Form 8-K ABERCROMBIE & FITCH CO For: May 24

ABERCROMBIE & FITCH CO. REPORTS FIRST QUARTER RESULTS

Delivers highest first quarter net sales since 2014

Operating margin below company expectations on higher-than-expected freight and product costs

Repurchased 3.3 million shares, reducing outstanding share count by 6% from fiscal year-end 2021

New Albany, Ohio, May 24, 2022: Abercrombie & Fitch Co. (NYSE: ANF) today announced results for the first quarter ended April 30, 2022. These compare to results for the first quarter ended May 1, 2021. Descriptions of the use of non-GAAP financial measures and reconciliations of GAAP and non-GAAP financial measures accompany this release.

Fran Horowitz, Chief Executive Officer, said “First quarter net sales exceeded expectations, rising 4% to $813 million, our highest first quarter level since 2014. Results were driven by ongoing strength at the Abercrombie & Fitch brand, where global sales were above plan. Net sales at Hollister were in line with expectations. By region, the U.S. continued to outperform, EMEA net sales returned to positive territory, and APAC was impacted by COVID lockdowns in China. We continued to reduce our promotional activity, contributing to our eighth consecutive quarter of AUR improvement. This was more than offset by higher-than-expected freight and product costs.

Looking forward, we expect higher costs to remain a headwind through at least year-end. We expect freight relief in the fourth quarter as we anniversary increased air usage last year due to the Vietnam shutdown. We will continue to manage expenses tightly and are committed to finding opportunities to offset these costs while protecting strategic investments in marketing, technology and our customer experience, which should drive sustained, long-term sales growth.”

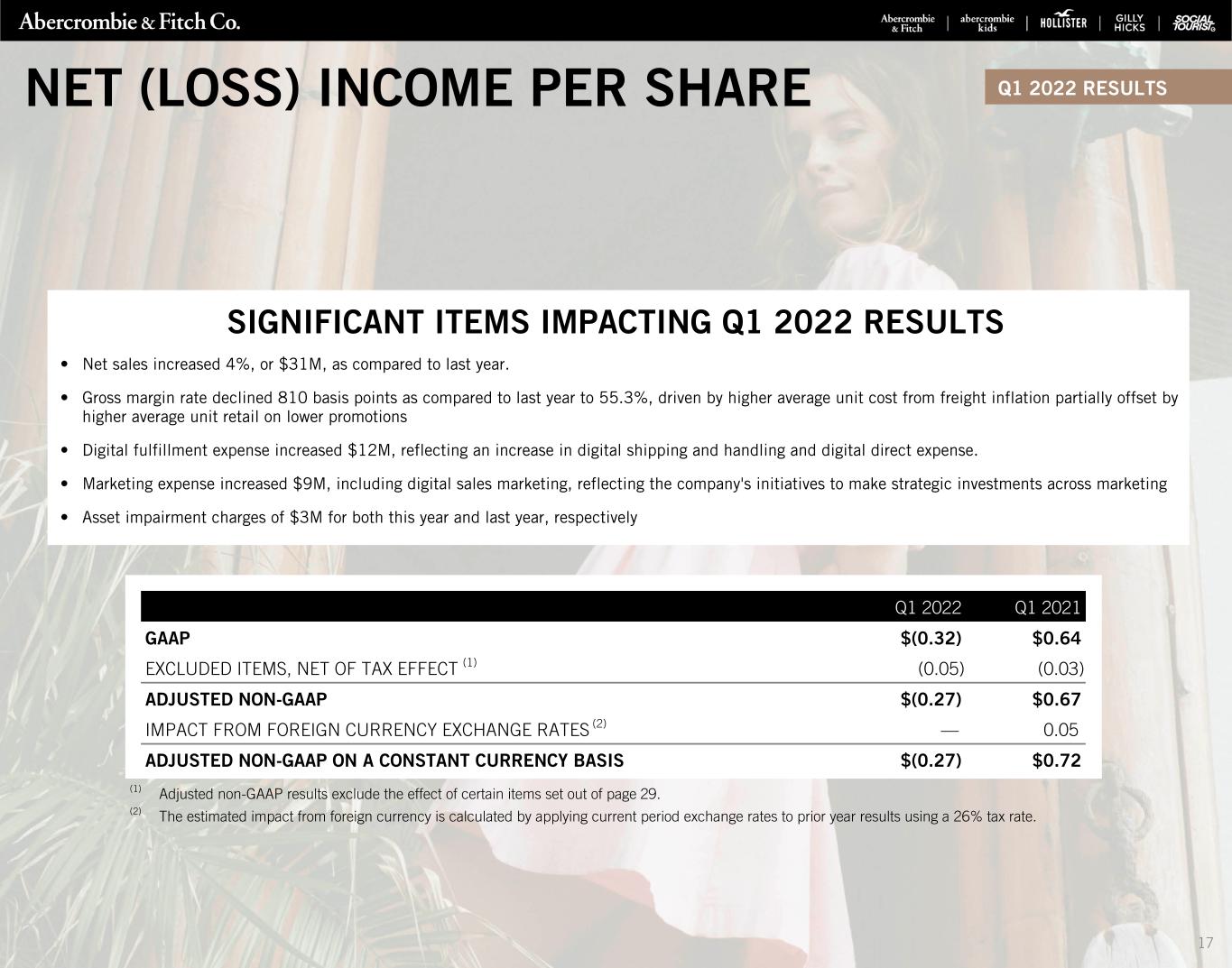

Details related to net income (loss) per diluted share for the first quarter are as follows:

| 2022 | 2021 | |||||||||||||

| GAAP | $ | (0.32) | $ | 0.64 | ||||||||||

Excluded items, net of tax effect (1) | (0.05) | (0.03) | ||||||||||||

| Adjusted non-GAAP | $ | (0.27) | $ | 0.67 | ||||||||||

Impact from changes in foreign currency exchange rates (2) | — | 0.05 | ||||||||||||

| Adjusted non-GAAP constant currency | $ | (0.27) | $ | 0.72 | ||||||||||

(1)Excluded items consist of pre-tax store asset impairment charges.

(2)The estimated impact from foreign currency is calculated by applying current period exchange rates to prior year results using a 26% tax rate.

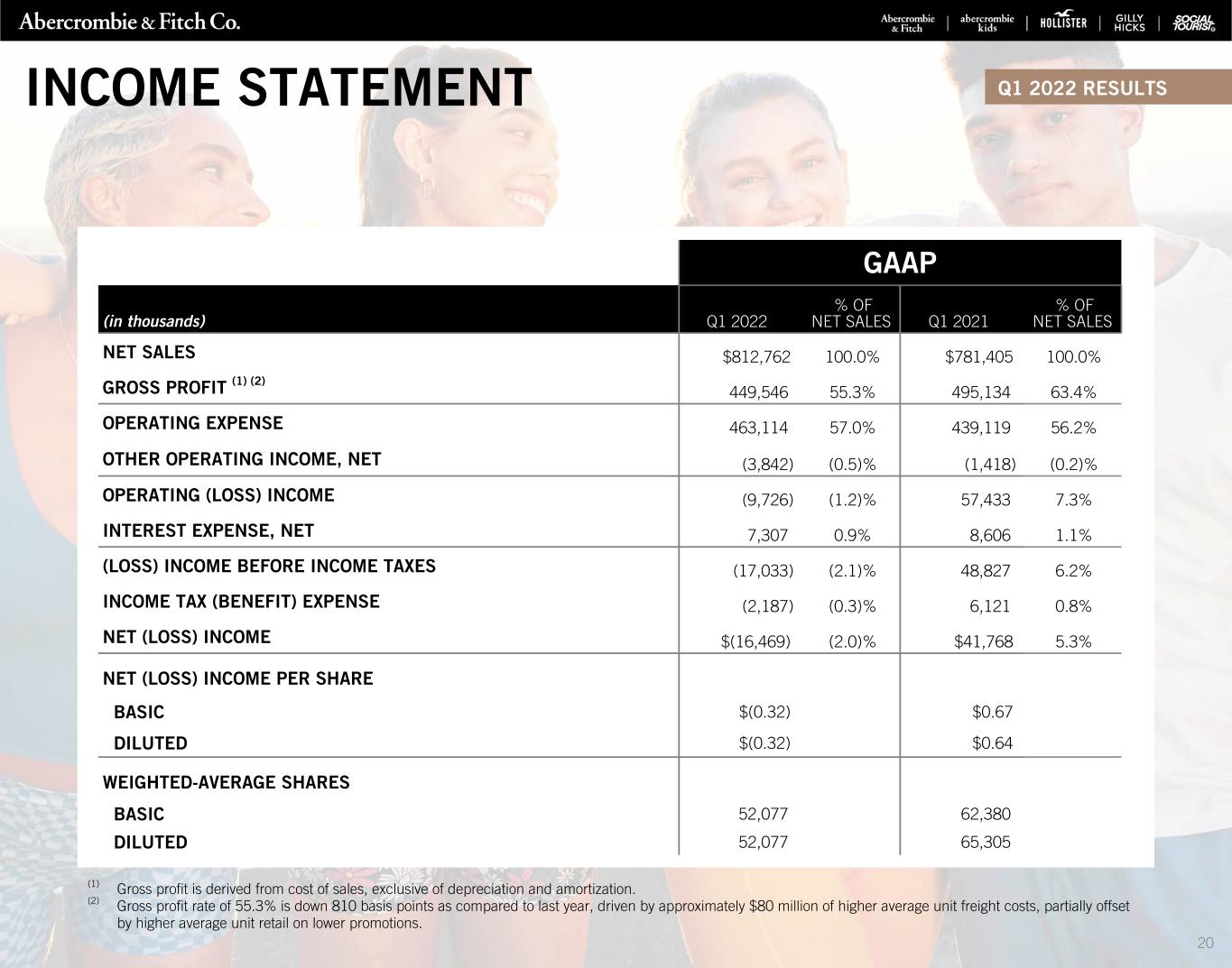

A summary of results for the first quarter ended April 30, 2022 as compared to the first quarter ended May 1, 2021:

•Net sales of $813 million, up 4% as compared to last year.

•Gross profit rate of 55.3%, down approximately 810 basis points as compared to last year. The year-over-year decline is driven by approximately $80 million of higher freight costs, partially offset by higher average unit retail on lower promotions.

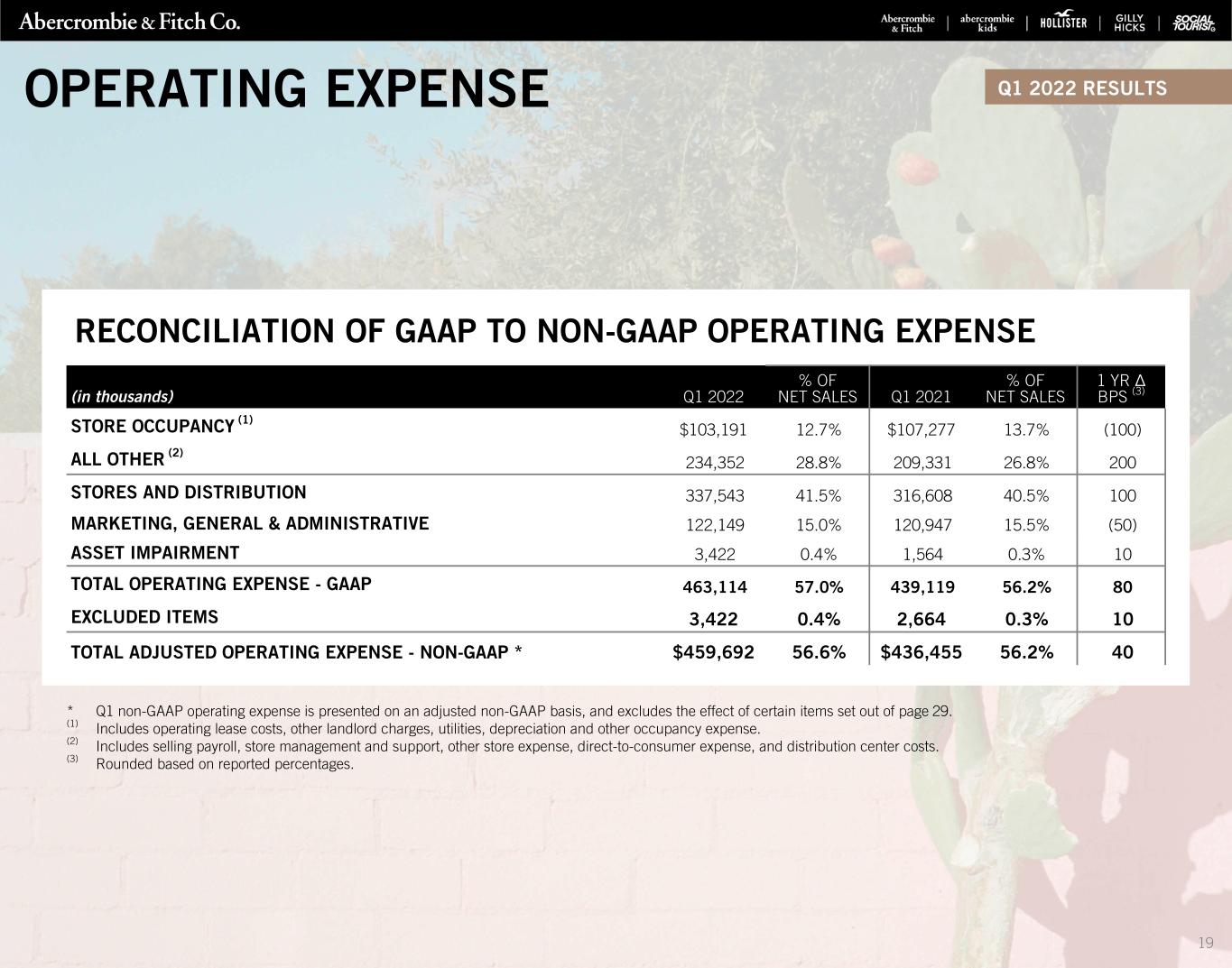

•Operating expense, excluding other operating income, net, was up 5% compared to last year. Approximately half of the increase was due to the lapping of COVID-related rent abatements and payroll credits last year, and the other half due to an increase in marketing and digital fulfillment expenses. Operating expense as a percentage of sales increased to 56.9% from 56.2% last year.

• Operating loss of $10 million and $6 million on a reported and adjusted non-GAAP basis, respectively, as compared to operating income of $57 million and $60 million last year, on a reported and adjusted non-GAAP basis, respectively.

•Net loss per diluted share of $0.32 and $0.27 on a reported and adjusted non-GAAP basis, respectively, as compared to net income per diluted share last year of $0.64 and $0.67 on a reported and adjusted non-GAAP basis, respectively

1

| Net Sales | ||

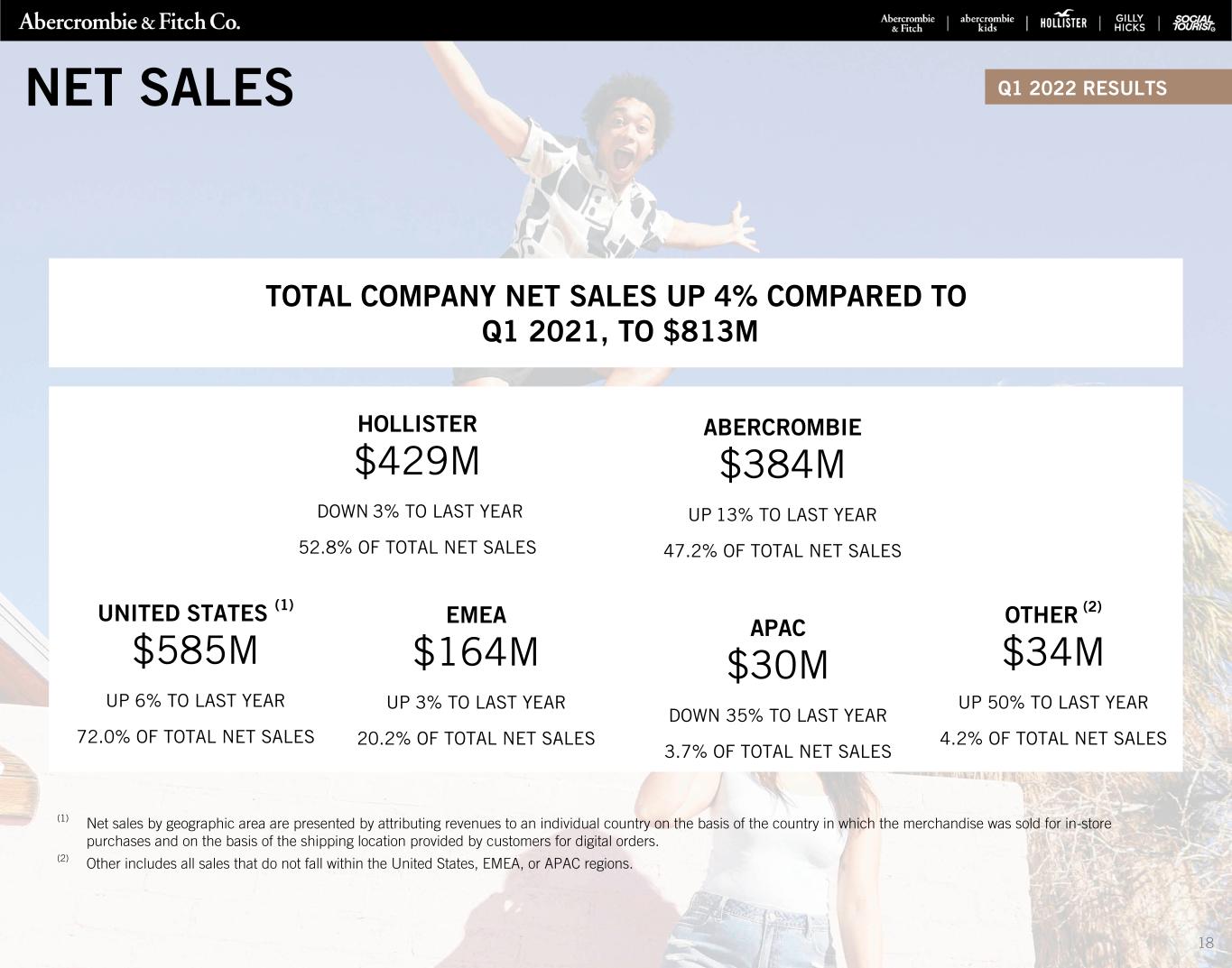

Net sales by brand and region for the first quarter are as follows:

| (in thousands) | 2022 | 2021 | 1 YR % Change | ||||||||||||||

| Net sales by brand: | |||||||||||||||||

Hollister (1) | $ | 428,834 | $ | 442,408 | (3)% | ||||||||||||

Abercrombie (2) | 383,928 | 338,997 | 13% | ||||||||||||||

| Total company | $ | 812,762 | $ | 781,405 | 4% | ||||||||||||

Net sales by region: (3) | 2022 | 2021 | 1 YR % Change | ||||||||||||||

| United States | $ | 585,106 | $ | 553,846 | 6% | ||||||||||||

| EMEA | 163,969 | 159,002 | 3% | ||||||||||||||

| APAC | 29,897 | 46,046 | (35)% | ||||||||||||||

Other (4) | 33,790 | 22,511 | 50% | ||||||||||||||

| International | $ | 227,656 | $ | 227,559 | 0% | ||||||||||||

| Total company | $ | 812,762 | $ | 781,405 | 4% | ||||||||||||

(1) Hollister includes the Hollister, Gilly Hicks and Social Tourist brands.

