Form 6-K/A New Found Gold Corp. For: May 16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2022

Commission File Number 001-39966

New Found Gold Corp.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name)

Suite 1430 – 800 West Pender Street

Vancouver, British

Columbia V6C 2V6

604-562-9664

(Address and telephone number of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EXPLANATORY NOTE

This report on Form 6-K is being furnished to replace the Management’s discussion and analysis of financial condition and results of operations for the years ended December 31, 2021 and 2020 attached as Exhibit 99.2 to the Form 6-K originally furnished to the Securities and Exchange Commission on March 10, 2022 (the “Original Annual MD&A”). The Amended Management’s discussion and analysis of financial condition and results of operations for the years ended December 31, 2021 and 2020 attached as Exhibit 99.1 hereto supersedes the Original Annual MD&A.

DOCUMENTS INCLUDED AS PART OF THIS REPORT

| Exhibit | |

| 99.1 | Amended Management’s discussion and analysis of financial condition and results of operations for the years ended December 31, 2021 and 2020. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| New Found Gold Corp. | |||

| Date: May16, 2022 | By: | ||

| Name: | Michael Kanevsky | ||

| Title: | Chief Financial Officer | ||

Exhibit 99.1

Management’s Discussion and Analysis

|

AMENDED

|

The following discussion is management’s assessment and analysis of the results and financial condition of New Found Gold Corp. (the “Company” or “NFG”) and should be read in conjunction with the accompanying audited financial statements and related notes. The financial data was prepared using accounting policies consistent with International Financial Reporting Standards (“IFRS”) and all figures are reported in Canadian dollars unless otherwise indicated. Please refer to the cautionary note regarding forward-looking statements and information within this Management’s Discussion & Analysis (“MD&A”) and the Risks Factors discussed in the Company’s most recent Annual Information Form on file with the Canadian provincial securities regulatory authorities and Form 40-F on file with the U.S. Securities and Exchange Commission (the “SEC”).

This MD&A contains forward-looking information and forward-looking statements, within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), that involve numerous risks and uncertainties. The Company continually seeks to minimize its exposure to business risks, but by the nature of its business and exploration activities and size, will always have some risk. These risks are not always quantifiable due to their uncertain nature. Should one or more of these risks and uncertainties, including those described under the headings “Risks and Uncertainties” and “Cautionary Notes Regarding Forward-Looking Statements” materialize, or should underlying assumptions prove incorrect, then actual results may vary materially from those expressed or implied in forward-looking statements. The effective date of this report is May 16, 2022.

The technical content disclosed in this MD&A was reviewed and approved by Greg Matheson, P. Geo., Chief Operating Officer, and a Qualified Person as defined under National Instrument 43-101. Mr. Matheson consents to the publication of this MD&A, by NFG. The scientific and technical information in this MD&A relating to the Queensway Project is derived from, and in some instances is a direct extract from, and is based on the assumptions, qualifications and procedures set out in, the report entitled “43-101 Technical Report for the Queensway Project, Newfoundland, Canada” with an effective date of February 18, 2022, prepared in accordance with NI 43-101 (the “Queensway Technical Report”). Reference should be made to the full text of the Queensway Technical Report, which is available for review under the Company’s profile on SEDAR at www.sedar.com.

Description of Business

The Company was incorporated on January 6, 2016, under the Business Corporations Act (Ontario). On June 23, 2020, the Company continued as a British Columbia corporation under the Business Corporation Act in the province of British Columbia. The Company’s head office is located at 1430 – 800 West Pender Street, Vancouver, British Columbia V6C 2V6, and its registered office is located at Suite 2600 – 595 Burrard Street, Vancouver, British Columbia V7X 1L3. On August 11, 2020, the Company completed an initial public offering and listed on the TSX Venture Exchange under the symbol “NFG”. On September 29, 2021, the Company also listed its shares on the NYSE American stock exchange under the symbol “NFGC”.

The Company is a mineral exploration company engaged in the acquisition, exploration and evaluation of resource properties with a focus on gold properties located in the Provinces of Newfoundland and Labrador and Ontario, Canada. The Company’s principal objective is to explore and develop the Queensway Project, which is located near Gander, Newfoundland and to identify other properties worthy of investment and exploration. For the purpose of NI 43-101, the Queensway Project is the Company’s only material property.

The Queensway Project is comprised of 86 mineral licenses, including 6,041 claims comprising 151,030 hectares of land located near Gander, Newfoundland. The Queensway Project is accessible by main access roads including the Trans-Canada Highway (“TCH”) that passes through the southern portion of the project and has high voltage electric transmission lines running through the project area. In addition, the Company owns a 100% interest in the Lucky Strike project in Kirkland Lake, Ontario comprising 11,684 hectares, as well as a portfolio of mining and royalty interests throughout northeastern Ontario.

- 1 -

Management’s

Discussion and Analysis |

AMENDED

|

The Lucky Strike Property is located 10km north of Larder Lake, Ontario and is comprised of 639 single cell un-patented mining claims. The Company is well financed to advance its planned exploration activities on the projects as intended.

As of the date of this MD&A, the Company’s Board of Directors consisted of the following: Collin Kettell (Executive Chairman), Vijay Mehta , Denis Laviolette, Douglas Hurst and Quinton Hennigh.

Additional information relating to the Company is available on the Company’s website at www.newfoundgold.ca.

Project Summary

Queensway Project, Newfoundland

Ownership

The Queensway Project contains nine optioned claim packages along with mineral licenses map staked by NFG. The Company acquired the rights to the Queensway Project by map staking mineral licenses and making a series of staged payments in cash and common shares of the Company from 2016 through 2019 under nine separate option agreements. All of the option agreements have been fully exercised resulting in 100% ownership by NFG of the mineral licenses related to such option agreements. In addition to the nine option agreements, NFG also conducted map staking resulting in 49 map staked mineral licenses, which are held 100% by NFG. The optioned lands also carry various net smelter royalties, the option agreements locations can be seen in the figure below.

Queensway Project – Option Agreement Claim Groups

- 2 -

Management’s

Discussion and Analysis |

AMENDED

|

Queensway Project – Overall Project Showing Gold Occurrences

- 3 -

Management’s

Discussion and Analysis |

AMENDED

|

Queensway Project – Locations of Prospects along the AFZ and JBPFZ.

- 4 -

Management’s

Discussion and Analysis |

AMENDED

|

Environmental and Exploration Permitting

All exploration activities, including reclamation, must comply with all pertinent federal and provincial laws and regulations, the fundamental requirement of which, is that exploration on crown land must prevent unnecessary or undue degradation or impact on fish and wildlife and requires reclamation if any degradation or impacts that occur. All exploration activities in Newfoundland and Labrador require an Exploration Approval from the Department of Natural Resources prior to the start of work. In this, approval requirements for the exploration are listed with contacts for the various entities given. Four Exploration Approvals are in place at the Queensway Project as of the date of this MD&A along with other associated provincial permits.

The first Exploration Approval is for diamond drilling (1500 Holes) on the Queensway North (“QWN”) area shown on the map above; this approval expires on November 4, 2022. The second Exploration Approval is for trenching within the Queensway South (“QWS”) area shown on the map above and expires on June 17, 2022. A third Exploration Approval covers geochemical sampling and prospecting over the entire Queensway Project and expires on June 10, 2022. The fourth Exploration Approval covers passive seismic geophysics within the GGN area and expires on October 14, 2022. Any changes to the planned work have to be submitted to the Department of Natural Resources and either an amended approval is given, or a new application has to be made.

A number of secondary permits and authorizations are held by the Company to conduct its exploration activities related to camp development, the cutting of wood, construction of access trails and modifications to water bodies.

In October 2020, the Company submitted an environmental registration document with the Newfoundland Ministry of Environment for review related to its diamond drilling activities on the QWN claim group. The Company was released from the environmental review on December 12, 2020, subject to several operating/reporting conditions including:

| · | Limitations on the percentage of land disturbance within protected public supply areas (“PPWSAs”) |

| · | Requirements for the capping or sealing of drill holes in and outside of PPWSAs |

| · | The establishment of a water-sampling program |

| · | The development of a waste management plan |

| · | The maintenance of buffers at certain shoreline, outflow, waterbodies and wetland sites and restrictions on vegetation clearing near bird habitats; and |

| · | The development of a women’s employment plan |

To date, all of our operating conditions have been met, and the Company is in compliance with all reporting conditions.

Generally, the mineral licenses are available for exploration activities year-round and only subject to the conditions of the exploration approvals; other activities such as construction, road building, camps and water crossings may require additional permits from outside of the mines department. Mineral licenses within the southernmost portion of Gander Gold South (“GGS”), specifically licenses 024557M, 024558M, 024561M, 024563M, 024568M, and 024570M are restricted from exploration activities from mid-May to early-July due to spring habitat for Newfoundland caribou.

Project Infrastructure

The main access roads include the TCH that passes through the southern portion of the Appleton Fault Zone (“AFZ”) / Joe Batts Pond Deformation Zone (“JBPFZ”) claim areas on the QWN, and the Northwest Gander (“NWG”) road that extends along the western portion of the property from the TCH just west of Glenwood, to the south and west of Gander Lake on the GGS.

- 5 -

Management’s

Discussion and Analysis |

AMENDED

|

Gravel woods access roads originally built for the forestry industry, such as the AFZ access, the JBPFZ access, the JBP road and the roads to the east of the steel bridge across the NWG River and across the bridge to the east of the Southwest Gander River extend through most of the property, with areas in the extreme SE and SW the most difficult to access. The SW area is best accessed by woods roads from Route 360, the Baie D’Espoir highway, that leaves the TCH at Bishop’s Falls, approximately 70 km to the west of Glenwood.

Transportation availability includes the international airport at Gander which has bush plane and helicopter bases, a helicopter base in Appleton and shipping through the ports of Lewisporte and Botwood, 25 km and 70 km to the west respectively, and north of the TCH, both with good harbours although problems with winter shipping due to sea and pack ice.

