Form 8-K Eagle Bancorp Montana, For: Jan 24

Exhibit 10.1

SUBORDINATED NOTE PURCHASE AGREEMENT

This SUBORDINATED NOTE PURCHASE AGREEMENT (this “Agreement”) is dated as of January 21, 2022, and is made by and among Eagle Bancorp Montana, Inc. a Delaware corporation (“Company”), and the several purchasers of the Subordinated Notes identified on the signature pages hereto (each a “Purchaser” and collectively, the “Purchasers”).

RECITALS

WHEREAS, Company has requested that the Purchasers purchase from Company up to $40.0 million in aggregate principal amount of Subordinated Notes (as defined herein), which aggregate amount is intended to qualify as Tier 2 Capital (as defined herein).

WHEREAS, Company has engaged Performance Trust Capital Partners, LLC as its sole placement agent the “Placement Agent”) for the offering of the Subordinated Notes.

WHEREAS, each of the Purchasers is an institutional “accredited investor” as such term is defined in Rule 501(a)(1)-(3), (7) and (9) of Regulation D (“Regulation D”) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), or a QIB (as defined below).

WHEREAS, the offer and sale of the Subordinated Notes by Company is being made in reliance upon the exemptions from registration available under Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation D.

WHEREAS, each Purchaser is willing to purchase from Company a Subordinated Note in the principal amount set forth on each Purchaser’s signature page (the “Subordinated Note Amount”) in accordance with the terms, subject to the conditions and in reliance on, the recitals, representations, warranties, covenants and agreements set forth herein and in the Subordinated Notes.

NOW, THEREFORE, in consideration of the mutual covenants, conditions and agreements herein contained and other good and valuable consideration, the receipt of which is hereby acknowledged, the parties hereto hereby agree as follows:

AGREEMENT

1. DEFINITIONS.

1.1 Defined Terms. The following capitalized terms used in this Agreement have the meanings defined or referenced below. Certain other capitalized terms used only in specific sections of this Agreement may be defined in such sections.

“Affiliate(s)” means, with respect to any Person, such Person’s immediate family members, partners, members or parent and subsidiary corporations, and any other Person directly or indirectly controlling, controlled by, or under direct or indirect common control with said Person and their respective Affiliates. For the purposes of this definition, "control," when used with respect to any specified Person means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; and the terms "controlling" and "controlled" have meanings correlative to the foregoing.

“Agreement” has the meaning set forth in the preamble hereto.

“Applicable Procedures” means, with respect to any transfer or exchange of or for beneficial interests in any Subordinated Note represented by a global certificate, the rules and procedures of DTC that apply to such transfer or exchange.

"Articles of Incorporation" means the Amended and Restated Articles of Incorporation of Company, as in effect on the Closing Date.

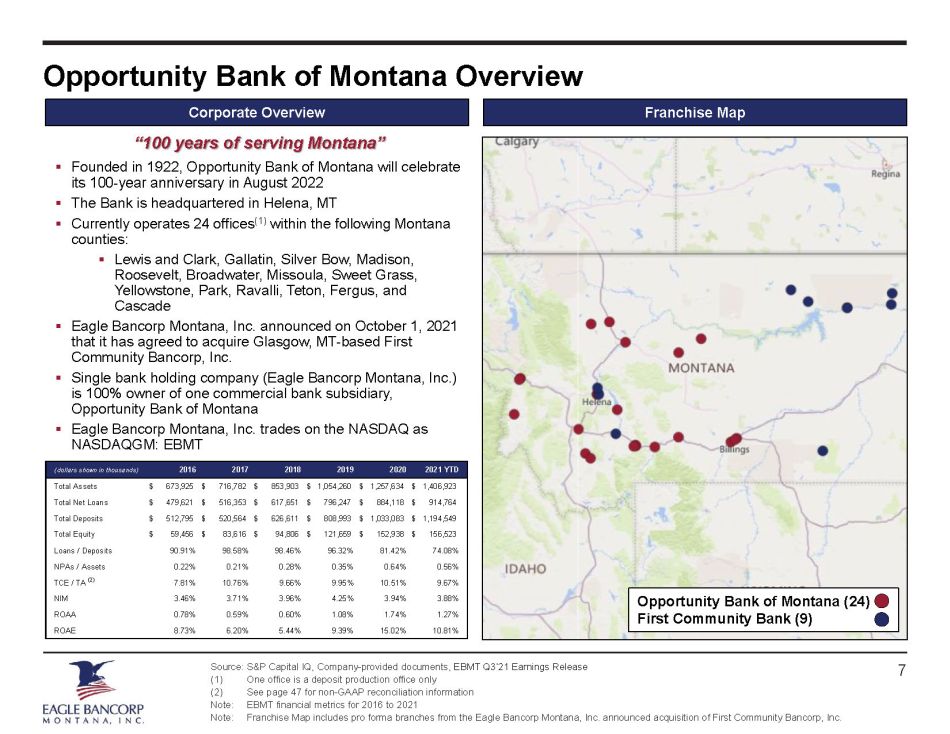

“Bank” means Opportunity Bank of Montana, a commercial bank organized under the laws of the State of Montana and a wholly owned Subsidiary of Company.

“Business Day” means any day other than a Saturday, Sunday or any other day on which banking institutions in the State of Montana are permitted or required by any applicable law or executive order to close.

"Bylaws" means the Bylaws of Company, as in effect on the Closing Date.

“Closing” has the meaning set forth in Section 2.2.

“Closing Date” means January 21, 2022.

“Company” has the meaning set forth in the preamble hereto and shall include any successors to Company.

“Company’s Reports” means (i) the Company’s annual, quarterly and other reports, schedules, forms, statements and other documents (including exhibits and other information incorporated therein) filed or furnished by the Company with the SEC under the Securities Act, Exchange Act, or the regulations thereunder, in each case since January 1, 2020, and (ii) the Company’s reports for the year ended December 31, 2020 and the nine months ended September 30, 2021 as filed with the FRB as required by regulations of the FRB.

“Disbursement” has the meaning set forth in Section 3.1.

"Disqualification Event" has the meaning set forth in Section 4.2.4.

“DTC” has the meaning set forth in Section 5.7.

“Equity Interest” means any and all shares, interests, participations or other equivalents (however designated) of capital stock of a corporation, any and all equivalent ownership interests in a Person which is not a corporation, and any and all warrants, options or other rights to purchase any of the foregoing.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“FDIC” means the Federal Deposit Insurance Corporation.

| 2 |

“FRB” means the Board of Governors of the Federal Reserve System.

“GAAP” means generally accepted accounting principles in effect from time to time in the United States of America.

“Global Note” has the meaning set forth in Section 3.1.

“Governmental Agency(ies)” means, individually or collectively, any federal, state, county or local governmental department, commission, board, regulatory authority or agency (including each applicable Regulatory Agency) with jurisdiction over Company or a Subsidiary.

“Governmental Licenses” has the meaning set forth in Section 4.3.

“Hazardous Materials” means flammable explosives, asbestos, urea formaldehyde insulation, polychlorinated biphenyls, radioactive materials, hazardous wastes, toxic or contaminated substances or similar materials, including any substances which are “hazardous substances,” “hazardous wastes,” “hazardous materials” or “toxic substances” under the Hazardous Materials Laws and/or other applicable environmental laws, ordinances or regulations.

“Hazardous Materials Laws” mean any laws, regulations, permits, licenses or requirements pertaining to the protection, preservation, conservation or regulation of the environment which relates to real property, including: the Clean Air Act, as amended, 42 U.S.C. Section 7401 et seq.; the Federal Water Pollution Control Act, as amended, 33 U.S.C. Section 1251 et seq.; the Resource Conservation and Recovery Act of 1976, as amended, 42 U.S.C. Section 6901 et seq.; the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (including the Superfund Amendments and Reauthorization Act of 1986), 42 U.S.C. Section 9601 et seq.; the Toxic Substances Control Act, as amended, 15 U.S.C. Section 2601 et seq.; the Occupational Safety and Health Act, as amended, 29 U.S.C. Section 651, the Emergency Planning and Community Right-to-Know Act of 1986, 42 U.S.C. Section 11001 et seq.; the Mine Safety and Health Act of 1977, as amended, 30 U.S.C. Section 801 et seq.; the Safe Drinking Water Act, 42 U.S.C. Section 300f et seq.; and all comparable state and local laws, laws of other jurisdictions or orders and regulations.

