Form 6-K WESTPAC BANKING CORP For: Sep 21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

September 21, 2021

Commission File Number 1-10167

WESTPAC BANKING CORPORATION

(Translation of registrant’s name into English)

275 KENT STREET, SYDNEY, NEW SOUTH WALES 2000, AUSTRALIA

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Index to Exhibits

| Exhibit No. |

Description | |

| 1 | ASX Release – ESG Market Update |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| WESTPAC BANKING CORPORATION | ||

| (Registrant) | ||

| Date: September 21, 2021 | By: | /s/ Yvette Adiguzel |

| Yvette Adiguzel | ||

| Tier One Attorney | ||

Exhibit 1

| ASX Release 21 September 2021 ESG Market Update Westpac Banking Corporation (“Westpac”) today provides the attached ESG Market Update. For further information: David Lording Andrew Bowden Group Head of Media Relations Head of Investor Relations 0419 683 411 0438 284 863 This document has been authorised for release by Tim Hartin, General Manager & Company Secretary. Level 18, 275 Kent Street Sydney, NSW, 2000 |

| ESG market update Fix. Simplify. Perform. 21 SEPTEMBER 2021 WESTPAC BANKING CORPORATION ABN 33 007 457 141 |

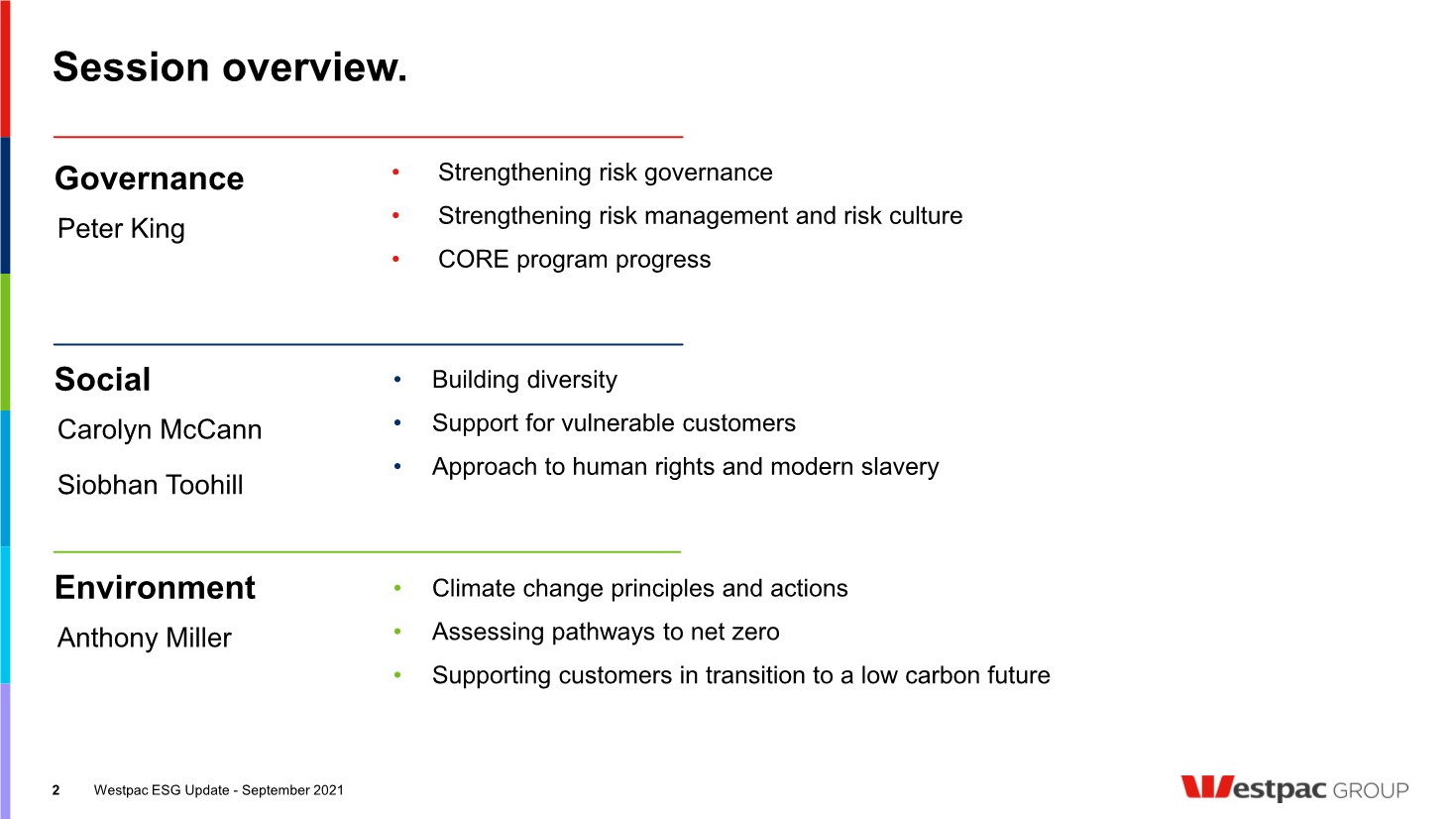

| Session overview. 2 Westpac ESG Update - September 2021 Social Governance Environment • Building diversity • Support for vulnerable customers • Approach to human rights and modern slavery • Strengthening risk governance • Strengthening risk management and risk culture • CORE program progress • Climate change principles and actions • Assessing pathways to net zero • Supporting customers in transition to a low carbon future Peter King Carolyn McCann Anthony Miller Siobhan Toohill |

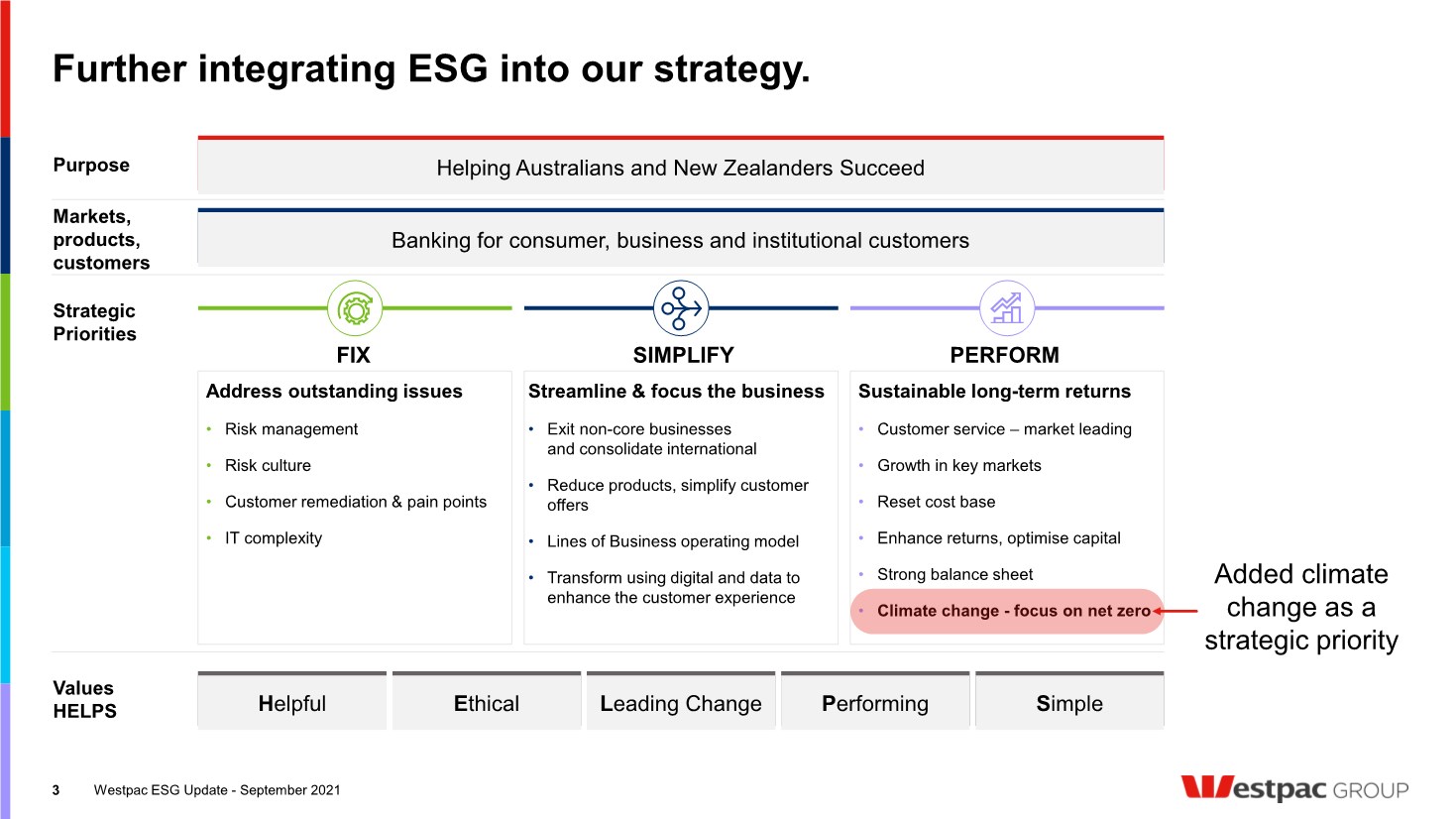

| Further integrating ESG into our strategy. Strategic Priorities Values HELPS Helpful Ethical Leading Change Performing Simple Purpose Markets, products, customers Helping Australians and New Zealanders Succeed Banking for consumer, business and institutional customers SIMPLIFY Sustainable long-term returns • Customer service – market leading • Growth in key markets • Reset cost base • Enhance returns, optimise capital • Strong balance sheet • Climate change - focus on net zero Streamline & focus the business • Exit non-core businesses and consolidate international • Reduce products, simplify customer offers • Lines of Business operating model • Transform using digital and data to enhance the customer experience Address outstanding issues • Risk management • Risk culture • Customer remediation & pain points • IT complexity FIX PERFORM Added climate change as a strategic priority Westpac ESG Update - September 2021 3 |