Electricity is available from the NL provincial grid, which has three transmission lines through the Queensway Project as follows:

| 1) | A 350 kV HVdc direct current line which passes through the approximate centre of the GGS licences; |

| 2) | Two 138 kV HVac transmission lines to the north of the TCH crossing the AFZ and JBPFZ trends on the QWN licences; |

| 3) | A 69 kV HVac transmission line that approximately parallels the TCH to the north across the AFZ and JBPFZ trends on the QWN licences and follows the TCH and secondary routes. |

In addition, electrical power is supplied, through the provincial grid, to the towns of Glenwood and Appleton which are surrounded by the NFG Queensway licences.

Historical Work

There has been over 29,200 metres of core in 238 holes drilled historically on the Queensway Project by Noranda, Rubicon and various operators from the mid 1980’s through to 2012. Historical core drilling has primarily occurred north of Gander Lake along the two principal fault structures the AFZ and JBPFZ; the exploration drilling has been spread out amongst individual zones with drilling along 5 km of the AFZ targeting the Lotto, Powerline, Cokes, Keats, Dome, Trench 26, Road, Knob, Letha and Grouse Zones. Drilling at the JBPFZ has focussed along 3 km targeting the Pocket Pond and H-Pond zones and one drill hole targeting the 798 Zone. Significantly lesser number of drill holes have also targeted zones south of Gander Lake including the Paul’s Pond showing, Aztec and A-Zone extension and the Goose zone.

Throughout the 1980’s through mid-2000’s various operators and prospectors have completed surface geochemical sampling including tills, soils and rock samples. This amounts to roughly 2,500 till samples, over 14,000 soil samples and 6,000 rock samples spread across the large district scale project with concentrations of work around the many showings in the Queensway license group. This work has identified a number of gold in soil or gold in till anomalies that have led to surface gold discoveries or have yet to be explained with follow up exploration. Several locations throughout the project have defined surface float samples containing high grade gold mineralization some of which have led to surface gold occurrences while other locations have not been adequately explored to trace them to source.

Various historical ground geophysical surveys have been conducted throughout the Queensway Project with most of this work concentrated either along the AFZ, JBPFZ or in the region of the Paul’s Pond and Greenwood Pond showings in the QWS claim group. Over 50 different geophysical surveys including VLF, EM, MAG and IP have covered ground-based grids throughout the Queensway Project. Various anomalies have been identified and often limited follow up exploration has occurred.

- 6 -

Management’s

Discussion and Analysis |

AMENDED

|

A significant number of surface trenches have been conducted at the project with over 330 trenches. Many of the historical trenches have targeted soil and till anomalies with only some of these reaching bedrock; often the trenches not reaching bedrock have left both soil and till anomalies unexplained and open for further interpretation and exploration.

Project Geology

The Queensway Project is located within the Exploits subzone of the Dunnage zone and lies just to the west of the Gander River Ultramafic Complex (“GRUC”) fault, which is the Dunnage-Gander zones boundary. See figure below:

Queensway Project – Geological context of the Queensway Project Geological map from Colman-Sadd et al., 1990. A) Location of the

major terranes of Newfoundland. B) Regional geological context.

- 7 -

Management’s

Discussion and Analysis |

AMENDED

|

It mostly comprises Cambrian to Silurian meta-sedimentary rocks of the Davidsville group (Williams et al., 1988; Colman-Sadd et al., 1990; Valverde-Vaquero et al., 2006; van Staal, 2007; O’Reilly et al., 2010). The Davidsville group is divided into the Outflow Formation and the Hunt’s Cove Formation. The property south of Gander Lake also includes the boundary between the Davidsville and Indian Island groups. The latter mainly comprises Silurian siliciclastic rocks, intruded by the Mount Peyton Intrusive suite.

There are over 100 gold showings/occurrences on and around the Queensway Project however the most notable mineralized zones in the Queensway Project are the JBPFZ which includes the H-Pond, Pocket Pond, Glass, Logan and Lachlan showings and the AFZ which includes the Dome, Little, Knob, Letha, Lotto, Grouse, Road, Bullet, Trench 26, Cokes, Powerline, Keats and Bowater showings. A number of gold mineralized occurrences also occur within the QWS claim group including the Greenwood Pond, Hornet, North Pauls Pond, Aztec, Goose, Road Gabbro and LBNL showings.

Recent Exploration

Queensway Drill Program

On August 17, 2020, the Company announced it had initiated a 100,000m HQ size diamond drilling program at the Queensway Project. The Company announced on January 6, 2021, that it has now increased the drilling program started in 2020 to a total of 200,000m; this program was further expanded on October 15, 2021 to 400,000m and is expected to reach 14 drill rigs in 2022. In 2020 the Company completed 66 drill holes targeting the Little-Powerline, Lotto, Dome and Keats zones for a total of 13,400m. In 2021 the Company has completed an additional 391 drill holes totalling 117,043m. The drilling program is ongoing with ten rigs active and approximately 43% complete as of May 5, 2022, and is expected to continue into Q2 2023.

The drilling program is designed to test multiple exploration targets and zones along the 7.8 km of the Appleton Fault Zone and 12 km of the JBP Fault Zone at Queensway North. The primary focus is on the expansion of known zones of mineralization and testing targets to generate new mineralized zones.

In 2022 the Company also expects to complete an inaugural drilling program at the Queensway South part of the project testing early-stage exploration targets as part of the 400,000m program.

The majority of drilling to date has occurred along the Appleton Fault with eleven drill rigs active. To date 320 drill holes have been completed at the Keats Zone totalling 87,595m, 77 drill holes at the Lotto Zone totalling 21,497m, 70 drill holes at the Golden Joint zone totalling 23,681m with the balance of 68 drill holes totalling 15,721m completed at other zones/targets along the Appleton Fault including the Little-Powerline, Cokes, Road, Zone 36, Knob, TCH, Dome and Big Dave.

The Company is also actively exploring along the JBP Fault zone with 88 holes totalling 23,605m completed to date at the 798, 1744 and Pocket Pond prospects.

Keats Zone Drilling

To date the Company has focussed its drilling efforts at the Keats zone where a discovery hole in late 2019 (NFGC-19-01) was drilled. A number of significant gold assay intercepts have been encountered within multiple individual zones at Keats.

- 8 -

Management’s

Discussion and Analysis |

AMENDED

|

Initial assay results from five drill holes at the Keats zones were reported in press release dated October 27, 2020, with further assay results reported on November 16, 2020; December 15, 2020; January 11, 2021; February 9, 2021; March 1, 2021; March 9, 2021; March 16, 2021; March 30, 2021; April 5, 2021; April 20, 2021; April 27, 2021; May 4, 2021; May 21,2021; June 15, 2021; July 5, 2021; September 15, 2021; October 13, 2021; October 14, 2021; January 13, 2022; January 26, 2022; February 24, 2022; March 2, 2022; April 11, 2022; April 13, 2022 and May 4, 2022 found through SEDAR.

The Keats zone continues to see a steady increase in both strike length and depth with the largest step-out result of 62.3 g/t Au over 2m in NFGC-21-387 reported on February 24, 2022, indicating the down plunge of the Keats Main high-grade zone has now increased to 845m starting at the bedrock surface. Additional highlight intercepts reported up-plunge within this high-grade domain of the Keats Main Zone include 106.2 g/t Au over 35.4m in NFGC-21-182 (reported May 21, 2021), 124.4 g/t Au over 17.7m in NFGC-20-59 (reported on May 4, 2021) and the discovery hole, NFGC-19-01 yielding 86.2 g/t Au over 20.5m (reported on January 28, 2020). Assay results from October 13, 2021, January 13, 2022, and January 26, 2022, have shown a new area of significant high-grade gold which was originally reported to be located within the Keats Footwall (“Keats FW”). Reinterpretation of these intercepts and an update to the geological model, indicate that these intercepts are instead a part of the Keats Main Zone hosted within the Keats-Baseline Fault. These zones originally referenced as Keats FW include an intercept of 88.5g/t Au over 3.35m in NFGC-21-238, 56.7g/t Au over 2.45m in NFGC-21-407 and 28.2 g/t Au over 4.5m in NFGC-21-413A; the Keats Main Zone long-section has been updated to reflect this change in interpretation.

Exploration drilling focused on testing above the southwest-plunging domain of high-grade within the Keats Main Zone successfully expanded the high-grade gold mineralization up-dip towards surface. This is demonstrated by intercept 55.6 g/t Au over 3.20m in NFGC-21-385, located at surface and 200m up-dip of the dilatant zone and intercept 10.7 g/t Au over 3.15m in NFGC-21-306 located 75m up-dip of the dilatant zone, both reported on March 2, 2022. On average, the Keats Main zone has been defined over a down-dip extent of ~200m.

More recent results reported in the April 11, 2022, news release continue to demonstrate that the Keats-Baseline Fault Zone forms an extension damage zone consisting of a multitude of faults and vein arrays that host high-grade gold mineralization. Examples include:

| - | the new near surface discovery, the “421 Zone” at the south end of Keats, defined by intercepts 4.49 g/t Au over 3.55m and 7.85 g/t Au 4.85m in NFGC-21-421 and 4.31 g/t Au over 2.25m and 2.58 g/t Au over 10.40m in NFGC-21-467; |

| - | the footwall (the area between the Keats-Baseline Fault and the AFZ) intercepts of 119.5 g/t Au over 2.4m in NFGC-21-375 and 6.66 g/t Au over 5.9m in NFGC-21-342; |

| - | the intercepts of 9.35 g/t Au over 2.70m in NFGC-21-254 and 7.21 g/t over 5.75m in NFGC-21-392 that occur within two distinct structures that are adjacent to and crosscut the Keats Main Zone. |

Additional results released on April 11, 2022, further confirm the continuity, robust width and high-grade nature of the gold mineralization within the southwest-plunging dilational segment of the Keats-Baseline Fault with the intercept of 21.1 g/t Au over 7.2m in NFGC-21-464 and the identification of significant high-grade gold mineralization ~50m down-dip of this dilational segment at the north end of Keats with the result of 79.8 g/t Au over 3m in NFGC-22-491.

