Form 8-K Colony Capital, Inc. For: Feb 25

| ||||||||

Exhibit 99.1

COLONY CAPITAL ANNOUNCES FOURTH QUARTER AND FULL YEAR 2020 FINANCIAL RESULTS

Boca Raton, February 25, 2021 - Colony Capital, Inc. (NYSE: CLNY) and subsidiaries (collectively, “Colony Capital,” or the “Company”) today announced financial results for the fourth quarter and full year ended December 31, 2020. The Company reported fourth quarter 2020: (i) total revenues of $339 million, (ii) GAAP net income attributable to common stockholders of $(141) million, or $(0.30) per share and (iii) Core FFO excluding gains/losses of $18.2 million, or $0.03 per share, and full year 2020: (i) total revenues of $1.2 billion, (ii) GAAP net income attributable to common stockholders of $(2.8) billion, or $(5.81) per share and (iii) Core FFO excluding gains/losses of $46.7 million, or $0.09 per share. Beginning in the fourth quarter 2020 Core FFO excludes results from discontinued operations, which was applied to prior periods.

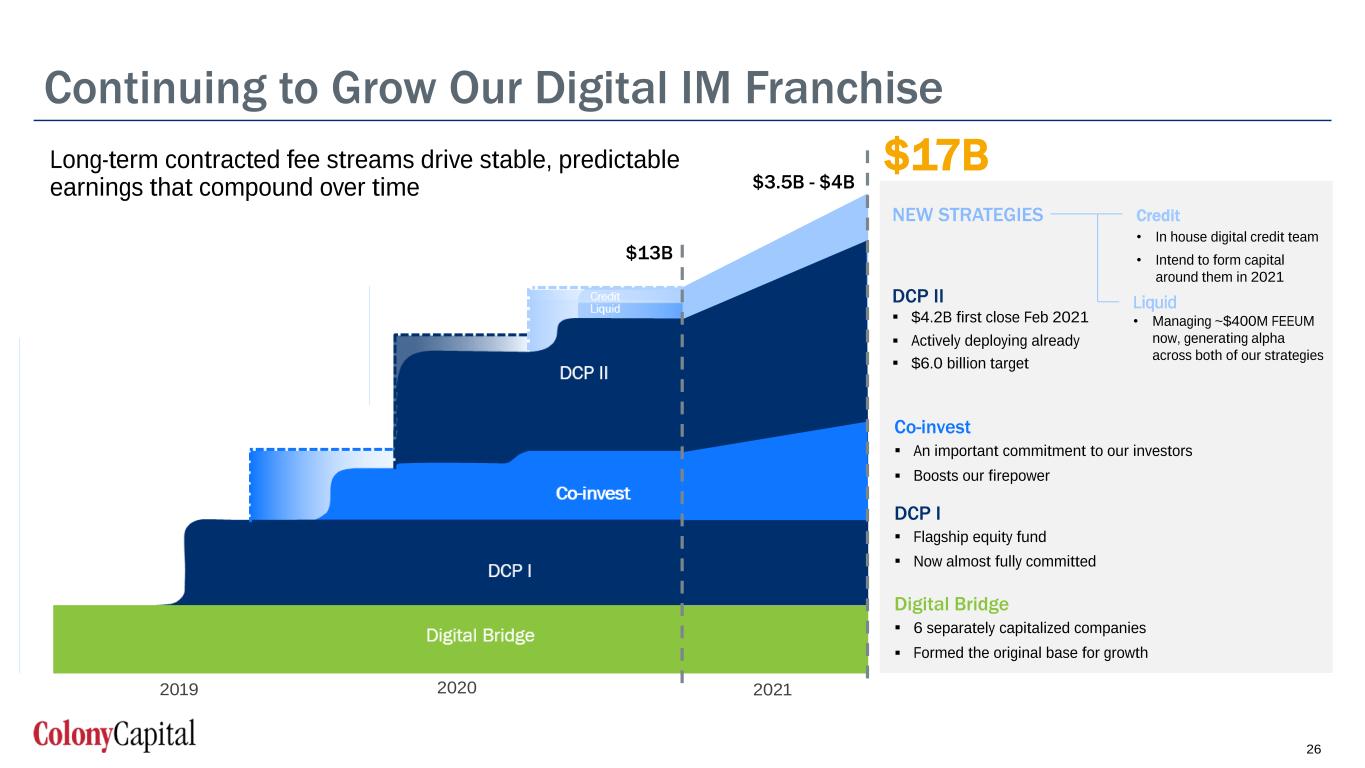

“We made transformational progress in 2020 towards our digital rotation, capped off by the first closing of DCP II at $4.2 billion earlier this year. The digital rotation is manifesting itself in our earnings, assets, and employees,” said Marc Ganzi, President and Chief Executive Officer. "Thanks to our amazing team, we delivered on all of the key pillars of that transition, despite the pressures of the pandemic. That foundational work positions us to capitalize on the powerful secular tailwinds supporting the continued growth and investment in digital infrastructure. We are looking forward to 2021 and the opportunity to collaborate with our partner companies and customers to build the next-generation networks connecting enterprises and consumers globally."

4Q 2020 HIGHLIGHTS

Consecutive Quarter of Positive Core FFO

•Positive Core FFO excluding gains/losses of $18.2 million reflecting the results of continuing operations.

•Continued strong performance from the Digital segments and lower corporate expenses with earnings rotation through divestment of legacy businesses and assets.

Digital Offense

•Digital AUM rose to $30.0 billion or 58% of total AUM.

•In early 2021, the Company held a first closing of $4.2 billion on DCP II, the follow-on to our flagship digital equity fund. DCP II has a target capital raise of $6 billion.

•DataBank completed the acquisition of zColo at a $1.4 billion valuation with the Company maintaining its 20% interest for a $145 million equity investment alongside $575 million of new third-party co-invest capital.

•Vantage raised $1.3 billion in securitized notes to refinance existing debt on highly attractive terms, decreasing its overall cost of debt, extending term, and enhancing investor returns.

•In February 2021, DataBank raised $658 million in securitized notes to refinance existing debt, extending its debt maturities and lowering its overall cost of debt. This securitization represents the first of its kind in the enterprise data center sector.

| Financial Summary | |||||||||||||||||

| ($ in millions, except per share data and where noted) | |||||||||||||||||

| Revenues | 4Q 2020 | 4Q 2019 | FY 2020 | FY 2019 | |||||||||||||

| Property operating income | $270 | $193 | $936 | $737 | |||||||||||||

| Interest income | 10 | 45 | 80 | 167 | |||||||||||||

| Fee income | 47 | 46 | 178 | 224 | |||||||||||||

| Other income | 12 | 15 | 42 | 79 | |||||||||||||

| Total revenues | $339 | $299 | $1,236 | $1,207 | |||||||||||||

| Net income to common stockholders | $(141) | $(26) | $(2,751) | $(1,152) | |||||||||||||

| Core FFO | $(52) | $0 | $(267) | $55 | |||||||||||||

| Core FFO per share | $(0.10) | $0.00 | $(0.50) | $0.10 | |||||||||||||

| Core FFO excluding gains/losses | $18 | $21 | $47 | $99 | |||||||||||||

| Core FFO excluding gains/losses per share | $0.03 | $0.04 | $0.09 | $0.19 | |||||||||||||

| Balance Sheet & Other | 12/31/20 | 12/31/19 | |||||||||||||||

Liquidity (cash & undrawn RCF)(1) | $737 | $1,634 | |||||||||||||||

| Digital AUM (in billions) | $30.0 | $13.8 | |||||||||||||||

| % of Total AUM | 58% | 33% | |||||||||||||||

________________________________________________

Note: Revenues are consolidated while Core FFO and Liquidity are CLNY OP share

(1) RCF maximum availability was $450 million as of December 31, 2020 and $750 million as of December 31, 2019.

1

| ||||||||

2020 YEAR IN REVIEW – TRANSFORMATIONAL PROGRESS

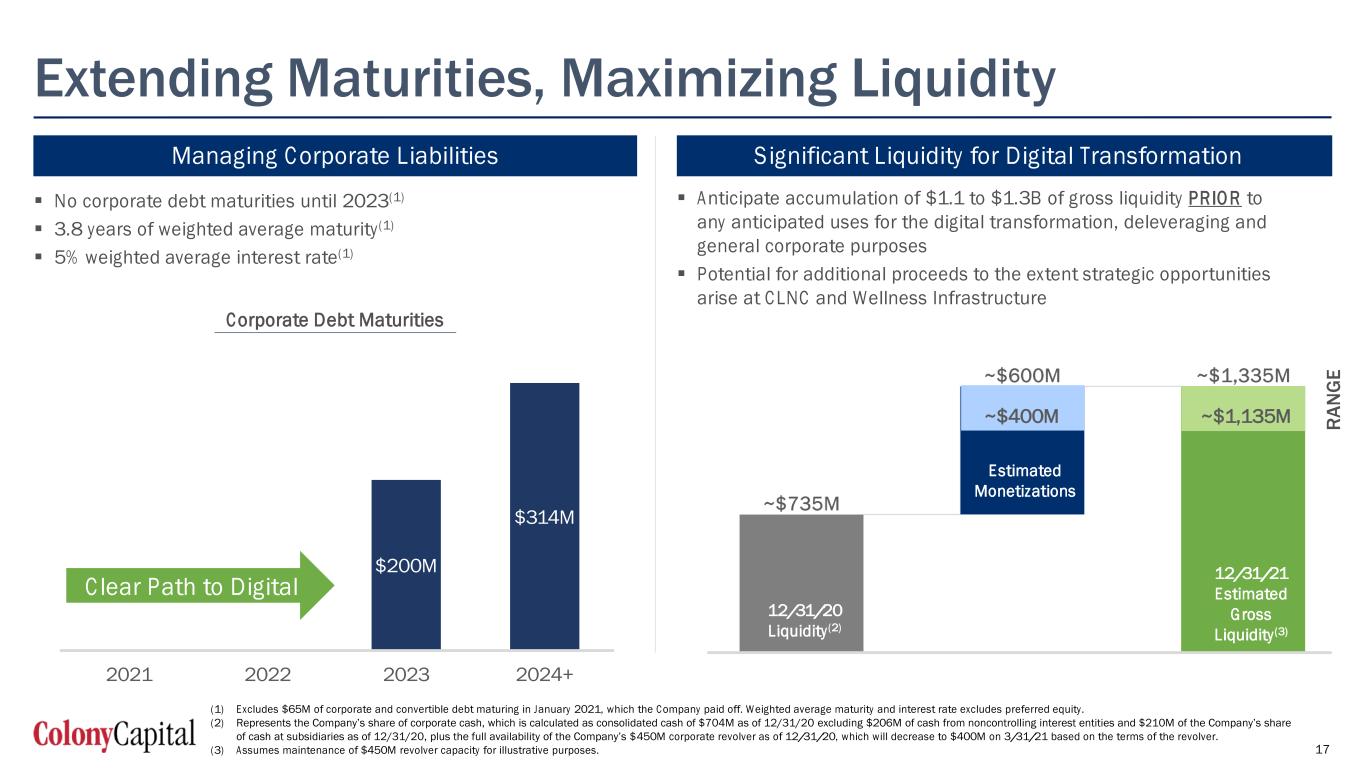

•Built Liquidity and Strengthened Capital Structure:

