Form 8-K Altus Power, Inc. For: May 16

Altus Power, Inc. Announces First Quarter 2022

Financial Results

First Quarter Highlights

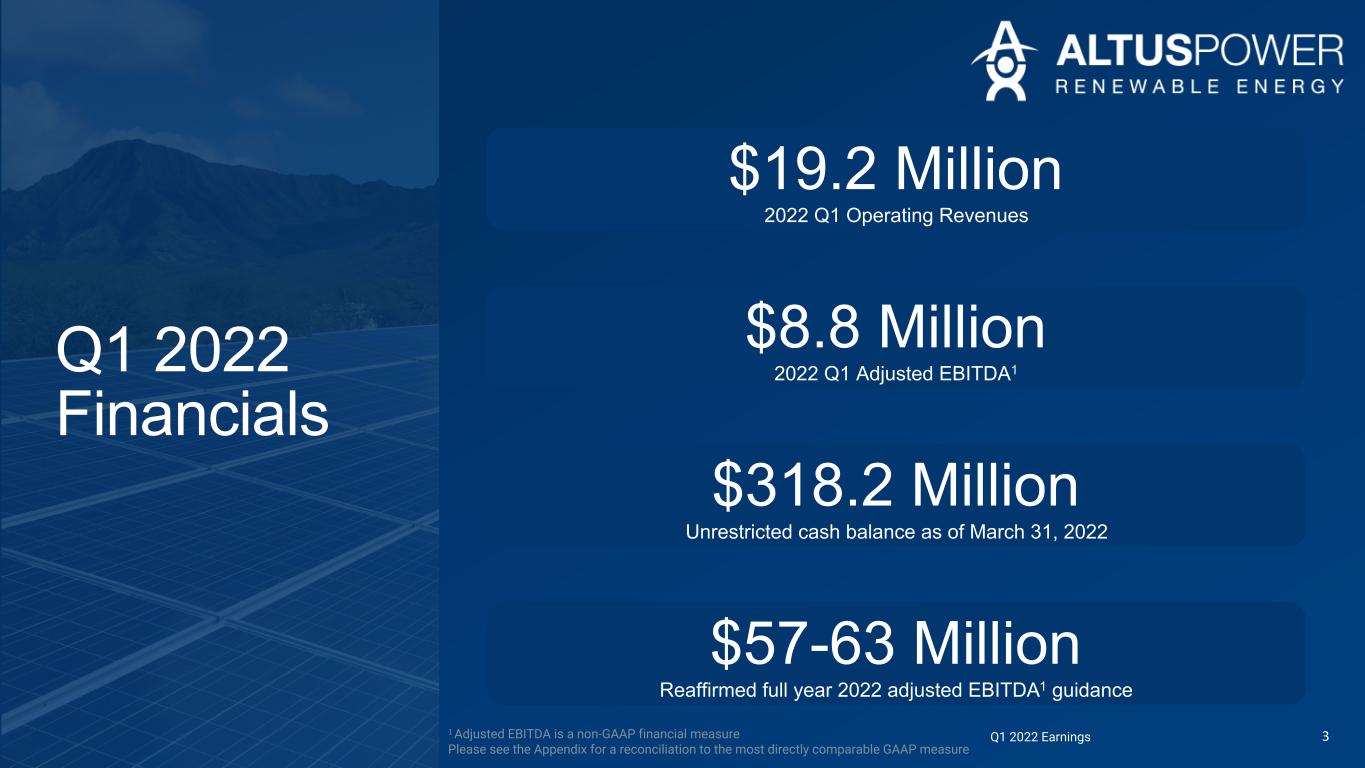

•Operating revenues of $19.2 million for first quarter 2022, an increase of 54% over first quarter 2021

•First quarter 2022 GAAP net income of $60.1 million, as compared to first quarter 2021 net income of $0.3 million driven by a $64.8 million non-cash gain from fair value remeasurement of both warrants and alignment shares

•First quarter 2022 adjusted EBITDA* of $8.8 million, an increase of 38% over first quarter 2021

•Unrestricted cash balance of $318.2 million as of March 31, 2022

•Reaffirmed full year 2022 adjusted EBITDA* guidance of $57-63 million

•Announced partnership with Trammell Crow for installation of up to 300 MW of solar generation assets

STAMFORD, CT, May 16, 2022 – Altus Power, Inc. (NYSE: AMPS) (“Altus Power” or the “Company”), a leading clean electrification company, today announced its financial results for the first quarter of 2022.

“We believe our first quarter results position us well to achieve our 2022 financial projections as we focus on driving growth from our over one gigawatt pipeline of opportunities," said Gregg Felton, Co-CEO of Altus Power. "We are continuing to experience a significant level of customer engagement and we believe the substantial upward pressure on utility rates from a variety of factors serves to enhance the economic incentive to install solar, growing our addressable market further.”

Co-CEO Lars Norell added, “Altus Power’s agreement to install up to 300 megawatts of solar power generation assets in partnership with Trammell Crow demonstrated new potential for our renewable solutions. Clean electrification can be included into building plans from the earliest stages of design and construction, which we believe not only optimizes design but also increases sustainability for tenants out of the gate.”

