Form 6-K SANTANDER UK GROUP HOLDI For: Jun 30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 6-K Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange Act of 1934 For the month of July, 2022 Commission File Number 001-37595 SANTANDER UK GROUP HOLDINGS PLC (Translation of registrant's name into English) 2 Triton Square, Regent's Place, London NW1 3AN, England (Address of principal executive office) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F . . . .X. . . . Form 40-F . . . . . . . . Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):_ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):_

Quarterly Management Statement, 30 June 2022 1 Santander UK Group Holdings plc The information contained in this report is unaudited and does not comprise statutory accounts within the meaning of section 434 of the Companies Act 2006 (‘the Act’). The statutory accounts for the year ended 31 December 2021 have been filed with the Registrar of Companies. The report of the auditor on those statutory accounts was unqualified, did not draw attention to any matters by way of emphasis and did not contain a statement under section 498(2) or (3) of the Act. This report provides a summary of the unaudited business and financial trends for the six months ended 30 June 2022 for Santander UK Group Holdings plc and its subsidiaries (Santander UK), including its principal subsidiary Santander UK plc. The unaudited business and financial trends in this statement only pertain to Santander UK on a statutory basis (the statutory perimeter). Unless otherwise stated, references to results in previous periods and other general statements regarding past performance refer to the business results for the same period in 2021. This report contains non-IFRS financial measures that are reviewed by management in order to measure our overall performance. These are financial measures which management believe provide useful information to investors regarding our results and are outlined as Alternative Performance Measures in Appendix 1. These measures are not a substitute for IFRS measures. Appendix 2 contains supplementary consolidated information for Santander UK plc, our principal ring-fenced bank. A list of abbreviations is included at the end of this report and a glossary of terms is available at: https://www.santander.co.uk/about-santander/investor-relations/glossary Santander UK Group Holdings plc Quarterly Management Statement for the six months ended 30 June 2022 Paul Sharratt Head of Investor Relations [email protected] Stewart Todd Head of External Affairs [email protected] For more information: See Investor Update presentation www.santander.co.uk

Quarterly Management Statement, 30 June 2022 2 Santander UK Group Holdings plc Mike Regnier, Chief Executive Officer, commented: “We are living through uncertain economic times and our priority remains doing all we can to support our customers and people. We know many of them are worried about the rising costs of living and doing business, so we have increased the support available through our digital channels on a range of key issues including energy costs, spending and budget planning. “We are also supporting British businesses with our new pioneering Santander Navigator platform, helping them explore new markets and grow internationally with a wide range of expertise, information and practical support through our extensive global network. “Despite the uncertain operating environment, the hard work of our teams across the business has helped us deliver a strong set of results for the first half of the year. We have driven a 32% increase in profit from continuing operations before tax, to £993m, underpinned by £7.1bn of net mortgage lending, and enabled over 18,000 customers to take that first step onto the housing ladder in 2022. “The increase in the Bank of England’s base rate has enabled us to increase the interest rate on our 1I2I3 Current Account which continues to provide up to 3% cashback on household bills. We have also been able to increase rates right across our savings range, which are amongst the most competitive on the high street. “Our ongoing transformation programme has realised £572m savings which has helped to mitigate the impact of rising inflation and allowed us to continue improving our customer experience whilst delivering on our strategic priorities of being a responsible and sustainable business.” Business highlights Supporting our customers with what matters most Outreach to over 776k customers most likely to be impacted by the cost of living crisis, highlighting the support we have available. Dedicated support to help customers stay on top of their spending, plan budgets and manage their energy bills. Increased the customer interest rate on our 1I2I3 Current Account to 0.75% and on our Regular eSaver account to 2.50%. Successfully improved retail NPS score, ranked 4th. Ranked 1st for NPS in Business Banking and Corporate1. A clear focus on our communities and being a sustainable and responsible bank for our customers and colleagues Over £6.5bn of green finance since 2020, helping our customers reduce their carbon footprint, targeting £20bn by 20252. Launched a home improvement loan with a 25bps discount for mortgage customers improving the energy efficiency of their home. Raised and donated over £440k in H1-22 for the Red Cross and UNHCR to help those affected by the conflict in Ukraine. Announced Macmillan Cancer Support as our new charity partner to help transform financial support for those affected by cancer. Additional 4% pay increase for 60% of our lower paid employees to help them with the increased cost of living. Won Working Families ‘Best for Mental Health & Wellbeing’ award for our physical, mental, social and financial health people support. H1-22 financial highlights Profit from continuing operations3 before tax up 32% to £993m; Return on ordinary shareholders’ equity of 10.9% (Dec-21: 9.9%) and adjusted RoTE4 of 12.8%, above our cost of capital (Dec-21: 13.2%) Banking NIM4 improved by 16bps to 2.03% (H1-21: 1.87%). Operating expenses down 12%, reflecting lower transformation spend following significant restructuring in 2021. Credit impairment charges of £118m (H1-21: £70m write-backs) due to deterioration in economic outlook. Provisions for other liabilities and charges down 38%, as a result of the lower transformation spend. Ongoing transformation programme savings of £572m from £837m investment since 2019. Profit from continuing operations2 before tax up 32% to £993m. Adjusted profit from continuing operations3,4 before tax up 11% largely due to higher operating income. Proven balance sheet resilience with strong capital and liquidity Prudent approach to risk across our businesses and operations with lower Stage 3 ratio of 1.21% (Dec-21: 1.43%). Resilient asset quality with low arrears and no material corporate defaults. CET1 capital ratio of 15.5% (2021: 15.9%) and UK leverage ratio of 5.2% (2021: 5.2%), well above regulatory requirements. Strong LCR of 172%, with £5.3bn wholesale funding issuance transacted. The BoE published its first RAF assessment in June, we were the only UK bank with no material issues to achieve resolution identified. 1. See Appendix 3 for more on NPS rank. 2. Includes lending to finance properties with an EPC rating of A and B, renewable energy and electric vehicles as well as financing raised and facilitated. 3. In H1-21, CIB is presented as a discontinued operation after its transfer to SLB under a Part VII banking business transfer scheme, completed on 11 October 2021. 4. Non-IFRS measure. See Appendix 1 for details and a reconciliation of adjusted metrics to the nearest IFRS measure.

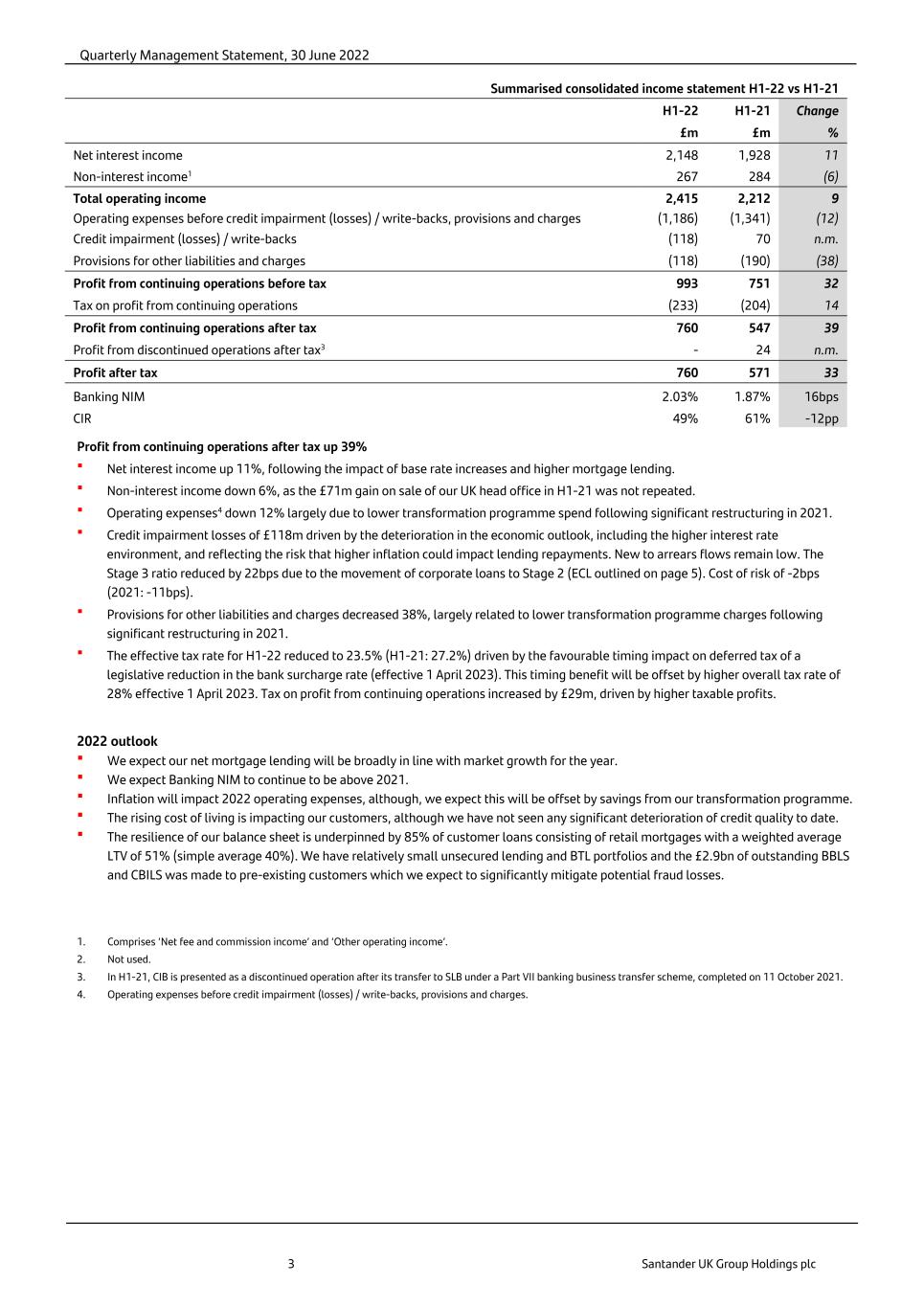

Quarterly Management Statement, 30 June 2022 3 Santander UK Group Holdings plc Summarised consolidated income statement H1-22 vs H1-21 H1-22 H1-21 Change £m £m % Net interest income 2,148 1,928 11 Non-interest income1 267 284 (6) Total operating income 2,415 2,212 9 Operating expenses before credit impairment (losses) / write-backs, provisions and charges (1,186) (1,341) (12) Credit impairment (losses) / write-backs (118) 70 n.m. Provisions for other liabilities and charges (118) (190) (38) Profit from continuing operations before tax 993 751 32 Tax on profit from continuing operations (233) (204) 14 Profit from continuing operations after tax 760 547 39 Profit from discontinued operations after tax3 - 24 n.m. Profit after tax 760 571 33 Banking NIM 2.03% 1.87% 16bps CIR 49% 61% -12pp Profit from continuing operations after tax up 39% Net interest income up 11%, following the impact of base rate increases and higher mortgage lending. Non-interest income down 6%, as the £71m gain on sale of our UK head office in H1-21 was not repeated. Operating expenses4 down 12% largely due to lower transformation programme spend following significant restructuring in 2021. Credit impairment losses of £118m driven by the deterioration in the economic outlook, including the higher interest rate environment, and reflecting the risk that higher inflation could impact lending repayments. New to arrears flows remain low. The Stage 3 ratio reduced by 22bps due to the movement of corporate loans to Stage 2 (ECL outlined on page 5). Cost of risk of -2bps (2021: -11bps). Provisions for other liabilities and charges decreased 38%, largely related to lower transformation programme charges following significant restructuring in 2021. The effective tax rate for H1-22 reduced to 23.5% (H1-21: 27.2%) driven by the favourable timing impact on deferred tax of a legislative reduction in the bank surcharge rate (effective 1 April 2023). This timing benefit will be offset by higher overall tax rate of 28% effective 1 April 2023. Tax on profit from continuing operations increased by £29m, driven by higher taxable profits. 2022 outlook We expect our net mortgage lending will be broadly in line with market growth for the year. We expect Banking NIM to continue to be above 2021. Inflation will impact 2022 operating expenses, although, we expect this will be offset by savings from our transformation programme. The rising cost of living is impacting our customers, although we have not seen any significant deterioration of credit quality to date. The resilience of our balance sheet is underpinned by 85% of customer loans consisting of retail mortgages with a weighted average LTV of 51% (simple average 40%). We have relatively small unsecured lending and BTL portfolios and the £2.9bn of outstanding BBLS and CBILS was made to pre-existing customers which we expect to significantly mitigate potential fraud losses. 1. Comprises ‘Net fee and commission income’ and ‘Other operating income’. 2. Not used. 3. In H1-21, CIB is presented as a discontinued operation after its transfer to SLB under a Part VII banking business transfer scheme, completed on 11 October 2021. 4. Operating expenses before credit impairment (losses) / write-backs, provisions and charges.

