Form 8-K Arcosa, Inc. For: Aug 17

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of Earliest Event Reported): | ||||||||

__________________________________________

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | |||||||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||||||||

Registrant's telephone number, including area code: (972 ) 942-6500

| Not Applicable | ||

| (Former name or former address, if changed since last report) | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Arcosa, Inc. (the “Company”) has updated its presentation materials that management intends to use from time to time in investor presentations about the Company’s operations and performance. The investor presentation is attached as Exhibit 99.1 to this report and is incorporated herein by reference. In addition, the investor presentation will be made available on www.arcosa.com.

The information in Item 7.01 of this report (including Exhibit 99.1) is being furnished and shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing. Additionally, the submission of this Item 7.01 in this report on Form 8-K is not an admission of the materiality of any information in this Item 7.01 of this report that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | ||||

| Arcosa, Inc. Investor Presentation dated August 2022 | |||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Arcosa, Inc. | ||||||||

| (Registrant) | ||||||||

| August 17, 2022 | By: | /s/ Gail M. Peck | ||||||

| Name: Gail M. Peck | ||||||||

| Title: Chief Financial Officer | ||||||||

MOVING INFRASTRUCTURE FORWARD | AUGUST 2022 Investor Presentation Exhibit 99.1

2 I MOVING INFRASTRUCTURE FORWARD I 2022 FORWARD LOOKING STATEMENTS Some statements in this presentation, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Arcosa’s estimates, expectations, beliefs, intentions or strategies for the future. Arcosa uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “outlook,” “strategy,” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this presentation, and Arcosa expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, except as required by federal securities laws. Forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to assumptions, risks and uncertainties regarding the impact of the COVID-19 pandemic on Arcosa’s customer demand for Arcosa’s products and services, Arcosa’s supply chain, Arcosa’s employees ability to work because of COVID-19 related illness, the health and safety of our employees, the effect of governmental regulations imposed in response to the COVID-19 pandemic; assumptions, risks and uncertainties regarding achievement of the expected benefits of Arcosa’s spin-off from Trinity; tax treatment of the spin-off; failure to successfully integrate acquisitions or divest any business, or failure to achieve the expected benefit of acquisitions or divestitures; market conditions and customer demand for Arcosa’s business products and services; the cyclical nature of, and seasonal or weather impact on, the industries in which Arcosa competes; competition and other competitive factors; governmental and regulatory factors; changing technologies; availability of growth opportunities; market recovery; ability to improve margins; the impact of inflation and costs of materials; and Arcosa’s ability to execute its long-term strategy, and such forward-looking statements are not guarantees of future performance. For further discussion of such risks and uncertainties, see "Risk Factors" and the "Forward-Looking Statements" section of "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Arcosa's Form 10-K for the year-ended December 31, 2021, and as may be revised and updated by Arcosa's Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. NON-GAAP FINANCIAL MEASURES This presentation contains financial measures that have not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Reconciliations of non- GAAP financial measures to the closest GAAP measure are provided in the Appendix.

01 03 04 COMPANY OVERVIEW 2022 OUTLOOK ESG UPDATE 02 RECENT FINANCIAL HIGHLIGHTS TABLE OF CONTENTS 3 I MOVING INFRASTRUCTURE FORWARD I 2022

HOW TO FIND US OUR WEBSITE www.arcosa.com NYSE TICKER ACA HEADQUARTERS Arcosa, Inc. 500 North Akard Street, Suite 400 Dallas, TX 75201 INVESTOR CONTACT [email protected] 4 I MOVING INFRASTRUCTURE FORWARD I 2022

COMPANY OVERVIEW 01

ARCOSA’S VALUE PROPOSITION HEALTHY BALANCE sheet and ample liquidity to navigate cycles and pursue strategic growth EXPERIENCED management team with history of managing through economic cycles LEADING businesses serving critical infrastructure markets TRACK RECORD of executing on strategic priorities as an independent public company DISCIPLINED CAPITAL allocation process to grow in attractive markets and improve returns on capital 6 I MOVING INFRASTRUCTURE FORWARD I 2022

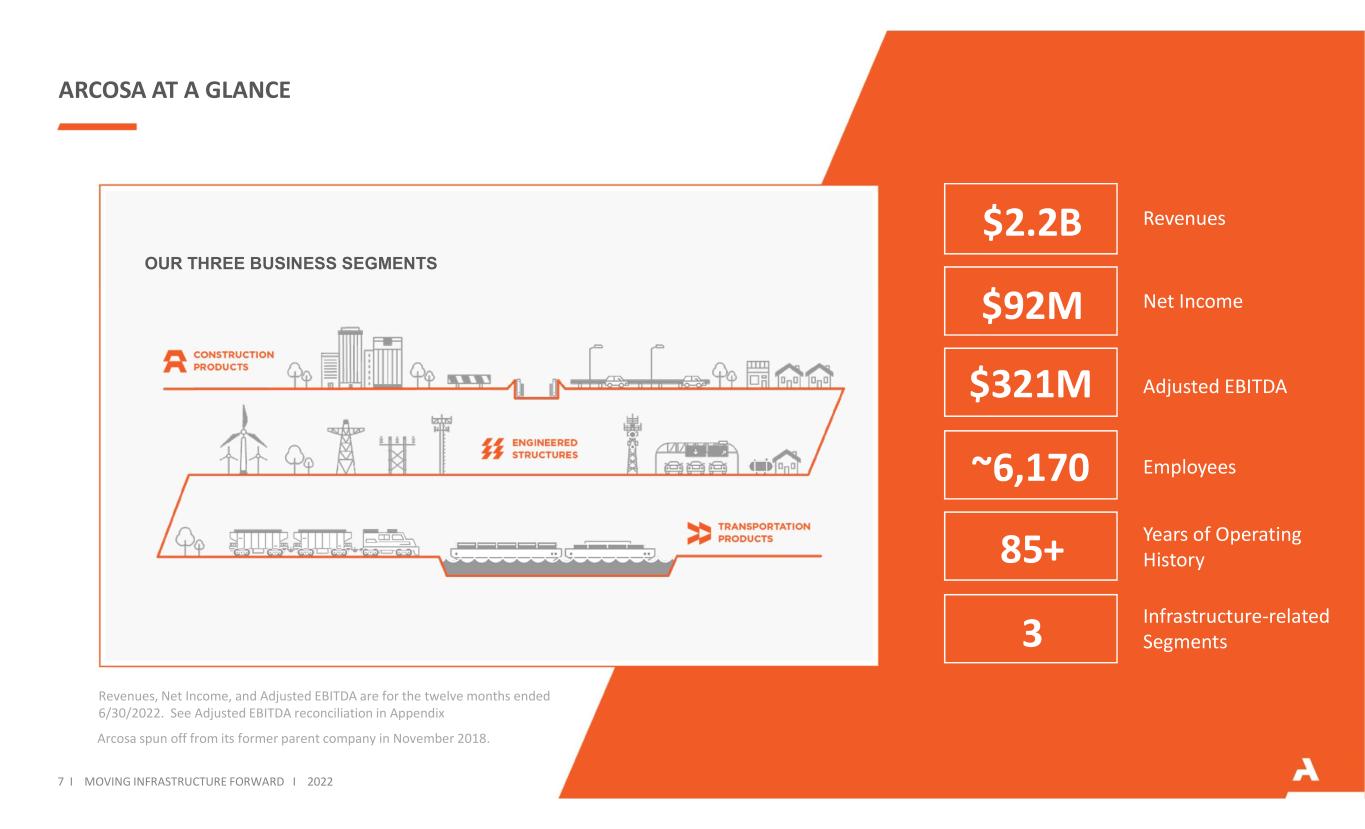

ARCOSA AT A GLANCE Revenues, Net Income, and Adjusted EBITDA are for the twelve months ended 6/30/2022. See Adjusted EBITDA reconciliation in Appendix Arcosa spun off from its former parent company in November 2018. Net Income Adjusted EBITDA Infrastructure-related Segments Employees Years of Operating History OUR THREE BUSINESS SEGMENTS Revenues$2.2B $92M $321M ~6,170 85+ 3 7 I MOVING INFRASTRUCTURE FORWARD I 2022

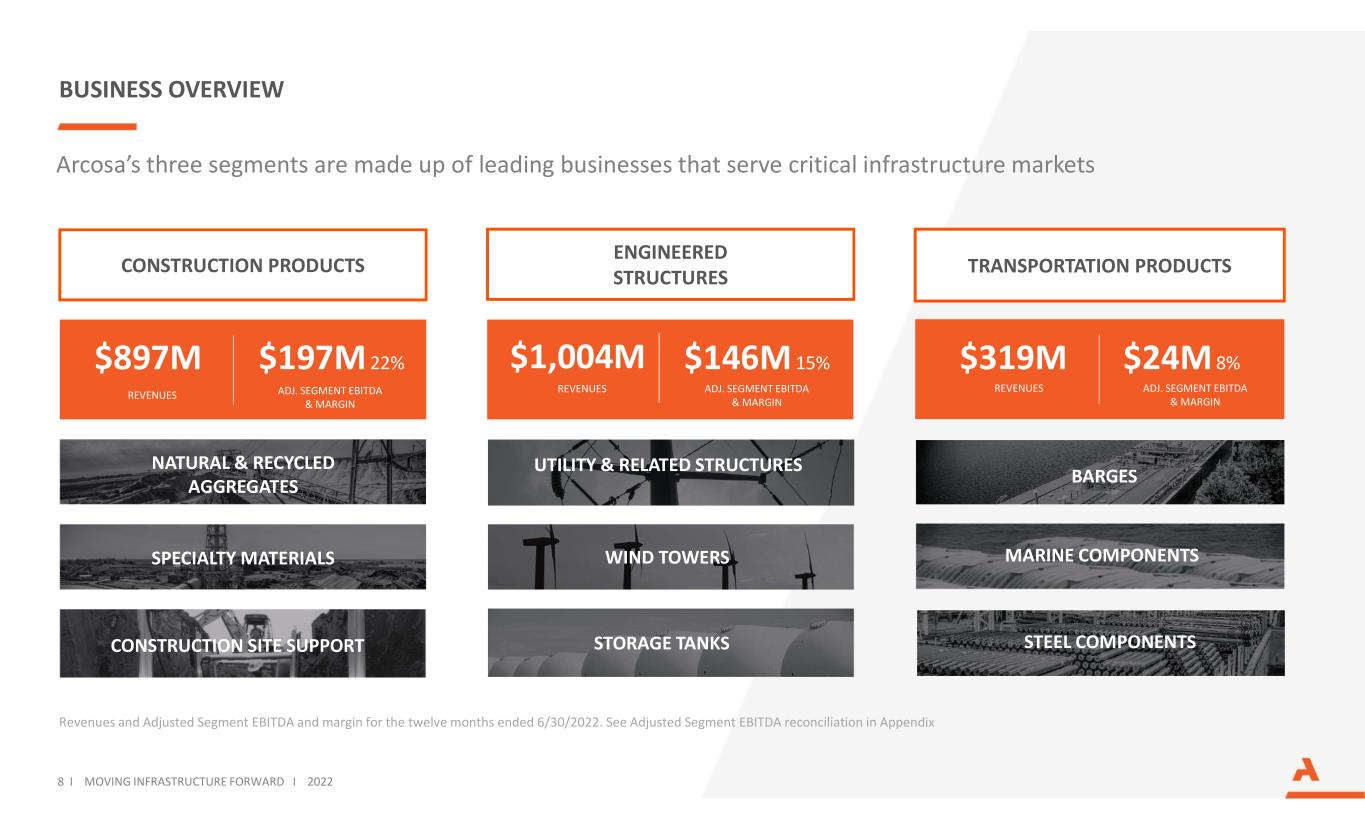

BUSINESS OVERVIEW ENGINEERED STRUCTURES TRANSPORTATION PRODUCTSCONSTRUCTION PRODUCTS Revenues and Adjusted Segment EBITDA and margin for the twelve months ended 6/30/2022. See Adjusted Segment EBITDA reconciliation in Appendix NATURAL & RECYCLED AGGREGATES SPECIALTY MATERIALS CONSTRUCTION SITE SUPPORT WIND TOWERS UTILITY & RELATED STRUCTURES STORAGE TANKS BARGES STEEL COMPONENTS Arcosa’s three segments are made up of leading businesses that serve critical infrastructure markets 8 I MOVING INFRASTRUCTURE FORWARD I 2022 REVENUES ADJ. SEGMENT EBITDA & MARGIN $897M $1,004M $319M $197M 22% $146M 15% $24M 8% REVENUES ADJ. SEGMENT EBITDA & MARGIN REVENUES ADJ. SEGMENT EBITDA & MARGIN MARINE COMPONENTS

ARCOSA’S LONG-TERM VISION 9 I MOVING INFRASTRUCTURE FORWARD I 2022 Grow in attractive markets where we can achieve sustainable competitive advantages Reduce the complexity and cyclicality of the overall business Improve long-term returns on invested capital Integrate Environmental, Social, and Governance initiatives (ESG) into our long- term strategy

