the U.S. The following table summarizes wholesale vehicle sales by automotive segment (vehicles in thousands):

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | ||||||||||||||||||||

| GMNA | 423 | 799 | 1,729 | 1,905 | |||||||||||||||||||

| GMI | 113 | 166 | 388 | 447 | |||||||||||||||||||

| Total | 536 | 965 | 2,117 | 2,352 | |||||||||||||||||||

7

General Motors Company and Subsidiaries

Supplemental Material

(Unaudited)

Total vehicle sales data represents: (1) retail sales (i.e., sales to consumers who purchase new vehicles from dealers or distributors); (2) fleet sales (i.e., sales to large and small businesses, governments, and daily rental car companies); and (3) vehicles used by dealers in their businesses, including courtesy transportation vehicles. Total vehicle sales data includes all sales by joint ventures on a total vehicle basis, not based on our percentage ownership interest in the joint venture. Certain joint venture agreements in China allow for the contractual right to report vehicle sales of non-GM trademarked vehicles by those joint ventures, which are included in the total vehicle sales we report for China. While total vehicle sales data does not correlate directly to the revenue GM recognizes during a particular period, we believe it is indicative of the underlying demand for GM vehicles. Total vehicle sales data represents management's good faith estimate based on sales reported by GM's dealers, distributors, and joint ventures, commercially available data sources such as registration and insurance data, and internal estimates and forecasts when other data is not available.

The following table summarizes total vehicle sales by geographic region (vehicles in thousands):

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | ||||||||||||||||||||

| United States | |||||||||||||||||||||||

| Chevrolet – Cars | 19 | 55 | 97 | 152 | |||||||||||||||||||

| Chevrolet – Trucks | 178 | 221 | 616 | 607 | |||||||||||||||||||

| Chevrolet – Crossovers | 90 | 174 | 436 | 458 | |||||||||||||||||||

| Cadillac | 23 | 33 | 96 | 87 | |||||||||||||||||||

| Buick | 39 | 49 | 151 | 119 | |||||||||||||||||||

| GMC | 98 | 133 | 381 | 353 | |||||||||||||||||||

| Total United States | 447 | 665 | 1,777 | 1,776 | |||||||||||||||||||

| Canada, Mexico and Other | 75 | 100 | 285 | 273 | |||||||||||||||||||

| Total North America | 522 | 765 | 2,062 | 2,049 | |||||||||||||||||||

| Asia/Pacific, Middle East and Africa | |||||||||||||||||||||||

| Chevrolet | 134 | 198 | 458 | 564 | |||||||||||||||||||

| Wuling | 314 | 278 | 1,018 | 722 | |||||||||||||||||||

| Buick | 166 | 252 | 616 | 595 | |||||||||||||||||||

| Baojun | 40 | 100 | 178 | 276 | |||||||||||||||||||

| Cadillac | 62 | 67 | 188 | 155 | |||||||||||||||||||

| Other | 3 | 8 | 16 | 38 | |||||||||||||||||||

| Total Asia/Pacific, Middle East and Africa | 719 | 903 | 2,474 | 2,350 | |||||||||||||||||||

| South America(a) | 70 | 122 | 276 | 311 | |||||||||||||||||||

| Total in GM markets | 1,311 | 1,790 | 4,812 | 4,710 | |||||||||||||||||||

| Total Europe | — | — | 1 | — | |||||||||||||||||||

| Total Worldwide | 1,311 | 1,790 | 4,813 | 4,710 | |||||||||||||||||||

_______

(a)Primarily Chevrolet.

