Form 8-K AERIE PHARMACEUTICALS For: May 12

Company Overview Investor Presentation May 2021 Exhibit 99.1

For Investor Use Important Information The information in this presentation does not contain all of the information that a potential investor should review before investing in Aerie shares. The descriptions of Aerie Pharmaceuticals, Inc. (the “Company” or “Aerie”) in this presentation are qualified in their entirety by reference to reports filed with the SEC. Certain information in this presentation has been obtained from outside sources or is anecdotal in nature. While such information is believed to be reliable for the purposes used herein, no representations are made as to the accuracy or completeness thereof and we take no responsibility for such information. Any discussion of the potential use or expected success of Rhopressa® (netarsudil ophthalmic solution) 0.02% or Rocklatan® (netarsudil and latanoprost ophthalmic solution) 0.02%/0.005%, with respect to foreign approval or additional indications, and our current or any future product candidates, including AR-1105, AR-13503, AR-14034 and AR-15512, is subject to regulatory approval. In addition, any discussion of U.S. Food and Drug Administration (“FDA”) approval of Rhopressa® or Rocklatan® does not guarantee successful commercialization of Rhopressa® or Rocklatan®. For more information on Rhopressa®, including prescribing information, refer to the full Rhopressa® product label at www.rhopressa.com. For more information on Rocklatan®, including prescribing information, refer to the full Rocklatan® product label at www.rocklatan.com. The information in this presentation is current only as of its date and may have changed or may change in the future. We undertake no obligation to update this information in light of new information, future events or otherwise. We are not making any representation or warranty that the information in this presentation is accurate or complete. This presentation shall not constitute an offer to sell, nor a solicitation of an offer to buy, any of Aerie’s securities. Certain statements in this presentation, including any guidance or timelines presented herein, are “forward-looking statements” within the meaning of the federal securities laws. Words such as “may,” “will,” “should,” “would,” “could,” “believe,” “expects,” “anticipates,” “plans,” “intends,” “estimates,” “targets,” “projects,” “potential” or similar expressions are intended to identify these forward-looking statements. These statements are based on the Company’s current plans and expectations. Known and unknown risks, uncertainties and other factors could cause actual results to differ materially from those contemplated by the statements. In evaluating these statements, you should specifically consider various factors that may cause our actual results to differ materially from any forward-looking statements. For example, uncertainties around the duration and severity of the current global COVID-19 pandemic including its possible impact on our clinical and commercial operations and our global supply chain could cause our actual results to be materially different than those expressed in our forward-looking statements. In particular, these statements include any discussion of potential commercial sales, placement or utilization of Rocklatan® or Rhopressa® in the United States or any other market. Likewise, FDA approval of Rhopressa® and Rocklatan® does not constitute approval of any future product candidates. Any top line data presented herein is preliminary and based solely on information available to us as of the date of this presentation and additional information about the results may be disclosed at any time. FDA approval of Rhopressa® and Rocklatan® also does not constitute regulatory approval of Rhopressa® or Rocklatan® in jurisdictions outside the United States and there can be no assurance that we will receive regulatory approval for Rhopressa® or Rocklatan® in jurisdictions outside the United States. In addition, any discussion in this presentation about preclinical activities or opportunities associated with our products or discussions involving the potential for our dry eye or retinal product candidates are preliminary and the outcome of any studies may not be predictive of the outcome of later trials and ultimate regulatory approval. Any future clinical trial results may not demonstrate safety and efficacy sufficient to obtain regulatory approval related to the preclinical research findings discussed in this presentation. Any statements regarding Aerie’s future liquidity, cash balances or financing transactions also constitute forward-looking statements as are discussions of the possibility of, or possible results of, any commercial transactions or collaborations. These risks and uncertainties are described more fully in the quarterly and annual reports that we file with the SEC, particularly in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Such forward-looking statements only speak as of the date they are made. We undertake no obligation to publicly update or revise any forward-looking statements, whether because of new information, future events or otherwise, except as otherwise required by law.

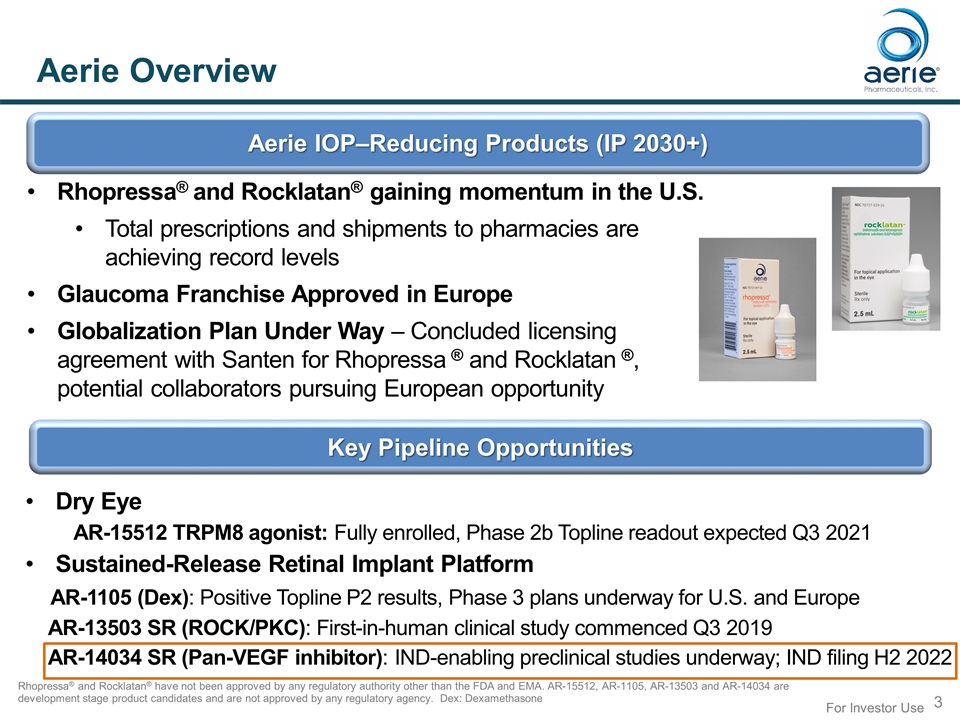

Aerie Overview Rhopressa® and Rocklatan® have not been approved by any regulatory authority other than the FDA and EMA. AR-15512, AR-1105, AR-13503 and AR-14034 are development stage product candidates and are not approved by any regulatory agency. Dex: Dexamethasone Aerie IOP–Reducing Products (IP 2030+) Key Pipeline Opportunities Dry Eye AR-15512 TRPM8 agonist: Fully enrolled, Phase 2b Topline readout expected Q3 2021 Sustained-Release Retinal Implant Platform AR-1105 (Dex): Positive Topline P2 results, Phase 3 plans underway for U.S. and Europe AR-13503 SR (ROCK/PKC): First-in-human clinical study commenced Q3 2019 AR-14034 SR (Pan-VEGF inhibitor): IND-enabling preclinical studies underway; IND filing H2 2022 Rhopressa® and Rocklatan® gaining momentum in the U.S. Total prescriptions and shipments to pharmacies are achieving record levels Glaucoma Franchise Approved in Europe Globalization Plan Under Way – Concluded licensing agreement with Santen for Rhopressa ® and Rocklatan ®, potential collaborators pursuing European opportunity For Investor Use

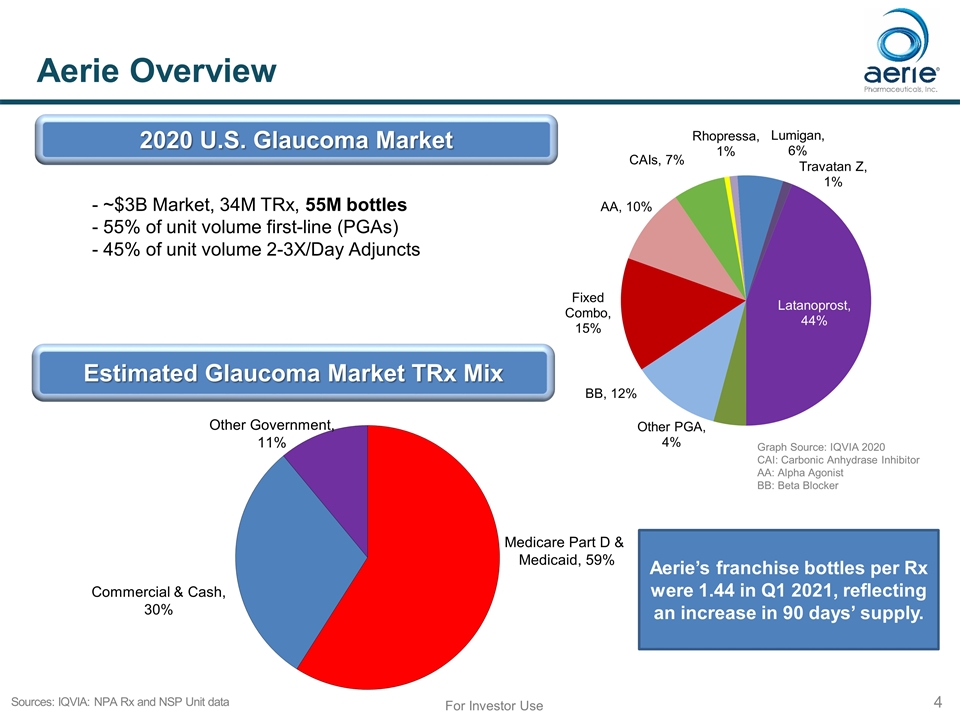

Aerie Overview For Investor Use Sources: IQVIA: NPA Rx and NSP Unit data Estimated Glaucoma Market TRx Mix Medicare Part D & Medicaid, 59% Commercial & Cash, 30% Graph Source: IQVIA 2020 CAI: Carbonic Anhydrase Inhibitor AA: Alpha Agonist BB: Beta Blocker - ~$3B Market, 34M TRx, 55M bottles - 55% of unit volume first-line (PGAs) - 45% of unit volume 2-3X/Day Adjuncts 2020 U.S. Glaucoma Market Aerie’s franchise bottles per Rx were 1.44 in Q1 2021, reflecting an increase in 90 days’ supply.