- 9 -

Management’s

Discussion and Analysis |

AMENDED

|

Reconnaissance drilling working in the highly prospective region between the Keats Main and Golden Joint zones intersected significant mineralization, now named the “515 Zone”, returning initial intercepts of 9.21 g/t Au over 2.15m and 43.9 g/t Au over 3.85m in NFGC-22-515 approximately 440m north of the Keats Main Zone. Following this discovery, reconnaissance drilling in this region identified two additional new near surface zones. This includes the intercept of 275 g/t Au over 2.15 m in NFGC-22-538 which occurs at a vertical depth of 22m adjacent to the AFZ and is approximately 65m north of the Keats Zone and the intercept of 8.70 g/t Au over 6.75m in NFGC-22-533, located at a vertical depth of 65m in the black shales that form the hanging wall to the AFZ, this a new part of the stratigraphy that is largely unexplored and this intercept represents and important new target.

Advancements in the detailed geologic modelling with a focus on veins and associated faults has greatly increased the understanding of the Keats zone, identified a number of drill targets and has demonstrated good continuity of the high-grade gold mineralization within the host structures. An aggressive drill program will continue to expand this extensive network of high-grade gold veins and follow up on the new 515 and 421 discoveries.

Highlighted assay values and drill hole locations from Keats Main drilling are shown in the tables below:

| Hole No. | From (m) | To (m) | Interval (m)1 | Au (g/t) | ||||||||||||

| KEATS HW | ||||||||||||||||

| NFGC-21-254 | 136.85 | 139.55 | 2.70 | 9.35 | ||||||||||||

| Including | 138.6 | 139.55 | 0.95 | 22.70 | ||||||||||||

| NFGC-21-392 | 47.15 | 52.90 | 5.75 | 7.21 | ||||||||||||

| Including | 47.15 | 48.70 | 1.55 | 20.59 | ||||||||||||

| KEATS MAIN | ||||||||||||||||

| NFGC-21-256A | 127.15 | 129.40 | 2.25 | 15.07 | ||||||||||||

| And | 157.00 | 166.75 | 9.75 | 47.82 | ||||||||||||

| Including | 158.00 | 161.65 | 3.65 | 125.49 | ||||||||||||

| NFGC-21-263 | 189.70 | 195.25 | 5.55 | 28.16 | ||||||||||||

| Including | 193.10 | 195.25 | 2.15 | 71.86 | ||||||||||||

| NFGC-21-272 | 152.00 | 155.10 | 3.1 | 43.78 | ||||||||||||

| NFGC-21-297 | 219.5 | 227.75 | 8.25 | 8.79 | ||||||||||||

| Including | 219.5 | 224.35 | 4.85 | 14.29 | ||||||||||||

| NFGC-21-306 | 113.85 | 117.00 | 3.15 | 10.66 | ||||||||||||

| NFGC-21-318 | 141.00 | 143.00 | 2.00 | 16.03 | ||||||||||||

| Including | 141.00 | 142.00 | 1.00 | 31.60 | ||||||||||||

| NFGC-21-376 | 191.00 | 193.05 | 2.05 | 13.65 | ||||||||||||

| NFGC-21-385 | 69.60 | 72.80 | 3.20 | 55.61 | ||||||||||||

| NFGC-21-387 | 444.40 | 446.40 | 2.00 | 62.30 | ||||||||||||

| NFGC-21-407 | 393.55 | 396.00 | 2.45 | 56.69 | ||||||||||||

| NFGC-21-413A | 463.05 | 467.55 | 4.50 | 28.20 | ||||||||||||

| Including | 463.05 | 466.00 | 2.95 | 41.02 | ||||||||||||

| NFGC-21-464 | 138.00 | 145.20 | 7.20 | 21.12 | ||||||||||||

| Including | 139.55 | 141.80 | 2.25 | 61.36 | ||||||||||||

| NFGC-22-491 | 92.00 | 95.00 | 3.00 | 79.81 | ||||||||||||

| Including | 92.45 | 94.35 | 1.90 | 124.56 | ||||||||||||

- 10 -

Management’s

Discussion and Analysis |

AMENDED

|

| KEATS FW | ||||||||||||||||

| NFGC-21-342 | 138.65 | 144.55 | 5.90 | 6.66 | ||||||||||||

| Including | 142.00 | 143.00 | 1.00 | 30.60 | ||||||||||||

| NFGC-21-375 | 181.60 | 184.00 | 2.40 | 119.45 | ||||||||||||

| Including | 182.20 | 182.70 | 0.50 | 570.71 | ||||||||||||

| 421 | ||||||||||||||||

| NFGC-21-421 | 19.00 | 22.55 | 3.55 | 4.49 | ||||||||||||

| And | 26.30 | 31.15 | 4.85 | 7.85 | ||||||||||||

| Including | 28.60 | 29.50 | 0.90 | 35.51 | ||||||||||||

| NFGC-21-467 | 66.15 | 68.40 | 2.25 | 4.31 | ||||||||||||

| Including | 67.00 | 67.60 | 0.60 | 13.85 | ||||||||||||

| And | 70.00 | 80.40 | 10.40 | 2.58 | ||||||||||||

| KEATS NORTH | ||||||||||||||||

| NFGC-22-515 | 198.50 | 200.65 | 2.15 | 9.21 | ||||||||||||

| Including | 199.25 | 199.75 | 0.50 | 38.9 | ||||||||||||

| And | 209.00 | 212.85 | 3.85 | 43.9 | ||||||||||||

| Including | 209.00 | 210.65 | 1.65 | 76.0 | ||||||||||||

| Including | 211.35 | 212.35 | 1.00 | 43.1 | ||||||||||||

| NFGC-22-533 | 98.25 | 105.00 | 6.75 | 8.70 | ||||||||||||

| Including | 100.65 | 101.50 | 0.85 | 53.3 | ||||||||||||

| And | 127.40 | 129.55 | 2.15 | 1.60 | ||||||||||||

| NFGC-22-538 | 32.45 | 34.60 | 2.15 | 275 | ||||||||||||

| Including | 33.10 | 33.90 | 0.80 | 738 |

1Note that the host structures are interpreted to be steeply dipping and true widths are generally estimated to be 60% to 95% of reported intervals. Infill veining in secondary structures with multiple orientations crosscutting the primary host structures are commonly observed in drill core which could result in additional uncertainty in true width. Intervals are calculated at a 1 g/t Au cut-off grade; grades have not been capped in the averaging.

- 11 -

Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

AMENDED |

| Hole No. | Azimuth (°) | Dip (°) | Length (m) | UTM E | UTM N | |||||||||||||||

| NFGC-21-254 | 299 | -46 | 293 | 658119 | 5427290 | |||||||||||||||

| NFGC-21-256A | 299 | -46 | 257 | 658197 | 5427374 | |||||||||||||||

| NFGC-21-263 | 118 | -72 | 334 | 657952 | 5427310 | |||||||||||||||

| NFGC-21-272 | 298.5 | -45.5 | 227 | 658187 | 5427380 | |||||||||||||||

| NFGC-21-297 | 300 | -45 | 377 | 658126 | 5427228 | |||||||||||||||

| NFGC-21-306 | 299 | -45.5 | 179 | 658100 | 5427358 | |||||||||||||||

| NFGC-21-318 | 300 | -45 | 200 | 658089 | 5427335 | |||||||||||||||

| NFGC-21-342 | 300 | -45 | 260 | 658018 | 5427377 | |||||||||||||||

| NFGC-21-375 | 300 | -45 | 278 | 658011 | 5427352 | |||||||||||||||

| NFGC-21-376 | 120 | -72 | 351 | 657972 | 5427337 | |||||||||||||||

| NFGC-21-385 | 299 | -45.5 | 290 | 657961 | 5427265 | |||||||||||||||

| NFGC-21-387 | 299 | -45.5 | 635 | 657936 | 5426877 | |||||||||||||||

| NFGC-21-392 | 300 | -42 | 281 | 657939 | 5427279 | |||||||||||||||

| NFGC-21-407 | 296 | -57 | 467 | 658109 | 5427123 | |||||||||||||||

| NFGC-21-413A | 296 | -57 | 515 | 658086 | 5427134 | |||||||||||||||

| NFGC-21-421 | 325 | -56 | 452 | 657830 | 5427099 | |||||||||||||||

| NFGC-21-467 | 325 | -56 | 494 | 657825 | 5427070 | |||||||||||||||

| NFGC-21-464 | 299 | -46 | 320 | 658193 | 5427391 | |||||||||||||||

| NFGC-22-491 | 299 | -46 | 206 | 658300 | 5427503 | |||||||||||||||

| NFGC-22-515 | 299 | -46 | 281 | 658344 | 5428026 | |||||||||||||||

| NFGC-22-538 | 300 | -45 | 386 | 658193 | 5427710 | |||||||||||||||

| NFGC-22-533 | 120 | -45 | 320 | 657951 | 5427748 | |||||||||||||||

- 12 -

Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

AMENDED |

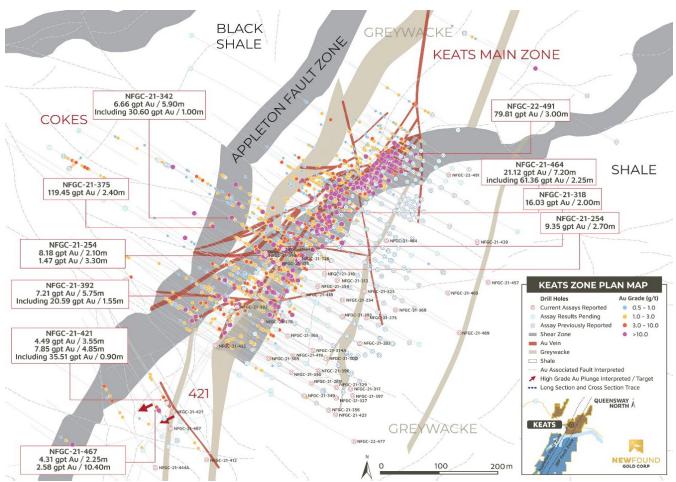

The latest drilling results are shown on the long section, plan map and 3-D composite cross section below:

