Form 8-K FEDERAL AGRICULTURAL For: Aug 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 8, 2022

(Exact name of registrant as specified in its charter)

Federally chartered instrumentality of the United States | ||||||||||||||

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||

Registrant’s telephone number, including area code (202 ) 872-7700

No change

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol | Exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2022, the Federal Agricultural Mortgage Corporation (“Farmer Mac”) issued a press release to announce (1) its financial results for the fiscal quarter ended June 30, 2022 and (2) a conference call to discuss those results and Farmer Mac’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2022. A copy of the press release is attached as Exhibit 99.1 and is incorporated by reference into this report. All references to www.farmermac.com in Exhibit 99.1 are inactive textual references only, and the information contained on that website is not incorporated by reference into this report.

The information furnished in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor will any of such information or Exhibit be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

On August 8, 2022, Farmer Mac posted an investor slide presentation for equity investors to its website at www.farmermac.com under the tab “Investors — Events and Presentations.” Farmer Mac expects to use the slide presentation in connection with future investor presentations to analysts and investors. The slide presentation is attached as Exhibit 99.2 and is incorporated by reference into this report. All references to www.farmermac.com in Exhibit 99.2 are inactive textual references only, and the information contained on that website is not incorporated by reference into this report.

The information furnished in this Item 7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section, nor will any of such information or Exhibit be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

104 Cover Page Inline Interactive Data File - the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document included as Exhibit 101

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

FEDERAL AGRICULTURAL MORTGAGE CORPORATION

By: /s/ Stephen P. Mullery

Name: Stephen P. Mullery

Title: Executive Vice President – General Counsel

Dated: August 8, 2022

Farmer Mac Reports Second Quarter 2022 Results

- Outstanding Business Volume of $24.5 Billion -

WASHINGTON, D.C., August 8, 2022 — The Federal Agricultural Mortgage Corporation (Farmer Mac; NYSE: AGM and AGM.A), the nation's secondary market provider that increases the availability and affordability of credit for the benefit of rural America, today announced its results for the fiscal quarter ended June 30, 2022.

Second Quarter 2022 Highlights

•Added $1.9 billion of gross business volume, resulting in net growth of $236.0 million

•Net interest income grew $14.3 million year-over-year to $69.4 million

•Net effective spread1 increased 8% from the prior-year period to $60.9 million

•Net income attributable to common stockholders of $39.1 million compared to $25.4 million in second quarter 2021

•Core earnings1 grew 3% year-over-year to $30.7 million, or $2.83 per diluted common share

•90-day delinquencies were 0.08% across the entire $24.5 billion portfolio as of June 30, 2022

"Farmer Mac delivered another quarter of strong results, generating record core earnings and demonstrating the consistency of our fundamental business model as we continue to successfully execute against our multi-year growth plan," said President & Chief Executive Officer, Brad Nordholm. "These results are again noteworthy given the current economic and market backdrop, where inflationary pressures have created heightened uncertainty across credit markets and high volatility across a broad range of prices, including key agricultural commodities. Our continued strong credit quality, solid capital position, and growing execution capability has enabled Farmer Mac to consistently deliver on our mission to bring even greater efficiencies, and lower costs, in providing financing to lenders for the benefit of their farm and ranch, agribusiness, and rural infrastructure customers. We remain confident in our ability to navigate the current environment and make the necessary investments in our infrastructure to pursue strategic growth opportunities."

| $ in thousands, except per share amounts | Quarter Ended | ||||||||||||||||

| Jun. 30, 2022 | Mar. 31, 2022 | Jun. 30, 2021 | Sequential % Change | YoY % Change | |||||||||||||

| Net Change in Business Volume | $235,981 | $628,947 | $334,630 | N/A | N/A | ||||||||||||

| Net Interest Income (GAAP) | $69,402 | $61,875 | $55,129 | 12% | 26% | ||||||||||||

| Net Effective Spread (Non-GAAP) | $60,946 | $57,839 | $56,551 | 5% | 8% | ||||||||||||

| Diluted EPS (GAAP) | $3.60 | $3.77 | $2.35 | (5)% | 53% | ||||||||||||

| Core EPS (Non-GAAP) | $2.83 | $2.37 | $2.77 | 19% | 2% | ||||||||||||

1 Non-GAAP Measure

1

Second Quarter 2022 Results

Spreads

Net interest income for second quarter 2022 was $69.4 million, a $14.3 million increase compared to $55.1 million in the prior-year period, primarily due to a $7.8 million increase in the fair value of designated financial derivatives, a $4.3 million increase from net new business volume, and a $2.5 million decrease in funding costs. Net interest yield was 1.09% in second quarter 2022 compared to 0.94% in the prior-year period.

Net effective spread, a non-GAAP measure, for second quarter 2022 was $60.9 million, a $4.4 million increase from $56.6 million in the prior-year period. The $4.4 million year-over-year increase in net effective spread was primarily due to a $4.8 million increase from net new business volume, a $0.9 million increase in net coupon yields related to the acquisition of loan servicing rights, and a $0.4 million increase in cash-basis interest income. These factors were partially offset by a $1.4 million increase in non-GAAP funding costs. In percentage terms, net effective spread was 0.99% in second quarter 2022, compared to 1.01% in the prior-year period.

Earnings

Farmer Mac's net income attributable to common stockholders for second quarter 2022 was $39.1 million ($3.60 per diluted common share), compared to $25.4 million ($2.35 per diluted common share) in the prior-year period. The $13.7 million year-over-year increase in net income attributable to common stockholders was due to a $11.3 million after-tax increase in net interest income, a $5.1 million after-tax increase in the fair value of undesignated financial derivatives, and an increase in our release of credit losses of $0.4 million after tax. These factors were partially offset by a $2.5 million after-tax increase in operating expenses and a $0.9 million increase in preferred stock dividends.

Farmer Mac enters into financial derivatives transactions to hedge interest rate risks inherent in its business and carries its financial derivatives at fair value in its consolidated financial statements. The fair value fluctuations of these financial derivatives are not expected to have a cumulative net impact on Farmer Mac's financial condition or results of operations reported with GAAP if the derivatives are held to maturity, as is expected. Therefore, Farmer Mac uses core earnings, a non-GAAP measure that excludes the effects of fair value fluctuations, as a useful alternative measure to understand the business.

Farmer Mac's core earnings for second quarter 2022 were $30.7 million ($2.83 per diluted common share), compared to $30.0 million ($2.77 per diluted common share) in second quarter 2021. The $0.8 million year-over-year increase in core earnings was due to a $3.5 million after-tax increase in net effective spread and an increase in our release of credit losses of $0.4 million after tax. These factors were partially offset by a $2.5 million after-tax increase in operating expenses and a $0.9 million increase in preferred stock dividends.

Business Volume

Farmer Mac's outstanding business volume was $24.5 billion as of June 30, 2022, a net increase of $0.2 billion from March 31, 2022 after taking into account all new business, maturities, sales, and paydowns on existing assets. The net increase was primarily attributable to net increases of $193.0 million in the Rural Infrastructure Finance line of business and $43.0 million in the Agricultural Finance line of business.

2

The $16.4 million net increase in Farm & Ranch during second quarter 2022 resulted from $1.4 billion of new purchases, commitments, and guarantees, mostly offset by $1.4 billion of scheduled maturities and repayments. Farmer Mac purchased a total of $432.6 million in loans, which was primarily driven by improved borrower economics as well as a competitive, albeit an increasing interest rate environment resulting in demand for intermediate and long-term financing solutions. The $432.6 million in gross Farm & Ranch loan purchases was partially offset by $153.8 million in scheduled maturities and repayments.

Farmer Mac also purchased a total of $0.8 billion in Farm & Ranch AgVantage Securities during second quarter 2022, which primarily reflected the refinancing of maturing securities as well as financial counterparties seeking to add longer term AgVantage securities to manage their asset-liability maturity profile given recent increases in credit spreads and interest rates. The $0.8 billion in gross purchases was more than offset by $1.0 billion in scheduled maturities. Approximately $0.3 billion of the total $0.8 billion in gross purchases reflected purchases that refinanced maturing AgVantage securities and were issued at short-term tenors, which may create some volatility in AgVantage volumes throughout the year.

The $26.6 million net increase in Corporate AgFinance during second quarter 2022 resulted from $107.9 million of new loan purchases, which was offset by $81.4 million of scheduled maturities, repayments, and sales. Farmer Mac purchased a total of $85.4 million in loans, which was offset by $44.3 million in scheduled maturities, repayments, and sales. This net increase in loans was primarily due to Farmer Mac's continued focus to support loans to larger and more complex agribusinesses focused on food and fiber processing, and other supply chain production.

The $165.6 million net increase in Rural Utilities during second quarter 2022 resulted from $326.9 million of new purchases, commitments, and guarantees, which was partially offset by $161.3 million of scheduled maturities and repayments. Farmer Mac purchased a total of $196.5 million in Rural Utilities loans; electric distribution and generation and transmission comprised $161.5 million and telecommunication comprised $35.0 million, which was fueled by a competitive but increasing interest rate environment resulting in demand for long-term financing solutions for planned maintenance and capital expenditures. The $196.5 million in loan purchases was partially offset by $24.4 million in scheduled maturities and repayments.

The $27.4 million net increase in Renewable Energy during second quarter 2022 primarily reflects $35.3 million in loan purchases, partially offset by $7.9 million in repayments.

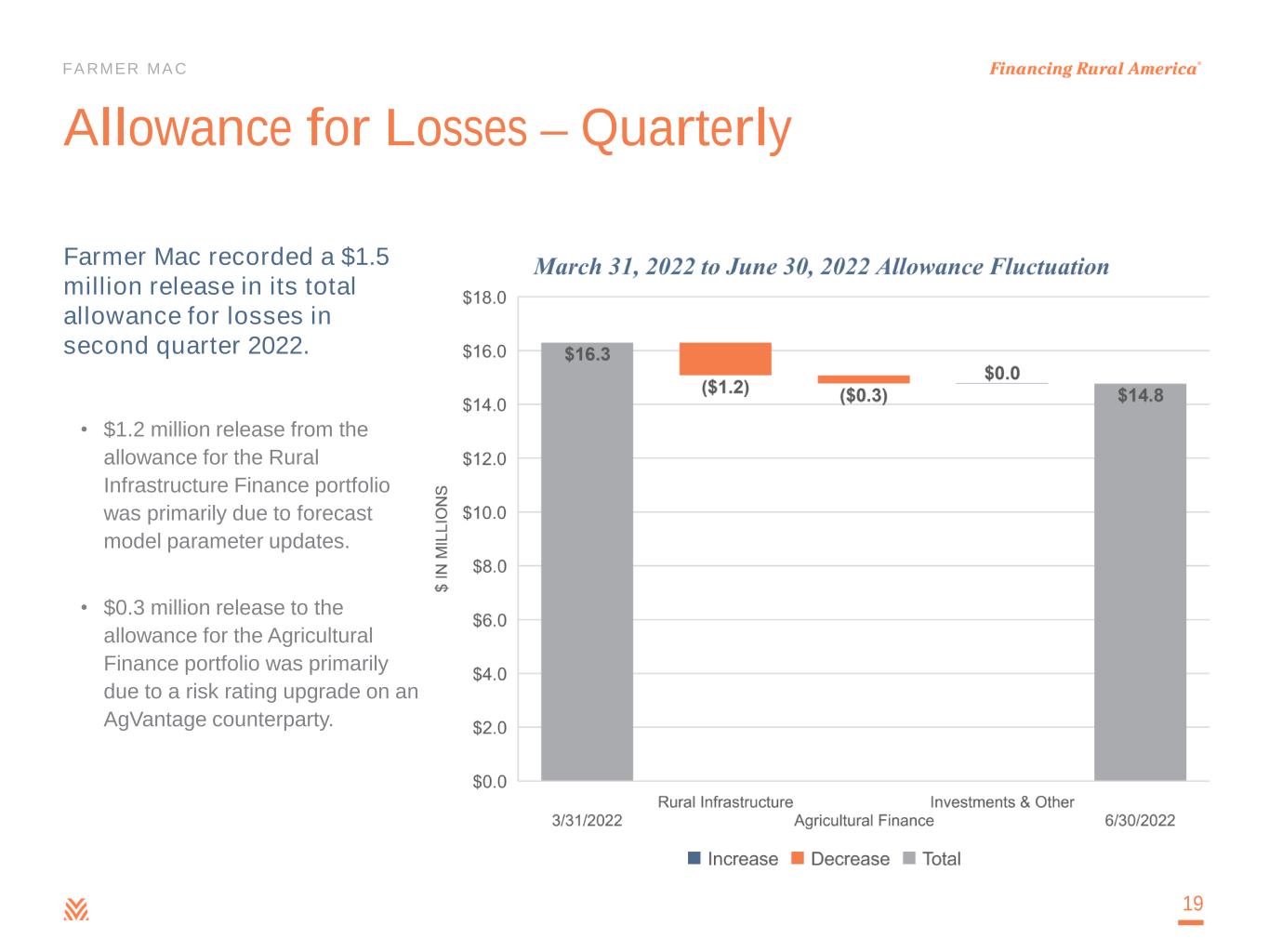

Credit

As of June 30, 2022, the total allowance for losses was $14.8 million, compared to $16.3 million as of March 31, 2022. The $1.5 million release from the total allowance for losses in second quarter 2022 was comprised of a $1.2 million release from the Rural Infrastructure Finance portfolio and a $0.3 million release from the allowance for the Agricultural Finance portfolio. The $1.2 million release from the allowance for the Rural Infrastructure portfolio was primarily attributable to updated credit loss model forecast assumptions and improvements in risk ratings. The $0.3 million release from the allowance for the Agricultural Finance mortgage loan portfolio was primarily due to a risk rating upgrade on an AgVantage counterparty.

3

As of June 30, 2022, Farmer Mac's 90-day delinquencies were $20.6 million (0.20% of the Agricultural Finance Mortgage Loan portfolio), compared to $63.1 million (0.70% of the Agricultural Finance Mortgage Loan portfolio) as of June 30, 2021. Across all of Farmer Mac's lines of business, 90-day delinquencies represented 0.08% of total outstanding business volume as of June 30, 2022, compared to 0.28% as of June 30, 2021.

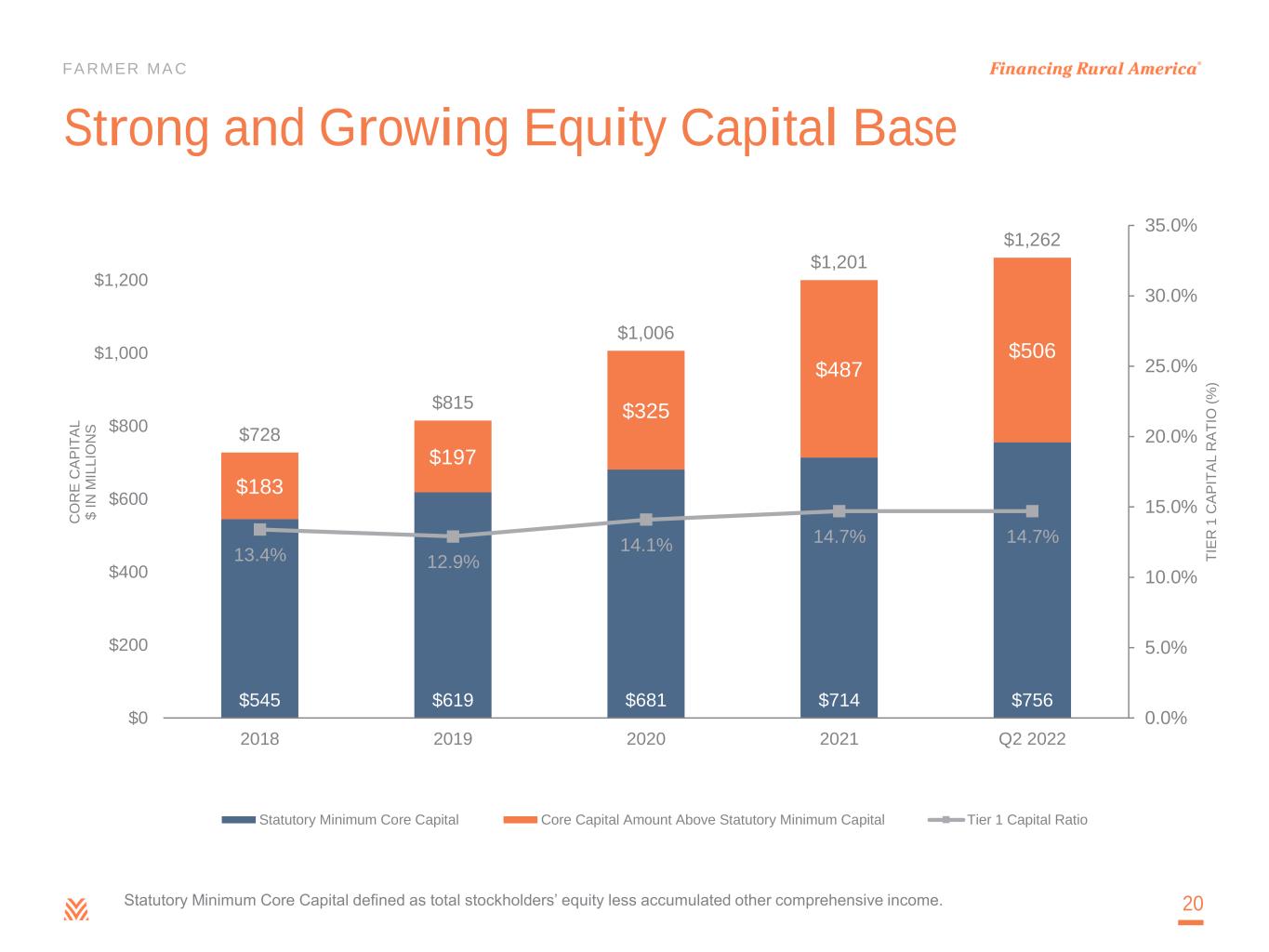

Capital

As of June 30, 2022, Farmer Mac's core capital level was $1.3 billion, $506.3 million above the minimum capital level required by the company's statutory charter. Farmer Mac's Tier 1 capital ratio was 14.7% as of June 30, 2022.

Earnings Conference Call Information

The conference call to discuss Farmer Mac's second quarter 2022 financial results will be held beginning at 4:30 p.m. eastern time on Monday, August 8, 2022, and can be accessed by telephone or live webcast as follows:

Telephone (Domestic): (888) 346-2616

Telephone (International): (412) 902-4254

Webcast: https://www.farmermac.com/investors/events-presentations/

When dialing in to the call, please ask for the "Farmer Mac Earnings Conference Call." The call can be heard live and will also be available for replay on Farmer Mac’s website for two weeks following the conclusion of the call.

More complete information about Farmer Mac's performance for second quarter 2022 is in Farmer Mac's Quarterly Report on Form 10-Q for the quarter ended June 30, 2022 filed today with the SEC.

