Form 8-K Adtalem Global Education For: Jan 24

Exhibit 99.1

Investor Contact

Chandrika Nigam

312-681-3209

Media Contact

Kelly Finelli

872-270-0230

Adtalem Global Education Announces Definitive Agreement

to Divest Financial Services Segment

Wendel Group and Colibri Group consortium to purchase segment for $1 billion

CHICAGO — Jan. 24, 2022 — Adtalem Global Education (NYSE: ATGE), a leading provider of professional talent to the healthcare industry, announced today it has entered into a definitive agreement to sell its Financial Services segment, which includes ACAMS (Association of Certified Anti-Money Laundering Specialists), Becker Professional Education and OnCourse Learning, to a consortium of Wendel Group and Colibri Group in an all cash transaction for $1 billion. The transaction is expected to close in the third quarter of fiscal year 2022, subject to customary closing conditions.

“We are incredibly proud of the tremendous growth and operating performance we have generated in our financial services segment over the past two years, which has produced the opportunity to unlock significant shareholder value through this transaction,” said Steve Beard, president and CEO of Adtalem Global Education. “I’m confident each of the brands and companies in the financial services segment will continue to lead in their respective markets under the new ownership and leadership of Wendel and Colibri.

"This transaction is the culmination of a long-term strategy to sharpen the focus of our portfolio and greatly enhance our ability to address – at scale – the rapidly growing and unmet demand for healthcare professionals in the U.S.,” Beard added.

Wendel Group, based in Paris, is one of Europe’s largest listed investment firms. It selects leading companies in making long-term investments. Colibri Group, a Gridiron Capital company based in St. Louis, helps millions of professionals manage and advance their careers through online learning solutions.

The company will begin reporting the financial services segment as a held for sale and discontinued operation in its second quarter fiscal 2022 earnings report.

Morgan Stanley & Co. LLC served as Adtalem’s financial advisor and Skadden, Arps, Slate, Meagher & Flom LLP as its legal counsel in the sale of the financial services segment. Houlihan Lokey served as Colibri and Gridiron’s financial advisor and Finn Dixon & Herling LLP as its legal counsel. Macquarie Capital served as Wendel’s financial advisor and Kirkland & Ellis LLP as its legal advisor.

| Page 1 of 2 |

About Adtalem Global Education

Adtalem Global Education (NYSE: ATGE), a leading workforce solutions provider, partners with organizations in the healthcare and financial services industries to solve critical workforce talent needs by expanding access to education, certifications and upskilling programs at scale. With a dedicated focus on driving strong outcomes that increase workforce preparedness, Adtalem empowers a diverse learner population to achieve their goals and make inspiring contributions to the global community. Adtalem is the parent organization of ACAMS, American University of the Caribbean School of Medicine, Becker Professional Education, Chamberlain University, EduPristine, OnCourse Learning, Ross University School of Medicine, Ross University School of Veterinary Medicine and Walden University. Adtalem has more than 10,000 employees, a network of more than 275,000 alumni and serves over 82,000 members across 200 countries and territories. Adtalem was named one of America’s Most Responsible Companies 2021 by Newsweek and one of America’s Best Employers for Diversity 2021 by Forbes. Follow Adtalem on Twitter (@adtalemglobal), LinkedIn or visit adtalem.com for more information.

About Wendel Group

Wendel is one of Europe's leading listed investment firms. The Group invests in Europe and North America in companies which are leaders in their field, such as Bureau Veritas, Tarkett, Stahl, IHS Towers, Constantia Flexibles, and Crisis Prevention Institute. Wendel often plays an active role as a controlling or significant shareholder in its portfolio companies. Wendel seeks to implement long-term development strategies, which involve boosting growth and margins of companies so as to enhance their leading market positions.

About Colibri Group

Colibri Group, a Gridiron Capital company based in St. Louis, helps millions of professionals manage and advance their careers through online learning solutions, focused on licensing, continuing education, industry news, and job opportunities for healthcare, real estate, appraisal and financial services, among other professions.

