Form 8-K American Water Works For: May 20

Investor Presentation May 2022 Exhibit 99.1

Forward-Looking Statements Safe Harbor This presentation includes forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. They are not guarantees or assurances of any outcomes, financial results, levels of activity, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may differ materially from those discussed in the forward-looking statements included in this presentation. The factors that could cause actual results to differ are discussed in the Appendix to this presentation, and in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, as filed with the SEC on April 27, 2022. Non-GAAP Financial Information This presentation includes non-GAAP financial measures. Further information regarding these non-GAAP financial measures, including a reconciliation of each of these measures to the most directly comparable GAAP measure, is included in the Appendix to this presentation.

Business Review

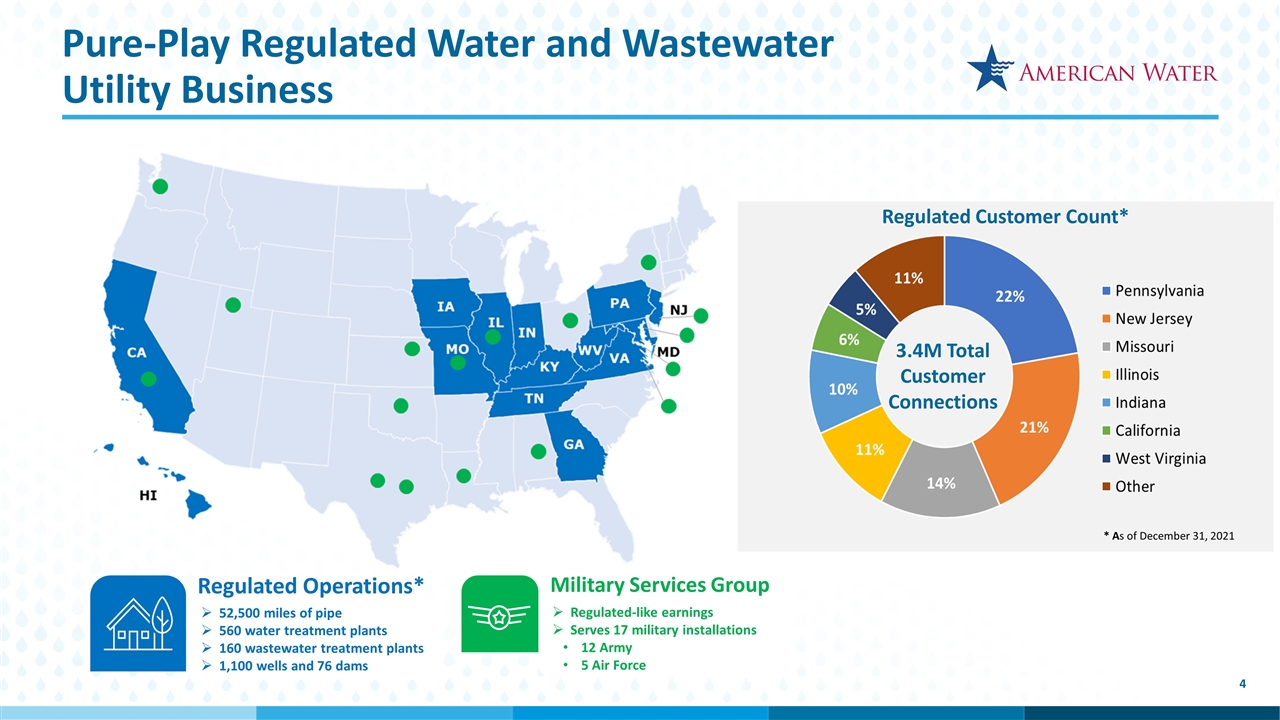

Pure-Play Regulated Water and Wastewater Utility Business Regulated Operations* Military Services Group 52,500 miles of pipe 560 water treatment plants 160 wastewater treatment plants 1,100 wells and 76 dams Regulated-like earnings Serves 17 military installations 12 Army 5 Air Force Regulated Customer Count* 3.4M Total Customer Connections * As of December 31, 2021

Focused on Executing the Plan and Building on Our Strengths People Inclusion & empowerment pave a path for employee & company success. Employees are the Heart of Our Business Performance Safety is both a strategy & core company value. Safety is More Than “the Right Thing to Do” Safety Growth Growth enables investment in critical infrastructure and communities and leads to improved affordability. Industry Leaders in Customer Growth ESG ESG affirms the values we have upheld for decades. Leading by Example Going beyond the minimum requirement to solidify our position as a leader in O&M excellence. Excellence is Getting the Fundamentals Right

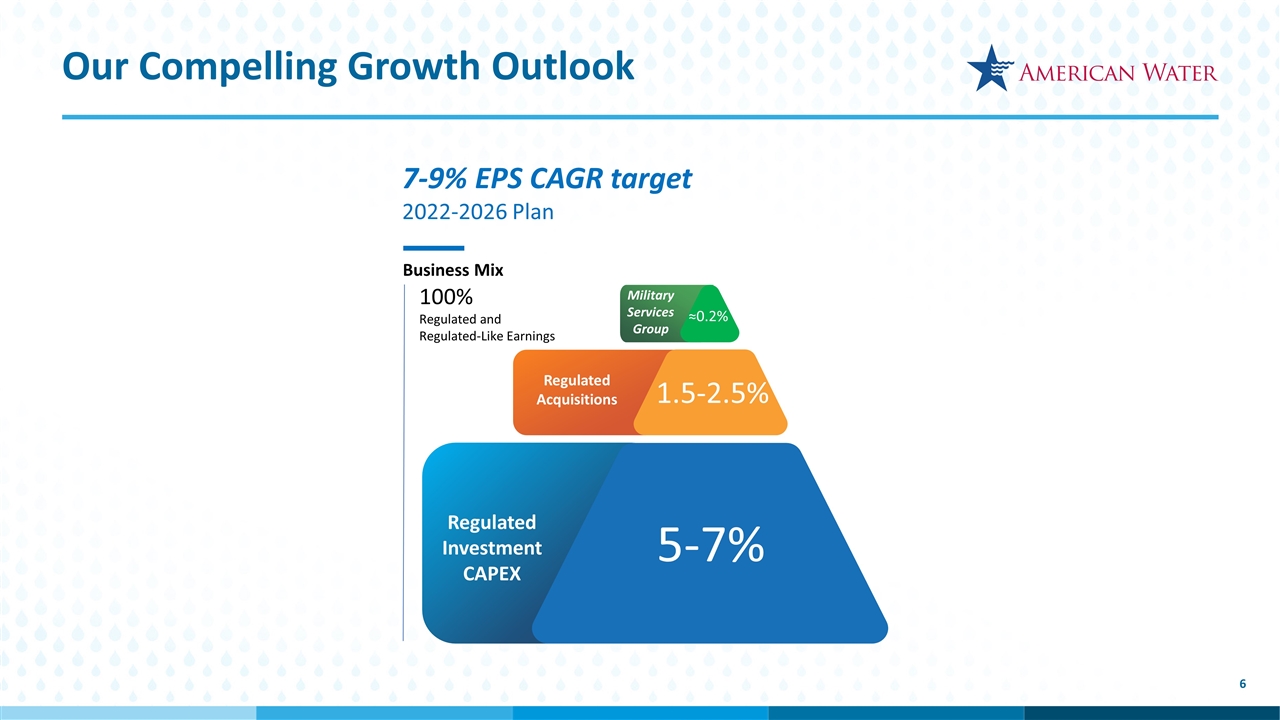

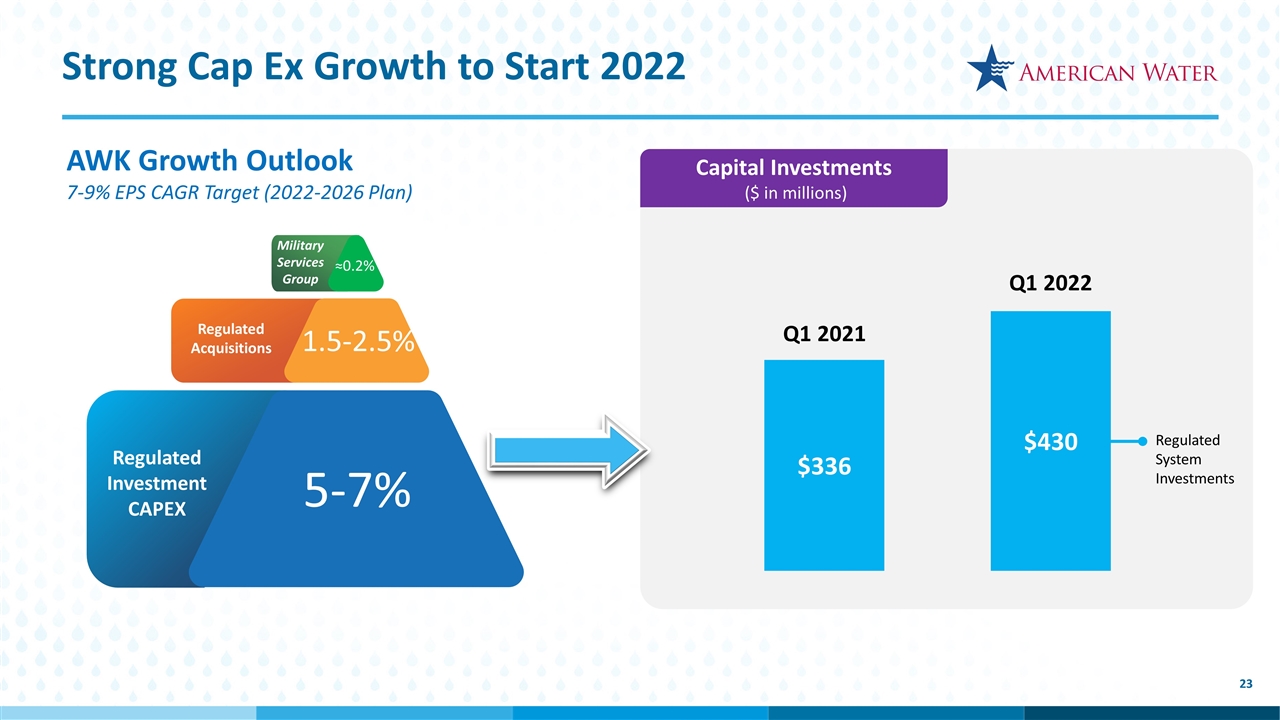

7-9% EPS CAGR target 2022-2026 Plan Regulated Investment CAPEX Regulated Investment CAPEX ~0.5% 5-7% 2-3% Regulated Investment CAPEX Regulated Acquisitions ~1% 5-7% 1.5-2.5% ≈0.2% Business Mix 100% Regulated and Regulated-Like Earnings Military Services Group Our Compelling Growth Outlook

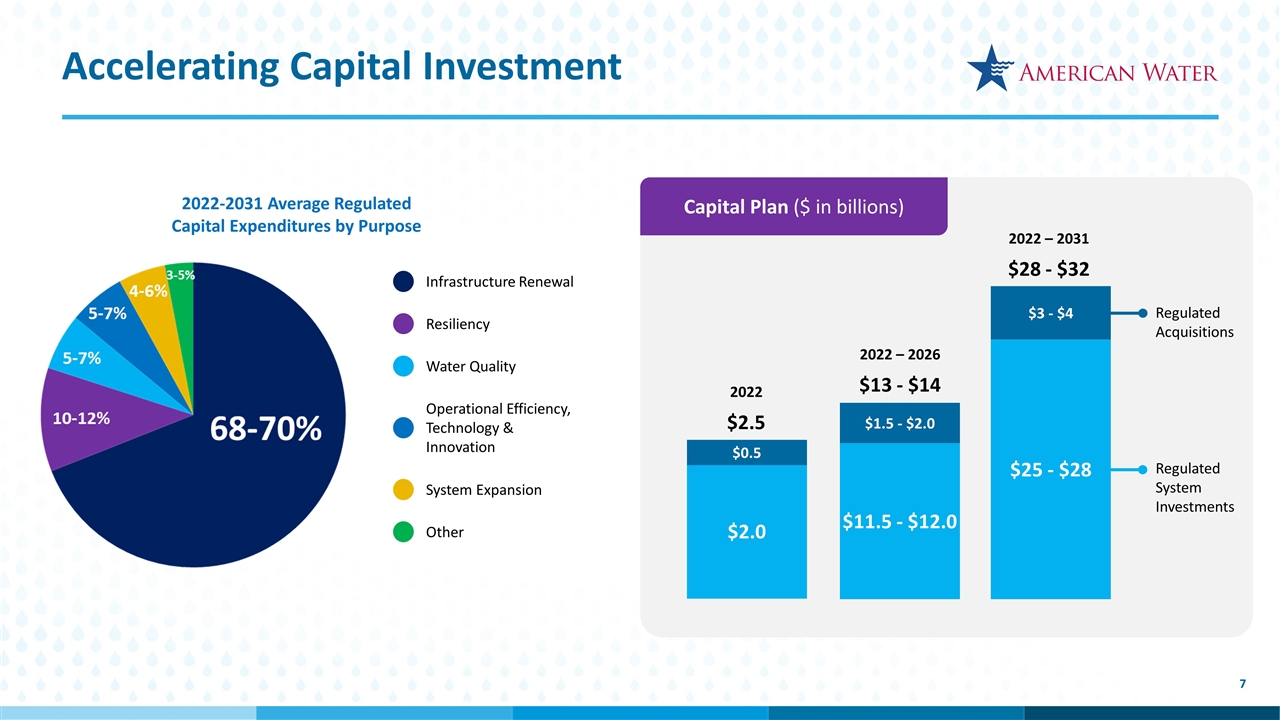

$11.5 - $12.0 $1.5 - $2.0 $25 - $28 $3 - $4 2022 – 2026 $13 - $14 2022 – 2031 $28 - $32 $2.0 $0.5 2022 $2.5 Regulated System Investments Regulated Acquisitions 2022-2031 Average Regulated Capital Expenditures by Purpose Capital Plan ($ in billions) Accelerating Capital Investment Infrastructure Renewal Operational Efficiency, Technology & Innovation Water Quality Resiliency System Expansion Other

