Form 8-K ACCURAY INC For: Apr 22

Exhibit 99.1

Accuray Reports Fiscal 2022 Third Quarter Financial Results

SUNNYVALE, Calif., April 27, 2022 — Accuray Incorporated (NASDAQ: ARAY) today reported financial results for the third quarter of fiscal 2022 ended March 31, 2022.

Third Quarter Fiscal 2022 Summary

| • | Gross orders of $88.6 million, an increase of 1 percent compared to the prior year |

| • | Net revenue of $96.2 million representing a decrease of 6 percent compared to the prior year |

| • | GAAP net loss of $1.0 million as compared to GAAP net loss of $0.4 million in the prior year. Adjusted EBITDA of $5.4 million as compared to adjusted EBITDA of $8.7 million in the prior year |

Other Recent Operational Highlights

| • | Demand continues for ClearRT™ Helical kVCT Imaging for the Radixact® System and VOLO™ Ultra enhancement to the Accuray Precision® treatment planning system for the Radixact System and CyberKnife® S7™ platform |

| • | Data from a phase III trial indicates that Accuray TomoTherapy® Helical Radiotherapy System can help preserve breast cancer patients’ long-term heart and lung functionality |

| • | Introduction of CyberKnife Neuro package with Brainlab Elements software at the Radiosurgery Society was completed |

| • | 10-year data shows Accuray CyberKnife System can provide long-lasting relief of the excruciating pain caused by trigeminal neuralgia |

“Accuray’s fiscal 2022 third quarter performance continues to reflect the strong customer demand and revenue momentum our business is generating, but also highlighted the continuation of supply chain challenges and operational headwinds created by the Covid environment. Driving our accelerated revenue growth is the continued adoption of our new technology upgrades on the Radixact platform and the increasing demand for the CyberKnife S7 platform which are having an impact across all regions,” said Joshua Levine, Chief Executive Officer.

Fiscal Third Quarter Results

Total net revenue was $96.2 million for the third quarter of fiscal 2022 compared to $102.6 million for the prior fiscal year third quarter. Product revenue totaled $43.2 million for the third quarter of fiscal 2022 compared to $47.4 million for the prior fiscal year third quarter, while service revenue totaled $53.0 million for the third quarter of fiscal 2022 compared to $55.1 million for the prior fiscal year third quarter.

Total gross profit for the third quarter of fiscal 2022 was $34.8 million or approximately 36.2 percent of total net revenue, comprised of product gross margin of 34.3 percent of product net revenue and service gross margin of 37.7 percent of service net revenue. This compares to total gross profit of $39.5 million or 38.5 percent of total net revenue, comprised of product gross margin of 41.6 percent of product net revenue and service gross margin of 35.9 percent of service net revenue for the prior fiscal year third quarter.

Operating expenses for the third quarter of fiscal 2022 were $35.1 million, which was flat as compared to $35.1 million in the prior fiscal year third quarter.

Net loss was $1.0 million, or $0.01 per share, for the third quarter of fiscal 2022, compared to net loss of $0.4 million, or $0 per share, for the prior fiscal year third quarter.

Gross product orders totaled $88.6 million for the third quarter of fiscal 2022 compared to $87.4 million for the prior fiscal year third quarter. Order backlog as of March 31, 2022 was $580.4 million, approximately 5 percent lower than at the end of the prior fiscal year third quarter.

Adjusted EBITDA for the third quarter of fiscal 2022 was $5.4 million, compared to $8.7 million for the prior fiscal year third quarter.

Cash, cash equivalents, and short-term restricted cash were $98.0 million as of March 31, 2022 compared with $123.4 million as of December 31, 2021.

Fiscal Nine Months Results

Total net revenue for the nine months ended March 31, 2022 was $319.9 million compared to $285.4 million in the same prior fiscal year period, a 12 percent increase. Product revenue for the nine months ended Mach 31, 2022 totaled $156.7 million compared to $120.5 million, an increase of 30 percent, while service revenue totaled $163.2 million compared to $164.9 million in the same prior fiscal year period, a decrease of 1 percent.

Total gross profit for the nine months ended March 31, 2022 was $116.9 million, or 36.6 percent of net revenue, comprised of product gross margin of 39.1 percent of product revenue and service gross margin of 34.1 percent of service revenue. This compares to total gross profit of $115.8 million, or 40.6 percent of net revenue, comprised of product gross margin of 42.6 percent of product revenue and service gross margin of 39.1 percent of service revenue in the same prior fiscal year period.

Operating expenses for the nine months ended March 31, 2022 were $110.8 million, an increase of 13 percent compared with $97.7 million in the same prior fiscal year period.

Net loss was $1.9 million, or $0.02 of loss per share, for the nine months ended March 31, 2022, compared to net income of $4.8 million, or $0.05 per share, in the same prior fiscal year period.

Gross product orders totaled $243.9 million for the nine months ended March 31, 2022, compared to $213.3 million for the same prior fiscal year period, an increase of 14 percent. Order backlog as of March 31, 2022 was $580.4 million, approximately 5 percent lower than at the end of the prior fiscal year third quarter.

Adjusted EBITDA for the nine months ended March 31, 2022 was $17.7 million, compared to $31.3 million in the prior fiscal year period.

Fiscal Year 2022 Financial Guidance

Accuray’s financial guidance is based on current expectations. The following statements are forward-looking and actual results could differ materially depending on market conditions, the impact of the Covid-19 pandemic, supply chain disruption, and the factors set forth under “Safe Harbor Statement” below.

The Company is re-affirming guidance for fiscal year 2022 as follows:

| • | Total revenue is expected in the range of $420.0 million to $430.0 million, representing a year-over-year growth at the midpoint of the range of 7%. |

| • | Adjusted EBITDA is expected in the range of $15.0 million to $20.0 million. |

Guidance for non-GAAP financial measures excludes depreciation and amortization, stock-based compensation expense, interest expense and provision for income taxes. For more information regarding the non-GAAP financial measures discussed in this press release, please see “Use of Non-GAAP Financial Measures” below.

