Form 8-K Emergent BioSolutions For: Feb 24

EMERGENT BIOSOLUTIONS REPORTS FINANCIAL RESULTS FOR FOURTH QUARTER 2021

•Reports Q4 2021 total revenues of $723M and Adjusted EBITDA of $348M resulting in FY 2021 total revenues of $1,793M and Adjusted EBITDA of $518M, in line with prior guidance

•Updates full year 2022 guidance; provides guidance on Q1 2022 total revenues

GAITHERSBURG, Md., February 24, 2022—Emergent BioSolutions Inc. (NYSE: EBS) today reported financial results for the fourth quarter and year ended December 31, 2021.

"Emergent’s performance in 2021 is a testament to our strategic focus and highly capable team," said Robert G. Kramer, president and CEO of Emergent BioSolutions. "Looking forward, I am encouraged by the stability and durability of our diversified business lines and exciting R&D portfolio, supported by our improved operational structure that better aligns us with patients and customers, and more effectively positions us for success."

FINANCIAL HIGHLIGHTS (1)

Q4 2021 vs. Q4 2020

| ($ in millions, except per share amounts) | Q4 2021 | Q4 2020 | % Change | ||||||||

| Total Revenues | $723.2 | $583.0 | 24% | ||||||||

| Net Income | $189.3 | $185.4 | 2% | ||||||||

| Net Income per Diluted Share | $3.50 | $3.44 | 2% | ||||||||

Adjusted Net Income (2) | $243.4 | $198.8 | 22% | ||||||||

Adjusted Net Income (2) per Diluted Share | $4.50 | $3.67 | 23% | ||||||||

Adjusted EBITDA (2) | $347.9 | $290.9 | 20% | ||||||||

Gross Margin % (2) | 67% | 69% | |||||||||

Adjusted Gross Margin % (2) | 67% | 69% | |||||||||

Full Year 2021 vs. Full Year 2020

| ($ in millions, except per share amounts) | Full Year 2021 | Full Year 2020 | % Change | ||||||||

| Total Revenues | $1,792.7 | $1,555.4 | 15% | ||||||||

| Net Income | $230.9 | $305.1 | (24)% | ||||||||

| Net Income per Diluted Share | $4.27 | $5.67 | (25)% | ||||||||

Adjusted Net Income (2) | $325.7 | $423.9 | (23)% | ||||||||

Adjusted Net Income (2) per Diluted Share | $6.02 | $7.88 | (24)% | ||||||||

Adjusted EBITDA (2) | $517.6 | $630.4 | (18)% | ||||||||

Gross Margin % (2) | 54% | 64% | |||||||||

Adjusted Gross Margin % (2) | 55% | 67% | |||||||||

SELECT Q4 2021 AND OTHER RECENT BUSINESS UPDATES

•Announced a supply agreement with Sandoz for them to distribute an authorized generic of NARCAN® (naloxone HCl) Nasal Spray 4 mg, which is available in the U.S. via retail pharmacies and institutions, including hospitals

•Initiated the rolling submission to the U.S. Food and Drug Administration (FDA) of the Biologics License Application (BLA) for AV7909 (Anthrax Vaccine Adsorbed, Adjuvanted), the Company’s investigational anthrax vaccine candidate

•Initiated a pivotal Phase 3 safety and immunogenicity study to evaluate CHIKV VLP, the Company's single-dose chikungunya virus virus-like particle (VLP) vaccine candidate

•Initiated a Phase 1 safety, tolerability, and immunogenicity study to evaluate UniFlu, the Company’s universal influenza vaccine candidate comprised of multiple components intended to induce broad and supra-seasonal immunity against influenza A viruses

1 of 18

•Announced the Company’s Board of Directors authorization to management to repurchase up to $250 million of the Company’s common stock through November 11, 2022; as of December 31, 2021, the Company repurchased approximately 2.6 million shares for $112.6 million, an average price per share of $42.67

•Announced the retirement of the Company's founder and executive chairman, Fuad El-Hibri, effective April 1, 2022

Q4 2021 FINANCIAL PERFORMANCE (1)

| ($ in millions) | Q4 2021 | Q4 2020 | % Change | ||||||||

| Product sales, net (3): | |||||||||||

•Anthrax vaccines | $137.7 | $115.7 | 19% | ||||||||

•ACAM2000® | $125.8 | $129.3 | (3)% | ||||||||

•Nasal naloxone products | $120.6 | $77.4 | 56% | ||||||||

•Other (4) | $50.2 | $18.5 | * | ||||||||

| Total product sales, net | $434.3 | $340.9 | 27% | ||||||||

| Contract development and manufacturing (CDMO): | |||||||||||

•Services | $51.2 | $64.0 | (20)% | ||||||||

•Leases | $167.1 | $135.1 | 24% | ||||||||

| Total CDMO | $218.3 | $199.1 | 10% | ||||||||

| Contracts and grants | $70.6 | $43.0 | 64% | ||||||||

| Total revenues | $723.2 | $583.0 | 24% | ||||||||

| * % change is greater than 100% | |||||||||||

Product Sales, net

Anthrax vaccines

For Q4 2021, revenues from anthrax vaccines increased $22.0 million as compared to Q4 2020. The increase is largely driven by an increase in deliveries of AV7909 to the U.S. government (USG), specifically the Strategic National Stockpile (SNS). The Company received an AV7909 contract modification in September 2021 and began delivering additional doses of AV7909 under that modification, which covers a period of 18 months and is valued at approximately $399 million.

ACAM2000

For Q4 2021, revenues from ACAM2000® (Smallpox (Vaccinia) Vaccine, Live) decreased $3.5 million as compared to Q4 2020. The decrease is largely driven by the timing of deliveries to the USG. The revenues recognized in Q4 2021 reflect delivery of doses into the SNS resulting from the July 2021 exercise by the USG of the second of nine annual contract term extension options pursuant to the Company's 10-year supply agreement with the USG. This latest option is valued at approximately $182 million.

Nasal naloxone products

For Q4 2021, revenues from nasal naloxone products increased $43.2 million as compared to Q4 2020. The increase is driven by continued demand for NARCAN® (naloxone HCI) Nasal Spray across customer channels in the U.S. and Canada. The increase also reflects the impact of revenues related to the authorized generic of NARCAN® (naloxone HCI) Nasal Spray 4mg, a product licensed to Sandoz and launched in late 2021 and one in which the Company retains a financial interest.

Other (4)

For Q4 2021, revenues from other product sales increased $31.7 million as compared to Q4 2020. The increase is largely due to sales of VIGIV [Vaccinia Immune Globulin Intravenous (Human)], driven by timing of deliveries to the USG and based on the June 2021 exercise by the USG of the second of nine annual contract term extension options pursuant to the Company's 10-year supply agreement with the USG. This latest option is valued at approximately $56 million.

2 of 18

Contract Development and Manufacturing (CDMO)

CDMO Services

For Q4 2021, revenue from contract development and manufacturing services decreased $12.8 million as compared to Q4 2020. This decrease is largely due to the discontinuation of manufacturing activities related to the Company's arrangement with AstraZeneca as was previously announced in the second quarter of 2021. Additionally, there was less activity as compared to Q4 2020 due to routine maintenance in the Company's manufacturing network.

CDMO Leases

For Q4 2021, revenue from contract development and manufacturing leases increased $32.0 million as compared to Q4 2020. This increase is largely due to the timing of $155.7 million in final cash collections associated with the Center for Innovation in Advanced Development and Manufacturing (CIADM) public-private partnership with the Biomedical Advanced Research and Development Authority (BARDA), an arrangement that was mutually terminated by both parties in the fourth quarter. The Company anticipates ongoing CDMO lease revenues in subsequent periods related primarily to its existing CDMO manufacturing agreement with Johnson & Johnson, a portion of which is considered a lease.

Contracts and Grants

For Q4 2021, revenues from contracts and grants increased $27.6 million as compared to Q4 2020. The increase is a result of $59.7 million being recognized in Q4 2021, primarily deferred revenue, as a result of the CIADM base contract termination offset by a decrease in third party development activities.

Operating Expenses

| ($ in millions) | Q4 2021 | Q4 2020 | % Change | ||||||||

| Cost of product sales | $145.0 | $104.4 | 39% | ||||||||

| Cost of CDMO | $67.9 | $63.9 | 6% | ||||||||

| Research and development | $83.0 | $59.5 | 39% | ||||||||

| Selling, general and administrative | $94.2 | $82.1 | 15% | ||||||||

| Goodwill impairment | $41.7 | $— | * | ||||||||

| Amortization of intangible assets | $14.0 | $15.0 | (7)% | ||||||||

| Total operating expenses | $445.8 | $324.9 | 37% | ||||||||

| * % change is greater than 100% | |||||||||||

Cost of Product Sales

For Q4 2021, cost of product sales increased $40.6 million as compared to Q4 2020. The increase is primarily due to a higher volume of product sales, specifically nasal naloxone products, AV7909 and VIGIV.

Cost of CDMO

For Q4 2021, cost of CDMO increased $4.0 million as compared to Q4 2020. The increase is primarily due to additional costs at the Company's Bayview facility to further support enhancements to quality systems and capabilities at the site.