Queensway Project – Long Section of Keats Main (April 11, 2022)

- 13 -

Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

AMENDED |

Queensway Project – Plan Map of Keats Zone (April 11, 2022)

- 14 -

Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

AMENDED |

Queensway Project – Plan Map of Keats – Lotto with Location Lotto with Location Keats North Discoveries (May 4, 2022)

- 15 -

Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

AMENDED |

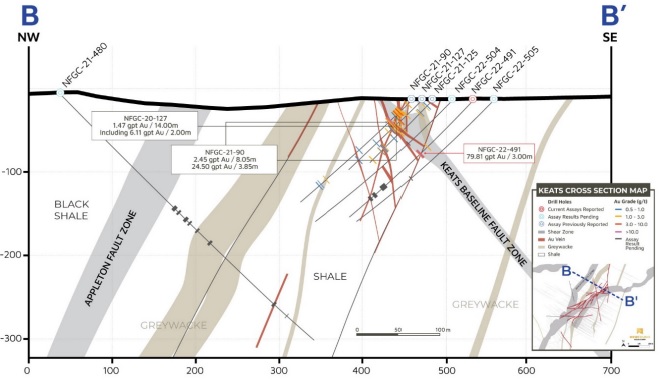

Queensway Project – Keats Cross-Section, Looking NE (+/- 10m) (April 11, 2022)

Queensway Project – Keats Cross-Section, Looking NE (+/- 10m) (April 11, 2022)

- 16 -

Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

AMENDED |

Queensway Project – Keats Cross-Section, Looking NE (+/- 10m) (April 11, 2022)

Lotto Zone Drilling

The Company has reported several significant gold assay intervals from the Lotto Zone starting with its first drill hole NFGC-20-17 reporting 16.3 g/t Au over 2.2m, 41.2 g/t Au over 4.75m and a third interval of 25.4 g/t Au over 5.15 m. The Lotto Zone is comprised of an approximately north-south striking, steeply east-dipping vein associated with a brittle fault. On January 14, 2021, the Company announced the discovery of a new zone named the “Sunday Zone” proximal to the Lotto Zone along the hanging wall of the AFZ. The new discovery represents the first known occurrence of gold mineralization proximal to the primary Appleton Fault structure with an intercept in drill hole NFGC-20-44 grading 18.1g/t Au over 6.5m at a down hole depth of 239m. Additional gold mineralized intercepts were reported on February 23, 2021, March 23, 2021, June 23, 2021 highlighted by drill holes NFGC-21-100 reporting 224.7 g/t Au over 2.45m, NFGC-21-109 reporting 51.3 g/t Au over 3.20m, NFGC-21-115 reporting 53.3 g/t Au over 3.10m NFGC-21-201 reporting 150.3g/t over 11.5m.

The most recent drilling highlights from the Lotto Zone showed an increase of the Lotto high-grade mineralization to 225m vertical depth from NFGC-21-367A reporting 24.3 g/t Au over 2.2m on March 24, 2022, with a vein-defined depth of ~300m and a strike length of ~200m. An additional highlight from the March 24, 2022, release includes the intercept of 23.1 g/t Au over 2.05m in NFGC-21-319 into the Sunday Zone located ~65m down-dip of the previously reported intercept of 18.1 g/t Au over 6.5m in NFGC-20-44 (January 14, 2021).

- 17 -

Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

AMENDED |

Highlighted assay values and drill hole locations from Lotto drilling are shown in the tables below:

| Hole No. | From (m) | To (m) | Interval (m)1 | Au (g/t) | Zone | |||||||||||||

| NFGC-21-243 | 243.75 | 245.75 | 2.00 | 10.74 | Lotto Main | |||||||||||||

| Including | 244.50 | 245.45 | 0.95 | 22.49 | ||||||||||||||

| NFGC-21-289 | 192.95 | 195.35 | 2.40 | 12.57 | Lotto Main | |||||||||||||

| Including | 193.25 | 194.55 | 1.30 | 21.58 | ||||||||||||||

| NFGC-21-295 | 110.20 | 112.20 | 2.00 | 12.19 | Lotto Main | |||||||||||||

| Including | 110.55 | 111.25 | 0.70 | 34.81 | ||||||||||||||

| NFGC-21-296 | 228.00 | 230.60 | 2.60 | 15.66 | Lotto Main | |||||||||||||

| NFGC-21-319 | 176.60 | 179.00 | 2.40 | 20.01 | Lotto Main | |||||||||||||

| Including | 176.60 | 177.70 | 1.10 | 43.32 | ||||||||||||||

| And | 315.30 | 317.35 | 2.05 | 23.08 | Sunday | |||||||||||||

| NFGC-21-333 | 61.40 | 64.00 | 2.60 | 11.67 | Lotto Main | |||||||||||||

| Including | 62.75 | 63.25 | 0.50 | 58.00 | ||||||||||||||

| NFGC-21-338 | 282.65 | 284.80 | 2.15 | 25.31 | Lotto Main | |||||||||||||

| Including | 284.05 | 284.50 | 0.45 | 115.25 | Lotto Main | |||||||||||||

| NFGC-21-367A | 324.45 | 326.65 | 2.20 | 24.25 | Lotto Main | |||||||||||||

| NFGC-21-404A | 217.15 | 219.20 | 2.05 | 31.63 | Lotto Main | |||||||||||||

| Including | 217.45 | 218.05 | 0.60 | 107.50 | Lotto Main | |||||||||||||

1Note that the host structures are interpreted to be steeply dipping and true widths are generally estimated to be 70% to 90% of reported intervals. Infill veining in secondary structures with multiple orientations crosscutting the primary host structures are commonly observed in drill core which could result in additional uncertainty in true width. Composite intervals reported carry a minimum weighted average of 1 g/t Au diluted over a minimum core length of 2m with a maximum of 2m consecutive dilution. Included high-grade intercepts are reported as any consecutive interval with grades greater than 10 g/t Au. Grades have not been capped in the averaging and intervals are reported as drill thickness.

| Hole No. | Azimuth (°) | Dip (°) | Length (m) | UTM E | UTM N | |||||||||||||||

| NFGC-21-243 | 298 | -50 | 323 | 659064 | 5428888 | |||||||||||||||

| NFGC-21-289 | 299 | -45 | 345 | 659030 | 5428958 | |||||||||||||||

| NFGC-21-295 | 300 | -45 | 128 | 659052 | 5429149 | |||||||||||||||

| NFGC-21-296 | 299 | -45.5 | 255 | 659058 | 5428943 | |||||||||||||||

| NFGC-21-319 | 299 | -45.5 | 342 | 659010 | 5428998 | |||||||||||||||

| NFGC-21-333 | 299 | -45.5 | 336 | 658985 | 5429013 | |||||||||||||||

| NFGC-21-338 | 298 | -45.5 | 312 | 659099 | 5428890 | |||||||||||||||

| NFGC-21-343A | 298 | -48 | 404 | 658588 | 5428275 | |||||||||||||||

| NFGC-21-367A | 298 | -47 | 369 | 659125 | 5428876 | |||||||||||||||

| NFGC-21-404A | 299 | -48 | 374 | 659046 | 5429007 | |||||||||||||||

- 18 -

Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

AMENDED |

The latest results from the Lotto Zone are shown in the long section, plan map and cross section below:

Queensway Project – Lotto Zone Long Section (March 24, 2022)

- 19 -

Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

AMENDED |

Queensway Project – Lotto Zone Plan Map (March 24, 2022)

- 20 -

AMENDED

Management’s Discussion and Analysis

For the year ended December 31, 2021 and 2020

Queensway Project – Cross Section of Current Drilling Program, +/- 12.5m, Looking NE (Lotto Zone – March 24, 2022)

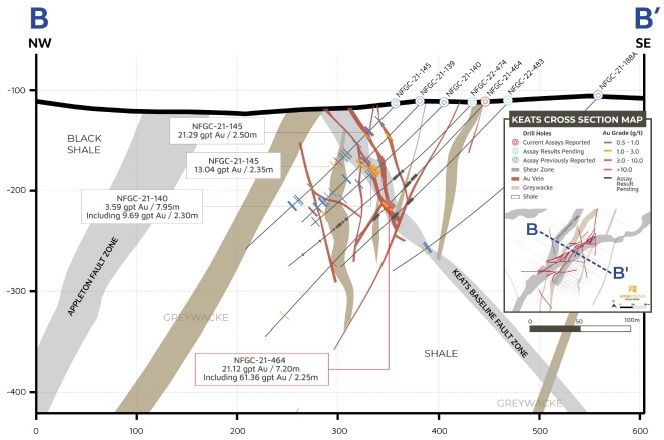

Golden Joint Drilling

On June 29, 2021, the Company announced the discovery of a new high-grade zone along the hanging wall of the AFZ named the Golden Joint. Comprised of two sub-parallel vein systems (Main Zone and HW Zone) and located between the Keats and Lotto zones this new discovery has yielded several notable high-grade intervals including NFGC-21-171 (10.4g/t Au over 4.85m), NFGC-21-241 (430.2g/t Au over 5.25m) within the Golden Joint Main Zone, consisting of an approximately north-south striking, steeply west-dipping quartz vein and brittle fault. Further assay results were published on September 28, 2021, with a notable intersection in NFGC-21-386 yielding 70.7 g/t Au over 5.25m. On January 19, 2022, the results reported showed the expansion of the Golden Joint Main Zone to a vertical depth of ~305m with drill hole NFGC-21-401 intersecting 98.1g/t Au over 3.85m and a vein-defined strike length of ~250m. Infill drilling results reported on March 24, 2022, the latest release, identified a domain of significant high-grade in NFGC-21-462 which returned 69.2 g/t Au over 14.15m.

