Form 8-K BRISTOL MYERS SQUIBB CO For: Jul 28

Exhibit 99.1

Bristol Myers Squibb Reports Second Quarter Financial Results for 2021

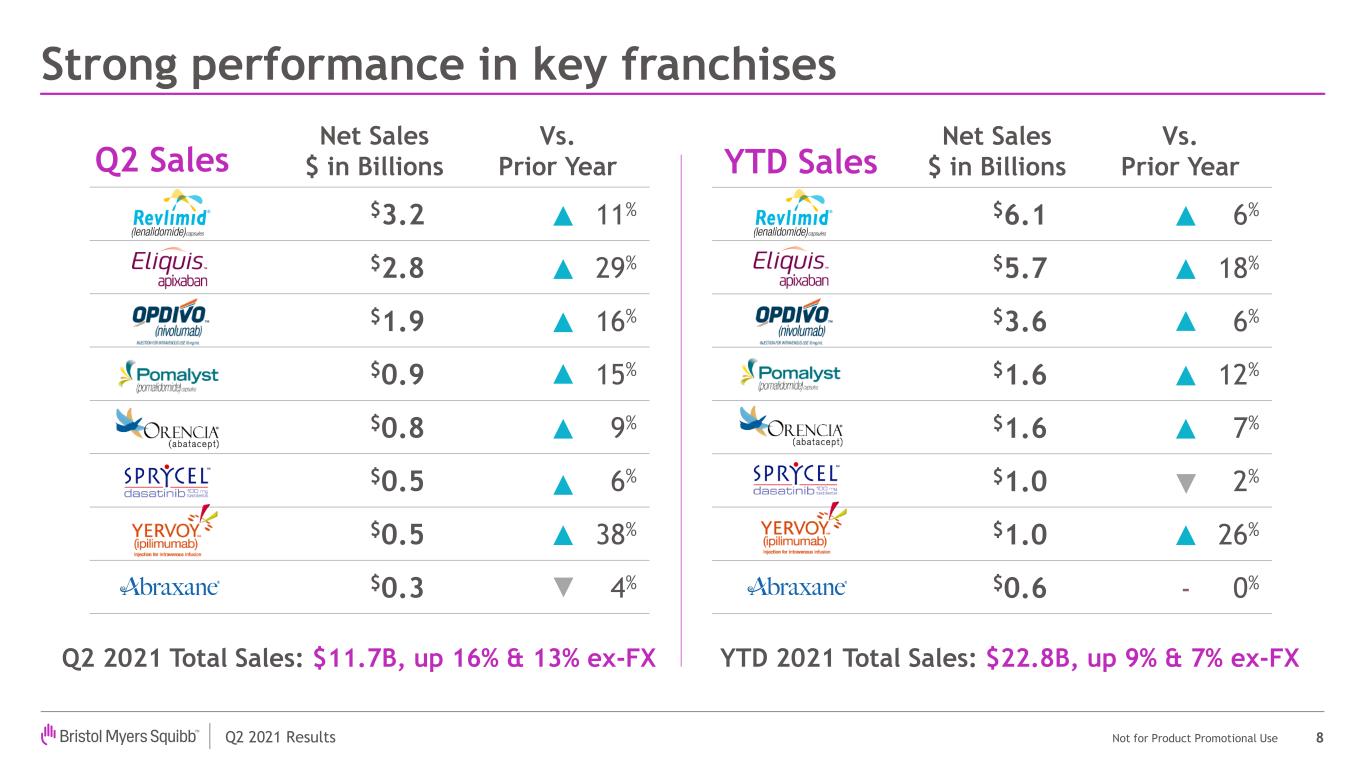

•Reports Second Quarter Revenues of $11.7 Billion, an Increase of 16% YoY, or 13% When Adjusted for Foreign Exchange

•Posts Second Quarter Earnings Per Share of $0.47 and Non-GAAP EPS of $1.93

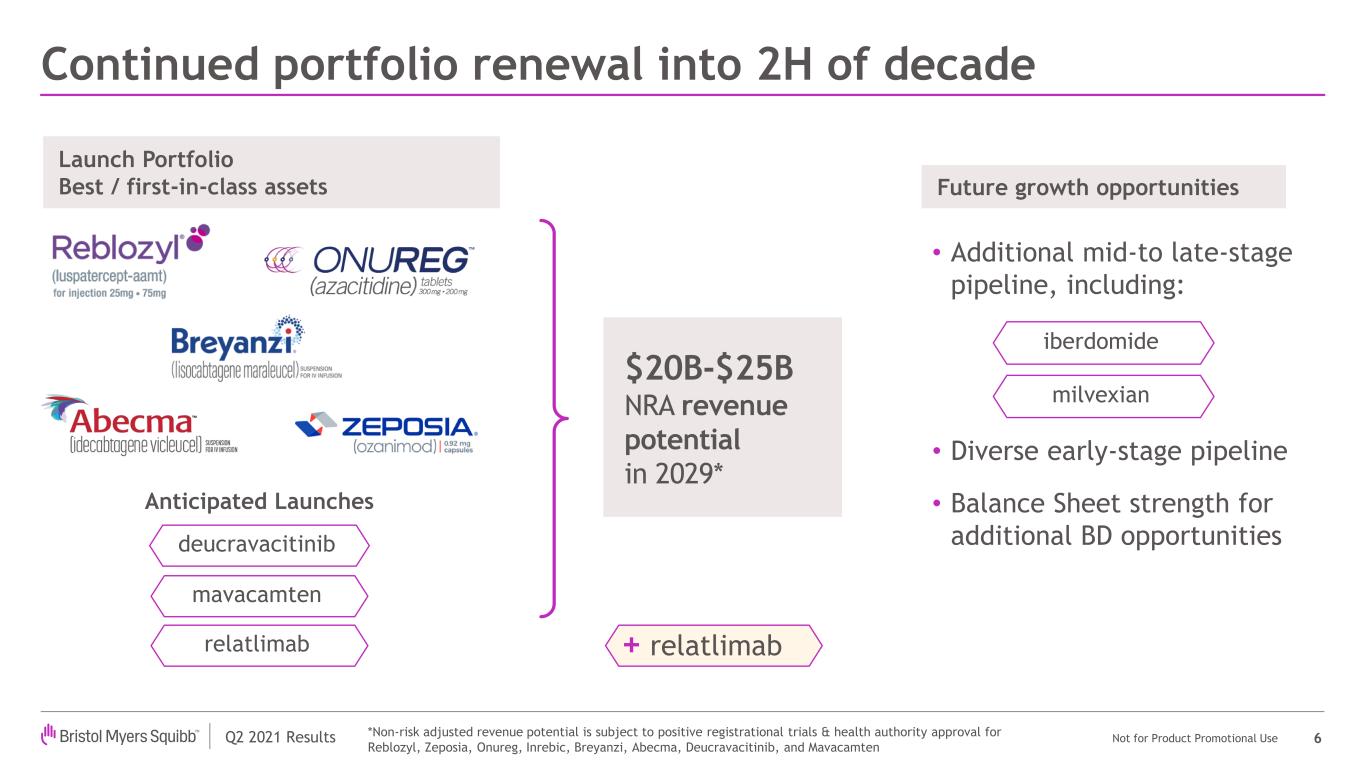

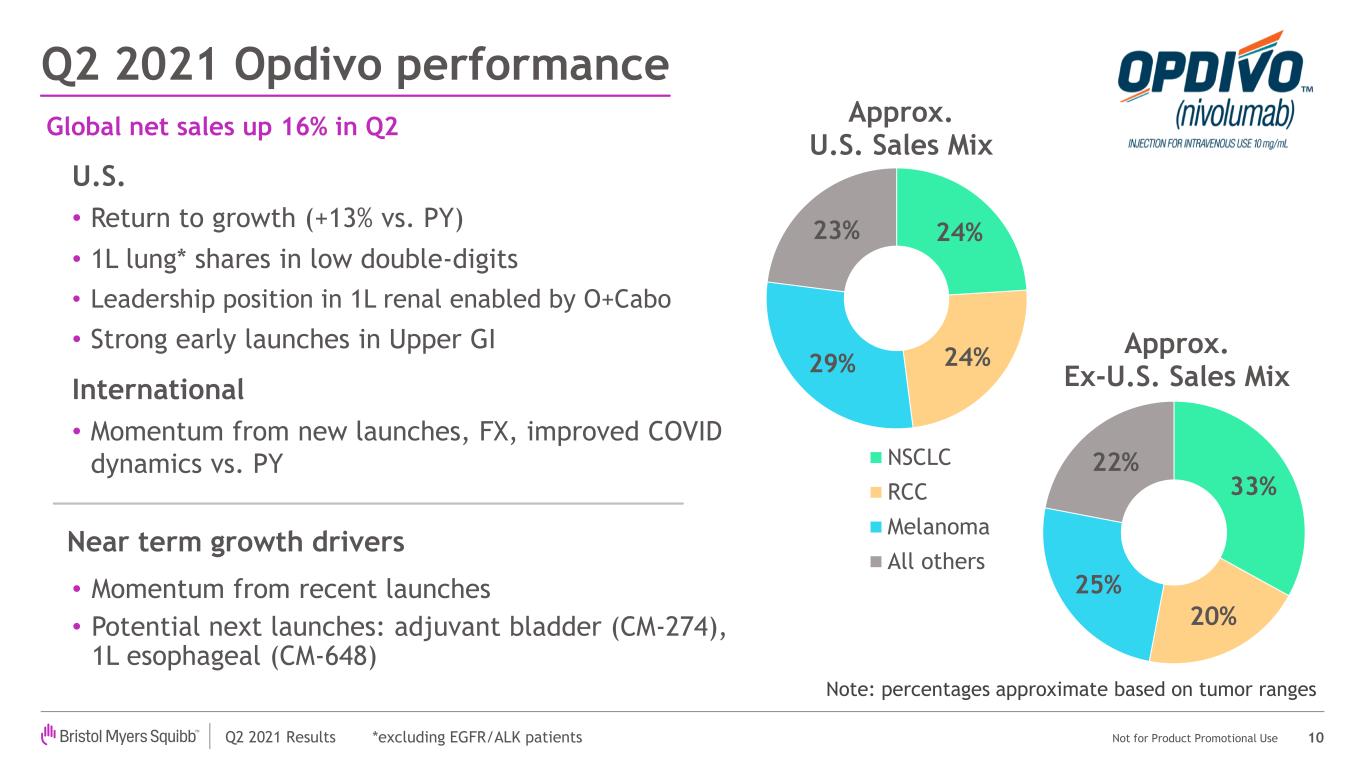

•Delivers Strong Commercial Performance, Including Opdivo’s Return to Growth and Momentum across New Product Portfolio

•Achieves Significant Regulatory and Clinical Milestones across Product Pipeline

•Further Strengthens Pipeline through Disciplined Business Development Agreements, including with Agenus and Eisai

•Adjusts GAAP and Reaffirms Non-GAAP EPS Guidance for 2021

(NEW YORK, July 28, 2021) – Bristol Myers Squibb (NYSE:BMY) today reports results for the second quarter of 2021, which reflect robust product sales, continued advancement of the pipeline and strong clinical and operational performance across the company.