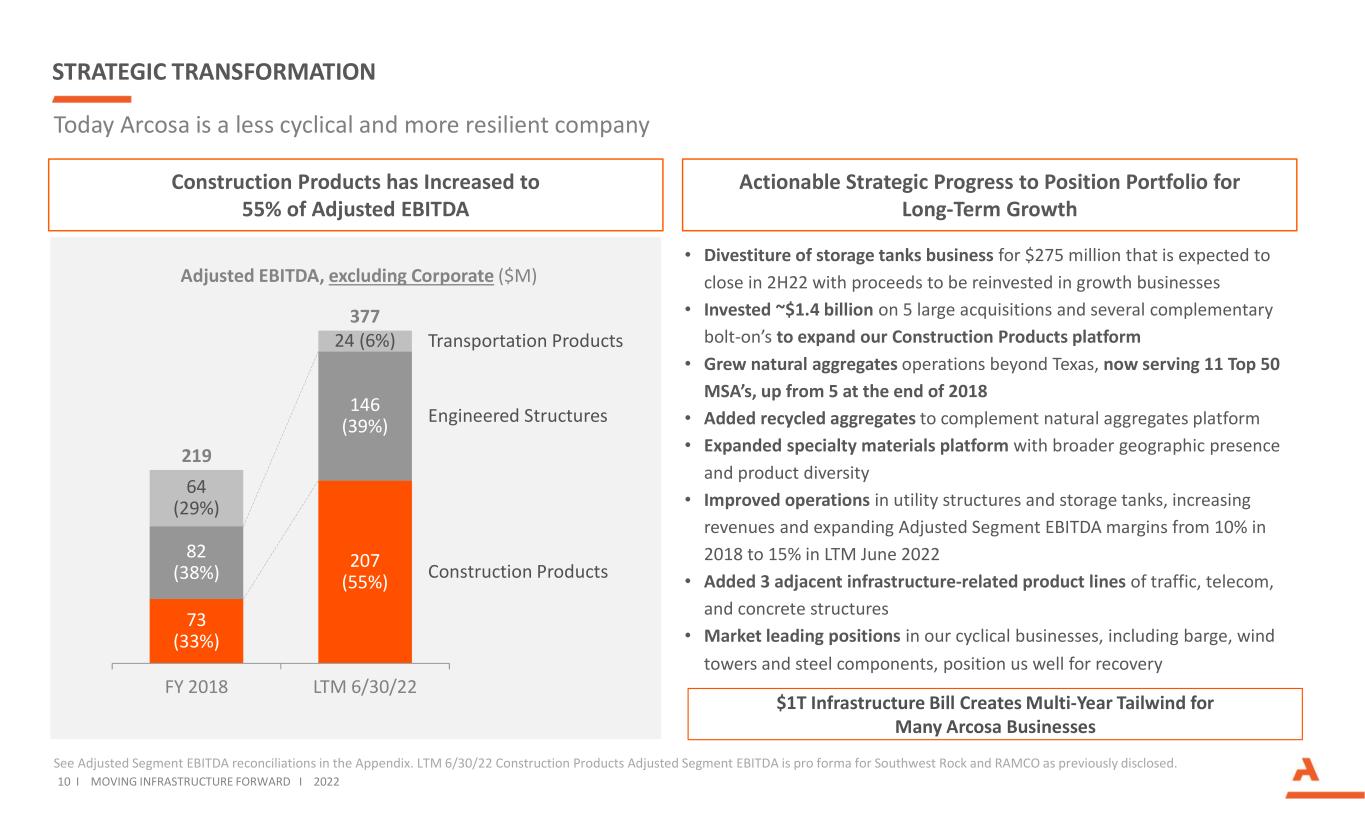

10 I MOVING INFRASTRUCTURE FORWARD I 2022 STRATEGIC TRANSFORMATION Adjusted EBITDA, excluding Corporate ($M) 24 (6%) 64 (29%) 82 (38%) 207 (55%) FY 2018 73 (33%) 146 (39%) LTM 6/30/22 Transportation Products Engineered Structures Construction Products 219 377 See Adjusted Segment EBITDA reconciliations in the Appendix. LTM 6/30/22 Construction Products Adjusted Segment EBITDA is pro forma for Southwest Rock and RAMCO as previously disclosed. Construction Products has Increased to 55% of Adjusted EBITDA • Divestiture of storage tanks business for $275 million that is expected to close in 2H22 with proceeds to be reinvested in growth businesses • Invested ~$1.4 billion on 5 large acquisitions and several complementary bolt-on’s to expand our Construction Products platform • Grew natural aggregates operations beyond Texas, now serving 11 Top 50 MSA’s, up from 5 at the end of 2018 • Added recycled aggregates to complement natural aggregates platform • Expanded specialty materials platform with broader geographic presence and product diversity • Improved operations in utility structures and storage tanks, increasing revenues and expanding Adjusted Segment EBITDA margins from 10% in 2018 to 15% in LTM June 2022 • Added 3 adjacent infrastructure-related product lines of traffic, telecom, and concrete structures • Market leading positions in our cyclical businesses, including barge, wind towers and steel components, position us well for recovery $1T Infrastructure Bill Creates Multi-Year Tailwind for Many Arcosa Businesses Actionable Strategic Progress to Position Portfolio for Long-Term Growth Today Arcosa is a less cyclical and more resilient company

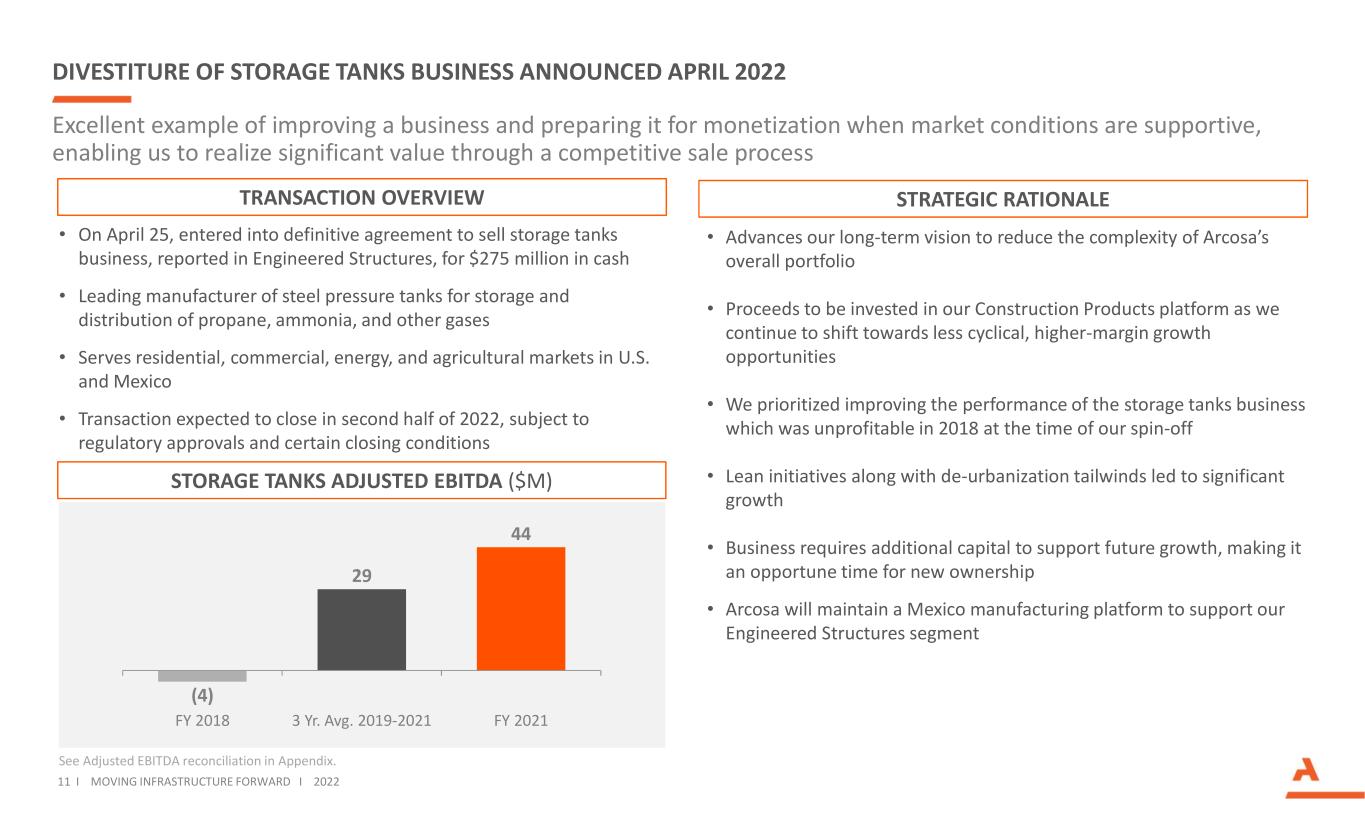

• Advances our long-term vision to reduce the complexity of Arcosa’s overall portfolio • Proceeds to be invested in our Construction Products platform as we continue to shift towards less cyclical, higher-margin growth opportunities • We prioritized improving the performance of the storage tanks business which was unprofitable in 2018 at the time of our spin-off • Lean initiatives along with de-urbanization tailwinds led to significant growth • Business requires additional capital to support future growth, making it an opportune time for new ownership • Arcosa will maintain a Mexico manufacturing platform to support our Engineered Structures segment 11 I MOVING INFRASTRUCTURE FORWARD I 2022 • On April 25, entered into definitive agreement to sell storage tanks business, reported in Engineered Structures, for $275 million in cash • Leading manufacturer of steel pressure tanks for storage and distribution of propane, ammonia, and other gases • Serves residential, commercial, energy, and agricultural markets in U.S. and Mexico • Transaction expected to close in second half of 2022, subject to regulatory approvals and certain closing conditions TRANSACTION OVERVIEW STORAGE TANKS ADJUSTED EBITDA ($M) (4) 29 44 FY 2018 3 Yr. Avg. 2019-2021 FY 2021 STRATEGIC RATIONALE DIVESTITURE OF STORAGE TANKS BUSINESS ANNOUNCED APRIL 2022 Excellent example of improving a business and preparing it for monetization when market conditions are supportive, enabling us to realize significant value through a competitive sale process See Adjusted EBITDA reconciliation in Appendix.

GROWING OUR CONSTRUCTION PRODUCTS PLATFORM Attractive markets with long-term pricing and volume growth; less cyclical than other Arcosa businesses Sustainable competitive advantages, through reserve positions, product portfolio, proprietary processing capabilities, and deep market knowledge Fragmented industry structure with ability to buy small to medium size assets at attractive multiples Ability to use acquisitions as growth platforms for organic and bolt-on growth We have an active pipeline of attractive acquisition and organic opportunities. The sale of our storage tanks business will allow us to continue to deploy capital to our construction businesses and accelerate our growth. October 2020January 2020 December 2018 • Top 25 U.S. aggregates platform adding attractive new geographies, more than 40 years of reserve life, and an experienced management team • Two acquisitions building leadership position in recycled aggregates, a new product category for Arcosa and growing in importance due to resource scarcity and ESG benefits • Cherry expands aggregates business into attractive Houston market, filling a key gap in our Texas network • Strata expands ability to serve DFW customers with a complementary product offering that includes both natural and recycled aggregates • Adds complementary, scaled specialty materials and aggregates platforms • Diversifies customer base across attractive end markets April 2021 August 2021 • Scaled entry into attractive Phoenix metropolitan area with accretive EBITDA margins We have deployed ~$1.4B on Construction Products acquisitions as we seek to expand our growth platforms Attractive fundamentals of Aggregates and Specialty Materials 12 I MOVING INFRASTRUCTURE FORWARD I 2022 • Expands recycled aggregates platform into attractive Southern California market at an attractive valuation and accretive margins; see next slide for additional details May 2022

COMPLETED $75 MILLION ACQUISITION OF RECYCLED AGGREGATES MATERIALS COMPANY (“RAMCO”) IN MAY 2022 • Enhances Arcosa’s industry-leading position in recycled aggregates and advances portfolio shift into Construction Products • Increases exposure to growing product category driven by ESG and economic benefits ‒ Opportunity for added focus on sales and marketing, highlighting additional product applications and increased value to customers • Gains entry into attractive southern California market: ‒ Large, growing Los Angeles metro area with 19M+ population ‒ California focus on recycling ‒ Provides pipeline of actionable organic and bolt-on growth opportunities • Complements our existing operational footprint and customer base in the California market 13 I MOVING INFRASTRUCTURE FORWARD I 2022 Expands Arcosa’s recycled aggregates platform into southern California at an attractive valuation, building on our existing platforms in Dallas-Fort Worth and Houston, Texas Adjusted EBITDA as of LTM 2/28/22; see Adjusted EBITDA reconciliation in Appendix. BUSINESS PROFILE Founded in 1947, RAMCO is a top 10 U.S. recycled aggregates producer serving the greater Los Angeles, CA region HQ ~850K TONS PRODUCED ANNUALLY Margin accretive to both Construction Products segment and Arcosa overall STRATEGIC RATIONALE 4 SO CALIFORNIA LOCATIONS $10M ADJUSTED EBITDA

