Form 8-K AMICUS THERAPEUTICS, For: Aug 04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of

earliest event reported):

(Exact Name of Registrant as Specified in Its Charter)

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

(Address of Principal Executive Offices, and Zip Code)

Registrant’s Telephone Number, Including Area Code

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2). Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition

On August 4, 2022, Amicus Therapeutics, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended June 30, 2022. A copy of this press release is attached hereto as Exhibit 99.1. The Company will host a conference call and webcast on August 4, 2022 to discuss its second quarter results of operations. A copy of the conference call presentation materials is attached hereto as Exhibit 99.2. Both exhibits are incorporated herein by reference.

In accordance with General Instruction B.2. of Form 8-K, the information in this Current Report on Form 8-K and the Exhibits shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

| Exhibit No. | Description | |

| 99.1 | Press Release dated August 4, 2022 | |

| 99.2 | August 4, 2022 Conference Call Presentation Materials | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signature Page

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AMICUS THERAPEUTICS, INC. | ||

| Date: August 4, 2022 | By: | /s/ Ellen S. Rosenberg |

| Name: Ellen S. Rosenberg | ||

| Title: Chief Legal Officer and Corporate Secretary | ||

Exhibit 99.1

Amicus Therapeutics

Announces Second Quarter 2022

Financial Results

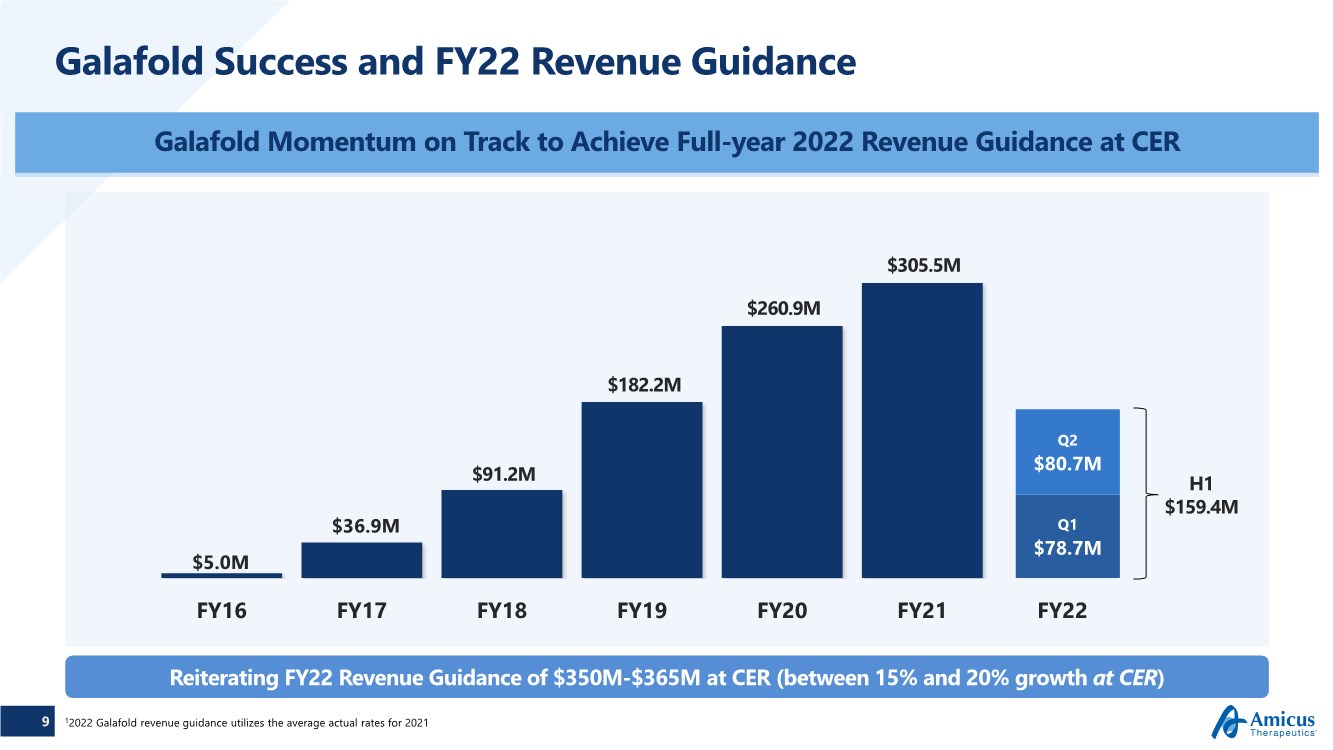

1H22 Galafold® Revenue of $159.4M, reflecting 11% Sales Growth

with Operational Growth of 18%, Partly Offset by Currency Headwinds of 7%

On-Track to Deliver Full-Year Double-Digit Revenue Growth of 15-20%

at Constant Exchange Rates

Advancing U.S. and EU Regulatory Reviews and Launch Preparations

for AT-GAA in Pompe Disease

3 Newly Issued U.S. Composition of Matter Patents for Galafold

Add to Growing U.S. Patent Portfolio

Conference Call and Webcast Today at 8:30 a.m. ET

PHILADELPHIA, PA, Aug. 4, 2022 – Amicus Therapeutics (Nasdaq: FOLD), a patient-dedicated global biotechnology company focused on developing and commercializing novel medicines for rare diseases, today announced financial results for the quarter ended June 30, 2022.

Bradley Campbell, President and Chief Executive Officer of Amicus Therapeutics, Inc., stated, “Through the first half of the year and into the third quarter, we have gained great momentum towards achieving our key strategic priorities for 2022. We are pleased by the continued global uptake of Galafold and continued patient demand, which is driving strong operational growth in-line with our 2022 guidance. We are focused on gaining regulatory approvals of AT-GAA for people living with Pompe disease around the world. Importantly, we are poised for the anticipated successful launch of AT-GAA and continue to believe in the potential of this treatment regimen to become the new global standard of care in Pompe disease. These efforts, together with our careful management of expenses and the financial strength of our business, uniquely position Amicus to deliver sustainable value for shareholders while upholding our mission for people living with rare diseases.”

Corporate Highlights

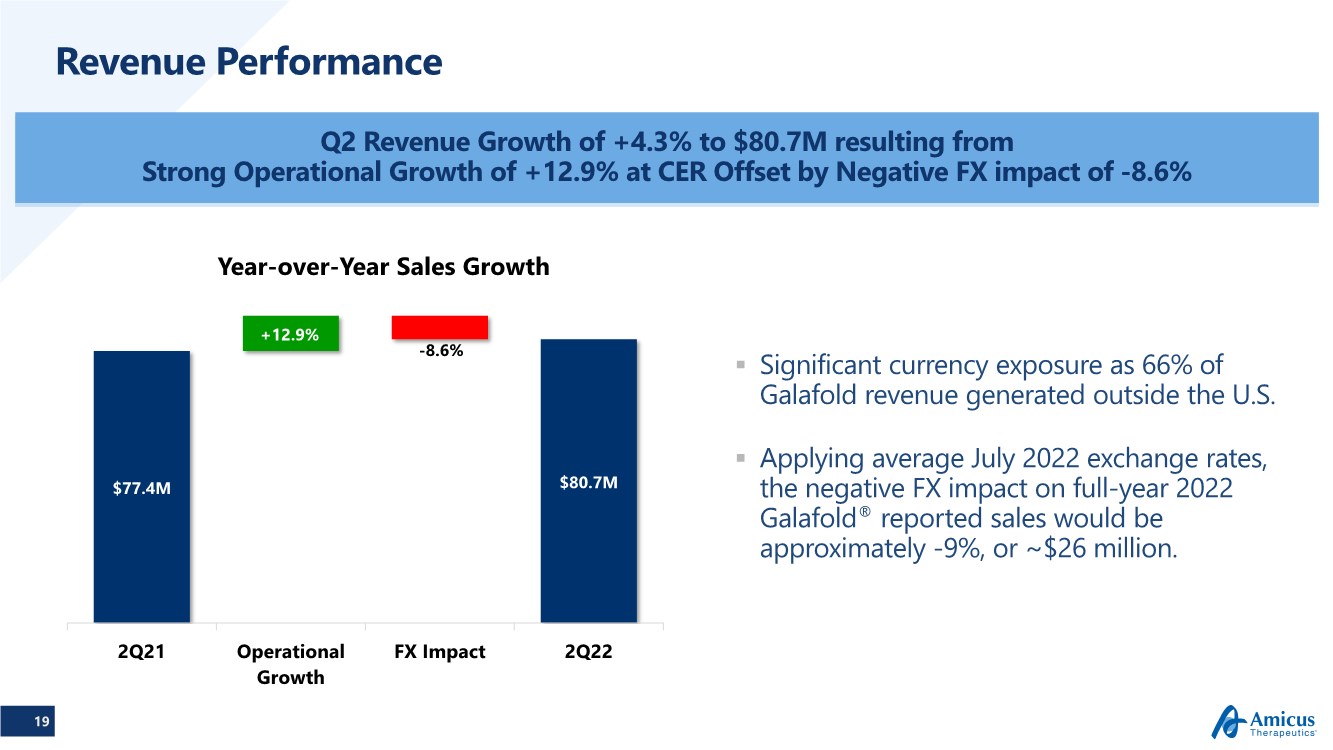

| · | Global revenue for Galafold® (migalastat) in the first half of 2022 was $159.4M, reflecting 11% growth with operational growth of 18% offset by currency headwinds of 7%. Second quarter sales of $80.7 million represented a year-over-year increase of 13% at constant exchange rates (CER)1. Second quarter reported revenue growth was 4% given significant currency headwinds of $6.7 million, or 9%. |

| (in thousands) | Three Months Ended June 30, | Year over Year % Growth | Six Months Ended June 30, | Year over Year % Growth | ||||||||||||||||||||||||||||

| 2022 | 2021 | As Reported | at CER1 | 2022 | 2021 | As Reported | at CER1 | |||||||||||||||||||||||||

| Galafold Net Product Revenues | $ | 80,731 | $ | 77,413 | 4 | % | 13 | % | $ | 159,446 | $ | 143,815 | 11 | % | 18 | % | ||||||||||||||||

| · | Galafold U.S. intellectual property estate strengthened following the issuance of 17 new patents this year. The Galafold U.S. intellectual property portfolio now includes 44 orange book listed patents, 28 of which provide protection through at least 2038, including 3 newly issued composition of matter patents. |

