Form 8-K FIFTH THIRD BANCORP For: Oct 19

Fifth Third Announces Third Quarter 2021 Results

Reported diluted earnings per share of $0.97

Reported results included a positive $0.03 impact from certain items on page 2

| Key Financial Data | Key Highlights | |||||||||||||||||||||||||

| $ millions for all balance sheet and income statement items | ||||||||||||||||||||||||||

3Q21 | 2Q21 | 3Q20 | Select Business Highlights: •Closed acquisition of Provide, a leading fintech company serving healthcare practices •Finalized HSA deposit sale, generating a pre-tax gain of $60 million (noninterest income) •Made $15 million pre-tax contribution to accelerate racial equality, equity and inclusion in our communities •Generated consumer household growth of 3% vs. 3Q20 •Commercial loan production increased 5% compared to 2Q21; strongest production quarter since 4Q19 Select Financial Highlights: •ROTCE(a) of 16.9%; adjusted ROTCE(a) of 18.7% excl. AOCI •PPNR(a) increased 17% and adjusted PPNR(a) increased 4% compared to 3Q20 •Period-end C&I loan growth of 1% (or 4% excl. impact of PPP loans) compared to 2Q21 •Historically low NCO ratio of 0.08% reflecting improvements in both commercial and consumer •Repurchased shares totaling $550 million; capital plans support repurchase of shares totaling approximately $300 million in 4Q21; continue to target 9.5% CET1 by June 2022 | |||||||||||||||||||||||

| Income Statement Data | ||||||||||||||||||||||||||

| Net income available to common shareholders | $684 | $674 | $562 | |||||||||||||||||||||||

| Net interest income (U.S. GAAP) | 1,189 | 1,208 | 1,170 | |||||||||||||||||||||||

Net interest income (FTE)(a) | 1,192 | 1,211 | 1,173 | |||||||||||||||||||||||

| Noninterest income | 836 | 741 | 722 | |||||||||||||||||||||||

| Noninterest expense | 1,172 | 1,153 | 1,161 | |||||||||||||||||||||||

| Per Share Data | ||||||||||||||||||||||||||

| Earnings per share, basic | $0.98 | $0.95 | $0.78 | |||||||||||||||||||||||

| Earnings per share, diluted | 0.97 | 0.94 | 0.78 | |||||||||||||||||||||||

| Book value per share | 29.59 | 29.57 | 29.25 | |||||||||||||||||||||||

Tangible book value per share(a) | 22.79 | 23.34 | 23.06 | |||||||||||||||||||||||

| Balance Sheet & Credit Quality | ||||||||||||||||||||||||||

| Average portfolio loans and leases | $107,970 | $108,534 | $113,362 | |||||||||||||||||||||||

| Average deposits | 162,647 | 162,619 | 155,911 | |||||||||||||||||||||||

Net charge-off ratio(b) | 0.08 | % | 0.16 | % | 0.35 | % | ||||||||||||||||||||

Nonperforming asset ratio(c) | 0.52 | 0.61 | 0.84 | |||||||||||||||||||||||

| Financial Ratios | ||||||||||||||||||||||||||

| Return on average assets | 1.36 | % | 1.38 | % | 1.14 | % | ||||||||||||||||||||

| Return on average common equity | 13.0 | 13.0 | 10.7 | |||||||||||||||||||||||

Return on average tangible common equity(a) | 16.9 | 16.6 | 13.8 | |||||||||||||||||||||||

CET1 capital(d)(e) | 9.85 | 10.37 | 10.14 | |||||||||||||||||||||||

Net interest margin(a) | 2.59 | 2.63 | 2.58 | |||||||||||||||||||||||

Efficiency(a) | 57.8 | 59.1 | 61.3 | |||||||||||||||||||||||

Other than the Quarterly Financial Review tables beginning on page 14, commentary is on a fully taxable-equivalent (FTE) basis unless otherwise noted. Consistent with SEC guidance in Industry Guide 3 that contemplates the calculation of tax-exempt income on a taxable-equivalent basis, net interest income, net interest margin, net interest rate spread, total revenue and the efficiency ratio are provided on an FTE basis. | ||||||||||||||||||||||||||

| CEO Commentary | ||||||||||||||

"Fifth Third has continued to deliver strong and steady financial results throughout the pandemic while fully supporting our customers, communities, and employees. Our performance this quarter once again reflected strong business outcomes across our franchise, resulting in improved and diversified revenues. This was combined with disciplined balance sheet management, expense management, and yet another quarter of benign credit results. As a result of our continued momentum, we generated positive operating leverage on a year-over-year basis.

Excluding the impact of the Paycheck Protection Program (PPP), loan growth this quarter reflected robust production, with even better growth on an end-of-period basis. We expect this positive momentum to carry forward in the fourth quarter and beyond.

I am very proud that, in addition to producing strong financial results, we have also continued to take deliberate actions to improve the lives of our customers and the well-being of our communities. We made a $15 million contribution in the third quarter to accelerate racial equality, equity and inclusion in our communities.

We closed two transactions during the third quarter to improve growth and profitability. The acquisition of Provide – a leading fintech company serving healthcare practices – will further accelerate profitable relationship growth. Additionally, we finalized the sale of HSA deposits as part of our multi-year strategy to simplify the organization and prioritize investments in order to generate differentiated outcomes for customers and shareholders. We continue to focus on growing strong relationships and managing the balance sheet with a through-the-cycle perspective in order to generate sustainable long-term value."

-Greg D. Carmichael, Chairman and CEO

Investor contact: Chris Doll (513) 534-2345 | Media contact: Ed Loyd (513) 534-6397 October 19, 2021

| Income Statement Highlights | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions, except per share data) | For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||

| September | June | September | ||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2021 | 2020 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Condensed Statements of Income | ||||||||||||||||||||||||||||||||||||||||||||

Net interest income (NII)(a) | $1,192 | $1,211 | $1,173 | (2)% | 2% | |||||||||||||||||||||||||||||||||||||||

| Benefit from credit losses | (42) | (115) | (15) | (63)% | 180% | |||||||||||||||||||||||||||||||||||||||

| Noninterest income | 836 | 741 | 722 | 13% | 16% | |||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 1,172 | 1,153 | 1,161 | 2% | 1% | |||||||||||||||||||||||||||||||||||||||

Income before income taxes(a) | $898 | $914 | $749 | (2)% | 20% | |||||||||||||||||||||||||||||||||||||||

| Taxable equivalent adjustment | $3 | $3 | $3 | — | — | |||||||||||||||||||||||||||||||||||||||

| Applicable income tax expense | 191 | 202 | 165 | (5)% | 16% | |||||||||||||||||||||||||||||||||||||||

| Net income | $704 | $709 | $581 | (1)% | 21% | |||||||||||||||||||||||||||||||||||||||

| Dividends on preferred stock | 20 | 35 | 19 | (43)% | 5% | |||||||||||||||||||||||||||||||||||||||

| Net income available to common shareholders | $684 | $674 | $562 | 1% | 22% | |||||||||||||||||||||||||||||||||||||||

| Earnings per share, diluted | $0.97 | $0.94 | $0.78 | 3% | 24% | |||||||||||||||||||||||||||||||||||||||

Fifth Third Bancorp (NASDAQ®: FITB) today reported third quarter 2021 net income of $704 million compared to net income of $709 million in the prior quarter and $581 million in the year-ago quarter. Net income available to common shareholders in the current quarter was $684 million, or $0.97 per diluted share, compared to $674 million, or $0.94 per diluted share, in the prior quarter and $562 million, or $0.78 per diluted share, in the year-ago quarter.

Diluted earnings per share impact of certain items - 3Q21 | |||||||||||||||||

(after-tax impacts(f); $ in millions, except per share data) | |||||||||||||||||

| Valuation of Visa total return swap (noninterest income) | $(13) | ||||||||||||||||

| Fifth Third Foundation contribution expense | (12) | ||||||||||||||||

| HSA disposition gain (noninterest income) | 46 | ||||||||||||||||

After-tax impact(f) of certain items | $21 | ||||||||||||||||

Diluted earnings per share impact of certain items1 | $0.03 | ||||||||||||||||

1Diluted earnings per share impact reflects 706.090 million average diluted shares outstanding | |||||||||||||||||

2

| Net Interest Income | ||||||||||||||||||||||||||||||||||||||||||||

(FTE; $ in millions)(a) | For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||

| September | June | September | ||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2021 | 2020 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Interest Income | ||||||||||||||||||||||||||||||||||||||||||||

| Interest income | $1,295 | $1,326 | $1,332 | (2)% | (3)% | |||||||||||||||||||||||||||||||||||||||

| Interest expense | 103 | 115 | 159 | (10)% | (35)% | |||||||||||||||||||||||||||||||||||||||

| Net interest income (NII) | $1,192 | $1,211 | $1,173 | (2)% | 2% | |||||||||||||||||||||||||||||||||||||||

| Average Yield/Rate Analysis | bps Change | |||||||||||||||||||||||||||||||||||||||||||

| Yield on interest-earning assets | 2.81 | % | 2.88 | % | 2.93 | % | (7) | (12) | ||||||||||||||||||||||||||||||||||||

| Rate paid on interest-bearing liabilities | 0.36 | % | 0.40 | % | 0.51 | % | (4) | (15) | ||||||||||||||||||||||||||||||||||||

| Ratios | ||||||||||||||||||||||||||||||||||||||||||||

| Net interest rate spread | 2.45 | % | 2.48 | % | 2.42 | % | (3) | 3 | ||||||||||||||||||||||||||||||||||||

| Net interest margin (NIM) | 2.59 | % | 2.63 | % | 2.58 | % | (4) | 1 | ||||||||||||||||||||||||||||||||||||

Compared to the prior quarter, NII decreased $19 million, or 2%, primarily due to lower PPP-related income, lower yields on commercial loan balances (excluding PPP), and a reduction in prepayment penalties received in the investment portfolio, partially offset by higher day count and reductions in long-term debt. PPP-related interest income was $47 million compared to $53 million in the prior quarter. Compared to the prior quarter, NIM decreased 4 bps, primarily due to lower yields on commercial loan balances (excluding PPP), a reduction in prepayment penalties received in the investment portfolio, and higher day count, partially offset by reductions in long-term debt. Underlying NIM(g) decreased 9 bps sequentially. Excess liquidity and PPP had a negative impact on reported NIM of approximately 44 bps in the current quarter, compared to 49 bps in the prior quarter.

Compared to the year-ago quarter, NII increased $19 million, or 2%, primarily reflecting the benefit of GNMA forbearance loan buyout purchases, lower deposit costs, a reduction in long-term debt, and higher interest income from PPP loans, partially offset by lower C&I, home equity, and credit card balances and the impact of lower market rates. Compared to the year-ago quarter, reported NIM increased 1 bp, primarily reflecting lower deposit costs, PPP-related income, and a reduction in long-term debt, partially offset by lower market rates, loan spread compression, and the impact of excess liquidity.