The vehicle sales at GM's China joint ventures presented in the following table are included in the preceding vehicle sales table (vehicles in thousands):

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | ||||||||||||||||||||

| SAIC General Motors Sales Co., Ltd. | 275 | 395 | 974 | 952 | |||||||||||||||||||

| SAIC GM Wuling Automobile Co., Ltd. | 349 | 376 | 1,180 | 995 | |||||||||||||||||||

8

General Motors Company and Subsidiaries

Supplemental Material

(Unaudited)

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | ||||||||||||||||||||

| Market Share | |||||||||||||||||||||||

| United States – Cars | 2.9 | % | 7.0 | % | 4.2 | % | 7.0 | % | |||||||||||||||

| United States – Trucks | 28.7 | % | 29.8 | % | 29.8 | % | 30.2 | % | |||||||||||||||

| United States – Crossovers | 8.8 | % | 13.8 | % | 11.7 | % | 14.0 | % | |||||||||||||||

| Total United States | 12.8 | % | 16.6 | % | 14.8 | % | 16.8 | % | |||||||||||||||

| Total North America | 12.2 | % | 15.9 | % | 14.3 | % | 16.2 | % | |||||||||||||||

| Total Asia/Pacific, Middle East and Africa | 6.9 | % | 7.9 | % | 7.3 | % | 7.9 | % | |||||||||||||||

| Total South America | 7.8 | % | 14.3 | % | 10.3 | % | 14.7 | % | |||||||||||||||

| Total GM Market | 8.4 | % | 10.4 | % | 9.4 | % | 10.6 | % | |||||||||||||||

| Total Worldwide | 6.8 | % | 8.3 | % | 7.6 | % | 8.5 | % | |||||||||||||||

| United States fleet sales as a percentage of retail vehicle sales | 12.8 | % | 12.2 | % | 15.0 | % | 17.5 | % | |||||||||||||||

| North America capacity two-shift utilization | 60.4 | % | 112.3 | % | 81.3 | % | 85.1 | % | |||||||||||||||

9

General Motors Company and Subsidiaries

Combining Income Statement Information

(In millions) (Unaudited)

| Three Months Ended September 30, 2021 | Three Months Ended September 30, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive | Cruise | GM Financial | Reclassifications/Eliminations | Combined | Automotive | Cruise | GM Financial | Reclassifications/Eliminations | Combined | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales and revenue | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive | $ | 23,424 | $ | 26 | $ | — | $ | (24) | $ | 23,426 | $ | 32,066 | $ | 26 | $ | — | $ | (25) | $ | 32,067 | |||||||||||||||||||||||||||||||||||||||

| GM Financial | — | — | 3,354 | (1) | 3,353 | — | — | 3,421 | (8) | 3,413 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total net sales and revenue | 23,424 | 26 | 3,354 | (25) | 26,779 | 32,066 | 26 | 3,421 | (33) | 35,480 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Costs and expenses | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive and other cost of sales | 20,391 | 282 | — | (1) | 20,672 | 26,980 | 190 | — | (1) | 27,169 | |||||||||||||||||||||||||||||||||||||||||||||||||

| GM Financial interest, operating and other expenses | — | — | 2,314 | — | 2,314 | — | — | 2,260 | (1) | 2,259 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive and other selling, general and administrative expense | 2,095 | 53 | — | — | 2,148 | 1,565 | 63 | — | — | 1,628 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total costs and expenses | 22,486 | 335 | 2,314 | (1) | 25,134 | 28,545 | 253 | 2,260 | (2) | 31,056 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Operating income (loss) | 938 | (309) | 1,040 | (24) | 1,645 | 3,521 | (227) | 1,161 | (31) | 4,424 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive interest expense | 229 | — | — | 1 | 230 | 333 | — | — | (6) | 327 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Interest income and other non-operating income, net | 774 | (1) | — | 27 | 800 | 471 | 6 | — | 22 | 499 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Equity income | 270 | — | 53 | — | 323 | 263 | — | 46 | — | 309 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income (loss) before income taxes | $ | 1,753 | $ | (310) | $ | 1,093 | $ | 2 | 2,538 | $ | 3,922 | $ | (221) | $ | 1,207 | $ | (3) | 4,905 | |||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 152 | 887 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | 2,386 | 4,018 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss attributable to noncontrolling interests | 34 | 27 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to stockholders | $ | 2,420 | $ | 4,045 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to common stockholders | $ | 2,375 | $ | 4,005 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2021 | Nine Months Ended September 30, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive | Cruise | GM Financial | Reclassifications/Eliminations | Combined | Automotive | Cruise | GM Financial | Reclassifications/Eliminations | Combined | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales and revenue | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive | $ | 83,231 | $ | 81 | $ | — | $ | (75) | $ | 83,237 | $ | 74,576 | $ | 79 | $ | — | $ | (75) | $ | 74,580 | |||||||||||||||||||||||||||||||||||||||