(2) Abercrombie includes the Abercrombie & Fitch and abercrombie kids brands.

(3) Net sales by geographic area are presented by attributing revenues to an individual country on the basis of the country in which the merchandise was sold for in-store purchases and on the basis of the shipping location provided by customers for digital orders.

(4) Other includes all sales that do not fall within the United States, EMEA, or APAC regions.

| Financial Position and Liquidity | ||

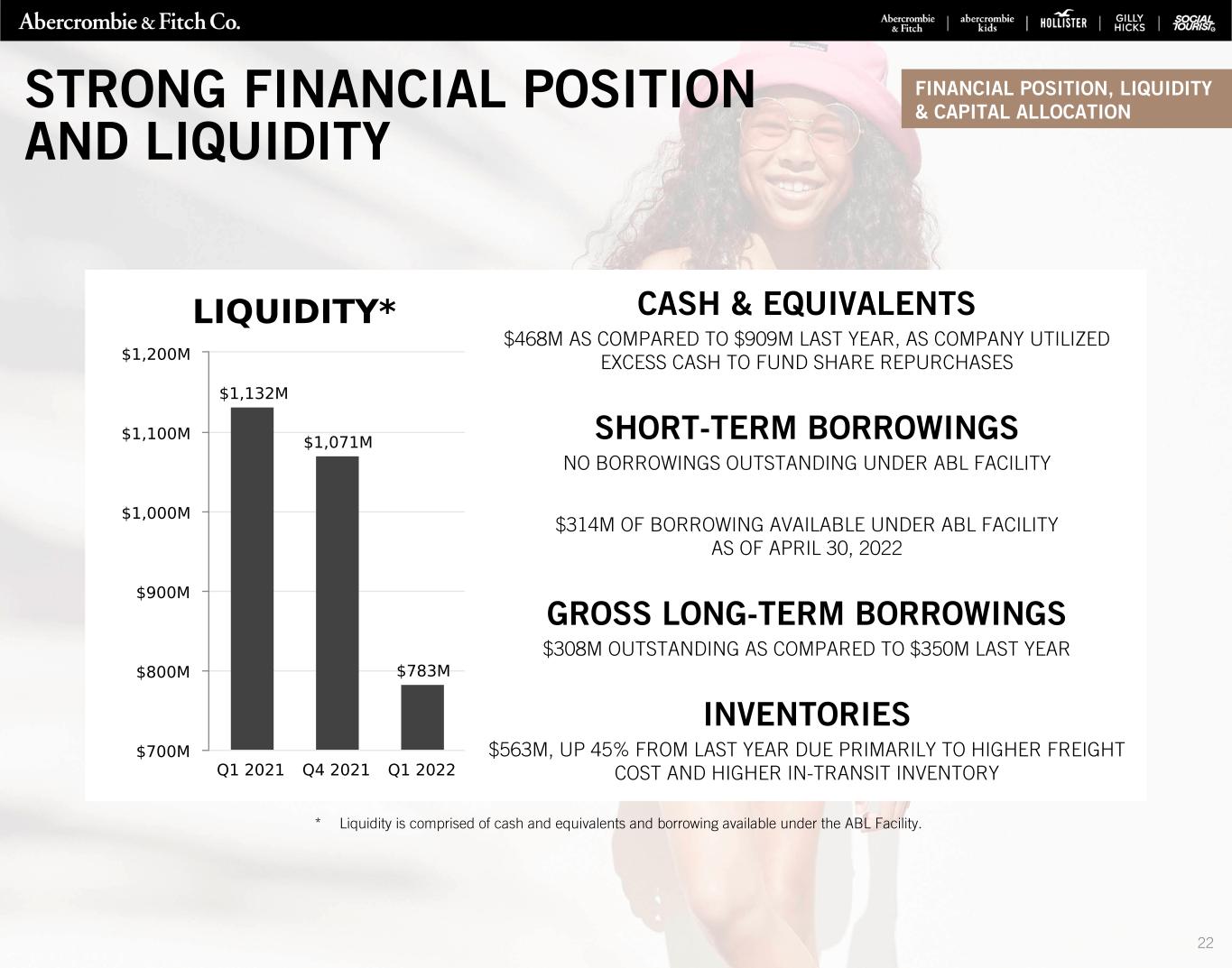

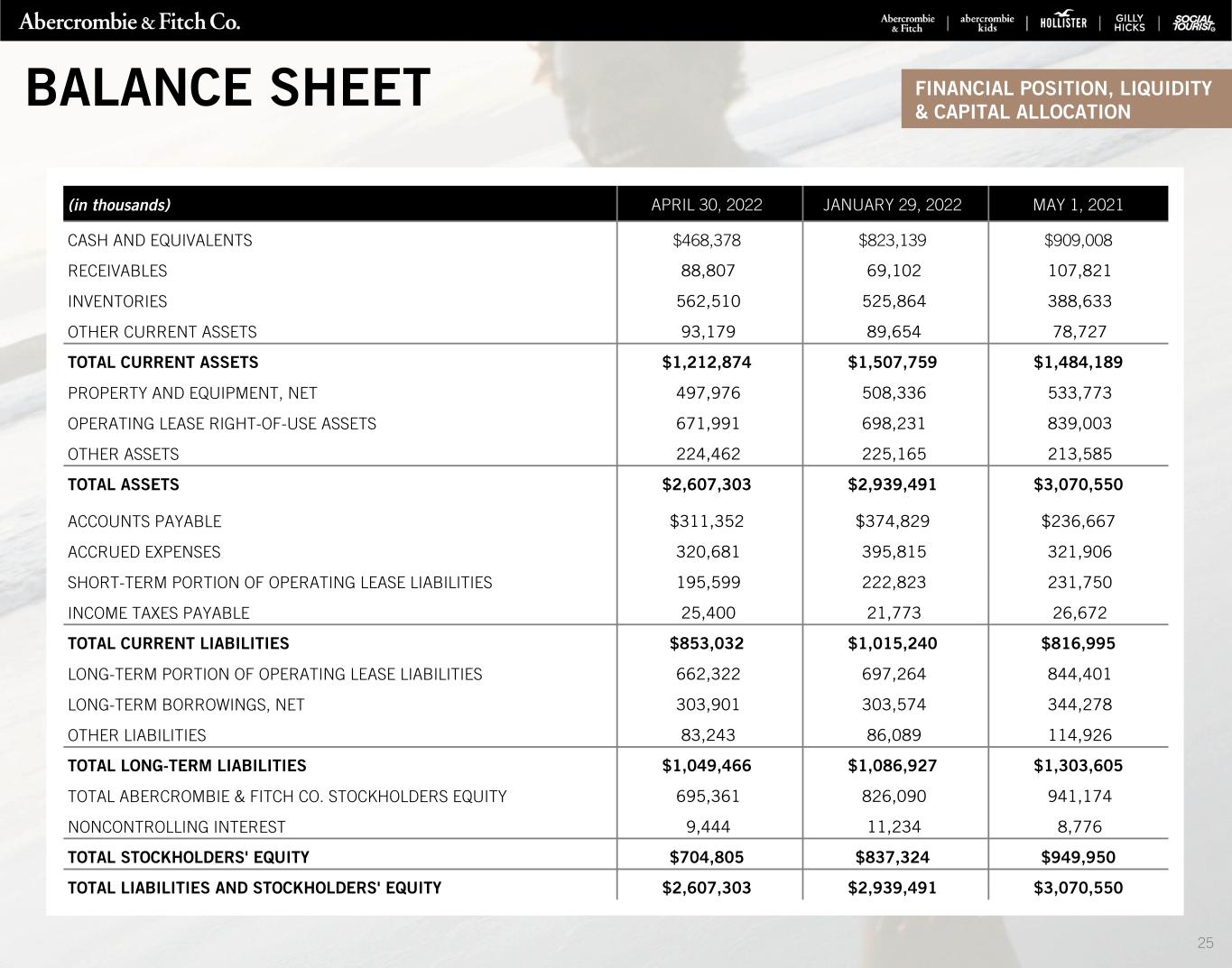

As of April 30, 2022 the company had:

•Cash and equivalents of $468 million. This compares to cash and equivalents of $823 million and $909 million as of January 29, 2022 and May 1, 2021, respectively.

•Inventories of $563 million, an increase of approximately 45% over last year due to increased in-transit inventory, higher units on hand, and increased average unit costs driven by freight compared to May 1, 2021.

•Long-term gross borrowings under the company’s senior secured notes of $308 million (the “Senior Secured Notes”) which mature in July 2025 and bear interest at a rate of 8.75% per annum.

•Borrowing available under the senior-secured asset-based revolving credit facility (the “ABL Facility”) of $314 million.

•Liquidity, comprised of cash and equivalents and borrowing available under the ABL Facility, of approximately $0.8 billion. This compares to liquidity of $1.1 billion and $1.1 billion as of January 29, 2022 and May 1, 2021, respectively.

Cash Flow and Capital Allocation | ||

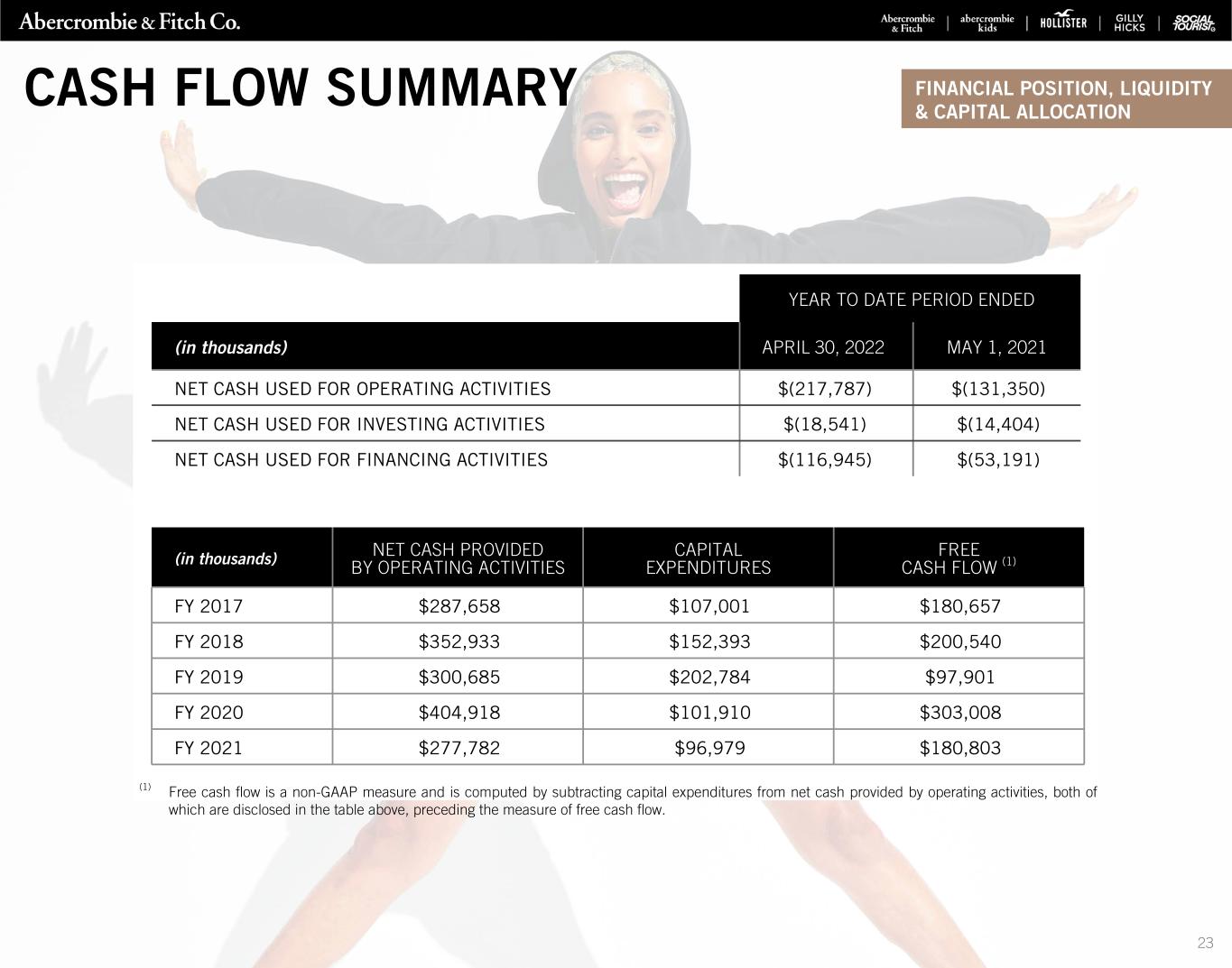

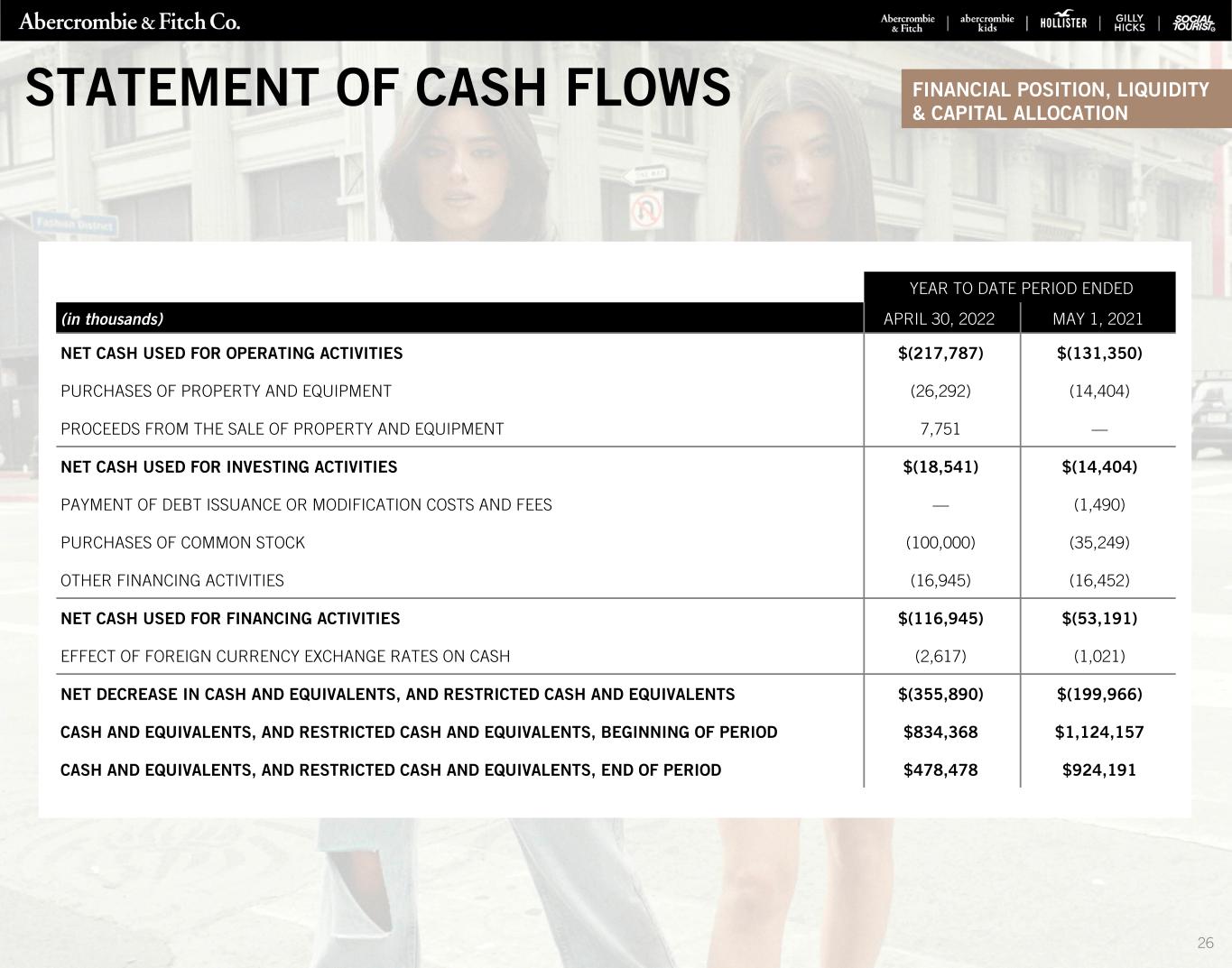

Details related to the company’s cash flows for the year-to-date period ended April 30, 2022 are as follows:

•Net cash used for operating activities of $218 million.