“We delivered a strong quarter across each of our four therapeutic areas, including building momentum for our new product portfolio and Opdivo returning to growth,” said Giovanni Caforio, M.D., board chair and chief executive officer, Bristol Myers Squibb. “We achieved

significant clinical and regulatory milestones reflecting the hard work and dedication of our team, who together have built a portfolio of best-in-class medicines to meet the needs of patients with serious diseases. As we move forward, we remain focused on driving inline product performance, progressing our new launches, and advancing pipeline opportunities. Our robust and diverse pipeline combined with our clinical and commercial execution strengthen our confidence in our ability to renew the portfolio and achieve sustained growth.”

| Second Quarter | |||||||||||||||||

| $ amounts in millions, except per share amounts | |||||||||||||||||

| 2021 | 2020 | Change | |||||||||||||||

| Total Revenues | $11,703 | $10,129 | 16 | % | |||||||||||||

| Earnings (Loss) Per Share - GAAP | 0.47 | (0.04) | N/A | ||||||||||||||

| Earnings Per Share - Non-GAAP | 1.93 | 1.63 | 18 | % | |||||||||||||

1

SECOND QUARTER FINANCIAL RESULTS

All comparisons are made versus the same period in 2020 unless otherwise stated.

•Bristol Myers Squibb posted second quarter revenues of $11.7 billion, an increase of 16%, or 13% when adjusted for foreign exchange. Sales in the same period a year ago were negatively impacted by approximately $350 million of COVID-19-related channel inventory work downs.

•U.S. revenues increased 14% to $7.4 billion in the quarter. International revenues increased 18% to $4.3 billion in the quarter. When adjusted for foreign exchange impact, international revenues increased 10%.

•Gross margin increased from 73.4% to 79.0% in the quarter primarily due to lower unwinding of inventory purchase price accounting adjustments, partially offset by foreign exchange.

On a non-GAAP basis, gross margin decreased from 80.5% to 79.8% in the quarter driven by foreign exchange and product mix.

•Marketing, selling and administrative expenses increased 16% to $1.9 billion in the quarter on a GAAP and non-GAAP basis primarily due to higher advertising and promotion expenses, higher costs to support new product launches and lower spending in the prior year due to COVID-19.

•Research and development expenses increased 30% to $3.3 billion in the quarter primarily due to higher license and asset acquisition charges and an in-process research and development (IPR&D) impairment charge.

On a non-GAAP basis, research and development expenses increased 4% to $2.3 billion in the quarter primarily due to higher costs associated with the broader portfolio and lower spending in the prior year due to COVID-19.

•Amortization of acquired intangible assets increased $158 million to $2.5 billion in the quarter.

•The effective tax rate was 31.7% in the quarter. Income taxes were $1.7 billion on pre-tax earnings of $1.6 billion in the same period a year ago primarily due to tax charges resulting from an internal transfer of certain intangible assets and the Otezla® divestiture and purchase price adjustments.

On a non-GAAP basis, the effective tax rate increased 3.1% to 16.9% in the quarter primarily driven by earnings mix.

•The company reported net earnings attributable to Bristol Myers Squibb of $1.1 billion, or $0.47 per share, in the second quarter, compared to net loss of $85 million, or $0.04 per share, for the same period a year ago.

2

•The company reported non-GAAP net earnings attributable to Bristol Myers Squibb of $4.3 billion, or $1.93 per share, in the second quarter, compared to non-GAAP net earnings of $3.8 billion, or $1.63 per share, for the same period a year ago.

A discussion of the non-GAAP financial measures is included under the “Use of Non-GAAP Financial Information” section.

SECOND QUARTER PRODUCT REVENUE HIGHLIGHTS

| $ amounts in millions | |||||||||||

| Product | Quarter Ended June 30, 2021 | Quarter Ended June 30, 2020 | % Change from Quarter Ended June 30, 2020 | ||||||||

| Revlimid | $3,202 | $2,884 | 11% | ||||||||

| Eliquis | $2,792 | $2,163 | 29% | ||||||||

| Opdivo | $1,910 | $1,653 | 16% | ||||||||

| Orencia | $814 | $750 | 9% | ||||||||

| Pomalyst/Imnovid | $854 | $745 | 15% | ||||||||

| Sprycel | $541 | $511 | 6% | ||||||||

| Yervoy | $510 | $369 | 38% | ||||||||

| Abraxane | $296 | $308 | (4)% | ||||||||

| Empliciti | $86 | $97 | (11)% | ||||||||

| Reblozyl** | $128 | $55 | * | ||||||||

| Inrebic** | $16 | $15 | 7% | ||||||||

| Onureg** | $12 | N/A | N/A | ||||||||

| Zeposia** | $28 | $1 | * | ||||||||

| Breyanzi** | $17 | N/A | N/A | ||||||||

| Abecma** | $24 | N/A | N/A | ||||||||

* In excess of +100%.

** Included as part of the new product portfolio

FIRST HALF PRODUCT REVENUE HIGHLIGHTS

| $ amounts in millions | |||||||||||

| Product | Six Months Ended June 30, 2021 | Six Months Ended June 30, 2020 | % Change from Six Months Ended June 30, 2020 | ||||||||

| Revlimid | $6,146 | $5,799 | 6% | ||||||||

| Eliquis | $5,678 | $4,804 | 18% | ||||||||

| Opdivo | $3,630 | $3,419 | 6% | ||||||||

| Orencia | $1,572 | $1,464 | 7% | ||||||||

| Pomalyst/Imnovid | $1,627 | $1,458 | 12% | ||||||||

| Sprycel | $1,011 | $1,032 | (2)% | ||||||||

| Yervoy | $966 | $765 | 26% | ||||||||

3

| Abraxane | $610 | $608 | — | ||||||||

| Empliciti | $171 | $194 | (12)% | ||||||||

| Reblozyl** | $240 | $63 | * | ||||||||

| Inrebic** | $32 | $27 | 19% | ||||||||

| Onureg** | $27 | N/A | N/A | ||||||||

| Zeposia** | $46 | $1 | * | ||||||||

| Breyanzi** | $17 | N/A | N/A | ||||||||

| Abecma** | $24 | N/A | N/A | ||||||||

* In excess of +100%.

** Included as part of the new product portfolio

SECOND QUARTER PRODUCT AND PIPELINE UPDATE

Cardiovascular

mavacamten

Medical Meeting

•In May, at the American College of Cardiology’s 70th Annual Scientific Session (ACC.21), the company presented:

◦New analysis of data from the Phase 3 EXPLORER-HCM study that demonstrated a Health Status Benefit in patients with obstructive hypertrophic cardiomyopathy (oHCM) receiving mavacamten compared to placebo. The data were simultaneously published in The Lancet. (link)

◦Interim results from MAVA-LTE, an ongoing, dose-blinded five-year extension study of the EXPLORER-HCM Phase 3 trial, which demonstrated that in patients with oHCM, mavacamten was well tolerated and showed durable improvement in left ventricular outflow tract gradients, diastolic function, N-terminal-pro hormone B-type natriuretic peptide and symptoms. (link)

◦Results from a real-world data analysis measuring the clinical and economic burden of oHCM in the United States, which found the condition is associated with substantial healthcare resource utilization and costs. (link)

4

Oncology

Opdivo

Regulatory

•In June, the company announced that the European Commission (EC) has approved Opdivo® (nivolumab) plus Yervoy® (ipilimumab) for the treatment of adult patients with mismatch repair deficient or microsatellite instability-high (dMMR/MSI-H) metastatic colorectal cancer (mCRC) after prior fluoropyrimidine-based combination chemotherapy. The EC approval is based on results from the Phase 2 CheckMate -142 study. (link). In May, the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) recommended approval for this indication (link)

•In June, the company announced that the CHMP of the EMA has recommended approval of Opdivo for the adjuvant treatment of adult patients with esophageal or gastroesophageal junction cancer (GEJC) who have residual pathologic disease following prior neoadjuvant chemoradiotherapy (CRT). The recommendation is based on results from the Phase 3 CheckMate -577 study in which Opdivo doubled disease-free survival compared to placebo in the all-randomized population. (link)

•In June, the company announced that the EC has approved Opdivo plus Yervoy for the first-line treatment of adults with unresectable malignant pleural mesothelioma (MPM). The EC’s decision is based on results from the CheckMate -743 study, the first and only positive Phase 3 study of an immunotherapy in first-line MPM.(link)

•In May, the company announced that the U.S. Food & Drug Administration (FDA) has approved Opdivo for the adjuvant treatment of completely resected esophageal cancer or GEJC with residual pathologic disease in patients who have received neoadjuvant CRT. The FDA approval is based on results from the Phase 3 CheckMate -577 study. (link)

•In April, the company announced that the FDA has accepted the supplemental Biologics License Application for Opdivo for the adjuvant treatment of patients with surgically resected, high-risk muscle-invasive urothelial carcinoma, based on results from the Phase 3 CheckMate -274 study. The FDA granted the application Priority Review and assigned a Prescription Drug User Fee Act goal date of September 3, 2021. (link)

Clinical

•Today, the company announced that the Phase 3 CheckMate -649 trial did not meet the secondary endpoint of overall survival (OS) with the combination of Opdivo plus Yervoy as

5

compared to chemotherapy as a first-line treatment for metastatic gastric cancer (GC), GEJC or esophageal adenocarcinoma (EAC) in patients whose tumors express PD-L1 with a combined positive score (CPS) ≥ 5, at a final analysis. The safety profiles of Opdivo and Yervoy in this trial were consistent with those previously reported for other tumor types. These data have no impact on the U.S. indication for Opdivo plus chemotherapy for the treatment of patients with advanced or metastatic GC, GEJC and EAC, regardless of PD-L1 expression status, which received full approval from the FDA based on results from the CheckMate -649 study.