Conference Call Information

Accuray will host a conference call beginning at 1:30 p.m. PT/4:30 p.m. ET today to discuss results for the third quarter of fiscal 2022 as well as recent corporate developments. Conference call dial-in information is as follows:

| • | U.S. callers: (833) 316-0563 |

| • | International callers: (412) 317-5747 |

Individuals interested in listening to the live conference call via the Internet may do so by logging on to the Investor Relations section of Accuray’s website, www.accuray.com. There will be a slide presentation accompanying today’s event which can also be accessed on the company’s Investor Relations page at www.accuray.com.

In addition, a taped replay of the conference call will be available beginning approximately one hour after the call’s conclusion and will be available for seven days. The replay number is (877) 344-7529 (USA), or (412) 317-0088 (International), Conference ID: 6435845. An archived webcast will also be available on Accuray’s website until Accuray announces its results for the fourth quarter of fiscal 2022.

Use of Non-GAAP Financial Measures

Accuray has supplemented its GAAP net income (loss) with a non-GAAP measure of adjusted earnings before interest, taxes, depreciation, amortization and stock-based compensation (“adjusted EBITDA”). The calculation of adjusted EBITDA also excludes certain non-recurring, irregular and one-time items. Management believes that this non-GAAP financial measure provides useful supplemental information to management and investors regarding the performance of the company and facilitates a meaningful comparison of results for current periods with previous operating results. A reconciliation of GAAP net income (loss) (the most directly comparable GAAP measure) to non-GAAP adjusted EBITDA is provided in the schedules below.

There are limitations in using these non-GAAP financial measures because they are not prepared in accordance with GAAP and may be different from non-GAAP financial measures used by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for GAAP financial measures. Investors and potential investors should consider non-GAAP financial measures only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP.

About Accuray

Accuray Incorporated (Nasdaq: ARAY) is committed to expanding the powerful potential of radiation therapy to improve as many lives as possible. We invent unique, market-changing solutions that are designed to deliver radiation treatments for even the most complex cases—while making commonly treatable cases even easier—to meet the full spectrum of patient needs. We are dedicated to continuous innovation in radiation therapy for oncology, neuro-radiosurgery, and beyond, as we partner with clinicians and administrators, empowering them to help patients get back to their lives, faster. Accuray is headquartered in Sunnyvale, California, with facilities worldwide.

Safe Harbor Statement

Statements made in this press release that are not statements of historical fact are forward-looking statements and are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this press release relate, but are not limited, to the company’s future results of operations, including expectations regarding total revenue and adjusted EBITDA; expectations regarding the effect of the COVID-19 pandemic on the company; expectations regarding supply chain and logistics challenges; expectations regarding the company’s commercial strategy and execution as well as long-term growth opportunities; expectations regarding the company’s order growth; the company’s ability to continue to drive long-term sustainable revenue growth, grow its top line, expand margins and create value for shareholders; expectations regarding the company’s China joint venture and other partnerships; expectations regarding the company’s strategic initiatives, product innovations and developments; expectations regarding the company’s product portfolio and its ability to position the company for growth; the impact of the company’s products on its customers and its business, and market adoption of such products and other strategic product innovations; expectations regarding the future of radiotherapy treatment and the company’s addressable market; and the company’s leadership position in radiation oncology innovation and technologies. These forward-looking statements involve risks and uncertainties. If any of these risk or uncertainties materialize, or if any of the company’s assumptions prove incorrect, actual results could differ materially from the results express or implied by these forward-

looking statements. These risks and uncertainties include, but are not limited to, the effect of the COVID-19 pandemic on the operations of the company and those of its customers and suppliers; disruptions to our supply chain, including increased logistics costs; the company’s ability to achieve widespread market acceptance of its products, including new product and software offerings; the company’s ability to develop new products or enhance existing products to meet customers’ needs and compete favorably in the market, the company’s ability to realize the expected benefits of the China joint venture and other partnerships; risks inherent in international operations; the company’s ability to effectively manage its growth; the company’s ability to maintain or increase its gross margins on product sales and services; delays in regulatory approvals or the development or release of new offerings; the company’s ability to meet the covenants under its credit facilities; the company’s ability to convert backlog to revenue; and such other risks identified under the heading “Risk Factors” in the company’s Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (the “SEC”) on January 28, 2022 and as updated periodically with the company’s other filings with the SEC.

Forward-looking statements speak only as of the date the statements are made and are based on information available to the company at the time those statements are made and/or management’s good faith belief as of that time with respect to future events. The company assumes no obligation to update forward-looking statements to reflect actual performance or results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. Accordingly, investors should not put undue reliance on any forward-looking statements.

| Aman Patel, CFA | Beth Kaplan | |||

| Investor Relations, ICR-Westwicke | Public Relations Director, Accuray | |||

| +1 (443) 450-4191 | +1 (408) 789-4426 | |||

| [email protected] | [email protected] |

###

Financial Tables to Follow

Accuray Incorporated

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(Unaudited)

| Three Months Ended March 31, |

Nine Months Ended March 31, |

|||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Net revenue: |

||||||||||||||||

| Products |

$ | 43,198 | $ | 47,439 | $ | 156,678 | $ | 120,502 | ||||||||

| Services |

52,971 | 55,123 | 163,208 | 164,851 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total net revenue |

96,169 | 102,562 | 319,886 | 285,353 | ||||||||||||

| Cost of revenue: |

||||||||||||||||

| Cost of products |

28,371 | 27,709 | 95,400 | 69,237 | ||||||||||||

| Cost of services |

33,014 | 35,311 | 107,551 | 100,340 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of revenue |

61,385 | 63,020 | 202,951 | 169,577 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

34,784 | 39,542 | 116,935 | 115,776 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Research and development |

14,104 | 13,268 | 43,183 | 37,372 | ||||||||||||

| Selling and marketing |

10,798 | 10,567 | 35,302 | 29,813 | ||||||||||||

| General and administrative |

10,174 | 11,281 | 32,350 | 30,498 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

35,076 | 35,116 | 110,835 | 97,683 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations |

(292 | ) | 4,426 | 6,100 | 18,093 | |||||||||||

| Income (loss) on equity investment, net |

1,946 | (68 | ) | 774 | 1,021 | |||||||||||

| Other expense, net |

(2,293 | ) | (4,027 | ) | (7,451 | ) | (12,981 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before provision for income taxes |

(639 | ) | 331 | (577 | ) | 6,133 | ||||||||||

| Provision for income taxes |

407 | 721 | 1,318 | 1,352 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

$ | (1,046 | ) | $ | (390 | ) | $ | (1,895 | ) | $ | 4,781 | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) per share - basic |

$ | (0.01 | ) | $ | (0.00 | ) | $ | (0.02 | ) | $ | 0.05 | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) per share - diluted |

$ | (0.01 | ) | $ | (0.00 | ) | $ | (0.02 | ) | $ | 0.05 | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares used in computing income (loss) per share: |

||||||||||||||||

| Basic |

92,761 | 93,123 | 91,780 | 92,106 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

92,761 | 93,123 | 91,780 | 93,422 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Accuray Incorporated

Condensed Consolidated Balance Sheets

(in thousands)

(Unaudited)

| March 31, | June 30, | |||||||

| 2022 | 2021 | |||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 97,839 | $ | 116,369 | ||||

| Restricted cash |

205 | 560 | ||||||

| Accounts receivable, net |

89,295 | 85,360 | ||||||

| Inventories |

137,519 | 125,929 | ||||||

| Prepaid expenses and other current assets |

21,987 | 21,547 | ||||||

| Deferred cost of revenue |

351 | 3,008 | ||||||

|

|

|

|

|

|||||

| Total current assets |

347,196 | 352,773 | ||||||

| Property and equipment, net |

12,220 | 12,332 | ||||||

| Investment in joint venture |

14,251 | 15,935 | ||||||

| Goodwill |

58,000 | 57,960 | ||||||

| Intangible assets, net |

286 | 435 | ||||||

| Operating lease right-of-use assets |

17,851 | 22,522 | ||||||

| Other assets |

19,632 | 18,141 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 469,436 | $ | 480,098 | ||||

|

|

|

|

|

|||||

| Liabilities and equity |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 32,364 | $ | 19,467 | ||||

| Accrued compensation |

25,461 | 26,865 | ||||||

| Operating lease liabilities, current |

8,351 | 8,169 | ||||||

| Other accrued liabilities |

26,018 | 27,471 | ||||||

| Customer advances |

24,363 | 24,937 | ||||||

| Deferred revenue |

76,732 | 81,660 | ||||||

| Short-term debt |

8,051 | 3,790 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

201,340 | 192,359 | ||||||

| Long-term other liabilities |

6,812 | 7,766 | ||||||

| Deferred revenue |

24,550 | 23,685 | ||||||

| Operating lease liabilities, non-current |

11,929 | 17,441 | ||||||

| Long-term debt |

173,196 | 170,007 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

417,827 | 411,258 | ||||||

| Equity: |

||||||||

| Common stock |

93 | 91 | ||||||

| Additional paid-in capital |

539,383 | 554,680 | ||||||

| Accumulated other comprehensive income |

1,203 | 2,093 | ||||||

| Accumulated deficit |

(489,070 | ) | (488,024 | ) | ||||

|

|

|

|

|

|||||

| Total equity |

51,609 | 68,840 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 469,436 | $ | 480,098 | ||||

|

|

|

|

|

|||||

Accuray Incorporated

Summary of Orders and Backlog

(in thousands)

(Unaudited)

| Three Months Ended March 31, |

Nine Months Ended March 31, |

|||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Gross Orders |

$ | 88,561 | $ | 87,365 | $ | 243,926 | $ | 213,258 | ||||||||

| Net Orders |

43,542 | 62,826 | 124,488 | 128,843 | ||||||||||||

| Order Backlog |

580,428 | 610,795 | 580,428 | 610,795 | ||||||||||||

Accuray Incorporated

Reconciliation of GAAP Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation,

Amortization and Stock-Based Compensation (Adjusted EBITDA)

(in thousands)

(Unaudited)

| Three Months Ended March 31, |

Nine Months Ended March 31, |

|||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| GAAP net income (loss) |

$ | (1,046 | ) | $ | (390 | ) | $ | (1,895 | ) | $ | 4,781 | |||||

| Depreciation and amortization (a) |

1,406 | 1,577 | 4,247 | 4,890 | ||||||||||||

| Stock-based compensation |

2,695 | 2,489 | 7,906 | 7,097 | ||||||||||||

| Interest expense, net (b) |

1,975 | 4,320 | 6,081 | 13,143 | ||||||||||||

| Provision for income taxes |

407 | 721 | 1,318 | 1,352 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA |

$ | 5,437 | $ | 8,717 | $ | 17,657 | $ | 31,263 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | consists of depreciation, primarily on property and equipment as well as amortization of intangibles. |

| (b) | consists primarily of interest expense associated with outstanding debt. |