| Governance Peter King Chief Executive Officer |

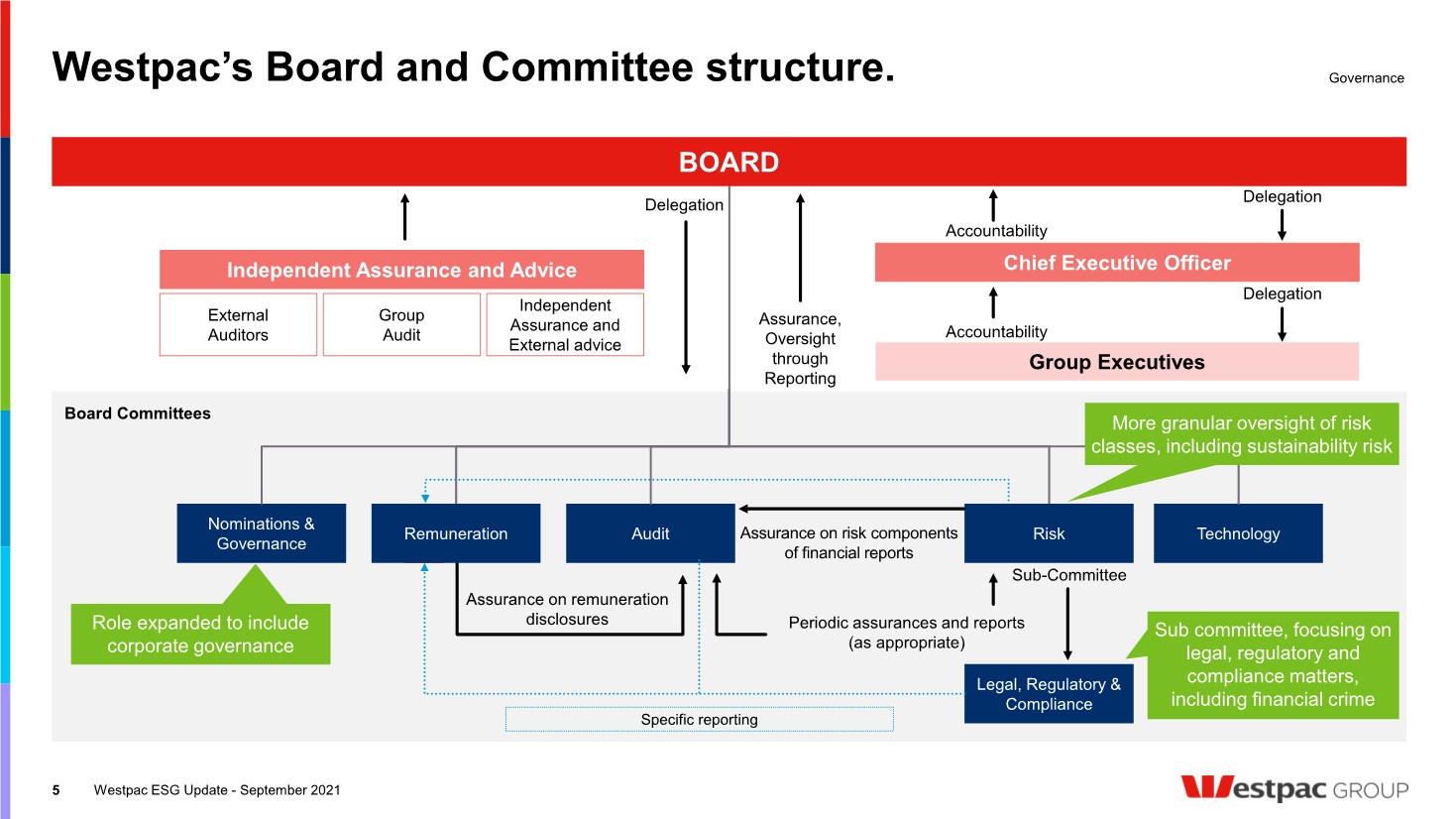

| Westpac’s Board and Committee structure. Westpac ESG Update - September 2021 5 Governance Independent Assurance and Advice External Auditors Group Audit Independent Assurance and External advice Chief Executive Officer Group Executives Accountability Accountability Delegation Delegation Delegation Assurance, Oversight through Reporting Board Committees Nominations & Governance Audit Technology Legal, Regulatory & Compliance Assurance on remuneration disclosures Assurance on risk components of financial reports Periodic assurances and reports (as appropriate) Specific reporting Sub-Committee Remuneration Risk Sub committee, focusing on legal, regulatory and compliance matters, including financial crime Role expanded to include corporate governance More granular oversight of risk classes, including sustainability risk BOARD |

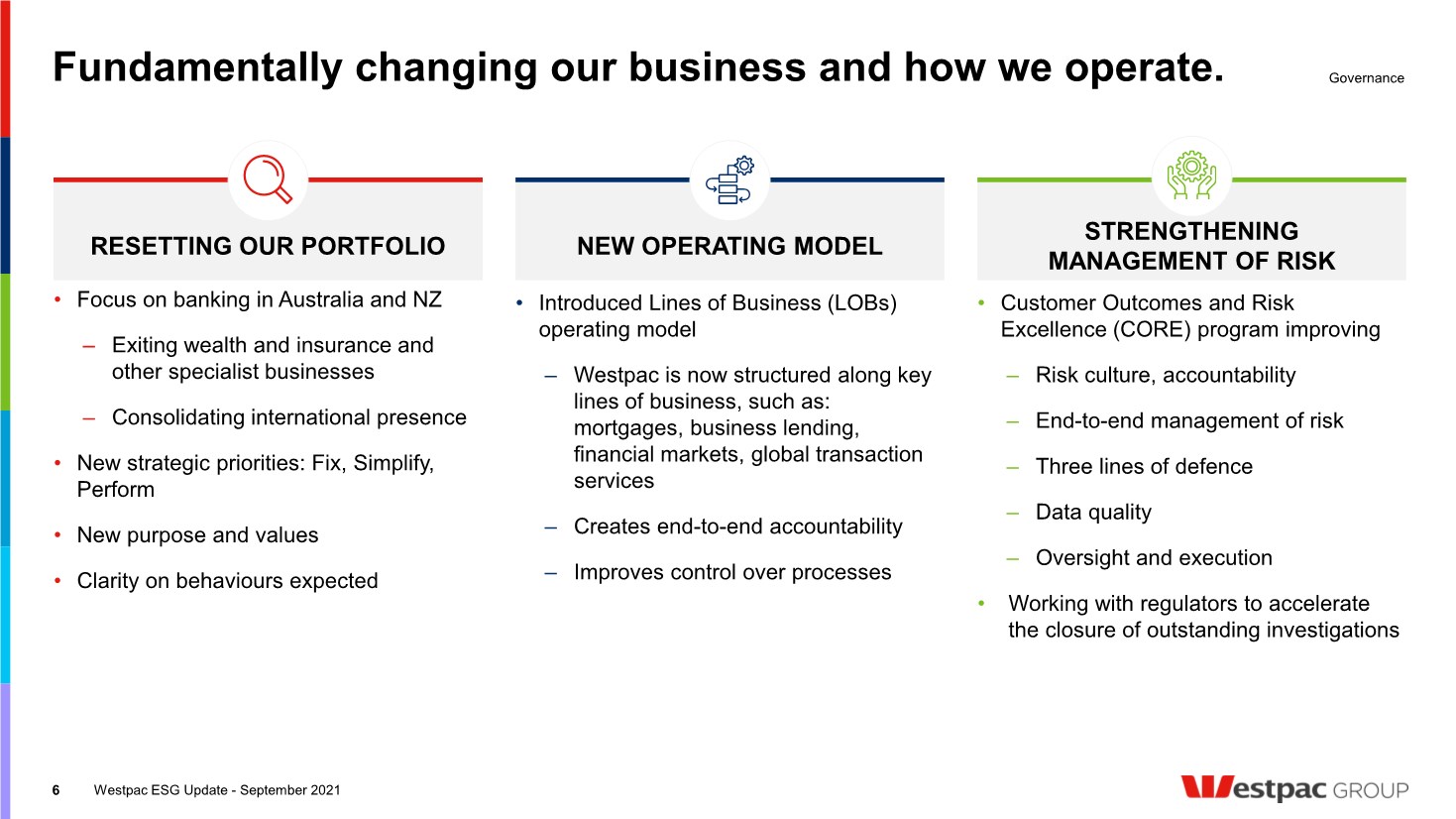

| STRENGTHENING MANAGEMENT OF RISK NEW OPERATING MODEL RESETTING OUR PORTFOLIO Fundamentally changing our business and how we operate. Westpac ESG Update - September 2021 6 Governance • Focus on banking in Australia and NZ ‒ Exiting wealth and insurance and other specialist businesses ‒ Consolidating international presence • New strategic priorities: Fix, Simplify, Perform • New purpose and values • Clarity on behaviours expected • Introduced Lines of Business (LOBs) operating model ‒ Westpac is now structured along key lines of business, such as: mortgages, business lending, financial markets, global transaction services ‒ Creates end-to-end accountability ‒ Improves control over processes • Customer Outcomes and Risk Excellence (CORE) program improving ‒ Risk culture, accountability ‒ End-to-end management of risk ‒ Three lines of defence ‒ Data quality ‒ Oversight and execution • Working with regulators to accelerate the closure of outstanding investigations |