•Net cash used for investing activities of $19 million.

•Net cash used for financing activities of $117 million.

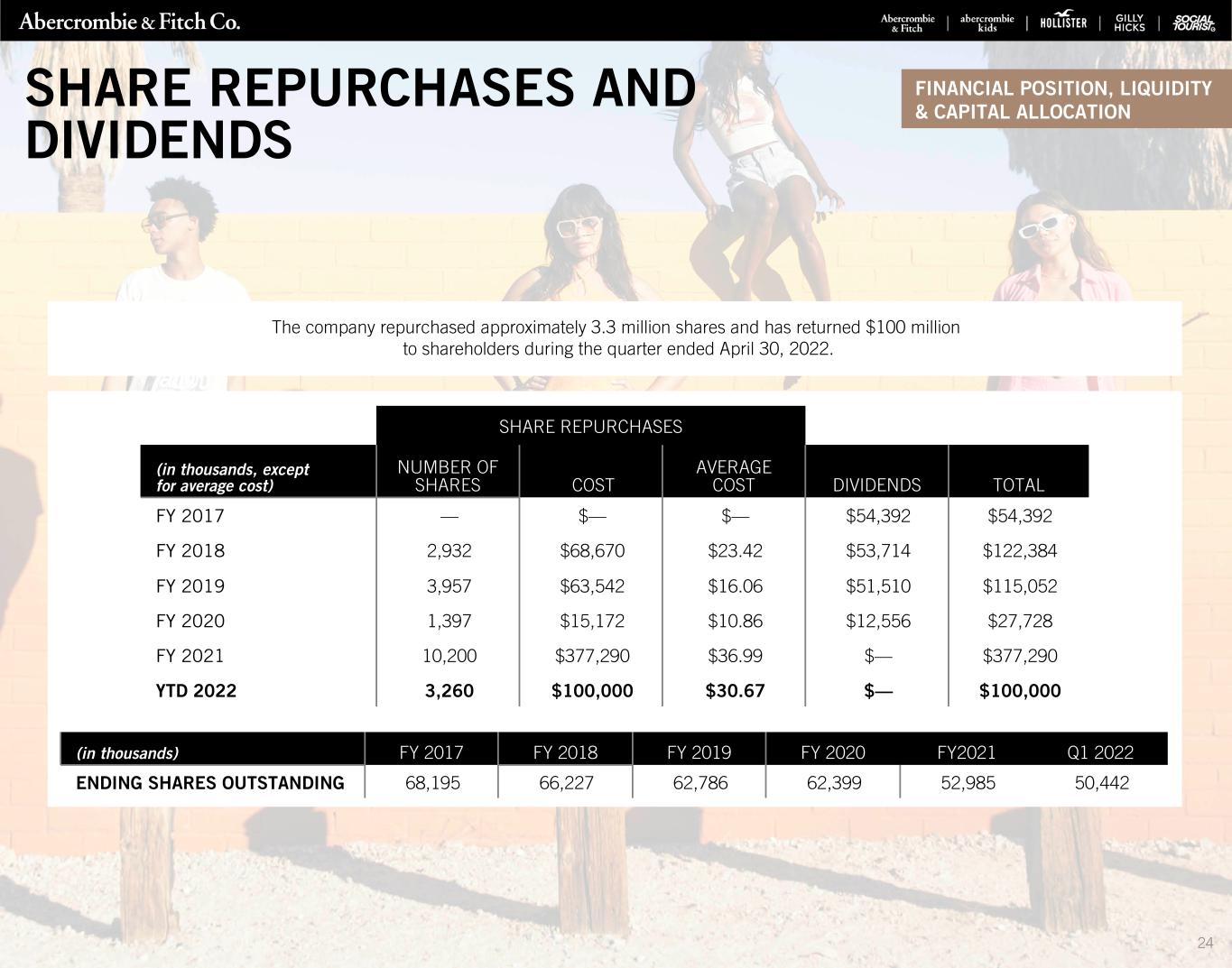

In the quarter, the company returned approximately $100 million to shareholders through the repurchase of approximately 3.3 million shares. The company has $258 million remaining on the share repurchase authorization established in November 2021.

Depreciation and amortization was $34 million for the year-to-date period ended April 30, 2022.

| Fiscal 2022 Full Year Outlook | ||

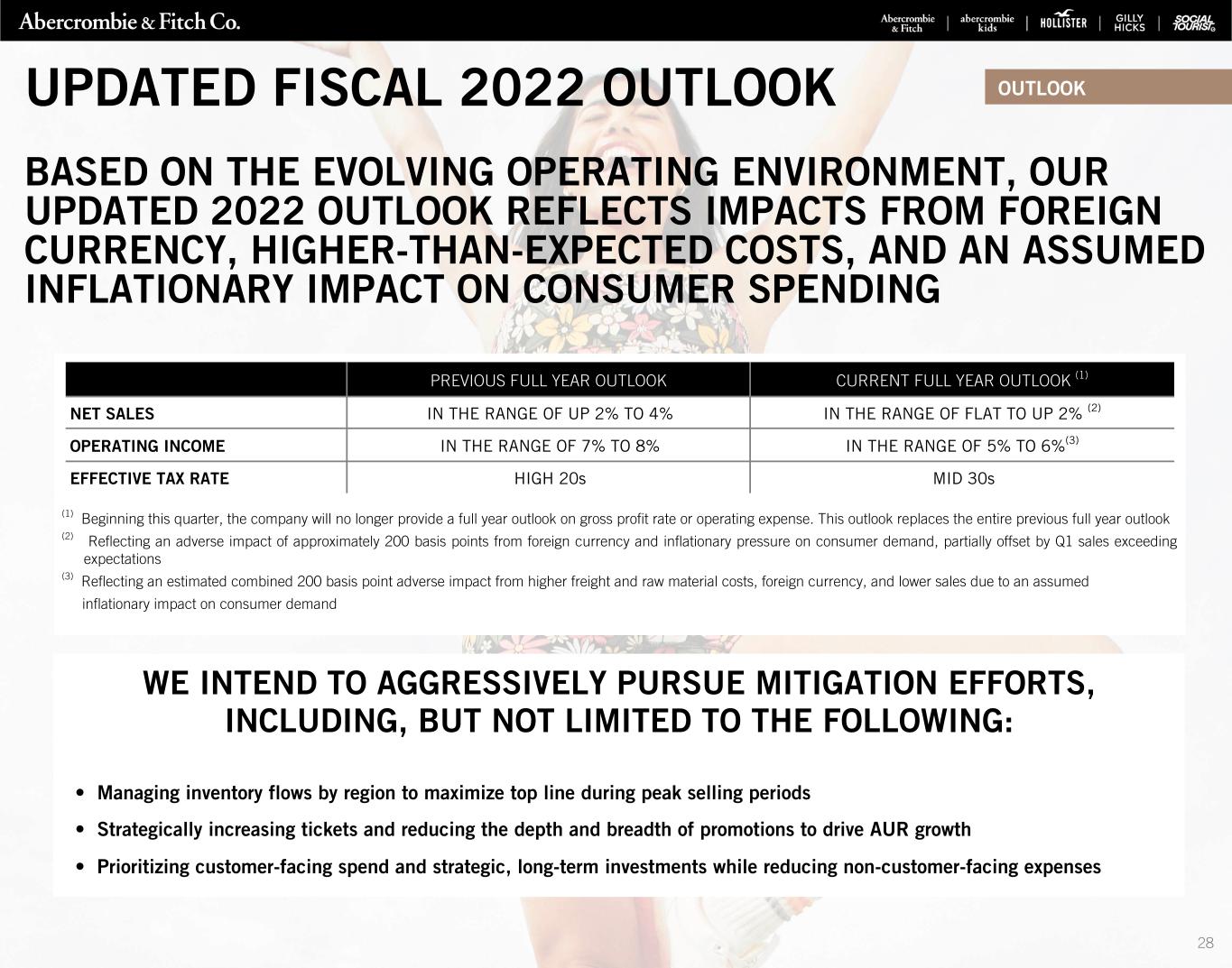

To more closely align with industry practices, and the company’s plans to flex operating expenses in response to volatility in freight and other costs, beginning this quarter, the company will no longer provide a full year outlook on gross profit rate or operating expense. The following outlook replaces all previous full year guidance. For fiscal 2022, the company now expects:

•Net sales to be flat to up 2% from $3.7 billion in 2021, down from previous outlook of up 2 to 4% driven by a combined 200 basis point adverse impact from foreign currency and an assumed inflationary impact on consumer demand, partially offset by higher-than-expected sales in Q1.

•Operating margin in the range of 5 to 6%, down from previous outlook of 7 to 8% reflecting a combined 200 basis point adverse impact from higher freight and raw material costs, foreign currency, and lower sales due to an assumed inflationary impact on consumer. Mitigating these factors will be actions to drive AUR growth, reduce certain expenses, and adjust inventory flows by region in response to current market forces.

•Effective tax rate to be in the mid-30s.

•Capital expenditures of approximately $150 million.

2

| Fiscal 2022 Second Quarter Outlook | ||

•Net sales to be down low-single-digits to fiscal second quarter 2021 level of $865 million, reflecting a combined, estimated adverse impact of approximately 300 basis points from foreign currency and COVID-related lockdowns in China and approximately 300 basis points due to an assumed impact of inflationary impact on consumer demand.

•Operating margin in the range of 3 to 4% with the year-over-year decline driven by higher freight and raw material costs.

•Effective tax rate to be in the mid-to-high 30s.

| Conference Call | ||

Today at 8:30 AM, ET, the company will conduct a conference call and provide additional details around its quarterly results and its outlook for the second quarter. To listen to the conference call, dial (800) 458-4121 or go to corporate.abercrombie.com. The international call-in number is (323) 794-2093. This call will be recorded and made available by dialing the replay number (888) 203-1112 or the international number (719) 457-0820 followed by the conference ID number 5209585 or through corporate.abercrombie.com. A presentation of first quarter results will be available in the “Investors” section at corporate.abercrombie.com at approximately 7:30 AM, ET, today.

| Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 | ||

A&F cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this Press Release or made by management or spokespeople of A&F involve risks and uncertainties and are subject to change based on various important factors, many of which may be beyond the company’s control. Words such as “estimate,” “project,” “plan,” “believe,” “expect,” “anticipate,” “intend,” “should,” “are confident,” and similar expressions may identify forward-looking statements. Except as may be required by applicable law, we undertake no obligation to publicly update or revise any forward-looking statements. The following factors, in addition to those disclosed in “ITEM 1A. RISK FACTORS” of A&F’s Annual Report on Form 10-K for the fiscal year ended January 29, 2022, in some cases have affected, and in the future could affect, A&F’s financial performance and could cause actual results for fiscal 2022 and beyond to differ materially from those expressed or implied in any of the forward-looking statements included in this Press Release or otherwise made by management: COVID‐19 has and may continue to materially adversely impact and cause disruption to our business; changes in global economic and financial conditions, and the resulting impact on consumer confidence and consumer spending, as well as other changes in consumer discretionary spending habits could have a material adverse impact on our business; failure to engage our customers, anticipate customer demand and changing fashion trends, and manage our inventory commensurately could have a material adverse impact on our business; our failure to operate effectively in a highly competitive and constantly evolving industry could have a material adverse impact on our business; fluctuations in foreign currency exchange rates could have a material adverse impact on our business; recent inflationary pressures and global supply chain constraints could continue to affect freight and other costs and could have a material adverse impact on our business; our ability to attract customers to our stores depends, in part, on the success of the shopping malls or area attractions that our stores are located in or around; the impact of geopolitical conflict, including the on-going hostilities in Ukraine, acts of terrorism, mass casualty events, social unrest, civil disturbance or disobedience could have a material adverse impact on our business; the impact of extreme weather, infectious disease outbreaks, including COVID-19, and other unexpected events could result in an interruption to our business, as well as to the operations of our third-party partners, and have a material adverse impact on our business; failure to successfully develop an omnichannel shopping experience, a significant component of our growth strategy, or failure to successfully invest in customer, digital and omnichannel initiatives could have a material adverse impact on our business; our failure to optimize our global store network could have a material adverse impact on our business; our failure to execute our international growth strategy successfully and inability to conduct business in international markets as a result of legal, tax, regulatory, political and economic risks could have a material adverse impact on our business; our failure to appropriately address emerging environmental, social and governance (“ESG”) matters, including the perceived adequacy of our responses to new laws and regulations relating to ESG, could have a material adverse impact on our reputation and, as a result, our business; failure to protect our reputation could have a material adverse impact on our business; if our information technology systems are disrupted or cease to operate effectively, it could have a material adverse impact on our business; we may be exposed to risks and costs associated with cyber-attacks, state-sponsored cyberthreats, data protection, credit card fraud and identity theft that could have a material adverse impact on our business; our reliance on our distribution centers makes us susceptible to disruptions or adverse conditions affecting our supply chain; Trade relations and changes in the cost, availability and quality of raw materials, labor, and transportation could have a material adverse impact on our business; we depend upon independent third parties for the manufacture and delivery of all our merchandise, and a disruption of the manufacture or delivery of our merchandise could have a material adverse impact on our business; we rely on the experience and skills of our executive officers and associates, and the failure to attract or retain this talent, effectively manage succession, and establish a diverse workforce could have a material adverse impact on our business; in the past, we have identified a material weakness in our internal control over financial reporting and may identify additional material weaknesses in the future. If we fail to establish and maintain effective internal control over financial reporting, our ability to accurately and timely report our financial results could be adversely affected; fluctuations in our tax obligations and effective tax rate may result in volatility in our results of operations could have a material adverse impact on our business; our litigation exposure, or any securities litigation and any potential stockholder activism, could have a material adverse impact on our business; failure to adequately protect our trademarks could have a negative impact on our brand image and limit our ability to penetrate new markets which could have a material adverse

3

impact on our business; changes in the regulatory or compliance landscape could have a material adverse impact on our business; and the agreements related to our senior secured asset-based revolving credit facility and our senior secured notes include restrictive covenants that limit our flexibility in operating our business and our inability to obtain credit on reasonable terms in the future could have an adverse impact on our business.

| Other Information | ||

This document includes certain adjusted non-GAAP financial measures where management believes it to be helpful in understanding the Company's results of operations or financial position. Additional details about non-GAAP financial measures and a reconciliation of GAAP financial measures to non-GAAP financial measures can be found in the "Reporting and Use of GAAP and Non-GAAP Measures" section. As used in the presentation, "Hollister" refers to the company's Hollister, Gilly Hicks, and Social Tourist brands and "Abercrombie" refers to the company's Abercrombie & Fitch and abercrombie kids brands. Sub-totals and totals may not foot due to rounding. Net income (loss) and net income (loss) per share financial measures included herein are attributable to Abercrombie & Fitch Co., excluding net income attributable to noncontrolling interests.

| About Abercrombie & Fitch Co. | ||

Abercrombie & Fitch Co. (NYSE: ANF) is a leading, global, omnichannel specialty retailer of apparel and accessories for men, women and kids through five renowned brands. The iconic Abercrombie & Fitch brand was born in 1892 and aims to make every day feel as exceptional as the start of a long weekend. abercrombie kids sees the world through kids’ eyes, where play is life and every day is an opportunity to be anything and better anything. The Hollister brand believes in liberating the spirit of an endless summer inside everyone and making teens feel celebrated and comfortable in their own skin. Gilly Hicks, offering intimates, loungewear and sleepwear, is designed to give all Gen Z customers their daily dose of happy. Social Tourist, the creative vision of Hollister and social media personalities, Dixie and Charli D’Amelio, offers trend forward apparel that allows teens to experiment with their style, while exploring the duality of who they are both on social media and in real life.

