Form 8-K CF Acquisition Corp. VI For: Aug 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

(Exact name of registrant as specified in its charter)

|

|

|

|

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification Number) |

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including

area code:

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The Capital Market | ||||

| The Capital Market | ||||

| The Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 7.01. | Regulation FD Disclosure |

As previously disclosed, on December 1, 2021, CF Acquisition Corp. VI, a Delaware corporation (“CF VI”) entered into a Business Combination Agreement (as the terms and conditions therein may be amended, modified or waived from time to time, the “BCA”) with Rumble Inc., a corporation formed under the laws of the Province of Ontario, Canada (“Rumble”).

Attached as Exhibit 99.1 to this Current Report on Form 8-K is an updated investor presentation that will be used to discuss the transactions contemplated by the BCA with certain persons, including persons potentially interested in purchasing CF VI’s securities in connection with the transactions described therein.

The information in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of CF VI under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any of the information in this Item 7.01, including Exhibit 99.1.

Important Information and Where to Find It

This Current Report on Form 8-K relates to a proposed transaction between Rumble and CF VI. This Current Report on Form 8-K does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the transaction described herein, CF VI has filed with the United States Securities and Exchange Commission (“SEC”) an effective registration statement on Form S-4, which includes a proxy statement/prospectus of CF VI, on August 12, 2022 (the “Registration Statement”), and has filed, and will file, other relevant materials with the SEC. The definitive proxy statement/prospectus has been sent to all CF VI stockholders. Investors and security holders of CF VI are urged to read the Registration Statement, the definitive proxy statement/prospectus (and any supplements thereto, if and when filed), and all other relevant documents filed or to be filed in connection with the proposed transaction because they contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the Registration Statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by CF VI through the website maintained by the SEC at www.sec.gov.

The documents filed or that will be filed by CF VI with the SEC also may be obtained free of charge upon written request to CF Acquisition Corp. VI, 110 East 59th Street, New York, NY 10022 or via email at [email protected].

Participants in the Solicitation

CF VI, Rumble and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from CF VI’s stockholders in connection with the proposed transactions. CF VI's stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and executive officers of CF VI in the Registration Statement. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies from CF VI’s stockholders in connection with the proposed business combination is set forth in the Registration Statement.

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of CF VI, or Rumble, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed transaction between CF VI and Rumble. Such forward-looking statements include, but are not limited to, statements regarding the closing of the transaction and CF VI’s, Rumble’s, or their respective management teams’ expectations, hopes, beliefs, intentions or strategies regarding the future. The words “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intends”, “may”, “might”, “plan”, “possible”, “potential”, “predict”, “project”, “should”, “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to assumptions, risks and uncertainties. These statements are based on various assumptions, whether or not identified in this Current Report on Form 8-K. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by an investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of CF VI and Rumble. Many factors could cause actual future events to differ from the forward looking-statements in this Current Report on Form 8-K, including but not limited, to (i) the risk that the transaction may not be completed in a timely manner or at all, (ii) the failure to satisfy the conditions to the consummation of the transaction, (iii) the inability to complete the PIPE offering, (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the BCA, (v) the outcome of any legal proceedings that may be instituted against Rumble and/or CF VI related to the BCA or the transactions contemplated thereby, (vi) the ability to maintain the listing of CF VI stock on Nasdaq, (vii) costs related to the transactions and the failure to realize anticipated benefits of the transactions or to realize estimated pro forma results and underlying assumptions, including with respect to estimated stockholder redemptions, (viii) the effect of the announcement or pendency of the transaction on Rumble’s business relationships, operating results, performance and business generally, (ix) changes in the combined capital structure of Rumble and CF VI following the transactions, (x) changes in laws and regulations affecting Rumble’s business, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the transactions, and identify and realize additional opportunities, (xii) risks related to Rumble’s limited operating history, the rollout of its business and the timing of expected business milestones, (xiii) risks related to Rumble’s potential inability to achieve or maintain profitability and generate cash, (xiv) current and future conditions in the global economy, including as a result of the impact of the COVID-19 pandemic, and their impact on Rumble, its business and markets in which it operates, (xv) the ability of Rumble to retain existing content providers and users and attract new content providers and customers, (xvi) the potential inability of Rumble to manage growth effectively, (xvii) the enforceability of Rumble’s intellectual property, including its patents and the potential infringement on the intellectual property rights of others, and (xviii) the ability to recruit, train and retain qualified personnel. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Registration Statement, CF VI’s Form 10-Q filed on August 15, 2022 and the other filings that CF VI has filed or will file with the SEC from time to time. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Rumble and CF VI assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Rumble nor CF VI gives any assurance that either Rumble or CF VI will achieve its expectations.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

|

Exhibit No. |

Description |

| 99.1 | Form of Investor Presentation. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CF ACQUISITION CORP. VI | ||