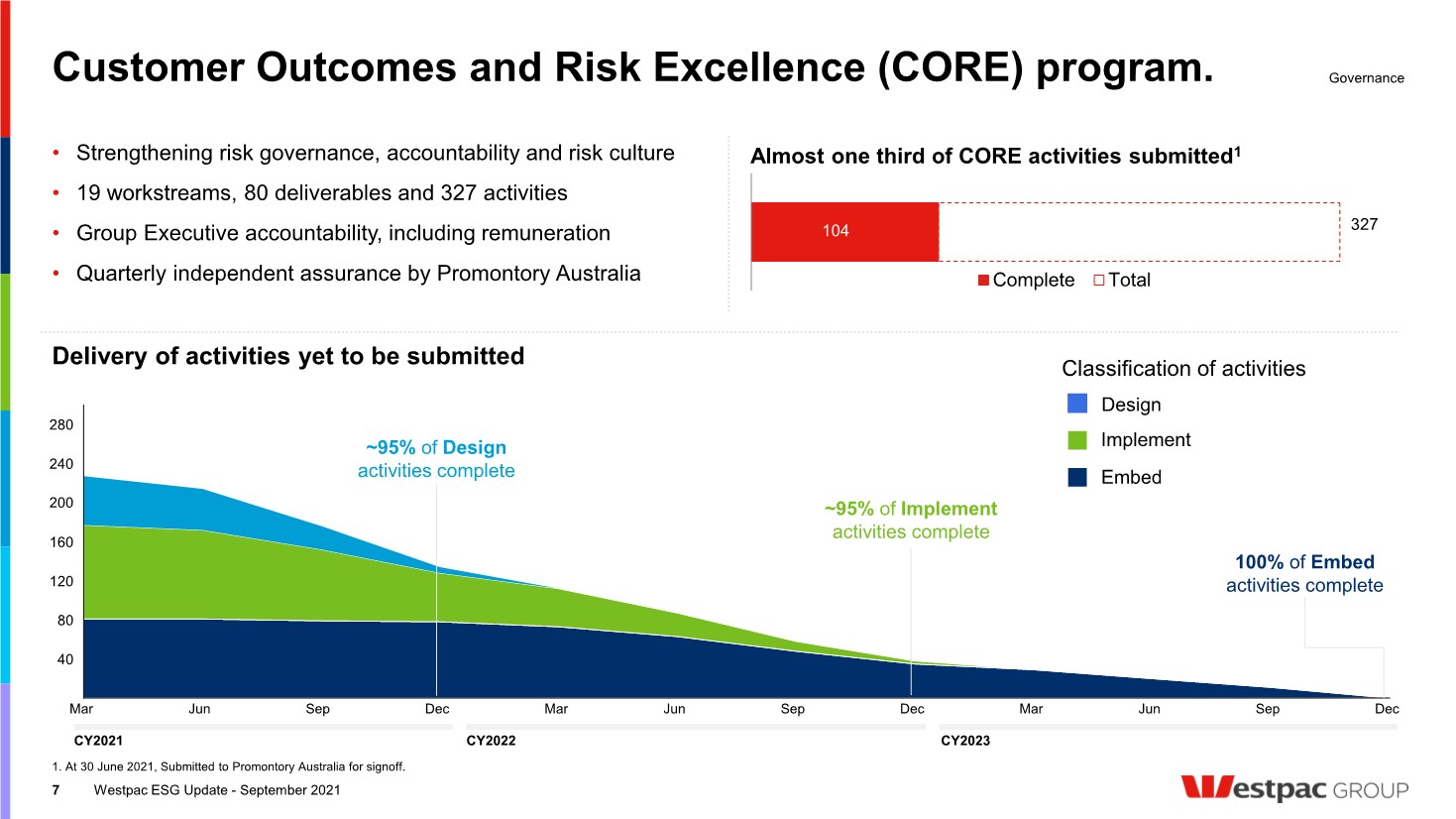

| Customer Outcomes and Risk Excellence (CORE) program. 1. At 30 June 2021, Submitted to Promontory Australia for signoff. 7 • Strengthening risk governance, accountability and risk culture • 19 workstreams, 80 deliverables and 327 activities • Group Executive accountability, including remuneration • Quarterly independent assurance by Promontory Australia Almost one third of CORE activities submitted1 104 Complete Total Governance Delivery of activities yet to be submitted 40 80 160 120 200 240 280 Sep Sep Mar Jun Sep Mar Jun Dec Jun Dec Mar Dec CY2021 CY2022 CY2023 ~95% of Design activities complete ~95% of Implement activities complete 100% of Embed activities complete Design Implement Embed Westpac ESG Update - September 2021 Classification of activities 327 |

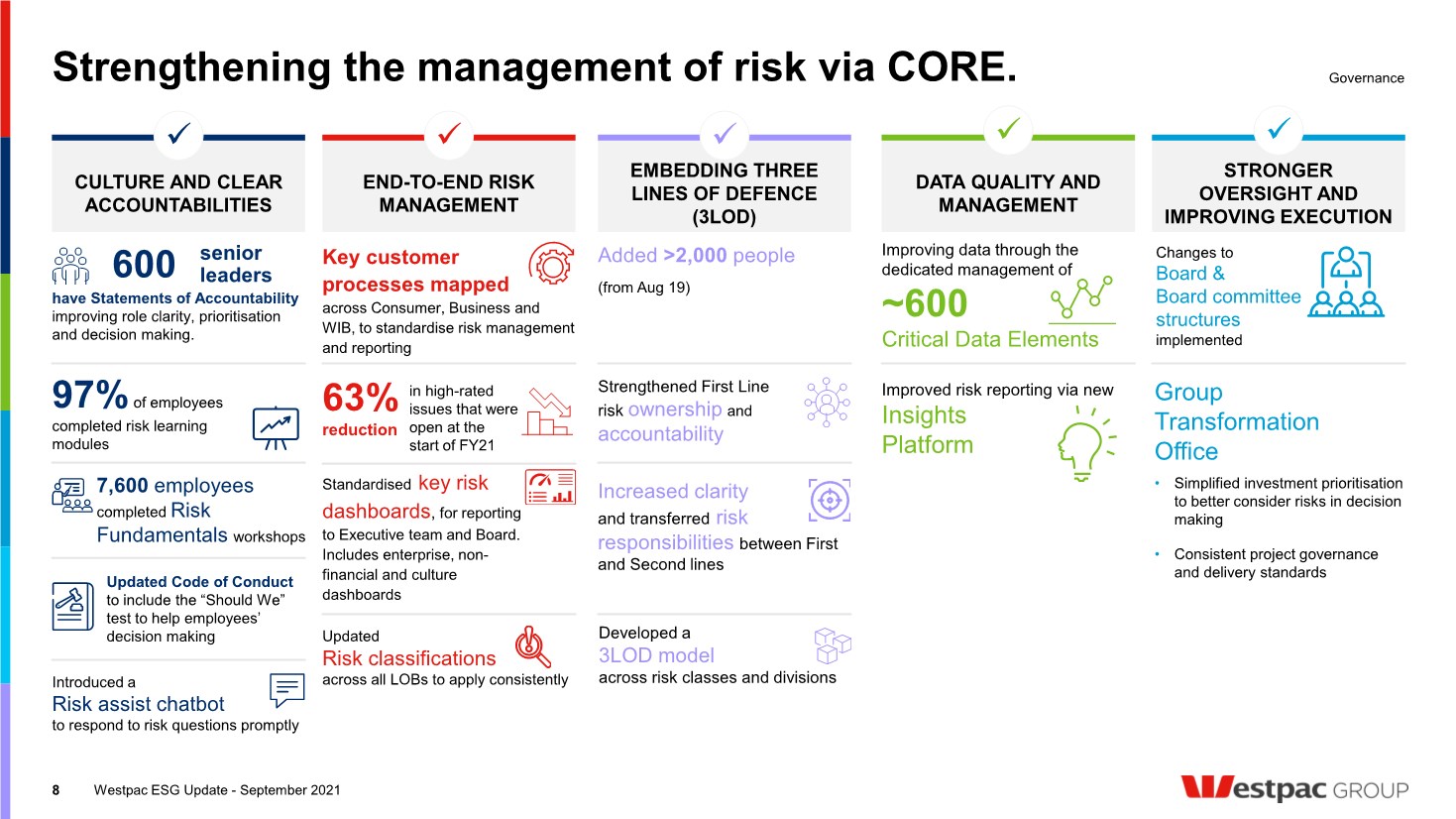

| Strengthening the management of risk via CORE. Changes to Board & Board committee structures implemented Governance STRONGER OVERSIGHT AND IMPROVING EXECUTION CULTURE AND CLEAR ACCOUNTABILITIES 7,600 employees completed Risk Fundamentals workshops END-TO-END RISK MANAGEMENT Standardised key risk dashboards, for reporting to Executive team and Board. Includes enterprise, non- financial and culture dashboards EMBEDDING THREE LINES OF DEFENCE (3LOD) Strengthened First Line risk ownership and accountability DATA QUALITY AND MANAGEMENT Improved risk reporting via new Insights Platform 600 have Statements of Accountability improving role clarity, prioritisation and decision making. senior leaders 97% of employees completed risk learning modules Updated Code of Conduct to include the “Should We” test to help employees’ decision making Introduced a Risk assist chatbot to respond to risk questions promptly Key customer processes mapped across Consumer, Business and WIB, to standardise risk management and reporting 63% reduction in high-rated issues that were open at the start of FY21 Updated Risk classifications across all LOBs to apply consistently Added >2,000 people (from Aug 19) Developed a 3LOD model across risk classes and divisions Increased clarity and transferred risk responsibilities between First and Second lines Improving data through the dedicated management of ~600 Critical Data Elements Group Transformation Office • Simplified investment prioritisation to better consider risks in decision making • Consistent project governance and delivery standards 8 Westpac ESG Update - September 2021 |