“Indebtedness” means and includes: (i) all items arising from the borrowing of money that, according to GAAP as in effect from time to time, would be included in determining total liabilities as shown on the consolidated balance sheet of Company; and (ii) all obligations secured by any lien in property owned by Company or any Subsidiary whether or not such obligations shall have been assumed; provided, however, Indebtedness shall not include deposits or other indebtedness created, incurred or maintained in the ordinary course of Company’s or any of its Subsidiaries business (including federal funds purchased, advances from any Federal Home Loan Bank, secured deposits of municipalities, letters of credit issued by Company or any of its Subsidiaries and repurchase arrangements) and consistent with customary banking practices and applicable laws and regulations.

“Indenture” means the indenture, dated as of the date hereof, by and between Company and U.S. Bank National Association, a national banking association, as trustee, substantially in the form attached hereto as Exhibit A, as the same may be amended or supplemented from time to time in accordance with the terms thereof.

| 3 |

“Leases” means all leases, licenses or other documents providing for the use or occupancy of any portion of any Property, including all amendments, extensions, renewals, supplements, modifications, sublets and assignments thereof and all separate letters or separate agreements relating thereto.

“Material Adverse Effect” means, with respect to any Person, any change or effect that (i) is or would be reasonably likely to be material and adverse to the financial condition, results of operations or business of such Person, or (ii) would materially impair the ability of such Person to perform its respective obligations under any of the Transaction Documents, or otherwise materially impede the consummation of the transactions contemplated hereby; provided, however, that “Material Adverse Effect” shall not be deemed to include the impact of (1) changes in banking and similar laws, rules or regulations of general applicability or interpretations thereof by Governmental Agencies, (2) changes in GAAP or regulatory accounting requirements applicable to financial institutions and their holding companies generally, (3) changes after the date of this Agreement in general economic or capital market conditions affecting financial institutions or their market prices generally and not specifically related to Company or Purchasers, (4) the effects of the COVID-19 pandemic that do not disproportionately affect the operations or business of the Company in comparison to other banking institutions with similar operations, (5) direct effects of compliance with this Agreement on the operating performance of Company or Purchasers, including expenses incurred by Company or Purchasers in consummating the transactions contemplated by this Agreement, and (6) the effects of any action or omission taken by Company with the prior written consent of Purchasers, and vice versa, or as otherwise contemplated by this Agreement, the Indenture and the Subordinated Notes.

“Maturity Date” means February 1, 2032.

“Person” means an individual, a corporation (whether or not for profit), a partnership, a limited liability company, a joint venture, an association, a trust, an unincorporated organization, a government or any department or agency thereof (including a Governmental Agency) or any other entity or organization.

“Placement Agent” has the meaning set forth in the Recitals.

“Property” means any real property owned or leased by Company or any Affiliate or Subsidiary of Company.

“Purchaser” or “Purchasers” has the meaning set forth in the preamble hereto.

“QIB” has the meaning set forth in Section 5.7.

“Registration Rights Agreement” means the Registration Rights Agreement, dated as of the date hereof, by and among Company and the Purchasers in the form attached as Exhibit B hereto.

“Regulation D” has the meaning set forth in the Recitals.

“Regulatory Agencies” means any federal or state agency charged with the supervision or regulation of depository institutions or holding companies of depository institutions, or engaged in the insurance of depository institution deposits, or any court, administrative agency or commission or other authority, body or agency having supervisory or regulatory authority with respect to Company, Bank or any of their respective Subsidiaries.

| 4 |

“SEC” means the Securities and Exchange Commission.

“Secondary Market Transaction” has the meaning set forth in Section 5.5.

“Securities Act” has the meaning set forth in the Recitals.

“Subordinated Note” means the Subordinated Note (or collectively, the “Subordinated Notes”) in the form attached as an exhibit to the Indenture, as amended, restated, supplemented or modified from time to time, and each Subordinated Note delivered in substitution or exchange for such Subordinated Note.

“Subordinated Note Amount” has the meaning set forth in the Recitals.

“Subsidiary” means, with respect to any Person, any corporation or entity in which a majority of the outstanding Equity Interest is directly or indirectly owned by such Person.

“Tier 2 Capital” has the meaning given to the term “Tier 2 capital” in 12 C.F.R. Part 217, as amended, modified and supplemented and in effect from time to time or any replacement thereof.

“Transaction Documents” has the meaning set forth in Section 3.2.1.1.

“Trustee” means the trustee or successor in accordance with the applicable provisions of the Indenture.

1.2 Interpretations. The foregoing definitions are equally applicable to both the singular and plural forms of the terms defined. The words “hereof”, “herein” and “hereunder” and words of like import when used in this Agreement shall refer to this Agreement as a whole and not to any particular provision of this Agreement. The word “including” when used in this Agreement without the phrase “without limitation,” shall mean “including, without limitation.” All references to time of day herein are references to Eastern Time unless otherwise specifically provided. All references to this Agreement, the Subordinated Notes and the Indenture shall be deemed to be to such documents as amended, modified or restated from time to time. With respect to any reference in this Agreement to any defined term, (i) if such defined term refers to a Person, then it shall also mean all heirs, legal representatives and permitted successors and assigns of such Person, and (ii) if such defined term refers to a document, instrument or agreement, then it shall also include any amendment, replacement, extension or other modification thereof.

1.3 Exhibits Incorporated. All Exhibits attached are hereby incorporated into this Agreement.

| 5 |

2. SUBORDINATED DEBT.

2.1 Certain Terms. Subject to the terms and conditions herein contained, Company proposes to issue and sell to the Purchasers, severally and not jointly, Subordinated Notes, which will be issued pursuant to the Indenture, in an aggregate principal amount equal to the aggregate of the Subordinated Note Amounts. Purchasers, severally and not jointly, each agree to purchase the Subordinated Notes, which will be issued pursuant to the Indenture, from Company on the Closing Date in accordance with the terms of, and subject to the conditions and provisions set forth in, this Agreement, the Indenture and the Subordinated Notes. The Subordinated Note Amounts shall be disbursed in accordance with Section 3.1.

2.2 The Closing. The execution and delivery of the Transaction Documents (the “Closing”) shall occur at the offices of Company at 10:00 a.m. (local time) on the Closing Date, or at such other place or time or on such other date as the parties hereto may agree.

2.3 Right of Offset. Each Purchaser hereby expressly waives any right of offset such Purchaser may have against Company or Bank.

2.4 Use of Proceeds. Company shall use the net proceeds from the sale of Subordinated Notes for general corporate purposes, including, without limitation, providing capital to support its acquisition of First Community Bancorp, Inc. and the prepayment of outstanding senior notes.

3. DISBURSEMENT.

3.1 Disbursement. On the Closing Date, assuming all of the terms and conditions set forth in Section 3.2 have been satisfied by Company and Company has executed and delivered to each of the Purchasers this Agreement and any other related documents in form and substance reasonably satisfactory to Purchasers, each Purchaser shall disburse in immediately available funds the Subordinated Note Amount set forth on such Purchaser’s signature page to Company in exchange for an electronic securities entitlement through the facilities of DTC (defined below) in accordance with the Applicable Procedures in the Subordinated Note with a principal amount equal to such Subordinated Note Amount (the “Disbursement”). Company will deliver to the Trustee a global certificate representing the Subordinated Notes (the “Global Note”) registered in the name of Cede & Co., as nominee for DTC.

3.2 Conditions Precedent to Disbursement.

3.2.1 Conditions to the Purchasers’ Obligation. The obligation of each Purchaser to consummate the purchase of the Subordinated Notes to be purchased by them at Closing and to effect the Disbursement is subject to delivery by or at the direction of Company to such Purchaser (or, with respect to the Indenture, the Trustee) each of the following (or written waiver by such Purchaser prior to the Closing of such delivery):

3.2.1.1 Transaction Documents. This Agreement, the Indenture, the Global Note and the Registration Rights Agreement (collectively, the “Transaction Documents”), each duly authorized and executed by Company, and delivery of written instruction to the Trustee (with respect to the Indenture).

| 6 |

3.2.1.2 Authority Documents.

| (a) | A copy, certified by the Secretary or Assistant Secretary of Company, of the Articles of Incorporation of Company; |

| (b) | A certificate of existence of Company issued by the Secretary of State of the State of Delaware; |

| (c) | A copy, certified by the Secretary or Assistant Secretary, of the Bylaws of Company; |

| (d) | A copy, certified by the Secretary or Assistant Secretary of Company, of the resolutions of the board of directors (and any committee thereof) of Company authorizing the execution, delivery and performance of the Transaction Documents; |

| (e) | An incumbency certificate of the Secretary or Assistant Secretary of Company certifying the names of the officer or officers of Company authorized to sign the Transaction Documents and the other documents provided for in this Agreement; and |

| (f) | The opinion of Holland & Knight LLP, counsel to Company, dated as of the Closing Date, substantially in the form set forth at Exhibit C attached hereto addressed to the Purchasers and Placement Agent. |

3.2.1.3 Other Requirements. Such other certificates, affidavits, schedules, resolutions, notes and/or other documents which are provided for hereunder or as a Purchaser may reasonably request.

