Form 8-K FIRSTENERGY CORP For: Apr 21

Exhibit 99.1

| FirstEnergy Corp. | For Release: April 21, 2022 | |||||||

| 76 South Main Street | ||||||||

| Akron, Ohio 44308 | ||||||||

www.firstenergycorp.com | ||||||||

| News Media Contact: | Investor Contact: | |||||||

Tricia Ingraham | Irene Prezelj | |||||||

| (330) 384-5247 | (330) 384-3859 | |||||||

FirstEnergy Announces First Quarter 2022 Financial Results

Reports first quarter GAAP earnings of $0.51 per share and operating

(non-GAAP) earnings of $0.60 per share, in line with guidance midpoint

Building on transformational initiatives to deliver strong

operational and financial results with sustainable investment plan

Updates and affirms full-year GAAP and operating guidance

and provides outlook for second quarter

Akron, Ohio – FirstEnergy Corp. (NYSE: FE) today reported first quarter 2022 GAAP earnings of $288 million, or $0.51 per basic share of common stock ($0.50 diluted), on revenue of $3.0 billion. In the first quarter of 2021, the company reported GAAP earnings of $335 million, or $0.62 per basic and diluted share of common stock, on revenue of $2.7 billion. Results for both periods include the impact of special items listed below.

Operating (non-GAAP) earnings* for the first quarter of 2022 were $0.60 per share, at the midpoint of the company’s earnings guidance for the quarter. Operating (non-GAAP) earnings in the first quarter of 2021 were $0.69 per share.

“We’re off to a solid start in 2022, and I’m excited about our progress and future,” said Steven E. Strah, FirstEnergy president and chief executive officer. “Across FirstEnergy, we’re advancing our transformation plan to become an industry-leading company that delivers value to our customers, communities and investors, while building a culture based on our core values where employees can thrive. This year, we’re further strengthening our company through our ongoing cultural and operational transformation, implementing solutions that anticipate and respond to customer needs, and making sustainable investments to support grid modernization, service reliability and the energy transition.”

For the second quarter of 2022, FirstEnergy is providing a GAAP and operating (non-GAAP) earnings forecast range of $265 million to $320 million, or $0.46 to $0.56 per share, based on 571 million shares outstanding.

In addition, the company is updating its full-year 2022 GAAP earnings forecast range to $1,355 million to $1,470 million, or $2.37 to $2.57 per share based on 571 million shares outstanding. FirstEnergy also affirmed its full-year 2022 operating (non-GAAP) earnings guidance range of $1,315 million to $1,430 million, or $2.30 to $2.50 per share based on 571 million shares outstanding.

First Quarter Results

In FirstEnergy’s Regulated Distribution business, first quarter 2022 operating results reflect the impacts of certain accounting policy changes, rate credits that were provided to Ohio customers under a previously approved stipulation and share dilution related to the common equity financing transaction that closed at the end of 2021.

Excluding these items, operating results in the Regulated Distribution business declined slightly as a result of higher operating expenses associated with planned outage work and higher storm costs, partially offset by higher customer demand and the continued economic recovery in the commercial and industrial segments.

Total distribution deliveries increased 3.6% compared to the first quarter of 2021. Residential sales increased 2.2% as a result of higher weather-related usage. Commercial deliveries increased 7.6%, while sales to industrial customers increased 2.5%. When adjusted for the impact of weather, total deliveries increased 1.4% as a result of higher demand from commercial and industrial customers, partially offset by a slight decrease in usage by residential customers.

In the Regulated Transmission business, operating results for the first quarter of 2022 increased due to the company’s ongoing Energizing the Future capital investment program.

In Corporate/Other, operating results improved from 2021 due to lower interest expense from the early redemption of FE Corp debt and higher returns on certain passive investments.

Consolidated GAAP Earnings Per Share (EPS) to Operating (Non-GAAP) EPS* Reconciliation | |||||||||||||||||||||||||||||

First Quarter | 2022 Estimates | ||||||||||||||||||||||||||||

| 2022 | 2021 | Second Quarter | Full Year | ||||||||||||||||||||||||||

| Net Income (GAAP) - $M | $288 | $335 | $265 - $320 | $1,355 - $1,470 | |||||||||||||||||||||||||

Basic EPS (GAAP) | $0.51 | $0.62 | $0.46 - $0.56 | $2.37 - $2.57 | |||||||||||||||||||||||||

| Excluding Special Items*: | |||||||||||||||||||||||||||||

| Regulatory charges | 0.01 | 0.04 | — | 0.01 | |||||||||||||||||||||||||

| Investigation and other related costs (credits) | 0.01 | 0.03 | — | (0.15) | |||||||||||||||||||||||||

| Debt-related costs | 0.06 | — | — | 0.06 | |||||||||||||||||||||||||

| Strategic transaction costs | 0.01 | — | — | 0.01 | |||||||||||||||||||||||||

| Total Special Items* | 0.09 | 0.07 | — | (0.07) | |||||||||||||||||||||||||

| Operating EPS (Non-GAAP) | $0.60 | $0.69 | $0.46 - $0.56 | $2.30 - $2.50 | |||||||||||||||||||||||||

Per share amounts for the special items above are based on the after-tax effect of each item divided by the number of shares outstanding for the period. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rate ranges from 21% to 29%. Basic EPS (GAAP) and Operating EPS (Non-GAAP) is based on 570 million shares for the First Quarter 2022, 571 million shares for the Second Quarter and Full Year 2022, and 543 million shares for the First Quarter 2021. | |||||||||||||||||||||||||||||

Non-GAAP financial measures

* Operating earnings (loss) excludes “special items” as described below, and is a non-GAAP financial measure. Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating the Company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items are not necessarily non-recurring. Management uses Operating earnings (loss) and Operating earnings (loss) per share to evaluate the Company’s performance and manage its operations and frequently references these non-GAAP financial measures in its decision making, using them to facilitate historical and ongoing performance comparisons. Additionally, management uses Operating earnings (loss) per share by segment to further evaluate the Company's performance by segment and references this non-GAAP financial measure in its decision making. Operating earnings (loss) per share and Operating earnings (loss) per share for each segment is calculated by dividing Operating earnings (loss), which excludes special items as discussed herein, for the periods presented by the number of shares outstanding. Basic EPS (GAAP) and Operating EPS (Non-GAAP) is based on 570 million shares in the first quarter of 2022, 543 million shares for the first quarter of 2021, and 571 million shares for the second quarter and full year of 2022. Management believes that the non-GAAP financial measures of Operating earnings (loss) and Operating earnings (loss) per share and Operating earnings (loss) per share by segment provide consistent and comparable measures of performance of its businesses on an ongoing basis. Management also believes that such measures are useful to shareholders and other interested parties to understand performance trends and evaluate the Company against its peer group by presenting period-over-period operating results without the effect of certain charges or benefits that may not be consistent or comparable across periods or across the Company’s peer group. Generally, a non-GAAP financial measure is a numerical measure of a company's historical or future financial performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with accounting principles generally accepted in the United States (GAAP). These non-GAAP financial measures are intended to complement, and are not considered as alternatives to, the most directly comparable GAAP financial measures. Also, the non-GAAP financial measures may not be comparable to similarly titled measures used by other entities. Pursuant to the requirements of Regulation G, FirstEnergy has provided, where possible without unreasonable effort, quantitative reconciliations within this presentation of the non-GAAP financial measures to the most directly comparable GAAP financial measures.

Investor Materials and Teleconference

FirstEnergy’s Strategic and Financial Highlights report has been posted on the company’s Investor Information website – www.firstenergycorp.com/ir. To access the report, click on the First Quarter 2022 Financial Results link.

The company invites investors, customers and other interested parties to listen to a live webcast of its teleconference for financial analysts and view presentation slides at 10:00 a.m. EDT tomorrow.

FirstEnergy management will present an overview of the company’s financial results, followed by a question-and-answer session. The teleconference and presentation can be accessed on the website by selecting the First Quarter 2022 Earnings Webcast link. The webcast and presentation will be archived on the website.

FirstEnergy is dedicated to integrity, safety, reliability and operational excellence. Its 10 electric distribution companies form one of the nation's largest investor-owned electric systems, serving customers in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland and New York. The company's transmission subsidiaries operate approximately 24,000 miles of transmission lines that connect the Midwest and Mid-Atlantic regions. Follow FirstEnergy on Twitter @FirstEnergyCorp or online at www.firstenergycorp.com.

Forward-Looking Statements: This news release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management's intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” "forecast," "target," "will," "intend," “believe,” "project," “estimate," "plan" and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following the potential liabilities, increased costs and unanticipated developments resulting from government investigations and agreements, including those associated with compliance with or failure to comply with the Deferred Prosecution Agreement with the U.S. Attorney’s Office for the Southern District of Ohio; the risks and uncertainties associated with government investigations and audits regarding Ohio House Bill 6, as passed by Ohio’s 133rd General Assembly (“HB 6”) and related matters, including potential adverse impacts on federal or state regulatory matters, including, but not limited to, matters relating to rates; the risks and uncertainties associated with litigation, arbitration, mediation, and similar proceedings, particularly regarding HB 6 related matters, including risks associated with obtaining court approval of the definitive settlement agreement in the derivative shareholder lawsuits; weather conditions, such as temperature variations and severe weather conditions, or other natural disasters affecting future operating results and associated regulatory actions or outcomes in response to such conditions; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity, cybersecurity, and climate change; the ability to accomplish or realize anticipated benefits from our FE Forward initiative and our other strategic and financial goals, including, but not limited to, overcoming current uncertainties and challenges associated with the ongoing government investigations, executing our transmission and distribution investment plans, greenhouse gas reduction goals, controlling costs, improving our credit metrics, growing earnings, strengthening our balance sheet, and satisfying the conditions necessary to close the sale of the minority interest in FirstEnergy Transmission, LLC; the risks associated with cyber-attacks and other disruptions to our, or our vendors’, information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; the extent and duration of the COVID-19 pandemic and the related impacts to our business, operations and financial condition resulting from the outbreak of COVID-19 including, but not limited to, disruption of businesses in our territories, supply chain disruptions, additional costs, workforce impacts and governmental and regulatory responses to the pandemic, such as moratoriums on utility disconnections and workforce vaccination mandates; actions that may be taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; changes in assumptions regarding factors such as economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; changes in customers’ demand for power, including, but not limited to, economic conditions, the impact of climate change, or energy efficiency and peak demand reduction mandates; changes in national and regional economic conditions, including recession and inflationary pressure, affecting us and/or our customers and those vendors with which we do business; the potential of non-compliance with debt covenants in our credit facilities; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; changes to environmental laws and regulations, including, but not limited to, those related to climate change; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts, or causing us to make contributions sooner, or in amounts that are larger, than currently anticipated; labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, or adverse tax audit results or rulings; the risks and other factors discussed from time to time in our Securities and Exchange Commission (“SEC”) filings. Dividends declared from time to time on FirstEnergy Corp.’s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy Corp.’s Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in FirstEnergy Corp.’s filings with the SEC, including, but not limited to, the most recent Annual Report on Form 10-K and any subsequent Current Reports on Form 8-K. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such

factor on FirstEnergy Corp.’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy Corp. expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein or in the information incorporated by reference as a result of new information, future events or otherwise.