Glaucoma Commercialization Focus Ongoing communication of the MOST Data and coverage via various communication channels Rhopressa® Coverage: 90% Commercial, 89% Med D Rocklatan® Coverage: 89% Commercial, 59% Med D plus 15% Low Income Subsidy Continued execution of the Pulse Strategy, focused on driving monthly prescribers (now nearly 10,000) to weekly prescribers (now nearly 5,000) Franchise prescribers currently over 18,000 Increasing share of voice with HCP’s to further bolster sales momentum Aerie reps calling on top 10,400 highest prescribers Contract Sales Organization calling on next 1,400 highest prescribers Telesales team calling on next 4,400 highest prescribers For Investor Use

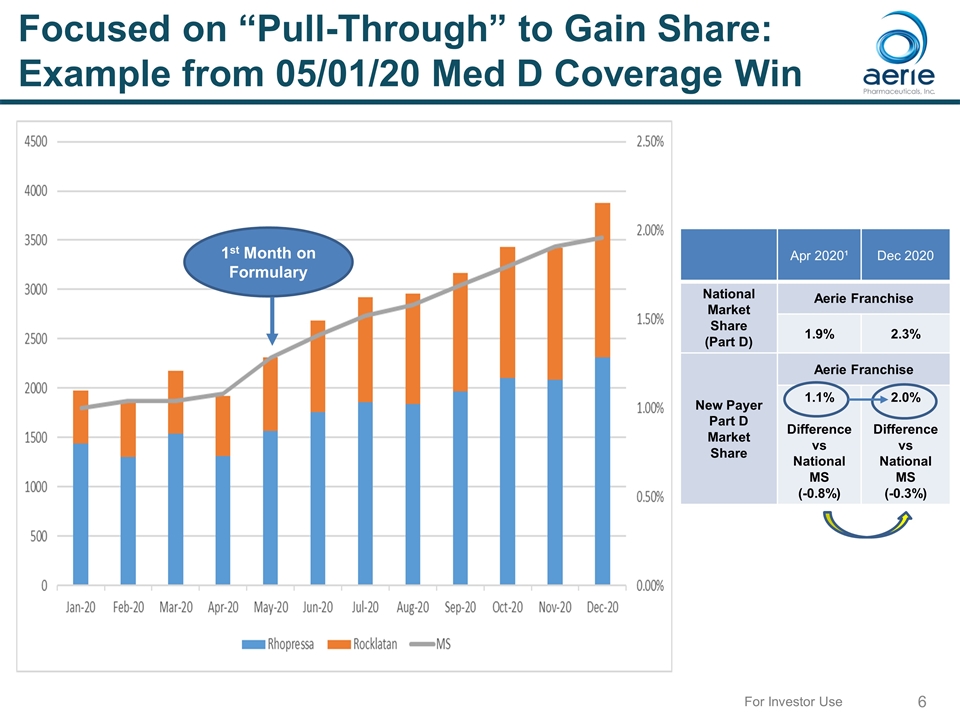

Focused on “Pull-Through” to Gain Share: Example from 05/01/20 Med D Coverage Win Humana Part D Effective May 1, 2020 PA to PB (eST) Apr 2020¹ Dec 2020 National Market Share (Part D) Aerie Franchise 1.9% 2.3% New Payer Part D Market Share Aerie Franchise 1.1% Difference vs National MS (-0.8%) 2.0% Difference vs National MS (-0.3%) TRx MS 1st Month on Formulary For Investor Use

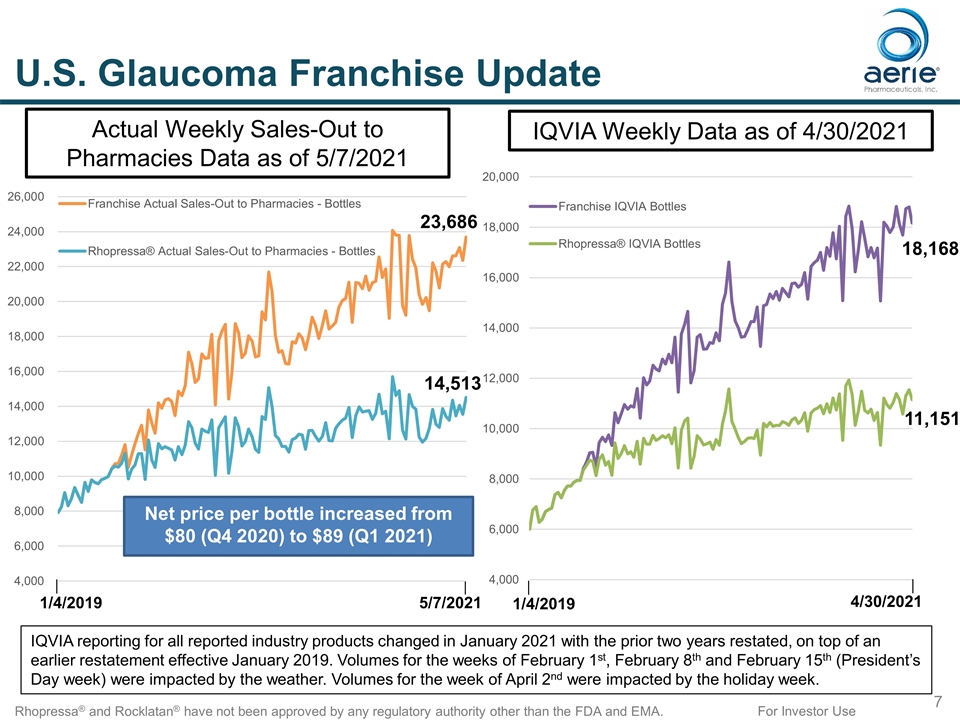

For Investor Use U.S. Glaucoma Franchise Update Rhopressa® and Rocklatan® have not been approved by any regulatory authority other than the FDA and EMA. Actual Weekly Sales-Out to Pharmacies Data as of 5/7/2021 IQVIA Weekly Data as of 4/30/2021 IQVIA reporting for all reported industry products changed in January 2021 with the prior two years restated, on top of an earlier restatement effective January 2019. Volumes for the weeks of February 1st, February 8th and February 15th (President’s Day week) were impacted by the weather. Volumes for the week of April 2nd were impacted by the holiday week. 1/4/2019 5/7/2021 4/30/2021 1/4/2019 14,513 23,686 11,151 18,168 Net price per bottle increased from $80 (Q4 2020) to $89 (Q1 2021)