◦Amended and repaid corporate revolver and fully repaid January 2021 convertible notes resolving near-term corporate debt maturities

◦Finalized strategic investment from Wafra, which has already boosted its overall investment and commitment from $400 million to over $500 million

◦Ended the year with $737 million of liquidity between corporate cash-on-hand and the Company’s corporate revolver

•Harvested Legacy Assets and Streamlined the Organization:

◦Reached an agreement to sell its hospitality portfolios in a transaction valued at $2.8 billion, including $67.5 million of gross proceeds on a consolidated basis and the reduction of $2.7 billion in consolidated debt

◦Monetized $698 million of Other Equity & Debt (OED) assets, achieving the high end of the Company's monetization guidance of $600 to $700 million

◦Eliminated $55 million of annualized run-rate legacy costs significantly exceeding the $40 million target

•Invested in High Quality Digital Assets:

◦Anchored by key strategic investments in DataBank and Vantage Stabilized Data Centers (Vantage SDC), the Company now owns or has committed approximately $900 million of equity capital in digital operating and GP co-investments

◦Annualized fourth quarter 2020 Consolidated Digital Operating Adjusted EBITDA of $244 million, or $39 million CLNY OP share, which is expected to ramp through a combination of organic and external growth

•Rapidly Grew Digital Investment Management:

◦Raised $7.4 billion of new fee-bearing third-party capital through flagship equity, co-invest, and liquid securities strategies representing net growth of 90% of December 31, 2019 FEEUM, far exceeding original 2020 guidance of 15%

◦Significant contribution from the successful $4.2 billion first closing of the Company's second flagship digital equity fund, DCP II

•Executive Leadership and Board of Director Updates:

◦Marc Ganzi assumed the role of President and CEO and Jacky Wu assumed the role of CFO on July 1, 2020, finalizing the transition to a digital-focused management team

◦Appointed three distinguished independent board members to the Company's Board with significant experience in technology and telecommunications with the addition of Jeannie Diefenderfer (2020), Gregory McCray (2021) and J. Braxton Carter (effective March 2, 2021)

◦Mr. Carter was appointed to the Board of Directors on February 23, 2021. He most recently served as the Chief Financial Officer of T-Mobile US Inc. (NASD:TMUS) until his retirement in July 2020. The Company expects to benefit from his extensive senior management experience in the wireless and telecommunications industry.

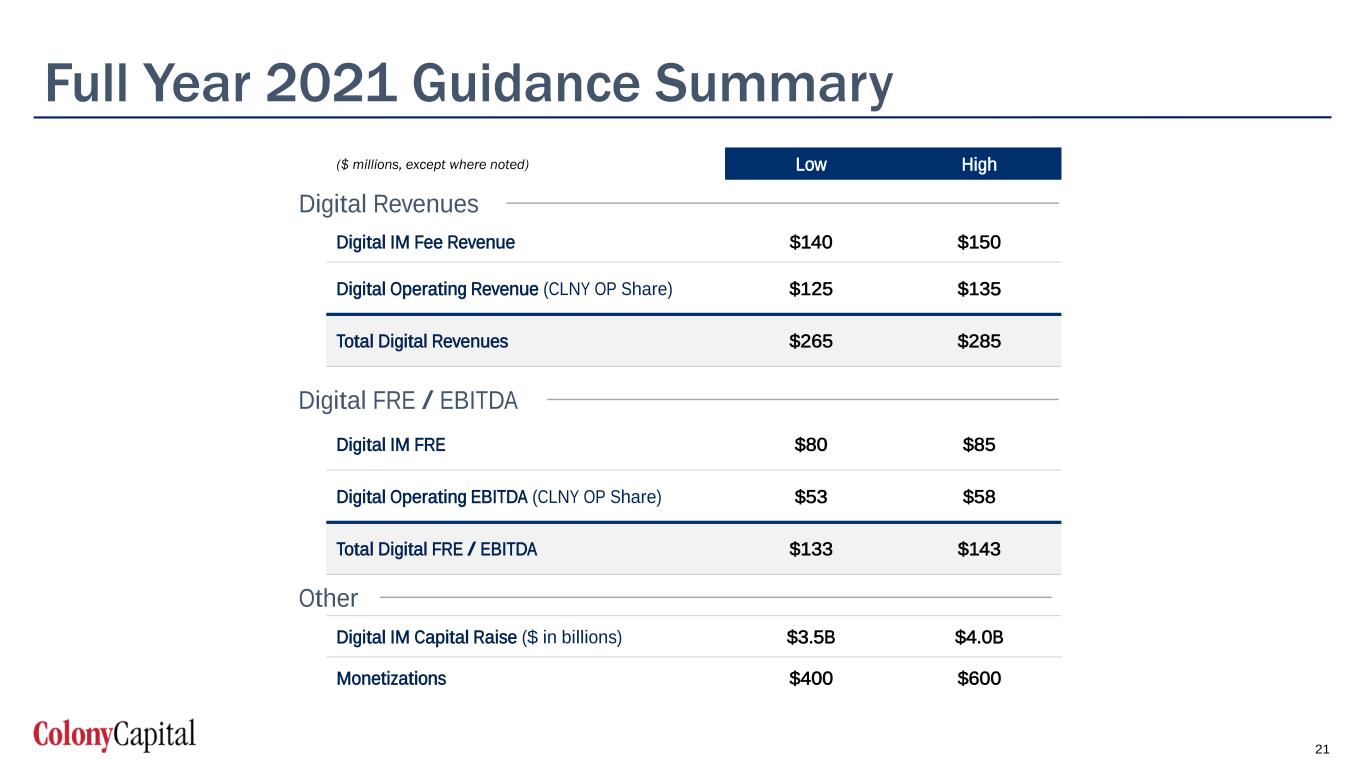

FULL YEAR 2021 GUIDANCE

The Company is re-initiating annual guidance for the key drivers of its digital transformation, subject to our current view of existing market conditions and assumptions for the year ending December 31, 2021, including, among others, that the decline in COVID-19 cases and the deployment of vaccines across the globe continue successfully. There can be no assurance that actual amounts will not be materially higher or lower than these expectations. Readers should refer to the discussion in the Cautionary Statement Regarding Forward-Looking Statements section at the end of this press release.

| Full Year 2021 Guidance | |||||||||||||||||

| ($ in millions, except where noted) | Low | High | |||||||||||||||

| Digital IM Capital Raise ($ in billions) | $3.5 | $4.0 | |||||||||||||||

| Digital IM Revenue | 140 | 150 | |||||||||||||||

| Digital IM FRE | 80 | 85 | |||||||||||||||

| Digital Operating Revenue | 125 | 135 | |||||||||||||||

| Digital Operating EBITDA | 53 | 58 | |||||||||||||||

| Other Monetizations | 400 | 600 | |||||||||||||||

2

| ||||||||

Digital Investment Management (IM)

During the fourth quarter 2020, the Digital IM segment generated revenues of $24.4 million, net income attributable to common stockholders of $3.6 million and Core FFO of $1.0 million. Fee Related Earnings (FRE) was $4.6 million, or $10.3 million excluding $5.7 million of the $7.7 million one-time incentives driven by the outperformance of key digital capital formation targets ($2 million of the one-time incentives are reported in the unallocated segment).

•Revenues: Total Digital IM revenues were $25.2 million (inclusive of $0.9 million of fee income that is eliminated in our consolidated results because we consolidate certain limited partner interests), which represents a 27% year-over-year (YoY) increase. Approximately $4 million of the increase resulted from a partial quarter contribution from DCP II, which would have been $10 million on a full quarter run-rate basis.

•FRE Margins: FRE margin of 41% for 4Q20. On a pro forma basis assuming a full quarter of fees from DCP II's first closing and adjusted for the one-time performance incentive, FRE margins would have been 52%.

•FEEUM: FEEUM increased 88% YoY to $12.8 billion driven principally by $5.2 billion of capital closed in the fourth quarter, including from DCP II and capital raised for the Vantage entities, zColo and liquid securities strategies.

| Digital IM Summary | ||||||||||||||

| ($ in millions, except where noted) | ||||||||||||||

| 4Q 2020 | 4Q 2019 | |||||||||||||

| Revenue | $ | 24.4 | $ | 19.8 | ||||||||||

FRE(1) | 10.3 | 12.3 | ||||||||||||

Core FFO(1)(2) | 1.0 | 10.7 | ||||||||||||

| AUM (in billions) | 28.6 | 13.5 | ||||||||||||

| FEEUM (in billions) | 12.8 | 6.8 | ||||||||||||

| W.A. Management Fee % | 0.9 | % | 1.0 | % | ||||||||||

________________________________________________

Note: All figures are consolidated except Core FFO

(1) 4Q20 FRE excludes a $5.7 million consolidated one-time performance incentive related to the successful first closing of DCP II, while 4Q20 Core FFO includes this one-time performance incentive ($4.9 million CLNY OP share).

