Form 8-K FREYR Battery For: Aug 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

(Exact name of registrant as specified in its charter)

|

|

|

| ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

|

| ||

| (Address of principal executive offices, including zip code) | ||

| Registrant’s telephone number, including area code: + | ||

|

Not Applicable | ||

| (Former name or former address, if changed since last report) | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities registered pursuant to Section 12(b) of the Act: |

|

Title of each class |

Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2).

Emerging growth company

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2022, FREYR Battery, a corporation in the form of a public limited liability company (société anonyme) incorporated under the laws of Luxembourg (“FREYR Battery”), issued a press release announcing its financial results for the second quarter ended June 30, 2022.

The information set forth under Item 9.01 of this Current Report on Form 8-K is incorporated herein by reference.

The information in this Item 2.02, including the Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

FREYR Battery is also furnishing a Second Quarter 2022 Earnings Call presentation, dated August 8, 2022 (the “Presentation”), attached as Exhibit 99.2 to this Current Report on Form 8-K, which may be referred to on FREYR Battery’s second quarter 2022 conference call to be held on August 8, 2022. The Presentation will also be available on FREYR Battery’s website at https://www.freyrbattery.com.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Press Release, dated August 8, 2022, reporting FREYR Battery’s financial results for the second quarter ended June 30, 2022. | |

| 99.2 | Second Quarter 2022 Earnings Call presentation. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

1

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| FREYR Battery | |||

| Dated: August 8, 2022 | By: | /s/ Oscar K. Brown | |

| Name: | Oscar K. Brown | ||

| Title: | Group Chief Financial Officer | ||

2

Exhibit 99.1

News Release

FREYR Battery Reports Second Quarter 2022 Results

New York, Oslo, and Luxembourg, August 8, 2022, FREYR Battery (NYSE: FREY) (“FREYR” or the “company”), a developer of clean, next-generation battery cell production capacity, today reported financial results for the second quarter of 2022.

Highlights of the second quarter 2022 and subsequent events:

| ● | In June, FREYR’s Board of Directors sanctioned the construction of its first commercial scale battery manufacturing facility, the 29 GWh nameplate capacity Giga Arctic development in Mo i Rana, Norway. |

| ● | Launched Giga Arctic project financing efforts in mid-July with the initiation of a market sounding process across a consortium of commercial banks, Export Credit Agencies (“ECAs”) and Multinational Development Financings Institutions (“MDFIs”). |

| ● | Advanced the site selection process in conjunction with Koch Strategic Platforms of the joint venture’s first planned Gigafactory in the U.S., Giga America, ahead of the proposal of the Inflation Reduction Act of 2022. FREYR plans to develop Giga America to a targeted nameplate capacity of 35 GWh with generation 3 technology from 24M Technologies. |

| ● | Hosted a delegation from the Norwegian Government at FREYR’s Giga Arctic site for the announcement of the comprehensive Norwegian national battery strategy, which includes an indicative commitment of €400 million in loan guarantees and/or direct lending from Export Finance Norway (“Eksfin”) to support FREYR’s development of Giga Arctic. |

| ● | Identified total debt financing support of over $1.6 billion based on visibility from ECAs and MDFIs, exceeding management’s leverage target for the $1.7 billion estimated total capital cost for the expanded Giga Arctic project. |

“Our second quarter was punctuated by the achievement of key milestones, the demonstration of meaningful financial support from the Norwegian Government and other key OECD governmental entities, the consummation of new strategic relationships across the battery value chain, and accelerating commercial momentum,” remarked Tom Einar Jensen, FREYR’s CEO. “As energy security and government-backed decarbonization mandates gain traction in key end markets across Europe and the U.S., we are advancing several strategic initiatives to further our aspirations to become an industrial partner of choice in the clean battery space.”

“Looking ahead to the second half of 2022 and beyond, our team is focused on executing construction of the Customer Qualification Plant and Giga Arctic projects in Mo i Rana, formalizing commitments with our financial, governmental, and strategic partners to accelerate our growth, and increasing our presence across the battery value chain,” concluded Jensen.

1 | News Release | FREYR Battery | www.freyrbattery.com/news

Business Update

| ● | FREYR is in advanced negotiations to convert the company’s key COAs to value accretive long-term sales agreements. |

| ● | FREYR is deeply committed to accelerating its development plans in the U.S. based on improving market conditions and the financial incentives attendant to the proposed Inflation Reduction Act. In conjunction with joint venture partner Koch Strategic Platforms, the company has narrowed the candidate sites for its Gigafactory development in the U.S. down to five potential locations and opened an office in Boston, MA. The company expects to reach final site selection during 2H 2022. |

| ● | FREYR’s Board of Directors has approved approximately $70 million of incremental capital spending on the Giga Arctic development to ensure timely orders of critical path, long-lead time items. |

| ● | Construction of FREYR’s CQP in Mo i Rana is progressing steadily with anticipated factory acceptance testing in 2H 2022. The facility is on track to commence a ramp up of sample cell production in 1Q 2023. |

| ● | FREYR formally launched the project financing process for the Giga Arctic development in mid-July. The company is engaged in a market sounding process with a consortium of potential lenders that includes 14 commercial banks, led by the mandated lead arrangers Société General and DNB; four ECAs, including Eksfin; and two MDFIs, the Nordic Investment Bank and the European Investment Bank. Initial feedback from the market sounding process is anticipated during 3Q 2022. |

| ● | FREYR finalized its previously announced long-term physical supply agreement with Statkraft, Europe’s largest producer of renewable energy, which secures hydropower renewable electricity for Giga Arctic and the Customer Qualification Plant on globally competitive terms. |