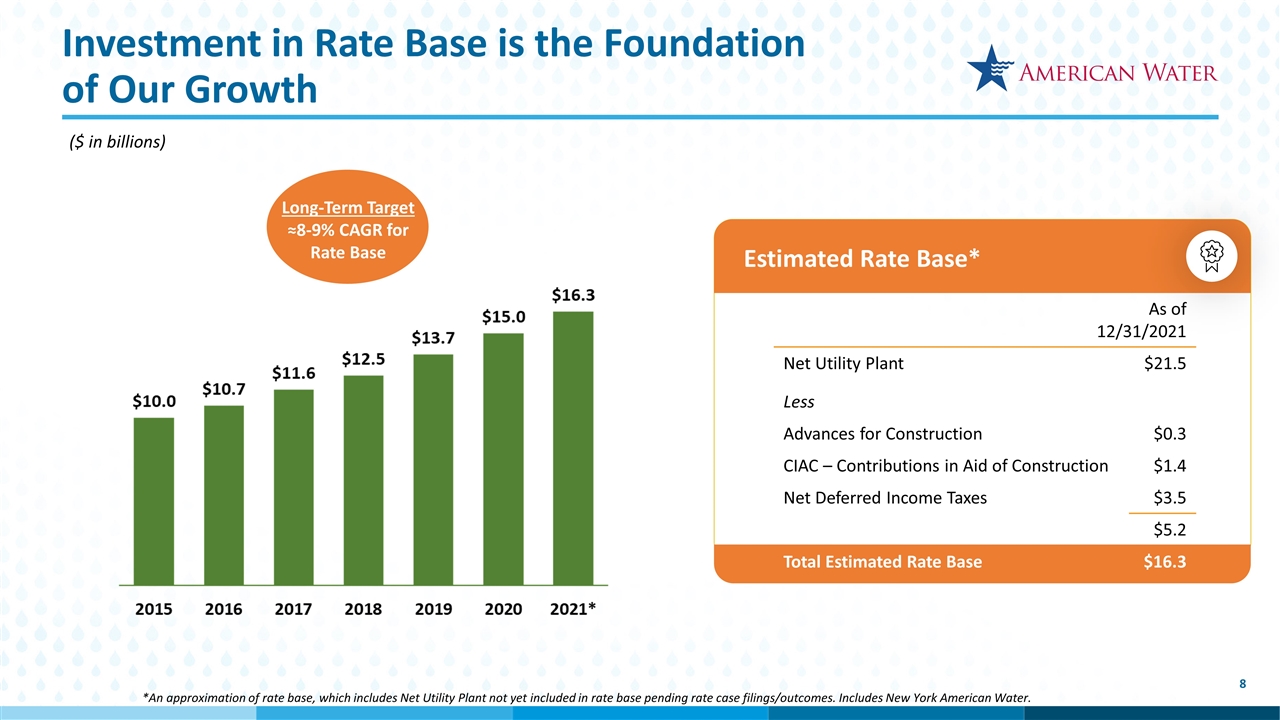

Investment in Rate Base is the Foundation of Our Growth Long-Term Target ≈8-9% CAGR for Rate Base Estimated Rate Base* *An approximation of rate base, which includes Net Utility Plant not yet included in rate base pending rate case filings/outcomes. Includes New York American Water. ($ in billions) As of 12/31/2021 As of 12/31/2021 Net Utility Plant $21.5 Less Advances for Construction $0.3 CIAC – Contributions in Aid of Construction $1.4 Net Deferred Income Taxes $3.5 $5.2 Total Estimated Rate Base $16.3

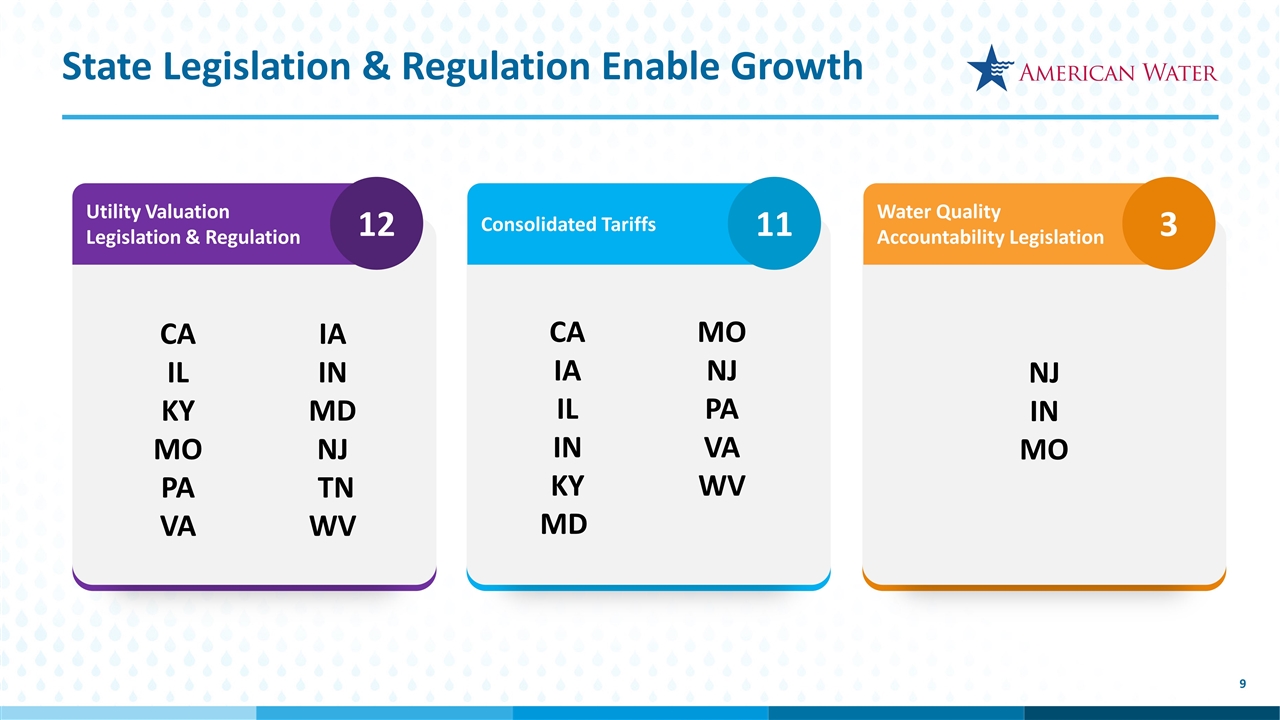

State Legislation & Regulation Enable Growth Utility Valuation Legislation & Regulation Consolidated Tariffs Water Quality Accountability Legislation 12 11 3 CA IL KY MO PA VA IA IN MD NJ TN WV CA IA IL IN KY MD MO NJ PA VA WV NJ IN MO

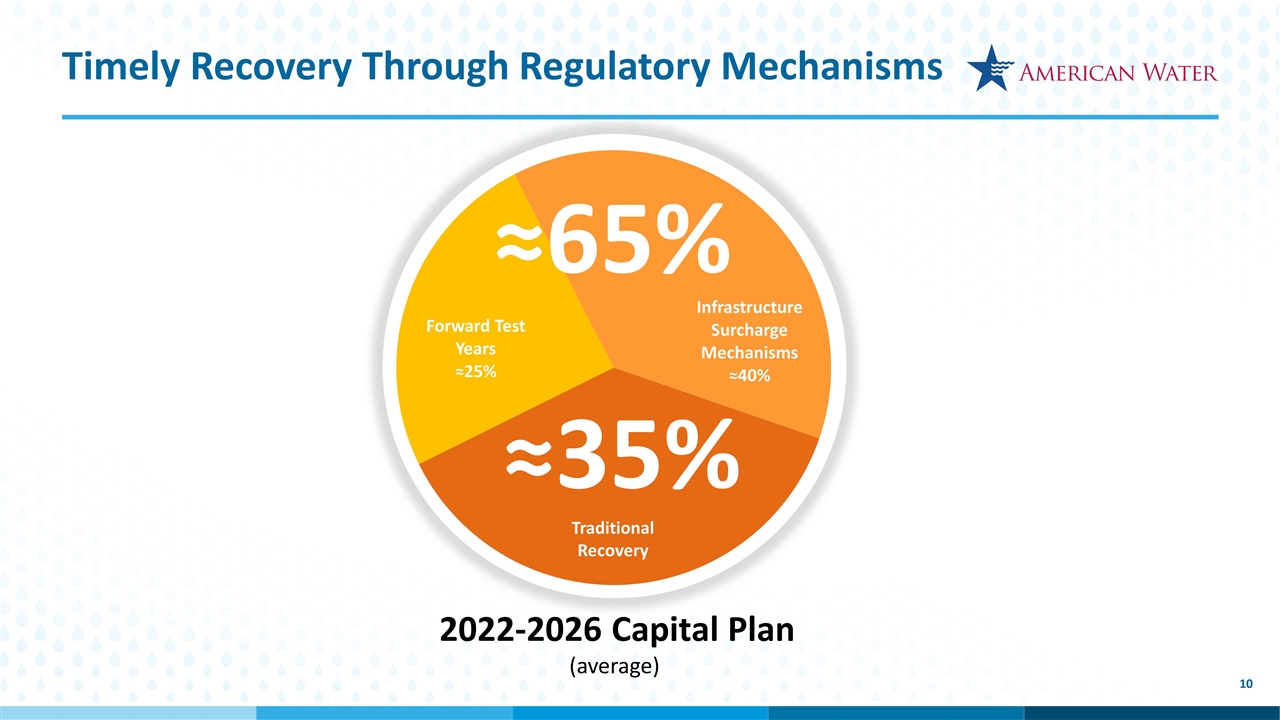

Timely Recovery Through Regulatory Mechanisms 2022-2026 Capital Plan (average) Traditional Recovery Forward Test Years (25%) Infrastructure Surcharge Mechanisms (38%) ≈35% ≈65%

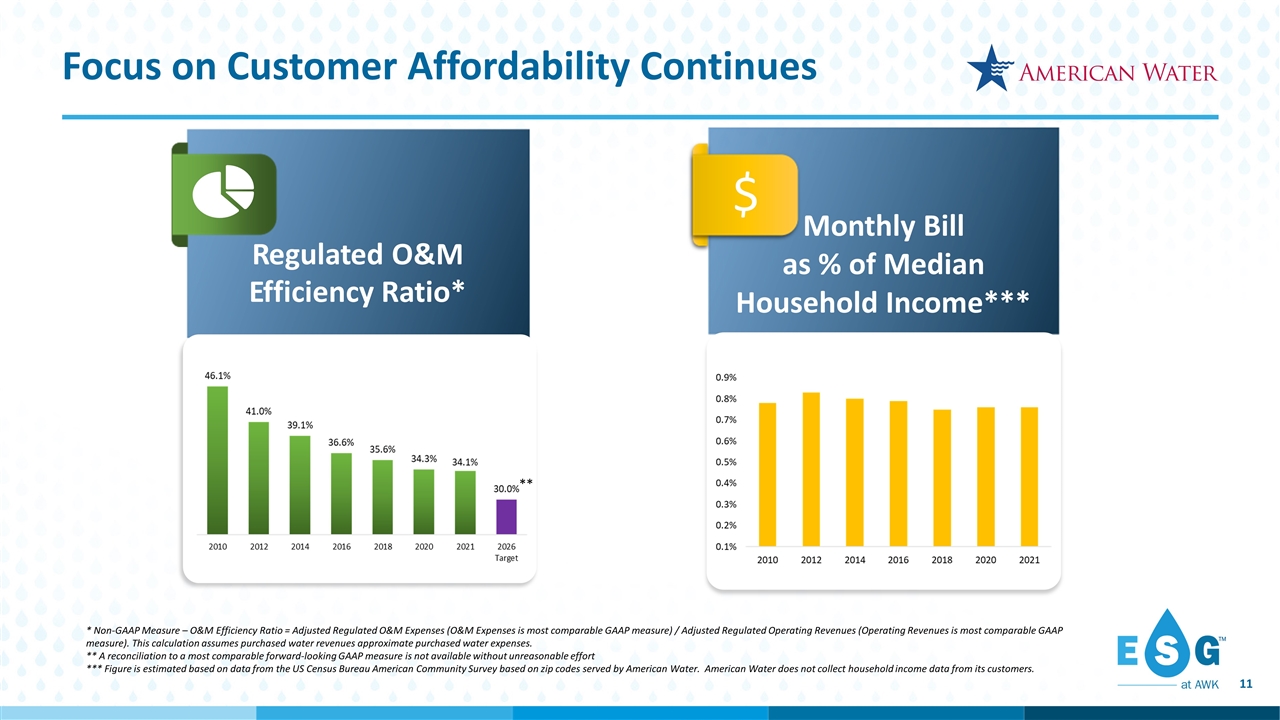

Focus on Customer Affordability Continues Regulated O&M Efficiency Ratio* Monthly Bill as % of Median Household Income*** $ ** * Non-GAAP Measure – O&M Efficiency Ratio = Adjusted Regulated O&M Expenses (O&M Expenses is most comparable GAAP measure) / Adjusted Regulated Operating Revenues (Operating Revenues is most comparable GAAP measure). This calculation assumes purchased water revenues approximate purchased water expenses. ** A reconciliation to a most comparable forward-looking GAAP measure is not available without unreasonable effort *** Figure is estimated based on data from the US Census Bureau American Community Survey based on zip codes served by American Water. American Water does not collect household income data from its customers.

