Form 8-K CASTLE BIOSCIENCES INC For: Aug 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2022

(Exact name of registrant as specified in its charter)

| (state or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

Registrant’s telephone number, including area code: (866 ) 788-9007

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2022, Castle Biosciences, Inc. (the “Company”) issued a press release announcing its financial results for the second quarter and six months ended June 30, 2022. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information contained or incorporated in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), except as expressly set forth by specific reference in such filing to this Current Report on Form 8-K.

Item 7.01 Regulation FD Disclosure.

On August 8, 2022, the Company made available the slide presentation attached hereto as Exhibit 99.2. Information from this slide presentation may also be used by the management of the Company in future meetings regarding the Company.

The information contained or incorporated in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing under the Exchange Act or the Securities Act except as expressly set forth by specific reference in such filing to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit | ||||||||

| Number | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Inline XBRL for the cover page of this Current Report on Form 8-K. | |||||||

| SIGNATURES | ||

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | ||

| CASTLE BIOSCIENCES, INC. | ||||||||

| By: | /s/ Frank Stokes | |||||||

| Frank Stokes | ||||||||

| Chief Financial Officer | ||||||||

Date: August 8, 2022 | ||||||||

Castle Biosciences Reports Second Quarter 2022 Results

Q2 2022 revenue increased 53% over Q2 2021 to $34.8 million

Delivered 11,034 total test reports in Q2 2022, an increase of 57% compared to Q2 2021

Skin cancer gene expression profile test report volume increased 44% compared to Q2 2021

Raising 2022 Revenue Guidance to $130–135 million from $118–123 million

Conference call and webcast today at 4:30 p.m. ET

FRIENDSWOOD, Texas- Aug. 8, 2022--Castle Biosciences, Inc. (Nasdaq: CSTL), a company improving health through innovative tests that guide patient care, today announced its financial results for the second quarter and six months ended June 30, 2022.

“In the second quarter, we saw strong execution across the Castle team, which produced another quarter of record test report volume,” said Derek Maetzold, president and chief executive officer of Castle Biosciences. “In our core dermatology business, we delivered a 44% increase in test report volume over the second quarter of 2021 and a 16% increase over the first quarter of 2022. We believe our continued momentum is directly linked to the clinical value our tests provide to clinicians and their patients, coupled with the focused investments we have made and continue to make in our business.

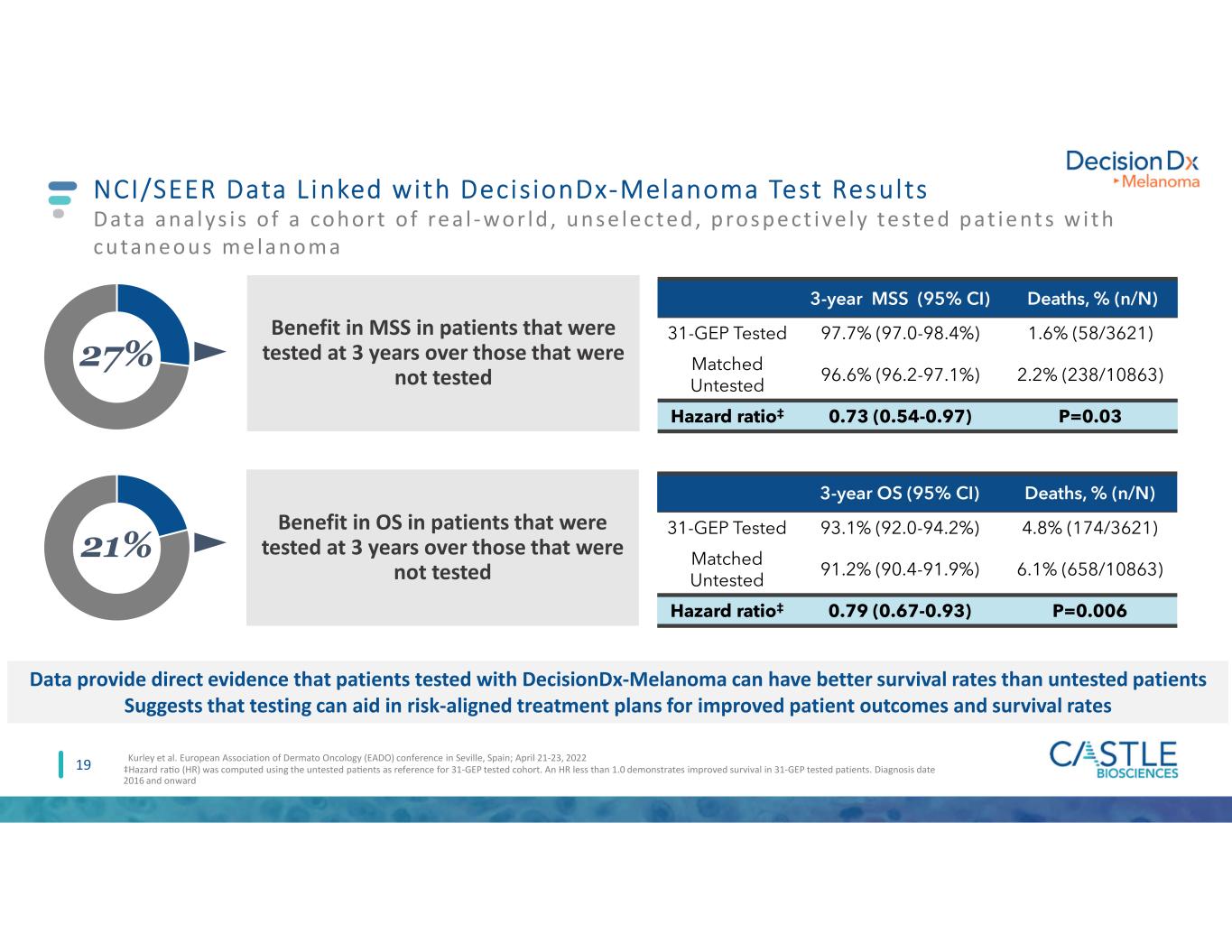

“We are excited about the Company’s ongoing collaboration with the National Cancer Institute (NCI) to link DecisionDx®-Melanoma testing data with data from the Surveillance, Epidemiology and End Results (SEER) program registries on cutaneous melanoma cases. Data from this real-world cohort showed that patients diagnosed with melanoma and tested with DecisionDx-Melanoma had improved survival—27% improvement in melanoma-specific survival—compared to untested patients. We expect to generate data from this collaboration, as we expand our matched data beyond the initial cohort.

“Turning to our newest franchises, gastroenterology and mental health, we are making great progress with our integration efforts, and the initial reception from clinicians for both tests is strong. We made these acquisitions to contribute meaningfully to our top-line growth in the mid-to long-term, and along with focused investments, we believe they will contribute to our anticipated operating cash-flow neutrality by 2025.

“Our progress is the direct result of our dedicated team of professionals at Castle, who are committed to improving health through the innovative tests we offer. Thanks to their efforts, we believe Castle will continue with the current momentum we have seen and continue creating value for stockholders.”

Second Quarter Ended June 30, 2022, Financial and Operational Highlights

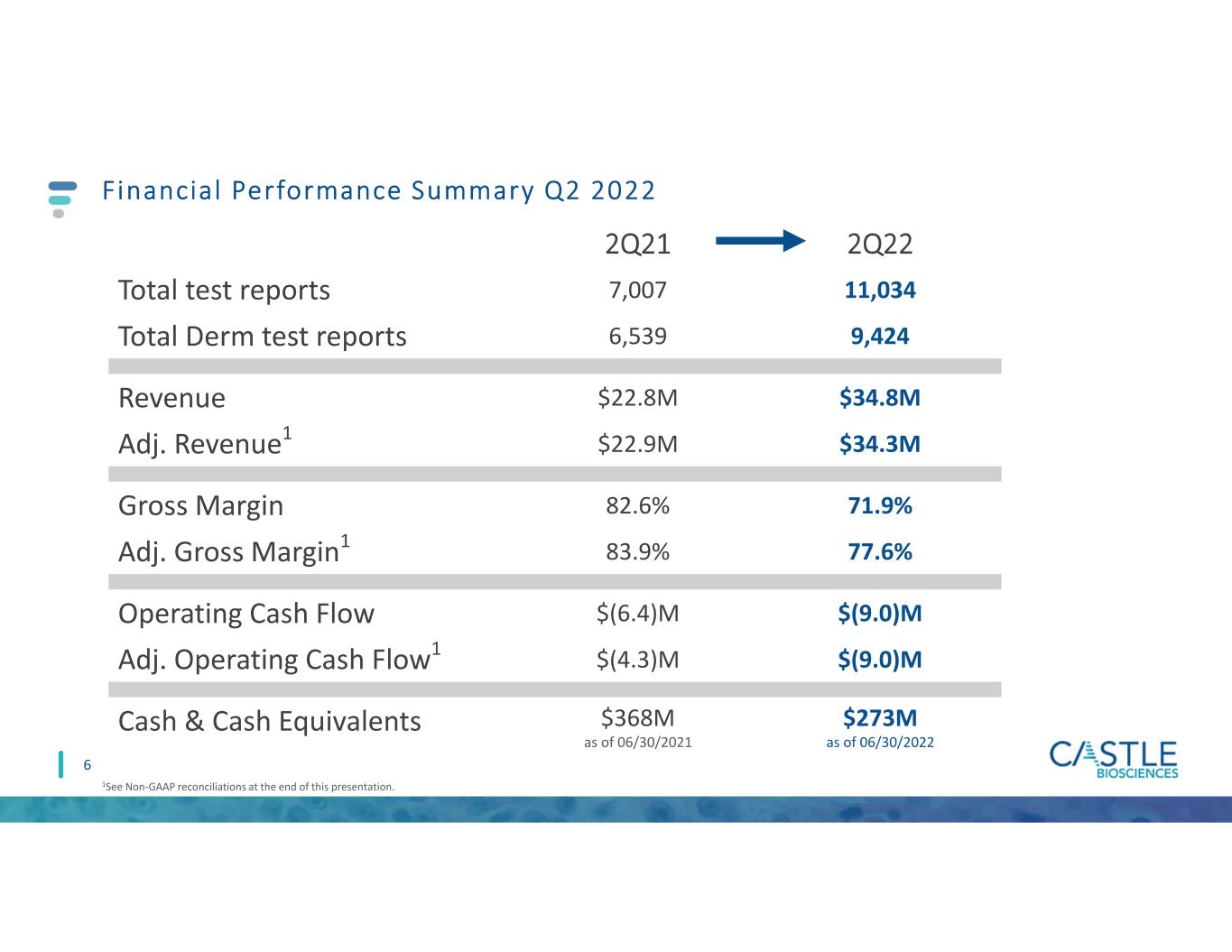

•Revenues were $34.8 million, a 53% increase compared to $22.8 million during the same period in 2021. Included in revenue for the current year was $0.6 million related to tests delivered in prior periods. Revenue for the same quarter last year included $(0.2) million related to tests delivered in prior periods.

•Adjusted revenues, which exclude the effects of revenue adjustments related to tests delivered in prior periods, were $34.3 million, a 49% increase compared to $22.9 million for the same period in 2021.

•Delivered 11,034 total test reports in the second quarter of 2022, an increase of 57% compared to 7,007 in the same period of 2021:

◦DecisionDx-Melanoma test reports delivered in the quarter were 7,125, compared to 5,128 in the second quarter of 2021, an increase of 39%.

◦DecisionDx®-SCC test reports delivered in the quarter were 1,344, compared to 784 in the second quarter of 2021, an increase of 71%.

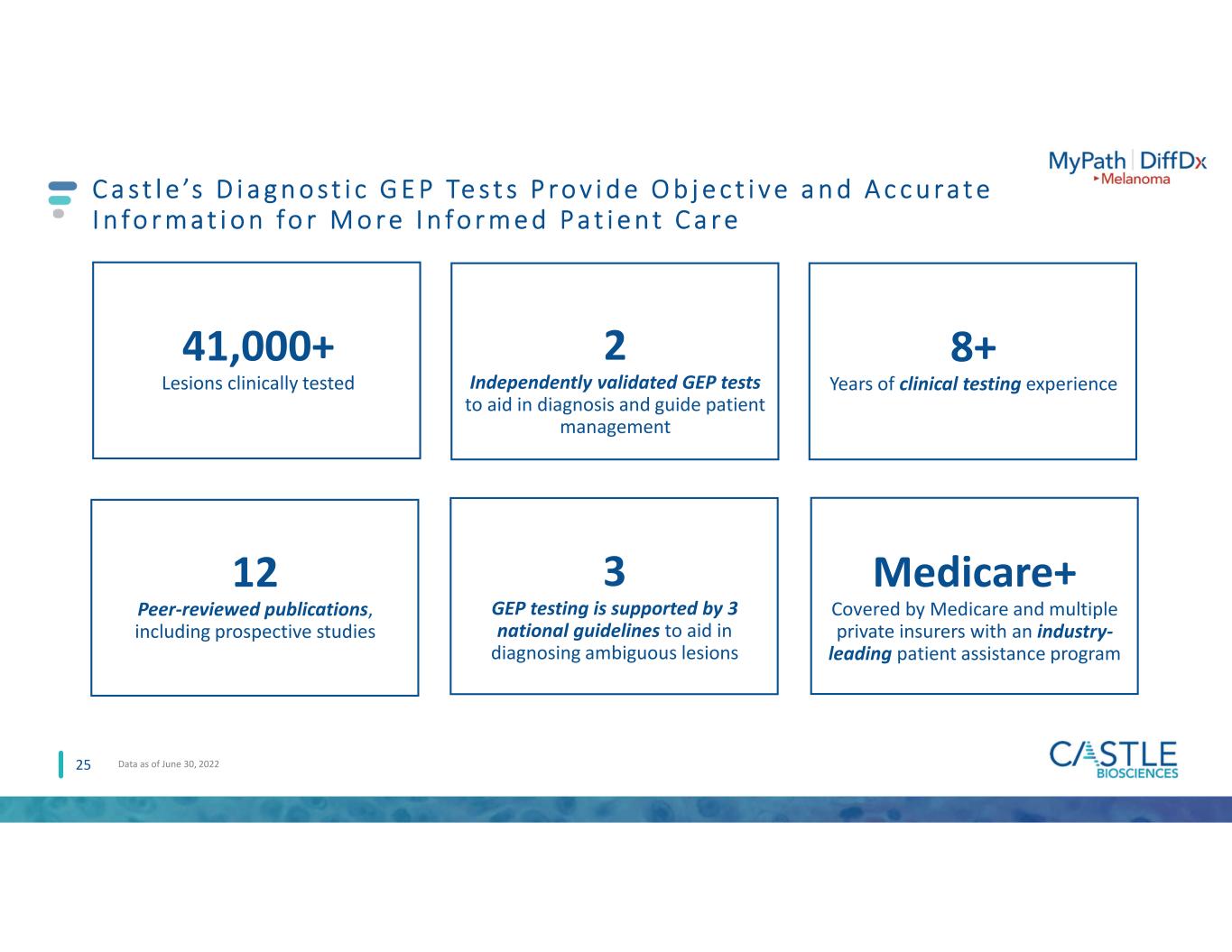

◦MyPath® Melanoma and DiffDx®-Melanoma diagnostic gene expression profile (GEP) aggregate test reports delivered in the quarter were 955, compared to 627 in the second quarter of 2021, an increase of 52%.

◦DecisionDx®-UM test reports delivered in the quarter were 431, compared to 468 in the second quarter of 2021, a decrease of 8%.

◦TissueCypher® Barrett’s Esophagus test reports delivered in the quarter were 352.

◦IDgenetix test reports delivered in the quarter were 827 (April 26, 2022–June 30, 2022).

•Gross margin for the quarter ended June 30, 2022, was 72%, and adjusted gross margin was 78%.

•Operating cash flow was $(9.0) million, compared to $(6.4) million for the same period in 2021, and adjusted operating cash flow was $(9.0) million, compared to $(4.3) million for the same period in 2021.

•Net loss for the second quarter was $(1.6) million, compared to $(8.8) million for the same period in 2021.

•Adjusted EBITDA for the second quarter was $(10.9) million, compared to $(3.4) million for the same period in 2021.

Six Months Ended June 30, 2022, Financial and Operational Highlights

•Revenues were $61.7 million, a 35% increase compared to $45.6 million during the same period in 2021. Included in revenue for the for the period was $(0.3) million related to tests delivered in prior periods. Revenue for the same period last year included $5.1 million related to tests delivered in prior periods.

•Adjusted revenues were $62.0 million, a 53% increase, which exclude the effects of revenue adjustments related to tests delivered in prior periods, compared to $40.5 million for the same period in 2021.

•Total test reports delivered in the six months ended June 30, 2022, were 19,661, compared to 12,149 in the same period of 2021, an increase of 62%:

◦DecisionDx-Melanoma test reports delivered in the six months ended June 30, 2022, were 13,148, compared to 9,188 during the same period of 2021, an increase of 43%.

◦DecisionDx-SCC test reports delivered in the six months ended June 30, 2022, were 2,486, compared to 1,311 during the same period in 2021, an increase of 90%.

◦MyPath Melanoma and DiffDx-Melanoma aggregate diagnostic GEP test reports delivered in the six months ended June 30, 2022, were 1,905, compared to 845 during the same period in 2021, an increase of 125%.

◦DecisionDx-UM test reports delivered in the six months ended June 30, 2022, were 887, compared to 805 during the same period in 2021, an increase of 10%.

◦TissueCypher Barrett’s Esophagus test reports delivered in the six months ended June 30, 2022, were 408.

◦IDgenetix test reports delivered in the six months ended June 30, 2022, were 827 (April 26, 2022–June 30, 2022).

•Gross margin for the six months ended June 30, 2022, was 72%, and adjusted gross margin was 78%.

•Operating cash flow was $(30.4) million, compared to $(10.1) million for the same period in 2021.

•Adjusted operating cash flow was $(30.4) million, compared to $(9.8) million for the same period in 2021.

•Net loss for the six months ended June 30, 2022, was $(26.3) million, compared to $(13.1) million for the same period in 2021.

•Adjusted EBITDA for the six months ended June 30, 2022, was $(22.2) million, compared to $(2.5) million for the same period in 2021.

Cash and Cash Equivalents

As of June 30, 2022, the Company’s cash and cash equivalents totaled $273 million.

2022 Revenue Guidance

•Castle Biosciences is increasing its previously issued guidance for anticipated total revenue in 2022. The Company now anticipates generating $130–135 million in total revenue in 2022, compared to the previously provided guidance of $118–123 million.

Second Quarter and Recent Accomplishments and Highlights

Dermatology

•In April, the Company announced new real-world data from its ongoing collaboration with the National Cancer Institute (NCI). In a recent study, patients who received DecisionDx-Melanoma test results in addition to traditional clinicopathologic factors, as part of their clinical care, had improved survival compared to patients who were not tested (that is, their clinician could only rely upon available

traditional clinicopathologic factors), with a 27% (hazard ratio (HR)=0.73, p=0.028) and 21% (HR=0.79, p=0.006) MSS (melanoma-specific survival) and OS (overall survival) survival benefit compared to matched patients who were not tested, respectively. The data was shared in a poster presentation at the 18th European Association of Dermato-Oncology (EADO) Congress. See the Company’s news release from April 21, 2022, for more information.

•In May, the Company announced new data showing that DecisionDx-SCC can independently risk-stratify patients with cutaneous squamous cell carcinoma (SCC) and one or more risk factors according to their biologic risk of metastasis, consistent with findings in previous development and validation studies. The poster was presented at the 2022 American College of Mohs Surgery (ACMS) Annual Meeting. Overall, the study data confirm what previous development and validation studies have substantiated: DecisionDx-SCC can accurately classify risk for metastasis in SCC patients with one or more risk factors and provides significant prognostic information independent from current risk prediction methods. Additionally, the study data further support the use of DecisionDx-SCC test results in combination with other risk-assessment and staging systems to guide more refined and risk-aligned patient care. See the Company's news release from May 19, 2022, for more information.

•In May, the Company announced that it had been selected as the winner of the "Best New Technology Solution - Dermatology" award in the sixth annual MedTech Breakthrough Awards program for its innovative DecisionDx-Melanoma gene expression profile (GEP) test. The mission of the MedTech Breakthrough Awards is to honor excellence and recognize the innovation, hard work and success in a range of health and medical technology categories. This year's program attracted more than 3,900 nominations from over 15 different countries throughout the world. See the Company's news release from May 27, 2022, for more information.

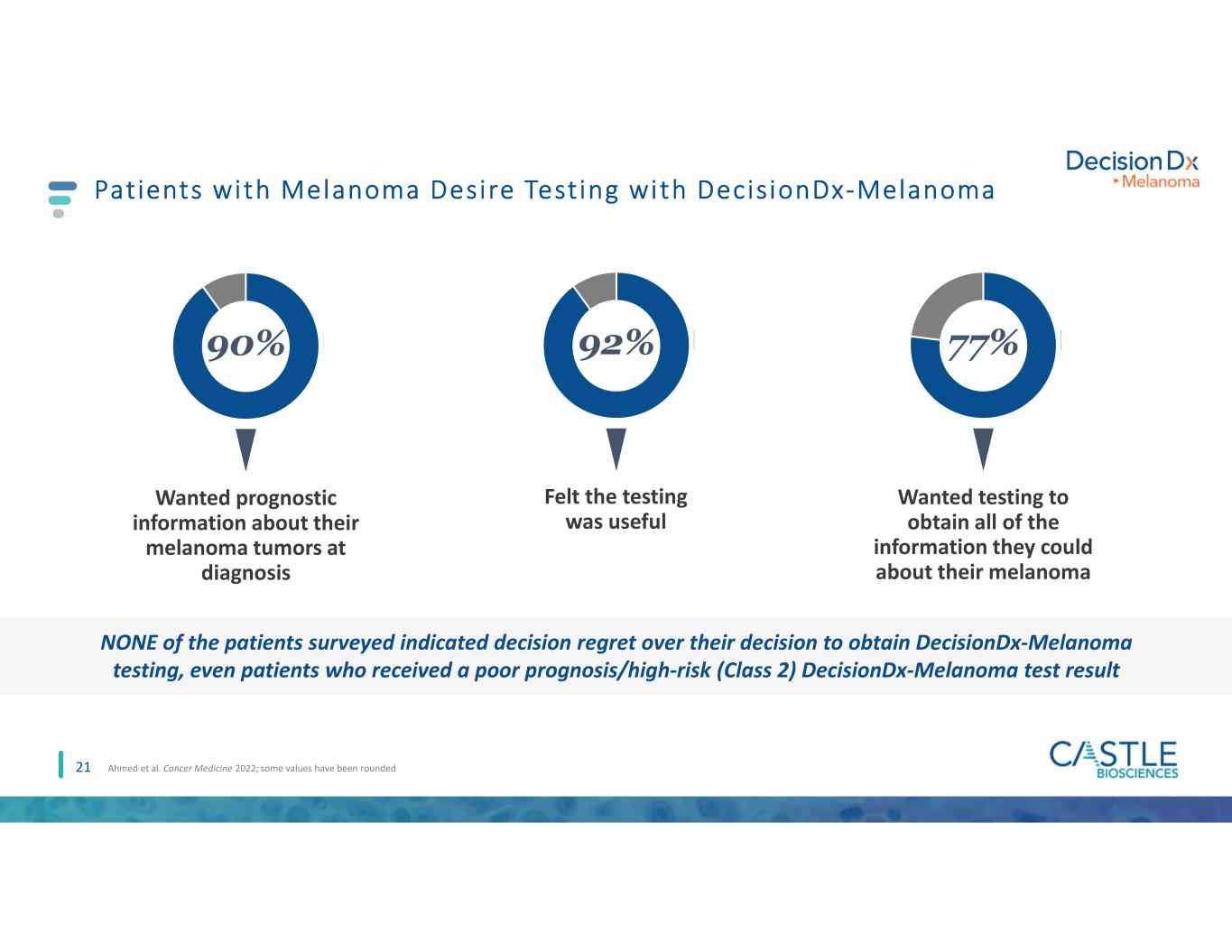

•In June, the Company announced a poster presentation on DecisionDx-Melanoma at the 2022 Fall Clinical Dermatology Conference for PAs & NPs. The poster, titled "Attitudes of Patients with Cutaneous Melanoma Towards Prognostic Testing Using Gene Expression Profiling," shares results from a survey of 120 melanoma patients regarding prognostic testing with DecisionDx-Melanoma. In the survey, a significant majority of patients desired testing with DecisionDx-Melanoma after receiving a melanoma diagnosis and appreciated the in-depth information provided by the results, regardless of whether they received low or high-risk scores. See the Company's news release from June 14, 2022, for more information.