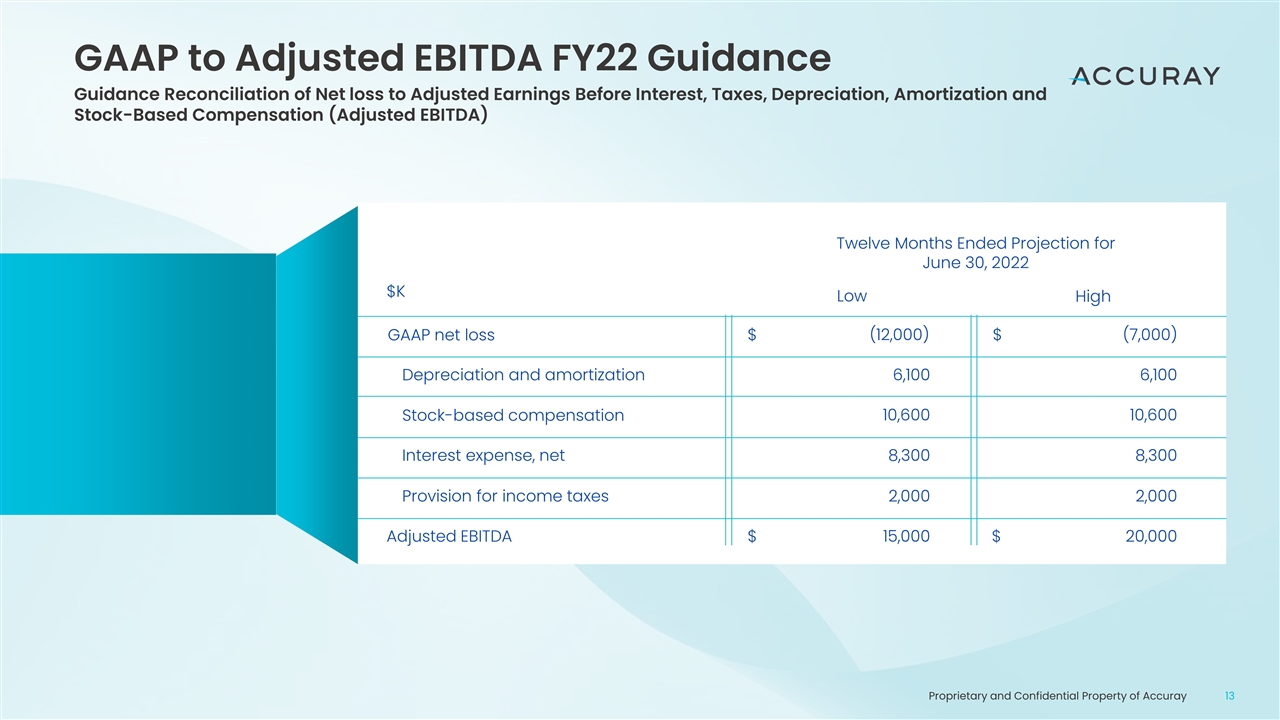

Accuray Incorporated

Forward-Looking Guidance

Reconciliation of Projected Net Loss to Projected Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA)

(in thousands)

(Unaudited)

| Twelve Months Ending June 30, 2022 |

||||||||

| From | To | |||||||

| GAAP net loss |

$ | (12,000 | ) | $ | (7,000 | ) | ||

| Depreciation and amortization (a) |

6,100 | 6,100 | ||||||

| Stock-based compensation |

10,600 | 10,600 | ||||||

| Interest expense, net (b) |

8,300 | 8,300 | ||||||

| Provision for income taxes |

2,000 | 2,000 | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 15,000 | $ | 20,000 | ||||

|

|

|

|

|

|||||

| (a) | consists of depreciation, primarily on property and equipment as well as amortization of intangibles. |

| (b) | consists primarily of interest expense associated with outstanding debt. |

Exhibit 99.2

Accuray Announces Suzanne Winter, President, Promoted to President and CEO; Joshua

Levine Will Retire as CEO and Board Member

Accuray Also Announces Chief Financial Officer, Ali Pervaiz

SUNNYVALE, Calif., April 27, 2022 – Accuray Incorporated (NASDAQ: ARAY) announced today that Suzanne Winter, President, will succeed Joshua Levine as the company’s Chief Executive Officer, effective July 1, 2022.

Mr. Levine will retire from the Accuray Board of Directors at the end of the company’s fiscal year on June 30, 2022 and will remain available to the company in a consulting role through June 30, 2023 to ensure a smooth transition over the next year. Ms. Winter has been appointed as a director of the company and will join the Board effective April 27, 2022.

Ms. Winter joined Accuray as Senior Vice President, Chief Commercial Officer in October 2019 and has served as the company’s President since July 2021. In this role she directs the Company’s day-to-day operations, leads its global growth initiatives, and manages its innovation, regulatory and clinical efforts. During her tenure, Ms. Winter has implemented bold, forward-looking strategies including refocused investment in innovation and high impact product introductions delivering historic commercial results.

“Accuray has changed the way radiation therapy treatments are delivered. The unwavering commitment to ensuring that personalized precision treatments are available to anyone who has been diagnosed with cancer or neurological disorders is fundamental to who we are as a company,” said Ms. Winter. “I want to thank the Board for their vote of confidence in selecting me as the company’s next CEO. I am most excited about the opportunities ahead of us and the chance to lead our team of passionate professionals whose expertise and dedication to advancing patient care is key to our success. I look forward to building on the strong foundation built by Josh and leading the company into its next chapter, expanding on its legacy of innovation and creating value for all of our stakeholders.”

“It has been a privilege over the past nine+ years to lead this organization that has made such a meaningful difference in the lives of cancer patients around the world,” said Joshua Levine, Chief Executive Officer of Accuray. “We have made important improvements during my tenure with the company including strengthening our financial position, building the best product portfolio in the company’s history, and establishing strategically impactful industrial relationships with premier collaboration partners. As a result of these important business development activities, I believe we are at an important inflection point to transition the company to its next leader. Suzanne has made a significant impact since joining Accuray and I am confident she will effectively lead Accuray on behalf of all of our stakeholders: our employees, our customers and their patients, and our shareholders.”

“The leadership succession plan announced today is based on a thoughtful evaluation of the skills necessary to accelerate the organization’s growth and build shareholder value. During her time at Accuray, Suzanne has demonstrated her ability to lead, transform and attain results, and the Board has full confidence in her and her ability to chart the next path forward for Accuray,” said Joseph E. Whitters, Chairperson of Accuray’s Board of Directors. “The Board would like to thank Josh for his commitment to the company as CEO. Josh has done an outstanding job in

preparing the organization for future success, leading improvements in its financial position and development of a strategically focused product roadmap, and formation of important partnerships to leverage Accuray’s competitive positioning. We are grateful for what he has achieved during his tenure and his continued leadership during the transition period.”

Accuray also announced today that Ali Pervaiz has been appointed Senior Vice President and Chief Financial Officer (CFO), leading the global finance organization and overseeing all financial aspects of the company, effective May 9, 2022. Pervaiz has been with Accuray for two years and currently serves as the company’s Vice President, Global Commercial Operations.