First Quarter Financial Results

Operating revenues during the first quarter of 2022 totaled $19.2 million, compared to $12.5 million during the same period of 2021, an increase of 54%. The increase reflects the growth of megawatts installed over the past twelve months. First quarter 2022 GAAP net income totaled $60.1 million, which was driven by a $64.8 million non-cash gain from remeasurement of both warrants and alignment shares, compared to net income of $0.3 million for the same period last year. This benefit from remeasurement is non-cash and is driven by a lower Altus Power common share price between December 31, 2021 and March 31, 2022, and is subject to remeasurement based on our share price at the end of each quarter.

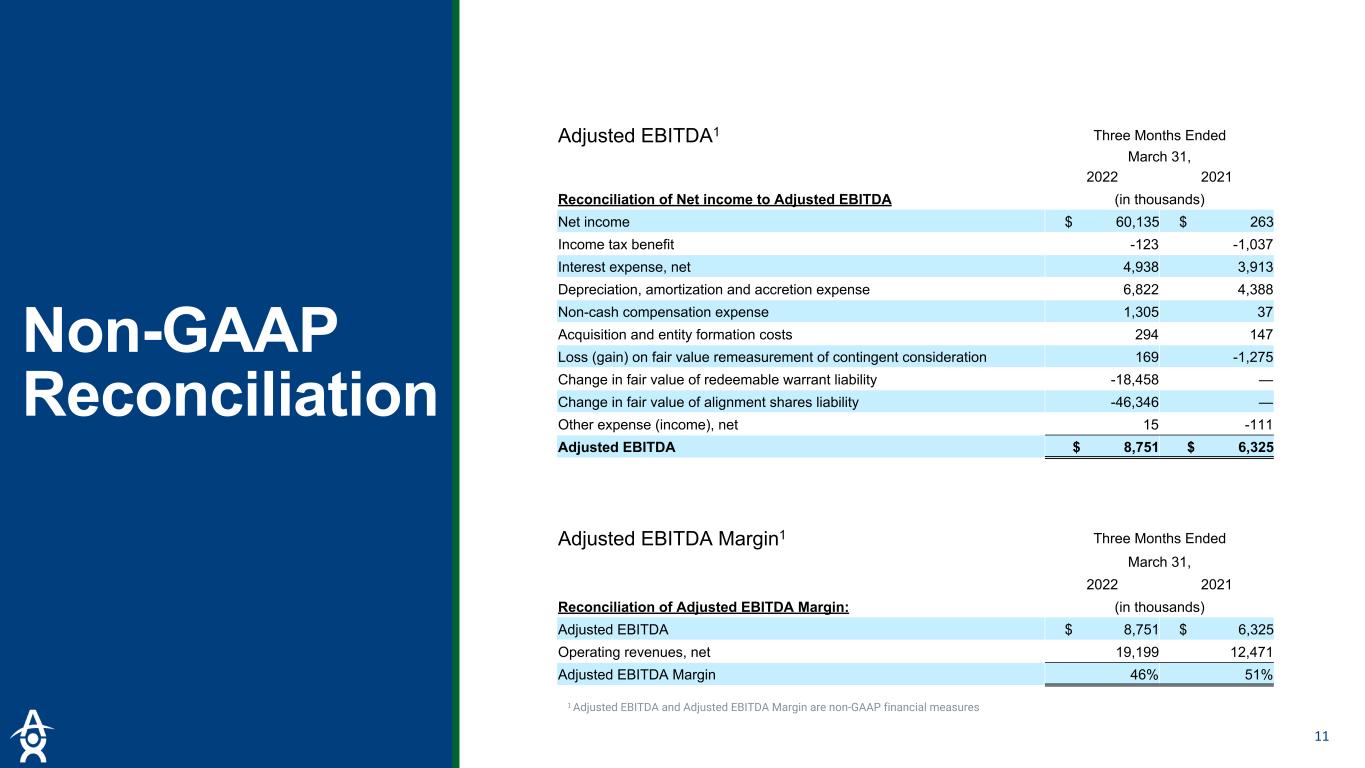

Adjusted EBITDA* during the first quarter of 2022 was $8.8 million, compared to $6.3 million for the first quarter of 2021, a 38% increase. The quarter over quarter growth in adjusted EBITDA* is primarily the result of increased revenue from additional solar energy facilities, offset by an increase in our general and administrative expenses. Adjusted EBITDA margin* during the first quarter was 46%, compared to 51% in the first quarter of 2021, largely driven by an increase in general and administrative expenses to support future growth.

Balance Sheet and Liquidity

Altus Power ended the first quarter of 2022 with $318.2 million in unrestricted cash, and $543.1 million of total debt, resulting in net debt of $224.9 million. The Company expects to fund its operations using available cash, additional borrowings under debt facilities and third-party tax equity financing, for the foreseeable future.

2022 Guidance

Altus Power reaffirms its 2022 adjusted EBITDA* guidance range of $57-63 million, as well as guidance for 2022 adjusted EBITDA margin* in the mid-50% range. First quarter is historically the most impacted by shorter daylight hours and snow conditions experienced by our portfolio, particularly given our exposure to northeastern states. This seasonality historically produces lower margins in the first quarter relative to annual results. Management focuses on adjusted EBITDA and adjusted EBITDA margin as key measures of profitable growth and approximation of cash flow generation.

Conference Call Information

The Altus Power management team will host a conference call to discuss its first quarter 2022 financial results on Monday, May 16, 2022, at 8:30 a.m. Eastern Time. The call can be accessed via a live webcast accessible on the Events & Presentations page in the Investor Relations section of Altus Power’s website at www.altuspower.com. An archive of the webcast will be available after the call on the Investor Relations section of Altus Power’s website as well.