3

| Noninterest Income | |||||||||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | % Change | |||||||||||||||||||||||||||||||||

| September | June | September | |||||||||||||||||||||||||||||||||

| 2021 | 2021 | 2020 | Seq | Yr/Yr | |||||||||||||||||||||||||||||||

| Noninterest Income | |||||||||||||||||||||||||||||||||||

| Service charges on deposits | $152 | $149 | $144 | 2% | 6% | ||||||||||||||||||||||||||||||

| Commercial banking revenue | 152 | 160 | 125 | (5)% | 22% | ||||||||||||||||||||||||||||||

| Mortgage banking net revenue | 86 | 64 | 76 | 34% | 13% | ||||||||||||||||||||||||||||||

| Wealth and asset management revenue | 147 | 145 | 132 | 1% | 11% | ||||||||||||||||||||||||||||||

| Card and processing revenue | 102 | 102 | 92 | — | 11% | ||||||||||||||||||||||||||||||

| Leasing business revenue | 78 | 61 | 77 | 28% | 1% | ||||||||||||||||||||||||||||||

| Other noninterest income | 120 | 49 | 26 | 145% | 362% | ||||||||||||||||||||||||||||||

| Securities (losses) gains, net | (1) | 10 | 51 | NM | NM | ||||||||||||||||||||||||||||||

| Securities (losses) gains, net - non-qualifying hedges | |||||||||||||||||||||||||||||||||||

| on mortgage servicing rights | — | 1 | (1) | (100)% | (100)% | ||||||||||||||||||||||||||||||

| Total noninterest income | $836 | $741 | $722 | 13% | 16% | ||||||||||||||||||||||||||||||

Reported noninterest income increased $95 million, or 13%, from the prior quarter, and increased $114 million, or 16%, from the year-ago quarter. The reported results reflect the impact of certain items in the table below, including securities gains and losses.

| Noninterest Income excluding certain items | |||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | ||||||||||||||||||||||||||||

| September | June | September | |||||||||||||||||||||||||||

| 2021 | 2021 | 2020 | |||||||||||||||||||||||||||

| Noninterest Income excluding certain items | |||||||||||||||||||||||||||||

| Noninterest income (U.S. GAAP) | $836 | $741 | $722 | ||||||||||||||||||||||||||

| Valuation of Visa total return swap | 17 | 37 | 22 | ||||||||||||||||||||||||||

| HSA disposition gain | (60) | — | — | ||||||||||||||||||||||||||

| Branch and non-branch real estate charges | — | — | 10 | ||||||||||||||||||||||||||

| Securities losses/(gains), net | 1 | (10) | (51) | ||||||||||||||||||||||||||

Noninterest income excluding certain items(a) | $794 | $768 | $703 | ||||||||||||||||||||||||||

Compared to the prior quarter, noninterest income excluding certain items increased $26 million, or 3%. Compared to the year-ago quarter, noninterest income excluding certain items increased $91 million, or 13%.

Compared to the prior quarter, service charges on deposits increased $3 million, or 2%, reflecting an increase in both commercial and consumer deposit fees. Commercial banking revenue decreased $8 million, or 5%, primarily driven by lower financial risk management revenue and corporate bond fees, partially offset by an increase in M&A advisory revenue. Mortgage banking net revenue increased $22 million, or 34%, reflecting an incremental $12 million favorable impact from MSR net valuation adjustments and a $9 million decrease in MSR asset decay reflecting slower prepayment speeds. This was partially offset by a $3 million decrease in origination fees and gains on loan sales. Current quarter mortgage originations of $5.0 billion were flat compared to the prior quarter. Wealth and asset management revenue increased $2 million, or 1%, driven primarily by higher personal asset management revenue. Leasing business revenue increased $17 million, or 28%, primarily driven by an increase in business solutions revenue and lease syndication revenue.

Compared to the year-ago quarter, service charges on deposits increased $8 million, or 6%, reflecting an increase in both commercial treasury management and consumer deposit fees. Commercial banking revenue increased $27 million, or 22%, primarily driven by increases in loan syndication revenue and M&A advisory revenue, partially offset by lower corporate bond fees. Mortgage banking net revenue increased $10 million, or 13%, reflecting an incremental $17 million

4

favorable impact from MSR net valuation adjustments and an $11 million decrease in MSR asset decay reflecting slower prepayment speeds. This was partially offset by a $15 million decrease in origination fees and gains on loan sales. Wealth and asset management revenue increased $15 million, or 11%, primarily driven by higher personal asset management revenue and brokerage fees. Card and processing revenue increased $10 million, or 11%, primarily driven by higher spend volumes, partially offset by higher rewards. Leasing business revenue increased $1 million, or 1%, primarily reflecting increases in lease syndication revenue. Other noninterest income excluding certain items increased $19 million, primarily reflecting higher private equity income in the current quarter compared to the year-ago quarter.

| Noninterest Expense | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||

| September | June | September | ||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2021 | 2020 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Noninterest Expense | ||||||||||||||||||||||||||||||||||||||||||||

| Compensation and benefits | $627 | $638 | $637 | (2)% | (2)% | |||||||||||||||||||||||||||||||||||||||

| Net occupancy expense | 79 | 77 | 90 | 3% | (12)% | |||||||||||||||||||||||||||||||||||||||

| Technology and communications | 98 | 94 | 89 | 4% | 10% | |||||||||||||||||||||||||||||||||||||||

| Equipment expense | 34 | 34 | 33 | — | 3% | |||||||||||||||||||||||||||||||||||||||

| Card and processing expense | 19 | 20 | 29 | (5)% | (34)% | |||||||||||||||||||||||||||||||||||||||

| Leasing business expense | 33 | 33 | 35 | — | (6)% | |||||||||||||||||||||||||||||||||||||||

| Marketing expense | 29 | 20 | 23 | 45% | 26% | |||||||||||||||||||||||||||||||||||||||

| Other noninterest expense | 253 | 237 | 225 | 7% | 12% | |||||||||||||||||||||||||||||||||||||||

| Total noninterest expense | $1,172 | $1,153 | $1,161 | 2% | 1% | |||||||||||||||||||||||||||||||||||||||

Reported noninterest expense increased $19 million, or 2%, from the prior quarter, and increased $11 million, or 1%, from the year-ago quarter. The reported results reflect the impact of certain items in the table below.

| Noninterest Expense excluding certain items | |||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | ||||||||||||||||||||||||||||

| September | June | September | |||||||||||||||||||||||||||

| 2021 | 2021 | 2020 | |||||||||||||||||||||||||||

| Noninterest Expense excluding certain items | |||||||||||||||||||||||||||||

| Noninterest expense (U.S. GAAP) | $1,172 | $1,153 | $1,161 | ||||||||||||||||||||||||||

| Fifth Third Foundation contribution | (15) | — | — | ||||||||||||||||||||||||||

| Restructuring severance expense | — | — | (19) | ||||||||||||||||||||||||||

| Branch and non-branch real estate charges | — | — | (9) | ||||||||||||||||||||||||||

Noninterest expense excluding certain items(a) | $1,157 | $1,153 | $1,133 | ||||||||||||||||||||||||||

Compared to the prior quarter, noninterest expense excluding certain items increased $4 million, primarily reflecting an increase in marketing expense associated with Fifth Third Momentum Banking, and an increase in travel and entertainment expense. This was partially offset by a decrease in compensation and benefits expense, primarily reflecting a decline in full-time equivalent employees compared to the prior quarter.

Compared to the year-ago quarter, noninterest expense excluding certain items increased $24 million, or 2%, primarily driven by an increase in performance-based compensation expense reflecting strong business results, expenses associated with the aforementioned GNMA forbearance loan buyout purchases, and an increase in travel and entertainment expense. This was partially offset by lower card and processing expense due to contract renegotiations and lower net occupancy expense. Full-time equivalent employees declined 5% compared to the year-ago quarter.

5

| Average Interest-Earning Assets | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||

| September | June | September | ||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2021 | 2020 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Average Portfolio Loans and Leases | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial loans and leases: | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial loans | $47,766 | $48,773 | $54,004 | (2)% | (12)% | |||||||||||||||||||||||||||||||||||||||

| Commercial mortgage loans | 10,317 | 10,459 | 11,069 | (1)% | (7)% | |||||||||||||||||||||||||||||||||||||||

| Commercial construction loans | 5,728 | 6,043 | 5,534 | (5)% | 4% | |||||||||||||||||||||||||||||||||||||||

| Commercial leases | 3,158 | 3,174 | 2,966 | (1)% | 6% | |||||||||||||||||||||||||||||||||||||||

| Total commercial loans and leases | $66,969 | $68,449 | $73,573 | (2)% | (9)% | |||||||||||||||||||||||||||||||||||||||

| Consumer loans: | ||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage loans | $16,223 | $15,883 | $16,618 | 2% | (2)% | |||||||||||||||||||||||||||||||||||||||

| Home equity | 4,409 | 4,674 | 5,581 | (6)% | (21)% | |||||||||||||||||||||||||||||||||||||||

| Indirect secured consumer loans | 15,590 | 14,702 | 12,599 | 6% | 24% | |||||||||||||||||||||||||||||||||||||||

| Credit card | 1,748 | 1,770 | 2,134 | (1)% | (18)% | |||||||||||||||||||||||||||||||||||||||

| Other consumer loans | 3,031 | 3,056 | 2,857 | (1)% | 6% | |||||||||||||||||||||||||||||||||||||||

| Total consumer loans | $41,001 | $40,085 | $39,789 | 2% | 3% | |||||||||||||||||||||||||||||||||||||||

| Total average portfolio loans and leases | $107,970 | $108,534 | $113,362 | (1)% | (5)% | |||||||||||||||||||||||||||||||||||||||

| Memo: | ||||||||||||||||||||||||||||||||||||||||||||

| Average PPP loans | $3,071 | $4,810 | $5,216 | (36)% | (41)% | |||||||||||||||||||||||||||||||||||||||

| Average portfolio commercial and industrial loans - excl. PPP loans | $44,695 | $43,963 | $48,788 | 2% | (8)% | |||||||||||||||||||||||||||||||||||||||

| Average Loans and Leases Held for Sale | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial loans and leases held for sale | $31 | $52 | $55 | (40)% | (44)% | |||||||||||||||||||||||||||||||||||||||

| Consumer loans held for sale | 5,527 | 5,857 | 1,196 | (6)% | 362% | |||||||||||||||||||||||||||||||||||||||

| Total average loans and leases held for sale | $5,558 | $5,909 | $1,251 | (6)% | 344% | |||||||||||||||||||||||||||||||||||||||

| Securities (taxable and tax-exempt) | $37,208 | $36,917 | $36,300 | 1% | 3% | |||||||||||||||||||||||||||||||||||||||

| Other short-term investments | 32,065 | 33,558 | 29,791 | (4)% | 8% | |||||||||||||||||||||||||||||||||||||||

| Total average interest-earning assets | $182,801 | $184,918 | $180,704 | (1)% | 1% | |||||||||||||||||||||||||||||||||||||||

Compared to the prior quarter, total average portfolio loans and leases decreased 1%, as a decline in commercial loan and lease balances (primarily due to PPP balance declines) was partially offset by an increase in consumer loans. Average commercial portfolio loans and leases decreased 2%, as a decline in PPP balances was partially offset by growth in C&I loans (excluding PPP). Average consumer portfolio loans increased 2%, as higher indirect secured consumer loans and residential mortgage loans were partially offset by lower home equity balances.