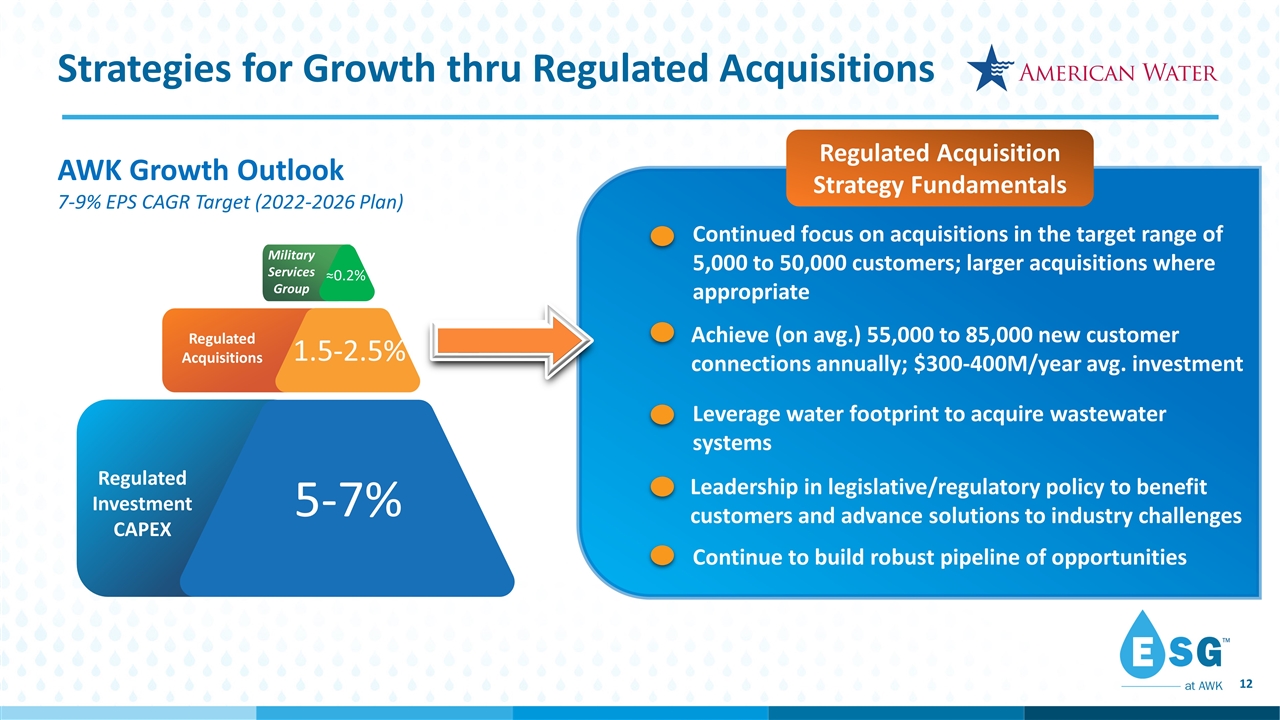

Continued focus on acquisitions in the target range of 5,000 to 50,000 customers; larger acquisitions where appropriate Strategies for Growth thru Regulated Acquisitions Regulated Acquisition Strategy Fundamentals Leverage water footprint to acquire wastewater systems Leadership in legislative/regulatory policy to benefit customers and advance solutions to industry challenges Continue to build robust pipeline of opportunities Achieve (on avg.) 55,000 to 85,000 new customer connections annually; $300-400M/year avg. investment Regulated Investment CAPEX Regulated Investment CAPEX ~0.5% 5-7% 2-3% Regulated Investment CAPEX Regulated Acquisitions ~1% 5-7% 1.5-2.5% ≈0.2% Military Services Group AWK Growth Outlook 7-9% EPS CAGR Target (2022-2026 Plan)

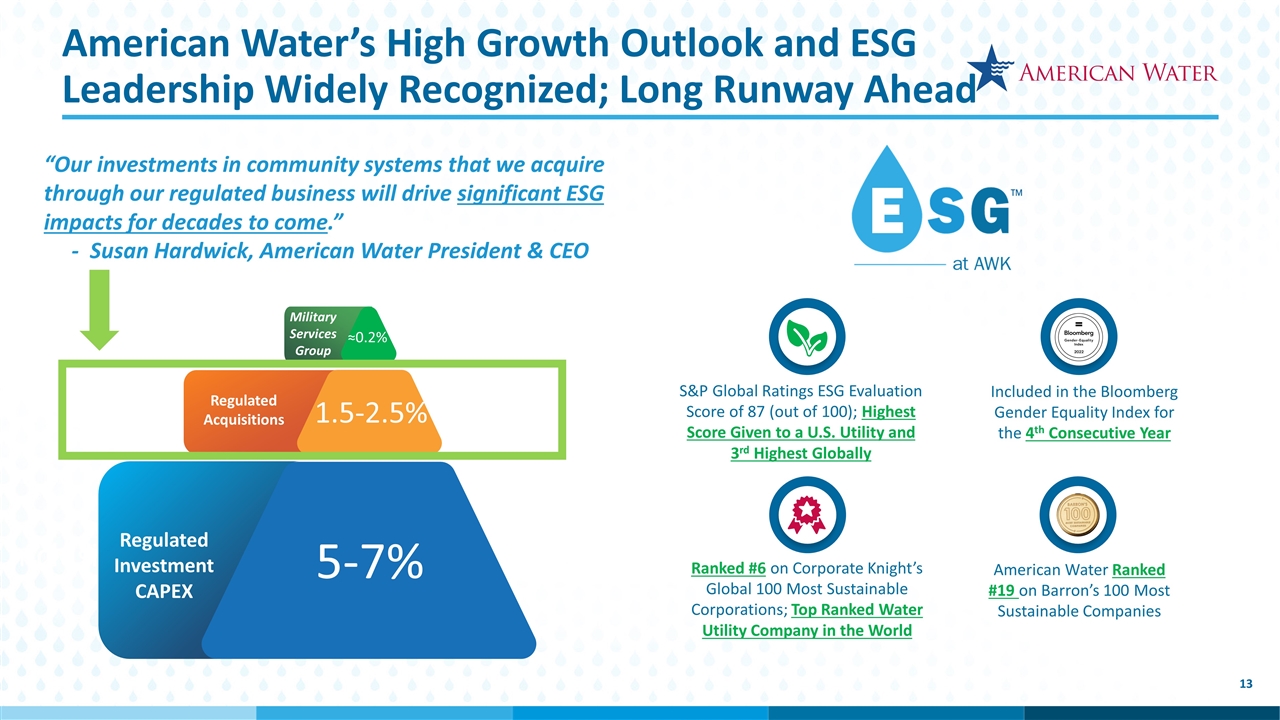

Sustainability Supplier Diversity Inclusion & Diversity Regulated Investment CAPEX Regulated Investment CAPEX ~0.5% 5-7% 2-3% Regulated Investment CAPEX Regulated Acquisitions ~1% 5-7% 1.5-2.5% ≈0.2% Military Services Group “Our investments in community systems that we acquire through our regulated business will drive significant ESG impacts for decades to come.” - Susan Hardwick, American Water President & CEO American Water’s High Growth Outlook and ESG Leadership Widely Recognized; Long Runway Ahead Ranked #6 on Corporate Knight’s Global 100 Most Sustainable Corporations; Top Ranked Water Utility Company in the World American Water Ranked #19 on Barron’s 100 Most Sustainable Companies S&P Global Ratings ESG Evaluation Score of 87 (out of 100); Highest Score Given to a U.S. Utility and 3rd Highest Globally Included in the Bloomberg Gender Equality Index for the 4th Consecutive Year

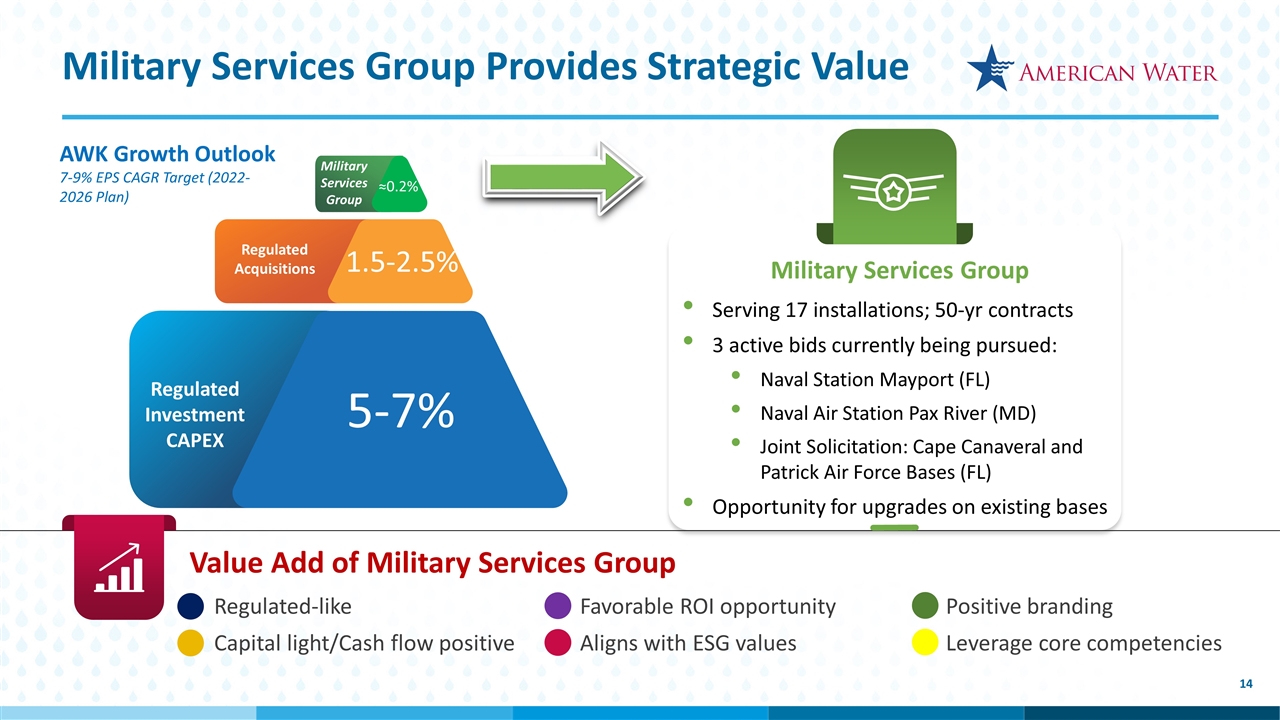

Regulated-like Capital light/Cash flow positive Favorable ROI opportunity Aligns with ESG values Positive branding Leverage core competencies Military Services Group Provides Strategic Value Serving 17 installations; 50-yr contracts 3 active bids currently being pursued: Naval Station Mayport (FL) Naval Air Station Pax River (MD) Joint Solicitation: Cape Canaveral and Patrick Air Force Bases (FL) Opportunity for upgrades on existing bases Military Services Group Value Add of Military Services Group Regulated Investment CAPEX Regulated Investment CAPEX ~0.5% 5-7% 2-3% Regulated Investment CAPEX Regulated Acquisitions ~1% 5-7% 1.5-2.5% ≈0.2% Military Services Group AWK Growth Outlook 7-9% EPS CAGR Target (2022-2026 Plan)

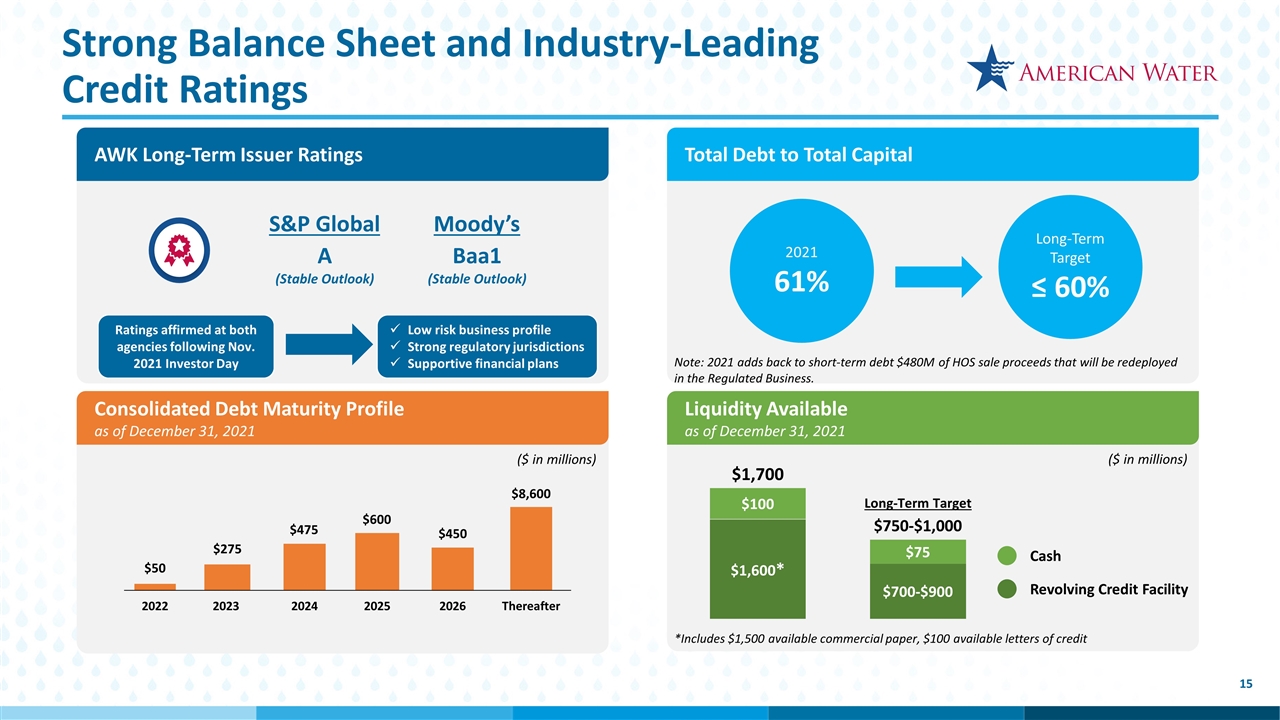

Strong Balance Sheet and Industry-Leading Credit Ratings AWK Long-Term Issuer Ratings Consolidated Debt Maturity Profile as of December 31, 2021 Liquidity Available as of December 31, 2021 A (Stable Outlook) Baa1 (Stable Outlook) S&P Global Moody’s $50 2022 $275 2023 $475 2024 $600 2025 2026 $450 $1,600* $100 $1,700 $700-$900 Long-Term Target $75 $750-$1,000 Revolving Credit Facility Cash Thereafter $8,600 *Includes $1,500 available commercial paper, $100 available letters of credit Total Debt to Total Capital 2021 61% Long-Term Target ≤ 60% ($ in millions) ($ in millions) Ratings affirmed at both agencies following Nov. 2021 Investor Day Low risk business profile Strong regulatory jurisdictions Supportive financial plans Note: 2021 adds back to short-term debt $480M of HOS sale proceeds that will be redeployed in the Regulated Business.