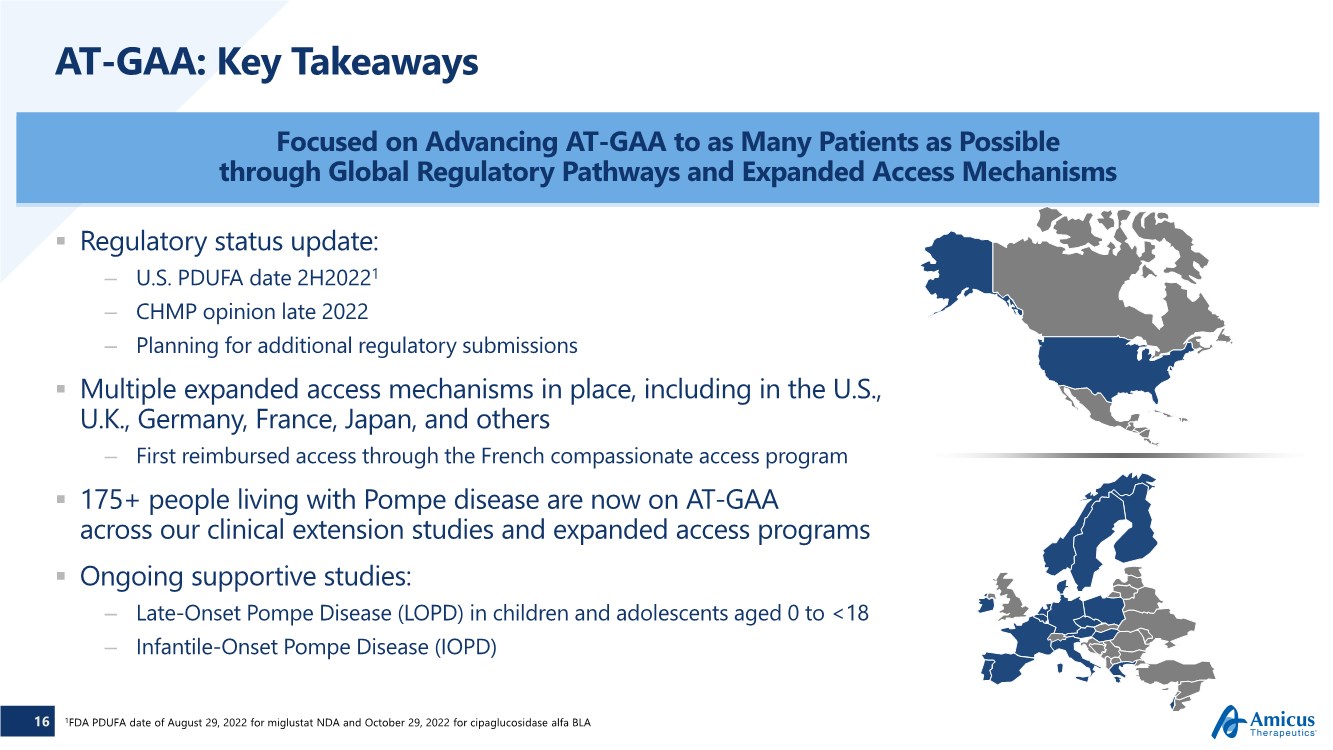

| · | AT-GAA regulatory reviews progressing and pre-launch activities underway. In the U.S., the Food and Drug Administration (FDA) extended the Prescription Drug User Fee Act (PDUFA) action dates to August 29, 2022, for the New Drug Application (NDA) and October 29, 2022, for the Biologic License Application (BLA), reflective of the two components of AT-GAA. The Company continues to expect the FDA to approve the applications together by the October 29, 2022, action date. In the EU, the Committee for Medicinal Products for Human Use (CHMP) opinion is expected in late 2022. |

| · | Expanded access programs in place to meet the growing demand for AT-GAA across multiple countries. In France, the National Agency for the Medicines and Health Products Safety (ANSM) granted the first reimbursed access to AT-GAA under their compassionate access (“Accès Compassionnel”) program. In the U.K., under the Early Access to Medicines Scheme (EAMS) multiple physicians have requested access across the leading Pompe centers in the country. Additional expanded access programs are in place in Germany and Japan with multiple Pompe patients participating in each. |

1

| · | Amicus announces a program to explore next-generation pharmacological chaperones for Fabry disease through academic research collaboration agreement with the Spanish National Research Council (CSIC) and the University of Seville. This new collaboration will search for innovative glycomimetics with optimal activity and pharmacokinetic properties. Lead compounds will be selected based on their potential for greater potency, expanded number of amenable mutations, and optimal dosing. |

| · | Company leadership transition complete. As of August 1, 2022, Bradley Campbell transitioned to the role of President and Chief Executive Officer of Amicus. John F. Crowley has transitioned to the role of Executive Chairman of Amicus for a two-year term, after which he is expected to continue as the non-executive Chairman of the Board. |

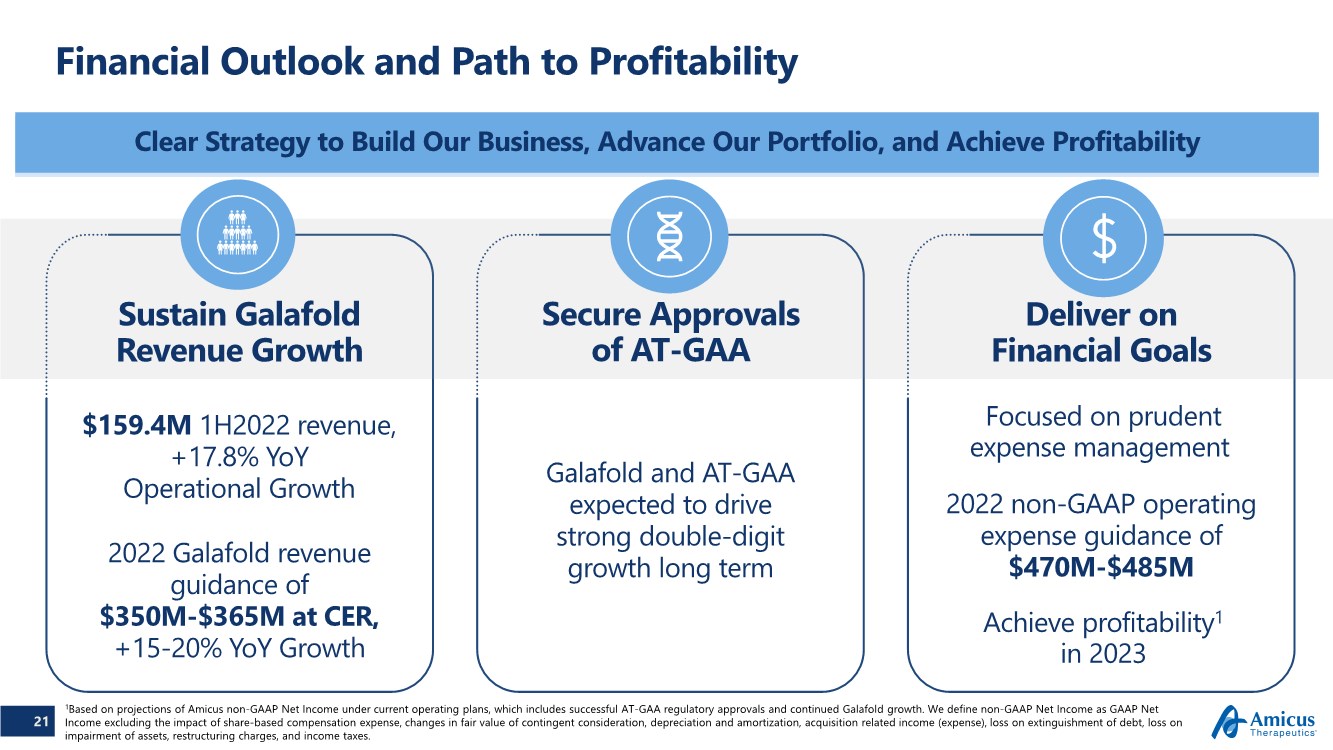

| · | On track to achieve non-GAAP profitability2 in 2023. Through careful management of expenses, based on current operating models, the Company is on the path to achieve profitability in 2023, as it executes on the global expansion of Galafold and prepares for the global launch of AT-GAA. |