(042122)

Focused on Our Future 1Q 2022 Strategic & Financial Highlights Steven E. Strah, President and CEO K. Jon Taylor, SVP, CFO & Strategy

Forward-Looking Statements Forward-Looking Statements: This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management's intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” "forecast," "target," "will," "intend," “believe,” "project," “estimate," "plan" and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following the potential liabilities, increased costs and unanticipated developments resulting from government investigations and agreements, including those associated with compliance with or failure to comply with the Deferred Prosecution Agreement with the U.S. Attorney’s Office for the Southern District of Ohio; the risks and uncertainties associated with government investigations and audits regarding Ohio House Bill 6, as passed by Ohio’s 133rd General Assembly (“HB 6”) and related matters, including potential adverse impacts on federal or state regulatory matters, including, but not limited to, matters relating to rates; the risks and uncertainties associated with litigation, arbitration, mediation, and similar proceedings, particularly regarding HB 6 related matters, including risks associated with obtaining court approval of the definitive settlement agreement in the derivative shareholder lawsuits; weather conditions, such as temperature variations and severe weather conditions, or other natural disasters affecting future operating results and associated regulatory actions or outcomes in response to such conditions; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity, cybersecurity, and climate change; the ability to accomplish or realize anticipated benefits from our FE Forward initiative and our other strategic and financial goals, including, but not limited to, overcoming current uncertainties and challenges associated with the ongoing government investigations, executing our transmission and distribution investment plans, greenhouse gas reduction goals, controlling costs, improving our credit metrics, growing earnings, strengthening our balance sheet, and satisfying the conditions necessary to close the sale of the minority interest in FirstEnergy Transmission, LLC; the risks associated with cyber-attacks and other disruptions to our, or our vendors’, information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; the extent and duration of the COVID-19 pandemic and the related impacts to our business, operations and financial condition resulting from the outbreak of COVID-19 including, but not limited to, disruption of businesses in our territories, supply chain disruptions, additional costs, workforce impacts and governmental and regulatory responses to the pandemic, such as moratoriums on utility disconnections and workforce vaccination mandates; actions that may be taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; changes in assumptions regarding factors such as economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; changes in customers’ demand for power, including, but not limited to, economic conditions, the impact of climate change, or energy efficiency and peak demand reduction mandates; changes in national and regional economic conditions, including recession and inflationary pressure, affecting us and/or our customers and those vendors with which we do business; the potential of non-compliance with debt covenants in our credit facilities; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; changes to environmental laws and regulations, including, but not limited to, those related to climate change; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts, or causing us to make contributions sooner, or in amounts that are larger, than currently anticipated; labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, or adverse tax audit results or rulings; the risks and other factors discussed from time to time in our Securities and Exchange Commission (“SEC”) filings. Dividends declared from time to time on FirstEnergy Corp.’s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy Corp.’s Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in FirstEnergy Corp.’s filings with the SEC, including, but not limited to, the most recent Annual Report on Form 10-K and any subsequent Current Reports on Form 8-K. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on FirstEnergy Corp.’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy Corp. expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein or in the information incorporated by reference as a result of new information, future events or otherwise. Strategic & Financial Highlights – Published April 21, 20222

Non-GAAP Financial Matters This presentation contains references to non-GAAP financial measures including, among others, Operating earnings (loss), Operating earnings (loss) per share (“EPS”), and Operating EPS by segment. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with accounting principles generally accepted in the United States (“GAAP”). Operating earnings (loss), Operating EPS, and Operating EPS by segment are not calculated in accordance with GAAP to the extent they exclude the impact of “special items.” Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating the Company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items are not necessarily non-recurring. Management cannot estimate on a forward-looking basis the impact of these items in the context of long-term annual operating EPS growth rate projections because these items, which could be significant, are difficult to predict and may be highly variable. Consequently, the Company is unable to reconcile long- term annual operating EPS growth projections to a GAAP measure without unreasonable effort. Basic (GAAP) EPS and Operating EPS and Basic (GAAP) EPS and Operating EPS for each segment are calculated by dividing Operating earnings (loss), which excludes special items as discussed above, for the periods presented by 545 million shares for the full year 2021, 543 million for the first quarter of 2021, 570 million shares for the first quarter of 2022, and 571 million shares for the second quarter and full year 2022. Management uses non-GAAP financial measures such as Operating earnings (loss), and Operating EPS to evaluate the Company’s performance and manage its operations and frequently references these non-GAAP financial measures in its decision-making, using them to facilitate historical and ongoing performance comparisons. Additionally, management uses Operating EPS by segment to further evaluate the Company’s performance by segment and references this non-GAAP financial measure in its decision-making. Management believes that the non-GAAP financial measures of Operating earnings (loss), Operating EPS and Operating EPS by segment provide consistent and comparable measures of performance of its businesses on an ongoing basis. Management also believes that such measures are useful to shareholders and other interested parties to understand performance trends and evaluate the Company against its peer group by presenting period-over-period operating results without the effect of certain charges or benefits that may not be consistent or comparable across periods or across the Company’s peer group. All of these non-GAAP financial measures are intended to complement, and are not considered as alternatives to, the most directly comparable GAAP financial measures. Also, the non-GAAP financial measures may not be comparable to similarly titled measures used by other entities. Pursuant to the requirements of Regulation G, FE has provided, where possible without unreasonable effort, quantitative reconciliations within this presentation of the non-GAAP financial measures to the most directly comparable GAAP financial measures. Strategic & Financial Highlights – Published April 21, 20223

Moving FirstEnergy Forward Steve Strah, President and CEO Strategic & Financial Highlights – Published April 21, 20224 Reported 1Q22 GAAP EPS of $0.51 and Operating (non-GAAP) EPS of $0.60 Updating 2022 GAAP EPS forecast to $2.37-$2.57 Reaffirming 2022 Operating (non-GAAP) EPS guidance of $2.30-$2.50 Reaffirming long-term annual Operating EPS growth rate of 6%-8% Reaffirming 2022 Cash From Operations guidance of $2.6B-$3.0B ■ Cultural transformation ■ Enhancing the customer experience ■ Strong financial & operating results Focus for Today’s Call:

Continuing our Transformation A strong foundation, an unrelenting customer focus, and a leader in the energy transition Strategic & Financial Highlights – Published April 21, 20225 ■ Formed a cross-functional Culture Transformation working group to consolidate, coordinate and streamline numerous initiatives designed to drive culture change ■ Striving to empower employees, make their jobs more meaningful, and encourage the candor and collaboration to make our company more innovative, customer focused, and a great place to work Integrity We always act ethically with honesty, humility and accountability. Safety We keep ourselves and others safe. Diversity, Equity and Inclusion We embrace differences, ensure every employee is treated fairly and create a culture where everyone feels they belong. Performance Excellence We pursue excellence and seek opportunities for growth, innovation and continuous improvement. Stewardship We positively impact our customers, communities and other stakeholders, and strive to protect the environment. 2022 Culture Transformation Focus Areas Embed our refreshed core values into every aspect of our culture Fostering an open, trusting environment where leaders create opportunities for two-way dialogue and employees feel valued and empowered Improve advancement and development opportunities for our employees

Enhancing the Customer Experience Strategic & Financial Highlights – Published April 21, 20226 ■ Launched an enhanced campaign to engage residential customers who may be facing financial hardships with the goal of inviting customers to come to us for help ■ Through March 2022, 250K+ enrolled customers in utility assistance programs with $71M in funding ■ This effort contributed to a continued decline in past-due balances, which are now on par with pre-pandemic levels in Ohio and West Virginia ■ Recently enhanced our website for customers to better understand and pay their bills – New features to easily make a payment for a family member or friend, enroll in payment plans, identify assistance programs and avoid service disconnection Through FE Forward, customer-focused initiatives include numerous projects designed to enhance communications, self-service options, and a better experience

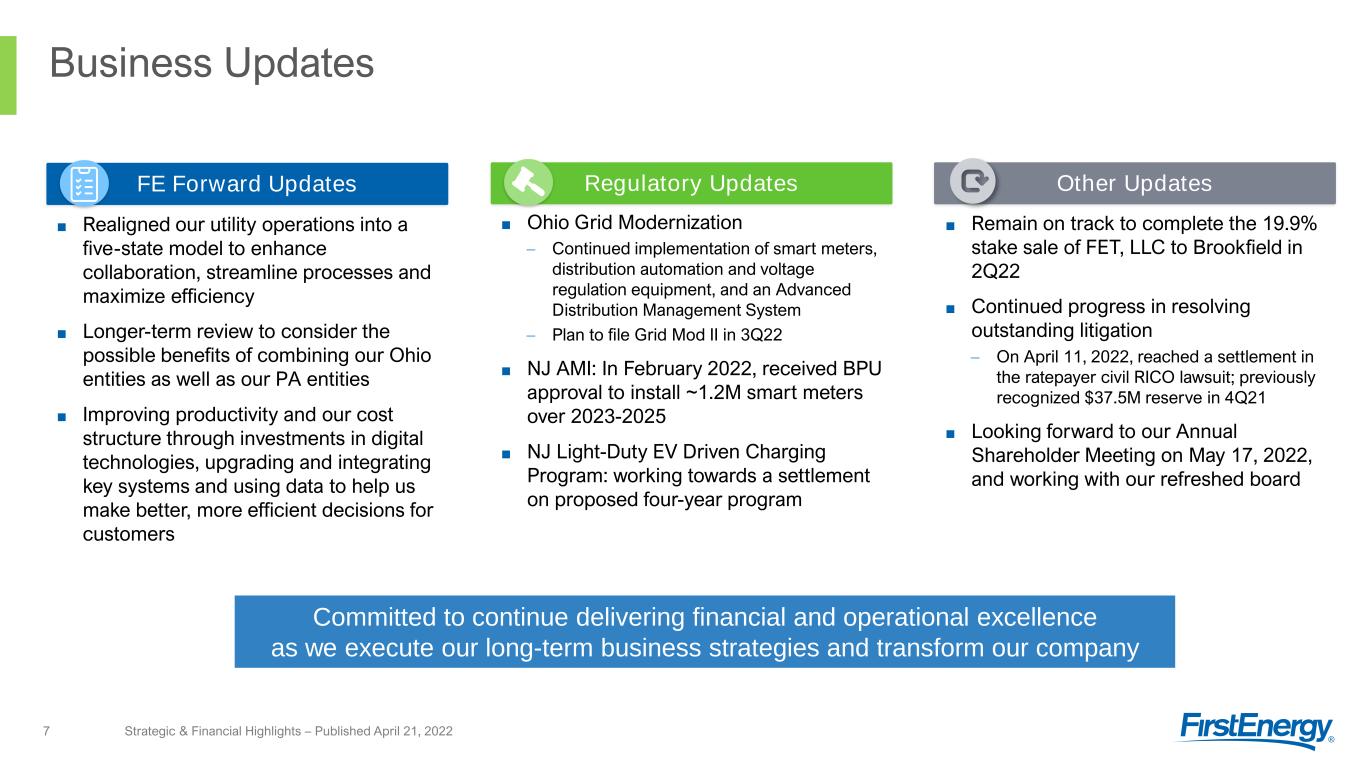

FE Forward Updates Business Updates Strategic & Financial Highlights – Published April 21, 20227 ■ Realigned our utility operations into a five-state model to enhance collaboration, streamline processes and maximize efficiency ■ Longer-term review to consider the possible benefits of combining our Ohio entities as well as our PA entities ■ Improving productivity and our cost structure through investments in digital technologies, upgrading and integrating key systems and using data to help us make better, more efficient decisions for customers Regulatory Updates Other Updates ■ Remain on track to complete the 19.9% stake sale of FET, LLC to Brookfield in 2Q22 ■ Continued progress in resolving outstanding litigation – On April 11, 2022, reached a settlement in the ratepayer civil RICO lawsuit; previously recognized $37.5M reserve in 4Q21 ■ Looking forward to our Annual Shareholder Meeting on May 17, 2022, and working with our refreshed board ■ Ohio Grid Modernization – Continued implementation of smart meters, distribution automation and voltage regulation equipment, and an Advanced Distribution Management System – Plan to file Grid Mod II in 3Q22 ■ NJ AMI: In February 2022, received BPU approval to install ~1.2M smart meters over 2023-2025 ■ NJ Light-Duty EV Driven Charging Program: working towards a settlement on proposed four-year program Committed to continue delivering financial and operational excellence as we execute our long-term business strategies and transform our company