| GM Financial | — | — | 10,187 | (4) | 10,183 | — | — | 10,405 | (18) | 10,387 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total net sales and revenue | 83,231 | 81 | 10,187 | (79) | 93,420 | 74,576 | 79 | 10,405 | (93) | 84,967 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Costs and expenses | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive and other cost of sales | 72,232 | 822 | — | (1) | 73,053 | 66,779 | 561 | — | (1) | 67,339 | |||||||||||||||||||||||||||||||||||||||||||||||||

| GM Financial interest, operating and other expenses | — | — | 6,488 | (1) | 6,487 | — | — | 8,855 | (2) | 8,853 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive and other selling, general and administrative expense | 5,886 | 190 | — | — | 6,076 | 4,718 | 190 | — | — | 4,908 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total costs and expenses | 78,118 | 1,012 | 6,488 | (2) | 85,616 | 71,497 | 751 | 8,855 | (3) | 81,100 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Operating income (loss) | 5,113 | (931) | 3,699 | (77) | 7,804 | 3,079 | (672) | 1,550 | (90) | 3,867 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive interest expense | 725 | — | — | (2) | 723 | 838 | — | — | (15) | 823 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Interest income and other non-operating income, net | 2,303 | 12 | — | 68 | 2,383 | 1,131 | 8 | — | 84 | 1,223 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Equity income | 858 | — | 157 | — | 1,015 | 276 | — | 113 | — | 389 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income (loss) before income taxes | $ | 7,549 | $ | (919) | $ | 3,856 | $ | (7) | 10,479 | $ | 3,648 | $ | (664) | $ | 1,663 | $ | 9 | 4,656 | |||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 2,300 | 1,132 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | 8,179 | 3,524 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss attributable to noncontrolling interests | 99 | 57 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to stockholders | $ | 8,278 | $ | 3,581 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net income (loss) attributable to common stockholders | $ | 8,141 | $ | 3,446 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

10

General Motors Company and Subsidiaries

Basic and Diluted Earnings per Share

(Unaudited)

The following table summarizes basic and diluted earnings per share (in millions, except per share amounts):

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | ||||||||||||||||||||

| Basic earnings per share | |||||||||||||||||||||||

| Net income attributable to stockholders | $ | 2,420 | $ | 4,045 | $ | 8,278 | $ | 3,581 | |||||||||||||||

| Less: cumulative dividends on subsidiary preferred stock | (45) | (40) | (137) | (135) | |||||||||||||||||||

| Net income attributable to common stockholders | $ | 2,375 | $ | 4,005 | $ | 8,141 | $ | 3,446 | |||||||||||||||

| Weighted-average common shares outstanding | 1,452 | 1,432 | 1,450 | 1,432 | |||||||||||||||||||

| Basic earnings per common share | $ | 1.64 | $ | 2.80 | $ | 5.61 | $ | 2.41 | |||||||||||||||

| Diluted earnings per share | |||||||||||||||||||||||

| Net income attributable to common stockholders – diluted | $ | 2,375 | $ | 4,005 | $ | 8,141 | $ | 3,446 | |||||||||||||||

| Weighted-average common shares outstanding – diluted | 1,467 | 1,439 | 1,467 | 1,439 | |||||||||||||||||||

| Diluted earnings per common share | $ | 1.62 | $ | 2.78 | $ | 5.55 | $ | 2.40 | |||||||||||||||

| Potentially dilutive securities(a) | 2 | 31 | 2 | 31 | |||||||||||||||||||

__________

(a)Potentially dilutive securities attributable to outstanding stock options and Restricted Stock Units (RSUs) at September 30, 2021 and 2020 were excluded from the computation of diluted earnings per share (EPS) because the securities would have had an antidilutive effect.