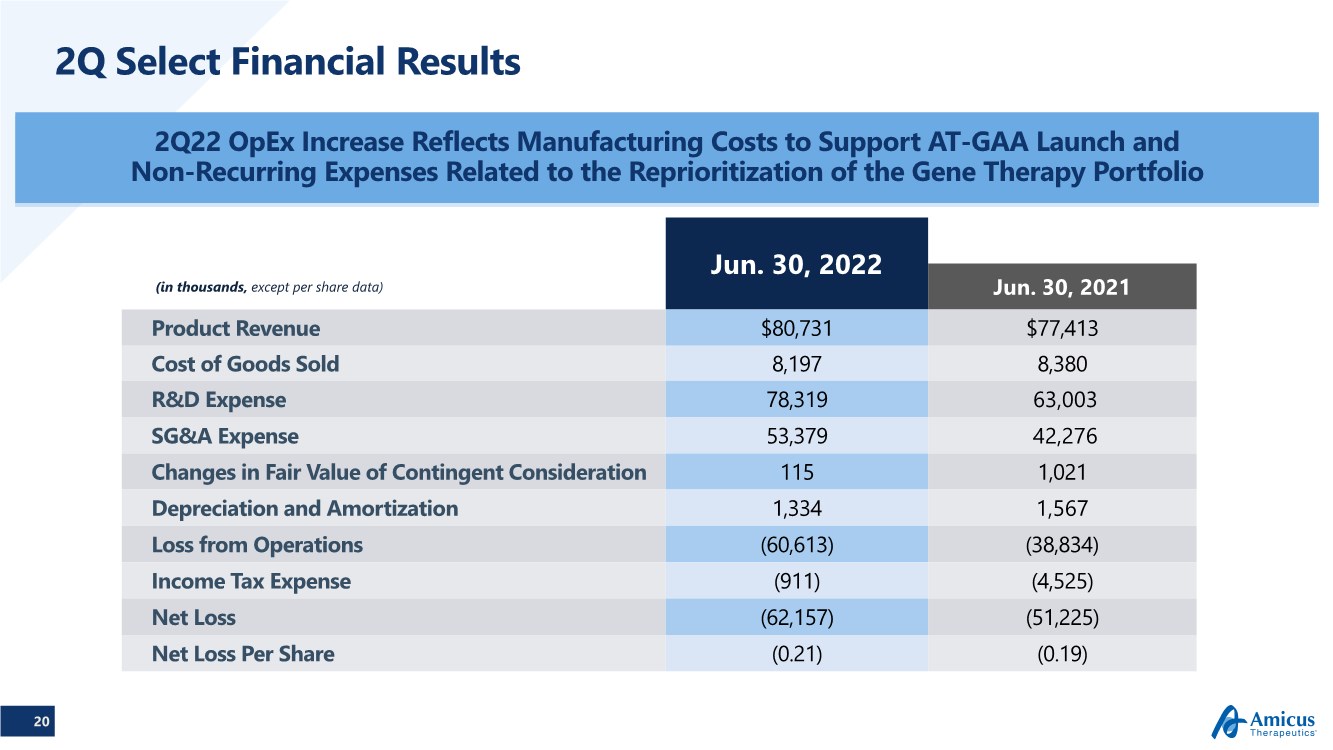

Second Quarter 2022 Financial Results

| · | Total revenue in the second quarter 2022 was $80.7 million, a year-over-year increase of 4% from total revenue of $77.4 million in the second quarter of 2021. On a constant currency basis, second quarter 2022 total revenue growth was 13%. Reported revenue was offset by a negative currency impact of $6.7 million, or 9%. | |

| · | Cash, cash equivalents, and marketable securities totaled $386.8 million at June 30, 2022, compared to $482.5 million at December 31, 2021. | |

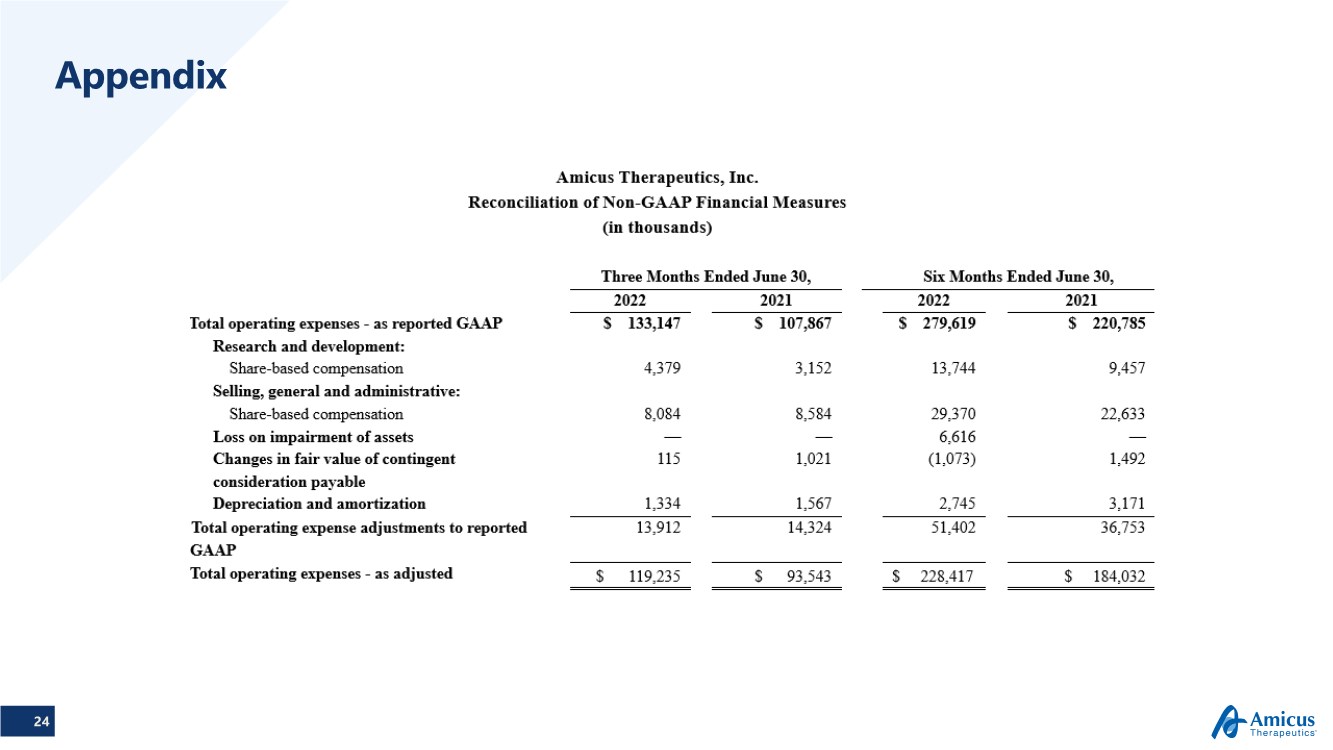

| · | Total GAAP operating expenses of $133.1 million for the second quarter 2022 increased as compared to $107.9 million for the second quarter 2021. | |

| · | Total non-GAAP operating expenses of $119.2 million for the second quarter of 2022 increased as compared to $93.5 million in the second quarter of 2021, reflecting non-recurring expenses related to the reprioritization of the gene therapy portfolio.3 | |

| · | Net loss was $62.2 million, or $0.21 per share, compared to a net loss of $51.2 million, or $0.19 per share, for the second quarter 2021. |

2022 Financial Guidance

| · | For the full-year 2022, the Company anticipates total Galafold revenue of $350 million to $365 million at constant exchange rates1. Double-digit revenue growth between 15 and 20% at CER1 in 2022 is expected to be driven by continued underlying demand from both switch and treatment-naïve patients, geographic expansion, the continued diagnosis of new Fabry patients and commercial execution across all major markets, including the U.S., EU, U.K., and Japan. Applying average July 2022 exchange rates, the negative currency impact on full-year 2022 Galafold reported sales would be approximately 9%. | |

| · | Non-GAAP operating expense guidance for the full-year 2022 is $470 million to $485 million, driven by continued investment in the global Galafold launch, AT-GAA clinical studies and pre-launch activities, in addition to certain non-recurring costs for manufacturing to support the global launch of AT-GAA and committed obligations for the gene therapy portfolio. In 2023, Amicus expects non-GAAP operating expense at a level below 2021.4 |

Anticipated 2022 Milestones by Program

Galafold (migalastat) Oral Precision Medicine for Fabry Disease

| · | Sustain double-digit revenue growth in 2022 of $350 million to $365 million at CER |

| · | Continue geographic expansion |

| · | Registry and other Phase 4 studies ongoing |

AT-GAA for Pompe Disease

| · | U.S. Prescription Drug User Fee Act (PDUFA) action date of August 29, 2022, for the NDA and October 29, 2022, for the BLA |

2

| · | EU Committee for Medicinal Products for Human Use (CHMP) opinion expected in late 2022 |

| · | Continue to broaden expanded access plans in the U.K., Germany, France, Japan, and other countries |

| · | Ongoing supportive studies, including pediatric and extension studies |

1 In order to illustrate underlying performance, Amicus discusses its results in terms of constant exchange rate (CER) growth. This represents growth calculated as if the exchange rates had remained unchanged from those used in the comparative period. Full-year 2022 Galafold revenue guidance utilizes the average actual exchange rates for 2021.

2 Based on projections of Amicus non-GAAP Net Income under current operating plans, which includes successful AT-GAA regulatory approvals and continued Galafold growth. We define non-GAAP Net Income as GAAP Net Income excluding the impact of share-based compensation expense, changes in fair value of contingent consideration, loss on impairment of assets, depreciation and amortization, acquisition related income (expense), loss on extinguishment of debt, loss on impairment of assets, restructuring charges and income taxes.

3 Full reconciliation of GAAP results to the Company’s non-GAAP adjusted measures for all reporting periods appear in the tables to this press release.

4 A reconciliation of the differences between the non-GAAP expectation and the corresponding GAAP measure is not available without unreasonable effort due to high variability, complexity, and low visibility as to the items that would be excluded from the GAAP measure.

Conference Call and Webcast

Amicus Therapeutics will host a conference call and audio webcast today, August 4, 2022, at 8:30 a.m. ET to discuss the second quarter 2022 financial results and corporate updates. Interested participants and investors may access the conference call by dialing 1-833-634-2601 (U.S. Toll Free) or 1-412-902-4113 (International).

A live audio webcast and related presentation materials can also be accessed via the Investors section of the Amicus Therapeutics corporate website at ir.amicusrx.com. Web participants are encouraged to register on the website 15 minutes prior to the start of the call. A replay of the call will be available for seven days beginning two hours after the conclusion of the event. Access numbers for this replay are 1-877-344-7529 (U.S. Toll Free), 1-855-669-9658 (Canada Toll Free), and 1-412-317-0088 (International); Access Code: 3033146.

About Galafold

Galafold® (migalastat) 123 mg capsules is an oral pharmacological chaperone of alpha-Galactosidase A (alpha-Gal A) for the treatment of Fabry disease in adults who have amenable galactosidase alpha gene (GLA) variants. In these patients, Galafold works by stabilizing the body’s own dysfunctional enzyme so that it can clear the accumulation of disease substrate. Globally, Amicus Therapeutics estimates that approximately 35 to 50 percent of Fabry patients may have amenable GLA variants, though amenability rates within this range vary by geography. Galafold is approved in more than 40 countries around the world, including the U.S., EU, U.K., and Japan.

U.S. INDICATIONS AND USAGE

Galafold is indicated for the treatment of adults with a confirmed diagnosis of Fabry disease and an amenable galactosidase alpha gene (GLA) variant based on in vitro assay data.