The brands share a commitment to offering products of enduring quality and exceptional comfort that allow consumers around the world to express their own individuality and style. Abercrombie & Fitch Co. operates approximately 730 stores under these brands across North America, Europe, Asia and the Middle East, as well as the e-commerce sites www.abercrombie.com, www.abercrombiekids.com, www.hollisterco.com, www.gillyhicks.com and www.socialtourist.com.

| Investor Contact: | Media Contact: | |||||||

| Pamela Quintiliano | Mackenzie Gusweiler | |||||||

| Abercrombie & Fitch Co. | Abercrombie & Fitch Co. | |||||||

| (614) 283-6751 | (614) 283-6192 | |||||||

| Investor_Relations@anfcorp.com | Public_Relations@anfcorp.com | |||||||

4

| Abercrombie & Fitch Co. | |||||||||||||||||||||||

| Condensed Consolidated Statements of Operations | |||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||

| Thirteen Weeks Ended | Thirteen Weeks Ended | ||||||||||||||||||||||

| April 30, 2022 | % of Net Sales | May 1, 2021 | % of Net Sales | ||||||||||||||||||||

| Net sales | $ | 812,762 | 100.0 | % | $ | 781,405 | 100.0 | % | |||||||||||||||

| Cost of sales, exclusive of depreciation and amortization | 363,216 | 44.7 | % | 286,271 | 36.6 | % | |||||||||||||||||

| Gross profit | 449,546 | 55.3 | % | 495,134 | 63.4 | % | |||||||||||||||||

| Stores and distribution expense | 337,543 | 41.5 | % | 316,608 | 40.5 | % | |||||||||||||||||

| Marketing, general and administrative expense | 122,149 | 15.0 | % | 120,947 | 15.5 | % | |||||||||||||||||

| Flagship store exit benefits | — | 0.0 | % | (1,100) | (0.1) | % | |||||||||||||||||

| Asset impairment | 3,422 | 0.4 | % | 2,664 | 0.3 | % | |||||||||||||||||

| Other operating income, net | (3,842) | (0.5) | % | (1,418) | (0.2) | % | |||||||||||||||||

| Operating (loss) income | (9,726) | (1.2) | % | 57,433 | 7.3 | % | |||||||||||||||||

| Other expense, net | 7,307 | 0.9 | % | 8,606 | 1.1 | % | |||||||||||||||||

| (Loss) income before income taxes | (17,033) | (2.1) | % | 48,827 | 6.2 | % | |||||||||||||||||

| Income tax (benefit) expense | (2,187) | (0.3) | % | 6,121 | 0.8 | % | |||||||||||||||||

| Net (loss) income | (14,846) | (1.8) | % | 42,706 | 5.5 | % | |||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 1,623 | 0.2 | % | 938 | 0.1 | % | |||||||||||||||||

| Net (loss) income attributable to A&F | $ | (16,469) | (2.0) | % | $ | 41,768 | 5.3 | % | |||||||||||||||

| Net (loss) income per share attributable to A&F | |||||||||||||||||||||||

| Basic | $ | (0.32) | $ | 0.67 | |||||||||||||||||||

| Diluted | $ | (0.32) | $ | 0.64 | |||||||||||||||||||

| Weighted-average shares outstanding: | |||||||||||||||||||||||

| Basic | 52,077 | 62,380 | |||||||||||||||||||||

| Diluted | 52,077 | 65,305 | |||||||||||||||||||||

5

Reporting and Use of GAAP and Non-GAAP Measures

The company believes that each of the non-GAAP financial measures presented are useful to investors as they provide a measure of the company’s operating performance excluding the effect of certain items which the company believes do not reflect its future operating outlook, such as asset impairment charges, therefore supplementing investors’ understanding of comparability of operations across periods. Management used these non-GAAP financial measures during the periods presented to assess the company’s performance and to develop expectations for future operating performance. Non-GAAP financial measures should be used supplemental to, and not as an alternative to, the company’s GAAP financial results, and may not be calculated in the same manner as similar measures presented by other companies.

In addition, at times the company provides comparable sales, defined as the percentage year-over-year change in the aggregate of: (1) sales for stores that have been open as the same brand at least one year and whose square footage has not been expanded or reduced by more than 20% within the past year, with prior year’s net sales converted at the current year’s foreign currency exchange rate to remove the impact of foreign currency rate fluctuation, and (2) digital net sales with prior year’s net sales converted at the current year’s foreign currency exchange rate to remove the impact of foreign currency rate fluctuation.

The company also provides certain financial information on a constant currency basis to enhance investors’ understanding of underlying business trends and operating performance, by removing the impact of foreign currency exchange rate fluctuations. The effect from foreign currency, calculated on a constant currency basis, is determined by applying current year average exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share effect from foreign currency is calculated using a 26% tax rate.

| Abercrombie & Fitch Co. | |||||||||||||||||

| Schedule of Non-GAAP Financial Measures | |||||||||||||||||

| Thirteen Weeks Ended April 30, 2022 | |||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||

| (Unaudited) | |||||||||||||||||

GAAP (1) | Excluded items | Adjusted non-GAAP | |||||||||||||||

Asset impairment, exclusive of flagship store exit charges (2) | $ | 3,422 | $ | 3,422 | $ | — | |||||||||||

| Operating loss | (9,726) | (3,422) | (6,304) | ||||||||||||||

| Loss before income taxes | (17,033) | (3,422) | (13,611) | ||||||||||||||

Income tax benefit (3) | (2,187) | (918) | (1,269) | ||||||||||||||

| Net loss attributable to Abercrombie & Fitch Co. | $ | (16,469) | $ | (2,504) | $ | (13,965) | |||||||||||

| Net loss per diluted share attributable to Abercrombie & Fitch Co. | $ | (0.32) | $ | (0.05) | $ | (0.27) | |||||||||||

| Diluted weighted-average shares outstanding: | 52,077 | 52,077 | |||||||||||||||

(1) “GAAP” refers to accounting principles generally accepted in the United States of America.

(2) Excluded items consist of pre-tax store asset impairment charges of $3.4 million.

(3) The tax effect of excluded items is the difference between the tax provision calculated on a GAAP basis and an adjusted non-GAAP basis.

6

| Abercrombie & Fitch Co. | |||||||||||||||||

| Schedule of Non-GAAP Financial Measures | |||||||||||||||||

| Thirteen Weeks Ended May 1, 2021 | |||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||

| (Unaudited) | |||||||||||||||||

GAAP (1) | Excluded items | Adjusted non-GAAP | |||||||||||||||

Asset impairment, exclusive of flagship store exit charges (2) | $ | 2,664 | $ | 2,664 | $ | — | |||||||||||

| Operating income | 57,433 | (2,664) | 60,097 | ||||||||||||||

| Income before income taxes | 48,827 | (2,664) | 51,491 | ||||||||||||||

Income tax expense (3) | 6,121 | (449) | 6,570 | ||||||||||||||

| Net income attributable to Abercrombie & Fitch Co. | $ | 41,768 | $ | (2,215) | $ | 43,983 | |||||||||||

| Net income per diluted share attributable to Abercrombie & Fitch Co. | $ | 0.64 | $ | (0.03) | $ | 0.67 | |||||||||||

| Diluted weighted-average shares outstanding: | 65,305 | 65,305 | |||||||||||||||

(1) “GAAP” refers to accounting principles generally accepted in the United States of America.

(2) Excluded items consist of pre-tax store asset impairment charges of $2.7 million.

(3) The tax effect of excluded items is the difference between the tax provision calculated on a GAAP basis and an adjusted non-GAAP basis.

7

| Abercrombie & Fitch Co. | |||||||||||||||||

| Reconciliation of Constant Currency Financial Measures | |||||||||||||||||

| Thirteen Weeks Ended April 30, 2022 | |||||||||||||||||

| (in thousands, except percentage and basis point changes and per share data) | |||||||||||||||||

| (Unaudited) | |||||||||||||||||

| 2022 | 2021 | % Change | |||||||||||||||

| Net sales | |||||||||||||||||

GAAP (1) | $ | 812,762 | $ | 781,405 | 4% | ||||||||||||

Impact from changes in foreign currency exchange rates (2) | — | (8,529) | 1% | ||||||||||||||

| Net sales on a constant currency basis | $ | 812,762 | $ | 772,876 | 5% | ||||||||||||

| Gross profit | 2022 | 2021 | BPS Change (3) | ||||||||||||||

GAAP (1) | $ | 449,546 | $ | 495,134 | (810) | ||||||||||||

Impact from changes in foreign currency exchange rates (2) | — | (3,283) | (20) | ||||||||||||||

| Gross profit on a constant currency basis | $ | 449,546 | $ | 491,851 | (830) | ||||||||||||

| Operating (loss) income | 2022 | 2021 | BPS Change (3) | ||||||||||||||

GAAP (1) | $ | (9,726) | $ | 57,433 | (850) | ||||||||||||

Excluded items (4) | (3,422) | (2,664) | (10) | ||||||||||||||

| Adjusted non-GAAP | $ | (6,304) | $ | 60,097 | (860) | ||||||||||||

Impact from changes in foreign currency exchange rates (2) | — | 4,341 | (50) | ||||||||||||||

| Adjusted non-GAAP constant currency basis | $ | (6,304) | $ | 64,438 | (910) | ||||||||||||

| Net income (loss) per diluted share attributable to Abercrombie & Fitch Co. | 2022 | 2021 | $ Change | ||||||||||||||

GAAP (1) | $ | (0.32) | $ | 0.64 | $(0.96) | ||||||||||||

Excluded items, net of tax (4) | (0.05) | (0.03) | (0.02) | ||||||||||||||

| Adjusted non-GAAP | $ | (0.27) | $ | 0.67 | $(0.94) | ||||||||||||

Impact from changes in foreign currency exchange rates (2) | — | 0.05 | (0.05) | ||||||||||||||

| Adjusted non-GAAP constant currency basis | $ | (0.27) | $ | 0.72 | $(0.99) | ||||||||||||

(1) “GAAP” refers to accounting principles generally accepted in the United States of America.

(2) The estimated impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share estimated impact from foreign currency is calculated using a 26% tax rate.

(3) The estimated basis point change has been rounded based on the percentage change.

(4) Excluded items consist of pre-tax store asset impairment charges of $3.4 million and $2.7 million for the current year and prior year, respectively.

8

| Abercrombie & Fitch Co. | |||||||||||||||||

| Condensed Consolidated Balance Sheets | |||||||||||||||||

| (in thousands) | |||||||||||||||||

| (Unaudited) | |||||||||||||||||

| April 30, 2022 | January 29, 2022 | May 1, 2021 | |||||||||||||||

| Assets | |||||||||||||||||

| Current assets: | |||||||||||||||||

| Cash and equivalents | $ | 468,378 | $ | 823,139 | $ | 909,008 | |||||||||||

| Receivables | 88,807 | 69,102 | 107,821 | ||||||||||||||

| Inventories | 562,510 | 525,864 | 388,633 | ||||||||||||||

| Other current assets | 93,179 | 89,654 | 78,727 | ||||||||||||||

| Total current assets | 1,212,874 | 1,507,759 | 1,484,189 | ||||||||||||||

| Property and equipment, net | 497,976 | 508,336 | 533,773 | ||||||||||||||

| Operating lease right-of-use assets | 671,991 | 698,231 | 839,003 | ||||||||||||||

| Other assets | 224,462 | 225,165 | 213,585 | ||||||||||||||

| Total assets | $ | 2,607,303 | $ | 2,939,491 | $ | 3,070,550 | |||||||||||

| Liabilities and stockholders’ equity | |||||||||||||||||

| Current liabilities: | |||||||||||||||||

| Accounts payable | $ | 311,352 | $ | 374,829 | $ | 236,667 | |||||||||||

| Accrued expenses | 320,681 | 395,815 | 321,906 | ||||||||||||||

| Short-term portion of operating lease liabilities | 195,599 | 222,823 | 231,750 | ||||||||||||||

| Income taxes payable | 25,400 | 21,773 | 26,672 | ||||||||||||||

| Total current liabilities | 853,032 | 1,015,240 | 816,995 | ||||||||||||||

| Long-term liabilities: | |||||||||||||||||

| Long-term portion of operating lease liabilities | $ | 662,322 | $ | 697,264 | $ | 844,401 | |||||||||||

| Long-term borrowings, net | 303,901 | 303,574 | 344,278 | ||||||||||||||

| Other liabilities | 83,243 | 86,089 | 114,926 | ||||||||||||||

| Total long-term liabilities | 1,049,466 | 1,086,927 | 1,303,605 | ||||||||||||||

| Total Abercrombie & Fitch Co. stockholders’ equity | 695,361 | 826,090 | 941,174 | ||||||||||||||

| Noncontrolling interests | 9,444 | 11,234 | 8,776 | ||||||||||||||

| Total stockholders’ equity | 704,805 | 837,324 | 949,950 | ||||||||||||||

| Total liabilities and stockholders’ equity | $ | 2,607,303 | $ | 2,939,491 | $ | 3,070,550 | |||||||||||

9

| Abercrombie & Fitch Co. | |||||||||||

| Condensed Consolidated Statements of Cash Flows | |||||||||||

| (in thousands, except per share data) | |||||||||||

| (Unaudited) | |||||||||||

| Thirteen Weeks Ended | |||||||||||

| April 30, 2022 | May 1, 2021 | ||||||||||

| Operating activities | |||||||||||

| Net cash used for operating activities | $ | (217,787) | $ | (131,350) | |||||||

| Investing activities | |||||||||||

| Purchases of property and equipment | $ | (26,292) | $ | (14,404) | |||||||

| Proceeds from sale of property and equipment | 7,751 | — | |||||||||

| Net cash used for investing activities | $ | (18,541) | $ | (14,404) | |||||||

| Financing activities | |||||||||||

| Payment of debt issuance or modification costs and fees | — | (1,490) | |||||||||

| Purchases of common stock | (100,000) | (35,249) | |||||||||

| Other financing activities | (16,945) | (16,452) | |||||||||

| Net cash used for financing activities | $ | (116,945) | $ | (53,191) | |||||||

| Effect of foreign currency exchange rates on cash | $ | (2,617) | $ | (1,021) | |||||||

| Net decrease in cash and equivalents, and restricted cash and equivalents | $ | (355,890) | $ | (199,966) | |||||||

| Cash and equivalents, and restricted cash and equivalents, beginning of period | $ | 834,368 | $ | 1,124,157 | |||||||

| Cash and equivalents, and restricted cash and equivalents, end of period | $ | 478,478 | $ | 924,191 | |||||||

10

Abercrombie & Fitch Co.

Store Count

| Thirteen Weeks Ended April 30, 2022 | |||||||||||||||||||||||||||||||||||||||||

Hollister (1) | Abercrombie (2) | Total Company (3) | |||||||||||||||||||||||||||||||||||||||

| United States | International | United States | International | United States | International | Total | |||||||||||||||||||||||||||||||||||

| January 29, 2022 | 351 | 154 | 173 | 51 | 524 | 205 | 729 | ||||||||||||||||||||||||||||||||||

| New | 1 | 2 | 1 | — | 2 | 2 | 4 | ||||||||||||||||||||||||||||||||||

| Permanently closed | — | — | (3) | (2) | (3) | (2) | (5) | ||||||||||||||||||||||||||||||||||

| April 30, 2022 | 352 | 156 | 171 | 49 | 523 | 205 | 728 | ||||||||||||||||||||||||||||||||||

(1)Hollister includes the company’s Hollister and Gilly Hicks brands. Locations with Gilly Hicks carveouts within Hollister stores are represented as a single store count. Excludes 9 international franchise stores as of April 30, 2022, and January 29, 2022. Excludes 13 Company-operated temporary stores as of April 30, 2022 and 14 Company-operated temporary stores January 29, 2022.

(2)Abercrombie includes the company's Abercrombie & Fitch and abercrombie kids brands. Locations with abercrombie kids carveouts within Abercrombie & Fitch stores are represented as a single store count. Excludes 14 international franchise stores as of April 30, 2022 and January 29, 2022. Excludes 5 Company-operated temporary stores as of each of April 30, 2022 and January 29, 2022.

(3)This store count excludes one international third-party operated multi-brand outlet store as of each of April 30, 2022, January 29, 2022, and January 29, 2022.