1Q 2022 Earnings Summary Jon Taylor, SVP, CFO and Strategy ■ Reported 1Q 2022 GAAP earnings of $0.51 per share vs. $0.62 per share in 1Q21 – 1Q 2022 results include $0.09 of special items, including debt related costs ($0.06), regulatory charges ($0.01), strategic transaction charges ($0.01) and investigation and other related costs ($0.01) ■ Reported 1Q 2022 Operating (non-GAAP) earnings of $0.60 per share vs. $0.69 per share in 1Q21 ■ As discussed previously, results reflect several unique drivers to 2022, including accounting policy changes, Ohio rate credits, and the impact of equity financing transactions – No impact from planned FET minority interest sale in 1Q; expect transaction to close in 2Q22 Strategic & Financial Highlights – Published April 21, 20228 Quarter-over-Quarter Operating EPS Summary ✓ Operating results in line with guidance midpoint ✓ Continued execution of our regulated growth strategy Note: Reconciliations between GAAP and Operating (non-GAAP) earnings and detailed information is available in the Earnings Supplement and Quarterly Support sections of the Strategic & Financial Highlights RD: $0.62 RT: $0.20 Corp: ($0.13) RD: $0.48 RT: $0.22 Corp: ($0.10) Acctg. Policy Changes ($0.05) Ohio Rate Credits ($0.03) Equity Transaction ($0.04) $0.57 RD: $0.51 RT: $0.19 Corp: ($0.13) Total Weather-Adj. Sales +1.4% Res -1.5% Com +4.7% Ind +2.5% Higher planned gen. outage spend, employee benefits and non- deferred storm costs, partially offset by lower uncollectible expense Lower FE Corp. interest expense, offset by higher pension expense and depreciation Energizing the Future program and certain passive investments Vs. 1Q Guidance (Range: $0.55 - $0.65)

Financial Updates Strategic & Financial Highlights – Published April 21, 20229 We’re off to a solid start this year, and we’ve got an excellent transformation plan to continue becoming an industry-leading company focused on long-term value for all stakeholders ■ Met with Moody’s, S&P and Fitch in April 2022 to discuss our continued transformation and ongoing efforts to improve our balance sheet – Focused on 13% FFO-to-Debt no later than 2024; targeting mid-teens thereafter ■ Plan to use a significant portion of the $3.4B proceeds from the Brookfield and Blackstone transactions to strengthen our balance sheet and to fund investments – This includes reducing FE Corp debt by $1.35B and recapitalizing certain operating companies – Options to deploy the remaining $800M include a pension contribution, further FE Corp debt reduction, or to fund investments ■ Well-positioned in the current rising interest rate environment, given our 2022 debt financing plan and minimal draws on our revolving credit facilities ■ Rising interest rates and market volatility have impacted our pension plan – Although the funded status has improved, the volatility creates a potential headwind for higher pension expense in 2023 and beyond – We will continue to monitor potential impacts and are thinking through different opportunities to offset this potential headwind Operating (Non-GAAP) Earnings $2.30-$2.50/sh Cash From Operations guidance $2.6-$3.0B Investment plan $3.3B Annual dividend (subject to Board approval) $1.56/sh 2022 Financial Commitments 2Q22 GAAP & Operating (non-GAAP) Earnings: $0.46-$0.56/sh Note: Reconciliations between GAAP and Operating (non-GAAP) earnings and detailed information is available in the Earnings Supplement and Quarterly Support sections of the Strategic & Financial Highlights Qualified Pension 3/31/22 YE 2021 Funded Status 84% 82% Discount Rate 3.75% 3.02% Return on Assets -5.8% (YTD) 7.6% (Full year)

Earnings Supplement to the Financial Community Strategic & Financial Highlights – Published April 21, 2022 11. 1Q Earnings Summary and Reconciliation 12. 1Q Earnings Drivers by Segment 13. Special Items Descriptions 14. 1Q 2022 Earnings Results 15. 1Q 2021 Earnings Results 16. Quarter-over-Quarter Earnings Comparison TABLE OF CONTENTS (Slide) Irene M. Prezelj Vice President, IR & Communications [email protected] 330.384.3859 Gina E. Caskey Director, IR & Corporate Responsibility [email protected] 330.761.4185 Jake M. Mackin Manager, IR [email protected] 330.384.4829 10

EPS Variance Analysis FirstEnergy Regulated Regulated Corporate / Corp. (in millions, except per share amounts) Distribution Transmission Other Consolidated 2021 Net Income (Loss) (GAAP) $313 $109 $(87) $335 2021 Basic Earnings (Loss) Per Share (avg. shares outstanding 543M) $0.58 $0.20 $(0.16) $0.62 Special Items - 2021 Regulatory charges 0.04 — — 0.04 Investigation and other related costs — — 0.03 0.03 Total Special Items - 2021 0.04 — 0.03 0.07 2021 Operating Earnings (Loss) Per Share - Non-GAAP $0.62 $0.20 $(0.13) $0.69 Accounting policy changes (0.05) — — (0.05) Ohio rate credits (0.03) — — (0.03) Equity financing transaction (0.03) (0.01) — (0.04) 2021 Pro-Forma $0.51 $0.19 $(0.13) $0.57 Investments — 0.02 0.02 0.04 Customer demand 0.01 — — 0.01 O&M (0.02) — — (0.02) Other (0.02) 0.01 0.01 — 2022 Operating Earnings (Loss) Per Share - Non-GAAP $0.48 $0.22 $(0.10) $0.60 Special Items - 2022 Regulatory charges (0.01) — — (0.01) Debt related costs — — (0.06) (0.06) Strategic transaction charges — — (0.01) (0.01) Investigation and other related costs — — (0.01) (0.01) Total Special Items - 2022 (0.01) — (0.08) (0.09) 2022 Basic Earnings (Loss) Per Share (avg. shares outstanding 570M) $0.47 $0.22 $(0.18) $0.51 2022 Net Income (Loss) (GAAP) $265 $125 $(102) $288 Per share amounts for the special items and earnings drivers above and throughout this report are based on the after-tax effect of each item divided by the number of shares outstanding for the period. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29% in 2022 and 2021. First Quarter Summary First Quarter Reconciliation 2022 2021 Change GAAP Earnings Per Basic Share $0.51 $0.62 $(0.11) Special Items $0.09 $0.07 $0.02 Operating (Non-GAAP) Earnings Per Share $0.60 $0.69 $(0.09) Note: Refer to slide 3 for information on Non-GAAP Financial Matters. Strategic & Financial Highlights – Published April 21, 202211

Earnings Drivers: 1Q 2022 vs. 1Q 2021 Regulated Distribution (RD) ▪ Accounting policy changes ($0.05): Due to lower capitalization of vegetation management spend ($0.03) and corporate support costs ($0.02) ▪ Ohio rate credits ($0.03): Resulting from the 4Q21 unanimous settlement to provide FE's Ohio customers with a total of $80M in prospective rate reductions in 2022 ▪ Equity financing transactions ($0.03): Due to higher average shares outstanding (570M vs. 543M in 1Q 2021) ▪ Customer Demand +$0.01: Higher weather-related usage and weather-adjusted load (+$0.01) ▪ O&M ($0.02): Primarily due to higher planned generation outage spend ($0.01), employee benefits ($0.01) and non-deferred storm costs ($0.01), partially offset by lower uncollectible expense (+$0.01) ▪ Other ($0.02): Primarily due to higher pension expense ($0.01) and depreciation expense ($0.01) ▪ Special Items: In 1Q22 and 1Q21, special items totaled $0.01 per share and $0.04 per share, respectively Regulated Transmission (RT) ▪ Equity financing transactions ($0.01): Due to higher average shares outstanding ▪ Investments +$0.02: Due to continued formula rate base growth from Energizing the Future program ▪ Other +$0.01: Higher capitalized interest due to the absence of an adjustment recognized in 1Q21 Corporate / Other (Corp) ▪ Investments +$0.02: Higher returns on certain passive investments ▪ Other +$0.01: Lower interest expense from the early redemption of an $850M FE Corp note due 2023 (+$0.02), partially offset by higher misc. and other operating expenses ($0.01) ▪ Special Items: In 1Q22 and 1Q21, special items totaled $0.08 per share and $0.03 per share, respectively (1.5)% 4.7% 2.5% 1.4% Residential Commercial* Industrial Total Q-o-Q Weather-Adjusted Distribution Deliveries *Commercial includes street lighting. Q-o-Q Actual Distribution Deliveries 2.2% 7.6% 2.5% 3.6% Residential Commercial* Industrial Total Strategic & Financial Highlights – Published April 21, 202212

Special Items Descriptions ▪ Regulatory charges: Primarily reflects the impact of regulatory agreements, proceedings, audits, concessions or orders requiring certain commitments, refunds, and/or disallowing the recoverability of costs, net of related credits. ▪ Debt-related costs: Primarily reflects costs associated with the redemption and early retirement of debt. ▪ Strategic transaction charges: Primarily reflects the remeasurement of certain deferred tax assets associated with the planned FET minority asset sale. ▪ Investigation and other related costs (credits): Primarily reflects the litigation settlements and reserves, and legal and advisory expenses related to the government investigations. ▪ FE Forward cost to achieve: Primarily reflects certain advisory costs incurred to transform the company for the future. Note: Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating, the Company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items are not necessarily non-recurring. Strategic & Financial Highlights – Published April 21, 202213