Compared to the year-ago quarter, total average portfolio loans and leases decreased 5%, as lower commercial loan and lease balances were partially offset by an increase in consumer loans. Average commercial portfolio loans and leases decreased 9% due to declines in C&I revolving line of credit utilization and term loan balances, PPP forgiveness, and lower commercial mortgage loans. Average consumer portfolio loans increased 3%, as higher indirect secured consumer loans were partially offset by lower home equity, residential mortgage, and credit card balances.

Average loans and leases held for sale were $6 billion in the current quarter compared to $6 billion in the prior quarter and $1 billion in the year-ago quarter. The increase from the year-ago quarter was primarily attributable to the aforementioned GNMA forbearance loan buyout purchases within consumer loans held for sale (approximately $4.0 billion purchased since December 2020, including $0.3 billion in September 2021).

Average securities (taxable and tax-exempt) of $37 billion in the current quarter increased $0.3 billion, or 1%, compared to the prior quarter and increased $1 billion, or 3%, compared to the year-ago quarter.

6

Average other short-term investments (including interest-bearing cash) of $32 billion in the current quarter decreased $1 billion, or 4%, compared to the prior quarter and increased $2 billion, or 8%, compared to the year-ago quarter.

Total period-end commercial portfolio loans and leases of $67 billion were flat compared to the prior quarter, as PPP forgiveness and lower construction loan balances were offset by an increase in C&I loan balances (excluding PPP). Compared to the year-ago quarter, total period-end commercial portfolio loans decreased $5 billion, or 6%, reflecting PPP forgiveness, lower C&I revolving line of credit utilization and term loan balances as well as lower commercial mortgage loans. Period-end commercial revolving line utilization was flat compared to the prior quarter at 31%, down from 33% in the year-ago quarter.

Period-end consumer portfolio loans of $41 billion increased 1% compared to the prior quarter, as continued growth in indirect secured consumer loans was partially offset by a decline in home equity balances. Compared to the year-ago quarter, total period-end consumer portfolio loans increased $2 billion, or 4%, reflecting higher indirect secured consumer loan balances, partially offset by lower home equity balances.

| Average Deposits | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||

| September | June | September | ||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2021 | 2020 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Average Deposits | ||||||||||||||||||||||||||||||||||||||||||||

| Demand | $62,626 | $61,994 | $50,414 | 1% | 24% | |||||||||||||||||||||||||||||||||||||||

| Interest checking | 45,128 | 45,307 | 49,800 | — | (9)% | |||||||||||||||||||||||||||||||||||||||

| Savings | 20,941 | 20,494 | 17,013 | 2% | 23% | |||||||||||||||||||||||||||||||||||||||

| Money market | 30,514 | 30,844 | 31,151 | (1)% | (2)% | |||||||||||||||||||||||||||||||||||||||

Foreign office(h) | 195 | 140 | 189 | 39% | 3% | |||||||||||||||||||||||||||||||||||||||

| Total transaction deposits | $159,404 | $158,779 | $148,567 | — | 7% | |||||||||||||||||||||||||||||||||||||||

| Other time | 2,383 | 2,696 | 3,711 | (12)% | (36)% | |||||||||||||||||||||||||||||||||||||||

| Total core deposits | $161,787 | $161,475 | $152,278 | — | 6% | |||||||||||||||||||||||||||||||||||||||

| Certificates - $100,000 and over | 860 | 1,144 | 3,633 | (25)% | (76)% | |||||||||||||||||||||||||||||||||||||||

| Total average deposits | $162,647 | $162,619 | $155,911 | — | 4% | |||||||||||||||||||||||||||||||||||||||

Compared to the prior quarter, average core deposits were flat, as increases in demand and savings deposit balances were offset by decreases in money market deposit balances and other time deposit balances. The HSA deposit sale was finalized near the end of the third quarter, and consisted of approximately $360 million in average interest checking balances for the third quarter of 2021. Average demand deposits represented 39% of total core deposits in the current quarter compared to 38% in the prior quarter. Average commercial transaction deposits were flat and average consumer transaction deposits increased 1%.

Compared to the year-ago quarter, average core deposits increased 6%, driven by the impacts of fiscal and monetary stimulus combined with success in generating consumer household growth. Average commercial transaction deposits increased 2% and average consumer transaction deposits increased 14%.

The period end portfolio loan-to-core deposit ratio was 66% in the current quarter, compared to 67% in the prior quarter and 72% in the year-ago quarter. Excluding the impact of PPP loans, the period end portfolio loan-to-core deposit ratio was 64% in the current quarter, compared to 64% in the prior quarter and 69% in the year-ago quarter.

7

| Average Wholesale Funding | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||

| September | June | September | ||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2021 | 2020 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Average Wholesale Funding | ||||||||||||||||||||||||||||||||||||||||||||

| Certificates - $100,000 and over | $860 | $1,144 | $3,633 | (25)% | (76)% | |||||||||||||||||||||||||||||||||||||||

| Federal funds purchased | 348 | 346 | 273 | 1% | 27% | |||||||||||||||||||||||||||||||||||||||

| Other short-term borrowings | 1,122 | 1,097 | 1,626 | 2% | (31)% | |||||||||||||||||||||||||||||||||||||||

| Long-term debt | 12,057 | 13,883 | 16,230 | (13)% | (26)% | |||||||||||||||||||||||||||||||||||||||

| Total average wholesale funding | $14,387 | $16,470 | $21,762 | (13)% | (34)% | |||||||||||||||||||||||||||||||||||||||

Compared to the prior quarter, average wholesale funding decreased 13%, reflecting the impact of reductions in long-term debt over the past two quarters (including the retirement of $850 million in long-term debt in September 2021), as well as continued runoff in jumbo CD balances. Compared to the year-ago quarter, average wholesale funding decreased 34%, reflecting decreases in long-term debt, jumbo CD balances, and other short-term borrowings.

8

| Credit Quality Summary | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | As of and For the Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||

| September | June | March | December | September | ||||||||||||||||||||||||||||||||||||||||

| 2021 | 2021 | 2021 | 2020 | 2020 | ||||||||||||||||||||||||||||||||||||||||

| Total nonaccrual portfolio loans and leases (NPLs) | $528 | $621 | $741 | $834 | $891 | |||||||||||||||||||||||||||||||||||||||

| Repossessed property | 4 | 5 | 7 | 9 | 7 | |||||||||||||||||||||||||||||||||||||||

| OREO | 27 | 31 | 35 | 21 | 33 | |||||||||||||||||||||||||||||||||||||||

| Total nonperforming portfolio loans and leases and OREO (NPAs) | $559 | $657 | $783 | $864 | $931 | |||||||||||||||||||||||||||||||||||||||

NPL ratio(i) | 0.49 | % | 0.58 | % | 0.68 | % | 0.77 | % | 0.80 | % | ||||||||||||||||||||||||||||||||||

NPA ratio(c) | 0.52 | % | 0.61 | % | 0.72 | % | 0.79 | % | 0.84 | % | ||||||||||||||||||||||||||||||||||

| Total loans and leases 30-89 days past due (accrual) | $267 | $281 | $305 | $357 | $323 | |||||||||||||||||||||||||||||||||||||||

| Total loans and leases 90 days past due (accrual) | 92 | 83 | 124 | 163 | 139 | |||||||||||||||||||||||||||||||||||||||

| Allowance for loan and lease losses (ALLL), beginning | $2,033 | $2,208 | $2,453 | $2,574 | $2,696 | |||||||||||||||||||||||||||||||||||||||

| Total net losses charged-off | (21) | (44) | (71) | (118) | (101) | |||||||||||||||||||||||||||||||||||||||

| Benefit from loan and lease losses | (58) | (131) | (174) | (3) | (21) | |||||||||||||||||||||||||||||||||||||||

| ALLL, ending | $1,954 | $2,033 | $2,208 | $2,453 | $2,574 | |||||||||||||||||||||||||||||||||||||||

| Reserve for unfunded commitments, beginning | $189 | $173 | $172 | $182 | $176 | |||||||||||||||||||||||||||||||||||||||

| Provision for (benefit from) the reserve for unfunded commitments | 16 | 16 | 1 | (10) | 6 | |||||||||||||||||||||||||||||||||||||||

| Reserve for unfunded commitments, ending | $205 | $189 | $173 | $172 | $182 | |||||||||||||||||||||||||||||||||||||||

| Total allowance for credit losses (ACL) | $2,159 | $2,222 | $2,381 | $2,625 | $2,756 | |||||||||||||||||||||||||||||||||||||||

| ACL ratios: | ||||||||||||||||||||||||||||||||||||||||||||

| As a % of portfolio loans and leases | 2.00 | % | 2.06 | % | 2.19 | % | 2.41 | % | 2.49 | % | ||||||||||||||||||||||||||||||||||

| As a % of nonperforming portfolio loans and leases | 409 | % | 358 | % | 321 | % | 315 | % | 309 | % | ||||||||||||||||||||||||||||||||||

| As a % of nonperforming portfolio assets | 386 | % | 338 | % | 304 | % | 304 | % | 296 | % | ||||||||||||||||||||||||||||||||||

| ALLL as a % of portfolio loans and leases | 1.81 | % | 1.89 | % | 2.03 | % | 2.25 | % | 2.32 | % | ||||||||||||||||||||||||||||||||||

| Total losses charged-off | $(56) | $(103) | $(109) | $(154) | $(135) | |||||||||||||||||||||||||||||||||||||||

| Total recoveries of losses previously charged-off | 35 | 59 | 38 | 36 | 34 | |||||||||||||||||||||||||||||||||||||||

| Total net losses charged-off | $(21) | $(44) | $(71) | $(118) | $(101) | |||||||||||||||||||||||||||||||||||||||

Net charge-off ratio (NCO ratio)(b) | 0.08 | % | 0.16 | % | 0.27 | % | 0.43 | % | 0.35 | % | ||||||||||||||||||||||||||||||||||

| Commercial NCO ratio | 0.03 | % | 0.10 | % | 0.17 | % | 0.40 | % | 0.33 | % | ||||||||||||||||||||||||||||||||||

| Consumer NCO ratio | 0.16 | % | 0.26 | % | 0.43 | % | 0.47 | % | 0.40 | % | ||||||||||||||||||||||||||||||||||

Nonperforming portfolio loans and leases were $528 million in the current quarter, with the resulting NPL ratio of 0.49%. Compared to the prior quarter, NPLs decreased $93 million with the NPL ratio decreasing 9 bps. Compared to the year-ago quarter, NPLs decreased $363 million with the NPL ratio decreasing 31 bps.