11

| Abercrombie & Fitch Co. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Information | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands, except per share data, store data, and comparable sales data) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fiscal 2021 | Fiscal 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2019 | 2020 | Q1 | Q2 | Q3 | Q4 | 2021 | Q1 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales | $ | 3,590,109 | $ | 3,623,073 | $ | 3,125,384 | $ | 781,405 | $ | 864,850 | $ | 905,160 | $ | 1,161,353 | $ | 3,712,768 | $ | 812,762 | $ | 812,762 | ||||||||||||||||||||||||||||||||||||||||||

| Cost of sales, exclusive of depreciation and amortization | 1,430,193 | 1,472,155 | 1,234,179 | 286,271 | 301,365 | 328,916 | 484,221 | 1,400,773 | 363,216 | 363,216 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross profit | 2,159,916 | 2,150,918 | 1,891,205 | 495,134 | 563,485 | 576,244 | 677,132 | 2,311,995 | 449,546 | 449,546 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stores and distribution expense | 1,536,216 | 1,551,243 | 1,391,584 | 316,608 | 325,935 | 351,804 | 435,129 | 1,429,476 | 337,543 | 337,543 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marketing, general and administrative expense | 484,863 | 464,615 | 463,843 | 120,947 | 123,913 | 146,269 | 145,686 | 536,815 | 122,149 | 122,149 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Flagship store exit charges (benefits) | 5,806 | 47,257 | (11,636) | (1,100) | (88) | 11 | 24 | (1,153) | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset impairment, exclusive of flagship store exit charges | 11,580 | 19,135 | 72,937 | 2,664 | 786 | 6,749 | 1,901 | 12,100 | 3,422 | 3,422 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other operating (income) loss, net | (5,915) | (1,400) | (5,054) | (1,418) | (1,848) | (1,320) | (3,741) | (8,327) | (3,842) | (3,842) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating income (loss) | 127,366 | 70,068 | (20,469) | 57,433 | 114,787 | 72,731 | 98,133 | 343,084 | (9,726) | (9,726) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense, net | 10,999 | 7,737 | 28,274 | 8,606 | 11,275 | 7,270 | 6,959 | 34,110 | 7,307 | 7,307 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income (loss) before income taxes | 116,367 | 62,331 | (48,743) | 48,827 | 103,512 | 65,461 | 91,174 | 308,974 | (17,033) | (17,033) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 37,559 | 17,371 | 60,211 | 6,121 | (6,944) | 16,383 | 23,348 | 38,908 | (2,187) | (2,187) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | 78,808 | 44,960 | (108,654) | 42,706 | 110,456 | 49,078 | 67,826 | 270,066 | (14,846) | (14,846) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 4,267 | 5,602 | 5,067 | 938 | 1,956 | 1,845 | 2,317 | 7,056 | 1,623 | 1,623 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) attributable to Abercrombie & Fitch Co. | $ | 74,541 | $ | 39,358 | $ | (114,021) | $ | 41,768 | $ | 108,500 | $ | 47,233 | $ | 65,509 | $ | 263,010 | $ | (16,469) | $ | (16,469) | ||||||||||||||||||||||||||||||||||||||||||

1

| Fiscal 2021 | Fiscal 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2019 | 2020 | Q1 | Q2 | Q3 | Q4 | 2021 | Q1 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) per share attributable to Abercrombie & Fitch Co.: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic | $ | 1.11 | $ | 0.61 | $ | (1.82) | $ | 0.67 | $ | 1.77 | $ | 0.80 | $ | 1.18 | $ | 4.41 | $ | (0.32) | $ | (0.32) | ||||||||||||||||||||||||||||||||||||||||||

| Diluted | $ | 1.08 | $ | 0.60 | $ | (1.82) | $ | 0.64 | $ | 1.69 | $ | 0.77 | $ | 1.12 | $ | 4.20 | $ | (0.32) | $ | (0.32) | ||||||||||||||||||||||||||||||||||||||||||

| Weighted-average shares outstanding: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic | 67,350 | 64,428 | 62,551 | 62,380 | 61,428 | 58,796 | 55,740 | 59,597 | 52,077 | 52,077 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted | 69,137 | 65,778 | 62,551 | 65,305 | 64,136 | 61,465 | 58,700 | 62,636 | 52,077 | 52,077 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Hollister comparable sales (1) (2) | 5 | % | (1) | % | Not provided | Not provided | Not provided | Not provided | Not provided | Not provided | Not provided | Not provided | ||||||||||||||||||||||||||||||||||||||||||||||||||

Abercrombie comparable sales (1) (3) | 1 | % | 3 | % | Not provided | Not provided | Not provided | Not provided | Not provided | Not provided | Not provided | Not provided | ||||||||||||||||||||||||||||||||||||||||||||||||||

Comparable sales (1) | 3 | % | 1 | % | Not provided | Not provided | Not provided | Not provided | Not provided | Not provided | Not provided | Not provided | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares outstanding | 66,227 | 62,786 | 62,399 | 61,935 | 59,692 | 57,037 | 52,985 | 52,985 | 50,442 | 50,442 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of stores - end of period | 861 | 857 | 735 | 731 | 733 | 735 | 729 | 729 | 728 | 728 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross square feet - end of period | 6,566 | 6,314 | 5,232 | 5,189 | 5,150 | 5,159 | 5,052 | 5,052 | 5,029 | 5,029 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) Comparable sales are calculated on a constant currency basis and exclude revenue other than store and online sales. The Company did not provide comparable sales results for fiscal 2020, fiscal 2021 or fiscal 2022 due to temporary store closures as a result of COVID-19. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Hollister includes the Company's Hollister, Gilly Hicks, and Social Tourist brands. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Abercrombie includes the Company's Abercrombie & Fitch and abercrombie kids brands. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2

INVESTOR PRESENTATION: FIRST QUARTER 2022

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 A&F cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this presentation or made by management or spokespeople of A&F involve risks and uncertainties and are subject to change based on various important factors, many of which may be beyond the company's control. Words such as "estimate," "project," "plan," "believe," "expect," "anticipate," "intend," "should," "are confident," and similar expressions may identify forward-looking statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise our forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. The following factors, in addition to those disclosed in "ITEM 1A. RISK FACTORS" of A&F's Annual Report on Form 10-K for the fiscal year ended January 29, 2022, could affect the company's financial performance and could cause actual results to differ materially from those expressed or implied in any of the forward-looking statements included in this presentation or otherwise made by management: the ongoing impact of COVID-19 to our business; changes in global economic and financial conditions and the resulting impact on consumer confidence and consumer spending; failure to anticipate customer demand and changing fashion trends and manage our inventory commensurately; failure to operate effectively in a highly competitive industry; the impact of government sanctions, conflict, war, social unrest, civil disturbance, or disobedience; failure to successfully develop and/or successfully invest in customer, digital, and omnichannel initiatives; failure to appropriately address emerging environmental, social, and governance matters; failure to protect our reputation; cyber- and data privacy-related risks; adverse conditions affecting our supply chain; or ability to attract or retain talent. OTHER INFORMATION The following presentation includes certain adjusted non-GAAP financial measures. Additional details about non-GAAP financial measures and a reconciliation of GAAP financial measures to non-GAAP financial measures is included in the Appendix to this presentation. As used in the presentation, "GAAP" refers to accounting principles generally accepted in the United States of America. References to "Hollister" include the company's Hollister, Gilly Hicks, and Social Tourist brands and references to "Abercrombie" includes the company's Abercrombie & Fitch and abercrombie kids brands. Sub-totals and totals may not foot due to rounding. Net income (loss) and net income (loss) per share financial measures included herein are attributable to Abercrombie & Fitch Co., excluding net income attributable to noncontrolling interests. 2

Safe Harbor and Other Information 2 Company Overview 4 Focus Areas 7 Digital Evolution 10 Global Store Network Optimization 12 Q1 2022 Results 15 Financial Position, Liquidity & Capital Allocation 21 Updated Fiscal 2022 Outlook 27 Appendix 29 TABLE OF CONTENTS

4 COMPANY OVERVIEW

The quintessential apparel brand of the global teen consumer, Hollister Co. believes in liberating the spirit of an endless summer inside everyone. At Hollister, summer isn’t just a season, it’s a state of mind. Hollister creates carefree style designed to make all teens feel celebrated and comfortable in their own skin, so they can live in a summer mindset all year long, whatever the season. At Gilly Hicks, we know everyone has their own unique happy place. We exist to help you find yours. Gilly Hicks focuses on underwear, loungewear and activewear designed to give all Gen Z customers their daily dose of happy. A global specialty retailer of quality, comfortable, made- to-play favorites, abercrombie kids sees the world through kids’ eyes, where play is life and every day is an opportunity to be anything and better everything. Social Tourist is the creative vision of Hollister, the teen brand liberating the spirit of an endless summer, and social media personalities Dixie and Charli D’Amelio. The lifestyle brand creates trend forward apparel that allows teens to experiment with their style, while exploring the duality of who they are both on social media and in real life. Abercrombie & Fitch believes that every day should feel as exceptional as the start of the long weekend. Since 1892, the brand has been a specialty retailer of quality apparel, outerwear and fragrance - designed to inspire our global customers to feel confident, be comfortable and face their Fierce. COMPANY OVERVIEWOUR FIVE GLOBAL BRANDS 5

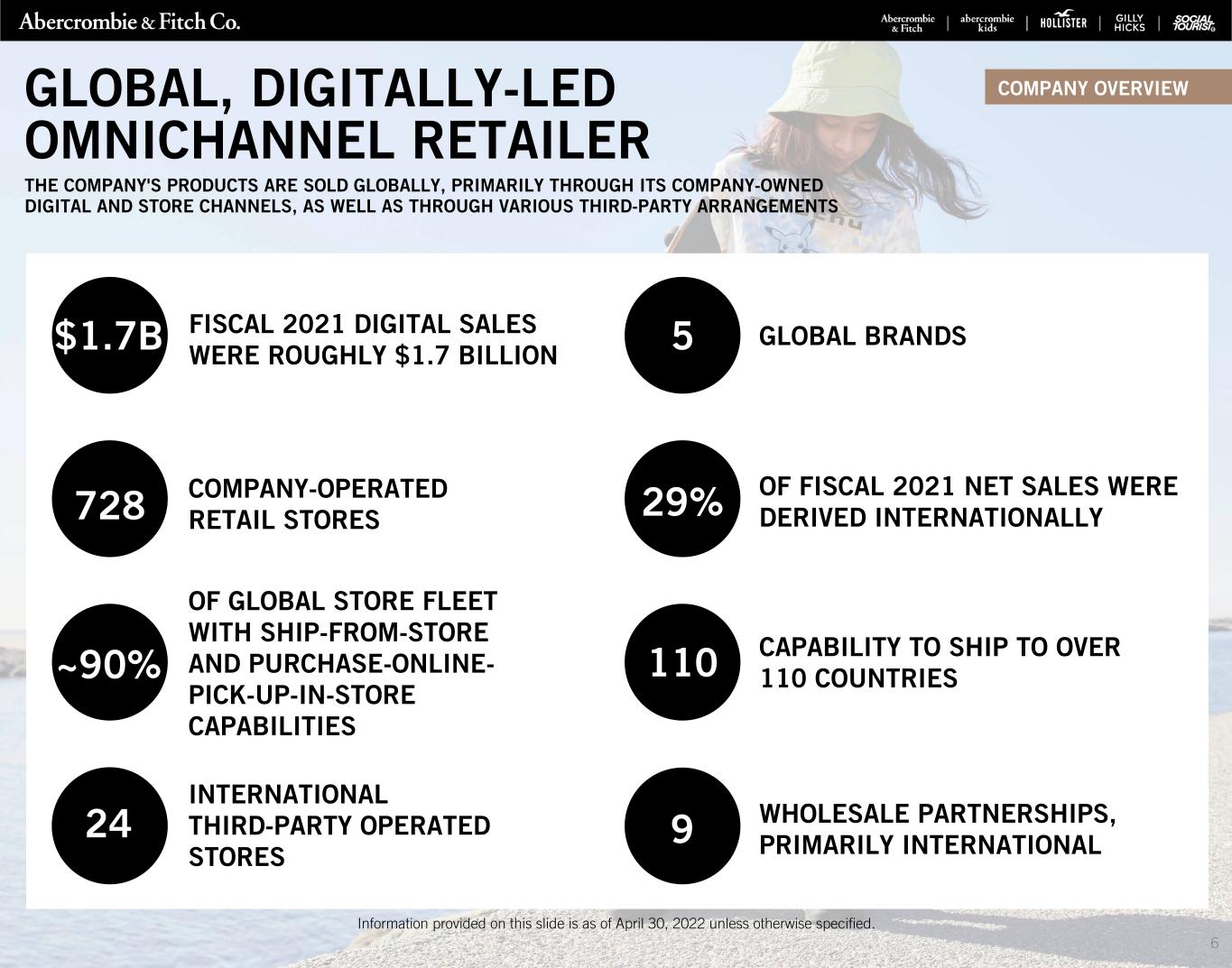

6 728 GLOBAL, DIGITALLY-LED OMNICHANNEL RETAILER COMPANY-OPERATED RETAIL STORES THE COMPANY'S PRODUCTS ARE SOLD GLOBALLY, PRIMARILY THROUGH ITS COMPANY-OWNED DIGITAL AND STORE CHANNELS, AS WELL AS THROUGH VARIOUS THIRD-PARTY ARRANGEMENTS CAPABILITY TO SHIP TO OVER 110 COUNTRIES GLOBAL BRANDS WHOLESALE PARTNERSHIPS, PRIMARILY INTERNATIONAL OF GLOBAL STORE FLEET WITH SHIP-FROM-STORE AND PURCHASE-ONLINE- PICK-UP-IN-STORE CAPABILITIES OF FISCAL 2021 NET SALES WERE DERIVED INTERNATIONALLY FISCAL 2021 DIGITAL SALES WERE ROUGHLY $1.7 BILLION Information provided on this slide is as of April 30, 2022 unless otherwise specified. $1.7B COMPANY OVERVIEW ~90% INTERNATIONAL THIRD-PARTY OPERATED STORES 5 29% 110 924

FOCUS AREAS 7

OUR PREVIOUSLY-STATED TRANSFORMATION INITIATIVES OPTIMIZING OUR GLOBAL STORE NETWORK • Rightsizing store fleet and adapting to the evolving role of the store as customers' shopping preferences shift ENHANCING DIGITAL AND OMNICHANNEL CAPABILITIES • Creating best-in-class customer experiences while growing profitably across channels INCREASING THE SPEED AND EFFICIENCY OF OUR CONCEPT-TO-CUSTOMER PRODUCT LIFE CYCLE • Investing in capabilities to position supply chain for greater speed, agility and flexibility • Utilizing data and analytics to offer the right product at the right time and the right price IMPROVING OUR CUSTOMER ENGAGEMENT THROUGH OUR LOYALTY PROGRAMS AND MARKETING OPTIMIZATION • Leveraging data, including our loyalty programs, to engage with customers across channels • Driving more efficient and effective marketing spend THE FOLLOWING TRANSFORMATION INITIATIVES HAVE CREATED THE FOUNDATION TO ALLOW US TO QUICKLY RESPOND TO COVID-19 AND FOCUS ON LONG-TERM SUSTAINABLE GROWTH: 1 2 3 4 FOCUS AREAS 8

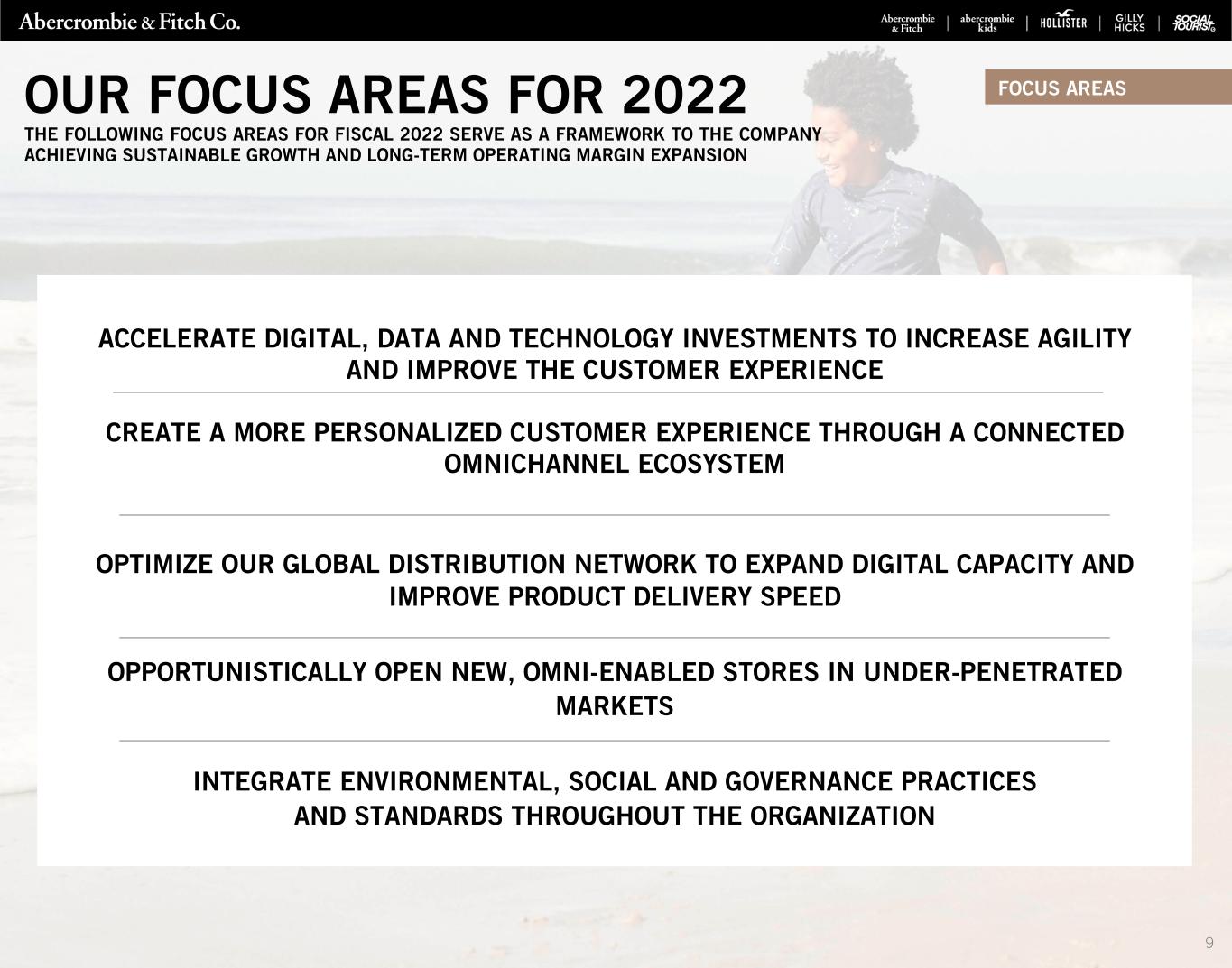

THE FOLLOWING FOCUS AREAS FOR FISCAL 2022 SERVE AS A FRAMEWORK TO THE COMPANY ACHIEVING SUSTAINABLE GROWTH AND LONG-TERM OPERATING MARGIN EXPANSION OUR FOCUS AREAS FOR 2022 ACCELERATE DIGITAL, DATA AND TECHNOLOGY INVESTMENTS TO INCREASE AGILITY AND IMPROVE THE CUSTOMER EXPERIENCE CREATE A MORE PERSONALIZED CUSTOMER EXPERIENCE THROUGH A CONNECTED OMNICHANNEL ECOSYSTEM OPTIMIZE OUR GLOBAL DISTRIBUTION NETWORK TO EXPAND DIGITAL CAPACITY AND IMPROVE PRODUCT DELIVERY SPEED OPPORTUNISTICALLY OPEN NEW, OMNI-ENABLED STORES IN UNDER-PENETRATED MARKETS INTEGRATE ENVIRONMENTAL, SOCIAL AND GOVERNANCE PRACTICES AND STANDARDS THROUGHOUT THE ORGANIZATION FOCUS AREAS 9

