Form 8-K Collective Growth Corp For: Dec 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 10, 2020

COLLECTIVE GROWTH CORPORATION

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-39276 | 84-3954038 |

| (State or Other Jurisdiction | (Commission | (IRS Employer |

| of Incorporation) | File Number) | Identification No.) |

1805 West Avenue

Austin, TX 78701

(Address of Principal Executive Offices) (Zip Code)

(512) 358-9085

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Units, each consisting of one share of Class A common stock and one-half of one redeemable warrant | CGROU | The Nasdaq Stock Market LLC | ||

| Class A common stock, par value $0.0001 per share | CGRO | The Nasdaq Stock Market LLC | ||

| Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share | CGROW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

Business Combination Agreement

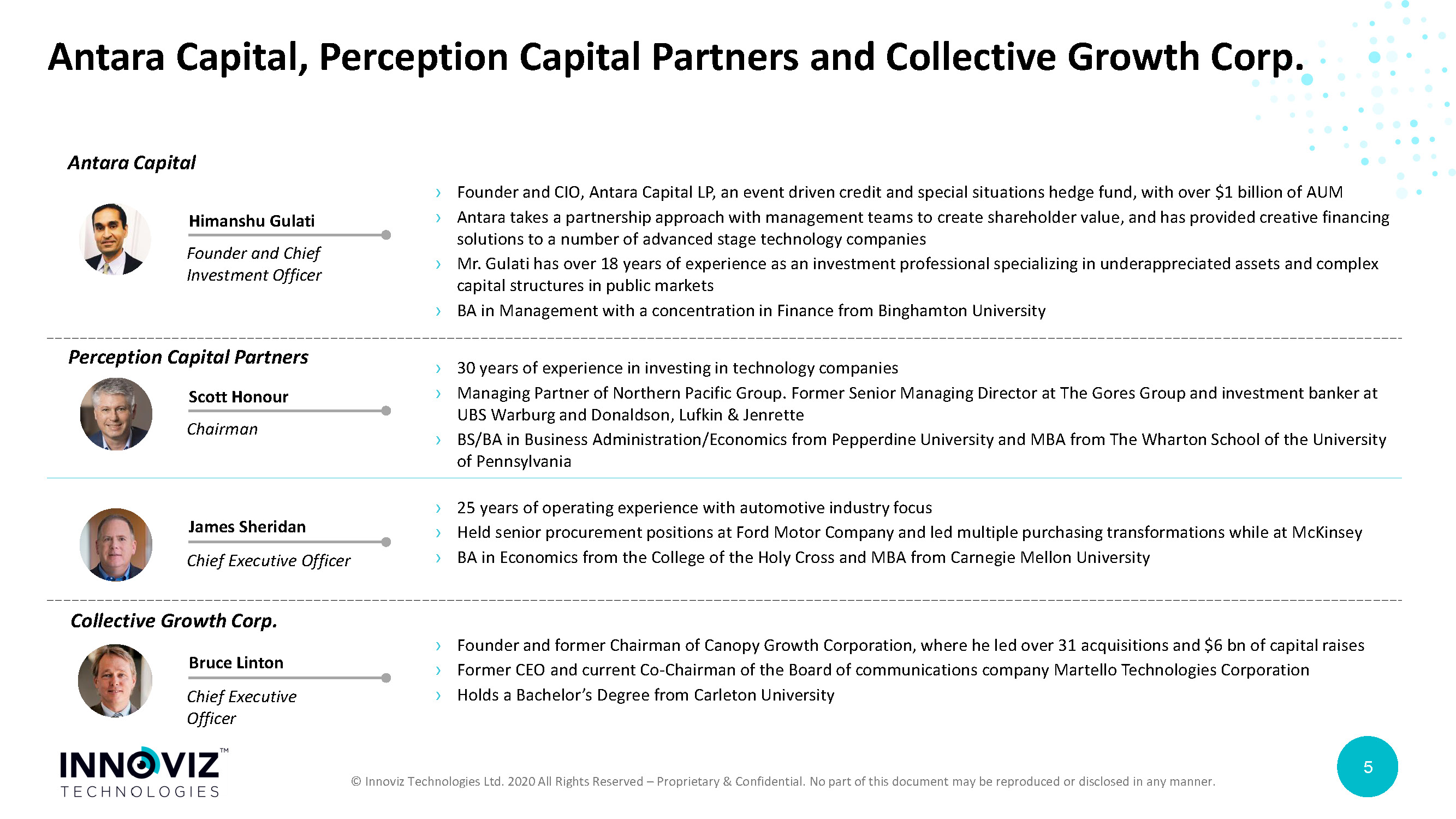

On December 10, 2020, Collective Growth Corporation, a Delaware corporation (“Collective Growth”), entered into a Business Combination Agreement (“Business Combination Agreement”) by and among Collective Growth, Innoviz Technologies Ltd., a company organized under the laws of the State of Israel (the “Company” or “Innoviz”), Hatzata Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of the Company (“Merger Sub”), Perception Capital Partners LLC, a Delaware limited liability company (“Perception”) (solely for purposes of Sections 2.2(d), 2.3(a), 2.8, 2.9, 5.2, 5.5, 7.2 and Article VIII) and Antara Capital LP, a Delaware limited partnership (“Antara”) (solely for purposes of Sections 5.2, 5.5, 7.2 and Article VIII).

Pursuant to the Business Combination Agreement, Merger Sub will merge with and into Collective Growth, with Collective Growth surviving the merger (the “Merger”). As a result of the Merger, and upon consummation of the Merger and the other transactions contemplated by the Business Combination Agreement (“Transactions”) Collective Growth will become a wholly-owned subsidiary of the Company, with the stockholders of Collective Growth becoming securityholders of the Company.

The pro forma valuation of the Company upon consummation of the Transactions is $1,375,000,000. We estimate that, upon consummation of the Transactions (the “Effective Time”), without giving effect to the issuance of Earnout Shares (defined below) and assuming none of Collective Growth’s public stockholders demand redemption (“SPAC Redemptions”) pursuant to Collective Growth’s amended and restated certificate of incorporation, the securityholders of the Company and certain members of the Company’s management receiving shares in the Transactions (“Company Management”) will own more than 75% of the outstanding ordinary shares of the Company (“Company Ordinary Shares”) and the securityholders of Collective Growth, Perception, Antara, and the Investors purchasing PIPE Shares will own the remaining Company Ordinary Shares.

The following securities issuances will be made by the Company to Collective Growth securityholders at the Effective Time and in each case assume the Stock Split (as defined below) has occurred: (i) each share of Class B common stock of Collective Growth after taking into account the forfeiture of 1,875,000 shares pursuant to the Forfeiture Agreement, will be exchanged for one Company Ordinary Share, (ii) each outstanding share of Class A common stock of Collective Growth will be exchanged for one Company Ordinary Share, and (iii) each outstanding warrant of Collective Growth will be assumed by the Company and will become a warrant of the company (“Company Warrant”) (with the number of Company Ordinary Shares underlying the Company Warrant and the exercise price of such Company Warrants subject to adjustment in accordance with the terms of the Merger Agreement).

The following securities issuances will be made by the Company to Company Management, the Company’s securityholders, and Perception at the Effective Time and in each case assume the Stock Split (as defined below): (i) each outstanding preferred share of the Company will be converted into one Company Ordinary Share, (ii) Company Management will be issued an aggregate of 2,847,436 Company Ordinary Shares and 3,986,410 Company Warrants, and (iii) Perception will be issued an aggregate of 3,448,526 Company Warrants.

Additionally, the Company will issue securities pursuant to the Subscription Agreement and the Antara Put Option Agreement, each as described in more detail below.

The Company Ordinary Shares and Company Warrants to be received by the Sponsors, Company Management, Perception, and Antara in connection with the Transactions, including the Earnout Shares, will be subject to the transfer restrictions described below under the heading “Lockup Agreement”.

Earnout

Pursuant to the Business Combination Agreement, if the last sale price of the Company Ordinary Shares on the Nasdaq Capital Market (“Nasdaq”) is greater than $10.97 for any ten (10) trading days out of a twenty (20) consecutive trading-day period at any time during the four years after the consummation of the Transactions, Perception, Antara and certain members of the Company’s management may be issued additional Company Ordinary Shares as follows:

(1) to Perception as additional consideration for services provided by Perception to the Company (x) 2,477,269 Company Ordinary Shares if the Initial Transaction Proceeds is equal to or greater than $150,000,000 or (y) a number of Company Ordinary Shares equal to the difference of (A) 2,477,269 and (B) the product of (i) 0.3866 and (ii) an earnout calculation (“Perception Earnout Calculation”) set forth in the Business Combination Agreement if the Initial Transaction Proceeds are less than $150,000,000 (such shares issuable to Perception, the “Perception Earnout Shares”); and

(2) to the Company Management, 1,423,718 Company Ordinary Shares (such shares, the “Management Earnout Shares”)

Pursuant to the Put Option Agreement, concurrently with the issuance of the Perception Earnout Shares, if any, Antara will be issued (x) 370,167 Company Ordinary Shares if the Initial Transaction Proceeds is equal to or greater than $150,000,000 or (y) a number of Company Ordinary Shares equal to the difference of (A) 370,167 and (B) the product of (i) 0.577 and (ii) the Perception Earnout Calculation if the Initial Transaction Proceeds are less than $150,000,000 (such shares issuable to Perception, the “Antara Earnout Shares”, and together with the Perception Earnout Shares and Management Earnout Shares, the “Earnout Shares”).

Adjustments to Consideration

Prior to the Effective Time, the Company intends to effect a reverse stock split to cause the value of the outstanding Company Ordinary Shares immediately prior to the Effective Time to equal $10.00 per share (the “Stock Split”). Upon consummation of the Stock Split, the consideration to be issued to securityholders of Collective Growth, Company Management, Antara, and Perception shall be adjusted appropriately to reflect the effect of the Stock Split.

The Transactions are targeted to be consummated in the first quarter of 2021, after the required approval by the stockholders of Collective Growth (“Collective Growth Stockholder Approval”), ordinary shareholders of the Company (“Company Shareholder Approval”), and preferred shareholders of the Company (“Company Preferred Shareholder Approval”) and the fulfillment of certain other conditions.

Governance

After the consummation of the Transactions, the current officers of the Company will remain officers of the Company. The size of the board of directors of the Company will be increased and one director will be designated by Perception.

The following summaries of the Business Combination Agreement and the other agreements to be entered into by the parties are qualified in their entirety by reference to the text of the Business Combination Agreement and agreements entered into in connection therewith. The Business Combination Agreement is attached as an exhibit hereto and incorporated herein by reference.

