Form 8-K Bank First Corp For: May 19

Exhibit 99.1

| To our shareholders, We are pleased to announce that Bank First began 2022 by delivering strong financial results in the first quarter. I promised our Chief Financial Officer, Kevin LeMahieu, that I would not steal his thunder. So, to learn more about our first quarter performance, please turn the page after reading the very important announcements below. We are excited to invite you to both our upcoming Annual Shareholder and Special Shareholder Meetings being held on June 13 at the Franciscan Center for Music Education and Performance, located at 6751 Calumet Drive in Manitowoc. This will be our first in-person shareholder meeting since 2019. The Annual Meeting will begin at 4:00 p.m., followed directly by the Special Meeting. The only business to come before the shareholders at the Special Meeting is the approval of Bank First Corporation’s merger with Denmark Bancshares Inc., parent company of Denmark State Bank. Light refreshments will be served upon adjournment of both meetings. On behalf of our Board of Directors, we hope you will be able to join us. It is imperative that you cast your votes for both the Annual and Special Meetings. We hope you vote as recommended by our Board of Directors, but respect however you vote. Every vote counts toward having a meeting quorum. A minimum of 50% of outstanding shares must vote in order to reach a quorum. Without a quorum, no decisions are made. Thank you to those who have already voted by proxy for both meetings! If you haven’t voted yet, please do so by the end the May. If you need assistance with voting, please do not hesitate to call our Corporate Secretary, Kelly Dvorak, or me, at (920) 652-3244 and (920) 652- 3202, respectively. The teams at Denmark State Bank and Bank First have been working diligently to accomplish a seamless merger for the customers of both organizations. The systems conversion of Denmark State Bank to Bank First will take place the weekend of August 13, 2022. We are very much looking forward to introducing the Denmark State Bank customers to the additional products and services that Bank First offers to our consumer and business customers. Our technology outfitter, UFS, and its partner, Fiserv, are fully committed to making this happen. Bank First owns 49.8% of UFS, which provides core and information technology services to more than 60 banks throughout the Midwest. 2022 is a very exciting year for Bank First. In addition to our merger with Denmark Bancshares, Inc. and Denmark State Bank, we will be completing our new Operations Center in Manitowoc, and continuing to make Bank First “greener” by remodeling our older offices. We look forward to sharing our progress with you on these projects and others throughout the year. Michael B. Molepske CEO and President (920) 652-3202 MESSAGE FROM THE CEO Ticker: BFC www.bankfirst.com CORPORATION MAY 2022 SHAREHOLDER NEWS Bank First announces plans to renovate its Watertown office MIKE MOLEPSKE Bank First is pleased to announce its plans to renovate its existing facility located at 104 West Main Street in Watertown. The main level will be fully renovated to emulate the modern design and efficient use of space similar to other recently constructed and renovated Bank First offices. The project also includes the relocation of restrooms and the employee breakroom from the lower level to the main level, updating the HVAC system, and adding LED lighting to improve energy efficiency. The utilization of environmentally- friendly materials is a high priority for Bank First and, as such, recycled products were selected during the design process for carpet, tile, and office furniture. Construction is anticipated to begin the middle of May and is expected to be completed in October, pending the timely arrival of building materials. Stauss Architect, LLC will be assisting in the design and planning process and Maas Brothers Construction of Watertown will serve as General Contractor. |