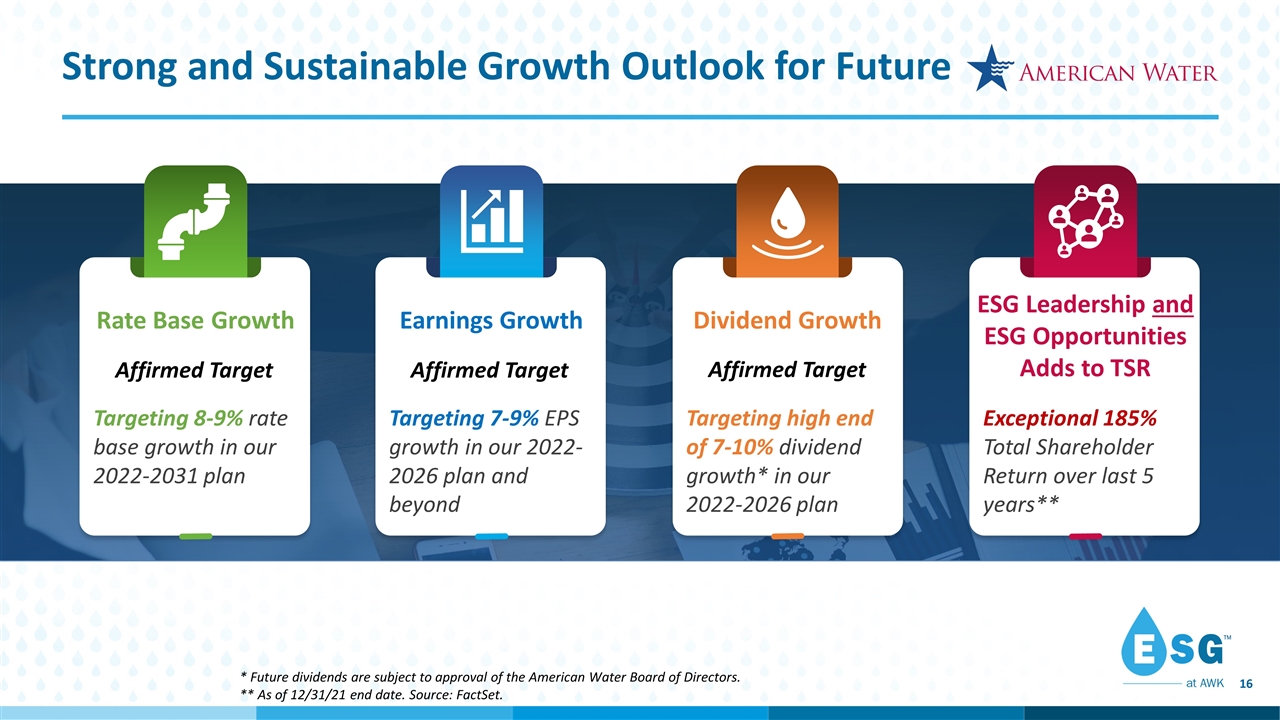

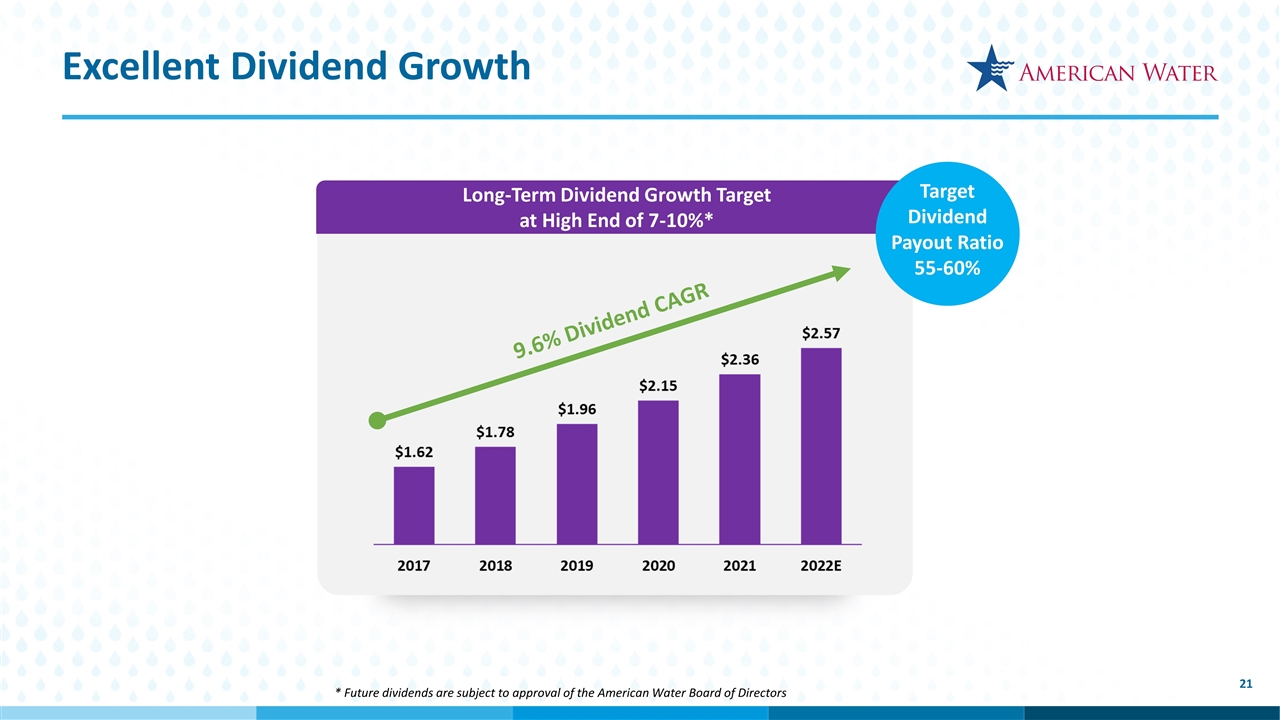

Dividend Growth Targeting high end of 7-10% dividend growth* in our 2022-2026 plan ESG Leadership and ESG Opportunities Adds to TSR Exceptional 185% Total Shareholder Return over last 5 years** Earnings Growth Targeting 7-9% EPS growth in our 2022-2026 plan and beyond Rate Base Growth Targeting 8-9% rate base growth in our 2022-2031 plan * Future dividends are subject to approval of the American Water Board of Directors. ** As of 12/31/21 end date. Source: FactSet. Affirmed Target Affirmed Target Affirmed Target Strong and Sustainable Growth Outlook for Future

First Quarter 2022 Results

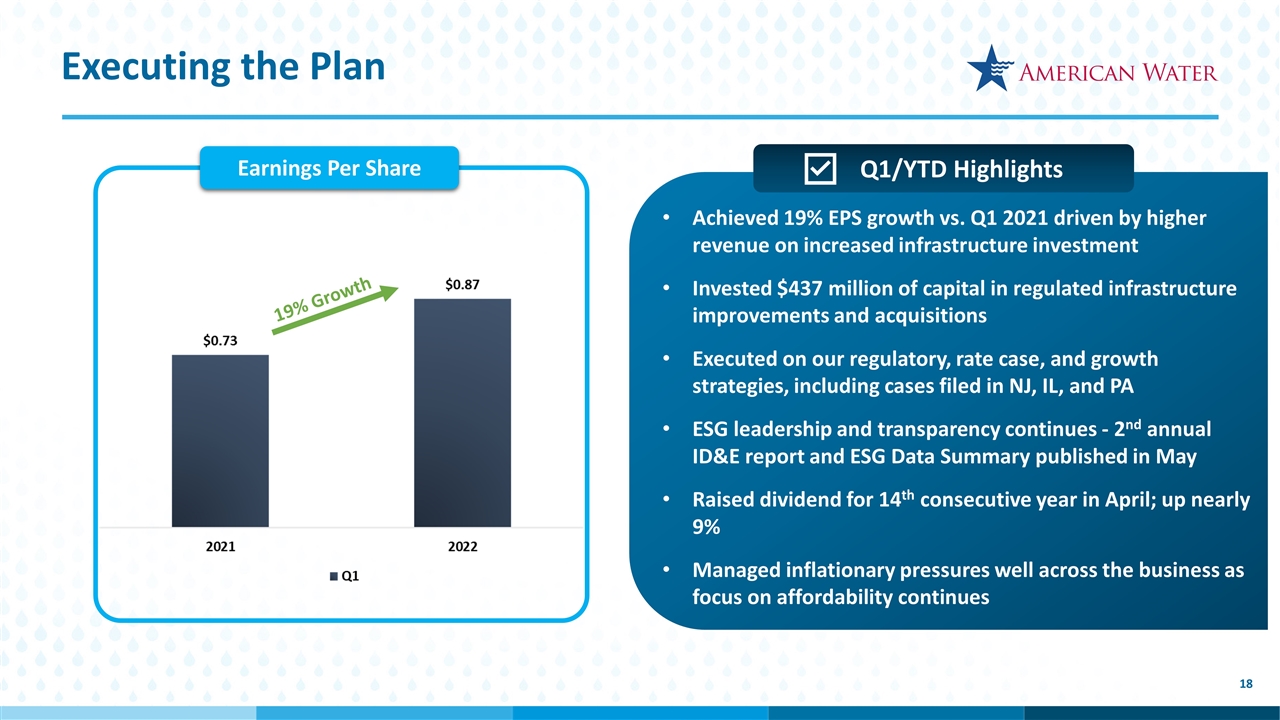

Executing the Plan Earnings Per Share Achieved 19% EPS growth vs. Q1 2021 driven by higher revenue on increased infrastructure investment Invested $437 million of capital in regulated infrastructure improvements and acquisitions Executed on our regulatory, rate case, and growth strategies, including cases filed in NJ, IL, and PA ESG leadership and transparency continues - 2nd annual ID&E report and ESG Data Summary published in May Raised dividend for 14th consecutive year in April; up nearly 9% Managed inflationary pressures well across the business as focus on affordability continues 19% Growth Q1/YTD Highlights