The Golden Joint HW continues to expand in all directions, forming a network of stock-work style veining that is largely constrained to a thick bed of greywacke. Drilling to date has extended the zone over a strike length of ~190m and to a vertical depth of ~125m. Highlight intervals include 64.9 g/t Au over 2.1m and 17.4 g/t Au over 2.45m in NFGC-21-225 reported on September 30, 2021, 33.1 g/t Au over 2.1m in NFGC-21-274 reported on January 6, 2022, 4.96 g/t Au over 6.2m in NFGC-21-187 reported on January 6, 2022 and the latest reported result on March 24, 2022 of 13.4 g/t Au over 2.1m in NFGC-21-264.

- 21 -

AMENDED

Management’s Discussion and Analysis

For the year ended December 31, 2021 and 2020

Highlighted assay values and drill hole locations from Golden Joint drilling are shown in the tables below:

| Hole No. | From (m) | To (m) | Interval (m)1 | Au (g/t) | ||||||||||||

| Golden Joint | ||||||||||||||||

| NFGC-21-386 | 424.75 | 430.00 | 5.25 | 70.65 | ||||||||||||

| NFGC-21-401 | 450.15 | 454.00 | 3.85 | 98.13 | ||||||||||||

| NFGC-21-462 | 325.75 | 339.90 | 14.15 | 69.15 | ||||||||||||

| Including | 325.75 | 330.70 | 4.95 | 40.36 | ||||||||||||

| Including | 326.30 | 327.25 | 0.95 | 182.50 | ||||||||||||

| And Including | 333.30 | 339.90 | 6.60 | 117.85 | ||||||||||||

| Including | 333.30 | 334.25 | 0.95 | 96.10 | ||||||||||||

| Including | 335.85 | 337.15 | 1.30 | 190.63 | ||||||||||||

| Including | 338.00 | 339.90 | 1.90 | 228.03 | ||||||||||||

| Golden Joint HW | ||||||||||||||||

| NFGC-21-264 | 102.00 | 104.10 | 2.10 | 13.35 | ||||||||||||

| NFGC-21-274 | 164.65 | 166.75 | 2.10 | 33.10 | ||||||||||||

1Note that the host structures are interpreted to be steeply dipping and true widths are generally estimated to be 70% to 90% of reported intervals. Infill veining in secondary structures with multiple orientations crosscutting the primary host structures are commonly observed in drill core which could result in additional uncertainty in true width. Composite intervals reported carry a minimum weighted average of 1 g/t Au diluted over a minimum core length of 2m. Grades have not been capped in the averaging and intervals are reported as drill thickness.

| Hole No. | Azimuth (°) | Dip (°) | Length (m) | UTM E | UTM N | |||||||||||||||

| NFGC-21-264 | 297 | -45 | 438 | 658595 | 5428386 | |||||||||||||||

| NFGC-21-274 | 294 | -49 | 552 | 658616 | 5428373 | |||||||||||||||

| NFGC-21-386 | 298.5 | -46.5 | 582 | 658634 | 5428306 | |||||||||||||||

| NFGC-21-401 | 298.5 | -46.5 | 492 | 658613 | 5428319 | |||||||||||||||

| NFGC-21-462 | 298 | -47.5 | 486 | 658590 | 5428331 | |||||||||||||||

- 22 -

AMENDED

Management’s Discussion and Analysis

For the year ended December 31, 2021 and 2020

The latest results from the Golden Joint Zone are shown in the long section and cross-section below and the plan map can be found in the section above:

Queensway Project – Golden Joint Long Section (March 24, 2022)

- 23 -

AMENDED

Management’s Discussion and Analysis

For the year ended December 31, 2021 and 2020

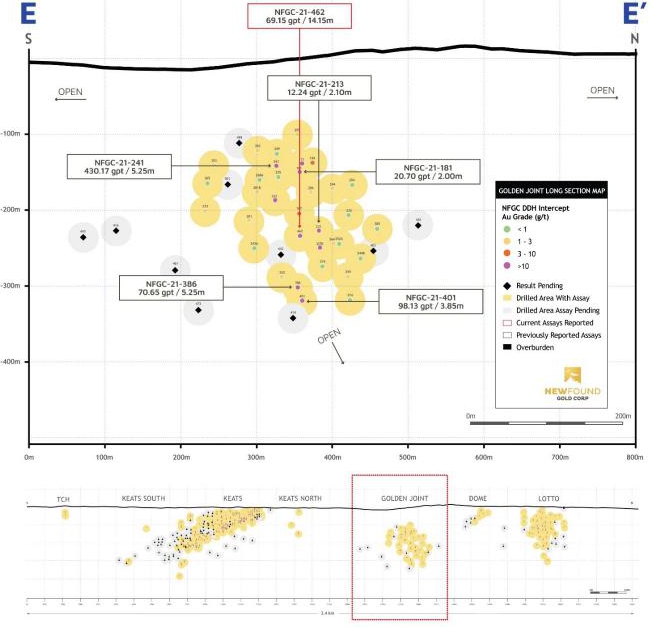

Queensway Project – Golden Joint Cross-Section, +/- 12.5m, Looking NE (March 24, 2022)

JBP Drilling

On March 9, 2022, the Company announced results from reconnaissance diamond drilling designed to test for epizonal style high-grade gold mineralization along the JBPFZ. This initial phase of drilling focused on a +3.5km segment of the JBPFZ encompassing 1744 and Pocket Pond target areas following up on historic drill results, high-grade float samples and Au-in-till anomalies as well as testing new conceptual targets. This program to date has produced a number of salient results including 31.88 g/t Au over 2.05m in NFGC-21-180 at 1744 and 25.40 g/t Au over 2.25m in NFGC-21-304 at Pocket Pond.

- 24 -

AMENDED

Management’s Discussion and Analysis

For the year ended December 31, 2021 and 2020

Highlighted assay values and drill hole locations from the JBP drilling are shown in the tables below:

| Hole No. | From (m) | To (m) | Interval (m)1 | Au (g/t) | Zone | |||||||||||||||

| NFGC-21-180 | 32.00 | 34.05 | 2.05 | 31.88 | 1744 | |||||||||||||||

| NFGC-21-195 | 283.70 | 286.50 | 2.80 | 16.66 | 1744 | |||||||||||||||

| NFGC-21-202 | 145.85 | 147.90 | 2.05 | 17.10 | 1744 | |||||||||||||||

| NFGC-21-207 | 60.00 | 66.00 | 6.00 | 8.66 | 1744 | |||||||||||||||

| Including | 63.55 | 66.00 | 2.45 | 19.66 | ||||||||||||||||

| NFGC-21-230 | 87.00 | 89.00 | 2.00 | 8.92 | Pocket Pond | |||||||||||||||

| NFGC-21-245 | 152.60 | 154.80 | 2.20 | 7.26 | Pocket Pond | |||||||||||||||

| NFGC-21-304 | 81.60 | 83.85 | 2.25 | 25.40 | Pocket Pond | |||||||||||||||

| And | 90.50 | 96.35 | 5.85 | 5.46 | ||||||||||||||||

| Including | 90.50 | 93.85 | 3.35 | 8.94 | ||||||||||||||||

1Note that the host structures are interpreted to be steeply dipping and true widths are generally estimated to be 75% to 90% of reported intervals for Pocket Pond and 55% to 65% of reported intervals for 1744. Infill veining in secondary structures with multiple orientations crosscutting the primary host structures are commonly observed in drill core which could result in additional uncertainty in true width. Intervals are calculated at a 1 g/t Au cut-off grade; grades have not been capped in the averaging.

| Hole No. | Azimuth (°) | Dip (°) | Length (m) | UTM E | UTM N | |||||||||||||||

| NFGC-21-180 | 300 | -45 | 245 | 665204 | 5430850 | |||||||||||||||

| NFGC-21-195 | 300 | -45 | 304 | 665267 | 5430870 | |||||||||||||||

| NFGC-21-202 | 300 | -45 | 245 | 665190 | 5430887 | |||||||||||||||

| NFGC-21-207 | 299 | -45.5 | 341 | 665232 | 5430862 | |||||||||||||||

| NFGC-21-230 | 119 | -45.5 | 182 | 663403 | 5428873 | |||||||||||||||

| NFGC-21-245 | 120 | -45 | 251 | 663365 | 5428880 | |||||||||||||||

| NFGC-21-304 | 121 | -45.5 | 182 | 663432 | 5428898 | |||||||||||||||

- 25 -

AMENDED

Management’s Discussion and Analysis

For the year ended December 31, 2021 and 2020

The latest results from the JBPFZ covering both 1744 and Pocket Pond target areas are shown in the long sections and plan maps below:

Queensway Project – 1744 Long Section (March 9, 2022)

- 26 -

AMENDED

Management’s Discussion and Analysis

For the year ended December 31, 2021 and 2020

Queensway Project – 1744 Plan Map (March 9, 2022)

Queensway Project – Pocket Pond Long Section (March 9, 2022)

- 27 -

AMENDED

Management’s Discussion and Analysis

For the year ended December 31, 2021 and 2020

Queensway Project – Pocket Pond Plan Map (March 9, 2022)

2020-2021 Field Program

Starting in June 2020, the Company initiated a field reconnaissance program within the QWS mineral licenses. The objective of this program is to conduct geological mapping, structural analysis, prospecting and the collection of C horizon till samples to be processed for gold grain analysis.