11

General Motors Company and Subsidiaries

Combining Balance Sheet Information

(In millions, except per share amounts) (Unaudited)(a)

| September 30, 2021 | December 31, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive | Cruise | GM Financial | Reclassifications/Eliminations | Combined | Automotive | Cruise | GM Financial | Reclassifications/Eliminations | Combined | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 10,669 | $ | 1,832 | $ | 4,865 | $ | — | $ | 17,365 | $ | 14,168 | $ | 761 | $ | 5,063 | $ | — | $ | 19,992 | |||||||||||||||||||||||||||||||||||||||

| Marketable debt securities | 4,792 | 1,803 | — | (20) | 6,575 | 8,103 | 972 | — | (29) | 9,046 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Accounts and notes receivable, net(b) | 8,222 | 1 | 717 | (850) | 8,091 | 7,951 | 3 | 1,035 | (954) | 8,035 | |||||||||||||||||||||||||||||||||||||||||||||||||

| GM Financial receivables, net(c) | — | — | 25,277 | (184) | 25,093 | — | — | 26,607 | (398) | 26,209 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Inventories | 14,535 | — | — | (1) | 14,534 | 10,236 | 1 | — | (2) | 10,235 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other current assets | 2,053 | 85 | 4,126 | (131) | 6,133 | 1,884 | 32 | 5,524 | (32) | 7,407 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total current assets | 40,270 | 3,721 | 34,984 | (1,184) | 77,791 | 42,342 | 1,769 | 38,228 | (1,414) | 80,924 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Non-current Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GM Financial receivables, net | — | — | 34,645 | — | 34,645 | — | — | 31,783 | — | 31,783 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Equity in net assets of nonconsolidated affiliates | 7,585 | — | 1,649 | — | 9,234 | 6,825 | — | 1,581 | — | 8,406 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Property, net | 39,365 | 112 | 160 | — | 39,637 | 37,325 | 123 | 184 | — | 37,632 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill and intangible assets, net | 3,047 | 739 | 1,340 | — | 5,126 | 3,152 | 735 | 1,343 | — | 5,230 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Equipment on operating leases, net | — | — | 39,657 | — | 39,657 | — | — | 39,819 | — | 39,819 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred income taxes | 22,650 | — | (405) | — | 22,245 | 23,853 | 617 | (334) | — | 24,136 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 8,203 | 340 | 1,711 | (32) | 10,222 | 6,129 | 382 | 805 | (53) | 7,264 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total non-current assets | 80,850 | 1,191 | 78,757 | (32) | 160,766 | 77,284 | 1,856 | 75,182 | (53) | 154,270 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $ | 121,120 | $ | 4,912 | $ | 113,741 | $ | (1,216) | $ | 238,557 | $ | 119,625 | $ | 3,625 | $ | 113,410 | $ | (1,466) | $ | 235,194 | |||||||||||||||||||||||||||||||||||||||

| LIABILITIES AND EQUITY | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounts payable (principally trade)(b) | $ | 18,411 | $ | 128 | $ | 957 | $ | (850) | $ | 18,648 | $ | 19,928 | $ | 93 | $ | 867 | $ | (959) | $ | 19,928 | |||||||||||||||||||||||||||||||||||||||

| Short-term debt and current portion of long-term debt | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive (c) | 658 | 1 | — | (184) | 476 | 1,674 | — | — | (398) | 1,276 | |||||||||||||||||||||||||||||||||||||||||||||||||

| GM Financial | — | — | 34,343 | — | 34,343 | — | — | 35,637 | — | 35,637 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Accrued liabilities | 14,969 | 242 | 3,403 | (130) | 18,484 | 18,751 | 133 | 4,218 | (34) | 23,069 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total current liabilities | 34,038 | 372 | 38,704 | (1,164) | 71,951 | 40,353 | 226 | 40,722 | (1,391) | 79,910 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Non-current Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive | 16,364 | 7 | — | — | 16,372 | 16,193 | — | — | — | 16,193 | |||||||||||||||||||||||||||||||||||||||||||||||||