Representations and Warranties

The Business Combination Agreement contains representations and warranties of the Company and its subsidiaries, including Merger Sub, relating, among other things, to proper organization and qualification; capitalization; the authorization, performance and enforceability against the Company of the Business Combination Agreement; financial statements; absence of undisclosed liabilities; governmental actions and filings; permits; material contracts; absence of certain changes; litigation; compliance with laws; benefit plans; environmental matters; intellectual property; labor matters; insurance; tax matters; brokers’ fees; real and personal property; transactions with affiliates; compliance with international trade and anti-corruption laws; the Company’s major customers and suppliers; product warranties and product liability; and the execution of the Subscription Agreements.

The Business Combination Agreement contains representations and warranties of Collective Growth relating, among other things, to proper organization and qualification; the authorization, performance and enforceability against Collective Growth of the Business Combination Agreement; governmental actions and filings; brokers’ fees; capitalization; reports filed with the Securities and Exchange Commission (“SEC”), financial statements, and compliance with the Sarbanes-Oxley Act; Collective Growth’s trust account; indebtedness; transactions with affiliates; litigation; compliance with laws; restrictions on business activities; Collective Growth’s internal controls, financial statements, and Nasdaq listing; absence of undisclosed liabilities; tax matters; absence of changes; employment matters; the execution of the Sponsor Support Agreement; status under the Investment Company Act; the absence of poison pill or similar anti-takeover matters; compliance with international trade and anti-corruption laws; the execution of the Sponsor Forfeiture Agreement; and non-Israeli residence.

Covenants

The Business Combination Agreement includes customary covenants of the parties with respect to business operations prior to consummation of the Transactions and efforts to satisfy conditions to the consummation of the Transactions. The Business Combination Agreement also contains additional covenants of the parties, including, among others, covenants providing for Collective Growth and the Company to cooperate in the preparation of the Registration Statement on Form F-4 required to be prepared in connection with the Merger (the “Registration Statement”), for the Company to terminate certain existing investor rights agreements with its securityholders (collectively, the “Company Investor Agreements”), and to enter into a consulting agreement with Wilson Kello, an officer of Collective Growth, with respect to transition and public company consulting services.

Additionally, prior to the Effective Time, Collective Growth will transfer the intellectual property rights relating to its name, trading symbols, and internet domain name, and certain material relating to its evaluation of alternative business combinations, to a third party.

Conditions to Closing

General Conditions

In addition, the consummation of the Transactions is conditioned upon, among other things:

| • | all specified waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended shall have expired; |

| • | no order, judgment, injunction, decree, writ, stipulation, determination or award, in each case, entered by or with any governmental authority or statute, rule or regulation that is in effect and prohibits or enjoins the consummation of the Transactions; |

| • | the Registration Statement shall have become effective in accordance with the provisions of the Securities Act of 1933, as amended (“Securities Act”), no stop order shall have been issued by the SEC that remains in effect with respect to the Registration Statement, and no proceeding seeking such a stop order shall have been threatened or initiated by the SEC which remains pending; |

| • | the Company Shareholder Approval and Company Preferred Shareholder Approval shall have been obtained; |

| • | the Collective Growth Stockholder Approval shall have been obtained; |

| • | Collective Growth having at least $5,000,001 of net tangible assets remaining prior to the Transactions after taking into account the SPAC Redemptions; |

| • | no proceeding is pending or threatened that is reasonably likely to prevent consummation of the Transactions or cause the Transactions to be rescinded following consummation; |

| • | the Company’s application to list the Company Ordinary Shares (including the Company Ordinary Shares to be issued pursuant to the Merger) shall have been approved by Nasdaq, subject to official notice thereof and public holder requirements; and |

| • | the Sponsor Support Agreement, Sponsor Forfeiture Agreement, Company Transaction Support Agreement, Registration Rights Agreement, Lockup Agreement and an amendment to the Company’s warrant agreement shall have been executed and delivered by the parties thereto and shall be in full force and effect. |

Other Conditions to Collective Growth’s Obligations

The obligations of Collective Growth to consummate the Transactions are also conditioned upon, among other things:

| • | the accuracy of the representations and warranties of the Company and Merger Sub (subject to certain bring-down standards); |

| • | performance in all material respects of the covenants of the Company required by the Business Combination Agreement to be performed on or prior to the closing; |

| • | no material adverse effect with respect to the Company shall have occurred between the date of the Business Combination Agreement and the closing of the Transactions; |

| • | the Company having delivered certain customary officer’s and secretary’s certificates; |

| • | the Company’s board consisting of certain agreed persons; and |

| • | the Company having terminated the Company Investor Agreements. |

Other Conditions to the Company’s and Merger Sub’s Obligations

The obligations of the Company and Merger Sub to consummate the Transactions are also conditioned upon, among other things:

| • | the accuracy of the representations and warranties of Collective Growth (subject to certain bring-down standards); |

| • | performance in all material respects of the covenants of Collective Growth required by the Business Combination Agreement to be performed on or prior to the closing; |

| • | the aggregate amount remaining in Collective Growth’s trust account after taking into account the SPAC Redemptions, plus the aggregate amount raised in the PIPE, plus the aggregate purchase price of additional Company Ordinary Shares (the “Antara Top Up Shares”) subscribed for by Antara following any SPAC Redemptions (such amount, the “Initial Transaction Proceeds”), shall be equal to or greater than $200,000,000; |

| • | Collective Growth having delivered certain customary officer’s and secretary’s certificates; |

| • | each officer and director of Collective Growth having resigned as of the closing date; |

| • | the existing liabilities and expenses of Collective Growth shall not exceed $9,700,000; and |

| • | the Forfeiture shall have occurred and each other covenant pursuant to the Sponsor Forfeiture Agreement shall have been performed in all material respects. |

Waivers

Either Collective Growth or the Company may waive any inaccuracies in the representations and warranties made to such party contained in the Business Combination Agreement or in any document delivered pursuant to the Business Combination Agreement and waive compliance with any agreements or conditions for the benefit of itself or such party contained in the Business Combination Agreement or in any document delivered pursuant to the Business Combination Agreement. Notwithstanding the foregoing, pursuant to Collective Growth’s amended and restated certificate of incorporation, Collective Growth cannot consummate the proposed business combination if it has less than $5,000,001 of net tangible assets remaining upon consummation of the Transactions after taking into account the holders of public shares that properly demanded that Collective Growth redeem their public shares for their pro rata share of the trust account.

Termination

The Business Combination Agreement may be terminated:

| • | by mutual written consent of Collective Growth and the Company; | ||

| • | by Collective Growth if the Company or Merger Sub has breached any of its covenants or representations and warranties in any material respect and has not cured by the Termination Date, provided that Collective Growth is itself not in material breach; | ||

| • | by the Company if Collective Growth has breached any of its covenants or representations and warranties in any material respect and has not cured by the Termination Date, provided that the Company or Merger Sub is itself not in material breach; |

| • | by either Collective Growth or the Company if the Transactions are not consummated on or before May 30, 2021 (“Termination Date”), provided that the right to terminate the Business Combination Agreement will not be available to any party whose action or failure to act has been a principal cause of or primarily resulted in the failure of the Transactions to occur on or before such date and such action or failure to act constitutes a breach of the Business Combination Agreement; |

| • | by either Collective Growth or the Company if a governmental entity shall have issued an order, decree or ruling or taken any other action, in any case having the effect of permanently restraining, enjoining or otherwise prohibiting the Transactions, which order, decree, judgment, ruling or other action is final and non-appealable, provided that the right to terminate the Business Combination Agreement will not be available to any party whose action or failure to act has been a principal cause of or primarily resulted in the failure of the Transactions to occur on or before such date and such action or failure to act constitutes a breach of the Business Combination Agreement; | ||

| • | by ether Collective Growth or the Company if the Collective Growth shareholder meeting has been held, has concluded, Collective Growth’s stockholders have duly voted and the Collective Growth Stockholder Approval was not obtained; | ||

| • | by ether Collective Growth or the Company if the Company shareholder meeting has been held, has concluded, the Company’s shareholders have duly voted and the Company Shareholder Approval or the Company Preferred Shareholder Approval were not obtained; | ||

| • | by Collective Growth if, prior to obtaining the Company Shareholder Approval and the Company Preferred Shareholder Approval the Company board of directors changes its recommendation with respect to the Merger as permitted by the Business Combination Agreement; and | ||

| • | by the Company if, prior to obtaining the Collective Growth Stockholder Approval, the Collective Growth board of directors changes its recommendation with respect to the Merger as permitted by the Business Combination Agreement or fails to include a recommendation to vote in favor of the Merger in the Registration Statement. |

In the event that the Business Combination Agreement is terminated because the Company board of directors has changed its recommendation with respect to the Merger, the Company shall pay Collective Growth a termination fee in an amount equal to $14,625,000 as liquidated damages.

Incentive Equity Plan

Prior to the effectiveness of the Registration Statement, the Company will adopt an incentive equity plan, the form and terms of which shall be prepared by the Company and be reasonably acceptable to Collective Growth, reserving a number of Company Ordinary Shares for grant thereunder equal to seven percent (7%) of the fully-diluted issued and outstanding Company Ordinary Shares immediately after the Effective Time.

Lockup Agreement

Concurrently with the execution of the Business Combination Agreement, the Sponsors, Company Management, Perception, Antara, and certain securityholders of the Company entered into a Confidentiality and Lockup Agreement with the Company (“Lockup Agreement”), pursuant to which such persons agreed (i) to keep confidential certain Company information furnished to them and (ii) not to transfer certain Company Ordinary Shares and Company Warrants and any equity or derivative securities of the Company, except to certain permitted transferees, beginning at the Effective Time and continuing a period of one hundred eighty (180) days.

In connection with the Lockup Agreement, at the Effective Time, the transfer restrictions set forth in certain letter agreements among Collective Growth and the Sponsors will terminate.

Registration Rights Agreement

Concurrently with the execution of the Business Combination Agreement, the Company, Sponsors, Perception, Antara, and certain securityholders of the Company entered into a registration rights agreement (“Registration Rights Agreement”) pursuant to which the Company agreed to file a registration statement with respect to the registrable securities under the Registration Rights Agreement within sixty (60) days of the Effective Time to register the resale under the Securities Act of Company Ordinary Shares, including Company Ordinary Shares issuable upon the exercise of Company Warrants and any earned Earnout Shares, and the Company Warrants to be held by such securityholders, subject to certain conditions set forth therein. The Company also agreed to provide customary “piggyback” registration rights. The Registration Rights Agreement also provides that the Company will pay certain expenses relating to such registrations and indemnify the securityholders against certain liabilities. The rights granted under the Registration Rights Agreement supersede any prior registration, qualification, or similar rights of the parties with respect to their Company Securities, and all such prior agreements shall be terminated.