RECENT FINANCIAL HIGHLIGHTS 02

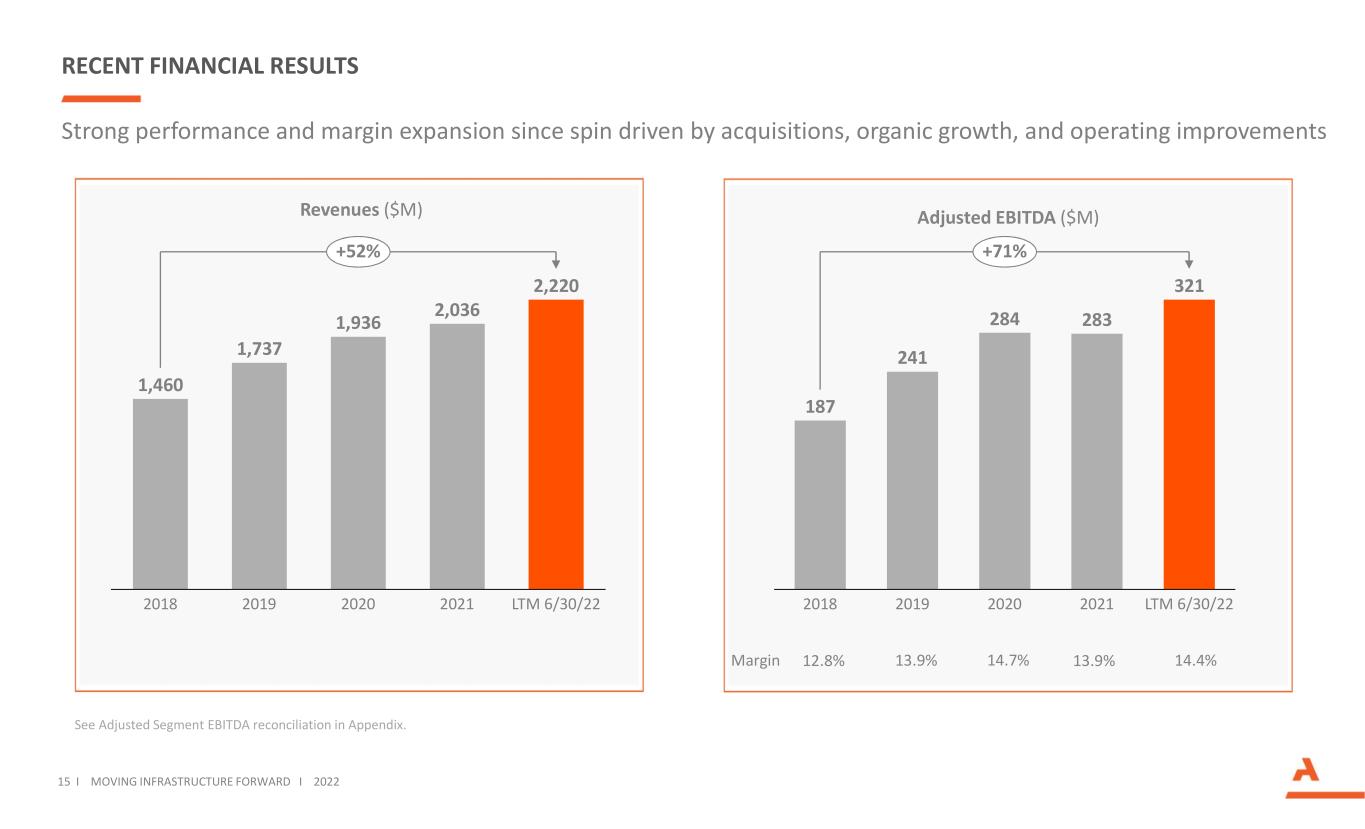

15 I MOVING INFRASTRUCTURE FORWARD I 2022 RECENT FINANCIAL RESULTS See Adjusted Segment EBITDA reconciliation in Appendix. Strong performance and margin expansion since spin driven by acquisitions, organic growth, and operating improvements Margin 12.8% 13.9% Revenues ($M) Adjusted EBITDA ($M) 1,460 1,737 1,936 2,036 2,220 20192018 20212020 LTM 6/30/22 +52% 187 241 284 283 321 2018 2019 2020 2021 LTM 6/30/22 +71% 13.9% 14.7% 14.4%

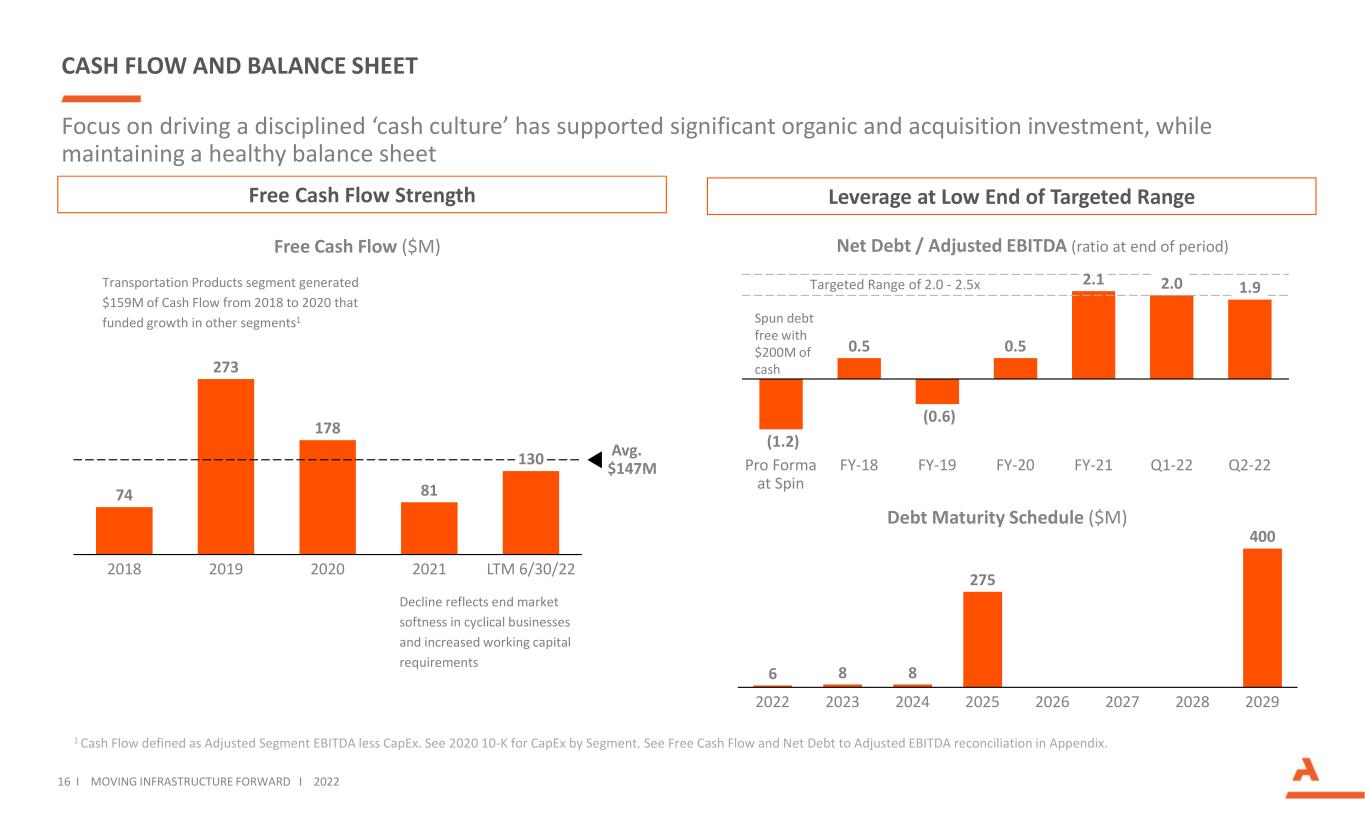

16 I MOVING INFRASTRUCTURE FORWARD I 2022 CASH FLOW AND BALANCE SHEET Focus on driving a disciplined ‘cash culture’ has supported significant organic and acquisition investment, while maintaining a healthy balance sheet (1.2) 0.5 (0.6) 0.5 2.1 2.0 1.9 Q1-22Pro Forma at Spin Q2-22FY-19FY-18 FY-21FY-20 Net Debt / Adjusted EBITDA (ratio at end of period) Debt Maturity Schedule ($M) 1 Cash Flow defined as Adjusted Segment EBITDA less CapEx. See 2020 10-K for CapEx by Segment. See Free Cash Flow and Net Debt to Adjusted EBITDA reconciliation in Appendix. Targeted Range of 2.0 - 2.5xTransportation Products segment generated $159M of Cash Flow from 2018 to 2020 that funded growth in other segments1 74 273 178 81 130 Avg. $147M LTM 6/30/22202020192018 2021 Decline reflects end market softness in cyclical businesses and increased working capital requirements Free Cash Flow Strength Free Cash Flow ($M) Leverage at Low End of Targeted Range 6 8 8 275 400 2023 20242022 2025 2026 20282027 2029 Spun debt free with $200M of cash

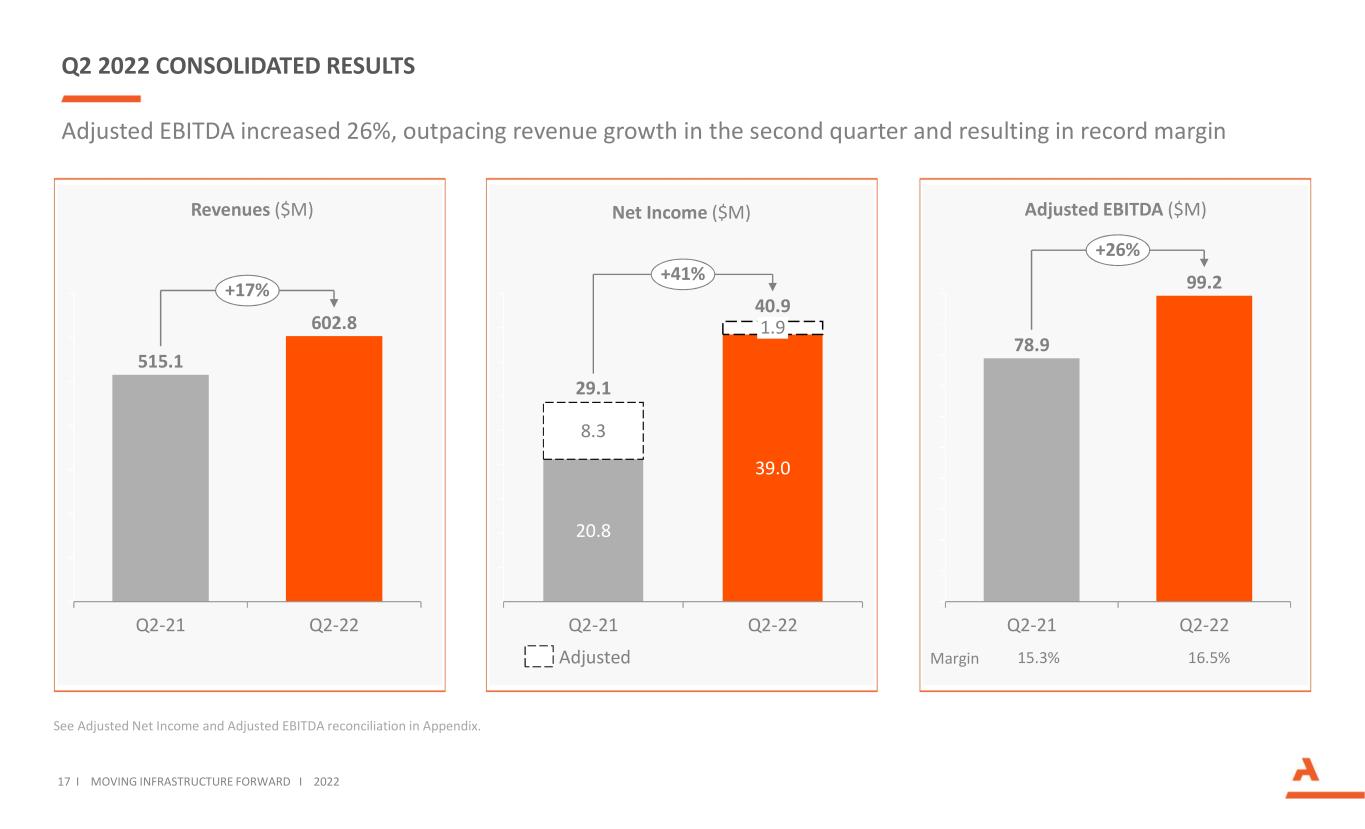

17 I MOVING INFRASTRUCTURE FORWARD I 2022 Q2 2022 CONSOLIDATED RESULTS See Adjusted Net Income and Adjusted EBITDA reconciliation in Appendix. Margin 15.3% 16.5% Revenues ($M) Adjusted EBITDA ($M) 515.1 602.8 Q2-21 Q2-22 +17% 78.9 99.2 Q2-21 Q2-22 +26% 20.8 39.0 8.3 Q2-22 29.1 Q2-21 1.9 40.9 +41% Adjusted Net Income ($M) Adjusted EBITDA increased 26%, outpacing revenue growth in the second quarter and resulting in record margin