| By: | /s/ Howard W. Lutnick | |

| Name: | Howard W. Lutnick | |

| Title: | Chief Executive Officer | |

Dated: August 17, 2022

Exhibit 99.1

Investor Presentation August 2022

Disclaimer Disclaimers and Other Important Information This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist intereste d p arties in making their own evaluation with respect to a potential business combination between CF Acquisition Corp. VI (“CF VI”) and Rumble, Inc. (“Rumble” or the “Company”) and related transactions (the “Potential Business Co mbination”), and for no other purpose. By reviewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below. This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell, or a sol icitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the Potential Business Combinatio n o r any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdi cti on. This Presentation does not constitute either advice or a recommendation regarding any securities. The communication of this Presentation is restricted by law; it is not intended for distribution to, or use by any person in, an y jurisdiction where such distribution or use would be contrary to local law or regulation. No representations or warranties, express or implied, are given in, or in respect of, this Presentation. This Presentation is su bject to updating, revision, verification and further amendment. None of CF VI, Rumble or their respective affiliates has authorized anyone to provide interested parties with additional or different information. No securi tie s regulatory authority has expressed an opinion about the securities discussed in this Presentation and it is an offense to claim otherwise. To the fullest extent permitted by law, in no circumstances will CF VI, Rumble or any of th eir respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arisi ng from the use of this Presentation, its contents (including the internal economic models), its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in conn ect ion therewith. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with CF V I, Rumble or their respective representatives, as investment, legal or tax advice. In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analy sis of CF VI, Rumble, or the Potential Business Combination. Recipients of this Presentation should each make their own evaluation of CF VI, Rumble, the Potential Business Combination and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. This Presentation supersedes and replaces all previous oral or written communications between the parties hereto relating to the s ubj ect matter hereof. Forward - Looking Information This Presentation (and oral statements regarding the subjects of this Presentation) contains certain forward - looking statements within the meaning of the U.S. federal securities laws with respect to Rumble and the Potential Business Combination, including statements regarding the anticipated benefits of the Potential Business Combination, the anti cip ated timing of the Potential Business Combination, the products and services offered by Rumble and the markets in which it operates (including future market opportunities), Rumble’s projected future results, future finan cia l condition and performance and expected financial impacts of the Potential Business Combination (including future revenue, pro forma enterprise value and cash balance), the satisfaction of closing conditions to the Potent ial Business Combination, and the level of redemptions of CF VI’s public stockholders, and Rumble’s expectations, intentions, strategies, assumptions or beliefs about future events, results of operations or performance or tha t d o not solely relate to historical or current facts. These forward - looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “scales,” “ rep resentative of,” “valuation,” “potential,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward - looking statements are predictions, projections and other stat ements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward - look ing statements in this Presentation, including but not limited to: (i) the risk that the Potential Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of CF VI’s securities, ( ii) the risk that the Potential Business Combination may not be completed by CF VI’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by CF VI , ( iii) the failure to satisfy the conditions to the consummation of the Potential Business Combination, including the approval of the business combination agreement by the stockholders of CF VI, the satisfaction of the minimum tr ust account amount following any redemptions by CF VI’s public stockholders (if applicable), and the receipt of certain governmental and regulatory approvals, (iv) the lack of a fairness opinion in determining whether or not t o p ursue the Potential Business Combination, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement, (vi) the effect of the pendency o f t he Potential Business Combination on Rumble’s business relationships, operating results, performance and business generally, (vii) risks that the Potential Business Combination disrupts current plans and operations of Rumble, (viii) the outcome of any legal proceedings that may be instituted against Rumble or CF VI related to the business combination agreement or the Potential Business Combination, (ix) the ability to maintain the listing of CF VI’s securities on a national securities exchange, (x) changes in the combined capital structure of Rumble and CF VI following the Potential Business Combination, (xi) changes in the competitive industries and markets in whic h R umble operates or plans to operate, (xii) changes in laws and regulations affecting Rumble’s business, (xiii) the ability to implement business plans, forecasts, and other expectations after the completion of the Poten tia l Business Combination, and identify and realize additional opportunities, (xiv) risks related to the uncertainty of Rumble’s projected user metrics and other financial and operating forecasts and projections (xv) risks related to Rumble’s limited operating history, the rollout of its business and the timing of expected business milestones, (xvi) risks related to Rumble’s potential inability to achieve or maintain profitability and generate cash, (xvii ) c urrent and future conditions in the global economy, including as a result of the impact of the COVID - 19 pandemic, and their impact on Rumble, its business and markets in which it operates, (xviii) the ability of Rumble to retain exi sting content providers and users and attract new content providers and customers, (xix) the potential inability of Rumble to manage growth effectively, (xx) the enforceability of Rumble’s intellectual property, including its pa ten ts and the potential infringement on the intellectual property rights of others, (xxi) costs related to the Potential Business Combination and the failure to realize anticipated benefits of the Potential Business Combination or to re ali ze estimated pro forma results and underlying assumptions, including with respect to estimated stockholder redemptions, and (xxii) the ability to recruit, train and retain qualified personnel. The foregoing list of risk factors is not exhaustive. You should carefully consider the foregoing factors and the other risks an d uncertainties described in the “Risk Factors” section of CF VI’s prospectus filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 19, 2021, its Form 10 - Q filed on August 15,2022, and other documents filed or to be filed with the SEC (including the definitive proxy statement / prospectus filed on August 12, 2022 in connection with the Potential Business Combination). There may be additional risks that neither CF VI nor Rum ble presently know or that CF VI and Rumble currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements. Forward - looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward - l ooking statements, and Rumble and CF VI assume no obligation and do not intend to update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise. Neither Rumble nor CF VI gives any assurance that either Rumble, CF VI or the combined company will achieve its expectations. 2

Disclaimer (Cont’d) Financial Information The financial and operating forecasts and projections contained in this Presentation represent certain estimates of Rumble as of the date thereof. Rumble’s independent public accountants have not examined, reviewed or compiled the forecasts or projections and, accordingly, do not express an opinion or other form of assu ran ce with respect thereto. These projections should not be relied upon as being indicative of future results. Furthermore, none of Rumble or its management team can give any assurance that the for eca sts or projections contained herein accurately represents Rumble’s future operations or financial condition. The assumptions and estimates underlying such financial forecast information are in her ently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those conta ine d in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Rumble or that actual results will not dif fer materially from those presented in these materials. Some of the assumptions upon which the projections are based inevitably will not materialize and unanticipated events may occur that coul d a ffect results. Therefore, actual results achieved during the periods covered by the projections may vary and may vary materially from the projected results. Inclusion of the prospective financia l i nformation in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information are indicative of future res ult s or will be achieved. The financial information and data contained this Presentation is unaudited and does not conform to Regulation S - X promulgated b y the SEC. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any registration statement, prospectus, proxy statement or other report or document to be filed or furnished by CF VI, or any other report or document to be filed by the combined company following completion of the Potential Business Combination, with the S EC. Any “pro forma” financial data included in this Presentation has not been prepared in accordance with Article 11 of Regulatio n S - X of the SEC, is presented for informational purposes only and may differ materially from the Regulation S - X compliant pro forma financial statements of Rumble to be included any filings with the SEC. Industry and Market Data This Presentation has been prepared by CF VI and Rumble and includes market data and other statistical information from third - pa rty industry publications and sources as well as from research reports prepared for other purposes. Although CF VI and Rumble believe these third - party sources are reliable as of their respective dates, none of CF VI, Rumble, or any of their respective affiliates has independently verified the accuracy or completeness of this information and cannot assure you of the data’s accuracy or completeness. Some data are also based on Ru mbl e’s good faith estimates, which are derived from both internal sources and the third - party sources described above. None of CF VI, Rumble, their respective affiliates, or their respective directors, officers, employe es, members, partners, stockholders or agents make any representation or warranty with respect to the accuracy of such information. Trademarks and Intellectual Property All trademarks, service marks, and trade names of Rumble or CF VI or their respective affiliates used herein are trademarks, ser vice marks, or registered trade names of Rumble or CF VI, respectively, as noted herein. Any other product, company names, or logos mentioned herein are the trademarks and/or intellec tua l property of their respective owners, and their use is not alone intended to, and does not alone imply, a relationship with Rumble or CF VI, or an endorsement or sponsorship by or of Rumble or CF VI. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that Rumble, CF VI or the applicable rights owner will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to th ese trademarks, service marks and trade names. Additional Information and Where to Find It In connection with the Potential Business Combination, CF VI has and intends to file relevant materials with the SEC, includi ng a registration statement on Form S - 4, which includes a document that serves as a joint prospectus and proxy statement, referred to as a proxy statement/prospectus. The definitive proxy statement /pr ospectus has been sent to all CF VI stockholders. CF VI will also file other documents regarding the proposed transaction with the SEC. Before making any voting or investment decision, investors a nd security holders of CF VI are urged to read the registration statement, the definitive proxy statement/prospectus and all other relevant documents filed or that will be filed with the SE C i n connection with the proposed transaction as they become available because they will contain important information about the proposed transaction. Investors and security holders will be able to obtain free copies of the registration statement, the definitive proxy stateme nt/ prospectus and all other relevant documents filed or that will be filed with the SEC by CF VI through the website maintained by the SEC at www.sec.gov. The documents filed by CF VI with the SEC also may be obtained free of charge upon written request to CF Acquisition Corp. VI , 1 10 East 59th Street, New York, NY 10022 or via email at [email protected]. Participants in the Solicitation CF VI, Rumble and their respective directors and executive officers may be deemed to be participants in the solicitation of p rox ies from CF VI’s stockholders in connection with the proposed transaction. A list of the names of such directors and executive officers, and information regarding their interests in the b usi ness combination and their ownership of CF VI’s securities are, or will be, contained in CF VI’s filings with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the definitive proxy statement/prospectus regarding the Proposed Business Combination. You may obtain fre e c opies of these documents as described in the preceding paragraph. 3