Results Overview, Financing and Liquidity

| ● | FREYR reported net income for the second quarter of 2022 of $4.7 million or $0.04 per diluted share compared to a net loss for the first quarter 2022 of ($34.9) million or ($0.30) per diluted share. Net income in the second quarter of 2022 was primarily due to a $33.4 million gain on the fair value adjustment to our warrant liability. This non-cash fair value adjustment can vary materially from period-to-period based on several factors, including changes to FREYR’s stock price. |

| ● | As of June 30, 2022, FREYR had cash, cash equivalents, and restricted cash of $488.4 million. |

Business Outlook

FREYR is focused on advancing the following strategic mandates and milestones over the next 18 months:

| ● | Finalize commitments of capital support from ECAs, MDFIs, and commercial banking partners to fund the construction of the Giga Arctic project. |

| ● | Complete the site selection process for the Giga America project in the U.S. and engage with key stakeholders to accelerate development in accordance with the Inflation Reduction Act. |

| ● | Based on the continued favorable evolution of supply-demand dynamics in core end markets, FREYR has established upsized capacity targets for 2025 of a minimum of 50 GWh, over 100 GWh by 2028, and more than 200 GWh by 2030, respectively. |

| ● | Replicate the Giga Arctic development across multiple jurisdictions based on a commercial framework of allocating 50% of respective plant capacities to long-term sales agreements and 50% to merchant sales. FREYR’s planned 50/50 approach aligns with an increasingly favorable supply-demand environment for clean battery production. |

2 | News Release | FREYR Battery | www.freyrbattery.com/news

| ● | Pursue a technology licensing agreement with Aleees (TWSE: 5227) that will unlock the potential construction of a lithium iron phosphate (“LFP”) cathode plant in the Nordic region to significantly reduce costs and CO2 footprint. |

| ● | Progress discussions that will further FREYR’s ambition to be an industrial scaling partner of choice for leading complementary technology platforms that target distinct and additional end market applications across the ESS, passenger EV, and commercial electric mobility markets. |

| ● | Continue to advance FREYR’s augmented value proposition strategy with the intention to maximize sustainable long-term shareholder value and enhance the company’s competitive position. Key objectives in accordance with this strategy are to continue to evaluate opportunities to diversify FREYR’s position across the global battery value chain; and to explore potential partnerships that would enable FREYR to broaden its participation across the battery technology spectrum. |

Presentation of Second Quarter 2022 Results

A presentation will be held today, August 8, 2022, at 7:30 am Eastern Daylight Time (1:30 pm Central European Time) to discuss financial results for the second quarter 2022. The results and presentation material will be available for download at https://ir.freyrbattery.com.

To access the conference call, listeners should contact the conference call operator at the appropriate number listed below approximately 10 minutes prior to the start of the call.

Participant conference call dial-in numbers:

United

Kingdom: 020 3936 2999

United States: 1 (646) 664 1960

All other locations: +44 20 3936 2999

The participant passcode for the call is: 868004

A webcast of the conference call will be broadcast simultaneously at https://streams.eventcdn.net/freyer/2022q2/ on a listen-only basis. Please log in at least 10 minutes in advance to register and download any necessary software.

A replay of the webcast will be available at https://ir.freyrbattery.com/events-and-presentations/Events-Calendar/default.aspx

***

3 | News Release | FREYR Battery | www.freyrbattery.com/news

About FREYR Battery

FREYR Battery aims to provide industrial scale clean battery solutions to reduce global emissions. Listed on the New York Stock Exchange, FREYR’s mission is to produce green battery cells to accelerate the decarbonization of energy and transportation systems globally. FREYR has commenced building the first of its planned factories in Mo i Rana, Norway and announced potential development of industrial scale battery cell production in Vaasa, Finland, and the United States. FREYR intends to deliver a minimum of 50 GWh of battery cell capacity by 2025, over 100 GWh of annual capacity by 2028, and over 200 GWh of annual capacity by 2030. To learn more about FREYR, please visit www.freyrbattery.com.

Investor contact:

Jeffrey Spittel

Vice President, Investor Relations

Tel: (+1) 281-222-0161

Media contact:

Katrin Berntsen

Vice

President, Communication and Public Affairs

[email protected]

Tel: (+47) 920 54 570

Cautionary Statement Concerning Forward-Looking Statements

The information in this press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, including, without limitation, statements regarding the development, construction, timeline, capacity, and other usefulness of FREYR’s CQP, Giga Arctic, and other planned or future production facilities or Gigafactories in the U.S. (collectively, the “FREYR Facilities”); the ability to secure critical path, long-lead time equipment for the FREYR Facilities in a timely manner; the construction of FREYR’s CQP and its anticipated factory acceptance testing in H2 2022, as well as the commencement of a ramp up of sample cell production in Q1 2023; the progress and development of customer relationships and offtake agreements; FREYR’s ability to convert any conditional agreements, including heads of terms agreements, into definitive agreements; the development and growth of FREYR’s target markets; the progress and development of FREYR’s joint ventures and partnerships; the development and commercialization of other battery technologies or battery chemistries; exploration of or progress toward additional debt or equity capital raises, including securing financial support, such as loan guarantees and debt financing support from governments and other entities, to fund FREYR’s planned expansion; FREYR’s ability to advance strategic initiatives to further its aspirations to become an industrial partner of choice in the clean battery space; FREYR’s expansion across the battery value chain; FREYR’s commitment to accelerating its development plans in the U.S. based on improving market conditions and the financial incentives attendant to the proposed Inflation Reduction Act; the continued favorable evolution of supply-demand dynamics in core end markets; FREYR’s ability to replicate the Giga Arctic development across multiple jurisdictions based on a commercial framework of allocating 50% of respective plant capacities to long-term sales agreements and 50% to merchant sales; the pursuit of a technology licensing agreement with Aleees; the progress of discussions that will further FREYR’s ambition to be a scaling partner of choice for leading parallel technology platforms that target distinct and complimentary end market applications across the ESS, passenger EV, and commercial electric mobility spaces; the advancement of FREYR’s augmented value proposition strategy and the ability to meet its key objectives in accordance with this strategy; and the attainment of operational milestones are forward looking statements.