(2) 4Q20 Core FFO represents the Company’s 68.5% share after the strategic Wafra investment on July 17, 2020.

3

| ||||||||

Digital Operating

The Digital Operating segment details the financial performance of the digital infrastructure operating companies in which the Company maintains balance sheet investments. The Company currently owns a 20% interest in DataBank, and a 13% interest in Vantage SDC, a portfolio of stabilized data centers acquired from Vantage Data Centers. The financial results of these interests are presented on a consolidated basis (e.g. Revenue and Adjusted EBITDA) while Core FFO represents CLNY OP's share. Further detail on CLNY OP's share of the financial results is presented in the Company’s quarterly Supplemental Financial Report. Third-party interests in DataBank and Vantage are managed within the Company’s Digital IM segment.

DataBank completed the acquisition of zColo, a portfolio of 44 data centers from Zayo Group Holdings, Inc., for total consideration of $1.4 billion including $725 million of acquisition financing and capital lease obligations and $720 million of equity. The Company raised $575 million of third-party co-invest capital and invested approximately $145 million to maintain its 20% ownership interest in DataBank.

In October 2020, Vantage SDC raised $1.3 billion in securitized notes at a blended interest rate of 1.8% primarily to refinance existing debt, extending its debt maturities and lowering its overall cost of debt.

In February 2021, DataBank priced a $658 million offering of securitized notes at a blended interest rate of 2.3% primarily to refinance existing debt, extending its debt maturities and lowering its overall cost of debt. This securitization represents the first of its kind in the enterprise data center sector.

During the fourth quarter 2020, the Digital Operating segment generated revenues of $127.5 million, net income attributable to common stockholders of $(7.4) million, Adjusted EBITDA of $60.5 million and Core FFO of $6.9 million. Fourth quarter 2020 Digital Operating segment includes a partial quarter of results from zColo, which was acquired on December 14, 2020. The Company acquired its first digital operating company interest in December 2019 with the acquisition of a 20% stake in DataBank and did not have interest in Vantage SDC or zColo in the prior year period.

•Solid Operating Company Growth: On a consolidated basis, the Digital Operating segment generated $127.5 million of revenues and $60.5 million of adjusted EBITDA based on a full quarter of contribution from DataBank and Vantage SDC and a partial quarter contribution from zColo.

•CLNY OP's share of revenues and adjusted EBITDA was $21.0 million and $9.9 million, respectively, which represents a 47% EBITDA margin.

•Although the Company only had a partial quarter of ownership in DataBank in the prior period, operating metrics for the comparative prior period are presented as if both DataBank and Vantage SDC were owned for the full fourth quarter of 2019 for comparative purposes.

•Utilization rate, MRR and Churn improved on a YoY basis as both DataBank and Vantage SDC have successfully leased up their data centers while experiencing lower tenant turnover. MRR decreased on a YoY basis principally as certain data centers have leased up to stabilized capacity.

| Digital Operating Summary | ||||||||||||||

| ($ in millions, except where noted) | ||||||||||||||

4Q 2020(1) | 4Q 2019(2) | |||||||||||||

| Revenue | $127.5 | $6.0 | ||||||||||||

| Adjusted EBITDA | 60.5 | 2.5 | ||||||||||||

| Core FFO | 6.9 | 0.2 | ||||||||||||

Metrics(3) | ||||||||||||||

| Number of Data Centers | 32 | 31 | ||||||||||||

| Max Critical I.T. SF | 1,138,048 | 1,082,161 | ||||||||||||

| Leased SF | 967,879 | 896,465 | ||||||||||||

| % Utilization Rate | 85.0% | 82.8% | ||||||||||||

| MRR (Annualized) | $442.0 | $387.0 | ||||||||||||

| Bookings (Annualized) | $6.0 | $17.0 | ||||||||||||

| Quarterly Churn (% of Prior Quarter MRR) | 0.9% | 1.6% | ||||||||||||

________________________________________________

Note: All figures are consolidated except for Core FFO

(1) Fourth quarter 2020 Digital Operating segment includes a partial quarter of results from zColo, which DataBank acquired on December 14, 2020.

(2) The Company acquired a 20% stake in DataBank in December 2019 and did not have interest in Vantage SDC or zColo in the fourth quarter 2019.

(3) Operating metrics exclude zColo data given recent acquisition on December 14, 2020 and therefore minimal contribution to the metrics. The metrics do include a full quarter of operating data for DataBank and Vantage SDC given a full quarter of ownership during 4Q 2020 and corresponding data is presented for the prior year period for comparative purposes.

4

| ||||||||

Digital Other

This segment is composed of equity interests in digital investment vehicles managed by the Company, the majority of which are in DCP I and DCP II, the Company’s flagship digital infrastructure private equity vehicles. This segment also includes the Company’s investment and commitment to the digital liquid strategies and seed investments for future digital investment vehicles.

The Company’s aggregate exposure to the Digital Other segment is approximately $315 million, of which $164 million has been funded to date. In addition, Wafra has committed $259 milllion to funds comprising the Digital Other segment.

During the fourth quarter, the Company originated a $31 million senior term loan to a U.K. broadband provider, which the Company expects to contribute to a future digital credit investment vehicle.

During the fourth quarter 2020, the Digital Other segment generated net income attributable to common stockholders of $9.0 million and Core FFO of $10.0 million. Core FFO was primarily composed of an increase in the fair value of the Company's interest in DCP I, which experienced strong underlying portfolio company performance, with additional contribution from interest on the new Digital loan and mark-to-market gains and losses from the digital liquid investments.

| Digital Other Summary | ||||||||||||||

| ($ in millions, except where noted) | ||||||||||||||

| 4Q 2020 | 4Q 2019 | |||||||||||||

| Revenue | $ | 2.6 | $ | — | ||||||||||

| Equity Method Earnings | 9.9 | (4.3) | ||||||||||||

| Other Gain/Loss | 7.4 | — | ||||||||||||

| Core FFO | 10.0 | (4.3) | ||||||||||||

________________________________________________

Note: All figures are consolidated except for Core FFO

5

| ||||||||

Wellness Infrastructure

During the fourth quarter, the Wellness Infrastructure segment generated revenues of $121.1 million, net income attributable to common stockholders of $(6.6) million and Core FFO of $18.6 million. Fourth quarter results included $4.1 million of consolidated, or $2.9 million CLNY OP share, one-time recovery of tenant rent receivables.

Despite the ongoing impacts of the COVID-19 pandemic, overall same-store NOI (which excludes the benefit from the one-time recovery of tenant rent receivables) was up $0.8 million, or 1.3%, from third quarter 2020. This increase was primarily due to better results in the medical office building (MOB) portfolio and the NNN portfolios due to lower expenses and increased rents, partially offset by decreased NOI in the senior housing operating properties (SHOP) portfolio due to lower occupancy resulting from COVID-19.

Portfolio Performance

•Decrease in revenues YoY was primarily due to portfolio sales and transfers and to a lesser degree, the impact of COVID-19 on the SHOP portfolio.

•Improving contractual rent collections at 99% received in the fourth quarter across the NNN and MOB portfolios, which represents 85% of total segment NOI.

•Same-store NOI decreased $6.9 million, or 10%, YoY to $61.7 primarily due to the impact of COVID-19 on the SHOP portfolio and weaker results in the Hospital portfolio. However, same-store NOI was stable compared to the prior quarter as noted above.

•Core FFO increased $1.0 million YoY to $18.6 million primarily due to lower interest expense from a decrease in LIBOR, less debt from sales and lower investment & servicing and general & administrative expenses, partially offset by a decrease in NOI from sales and transfers and the impact of COVID-19 on occupancy levels and operating expenses.

| Wellness Infrastructure Summary | ||||||||||||||

| ($ in millions) | 4Q 2020 | 4Q 2019 | ||||||||||||

| Revenue | $ | 121.1 | $ | 154.4 | ||||||||||

| NOI | 65.6 | 76.6 | ||||||||||||

| Interest Expense | 31.3 | 41.9 | ||||||||||||

Core FFO(1) | 18.6 | 17.6 | ||||||||||||

| Same Store NOI | 61.7 | 68.6 | ||||||||||||

________________________________________________

Note: All figures are consolidated except for Core FFO

(1) Beginning in the third quarter of 2020, the Company applied a new methodology for allocating compensation and administrative expenses across individual reportable segments. The new methodology was applied to prior periods.

Capital Structure & Activity

•Disposed of five skilled nursing facilities, which had $45 million of defaulted consolidated debt. Net sale proceeds were $2.5 million after the repayment of debt.

6

| ||||||||

Other

This segment is composed of other equity and debt investments (OED) and the Company’s non-digital investment management business (Other IM). OED encompasses a diversified group of non-digital real estate and real estate-related equity and debt investments, including shares in Colony Credit Real Estate, Inc (NYSE: CLNC). Over the course of the next twenty-four months, the Company expects to monetize the bulk of its OED portfolio as it completes its digital transformation.

Other IM encompasses the Company’s management of private real estate credit funds and related co-investment vehicles, CLNC, and NorthStar Healthcare Income, Inc., a public non-traded healthcare REIT. Many of the investments underlying these vehicles are co-owned by the Company’s balance sheet and reported under OED. The Company earns management fees, generally based on the amount of assets or capital managed, and contractual incentive fees or potential carried interest based on the performance of the investment vehicles managed subject to achievement of minimum return hurdles.