Use of Non-GAAP Measures

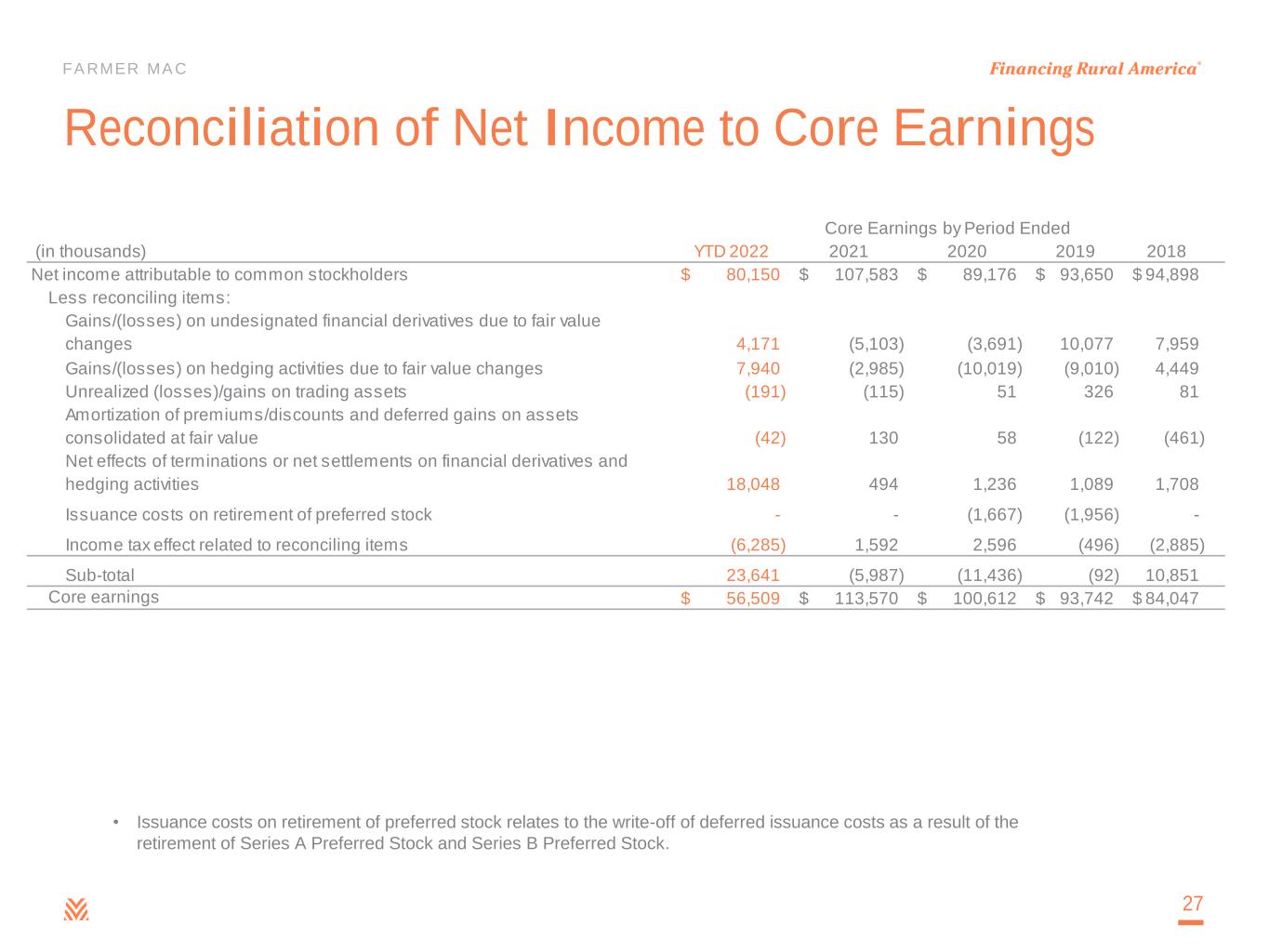

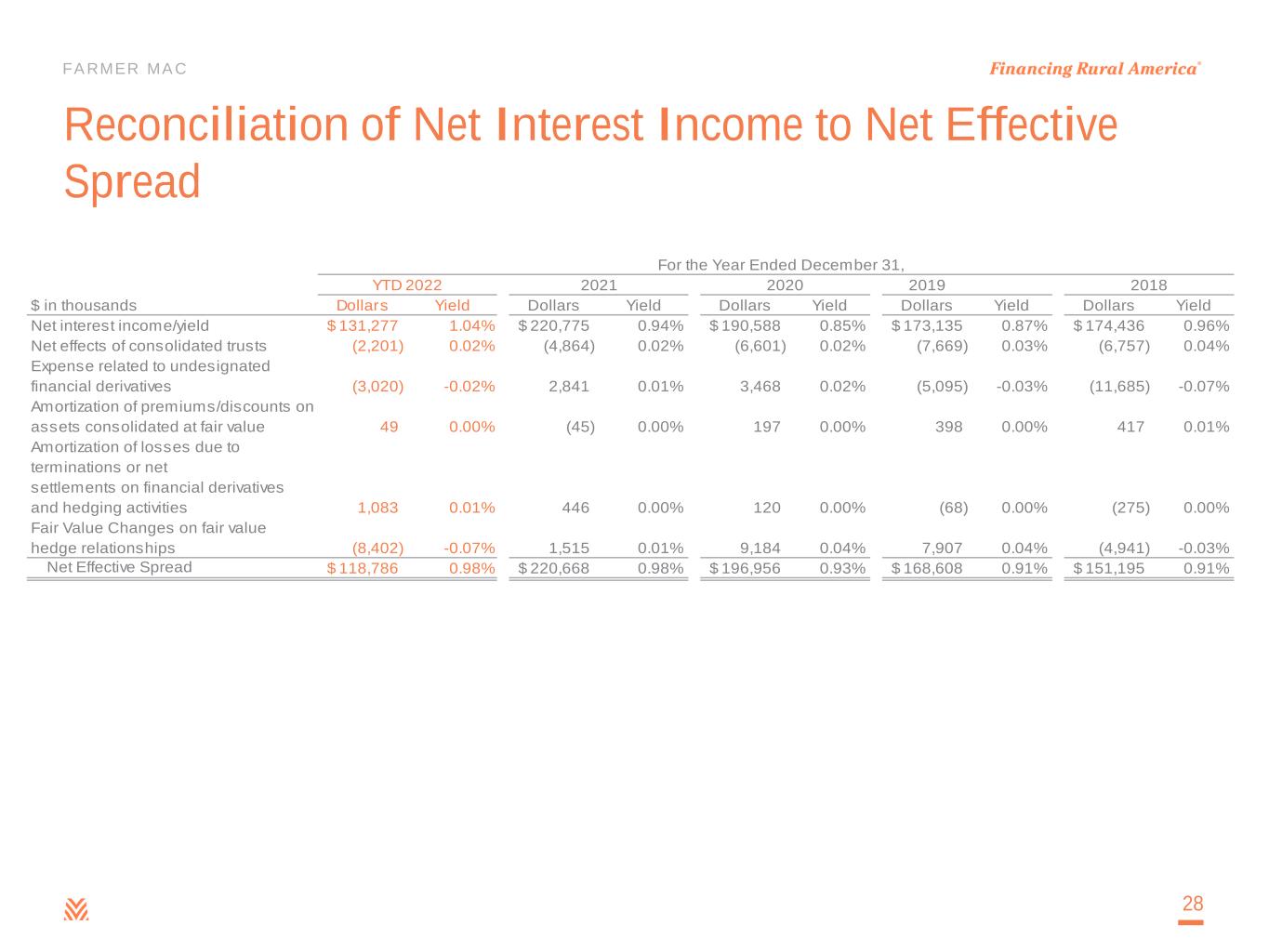

In the accompanying analysis of its financial information, Farmer Mac uses the following non-GAAP measures: "core earnings," "core earnings per share," and "net effective spread." Farmer Mac uses these non-GAAP measures to measure corporate economic performance and develop financial plans because, in management's view, they are useful alternative measures in understanding Farmer Mac's economic performance, transaction economics, and business trends. The non-GAAP financial measures that Farmer Mac uses may not be comparable to similarly labeled non-GAAP financial measures disclosed by other companies. Farmer Mac's disclosure of these non-GAAP measures is intended to be supplemental in nature and is not meant to be considered in isolation from, as a substitute for, or as more important than, the related financial information prepared in accordance with GAAP.

Core earnings and core earnings per share principally differ from net income attributable to common stockholders and earnings per common share, respectively, by excluding the effects of fair value fluctuations. These fluctuations are not expected to have a cumulative net impact on Farmer Mac's financial condition or results of operations reported in accordance with GAAP if the related financial instruments are held to maturity, as is expected.

Core earnings and core earnings per share also differ from net income attributable to common stockholders and earnings per common share, respectively, by excluding specified infrequent or unusual

4

transactions that Farmer Mac believes are not indicative of future operating results and that may not reflect the trends and economic financial performance of Farmer Mac's core business. For example, we have excluded from core earnings losses on retirement of preferred stock and the re-measurement of the deferred tax asset.

Farmer Mac uses net effective spread to measure the net spread Farmer Mac earns between its interest-earning assets and the related net funding costs of these assets. Net effective spread differs from net interest income and net interest yield because it excludes: (1) the amortization of premiums and discounts on assets consolidated at fair value that are amortized as adjustments to yield in interest income over the contractual or estimated remaining lives of the underlying assets; (2) interest income and interest expense related to consolidated trusts with beneficial interests owned by third parties, which are presented on Farmer Mac's consolidated balance sheets as "Loans held for investment in consolidated trusts, at amortized cost"; and (3) the fair value changes of financial derivatives and the corresponding assets or liabilities designated in a fair value hedge accounting relationship.

Net effective spread also principally differs from net interest income and net interest yield because it includes: (1) the accrual of income and expense related to the contractual amounts due on financial derivatives that are not designated in hedge accounting relationships ("undesignated financial derivatives"); and (2) the net effects of terminations or net settlements on financial derivatives. More information about Farmer Mac’s use of non-GAAP measures is available in "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations" in Farmer Mac's Annual Report on Form 10-K for the year ended December 31, 2021, filed February 28, 2022 with the SEC.

For a reconciliation of Farmer Mac's net income attributable to common stockholders to core earnings and of earnings per common share to core earnings per share, and net interest income and net interest yield to net effective spread, see "Reconciliations" below.

Forward-Looking Statements

Management's expectations for Farmer Mac's future necessarily involve assumptions and estimates and the evaluation of risks and uncertainties. Various factors or events, both known and unknown, could cause Farmer Mac's actual results to differ materially from the expectations as expressed or implied by the forward-looking statements in this release, including uncertainties about:

•the availability to Farmer Mac of debt and equity financing and, if available, the reasonableness of rates and terms;

•legislative or regulatory developments that could affect Farmer Mac, its sources of business, or agricultural or rural infrastructure industries;

•fluctuations in the fair value of assets held by Farmer Mac and its subsidiaries;

•the level of lender interest in Farmer Mac's products and the secondary market provided by Farmer Mac;

•the general rate of growth in agricultural mortgage and rural utilities indebtedness;

•the effect of economic conditions and geopolitics on agricultural mortgage or rural utilities lending, borrower repayment capacity, or collateral values, including fluctuations in interest rates, changes in U.S. trade policies, fluctuations in export demand for U.S. agricultural products, supply chain disruptions, increases in input costs, labor availability, volatility in commodity prices, and the effects of the conflict between Russia and Ukraine;

•the degree to which Farmer Mac is exposed to interest rate risk resulting from fluctuations in Farmer Mac's borrowing costs relative to market indexes;

5

•developments in the financial markets, including possible investor, analyst, and rating agency reactions to events involving government-sponsored enterprises, including Farmer Mac;

•the effects of the Federal Reserve’s efforts to achieve monetary policy normalization and slow inflation;

•other factors that could hinder agricultural mortgage lending or borrower repayment capacity, including the effects of severe weather and drought, climate change, or fluctuations in agricultural real estate values; and

•the duration, mitigation efforts, spread, severity, and social and economic disruption of the ongoing COVID-19 pandemic and its effects on the business operations of agricultural and rural borrowers, the capital markets, and Farmer Mac's business operations.

Other risk factors are discussed in "Risk Factors" in Part I, Item 1A in Farmer Mac's Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the SEC on February 28, 2022. Considering these potential risks and uncertainties, no undue reliance should be placed on any forward-looking statements expressed in this release. The forward-looking statements contained in this release represent management's expectations as of the date of this release. Farmer Mac undertakes no obligation to release publicly the results of revisions to any forward-looking statements included in this release to reflect new information or any future events or circumstances, except as otherwise required by applicable law. The information in this release is not necessarily indicative of future results.

About Farmer Mac

Farmer Mac is a vital part of the agricultural credit markets and was created to increase access to and reduce the cost of credit for the benefit of American agricultural and rural communities. As the nation’s secondary market for agricultural credit, we provide financial solutions to a broad spectrum of the agricultural community, including agricultural lenders, agribusinesses, and other institutions that can benefit from access to flexible, low-cost financing and risk management tools. Farmer Mac's customers benefit from our low cost of funds, low overhead costs, and high operational efficiency. More information about Farmer Mac (including the Annual Report on Form 10-K referenced above) is available on Farmer Mac's website at www.farmermac.com.

CONTACT: Jalpa Nazareth, Investor Relations

Megan Murray-Pelaez, Media Inquiries

(202) 872-7700

* * * *

6

FEDERAL AGRICULTURAL MORTGAGE CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(unaudited)

| As of | |||||||||||

| June 30, 2022 | December 31, 2021 | ||||||||||

| (in thousands) | |||||||||||

| Assets: | |||||||||||

| Cash and cash equivalents | $ | 909,430 | $ | 908,785 | |||||||

| Investment securities: | |||||||||||

| Available-for-sale, at fair value (amortized cost of $4,354,855 and $3,834,714, respectively) | 4,246,012 | 3,836,391 | |||||||||

| Held-to-maturity, at amortized cost | 45,032 | 44,970 | |||||||||

| Other investments | 1,537 | 1,229 | |||||||||

| Total Investment Securities | 4,292,581 | 3,882,590 | |||||||||

| Farmer Mac Guaranteed Securities: | |||||||||||

| Available-for-sale, at fair value (amortized cost of $6,679,196 and $6,135,807, respectively) | 6,450,212 | 6,328,559 | |||||||||

| Held-to-maturity, at amortized cost | 1,689,469 | 2,033,239 | |||||||||

| Total Farmer Mac Guaranteed Securities | 8,139,681 | 8,361,798 | |||||||||

| USDA Securities: | |||||||||||

| Trading, at fair value | 2,275 | 4,401 | |||||||||

| Held-to-maturity, at amortized cost | 2,430,830 | 2,436,331 | |||||||||

| Total USDA Securities | 2,433,105 | 2,440,732 | |||||||||

| Loans: | |||||||||||

| Loans held for investment, at amortized cost | 8,911,475 | 8,314,096 | |||||||||

| Loans held for investment in consolidated trusts, at amortized cost | 834,941 | 948,623 | |||||||||

| Allowance for losses | (12,403) | (14,041) | |||||||||

| Total loans, net of allowance | 9,734,013 | 9,248,678 | |||||||||

| Financial derivatives, at fair value | 30,011 | 19,139 | |||||||||

| Interest receivable (includes $7,664 and $10,418, respectively, related to consolidated trusts) | 177,956 | 177,355 | |||||||||

| Guarantee and commitment fees receivable | 44,388 | 45,538 | |||||||||

| Deferred tax asset, net | 25,971 | 15,558 | |||||||||

| Prepaid expenses and other assets | 129,267 | 45,318 | |||||||||

| Total Assets | $ | 25,916,403 | $ | 25,145,491 | |||||||

| Liabilities and Equity: | |||||||||||

| Liabilities: | |||||||||||

| Notes payable | $ | 23,474,095 | $ | 22,716,156 | |||||||

| Debt securities of consolidated trusts held by third parties | 866,107 | 981,379 | |||||||||

| Financial derivatives, at fair value | 127,983 | 34,248 | |||||||||

| Accrued interest payable (includes $6,753 and $9,619, respectively, related to consolidated trusts) | 93,823 | 83,992 | |||||||||

| Guarantee and commitment obligation | 42,990 | 43,926 | |||||||||

| Accounts payable and accrued expenses | 97,380 | 79,427 | |||||||||

| Reserve for losses | 1,677 | 1,950 | |||||||||

| Total Liabilities | 24,704,055 | 23,941,078 | |||||||||

| Commitments and Contingencies | |||||||||||

| Equity: | |||||||||||

| Preferred stock: | |||||||||||

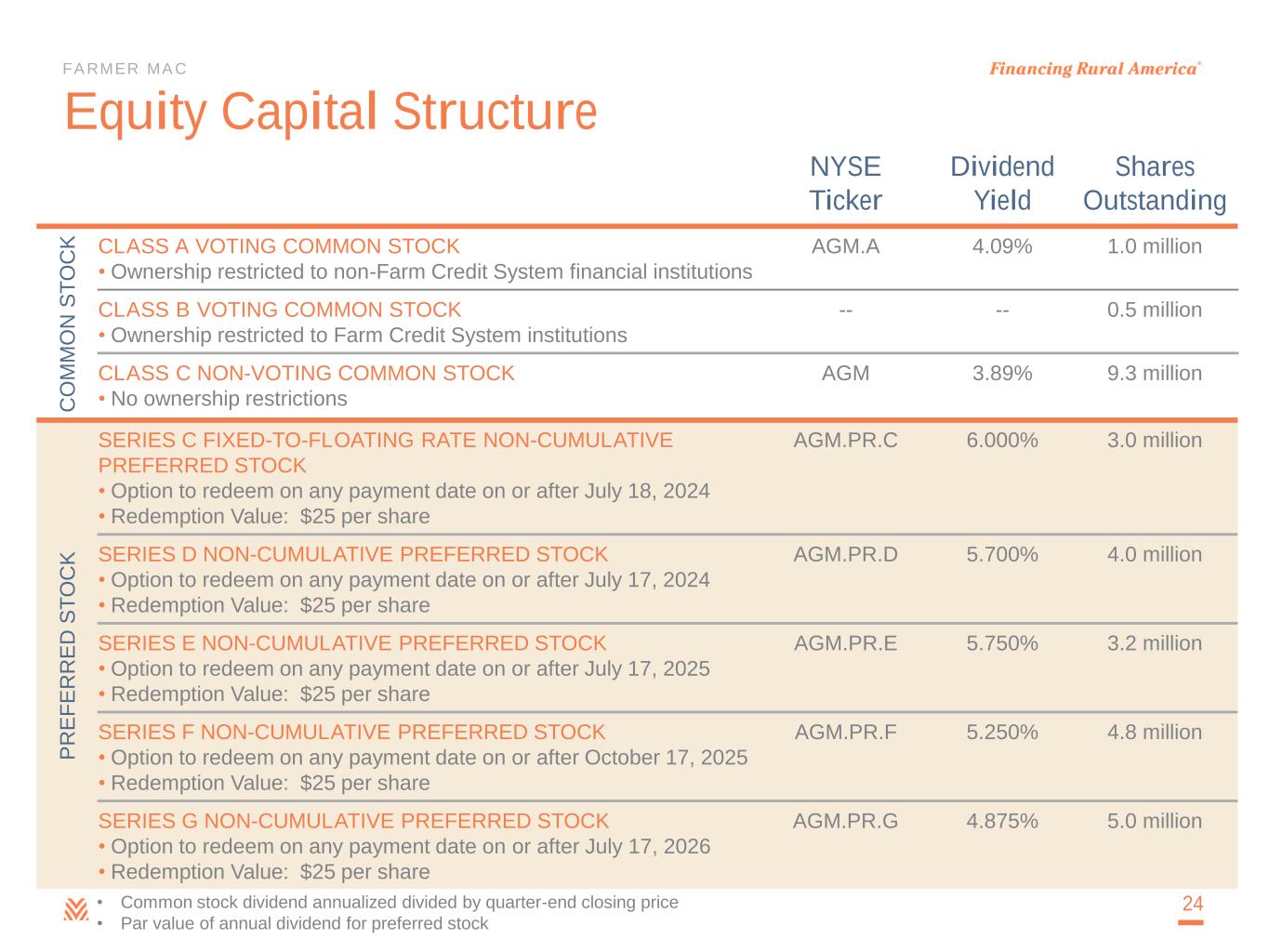

| Series C, par value $25 per share, 3,000,000 shares authorized, issued and outstanding | 73,382 | 73,382 | |||||||||

| Series D, par value $25 per share, 4,000,000 shares authorized, issued and outstanding | 96,659 | 96,659 | |||||||||