About Altus Power, Inc.

Altus Power, based in Stamford, Connecticut, is the nation’s premier clean electrification company. Altus Power serves its commercial, industrial, public sector and community solar customers by developing, owning and operating locally sited solar generation, energy storage, and EV charging infrastructure across 18 states from Vermont to Hawaii. Visit altuspower.com to learn more.

Use of Non-GAAP Financial Information

*Denotes Non-GAAP financial measure. We present our operating results in accordance with accounting principles generally accepted in the U.S. (“GAAP”). We believe certain financial measures, such as adjusted EBITDA and adjusted EBITDA margin provide users of our financial statements with supplemental information that may be useful in evaluating our business. The presentation of non-GAAP financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We define adjusted EBITDA as net income (loss) plus net interest expense, depreciation, amortization and accretion expense, income tax expense, acquisition and entity formation costs, non-cash compensation expense, and excluding the effect of certain non-recurring items we do not consider to be indicative of our ongoing operating performance such as, but not limited to, gain on fair value remeasurement of contingent consideration, gain on disposal of property, plant and equipment, change in fair value of redeemable warrant liability, change in fair value of alignment shares, loss on extinguishment of debt, and other miscellaneous items of other income and expenses.

We define adjusted EBITDA margin as adjusted EBITDA divided by operating revenues.

Adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures that we use to measure our performance. We believe that investors and analysts also use adjusted EBITDA in evaluating our operating performance. This measurement is not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. The GAAP measure most directly comparable to adjusted EBITDA is net income and to adjusted EBITDA margin is net income over operating revenues. The presentation of adjusted EBITDA and adjusted EBITDA margin should not be construed to suggest that our future results will be unaffected by non-cash or non-recurring items. In addition, our calculation of adjusted EBITDA and adjusted EBITDA margin are not necessarily comparable to adjusted EBITDA as calculated by other companies and investors and analysts should read carefully the components of our calculations of these non-GAAP financial measures.

We believe adjusted EBITDA is useful to management, investors and analysts in providing a measure of core financial performance adjusted to allow for comparisons of results of operations across reporting periods on a consistent basis. These adjustments are intended to exclude items that are not indicative of the ongoing operating performance of the business. Adjusted EBITDA is also used by our management for internal planning purposes, including our consolidated operating budget, and by our board of directors in setting performance-based compensation targets. Adjusted EBITDA should not be considered an alternative to but viewed in conjunction with GAAP results, as we believe it provides a more complete understanding of ongoing business performance and trends than GAAP measures alone. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP.

Altus Power does not provide GAAP financial measures on a forward-looking basis because the Company is unable to predict with reasonable certainty and without unreasonable effort, items such as acquisition and entity formation costs, gain on fair value remeasurement of contingent consideration, change in fair value of redeemable warrant liability, change in fair value of alignment shares. These items are uncertain, depend on various factors, and could be material to Altus Power’s results computed in accordance with GAAP.

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking statements may be identified by the use of words such as "believes," "expects," "intends," "may," “could,” "will," "should," "plans," “projects,” “forecasts,” “seeks,” “anticipates,” “goal,” “objective,” “target,” “estimate,” “future,” “outlook,” “vision,” or variations of such words or similar terminology that

predict or indicate future events or trends or that are not statements of historical matters. These statements, which involve risks and uncertainties, relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable and may also relate to Altus Power’s future prospects, developments and business strategies. These statements are based on Altus Power’s management’s current expectations and beliefs, as well as a number of assumptions concerning future events.

Such forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Altus Power’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. These risks, uncertainties, assumptions and other important factors include, but are not limited to: (1) the ability of Altus Power to maintain its listing on the New York Stock Exchange; (2) the ability to recognize the anticipated benefits of the recently completed business combination and related transactions, which may be affected by, among other things, competition, the ability of Altus Power to grow and manage growth profitably, maintain relationships with customers, business partners, suppliers and agents and retain its management and key employees; ; (3) changes in applicable laws or regulations; (4) the possibility that Altus Power may be adversely affected by other economic, business, regulatory and/or competitive factors; and (5) the impact of COVID-19 on Altus Power’s business.

Additional factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements can be found under the heading “Risk Factors” in Altus Power’s Form 10-K filed with the Securities and Exchange Commission on March 24th, 2022, as well as the other information we file with the Securities and Exchange Commission., as well as the other information we file with the Securities and Exchange Commission. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made and the information and assumptions underlying such statement as we know it and on the date such statement was made, and Altus Power undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, changes in expectations, future events or otherwise.

This press release is not intended to be all-inclusive or to contain all the information that a person may desire in considering an investment in Altus Power and is not intended to form the basis of an investment decision in Altus Power. All subsequent written and oral forward-looking statements concerning Altus Power or other matters and attributable to Altus Power or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

Altus Power Contacts

For Media:

Cory Ziskind

ICR, Inc.

ICR, Inc.

AltusPowerPR@icrinc.com

For Investors:

Chris Shelton, Head of IR

Chris Shelton, Head of IR

Caldwell Bailey, ICR, Inc.