Forward-Looking Statements

Certain statements in this press release are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact, which includes statements regarding the future impact of the novel coronavirus (“COVID-19”) pandemic, the efficacy and distribution of the vaccines, and the pending sale of the financial services segment including our anticipated net proceeds and whether the pending sale will be completed in the anticipated timeframe, if at all. Forward-looking statements can also be identified by words such as “future,” “believe,” “expect,” “anticipate,” “estimate,” “plan,” “intend,” “may,” “will,” “would,” “could,” “can,” “continue,” “preliminary,” “range,” and similar terms. These forward-looking statements are subject to risk and uncertainties that could cause actual results to differ materially from those described in the statements. These risk and uncertainties include the risk factors described in Item 1A. “Risk Factors” of our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC) and our other filings with the SEC. These forward-looking statements are based on information available to us as of the date any such statements are made, and we do not undertake any obligation to update any forward-looking statement, except as required by law.

| Page 2 of 2 |

Exhibit 99.2

Confidential Financial Services Divestiture Supplemental Information January 2022

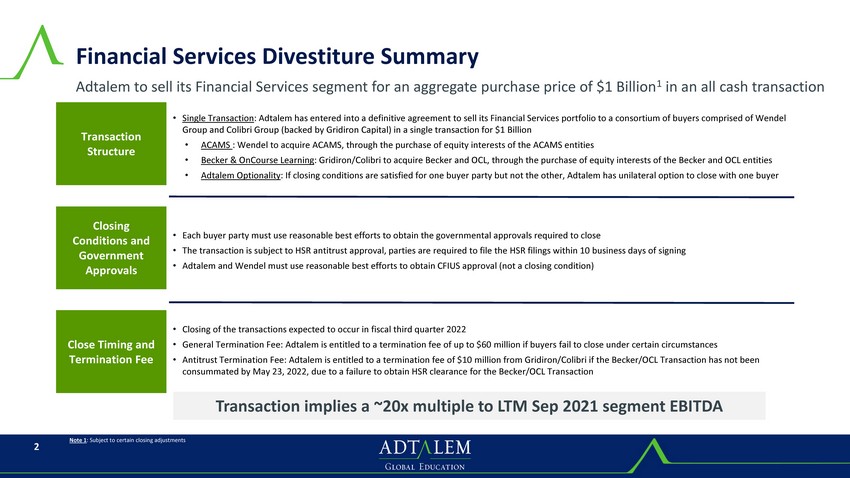

2 Financial Services Divestiture Summary Adtalem to sell its Financial Services segment for an aggregate purchase price of $1 Billion 1 in an all cash transaction Transaction Structure • Single Transaction : Adtalem has entered into a definitive agreement to sell its Financial Services portfolio to a consortium of buyers comprise d o f Wendel Group and Colibri Group (backed by Gridiron Capital) in a single transaction for $1 Billion • ACAMS : Wendel to acquire ACAMS, through the purchase of equity interests of the ACAMS entities • Becker & OnCourse Learning : Gridiron/Colibri to acquire Becker and OCL, through the purchase of equity interests of the Becker and OCL entities • Adtalem Optionality : If closing conditions are satisfied for one buyer party but not the other, Adtalem has unilateral option to close with one buy er Closing Conditions and Government Approvals • Each buyer party must use reasonable best efforts to obtain the governmental approvals required to close • The transaction is subject to HSR antitrust approval, parties are required to file the HSR filings within 10 business days of si gning • Adtalem and Wendel must use reasonable best efforts to obtain CFIUS approval (not a closing condition) Close Timing and Termination Fee • Closing of the transactions expected to occur in fiscal third quarter 2022 • General Termination Fee: Adtalem is entitled to a termination fee of up to $60 million if buyers fail to close under certain cir cumstances • Antitrust Termination Fee: Adtalem is entitled to a termination fee of $10 million from Gridiron/Colibri if the Becker/OCL Tr ans action has not been consummated by May 23, 2022, due to a failure to obtain HSR clearance for the Becker/OCL Transaction Note 1 : Subject to certain closing adjustments Transaction implies a ~20x multiple to LTM Sep 2021 segment EBITDA