This indication is approved under accelerated approval based on reduction in kidney interstitial capillary cell globotriaosylceramide (KIC GL-3) substrate. Continued approval for this indication may be contingent upon verification and description of clinical benefit in confirmatory trials.

U.S. IMPORTANT SAFETY INFORMATION

ADVERSE REACTIONS

The most common adverse reactions reported with Galafold (≥10%) were headache, nasopharyngitis, urinary tract infection, nausea and pyrexia.

USE IN SPECIFIC POPULATIONS

There is insufficient clinical data on Galafold use in pregnant women to inform a drug-associated risk for major birth defects and miscarriage. Advise women of the potential risk to a fetus.

It is not known if Galafold is present in human milk. Therefore, the developmental and health benefits of breastfeeding should be considered along with the mother’s clinical need for Galafold and any potential adverse effects on the breastfed child from Galafold or from the underlying maternal condition.

Galafold is not recommended for use in patients with severe renal impairment or end-stage renal disease requiring dialysis.

The safety and effectiveness of Galafold have not been established in pediatric patients.

To report Suspected Adverse Reactions, contact Amicus Therapeutics at 1-877-4AMICUS or FDA at 1-800-FDA-1088 or www.fda.gov/medwatch.

For additional information about Galafold, including the full U.S. Prescribing Information, please visit https://www.amicusrx.com/pi/Galafold.pdf.

3

EU Important Safety Information

Treatment with Galafold should be initiated and supervised by specialists experienced in the diagnosis and treatment of Fabry disease. Galafold is not recommended for use in patients with a nonamenable mutation.

| · | Galafold is not intended for concomitant use with enzyme replacement therapy. | |

| · | Galafold is not recommended for use in patients with Fabry disease who have severe renal impairment (<30 mL/min/1.73 m2). The safety and efficacy of Galafold in children less than 12 years of age have not yet been established. No data are available. | |

| · | No dosage adjustments are required in patients with hepatic impairment or in the elderly population. | |

| · | There is very limited experience with the use of this medicine in pregnant women. If you are pregnant, think you may be pregnant, or are planning to have a baby, do not take this medicine until you have checked with your doctor, pharmacist, or nurse. | |

| · | While taking Galafold, effective birth control should be used. It is not known whether Galafold is excreted in human milk. | |

| · | Contraindications to Galafold include hypersensitivity to the active substance or to any of the excipients listed in the PRESCRIBING INFORMATION. | |

| · | Galafold 123 mg capsules are not for children (≥12 years) weighing less than 45 kg. | |

| · | It is advised to periodically monitor renal function, echocardiographic parameters and biochemical markers (every 6 months) in patients initiated on Galafold or switched to Galafold. | |

| · | OVERDOSE: General medical care is recommended in the case of Galafold overdose. | |

| · | The most common adverse reaction reported was headache, which was experienced by approximately 10% of patients who received Galafold. For a complete list of adverse reactions, please review the SUMMARY OF PRODUCT CHARACTERISTICS. | |

| · | Call your doctor for medical advice about side effects. |

For further important safety information for Galafold, including posology and method of administration, special warnings, drug interactions and adverse drug reactions, please see the European SmPC for Galafold available from the EMA website at www.ema.europa.eu.

About Amicus Therapeutics

Amicus Therapeutics (Nasdaq: FOLD) is a global, patient-dedicated biotechnology company focused on discovering, developing and delivering novel high-quality medicines for people living with rare metabolic diseases. With extraordinary patient focus, Amicus Therapeutics is committed to advancing and expanding a robust pipeline of cutting-edge, first- or best-in-class medicines for rare metabolic diseases. For more information please visit the company’s website at www.amicusrx.com, and follow on Twitter and LinkedIn.

Non-GAAP Financial Measures

In addition to financial information prepared in accordance with U.S. GAAP, this press release also contains adjusted financial measures that we believe provide investors and management with supplemental information relating to operating performance and trends that facilitate comparisons between periods and with respect to projected information. These adjusted financial measures are non-GAAP measures and should be considered in addition to, but not as a substitute for, the information prepared in accordance with U.S. GAAP. We typically exclude certain GAAP items that management does not believe affect our basic operations and that do not meet the GAAP definition of unusual or non-recurring items. Other companies may define these measures in different ways. Full reconciliations of GAAP results to the comparable non-GAAP measures for the reported periods appear in the financial tables section of this press release. When we provide our expectation for non-GAAP operating expenses on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectation and the corresponding GAAP measure generally is not available without unreasonable effort due to potentially high variability, complexity and low visibility as to the items that would be excluded from the GAAP measure in the relevant future period, such as unusual gains or losses. The variability of the excluded items may have a significant, and potentially unpredictable, impact on our future GAAP results.

4

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 relating to preclinical and clinical development of our product candidates, the timing and reporting of results from preclinical studies and clinical trials, the prospects and timing of the potential regulatory approval of our product candidates, commercialization plans, manufacturing and supply plans, financing plans, and the projected revenues, expenses, cash position, and future profitability for the Company. The inclusion of forward-looking statements should not be regarded as a representation by us that any of our plans will be achieved. Any or all of the forward-looking statements in this press release may turn out to be wrong and can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties. For example, with respect to statements regarding the goals, progress, timing, and outcomes of discussions with regulatory authorities, and in particular the potential goals, progress, timing, and results of preclinical studies and clinical trials, including as they are impacted by COVID-19 related disruption, are based on current information. The potential impact on operations from the COVID-19 pandemic is inherently unknown and cannot be predicted with confidence and may cause actual results and performance to differ materially from the statements in this release, including without limitation, because of the impact on general political and economic conditions, including as a result of efforts by governmental authorities to mitigate COVID-19, such as travel bans, shelter in place orders and third-party business closures and resource allocations, manufacturing and supply chain disruptions and limitations on patient access to commercial or clinical product. In addition to the impact of the COVID-19 pandemic, actual results may differ materially from those set forth in this release due to the risks and uncertainties inherent in our business, including, without limitation: the potential that results of clinical or preclinical studies indicate that the product candidates are unsafe or ineffective; the potential that it may be difficult to enroll patients in our clinical trials; the potential that regulatory authorities, including the FDA, EMA, and PMDA, may not grant or may delay approval for our product candidates; the potential that we may not be successful in commercializing Galafold in Europe, Japan, the US and other geographies or our other product candidates if and when approved; the potential that preclinical and clinical studies could be delayed because we identify serious side effects or other safety issues; the potential that we may not be able to manufacture or supply sufficient clinical or commercial products; and the potential that we will need additional funding to complete all of our studies, manufacturing and launch preparations. Further, the results of earlier preclinical studies and/or clinical trials may not be predictive of future results. With respect to statements regarding projections of the Company's revenue, expenses, cash position, and future profitability, actual results may differ based on market factors and the Company's ability to execute its operational and budget plans. In addition, all forward-looking statements are subject to other risks detailed in our Annual Report on Form 10-K for the year ended December 31, 2021 and Form 10-Q for the quarter ended June 30, 2022, to be filed today. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, and we undertake no obligation to revise or update this news release to reflect events or circumstances after the date hereof.

CONTACTS:

Investors:

Amicus Therapeutics

Andrew Faughnan

Executive Director, Investor Relations

(609) 662-3809

Media:

Amicus Therapeutics

Diana Moore

Head of Global Corporate Communications

(609) 662-5079

FOLD-G

5

TABLE 1

Amicus Therapeutics, Inc.

Consolidated Statements of Operations

(Unaudited)

(in thousands, except share and per share amounts)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Net product sales | $ | 80,731 | $ | 77,413 | $ | 159,446 | $ | 143,815 | ||||||||

| Cost of goods sold | 8,197 | 8,380 | 15,779 | 14,919 | ||||||||||||

| Gross profit | 72,534 | 69,033 | 143,667 | 128,896 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | 78,319 | 63,003 | 159,836 | 127,120 | ||||||||||||

| Selling, general, and administrative | 53,379 | 42,276 | 111,495 | 89,002 | ||||||||||||

| Changes in fair value of contingent consideration payable | 115 | 1,021 | (1,073 | ) | 1,492 | |||||||||||

| Loss on impairment of assets | — | — | 6,616 | — | ||||||||||||

| Depreciation and amortization | 1,334 | 1,567 | 2,745 | 3,171 | ||||||||||||

| Total operating expenses | 133,147 | 107,867 | 279,619 | 220,785 | ||||||||||||

| Loss from operations | (60,613 | ) | (38,834 | ) | (135,952 | ) | (91,889 | ) | ||||||||

| Other (expense) income: | ||||||||||||||||

| Interest income | 356 | 50 | 489 | 215 | ||||||||||||

| Interest expense | (8,257 | ) | (8,150 | ) | (16,404 | ) | (16,142 | ) | ||||||||

| Other income | 7,268 | 234 | 9,170 | (2,966 | ) | |||||||||||

| Loss before income tax | (61,246 | ) | (46,700 | ) | (142,697 | ) | (110,782 | ) | ||||||||

| Income tax expense | (911 | ) | (4,525 | ) | (4,720 | ) | (6,107 | ) | ||||||||

| Net loss attributable to common stockholders | $ | (62,157 | ) | $ | (51,225 | ) | $ | (147,417 | ) | $ | (116,889 | ) | ||||

| Net loss attributable to common stockholders per common share — basic and diluted | $ | (0.21 | ) | $ | (0.19 | ) | $ | (0.51 | ) | $ | (0.44 | ) | ||||

| Weighted-average common shares outstanding — basic and diluted | 291,970,562 | 266,398,516 | 288,646,587 | 265,384,865 | ||||||||||||

6

TABLE 2

Amicus Therapeutics, Inc.