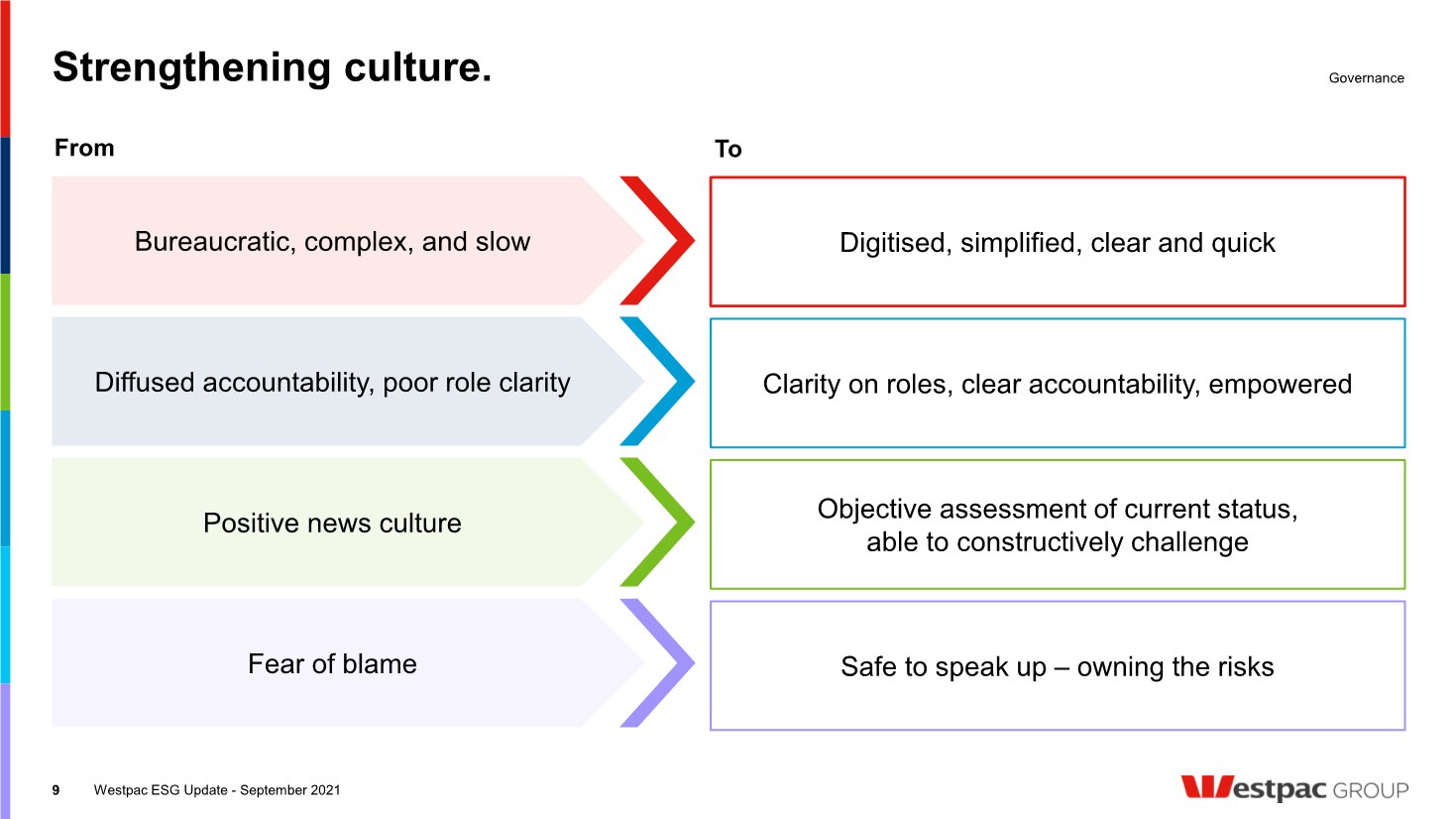

| Strengthening culture. Westpac ESG Update - September 2021 9 Governance Bureaucratic, complex, and slow Digitised, simplified, clear and quick Diffused accountability, poor role clarity Clarity on roles, clear accountability, empowered Positive news culture Objective assessment of current status, able to constructively challenge Fear of blame Safe to speak up – owning the risks From To |

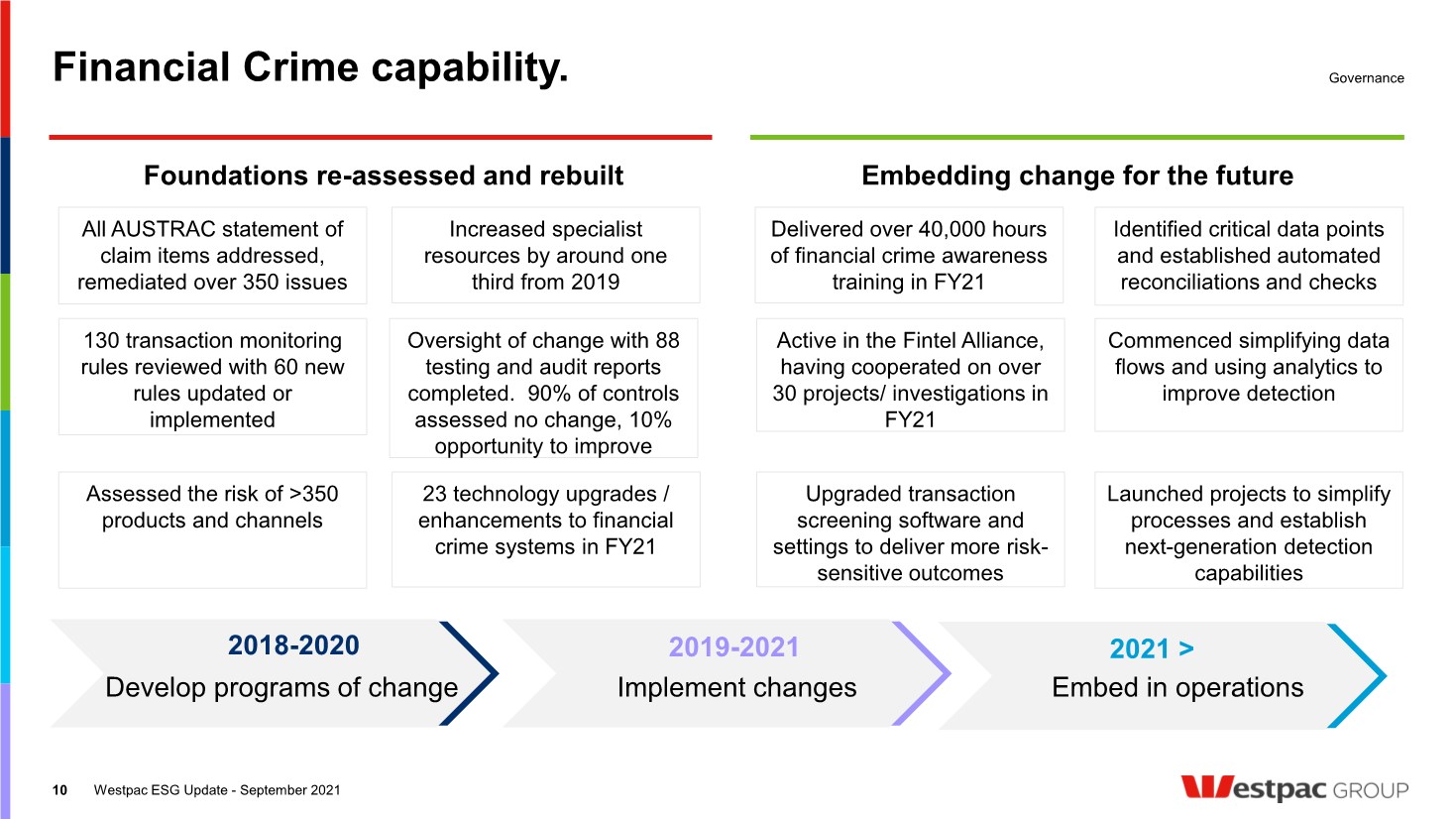

| Financial Crime capability. Westpac ESG Update - September 2021 10 Governance Oversight of change with 88 testing and audit reports completed. 90% of controls assessed no change, 10% opportunity to improve Delivered over 40,000 hours of financial crime awareness training in FY21 Identified critical data points and established automated reconciliations and checks All AUSTRAC statement of claim items addressed, remediated over 350 issues Develop programs of change Implement changes Embed in operations Foundations re-assessed and rebuilt Embedding change for the future 130 transaction monitoring rules reviewed with 60 new rules updated or implemented 23 technology upgrades / enhancements to financial crime systems in FY21 Commenced simplifying data flows and using analytics to improve detection Active in the Fintel Alliance, having cooperated on over 30 projects/ investigations in FY21 2018-2020 2019-2021 2021 > Increased specialist resources by around one third from 2019 Assessed the risk of >350 products and channels Upgraded transaction screening software and settings to deliver more risk- sensitive outcomes Launched projects to simplify processes and establish next-generation detection capabilities |