These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from the expected results. Most of these factors are outside FREYR’s control and are difficult to predict. Additional information about factors that could materially affect FREYR is set forth under the “Risk Factors” section in (i) FREYR’s Registration Statement on Form S-1 filed with the Securities and Exchange Commission (the “SEC”) on August 9, 2021, as amended, and (ii) FREYR’s annual report on Form 10-K filed with the SEC on March 9, 2022, available on the SEC’s website at www.sec.gov.

Except as otherwise required by applicable law, FREYR disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. Should underlying assumptions prove incorrect, actual results and projections could differ material from those expressed in any forward-looking statements.

4 | News Release | FREYR Battery | www.freyrbattery.com/news

FREYR BATTERY

CONDENSED CONSOLIDATED BALANCE SHEETS

(In Thousands)

(Unaudited)

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 484,204 | $ | 563,956 | ||||

| Restricted cash | 4,160 | 1,671 | ||||||

| Prepaid assets | 19,348 | 15,882 | ||||||

| Other current assets | 5,728 | 1,282 | ||||||

| Total current assets | 513,440 | 582,791 | ||||||

| Property and equipment, net | 45,339 | 21,062 | ||||||

| Convertible note | 20,722 | 20,231 | ||||||

| Equity method investments | 2,475 | 2,938 | ||||||

| Right-of-use asset under operating leases | 12,785 | — | ||||||

| Other long-term assets | 11 | 11 | ||||||

| Total assets | $ | 594,772 | $ | 627,033 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 9,025 | $ | 3,813 | ||||

| Accrued liabilities and other | 31,853 | 15,077 | ||||||

| Accounts payable and accrued liabilities - related party | 620 | 3,316 | ||||||

| Deferred income | 1,236 | 1,380 | ||||||

| Share-based compensation liability | 985 | 2,211 | ||||||

| Total current liabilities | 43,719 | 25,797 | ||||||

| Warrant liability | 24,420 | 49,124 | ||||||

| Operating lease liability | 11,090 | — | ||||||

| Long-term share-based compensation liability | 2,583 | 6,627 | ||||||

| Total liabilities | 81,812 | 81,548 | ||||||

| Commitments and contingencies | ||||||||

| Shareholders’ equity: | ||||||||

| Ordinary share capital, no par value, 245,000 ordinary shares authorized and 116,854 issued as of both June 30, 2022 and December 31, 2021 and 116,704 and 116,854 ordinary shares outstanding as of June 30, 2022 and December 31, 2021, respectively | 116,854 | 116,854 | ||||||

| Additional paid-in capital | 539,639 | 533,418 | ||||||

| Treasury stock | (1,052 | ) | — | |||||

| Accumulated other comprehensive (loss) income | (7,982 | ) | (524 | ) | ||||

| Accumulated deficit | (134,499 | ) | (104,263 | ) | ||||

| Total shareholders’ equity | 512,960 | 545,485 | ||||||

| Total liabilities and shareholders’ equity | $ | 594,772 | $ | 627,033 | ||||

5 | News Release | FREYR Battery | www.freyrbattery.com/news

FREYR BATTERY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In Thousands, Except per Share Amounts)

(Unaudited)

| Three months ended | Six months ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative | $ | 28,150 | $ | 7,176 | $ | 52,764 | $ | 16,188 | ||||||||

| Research and development | 3,082 | 3,045 | 5,941 | 5,952 | ||||||||||||

| Equity in losses from investee | 296 | — | 463 | — | ||||||||||||

| Total operating expenses | 31,528 | 10,221 | 59,168 | 22,140 | ||||||||||||

| Loss from operations | (31,528 | ) | (10,221 | ) | (59,168 | ) | (22,140 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Warrant liability fair value adjustment | 33,392 | — | 24,704 | — | ||||||||||||

| Redeemable preferred shares fair value adjustment | — | 69 | — | 75 | ||||||||||||

| Convertible notes fair value adjustment | 270 | — | 491 | — | ||||||||||||

| Interest income | 26 | 2 | 61 | 8 | ||||||||||||

| Interest expense | (12 | ) | — | (32 | ) | — | ||||||||||

| Foreign currency transaction gain (loss) | 1,421 | (208 | ) | 1,090 | (188 | ) | ||||||||||

| Other income, net | 1,102 | 2,322 | 2,618 | 2,322 | ||||||||||||

| Total other income (expense) | 36,199 | 2,185 | 28,932 | 2,217 | ||||||||||||

| Income (loss) before income taxes | 4,671 | (8,036 | ) | (30,236 | ) | (19,923 | ) | |||||||||

| Income tax expense | — | — | — | — | ||||||||||||

| Net income (loss) | $ | 4,671 | $ | (8,036 | ) | $ | (30,236 | ) | $ | (19,923 | ) | |||||

| Weighted average shares outstanding: | ||||||||||||||||

| Basic | 116,830 | 37,452 | 116,842 | 37,452 | ||||||||||||

| Diluted | 119,250 | 37,452 | 116,842 | 37,452 | ||||||||||||

| Net income (loss) per share: | ||||||||||||||||

| Basic | $ | 0.04 | $ | (0.21 | ) | $ | (0.26 | ) | $ | (0.53 | ) | |||||

| Diluted | 0.04 | (0.21 | ) | (0.26 | ) | (0.53 | ) | |||||||||

| Other comprehensive income (loss): | ||||||||||||||||

| Net income (loss) | $ | 4,671 | $ | (8,036 | ) | $ | (30,236 | ) | $ | (19,923 | ) | |||||

| Foreign currency translation adjustments | (7,791 | ) | 177 | (7,458 | ) | 234 | ||||||||||

| Total comprehensive loss | $ | (3,120 | ) | $ | (7,859 | ) | $ | (37,694 | ) | $ | (19,689 | ) | ||||