Consolidated Balance Sheets

(Unaudited)

(in thousands, except share and per share amounts)

| June 30, 2022 | December 31, 2021 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 235,639 | $ | 245,197 | ||||

| Investments in marketable securities | 151,202 | 237,299 | ||||||

| Accounts receivable | 52,556 | 52,672 | ||||||

| Inventories | 20,879 | 26,818 | ||||||

| Prepaid expenses and other current assets | 37,367 | 34,848 | ||||||

| Total current assets | 497,643 | 596,834 | ||||||

| Operating lease right-of-use assets, net | 30,447 | 20,586 | ||||||

| Property and equipment, less accumulated depreciation of $22,188 and $19,882 at June 30, 2022 and December 31, 2021, respectively | 33,657 | 42,496 | ||||||

| In-process research & development | 23,000 | 23,000 | ||||||

| Goodwill | 197,797 | 197,797 | ||||||

| Other non-current assets | 18,045 | 24,427 | ||||||

| Total Assets | $ | 800,589 | $ | 905,140 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 23,113 | $ | 21,513 | ||||

| Accrued expenses and other current liabilities | 114,703 | 98,153 | ||||||

| Contingent consideration payable | 19,266 | 18,900 | ||||||

| Operating lease liabilities | 7,543 | 7,409 | ||||||

| Total current liabilities | 164,625 | 145,975 | ||||||

| Long-term debt | 390,652 | 389,357 | ||||||

| Operating lease liabilities | 52,844 | 43,363 | ||||||

| Deferred reimbursements | 5,906 | 5,906 | ||||||

| Deferred income taxes | 4,930 | 4,930 | ||||||

| Other non-current liabilities | 8,207 | 8,240 | ||||||

| Total liabilities | 627,164 | 597,771 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity: | ||||||||

| Common stock, $0.01 par value, 500,000,000 shares authorized, 280,456,667 and 278,912,800 shares issued and outstanding at June 30, 2022 and December 31, 2021, respectively | 2,811 | 2,808 | ||||||

| Additional paid-in capital | 2,631,110 | 2,595,419 | ||||||

| Accumulated other comprehensive (loss) gain: | ||||||||

| Foreign currency translation adjustment | (16,603 | ) | 5,251 | |||||

| Unrealized loss on available-for-sale securities | (637 | ) | (270 | ) | ||||

| Warrants | 83 | 83 | ||||||

| Accumulated deficit | (2,443,339 | ) | (2,295,922 | ) | ||||

| Total stockholders’ equity | 173,425 | 307,369 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 800,589 | $ | 905,140 | ||||

7

TABLE 3

Amicus Therapeutics, Inc.

Reconciliation of Non-GAAP Financial Measures

(in thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Total operating expenses - as reported GAAP | $ | 133,147 | $ | 107,867 | $ | 279,619 | $ | 220,785 | ||||||||

| Research and development: | ||||||||||||||||

| Share-based compensation | 4,379 | 3,152 | 13,744 | 9,457 | ||||||||||||

| Selling, general and administrative: | ||||||||||||||||

| Share-based compensation | 8,084 | 8,584 | 29,370 | 22,633 | ||||||||||||

| Loss on impairment of assets | — | — | 6,616 | — | ||||||||||||

| Changes in fair value of contingent consideration payable | 115 | 1,021 | (1,073 | ) | 1,492 | |||||||||||

| Depreciation and amortization | 1,334 | 1,567 | 2,745 | 3,171 | ||||||||||||

| Total operating expense adjustments to reported GAAP | 13,912 | 14,324 | 51,402 | 36,753 | ||||||||||||

| Total operating expenses - as adjusted | $ | 119,235 | $ | 93,543 | $ | 228,417 | $ | 184,032 | ||||||||

8

Exhibit 99.2

| 2Q22 Financial Results Conference Call & Webcast August 4, 2022 At the Forefront of Therapies for Rare Diseases |

| 2 Forward-Looking Statements This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 relating to preclinical and clinical development of our product candidates, the timing and reporting of results from preclinical studies and clinical trials, the prospects and timing of the potential regulatory approval of our product candidates, commercialization plans, manufacturing and supply plans, financing plans, and the projected revenues, expenses, cash position, and future profitability for the Company. The inclusion of forward-looking statements should not be regarded as a representation by us that any of our plans will be achieved. Any or all of the forward-looking statements in this press release may turn out to be wrong and can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties. For example, with respect to statements regarding the goals, progress, timing, and outcomes of discussions with regulatory authorities, and in particular the potential goals, progress, timing, and results of preclinical studies and clinical trials, including as they are impacted by COVID-19 related disruption, are based on current information. The potential impact on operations from the COVID-19 pandemic is inherently unknown and cannot be predicted with confidence and may cause actual results and performance to differ materially from the statements in this release, including without limitation, because of the impact on general political and economic conditions, including as a result of efforts by governmental authorities to mitigate COVID-19, such as travel bans, shelter in place orders and third-party business closures and resource allocations, manufacturing and supply chain disruptions and limitations on patient access to commercial or clinical product. In addition to the impact of the COVID-19 pandemic, actual results may differ materially from those set forth in this release due to the risks and uncertainties inherent in our business, including, without limitation: the potential that results of clinical or preclinical studies indicate that the product candidates are unsafe or ineffective; the potential that it may be difficult to enroll patients in our clinical trials; the potential that regulatory authorities, including the FDA, EMA, and PMDA, may not grant or may delay approval for our product candidates; the potential that we may not be successful in commercializing Galafold in Europe, Japan, the US and other geographies or our other product candidates if and when approved; the potential that preclinical and clinical studies could be delayed because we identify serious side effects or other safety issues; the potential that we may not be able to manufacture or supply sufficient clinical or commercial products; and the potential that we will need additional funding to complete all of our studies, manufacturing and launch preparations. Further, the results of earlier preclinical studies and/or clinical trials may not be predictive of future results. With respect to statements regarding projections of the Company's revenue, expenses, cash position, and future profitability, actual results may differ based on market factors and the Company's ability to execute its operational and budget plans. In addition, all forward-looking statements are subject to other risks detailed in our Annual Report on Form 10-K for the year ended December 31, 2021 and Form 10-Q for the quarter ended June 30, 2022, to be filed today. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, and we undertake no obligation to revise or update this news release to reflect events or circumstances after the date hereof. Non-GAAP Financial Measures In addition to financial information prepared in accordance with U.S. GAAP, this presentation also contains adjusted financial measures that we believe provide investors and management with supplemental information relating to operating performance and trends that facilitate comparisons between periods and with respect to projected information. These adjusted financial measures are non-GAAP measures and should be considered in addition to, but not as a substitute for, the information prepared in accordance with U.S. GAAP. We typically exclude certain GAAP items that management does not believe affect our basic operations and that do not meet the GAAP definition of unusual or non-recurring items. Other companies may define these measures in different ways. When we provide our expectation for non-GAAP operating expenses on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectation and the corresponding GAAP measure generally is not available without unreasonable effort due to potentially high variability, complexity and low visibility as to the items that would be excluded from the GAAP measure in the relevant future period, such as unusual gains or losses. The variability of the excluded items may have a significant, and potentially unpredictable, impact on our future GAAP results. |

| 3 A Rare Company Patient-dedicated, Rare Disease Biotechnology Company with Sustained Double-digit Revenue Growth, a Global Commercial Infrastructure, and Late-stage Development Capabilities AT-GAA a Two-component Therapy Under Global Regulatory Reviews for Pompe Disease GLOBAL COMMERCIAL ORGANIZATION World-class CLINICAL DEVELOPMENT Capabilities EMPLOYEES in 27 Countries GALAFOLD & AT-GAA Gene Therapy PLATFORM Leveraging Experience in Protein Engineering & Glycobiology $386.8M Cash as of 6/30/22 $350M-$365M FY22 Global Galafold Revenue at CER Non-GAAP PROFITABILITY expected in 2023 Cumulative $2B Peak Potential |

| 4 Positioned for Significant Value Growth Focused on Execution and Driving Sustainable Double-digit Revenue Growth on Path to Profitability Continue to bring Galafold® to as many patients as possible, sustain double-digit revenue growth Successful launch of AT-GAA for people living with Pompe disease Advance next-generation gene therapies in Fabry and Pompe diseases Fully leverage global capabilities and infrastructure as a leader in rare diseases Achieve non-GAAP profitability in 2023 |

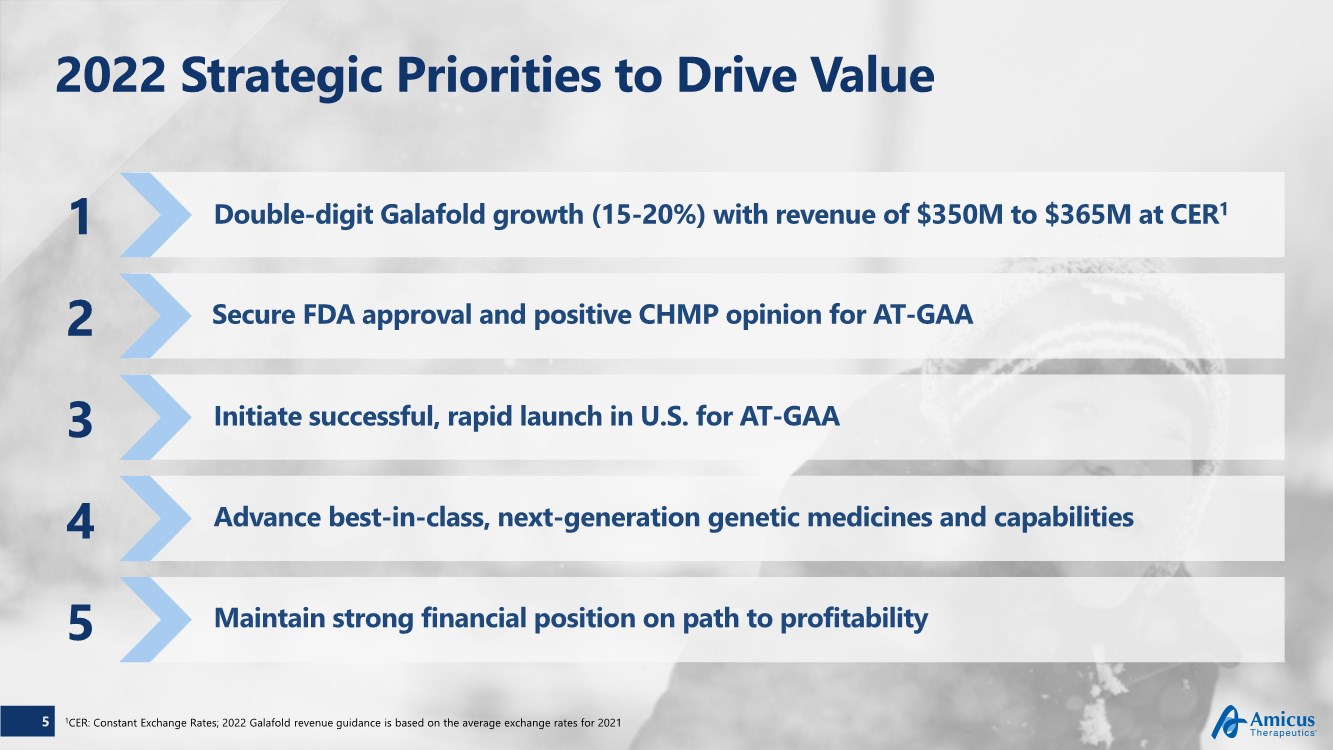

| 2022 Strategic Priorities to Drive Value 1 2 3 4 5 Double-digit Galafold growth (15-20%) with revenue of $350M to $365M at CER1 Secure FDA approval and positive CHMP opinion for AT-GAA Initiate successful, rapid launch in U.S. for AT-GAA Advance best-in-class, next-generation genetic medicines and capabilities Maintain strong financial position on path to profitability 5 1CER: Constant Exchange Rates; 2022 Galafold revenue guidance is based on the average exchange rates for 2021 |