1Q 2022 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 2,532 $ 451 $ (39) $ 2,944 $ — $ 2 (a) $ — $ 2 $ 2,532 $ 453 $ (39) $ 2,946 (2) Other 57 2 (14) 45 — — — — 57 2 (14) 45 (3) Total Revenues 2,589 453 (53) 2,989 — 2 — 2 2,589 455 (53) 2,991 (4) Fuel 140 — — 140 — — — — 140 — — 140 (5) Purchased power 870 — 5 875 — — — — 870 — 5 875 (6) Other operating expenses 798 90 (68) 820 (1) (e) — (9) (d) (10) 797 90 (77) 810 (7) Provision for depreciation 235 86 19 340 — — — — 235 86 19 340 (8) Amortization (deferral) of regulatory assets, net (38) 1 — (37) (7) (a) — — (7) (45) 1 — (44) (9) General taxes 215 66 11 292 — — — — 215 66 11 292 (10) Total Operating Expenses 2,220 243 (33) 2,430 (8) — (9) (17) 2,212 243 (42) 2,413 (11) Operating Income (Loss) 369 210 (20) 559 8 2 9 19 377 212 (11) 578 (12) Miscellaneous income, net 85 6 15 106 — — — — 85 6 15 106 (13) Interest expense (129) (59) (125) (313) — — 40 (b) 40 (129) (59) (85) (273) (14) Capitalized financing costs 9 9 1 19 — — — — 9 9 1 19 (15) Total Other Expense (35) (44) (109) (188) — — 40 40 (35) (44) (69) (148) (16) Income (Loss) Before Income Taxes (Benefits) 334 166 (129) 371 8 2 49 59 342 168 (80) 430 (17) Income taxes (benefits) 69 41 (27) 83 1 (a) (e) 1 (a) 5 (b)-(d) 7 70 42 (22) 90 (18) Net Income (Loss) 265 125 (102) 288 7 1 44 52 272 126 (58) 340 (19) Average Shares Outstanding 570 570 570 (20) Earnings (Loss) per Share $ 0.47 $ 0.22 $ (0.18) $ 0.51 $ 0.01 $ — $ 0.08 $ 0.09 $ 0.48 $ 0.22 $ (0.10) $ 0.60 Special Items (after-tax impact): (a) Regulatory charges $ 6 $ 1 $ — $ 7 (b) Debt related costs — — 32 32 (c) Strategic transaction charges — — 6 6 (d) Investigation and other related costs — — 6 6 (e) FE Forward cost to achieve 1 — — 1 Impact to Earnings $ 7 $ 1 $ 44 $ 52 Strategic & Financial Highlights – Published April 21, 202214

1Q 2021 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 2,316 $ 401 $ (34) $ 2,683 $ 26 (a) $ — $ — $ 26 $ 2,342 $ 401 $ (34) $ 2,709 (2) Other 54 4 (15) 43 — — — — 54 4 (15) 43 (3) Total Revenues 2,370 405 (49) 2,726 26 — — 26 2,396 405 (49) 2,752 (4) Fuel 118 — — 118 — — — — 118 — — 118 (5) Purchased power 714 — 4 718 — — — — 714 — 4 718 (6) Other operating expenses 728 67 (43) 752 (1) (b) — (23) (b) (24) 727 67 (66) 728 (7) Provision for depreciation 226 81 16 323 — — — — 226 81 16 323 (8) Amortization of regulatory assets, net 87 5 — 92 — — — — 87 5 — 92 (9) General taxes 201 62 10 273 — — — — 201 62 10 273 (10) Gain on sale of Yards Creek (109) — — (109) — — — — (109) — — (109) (11) Total Operating Expenses 1,965 215 (13) 2,167 (1) — (23) (24) 1,964 215 (36) 2,143 (12) Operating Income (Loss) 405 190 (36) 559 27 — 23 50 432 190 (13) 609 (13) Miscellaneous income, net 107 11 17 135 — — — — 107 11 17 135 (14) Interest expense (128) (61) (96) (285) — — — — (128) (61) (96) (285) (15) Capitalized financing costs 11 2 — 13 — — — — 11 2 — 13 (16) Total Other Expense (10) (48) (79) (137) — — — — (10) (48) (79) (137) (17) Income (Loss) Before Income Taxes (Benefits) 395 142 (115) 422 27 — 23 50 422 142 (92) 472 (18) Income taxes (benefits) 82 33 (28) 87 6 (a) (b) — 5 (a) (b) 11 88 33 (23) 98 (19) Net Income (Loss) 313 109 (87) 335 21 — 18 39 334 109 (69) 374 (20) Average Shares Outstanding 543 543 543 (21) Earnings (Loss) per Share $ 0.58 $ 0.20 $ (0.16) $ 0.62 $ 0.04 $ — $ 0.03 $ 0.07 $ 0.62 $ 0.20 $ (0.13) $ 0.69 Special Items (after-tax impact): (a) Regulatory charges $ 20 $ — $ — $ 20 (b) Investigation and other related costs 1 — 18 19 Impact to Earnings $ 21 $ — $ 18 $ 39 Strategic & Financial Highlights – Published April 21, 202215

1Q 2022 vs 1Q 2021 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 216 $ 50 $ (5) $ 261 $ (26) $ 2 $ — $ (24) $ 190 $ 52 $ (5) $ 237 (2) Other 3 (2) 1 2 — — — — 3 (2) 1 2 (3) Total Revenues 219 48 (4) 263 (26) 2 — (24) 193 50 (4) 239 (4) Fuel 22 — — 22 — — — — 22 — — 22 (5) Purchased power 156 — 1 157 — — — — 156 — 1 157 (6) Other operating expenses 70 23 (25) 68 — — 14 14 70 23 (11) 82 (7) Provision for depreciation 9 5 3 17 — — — — 9 5 3 17 (8) Amortization (deferral) of regulatory assets, net (125) (4) — (129) (7) — — (7) (132) (4) — (136) (9) General taxes 14 4 1 19 — — — — 14 4 1 19 (10) Gain on sale of Yards Creek 109 — — 109 — — — — 109 — — 109 (11) Total Operating Expenses 255 28 (20) 263 (7) — 14 7 248 28 (6) 270 (12) Operating Income (Loss) (36) 20 16 — (19) 2 (14) (31) (55) 22 2 (31) (13) Miscellaneous income, net (22) (5) (2) (29) — — — — (22) (5) (2) (29) (14) Interest expense (1) 2 (29) (28) — — 40 40 (1) 2 11 12 (15) Capitalized financing costs (2) 7 1 6 — — — — (2) 7 1 6 (16) Total Other Expense (25) 4 (30) (51) — — 40 40 (25) 4 10 (11) (17) Income (Loss) Before Income Taxes (Benefits) (61) 24 (14) (51) (19) 2 26 9 (80) 26 12 (42) (18) Income taxes (benefits) (13) 8 1 (4) (5) 1 — (4) (18) 9 1 (8) (19) Net Income (Loss) (48) 16 (15) (47) (14) 1 26 13 (62) 17 11 (34) (20) Average Shares Outstanding 27 27 27 (21) Earnings (Loss) per Share $ (0.11) $ 0.02 $ (0.02) $ (0.11) $ (0.03) $ — $ 0.05 $ 0.02 $ (0.14) $ 0.02 $ 0.03 $ (0.09) Strategic & Financial Highlights – Published April 21, 202216

Quarterly Support & Guidance Strategic & Financial Highlights – Published April 21, 2022 18. 2022 Key Priorities 19. 2022 Regulatory Calendar 20. TTM RD ROEs – by State 21. TTM Actual Sales by Class 22. TTM Weather-Adjusted Sales 23. TTM Weather Impacts 24. Credit Ratings Summary 25. Credit Profile 26. Debt Maturities Schedule 17 TABLE OF CONTENTS (Slide) 27. Financial Guidance Overview 28. Sustainable Investment Plan (2021-2025) 29. Investment Plan Summary 30. Rate Base Summary 31. Targeting 6-8% Annual Operating EPS Growth 32. 2022 Operating EPS Guidance 33. 2021-2025 Financial Plan 34. 2021-2025 Cash Flow and Debt Projections 35. Dividend Overview 36. Long-Term Load Forecast 37. 2022 Guidance Sensitivities 38. 2021 GAAP to Operating (Non-GAAP) Earnings Reconciliation 39. 2022F GAAP to Operating (Non-GAAP) Earnings Reconciliation 40. 2021-2022 Special Items Descriptions

2022 Key Priorities Strategic & Financial Highlights – Published April 21, 2022 ■ Transform how we operate and enhance our organization – Simplify and implement best practices throughout our organization – Focus on customer experience – Improve organizational health and culture ■ Focus on performance excellence – Invest in innovation and continuous improvement – Utilize data and analytics to drive efficient and better outcomes – Focus on effective and efficient operations ■ Refocus our investment strategy – Reinvest capital efficiencies to support the energy transition – Focus on lowering operating costs to keep customer rates affordable – Improve cash from operations to enhance our credit profile 18 ■ Working through various Ohio HB6 related proceedings ■ Preparing filings focused on sustainable investments that support the grid of the future and improve the customer experience – OH Grid Mod II – NJ Medium-Heavy Duty EV Charging Program ■ Working towards settlement and/or resolution – NJ AMI plan (approved) – NJ Light-Duty EV charging program – WV Solar filing – WV ELG fling – PE, MP, WPP Tx Formula Rate Cases ■ Preparing for rate case activity – MD (early 2023) – WV (early 2023) – NJ (likely 2023) – OH (2024) ■ Operating EPS guidance range of $2.30 - $2.50 ■ Cash from Operations guidance of $2.6B - $3.0B ■ Investment plan of $3.3B ■ Annual Dividend of $1.56/sh, subject to Board approval ■ Close on FET minority interest sale and implement financing plan ■ Focused on achieving investment-grade credit metrics and ratings ■ Continuing to build a more centralized and robust compliance organization under the leadership of the Chief Ethics and Compliance Officer ■ Updating and refining processes, policies and controls ■ Creating multiple channels for incident reporting and developing thorough and objective processes to investigate and address incidents of misconduct ■ Seeking continuous improvement by monitoring, benchmarking and independent assessment of the program ■ Integrating Governance, Risk, and Compliance tool to be a central repository for document management and case management Compliance Financial FE Forward Regulatory

