Form 6-K PEMBINA PIPELINE CORP For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2022

Commission File Number: 001-35563

PEMBINA PIPELINE CORPORATION

(Name of registrant)

(Room #39-095) 4000, 585 8th Avenue S.W.

Calgary, Alberta T2P 1G1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

o Form 20-F | x Form 40-F | ||||||||||

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

INCORPORATION BY REFERENCE

Exhibit 99.1 to this Report on Form 6-K is hereby incorporated by reference as an exhibit to the Registration Statement on Form F-10 (File No. 333-261207) of Pembina Pipeline Corporation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| PEMBINA PIPELINE CORPORATION | |||||||||||

| Date: | May 5, 2022 | By: | /s/ Cameron J. Goldade | ||||||||

| Name: Cameron J. Goldade | |||||||||||

| Title: Interim Chief Financial Officer | |||||||||||

Form 6-K Exhibit Index

| Exhibit Number | Document Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 99.3 | ||||||||

REPORT TO SHAREHOLDERS |  | ||||||||||

First Quarter 2022 | |||||||||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |||||||||||

Table of Contents | |||||||||||

6. Capital Expenditures | |||||||||||

Basis of Presentation

The following Management's Discussion and Analysis ("MD&A") of the financial and operating results of Pembina Pipeline Corporation ("Pembina" or the "Company") is dated May 5, 2022, and is supplementary to, and should be read in conjunction with, Pembina's unaudited condensed consolidated interim financial statements as at and for the three months ended March 31, 2022 ("Interim Financial Statements") as well as Pembina's audited consolidated annual financial statements ("Consolidated Financial Statements") and MD&A for the year ended December 31, 2021. All financial information provided in this MD&A has been prepared in accordance with International Accounting Standard ("IAS") 34 Interim Financial Reporting and is expressed in Canadian dollars, unless otherwise noted. A description of Pembina's operating segments and additional information about Pembina is filed with Canadian and U.S. securities commissions, including quarterly and annual reports, annual information forms (which are filed with the U.S. Securities and Exchange Commission under Form 40-F) and management information circulars, which can be found online at www.sedar.com, www.sec.gov and through Pembina's website at www.pembina.com. Information contained in or otherwise accessible through Pembina's website does not form part of this MD&A and is not incorporated into this document by reference.

Abbreviations

For a list of abbreviations that may be used in this MD&A, refer to the "Abbreviations" section of this MD&A.

Non-GAAP Financial Measures

Pembina has disclosed certain financial measures and ratios within this MD&A that management believes provide meaningful information in assessing Pembina's underlying performance, but which are not specified, defined or determined in accordance with the Canadian generally accepted accounting principles ("GAAP") and which are not disclosed in Pembina's Interim Financial Statements. Such non-GAAP financial measures and non-GAAP ratios do not have any standardized meaning prescribed by IFRS and may not be comparable to similar financial measures disclosed by other issuers. Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A for additional information regarding these non-GAAP measures and non-GAAP ratios.

Risk Factors and Forward-Looking Information

Management has identified the primary risk factors that could have a material impact on the financial results and operations of Pembina. Such risk factors are presented in the "Risk Factors" sections of Pembina's MD&A and Annual Information Form ("AIF") for the year ended December 31, 2021, respectively, and have been updated in the "Risk Factors" section of this MD&A, as necessary. The Company's financial and operational performance is potentially affected by a number of factors, including, but not limited to, the factors described within the "Forward-Looking Statements & Information" section of this MD&A. This MD&A contains forward-looking statements based on Pembina's current expectations, estimates, projections and assumptions. This information is provided to assist readers in understanding the Company's future plans and expectations and may not be appropriate for other purposes.

Pembina Pipeline Corporation First Quarter 2022 1

1. ABOUT PEMBINA

Pembina Pipeline Corporation is a leading energy transportation and midstream service provider that has served North America's energy industry for more than 65 years. Pembina owns an integrated network of hydrocarbon liquids and natural gas pipelines, gas gathering and processing facilities, oil and natural gas liquids infrastructure and logistics services, and a growing export terminals business. Through our integrated value chain, we seek to provide safe and reliable infrastructure solutions which connect producers and consumers of energy across the world, support a more sustainable future and benefit our customers, investors, employees and communities. For more information, please visit www.pembina.com.

Purpose of Pembina:

To be the leader in delivering integrated infrastructure solutions connecting global markets:

•Customers choose us first for reliable and value-added services;

•Investors receive sustainable industry-leading total returns;

•Employees say we are the 'employer of choice' and value our safe, respectful, collaborative and inclusive work culture; and

•Communities welcome us and recognize the net positive impact of our social and environmental commitment.

Western Canadian Processing Joint Venture

On March 1, 2022, Pembina announced that it has entered into definitive agreements with affiliates of KKR & Co., Inc. (collectively, "KKR") to combine their respective western Canadian natural gas processing assets into a single, new joint venture entity ("Newco"). Pembina will hold a 60 percent interest in Newco and serve as its operator and manager, while KKR's global infrastructure funds will hold the remaining 40 percent interest in Newco.

Pembina will contribute to Newco its field-based gas processing assets, which include the Cutbank Complex, the Saturn Complex, the Resthaven Facility, the Duvernay Complex and the Saskatchewan Ethane Extraction Plant, as well as its 45 percent interest in Veresen Midstream. Pembina's Empress, Younger and Burstall assets will be excluded from the transaction and Pembina will retain its current ownership position in respect of such assets.

KKR will contribute its 55 percent interest in Veresen Midstream to Newco, as well as the 49 percent interest in Energy Transfer Canada ULC ("ETC") that it currently owns. Newco has also agreed to acquire the remaining 51 percent interest in ETC from an affiliate of Energy Transfer LP, aligning ownership of those assets and driving additional efficiencies within Newco. The contribution of Pembina's and KKR's assets to Newco, and Newco's acquisition of the remaining 51 percent interest in ETC, are cross-conditional upon each other and will occur concurrently.

Completion of the transactions is subject to approval under the Competition Act (Canada) and other customary closing conditions. As part of the transaction, Pembina and KKR intend to dispose of Newco's non-operated interest in the Key Access Pipeline System following closing of the transaction, subject to receiving acceptable purchase terms through the sale process. Closing is expected to occur in the third quarter of 2022. In connection with closing of the transaction, and subject to approval and declaration by its Board of Directors, Pembina also intends to increase its common share dividend upon closing by $0.0075 per share per month, or 3.6 percent. The increase, if implemented, would reflect the expected immediate cash flow accretion from creation of the joint venture.

2 Pembina Pipeline Corporation First Quarter 2022

2. FINANCIAL & OPERATING OVERVIEW

Consolidated Financial Overview for the Three Months Ended March 31

Results of Operations

| ($ millions, except where noted) | 2022 | 2021 | Change | ||||||||

| Revenue | 3,038 | 2,016 | 1,022 | ||||||||

Net revenue(1) | 1,154 | 999 | 155 | ||||||||

Gross profit | 858 | 630 | 228 | ||||||||

Earnings | 481 | 320 | 161 | ||||||||

Earnings per common share – basic and diluted (dollars) | 0.81 | 0.51 | 0.30 | ||||||||

| Cash flow from operating activities | 655 | 456 | 199 | ||||||||

Cash flow from operating activities per common share – basic (dollars) | 1.19 | 0.83 | 0.36 | ||||||||

Adjusted cash flow from operating activities(1) | 700 | 582 | 118 | ||||||||

Adjusted cash flow from operating activities per common share – basic (dollars)(1) | 1.27 | 1.06 | 0.21 | ||||||||

| Capital expenditures | 179 | 127 | 52 | ||||||||

Adjusted EBITDA(1) | 1,006 | 835 | 171 | ||||||||

Total volumes (mboe/d)(2) | 3,369 | 3,482 | (113) | ||||||||

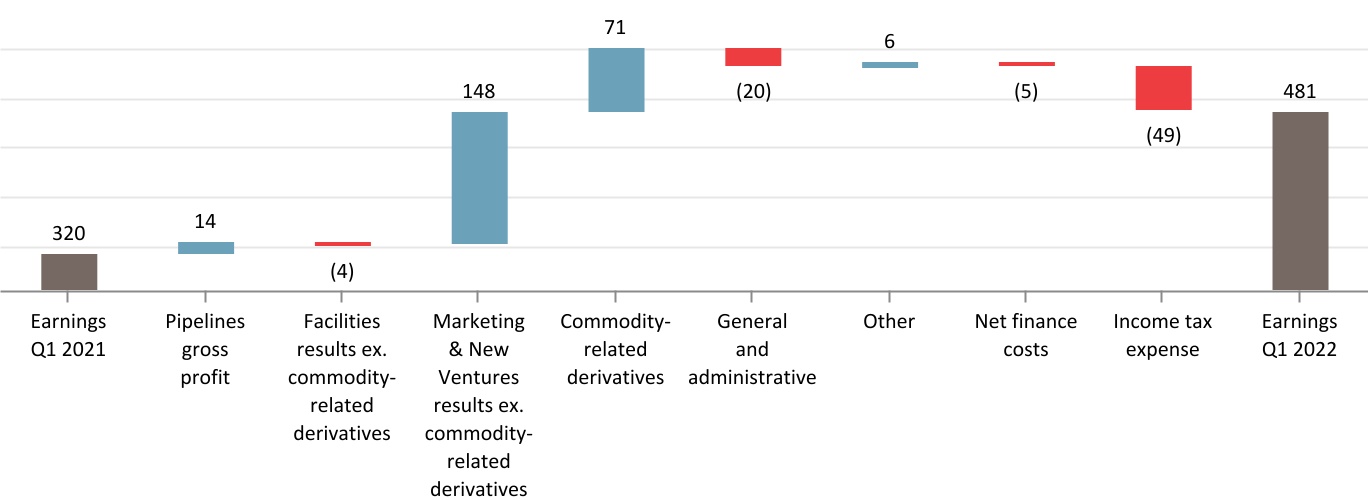

Change in Earnings ($ millions)(3)(4)

Results Overview

Earnings in the first quarter of 2022 were positively impacted by higher gross profit in Marketing & New Ventures due to higher margins on NGL and crude oil sales, combined with higher share of profit from Aux Sable and lower realized losses on commodity-related derivative financial instruments compared to the first quarter of 2021. Pipelines gross profit was positively impacted by higher volumes on the Peace Pipeline system and higher recoverable costs from the Horizon Pipeline system, partially offset by lower contracted volumes on the Nipisi and Mitsue Pipeline systems due to the expiration of contracts and a lower share of profit from Ruby. Facilities gross profit was positively impacted by realized and unrealized gains for certain gas processing fees tied to AECO prices. General & administrative expense increased due to higher long-term incentive costs as a result of the increase in Pembina's share price and Pembina's performance relative to peers. Income tax expense increased as a result of higher taxable income due to the growth in partnership earnings in the prior year and higher earnings.