•In June, the Company announced a new collaboration with the Oregon Health & Science University's (OHSU) War on Melanoma™. The War on Melanoma is a multi-faceted public health campaign with a focus on early detection and prevention of melanoma through various education, activism and research programs. The collaboration includes support of various aspects of the War on Melanoma program, including the Start Seeing Melanoma™ campaign and the Skin Crew. See the Company's news release from June 20, 2022, for more information.

Uveal Melanoma

•In May, the Company announced a partnership with Research to Prevent Blindness (RPB), the leading nonprofit organization supporting eye research directed at the prevention, treatment or eradication of all diseases that damage and destroy sight, to provide funding for the RPB/Castle Biosciences Medical Student Eye Research Fellowship in Ocular Cancer, which allows medical students to take a year off from medical school to devote time to the pursuit of a research project within an RPB-supported department of ophthalmology. See the Company's news release from May 20, 2022, for more information.

•In June, the Company announced findings from a study that evaluated uveal melanoma (UM) patients' attitudes toward prognostic testing and specifically with respect to DecisionDx-UM. Highlights from the study were shared in a poster presentation at the 20th congress of the International Society of Ocular Oncology (ISOO), recently held in Leiden, The Netherlands. Of the 177 survey participants, 90% reported wanting prognostic information at diagnosis. And of the patients who received prognostic testing with DecisionDx-UM, there was no significant difference in decision regret levels among those receiving a low- (Class 1A), intermediate- (Class 1B) or high-risk (Class 2) test result (Kruskal-Wallis rank sum test, X2=4.1, p=0.13). Patients tested with DecisionDx-UM reported gaining value from their test result, including increased knowledge and understanding of their disease, more personalized treatment options, information relevant to life planning, and relief from uncertainty about the future. See the Company's news release from June 23, 2022, for more information.

Gastroenterology

•In April, the Company announced an independent, peer-reviewed article published in Clinical Gastroenterology and Hepatology. The authors performed a pooled analysis, and the data demonstrated the ability of TissueCypher to significantly improve predictions of progression to esophageal cancer in patients with Barrett’s Esophagus (BE), compared to predictions based on traditional clinicopathologic variables alone, allowing for more informed disease management decisions. See the Company's news release from April 27, 2022, for more information.

•In May, the Company announced new study data demonstrating the ability of its TissueCypher Barrett's Esophagus test to independently predict malignant progression to high-grade dysplasia (HGD) and esophageal adenocarcinoma (EAC) in patients with non-dysplastic (ND), indefinite or low-grade dysplasia (LGD) (BE). Overall, the study demonstrated that TissueCypher can accurately predict progression to HGD or EAC in BE patients who are initially diagnosed with LGD, outperforming the majority of pathologist diagnoses evaluated in the study. Further, TissueCypher test results may provide an objective solution to observer variability, identifying more progressors early and helping to inform management decisions and standardize care plans for patients with BE. See the Company's news release from May 24, 2022, for more information.

•In August, the Company announced that the American Gastroenterological Association (AGA) recently published a best practice advice article stating that the TissueCypher Barrett’s Esophagus test may be beneficial for risk-stratification of patients with non-dysplastic BE. The best practice advice article from the AGA, titled “AGA Clinical Practice Update on New Technology and Innovation for Surveillance and Screening in Barrett’s Esophagus: Expert Review,” was recently published online in Clinical Gastroenterology and Hepatology and can be viewed here. See the Company's news release from Aug. 4, 2022, for more information.

Mental Health

•In May, the Company announced a collaboration with Camille Schrier, Miss America 2020, as part of Mental Health Awareness Month, to promote the potential of genetic testing and the IDgenetix test to help improve treatment for mental health conditions. See the Company’s news release from May 6, 2022, for more information.

Conference Call and Webcast Details

Castle Biosciences will hold a conference call on Monday, Aug. 8, 2022, at 4:30 p.m. Eastern time to discuss its second quarter 2022 results and provide a corporate update.

A live webcast of the conference call can be accessed here: https://events.q4inc.com/attendee/949303499 or via the webcast link on the Investor Relations page of the Company’s website, https://ir.castlebiosciences.com/overview/default.aspx. Please access the webcast at least 10 minutes before the conference call start time. An archive of the webcast will be available on the Company’s website until Aug. 31, 2022.

To access the live conference call via phone, please dial 844 200 6205 from the United States, or +1 929 526 1599 internationally, at least 10 minutes prior to the start of the call, using the conference ID 705869.

There will be a brief Question & Answer session following management commentary.

Use of Non-GAAP Financial Measures (UNAUDITED)

In this release, we use the metrics of Adjusted Revenue, Adjusted Gross Margin, Adjusted Operating Cash Flow and Adjusted EBITDA, which are non-GAAP financial measures and are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). Adjusted Revenue and Adjusted Gross Margin reflect adjustments to net revenues to exclude changes in variable consideration related to test reports delivered in previous periods. Adjusted Gross Margin further excludes acquisition-related intangible asset amortization. Adjusted Operating Cash Flow excludes the effects of repayments to Medicare of COVID-19 government relief advancements to healthcare providers. Adjusted EBITDA excludes from net loss interest expense, depreciation and amortization expense, income tax (benefit) expense, stock compensation expense, acquisition-related transaction costs and change in fair value of contingent consideration.

We use Adjusted Revenue, Adjusted Gross Margin, Adjusted Operating Cash Flow and Adjusted EBTIDA internally because we believe these metrics provide useful supplemental information in assessing our revenue and cash flow performance reported in accordance with GAAP, respectively. We believe Adjusted Revenue and

Adjusted Gross Margin are also useful to investors because they provide additional information on current-period performance by removing the effects of revenue adjustments related to tests delivered in previous periods and, with respect to Adjusted Gross Margin, acquisition-related intangible asset amortization, which we believe may facilitate revenue and gross margin comparisons to historical periods. We believe Adjusted Operating Cash Flow is also useful to investors as a supplement to GAAP measures in the assessment of our cash flow performance by removing the effects of COVID-19 government relief payments, which we believe are not indicative of our ongoing operations. We believe Adjusted EBITDA may enhance an evaluation of our operating performance based on recent revenue generation and product/overhead cost control because it excludes the impact of prior decisions made about capital investment, financing and other expenses. However, these non-GAAP financial measures may be different from non-GAAP financial measures used by other companies, even when the same or similarly titled terms are used to identify such measures, limiting their usefulness for comparative purposes.

These non-GAAP financial measures are not meant to be considered in isolation or used as substitutes for net revenues, gross margin, net cash (used in) provided by operating activities or net loss reported in accordance with GAAP; should be considered in conjunction with our financial information presented in accordance with GAAP; have no standardized meaning prescribed by GAAP; and are not prepared under any comprehensive set of accounting rules or principles. In addition, from time to time in the future, there may be other items that we may exclude for purposes of these non-GAAP financial measures, and we may in the future cease to exclude items that we have historically excluded for purposes of these non-GAAP financial measures. Likewise, we may determine to modify the nature of adjustments to arrive at these non-GAAP financial measures. Because of the non-standardized definitions of non-GAAP financial measures, the non-GAAP financial measure as used by us in this press release and the accompanying reconciliation tables have limits in their usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. Accordingly, investors should not place undue reliance on non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the tables at the end of this release.

1Centers for Medicare & Medicaid Services: https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/ClinicalLabFeeSched/Downloads/Guidance-for-Laboratories-on-ADLTs.pdf

About Castle Biosciences

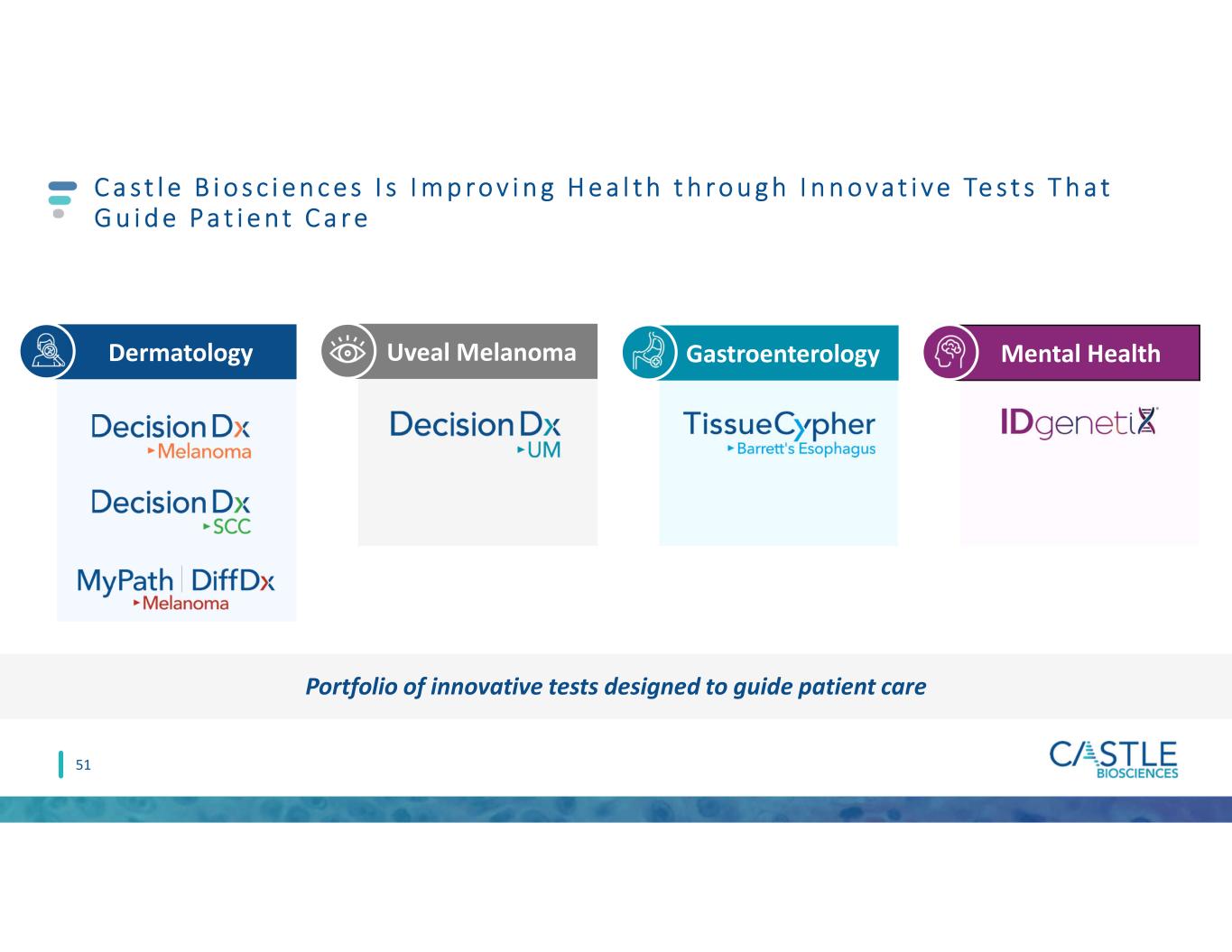

Castle Biosciences (Nasdaq: CSTL) is a leading diagnostics company improving health through innovative tests that guide patient care. The Company aims to transform disease management by keeping people first: patients, clinicians, employees and investors.

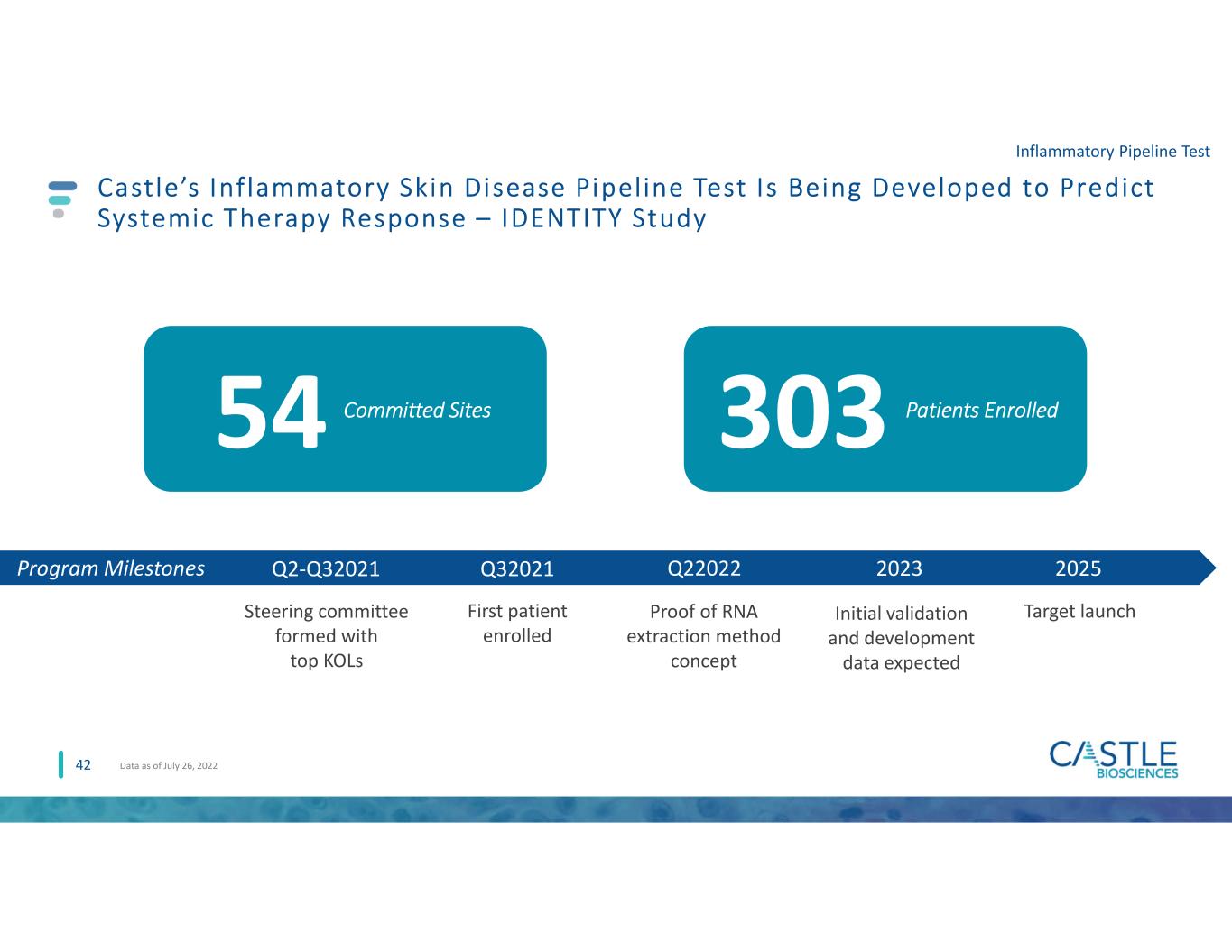

Castle’s current portfolio consists of tests for skin cancers, uveal melanoma, Barrett’s esophagus and mental health conditions. Additionally, the Company has active research and development programs for tests in other diseases with high clinical need, including its test in development to predict systemic therapy response in patients with moderate-to-severe psoriasis, atopic dermatitis and related conditions. To learn more, please visit www.CastleBiosciences.com and connect with us on LinkedIn, Facebook, Twitter and Instagram.

DecisionDx-Melanoma, DecisionDx-CMSeq, DecisionDx-SCC, MyPath Melanoma, DecisionDx DiffDx-Melanoma, DecisionDx-UM, DecisionDx-PRAME, DecisionDx-UMSeq, TissueCypher and IDgenetix are trademarks of Castle Biosciences, Inc.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning: the value that our tests have to answer clinical questions; our expectation that we will continue to generate data from our collaboration with the NCI as we expand our matched data beyond the initial cohort; our belief in the progress of our ongoing integration efforts of our newly acquired gastroenterology and mental health franchises and the belief that these franchises will contribute meaningfully to our top-line growth in the mid-to long-term, and along with focused investments, contribute to our anticipated operating

cash-flow neutrality by 2025; our belief that we will continue with current momentum and continue creating value for stockholders; our expectation that we will generate $130-135 million in total revenue in 2022; the ability of DecisionDx-SCC to independently and accurately risk-stratify patients with cutaneous squamous cell carcinoma and one or more risk factors according to their biologic risk of metastasis and provide significant prognostic information independent from current risk prediction methods; and the ability of TissueCypher to accurately predict progression to HGD or EAC in BE patients who are initially diagnosed with LGD and provide an objective solution to observer variability, identifying more progressors early and helping to inform management decisions and standardize care plans for patients with BE. The words “anticipates,” “believes,” “can,” “may,” “potential,” “will” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation: the effects of the COVID-19 pandemic on our business and our efforts to address its impact on our business; subsequent study or trial results and findings may contradict earlier study or trial results and findings or may not support the results discussed in this press release, including with respect to the diagnostic and prognostic tests discussed in this press release; actual application of our tests may not provide the aforementioned benefits to patients; and the risks set forth under the heading “Risk Factors” in our Quarterly Report on Form 10-Q for the three months ended June 30, 2022, and in our other filings with the SEC. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements, except as may be required by law.

The COVID-19 situation continues to evolve and brings along with it a high level of uncertainty surrounding potential future impacts. Therefore, trends in revenues and test report volumes are not necessarily indicative of the Company’s results of operations that can be expected for future interim periods or for the year ending December 31, 2022.

Investor and Media Contact:

Camilla Zuckero

VP, Investor Relations & Corporate Affairs

czuckero@castlebiosciences.com

CASTLE BIOSCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

(in thousands, except per share data)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| NET REVENUES | $ | 34,838 | $ | 22,758 | $ | 61,690 | $ | 45,571 | |||||||||||||||

| OPERATING EXPENSES AND OTHER OPERATING INCOME | |||||||||||||||||||||||

| Cost of sales (exclusive of amortization of acquired intangible assets) | 7,686 | 3,697 | 13,630 | 6,725 | |||||||||||||||||||

| Research and development | 11,926 | 6,793 | 22,687 | 12,701 | |||||||||||||||||||

| Selling, general and administrative | 37,498 | 20,822 | 67,951 | 38,983 | |||||||||||||||||||

| Amortization of acquired intangible assets | 2,097 | 256 | 3,745 | 256 | |||||||||||||||||||

| Change in fair value of contingent consideration | (20,398) | — | (17,836) | — | |||||||||||||||||||

| Total operating expenses, net | 38,809 | 31,568 | 90,177 | 58,665 | |||||||||||||||||||

| Operating loss | (3,971) | (8,810) | (28,487) | (13,094) | |||||||||||||||||||

| Interest income | 370 | 24 | 400 | 28 | |||||||||||||||||||

| Interest expense | (4) | — | (7) | — | |||||||||||||||||||

| Loss before income taxes | (3,605) | (8,786) | (28,094) | (13,066) | |||||||||||||||||||

| Income tax (benefit) expense | (1,957) | 5 | (1,823) | 5 | |||||||||||||||||||

| Net loss and comprehensive loss | $ | (1,648) | $ | (8,791) | $ | (26,271) | $ | (13,071) | |||||||||||||||

| Loss per share, basic and diluted | $ | (0.06) | $ | (0.35) | $ | (1.02) | $ | (0.52) | |||||||||||||||

| Weighted-average shares outstanding, basic and diluted | 26,064 | 25,091 | 25,746 | 25,002 | |||||||||||||||||||

Stock-Based Compensation Expense

Stock-based compensation expense is included in the condensed consolidated statements of operations and comprehensive loss as follows (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Cost of sales (exclusive of amortization of acquired intangible assets) | $ | 897 | $ | 415 | $ | 1,750 | $ | 925 | |||||||||||||||

| Research and development | 1,831 | 1,073 | 3,659 | 2,131 | |||||||||||||||||||

| Selling, general and administrative | 6,055 | 3,278 | 11,793 | 6,623 | |||||||||||||||||||

| Total stock-based compensation expense | $ | 8,783 | $ | 4,766 | $ | 17,202 | $ | 9,679 | |||||||||||||||

CASTLE BIOSCIENCES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

| June 30, 2022 | December 31, 2021 | ||||||||||

| ASSETS | (unaudited) | ||||||||||

| Current Assets | |||||||||||

| Cash and cash equivalents | $ | 273,166 | $ | 329,633 | |||||||

| Accounts receivable, net | 22,606 | 17,282 | |||||||||

| Inventory | 3,365 | 2,021 | |||||||||

| Prepaid expenses and other current assets | 5,775 | 4,807 | |||||||||

| Total current assets | 304,912 | 353,743 | |||||||||

| Long-term accounts receivable, net | 1,367 | 1,308 | |||||||||

| Property and equipment, net | 11,203 | 9,501 | |||||||||

| Operating lease assets | 7,004 | 7,383 | |||||||||

| Goodwill and other intangible assets, net | 132,671 | 88,922 | |||||||||

| Other assets – long-term | 1,223 | 1,715 | |||||||||

| Total assets | $ | 458,380 | $ | 462,572 | |||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current Liabilities | |||||||||||

| Accounts payable | $ | 3,281 | $ | 2,546 | |||||||

| Accrued compensation | 14,850 | 15,483 | |||||||||

| Operating lease liabilities | 1,211 | 1,179 | |||||||||

| Other accrued and current liabilities | 8,177 | 5,678 | |||||||||

| Total current liabilities | 27,519 | 24,886 | |||||||||

| Noncurrent portion of contingent consideration | 1,949 | 18,287 | |||||||||

| Noncurrent operating lease liabilities | 6,480 | 6,900 | |||||||||

| Deferred tax liability | 614 | 635 | |||||||||

| Other liabilities | 158 | 124 | |||||||||

| Total liabilities | 36,720 | 50,832 | |||||||||

| Stockholders’ Equity | |||||||||||

Common stock | 26 | 25 | |||||||||

| Additional paid-in capital | 541,672 | 505,482 | |||||||||

| Accumulated deficit | (120,038) | (93,767) | |||||||||

| Total stockholders’ equity | 421,660 | 411,740 | |||||||||

| Total liabilities and stockholders’ equity | $ | 458,380 | $ | 462,572 | |||||||

CASTLE BIOSCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in thousands)

| Six Months Ended June 30, | |||||||||||

| 2022 | 2021 | ||||||||||

| OPERATING ACTIVITIES | |||||||||||

| Net loss | $ | (26,271) | $ | (13,071) | |||||||

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||||||

| Depreciation and amortization | 4,779 | 867 | |||||||||

| Stock-based compensation expense | 17,202 | 9,679 | |||||||||

| Change in fair value of contingent consideration | (17,836) | — | |||||||||

| Deferred income taxes | (1,839) | — | |||||||||

| Other | 39 | 69 | |||||||||

| Change in operating assets and liabilities: | |||||||||||

| Accounts receivable | (5,628) | (5,275) | |||||||||

| Prepaid expenses and other current assets | (707) | 1,347 | |||||||||

| Inventory | (1,066) | 223 | |||||||||

| Operating lease assets | 437 | 462 | |||||||||

| Other assets | 504 | (95) | |||||||||

| Accounts payable | 302 | (683) | |||||||||

| Operating lease liabilities | (445) | (590) | |||||||||

| Accrued compensation | (1,013) | (523) | |||||||||

| Medicare advance payment | — | (2,173) | |||||||||

| Other accrued liabilities | 1,111 | (306) | |||||||||

| Net cash used in operating activities | (30,431) | (10,069) | |||||||||

| INVESTING ACTIVITIES | |||||||||||

| Purchases of property and equipment | (1,807) | (1,663) | |||||||||

| Asset acquisition | 547 | (33,184) | |||||||||

| Acquisition of business, net of cash and cash equivalents acquired | (26,661) | — | |||||||||

| Proceeds from sale of property and equipment | 8 | 2 | |||||||||

| Net cash used in investing activities | (27,913) | (34,845) | |||||||||

| FINANCING ACTIVITIES | |||||||||||

| Payment of common stock offering costs | — | (336) | |||||||||

| Proceeds from exercise of common stock options | 509 | 2,345 | |||||||||

| Payment of employees’ taxes on vested restricted stock units | (88) | — | |||||||||

| Proceeds from contributions to the employee stock purchase plan | 1,511 | 1,392 | |||||||||

| Repayment of principal portion of finance lease liabilities | (55) | — | |||||||||

| Net cash provided by financing activities | 1,877 | 3,401 | |||||||||

| NET CHANGE IN CASH AND CASH EQUIVALENTS | (56,467) | (41,513) | |||||||||

| Beginning of period | 329,633 | 409,852 | |||||||||

| End of period | $ | 273,166 | $ | 368,339 | |||||||

CASTLE BIOSCIENCES, INC.