Sponsor Forfeiture Agreement

Concurrently with the execution of the Business Combination Agreement, the Sponsors entered into a letter agreement (“Sponsor Forfeiture Agreement”) in favor of the Company and Collective Growth, pursuant to which they have agreed to forfeit an aggregate of 1,875,000 shares of Collective Growth Class B common stock and 1,875,000 Collective Growth warrants for cancellation in exchange for no consideration at the Effective Time (the “Forfeiture”).

Sponsor Support Agreement

Concurrently with the execution of the Business Combination Agreement, the Sponsors entered into a letter agreement (“Sponsor Support Agreement”) in favor of the Company and Collective Growth, pursuant to which they have agreed to (i) vote all shares of Class B common stock and Class A common stock of Collective Growth beneficially owned by them in favor of the Merger and each other proposal related to the Merger on the agenda at the meeting of Collective Growth shareholders called to approve the Merger, (ii) appear at such shareholder meeting for the purpose of establishing a quorum, (iii) vote all such shares against any action that would reasonably be expected to materially impede, interfere with, delay, postpone, or adversely affect the Merger or any of the other transactions contemplated by the Business Combination Agreement, and (iv) not to transfer, assign, or sell such shares, except to certain permitted transferees, prior to the consummation of the Transactions.

Company Transaction Support Agreement

Concurrently with the execution of the Business Combination Agreement, Collective Growth, the Company, holders of Company Ordinary Shares who hold a majority of the then-outstanding Company Ordinary Shares, holders of at least sixty percent (60%) of the issued and outstanding Company preferred shares voting together as a single class on an as-converted basis, and holders of a majority of the then-outstanding series C convertible preferred shares of the Company and the series C-1 convertible preferred shares of the Company, entered into agreements (“Transaction Support Agreement”) pursuant to which they agreed to (i) appear at a shareholder meeting called by the Company for the purpose of approving the Business Combination, Merger, and other transactions contemplated by the Business Combination, for the purpose of establishing a quorum, (ii) execute a written consent in favor of the Merger, the adoption of the Business Combination, a proposal to increase the size of the Company’s board of directors, the termination of the Company Investor Agreements, and, with respect to the Company preferred shares, proposals to adopt amended and restated articles of association and waive certain preemptive rights as set forth in the Company’s charter documents, (iii) vote all such shares against any action that would reasonably be expected to materially impede, interfere with, delay, postpone, or adversely affect the Merger or any of the other transactions contemplated by the Business Combination Agreement, (iv) not to solicit, initiate, encourage, or facilitate certain alternate business combinations, and (v) not to transfer, assign, or sell such covered shares, except to certain permitted transferees, prior to the consummation of the Transactions.

PIPE Subscription Agreements

In connection with the Transactions, the Company engaged Goldman Sachs & Co. LLC as placement agent of a private placement of not less than $200,000,000 of Company Ordinary Shares (the “PIPE”).

Concurrently with the execution of the Business Combination Agreement, the Company and certain accredited investors (“Investors”) entered into a series of subscription agreements (“Subscription Agreements”) providing for the purchase by the Investors at the Effective Time of an aggregate of 20,000,000 Company Ordinary Shares (“PIPE Shares”) at a price per share of $10.00, for gross proceeds to the Company of $200,000,000. Each Investor agreed to fund the purchase price for its PIPE Shares within two (2) business days after receiving notice from the Company of the expected closing date of the Transactions. The price per share to be paid by the Investors pursuant to the Subscription Agreements assumes that the Company has effected the Stock Split. The closing of the PIPE is conditioned upon the consummation of the Transactions and other transactions contemplated by the Business Combination Agreement.

The Company agreed to file a registration statement registering the resale of the PIPE Shares within forty-five (45) days after the consummation of the Transactions.

The Company Ordinary Shares were offered and sold to the Investors in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act, based on the fact that the sale will have been made without any general solicitation or advertising and based on representations from each Investor, among other things, that (a) it was a qualified institutional buyer or an accredited investor (to the extent applicable), (b) it was purchasing the shares for its own account investment, and not with a view to distribution, (c) it had been given access to full and complete access to information regarding Collective Growth, the Company, and the Merger, and (d) it understood that the offer and sale of the shares was not registered and the shares may not be publicly sold or otherwise disposed of without registration under the Securities Act or an applicable exemption therefrom.

Antara Put Option Agreement

Concurrently with the execution of the Business Combination Agreement, the Company and Antara, on behalf of the funds it manages and/or its designees, entered into a put option agreement (“Put Option Agreement”) pursuant to which the Company caused Antara to subscribe for a number of Company Ordinary Shares in the PIPE with an aggregate equity value equal to $70,000,000. Additionally, Antara will receive at the Effective Time an additional 4,310,736 Company Warrants and up to 3,559,294 Company Ordinary Shares, as follows: (x) 3,559,294 Company Ordinary Shares if the Initial Transaction Proceeds is equal to or greater than $150,000,000 or (y) a number of Company Ordinary Shares equal to the difference of (A) 3,559,294 and (B) the product of (i) 0.5556 and (ii) the Perception Earnout Calculation if the Initial Transaction Proceeds are less than $150,000,000 (such shares issuable to Antara, the “Antara Additional Shares”). Antara may also receive the Antara Earnout Shares, as described above under the section titled “Earnout”. The number of Company Shares and Company Warrants issuable pursuant to the Put Option Agreement assumes that the Company has effected the Stock Split.

The foregoing descriptions of the Lockup Agreement, Registration Rights Agreement, Sponsor Forfeiture Agreement, Sponsor Support Agreement, Company Transaction Support Agreement, Subscription Agreements, and Put Option Agreement are qualified in their entirety by the text of the Registration Rights Agreement, Sponsor Forfeiture Agreement, Sponsor Support Agreement, Company Transaction Support Agreement, Subscription Agreements, and Put Option Agreement, respectively. The forms of such agreements are attached as exhibits hereto and are incorporated herein by reference.

| Item 7.01 | Regulation FD Disclosure. |

Press Release

Attached as Exhibit 99.1 to this Report is the press release jointly issued by the parties announcing the Transactions.