During the fourth quarter, the Other segment generated revenues of $62.3 million, net income attributable to common stockholders of $(32.0) million and Core FFO ex-gains/losses of $26.8 million. Core FFO excluding gains/losses decreased YoY due to: 1) lower Core FFO from Other IM which included $20 million of net carried interest in the fourth quarter 2019 primarily related to the sale of the Company’s light industrial portfolio, 2) the continued monetization of OED investments, and 3) decrease in CLNC Distributable Earnings, of which the Company absorbs its proportionate share of earnings based on the percent of CLNC shares it owns.

| Legacy Other Summary | ||||||||||||||

| ($ in millions) | 4Q 2020 | 4Q 2019 | ||||||||||||

| Revenue | $ | 62.3 | $ | 114.9 | ||||||||||

| Equity method earnings | (146.0) | 47.9 | ||||||||||||

| Core FFO | (43.1) | 36.0 | ||||||||||||

| Core FFO excluding gains/losses | 26.8 | 57.4 | ||||||||||||

________________________________________________

Note: All figures are consolidated except for Core FFO

Other Equity and Debt ("OED")

•Continued monetizations: $311 million of monetizations in the fourth quarter bringing full year 2020 Other monetizations to $698 million (including the RXR divestiture in the first quarter 2020). The Company achieved the high end of its 2020 target of $600-700 million of monetizations. Notable fourth quarter monetizations included: the Cortland multifamily preferred equity with net proceeds of $125 million; our 51% interest in a portfolio of bulk industrial assets with net proceeds of $85 million; the Origination DrillCo joint venture financing with net proceeds of $50 million; and a $30 million discounted payoff on a mortgage secured by retail properties.

•THL Hotel Portfolio: This portfolio is included in the overall sale of hospitality portfolios to Highgate and is classified in discontinued operations for the fourth quarter, but the related book value is included in the OED table below.

•Impairments and Core FFO excluding Gains/Losses: The Company recorded impairments of $16 million consolidated, or $7million CLNY OP share, which are added back in FFO and Core FFO. Core FFO also included net investment losses of $70 million, of which $18 million is our share of losses from CLNC’s Distributable Earnings and the remainder is our share of net investment losses and impairments primarily from European and oil and gas investments. These net investment losses were recorded within equity method earnings; other gain (loss), net; and gain on sale of real estate assets (net of depreciation, amortization and impairment previously adjusted for FFO) line items on the Company’s consolidated statement of operations.

7

| ||||||||

| OED Summary | ||||||||||||||||||||||||||

| CLNY OP Share | ||||||||||||||||||||||||||

| Depreciated Carrying Value | ||||||||||||||||||||||||||

| ($ in millions) | 12/31/2020 | |||||||||||||||||||||||||

| Investment | Investment Type | Property Type | Geography | CLNY Ownership %(1) | Assets(2) | Equity(2) | % of Total Equity | |||||||||||||||||||

| Colony Credit Real Estate, Inc. (CLNC) | Public Company Common Shares | Various | Various | 36% | $ | 385.2 | $ | 385.2 | 29 | % | ||||||||||||||||

| Tolka Irish NPL Portfolio | Non-Performing First Mortgage Loans | Primarily Office | Ireland | 100% | 404.6 | 173.4 | 13 | % | ||||||||||||||||||

| Ronan CRE Portfolio Loan | Mezzanine Loan | Office, Residential, Mixed-Use | Ireland / France | 50% | 70.3 | 70.3 | 5 | % | ||||||||||||||||||

| Spencer Dock Loan | Mezzanine Loan with Profit Participation | Office, Hospitality & Residential | Ireland | 20% | 52.5 | 52.5 | 4 | % | ||||||||||||||||||

| McKillin Portfolio Loan | Debt Financing | Office and Personal Guarantee | Primarily US and UK | 96% | 51.5 | 51.5 | 4 | % | ||||||||||||||||||

| France & Spain CRE Portfolio | Real Estate Equity | Primarily Office & Hospitality | France & Spain | 33% | 123.3 | 48.4 | 4 | % | ||||||||||||||||||

| Maranatha French Hotel Portfolio | Real Estate Equity | Hospitality | France | 44% | 47.9 | 47.2 | 4 | % | ||||||||||||||||||

| Albertsons | Equity | Grocery Stores | Nationwide | n/a | 41.2 | 41.2 | 3 | % | ||||||||||||||||||

| AccorInvest | Real Estate Equity | Hospitality | Primarily Europe | 1% | 37.7 | 37.7 | 3 | % | ||||||||||||||||||

| Dublin Docklands | Senior Loan with Profit Participation | Office & Residential | Ireland | 15% | 32.5 | 32.5 | 2 | % | ||||||||||||||||||

| Remaining OED (>35 Investments) | Various | Various | Various | Various | 1,081.4 | 383.9 | 29 | % | ||||||||||||||||||

| Total Other Equity and Debt | $ | 2,328.1 | $ | 1,323.8 | 100 | % | ||||||||||||||||||||

________________________________________________

(1) Ownership % represents CLNY OP’s share of the entire investment accounting for all non-controlling interests including interests managed by the Company and other third parties.

(2) Beginning in the fourth quarter of 2020, the Company included the net assets of investments, which includes cash and cash equivalents, restricted cash, other assets, and accrued and other liabilities of each investment. For prior periods, net assets of investments were included in the total net assets of the Company presented in the Financial Overview - Summary of Segments section of the Company's Supplemental Financial Report.

Other Investment Management

The Company’s non-digital investment management business had FEEUM of $7.2 billion as of December 31, 2020, a decline of 21% from the prior year due principally to asset sales in legacy funds and a decrease in the net asset value of NorthStar Healthcare Income.

| Other IM Summary | ||||||||||||||

| ($ in billions) | ||||||||||||||

| 4Q 2020 | 4Q 2019 | |||||||||||||

| AUM (in billions) | 13.4 | 15.5 | ||||||||||||

| FEEUM (in billions) | 7.2 | 8.9 | ||||||||||||

| W.A. Management Fee % | 1.1 | % | 1.1 | % | ||||||||||

8

| ||||||||

Discontinued Operations

In September, the Company entered into a definitive agreement to sell five of the six hotel portfolios in its Hospitality segment and its 55% interest in the THL Hotel Portfolio totaling 197 hotel properties. The sixth hotel portfolio is under receivership and the other 45% interest in the THL Hotel Portfolio continues to be held by investment vehicles managed by the Company. The transaction is valued at approximately $2.8 billion and acquirer's assumption of $2.7 billion of consolidated investment-level debt. Consummation of the sale is subject to customary closing conditions, including but not limited to, acquirer’s assumption of the outstanding mortgage notes encumbering the hotel properties and third-party approvals. In October, the parties amended the sale agreement to address certain payments made by the Company to lenders in order to cure debt default on a portfolio, and, subject to the satisfaction of certain conditions, to provide the Company with a purchase price credit for a portion of such funded amount. The sale is expected to close during the first half of 2021. There can be no assurance that the sale will close in the timeframe contemplated or on the terms anticipated, if at all.

The Company’s pending exit from the hospitality business represents a key milestone in its digital transformation. The sale of these hotel portfolios is a strategic shift that will have a significant effect on the Company’s operations and financial results, and has met the criteria as held for sale and discontinued operations. For all current and prior periods presented, the related assets and liabilities are presented as assets and liabilities held for disposition on the consolidated balance sheets and the related operating results are presented as loss from discontinued operations on the consolidated statement of operations.

In December 2019, the Company completed the sale of the light industrial portfolio and its related management platform, which represented the vast majority of the former industrial segment. The Company continued to own the bulk industrial assets which it monetized in December 2020. For the fourth quarter 2020, the bulk industrial portfolio was held for sale and presented as discontinued operations on the consolidated statements of operations.

Other Corporate Matters

Convertible Senior Notes

In January 2021, the Company’s 3.875% convertible senior notes matured and the remaining balance of $32 million was paid off.

Corporate Revolving Credit Facility (“RCF”)

In December 2020, the Company reduced the revolver capacity from $500 million to $450 million due to the successful monetization of certain OED assets which serve as borrowing base collateral. In conjunction, the Company exercised its first six-month option to extend the maturity to July 11, 2021 with one six-month extension option remaining. The RCF is undrawn and the Company is in full compliance with the RCF covenants and terms.

Common Stock and Operating Company Units

As of February 22, 2021, the Company had 484.2 million shares of Class A and B common stock outstanding and the Company’s operating partnership had 51.1 million operating company units outstanding and held by members other than the Company.

Preferred Dividends

On November 5, 2020, the Company’s Board declared cash dividends with respect to each series of the Company’s cumulative redeemable perpetual preferred stock in accordance with the terms of such series, as follows: with respect to each of the Series G preferred stock: $0.46875 per share; Series H preferred stock: $0.4453125 per share; Series I preferred stock: $0.446875 per share; and Series J preferred stock: $0.4453125 per share, such dividends were paid on January 15, 2021 to the respective stockholders of record on January 11, 2021.

On February 23, 2021, the Company’s Board declared cash dividends with respect to each series of the Company’s cumulative redeemable perpetual preferred stock in accordance with the terms of such series, as follows: with respect to each of the Series G preferred stock: $0.46875 per share; Series H preferred stock: $0.4453125 per share; Series I preferred stock: $0.446875 per share; and Series J preferred stock: $0.4453125 per share, such dividends will be paid on April 15, 2021 to the respective stockholders of record on April 12, 2021.

9

| ||||||||

Fourth Quarter 2020 Conference Call

The Company will conduct an earnings presentation and conference call to discuss the financial results on Thursday, February 25, 2021 at 7:00 a.m. PT / 10:00 a.m. ET. The earnings presentation will be broadcast live over the Internet and can be accessed on the Shareholders section of the Company’s website at www.clny.com.

The earnings presentation will be broadcast live over the Internet and can be accessed on the Shareholders section of the Company’s website at ir.clny.com/events. A webcast of the presentation and conference call will be available for 90 days on the Company’s website. To participate in the event by telephone, please dial (877) 407-4018 ten minutes prior to the start time (to allow time for registration). International callers should dial (201) 689-8471.

For those unable to participate during the live call, a replay will be available starting February 25, 2021, at 10:00 a.m. PT / 1:00 p.m. ET, through March 4, 2021, at 8:59 p.m. PT / 11:59 p.m. ET. To access the replay, dial (844) 512-2921 (U.S.), and use passcode 13715584. International callers should dial (412) 317-6671 and enter the same conference ID number.

Earnings Presentation and Supplemental Financial Report

A Fourth Quarter 2020 Earnings Presentation and Supplemental Financial Report is available in the Events & Presentations and Financial Information sections, respectively, of the Shareholders tab on the Company’s website at www.clny.com. This information has also been furnished to the U.S. Securities and Exchange Commission in a Current Report on Form 8-K.