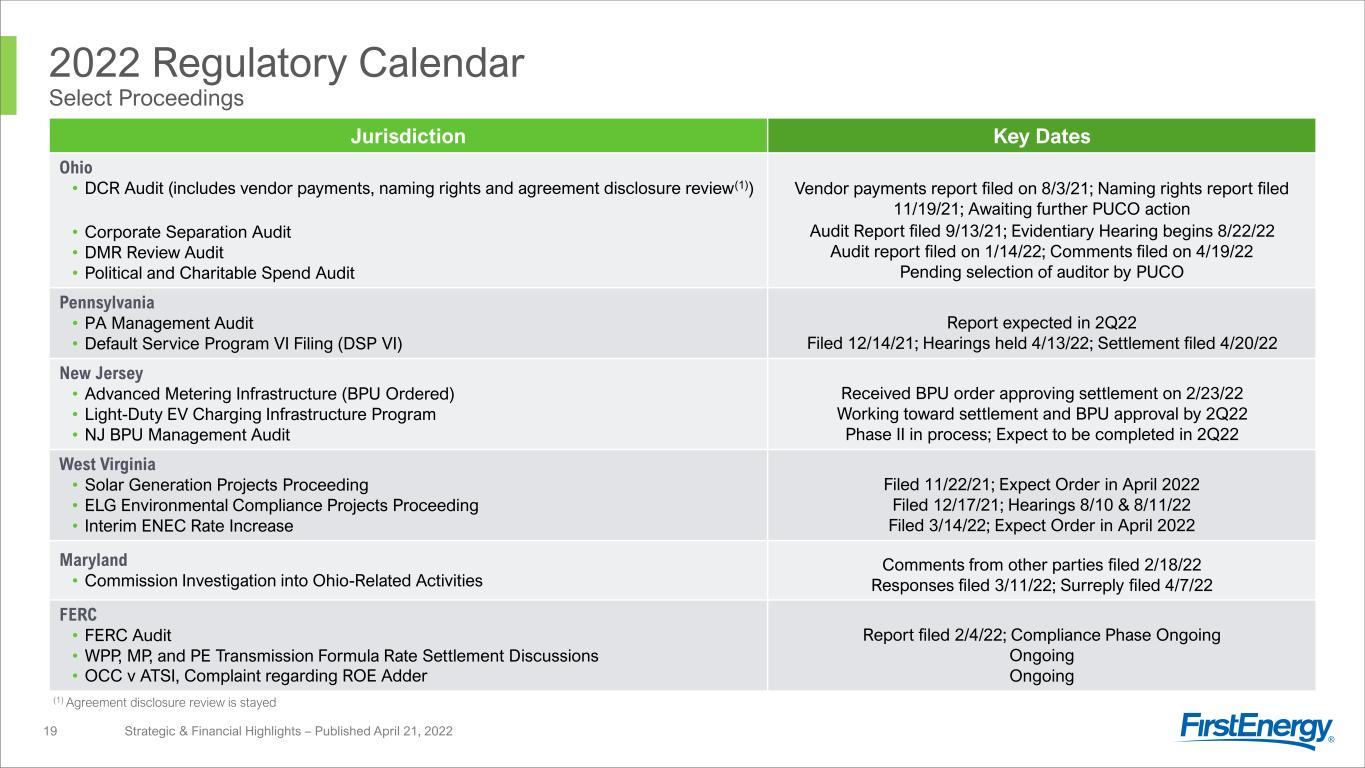

2022 Regulatory Calendar Select Proceedings Strategic & Financial Highlights – Published April 21, 2022 Jurisdiction Key Dates Ohio • DCR Audit (includes vendor payments, naming rights and agreement disclosure review(1)) • Corporate Separation Audit • DMR Review Audit • Political and Charitable Spend Audit Vendor payments report filed on 8/3/21; Naming rights report filed 11/19/21; Awaiting further PUCO action Audit Report filed 9/13/21; Evidentiary Hearing begins 8/22/22 Audit report filed on 1/14/22; Comments filed on 4/19/22 Pending selection of auditor by PUCO Pennsylvania • PA Management Audit • Default Service Program VI Filing (DSP VI) Report expected in 2Q22 Filed 12/14/21; Hearings held 4/13/22; Settlement filed 4/20/22 New Jersey • Advanced Metering Infrastructure (BPU Ordered) • Light-Duty EV Charging Infrastructure Program • NJ BPU Management Audit Received BPU order approving settlement on 2/23/22 Working toward settlement and BPU approval by 2Q22 Phase II in process; Expect to be completed in 2Q22 West Virginia • Solar Generation Projects Proceeding • ELG Environmental Compliance Projects Proceeding • Interim ENEC Rate Increase Filed 11/22/21; Expect Order in April 2022 Filed 12/17/21; Hearings 8/10 & 8/11/22 Filed 3/14/22; Expect Order in April 2022 Maryland • Commission Investigation into Ohio-Related Activities Comments from other parties filed 2/18/22 Responses filed 3/11/22; Surreply filed 4/7/22 FERC • FERC Audit • WPP, MP, and PE Transmission Formula Rate Settlement Discussions • OCC v ATSI, Complaint regarding ROE Adder Report filed 2/4/22; Compliance Phase Ongoing Ongoing Ongoing 19 (1) Agreement disclosure review is stayed

RD Segment – State ROEs TTM 3/31/2022 Strategic & Financial Highlights – Published April 21, 202220 Key Common Regulatory Adjustments ■ Actual revenue, not weather normalized ■ Income taxes calculated using statutory rates, consistent with practice used in base rate case filings ■ Pension/OPEB expense adjusted for jurisdictional ratemaking treatment ROE Projections Absent base rate increases, ROEs for most jurisdictions expected to decrease: ■ Growth in rate base and associated expenses due to incremental capital investments ■ Projected increase in equity capitalization rates due to deployment of equity financing proceeds ■ Accounting changes(3) – capital to expense: – Vegetation management (~$90M annual) – Corporate support (~$60M annual) (1) Calculated using allowed capital structure for OH, actual capital structure for PA, WV & MD and actual capital structure for NJ (adjusted for Goodwill) – consistent methodology as the last base rate case and/or quarterly earnings reports, as applicable (2) Includes generation and transmission (3) Amounts estimated, rounded to the nearest $10M and assumed in 2022 earnings guidance; corporate support subject to completion of time study Rate base at 3/31/22 $4.0B $6.0B $2.9B $3.2B $0.5B Equity/Total Capitalization(1) 49% 52% 49% 46% 53% ROE EPS Sensitivity +/- 1% ~$0.03 ~$0.05 ~$0.02 ~$0.03 ~$0.01 12.7% 10.1% 8.2% 9.4% 8.7% 9.0% 8.7% 7.8% 9.0% 7.0% 0% 5% 10% 15% OH PA NJ WV MD (2) TTM Pro-forma ROE (with 12 months of accounting changes(3) and 2022 Ohio rate credits) Actual TTM ROE

(MWh in thousands) 2Q20 2Q21 3Q20 3Q21 4Q20 4Q21 1Q21 1Q22 TTM 1Q21 TTM 1Q22 Residential 12,764 12,347 16,091 15,652 12,919 12,735 14,890 15,213 56,664 55,947 Commercial 7,824 8,590 9,589 9,785 8,495 8,594 8,631 9,291 34,539 36,260 Industrial 12,010 13,384 13,560 14,018 12,916 13,368 13,257 13,583 51,743 54,353 Total 32,598 34,321 39,240 39,455 34,330 34,697 36,778 38,087 142,946 146,560 Sales by Class Percent change vs. prior year Strategic & Financial Highlights – Published April 21, 2022 Commercial includes street lighting 21 -3.3% -2.7% -1.4% 2.2% -1.3% 9.8% 2.0% 1.2% 7.6% 5.0% 11.4% 3.4% 3.5% 2.5% 5.0%5.3% 0.5% 1.1% 3.6% 2.5% 2Q21 3Q21 4Q21 1Q22 TTM Residential Commercial Industrial Total

(MWh in thousands) 2Q20 2Q21 3Q20 3Q21 4Q20 4Q21 1Q21 1Q22 TTM 1Q21 TTM 1Q22 Residential 12,669 11,861 15,157 15,200 13,418 13,220 15,397 15,170 56,641 55,451 Commercial 7,823 8,466 9,360 9,672 8,631 8,753 8,853 9,265 34,667 36,156 Industrial 12,007 13,384 13,533 14,018 12,942 13,368 13,258 13,583 51,740 54,353 Total 32,499 33,711 38,050 38,890 34,991 35,341 37,508 38,018 143,048 145,960 Weather-Adjusted Sales by Class Percent change vs. prior year Strategic & Financial Highlights – Published April 21, 2022 l Commercial includes street lighting. 22 -6.4% 0.3% -1.5% -1.5% -2.1% 8.2% 3.3% 1.4% 4.7% 4.3% 11.5% 3.6% 3.3% 2.5% 5.0% 3.7% 2.2% 1.0% 1.4% 2.0% 2Q21 3Q21 4Q21 1Q22 TTM Residential Commercial Industrial Total

Weather Impacts Strategic & Financial Highlights – Published April 21, 202223 0 100 200 300 400 500 1,250 1,000 750 500 250 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 HDD CDD HDD Norm CDD Norm OH PA NJ WV MD Total Days % Days % Days % Days % Days % Days % 1Q22 HDD vs Normal -57 -2% -12 0% 1 0% -23 -1% -85 -3% -30 -1% HDD vs 1Q21 146 5% 117 4% 75 3% 54 2% 69 3% 110 4%

■ On November 8, 2021, Moody’s changed FE’s outlook to Positive from Stable • Outlook changed at OE to Stable from Negative ■ On November 8, 2021, S&P issued one- notch upgrade for FE and all subsidiaries • Outlook changed on FE, FET, and all subsidiaries to Stable from CreditWatch Positive ■ On November 12, 2021, Fitch changed outlook on FE, FET, and all subsidiaries to Positive from Stable Credit Ratings As of April 18, 2022 Strategic & Financial Highlights – Published April 21, 2022 Most recent ratings actions in November 2021 24 S&P Moody's Fitch S&P Moody's Fitch S&P Moody's Fitch S&P Moody's Fitch FirstEnergy Corp. (*) BBB- Ba1 BB+ BB+ Ba1 BB+ S P P Allegheny Generating Co. BB+ Baa2 BBB- S S P American Transmission Systems Inc. BBB A3 BBB- BBB A3 BBB S S P Cleveland Electric Illuminating BBB Baa2 BBB- A- A3 BBB+ BBB Baa2 BBB S N P FirstEnergy Transmission (*) BBB- Baa2 BB+ BB+ Baa2 BB+ S S P Jersey Central Power & Light BBB A3 BBB- BBB A3 BBB S S P Metropolitan Edison BBB A3 BBB- BBB A3 BBB S S P Mid-Atlantic Interstate Transmission BBB A3 BBB- BBB A3 BBB S S P Monongahela Power BBB Baa2 BBB- A- A3 BBB+ BBB Baa2 S S P Ohio Edison BBB A3 BBB- A- A1 BBB+ BBB A3 BBB S S P Pennsylvania Electric BBB Baa1 BBB- BBB Baa1 BBB S S P Pennsylvania Power BBB A3 BBB- A- A1 BBB+ S S P Potomac Edison BBB Baa2 BBB- A- A3 BBB+ S S P Toledo Edison BBB Baa1 BBB- A- A2 BBB+ S N P Trans-Allegheny Interstate Line Co. BBB A3 BBB- BBB A3 BBB S S P West Penn Power BBB A3 BBB- A- A1 BBB+ S S P S = Stable (*) = holding company P = Positive Shaded cells reflect non-investment grade ratings N = Negative Ratings are not recommendations to buy, sell, or hold securities. Ratings are subject to change or withdrawal at any time by the credit rating agencies. Issuer/Corporate Family Senior Secured Senior Unsecured Outlook/CreditWatch