2022 OUTLOOK 03

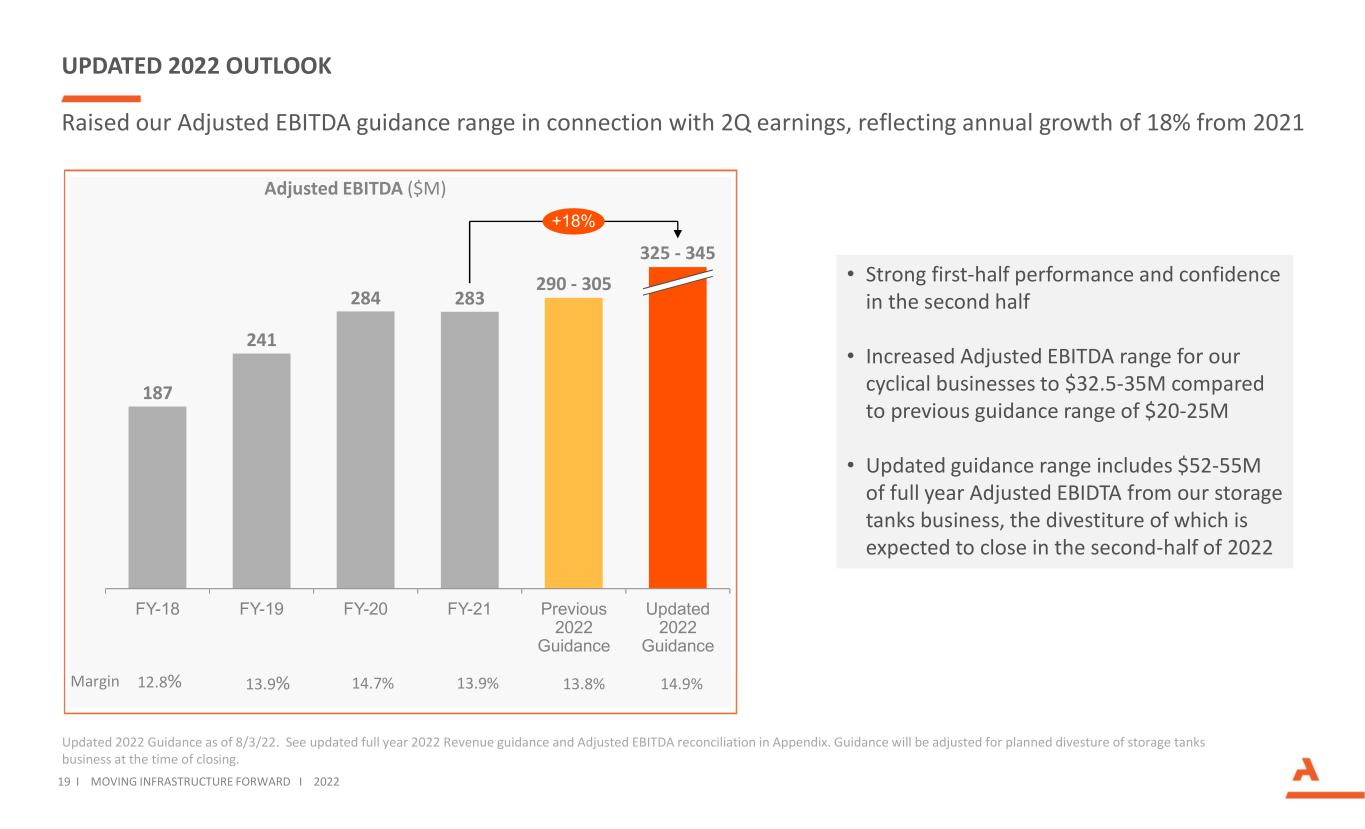

19 I MOVING INFRASTRUCTURE FORWARD I 2022 Raised our Adjusted EBITDA guidance range in connection with 2Q earnings, reflecting annual growth of 18% from 2021 Updated 2022 Guidance as of 8/3/22. See updated full year 2022 Revenue guidance and Adjusted EBITDA reconciliation in Appendix. Guidance will be adjusted for planned divesture of storage tanks business at the time of closing. • Strong first-half performance and confidence in the second half • Increased Adjusted EBITDA range for our cyclical businesses to $32.5-35M compared to previous guidance range of $20-25M • Updated guidance range includes $52-55M of full year Adjusted EBIDTA from our storage tanks business, the divestiture of which is expected to close in the second-half of 2022 UPDATED 2022 OUTLOOK Adjusted EBITDA ($M) 187 241 284 283 FY-19 FY-20 FY-21 Previous 2022 Guidance Updated 2022 Guidance FY-18 290 - 305 325 - 345 +18% Margin 13.9% 14.7% 13.9% 13.8% 14.9%12.8%

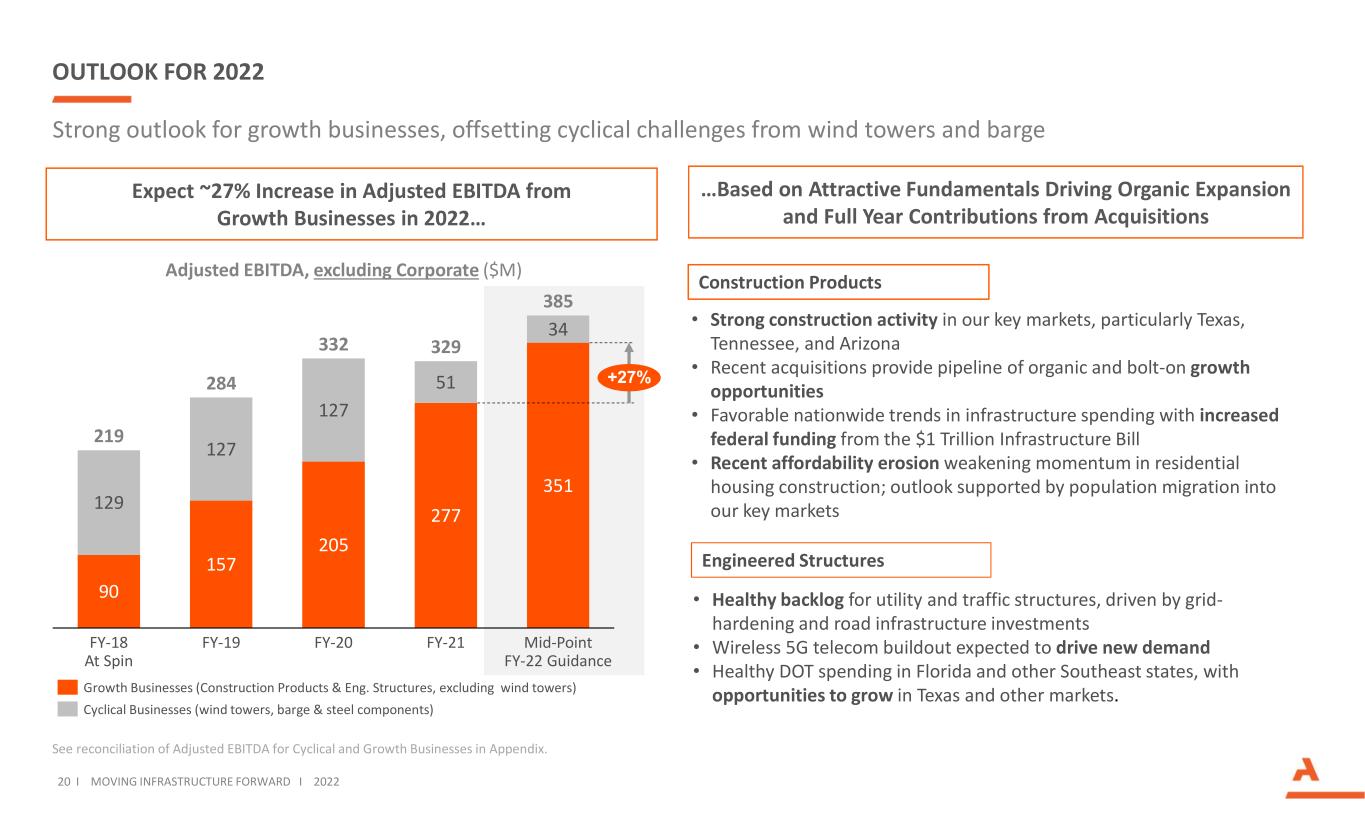

20 I MOVING INFRASTRUCTURE FORWARD I 2022 90 157 205 277 351 129 127 127 51 34 Mid-Point FY-22 Guidance FY-18 At Spin FY-19 FY-20 FY-21 329 219 284 332 385 +27% OUTLOOK FOR 2022 Adjusted EBITDA, excluding Corporate ($M) See reconciliation of Adjusted EBITDA for Cyclical and Growth Businesses in Appendix. Expect ~27% Increase in Adjusted EBITDA from Growth Businesses in 2022… …Based on Attractive Fundamentals Driving Organic Expansion and Full Year Contributions from Acquisitions Strong outlook for growth businesses, offsetting cyclical challenges from wind towers and barge Growth Businesses (Construction Products & Eng. Structures, excluding wind towers) Cyclical Businesses (wind towers, barge & steel components) Construction Products Engineered Structures • Strong construction activity in our key markets, particularly Texas, Tennessee, and Arizona • Recent acquisitions provide pipeline of organic and bolt-on growth opportunities • Favorable nationwide trends in infrastructure spending with increased federal funding from the $1 Trillion Infrastructure Bill • Recent affordability erosion weakening momentum in residential housing construction; outlook supported by population migration into our key markets • Healthy backlog for utility and traffic structures, driven by grid- hardening and road infrastructure investments • Wireless 5G telecom buildout expected to drive new demand • Healthy DOT spending in Florida and other Southeast states, with opportunities to grow in Texas and other markets.

Low High Plate steel prices began escalating in late 4Q20 84 90 17 18 81 16 55 49 13 105 35 1Q212Q201Q204Q19 3Q214Q203Q20 2Q21 4Q21 1Q22 2Q22 21 I MOVING INFRASTRUCTURE FORWARD I 2022 CYCLICAL BUSINESSES In 2022, our cyclical businesses are expected to be at ~25% of their combined 2018 Adjusted EBITDA levels, but long-term fundamentals remain supportive Inflation Reduction Act, approved on August 16th, includes multi- year extension of Production Tax Credit (“PTC”) 1Criton Corporation: Prospects for the Dry Cargo Inland Barge Market Through 2026, Nov. 2021; 2Company estimates and IHS Markit, May 2021; 3River Transport News annual survey of new hopper barge construction; 4Actual data provided by Railway Supply Institute, Inc. and forecast data from FTR Transportation Intelligence. June. 2022; 5Wood Mackenzie, Global wind power market outlook update: Q2, June 2022 Outlook for Dry Barge Replacement Cycle Remains Intact Fleet age is Increasing due to underinvestment since 2016; forecasts indicate potential for ~750 average annual barge construction needs through 20261 High plate steel prices continue to be a demand headwind, but our ability to obtain competitive steel pricing has supported recent order trends 14.4 16.3 2016 2020 Hopper Fleet Age2 (in Years) 0 600 1,200 6 10 1592005 7 8 11 1812 13 14 16 17 19 20 21 Theoretical Replacement Level Annual Industry Deliveries Since ‘053 (# Hopper Barges) Lowest level in 30 years New builds for N.A. Railcar Market Forecasted to Increase 51 2021 33 2018 2019 2023F2022F2020 2024F 58 53 29 42 42 Actual Forecast to meet or exceed replacement levels through 2024 at high end of range. Low end reflects weaker economic scenario, but ahead of 2021 cyclical trough Annual Industry Deliveries4 (# Railcars in K’s) Need for Renewable Energy Continues to Rise and Recent Passage of Inflation Reduction Act is a Positive Catalyst 0 5 10 15 20 26 30212020 2722 23 24 25 28 29 U.S. Wind Installations (2020-2030)5 (GW) Forecast Range Arcosa Historical Barge Orders ($M) COVID-19 pull-back Beginning of hopper barge replacement cycle