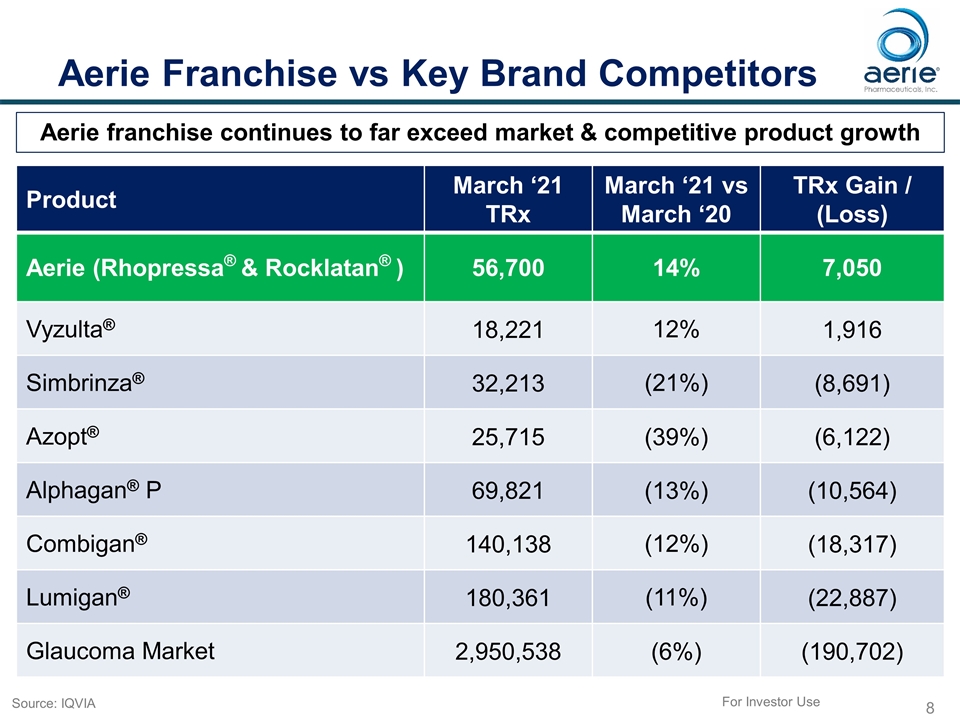

Aerie Franchise vs Key Brand Competitors Product March ‘21 TRx March ‘21 vs March ‘20 TRx Gain / (Loss) Aerie (Rhopressa® & Rocklatan® ) 56,700 14% 7,050 Vyzulta® 18,221 12% 1,916 Simbrinza® 32,213 (21%) (8,691) Azopt® 25,715 (39%) (6,122) Alphagan® P 69,821 (13%) (10,564) Combigan® 140,138 (12%) (18,317) Lumigan® 180,361 (11%) (22,887) Glaucoma Market 2,950,538 (6%) (190,702) Aerie franchise continues to far exceed market & competitive product growth For Investor Use Source: IQVIA

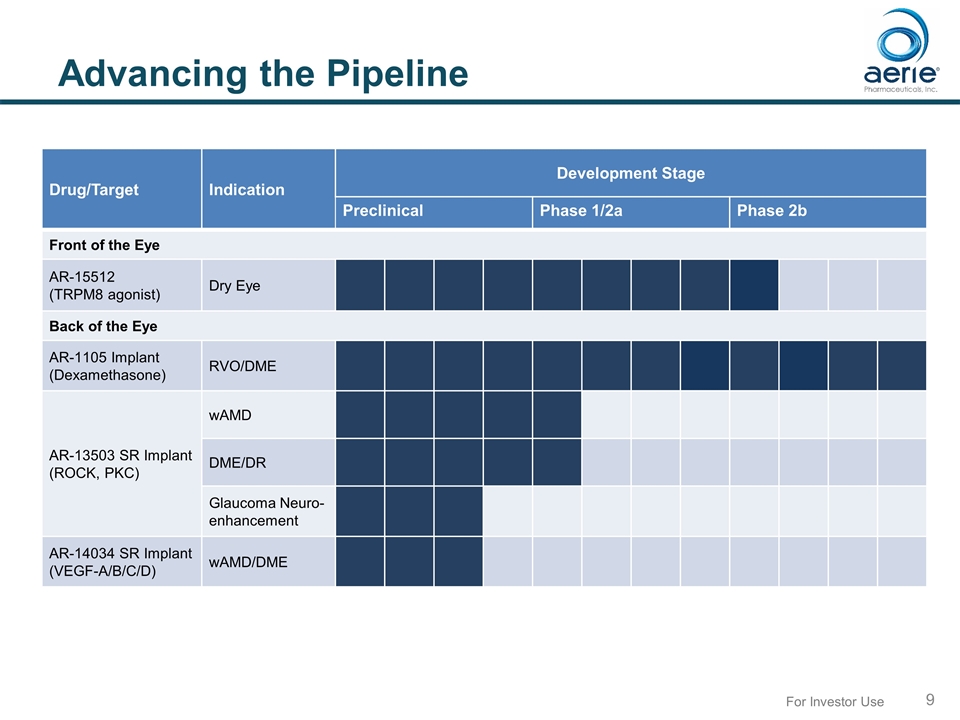

For Investor Use Advancing the Pipeline Drug/Target Indication Development Stage Preclinical Phase 1/2a Phase 2b Front of the Eye AR-15512 (TRPM8 agonist) Dry Eye Back of the Eye AR-1105 Implant (Dexamethasone) RVO/DME AR-13503 SR Implant (ROCK, PKC) wAMD DME/DR Glaucoma Neuro- enhancement AR-14034 SR Implant (VEGF-A/B/C/D) wAMD/DME

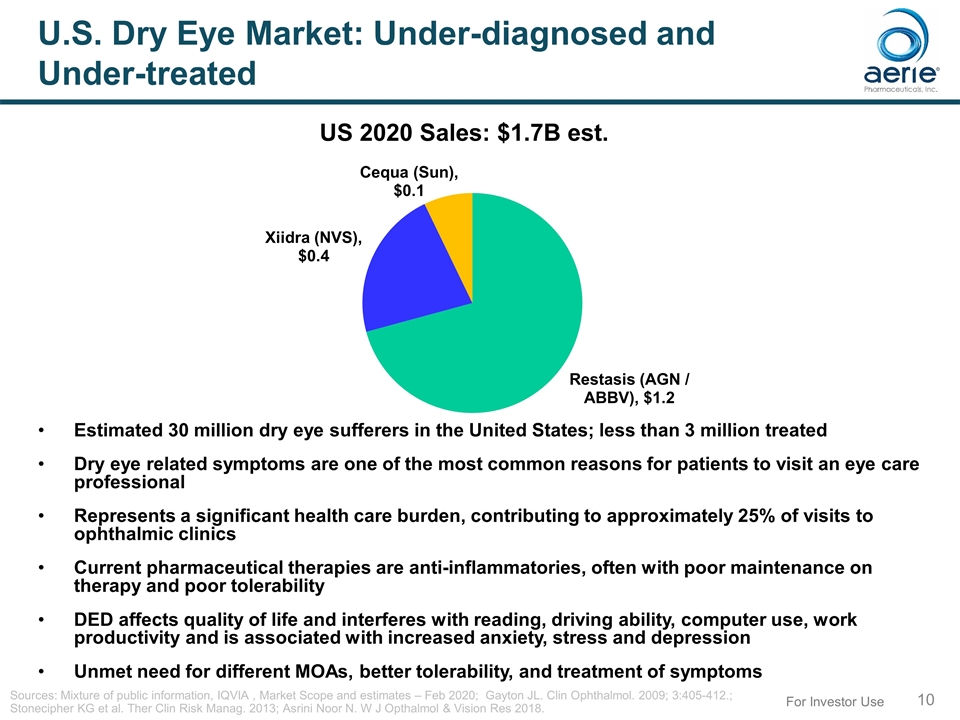

For Investor Use U.S. Dry Eye Market: Under-diagnosed and Under-treated Estimated 30 million dry eye sufferers in the United States; less than 3 million treated Dry eye related symptoms are one of the most common reasons for patients to visit an eye care professional Represents a significant health care burden, contributing to approximately 25% of visits to ophthalmic clinics Current pharmaceutical therapies are anti-inflammatories, often with poor maintenance on therapy and poor tolerability DED affects quality of life and interferes with reading, driving ability, computer use, work productivity and is associated with increased anxiety, stress and depression Unmet need for different MOAs, better tolerability, and treatment of symptoms Sources: Mixture of public information, IQVIA , Market Scope and estimates – Feb 2020; Gayton JL. Clin Ophthalmol. 2009; 3:405-412.; Stonecipher KG et al. Ther Clin Risk Manag. 2013; Asrini Noor N. W J Opthalmol & Vision Res 2018. US 2020 Sales: $1.7B est.

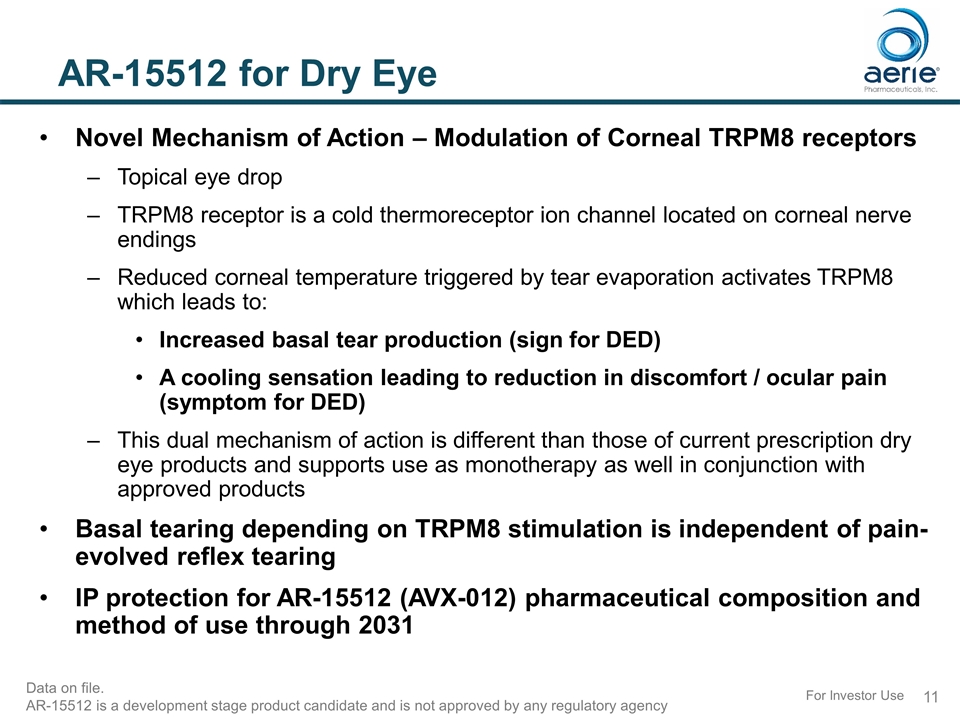

AR-15512 for Dry Eye Novel Mechanism of Action – Modulation of Corneal TRPM8 receptors Topical eye drop TRPM8 receptor is a cold thermoreceptor ion channel located on corneal nerve endings Reduced corneal temperature triggered by tear evaporation activates TRPM8 which leads to: Increased basal tear production (sign for DED) A cooling sensation leading to reduction in discomfort / ocular pain (symptom for DED) This dual mechanism of action is different than those of current prescription dry eye products and supports use as monotherapy as well in conjunction with approved products Basal tearing depending on TRPM8 stimulation is independent of pain-evolved reflex tearing IP protection for AR-15512 (AVX-012) pharmaceutical composition and method of use through 2031 For Investor Use Data on file. AR-15512 is a development stage product candidate and is not approved by any regulatory agency