3.2.1.4 Aggregate Investments. Prior to, or contemporaneously with the Closing, each Purchaser shall have actually subscribed for the Subordinated Note Amount set forth on such Purchaser’s signature page.

3.2.2 Conditions to Company’s Obligation.

3.2.2.1 The obligation of Company to consummate the sale of the Subordinated Notes and to effect the Closing is subject to: (i) with respect to a given Purchaser, delivery by or at the direction of such Purchaser to Company (or written waiver by Company prior to the Closing of such delivery) of this Agreement and the Registration Rights Agreement, each duly authorized and executed by such Purchaser; (ii) with respect to a given Purchaser, Company's receipt of the Subordinated Note Amount set forth on such Purchaser's signature page; and (iii) Company's receipt of the Indenture, duly authorized and executed by the Trustee.

| 7 |

4. REPRESENTATIONS AND WARRANTIES OF COMPANY.

Company hereby represents and warrants to each Purchaser as follows:

4.1 Organization and Authority.

4.1.1 Organization Matters of Company and Its Subsidiaries.

4.1.1.1 Company is validly existing and in good standing under the laws of the State of Delaware and has all requisite corporate power and authority to conduct its business and activities as presently conducted, to own its properties, and to perform its obligations under the Transaction Documents. Company is duly qualified as a foreign corporation to transact business and is in good standing in each other jurisdiction in which such qualification is required, whether by reason of the ownership or leasing of property or the conduct of business, except where the failure so to qualify or to be in good standing would not result in a Material Adverse Effect on Company and its Subsidiaries taken as a whole. Company is duly registered as a bank holding company under the Bank Holding Company Act of 1956, as amended.

4.1.1.2 The Bank, Eagle Bancorp Statutory Trust I and Western Financial Services, Inc. are the only direct or indirect Subsidiaries of the Company. Each Subsidiary of the Company other than the Bank has been duly organized and is validly existing as a corporation, or, in the case of the Bank, has been duly chartered and is validly existing as a Montana-chartered commercial bank, in each case in good standing under the laws of the jurisdiction of incorporation, has corporate power and authority to own, lease and operate its properties and to conduct its business and is duly qualified as a foreign corporation to transact business and is in good standing in each jurisdiction in which such qualification is required, whether by reason of the ownership or leasing of property or the conduct of business, except where the failure so to qualify or to be in good standing would not result in a Material Adverse Effect on Company and its Subsidiaries taken as a whole. All of the issued and outstanding shares of capital stock or other equity interests in each Subsidiary of the Company have been duly authorized and validly issued, are fully paid and non-assessable and are owned by Company, directly, free and clear of any security interest, mortgage, pledge, lien, encumbrance or claim; none of the outstanding shares of capital stock of, or other Equity Interests in, any Subsidiary of the Company were issued in violation of the preemptive or similar rights of any securityholder of such Subsidiary of the Company or any other entity.

4.1.1.3 The deposit accounts of Bank are insured by the FDIC up to applicable limits. Neither Company nor Bank has received any notice or other information indicating that Bank is not an “insured depository institution” as defined in 12 U.S.C. Section 1813, nor has any event occurred which could reasonably be expected to adversely affect the status of Bank as an FDIC-insured institution.

4.1.2 Capital Stock and Related Matters. All of the outstanding capital stock of Company has been duly authorized and validly issued and is fully paid and nonassessable. There are, as of the date hereof, no outstanding options, rights, warrants or other agreements or instruments obligating Company to issue, deliver or sell, or cause to be issued, delivered or sold, additional shares of the capital stock of Company or obligating Company to grant, extend or enter into any such agreement or commitment to any Person other than Company except pursuant to Company’s equity incentive plans duly adopted by Company’s Board of Directors.

| 8 |

4.2 No Impediment to Transactions.

4.2.1 Transaction is Legal and Authorized. The issuance of the Subordinated Notes pursuant to the Indenture, the borrowing of the aggregate of the Subordinated Note Amount, the execution of the Transaction Documents and compliance by Company with all of the provisions of the Transaction Documents are within the corporate and other powers of Company.

4.2.2 Agreement, Indenture and Registration Rights Agreement. This Agreement, the Indenture and the Registration Rights Agreement have been duly authorized, executed and delivered by Company, and, assuming due authorization, execution and delivery by the other parties thereto, including the Trustee for purposes of the Indenture, are the legal, valid and binding obligations of Company, enforceable in accordance with their terms, except as enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or affecting creditors’ rights generally or by general equitable principles.

4.2.3 Subordinated Notes. The Subordinated Notes have been duly authorized by Company and when executed by Company and completed and authenticated by the Trustee in accordance with, and in the form contemplated by, the Indenture and issued, delivered to and paid for as provided in this Agreement, will have been duly issued under the Indenture and will constitute legal, valid and binding obligations of Company, entitled to the benefits of the Indenture, and enforceable in accordance with their terms, except as enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or affecting creditors’ rights generally or by general equitable principles. When executed and delivered, the Subordinated Notes will be substantially in the form attached as an exhibit to the Indenture.

4.2.4 Exemption from Registration. Neither the Company, nor any of its Subsidiaries or Affiliates, nor any Person acting on its or their behalf, has engaged in any form of general solicitation or general advertising (within the meaning of Regulation D) in connection with the offer or sale of the Subordinated Notes. Assuming the accuracy of the representations and warranties of each Purchaser set forth in this Agreement, the Subordinated Notes will be issued in a transaction exempt from the registration requirements of the Securities Act. No “bad actor” disqualifying event described in Rule 506(d)(1)(i)-(viii) of the Securities Act (a “Disqualification Event”) is applicable to the Company or, to the Company’s knowledge, any Person described in Rule 506(d)(1) (each, a “Company Covered Person”). The Company has exercised reasonable care to determine whether any Company Covered Person is subject to a Disqualification Event. The Company has complied, to the extent applicable, with its disclosure obligations under Rule 506(e).

4.2.5 No Defaults or Restrictions. Neither the execution and delivery of the Transaction Documents nor compliance with their respective terms and conditions will (whether with or without the giving of notice or lapse of time or both) (i) violate, conflict with or result in a breach of, or constitute a default under: (1) the Articles of Incorporation or Bylaws of Company; (2) any of the terms, obligations, covenants, conditions or provisions of any corporate restriction or of any contract, agreement, indenture, mortgage, deed of trust, pledge, bank loan or credit agreement, or any other agreement or instrument to which Company or any of its Subsidiaries, as applicable, is now a party or by which it or any of its properties may be bound or affected; (3) any judgment, order, writ, injunction, decree or demand of any court, arbitrator, grand jury, or Governmental Agency applicable to the Company or any of its Subsidiaries; or (4) any statute, rule or regulation applicable to Company, except, in the case of items (2), (3) or (4), for such violations and conflicts that would not reasonably be expected to have, singularly or in the aggregate, a Material Adverse Effect on Company and its Subsidiaries taken as a whole, or (ii) result in the creation or imposition of any lien, charge or encumbrance of any nature whatsoever upon any property or asset of Company. Neither Company nor any of its Subsidiaries is in default in the performance, observance or fulfillment of any of the terms, obligations, covenants, conditions or provisions contained in any indenture or other agreement creating, evidencing or securing Indebtedness of any kind or pursuant to which any such Indebtedness is issued, or any other agreement or instrument to which Company or any of its Subsidiaries, as applicable, is a party or by which Company or any of its Subsidiaries, as applicable, or any of its properties may be bound or affected, except, in each case, only such defaults that would not reasonably be expected to have, singularly or in the aggregate, a Material Adverse Effect on Company and its Subsidiaries taken as a whole.

| 9 |

4.2.6 Governmental Consent. No governmental orders, permissions, consents, approvals or authorizations are required to be obtained by Company that have not been obtained, and no registrations or declarations are required to be filed by Company that have not been filed in connection with, or, in contemplation of, the execution and delivery of, and performance under, the Transaction Documents, except for applicable requirements, if any, of the Securities Act, the Exchange Act or state securities laws or “blue sky” laws of the various states and any applicable federal or state banking laws and regulations.

