Form 8-K ENDI Corp. For: Aug 09

|

|

|

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

||

|

|

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

●

|

Enterprise Diversified merged with First Merger Sub, a wholly-owned subsidiary of the Company, with Enterprise Diversified being the surviving entity (the “First Merger”);

|

|

●

|

CrossingBridge merged with Second Merger Sub, a wholly-owned subsidiary of the Company, with CrossingBridge being the surviving entity (the “Second Merger” and, together with the First Merger, the “Merger”);

|

|

●

|

Each share of common stock of Enterprise Diversified was converted into the right to receive one share of Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”), of the Company; and

|

|

●

|

Cohanzick, as the sole member of CrossingBridge, received 2,400,000 shares of the Company’s Class A Common, 1,800,000 shares of the Company’s Class B Common Stock, par value $0.0001 per share (the “Class B Common Stock” and together with the Class A Common Stock, the “Common Stock”), a Class W-1 Warrant to purchase 1,800,000 shares of the Company’s Class A Common Stock (the “Class W-1 Warrant”), and a Class W-2 Warrant to purchase 250,000 shares of the Company’s Class A Common Stock (the “Class W-2 Warrant” and together with the Class W-1 Warrant, the “Warrants”).

|

|

ENDI CORP.

|

|

|

Date: August 12, 2022

|

/s/ David Sherman

|

|

David Sherman

|

|

|

Chief Executive Officer

|

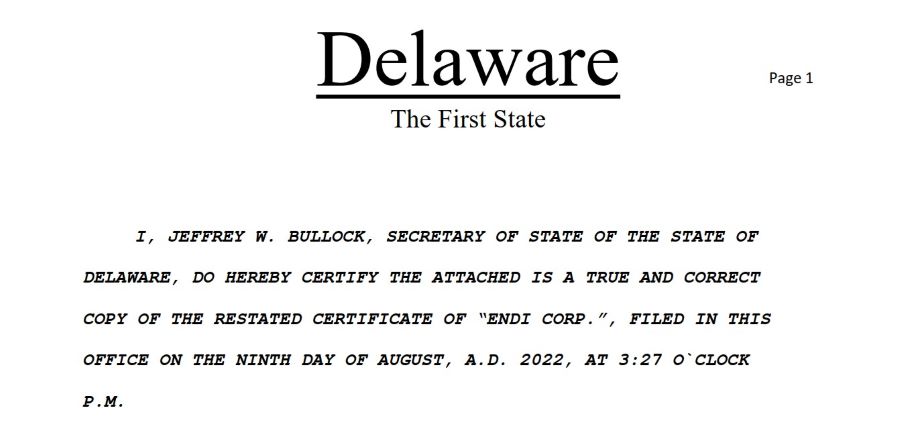

Exhibit 3.1

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION OF

ENDI CORP.

ENDI Corp., a corporation organized and existing under the laws of the State of Delaware (the "Corporation"), certifies that:

A. The name of the Corporation is ENDI Corp. The Corporation's original Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on December 23, 2021.

B. The Corporation has not received any payment for any of its capital stock.

C. This Amended and Restated Certificate of Incorporation has been duly adopted by the director of the Corporation in accordance with Sections 241 and 245 of the General Corporation Law of the State of Delaware.

D. The text of the Certificate of Incorporation is amended and restated to read as set forth in Exhibit A attached hereto.

IN WITNESS WHEREOF, ENDI Corp. has caused this Amended and Restated Certificate of Incorporation to be signed by Steven Kiel, a duly authorized officer of the Corporation, on August 9, 2022.

/s/ Steven L. Kiel

Steven Kiel

EXHIBIT A

ARTICLE 1

Section 1.01 Name. The name of the corporation is ENDI CORP. (the “Corporation”).

ARTICLE 2

Section 2.01 Address. The address of its registered office in the State of Delaware is 251 Little Falls Drive, Wilmington, County of New Castle, State of Delaware 19808. The name of its registered agent at such address is Corporation Service Company.

ARTICLE 3

Section 3.01 Purpose. The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware as the same exists or may hereafter be amended (the “DGCL”).

ARTICLE 4

Section 4.01 Capitalization. The total number of shares of all classes of stock that the Corporation is authorized to issue is 17,800,000 shares, divided into three classes as follows: (i) 14,000,000 shares of Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”); (ii) 1,800,000 shares of Class B Common Stock, par value $0.0001 per share (“Class B Common Stock” and, together with the Class A Common Stock, the “Common Stock”); and (iii) 2,000,000 shares of Preferred Stock, par value $0.0001 per share (“Preferred Stock”). The number of authorized shares of any of the Class A Common Stock, Class B Common Stock or Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority in voting power of the stock of the Corporation entitled to vote thereon irrespective of the provisions of Section 242(b)(2) of the DGCL (or any successor provision thereto), and no vote of the holders of any of the Class A Common Stock, Class B Common Stock or Preferred Stock voting separately as a class shall be required therefor, unless a vote of any such holder is required pursuant to this Certificate of Incorporation of the Corporation (including any certificate of designation relating to any series of Preferred Stock) (as the same may be amended and/or restated from time to time, the “Certificate of Incorporation”).

Section 4.02 Common Stock. (a) Voting Rights.

(i) Except as may otherwise be provided in the Certificate of Incorporation or by applicable law, each holder of record of Class A Common Stock, as such, shall be entitled to one vote for each share of Class A Common Stock held of record by such holder on all matters on which stockholders generally or holders of Class A Common Stock as a separate class are entitled to vote (whether voting separately as a class or together with one or more classes of the Corporation’s capital stock); provided, however, that, to the fullest extent permitted by applicable law, holders of Class A Common Stock, as such, shall have no voting power with respect to, and shall not be entitled to vote on, any amendment to the Certificate of Incorporation that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of such affected series are entitled, either separately or together with the holders of one or more other such series, to vote thereon pursuant to the Certificate of Incorporation or pursuant to the DGCL.

(ii) Except as may otherwise be provided in the Certificate of Incorporation or by applicable law, each holder of record of Class B Common Stock, as such, shall be entitled to one vote for each share of Class B Common Stock held of record by such holder on all matters on which stockholders generally or holders of Class B Common Stock as a separate class are entitled to vote (whether voting separately as a class or together with one or more classes of the Corporation’s capital stock); provided, however, that, to the fullest extent permitted by applicable law, holders of Class B Common Stock, as such, shall have no voting power with respect to, and shall not be entitled to vote on, any amendment to the Certificate of Incorporation that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of such affected series are entitled, either separately or together with the holders of one or more other such series, to vote thereon pursuant to the Certificate of Incorporation or pursuant to the DGCL.

(iii) Except as otherwise provided in the Certificate of Incorporation or required by applicable law, the holders of record of Common Stock shall vote together as a single class (or, if the holders of record of one or more outstanding series of Preferred Stock are entitled to vote together with the holders of record of Common Stock, as a single class, together with the holders of record of such one or more series of Preferred Stock) on all matters submitted to a vote of the stockholders generally.

(b) Dividends and Distributions. Subject to applicable law and the rights, if any, of the holders of any outstanding series of Preferred Stock or any other outstanding class or series of stock of the Corporation, having a preference over or the right to participate with the Class A Common Stock with respect to the payment of dividends and other distributions in cash, property or shares of stock of the Corporation, the holders of Class A Common Stock, as such, shall be entitled to receive such dividends and other distributions in cash, property or shares of stock of the Corporation when, as and if declared thereon by the Board of Directors of the Corporation (the “Board”) from time to time out of the assets or funds of the Corporation that are by applicable law available therefor. The holders of Class B Common Stock, as such, shall not be entitled to receive any dividends or other distributions in cash, property or shares of stock of the Corporation.