| 6 Galafold® (migalastat) Continued Growth... … building a leadership position in the treatment of Fabry disease |

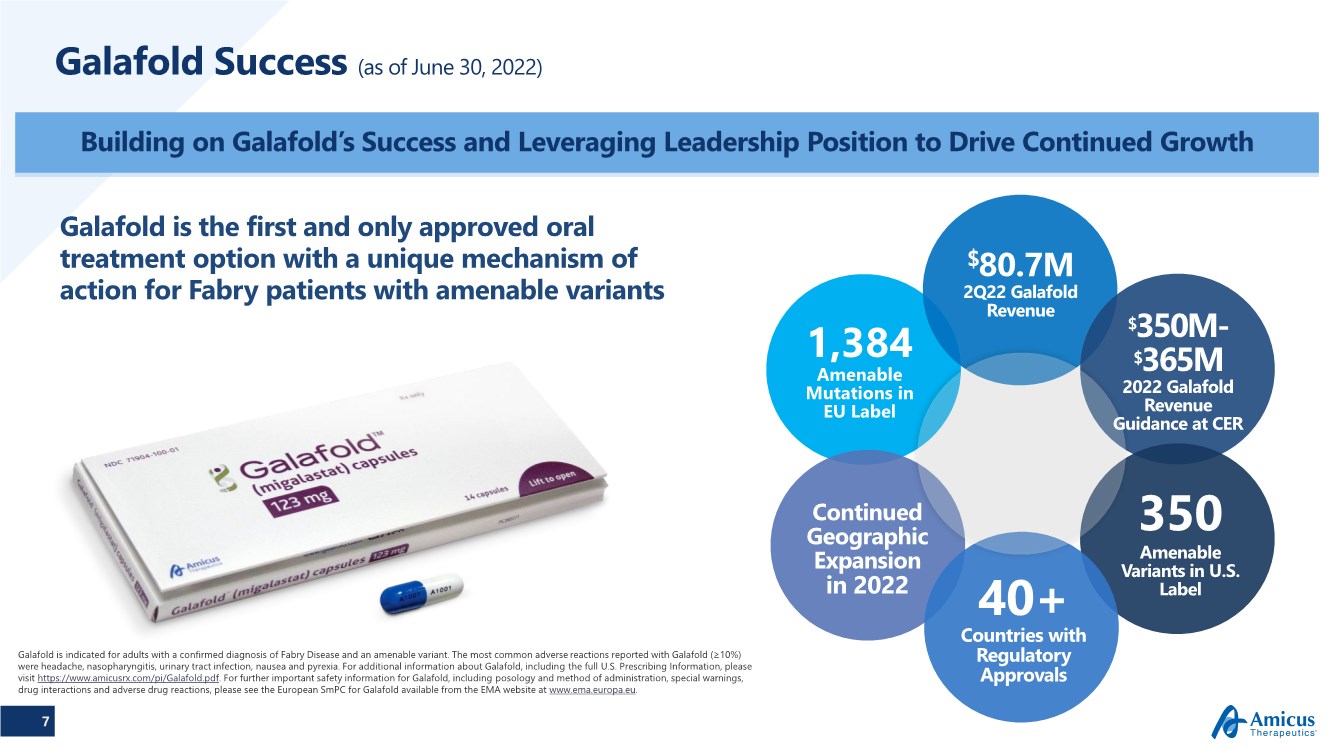

| 7 Galafold Success (as of June 30, 2022) Building on Galafold’s Success and Leveraging Leadership Position to Drive Continued Growth Galafold is indicated for adults with a confirmed diagnosis of Fabry Disease and an amenable variant. The most common adverse reactions reported with Galafold (≥10%) were headache, nasopharyngitis, urinary tract infection, nausea and pyrexia. For additional information about Galafold, including the full U.S. Prescribing Information, please visit https://www.amicusrx.com/pi/Galafold.pdf. For further important safety information for Galafold, including posology and method of administration, special warnings, drug interactions and adverse drug reactions, please see the European SmPC for Galafold available from the EMA website at www.ema.europa.eu. Galafold is the first and only approved oral treatment option with a unique mechanism of action for Fabry patients with amenable variants 350 Amenable Variants in U.S. Label 40+ Countries with Regulatory Approvals Continued Geographic Expansion in 2022 $80.7M 2Q22 Galafold Revenue $350M- $365M 2022 Galafold Revenue Guidance at CER 1,384 Amenable Mutations in EU Label |

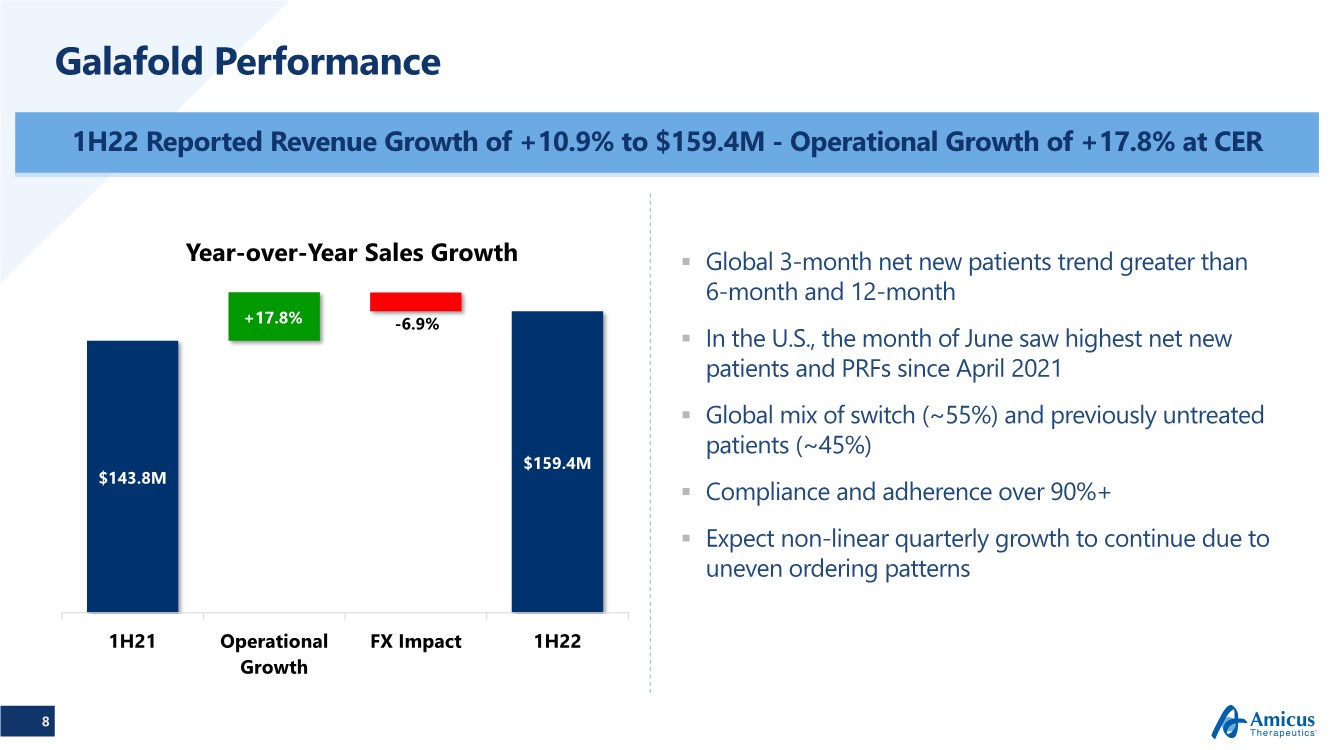

| 8 Galafold Performance 1H22 Reported Revenue Growth of +10.9% to $159.4M - Operational Growth of +17.8% at CER .. Global 3-month net new patients trend greater than 6-month and 12-month .. In the U.S., the month of June saw highest net new patients and PRFs since April 2021 .. Global mix of switch (~55%) and previously untreated patients (~45%) .. Compliance and adherence over 90%+ .. Expect non-linear quarterly growth to continue due to uneven ordering patterns $143.8M $159.4M -6.9% +17.8% 1H21 Operational Growth FX Impact 1H22 Year-over-Year Sales Growth |

| 9 Galafold Success and FY22 Revenue Guidance Galafold Momentum on Track to Achieve Full-year 2022 Revenue Guidance at CER FY16 FY17 FY18 FY19 FY20 FY21 FY22 $5.0M Q1 $78.7M Q2 $80.7M $36.9M $91.2M $182.2M $260.9M $305.5M 12022 Galafold revenue guidance utilizes the average actual rates for 2021 H1 $159.4M Reiterating FY22 Revenue Guidance of $350M-$365M at CER (between 15% and 20% growth at CER) |

| 10 Penetration of the diagnosed untreated population Increase in newborn screening and diagnostic initiatives Strong IP rights, including COM protection through 2038 Continued penetration into existing markets Expansion into new geographies Broadening of labels Galafold Growth Opportunity $1B Annual Sales Opportunity at Peak Sustained double-digit revenue growth: Near-term growth to $500M driven by: Long-term growth towards peak sales potential driven by: 1H operational revenue growth of +17.8% COM: Composition of Matter |

| 11 AT-GAA (cipaglucosidase alfa + miglustat) … potential to establish a new standard of care for people living with Pompe disease |