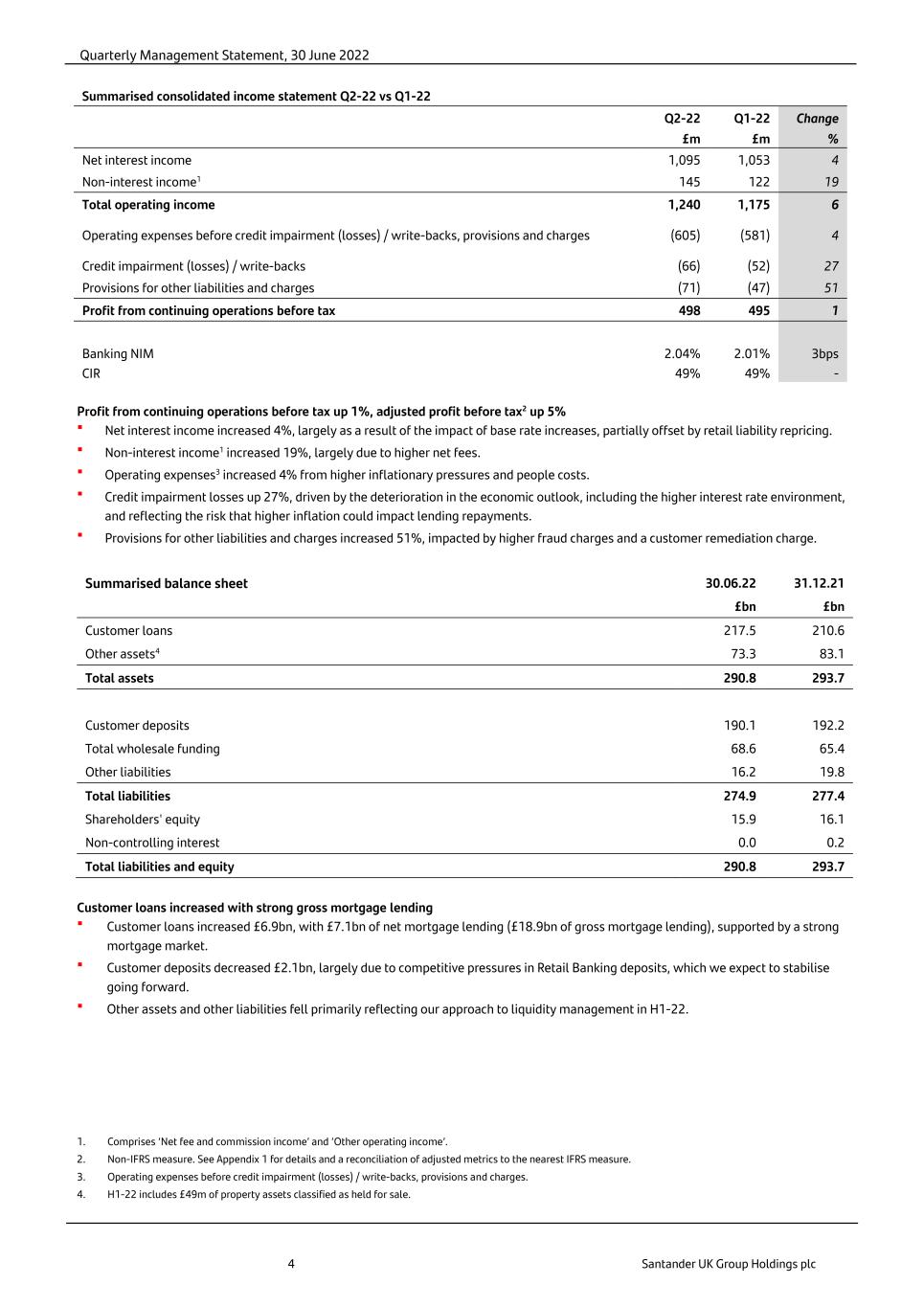

Quarterly Management Statement, 30 June 2022 4 Santander UK Group Holdings plc Summarised consolidated income statement Q2-22 vs Q1-22 Q2-22 Q1-22 Change £m £m % Net interest income 1,095 1,053 4 Non-interest income1 145 122 19 Total operating income 1,240 1,175 6 Operating expenses before credit impairment (losses) / write-backs, provisions and charges (605) (581) 4 Credit impairment (losses) / write-backs (66) (52) 27 Provisions for other liabilities and charges (71) (47) 51 Profit from continuing operations before tax 498 495 1 Banking NIM 2.04% 2.01% 3bps CIR 49% 49% - Profit from continuing operations before tax up 1%, adjusted profit before tax2 up 5% Net interest income increased 4%, largely as a result of the impact of base rate increases, partially offset by retail liability repricing. Non-interest income1 increased 19%, largely due to higher net fees. Operating expenses3 increased 4% from higher inflationary pressures and people costs. Credit impairment losses up 27%, driven by the deterioration in the economic outlook, including the higher interest rate environment, and reflecting the risk that higher inflation could impact lending repayments. Provisions for other liabilities and charges increased 51%, impacted by higher fraud charges and a customer remediation charge. Summarised balance sheet 30.06.22 31.12.21 £bn £bn Customer loans 217.5 210.6 Other assets4 73.3 83.1 Total assets 290.8 293.7 Customer deposits 190.1 192.2 Total wholesale funding 68.6 65.4 Other liabilities 16.2 19.8 Total liabilities 274.9 277.4 Shareholders' equity 15.9 16.1 Non-controlling interest 0.0 0.2 Total liabilities and equity 290.8 293.7 Customer loans increased with strong gross mortgage lending Customer loans increased £6.9bn, with £7.1bn of net mortgage lending (£18.9bn of gross mortgage lending), supported by a strong mortgage market. Customer deposits decreased £2.1bn, largely due to competitive pressures in Retail Banking deposits, which we expect to stabilise going forward. Other assets and other liabilities fell primarily reflecting our approach to liquidity management in H1-22. 1. Comprises ‘Net fee and commission income’ and ‘Other operating income’. 2. Non-IFRS measure. See Appendix 1 for details and a reconciliation of adjusted metrics to the nearest IFRS measure. 3. Operating expenses before credit impairment (losses) / write-backs, provisions and charges. 4. H1-22 includes £49m of property assets classified as held for sale.