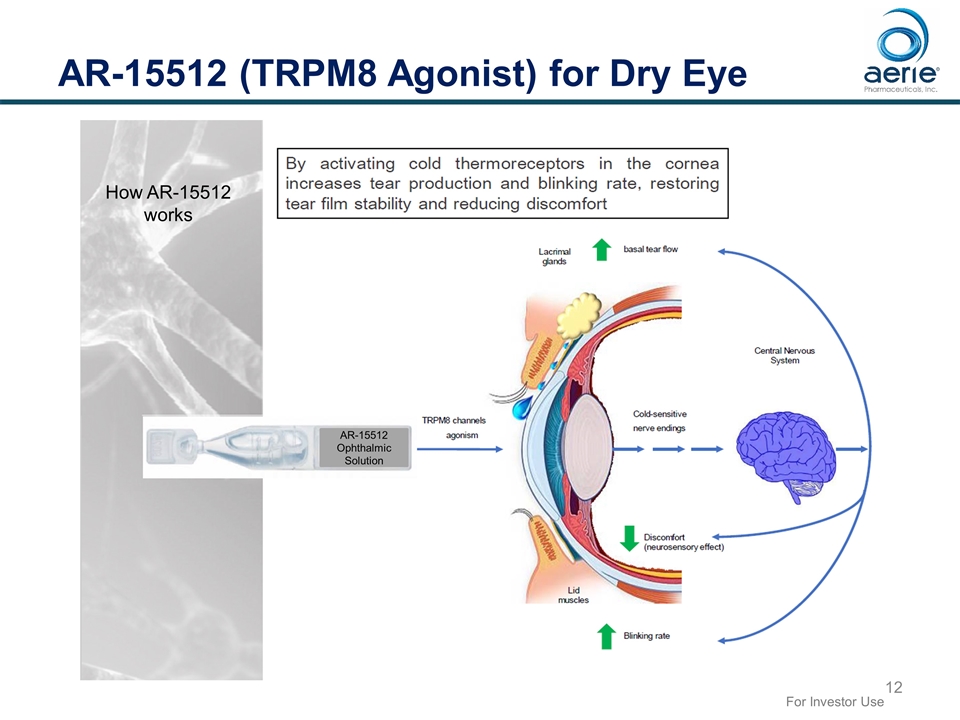

AR-15512 (TRPM8 Agonist) for Dry Eye For Investor Use How AR-15512 works AR-15512 Ophthalmic Solution