Credit Profile As of April 18, 2022 Strategic & Financial Highlights – Published April 21, 2022 (1) S&P could raise the ratings on FE and its subsidiaries over the next 12-24 months if FE maintains FFO to debt consistently above 12% or if the company improves management and governance. This could occur if FE reduces its leverage and demonstrates it can effectively manage its regulatory risk on a consistent basis. (2) Moody’s rating upgrade could be considered if the regulatory environments in all jurisdictions remain stable and the company continues to improve its risk profile, both from a financial and corporate governance standpoint. Also, if its financial metrics improve, including CFO pre-WC to debt above 12%, a rating upgrade could be possible. 25 FE Corp: 2.5x interest coverage ratio FET, LLC: 75% debt-to-capitalization ratio Utilities & Transmission Companies: 65% debt-to-capitalization ratio FE Corp & FET, LLC $1,000M OH $800M PA $950M NJ $500M WV & MD $400M Tx Op Co's $850M Total: $4.5B ▪ Focused on 13% FFO-to-Debt no later than 2024; targeting mid-teens thereafter ▪ Targeting ~25% FE Corp. HoldCo debt as % of total debt ▪ Long-term aspiration to be a BBB company BB+, Stable Outlook 12% FFO/Debt upgrade threshold(1) Ba1, Positive Outlook 12% CFO pre-WC/Debt upgrade threshold (2) BB+, Positive Outlook 6.5x FFO Leverage upgrade threshold Focused on Investment-Grade ratings All Utilities and Transmission Companies are Investment-Grade at all 3 Rating Agencies Focused on strong Liquidity ▪ Available Liquidity: $4.5B, includes ~$383M of cash and cash equivalents ▪ $4.5B Revolving credit facilities; committed through October 18, 2026 ✓ In compliance with bank covenants

Consolidated Long-Term Debt Maturities As of March 31, 2022 Strategic & Financial Highlights – Published April 21, 2022 $22.4B FACE VALUE AVG RATES FEU FET CORP 4.54% 4.01% 4.47% AVG LENGTH FEU FET CORP 12yrs 11yrs 12yrs $M Excludes securitization bonds 26 2 0 0 3 0 0 1 ,2 0 0 4 5 0 6 5 0 4 5 0 7 7 5 1 ,0 0 5 3 0 0 7 0 0 1 2 5 8 5 0 6 0 0 5 2 5 1 0 0 6 0 0 2 0 0 2 9 5 2 5 5 3 7 5 5 0 4 5 1 0 0 5 0 2 5 0 1 ,2 2 5 7 5 1 ,1 0 0 1 0 0 1 0 0 8 7 5 1 2 5 8 0 0 7 5 5 0 0 5 0 0 3 0 0 3 0 0 1 ,5 0 0 1 ,0 5 0 1 ,5 0 0 1 ,0 0 0 8 5 0 - 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2 0 2 2 2 0 2 3 2 0 2 4 2 0 2 5 2 0 2 6 2 0 2 7 2 0 2 8 2 0 2 9 2 0 3 0 2 0 3 1 2 0 3 2 2 0 3 4 2 0 3 5 2 0 3 6 2 0 3 7 2 0 3 8 2 0 4 0 2 0 4 3 2 0 4 4 2 0 4 5 2 0 4 6 2 0 4 7 2 0 4 8 2 0 4 9 2 0 5 0 2 0 5 1 2 0 5 6 2 0 5 9 FEU FET FE Corp.

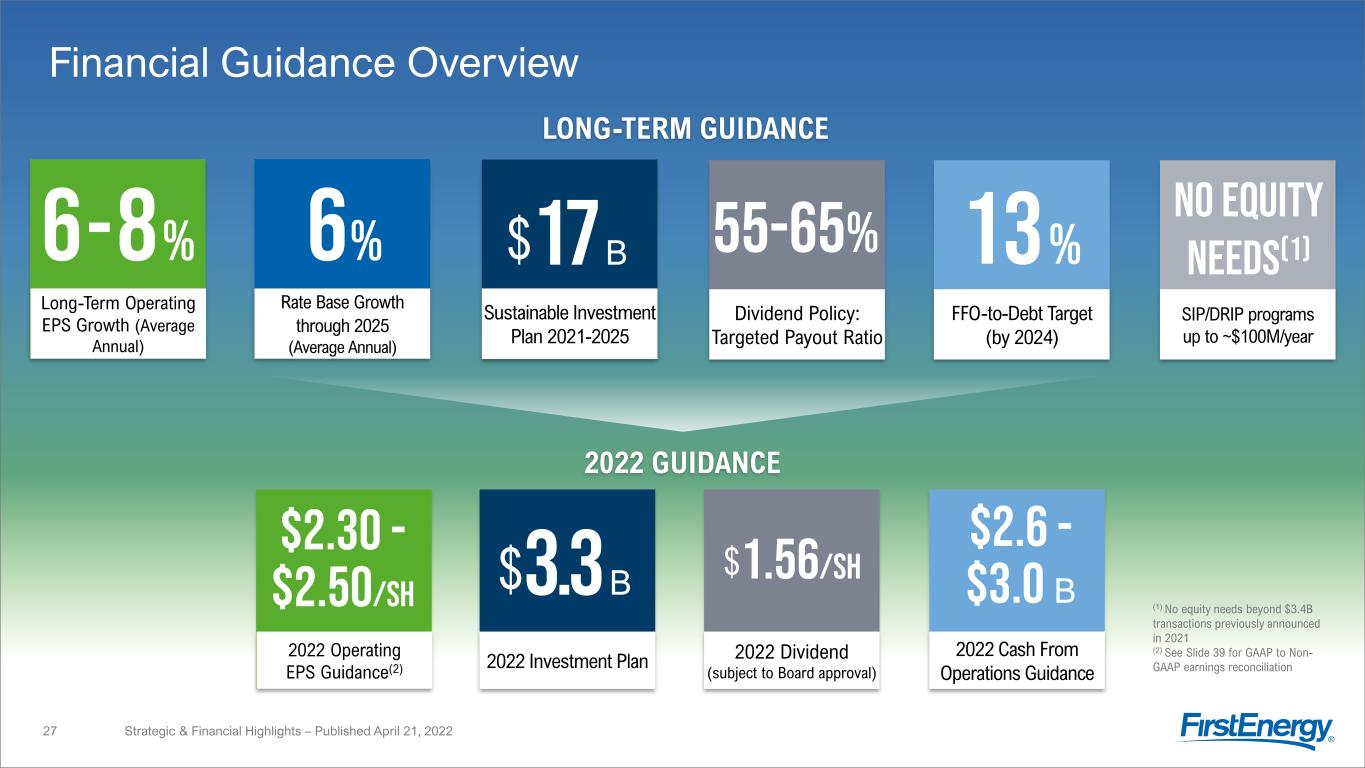

6 % 55-65% 13%6-8% Financial Guidance Overview Long-Term Operating EPS Growth (Average Annual) Rate Base Growth through 2025 (Average Annual) Dividend Policy: Targeted Payout Ratio FFO-to-Debt Target (by 2024) LONG-TERM GUIDANCE 1.56/SH $2.30 - $2.50/sh 2022 Operating EPS Guidance(2) 2022 Investment Plan 2022 Dividend (subject to Board approval) 2022 GUIDANCE 3.3B 2022 Cash From Operations Guidance Sustainable Investment Plan 2021-2025 17B No Equity Needs(1) SIP/DRIP programs up to ~$100M/year $2.6 - $3.0 B (1) No equity needs beyond $3.4B transactions previously announced in 2021 (2) See Slide 39 for GAAP to Non- GAAP earnings reconciliation Strategic & Financial Highlights – Published April 21, 202227

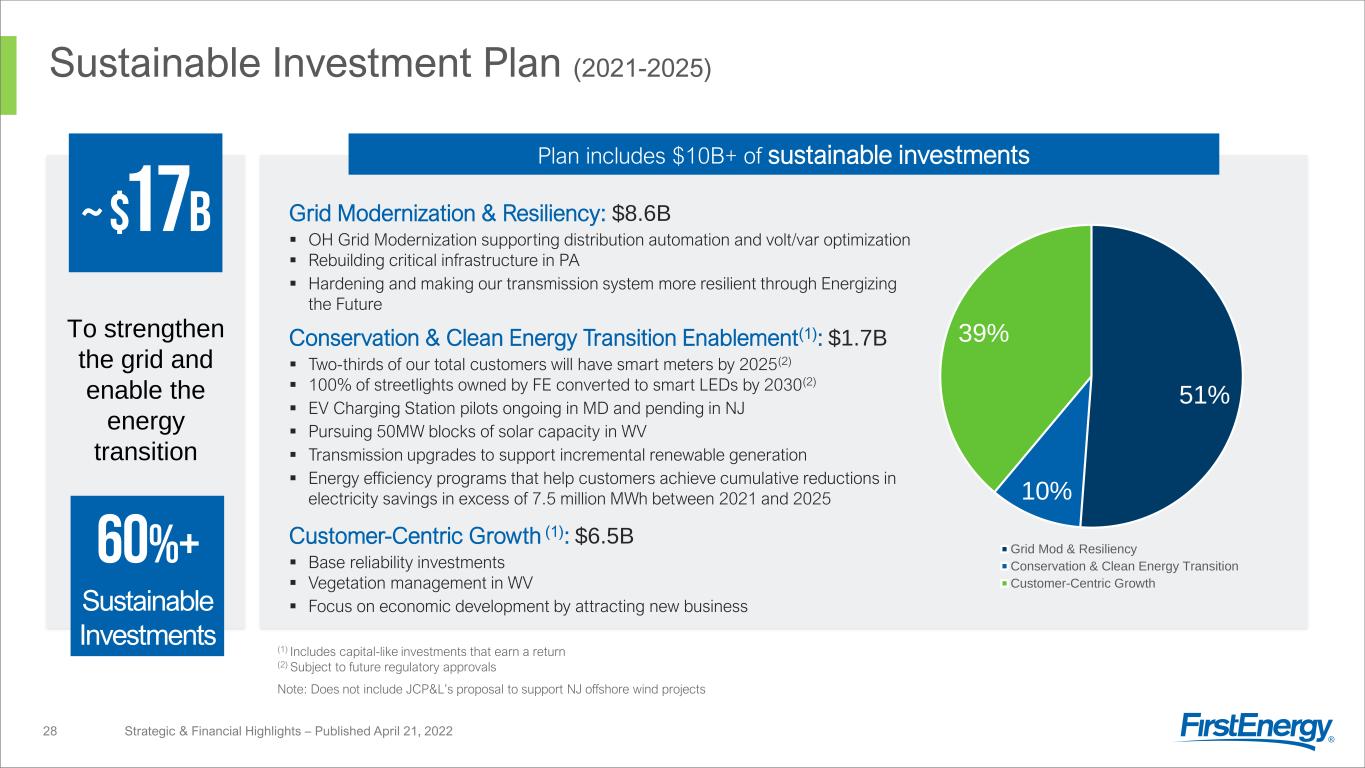

Sustainable Investment Plan (2021-2025) (1) Includes capital-like investments that earn a return (2) Subject to future regulatory approvals Note: Does not include JCP&L’s proposal to support NJ offshore wind projects To strengthen the grid and enable the energy transition Plan includes $10B+ of sustainable investments ~ $17B Grid Modernization & Resiliency: $8.6B ▪ OH Grid Modernization supporting distribution automation and volt/var optimization ▪ Rebuilding critical infrastructure in PA ▪ Hardening and making our transmission system more resilient through Energizing the Future Conservation & Clean Energy Transition Enablement(1): $1.7B ▪ Two-thirds of our total customers will have smart meters by 2025(2) ▪ 100% of streetlights owned by FE converted to smart LEDs by 2030(2) ▪ EV Charging Station pilots ongoing in MD and pending in NJ ▪ Pursuing 50MW blocks of solar capacity in WV ▪ Transmission upgrades to support incremental renewable generation ▪ Energy efficiency programs that help customers achieve cumulative reductions in electricity savings in excess of 7.5 million MWh between 2021 and 2025 Customer-Centric Growth (1): $6.5B ▪ Base reliability investments ▪ Vegetation management in WV ▪ Focus on economic development by attracting new business 60%+ Sustainable Investments 51% 10% 39% Grid Mod & Resiliency Conservation & Clean Energy Transition Customer-Centric Growth Strategic & Financial Highlights – Published April 21, 202228