Series E, par value $25 per share, 3,180,000 shares authorized, issued and outstanding | 77,003 | 77,003 | |||||||||

| Series F, par value $25 per share, 4,800,000 shares authorized, issued and outstanding | 116,160 | 116,160 | |||||||||

| Series G, par value $25 per share, 5,000,000 shares authorized, issued and outstanding | 121,327 | 121,327 | |||||||||

| Common stock: | |||||||||||

| Class A Voting, $1 par value, no maximum authorization, 1,030,780 shares outstanding | 1,031 | 1,031 | |||||||||

| Class B Voting, $1 par value, no maximum authorization, 500,301 shares outstanding | 500 | 500 | |||||||||

| Class C Non-Voting, $1 par value, no maximum authorization, 9,265,842 shares and 9,235,205 shares outstanding, respectively | 9,266 | 9,235 | |||||||||

| Additional paid-in capital | 127,569 | 125,993 | |||||||||

| Accumulated other comprehensive (loss)/income, net of tax | (49,484) | 3,853 | |||||||||

| Retained earnings | 638,935 | 579,270 | |||||||||

| Total Equity | 1,212,348 | 1,204,413 | |||||||||

| Total Liabilities and Equity | $ | 25,916,403 | $ | 25,145,491 | |||||||

7

FEDERAL AGRICULTURAL MORTGAGE CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| For the Three Months Ended | For the Six Months Ended | ||||||||||||||||||||||

| June 30, 2022 | June 30, 2021 | June 30, 2022 | June 30, 2021 | ||||||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||||||||

| Interest income: | |||||||||||||||||||||||

| Investments and cash equivalents | $ | 11,200 | $ | 4,457 | $ | 16,916 | $ | 9,986 | |||||||||||||||

| Farmer Mac Guaranteed Securities and USDA Securities | 57,104 | 42,414 | 96,361 | 84,818 | |||||||||||||||||||

| Loans | 76,632 | 60,214 | 143,879 | 119,708 | |||||||||||||||||||

| Total interest income | 144,936 | 107,085 | 257,156 | 214,512 | |||||||||||||||||||

| Total interest expense | 75,534 | 51,956 | 125,879 | 106,132 | |||||||||||||||||||

| Net interest income | 69,402 | 55,129 | 131,277 | 108,380 | |||||||||||||||||||

| Release of/(provision for) losses | 1,372 | 761 | 1,316 | (152) | |||||||||||||||||||

| Net interest income after release of/(provision for) losses | 70,774 | 55,890 | 132,593 | 108,228 | |||||||||||||||||||

| Non-interest income/(expense): | |||||||||||||||||||||||

| Guarantee and commitment fees | 3,213 | 2,997 | 6,908 | 6,027 | |||||||||||||||||||

| Gains/(losses) on financial derivatives | 3,418 | (3,066) | 19,492 | 1,227 | |||||||||||||||||||

| Gains/(losses) on trading securities | 29 | (62) | (34) | (75) | |||||||||||||||||||

| Release of reserve for losses | 163 | 222 | 273 | 1,166 | |||||||||||||||||||

| Other income | 479 | 435 | 1,154 | 1,018 | |||||||||||||||||||

| Non-interest income | 7,302 | 526 | 27,793 | 9,363 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Compensation and employee benefits | 11,715 | 9,779 | 25,013 | 21,574 | |||||||||||||||||||

| General and administrative | 7,520 | 6,349 | 14,798 | 12,685 | |||||||||||||||||||

| Regulatory fees | 813 | 750 | 1,625 | 1,500 | |||||||||||||||||||

| Operating expenses | 20,048 | 16,878 | 41,436 | 35,759 | |||||||||||||||||||

| Income before income taxes | 58,028 | 39,538 | 118,950 | 81,832 | |||||||||||||||||||

| Income tax expense | 12,132 | 8,252 | 25,217 | 17,319 | |||||||||||||||||||

| Net income | 45,896 | 31,286 | 93,733 | 64,513 | |||||||||||||||||||

| Preferred stock dividends | (6,792) | (5,842) | (13,583) | (11,111) | |||||||||||||||||||

| Net income attributable to common stockholders | $ | 39,104 | $ | 25,444 | $ | 80,150 | $ | 53,402 | |||||||||||||||

| Earnings per common share: | |||||||||||||||||||||||

| Basic earnings per common share | $ | 3.62 | $ | 2.36 | $ | 7.43 | $ | 4.96 | |||||||||||||||

| Diluted earnings per common share | $ | 3.60 | $ | 2.35 | $ | 7.37 | $ | 4.93 | |||||||||||||||

8

Reconciliations

Reconciliations of Farmer Mac's net income attributable to common stockholders to core earnings and core earnings per share are presented in the following tables along with information about the composition of core earnings for the periods indicated:

| Reconciliation of Net Income Attributable to Common Stockholders to Core Earnings | |||||||||||||||||

| For the Three Months Ended | |||||||||||||||||

| June 30, 2022 | March 31, 2022 | June 30, 2021 | |||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||

| Net income attributable to common stockholders | $ | 39,104 | $ | 41,046 | $ | 25,444 | |||||||||||

| Less reconciling items: | |||||||||||||||||

| Gains/(losses) on undesignated financial derivatives due to fair value changes | 2,473 | 1,698 | (3,721) | ||||||||||||||

| Gains/(losses) on hedging activities due to fair value changes | 5,916 | 2,024 | (2,097) | ||||||||||||||

| Unrealized (losses)/gains on trading assets | (285) | 94 | (61) | ||||||||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | (62) | 20 | 20 | ||||||||||||||

| Net effects of terminations or net settlements on financial derivatives | 2,536 | 15,512 | 109 | ||||||||||||||

| Income tax effect related to reconciling items | (2,222) | (4,063) | 1,208 | ||||||||||||||

| Sub-total | 8,356 | 15,285 | (4,542) | ||||||||||||||

| Core earnings | $ | 30,748 | $ | 25,761 | $ | 29,986 | |||||||||||

| Composition of Core Earnings: | |||||||||||||||||

| Revenues: | |||||||||||||||||

Net effective spread(1) | $ | 60,946 | $ | 57,839 | $ | 56,551 | |||||||||||

Guarantee and commitment fees(2) | 4,709 | 4,557 | 4,334 | ||||||||||||||

Other(3) | 307 | 514 | 301 | ||||||||||||||

| Total revenues | 65,962 | 62,910 | 61,186 | ||||||||||||||

| Credit related expense (GAAP): | |||||||||||||||||

| Release of losses | (1,535) | (54) | (983) | ||||||||||||||

| Total credit related expense | (1,535) | (54) | (983) | ||||||||||||||

| Operating expenses (GAAP): | |||||||||||||||||

| Compensation and employee benefits | 11,715 | 13,298 | 9,779 | ||||||||||||||

| General and administrative | 7,520 | 7,278 | 6,349 | ||||||||||||||

| Regulatory fees | 813 | 812 | 750 | ||||||||||||||

| Total operating expenses | 20,048 | 21,388 | 16,878 | ||||||||||||||

| Net earnings | 47,449 | 41,576 | 45,291 | ||||||||||||||

Income tax expense(4) | 9,909 | 9,024 | 9,463 | ||||||||||||||

| Preferred stock dividends (GAAP) | 6,792 | 6,791 | 5,842 | ||||||||||||||

| Core earnings | $ | 30,748 | $ | 25,761 | $ | 29,986 | |||||||||||

| Core earnings per share: | |||||||||||||||||

| Basic | $ | 2.85 | $ | 2.39 | $ | 2.79 | |||||||||||

| Diluted | $ | 2.83 | $ | 2.37 | $ | 2.77 | |||||||||||

(1)Net effective spread is a non-GAAP measure. See "Use of Non-GAAP Measures" above for an explanation of net effective spread. See below for a reconciliation of net interest income to net effective spread.

(2)Includes interest income and interest expense related to consolidated trusts owned by third parties reclassified from net interest income to guarantee and commitment fees to reflect management's view that the net interest income Farmer Mac earns is effectively a guarantee fee on the consolidated Farmer Mac Guaranteed Securities.

(3)Reflects reconciling adjustments for the reclassification to exclude expenses related to interest rate swaps not designated as hedges and terminations or net settlements on financial derivatives, and reconciling adjustments to exclude fair value adjustments on financial derivatives and trading assets and the recognition of deferred gains over the estimated lives of certain Farmer Mac Guaranteed Securities and USDA Securities.

(4)Includes the tax impact of non-GAAP reconciling items between net income attributable to common stockholders and core earnings.

9

| Reconciliation of Net Income Attributable to Common Stockholders to Core Earnings | |||||||||||

| For the Six Months Ended | |||||||||||

| June 30, 2022 | June 30, 2021 | ||||||||||

| (in thousands, except per share amounts) | |||||||||||

| Net income attributable to common stockholders | $ | 80,150 | $ | 53,402 | |||||||

| Less reconciling items: | |||||||||||

| Gains/(losses) on undesignated financial derivatives due to fair value changes | 4,171 | (2,026) | |||||||||

| Gains/(losses) on hedging activities due to fair value changes | 7,940 | (2,368) | |||||||||

| Unrealized losses on trading assets | (191) | (75) | |||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | (42) | 36 | |||||||||

| Net effects of terminations or net settlements on financial derivatives | 18,048 | 1,274 | |||||||||

| Income tax effect related to reconciling items | (6,285) | 664 | |||||||||

| Sub-total | 23,641 | (2,495) | |||||||||

| Core earnings | $ | 56,509 | $ | 55,897 | |||||||

| Composition of Core Earnings: | |||||||||||

| Revenues: | |||||||||||

Net effective spread(1) | $ | 118,785 | $ | 110,410 | |||||||

Guarantee and commitment fees(2) | 9,266 | 8,574 | |||||||||

Other(3) | 821 | 752 | |||||||||

| Total revenues | 128,872 | 119,736 | |||||||||

| Credit related expense (GAAP): | |||||||||||

| Release of losses | (1,589) | (1,014) | |||||||||

| Total credit related expense | (1,589) | (1,014) | |||||||||

| Operating expenses (GAAP): | |||||||||||

| Compensation and employee benefits | 25,013 | 21,574 | |||||||||

| General and administrative | 14,798 | 12,685 | |||||||||

| Regulatory fees | 1,625 | 1,500 | |||||||||

| Total operating expenses | 41,436 | 35,759 | |||||||||

| Net earnings | 89,025 | 84,991 | |||||||||

Income tax expense(4) | 18,933 | 17,983 | |||||||||

| Preferred stock dividends (GAAP) | 13,583 | 11,111 | |||||||||

| Core earnings | $ | 56,509 | $ | 55,897 | |||||||

| Core earnings per share: | |||||||||||

| Basic | $ | 5.24 | $ | 5.20 | |||||||

| Diluted | $ | 5.20 | $ | 5.16 | |||||||

(1)Net effective spread is a non-GAAP measure. See "Use of Non-GAAP Measures" above for an explanation of net effective spread. See below for a reconciliation of net interest income to net effective spread.

(2)Includes interest income and interest expense related to consolidated trusts owned by third parties reclassified from net interest income to guarantee and commitment fees to reflect management's view that the net interest income Farmer Mac earns is effectively a guarantee fee on the consolidated Farmer Mac Guaranteed Securities.

(3)Reflects reconciling adjustments for the reclassification to exclude expenses related to interest rate swaps not designated as hedges and terminations or net settlements on financial derivatives, and reconciling adjustments to exclude fair value adjustments on financial derivatives and trading assets and the recognition of deferred gains over the estimated lives of certain Farmer Mac Guaranteed Securities and USDA Securities.

(4)Includes the tax impact of non-GAAP reconciling items between net income attributable to common stockholders and core earnings.

10

| Reconciliation of GAAP Basic Earnings Per Share to Core Earnings Basic Earnings Per Share | |||||||||||||||||||||||||||||

| For the Three Months Ended | For the Six Months Ended | ||||||||||||||||||||||||||||

| June 30, 2022 | March 31, 2022 | June 30, 2021 | June 30, 2022 | June 30, 2021 | |||||||||||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||||||||||||||

| GAAP - Basic EPS | $ | 3.62 | $ | 3.81 | $ | 2.36 | $ | 7.43 | $ | 4.96 | |||||||||||||||||||

| Less reconciling items: | |||||||||||||||||||||||||||||

| Gains/(losses) on undesignated financial derivatives due to fair value changes | 0.23 | 0.16 | (0.35) | 0.39 | (0.19) | ||||||||||||||||||||||||

| Gains/(losses) on hedging activities due to fair value changes | 0.55 | 0.19 | (0.19) | 0.74 | (0.22) | ||||||||||||||||||||||||

| Unrealized (losses)/gains on trading securities | (0.03) | 0.01 | (0.01) | (0.02) | (0.01) | ||||||||||||||||||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | (0.01) | — | — | — | — | ||||||||||||||||||||||||

| Net effects of terminations or net settlements on financial derivatives | 0.24 | 1.44 | 0.01 | 1.67 | 0.12 | ||||||||||||||||||||||||

| Income tax effect related to reconciling items | (0.21) | (0.38) | 0.11 | (0.59) | 0.06 | ||||||||||||||||||||||||

| Sub-total | 0.77 | 1.42 | (0.43) | 2.19 | (0.24) | ||||||||||||||||||||||||

| Core Earnings - Basic EPS | $ | 2.85 | $ | 2.39 | $ | 2.79 | $ | 5.24 | $ | 5.20 | |||||||||||||||||||

| Shares used in per share calculation (GAAP and Core Earnings) | 10,796 | 10,767 | 10,763 | 10,782 | 10,751 | ||||||||||||||||||||||||

| Reconciliation of GAAP Diluted Earnings Per Share to Core Earnings Diluted Earnings Per Share | |||||||||||||||||||||||||||||

| For the Three Months Ended | For the Six Months Ended | ||||||||||||||||||||||||||||

| June 30, 2022 | March 31, 2022 | June 30, 2021 | June 30, 2022 | June 30, 2021 | |||||||||||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||||||||||||||

| GAAP - Diluted EPS | $ | 3.60 | $ | 3.77 | $ | 2.35 | $ | 7.37 | $ | 4.93 | |||||||||||||||||||

| Less reconciling items: | |||||||||||||||||||||||||||||

| Gains/(losses) on undesignated financial derivatives due to fair value changes | 0.23 | 0.16 | (0.34) | 0.38 | (0.18) | ||||||||||||||||||||||||

| Gains/(losses) on hedging activities due to fair value changes | 0.55 | 0.19 | (0.19) | 0.73 | (0.22) | ||||||||||||||||||||||||

| Unrealized (losses)/gains on trading securities | (0.03) | 0.01 | (0.01) | (0.02) | (0.01) | ||||||||||||||||||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | (0.01) | — | — | — | — | ||||||||||||||||||||||||

| Net effects of terminations or net settlements on financial derivatives | 0.23 | 1.42 | 0.01 | 1.66 | 0.12 | ||||||||||||||||||||||||

| Income tax effect related to reconciling items | (0.20) | (0.38) | 0.11 | (0.58) | 0.06 | ||||||||||||||||||||||||

| Sub-total | 0.77 | 1.40 | (0.42) | 2.17 | (0.23) | ||||||||||||||||||||||||

| Core Earnings - Diluted EPS | $ | 2.83 | $ | 2.37 | $ | 2.77 | $ | 5.20 | $ | 5.16 | |||||||||||||||||||

| Shares used in per share calculation (GAAP and Core Earnings) | 10,864 | 10,887 | 10,838 | 10,876 | 10,829 | ||||||||||||||||||||||||

11

The following table presents a reconciliation of net interest income and net yield to net effective spread for the periods indicated:

| Reconciliation of GAAP Net Interest Income/Yield to Net Effective Spread | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2022 | March 31, 2022 | June 30, 2021 | June 30, 2022 | June 30, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income/yield | $ | 69,402 | 1.09 | % | $ | 61,875 | 1.00 | % | $ | 55,129 | 0.94 | % | $ | 131,277 | 1.04 | % | $ | 108,380 | 0.93 | % | |||||||||||||||||||||||||||||||||||||||

| Net effects of consolidated trusts | (1,183) | 0.02 | % | (1,018) | 0.02 | % | (1,337) | 0.02 | % | (2,201) | 0.02 | % | (2,547) | 0.02 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Expense related to undesignated financial derivatives | (2,026) | (0.03) | % | (994) | (0.02) | % | 970 | 0.02 | % | (3,020) | (0.02) | % | 3,038 | 0.03 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Amortization of premiums/discounts on assets consolidated at fair value | 65 | — | % | (16) | — | % | (13) | — | % | 49 | — | % | (20) | — | % | ||||||||||||||||||||||||||||||||||||||||||||

| Amortization of losses due to terminations or net settlements on financial derivatives | 725 | 0.01 | % | 356 | 0.01 | % | 77 | — | % | 1,083 | 0.01 | % | 180 | — | % | ||||||||||||||||||||||||||||||||||||||||||||

| Fair value changes on fair value hedge relationships | (6,037) | (0.10) | % | (2,364) | (0.04) | % | 1,725 | 0.03 | % | (8,403) | (0.07) | % | 1,379 | 0.01 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Net effective spread | $ | 60,946 | 0.99 | % | $ | 57,839 | 0.97 | % | $ | 56,551 | 1.01 | % | $ | 118,785 | 0.98 | % | $ | 110,410 | 0.99 | % | |||||||||||||||||||||||||||||||||||||||

12

The following table presents core earnings for Farmer Mac's reportable operating segments and a reconciliation to consolidated net income for the three months ended June 30, 2022:

| Core Earnings by Business Segment | |||||||||||||||||||||||||||||||||||||||||||||||||||||

For the Three Months Ended June 30, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agricultural Finance | Rural Infrastructure | Treasury | Corporate | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Farm & Ranch | Corporate AgFinance | Rural Utilities | Renewable Energy | Funding | Investments | Reconciling Adjustments | Consolidated Net Income | ||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 33,670 | $ | 6,929 | $ | 3,772 | $ | 468 | $ | 25,845 | $ | (1,282) | $ | — | $ | — | $ | 69,402 | |||||||||||||||||||||||||||||||||||