Research and Development

For Q4 2021, research and development expenses increased $23.5 million as compared to Q4 2020. The increase is primarily due to the non-cash write-off of $38.0 million associated with a contract asset balance resulting from the CIADM contract termination.

Selling, General and Administrative

For Q4 2021, selling, general and administrative expenses increased $12.1 million as compared to Q4 2020. The increase is primarily due to professional services costs.

Goodwill Impairment

During Q4 2021, the Company performed its annual impairment testing reflecting its revised reporting unit structure. Pursuant to this analysis, the Company recognized a $41.7 million non-cash impairment of goodwill in the Commercial reporting unit.

3 of 18

ADDITIONAL FINANCIAL INFORMATION

Product Gross Margin (2)

| ($ in millions) | Q4 2021 | Q4 2020 | % Change | ||||||||

| Product gross margin | $289.3 | $236.5 | 22% | ||||||||

| Product gross margin % (product gross margin divided by product revenues) (2) | 67% | 69% | (2)% | ||||||||

For Q4 2021, product gross margin increased $52.8 million as compared to Q4 2020. The increase is primarily due to the increase in product sales. Product gross margin percent decreased primarily due to changes in product mix.

CDMO Gross Margin and Adjusted CDMO Gross Margin (2)

| ($ in millions) | Q4 2021 | Q4 2020 | % Change | ||||||||

| CDMO gross margin | ($16.7) | $0.1 | * | ||||||||

| CDMO gross margin % (CDMO gross margin divided by CDMO revenues) (2) | (33)% | —% | * | ||||||||

| Adjusted CDMO gross margin | ($5.3) | $12.4 | * | ||||||||

| Adjusted CDMO gross margin % (adjusted CDMO gross margin divided by adjusted CDMO revenues) (2) | (8)% | 16% | * | ||||||||

| * % change is greater than 100% | |||||||||||

For Q4 2021, CDMO gross margin decreased $16.8 million as compared to Q4 2020. Adjusted CDMO gross margin decreased $17.7 million as compared to Q4 2020. The decline in CDMO gross margin and adjusted CDMO gross margin is primarily due to routine maintenance activity that occurred in the Company's manufacturing network in Q4 2021 that did not occur in Q4 2020 as well as increased costs to support remediation efforts for the Company's manufacturing activities at its Bayview facility.

CDMO Metrics (presentation on a sequential basis)

| ($ in millions) | In 4Q21 | In 3Q21 | % Change | ||||||||

| CDMO New Business Secured (5) | $53.5 | $117.7 | (55)% | ||||||||

| ($ in millions) | As of 12/31/2021 | As of 09/30/2021 | % Change | ||||||||

| CDMO Backlog (6) | $837.2 | $1,002.0 | (16)% | ||||||||

| CDMO Customers (7) | 70 | 71 | (1)% | ||||||||

| CDMO Backlog Rollforward (6) | ($ in millions) | ||||

| Beginning Backlog (As of 9/30/2021) | $1,002.0 | ||||

| Less: CDMO revenue recognized in Q4 2021 | ($218.3) | ||||

| Plus: New Business Secured in Q4 2021 (5) | $53.5 | ||||

| Ending Backlog (As of 12/31/2021) | $837.2 | ||||

For Q4 2021, the Company has revised the metrics it provides related to specific aspects of the CDMO business. The Company will continue to provide the CDMO New Business Secured and Backlog metrics. The Company is introducing CDMO Customers as a new metric, and is discontinuing reporting of the CDMO Opportunity Funnel. The Company believes this set of supplemental information provides more valuable and relevant context on the performance and stability of the CDMO business.

4 of 18

Capital Expenditures

| ($ in millions) | Q4 2021 | Q4 2020 | % Change | ||||||||

| Gross capital expenditures | $46.7 | $36.0 | 30% | ||||||||

| - Capital expenditures reimbursed | 60.5 | 16.7 | * | ||||||||

| Net capital expenditures | ($13.8) | $19.3 | * | ||||||||

| Gross capital expenditures as a % of total revenues | 6% | 6% | —% | ||||||||

| Net capital expenditures as a % of total revenues | (2)% | 3% | (5)% | ||||||||

* % change is greater than 100% | |||||||||||

For Q4 2021, capital expenditures increased largely due to the Company's continued investments in expanded capacity and capabilities at the Company's Rockville manufacturing facility. The increase in gross capital expenditures was offset by the timing of reimbursements of $60.5 million related to arrangements funded by the USG. The capital expenditures related to this reimbursement were incurred in a prior period.

SELECT FULL YEAR 2021 FINANCIAL INFORMATION

Revenues

| ($ in millions) | Full Year 2021 | Full Year 2020 | % Change | ||||||||

| Product sales, net (3): | |||||||||||

•Nasal naloxone products | $434.3 | $311.2 | 40% | ||||||||

•ACAM2000® | $206.5 | $200.3 | 3% | ||||||||

•Anthrax vaccines** | $259.8 | $373.8 | (30)% | ||||||||

•Other (4) | $123.3 | $104.5 | 18% | ||||||||

| Total product sales, net | $1,023.9 | $989.8 | 3% | ||||||||

| Contract development and manufacturing (CDMO): | |||||||||||

•Services | $334.9 | $166.7 | * | ||||||||

•Leases | $299.7 | $283.8 | 6% | ||||||||

| Total CDMO | $634.6 | $450.5 | 41% | ||||||||

| Contracts and grants | $134.2 | $115.1 | 17% | ||||||||

| Total revenues | $1,792.7 | $1,555.4 | 15% | ||||||||

| * % change is greater than 100% | |||||||||||

| ** Full year 2020 anthrax vaccine sales were larger than average due to strong sales volumes associated with the transition from BioThrax alone to a combination of BioThrax and AV7909 in the SNS which had resulted in delayed deliveries in 2019. | |||||||||||

| ($ in millions) | Full Year 2021 | Full Year 2020 | % Change | ||||||||

| Cost of product sales | $382.0 | $392.0 | (3)% | ||||||||

| Cost of CDMO | $375.5 | $132.0 | * | ||||||||

| Research and development | $234.0 | $234.5 | —% | ||||||||

| Selling, general and administrative | $348.4 | $303.3 | 15% | ||||||||

| Goodwill impairment | $41.7 | $— | * | ||||||||

| Amortization of intangible assets | $58.5 | $59.8 | (2)% | ||||||||

| Total operating expenses | $1,440.1 | $1,121.6 | 28% | ||||||||

| * % change is greater than 100% | |||||||||||

5 of 18

Other Financial Information

| ($ in millions) | Full Year 2021 | Full Year 2020 | % Change | ||||||||

| Gross capital expenditures | $225.0 | $141.0 | 60% | ||||||||

| Net capital expenditures** | $140.2 | $99.2 | 41% | ||||||||

| ** Reflects reimbursements of $84.8 and $41.8 in 2021 and 2020, respectively | |||||||||||

2022 FINANCIAL FORECAST

Full Year 2022

For full year 2022, the Company provides the following update to its forecast of key financial metrics, which were originally announced on January 9, 2022.

| (in millions) | Updated 2022 Forecast | |||||||

| Total Revenues | $1,300 - $1,400 | Revised (previous: $1,400 - $1,500) | ||||||

| Adjusted EBITDA (1) | $240- $300 | Revised (previous: $280 - $340) | ||||||

| Adjusted Net Income (1) | $95 - $140 | Revised (previous: $135 - $180) | ||||||

| Gross Margin % | 47% - 51% | Reaffirmed | ||||||

| Product/Service Level Revenue | ||||||||

| • Anthrax Vaccines | $280 - $300 | Reaffirmed | ||||||

| • ACAM2000® | $190 - $210 | Reaffirmed | ||||||

| • Nasal Naloxone Products | $240 - $310 | Reaffirmed | ||||||

| • CDMO Services | $330 - $380 | Revised (previous: $430 - $480) | ||||||

| • Other Products + Contracts and Grants | $200 - $260 | Reaffirmed | ||||||

The Company's 2022 financial forecast includes the following considerations:

Revised Considerations

The revision to total revenues, CDMO services revenue, Adjusted EBITDA and adjusted net income reflect the impact of the Company's decision to take the opportunity to initiate a maintenance period that it would normally plan for the Bayview facility earlier than anticipated and also extend it in order to make additional improvements and modifications that will better position Bayview for future non-pandemic work.

Unchanged Considerations

2022 Product/Service Level Revenues – Select Assumptions

•Anthrax vaccines revenues are expected to continue at similar levels to 2021 under the terms of the Company's existing contract with BARDA.

•ACAM2000® (Smallpox (Vaccinia) Vaccine, Live) vaccine deliveries are expected to continue under the terms of the Company’s existing contract with the U.S. Department of Health and Human Services (HHS) at unit volume levels consistent with 2021 deliveries.

•Nasal naloxone products revenues reflect the formation of a generic market and comprise revenues from a combination of NARCAN®(naloxone HCl) Nasal Spray and the authorized generic of NARCAN® Nasal Spray, a product licensed to Sandoz and launched in late 2021 and one in which the Company retains a financial interest.