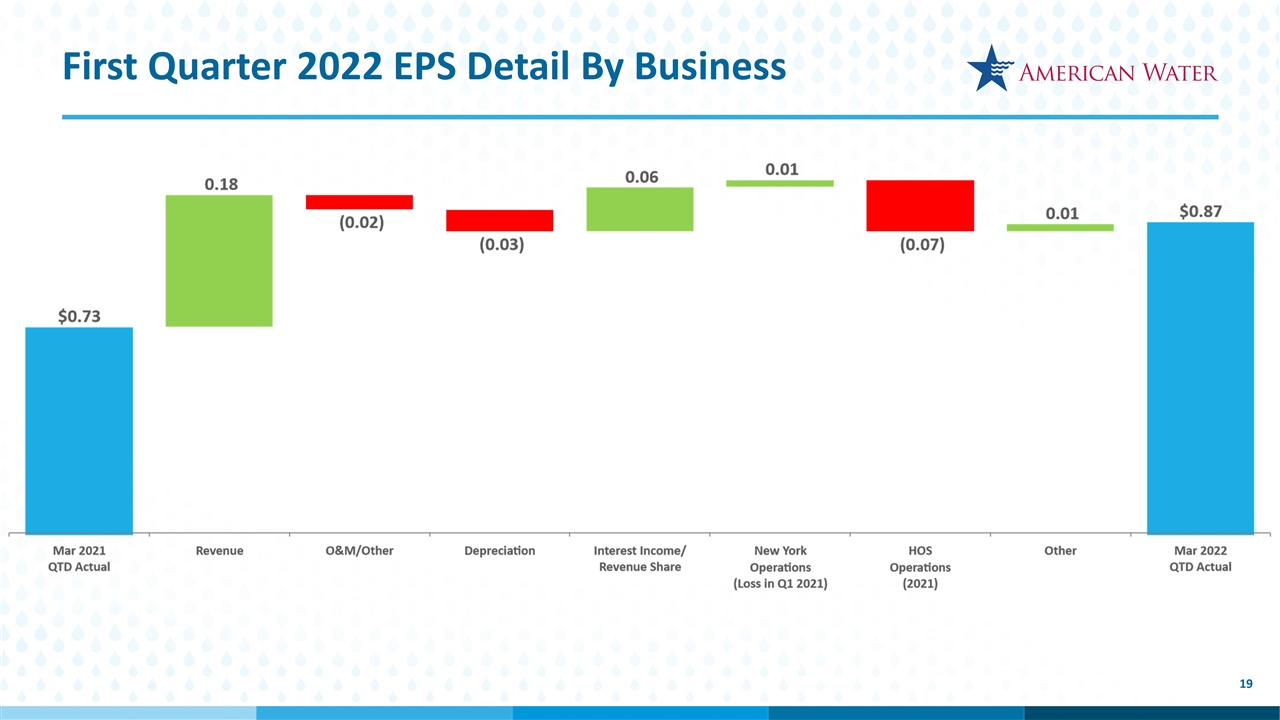

First Quarter 2022 EPS Detail By Business

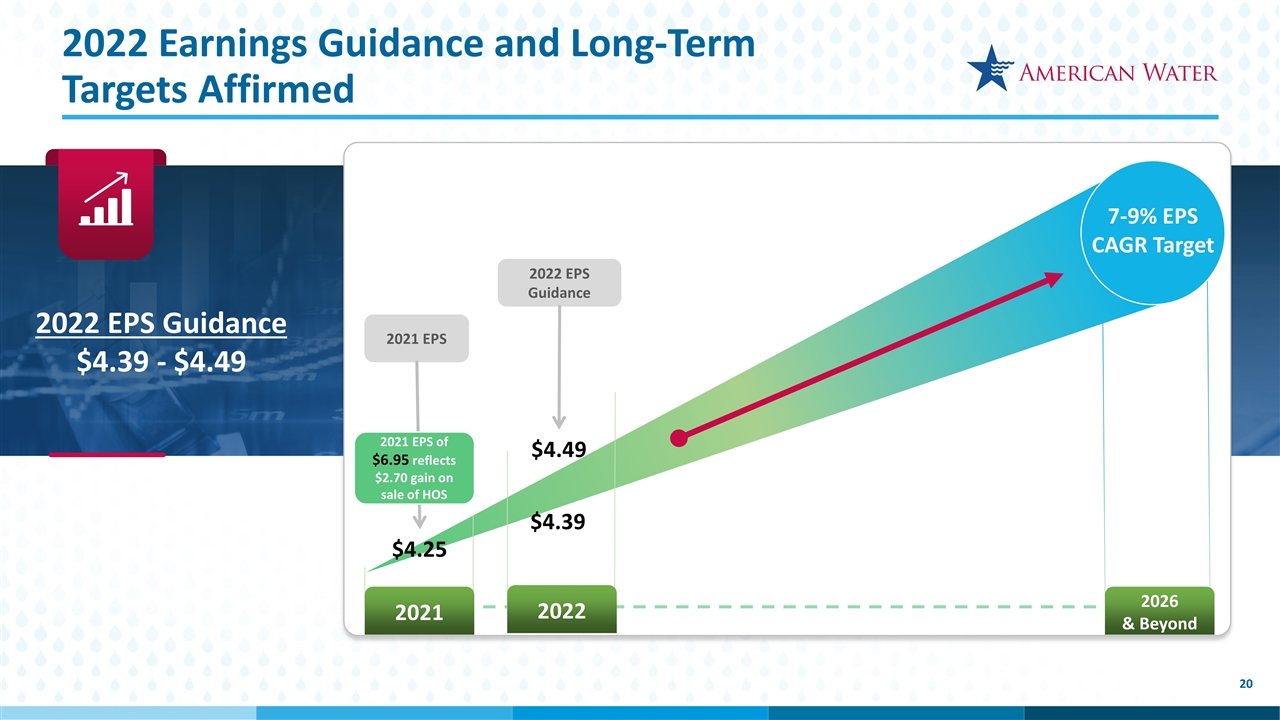

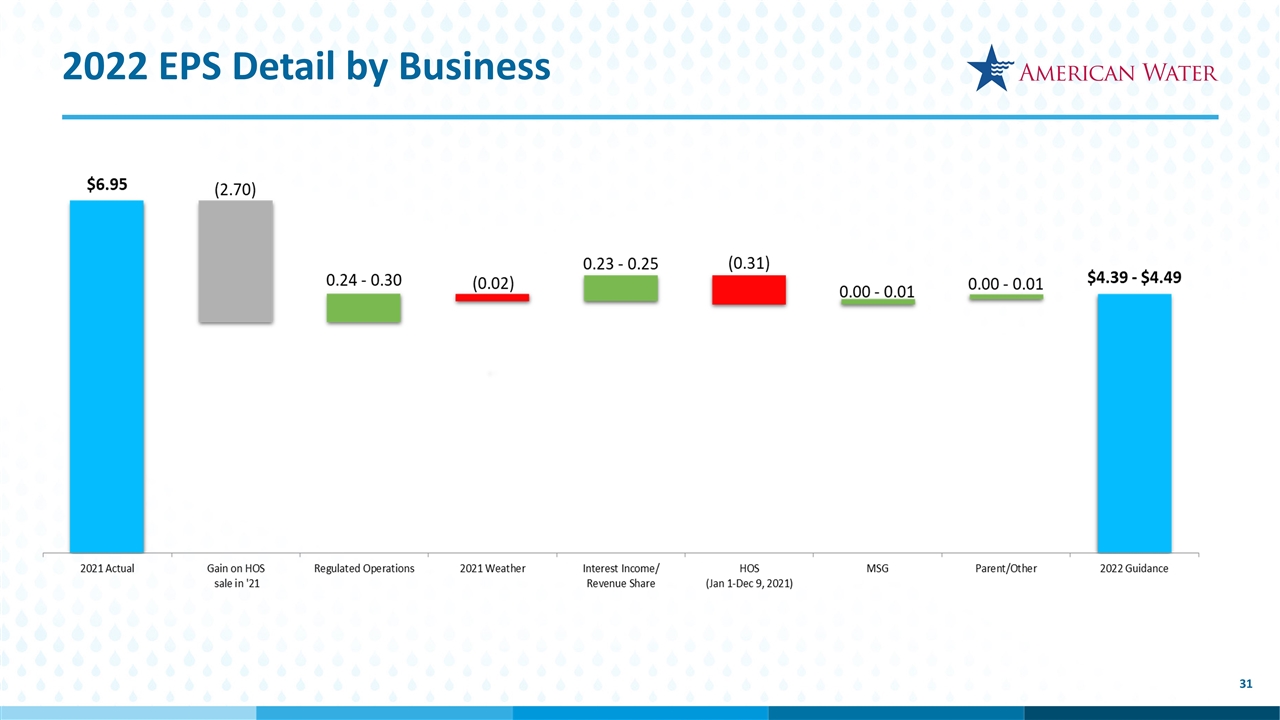

2022 Earnings Guidance and Long-Term Targets Affirmed 2021 2026 & Beyond 2022 EPS Guidance 7-9% EPS CAGR Target $4.49 $4.39 2022 EPS Guidance $4.39 - $4.49 2020 EPS of $3.84 excludes $0.07 per share of favorable weather 2022 2021 EPS $4.25 2021 EPS of $6.95 reflects $2.70 gain on sale of HOS

Excellent Dividend Growth * Future dividends are subject to approval of the American Water Board of Directors Long-Term Dividend Growth Target at High End of 7-10%* Target Dividend Payout Ratio 55-60% 9.6% Dividend CAGR

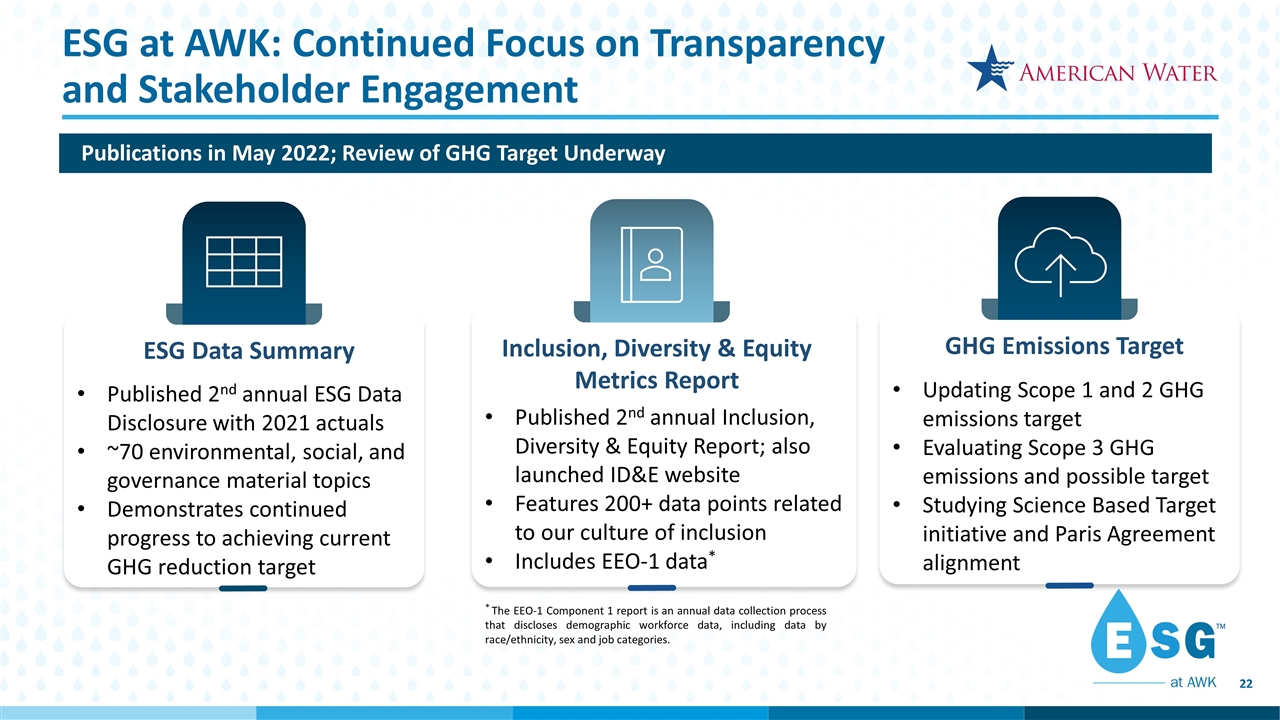

ESG at AWK: Continued Focus on Transparency and Stakeholder Engagement Published 2nd annual ESG Data Disclosure with 2021 actuals ~70 environmental, social, and governance material topics Demonstrates continued progress to achieving current GHG reduction target ESG Data Summary Published 2nd annual Inclusion, Diversity & Equity Report; also launched ID&E website Features 200+ data points related to our culture of inclusion Includes EEO-1 data* Inclusion, Diversity & Equity Metrics Report Updating Scope 1 and 2 GHG emissions target Evaluating Scope 3 GHG emissions and possible target Studying Science Based Target initiative and Paris Agreement alignment GHG Emissions Target * The EEO-1 Component 1 report is an annual data collection process that discloses demographic workforce data, including data by race/ethnicity, sex and job categories. Publications in May 2022; Review of GHG Target Underway

$336 $430 Q1 2021 Q1 2022 Regulated System Investments Capital Investments ($ in millions) Strong Cap Ex Growth to Start 2022 Regulated Investment CAPEX Regulated Investment CAPEX ~0.5% 5-7% 2-3% Regulated Investment CAPEX Regulated Acquisitions ~1% 5-7% 1.5-2.5% ≈0.2% Military Services Group AWK Growth Outlook 7-9% EPS CAGR Target (2022-2026 Plan)

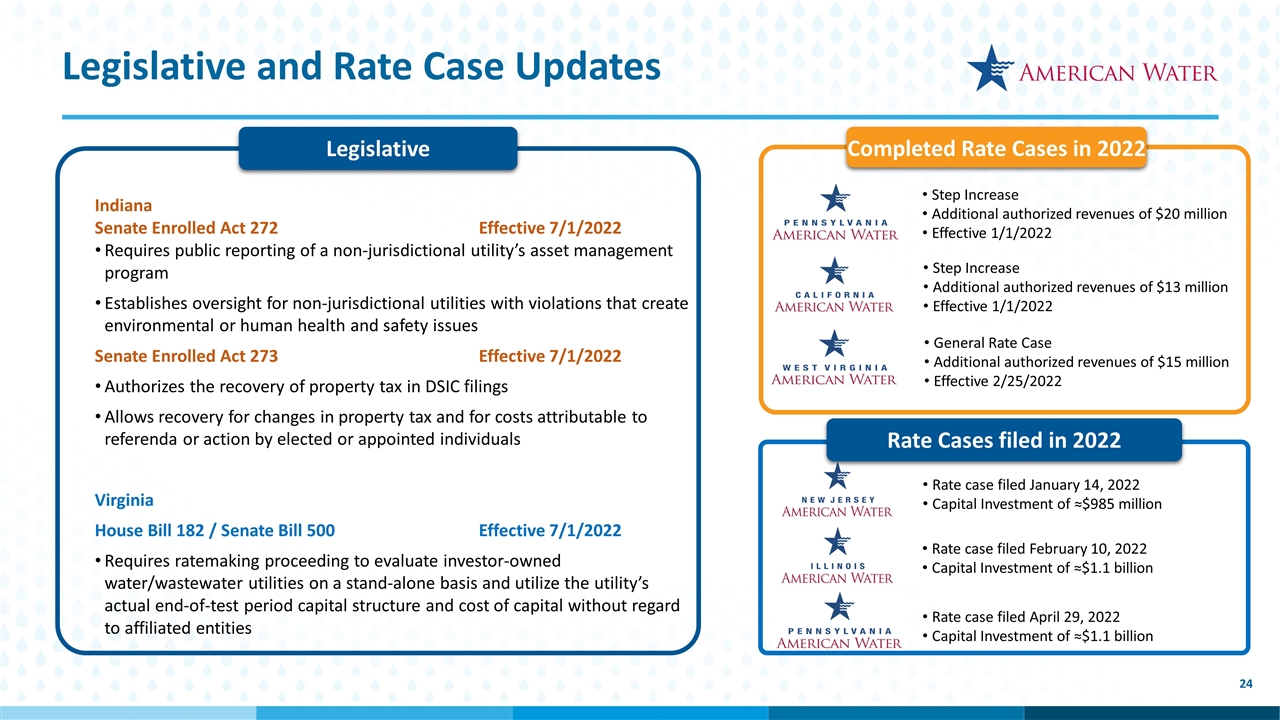

Legislative and Rate Case Updates Rate case filed January 14, 2022 Capital Investment of ≈$985 million Rate case filed February 10, 2022 Capital Investment of ≈$1.1 billion Rate Cases filed in 2022 Legislative Indiana Senate Enrolled Act 272Effective 7/1/2022 Requires public reporting of a non-jurisdictional utility’s asset management program Establishes oversight for non-jurisdictional utilities with violations that create environmental or human health and safety issues Senate Enrolled Act 273Effective 7/1/2022 Authorizes the recovery of property tax in DSIC filings Allows recovery for changes in property tax and for costs attributable to referenda or action by elected or appointed individuals Virginia House Bill 182 / Senate Bill 500Effective 7/1/2022 Requires ratemaking proceeding to evaluate investor-owned water/wastewater utilities on a stand-alone basis and utilize the utility’s actual end-of-test period capital structure and cost of capital without regard to affiliated entities Completed Rate Cases in 2022 Step Increase Additional authorized revenues of $20 million Effective 1/1/2022 Step Increase Additional authorized revenues of $13 million Effective 1/1/2022 General Rate Case Additional authorized revenues of $15 million Effective 2/25/2022 Rate case filed April 29, 2022 Capital Investment of ≈$1.1 billion

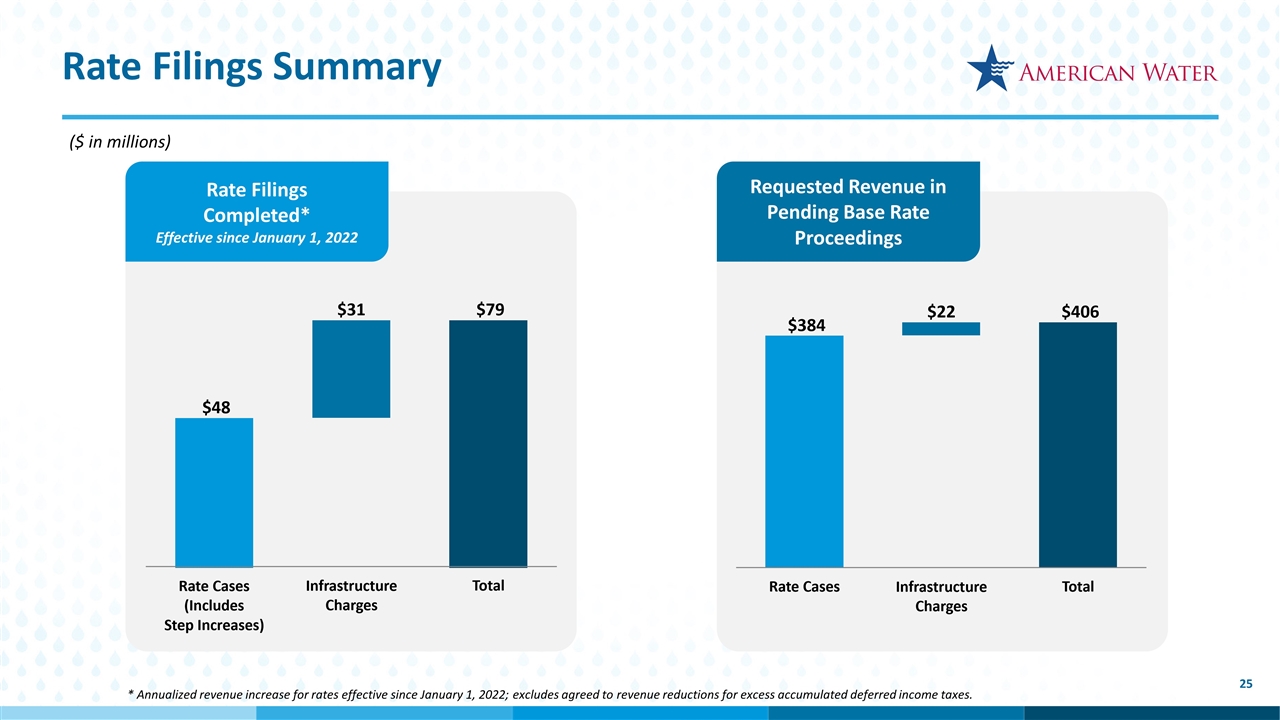

Rate Filings Summary Requested Revenue in Pending Base Rate Proceedings * Annualized revenue increase for rates effective since January 1, 2022; excludes agreed to revenue reductions for excess accumulated deferred income taxes. Rate Filings Completed* Effective since January 1, 2022 ($ in millions)