InvestorRelations@altuspower.com

Altus Power, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(In thousands, except share and per share data)

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Operating revenues, net | $ | 19,199 | $ | 12,471 | |||||||

| Operating expenses | |||||||||||

| Cost of operations (exclusive of depreciation and amortization shown separately below) | 4,064 | 2,920 | |||||||||

| General and administrative | 6,384 | 3,226 | |||||||||

| Depreciation, amortization and accretion expense | 6,822 | 4,388 | |||||||||

| Acquisition and entity formation costs | 294 | 147 | |||||||||

| Loss (gain) on fair value remeasurement of contingent consideration | 169 | (1,275) | |||||||||

| Stock-based compensation | 1,305 | 37 | |||||||||

| Total operating expenses | $ | 19,038 | $ | 9,443 | |||||||

| Operating income | 161 | 3,028 | |||||||||

| Other (income) expense | |||||||||||

| Change in fair value of redeemable warrant liability | (18,458) | — | |||||||||

| Change in fair value of alignment shares liability | (46,346) | — | |||||||||

| Other expense (income), net | 15 | (111) | |||||||||

| Interest expense, net | 4,938 | 3,913 | |||||||||

| Total other (income) expense | $ | (59,851) | $ | 3,802 | |||||||

| Income (loss) before income tax benefit | $ | 60,012 | $ | (774) | |||||||

| Income tax benefit | 123 | 1,037 | |||||||||

| Net income | $ | 60,135 | $ | 263 | |||||||

| Net loss attributable to noncontrolling interests and redeemable noncontrolling interests | (284) | (699) | |||||||||

| Net income attributable to Altus Power, Inc. | $ | 60,419 | $ | 962 | |||||||

| Net income per share attributable to common stockholders | |||||||||||

| Basic | $ | 0.39 | $ | 0.01 | |||||||

| Diluted | $ | 0.39 | $ | 0.01 | |||||||

| Weighted average shares used to compute net income per share attributable to common stockholders | |||||||||||

| Basic | 152,662,512 | 88,741,089 | |||||||||

| Diluted | 153,586,538 | 89,991,570 | |||||||||

Altus Power, Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

(In thousands, except share and per share data)

| As of March 31, 2022 | As of December 31, 2021 | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash | $ | 318,177 | $ | 325,983 | |||||||

| Current portion of restricted cash | 2,558 | 2,544 | |||||||||

| Accounts receivable, net | 8,494 | 9,218 | |||||||||

| Other current assets | 6,619 | 6,659 | |||||||||

| Total current assets | 335,848 | 344,404 | |||||||||

| Restricted cash, noncurrent portion | 1,794 | 1,794 | |||||||||

| Property, plant and equipment, net | 745,991 | 745,711 | |||||||||

| Intangible assets, net | 16,377 | 16,702 | |||||||||

| Goodwill | 601 | 601 | |||||||||

| Other assets | 3,738 | 4,037 | |||||||||

| Total assets | $ | 1,104,349 | $ | 1,113,249 | |||||||

| Liabilities, redeemable noncontrolling interests, and stockholders' equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 2,394 | $ | 3,591 | |||||||

| Interest payable | 4,362 | 4,494 | |||||||||

| Current portion of long-term debt | 21,218 | 21,143 | |||||||||

| Other current liabilities | 3,499 | 3,663 | |||||||||

| Total current liabilities | 31,473 | 32,891 | |||||||||

| Redeemable warrant liability | 31,475 | 49,933 | |||||||||

| Alignment shares liability | 81,113 | 127,474 | |||||||||

| Long-term debt, net of unamortized debt issuance costs and current portion | 521,869 | 524,837 | |||||||||

| Intangible liabilities, net | 12,847 | 13,758 | |||||||||

| Asset retirement obligations | 7,688 | 7,628 | |||||||||

| Deferred tax liabilities, net | 9,473 | 9,603 | |||||||||

| Other long-term liabilities | 6,698 | 5,587 | |||||||||

| Total liabilities | $ | 702,636 | $ | 771,711 | |||||||

| Commitments and contingent liabilities | |||||||||||

| Redeemable noncontrolling interests | 15,407 | 15,527 | |||||||||

| Stockholders' equity | |||||||||||

Common stock $0.0001 par value; 988,591,250 shares authorized as of March 31, 2022, and December 31, 2021; 153,648,830 shares issued and outstanding as of March 31, 2022, and December 31, 2021 | 15 | 15 | |||||||||

Preferred stock $0.0001 par value; 10,000,000 shares authorized, zero shares issued and outstanding as of March 31, 2022, and December 31, 2021 | — | — | |||||||||

| Additional paid-in capital | 406,867 | 406,259 | |||||||||

| Accumulated deficit | (40,937) | (101,356) | |||||||||

| Total stockholders' equity | $ | 365,945 | $ | 304,918 | |||||||

| Noncontrolling interests | 20,361 | 21,093 | |||||||||

| Total equity | $ | 386,306 | $ | 326,011 | |||||||

| Total liabilities, redeemable noncontrolling interests, and stockholders' equity | $ | 1,104,349 | $ | 1,113,249 | |||||||