•Other Products + Contracts and Grants revenues: 1) other products revenues reflect continued procurement of other products not highlighted on a standalone basis from various government customers under existing multi-year contracts; 2) contracts and grants revenues reflect continued funding of select development programs from various government and other non-dilutive sources.

6 of 18

Other 2022 Assumptions

•Gross margin primarily reflects the influence of the mix of product and services revenues.

•Pipeline progress is expected across the R&D portfolio with the ongoing advancement of the CHIKV VLP Phase 3 clinical trial, the completion of the BLA filing for AV7909, and anticipated advancements of a number of early-stage programs.

•Capital expenditures, net of reimbursement, are expected to be approximately 10% of total revenues at the midpoint, reflecting ongoing investments in capacity and capability expansions related to the CDMO business and the Company's R&D programs, and aligned with the average over the previous five-year period.

Q1 2022

For Q1 2022, the Company expects total revenues of $280 million to $310 million.

FOOTNOTES

(1) All financial information incorporated within this release is unaudited.

(2) See "Reconciliation of Net Income to Adjusted Net Income," "Reconciliation of Net Income to Adjusted EBITDA," "Reconciliation of Product Gross Margin and Adjusted Product Gross Margin," "Reconciliation of CDMO Gross Margin and Adjusted CDMO Gross Margin" and "Adjusted Revenues" for a definition of terms and the reconciliation tables.

(3) Product sales, net are reported net of variable consideration including returns, rebates, wholesaler fees and prompt pay discounts.

(4) Other can include a combination of sales of any of the following products: BAT, VIGIV, Anthrasil, raxibacumab, RSDL, Trobigard, Vivotif, and Vaxchora.

(5) CDMO New Business Secured is defined as initial value of contracts secured as well as incremental value of existing contracts modified within the indicated period and is incorporated into Backlog.

(6) CDMO Backlog is defined as estimated remaining contract value as of the indicated period pursuant to signed contracts, the majority of which is expected to be recognized over the next 24 months. This excludes any value associated with an extension of the commercial supply agreement (CSA) with Johnson & Johnson.

(7) CDMO Customers is defined as a client (commercial, government, NGO) for whom the Company has performed CDMO services where there is evidence of meeting all of the following criteria: i) completion of any invoiceable project milestones in the preceding 24-month period, indicating ongoing work; ii) secured project work planned in the future, which has not yet been invoiced, capturing future work not yet indicated in the invoice record; and, iii) neither the Company nor the client having yet to formally terminate the last remaining project, thereby removing any client for whom work has fully concluded.

CONFERENCE CALL, PRESENTATION SUPPLEMENT AND WEBCAST INFORMATION

Company management will host a conference call at 5:00 pm (Eastern Time) today, February 24, 2022, to discuss these financial results. The conference call and presentation supplement can be accessed from the Company's website or through the following:

Live Teleconference Information: Dial in: [US] (855) 766-6521; [International] (262) 912-6157 Conference ID: 7619558 | |||||

Live Webcast Information: Visit https://edge.media-server.com/mmc/p/tfd93ojy for the webcast. | |||||

A replay of the call can be accessed from the Emergent website.

ABOUT EMERGENT BIOSOLUTIONS INC.

At Emergent, our mission is to protect and enhance life. We develop, manufacture, and deliver protections against public health threats through a pipeline of innovative vaccines and therapeutics. For over 20 years, we’ve been at work defending people from things we hope will never happen—so that we’re prepared just in case they ever do. We do what we do because we see the opportunity to create a better, more secure world. One where preparedness empowers protection from the threats we face. And peace of mind prevails. In working together, we envision protecting or enhancing 1 billion lives by 2030. For more information, visit our website and follow us on LinkedIn, Twitter, and Instagram.

7 of 18

RECONCILIATION OF NON-GAAP MEASURES

This press release contains financial measures (Adjusted Net Income, Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization), Adjusted Revenues, Adjusted COGS, Adjusted Gross Margin, Adjusted Cost of Product Sales, Adjusted Product Margin, Adjusted CDMO Service Revenues and Adjusted CDMO Service Margin) that are considered “non-GAAP” financial measures under applicable Securities and Exchange Commission rules and regulations. These non-GAAP financial measures should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted accounting principles. The Company’s definition of these non-GAAP measures may differ from similarly titled measures used by others. For its non-GAAP measures, the Company adjusts for specified items that can be highly variable or difficult to predict, or reflect the non-cash impact of charges or accounting changes. As needed, such adjustments are tax effected utilizing the federal statutory tax rate for the U.S., except for both changes in the fair value of contingent consideration, the vast majority of which is non-deductible for tax purposes, and goodwill impairment, all of which is non-deductible for tax purposes. The Company views these non-GAAP financial measures as a means to facilitate management’s financial and operational decision-making, including evaluation of the Company’s historical operating results and comparison to competitors’ operating results. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with GAAP results and the reconciliations to the corresponding GAAP financial measure, may provide a more complete understanding of factors and trends affecting the Company’s business. For more information on these non-GAAP financial measures, please see the tables captioned "Reconciliation of Net Income to Adjusted Net Income," "Reconciliation of Net Income to Adjusted EBITDA," "Reconciliation of Gross Margin and Adjusted Gross Margin," "Reconciliation of Product Margin and Adjusted Product Margin," and "Reconciliation of CDMO Services Margin and Adjusted CDMO Services Margin" and included at the end of this release.

The determination of the amounts that are excluded from these non-GAAP financial measures are a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety.

SAFE HARBOR STATEMENT

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact, including, without limitation, our financial guidance and related projections and statements regarding our ability to meet such projections in the anticipated timeframe, if at all, statements regarding our future performance and future revenue levels and the sources of such revenues, capital expenditures, gross margin, ACAM2000 vaccine deliveries, the impact of a generic market on NARCAN Nasal Spray, the timing of advancement of early-stage programs and completion of a Biologics License Application filing for AV7909, progress of the CHIKV VLP Phase 3 clinical trial, and any other statements containing the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “targets,” “forecasts,” “estimates” and similar expressions in conjunction with, among other things, discussions of the Company’s outlook, financial performance or financial condition, financial and operation goals, strategic goals, growth strategy, product sales, government development or procurement contracts or awards, government appropriations, manufacturing capabilities, and the timing of certain regulatory approvals or expenditures are forward-looking statements. These forward-looking statements are based on our current intentions, beliefs and expectations regarding future events. We cannot guarantee that any forward-looking statement will be accurate.

The reader should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. Readers are, therefore, cautioned not to place undue reliance on any forward-looking statement. Any forward-looking statements speak only as of the date of this press release, and, except as required by law, we do not undertake to update any forward-looking statement to reflect new information, events or circumstances. There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements, including the availability of U.S. government funding for procurement of AV7909 and/or BioThrax or ACAM2000 and our other U.S. government procurement and development contracts, the timing of completion of our submission of the application for and our ability to secure licensure of AV7909 from the FDA within the anticipated timeframe, if at all, our ability to perform under our contracts with the U.S. government, including the timing of and specifications relating to deliveries, whether we will realize the full benefit of our investments in additional manufacturing and quality control systems, our ability to meet our commitments to continued quality and manufacturing compliance at our manufacturing facilities and the potential impact on our ability to continue production of bulk drug substance for Johnson & Johnson’s COVID-19 vaccine, our ability to provide CDMO services for the development and/or manufacture of product candidates of our

8 of 18

customers at required levels and on required timelines, our ability and the ability of our contractors and suppliers to maintain compliance with Current Good Manufacturing Practices and other regulatory obligations, our ability to obtain and maintain regulatory approvals for our product candidates and the timing of any such approvals, changes to U.S. government priorities for the strategic national stockpile, our ability to negotiate additional U.S. government procurement or follow-on contracts for our public health threat products that have expired or will be expiring, the negotiation of further commitments or contracts related to the collaboration and deployment of capacity toward future commercial manufacturing under our CDMO contracts, our ability to comply with the operating and financial covenants required by our senior secured credit facilities and our 3.875% Senior Unsecured Notes due 2028, procurement by U.S. government entities under regulatory exemptions prior to approval by the FDA and corresponding procurement by government entities outside of the United States under regulatory exemptions prior to approval by the corresponding regulatory authorities in the applicable country, the full impact of COVID-19 disease on our markets, operations and employees as well as those of our customers and suppliers, the impact on our revenues from and duration of declines in sales of our vaccine products that target travelers due to the reduction of international travel caused by the COVID-19 pandemic, our ability to identify and acquire companies, businesses, products or product candidates that satisfy our selection criteria, the success of our commercialization, marketing and manufacturing capabilities and strategy, and the accuracy of our estimates regarding future revenues, expenses and capital requirements and needs for additional financing. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward-looking statement. The reader should consider this cautionary statement as well as the risk factors identified in our periodic reports filed with the Securities and Exchange Commission when evaluating our forward-looking statements.

Investor Contact Robert Burrows Vice President, Investor Relations burrowsr@ebsi.com (240) 413-1917 | Media Contact Matt Hartwig Senior Director, Media Relations mediarelations@ebsi.com | ||||

9 of 18

Emergent BioSolutions Inc.