Howard Lutnick Chairman and Chief Executive Officer Cantor Fitzgerald 4 • Joined Cantor Fitzgerald in 1983 and was appointed President and CEO in 1991. Named Chairman in 1996 • Chairman and CEO of BGC Partners, Inc. (NASDAQ: BGCP), Executive Chairman of Newmark Group, Inc. (NASDAQ: NMRK) and Chairman and CEO of each SPAC sponsored by Cantor Fitzgerald • Longest serving CEO of any U.S. Federal Reserve Primary Dealer • Acquired Newmark Knight Frank in 2011 and created 4th largest US real estate services firm 1 Cantor Fitzgerald, founded in 1945, is a leading Investment Bank led by a highly experienced executive team including Howard Lutnick , Chairman and CEO, and Anshu Jain, President. Cantor has a leading SPAC sponsorship franchise and is a leading SPAC underwriter for third parties 2 Cantor is the largest broker - dealer private partnership on Wall Street with over $300 trillion of financial transactions annually covering more than 5,000 fixed income and equities clients; Cantor is 1 of 24 Primary Dealers of U.S. Treasuries 3 Cantor’s Financial and Real Estate Services businesses have over 12,000 employees primarily across Cantor Fitzgerald, BGC Partners, Inc. and Newmark Group, Inc. Cantor’s SPAC Track Record: • CF Finance Acquisition Corp. combined with GCM Grosvenor Inc. (NASDAQ: GCMG) in November 2020 • CF Finance Acquisition Corp. II combined with View, Inc. (NASDAQ: VIEW) in March 2021 • CF Finance Acquisition Corp. III combined with AEye , Inc. (NASDAQ: LIDR) in August 2021 • CF Acquisition Corp. V combined with Satellogic (NASDAQ: SATL) in January 2022 4 Overview of Sponsor

Transaction Summary ▪ CF Acquisition Corp. VI (“CFAC VI”) and Rumble, Inc. (“Rumble”) are parties to a Business Combination Agreement dated as of December 1, 2021 ▪ The post - closing company will retain the Rumble name 5 OVERVIEW ▪ $2.2B pro forma enterprise value with strong balance sheet (3) ▪ Highly attractive valuation relative to growth profile VALUATION ▪ $300M cash in trust from CFAC VI (1) ▪ $100M PIPE (2) TRANSACTION SIZE ▪ ~82% existing fully diluted Rumble equity holders, ~12% SPAC public stockholders, ~4% PIPE investors (2) and ~3% SPAC sponsor shares OWNERSHIP (1)(3)(5) ▪ Rumble shareholders are rolling substantially all of their equity in the transaction ▪ $383M cash to balance sheet to fund the company’s growth plan (1)(4) CAPITAL STRUCTURE (1) Assumes no redemptions by CFAC VI’s public stockholders. (2) Includes $15M from CFAC VI sponsor’s forward purchase agreem ent (“FPA”). (3) Excludes shares placed in escrow and those subject to vesting. (4) Assumes $55M of transaction expenses, $48M of existing cash on balance sheet and $10M net repurchase of Rumble shares ($11M gross repurchase of Rumble shares net for $1M issuance of high - vote Class D stock). (5) All numbers are approximate and based on deal documents as of transaction announcement date. Pro forma for 1.1M share repurchase of Rumble shares and 1.1M issuance of restricted stock with certain time vesting requirements. Excludes 1.96M sponsor shares (“s pon sor earnout shares”) and 105.0M seller earnout shares to existing Rumble shareholders and optionholders (“seller earnout shares”). Includes 2.21M sponsor shares that will be subject to forfeiture to the extent the target $400M of c apital is not available to CFAC VI at closing (“sponsor support shares”). The sponsor earnout shares and seller earnout shares are subject to 50% vestin g a t $15.00 and 50% vesting at $17.50 (price represents public trading price for 20 out of 30 trading days); also excludes 7.5M CFAC VI public warrants and 0.6M CFAC VI sponsor warrants (i ncl uding FPA warrants). If the target capital of $400M is not available to CFAC VI at closing, a pro rata portion of the sponsor support shares will be subject to the same price based vesting descr ibe d above and certain other vesting requirements.