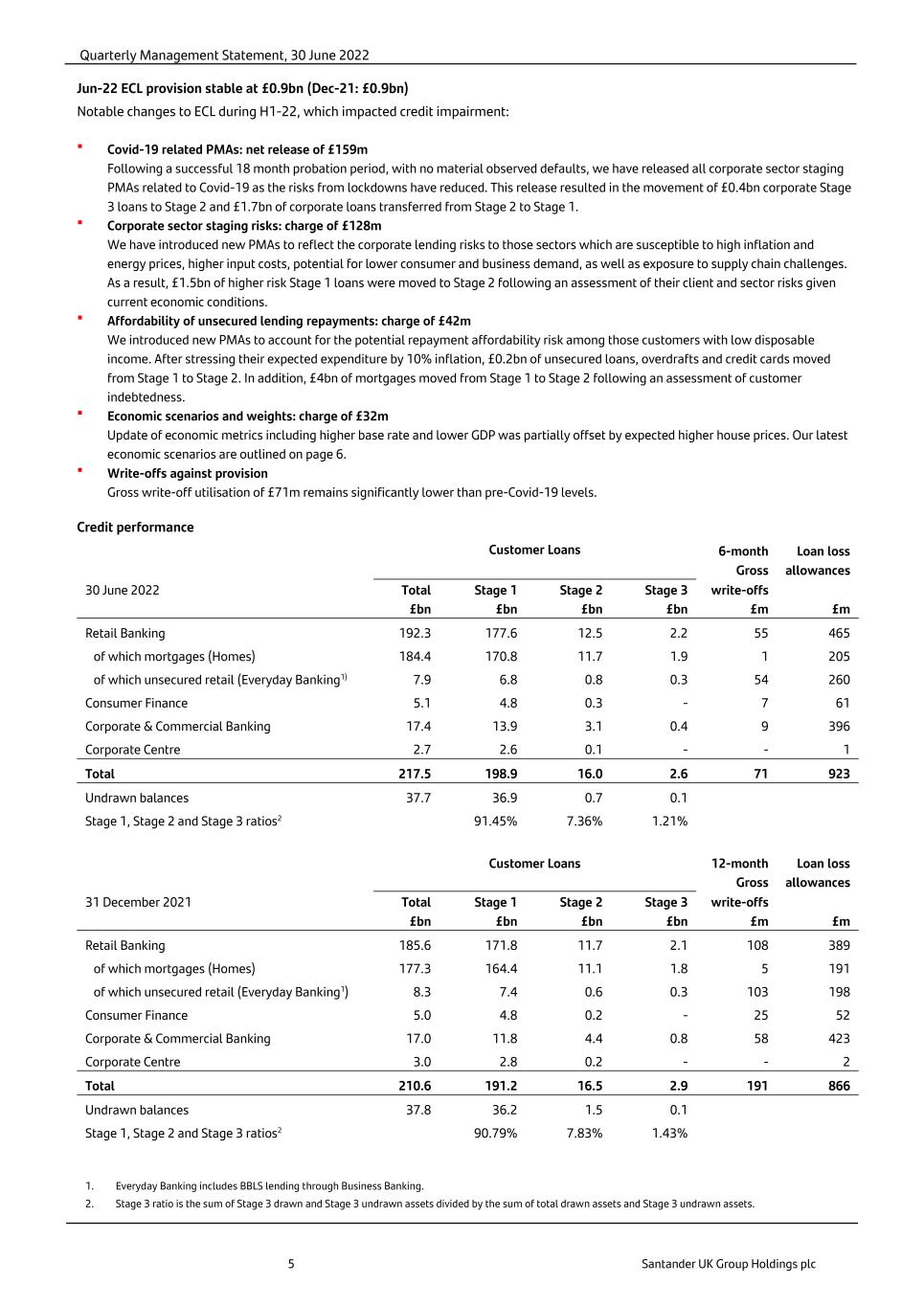

Quarterly Management Statement, 30 June 2022 5 Santander UK Group Holdings plc Jun-22 ECL provision stable at £0.9bn (Dec-21: £0.9bn) Notable changes to ECL during H1-22, which impacted credit impairment: Covid-19 related PMAs: net release of £159m Following a successful 18 month probation period, with no material observed defaults, we have released all corporate sector staging PMAs related to Covid-19 as the risks from lockdowns have reduced. This release resulted in the movement of £0.4bn corporate Stage 3 loans to Stage 2 and £1.7bn of corporate loans transferred from Stage 2 to Stage 1. Corporate sector staging risks: charge of £128m We have introduced new PMAs to reflect the corporate lending risks to those sectors which are susceptible to high inflation and energy prices, higher input costs, potential for lower consumer and business demand, as well as exposure to supply chain challenges. As a result, £1.5bn of higher risk Stage 1 loans were moved to Stage 2 following an assessment of their client and sector risks given current economic conditions. Affordability of unsecured lending repayments: charge of £42m We introduced new PMAs to account for the potential repayment affordability risk among those customers with low disposable income. After stressing their expected expenditure by 10% inflation, £0.2bn of unsecured loans, overdrafts and credit cards moved from Stage 1 to Stage 2. In addition, £4bn of mortgages moved from Stage 1 to Stage 2 following an assessment of customer indebtedness. Economic scenarios and weights: charge of £32m Update of economic metrics including higher base rate and lower GDP was partially offset by expected higher house prices. Our latest economic scenarios are outlined on page 6. Write-offs against provision Gross write-off utilisation of £71m remains significantly lower than pre-Covid-19 levels. Credit performance Customer Loans 6-month Gross Loan loss allowances 30 June 2022 Total Stage 1 Stage 2 Stage 3 write-offs £bn £bn £bn £bn £m £m Retail Banking 192.3 177.6 12.5 2.2 55 465 of which mortgages (Homes) 184.4 170.8 11.7 1.9 1 205 of which unsecured retail (Everyday Banking1) 7.9 6.8 0.8 0.3 54 260 Consumer Finance 5.1 4.8 0.3 - 7 61 Corporate & Commercial Banking 17.4 13.9 3.1 0.4 9 396 Corporate Centre 2.7 2.6 0.1 - - 1 Total 217.5 198.9 16.0 2.6 71 923 Undrawn balances 37.7 36.9 0.7 0.1 Stage 1, Stage 2 and Stage 3 ratios2 91.45% 7.36% 1.21% Customer Loans 12-month Gross Loan loss allowances 31 December 2021 Total Stage 1 Stage 2 Stage 3 write-offs £bn £bn £bn £bn £m £m Retail Banking 185.6 171.8 11.7 2.1 108 389 of which mortgages (Homes) 177.3 164.4 11.1 1.8 5 191 of which unsecured retail (Everyday Banking1) 8.3 7.4 0.6 0.3 103 198 Consumer Finance 5.0 4.8 0.2 - 25 52 Corporate & Commercial Banking 17.0 11.8 4.4 0.8 58 423 Corporate Centre 3.0 2.8 0.2 - - 2 Total 210.6 191.2 16.5 2.9 191 866 Undrawn balances 37.8 36.2 1.5 0.1 Stage 1, Stage 2 and Stage 3 ratios2 90.79% 7.83% 1.43% 1. Everyday Banking includes BBLS lending through Business Banking. 2. Stage 3 ratio is the sum of Stage 3 drawn and Stage 3 undrawn assets divided by the sum of total drawn assets and Stage 3 undrawn assets.

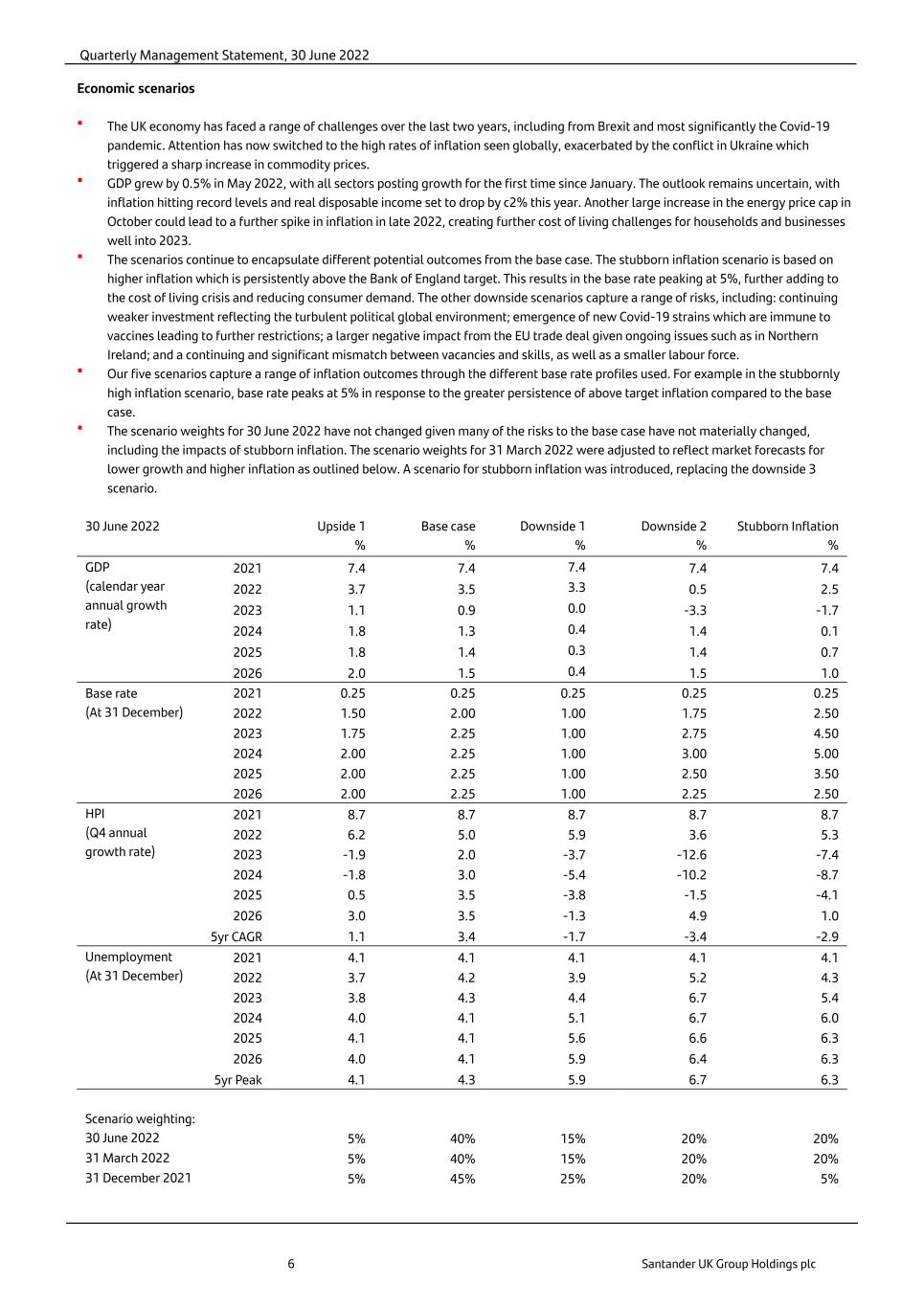

Quarterly Management Statement, 30 June 2022 6 Santander UK Group Holdings plc Economic scenarios The UK economy has faced a range of challenges over the last two years, including from Brexit and most significantly the Covid-19 pandemic. Attention has now switched to the high rates of inflation seen globally, exacerbated by the conflict in Ukraine which triggered a sharp increase in commodity prices. GDP grew by 0.5% in May 2022, with all sectors posting growth for the first time since January. The outlook remains uncertain, with inflation hitting record levels and real disposable income set to drop by c2% this year. Another large increase in the energy price cap in October could lead to a further spike in inflation in late 2022, creating further cost of living challenges for households and businesses well into 2023. The scenarios continue to encapsulate different potential outcomes from the base case. The stubborn inflation scenario is based on higher inflation which is persistently above the Bank of England target. This results in the base rate peaking at 5%, further adding to the cost of living crisis and reducing consumer demand. The other downside scenarios capture a range of risks, including: continuing weaker investment reflecting the turbulent political global environment; emergence of new Covid-19 strains which are immune to vaccines leading to further restrictions; a larger negative impact from the EU trade deal given ongoing issues such as in Northern Ireland; and a continuing and significant mismatch between vacancies and skills, as well as a smaller labour force. Our five scenarios capture a range of inflation outcomes through the different base rate profiles used. For example in the stubbornly high inflation scenario, base rate peaks at 5% in response to the greater persistence of above target inflation compared to the base case. The scenario weights for 30 June 2022 have not changed given many of the risks to the base case have not materially changed, including the impacts of stubborn inflation. The scenario weights for 31 March 2022 were adjusted to reflect market forecasts for lower growth and higher inflation as outlined below. A scenario for stubborn inflation was introduced, replacing the downside 3 scenario. 30 June 2022 Upside 1 % Base case % Downside 1 % Downside 2 % Stubborn Inflation % GDP (calendar year annual growth rate) 2021 7.4 7.4 7.4 7.4 7.4 2022 3.7 3.5 3.3 0.5 2.5 2023 1.1 0.9 0.0 -3.3 -1.7 2024 1.8 1.3 0.4 1.4 0.1 2025 1.8 1.4 0.3 1.4 0.7 2026 2.0 1.5 0.4 1.5 1.0 Base rate (At 31 December) 2021 0.25 0.25 0.25 0.25 0.25 2022 1.50 2.00 1.00 1.75 2.50 2023 1.75 2.25 1.00 2.75 4.50 2024 2.00 2.25 1.00 3.00 5.00 2025 2.00 2.25 1.00 2.50 3.50 2026 2.00 2.25 1.00 2.25 2.50 HPI (Q4 annual growth rate) 2021 8.7 8.7 8.7 8.7 8.7 2022 6.2 5.0 5.9 3.6 5.3 2023 -1.9 2.0 -3.7 -12.6 -7.4 2024 -1.8 3.0 -5.4 -10.2 -8.7 2025 0.5 3.5 -3.8 -1.5 -4.1 2026 3.0 3.5 -1.3 4.9 1.0 5yr CAGR 1.1 3.4 -1.7 -3.4 -2.9 Unemployment (At 31 December) 2021 4.1 4.1 4.1 4.1 4.1 2022 3.7 4.2 3.9 5.2 4.3 2023 3.8 4.3 4.4 6.7 5.4 2024 4.0 4.1 5.1 6.7 6.0 2025 4.1 4.1 5.6 6.6 6.3 2026 4.0 4.1 5.9 6.4 6.3 5yr Peak 4.1 4.3 5.9 6.7 6.3 Scenario weighting: 30 June 2022 5% 40% 15% 20% 20% 31 March 2022 5% 40% 15% 20% 20% 31 December 2021 5% 45% 25% 20% 5%