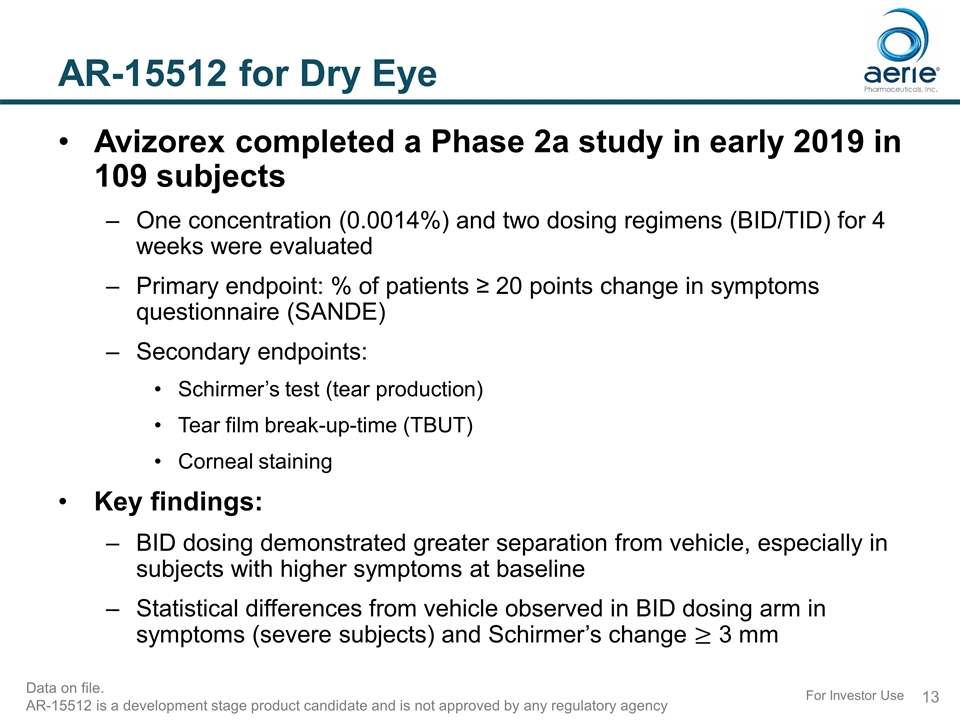

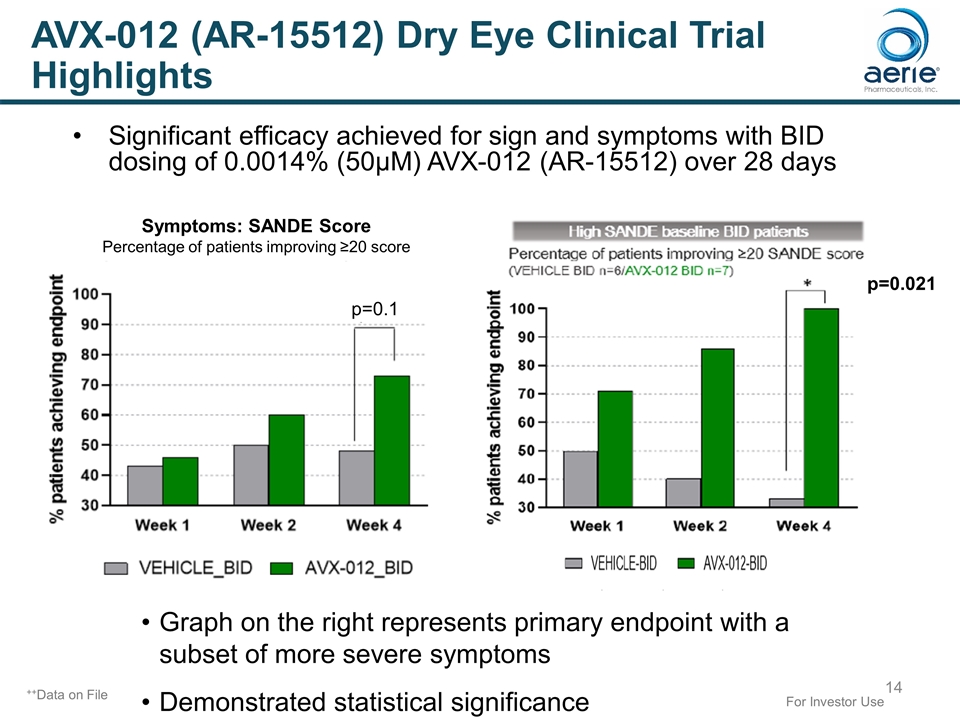

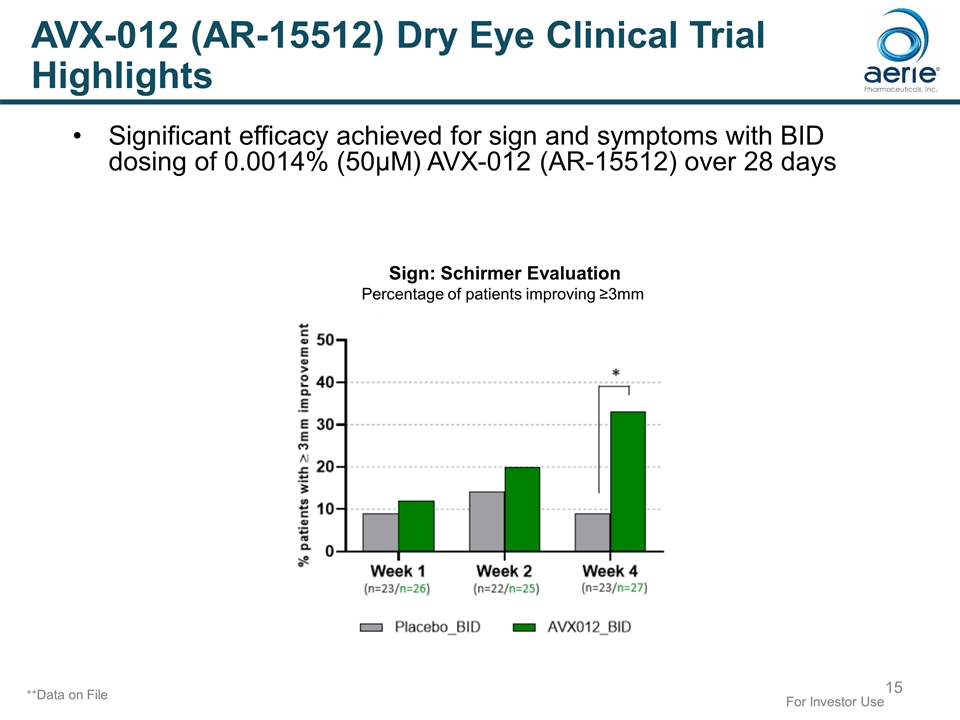

AR-15512 for Dry Eye Avizorex completed a Phase 2a study in early 2019 in 109 subjects One concentration (0.0014%) and two dosing regimens (BID/TID) for 4 weeks were evaluated Primary endpoint: % of patients ≥ 20 points change in symptoms questionnaire (SANDE) Secondary endpoints: Schirmer’s test (tear production) Tear film break-up-time (TBUT) Corneal staining Key findings: BID dosing demonstrated greater separation from vehicle, especially in subjects with higher symptoms at baseline Statistical differences from vehicle observed in BID dosing arm in symptoms (severe subjects) and Schirmer’s change 3 mm For Investor Use Data on file. AR-15512 is a development stage product candidate and is not approved by any regulatory agency

Significant efficacy achieved for sign and symptoms with BID dosing of 0.0014% (50µM) AVX-012 (AR-15512) over 28 days For Investor Use ++Data on File Symptoms: SANDE Score Percentage of patients improving ≥20 score p=0.1 p=0.021 Graph on the right represents primary endpoint with a subset of more severe symptoms Demonstrated statistical significance AVX-012 (AR-15512) Dry Eye Clinical Trial Highlights

++Data on File For Investor Use AVX-012 (AR-15512) Dry Eye Clinical Trial Highlights Sign: Schirmer Evaluation Percentage of patients improving ≥3mm Significant efficacy achieved for sign and symptoms with BID dosing of 0.0014% (50µM) AVX-012 (AR-15512) over 28 days

For Investor Use Dry Eye Program: AR-15512 Target symptoms: significant step in addressing the symptoms of dry eye patients and providing a cooling sensation Impact basal tear production: production of natural tears and not just an acute reflex tear Safe for long-term use Other approved products on the market: Xiidra®: only approved product for the treatment of signs and symptoms Restasis®, Cequa™ and TrueTear®: approved for increase in tear production

For Investor Use AR-15512: COMET-1 Phase 2b Underway Clinical Trial Series named “COMET” = Cold Thermoreceptor Modulation as an Effective Treatment Phase 2b clinical study commenced October 2020; enrollment completed April 2021 Phase 2b study is evaluating efficacy and safety of 0.0014% and 0.003% BID 360 patients (1:1:1) for 3 months Environmental and Controlled Adverse Environment (CAE) conditions Primary endpoints: ocular discomfort (symptom) and tear production (sign) at day 28 Secondary endpoints include: SANDE, staining TBUT, changes post CAE COMET-1 Phase 2b topline results expected Q3 2021

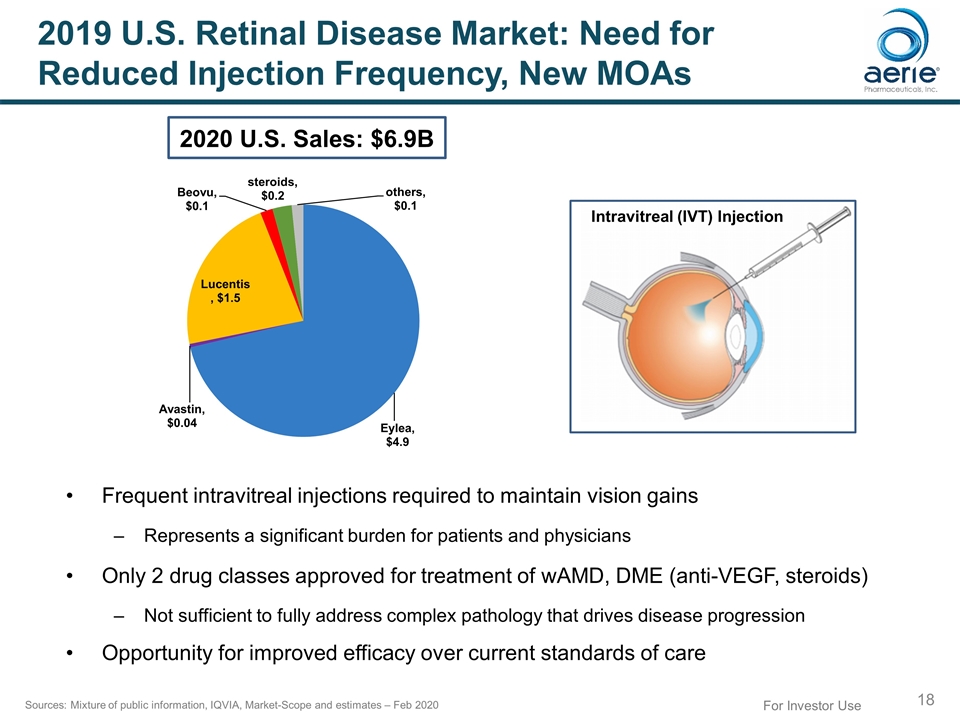

For Investor Use 2019 U.S. Retinal Disease Market: Need for Reduced Injection Frequency, New MOAs Sources: Mixture of public information, IQVIA, Market-Scope and estimates – Feb 2020 Frequent intravitreal injections required to maintain vision gains Represents a significant burden for patients and physicians Only 2 drug classes approved for treatment of wAMD, DME (anti-VEGF, steroids) Not sufficient to fully address complex pathology that drives disease progression Opportunity for improved efficacy over current standards of care Intravitreal (IVT) Injection 2020 U.S. Sales: $6.9B

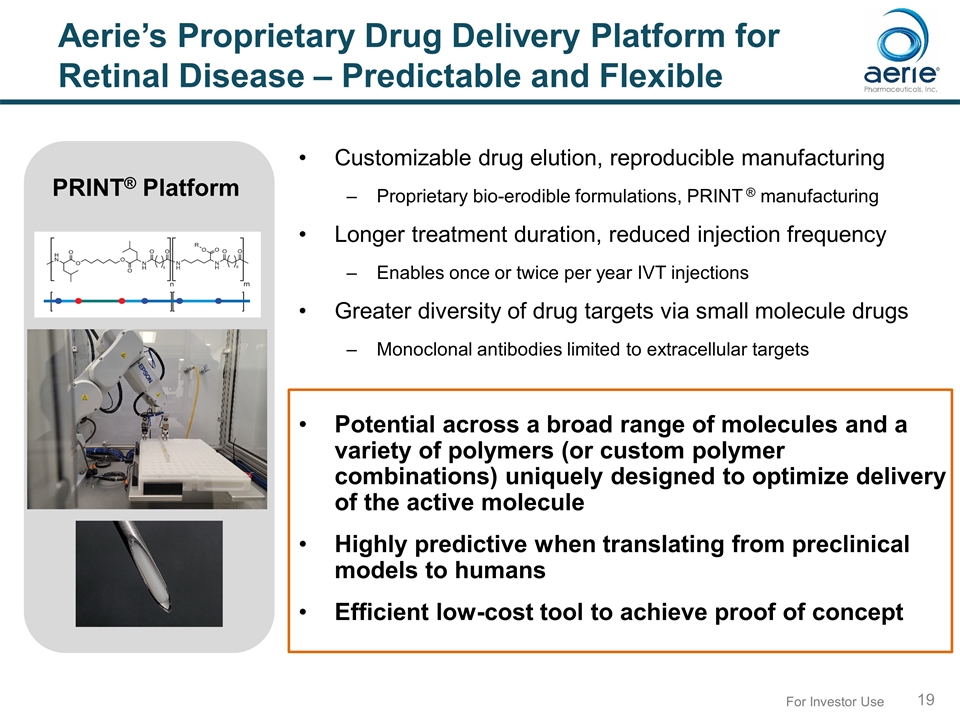

For Investor Use Aerie’s Proprietary Drug Delivery Platform for Retinal Disease – Predictable and Flexible Customizable drug elution, reproducible manufacturing Proprietary bio-erodible formulations, PRINT ® manufacturing Longer treatment duration, reduced injection frequency Enables once or twice per year IVT injections Greater diversity of drug targets via small molecule drugs Monoclonal antibodies limited to extracellular targets Potential across a broad range of molecules and a variety of polymers (or custom polymer combinations) uniquely designed to optimize delivery of the active molecule Highly predictive when translating from preclinical models to humans Efficient low-cost tool to achieve proof of concept PRINT® Platform