Altus Power, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

(In thousands)

| Three months ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Cash flows from operating activities | |||||||||||

| Net income | $ | 60,135 | $ | 263 | |||||||

| Adjustments to reconcile net income to net cash from operating activities: | |||||||||||

| Depreciation, amortization and accretion | 6,822 | 4,388 | |||||||||

| Unrealized gain on interest rate swaps | (901) | (562) | |||||||||

| Deferred tax benefit | (130) | (1,057) | |||||||||

| Amortization of debt discount and financing costs | 711 | 722 | |||||||||

| Change in fair value of redeemable warrant liability | (18,458) | — | |||||||||

| Change in fair value of alignment shares liability | (46,346) | — | |||||||||

| Remeasurement of contingent consideration | 169 | (1,275) | |||||||||

| Stock-based compensation | 1,305 | 37 | |||||||||

| Other | 283 | (19) | |||||||||

| Changes in assets and liabilities, excluding the effect of acquisitions | |||||||||||

| Accounts receivable | 724 | (980) | |||||||||

| Other assets | 769 | (286) | |||||||||

| Accounts payable | (1,197) | 1,566 | |||||||||

| Interest payable | (99) | 757 | |||||||||

| Other liabilities | (288) | (332) | |||||||||

| Net cash provided by operating activities | 3,499 | 3,222 | |||||||||

| Cash flows from investing activities | |||||||||||

| Capital expenditures | (6,571) | (2,210) | |||||||||

| Payments to acquire businesses, net of cash and restricted cash acquired | — | (1,493) | |||||||||

| Payments to acquire renewable energy facilities from third parties, net of cash and restricted cash acquired | — | (4,968) | |||||||||

| Net cash used for investing activities | (6,571) | (8,671) | |||||||||

| Cash flows from financing activities | |||||||||||

| Proceeds from issuance of long-term debt | — | 7,396 | |||||||||

| Repayments of long-term debt | (3,411) | (6,693) | |||||||||

| Payment of debt issuance costs | (29) | — | |||||||||

| Payment of dividends and commitment fees on Series A preferred stock | — | (8,379) | |||||||||

| Payment of contingent consideration | — | (53) | |||||||||

| Payment of equity issuance costs | (712) | — | |||||||||

| Distributions to noncontrolling interests | (568) | (472) | |||||||||

| Net cash used for financing activities | (4,720) | (8,201) | |||||||||

| Net decrease in cash and restricted cash | (7,792) | (13,650) | |||||||||

| Cash and restricted cash, beginning of period | 330,321 | 38,206 | |||||||||

| Cash and restricted cash, end of period | $ | 322,529 | $ | 24,556 | |||||||

Non-GAAP Financial Reconciliation

Reconciliation of GAAP reported Net Income to non-GAAP adjusted EBITDA:

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in thousands) | |||||||||||

| Reconciliation of Net income to Adjusted EBITDA: | |||||||||||

| Net income | $ | 60,135 | $ | 263 | |||||||

| Income tax benefit | (123) | (1,037) | |||||||||

| Interest expense, net | 4,938 | 3,913 | |||||||||

| Depreciation, amortization and accretion expense | 6,822 | 4,388 | |||||||||

| Non-cash compensation expense | 1,305 | 37 | |||||||||

| Acquisition and entity formation costs | 294 | 147 | |||||||||

| Loss (gain) on fair value remeasurement of contingent consideration | 169 | (1,275) | |||||||||

| Change in fair value of redeemable warrant liability | (18,458) | — | |||||||||

| Change in fair value of alignment shares liability | (46,346) | — | |||||||||

| Other expense (income), net | 15 | (111) | |||||||||

Adjusted EBITDA | $ | 8,751 | $ | 6,325 | |||||||

Reconciliation of non-GAAP adjusted EBITDA margin:

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in thousands) | |||||||||||

| Reconciliation of Adjusted EBITDA margin: | |||||||||||

| Adjusted EBITDA | $ | 8,751 | $ | 6,325 | |||||||

| Operating revenues, net | 19,199 | 12,471 | |||||||||

Adjusted EBITDA margin | 46 | % | 51 | % | |||||||

Q1 2022 Earnings Presentation MAY 1 6 , 2 0 2 2

Cautionary Statements And Risk Factors That May Affect Future Results 2 The following presentation for Altus Power, Inc. (as used in this section, “Altus” or the “Company”) has been prepared by Altus’s management. You should read the following discussion and analysis together with our condensed consolidated financial statements and related notes appearing elsewhere in this Quarterly Report on Form 10-Q, and our 2021 Annual Report on Form 10-K. Any references in this section to “we,” “our” or “us” shall mean Altus. The following discussion and analysis of financial condition and operating results for Altus Power, Inc. (as used in this section, “Altus” or the “Company”) has been prepared by Altus’s management. You should read the following discussion and analysis together with our condensed consolidated financial statements and related notes appearing elsewhere in this Quarterly Report on Form 10-Q, and our 2021 Annual Report on Form 10-K. Any references in this section to “we,” “our” or “us” shall mean Altus. In addition to historical information, this Quarterly Report on Form 10-Q for the period ended March 31, 2022 (this “Report”), including this management’s discussion and analysis (“MD&A”), contains statements that are considered "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements do not convey historical information but relate to predicted or potential future events and financial results, such as statements of our plans, strategies and intentions, or our future performance or goals that are based upon management's current expectations. Our forward-looking statements can often be identified by the use of forward-looking terminology such as "believes," "expects," "intends," "may," “could,” "will," "should," "plans," “projects,” “forecasts,” “seeks,” “anticipates,” “goal,” “objective,” “target,” “estimate,” “future,” “outlook,” “vision,” or variations of such words or similar terminology. Investors and prospective investors are cautioned that such forward-looking statements are only projections based on current estimations. These statements involve risks and uncertainties and are based upon various assumptions. Such risks and uncertainties include, but are not limited to the risks as described in the "Risk Factors" in our 2021 Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 24, 2022 (the “2021 Annual Report on Form 10-K.)” These risks and uncertainties, among others, could cause our actual future results to differ materially from those described in our forward-looking statements or from our prior results. Any forward-looking statement made by us in this Report is based only on information currently available to us and speaks to circumstances only as of the date on which it is made. We are not obligated to update these forward-looking statements, even though our situation may change in the future. Such forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Altus Power’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. These risks, uncertainties, assumptions and other important factors include, but are not limited to: (1) the ability of Altus Power to maintain its listing on the New York Stock Exchange; (2) the ability to recognize the anticipated benefits of the recently completed business combination and related transactions, which may be affected by, among other things, competition, the ability of Altus Power to grow and manage growth profitably, maintain relationships with customers, business partners, suppliers and agents and retain its management and key employees; (3) changes in applicable laws or regulations; (4) the possibility that Altus Power may be adversely affected by other economic, business, regulatory and/or competitive factors; and (5) the impact of COVID-19 on Altus Power’s business. This presentation is not intended to be all-inclusive or to contain all the information that a person may desire in considering an investment in Altus Power and is not intended to form the basis of an investment decision in Altus Power. All subsequent written and oral forward-looking statements concerning Altus Power or other matters and attributable to Altus Power or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Q12022Earnings