•In July, the company announced an update on the Phase 3 CheckMate -651 study comparing Opdivo plus Yervoy to the EXTREME regimen (cetuximab, cisplatin/carboplatin and fluorouracil) as a first-line treatment in platinum-eligible patients with recurrent or metastatic squamous cell carcinoma of the head and neck. Although Opdivo plus Yervoy showed a clear, positive trend towards OS in patients whose tumors express PD-L1 with a combined CPS ≥ 20, the study did not meet its primary endpoints. (link)

Medical Meetings

•In May and June, the company announced new data and analyses across its cancer portfolio (link) that were presented at the American Society of Clinical Oncology (ASCO) 2021 Annual Meeting, including results from the:

◦Phase 2/3 RELATIVITY-047 study, which showed that the fixed-dose combination of relatlimab, a LAG-3-blocking antibody, and nivolumab, administered as a single infusion, demonstrated a statistically significant and clinically meaningful progression-free survival benefit compared to Opdivo alone in patients with previously untreated metastatic or unresectable melanoma. (link)

◦Phase 3 CheckMate -648 study, in which two Opdivo-based treatment combinations — Opdivo plus chemotherapy and Opdivo plus Yervoy — demonstrated a statistically significant and clinically meaningful OS benefit compared to chemotherapy at the pre-specified interim analysis in patients with unresectable advanced or metastatic esophageal squamous cell carcinoma with tumor cell PD-L1 expression ≥1%, as well as in the all-randomized population. (link)

◦Six-and-a-half-year follow-up analysis from the Phase 3 CheckMate -067 study, which showed a continued, durable improvement in OS with Opdivo plus Yervoy therapy and

6

Opdivo monotherapy, versus Yervoy alone, in patients with previously untreated advanced melanoma. (link)

◦Two-year follow-up analysis from the Phase 3 CheckMate -9LA study, which demonstrated that Opdivo plus Yervoy with two cycles of chemotherapy showed a durable survival benefit compared to four cycles of chemotherapy alone after two years in patients with previously untreated, advanced non-small cell lung cancer (NSCLC). (link)

◦Four-year follow-up analysis from Part 1 of the Phase 3 CheckMate -227 study, which demonstrated a durable, long-term survival benefit of first-line treatment with Opdivo plus Yervoy compared to chemotherapy in patients with previously untreated, advanced NSCLC with a minimum follow-up of over four years (49.4 months). (link)

Hematology

Abecma

Regulatory

•In June, the company announced the CHMP of the EMA has recommended granting Conditional Marketing Authorization for Abecma® (idecabtagene vicleucel; ide-cel), the company’s B-cell maturation antigen (BCMA)-directed chimeric antigen receptor (CAR) T cell immunotherapy, for the treatment of adult patients with relapsed and refractory multiple myeloma who have received at least three prior therapies, including an immunomodulatory agent, a proteasome inhibitor and an anti-CD38 antibody and have demonstrated disease progression on the last therapy. The CHMP opinion was based on results from the pivotal Phase 2 KarMMa study. (link)

Breyanzi

Clinical

•In June, the company announced positive topline results from TRANSFORM, a global, randomized, multicenter Phase 3 study evaluating Breyanzi® (lisocabtagene maraleucel) as a second-line treatment in adults with relapsed or refractory large B-cell lymphoma (LBCL) compared to salvage therapy followed by high-dose chemotherapy and hematopoietic stem cell transplant, which is currently considered a gold standard treatment for these patients. (link)

7

Onureg

Regulatory

◦In June, the company announced that the EC has granted full Marketing Authorization for Onureg® (azacitidine tablets) as a maintenance therapy in adult patients with acute myeloid leukemia who achieved complete remission or complete remission with incomplete blood count recovery (CRi) following induction therapy with or without consolidation treatment and who are not candidates for, including those who choose not to proceed to, hematopoietic stem cell transplantation. The EC approval was based on results from the QUAZAR® AML-001 study. (link)

Medical Meetings

•In June, at the 26th European Hematology Association, the company announced new data and analyses from the:

◦Phase 2 BEYOND study with Acceleron Pharma Inc. (NASDAQ: XLRN), which showed treatment with Reblozyl® (luspatercept-aamt), a first-in-class erythroid maturation agent, plus best supportive care compared to placebo improved anemia in adult patients with non-transfusion dependent beta thalassemia. (link)

•In May, at the ASCO 2021 Annual Meeting, the company announced new data and analyses from the:

◦Pivotal Phase 2 KarMMa study with bluebird bio, Inc. (NASDAQ: BLUE), which showed patients treated with Abecma achieved an overall response rate that remained consistent or achieved a complete response or better after a median follow-up of 24.8 months. The data represent the longest follow-up to date from a global clinical trial of a CAR T cell therapy in multiple myeloma. (link)

Immunology

Zeposia

Regulatory

•In May, the company announced that the FDA approved Zeposia® (ozanimod) for the treatment of adults with moderately to severely active ulcerative colitis, a chronic

8

inflammatory bowel disease. The approval is based on data from the pivotal, Phase 3 True North study. (link)

Business Development

•In June, the company and Eisai Co., Ltd. announced that the companies have entered into an exclusive global strategic collaboration agreement for the co-development and co-commercialization of MORAb-202, an antibody drug conjugate. (link)

•In May, the company and Agenus Inc. (NASDAQ: AGEN) announced that they have entered into a definitive agreement under which Bristol Myers Squibb will be granted a global exclusive license to Agenus’ proprietary bispecific antibody program, AGEN1777, that blocks TIGIT and a second undisclosed target. (link)

Financial Guidance

Bristol Myers Squibb is updating its 2021 GAAP EPS guidance range of $3.18 - $3.38 to $2.77 - $2.97 and reaffirming its non-GAAP EPS guidance range of $7.35 - $7.55. Both GAAP and non-GAAP guidance assume current exchange rates. Key 2021 GAAP and non-GAAP line-item guidance assumptions are:

•Worldwide revenues increasing in the high-single digits.

•Gross margin as a percentage of revenue is expected to be approximately 79% for GAAP and approximately 80% for non-GAAP.

•Marketing, selling and administrative expenses to be in-line with 2020 levels for GAAP and increasing in the low-single digits for non-GAAP.

•Research and development expenses decreasing in the low-single digits for GAAP and increasing in the mid-single digits for non-GAAP.

•An effective tax rate of approximately 23% for GAAP and approximately 16% for non-GAAP.

The 2021 financial guidance excludes the impact of any potential future strategic acquisitions and divestitures, and any specified items that have not yet been identified and quantified. The 2021 non-GAAP EPS guidance is explained and further excludes other specified items as discussed under “Use of Non-GAAP Financial Information.” The financial guidance is subject to risks and uncertainties applicable to all forward-looking statements as described elsewhere in this press release.

9

Company and Conference Call Information

Bristol Myers Squibb is a global biopharmaceutical company whose mission is to discover, develop and deliver innovative medicines that help patients prevail over serious diseases. For more information about Bristol Myers Squibb, visit us at BMS.com or follow us on LinkedIn, Twitter, YouTube, Facebook, and Instagram.

There will be a conference call on July 28, 2021 at 8 a.m. ET during which company executives will review financial information and address inquiries from investors and analysts.

Investors and the general public are invited to listen to a live webcast of the call at

http://investor.bms.com or by using this link which becomes active 15 minutes prior to the scheduled start time and entering your information to be connected. Investors and the general public can also access the live webcast by dialing in the U.S. toll free 888-204-4368 or international +1 313-209-4906, confirmation code: 1720109. Materials related to the call will be available at the same website prior to the conference call.

A replay of the call will be available beginning at 11:30 a.m. ET on July 28 through 11:30 a.m. ET on August 11, 2021. The replay will also be available through http://investor.bms.com or by dialing in the U.S. toll free 888-203-1112 or international +1 719-457-0820, confirmation code: 1720109.

Use of Non-GAAP Financial Information

In discussing financial results and guidance, the company refers to financial measures that are not in accordance with U.S. Generally Accepted Accounting Principles (GAAP). The non-GAAP financial measures are provided as supplemental information to the financial measures presented in this press release that are calculated and presented in accordance with GAAP and are presented because management has evaluated the company’s financial results both including and excluding the adjusted items or the effects of foreign currency translation, as applicable, and believes that the non-GAAP financial measures presented portray the results of the company’s baseline performance, supplement or enhance management, analysts and investors overall understanding of the company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods. For example, non-GAAP earnings and EPS information are indications of the company’s baseline performance before items that are considered by us to not be reflective of the company’s ongoing results. This information is among the primary indicators that we use as a basis for evaluating performance, allocating resources, setting incentive compensation targets and planning and forecasting for future periods. In addition, non-GAAP gross margin, which is gross profit excluding certain specified items as a percentage of revenues, non-GAAP marketing, selling and administrative expenses, which is marketing, selling and administrative expense excluding certain specified items, and non-GAAP research and development expenses, which is research and development expenses excluding certain specified items, are relevant and useful for investors because they allow investors to view performance in a manner similar to the method used by our management and make it easier for investors, analysts and peers

10

to compare our operating performance to other companies in our industry and to compare our year-over-year results.