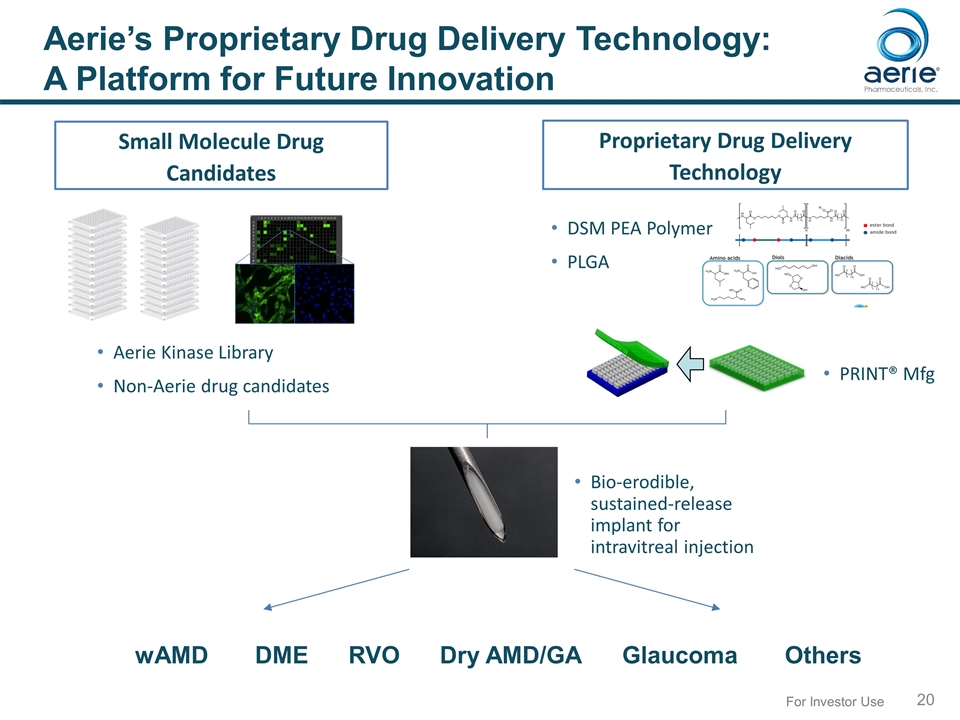

For Investor Use Aerie’s Proprietary Drug Delivery Technology: A Platform for Future Innovation Small Molecule Drug Candidates Proprietary Drug Delivery Technology Bio-erodible, sustained-release implant for intravitreal injection DSM PEA Polymer PLGA PRINT® Mfg wAMD DME RVO Dry AMD/GA Glaucoma Others Aerie Kinase Library Non-Aerie drug candidates

AR-1105 (Dexamethasone) Implant Positive Topline Phase 2 results in RVO Phase 3 plans underway for the U.S. and Europe for DME Target product profile vs. Ozurdex® Designed for longer duration of efficacy (6 mo vs 3 mo) Designed for improved administration due to smaller needle Potential for fewer adverse effects due to lower peak drug levels For Investor Use For more information on Ozurdex® please see the product webpage https://www.ozurdex.com AR-1105 and AR-13503 are development stage product candidates and are not approved by any regulatory agency

AR-1105 (Dexamethasone) Implant: Phase 2 Topline Summary The Phase 2 clinical trial (AR-1105-CS201) was conducted at 19 centers in the United States. The objective was to evaluate two clinical formulations of AR-1105, CF-1 and CF-2 (each containing 340 µg dexamethasone), with different release profiles, in patients with chronic macular edema secondary to retinal vein occlusion (RVO). A total of 49 patients completed the study. Both formulations demonstrated sustained treatment effects in best corrected visual acuity and reductions in macular edema. Peak efficacy was observed earlier with CF-1, while CF-2 demonstrated a longer overall duration of effect of up to six months. Both formulations were well tolerated with no unexpected safety findings. Adverse events were consistent with other corticosteroid treatments and intravitreal injection procedures. For Investor Use Data on file. The results match expectations from preclinical models and demonstrate the flexibility and predictability of the PRINT® technology platform in developing longer duration therapies

AR-1105 Opportunity The DME market is growing in the United States and abroad The 6-month sustained efficacy of AR-1105 in the P2 study may render this product, if approved, highly competitive in both the U.S. and European markets AR-1105 may be viewed as a more favorable treatment alternative for anti-VEGF non-responders Aerie’s exclusive PRINT® platform may allow for low-cost production and significant pricing flexibility Six-month dosing may also benefit physician productivity and overall health economics Opportunity for market expansion – market currently over $100M in the U.S. and nearly $300M in Europe Positive AR-1105 P2 topline sustained efficacy data supports advancement as a potentially significant pipeline asset for Aerie, of particular value in Europe For Investor Use AR-1105 is a development stage product candidate and is not approved by any regulatory agency

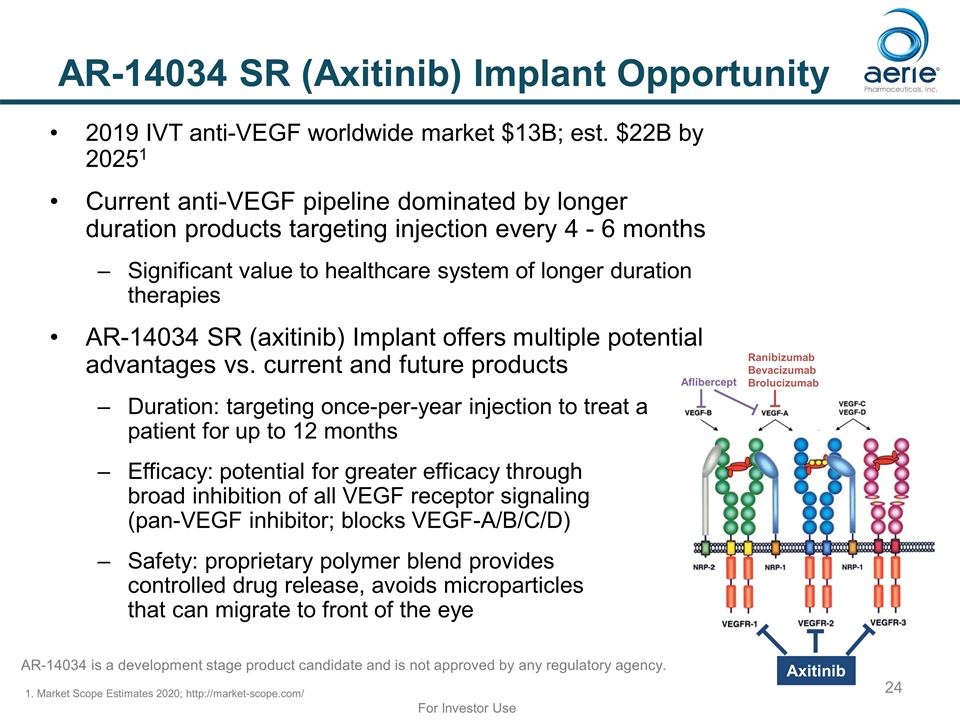

AR-14034 SR (Axitinib) Implant Opportunity 1. Market Scope Estimates 2020; http://market-scope.com/ Aflibercept Ranibizumab Bevacizumab Brolucizumab Axitinib For Investor Use 2019 IVT anti-VEGF worldwide market $13B; est. $22B by 20251 Current anti-VEGF pipeline dominated by longer duration products targeting injection every 4 - 6 months Significant value to healthcare system of longer duration therapies AR-14034 SR (axitinib) Implant offers multiple potential advantages vs. current and future products Duration: targeting once-per-year injection to treat a patient for up to 12 months Efficacy: potential for greater efficacy through broad inhibition of all VEGF receptor signaling (pan-VEGF inhibitor; blocks VEGF-A/B/C/D) Safety: proprietary polymer blend provides controlled drug release, avoids microparticles that can migrate to front of the eye AR-14034 is a development stage product candidate and is not approved by any regulatory agency.