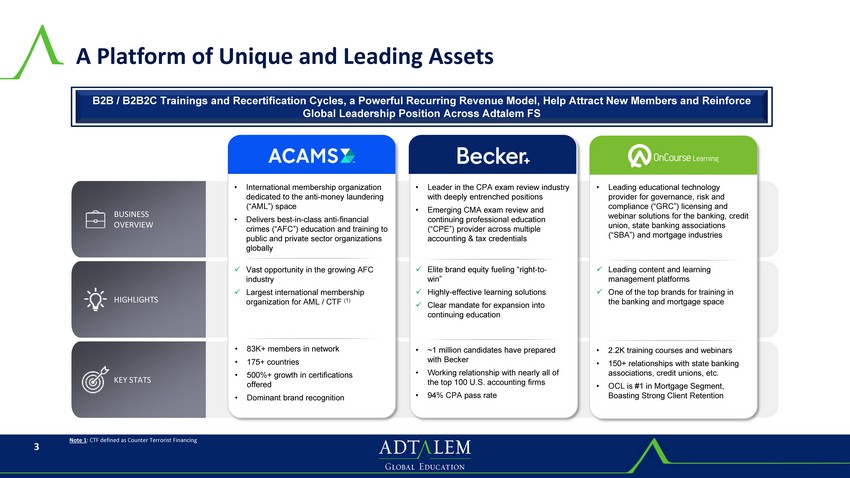

3 A Platform of Unique and Leading Assets BUSINESS OVERVIEW HIGHLIGHTS KEY STATS • Leading educational technology provider for governance, risk and compliance (“GRC”) licensing and webinar solutions for the banking, credit union, state banking associations (“SBA”) and mortgage industries x Leading content and learning management platforms x One of the top brands for training in the banking and mortgage space • 2.2K training courses and webinars • 150+ relationships with state banking associations, credit unions, etc. • OCL is #1 in Mortgage Segment, Boasting Strong Client Retention • Leader in the CPA exam review industry with deeply entrenched positions • Emerging CMA exam review and continuing professional education (“CPE”) provider across multiple accounting & tax credentials x Elite brand equity fueling “right - to - win” x Highly - effective learning solutions x Clear mandate for expansion into continuing education • ~1 million candidates have prepared with Becker • Working relationship with nearly all of the top 100 U.S. accounting firms • 94% CPA pass rate • International membership organization dedicated to the anti - money laundering (“AML”) space • Delivers best - in - class anti - financial crimes (“AFC”) education and training to public and private sector organizations globally x Vast opportunity in the growing AFC industry x Largest international membership organization for AML / CTF (1) • 83K+ members in network • 175+ countries • 500%+ growth in certifications offered • Dominant brand recognition B2B / B2B2C Trainings and Recertification Cycles, a Powerful Recurring Revenue Model, Help Attract New Members and Reinforce Global Leadership Position Across Adtalem FS Note 1 : CTF defined as Counter Terrorist Financing