4.3 Possession of Licenses and Permits. Company and its Subsidiaries possess such permits, licenses, approvals, consents and other authorizations (collectively, “Governmental Licenses”) issued by the appropriate Governmental Agencies necessary to conduct the business now operated by them except where the failure to possess such Governmental Licenses would not, singularly or in the aggregate, have a Material Adverse Effect on Company and its Subsidiaries taken as a whole; Company and each Subsidiary of the Company are in compliance with the terms and conditions of all such Governmental Licenses, except where the failure so to comply would not, individually or in the aggregate, have a Material Adverse Effect on Company and its Subsidiaries taken as a whole; all of the Governmental Licenses are valid and in full force and effect, except where the invalidity of such Governmental Licenses or the failure of such Governmental Licenses to be in full force and effect would not have a Material Adverse Effect on Company and its Subsidiaries taken as a whole; and neither Company nor any Subsidiary of the Company has received any notice of proceedings relating to the revocation or modification of any such Governmental Licenses.

4.4 Financial Condition.

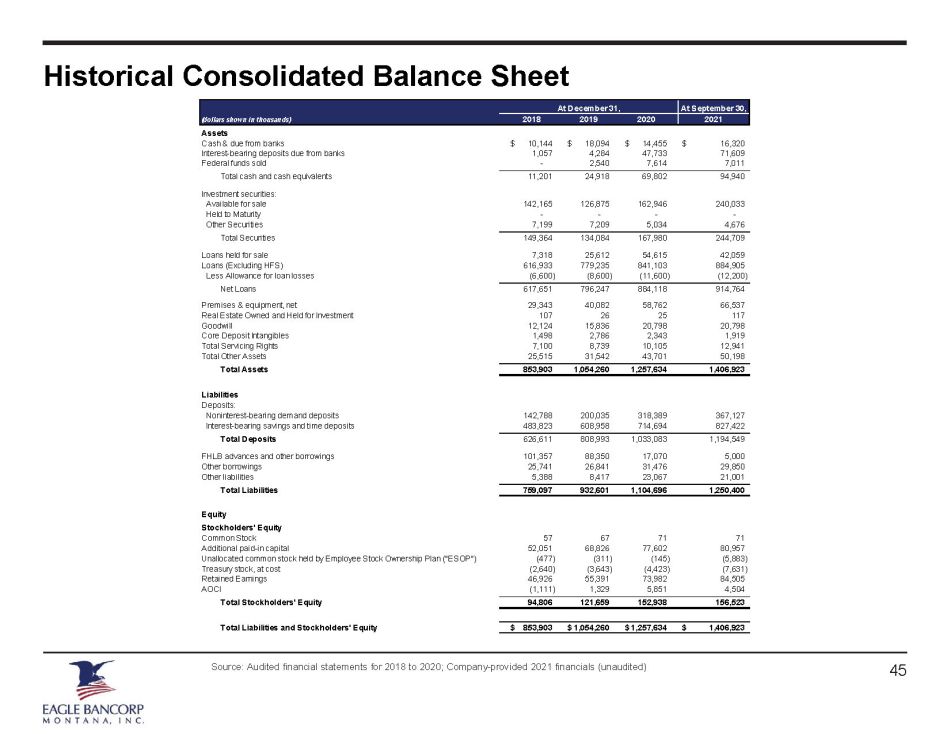

4.4.1 Company Financial Statements. The financial statements of Company included in Company’s Reports (including the related notes, where applicable) (i) have been prepared from, and are in accordance with, the books and records of Company; (ii) fairly present in all material respects the results of operations, cash flows, changes in stockholders’ equity and financial position of Company and its consolidated Subsidiaries, for the respective fiscal periods or as of the respective dates therein set forth (subject in the case of unaudited statements to recurring year-end audit adjustments normal in nature and amount), as applicable; (iii) complied as to form, as of their respective dates of filing in all material respects with applicable accounting and banking requirements as applicable, with respect thereto; and (iv) have been prepared in accordance with GAAP consistently applied during the periods involved, except, in each case, (x) as indicated in such statements or in the notes thereto, (y) for any statement therein or omission therefrom that was corrected, amended, or supplemented or otherwise disclosed or updated in a subsequent Company's Report, and (z) to the extent that any unaudited interim financial statements do not contain the footnotes required by GAAP, and were or are subject to normal and recurring year-end adjustments, which were not or are not expected to be material in amount, either individually or in the aggregate. The consolidated books and records of Company have been, and are being, maintained in all material respects in accordance with GAAP and any other applicable legal and accounting requirements. Company does not have any material liability of any nature whatsoever (whether absolute, accrued, contingent (including any off-balance sheet obligations) or otherwise and whether due or to become due), except for those liabilities that are reflected or reserved against on the consolidated balance sheet of Company contained in Company’s Reports for Company’s most recently completed quarterly or annual fiscal period, as applicable, and for liabilities incurred in the ordinary course of business consistent with past practice or in connection with this Agreement and the transactions contemplated hereby.

| 10 |

4.4.2 Absence of Default. Since the date of the latest audited financial statements included in Company’s Reports, no event has occurred which either of itself or with the lapse of time or the giving of notice or both, would give any creditor of Company the right to accelerate the maturity of any material Indebtedness of Company. Company is not in default under any other Lease, agreement or instrument, or any law, rule, regulation, order, writ, injunction, decree, determination or award, non-compliance with which could reasonably be expected to result in a Material Adverse Effect on Company and its Subsidiaries taken as a whole.

4.4.3 Solvency. After giving effect to the consummation of the transactions contemplated by this Agreement, Company has capital sufficient to carry on its business and transactions and is solvent and able to pay its debts as they mature. No transfer of property is being made and no Indebtedness is being incurred in connection with the transactions contemplated by this Agreement with the intent to hinder, delay or defraud either present or future creditors of Company or any Subsidiary of the Company.

4.4.4 Ownership of Property. Company and each of its Subsidiaries has good and marketable title as to all real property owned by it and good title to all assets and properties owned by Company and each such Subsidiary in the conduct of its businesses, whether such assets and properties are real or personal, tangible or intangible, including assets and property reflected in the most recent balance sheet contained in Company’s Reports or acquired subsequent thereto (except to the extent that such assets and properties have been disposed of in the ordinary course of business, since the date of such balance sheet), subject to no encumbrances, liens, mortgages, security interests or pledges, except (i) those items which secure liabilities for public or statutory obligations or any discount with, borrowing from or other obligations to the Federal Home Loan Bank, inter-bank credit facilities, reverse repurchase agreements or any transaction by Company or any Subsidiary thereof acting in a fiduciary capacity, (ii) statutory liens for amounts not yet delinquent or which are being contested in good faith and (iii) such as do not, individually or in the aggregate, materially affect the value of such property and do not materially interfere with the use made and proposed to be made of such property by Company or any of its Subsidiaries. Company and each of its Subsidiaries, as lessee, has the right under valid and existing Leases of real and personal properties that are material to Company or such Subsidiary, as applicable, in the conduct of its business to occupy or use all such properties as presently occupied and used by it. Such existing Leases and commitments to Lease constitute or will constitute operating leases for both tax and financial accounting purposes and the lease expense and minimum rental commitments with respect to such Leases and Lease commitments are as disclosed in all material respects in Company’s Reports.

| 11 |

4.5 No Material Adverse Change. Since the date of the latest audited financial statements included in Company’s Reports, there has been no development or event which has had or would reasonably be expected to have a Material Adverse Effect on Company and its Subsidiaries taken as a whole.