This earnings release and the accompanying tables also provide certain revenues and expenses as well as non-GAAP measures excluding the impact of foreign exchange. We calculate foreign exchange impacts by converting our current-period local currency financial results using the prior period average currency rates and comparing these adjusted amounts to our current-period results.

Non-GAAP financial measures such as non-GAAP earnings and related EPS information are adjusted to exclude certain costs, expenses, gains and losses and other specified items that are evaluated on an individual basis after considering their quantitative and qualitative aspects and typically have one or more of the following characteristics, such as being highly variable, difficult to project, unusual in nature, significant to the results of a particular period or not indicative of past or future operating results. These items are excluded from non-GAAP earnings and related EPS information because the company believes they neither relate to the ordinary course of the company’s business nor reflect the company’s underlying business performance. Similar charges or gains were recognized in prior periods and will likely reoccur in future periods, including amortization of acquired intangible assets, including product rights that generate a significant portion of our ongoing revenue and will recur until the intangible assets are fully amortized, unwind of inventory fair value adjustments, acquisition and integration expenses, restructuring costs, accelerated depreciation and impairment of property, plant and equipment and intangible assets, R&D charges or other income resulting from upfront or contingent milestone payments in connection with the acquisition or licensing of third-party intellectual property rights, divestiture gains or losses, stock compensation resulting from accelerated vesting of Celgene awards, certain retention-related employee compensation charges related to the Celgene transaction, pension, legal and other contractual settlement charges, equity investment and contingent value rights fair value adjustments (including fair value adjustments attributed to limited partnership equity method investments beginning in 2021) and amortization of fair value adjustments of debt acquired from Celgene in our 2019 exchange offer, among other items. Certain other significant tax items are also excluded such as the impact resulting from internal transfer of intangible assets and the Otezla* divestiture in the second quarter 2020. Deferred and current income taxes attributed to these items are also adjusted for considering their individual impact to the overall tax expense, deductibility and jurisdictional tax rates.

Because the non-GAAP financial measures are not calculated in accordance with GAAP, they should not be considered superior to and are not intended to be considered in isolation or as a substitute for the related financial measures presented in the press release that are prepared in accordance with GAAP and may not be the same as or comparable to similarly titled measures presented by other companies due to possible differences in method and in the items being adjusted. We encourage investors to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure.

Reconciliations of the non-GAAP financial measures to the most comparable GAAP measures are provided in the accompanying financial tables and also available on the company’s website at www.bms.com. Within the attached financial tables presented, certain columns and rows may not add due to the use of rounded numbers. Percentages and earnings per share amounts presented are calculated from the underlying amounts.

11

Website Information

We routinely post important information for investors on our website, BMS.com, in the “Investors” section. We may use this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. We may also use social media channels to communicate with our investors and the public about our company, our products and other matters, and those communications could be deemed to be material information. The information contained on, or that may be accessed through, our website or social media channels are not incorporated by reference into, and are not a part of, this document.

Cautionary Statement Regarding Forward-Looking Statements

This earnings release and the related attachments (as well as the oral statements made with respect to information contained in this release and the attachments) contain certain “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, statements relating to goals, plans and projections regarding the company’s financial position, results of operations, market position, product development and business strategy. These statements may be identified by the fact they use words such as “should,” “could,” “expect,” “anticipate,” “estimate,” “target,” “may,” “project,” “guidance,” “intend,” “plan,” “believe,” “will” and other words and terms of similar meaning and expression in connection with any discussion of future operating or financial performance, although not all forward-looking statements contain such terms. One can also identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements are likely to relate to, among other things, the company’s ability to execute successfully its strategic plans, including its business development strategy generally and in relation to its ability to realize the projected benefits of the Celgene Acquisition and the MyoKardia Acquisition, the full extent of the impact of the COVID-19 pandemic on the company’s operations and the development and commercialization of its products, potential laws and regulations to lower drug costs, market actions taken by private and government payers to manage drug utilization and contain costs, the expiration of patents or data protection on certain products, including assumptions about the company’s ability to retain patent exclusivity of certain products, and the impact and the result of governmental investigations. No forward-looking statement can be guaranteed, including that the company’s future clinical studies will support the data described in this release, product candidates will receive necessary clinical and manufacturing regulatory approvals, pipeline products will prove to be commercially successful, clinical and manufacturing regulatory approvals will be sought or obtained within currently expected timeframes or contractual milestones will be achieved.

Such forward-looking statements are based on historical performance and current expectations and projections about the company’s future financial results, goals, plans and objectives and involve inherent risks, assumptions and uncertainties, including internal or external factors that could delay, divert or change any of them in the next several years, that are difficult to predict, may be beyond the company’s control and could cause the company’s future financial results, goals, plans and objectives to differ materially from those expressed in, or implied by, the statements. Such risks, uncertainties and other matters include, but are not limited to, risks relating to various risks related to public health outbreaks, epidemics and pandemics, including the impact of the COVID-19 pandemic on the company’s operations and that the company cannot reasonably assess or predict at this time the full extent of the adverse effect that the COVID-19 pandemic will have on its business, financial condition, results of operations and cash flows; increasing pricing pressures from market access, pharmaceutical pricing controls and discounting, changes to tax and importation laws and other restrictions in the United States, the European Union and other regions around the

12

world that result in lower prices, lower reimbursement rates and smaller populations for whom payers will reimburse; challenges inherent in new product development, including obtaining and maintaining regulatory approval; the company’s ability to obtain and protect market exclusivity rights and enforce patents and other intellectual property rights; the possibility of difficulties and delays in product introduction and commercialization; the risk of certain novel approaches to disease treatment (such as CAR T therapy); industry competition from other manufacturers; potential difficulties, delays and disruptions in manufacturing, distribution or sale of products, including without limitation, interruptions caused by damage to the company’s and the company’s suppliers’ manufacturing sites; the impact of integrating the company’s and Celgene’s business and operations, including with respect to human capital management, portfolio rationalization, finance and accounting systems, sales operations and product distribution, pricing systems and methodologies, data security systems, compliance programs and internal controls processes, on the company’s ability to realize the anticipated benefits from the Celgene Acquisition; the risk of an adverse patent litigation decision or settlement and exposure to other litigation and/or regulatory actions; the impact of any healthcare reform and legislation or regulatory action in the United States and international markets; changes in tax law and regulations; the failure of the company’s suppliers, vendors, outsourcing partners, alliance partners and other third parties to meet their contractual, regulatory and other obligations; regulatory decisions impacting labeling, manufacturing processes and/or other matters; the impact on the company’s competitive position from counterfeit or unregistered versions of its products or stolen products; the adverse impact of cyber-attacks on the company’s information systems or products, including unauthorized disclosure of trade secrets or other confidential data stored in the company’s information systems and networks; the company’s ability to execute its financial, strategic and operational plans; the company’s ability to identify potential strategic acquisitions, licensing opportunities or other beneficial transactions; the company’s dependency on several key products; any decline in the company’s future royalty streams; the company’s ability to effectively manage acquisitions, divestitures, alliances and other portfolio actions and to successfully realize the expected benefits of such actions; the company’s ability to attract and retain key personnel; the impact of the company’s significant additional indebtedness that it incurred in connection with the Celgene Acquisition and the MyoKardia Acquisition and its issuance of additional shares in connection with the Celgene Acquisition on its ability to operate the combined company; political and financial instability of international economies and sovereign risk; interest rate and currency exchange rate fluctuations, credit and foreign exchange risk management; the impact of our exclusive forum provision in our by-laws for certain lawsuits on our stockholders’ ability to obtain a judicial forum that it finds favorable for such lawsuits; and issuance of new or revised accounting standards. In addition, the financial guidance provided in this release relies on assumptions about the duration and severity of the COVID-19 pandemic, timing of the return to a more stable business environment, patient and physician behaviors, buying patterns and clinical trial activities (together, the “Recovery Process”), among other things. If the actual Recovery Process differs materially from our assumptions, the impact of COVID-19 on our business could be worse than expected and our results may be negatively impacted.

13

Forward-looking statements in this earnings release should be evaluated together with the many risks and uncertainties that affect the company’s business and market, particularly those identified in the cautionary statement and risk factors discussion in the company’s Annual Report on Form 10-K for the year ended December 31, 2020, as updated by the company’s subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the Securities and Exchange Commission. The forward-looking statements included in this document are made only as of the date of this document and except as otherwise required by applicable law, the company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise.