Investment Plan Summary (2021-2025) ~$17B investment plan to strengthen the grid and enable the energy transition Increasing the percentage of formula rate investments; Targeting ~75% in 2025 Plan includes higher RT investments and refocused RD spend through FE Forward Notes: Includes capital-like investments that earn a return Numbers rounded to nearest $100M We expect to update the forecast over the period for items such as regulatory filings and approvals, and other changes $1.7 $1.8 $1.7 $1.8 $1.8 $1.1 $1.5 $1.6 $1.7 $1.8$0.09 $0.07 $0.05 $0.05 $0.05 2021A 2022F 2023F 2024F 2025F Corp/Other RT RD ~$3.3B $2.9B ~$3.4B ~$3.5B ~$3.6B $B % Formula ~65% ~70% ~70% ~75% ~75% Strategic & Financial Highlights – Published April 21, 202229

Rate Base Summary (2021-2025) Notes: Includes capital-like investments that earn a return We expect to update the forecast over the period for items such as regulatory filings and approvals, and other changes $B $16.2 $17.0 $17.6 $18.1 $18.7 $8.1 $8.9 $9.6 $10.6 $11.4 2021A 2022F 2023F 2024F 2025F RD RT ~$26B $24.3B ~$27B ~$29B ~$30B Strong rate base growth driven by ~$17B investment plan to strengthen the grid and enable the energy transition Rate Base growth excludes increasing CWIP balances of ~$1B to ~$2B that earn AFUDC Strategic & Financial Highlights – Published April 21, 202230

Targeting 6-8% Annual Operating EPS Growth Key Drivers to consider over time ▪ Investments & new rates ▪ Optimized operating expenses ▪ Customer demand and load trends (economy, electrification, post-pandemic impacts) ▪ Pension (asset performance & interest rates) ▪ Economic factors (GDP, inflation, interest rates) 2022 2023 2024 2025 Annually Post-2025 Long-Term Earnings Growth (Illustrative) +6-8% Targeted Operating EPS midpoint of ~$2.55-$2.60 $2.40/sh Strategic & Financial Highlights – Published April 21, 202231

2022 Operating EPS(1) Guidance 2021A Operating EPS(2) (545M shares) 2022 Guidance Range: $2.30 - $2.50 2022F Operating EPS Midpoint(2) (571M shares) (1) See Slide 3 for information on Non-GAAP Financial Matters (2) See Slides 38-39 for GAAP to Non-GAAP earnings reconciliation (3) Includes impact of $2.4B FET minority interest sale (assumes close in 2Q 2022) and $1B common equity issuance in December 2021 $2.60 2021 Revised Guidance Range $2.55 - 2.65 2022 Operating EPS Guidance range of $2.30 - $2.50 2021 Original Guidance Range $2.40 - 2.60 Note: 2022F ETR: Consolidated 21-24% 2021A ETR: Consolidated 20.5% RD 21% RT 23% ($0.30) $0.80 $1.90 $2.40 (midpoint) Regulated Distribution Regulated Transmission Corp/Other Key Segment Drivers RD RT Corp + + + Investments + + FE Forward - Ohio rate credits - Accounting policy changes - - + Equity financing transactions(3) ($0.48) $0.83 $2.25 Operating EPS Segment Ranges RD $1.84 – $1.96 RT $0.78 – $0.82 Corp ($0.32) – ($0.28) FE $2.30 – $2.50 Drivers unique to 2022 Strategic & Financial Highlights – Published April 21, 202232

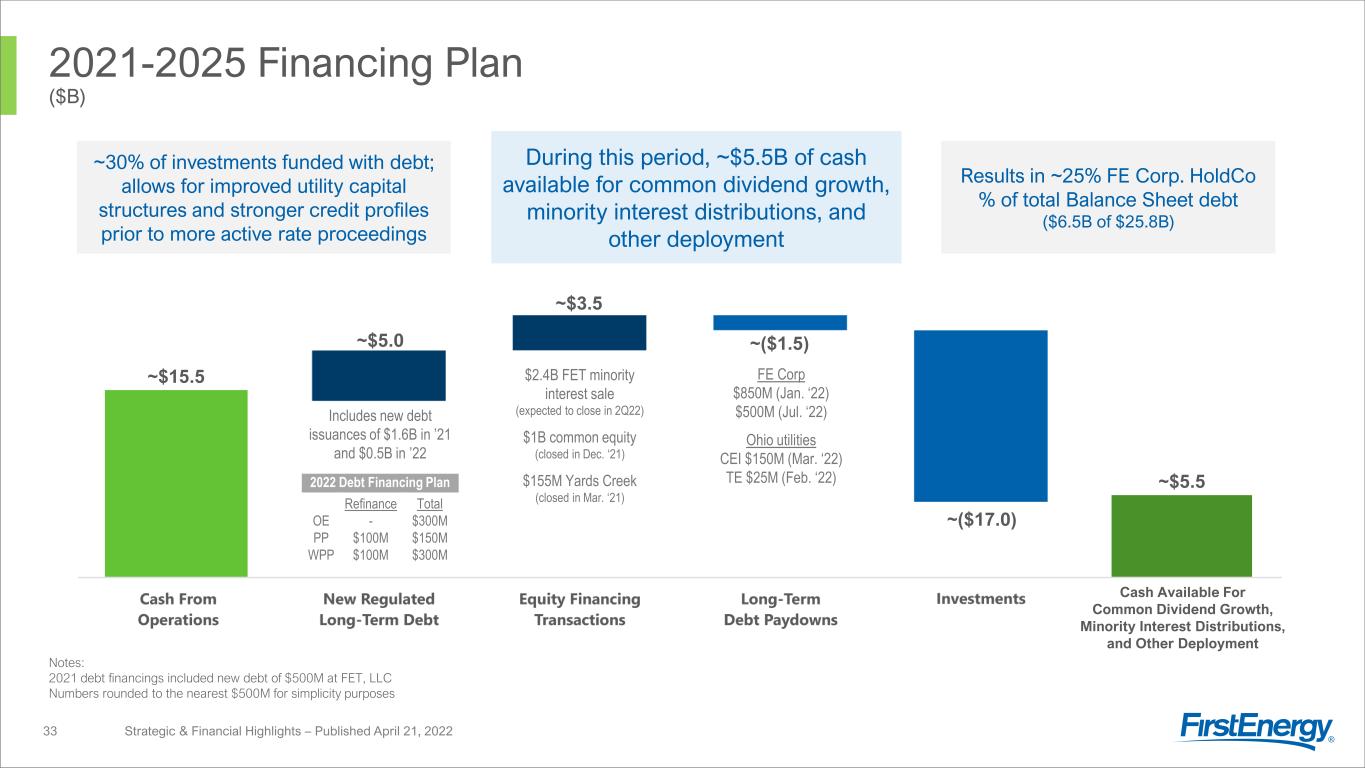

2021-2025 Financing Plan ($B) During this period, ~$5.5B of cash available for common dividend growth, minority interest distributions, and other deployment ~30% of investments funded with debt; allows for improved utility capital structures and stronger credit profiles prior to more active rate proceedings $2.4B FET minority interest sale (expected to close in 2Q22) $1B common equity (closed in Dec. ‘21) $155M Yards Creek (closed in Mar. ‘21) FE Corp $850M (Jan. ‘22) $500M (Jul. ‘22) Ohio utilities CEI $150M (Mar. ‘22) TE $25M (Feb. ‘22) Includes new debt issuances of $1.6B in ’21 and $0.5B in ’22 2022 Debt Financing Plan Refinance Total OE - $300M PP $100M $150M WPP $100M $300M Notes: 2021 debt financings included new debt of $500M at FET, LLC Numbers rounded to the nearest $500M for simplicity purposes ~$15.5 ~$5.0 Results in ~25% FE Corp. HoldCo % of total Balance Sheet debt ($6.5B of $25.8B) ~$3.5 ~($1.5) ~($17.0) ~$5.5 Cash Available For Common Dividend Growth, Minority Interest Distributions, and Other Deployment Strategic & Financial Highlights – Published April 21, 202233

2021-2025 Cash Flow & Debt Projections ($B) Investment-grade credit profile supports ~$17B investment plan and sustainable earnings growth; targeting ~13% FFO/Debt by 2024 Cash From Operations growth is primarily driven by continued formula investments and in line with earnings growth $1.4 $2.8 $2.8 $3.1 $3.3 $3.5 2020 2021 2022 2023 2024 2025 Projected Cash From Operations 2020 2021 2022 2023 2024 2025 Balance Sheet Debt (YE): $24.5B $23.9B $22.7B $23.7B $24.7B $25.7B Primary Drivers (2021-2025) ■ RT formula investments ■ RD formula investments and new rates ■ Regulatory accounting changes ■ FE Forward efficiencies ■ 2021 non-recurring, HB6 related costs Notes: 2020 Cash from Operations includes settlement agreement and tax sharing payments to the FES debtors of ($978M) upon their emergence from bankruptcy on February 27, 2020 2020 Balance Sheet Debt includes $2.2B of short-term borrowings that were repaid in 2021 2021 Cash from Operations includes ~$300M of non-recurring costs, including the $230M payment under the Deferred Prosecution Agreement and investigation-related costs Balance Sheet Debt amounts do not include rating agency adjustments such as unfunded pension liability (expected to decrease assuming annual EROA of 7.5%) Numbers rounded to the nearest $100M and assume midpoint of current forecast, which includes a range for expected cash flows of +/- 10% vs. midpoint for 2023-2025 2022 guidance range: $2.6 - $3.0B Strategic & Financial Highlights – Published April 21, 202234