Consolidated Balance Sheets

(unaudited in millions, except per share data)

| December 31, | |||||||||||

| 2021 | 2020 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 576.1 | $ | 621.3 | |||||||

| Restricted cash | 0.2 | 0.2 | |||||||||

| Accounts receivable, net | 274.7 | 230.9 | |||||||||

| Inventories, net | 350.8 | 307.0 | |||||||||

| Prepaid expenses and other current assets | 70.3 | 36.5 | |||||||||

| Total current assets | 1,272.1 | 1,195.9 | |||||||||

| Property, plant and equipment, net | 800.1 | 644.1 | |||||||||

| Intangible assets, net | 604.6 | 663.1 | |||||||||

| Goodwill | 224.9 | 266.7 | |||||||||

| Other assets | 57.3 | 113.4 | |||||||||

| Total assets | $ | 2,959.0 | $ | 2,883.2 | |||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 128.9 | $ | 136.1 | |||||||

| Accrued expenses | 51.7 | 46.9 | |||||||||

| Accrued compensation | 88.7 | 84.6 | |||||||||

| Debt, current portion | 31.6 | 33.8 | |||||||||

| Other current liabilities | 72.9 | 83.1 | |||||||||

| Total current liabilities | 373.8 | 384.5 | |||||||||

| Contingent consideration, net of current portion | 4.5 | 34.2 | |||||||||

| Debt, net of current portion | 809.4 | 841.0 | |||||||||

| Deferred tax liability | 94.9 | 53.2 | |||||||||

| Contract liabilities, net of current portion | 4.7 | 55.5 | |||||||||

| Other liabilities | 52.7 | 67.8 | |||||||||

| Total liabilities | $ | 1,340.0 | $ | 1,436.2 | |||||||

| Stockholders’ equity: | |||||||||||

| Preferred stock, $0.001 par value; 15.0 shares authorized, no shares issued and outstanding | — | — | |||||||||

| Common stock, $0.001 par value; 200.0 shares authorized, 55.1 and 54.3 shares issued; 51.4 and 53.1 shares outstanding, respectively. | 0.1 | 0.1 | |||||||||

Treasury stock, at cost, 3.8 and 1.2 common shares, respectively | (152.2) | (39.6) | |||||||||

| Additional paid-in capital | 829.4 | 784.9 | |||||||||

| Accumulated other comprehensive loss, net | (16.1) | (25.3) | |||||||||

| Retained earnings | 957.8 | 726.9 | |||||||||

| Total stockholders’ equity | $ | 1,619.0 | $ | 1,447.0 | |||||||

| Total liabilities and stockholders’ equity | $ | 2,959.0 | $ | 2,883.2 | |||||||

10 of 18

Emergent BioSolutions Inc.

Consolidated Statements of Operations

(unaudited in millions, except per share data)

| Three Months Ended December 31, | |||||||||||

| 2021 | 2020 | ||||||||||

| Revenues: | |||||||||||

| Product sales, net | $ | 434.3 | $ | 340.9 | |||||||

| CDMO: | |||||||||||

| Services | 51.2 | 64.0 | |||||||||

| Leases | 167.1 | 135.1 | |||||||||

| Total CDMO | 218.3 | 199.1 | |||||||||

| Contracts and grants | 70.6 | 43.0 | |||||||||

| Total revenues | 723.2 | 583.0 | |||||||||

| Operating expenses: | |||||||||||

| Cost of product sales | 145.0 | 104.4 | |||||||||

| Cost of CDMO | 67.9 | 63.9 | |||||||||

| Research and development | 83.0 | 59.5 | |||||||||

| Selling, general and administrative | 94.2 | 82.1 | |||||||||

| Goodwill impairment | 41.7 | — | |||||||||

| Amortization of intangible assets | 14.0 | 15.0 | |||||||||

| Total operating expenses | 445.8 | 324.9 | |||||||||

| Income from operations | 277.4 | 258.1 | |||||||||

| Other income (expense): | |||||||||||

| Interest expense | (9.0) | (8.7) | |||||||||

| Other, net | (0.9) | 3.4 | |||||||||

| Total other income (expense), net | (9.9) | (5.3) | |||||||||

| Income before income taxes | 267.5 | 252.8 | |||||||||

| Income taxes | 78.2 | 67.4 | |||||||||

| Net income | $ | 189.3 | $ | 185.4 | |||||||

| Net income per common share | |||||||||||

| Basic | $ | 3.54 | $ | 3.51 | |||||||

| Diluted | $ | 3.50 | $ | 3.44 | |||||||

| Shares used in computing net income per share | |||||||||||

| Basic | 53.5 | 53.1 | |||||||||

| Diluted | 54.1 | 54.2 | |||||||||

11 of 18

Emergent BioSolutions Inc.

Consolidated Statements of Operations

(unaudited in millions, except per share data)

| Year Ended December 31, | |||||||||||

| 2021 | 2020 | ||||||||||

| Revenues: | |||||||||||

| Product sales, net | $ | 1,023.9 | $ | 989.8 | |||||||

| CDMO: | |||||||||||

| Services | 334.9 | 166.7 | |||||||||

| Leases | 299.7 | 283.8 | |||||||||

| Total CDMO | 634.6 | 450.5 | |||||||||

| Contracts and grants | 134.2 | 115.1 | |||||||||

| Total revenues | 1,792.7 | 1,555.4 | |||||||||

| Operating expenses: | |||||||||||

| Cost of product sales | 382.0 | 392.0 | |||||||||

| Cost of CDMO | 375.5 | 132.0 | |||||||||

| Research and development | 234.0 | 234.5 | |||||||||

| Selling, general and administrative | 348.4 | 303.3 | |||||||||

| Goodwill impairment | 41.7 | — | |||||||||

| Amortization of intangible assets | 58.5 | 59.8 | |||||||||

| Total operating expenses | 1,440.1 | 1,121.6 | |||||||||

| Income from operations | 352.6 | 433.8 | |||||||||

| Other income (expense): | |||||||||||

| Interest expense | (34.5) | (31.3) | |||||||||

| Other, net | (3.7) | 4.7 | |||||||||

| Total other income (expense), net | (38.2) | (26.6) | |||||||||

| Income before income taxes | 314.4 | 407.2 | |||||||||

| Income taxes | 83.5 | 102.1 | |||||||||

| Net income | $ | 230.9 | $ | 305.1 | |||||||

| Net income per common share | |||||||||||

| Basic | $ | 4.32 | $ | 5.79 | |||||||

| Diluted | $ | 4.27 | $ | 5.67 | |||||||

| Shares used in computing net income per share | |||||||||||

| Basic | 53.5 | 52.7 | |||||||||

| Diluted | 54.1 | 53.8 | |||||||||

12 of 18

Emergent BioSolutions Inc.

Consolidated Statements of Cash Flows

(unaudited, in millions)

| Year Ended December 31, | |||||||||||

| 2021 | 2020 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income | $ | 230.9 | $ | 305.1 | |||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Stock-based compensation expense | 42.4 | 51.0 | |||||||||

| Depreciation and amortization | 123.8 | 114.5 | |||||||||

| Change in fair value of contingent obligations, net | 2.9 | 31.7 | |||||||||

| Amortization of deferred financing costs | 4.1 | 3.5 | |||||||||

| Impairments | 41.7 | 29.0 | |||||||||

| Deferred income taxes | 46.9 | (2.4) | |||||||||

| Write off of contract asset and liability | (17.2) | — | |||||||||

| Other | 2.0 | (5.2) | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable | (48.2) | 49.0 | |||||||||

| Inventories | (44.0) | (83.2) | |||||||||

| Prepaid expenses and other assets | (24.7) | (29.2) | |||||||||

| Accounts payable | (2.5) | 19.8 | |||||||||

| Accrued expenses and other liabilities | (9.2) | 19.4 | |||||||||

| Accrued compensation | 4.0 | 21.8 | |||||||||

| Contract liabilities | (31.8) | 11.2 | |||||||||

| Net cash provided by operating activities | 321.1 | 536.0 | |||||||||

| Cash flows from investing activities: | |||||||||||

| Purchases of property, plant and equipment | (225.0) | (141.0) | |||||||||

| Milestone payment from prior asset acquisition | — | (10.0) | |||||||||

| Net cash used in investing activities | (225.0) | (151.0) | |||||||||

| Cash flows (used in) provided by financing activities: | |||||||||||

| Purchases of treasury stock | (106.0) | — | |||||||||

| Proceeds from revolving credit facility | — | — | |||||||||

| Proceeds from senior unsecured notes | — | 450.0 | |||||||||

| Principal payments on convertible senior notes | (10.6) | — | |||||||||

| Principal payments on revolving credit facility | — | (373.0) | |||||||||

| Principal payments on term loan facility | (25.3) | (14.1) | |||||||||

| Proceeds from stock-based compensation activity | 15.9 | 31.6 | |||||||||

| Taxes paid for stock-based compensation activity | (13.8) | (13.8) | |||||||||

| Debt issuance costs | — | (8.4) | |||||||||

| Contingent consideration payments | (1.2) | (2.8) | |||||||||

| Net cash (used in) provided by financing activities: | (141.0) | 69.5 | |||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (0.3) | (1.0) | |||||||||