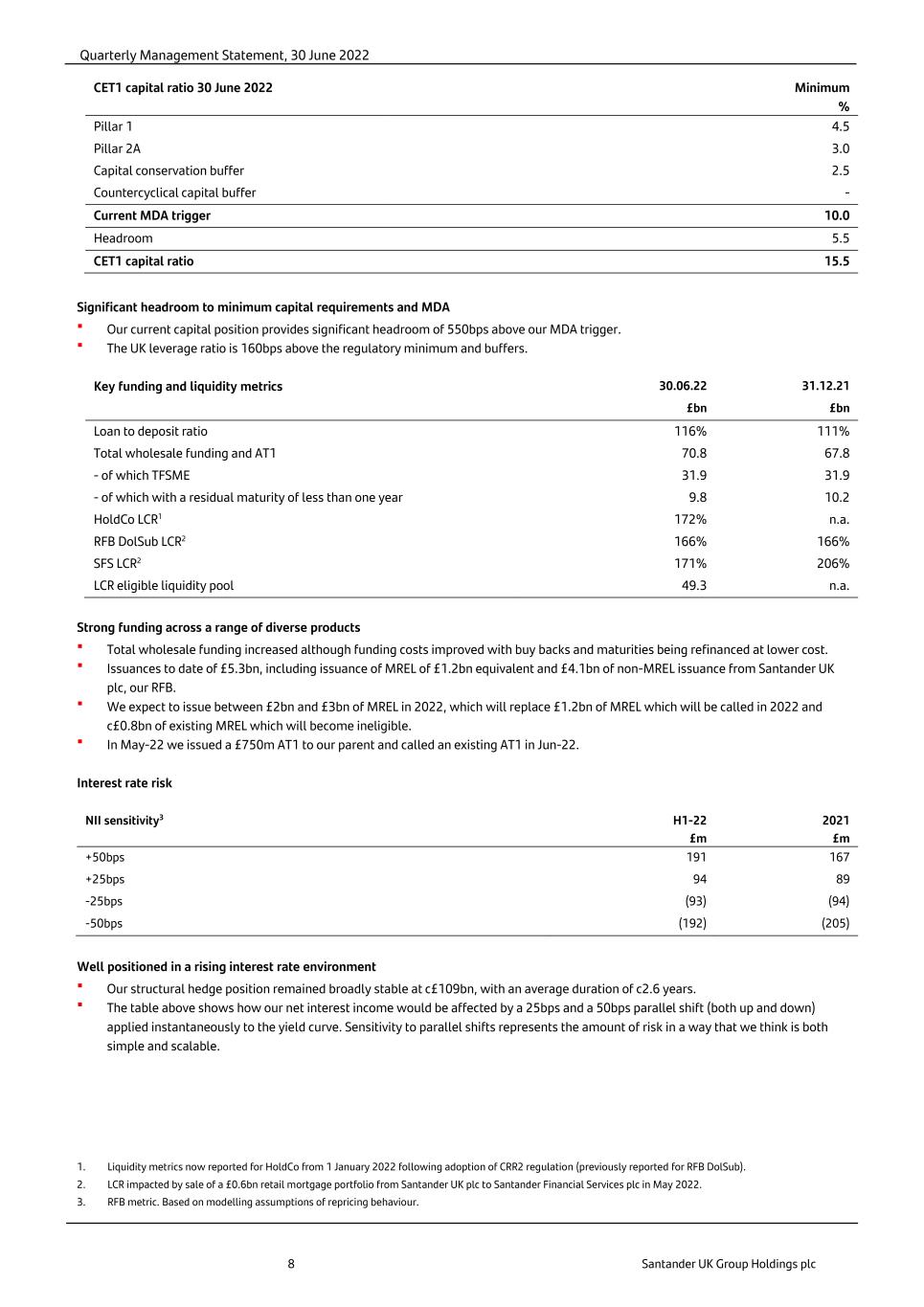

Quarterly Management Statement, 30 June 2022 7 Santander UK Group Holdings plc Treasury Key capital metrics 30.06.22 31.12.21 £bn £bn CET1 capital 10.9 10.8 Total qualifying regulatory capital 14.6 14.7 CET1 capital ratio 15.5% 15.9% Total capital ratio 20.8% 21.6% UK leverage ratio 5.2% 5.2% RWA 70.4 68.1 UK leverage exposure 248.6 246.3 Summarised change in CET1 capital ratio Change bps CET1 capital ratio % 31 December 2021 15.9 Regulatory changes on 1 January 2022 (38) Pro forma at 1 January 2022 15.5 Profit post distributions 41 Fixed pension deficit contributions (13) Expected loss provisions 7 Other 4 RWA growth (41) 30 June 2022 15.5 Capital ratios impacted by the change in treatment of software assets The CET1 capital ratio decreased 40bps to 15.5%, largely due to the regulatory changes that took effect from January 2022. RWA growth in Retail Banking and Consumer Finance were offset by retained profit. The business remains strongly capitalised. The UK leverage ratio was unchanged as the impact of the change in treatment of software assets on 1 January 2022 was offset by retained profit, UK leverage exposure remained broadly stable. Total capital ratio decreased by 80bps to 20.8%, due to the one-off regulatory changes that took effect on 1 January 2022 and the reduction in Additional Tier 1 and Tier 2 capital securities recognised following the end of the CRR Grandfathering period on 1 January 2022. 2022 ordinary share dividends are expected to be in line with our existing dividend policy of 50% of recurring profit after tax.

Quarterly Management Statement, 30 June 2022 8 Santander UK Group Holdings plc CET1 capital ratio 30 June 2022 Minimum % Pillar 1 4.5 Pillar 2A 3.0 Capital conservation buffer 2.5 Countercyclical capital buffer - Current MDA trigger 10.0 Headroom 5.5 CET1 capital ratio 15.5 Significant headroom to minimum capital requirements and MDA Our current capital position provides significant headroom of 550bps above our MDA trigger. The UK leverage ratio is 160bps above the regulatory minimum and buffers. Key funding and liquidity metrics 30.06.22 31.12.21 £bn £bn Loan to deposit ratio 116% 111% Total wholesale funding and AT1 70.8 67.8 - of which TFSME 31.9 31.9 - of which with a residual maturity of less than one year 9.8 10.2 HoldCo LCR1 172% n.a. RFB DolSub LCR2 166% 166% SFS LCR2 171% 206% LCR eligible liquidity pool 49.3 n.a. Strong funding across a range of diverse products Total wholesale funding increased although funding costs improved with buy backs and maturities being refinanced at lower cost. Issuances to date of £5.3bn, including issuance of MREL of £1.2bn equivalent and £4.1bn of non-MREL issuance from Santander UK plc, our RFB. We expect to issue between £2bn and £3bn of MREL in 2022, which will replace £1.2bn of MREL which will be called in 2022 and c£0.8bn of existing MREL which will become ineligible. In May-22 we issued a £750m AT1 to our parent and called an existing AT1 in Jun-22. Interest rate risk NII sensitivity3 H1-22 2021 £m £m +50bps 191 167 +25bps 94 89 -25bps (93) (94) -50bps (192) (205) Well positioned in a rising interest rate environment Our structural hedge position remained broadly stable at c£109bn, with an average duration of c2.6 years. The table above shows how our net interest income would be affected by a 25bps and a 50bps parallel shift (both up and down) applied instantaneously to the yield curve. Sensitivity to parallel shifts represents the amount of risk in a way that we think is both simple and scalable. 1. Liquidity metrics now reported for HoldCo from 1 January 2022 following adoption of CRR2 regulation (previously reported for RFB DolSub). 2. LCR impacted by sale of a £0.6bn retail mortgage portfolio from Santander UK plc to Santander Financial Services plc in May 2022. 3. RFB metric. Based on modelling assumptions of repricing behaviour.