3 Q1 2022 Financials 1 AdjustedEBITDAisanon-GAAPfinancialmeasure PleaseseetheAppendixforareconciliationtothemostdirectlycomparableGAAPmeasure $57-63 Million Reaffirmed full year 2022 adjusted EBITDA1 guidance $318.2 Million Unrestricted cash balance as of March 31, 2022 $8.8 Million 2022 Q1 Adjusted EBITDA1 $19.2 Million 2022 Q1 Operating Revenues Q12022Earnings

2021 Quarterly Distribution ($ in m ill io ns ) ($ in m ill io ns ) 4 1 Adjusted EBITDA is a non-GAAP financial measure Please see the Appendix for a reconciliation to the most directly comparable GAAP measure 1Q21 2Q21 3Q21 4Q21 $12.5 $17.6 $20.1 $21.6 Revenue 1Q21 2Q21 3Q21 4Q21 0 2 4 6 8 10 12 14 $ 6.3 $ 10.1 $ 11.7 $ 12.9 Adjusted EBITDA1 Seasonality expected throughout the year Q12022Earnings

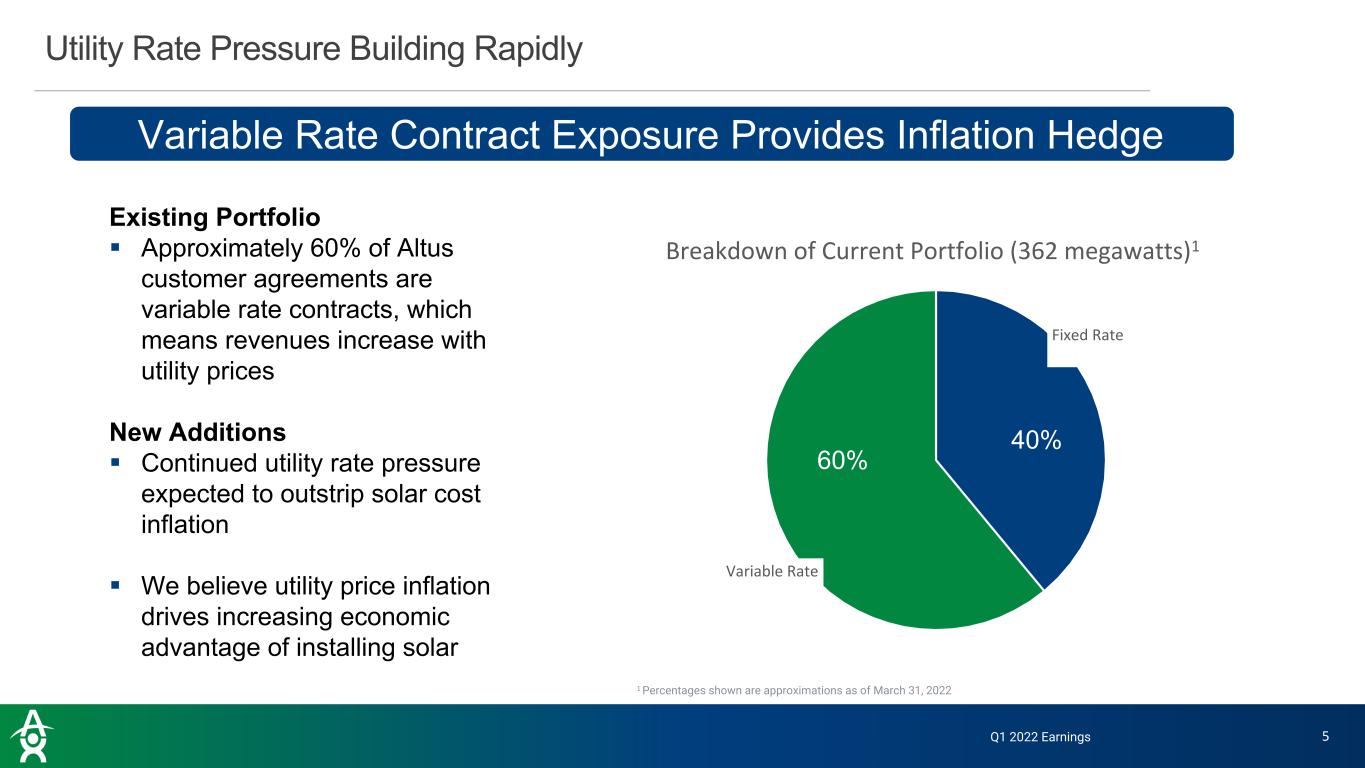

Utility Rate Pressure Building Rapidly Existing Portfolio Approximately 60% of Altus customer agreements are variable rate contracts, which means revenues increase with utility prices New Additions Continued utility rate pressure expected to outstrip solar cost inflation We believe utility price inflation drives increasing economic advantage of installing solar Fixed Rate Variable Rate Breakdown of Current Portfolio (362 megawatts)1 60% 40% 1 PercentagesshownareapproximationsasofMarch31,2022 5 Variable Rate Contract Exposure Provides Inflation Hedge Q12022Earnings

Community Solar – An Altus Power Solution for the Residential Segment Over 5,000 community customers served by almost 40 megawatts of our projects including apartment residents and lower/middle income (LMI) customers 55 megawatts2 of additional community projects agreed including 35 megawatts Blackstone Link Logistics NJ and 20 megawatts of CBRE IM Maryland programs Bulk discount to customers drives demand for our projects since Altus bills customer for power at a fixed discount to the prevailing local utility rate Community solar enables residential customers to sign up as off takers for our commercial-scale projects under a “virtual” net metering rate, currently offered in IL, MD, MA, MN, NJ, HI1 and NY 6 1 InConstruction 2Theseadditionsareapproximateandaresubjecttocompletionandthereisnoguaranteeastowhenoriftheseadditionswillberealizedandcontributetorevenues Q12022Earnings