14

BRISTOL-MYERS SQUIBB COMPANY

PRODUCT REVENUES

FOR THE THREE MONTHS ENDED JUNE 30, 2021 AND 2020

(Unaudited, dollars in millions)

| Worldwide Revenues | U.S. Revenues(b) | ||||||||||||||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | ||||||||||||||||||||||||||||||

| Prioritized Brands | |||||||||||||||||||||||||||||||||||

| Revlimid | $ | 3,202 | $ | 2,884 | 11 | % | $ | 2,164 | $ | 2,048 | 6 | % | |||||||||||||||||||||||

| Eliquis | 2,792 | 2,163 | 29 | % | 1,722 | 1,363 | 26 | % | |||||||||||||||||||||||||||

| Opdivo | 1,910 | 1,653 | 16 | % | 1,076 | 956 | 13 | % | |||||||||||||||||||||||||||

| Orencia | 814 | 750 | 9 | % | 593 | 554 | 7 | % | |||||||||||||||||||||||||||

| Pomalyst/Imnovid | 854 | 745 | 15 | % | 567 | 522 | 9 | % | |||||||||||||||||||||||||||

| Sprycel | 541 | 511 | 6 | % | 325 | 308 | 6 | % | |||||||||||||||||||||||||||

| Yervoy | 510 | 369 | 38 | % | 328 | 254 | 29 | % | |||||||||||||||||||||||||||

| Abraxane | 296 | 308 | (4) | % | 234 | 218 | 7 | % | |||||||||||||||||||||||||||

| Empliciti | 86 | 97 | (11) | % | 51 | 59 | (14) | % | |||||||||||||||||||||||||||

| Reblozyl | 128 | 55 | ** | 110 | 55 | 100 | % | ||||||||||||||||||||||||||||

| Inrebic | 16 | 15 | 7 | % | 15 | 15 | — | ||||||||||||||||||||||||||||

| Onureg | 12 | — | N/A | 12 | — | N/A | |||||||||||||||||||||||||||||

| Zeposia | 28 | 1 | ** | 20 | 1 | ** | |||||||||||||||||||||||||||||

| Breyanzi | 17 | — | N/A | 17 | — | N/A | |||||||||||||||||||||||||||||

| Abecma | 24 | — | N/A | 24 | — | N/A | |||||||||||||||||||||||||||||

| Established Brands | |||||||||||||||||||||||||||||||||||

| Vidaza | 45 | 126 | (64) | % | 2 | — | N/A | ||||||||||||||||||||||||||||

| Baraclude | 109 | 121 | (10) | % | 2 | 3 | (33) | % | |||||||||||||||||||||||||||

Other Brands(a) | 319 | 331 | (4) | % | 126 | 131 | (4) | % | |||||||||||||||||||||||||||

| Total | $ | 11,703 | $ | 10,129 | 16 | % | $ | 7,388 | $ | 6,487 | 14 | % | |||||||||||||||||||||||

** In excess of +/- 100%

(a) Includes products that have lost exclusivity in major markets, over-the-counter (OTC) brands and royalty revenue.

(b) Includes Puerto Rico.

15

BRISTOL-MYERS SQUIBB COMPANY

PRODUCT REVENUES

FOR THE SIX MONTHS ENDED JUNE 30, 2021 AND 2020

(Unaudited, dollars in millions)

| Worldwide Revenues | U.S. Revenues(b) | ||||||||||||||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | ||||||||||||||||||||||||||||||

| Prioritized Brands | |||||||||||||||||||||||||||||||||||

| Revlimid | $ | 6,146 | $ | 5,799 | 6 | % | $ | 4,122 | $ | 4,014 | 3 | % | |||||||||||||||||||||||

| Eliquis | 5,678 | 4,804 | 18 | % | 3,645 | 3,140 | 16 | % | |||||||||||||||||||||||||||

| Opdivo | 3,630 | 3,419 | 6 | % | 2,020 | 1,964 | 3 | % | |||||||||||||||||||||||||||

| Orencia | 1,572 | 1,464 | 7 | % | 1,129 | 1,054 | 7 | % | |||||||||||||||||||||||||||

| Pomalyst/Imnovid | 1,627 | 1,458 | 12 | % | 1,079 | 1,011 | 7 | % | |||||||||||||||||||||||||||

| Sprycel | 1,011 | 1,032 | (2) | % | 600 | 608 | (1) | % | |||||||||||||||||||||||||||

| Yervoy | 966 | 765 | 26 | % | 622 | 511 | 22 | % | |||||||||||||||||||||||||||

| Abraxane | 610 | 608 | — | 459 | 423 | 9 | % | ||||||||||||||||||||||||||||

| Empliciti | 171 | 194 | (12) | % | 102 | 118 | (14) | % | |||||||||||||||||||||||||||

| Reblozyl | 240 | 63 | ** | 208 | 63 | ** | |||||||||||||||||||||||||||||

| Inrebic | 32 | 27 | 19 | % | 30 | 27 | 11 | % | |||||||||||||||||||||||||||

| Onureg | 27 | — | N/A | 26 | — | N/A | |||||||||||||||||||||||||||||

| Zeposia | 46 | 1 | ** | 33 | 1 | ** | |||||||||||||||||||||||||||||

| Breyanzi | 17 | — | N/A | 17 | — | N/A | |||||||||||||||||||||||||||||

| Abecma | 24 | — | N/A | 24 | — | N/A | |||||||||||||||||||||||||||||

| Established Brands | |||||||||||||||||||||||||||||||||||

| Vidaza | 99 | 284 | (65) | % | 7 | 2 | ** | ||||||||||||||||||||||||||||

| Baraclude | 222 | 243 | (9) | % | 6 | 6 | — | ||||||||||||||||||||||||||||

Other Brands(a) | 658 | 749 | (12) | % | 269 | 311 | (14) | % | |||||||||||||||||||||||||||

| Total | $ | 22,776 | $ | 20,910 | 9 | % | $ | 14,398 | $ | 13,253 | 9 | % | |||||||||||||||||||||||

** In excess of +/- 100%

(a) Includes products that have lost exclusivity in major markets, over-the-counter (OTC) brands and royalty revenue.

(b) Includes Puerto Rico.

16

BRISTOL-MYERS SQUIBB COMPANY

CONSOLIDATED STATEMENTS OF EARNINGS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2021 AND 2020

(Unaudited, dollars and shares in millions except per share data)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Net product sales | $ | 11,405 | $ | 9,817 | $ | 22,203 | $ | 20,358 | |||||||||||||||

| Alliance and other revenues | 298 | 312 | 573 | 552 | |||||||||||||||||||

| Total Revenues | 11,703 | 10,129 | 22,776 | 20,910 | |||||||||||||||||||

Cost of products sold(a) | 2,452 | 2,699 | 5,293 | 6,361 | |||||||||||||||||||

| Marketing, selling and administrative | 1,882 | 1,628 | 3,548 | 3,234 | |||||||||||||||||||

| Research and development | 3,271 | 2,522 | 5,496 | 4,894 | |||||||||||||||||||

| Amortization of acquired intangible assets | 2,547 | 2,389 | 5,060 | 4,671 | |||||||||||||||||||

| Other (income)/expense, net | (2) | (736) | (704) | 427 | |||||||||||||||||||

| Total Expenses | 10,150 | 8,502 | 18,693 | 19,587 | |||||||||||||||||||

| Earnings Before Income Taxes | 1,553 | 1,627 | 4,083 | 1,323 | |||||||||||||||||||

| Provision for Income Taxes | 492 | 1,707 | 993 | 2,169 | |||||||||||||||||||

| Net Earnings/(Loss) | 1,061 | (80) | 3,090 | (846) | |||||||||||||||||||

| Noncontrolling Interest | 6 | 5 | 14 | 14 | |||||||||||||||||||

| Net Earnings/(Loss) Attributable to BMS | $ | 1,055 | $ | (85) | $ | 3,076 | $ | (860) | |||||||||||||||

| Weighted-Average Common Shares Outstanding: | |||||||||||||||||||||||

| Basic | 2,227 | 2,263 | 2,232 | 2,261 | |||||||||||||||||||

| Diluted | 2,252 | 2,263 | 2,258 | 2,261 | |||||||||||||||||||

| Earnings/(Loss) per Common Share: | |||||||||||||||||||||||

| Basic | $ | 0.47 | $ | (0.04) | $ | 1.38 | $ | (0.38) | |||||||||||||||

| Diluted | 0.47 | (0.04) | 1.36 | (0.38) | |||||||||||||||||||

| Other (income)/expense, net | |||||||||||||||||||||||

Interest expense(b) | $ | 330 | $ | 357 | $ | 683 | $ | 719 | |||||||||||||||

| Contingent consideration | — | (165) | (510) | 391 | |||||||||||||||||||

| Royalties and licensing income | (405) | (311) | (772) | (721) | |||||||||||||||||||

| Equity investment gains | (148) | (818) | (749) | (480) | |||||||||||||||||||

| Integration expenses | 152 | 166 | 293 | 340 | |||||||||||||||||||

| Provision for restructuring | 78 | 115 | 123 | 275 | |||||||||||||||||||

| Litigation and other settlements | 44 | (1) | 36 | 31 | |||||||||||||||||||

| Transition and other service fees | (22) | (50) | (37) | (111) | |||||||||||||||||||

| Investment income | (12) | (25) | (21) | (86) | |||||||||||||||||||

| Reversion excise tax | — | — | — | 76 | |||||||||||||||||||

| Divestiture (gains)/losses | (11) | 9 | (11) | (7) | |||||||||||||||||||

| Intangible asset impairment | — | 21 | — | 21 | |||||||||||||||||||

| Loss on debt redemption | — | — | 281 | — | |||||||||||||||||||

| Other | (8) | (34) | (20) | (21) | |||||||||||||||||||

| Other (income)/expense, net | $ | (2) | $ | (736) | $ | (704) | $ | 427 | |||||||||||||||

(a) Excludes amortization of acquired intangible assets.

(b) Includes amortization of purchase price adjustments to Celgene debt.