Less: reconciling adjustments(1)(2)(3) | (1,080) | — | (39) | — | (7,337) | — | — | 8,456 | — | ||||||||||||||||||||||||||||||||||||||||||||

| Net effective spread | 32,590 | 6,929 | 3,733 | 468 | 18,508 | (1,282) | — | 8,456 | — | ||||||||||||||||||||||||||||||||||||||||||||

| Guarantee and commitment fees | 4,338 | 43 | 308 | 20 | — | — | — | (1,496) | 3,213 | ||||||||||||||||||||||||||||||||||||||||||||

Other income/(expense)(3) | 161 | 143 | — | — | — | — | 3 | 3,619 | 3,926 | ||||||||||||||||||||||||||||||||||||||||||||

| Total revenues | 37,089 | 7,115 | 4,041 | 488 | 18,508 | (1,282) | 3 | 10,579 | 76,541 | ||||||||||||||||||||||||||||||||||||||||||||

| Release of/(provision for) losses | 857 | (650) | 1,172 | (8) | — | 1 | — | — | 1,372 | ||||||||||||||||||||||||||||||||||||||||||||

| Release of reserve for losses | 111 | — | 52 | — | — | — | — | — | 163 | ||||||||||||||||||||||||||||||||||||||||||||

| Operating expenses | — | — | — | — | — | — | (20,048) | — | (20,048) | ||||||||||||||||||||||||||||||||||||||||||||

| Total non-interest expense | 111 | — | 52 | — | — | — | (20,048) | — | (19,885) | ||||||||||||||||||||||||||||||||||||||||||||

| Core earnings before income taxes | 38,057 | 6,465 | 5,265 | 480 | 18,508 | (1,281) | (20,045) | 10,579 | (4) | 58,028 | |||||||||||||||||||||||||||||||||||||||||||

| Income tax (expense)/benefit | (7,991) | (1,357) | (1,105) | (101) | (3,887) | 269 | 4,263 | (2,223) | (12,132) | ||||||||||||||||||||||||||||||||||||||||||||

| Core earnings before preferred stock dividends | 30,066 | 5,108 | 4,160 | 379 | 14,621 | (1,012) | (15,782) | 8,356 | (4) | 45,896 | |||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | — | — | (6,792) | — | (6,792) | ||||||||||||||||||||||||||||||||||||||||||||

| Segment core earnings/(losses) | $ | 30,066 | $ | 5,108 | $ | 4,160 | $ | 379 | $ | 14,621 | $ | (1,012) | $ | (22,574) | $ | 8,356 | (4) | $ | 39,104 | ||||||||||||||||||||||||||||||||||

| Total Assets | $ | 13,686,589 | $ | 1,521,102 | $ | 5,632,551 | $ | 126,513 | $ | — | $ | 4,802,159 | $ | 147,489 | $ | — | $ | 25,916,403 | |||||||||||||||||||||||||||||||||||

| Total on- and off-balance sheet program assets at principal balance | $ | 16,591,999 | $ | 1,567,311 | $ | 6,172,063 | $ | 148,018 | $ | — | $ | — | $ | — | $ | — | $ | 24,479,391 | |||||||||||||||||||||||||||||||||||

(1)Includes the amortization of premiums and discounts on assets consolidated at fair value, originally included in interest income, to reflect core earnings amounts.

(2)Includes the reclassification of interest income and interest expense from consolidated trusts owned by third parties to guarantee and commitment fees, to reflect management's view that the net interest income Farmer Mac earns is effectively a guarantee fee.

(3)Includes the reclassification of interest expense related to interest rate swaps not designated as hedges, which are included in "Gains/(losses) on financial derivatives" on the consolidated financial statements, to determine the effective funding cost for each operating segment.

(4)Net adjustments to reconcile to the corresponding income measures: core earnings before income taxes reconciled to income before income taxes; core earnings before preferred stock dividends reconciled to net income; and segment core earnings reconciled to net income attributable to common stockholders.

13

Supplemental Information

The following table sets forth information about outstanding volume in each of Farmer Mac's lines of business as of the dates indicated:

| Outstanding Business Volume | ||||||||||||||||||||

| On or Off Balance Sheet | As of June 30, 2022 | As of December 31, 2021 | ||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Agricultural Finance: | ||||||||||||||||||||

| Farm & Ranch: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 5,214,307 | $ | 4,775,070 | |||||||||||||||

| Loans held in consolidated trusts: | ||||||||||||||||||||

| Beneficial interests owned by third-party investors | On-balance sheet | 834,941 | 948,623 | |||||||||||||||||

IO-FMGS(1) | On-balance sheet | 11,561 | 12,297 | |||||||||||||||||

| USDA Securities | On-balance sheet | 2,429,407 | 2,445,806 | |||||||||||||||||

| AgVantage Securities | On-balance sheet | 4,995,000 | 4,725,000 | |||||||||||||||||

| LTSPCs and unfunded commitments | Off-balance sheet | 2,562,467 | 2,587,154 | |||||||||||||||||

| Farmer Mac Guaranteed Securities | Off-balance sheet | 523,580 | 578,358 | |||||||||||||||||

| Loans serviced for others | Off-balance sheet | 20,736 | 22,331 | |||||||||||||||||

| Total Farm & Ranch | $ | 16,591,999 | $ | 16,094,639 | ||||||||||||||||

| Corporate AgFinance: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 1,149,614 | $ | 1,123,300 | |||||||||||||||

| AgVantage Securities | On-balance sheet | 352,968 | 367,464 | |||||||||||||||||

| Unfunded Loan Commitments | Off-balance sheet | 64,729 | 47,070 | |||||||||||||||||

| Total Corporate AgFinance | $ | 1,567,311 | $ | 1,537,834 | ||||||||||||||||

| Total Agricultural Finance | $ | 18,159,310 | $ | 17,632,473 | ||||||||||||||||

| Rural Infrastructure Finance: | ||||||||||||||||||||

| Rural Utilities: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 2,631,694 | $ | 2,302,373 | |||||||||||||||

| AgVantage Securities | On-balance sheet | 2,986,404 | 3,033,262 | |||||||||||||||||

| LTSPCs and Unfunded Loan Commitments | Off-balance sheet | 551,210 | 556,837 | |||||||||||||||||

| Farmer Mac Guaranteed Securities | Off-balance sheet | 2,755 | 2,755 | |||||||||||||||||

| Total Rural Utilities | $ | 6,172,063 | $ | 5,895,227 | ||||||||||||||||

| Renewable Energy: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 126,299 | $ | 86,763 | |||||||||||||||

| Unfunded Loan Commitments | Off-balance sheet | 21,719 | — | |||||||||||||||||

| Total Renewable Energy | $ | 148,018 | $ | 86,763 | ||||||||||||||||

| Total Rural Infrastructure Finance | $ | 6,320,081 | $ | 5,981,990 | ||||||||||||||||

| Total | $ | 24,479,391 | $ | 23,614,463 | ||||||||||||||||

(1) An interest-only Farmer Mac Guaranteed Security retained as part of a structured securitization.

14

The following table presents the quarterly net effective spread (a non-GAAP measure) by segment:

Net Effective Spread(1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agricultural Finance | Rural Infrastructure Finance | Treasury | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Farm & Ranch | Corporate AgFinance | Rural Utilities | Renewable Energy | Funding | Investments | Net Effective Spread | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the quarter ended: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

June 30, 2022(1) | $ | 32,590 | 1.05 | % | $ | 6,929 | 1.87 | % | $ | 3,733 | 0.27 | % | $ | 468 | 1.78 | % | $ | 18,508 | 0.30 | % | $ | (1,282) | (0.10) | % | $ | 60,946 | 0.99 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 31, 2022 | 30,354 | 1.02 | % | 7,209 | 1.96 | % | 3,159 | 0.23 | % | 375 | 1.69 | % | 16,738 | 0.28 | % | 4 | — | % | 57,839 | 0.97 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2021 | 28,998 | 0.99 | % | 6,321 | 1.84 | % | 2,521 | 0.19 | % | 356 | 1.53 | % | 15,979 | 0.28 | % | 158 | 0.01 | % | 54,333 | 0.94 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2021 | 28,914 | 1.06 | % | 7,163 | 1.80 | % | 2,067 | 0.16 | % | 236 | 1.09 | % | 17,386 | 0.31 | % | 159 | 0.01 | % | 55,925 | 0.99 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2021 | 29,163 | 1.06 | % | 6,676 | 1.65 | % | 1,759 | 0.14 | % | 378 | 1.80 | % | 18,449 | 0.33 | % | 126 | 0.01 | % | 56,551 | 1.01 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 31, 2021 | 26,461 | 0.98 | % | 6,921 | 1.67 | % | 1,720 | 0.14 | % | 249 | 1.28 | % | 18,394 | 0.33 | % | 114 | 0.01 | % | 53,859 | 0.97 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2020 | 25,596 | 0.95 | % | 6,237 | 1.53 | % | 1,838 | 0.15 | % | 123 | 1.20 | % | 20,585 | 0.37 | % | 143 | 0.01 | % | 54,522 | 0.98 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2020 | 23,735 | 0.89 | % | 5,786 | 1.45 | % | 2,022 | 0.16 | % | 75 | 1.19 | % | 20,034 | 0.37 | % | 150 | 0.01 | % | 51,802 | 0.96 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2020 | 21,597 | 0.83 | % | 4,997 | 1.36 | % | 1,701 | 0.14 | % | 47 | 0.93 | % | 19,449 | 0.37 | % | (1,322) | (0.13) | % | 46,469 | 0.89 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1)Farmer Mac excludes the Corporate segment in the presentation above because the segment does not have any interest-earning assets.

(2)See above for a reconciliation of GAAP net interest income by line of business to net effective spread by line of business for the three months ended June 30, 2022.

15

The following table presents quarterly core earnings reconciled to net income attributable to common stockholders:

| Core Earnings by Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 2022 | March 2022 | December 2021 | September 2021 | June 2021 | March 2021 | December 2020 | September 2020 | June 2020 | |||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net effective spread | $ | 60,946 | $ | 57,839 | $ | 54,333 | $ | 55,925 | $ | 56,551 | $ | 53,859 | $ | 54,522 | $ | 51,802 | $ | 46,469 | |||||||||||||||||||||||||||||||||||

| Guarantee and commitment fees | 4,709 | 4,557 | 4,637 | 4,322 | 4,334 | 4,240 | 4,652 | 4,659 | 4,943 | ||||||||||||||||||||||||||||||||||||||||||||

| Gain on sale of mortgage loans | — | — | 6,539 | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Other | 307 | 514 | 241 | 687 | 301 | 451 | 512 | 453 | 1,048 | ||||||||||||||||||||||||||||||||||||||||||||

| Total revenues | 65,962 | 62,910 | 65,750 | 60,934 | 61,186 | 58,550 | 59,686 | 56,914 | 52,460 | ||||||||||||||||||||||||||||||||||||||||||||

| Credit related expense/(income): | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Release of)/provision for losses | (1,535) | (54) | (1,428) | 255 | (983) | (31) | 2,973 | 1,200 | 51 | ||||||||||||||||||||||||||||||||||||||||||||

| REO operating expenses | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Losses/(gains) on sale of REO | — | — | — | — | — | — | 22 | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Total credit related expense/(income) | (1,535) | (54) | (1,428) | 255 | (983) | (31) | 2,995 | 1,200 | 51 | ||||||||||||||||||||||||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Compensation and employee benefits | 11,715 | 13,298 | 11,246 | 10,027 | 9,779 | 11,795 | 9,497 | 8,791 | 8,087 | ||||||||||||||||||||||||||||||||||||||||||||

| General and administrative | 7,520 | 7,278 | 8,492 | 6,330 | 6,349 | 6,336 | 6,274 | 5,044 | 5,295 | ||||||||||||||||||||||||||||||||||||||||||||

| Regulatory fees | 813 | 812 | 812 | 750 | 750 | 750 | 750 | 725 | 725 | ||||||||||||||||||||||||||||||||||||||||||||

| Total operating expenses | 20,048 | 21,388 | 20,550 | 17,107 | 16,878 | 18,881 | 16,521 | 14,560 | 14,107 | ||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | 47,449 | 41,576 | 46,628 | 43,572 | 45,291 | 39,700 | 40,170 | 41,154 | 38,302 | ||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 9,909 | 9,024 | 9,809 | 9,152 | 9,463 | 8,520 | 8,470 | 8,297 | 8,016 | ||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | 6,792 | 6,791 | 6,792 | 6,774 | 5,842 | 5,269 | 5,269 | 5,166 | 3,939 | ||||||||||||||||||||||||||||||||||||||||||||

| Core earnings | $ | 30,748 | $ | 25,761 | $ | 30,027 | $ | 27,646 | $ | 29,986 | $ | 25,911 | $ | 26,431 | $ | 27,691 | $ | 26,347 | |||||||||||||||||||||||||||||||||||

| Reconciling items: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gains/(losses) on undesignated financial derivatives due to fair value changes | $ | 2,473 | $ | 1,698 | $ | (1,213) | $ | (1,864) | $ | (3,721) | $ | 1,695 | $ | (1,758) | $ | (4,149) | $ | 8,700 | |||||||||||||||||||||||||||||||||||

| Gains/(losses) on hedging activities due to fair value changes | 5,916 | 2,024 | 1,476 | (2,093) | (2,097) | (271) | 3,827 | (5,245) | (2,676) | ||||||||||||||||||||||||||||||||||||||||||||

| Unrealized gains/(losses) on trading assets | (285) | 94 | (76) | 36 | (61) | (14) | 223 | (258) | (20) | ||||||||||||||||||||||||||||||||||||||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | (62) | 20 | 71 | 23 | 20 | 16 | (77) | 97 | 35 | ||||||||||||||||||||||||||||||||||||||||||||

| Net effects of terminations or net settlements on financial derivatives | 2,536 | 15,512 | (429) | (351) | 109 | 1,165 | 1,583 | 233 | 720 | ||||||||||||||||||||||||||||||||||||||||||||

| Issuance costs on the retirement of preferred stock | — | — | — | — | — | — | — | (1,667) | — | ||||||||||||||||||||||||||||||||||||||||||||

| Income tax effect related to reconciling items | (2,222) | (4,063) | 36 | 892 | 1,208 | (544) | (798) | 1,957 | (1,419) | ||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to common stockholders | $ | 39,104 | $ | 41,046 | $ | 29,892 | $ | 24,289 | $ | 25,444 | $ | 27,958 | $ | 29,431 | $ | 18,659 | $ | 31,687 | |||||||||||||||||||||||||||||||||||

16

Equity Investor Presentation Second Quarter 2022

FARMER MAC Forward-Looking Statements In addition to historical information, this presentation includes forward- looking statements that reflect management’s current expectations for Farmer Mac’s future financial results, business prospects, and business developments. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievements. Management’s expectations for Farmer Mac’s future necessarily involve assumptions, estimates, and the evaluation of risks and uncertainties. Various factors or events, both known and unknown, could cause Farmer Mac’s actual results to differ materially from the expectations as expressed or implied by the forward- looking statements. Some of these factors are identified and discussed in Farmer Mac’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the U.S. Securities and Exchange Commission (“SEC”) on February 28, 2022, Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, filed with the SEC on May 9, 2022, and Quarterly Report on Form 10-Q for the quarter ended June 30, 2022, filed with the SEC on August 8, 2022. These reports are also available on Farmer Mac’s website (www.farmermac.com). Considering these potential risks and uncertainties, no undue reliance should be placed on any forward-looking statements expressed in this presentation. Any forward-looking statements made in this presentation are current only as of June 30, 2022, except as otherwise indicated. Farmer Mac undertakes no obligation to release publicly the results of revisions to any such forward-looking statements that may be made to reflect new information or any future events or circumstances, except as otherwise mandated by the SEC. The information in this presentation is not necessarily indicative of future results. NO OFFER OR SOLICITATION OF SECURITIES This presentation does not constitute an offer to sell or a solicitation of an offer to buy any Farmer Mac security. Farmer Mac securities are offered only in jurisdictions where permissible by offering documents available through qualified securities dealers. Any investor who is considering purchasing a Farmer Mac security should consult the applicable offering documents for the security and their own financial and legal advisors for information about and analysis of the security, the risks associated with the security, and the suitability of the investment for the investor’s particular circumstances. Copyright © 2022 by Farmer Mac. No part of this document may be duplicated, reproduced, distributed, or displayed in public in any manner or by any means without the written permission of Farmer Mac. 02