“Ali is a high-impact executive who, since joining Accuray, has led the transformation of our commercial operations and helped to drive revenue performance. Ali brings a 15- year career of financial leadership from GE Healthcare including an impressive blend of financial planning and analysis, well-honed operating skills and depth of experience in medical capital equipment commercial operations. His deep understanding of our business combined with a proven track record of delivering results and creating value makes him an outstanding candidate as our next CFO. Ali will be an invaluable partner to the business and allow us to continue to move the company forward executing on our revenue growth agenda and margin expansion plans,” stated Suzanne Winter.

Ms. Winter added, “We would also like to thank Brandy Green, Controller and interim CFO, for her dedication to the company over this last year. She deserves the highest level of recognition for what she has accomplished in the role.”

More About Suzanne Winter

Ms. Winter’s expertise includes senior executive roles spanning general management, commercial operations, and strategic business development across a range of healthcare industry segments, including diagnostic imaging, cardiovascular, neurology, women’s health and surgery. Prior to joining Accuray, she served as group vice president – Americas region at Medtronic Diabetes, where she led the $1.4 billion diabetes business. Previously, Ms. Winter was the general manager of GE Healthcare’s $500M Detection and Guidance Solutions as well as Commercial leadership of the Ultrasound business unit at Toshiba America Medical Systems. Ms Winter received an M.B.A. from Harvard Business School and has a B.S. in Chemistry from Saint Lawrence University.

More About Ali Pervaiz

Prior to joining Accuray, Mr. Pervaiz was with GE Healthcare for over 15 years in senior financial leadership roles. He began his finance career in GE’s prestigious Corporate Audit Staff program, a rigorous multi-year rotation through different divisions used to groom future leaders before assuming increasing levels of responsibility within the Finance organization. Mr. Pervaiz previously held the roles of Chief Financial Officer for two GE Healthcare business units including the $1.3B US Imaging Equipment and $650M US Life Support Solutions business. Mr. Pervaiz received an M.B.A. from the University of Chicago Booth School of Business with a focus on finance & operations, a M.S. in healthcare technologies management from the Medical College of Wisconsin and a B.S. from Marquette University. He will be based in Accuray Incorporated’s Madison, Wisconsin location.

About Accuray

Accuray is committed to expanding the powerful potential of radiation therapy to improve as many lives as possible. We invent unique, market-changing solutions that are designed to deliver radiation treatments for even the most complex cases—while making commonly treatable cases even easier—to meet the full spectrum of patient needs. We are dedicated to continuous

innovation in radiation therapy for oncology, neuro-radiosurgery, and beyond, as we partner with clinicians and administrators, empowering them to help patients get back to their lives, faster. Accuray is headquartered in Sunnyvale, California, with facilities worldwide. To learn more, visit www.accuray.com or follow us on Facebook, LinkedIn, Twitter, and YouTube.

Safe Harbor Statement

Statements made in this press release that are not statements of historical fact are forward-looking statements and are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this press release relate, but are not limited, expectations related to value creation, revenue growth, and margin expansion and expectations regarding the transition of leadership, including related to the company’s plans, goals and objectives. If any of these risks or uncertainties materialize, or if any of the company’s assumptions prove incorrect, actual results could differ materially from the results expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the effect of the COVID-19 pandemic on the operations of the company and those of its customers and suppliers; disruptions to our supply chain, including increased logistics costs; the company’s ability to achieve widespread market acceptance of its products, including new product and software offerings; the company’s ability to develop new products or enhance existing products to meet customers’ needs and compete favorably in the market, the company’s ability to realize the expected benefits of the China joint venture and other partnerships; risks inherent in international operations; the company’s ability to effectively manage its growth; the company’s ability to maintain or increase its gross margins on product sales and services; delays in regulatory approvals or the development or release of new offerings; the company’s ability to meet the covenants under its credit facilities; the company’s ability to convert backlog to revenue; and such other risks identified under the heading “Risk Factors” in the company’s Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (the “SEC”) on January 28, 2022 and as updated periodically with the company’s other filings with the SEC.

Forward-looking statements speak only as of the date the statements are made and are based on information available to the company at the time those statements are made and/or management’s good faith belief as of that time with respect to future events. The company assumes no obligation to update forward-looking statements to reflect actual performance or results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. Accordingly, investors should not put undue reliance on any forward-looking statements.

###

Media Contact

Beth Kaplan

Accuray

+1 (408) 789-4426

Investor Contact

Aman Patel, CFA

Investor Relations, ICR-Westwicke

+1 (443) 450-4191

Q3’FY22 Earnings Call April 27, 2022 Exhibit 99.3

Proprietary and Confidential Property of Accuray Safe Harbor Statement Statements in this presentation (including the oral commentary that accompanies it) that are not statements of historical fact are forward-looking statements and are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this presentation relate, but are not limited, to: expectations regarding fiscal 2022 full-year adjusted EBITDA and revenue; our positioning and strategy for accelerating revenue and market share; expectations regarding continued momentum in investment in R&D; expectations regarding market growth rates and market trends; expectations regarding new product enhancements or offerings and partnerships; expectations related to our ability to drive additional growth and market share in China; our ability to expand addressable markets; and our ability to capitalize on operating leverage to drive greater profits and cash flows. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “may,” “will be,” “will continue,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to: the effects of the COVID-19 pandemic on our business, financial condition, results of operations or cash flows; disruptions to our supply chain, including increased logistics costs; our ability to achieve widespread market acceptance of our products, including new product offerings and improvements; our ability to develop new products or enhance existing products to meet customers’ needs and compete favorably in the market; our ability to realize the expected benefits of the joint-venture and other partnerships; risks inherent in international operations; our ability to effectively manage our growth; our ability to maintain or increase our gross margins on product sales and services; delays in regulatory approvals or the development or release of new offerings; our ability to meet the covenants under our credit facilities; our ability to convert backlog to revenue; and other risks identified under the heading “Risk Factors” in our quarterly report on Form 10-Q, filed with the Securities and Exchange Commission (the “SEC”) on January 28, 2022, and as updated periodically with our other filings with the SEC. Forward-looking statements speak only as of the date the statements are made and are based on information available to Accuray at the time those statements are made and/or management’s good faith belief as of that time with respect to future events. Accuray assumes no obligation to update forward-looking statements to reflect actual performance or results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. Accordingly, investors should not place undue reliance on any forward-looking statements. Non-GAAP Financial Measures This presentation also contains non-GAAP financial measures. Management believes that non-GAAP financial measures provide useful supplemental information to management and investors regarding the performance of the company and facilitates a more meaningful comparison of results for current periods with previous operating results. Additionally, these non-GAAP financial measures assist management in analyzing future trends, making strategic and business decisions, and establishing internal budgets and forecasts. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measure is provided in the Appendix. There are limitations in using these non-GAAP financial measures because they are not prepared in accordance with GAAP and may be different from non-GAAP financial measures used by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for GAAP financial measures. Investors and potential investors should consider non-GAAP financial measures only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP. Medical Advice Disclaimer Accuray Incorporated as a medical device manufacturer cannot and does not recommend specific treatment approaches. Individual results may vary. Forward-looking statements This presentation is intended exclusively for investors. It is not intended for use in Sales or Marketing.