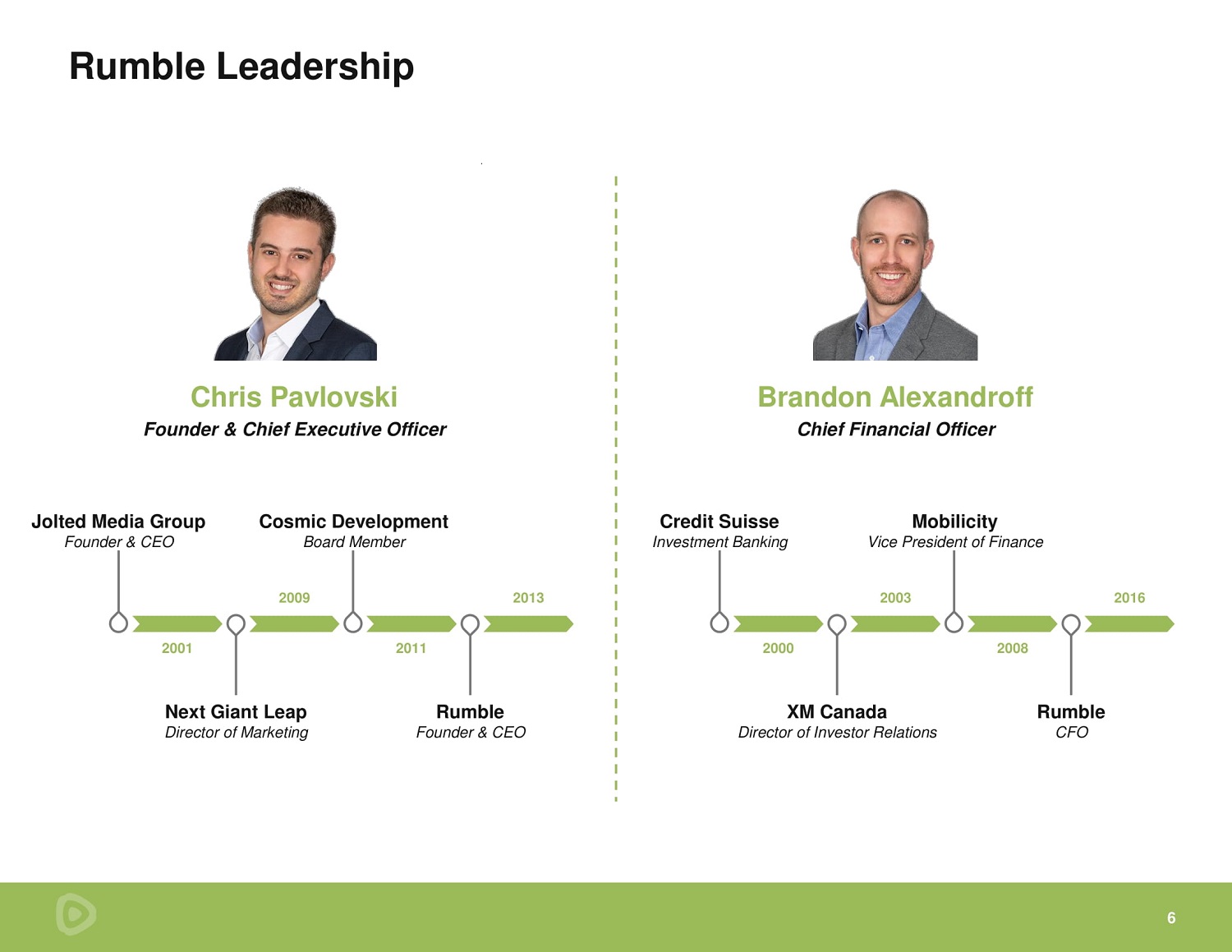

Rumble Leadership 6 Founder & Chief Executive Officer Jolted Media Group Founder & CEO Cosmic Development Board Member Next Giant Leap Director of Marketing Rumble Founder & CEO Credit Suisse Investment Banking Mobilicity Vice President of Finance XM Canada Director of Investor Relations Rumble CFO Chief Financial Officer

The Opportunity 7 A ‘neutral’ video platform and cloud

[DRAFT MATERIALS – SUBJECT TO SUBSTANTIAL REVISION] Today, We Sit on an Incredible Opportunity With a Sustainable Competitive Advantage AT A GLANCE 8.1B Minutes Watched Per Month (1)(3) 8,948 Hours of Uploaded Video Per Day (1) 44M Monthly Active Users (1)(2) 29M U.S. MAUs (1)(2) ▪ We have built technical independence with our infrastructure 2 ▪ The trust in Big Tech has materially diminished 3 8 Global ▪ Unwavering focus on the value we bring to creators 1 (1) Average over Q2 2022. (2) Represents average global MAUs for the quarter. Reflects unique web and app users, based on dat a p rovided by 3rd party analytics providers using company set parameters, with minor potential overlap in reporting resulting from users accessing Rumble’s content from both the web and the app in a giv en measurement period. Does not include embedded video, certain Connected TV users, or users of the Locals platform. Like other major social media platforms, fraud and unauthorized access, if undetec ted , may contribute, from time to time, to some amount of overstatement of our performance indicators, including reporting of MAUs by our third - party analytics provider. Fraudulent activity is typically desi gned to inflate payments to individual rights holders. (3) Estimate based on bandwidth consumption.

The Opportunity Has Found 9 Note: The inclusion of individuals’ names and likenesses in this presentation is a “fair use” solely for informational and fa ctu al purposes relating to Rumble and its platform, and unless otherwise expressly noted, does not constitute any affiliation with Rumble or any endorsement or recommendation by them of Rumble or any potentia l i nvestment opportunity related to Rumble. U.S. Election Season Increasing adoption from top creators Q2 2020 Q3 2020 Q4 2020 Today (as of Q2 ‘22) Donald Trump Jorge Masvidal Dr. Drew Russell Brand Glenn Greenwald Dan Bongino Devin Nunes Global MAUs Acceleration of Big Tech Censorship Q2 Peak MAUs of 52M

10 Shift in Big Tech Has Created Neutral High Censorship High Partisanship

11M 27M 40M 92M 100M 130M 1M 23M 29M to TikTok 11 Rumble is Growing at a Rapid Pace Rumble vs. TikTok (1) – U.S. MAUs Q3 2021 Mar 2021 Feb - 2019 Aug - 2020 Jun - 2020 Jan - 2018 (1) TikTok data sourced from CNBC and Business Insider. Oct - 2019 Q3 2020 Average Global MAUs of 36M U.S. Global 29M 44M Peak Q3 2021 MAUs Average Global MAUs of 44M U.S. Global 35M 52M Peak Q2 2022 MAUs Q2 2022