Dividend Overview Dividend payments are subject to declaration by the Board of Directors, which will consider the risks and uncertainties of the government investigations, among other matters $1.44/sh $1.52/sh $1.56/sh $1.56/sh $1.56/sh 2014-2018 2019 2020 2021 2022F Annual Dividends Per Share Expected Payout Ratio: 65%60% ■ Dividend yield of more than 3% (as of 4/18/2022) ■ Sustained commitment to a strong dividend ■ Goal to resume dividend growth within the payout ratio, as earnings increase from 2022 base year Dividend Policy: 55-65% Targeted payout ratio Strategic & Financial Highlights – Published April 21, 202235

Long-Term Load Forecast Weather-Adjusted; M MWHs (1) Commercial includes street lighting ’21A ‘22F ‘23F ‘24F ‘25F Total 145 148 148 150 149 Res 56 55 54 55 54 Com 36 37 36 36 36 Ind 54 57 58 59 59 Residential ’21A ‘22F% Chg 56 55 -1% 18 17 -2% 19 19 -1% 6 6 - 10 10 -2% 3 3 - Commercial(1) ’21A ‘22F% Chg 36 37 2% 14 14 4% 8 8 1% 4 4 - 8 8 2% 2 2 1 Industrial ’21A ‘22F% Chg 54 57 5% 20 21 8% 24 25 2% 7 7 6% 2 2 5% 1 2 7% Note: Numbers may not add down and/or across due to rounding Total ’21A ‘22F % Chg Total 145 148 2% OH 51 53 3% PA 52 52 1% WV 16 17 3% NJ 20 20 1% MD 7 7 1% ‘19A 147 54 38 56 Key Assumptions (embedded into load forecast) ■ Structural shift between Res and Com driven by workplace flexibility – Lower demand for office space and higher demand for homes and larger home space ■ Strong Industrial sales growth annually of ~1-5% through 2025 – New customers / expansions driving growth for Primary Metals, Shale, Chemical sectors – WV oil & gas growth ~8% ■ Minimal EV penetration through 2025 Key Drivers to consider over time ■ Economic factors ■ Energy efficiency adoption and mandate changes ■ Customer growth ■ Accelerated electrification (i.e., electric vehicles) ■ Distributed generation adoption ■ Post-pandemic impacts ~3% increase in total load (2025 vs. 2021) Strategic & Financial Highlights – Published April 21, 202236

2022 Guidance Sensitivities RD Segment ■ ~80-90% of Commercial and Industrial revenues are based on fixed charges ■ Residential class is more sensitive to changes in volume due to a higher percentage of volume-based revenues Weather Impact on Residential/Commercial Sales Volumes + / - 80 HDD vs. normal (Dec-Mar) ~$0.01/share + / - 26 CDD vs. normal (June-Sept) ~$0.01/share Estimated Impact of Annual Retail Sales Volumes + / - 1% Change in Residential Deliveries ~$0.03/share + / - 1% Change in Commercial Deliveries ~$0.01/share + / - 1% Change in Industrial Deliveries < $0.01/share 17% 81% 91% 41% 83% 19% 9% 61% Res. Com. Ind. Total Non-Energy Based Volumetric 2021 Annual Base Distribution Revenues Strategic & Financial Highlights – Published April 21, 202237

2021 GAAP to Operating (Non-GAAP) Earnings(1) Reconciliation Strategic & Financial Highlights – Published April 21, 202238 (1) Operating earnings exclude special items as described in the reconciliation table above and is a non-GAAP financial measure. Per share amounts for the special items above are based on the after-tax effect of each item divided by the number of shares outstanding for the period. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29%. 2021 Actual (In $M, except per share amounts) Regulated Distribution Regulated Transmission Corporate/ Other FirstEnergy Consolidated 2021A Net Income (Loss) (GAAP) $1,288 $408 ($413) $1,283 2021A Earnings (Loss) Per Share (545M shares) $2.36 $0.75 ($0.76) $2.35 Excluding Special Items: Regulatory Charges $0.22 $0.08 – $0.30 Asset Impairments – – $0.01 $0.01 Exit of Generation $0.02 – ($0.21) ($0.19) State Tax Legislative Changes – – $0.02 $0.02 Investigation and Other Related Costs – – $0.58 $0.58 FE Forward Cost to Achieve $0.01 – – $0.01 Mark-to-market adjustments – Pension/OPEB actuarial assumptions ($0.36) – ($0.12) ($0.48) Total Special Items ($0.11) $0.08 $0.28 $0.25 2021A Operating Earnings (Loss) Per Share – Non-GAAP (545M shares) $2.25 $0.83 ($0.48) $2.60

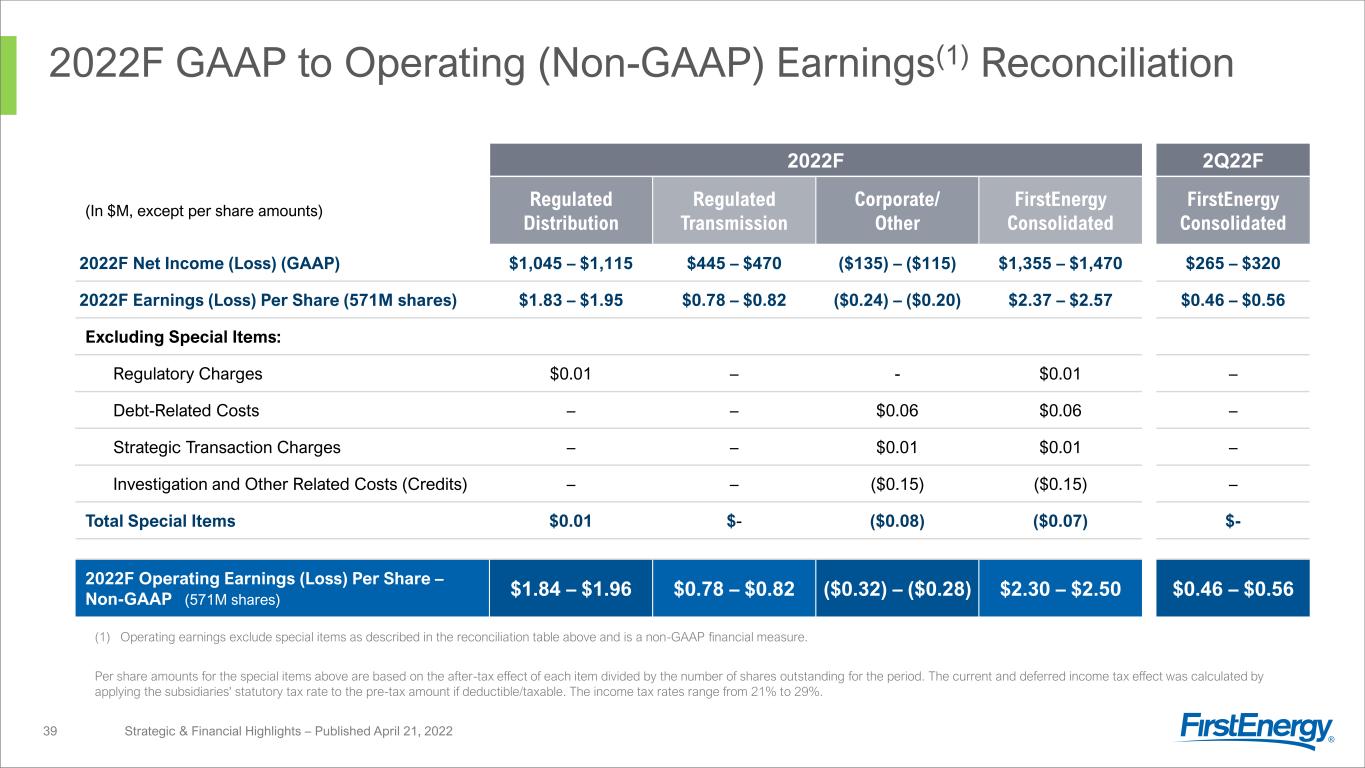

2022F GAAP to Operating (Non-GAAP) Earnings(1) Reconciliation Strategic & Financial Highlights – Published April 21, 202239 (1) Operating earnings exclude special items as described in the reconciliation table above and is a non-GAAP financial measure. Per share amounts for the special items above are based on the after-tax effect of each item divided by the number of shares outstanding for the period. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29%. 2022F 2Q22F (In $M, except per share amounts) Regulated Distribution Regulated Transmission Corporate/ Other FirstEnergy Consolidated FirstEnergy Consolidated 2022F Net Income (Loss) (GAAP) $1,045 – $1,115 $445 – $470 ($135) – ($115) $1,355 – $1,470 $265 – $320 2022F Earnings (Loss) Per Share (571M shares) $1.83 – $1.95 $0.78 – $0.82 ($0.24) – ($0.20) $2.37 – $2.57 $0.46 – $0.56 Excluding Special Items: Regulatory Charges $0.01 – - $0.01 – Debt-Related Costs – – $0.06 $0.06 – Strategic Transaction Charges – – $0.01 $0.01 – Investigation and Other Related Costs (Credits) – – ($0.15) ($0.15) – Total Special Items $0.01 $- ($0.08) ($0.07) $- 2022F Operating Earnings (Loss) Per Share – Non-GAAP (571M shares) $1.84 – $1.96 $0.78 – $0.82 ($0.32) – ($0.28) $2.30 – $2.50 $0.46 – $0.56

2021-2022 Special Items(1) (1) Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating the company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items are not necessarily non-recurring. ■ Regulatory Charges – Primarily reflects the impact of regulatory agreements, proceedings, audits, concessions or orders requiring certain commitments and/or disallowing the recoverability of costs, net of related credits. ■ Debt-Related Costs – Primarily reflects costs associated with the redemption and early retirement of debt and amendments to revolving credit facilities. ■ Asset Impairments – Primarily reflects charges resulting from non-cash asset impairments. ■ Exit of Generation – Primarily reflects charges or credits resulting from the exit of competitive operations, including retired generation facilities and adjustments related to the Energy Harbor bankruptcy settlement, and restructuring and strategic review costs. ■ State Tax Legislative Changes – Primarily reflects charges resulting from state tax legislative changes. ■ Strategic Transaction Charges – Primarily reflects the remeasurement of certain deferred tax assets associated with the planned FET minority asset sale. ■ FE Forward Cost to Achieve – Primarily reflects certain advisory costs incurred to transform the Company for the future. ■ Investigation and Other Related Costs (Credits) – Primarily reflects the DPA penalty, litigation settlement and reserves, and other legal and advisory expenses related to the government investigations. ■ Mark-to-market adjustments: Pension/OPEB actuarial assumptions – Primarily reflects the change in fair value of plan assets and net actuarial gains and losses associated with the Company's pension and other postemployment benefit plans. Strategic & Financial Highlights – Published April 21, 202240

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- FirstEnergy Corp. (FE) PT Raised to $35 at BofA Securities

- Mueller Water Products Announces Quarterly Dividend

- Trulioo 24/7 Support Empowers Top APAC Region Companies to Expand Into New Markets, Achieve Compliance and Accelerate Customer Onboarding

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share