Reconciliation of Non-GAAP Financial Measures (UNAUDITED)

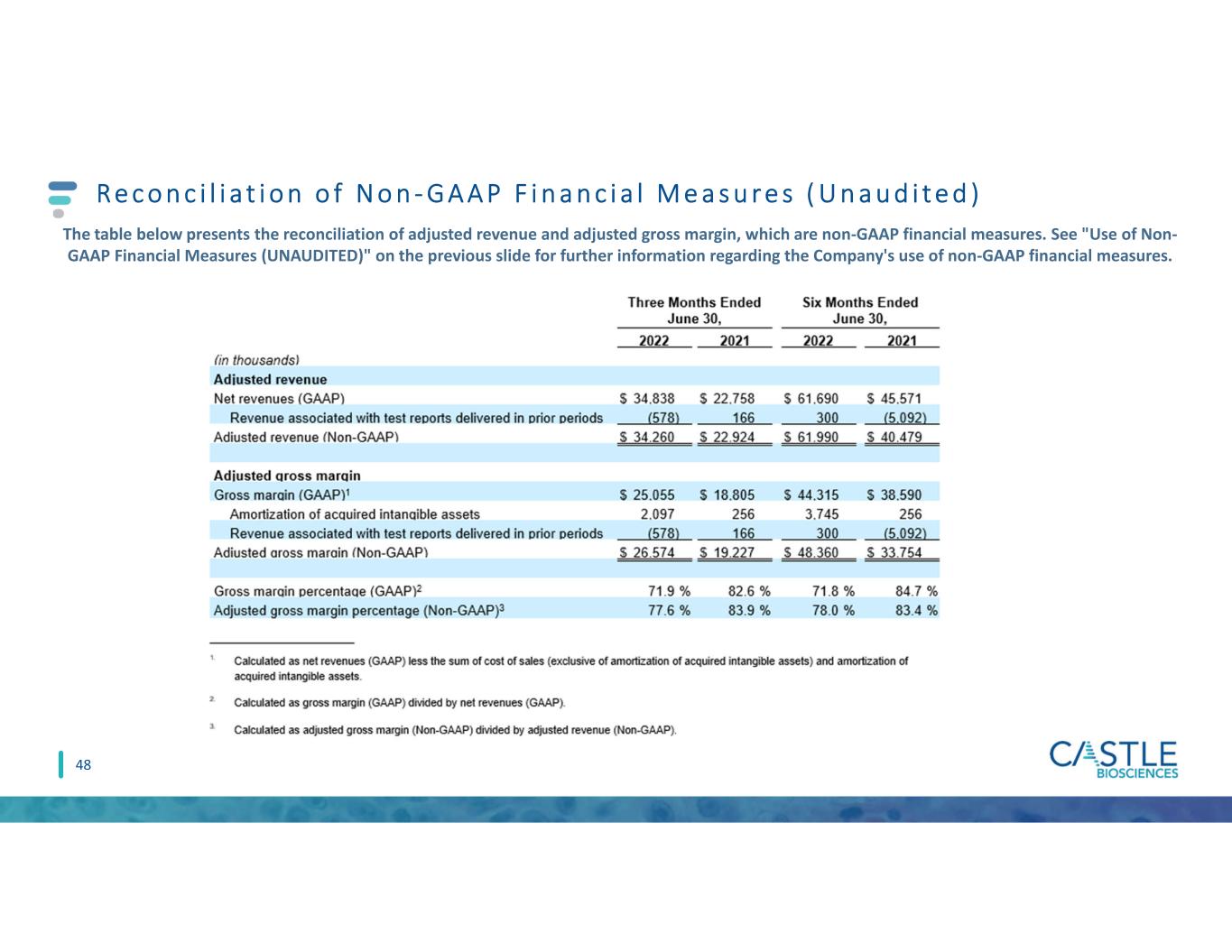

The table below presents the reconciliation of adjusted revenue and adjusted gross margin, which are non-GAAP financial measures. See "Use of Non-GAAP Financial Measures (UNAUDITED)" above for further information regarding the Company's use of non-GAAP financial measures.

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||

| Adjusted revenue | |||||||||||||||||||||||

| Net revenues (GAAP) | $ | 34,838 | $ | 22,758 | $ | 61,690 | $ | 45,571 | |||||||||||||||

| Revenue associated with test reports delivered in prior periods | (578) | 166 | 300 | (5,092) | |||||||||||||||||||

| Adjusted revenue (Non-GAAP) | $ | 34,260 | $ | 22,924 | $ | 61,990 | $ | 40,479 | |||||||||||||||

| Adjusted gross margin | |||||||||||||||||||||||

Gross margin (GAAP)1 | $ | 25,055 | $ | 18,805 | $ | 44,315 | $ | 38,590 | |||||||||||||||

| Amortization of acquired intangible assets | 2,097 | 256 | 3,745 | 256 | |||||||||||||||||||

| Revenue associated with test reports delivered in prior periods | (578) | 166 | 300 | (5,092) | |||||||||||||||||||

| Adjusted gross margin (Non-GAAP) | $ | 26,574 | $ | 19,227 | $ | 48,360 | $ | 33,754 | |||||||||||||||

Gross margin percentage (GAAP)2 | 71.9 | % | 82.6 | % | 71.8 | % | 84.7 | % | |||||||||||||||

Adjusted gross margin percentage (Non-GAAP)3 | 77.6 | % | 83.9 | % | 78.0 | % | 83.4 | % | |||||||||||||||

________________________

1.Calculated as net revenues (GAAP) less the sum of cost of sales (exclusive of amortization of acquired intangible assets) and amortization of acquired intangible assets.

2.Calculated as gross margin (GAAP) divided by net revenues (GAAP).

3.Calculated as adjusted gross margin (Non-GAAP) divided by adjusted revenue (Non-GAAP).

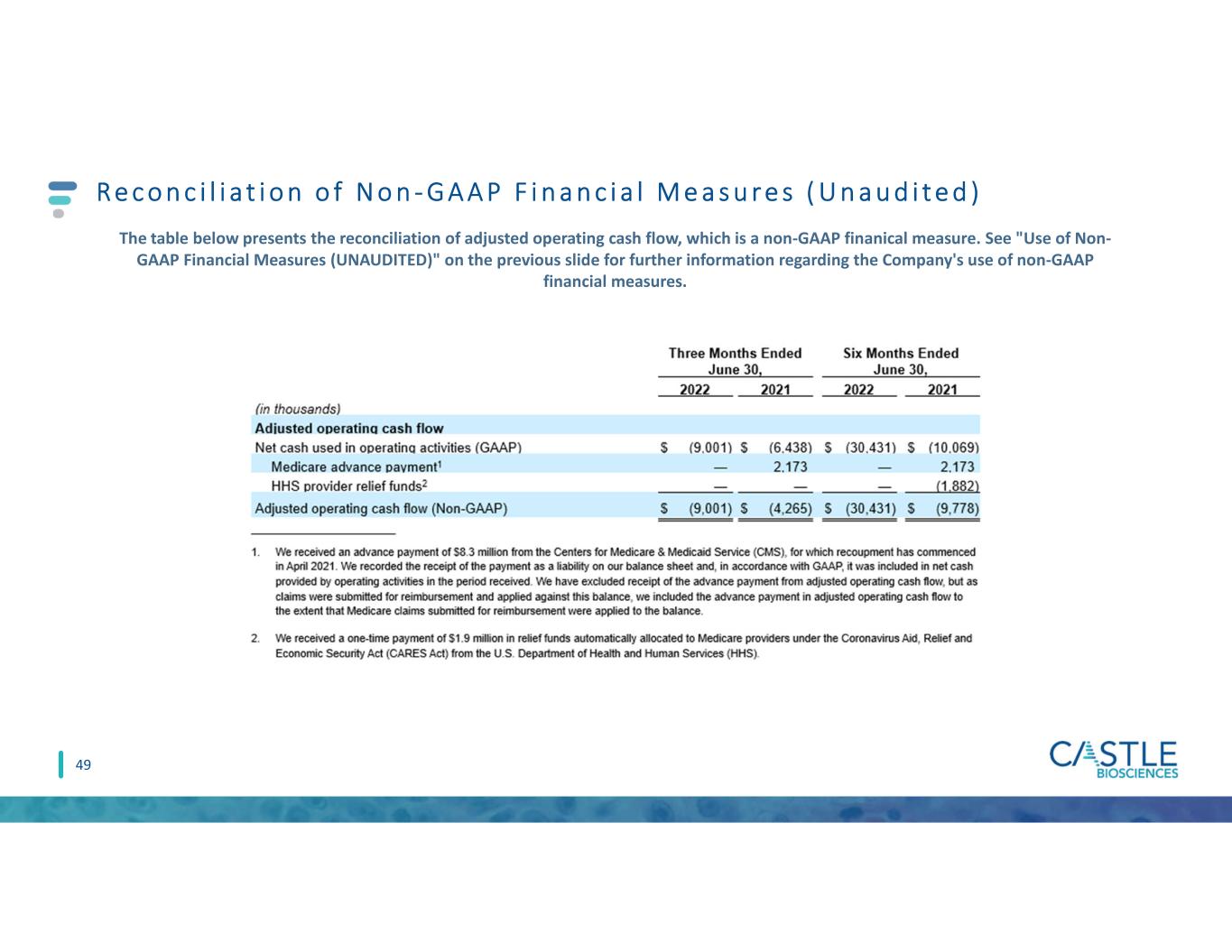

The table below presents the reconciliation of adjusted operating cash flow, which is a non-GAAP financial measure. See "Use of Non-GAAP Financial Measures (UNAUDITED)" above for further information regarding the Company's use of non-GAAP financial measures.

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||

| Adjusted operating cash flow | |||||||||||||||||||||||

| Net cash used in operating activities (GAAP) | $ | (9,001) | $ | (6,438) | $ | (30,431) | $ | (10,069) | |||||||||||||||

Medicare advance payment1 | — | 2,173 | — | 2,173 | |||||||||||||||||||

HHS provider relief funds2 | — | — | — | (1,882) | |||||||||||||||||||

| Adjusted operating cash flow (Non-GAAP) | $ | (9,001) | $ | (4,265) | $ | (30,431) | $ | (9,778) | |||||||||||||||

________________________

1.We received an advance payment of $8.3 million from the Centers for Medicare & Medicaid Service (CMS), for which recoupment has commenced in April 2021. We recorded the receipt of the payment as a liability on our balance sheet and, in accordance with GAAP, it was included in net cash provided by operating activities in the period received. We have excluded receipt of the advance payment from adjusted operating cash flow, but as claims were submitted for reimbursement and applied against this balance, we included the advance payment in adjusted operating cash flow to the extent that Medicare claims submitted for reimbursement were applied to the balance.

2.We received a one-time payment of $1.9 million in relief funds automatically allocated to Medicare providers under the Coronavirus Aid, Relief and Economic Security Act (CARES Act) from the U.S. Department of Health and Human Services (HHS).

The table below presents the reconciliation of adjusted EBITDA, which is a non-GAAP financial measure. See "Use of Non-GAAP Financial Measures (UNAUDITED)" above for further information regarding the Company's use of non-GAAP financial measures.

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||

| Adjusted EBITDA | |||||||||||||||||||||||

| Net loss | $ | (1,648) | $ | (8,791) | $ | (26,271) | $ | (13,071) | |||||||||||||||

| Interest expense | 4 | — | 7 | — | |||||||||||||||||||

| Depreciation and amortization expense | 2,628 | 634 | 4,779 | 867 | |||||||||||||||||||

| Income tax (benefit) expense | (1,957) | 5 | (1,823) | 5 | |||||||||||||||||||

| Stock-based compensation expense | 8,783 | 4,766 | 17,202 | 9,679 | |||||||||||||||||||

| Change in fair value of contingent consideration | (20,398) | — | (17,836) | — | |||||||||||||||||||

| Acquisition related transaction costs | 1,711 | — | 1,711 | — | |||||||||||||||||||

| Adjusted EBITDA (Non-GAAP) | $ | (10,877) | $ | (3,386) | $ | (22,231) | $ | (2,520) | |||||||||||||||

A u g u s t 8 , 2 0 2 2 Tra n s fo r m i n g D i s e a s e M a n a g e m e nt

D i s c l a i m e rs F O R W A R D - L O O K I N G S T A T E M E N T S This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning: estimated sizes of the total addressable markets of our current and future commercial and pipeline products within our dermatologic, GI and mental health franchises; our expectations with respect to future financial or operations performance, including revenue opportunities for our tests; the impact, accuracy and effectiveness of our commercial and pipeline tests on physicians, patients and their treatment plans, including the potential impact of DecisionDx-Melanoma on survival rates, and their individual or collective impact on our prospects and plans, including any objectives of management related thereto; the ability of our tests to provide valuable, clinically actionable risk stratification information to clinicians and patients, improve health and guide patient care; expected expansion of outside sales territories and laboratory facilities; our progress roadmaps for our tests; expected launch dates for tests in our pipeline expansion and estimates regarding their total addressable markets or future success; expectations regarding LCD effective timeframes and reimbursement capabilities; our ability to utilize existing relationships and build a suite of complementary tests in a single call point; increases in headcount in furtherance of our pipeline tests, clinical research and development and other expected drivers of growth, as well as efficiencies and synergies from capital expenditures related to expansion of laboratory facilities contributing to our growth; our ability to develop clinical evidence and publish peer-reviewed reports and studies that increase adoption among providers and commercial payors; estimated healthcare cost savings provided by our tests; the ability of our risk stratification tests to classify risk of metastasis in ways that better support risk-appropriate treatment than reliance on traditional clinicopathologic risk factors alone; program milestones for our pipeline test designed to predict systemic therapy response and the potential of systemic therapy guidance tools to streamline therapeutic interventions for patients and avoid ineffective, expensive medication courses; integration timelines, expected future revenue contributions, potential cost savings, growth expectations and strategic opportunities for our TissueCypher test and GI franchise, and our IDgenetix test and our mental health franchise; and our ability to integrate our recent acquisitions into our existing business and the ability of such acquisitions to complement our existing business. The words “anticipates,” “believes,” “can,” “could,” “estimates,” “expects,” “may,” “plans,” “potential,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation, the effects of the COVID-19 pandemic on our business and our efforts to address its impact on our business, subsequent study or trial results and findings may contradict earlier study or trial results and findings, including with respect to the diagnostic and prognostic tests discussed in this presentation, actual application of our tests may not provide the aforementioned benefits to patients, and the risks set forth under the heading “Risk Factors” in our Quarterly Report on Form 10-Q for the three months ended June 30, 2022, and in our other filings with the SEC. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements, except as may be required by law. 2

3 MISSION: VISION: VALUES: Improving health through innovative tests that guide patient care To transform disease management by keeping people first: patients, clinicians, employees and investors ExCIITE: Excitement, Collaboration, Integrity, Innovation, Trust and Excellence

4 Castle Remains Focused on Transforming Disease Management S t rate g ic pr inc ip le s t hat c re ate va lue for custome rs , pat ie nt s and s tockholde rs Address areas with unmet clinical need Leverage advanced technologies to develop innovative tests Accelerate test adoption through proven commercial excellence Provide robust data to support the clinical value of our tests

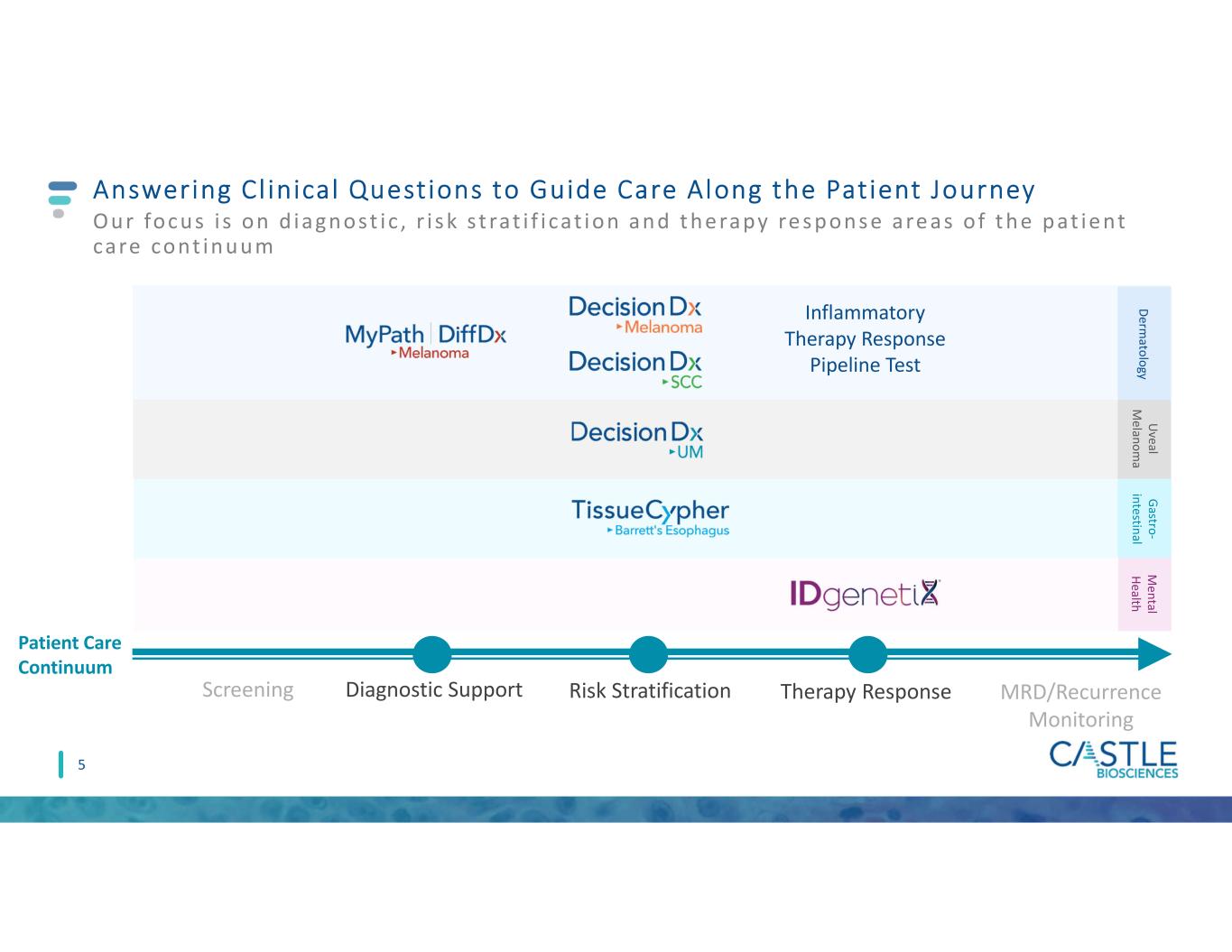

4 55 Screening Diagnostic Support Risk Stratification Therapy Response MRD/Recurrence Monitoring Answering Cl inical Questions to Guide Care Along the Patient Journey Our focus i s on d iagnost ic , r i s k s t rat i f i cat ion and t he rapy re s pons e are as o f t he pat ie nt care cont inuum Inflammatory Therapy Response Pipeline Test Patient Care Continuum D erm ato lo gy U veal M e lan o m a G astro - in testin al M e n tal H ealth

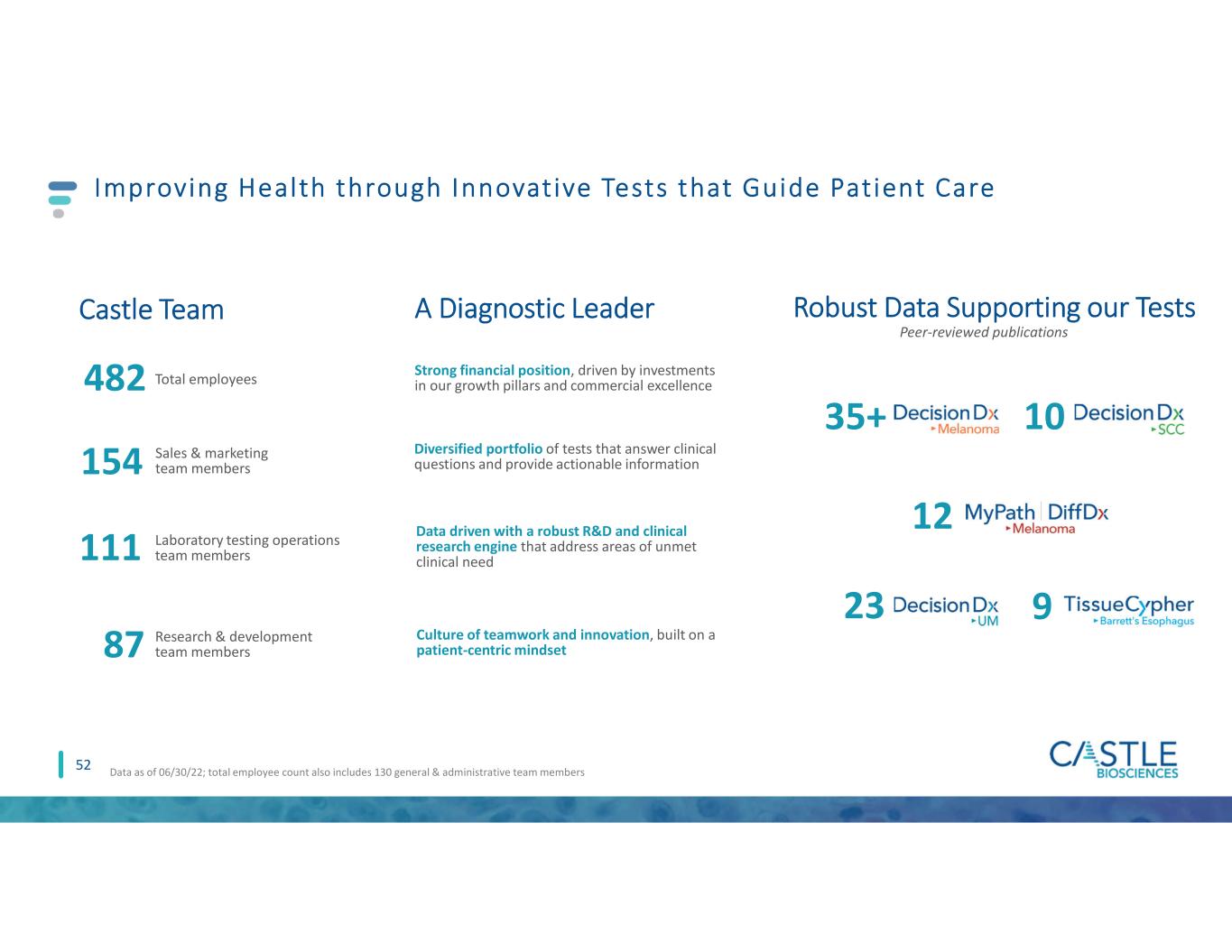

Financial Performance Summary Q2 2022 2Q21 2Q22 Total test reports 7,007 11,034 Total Derm test reports 6,539 9,424 Revenue $22.8M $34.8M Adj. Revenue1 $22.9M $34.3M Gross Margin 82.6% 71.9% Adj. Gross Margin1 83.9% 77.6% Operating Cash Flow $(6.4)M $(9.0)M Adj. Operating Cash Flow1 $(4.3)M $(9.0)M Cash & Cash Equivalents $368M as of 06/30/2021 $273M as of 06/30/2022 1See Non-GAAP reconciliations at the end of this presentation. 6