About Colony Capital, Inc.

Colony Capital, Inc. (NYSE: CLNY) is a leading global investment firm with a heritage of identifying and capitalizing on key secular trends in real estate. The Company manages an approximately $52 billion portfolio of real assets on behalf of its shareholders and limited partners, including $30 billion in digital real estate investments through Digital Colony, its digital infrastructure platform. Colony Capital, structured as a REIT, is headquartered in Boca Raton with key offices in Los Angeles, New York, and London, and has over 350 employees across 18 locations in 12 countries. For more information on Colony Capital, visit www.clny.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the Company’s control, and may cause the Company’s actual results to differ significantly from those expressed in any forward-looking statement. Factors that might cause such a difference include, without limitation, the impact of COVID-19 on the global economy, including the Company’s businesses, whether the Company will capitalize on the powerful secular tailwinds supporting the continued growth and investment in digital infrastructure, whether the Company’s wellness infrastructure segment, including contractual rent collections, will continue to perform well despite ongoing impacts of COVID-19, the Company’s ability to continue driving strong growth in its digital business and accelerating its digital transformation, including whether the Company will continue to lower corporate expenses and achieve earnings rotation through divestment of legacy businesses and assets, the impact of the digital transformation on the Company’s earnings profile, the Company’s ability to collaborate with its partner companies and customers to build the next-generation networks connecting enterprises and consumers globally, whether the Company will realize the anticipated benefits of Wafra’s strategic investment in the Company’s digital investment management business, including whether the Wafra investment will become subject to redemption and the amount of commitments Wafra will make to the Company’s digital investment products, the Company’s ability to raise third party capital in its managed funds or co-investment structures and the pace of such fundraising (including as a result of the impact of COVID-19), whether the DCP II fund raising target will be met, in the amounts anticipated or at all, the performance of DataBank, including zColo, the success and performance of the Company’s future investment product offerings, including a digital credit investment vehicle, whether the Company will realize the anticipated benefits of its investment in Vantage SDC, including the performance and stability of its portfolio, the pace of growth in the Company’s digital investment management franchise, the Company’s ability to continue to make investments in digital assets onto the balance sheet and the quality and earnings profile of such investments, the resilience and growth in demand for digital infrastructure, whether the Company will realize the anticipated benefits of its securitization transactions, the Company’s ability to simplify its business and continue to monetize legacy businesses/OED assets, including the timing and amount of proceeds to be received by the Company in those monetizations and its impact on the Company’s liquidity, if any, the Company’s ability to consummate the pending hospitality exit transaction and the amount of net proceeds to be received by the Company from the transaction, whether warehoused investments will ultimately be transferred to a managed investment vehicle or at all, the impact of impairments, the level of expenses within the wellness infrastructure segment and the impact on performance for the segment, whether the Company will maintain or produce higher Core FFO per share (including or excluding gains and losses from sales of certain investments) in the coming quarters, or ever, the Company’s FRE and FEEUM and its ability to continue growth

10

| ||||||||

at the current pace or at all, whether the Company will continue to pay dividends on its preferred stock, the impact of changes to the Company’s management or board of directors, employee and organizational structure, the Company’s financial flexibility and liquidity, including borrowing capacity under its revolving credit facility (including as a result of the impact of COVID-19), whether the Company will further extend the term of its revolving credit facility, the use of sales proceeds and available liquidity, the performance of the Company’s investment in CLNC (including as a result of the impact of COVID-19), including the CLNC share price as compared to book value and how the Company evaluates the Company’s investment in CLNC, the impact of management changes at CLNC, the Company’s ability to minimize balance sheet commitments to its managed investment vehicles, customer demand for data centers, the Company's portfolio composition, the Company's expected taxable income and net cash flows, excluding the contribution of gains, the Company’s ability to pay or grow the dividend at all in the future, the impact of any changes to the Company’s management agreements with NorthStar Healthcare Income, Inc., CLNC and other managed investment vehicles, whether Colony Capital will be able to maintain its qualification as a REIT for U.S. federal income tax purposes, the timing of and ability to deploy available capital, including whether any redeployment of capital will generate higher total returns, Colony Capital’s ability to maintain inclusion and relative performance on the RMZ, Colony Capital’s leverage, including the Company’s ability to reduce debt and the timing and amount of borrowings under its credit facility, increased interest rates and operating costs, adverse economic or real estate developments in Colony Capital’s markets, Colony Capital’s failure to successfully operate or lease acquired properties, decreased rental rates, increased vacancy rates or failure to renew or replace expiring leases, increased costs of capital expenditures, defaults on or non-renewal of leases by tenants, the impact of economic conditions (including the impact of COVID-19 on such conditions) on the borrowers of Colony Capital’s commercial real estate debt investments and the commercial mortgage loans underlying its commercial mortgage backed securities, adverse general and local economic conditions, an unfavorable capital market environment, decreased leasing activity or lease renewals, and other risks and uncertainties, including those detailed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, Quarterly Report on Form 10-Q for the quarter ended June 30, 2020, and Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, each under the heading “Risk Factors,” as such factors may be updated from time to time in the Company’s subsequent periodic filings with the U.S. Securities and Exchange Commission (“SEC”). All forward-looking statements reflect the Company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance. Additional information about these and other factors can be found in Colony Capital’s reports filed from time to time with the SEC.

Colony Capital cautions investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this press release. Colony Capital is under no duty to update any of these forward-looking statements after the date of this press release, nor to conform prior statements to actual results or revised expectations, and Colony Capital does not intend to do so.

Source: Colony Capital, Inc.

Investor Contacts:

Severin White

Managing Director, Head of Public Investor Relations

212-547-2777

swhite@clny.com

11

| ||||||||

Non-GAAP Financial Measures and Definitions

Assets Under Management (AUM)

Assets owned by the Company’s balance sheet and assets for which the Company and its affiliates provide investment management services, including assets for which the Company may or may not charge management fees and/or performance allocations. Balance sheet AUM is based on the undepreciated carrying value of digital investments and the impaired carrying value of non-digital investments as of the report date. Investment management AUM is based on the cost basis of managed investments as reported by each underlying vehicle as of the report date. AUM further includes uncalled capital commitments, but excludes CLNY OP’s share of non wholly-owned real estate investment management platform’s AUM. The Company's calculations of AUM may differ from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers.

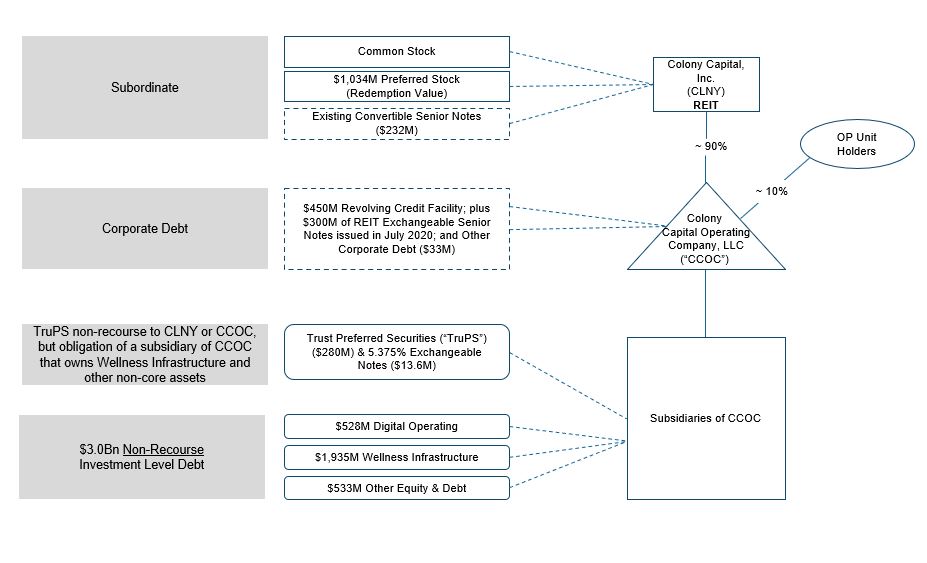

CLNY Operating Partnership (CLNY OP)

The operating partnership through which the Company conducts all of its activities and holds substantially all of its assets and liabilities. The Company is the sole managing member of, and directly owns approximately 90% of the common units in, CLNY OP. The remaining common units in CLNY OP are held primarily by current and former employees of the Company. Each common unit is redeemable at the election of the holder for cash equal to the then fair value of one share of the Company’s Class A common stock or, at the Company’s option, one share of the Company’s Class A common stock. CLNY OP share excludes noncontrolling interests in investment entities.

Fee-Earning Equity Under Management (FEEUM)

Equity for which the Company and its affiliates provides investment management services and derives management fees and/or performance allocations. FEEUM generally represents a) the basis used to derive fees, which may be based on invested equity, stockholders’ equity, or fair value pursuant to the terms of each underlying investment management agreement and b) the Company’s pro-rata share of fee bearing equity of each affiliate as presented and calculated by the affiliate. Affiliates include Alpine Energy LLC and American Healthcare Investors. The Company's calculations of FEEUM may differ materially from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers.

Fee Related Earnings (FRE)

The Company calculates FRE for its investment management business within the digital segment as base management fees, other service fee income, and other income inclusive of cost reimbursements, less compensation expense (excluding equity-based compensation), administrative expenses (excluding fund raising placement agent fee expenses), and other operating expenses related to the investment management business. The Company uses FRE as a supplemental performance measure as it may provide additional insight into the profitability of the overall digital investment management business. FRE is presented prior to the deduction for Wafra's 31.5% interest.

Funds From Operations (FFO) and Core Funds From Operations (Core FFO)

The Company calculates funds from operations (FFO) in accordance with standards established by the National Association of Real Estate Investment Trusts, which defines FFO as net income or loss calculated in accordance with GAAP, excluding (i) extraordinary items, as defined by GAAP; (ii) gains and losses from sales of depreciable real estate; (iii) impairment write-downs associated with depreciable real estate; (iv) gains and losses from a change in control in connection with interests in depreciable real estate or in-substance real estate, plus (v) real estate-related depreciation and amortization; and (vi) including similar adjustments for equity method investments. Included in FFO are gains and losses from sales of assets which are not depreciable real estate such as loans receivable, equity method investments, as well as equity and debt securities, as applicable.