Pembina Pipeline Corporation First Quarter 2022 3

Changes in Results for the Three Months Ended March 31 | ||||||||

| Revenue | ▲ | $1.0 billion increase, largely due to an increase in NGL and crude oil market prices during the first quarter of 2022, higher volumes on the Peace Pipeline system and higher recoverable costs, combined with the Prince Rupert Terminal being placed into service, partially offset by lower contracted volumes on the Nipisi and Mitsue Pipeline systems as a result of the expiration of contracts during the fourth quarter of 2021. | ||||||

| Cost of goods sold | ▼ | $867 million increase, largely due to higher NGL and crude oil market prices. | ||||||

| Operating expenses | ▼ | $11 million increase, primarily due to higher power and fuel costs in Facilities, the majority of which are recoverable, as a result of higher consumption of power at Younger and higher AECO prices, combined with higher repairs and maintenance costs and higher recoverable geotechnical costs largely related to the Western Pipeline. | ||||||

| Depreciation and amortization included in operations | ● | Consistent with the prior period. | ||||||

| Share of profit from equity accounted investees | ▲ | $15 million increase, largely due to higher share of profit from Aux Sable as a result of higher NGL margins and higher share of profit from Veresen Midstream due to higher volumes on the Dawson Assets and the Veresen Midstream Hythe Developments going into service, partially offset by a lower contribution from Ruby. Refer to the "Selected Equity Accounted Investee Information" section for further details. | ||||||

| Realized loss on commodity-related derivatives | ▲ | $41 million positive variance, due to lower realized losses on NGL- and crude oil- based derivative instruments for the period due to the change in the NGL and crude oil market prices during the first quarter of 2022 compared to the first quarter of 2021, partially offset by the increase in the AECO price during the period resulting in realized gains for certain gas processing fees tied to AECO prices. | ||||||

| Unrealized (gain) loss on commodity-related derivatives | ▲ | $30 million positive variance, primarily due to the increase in the the AECO price during the period resulting in unrealized gains for certain gas processing fees tied to AECO prices, combined with contracts maturing in the period, partially offset by an increase in the forward prices for NGL and crude oil during the first quarter of 2022. | ||||||

| General & administrative | ▼ | $20 million increase, primarily due to higher long-term incentive costs driven by a larger increase in Pembina's share price during the first quarter of 2022 compared to the first quarter of 2021 and Pembina's performance relative to peers. | ||||||

| Other expense | ▲ | $7 million decrease, primarily due to a gain on the initial recognition of a new lease on the Western Pipeline, a $10 million impairment charge recognized during the first quarter of 2021 associated with an advance made to Ruby compared to nil recognized in the first quarter of 2022, and lower restructuring costs, partially offset by higher acquisition fees related to Newco. | ||||||

Net finance costs | ● | Consistent with the prior period. Higher interest expense as a result of terming out variable rate debt to fixed rate debt at higher interest rates was largely offset by gains on non-commodity-related derivative financial instruments compared to losses in the first quarter of 2021. | ||||||

| Current tax expense | ▼ | $63 million increase, primarily due to higher taxable income as a result of the growth in partnership earnings in the prior year and higher current year earnings. | ||||||

Deferred tax expense | ▲ | $14 million decrease, primarily due to growth in partnership earnings in the prior year that are recognized in the taxable income in the current year, partially offset by higher current year earnings. | ||||||

| Cash flow from operating activities | ▲ | $199 million increase, primarily driven by an increase in operating results after adjusting for non-cash items, a $40 million increase in distributions from equity accounted investees, combined with a $40 million change in non-cash working capital, partially offset by a $25 million increase in taxes paid, a $13 million increase in share-based compensation payments and a $10 million increase in net interest paid. | ||||||

Adjusted cash flow from operating activities(1) | ▲ | $118 million increase, largely due to the same items impacting cash flow from operating activities, discussed above, net of the change in non-cash working capital, taxes paid and share-based compensation payments, partially offset by $63 million higher current tax expense and $21 million increase in accrued share-based payments. | ||||||

Adjusted EBITDA(1) | ▲ | $171 million increase, largely due to higher margins on NGL and crude oil sales, lower realized losses on commodity-related derivatives, and higher volumes on the Peace Pipeline system, combined with higher contributions from Aux Sable and from Veresen Midstream, partially offset by lower contracted volumes on the Nipisi and Mitsue Pipeline systems as a result of the expiration of contracts and lower contribution from Ruby, discussed above. Included in adjusted EBITDA is $179 million (2021: $184 million) related to equity accounted investees. | ||||||

Total volumes (mboe/d)(2) | ▼ | 113 mboe/d decrease, largely driven by lower contracted volumes on the Nipisi and Mitsue Pipeline systems and on the Ruby Pipeline, combined with lower volumes at Alberta Ethane Gathering System ("AEGS") due to third party outages and lower volumes from Pembina's NGL services, partially offset by higher volumes on the Peace Pipeline system, Drayton Valley Pipeline, the Dawson Assets and from the Veresen Midstream Hythe Developments going into service. Volumes include 294 mboe/d (2021: 336 mboe/d) related to equity accounted investees. | ||||||

| ▲ | Increase; | ▼ | Decrease; or | ● | No impact; | to earnings, adjusted EBITDA, cash flow from operations, adjusted cash flow from operating activities or total volumes. | ||||||||||||||

(1) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(2) Total revenue volumes. See the "Abbreviations" section of this MD&A for definition. Marketed NGL volumes are excluded from volumes to avoid double counting. Refer to the "Marketing & New Ventures" section of this MD&A for further information.

(3) Facilities results ex. commodity-related derivatives and Marketing & New Ventures results ex. commodity-related derivatives includes gross profit less realized and unrealized losses on commodity related derivative financial instruments.

(4) Other includes other expenses and corporate.

4 Pembina Pipeline Corporation First Quarter 2022

3. SEGMENT RESULTS

Business Overview

The Pipelines Division provides customers with pipeline transportation, terminalling, storage and rail services in key market hubs in Canada and the United States for crude oil, condensate, natural gas liquids and natural gas. The division manages pipeline transportation capacity of 3.1 mmboe/d(1), above ground storage capacity of 11 mmbls(1) and rail terminalling capacity of approximately 105 mboe/d(1) within its conventional, oil sands and heavy oil, and transmission assets. The conventional assets include strategically located pipelines and terminalling hubs that gather and transport light and medium crude oils, condensate and natural gas liquids from western Alberta and northeast British Columbia to the Edmonton, Alberta area for further processing or transportation on downstream pipelines. The oil sands and heavy oil assets transport heavy and synthetic crude oil produced within Alberta to the Edmonton, Alberta area and offer associated storage, terminalling and rail services. The transmission assets transport natural gas, ethane and condensate throughout Canada and the United States on long haul pipelines linking various key market hubs. In addition, the Pipelines Division assets provide linkages between Pembina's upstream and downstream assets across North America, enabling integrated customer service offerings. Together, these assets supply products from hydrocarbon producing regions to refineries, fractionators and market hubs in Alberta, British Columbia, Illinois and California, as well as other regions throughout North America.

The Facilities Division includes infrastructure that provides Pembina's customers with natural gas, condensate and NGL services. Pembina's natural gas gathering and processing assets are strategically positioned in active, liquids-rich areas of the WCSB and Williston Basin and are integrated with the Company's other businesses. Pembina provides sweet and sour gas gathering, compression, condensate stabilization, and both shallow cut and deep cut gas processing services with a total capacity of approximately 6.1 bcf/d(2) for its customers. Condensate and NGL extracted at virtually all Canadian-based facilities have access to transportation on Pembina's pipelines. In addition, all NGL transported along the Alliance Pipeline are extracted through the Pembina operated Channahon Facility at the terminus. The Facilities Division includes approximately 354 mbpd(2) of NGL fractionation capacity, 21 mmbbls(1) of cavern storage capacity and associated pipeline and rail terminalling facilities and a liquefied propane export facility on Canada's West Coast. These facilities are fully integrated with the Company's other divisions, providing customers with the ability to access a comprehensive suite of services to enhance the value of their hydrocarbons. In addition, Pembina owns a bulk marine import/export terminal in Vancouver, British Columbia.

The Marketing & New Ventures Division strives to maximize the value of hydrocarbon liquids and natural gas originating in the basins where the Company operates. Pembina pursues this goal through the creation of new markets, and further enhances existing markets, to support both the Company's and its customers' overall business interests. In particular, Pembina seeks to identify opportunities to connect hydrocarbon production to new demand locations through the development of infrastructure. Pembina strives to increase producer netbacks and product demand to improve the overall competitiveness of the basins where the Company operates. Within the Marketing & New Ventures Division, Pembina undertakes value-added commodity marketing activities including buying and selling products (natural gas, ethane, propane, butane, condensate, crude oil and electricity), commodity arbitrage, and optimizing storage opportunities. The marketing business enters into contracts for capacity on both Pembina's and third-party infrastructure, handles proprietary and customer volumes and aggregates production for onward sale.

(1)Net capacity; excludes projects under development.

(2)Net capacity. Includes Aux Sable capacity. The financial and operational results for Aux Sable are included in the Marketing & New Ventures Division; excludes projects under development.