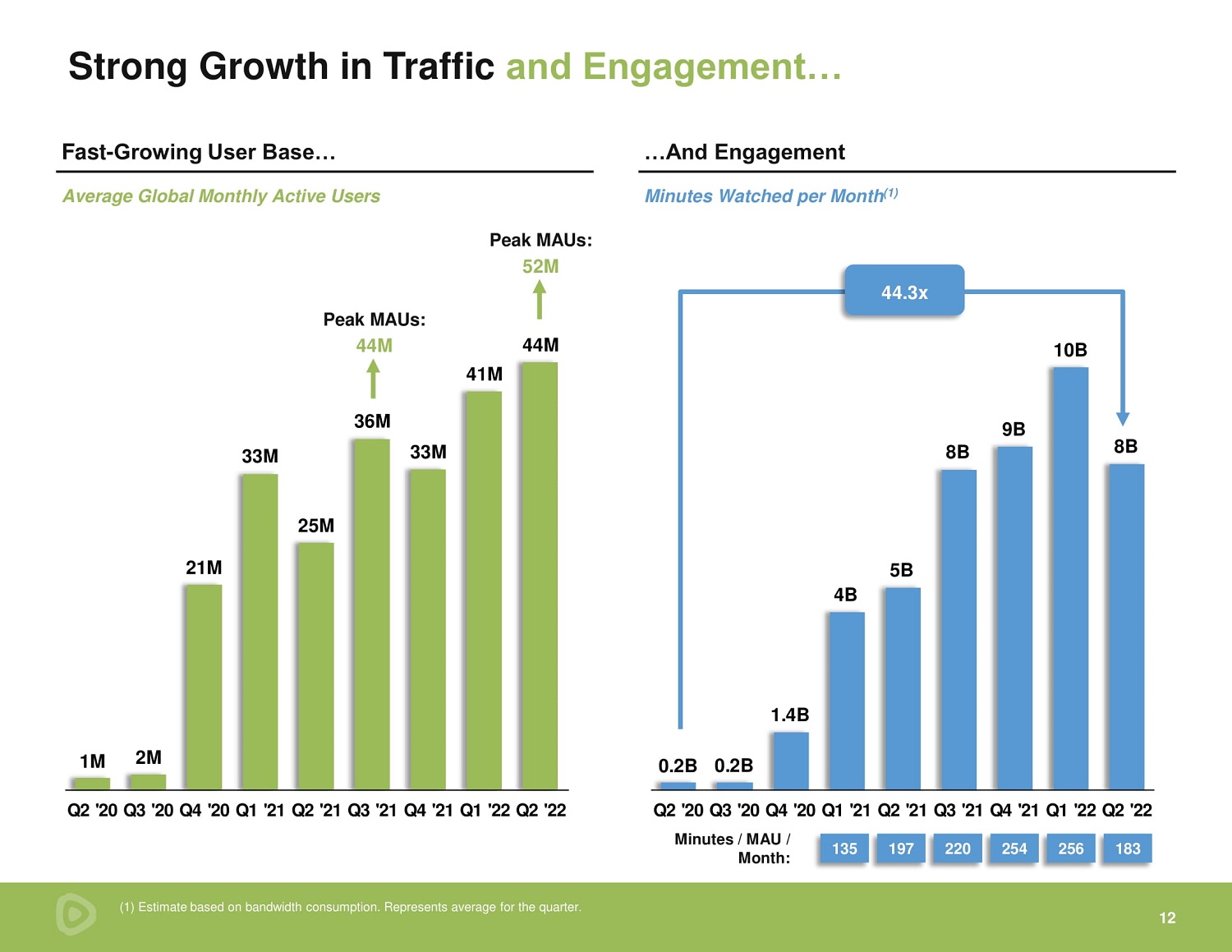

0.2B 0.2B 1.4B 4B 5B 8B 9B 10B 8B Q2 '20 Q3 '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21 Q4 '21 Q1 '22 Q2 '22 Strong Growth in Traffic 12 (1) Estimate based on bandwidth consumption. Represents average for the quarter. Fast - Growing User Base… …And Engagement Average Global Monthly Active Users Minutes Watched per Month (1) 44.3x Peak MAUs: 52M Minutes / MAU / Month: 135 254 220 256 183 1M 2M 21M 33M 25M 36M 33M 41M 44M Q2 '20 Q3 '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21 Q4 '21 Q1 '22 Q2 '22 197 Peak MAUs: 44M

…As Well as 13 (1) Represents average for the quarter. Significant Creator Adoption Hours of Uploaded Video per Day (1) 212.9x 42 86 630 1,883 2,338 2,746 3,278 6,158 8,948 Q2 '20 Q3 '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21 Q4 '21 Q1 '22 Q2 '22