DIGITAL EVOLUTION 10

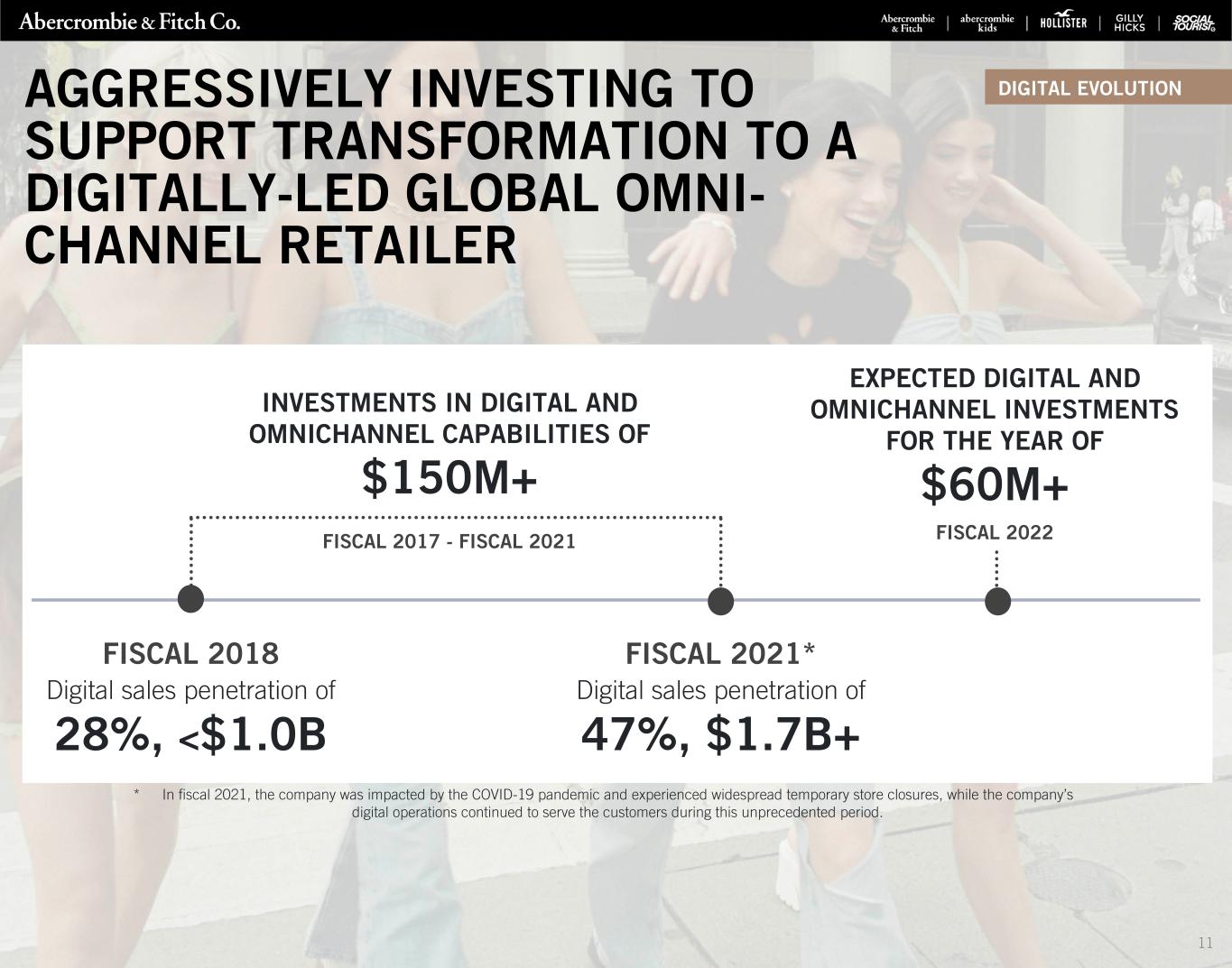

* In fiscal 2021, the company was impacted by the COVID-19 pandemic and experienced widespread temporary store closures, while the company’s digital operations continued to serve the customers during this unprecedented period. INVESTMENTS IN DIGITAL AND OMNICHANNEL CAPABILITIES OF $150M+ FISCAL 2017 - FISCAL 2021 FISCAL 2018 Digital sales penetration of 28%, <$1.0B FISCAL 2021* Digital sales penetration of 47%, $1.7B+ EXPECTED DIGITAL AND OMNICHANNEL INVESTMENTS FOR THE YEAR OF $60M+ FISCAL 2022 DIGITAL EVOLUTIONAGGRESSIVELY INVESTING TO SUPPORT TRANSFORMATION TO A DIGITALLY-LED GLOBAL OMNI- CHANNEL RETAILER 11

GLOBAL STORE NETWORK OPTIMIZATION 12

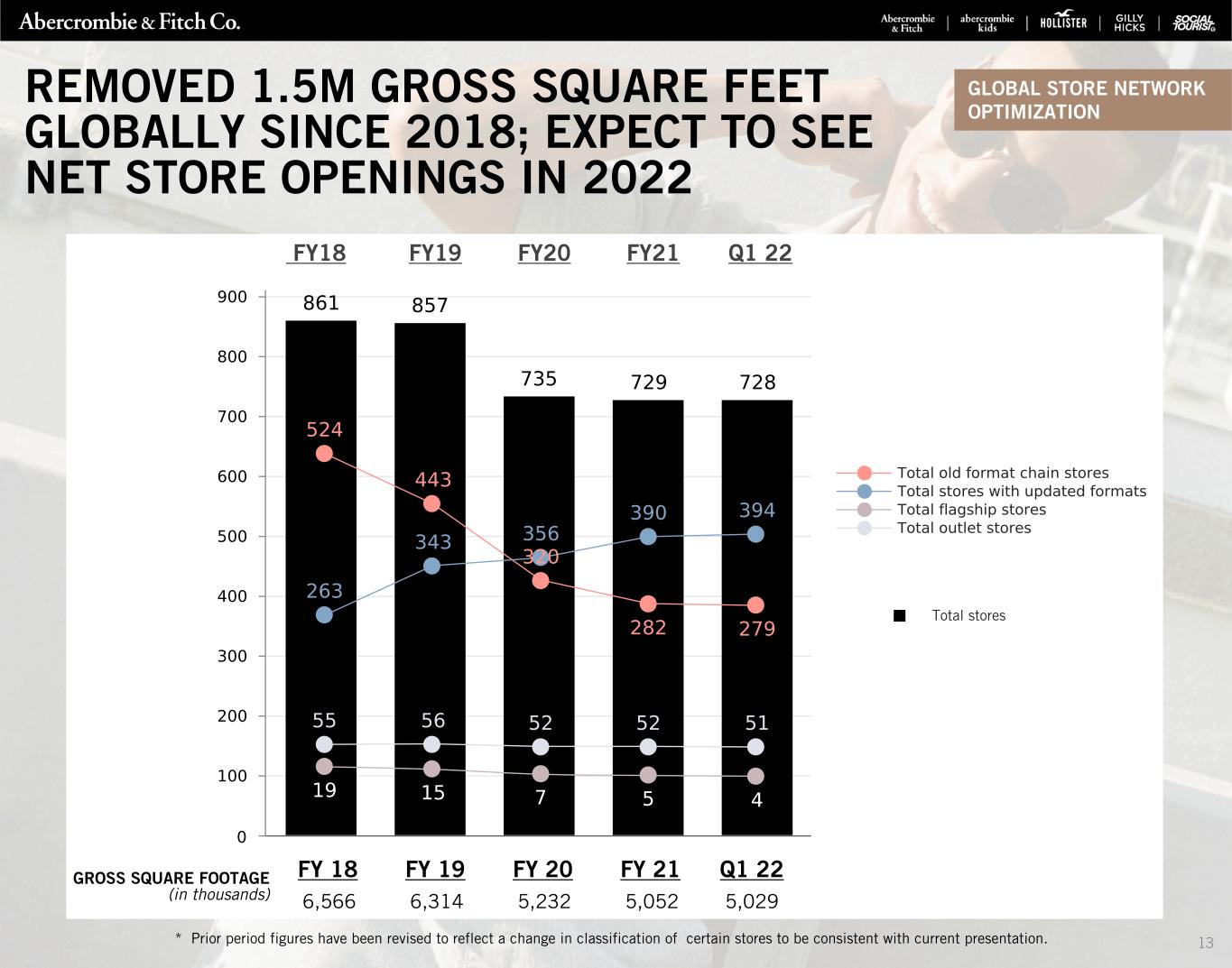

13 REMOVED 1.5M GROSS SQUARE FEET GLOBALLY SINCE 2018; EXPECT TO SEE NET STORE OPENINGS IN 2022 Total stores FY18 FY19 FY20 FY21 Q1 22 * Prior period figures have been revised to reflect a change in classification of certain stores to be consistent with current presentation. GROSS SQUARE FOOTAGE (in thousands) FY 18 FY 19 FY 20 FY 21 Q1 22 6,566 6,314 5,232 5,052 5,029 GLOBAL STORE NETWORK OPTIMIZATION

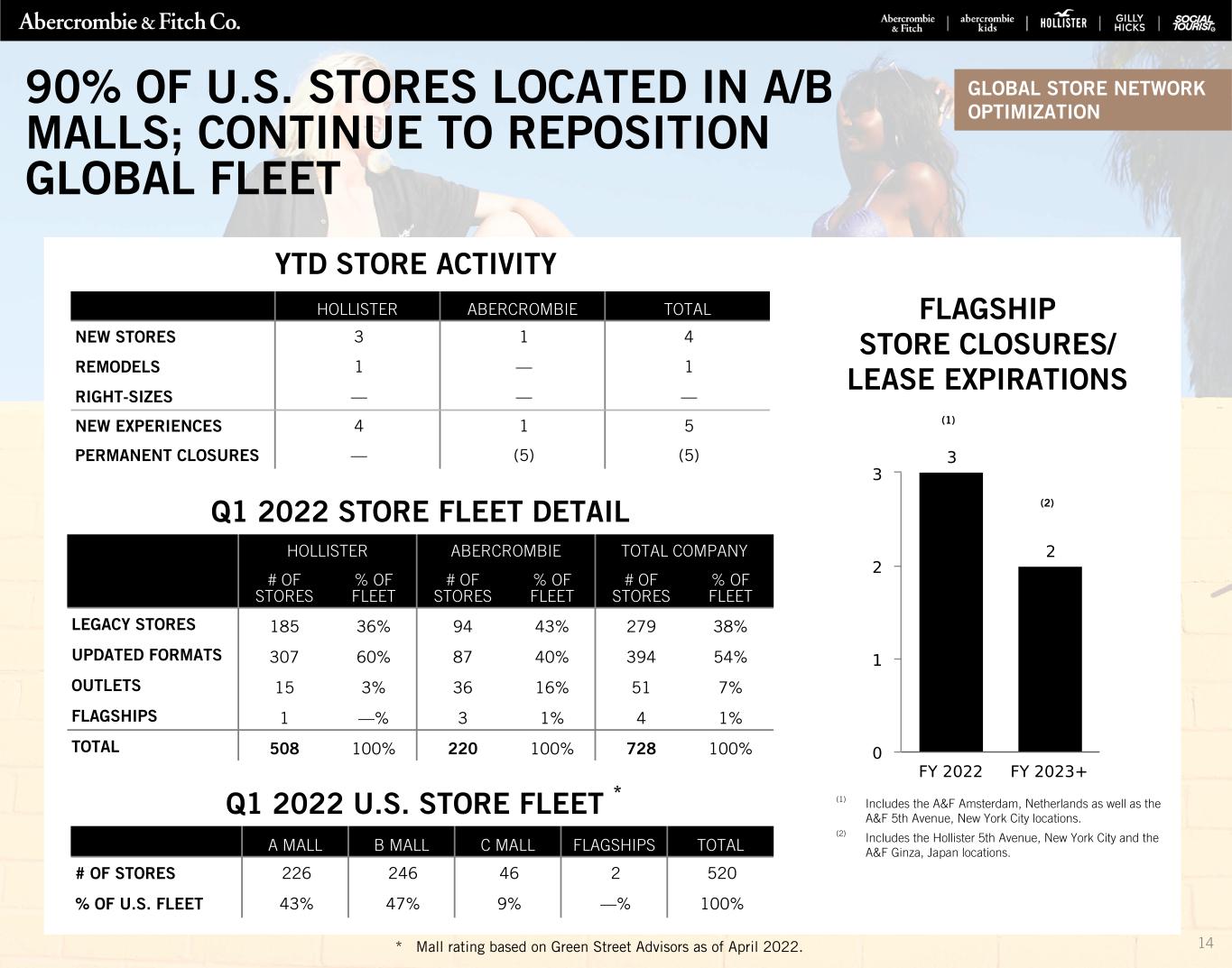

14 90% OF U.S. STORES LOCATED IN A/B MALLS; CONTINUE TO REPOSITION GLOBAL FLEET * Mall rating based on Green Street Advisors as of April 2022. YTD STORE ACTIVITY Q1 2022 STORE FLEET DETAIL HOLLISTER ABERCROMBIE TOTAL COMPANY # OF STORES % OF FLEET # OF STORES % OF FLEET # OF STORES % OF FLEET LEGACY STORES 185 36% 94 43% 279 38% UPDATED FORMATS 307 60% 87 40% 394 54% OUTLETS 15 3% 36 16% 51 7% FLAGSHIPS 1 —% 3 1% 4 1% TOTAL 508 100% 220 100% 728 100% HOLLISTER ABERCROMBIE TOTAL NEW STORES 3 1 4 REMODELS 1 — 1 RIGHT-SIZES — — — NEW EXPERIENCES 4 1 5 PERMANENT CLOSURES — (5) (5) FLAGSHIP STORE CLOSURES/ LEASE EXPIRATIONS (1) (1) Includes the A&F Amsterdam, Netherlands as well as the A&F 5th Avenue, New York City locations. (2) Includes the Hollister 5th Avenue, New York City and the A&F Ginza, Japan locations. (2) Q1 2022 U.S. STORE FLEET * A MALL B MALL C MALL FLAGSHIPS TOTAL # OF STORES 226 246 46 2 520 % OF U.S. FLEET 43% 47% 9% —% 100% GLOBAL STORE NETWORK OPTIMIZATION

Q1 2022 RESULTS 15

Q1 2022 RESULTS “First quarter net sales exceeded expectations, rising 4% to $813 million, our highest first quarter level since 2014. Results were driven by ongoing strength at the Abercrombie & Fitch brand, where global sales were above plan. Net sales at Hollister were in line with expectations. By region, the U.S. continued to outperform, EMEA net sales returned to positive territory, and APAC was impacted by COVID lockdowns in China. We continued to reduce our promotional activity, contributing to our eighth consecutive quarter of AUR improvement. This was more than offset by higher-than-expected freight and product costs. Looking forward, we expect higher costs to remain a headwind through at least year-end. We expect freight relief in the fourth quarter as we anniversary increased air usage last year due to the Vietnam shutdown. We will continue to manage expenses tightly and are committed to finding opportunities to offset these costs while protecting strategic investments in marketing, technology and our customer experience, which should drive sustained, long-term sales growth.” FRAN HOROWITZ, CHIEF EXECUTIVE OFFICER CEO COMMENTARY 16

SIGNIFICANT ITEMS IMPACTING Q1 2022 RESULTS • Net sales increased 4%, or $31M, as compared to last year. • Gross margin rate declined 810 basis points as compared to last year to 55.3%, driven by higher average unit cost from freight inflation partially offset by higher average unit retail on lower promotions • Digital fulfillment expense increased $12M, reflecting an increase in digital shipping and handling and digital direct expense. • Marketing expense increased $9M, including digital sales marketing, reflecting the company's initiatives to make strategic investments across marketing • Asset impairment charges of $3M for both this year and last year, respectively (1) Adjusted non-GAAP results exclude the effect of certain items set out of page 29. (2) The estimated impact from foreign currency is calculated by applying current period exchange rates to prior year results using a 26% tax rate. Q1 2022 Q1 2021 GAAP $(0.32) $0.64 EXCLUDED ITEMS, NET OF TAX EFFECT (1) (0.05) (0.03) ADJUSTED NON-GAAP $(0.27) $0.67 IMPACT FROM FOREIGN CURRENCY EXCHANGE RATES (2) — 0.05 ADJUSTED NON-GAAP ON A CONSTANT CURRENCY BASIS $(0.27) $0.72 Q1 2022 RESULTSNET (LOSS) INCOME PER SHARE 17

TOTAL COMPANY NET SALES UP 4% COMPARED TO Q1 2021, TO $813M ABERCROMBIE $384M UP 13% TO LAST YEAR 47.2% OF TOTAL NET SALES HOLLISTER $429M DOWN 3% TO LAST YEAR 52.8% OF TOTAL NET SALES EMEA $164M UP 3% TO LAST YEAR 20.2% OF TOTAL NET SALES UNITED STATES (1) $585M UP 6% TO LAST YEAR 72.0% OF TOTAL NET SALES APAC $30M DOWN 35% TO LAST YEAR 3.7% OF TOTAL NET SALES OTHER (2) $34M UP 50% TO LAST YEAR 4.2% OF TOTAL NET SALES Q1 2022 RESULTSNET SALES 18 (1) Net sales by geographic area are presented by attributing revenues to an individual country on the basis of the country in which the merchandise was sold for in-store purchases and on the basis of the shipping location provided by customers for digital orders. (2) Other includes all sales that do not fall within the United States, EMEA, or APAC regions.