Nonperforming portfolio assets were $559 million in the current quarter, with the resulting NPA ratio of 0.52%. Compared to the prior quarter, NPAs decreased $98 million with the NPA ratio decreasing 9 bps. Compared to the year-ago quarter, NPAs decreased $372 million with the NPA ratio decreasing 32 bps.

The benefit from credit losses totaled $42 million in the current quarter. The allowance for credit loss ratio represented 2.00% of total portfolio loans and leases in the current quarter, compared with 2.06% in the prior quarter and 2.49% in the year-ago quarter. In the current quarter, the allowance for credit losses represented 409% of nonperforming portfolio loans

9

and leases and 386% of nonperforming portfolio assets. The allowance for loan and lease losses ratio represented 1.81% of total portfolio loans and leases in the current quarter.

Net charge-offs were $21 million in the current quarter, with the resulting NCO ratio of 0.08%. Compared to the prior quarter, net charge-offs decreased $23 million and the NCO ratio decreased 8 bps, reflecting improvement in both commercial and consumer portfolios. Compared to the year-ago quarter, net charge-offs decreased $80 million and the NCO ratio decreased 27 bps.

| Capital Position | ||||||||||||||||||||||||||||||||||||||||||||||||||

| As of and For the Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||

| September | June | March | December | September | ||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2021 | 2021 | 2020 | 2020 | ||||||||||||||||||||||||||||||||||||||||||||||

| Capital Position | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Average total Bancorp shareholders' equity as a % of average assets | 11.16 | % | 11.11 | % | 11.26% | 11.34% | 11.33 | % | ||||||||||||||||||||||||||||||||||||||||||

Tangible equity(a) | 8.06 | % | 8.35 | % | 8.20% | 8.18% | 8.09 | % | ||||||||||||||||||||||||||||||||||||||||||

Tangible common equity (excluding AOCI)(a) | 7.01 | % | 7.28 | % | 7.14% | 7.11% | 6.99 | % | ||||||||||||||||||||||||||||||||||||||||||

Tangible common equity (including AOCI)(a) | 7.74 | % | 8.18 | % | 7.95% | 8.29% | 8.31 | % | ||||||||||||||||||||||||||||||||||||||||||

Regulatory Capital Ratios(d)(e) | ||||||||||||||||||||||||||||||||||||||||||||||||||

CET1 capital | 9.85 | % | 10.37 | % | 10.46% | 10.34% | 10.14 | % | ||||||||||||||||||||||||||||||||||||||||||

Tier I risk-based capital | 11.27 | % | 11.83 | % | 11.94% | 11.83% | 11.64 | % | ||||||||||||||||||||||||||||||||||||||||||

Total risk-based capital | 13.92 | % | 14.60 | % | 14.80% | 15.08% | 14.93 | % | ||||||||||||||||||||||||||||||||||||||||||

| Tier I leverage | 8.35 | % | 8.55 | % | 8.61% | 8.49% | 8.37 | % | ||||||||||||||||||||||||||||||||||||||||||

Capital ratios remained strong this quarter. The CET1 capital ratio was 9.85%, the tangible common equity to tangible assets ratio was 7.01% excluding AOCI, and 7.74% including AOCI. The Tier I risk-based capital ratio was 11.27%, the Total risk-based capital ratio was 13.92%, and the Tier I leverage ratio was 8.35%. Certain capital ratios, including the Tier I leverage ratio, continued to be impacted by the increase in assets since the onset of the pandemic, predominantly from 0% risk-weighted assets resulting from interest-bearing cash as well as PPP loans.

During the third quarter of 2021, Fifth Third repurchased approximately $550 million of its outstanding stock, which reduced common shares by approximately 14.5 million at quarter end. Fifth Third also increased its quarterly cash dividend on its common shares $0.03, or 11%, to $0.30 per share for the third quarter of 2021.

10

Tax Rate

The effective tax rate was 21.3% compared with 22.1% in the prior quarter and 22.1% in the year-ago quarter.

Conference Call

Fifth Third will host a conference call to discuss these financial results at 9:00 a.m. (Eastern Time) today. This conference call will be webcast live and may be accessed through the Fifth Third Investor Relations website at www.53.com (click on “About Us” then “Investor Relations”). Those unable to listen to the live webcast may access a webcast replay through the Fifth Third Investor Relations website at the same web address, which will be available for 30 days.

Corporate Profile

Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio, and the indirect parent company of Fifth Third Bank, National Association, a federally chartered institution. As of September 30, 2021, the Company had $208 billion in assets and operates 1,100 full-service Banking Centers, and 2,336 Fifth Third branded ATMs in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia, North Carolina and South Carolina. In total, Fifth Third provides its customers with access to approximately 52,000 fee-free ATMs across the United States. Fifth Third operates four main businesses: Commercial Banking, Branch Banking, Consumer Lending, and Wealth & Asset Management. Fifth Third is among the largest money managers in the Midwest and, as of September 30, 2021, had $541 billion in assets under care, of which it managed $61 billion for individuals, corporations and not-for-profit organizations through its Trust and Registered Investment Advisory businesses. Investor information and press releases can be viewed at www.53.com. Fifth Third’s common stock is traded on the NASDAQ® Global Select Market under the symbol “FITB.”

Earnings Release End Notes

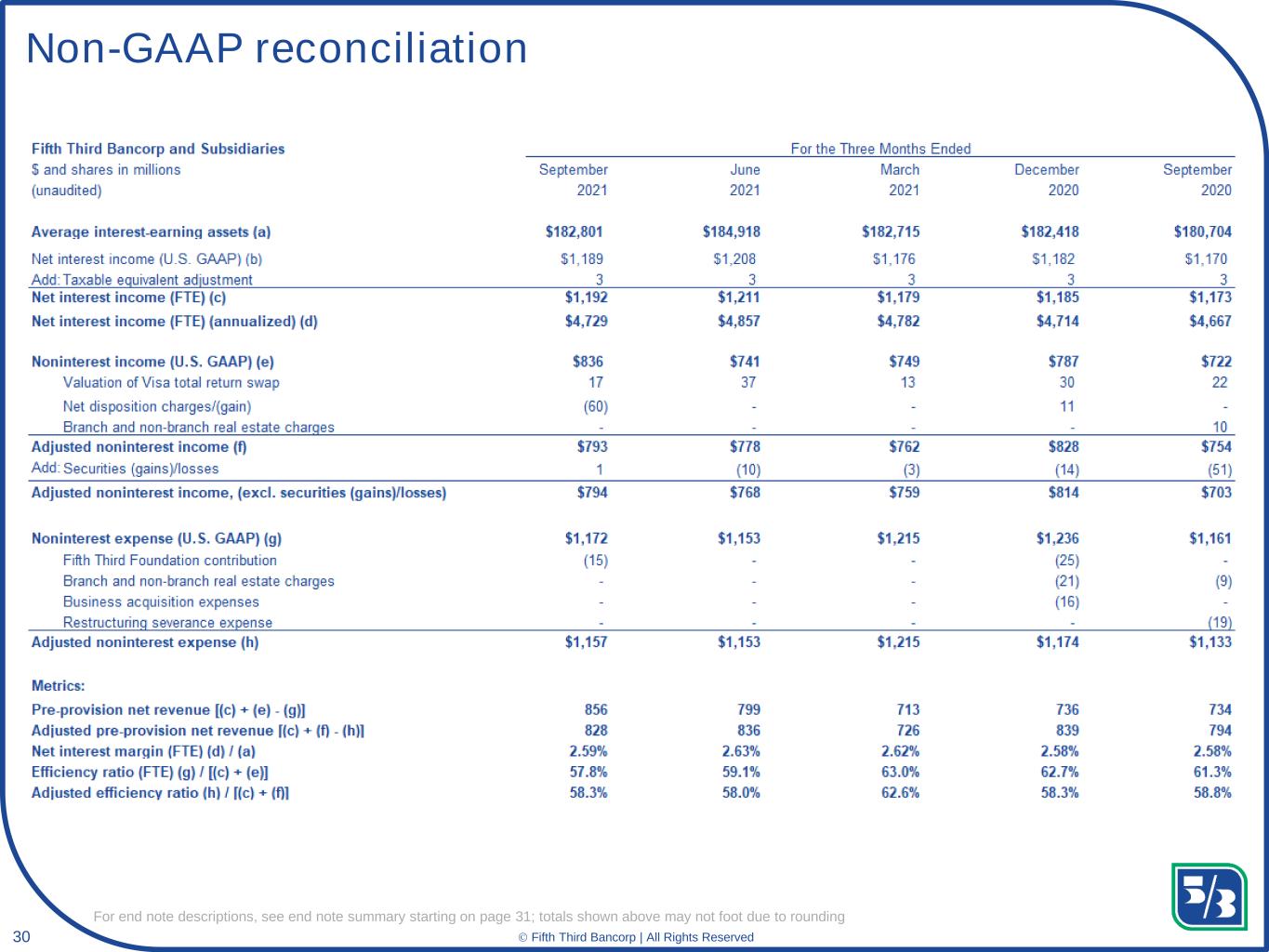

(a)Non-GAAP measure; see discussion of non-GAAP reconciliation beginning on page 27.

(b)Net losses charged-off as a percent of average portfolio loans and leases presented on an annualized basis.

(c)Nonperforming portfolio assets as a percent of portfolio loans and leases and OREO.

(d)Regulatory capital ratios are calculated pursuant to the five-year transition provision option to phase in the effects of CECL on regulatory capital after its adoption on January 1, 2020.

(e)Current period regulatory capital ratios are estimated.

(f)Assumes a 23% tax rate.