Investor Meetings

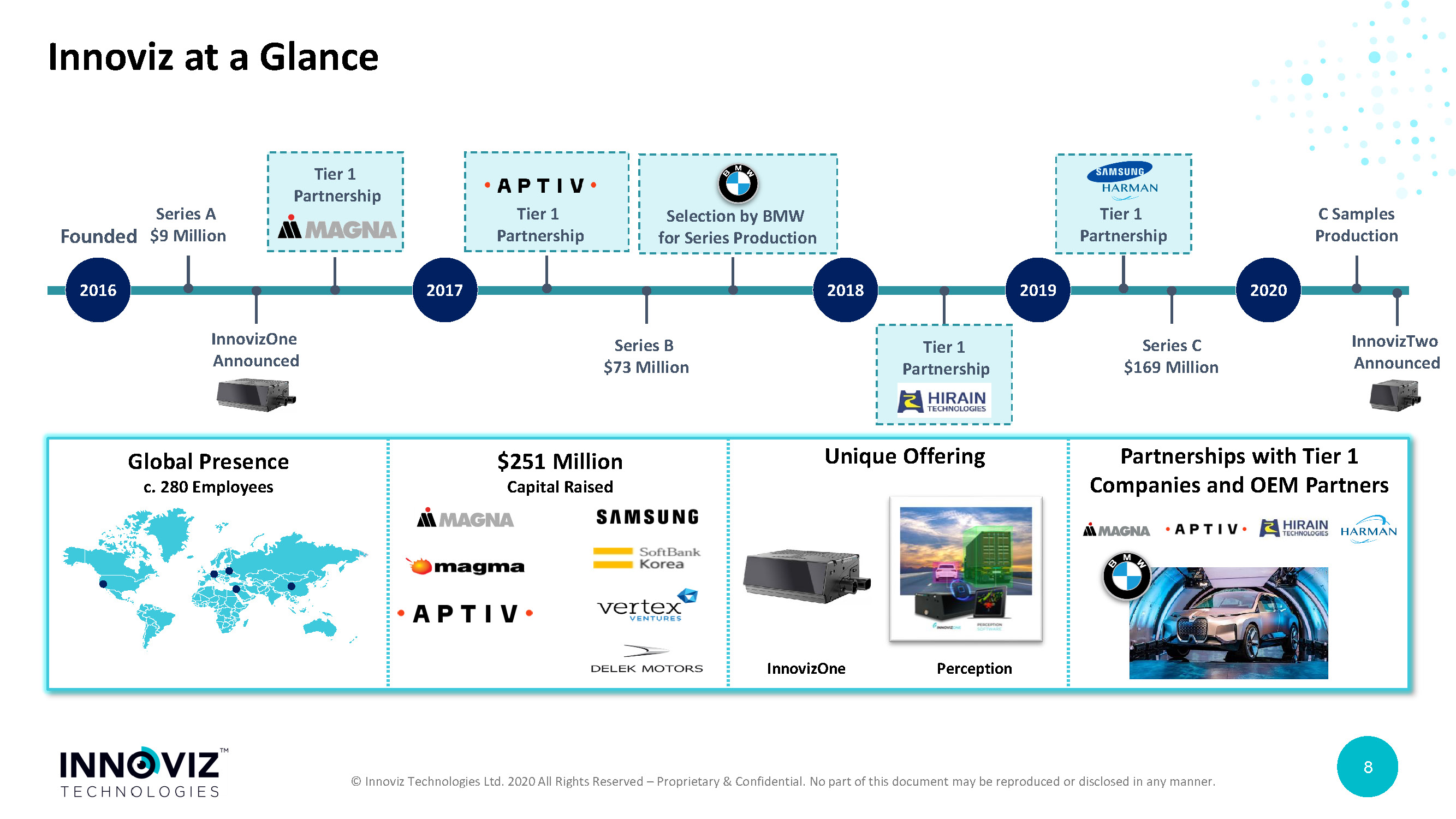

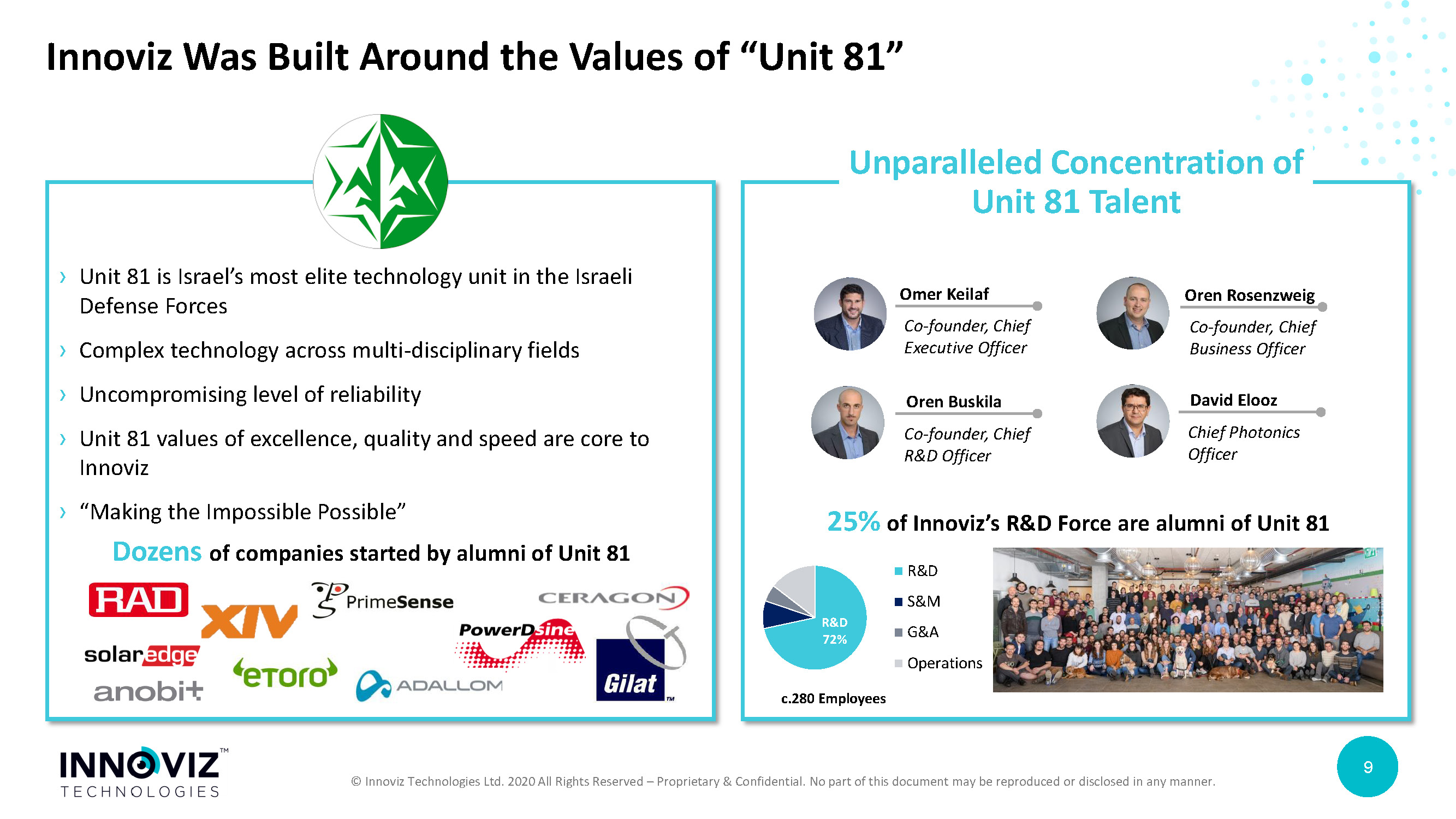

Attached as Exhibits 99.2 and 99.3 to this Report are the form of investor presentation to be used by Collective Growth and the Company in presentations to certain of their securityholders and other persons regarding the proposed Merger and a transcript of the investor presentation that was made in connection with the announcement of the execution of the Business Combination Agreement.

The information set forth below under this Item 7.01, including the exhibits attached hereto, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Innoviz and Collective Growth, including statements regarding the benefits of the transaction, the anticipated timing of the transaction, the services offered by Innoviz and the markets in which it operates, and Innoviz’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of Collective Growth’s securities, (ii) the risk that the transaction may not be completed by Collective Growth’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Collective Growth, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the adoption of the business combination agreement by the shareholders of Collective Growth and Innoviz, the satisfaction of the minimum trust account amount following redemptions by Collective Growth’s public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement, (vi) the effect of the announcement or pendency of the transaction on Innoviz’s business relationships, performance, and business generally, (vii) risks that the proposed transaction disrupts current plans of Innoviz and potential difficulties in Innoviz employee retention as a result of the proposed transaction, (viii) the outcome of any legal proceedings that may be instituted against Innoviz or against Collective Growth related to the business combination agreement or the proposed transaction, (ix) the ability of Innoviz to list its ordinary shares on the Nasdaq, (x) the price of Innoviz’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Innoviz plans to operate, variations in performance across competitors, changes in laws and regulations affecting Innoviz’s business and changes in the combined capital structure, and (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Collective Growth’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and other documents filed by Collective Growth from time to time with the U.S. Securities and Exchange Commission (the “SEC”) and the registration statement on Form F-4 and proxy statement/prospectus discussed below. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Innoviz and Collective Growth assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Innoviz nor Collective Growth gives any assurance that either Innoviz or Collective Growth will achieve its expectations.

Additional Information

COMMENCING SHORTLY AFTER THE FILING OF THIS CURRENT REPORT ON FORM 8-K, COLLECTIVE GROWTH INTENDS TO HOLD PRESENTATIONS FOR CERTAIN OF ITS STOCKHOLDERS, AS WELL AS OTHER PERSONS WHO MIGHT BE INTERESTED IN PURCHASING COLLECTIVE GROWTH’S SECURITIES, IN CONNECTION WITH THE PROPOSED TRANSACTIONS WITH INNOVIZ, AS DESCRIBED IN THIS CURRENT REPORT ON FORM 8-K. THIS CURRENT REPORT ON FORM 8-K, INCLUDING SOME OR ALL OF THE EXHIBITS HERETO, MAY BE DISTRIBUTED TO PARTICIPANTS AT SUCH PRESENTATIONS.

COLLECTIVE GROWTH AND INNOVIZ AND THEIR RESPECTIVE DIRECTORS AND EXECUTIVE OFFICERS, UNDER SEC RULES, MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF PROXIES OF COLLECTIVE GROWTH’S STOCKHOLDERS IN CONNECTION WITH THE PROPOSED TRANSACTIONS. INVESTORS AND SECURITY HOLDERS MAY OBTAIN MORE DETAILED INFORMATION REGARDING THE NAMES AND INTERESTS IN THE PROPOSED TRANSACTIONS OF COLLECTIVE GROWTH’S DIRECTORS AND OFFICERS IN COLLECTIVE GROWTH’S FILINGS WITH THE SEC. INFORMATION REGARDING THE PERSONS WHO MAY, UNDER SEC RULES, BE DEEMED PARTICIPANTS IN THE SOLICITATION OF PROXIES TO COLLECTIVE GROWTH’S STOCKHOLDERS IN CONNECTION WITH THE PROPOSED TRANSACTIONS WILL BE SET FORTH IN THE REGISTRATION STATEMENT FOR THE PROPOSED TRANSACTIONS THAT INNOVIZ INTENDS TO FILE WITH THE SEC, WHICH WILL INCLUDE A PROXY STATEMENT AND PROSPECTUS FOR THE TRANSACTIONS. ADDITIONAL INFORMATION REGARDING THE INTERESTS OF PARTICIPANTS IN THE SOLICITATION OF PROXIES IN CONNECTION WITH THE PROPOSED TRANSACTIONS WILL BE INCLUDED IN THE REGISTRATION STATEMENT.

INVESTORS AND SECURITY HOLDERS OF COLLECTIVE GROWTH AND INNOVIZ ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTIONS. INVESTORS AND SECURITY HOLDERS WILL BE ABLE TO OBTAIN FREE COPIES OF THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS CONTAINING IMPORTANT INFORMATION ABOUT COLLECTIVE GROWTH AND INNOVIZ ONCE SUCH DOCUMENTS ARE FILED WITH THE SEC, THROUGH THE WEBSITE MAINTAINED BY THE SEC AT WWW.SEC.GOV. COPIES OF THE DOCUMENTS FILED WITH THE SEC BY COLLECTIVE GROWTH WHEN AND IF AVAILABLE, CAN BE OBTAINED FREE OF CHARGE ON COLLECTIVE GROWTH’S WEBSITE AT WWW.COLLECTIVE GROWTHCORP.COM OR BY DIRECTING A WRITTEN REQUEST TO COLLECTIVE GROWTH CORPORATION 1805 WEST AVENUE, AUSTIN, TX 78701.