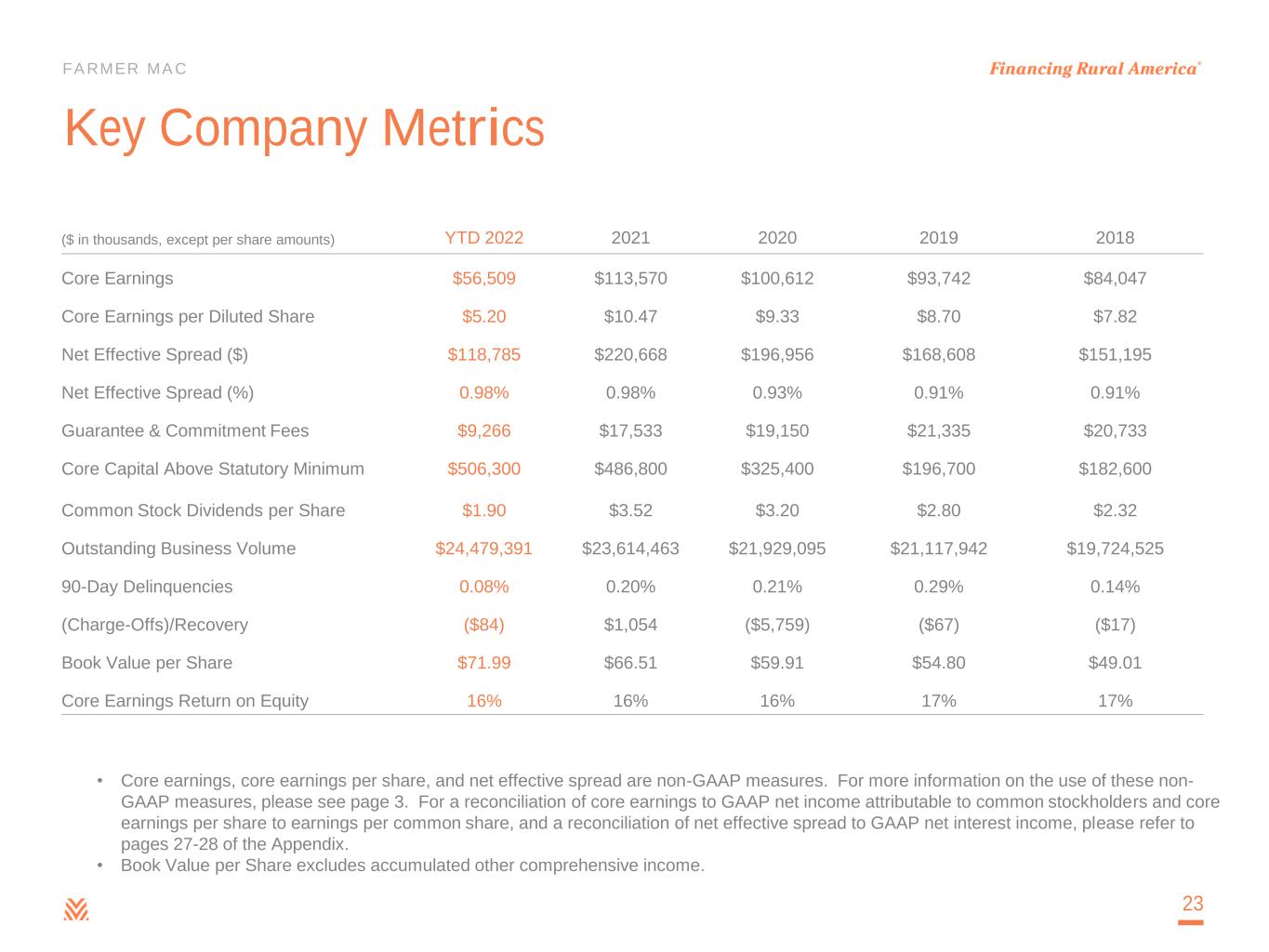

FARMER MAC Use of Non-GAAP Financial Measures This presentation is for general informational purposes only, is current only as of June 30, 2022 and should be read in conjunction with Farmer Mac’s Quarterly Report on Form 10-Q filed with the SEC on August 8, 2022. In the accompanying analysis of its financial information, Farmer Mac uses the following non-GAAP financial measures: core earnings, core earnings per share, and net effective spread. Farmer Mac uses these non-GAAP measures to measure corporate economic performance and develop financial plans because, in management's view, they are useful alternative measures in understanding Farmer Mac's economic performance, transaction economics, and business trends. The non-GAAP financial measures that Farmer Mac uses may not be comparable to similarly labeled non- GAAP financial measures disclosed by other companies. Farmer Mac's disclosure of these non-GAAP financial measures is intended to be supplemental in nature and is not meant to be considered in isolation from, as a substitute for, or as more important than, the related financial information prepared in accordance with GAAP. Core earnings and core earnings per share principally differ from net income attributable to common stockholders and earnings per common share, respectively, by excluding the effects of fair value fluctuations. These fluctuations are not expected to have a cumulative net impact on Farmer Mac's financial condition or results of operations reported in accordance with GAAP if the related financial instruments are held to maturity, as is expected. Core earnings and core earnings per share also differ from net income attributable to common stockholders and earnings per common share, respectively, by excluding specified infrequent or unusual transactions that Farmer Mac believes are not indicative of future operating results and that may not reflect the trends and economic financial performance of Farmer Mac's core business. Farmer Mac uses net effective spread to measure the net spread Farmer Mac earns between its interest-earning assets and the related net funding costs of these assets. Net effective spread differs from net interest income and net interest yield because it excludes: (1) the amortization of premiums and discounts on assets consolidated at fair value that are amortized as adjustments to yield in interest income over the contractual or estimated remaining lives of the underlying assets; (2) interest income and interest expense related to consolidated trusts with beneficial interests owned by third parties, which are presented on Farmer Mac's consolidated balance sheets as “Loans held for investment in consolidated trusts, at amortized cost;” and (3) beginning January 1, 2018, the fair value changes of financial derivatives and the corresponding assets and liabilities designated in a fair value hedge relationship. Net effective spread also principally differs from net interest income and net interest yield because it includes: (1) the accrual of income and expense related to the contractual amounts due on financial derivatives that are not designated in hedge relationships; and (2) the net effects of terminations or net settlements on financial derivatives. 03