4.6 Legal Matters.

4.6.1 Compliance with Law. Company and each of its Subsidiaries (i) has complied with and (ii) is not under investigation with respect to, and, to Company’s knowledge, has not been threatened to be charged with or given any notice of any material violation of any applicable statutes, rules, regulations, orders and restrictions of any domestic or foreign government, or any Governmental Agency, having jurisdiction over the conduct of its business or the ownership of its properties, except where any such failure to comply or violation would not reasonably be expected to have a Material Adverse Effect on Company and its Subsidiaries taken as a whole. Company and each of its Subsidiaries is compliant with its own privacy policies and written commitments to its respective customers, consumers and employees, concerning data protection and the privacy and security of personal data and the nonpublic personal information of its respective customers, consumers and employees, except where the failure to comply with which would not reasonably be expected to result, individually or in the aggregate, in a Material Adverse Effect on Company and its Subsidiaries taken as a whole.

4.6.2 Regulatory Enforcement Actions. Company, the Bank and its other Subsidiaries are in compliance in all material respects with all laws administered by and regulations of any Governmental Agency applicable to it or to them, except where the failure to comply with which would not reasonably be expected to have a Material Adverse Effect on Company and its Subsidiaries taken as a whole. None of Company, the Bank or the Company's other Subsidiaries nor any of their respective officers or directors is now operating under any restrictions, agreements, memoranda, commitment letter, supervisory letter or similar regulatory correspondence, or other commitments (other than restrictions of general application) imposed by any Governmental Agency, nor are, to Company’s knowledge, (a) any such restrictions threatened, (b) any agreements, memoranda or commitments being sought by any Governmental Agency, or (c) any legal or regulatory violations previously identified by, or penalties or other remedial action previously imposed by, any Governmental Agency unresolved.

| 12 |

4.6.3 Pending Litigation. There are no actions, suits, proceedings or written agreements pending, or, to Company’s knowledge, threatened or proposed, against Company or any of its Subsidiaries, at law or in equity or before or by any Governmental Agency that, either separately or in the aggregate, would reasonably be expected to have a Material Adverse Effect on Company and its Subsidiaries taken as a whole or affect issuance or payment of the Subordinated Notes; and neither Company nor any of its Subsidiaries is a party to or named as subject to the provisions of any order, writ, injunction, or decree of, or any written agreement with, any Governmental Agency that, either separately or in the aggregate, will have a Material Adverse Effect on Company and its Subsidiaries taken as a whole.

4.6.4 Environmental. No Property is or, to Company’s knowledge, has been a site for the use, generation, manufacture, storage, treatment, release, threatened release, discharge, disposal, transportation or presence of any Hazardous Materials and neither Company nor any of its Subsidiaries has engaged in such activities. There are no claims or actions pending or, to Company’s knowledge, threatened against Company or any of its Subsidiaries by any Governmental Agency or by any other Person relating to any Hazardous Materials or pursuant to any Hazardous Materials Law except for such actions or claims that would not reasonably be expected to have a Material Adverse Effect on Company and its Subsidiaries taken as a whole.

4.6.5 Brokerage Commissions. Except for commissions paid to the Placement Agent, neither Company nor any Affiliate of Company is obligated to pay any brokerage commission or finder’s fee to any Person in connection with the transactions contemplated by this Agreement.

4.6.6 Investment Company Act. Neither Company nor any of its Subsidiaries is an “investment company” or a company “controlled” by an “investment company,” within the meaning of the Investment Company Act of 1940, as amended.

4.7 No Misstatement. None of the representations, warranties, covenants or agreements made in the Transaction Documents (including any exhibits or schedules thereto and any certificates delivered to the Purchasers in connection therewith), nor any statements made in the Investor Presentation, contains any untrue statement of a material fact, or omits to state a material fact necessary to make the statements contained therein not misleading in light of the circumstances when made or furnished to Purchasers, except for any statement therein or omission therefrom which was corrected, amended or supplemented or otherwise disclosed or updated in a subsequent exhibit, report, schedule or document prior to the date hereof.

4.8 Reporting Compliance. Company is subject to, and is in compliance in all material respects with, the reporting requirements of Section 13 and Section 15(d), as applicable, of the Exchange Act. The Company’s Reports at the time they were or hereafter are filed with the SEC, complied and will comply in all material respects with the requirements of the Exchange Act and did not and will not include any untrue statement of a material fact or omit to state a material fact necessary to make the statements therein, in light of the circumstances under which they were or are made, not misleading.

4.9 Internal Control Over Financial Reporting. Company maintains systems of “internal control over financial reporting” (as defined in Rule 13a-15(f) of the Exchange Act) that comply with the requirements of the Exchange Act and have been designed by, or under the supervision of, their respective principal executive and principal financial officers, or persons performing similar functions, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with GAAP, including, but not limited to, a system of accounting controls sufficient to provide reasonable assurances that (i) transactions are executed in accordance with management’s general or specific authorizations; (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with GAAP and to maintain accountability for assets; (iii) access to assets is permitted only in accordance with management’s general or specific authorization; and (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences. Since the end of Company’s most recent audited fiscal year, (y) Company has no knowledge of (i) any material weakness in Company’s internal control over financial reporting (whether or not remediated) or (ii) any fraud, whether or not material, that involves management or other employees who have a significant role in Company’s internal controls and (z) there has been no change in Company’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, Company’s internal control over financial reporting.

| 13 |

4.10 Disclosure Controls and Procedures. Company maintains an effective system of disclosure controls and procedures (as defined in Rule 13a-15 and Rule 15d-15 of the Exchange Act), that (i) are designed to ensure that information required to be disclosed by Company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and that material information relating to Company and its Subsidiaries is made known to Company’s principal executive officer and principal financial officer by others within Company and its Subsidiaries to allow timely decisions regarding disclosure, and (ii) are effective in all material respects to perform the functions for which they were established. As of the date hereof, Company has no knowledge that would cause it to believe that the evaluation to be conducted of the effectiveness of Company’s disclosure controls and procedures for the most recently ended fiscal quarter period will result in a finding that such disclosure controls and procedures are ineffective in any material respect for such quarter ended. Based on the evaluation of Company’s and the Bank’s disclosure controls and procedures described above, Company is not aware of (1) any significant deficiency in the design or operation of internal controls which could adversely affect Company’s ability to record, process, summarize and report financial data or any material weaknesses in internal controls or (2) any fraud, whether or not material, that involves management or other employees who have a significant role in Company’s internal controls. Since the most recent evaluation of Company’s disclosure controls and procedures described above, there have been no significant changes in internal controls or in other factors that could significantly affect internal controls.

4.11 Tax Matters. The Company, Bank and each other Subsidiary of the Company have (i) filed all material foreign, U.S. federal, state and local tax returns, information returns and similar reports that are required to be filed, and all such tax returns are true, correct and complete in all material respects, and (ii) paid all material taxes required to be paid by it and any other material assessment, fine or penalty levied against it other than taxes (x) currently payable without penalty or interest, or (y) being contested in good faith by appropriate proceedings.

| 14 |

4.12 Exempt Offering. Assuming the accuracy of the Purchasers' representations and warranties set forth in this Agreement, no registration under the Securities Act is required for the offer and sale of the Subordinated Notes by the Company to the Purchasers.

4.13 Representations and Warranties Generally. The representations and warranties of the Company set forth in this Agreement or in any other document delivered to the Purchasers by or on behalf of the Company pursuant to or in connection with this Agreement are true and correct as of the date hereof and as otherwise specifically provided herein or therein. Any certificate signed by a duly authorized representative of the Company and delivered to a Purchaser or to counsel for a Purchaser shall be deemed to be a representation and warranty by the Company to such Purchaser as to the matters set forth therein.

5. GENERAL COVENANTS, CONDITIONS AND AGREEMENTS.

Company hereby further covenants and agrees with each Purchaser as follows:

5.1 Compliance with Transaction Documents. Company shall comply with, observe and timely perform each and every one of its covenants, agreements and obligations under the Transaction Documents.

5.2 Affiliate Transactions. Company shall not itself, nor shall it cause, permit or allow the Bank to enter into any material transaction, including, the purchase, sale or exchange of property or the rendering of any service, with any Affiliate of Company except in the ordinary course of business and pursuant to the reasonable requirements of Company’s or such Affiliate’s business and upon terms consistent with applicable laws and regulations and reasonably found by the appropriate board(s) of directors to be fair and reasonable and no less favorable to Company or such Affiliate than would be obtained in a comparable arm’s length transaction with a Person not an Affiliate.