Pembina Pipeline Corporation First Quarter 2022 5

Financial and Operational Overview by Division

| 3 Months Ended March 31 | ||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||

($ millions, except where noted) | Volumes(1) | Reportable Segment Earnings (Loss) Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings (Loss) Before Tax | Adjusted EBITDA(2) | ||||||||||||||

| Pipelines | 2,493 | 361 | 521 | 2,587 | 333 | 529 | ||||||||||||||

| Facilities | 876 | 246 | 281 | 895 | 187 | 269 | ||||||||||||||

Marketing & New Ventures(3) | — | 221 | 268 | — | 67 | 90 | ||||||||||||||

| Corporate | — | (195) | (64) | — | (164) | (53) | ||||||||||||||

| Total | 3,369 | 633 | 1,006 | 3,482 | 423 | 835 | ||||||||||||||

(1) Volumes for Pipelines and Facilities are revenue volumes, which are physical volumes plus volumes recognized from take-or-pay commitments. Volumes are stated in mboe/d, with natural gas volumes converted to mboe/d from MMcf/d at a 6:1 ratio.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Marketed NGL volumes are excluded from volumes to avoid double counting. Refer to the "Marketing & New Ventures" section of this MD&A for further information.

6 Pembina Pipeline Corporation First Quarter 2022

Pipelines

Financial Overview for the Three Months Ended March 31

Results of Operations

| ($ millions, except where noted) | 2022 | 2021 | Change | ||||||||

Conventional revenue(1)(2) | 360 | 329 | 31 | ||||||||

Transmission revenue(1)(2) | 105 | 108 | (3) | ||||||||

Oil Sands revenue(1)(2) | 108 | 116 | (8) | ||||||||

Pipelines revenue(1) | 573 | 553 | 20 | ||||||||

Operating expenses(1) | 141 | 137 | 4 | ||||||||

| Depreciation and amortization included in operations | 99 | 104 | (5) | ||||||||

| Share of profit from equity accounted investees | 40 | 47 | (7) | ||||||||

| Gross profit | 373 | 359 | 14 | ||||||||

| Reportable segment earnings before tax | 361 | 333 | 28 | ||||||||

Adjusted EBITDA(3) | 521 | 529 | (8) | ||||||||

Volumes (mboe/d)(4) | 2,493 | 2,587 | (94) | ||||||||

| Distributions from equity accounted investees | 87 | 68 | 19 | ||||||||

| Change in Results | ||||||||

Conventional revenue(1)(2) | ▲ | Increase largely due to higher volumes on the Peace Pipeline system as higher crude oil and NGL market prices have resulted in increased upstream activities, combined with higher tolls largely due to inflation. | ||||||

Transmission revenue(1)(2) | ● | Consistent with prior period. | ||||||

Oil Sands revenue(1)(2) | ▼ | Decrease largely due to lower contracted volumes on the Nipisi and Mitsue Pipeline systems as a result of the expiration of contracts during the fourth quarter of 2021, partially offset by $15 million in higher recoverable costs on the Horizon Pipeline system related to extensive slope mitigation. | ||||||

Operating expenses(1) | ● | Consistent with prior period. Higher recoverable geotechnical spend primarily related to the Western Pipeline, was largely offset by lower operating expense associated with the Nipisi and Mitsue Pipeline systems due to expiration of contracts during the fourth quarter of 2021. | ||||||

| Share of profit from equity accounted investees | ▼ | Decrease primarily due to lower contributions from Ruby, partially offset by an increased share of profit from Alliance due to lower interest expenses as a result of its debt re-financing in the fourth quarter of 2021. | ||||||

| Reportable segment earnings before tax | ▲ | Increase largely due to higher volumes on the Peace Pipeline system, discussed above, higher recoverable costs from the Horizon Pipeline system, discussed above, combined with a $10 million impairment charge recognized during the first quarter of 2021 associated with an advance made to Ruby compared to nil recognized in the first quarter of 2022, partially offset by lower contribution from Ruby and the expiration of contracts on the Nipisi and Mitsue Pipeline systems. | ||||||

Adjusted EBITDA(3) | ▼ | Decrease largely due to the same items impacting reportable segment earnings before tax, discussed above, net of the decrease in impairments. Included in adjusted EBITDA is $76 million (2021: $75 million) related to Alliance and $15 million (2021: $47 million) related to Ruby. | ||||||

Volumes (mboe/d)(4) | ▼ | Decrease largely driven by lower contracted volumes on the Nipisi and Mitsue Pipeline systems and on the Ruby Pipeline, combined with lower volumes at AEGS due to third party outages, partially offset by higher volumes on the Peace Pipeline system and Drayton Valley Pipeline. Volumes include 146 mboe/d (2021: 149 mboe/d) related to Alliance and 57 mboe/d (2021: 105 mboe/d) related to Ruby. | ||||||

| Distributions from equity accounted investees | ▲ | $87 million (2021: $55 million) from Alliance and no distributions (2021: $13 million) from Ruby. The increase in distributions from Alliance is largely due to its debt re-financing in the fourth quarter of 2021. | ||||||

Pembina Pipeline Corporation First Quarter 2022 7

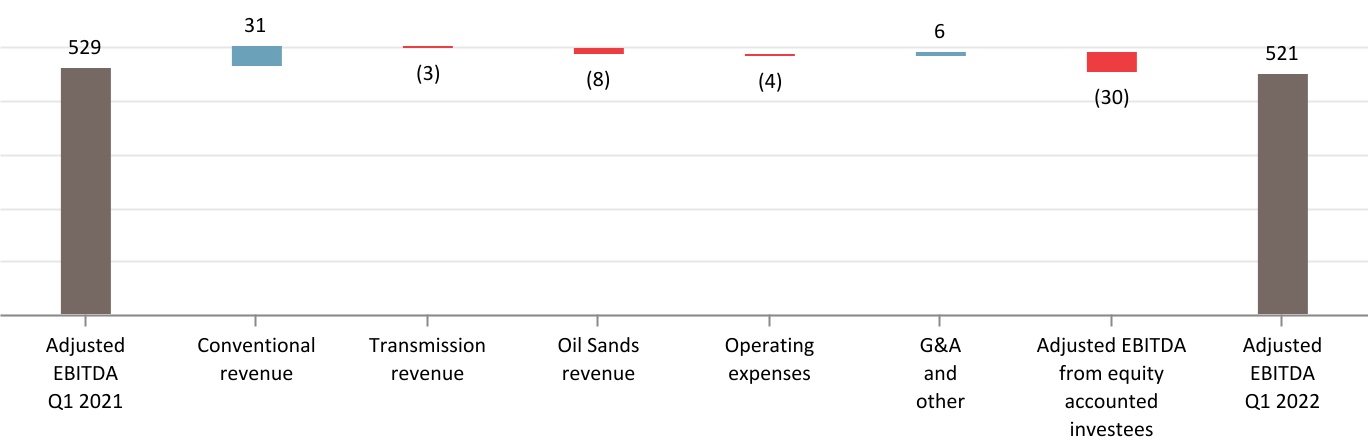

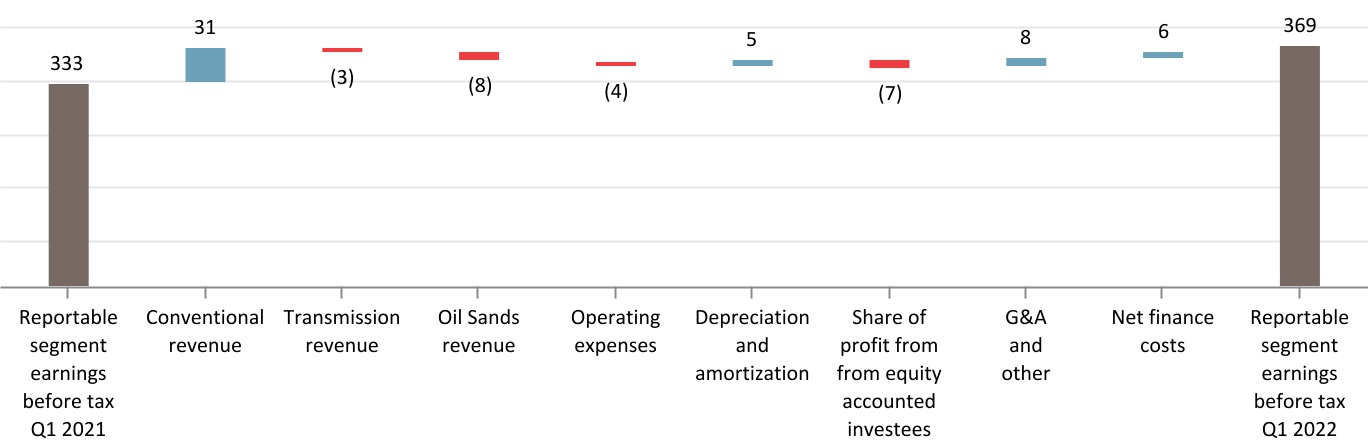

Change in Adjusted EBITDA ($ millions)(2)(3)

Change in Reportable Segment Earnings Before Tax ($ millions)(2)

(1) Includes inter-segment transactions. See Note 10 of the Interim Financial Statements.

(2) Conventional, transmission and oil sands revenue include revenue generated from Pembina's conventional, transmission and oil sands and heavy oil assets within the Pipelines operating segment, respectively. For further details on Pembina's assets, refer to Pembina's AIF for the year ended December 31, 2021.

(3) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(4) Revenue volumes. See the "Abbreviations" section of this MD&A for definition.

8 Pembina Pipeline Corporation First Quarter 2022

Financial and Operational Overview

| 3 Months Ended March 31 | ||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||

| ($ millions, except where noted) | Volumes(1) | Reportable Segment Earnings (Loss) Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) | ||||||||||||||

Pipelines(3) | ||||||||||||||||||||

| Conventional | 897 | 245 | 286 | 862 | 199 | 252 | ||||||||||||||

| Transmission | 621 | 85 | 166 | 674 | 87 | 203 | ||||||||||||||

| Oil Sands | 975 | 37 | 75 | 1,051 | 47 | 74 | ||||||||||||||

General & administrative(4) | — | (6) | (6) | — | — | — | ||||||||||||||

| Total | 2,493 | 361 | 521 | 2,587 | 333 | 529 | ||||||||||||||

(1) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's conventional, transmission and oil sands and heavy oil assets within the Pipelines operating segment. Refer to Pembina's AIF for the year ended December 31, 2021.

(4) Includes general & administrative expenses related to engineering & construction, systems & operations, and business development within the Pipeline operating segment. These expenses were included at the asset level in 2021 and elevated to the divisional level as at January 1, 2022.