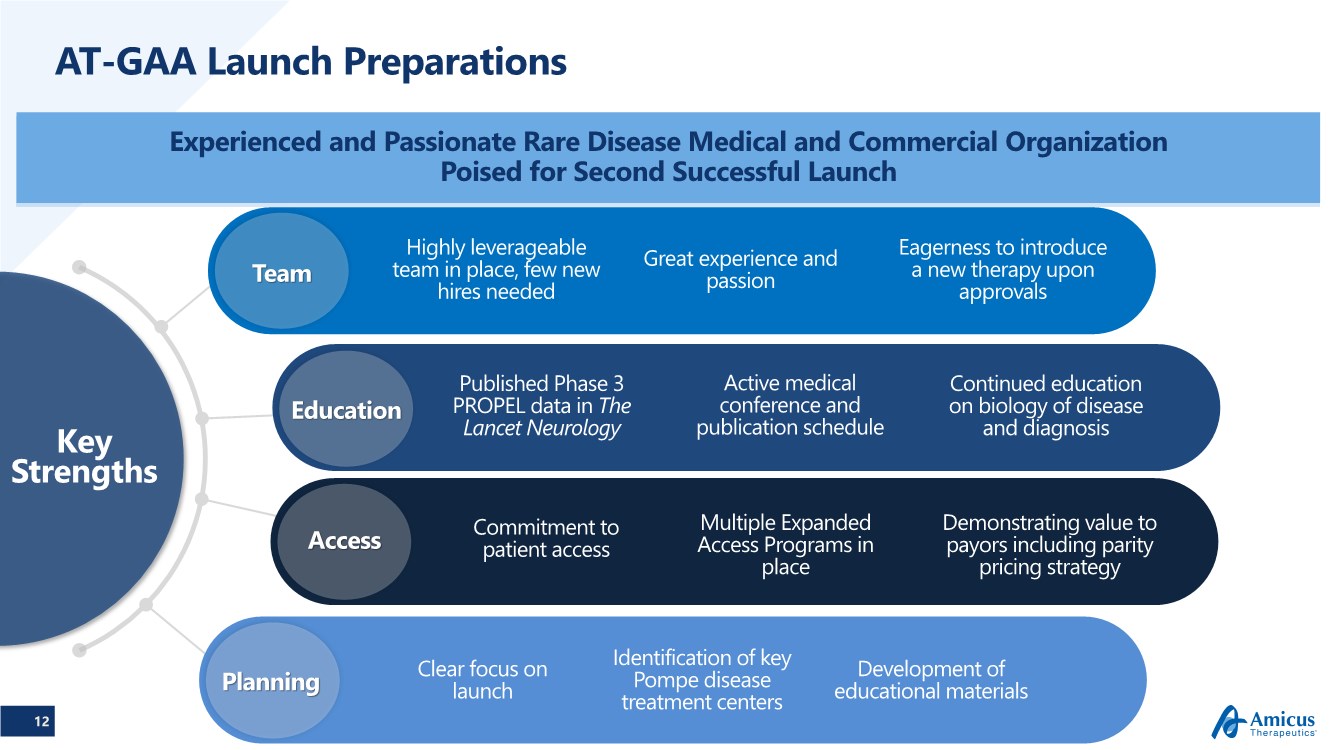

| 12 AT-GAA Launch Preparations Experienced and Passionate Rare Disease Medical and Commercial Organization Poised for Second Successful Launch Key Strengths Commitment to patient access Clear focus on launch Identification of key Pompe disease treatment centers Development of educational materials Planning Access Education Team Great experience and passion Eagerness to introduce a new therapy upon approvals Highly leverageable team in place, few new hires needed Published Phase 3 PROPEL data in The Lancet Neurology Active medical conference and publication schedule Multiple Expanded Access Programs in place Continued education on biology of disease and diagnosis Demonstrating value to payors including parity pricing strategy |

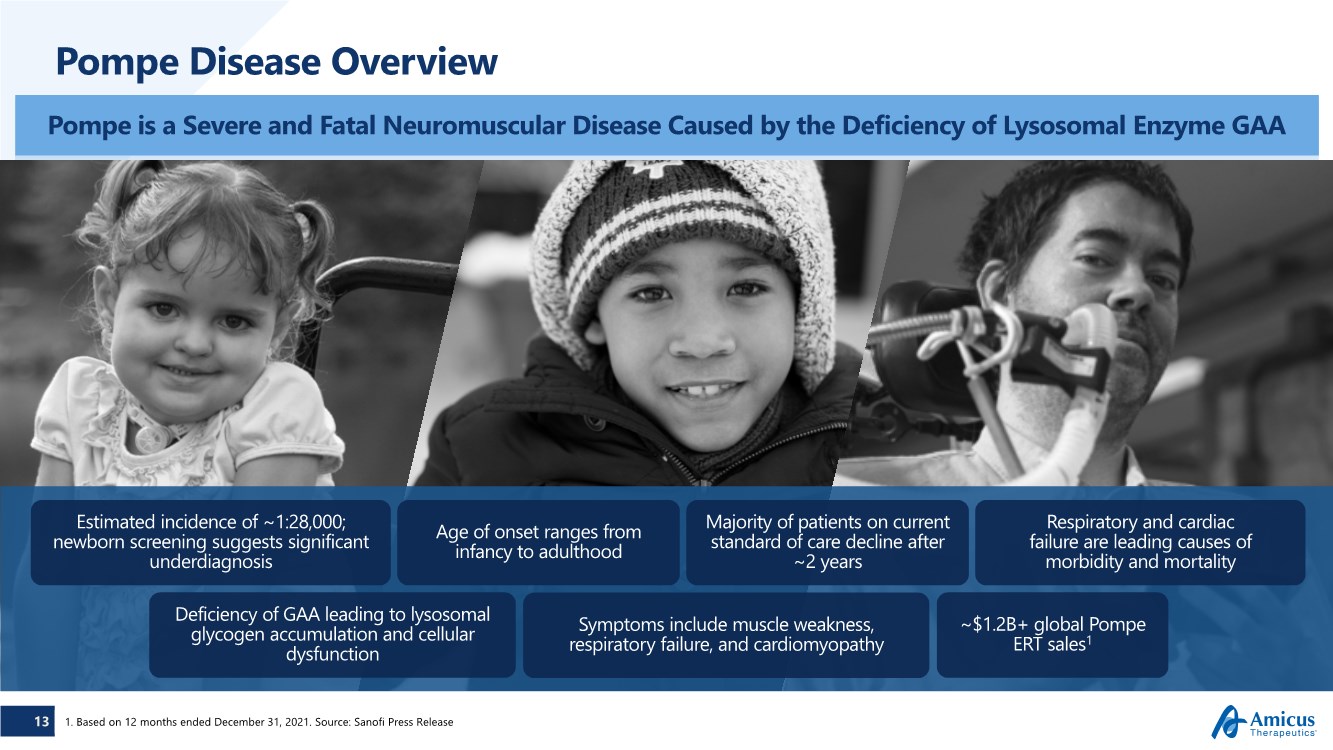

| 13 Deficiency of GAA leading to lysosomal glycogen accumulation and cellular dysfunction Age of onset ranges from infancy to adulthood Symptoms include muscle weakness, respiratory failure, and cardiomyopathy Respiratory and cardiac failure are leading causes of morbidity and mortality Estimated incidence of ~1:28,000; newborn screening suggests significant underdiagnosis ~$1.2B+ global Pompe ERT sales1 Majority of patients on current standard of care decline after ~2 years Pompe Disease Overview 1. Based on 12 months ended December 31, 2021. Source: Sanofi Press Release Pompe is a Severe and Fatal Neuromuscular Disease Caused by the Deficiency of Lysosomal Enzyme GAA |

| 14 Phase 3 PROPEL Study Results Overall Population (n=122*) Primary and First Key Secondary Endpoint Showed Greater Improvement with AT-GAA vs. alglucosidase alfa in the Overall Population of ERT-Naïve and ERT-Experienced Patients 6MWD=6-minute walk distance;; FVC=forced vital capacity; SE=standard error. P values are nominal 2-sided; FVC data normally distributed and P value is from ANCOVA. 6MWD data not normally distributed and P value is for nonparametric ANCOVA; *Results exclude one outlier subject 6MWD (m): Change from baseline (n=85, n=37) FVC (% predicted): Change from baseline (n=85, n=37) Results in ERT-Experienced Patients (n=92) Showed Meaningful Improvement for Both 6MWD (P=0.046) and FVC (P=0.006) |