(in thousands) Q1 2022 % OF NET SALES Q1 2021 % OF NET SALES 1 YR Δ BPS (3) STORE OCCUPANCY (1) $103,191 12.7% $107,277 13.7% (100) ALL OTHER (2) 234,352 28.8% 209,331 26.8% 200 STORES AND DISTRIBUTION 337,543 41.5% 316,608 40.5% 100 MARKETING, GENERAL & ADMINISTRATIVE 122,149 15.0% 120,947 15.5% (50) ASSET IMPAIRMENT 3,422 0.4% 1,564 0.3% 10 TOTAL OPERATING EXPENSE - GAAP 463,114 57.0% 439,119 56.2% 80 EXCLUDED ITEMS 3,422 0.4% 2,664 0.3% 10 TOTAL ADJUSTED OPERATING EXPENSE - NON-GAAP * $459,692 56.6% $436,455 56.2% 40 RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSE * Q1 non-GAAP operating expense is presented on an adjusted non-GAAP basis, and excludes the effect of certain items set out of page 29. (1) Includes operating lease costs, other landlord charges, utilities, depreciation and other occupancy expense. (2) Includes selling payroll, store management and support, other store expense, direct-to-consumer expense, and distribution center costs. (3) Rounded based on reported percentages. Q1 2022 RESULTSOPERATING EXPENSE 19

(1) Gross profit is derived from cost of sales, exclusive of depreciation and amortization. (2) Gross profit rate of 55.3% is down 810 basis points as compared to last year, driven by approximately $80 million of higher average unit freight costs, partially offset by higher average unit retail on lower promotions. GAAP (in thousands) Q1 2022 % OF NET SALES Q1 2021 % OF NET SALES NET SALES $812,762 100.0% $781,405 100.0% GROSS PROFIT (1) (2) 449,546 55.3% 495,134 63.4% OPERATING EXPENSE 463,114 57.0% 439,119 56.2% OTHER OPERATING INCOME, NET (3,842) (0.5)% (1,418) (0.2)% OPERATING (LOSS) INCOME (9,726) (1.2)% 57,433 7.3% INTEREST EXPENSE, NET 7,307 0.9% 8,606 1.1% (LOSS) INCOME BEFORE INCOME TAXES (17,033) (2.1)% 48,827 6.2% INCOME TAX (BENEFIT) EXPENSE (2,187) (0.3)% 6,121 0.8% NET (LOSS) INCOME $(16,469) (2.0)% $41,768 5.3% NET (LOSS) INCOME PER SHARE BASIC $(0.32) $0.67 DILUTED $(0.32) $0.64 WEIGHTED-AVERAGE SHARES BASIC 52,077 62,380 DILUTED 52,077 65,305 Q1 2022 RESULTSINCOME STATEMENT 20

FINANCIAL POSITION, LIQUIDITY & CAPITAL ALLOCATION 21

22 FINANCIAL POSITION, LIQUIDITY & CAPITAL ALLOCATIONSTRONG FINANCIAL POSITION AND LIQUIDITY CASH & EQUIVALENTS $468M AS COMPARED TO $909M LAST YEAR, AS COMPANY UTILIZED EXCESS CASH TO FUND SHARE REPURCHASES SHORT-TERM BORROWINGS NO BORROWINGS OUTSTANDING UNDER ABL FACILITY $314M OF BORROWING AVAILABLE UNDER ABL FACILITY AS OF APRIL 30, 2022 GROSS LONG-TERM BORROWINGS $308M OUTSTANDING AS COMPARED TO $350M LAST YEAR INVENTORIES $563M, UP 45% FROM LAST YEAR DUE PRIMARILY TO HIGHER FREIGHT COST AND HIGHER IN-TRANSIT INVENTORY * Liquidity is comprised of cash and equivalents and borrowing available under the ABL Facility.

(in thousands) NET CASH PROVIDED BY OPERATING ACTIVITIES CAPITAL EXPENDITURES FREE CASH FLOW (1) FY 2017 $287,658 $107,001 $180,657 FY 2018 $352,933 $152,393 $200,540 FY 2019 $300,685 $202,784 $97,901 FY 2020 $404,918 $101,910 $303,008 FY 2021 $277,782 $96,979 $180,803 (1) Free cash flow is a non-GAAP measure and is computed by subtracting capital expenditures from net cash provided by operating activities, both of which are disclosed in the table above, preceding the measure of free cash flow. YEAR TO DATE PERIOD ENDED (in thousands) APRIL 30, 2022 MAY 1, 2021 NET CASH USED FOR OPERATING ACTIVITIES $(217,787) $(131,350) NET CASH USED FOR INVESTING ACTIVITIES $(18,541) $(14,404) NET CASH USED FOR FINANCING ACTIVITIES $(116,945) $(53,191) CASH FLOW SUMMARY FINANCIAL POSITION, LIQUIDITY & CAPITAL ALLOCATION 23

The company repurchased approximately 3.3 million shares and has returned $100 million to shareholders during the quarter ended April 30, 2022. SHARE REPURCHASES (in thousands, except for average cost) NUMBER OF SHARES COST AVERAGE COST DIVIDENDS TOTAL FY 2017 — $— $— $54,392 $54,392 FY 2018 2,932 $68,670 $23.42 $53,714 $122,384 FY 2019 3,957 $63,542 $16.06 $51,510 $115,052 FY 2020 1,397 $15,172 $10.86 $12,556 $27,728 FY 2021 10,200 $377,290 $36.99 $— $377,290 YTD 2022 3,260 $100,000 $30.67 $— $100,000 (in thousands) FY 2017 FY 2018 FY 2019 FY 2020 FY2021 Q1 2022 ENDING SHARES OUTSTANDING 68,195 66,227 62,786 62,399 52,985 50,442 FINANCIAL POSITION, LIQUIDITY & CAPITAL ALLOCATION SHARE REPURCHASES AND DIVIDENDS 24

(in thousands) APRIL 30, 2022 JANUARY 29, 2022 MAY 1, 2021 CASH AND EQUIVALENTS $468,378 $823,139 $909,008 RECEIVABLES 88,807 69,102 107,821 INVENTORIES 562,510 525,864 388,633 OTHER CURRENT ASSETS 93,179 89,654 78,727 TOTAL CURRENT ASSETS $1,212,874 $1,507,759 $1,484,189 PROPERTY AND EQUIPMENT, NET 497,976 508,336 533,773 OPERATING LEASE RIGHT-OF-USE ASSETS 671,991 698,231 839,003 OTHER ASSETS 224,462 225,165 213,585 TOTAL ASSETS $2,607,303 $2,939,491 $3,070,550 ACCOUNTS PAYABLE $311,352 $374,829 $236,667 ACCRUED EXPENSES 320,681 395,815 321,906 SHORT-TERM PORTION OF OPERATING LEASE LIABILITIES 195,599 222,823 231,750 INCOME TAXES PAYABLE 25,400 21,773 26,672 TOTAL CURRENT LIABILITIES $853,032 $1,015,240 $816,995 LONG-TERM PORTION OF OPERATING LEASE LIABILITIES 662,322 697,264 844,401 LONG-TERM BORROWINGS, NET 303,901 303,574 344,278 OTHER LIABILITIES 83,243 86,089 114,926 TOTAL LONG-TERM LIABILITIES $1,049,466 $1,086,927 $1,303,605 TOTAL ABERCROMBIE & FITCH CO. STOCKHOLDERS EQUITY 695,361 826,090 941,174 NONCONTROLLING INTEREST 9,444 11,234 8,776 TOTAL STOCKHOLDERS' EQUITY $704,805 $837,324 $949,950 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $2,607,303 $2,939,491 $3,070,550 BALANCE SHEET FINANCIAL POSITION, LIQUIDITY & CAPITAL ALLOCATION 25

YEAR TO DATE PERIOD ENDED (in thousands) APRIL 30, 2022 MAY 1, 2021 NET CASH USED FOR OPERATING ACTIVITIES $(217,787) $(131,350) PURCHASES OF PROPERTY AND EQUIPMENT (26,292) (14,404) PROCEEDS FROM THE SALE OF PROPERTY AND EQUIPMENT 7,751 — NET CASH USED FOR INVESTING ACTIVITIES $(18,541) $(14,404) PAYMENT OF DEBT ISSUANCE OR MODIFICATION COSTS AND FEES — (1,490) PURCHASES OF COMMON STOCK (100,000) (35,249) OTHER FINANCING ACTIVITIES (16,945) (16,452) NET CASH USED FOR FINANCING ACTIVITIES $(116,945) $(53,191) EFFECT OF FOREIGN CURRENCY EXCHANGE RATES ON CASH (2,617) (1,021) NET DECREASE IN CASH AND EQUIVALENTS, AND RESTRICTED CASH AND EQUIVALENTS $(355,890) $(199,966) CASH AND EQUIVALENTS, AND RESTRICTED CASH AND EQUIVALENTS, BEGINNING OF PERIOD $834,368 $1,124,157 CASH AND EQUIVALENTS, AND RESTRICTED CASH AND EQUIVALENTS, END OF PERIOD $478,478 $924,191 FINANCIAL POSITION, LIQUIDITY & CAPITAL ALLOCATION STATEMENT OF CASH FLOWS 26

27 UPDATED FISCAL 2022 OUTLOOK

PREVIOUS FULL YEAR OUTLOOK CURRENT FULL YEAR OUTLOOK (1) NET SALES IN THE RANGE OF UP 2% TO 4% IN THE RANGE OF FLAT TO UP 2% (2) OPERATING INCOME IN THE RANGE OF 7% TO 8% IN THE RANGE OF 5% TO 6%(3) EFFECTIVE TAX RATE HIGH 20s MID 30s UPDATED FISCAL 2022 OUTLOOK OUTLOOK WE INTEND TO AGGRESSIVELY PURSUE MITIGATION EFFORTS, INCLUDING, BUT NOT LIMITED TO THE FOLLOWING: • Managing inventory flows by region to maximize top line during peak selling periods • Strategically increasing tickets and reducing the depth and breadth of promotions to drive AUR growth • Prioritizing customer-facing spend and strategic, long-term investments while reducing non-customer-facing expenses 28 (1) Beginning this quarter, the company will no longer provide a full year outlook on gross profit rate or operating expense. This outlook replaces the entire previous full year outlook (2) Reflecting an adverse impact of approximately 200 basis points from foreign currency and inflationary pressure on consumer demand, partially offset by Q1 sales exceeding expectations (3) Reflecting an estimated combined 200 basis point adverse impact from higher freight and raw material costs, foreign currency, and lower sales due to an assumed inflationary impact on consumer demand BASED ON THE EVOLVING OPERATING ENVIRONMENT, OUR UPDATED 2022 OUTLOOK REFLECTS IMPACTS FROM FOREIGN CURRENCY, HIGHER-THAN-EXPECTED COSTS, AND AN ASSUMED INFLATIONARY IMPACT ON CONSUMER SPENDING

APPENDIX 29

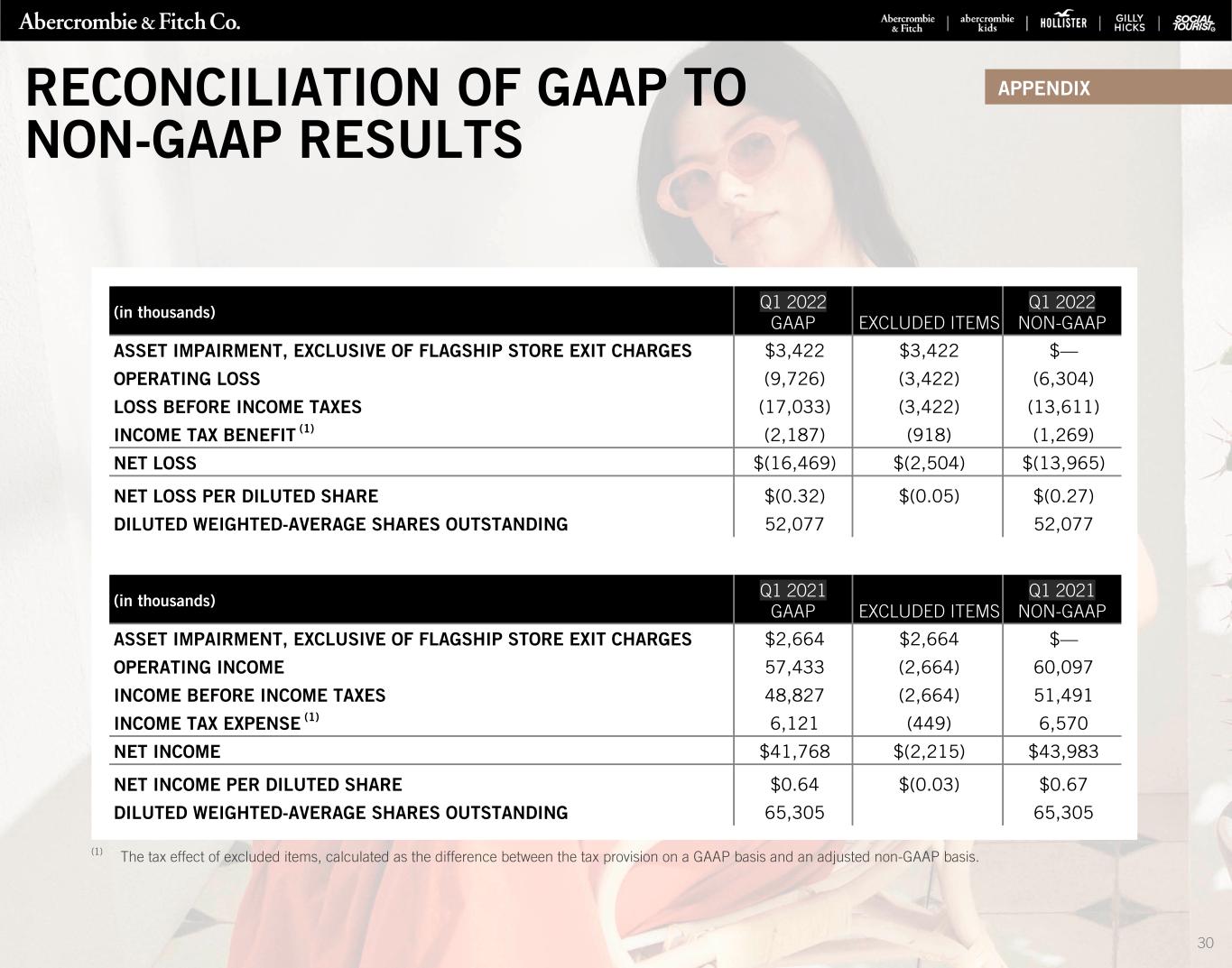

(1) The tax effect of excluded items, calculated as the difference between the tax provision on a GAAP basis and an adjusted non-GAAP basis. (in thousands) Q1 2022 GAAP EXCLUDED ITEMS Q1 2022 NON-GAAP ASSET IMPAIRMENT, EXCLUSIVE OF FLAGSHIP STORE EXIT CHARGES $3,422 $3,422 $— OPERATING LOSS (9,726) (3,422) (6,304) LOSS BEFORE INCOME TAXES (17,033) (3,422) (13,611) INCOME TAX BENEFIT (1) (2,187) (918) (1,269) NET LOSS $(16,469) $(2,504) $(13,965) NET LOSS PER DILUTED SHARE $(0.32) $(0.05) $(0.27) DILUTED WEIGHTED-AVERAGE SHARES OUTSTANDING 52,077 52,077 (in thousands) Q1 2021 GAAP EXCLUDED ITEMS Q1 2021 NON-GAAP ASSET IMPAIRMENT, EXCLUSIVE OF FLAGSHIP STORE EXIT CHARGES $2,664 $2,664 $— OPERATING INCOME 57,433 (2,664) 60,097 INCOME BEFORE INCOME TAXES 48,827 (2,664) 51,491 INCOME TAX EXPENSE (1) 6,121 (449) 6,570 NET INCOME $41,768 $(2,215) $43,983 NET INCOME PER DILUTED SHARE $0.64 $(0.03) $0.67 DILUTED WEIGHTED-AVERAGE SHARES OUTSTANDING 65,305 65,305 APPENDIX 30 RECONCILIATION OF GAAP TO NON-GAAP RESULTS