(c) Liquidation, Dissolution or Winding Up. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation, after payment or provision for payment of the debts and other liabilities of the Corporation and of the preferential and other amounts, if any, to which the holders of Preferred Stock shall be entitled, the holders of all outstanding shares of Class A Common Stock shall be entitled to receive, on a pro rata basis, the remaining assets of the Corporation available for distribution ratably in proportion to the number of shares held by each such stockholder. The holders of shares of Class B Common Stock, as such, shall not be entitled to receive any assets of the Corporation in the event of any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation.

Section 4.03 Preferred Stock. (a) The Board is hereby expressly authorized, by resolution or resolutions thereof, at any time and from time to time, to provide, out of the unissued shares of Preferred Stock, for one or more series of Preferred Stock and, with respect to each such series, to fix the number of shares constituting such series and the designation of such series, the powers (including voting powers), if any, and the preferences and relative, participating, optional, special or other rights, if any, and the qualifications, limitations or restrictions thereof, if any, of the shares of such series and to cause to be filed with the Secretary of State of the State of Delaware a certificate of designation with respect thereto. The designations, powers (including voting powers), preferences and relative, participating, optional, special or other rights of each series of Preferred Stock, if any, and the qualifications, limitations or restrictions thereof, if any, may differ from those of any and all other series of Preferred Stock at any time outstanding.

(a) Except as otherwise required by law, holders of a series of Preferred Stock, as such, shall be entitled only to such voting rights, if any, as shall expressly be granted thereto by this Certificate of Incorporation (including, without limitation, any certificate of designations relating to such series).

Section 4.04 Changes in Common Stock. If the Corporation in any manner subdivides or combines the outstanding shares of Class A Common Stock, the outstanding shares of Class B Common Stock shall be proportionately subdivided or combined, as the case may be. If the Corporation in any manner subdivides or combines the outstanding shares of Class B Common Stock, the outstanding shares of Class A Common Stock shall be proportionately subdivided or combined, as the case may be.

Section 4.05 Reorganization or Merger. In connection with any reorganization, share exchange, consolidation, conversion or merger of the Corporation with or into another person, the Corporation shall not adversely affect, alter, repeal, change or otherwise impair any of the powers, preferences, rights or privileges of the Class B Common Stock (whether directly, by the filing of a certificate of designations, powers, preferences, rights or privileges, by reorganization, share exchange, consolidation, conversion or merger or otherwise), including, without limitation (i) any of the voting rights of the holders of the Class B Common Stock, and (ii) the requisite vote or percentage required to approve or take any action described in this ARTICLE 4, in ARTICLE 10 or elsewhere in this Certificate of Incorporation or described in the by-laws of the Corporation, without in each case the affirmative vote of the holders of a majority of the shares of Class B Common Stock, voting as a separate class.

Section 4.06 Restrictions on Transfer.

(a) Definitions. As used in this Section 4.06, the following capitalized terms have the following meanings when used herein with initial capital letters:

“24.99% Transaction” means any Transfer described in Section 4.06(b).

“Corporation Securities” means (i) shares of Common Stock, (ii) shares of Preferred Stock (other than preferred stock described in Section 1504(a)(4) of the Code), and (iii) warrants, rights, or options to purchase securities of the Corporation.

“Outstanding Voting Corporation Securities” means those outstanding Corporation Securities with a right to vote.

“Person” means any individual, firm, corporation or other legal entity, and includes any successor (by merger or otherwise) of such entity.

“Restricted Period” means the period of time in which the Principal Stockholder (as defined in the Stockholders Agreement) owns at least 25% of the Outstanding Voting Corporation Securities.

“Stockholders Agreement” means that certain stockholders agreement dated on or about the date of the filing of this Certificate of Incorporation with the Secretary of State of the State of Delaware, by and among the Corporation and the stockholders of the Corporation party thereto (as amended, supplemented, restated or otherwise modified from time to time).

“Transfer” means any direct or indirect sale, transfer, assignment, conveyance, pledge or other disposition of Corporation Securities.

(b) Restrictions on Transfer. Except as set forth in Section 4.06(c) below, any attempted Transfer of Corporation Securities during the Restricted Period and any attempted Transfer of Corporation Securities pursuant to an agreement entered into during the Restricted Period, shall be prohibited and void ab initio to the extent that, as a result of such Transfer (or any series of Transfers of which such Transfer is a part), any Person or group of Persons (other than the Principal Stockholder) would then own at least 24.99% of Outstanding Voting Corporation Securities.

(c) Exception. The restrictions set forth in Section 4.06(b) shall not apply to an attempted Transfer that is a 24.99% Transaction if the transferor or the transferee obtains the prior written approval of a majority of the members of the Board then in office, including approval of at least one Class B Director (as defined below) designated by the Principal Stockholder for such purpose.

ARTICLE 5

Section 5.01 Bylaws. In furtherance and not in limitation of the powers conferred by the DGCL, the Board is expressly authorized to make, amend, alter, change, add to or repeal, in whole or in part, the bylaws of the Corporation (as the same may be amended and/or restated from time to time, the “Bylaws”). In addition to any affirmative vote required by the Certificate of Incorporation, the affirmative vote of the holders of at least eighty percent (80%) of the total voting power of all the then outstanding shares of stock of the Corporation entitled to vote thereon, voting together as a single class, shall be required in order for the stockholders of the Corporation to alter, amend, repeal or rescind, in whole or in part, any provision of the Bylaws or to adopt any provision inconsistent therewith.

ARTICLE 6

Section 6.01 Board of Directors.

(a) The business and affairs of the Corporation shall be managed by or under the direction of the Board with the exact number of directors to be determined from time to time solely by resolution adopted by the affirmative vote of a majority of the entire Board.

(b) The holders of the New Parent Class B Common Stock, voting together as a single class, have the right to designate a number of directors of the Corporation’s board (rounded up to the nearest whole number) equal to the percentage of the Corporation’s Common Stock beneficially owned by the holders of the Corporation’s Class B Common Stock and their Affiliates at the time of such designation, provided however, that for purposes of this designation right, the holders of the Corporation’s Class B Common Stock, voting together as a single class, shall have the right to designate not more than a majority of the members of the Corporation’s board then in office and, provided further that so long as holders of the Corporation’s Class B Common Stock and their Affiliates beneficially own at least 5.0% of the total outstanding shares of Common Stock of the Corporation, holders of the Corporation’s Class B Common Stock, voting together as a single class, shall have the right to designate at least one director. Any Class B Director may only be removed by the holders of a majority of the Class B Common Stock. All other directors shall be elected by the holders of the Class A Common Stock in the manner set forth in the Bylaws.

(c) Notwithstanding the provisions set forth in Section 6.01(b), in the event the holders of Class B Common Stock and their Affiliates hold less than 5% in the aggregate of the outstanding shares of Common Stock, such holders shall no longer be entitled to nominate or elect any Class B Directors.

(d) Each director shall hold office for a term of one (1) year, until the next annual meeting of stockholders, or (if longer) until a successor has been duly elected and qualified or until the earlier death, resignation or removal of such director. Directors may be elected to an unlimited number of successive terms. Directors need not be elected by written ballot unless the Bylaws so provide. There shall be no cumulative voting in the election of directors.