6 | News Release | FREYR Battery | www.freyrbattery.com/news

FREYR BATTERY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

(Unaudited)

| Six months ended June 30, | ||||||||

| 2022 | 2021 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (30,236 | ) | $ | (19,923 | ) | ||

| Adjustments to reconcile net loss to cash used in operating activities: | ||||||||

| Share-based compensation expense | 2,923 | 4,688 | ||||||

| Depreciation | 186 | 24 | ||||||

| Reduction in the carrying amount of right-of-use assets | 746 | — | ||||||

| Warrant liability fair value adjustment | (24,704 | ) | — | |||||

| Redeemable preferred shares fair value adjustment | — | (75 | ) | |||||

| Convertible note fair value adjustment | (491 | ) | — | |||||

| Equity in losses from investee | 463 | — | ||||||

| Foreign currency transaction net unrealized gain | (2,113 | ) | — | |||||

| Other | — | 28 | ||||||

| Changes in assets and liabilities: | ||||||||

| Prepaid assets | (5,229 | ) | (1,049 | ) | ||||

| Other current assets | (7,434 | ) | (50 | ) | ||||

| Accounts payable and accrued liabilities | 15,265 | 3,659 | ||||||

| Accounts payable and accrued liabilities – related party | 638 | 950 | ||||||

| Other current liabilities | (1 | ) | — | |||||

| Deferred income | — | 1,431 | ||||||

| Operating lease liability | (443 | ) | — | |||||

| Net cash used in operating activities | (50,430 | ) | (10,317 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Proceeds from property related grants | 4,874 | — | ||||||

| Purchases of property and equipment | (26,420 | ) | (107 | ) | ||||

| Investments in equity method investee | (3,000 | ) | — | |||||

| Purchases of other long-term assets | — | (12 | ) | |||||

| Net cash used in investing activities | (24,546 | ) | (119 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Repurchase of treasury shares | (1,052 | ) | — | |||||

| Proceeds from issuance of redeemable preferred shares | — | 7,500 | ||||||

| Net cash (used in) provided by financing activities | (1,052 | ) | 7,500 | |||||

| Effect of changes in foreign exchange rates on cash, cash equivalents, and restricted cash | (1,235 | ) | 73 | |||||

| Net decrease in cash, cash equivalents, and restricted cash | (77,263 | ) | (2,863 | ) | ||||

| Cash, cash equivalents, and restricted cash at beginning of period | 565,627 | 14,945 | ||||||

| Cash, cash equivalents, and restricted cash at end of period | $ | 488,364 | $ | 12,082 | ||||