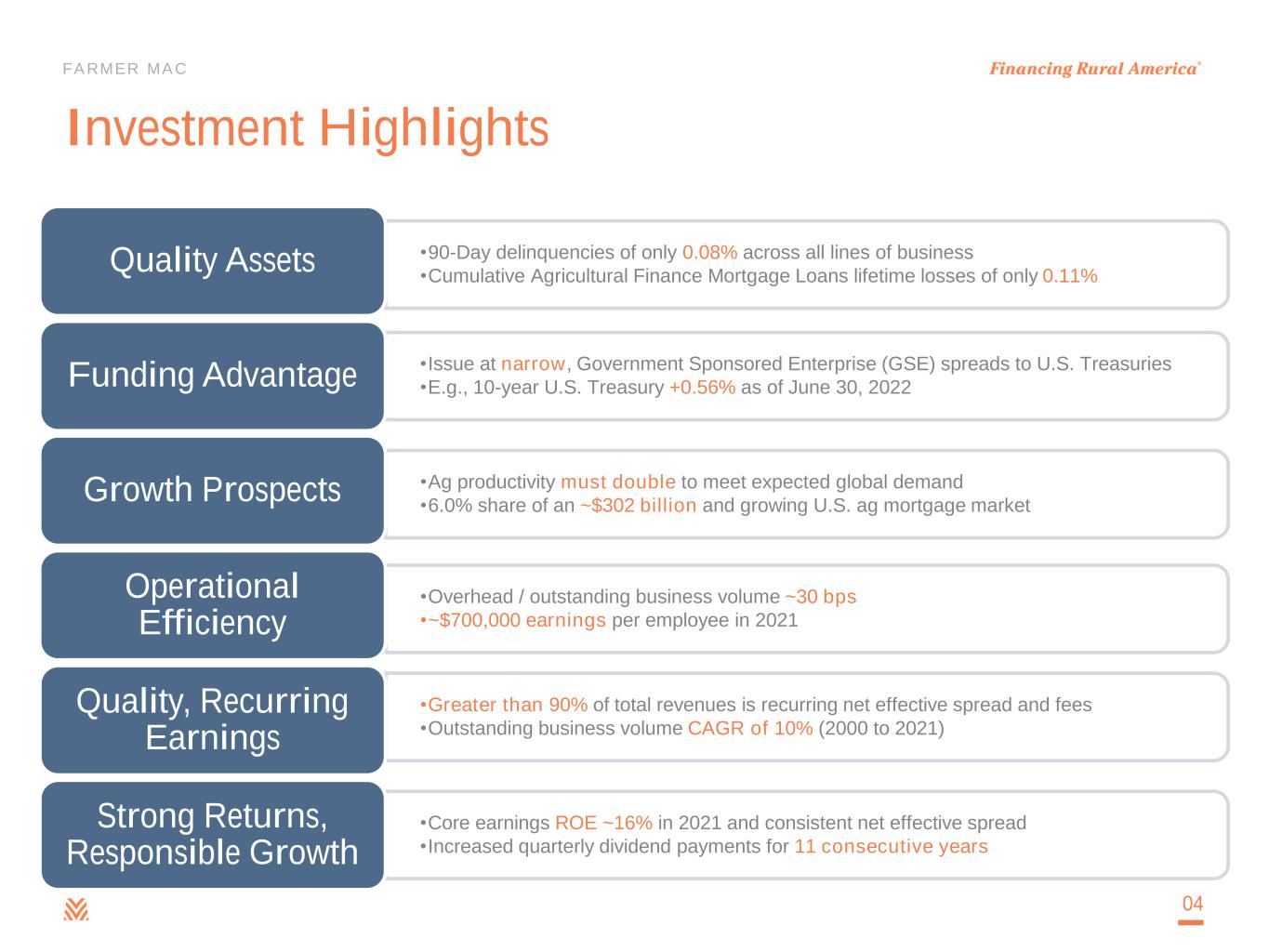

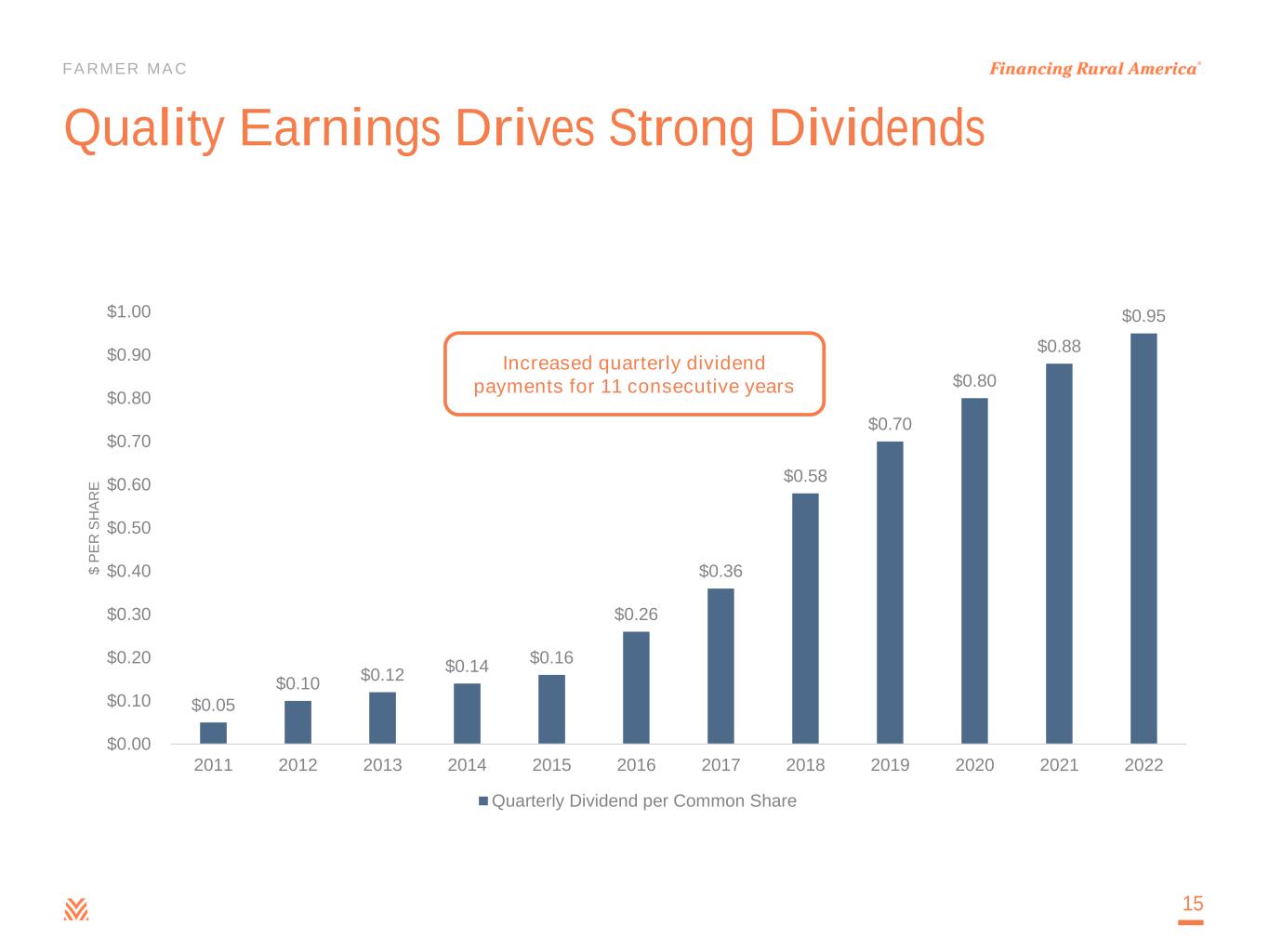

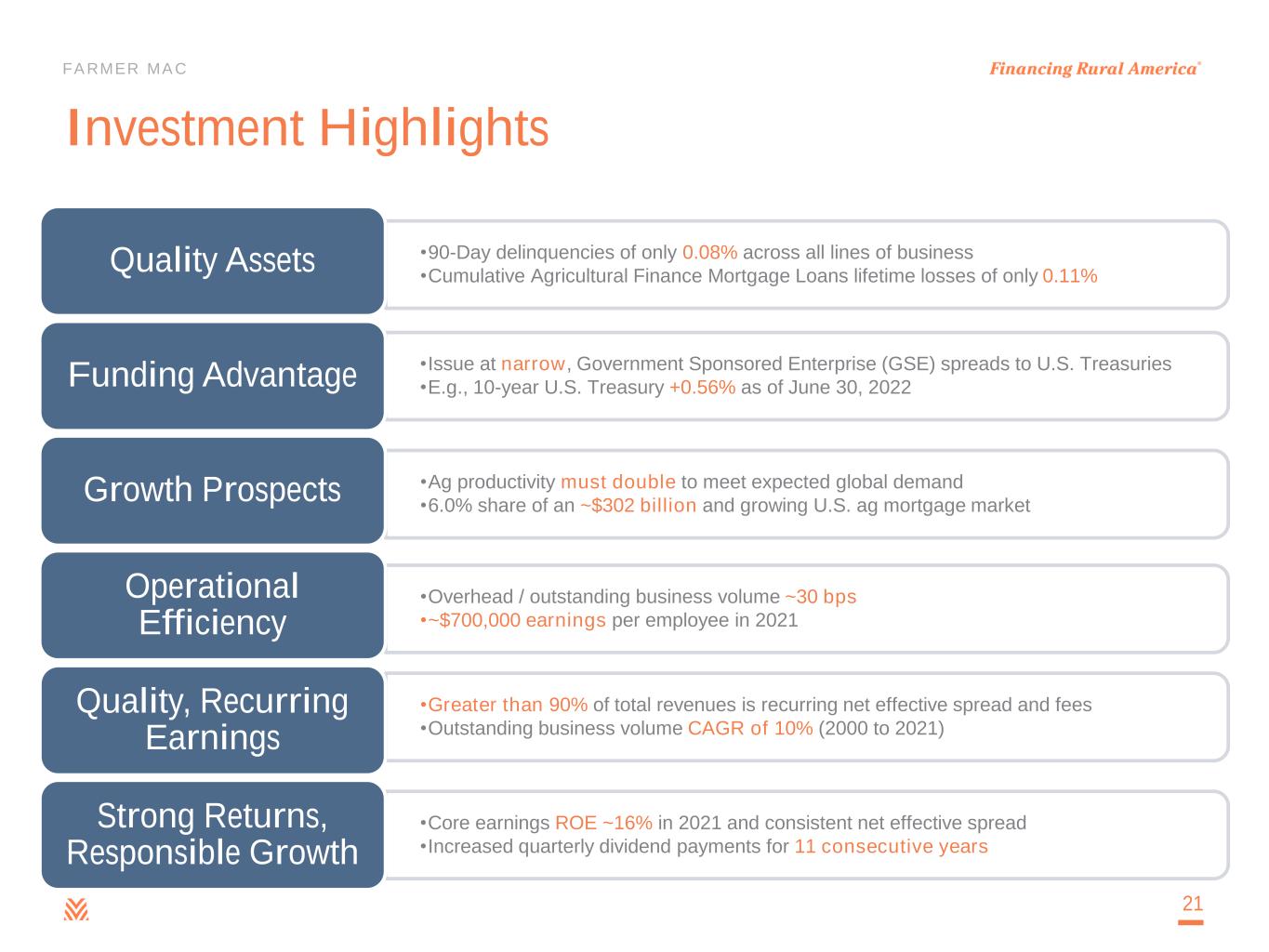

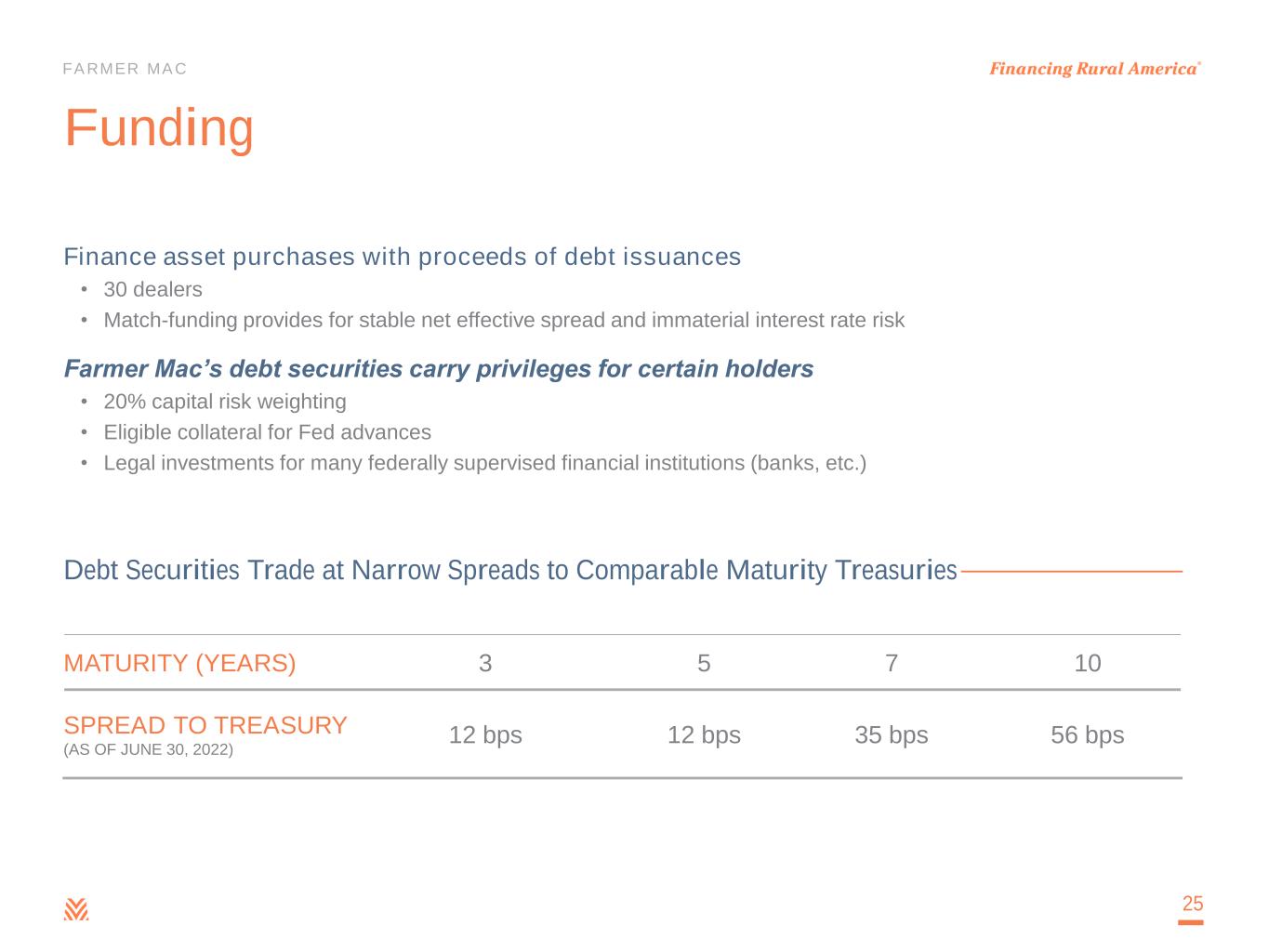

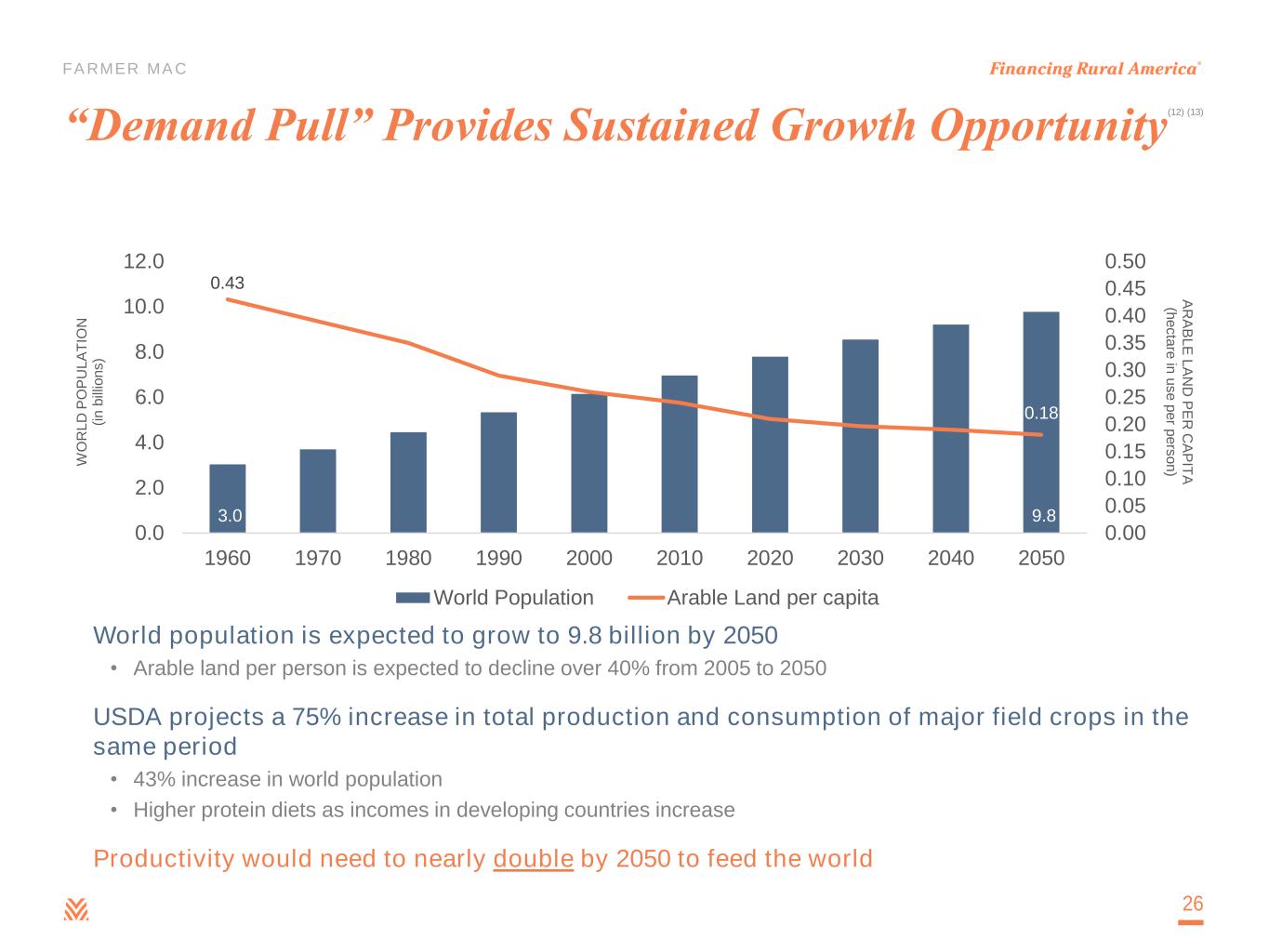

FARMER MAC Investment Highlights •90-Day delinquencies of only 0.08% across all lines of business •Cumulative Agricultural Finance Mortgage Loans lifetime losses of only 0.11% Quality Assets •Issue at narrow, Government Sponsored Enterprise (GSE) spreads to U.S. Treasuries •E.g., 10-year U.S. Treasury +0.56% as of June 30, 2022Funding Advantage •Ag productivity must double to meet expected global demand •6.0% share of an ~$302 billion and growing U.S. ag mortgage market Growth Prospects •Overhead / outstanding business volume ~30 bps •~$700,000 earnings per employee in 2021 Operational Efficiency •Greater than 90% of total revenues is recurring net effective spread and fees •Outstanding business volume CAGR of 10% (2000 to 2021) Quality, Recurring Earnings •Core earnings ROE ~16% in 2021 and consistent net effective spread •Increased quarterly dividend payments for 11 consecutive years Strong Returns, Responsible Growth 04

FARMER MAC Farmer Mac initially chartered by Congress as an instrumentality of the United States Initial public offering First listed on NASDAQ (FAMCU & FAMCL) First major charter revision and expansion of authority (direct loan purchases) First listed on NYSE (AGM & AGM.A) Second major charter revision and expansion of authority (Rural Utilities) A Mission-Driven, For-Profit Company Our Mission Farmer Mac is committed to help build a strong and vital rural America by increasing the availability and affordability of credit for the benefit of American agricultural and rural communities Our Stakeholders • Farmers, ranchers and rural communities • Employees • Stockholders • Financial Institutions & Cooperatives • Congress • Regulators Our Corporate Social Responsibility • To help create sustainable, vibrant rural American communities • We achieve this by conducting our business – With absolute integrity – By holding ourselves to high ethical standards – By promoting a diverse, respectful, and inclusive culture – By adopting an Environmental, Social, Governance (ESG) policy statement 05 1987 1988 1996 1999 2008

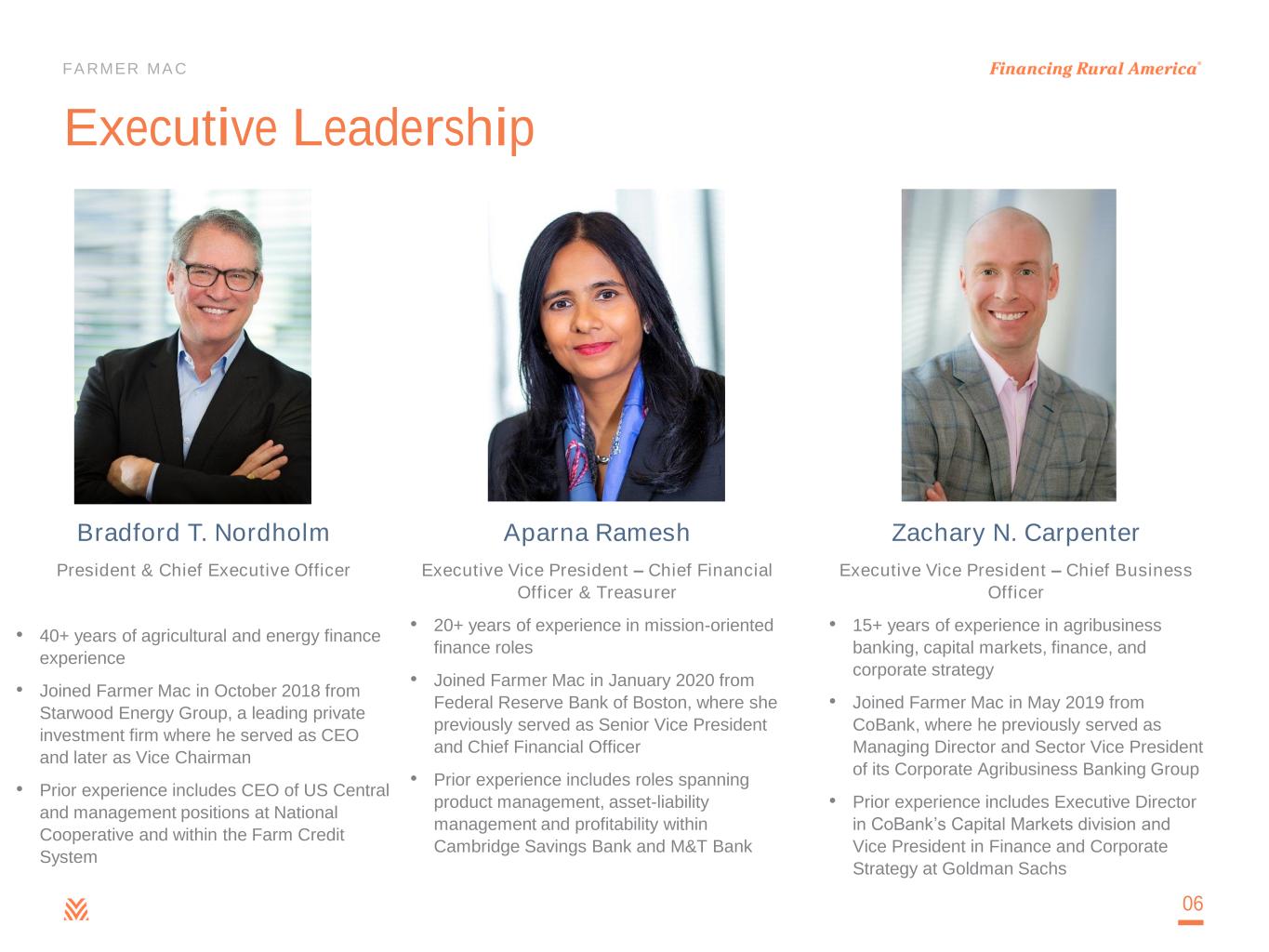

FARMER MAC Aparna Ramesh Executive Vice President – Chief Financial Officer & Treasurer • 20+ years of experience in mission-oriented finance roles • Joined Farmer Mac in January 2020 from Federal Reserve Bank of Boston, where she previously served as Senior Vice President and Chief Financial Officer • Prior experience includes roles spanning product management, asset-liability management and profitability within Cambridge Savings Bank and M&T Bank Bradford T. Nordholm President & Chief Executive Officer • 40+ years of agricultural and energy finance experience • Joined Farmer Mac in October 2018 from Starwood Energy Group, a leading private investment firm where he served as CEO and later as Vice Chairman • Prior experience includes CEO of US Central and management positions at National Cooperative and within the Farm Credit System Executive Leadership 06 Zachary N. Carpenter Executive Vice President – Chief Business Officer • 15+ years of experience in agribusiness banking, capital markets, finance, and corporate strategy • Joined Farmer Mac in May 2019 from CoBank, where he previously served as Managing Director and Sector Vice President of its Corporate Agribusiness Banking Group • Prior experience includes Executive Director in CoBank’s Capital Markets division and Vice President in Finance and Corporate Strategy at Goldman Sachs

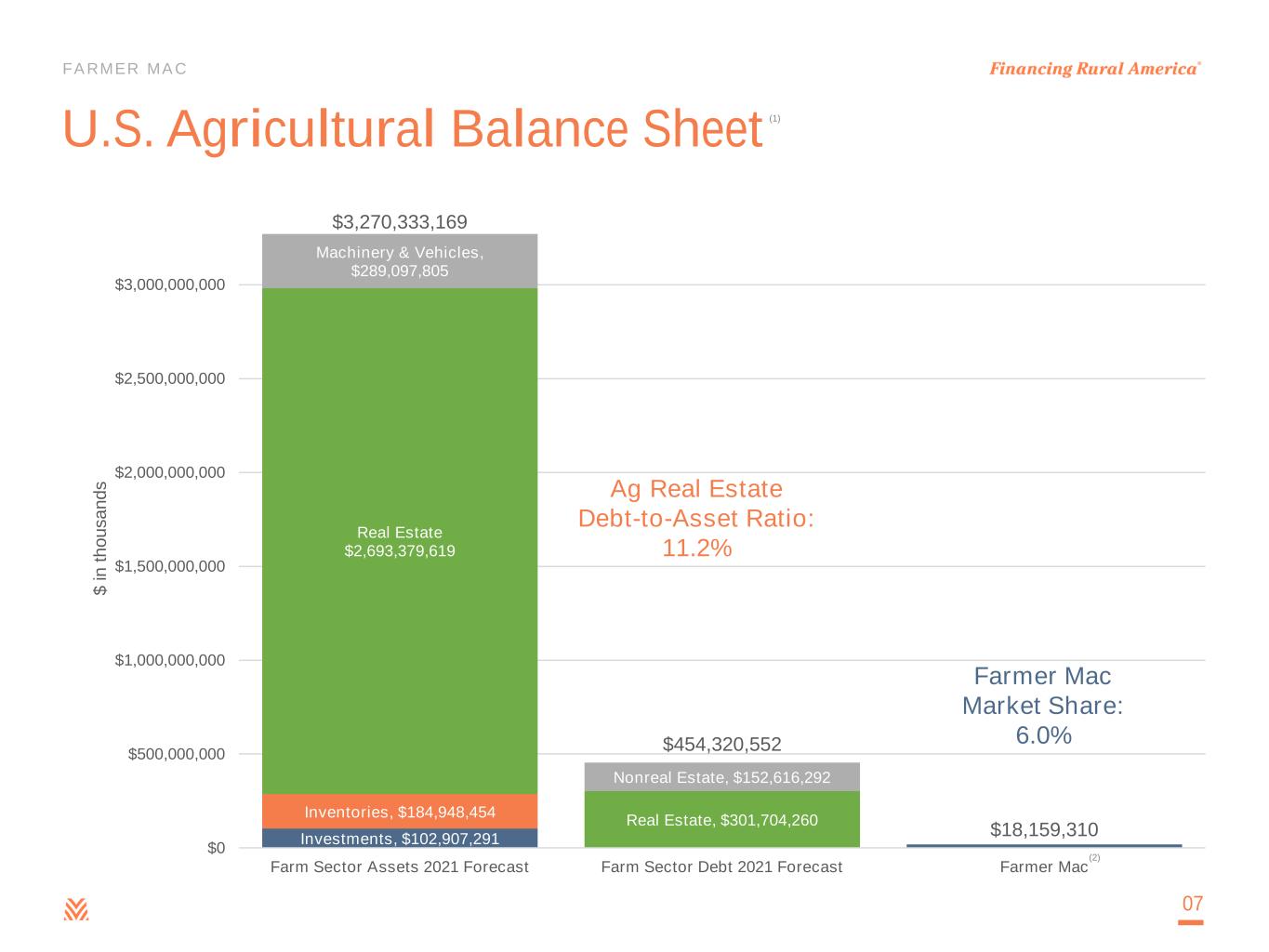

FARMER MAC U.S. Agricultural Balance Sheet 07 Investments, $102,907,291 Inventories, $184,948,454 Real Estate $2,693,379,619 Machinery & Vehicles, $289,097,805 $3,270,333,169 Real Estate, $301,704,260 Nonreal Estate, $152,616,292 $454,320,552 $18,159,310 $0 $500,000,000 $1,000,000,000 $1,500,000,000 $2,000,000,000 $2,500,000,000 $3,000,000,000 Farm Sector Assets 2021 Forecast Farm Sector Debt 2021 Forecast Farmer Mac $ i n t h o u s a n d s Ag Real Estate Debt-to-Asset Ratio: 11.2% (1) (2) Farmer Mac Market Share: 6.0%

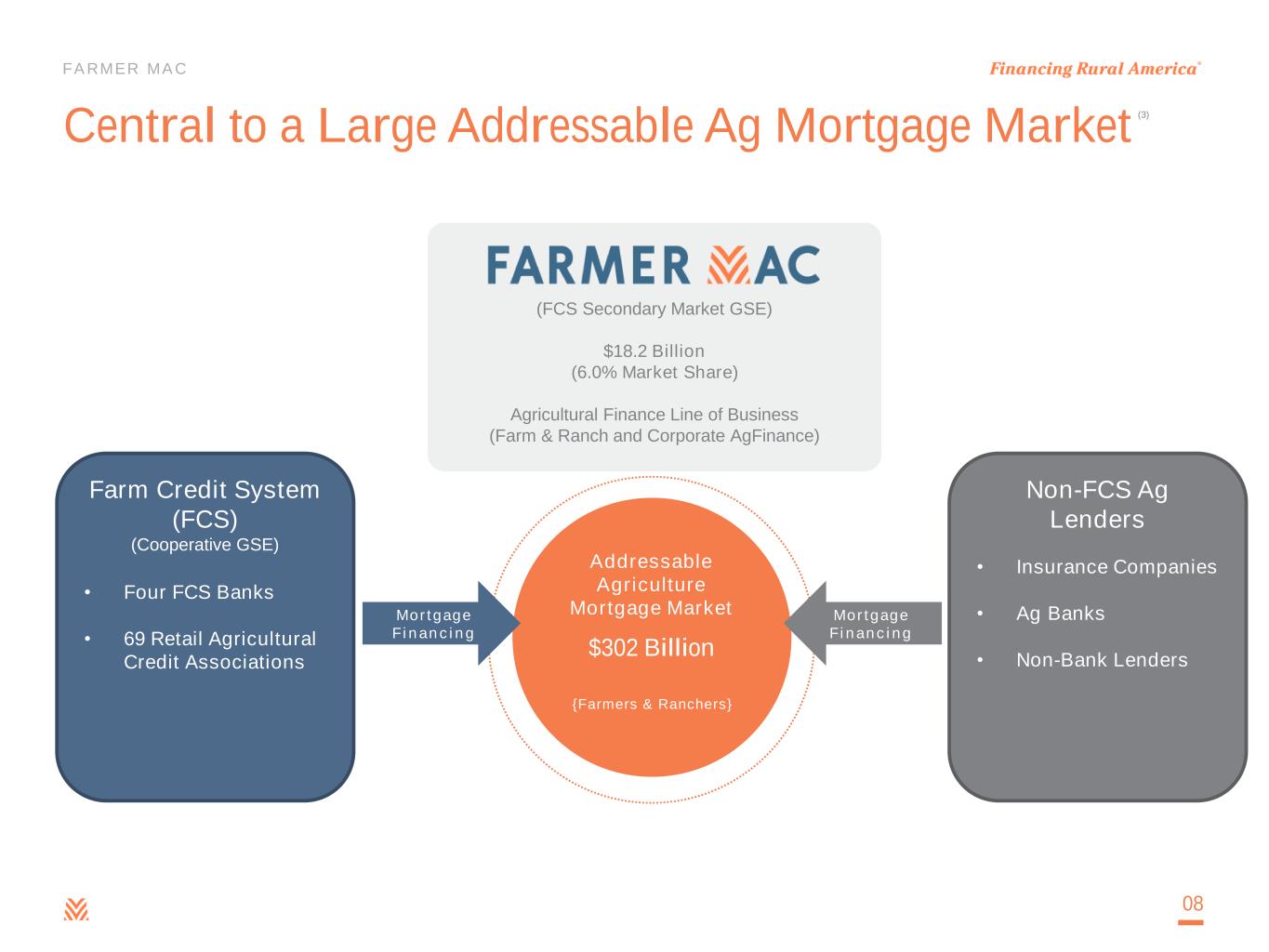

FARMER MAC (FCS Secondary Market GSE) $18.2 Billion (6.0% Market Share) Agricultural Finance Line of Business (Farm & Ranch and Corporate AgFinance) Farm Credit System (FCS) (Cooperative GSE) • Four FCS Banks • 69 Retail Agricultural Credit Associations Central to a Large Addressable Ag Mortgage Market 08 Addressable Agriculture Mortgage Market {Farmers & Ranchers} Mortgage Financing Mortgage Financing $302 Billion A G B A N K S $ 6 1 B N O N -B A N K L E N D E R S $ 1 3 B (3) Non-FCS Ag Lenders • Insurance Companies • Ag Banks • Non-Bank Lenders