Projects & New Developments(1)

Pipelines continues to focus on the execution of various system expansions. The projects in the following table were recently placed into service.

| Significant Projects | In-service Date | ||||

| NEBC Montney Infrastructure | February 2021 | ||||

The following outlines the projects and new developments within Pipelines:

Construction and line fill of Phase VII Peace Pipeline Expansion are complete and final commissioning is underway. Phase VII is expected to be approximately $150 million under budget and is expected to enter commercial service on June 1, 2022. Phase VII was constructed to provide transportation for the growing condensate supply in the WCSB and will divert condensate off of the existing LaGlace-Kakwa-Fox Creek corridor, creating additional firm capacity for Pembina's customers.

Pembina is reactivating the previously deferred Phase VIII Peace Pipeline Expansion. Based on significant long-term commitments from leading northeast British Columbia producers, we have clear visibility to the demand for incremental capacity in this region and as a result, the Company is confident in the decision to reactivate Phase VIII at this time. The scope of Phase VIII, as described in the table below, has been optimized to align with current system constraints and forecasted future demand, and redeploys certain infrastructure previously removed out of Phase VII. The project has an estimated cost of approximately $530 million, which relative to the original $500 million cost estimate, reflects the optimized scope and the net effect of cost increases due to market factors and cost savings arising from value engineering. Approximately $75 million had been spent on this project at the end of 2021, with an incremental $100 million expected to be spent in 2022.

On March 31, 2022, Ruby Pipeline filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware. Refer to the "Selected Equity Accounted Investee Information - Financing Activities for Equity Accounted Investees" section for further details.

Pembina Pipeline Corporation First Quarter 2022 9

| Phase VIII Peace Pipeline Expansion | ||||||||

Capital Budget: $530 million | In-service Date: First half of 2024 | Status: Recently reactivated | ||||||

This expansion will enable segregated pipeline service for ethane-plus and propane-plus NGL mix from the central Montney area at Gordondale, Alberta, into the Edmonton area for market delivery. The project includes new 10 and 16-inch pipelines, totaling approximately 150 km, in the Gordondale to La Glace corridor of Alberta, as well as new mid-point pump stations and terminal upgrades located throughout the Peace Pipeline system. Phase VIII will add approximately 235 mbpd of incremental capacity between Gordondale, Alberta and La Glace, Alberta, as well as approximately 65 mbpd of capacity between La Glace, Alberta and the Namao hub near Edmonton, Alberta. | ||||||||

| Phase IX Peace Pipeline Expansion | ||||||||

Capital Budget: $120 million | In-service Date: Fourth quarter of 2022 | Status: On time, trending on budget | ||||||

This expansion includes new 6-inch and 16-inch pipelines debottlenecking the corridor north of Gordondale, Alberta as well as upgrades at one pump station. In addition, this expansion will see existing pipelines, which are currently batching, converted to single product lines. Phase IX also includes a pump station in the Wapiti-to-Kakwa corridor that was previously part of the Phase VII project scope. Clearing activities are complete and mainline pipe delivery and construction are expected to commence in June. | ||||||||

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2021 filed at www.sedar.com (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

10 Pembina Pipeline Corporation First Quarter 2022

Facilities

Financial Overview for the Three Months Ended March 31

Results of Operations

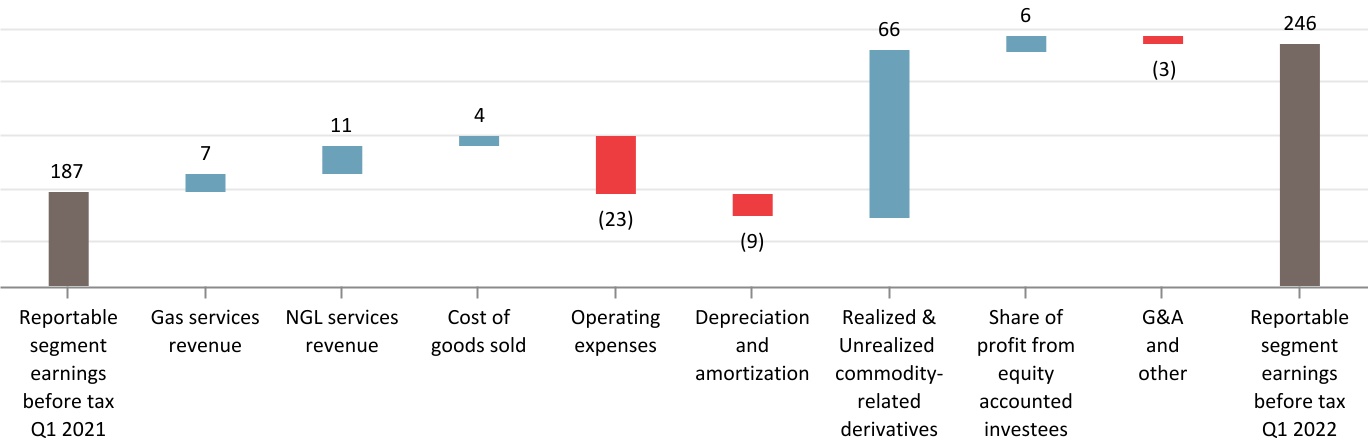

| ($ millions, except where noted) | 2022 | 2021 | Change | ||||||||

Gas Services revenue(1)(2) | 175 | 168 | 7 | ||||||||

NGL Services revenue(1)(2) | 182 | 171 | 11 | ||||||||

Facilities revenue(1) | 357 | 339 | 18 | ||||||||

Operating expenses(1) | 134 | 111 | 23 | ||||||||

Cost of goods sold(1) | — | 4 | (4) | ||||||||

Depreciation and amortization included in operations | 55 | 46 | 9 | ||||||||

| Realized gain on commodity-related derivative financial instruments | (7) | — | (7) | ||||||||

| Unrealized gain on commodity-related derivative financial instruments | (60) | (1) | (59) | ||||||||

Share of profit from equity accounted investees | 24 | 18 | 6 | ||||||||

| Gross profit | 259 | 197 | 62 | ||||||||

| Reportable segment earnings before tax | 246 | 187 | 59 | ||||||||

Adjusted EBITDA(3) | 281 | 269 | 12 | ||||||||

Volumes (mboe/d)(4) | 876 | 895 | (19) | ||||||||

| Distributions from equity accounted investees | 35 | 29 | 6 | ||||||||

| Changes in Results | ||||||||

Gas Services revenue(1)(2) | ▲ | Increase largely due to higher recoveries at Younger and at the Empress Infrastructure as a result of higher power costs. | ||||||

NGL Services revenue(1)(2) | ▲ | Increase primarily due to the Prince Rupert Terminal being placed into service in March 2021 and higher recoveries at the Redwater Complex. | ||||||

Operating expenses(1) | ▼ | Increase largely due to an increase in power and fuel costs, the majority of which are recovered in revenue, as a result of higher consumption of power at Younger and higher AECO prices during the first quarter of 2022, combined with higher repairs and maintenance costs. | ||||||

| Depreciation and amortization included in operations | ▼ | Increase primarily due to the Prince Rupert Terminal being placed into service in March 2021. | ||||||

| Realized & unrealized gain on commodity-related derivatives | ▲ | Certain gas processing fees are tied to AECO prices and the increase in the AECO price has resulted in higher realized and unrealized gains for the first quarter of 2022. | ||||||

Share of profit from equity accounted investees | ▲ | Increase primarily due to higher volumes on the Dawson Assets and from the Veresen Midstream Hythe Developments going into service in March 2021, partially offset by higher operating expenses. | ||||||

| Reportable segment earnings before tax | ▲ | Increase primarily due to the gains on commodity-related derivatives recognized in the first quarter of 2022, discussed above, combined with the contributions from the Prince Rupert Terminal being placed into service and higher contribution from Veresen Midstream, discussed above. | ||||||

Adjusted EBITDA(3) | ▲ | Increase primarily due to the same items impacting reportable segment earnings before tax, discussed above, net of the unrealized gains on commodity-related derivatives. Included in adjusted EBITDA is $54 million (2021: $46 million) related to Veresen Midstream. | ||||||

Volumes (mboe/d)(4) | ▼ | Decrease largely due to lower volumes from Pembina's NGL services, partially offset by higher volumes on the Dawson Assets and from the Veresen Midstream Hythe Developments going into service in March 2021. Volumes include 91 mboe/d (2021: 82 mboe/d) related to Veresen Midstream. | ||||||

| Distributions from equity accounted investees | ● | $34 million (2021: $28 million) from Veresen Midstream and $1 million (2021: $1 million) from Fort Corp. The increase in distributions is due to the same reasons impacting share of profit above. | ||||||

Pembina Pipeline Corporation First Quarter 2022 11

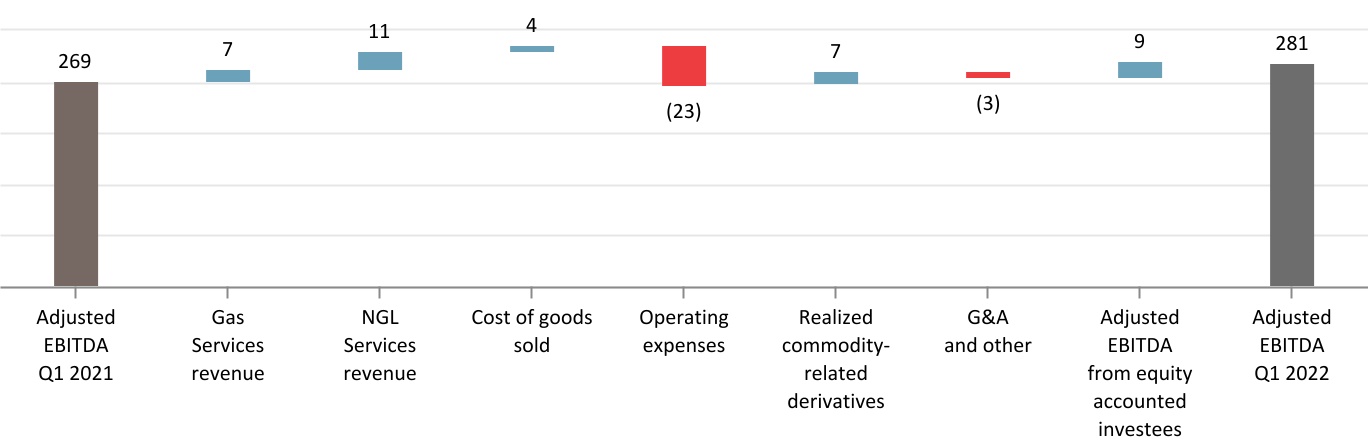

Change in Adjusted EBITDA ($ millions)(2)(3)

Change in Reportable Segment Earnings Before Tax ($ millions)(2)

(1) Includes inter-segment transactions. See Note 10 of the Interim Financial Statements.