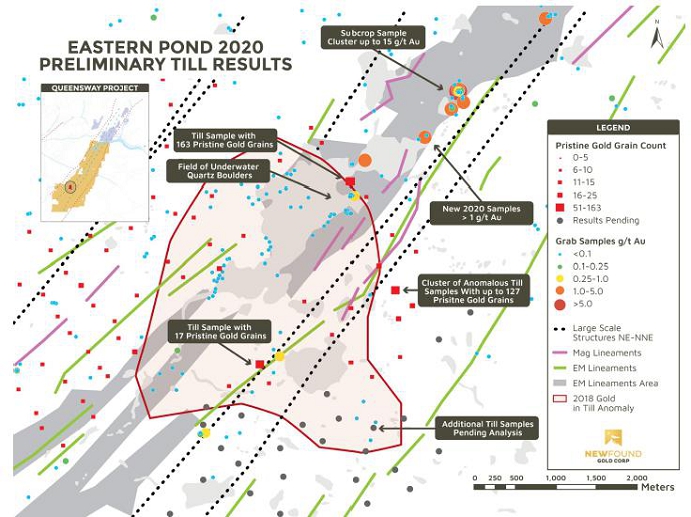

Initial results from the 2020 field program detailed till survey were reported on August 27, 2020, where the Company had announced it had found a new fertile gold region 45 km south of the current Queensway North drill targets. The Eastern Pond target is comprised of two areas where recent till results have shown highly anomalous total gold grain counts including a high percentage of pristine gold grains and yielded several sub-crop samples up to 15.0 g/t Au.

- 28 -

AMENDED

Management’s Discussion and Analysis

For the year ended December 31, 2021 and 2020

One till sample yielded 216 gold grains, 163 (75%) of them classified as pristine. A second cluster of samples yielded up to 155 gold grains with 127 (82%) of these classified as pristine. The pristine morphology of these grains indicates that they have not travelled far from their bedrock source.

To date the Eastern Pond target is defined by sub-crop and till sample results over an approximately 4 km of strike length (see Figures below). Five other gold in till anomalies have been discovered to date within QWS and warrant follow up exploration.

Queensway South Project: Location of the Eastern Pond Anomaly at Queensway South

- 29 -

AMENDED

Management’s Discussion and Analysis

For the year ended December 31, 2021 and 2020

Queensway South Project: Eastern Pond anomaly and preliminary till results

Queensway South Project: Eastern Pond target till samples

Field crews were remobilized to the Eastern Pond area in late 2020 to conduct follow up work including prospecting, geological mapping and the collection of additional till samples to further vector the Company’s exploration towards bedrock sources. Follow up work at Eastern Pond in late 2020 resulted in the collection of rock samples, additional tills samples and two trenches were excavated.

In June 2021 field crews were mobilized to conduct early-stage exploration work throughout the Queensway Project including till sampling, geological mapping, rock sampling and trenching. The goal of this program has been to aid in the development of drilling targets for a planned diamond drilling program in 2022.

- 30 -

|

AMENDED |

| Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

Sampling, Sub-sampling and Laboratory

Host structures along the Appleton Fault Zone are generally interpreted to be steeply dipping and true widths are estimated to be 85% to 95% of reported widths at Keats, unknown at Keats FW, 80% to 90% at Lotto, 70% to 90% at Golden Joint, in some areas infill veining in secondary structures with multiple orientations crosscutting the primary host structures are commonly observed in drill core which could result in additional variability in true width. Assays are uncut, and calculated intervals are reported over a minimum length of 2 meters using a lower cut-off of 1.0 g/t Au. Samples comprise either whole or split HQ size core and the assays reported were obtained by either complete sample metallic screen/fire assay or standard 30-gram fire-assaying with ICP finish at ALS Minerals in Vancouver, British Columbia, or by entire sample screened metallic screen fire assay at Eastern Analytical in Springdale, Newfoundland or through Chrysos PhotonAssayTM method with Intertek based in Perth, Australia.

The metallic screen or PhotonAssayTM method is selected by the geologist when samples contain coarse gold or any samples displaying gold initial fire assay values greater than 1.0 g/t Au. Drill program design, Quality Assurance/Quality Control and interpretation of results is performed by qualified persons employing a Quality Assurance/Quality Control program consistent with National Instrument 43-101 and industry best practices. Standards and blanks are included at a minimum with every 20 samples for Quality Assurance/Quality Control purposes by the Company as well as the lab. Approximately 3% of sample pulps are sent to secondary laboratories for check assays.

Qualified Person

The technical content disclosed in this MD&A was reviewed and approved by Greg Matheson, P. Geo., Chief Operating Officer, and a Qualified Person as defined under National Instrument 43-101. Mr. Matheson consents to the publication of this MD&A, by NFG.

Report of QA/QC Program Review

On February 23, 2022, the Company announced the results of work programs and analysis completed by independent consultants initiated to investigate possible bias indicated by a set of 30 half-core duplicate assays (see Company's November 4, 2021, news release). The work program included completion of a substantial number of additional half-core screen fire assays providing a data set of 475 half-core duplicates, and the detailed statistical assessment of these results. The work also included detailed review of sample selection, preparation, and lab analysis procedures for the screen fire assays at ALS Minerals (‘ALS’) in Vancouver, BC and Eastern Analytical (‘EA’) in Springdale, NL. New Found's independent consultants concluded that there was no evidence of systematic bias in the Company's assay results and that the project uses well conceived and documented standard operating procedures (SOPs) for marking and sawing core, and for selecting the half-core samples sent for analysis. Based on these conclusions the Company resumed normal reporting of assay results.

Lucky Strike Project, Ontario

The Lucky Strike Project is located 10 km north of Larder Lake, Ontario and covers favourable and underexplored structural corridors associated with the Larder Cadillac Deformation Zone. The project is comprised of 639 single cell un-patented mining claims.

Land History

The current mineral cells comprising the Lucky Strike Project were acquired from the completion of two option agreements, one purchase agreement and online staking. The project was consolidated from May 2016 through May 2020 and currently the project is 100% owned by the company subject to various NSR up to 2%.

- 31 -

|

AMENDED |

| Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

Lucky Strike Project – Project Location map, fault systems and Adjacent Projects

Environmental and Exploration Permitting

The Company has been issued four active exploration permits/plans by the Ontario MNDM which covers all areas of current exploration focus on the property. The permits allow for exploration activities on the property including mechanized stripping, mechanized diamond drilling and geophysical surveys with a generator. The four permits/plans are applicable for 3 years and will expire between the end of September 2023 and January 2024.

Project Geology

The Lucky Strike Project is covered by the Lower Blake River Group which are dominated by intermediate to mafic, massive volcanic flows. The volcanic flows have been intruded by diorite-gabbro intrusions which are up to 7 kilometres by 1.5 kilometre in size. In the Walsh-FP area a syenite-syenite porphyry intrudes the mafic-intermediate volcanics and hosts the gold-bearing quartz-ankerite veins of the Walsh Mine. The long axis of this syenite intrusion strikes approximately north-south and extends for 3.5 kilometres on the property and another 3 kilometres south of the property and is generally 0.5 kilometres wide. Two major regional faults cross the property, the Misema-Misty Lake Fault and the Mulven Fault, striking roughly in a northeast-southwest direction. These structures have been speculated as being as a continuation of the Kirkland Main Break Fault system which hosted the seven historic gold mines of the Kirkland Lake Gold camp. The Victoria Creek Deformation Zone, possibly a splay off the Misema-Misty Lake Fault and a control on the Victoria Creek and Upper Beaver Mines, lies just south of the property with splay structures extending onto the property.

- 32 -

|

AMENDED |

| Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

2021 3-D IP Survey

In mid 2021 the Company initiated a 3-D distributed induced polarization geophysical survey within the central and eastern portions of the property to cover prominent target areas encountered in field reconnaissance surveys in 2018 through 2021. This survey covers projected extensions of the Misema-Misty Lake and Mulven Fault zones as well as a large mafic syenitic body associated with the Kerr North target area. This survey resulted in the delineation of several geophysical targets and anomalies predominantly related to chargeability associated with the Mulven Fault Zone. The Company plans to test several of these anomalies with diamond drilling in early 2022.

Lucky Strike Project – Angled View of IP data cloud with the IP inversion model looking north-east

Lucky Strike Project – 3-D Chargeability Voxel with 0m MSL slice (purple voxel = > 6mV/V)

- 33 -

|

AMENDED |

| Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

Diamond Drilling Program

Starting in November 2021 the Company has initiated a 4000m diamond drilling program at the Lucky Strike project. This program has been designed to test a variety of targets including the surface stripped outcrop located at the FP Zone where channel samples in 2018 yielded gold grades up to 72.2g/t Au over 3.9m. Other targets include geophysical chargeability anomalies associated with the Mulven Fault as well as within a large syenitic intrusion hosting the historic Kerr North showings. It is anticipated this program continues through Q2 2022.