The Company computes core funds from operations (Core FFO) by adjusting FFO for the following items, including the Company’s share of these items recognized by its unconsolidated partnerships and joint ventures: (i) gains and losses from sales of depreciable real estate within the Other segment, net of depreciation, amortization and impairment previously adjusted for FFO; (ii) gains and losses from sales of investment management businesses and impairment write-downs associated investment management; (iii) equity-based compensation expense; (iv) effects of straight-line rent revenue and expense; (v) amortization of acquired above- and below-market lease values; (vi) debt prepayment penalties and amortization of deferred financing costs and debt premiums and discounts; (vii) unrealized fair value gains or losses on interest rate and foreign currency hedges, and foreign currency remeasurements; (viii) acquisition and merger related transaction costs; (ix) restructuring and merger integration costs; (x) amortization and impairment of finite-lived intangibles related to investment management contracts and customer relationships; (xi) gain on remeasurement of consolidated investment entities and the effect of amortization thereof; (xii) non-real estate fixed asset depreciation, amortization and impairment; (xiii) change in fair value of contingent consideration; and (xiv) tax effect on certain of the foregoing adjustments. Beginning with the first quarter of 2018, the Company’s Core FFO from its interest in Colony Credit Real Estate (NYSE: CLNC) represented its percentage interest multiplied by CLNC’s Distributable Earnings (previously referred to as Core Earnings). Refer to CLNC’s filings with the SEC for the definition and calculation of Distributable Earnings. Beginning in the fourth quarter of 2020, the Company excluded results from discontinued operations in its calculation of Core FFO and applied this exclusion retrospectively to prior periods. The Company computes Core FFO excluding gains and losses by adjusting Core FFO to exclude gains and losses from the Company’s Other segment.

12

| ||||||||

FFO and Core FFO should not be considered alternatives to GAAP net income as indications of operating performance, or to cash flows from operating activities as measures of liquidity, nor as indications of the availability of funds for our cash needs, including funds available to make distributions. FFO and Core FFO should not be used as supplements to or substitutes for cash flow from operating activities computed in accordance with GAAP. The Company’s calculations of FFO and Core FFO may differ from methodologies utilized by other REITs for similar performance measurements, and, accordingly, may not be comparable to those of other REITs.

The Company uses FFO and Core FFO as supplemental performance measures because, in excluding real estate depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that captures trends in occupancy rates, rental rates, and operating costs. The Company also believes that, as widely recognized measures of the performance of REITs, FFO and Core FFO will be used by investors as a basis to compare its operating performance with that of other REITs. However, because FFO and Core FFO exclude depreciation and amortization and capture neither the changes in the value of the Company’s properties that resulted from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of its properties, all of which have real economic effect and could materially impact the Company’s results from operations, the utility of FFO and Core FFO as measures of the Company’s performance is limited. FFO and Core FFO should be considered only as supplements to GAAP net income as a measure of the Company’s performance. Additionally, Core FFO excludes the impact of certain fair value fluctuations, which, if they were to be realized, could have a material impact on the Company’s operating performance. The Company also presents Core FFO excluding gains and losses from sales of certain investments as well as its share of similar adjustments for CLNC. The Company believes that such a measure is useful to investors as it excludes periodic gains and losses from sales of investments that are not representative of its ongoing operations.

This release also includes certain forward-looking non-GAAP information including Core FFO. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these estimates, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable efforts.

Net Operating Income (NOI)

NOI for our real estate segments represents total property and related income less property operating expenses, adjusted for the effects of (i) straight-line rental income adjustments; (ii) amortization of acquired above- and below-market lease adjustments to rental income; and (iii) other items such as adjustments for the Company’s share of NOI of unconsolidated ventures.

The Company believes that NOI is a useful measure of operating performance of its respective real estate portfolios as it is more closely linked to the direct results of operations at the property level. NOI also reflects actual rents received during the period after adjusting for the effects of straight-line rents and amortization of above- and below- market leases; therefore, a comparison of NOI across periods better reflects the trend in occupancy rates and rental rates of the Company’s properties.

NOI excludes historical cost depreciation and amortization, which are based on different useful life estimates depending on the age of the properties, as well as adjust for the effects of real estate impairment and gains or losses on sales of depreciated properties, which eliminate differences arising from investment and disposition decisions. This allows for comparability of operating performance of the Company’s properties period over period and also against the results of other equity REITs in the same sectors. Additionally, by excluding corporate level expenses or benefits such as interest expense, any gain or loss on early extinguishment of debt and income taxes, which are incurred by the parent entity and are not directly linked to the operating performance of the Company’s properties, NOI provides a measure of operating performance independent of the Company’s capital structure and indebtedness. However, the exclusion of these items as well as others, such as capital expenditures and leasing costs, which are necessary to maintain the operating performance of the Company’s properties, and transaction costs and administrative costs, may limit the usefulness of NOI. NOI may fail to capture significant trends in these components of U.S. GAAP net income (loss) which further limits its usefulness.

NOI should not be considered as an alternative to net income (loss), determined in accordance with U.S. GAAP, as an indicator of operating performance. In addition, the Company’s methodology for calculating NOI involves subjective judgment and discretion and may differ from the methodologies used by other comparable companies, including other REITs, when calculating the same or similar supplemental financial measures and may not be comparable with other companies.

13

| ||||||||

Definitions applicable to DataBank (including zColo) and Vantage SDC

Contracted Revenue Growth (Bookings)

The Company defines Bookings as either (1) a new data center customer contract for new or additional services over and above any services already being provided as well as (2) an increase in contracted rates on the same services when a contract renews. In both instances a booking is considered to be generated when a new contract is signed with the recognition of new revenue to occur when the new contract begins billing.

Churn

The Company calculates Churn as the percentage of MRR lost during the period divided by the prior period’s MRR. Churn is intended to represent data center customer contracts which are terminated during the period, not renewed or are renewed at a lower rate.

Earnings before Interest, Taxes, Depreciation and Amortization for Real Estate (EBITDAre) and Adjusted EBITDA

The Company calculates EBITDAre in accordance with the standards established by the National Association of Real Estate Investment Trusts, which defines EBITDAre as net income or loss calculated in accordance with GAAP, excluding interest, taxes, depreciation and amortization, gains or losses from the sale of depreciated property, and impairment of depreciated property. The Company calculates Adjusted EBITDA by adjusting EBITDAre for the effects of straight-line rental income/expense adjustments and amortization of acquired above- and below-market lease adjustments to rental income, equity-based compensation expense, restructuring and integration costs, transaction costs from unsuccessful deals and business combinations, litigation expense, the impact of other impairment charges, gains or losses from sales of undepreciated land, and gains or losses on early extinguishment of debt and hedging instruments. Revenues and corresponding costs related to the delivery of services that are not ongoing, such as installation services, are also excluded from Adjusted EBITDA. The Company uses EBITDAre and Adjusted EBITDA as supplemental measures of our performance because they eliminate depreciation, amortization, and the impact of the capital structure from its operating results. However, because EBITDAre and Adjusted EBITDA are calculated before recurring cash charges including interest expense and taxes, and are not adjusted for capital expenditures or other recurring cash requirements, their utilization as a cash flow measurement is limited.

Max Critical I.T. Square Feet

Amount of total rentable square footage.

Monthly Recurring Revenue (MRR)

The Company defines MRR as revenue from ongoing services that is generally fixed in price and contracted for longer than 30 days.

% Utilization Rate

Amount of leased square feet divided by max critical I.T. square feet.

(FINANCIAL TABLES FOLLOW)

14

| ||||||||

CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

| December 31, 2020 | December 31, 2019 | |||||||||||||

Assets | ||||||||||||||

Cash and cash equivalents | $ | 703,544 | $ | 1,205,190 | ||||||||||

Restricted cash | 161,919 | 91,063 | ||||||||||||

Real estate, net | 8,727,920 | 6,218,196 | ||||||||||||

Loans receivable | 1,295,337 | 1,566,328 | ||||||||||||

Equity and debt investments | 1,737,479 | 2,313,805 | ||||||||||||

Goodwill | 842,929 | 1,452,891 | ||||||||||||

Deferred leasing costs and intangible assets, net | 1,524,968 | 632,157 | ||||||||||||

| Assets held for disposition | 4,105,801 | 5,743,085 | ||||||||||||

| Other assets | 1,017,119 | 557,989 | ||||||||||||

Due from affiliates | 83,544 | 51,480 | ||||||||||||

Total assets | $ | 20,200,560 | $ | 19,832,184 | ||||||||||

Liabilities | ||||||||||||||

| Debt, net | $ | 7,789,738 | $ | 5,517,918 | ||||||||||

| Accrued and other liabilities | 1,310,100 | 887,519 | ||||||||||||

Intangible liabilities, net | 94,196 | 111,484 | ||||||||||||

| Liabilities related to assets held for disposition | 3,697,541 | 3,862,521 | ||||||||||||

| Due to affiliates | 601 | 34,064 | ||||||||||||

Dividends and distributions payable | 18,516 | 83,301 | ||||||||||||

Preferred stock redemptions payable | — | 402,855 | ||||||||||||

Total liabilities | 12,910,692 | 10,899,662 | ||||||||||||

| Commitments and contingencies | ||||||||||||||

Redeemable noncontrolling interests | 305,278 | 6,107 | ||||||||||||

Equity | ||||||||||||||

Stockholders’ equity: | ||||||||||||||

| Preferred stock, $0.01 par value per share; $1,033,750 liquidation preference; 250,000 shares authorized; 41,350 shares issued and outstanding | 999,490 | 999,490 | ||||||||||||

| Common stock, $0.01 par value per share | ||||||||||||||

| Class A, 949,000 shares authorized; 483,406 and 487,044 shares issued and outstanding, respectively | 4,834 | 4,871 | ||||||||||||

| Class B, 1,000 shares authorized; 734 shares issued and outstanding | 7 | 7 | ||||||||||||