(g)Third quarter 2021 underlying NIM calculated by reducing average interest-earning assets approximately $29.6 billion resulting from excess cash compared to normalized levels (average other short term investments less a $2.5 billion normalized level) and approximately $3.1 billion from average PPP balances (with a corresponding reduction to net interest income of approximately $47 million), resulting in an underlying NIM of approximately 3.03%; Second quarter 2021 underlying NIM calculated by reducing average interest-earning assets approximately $31.1 billion resulting from excess cash compared to normalized levels (average other short term investments less a $2.5 billion normalized level) and approximately $4.8 billion from average PPP balances (with a corresponding reduction to net interest income of approximately $53 million), resulting in an underlying NIM of approximately 3.12%.

(h)Includes commercial customer Eurodollar sweep balances for which the Bank pays rates comparable to other commercial deposit accounts.

(i)Nonperforming portfolio loans and leases as a percent of portfolio loans and leases and OREO.

11

FORWARD-LOOKING STATEMENTS

This release contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. All statements other than statements of historical fact are forward-looking statements. These statements relate to our financial condition, results of operations, plans, objectives, future performance, capital actions or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K as updated by our filings with the U.S. Securities and Exchange Commission (“SEC”). When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We undertake no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this document.

There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) effects of the global COVID-19 pandemic; (2) deteriorating credit quality; (3) loan concentration by location or industry of borrowers or collateral; (4) problems encountered by other financial institutions; (5) inadequate sources of funding or liquidity; (6) unfavorable actions of rating agencies; (7) inability to maintain or grow deposits; (8) limitations on the ability to receive dividends from subsidiaries; (9) cyber-security risks; (10) Fifth Third’s ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (11) failures by third-party service providers; (12) inability to manage strategic initiatives and/or organizational changes; (13) inability to implement technology system enhancements; (14) failure of internal controls and other risk management systems; (15) losses related to fraud, theft, misappropriation or violence; (16) inability to attract and retain skilled personnel; (17) adverse impacts of government regulation; (18) governmental or regulatory changes or other actions; (19) failures to meet applicable capital requirements; (20) regulatory objections to Fifth Third’s capital plan; (21) regulation of Fifth Third’s derivatives activities; (22) deposit insurance premiums; (23) assessments for the orderly liquidation fund; (24) replacement of LIBOR; (25) weakness in the national or local economies; (26) global political and economic uncertainty or negative actions; (27) changes in interest rates; (28) changes and trends in capital markets; (29) fluctuation of Fifth Third’s stock price; (30) volatility in mortgage banking revenue; (31) litigation, investigations, and enforcement proceedings by governmental authorities; (32) breaches of contractual covenants, representations and warranties; (33) competition and changes in the financial services industry; (34) changing retail distribution strategies, customer preferences and behavior; (35) difficulties in identifying, acquiring or integrating suitable strategic partnerships, investments or acquisitions; (36) potential dilution from future acquisitions; (37) loss of income and/or difficulties encountered in the sale and separation of businesses, investments or other assets; (38) results of investments or acquired entities; (39) changes in accounting standards or interpretation or declines in the value of Fifth Third’s goodwill or other intangible assets; (40) inaccuracies or other failures from the use of models; (41) effects of critical accounting policies and judgments or the use of inaccurate estimates; (42) weather-related events, other natural disasters, or health emergencies (including pandemics); (43) the impact of reputational risk created by these or other developments on such matters as business generation and retention, funding and liquidity; and (44) changes in law or requirements imposed by Fifth Third’s regulators impacting our capital actions, including dividend payments and stock repurchases.

You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as may be required by law, and we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The information contained herein is intended to be reviewed in its totality, and any stipulations, conditions or provisos that apply to a given piece of information in one part of this press release should be read as applying mutatis mutandis to every other instance of such information appearing herein.

# # #

12

Quarterly Financial Review for September 30, 2021

Table of Contents

| Financial Highlights | 14-15 | ||||||||||

| Consolidated Statements of Income | 16-17 | ||||||||||

| Consolidated Balance Sheets | 18-19 | ||||||||||

| Consolidated Statements of Changes in Equity | 20 | ||||||||||

| Average Balance Sheet and Yield Analysis | 21-22 | ||||||||||

| Summary of Loans and Leases | 23 | ||||||||||

| Regulatory Capital | 24 | ||||||||||

| Summary of Credit Loss Experience | 25 | ||||||||||

| Asset Quality | 26 | ||||||||||

| Non-GAAP Reconciliation | 27-29 | ||||||||||

| Segment Presentation | 30 | ||||||||||

13

| Fifth Third Bancorp and Subsidiaries | |||||||||||||||||||||||||||||

| Financial Highlights | % / bps | % / bps | |||||||||||||||||||||||||||

| $ in millions, except per share data | For the Three Months Ended | Change | Year to Date | Change | |||||||||||||||||||||||||

| (unaudited) | September | June | September | September | September | ||||||||||||||||||||||||

| 2021 | 2021 | 2020 | Seq | Yr/Yr | 2021 | 2020 | Yr/Yr | ||||||||||||||||||||||

| Income Statement Data | |||||||||||||||||||||||||||||

| Net interest income | $1,189 | $1,208 | $1,170 | (2%) | 2% | $3,574 | $3,600 | (1%) | |||||||||||||||||||||

Net interest income (FTE)(a) | 1,192 | 1,211 | 1,173 | (2%) | 2% | 3,583 | 3,610 | (1%) | |||||||||||||||||||||

| Noninterest income | 836 | 741 | 722 | 13% | 16% | 2,326 | 2,043 | 14% | |||||||||||||||||||||

Total revenue (FTE)(a) | 2,028 | 1,952 | 1,895 | 4% | 7% | 5,909 | 5,653 | 5% | |||||||||||||||||||||

| (Benefit from) provision for credit losses | (42) | (115) | (15) | (63%) | 180% | (330) | 1,110 | NM | |||||||||||||||||||||

| Noninterest expense | 1,172 | 1,153 | 1,161 | 2% | 1% | 3,541 | 3,482 | 2% | |||||||||||||||||||||

| Net income | 704 | 709 | 581 | (1%) | 21% | 2,107 | 823 | 156% | |||||||||||||||||||||

| Net income available to common shareholders | 684 | 674 | 562 | 1% | 22% | 2,032 | 754 | 169% | |||||||||||||||||||||

| Earnings Per Share Data | |||||||||||||||||||||||||||||

| Net income allocated to common shareholders | $683 | $673 | $560 | 1% | 22% | $2,027 | $751 | 170% | |||||||||||||||||||||

| Average common shares outstanding (in thousands): | |||||||||||||||||||||||||||||

| Basic | 697,457 | 708,833 | 715,102 | (2%) | (2%) | 706,846 | 714,477 | (1%) | |||||||||||||||||||||

| Diluted | 706,090 | 718,085 | 718,894 | (2%) | (2%) | 715,803 | 718,943 | — | |||||||||||||||||||||

| Earnings per share, basic | $0.98 | $0.95 | $0.78 | 3% | 26% | $2.87 | $1.05 | 173% | |||||||||||||||||||||

| Earnings per share, diluted | 0.97 | 0.94 | 0.78 | 3% | 24% | 2.83 | 1.04 | 172% | |||||||||||||||||||||

| Common Share Data | |||||||||||||||||||||||||||||

| Cash dividends per common share | $0.30 | $0.27 | $0.27 | 11% | 11% | $0.84 | $0.81 | 4% | |||||||||||||||||||||

| Book value per share | 29.59 | 29.57 | 29.25 | — | 1% | 29.59 | 29.25 | 1% | |||||||||||||||||||||

| Market value per share | 42.44 | 38.23 | 21.32 | 11% | 99% | 42.44 | 21.32 | 99% | |||||||||||||||||||||

| Common shares outstanding (in thousands) | 689,790 | 703,740 | 712,328 | (2%) | (3%) | 689,790 | 712,328 | (3%) | |||||||||||||||||||||

| Market capitalization | $29,275 | $26,904 | $15,187 | 9% | 93% | $29,275 | $15,187 | 93% | |||||||||||||||||||||

| Financial Ratios | |||||||||||||||||||||||||||||

| Return on average assets | 1.36 | % | 1.38 | % | 1.14 | % | (2) | 22 | 1.37 | % | 0.58 | % | 79 | ||||||||||||||||

| Return on average common equity | 13.0 | % | 13.0 | % | 10.7 | % | — | 230 | 13.1 | % | 4.9 | % | 820 | ||||||||||||||||

Return on average tangible common equity(a) | 16.9 | % | 16.6 | % | 13.8 | % | 30 | 310 | 16.8 | % | 6.5 | % | NM | ||||||||||||||||

Noninterest income as a percent of total revenue(a) | 41 | % | 38 | % | 38 | % | 300 | 300 | 39 | % | 36 | % | 300 | ||||||||||||||||

| Dividend payout | 30.6 | % | 28.4 | % | 34.6 | % | 220 | (620) | 29.3 | % | 77.1 | % | NM | ||||||||||||||||

| Average total Bancorp shareholders' equity as a percent of average assets | 11.16 | % | 11.11 | % | 11.33 | % | 5 | (17) | 11.18 | % | 11.71 | % | (53) | ||||||||||||||||

Tangible common equity(a) | 7.01 | % | 7.28 | % | 6.99 | % | (27) | 2 | 7.01 | % | 6.99 | % | 2 | ||||||||||||||||

Net interest margin (FTE)(a) | 2.59 | % | 2.63 | % | 2.58 | % | (4) | 1 | 2.61 | % | 2.85 | % | (24) | ||||||||||||||||

Efficiency (FTE)(a) | 57.8 | % | 59.1 | % | 61.3 | % | (130) | (350) | 59.9 | % | 61.6 | % | (170) | ||||||||||||||||

| Effective tax rate | 21.3 | % | 22.1 | % | 22.1 | % | (80) | (80) | 21.6 | % | 21.6 | % | — | ||||||||||||||||

| Credit Quality | |||||||||||||||||||||||||||||

| Net losses charged-off | $21 | $44 | $101 | (52 | %) | (79 | %) | $136 | $353 | (61 | %) | ||||||||||||||||||

| Net losses charged-off as a percent of average portfolio loans and leases (annualized) | 0.08 | % | 0.16 | % | 0.35 | % | (8) | (27) | 0.17 | % | 0.41 | % | (24) | ||||||||||||||||

| ALLL as a percent of portfolio loans and leases | 1.81 | % | 1.89 | % | 2.32 | % | (8) | (51) | 1.81 | % | 2.32 | % | (51) | ||||||||||||||||