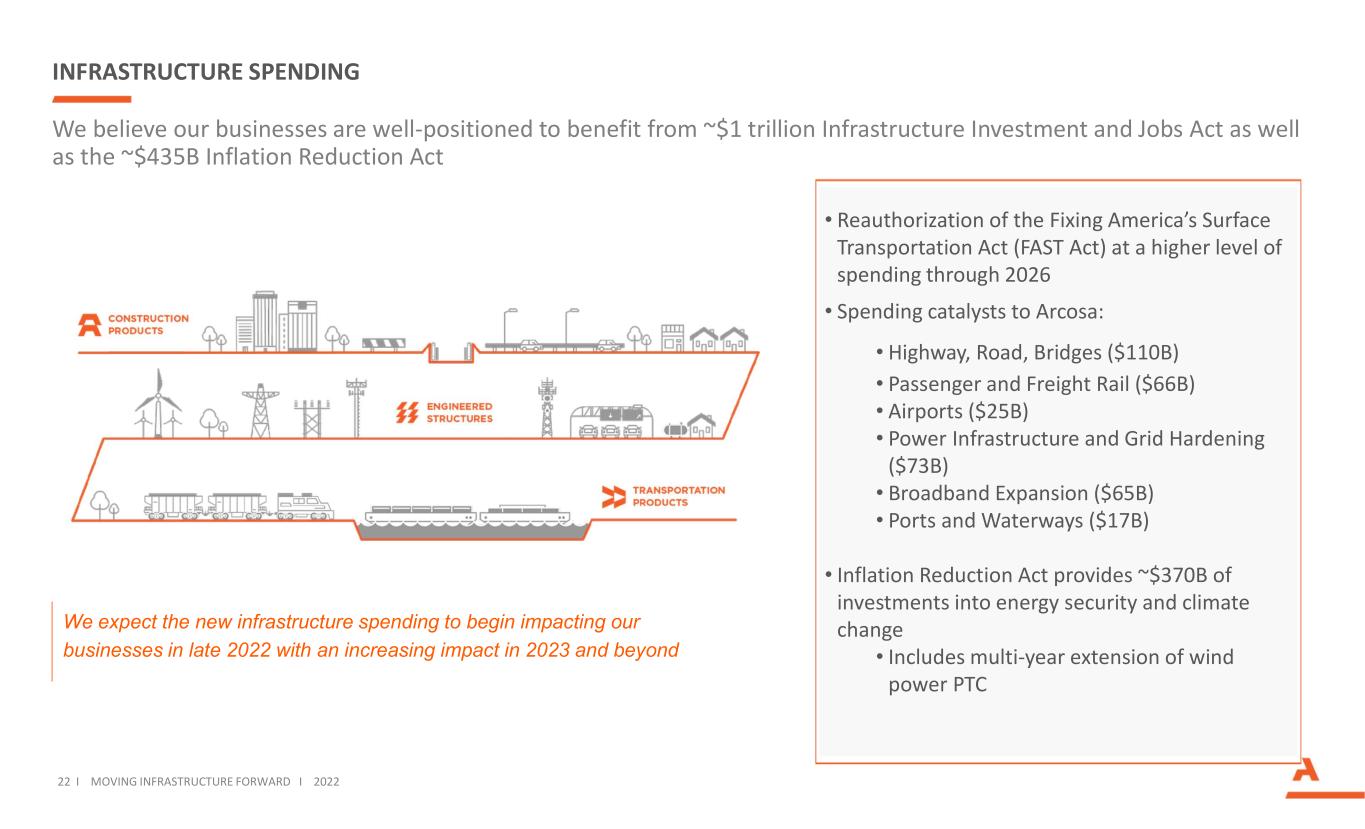

INFRASTRUCTURE SPENDING We believe our businesses are well-positioned to benefit from ~$1 trillion Infrastructure Investment and Jobs Act as well as the ~$435B Inflation Reduction Act • Reauthorization of the Fixing America’s Surface Transportation Act (FAST Act) at a higher level of spending through 2026 • Spending catalysts to Arcosa: • Highway, Road, Bridges ($110B) • Passenger and Freight Rail ($66B) • Airports ($25B) • Power Infrastructure and Grid Hardening ($73B) • Broadband Expansion ($65B) • Ports and Waterways ($17B) • Inflation Reduction Act provides ~$370B of investments into energy security and climate change • Includes multi-year extension of wind power PTC We expect the new infrastructure spending to begin impacting our businesses in late 2022 with an increasing impact in 2023 and beyond 22 I MOVING INFRASTRUCTURE FORWARD I 2022

ESG UPDATE 04

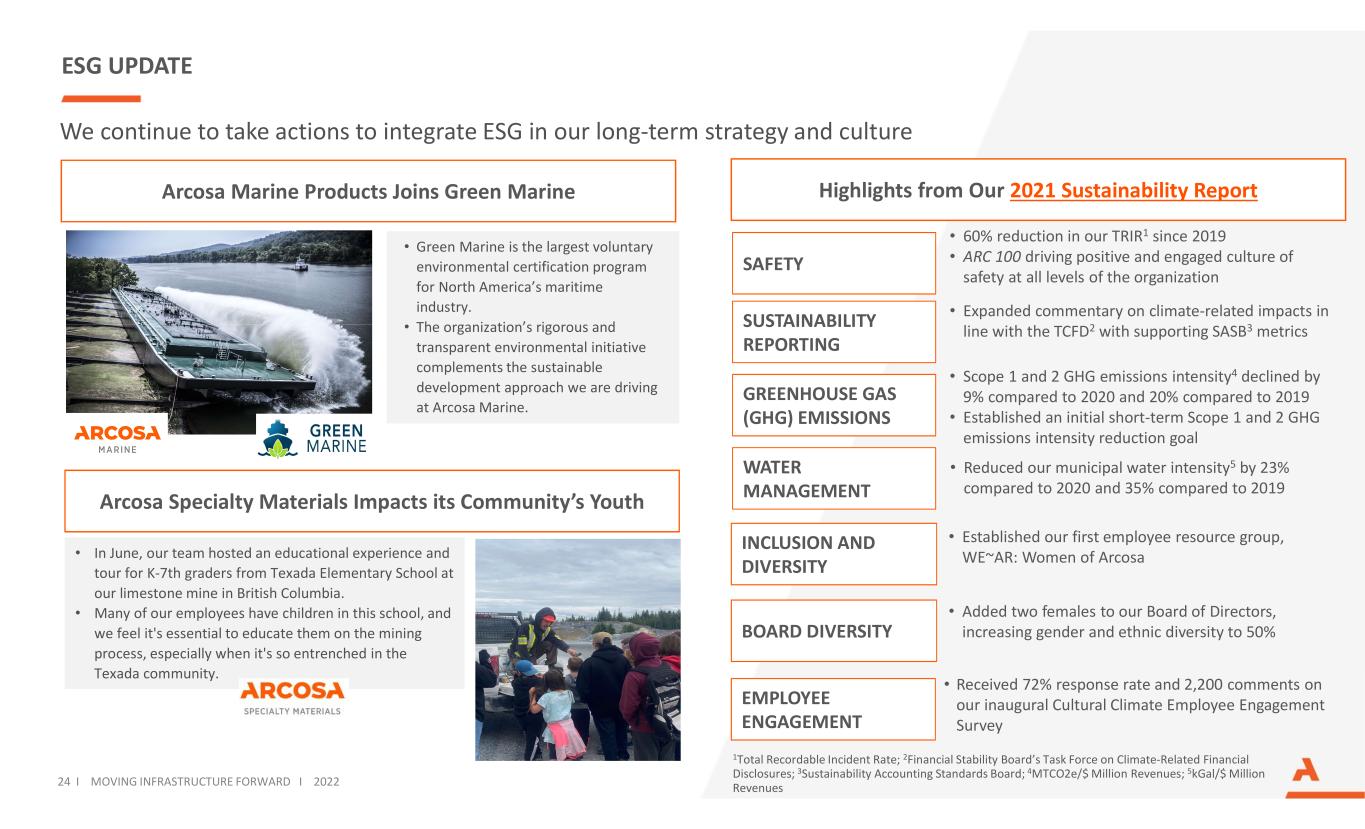

ESG UPDATE 24 I MOVING INFRASTRUCTURE FORWARD I 2022 We continue to take actions to integrate ESG in our long-term strategy and culture Arcosa Marine Products Joins Green Marine • Green Marine is the largest voluntary environmental certification program for North America’s maritime industry. • The organization’s rigorous and transparent environmental initiative complements the sustainable development approach we are driving at Arcosa Marine. Arcosa Specialty Materials Impacts its Community’s Youth • In June, our team hosted an educational experience and tour for K-7th graders from Texada Elementary School at our limestone mine in British Columbia. • Many of our employees have children in this school, and we feel it's essential to educate them on the mining process, especially when it's so entrenched in the Texada community. Highlights from Our 2021 Sustainability Report SAFETY GREENHOUSE GAS (GHG) EMISSIONS WATER MANAGEMENT SUSTAINABILITY REPORTING INCLUSION AND DIVERSITY BOARD DIVERSITY EMPLOYEE ENGAGEMENT • 60% reduction in our TRIR1 since 2019 • ARC 100 driving positive and engaged culture of safety at all levels of the organization • Expanded commentary on climate-related impacts in line with the TCFD2 with supporting SASB3 metrics • Scope 1 and 2 GHG emissions intensity4 declined by 9% compared to 2020 and 20% compared to 2019 • Established an initial short-term Scope 1 and 2 GHG emissions intensity reduction goal • Reduced our municipal water intensity5 by 23% compared to 2020 and 35% compared to 2019 • Established our first employee resource group, WE~AR: Women of Arcosa • Added two females to our Board of Directors, increasing gender and ethnic diversity to 50% • Received 72% response rate and 2,200 comments on our inaugural Cultural Climate Employee Engagement Survey 1Total Recordable Incident Rate; 2Financial Stability Board’s Task Force on Climate-Related Financial Disclosures; 3Sustainability Accounting Standards Board; 4MTCO2e/$ Million Revenues; 5kGal/$ Million Revenues

APPENDIX

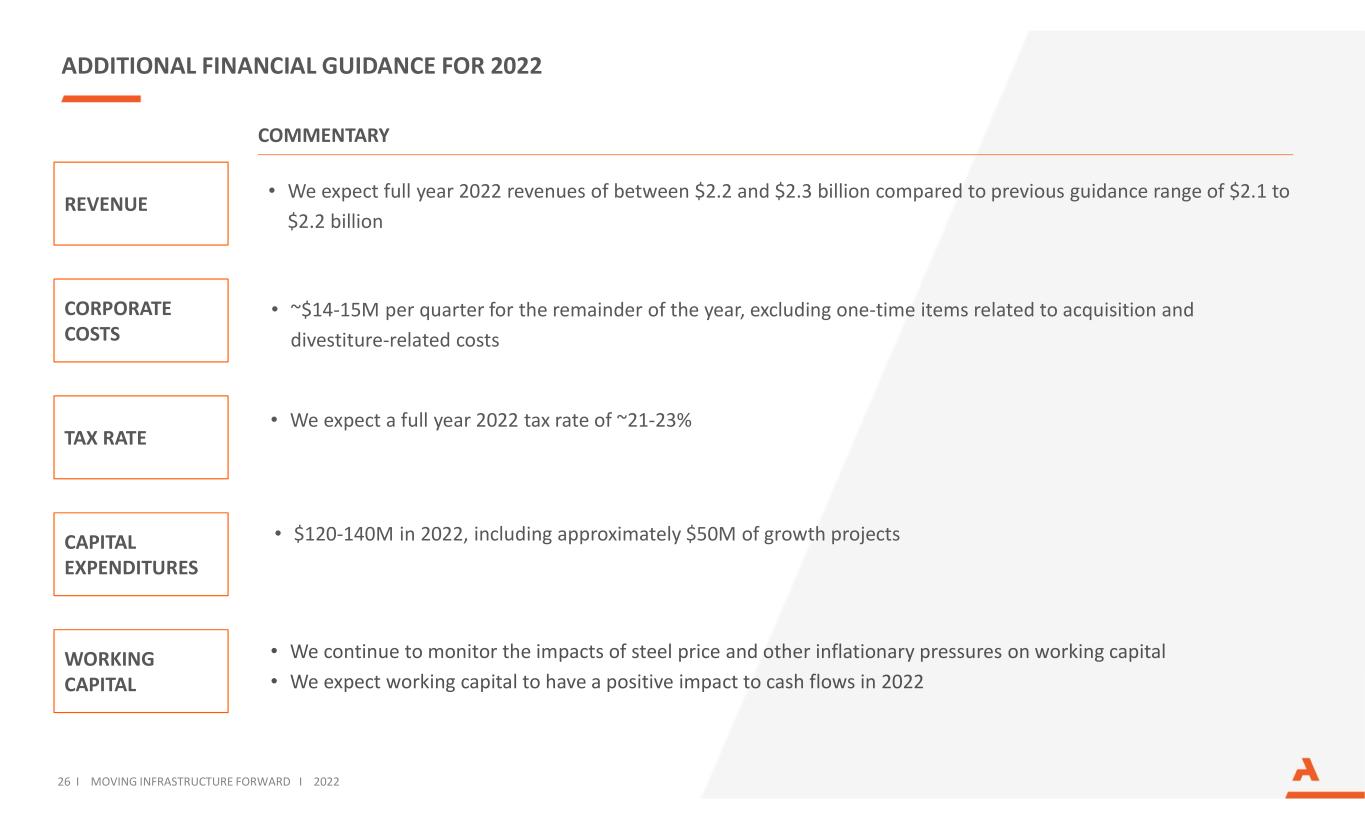

26 I MOVING INFRASTRUCTURE FORWARD I 2022 ADDITIONAL FINANCIAL GUIDANCE FOR 2022 CORPORATE COSTS COMMENTARY CAPITAL EXPENDITURES WORKING CAPITAL • ~$14-15M per quarter for the remainder of the year, excluding one-time items related to acquisition and divestiture-related costs • $120-140M in 2022, including approximately $50M of growth projects TAX RATE • We continue to monitor the impacts of steel price and other inflationary pressures on working capital • We expect working capital to have a positive impact to cash flows in 2022 • We expect a full year 2022 tax rate of ~21-23% REVENUE • We expect full year 2022 revenues of between $2.2 and $2.3 billion compared to previous guidance range of $2.1 to $2.2 billion