Our Pipeline of Projects1 Potential Operating Acquisitions2 Projects Under Development 7 Over 1 Gigawatt of Actionable Pipeline Ordinary Course Larger Operating 75% 25% In Construction / In Contract / Customer Engagem ent 60% 20% 20% 1 PercentagesshownareapproximationsasofMarch31,2022 2Aportionoftheseacquisitionsaresubjecttoduediligenceandtheexecutionofdefinitiveagreementsandthereisnoguarantee astowhenoriftheprospectiveacquisitionsinourpipelinewillberealizedormakeapositivecontributiontoouroperatingresults Over 500 MW Over 500 MW Q12022Earnings

Origination – Project Timeline to Completion1 8 Historical Timeline 12-15 months Current Timeline Extension 3-6 months Altus Power Self-Developed/Construction Channel Partner Fully Developed/Construction 1Allreferencestotimelinesrefertotimebetweentermsagreeduntilcommercialoperationsandisbasedonourhistoricalbusinessoperations.Thereisnoguaranteethatprojects developedinthefuturewillfollowthesametimelineasourhistoricaloperations Historical Timeline 6-9 months Current Timeline Extension 3-6 months \ Extended Project Timelines Create Challenges Q12022Earnings

9 Largest and only public pure play company in our lucrative and fast-growing sector Focused on growing profitably and equipped with the capital necessary to carry out our plan Vertically integrated making Altus the one-stop solution for delivering savings and decarbonization benefits to customers Valuable strategic partnerships that streamline our customer engagement Altus’ DNA Q12022Earnings

Appendix

Non-GAAP Reconciliation 11 Adjusted EBITDA1 Three Months Ended March 31, 2022 2021 Reconciliation of Net income to Adjusted EBITDA (in thousands) Net income $ 60,135 $ 263 Income tax benefit -123 -1,037 Interest expense, net 4,938 3,913 Depreciation, amortization and accretion expense 6,822 4,388 Non-cash compensation expense 1,305 37 Acquisition and entity formation costs 294 147 Loss (gain) on fair value remeasurement of contingent consideration 169 -1,275 Change in fair value of redeemable warrant liability -18,458 — Change in fair value of alignment shares liability -46,346 — Other expense (income), net 15 -111 Adjusted EBITDA $ 8,751 $ 6,325 Adjusted EBITDA Margin1 Three Months Ended March 31, 2022 2021 Reconciliation of Adjusted EBITDA Margin: (in thousands) Adjusted EBITDA $ 8,751 $ 6,325 Operating revenues, net 19,199 12,471 Adjusted EBITDA Margin 46% 51% 1 AdjustedEBITDAandAdjustedEBITDAMarginarenon-GAAPfinancialmeasures