ACL as a percent of portfolio loans and leases(g) | 2.00 | % | 2.06 | % | 2.49 | % | (6) | (49) | 2.00 | % | 2.49 | % | (49) | ||||||||||||||||

| Nonperforming portfolio assets as a percent of portfolio loans and leases and OREO | 0.52 | % | 0.61 | % | 0.84 | % | (9) | (32) | 0.52 | % | 0.84 | % | (32) | ||||||||||||||||

| Average Balances | |||||||||||||||||||||||||||||

| Loans and leases, including held for sale | $113,528 | $114,443 | $114,613 | (1%) | (1%) | $113,890 | $115,401 | (1%) | |||||||||||||||||||||

| Securities and other short-term investments | 69,273 | 70,475 | 66,091 | (2%) | 5% | 69,589 | 54,021 | 29% | |||||||||||||||||||||

| Assets | 205,449 | 206,353 | 202,533 | — | 1% | 205,219 | 190,973 | 7% | |||||||||||||||||||||

Transaction deposits(b) | 159,404 | 158,779 | 148,567 | — | 7% | 157,361 | 136,293 | 15% | |||||||||||||||||||||

Core deposits(c) | 161,787 | 161,475 | 152,278 | — | 6% | 160,067 | 140,695 | 14% | |||||||||||||||||||||

Wholesale funding(d) | 14,387 | 16,470 | 21,762 | (13%) | (34%) | 16,400 | 22,441 | (27%) | |||||||||||||||||||||

| Bancorp shareholders' equity | 22,927 | 22,927 | 22,952 | — | — | 22,935 | 22,364 | 3% | |||||||||||||||||||||

Regulatory Capital Ratios(e)(f) | |||||||||||||||||||||||||||||

CET1 capital | 9.85 | % | 10.37 | % | 10.14 | % | (52) | (29) | 9.85 | % | 10.14 | % | (29) | ||||||||||||||||

Tier I risk-based capital | 11.27 | % | 11.83 | % | 11.64 | % | (56) | (37) | 11.27 | % | 11.64 | % | (37) | ||||||||||||||||

Total risk-based capital | 13.92 | % | 14.60 | % | 14.93 | % | (68) | (101) | 13.92 | % | 14.93 | % | (101) | ||||||||||||||||

| Tier I leverage | 8.35 | % | 8.55 | % | 8.37 | % | (20) | (2) | 8.35 | % | 8.37 | % | (2) | ||||||||||||||||

| Operations | |||||||||||||||||||||||||||||

| Banking centers | 1,100 | 1,096 | 1,122 | — | (2%) | 1,100 | 1,122 | (2%) | |||||||||||||||||||||

| ATMs | 2,336 | 2,369 | 2,414 | (1%) | (3%) | 2,336 | 2,414 | (3%) | |||||||||||||||||||||

| Full-time equivalent employees | 19,171 | 19,402 | 20,283 | (1%) | (5%) | 19,171 | 20,283 | (5%) | |||||||||||||||||||||

(a)Non-GAAP measure; see discussion and reconciliation of non-GAAP measures beginning on page 27.

(b)Includes demand, interest checking, savings, money market and foreign office deposits of commercial customers.

(c)Includes transaction deposits plus other time deposits.

(d)Includes certificates $100,000 and over, other deposits, federal funds purchased, other short-term borrowings and long-term debt.

(e)Current period regulatory capital ratios are estimates.

(f)Regulatory capital ratios are calculated pursuant to the five-year transition provision option to phase in the effects of CECL on regulatory capital after its adoption on January 1, 2020.

(g)The allowance for credit losses is the sum of the ALLL and the reserve for unfunded commitments.

14

| Fifth Third Bancorp and Subsidiaries | ||||||||||||||||||||

| Financial Highlights | ||||||||||||||||||||

| $ in millions, except per share data | For the Three Months Ended | |||||||||||||||||||

| (unaudited) | September | June | March | December | September | |||||||||||||||

| 2021 | 2021 | 2021 | 2020 | 2020 | ||||||||||||||||

| Income Statement Data | ||||||||||||||||||||

| Net interest income | $1,189 | $1,208 | $1,176 | $1,182 | $1,170 | |||||||||||||||

Net interest income (FTE)(a) | 1,192 | 1,211 | 1,179 | 1,185 | 1,173 | |||||||||||||||

| Noninterest income | 836 | 741 | 749 | 787 | 722 | |||||||||||||||

Total revenue (FTE)(a) | 2,028 | 1,952 | 1,928 | 1,972 | 1,895 | |||||||||||||||

| Benefit from credit losses | (42) | (115) | (173) | (13) | (15) | |||||||||||||||

| Noninterest expense | 1,172 | 1,153 | 1,215 | 1,236 | 1,161 | |||||||||||||||

| Net income | 704 | 709 | 694 | 604 | 581 | |||||||||||||||

| Net income available to common shareholders | 684 | 674 | 674 | 569 | 562 | |||||||||||||||

| Earnings Per Share Data | ||||||||||||||||||||

| Net income allocated to common shareholders | $683 | $673 | $672 | $567 | $560 | |||||||||||||||

| Average common shares outstanding (in thousands): | ||||||||||||||||||||

| Basic | 697,457 | 708,833 | 714,433 | 715,482 | 715,102 | |||||||||||||||

| Diluted | 706,090 | 718,085 | 723,425 | 722,096 | 718,894 | |||||||||||||||

| Earnings per share, basic | $0.98 | $0.95 | $0.94 | $0.79 | $0.78 | |||||||||||||||

| Earnings per share, diluted | 0.97 | 0.94 | 0.93 | 0.78 | 0.78 | |||||||||||||||

| Common Share Data | ||||||||||||||||||||

| Cash dividends per common share | $0.30 | $0.27 | $0.27 | $0.27 | $0.27 | |||||||||||||||

| Book value per share | 29.59 | 29.57 | 28.78 | 29.46 | 29.25 | |||||||||||||||

| Market value per share | 42.44 | 38.23 | 37.45 | 27.57 | 21.32 | |||||||||||||||

| Common shares outstanding (in thousands) | 689,790 | 703,740 | 711,596 | 712,760 | 712,328 | |||||||||||||||

| Market capitalization | $29,275 | $26,904 | $26,649 | $19,651 | $15,187 | |||||||||||||||

| Financial Ratios | ||||||||||||||||||||

| Return on average assets | 1.36 | % | 1.38 | % | 1.38 | % | 1.18 | % | 1.14 | % | ||||||||||

| Return on average common equity | 13.0 | % | 13.0 | % | 13.1 | % | 10.8 | % | 10.7 | % | ||||||||||

Return on average tangible common equity(a) | 16.9 | % | 16.6 | % | 16.8 | % | 13.9 | % | 13.8 | % | ||||||||||

Noninterest income as a percent of total revenue(a) | 41 | % | 38 | % | 39 | % | 40 | % | 38 | % | ||||||||||

| Dividend payout | 30.6 | % | 28.4 | % | 28.7 | % | 34.2 | % | 34.6 | % | ||||||||||

| Average total Bancorp shareholders' equity as a percent of average assets | 11.16 | % | 11.11 | % | 11.26 | % | 11.34 | % | 11.33 | % | ||||||||||

Tangible common equity(a) | 7.01 | % | 7.28 | % | 7.14 | % | 7.11 | % | 6.99 | % | ||||||||||

Net interest margin (FTE)(a) | 2.59 | % | 2.63 | % | 2.62 | % | 2.58 | % | 2.58 | % | ||||||||||

Efficiency (FTE)(a) | 57.8 | % | 59.1 | % | 63.0 | % | 62.7 | % | 61.3 | % | ||||||||||

| Effective tax rate | 21.3 | % | 22.1 | % | 21.4 | % | 19.1 | % | 22.1 | % | ||||||||||

| Credit Quality | ||||||||||||||||||||

| Net losses charged-off | $21 | $44 | $71 | $118 | $101 | |||||||||||||||

| Net losses charged-off as a percent of average portfolio loans and leases (annualized) | 0.08 | % | 0.16 | % | 0.27 | % | 0.43 | % | 0.35 | % | ||||||||||

| ALLL as a percent of portfolio loans and leases | 1.81 | % | 1.89 | % | 2.03 | % | 2.25 | % | 2.32 | % | ||||||||||

ACL as a percent of portfolio loans and leases(g) | 2.00 | % | 2.06 | % | 2.19 | % | 2.41 | % | 2.49 | % | ||||||||||

| Nonperforming portfolio assets as a percent of portfolio loans and leases and OREO | 0.52 | % | 0.61 | % | 0.72 | % | 0.79 | % | 0.84 | % | ||||||||||

| Average Balances | ||||||||||||||||||||

| Loans and leases, including held for sale | $113,528 | $114,443 | $113,701 | $111,464 | $114,613 | |||||||||||||||

| Securities and other short-term investments | 69,273 | 70,475 | 69,014 | 70,954 | 66,091 | |||||||||||||||

| Assets | 205,449 | 206,353 | 203,836 | 203,930 | 202,533 | |||||||||||||||

Transaction deposits(b) | 159,404 | 158,779 | 153,834 | 153,053 | 148,567 | |||||||||||||||

Core deposits(c) | 161,787 | 161,475 | 156,879 | 156,326 | 152,278 | |||||||||||||||

Wholesale funding(d) | 14,387 | 16,470 | 18,391 | 18,716 | 21,762 | |||||||||||||||

| Bancorp shareholders' equity | 22,927 | 22,927 | 22,952 | 23,126 | 22,952 | |||||||||||||||

Regulatory Capital Ratios(e)(f) | ||||||||||||||||||||

CET1 capital | 9.85 | % | 10.37 | % | 10.46 | % | 10.34 | % | 10.14 | % | ||||||||||

Tier I risk-based capital | 11.27 | % | 11.83 | % | 11.94 | % | 11.83 | % | 11.64 | % | ||||||||||

Total risk-based capital | 13.92 | % | 14.60 | % | 14.80 | % | 15.08 | % | 14.93 | % | ||||||||||

| Tier I leverage | 8.35 | % | 8.55 | % | 8.61 | % | 8.49 | % | 8.37 | % | ||||||||||

| Operations | ||||||||||||||||||||

| Banking centers | 1,100 | 1,096 | 1,098 | 1,134 | 1,122 | |||||||||||||||

| ATMs | 2,336 | 2,369 | 2,383 | 2,397 | 2,414 | |||||||||||||||

| Full-time equivalent employees | 19,171 | 19,402 | 19,819 | 19,872 | 20,283 | |||||||||||||||

(a)Non-GAAP measure; see discussion and reconciliation of non-GAAP measures beginning on page 27.

(b)Includes demand, interest checking, savings, money market and foreign office deposits of commercial customers.

(c)Includes transaction deposits plus other time deposits.

(d)Includes certificates $100,000 and over, other deposits, federal funds purchased, other short-term borrowings and long-term debt.

(e)Current period regulatory capital ratios are estimates.

(f)Regulatory capital ratios are calculated pursuant to the five-year transition provision option to phase in the effects of CECL on regulatory capital after its adoption on January 1, 2020.