| Net change in cash, cash equivalents and restricted cash | (45.2) | 453.5 | |||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 621.5 | 168.0 | |||||||||

| Cash, cash equivalents and restricted cash at end of period | 576.3 | 621.5 | |||||||||

| Supplemental disclosure of cash flow information: | |||||||||||

| Cash paid during the year for interest | 30.4 | 21.0 | |||||||||

| Cash paid during the year for income taxes | 71.6 | 109.3 | |||||||||

| Supplemental information on non-cash investing and financing activities: | |||||||||||

| Purchases of property, plant and equipment unpaid at period end | 20.0 | 22.0 | |||||||||

| Purchase of Treasury Stock | 6.6 | — | |||||||||

| Reconciliation of cash and cash equivalents and restricted cash: | |||||||||||

| Cash and cash equivalents | 576.1 | 621.3 | |||||||||

| Restricted cash | 0.2 | 0.2 | |||||||||

| Total | $ | 576.3 | $ | 621.5 | |||||||

13 of 18

Reconciliation of Net Income to Adjusted Net Income (1)

| ($ in millions, except per share value) | Three Months Ended December 31, | ||||||||||

| 2021 | 2020 | Source | |||||||||

| Net income | $189.3 | $185.4 | |||||||||

| Adjustments: | |||||||||||

| + Non-cash amortization charges | 15.2 | 16.2 | Intangible Asset (IA) Amortization, Other Income | ||||||||

| + Changes in fair value of contingent consideration | 0.3 | 0.4 | Product COGS | ||||||||

| + Impairments | 41.7 | — | Goodwill impairment | ||||||||

| + Exit and disposal costs | — | 0.1 | COGS, SG&A, Other Income | ||||||||

| + Acquisition-related costs (transaction & integration) | 0.2 | 0.1 | SG&A | ||||||||

| Tax effect | (3.3) | (3.4) | |||||||||

| Total adjustments: | $54.1 | $13.4 | |||||||||

| Adjusted net income | $243.4 | $198.8 | |||||||||

| Adjusted net income per diluted share | $4.50 | $3.67 | |||||||||

| ($ in millions, except per share value) | Twelve Months Ended December 31, | ||||||||||

| 2021 | 2020 | Source | |||||||||

| Net income | $230.9 | $305.1 | |||||||||

| Adjustments: | |||||||||||

| + Non-cash amortization charges | 62.7 | 63.4 | Intangible Asset (IA) Amortization, Other Income | ||||||||

| + Changes in fair value of contingent consideration | 2.9 | 31.7 | Product COGS | ||||||||

| + Impairments | 41.7 | 29.0 | Goodwill impairment/R&D | ||||||||

| + Exit and disposal costs | — | 17.2 | COGS, SG&A, Other Income | ||||||||

| + Acquisition-related costs (transaction & integration) | 0.9 | 0.6 | SG&A | ||||||||

| Tax effect | (13.4) | (23.1) | |||||||||

| Total adjustments: | $94.8 | $118.8 | |||||||||

| Adjusted net income | $325.7 | $423.9 | |||||||||

| Adjusted net income per diluted share | $6.02 | $7.88 | |||||||||

| ($ in millions) | Revised 2022 Full Year Forecast | Source | ||||||

| Net income | $45 - $90 | |||||||

| Adjustments: | ||||||||

| + Non-cash amortization charges | 60 | IA Amortization, Other Income | ||||||

| + Changes in fair value of contingent consideration | 1 | COGS | ||||||

| + Acquisition-related costs (transaction & integration) | 2 | SG&A | ||||||

| Tax effect | (13) | |||||||

| Total adjustments: | $50 | |||||||

| Adjusted net income | $95 - $140 | |||||||

14 of 18

Reconciliation of Net Income to Adjusted EBITDA (1)

| ($ in millions) | Three Months Ended December 31, | |||||||

| 2021 | 2020 | |||||||

| Net income (loss) | $189.3 | $185.4 | ||||||

| Adjustments: | ||||||||

| + Income taxes | 78.2 | 67.4 | ||||||

| + Depreciation & amortization | 29.3 | 28.9 | ||||||

| + Total interest expense, net | 8.9 | 8.6 | ||||||

| + Impairments | 41.7 | — | ||||||

| + Changes in fair value of contingent consideration | 0.3 | 0.4 | ||||||

| + Acquisition-related costs (transaction & integration) | 0.2 | 0.1 | ||||||

| + Exit and disposal costs | — | 0.1 | ||||||

| Total adjustments | $158.6 | $105.5 | ||||||

| Adjusted EBITDA | $347.9 | $290.9 | ||||||

| ($ in millions) | Twelve Months Ended December 31, | |||||||

| 2021 | 2020 | |||||||

| Net income | $230.9 | $305.1 | ||||||

| Adjustments: | ||||||||

| + Depreciation & amortization | 123.8 | 114.5 | ||||||

| + Income taxes | 83.5 | 102.1 | ||||||

| + Total interest expense, net | 33.9 | 30.2 | ||||||

| + Impairments | 41.7 | 29.0 | ||||||

| + Changes in fair value of contingent consideration | 2.9 | 31.7 | ||||||

| + Acquisition-related costs (transaction & integration) | 0.9 | 0.6 | ||||||

| + Exit and disposal costs | — | 17.2 | ||||||

| Total adjustments | $286.7 | $325.3 | ||||||

| Adjusted EBITDA | $517.6 | $630.4 | ||||||

| ($ in millions) | Revised 2022 Full Year Forecast | ||||

| Net income | $45 - $90 | ||||

| Adjustments: | |||||

| + Depreciation & amortization | 133 | ||||

| + Provision for income taxes | 26 - 41 | ||||

| + Total interest expense, net | 33 | ||||

| + Changes in fair value of contingent consideration | 1 | ||||

| + Acquisition-related costs (transaction & integration) | 2 | ||||

| Total adjustments | $195 - $210 | ||||

| Adjusted EBITDA | $240 - $300 | ||||

15 of 18

Reconciliation of Gross Margin and Adjusted Gross Margin (1)

| ($ in millions) | Three Months Ended December 31, | |||||||

| 2021 | 2020 | |||||||

| Total revenues | $723.2 | $583.0 | ||||||

| - Contract and grants revenues | (70.6) | (43.0) | ||||||

| Adjusted revenues | $652.6 | $540.0 | ||||||

| Cost of product sales | $145.0 | $104.4 | ||||||

| Cost of contract development and manufacturing | $67.9 | $63.9 | ||||||

| Cost of product sales and cost of contract development and manufacturing services ("COGS") | $212.9 | $168.3 | ||||||

| - Changes in fair value of contingent consideration | (0.3) | (0.4) | ||||||

| - Inventory reserves related to Travel Health vaccines | — | 1.5 | ||||||

| Adjusted COGS | $212.6 | $169.4 | ||||||

| Gross margin (adjusted revenues minus COGS) | $439.7 | $371.7 | ||||||

| Gross margin % (gross margin divided by adjusted revenues) | 67% | 69% | ||||||

| Adjusted gross margin (adjusted revenues minus adjusted COGS) | $440.0 | $370.6 | ||||||

| Adjusted gross margin % (adjusted gross margin divided by adjusted revenues) | 67% | 69% | ||||||

| ($ in millions) | Twelve Months Ended December 31, | |||||||

| 2021 | 2020 | |||||||

| Total revenues | $1,792.7 | $1,555.4 | ||||||

| - Contract and grants revenues | (134.2) | ($115.1) | ||||||

| Adjusted revenues | $1,658.5 | $1,440.3 | ||||||

| Cost of product sales | $382.0 | $392.0 | ||||||

| Cost of contract development and manufacturing | $375.5 | $132.0 | ||||||

| Cost of product sales and cost of contract development and manufacturing services ("COGS") | $757.5 | $524.0 | ||||||

| - Changes in fair value of contingent consideration | ($2.9) | ($31.7) | ||||||

| - Inventory reserves related to Travel Health vaccines | $— | ($12.6) | ||||||

| Adjusted COGS | $754.6 | $479.7 | ||||||

| Gross margin (adjusted revenues minus COGS) | $901.0 | $916.3 | ||||||

| Gross margin % (gross margin divided by adjusted revenues) | 54% | 64% | ||||||

| Adjusted gross margin (adjusted revenues minus adjusted COGS) | $903.9 | $960.6 | ||||||

| Adjusted gross margin % (adjusted gross margin divided by adjusted revenues) | 55% | 67% | ||||||