17

BRISTOL-MYERS SQUIBB COMPANY

SPECIFIED ITEMS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2021 AND 2020

(Unaudited, dollars in millions)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Inventory purchase price accounting adjustments | $ | 88 | $ | 714 | $ | 167 | $ | 2,134 | |||||||||||||||

| Intangible asset impairment | — | — | 315 | — | |||||||||||||||||||

| Employee compensation charges | — | 1 | — | 3 | |||||||||||||||||||

| Site exit and other costs | 1 | 13 | 24 | 29 | |||||||||||||||||||

| Cost of products sold | 89 | 728 | 506 | 2,166 | |||||||||||||||||||

| Employee compensation charges | 1 | 12 | 1 | 27 | |||||||||||||||||||

| Site exit and other costs | — | (1) | (1) | 5 | |||||||||||||||||||

| Marketing, selling and administrative | 1 | 11 | — | 32 | |||||||||||||||||||

| License and asset acquisition charges | 780 | 300 | 780 | 325 | |||||||||||||||||||

| IPRD impairments | 230 | — | 230 | — | |||||||||||||||||||

| Inventory purchase price accounting adjustments | — | — | — | 17 | |||||||||||||||||||

| Employee compensation charges | — | 15 | 1 | 33 | |||||||||||||||||||

| Site exit and other costs | — | 39 | — | 95 | |||||||||||||||||||

| Research and development | 1,010 | 354 | 1,011 | 470 | |||||||||||||||||||

| Amortization of acquired intangible assets | 2,547 | 2,389 | 5,060 | 4,671 | |||||||||||||||||||

Interest expense(a) | (28) | (41) | (62) | (82) | |||||||||||||||||||

| Contingent consideration | — | (165) | (510) | 391 | |||||||||||||||||||

| Royalties and licensing income | (15) | (18) | (29) | (101) | |||||||||||||||||||

| Equity investment gains | (154) | (818) | (762) | (479) | |||||||||||||||||||

| Integration expenses | 152 | 166 | 293 | 340 | |||||||||||||||||||

| Provision for restructuring | 78 | 115 | 123 | 275 | |||||||||||||||||||

| Reversion excise tax | — | — | — | 76 | |||||||||||||||||||

| Divestiture (gains)/losses | (11) | 9 | (11) | (7) | |||||||||||||||||||

| Loss on debt redemption | — | — | 281 | — | |||||||||||||||||||

| Other (income)/expense, net | 22 | (752) | (677) | 413 | |||||||||||||||||||

| Increase to pretax income | 3,669 | 2,730 | 5,900 | 7,752 | |||||||||||||||||||

| Income taxes on items above | (388) | (3) | (688) | (294) | |||||||||||||||||||

Income taxes attributed to Otezla® divestiture | — | 255 | — | 255 | |||||||||||||||||||

| Income taxes attributed to internal transfer of intangible assets | — | 853 | — | 853 | |||||||||||||||||||

| Income taxes | (388) | 1,105 | (688) | 814 | |||||||||||||||||||

| Increase to net earnings | $ | 3,281 | $ | 3,835 | $ | 5,212 | $ | 8,566 | |||||||||||||||

(a) Includes amortization of purchase price adjustments to Celgene debt.

18

BRISTOL-MYERS SQUIBB COMPANY

RECONCILIATION OF CERTAIN GAAP LINE ITEMS TO CERTAIN NON-GAAP LINE ITEMS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2021 AND 2020

(Unaudited, dollars and shares in millions except per share data)

| Three Months Ended June 30, 2021 | Six Months Ended June 30, 2021 | ||||||||||||||||||||||||||||||||||

| GAAP | Specified Items(a) | Non-GAAP | GAAP | Specified Items(a) | Non-GAAP | ||||||||||||||||||||||||||||||

| Gross Profit | $ | 9,251 | $ | 89 | $ | 9,340 | $ | 17,483 | $ | 506 | $ | 17,989 | |||||||||||||||||||||||

| Marketing, selling and administrative | 1,882 | (1) | 1,881 | 3,548 | — | 3,548 | |||||||||||||||||||||||||||||

| Research and development | 3,271 | (1,010) | 2,261 | 5,496 | (1,011) | 4,485 | |||||||||||||||||||||||||||||

| Amortization of acquired intangible assets | 2,547 | (2,547) | — | 5,060 | (5,060) | — | |||||||||||||||||||||||||||||

| Other (income)/expense, net | (2) | (22) | (24) | (704) | 677 | (27) | |||||||||||||||||||||||||||||

| Earnings Before Income Taxes | 1,553 | 3,669 | 5,222 | 4,083 | 5,900 | 9,983 | |||||||||||||||||||||||||||||

| Provision for Income Taxes | 492 | 388 | 880 | 993 | 688 | 1,681 | |||||||||||||||||||||||||||||

| Noncontrolling interest | 6 | — | 6 | 14 | — | 14 | |||||||||||||||||||||||||||||

| Net Earnings Attributable to BMS used for Diluted EPS Calculation | $ | 1,055 | $ | 3,281 | $ | 4,336 | $ | 3,076 | $ | 5,212 | $ | 8,288 | |||||||||||||||||||||||

| Weighted-Average Common Shares Outstanding - Diluted | 2,252 | 2,252 | 2,252 | 2,258 | 2,258 | 2,258 | |||||||||||||||||||||||||||||

| Diluted Earnings Per Share | $ | 0.47 | $ | 1.46 | $ | 1.93 | $ | 1.36 | $ | 2.31 | $ | 3.67 | |||||||||||||||||||||||

| Effective Tax Rate | 31.7 | % | (14.8) | % | 16.9 | % | 24.3 | % | (7.5) | % | 16.8 | % | |||||||||||||||||||||||

| Three Months Ended June 30, 2020 | Six Months Ended June 30, 2020 | ||||||||||||||||||||||||||||||||||

| GAAP | Specified Items(a) | Non-GAAP | GAAP | Specified Items(a) | Non-GAAP | ||||||||||||||||||||||||||||||

| Gross Profit | $ | 7,430 | $ | 728 | $ | 8,158 | $ | 14,549 | $ | 2,166 | $ | 16,715 | |||||||||||||||||||||||

| Marketing, selling and administrative | 1,628 | (11) | 1,617 | 3,234 | (32) | 3,202 | |||||||||||||||||||||||||||||

| Research and development | 2,522 | (354) | 2,168 | 4,894 | (470) | 4,424 | |||||||||||||||||||||||||||||

| Amortization of acquired intangible assets | 2,389 | (2,389) | — | 4,671 | (4,671) | — | |||||||||||||||||||||||||||||

| Other (income)/expense, net | (736) | 752 | 16 | 427 | (413) | 14 | |||||||||||||||||||||||||||||

| Earnings Before Income Taxes | 1,627 | 2,730 | 4,357 | 1,323 | 7,752 | 9,075 | |||||||||||||||||||||||||||||

| Provision for Income Taxes | 1,707 | (1,105) | 602 | 2,169 | (814) | 1,355 | |||||||||||||||||||||||||||||

| Noncontrolling interest | 5 | — | 5 | 14 | — | 14 | |||||||||||||||||||||||||||||

| Net (Loss)/Earnings Attributable to BMS used for Diluted EPS Calculation | $ | (85) | $ | 3,835 | $ | 3,750 | $ | (860) | $ | 8,566 | $ | 7,706 | |||||||||||||||||||||||

| Weighted-Average Common Shares Outstanding - Diluted | 2,263 | 2,297 | 2,297 | 2,261 | 2,298 | 2,298 | |||||||||||||||||||||||||||||

| Diluted (Loss)/Earnings Per Share | $ | (0.04) | $ | 1.67 | $ | 1.63 | $ | (0.38) | $ | 3.73 | $ | 3.35 | |||||||||||||||||||||||

| Effective Tax Rate | 104.9 | % | (91.1) | % | 13.8 | % | 163.9 | % | (149.0) | % | 14.9 | % | |||||||||||||||||||||||

(a) Refer to the Specified Items schedule for further details. Effective tax rate on the Specified Items represents the difference between the GAAP and Non-GAAP effective tax rate.

19

BRISTOL-MYERS SQUIBB COMPANY

NET DEBT CALCULATION

AS OF JUNE 30, 2021 AND DECEMBER 31, 2020

(Unaudited, dollars in millions)

| June 30, 2021 | December 31, 2020 | ||||||||||

| Cash and cash equivalents | $ | 11,024 | $ | 14,546 | |||||||

| Marketable debt securities - current | 1,946 | 1,285 | |||||||||

| Marketable debt securities - non-current | 143 | 433 | |||||||||

| Cash, cash equivalents and marketable debt securities | 13,113 | 16,264 | |||||||||

| Short-term debt obligations | (2,655) | (2,340) | |||||||||

| Long-term debt | (42,503) | (48,336) | |||||||||

| Net debt position | $ | (32,045) | $ | (34,412) | |||||||

20

Media:

media@bms.com

Investor Relations:

Tim Power, 609-252-7509, timothy.power@bms.com;

Nina Goworek, 908-673-9711, nina.goworek@bms.com.

21

Exhibit 99.2

BRISTOL-MYERS SQUIBB COMPANY

QUARTERLY TREND ANALYSIS OF REVENUES

(Unaudited, dollars in millions)

| Revenues | 2020 | 2021 | % Change | FX Impact(b) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | Qtr vs. Qtr | YTD vs. YTD | Qtr vs. Qtr | YTD vs. YTD | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| United States | $ | 6,766 | $ | 6,487 | $ | 13,253 | $ | 6,542 | $ | 19,795 | $ | 6,782 | $ | 26,577 | $ | 7,010 | $ | 7,388 | $ | 14,398 | 14% | 9% | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | 2,567 | 2,136 | 4,703 | 2,453 | 7,156 | 2,697 | 9,853 | 2,553 | 2,689 | 5,242 | 26% | 11% | 10% | 9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rest of the World | 1,335 | 1,334 | 2,669 | 1,361 | 4,030 | 1,427 | 5,457 | 1,346 | 1,435 | 2,781 | 8% | 4% | 4% | 3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other(a) | 113 | 172 | 285 | 184 | 469 | 162 | 631 | 164 | 191 | 355 | 11% | 25% | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 10,781 | $ | 10,129 | $ | 20,910 | $ | 10,540 | $ | 31,450 | $ | 11,068 | $ | 42,518 | $ | 11,073 | $ | 11,703 | $ | 22,776 | 16% | 9% | 3% | 2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| % of Revenues | 2020 | 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| United States | 62.8 | % | 64.0 | % | 63.4 | % | 62.1 | % | 62.9 | % | 61.3 | % | 62.5 | % | 63.3 | % | 63.1 | % | 63.2 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | 23.8 | % | 21.1 | % | 22.5 | % | 23.3 | % | 22.8 | % | 24.4 | % | 23.2 | % | 23.1 | % | 23.0 | % | 23.0 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rest of the World | 12.4 | % | 13.2 | % | 12.8 | % | 12.9 | % | 12.8 | % | 12.9 | % | 12.8 | % | 12.2 | % | 12.3 | % | 12.2 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 1.0 | % | 1.7 | % | 1.3 | % | 1.7 | % | 1.5 | % | 1.4 | % | 1.5 | % | 1.4 | % | 1.6 | % | 1.6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) Other revenues include royalties and alliance-related revenues for products not sold by our regional commercial organizations.

(b) Foreign exchange impacts were derived by converting our current-period local currency financial results using the prior period average currency rates and comparing these adjusted amounts to our current-period results.