Balance Sheet 12 As of March 31, 2022 As of December 31, 2021 Assets Current assets: Cash $ 318,177 $ 325,983 Current portion of restricted cash 2,558 2,544 Accounts receivable, net 8,494 9,218 Other current assets 6,619 6,659 Total current assets 335,848 344,404 Restricted cash, noncurrent portion 1,794 1,794 Property, plant and equipment, net 745,991 745,711 Intangible assets, net 16,377 16,702 Goodwill 601 601 Other assets 3,738 4,037 Total assets $ 1,104,349 $ 1,113,249 Liabilities, redeemable noncontrolling interests, and stockholders' equity Current liabilities: Accounts payable $ 2,394 $ 3,591 Interest payable 4,362 4,494 Current portion of long-term debt 21,218 21,143 Other current liabilities 3,500 3,663 Total current liabilities 31,474 32,891 Redeemable warrant liability 31,475 49,933 Alignment shares liability 81,114 127,474 Long-term debt, net of unamortized debt issuance costs and current portion 521,869 524,837 Intangible liabilities, net 12,847 13,758 Asset retirement obligations 7,688 7,628 Deferred tax liabilities, net 9,473 9,603 Other long-term liabilities 6,698 5,587 Total liabilities $ 702,638 $ 771,711 Commitments and contingent liabilities Redeemable noncontrolling interests 15,407 15,527 Stockholders' equity Common stock $0.0001 par value; 988,591,250 shares authorized as of March 31, 2022, and December 31, 2021; 153,648,830 shares issued and outstanding as of March 31, 2022, and December 31, 2021 15 15 Preferred stock $0.0001 par value; 10,000,000 shares authorized, zero shares issued and outstanding as of March 31, 2022, and December 31, 2021 — — Additional paid-in capital 406,866 406,259 Accumulated deficit (40,937) (101,356) Total stockholders' equity $ 365,944 $ 304,918 Noncontrolling interests 20,360 21,093 Total equity $ 386,304 $ 326,011 Total liabilities, redeemable noncontrolling interests, and stockholders' equity $ 1,104,349 $ 1,113,249 Condensed Consolidated Balance Sheets (In thousands, except share and per share data)

Statement of Operations 13 Condensed Consolidated Balance Sheets (In thousands, except share and per share data) Three Months Ended March 31, 2022 2021 Operating revenues, net $ 19,199 $ 12,471 Operating expenses Cost of operations (exclusive of depreciation and amortization shown separately below) 4,064 2,920 General and administrative 6,384 3,226 Depreciation, amortization and accretion expense 6,822 4,388 Acquisition and entity formation costs 294 147 Loss (gain) on fair value remeasurement of contingent consideration 169 (1,275) Stock-based compensation 1,305 37 Total operating expenses $ 19,038 $ 9,443 Operating income 161 3,028 Other (income) expense Change in fair value of redeemable warrant liability (18,458) — Change in fair value of alignment shares liability (46,346) — Other expense (income), net 15 (111) Interest expense, net 4,938 3,913 Total other (income) expense $ (59,851) $ 3,802 Income (loss) before income tax benefit $ 60,012 $ (774) Income tax benefit 123 1,037 Net income $ 60,135 $ 263 Net loss attributable to noncontrolling interests and redeemable noncontrolling interests (284) (699) Net income attributable to Altus Power, Inc. $ 60,419 $ 962 Net income per share attributable to common stockholders Basic $ 0.39 $ 0.01 Diluted $ 0.39 $ 0.01 Weighted average shares used to compute net income per share attributable to common stockholders Basic 152,662,512 88,741,089 Diluted 153,586,538 89,991,570

Non-GAAP Definitions 14 Adjusted EBITDA is a non-GAAP financial measure and is defined as net income (loss) plus net interest expense, depreciation, amortization and accretion expense, income tax expense, acquisition and entity formation costs, non-cash compensation expense, and excluding the effect of certain non-recurring items we do not consider to be indicative of our ongoing operating performance such as, but not limited to, gain on fair value remeasurement of contingent consideration, gain on disposal of property, plant and equipment, change in fair value of redeemable warrant liability, change in fair value of alignment shares, loss on extinguishment of debt, and other miscellaneous items of other income and expenses. Adjusted EBITDA margin is a non-GAAP financial measure and is defined as Adjusted EBITDA divided by operating revenues. Adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures that we use to measure out performance. We believe that investors and analysts also use adjusted EBITDA in evaluating our operating performance. This measurement is not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. The GAAP measure most directly comparable to adjusted EBITDA is net income and to adjusted EBITDA margin is net income over operating revenues. The presentation of adjusted EBITDA and adjusted EBITDA margin should not be construed to suggest that our future results will be unaffected by non-cash or non-recurring items. In addition, our calculation of adjusted EBITDA and adjusted EBITDA margin are not necessarily comparable to adjusted EBITDA as calculated by other companies and investors and analysts should read carefully the components of our calculations of these non-GAAP financial measures. We believe adjusted EBITDA is useful to management, investors and analysts in providing a measure of core financial performance adjusted to allow for comparisons of results of operations across reporting periods on a consistent basis. These adjustments are intended to exclude items that are not indicative of the ongoing operating performance of the business. Adjusted EBITDA is also used by our management for internal planning purposes, including our consolidated operating budget, and by our board of directors in setting performance-based compensation targets. Adjusted EBITDA should not be considered an alternative to but viewed in conjunction with GAAP results, as we believe it provides a more complete understanding of ongoing business performance and trends than GAAP measures alone. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Altus Power does not provide GAAP financial measures on a forward-looking basis because the Company is unable to predict with reasonable certainty and without unreasonable effort, items such as acquisition and entity formation costs, gain on fair value remeasurement of contingent consideration, change in fair value of redeemable warrant liability, change in fair value of alignment shares. These items are uncertain, depend on various factors, and could be material to Altus Power’s results computed in accordance with GAAP. Q12022Earnings

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Altus Power (AMPS) PT Lowered to $7 at B.Riley

- Commencement Bancorp, Inc. (CBWA) Announces Cash Dividend

- Nihon Global Growth Partners Submits Shareholder Proposals for Consideration at Toyo Suisan’s 2024 General Shareholders’ Meeting

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share