(e) Subject to Section 6.01(b), vacancies on the Board resulting from death, resignation, removal or otherwise and newly created directorships resulting from any increase in the number of directors may be filled solely by a majority of the directors then in office (although less than a quorum) or by the sole remaining director, and each director so elected shall hold office for a term that shall coincide with the term to which such director shall have been elected and until his or her successor is elected and qualified or until his or her earlier resignation or removal.

(f) Any or all of the directors (other than any Class B Directors) may be removed at any time either with or without cause by the affirmative vote of a majority in voting power of all outstanding shares of stock of the Corporation entitled to vote thereon, voting together as a single class; provided, however, that, until the annual meeting of stockholders held in the year 2024, any director of the Corporation as of the date of the adoption of this Certificate of Incorporation (other than any Class B Directors) may be removed, with or without cause, solely by the affirmative vote of two-thirds of the voting power of all outstanding shares of stock of the Corporation entitled to vote thereon, voting together as a single class.

(g) Notwithstanding the provisions of Section 6.01(b), it shall be a requirement for election for any Class B Director that the election of such director shall not cause the Corporation to violate any law or the corporate governance requirements of any securities exchange or other trading facility on which the Common Stock or other securities of the Corporation may then be listed or quoted, that listed or quoted companies must have a majority of independent directors.

(h) Notwithstanding the foregoing, whenever the holders of one or more classes or series of Preferred Stock shall have the right, voting separately as a class or series, to elect directors, the election, term of office, filling of vacancies, removal and other features of such directorships shall be governed by the terms of the resolution or resolutions adopted by the Board pursuant to ARTICLE 4 applicable thereto, and such directors so elected shall not be subject to the provisions of this ARTICLE 6 unless otherwise provided therein.

(i) For purposes of this Section 6.01, “Affiliate” shall mean, with respect to any holder of shares of Class B Common Stock, any person, entity or firm which, directly or indirectly, controls, is controlled by or is under common control with such holder, including, without limitation, any entity of which the holder is a partner or member, any partner, officer, director, member or employee of such holder, any trust or other estate in which the Principal Stockholder holds at least a 10% beneficial interest or as to which the Principal Stockholder serves as trustee, grantor, or in a similar fiduciary capacity, and any trust established for estate planning purposes of which any partner or member of the Principal Stockholder, individually or jointly with such Person’s spouse, has the exclusive right to control such trust; and “control” (including the terms “controlling,” “controlled by,” and “under common control with”), as applied to any Person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of that Person, whether through the ownership of voting securities, by contract, or otherwise.

ARTICLE 7

Section 7.01 Meetings of Stockholders. Any action required or permitted to be taken by the holders of stock of the Corporation must be effected at a duly called annual or special meeting of such holders and may not be effected by any consent by such holders unless such action is recommended by all directors of the Corporation then in office; provided, however, that any action required or permitted to be taken by the holders of Class B Common Stock, voting separately as a class, or, to the extent expressly permitted by the provisions of the Certificate of Incorporation relating to one or more outstanding series of Preferred Stock, by the holders of such series of Preferred Stock, voting separately as a series or separately as a class with one or more other such series, may be taken without a meeting, without prior notice and without a vote, if a consent or consents, setting forth the action so taken, shall be signed by the holders of outstanding shares of the relevant class or series having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted and shall be delivered to the Corporation in accordance with the DGCL. Subject to the rights of the holders of any outstanding series of Preferred Stock and any rights granted pursuant to the Stockholders Agreement, special meetings of the stockholders of the Corporation for any purpose or purposes may be called only by or at the direction of the Board or the Chairman of the Board.

ARTICLE 8

Section 8.01 Limited Liability of Directors. No director of the Corporation will have any personal liability to the Corporation or its stockholders for monetary damages for any breach of fiduciary duty as a director, except to the extent such exemption from liability or limitation thereof is not permitted under the DGCL as the same exists or hereafter may be amended. Neither the amendment nor the repeal of this ARTICLE 8 shall eliminate or reduce the effect thereof in respect of any matter occurring, or any cause of action, suit or claim that, but for this ARTICLE 8, would accrue or arise, prior to such amendment or repeal.

ARTICLE 9

Section 9.01 Corporate Opportunities. (a) In recognition and anticipation that (i) members of the Board who are not employees of the Corporation (“Non-Employee Directors”) and their respective Affiliates and Affiliated Entities (each, as defined below) may now engage and may continue to engage in the same or similar activities or related lines of business as those in which the Corporation, directly or indirectly, may engage and/or other business activities that overlap with or compete with those in which the Corporation, directly or indirectly, may engage and (ii) the Principal Stockholder and its respective Affiliates and Affiliated Entities may now engage and may continue to engage in the same or similar activities or related lines of business as those in which the Corporation, directly or indirectly, may engage and/or other business activities that overlap with or compete with those in which the Corporation, directly or indirectly, may engage, the provisions of this ARTICLE 9 are set forth to regulate and define the conduct of certain affairs of the Corporation with respect to certain classes or categories of business opportunities as they may involve any of the Non-Employee Directors, the Principal Stockholder or their respective Affiliates and the powers, rights, duties and liabilities of the Corporation and its directors, officers and stockholders in connection therewith.

(a) None of (i) the Non-Employee Directors (including any Non-Employee Director who serves as an officer of the Corporation in both his or her director and officer capacities) or his or her Affiliates or Affiliated Entities or (ii) the Principal Stockholder or any of its respective Affiliates or Affiliated Entities (the Persons (as defined below) above being referred to, collectively, as “Identified Persons” and, individually, as an “Identified Person”) shall, to the fullest extent permitted by applicable law, have any duty to refrain from directly or indirectly (1) engaging in the same or similar business activities or lines of business in which the Corporation or any of its Affiliates now engages or proposes to engage or (2) otherwise competing with the Corporation or any of its Affiliates, and, to the fullest extent permitted by applicable law, no Identified Person shall be liable to the Corporation or its stockholders or to any Affiliate of the Corporation for breach of any fiduciary duty solely by reason of the fact that such Identified Person engages in any such activities. To the fullest extent permitted by applicable law, the Corporation hereby renounces any interest or expectancy in, or right to be offered an opportunity to participate in, any business opportunity that may be a corporate opportunity for an Identified Person and the Corporation or any of its Affiliates, except as provided in Section 9.01(c) of this ARTICLE 9. Subject to said Section 9.01(c) of this ARTICLE 9, in the event that any Identified Person acquires knowledge of a potential transaction or other business opportunity that may be a corporate opportunity for itself, herself or himself and the Corporation or any of its Affiliates, such Identified Person shall, to the fullest extent permitted by applicable law, have no duty to communicate or offer such transaction or other business opportunity to the Corporation or any of its Affiliates and, to the fullest extent permitted by applicable law, shall not be liable to the Corporation or its stockholders or to any Affiliate of the Corporation for breach of any fiduciary duty as a stockholder, director or officer of the Corporation solely by reason of the fact that such Identified Person pursues or acquires such corporate opportunity for itself, herself or himself, or offers or directs such corporate opportunity to another Person or does not communicate information regarding such corporate opportunity to the Corporation.

(b) Notwithstanding the foregoing provision of this ARTICLE 9, the Corporation does not renounce its interest in any corporate opportunity offered to any Non-Employee Director (including any Non-Employee Director who serves as an officer of the Corporation in both his or her director and officer capacities) if such opportunity is expressly offered to such Non-Employee Director solely in his or her capacity as a director or officer of the Corporation, and the provisions of Section 9.01(b) of this ARTICLE 9 shall not apply to any such corporate opportunity.