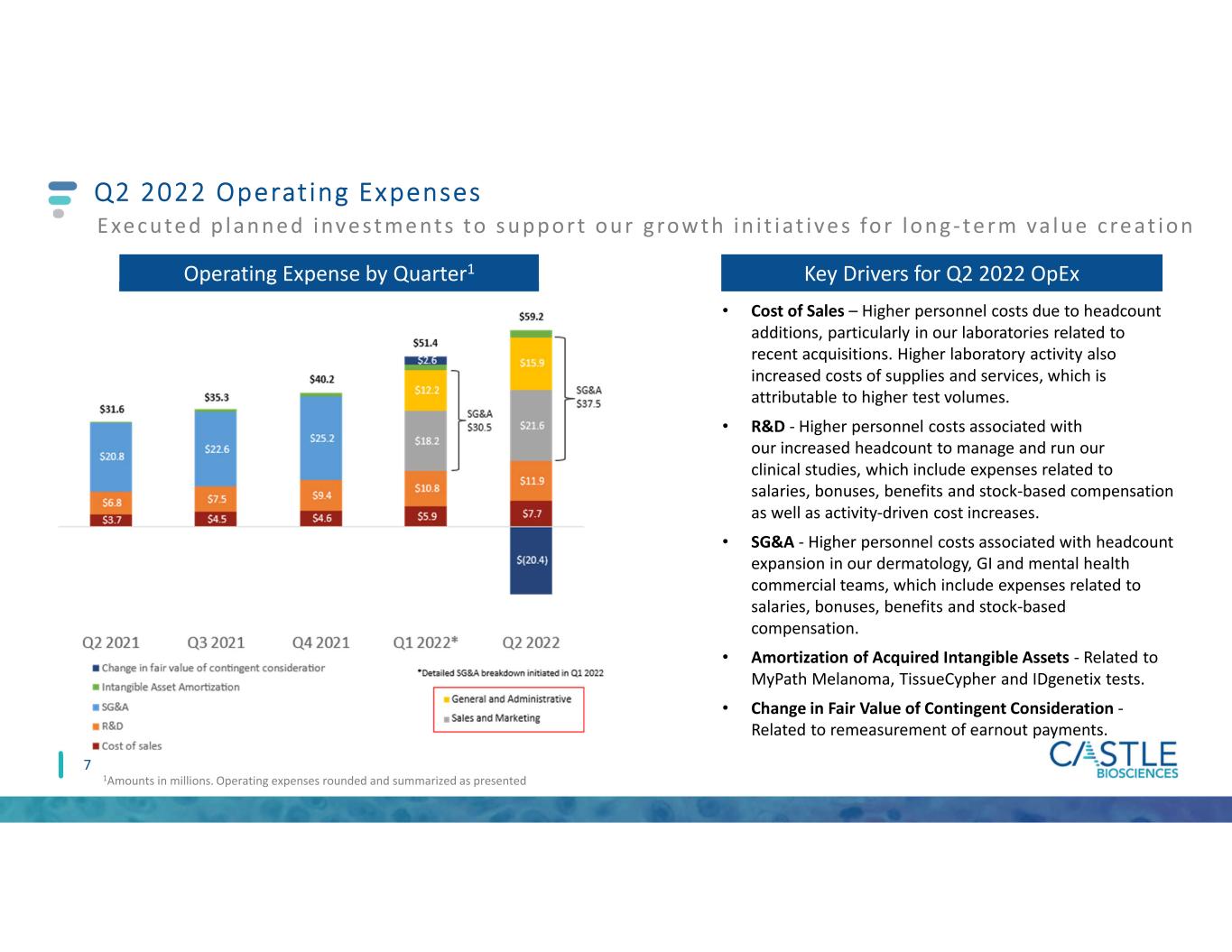

Q2 2022 Operating Expenses 7 Operating Expense by Quarter1 1Amounts in millions. Operating expenses rounded and summarized as presented E xe cute d p lanne d inve st me nts to s upport our grow t h in i t iat ive s for long- te rm va lue cre at ion Key Drivers for Q2 2022 OpEx • Cost of Sales – Higher personnel costs due to headcount additions, particularly in our laboratories related to recent acquisitions. Higher laboratory activity also increased costs of supplies and services, which is attributable to higher test volumes. • R&D - Higher personnel costs associated with our increased headcount to manage and run our clinical studies, which include expenses related to salaries, bonuses, benefits and stock-based compensation as well as activity-driven cost increases. • SG&A - Higher personnel costs associated with headcount expansion in our dermatology, GI and mental health commercial teams, which include expenses related to salaries, bonuses, benefits and stock-based compensation. • Amortization of Acquired Intangible Assets - Related to MyPath Melanoma, TissueCypher and IDgenetix tests. • Change in Fair Value of Contingent Consideration - Related to remeasurement of earnout payments.

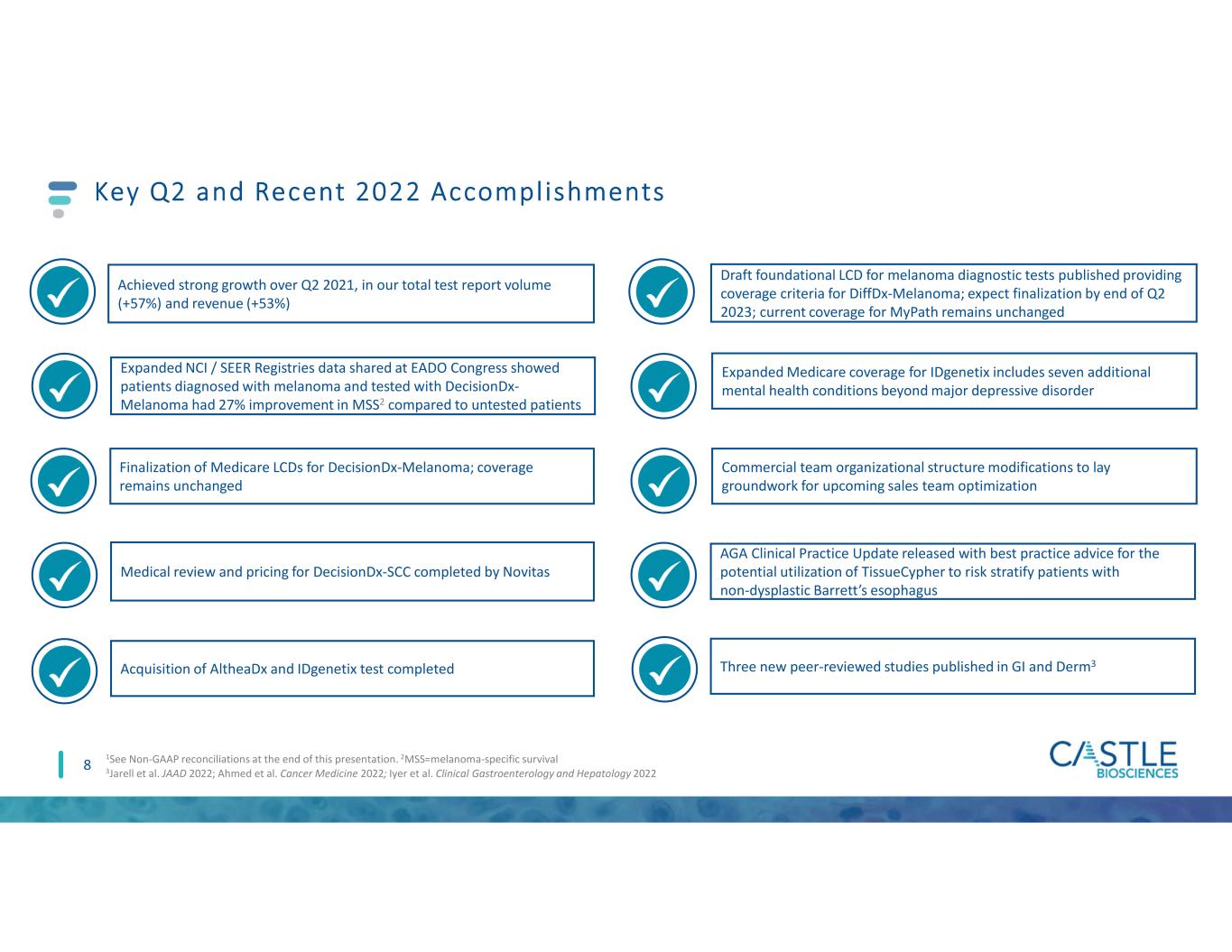

Draft foundational LCD for melanoma diagnostic tests published providing coverage criteria for DiffDx-Melanoma; expect finalization by end of Q2 2023; current coverage for MyPath remains unchanged Expanded NCI / SEER Registries data shared at EADO Congress showed patients diagnosed with melanoma and tested with DecisionDx- Melanoma had 27% improvement in MSS2 compared to untested patients 8 Key Q2 and Recent 2022 Accomplishments 1See Non-GAAP reconciliations at the end of this presentation. 2MSS=melanoma-specific survival 3Jarell et al. JAAD 2022; Ahmed et al. Cancer Medicine 2022; Iyer et al. Clinical Gastroenterology and Hepatology 2022 Achieved strong growth over Q2 2021, in our total test report volume (+57%) and revenue (+53%) Acquisition of AltheaDx and IDgenetix test completed Expanded Medicare coverage for IDgenetix includes seven additional mental health conditions beyond major depressive disorder Finalization of Medicare LCDs for DecisionDx-Melanoma; coverage remains unchanged Commercial team organizational structure modifications to lay groundwork for upcoming sales team optimization AGA Clinical Practice Update released with best practice advice for the potential utilization of TissueCypher to risk stratify patients with non-dysplastic Barrett’s esophagus Three new peer-reviewed studies published in GI and Derm3 Medical review and pricing for DecisionDx-SCC completed by Novitas

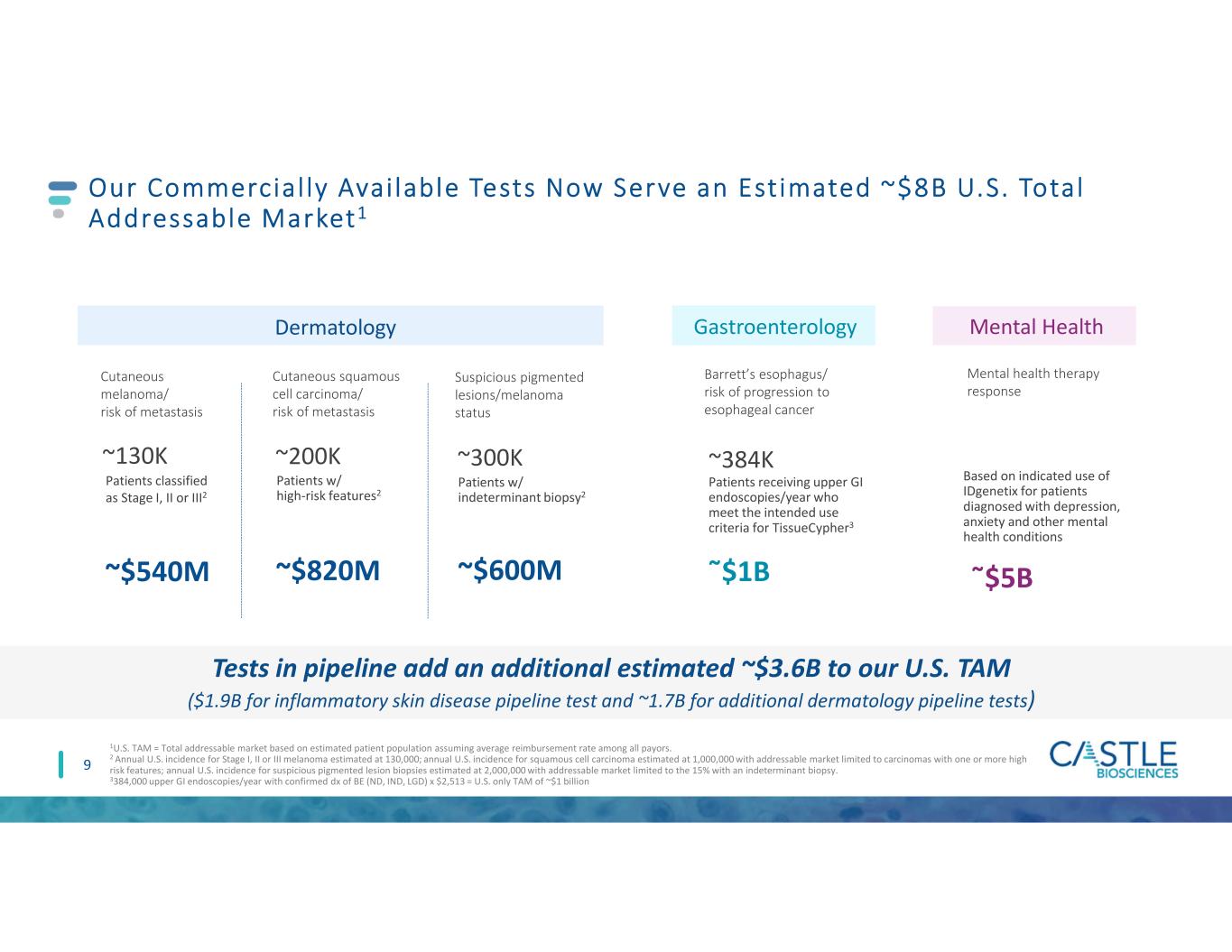

Barrett’s esophagus/ risk of progression to esophageal cancer Patients receiving upper GI endoscopies/year who meet the intended use criteria for TissueCypher3 ῀$1B ~384K Our Commercial ly Avai lable Tests Now Serve an Est imated ~$8B U.S. Total Addressable Market1 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2 Annual U.S. incidence for Stage I, II or III melanoma estimated at 130,000; annual U.S. incidence for squamous cell carcinoma estimated at 1,000,000 with addressable market limited to carcinomas with one or more high risk features; annual U.S. incidence for suspicious pigmented lesion biopsies estimated at 2,000,000 with addressable market limited to the 15% with an indeterminant biopsy. 3384,000 upper GI endoscopies/year with confirmed dx of BE (ND, IND, LGD) x $2,513 = U.S. only TAM of ~$1 billion 9 Cutaneous melanoma/ risk of metastasis Cutaneous squamous cell carcinoma/ risk of metastasis Suspicious pigmented lesions/melanoma status ~130K ~200K ~300K ~$540M ~$820M ~$600M Patients classified as Stage I, II or III2 Patients w/ high-risk features2 Patients w/ indeterminant biopsy2 Gastroenterology Mental health therapy response Based on indicated use of IDgenetix for patients diagnosed with depression, anxiety and other mental health conditions ῀$5B Mental HealthDermatology Tests in pipeline add an additional estimated ~$3.6B to our U.S. TAM ($1.9B for inflammatory skin disease pipeline test and ~1.7B for additional dermatology pipeline tests)

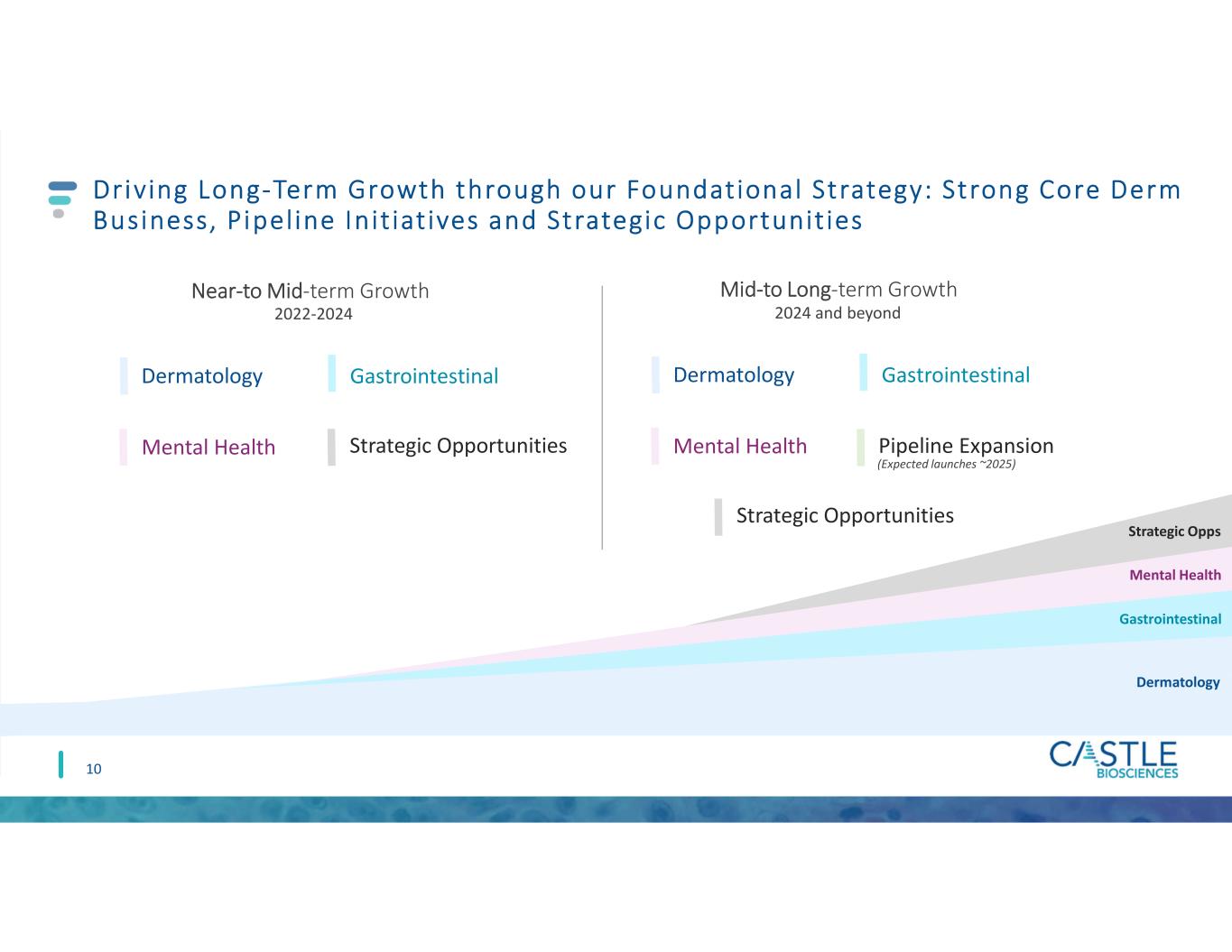

Driving Long-Term Growth through our Foundational Strategy: Strong Core Derm Business, Pipeline Init iat ives and Strategic Opportunit ies 10 Near-to Mid-term Growth Mid-to Long-term Growth (Expected launches ~2025) 2022-2024 2024 and beyond Gastrointestinal Strategic Opps Mental Health Gastrointestinal Dermatology Gastrointestinal Mental Health Strategic Opportunities Dermatology Gastrointestinal Mental Health Pipeline Expansion Strategic Opportunities Dermatology Gastrointestinal

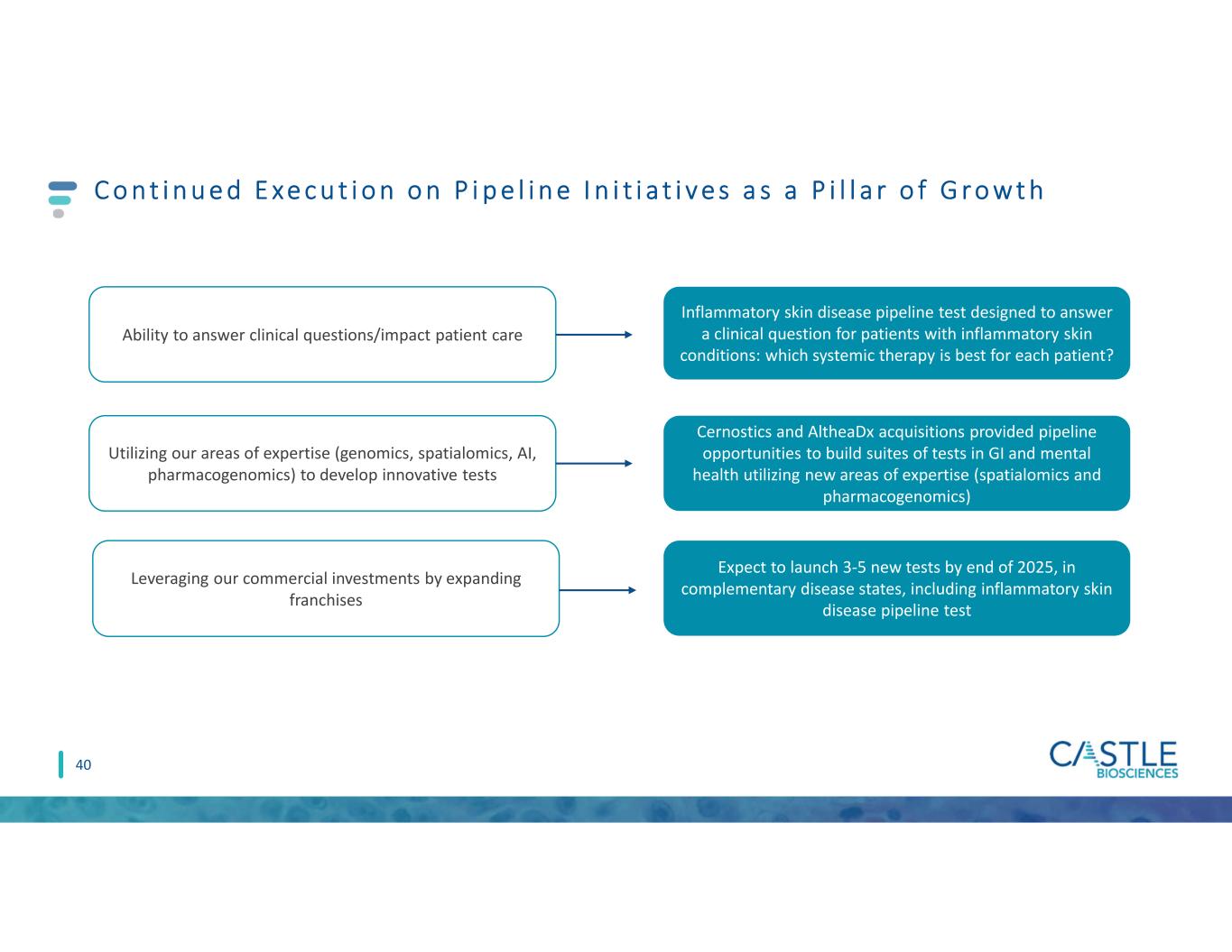

Operational Growth Pi l lars 11 Cons i s te nt exe cut ion f ur t he rs our le ad ing pos i t ion in de rmato logy and in t he Dx s pace Strong Core Derm Business Pipeline Initiatives Strategic Opportunities • Continuing provider education • Optimizing commercial team • Evolving our go-to-market strategy • Data that drives value: NCI/SEER collaboration • Ability to answer clinical questions/impact patient care • Utilizing our areas of expertise (genomics, spatialomics, AI) to develop innovative tests • Focusing on complementary/ adjacent disease states • Significant opportunities where early reimbursement wins have been achieved and we can utilize our commercial success • Potential to create a suite of tests in a single call point + +