5.3 Compliance with Laws.

5.3.1 Generally. Company shall comply and cause each of its Subsidiaries to comply in all material respects with all applicable statutes, rules, regulations, orders and restrictions in respect of the conduct of its business and the ownership of its properties, except, in each case, where such non-compliance would not reasonably be expected to have a Material Adverse Effect on Company and its Subsidiaries taken as a whole.

5.3.2 Regulated Activities. Company shall not itself, nor shall it cause, permit or allow any of its Subsidiaries to (i) engage in any business or activity not permitted by all applicable laws and regulations, except where such business or activity would not reasonably be expected to have a Material Adverse Effect on Company and its Subsidiaries taken as a whole or (ii) make any loan or advance secured by the capital stock of another bank or depository institution, or acquire the capital stock, assets or obligations of or any interest in another bank or depository institution, in each case other than in accordance with applicable laws and regulations and safe and sound banking practices.

5.3.3 Taxes. Company shall and shall cause each of its Subsidiaries to promptly pay and discharge all taxes, assessments and other governmental charges imposed upon Company or any of its Subsidiaries or upon the income, profits, or property of Company or any of its Subsidiaries and all claims for labor, material or supplies which, if unpaid, might by law become a lien or charge upon the property of Company or any of its Subsidiaries if such nonpayment could reasonably be expected to have a Material Adverse Effect on the Company and its Subsidiaries taken as a whole. Notwithstanding the foregoing, neither Company nor any of its Subsidiaries shall be required to pay any such tax, assessment, charge or claim, so long as the validity thereof shall be contested in good faith by appropriate proceedings, and appropriate reserves therefor shall be maintained on the books of Company and its Subsidiaries.

| 15 |

5.3.4 Tier 2 Capital. If all or any portion of the Subordinated Notes ceases to be deemed to be Tier 2 Capital, other than due to the limitation imposed on the capital treatment of subordinated debt during the five (5) years immediately preceding the Maturity Date of the Subordinated Notes, the Company may immediately notify the Holder (as defined in the Indenture), and thereafter, subject to the terms of the Indenture, Company may request that the Holder work together with the Company in good faith to execute and deliver all agreements as reasonably necessary in order to restructure the applicable portions of the obligations evidenced by the Subordinated Notes to qualify as Tier 2 Capital; provided, however, that nothing contained in this Agreement shall limit the Company's right to redeem the Subordinated Notes, including upon the occurrence of a Tier 2 Capital Event as described in the Subordinated Notes and the Indenture.

5.3.5 Corporate Existence. The Company shall do or cause to be done all things reasonably necessary to maintain, preserve and renew its corporate existence and that of the Bank and its and their rights and franchises, and comply in all material respects with all related laws applicable to the Company, the Bank or the other Subsidiaries.

5.4 Absence of Control. It is the intent of the parties to this Agreement that in no event shall Purchasers, by reason of any of the Transaction Documents, be deemed to control, directly or indirectly, Company, and Purchasers shall not exercise, or be deemed to exercise, directly or indirectly, a controlling influence over the management or policies of Company.

5.5 Secondary Market Transactions. Each Purchaser shall have the right at any time and from time to time to securitize such Purchaser’s Subordinated Notes or any portion thereof in a single asset securitization or a pooled loan securitization of rated single or multi-class securities secured by or evidencing ownership interests in the Subordinated Notes (each such securitization is referred to herein as a “Secondary Market Transaction”). In connection with any such Secondary Market Transaction, Company shall, at Company’s expense, cooperate with any such Purchaser and otherwise reasonably assist any such Purchaser in satisfying the market standards to which any such Purchaser customarily adheres or which may be reasonably required in the marketplace or by applicable rating agencies in connection with any such Secondary Market Transaction. Subject to any written confidentiality obligation, all information regarding Company may be furnished, without liability except in the case of gross negligence or willful misconduct, to any Purchaser and to any Person reasonably deemed necessary by a Purchaser in connection with participation in such Secondary Market Transaction. All documents, financial statements, appraisals and other data relevant to Company or the Subordinated Notes may be retained by any such Person subject to the terms of applicable confidentiality agreements.

| 16 |

5.6 Insurance. At its sole cost and expense, Company shall maintain, and shall cause its Subsidiaries to maintain, bonds and insurance in such amounts as are prudent and customary in the businesses in which it is engaged. All such bonds and policies of insurance shall be in a form, and with insurers of recognized financial responsibility against such losses and risks.

5.7 DTC Registration. Company shall use commercially reasonable efforts to cause the Subordinated Notes to be quoted on Bloomberg and, with respect to Subordinated Notes held by Qualified Institutional Buyers as defined in Rule 144A of the Securities Act (“QIB”), shall cause such Subordinated Notes to be registered in the name of Cede & Co. as nominee of The Depository Trust Company (“DTC”).

5.8 Rule 144A Information. While any Subordinated Notes remain “restricted securities” within the meaning of the Securities Act, Company will make available, upon request, to any seller of such Subordinated Notes the information specified in Rule 144A(d)(4) under the Securities Act, unless Company is then subject to Section 13 or 15(d) of the Exchange Act.

5.9 Resale Registration Statement. Subject to the terms and conditions of this Agreement, the Company will provide to the Purchasers the resale registration rights described in the Registration Rights Agreement.

6. REPRESENTATIONS, WARRANTIES AND COVENANTS OF PURCHASERS.

Each Purchaser hereby represents and warrants to Company, and covenants with Company, severally and not jointly, as follows:

6.1 Legal Power and Authority. The Purchaser has all necessary power and authority to execute, deliver and perform its obligations under this Agreement and to consummate the transactions contemplated hereby, is an entity duly organized, validly existing and in good standing under the laws its jurisdiction of organization.

6.2 Authorization and Execution. The execution, delivery and performance of this Agreement and the Registration Rights Agreement have been duly authorized by all necessary action on the part of such Purchaser, and, assuming due authorization, execution and delivery by the other parties thereto, this Agreement and the Registration Rights Agreement are each a legal, valid and binding obligation of such Purchaser, enforceable against such Purchaser in accordance with its terms, except as enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or affecting creditors’ rights generally or by general equitable principles.

6.3 No Conflicts. Neither the execution, delivery or performance of the Transaction Documents nor the consummation of any of the transactions contemplated thereby will conflict with, violate, constitute a breach of or a default (whether with or without the giving of notice or lapse of time or both) under (i) the Purchaser’s organizational documents, (ii) any agreement to which the Purchaser is party, (iii) any law applicable to the Purchaser or (iv) any order, writ, judgment, injunction, decree, determination or award binding upon or affecting the Purchaser.

6.4 Purchase for Investment. The Purchaser is purchasing the Subordinated Note for his, her or its own account and not with a view to distribution and with no present intention of reselling, distributing or otherwise disposing of the same. The Purchaser has no present or contemplated agreement, undertaking, arrangement, obligation, indebtedness or commitment providing for, or which is likely to compel, a disposition of the Subordinated Notes in any manner.

| 17 |

6.5 Institutional Accredited Investor. The Purchaser is and will be on the Closing Date either (a) an institutional “accredited investor” as such term is defined in Rule 501(a) of Regulation D and as contemplated by subsections (1), (2), (3), (7) and (9) of Rule 501(a) of Regulation D, and has no less than $5,000,000 in total assets, or (b) a QIB.

6.6 Financial and Business Sophistication. The Purchaser has such knowledge and experience in financial and business matters that such Purchaser is capable of evaluating the merits and risks of the prospective investment in the Subordinated Notes. The Purchaser has relied solely upon its own knowledge of, and/or the advice of its own legal, financial or other advisors with regard to, the legal, financial, tax and other considerations involved in deciding to invest in the Subordinated Notes.

6.7 Ability to Bear Economic Risk of Investment. The Purchaser recognizes that an investment in the Subordinated Notes involves substantial risk, including risks related to the Company's business, operating results, financial condition and cash flows, which risks it has carefully considered in connection with making an investment in the Subordinated Notes. The Purchaser has the ability to bear the economic risk of the prospective investment in the Subordinated Notes, including the ability to hold the Subordinated Notes indefinitely, and further including the ability to bear a complete loss of all of the Purchaser’s investment in Company.