Executive Summary Q3’FY22 Good business performance amid supply and logistic challenges Q3 ending backlog at $580M with 1% Q3 Y/Y order growth 2% net installed base growth Q3 Y/Y to drive future recurring service and upgrade revenues 12% YTD Q3 revenue growth Y/Y while continuing momentum with R&D investments Maintaining FY22 full year revenue guidance of $420M to $430M and adjusted EBITDA guidance of $15M to $20M1 1 Adjusted EBITDA is a non-GAAP measure. Please see Slide 11 , 12, and 13 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure.

Our Vision: To EXPAND the CURATIVE POWER of RADIATION THERAPY to improve as many lives as possible Broader treatment options Beyond oncology Global patient access Enable advanced treatments Survival, long term outcomes Quality of life Precision technology Superior patient experience Partnerships Focused resources Expertise Best in class

Strategy for Accelerating Momentum Financial model designed to both invest as well as grow the top line Reposition for Success Enhanced leadership team Established China joint-venture Introduced artificial intelligence (AI)-driven Synchrony® technology Reset cost structure to increase operating leverage FY18 - FY19 Transform Culture and Begin Innovation Driven Growth Redefined vision and strategic roadmap High impact product introduction Executed China type-A revenue ramp Continued to build out our global infrastructure and operations Restructured debt to allow for growth FY20 - FY21 Accelerate Growth Consistent cadence of new products and partnerships Drive additional growth and share in China market Expand addressable markets and drive further market share gain Capitalize on operating leverage to drive greater profits and cash flows FY22+ Plan

Accuray Systems: Differentiated Solutions TomoTherapy® System Radixact® System Personalized Universal Fast S7™ System CyberKnife® Tracking, Gating-free, ITV-free Precise Speed Treatment Planning System Accuray Precision® Efficient Integrated Automated Ultimate IMRT/SBRT Workhorse Connectivity to the RT Department Dedicated Whole Body SRS/SBRT System

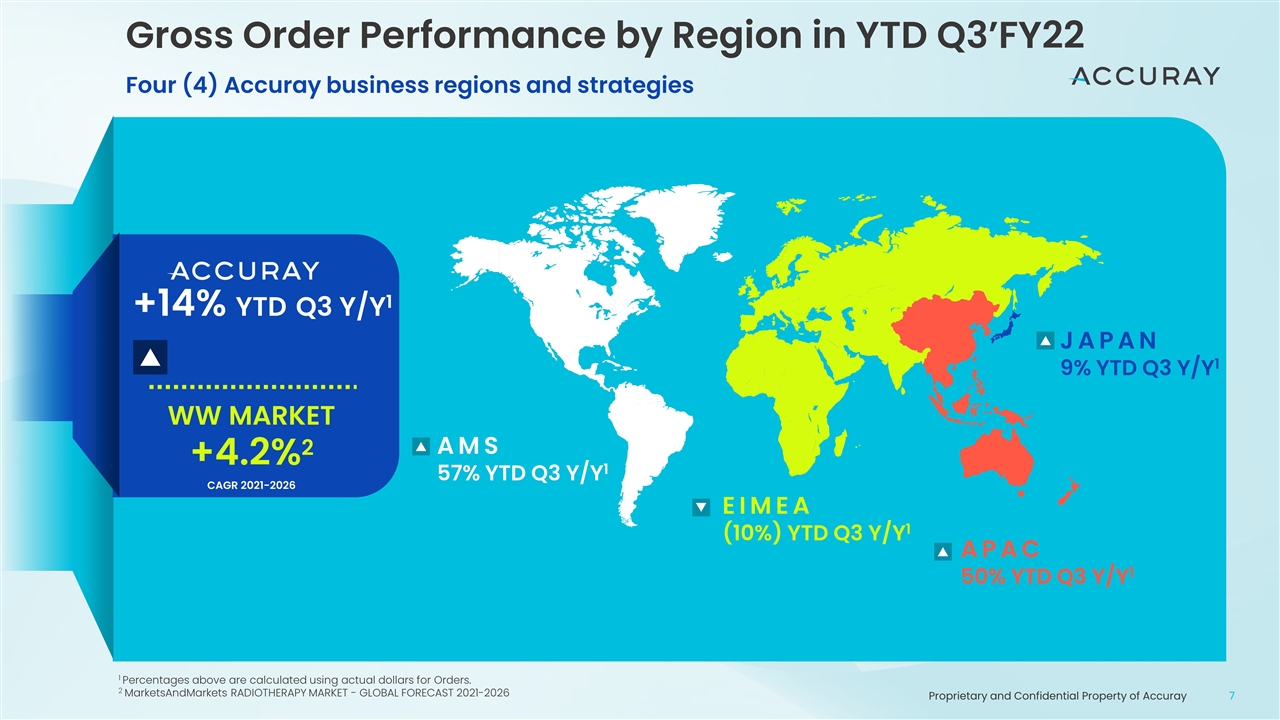

AMS 57% YTD Q3 Y/Y1 EIMEA (10%) YTD Q3 Y/Y1 APAC 50% YTD Q3 Y/Y1 JAPAN 9% YTD Q3 Y/Y1 1 Percentages above are calculated using actual dollars for Orders. 2 MarketsAndMarkets RADIOTHERAPY MARKET - GLOBAL FORECAST 2021-2026 Gross Order Performance by Region in YTD Q3’FY22 Four (4) Accuray business regions and strategies +14% YTD Q3 Y/Y1 WW MARKET +4.2%2 CAGR 2021-2026