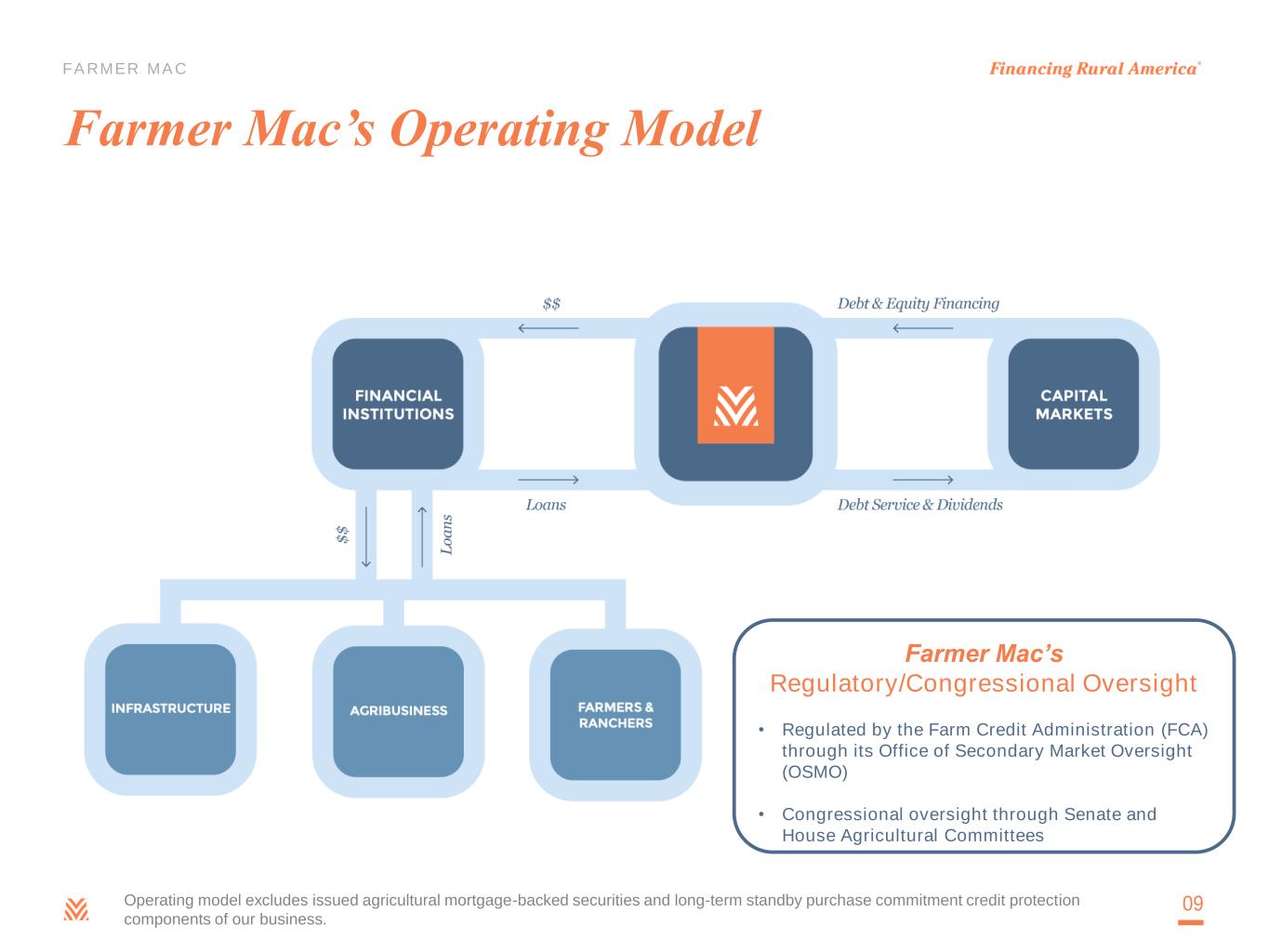

FARMER MAC Farmer Mac’s Operating Model 09 Farmer Mac’s Regulatory/Congressional Oversight • Regulated by the Farm Credit Administration (FCA) through its Office of Secondary Market Oversight (OSMO) • Congressional oversight through Senate and House Agricultural Committees Operating model excludes issued agricultural mortgage-backed securities and long-term standby purchase commitment credit protection components of our business.

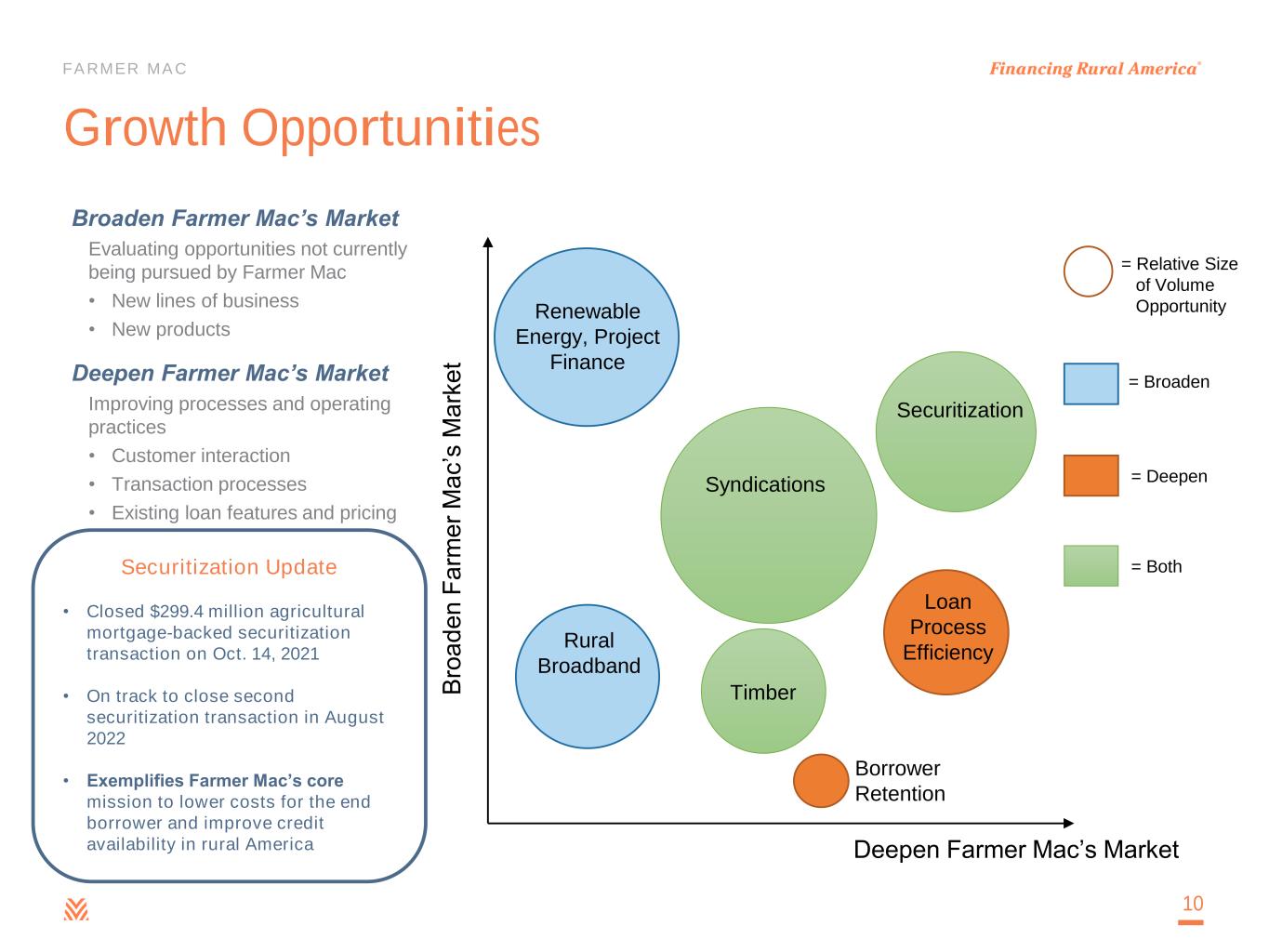

FARMER MAC Growth Opportunities 10 Deepen Farmer Mac’s Market B ro a d e n F a rm e r M a c ’s M a rk e t Loan Process Efficiency Rural Broadband Borrower Retention Renewable Energy, Project Finance Timber Securitization = Relative Size of Volume Opportunity = Broaden = Deepen = Both Syndications Broaden Farmer Mac’s Market Evaluating opportunities not currently being pursued by Farmer Mac • New lines of business • New products Deepen Farmer Mac’s Market Improving processes and operating practices • Customer interaction • Transaction processes • Existing loan features and pricing Securitization Update • Closed $299.4 million agricultural mortgage-backed securitization transaction on Oct. 14, 2021 • On track to close second securitization transaction in August 2022 • Exemplifies Farmer Mac’s core mission to lower costs for the end borrower and improve credit availability in rural America

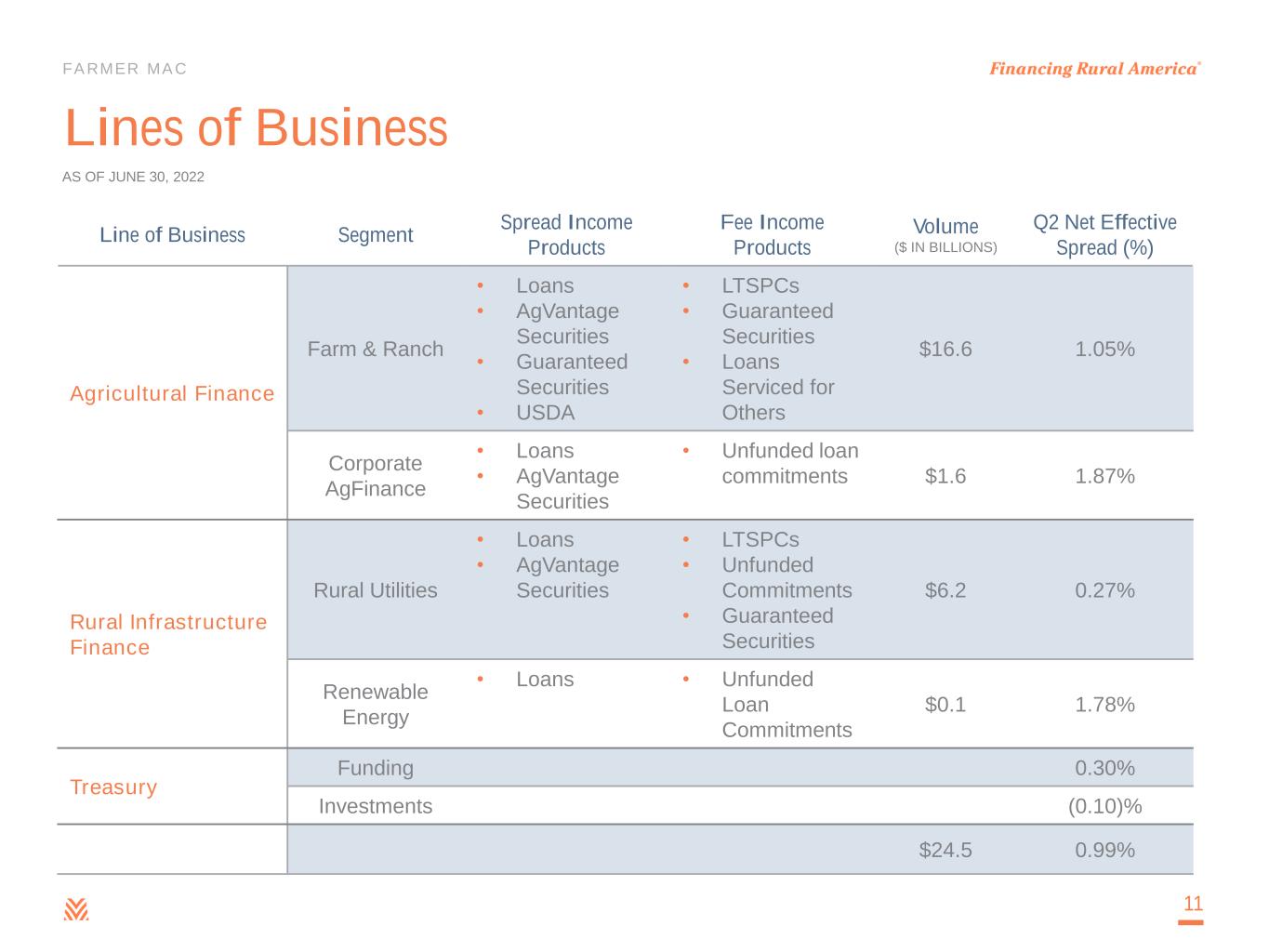

FARMER MAC Lines of Business Line of Business Segment Spread Income Products Fee Income Products Volume ($ IN BILLIONS) Q2 Net Effective Spread (%) Agricultural Finance Farm & Ranch • Loans • AgVantage Securities • Guaranteed Securities • USDA • LTSPCs • Guaranteed Securities • Loans Serviced for Others $16.6 1.05% Corporate AgFinance • Loans • AgVantage Securities • Unfunded loan commitments $1.6 1.87% Rural Infrastructure Finance Rural Utilities • Loans • AgVantage Securities • LTSPCs • Unfunded Commitments • Guaranteed Securities $6.2 0.27% Renewable Energy • Loans • Unfunded Loan Commitments $0.1 1.78% Treasury Funding 0.30% Investments (0.10)% $24.5 0.99% 11 AS OF JUNE 30, 2022

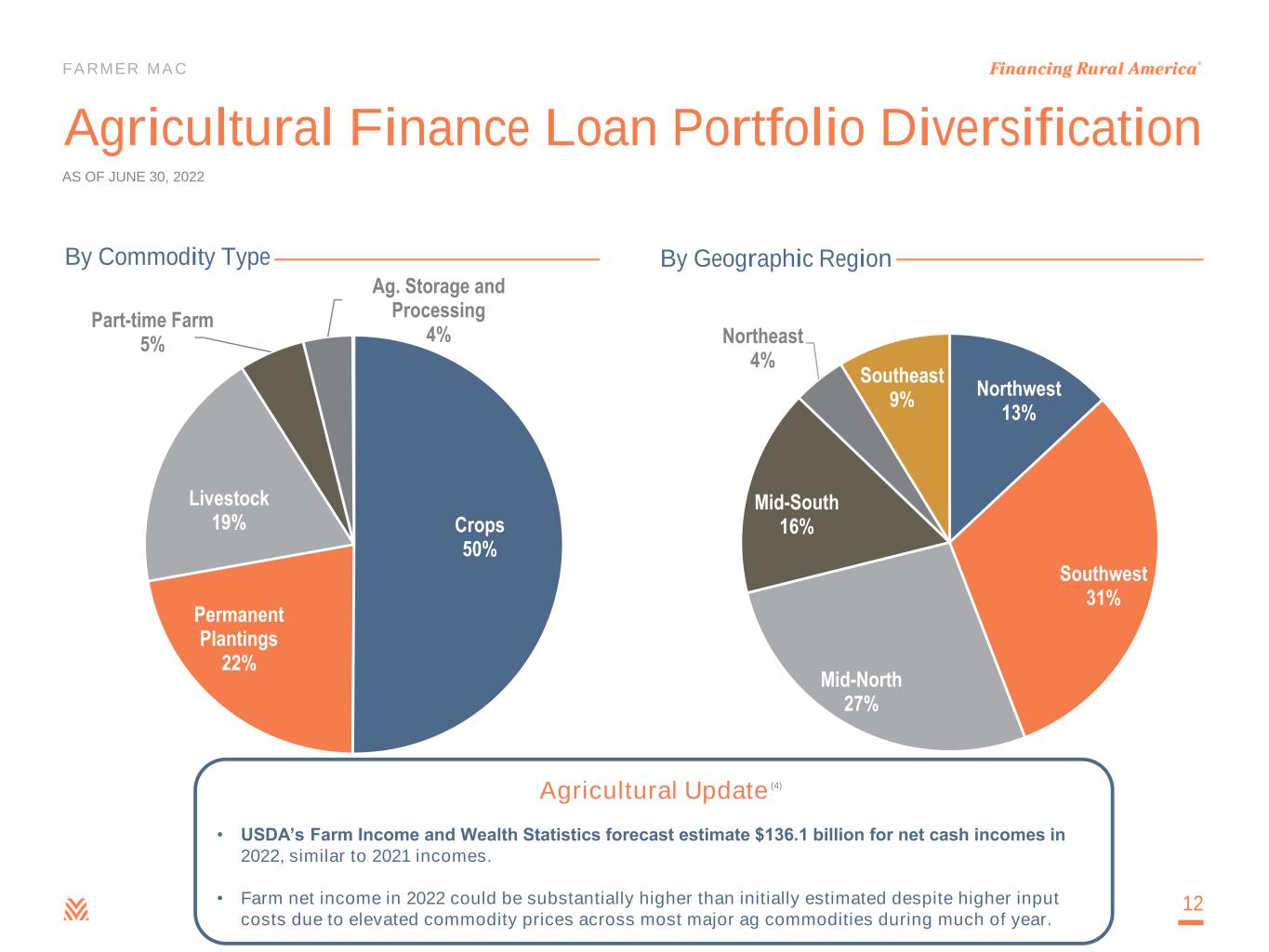

FARMER MAC Northwest 13% Southwest 31% Mid-North 27% Mid-South 16% Northeast 4% Southeast 9% By Geographic Region Crops 50% Permanent Plantings 22% Livestock 19% Part-time Farm 5% Ag. Storage and Processing 4% By Commodity Type Agricultural Finance Loan Portfolio Diversification 12 AS OF JUNE 30, 2022 Agricultural Update • USDA’s Farm Income and Wealth Statistics forecast estimate $136.1 billion for net cash incomes in 2022, similar to 2021 incomes. • Farm net income in 2022 could be substantially higher than initially estimated despite higher input costs due to elevated commodity prices across most major ag commodities during much of year. (4)