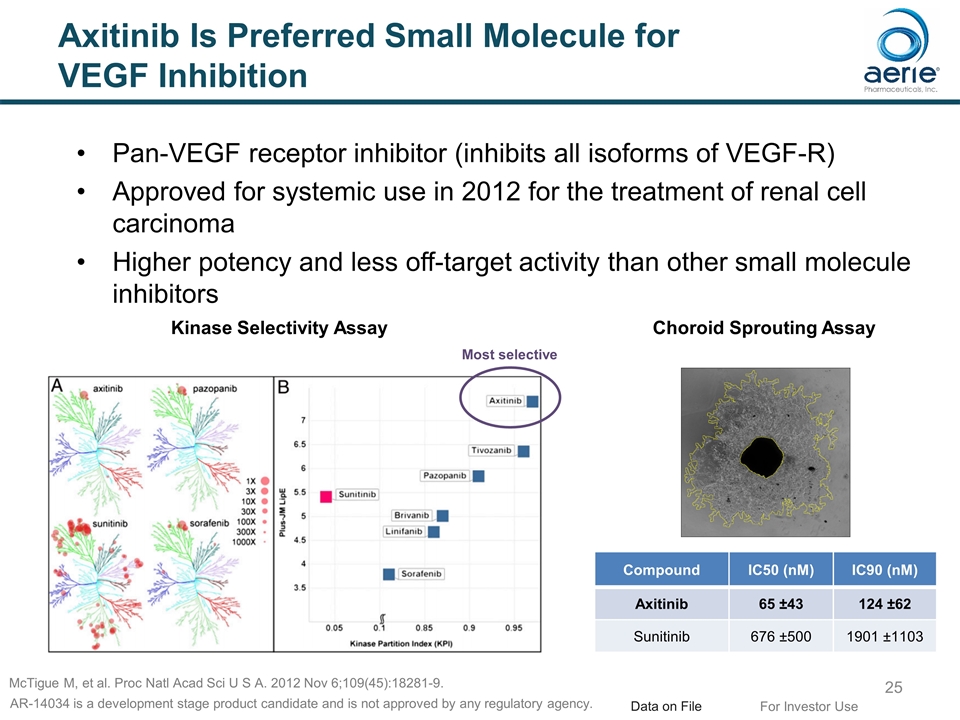

Axitinib Is Preferred Small Molecule for VEGF Inhibition Pan-VEGF receptor inhibitor (inhibits all isoforms of VEGF-R) Approved for systemic use in 2012 for the treatment of renal cell carcinoma Higher potency and less off-target activity than other small molecule inhibitors Most selective For Investor Use McTigue M, et al. Proc Natl Acad Sci U S A. 2012 Nov 6;109(45):18281-9. Compound IC50 (nM) IC90 (nM) Axitinib 65 ±43 124 ±62 Sunitinib 676 ±500 1901 ±1103 Choroid Sprouting Assay Kinase Selectivity Assay Data on File AR-14034 is a development stage product candidate and is not approved by any regulatory agency.

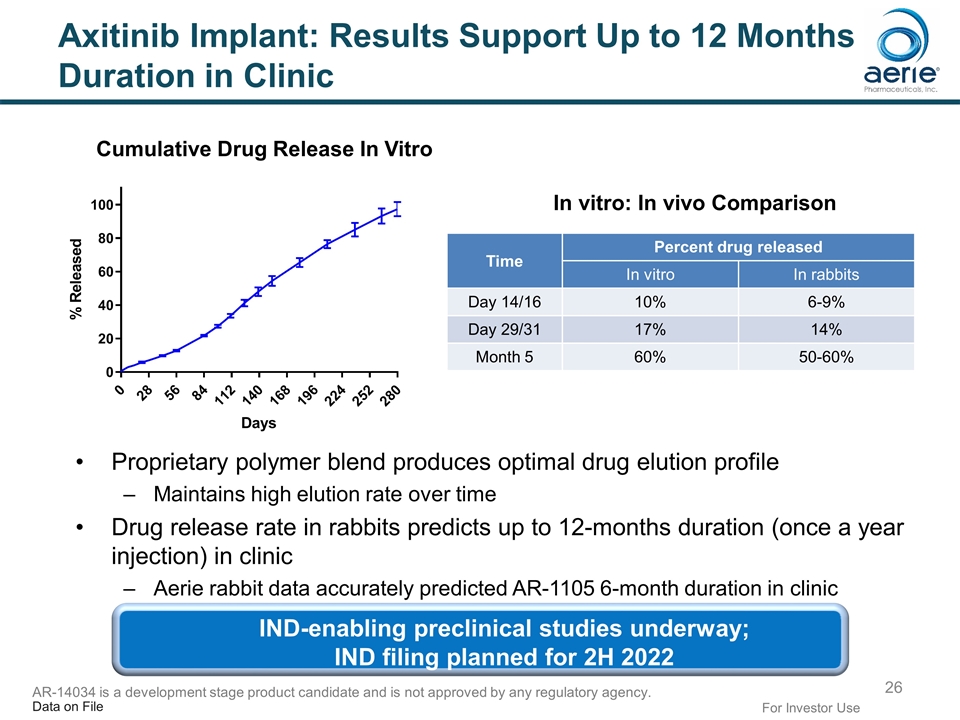

Axitinib Implant: Results Support Up to 12 Months Duration in Clinic Proprietary polymer blend produces optimal drug elution profile Maintains high elution rate over time Drug release rate in rabbits predicts up to 12-months duration (once a year injection) in clinic Aerie rabbit data accurately predicted AR-1105 6-month duration in clinic Time Percent drug released In vitro In rabbits Day 14/16 10% 6-9% Day 29/31 17% 14% Month 5 60% 50-60% In vitro: In vivo Comparison For Investor Use Cumulative Drug Release In Vitro IND-enabling preclinical studies underway; IND filing planned for 2H 2022 Data on File AR-14034 is a development stage product candidate and is not approved by any regulatory agency.

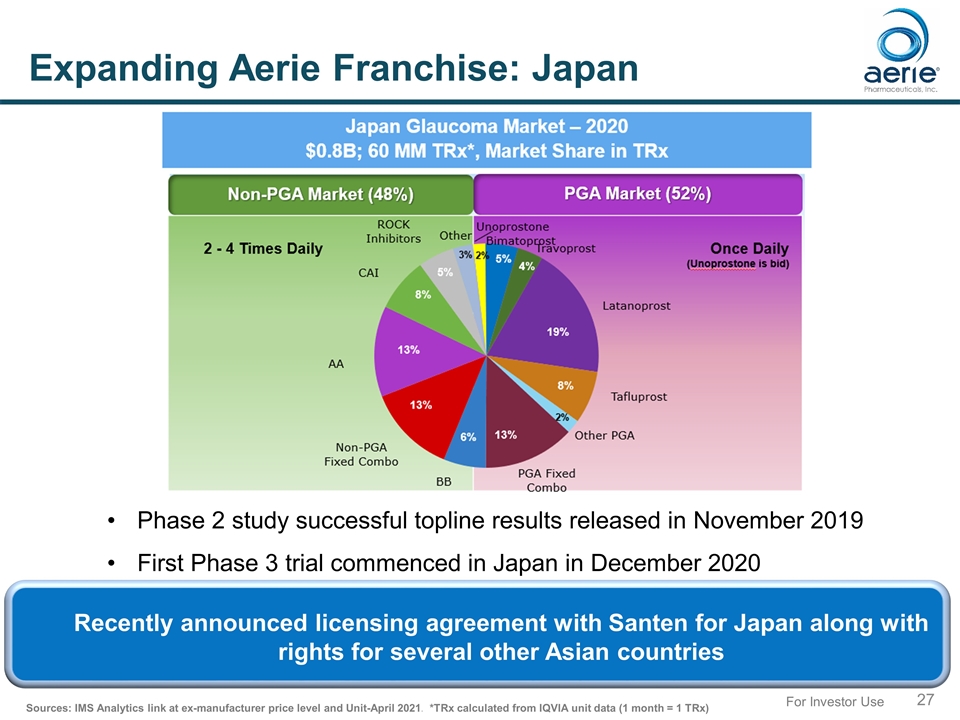

For Investor Use Expanding Aerie Franchise: Japan Phase 2 study successful topline results released in November 2019 First Phase 3 trial commenced in Japan in December 2020 Sources: IMS Analytics link at ex-manufacturer price level and Unit-April 2021. *TRx calculated from IQVIA unit data (1 month = 1 TRx) Recently announced licensing agreement with Santen for Japan along with rights for several other Asian countries