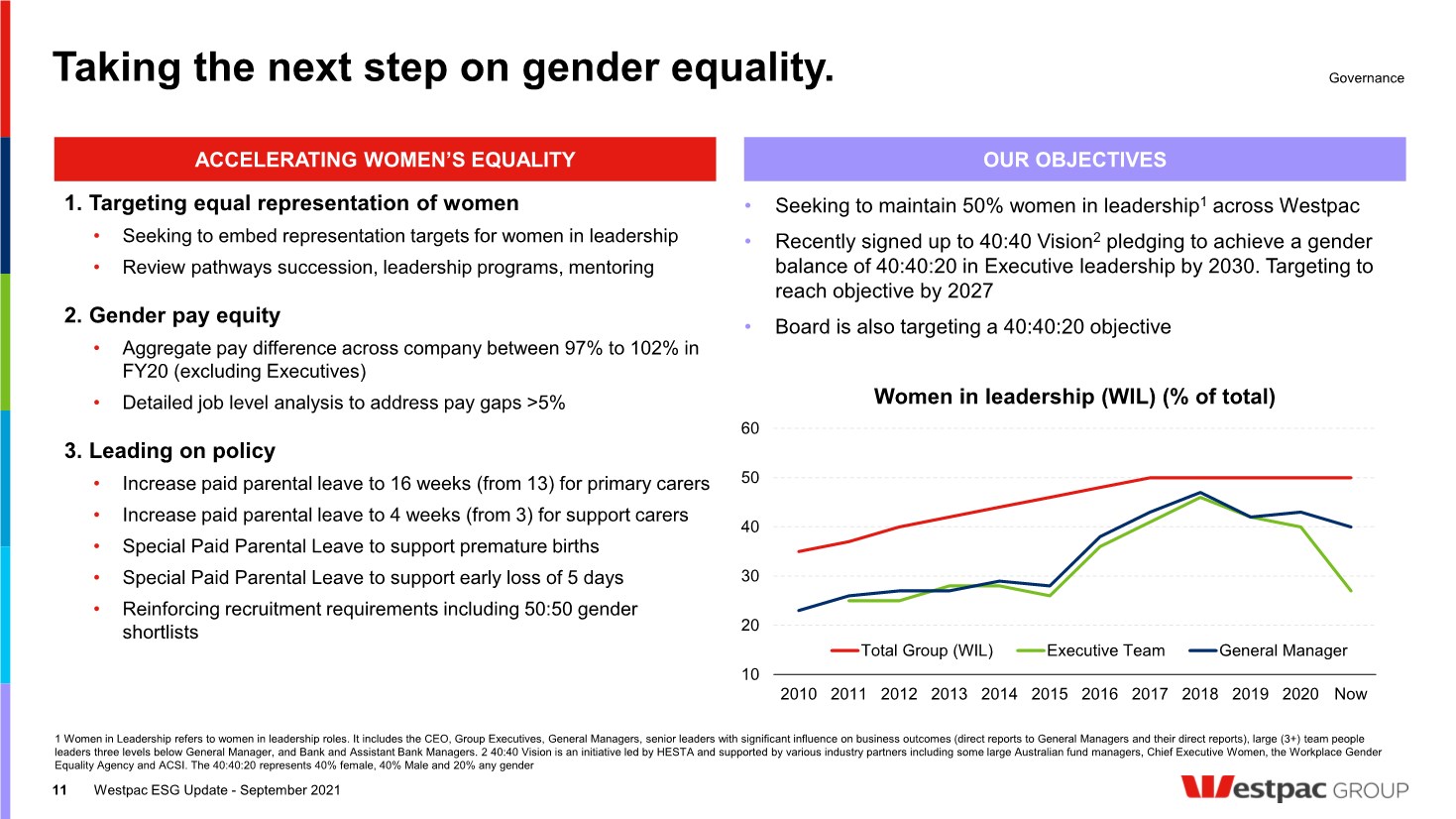

| Taking the next step on gender equality. Westpac ESG Update - September 2021 11 Governance • Seeking to maintain 50% women in leadership1 across Westpac • Recently signed up to 40:40 Vision2 pledging to achieve a gender balance of 40:40:20 in Executive leadership by 2030. Targeting to reach objective by 2027 • Board is also targeting a 40:40:20 objective ACCELERATING WOMEN’S EQUALITY OUR OBJECTIVES 10 20 30 40 50 60 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Now Women in leadership (WIL) (% of total) Total Group (WIL) Executive Team General Manager 1. Targeting equal representation of women • Seeking to embed representation targets for women in leadership • Review pathways succession, leadership programs, mentoring 2. Gender pay equity • Aggregate pay difference across company between 97% to 102% in FY20 (excluding Executives) • Detailed job level analysis to address pay gaps >5% 3. Leading on policy • Increase paid parental leave to 16 weeks (from 13) for primary carers • Increase paid parental leave to 4 weeks (from 3) for support carers • Special Paid Parental Leave to support premature births • Special Paid Parental Leave to support early loss of 5 days • Reinforcing recruitment requirements including 50:50 gender shortlists 1 Women in Leadership refers to women in leadership roles. It includes the CEO, Group Executives, General Managers, senior leaders with significant influence on business outcomes (direct reports to General Managers and their direct reports), large (3+) team people leaders three levels below General Manager, and Bank and Assistant Bank Managers. 2 40:40 Vision is an initiative led by HESTA and supported by various industry partners including some large Australian fund managers, Chief Executive Women, the Workplace Gender Equality Agency and ACSI. The 40:40:20 represents 40% female, 40% Male and 20% any gender |

| Social Carolyn McCann Group Executive, Customer & Corporate Relations Siobhan Toohill Group Head of Sustainability |

| INDIGENOUS REPRESENTATION • Employee Action Group with over 1,000 members with 62 different cultural heritages that work to promote awareness and inclusion • Established a Group-wide Leadership Shadowing Program to promote development • Feedback informs policies, training and development Focused on enhancing diversity. Westpac ESG Update - September 2021 13 Social • Updating our Reconciliation Action Plan (RAP) • Refreshed our cultural competency training • Improved banking accessibility for over 4,500 indigenous and remote Australians through Yuri Ingkarninthi, our Indigenous Connection Team • Access to capital for indigenous businesses through our partnership with First Australian's Capital • In 1H21 hired 28 permanent employees along with 71 Trainees and 23 Interns under our Indigenous program CULTURAL DIVERSITY |

| Helping customers in need of extra care. 14 DOMESTIC & FAMILY VIOLENCE FINANCIAL HARDSHIP FINANCIAL ABUSE LIVING WITH DEMENTIA LIFE MOMENTS HELP WITH GAMBLING ELDER FINANCIAL ABUSE FRAUD AND SCAMS • Updated customer vulnerability policy and standard • Trained over 19,000 staff • Dedicated customer vulnerability teams – Accessibility and inclusion team – Customer vulnerability and financial resilience team STRENGTHENED CAPABILITY • Material improvement in complaints management • New Group-wide complaints management system Westpac ESG Update - September 2021 Social |

| Using digital to help protect customers. 15 • 24,000 blocks, requiring a change of language (19,000 customers) • 800+ warning letters, suspended, cancelled banking • 70+ customers reported to authorities ABUSIVE PAYMENTS Westpac ESG Update - September 2021 • 120,000+ visits to the digital gambling block page • 30,000+ consumer debit and credit cards using the block GAMBLING BLOCK Social |

| Respecting human rights. HUMAN RIGHTS POSITION STATEMENT AND ACTION PLAN MODERN SLAVERY Our principles 1. We respect human rights 2. We assess our human rights impacts 3. We integrate human rights considerations into our business and relationships 4. We provide access to remedy when appropriate 5. We engage with stakeholders on human rights 6. We aim to be transparent and provide accurate and timely disclosure Recent Actions: • Released Modern Slavery report under Australian requirements • Reviewed and updated supplier screening process • Expanded training to better identify issues and potential risks • Refreshed ESG Credit Risk Policy Released first Human Rights Position Statement and Action Plan Published first UK Modern Slavery Statement Released 3rd Human Rights Position Statement and Action Plan Published first Australian Modern Slavery Statement 2015 2020 2016 First Australian publicly- listed company to provide paid parental leave 1995 2010 Launched first Reconciliation Action Plan Westpac ESG Update - September 2021 16 Social |

| UN guiding principles on human rights - Access to remedy 17 Social SAFER CHILDREN, SAFER COMMUNITIES • Roundtable of experts in human rights, child safety, online safety, and law enforcement • Program is designed to achieve long-term impact in addressing child safety • Sustained approach based on outcomes and longer-term impact • Providing $24m to Save the Children Australian and International Justice Mission in the Philippines (over 3 – 6 years) • Committed $18m funding to 50 organisations in our 2020 and 2021 impact grants rounds SAVE THE CHILDREN (PHILIPPINES) (BETWEEN JANUARY – JUNE 2021) • 687 participants trained on online exploitation issues • 2,648 students participated in online safety campaigns • Policy discussions initiated with 8 government agencies CHILDREN IN THE PICTURES (THREE-YEAR IMPACT CAMPAIGN) • Increasing awareness of the issue of online sexual exploitation of children • Educate and empower parents/caregivers to protect children from online harm • Remove barriers to identify perpetrators and rescue children • Providing $1m to support the campaign Westpac ESG Update - September 2021 |