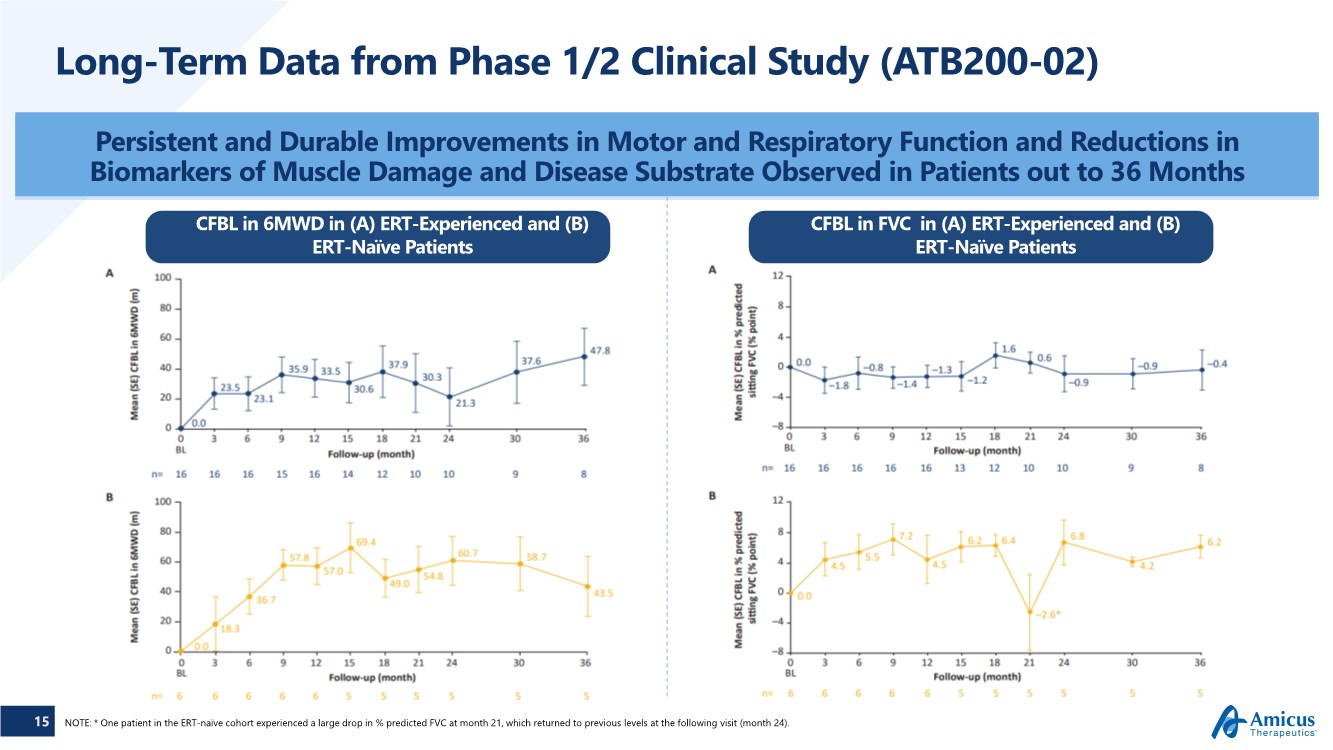

| 15 Long-Term Data from Phase 1/2 Clinical Study (ATB200-02) Persistent and Durable Improvements in Motor and Respiratory Function and Reductions in Biomarkers of Muscle Damage and Disease Substrate Observed in Patients out to 36 Months NOTE: * One patient in the ERT-naïve cohort experienced a large drop in % predicted FVC at month 21, which returned to previous levels at the following visit (month 24). CFBL in 6MWD in (A) ERT-Experienced and (B) ERT-Naïve Patients CFBL in FVC in (A) ERT-Experienced and (B) ERT-Naïve Patients |

| 16 AT-GAA: Key Takeaways .. Regulatory status update: – U.S. PDUFA date 2H20221 – CHMP opinion late 2022 – Planning for additional regulatory submissions .. Multiple expanded access mechanisms in place, including in the U.S., U.K., Germany, France, Japan, and others – First reimbursed access through the French compassionate access program .. 175+ people living with Pompe disease are now on AT-GAA across our clinical extension studies and expanded access programs .. Ongoing supportive studies: – Late-Onset Pompe Disease (LOPD) in children and adolescents aged 0 to <18 – Infantile-Onset Pompe Disease (IOPD) Focused on Advancing AT-GAA to as Many Patients as Possible through Global Regulatory Pathways and Expanded Access Mechanisms 1FDA PDUFA date of August 29, 2022 for miglustat NDA and October 29, 2022 for cipaglucosidase alfa BLA |

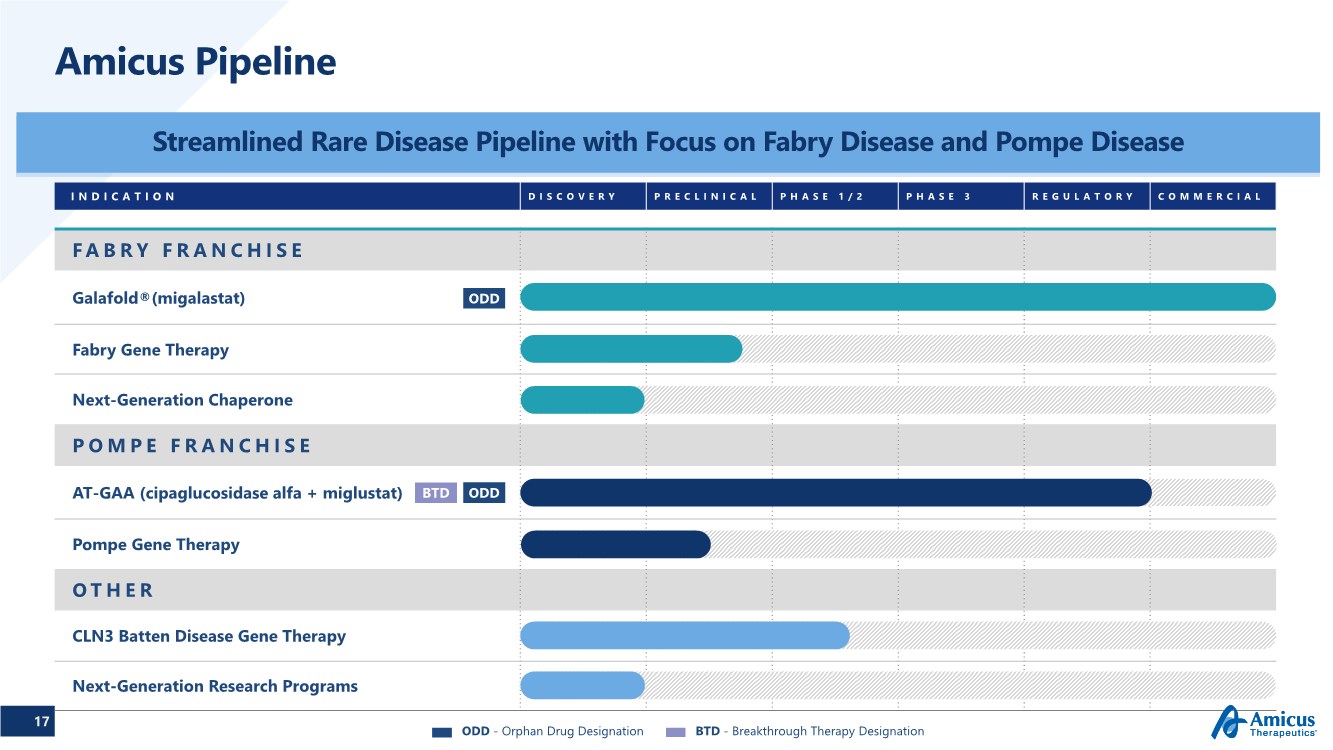

| 17 INDICATION DISCOVERY PRECLINICAL PHASE 1/2 PHASE 3 REGULATORY COMMERCIAL FABRY FRANCHISE Galafold®(migalastat) Fabry Gene Therapy Next-Generation Chaperone POMPE FRANCHISE AT-GAA (cipaglucosidase alfa + miglustat) Pompe Gene Therapy OTHER CLN3 Batten Disease Gene Therapy Next-Generation Research Programs Amicus Pipeline Streamlined Rare Disease Pipeline with Focus on Fabry Disease and Pompe Disease ODD ODD BTD ODD - Orphan Drug Designation BTD - Breakthrough Therapy Designation |

| 18 Financial & Operational Strategy … maintaining a strong financial outlook |

| 19 Revenue Performance Q2 Revenue Growth of +4.3% to $80.7M resulting from Strong Operational Growth of +12.9% at CER Offset by Negative FX impact of -8.6% $77.4M $80.7M -8.6% +12.9% 2Q21 Operational Growth FX Impact 2Q22 Year-over-Year Sales Growth .. Significant currency exposure as 66% of Galafold revenue generated outside the U.S. .. Applying average July 2022 exchange rates, the negative FX impact on full-year 2022 Galafold® reported sales would be approximately -9%, or ~$26 million. |

| 20 2Q Select Financial Results 2Q22 OpEx Increase Reflects Manufacturing Costs to Support AT-GAA Launch and Non-Recurring Expenses Related to the Reprioritization of the Gene Therapy Portfolio Jun. 30, 2022 (in thousands, except per share data) Jun. 30, 2021 Product Revenue $80,731 $77,413 Cost of Goods Sold 8,197 8,380 R&D Expense 78,319 63,003 SG&A Expense 53,379 42,276 Changes in Fair Value of Contingent Consideration 115 1,021 Depreciation and Amortization 1,334 1,567 Loss from Operations (60,613) (38,834) Income Tax Expense (911) (4,525) Net Loss (62,157) (51,225) Net Loss Per Share (0.21) (0.19) |

| Financial Outlook and Path to Profitability Clear Strategy to Build Our Business, Advance Our Portfolio, and Achieve Profitability 21 Sustain Galafold Revenue Growth Deliver on Financial Goals Secure Approvals of AT-GAA $159.4M 1H2022 revenue, +17.8% YoY Operational Growth 2022 Galafold revenue guidance of $350M-$365M at CER, +15-20% YoY Growth Galafold and AT-GAA expected to drive strong double-digit growth long term Focused on prudent expense management Achieve profitability1 in 2023 1Based on projections of Amicus non-GAAP Net Income under current operating plans, which includes successful AT-GAA regulatory approvals and continued Galafold growth. We define non-GAAP Net Income as GAAP Net Income excluding the impact of share-based compensation expense, changes in fair value of contingent consideration, depreciation and amortization, acquisition related income (expense), loss on extinguishment of debt, loss on impairment of assets, restructuring charges, and income taxes. 2022 non-GAAP operating expense guidance of $470M-$485M |

| Thank You |

| Appendix |

| 24 Appendix |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Three-quarters of New Jerseyans Familiar With Proper Guidelines to Store and Dispose of Medications, Opioids and Edibles

- Full Line Stencil Introduces Transformative Quilting Designs for Modern Quilters

- Neo-Concept International Group Holdings Limited Announced Closing of Initial Public Offering

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share