| Reconciliation to consolidated balance sheets: | ||||||||

| Cash and cash equivalents | $ | 484,204 | $ | 11,279 | ||||

| Restricted cash | 4,160 | 803 | ||||||

| Cash, cash equivalents, and restricted cash | $ | 488,364 | $ | 12,082 | ||||

7 | News Release | FREYR Battery | www.freyrbattery.com/news

Exhibit 99.2

August 8, 2022 FREYR 2Q 2022 Earnings Call

2 Important notices Forward looking statements All statements, other than statements of present or historical fact included in this presentation, including, without limitation, regarding FREYR’s accelerated growth ambitions based on FREYR’s traction to date; the growing interest in FREYR’s augmented value proposition from customers, partners, investors and key stakeholders; the accelerating of secular growth trends despite supply chain challenges and price increases in materials and energy; the expected timeline of Giga Arctic’s SOP for 1H 2024, reserving +/ - 50% of capacity for customers under final negotiations; the expected timeline for the CQP equipment to be on site by year end 2022 with commissioning and ramp up in 1Q 2023; the expected accelerated site and concept selection in the U.S. with Koch Strategic Partners in 2H 2022 catalyzed by the U.S. Inflation Reduction Act; FREYR’s ability to maintain commercial discipline in offtake negotiations to support competitive financing; FREYR’s target of 80% CO2 reduction based on supply chain progress; FREYR’s ability to take commercially proven technology to GWh scale in advantaged locations; FREYR’s commitment to generating strong financial returns through pricing discipline and 50/50 balance of long - term sales agreements/merchant sales; the localization of FREYR’s supply chain based on low - cost renewable energy; the secular demand drivers for batteries; 24M Technology, Inc.’s technology being greatly fitted for storage systems applications; the acceleration of electrification and the demand projections that are consistently being revised higher across the EV and ESS verticals; FREYR’s anticipated path to commercialization; FREYR’s expanding revenue opportunity and its growth ambitions to capitalize on adoption trends and supply constraints; the development, timeline, capacity and other usefulness of FREYR’s CQP and planned Gigafactories; the projection that Giga Arctic will be the most capital efficient Gigafactory in the OECD; FREYR’s goal to deliver 50 GWh of battery cell capacity by 2025 in the Nordics, over 100 GWh of annual capacity by 2028 in the Nordics and the U.S., and over 200 GWh of annual capacity by 2030 across multiple geographies; Giga Arctic’s capacity evolution to optimize efficiency and address growing customer demand; the expected CAPEX of approximately $1.7 billion for Giga Arctic; the details of production lines, including the use of 24M Technology, Inc.’s technology and Giga Arctic’s modules, test center and head count; the intention for the CQP to facilitate increasingly rapid problem - solving capability; the construction of FREYR’s CQP and plan for final critical equipment deliveries before year - end 2022, as well as the commencement of a ramp up of sample cell production in 1Q 2023; the expected staged FID in 3Q - 4Q 2022 and anticipated start of production in 1H 2024 for Giga Arctic; the ability of Giga Arctic to serve as a blueprint for a modularized battery cell manufacturing facility that can be replicated in other locations; FREYR’s aspiration to be an industrial partner of choice in the decarbonized battery space; the realization of FREYR’s capital spending plan; the progress and development of customer relationships and offtake agreements and supply chain partnerships; the success and timeline of any capital raising paths, including securing financial support from governments, such as the visibility to over $1.6 billion of project financing credit support from ECAs and MDFIs, to fund FREYR’s planned expansion; FREYR’s timeline of the project financing process for Giga Arctic, including the launch of due diligence shortly, credit commitments later this year and financial close during 1Q 2023; FREYR’s ability to secure additional raw materials or finalize pricing terms of secured key raw materials capacity; the timing of the full FID for Giga Arctic; the potential incentives for FREYR and U.S. customers from the proposed U.S. Inflation Reduction Act for localized U.S. battery production, including tax credits for battery cell manufacturing, battery module manufacturing and critical materials and active cathode/anode materials, as well as the potential direct pay option; the realization of FREYR's supply chain strategy and augmented value proposition; FREYR’s finalization and success of any joint ventures, including with Koch Strategic Platforms, as well as with Asian providers who have expressed interest; FREYR’s accelerated development of the U.S. Giga America project through the joint venture with Koch Strategic Platforms; the aspiration to launch preliminary Giga America project development in 2H 2022; the plan to develop Giga America with generation 3 technology from 24M Technologies, Inc. with targeted nameplate capacity of 35GWh; the development of 24M Technologies, Inc.’s technology and their use in FREYR’s Gigafactories; the ability of an optimal, modularized battery cell manufacturing facility that can be rapidly replicated in other locations; FREYR's growing pipeline of commercial opportunities; FREYR’s ability to convert any conditional agreements into definitive agreements; the development and growth of FREYR's target markets; the scale and arrangements for any FREYR production facilities; FREYR's ability to establish a global supply chain on the path to localization, and achieve its ambition to localize and decarbonize its global supply chain; FREYR’s expectation to supply significant part of raw materials out of its Nordic Supply Chain by the startup of Giga Arctic; FREYR’s aspiration to produce the world’s lowest CO2 lifecycle emissions batteries; its ambition of 65 Kg/kWh emissions and the expectation that this equates to gross value of $150MM/year for Giga Arctic at $100/t CO2; any projections related to FREYR’s targeted CO2 emissions footprint; the completion of site selection and advancing to construction of Giga America in H2 2022; the ability to replicate the idealized Giga Arctic concept in multiple jurisdictions, starting with Giga America; the ability to establish decarbonized and localized supply chains in Europe and the U.S.; FREYR’s achievement of its key milestones; and FREYR’s ability to maintain relentless operational focus on construction execution, implement a 50%/50% commercial framework between long - term agreements and merchant sales volumes, and diversity across complementary technology platforms are forward - looking statements. These forward - looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside FREYR’s control and are difficult to predict. Additional information about factors that could materially affect FREYR is set forth under the “Risk Factors” section in (i) FREYR’s Registration Statement on Form S - 1 filed with the Securities and Exchange Commission on August 9, 2021, as amended, and (ii) FREYR’s annual report on Form 10 - K filed with the Securities and Exchange Commission on March 9, 2022, and available on the SEC’s website at www.sec.gov. Except as otherwise required by applicable law, FREYR disclaims any duty to update any forward - looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. Should underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward - looking statements Additional information about factors that could materially affect FREYR is set forth under the “Risk Factors” section in (i) FREYR’s Registration Statement on Form S - 1 filed with the Securities and Exchange Commission on August 9, 2021, as amended, and (ii) FREYR’s annual report on Form 10 - K filed with the Securities and Exchange Commission on March 9, 2022, and available on the SEC’s website at www.sec.gov . Except as otherwise required by applicable law, FREYR disclaims any duty to update any forward - looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. Should underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward - looking statements.

3 Today’s Agenda • Key messages • Business update • Giga Arctic project overview • Governments supporting energy transition • Financial update • Operations and projects update • Strategic priorities • Q&A

Key Messages Accelerating our growth ambitions based on FREYR’s traction to date Growing interest in FREYR’s augmented value proposition from customers, partners, investors, and key stakeholders Secular growth trends accelerating despite supply chain challenges and price increases in materials and energy Giga Arctic sanctioned by BOD in June 2022 through a 'staged FID process' with deep support from 'Norway Inc.' Giga Arctic SOP on track for 1H 2024 - reserving +/ - 50% of capacity for customers under final negotiations CQP largely on track: all equipment expected on site by YE 2022; commissioning and ramp up in 1Q 2023 Accelerating towards site & concept selection in the U.S. in 2H 2022 catalyzed by Inflation Reduction Act Maintaining commercial discipline in offtake negotiations to support competitive financing CO 2 reduction targets on track based on supply chain progress Increasing customer traction across all market verticals Increasing 2030 capacity ambition to 200 GWh

Business Update Accelerating our growth ambitions through expanded capacity targets SPEED SCALE SUSTAINABILITY Strong project execution skills across deeply experienced operations, supply chain, and technical teams Problem solving approach enabling Giga Arctic and CQP construction to progress according to plan Taking commercially proven technology to GWh scale in advantaged location Signed COAs from six of the largest technology providers and utilities in ESS space exceeding Giga Arctic's capacity by 2030 In advanced discussions with potential customers to address unmet demand in excess of 150 GWh of cumulative capacity by 2030 across the ESS, passenger EV and commercial mobility verticals Committed to generating strong financial returns through pricing discipline and 50/50 balance of long - term sales agreements/merchant sales Localizing supply chain based on low - cost renewable energy Deep interest from Asian providers to establish localized European/U.S. JVs >100 GWh total capacity By 2028 in The Nordics and U.S. >200 GWh capacity By 2030 across multiple geographies 50 GWh capacity By 2025 in the Nordics