| Environment Anthony Miller Chief Executive, Westpac Institutional Bank |

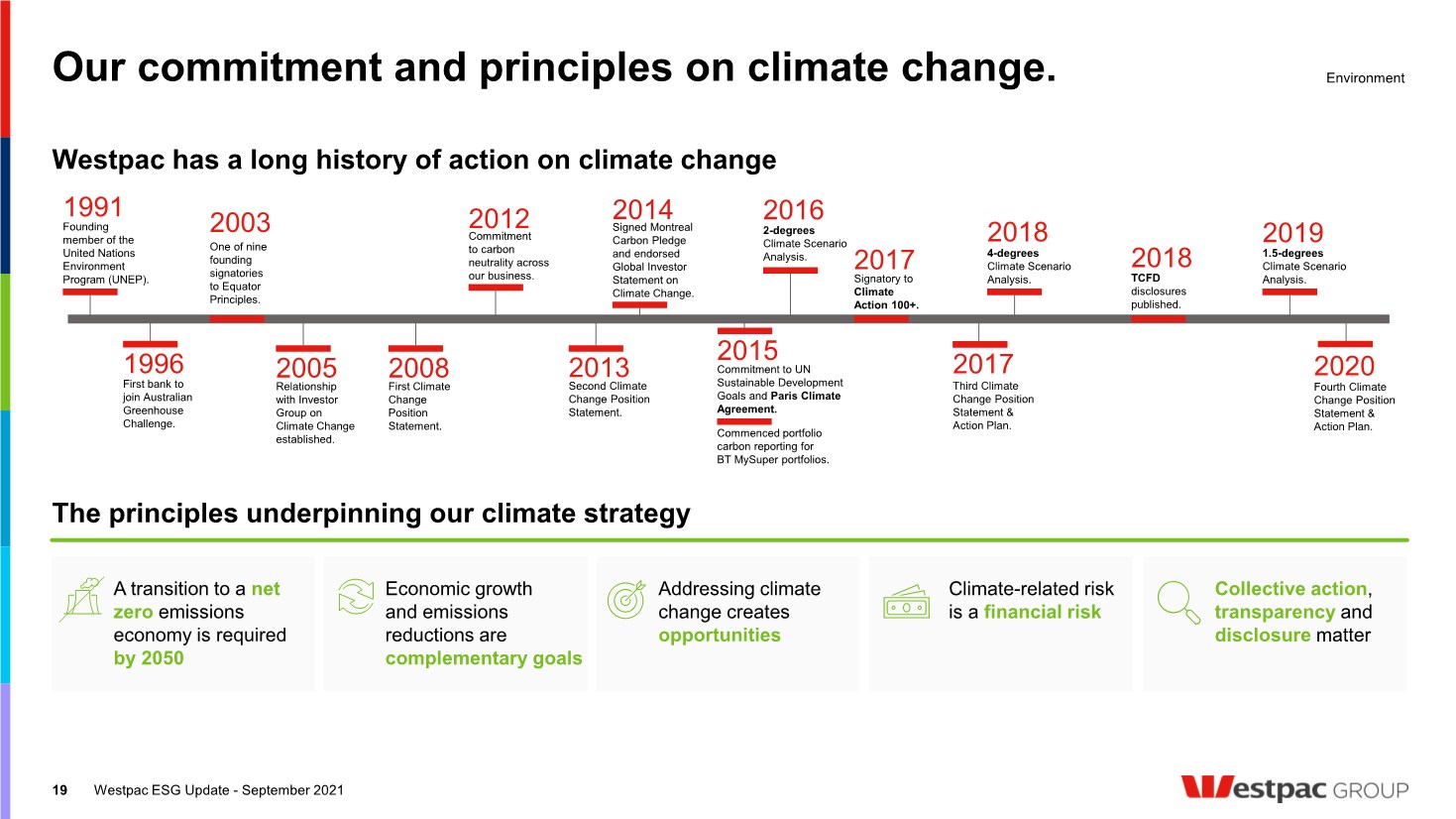

| Our commitment and principles on climate change. Westpac ESG Update - September 2021 19 Westpac has a long history of action on climate change Environment 2017 Commenced portfolio carbon reporting for BT MySuper portfolios. 1996 Founding member of the United Nations Environment Program (UNEP). 2008 4-degrees Climate Scenario Analysis. 1.5-degrees Climate Scenario Analysis. TCFD disclosures published. Signed Montreal Carbon Pledge and endorsed Global Investor Statement on Climate Change. 2015 Commitment to carbon neutrality across our business. 2013 2005 1991 First bank to join Australian Greenhouse Challenge. One of nine founding signatories to Equator Principles. 2003 Relationship with Investor Group on Climate Change established. First Climate Change Position Statement. 2012 Second Climate Change Position Statement. 2014 Commitment to UN Sustainable Development Goals and Paris Climate Agreement. 2017 Signatory to Climate Action 100+. Third Climate Change Position Statement & Action Plan. 2018 2018 2019 2020 Fourth Climate Change Position Statement & Action Plan. 2-degrees Climate Scenario Analysis. 2016 A transition to a net zero emissions economy is required by 2050 Economic growth and emissions reductions are complementary goals Addressing climate change creates opportunities Climate-related risk is a financial risk Collective action, transparency and disclosure matter The principles underpinning our climate strategy |

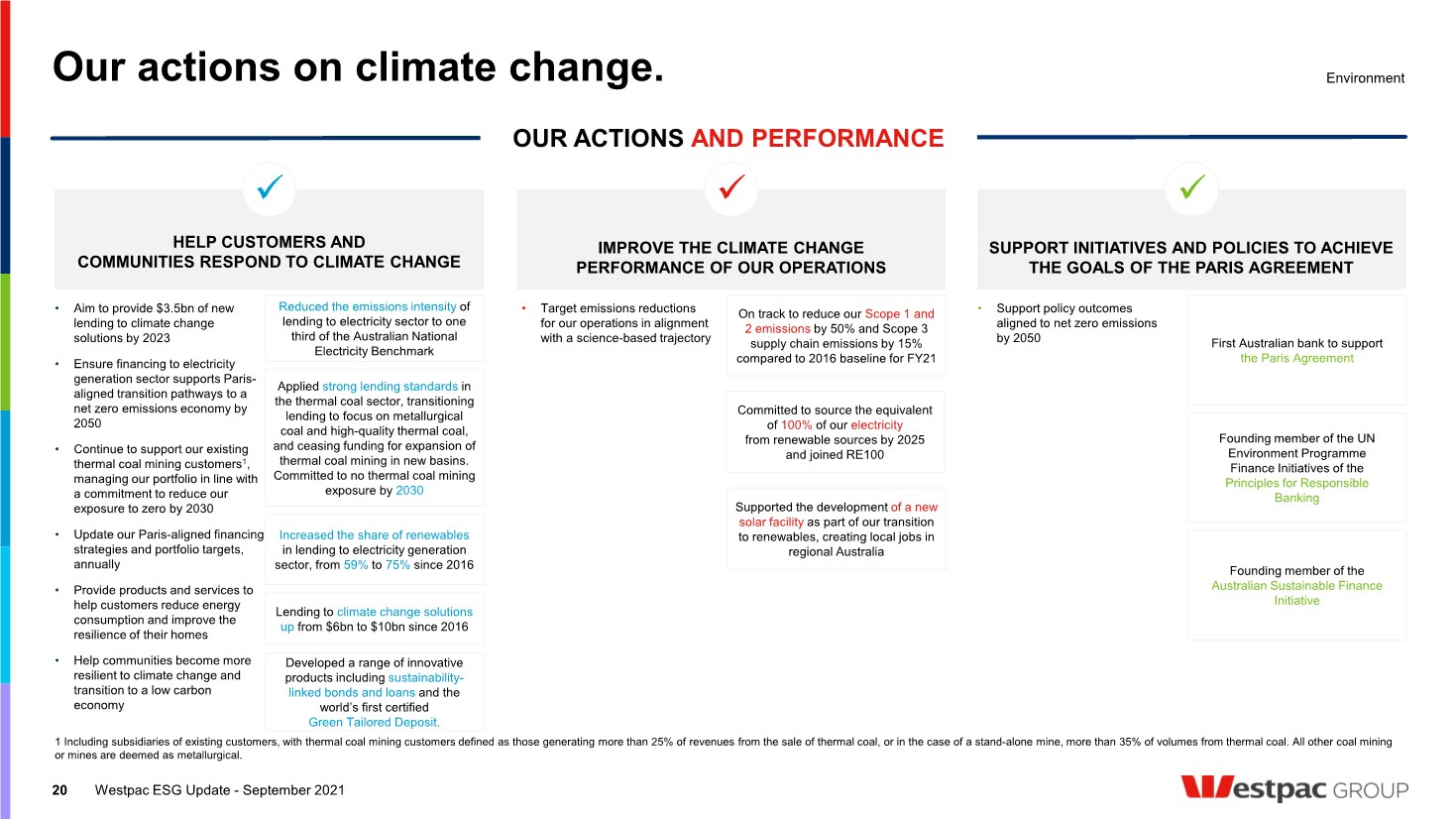

| Our actions on climate change. 20 Westpac ESG Update - September 2021 Environment On track to reduce our Scope 1 and 2 emissions by 50% and Scope 3 supply chain emissions by 15% compared to 2016 baseline for FY21 Committed to source the equivalent of 100% of our electricity from renewable sources by 2025 and joined RE100 Supported the development of a new solar facility as part of our transition to renewables, creating local jobs in regional Australia Increased the share of renewables in lending to electricity generation sector, from 59% to 75% since 2016 Lending to climate change solutions up from $6bn to $10bn since 2016 Developed a range of innovative products including sustainability- linked bonds and loans and the world’s first certified Green Tailored Deposit. Reduced the emissions intensity of lending to electricity sector to one third of the Australian National Electricity Benchmark Applied strong lending standards in the thermal coal sector, transitioning lending to focus on metallurgical coal and high-quality thermal coal, and ceasing funding for expansion of thermal coal mining in new basins. Committed to no thermal coal mining exposure by 2030 Founding member of the UN Environment Programme Finance Initiatives of the Principles for Responsible Banking First Australian bank to support the Paris Agreement Founding member of the Australian Sustainable Finance Initiative • Aim to provide $3.5bn of new lending to climate change solutions by 2023 • Ensure financing to electricity generation sector supports Paris- aligned transition pathways to a net zero emissions economy by 2050 • Continue to support our existing thermal coal mining customers1, managing our portfolio in line with a commitment to reduce our exposure to zero by 2030 • Update our Paris-aligned financing strategies and portfolio targets, annually • Provide products and services to help customers reduce energy consumption and improve the resilience of their homes • Help communities become more resilient to climate change and transition to a low carbon economy • Target emissions reductions for our operations in alignment with a science-based trajectory • Support policy outcomes aligned to net zero emissions by 2050 OUR ACTIONS AND PERFORMANCE HELP CUSTOMERS AND COMMUNITIES RESPOND TO CLIMATE CHANGE IMPROVE THE CLIMATE CHANGE PERFORMANCE OF OUR OPERATIONS SUPPORT INITIATIVES AND POLICIES TO ACHIEVE THE GOALS OF THE PARIS AGREEMENT 1 Including subsidiaries of existing customers, with thermal coal mining customers defined as those generating more than 25% of revenues from the sale of thermal coal, or in the case of a stand-alone mine, more than 35% of volumes from thermal coal. All other coal mining or mines are deemed as metallurgical. |