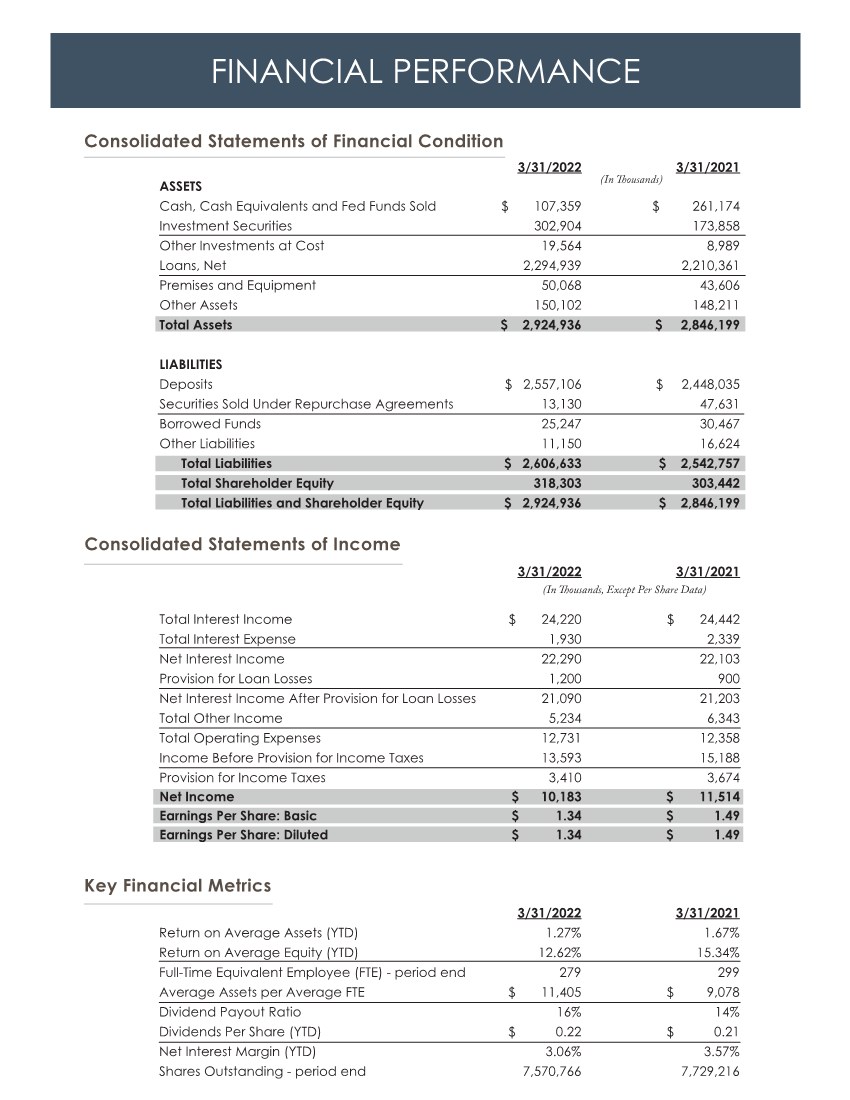

| Total assets for the Company increased by 2.8% to $2.92 billion at March 31, 2022, compared to $2.85 billion at March 31, 2021. Loans grew by $87.8 million, representing a 3.9% increase year-over-year. Loan balances originated under the Small Business Administration’s Paycheck Protection Program (“PPP”) totaled $16.9 million at March 31, 2022 compared to $188.2 million at March 31, 2021. Excluding the impact of PPP loans, other loans at the Company increased by $259.1 million, or 12.7%, year-over-year. Deposits increased by $109.1 million during this same period, or 4.5%. Growth in deposits trailed growth in loans during the previous twelve months. Significant government stimulus was put into the economy during 2020 and early 2021, with limited ways to spend it due to many areas of society being shut down, causing deposits at Bank First as well as most financial institutions to swell. During the latter part of 2021 and the first quarter of 2022 some of this stimulus has begun to be leave depository accounts as it is deployed into the economy, stunting the growth in overall deposits at the Company year-over-year. Earnings per share for the quarter ended March 31, 2022, was $1.34. This represents a decrease of 10.1% compared to earnings per share of $1.49 during the first quarter of 2021. Loans originated under PPP added $0.6 million to interest income for the first quarter of 2022, compared to $2.4 million for the first quarter of 2021, a reduction of approximately $0.16 in quarterly earnings per share for the first quarter year-over- year. The decline in retail residential lending mentioned in the next paragraph further reduced first quarter year-over-year earnings per share by $0.20. Net income was $10.2 million for the quarter ended March 31, 2022, compared to $11.5 million during the quarter ended March 31, 2021. Non-interest income totaled $5.2 million for the quarter ended March 31, 2022, down from $6.3 million during the first quarter of 2021. A primary driver for this decrease was a significant slowdown in the retail lending environment after a robust run through 2020 and 2021, leading to gains on sales of mortgage loans to the secondary market of $0.7 million during the first quarter of 2022, compared to $2.8 million during the first quarter of 2021. Non-interest expense totaled $12.7 million for the quarter ended March 31, 2022, up from $12.4 million for the first quarter of 2021. Most areas of non-interest expense experienced modest increases, though overall expenses were well contained considering the inflationary environment that developed during the end of 2021 and start of 2022. Outside service fees increased by $0.4 million, or 55.2%, during the first quarter of 2022 compared to the first quarter of 2021, due primarily to $0.5 million in expenses related to the pending acquisition of Denmark Bancshares, Inc. Total shareholders’ equity increased by 4.9% to $318.3 million at March 31, 2022, compared to $303.4 million at March 31, 2021. Equity increased due to strong earnings which were offset by dividends totaling $8.8 million, common share repurchases totaling $12.9 million, and a decline in the fair value of our available for sale securities portfolio (due to interest rate movements) of $9.1 million over the twelve months from the end of the first quarter of 2021 to the end of the first quarter of 2022. FIRST QUARTER KEVIN LEMAHIEU Chief Financial Officer (920) 652-3362 Quarterly Common Stock Cash Dividend The Corporation’s Board of Directors approved a quarterly cash dividend of $0.22 per common share. The dividend is payable on July 6, 2022, to shareholders of record as of June 22, 2022. BFC Stock Repurchase Program Bank First has a stock repurchase program under which the Corporation may repurchase shares of outstanding BFC stock. Please contact Mike Molepske at (920) 652-3202 or Shannon Klahn at (920) 652-3222 for further information. Dividend Reinvestment Program (DRIP) In June 2020, Bank First instituted a Dividend Reinvestment Program (DRIP), with the goal of making it easier for shareholders to purchase our stock. This program allows both registered and “street name” holders to use their cash dividends to automatically purchase additional shares on a quarterly basis. This benefit is available through our transfer agent, Computershare, as well as through major brokers like TD Ameritrade, Fidelity, and Morgan Stanley, among others. A copy of the Plan Prospectus is available on our Investor Relations website and it describes the Plan benefits and eligibility, as well as explains stock purchases and sales through the Plan. The process for registering for the DRIP is quick and easy! STEP 1: If you hold your shares with Computershare, you can obtain a copy of the enrollment form and prospectus by visiting www.computershare.com/investor. STEP 2: If you have not set up an online account, do so by choosing “Register Now.” STEP 3: After you have logged into your account, choose “Manage Investment Plans.” You will be guided through the process of enrolling in the DRIP. If you do not have an online account and wish to enroll using a paper form, please contact the Investor Relations Team at Bank First by calling (920) 652-3360 or emailing [email protected]. |