16 of 18

Reconciliation of Product Margin and Adjusted Product Margin (1)

| ($ in millions) | Three Months Ended December 31, | |||||||

| 2021 | 2020 | |||||||

| Product revenues | $434.3 | $340.9 | ||||||

| Cost of product sales (COPS) | $145.0 | $104.4 | ||||||

| - Changes in fair value of contingent consideration | (0.3) | (0.4) | ||||||

| - Inventory reserves related to Travel Health vaccines | — | 1.5 | ||||||

| Adjusted cost of product sales | $144.7 | $105.5 | ||||||

| Product margin (product revenues minus COPS) | $289.3 | $236.5 | ||||||

| Product margin % (product margin divided by product revenues) | 67% | 69% | ||||||

| Adjusted product margin (product revenues minus adjusted COPS) | $289.6 | $235.4 | ||||||

| Adjusted product margin % (adjusted product margin divided by product revenues) | 67% | 69% | ||||||

| ($ in millions) | Twelve Months Ended December 31, | |||||||

| 2021 | 2020 | |||||||

| Product revenues | $1,023.9 | $989.8 | ||||||

| Cost of product sales | $382.0 | $392.0 | ||||||

| - Changes in fair value of contingent consideration | (2.9) | (31.7) | ||||||

| - Inventory reserves related to Travel Health vaccines | — | (12.6) | ||||||

| Adjusted COPS | $379.1 | $347.7 | ||||||

| Product margin (product revenues minus COPS) | $641.9 | $597.8 | ||||||

| Product margin % (product margin divided by product revenues) | 63% | 60% | ||||||

| Adjusted product margin (product revenues minus adjusted COPS) | $644.8 | $642.1 | ||||||

| Adjusted product margin % (adjusted product margin divided by product revenues) | 63% | 65% | ||||||

Reconciliation of CDMO Services Margin and Adjusted CDMO Services Margin (1)

| ($ in millions) | Three Months Ended December 31, | |||||||

| 2021 | 2020 | |||||||

| CDMO services revenues | $51.2 | $64.0 | ||||||

| + Non-USG lease revenue | 11.4 | 12.3 | ||||||

| Adjusted CDMO services revenues | $62.6 | $76.3 | ||||||

| Cost of CDMO services | $67.9 | $63.9 | ||||||

| CDMO services margin (CDMO services revenues minus Cost of CDMO services) | $(16.7) | $0.1 | ||||||

| CDMO services margin % (CDMO margin divided by CDMO services revenues) | (33)% | —% | ||||||

| Adjusted CDMO services margin (adjusted CDMO services revenues minus Cost of CDMO services) | ($5.3) | $12.4 | ||||||

| Adjusted CDMO services margin % (adjusted CDMO margin divided by adjusted CDMO services revenues) | (8)% | 16% | ||||||

17 of 18

| ($ in millions) | Twelve Months Ended December 31, | |||||||

| 2021 | 2020 | |||||||

| CDMO services revenues | $334.9 | $166.7 | ||||||

| + Non-USG lease revenue | 62.1 | 30.5 | ||||||

| Adjusted CDMO services revenues | $397.0 | $197.2 | ||||||

| Cost of CDMO services | $375.5 | $132.0 | ||||||

| CDMO services margin (CDMO services revenues minus Cost of CDMO services) | $(40.6) | $34.7 | ||||||

| CDMO services margin % (CDMO margin divided by CDMO services revenues) | (12)% | 21% | ||||||

| Adjusted CDMO services margin (adjusted CDMO services revenues minus Cost of CDMO services) | $21.5 | $65.2 | ||||||

| Adjusted CDMO services margin % (adjusted CDMO margin divided by adjusted CDMO services revenues) | 5% | 33% | ||||||

18 of 18

4Q 2021 and Full Year 2021 Investor Update February 24, 2022

PROPRIETARY AND CONFIDENTIAL 24Q 2021 Investor Update Introduction Robert G. Burrows Vice President, Investor Relations Officer

This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact, including, without limitation, our financial guidance and related projections and statements regarding our ability to meet such projections in the anticipated timeframe, if at all, statements regarding our future performance and future revenue levels and the sources of such revenues, capital expenditures, gross margin, ACAM2000 vaccine deliveries, the impact of a generic market on NARCAN Nasal Spray, future procurement of existing products, continued funding of development programs, the timing of advancement of early-stage programs, progress of the CHIKV VLP Phase 3 clinical trial, better positioning Bayview for future non-pandemic work and any other statements containing the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “targets,” “forecasts,” “estimates” and similar expressions in conjunction with, among other things, discussions of the Company’s outlook, financial performance or financial condition, financial and operation goals, strategic goals, growth strategy, product sales, government development or procurement contracts or awards, government appropriations, manufacturing capabilities, and the timing of certain regulatory approvals or expenditures are forward-looking statements. These forward-looking statements are based on our current intentions, beliefs and expectations regarding future events. We cannot guarantee that any forward-looking statement will be accurate. Investors should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. Investors are, therefore, cautioned not to place undue reliance on any forward-looking statement. Any forward-looking statements speak only as of the date of this presentation, and, except as required by law, we do not undertake to update any forward-looking statement to reflect new information, events, or circumstances. There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements, including the availability of U.S. government funding for procurement of AV7909 and/or BioThrax or ACAM2000 and our other U.S. government procurement and development contracts, our ability to meet our commitments to continued quality and manufacturing compliance at our manufacturing facilities and the potential impact on our ability to continue production of bulk drug substance for Johnson & Johnson’s COVID-19 vaccine, the impact of a generic marketplace on NARCAN Nasal Spray and future NARCAN Nasal Spray sales, , our ability to perform under our contracts with the U.S. government, including the timing of and specifications relating to deliveries, whether we will realize the full benefit of our investments in additional manufacturing and quality control systems, our ability to provide CDMO services for the development and/or manufacture of product candidates of our customers at required levels and on required timelines, our ability and the ability of our contractors and suppliers to maintain compliance with Current Good Manufacturing Practices and other regulatory obligations, our ability to obtain and maintain regulatory approvals for our product candidates and the timing of any such approvals, changes to U.S. government priorities for the strategic national stockpile, our ability to negotiate additional U.S. government procurement or follow-on contracts for our public health threat products that have expired or will be expiring, the negotiation of further commitments or contracts related to the collaboration and deployment of capacity toward future commercial manufacturing under our CDMO contracts, our ability to comply with the operating and financial covenants required by our senior secured credit facilities and our 3.875% Senior Unsecured Notes due 2028, procurement by U.S. government entities under regulatory exemptions prior to approval by the FDA and corresponding procurement by government entities outside of the United States under regulatory exemptions prior to approval by the corresponding regulatory authorities in the applicable country, the full impact of COVID-19 disease on our markets, operations and employees as well as those of our customers and suppliers, the impact on our revenues from and duration of declines in sales of our vaccine products that target travelers due to the reduction of international travel caused by the COVID-19 pandemic, our ability to identify and acquire companies, businesses, products or product candidates that satisfy our selection criteria, the success of our commercialization, marketing and manufacturing capabilities and strategy, and the accuracy of our estimates regarding future revenues, expenses and capital requirements and needs for additional financing. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward-looking statement. Investors should consider this cautionary statement as well as the risk factors identified in our periodic reports filed with the Securities and Exchange Commission when evaluating our forward-looking statements. Trademarks Emergent,® BioThrax® (Anthrax Vaccine Adsorbed), RSDL® (Reactive Skin Decontamination Lotion Kit), BAT® (Botulism Antitoxin Heptavalent (A,B,C,D,E,F and G)-(Equine)), Anthrasil® (Anthrax Immune Globulin Intravenous (Human)), VIGIV (Vaccinia Immune Globulin Intravenous (Human)), Trobigard® (atropine sulfate, obidoxime chloride), ACAM2000® (Smallpox (Vaccinia) Vaccine, Live), Vivotif® (Typhoid Vaccine Live Oral Ty21a), Vaxchora® (Cholera Vaccine, Live, Oral), NARCAN® (naloxone HCI) Nasal Spray and any and all Emergent BioSolutions Inc. brands, products, services and feature names, logos and slogans are trademarks or registered trademarks of Emergent BioSolutions Inc. or its subsidiaries in the United States or other countries. All other brands, products, services and feature names or trademarks are the property of their respective owners. Safe Harbor Statement/Trademarks 34Q 2021 Investor Update

This presentation contains four financial measures Adjusted Net Income, Adjusted Net Income Per Diluted Share, Adjusted EBITDA (Earnings Before Interest, Taxes, and Depreciation and Amortization), and Adjusted Gross Margin, all of which are considered “non-GAAP” financial measures under applicable Securities and Exchange Commission rules and regulations. These non-GAAP financial measures should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted accounting principles. The Company’s definition of these non-GAAP measures may differ from similarly titled measures used by others. Adjusted Net Income reflects net income excluding the impact of certain non- cash, one-time or non-recurring expenses. Adjusted Net Income Per Diluted Share is defined as Adjusted Net Income divided by diluted shares outstanding. Adjusted EBITDA reflects net income excluding the impact of depreciation, amortization, interest expense and income taxes, excluding specified items that can be highly variable and the non-cash impact of certain accounting adjustments. The Company views these non-GAAP financial measures as a means to facilitate management’s financial and operational decision-making, including evaluation of the Company’s historical operating results and comparison to competitors’ operating results. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with GAAP results and the reconciliations to the corresponding GAAP financial measure may provide a more complete understanding of factors and trends affecting the Company’s business. The determination of the amounts that are excluded from these non-GAAP financial measures are a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety. For additional information on the non-GAAP financial measures noted here, please refer to the reconciliation tables provide in the Appendix to this presentation as well as the associated press release which can be found on the Company’s website at www.emergentbiosolutions.com. Non-GAAP Financial Measures 44Q 2021 Investor Update