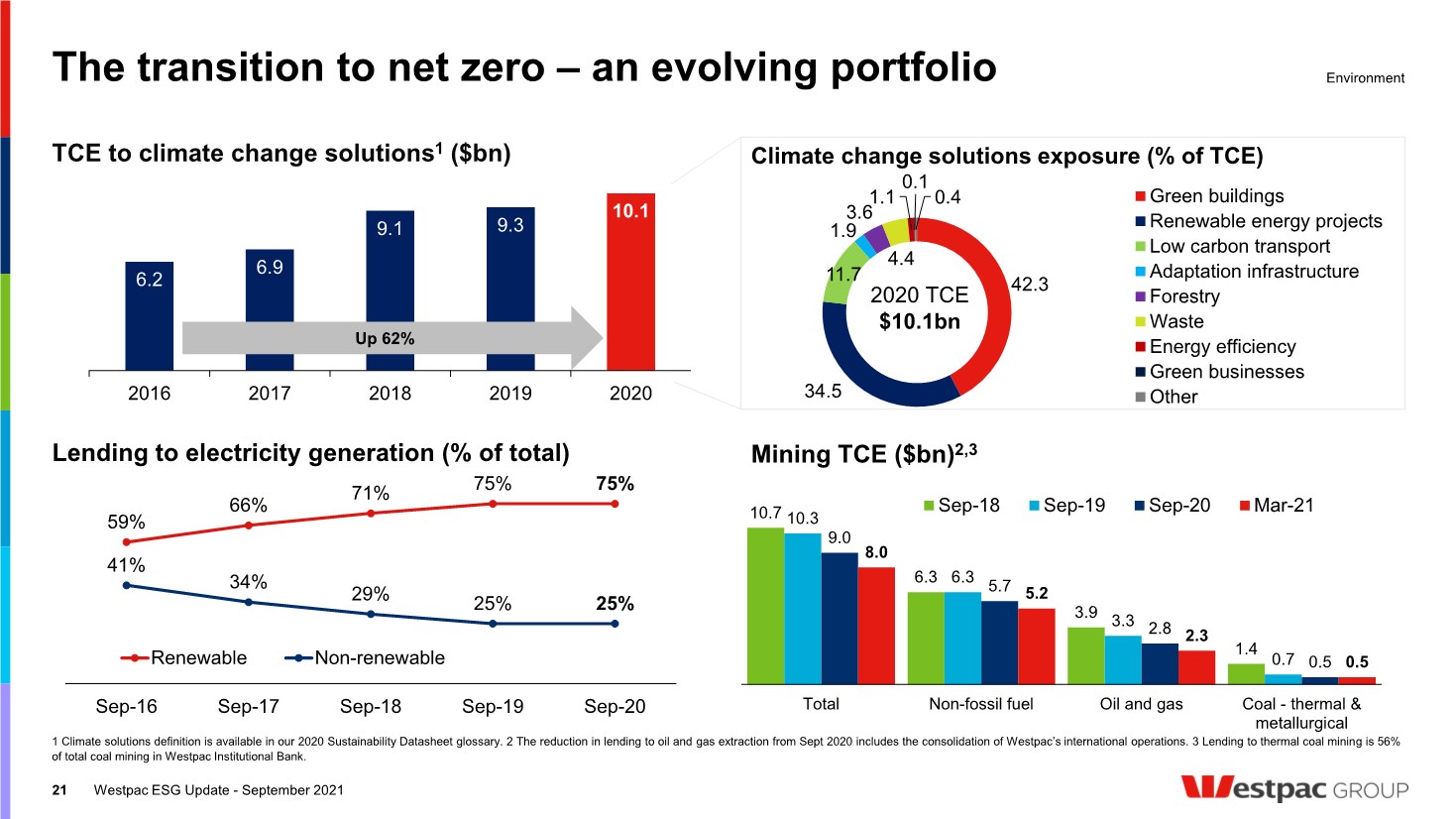

| 42.3 34.5 11.7 1.9 3.6 4.4 1.1 0.1 0.4 Green buildings Renewable energy projects Low carbon transport Adaptation infrastructure Forestry Waste Energy efficiency Green businesses Other 2020 TCE $10.1bn The transition to net zero – an evolving portfolio 1 Climate solutions definition is available in our 2020 Sustainability Datasheet glossary. 2 The reduction in lending to oil and gas extraction from Sept 2020 includes the consolidation of Westpac’s international operations. 3 Lending to thermal coal mining is 56% of total coal mining in Westpac Institutional Bank. 21 Westpac ESG Update - September 2021 Environment 6.2 6.9 9.1 9.3 10.1 0 2 4 6 8 10 12 2016 2017 2018 2019 2020 Up 62% 59% 66% 71% 75% 75% 41% 34% 29% 25% 25% Sep-16 Sep-17 Sep-18 Sep-19 Sep-20 Renewable Non-renewable Mining TCE ($bn)2,3 Climate change solutions exposure (% of TCE) TCE to climate change solutions1 ($bn) Lending to electricity generation (% of total) 10.7 6.3 3.9 1.4 10.3 6.3 3.3 0.7 9.0 5.7 2.8 0.5 8.0 5.2 2.3 0.5 Total Non-fossil fuel Oil and gas Coal - thermal & metallurgical Sep-18 Sep-19 Sep-20 Mar-21 |