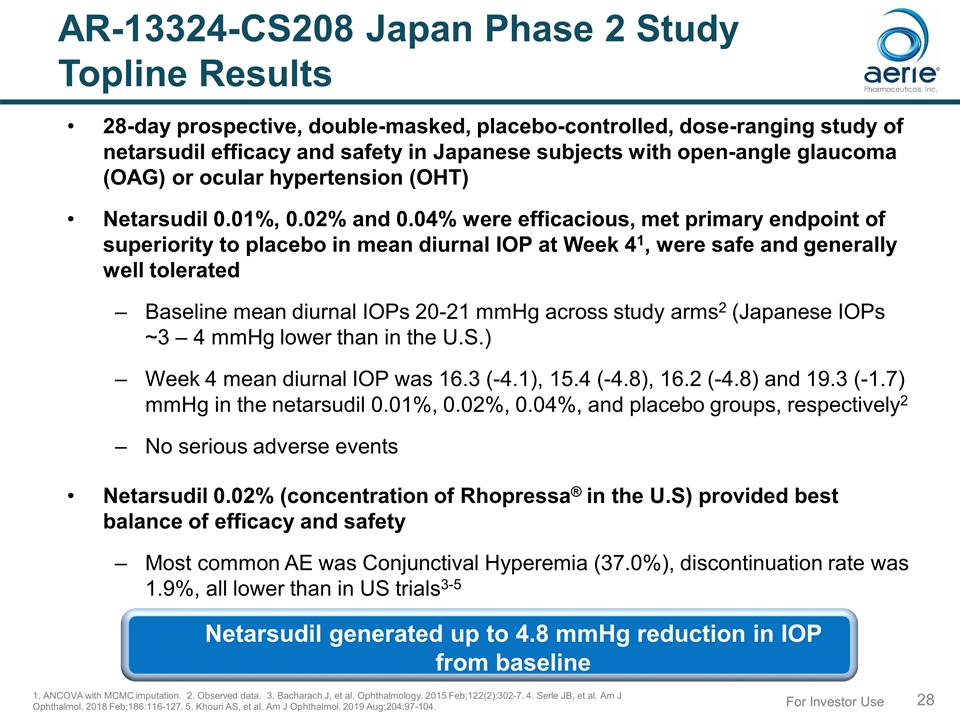

AR-13324-CS208 Japan Phase 2 Study Topline Results 28-day prospective, double-masked, placebo-controlled, dose-ranging study of netarsudil efficacy and safety in Japanese subjects with open-angle glaucoma (OAG) or ocular hypertension (OHT) Netarsudil 0.01%, 0.02% and 0.04% were efficacious, met primary endpoint of superiority to placebo in mean diurnal IOP at Week 41, were safe and generally well tolerated Baseline mean diurnal IOPs 20-21 mmHg across study arms2 (Japanese IOPs ~3 – 4 mmHg lower than in the U.S.) Week 4 mean diurnal IOP was 16.3 (-4.1), 15.4 (-4.8), 16.2 (-4.8) and 19.3 (-1.7) mmHg in the netarsudil 0.01%, 0.02%, 0.04%, and placebo groups, respectively2 No serious adverse events Netarsudil 0.02% (concentration of Rhopressa® in the U.S) provided best balance of efficacy and safety Most common AE was Conjunctival Hyperemia (37.0%), discontinuation rate was 1.9%, all lower than in US trials3-5 1. ANCOVA with MCMC imputation. 2. Observed data. 3. Bacharach J, et al. Ophthalmology. 2015 Feb;122(2):302-7. 4. Serle JB, et al. Am J Ophthalmol. 2018 Feb;186:116-127. 5. Khouri AS, et al. Am J Ophthalmol. 2019 Aug;204:97-104. For Investor Use Netarsudil generated up to 4.8 mmHg reduction in IOP from baseline

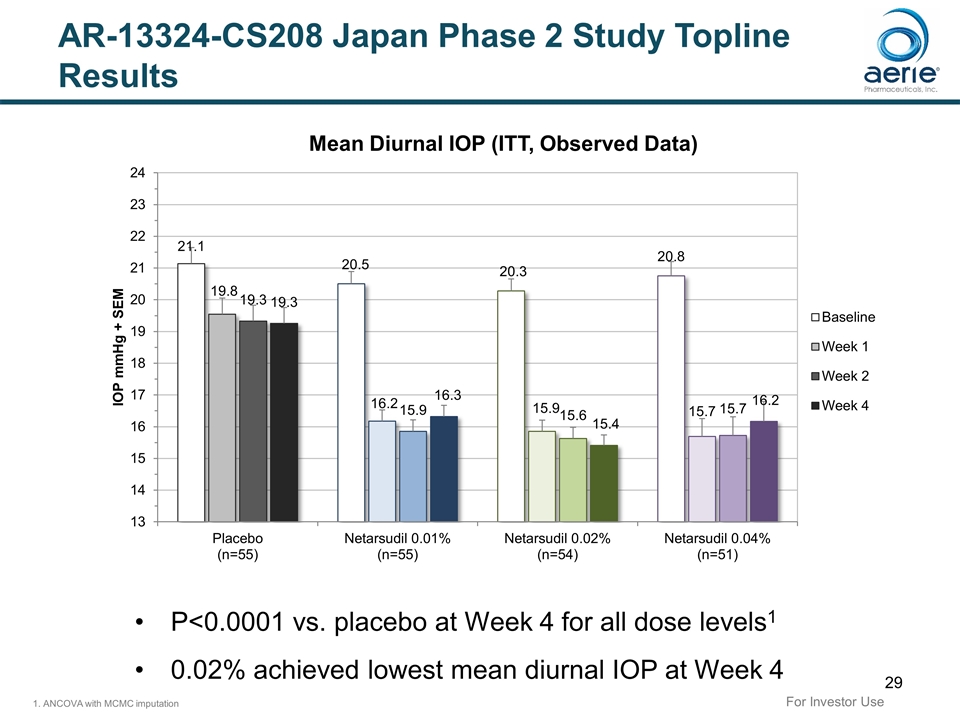

P<0.0001 vs. placebo at Week 4 for all dose levels1 0.02% achieved lowest mean diurnal IOP at Week 4 1. ANCOVA with MCMC imputation AR-13324-CS208 Japan Phase 2 Study Topline Results For Investor Use

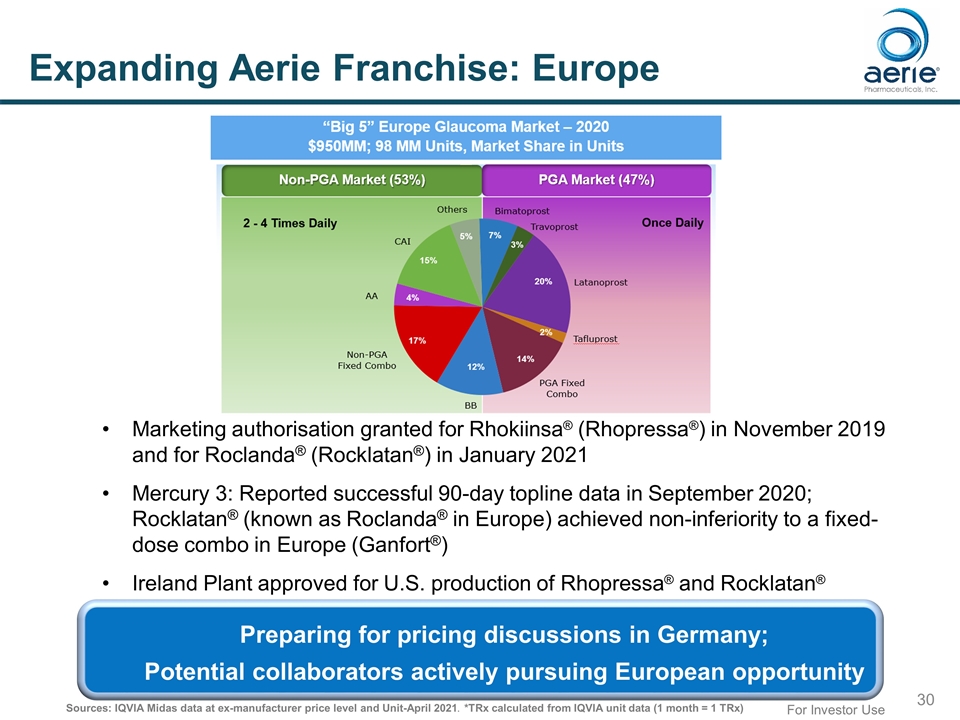

For Investor Use Expanding Aerie Franchise: Europe Marketing authorisation granted for Rhokiinsa® (Rhopressa®) in November 2019 and for Roclanda® (Rocklatan®) in January 2021 Mercury 3: Reported successful 90-day topline data in September 2020; Rocklatan® (known as Roclanda® in Europe) achieved non-inferiority to a fixed-dose combo in Europe (Ganfort®) Ireland Plant approved for U.S. production of Rhopressa® and Rocklatan® Sources: IQVIA Midas data at ex-manufacturer price level and Unit-April 2021. *TRx calculated from IQVIA unit data (1 month = 1 TRx) Preparing for pricing discussions in Germany; Potential collaborators actively pursuing European opportunity

For Investor Use Summary Key Priorities Driving continued Rhopressa® and Rocklatan® volume growth in the U.S. Globalization Strategy Japan: Santen collaboration commencing and first Phase 3 trial underway Europe: Significant interest from potential collaborators Ireland Manufacturing Facility approved for U.S. production of Rhopressa® and Rocklatan® Research Initiatives TRPM8 agonist for dry eye P2b underway Retina Programs, including AR-1105 prospects with positive P2 topline; and AR-14034 SR (Axitinib Pan-VEGF inhibitor) sustained-release implant Well-Financed $208.2M cash/investments at 3/31/21 Santen upfront payment of $50M received in fourth-quarter 2020

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Resolutions of Huhtamäki Oyj’s Annual General Meeting of Shareholders

- Eliminating carbon emissions in Canada’s residential, commercial, and institutional buildings could place further pressures on already-tight construction labour markets

- Carrier Reports Strong First Quarter 2024 Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share