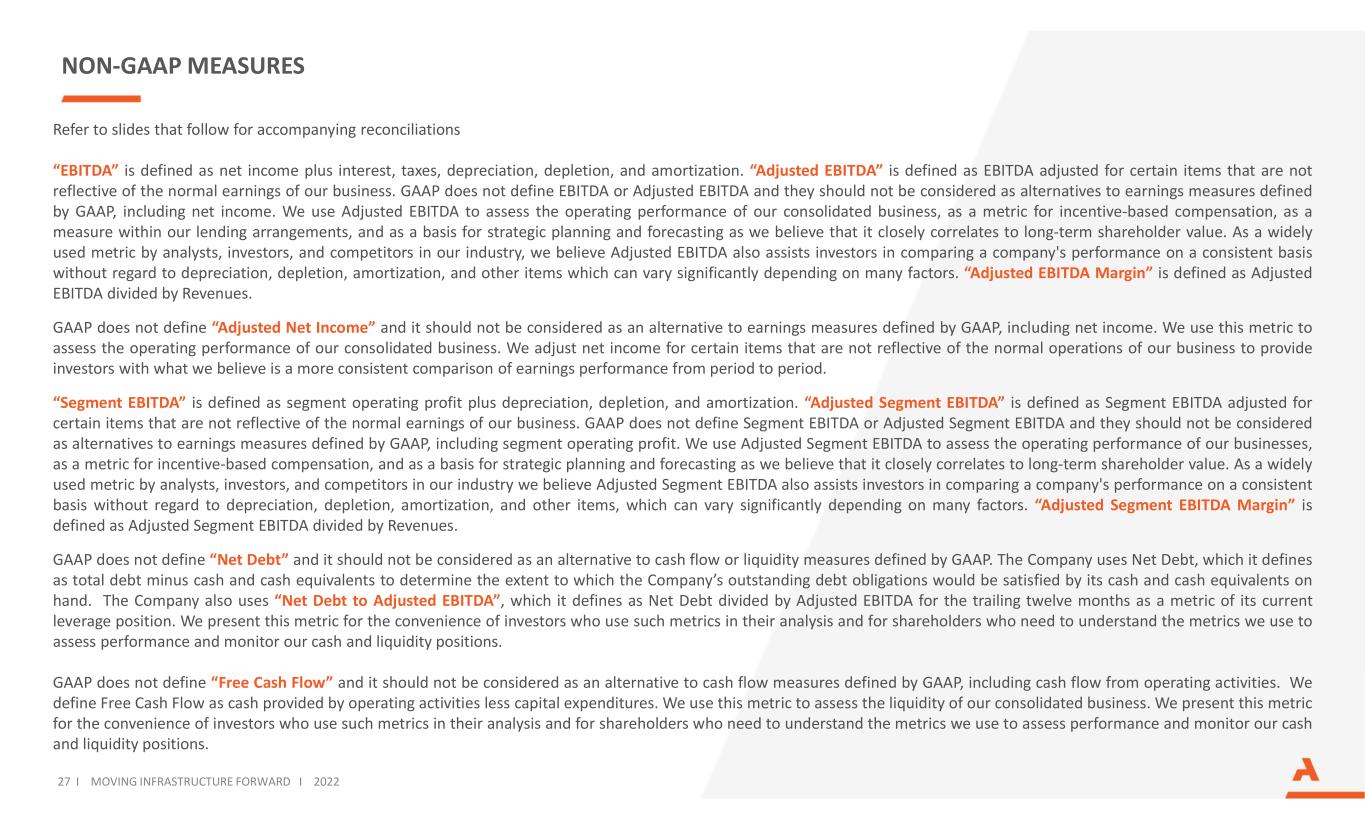

27 I MOVING INFRASTRUCTURE FORWARD I 2022 NON-GAAP MEASURES Refer to slides that follow for accompanying reconciliations “EBITDA” is defined as net income plus interest, taxes, depreciation, depletion, and amortization. “Adjusted EBITDA” is defined as EBITDA adjusted for certain items that are not reflective of the normal earnings of our business. GAAP does not define EBITDA or Adjusted EBITDA and they should not be considered as alternatives to earnings measures defined by GAAP, including net income. We use Adjusted EBITDA to assess the operating performance of our consolidated business, as a metric for incentive-based compensation, as a measure within our lending arrangements, and as a basis for strategic planning and forecasting as we believe that it closely correlates to long-term shareholder value. As a widely used metric by analysts, investors, and competitors in our industry, we believe Adjusted EBITDA also assists investors in comparing a company's performance on a consistent basis without regard to depreciation, depletion, amortization, and other items which can vary significantly depending on many factors. “Adjusted EBITDA Margin” is defined as Adjusted EBITDA divided by Revenues. GAAP does not define “Adjusted Net Income” and it should not be considered as an alternative to earnings measures defined by GAAP, including net income. We use this metric to assess the operating performance of our consolidated business. We adjust net income for certain items that are not reflective of the normal operations of our business to provide investors with what we believe is a more consistent comparison of earnings performance from period to period. “Segment EBITDA” is defined as segment operating profit plus depreciation, depletion, and amortization. “Adjusted Segment EBITDA” is defined as Segment EBITDA adjusted for certain items that are not reflective of the normal earnings of our business. GAAP does not define Segment EBITDA or Adjusted Segment EBITDA and they should not be considered as alternatives to earnings measures defined by GAAP, including segment operating profit. We use Adjusted Segment EBITDA to assess the operating performance of our businesses, as a metric for incentive-based compensation, and as a basis for strategic planning and forecasting as we believe that it closely correlates to long-term shareholder value. As a widely used metric by analysts, investors, and competitors in our industry we believe Adjusted Segment EBITDA also assists investors in comparing a company's performance on a consistent basis without regard to depreciation, depletion, amortization, and other items, which can vary significantly depending on many factors. “Adjusted Segment EBITDA Margin” is defined as Adjusted Segment EBITDA divided by Revenues. GAAP does not define “Net Debt” and it should not be considered as an alternative to cash flow or liquidity measures defined by GAAP. The Company uses Net Debt, which it defines as total debt minus cash and cash equivalents to determine the extent to which the Company’s outstanding debt obligations would be satisfied by its cash and cash equivalents on hand. The Company also uses “Net Debt to Adjusted EBITDA”, which it defines as Net Debt divided by Adjusted EBITDA for the trailing twelve months as a metric of its current leverage position. We present this metric for the convenience of investors who use such metrics in their analysis and for shareholders who need to understand the metrics we use to assess performance and monitor our cash and liquidity positions. GAAP does not define “Free Cash Flow” and it should not be considered as an alternative to cash flow measures defined by GAAP, including cash flow from operating activities. We define Free Cash Flow as cash provided by operating activities less capital expenditures. We use this metric to assess the liquidity of our consolidated business. We present this metric for the convenience of investors who use such metrics in their analysis and for shareholders who need to understand the metrics we use to assess performance and monitor our cash and liquidity positions.

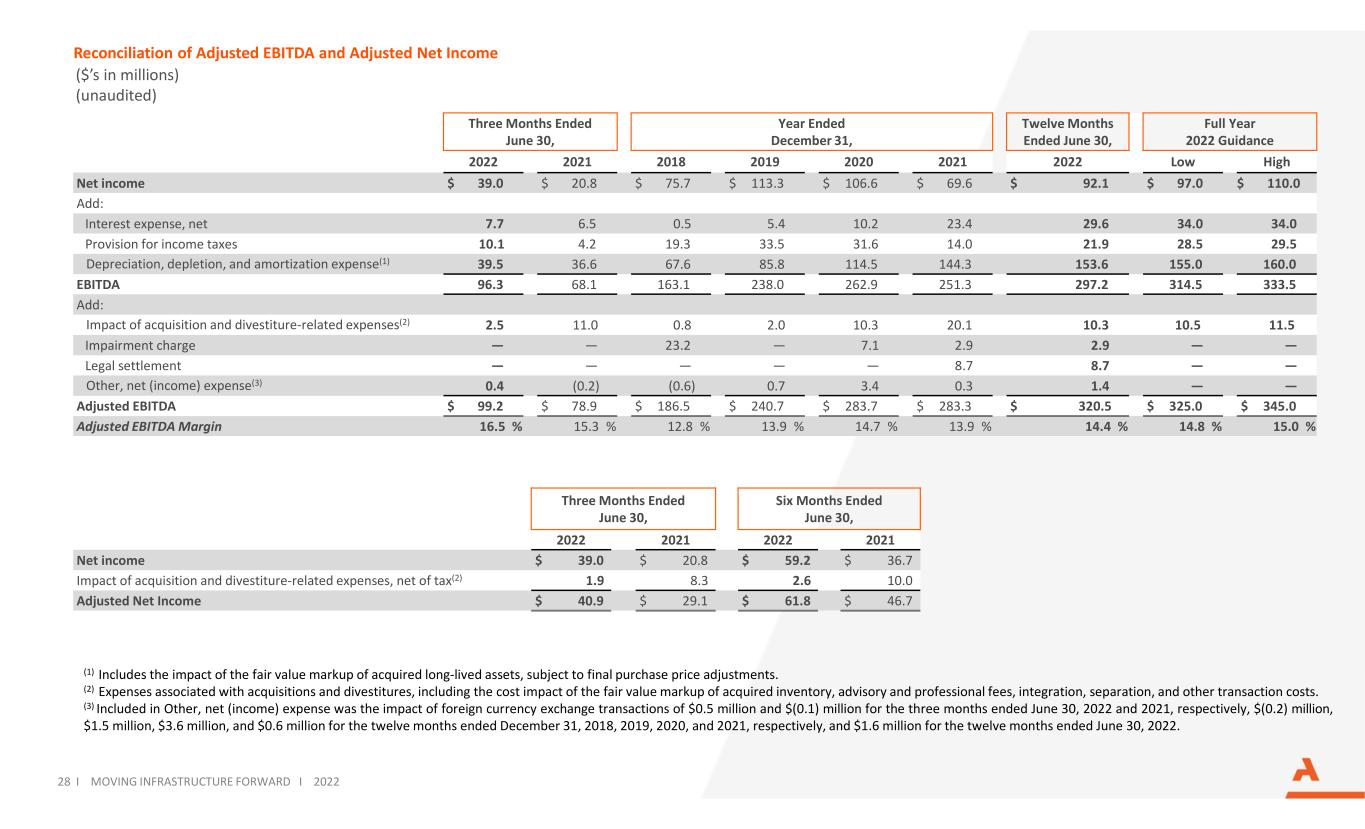

Reconciliation of Adjusted EBITDA and Adjusted Net Income ($’s in millions) (unaudited) 28 I MOVING INFRASTRUCTURE FORWARD I 2022 Three Months Ended June 30, Year Ended December 31, Twelve Months Ended June 30, Full Year 2022 Guidance 2022 2021 2018 2019 2020 2021 2022 Low High Net income $ 39.0 $ 20.8 $ 75.7 $ 113.3 $ 106.6 $ 69.6 $ 92.1 $ 97.0 $ 110.0 Add: Interest expense, net 7.7 6.5 0.5 5.4 10.2 23.4 29.6 34.0 34.0 Provision for income taxes 10.1 4.2 19.3 33.5 31.6 14.0 21.9 28.5 29.5 Depreciation, depletion, and amortization expense(1) 39.5 36.6 67.6 85.8 114.5 144.3 153.6 155.0 160.0 EBITDA 96.3 68.1 163.1 238.0 262.9 251.3 297.2 314.5 333.5 Add: Impact of acquisition and divestiture-related expenses(2) 2.5 11.0 0.8 2.0 10.3 20.1 10.3 10.5 11.5 Impairment charge — — 23.2 — 7.1 2.9 2.9 — — Legal settlement — — — — — 8.7 8.7 — — Other, net (income) expense(3) 0.4 (0.2) (0.6) 0.7 3.4 0.3 1.4 — — Adjusted EBITDA $ 99.2 $ 78.9 $ 186.5 $ 240.7 $ 283.7 $ 283.3 $ 320.5 $ 325.0 $ 345.0 Adjusted EBITDA Margin 16.5 % 15.3 % 12.8 % 13.9 % 14.7 % 13.9 % 14.4 % 14.8 % 15.0 % Three Months Ended June 30, Six Months Ended June 30, 2022 2021 2022 2021 Net income $ 39.0 $ 20.8 $ 59.2 $ 36.7 Impact of acquisition and divestiture-related expenses, net of tax(2) 1.9 8.3 2.6 10.0 Adjusted Net Income $ 40.9 $ 29.1 $ 61.8 $ 46.7 (1) Includes the impact of the fair value markup of acquired long-lived assets, subject to final purchase price adjustments. (2) Expenses associated with acquisitions and divestitures, including the cost impact of the fair value markup of acquired inventory, advisory and professional fees, integration, separation, and other transaction costs. (3) Included in Other, net (income) expense was the impact of foreign currency exchange transactions of $0.5 million and $(0.1) million for the three months ended June 30, 2022 and 2021, respectively, $(0.2) million, $1.5 million, $3.6 million, and $0.6 million for the twelve months ended December 31, 2018, 2019, 2020, and 2021, respectively, and $1.6 million for the twelve months ended June 30, 2022.