1

BRISTOL-MYERS SQUIBB COMPANY

EARNINGS FROM OPERATIONS

(Unaudited, dollars and shares in millions except per share data)

| 2020 | 2021 | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | Qtr vs. Qtr | YTD vs. YTD | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net product sales | $ | 10,541 | $ | 9,817 | $ | 20,358 | $ | 10,197 | $ | 30,555 | $ | 10,766 | $ | 41,321 | $ | 10,798 | $ | 11,405 | $ | 22,203 | 16% | 9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alliance and other revenues | 240 | 312 | 552 | 343 | 895 | 302 | 1,197 | 275 | 298 | 573 | (4)% | 4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Revenues | 10,781 | 10,129 | 20,910 | 10,540 | 31,450 | 11,068 | 42,518 | 11,073 | 11,703 | 22,776 | 16% | 9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Cost of products sold(a) | 3,662 | 2,699 | 6,361 | 2,502 | 8,863 | 2,910 | 11,773 | 2,841 | 2,452 | 5,293 | (9)% | (17)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marketing, selling and administrative | 1,606 | 1,628 | 3,234 | 1,706 | 4,940 | 2,721 | 7,661 | 1,666 | 1,882 | 3,548 | 16% | 10% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Research and development | 2,372 | 2,522 | 4,894 | 2,499 | 7,393 | 3,750 | 11,143 | 2,225 | 3,271 | 5,496 | 30% | 12% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IPRD charge - MyoKardia acquisition | — | — | — | — | — | 11,438 | 11,438 | — | — | — | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of acquired intangible assets | 2,282 | 2,389 | 4,671 | 2,491 | 7,162 | 2,526 | 9,688 | 2,513 | 2,547 | 5,060 | 7% | 8% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other (income)/expense, net | 1,163 | (736) | 427 | (915) | (488) | (1,826) | (2,314) | (702) | (2) | (704) | (100)% | ** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Expenses | 11,085 | 8,502 | 19,587 | 8,283 | 27,870 | 21,519 | 49,389 | 8,543 | 10,150 | 18,693 | 19% | (5)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Earnings/(Loss) Before Income Taxes | (304) | 1,627 | 1,323 | 2,257 | 3,580 | (10,451) | (6,871) | 2,530 | 1,553 | 4,083 | (5)% | ** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision/(Benefit) for Income Taxes | 462 | 1,707 | 2,169 | 379 | 2,548 | (424) | 2,124 | 501 | 492 | 993 | (71)% | (54)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Earnings/(Loss) | (766) | (80) | (846) | 1,878 | 1,032 | (10,027) | (8,995) | 2,029 | 1,061 | 3,090 | ** | ** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noncontrolling Interest | 9 | 5 | 14 | 6 | 20 | — | 20 | 8 | 6 | 14 | 20% | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Earnings/(Loss) Attributable to BMS | $ | (775) | $ | (85) | $ | (860) | $ | 1,872 | $ | 1,012 | $ | (10,027) | $ | (9,015) | $ | 2,021 | $ | 1,055 | $ | 3,076 | ** | ** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted Earnings/(Loss) per Common Share* | $ | (0.34) | $ | (0.04) | $ | (0.38) | $ | 0.82 | $ | 0.44 | $ | (4.45) | $ | (3.99) | $ | 0.89 | $ | 0.47 | $ | 1.36 | ** | ** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Weighted-Average Common Shares Outstanding - Diluted | 2,258 | 2,263 | 2,261 | 2,290 | 2,295 | 2,252 | 2,258 | 2,265 | 2,252 | 2,258 | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared per common share | $ | 0.45 | $ | 0.45 | $ | 0.90 | $ | 0.45 | $ | 1.35 | $ | 0.49 | $ | 1.84 | $ | 0.49 | $ | 0.49 | $ | 0.98 | 9% | 9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| % of Total Revenues | 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross Margin | 66.0 | % | 73.4 | % | 69.6 | % | 76.3 | % | 71.8 | % | 73.7 | % | 72.3 | % | 74.3 | % | 79.0 | % | 76.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Ratios | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Effective tax rate | (152.0) | % | 104.9 | % | 163.9 | % | 16.8 | % | 71.2 | % | 4.1 | % | (30.9) | % | 19.8 | % | 31.7 | % | 24.3 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other (income)/expense, net | 2020 | 2021 | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | Qtr vs. Qtr | YTD vs. YTD | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest expense(b) | $ | 362 | $ | 357 | $ | 719 | $ | 346 | $ | 1,065 | $ | 355 | $ | 1,420 | $ | 353 | $ | 330 | $ | 683 | (8)% | (5)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Contingent consideration | 556 | (165) | 391 | (988) | (597) | (1,160) | (1,757) | (510) | — | (510) | (100)% | ** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Royalties and licensing income | (410) | (311) | (721) | (403) | (1,124) | (403) | (1,527) | (367) | (405) | (772) | 30% | 7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity investment (gains)/losses | 338 | (818) | (480) | (244) | (724) | (504) | (1,228) | (601) | (148) | (749) | (82)% | 56% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Integration expenses | 174 | 166 | 340 | 195 | 535 | 182 | 717 | 141 | 152 | 293 | (8)% | (14)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for restructuring | 160 | 115 | 275 | 176 | 451 | 79 | 530 | 45 | 78 | 123 | (32)% | (55)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Litigation and other settlements | 32 | (1) | 31 | 10 | 41 | (235) | (194) | (8) | 44 | 36 | ** | 16% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Transition and other service fees | (61) | (50) | (111) | (18) | (129) | (20) | (149) | (15) | (22) | (37) | (56)% | (67)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment income | (61) | (25) | (86) | (13) | (99) | (22) | (121) | (9) | (12) | (21) | (52)% | (76)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reversion excise tax | 76 | — | 76 | — | 76 | — | 76 | — | — | — | N/A | (100)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Divestiture (gains)/losses | (16) | 9 | (7) | 1 | (6) | (49) | (55) | — | (11) | (11) | ** | 57% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Intangible asset impairment | — | 21 | 21 | — | 21 | — | 21 | — | — | — | (100)% | (100)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loss on debt redemption | — | — | — | — | — | — | — | 281 | — | 281 | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 13 | (34) | (21) | 23 | 2 | (49) | (47) | (12) | (8) | (20) | (76)% | (5)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other (income)/expense, net | $ | 1,163 | $ | (736) | $ | 427 | $ | (915) | $ | (488) | $ | (1,826) | $ | (2,314) | $ | (702) | $ | (2) | $ | (704) | (100)% | ** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

* Quarterly amounts may not add to the year-to-date amounts, as each period is computed on a discrete basis.

** In excess of +/- 100%.

(a) Excludes amortization of acquired intangible assets.

(b) Includes amortization of purchase price adjustments to Celgene debt.

2

BRISTOL-MYERS SQUIBB COMPANY

RECONCILIATION OF GAAP AND NON-GAAP GROWTH DOLLARS AND PERCENTAGES EXCLUDING FOREIGN EXCHANGE IMPACT

FOR THE PERIOD ENDED JUNE 30, 2021

(Unaudited, dollars in millions)

| QUARTER-TO-DATE | 2021 | 2020 | $ Change | % Change | Favorable / (Unfavorable) FX Impact $* | 2021 Excluding FX | Favorable / (Unfavorable) FX Impact %* | % Change Excluding FX | |||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 11,703 | $ | 10,129 | $ | 1,574 | 16 | % | $ | 276 | $ | 11,427 | 3 | % | 13 | % | |||||||||||||||||||||||||||||||

| Gross profit | 9,251 | 7,430 | 1,821 | 25 | % | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||||

Gross profit excluding specified items(a) | 9,340 | 8,158 | 1,182 | 14 | % | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||||

| Gross profit excluding specified items as a % of revenues | 79.8 | % | 80.5 | % | |||||||||||||||||||||||||||||||||||||||||||

| Marketing, selling and administrative | 1,882 | 1,628 | 254 | 16 | % | (38) | 1,844 | (3) | % | 13 | % | ||||||||||||||||||||||||||||||||||||

Marketing, selling and administrative excluding specified items(a) | 1,881 | 1,617 | 264 | 16 | % | (38) | 1,843 | (2) | % | 14 | % | ||||||||||||||||||||||||||||||||||||

| Marketing, selling and administrative excluding specified items as a % of revenues | 16.1 | % | 16.0 | % | |||||||||||||||||||||||||||||||||||||||||||

| Research and development | 3,271 | 2,522 | 749 | 30 | % | (16) | 3,255 | (1) | % | 29 | % | ||||||||||||||||||||||||||||||||||||

Research and development excluding specified items(a) | 2,261 | 2,168 | 93 | 4 | % | (16) | 2,245 | — | 4 | % | |||||||||||||||||||||||||||||||||||||

| Research and development excluding specified items as a % of revenues | 19.3 | % | 21.4 | % | |||||||||||||||||||||||||||||||||||||||||||

| YEAR-TO-DATE | 2021 | 2020 | $ Change | % Change | Favorable / (Unfavorable) FX Impact $* | 2021 Excluding FX | Favorable / (Unfavorable) FX Impact %* | % Change Excluding FX | |||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 22,776 | $ | 20,910 | $ | 1,866 | 9 | % | $ | 499 | $ | 22,277 | 2 | % | 7 | % | |||||||||||||||||||||||||||||||

| Gross profit | 17,483 | 14,549 | 2,934 | 20 | % | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||||

Gross profit excluding specified items(a) | 17,989 | 16,715 | 1,274 | 8 | % | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||||

| Gross profit excluding specified items as a % of revenues | 79.0 | % | 79.9 | % | |||||||||||||||||||||||||||||||||||||||||||

| Marketing, selling and administrative | 3,548 | 3,234 | 314 | 10 | % | (66) | 3,482 | (2) | % | 8 | % | ||||||||||||||||||||||||||||||||||||

Marketing, selling and administrative excluding specified items(a) | 3,548 | 3,202 | 346 | 11 | % | (66) | 3,482 | (2) | % | 9 | % | ||||||||||||||||||||||||||||||||||||

| Marketing, selling and administrative excluding specified items as a % of revenues | 15.6 | % | 15.3 | % | |||||||||||||||||||||||||||||||||||||||||||

| Research and development | 5,496 | 4,894 | 602 | 12 | % | (28) | 5,468 | — | 12 | % | |||||||||||||||||||||||||||||||||||||

Research and development excluding specified items(a) | 4,485 | 4,424 | 61 | 1 | % | (28) | 4,457 | — | 1 | % | |||||||||||||||||||||||||||||||||||||

| Research and development excluding specified items as a % of revenues | 19.7 | % | 21.2 | % | |||||||||||||||||||||||||||||||||||||||||||

* Foreign exchange impacts were derived by converting our current-period local currency financial results using the prior period average currency rates and comparing these adjusted amounts to our current-period results.