(c) In addition to and notwithstanding the foregoing provisions of this ARTICLE 9, a potential corporate opportunity shall not be deemed to be a corporate opportunity of the Corporation if it is a business opportunity that (i) the Corporation is neither financially or legally able, nor contractually permitted, to undertake, (ii) from its nature, is not in the line of the Corporation’s business or is of no practical advantage to the Corporation or (iii) is one in which the Corporation has no interest or reasonable expectancy.

(d) For purposes of this ARTICLE 9, (i) “Affiliate” shall mean (a) in respect of a Non-Employee Director, any Person (as defined below) that, directly or indirectly, is controlled (as defined below) by such Non-Employee Director (other than the Corporation and any Person that is controlled by the Corporation), (b) in respect of the Principal Stockholder, a Person that, directly or indirectly, is controlled by the Principal Stockholder, controls the Principal Stockholder or is under common control with the Principal Stockholder and shall include any principal, member, director, partner, stockholder, officer, employee or other representative of any of the foregoing (other than the Corporation and any entity that is controlled by the Corporation) and (c) in respect of the Corporation, any Person that, directly or indirectly, is controlled by the Corporation; (ii) “Affiliated Entity” shall mean (a) any Person of which a Non-Employee Director serves as an officer, director, employee, agent or other representative (other than the Corporation and any Person that is controlled by the Corporation), (b) any direct or indirect partner, stockholder, member, manager or other representative of such Person or (c) any Affiliate of any of the foregoing; and (iii) “Person” shall mean any individual, corporation, general or limited partnership, limited liability company, joint venture, trust, association or any other entity.

(e) For the purposes of this ARTICLE 9, “control,” including the terms “controlling,” “controlled by” and “under common control with,” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting stock, by contract, or otherwise. Notwithstanding the foregoing, a presumption of control shall not apply where such person holds voting stock, in good faith and not for the purpose of circumventing this Section (f) of ARTICLE 9, as an agent, bank, broker, nominee, custodian or trustee for one or more owners who do not individually or as a group have control of such entity.

(f) To the fullest extent permitted by applicable law, any Person purchasing or otherwise acquiring any interest in any shares of stock of the Corporation shall be deemed to have notice of and to have consented to the provisions of this ARTICLE 9.

ARTICLE 10

Section 10.01 DGCL Section 203 and Business Combinations.

(a) The Corporation hereby expressly elects not to be governed by Section 203 of the DGCL.

(b) Notwithstanding the foregoing, the Corporation shall not engage in any business combination (as defined below), at any point in time at which shares of Common Stock are registered under Section 12(b) or 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with any interested stockholder (as defined below) for a period of three years following the time that such stockholder became an interested stockholder, unless:

(i) prior to such time, the Board approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder, or

(ii) upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock (as defined below) of the Corporation outstanding at the time the transaction commenced, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned by (A) persons who are directors and also officers and (B) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer, or

(iii) at or subsequent to such time, the business combination is approved by the Board and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock of the Corporation which is not owned by the interested stockholder.

(c) For purposes of this ARTICLE 10, references to:

(i)“ Affiliate” means a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, another person.

(ii)“ associate,” when used to indicate a relationship with any person, means: (i) any corporation, partnership, unincorporated association or other entity of which such person is a director, officer or partner or is, directly or indirectly, the owner of 20% or more of any class of voting stock; (ii) any trust or other estate in which such person has at least a 20% beneficial interest or as to which such person serves as trustee or in a similar fiduciary capacity; and (iii) any relative or spouse of such person, or any relative of such spouse, who has the same residence as such person.

(iii)“ business combination,” when used in reference to the Corporation and any interested stockholder of the Corporation, means:

(A) any merger or consolidation of the Corporation or any direct or indirect majority-owned subsidiary of the Corporation (1) with the interested stockholder, or (2) with any other corporation, partnership, unincorporated association or other entity if the merger or consolidation is caused by the interested stockholder and as a result of such merger or consolidation Section (b) of this ARTICLE 10 is not applicable to the surviving entity;

(B) any sale, lease, exchange, mortgage, pledge, transfer or other disposition (in one transaction or a series of transactions), except proportionately as a stockholder of the Corporation, to or with the interested stockholder, whether as part of a dissolution or otherwise, of assets of the Corporation or of any direct or indirect majority-owned subsidiary of the Corporation which assets have an aggregate market value equal to 10% or more of either the aggregate market value of all the assets of the Corporation determined on a consolidated basis or the aggregate market value of all the outstanding stock of the Corporation;

(C) any transaction which results in the issuance or transfer by the Corporation or by any direct or indirect majority-owned subsidiary of the Corporation of any stock of the Corporation or of such subsidiary to the interested stockholder, except: (1) pursuant to the exercise, exchange or conversion of securities exercisable for, exchangeable for or convertible into stock of the Corporation or any such subsidiary which securities were outstanding prior to the time that the interested stockholder became such; (2) pursuant to a merger under Section 251(g) of the DGCL; (3) pursuant to a dividend or distribution paid or made, or the exercise, exchange or conversion of securities exercisable for, exchangeable for or convertible into stock of the Corporation or any such subsidiary which security is distributed, pro rata to all holders of a class or series of stock of the Corporation subsequent to the time the interested stockholder became such; (4) pursuant to an exchange offer by the Corporation to purchase stock made on the same terms to all holders of said stock; or (5) any issuance or transfer of stock by the Corporation; provided, however, that in no case under items (3) through (5) of this subsection (C) shall there be an increase in the interested stockholder’s proportionate share of the stock of any class or series of the Corporation or of the voting stock of the Corporation (except as a result of immaterial changes due to fractional share adjustments);

(D) any transaction involving the Corporation or any direct or indirect majority-owned subsidiary of the Corporation which has the effect, directly or indirectly, of increasing the proportionate share of the stock of any class or series, or securities convertible into the stock of any class or series, of the Corporation or of any such subsidiary which is owned by the interested stockholder, except as a result of immaterial changes due to fractional share adjustments or as a result of any purchase or redemption of any shares of stock not caused, directly or indirectly, by the interested stockholder; or

(E) any receipt by the interested stockholder of the benefit, directly or indirectly (except proportionately as a stockholder of the Corporation), of any loans, advances, guarantees, pledges, or other financial benefits (other than those expressly permitted in subsections (A) through (D) above) provided by or through the Corporation or any direct or indirect majority-owned subsidiary.

(iv)“ control,” including the terms “controlling,” “controlled by” and “under common control with,” shall have the meaning set forth in Section 9.01(f).

(v)“ interested stockholder” means any person (other than the Corporation or any direct or indirect majority-owned subsidiary of the Corporation) that (i) is the owner of 15% or more of the outstanding voting stock of the Corporation, or (ii) is an Affiliate or associate of the Corporation and was the owner of 15% or more of the outstanding voting stock of the Corporation at any time within the three-year period immediately prior to the date on which it is sought to be determined whether such person is an interested stockholder; and the Affiliates and associates of such person; but “interested stockholder” shall not include (a) any Principal Stockholder, any Principal Stockholder Direct Transferee, any Principal Stockholder Indirect Transferee or any of their respective Affiliates or successors or any “group,” or any member of any such group, to which such persons are a party under Rule 13d-5 of the Exchange Act, or (b) any person whose ownership of shares in excess of the 15% limitation set forth herein is the result of any action taken solely by the Corporation; provided, further, that in the case of clause (b), such person shall be an interested stockholder if thereafter such person acquires additional shares of voting stock of the Corporation, except as a result of further corporate action not caused, directly or indirectly, by such person. For the purpose of determining whether a person is an “interested stockholder”, the voting stock of the Corporation deemed to be outstanding shall include stock deemed to be owned by the person through application of the definition of “owner” below but shall not include any other unissued stock of the Corporation which may be issuable pursuant to any agreement, arrangement or understanding, or upon exercise of conversion rights, warrants or options, or otherwise.