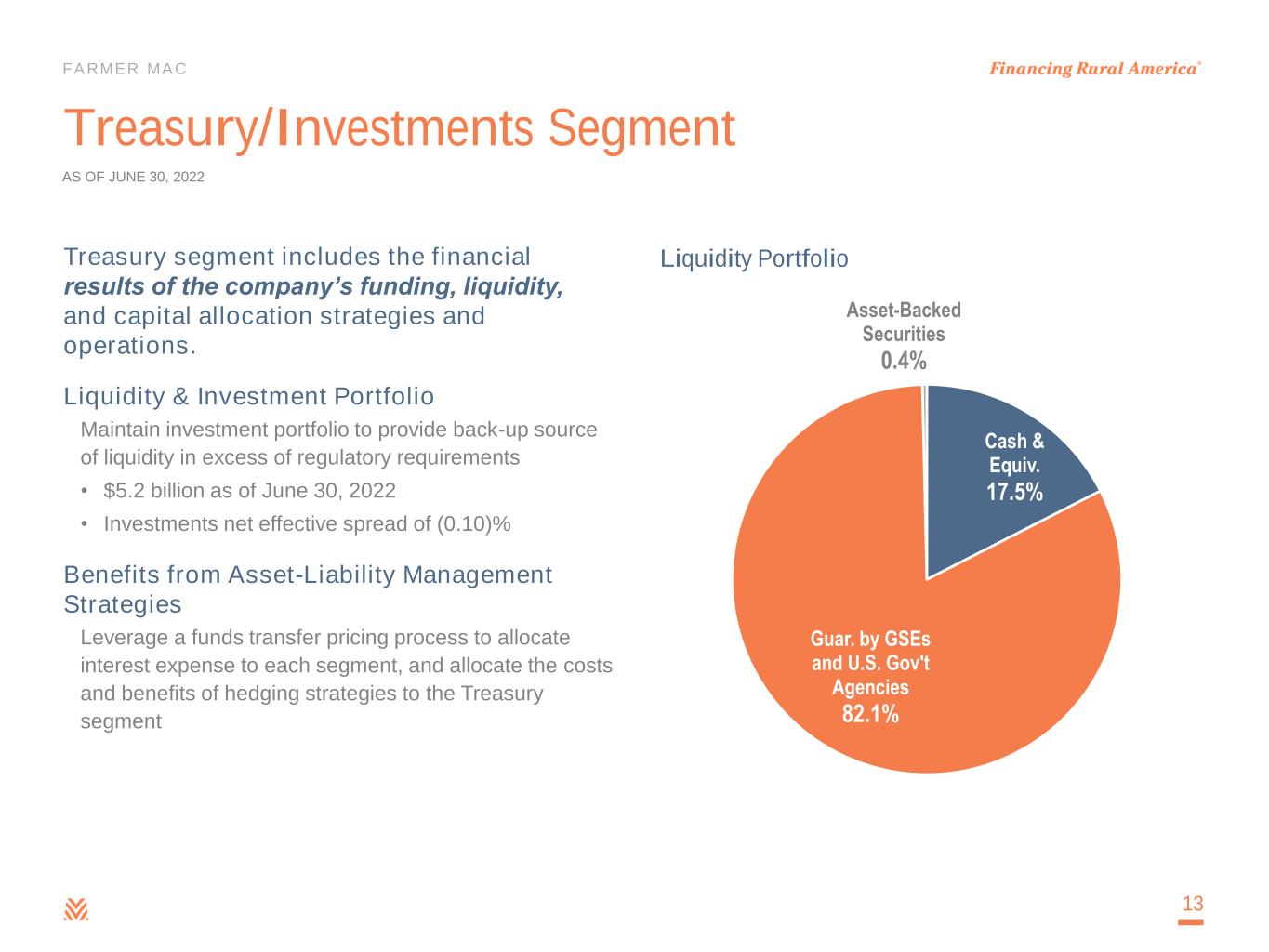

FARMER MAC Treasury/Investments Segment Treasury segment includes the financial results of the company’s funding, liquidity, and capital allocation strategies and operations. Liquidity & Investment Portfolio Maintain investment portfolio to provide back-up source of liquidity in excess of regulatory requirements • $5.2 billion as of June 30, 2022 • Investments net effective spread of (0.10)% Benefits from Asset-Liability Management Strategies Leverage a funds transfer pricing process to allocate interest expense to each segment, and allocate the costs and benefits of hedging strategies to the Treasury segment 13 Cash & Equiv. 17.5% Guar. by GSEs and U.S. Gov't Agencies 82.1% Asset-Backed Securities 0.4% Liquidity Portfolio AS OF JUNE 30, 2022

FARMER MAC $151.2 $168.6 $197.0 $220.7 $118.8$84.0 $93.7 $100.6 $113.6 $56.5 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 2018 2019 2020 2021 YTD Q2 2022 C O R E E A R N IN G S $ IN M IL L IO N S N E T E F F E C T IV E S P R E A D $ I N M IL L IO N S Net Effective Spread & Core Earnings Net Effective Spread Core Earnings Growing, Recurring, High-Quality Earnings $19.7 $21.1 $21.9 $23.6 $24.5 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 2018 2019 2020 2021 Q2 2022 $ I N B IL L IO N S Outstanding Business Volume Outstanding Business Volume 14 6.2% CAGR (2018-2021) 13.4% CAGR (2018-2020) 10.6% CAGR (2018-2021) CAGR is defined as Compound Annual Growth Rate Core earnings and net effective spread are non-GAAP measures. For more information on the use of these non-GAAP measures, please see page 3. For a reconciliation of core earnings to GAAP net income attributable to common stockholders and a reconciliation of net effective spread to GAAP net interest income, please refer to pages 27-28 of the Appendix.

FARMER MAC Quality Earnings Drives Strong Dividends $0.05 $0.10 $0.12 $0.14 $0.16 $0.26 $0.36 $0.58 $0.70 $0.80 $0.88 $0.95 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 $0.90 $1.00 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 $ P E R S H A R E Quarterly Dividend per Common Share 15 Increased quarterly dividend payments for 11 consecutive years

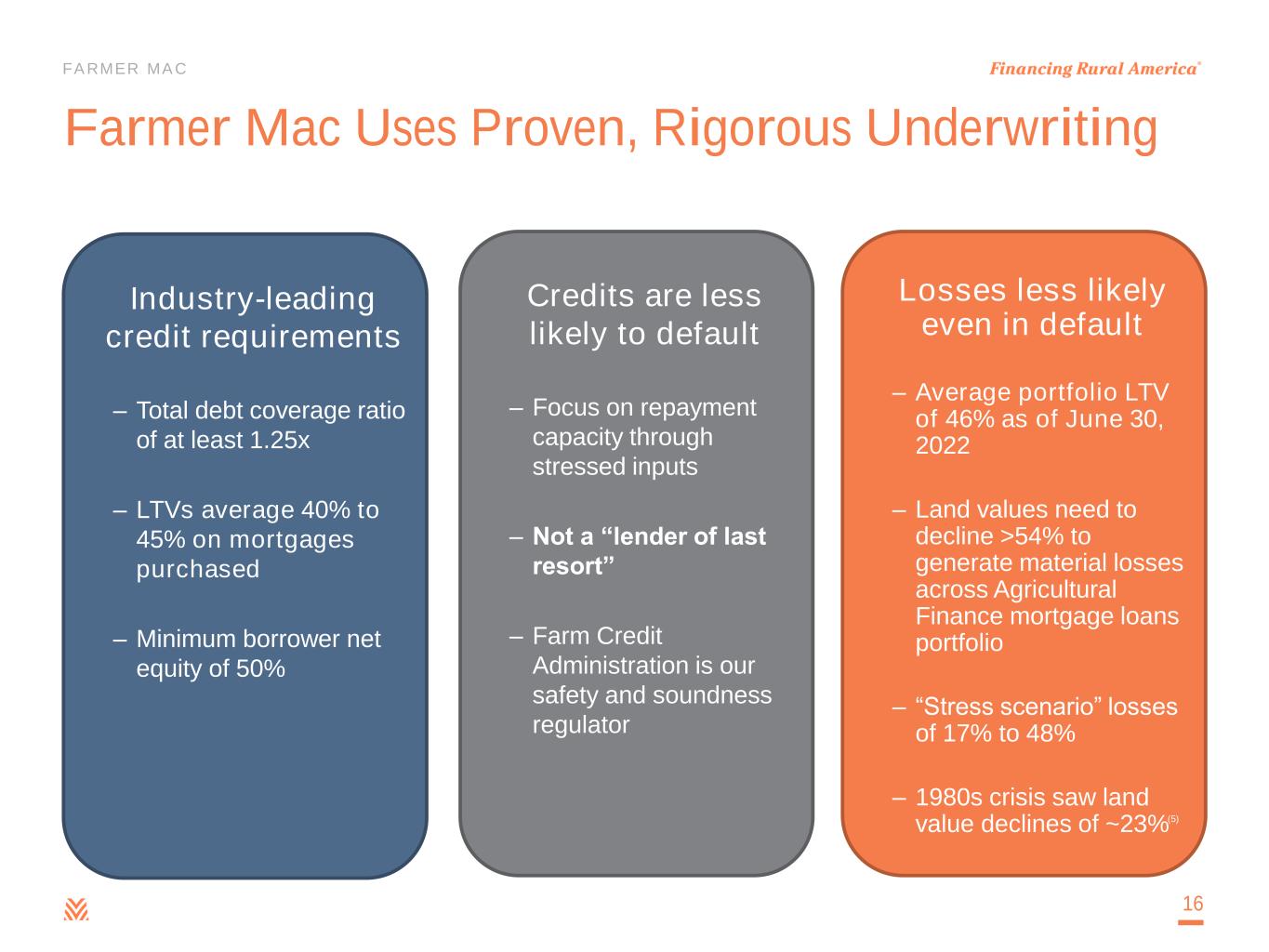

FARMER MAC Losses less likely even in default – Average portfolio LTV of 46% as of June 30, 2022 – Land values need to decline >54% to generate material losses across Agricultural Finance mortgage loans portfolio – “Stress scenario” losses of 17% to 48% – 1980s crisis saw land value declines of ~23% Farmer Mac Uses Proven, Rigorous Underwriting Industry-leading credit requirements – Total debt coverage ratio of at least 1.25x – LTVs average 40% to 45% on mortgages purchased – Minimum borrower net equity of 50% 16 Credits are less likely to default – Focus on repayment capacity through stressed inputs – Not a “lender of last resort” – Farm Credit Administration is our safety and soundness regulator (5)

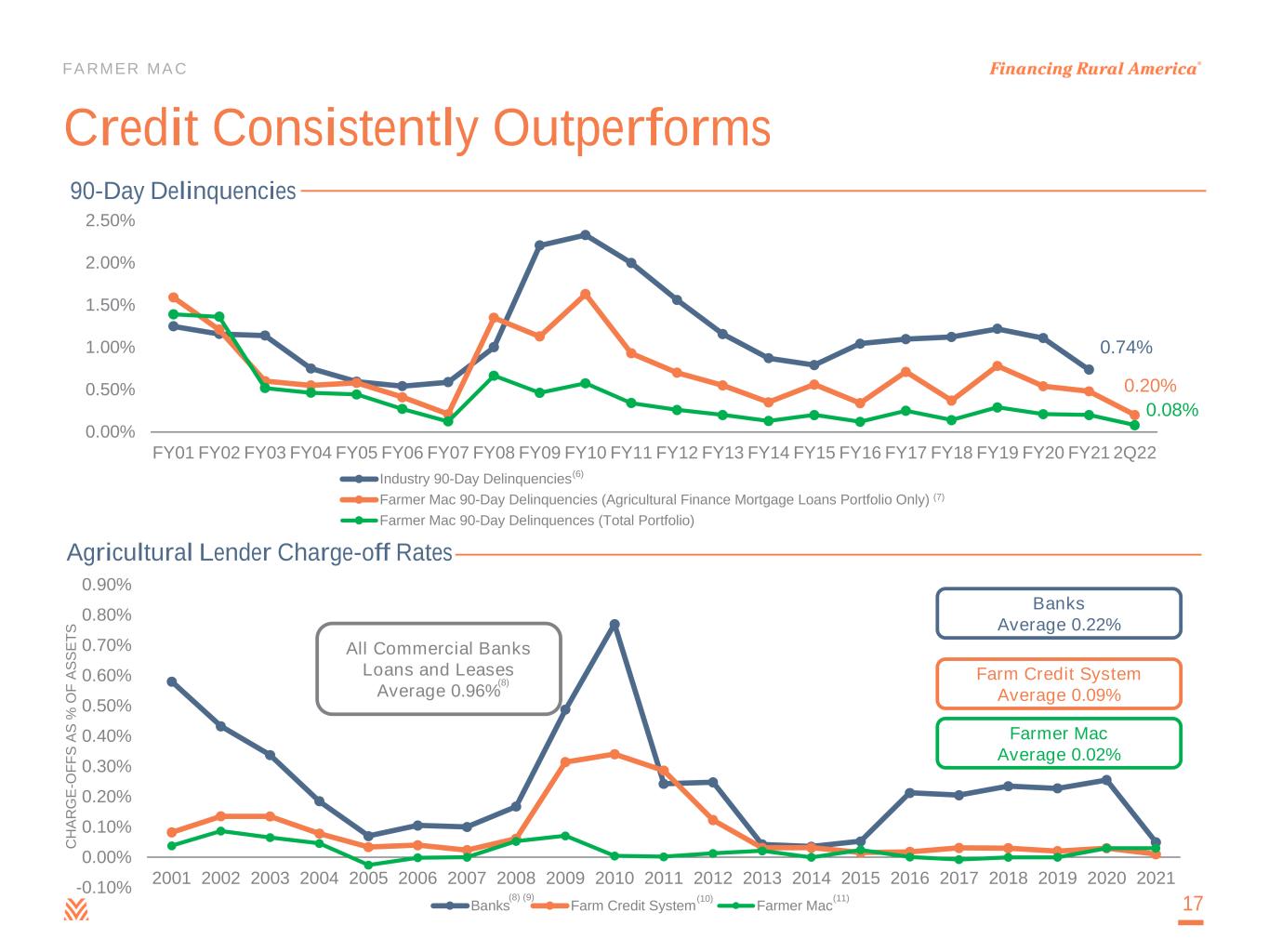

FARMER MAC Credit Consistently Outperforms 17 0.74% 0.20% 0.08% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 2Q22 90-Day Delinquencies Industry 90-Day Delinquencies Farmer Mac 90-Day Delinquencies (Agricultural Finance Mortgage Loans Portfolio Only) Farmer Mac 90-Day Delinquences (Total Portfolio) -0.10% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 0.90% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 C H A R G E -O F F S A S % O F A S S E T S Agricultural Lender Charge-off Rates Banks Farm Credit System Farmer Mac Farmer Mac Average 0.02% Farm Credit System Average 0.09% Banks Average 0.22% All Commercial Banks Loans and Leases Average 0.96% (8) (6) (7) (8) (9) (10) (11)

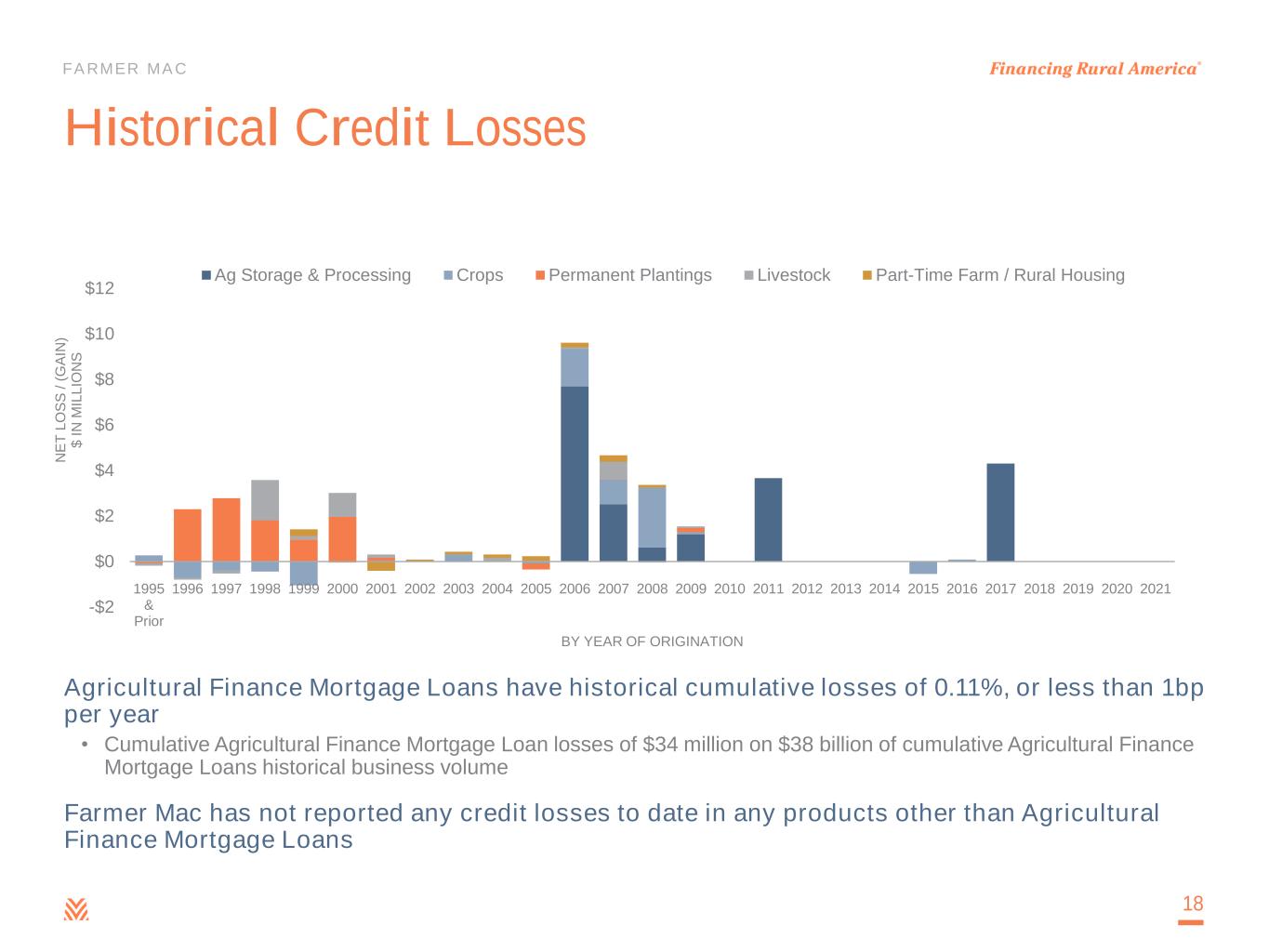

FARMER MAC Historical Credit Losses Agricultural Finance Mortgage Loans have historical cumulative losses of 0.11%, or less than 1bp per year • Cumulative Agricultural Finance Mortgage Loan losses of $34 million on $38 billion of cumulative Agricultural Finance Mortgage Loans historical business volume Farmer Mac has not reported any credit losses to date in any products other than Agricultural Finance Mortgage Loans 18 -$2 $0 $2 $4 $6 $8 $10 $12 1995 & Prior 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 N E T L O S S / ( G A IN ) $ I N M IL L IO N S BY YEAR OF ORIGINATION Ag Storage & Processing Crops Permanent Plantings Livestock Part-Time Farm / Rural Housing

FARMER MAC Allowance for Losses – Quarterly 19 Farmer Mac recorded a $1.5 million release in its total allowance for losses in second quarter 2022. • $1.2 million release from the allowance for the Rural Infrastructure Finance portfolio was primarily due to forecast model parameter updates. • $0.3 million release to the allowance for the Agricultural Finance portfolio was primarily due to a risk rating upgrade on an AgVantage counterparty.

FARMER MAC $545 $619 $681 $714 $756 $183 $197 $325 $487 $506 $728 $815 $1,006 $1,201 $1,262 13.4% 12.9% 14.1% 14.7% 14.7% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% $0 $200 $400 $600 $800 $1,000 $1,200 2018 2019 2020 2021 Q2 2022 T IE R 1 C A P IT A L R A T IO ( % ) C O R E C A P IT A L $ I N M IL L IO N S Statutory Minimum Core Capital Core Capital Amount Above Statutory Minimum Capital Tier 1 Capital Ratio Strong and Growing Equity Capital Base 20Statutory Minimum Core Capital defined as total stockholders’ equity less accumulated other comprehensive income.