Agenda 54Q 2021 Investor Update Financial Forecast: -- FY2022 -- 1Q22 (revenues only) • Rich Lindahl, CFO INTRODUCTION Q&A • Bob Kramer, CEO • Rich Lindahl, CFO • Adam Havey, COO Financial Results: -- 4Q21 vs. 4Q20 -- FY21 vs. FY20 • Rich Lindahl, CFO State of the Company: 2021 Review & Outlook for 2022 • Bob Kramer, CEO

PROPRIETARY AND CONFIDENTIAL4Q 2021 Investor Update State of the Company Bob Kramer President and Chief Executive Officer 6

Key Highlights of Full Year 2021 74Q 2021 Investor Update STATE OF THE COMPANY Generated total revenues of $1.8B, adjusted EBITDA of $518M, and significant operating cash flow. Realized over $600M in government contract options exercised, including for ACAM2000, VIGIV and AV7909. Initiated the rolling BLA submission for AV7909 and the pivotal Phase 3 clinical trial for single-dose Chikungunya virus VLP vaccine candidate, CHIKV VLP. Secured more than $400 million in new CDMO services business and invested in expanded capabilities and capacities at key CDMO sites. Delivered over 5M units of NARCAN Nasal Spray (equivalent of 10M doses) while further supporting those at risk of opioid overdose, including increased advocacy to expand access to naloxone in the US and Canada. Reorganized operating structure to focus on customers and markets, resulting in three business lines: (I) medical countermeasures; (II) commercial products; and (III) CDMO services. Aligned R&D function to enhance the development of product pipeline, including clinical and pre- clinical stage programs.

Outlook for 2022 and Beyond 84Q 2021 Investor Update CDMO Services: • Complete optimization of Bayview site • Operationalize investments in expanded capacities and capabilities at key sites • Pursue strategic opportunities to further expand capabilities across CDMO site network STATE OF THE COMPANY R&D: • Complete AV7909 BLA submission • Execute multiple clinical trial starts across portfolio programs focused on infectious diseases, substance use disorder and nerve agent antidotes Commercial Business: • Maximize market share in nasal naloxone while continuing to expand overall market addressing opioid use disorder • Relaunch travel health vaccines Vaxchora and Vivotif in key travel markets MCM Business: • Deliver on existing contractual obligations • Pursue additional C&G funding • Expand thought leadership in preparedness and response for the benefit of a growing global set of customers

PROPRIETARY AND CONFIDENTIAL 94Q 2021 Investor Update Financial Results Richard S. Lindahl Executive Vice President and Chief Financial Officer

4Q21 Summary Points Demonstrating Business Strength 104Q 2021 Investor Update Medical countermeasures business line reinforced with ACAM2000 and AV7909 contract option exercises for continued procurement Nasal naloxone products continue to strongly battle the opioid crisis R&D pipeline advancing – launch of CHIKV VLP Phase 3 trial and initiation of rolling submission to FDA of AV7909 BLA Repurchased 2.6M shares for $113M, average price of $42.67 per share, under Board authorized $250M share repurchase program Steady progress continues to build for CDMO Services business across existing 70 customers FINANCIAL RESULTS

4 Q 2 0 Key Financial Performance Metrics 4Q21 vs. 4Q20 114Q 2021 Investor Update Total Revenues Adjusted EBITDA1 Adjusted Net Income Per Diluted Share1 Adjusted Net Income1 1. See the Appendix for a definition of non-GAAP terms and reconciliation tables. $583.0 $723.2 $3.67 $4.50 FINANCIAL RESULTS $290.9 $347.9 $198.8 $243.4 ( $ I N M I LLI O N S , E XC E PT PE R S H A R E A M O U N T S ) 4 Q 2 1 4Q20 4Q21 4Q20 4Q21 4Q20 4Q21 4Q20 4Q21

66 66 67 71 70 12/31/20 3/31/21 6/30/21 9/30/21 12/31/21 $1,340 $1,343 $1,097 $1,002 $837 12/31/20 3/31/21 6/30/21 9/30/21 12/31/21 CDMO Metrics Trends 124Q 2021 Investor Update 1. New Business Secured is defined as initial value of contracts secured as well as incremental value of existing contracts modified within the indicated period and is incorporated into Backlog. 2. Backlog is defined as estimated remaining contract value as of the indicated period pursuant to signed contracts, the majority of which is expected to be realized over the next 24 months. This excludes any value associated with an extension of the commercial supply agreement (CSA) with Johnson & Johnson. 3. Customers is defined as a client (commercial, government, NGO) for whom the Company has performed CDMO services where there is evidence of meeting all of the following criteria: i) completion of any invoiceable project milestones in the preceding 24- month period, indicating ongoing work; ii) secured project work planned in the future, which has not yet been invoiced, capturing future work not yet indicated in the invoice record; and, iii) neither the Company nor the client having yet to formally terminate the last remaining project, thereby removing any client for whom work has fully concluded. 4. Difference due to rounding. FINANCIAL RESULTS New Business Secured1 ($ Millions) Backlog2 ($ Millions) Customers3 $53 $187 $53 $118 $54 4Q20 1Q21 2Q21 3Q21 4Q21 TTM TOTAL: $4114

F Y 2 0 Key Financial Performance Metrics FY21 vs. FY20 (1 of 2) 134Q 2021 Investor Update Adjusted EBITDA1 Adjusted Net Income Per Diluted Share1 Adjusted Net Income1 1. See the Appendix for a definition of non-GAAP terms and reconciliation tables. $1,555.4 $1,792.7 $7.88 $6.02 FINANCIAL RESULTS $630.4 $517.6 $423.9 $325.7 ( $ I N M I LLI O N S , E XC E PT PE R S H A R E A M O U N T S ) F Y 2 1 Total Revenues FY20 FY21 FY20 FY21 FY20 FY21 FY20 FY21

F Y 2 0 Key Financial Performance Metrics FY21 vs. FY20 (2 of 2) 144Q 2021 Investor Update SG&A R&D Adjusted Gross Margin2Gross Margin2 1. Reflects absolute value for the indicated period expressed as a percentage of total revenues for the indicated period. 2. See the Appendix for a definition of non-GAAP terms and reconciliation tables $303.3 $348.4 FINANCIAL RESULTS $234.5 $234.0 64% 54% ( $ I N M I LLI O N S , E XC E PT PE R S H A R E A M O U N T S ) F Y 2 1 67% 55% FY20 FY21 FY20 FY21 FY20 FY21 FY20 FY21 [19%1] [19%1] [15%1] [13%1]

Balance Sheet & Cash Flow Metrics 154Q 2021 Investor Update 1. Debt amount indicated on the Company’s balance sheet is net of unamortized debt issuance costs of $8.5M. 2. Net Debt is calculated as Total Debt minus Cash. 3. Net Capital Expenditures includes reimbursements of $84.8M. FINANCIAL RESULTS As of December 31, 2021 For the Twelve Months Ended December 31, 2021 C A S H $576.1 A C C O U N T S R E C E I V A B L E $274.7 N E T D E B T P O S I T I O N 1 , 2 $273.5 O P E R A T I N G C A S H F L O W $321.1 C A P I T A L E X P E N D I T U R E S $225.0 (Gross) $140.2 (Net3) ( $ I N M I LLI O N S )

2022 Forecast – Revised as of 02/24/2022 164Q 2021 Investor Update FINANCIAL RESULTS 1. See the Appendix for a definition of non-GAAP terms and reconciliation tables. ( $ I N M I L L I O N S ) M E T R I C U P D A T E D F O R E C A S T P R E V I O U S F O R E C A S T ( 0 1 / 0 9 / 2 2 ) Total Revenues $1,300 - $1,400 $1,400 - $1,500 • Anthrax Vaccines • ACAM2000® • Nasal Naloxone Products • CDMO services • Other Products + Contracts and Grants $280 - $300 $190 - $210 $240 - $310 $330 - $380 $200 - $260 $280 - $300 $190 - $210 $240 - $310 $430 - $480 $200 - $260 Adjusted EBITDA1 $240 - $300 $280 - $340 Adjusted Net Income1 $95 - $140 $135 - $180 Gross Margin 47%-51% 47%-51% 1Q22 Total Revenues (initial disclosure) $280 - $310

Continued solid contributions from our Government/Medical Countermeasure products business and our Commercial products business Key Takeaways – 2022 a Year to Re-Baseline 174Q 2021 Investor Update FINANCIAL RESULTS More normalized performance from our CDMO services business Achievement of important milestones in our R&D portfolio Keeping you informed as we execute on these plans and deliver further proof points that demonstrate the long-term growth potential of our strong, diversified business