(vi)“ owner,” including the terms “own” and “owned,” when used with respect to any stock, means a person that individually or with or through any of its Affiliates or associates:

(A) beneficially owns such stock, directly or indirectly; or

(B) has (1) the right to acquire such stock (whether such right is exercisable immediately or only after the passage of time) pursuant to any agreement, arrangement or understanding, or upon the exercise of conversion rights, exchange rights, warrants or options, or otherwise; provided, however, that a person shall not be deemed the owner of stock tendered pursuant to a tender or exchange offer made by such person or any of such person’s Affiliates or associates until such tendered stock is accepted for purchase or exchange; or (2) the right to vote such stock pursuant to any agreement, arrangement or understanding; provided, however, that a person shall not be deemed the owner of any stock because of such person’s right to vote such stock if the agreement, arrangement or understanding to vote such stock arises solely from a revocable proxy or consent given in response to a proxy or consent solicitation made to 10 or more persons; or

(C) has any agreement, arrangement or understanding for the purpose of acquiring, holding, voting (except voting pursuant to a revocable proxy or consent as described in item (2) of subsection (B) above), or disposing of such stock with any other person that beneficially owns, or whose Affiliates or associates beneficially own, directly or indirectly, such stock.

(vii)“ person” means any individual, corporation, partnership, unincorporated association or other entity.

(viii)“ Principal Stockholder Direct Transferee” means any person that acquires (other than in a registered public offering) directly from the Principal Stockholder or any of its successors or any “group,” or any member of any such group, of which such persons are a party under Rule 13d-5 of the Exchange Act beneficial ownership of 15% or more of the then outstanding voting stock of the Corporation.

(ix)“ Principal Stockholder Indirect Transferee” means any person that acquires (other than in a registered public offering) directly from any Principal Stockholder Direct Transferee or any other Principal Stockholder Indirect Transferee beneficial ownership of 15% or more of the then outstanding voting stock of the Corporation.

(x)“ stock” means, with respect to any corporation, capital stock and, with respect to any other entity, any equity interest.

(xi)“ voting stock” means stock of any class or series entitled to vote generally in the election of directors and, with respect to any entity that is not a corporation, any equity interest entitled to vote generally in the election of the governing body of such entity. Every reference to a percentage of voting stock shall refer to such percentages of the votes of such voting stock.

Section 10.02 Severability. If any provision or provisions of this Certificate of Incorporation shall be held to be invalid, illegal or unenforceable as applied to any circumstance for any reason whatsoever: (a) the validity, legality and enforceability of such provisions in any other circumstance and of the remaining provisions of this Certificate of Incorporation (including, without limitation, each portion of any paragraph of this Certificate of Incorporation containing any such provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) shall not in any way be affected or impaired thereby and (b) to the fullest extent possible, the provisions of this Certificate of Incorporation (including, without limitation, each such portion of any paragraph of this Certificate of Incorporation containing any such provision held to be invalid, illegal or unenforceable) shall be construed so as to permit the Corporation to protect its directors, officers, employees and agents from personal liability in respect of their good faith service to or for the benefit of the Corporation to the fullest extent permitted by law.

Section 10.03 Amendment. The Corporation reserves the right at any time, and from time to time, to amend, alter, change or repeal any provision contained in the Certificate of Incorporation, and other provisions of the DGCL at the time in force may be added or inserted, in the manner now or hereafter prescribed by applicable law; and all rights, preferences and privileges of whatsoever nature conferred upon stockholders, directors or any other persons whomsoever by and pursuant to the Certificate of Incorporation are granted subject to the rights reserved in this Section 10.03.

Section 10.04 Exceptions. Notwithstanding the foregoing or anything else in this Certificate of Incorporation, (a) any amendment, waiver, alteration or repeal of any provision of, or addition to, this Certificate of Incorporation or to the Bylaws that would adversely affect, alter, repeal, change or otherwise impair any of the powers, preferences, rights or privileges of the Class B Common Stock (whether directly, by the filing of a certificate of designations, powers, preferences, rights or privileges, by a reorganization, share exchange, consolidation, conversion or merger or otherwise), including, without limitation (i) any of the voting rights of the holders of the Class B Common Stock, and (ii) the requisite vote or percentage required to approve or take any action described in Section 10.03, ARTICLE 4 or elsewhere in this Certificate of Incorporation or described in the Bylaws, also must be approved by the affirmative vote of the holders of a majority of the outstanding shares of Class B Common Stock, voting as a separate class, and (b) the number of authorized shares of Class A Common Stock or Class B Common Stock may be increased or decreased (but not below the number of shares of Class A Common Stock or Class B Common Stock) by the affirmative vote of the holders of a majority of the voting power of all of the outstanding shares of Class A Common Stock and Class B Common Stock, voting together as a single class.

ARTICLE 11

Section 11.01 Forum Selection.

(a) Unless the Corporation consents in writing to an alternative forum, the Court of Chancery of the State of Delaware shall, to the fullest extent permitted by applicable law, be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any current or former director, officer, stockholder or employee of the Corporation to the Corporation or the Corporation’s stockholders, (iii) any action asserting a claim arising under any provision of the DGCL, the Certificate of Incorporation or the Bylaws or as to which the DGCL confers jurisdiction on the Court of Chancery of the State of Delaware, or (iv) any action asserting a claim governed by the internal affairs doctrine. Any person or entity that acquires or holds any interest in shares of stock of the Corporation will be deemed to have notice of and consented to the provisions of this section.

(b) The federal district courts of the United States of America shall, to the fullest extent permitted by applicable law, be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the federal securities laws of the United States, including, in each case, the applicable rules and regulations promulgated thereunder. Any person or entity that acquires or holds any interest in any security of the Corporation shall be deemed to have notice of and consented to the provisions of this Section 11.01.

[Remainder of this page intentionally left blank]

Exhibit 3.2

AMENDED AND RESTATED

BYLAWS

OF

ENDI CORP.

ARTICLE I

Offices

Section 1.01 Registered Office. The registered office and registered agent of ENDI Corp. (as such name may be changed in accordance with applicable law, the “Corporation”) in the State of Delaware shall be as set forth in the Certificate of Incorporation (as defined below). The Corporation may also have offices in such other places in the United States or elsewhere as the Board of Directors of the Corporation (the “Board of Directors”) may, from time to time, determine or as the business of the Corporation may require as determined by any officer of the Corporation.

ARTICLE II

Meetings of Stockholders

Section 2.01 Annual Meetings. Annual meetings of stockholders may be held at such place, if any, either within or without the State of Delaware, and at such time and date as the Board of Directors shall determine and state in the notice of meeting. The Board of Directors may, in its sole discretion, determine that annual meetings of the stockholders shall not be held at any place, but may instead be held solely by means of remote communication as described in Section 2.11 of these Bylaws in accordance with Section 211(a)(2) of the General Corporation Law of the State of Delaware (the “DGCL”). The Board of Directors may postpone, reschedule or cancel any annual meeting of stockholders previously scheduled by the Board of Directors.