- 34 -

|

AMENDED |

| Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

The schedules below summarize the carrying costs of acquisition and exploration costs incurred to date for each exploration and evaluation asset that the Company is continuing to explore as at December 31, 2021 and December 31, 2020:

| Newfoundland | ||||||||||||||||

| Year ended December 31, 2021 | Queensway

$ | Other

$ | Ontario $ | Total $ | ||||||||||||

| Exploration and evaluation assets | ||||||||||||||||

| Balance as at December 31, 2020 | 685,930 | 13,100 | 300,204 | 999,234 | ||||||||||||

| Additions | ||||||||||||||||

| Acquisition costs | 7,444,306 | - | - | 7,444,306 | ||||||||||||

| Claim staking and license renewal costs | 106,530 | 4,600 | - | 111,130 | ||||||||||||

| Disposal of exploration and evaluation assets | (585) | - | - | (585) | ||||||||||||

| Impairment of exploration and evaluation assets | - | - | (28,604) | (28,604) | ||||||||||||

| Balance as at December 31, 2021 | 8,236,181 | 17,700 | 271,600 | 8,525,481 | ||||||||||||

| Exploration and evaluation expenditures | ||||||||||||||||

| Cumulative exploration expense - December 31, 2020 | 10,245,545 | 45,851 | 1,286,951 | 11,578,347 | ||||||||||||

| Assays | 5,611,068 | - | 53,447 | 5,664,515 | ||||||||||||

| Drilling | 19,102,621 | - | 277,748 | 19,380,369 | ||||||||||||

| Environmental studies | 395,015 | - | - | 395,015 | ||||||||||||

| Geophysics | 3,257,813 | - | 374,660 | 3,632,473 | ||||||||||||

| Mapping & imaging | 104,665 | - | - | 104,665 | ||||||||||||

| Office & general | 512,922 | - | 1,631 | 514,553 | ||||||||||||

| Property taxes, mining leases and rent | 59,997 | - | - | 59,997 | ||||||||||||

| Petrography | - | - | 7,996 | 7,996 | ||||||||||||

| Reclamation | 335,783 | - | 732 | 336,515 | ||||||||||||

| Salaries & consulting | 6,391,133 | 12,295 | 165,863 | 6,569,291 | ||||||||||||

| Supplies & equipment | 3,893,748 | 923 | 62,338 | 3,957,009 | ||||||||||||

| Technical reports | 854,541 | - | 22,479 | 877,020 | ||||||||||||

| Travel & accommodations | 742,796 | 577 | 18,641 | 762,014 | ||||||||||||

| Trenching | 9,860 | - | 77,715 | 87,575 | ||||||||||||

| Exploration cost recovery | (77,550) | - | - | (77,550) | ||||||||||||

| 41,194,412 | 13,795 | 1,063,250 | 42,271,457 | |||||||||||||

| Cumulative exploration expense – December 31, 2021 | 51,439,957 | 59,646 | 2,350,201 | 53,849,804 | ||||||||||||

- 35 -

|

AMENDED |

| Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

| Newfoundland | ||||||||||||||||

| Year ended December 31, 2020 | Queensway

$ | Other

$ | Ontario $ | Total

$ | ||||||||||||

| Exploration and evaluation assets | ||||||||||||||||

| Balance as at December 31, 2019 | 658,700 | 16,500 | 425,516 | 1,100,716 | ||||||||||||

| Additions | ||||||||||||||||

| Acquisition costs | 75,000 | - | 25,000 | 100,000 | ||||||||||||

| Staking costs | 37,230 | 2,100 | 3,600 | 42,930 | ||||||||||||

| Disposal of exploration and evaluation assets | (75,000) | (2,750) | - | (77,750) | ||||||||||||

| Impairment of exploration and evaluation assets | (10,000) | (2,750) | (153,912) | (163,912) | ||||||||||||

| Balance as at December 31, 2020 | 685,930 | 13,100 | 300,204 | 999,234 | ||||||||||||

| Exploration and evaluation expenditures | ||||||||||||||||

| Cumulative exploration expense - December 31, 2019 | 2,633,775 | - | 837,133 | 3,470,908 | ||||||||||||

| Assays | 848,000 | 963 | 209,159 | 1,058,122 | ||||||||||||

| Drilling | 2,560,406 | - | - | 2,560,406 | ||||||||||||

| Geochemistry | - | - | 5,330 | 5,330 | ||||||||||||

| Geophysics | 838,235 | - | - | 838,235 | ||||||||||||

| Office & general | 47,130 | 499 | 714 | 48,343 | ||||||||||||

| Property taxes, mining leases and rent | 46,217 | - | 5,812 | 52,029 | ||||||||||||

| Reclamation | 163,598 | - | - | 163,598 | ||||||||||||

| Salaries & consulting | 1,801,863 | 37,870 | 115,985 | 1,955,718 | ||||||||||||

| Supplies & equipment | 879,816 | 6,470 | 80,803 | 967,089 | ||||||||||||

| Travel & accommodations | 225,550 | 49 | 150 | 225,749 | ||||||||||||

| Trenching | 231,635 | - | 31,865 | 263,500 | ||||||||||||

| Exploration cost recovery | (30,680) | - | - | (30,680) | ||||||||||||

| 7,611,770 | 45,851 | 449,818 | 8,107,439 | |||||||||||||

| Cumulative exploration expense – December 31, 2020 | 10,245,545 | 45,851 | 1,286,951 | 11,578,347 | ||||||||||||

Overall Performance and Results of Operations

Total assets increased to $148,057,847 at December 31, 2021, from $73,536,928 at December 31, 2020, primarily as a result of an increase in cash of $52,753,451, investments of $10,852,461, sales taxes recoverable of $782,813, prepaid expenses and deposits of $920,854, exploration and evaluation assets of $7,526,247, and property and equipment of $1,537,330. The most significant assets at December 31, 2021 were cash of $100,484,576 (December 31, 2020: $47,731,125), investments of $31,942,458 (December 31, 2020: $21,089,997), exploration and evaluation assets of $8,525,481 (December 31, 2020: $999,234), and property and equipment of $2,914,459 (December 31, 2020: $1,377,129). Cash increased by $52,753,451 during the year ended December 31, 2021 as a result of cash proceeds received from private placement financings completed in April 2021, August 2021 and November 2021 for gross proceeds of $120,501,665 net of share issue costs of $4,457,654, proceeds from disposals of investments of $1,313,462, proceeds received from stock options exercised of $1,236,170, and proceeds received from warrants exercised of $1,156,523, partially offset by cash used in operating activities of $48,512,082, purchases of investments of $12,850,001, purchases of exploration & evaluation assets of $3,938,898, and purchases of property and equipment of $1,484,104.

- 36 -

|

AMENDED |

| Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

Year ended December 31, 2021 and 2020

During the year ended December 31, 2021, loss from operating activities increased by $18,314,924 to $56,662,212 compared to $38,347,288 for the year ended December 31, 2020. The increase in loss from operating activities is largely due to:

| - | An increase of $34,164,018 in exploration and evaluation expenditures. Exploration and evaluation expenditures were $42,271,457 for the year ended December 31, 2021 compared to $8,107,439 for the year ended December 31, 2020. The Company continued its ongoing diamond drilling program at its Queensway project and completed approximately 117,043 meters of drilling and incurred higher salaries and consulting fees, geophysics, assay and supplies and equipment costs due to an increase in exploration activity at its Queensway Project as well as completed a geophysical survey and initiated a 4,000 meter diamond drill program at its Lucky Strike Project during the year ended December 31, 2021 compared to completing approximately 13,400 meters of drilling project as well as a 1,705 km airborne gravity survey, trenching, structural analysis, prospecting, till sampling and geological mapping at its Queensway Project during the year ended December 31, 2020. |

| - | An increase of $1,152,610 in salaries and consulting fees. Salaries and consulting fees were $3,100,723 for the year ended December 31, 2020 compared to $1,948,113 for the year ended December 31, 2020. The increase is due to more consulting fees paid during the year ended December 31, 2021 compared to less consulting fees paid during the year ended December 31, 2020. |

The increase was partially offset by:

| - | A decrease of $18,845,121 in share-based compensation. Share-based compensation was $7,612,214 for the year ended December 31, 2021 compared to $26,457,335 for the year ended December 31, 2020. A total of 1,756,500 stock options were granted, of which 1,336,750 stock options vested, with a value of $7,612,214 during the year ended December 31, 2021 compared to 15,492,500 fully vested stock options granted with a value of $26,457,335 during the year ended December 31, 2020. |

Other items

For the year ended December 31, 2021, other income was $6,022,137 compared to $5,812,849 for the year ended December 31, 2020. The $209,288 change is largely due to:

| - | An increase of $4,845,542 in settlement of flow-through share premium. Settlement of flow-through share premium was $6,617,730 for the year ended December 31, 2021 compared to $1,772,188 for the year ended December 31, 2020. The Company incurred $33,254,971 of qualifying Canadian exploration expenses and derecognized $6,617,730 of its flow-through share premium liability during the year ended December 31, 2021. |

| - | An increase of $1,152,438 in net change in unrealized losses on investments. Net change in unrealized losses on investments was $1,376,192 for the year ended December 31, 2021 compared to net change in unrealized losses on investments of $223,754 for the year ended December 31, 2020. The increase is due to changes in the fair values of investments held at December 31, 2021. |

The increase in other income was partially offset by:

| - | A decrease of $3,885,538 in gain on sale of exploration and evaluation assets. In 2021, the Company had sold a stand-alone claim that was part of the Queensway Project (claim 023951M also known as Unknown Brooke claim) to Long Range Exploration Corporation (“Long Range”) for non-cash consideration of 5,000,000 common shares of Long Range valued at $500,000. The Company recognized a gain on sale of exploration and evaluation assets in the amount of $499,415. In 2020, the Company recognized a gain on sale of exploration and evaluation assets of $4,384,953 in relation to the sale of certain Newfoundland exploration and evaluation assets for non-cash consideration comprised of investments with a fair value of $4,462,703. |

- 37 -

|

AMENDED |

| Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

The Company recorded a loss and comprehensive loss of $50,640,075 or $0.33 basic and diluted loss per share for the year ended December 31, 2021 (December 31, 2020: $32,534,439 or $0.29 basic and diluted loss per share).