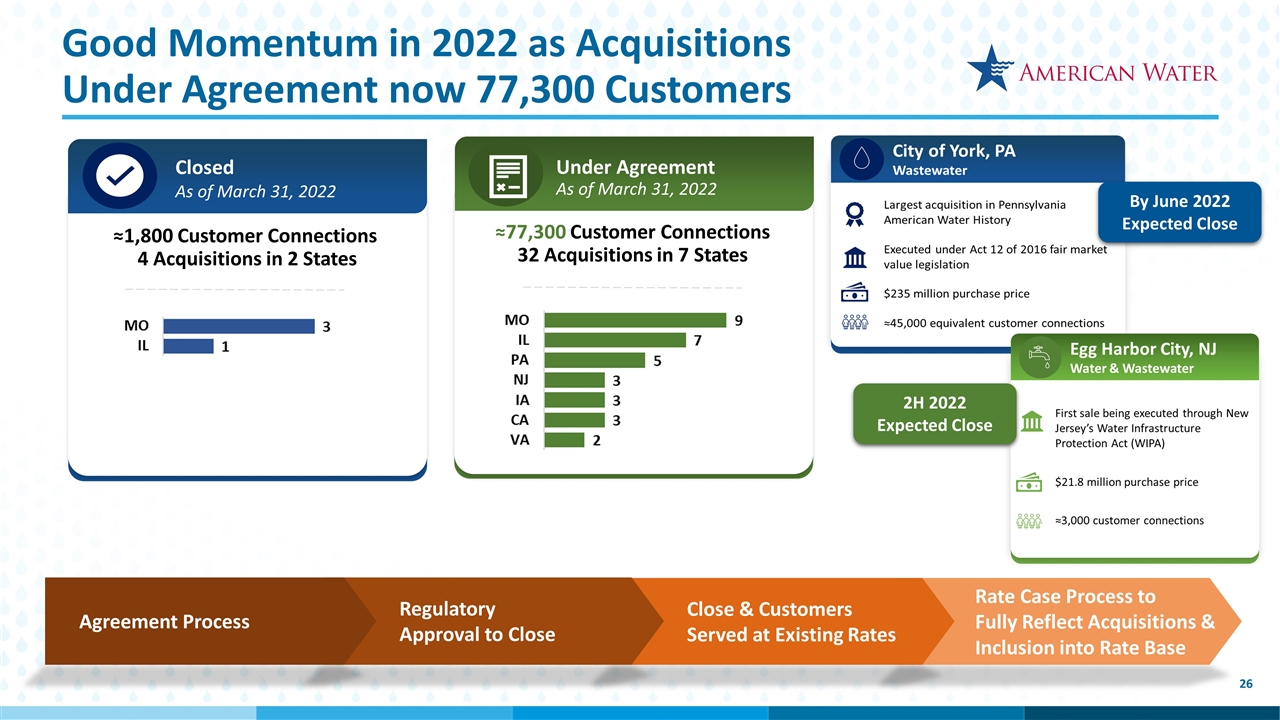

Rate Case Process to Fully Reflect Acquisitions & Inclusion into Rate Base Close & Customers Served at Existing Rates Regulatory Approval to Close Agreement Process Good Momentum in 2022 as Acquisitions Under Agreement now 77,300 Customers By June 2022 Expected Close 2H 2022 Expected Close Growing Opportunity for Customer Connections Over Five-Year Outlook Closed As of March 31, 2022 ≈1,800 Customer Connections 4 Acquisitions in 2 States ≈77,300 Customer Connections 32 Acquisitions in 7 States Under Agreement As of March 31, 2022

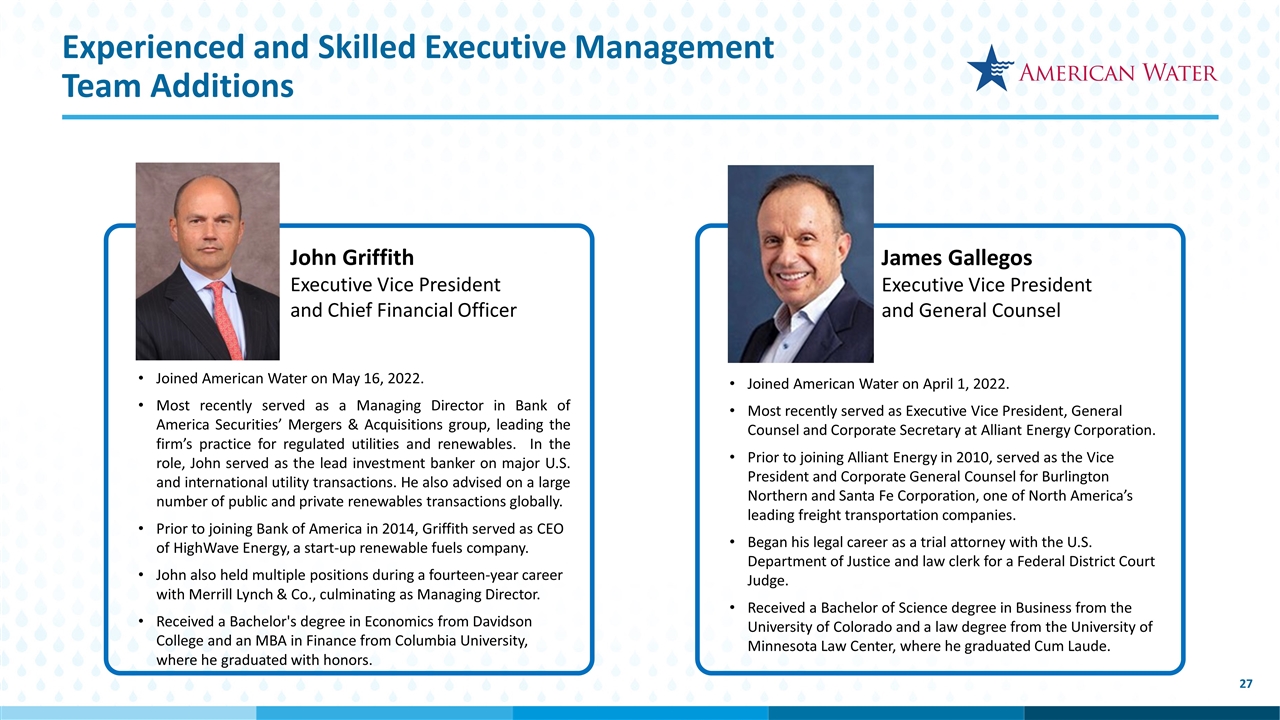

Experienced and Skilled Executive Management Team Additions Joined American Water on April 1, 2022. Most recently served as Executive Vice President, General Counsel and Corporate Secretary at Alliant Energy Corporation. Prior to joining Alliant Energy in 2010, served as the Vice President and Corporate General Counsel for Burlington Northern and Santa Fe Corporation, one of North America’s leading freight transportation companies. Began his legal career as a trial attorney with the U.S. Department of Justice and law clerk for a Federal District Court Judge. Received a Bachelor of Science degree in Business from the University of Colorado and a law degree from the University of Minnesota Law Center, where he graduated Cum Laude. James Gallegos Executive Vice President and General Counsel Joined American Water on May 16, 2022. Most recently served as a Managing Director in Bank of America Securities’ Mergers & Acquisitions group, leading the firm’s practice for regulated utilities and renewables. In the role, John served as the lead investment banker on major U.S. and international utility transactions. He also advised on a large number of public and private renewables transactions globally. Prior to joining Bank of America in 2014, Griffith served as CEO of HighWave Energy, a start-up renewable fuels company. John also held multiple positions during a fourteen-year career with Merrill Lynch & Co., culminating as Managing Director. Received a Bachelor's degree in Economics from Davidson College and an MBA in Finance from Columbia University, where he graduated with honors. John Griffith Executive Vice President and Chief Financial Officer

Appendix

Forward-Looking Statements Certain statements made, referred to or relied upon in this presentation including, without limitation, with respect to 2022 earnings guidance, the Company’s long-term financial, growth and dividend targets, future capital needs, the ability to achieve the Company’s strategies and goals, including with respect to its ESG focus and related to the sale of HOS, the Company’s receipt of contingent consideration, the repayment of the seller note, and the redeployment of the net proceeds from its divestitures, the outcome of the Company’s pending acquisition activity, including the proposed acquisition of the York, Pennsylvania wastewater system assets, the amount and allocation of projected capital expenditures; and estimated revenues from rate cases and other government agency authorizations, are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “propose,” “assume,” “forecast,” “likely,” “uncertain,” “outlook,” “future,” “pending,” “goal,” “objective,” “potential,” “continue,” “seek to,” “may,” “can,” “will,” “should” and “could” and or the negative of such terms or other variations or similar expressions. These forward-looking statements are predictions based on American Water’s current expectations and assumptions regarding future events. They are not guarantees or assurances of any outcomes, financial results of levels of activity, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may differ materially from those discussed in the forward-looking statements included in this presentation as a result of the factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, and subsequent filings with the SEC, and because of factors such as: the decisions of governmental and regulatory bodies, including decisions to raise or lower customer rates and regulatory responses to the COVID-19 pandemic; the timeliness and outcome of regulatory commissions’ and other authorities’ actions concerning rates, capital structure, authorized return on equity, capital investment, system acquisitions and dispositions, taxes, permitting, water supply and management, and other decisions; changes in customer demand for, and patterns of use of, water, such as may result from conservation efforts, impacts of the COVID-19 pandemic, or otherwise; a loss of one or more large industrial or commercial customers due to adverse economic conditions, the COVID-19 pandemic, or other factors; limitations on the availability of the Company’s water supplies or sources of water, or restrictions on its use thereof, resulting from allocation rights, governmental or regulatory requirements and restrictions, drought, overuse or other factors; changes in laws, governmental regulations and policies, including with respect to the environment, health and safety, water quality and water quality accountability, contaminants of emerging concern, public utility and tax regulations and policies, and impacts resulting from U.S., state and local elections and changes in federal, state and local executive administrations; the Company’s ability to collect, distribute, use, secure and store consumer data in compliance with current or future governmental laws, regulation and policies with respect to data and consumer privacy, security and protection; weather conditions and events, climate variability patterns, and natural disasters, including drought or abnormally high rainfall, prolonged and abnormal ice or freezing conditions, strong winds, coastal and intercoastal flooding, pandemics (including COVID-19) and epidemics, earthquakes, landslides, hurricanes, tornadoes, wildfires, electrical storms, sinkholes and solar flares; the outcome of litigation and similar governmental and regulatory proceedings, investigations or actions; the risks associated with the Company’s aging infrastructure, and its ability to appropriately improve the resiliency of, or maintain and replace, current or future infrastructure and systems, including its technology and other assets, and manage the expansion of its businesses; exposure or infiltration of the Company’s technology and critical infrastructure systems, including the disclosure of sensitive, personal or confidential information contained therein, through physical or cyber attacks or other means; the Company’s ability to obtain permits and other approvals for projects and construction of various water and wastewater facilities; changes in the Company’s capital requirements; the Company’s ability to control operating expenses and to achieve operating efficiencies; the intentional or unintentional actions of a third party, including contamination of the Company’s water supplies or the water provided to its customers; the Company’s ability to obtain adequate and cost-effective supplies of pipe, equipment (including personal protective equipment), chemicals, electricity, fuel, water and other raw materials and to address or mitigate supply chain constraints impacting the Company’s business operations; the Company’s ability to successfully meet its operational growth projections, either individually or in the aggregate, and capitalize on growth opportunities, including, among other things, with respect to acquiring, closing and successfully integrating regulated operations and market-based businesses, the Company’s Military Services Group entering into new contracts, price redeterminations and other agreements and contracts, and realizing anticipated benefits and synergies from new acquisitions; risks and uncertainties following the completion of the sale of HOS and the Company’s New York subsidiary; risks and uncertainties associated with contracting with the U.S. government, including ongoing compliance with applicable government procurement and security regulations; cost overruns relating to improvements in or the expansion of the Company’s operations; the Company’s ability to successfully develop and implement new technologies and to protect related intellectual property; the Company’s ability to maintain safe work sites; the Company’s exposure to liabilities related to environmental laws and similar matters resulting from, among other things, water and wastewater service provided to customers; changes in general economic, political, business and financial market conditions, including without limitation conditions and collateral consequences associated with COVID-19; access to sufficient debt and/or equity capital on satisfactory terms and when and as needed to support operations and capital expenditures; fluctuations in inflation or interest rates; the ability to comply with affirmative or negative covenants in the current or future indebtedness of the Company or any of its subsidiaries, or the issuance of new or modified credit ratings or outlooks or other communications by credit rating agencies with respect to the Company or any of its subsidiaries (or any current or future indebtedness thereof), which could increase financing costs or funding requirements and affect the Company’s or its subsidiaries’ ability to issue, repay or redeem debt, pay dividends or make distributions; fluctuations in the value of benefit plan assets and liabilities that could increase the Company’s cost and funding requirements; changes in federal or state general, income and other tax laws, including (i) future significant tax legislation; (ii) the availability of, or the Company’s compliance with, the terms of applicable tax credits and tax abatement programs; and (iii) the Company’s ability to utilize its state income tax net operating loss carryforwards; migration of customers into or out of the Company’s service territories; the use by municipalities of the power of eminent domain or other authority to condemn the systems of one or more of the Company’s utility subsidiaries, or the assertion by private landowners of similar rights against such utility subsidiaries; any difficulty or inability to obtain insurance for the Company, its inability to obtain insurance at acceptable rates and on acceptable terms and conditions, or its inability to obtain reimbursement under existing or future insurance programs and coverages for any losses sustained; the incurrence of impairment charges related to the Company’s goodwill or other assets; labor actions, including work stoppages and strikes; the Company’s ability to retain and attract qualified employees; civil disturbances or unrest, or terrorist threats or acts, or public apprehension about future disturbances, unrest, or terrorist threats or acts; and the impact of new, and changes to existing, accounting standards. These forward-looking statements are qualified by, and should be read together with, the risks and uncertainties set forth above and the risk factors included in American Water’s annual, quarterly and other SEC filings, and readers should refer to such risks, uncertainties and risk factors in evaluating such forward-looking statements. Any forward-looking statements American Water makes speak only as of the date of this presentation. American Water does not have or undertake any obligation or intention to update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as otherwise required by the federal securities laws. New factors emerge from time to time, and it is not possible for the Company to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on the Company’s businesses, either viewed independently or together, or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive.