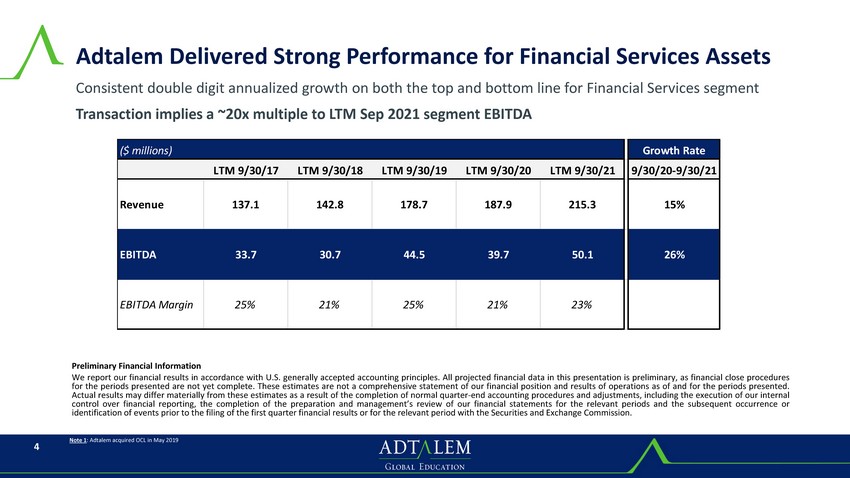

4 Adtalem Delivered Strong Performance for Financial Services Assets Preliminary Financial Information We report our financial results in accordance with U . S . generally accepted accounting principles . All projected financial data in this presentation is preliminary, as financial close procedures for the periods presented are not yet complete . These estimates are not a comprehensive statement of our financial position and results of operations as of and for the periods presented . Actual results may differ materially from these estimates as a result of the completion of normal quarter - end accounting procedures and adjustments, including the execution of our internal control over financial reporting, the completion of the preparation and management’s review of our financial statements for the relevant periods and the subsequent occurrence or identification of events prior to the filing of the first quarter financial results or for the relevant period with the Securities and Exchange Commission . Consistent double digit annualized growth on both the top and bottom line for Financial Services segment Transaction implies a ~20x multiple to LTM Sep 2021 segment EBITDA Note 1 : Adtalem acquired OCL in May 2019 ($ millions) Growth Rate LTM 9/30/17 LTM 9/30/18 LTM 9/30/19 LTM 9/30/20 LTM 9/30/21 9/30/20-9/30/21 Revenue 137.1 142.8 178.7 187.9 215.3 15% EBITDA 33.7 30.7 44.5 39.7 50.1 26% EBITDA Margin 25% 21% 25% 21% 23%