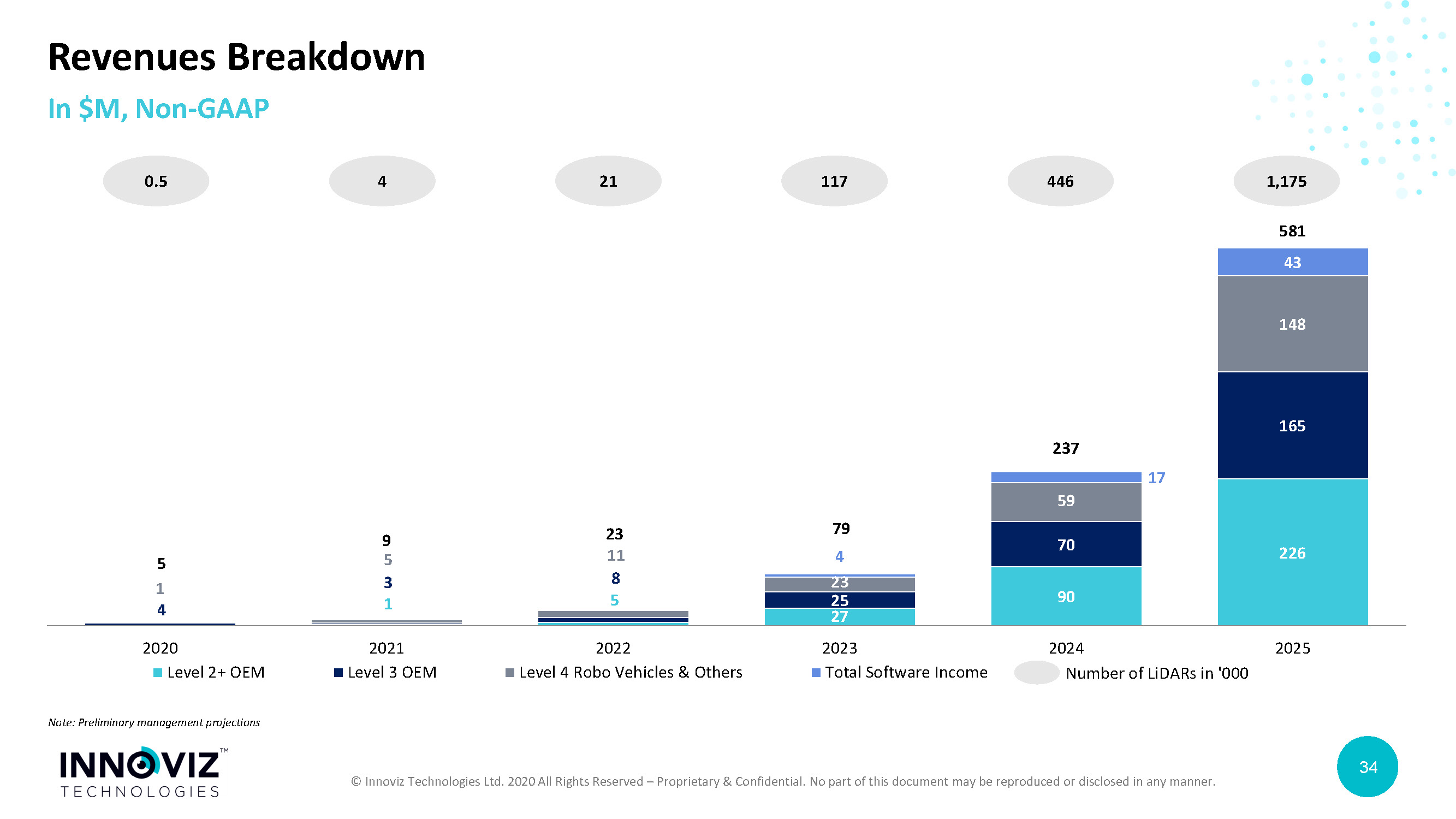

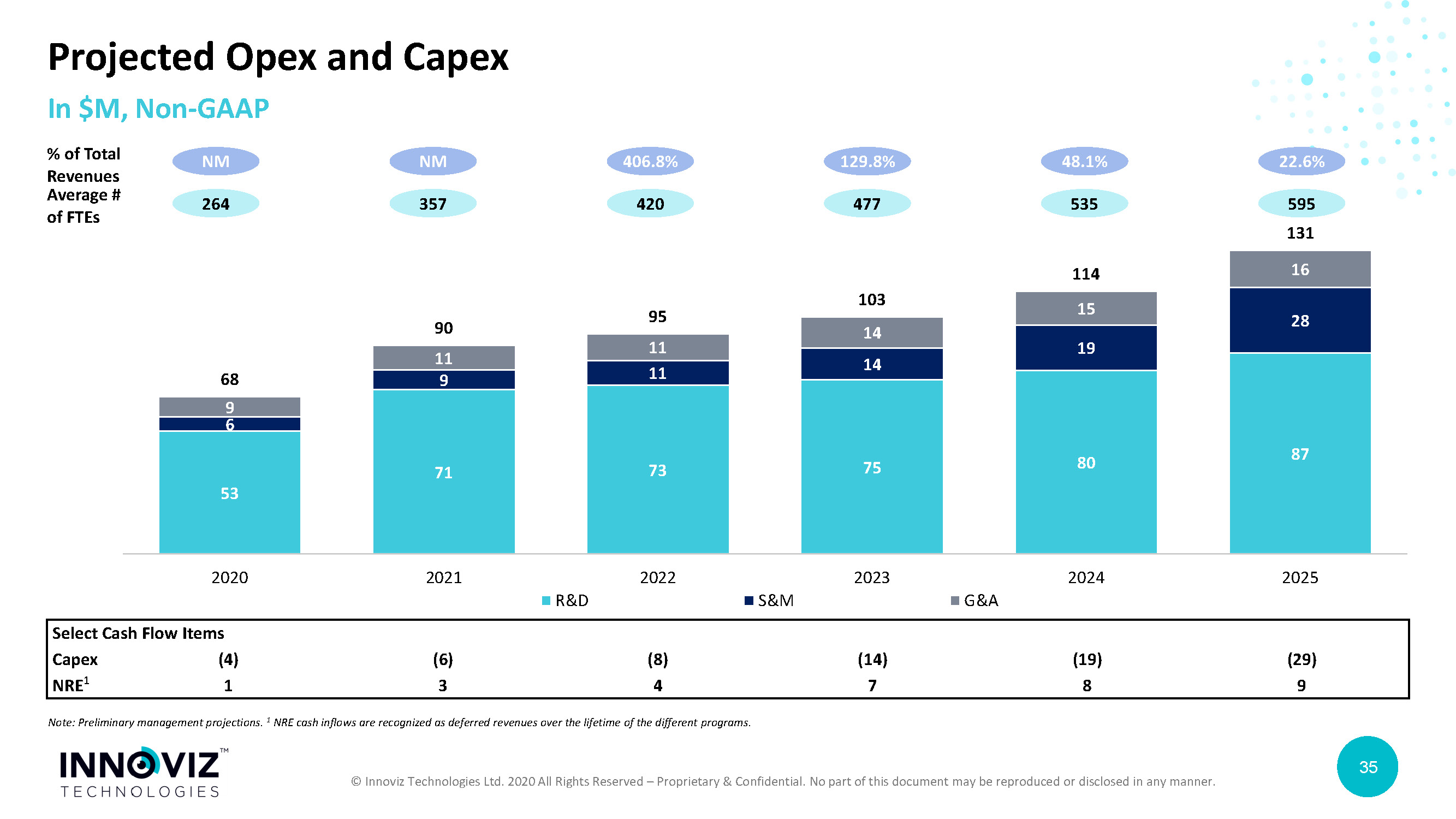

SOME OF INNOVIZ’S FINANCIAL INFORMATION AND DATA CONTAINED HEREIN AND IN THE EXHIBITS HERETO DOES NOT CONFORM TO SEC REGULATION S-X IN THAT IT INCLUDES CERTAIN FINANCIAL INFORMATION NOT DERIVED IN ACCORDANCE WITH UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (“GAAP”). ACCORDINGLY, SUCH INFORMATION AND DATA WILL BE ADJUSTED AND PRESENTED DIFFERENTLY IN THE REGISTRATION STATEMENT FILED WITH THE SEC. COLLECTIVE GROWTH AND INNOVIZ BELIEVE THAT THE PRESENTATION OF NON-GAAP MEASURES PROVIDES INFORMATION THAT IS USEFUL TO INVESTORS AS IT INDICATES MORE CLEARLY THE ABILITY OF INNOVIZ TO MEET CAPITAL EXPENDITURES AND WORKING CAPITAL REQUIREMENTS AND OTHERWISE MEET ITS OBLIGATIONS AS THEY BECOME DUE.

THE FINANCIAL PROJECTIONS INCLUDED IN THIS CURRENT REPORT AND THE EXHIBITS HERETO ARE FORWARD-LOOKING STATEMENTS THAT ARE BASED ON ASSUMPTIONS THAT ARE INHERENTLY SUBJECT TO SIGNIFICANT UNCERTAINTIES AND CONTINGENCIES, MANY OF WHICH ARE BEYOND COLLECTIVE GROWTH’S AND INNOVIZ’S CONTROL. WHILE ALL PROJECTIONS ARE NECESSARILY SPECULATIVE, COLLECTIVE GROWTH AND INNOVIZ BELIEVE THAT THE PROSPECTIVE FINANCIAL INFORMATION COVERING PERIODS BEYOND TWELVE MONTHS FROM ITS DATE OF PREPARATION CARRIES INCREASINGLY HIGHER LEVELS OF UNCERTAINTY AND SHOULD BE READ IN THAT CONTEXT. THERE WILL BE DIFFERENCES BETWEEN ACTUAL AND PROJECTED RESULTS, AND ACTUAL RESULTS MAY BE MATERIALLY GREATER OR MATERIALLY LESS THAN THOSE CONTAINED IN THE PROJECTIONS. THE INCLUSION OF PROJECTIONS IN THIS REPORT AND THE EXHIBITS HERETO SHOULD NOT BE REGARDED AS AN INDICATION THAT COLLECTIVE GROWTH AND INNOVIZ, OR THEIR REPRESENTATIVES, CONSIDERED OR CONSIDER THE PROJECTIONS TO BE A RELIABLE PREDICTION OF FUTURE EVENTS.

THIS CURRENT REPORT AND THE EXHIBITS HERETO ARE NOT A PROXY STATEMENT OR SOLICITATION OF A PROXY, CONSENT OR AUTHORIZATION WITH RESPECT TO ANY SECURITIES OR IN RESPECT OF THE PROPOSED TRANSACTIONS AND SHALL NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES OF COLLECTIVE GROWTH OR INNOVIZ, NOR SHALL THERE BE ANY SALE OF ANY SUCH SECURITIES IN ANY STATE OR JURISDICTION IN WHICH SUCH OFFER, SOLICITATION, OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF SUCH STATE OR JURISDICTION.

THIS REPORT AND THE EXHIBITS HERETO ARE NOT INTENDED TO BE ALL-INCLUSIVE OR TO CONTAIN ALL THE INFORMATION THAT A PERSON MAY DESIRE IN CONSIDERING AN INVESTMENT IN COLLECTIVE GROWTH AND IS NOT INTENDED TO FORM THE BASIS OF ANY INVESTMENT DECISION IN COLLECTIVE GROWTH OR INNOVIZ.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits:

| * | Certain exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2). Collective Growth agrees to furnish supplementally a copy of all omitted exhibits and schedules to the Securities and Exchange Commission upon its request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: December 14, 2020 | COLLECTIVE GROWTH CORPORATION | |||||

| By: |

/s/ Bruce Linton | |||||

| Bruce Linton | ||||||

| Chairman and Chief Executive Officer | ||||||

Exhibit 2.1

BUSINESS COMBINATION AGREEMENT

BY AND AMONG

COLLECTIVE GROWTH CORPORATION

HATZATA MERGER SUB, INC.

INNOVIZ TECHNOLOGIES LTD.