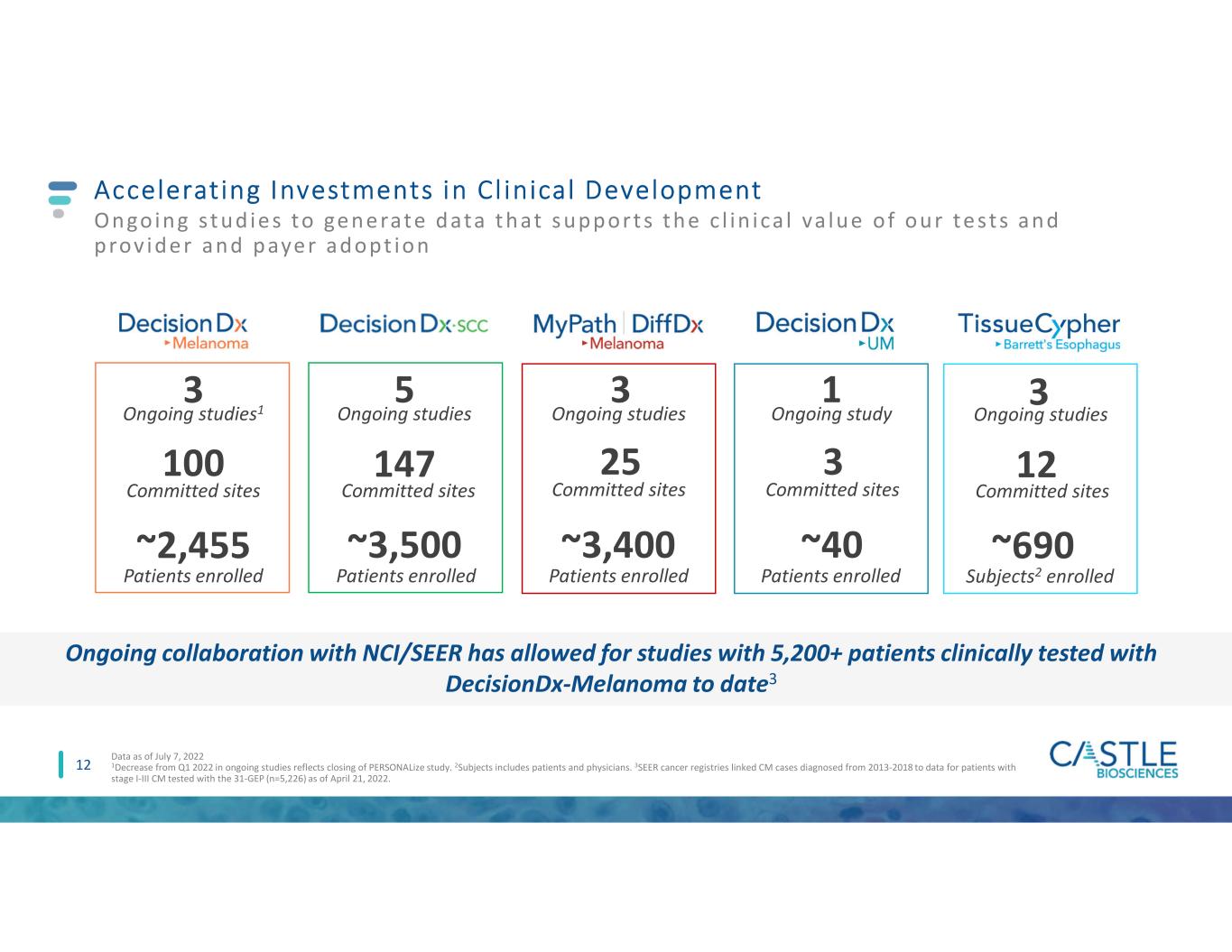

12 Accelerating Investments in Cl inical Development Ongoing s t ud ie s to ge ne rate data t hat s upport s t he c l in ica l va lue of our te sts and prov ide r and paye r adopt ion 100 Committed sites ~2,455 Patients enrolled 3 Ongoing studies1 147 ~3,500 5 Committed sites Patients enrolled Ongoing studies 25 ~3,400 3 Committed sites Patients enrolled Ongoing studies 12 ~690 3 Committed sites Subjects2 enrolled Ongoing studies Data as of July 7, 2022 1Decrease from Q1 2022 in ongoing studies reflects closing of PERSONALize study. 2Subjects includes patients and physicians. 3SEER cancer registries linked CM cases diagnosed from 2013-2018 to data for patients with stage I-III CM tested with the 31-GEP (n=5,226) as of April 21, 2022. 3 ~40 1 Committed sites Patients enrolled Ongoing study Ongoing collaboration with NCI/SEER has allowed for studies with 5,200+ patients clinically tested with DecisionDx-Melanoma to date3

Our Core Derm Bus iness i s S t rong

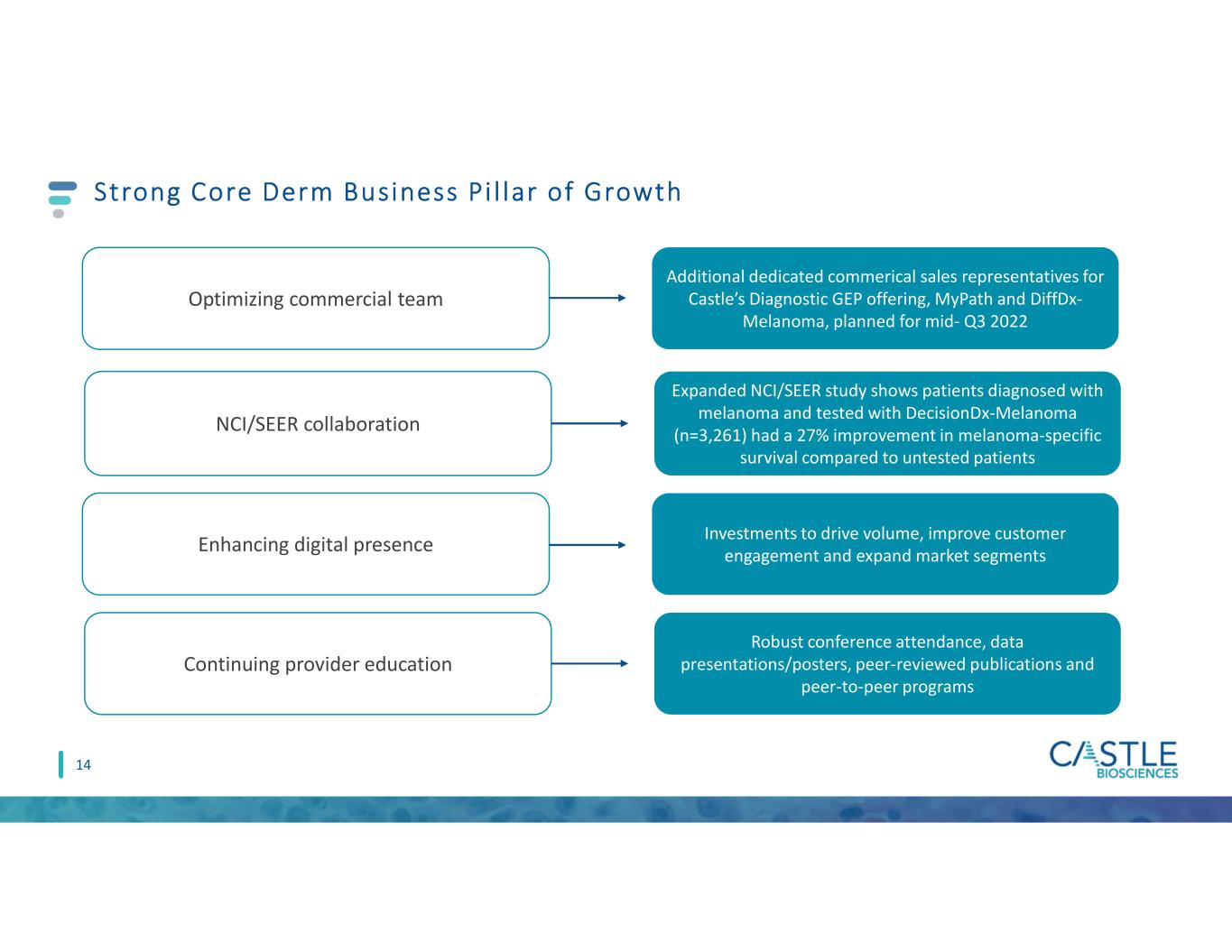

Strong Core Derm Business Pi l lar of Growth 14 Continuing provider education Optimizing commercial team Enhancing digital presence NCI/SEER collaboration Robust conference attendance, data presentations/posters, peer-reviewed publications and peer-to-peer programs Additional dedicated commerical sales representatives for Castle’s Diagnostic GEP offering, MyPath and DiffDx- Melanoma, planned for mid- Q3 2022 Investments to drive volume, improve customer engagement and expand market segments Expanded NCI/SEER study shows patients diagnosed with melanoma and tested with DecisionDx-Melanoma (n=3,261) had a 27% improvement in melanoma-specific survival compared to untested patients

15 First-to-Market Dermatologic Franchise, Additional Growth Opportunit ies Diagnostic Support Risk Stratification Therapy Response1 1Target launch anticipated by the end of 2025 2New and unique ordering clinicians for all dermatologic tests combined between June 30, 2021-June 30, 2022 . Inflammatory Skin Disease Therapy Response Pipeline Strong provider growth and continued adoption with ~2,280 new ordering clinicians and ~6,960 unique ordering clinicians for our dermatologic tests over the last 12 months2

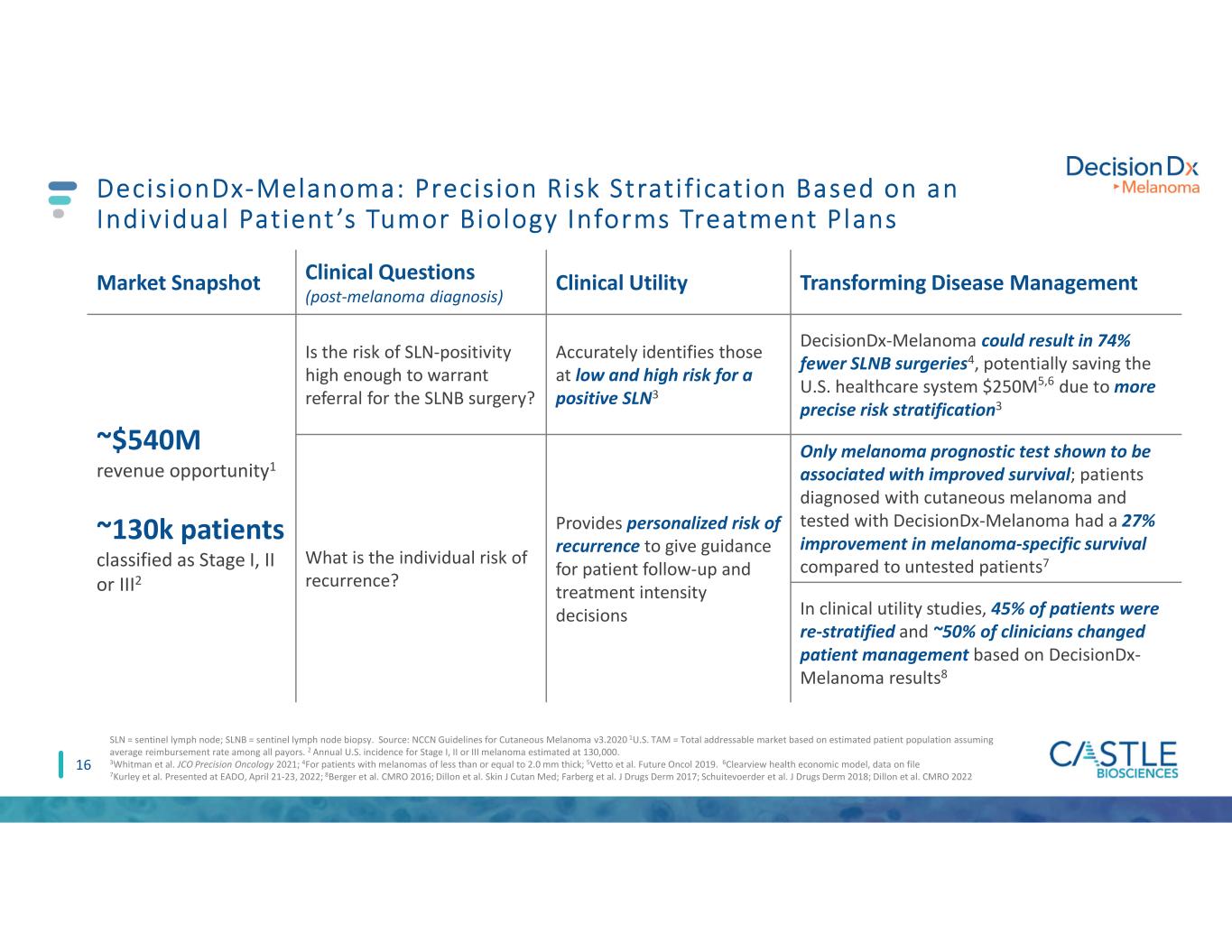

16 DecisionDx-Melanoma: Precision Risk Strati f ication Based on an Individual Patient ’s Tumor Biology Informs Treatment Plans Market Snapshot Clinical Questions (post-melanoma diagnosis) Clinical Utility Transforming Disease Management ~$540M revenue opportunity1 ~130k patients classified as Stage I, II or III2 Is the risk of SLN-positivity high enough to warrant referral for the SLNB surgery? Accurately identifies those at low and high risk for a positive SLN3 DecisionDx-Melanoma could result in 74% fewer SLNB surgeries4, potentially saving the U.S. healthcare system $250M5,6 due to more precise risk stratification3 What is the individual risk of recurrence? Provides personalized risk of recurrence to give guidance for patient follow-up and treatment intensity decisions Only melanoma prognostic test shown to be associated with improved survival; patients diagnosed with cutaneous melanoma and tested with DecisionDx-Melanoma had a 27% improvement in melanoma-specific survival compared to untested patients7 In clinical utility studies, 45% of patients were re-stratified and ~50% of clinicians changed patient management based on DecisionDx- Melanoma results8 SLN = sentinel lymph node; SLNB = sentinel lymph node biopsy. Source: NCCN Guidelines for Cutaneous Melanoma v3.2020 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2 Annual U.S. incidence for Stage I, II or III melanoma estimated at 130,000. 3Whitman et al. JCO Precision Oncology 2021; 4For patients with melanomas of less than or equal to 2.0 mm thick; 5Vetto et al. Future Oncol 2019. 6Clearview health economic model, data on file 7Kurley et al. Presented at EADO, April 21-23, 2022; 8Berger et al. CMRO 2016; Dillon et al. Skin J Cutan Med; Farberg et al. J Drugs Derm 2017; Schuitevoerder et al. J Drugs Derm 2018; Dillon et al. CMRO 2022

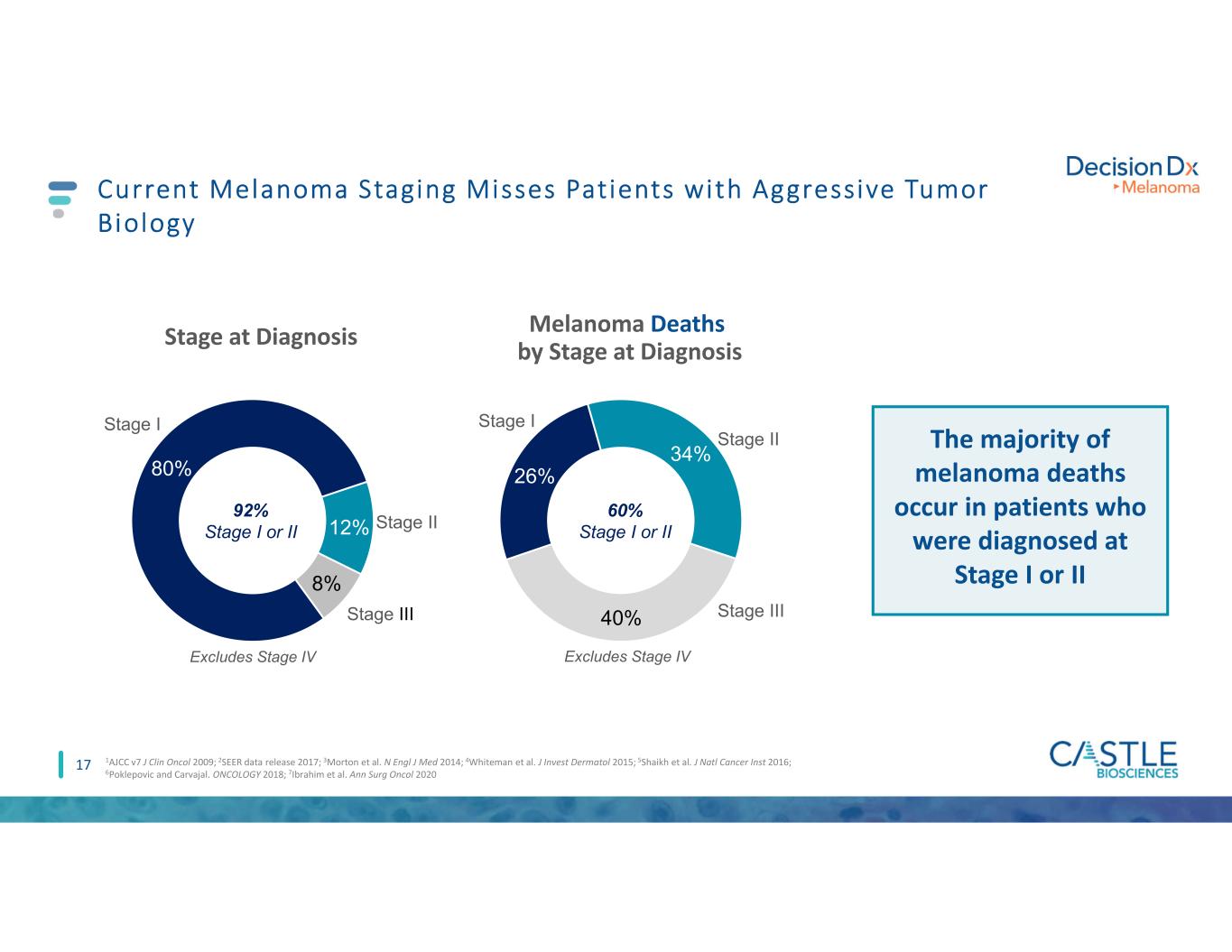

17 Current Melanoma Staging Misses Patients with Aggressive Tumor Biology 80% 12% 8% Stage at Diagnosis Stage II Stage III Stage I Excludes Stage IV 26% 34% 40% Melanoma Deaths by Stage at Diagnosis Stage II Stage III Stage I Excludes Stage IV 92% Stage I or II 60% Stage I or II The majority of melanoma deaths occur in patients who were diagnosed at Stage I or II 1AJCC v7 J Clin Oncol 2009; 2SEER data release 2017; 3Morton et al. N Engl J Med 2014; 4Whiteman et al. J Invest Dermatol 2015; 5Shaikh et al. J Natl Cancer Inst 2016; 6Poklepovic and Carvajal. ONCOLOGY 2018; 7Ibrahim et al. Ann Surg Oncol 2020

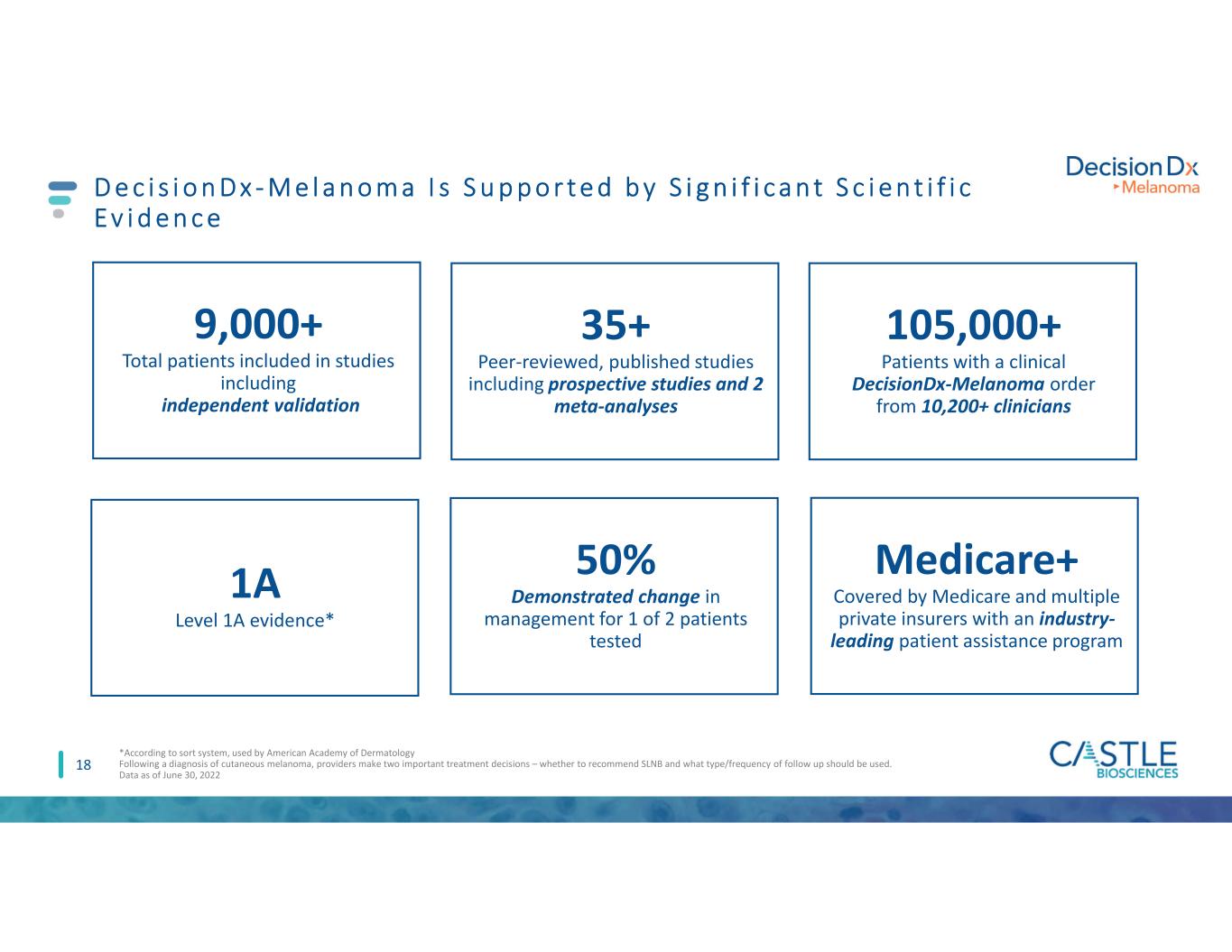

1A Level 1A evidence* D e c i s i o n D x - M e l a n o m a I s S u p p o r t e d b y S i g n i f i c a n t S c i e n t i f i c E v i d e n c e 18 9,000+ Total patients included in studies including independent validation 105,000+ Patients with a clinical DecisionDx-Melanoma order from 10,200+ clinicians 35+ Peer-reviewed, published studies including prospective studies and 2 meta-analyses Medicare+ Covered by Medicare and multiple private insurers with an industry- leading patient assistance program 50% Demonstrated change in management for 1 of 2 patients tested *According to sort system, used by American Academy of Dermatology Following a diagnosis of cutaneous melanoma, providers make two important treatment decisions – whether to recommend SLNB and what type/frequency of follow up should be used. Data as of June 30, 2022