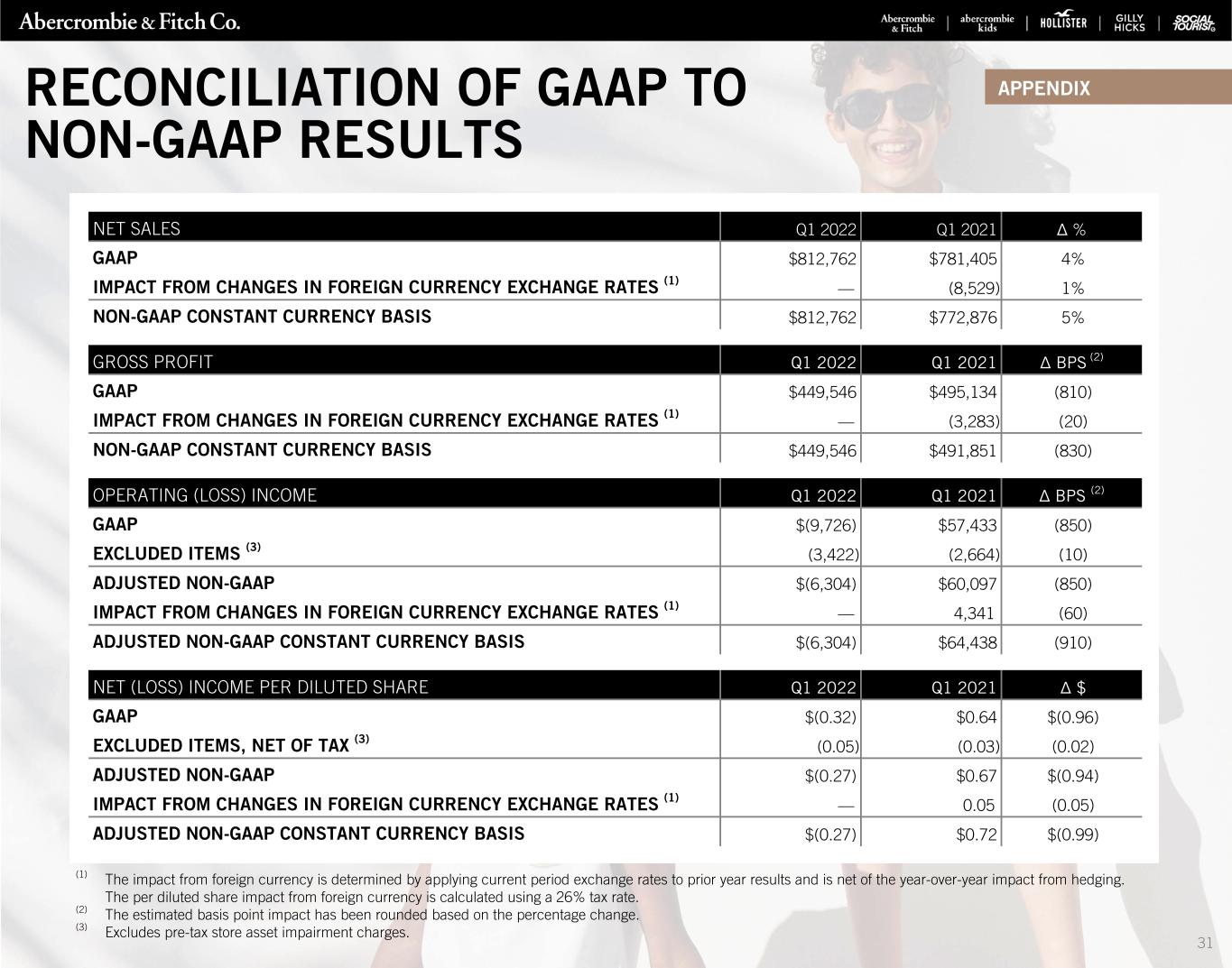

NET SALES Q1 2022 Q1 2021 Δ % GAAP $812,762 $781,405 4% IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — (8,529) 1% NON-GAAP CONSTANT CURRENCY BASIS $812,762 $772,876 5% GROSS PROFIT Q1 2022 Q1 2021 Δ BPS (2) GAAP $449,546 $495,134 (810) IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — (3,283) (20) NON-GAAP CONSTANT CURRENCY BASIS $449,546 $491,851 (830) OPERATING (LOSS) INCOME Q1 2022 Q1 2021 Δ BPS (2) GAAP $(9,726) $57,433 (850) EXCLUDED ITEMS (3) (3,422) (2,664) (10) ADJUSTED NON-GAAP $(6,304) $60,097 (850) IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — 4,341 (60) ADJUSTED NON-GAAP CONSTANT CURRENCY BASIS $(6,304) $64,438 (910) NET (LOSS) INCOME PER DILUTED SHARE Q1 2022 Q1 2021 Δ $ GAAP $(0.32) $0.64 $(0.96) EXCLUDED ITEMS, NET OF TAX (3) (0.05) (0.03) (0.02) ADJUSTED NON-GAAP $(0.27) $0.67 $(0.94) IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — 0.05 (0.05) ADJUSTED NON-GAAP CONSTANT CURRENCY BASIS $(0.27) $0.72 $(0.99) (1) The impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share impact from foreign currency is calculated using a 26% tax rate. (2) The estimated basis point impact has been rounded based on the percentage change. (3) Excludes pre-tax store asset impairment charges. APPENDIXRECONCILIATION OF GAAP TO NON-GAAP RESULTS 31

REFINITIV STREETEVENTS EDITED TRANSCRIPT ANF.N - Q1 2022 Abercrombie & Fitch Co Earnings Call EVENT DATE/TIME: MAY 24, 2022 / 12:30PM GMT REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

C O R P O R A T E P A R T I C I P A N T S Fran Horowitz Abercrombie & Fitch Co. - CEO & Director Pamela Nagler Quintiliano Abercrombie & Fitch Co. - VP of IR Scott D. Lipesky Abercrombie & Fitch Co. - Executive VP & CFO C O N F E R E N C E C A L L P A R T I C I P A N T S Corey Tarlowe Jefferies LLC, Research Division - Equity Analyst Dana Lauren Telsey Telsey Advisory Group LLC - CEO & Chief Research Officer Janet Joseph Kloppenburg JJK Research Associates, Inc. - President Kimberly Conroy Greenberger Morgan Stanley, Research Division - MD Marni Shapiro The Retail Tracker - Co-Founder Mauricio Serna Vega UBS Investment Bank, Research Division - Analyst Paul Lawrence Lejuez Citigroup Inc., Research Division - MD and Senior Analyst P R E S E N T A T I O N Operator Good day and welcome to the Abercrombie & Fitch First Quarter Fiscal Year 2022 Earnings Call. Today's call is being recorded. (Operator Instructions) At this time, I would like to turn the conference over to Pam Quintiliano. Please go ahead, ma'am. Pamela Nagler Quintiliano - Abercrombie & Fitch Co. - VP of IR Thank you. Good morning, and welcome to our First Quarter 2022 Earnings Call. Joining me today on the call are Fran Horowitz, Chief Executive Officer; and Scott Lipesky, Chief Financial Officer. Earlier this morning, we issued our first quarter earnings release, which is available on our website at corporate.abercrombie.com under the Investors section. Also available on our website is an investor presentation. Please keep in mind that any forward-looking statements made on the call are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the expectations and assumptions we mention today. A detailed discussion of these factors and uncertainties is contained in the company's filings with the Securities and Exchange Commission. In addition, we will be referring to certain non-GAAP financial measures during the call. Additional details and the reconciliation of GAAP to adjusted non-GAAP financial measures are included in the release issued earlier this morning. With that, I will turn the call over to Fran. Fran Horowitz - Abercrombie & Fitch Co. - CEO & Director Good morning. Thank you for joining us today to discuss our first quarter results. This earnings, we are going to approach things a little differently. Since 2018, we have dedicated a portion of our call to talking about the progress made on our key transformation initiatives, which were anchored 2 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. MAY 24, 2022 / 12:30PM, ANF.N - Q1 2022 Abercrombie & Fitch Co Earnings Call

to our goal of doubling our operating margin from 2017 levels. Last year, we not only achieved that goal, but we significantly surpassed it, more than tripling our operating margin. At our upcoming June 14 Investor Day, we will discuss the next phase of our corporate journey and how we will execute our Always Forward plan. From there, we will update you regularly on our progress. In the first quarter, we navigated yet another period of global volatility. We remained focused on controlling what we can control and never lost sight of what's important to drive our business, our customers, associates, communities and partners. We exceeded our sales plan, delivering our best Q1 revenue since 2014 despite several major headwinds, including: the lapping of stimulus and return to in-person learning for much of the U.S. last March; global inflationary pressures, significant COVID restrictions in China; and the conflict in Ukraine. For the quarter, total company revenues rose 4% year-over-year, above our outlook for a low single-digit increase. Abercrombie continued to outperform, rising 13% on top of a 60% gain last year. By region, our largest market, the U.S. registered a 6% increase, while international was flat. EMEA accelerated from last quarter and last year, benefiting from the reopening of our largest country in that region, the U.K. In APAC, China remained challenged due to COVID-related lockdowns. Our global revenues were healthy. Customers continue to respond favorably to our product, voice and experience, and we achieved our eighth consecutive quarter of AUR improvement as we benefited from higher tickets and slightly lower promotional activity. As a reminder, we implemented targeted ticket increases in the first quarter based on competitive pricing analysis. We took advantage of colder weather conditions to push through the delayed Q4 receipts to ensure we were clean for spring. Scott will discuss those pressures in more detail, but we remain focused on navigating through these near-term challenges while delivering the right product at the right time, at the right price. Looking ahead, we expect freight and raw material costs to remain elevated. We plan to tightly manage inventories and expenses and are actioning opportunities to offset a portion of these costs. We are carefully evaluating these opportunities and do not plan on trimming areas that support our longer-term growth strategies. Now on to the brands. Q1 represented a continuation of the Abercrombie brand's remarkable turnaround. Abercrombie adults delivered its best first quarter sales since 2014 and its highest Q1 AUR in brand history, benefiting from higher tickets and lower discounting. Results were led by ongoing strength in North America, which posted its highest sales since 2012, although we did also experience a sequential improvement on an international basis. And while we have heard that the consumer is spending more on experiences, our millennial Abercrombie customer is coming to us to refresh their wardrobe as they get back out there. And with an unwavering dedication to listening to our customers about the new, trending styles and fits they're looking for, we've been able to expand market share. And we're not just winning in 1 or 2 areas, strength was broad-based, with multiple categories registering growth. In women's, denim, dresses and knits were standouts, all delivering their highest Q1 sales and AUR in over a decade. In men's, our target customer is also taking notice of the changes we have made. Tops, which is our largest men's revenue driver were strong, with growth in graphics, sweaters and wovens. There is so much more market share opportunity at Abercrombie. In March, we launched YPB, or Your Personal Best. After hearing from customers, they want us to deliver a performance active line with the same dedication to fit, comfort and confidence they experience in our regular assortment. YPB has received high praise from customers, influencers, affiliates and media for its fit, fashion and function. The launch has truly served as a reflection of our personal best, far exceeding expectations. We sold out of over 25% of our SKUs within weeks of the launch and have been quickly working to replenish. The speed with which customers have embraced YPB gives us even more confidence in its future. A big part of Abercrombie's success can be attributed to our marketing team. Throughout the quarter, they continued to tap into human-powered brand building through our influencer and affiliate network, which we view as a vital social commerce revenue stream. In Q1, Abercrombie was the recipient of LTK's most loved product awards in multiple categories, had its best social commerce quarter ever with significant double-digit year-over-year growth and achieved volumes that beat our previous record, which we just hit last quarter. And we are not satisfied. We intend to continue building on the rapid rise of this channel as the team innovates and invents new possibilities. We're excited for Q2. Stay tuned for the third annual Abercrombie Pride collection codesigned with our partners, The Trevor Project, an organization that provides 3 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. MAY 24, 2022 / 12:30PM, ANF.N - Q1 2022 Abercrombie & Fitch Co Earnings Call

a essential services benefiting [LGBTQs]. In June, we're set to launch a getaway-inspired collaboration with 2 influencer friends of the brand, Champagne and Chanel and Dress Up Buttercup. And soon to come, we'll be bringing our popular Curve Love fits to both tops and bottoms in our YPB line. Now on to Abercrombie Kids. During the quarter, we experienced strong conversion and a record-setting basket size. Our comfy, dressy assortments for Easter and spring break drove results. In addition, we had our best Q1 swim season ever and our franchise collections, the cool stuff ready for play active and made for life essentials were well-received. Turning to Hollister, which includes Gilly Hicks and Social Tourist. In North America, we delivered our second-best sales results since 2012 behind only last year, even as we lapped stimulus and the mini back-to-school season in March. Internationally, although trends improved dramatically from last year and last quarter, the business has not yet returned to pre-pandemic levels. Taken together, global sales were in line with our expectations, declining 3% for the quarter. We continue to emphasize our top 30 items and must-win categories, which led the way in the first quarter, and we experienced strength in women's dresses, and fleece and men's woven, and swim. In denim, our customer embraced newer widere-leg fashion assortments, although skinny remains an important part of her wardrobe. Social commerce and affiliate growth continued to be key drivers of our success. In February, we wrapped our Respect the Jeans campaign, which was done in partnership with Black-ish Star and Gen Z favorite, Marsai Martin. The campaign outperformed benchmark goals, driving 11 million impressions and also won Gen Z over on TikTok, with benchmark-beating engagement and comments such as, "Now this is how you do an ad." During the quarter, we also launched our monthly Facebook Live shopping event, which drove social commerce sales up an average of 20%. Now let's talk about Gilly Hicks, where we continue to be excited about the global growth opportunity ahead. Customer response to our updated carve-out and side-by-side locations, which incorporate key elements of our stand-alone store has been very encouraging, with these locations outperforming the balance of the chain. We're also bringing our updated store concept to our global customer. We recently opened our first Gilly Hicks stand-alone EMEA store a few weeks ago in Centro Oberhausen, Germany, and plan to introduce more stores throughout the year, including Carnaby Street in London this summer. Last but not least, Social Tourist. Our newest brand has an engaged fan base who is providing valuable insights into up-and-coming fashion trends and the shopping habits of social-first customers, which we have applied to the brand and to our broader portfolio. Looking ahead, there's a lot of excitement at all 3 brands under the Hollister umbrella. In partnership with GLSEN, an organization that works to make K-12 schools feel safe and inclusive for LGBTQ+ students, we will be launching our sixth annual Hollister Pride Collection. At Gilly Hicks, we have plans to expand our active lifestyle collection, Gilly Go, which has consistently been our top performer since its launch. And at Social Tourist, we are set to open a pop-up shop on Melrose Avenue in Los Angeles, which will be the brand's first stand-alone experience. The pop-up will feature always on social content and programming, monthly activations, including consumer influencer events and PR engagement and visits from Dixie and Charli to meet customers, so exciting. Before turning it over to Scott, I want to take a moment to discuss our thoughts on the health of our global consumer. It is an interesting time. The weather has started to become more seasonal, and collectively, it seems as though we are ready to return to some form of normalcy. In our largest market, the U.S., unemployment is currently low, wages are high and there's hunger to participate in many of the social activities that were missed over the last 2-plus years. However, we are in an extreme inflationary period where experience, everything from food to gas is costing more and we expect those pressures to weigh on consumer confidence. We are keeping a close eye on each of our respective consumers and how they're being impacted and responding. With 5 distinct brands, we will not take a one size fits all approach. We will stay close to our customers and have the ability to quickly recalibrate reflecting their unique stages in life activities and pressure points. Internationally, while encouraged by recent improvements in EMEA, we are cognizant that our European customer is faced with similar inflationary pressures and is more directly impacted from the situation in Ukraine. Across the globe, we know there are a lot of options on where to spend, and as always, we will focus on offering a compelling and inclusive product, voice and experience for each of our respective customer bases with a commitment to fashion, fit and quality. We remain focused on profitable 4 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. MAY 24, 2022 / 12:30PM, ANF.N - Q1 2022 Abercrombie & Fitch Co Earnings Call