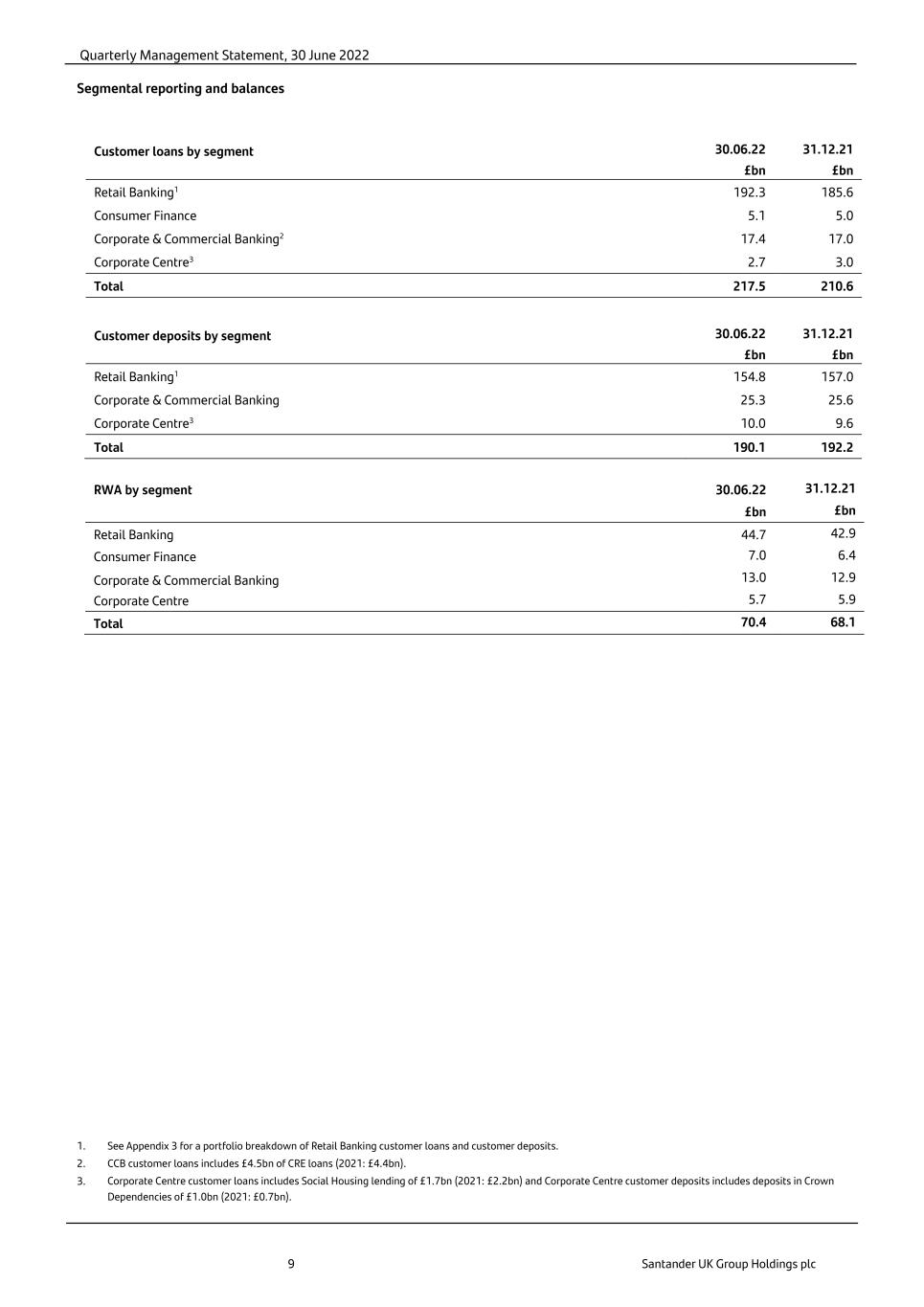

Quarterly Management Statement, 30 June 2022 9 Santander UK Group Holdings plc Segmental reporting and balances Customer loans by segment 30.06.22 31.12.21 £bn £bn Retail Banking1 192.3 185.6 Consumer Finance 5.1 5.0 Corporate & Commercial Banking2 17.4 17.0 Corporate Centre3 2.7 3.0 Total 217.5 210.6 Customer deposits by segment 30.06.22 31.12.21 £bn £bn Retail Banking1 154.8 157.0 Corporate & Commercial Banking 25.3 25.6 Corporate Centre3 10.0 9.6 Total 190.1 192.2 RWA by segment 30.06.22 31.12.21 £bn £bn Retail Banking 44.7 42.9 Consumer Finance 7.0 6.4 Corporate & Commercial Banking 13.0 12.9 Corporate Centre 5.7 5.9 Total 70.4 68.1 1. See Appendix 3 for a portfolio breakdown of Retail Banking customer loans and customer deposits. 2. CCB customer loans includes £4.5bn of CRE loans (2021: £4.4bn). 3. Corporate Centre customer loans includes Social Housing lending of £1.7bn (2021: £2.2bn) and Corporate Centre customer deposits includes deposits in Crown Dependencies of £1.0bn (2021: £0.7bn).

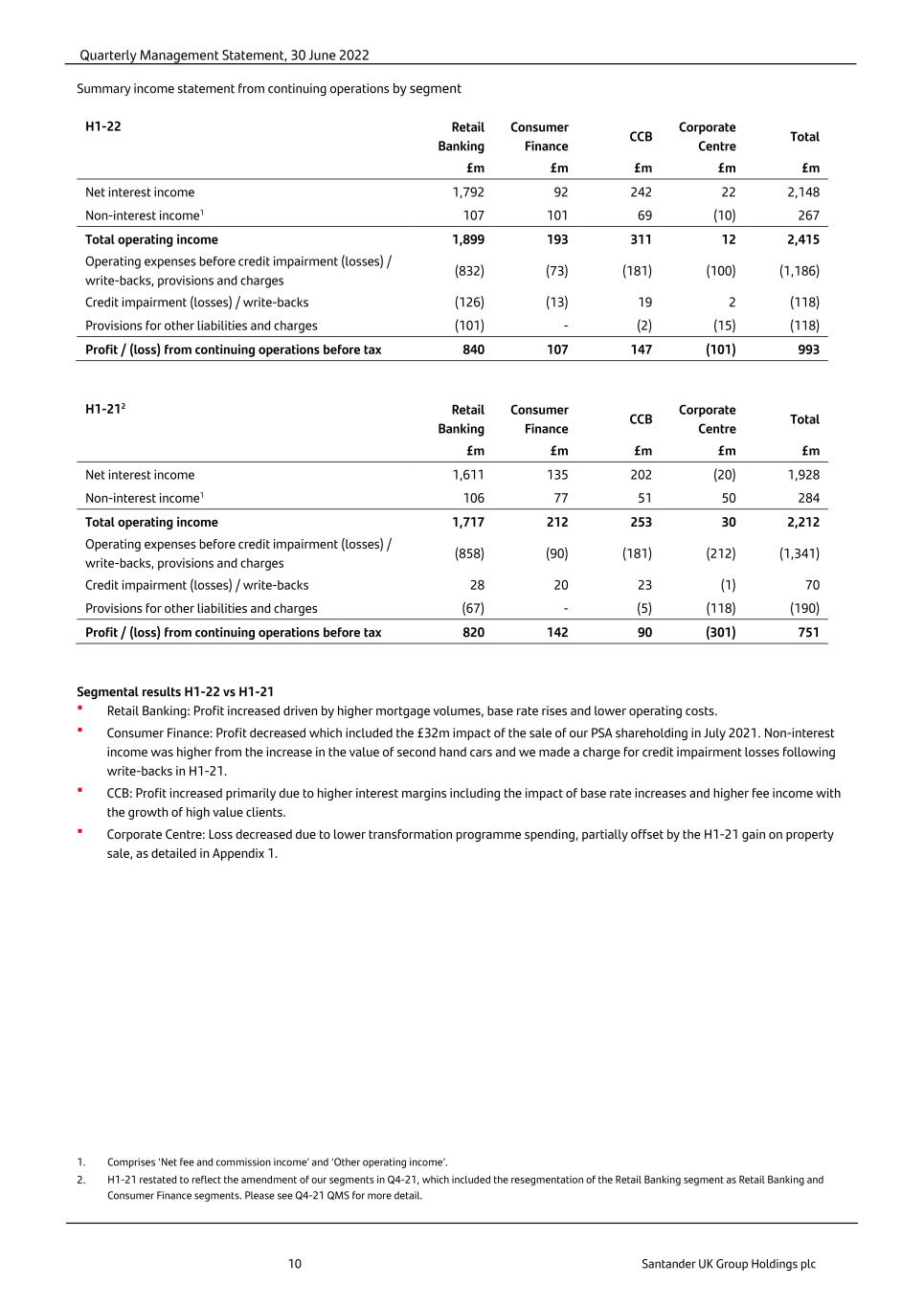

Quarterly Management Statement, 30 June 2022 10 Santander UK Group Holdings plc Summary income statement from continuing operations by segment H1-22 Retail Banking Consumer Finance CCB Corporate Centre Total £m £m £m £m £m Net interest income 1,792 92 242 22 2,148 Non-interest income1 107 101 69 (10) 267 Total operating income 1,899 193 311 12 2,415 Operating expenses before credit impairment (losses) / write-backs, provisions and charges (832) (73) (181) (100) (1,186) Credit impairment (losses) / write-backs (126) (13) 19 2 (118) Provisions for other liabilities and charges (101) - (2) (15) (118) Profit / (loss) from continuing operations before tax 840 107 147 (101) 993 H1-212 Retail Banking Consumer Finance CCB Corporate Centre Total £m £m £m £m £m Net interest income 1,611 135 202 (20) 1,928 Non-interest income1 106 77 51 50 284 Total operating income 1,717 212 253 30 2,212 Operating expenses before credit impairment (losses) / write-backs, provisions and charges (858) (90) (181) (212) (1,341) Credit impairment (losses) / write-backs 28 20 23 (1) 70 Provisions for other liabilities and charges (67) - (5) (118) (190) Profit / (loss) from continuing operations before tax 820 142 90 (301) 751 Segmental results H1-22 vs H1-21 Retail Banking: Profit increased driven by higher mortgage volumes, base rate rises and lower operating costs. Consumer Finance: Profit decreased which included the £32m impact of the sale of our PSA shareholding in July 2021. Non-interest income was higher from the increase in the value of second hand cars and we made a charge for credit impairment losses following write-backs in H1-21. CCB: Profit increased primarily due to higher interest margins including the impact of base rate increases and higher fee income with the growth of high value clients. Corporate Centre: Loss decreased due to lower transformation programme spending, partially offset by the H1-21 gain on property sale, as detailed in Appendix 1. 1. Comprises ‘Net fee and commission income’ and ‘Other operating income’. 2. H1-21 restated to reflect the amendment of our segments in Q4-21, which included the resegmentation of the Retail Banking segment as Retail Banking and Consumer Finance segments. Please see Q4-21 QMS for more detail.