(2) Gas services and NGL services revenue include revenue generated from Pembina's gas services and NGL services assets within the Facilities operating segment, respectively. For further details on Pembina’s assets, refer to Pembina's AIF for the year ended December 31, 2021.

(3) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(4) Revenue volumes. See the "Abbreviations" section of this MD&A for definition.

12 Pembina Pipeline Corporation First Quarter 2022

Financial and Operational Overview

| 3 Months Ended March 31 | ||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||

| ($ millions, except where noted) | Volumes(1) | Reportable Segment Earnings (Loss) Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) | ||||||||||||||

Facilities(3) | ||||||||||||||||||||

| Gas Services | 675 | 167 | 170 | 677 | 92 | 153 | ||||||||||||||

| NGL Services | 201 | 83 | 115 | 218 | 95 | 116 | ||||||||||||||

General & administrative expenses(4) | — | (4) | (4) | — | — | — | ||||||||||||||

| Total | 876 | 246 | 281 | 895 | 187 | 269 | ||||||||||||||

(1) Revenue volumes in mboe/d, with natural gas volumes converted to mboe/d from MMcf/d at a 6:1 ratio. See the "Abbreviations" section of this MD&A for definition.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's gas and NGL services assets within the Facilities operating segment. For a description of Pembina's gas and NGL assets, refer to Pembina's AIF for the year ended December 31, 2021.

(4) Includes general & administrative expenses related to engineering & construction and business development within the Facilities operating segment. These expenses were included at the asset level in 2021 and elevated to the divisional level as at January 1, 2022.

Projects & New Developments(1)

Facilities continues to build-out its natural gas and NGL processing and fractionation assets to service customer demand. The projects in the following table were recently placed into service.

| Significant Projects | In-service Date | ||||

Vancouver Wharves Expansion | June 2021 | ||||

| Prince Rupert Terminal | March 2021 | ||||

Veresen Midstream(2) | |||||

| Hythe Developments | March 2021 | ||||

The following outlines the projects and new developments within Facilities:

Subsequent to quarter end, Pembina made the decision to not proceed with the previously deferred expansion of Prince Rupert Terminal at this time. This decision was informed by a refreshed evaluation of market dynamics that included customer demand, shipping costs, and North American and international pricing. Given the outlook for strong domestic propane prices and new propane demand sources under development within the WCSB, Pembina believes it can provide customers with a more capital efficient offering that still achieves high netbacks, without the incremental egress arising from the expansion of Prince Rupert Terminal. Pembina will continue to evaluate future expansion opportunities as market conditions evolve.

| Empress Cogeneration Facility | ||||||||

Capital Budget: $120 million | In-service Date: Fourth quarter of 2022 | Status: Ahead of schedule, on budget | ||||||

The Empress Cogeneration Facility will use natural gas to generate up to 45 megawatts of electrical power, thereby reducing overall operating costs by providing electricity and heat to the existing Empress NGL Extraction Facility. All the power will be consumed on site, thereby supplying up to 90 percent of the site's electrical requirements. Further, this project will contribute to annual greenhouse gas emission reductions at the Empress NGL Extraction Facility through the utilization of the cogeneration waste heat and the low-emission power generated. Pembina anticipates a reduction of approximately 90,000 tonnes of carbon dioxide equivalent per year based on the current energy demand of the Empress NGL Extraction Facility. Contractors are on site and construction is progressing well. | ||||||||

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2021 filed at www.sedar.com (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

(2) Veresen Midstream is an equity accounted investee, in which Pembina had a 45 percent interest in as of March 31, 2022. Results from Veresen Midstream impact share of profit from equity accounted investees and proportionally consolidated metrics. See Note 4 to the Interim Financial Statements.

Pembina Pipeline Corporation First Quarter 2022 13

Marketing & New Ventures

Financial Overview for the Three Months Ended March 31

Results of Operations

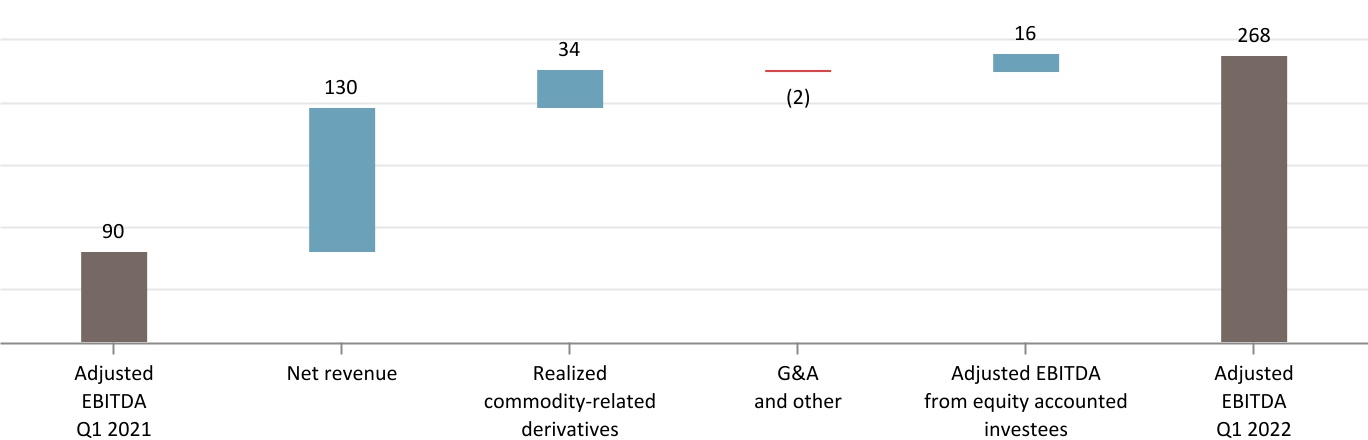

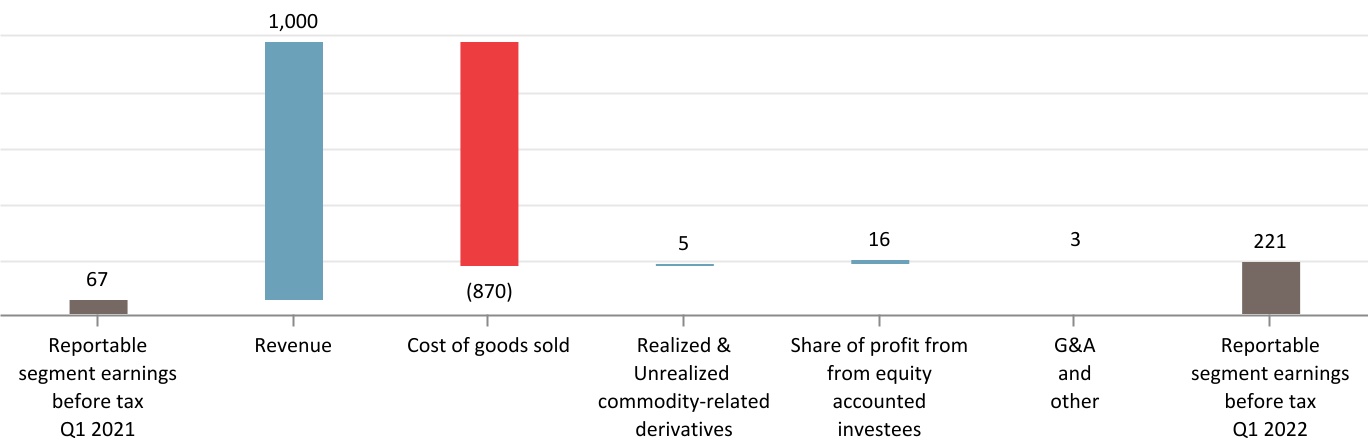

| ($ millions, except where noted) | 2022 | 2021(1) | Change | ||||||||

Marketing revenue(2) | 2,271 | 1,271 | 1,000 | ||||||||

Cost of goods sold(2) | 1,967 | 1,097 | 870 | ||||||||

Net revenue(2)(3) | 304 | 174 | 130 | ||||||||

| Depreciation and amortization included in operations | 11 | 13 | (2) | ||||||||

| Realized loss on commodity-related derivative financial instruments | 54 | 88 | (34) | ||||||||

| Unrealized loss on commodity-related derivative financial instruments | 35 | 6 | 29 | ||||||||

| Share of profit from equity accounted investees | 22 | 6 | 16 | ||||||||

| Gross profit | 226 | 73 | 153 | ||||||||

| Reportable segment earnings before tax | 221 | 67 | 154 | ||||||||

Adjusted EBITDA(3) | 268 | 90 | 178 | ||||||||

Volumes (mboe/d)(4) | 206 | 221 | (15) | ||||||||

| Distributions from equity accounted investees | 33 | 18 | 15 | ||||||||

| Change in Results | ||||||||

Net revenue(2)(3) | ▲ | Increase largely due to higher margins on NGL and crude oil sales as a result of the higher NGL and crude oil prices which contributed to a significant quarter-over-quarter increase for the marketing business. Contributions were made by NGL marketing, where higher margins resulted when seasonable inventories built up during the second and third quarters of 2021 were sold during the first quarter of 2022 in a higher price environment. In addition, crude marketing realized strong blending margins due to the rapidly rising crude oil price environment. | ||||||

| Realized loss on commodity-related derivatives | ▲ | Realized loss due to higher NGL and crude oil market prices during the first quarter of 2022, which also drove higher margins on NGL and crude sales, resulting in a realized loss on NGL- and crude oil-based derivative instruments for the period. | ||||||

| Unrealized loss on commodity-related derivatives | ▼ | Unrealized loss on commodity-related derivatives primarily due to an increase in the forward prices for NGL and crude oil during the first quarter of 2022, partially offset by contracts maturing in the period. | ||||||

| Share of profit from equity accounted investees | ▲ | Increase largely due to higher revenues at Aux Sable as a result of higher NGL margins partially offset by a narrower AECO-Chicago natural gas price differential. | ||||||

| Reportable segment earnings before tax | ▲ | Increase largely due to higher margins on NGL and crude oil sales as a result of the higher NGL and crude oil prices, discussed above, combined with a lower realized loss on commodity-related derivatives for the first quarter of 2022 compared to the first quarter of 2021 and a higher contribution from Aux Sable, discussed above, partially offset by the unrealized loss on commodity-related derivatives, discussed above. | ||||||