| 3/31/2022 3/31/2021 Return on Average Assets (YTD) 1.27% 1.67% Return on Average Equity (YTD) 12.62% 15.34% Full-Time Equivalent Employee (FTE) - period end 279 299 Average Assets per Average FTE $ 11,405 $ 9,078 Dividend Payout Ratio 16% 14% Dividends Per Share (YTD) $ 0.22 $ 0.21 Net Interest Margin (YTD) 3.06% 3.57% Shares Outstanding - period end 7,570,766 7,729,216 3/31/2022 3/31/2021 ASSETS Cash, Cash Equivalents and Fed Funds Sold $ 107,359 $ 261,174 Investment Securities 302,904 173,858 Other Investments at Cost 19,564 8,989 Loans, Net 2,294,939 2,210,361 Premises and Equipment 50,068 43,606 Other Assets 150,102 148,211 Total Assets $ 2,924,936 $ 2,846,199 LIABILITIES Deposits $ 2,557,106 $ 2,448,035 Securities Sold Under Repurchase Agreements 13,130 47,631 Borrowed Funds 25,247 30,467 Other Liabilities 11,150 16,624 Total Liabilities $ 2,606,633 $ 2,542,757 Total Shareholder Equity 318,303 303,442 Total Liabilities and Shareholder Equity $ 2,924,936 $ 2,846,199 3/31/2022 3/31/2021 Total Interest Income $ 24,220 $ 24,442 Total Interest Expense 1,930 2,339 Net Interest Income 22,290 22,103 Provision for Loan Losses 1,200 900 Net Interest Income After Provision for Loan Losses 21,090 21,203 Total Other Income 5,234 6,343 Total Operating Expenses 12,731 12,358 Income Before Provision for Income Taxes 13,593 15,188 Provision for Income Taxes 3,410 3,674 Net Income $ 10,183 $ 11,514 Earnings Per Share: Basic $ 1.34 $ 1.49 Earnings Per Share: Diluted $ 1.34 $ 1.49 FINANCIAL PERFORMANCE Consolidated Statements of Financial Condition Key Financial Metrics Consolidated Statements of Income (In Thousands) (In Thousands, Except Per Share Data) |