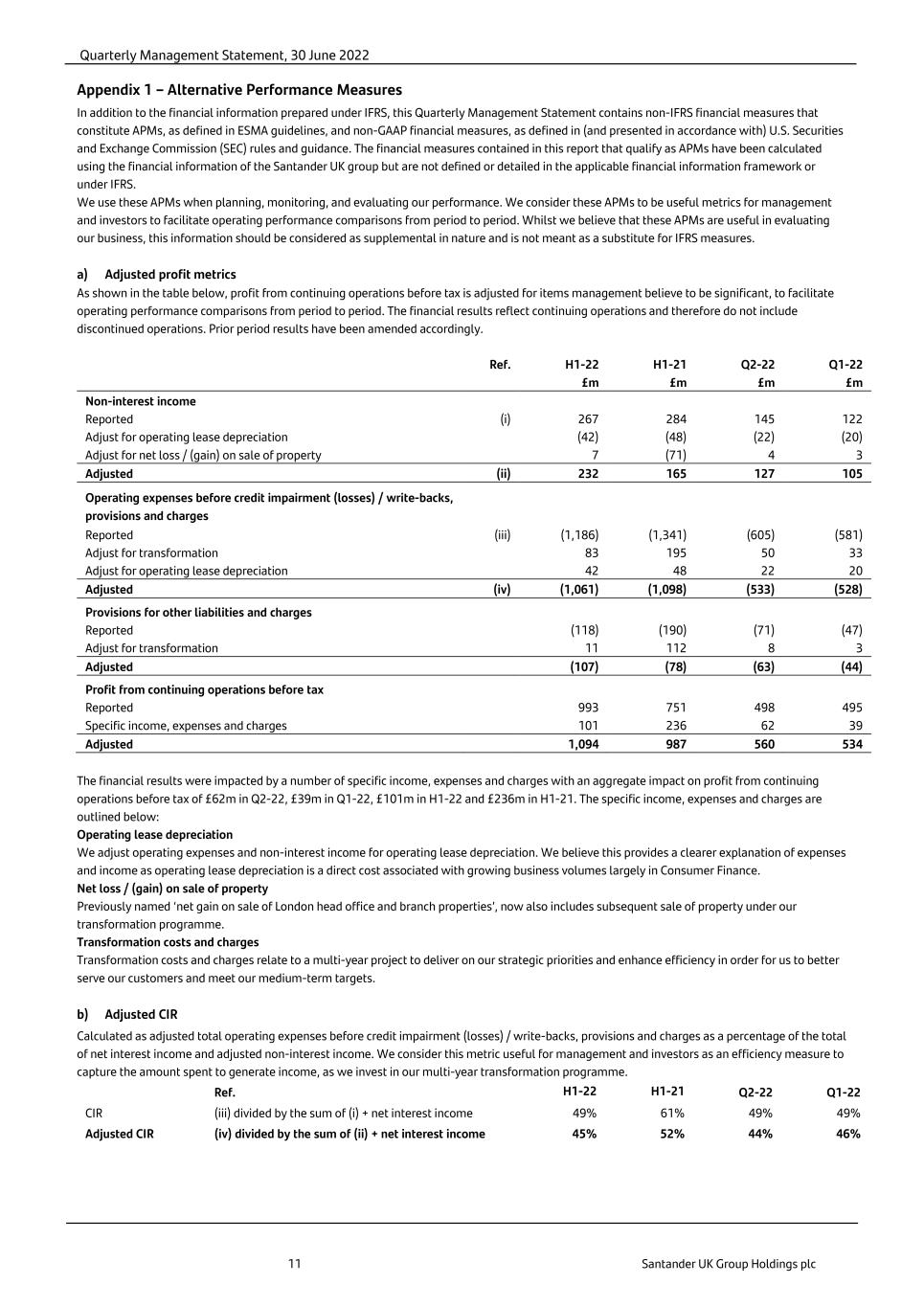

Quarterly Management Statement, 30 June 2022 11 Santander UK Group Holdings plc Appendix 1 – Alternative Performance Measures In addition to the financial information prepared under IFRS, this Quarterly Management Statement contains non-IFRS financial measures that constitute APMs, as defined in ESMA guidelines, and non-GAAP financial measures, as defined in (and presented in accordance with) U.S. Securities and Exchange Commission (SEC) rules and guidance. The financial measures contained in this report that qualify as APMs have been calculated using the financial information of the Santander UK group but are not defined or detailed in the applicable financial information framework or under IFRS. We use these APMs when planning, monitoring, and evaluating our performance. We consider these APMs to be useful metrics for management and investors to facilitate operating performance comparisons from period to period. Whilst we believe that these APMs are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for IFRS measures. a) Adjusted profit metrics As shown in the table below, profit from continuing operations before tax is adjusted for items management believe to be significant, to facilitate operating performance comparisons from period to period. The financial results reflect continuing operations and therefore do not include discontinued operations. Prior period results have been amended accordingly. Ref. H1-22 H1-21 Q2-22 Q1-22 £m £m £m £m Non-interest income Reported (i) 267 284 145 122 Adjust for operating lease depreciation (42) (48) (22) (20) Adjust for net loss / (gain) on sale of property 7 (71) 4 3 Adjusted (ii) 232 165 127 105 Operating expenses before credit impairment (losses) / write-backs, provisions and charges Reported (iii) (1,186) (1,341) (605) (581) Adjust for transformation 83 195 50 33 Adjust for operating lease depreciation 42 48 22 20 Adjusted (iv) (1,061) (1,098) (533) (528) Provisions for other liabilities and charges Reported (118) (190) (71) (47) Adjust for transformation 11 112 8 3 Adjusted (107) (78) (63) (44) Profit from continuing operations before tax Reported 993 751 498 495 Specific income, expenses and charges 101 236 62 39 Adjusted 1,094 987 560 534 The financial results were impacted by a number of specific income, expenses and charges with an aggregate impact on profit from continuing operations before tax of £62m in Q2-22, £39m in Q1-22, £101m in H1-22 and £236m in H1-21. The specific income, expenses and charges are outlined below: Operating lease depreciation We adjust operating expenses and non-interest income for operating lease depreciation. We believe this provides a clearer explanation of expenses and income as operating lease depreciation is a direct cost associated with growing business volumes largely in Consumer Finance. Net loss / (gain) on sale of property Previously named ‘net gain on sale of London head office and branch properties’, now also includes subsequent sale of property under our transformation programme. Transformation costs and charges Transformation costs and charges relate to a multi-year project to deliver on our strategic priorities and enhance efficiency in order for us to better serve our customers and meet our medium-term targets. b) Adjusted CIR Calculated as adjusted total operating expenses before credit impairment (losses) / write-backs, provisions and charges as a percentage of the total of net interest income and adjusted non-interest income. We consider this metric useful for management and investors as an efficiency measure to capture the amount spent to generate income, as we invest in our multi-year transformation programme. Ref. H1-22 H1-21 Q2-22 Q1-22 CIR (iii) divided by the sum of (i) + net interest income 49% 61% 49% 49% Adjusted CIR (iv) divided by the sum of (ii) + net interest income 45% 52% 44% 46%

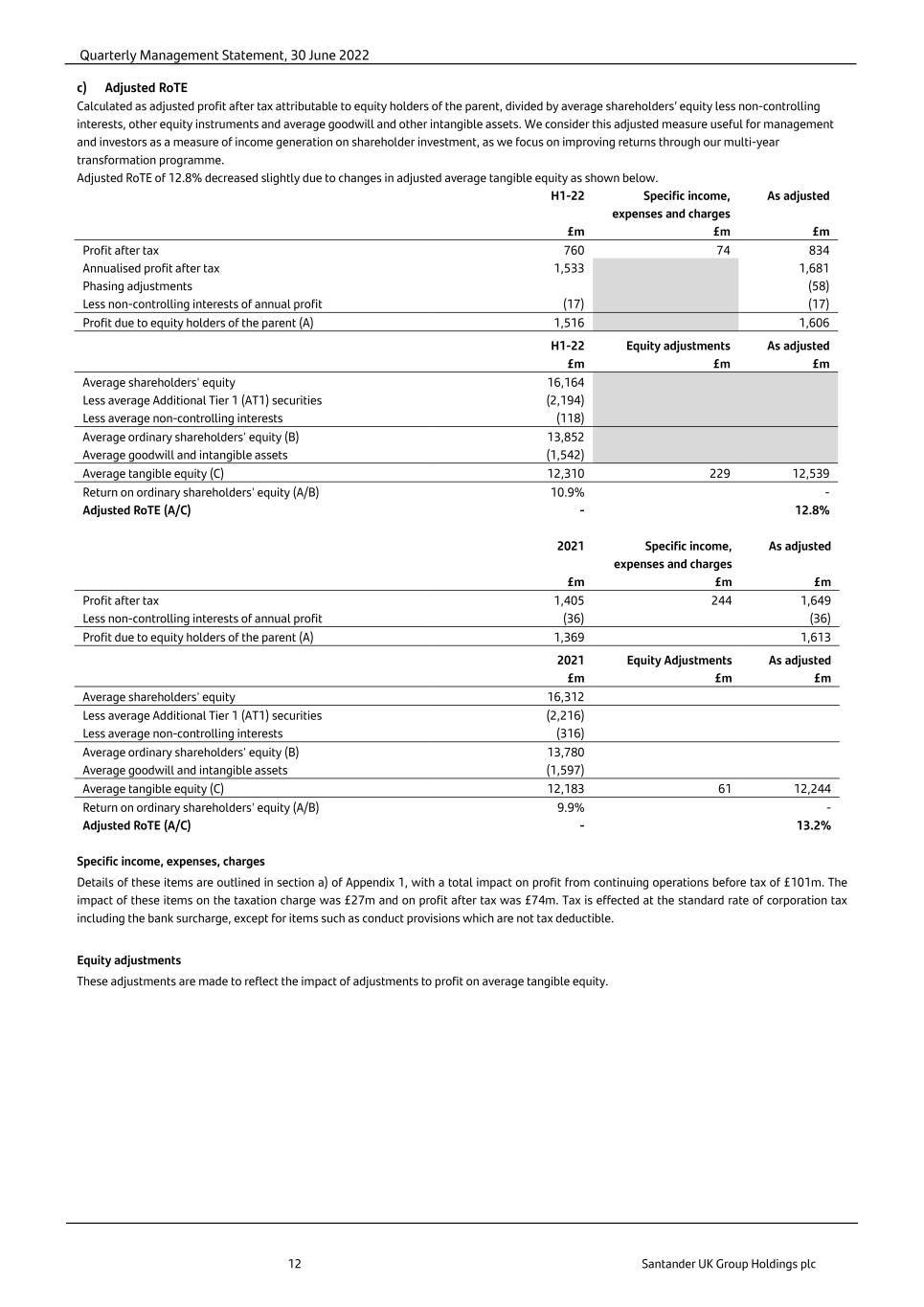

Quarterly Management Statement, 30 June 2022 12 Santander UK Group Holdings plc c) Adjusted RoTE Calculated as adjusted profit after tax attributable to equity holders of the parent, divided by average shareholders’ equity less non-controlling interests, other equity instruments and average goodwill and other intangible assets. We consider this adjusted measure useful for management and investors as a measure of income generation on shareholder investment, as we focus on improving returns through our multi-year transformation programme. Adjusted RoTE of 12.8% decreased slightly due to changes in adjusted average tangible equity as shown below. H1-22 Specific income, expenses and charges As adjusted £m £m £m Profit after tax 760 74 834 Annualised profit after tax 1,533 1,681 Phasing adjustments (58) Less non-controlling interests of annual profit (17) (17) Profit due to equity holders of the parent (A) 1,516 1,606 H1-22 Equity adjustments As adjusted £m £m £m Average shareholders' equity 16,164 Less average Additional Tier 1 (AT1) securities (2,194) Less average non-controlling interests (118) Average ordinary shareholders' equity (B) 13,852 Average goodwill and intangible assets (1,542) Average tangible equity (C) 12,310 229 12,539 Return on ordinary shareholders' equity (A/B) 10.9% - Adjusted RoTE (A/C) - 12.8% 2021 Specific income, expenses and charges As adjusted £m £m £m Profit after tax 1,405 244 1,649 Less non-controlling interests of annual profit (36) (36) Profit due to equity holders of the parent (A) 1,369 1,613 2021 Equity Adjustments As adjusted £m £m £m Average shareholders' equity 16,312 Less average Additional Tier 1 (AT1) securities (2,216) Less average non-controlling interests (316) Average ordinary shareholders' equity (B) 13,780 Average goodwill and intangible assets (1,597) Average tangible equity (C) 12,183 61 12,244 Return on ordinary shareholders' equity (A/B) 9.9% - Adjusted RoTE (A/C) - 13.2% Specific income, expenses, charges Details of these items are outlined in section a) of Appendix 1, with a total impact on profit from continuing operations before tax of £101m. The impact of these items on the taxation charge was £27m and on profit after tax was £74m. Tax is effected at the standard rate of corporation tax including the bank surcharge, except for items such as conduct provisions which are not tax deductible. Equity adjustments These adjustments are made to reflect the impact of adjustments to profit on average tangible equity.