PROPRIETARY AND CONFIDENTIAL 184Q 2021 Investor Update Q&A

194Q 2021 Investor Update Appendix

Reconciliation of Net Income to Adjusted Net Income – 4Q21 vs. 4Q20 204Q 2021 Investor Update APPENDIX ( $ I N M I L L I O N S , E X C E P T P E R S H A R E A M O U N T S ) T H R E E M O N T H S E N D E D D E C E M B E R 3 1 , 2 0 2 1 2 0 2 0 S O U R C E Net income $189.3 $185.4 Adjustments: + Non-cash amortization charges 15.2 16.2 Intangible Asset Amortization, Other Income + Changes in fair value of contingent consideration 0.3 0.4 Product COGS + Impairments 41.7 -- Goodwill impairment + Exit and disposal costs -- 0.1 COGS, SG&A, Other Income + Acquisition-related costs (transaction & integration) 0.2 0.1 SG&A Tax effect (3.3) (3.4) Total adjustments: $54.1 $13.4 Adjusted net income $243.4 $198.8 Adjusted net income per diluted share $4.50 $3.67

Reconciliation of Net Income to Adjusted Net Income – FY21 vs. FY20 214Q 2021 Investor Update APPENDIX ( $ I N M I L L I O N S , E X C E P T P E R S H A R E A M O U N T S ) T W E L V E M O N T H S E N D E D D E C E M B E R 3 1 , 2 0 2 1 2 0 2 0 S O U R C E Net income $230.9 $305.1 Adjustments: + Non-cash amortization charges 62.7 63.4 Intangible Asset Amortization, Other Income + Changes in fair value of contingent consideration 2.9 31.7 Product COGS + Impairments 41.7 29.0 Goodwill impairment; R&D + Exit and disposal costs -- 17.2 COGS, SG&A, Other Income + Acquisition-related costs (transaction & integration) 0.9 0.6 SG&A Tax effect (13.4) (23.1) Total adjustments: $94.8 $118.8 Adjusted net income $325.7 $423.9 Adjusted net income per diluted share $6.02 $7.88

Reconciliation of Net Income to Adjusted Net Income – 2022 Forecast 224Q 2021 Investor Update APPENDIX ( $ I N M I L L I O N S ) F U L L Y E A R F O R E C A S T 2 0 2 2 F S O U R C E Net income $45-$90 Adjustments: + Non-cash amortization charges 60 Intangible Asset Amortization, Other Income + Changes in fair value of contingent consideration 1 COGS + Acquisition-related costs (transaction & integration) 2 SG&A Tax effect (13) Total adjustments: $50 Adjusted net income $95-$140

Reconciliation of Net Income to Adjusted EBITDA – 4Q21 vs. 4Q20 234Q 2021 Investor Update APPENDIX ( $ I N M I L L I O N S ) T H R E E M O N T H S E N D E D D E C E M B E R 3 1 , 2 0 2 1 2 0 2 0 Net income $189.3 $185.4 Adjustments: + Income taxes 78.2 67.4 + Depreciation & amortization 29.3 28.9 + Total interest expense, net 8.9 8.6 + Impairments 41.7 -- + Changes in fair value of contingent consideration 0.3 0.4 + Acquisition-related costs (transaction & integration) 0.2 0.1 + Exit and disposal costs -- 0.1 Total adjustments: $158.6 $105.5 Adjusted EBITDA $347.9 $290.9

Reconciliation of Net Income to Adjusted EBITDA – FY21 vs. FY20 244Q 2021 Investor Update APPENDIX ( $ I N M I L L I O N S ) T W E L V E M O N T H S E N D E D D E C E M B E R 3 1 , 2 0 2 1 2 0 2 0 Net income $230.9 $305.1 Adjustments: + Depreciation & amortizationIncome taxes 123.8 114.5 + Income taxes 83.5 102.1 + Total interest expense, net 33.9 30.2 + Impairment of IPR&D intangible asset 41.7 29.0 + Changes in fair value of contingent consideration 2.9 31.7 + Acquisition-related costs (transaction & integration) 0.9 0.6 + Exit and disposal costs -- 17.2 Total adjustments: $286.7 $325.3 Adjusted EBITDA $517.6 $630.4

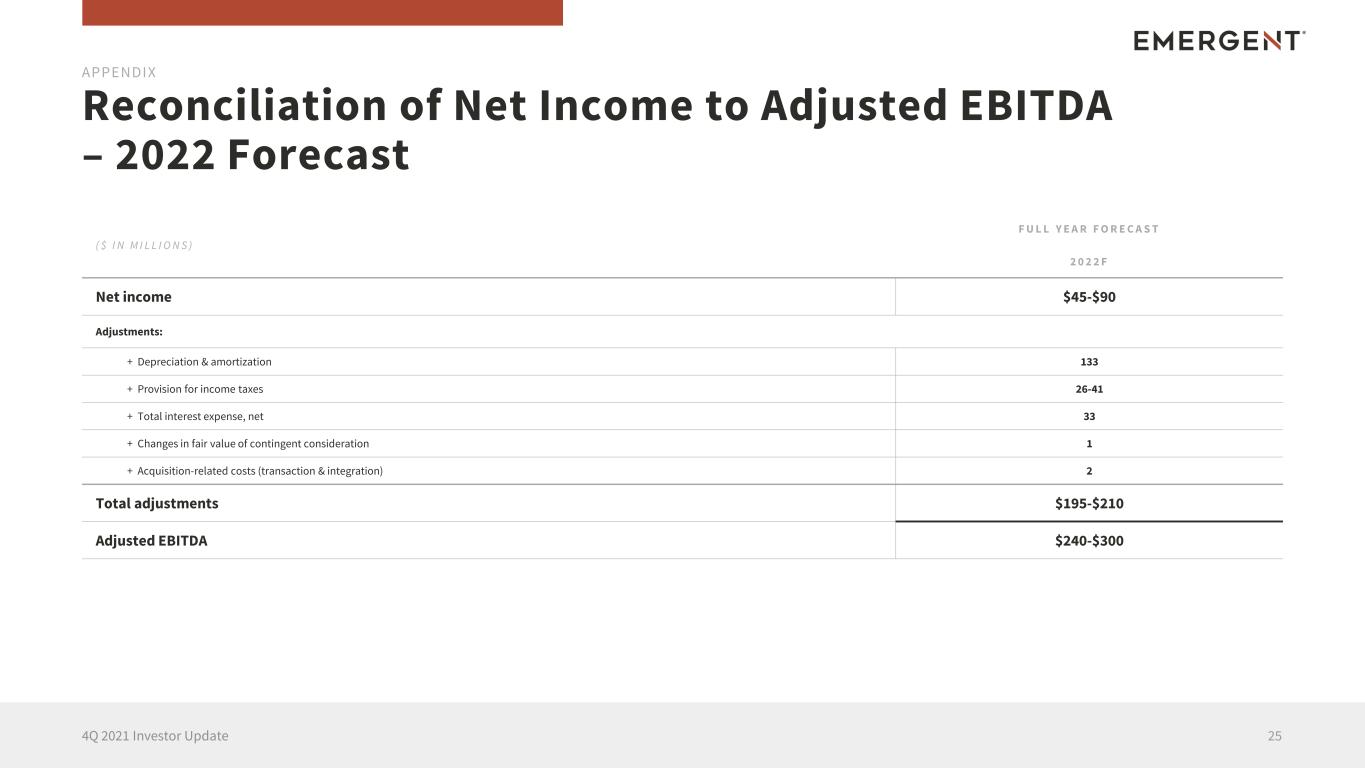

Reconciliation of Net Income to Adjusted EBITDA – 2022 Forecast 254Q 2021 Investor Update APPENDIX ( $ I N M I L L I O N S ) F U L L Y E A R F O R E C A S T 2 0 2 2 F Net income $45-$90 Adjustments: + Depreciation & amortization 133 + Provision for income taxes 26-41 + Total interest expense, net 33 + Changes in fair value of contingent consideration 1 + Acquisition-related costs (transaction & integration) 2 Total adjustments $195-$210 Adjusted EBITDA $240-$300

Reconciliation of Gross Margin and Adjusted Gross Margin – FY21 vs. FY20 264Q 2021 Investor Update APPENDIX ( $ I N M I L L I O N S , E X C E P T P E R S H A R E A M O U N T S ) T W E L V E M O N T H S E N D E D D E C E M B E R 3 1 , 2 0 2 1 2 0 2 0 Total revenues $1,792.7 $1,555.4 - Non-cash amortization charges (134.2) ($115.1) Adjusted revenues $1,658.5 $1,440.3 + Cost of product sales $382.0 $392.0 + Cost of contract development and manufacturing $375.5 $132.0 Cost of product sales and cost of contract development and manufacturing services ("COGS") $757.5 $524.0 + Changes in fair value of contingent consideration ($2.9) ($31.7) + Inventory reserves related to Travel Health vaccines — ($12.6) Adjusted COGS $754.6 $479.7 Gross margin (adjusted revenues minus COGS) $901.0 $916.3 Gross margin % (gross margin divided by adjusted revenues) 54% 64% Adjusted gross margin (adjusted revenues minus adjusted COGS) $903.9 $960.6 Adjusted gross margin % (adjusted gross margin divided by adjusted revenues) 55% 67%

www.emergentbiosolutions.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Emergent BioSolutions to Release First Quarter 2024 Financial Results & Conduct Conference Call on May 1, 2024

- MEDIROM Healthcare Technologies Inc. Announces March 2024 Key Performance Indicators (KPIs)

- Oshkosh Corporation Reports 2024 First Quarter Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share