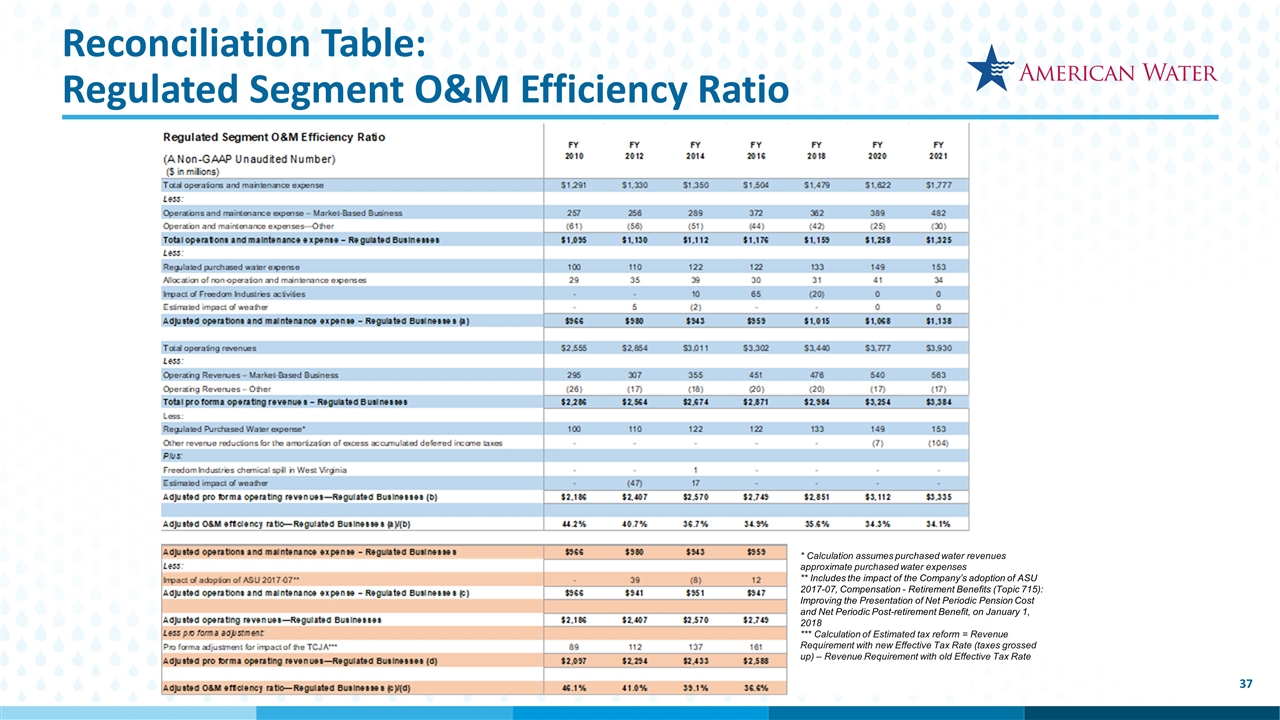

Non-GAAP Financial Information This presentation includes adjusted regulated O&M efficiency ratios, both historical and forward-looking, which exclude from their calculation (i) estimated purchased water and other revenues and purchased water expenses, (ii) the impact of the Freedom Industries chemical spill in 2014 and certain related settlement activities recognized in 2016 and 2018, (iii) the estimated impact in 2012 and 2014 of weather, (iv) as to operating revenues, the amortization of excess accumulated deferred income taxes, and (v) the allocable portion of non-O&M support services costs, mainly depreciation and general taxes. Also, an alternative presentation of these ratios has been provided for each of 2010, 2012, 2014 and 2016, which includes a pro forma adjustment for the impact of the Tax Cuts and Jobs Act of 2017, and includes for 2012, 2014 and 2016 the impact of our implementation of Accounting Standards Update 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Post-retirement Benefit, on January 1, 2018. These items were excluded from the O&M efficiency ratio calculation as they are not reflective of management’s ability to increase the efficiency of our regulated businesses. For that reason, these adjusted regulated O&M efficiency ratios constitute “non-GAAP financial measures” under SEC rules. We evaluate our operating performance using these ratios and believe that the presentation of them is useful to investors because the ratios directly measure improvement in the operating performance and efficiency of our regulated businesses. These ratios are derived from our consolidated financial information but are not presented in our consolidated financial statements prepared in accordance with GAAP. These non-GAAP financial measures supplement and should be read in conjunction with our GAAP disclosures and should be considered as an addition to, and not a substitute for, any GAAP measure. These ratios (i) are not accounting measures based on GAAP; (ii) are not based on a standard, objective industry definition or method of calculation; (iii) may not be comparable to other companies’ operating measures; and (iv) should not be used in place of the GAAP information provided elsewhere in this presentation. Management is unable to present a reconciliation of adjustments to the components of the forward-looking adjusted regulated O&M efficiency ratio without unreasonable effort because management cannot reliably predict the nature, amount or probable significance of all the adjustments for future periods; however, these adjustments may, individually or in the aggregate, cause each of the non-GAAP financial measure components of the forward-looking ratios to differ significantly from the most directly comparable GAAP financial measure. Set forth in this appendix are tables that reconcile each of the components of our historical adjusted regulated O&M efficiency ratios to its most directly comparable GAAP financial measure. All references throughout this presentation to EPS or earnings per share refer to diluted EPS attributable to common shareholders.

2022 EPS Detail by Business

STATE NUMBER OF SYSTEMS WATER CUSTOMER CONNECTIONS WASTEWATER CUSTOMER CONNECTIONS TOTAL CUSTOMER CONNECTIONS Closed Acquisitions March 31, 2022 Illinois 1 250 - 250 Missouri 3 400 1,150 1,550 Total 4 650 1,150 1,800

Acquisitions Under Agreement STATE NUMBER OF SYSTEMS WATER CUSTOMER CONNECTIONS WASTEWATER CUSTOMER CONNECTIONS TOTAL CUSTOMER CONNECTIONS California 3 3,450 - 3,450 Iowa 3 100 850 1,000 Illinois 7 2,600 1,850 4,450 Missouri 9 4,750 4,650 9,400 New Jersey 3 1,600 4,300 5,900 Pennsylvania 5 50 51,900 51,900 Virginia 2 1,200 - 1,200 Total 32 13,700 63,550 77,300 March 31, 2022

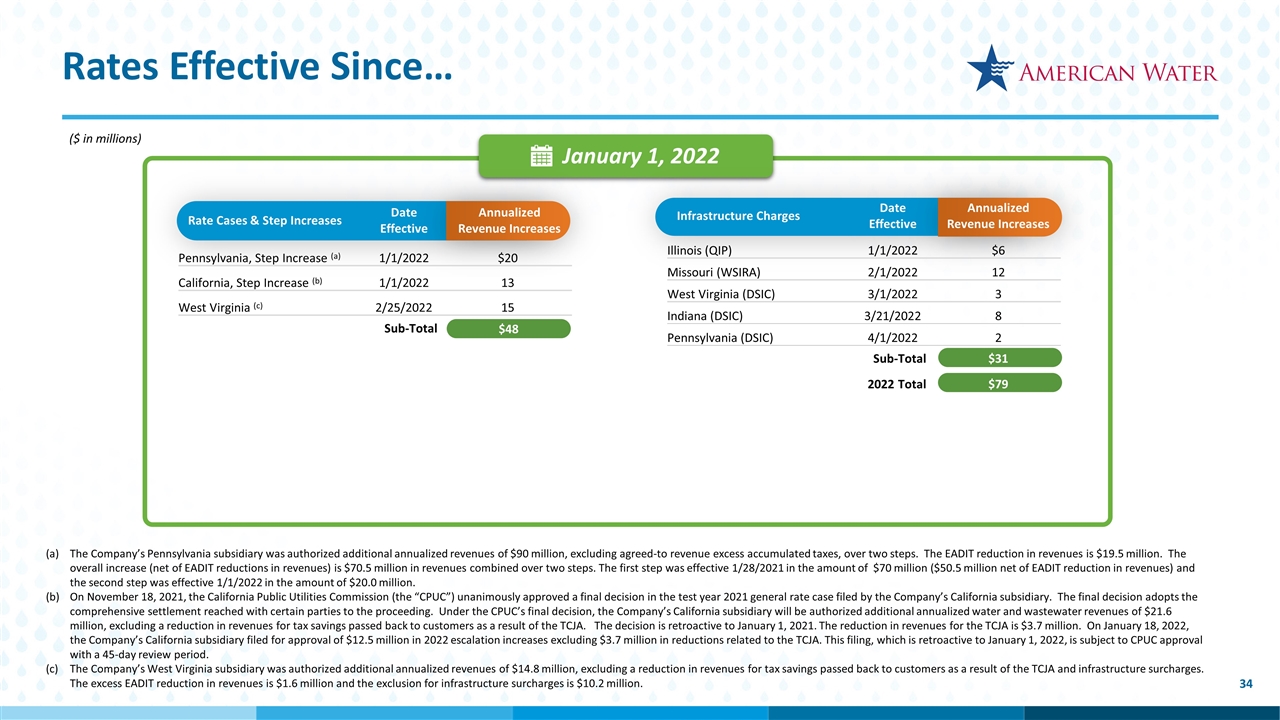

January 1, 2022 The Company’s Pennsylvania subsidiary was authorized additional annualized revenues of $90 million, excluding agreed-to revenue excess accumulated taxes, over two steps. The EADIT reduction in revenues is $19.5 million. The overall increase (net of EADIT reductions in revenues) is $70.5 million in revenues combined over two steps. The first step was effective 1/28/2021 in the amount of $70 million ($50.5 million net of EADIT reduction in revenues) and the second step was effective 1/1/2022 in the amount of $20.0 million. On November 18, 2021, the California Public Utilities Commission (the “CPUC”) unanimously approved a final decision in the test year 2021 general rate case filed by the Company’s California subsidiary. The final decision adopts the comprehensive settlement reached with certain parties to the proceeding. Under the CPUC’s final decision, the Company’s California subsidiary will be authorized additional annualized water and wastewater revenues of $21.6 million, excluding a reduction in revenues for tax savings passed back to customers as a result of the TCJA. The decision is retroactive to January 1, 2021. The reduction in revenues for the TCJA is $3.7 million. On January 18, 2022, the Company’s California subsidiary filed for approval of $12.5 million in 2022 escalation increases excluding $3.7 million in reductions related to the TCJA. This filing, which is retroactive to January 1, 2022, is subject to CPUC approval with a 45-day review period. The Company’s West Virginia subsidiary was authorized additional annualized revenues of $14.8 million, excluding a reduction in revenues for tax savings passed back to customers as a result of the TCJA and infrastructure surcharges. The excess EADIT reduction in revenues is $1.6 million and the exclusion for infrastructure surcharges is $10.2 million. $48 Rate Cases & Step Increases Date Effective Annualized Revenue Increases Pennsylvania, Step Increase (a) 1/1/2022 $20 California, Step Increase (b) 1/1/2022 13 West Virginia (c) 2/25/2022 15 Sub-Total Rates Effective Since… Infrastructure Charges Date Effective Annualized Revenue Increases Illinois (QIP) 1/1/2022 $6 Missouri (WSIRA) 2/1/2022 12 West Virginia (DSIC) 3/1/2022 3 Indiana (DSIC) 3/21/2022 8 Pennsylvania (DSIC) 4/1/2022 2 Sub-Total $31 2022 Total $79 ($ in millions)

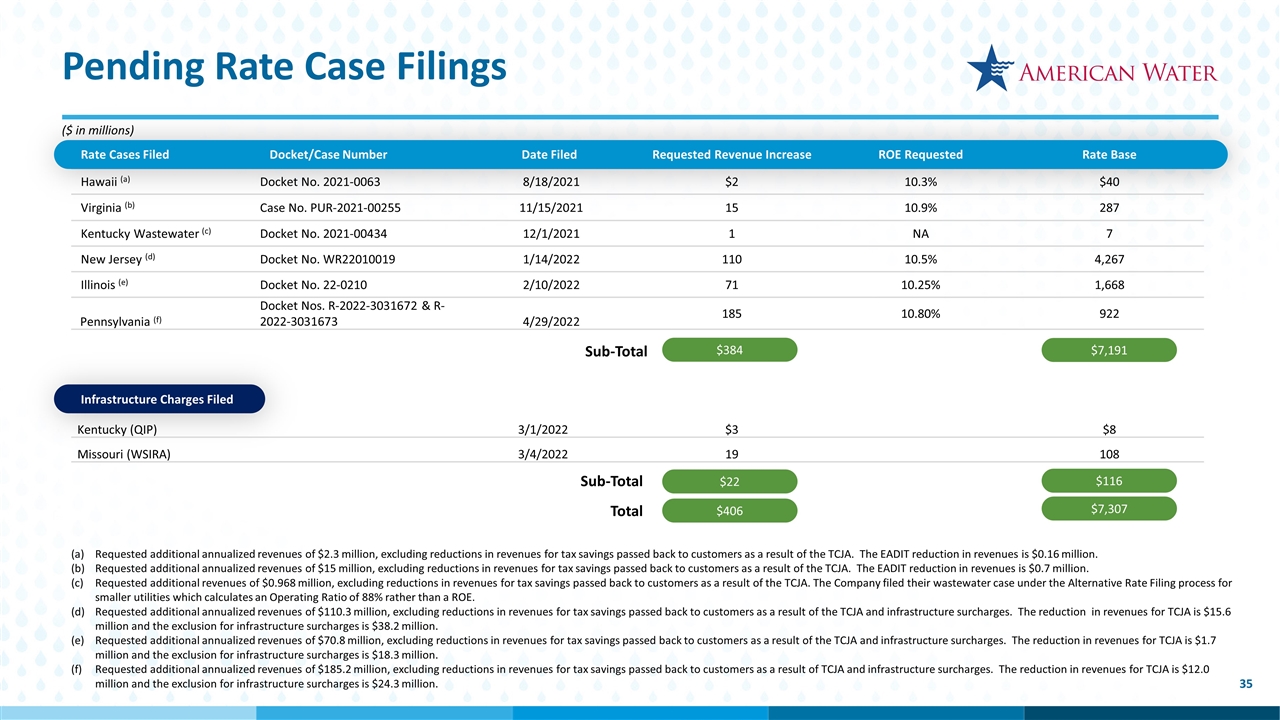

$384 Hawaii (a) Docket No. 2021-0063 8/18/2021 $2 10.3% $40 Virginia (b) Case No. PUR-2021-00255 11/15/2021 15 10.9% 287 Kentucky Wastewater (c) Docket No. 2021-00434 12/1/2021 1 NA 7 New Jersey (d) Docket No. WR22010019 1/14/2022 110 10.5% 4,267 Illinois (e) Docket No. 22-0210 2/10/2022 71 10.25% 1,668 Pennsylvania (f) Docket Nos. R-2022-3031672 & R-2022-3031673 4/29/2022 185 10.80% 922 Sub-Total Rate Cases Filed Docket/Case Number Date Filed Requested Revenue Increase ROE Requested Rate Base $7,191 Requested additional annualized revenues of $2.3 million, excluding reductions in revenues for tax savings passed back to customers as a result of the TCJA. The EADIT reduction in revenues is $0.16 million. Requested additional annualized revenues of $15 million, excluding reductions in revenues for tax savings passed back to customers as a result of the TCJA. The EADIT reduction in revenues is $0.7 million. Requested additional revenues of $0.968 million, excluding reductions in revenues for tax savings passed back to customers as a result of the TCJA. The Company filed their wastewater case under the Alternative Rate Filing process for smaller utilities which calculates an Operating Ratio of 88% rather than a ROE. Requested additional annualized revenues of $110.3 million, excluding reductions in revenues for tax savings passed back to customers as a result of the TCJA and infrastructure surcharges. The reduction in revenues for TCJA is $15.6 million and the exclusion for infrastructure surcharges is $38.2 million. Requested additional annualized revenues of $70.8 million, excluding reductions in revenues for tax savings passed back to customers as a result of the TCJA and infrastructure surcharges. The reduction in revenues for TCJA is $1.7 million and the exclusion for infrastructure surcharges is $18.3 million. Requested additional annualized revenues of $185.2 million, excluding reductions in revenues for tax savings passed back to customers as a result of TCJA and infrastructure surcharges. The reduction in revenues for TCJA is $12.0 million and the exclusion for infrastructure surcharges is $24.3 million. Pending Rate Case Filings Infrastructure Charges Filed Kentucky (QIP) 3/1/2022 $3 $8 Missouri (WSIRA) 3/4/2022 19 108 $22 Total $116 $406 Sub-Total ($ in millions) $7,307