Additional paid-in capital | 7,570,473 | 7,553,599 | ||||||||||||

Accumulated deficit | (6,195,456) | (3,389,592) | ||||||||||||

Accumulated other comprehensive income | 122,123 | 47,668 | ||||||||||||

Total stockholders’ equity | 2,501,471 | 5,216,043 | ||||||||||||

Noncontrolling interests in investment entities | 4,327,372 | 3,254,188 | ||||||||||||

Noncontrolling interests in Operating Company | 155,747 | 456,184 | ||||||||||||

Total equity | 6,984,590 | 8,926,415 | ||||||||||||

Total liabilities, redeemable noncontrolling interests and equity | $ | 20,200,560 | $ | 19,832,184 | ||||||||||

15

| ||||||||

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

| Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||||||||

| (unaudited) | (unaudited) | ||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

| Property operating income | $ | 269,503 | $ | 193,386 | $ | 936,160 | $ | 737,364 | |||||||||||||||||||||

| Interest income | 10,411 | 45,409 | 80,471 | 166,765 | |||||||||||||||||||||||||

| Fee income | 46,791 | 45,600 | 177,755 | 223,915 | |||||||||||||||||||||||||

Other income | 12,139 | 14,718 | 42,208 | 78,779 | |||||||||||||||||||||||||

| Total revenues | 338,844 | 299,113 | 1,236,594 | 1,206,823 | |||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||

Property operating expense | 114,163 | 84,640 | 423,716 | 333,354 | |||||||||||||||||||||||||

Interest expense | 96,507 | 70,053 | 310,454 | 306,809 | |||||||||||||||||||||||||

| Investment and servicing expense | 14,632 | 21,431 | 62,529 | 60,646 | |||||||||||||||||||||||||

| Transaction costs | 2,160 | 685 | 5,966 | 3,607 | |||||||||||||||||||||||||

Depreciation and amortization | 129,838 | 65,104 | 431,443 | 307,594 | |||||||||||||||||||||||||

Provision for loan loss | — | 33 | — | 35,880 | |||||||||||||||||||||||||

Impairment loss | 29,089 | 450,661 | 1,473,997 | 1,086,530 | |||||||||||||||||||||||||

Compensation expense | |||||||||||||||||||||||||||||

Cash and equity-based compensation | 77,746 | 52,221 | 246,938 | 209,504 | |||||||||||||||||||||||||

Carried interest and incentive fee compensation | 994 | 3,300 | (8,437) | 16,564 | |||||||||||||||||||||||||

| Administrative expenses | 34,964 | 26,502 | 110,210 | 89,906 | |||||||||||||||||||||||||

| Settlement loss | — | — | 5,090 | — | |||||||||||||||||||||||||

| Total expenses | 500,093 | 774,630 | 3,061,906 | 2,450,394 | |||||||||||||||||||||||||

| Other income (loss) | |||||||||||||||||||||||||||||

| Gain on sale of real estate assets | 1,928 | 19,162 | 25,986 | 62,003 | |||||||||||||||||||||||||

| Other gain (loss), net | (11,764) | (11,546) | (211,084) | (194,106) | |||||||||||||||||||||||||

| Equity method earnings (losses) | (136,009) | 38,064 | (455,840) | (140,384) | |||||||||||||||||||||||||

| Equity method earnings (losses) - carried interest | 6,627 | 5,424 | (8,026) | 11,682 | |||||||||||||||||||||||||

| Income (loss) before income taxes | (300,467) | (424,413) | (2,474,276) | (1,504,376) | |||||||||||||||||||||||||

| Income tax benefit (expense) | 13,285 | (2,253) | 10,039 | (13,976) | |||||||||||||||||||||||||

| Income (loss) from continuing operations | (287,182) | (426,666) | (2,464,237) | (1,518,352) | |||||||||||||||||||||||||

| Income (loss) from discontinued operations | (18,948) | 1,358,394 | (1,326,173) | 1,369,437 | |||||||||||||||||||||||||

| Net income (loss) | (306,130) | 931,728 | (3,790,410) | (148,915) | |||||||||||||||||||||||||

| Net income (loss) attributable to noncontrolling interests: | |||||||||||||||||||||||||||||

| Redeemable noncontrolling interests | 2,932 | 242 | 616 | 2,559 | |||||||||||||||||||||||||

| Investment entities | (171,592) | 938,616 | (812,547) | 990,360 | |||||||||||||||||||||||||

| Operating Company | (15,411) | (2,867) | (302,720) | (93,027) | |||||||||||||||||||||||||

| Net income (loss) attributable to Colony Capital, Inc. | (122,059) | (4,263) | (2,675,759) | (1,048,807) | |||||||||||||||||||||||||

| Preferred stock redemption | — | (5,150) | — | (5,150) | |||||||||||||||||||||||||

| Preferred stock dividends | 18,516 | 27,138 | 75,023 | 108,550 | |||||||||||||||||||||||||

| Net income (loss) attributable to common stockholders | $ | (140,575) | $ | (26,251) | $ | (2,750,782) | $ | (1,152,207) | |||||||||||||||||||||

| Loss per share—basic | |||||||||||||||||||||||||||||

| Loss from continuing operations per share—basic | $ | (0.24) | $ | (0.86) | $ | (3.60) | $ | (3.16) | |||||||||||||||||||||

| Net loss attributable to common stockholders per share—basic | $ | (0.30) | $ | (0.06) | $ | (5.81) | $ | (2.41) | |||||||||||||||||||||

| Loss per share—diluted | |||||||||||||||||||||||||||||

| Loss from continuing operations per share—diluted | $ | (0.24) | $ | (0.86) | $ | (3.60) | $ | (3.16) | |||||||||||||||||||||

| Net loss attributable to common stockholders per share—diluted | $ | (0.30) | $ | (0.06) | $ | (5.81) | $ | (2.41) | |||||||||||||||||||||

| Weighted average number of shares | |||||||||||||||||||||||||||||

| Basic | 472,155 | 480,108 | 473,558 | 479,588 | |||||||||||||||||||||||||

| Diluted | 472,155 | 480,108 | 473,558 | 479,588 | |||||||||||||||||||||||||

16

| ||||||||

FUNDS FROM OPERATIONS AND CORE FUNDS FROM OPERATIONS

(In thousands, except per share data, unaudited)

| Three Months Ended | Year Ended | ||||||||||||||||||||||

| December 31, 2020 | December 31, 2019 | December 31, 2020 | December 31, 2019 | ||||||||||||||||||||

| Net loss attributable to common stockholders | $ | (140,575) | $ | (26,251) | $ | (2,750,782) | $ | (1,152,207) | |||||||||||||||

| Adjustments for FFO attributable to common interests in Operating Company and common stockholders: | |||||||||||||||||||||||

| Net loss attributable to noncontrolling common interests in Operating Company | (15,411) | (2,867) | (302,720) | (93,027) | |||||||||||||||||||

| Real estate depreciation and amortization | 136,245 | 118,253 | 561,195 | 548,766 | |||||||||||||||||||

| Impairment of real estate | 31,365 | 60,273 | 1,956,662 | 351,395 | |||||||||||||||||||

| Loss (gain) from sales of real estate | (26,566) | (1,449,040) | (41,912) | (1,524,290) | |||||||||||||||||||

| Less: Adjustments attributable to noncontrolling interests in investment entities | (79,874) | 910,702 | (638,709) | 719,225 | |||||||||||||||||||

| FFO attributable to common interests in Operating Company and common stockholders | (94,816) | (388,930) | (1,216,266) | (1,150,138) | |||||||||||||||||||

| Additional adjustments for Core FFO attributable to common interests in Operating Company and common stockholders: | |||||||||||||||||||||||

Gains and losses from sales of depreciable real estate within the Other segment, net of depreciation, amortization and impairment previously adjusted for FFO(1) | (41,101) | 637 | (65,000) | (47,172) | |||||||||||||||||||

Gains and losses from sales of investment management businesses and impairment write-downs associated investment management | 6,464 | 399,999 | 503,337 | 809,419 | |||||||||||||||||||

CLNC Distributable Earnings and NRE Cash Available for Distribution adjustments(2) | (31,473) | (5,401) | 212,587 | 263,707 | |||||||||||||||||||

| Equity-based compensation expense | 8,689 | 20,154 | 36,642 | 48,482 | |||||||||||||||||||

| Straight-line rent revenue and expense | (6,404) | (5,735) | (19,953) | (18,462) | |||||||||||||||||||

| Amortization of acquired above- and below-market lease values, net | (1,224) | (9,991) | (6,828) | (20,884) | |||||||||||||||||||

Debt prepayment penalties and amortization of deferred financing costs and debt premiums and discounts | 25,017 | 49,253 | 54,336 | 108,409 | |||||||||||||||||||

| Unrealized fair value (gains) losses on interest rate and foreign currency hedges, and foreign currency remeasurements | (1,465) | (889) | 11,826 | 239,709 | |||||||||||||||||||

| Acquisition and merger-related transaction costs | 2,272 | (944) | 11,706 | 3,335 | |||||||||||||||||||

Restructuring and merger integration costs(3) | 33,174 | 16,684 | 68,733 | 36,406 | |||||||||||||||||||

| Amortization and impairment of investment management intangibles | 8,315 | 8,640 | 37,971 | 89,371 | |||||||||||||||||||

| Non-real estate fixed asset depreciation, amortization and impairment | 12,865 | 1,922 | 34,851 | 6,652 | |||||||||||||||||||

| Gain on consolidation of equity method investment | — | — | — | (51,400) | |||||||||||||||||||

| Amortization of gain on remeasurement of consolidated investment entities | — | 6 | 12,996 | 3,813 | |||||||||||||||||||

| Tax effect of Core FFO adjustments, net | (317) | (7,864) | (3,015) | (18,231) | |||||||||||||||||||

| Preferred share redemption gain | — | (5,150) | — | (5,150) | |||||||||||||||||||

| Less: Adjustments attributable to noncontrolling interests in investment entities | 6,782 | (24,801) | 1,964 | (31,588) | |||||||||||||||||||

| Less: Core FFO from discontinued operations | 21,491 | (47,904) | 57,450 | (211,698) | |||||||||||||||||||

| Core FFO attributable to common interests in Operating Company and common stockholders | $ | (51,731) | $ | (314) | $ | (266,663) | $ | 54,580 | |||||||||||||||

| Less: Core FFO (gains) losses | 69,928 | 21,382 | 313,383 | 44,235 | |||||||||||||||||||

| Core FFO ex-gains/losses attributable to common interests in Operating Company and common stockholders | $ | 18,197 | $ | 21,068 | $ | 46,720 | $ | 98,815 | |||||||||||||||