SELECT ANNUAL INFORMATION

Selected annual information from the audited financial statements for the years ended December 31, 2021, 2020, and 2019 is presented in the table below. The financial data below has been prepared in accordance with IFRS and is reported in Canadian dollars.

| Selected Annual Financial Information | December

31, 2021 $ | December

31, 2020 $ | December

31, 2019 $ | |||||||||

| Total Assets | 148,057,847 | 73,536,928 | 9,355,036 | |||||||||

| Operating expenses(1) | (6,778,541) | (3,782,514) | (1,137,342) | |||||||||

| Share-based compensation | (7,612,214) | (26,457,335) | (2,130,528) | |||||||||

| Exploration and evaluation expenditures | (42,271,457) | (8,107,439) | (657,539) | |||||||||

| Impairment of exploration and evaluation assets | (28,604) | (166,662) | (91,335) | |||||||||

| Net realized gain (loss) on disposal of investments | 192,114 | - | (120,734) | |||||||||

| Net change in unrealized (losses) gains on investments | (1,376,192) | (223,754) | 118,355 | |||||||||

| Settlement of flow-through premium liability | 6,617,730 | 1,772,188 | - | |||||||||

| Gain on sale of exploration and evaluation assets | 499,415 | 4,384,953 | - | |||||||||

| Net loss comprehensive loss | (50,640,075) | (32,534,439) | (4,020,032) | |||||||||

| Loss per share – basic and diluted | (0.33) | (0.29) | (0.07) | |||||||||

| (1) | Operating expenses is comprised of corporate development & investor relations, depreciation, office & sundry, professional fees, salaries and consulting, transfer agent & regulatory fees, and travel. |

Three months ended December 31, 2021 and 2020

During the three months ended December 31, 2021, loss from operating activities decreased by $9,459,353 to $14,246,280 compared to $23,705,633 for the three months ended December 31, 2020. The decrease in loss from operating activities is largely due to:

| - | A decrease of $17,588,790 in share-based compensation. Share-based compensation was $350,831 for the three months ended December 31, 2021 compared to $17,939,621 for the three months ended December 31, 2020. A total of 62,500 stock options were granted, of which 6,250 vested, with a value of $350,831 during the three months ended December 31, 2021 compared to 6,267,500 fully vested stock options granted with a value of $17,939,621 during the three months ended December 30, 2020. |

The decrease was partially offset by:

| - | An increase of $7,542,644 in exploration and evaluation expenditures. Exploration and evaluation expenditures were $12,094,840 for the three months ended December 31, 2021 compared to exploration and evaluation expenditures of $4,552,196 for the three months ended December 31, 2020. The Company continued its ongoing 400,000 meter diamond drilling program and completed approximately 31,154 meters of drilling in 90 holes during the three months ended December 31, 2021, and incurred higher salaries and consulting fees, and supplies and equipment costs due to an increase in exploration activity at its Queensway Project as well as completed a geophysical survey and initiated a 4,000 meter diamond drill program at its Lucky Strike Project during the three months ended December 31, 2020 compared to completing approximately 10,450 meters of diamond drilling in 51 holes at its Queensway project during the three months ended December 31, 2020. |

- 38 -

|

AMENDED |

| Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

Other items

For the three months ended December 31, 2021, other income was $548,011 compared to other expenses of $1,934,089 for the three months ended December 31, 2020. The $2,482,100 change is largely due to:

| - | A decrease of $4,975,546 in net change in unrealized losses on investments. Net change in unrealized losses on investments was $2,411,303 for the three months ended December 31, 2021 compared to $7,386,849 in unrealized loss on investments for the three months ended December 31, 2020. The change is due to changes in the fair values of equity investments held at December 31, 2021. |

| - | An increase of $1,732,172 in settlement of flow-through share premium. Settlement of flow-through share premium was $2,917,262 for the three months ended December 31, 2021 compared to $1,185,090 for the three months ended December 31, 2020. The Company incurred $10,804,674 of qualifying Canadian exploration expenses and derecognized $2,917,262 of its flow-through share premium liability during the three months ended December 31, 2021. |

The increase in other income was partially offset by the following:

| - | A decrease of $4,384,953 in gain on sale of exploration and evaluation assets. Gain on sale of exploration and evaluation assets was $Nil for the three months ended December 31, 2021 compare to $4,384,953 for the three months ended December 31, 2020. There were no sales of exploration and evaluation assets during the three months ended December 31, 2021 compared to the sale of certain Newfoundland exploration and evaluation assets for non-cash consideration comprised of investments with a fair value of $4,462,703 during the three months ended December 31, 2020. |

The Company recorded a loss and comprehensive loss of $13,698,269 or $0.09 basic and diluted loss per share for the three months ended December 31, 2021 (December 31, 2020: $25,639,722 or $0.18 basic and diluted loss per share).

Summary of Quarterly Results

| 2021 | 2020 | |||||||||||||||||||||||||||||||

| Dec.

31 $ | Sep.

30 $ | Jun.

30 $ | Mar.

31 $ | Dec.

31 $ | Sep.

30 $ | Jun.

30 $ | Mar.

31 $ | |||||||||||||||||||||||||

| Revenues | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Income (loss) and comprehensive income (loss) for the period | (13,698,269 | )(2) | (35,289,366 | )(3) | 3,738,904 | (4) | (5,391,344 | )(5) | (25,639,722 | )(6) | (10,986,378 | )(7) | 10,700,940 | (8) | (6,609,279 | )(9) | ||||||||||||||||

| Earnings (loss) per Common Share Basic(1) | (0.09 | ) | (0.23 | ) | 0.02 | (0.04 | ) | (0.18 | ) | (0.09 | ) | 0.11 | (0.08 | ) | ||||||||||||||||||

| Earnings (loss) per Common Share Diluted(1) | (0.09 | ) | (0.23 | ) | 0.02 | (0.04 | ) | (0.18 | ) | (0.09 | ) | 0.09 | (0.08 | ) | ||||||||||||||||||

| (1) | Per share amounts are rounded to the nearest cent, therefore aggregating quarterly amounts may not reconcile to year-to-date per share amounts. |

| (2) | Decrease of loss and comprehensive loss from prior quarter primarily driven by a decrease of $21,123,862 in net change in unrealized losses on investments, an increase of $794,521 in settlement of flow-through share premium, offset by a decrease of $499,415 in gain on sale of exploration and evaluation assets. | |

| (3) | Increase in loss and comprehensive loss from prior quarter primarily driven by increase in net change in unrealized losses on investments of $45,665,743, exploration and evaluation expenditures of $657,261, salaries and consulting of $363,512, offset by a decrease in stock-based compensation of $6,617,299, an increase in amortization of flow-through premium liability of $730,445 and gain on sale of exploration & exploration assets of $499,415. |

- 39 -

|

AMENDED |

| Management’s Discussion and Analysis For the year ended December 31, 2021 and 2020 |

| (4) | Increase of income and comprehensive income from prior quarter primarily driven by increase in net change in unrealized gains on investments of $19,690,880, and amortization of flow-through premium liability of $1,206,865, partially offset by an increase in share-based compensation of $6,939,341, exploration and evaluation expenditures of $4,266,113, salaries and consulting fees of $259,797, and a decrease in net realized gains on disposals of investments of $216,346. | |

| (5) | Decrease of loss and comprehensive loss from prior quarter primarily driven by a decrease in share-based compensation of $17,939,621, gain on sale of exploration and evaluation assets of $4,384,953, amortization of flow-through premium liability of $999,659, an increase in net change in unrealized gains on investments of $9,826,547 and net realized gains on disposals of investments of $204,230, partially offset by an increase in exploration and evaluation expenditures of $2,443,514. | |

| (6) | Increase of loss and comprehensive loss from prior quarter primarily driven by an increase in share-based compensation of $12,454,708, net change in unrealized losses on investments of $4,854,539, and exploration and evaluation expenditures of $2,298,723, partially offset by an increase in gain on sale of exploration and evaluation assets of $4,384,953, amortization of flow-through premium liability of $699,109, and a decrease of salaries and consulting fees of $217,685. | |

| (7) | Increase of loss and comprehensive loss from prior quarter primarily driven by an increase in net change in unrealized losses on investments of $17,431,256, share-based compensation of $2,452,112, exploration and evaluation expenditures of $1,666,095, salaries and consulting fees of $371,083, and corporate development and investor relations of $289,109, partially offset by amortization of flow-through premium liability of $384,864. | |

| (8) | Decrease from prior quarter primarily driven by an increase in net change in unrealized gains on investments of $20,102,487, amortization of flow-through premium liability of $101,117, and a decrease in exploration and evaluation expenditures of $145,268, partially offset by an increase in share-based compensation of $3,032,801. | |

| (9) | Increase from prior quarter primarily driven by increases in professional fees of $104,545, exploration and evaluation expenditures of $350,891 and net change in unrealized losses on investments of $5,279,853, partially offset by a decrease in share-based compensation of $2,130,528. |

Liquidity and Capital Resources

As at December 31, 2021, the Company had cash of $100,484,576 to settle current liabilities of $12,756,646.

The Company does not currently have a recurring source of revenue and has historically incurred negative cash flows from operating activities. As at December 31, 2021, the Company has working capital of $123,764,003 consisting primarily of cash, investments, prepaid expenses and deposits and sales taxes recoverable. The Company’s exploration and evaluation assets presently have no proven or probable reserves, and on the basis of information to date, it has not yet determined whether these properties contain economically recoverable resources.

The recoverability of amounts shown for exploration and evaluation assets are dependent upon the existence of economically recoverable reserves, the ability of the Company to obtain necessary financing to complete the development of those reserves and upon future profitable production.

The sources of funds currently available to the Company for its acquisition and exploration projects are solely due from equity financing.

The Company does not have bank debt or banking credit facilities in place as at the date of this report.

- 40 -

AMENDED

Management’s Discussion and Analysis

For the year ended December 31, 2021 and 2020

As at December 31, 2021, the Company had the following commitments (in addition to those disclosed elsewhere in this MD&A):

| Total $ | 1

Year $ | 1-3

Years $ | 4-5

Years $ | After

5 Years $ | ||||||||||||||||

| Lease obligations | 190,835 | 62,517 | 11,035 | 11,096 | 106,187 | |||||||||||||||

| Total contractual obligations | 190,835 | 62,517 | 11,035 | 11,096 | 106,187 | |||||||||||||||

November 2021 Financing – Net Proceeds of $47,384,035

On November 24, 2021, the Company completed a non-brokered private placement financing of 5,000,000 flow-through common shares of the Company at a price of $9.60 per common share for gross proceeds of $48,000,000. The Company paid share issuance costs of $615,965 in cash of which $480,000 were finder’s fees. The premium received on the flow-through shares issued was determined to be $12,600,000.