| Let’s stay in touch. Follow us! Bank First announces new hire and promotions ELIZABETH MILLER has been promoted to Vice President - Deposit Operations. Elizabeth joined the bank in 2009 as a Teller/ Customer Service Representative and advanced into other roles such as Personal Banker, Assistant Branch Manager, Branch Operations/Training Coordinator, and most recently as Deposit Operations Manager. In her role, Elizabeth will continue to use her extensive banking experience to oversee deposit operations of the bank. She attended Lakeshore Technical College and plans to pursue a bachelor’s degree in business administration at Lakeland University. PHIL PLAGEMANN has been promoted to Facilities Officer. Phil joined the bank in 2018 with several years of maintenance and carpentry experience. He served as Facilities Specialist and was later promoted to Facilities Manager. In his current role, Phil performs and manages general branch maintenance and oversees the facilities team, which is responsible for day-to-day maintenance and courier needs. He works closely with external vendors, architects, and engineers and is instrumental in coordinating the bank’s construction projects including new branch designs and the renovation of current offices. He received his Journeyman Apprenticeship in Carpentry from Lakeshore Technical College. BETTY BITTNER has been promoted to Assistant Vice President – Branch Manager at Bank First. Betty joined Bank First in 2017 and has over 23 years of experience in the banking industry. Betty is a valued member of the retail banking team at Bank First and is responsible for developing new and enhancing existing retail banking relationships. As Branch Manager, she is responsible for the overall administration and efficiency of the Two Rivers office including communicating the bank’s products and services, delivery of exceptional customer service, and assurance of the security and safety of the Two Rivers office employees and customers. Active in her community, Betty serves as past president and member of the Rotary Club of Two Rivers, treasurer of both the Two Rivers Rotary Foundation and Lakeshore Foster Families & Friends, Inc., as well as a member of the Two Rivers Business Industrial Development Committee, the Two Rivers Community Development Authority, the Two Rivers Business Association, and 100 Plus Women Who Care. She is a religious education instructor, Eucharist minister, and a graduate of the Chamber of Manitowoc County Leadership Program. Betty earned her Bachelor of Science degree in Microbiology and Chemistry from UW – La Crosse. KELLY DVORAK has been appointed to oversee the bank’s Compliance function. Kelly joined Bank First in 2017 as General Counsel and Corporate Secretary. In addition to her current role, Kelly will manage the Compliance team and utilize her extensive experience tracking regulatory obligations, changes to applicable banking laws, and emerging compliance risks. Kelly earned a bachelor’s degree in political science from UW – Madison, a juris doctorate from UW Law School, and is currently attending the Graduate School of Banking through UW – Madison. She serves on the board of directors of the Manitowoc Symphony Orchestra and UFS, a bank technology outfitter headquartered in Grafton, Wisconsin. JOSIAH GAMROTH recently joined the Bank First office in Watertown as Retail Banker. Josiah brings 10 years of experience in the lending industry, most recently specializing in mortgage loan origination. In his new role, he will assist new and existing retail customers in Watertown and the surrounding communities. Josiah grew up in Oconomowoc and graduated from Lake Country Lutheran High School in Hartland. He attended Calvin University in Grand Rapids, Michigan where he earned a bachelor’s degree in small business administration and a minor in economics. With a recent move back to Wisconsin after living in Michigan and Texas, Josiah is looking forward to establishing himself in the Watertown community. KRISTI ROUSH has been promoted to Retail Market Manager. Kristi joined Bank First in 2020 through the merger with Timberwood Bank and has over 15 years of retail banking experience. In her new role, Kristi will be responsible for the overall growth and performance of the retail lending portfolio of the bank’s Tomah market while providing mentorship to the retail lending team at the Tomah office. Kristi has a bachelor’s degree in marketing from UW – La Crosse. Active in her community, she is a Greater Tomah Area Chamber of Commerce Ambassador, a member of Our Town Tomah Beautification, and the treasurer for the Tomah Youth Hockey Association. KATHRYN SCHMITZ has been promoted to Vice President – Retail Banking. Kathryn joined the bank in 2016 and has over 15 years of experience in mortgage lending. Over the past six years, she has proven to be a leader in mortgage production and a strong resource of knowledge for her co- workers. She is a graduate of the University of Wisconsin – Green Bay where she received her bachelor’s degree in business administration. Kathryn is actively involved with the Manitowoc County Board of Realtors, the Manitowoc County Home Builders Association, and the Manitowoc Ships Girls Basketball Association. EVELYN GREEN has been promoted to Vice President - Retail Banking at Bank First. Evelyn began her career at Bank First in 2017 with over 40 years of banking experience and is a vital member of the retail banking team serving in the bank’s Plymouth office. Active in her community, Evelyn serves on the board of directors of Big Brothers Big Sisters Wisconsin Shoreline. She is also a firm believer in assisting aging seniors by volunteering her time delivering for Meals on Wheels and participating in other activities. PLAGEMANN BITTNER GAMROTH MILLER ROUSH DVORAK GREEN SCHMITZ |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Bank First Corporation (BFC) Tops Q1 EPS by 4c

- Coiled Tubing Market to Reach USD 4.21 Billion by 2031 Driven by Booming Exploration and Production Activities

- Game Engines Market Soar to reach USD 9,974.9 Million by 2031, Driven by Emergence of Cloud Gaming.

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share