6.8 Information. The Purchaser acknowledges that: (i) the Purchaser is not being provided with the disclosures that would be required if the offer and sale of the Subordinated Notes were registered under the Securities Act, nor is the Purchaser being provided with any offering circular or prospectus prepared in connection with the offer and sale of the Subordinated Notes; (ii) the Purchaser has conducted its own examination of Company and the terms of the Subordinated Notes to the extent the Purchaser deems necessary to make its decision to invest in the Subordinated Notes (including meeting with representatives of the Company); (iii) the Purchaser has availed itself of publicly available financial and other information concerning Company to the extent the Purchaser deems necessary to make his, her or its decision to purchase the Subordinated Notes; and (iv) the Purchaser has not received nor relied on any form of general solicitation or general advertising (within the meaning of Regulation D) from the Company in connection with the offer and sale of the Subordinated Notes. The Purchaser has reviewed the information set forth in Company’s Reports and the exhibits and schedules hereto and contained in the investor data room established by Company in connection with the transactions contemplated by this Agreement.

6.9 Access to Information. The Purchaser acknowledges that the Purchaser and his, her or its advisors have been furnished with all materials relating to the business, finances and operations of Company that have been requested by the Purchaser or his, her or its advisors and have been given the opportunity to ask questions of, and to receive answers from, persons acting on behalf of Company concerning terms and conditions of the transactions contemplated by this Agreement in order to make an informed and voluntary decision to enter into this Agreement.

| 18 |

6.10 Investment Decision. The Purchaser has made its own investment decision based upon the Purchaser’s own judgment, due diligence and advice from such advisors as the Purchaser has deemed necessary and not upon any view expressed by any other person or entity, including the Placement Agent (or, with respect to the Indenture, the Trustee). Neither such inquiries nor any other due diligence investigations conducted by the Purchaser or its advisors or representatives, if any, shall modify, amend or affect the Purchaser’s right to rely on Company’s representations and warranties contained herein. The Purchaser is not relying upon, and has not relied upon, any advice, statement, representation or warranty made by any Person by or on behalf of Company, including without limitation the Placement Agent (or, with respect to the Indenture, the Trustee), except for the express statements, representations and warranties of Company made or contained in this Agreement. Furthermore, the Purchaser acknowledges that (i) the Placement Agent has not performed any due diligence review on behalf of the Purchaser and (ii) nothing in this Agreement or any other materials presented by or on behalf of Company to the Purchaser in connection with the purchase of the Subordinated Notes constitutes legal, tax or investment advice.

6.11 Private Placement; No Registration; Restricted Legends. The Purchaser understands and acknowledges that the Subordinated Notes are being sold by Company without registration under the Securities Act in reliance on the exemption from federal and state registration set forth in, respectively, Rule 506(b) of Regulation D promulgated under Section 4(a)(2) of the Securities Act and Section 18 of the Securities Act, or any state securities laws, and accordingly, may be resold, pledged or otherwise transferred only if exemptions from the Securities Act and applicable state securities laws are available to it. It is not subscribing for the Subordinated Notes as a result of or subsequent to any general solicitation or general advertising, in each case within the meaning of Rule 502(c) of Regulation D, including any advertisement, article, notice or other communication published in any newspaper, magazine or similar media or broadcast over television or radio, or presented at any seminar or meeting. The Purchaser further acknowledges and agrees that all certificates or other instruments representing the Subordinated Notes will bear the restrictive legend set forth in the form of Subordinated Note, which is attached as an exhibit to the Indenture. The Purchaser further acknowledges his, her or its primary responsibilities under the Securities Act and, accordingly, will not sell or otherwise transfer the Subordinated Notes or any interest therein without complying with the requirements of the Securities Act and the rules and regulations promulgated thereunder and the requirements set forth in this Agreement. Neither the Placement Agent nor the Company has made or is making any representation, warranty or covenant, express or implied, as to the availability of any exemption from registration under the Securities Act or any applicable state securities laws for the resale, pledge or other transfer of the Subordinated Notes, or that the Subordinated Notes purchased by it will ever be able to be lawfully resold, pledged or otherwise transferred.

6.12 Placement Agent. The Purchaser will purchase the Subordinated Note(s) directly from Company and not from the Placement Agent and understands that neither the Placement Agent nor any other broker or dealer has any obligation to make a market in the Subordinated Notes.

6.13 Tier 2 Capital. If the Company provides notice as contemplated in Section 5.3.4 of the occurrence of the event contemplated in such section, thereafter, upon the Company’s request, the Purchasers will use commercially reasonable efforts to work with the Company in good faith to execute and deliver all agreements as reasonably necessary in order to restructure the applicable portions of the obligations evidenced by the Subordinated Notes to qualify as Tier 2 Capital; provided, however, that nothing contained in this Agreement shall limit the Company's right to redeem the Subordinated Notes upon the occurrence of a Tier 2 Capital Event as described in the Indenture.

| 19 |

6.14 Not Savings Accounts, etc. The Purchaser acknowledges and agrees that the Subordinated Notes are not savings accounts or deposits of the Bank and are not insured or guaranteed by the FDIC or any Governmental Agency, and that no Governmental Agency has passed upon or will pass upon the offer or sale of the Subordinated Notes or has made or will make any finding or determination as to the fairness of this investment.

6.15 Accuracy of Representations. The Purchaser understands that the Placement Agent and Company will each rely upon the truth and accuracy of the foregoing representations, acknowledgements and agreements in connection with the transactions contemplated by this Agreement, and agrees that if any of the representations or acknowledgements made by the Purchaser are no longer accurate as of the Closing Date, or if any of the agreements made by the Purchaser are breached on or prior to the Closing Date, the Purchaser shall promptly notify the Placement Agent and Company.

6.16 Representations and Warranties Generally. The representations and warranties of the Purchaser set forth in this Agreement are true and correct as of the date hereof and will be true and correct as of the Closing Date and as otherwise specifically provided herein. Any certificate signed by a duly authorized representative of the Purchaser and delivered to Company or to counsel for Company shall be deemed to be a representation and warranty by the Purchaser to Company as to the matters set forth therein.

7. MISCELLANEOUS.

7.1 Prohibition on Assignment by Company. Except as described in Article VII of the Indenture, Company may not assign, transfer or delegate any of its rights or obligations under this Agreement or the Subordinated Notes without the prior written consent of Purchasers.

7.2 Time of the Essence. Time is of the essence of this Agreement.

7.3 Waiver or Amendment. No waiver or amendment of any term, provision, condition, covenant or agreement herein shall be effective unless in writing and signed by all of the parties hereto. Waiver or amendment of any term of the Indenture and/or the Subordinated Note shall be governed by the terms of the Indenture. Notwithstanding the foregoing, the Company may amend or supplement the Subordinated Notes without the consent of the Holders of the Subordinated Notes to cure any ambiguity, defect or inconsistency or to provide for uncertificated Subordinated Notes in addition to or in place of certificated Subordinated Notes, or to make any change that does not adversely affect the rights of any Holder of any of the Subordinated Notes. No failure to exercise or delay in exercising, by a Purchaser or any Holder of the Subordinated Notes, of any right, power or privilege hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any right, power or privilege preclude any other or further exercise thereof, or the exercise of any other right or remedy provided by law. The rights and remedies provided in this Agreement are cumulative and not exclusive of any right or remedy provided by law or equity.

| 20 |

7.4 Severability. Any provision of this Agreement which is unenforceable or invalid or contrary to law, or the inclusion of which would adversely affect the validity, legality or enforcement of this Agreement, shall be of no effect and, in such case, all the remaining terms and provisions of this Agreement shall subsist and be fully effective according to the tenor of this Agreement the same as though any such invalid portion had never been included herein. Notwithstanding any of the foregoing to the contrary, if any provisions of this Agreement or the application thereof are held invalid or unenforceable only as to particular persons or situations, the remainder of this Agreement, and the application of such provision to persons or situations other than those to which it shall have been held invalid or unenforceable, shall not be affected thereby, but shall continue valid and enforceable to the fullest extent permitted by law.

7.5 Notices. Any notice which any party hereto may be required or may desire to give hereunder shall be deemed to have been given if in writing and if delivered personally, or if mailed, postage prepaid, by United States registered or certified mail, return receipt requested, or if delivered by a responsible overnight commercial courier promising next business day delivery, addressed:

| if to Company: |

Eagle Bancorp Montana, Inc. Helena, Montana 59601 Attention: Laura F. Clark, Executive Vice President, Chief Financial Officer and Chief Operating Officer

|

| with a copy to: |

Holland & Knight LLP 1801 California Street Denver, Colorado 80202 Attention: Shawn Turner

|

| if to Purchasers: | To the address indicated on such Purchaser’s signature page. |

or to such other address or addresses as the party to be given notice may have furnished in writing to the party seeking or desiring to give notice, as a place for the giving of notice; provided that no change in address shall be effective until five (5) Business Days after being given to the other party in the manner provided for above. Any notice given in accordance with the foregoing shall be deemed given when delivered personally or, if mailed, three (3) Business Days after it shall have been deposited in the United States mails as aforesaid or, if sent by overnight courier, the Business Day following the date of delivery to such courier (provided next business day delivery was requested).