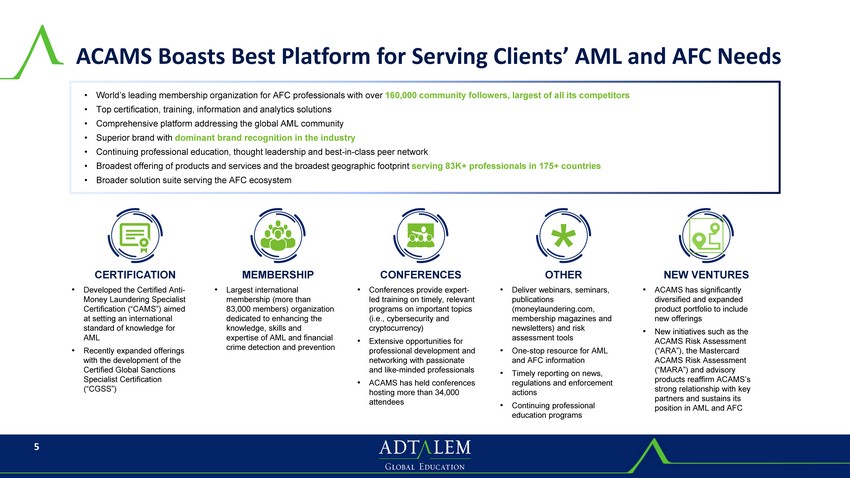

5 ACAMS Boasts Best Platform for Serving Clients’ AML and AFC Needs • World’s leading membership organization for AFC professionals with over 160,000 community followers, largest of all its competitors • Top certification, training, information and analytics solutions • Comprehensive platform addressing the global AML community • Superior brand with dominant brand recognition in the industry • Continuing professional education, thought leadership and best - in - class peer network • Broadest offering of products and services and the broadest geographic footprint serving 83K+ professionals in 175+ countries • Broader solution suite serving the AFC ecosystem • Largest international membership (more than 83,000 members) organization dedicated to enhancing the knowledge, skills and expertise of AML and financial crime detection and prevention MEMBERSHIP • Conferences provide expert - led training on timely, relevant programs on important topics (i.e., cybersecurity and cryptocurrency) • Extensive opportunities for professional development and networking with passionate and like - minded professionals • ACAMS has held conferences hosting more than 34,000 attendees CONFERENCES • Developed the Certified Anti - Money Laundering Specialist Certification (“CAMS”) aimed at setting an international standard of knowledge for AML • Recently expanded offerings with the development of the Certified Global Sanctions Specialist Certification (“CGSS”) CERTIFICATION • Deliver webinars, seminars, publications (moneylaundering.com, membership magazines and newsletters) and risk assessment tools • One - stop resource for AML and AFC information • Timely reporting on news, regulations and enforcement actions • Continuing professional education programs OTHER • ACAMS has significantly diversified and expanded product portfolio to include new offerings • New initiatives such as the ACAMS Risk Assessment (“ARA”), the Mastercard ACAMS Risk Assessment (“MARA”) and advisory products reaffirm ACAMS’s strong relationship with key partners and sustains its position in AML and AFC NEW VENTURES

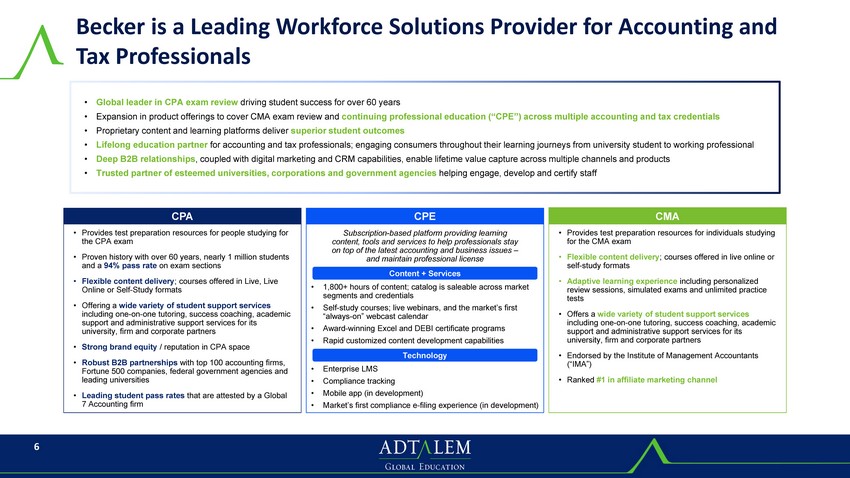

6 Becker is a Leading Workforce Solutions Provider for Accounting and Tax Professionals • Global leader in CPA exam review driving student success for over 60 years • Expansion in product offerings to cover CMA exam review and continuing professional education (“CPE”) across multiple accounting and tax credentials • Proprietary content and learning platforms deliver superior student outcomes • Lifelong education partner for accounting and tax professionals; engaging consumers throughout their learning journeys from university student to workin g p rofessional • Deep B2B relationships , coupled with digital marketing and CRM capabilities, enable lifetime value capture across multiple channels and products • Trusted partner of esteemed universities, corporations and government agencies helping engage, develop and certify staff • Provides test preparation resources for people studying for the CPA exam • Proven history with over 60 years, nearly 1 million students and a 94% pass rate on exam sections • Flexible content delivery ; courses offered in Live, Live Online or Self - Study formats • Offering a wide variety of student support services including one - on - one tutoring, success coaching, academic support and administrative support services for its university, firm and corporate partners • Strong brand equity / reputation in CPA space • Robust B2B partnerships with top 100 accounting firms, Fortune 500 companies, federal government agencies and leading universities • Leading student pass rates that are attested by a Global 7 Accounting firm • 1,800+ hours of content; catalog is saleable across market segments and credentials • Self - study courses; live webinars, and the market’s first “always - on” webcast calendar • Award - winning Excel and DEBI certificate programs • Rapid customized content development capabilities • Enterprise LMS • Compliance tracking • Mobile app (in development) • Market’s first compliance e - filing experience (in development) Subscription - based platform providing learning content, tools and services to help professionals stay on top of the latest accounting and business issues – and maintain professional license Technology Content + Services • Provides test preparation resources for individuals studying for the CMA exam • Flexible content delivery ; courses offered in live online or self - study formats • Adaptive learning experience including personalized review sessions, simulated exams and unlimited practice tests • Offers a wide variety of student support services including one - on - one tutoring, success coaching, academic support and administrative support services for its university, firm and corporate partners • Endorsed by the Institute of Management Accountants (“IMA”) • Ranked #1 in affiliate marketing channel CPA CMA CPE