Section 2.02 Special Meetings. Special meetings of the stockholders may only be called in the manner provided in the Corporation’s certificate of incorporation as then in effect (including any certificate of designation) (as the same may be amended and/or restated from time to time, the “Certificate of Incorporation”) and may be held at such place, if any, either within or without the State of Delaware, and at such time and date as the Board of Directors, the Chairman of the Board of Directors or the Chief Executive Officer of the Corporation (the “Chief Executive Officer”) shall determine and state in the notice of such meeting. The Board of Directors may, in its sole discretion, determine that special meetings of the stockholders shall not be held at any place, but may instead be held solely by means of remote communication as described in Section 2.11 of these Bylaws in accordance with Section 211(a)(2) of the DGCL. The Board of Directors may postpone, reschedule or cancel any special meeting of the stockholders previously scheduled by the Board of Directors, the Chairman of the Board of Directors or the Chief Executive Officer; provided, however, that with respect to any special meeting of stockholders previously scheduled by the Board of Directors or the Chairman of the Board of Directors at the request of the Principal Stockholder (as defined in the Certificate of Incorporation and hereinafter, the “Principal Stockholder”), the Board of Directors shall not postpone, reschedule or cancel such special meeting without the prior written consent of the Principal Stockholder.

Section 2.03 Notice of Stockholder Business and Nominations.

(A) Annual Meetings of Stockholders.

(1) Nominations of persons for election to the Board of Directors by the stockholders generally entitled to vote (which, for the avoidance of doubt, shall exclude nominations of one or more individuals elected by the separate vote of the holders of any one or more series of capital stock of the Corporation) and the proposal of other business to be considered by the stockholders generally entitled to vote (which, for the avoidance of doubt, shall exclude any question or business required by or pursuant to the Certificate of Incorporation with respect to the rights of the holders of any outstanding series of capital stock of the Corporation to be voted on by the holders of one or more such series, voting separately as a single class) may be made at an annual meeting of stockholders only (a) as provided in the Certificate of Incorporation or the Stockholders Agreement (as defined in the Certificate of Incorporation) (in either case with respect to nominations of persons for election to the Board of Directors only), (b) pursuant to the Corporation’s notice of meeting (or any supplement thereto) delivered pursuant to Section 2.04 of Article II of these Bylaws, (c) by or at the direction of the Board of Directors or any authorized committee thereof or (d) by any stockholder of the Corporation who is entitled to vote at the meeting, who, subject to paragraph (C)(4) of this Section 2.03, complied with the notice procedures set forth in paragraphs (A)(2) and (A)(3) of this Section 2.03 and who was a stockholder of record at the time such notice is delivered to the Secretary of the Corporation.

(2) For nominations or other business to be properly brought before an annual meeting by a stockholder pursuant to clause (d) of paragraph (A)(1) of this Section 2.03, the stockholder must have given timely notice thereof in writing to the Secretary of the Corporation, and, in the case of business other than nominations of persons for election to the Board of Directors, such other business must constitute a proper matter for stockholder action. To be timely, a stockholder’s notice shall be delivered to the Secretary of the Corporation at the principal executive offices of the Corporation not less than ninety (90) days nor more than one hundred and twenty (120) days prior to the first anniversary of the preceding year’s annual meeting (which date shall, for purposes of the Corporation’s first annual meeting of stockholders after its shares of Common Stock (as defined in the Certificate of Incorporation) are first publicly traded, be deemed to have occurred on June 30, 2022 of the preceding calendar year); provided, however, that in the event that the date of the annual meeting is advanced by more than thirty (30) days, or delayed by more than seventy (70) days, from the anniversary date of the previous year’s meeting, or if no annual meeting was held in the preceding year, notice by the stockholder to be timely must be so delivered not earlier than the close of business on the one hundred and twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the tenth (10th) day following the day on which public announcement (as defined below) of the date of such meeting is first made by the Corporation. Public announcement of an adjournment or postponement of an annual meeting shall not commence a new time period (or extend any time period) for the giving of a stockholder’s notice. The number of nominees a stockholder may nominate for election at the annual meeting (or in the case of a stockholder giving the notice on behalf of a beneficial owner, the number of nominees a stockholder may nominate for election at the annual meeting on behalf of such beneficial owner) shall not exceed the number of directors to be elected at such annual meeting. Notwithstanding anything in this Section 2.03(A)(2) to the contrary, if the number of directors to be elected to the Board of Directors at an annual meeting is increased and there is no public announcement by the Corporation naming all of the nominees for director or specifying the size of the increased Board of Directors at least one hundred (100) calendar days prior to the first anniversary of the prior year’s annual meeting of stockholders, then a stockholder’s notice required by this Section 2.03 shall be considered timely, but only with respect to nominees for any new positions created by such increase, if it is received by the Secretary of the Corporation not later than the close of business on the tenth (10th) calendar day following the day on which such public announcement is first made by the Corporation.

(3) A stockholder’s notice delivered pursuant to this Section 2.03 shall set forth: (a) as to each person whom the stockholder proposes to nominate for election or re-election as a director, all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to Section 14(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder, including such person’s written consent to being named in the Corporation’s proxy statement as a nominee of the stockholder and to serving as a director if elected; (b) as to any other business that the stockholder proposes to bring before the meeting, a brief description of the business desired to be brought before the meeting, the text of the proposal or business (including the text of any resolutions proposed for consideration and, in the event that such business includes a proposal to amend these Bylaws, the language of the proposed amendment), the reasons for conducting such business at the meeting and any material interest in such business of such stockholder and the beneficial owner, if any, on whose behalf the proposal is made; (c) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made (i) the name and address of such stockholder, as they appear on the Corporation’s books and records, and of such beneficial owner, (ii) the class or series and number of shares of stock of the Corporation that are owned, directly or indirectly, beneficially and of record by such stockholder and such beneficial owner, (iii) a representation that the stockholder is a holder of record of the stock of the Corporation at the time of the giving of the notice, will be entitled to vote at such meeting and will appear in person or by proxy at the meeting to propose such business or nomination, (iv) a representation whether the stockholder or the beneficial owner, if any, will be or is part of a group that will (x) deliver a proxy statement and/or form of proxy to holders of at least the percentage of the voting power of the Corporation’s outstanding shares of stock required to approve or adopt the proposal or elect the nominee and/or (y) otherwise solicit proxies or votes from stockholders in support of such proposal or nomination, (v) a certification regarding whether such stockholder and beneficial owner, if any, have complied with all applicable federal, state and other legal requirements in connection with the stockholder’s and/or beneficial owner’s acquisition of shares of stock or other securities of the Corporation and/or the stockholder’s and/or beneficial owner’s acts or omissions as a stockholder of the Corporation and (vi) any other information relating to such stockholder and beneficial owner, if any, required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for, as applicable, the proposal and/or for the election of directors in an election contest pursuant to and in accordance with Section 14(a) of the Exchange Act and the rules and regulations promulgated thereunder; (d) a description of any agreement, arrangement or understanding with respect to the nomination or proposal and/or the voting of shares of any class or series of stock of the Corporation between or among the stockholder giving the notice, the beneficial owner, if any, on whose behalf the nomination or proposal is made, any of their respective affiliates or associates and/or any others acting in concert with any of the foregoing (collectively, “proponent persons”); and (e) a description of any agreement, arrangement or understanding (including without limitation any contract to purchase or sell, acquire or grant of any option, right or warrant to purchase or sell, swap or other instrument) to which any proponent person is a party, the intent or effect of which may be (i) to transfer to or from any proponent person, in whole or in part, any of the economic consequences of ownership of any security of the Corporation, (ii) to increase or decrease the voting power of any proponent person with respect to shares of any class or series of stock of the Corporation and/or (iii) to provide any proponent person, directly or indirectly, with the opportunity to profit or share in any profit derived from, or to otherwise benefit economically from, any increase or decrease in the value of any security of the Corporation. A stockholder providing notice of a proposed nomination for election to the Board of Directors or other business proposed to be brought before a meeting (whether given pursuant to this paragraph (A)(3) or paragraph (B) of this Section 2.03 of these Bylaws) shall update and supplement such notice from time to time to the extent necessary so that the information provided or required to be provided in such notice shall be true and correct (x) as of the record date for determining the stockholders entitled to notice of the meeting and (y) as of the date that is fifteen (15) days prior to the meeting or any adjournment or postponement thereof, provided that if the record date for determining the stockholders entitled to vote at the meeting is less than fifteen (15) days prior to the meeting or any adjournment or postponement thereof, the information shall be supplemented and updated as of such later date. Any such update and supplement shall be delivered in writing to the Secretary of the Corporation at the principal executive offices of the Corporation not later than five (5) days after the record date for determining the stockholders entitled to notice of the meeting (in the case of any update and supplement required to be made as of the record date for determining the stockholders entitled to notice of the meeting), not later than ten (10) days prior to the date for the meeting or any adjournment or postponement thereof (in the case of any update or supplement required to be made as of fifteen (15) days prior to the meeting or adjournment or postponement thereof) and not later than five (5) days after the record date for determining the stockholders entitled to vote at the meeting, but no later than the day prior to the meeting or any adjournment or postponement thereof (in the case of any update and supplement required to be made as of a date less than fifteen (15) days prior to the date of the meeting or any adjournment or postponement thereof). The Corporation may require any proposed nominee to furnish such other information as it may reasonably require to determine the eligibility of such proposed nominee to serve as a director of the Corporation and to determine the independence of such director under the Exchange Act and rules and regulations thereunder and applicable stock exchange rules.