Adjusted EBITDA(3) | ▲ | Increase largely due to the same items impacting reportable segment earnings before tax, discussed above, net of the unrealized loss on commodity-related derivatives. Included in adjusted EBITDA is $28 million (2021: $12 million) related to Aux Sable. | ||||||

Volumes (mboe/d)(4) | ▼ | Marketed NGL volumes decreased largely due to lower propane sales during the first quarter of 2022 compared to the first quarter of 2021 when Pembina monetized storage positions that were built up during the second and third quarters of 2020, combined with lower ethane sales caused by third party outages. Revenue volumes includes 34 mboe/d (2021: 37 mboe/d) related to Aux Sable. | ||||||

| Distributions from equity accounted investees | ▲ | $33 million (2021: $18 million) from Aux Sable. Increase largely due to the higher NGL margins at Aux Sable, discussed above. | ||||||

14 Pembina Pipeline Corporation First Quarter 2022

Change in Adjusted EBITDA ($ millions)(3)

Change in Reportable Segment Earnings Before Tax(1) ($ millions)

(1) Comparative 2021 period has been restated. See "Accounting Policies & Estimates - Restatement of revenue and cost of goods sold" section of this MD&A and Note 14 to the Interim Financial Statements for further details.

(2) Includes inter-segment transactions. See Note 10 of the Interim Financial Statements.

(3) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(4) Marketed NGL volumes. See the "Abbreviations" section of this MD&A for definition.

(5) Other includes depreciation & amortization, net finance costs, and impairment expense.

Pembina Pipeline Corporation First Quarter 2022 15

Financial and Operational Overview

| 3 Months Ended March 31 | ||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||

| ($ millions, except where noted) | Volumes(1) | Reportable Segment Earnings (Loss) Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings (Loss) Before Tax | Adjusted EBITDA(2) | ||||||||||||||

Marketing & New Ventures(3) | ||||||||||||||||||||

| Marketing | 206 | 225 | 271 | 221 | 72 | 93 | ||||||||||||||

New Ventures(4) | — | (4) | (3) | — | (5) | (3) | ||||||||||||||

| Total | 206 | 221 | 268 | 221 | 67 | 90 | ||||||||||||||

(1) Marketed NGL volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's marketing activities and new ventures projects within the Marketing & New Ventures operating segment. For further details on Pembina's marketing activities and projects, refer to Pembina's AIF for the year ended December 31, 2021.

(4) All New Ventures projects have not yet commenced operations and therefore have no volumes.

Projects & New Developments(1)

Pembina's New Ventures group continues to advance business opportunities in liquefied natural gas ("LNG"), low-carbon energy, and petrochemicals. New Ventures is focused on developing opportunities that integrate into Pembina's core businesses, while progressing projects that will extend Pembina's value-chain and benefit stakeholders.

Pembina has formed a partnership agreement with the Haisla First Nation to develop the proposed Cedar LNG Project, a floating LNG facility strategically positioned to leverage Canada's abundant natural gas supply and British Columbia's growing LNG infrastructure to produce industry-leading low‑carbon, low-cost Canadian LNG for overseas markets. The Cedar LNG Project is expected to be the largest First Nation-owned infrastructure project in Canada and have one of the cleanest environmental profiles in the world. Cedar LNG's application for an Environmental Assessment Certificate was recently submitted to the British Columbia Environmental Assessment Office, moving the project into the 180-day application review phase.

In addition, Pembina and TC Energy Corporation ("TC Energy") intend to jointly develop the Alberta Carbon Grid, a world-scale carbon transportation and sequestration system, which will enable Alberta-based industries to effectively manage their greenhouse gas emissions, contribute positively to Alberta's lower-carbon economy and create sustainable long-term value for Pembina and TC Energy stakeholders. During the first quarter, the Government of Alberta announced that the Alberta Carbon Grid has been successfully chosen to move to the next stage of the Province's carbon capture utilization and storage ("CCUS") process in the industrial heartland. As an open-access system, the Alberta Carbon Grid will be a significant component of Alberta's emerging CCUS industry, connecting key sequestration locations and delivery points across the province to serve multiple industries. When fully constructed, the system is designed with the potential capability of transporting and sequestering more than 20 million tonnes of CO2 annually.

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2021 filed at www.sedar.com (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

16 Pembina Pipeline Corporation First Quarter 2022

Corporate

Financial Overview Three Months Ended March 31

Results of Operations(1)

| ($ millions, except where noted) (unaudited) | 2022 | 2021 | Change | ||||||||

| General and administrative | 76 | 66 | 10 | ||||||||

| Other expense | 17 | 10 | 7 | ||||||||

| Net finance costs | 102 | 89 | 13 | ||||||||

| Reportable segment loss before tax | (195) | (164) | (31) | ||||||||

Adjusted EBITDA(2) | (64) | (53) | (11) | ||||||||

| Change in Results | ||||||||

| General & administrative | ▼ | Increase primarily due to higher long-term incentive costs driven by a larger increase in Pembina's share price during the first quarter of 2022 compared to the first quarter of 2021 and Pembina's performance relative to peers. | ||||||

| Other expense | ▼ | Increase primarily due to higher acquisition fees related to Newco, partially offset by lower restructuring costs. | ||||||

| Net finance costs | ▼ | Increase primarily related to higher interest expense as a result of terming out variable rate debt to fixed rate debt at higher interest rates. | ||||||

| Reportable segment loss before tax | ▼ | Decrease primarily due to higher long-term incentives and interest expense, discussed above, combined with higher acquisition fees related to Newco, partially offset by lower restructuring costs. | ||||||

Adjusted EBITDA(2) | ▼ | Decrease largely due to higher long-term incentive costs, discussed above. | ||||||

(1) Includes inter-segment eliminations.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

Pembina Pipeline Corporation First Quarter 2022 17

4. LIQUIDITY & CAPITAL RESOURCES

Available Sources of Liquidity

| ($ millions) | March 31, 2022 | December 31, 2021 | ||||||

Working capital(1) | (1,084) | (1,145) | ||||||

Variable rate debt(2)(3) | ||||||||

| Senior unsecured credit facilities | 823 | 910 | ||||||

| Variable rate bank debt swapped to fixed | (313) | (316) | ||||||

| Total variable rate loans and borrowings outstanding (weighted average interest rate of 1.6% (2021: 1.1%)) | 510 | 594 | ||||||

Fixed rate debt(2) | ||||||||

| Senior unsecured medium-term notes | 9,650 | 9,700 | ||||||

| Variable rate bank debt swapped to fixed | 313 | 316 | ||||||

| Total fixed rate loans and borrowings outstanding (weighted average interest rate of 3.9% (2021: 3.9%)) | 9,963 | 10,016 | ||||||

| Total loans and borrowings outstanding | 10,473 | 10,610 | ||||||

| Cash and unutilized debt facilities | 2,537 | 2,469 | ||||||

| Subordinated hybrid notes (weighted average interest rate of 4.8% (2021: 4.8%) | 600 | 600 | ||||||

(1) As at March 31, 2022, working capital included $950 million (December 31, 2021: $1.0 billion) associated with the current portion of long-term debt.

(2) Face value.

(3) Includes U.S. $250 million variable rate debt outstanding at March 31, 2022 (December 31, 2021: U.S. $250 million).

Pembina currently anticipates that its cash flow from operating activities, the majority of which is derived from fee-based contracts, will be more than sufficient to meet its operating obligations, to fund its dividend and to fund its capital expenditures in the short-term and long-term. Pembina expects to source funds required for debt maturities from cash, its credit facilities and by accessing the capital markets, as required. Based on its successful access to financing in the capital markets over the past several years, Pembina expects to continue to have access to additional funds as required. Refer to "Risk Factors – General Risk Factors – Additional Financing and Capital Resources" in Pembina's MD&A for the year ended December 31, 2021 and Note 25 to the Consolidated Financial Statements for more information. Management continues to monitor Pembina's liquidity situation and remains satisfied that the leverage employed in Pembina's capital structure is sufficient and appropriate given the characteristics and operations of the underlying asset base.

Management may adjust Pembina's capital structure as a result of changes in economic conditions or the risk characteristics of the underlying assets. To maintain or modify Pembina's capital structure in the future, Pembina may renegotiate debt terms, repay existing debt, seek new borrowings, issue additional equity or hybrid securities and/or repurchase additional common or preferred shares.

As at March 31, 2022, Pembina's credit facilities consisted of: an unsecured $2.5 billion (December 31, 2021: $2.5 billion) revolving credit facility, which includes a $750 million (December 31, 2021: $750 million) accordion feature and matures in June 2026; an unsecured $500 million (December 31, 2021: $500 million) non-revolving term loan, which matures in August 2022; an unsecured U.S. $250 million (December 31, 2021: U.S. $250 million) non-revolving term loan, which matures in May 2025; and an operating facility of $20 million (December 31, 2021: $20 million), which matures in May 2022 and is typically renewed on an annual basis (collectively, the "Credit Facilities"). There are no mandatory principal repayments due over the term of the Credit Facilities, with principal repayments not due until maturity. Pembina is required to meet certain specific and customary affirmative and negative financial covenants under the indenture governing its medium-term notes and the agreements governing its Credit Facilities, including a requirement to maintain certain financial ratios. See "Liquidity & Capital Resources – Covenants" below for more information. Pembina is also subject to customary restrictions on its operations and activities under the indenture governing its medium-term notes and the agreements governing its Credit Facilities, including restrictions on the granting of security, incurring indebtedness and the sale of its assets.

On March 14, 2022, Pembina's $50 million senior unsecured medium term notes, series 3A, matured and were fully repaid.