(a) Refer to the Specified Items schedule for further details.

3

BRISTOL-MYERS SQUIBB COMPANY

WORLDWIDE REVENUES

QUARTERLY REVENUES TREND ANALYSIS

(Unaudited, dollars in millions)

| 2020 | 2021 | $ Change | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | Qtr vs. Qtr | YTD vs. YTD | Qtr vs. Qtr | YTD vs. YTD | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prioritized Brands | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revlimid | $ | 2,915 | $ | 2,884 | $ | 5,799 | $ | 3,027 | $ | 8,826 | $ | 3,280 | $ | 12,106 | $ | 2,944 | $ | 3,202 | $ | 6,146 | $ | 318 | $ | 347 | 11% | 6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliquis | 2,641 | 2,163 | 4,804 | 2,095 | 6,899 | 2,269 | 9,168 | 2,886 | 2,792 | 5,678 | 629 | 874 | 29% | 18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Opdivo | 1,766 | 1,653 | 3,419 | 1,780 | 5,199 | 1,793 | 6,992 | 1,720 | 1,910 | 3,630 | 257 | 211 | 16% | 6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Orencia | 714 | 750 | 1,464 | 826 | 2,290 | 867 | 3,157 | 758 | 814 | 1,572 | 64 | 108 | 9% | 7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pomalyst/Imnovid | 713 | 745 | 1,458 | 777 | 2,235 | 835 | 3,070 | 773 | 854 | 1,627 | 109 | 169 | 15% | 12% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sprycel | 521 | 511 | 1,032 | 544 | 1,576 | 564 | 2,140 | 470 | 541 | 1,011 | 30 | (21) | 6% | (2)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yervoy | 396 | 369 | 765 | 446 | 1,211 | 471 | 1,682 | 456 | 510 | 966 | 141 | 201 | 38% | 26% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Abraxane | 300 | 308 | 608 | 342 | 950 | 297 | 1,247 | 314 | 296 | 610 | (12) | 2 | (4)% | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Empliciti | 97 | 97 | 194 | 96 | 290 | 91 | 381 | 85 | 86 | 171 | (11) | (23) | (11)% | (12)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reblozyl | 8 | 55 | 63 | 96 | 159 | 115 | 274 | 112 | 128 | 240 | 73 | 177 | ** | ** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inrebic | 12 | 15 | 27 | 13 | 40 | 15 | 55 | 16 | 16 | 32 | 1 | 5 | 7% | 19% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Onureg | — | — | — | 3 | 3 | 14 | 17 | 15 | 12 | 27 | 12 | 27 | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Zeposia | — | 1 | 1 | 2 | 3 | 9 | 12 | 18 | 28 | 46 | 27 | 45 | ** | ** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breyanzi | — | — | — | — | — | — | — | — | 17 | 17 | 17 | 17 | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Abecma | — | — | — | — | — | — | — | — | 24 | 24 | 24 | 24 | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Established Brands | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Vidaza | 158 | 126 | 284 | 106 | 390 | 65 | 455 | 54 | 45 | 99 | (81) | (185) | (64)% | (65)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Baraclude | 122 | 121 | 243 | 100 | 343 | 104 | 447 | 113 | 109 | 222 | (12) | (21) | (10)% | (9)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other Brands(a) | 418 | 331 | 749 | 287 | 1,036 | 279 | 1,315 | 339 | 319 | 658 | (12) | (91) | (4)% | (12)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 10,781 | $ | 10,129 | $ | 20,910 | $ | 10,540 | $ | 31,450 | $ | 11,068 | $ | 42,518 | $ | 11,073 | $ | 11,703 | $ | 22,776 | $ | 1,574 | $ | 1,866 | 16% | 9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

** In excess of +/- 100%.

(a) Includes products that have lost exclusivity in major markets, over-the-counter (OTC) brands and royalty revenue.

4

BRISTOL-MYERS SQUIBB COMPANY

U.S. REVENUES

QUARTERLY REVENUES TREND ANALYSIS

(Unaudited, dollars in millions)

| 2020 | 2021 | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | Qtr vs. Qtr | YTD vs. YTD | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prioritized Brands | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revlimid | $ | 1,966 | $ | 2,048 | $ | 4,014 | $ | 2,080 | $ | 6,094 | $ | 2,197 | $ | 8,291 | $ | 1,958 | $ | 2,164 | $ | 4,122 | 6% | 3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliquis | 1,777 | 1,363 | 3,140 | 1,118 | 4,258 | 1,227 | 5,485 | 1,923 | 1,722 | 3,645 | 26% | 16% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Opdivo | 1,008 | 956 | 1,964 | 1,018 | 2,982 | 963 | 3,945 | 944 | 1,076 | 2,020 | 13% | 3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Orencia | 500 | 554 | 1,054 | 588 | 1,642 | 626 | 2,268 | 536 | 593 | 1,129 | 7% | 7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pomalyst/Imnovid | 489 | 522 | 1,011 | 548 | 1,559 | 577 | 2,136 | 512 | 567 | 1,079 | 9% | 7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sprycel | 300 | 308 | 608 | 336 | 944 | 351 | 1,295 | 275 | 325 | 600 | 6% | (1)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yervoy | 257 | 254 | 511 | 309 | 820 | 304 | 1,124 | 294 | 328 | 622 | 29% | 22% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Abraxane | 205 | 218 | 423 | 236 | 659 | 214 | 873 | 225 | 234 | 459 | 7% | 9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Empliciti | 59 | 59 | 118 | 59 | 177 | 53 | 230 | 51 | 51 | 102 | (14)% | (14)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reblozyl | 8 | 55 | 63 | 92 | 155 | 104 | 259 | 98 | 110 | 208 | 100% | ** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inrebic | 12 | 15 | 27 | 13 | 40 | 15 | 55 | 15 | 15 | 30 | — | 11% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Onureg | — | — | — | 3 | 3 | 14 | 17 | 14 | 12 | 26 | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Zeposia | — | 1 | 1 | 2 | 3 | 7 | 10 | 13 | 20 | 33 | ** | ** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breyanzi | — | — | — | — | — | — | — | — | 17 | 17 | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Abecma | — | — | — | — | — | — | — | — | 24 | 24 | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Established Brands | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Vidaza | 2 | — | 2 | — | 2 | — | 2 | 5 | 2 | 7 | N/A | ** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Baraclude | 3 | 3 | 6 | 3 | 9 | 3 | 12 | 4 | 2 | 6 | (33)% | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other Brands(a) | 180 | 131 | 311 | 137 | 448 | 127 | 575 | 143 | 126 | 269 | (4)% | (14)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total(b) | $ | 6,766 | $ | 6,487 | $ | 13,253 | $ | 6,542 | $ | 19,795 | $ | 6,782 | $ | 26,577 | $ | 7,010 | $ | 7,388 | $ | 14,398 | 14% | 9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

** In excess of +/- 100%.

(a) Includes products that have lost exclusivity in major markets, OTC brands and royalty revenue.

(b) Includes Puerto Rico.

5

BRISTOL-MYERS SQUIBB COMPANY

INTERNATIONAL REVENUES

QUARTERLY REVENUES TREND ANALYSIS

(Unaudited, dollars in millions)

| 2020 | 2021 | % Change(b) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | 1st Qtr | 2nd Qtr | 6 Months | 3rd Qtr | 9 Months | 4th Qtr | Year | Qtr vs. Qtr | YTD vs. YTD | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prioritized Brands | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revlimid | $ | 949 | $ | 836 | $ | 1,785 | $ | 947 | $ | 2,732 | $ | 1,083 | $ | 3,815 | $ | 986 | $ | 1,038 | $ | 2,024 | 24% | 13% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliquis | 864 | 800 | 1,664 | 977 | 2,641 | 1,042 | 3,683 | 963 | 1,070 | 2,033 | 34% | 22% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Opdivo | 758 | 697 | 1,455 | 762 | 2,217 | 830 | 3,047 | 776 | 834 | 1,610 | 20% | 11% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Orencia | 214 | 196 | 410 | 238 | 648 | 241 | 889 | 222 | 221 | 443 | 13% | 8% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pomalyst/Imnovid | 224 | 223 | 447 | 229 | 676 | 258 | 934 | 261 | 287 | 548 | 29% | 23% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sprycel | 221 | 203 | 424 | 208 | 632 | 213 | 845 | 195 | 216 | 411 | 6% | (3)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yervoy | 139 | 115 | 254 | 137 | 391 | 167 | 558 | 162 | 182 | 344 | 58% | 35% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Abraxane | 95 | 90 | 185 | 106 | 291 | 83 | 374 | 89 | 62 | 151 | (31)% | (18)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Empliciti | 38 | 38 | 76 | 37 | 113 | 38 | 151 | 34 | 35 | 69 | (8)% | (9)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reblozyl | — | — | — | 4 | 4 | 11 | 15 | 14 | 18 | 32 | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inrebic | — | — | — | — | — | — | — | 1 | 1 | 2 | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Onureg | — | — | — | — | — | — | — | 1 | — | 1 | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Zeposia | — | — | — | — | — | 2 | 2 | 5 | 8 | 13 | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||