Targeted Capacity Expansion Informed by Market Conditions Secular demand drivers for batteries continue to surprise to the upside Electrification is accelerating Demand projections are consistently being revised higher across the EV and ESS verticals FREYR’s revenue opportunity is expanding Fast tracking our growth ambitions to capitalize on adoption trends and supply constraints Tier 1 cell producers struggling to keep pace with EV demand, which is exacerbating the shortfall of available supply to ESS mar ket Conversations ongoing with OEMs to supplement commercial traction in ESS market with EV - focused offerings 24M technology greatly fitted for storage systems applications ; FREYR’s current ESS customer base comprising more than 2/3 of the global ESS players BCG Global EV Demand Forecasts EV adoption outpacing prior expectations Global Installed Capacity for ESS Consistent underestimated growth and unprecedented demand in coming decades Source: BCG, Inside EVs. Sources: IEA, BNEF, Rystad Energy

Business Update Advancing our aspiration to be an industrial partner of choice in the decarbonized battery space On track to deliver on key milestones: Giga Arctic construction sanctioned and on track for anticipated start of production in 1H 2024 CQP construction proceeding with ramp up of sample cell production expected in 1Q 2023 Giga Arctic project financing process underway with targeted completion in 1Q 2023 to support SOP in 1H 2024 Governments in Europe and the U.S. mobilizing support for clean battery production: ‘ Norway Inc.’ providing meaningful backing to FREYR through National Battery Strategy and indicative Eksfin financial support Proposed U.S. Inflation Reduction Act includes game changing financial incentives to spur development of battery value chain Accelerating development of U.S. Giga America project through JV with Koch Strategic Platforms: Site selection for first FREYR’s U.S. Gigafactory, Giga America , proceeding with candidate sites narrowed to five potential locations Expect to launch Giga America project development in 2H 2022 Plan to develop Giga America with generation 3 technology from 24M and targeted nameplate capacity of 35 GWh

Giga Arctic Project Overview Capacity evolution to optimize efficiency and address growing customer demand Giga Arctic: Mo Industrial Park • Previously combined Gigafactory 1 & 2 • Annual nameplate capacity: 29 GWh • Cell manufacturing capex – ~$ 1.7 billion • 8 production lines – I - shape lay out • 24M version – Lines 1 - 4 (Gen 2.5) Lines 5 - 8 (Gen 3) • Modules – Integrated facility for 80% of nameplate capacity • Test Center – End of line test requirements and in - line testing • Head Count – 625 employees Giga Arctic Capacity Evolution Upsized facility to optimize project

Giga Arctic Project Overview Projected to be the most capital efficient Gigafactory in Europe 170 150 128 126 114 114 107 106 61 $MM/GWh Average: ~ 127 2017 2020 2021 2022 2023 Source: Bloomberg NEF “Long - Term Electric Vehicle Outlook 2020” . Note: FREYR figure based on internal data. Rest of data based on BloombergNEF. 9 Competitor 1 Competitor 2 Competitor 3 Competitor 4 Competitor 5 Competitor 6 Competitor 7 Competitor 8

Governments supporting energy transition Meaningful financial commitment and ongoing support from ‘Norway Inc.’ Norway’s 10 - point plan on how to develop a profitable battery value chain… …and unlocks new opportunities with FREYR at the forefront of the industry …is a key component of helping the world to move towards sustainability targets… Leadership in sustainability across the battery value chain Promote Norway as an attractive host country for green investment Industrial partnerships with key countries Offer capital, loans and guarantees that encourage private capital Promote access to expertise Contribute to land and other central infrastructure Facilitate access to renewable power Ensure predictable, efficient, and coordinated public processes Support for growing pilot municipalities Leadership in future battery solutions and utilization of digital technology opportunities If we are to reach the goals in the Paris agreement, batteries will need to be produced in a more sustainable way with the lowest CO2 footprint possible ” [the plan] will facilitate private investments so that companies along the entire value chain can set up sustainable and successful businesses in Norwa y ” - Minister of Trade and Industry, Jan Christian Vestre - CEO of Eksfin * Tone Lunde Bakker It is an important confirmation that public and private partnerships are important to be successful in creating the green industry of the future” Long - term partnerships between state and private capital are needed to realize the transition to a zero - emission society” “ “ “ “ I am therefore very pleased and excited that FREYR Battery is moving along with its plans to establish a Gigafactory in Norway based on state capital and risk relief ” “ Tom Einar Jensen, CEO of Freyr, with Minister of Trade and Industry, Jan Christian Vestre €400MM Letter of intent received from Eksfin indicating a guarantee of up to €400MM - Minister of Trade and Industry, Jan Christian Vestre * Export Finance Norway

Governments supporting energy transition U.S. Inflation Reduction Act of 2022 contains significant incentives for localized U.S. battery production Proposals in the bill that are relevant to FREYR and our customers include: $35/kWh Battery cell manufacturing tax credit $10/kWh Battery module manufacturing tax credit 10% Separate t ax credits for critical materials and active cathode/anode materials Direct pay option through 2032 Source: US Capital Advisors 07/29/22 Battery Recap.