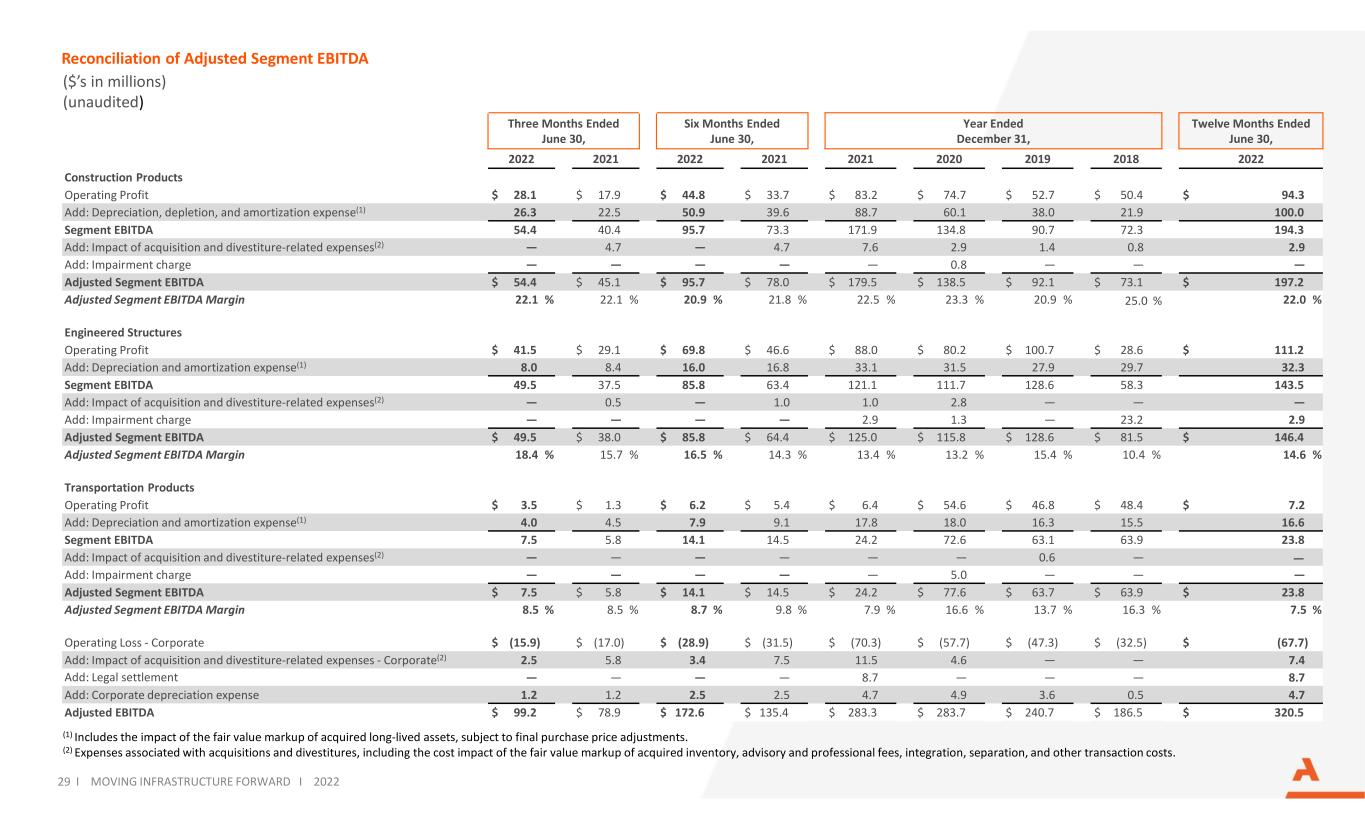

Reconciliation of Adjusted Segment EBITDA ($’s in millions) (unaudited) 29 I MOVING INFRASTRUCTURE FORWARD I 2022 Three Months Ended June 30, Six Months Ended June 30, Year Ended December 31, Twelve Months Ended June 30, 2022 2021 2022 2021 2021 2020 2019 2018 2022 Construction Products Operating Profit $ 28.1 $ 17.9 $ 44.8 $ 33.7 $ 83.2 $ 74.7 $ 52.7 $ 50.4 $ 94.3 Add: Depreciation, depletion, and amortization expense(1) 26.3 22.5 50.9 39.6 88.7 60.1 38.0 21.9 100.0 Segment EBITDA 54.4 40.4 95.7 73.3 171.9 134.8 90.7 72.3 194.3 Add: Impact of acquisition and divestiture-related expenses(2) — 4.7 — 4.7 7.6 2.9 1.4 0.8 2.9 Add: Impairment charge — — — — — 0.8 — — — Adjusted Segment EBITDA $ 54.4 $ 45.1 $ 95.7 $ 78.0 $ 179.5 $ 138.5 $ 92.1 $ 73.1 $ 197.2 Adjusted Segment EBITDA Margin 22.1 % 22.1 % 20.9 % 21.8 % 22.5 % 23.3 % 20.9 % 25.0 % 22.0 % Engineered Structures Operating Profit $ 41.5 $ 29.1 $ 69.8 $ 46.6 $ 88.0 $ 80.2 $ 100.7 $ 28.6 $ 111.2 Add: Depreciation and amortization expense(1) 8.0 8.4 16.0 16.8 33.1 31.5 27.9 29.7 32.3 Segment EBITDA 49.5 37.5 85.8 63.4 121.1 111.7 128.6 58.3 143.5 Add: Impact of acquisition and divestiture-related expenses(2) — 0.5 — 1.0 1.0 2.8 — — — Add: Impairment charge — — — — 2.9 1.3 — 23.2 2.9 Adjusted Segment EBITDA $ 49.5 $ 38.0 $ 85.8 $ 64.4 $ 125.0 $ 115.8 $ 128.6 $ 81.5 $ 146.4 Adjusted Segment EBITDA Margin 18.4 % 15.7 % 16.5 % 14.3 % 13.4 % 13.2 % 15.4 % 10.4 % 14.6 % Transportation Products Operating Profit $ 3.5 $ 1.3 $ 6.2 $ 5.4 $ 6.4 $ 54.6 $ 46.8 $ 48.4 $ 7.2 Add: Depreciation and amortization expense(1) 4.0 4.5 7.9 9.1 17.8 18.0 16.3 15.5 16.6 Segment EBITDA 7.5 5.8 14.1 14.5 24.2 72.6 63.1 63.9 23.8 Add: Impact of acquisition and divestiture-related expenses(2) — — — — — — 0.6 — — Add: Impairment charge — — — — — 5.0 — — — Adjusted Segment EBITDA $ 7.5 $ 5.8 $ 14.1 $ 14.5 $ 24.2 $ 77.6 $ 63.7 $ 63.9 $ 23.8 Adjusted Segment EBITDA Margin 8.5 % 8.5 % 8.7 % 9.8 % 7.9 % 16.6 % 13.7 % 16.3 % 7.5 % Operating Loss - Corporate $ (15.9) $ (17.0) $ (28.9) $ (31.5) $ (70.3) $ (57.7) $ (47.3) $ (32.5) $ (67.7) Add: Impact of acquisition and divestiture-related expenses - Corporate(2) 2.5 5.8 3.4 7.5 11.5 4.6 — — 7.4 Add: Legal settlement — — — — 8.7 — — — 8.7 Add: Corporate depreciation expense 1.2 1.2 2.5 2.5 4.7 4.9 3.6 0.5 4.7 Adjusted EBITDA $ 99.2 $ 78.9 $ 172.6 $ 135.4 $ 283.3 $ 283.7 $ 240.7 $ 186.5 $ 320.5 (1) Includes the impact of the fair value markup of acquired long-lived assets, subject to final purchase price adjustments. (2) Expenses associated with acquisitions and divestitures, including the cost impact of the fair value markup of acquired inventory, advisory and professional fees, integration, separation, and other transaction costs.