(g)The allowance for credit losses is the sum of the ALLL and the reserve for unfunded commitments.

15

| Fifth Third Bancorp and Subsidiaries | ||||||||||||||||||||||||||

| Consolidated Statements of Income | ||||||||||||||||||||||||||

| $ in millions | For the Three Months Ended | % Change | Year to Date | % Change | ||||||||||||||||||||||

| (unaudited) | September | June | September | September | September | |||||||||||||||||||||

| 2021 | 2021 | 2020 | Seq | Yr/Yr | 2021 | 2020 | Yr/Yr | |||||||||||||||||||

| Interest Income | ||||||||||||||||||||||||||

| Interest and fees on loans and leases | $1,014 | $1,035 | $1,047 | (2%) | (3%) | $3,078 | $3,397 | (9%) | ||||||||||||||||||

| Interest on securities | 266 | 279 | 274 | (5%) | (3%) | 809 | 840 | (4%) | ||||||||||||||||||

| Interest on other short-term investments | 12 | 9 | 8 | 33% | 50% | 29 | 20 | 45% | ||||||||||||||||||

| Total interest income | 1,292 | 1,323 | 1,329 | (2%) | (3%) | 3,916 | 4,257 | (8%) | ||||||||||||||||||

| Interest Expense | ||||||||||||||||||||||||||

| Interest on deposits | 12 | 15 | 46 | (20%) | (74%) | 48 | 295 | (84%) | ||||||||||||||||||

| Interest on federal funds purchased | — | — | — | — | — | — | 2 | (100%) | ||||||||||||||||||

| Interest on other short-term borrowings | — | — | 5 | — | (100%) | 1 | 13 | (92%) | ||||||||||||||||||

| Interest on long-term debt | 91 | 100 | 108 | (9%) | (16%) | 293 | 347 | (16%) | ||||||||||||||||||

| Total interest expense | 103 | 115 | 159 | (10%) | (35%) | 342 | 657 | (48%) | ||||||||||||||||||

| Net Interest Income | 1,189 | 1,208 | 1,170 | (2%) | 2% | 3,574 | 3,600 | (1%) | ||||||||||||||||||

| (Benefit from) provision for credit losses | (42) | (115) | (15) | (63%) | 180% | (330) | 1,110 | NM | ||||||||||||||||||

| Net Interest Income After (Benefit from) Provision for Credit Losses | 1,231 | 1,323 | 1,185 | (7%) | 4% | 3,904 | 2,490 | 57% | ||||||||||||||||||

| Noninterest Income | ||||||||||||||||||||||||||

| Service charges on deposits | 152 | 149 | 144 | 2% | 6% | 445 | 414 | 7% | ||||||||||||||||||

| Commercial banking revenue | 152 | 160 | 125 | (5%) | 22% | 465 | 387 | 20% | ||||||||||||||||||

| Mortgage banking net revenue | 86 | 64 | 76 | 34% | 13% | 235 | 295 | (20%) | ||||||||||||||||||

| Wealth and asset management revenue | 147 | 145 | 132 | 1% | 11% | 436 | 387 | 13% | ||||||||||||||||||

| Card and processing revenue | 102 | 102 | 92 | — | 11% | 298 | 260 | 15% | ||||||||||||||||||

| Leasing business revenue | 78 | 61 | 77 | 28% | 1% | 226 | 207 | 9% | ||||||||||||||||||

| Other noninterest income | 120 | 49 | 26 | 145% | 362% | 211 | 42 | 402% | ||||||||||||||||||

| Securities gains (losses), net | (1) | 10 | 51 | NM | NM | 12 | 48 | (75%) | ||||||||||||||||||

| Securities (losses) gains, net - non-qualifying hedges on mortgage servicing rights | — | 1 | (1) | (100%) | (100%) | (2) | 3 | NM | ||||||||||||||||||

| Total noninterest income | 836 | 741 | 722 | 13% | 16% | 2,326 | 2,043 | 14% | ||||||||||||||||||

| Noninterest Expense | ||||||||||||||||||||||||||

| Compensation and benefits | 627 | 638 | 637 | (2%) | (2%) | 1,971 | 1,911 | 3% | ||||||||||||||||||

| Net occupancy expense | 79 | 77 | 90 | 3% | (12%) | 235 | 254 | (7%) | ||||||||||||||||||

| Technology and communications | 98 | 94 | 89 | 4% | 10% | 285 | 272 | 5% | ||||||||||||||||||

| Equipment expense | 34 | 34 | 33 | — | 3% | 102 | 97 | 5% | ||||||||||||||||||

| Card and processing expense | 19 | 20 | 29 | (5%) | (34%) | 70 | 89 | (21%) | ||||||||||||||||||

| Leasing business expense | 33 | 33 | 35 | — | (6%) | 102 | 103 | (1%) | ||||||||||||||||||

| Marketing expense | 29 | 20 | 23 | 45% | 26% | 72 | 74 | (3%) | ||||||||||||||||||

| Other noninterest expense | 253 | 237 | 225 | 7% | 12% | 704 | 682 | 3% | ||||||||||||||||||

| Total noninterest expense | 1,172 | 1,153 | 1,161 | 2% | 1% | 3,541 | 3,482 | 2% | ||||||||||||||||||

| Income Before Income Taxes | 895 | 911 | 746 | (2%) | 20% | 2,689 | 1,051 | 156% | ||||||||||||||||||

| Applicable income tax expense | 191 | 202 | 165 | (5%) | 16% | 582 | 228 | 155% | ||||||||||||||||||

| Net Income | 704 | 709 | 581 | (1%) | 21% | 2,107 | 823 | 156% | ||||||||||||||||||

| Dividends on preferred stock | 20 | 35 | 19 | (43%) | 5% | 75 | 69 | 9% | ||||||||||||||||||

| Net Income Available to Common Shareholders | $684 | $674 | $562 | 1% | 22% | $2,032 | $754 | 169% | ||||||||||||||||||

16

| Fifth Third Bancorp and Subsidiaries | |||||||||||||||||

| Consolidated Statements of Income | |||||||||||||||||

| $ in millions | For the Three Months Ended | ||||||||||||||||

| (unaudited) | September | June | March | December | September | ||||||||||||

| 2021 | 2021 | 2021 | 2020 | 2020 | |||||||||||||

| Interest Income | |||||||||||||||||

| Interest and fees on loans and leases | $1,014 | $1,035 | $1,030 | $1,028 | $1,047 | ||||||||||||

| Interest on securities | 266 | 279 | 264 | 278 | 274 | ||||||||||||

| Interest on other short-term investments | 12 | 9 | 8 | 9 | 8 | ||||||||||||

| Total interest income | 1,292 | 1,323 | 1,302 | 1,315 | 1,329 | ||||||||||||

| Interest Expense | |||||||||||||||||

| Interest on deposits | 12 | 15 | 21 | 27 | 46 | ||||||||||||

| Interest on other short-term borrowings | — | — | 1 | 1 | 5 | ||||||||||||

| Interest on long-term debt | 91 | 100 | 104 | 105 | 108 | ||||||||||||

| Total interest expense | 103 | 115 | 126 | 133 | 159 | ||||||||||||

| Net Interest Income | 1,189 | 1,208 | 1,176 | 1,182 | 1,170 | ||||||||||||

| Benefit from credit losses | (42) | (115) | (173) | (13) | (15) | ||||||||||||

| Net Interest Income After Benefit from Credit Losses | 1,231 | 1,323 | 1,349 | 1,195 | 1,185 | ||||||||||||

| Noninterest Income | |||||||||||||||||

| Service charges on deposits | 152 | 149 | 144 | 146 | 144 | ||||||||||||

| Commercial banking revenue | 152 | 160 | 153 | 141 | 125 | ||||||||||||

| Mortgage banking net revenue | 86 | 64 | 85 | 25 | 76 | ||||||||||||

| Wealth and asset management revenue | 147 | 145 | 143 | 133 | 132 | ||||||||||||

| Card and processing revenue | 102 | 102 | 94 | 92 | 92 | ||||||||||||

| Leasing business revenue | 78 | 61 | 87 | 69 | 77 | ||||||||||||

| Other noninterest income | 120 | 49 | 42 | 168 | 26 | ||||||||||||

| Securities (losses) gains, net | (1) | 10 | 3 | 14 | 51 | ||||||||||||

| Securities (losses) gains, net - non-qualifying hedges on mortgage servicing rights | — | 1 | (2) | (1) | (1) | ||||||||||||

| Total noninterest income | 836 | 741 | 749 | 787 | 722 | ||||||||||||

| Noninterest Expense | |||||||||||||||||

| Compensation and benefits | 627 | 638 | 706 | 679 | 637 | ||||||||||||

| Net occupancy expense | 79 | 77 | 79 | 98 | 90 | ||||||||||||

| Technology and communications | 98 | 94 | 93 | 90 | 89 | ||||||||||||

| Equipment expense | 34 | 34 | 34 | 34 | 33 | ||||||||||||

| Card and processing expense | 19 | 20 | 30 | 31 | 29 | ||||||||||||

| Leasing business expense | 33 | 33 | 35 | 37 | 35 | ||||||||||||

| Marketing expense | 29 | 20 | 23 | 30 | 23 | ||||||||||||

| Other noninterest expense | 253 | 237 | 215 | 237 | 225 | ||||||||||||

| Total noninterest expense | 1,172 | 1,153 | 1,215 | 1,236 | 1,161 | ||||||||||||

| Income Before Income Taxes | 895 | 911 | 883 | 746 | 746 | ||||||||||||

| Applicable income tax expense | 191 | 202 | 189 | 142 | 165 | ||||||||||||

| Net Income | 704 | 709 | 694 | 604 | 581 | ||||||||||||

| Dividends on preferred stock | 20 | 35 | 20 | 35 | 19 | ||||||||||||

| Net Income Available to Common Shareholders | $684 | $674 | $674 | $569 | $562 | ||||||||||||

17

| Fifth Third Bancorp and Subsidiaries | |||||||||||||||||

| Consolidated Balance Sheets | |||||||||||||||||

| $ in millions, except per share data | As of | % Change | |||||||||||||||

| (unaudited) | September | June | September | ||||||||||||||

| 2021 | 2021 | 2020 | Seq | Yr/Yr | |||||||||||||

| Assets | |||||||||||||||||

| Cash and due from banks | $3,213 | $3,285 | $2,996 | (2%) | 7% | ||||||||||||

| Other short-term investments | 34,203 | 32,409 | 31,285 | 6% | 9% | ||||||||||||

Available-for-sale debt and other securities(a) | 37,870 | 38,012 | 37,425 | — | 1% | ||||||||||||