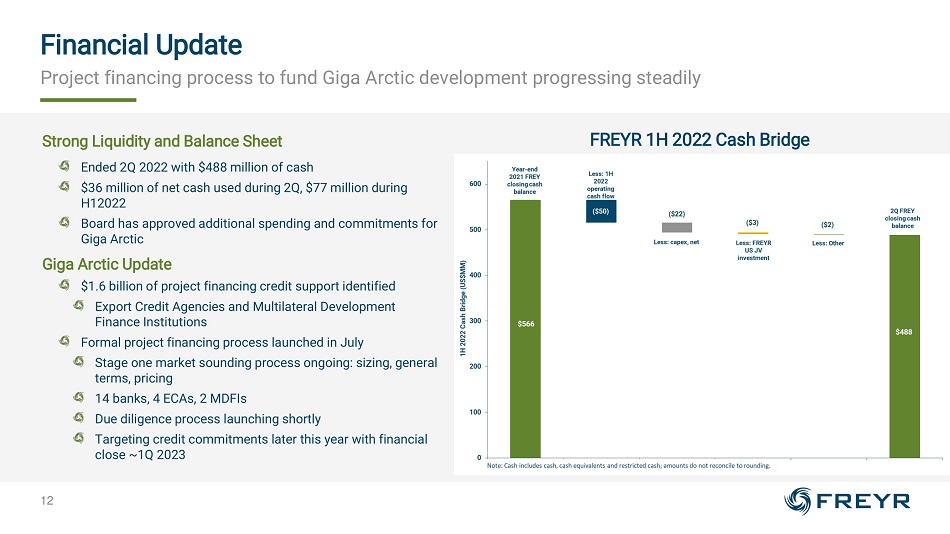

12 Financial Update FREYR 1H 2022 Cash Bridge Project financing process to fund Giga Arctic development progressing steadily Strong Liquidity and Balance Sheet Ended 2Q 2022 with $488 million of cash $36 million of net cash used during 2Q, $77 million during H12022 Board has approved additional spending and commitments for Giga Arctic Giga Arctic Update $1.6 billion of project financing credit support identified Export Credit Agencies and Multilateral Development Finance Institutions Formal project financing process launched in July Stage one market sounding process ongoing: sizing, general terms, pricing 14 banks, 4 ECAs, 2 MDFIs Due diligence process launching shortly Targeting credit commitments later this year with financial close ~1Q 2023

Operations update CQP construction proceeding towards key milestones CQP update: CQP Construction Dry room and staging area for production line FREYR’s dedicated project teams systematically and rigorously identify and solve problems at pace CQP intended to facilitate increasingly rapid problem - solving capability On track for final critical equipment deliveries before year - end 2022 Latest project timeline continues to facilitate ramp up of sample cell production in 1Q 2023 Committing to deliver and delivering on our commitments

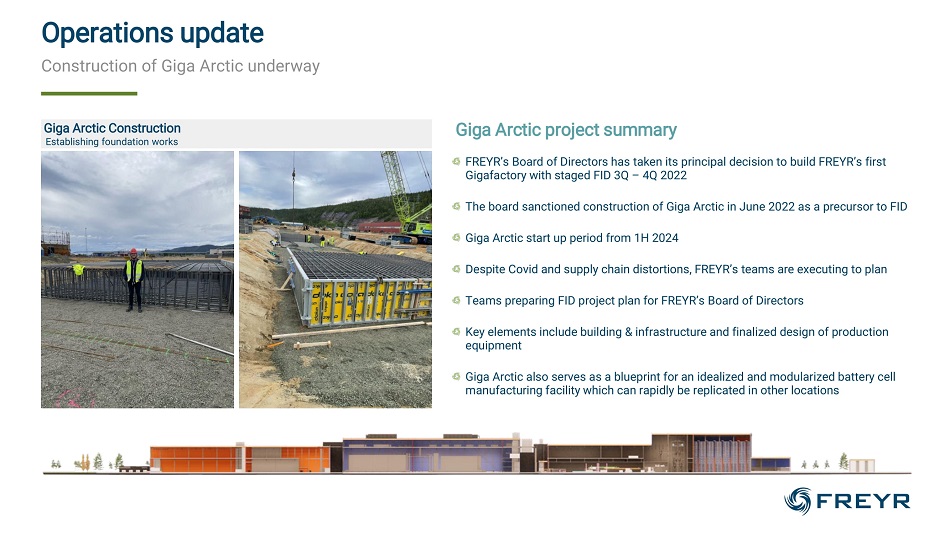

Operations update Construction of Giga Arctic underway Giga Arctic project summary FREYR’s Board of Directors has taken its principal decision to build FREYR’s first Gigafactory with staged FID 3Q – 4Q 2022 The board sanctioned construction of Giga Arctic in June 2022 as a precursor to FID Giga Arctic start up period from 1H 2024 Despite Covid and supply chain distortions, FREYR’s teams are executing to plan Teams preparing FID project plan for FREYR’s Board of Directors Key elements include building & infrastructure and finalized design of production equipment Giga Arctic also serves as a blueprint for an idealized and modularized battery cell manufacturing facility which can rapidly be replicated in other locations Giga Arctic Construction Establishing foundation works