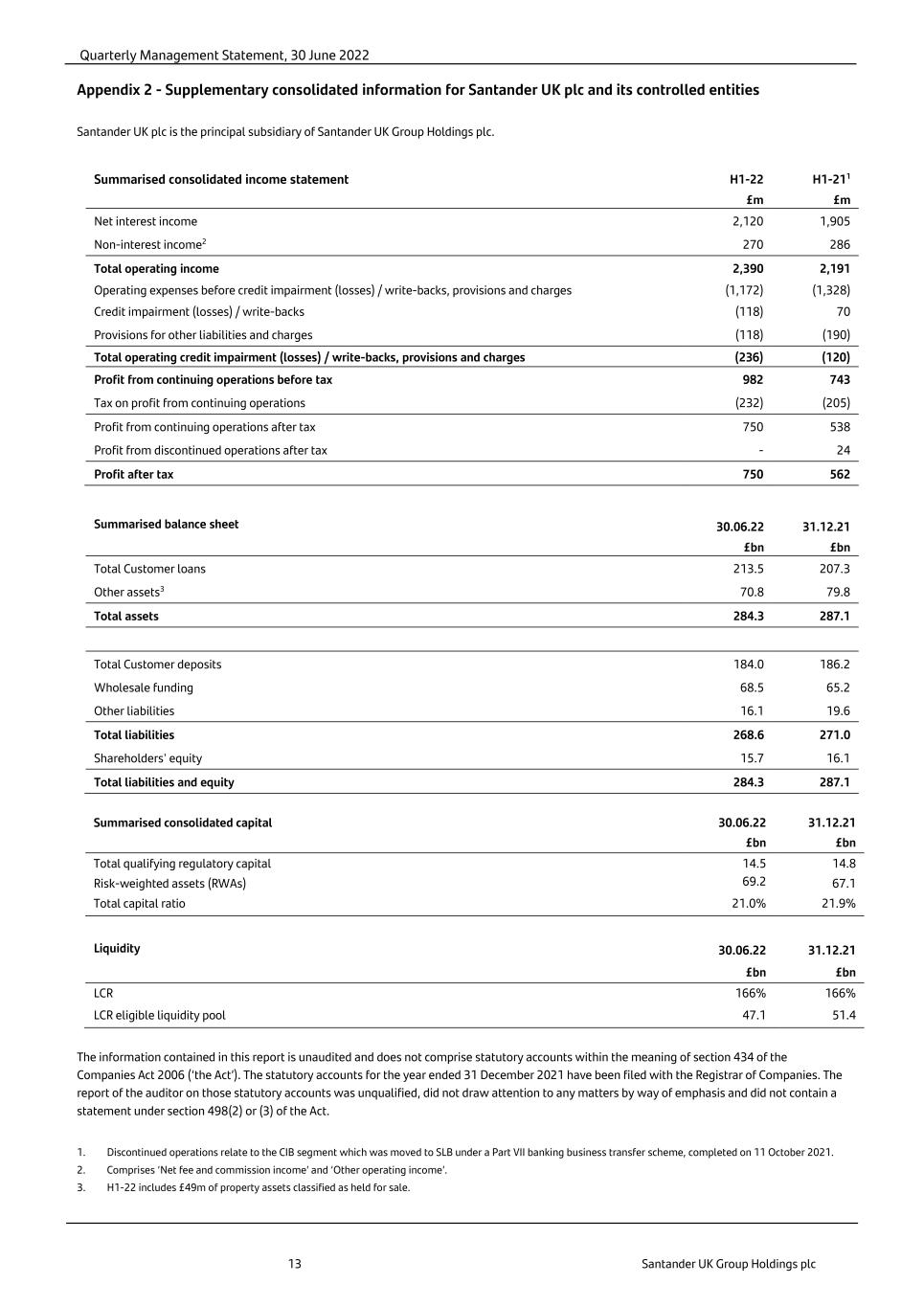

Quarterly Management Statement, 30 June 2022 13 Santander UK Group Holdings plc Appendix 2 - Supplementary consolidated information for Santander UK plc and its controlled entities Santander UK plc is the principal subsidiary of Santander UK Group Holdings plc. Summarised consolidated income statement H1-22 H1-211 £m £m Net interest income 2,120 1,905 Non-interest income2 270 286 Total operating income 2,390 2,191 Operating expenses before credit impairment (losses) / write-backs, provisions and charges (1,172) (1,328) Credit impairment (losses) / write-backs (118) 70 Provisions for other liabilities and charges (118) (190) Total operating credit impairment (losses) / write-backs, provisions and charges (236) (120) Profit from continuing operations before tax 982 743 Tax on profit from continuing operations (232) (205) Profit from continuing operations after tax 750 538 Profit from discontinued operations after tax - 24 Profit after tax 750 562 Summarised balance sheet 30.06.22 31.12.21 £bn £bn Total Customer loans 213.5 207.3 Other assets3 70.8 79.8 Total assets 284.3 287.1 Total Customer deposits 184.0 186.2 Wholesale funding 68.5 65.2 Other liabilities 16.1 19.6 Total liabilities 268.6 271.0 Shareholders' equity 15.7 16.1 Total liabilities and equity 284.3 287.1 Summarised consolidated capital 30.06.22 31.12.21 £bn £bn Total qualifying regulatory capital 14.5 14.8 Risk-weighted assets (RWAs) 69.2 67.1 Total capital ratio 21.0% 21.9% Liquidity 30.06.22 31.12.21 £bn £bn LCR 166% 166% LCR eligible liquidity pool 47.1 51.4 The information contained in this report is unaudited and does not comprise statutory accounts within the meaning of section 434 of the Companies Act 2006 (‘the Act’). The statutory accounts for the year ended 31 December 2021 have been filed with the Registrar of Companies. The report of the auditor on those statutory accounts was unqualified, did not draw attention to any matters by way of emphasis and did not contain a statement under section 498(2) or (3) of the Act. 1. Discontinued operations relate to the CIB segment which was moved to SLB under a Part VII banking business transfer scheme, completed on 11 October 2021. 2. Comprises ‘Net fee and commission income’ and ‘Other operating income’. 3. H1-22 includes £49m of property assets classified as held for sale.

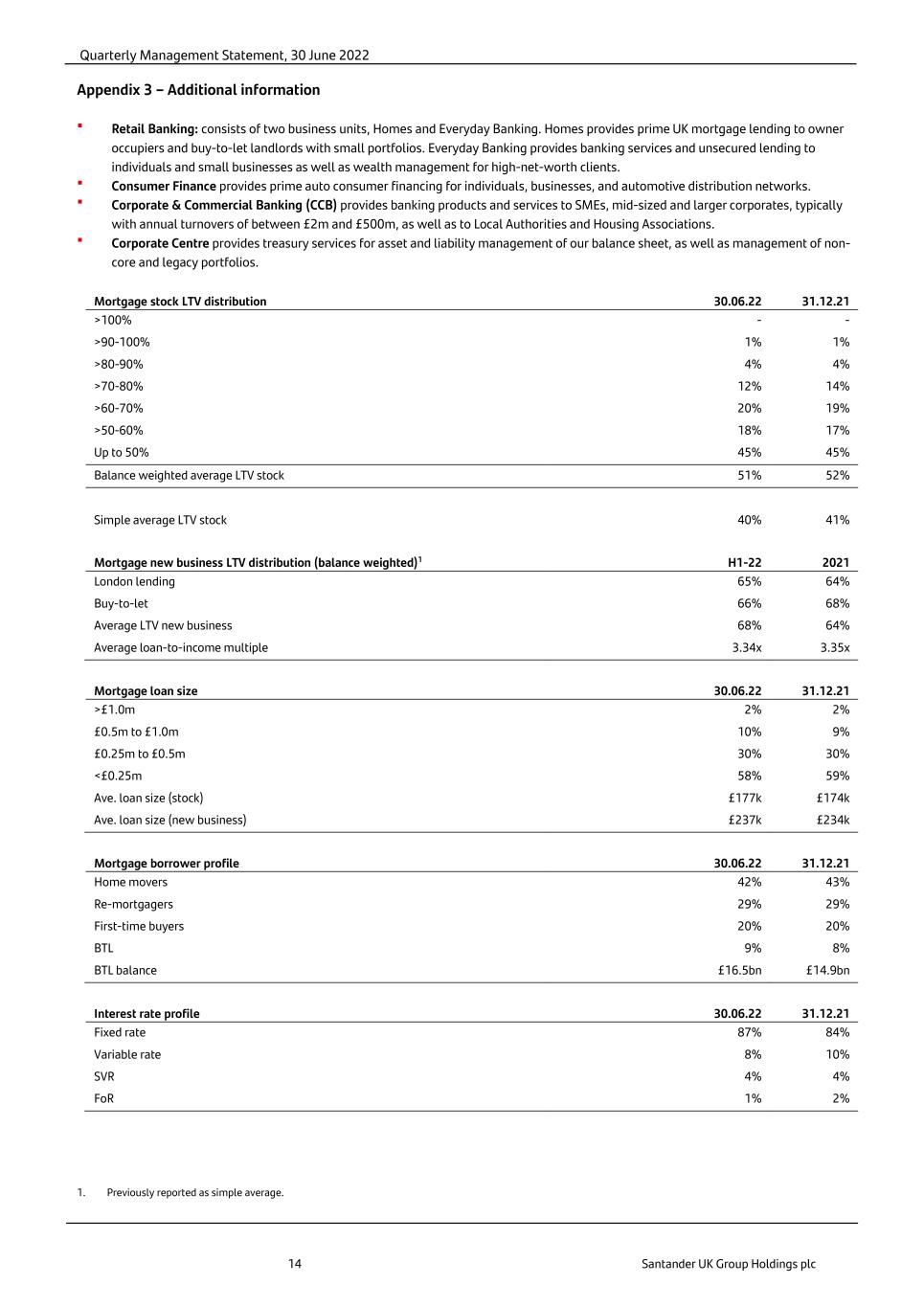

Quarterly Management Statement, 30 June 2022 14 Santander UK Group Holdings plc Appendix 3 – Additional information Retail Banking: consists of two business units, Homes and Everyday Banking. Homes provides prime UK mortgage lending to owner occupiers and buy-to-let landlords with small portfolios. Everyday Banking provides banking services and unsecured lending to individuals and small businesses as well as wealth management for high-net-worth clients. Consumer Finance provides prime auto consumer financing for individuals, businesses, and automotive distribution networks. Corporate & Commercial Banking (CCB) provides banking products and services to SMEs, mid-sized and larger corporates, typically with annual turnovers of between £2m and £500m, as well as to Local Authorities and Housing Associations. Corporate Centre provides treasury services for asset and liability management of our balance sheet, as well as management of non- core and legacy portfolios. Mortgage stock LTV distribution 30.06.22 31.12.21 >100% - - >90-100% 1% 1% >80-90% 4% 4% >70-80% 12% 14% >60-70% 20% 19% >50-60% 18% 17% Up to 50% 45% 45% Balance weighted average LTV stock 51% 52% Simple average LTV stock 40% 41% Mortgage new business LTV distribution (balance weighted)1 H1-22 2021 London lending 65% 64% Buy-to-let 66% 68% Average LTV new business 68% 64% Average loan-to-income multiple 3.34x 3.35x Mortgage loan size 30.06.22 31.12.21 >£1.0m 2% 2% £0.5m to £1.0m 10% 9% £0.25m to £0.5m 30% 30% <£0.25m 58% 59% Ave. loan size (stock) £177k £174k Ave. loan size (new business) £237k £234k Mortgage borrower profile 30.06.22 31.12.21 Home movers 42% 43% Re-mortgagers 29% 29% First-time buyers 20% 20% BTL 9% 8% BTL balance £16.5bn £14.9bn Interest rate profile 30.06.22 31.12.21 Fixed rate 87% 84% Variable rate 8% 10% SVR 4% 4% FoR 1% 2% 1. Previously reported as simple average.