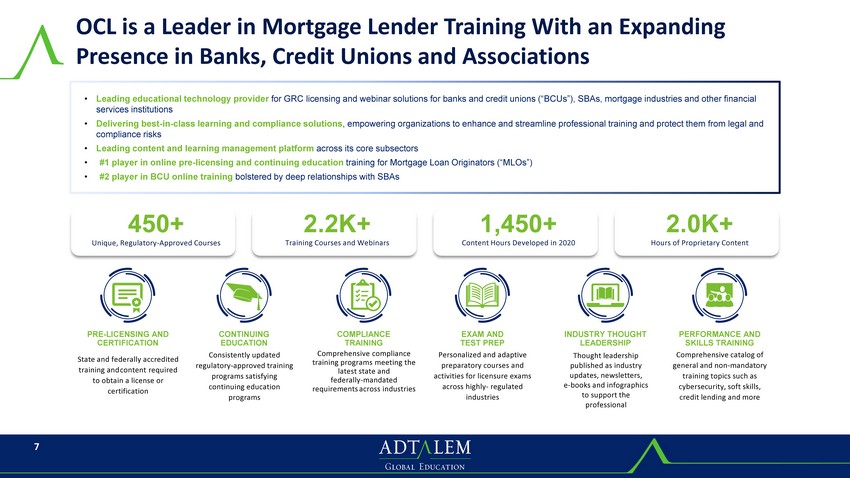

7 OCL is a Leader in Mortgage Lender Training With an Expanding Presence in Banks, Credit Unions and Associations • Leading educational technology provider for GRC licensing and webinar solutions for banks and credit unions (“BCUs”), SBAs, mortgage industries and other financial services institutions • Delivering best - in - class learning and compliance solutions , empowering organizations to enhance and streamline professional training and protect them from legal and compliance risks • Leading content and learning management platform across its core subsectors • #1 player in online pre - licensing and continuing education training for Mortgage Loan Originators (“MLOs”) • #2 player in BCU online training bolstered by deep relationships with SBAs 450+ Unique, Regulatory - Approved Courses State and federally accredited training and content required to obtain a license or certification PRE - LICENSING AND CERTIFICATION Consistently updated regulatory - approved training programs satisfying continuing education programs CONTINUING EDUCATION Comprehensive compliance training programs meeting the latest state and federally - mandated requirements across industries COMPLIANCE TRAINING Personalized and adaptive preparatory courses and activities for licensure exams across highly - regulated industries EXAM AND TEST PREP Thought leadership published as industry updates, newsletters, e - books and infographics to support the professional INDUSTRY THOUGHT LEADERSHIP Comprehensive catalog of general and non - mandatory training topics such as cybersecurity, soft skills, credit lending and more PERFORMANCE AND SKILLS TRAINING 2.2K+ Training Courses and Webinars 1,450+ Content Hours Developed in 2020 2.0K+ Hours of Proprietary Content

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Adtalem Global Education Announces Fiscal Third Quarter 2024 Conference Call

- Vertex, Inc. Announces Pricing of Upsized $300 Million Convertible Senior Notes Offering

- Hempacco Receives Notification of Deficiency from Nasdaq

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share