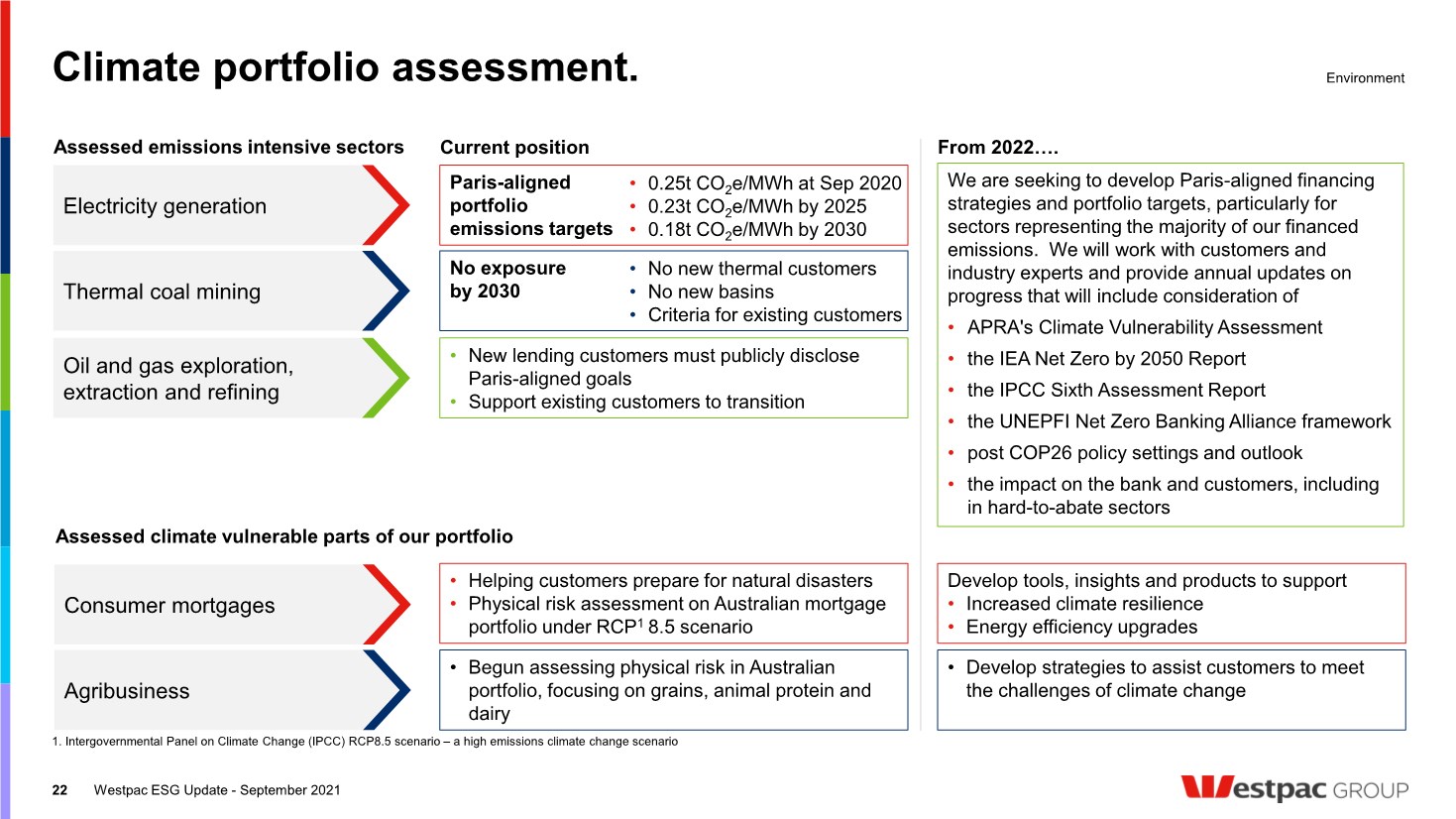

| Climate portfolio assessment. 1. Intergovernmental Panel on Climate Change (IPCC) RCP8.5 scenario – a high emissions climate change scenario 22 Environment From 2022…. Current position Assessed emissions intensive sectors Assessed climate vulnerable parts of our portfolio Paris-aligned portfolio emissions targets No exposure by 2030 • New lending customers must publicly disclose Paris-aligned goals • Support existing customers to transition • 0.25t CO2e/MWh at Sep 2020 • 0.23t CO2e/MWh by 2025 • 0.18t CO2e/MWh by 2030 • No new thermal customers • No new basins • Criteria for existing customers Electricity generation Thermal coal mining Oil and gas exploration, extraction and refining • Helping customers prepare for natural disasters • Physical risk assessment on Australian mortgage portfolio under RCP1 8.5 scenario • Begun assessing physical risk in Australian portfolio, focusing on grains, animal protein and dairy Develop tools, insights and products to support • Increased climate resilience • Energy efficiency upgrades • Develop strategies to assist customers to meet the challenges of climate change Consumer mortgages Agribusiness Westpac ESG Update - September 2021 We are seeking to develop Paris-aligned financing strategies and portfolio targets, particularly for sectors representing the majority of our financed emissions. We will work with customers and industry experts and provide annual updates on progress that will include consideration of • APRA's Climate Vulnerability Assessment • the IEA Net Zero by 2050 Report • the IPCC Sixth Assessment Report • the UNEPFI Net Zero Banking Alliance framework • post COP26 policy settings and outlook • the impact on the bank and customers, including in hard-to-abate sectors |

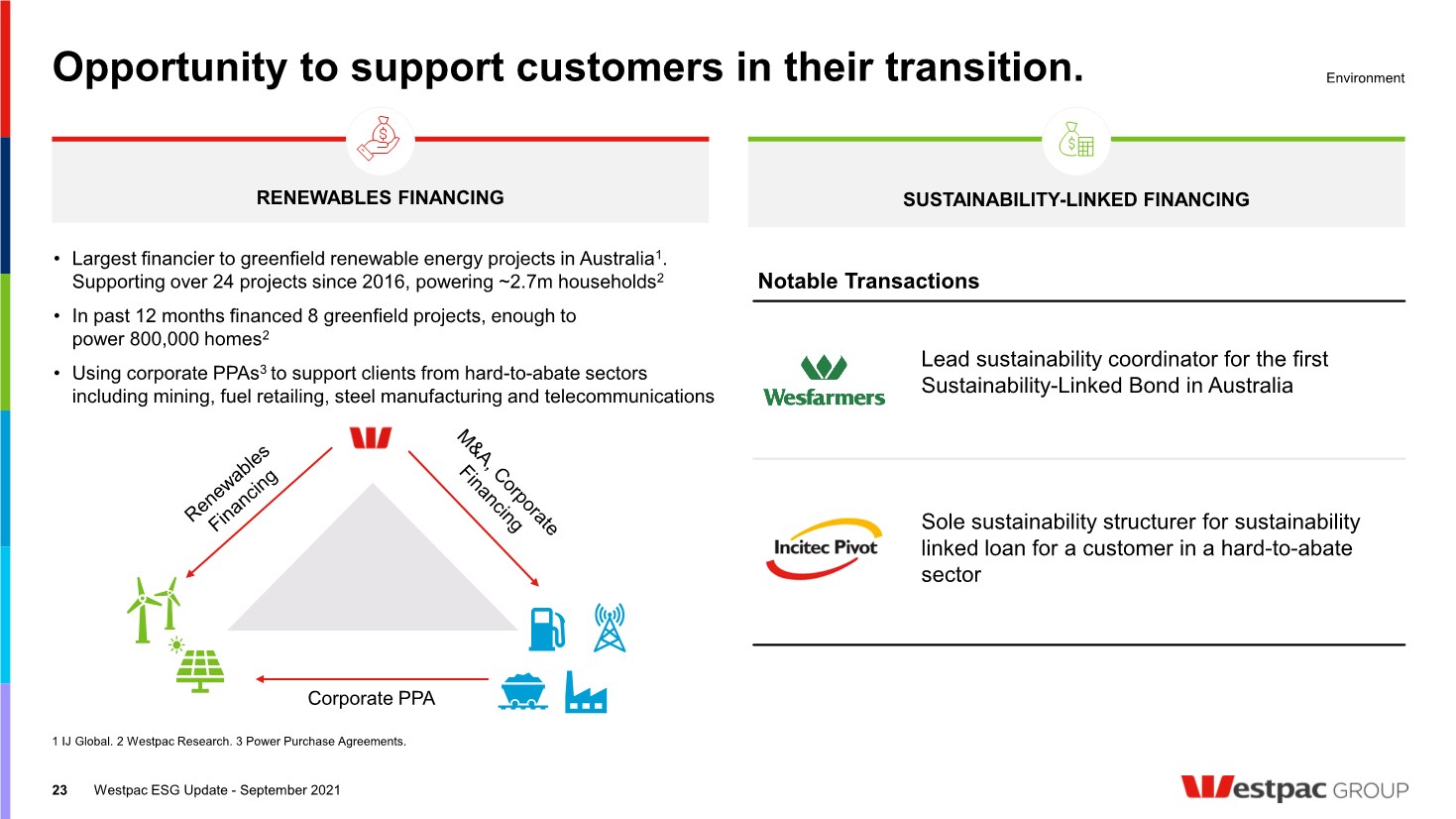

| Opportunity to support customers in their transition. 23 Environment • Largest financier to greenfield renewable energy projects in Australia1. Supporting over 24 projects since 2016, powering ~2.7m households2 • In past 12 months financed 8 greenfield projects, enough to power 800,000 homes2 • Using corporate PPAs3 to support clients from hard-to-abate sectors including mining, fuel retailing, steel manufacturing and telecommunications Corporate PPA We are helping customers transition through arranging debt structures which incentivise them to achieve ambitious emissions-based targets via pricing. Notable Transactions Lead sustainability coordinator for the first Sustainability-Linked Bond in Australia Sole sustainability structurer for sustainability linked loan for a customer in a hard-to-abate sector Westpac ESG Update - September 2021 1 IJ Global. 2 Westpac Research. 3 Power Purchase Agreements. RENEWABLES FINANCING SUSTAINABILITY-LINKED FINANCING |

| Questions Andrew Bowden Head of Investor Relations |

| Disclaimer Westpac ESG Update - September 2021 25 Disclaimer The material contained in this presentation is intended to be general background information on Westpac Banking Corporation (Westpac) and its activities. The information is supplied in summary form and is therefore not necessarily complete. It is not intended that it be relied upon as advice to investors or potential investors, who should consider seeking independent professional advice depending upon their specific investment objectives, financial situation or particular needs. The material contained in this presentation may include information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. All amounts are in Australian dollars unless otherwise indicated. Unless otherwise noted, financial information in this presentation is presented on a cash earnings basis. Cash earnings is a non-GAAP measure. Refer to Westpac’s 2021 Interim Financial Results (incorporating the requirements of Appendix 4D) for the six months ended 31 March 2021 available at westpac.com.au for details of the basis of preparation of cash earnings. This presentation contains statements that constitute “forward-looking statements” within the meaning of Section 21E of the US Securities Exchange Act of 1934. Forward-looking statements are statements about matters that are not historical facts. Forward-looking statements appear in a number of places in this presentation and include statements regarding our intent, belief or current expectations with respect to our business and operations, macro and micro economic and market conditions, results of operations and financial condition, including, without limitation, future loan loss provisions, financial support to certain borrowers, indicative drivers, forecasted economic indicators and performance metric outcomes. We use words such as ‘will’, ‘may’, ‘expect’, ‘intend’, ‘seek’, ‘would’, ‘should’, ‘could’, ‘continue’, ‘plan’, ‘estimate’, ‘anticipate’, ‘believe’, ‘probability’, ‘risk’, ‘aim’, or other similar words to identify forward-looking statements. These forward-looking statements reflect our current views with respect to future events and are subject to change, certain risks, uncertainties and assumptions which are, in many instances, beyond our control, and have been made based upon management’s expectations and beliefs concerning future developments and their potential effect upon us. There can be no assurance that future developments will be in accordance with our expectations or that the effect of future developments on us will be those anticipated. Actual results could differ materially from those which we expect, depending on the outcome of various factors. Factors that may impact on the forward-looking statements made include, but are not limited to, those described in the section titled ‘Risk factors' in Westpac’s 2021 Interim Financial Results (incorporating the requirements of Appendix 4D) for the six months ended 31 March 2021 available at www.westpac.com.au. When relying on forward-looking statements to make decisions with respect to us, investors and others should carefully consider such factors and other uncertainties and events. Except as required by law, we assume no obligation to update any forward-looking statements contained in this presentation, whether as a result of new information, future events or otherwise, after the date of this presentation. |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Gulf Resources Announces Receipt of Nasdaq Non-Compliance Notice

- Vaxxinity Announces Intention to Voluntarily Delist and Deregister its Class A Common Stock

- Biloxi Marsh Lands Corporation Announces Unaudited Results for the First Quarter of 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share