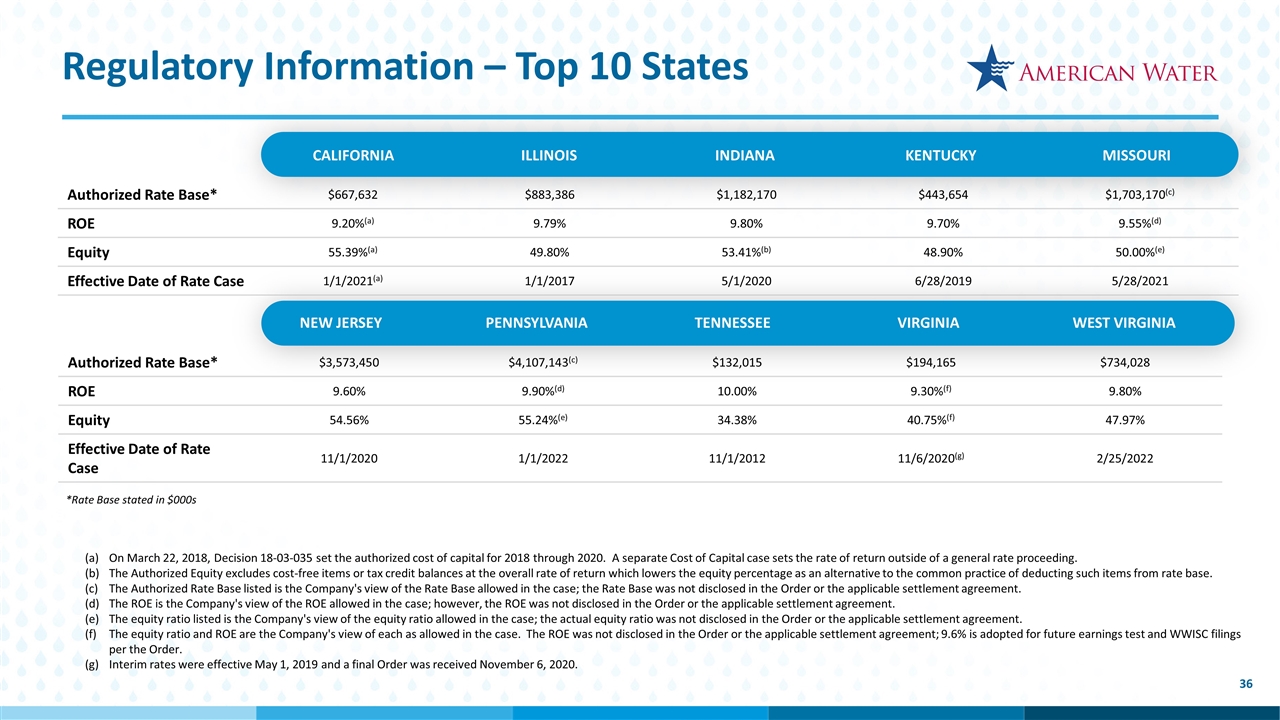

NEW JERSEY PENNSYLVANIA TENNESSEE VIRGINIA WEST VIRGINIA CALIFORNIA ILLINOIS INDIANA KENTUCKY MISSOURI *Rate Base stated in $000s Authorized Rate Base* $667,632 $883,386 $1,182,170 $443,654 $1,703,170(c) ROE 9.20%(a) 9.79% 9.80% 9.70% 9.55%(d) Equity 55.39%(a) 49.80% 53.41%(b) 48.90% 50.00%(e) Effective Date of Rate Case 1/1/2021(a) 1/1/2017 5/1/2020 6/28/2019 5/28/2021 Authorized Rate Base* $3,573,450 $4,107,143(c) $132,015 $194,165 $734,028 ROE 9.60% 9.90%(d) 10.00% 9.30%(f) 9.80% Equity 54.56% 55.24%(e) 34.38% 40.75%(f) 47.97% Effective Date of Rate Case 11/1/2020 1/1/2022 11/1/2012 11/6/2020(g) 2/25/2022 On March 22, 2018, Decision 18-03-035 set the authorized cost of capital for 2018 through 2020. A separate Cost of Capital case sets the rate of return outside of a general rate proceeding. The Authorized Equity excludes cost-free items or tax credit balances at the overall rate of return which lowers the equity percentage as an alternative to the common practice of deducting such items from rate base. The Authorized Rate Base listed is the Company's view of the Rate Base allowed in the case; the Rate Base was not disclosed in the Order or the applicable settlement agreement. The ROE is the Company's view of the ROE allowed in the case; however, the ROE was not disclosed in the Order or the applicable settlement agreement. The equity ratio listed is the Company's view of the equity ratio allowed in the case; the actual equity ratio was not disclosed in the Order or the applicable settlement agreement. The equity ratio and ROE are the Company's view of each as allowed in the case. The ROE was not disclosed in the Order or the applicable settlement agreement; 9.6% is adopted for future earnings test and WWISC filings per the Order. Interim rates were effective May 1, 2019 and a final Order was received November 6, 2020. Regulatory Information – Top 10 States

Reconciliation Table: Regulated Segment O&M Efficiency Ratio * Calculation assumes purchased water revenues approximate purchased water expenses ** Includes the impact of the Company’s adoption of ASU 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Post-retirement Benefit, on January 1, 2018 *** Calculation of Estimated tax reform = Revenue Requirement with new Effective Tax Rate (taxes grossed up) – Revenue Requirement with old Effective Tax Rate

Recent Stories of ESG at AWK

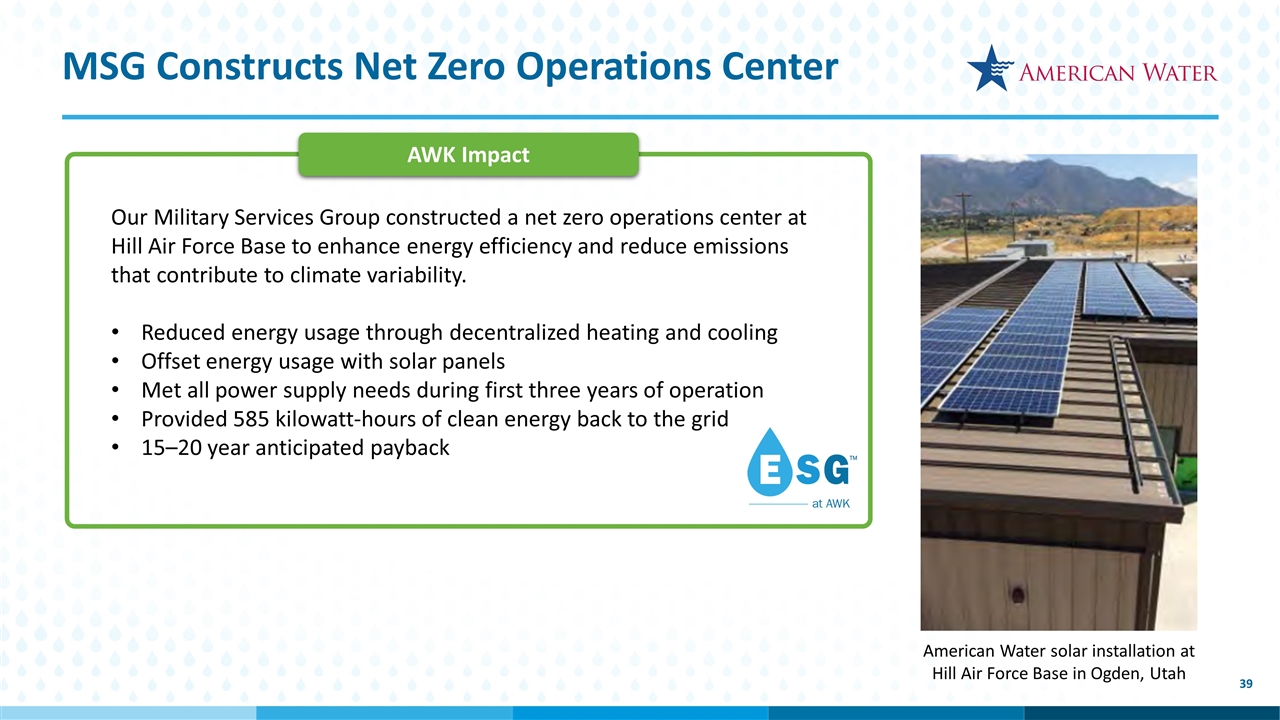

MSG Constructs Net Zero Operations Center Our Military Services Group constructed a net zero operations center at Hill Air Force Base to enhance energy efficiency and reduce emissions that contribute to climate variability. Reduced energy usage through decentralized heating and cooling Offset energy usage with solar panels Met all power supply needs during first three years of operation Provided 585 kilowatt-hours of clean energy back to the grid 15–20 year anticipated payback American Water solar installation at Hill Air Force Base in Ogden, Utah AWK Impact

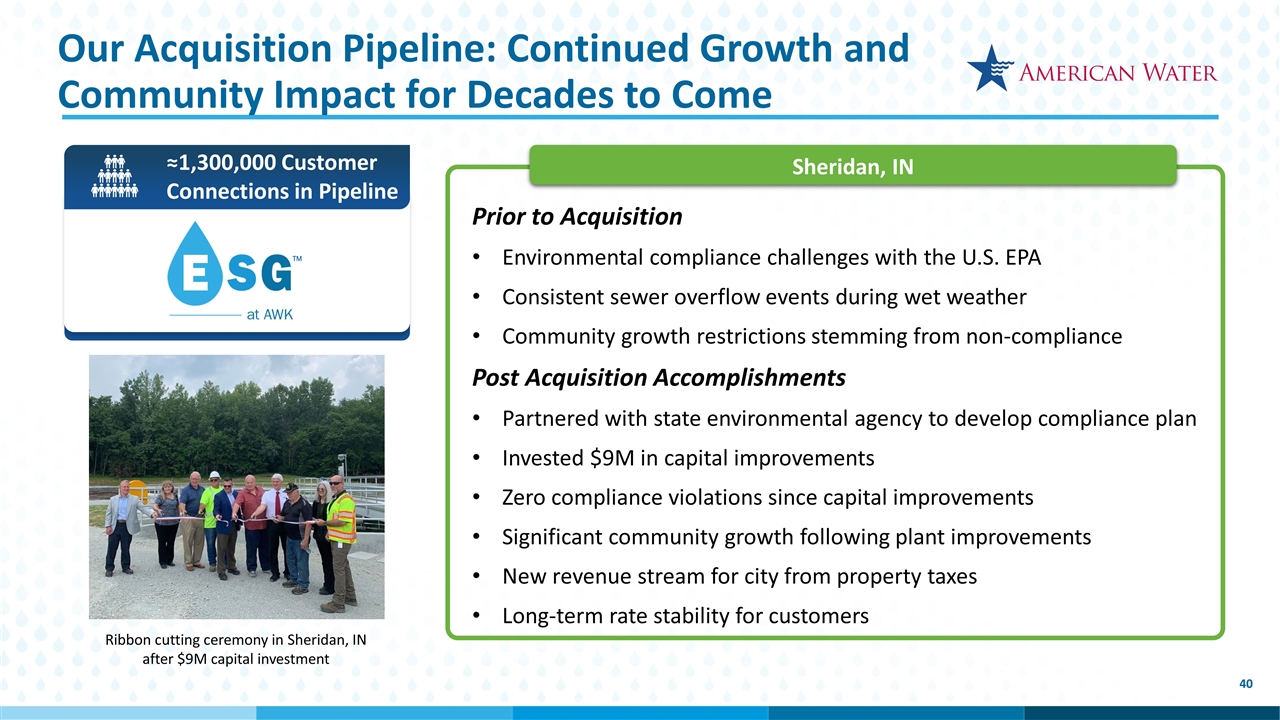

≈1,300,000 Customer Connections in Pipeline Our Acquisition Pipeline: Continued Growth and Community Impact for Decades to Come Prior to Acquisition Environmental compliance challenges with the U.S. EPA Consistent sewer overflow events during wet weather Community growth restrictions stemming from non-compliance Post Acquisition Accomplishments Partnered with state environmental agency to develop compliance plan Invested $9M in capital improvements Zero compliance violations since capital improvements Significant community growth following plant improvements New revenue stream for city from property taxes Long-term rate stability for customers Sheridan, IN Ribbon cutting ceremony in Sheridan, IN after $9M capital investment

Value of American Water’s Resiliency Investments Demonstrated During Hurricane Ida The river outside our Raritan-Millstone Plant in New Jersey crested at record height of 44.87’, three feet below the top of the recently heightened flood wall Flood doors at our Norristown Water Treatment Plant in Pennsylvania withstood 5’ of floodwater Recently reinforced Scranton, PA dam withstood heavy rains Maryland received 8” of rain, raising the turbidity of the typical water supply; our operations switched to alternate water source In New York, emergency sump pumps & post-Hurricane Sandy upgrades handled floodwaters Raritan-Millstone Water Treatment Plant

Investor Relations: Contacts Aaron Musgrave, CPA Senior Director, Investor Relations [email protected] Janelle McNally Senior Manager, Investor Relations & ESG [email protected] Upcoming Events July 28, 2022 (projected) Q2 2022 Earnings Call November 1, 2022 (projected) Q3 2022 Earnings Call Jack Quinn, CPA Senior Manager, Investor Relations [email protected]

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Virginia American Water Finalizes Acquisition of Town of Cape Charles Water and Wastewater Systems

- AS Tallink Grupp Investor Webinar introducing the results of the Q1 2024

- Donegal Group Inc. Announces First Quarter 2024 Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share