PERCEPTION CAPITAL PARTNERS LLC

(solely for purposes of Sections 2.2(d), 2.3(a), 2.8, 2.9, 5.2, 5.5, 7.2 and Article VIII)

AND

ANTARA CAPITAL LP

(solely for purposes of Sections 5.2, 5.5, 7.2 and Article VIII)

DATED AS OF DECEMBER 10, 2020

TABLE OF CONTENTS

| Page | |

| Article I. CERTAIN DEFINITIONS | 4 |

| Section 1.1 Definitions | 4 |

| Article II. MERGER | 22 |

| Section 2.1 The Merger; Company Preferred Shares. | 22 |

| Section 2.2 Merger Consideration | 23 |

| Section 2.3 Earnout | 24 |

| Section 2.4 No Fractional Company Ordinary Shares. | 25 |

| Section 2.5 Closing of the Transactions Contemplated by this Agreement. | 26 |

| Section 2.6 Deliverables | 26 |

| Section 2.7 Withholding | 28 |

| Section 2.8 Lockup Agreement and Registration Rights Agreement | 28 |

| Section 2.9 Adjustments. | 29 |

| Article III. REPRESENTATIONS AND WARRANTIES RELATING TO THE GROUP COMPANIES AND MERGER SUB | 29 |

| Section 3.1 Organization and Qualification | 29 |

| Section 3.2 Capitalization of the Group Companies | 30 |

| Section 3.3 Authority | 32 |

| Section 3.4 Financial Statements; Undisclosed Liabilities | 32 |

| Section 3.5 Consents and Requisite Governmental Approvals; No Violations | 33 |

| Section 3.6 Permits | 34 |

| Section 3.7 Material Contracts; No Defaults | 34 |

| Section 3.8 Absence of Changes | 36 |

| Section 3.9 Litigation | 36 |

| Section 3.10 Compliance with Applicable Law | 36 |

| Section 3.11 Employee Plans | 36 |

| Section 3.12 Environmental Matters | 38 |

| Section 3.13 Intellectual Property | 39 |

| Section 3.14 Labor Matters | 43 |

| Section 3.15 Insurance | 44 |

| Section 3.16 Tax Matters | 44 |

| Section 3.17 Brokers | 47 |

| Section 3.18 Real and Personal Property | 47 |

| Section 3.19 Transactions with Affiliates | 48 |

| Section 3.20 Compliance with International Trade & Anti-Corruption Laws | 48 |

| Section 3.21 Customers and Suppliers | 49 |

| Section 3.22 Product Warranties; Product Liability | 50 |

| Section 3.23 PIPE Financing | 50 |

| Section 3.24 Information Supplied | 51 |

i

| Section 3.25 Investigation; No Other Representations | 51 |

| Section 3.26 EXCLUSIVITY OF REPRESENTATIONS AND WARRANTIES | 51 |

| Article IV. REPRESENTATIONS AND WARRANTIES RELATING TO SPAC | 52 |

| Section 4.1 Organization and Qualification | 52 |

| Section 4.2 Authority | 52 |

| Section 4.3 Consents and Requisite Governmental Approvals; No Violations | 53 |

| Section 4.4 Brokers | 54 |

| Section 4.5 Information Supplied | 54 |

| Section 4.6 Capitalization of SPAC | 54 |

| Section 4.7 SEC Filings | 55 |

| Section 4.8 Trust Account | 56 |

| Section 4.9 Indebtedness | 56 |

| Section 4.10 Transactions with Affiliates | 57 |

| Section 4.11 Litigation | 57 |

| Section 4.12 Compliance with Applicable Law | 57 |

| Section 4.13 Business Activities | 57 |

| Section 4.14 Internal Controls; Listing; Financial Statements | 58 |

| Section 4.15 No Undisclosed Liabilities | 59 |

| Section 4.16 Tax Matters | 60 |

| Section 4.17 Material Contracts; No Defaults | 61 |

| Section 4.18 Absence of Changes | 62 |

| Section 4.19 Employee Benefit Plans | 62 |

| Section 4.20 Sponsor Letter Agreement | 63 |

| Section 4.21 Investment Company Act | 63 |

| Section 4.22 Charter Provisions | 63 |

| Section 4.23 Compliance with International Trade & Anti-Corruption Laws | 63 |

| Section 4.24 Forfeiture Agreement | 64 |

| Section 4.25 Investigation; No Other Representations | 64 |

| Section 4.26 Residency | 64 |

| Section 4.27 EXCLUSIVITY OF REPRESENTATIONS AND WARRANTIES | 65 |

| Article V. COVENANTS | 65 |

| Section 5.1 Conduct of Business of the Company | 65 |

| Section 5.2 Efforts to Consummate; Litigation | 69 |

| Section 5.3 Confidentiality and Access to Information | 71 |

| Section 5.4 Public Announcements | 72 |

| Section 5.5 Tax Matters | 73 |

| Section 5.6 Exclusive Dealing | 74 |

| Section 5.7 Preparation of Registration Statement / Proxy Statement | 76 |

| Section 5.8 SPAC Stockholder Approval | 77 |

| Section 5.9 Merger Sub Shareholder Approval | 78 |

| Section 5.10 Conduct of Business of SPAC | 78 |

| Section 5.11 Nasdaq Listing | 80 |

ii

| Section 5.12 Trust Account | 80 |

| Section 5.13 Transaction Support Agreements; Company Preferred Approval and Company Shareholder Approval; Subscription Agreements | 81 |

| Section 5.14 Indemnification; Directors’ and Officers’ Insurance | 82 |

| Section 5.15 Post-Closing Officers | 83 |

| Section 5.16 PCAOB Financials | 83 |

| Section 5.17 Certain Financial Information | 83 |

| Section 5.18 Company Incentive Equity Plan | 84 |

| Section 5.19 SPAC Transfer of Certain Intellectual Property | 84 |

| Section 5.20 Company Warrant Agreement | 84 |

| Section 5.21 Termination of Company Investor Agreements. | 84 |

| Section 5.22 No SPAC Securities Transactions. | 85 |

| Section 5.23 Section 16 of the Exchange Act | 85 |

| Section 5.24 Consulting Agreement | 85 |

| Article VI. CONDITIONS TO CONSUMMATION OF THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT | 85 |

| Section 6.1 Conditions to the Obligations of the Parties | 85 |

| Section 6.2 Other Conditions to the Obligations of SPAC | 86 |

| Section 6.3 Other Conditions to the Obligations of the Company Parties | 87 |

| Section 6.4 Frustration of Closing Conditions | 88 |

| Article VII. TERMINATION | 88 |

| Section 7.1 Termination | 88 |

| Section 7.2 Effect of Termination | 90 |

| Article VIII. MISCELLANEOUS | 90 |

| Section 8.1 Non-Survival | 90 |

| Section 8.2 Entire Agreement; Assignment | 91 |

| Section 8.3 Amendment | 91 |

| Section 8.4 Notices | 91 |

| Section 8.5 Governing Law | 93 |

| Section 8.6 Fees and Expenses | 94 |

| Section 8.7 Construction; Interpretation | 94 |

| Section 8.8 Exhibits and Schedules | 95 |

| Section 8.9 Parties in Interest | 95 |

| Section 8.10 Severability | 95 |

| Section 8.11 Counterparts; Electronic Signatures | 95 |

| Section 8.12 Knowledge of Company; Knowledge of SPAC | 96 |

| Section 8.13 No Recourse | 96 |

| Section 8.14 Extension; Waiver | 96 |

| Section 8.15 Waiver of Jury Trial | 97 |

| Section 8.16 Submission to Jurisdiction | 97 |

| Section 8.17 Remedies | 98 |

| Section 8.18 Trust Account Waiver | 98 |

| Section 8.19 Conflicts; Privilege | 99 |

EXHIBITS

| Exhibit A | Form of Subscription Agreement |

| Exhibit B | Form of Forfeiture Agreement |

| Exhibit C | Form of Sponsor Letter Agreement |

| Exhibit D | Form of Transaction Support Agreements |

| Exhibit E | Form of Registration Rights Agreement |

| Exhibit F | Form of Lockup Agreement |

| Exhibit G | Form of Company Warrant Agreement |

| Exhibit H | Form of Company A&R Articles of Association |

iii

BUSINESS COMBINATION AGREEMENT

This BUSINESS COMBINATION AGREEMENT (this “Agreement”), dated as of December 10, 2020, is entered into by and among Collective Growth Corporation, a Delaware corporation (“SPAC”), Hatzata Merger Sub, Inc., a Delaware corporation (“Merger Sub”), Innoviz Technologies Ltd., a company organized under the laws of the State of Israel (the “Company”), solely for purposes of Sections 2.2(d), 2.3, 2.8, 2.9, 5.2, 5.5, 7.2 and Article VIII (collectively with the definitions in Section 1.1 of any terms used but not defined in such Sections, the “Perception Provisions”), Perception Capital Partners LLC, a Delaware limited liability company (“Perception”), and solely for purposes of Sections 5.2, 5.5, 7.2 and Article VIII (collectively with the definitions in Section 1.1 of any terms used but not defined in such Sections, the “Antara Provisions”), Antara Capital LP (“Antara”). SPAC, Merger Sub and the Company shall be referred to herein from time to time collectively as the “Parties.” Capitalized terms used but not otherwise defined herein have the meanings set forth in Section 1.1.