18 Pembina Pipeline Corporation First Quarter 2022

Covenants

Pembina's financial covenants under the indenture governing its medium-term notes and the agreements governing the Credit Facilities include the following:

| Debt Instrument | Financial Covenant(1) | Ratio | Ratio as at March 31, 2022 | ||||||||

| Senior unsecured medium-term notes | Funded Debt to Capitalization | Maximum 0.70 | 0.41 | ||||||||

| Credit Facilities | Debt to Capital | Maximum 0.70 | 0.42 | ||||||||

(1) Terms as defined in relevant agreements.

Pembina was in compliance with all covenants under the note indenture governing its medium-term notes and the agreements governing its Credit Facilities as at March 31, 2022 (December 31, 2021: in compliance).

Credit Risk

Pembina continues to actively monitor and reassess the creditworthiness of its counterparties. The majority of Pembina's credit exposure is to investment grade or split-investment grade counterparties. Pembina assesses all counterparties during the on-boarding process and actively monitors credit limits and exposure across the business. Pembina may reduce or mitigate its exposure to certain counterparties where it is deemed warranted and permitted under contractual terms. Where warranted, financial assurances may be sought from counterparties to mitigate and reduce risk, which assurances may include guarantees, letters of credit and cash collateral. Letters of credit totaling $144 million (December 31, 2021: $100 million) were held as at March 31, 2022, primarily in respect of customer trade receivables.

Credit Ratings

The following information with respect to Pembina's credit ratings is provided as such information relates to Pembina's financing costs and liquidity. Specifically, credit ratings affect Pembina's ability to obtain short-term and long-term financing and the cost of such financing. A reduction in the current ratings of Pembina's debt by its rating agencies, particularly a downgrade below investment-grade ratings, could adversely affect Pembina's cost of financing and its access to sources of liquidity and capital. In addition, changes in credit ratings and the associated costs may affect Pembina's ability to enter into normal course derivative or hedging transactions. Credit ratings are intended to provide investors with an independent measure of the credit quality of any issues of securities. The credit ratings assigned by the rating agencies are not recommendations to purchase, hold or sell the securities, nor do the credit ratings comment on the market price or suitability for a particular investor. Any credit rating may not remain in effect for a given period of time or may be revised or withdrawn entirely by a rating agency in the future if, in its judgment, circumstances so warrant.

DBRS Limited ("DBRS") rates Pembina's senior unsecured medium-term notes 'BBB (high)'. DBRS has also assigned a debt rating of 'BBB (low)' to Pembina's Series 1 Subordinated Notes and a rating of 'Pfd-3 (high)' for each issued series of Pembina's Class A Preferred Shares, other than the Class A Preferred Shares, Series 2021-A (the "Series 2021-A Class A Preferred Shares"), which are deliverable to the holders of the Series 1 Subordinated Notes following the occurrence of certain bankruptcy or insolvency events in respect of Pembina.

The long-term corporate credit rating assigned by S&P Global Ratings ("S&P") on Pembina is 'BBB'. S&P has also assigned a debt rating of 'BBB' to Pembina's senior unsecured medium-term notes, a debt rating of 'BB+' to the Series 1 Subordinated Notes, and a rating of 'P-3 (High)' to each issued series of Pembina's Class A Preferred Shares, other than the Series 2021-A Class A Preferred Shares.

Refer to "Description of the Capital Structure of Pembina – Credit Ratings" in the AIF for further information.

Pembina Pipeline Corporation First Quarter 2022 19

Contractual Obligations and Off-Balance Sheet Arrangements

Contractual Obligations

Pembina had the following contractual obligations outstanding as at March 31, 2022:

Contractual Obligations(1) | Payments Due By Period | ||||||||||||||||

| ($ millions) | Total | Less than 1 year | 1 – 3 years | 3 – 5 years | After 5 years | ||||||||||||

Leases(2) | 945 | 107 | 175 | 146 | 517 | ||||||||||||

Long-term debt(3) | 17,158 | 1,454 | 2,441 | 1,602 | 11,661 | ||||||||||||

Construction commitments(4) | 880 | 276 | 41 | 24 | 539 | ||||||||||||

Other | 565 | 120 | 99 | 75 | 271 | ||||||||||||

Total contractual obligations | 19,548 | 1,957 | 2,756 | 1,847 | 12,988 | ||||||||||||

(1) | Pembina enters into product purchase agreements and power purchase agreements to secure supply for future operations. Purchase prices of both NGL and power are dependent on current market prices. Volumes and prices for NGL and power contracts cannot be reasonably determined, and therefore, an amount has not been included in the contractual obligations schedule. Product purchase agreements range from one to 9 years and involve the purchase of NGL products from producers. Assuming product is available, Pembina has secured between 40 and 188 mbpd of NGL each year up to and including 2030. Power purchase agreements range from one to 24 years and involve the purchase of power from electrical service providers. Pembina has secured up to 78 megawatts per day each year up to and including 2046. | ||||

(2) | Includes terminals, rail, office space, land and vehicle leases. | ||||

(3) | Includes loans and borrowings, subordinated hybrid notes and interest payments on Pembina's senior unsecured medium-term notes and subordinated hybrid notes. Excludes deferred financing costs. | ||||

(4) | Excluding significant projects that are awaiting regulatory approval, projects which Pembina is not committed to construct, and projects that are executed by equity accounted investees. | ||||

Off-Balance Sheet Arrangements

As at March 31, 2022, Pembina does not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on Pembina's financial condition, results of operations, liquidity or capital expenditures.

Letters of Credit

Pembina has provided letters of credit to various third parties in the normal course of conducting business. The letters of credit include guarantees to counterparties for product purchases and sales, transportation services, utilities, engineering and construction services. The letters of credit have not had and are not expected to have a material impact on Pembina's financial position, earnings, liquidity or capital resources. As at March 31, 2022, Pembina had $144 million (December 31, 2021: $135 million) in letters of credit issued.

20 Pembina Pipeline Corporation First Quarter 2022

5. SHARE CAPITAL

Common Shares

On March 8, 2022, the Toronto Stock Exchange ("TSX") accepted the renewal of Pembina's normal course issuer bid (the "NCIB") that allows the Company to repurchase, at its discretion, up to approximately 27.5 million common shares through the facilities of the TSX, the New York Stock Exchange and/or alternative Canadian trading systems or as otherwise permitted by applicable securities law, subject to certain restrictions on the number of common shares that may be purchased on a single day. Common shares purchased by the Company will be cancelled. The NCIB commenced on March 10, 2022 and will terminate on March 9, 2023 or on such earlier date as the Company has purchased the maximum number of common shares permitted pursuant to the notice of intention under the normal course issuer bid or at such time Pembina determines to no longer make purchases thereunder.

The following table summarizes Pembina's share repurchases under its NCIB:

| (millions, except as noted) | March 31, 2022 | December 31, 2021 | ||||||

Number of common shares repurchased for cancellation (thousands) | 600 | 450 | ||||||

| Average price per share | $46.43 | $37.77 | ||||||

Total cost(1) | 28 | 17 | ||||||

(1) Total cost includes $17 million (2021: $13 million) charged to share capital and $11 million (2021: $4 million) charged to deficit.

Common Share Dividends

Common share dividends are payable if, as and when declared by Pembina's Board of Directors. The amount and frequency of dividends declared and payable is at the discretion of Pembina's Board of Directors, which considers earnings, cash flow, capital requirements, the financial condition of Pembina and other relevant factors when making its dividend determination.

Preferred Share Dividends

Other than in respect of the Series 2021-A Class A Preferred Shares, the holders of Pembina's Class A Preferred Shares are entitled to receive fixed cumulative dividends. Dividends on the Series 1, 3, 5, 7, 9 and 21 Class A Preferred Shares are payable quarterly on the first day of March, June, September and December, if, as and when declared by the Board of Directors of Pembina. Dividends on the Series 15, 17 and 19 Class A Preferred Shares are payable on the last day of March, June, September and December in each year, if, as and when declared by the Board of Directors of Pembina. Dividends on the Series 23 and 25 Class A Preferred Shares are payable on the 15th day of February, May, August and November in each year, if, as and when declared by the Board of Directors of Pembina.

Dividends are not payable on the Series 2021-A Class A Preferred Shares, nor shall any dividends accumulate or accrue, prior to delivery to the holders of the Series 1 Subordinated Notes following the occurrence of certain bankruptcy or insolvency events in respect of Pembina. Thereafter, dividends on the Series 2021-A Class A Preferred Shares are payable on the 25th day of January and July in each year, if, as and when declared by the Board of Directors.

Pembina Pipeline Corporation First Quarter 2022 21

Outstanding Share Data

Issued and outstanding (thousands)(1) | April 29, 2022 | ||||

| Common shares | 554,276 | ||||

| Stock options | 14,818 | ||||

| Stock options exercisable | 8,584 | ||||

| Series 1 Class A Preferred Shares | 10,000 | ||||

| Series 3 Class A Preferred Shares | 6,000 | ||||

| Series 5 Class A Preferred Shares | 10,000 | ||||

| Series 7 Class A Preferred Shares | 10,000 | ||||

| Series 9 Class A Preferred Shares | 9,000 | ||||

| Series 15 Class A Preferred Shares | 8,000 | ||||

| Series 17 Class A Preferred Shares | 6,000 | ||||

| Series 19 Class A Preferred Shares | 8,000 | ||||

| Series 21 Class A Preferred Shares | 16,000 | ||||

| Series 23 Class A Preferred Shares | 12,000 | ||||

| Series 25 Class A Preferred Shares | 10,000 | ||||

(1) Pembina issued 600,000 Series 2021-A Class A Preferred shares to the Computershare Trust Company of Canada, to be held in trust to satisfy its obligations under the indenture governing the Series 1 Subordinated Notes, in connection with the issuance of the Series 1 Subordinated Notes.

22 Pembina Pipeline Corporation First Quarter 2022

6. CAPITAL EXPENDITURES

| 3 Months Ended March 31 | ||||||||

| ($ millions) | 2022 | 2021 | ||||||

| Pipelines | 114 | 83 | ||||||

| Facilities | 30 | 40 | ||||||

| Marketing & New Ventures | 29 | 2 | ||||||

| Corporate and other projects | 6 | 2 | ||||||

Total capital expenditures(1) | 179 | 127 | ||||||

(1) Includes $28 million for the three months ended March 31, 2022 (2021: $13 million) related to non-recoverable sustainment activities.