(4) This Section 2.03(A) is expressly intended to apply to any business proposed to be brought before an annual meeting other than any proposal made in accordance with Rule 14a-8 under the Exchange Act and included in the Corporation’s proxy statement. Nothing in this Section 2.03 shall be deemed to affect the rights of stockholders to request inclusion of proposals in the Corporation’s proxy statement pursuant to Rule 14a-8 under the Exchange Act.

(B) Special Meetings of Stockholders. Only such business (including the election of specific individuals to fill vacancies or newly created directorships on the Board of Directors) shall be conducted at a special meeting of stockholders as shall have been brought before the meeting pursuant to the Corporation’s notice of meeting. At any time that stockholders are not prohibited from filling vacancies or newly created directorships on the Board of Directors, nominations of persons for the election to the Board of Directors to fill any vacancy or unfilled newly created directorship may be made at a special meeting of stockholders at which any proposal to fill any vacancy or unfilled newly created directorship is to be presented to the stockholders (1) as provided in the Certificate of Incorporation or the Stockholders Agreement, (2) by or at the direction of the Board of Directors or any committee thereof or (3) by any stockholder of the Corporation who is entitled to vote at the meeting on such matters, who (subject to paragraph (C)(4) of this Section 2.03) complies with the notice procedures set forth in paragraphs (A)(2) and (A)(3) of this Section 2.03 and who is a stockholder of record at the time such notice is delivered to the Secretary of the Corporation. The number of nominees a stockholder may nominate for election at the special meeting (or in the case of a stockholder giving the notice on behalf of a beneficial owner, the number of nominees a stockholder may nominate for election at the special meeting on behalf of such beneficial owner) shall not exceed the number of directors to be elected at such special meeting. In the event the Corporation calls a special meeting of stockholders for the purpose of submitting a proposal to stockholders for the election of one or more directors to fill any vacancy or newly created directorship on the Board of Directors, any such stockholder entitled to vote on such matter may nominate a person or persons (as the case may be) for election to such position(s) as specified in the Corporation’s notice of meeting if the stockholder’s notice as required by paragraph (A)(2) of this Section 2.03 shall be delivered to the Secretary at the principal executive offices of the Corporation not earlier than the close of business on the one hundred and twentieth (120th) day prior to such special meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such special meeting or the tenth (10th) day following the day on which the Corporation first makes a public announcement of the date of the special at which directors are to be elected. In no event shall the public announcement of an adjournment or postponement of a special meeting commence a new time period (or extend any time period) for the giving of a stockholder’s notice as described above.

(C) General.

(1) Except as provided in paragraph (C)(4) of this Section 2.03, only such persons who are nominated in accordance with the procedures set forth in this Section 2.03, the Certificate of Incorporation or the Stockholders Agreement shall be eligible to serve as directors and only such business shall be conducted at an annual or special meeting of stockholders as shall have been brought before the meeting in accordance with the procedures set forth in this Section 2.03. Except as otherwise provided by the DGCL, the Certificate of Incorporation or these Bylaws, the Board of Directors and the chairman of the meeting (in addition to making any other determination that may be appropriate for the conduct of the meeting), shall have the power and duty to determine whether a nomination or any business proposed to be brought before the meeting was made or proposed, as the case may be, in accordance with the procedures set forth in these Bylaws and, if any proposed nomination or business is not in compliance with these Bylaws, to declare that such defective proposal or nomination shall be disregarded. The date and time of the opening and the closing of the polls for each matter upon which the stockholders will vote at a meeting shall be announced at the meeting by the chairman of the meeting. The Board of Directors may adopt by resolution such rules and regulations for the conduct of the meeting of stockholders as it shall deem appropriate. Except to the extent inconsistent with such rules and regulations as adopted by the Board of Directors, the chairman of the meeting shall have the right and authority to convene and (for any or no reason) to recess and/or adjourn the meeting, to prescribe such rules, regulations and procedures and to do all such acts as, in the judgment of such chairman, are appropriate for the proper conduct of the meeting. Such rules, regulations or procedures, whether adopted by the Board of Directors or prescribed by the chairman of the meeting, may include, without limitation, the following: (i) the establishment of an agenda or order of business for the meeting, (ii) rules and procedures for maintaining order at the meeting and the safety of those present; (iii) limitations on attendance at or participation in the meeting to stockholders entitled to vote at the meeting, their duly authorized and constituted proxies or such other persons as the chairman of the meeting shall determine; (iv) restrictions on entry to the meeting after the time fixed for the commencement thereof; and (v) limitations on the time allotted to questions or comments by participants and on shareholder approvals. Notwithstanding the foregoing provisions of this Section 2.03, unless otherwise required by the DGCL, if the stockholder (or a qualified representative of the stockholder) does not appear at the annual or special meeting of stockholders of the Corporation to present a nomination or business, such nomination shall be disregarded and such proposed business shall not be transacted, notwithstanding that proxies in respect of such vote may have been received by the Corporation. For purposes of this Section 2.03, to be considered a qualified representative of the stockholder, a person must be a duly authorized officer, manager or partner of such stockholder or must be authorized by a writing executed by such stockholder or an electronic transmission delivered by such stockholder to act for such stockholder as proxy at the meeting of stockholders and such person must produce such writing or electronic transmission, or a reliable reproduction of the writing or electronic transmission, at the meeting of stockholders. Unless and to the extent determined by the Board of Directors or the chairman of the meeting, the meeting of stockholders shall not be required to be held in accordance with the rules of parliamentary procedure.