WHEREAS, SPAC is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses or entities;

WHEREAS, Merger Sub is a newly formed, wholly owned, direct Subsidiary of the Company that was formed for purposes of consummating the transactions contemplated by this Agreement and the Ancillary Documents (the “Transactions”);

WHEREAS, subject to the terms and conditions hereof, on the Closing Date, (a) Merger Sub will merge with and into SPAC (the “Merger”), with SPAC surviving the Merger as a wholly owned Subsidiary of the Company, (b) each SPAC Share will be automatically converted as of the Effective Time into the right to receive the Per Share Consideration, (c) each of the 1,875,000 Sponsor Shares (which number excludes the Sponsor Shares to be forfeited pursuant to the Forfeiture Agreement) will be automatically converted as of the Effective Time into the right to receive the Per Share Consideration, (d) Perception will be issued 3,448,526 Perception Company Warrants, (e) certain members of Company Management will receive 2,847,436 Management Shares and 3,986,410 Management Warrants, (f) all of the Company Preferred Shares will be converted into Company Ordinary Shares, and (g) each of the 1,687,500 SPAC Warrants (which number excludes the SPAC Warrants to be forfeited pursuant to the Forfeiture Agreement) will automatically become a Company Warrant and all rights with respect to SPAC Shares underlying the SPAC Warrants will be automatically converted into rights with respect to Company Ordinary Shares and thereupon assumed by the Company;

WHEREAS, the SPAC Board has (a) approved this Agreement, the Ancillary Documents to which SPAC is or will be a party and the transactions contemplated hereby and thereby (including the Merger) and (b) recommended, among other things, approval of this Agreement and the Transactions (including the Merger) by the holders of SPAC Shares entitled to vote thereon;

WHEREAS, the board of directors of Merger Sub has approved this Agreement, the Ancillary Documents to which Merger Sub is or will be a party and the transactions contemplated hereby and thereby (including the Merger);

WHEREAS, the Company, acting in its capacity as the sole shareholder of Merger Sub, has approved this Agreement, the Ancillary Documents to which Merger Sub is or will be a party and the transactions contemplated hereby and thereby (including the Merger);

WHEREAS, the board of directors of the Company (the “Company Board”) has (a) approved this Agreement, the Ancillary Documents to which the Company is or will be a party and the transactions contemplated hereby and thereby (including the Merger) and (b) recommended, among other things, the approval of the Company Preferred Shareholder Proposals and the Company Shareholder Proposals, by the holders of Company Shares entitled to vote thereon at the Company Shareholder Meeting;

WHEREAS, concurrently with the execution of this Agreement, the Company and each of the parties (the “Subscribers”) subscribing for Company Ordinary Shares have entered into certain subscription agreements, dated as of the date hereof (as amended or modified from time to time, collectively, the “Subscription Agreements”), in substantially the form attached hereto as Exhibit A, pursuant to which, among other things, each Subscriber has agreed to subscribe for and purchase on the Closing Date immediately following the Closing, and the Company has agreed to issue and sell to each such Subscriber on the Closing Date immediately following the Closing, the number of Company Ordinary Shares set forth in the applicable Subscription Agreement in exchange for the purchase price set forth therein (the aggregate purchase price under all Subscription Agreements, collectively, the “PIPE Financing Amount”, and the equity financing under all Subscription Agreements, collectively, hereinafter referred to as, the “PIPE Financing”), on the terms and subject to the conditions set forth in the applicable Subscription Agreement;

WHEREAS, as of the date of this Agreement, the initial stockholders of SPAC (collectively, the “Sponsor”) own an aggregate of 3,750,000 Sponsor Shares and 1,875,000 SPAC Warrants;

WHEREAS, concurrently with the execution of this Agreement, Sponsor and SPAC are entering into the forfeiture agreement in substantially the form attached hereto as Exhibit B (the “Forfeiture Agreement”), pursuant to which, among other things, immediately prior to the Effective Time, Sponsor will forfeit to SPAC for cancellation in exchange for no consideration 1,875,000 Sponsor Shares and 187,500 SPAC Warrants (the “Forfeiture”);

WHEREAS, subject to the terms and conditions of Section 2.3, certain members of the Company Management may receive up to an additional 1,423,718 Company Ordinary Shares;

WHEREAS, subject to the terms and conditions of Section 2.3, Perception may receive up to 2,477,269 Company Ordinary Shares;

WHEREAS, subject to the terms and conditions of the Put Option Agreement, Antara, on behalf of the funds it manages and/or its designees, will receive 4,310,736 Company Warrants on the Closing Date and may receive up to 3,929,461 Company Ordinary Shares;

WHEREAS, concurrently with the execution of this Agreement, Sponsor, SPAC and the Company are entering into the sponsor letter agreement in substantially the form attached hereto as Exhibit C (the “Sponsor Letter Agreement”), pursuant to which, among other things, Sponsor has agreed to vote in favor of this Agreement and the transactions contemplated hereby (including the Merger) on the terms and subject to the conditions set forth in the Sponsor Letter Agreement;

2

WHEREAS, concurrently with the execution of this Agreement, certain Company Shareholders (collectively, the “Supporting Company Shareholders”) are entering into a transaction support agreement, substantially in the form attached hereto as Exhibit D (collectively, the “Transaction Support Agreements”), pursuant to which, among other things, each such Supporting Company Shareholder will agree to vote in favor of the approval of the Company Preferred Shareholder Proposals and the Company Shareholder Proposals, as applicable, at the Company Shareholder Meeting;

WHEREAS, pursuant to the Governing Documents of SPAC, SPAC is required to provide an opportunity for its public shareholders to have their outstanding SPAC Shares redeemed for the consideration, and on the terms and subject to the conditions and limitations, set forth in the Governing Documents of SPAC and the Trust Agreement (the “Offer”);

WHEREAS, concurrently with the execution of this Agreement, in connection with the Merger, the Company, certain Company Shareholders, the Sponsor and certain SPAC Stockholders who will receive Company Ordinary Shares pursuant to Article II of this Agreement will enter into that certain Registration Rights Agreement (the “Registration Rights Agreement”), substantially in the form set forth on Exhibit E to be effective upon the Closing;

WHEREAS, concurrently with the execution of this Agreement, in connection with the Merger, the Company, certain Company Shareholders, Sponsor and certain SPAC Stockholders who will receive Company Ordinary Shares pursuant to Article II of this Agreement have entered into those certain Lockup Agreements (collectively, the “Lockup Agreement”) substantially in the form set forth on Exhibit F, each to be effective upon the Closing;

WHEREAS, at the Closing, in connection with the Merger, the Company and Continental will enter into that certain Amendment to the Company Warrant Agreement (the “Company Warrant Agreement”), substantially in the form set forth on Exhibit G to be effective upon the Closing;

WHEREAS, the Company shall, subject to obtaining the Company Preferred Shareholder Approval, the Company Shareholder Approval, and the SPAC Stockholder Approval, adopt the amended and restated articles of association of the Company (the “Company A&R Articles of Association”) substantially in the form attached hereto as Exhibit H, effective immediately following the Effective Time; and

WHEREAS, immediately prior to the Effective Time, the Company shall, subject to obtaining the Company Preferred Shareholder Approval, the Company Shareholder Approval, and the SPAC Stockholder Approval, adopt the Company Incentive Equity Plan.

NOW, THEREFORE, in consideration of the premises and the mutual promises set forth herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, Perception, with respect to the Perception Provisions, and Antara, with respect to the Antara Provisions, each intending to be legally bound, hereby agree as follows:

3

Article

I.

CERTAIN DEFINITIONS

Section 1.1 Definitions. As used in this Agreement, the following terms have the respective meanings set forth below.

“Affiliate” means, with respect to any Person, any other Person who directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such Person. The term “control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise, and the terms “controlled” and “controlling” have meanings correlative thereto.

“Aggregate Transaction Proceeds” means an amount equal to (a) the aggregate cash proceeds available for release to SPAC from the Trust Account in connection with the transactions contemplated hereby (after, for the avoidance of doubt, giving effect to all of the SPAC Stockholder Redemptions but before release of any other funds) plus (b) the PIPE Financing Amount plus (c) the Antara Top-Up Amount, if any.

“Aggregate Transaction Share Consideration” means an aggregate number of Company Ordinary Shares equal to (a) Equity Value divided by (b) the Company Share Value.

“Agreement” has the meaning set forth in the introductory paragraph to this Agreement.

“Ancillary Documents” means the Sponsor Letter Agreement, the Subscription Agreements, the Forfeiture Agreement, the Transaction Support Agreements, the Registration Rights Agreement, the Lockup Agreement, the Company Warrant Agreement, and each other agreement, document, instrument and/or certificate contemplated by this Agreement executed or to be executed in connection with the transactions contemplated hereby.

“Antara” means Antara Capital LP, a Delaware limited partnership.

“Antara Top-up Amount” means the aggregate purchase price of the additional Company Ordinary Shares subscribed for by Antara, at a price per Company Ordinary Share equal to the Put Share Price (as defined in the Put Option Agreement), following the SPAC Stockholders Meeting, if any, to replace the cash released from the Trust Account in satisfaction of SPAC Stockholder Redemptions, if any.

“Anti-Corruption Laws” means, collectively, the Foreign Corrupt Practices Act (FCPA), the UK Bribery Act 2010, the Israeli Penal Law (Bribery Transactions), 1977; the Israeli Prohibition on Money Laundering Law (Bribery Transactions), 2000, OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, the UN Convention against Corruption, United States Currency, Foreign Transactions Reporting Act of 1970, as amended, and any other applicable anti-bribery or anti-corruption Laws related to combatting bribery, corruption and money laundering.

4

“Business Combination Proposal” has the meaning set forth in Section 5.8.

“Business Day” means a day, other than a Saturday or Sunday, on which commercial banks in New York, New York and Tel-Aviv, Israel are open for the general transaction of business.

“Certificate of Merger” has the meaning set forth in Section 2.1(b).

“Change of Control Consideration” means the amount per Company Share to be received by Company Shareholders in connection with a Change of Control Transaction, with any non-cash consideration valued as determined by the value ascribed to such consideration by the parties to such transaction.

“Change of Control Transaction” means any transaction or series of related transactions (a) under which any Person(s), directly or indirectly, acquires or otherwise purchases (i) another Person or any of its Affiliates or (ii) all or a material portion of assets, businesses or Equity Securities of another Person, (b) that results, directly or indirectly, in the shareholders of a Person as of immediately prior to such transaction holding, in the aggregate, less than fifty percent (50%) of the voting shares of such Person (or any successor or parent company of such Person) immediately after the consummation thereof (in the case of each of clause (a) and (b), whether by merger, consolidation, tender offer, recapitalization, purchase or issuance of Equity Securities, tender offer or otherwise), or (c) under which any Persons(s) makes any equity or similar investment in another Person.

“Closing” has the meaning set forth in Section 2.5.

“Closing Company Audited Financial Statements” has the meaning set forth in Section 5.16.

“Closing Date” has the meaning set forth in Section 2.5.

“Closing Filing” has the meaning set forth in Section 5.4(b).

“Closing Press Release” has the meaning set forth in Section 5.4(b).

“COBRA” means Part 6 of Subtitle B of Title I of ERISA, Section 4980B of the Code and any similar state Law.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“Company” has the meaning set forth in the introductory paragraph to this Agreement.

“Company A&R Articles of Association” has the meaning set forth in the recitals to this Agreement.

5

“Company Acquisition Proposal” means (a) any transaction or series of related transactions under which any Person(s), directly or indirectly, (i) acquires or otherwise purchases control of the Company or any of its controlled Affiliates or (ii) all or a material portion of assets or businesses of the Company or any of its controlled Affiliates (in the case of each of clause (i) and (ii), whether by merger, consolidation, recapitalization, purchase or issuance of Equity Securities, tender offer or otherwise), or (b) any equity or similar investment in the Company or any of its controlled Affiliates. Notwithstanding the foregoing or anything to the contrary herein, none of this Agreement, the Ancillary Documents nor the Transactions shall constitute a Company Acquisition Proposal.