Capturing the Opportunity

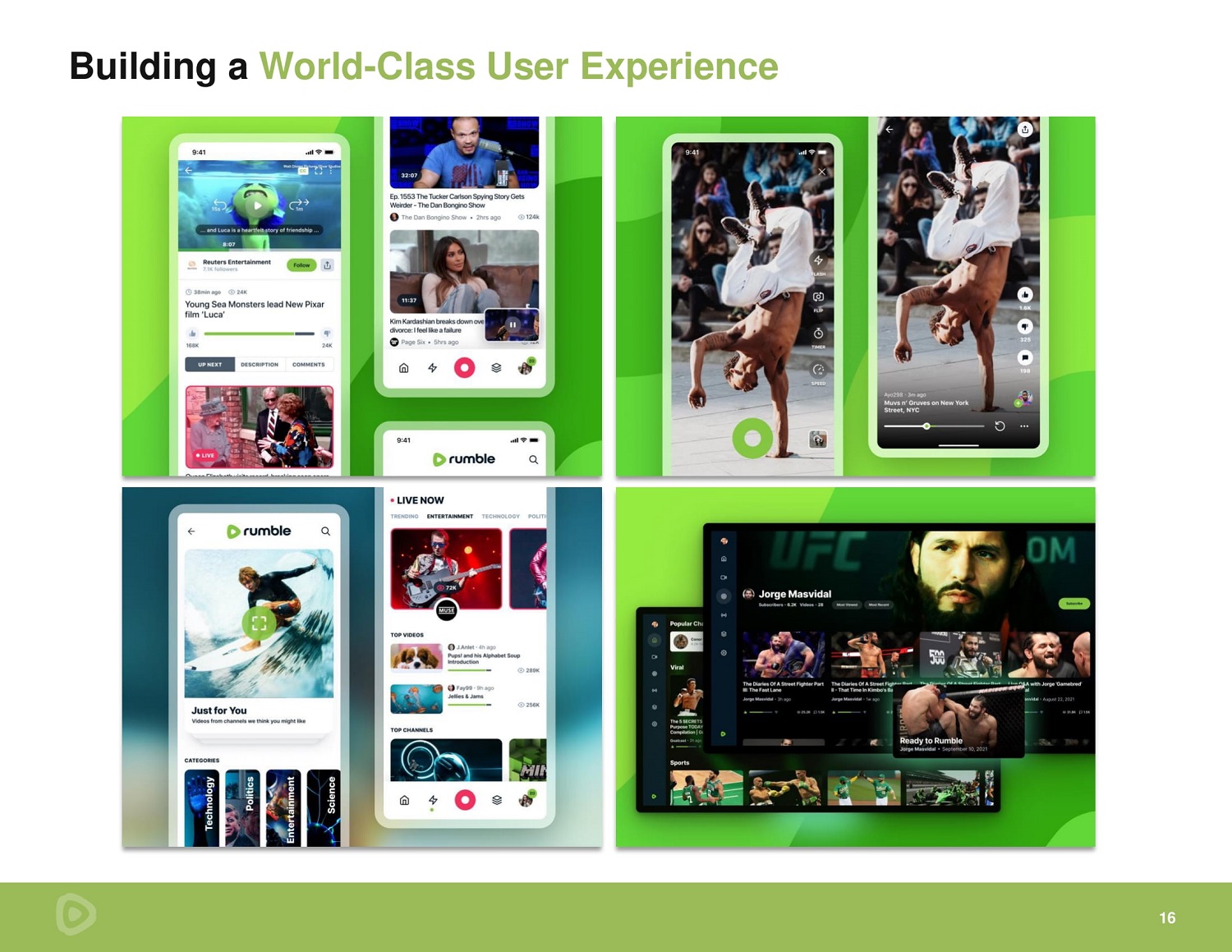

Engineering to 15 Web Browser Mobile App Connected TV Livestreaming Camera Integration Deeplinking User Interface Enhancements Gifting/Tipping New and Upcoming Features

Building a 16

Targeted Strategy 17 (1) Subscribers as of Q4 2021. We’re Identifying Top Creators and We’re Replicating This Strategy Across Multiple Content Verticals Ability to Monetize Expansion into New Verticals Ability to Increase Engagement Ability to Bring in New Users Dan Bongino ▪ 864K Subscribers (1) ▪ 1.9M Subscribers (1) 2.2x Key Verticals Today Potential Immediate Focus Areas Additional Growth Areas ▪ Music ▪ Movies ▪ News ▪ Pets ▪ Podcasts ▪ Politics ▪ Product Reviews ▪ Religion ▪ Science ▪ Sports ▪ Art ▪ Comedy ▪ Education ▪ Environment ▪ Gaming ▪ Government ▪ Health / Medicine ▪ Influencers ▪ Investing / Crypto ▪ Local News / Events Rumble Key Criteria

Across Diverse Categories 18 Note: The inclusion of individuals’ names and likenesses in this presentation is a “fair use” solely for informational and fa ctu al purposes relating to Rumble and its platform, and unless otherwise expressly noted, does not constitute any affiliation with Rumble or any endorsement or recommendation by the m o f Rumble or any potential investment opportunity related to Rumble. Jorge Masvidal Sports Matt Kohrs Investing / Crypto Russell Brand Comedy Donald Trump Politics Glenn Greenwald Politics Dr. Drew Health / Medicine

We Have Just Begun 19 Advertising IaaS Subscription & Tipping

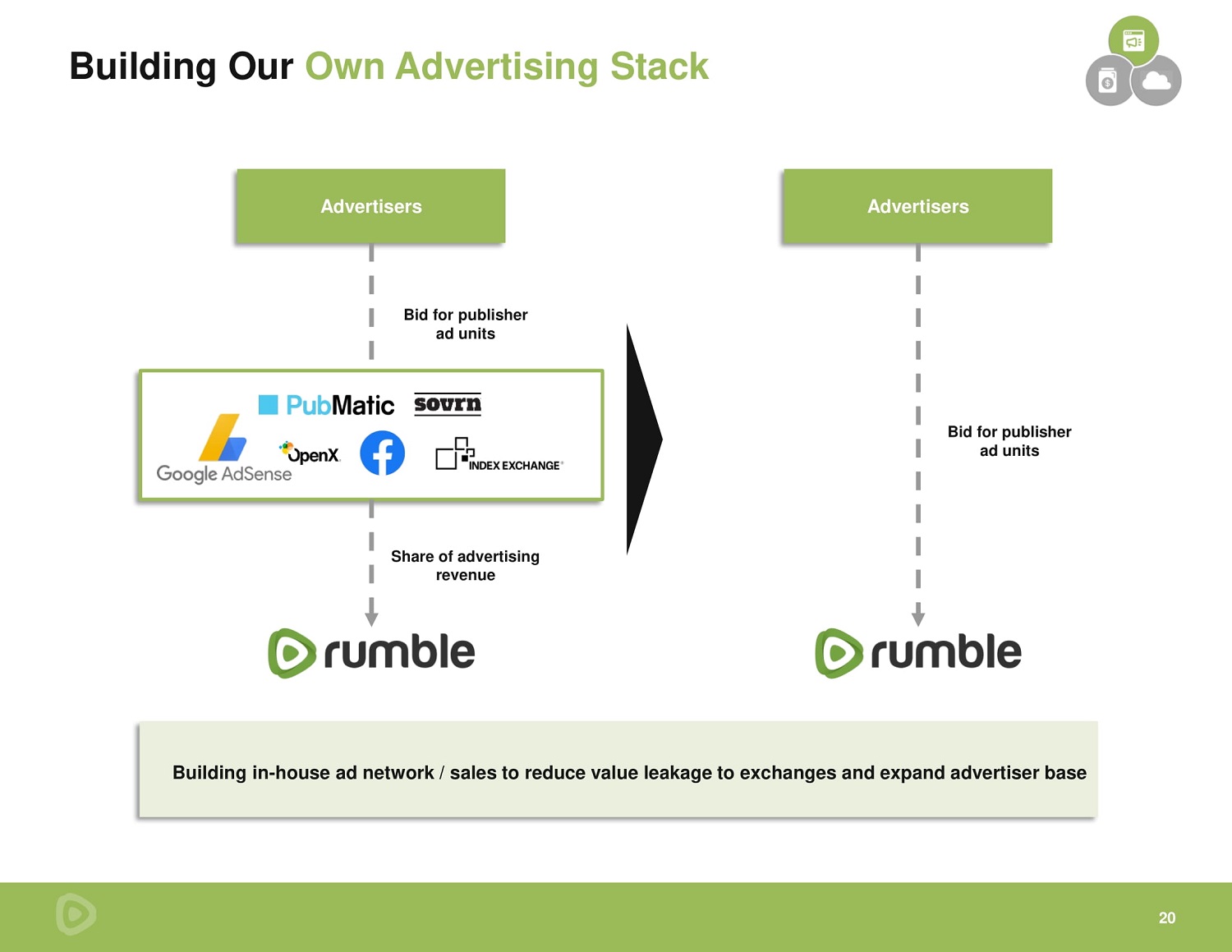

Building Our Own Advertising Stack 20 Building in - house ad network / sales to reduce value leakage to exchanges and expand advertiser base Share of advertising revenue Bid for publisher ad units Bid for publisher ad units Advertisers Advertisers

Subscription & Tipping Opportunity Supported by the Acquisition of Locals.com (1) Writer and Comedian “This is truly giving the creators the tools to their audience and access to their audience and not being a gatekeeper because in these times there are gatekeepers everywhere” Commentator, Writer, Comedian “Smaller communities are the future of the Internet” Physician, Content Creator “Locals has been very good at building a community, and for the cut, I would not dare to do it myself” Accelerates subscription revenue model and brings 86K subscribers to our platform 21 (1) Press release dated October 26 th , 2021.