Core FFO per common share / common OP unit(4) | $ | (0.10) | $ | 0.00 | $ | (0.50) | $ | 0.10 | |||||||||||||||

Core FFO per common share / common OP unit—diluted(4)(5)(6) | $ | (0.10) | $ | 0.00 | $ | (0.50) | $ | 0.10 | |||||||||||||||

Core FFO ex-gains/losses per common share / common OP unit(4) | $ | 0.03 | $ | 0.04 | $ | 0.09 | $ | 0.19 | |||||||||||||||

Core FFO ex-gains/losses per common share / common OP unit—diluted (4)(6)(7) | $ | 0.03 | $ | 0.04 | $ | 0.09 | $ | 0.19 | |||||||||||||||

Weighted average number of common OP units outstanding used for Core FFO and Core FFO ex-gains/losses per common share and OP unit(4) | 536,694 | 541,263 | 537,393 | 527,691 | |||||||||||||||||||

Weighted average number of common OP units outstanding used for Core FFO per common share and OP unit—diluted (4)(5)(6) | 536,694 | 541,263 | 537,393 | 528,756 | |||||||||||||||||||

Weighted average number of common OP units outstanding used for Core FFO ex-gains/losses per common share and OP unit-diluted (4)(6)(7) | 552,372 | 541,263 | 544,032 | 528,756 | |||||||||||||||||||

17

| ||||||||

__________

(1) For the three months ended December 31, 2020 and December 31, 2019, net of $43.1 million consolidated or $10.4 million CLNY OP share and $18.0 million consolidated or $9.6 million CLNY OP share, respectively, of depreciation, amortization and impairment charges previously adjusted to calculate FFO. For the twelve months ended December 31, 2020 and December 31, 2019, net of $90.5 million consolidated or $52.2 million CLNY OP share and $111.9 million consolidated or $70.7 million CLNY OP share, respectively, of depreciation, amortization and impairment charges previously adjusted to calculate FFO.

(2) Represents adjustments to align the Company’s Core FFO with CLNC’s definition of Distributable Earnings and NRE's definition of Cash Available for Distribution (“CAD”) to reflect the Company’s percentage interest in the respective company's earnings.

(3) Restructuring and merger integration costs primarily represent costs and charges incurred as a result of corporate restructuring and reorganization to implement the digital evolution. These costs and charges include severance, retention, relocation, transition, shareholder settlement and other related restructuring costs, which are not reflective of the Company’s core operating performance and the Company does not expect to incur these costs subsequent to the completion of the digital evolution.

(4) Calculated based on weighted average shares outstanding including participating securities and assuming the exchange of all common OP units outstanding for common shares.

(5) For the three and twelve months ended December 31, 2020 and December 31, 2019, excluded from the calculations of diluted Core FFO per share is the effect of adding back interest expense associated with convertible senior notes and weighted average dilutive common share equivalents for the assumed conversion of the convertible senior notes as the effect of including such interest expense and common share equivalents would be antidilutive.

(6) For the three and twelve months ended December 31, 2020 and for the three months ended December 31, 2019, excluded from the calculations of diluted Core FFO per share is the effect of weighted average performance stock units. For the twelve months ended December 31, 2019, included in the calculation of diluted Core FFO and Core FFO ex-gains/losses per share are 990,700 weighted average performance stock units, which are subject to both a service condition and market condition, and 74,100 weighted average shares of non-participating restricted stock.

(7) For the three and twelve months ended December 31, 2020, included in the calculation of diluted Core FFO ex-gains/losses per share are 13.8 million and 6.6 million, respectively, weighted average performance stock units, performance based restricted stock units and Wafra’s warrants, of which the issuance and/or vesting are subject to the performance of the Company's stock price or the achievement of certain Company-specific metrics. For the three months ended December 31, 2020, included in the calculation of diluted Core FFO ex-gains/losses per share is the effect of adding back interest expense associated with convertible senior notes and 1.9 million of weighted average dilutive common share equivalents for the assumed conversion of the convertible senior notes.

COLONY CAPTITAL, INC.

RECONCILIATION OF WELLNESS INFRASTRUCTURE NET INCOME (LOSS) TO NOI

The following tables present: (1) a reconciliation of property and other related revenues less property operating expenses for properties to NOI and (2) a reconciliation of net income (loss) for the three months ended December 31, 2020 to NOI:

| (In thousands) | Three Months Ended December 31, 2020 | |||||||

| Total revenues | $ | 121,121 | ||||||

| Straight-line rent revenue and amortization of above- and below-market lease intangibles | (4,902) | |||||||

Property operating expenses (1) | (50,579) | |||||||

| NOI | $ | 65,640 | ||||||

_________

(1) Property operating expenses include property management fees paid to third parties.

| (In thousands) | Three Months Ended December 31, 2020 | |||||||

| Net income (loss) | $ | 545 | ||||||

| Adjustments: | ||||||||

| Straight-line rent revenue and amortization of above- and below-market lease intangibles | (4,902) | |||||||

| Interest expense | 31,307 | |||||||

| Transaction, investment and servicing costs | 2,295 | |||||||

| Depreciation and amortization | 31,911 | |||||||

| Impairment loss | 4,263 | |||||||

| Compensation and administrative expense | 3,874 | |||||||

| Gain on sale of real estate | 11 | |||||||

| Other (gain) loss, net | (5,508) | |||||||

| Income tax (benefit) expense | 1,844 | |||||||

| NOI | $ | 65,640 | ||||||

18

| ||||||||

RECONCILIATION OF NET INCOME (LOSS) TO DIGITAL INVESTMENT MANAGEMENT FRE

| (In thousands) | Three Months Ended December 31, 2020 | ||||

| Digital Investment Management Net income (loss) | 1,840 | ||||

| Adjustments: | |||||

| Interest income | (1) | ||||

| Fee income eliminated in the Company's consolidated Statement of Operations | 862 | ||||

| Investment and servicing expense | 204 | ||||

| Depreciation and amortization | 6,421 | ||||

| Compensation expense—equity-based | 655 | ||||

| Compensation expense—carried interest and incentive | 994 | ||||

| Administrative expenses—straight-line rent | (1) | ||||

| Administrative expenses—placement agent fee | 1,202 | ||||

| Equity method (earnings) losses | (6,744) | ||||

| Other (gain) loss, net | (102) | ||||

| Income tax (benefit) expense | (757) | ||||

| FRE | $ | 4,573 | |||

Add: one-time incentive | 5,701 | ||||

| FRE (adjusted) | $ | 10,274 | |||

RECONCILIATION OF NET INCOME (LOSS) TO DIGITAL OPERATING ADJUSTED EBITDA

The following tables present: (1) a reconciliation of property and other related revenues less property operating expenses to Adjusted EBITDA and (2) a reconciliation of net income (loss) for the three months ended December 31, 2020 to Adjusted EBITDA:

| (In thousands) | Three Months Ended December 31, 2020 | ||||

| Total revenues | $ | 127,546 | |||

| Property operating expenses | (47,224) | ||||

| Compensation expense and administrative expenses | (16,413) | ||||

| Transaction, investment and servicing costs | (3,209) | ||||

| EBITDAre: | 60,700 | ||||

| Straight-line rent expenses and amortization of above- and below-market lease intangibles | (2,607) | ||||

| Interest income | (80) | ||||

| Compensation expense—equity-based | 728 | ||||

| Installation services | 429 | ||||

| Restructuring & integration costs | 803 | ||||

| Transaction, investment and servicing costs | 564 | ||||

| Adjusted EBITDA: | $ | 60,537 | |||

19

| ||||||||

| (In thousands) | Three Months Ended December 31, 2020 | ||||

| Net income (loss) from continuing operations (Digital Operating) | $ | (52,902) | |||

| Adjustments: | |||||

| Interest expense | 41,815 | ||||

| Income tax (benefit) expense | (6,967) | ||||

| Depreciation and amortization | 78,554 | ||||

| Other (gain) loss | 200 | ||||

| EBITDAre: | 60,700 | ||||

| Straight-line rent expenses and amortization of above- and below-market lease intangibles | (2,607) | ||||

| Interest income | (80) | ||||

| Compensation expense—equity-based | 728 | ||||

| Installation services | 429 | ||||

| Restructuring & integration costs | 803 | ||||

| Transaction, investment and servicing costs | 564 | ||||

| Adjusted EBITDA: | $ | 60,537 | |||

The following table summarizes fourth quarter 2020 net income (loss) from continuing operations by segment:

| (In thousands) | Net Income (Loss) from Continuing Operations | ||||||||||

| Digital Investment Management | $ | 1,840 | |||||||||

| Digital Operating | (52,902) | ||||||||||

| Digital Other | 19,788 | ||||||||||

| Wellness Infrastructure | 545 | ||||||||||

| Other | (181,340) | ||||||||||

| Amounts Not Allocated to Segments | (75,113) | ||||||||||

| Total Consolidated | $ | (287,182) | |||||||||

20

| ||||||||

The following table presents fourth quarter 2019 net income (loss) and Core Funds From Operations by segment:

| ($ in thousands; unaudited) | Digital IM | Digital Operating | Digital Other | Wellness Infrastructure | Other | Discontinued Operations | Amounts not allocated to segments | Total OP pro rata share | Amounts attributable to noncontrolling interests | CLNY consolidated | ||||||||||||||||||||||