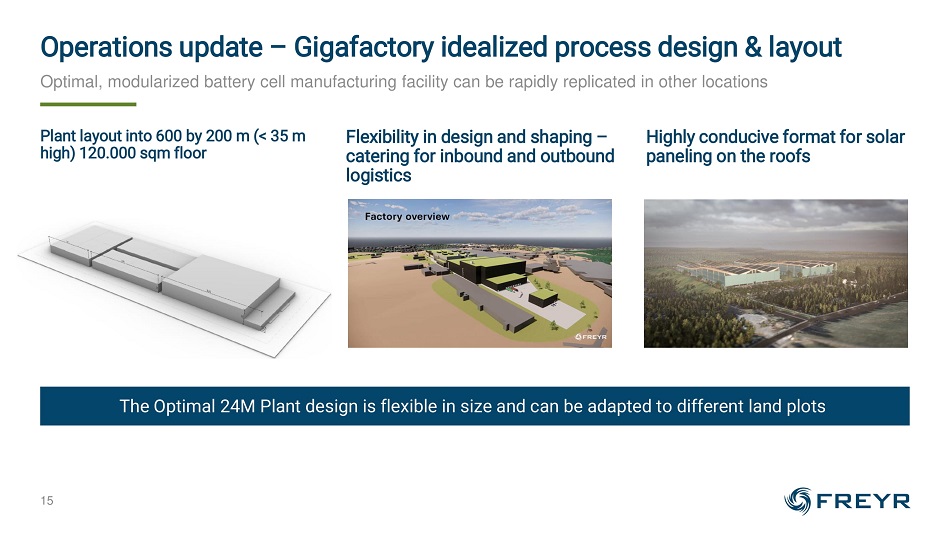

Plant layout into 600 by 200 m (< 35 m high) 120.000 sqm floor Highly conducive format for solar paneling on the roofs Flexibility in design and shaping – catering for inbound and outbound logistics Optimal, modularized battery cell manufacturing facility can be rapidly replicated in other locations 15 Operations update – Gigafactory idealized process design & layout The Optimal 24M Plant design is flexible in size and can be adapted to different land plots

Finalized PPA w/Statkraft to supply 100% hydro - based renewable power to CQP and Giga Arctic at globally competitive rates Volumes secured and pricing agreed for half of materials for CQP and Giga Arctic - progressing negotiations on 2 nd half Ambition to supply significant part of raw materials out of Nordic Supply Chain by startup of Giga Arctic Cathode materials, which account for up to 70% of raw materials required to produce LFP cells Initial discussions on Anode materials production in the Nordics Working on decarbonization of main contributors to carbon emissions in the value chain by localizing production in the Nordics Making substantial progress executing supply chain strategy 16 Operations update Working in parallel to secure raw materials for Giga Arctic while building a Nordic Supply Chain Initial Supply Nordic Supply Chain Establishing a global supply chain on the path to localization

FREYR aspires to produce world’s lowest CO 2 lifecycle emissions batteries Committed to Carbon Leadership Targeted FREYR CO 2 e Footprint Reduction (1) Global battery industry average for 2020. (2) Estimated medium - term benefits from localized supply chain. (3) Company estimate. (4) 65 x 100 x 23.2MM/1,000. Source: Study commissioned from global management consultancy 1 2 3 4 Global Average FREYR Target 81% CO 2 e Reduction - 31% - 19% - 13% - 19% 19% Emissions kg CO 2 /kWh ~80 FREYR ‘net zero’ cell production 1 (~25) Active material production in Norway/Nordics 2) (~15) Building a Nordic ecosystem of additional supply 2) (~15) Packaging and recycling 2) (~10) = ~15 Global Battery Industry CO 2 e Baseline 1) : 2 3 4 FREYR Target CO 2 e Emissions Level 3) : Reduction of 65 Kg/kWh reduction equates to gross value of $150MM/year 4 for Giga Arctic at $100/t CO 2

Key near - term objectives tied to Speed, Scale and Sustainability 18 Implementing our Strategy Maintain relentless operational focus on construction execution Convert COAs to long - term sales agreements Finalize indicative financial commitments from ECAs and MDFIs Progress and complete project financing process Complete site selection & advance to construction of Giga America in H2 - 22 Replicate idealized Giga Arctic concept across multiple jurisdictions Implement 50%/50% framework between committed & merchant sales volumes Establish decarbonized and localized supply chains in Europe and the U.S Diversify across complimentary technology platforms to increase TAM Continue to build global network of customers and strategic partners Accelerate our Planned Expansion Execute FREYR’s augmented value proposition Deliver CQP and Giga Arctic Projects

Q&A

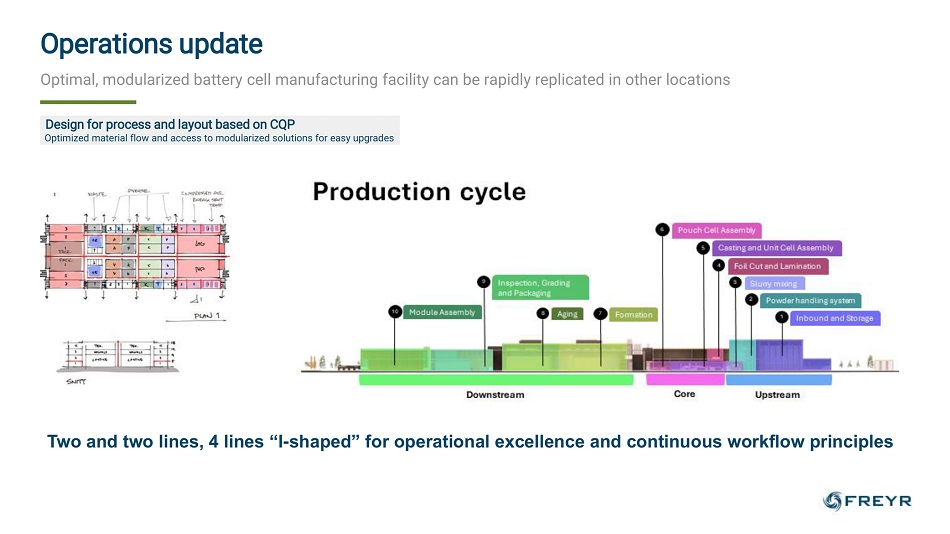

Optimal, modularized battery cell manufacturing facility can be rapidly replicated in other locations Operations update Two and two lines, 4 lines “I - shaped” for operational excellence and continuous workflow principles Design for process and layout based on CQP Optimized material flow and access to modularized solutions for easy upgrades

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- U.S. News & World Report Awards "Best of" Ratings for 24 Legend Senior Living Residences

- Greasecycle Founder and President Selected as North Carolina's Small Business Person of the Year

- Star Group, L.P. Increases Quarterly Distribution to 17.25 Cents per Unit

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share