$26B $35B $46B $58B $71B $87B 2020A 2021E 2022E 2023E 2024E 2025E The Opportunity Extends to Enterprise Cloud IaaS North America Public Cloud IaaS End - User Spend (1) (1) Per Gartner Public Cloud Services Forecast – 3Q21 Update. (2) Offerings are currently in development. 27% CAGR Our Cost - Competitive Infrastructure Offering (2) Video Streaming Email Services Storage Cloud & Website Hosting 22 A Similar Market Opportunity Exists Neutral High Censorship High Partisanship

Financial Highlights

1M 6M 32M 42M 1B 6B 78B 111B 2019 2020 2021 2022 Future Key Revenue Drivers 24 Engagement Users Web / App / Connected TV Drivers Monetization Content Livestreaming Advertising (load / CPM) Subscription / Tipping Licensing Scale Users / Engagement Average Global MAUs Total Annual Minutes Watched (1) Accelerating Consumption (1) Estimate based on bandwidth consumption. (2) Represents average across 6 month period from January 2022 – June 2022. (3) Rep resents average across 6 month period from January 2022 – June 2022, multiplied by 12 to calculate run - rate for the whole year. Consumption Geography YTD Run - Rate (3) (2)

23M 6M 7M 36M $5 . 0 0 % of Y ouTub e : 19% 38 % 57% 76% 95% 10% $0.3B $0 . 6 B $0.8B $1.1B $1.4B 13% 0.4 0.7 1.1 1.4 1.8 18% 0.5 1.0 1.4 1.9 2.4 27% 0.7 1.4 2.2 2.9 3.6 36% 1.0 1.9 2.9 3.8 4.8 45% 1.2 2.4 3.6 4.8 6.0 23M 29M 40 M 60M 80M 100 M …Which Will Drive Substantial Revenue Potential 25 Source: U.S. MAUs and Gross Advertising ARPU for YouTube per 2021 data from eMarketer. Note: Numbers are for illustrative purposes only. Represents metrics as of transaction announcement in December 2021. (1) Average Revenue Per User (“ARPU”). Advertising Monetization Potential of Rumble’s U.S. Audience 2021E U.S. Metrics: Significant additional revenue opportunity from international expansion and IaaS Global Monetizable Audience Illustrative U.S. Monthly ARPU (1) $1 . 0 0 $2 . 0 0 $3 . 0 0 $4 . 0 0 Illustrative Average U.S. MAUs 224M MAUs $5.28 Monthly ARPU Avg. MAUs in Q3 ‘21 P e a k: 2 9 M P e a k: 44M Annual Revenue Opportunity Avg. MAUs in Q3 ‘21 Peak MAUs in Q3 ‘21 29M 35M Figures in red font represent Q2 ‘22 MAUs 29M 35M 52M 44M

(1) User Interface (“UI”). User experience (“UX”). (2) Effective Cost Per Mille (“ eCPM ”). 26 We Have Only Scratched the Surface of Drive better engagement via improved UI/UX (1) and high - quality content Grow user base Build highly effective barriers to entry Realize higher eCPMs (2) / quality of advertisers Diversify and expand sustainable revenue streams and margins Use of Proceeds Value Creation Content Acquisition International Expansion Advertising Stack Infrastructure / Overhead

Closing Remarks 27 (1) Source: The Joe Rogan Experience Episode #1725 – Bridget Phetasy , 10/26/2021 Note: The inclusion of individuals’ names and likenesses in this presentation is a “fair use” solely for informational and fa ctu al purposes relating to Rumble and its platform, and unless otherwise expressly noted, does not constitute any affiliation with Rumble or any endorsement or recommendation by the m o f Rumble or any potential investment opportunity related to Rumble. Joe Rogan Discusses Rumble “As long as places like Rumble exist, you know, and I think they’re going to grow. I think that place is going to grow… …I think this is one of those things where they [expletive] up enough where the grip has slipped to the point where enough people are gonna , first of all, we’ll keep saying the name Rumble. Right, keep saying it, get people to keep going over there. I’m not over there, but I certainly would be” – Joe Rogan, 10/26/2021 (1)