Held-to-maturity securities(b) | 8 | 10 | 15 | (20%) | (47%) | ||||||||||||

| Trading debt securities | 685 | 711 | 704 | (4%) | (3%) | ||||||||||||

| Equity securities | 329 | 341 | 277 | (4%) | 19% | ||||||||||||

| Loans and leases held for sale | 5,203 | 5,730 | 2,323 | (9%) | 124% | ||||||||||||

| Portfolio loans and leases: | |||||||||||||||||

| Commercial and industrial loans | 47,834 | 47,564 | 51,695 | 1% | (7%) | ||||||||||||

| Commercial mortgage loans | 10,300 | 10,347 | 10,878 | — | (5%) | ||||||||||||

| Commercial construction loans | 5,456 | 5,871 | 5,656 | (7%) | (4%) | ||||||||||||

| Commercial leases | 3,130 | 3,238 | 3,021 | (3%) | 4% | ||||||||||||

| Total commercial loans and leases | 66,720 | 67,020 | 71,250 | — | (6%) | ||||||||||||

| Residential mortgage loans | 16,158 | 16,131 | 16,158 | — | — | ||||||||||||

| Home equity | 4,276 | 4,545 | 5,455 | (6%) | (22%) | ||||||||||||

| Indirect secured consumer loans | 16,004 | 15,192 | 12,925 | 5% | 24% | ||||||||||||

| Credit card | 1,744 | 1,793 | 2,087 | (3%) | (16%) | ||||||||||||

| Other consumer loans | 3,009 | 3,052 | 2,856 | (1%) | 5% | ||||||||||||

| Total consumer loans | 41,191 | 40,713 | 39,481 | 1% | 4% | ||||||||||||

| Portfolio loans and leases | 107,911 | 107,733 | 110,731 | — | (3%) | ||||||||||||

| Allowance for loan and lease losses | (1,954) | (2,033) | (2,574) | (4%) | (24%) | ||||||||||||

| Portfolio loans and leases, net | 105,957 | 105,700 | 108,157 | — | (2%) | ||||||||||||

| Bank premises and equipment | 2,101 | 2,073 | 2,090 | 1% | 1% | ||||||||||||

| Operating lease equipment | 647 | 715 | 818 | (10%) | (21%) | ||||||||||||

| Goodwill | 4,514 | 4,259 | 4,261 | 6% | 6% | ||||||||||||

| Intangible assets | 169 | 117 | 157 | 44% | 8% | ||||||||||||

| Servicing rights | 943 | 818 | 660 | 15% | 43% | ||||||||||||

| Other assets | 11,889 | 11,210 | 10,828 | 6% | 10% | ||||||||||||

| Total Assets | $207,731 | $205,390 | $201,996 | 1% | 3% | ||||||||||||

| Liabilities | |||||||||||||||||

| Deposits: | |||||||||||||||||

| Demand | $63,879 | $62,760 | $51,896 | 2% | 23% | ||||||||||||

| Interest checking | 45,964 | 44,872 | 49,566 | 2% | (7%) | ||||||||||||

| Savings | 21,423 | 20,667 | 17,221 | 4% | 24% | ||||||||||||

| Money market | 30,652 | 30,564 | 31,192 | — | (2%) | ||||||||||||

| Foreign office | 202 | 152 | 160 | 33% | 26% | ||||||||||||

| Other time | 2,204 | 2,408 | 3,337 | (8%) | (34%) | ||||||||||||

| Certificates $100,000 and over | 784 | 860 | 3,311 | (9%) | (76%) | ||||||||||||

| Total deposits | 165,108 | 162,283 | 156,683 | 2% | 5% | ||||||||||||

| Federal funds purchased | 309 | 338 | 251 | (9%) | 23% | ||||||||||||

| Other short-term borrowings | 949 | 1,130 | 1,196 | (16%) | (21%) | ||||||||||||

| Accrued taxes, interest and expenses | 2,083 | 2,045 | 2,500 | 2% | (17%) | ||||||||||||

| Other liabilities | 5,339 | 4,304 | 3,292 | 24% | 62% | ||||||||||||

| Long-term debt | 11,419 | 12,364 | 15,123 | (8%) | (24%) | ||||||||||||

| Total Liabilities | 185,207 | 182,464 | 179,045 | 2% | 3% | ||||||||||||

| Equity | |||||||||||||||||

Common stock(c) | 2,051 | 2,051 | 2,051 | — | — | ||||||||||||

| Preferred stock | 2,116 | 2,116 | 2,116 | — | — | ||||||||||||

| Capital surplus | 3,611 | 3,602 | 3,624 | — | — | ||||||||||||

| Retained earnings | 19,817 | 19,343 | 18,010 | 2% | 10% | ||||||||||||

| Accumulated other comprehensive income | 1,637 | 1,974 | 2,831 | (17%) | (42%) | ||||||||||||

| Treasury stock | (6,708) | (6,160) | (5,681) | 9% | 18% | ||||||||||||

| Total Equity | 22,524 | 22,926 | 22,951 | (2%) | (2%) | ||||||||||||

| Total Liabilities and Equity | $207,731 | $205,390 | $201,996 | 1% | 3% | ||||||||||||

| (a) Amortized cost | $36,308 | $36,081 | $34,693 | 1% | 5% | ||||||||||||

| (b) Market values | 8 | 10 | 15 | (20%) | (47%) | ||||||||||||

| (c) Common shares, stated value $2.22 per share (in thousands): | |||||||||||||||||

| Authorized | 2,000,000 | 2,000,000 | 2,000,000 | — | — | ||||||||||||

| Outstanding, excluding treasury | 689,790 | 703,740 | 712,328 | (2 | %) | (3 | %) | ||||||||||

| Treasury | 234,102 | 220,153 | 211,565 | 6 | % | 11 | % | ||||||||||

18

| Fifth Third Bancorp and Subsidiaries | |||||||||||||||||

| Consolidated Balance Sheets | |||||||||||||||||

| $ in millions, except per share data | As of | ||||||||||||||||

| (unaudited) | September | June | March | December | September | ||||||||||||

| 2021 | 2021 | 2021 | 2020 | 2020 | |||||||||||||

| Assets | |||||||||||||||||

| Cash and due from banks | $3,213 | $3,285 | $3,122 | $3,147 | $2,996 | ||||||||||||

| Other short-term investments | 34,203 | 32,409 | 34,187 | 33,399 | 31,285 | ||||||||||||

Available-for-sale debt and other securities(a) | 37,870 | 38,012 | 37,595 | 37,513 | 37,425 | ||||||||||||

Held-to-maturity securities(b) | 8 | 10 | 10 | 11 | 15 | ||||||||||||

| Trading debt securities | 685 | 711 | 728 | 560 | 704 | ||||||||||||

| Equity securities | 329 | 341 | 315 | 313 | 277 | ||||||||||||

| Loans and leases held for sale | 5,203 | 5,730 | 5,477 | 4,741 | 2,323 | ||||||||||||

| Portfolio loans and leases: | |||||||||||||||||

| Commercial and industrial loans | 47,834 | 47,564 | 49,094 | 49,665 | 51,695 | ||||||||||||

| Commercial mortgage loans | 10,300 | 10,347 | 10,481 | 10,602 | 10,878 | ||||||||||||

| Commercial construction loans | 5,456 | 5,871 | 6,198 | 5,815 | 5,656 | ||||||||||||

| Commercial leases | 3,130 | 3,238 | 3,255 | 2,915 | 3,021 | ||||||||||||

| Total commercial loans and leases | 66,720 | 67,020 | 69,028 | 68,997 | 71,250 | ||||||||||||

| Residential mortgage loans | 16,158 | 16,131 | 15,776 | 15,928 | 16,158 | ||||||||||||

| Home equity | 4,276 | 4,545 | 4,815 | 5,183 | 5,455 | ||||||||||||

| Indirect secured consumer loans | 16,004 | 15,192 | 14,336 | 13,653 | 12,925 | ||||||||||||

| Credit card | 1,744 | 1,793 | 1,810 | 2,007 | 2,087 | ||||||||||||

| Other consumer loans | 3,009 | 3,052 | 3,090 | 3,014 | 2,856 | ||||||||||||

| Total consumer loans | 41,191 | 40,713 | 39,827 | 39,785 | 39,481 | ||||||||||||

| Portfolio loans and leases | 107,911 | 107,733 | 108,855 | 108,782 | 110,731 | ||||||||||||

| Allowance for loan and lease losses | (1,954) | (2,033) | (2,208) | (2,453) | (2,574) | ||||||||||||

| Portfolio loans and leases, net | 105,957 | 105,700 | 106,647 | 106,329 | 108,157 | ||||||||||||

| Bank premises and equipment | 2,101 | 2,073 | 2,072 | 2,088 | 2,090 | ||||||||||||

| Operating lease equipment | 647 | 715 | 718 | 777 | 818 | ||||||||||||

| Goodwill | 4,514 | 4,259 | 4,259 | 4,258 | 4,261 | ||||||||||||

| Intangible assets | 169 | 117 | 127 | 139 | 157 | ||||||||||||

| Servicing rights | 943 | 818 | 784 | 656 | 660 | ||||||||||||

| Other assets | 11,889 | 11,210 | 10,858 | 10,749 | 10,828 | ||||||||||||

| Total Assets | $207,731 | $205,390 | $206,899 | $204,680 | $201,996 | ||||||||||||

| Liabilities | |||||||||||||||||

| Deposits: | |||||||||||||||||

| Demand | $63,879 | $62,760 | $61,363 | $57,711 | $51,896 | ||||||||||||

| Interest checking | 45,964 | 44,872 | 45,582 | 47,270 | 49,566 | ||||||||||||

| Savings | 21,423 | 20,667 | 20,162 | 18,258 | 17,221 | ||||||||||||

| Money market | 30,652 | 30,564 | 30,630 | 30,650 | 31,192 | ||||||||||||

| Foreign office | 202 | 152 | 113 | 143 | 160 | ||||||||||||

| Other time | 2,204 | 2,408 | 2,759 | 3,023 | 3,337 | ||||||||||||

| Certificates $100,000 and over | 784 | 860 | 1,784 | 2,026 | 3,311 | ||||||||||||

| Total deposits | 165,108 | 162,283 | 162,393 | 159,081 | 156,683 | ||||||||||||

| Federal funds purchased | 309 | 338 | 302 | 300 | 251 | ||||||||||||

| Other short-term borrowings | 949 | 1,130 | 1,106 | 1,192 | 1,196 | ||||||||||||

| Accrued taxes, interest and expenses | 2,083 | 2,045 | 1,879 | 2,614 | 2,500 | ||||||||||||

| Other liabilities | 5,339 | 4,304 | 3,881 | 3,409 | 3,292 | ||||||||||||