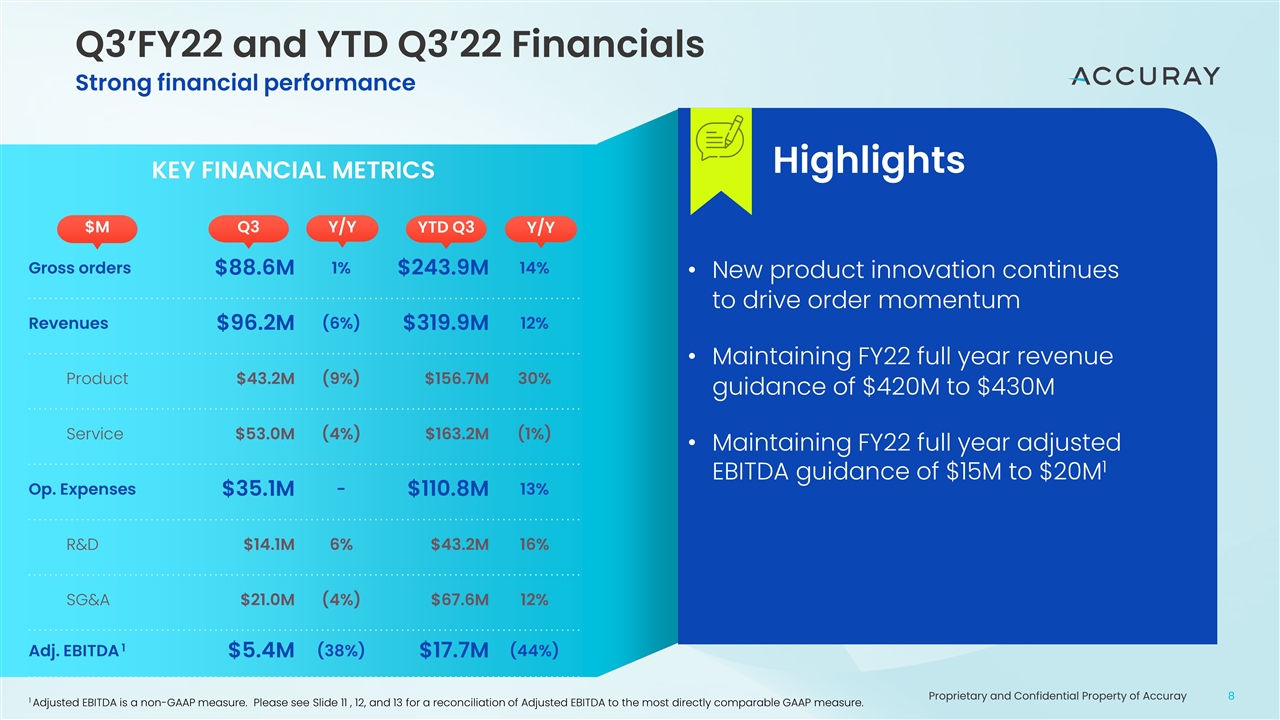

Q3’FY22 and YTD Q3’22 Financials Strong financial performance Gross orders $88.6M 1% $243.9M 14% Revenues $96.2M (6%) $319.9M 12% Product $43.2M (9%) $156.7M 30% Service $53.0M (4%) $163.2M (1%) Op. Expenses $35.1M - $110.8M 13% R&D $14.1M 6% $43.2M 16% SG&A $21.0M (4%) $67.6M 12% Adj. EBITDA 1 $5.4M (38%) $17.7M (44%) KEY FINANCIAL METRICS $M Q3 Y/Y Highlights New product innovation continues to drive order momentum Maintaining FY22 full year revenue guidance of $420M to $430M Maintaining FY22 full year adjusted EBITDA guidance of $15M to $20M1 1 Adjusted EBITDA is a non-GAAP measure. Please see Slide 11 , 12, and 13 for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure. YTD Q3 Y/Y

In Summary Year to date Momentum in Orders and Revenue Strongest Product Portfolio and Pipeline in Company’s History Multiple Growth Catalysts and Global Commercial Execution Strengthened Leadership Team and Operational Foundation Positioned for Accelerated Revenue Growth and Market Share Gains