“Company Board” has the meaning set forth in the recitals to this Agreement.

“Company Board Recommendation” has the meaning set forth in Section 5.13(c).

“Company Change in Recommendation” means a change to, withdrawal of, withholding of, qualification of or modification of, or public proposal to change, withdraw, withhold, qualify or modify, the Company Board Recommendation, in each case by the Company Board or a committee thereof.

“Company Disclosure Schedules” means the disclosure schedules to this Agreement delivered to SPAC by the Company on the date of this Agreement.

“Company Equity Award” means, as of any determination time, each Company Option and each other award to any current or former director, manager, officer, employee, individual independent contractor or other service provider of any Group Company of rights of any kind to receive any Equity Security of any Group Company under any Company Equity Plan or otherwise that is outstanding.

“Company Equity Plan” means the (a) Company’s Share Option Plan and (b) each other plan that provides for the award to any current or former director, manager, officer, employee, individual independent contractor or other service provider of any Group Company of rights of any kind to receive Equity Securities of any Group Company or benefits measured in whole or in part by reference to Equity Securities of any Group Company.

“Company Expenses” means, as of any determination time, the aggregate amount of fees, expense, commissions or other amounts incurred by or on behalf of, or otherwise payable by, whether or not due, any Group Company or Merger Sub in connection with the negotiation, preparation or execution of this Agreement or any Ancillary Documents, the performance of its covenants or agreements in this Agreement or any Ancillary Document or the consummation of the Transactions, including (a) the fees and expenses of outside legal counsel, accountants, advisors, brokers, investment bankers, consultants, or other agents or service providers of any Group Company or Merger Sub, and (b) any other fees, expenses, commissions or other amounts that are expressly allocated to any Group Company or Merger Sub pursuant to this Agreement or any Ancillary Document, including all fees for registering the Company Securities on the Registration Statement, all fees for the application for listing the Company Securities on Nasdaq, and fifty percent (50%) of the fees due in connection with the HSR Act filing (it being understood that the remainder of such fees will be paid by Perception and Antara and not by SPAC). Notwithstanding the foregoing or anything to the contrary herein, Company Expenses shall not include any SPAC Expenses.

6

“Company Fundamental Representations” means the representations and warranties set forth in Section 3.1(a) and Section 3.1(b) (Organization and Qualification), Section 3.2(a) and Section 3.2(c) (Capitalization of the Group Companies), Section 3.3 (Authority), Section 3.8 (Absence of Changes), and Section 3.17 (Brokers).

“Company Incentive Equity Plan” has the meaning set forth in Section 5.17.

“Company Investor Agreements” has the meaning set forth in Section 3.19.

“Company Licensed Intellectual Property” means Intellectual Property Rights owned by any Person (other than a Group Company) that is licensed to any Group Company.

“Company Management” means the employees of the Company listed in the first column in the chart on Schedule 2.2(e) of the Company Disclosure Schedules.

“Company Material Adverse Effect” means any change, event, effect or occurrence that, individually or in the aggregate with any other change, event, effect or occurrence, has had or would reasonably be expected to have a material adverse effect on the business, results of operations or financial condition of the Group Companies, taken as a whole; provided, however, that none of the following shall be taken into account in determining whether a Company Material Adverse Effect has occurred or is reasonably likely to occur: any adverse change, event, effect or occurrence arising after the date of this Agreement from or related to (i) general business or economic conditions in or affecting the United States or Israel, or changes therein, or the global economy generally, (ii) acts of war, sabotage, or terrorism (including cyberterrorism) in the United States, Israel, or other territories in which a material portion of the business of the Group Companies is located, (iii) changes in conditions of the financial, banking, capital or securities markets generally in the United States or Israel, including changes in interest rates in the United States or Israel and changes in exchange rates for the currencies of such countries, (iv) changes in any applicable Laws or GAAP or any official interpretation thereof, (v) any change, event, effect or occurrence that is generally applicable to the industries or markets in which any Group Company operates, (vi) the execution or public announcement of this Agreement or the pendency or consummation of the transactions contemplated by this Agreement, including the impact thereof on the relationships, contractual or otherwise, of any Group Company with employees, customers, investors, contractors, lenders, suppliers, vendors, partners, licensors, licensees, payors or other third-parties related thereto (provided that the exception in this clause (vi) shall not apply to the representations and warranties set forth in Section 3.5(b) to the extent that its purpose is to address the consequences resulting from the public announcement or pendency or consummation of the transactions contemplated by this Agreement or the condition set forth in Section 6.2(a) to the extent it relates to such representations and warranties), (vii) any failure by any Group Company to meet, or changes to, any internal or published budgets, projections, forecasts, estimates or predictions (it being understood that the underlying facts giving rise or contributing to such failure or change may be taken into account in determining whether there has been a Material Adverse Effect if otherwise contemplated by, and not otherwise excluded from, this definition), or (viii) any hurricane, tornado, flood, earthquake, tsunami, natural disaster, mudslides, wild fires, epidemics, pandemics (including COVID-19 or SARS-CoV-2 virus or any mutation or variation thereof) or acts of God or other natural disasters or comparable events in the United States or Israel, or any escalation of the foregoing; provided, however, that any change, event, effect or occurrence resulting from a matter described in any of the foregoing clauses (i) through (v) or (vii)-(viii) may be taken into account in determining whether a Company Material Adverse Effect has occurred or is reasonably likely to occur to the extent such change, event, effect or occurrence has a disproportionate adverse effect on the Group Companies, taken as a whole, relative to other participants operating in the industries or markets in which the Group Companies operate.

7

“Company Non-Party Affiliates” means, collectively, each Company Related Party and each former, current or future Affiliates, Representatives, successors or permitted assigns of any Company Related Party (other than, for the avoidance of doubt, the Company Parties).

“Company Option” means, as of any determination time, each option to purchase Company Ordinary Shares that is outstanding and unexercised, whether granted under a Company Equity Plan or otherwise.

“Company Ordinary Shares” means ordinary shares of no par value of the Company.

“Company Owned Intellectual Property” means all Intellectual Property Rights that are owned by the Group Companies, including the Company Registered Intellectual Property.

“Company Parties” means, together, the Company and Merger Sub.

“Company Preferred A Shares” means the series A convertible preferred shares of the Company, no par value.

“Company Preferred B Shares” means the series B convertible preferred shares of the Company, no par value.

“Company Preferred B-1 Shares” means the series B-1 convertible preferred shares of the Company, no par value.

“Company Preferred C Shares” means the series C convertible preferred shares of the Company, no par value.

“Company Preferred C-1 Shares” means the series C-1 convertible preferred shares of the Company, no par value.

“Company Preferred Shareholder Approval” means the affirmative vote of the Preferred Majority, voting as a single class, at the Company Shareholder Meeting, including the affirmative vote of the Preferred C Majority, approving the Company Preferred Shareholder Proposals.

8

“Company Preferred Shareholder Proposals” means (i) the adoption and approval of the proposal to convert the Company Preferred Shares into Company Ordinary Shares, (ii) the proposal to increase the size of the Company Board, (iii) the adoption and approval of a proposal to terminate each Company Investor Agreement requiring consent of the Company Preferred Shareholders, (iv) the adoption of the Company A&R Articles of Association, (v) the waiver of preemptive rights set forth in the Company’s Charter Documents, and (vi) the adoption and approval of each other proposal reasonably agreed to by the Company and SPAC as necessary or appropriate in connection with the consummation of the Transactions that would require the approval of all or certain holders of Company Preferred Shares.

“Company Preferred Shares” means, collectively, the Company Preferred A Shares, the Company Preferred B Shares, the Company Preferred B-1 Shares, the Company Preferred C Shares and the Company Preferred C-1 Shares.

“Company Product” means each product of the Group Companies that is sold or distributed to customers or end-users on a commercial basis.

“Company Registered Intellectual Property” means all Registered Intellectual Property owned by any Group Company.

“Company Related Party” has the meaning set forth in Section 3.19.

“Company Related Party Transactions” has the meaning set forth in Section 3.19.

“Company Share Value” means $8.779827.

“Company Shareholder Meeting” has the meaning set forth in Section 5.13(b).

“Company Shareholder Proposals” means (i) the proposal to increase the size of the Company Board, (ii) the adoption and approval of a proposal to terminate each Company Investor Agreement requiring consent of the Company Shareholders, (iii) the adoption and approval of each other proposal reasonably agreed to by the Company and SPAC as necessary or appropriate in connection with the consummation of the Transactions that would require the approval of all or certain holders of Company Shares, and (iv) the adoption of the Company A&R Articles of Association.

“Company Shareholder Approval” means the affirmative vote of the holders of Company Shares holding more than fifty percent (50%) of the then issued and outstanding Company Shares, on an as-converted basis, at the Company Shareholder Meeting, approving the Company Shareholder Proposals.

“Company Shareholders” means, collectively, the holders of Company Shares as of any determination time prior to the Effective Time.

“Company Shares” means, collectively, the Company Preferred Shares and the Company Ordinary Shares.

“Company Warrant Agreement” has the meaning set forth in the recitals to this Agreement.

“Company Warrants” means warrants to purchase Company Ordinary Shares on the terms set forth in the Company Warrant Agreement.

9

“Confidentiality Agreement” means, that certain Non-Disclosure Agreement, dated as of October 1, 2020, by and between the Company and SPAC.

“Consent” means any notice, authorization, qualification, registration, filing, notification, waiver, Order, consent, clearance or approval to be obtained from, filed with or delivered to, a Governmental Entity or other Person.

“Continental” means Continental Stock Transfer & Trust Company.

“Contract” or “Contracts” means any written agreement, contract, license, lease, obligation, undertaking or other commitment or arrangement that is legally binding upon a Person or any of his, her or its properties or assets.

“Copyrights” has the meaning set forth in the definition of Intellectual Property Rights.

“COVID-19” means SARS-CoV-2, coronavirus or COVID-19, and any evolutions thereof or related or associated epidemics, pandemic or disease outbreaks.

“COVID-19 Measures” means any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, mask wearing, temperature taking, personal declaration, “purple badge standard”, shut down, closure, sequester or any other Law, decree, judgment, injunction or other Order, directive, guidelines or recommendations by any Governmental Entity or industry group in connection with or in response to COVID-19 pandemic, including, the Coronavirus Aid, Relief, and Economic Security Act (CARES).

“Creator” has the meaning set forth in Section 3.13(d).