Appendix

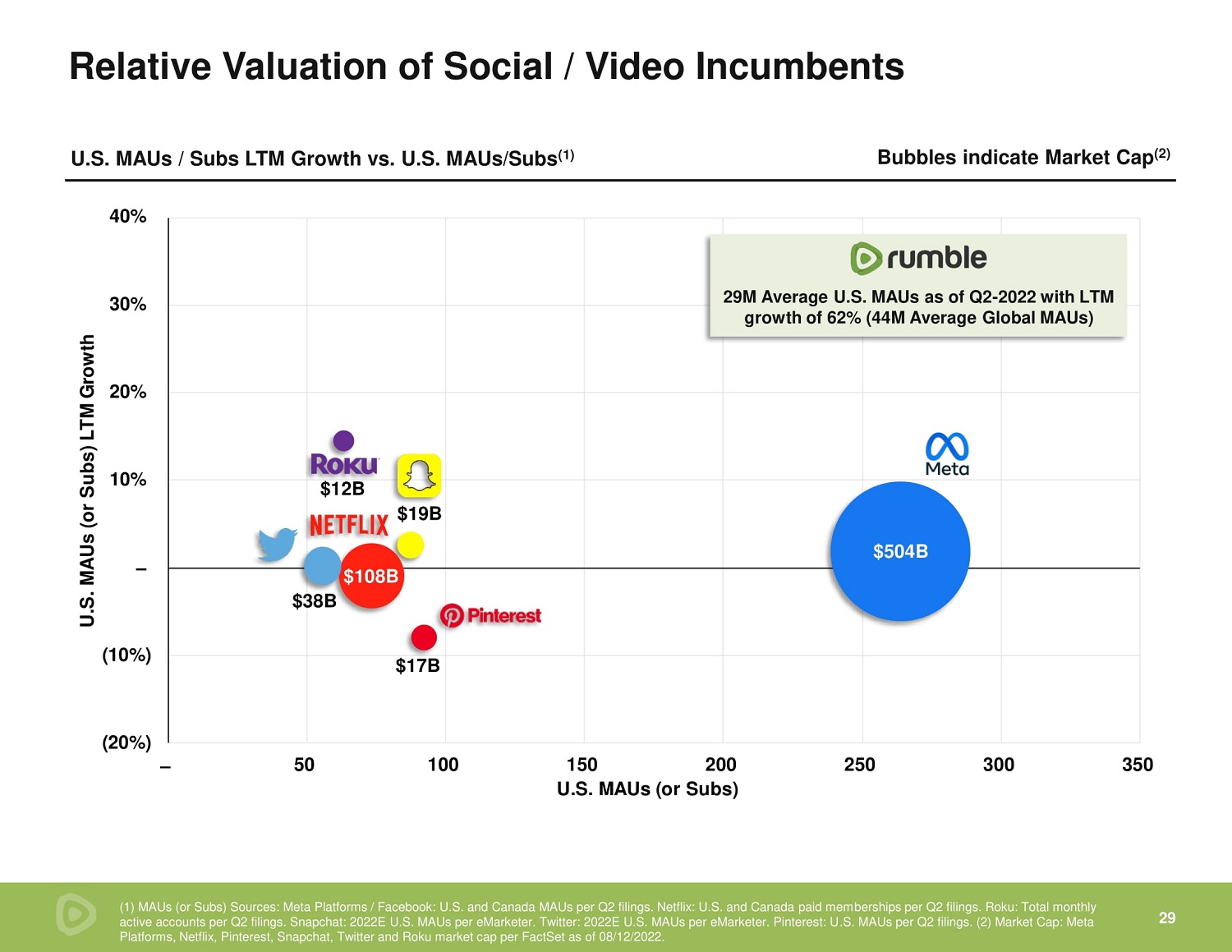

$504B $19B $108B $12B $38B $17B (20%) (10%) – 10% 20% 30% 40% – 50 100 150 200 250 300 350 U.S. MAUs (or Subs) LTM Growth U.S. MAUs (or Subs) Relative Valuation of Social / Video Incumbents 29 (1) MAUs (or Subs) Sources: Meta Platforms / Facebook: U.S. and Canada MAUs per Q2 filings. Netflix: U.S. and Canada paid mem ber ships per Q2 filings. Roku: Total monthly active accounts per Q2 filings. Snapchat: 2022E U.S. MAUs per eMarketer. Twitter: 2022E U.S. MAUs per eMarketer. Pinterest: U .S. MAUs per Q2 filings. (2) Market Cap: Meta Platforms, Netflix, Pinterest, Snapchat, Twitter and Roku market cap per FactSet as of 08/12/2022. U.S. MAUs / Subs LTM Growth vs. U.S. MAUs/Subs (1) Bubbles indicate Market Cap (2) 29M Average U.S. MAUs as of Q2 - 2022 with LTM growth of 62% (44M Average Global MAUs)

▪ Implied pro forma enterprise value of $2,231 million (1) ▪ CFAC VI to combine with Rumble ▪ $100 million PIPE at $10.00 per share (2) ▪ Existing Rumble shareholders are rolling substantially all of their equity in the transaction and are projected to own approximately 82.2% of company post - transaction (3) ▪ Rumble shareholders and option holders to receive 105.0M additional earnout shares, with 50% vesting at $15.00 (4) and 50% vesting at $17.50 (4) ▪ $383 million of cash to balance sheet to fund Rumble’s growth plan (5) 30 SOURCES ($M) USES ($M) PIPE Proceeds 100 Rumble Rollover Equity (3) 2,148 CFAC VI Cash Held in Trust Cash to Balance Sheet $300 $383 Cash on Rumble B/S (6) Rumble Rollover Equity (3) 48 2,148 Transaction Fees 55 Total Sources Total Uses $2,596 $2,596 PRO FORMA ENTERPRISE VALUE ($M) Share Price $10.00 Pro Forma Shares Outstanding (8) 261.4 ( - ) Net Cash on Balance Sheet 383 ILLUSTRATIVE PRO FORMA OWNERSHIP (8)(9) Equity Value $2,614 Pro Forma Enterprise Value $2,231 Rumble Rollover Equity (3) CFAC VI Public Stockholders CFAC VI Sponsor 82.2% 11.5% 3.8% 2.5% PIPE Investors Net Repurchase of Rumble Shares (7) 10 Key Assumptions: All numbers are approximate and based on deal documents as of transaction announcement date. Assumes no rede mpt ions, new shares issued at $10.00 and treasury stock method. (1) Excludes shares placed in escrow and certain shares subject to forfeiture/vesting. (2) Includes $15M from CFAC VI sponsor’s forward pu rch ase agreement (“FPA”). (3) Assumes $48M of cash on Rumble’s balance sheet at close (subject to change based on actual cash on B/S at close), $11M gross repurchase of Rumble shares and $11M issuance of restric ted stock with certain time vesting requirements. All existing Rumble shareholders receive pro forma common equity (includes current Rumble options and warrants based on treasury stock method). Excludes share s p laced in escrow and those subject to vesting. (4) Price represents public trading price for 20 out of 30 trading days within 5 years of closing. (5) Assumes no redemptions. (6) As of Q3 2021 (quarter - end prior to transaction announcement) and adjusted for $25M of pre - PIPE investment proceeds. (7) Reflects $11M gross repurchase of Rumble shares net for $1M issuance of high - vote Class D stock. (8) Share count includes 214.8M Rumble rollover shares (pro forma for 1.1M share repurchase of Rumble shares and 1.1M issuance of restricted stock with certain time vesting requirements; excludes seller earnout shares), 10.0M PIPE shares, 30 .0M CFAC VI public shares and 6.61M CFAC VI sponsor shares. Share count includes 2.21M sponsor support shares that will be subject to forfeiture to the extent the target $400M of capital is not available to SP AC at closing but only if certain other vesting requirements are not satisfied, and excludes 1.96M sponsor earnout shares subject to 50% vesting at $15.00 and 50% vesting at $17.50. Also excludes impact of 7.5M CFAC VI pu blic warrants and 0.6M CFAC VI sponsor warrants (including FPA warrants). (9) Excludes new equity incentive plan. Sources & Uses / Pro Forma Valuation (Per Q3 2021 Financials)

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Nordstrom (JWN) CEO Erik Nordstrom Reports 7.45% Stake, Seeks to Finance Potential Deal with Debt/Equity

- Can Schneider do a deal for Bentley? Citi discusses

- AMCON Distributing (DIT) to Acquire Richmond Master Distributors

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Definitive AgreementSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share