7.6 Successors and Assigns. This Agreement shall inure to the benefit of the parties and their respective heirs, legal representatives, successors and assigns; except that, unless a Purchaser consents in writing, no assignment made by Company in violation of this Agreement shall be effective or confer any rights on any purported assignee of Company. The term “successors and assigns” will not include a purchaser of any of the Subordinated Notes from any Purchaser merely because of such purchase.

| 21 |

7.7 No Joint Venture. Nothing contained herein or in any document executed pursuant hereto and no action or inaction whatsoever on the part of a Purchaser, shall be deemed to make a Purchaser a partner or joint venturer with Company.

7.8 Documentation. All documents and other matters required by any of the provisions of this Agreement to be submitted or furnished to a Purchaser shall be in form and substance satisfactory to such Purchaser.

7.9 Entire Agreement. This Agreement, the Indenture, the Registration Rights Agreement and the Subordinated Notes along with the exhibits thereto constitute the entire agreement between the parties hereto with respect to the subject matter hereof and may not be modified or amended in any manner other than by supplemental written agreement executed by the parties hereto. No party, in entering into this Agreement, has relied upon any representation, warranty, covenant, condition or other term that is not set forth in this Agreement, the Indenture, the Registration Rights Agreement or in the Subordinated Notes.

7.10 Choice of Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York without giving effect to its laws or principles of conflict of laws. Nothing herein shall be deemed to limit any rights, powers or privileges which a Purchaser may have pursuant to any law of the United States of America or any rule, regulation or order of any department or agency thereof and nothing herein shall be deemed to make unlawful any transaction or conduct by a Purchaser which is lawful pursuant to, or which is permitted by, any of the foregoing.

7.11 No Third Party Beneficiary. This Agreement is made for the sole benefit of Company and the Purchasers, and no other person shall be deemed to have any privity of contract hereunder nor any right to rely hereon to any extent or for any purpose whatsoever, nor shall any other person have any right of action of any kind hereon or be deemed to be a third party beneficiary hereunder; provided, that the Placement Agent may rely on the representations and warranties contained herein to the same extent as if it were a party to this Agreement.

7.12 Legal Tender of United States. All payments hereunder shall be made in coin or currency which at the time of payment is legal tender in the United States of America for public and private debts.

7.13 Captions; Counterparts. Captions contained in this Agreement in no way define, limit or extend the scope or intent of their respective provisions. This Agreement may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which taken together shall constitute but one and the same instrument. In the event that any signature is delivered by facsimile transmission, or by e-mail delivery of a “.pdf” format data file, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile signature page were an original thereof.

| 22 |

7.14 Knowledge; Discretion. All references herein to a Purchaser’s or Company’s knowledge shall be deemed to mean the knowledge of such party based on the actual knowledge of such party’s Chief Executive Officer, Chief Operating Officer, and Chief Financial Officer or such other persons holding equivalent offices. Unless specified to the contrary herein, all references herein to an exercise of discretion or judgment by a Purchaser, to the making of a determination or designation by a Purchaser, to the application of a Purchaser’s discretion or opinion, to the granting or withholding of a Purchaser’s consent or approval, to the consideration of whether a matter or thing is satisfactory or acceptable to a Purchaser, or otherwise involving the decision making of a Purchaser, shall be deemed to mean that such Purchaser shall decide using the reasonable discretion or judgment of a prudent lender.

7.15 Waiver Of Right To Jury Trial. TO THE EXTENT PERMITTED UNDER APPLICABLE LAW, THE PARTIES HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVE ANY RIGHT THAT THEY MAY HAVE TO A TRIAL BY JURY IN ANY LITIGATION ARISING IN ANY WAY IN CONNECTION WITH ANY OF THE TRANSACTION DOCUMENTS, OR ANY OTHER STATEMENTS OR ACTIONS OF COMPANY OR PURCHASERS. THE PARTIES ACKNOWLEDGE THAT THEY HAVE BEEN REPRESENTED IN THE SIGNING OF THIS AGREEMENT AND IN THE MAKING OF THIS WAIVER BY INDEPENDENT LEGAL COUNSEL SELECTED OF THEIR OWN FREE WILL. THE PARTIES FURTHER ACKNOWLEDGE THAT (I) THEY HAVE READ AND UNDERSTAND THE MEANING AND RAMIFICATIONS OF THIS WAIVER, (II) THIS WAIVER HAS BEEN REVIEWED BY THE PARTIES AND THEIR COUNSEL AND IS A MATERIAL INDUCEMENT FOR ENTRY INTO THIS AGREEMENT AND THE REGISTRATION RIGHTS AGREEMENT AND (III) THIS WAIVER SHALL BE EFFECTIVE AS TO EACH OF SUCH TRANSACTION DOCUMENTS AS IF FULLY INCORPORATED THEREIN.

7.16 Expenses. Except as otherwise provided in this Agreement, each of the parties will bear and pay all other costs and expenses incurred by it or on his, her or its behalf in connection with the transactions contemplated pursuant to this Agreement.

7.17 Survival. Each of the representations and warranties set forth in this Agreement shall survive the consummation of the transactions contemplated hereby for a period of one year after the date hereof. Except as otherwise provided herein, all covenants and agreements contained herein shall survive until, by their respective terms, they are no longer operative.

[Signature Pages Follow]

| 23 |

IN WITNESS WHEREOF, Company has caused this Subordinated Note Purchase Agreement to be executed by its duly authorized representative as of the date first above written.

|

COMPANY:

EAGLE BANCORP MONTANA, INC.

By: ______________________________ Name: Laura F. Clark Title: Executive Vice President, Chief Financial Officer and Chief Operating Officer

| |

[Company Signature Page to Subordinated Note Purchase Agreement]

IN WITNESS WHEREOF, the Purchaser has caused this Subordinated Note Purchase Agreement to be executed by its duly authorized representative as of the date first above written.

|

PURCHASER:

____________________________________ (Entity Name)

By: _________________________________

Name: _______________________________

Title: ________________________________

| |

|

Address of Purchaser:

____________________________________

____________________________________

____________________________________

| |

|

Principal Amount of Purchased Subordinated Note:

$ ___________________________________

|

[Company Signature Page to Subordinated Note Purchase Agreement]

EXHIBIT A

INDENTURE

EXHIBIT B

REGISTRATION RIGHTS AGREEMENT

| 27 |

EXHIBIT C

OPINION OF COUNSEL

1. Based solely on a certificate of good standing issued by the Secretary of State of Delaware dated [●] [●], 2022, Company is a corporation duly organized, validly existing, and in good standing under the laws of the State of Delaware. Company has the corporate power and authority to carry on its business and to own, lease, and operate its properties and assets in all material respects as described in the Company’s Reports.

2. Based solely on a certificate of good standing issued by the Montana Division of Banking and Financial Institutions, dated [●] [●], 2022, Bank is validly existing as a Montana commercial bank and in good standing under the laws of the State of Montana. Bank has the corporate power to own its properties and conduct its business in all material respects as described in the Company’s Reports.

3. Company has the necessary corporate power and authority to execute, deliver, and perform its obligations under the Transaction Documents to which it is a party and to consummate the transactions contemplated by the Transaction Documents.

4. Each of the Subordinated Note Purchase Agreement, the Indenture and the Registration Rights Agreement has been duly and validly authorized, executed, and delivered by Company, and each of the Subordinated Note Purchase Agreement, the Indenture and the Registration Rights Agreement will constitute valid and binding obligations of Company, enforceable against Company in accordance with their terms, except that the enforcement thereof may be subject to: (A) bankruptcy, insolvency, reorganization, receivership, moratorium, fraudulent conveyance, fraudulent transfer or other similar laws now or hereafter in effect relating to creditors’ rights generally; and (B) general principles of equity (whether applied by a court of law or equity) and the discretion of the court before which any proceeding therefor may be brought.