NCI/SEER Data L inked with DecisionDx-Melanoma Test Results Data ana lys i s o f a cohort o f re a l -wor ld , uns e le cted , pros pe ct ive ly te ste d pat ie nt s w i t h cutane ous me lanoma 19 Data provide direct evidence that patients tested with DecisionDx-Melanoma can have better survival rates than untested patients Suggests that testing can aid in risk-aligned treatment plans for improved patient outcomes and survival rates 3-year MSS (95% CI) Deaths, % (n/N) 31-GEP Tested 97.7% (97.0-98.4%) 1.6% (58/3621) Matched Untested 96.6% (96.2-97.1%) 2.2% (238/10863) Hazard ratio‡ 0.73 (0.54-0.97) P=0.03 27% Benefit in MSS in patients that were tested at 3 years over those that were not tested 21% Benefit in OS in patients that were tested at 3 years over those that were not tested 3-year OS (95% CI) Deaths, % (n/N) 31-GEP Tested 93.1% (92.0-94.2%) 4.8% (174/3621) Matched Untested 91.2% (90.4-91.9%) 6.1% (658/10863) Hazard ratio‡ 0.79 (0.67-0.93) P=0.006 ‡Hazard ra�o (HR) was computed using the untested pa�ents as reference for 31-GEP tested cohort. An HR less than 1.0 demonstrates improved survival in 31-GEP tested patients. Diagnosis date 2016 and onward Kurley et al. European Association of Dermato Oncology (EADO) conference in Seville, Spain; April 21-23, 2022

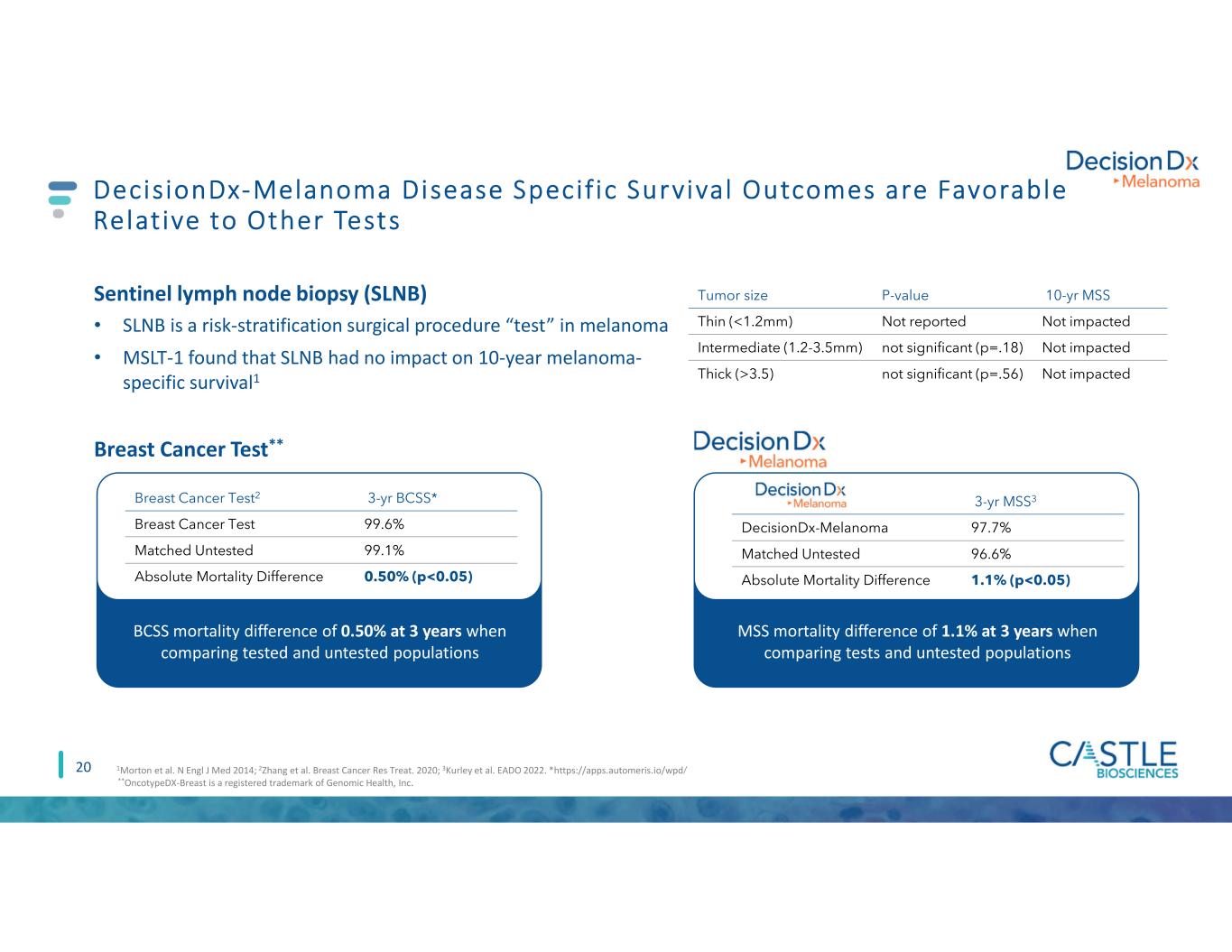

MSS mortality difference of 1.1% at 3 years when comparing tests and untested populations 20 DecisionDx-Melanoma Disease Specif ic Survival Outcomes are Favorable Relative to Other Tests Sentinel lymph node biopsy (SLNB) • SLNB is a risk-stratification surgical procedure “test” in melanoma • MSLT-1 found that SLNB had no impact on 10-year melanoma- specific survival1 Tumor size P-value 10-yr MSS Thin (<1.2mm) Not reported Not impacted Intermediate (1.2-3.5mm) not significant (p=.18) Not impacted Thick (>3.5) not significant (p=.56) Not impacted BCSS mortality difference of 0.50% at 3 years when comparing tested and untested populations Breast Cancer Test** Breast Cancer Test2 3-yr BCSS* Breast Cancer Test 99.6% Matched Untested 99.1% Absolute Mortality Difference 0.50% (p<0.05) **OncotypeDX-Breast is a registered trademark of Genomic Health, Inc. 1Morton et al. N Engl J Med 2014; 2Zhang et al. Breast Cancer Res Treat. 2020; 3Kurley et al. EADO 2022. *https://apps.automeris.io/wpd/ 3-yr MSS3 DecisionDx-Melanoma 97.7% Matched Untested 96.6% Absolute Mortality Difference 1.1% (p<0.05)

21 Patients with Melanoma Desire Testing with DecisionDx-Melanoma Ahmed et al. Cancer Medicine 2022; some values have been rounded Wanted prognostic information about their melanoma tumors at diagnosis 90% 92% Felt the testing was useful 77% Wanted testing to obtain all of the information they could about their melanoma NONE of the patients surveyed indicated decision regret over their decision to obtain DecisionDx-Melanoma testing, even patients who received a poor prognosis/high-risk (Class 2) DecisionDx-Melanoma test result

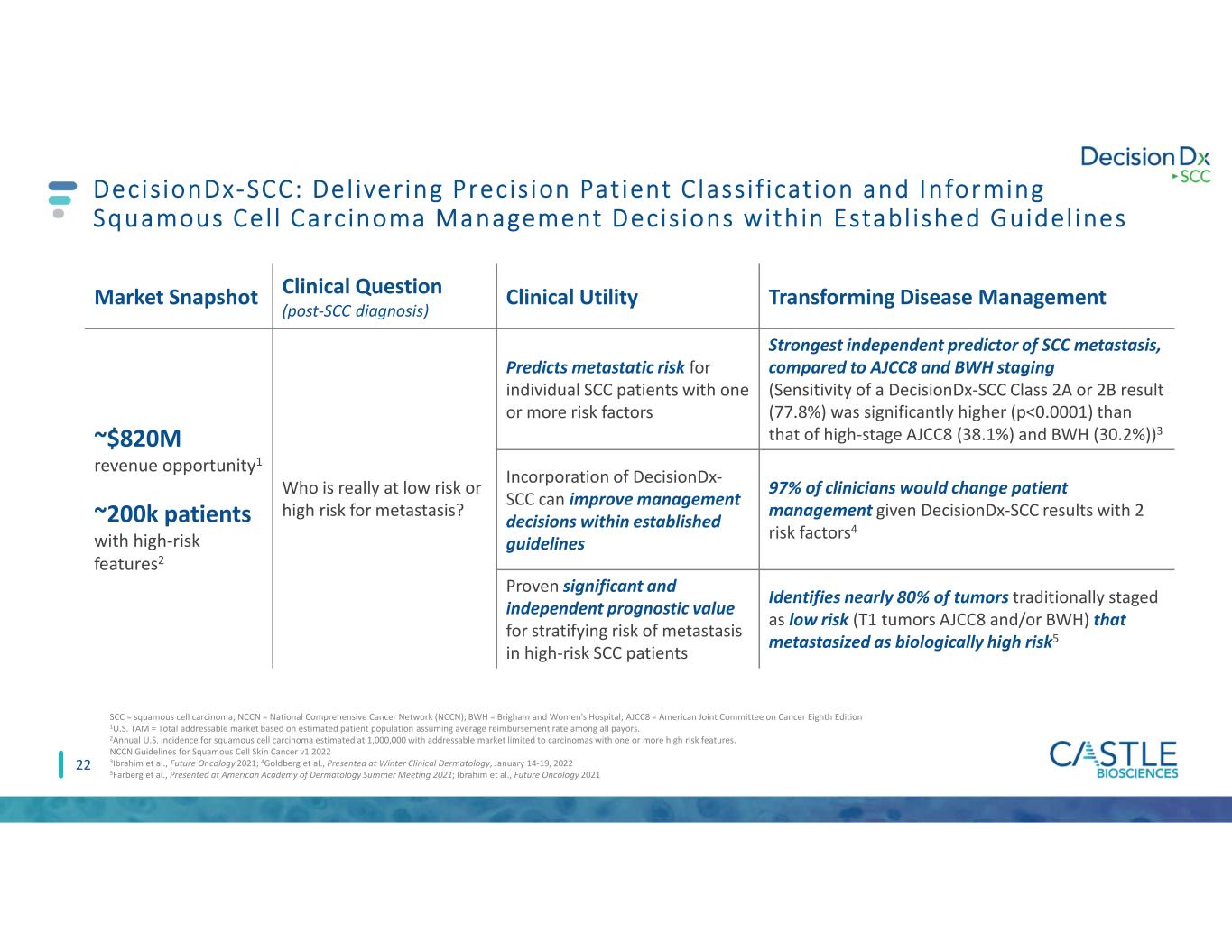

22 Market Snapshot Clinical Question (post-SCC diagnosis) Clinical Utility Transforming Disease Management ~$820M revenue opportunity1 ~200k patients with high-risk features2 Who is really at low risk or high risk for metastasis? Predicts metastatic risk for individual SCC patients with one or more risk factors Strongest independent predictor of SCC metastasis, compared to AJCC8 and BWH staging (Sensitivity of a DecisionDx-SCC Class 2A or 2B result (77.8%) was significantly higher (p<0.0001) than that of high-stage AJCC8 (38.1%) and BWH (30.2%))3 Incorporation of DecisionDx- SCC can improve management decisions within established guidelines 97% of clinicians would change patient management given DecisionDx-SCC results with 2 risk factors4 Proven significant and independent prognostic value for stratifying risk of metastasis in high-risk SCC patients Identifies nearly 80% of tumors traditionally staged as low risk (T1 tumors AJCC8 and/or BWH) that metastasized as biologically high risk5 SCC = squamous cell carcinoma; NCCN = National Comprehensive Cancer Network (NCCN); BWH = Brigham and Women's Hospital; AJCC8 = American Joint Committee on Cancer Eighth Edition 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2Annual U.S. incidence for squamous cell carcinoma estimated at 1,000,000 with addressable market limited to carcinomas with one or more high risk features. NCCN Guidelines for Squamous Cell Skin Cancer v1 2022 3Ibrahim et al., Future Oncology 2021; 4Goldberg et al., Presented at Winter Clinical Dermatology, January 14-19, 2022 5Farberg et al., Presented at American Academy of Dermatology Summer Meeting 2021; Ibrahim et al., Future Oncology 2021 DecisionDx-SCC: Del ivering Precis ion Pat ient C lassi f icat ion and Informing Squamous Cel l Carcinoma Management Decisions within Establ ished Guidel ines

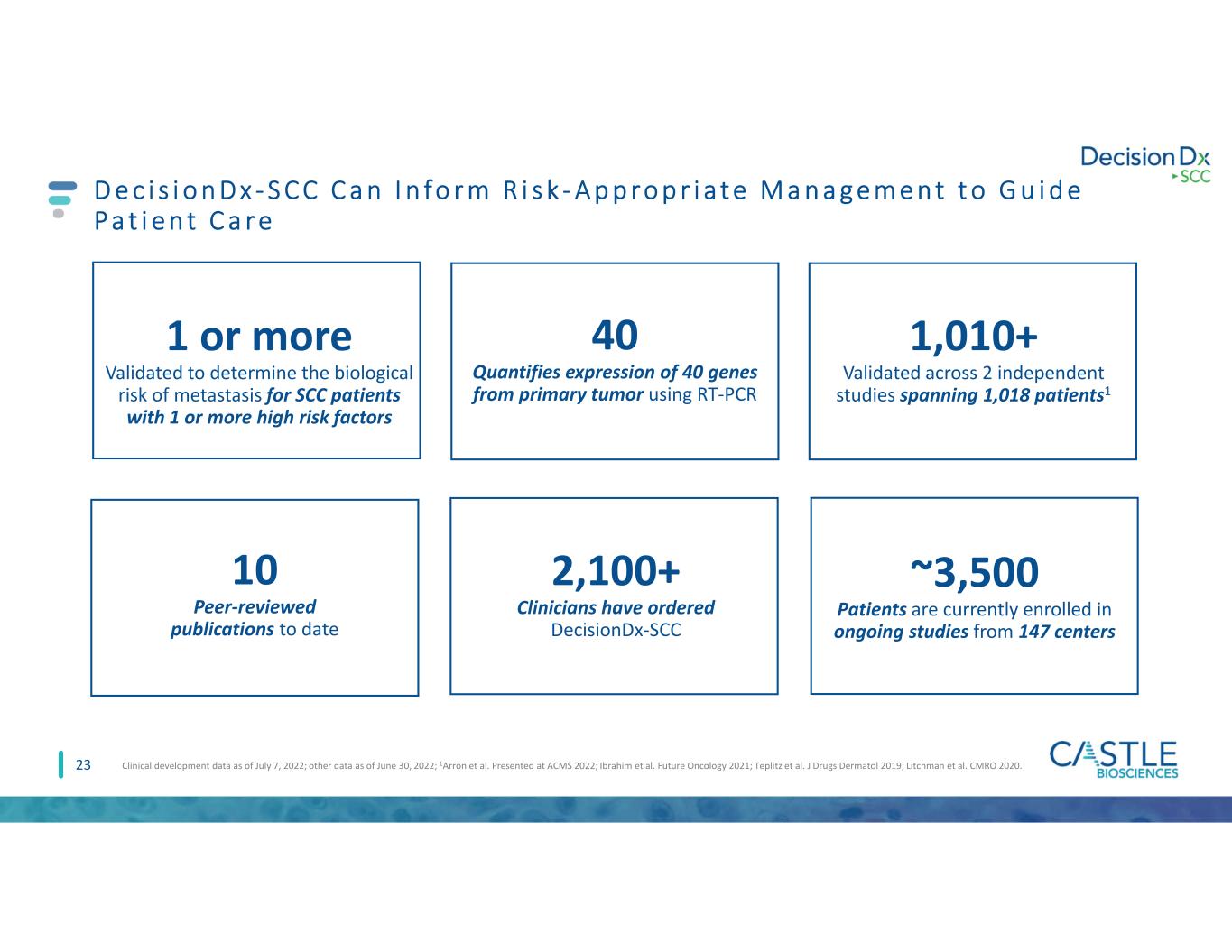

D e c i s i o n D x - S C C C a n I n fo r m R i s k - A p p ro p r i a t e M a n a g e m e n t t o G u i d e P a t i e n t C a r e 23 1,010+ Validated across 2 independent studies spanning 1,018 patients1 2,100+ Clinicians have ordered DecisionDx-SCC Clinical development data as of July 7, 2022; other data as of June 30, 2022; 1Arron et al. Presented at ACMS 2022; Ibrahim et al. Future Oncology 2021; Teplitz et al. J Drugs Dermatol 2019; Litchman et al. CMRO 2020. 1 or more Validated to determine the biological risk of metastasis for SCC patients with 1 or more high risk factors 40 Quantifies expression of 40 genes from primary tumor using RT-PCR 10 Peer-reviewed publications to date ~3,500 Patients are currently enrolled in ongoing studies from 147 centers

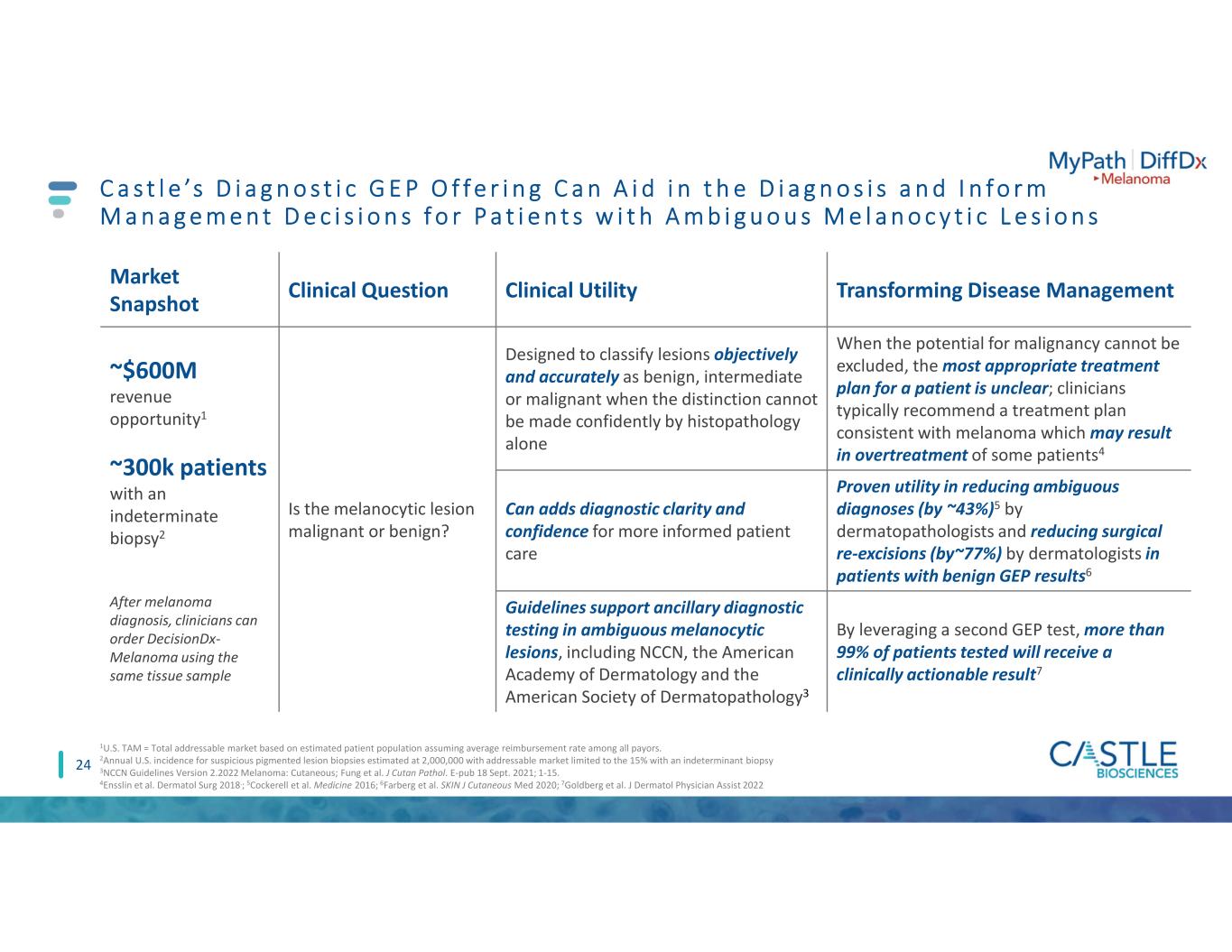

24 C a s t l e ’s D i a g n o s t i c G E P O f f e r i n g C a n A i d i n t h e D i a g n o s i s a n d I n f o r m M a n a g e m e n t D e c i s i o n s f o r P a t i e n t s w i t h A m b i g u o u s M e l a n o c y t i c L e s i o n s Market Snapshot Clinical Question Clinical Utility Transforming Disease Management ~$600M revenue opportunity1 ~300k patients with an indeterminate biopsy2 After melanoma diagnosis, clinicians can order DecisionDx- Melanoma using the same tissue sample Is the melanocytic lesion malignant or benign? Designed to classify lesions objectively and accurately as benign, intermediate or malignant when the distinction cannot be made confidently by histopathology alone When the potential for malignancy cannot be excluded, the most appropriate treatment plan for a patient is unclear; clinicians typically recommend a treatment plan consistent with melanoma which may result in overtreatment of some patients4 Can adds diagnostic clarity and confidence for more informed patient care Proven utility in reducing ambiguous diagnoses (by ~43%)5 by dermatopathologists and reducing surgical re-excisions (by~77%) by dermatologists in patients with benign GEP results6 Guidelines support ancillary diagnostic testing in ambiguous melanocytic lesions, including NCCN, the American Academy of Dermatology and the American Society of Dermatopathology3 By leveraging a second GEP test, more than 99% of patients tested will receive a clinically actionable result7 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2Annual U.S. incidence for suspicious pigmented lesion biopsies estimated at 2,000,000 with addressable market limited to the 15% with an indeterminant biopsy 3NCCN Guidelines Version 2.2022 Melanoma: Cutaneous; Fung et al. J Cutan Pathol. E-pub 18 Sept. 2021; 1-15. 4Ensslin et al. Dermatol Surg 2018.; 5Cockerell et al. Medicine 2016; 6Farberg et al. SKIN J Cutaneous Med 2020; 7Goldberg et al. J Dermatol Physician Assist 2022

12 Peer-reviewed publications, including prospective studies C a s t l e ’s D i a g n o s t i c G E P Te s t s P r o v i d e O b j e c t i v e a n d A c c u ra t e I n fo r m a t i o n fo r M o r e I n fo r m e d P a t i e n t C a r e 25 41,000+ Lesions clinically tested 8+ Years of clinical testing experience 2 Independently validated GEP tests to aid in diagnosis and guide patient management 3 GEP testing is supported by 3 national guidelines to aid in diagnosing ambiguous lesions Data as of June 30, 2022 Medicare+ Covered by Medicare and multiple private insurers with an industry- leading patient assistance program