| GM Financial | — | — | 57,762 | — | 57,762 | — | — | 56,788 | — | 56,788 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Postretirement benefits other than pensions | 6,111 | — | — | — | 6,111 | 6,277 | — | — | — | 6,277 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Pensions | 10,817 | — | 5 | — | 10,822 | 12,897 | — | 5 | — | 12,902 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 12,591 | 496 | 2,162 | (32) | 15,218 | 11,151 | 539 | 1,810 | (53) | 13,447 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total non-current liabilities | 45,884 | 504 | 59,929 | (32) | 106,285 | 46,519 | 539 | 58,602 | (53) | 105,607 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities | 79,922 | 876 | 98,633 | (1,196) | 178,236 | 86,872 | 764 | 99,325 | (1,444) | 185,517 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Commitments and contingencies | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock, $0.01 par value | 15 | — | — | — | 15 | 14 | — | — | — | 14 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Additional paid-in capital(d) | 26,931 | 96 | 1,611 | (1,713) | 26,926 | 26,551 | 76 | 1,730 | (1,816) | 26,542 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Retained earnings | 25,043 | 405 | 14,776 | (12) | 40,212 | 17,444 | 891 | 13,640 | (13) | 31,962 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive loss | (11,729) | 5 | (1,278) | — | (13,003) | (12,213) | 10 | (1,284) | — | (13,488) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total stockholders’ equity | 40,259 | 506 | 15,108 | (1,725) | 54,150 | 31,796 | 976 | 14,085 | (1,829) | 45,030 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Noncontrolling interests(d) | 938 | 3,530 | — | 1,704 | 6,171 | 959 | 1,884 | — | 1,804 | 4,647 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total Equity | 41,198 | 4,036 | 15,108 | (20) | 60,321 | 32,754 | 2,861 | 14,085 | (23) | 49,677 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 121,120 | $ | 4,912 | $ | 113,741 | $ | (1,216) | $ | 238,557 | $ | 119,625 | $ | 3,625 | $ | 113,410 | $ | (1,466) | $ | 235,194 | |||||||||||||||||||||||||||||||||||||||

_________

(a)Amounts may not sum due to rounding.

(b)Eliminations primarily include: GM Financial accounts and notes receivable of $332 million offset by Automotive accounts payable and Automotive accounts receivable of $470 million offset by GM Financial accounts payable at September 30, 2021; and GM Financial accounts and notes receivable of $643 million offset by Automotive accounts payable and Automotive accounts receivable of $268 million offset by GM Financial accounts payable at December 31, 2020.

(c)Eliminations include GM Financial loan receivable of $184 million and $398 million offset by an Automotive loan payable at September 30, 2021 and December 31, 2020.

(d)Primarily reclassification of GM Financial Cumulative Perpetual Preferred Stock, Series A, B and C. The preferred stock is classified as noncontrolling interests in our condensed consolidated balance sheets.

12

General Motors Company and Subsidiaries

Combining Cash Flow Information

(In millions) (Unaudited)(a)

| Nine Months Ended September 30, 2021 | Nine Months Ended September 30, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Automotive | Cruise | GM Financial | Reclassifications/Eliminations | Combined | Automotive | Cruise | GM Financial | Reclassifications/Eliminations | Combined | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash flows from operating activities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 6,522 | $ | (1,236) | $ | 2,900 | $ | (7) | $ | 8,179 | $ | 2,744 | $ | (472) | $ | 1,244 | $ | 9 | $ | 3,524 | |||||||||||||||||||||||||||||||||||||||