(2) Whenever used in these Bylaws, “public announcement” shall mean disclosure (a) in a press release released by the Corporation, provided such press release is released by the Corporation following its customary procedures, is reported by the Dow Jones News Service, Associated Press or comparable national news service, or is generally available on internet news sites, or (b) in a document publicly filed by the Corporation with the Securities and Exchange Commission pursuant to Section 13, 14 or 15(d) of the Exchange Act and the rules and regulations promulgated thereunder.

(3) Notwithstanding the foregoing provisions of this Section 2.03, a stockholder shall also comply with all applicable requirements of the Exchange Act and the rules and regulations promulgated thereunder with respect to the matters set forth in this Section 2.03; provided, however, that, to the fullest extent permitted by applicable law, any references in these Bylaws to the Exchange Act or the rules and regulations promulgated thereunder are not intended to and shall not limit any requirements applicable to nominations or proposals as to any other business to be considered pursuant to these Bylaws (including paragraphs (A)(1)(d) and (B) of this Section 2.03), and compliance with paragraphs (A)(1)(d) and (B) of this Section 2.03 of these Bylaws shall be the exclusive means for a stockholder to make nominations or submit other business. Nothing in these Bylaws shall be deemed to affect any rights of the holders of any class or series of stock to elect directors under specified circumstances.

(4) Notwithstanding anything to the contrary contained in this Section 2.03, for as long as the Stockholders Agreement remains in effect with respect to the Principal Stockholder, the Principal Stockholder (to the extent then subject to the Stockholders Agreement) shall not be subject to the notice procedures set forth in paragraphs (A)(2), (A)(3) or (B) of this Section 2.03 with respect to any annual or special meeting of stockholders.

Section 2.04 Notice of Meetings. Whenever stockholders are required or permitted to take any action at a meeting, a notice of the meeting in the form of a writing or by electronic transmission shall be given in the manner provided in Section 232 of the DGCL, which shall state the place, if any, date and time of the meeting, the means of remote communications, if any, by which stockholders and proxy holders may be deemed to be present in person and vote at such meeting, the record date for determining the stockholders entitled to vote at the meeting, if such date is different from the record date for determining stockholders entitled to notice of the meeting, and, in the case of a special meeting, the purpose or purposes for which the meeting is called. Unless otherwise provided by applicable law, the notice of any meeting shall be given not less than ten (10) nor more than sixty (60) days before the date of the meeting to each stockholder entitled to vote at such meeting as of the record date for determining the stockholders entitled to notice of the meeting.

Section 2.05 Quorum. Unless otherwise required by applicable law, the Certificate of Incorporation, these Bylaws or the rules of any stock exchange upon which the Corporation’s securities are listed, the holders of record of a majority of the voting power of the issued and outstanding shares of stock of the Corporation entitled to vote thereat, present in person or represented by proxy, shall constitute a quorum for the transaction of business at all meetings of stockholders. Notwithstanding the foregoing, where a separate vote by a class or series or classes or series is required, a majority in voting power of the outstanding shares of such class or series or classes or series, present in person or represented by proxy, shall constitute a quorum entitled to take action with respect to the vote on that matter. Once a quorum is present to organize a meeting, it shall not be broken by the subsequent withdrawal of any stockholders.

Section 2.06 Voting. Except as otherwise provided by or pursuant to the provisions of the Certificate of Incorporation, each stockholder entitled to vote at any meeting of the stockholders shall be entitled to one vote for each share of stock held by such stockholder that has voting power upon the matters in question. Each stockholder entitled to vote at a meeting of stockholders or to express consent to corporate action without a meeting may authorize another person or persons to act for such stockholder by proxy in any manner provided under Section 212(c) of the DGCL or as otherwise provided under applicable law, but no such proxy shall be voted or acted upon after three years from its date, unless the proxy provides for a longer period. A proxy shall be irrevocable if it states that it is irrevocable and if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power. A stockholder may revoke any proxy that is not irrevocable by attending the meeting and voting in person or by delivering to the Secretary of the Corporation a revocation of the proxy or a new proxy bearing a later date. Unless determined by the chairman of the meeting to be advisable, the stockholder vote on any question need not be by written ballot. On a vote by written ballot, each ballot shall be signed by the stockholder voting, or by such stockholder’s proxy, if there be such proxy. When a quorum is present or represented at any meeting of stockholders, the vote of the holders of a majority of the voting power of the shares of stock present in person or represented by proxy and entitled to vote on the subject matter shall decide any question brought before such meeting, unless the question is one upon which, by express provision of applicable law, of the rules or regulations of any stock exchange applicable to the Corporation, of any regulation applicable to the Corporation or its securities, of the Certificate of Incorporation or of these Bylaws, a different vote is required, in which case such express provision shall govern and control the decision of such question. Notwithstanding the foregoing sentence and subject to the Certificate of Incorporation, all elections of directors shall be determined by a plurality of the votes cast in respect of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors.

Section 2.07 Chairman of Meetings. The Chairman of the Board of Directors, if one is elected, or, in his or her absence or disability, the Chief Executive Officer of the Corporation, or in the absence of the Chairman of the Board of Directors and the Chief Executive Officer, a person designated by the Board of Directors shall be the chairman of the meeting and, as such, preside at the meeting of the stockholders.

Section 2.08 Secretary of Meetings. The Secretary of the Corporation shall act as Secretary at all meetings of the stockholders. In the absence or disability of the Secretary, the Chairman of the Board of Directors or the Chief Executive Officer shall appoint a person to act as Secretary at such meetings.

Section 2.09 Consent of Stockholders in Lieu of Meeting. Unless otherwise restricted by the Certificate of Incorporation, any action required or permitted to be taken at any annual or special meeting of stockholders of the Corporation may be taken without a meeting, without prior notice and without a vote in accordance with applicable law.

Section 2.10 Adjournment. At any meeting of stockholders of the Corporation, if less than a quorum be present, the chairman of the meeting or stockholders holding a majority in voting power of the shares of stock of the Corporation, present in person or by proxy and entitled to vote thereon, shall have the power to adjourn the meeting from time to time without notice other than announcement at the meeting of the time and place, if any, of such adjourned meeting, and the means of remote communication, if any, by which stockholders and proxy holders may be deemed to be present in person or proxy and vote at such adjourned meeting until a quorum shall be present. Any business may be transacted at the adjourned meeting that might have been transacted at the meeting originally noticed. If the adjournment is for more than thirty (30) days, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting. If after the adjournment a new record date for determination of stockholders entitled to vote is fixed for the adjourned meeting, the Board of Directors shall fix a new record date for determining stockholders entitled to notice of such adjourned meeting the same or an earlier date as that fixed for determination of stockholders entitled to vote at the adjourned meeting, and shall give notice of the adjourned meeting to each stockholder of record entitled to vote at such adjourned meeting as of the record date so fixed for notice of such adjourned meeting.

Section 2.11 Remote Communication. If authorized by the Board of Directors in its sole discretion, and subject to such guidelines and procedures as the Board of Directors may adopt, stockholders and proxy holders not physically present at a meeting of stockholders may, by means of remote communication:

(a) participate in a meeting of stockholders; and

(b) be deemed present in person and vote at a meeting of stockholders whether such meeting is to be held at a designated place or solely by means of remote communication;

provided, that

(i) the Corporation shall implement reasonable measures to verify that each person deemed present and permitted to vote at the meeting by means of remote communication is a stockholder or proxy holder;