In both 2022 and 2021, Pipeline capital expenditures continued to be largely related to Pembina's Peace Pipeline system expansion projects. Pipeline capital expenditures in 2022 also included slope mitigation on the Horizon Pipeline system. In 2022, Facilities capital expenditures were primarily related to continued expansion at the Empress Co-generation Facility and Vancouver Wharves. In 2021, Facilities capital expenditures were largely related to the expansion at Empress and the Prince Rupert Terminal. Marketing & New Ventures had capital expenditures primarily related to the purchase of linefill for the Phase VII Peace Pipeline expansion in 2022 and offshore LNG projects in 2021. Corporate capital expenditures relate to IT infrastructure and systems development.

Contributions to Equity Accounted Investees

| 3 Months Ended March 31 | ||||||||

| ($ millions) | 2022 | 2021 | ||||||

| Aux Sable | 1 | 1 | ||||||

| Veresen Midstream | 13 | 11 | ||||||

| Cedar LNG | 5 | — | ||||||

| Total | 19 | 12 | ||||||

Contributions made to Veresen Midstream during both 2022 and 2021 were to fund general capital expenditures.

Pembina Pipeline Corporation First Quarter 2022 23

7. SELECTED QUARTERLY INFORMATION

Selected Quarterly Operating Information

| (mboe/d) | 2022 | 2021 | 2020 | |||||||||||||||||||||||

| Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | |||||||||||||||||||

Volumes(1)(2) | ||||||||||||||||||||||||||

Pipelines | ||||||||||||||||||||||||||

Conventional Pipelines | 897 | 959 | 918 | 892 | 862 | 993 | 863 | 834 | ||||||||||||||||||

| Transmission Pipelines | 621 | 616 | 595 | 685 | 674 | 684 | 661 | 668 | ||||||||||||||||||

| Oil Sands Pipelines | 975 | 996 | 1,050 | 1,050 | 1,051 | 1,053 | 1,056 | 1,053 | ||||||||||||||||||

Facilities | ||||||||||||||||||||||||||

Gas Services | 675 | 677 | 660 | 662 | 677 | 673 | 657 | 658 | ||||||||||||||||||

| NGL Services | 201 | 189 | 188 | 211 | 218 | 211 | 214 | 214 | ||||||||||||||||||

| Total | 3,369 | 3,437 | 3,411 | 3,500 | 3,482 | 3,614 | 3,451 | 3,427 | ||||||||||||||||||

(1) Revenue volumes. See the "Abbreviations" section of this MD&A for definition.

(2) Includes Pembina's proportionate share of volumes from equity accounted investees.

Deferred Take-or-pay Revenue

| ($ millions) | 2022 | 2021 | 2020 | |||||||||||||||||||||||

| Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | |||||||||||||||||||

| Pipelines | ||||||||||||||||||||||||||

Opening balance | 3 | 21 | 32 | 22 | 3 | 42 | 45 | 22 | ||||||||||||||||||

Revenue deferred | 47 | 43 | 48 | 45 | 42 | 52 | 66 | 53 | ||||||||||||||||||

Revenue recognized | (26) | (61) | (59) | (35) | (23) | (91) | (69) | (30) | ||||||||||||||||||

Ending take-or-pay contract liability balance | 24 | 3 | 21 | 32 | 22 | 3 | 42 | 45 | ||||||||||||||||||

| Facilities | ||||||||||||||||||||||||||

Opening balance | — | — | 3 | 1 | — | — | 2 | 1 | ||||||||||||||||||

Revenue deferred | 1 | — | — | 2 | 1 | — | 1 | 1 | ||||||||||||||||||

Revenue recognized | — | (3) | — | — | — | (3) | — | |||||||||||||||||||

Ending take-or-pay contract liability balance | 1 | — | — | 3 | 1 | — | — | 2 | ||||||||||||||||||

24 Pembina Pipeline Corporation First Quarter 2022

Quarterly Financial Information

($ millions, except where noted) | 2022 | 2021 | 2020 | |||||||||||||||||||||||

| Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | |||||||||||||||||||

| Revenue | 3,038 | 2,560 | 2,149 | 1,902 | 2,016 | 1,680 | 1,496 | 1,229 | ||||||||||||||||||

Net revenue(1) | 1,154 | 1,084 | 961 | 894 | 999 | 954 | 849 | 776 | ||||||||||||||||||

| Operating expenses | 193 | 206 | 187 | 186 | 182 | 201 | 178 | 154 | ||||||||||||||||||

| Realized loss (gain) on commodity-related derivative financial instruments | 47 | 36 | 43 | 33 | 88 | 6 | (7) | (36) | ||||||||||||||||||

| Share of profit (loss) from equity accounted investees | 86 | 83 | 75 | 52 | 71 | (244) | 62 | 66 | ||||||||||||||||||

| Gross profit | 858 | 785 | 682 | 550 | 630 | 247 | 568 | 460 | ||||||||||||||||||

| Earnings (loss) | 481 | 80 | 588 | 254 | 320 | (1,216) | 323 | 258 | ||||||||||||||||||

Earnings (loss) per common share – basic and diluted (dollars) | 0.81 | 0.08 | 1.01 | 0.39 | 0.51 | (2.28) | 0.52 | 0.40 | ||||||||||||||||||

| Cash flow from operating activities | 655 | 697 | 913 | 584 | 456 | 766 | 434 | 642 | ||||||||||||||||||

Cash flow from operating activities per common share – basic (dollars) | 1.19 | 1.27 | 1.66 | 1.06 | 0.83 | 1.39 | 0.78 | 1.17 | ||||||||||||||||||

Adjusted cash flow from operating activities(1) | 700 | 734 | 786 | 538 | 582 | 603 | 524 | 586 | ||||||||||||||||||

Adjusted cash flow from operating activities per common share – basic (dollars)(1) | 1.27 | 1.33 | 1.43 | 0.98 | 1.06 | 1.10 | 0.95 | 1.07 | ||||||||||||||||||

Common shares outstanding (millions): | ||||||||||||||||||||||||||

| Weighted average – basic | 551 | 550 | 550 | 550 | 550 | 550 | 550 | 550 | ||||||||||||||||||

| Weighted average – diluted | 552 | 551 | 551 | 551 | 550 | 550 | 550 | 550 | ||||||||||||||||||

| End of period | 552 | 550 | 550 | 550 | 550 | 550 | 550 | 550 | ||||||||||||||||||

| Common share dividends declared | 347 | 346 | 347 | 347 | 346 | 346 | 346 | 347 | ||||||||||||||||||

Dividends per common share | 0.63 | 0.63 | 0.63 | 0.63 | 0.63 | 0.63 | 0.63 | 0.63 | ||||||||||||||||||

| Preferred share dividends declared | 31 | 33 | 31 | 35 | 36 | 38 | 38 | 37 | ||||||||||||||||||

| Capital expenditures | 179 | 176 | 209 | 146 | 127 | 161 | 174 | 211 | ||||||||||||||||||

| Contributions to equity accounted investees | 19 | 305 | 18 | — | 12 | — | 28 | 2 | ||||||||||||||||||

| Distributions from equity accounted investees | 155 | 128 | 106 | 112 | 115 | 109 | 111 | 116 | ||||||||||||||||||

Adjusted EBITDA(1) | 1,006 | 970 | 850 | 778 | 835 | 866 | 796 | 789 | ||||||||||||||||||

(1) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

During the periods in the table above, Pembina's financial and operating results were impacted by the following factors and trends:

•Impairments recognized on Pembina's interests in Ruby, CKPC and the assets associated with Jordan Cove in the fourth quarter of 2020 and on certain assets in Pipelines as a result of contract expirations in the fourth quarter of 2021;

•The COVID-19 pandemic and the resulting decrease in demand for commodities starting in the second quarter of 2020, which led to a significant decline in global energy prices and a reduction in capital spending budgets by Pembina and its customers in 2020, and the subsequent recovery in demand for commodities and global energy prices in 2021, which continued through the first quarter of 2022 in connection with supply concerns associated with the current conflict between Ukraine and Russia;

•Volatility in the AECO-Chicago natural gas price differential, power pool prices and foreign exchange rates impacting operating results;

•New large-scale growth projects across Pembina's business being placed into service;

•Volatility in commodity market prices impacting margins within the marketing business, partially mitigated through Pembina's risk management program;

•Higher net finance costs impacting earnings associated with debt related to financing growth projects, volatility in foreign exchange rates and volatility in Pembina's share price impacting incentive costs;

•Contract expiries on certain assets; and

•The receipt and associated tax of the Arrangement Termination Payment; and

•Higher contributions made to Alliance to redeem all of its issued and outstanding senior notes; and

•Higher number of common shares as a result of option exercises, partially offset by share repurchases.

Pembina Pipeline Corporation First Quarter 2022 25

8. SELECTED EQUITY ACCOUNTED INVESTEE INFORMATION

Loans and Borrowings of Equity Accounted Investees

Under equity accounting, the assets and liabilities of an investment are net into a single line item in the Consolidated Statement of Financial Position, "Investments in Equity Accounted Investees". To assist readers' understanding and to evaluate the capitalization of Pembina's investments, loans and borrowings associated with investments in equity accounted investees are presented below based on Pembina's proportionate ownership in such investments, as at March 31, 2022. The loans and borrowings are presented and classified by the division in which the results for the investment are reported. Please refer to the "Abbreviations" section for a summary of Pembina's investments in equity accounted investees and the division in which their results are reported.

($ millions)(1) | March 31, 2022 | December 31, 2021 | ||||||

Pipelines(2) | 636 | 642 | ||||||

| Facilities | 1,190 | 1,214 | ||||||

| Marketing & New Ventures | 1 | 1 | ||||||

| Total | 1,827 | 1,857 | ||||||

(1) Balances reflect Pembina's ownership percentage of the outstanding balance face value.

(2) Balance includes $297 million (2021: $300 million) of loans and borrowings associated with Ruby Pipeline, L.L.C.. On March 31, 2022, Ruby Pipeline, L.L.C. voluntarily filed for relief under Chapter 11 of the U.S. Bankruptcy Code, refer to "Financing Activities for Equity Accounted Investees" section below for further details.

Financing Activities for Equity Accounted Investees