| Depreciation and impairment of Equipment on operating leases, net | — | — | 4,757 | — | 4,757 | 3 | — | 5,515 | — | 5,518 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Depreciation, amortization and impairment charges on Property, net | 4,272 | 41 | 43 | — | 4,357 | 4,135 | 30 | 53 | — | 4,217 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency remeasurement and transaction (gains) losses | (59) | 2 | (2) | — | (59) | 52 | — | (2) | — | 50 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Undistributed earnings of nonconsolidated affiliates, net | (148) | — | (157) | — | (306) | 250 | — | (113) | — | 137 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Pension contributions and OPEB payments | (624) | — | — | — | (624) | (610) | — | — | — | (610) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Pension and OPEB income, net | (1,206) | — | 1 | — | (1,205) | (754) | — | 1 | — | (754) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Provision (benefit) for deferred taxes | 1,532 | 316 | 115 | — | 1,963 | 678 | (192) | 214 | — | 700 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Change in other operating assets and liabilities(b)(c) | (9,980) | 133 | (2,029) | 3,193 | (8,683) | (4,221) | 66 | (912) | 2,263 | (2,805) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net cash provided by (used in) operating activities | 309 | (744) | 5,628 | 3,186 | 8,379 | 2,276 | (569) | 5,998 | 2,272 | 9,977 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Cash flows from investing activities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenditures for property | (4,235) | (55) | (20) | — | (4,310) | (3,292) | (10) | (26) | — | (3,328) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Available-for-sale marketable securities, acquisitions | (2,307) | (3,477) | — | — | (5,784) | (9,269) | (2,921) | — | — | (12,190) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Available-for-sale marketable securities, liquidations | 5,597 | 2,656 | — | (17) | 8,236 | 5,260 | 1,776 | — | (18) | 7,018 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Purchases of finance receivables, net | — | — | (25,470) | (49) | (25,518) | — | — | (22,419) | 125 | (22,294) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Principal collections and recoveries on finance receivables(b) | — | — | 23,446 | (5,149) | 18,297 | — | — | 17,932 | (3,310) | 14,622 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Purchases of leased vehicles, net | — | — | (16,698) | — | (16,698) | — | — | (10,468) | — | (10,468) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Proceeds from termination of leased vehicles | — | — | 15,513 | — | 15,513 | — | — | 9,937 | — | 9,937 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other investing activities(d) | (1,739) | (6) | (14) | 1,084 | (675) | 27 | (71) | 3 | (75) | (116) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net cash provided by (used in) investing activities | (2,684) | (882) | (3,242) | (4,131) | (10,939) | (7,273) | (1,227) | (5,040) | (3,278) | (16,819) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Cash flows from financing activities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net increase (decrease) in short-term debt | (2) | — | 3,205 | — | 3,203 | (2) | — | 579 | 3 | 580 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Proceeds from issuance of debt (original maturities greater than three months) | 367 | 25 | 34,476 | (25) | 34,843 | 21,246 | — | 43,685 | — | 64,931 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Payments on debt (original maturities greater than three months) | (1,211) | (18) | (37,197) | 159 | (38,266) | (6,704) | — | (44,100) | 145 | (50,659) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Proceeds from issuance of preferred stock(d) | — | 2,736 | — | (1,000) | 1,736 | — | — | 492 | — | 492 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends paid(c) | (2) | (49) | (1,920) | 1,800 | (170) | (547) | (16) | (890) | 800 | (653) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other financing activities | (15) | 4 | (133) | 11 | (134) | (457) | 3 | (135) | 55 | (532) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net cash provided by (used in) financing activities | (863) | 2,698 | (1,568) | 945 | 1,212 | 13,537 | (14) | (370) | 1,005 | 14,159 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (74) | — | (43) | — | (118) | (265) | — | (140) | — | (404) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash | (3,312) | 1,071 | 775 | — | (1,466) | 8,273 | (1,809) | 448 | — | 6,913 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 14,225 | 766 | 8,126 | — | 23,117 | 13,487 | 2,355 | 7,102 | — | 22,943 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 10,913 | $ | 1,838 | $ | 8,901 | $ | — | $ | 21,651 | $ | 21,760 | $ | 545 | $ | 7,551 | $ | — | $ | 29,856 | |||||||||||||||||||||||||||||||||||||||

_________

(a)Amounts may not sum due to rounding.

(b)Includes reclassifications of $4.9 billion and $2.9 billion in the nine months ended September 30, 2021 and 2020 for purchases/collections of wholesale finance receivables resulting from vehicles sold by GM to dealers that have arranged their inventory floor plan financing through GM Financial.

(c)Eliminations include dividends issued by GM Financial to Automotive.

(d)Eliminations include $1.0 billion in the nine months ended September 30, 2021 for Automotive investments in Cruise Preferred Shares.

13

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- GM Energy (GM) Rolls Out New Product Suite

- Sensata Technologies Named a 2023 Supplier of the Year by General Motors

- IPG’s Commonwealth//McCann Recognized as GM Supplier of Year

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share