Thank you

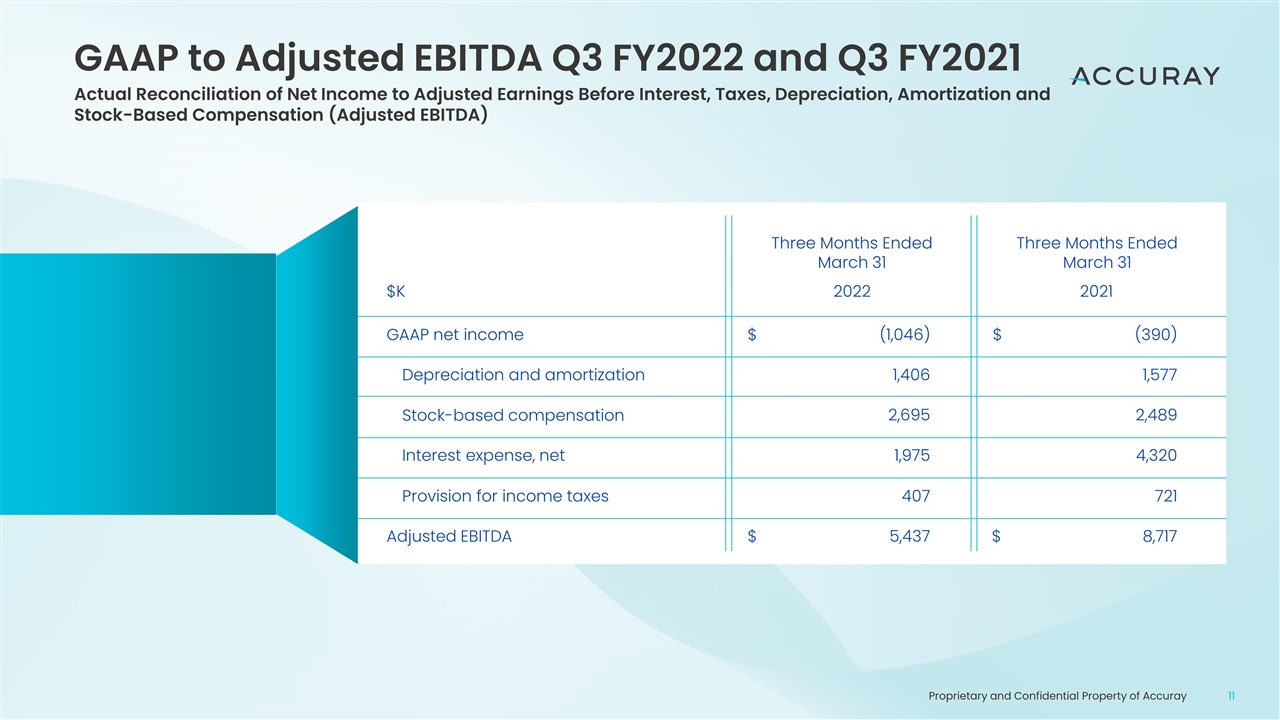

GAAP to Adjusted EBITDA Q3 FY2022 and Q3 FY2021 Actual Reconciliation of Net Income to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) $K GAAP net income Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Three Months Ended March 31 Three Months Ended March 31 2021 2022 $ $ $ $ (1,046) 1,406 2,695 1,975 407 5,437 (390) 1,577 2,489 4,320 721 8,717

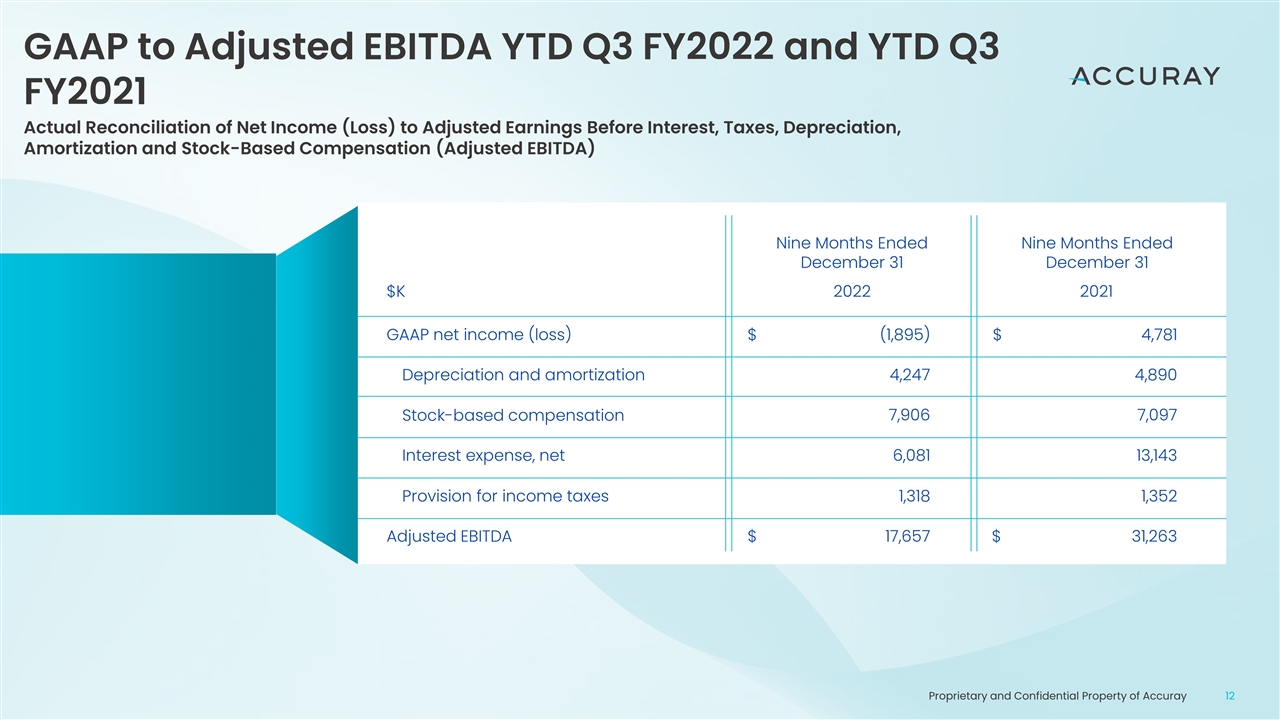

GAAP to Adjusted EBITDA YTD Q3 FY2022 and YTD Q3 FY2021 Actual Reconciliation of Net Income (Loss) to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) $K GAAP net income (loss) Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Nine Months Ended December 31 Nine Months Ended December 31 2021 2022 $ $ $ $ (1,895) 4,247 7,906 6,081 1,318 17,657 4,781 4,890 7,097 13,143 1,352 31,263

GAAP to Adjusted EBITDA FY22 Guidance Guidance Reconciliation of Net loss to Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (Adjusted EBITDA) $K GAAP net loss Stock-based compensation Interest expense, net Provision for income taxes Adjusted EBITDA Depreciation and amortization Twelve Months Ended Projection for June 30, 2022 Low $ $ $ $ (12,000) 6,100 10,600 8,300 2,000 15,000 (7,000) 6,100 10,600 8,300 2,000 20,000 High

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Accuray (ARAY) Opens New Facility in Genolier, Switzerland

- Helo Corp Announces Annual 2023 Results

- Net Income of R$ 55.3 mm in 1Q24, a 90.1% Increase YOY and Leases EBITDA Margin of 72.1%

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share