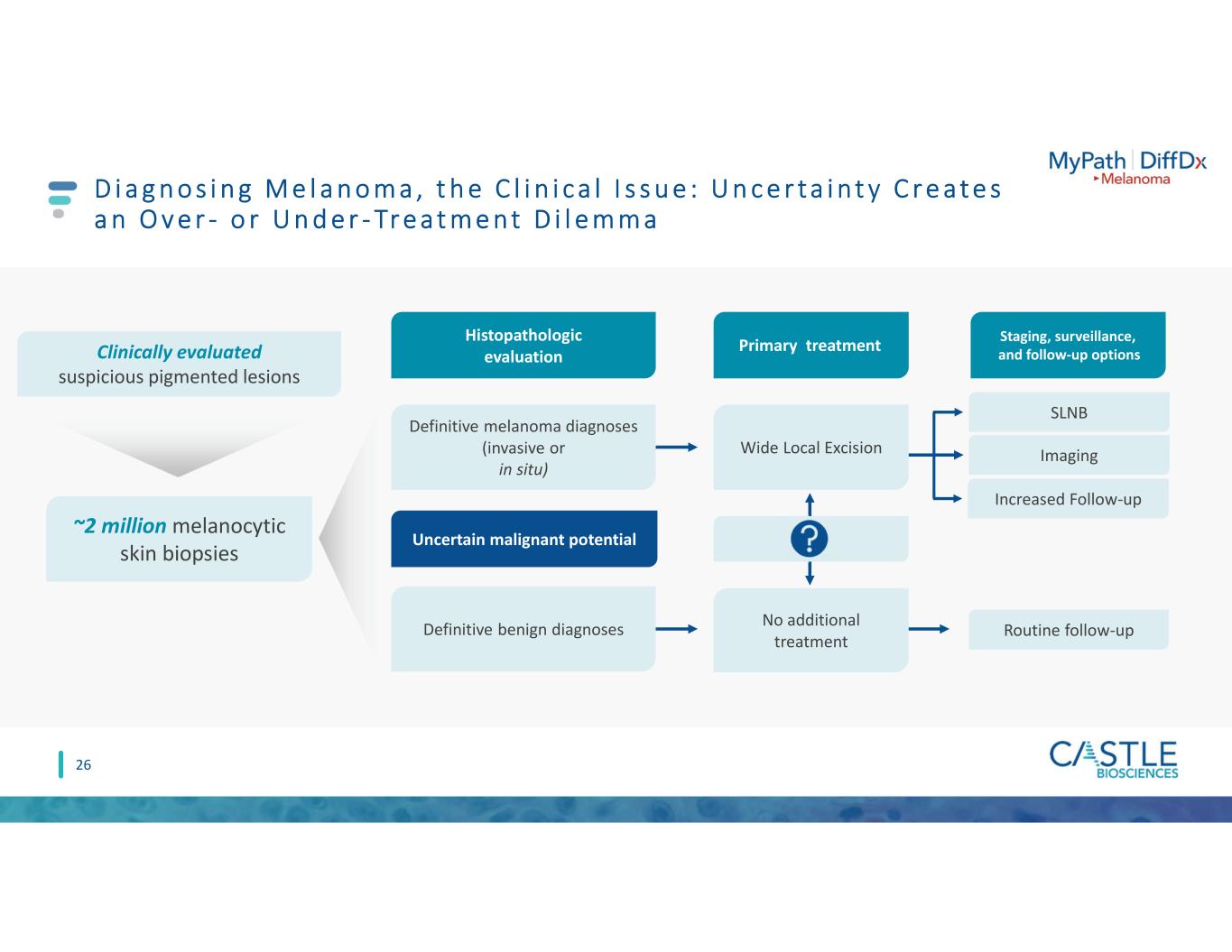

D i a g n o s i n g M e l a n o m a , t h e C l i n i c a l I s s u e : U n c e r t a i n t y C r e a t e s a n O v e r - o r U n d e r - Tr e a t m e n t D i l e m m a Definitive melanoma diagnoses (invasive or in situ) Definitive benign diagnoses SLNB Imaging Increased Follow-up No additional treatment Routine follow-up Clinically evaluated suspicious pigmented lesions Wide Local Excision ~2 million melanocytic skin biopsies Uncertain malignant potential Primary treatment Staging, surveillance, and follow-up options Histopathologic evaluation 26

Strategic Opportunit ies

C e r n o s t i c s A c q u i s i t i o n A l i g n s w i t h O u r S t ra t e g i c O p p o r t u n i t i e s G o a l s 28 Integrat ion expected to be a meaningful revenue contr ibutor in 2024 Our capital allocation priorities include strategic acquisitions with potential for mid- to long-term value creation and revenue and earnings growth Gastroenterology call point has the potential for a suite of tests Attractive clinical targets, need to assess what and when Innovative test that addresses a high unmet clinical need Is this patient with Barrett’s Esophagus at a higher or lower risk of progression to HGD or EAC Immediately adds significant in-market estimated U.S. TAM $1 billion estimated U.S. TAM 1The Medicare reimbursement rate is currently $2,350 for TissueCypher. Already achieved early reimbursement wins TissueCypher is covered by Medicare1 and some regional plans

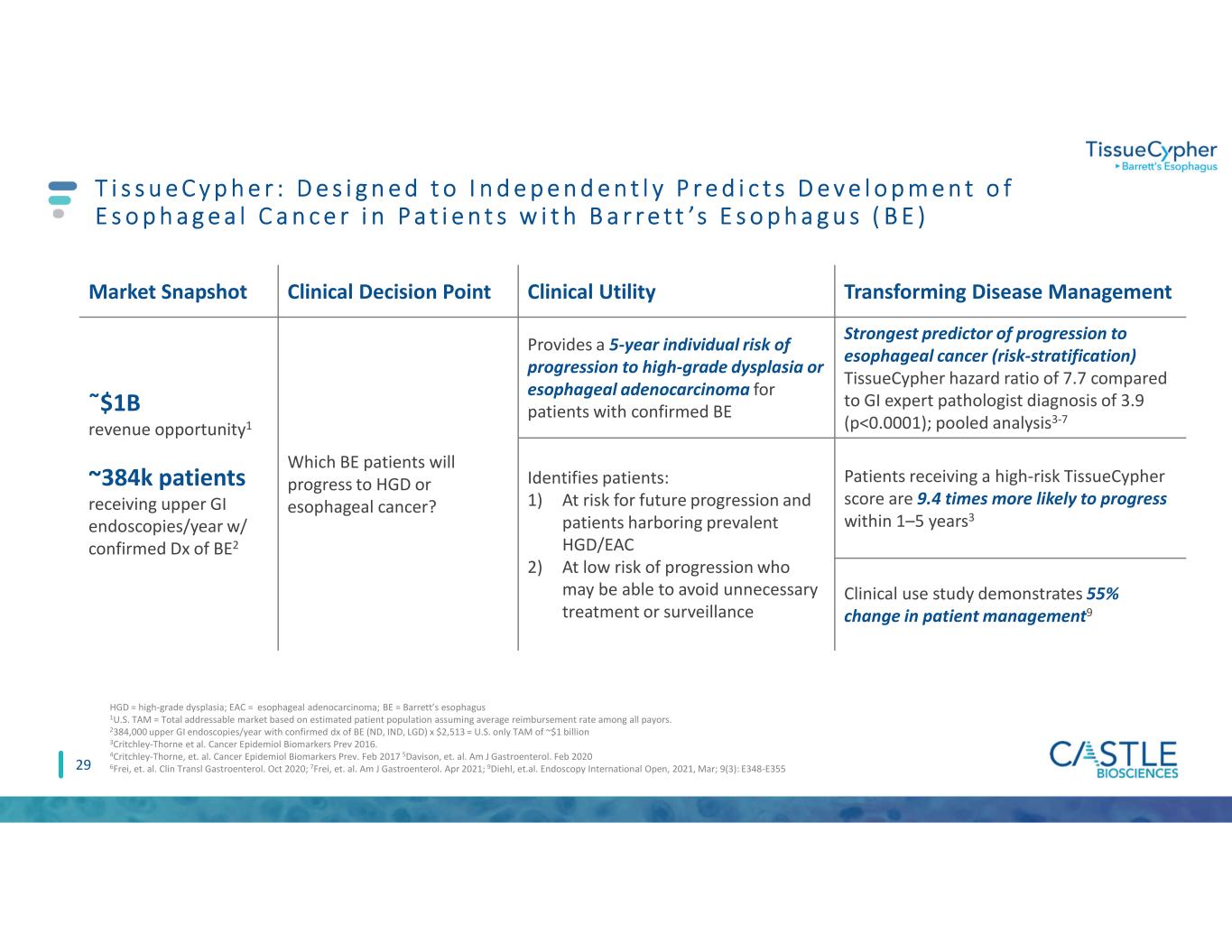

29 T i s s u e C y p h e r : D e s i g n e d t o I n d e p e n d e n t l y P r e d i c t s D e v e l o p m e n t o f E s o p h a g e a l C a n c e r i n P a t i e n t s w i t h B a r r e t t ’s E s o p h a g u s ( B E ) Market Snapshot Clinical Decision Point Clinical Utility Transforming Disease Management ῀$1B revenue opportunity1 ~384k patients receiving upper GI endoscopies/year w/ confirmed Dx of BE2 Which BE patients will progress to HGD or esophageal cancer? Provides a 5-year individual risk of progression to high-grade dysplasia or esophageal adenocarcinoma for patients with confirmed BE Strongest predictor of progression to esophageal cancer (risk-stratification) TissueCypher hazard ratio of 7.7 compared to GI expert pathologist diagnosis of 3.9 (p<0.0001); pooled analysis3-7 Identifies patients: 1) At risk for future progression and patients harboring prevalent HGD/EAC 2) At low risk of progression who may be able to avoid unnecessary treatment or surveillance Patients receiving a high-risk TissueCypher score are 9.4 times more likely to progress within 1–5 years3 Clinical use study demonstrates 55% change in patient management9 HGD = high-grade dysplasia; EAC = esophageal adenocarcinoma; BE = Barrett’s esophagus 1U.S. TAM = Total addressable market based on estimated patient population assuming average reimbursement rate among all payors. 2384,000 upper GI endoscopies/year with confirmed dx of BE (ND, IND, LGD) x $2,513 = U.S. only TAM of ~$1 billion 3Critchley-Thorne et al. Cancer Epidemiol Biomarkers Prev 2016. 4Critchley-Thorne, et. al. Cancer Epidemiol Biomarkers Prev. Feb 2017 5Davison, et. al. Am J Gastroenterol. Feb 2020 6Frei, et. al. Clin Transl Gastroenterol. Oct 2020; 7Frei, et. al. Am J Gastroenterol. Apr 2021; 9Diehl, et.al. Endoscopy International Open, 2021, Mar; 9(3): E348-E355

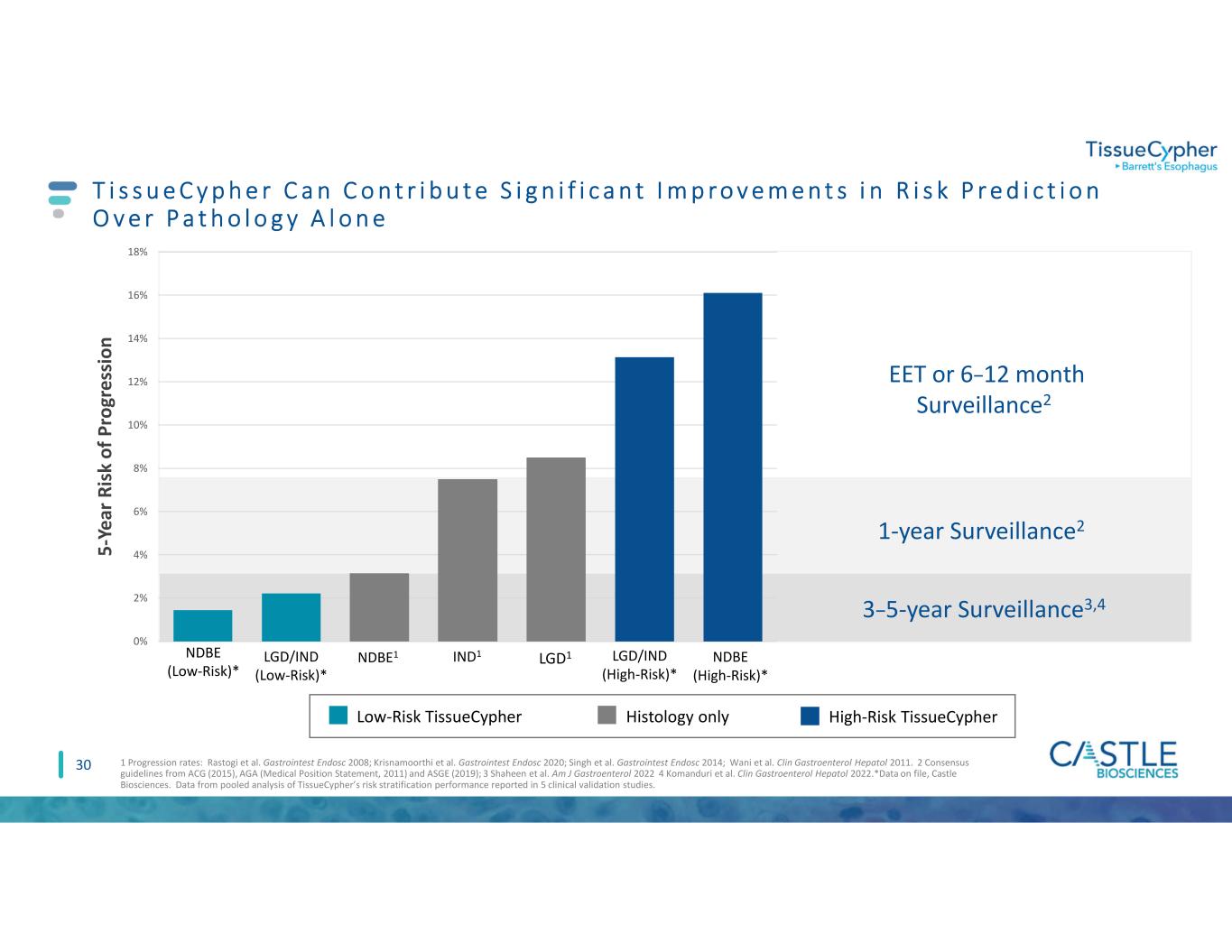

5 -Y e ar R is k o f P ro gr e ss io n 3–5-year Surveillance3,4 1-year Surveillance2 EET or 6–12 month Surveillance2 NDBE1 IND1 LGD1 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% NDBE (Low-Risk)* NDBE (High-Risk)* LGD/IND (High-Risk)* LGD/IND (Low-Risk)* High-Risk TissueCypherLow-Risk TissueCypher 30 T i s s u e C y p h e r C a n C o n t r i b u t e S i g n i f i c a n t I m p r o v e m e n t s i n R i s k P r e d i c t i o n O v e r P a t h o l o g y A l o n e 1 Progression rates: Rastogi et al. Gastrointest Endosc 2008; Krisnamoorthi et al. Gastrointest Endosc 2020; Singh et al. Gastrointest Endosc 2014; Wani et al. Clin Gastroenterol Hepatol 2011. 2 Consensus guidelines from ACG (2015), AGA (Medical Position Statement, 2011) and ASGE (2019); 3 Shaheen et al. Am J Gastroenterol 2022 4 Komanduri et al. Clin Gastroenterol Hepatol 2022.*Data on file, Castle Biosciences. Data from pooled analysis of TissueCypher’s risk stratification performance reported in 5 clinical validation studies. Histology only

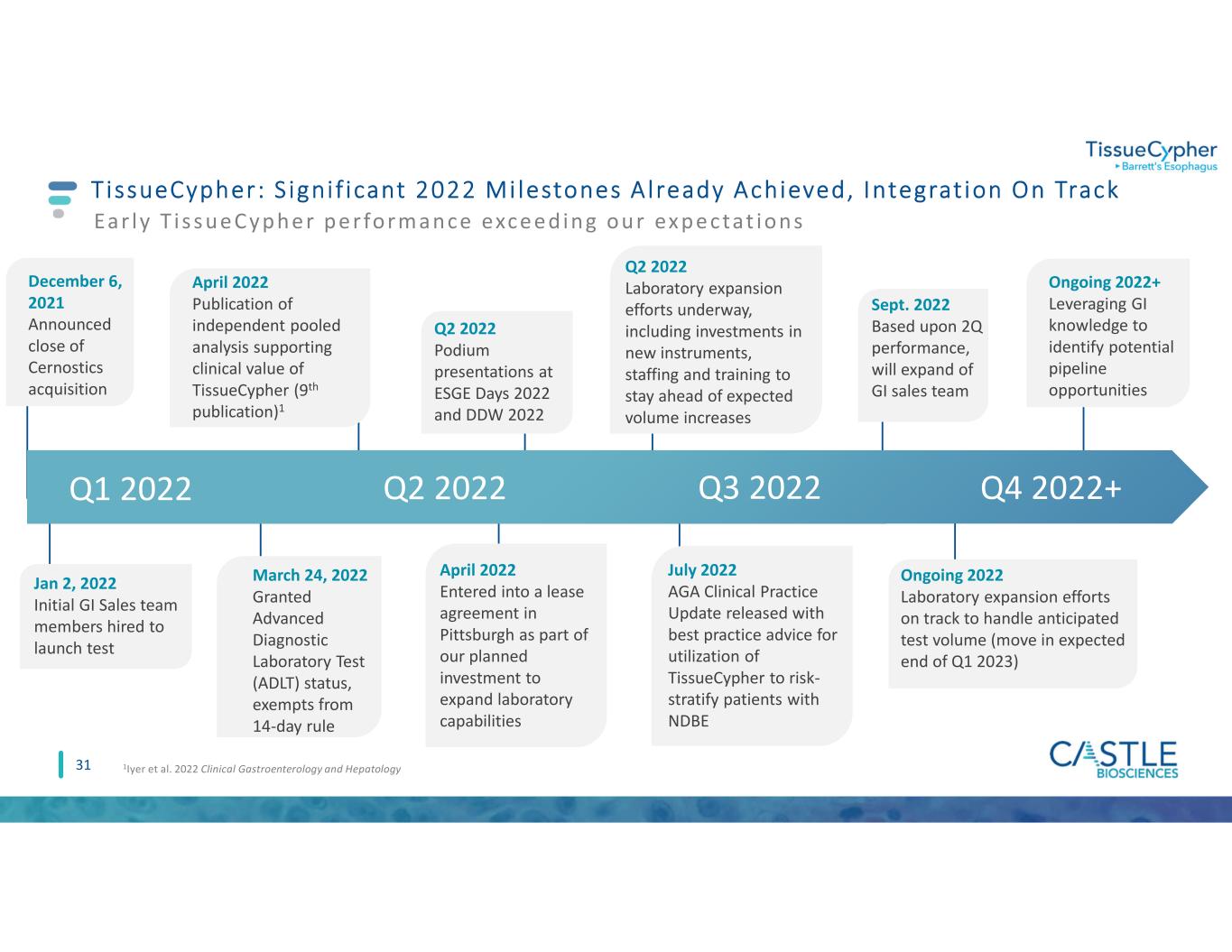

TissueCypher: S igni f icant 2022 Mi lestones A lready Achieved, Integrat ion On Track Q1 2022 31 March 24, 2022 Granted Advanced Diagnostic Laboratory Test (ADLT) status, exempts from 14-day rule April 2022 Entered into a lease agreement in Pittsburgh as part of our planned investment to expand laboratory capabilities 1Iyer et al. 2022 Clinical Gastroenterology and Hepatology Q2 2022 Ear ly T i s s ue Cyphe r pe r formance exce e d ing our ex pe ctat ions Ongoing 2022 Laboratory expansion efforts on track to handle anticipated test volume (move in expected end of Q1 2023) April 2022 Publication of independent pooled analysis supporting clinical value of TissueCypher (9th publication)1 Q4 2022+ Q2 2022 Podium presentations at ESGE Days 2022 and DDW 2022 Ongoing 2022+ Leveraging GI knowledge to identify potential pipeline opportunities July 2022 AGA Clinical Practice Update released with best practice advice for utilization of TissueCypher to risk- stratify patients with NDBE Sept. 2022 Based upon 2Q performance, will expand of GI sales team Q2 2022 Laboratory expansion efforts underway, including investments in new instruments, staffing and training to stay ahead of expected volume increases Jan 2, 2022 Initial GI Sales team members hired to launch test Q3 2022 December 6, 2021 Announced close of Cernostics acquisition

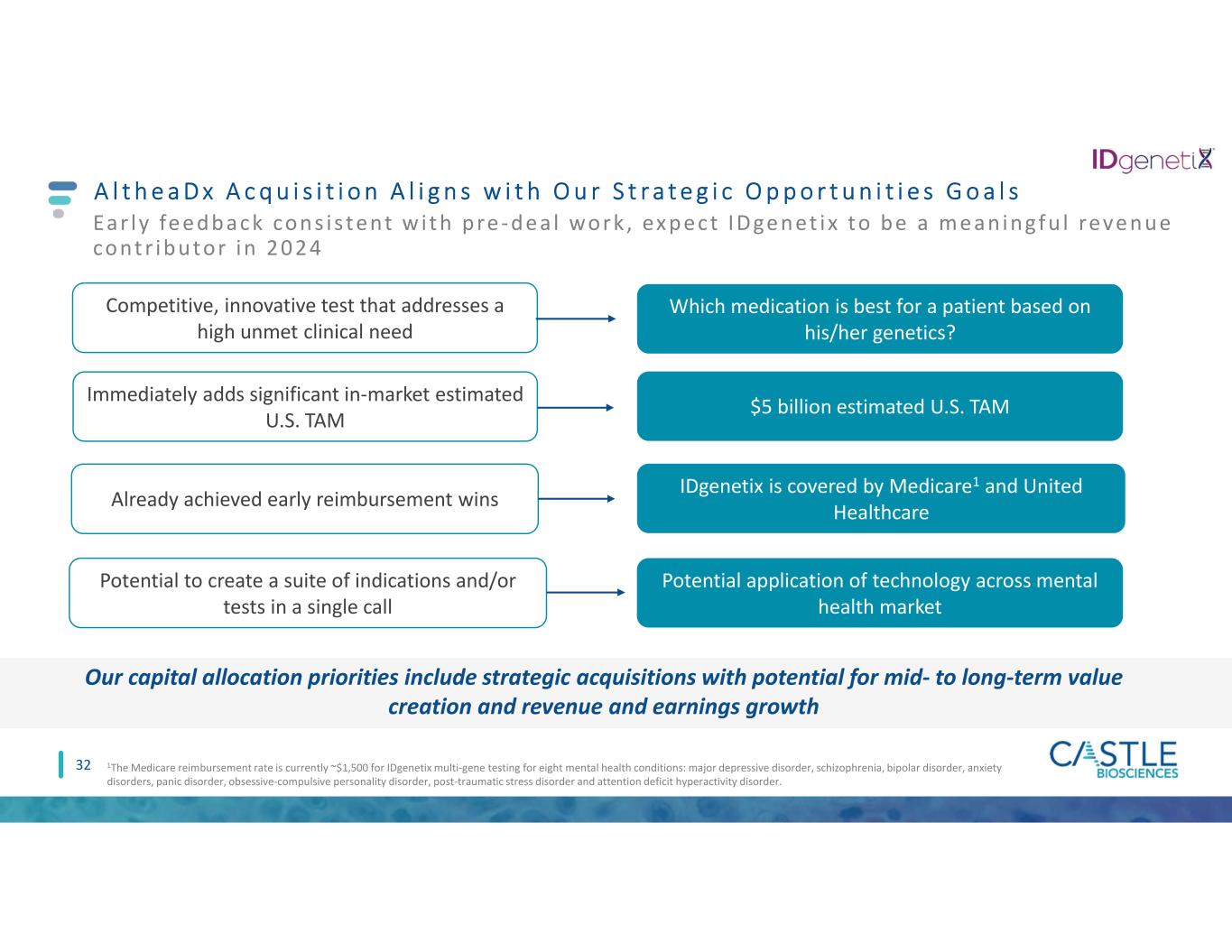

A l t h e a D x A c q u i s i t i o n A l i g n s w i t h O u r S t r a t e g i c O p p o r t u n i t i e s G o a l s 32 Our capital allocation priorities include strategic acquisitions with potential for mid- to long-term value creation and revenue and earnings growth Immediately adds significant in-market estimated U.S. TAM $5 billion estimated U.S. TAM Already achieved early reimbursement wins IDgenetix is covered by Medicare1 and United Healthcare 1The Medicare reimbursement rate is currently ~$1,500 for IDgenetix multi-gene testing for eight mental health conditions: major depressive disorder, schizophrenia, bipolar disorder, anxiety disorders, panic disorder, obsessive-compulsive personality disorder, post-traumatic stress disorder and attention deficit hyperactivity disorder. Ear ly fe e dback cons i s tent w i t h pre - de a l work , ex pe ct IDge net ix to be a me an ingf u l reve nue cont r ibutor in 2 0 2 4 Competitive, innovative test that addresses a high unmet clinical need Which medication is best for a patient based on his/her genetics? Potential to create a suite of indications and/or tests in a single call Potential application of technology across mental health market