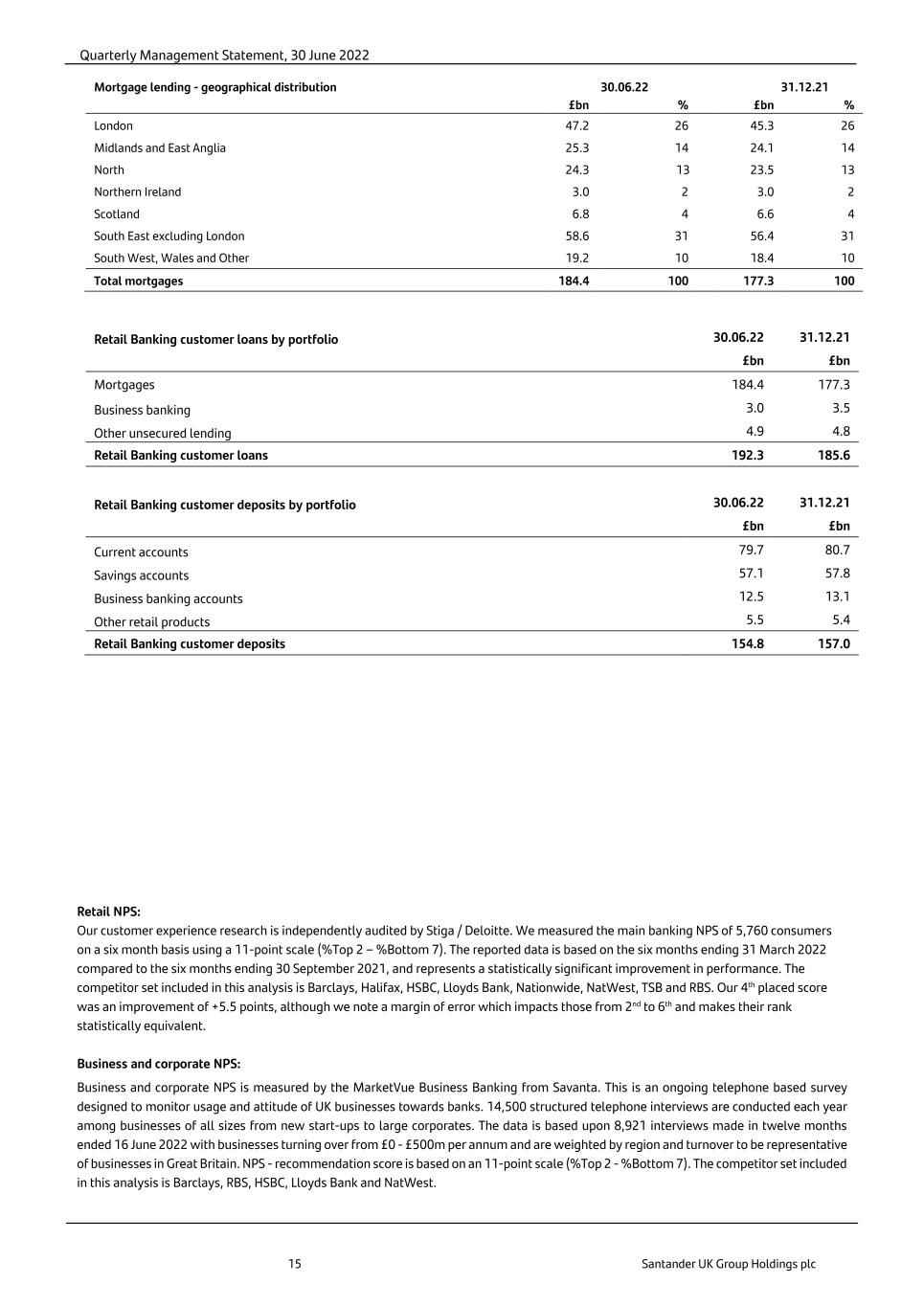

Quarterly Management Statement, 30 June 2022 15 Santander UK Group Holdings plc Mortgage lending - geographical distribution 30.06.22 31.12.21 £bn % £bn % London 47.2 26 45.3 26 Midlands and East Anglia 25.3 14 24.1 14 North 24.3 13 23.5 13 Northern Ireland 3.0 2 3.0 2 Scotland 6.8 4 6.6 4 South East excluding London 58.6 31 56.4 31 South West, Wales and Other 19.2 10 18.4 10 Total mortgages 184.4 100 177.3 100 Retail Banking customer loans by portfolio 30.06.22 31.12.21 £bn £bn Mortgages 184.4 177.3 Business banking 3.0 3.5 Other unsecured lending 4.9 4.8 Retail Banking customer loans 192.3 185.6 Retail Banking customer deposits by portfolio 30.06.22 31.12.21 £bn £bn Current accounts 79.7 80.7 Savings accounts 57.1 57.8 Business banking accounts 12.5 13.1 Other retail products 5.5 5.4 Retail Banking customer deposits 154.8 157.0 Retail NPS: Our customer experience research is independently audited by Stiga / Deloitte. We measured the main banking NPS of 5,760 consumers on a six month basis using a 11-point scale (%Top 2 – %Bottom 7). The reported data is based on the six months ending 31 March 2022 compared to the six months ending 30 September 2021, and represents a statistically significant improvement in performance. The competitor set included in this analysis is Barclays, Halifax, HSBC, Lloyds Bank, Nationwide, NatWest, TSB and RBS. Our 4th placed score was an improvement of +5.5 points, although we note a margin of error which impacts those from 2nd to 6th and makes their rank statistically equivalent. Business and corporate NPS: Business and corporate NPS is measured by the MarketVue Business Banking from Savanta. This is an ongoing telephone based survey designed to monitor usage and attitude of UK businesses towards banks. 14,500 structured telephone interviews are conducted each year among businesses of all sizes from new start-ups to large corporates. The data is based upon 8,921 interviews made in twelve months ended 16 June 2022 with businesses turning over from £0 - £500m per annum and are weighted by region and turnover to be representative of businesses in Great Britain. NPS - recommendation score is based on an 11-point scale (%Top 2 - %Bottom 7). The competitor set included in this analysis is Barclays, RBS, HSBC, Lloyds Bank and NatWest.

Quarterly Management Statement, 30 June 2022 16 Santander UK Group Holdings plc List of abbreviations APM Alternative Performance Measure AT1 Additional Tier 1 BBLS Bounce Back Loan Scheme Banco Santander Banco Santander S.A. Banking NIM Banking Net Interest Margin BTL Buy-To-Let CAGR Compound Annual Growth Rate CBES Climate Biennial Exploratory Scenario CBILS Coronavirus Business Interruption Loan Scheme CCB Corporate & Commercial Banking CET1 Common Equity Tier 1 CIB Corporate & Investment Banking CIR Cost-To-Income Ratio COP26 Conference of Parties 26 CRR Capital Requirements Regulation EBA European Banking Authority ECL Expected Credit Losses ESMA European Securities and Markets Authority EU European Union FoR Follow on Rate FCA Financial Conduct Authority FSCS Financial Services Compensation Scheme GDP Gross Domestic Product HoldCo Holding Company (Santander UK Group Holdings plc) HPI House Price Index IASB International Accounting Standards Board IFRS International Financial Reporting Standard LCR Liquidity Coverage Ratio LTV Loan-To-Value MDA Maximum Distributable Amount MREL Minimum Requirement for own funds and Eligible Liabilities n.a. Not applicable n.m. Not meaningful PH Payment Holiday NPS Net Promoter Score PMAs Post model adjustments PRA Prudential Regulation Authority QMS Quarterly Management Statement QoQ Quarter-on-Quarter RAF Resolvability Assessment Framework RFB Ring-Fenced Bank (Santander UK plc) RFB DoLSub Santander UK plc Domestic Liquidity Sub-group RoTE Return on Tangible Equity RWA Risk-Weighted Assets Santander UK Santander UK Group Holdings plc SFS Santander Financial Services plc SLB Santander London Branch SME Small and Medium-Sized Enterprise SVR Standard Variable Rate TFSME Term Funding Scheme with additional incentives for SMEs UK United Kingdom UNHCR United Nations High Commissioner for Refugees UPL Unsecured Personal Lending YoY Year-on-Year

Quarterly Management Statement, 30 June 2022 17 Santander UK Group Holdings plc Additional information about Santander UK and Banco Santander Santander UK is a financial services provider in the UK that offers a wide range of personal and commercial financial products and services. At 30 June 2022, the bank had around 18,000 employees and serves around 14 million active customers, via a nationwide branch network, telephone, mobile and online banking. Santander UK is subject to the full supervision of the FCA and the PRA in the UK. Santander UK plc customers’ eligible deposits are protected by the FSCS in the UK. Banco Santander (SAN SM, STD US, BNC LN) is a leading retail and commercial bank, founded in 1857 and headquartered in Spain and is one of the largest banks in the world by market capitalization. Its primary segments are Europe, North America, South America and Digital Consumer Bank, backed by its secondary segments: Santander Corporate & Investment Banking (Santander CIB), Wealth Management & Insurance (WM&I) and PagoNxt. Its purpose is to help people and businesses prosper in a simple, personal and fair way. Banco Santander is building a more responsible bank and has made a number of commitments to support this objective, including raising over €120 billion in green financing between 2019 and 2025, as well as financially empowering more than 10 million people over the same period. At the end of 2021, Banco Santander had more than 1.1 trillion euros in total funds, 152.9 million customers, of which 25.4 million are loyal and 47.4 million are digital, 9,900 branches and over 197,000 employees. Banco Santander has a standard listing of its ordinary shares on the London Stock Exchange and Santander UK plc has preference shares listed on the London Stock Exchange. None of the websites referred to in this Quarterly Management Statement, including where a link is provided, nor any of the information contained on such websites is incorporated by reference in this Quarterly Management Statement. Disclaimer Santander UK Group Holdings plc (Santander UK), Santander UK plc and Banco Santander caution that this announcement may contain forward-looking statements. Such forward-looking statements are found in various places throughout this announcement. Words such as “believes”, “anticipates”, “expects”, “intends”, “aims” and “plans” and other similar expressions are intended to identify forward-looking statements, but they are not the exclusive means of identifying such statements. Forward-looking statements include, without limitation, statements concerning our future business development and economic performance. These forward-looking statements are based on management’s current expectations, estimates and projections and Santander UK, Santander UK plc and Banco Santander caution that these statements are not guarantees of future performance. We also caution readers that a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. We have identified certain of these factors in the forward-looking statements on page 297 of the Santander UK Group Holdings plc 2021 Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (SEC) on 7 March 2022. Investors and others should carefully consider the foregoing factors and other uncertainties and events. Undue reliance should not be placed on forward-looking statements when making decisions with respect to Santander UK, Santander UK plc, Banco Santander and/or their securities. Such forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update or revise any of them, whether as a result of new information, future events or otherwise. Statements as to historical performance, historical share price or financial accretion are not intended to mean that future performance, future share price or future earnings for any period will necessarily match or exceed those of any prior quarter. Santander UK is a frequent issuer in the debt capital markets and regularly meets with investors via formal roadshows and other ad hoc meetings. In line with Santander UK’s usual practice, over the coming quarter it expects to meet with investors globally to discuss this Quarterly Management Statement, the results contained herein and other matters relating to Santander UK. Nothing in this announcement constitutes or should be construed as constituting a profit forecast.

SIGNATURES Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. SANTANDER UK GROUP HOLDINGS PLC Dated: 29 July 2022 By / s / Duke Dayal Duke Dayal Chief Financial Officer

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Island Fin Poké Co. Celebrates Earth Day by Sharing Its Sustainable Efforts Toward a Greener Earth

- Bragar Eagel & Squire, P.C. Is Investigating CI&T, Harbor, AXTI, and Morgan Stanley and Encourages Investors to Contact the Firm

- SHARECARE ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against Sharecare, Inc. and Encourages Investors to Contact the Firm

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share