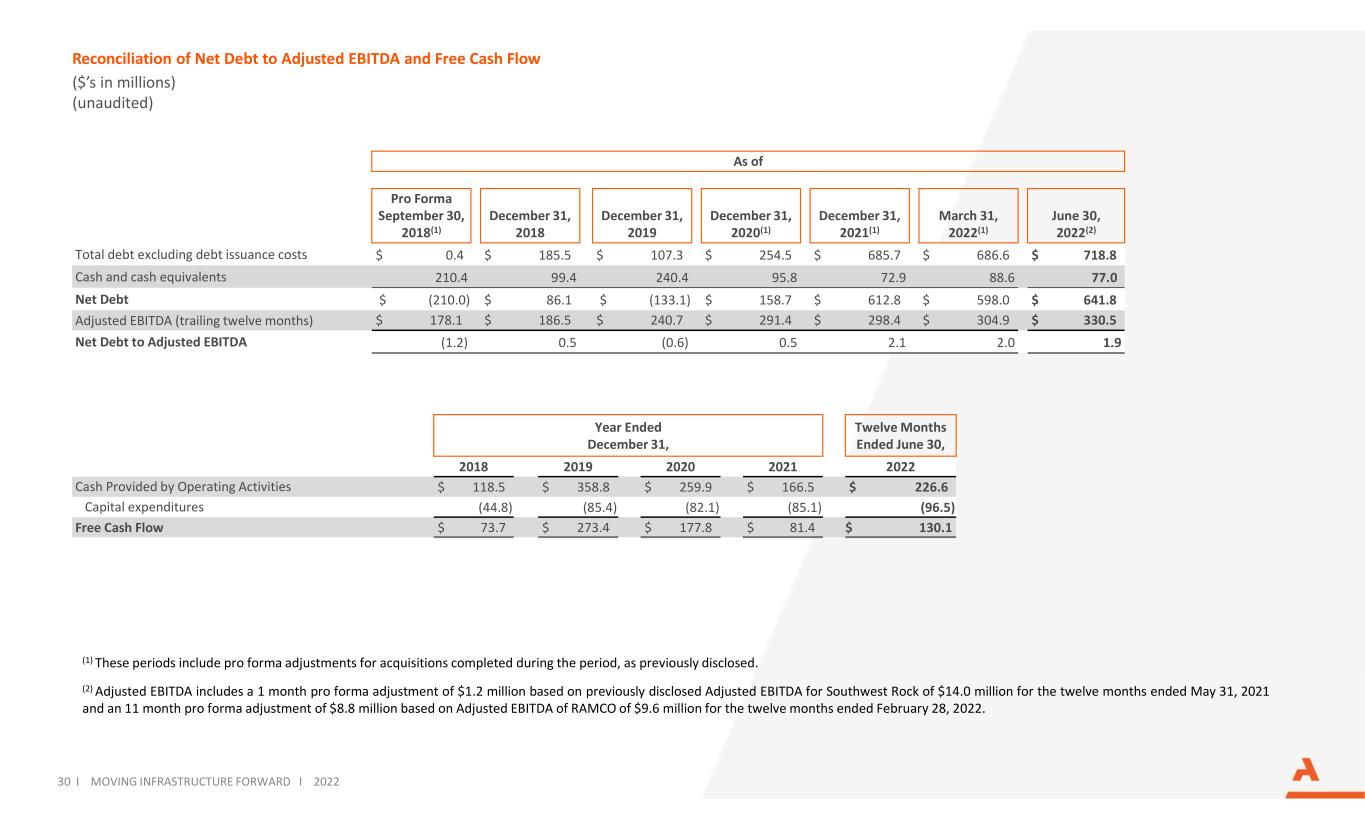

Reconciliation of Net Debt to Adjusted EBITDA and Free Cash Flow ($’s in millions) (unaudited) 30 I MOVING INFRASTRUCTURE FORWARD I 2022 Year Ended December 31, Twelve Months Ended June 30, 2018 2019 2020 2021 2022 Cash Provided by Operating Activities $ 118.5 $ 358.8 $ 259.9 $ 166.5 $ 226.6 Capital expenditures (44.8) (85.4) (82.1) (85.1) (96.5) Free Cash Flow $ 73.7 $ 273.4 $ 177.8 $ 81.4 $ 130.1 As of Pro Forma September 30, 2018(1) December 31, 2018 December 31, 2019 December 31, 2020(1) December 31, 2021(1) March 31, 2022(1) June 30, 2022(2) Total debt excluding debt issuance costs $ 0.4 $ 185.5 $ 107.3 $ 254.5 $ 685.7 $ 686.6 $ 718.8 Cash and cash equivalents 210.4 99.4 240.4 95.8 72.9 88.6 77.0 Net Debt $ (210.0) $ 86.1 $ (133.1) $ 158.7 $ 612.8 $ 598.0 $ 641.8 Adjusted EBITDA (trailing twelve months) $ 178.1 $ 186.5 $ 240.7 $ 291.4 $ 298.4 $ 304.9 $ 330.5 Net Debt to Adjusted EBITDA (1.2) 0.5 (0.6) 0.5 2.1 2.0 1.9 (1) These periods include pro forma adjustments for acquisitions completed during the period, as previously disclosed. (2) Adjusted EBITDA includes a 1 month pro forma adjustment of $1.2 million based on previously disclosed Adjusted EBITDA for Southwest Rock of $14.0 million for the twelve months ended May 31, 2021 and an 11 month pro forma adjustment of $8.8 million based on Adjusted EBITDA of RAMCO of $9.6 million for the twelve months ended February 28, 2022.

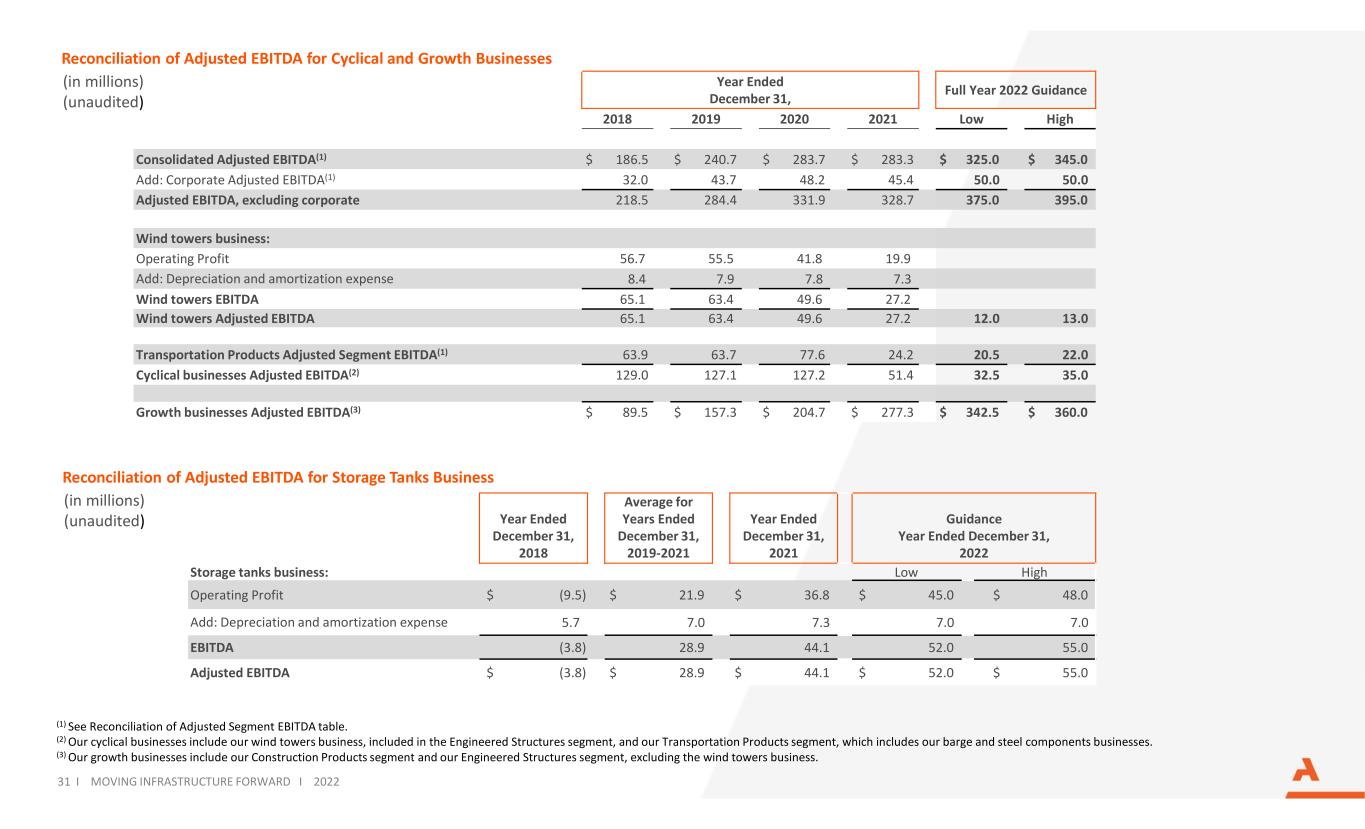

(1) See Reconciliation of Adjusted Segment EBITDA table. (2) Our cyclical businesses include our wind towers business, included in the Engineered Structures segment, and our Transportation Products segment, which includes our barge and steel components businesses. (3) Our growth businesses include our Construction Products segment and our Engineered Structures segment, excluding the wind towers business. 31 I MOVING INFRASTRUCTURE FORWARD I 2022 Year Ended December 31, Full Year 2022 Guidance 2018 2019 2020 2021 Low High Consolidated Adjusted EBITDA(1) $ 186.5 $ 240.7 $ 283.7 $ 283.3 $ 325.0 $ 345.0 Add: Corporate Adjusted EBITDA(1) 32.0 43.7 48.2 45.4 50.0 50.0 Adjusted EBITDA, excluding corporate 218.5 284.4 331.9 328.7 375.0 395.0 Wind towers business: Operating Profit 56.7 55.5 41.8 19.9 Add: Depreciation and amortization expense 8.4 7.9 7.8 7.3 Wind towers EBITDA 65.1 63.4 49.6 27.2 Wind towers Adjusted EBITDA 65.1 63.4 49.6 27.2 12.0 13.0 Transportation Products Adjusted Segment EBITDA(1) 63.9 63.7 77.6 24.2 20.5 22.0 Cyclical businesses Adjusted EBITDA(2) 129.0 127.1 127.2 51.4 32.5 35.0 Growth businesses Adjusted EBITDA(3) $ 89.5 $ 157.3 $ 204.7 $ 277.3 $ 342.5 $ 360.0 Reconciliation of Adjusted EBITDA for Cyclical and Growth Businesses (in millions) (unaudited) Reconciliation of Adjusted EBITDA for Storage Tanks Business (in millions) (unaudited) Year Ended December 31, Average for Years Ended December 31, Year Ended December 31, Guidance Year Ended December 31, 2018 2019-2021 2021 2022 Storage tanks business: Low High Operating Profit $ (9.5) $ 21.9 $ 36.8 $ 45.0 $ 48.0 Add: Depreciation and amortization expense 5.7 7.0 7.3 7.0 7.0 EBITDA (3.8) 28.9 44.1 52.0 55.0 Adjusted EBITDA $ (3.8) $ 28.9 $ 44.1 $ 52.0 $ 55.0

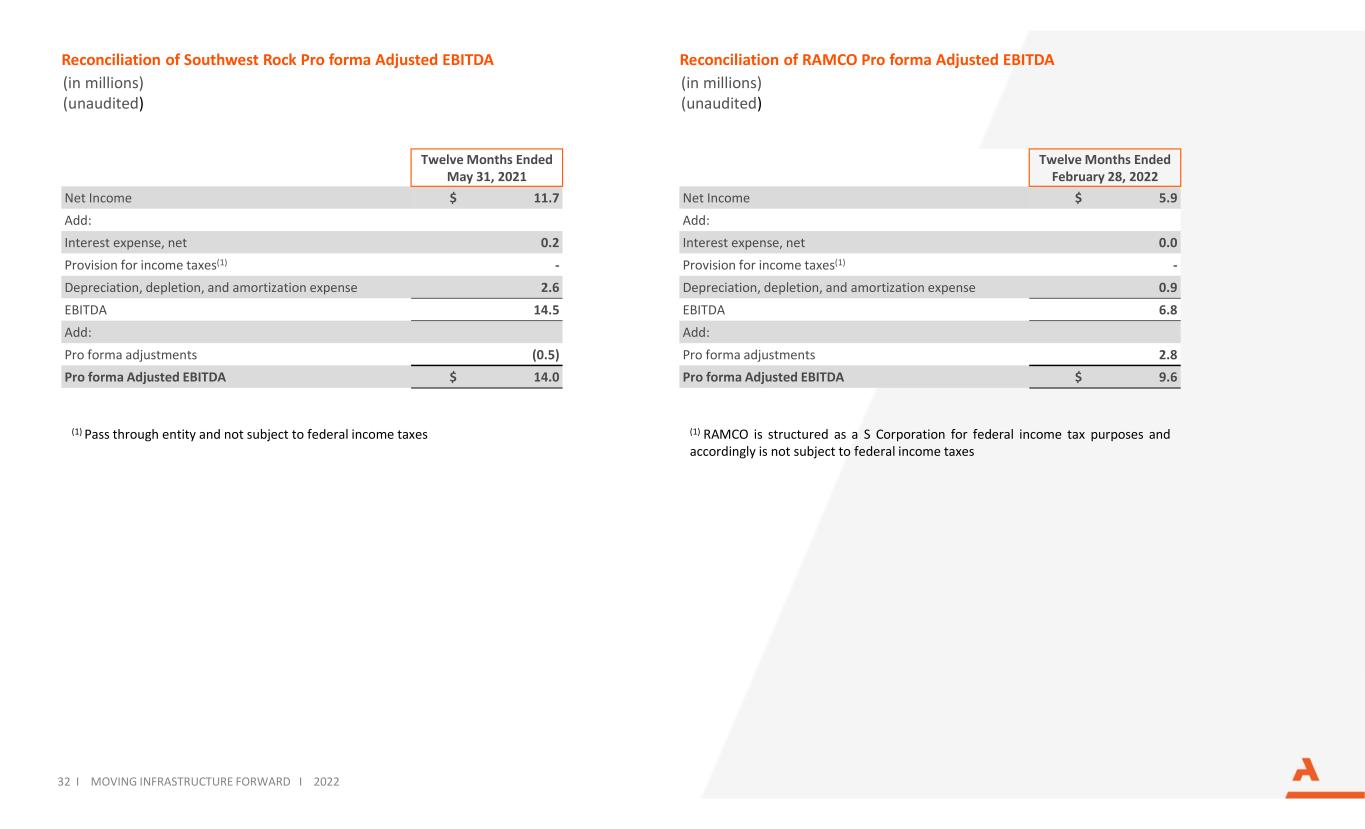

Reconciliation of Southwest Rock Pro forma Adjusted EBITDA (in millions) (unaudited) 32 I MOVING INFRASTRUCTURE FORWARD I 2022 Twelve Months Ended May 31, 2021 Net Income $ 11.7 Add: Interest expense, net 0.2 Provision for income taxes(1) - Depreciation, depletion, and amortization expense 2.6 EBITDA 14.5 Add: Pro forma adjustments (0.5) Pro forma Adjusted EBITDA $ 14.0 (1) Pass through entity and not subject to federal income taxes Reconciliation of RAMCO Pro forma Adjusted EBITDA (in millions) (unaudited) Twelve Months Ended February 28, 2022 Net Income $ 5.9 Add: Interest expense, net 0.0 Provision for income taxes(1) - Depreciation, depletion, and amortization expense 0.9 EBITDA 6.8 Add: Pro forma adjustments 2.8 Pro forma Adjusted EBITDA $ 9.6 (1) RAMCO is structured as a S Corporation for federal income tax purposes and accordingly is not subject to federal income taxes

500 N. Akard Street, Suite 400 Dallas, Texas 75201 (972) 942-6500 ir.arcosa.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- BGHL (GBP): NAV(s)

- AS Tallink Grupp will hold an Investor Webinar to introduce the results of the first quarter of 2024

- BGHL (EUR): NAV(s)

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share