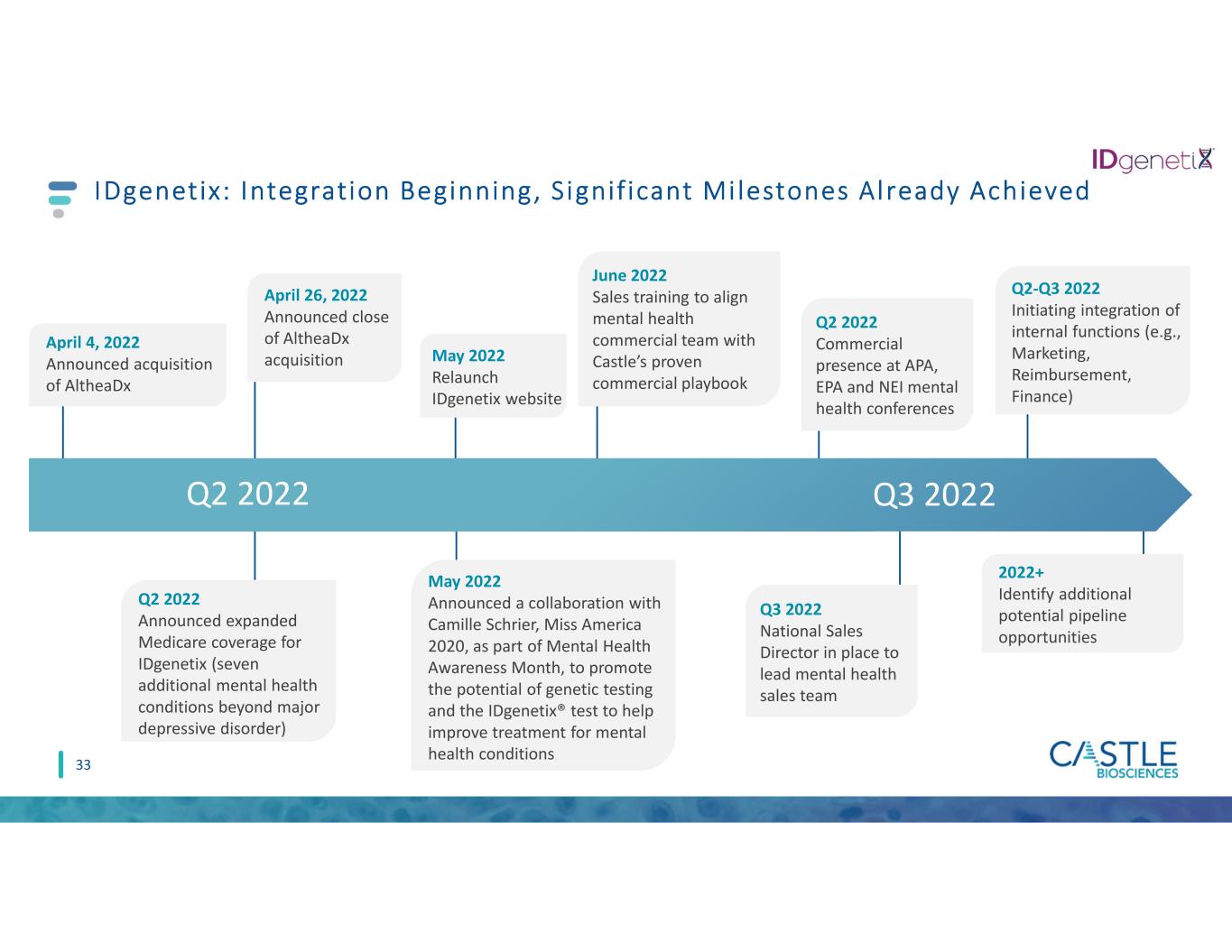

IDgenetix: Integration Beginning, S ignif icant Mi lestones Already Achieved Q2 2022 Q3 2022 33 April 4, 2022 Announced acquisition of AltheaDx Q2 2022 Announced expanded Medicare coverage for IDgenetix (seven additional mental health conditions beyond major depressive disorder) April 26, 2022 Announced close of AltheaDx acquisition May 2022 Announced a collaboration with Camille Schrier, Miss America 2020, as part of Mental Health Awareness Month, to promote the potential of genetic testing and the IDgenetix® test to help improve treatment for mental health conditions May 2022 Relaunch IDgenetix website June 2022 Sales training to align mental health commercial team with Castle’s proven commercial playbook 2022+ Identify additional potential pipeline opportunities Q2-Q3 2022 Initiating integration of internal functions (e.g., Marketing, Reimbursement, Finance) Q3 2022 National Sales Director in place to lead mental health sales team Q2 2022 Commercial presence at APA, EPA and NEI mental health conferences

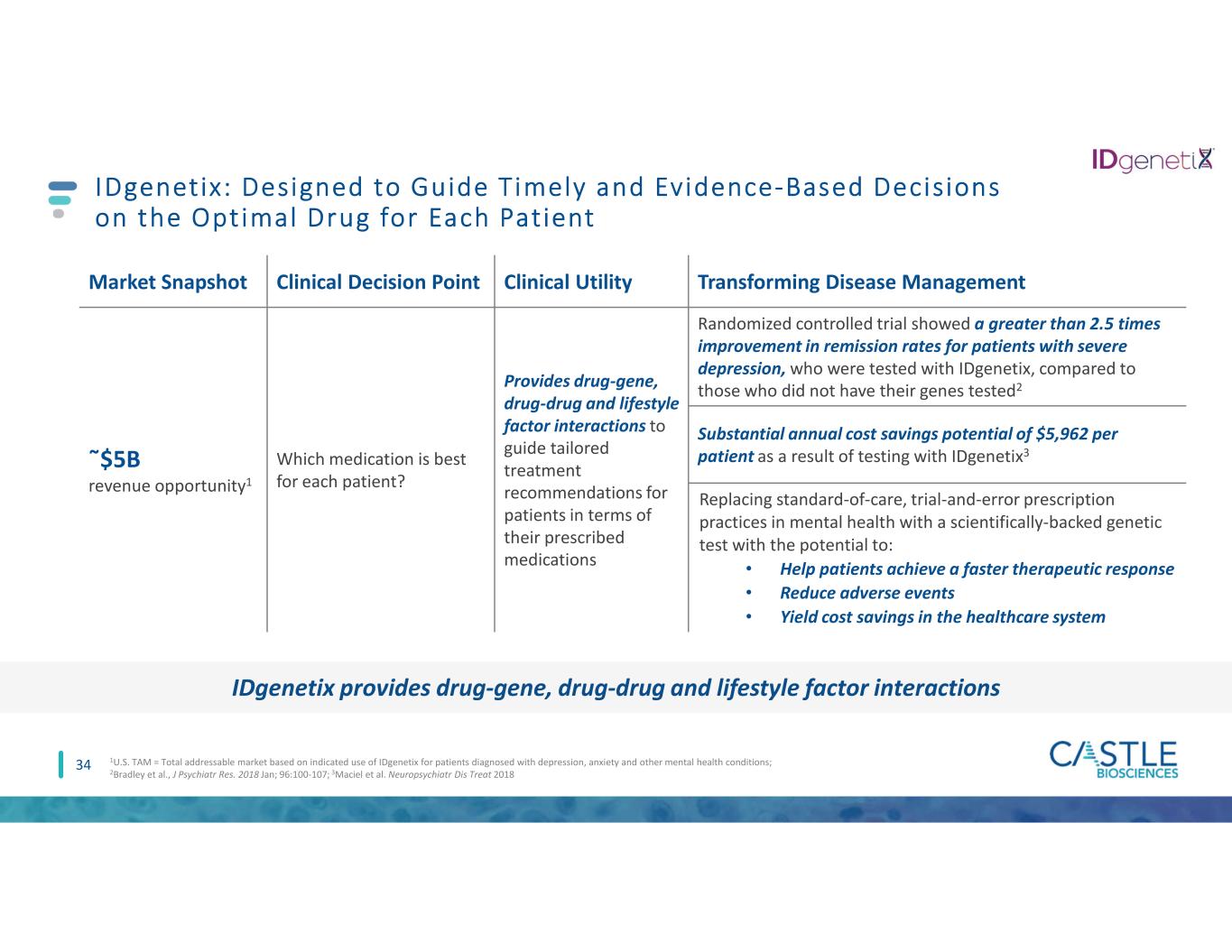

34 IDgenetix: Designed to Guide Timely and Evidence-Based Decisions on the Optimal Drug for Each Patient Market Snapshot Clinical Decision Point Clinical Utility Transforming Disease Management ῀$5B revenue opportunity1 Which medication is best for each patient? Provides drug-gene, drug-drug and lifestyle factor interactions to guide tailored treatment recommendations for patients in terms of their prescribed medications Randomized controlled trial showed a greater than 2.5 times improvement in remission rates for patients with severe depression, who were tested with IDgenetix, compared to those who did not have their genes tested2 Substantial annual cost savings potential of $5,962 per patient as a result of testing with IDgenetix3 Replacing standard-of-care, trial-and-error prescription practices in mental health with a scientifically-backed genetic test with the potential to: • Help patients achieve a faster therapeutic response • Reduce adverse events • Yield cost savings in the healthcare system 1U.S. TAM = Total addressable market based on indicated use of IDgenetix for patients diagnosed with depression, anxiety and other mental health conditions; 2Bradley et al., J Psychiatr Res. 2018 Jan; 96:100-107; 3Maciel et al. Neuropsychiatr Dis Treat 2018 IDgenetix provides drug-gene, drug-drug and lifestyle factor interactions

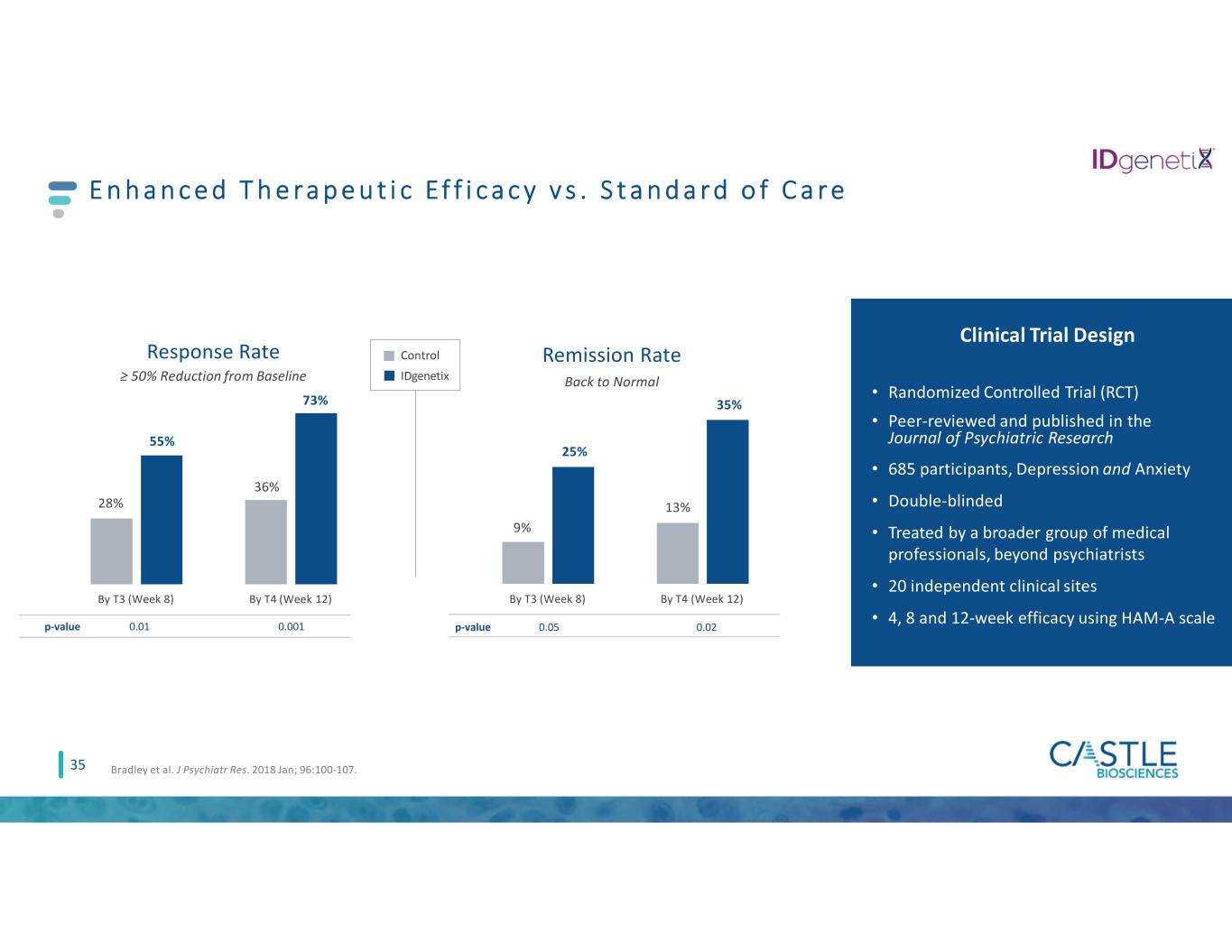

Clinical Trial Design • Randomized Controlled Trial (RCT) • Peer-reviewed and published in the Journal of Psychiatric Research • 685 participants, Depression and Anxiety • Double-blinded • Treated by a broader group of medical professionals, beyond psychiatrists • 20 independent clinical sites • 4, 8 and 12-week efficacy using HAM-A scale E n h a n c e d T h e ra p e u t i c Ef f i c a c y v s . S t a n d a r d o f C a r e 28% 36% 55% By T3 (Week 8) By T4 (Week 12) Response Rate ≥ 50% Reduction from Baseline p-value 0.01 0.001 73% 9% 13% 25% 35% By T3 (Week 8) By T4 (Week 12) Remission Rate Back to Normal p-value 0.05 0.02 Control IDgenetix 35 Bradley et al. J Psychiatr Res. 2018 Jan; 96:100-107.

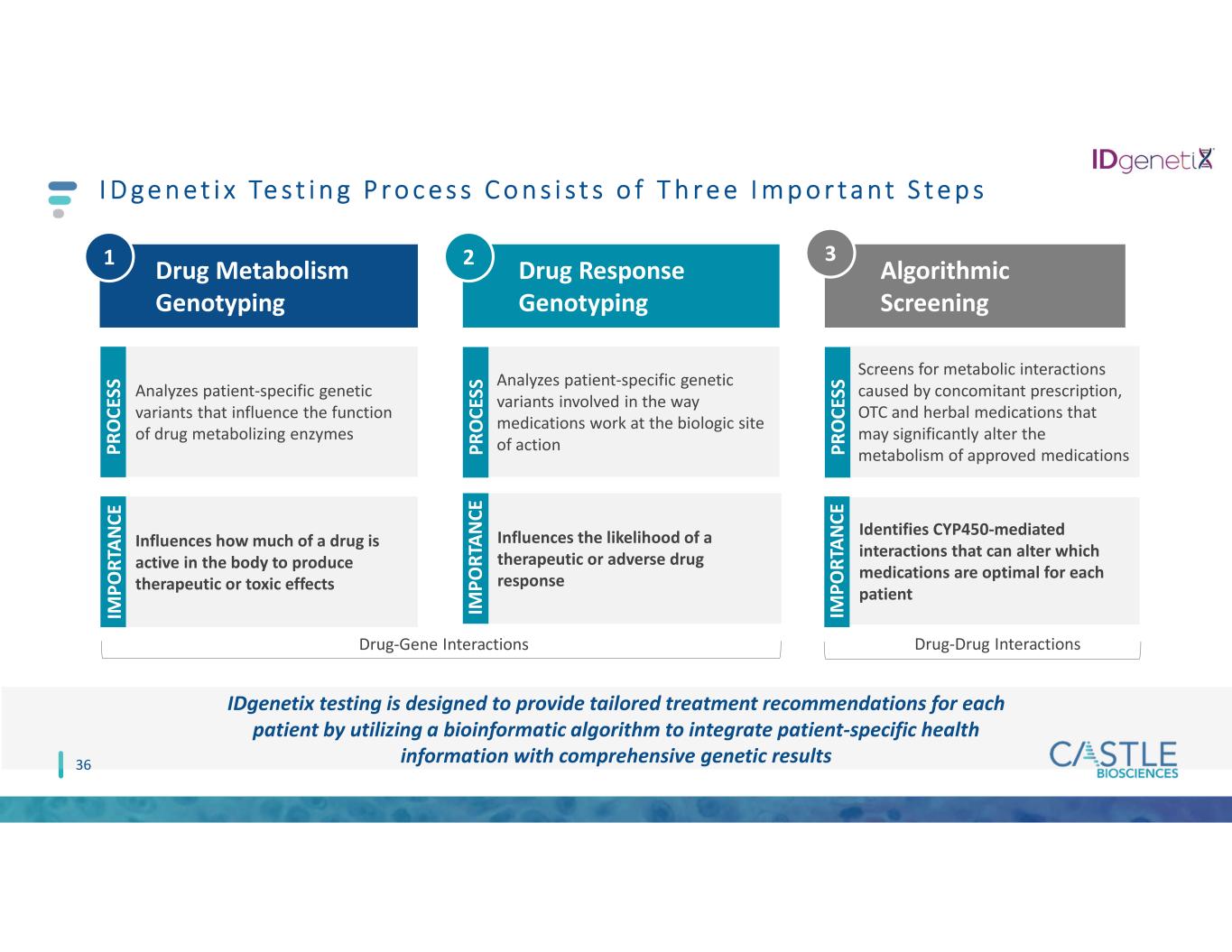

I D g e n e t i x Te s t i n g P r o c e s s C o n s i s t s o f T h r e e I m p o r t a n t S t e p s 36 Drug Metabolism Genotyping Drug Response Genotyping Algorithmic Screening Analyzes patient-specific genetic variants that influence the function of drug metabolizing enzymes Influences how much of a drug is active in the body to produce therapeutic or toxic effects P R O C ES S IM P O R TA N C E Analyzes patient-specific genetic variants involved in the way medications work at the biologic site of action Influences the likelihood of a therapeutic or adverse drug response Screens for metabolic interactions caused by concomitant prescription, OTC and herbal medications that may significantly alter the metabolism of approved medications Identifies CYP450-mediated interactions that can alter which medications are optimal for each patient IM P O R TA N C E IM P O R TA N C E P R O C ES S P R O C ES S 1 2 3 IDgenetix testing is designed to provide tailored treatment recommendations for each patient by utilizing a bioinformatic algorithm to integrate patient-specific health information with comprehensive genetic results Drug-Gene Interactions Drug-Drug Interactions

Uveal Melanoma

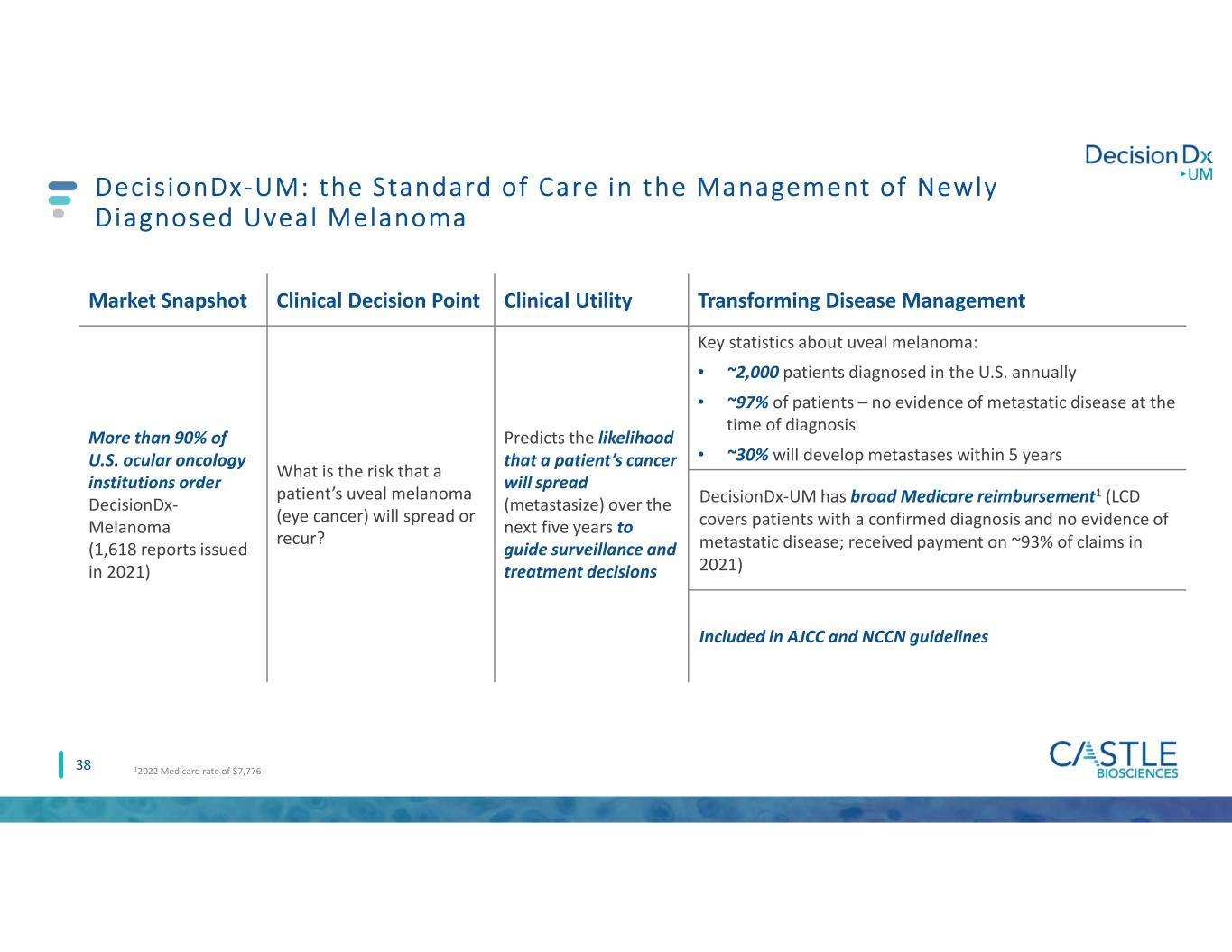

38 DecisionDx-UM: the Standard of Care in the Management of Newly Diagnosed Uveal Melanoma Market Snapshot Clinical Decision Point Clinical Utility Transforming Disease Management More than 90% of U.S. ocular oncology institutions order DecisionDx- Melanoma (1,618 reports issued in 2021) What is the risk that a patient’s uveal melanoma (eye cancer) will spread or recur? Predicts the likelihood that a patient’s cancer will spread (metastasize) over the next five years to guide surveillance and treatment decisions Key statistics about uveal melanoma: • ~2,000 patients diagnosed in the U.S. annually • ~97% of patients – no evidence of metastatic disease at the time of diagnosis • ~30% will develop metastases within 5 years DecisionDx-UM has broad Medicare reimbursement1 (LCD covers patients with a confirmed diagnosis and no evidence of metastatic disease; received payment on ~93% of claims in 2021) Included in AJCC and NCCN guidelines 12022 Medicare rate of $7,776

Pipel ine In i t iat ives 39