Form 6-K ONCOLYTICS BIOTECH INC For: Dec 31

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of May 2022

Commission File Number 001-38512

Oncolytics Biotech Inc.

(Translation of registrant’s name into English)

Suite 804, 322 11th Avenue SW

Calgary, Alberta, Canada T2R 0C5

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F þ | Form 40-F o | |||||||

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

| EXHIBIT NUMBER | DESCRIPTION | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Oncolytics Biotech Inc. (Registrant) | ||||||||||||||

| Date: May 17, 2022 | By: | /s/ Kirk Look Kirk Look Chief Financial Officer | ||||||||||||

NOTICE OF ANNUAL GENERAL MEETING

OF SHAREHOLDERS TO BE HELD ON JUNE 16, 2022

- AND -

MANAGEMENT INFORMATION CIRCULAR

April 29, 2022

April 29, 2022

Dear Shareholder:

Important Notice regarding Participation in the Annual Meeting of Shareholders on June 16, 2022

Oncolytics Biotech Inc. (“Oncolytics”) will be conducting its annual meeting (the “Meeting”) of shareholders scheduled for 4:00 p.m. (Toronto time) on June 16, 2022 in a virtual-only format via live audio webcast at https://virtual-meetings.tsxtrust.com/1330. While shareholders and duly appointed proxyholders will not be able to attend the Meeting in person, regardless of geographic location and ownership, they will have an equal opportunity to participate at the Meeting and vote on the matters considered at the Meeting. Detailed instructions about how to participate in the Meeting can be found in the accompanying Notice of Special Meeting of Shareholders and Management Information Circular in respect of the Meeting.

Our annual corporate update presentation and Q&A for institutional investors and analysts will follow the formal portion of the Meeting. The corporate update, beginning immediately following the Meeting at approximately 4:15 p.m. (Toronto time), may be accessed by dialing +1-888-231-8191 for callers in North America. Overseas callers should contact investor relations at Oncolytics for the toll-free dial information for their country. The live webcast of the call will be accessible on the Investor Relations page of Oncolytics’ website at www.oncolyticsbiotech.com and will be archived for three months.

Registered shareholders (who have not appointed a proxyholder) and duly appointed proxyholders (including non-registered shareholders who appoint themselves as proxyholders) will be able to virtually attend the Meeting, vote and ask questions, all in real-time, provided they are connected to the internet. Non-registered shareholders who have not properly appointed themselves as proxyholder will be able to attend the Meeting as guests, but will not be able to vote or ask questions at the Meeting. Non-registered shareholders who wish to vote and ask questions at the Meeting must appoint themselves as proxyholder and register with our transfer agent, TSX Trust Company as described under “How to Appoint and Register a Proxyholder,” in the accompanying Management Information Circular in respect of the Meeting.

We strongly encourage all shareholders, whether or not they plan on virtually attending the Meeting, to vote by completing and submitting their proxies or voting instruction forms, as applicable, well in advance of the Meeting. The deadline for voting or receiving proxies in relation to the Meeting is 4:00 p.m. (Toronto time) on June 14, 2022. Information on how to vote one’s shares by proxy is available in the accompanying Management Information Circular.

Sincerely yours,

(signed) Dr. Matthew C. Coffey,

President and Chief Executive Officer

TABLE OF CONTENTS

Page

| NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS | |||||

| MANAGEMENT INFORMATION CIRCULAR | |||||

| SOLICITATION OF PROXIES | |||||

| HOW TO VOTE YOUR COMMON SHARES | |||||

| HOW TO PARTICIPATE IN THE MEETING | |||||

| NOTICE TO SHAREHOLDERS IN THE UNITED STATES | |||||

| NOTICE-AND-ACCESS | |||||

| PERSONS MAKING THE SOLICITATION | |||||

| EXERCISE OF DISCRETION BY PROXY | |||||

| REVOCABILITY OF PROXY | |||||

| VOTING SHARES AND THE PRINCIPAL HOLDERS OF COMMON SHARES | |||||

| BUSINESS OF THE MEETING | |||||

| COMPENSATION DISCUSSION AND ANALYSIS | |||||

| DIRECTOR COMPENSATION | |||||

| EQUITY COMPENSATION PLAN INFORMATION | |||||

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | |||||

| TERMINATION AND CHANGE OF CONTROL BENEFITS | |||||

| PENSION PLAN BENEFITS | |||||

| INDEBTEDNESS OF DIRECTORS AND SENIOR OFFICERS | |||||

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | |||||

| INTERESTS OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON | |||||

| STATEMENT OF CORPORATE GOVERNANCE PRACTICES | |||||

| ADDITIONAL INFORMATION | |||||

SCHEDULE A MANDATE OF THE BOARD OF DIRECTORS | |||||

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an annual meeting (the “Meeting”) of the holders (“Shareholders”) of common shares of Oncolytics Biotech Inc. (the “Corporation”) will be held as follows:

When: Thursday, June 16, 2022 at 4:00 p.m. (Toronto time)

Where: Virtual-only meeting via live audio webcast online at https://virtual-meetings.tsxtrust.com/1330

Password: oncolytics2022 (case sensitive)

The Meeting will be held for the following purposes:

(a)to receive the audited financial statements of the Corporation for the year ended December 31, 2021, together with the auditors’ report thereon;

(b)to fix the number of directors of the Corporation for the ensuing year at six (6);

(c)to elect the directors of the Corporation for the ensuing year;

(d)to appoint auditors for the Corporation for the ensuing year and the authorization of the directors to fix their remuneration; and

(e)to transact such other business as may properly be brought before the Meeting or any adjournment or adjournments thereof.

Shareholders are referred to the accompanying management information circular dated April 29, 2022 (the “Circular”) for more detailed information with respect to the matters to be considered at the Meeting.

The Meeting is being conducted in a virtual-only format.

Registered Shareholders and duly appointed proxyholders will be able to virtually attend the Meeting, submit questions and vote in real time, provided they are connected to the internet and follow the instructions in the attached the Circular. Non-registered, or beneficial, Shareholders who have not duly appointed themselves as proxyholder will be able to virtually attend the Meeting as guests, but will not be able to vote at the Meeting.

Shareholders who wish to appoint a person other than the management nominees identified in the form of proxy or voting instruction form (including a beneficial Shareholder who wishes to appoint themselves to attend the Meeting) must carefully follow the instructions in the Circular and on their form of proxy or voting instruction form. These instructions include the additional step of registering such proxyholder with our transfer agent, TSX Trust Company (“TSX Trust”), after submitting the form of proxy or voting instruction form. If you wish that a person other than the management nominees identified on the form of proxy or voting instruction form attend and participate at the Meeting as your proxy and vote your common shares, you MUST register such proxyholder after having submitted your form of proxy or voting instruction form identifying such proxyholder. Failure to register the proxyholder with TSX Trust will result in the proxyholder not receiving a control number to participate in Meeting and only being able to attend as a guest. Guests will be able to listen to the Meeting but will not be able to vote.

DATED as of the 29th day of April, 2022.

| BY ORDER OF THE BOARD OF DIRECTORS | |||||

(signed) Dr. Matthew C. Coffey | |||||

| President and Chief Executive Officer | |||||

4

MANAGEMENT INFORMATION CIRCULAR

Except where indicated otherwise, the following information is dated as at April 29, 2022 and all dollar amounts are in Canadian dollars unless otherwise noted.

SOLICITATION OF PROXIES

This management information circular (the “Circular”) is supplied in connection with the solicitation of proxies by management of Oncolytics Biotech Inc. (“Oncolytics” or the “Corporation”) for use at the annual general meeting (the “Meeting”) of holders (“Shareholders”) of common shares (“Common Shares”) of the Corporation to be held on June 16, 2022 at 4:00 p.m. (Toronto time) for the purposes as described in the “Notice of Annual General Meeting of Shareholders” accompanying this Circular. The Meeting will be held as a virtual-only meeting. A virtual-only meeting format enfranchises and gives all of our Shareholders an equal opportunity to participate at the Meeting regardless of their geographic location or the particular constraints, circumstances or risks they may be facing as a result of COVID-19. See “How to Attend the Meeting” for further information on how you can virtually attend the Meeting.

HOW TO VOTE YOUR COMMON SHARES

Registered Shareholders

You are a Registered Shareholder if your name is recorded in the Corporation’s register of holders of Common Shares and you hold one or more share certificates which indicate your name and the number of Common Shares which you own.

Voting by Proxy

As a Registered Shareholder, you will receive a form of proxy from TSX Trust representing the Common Shares you hold. You may authorize the management representatives named on the enclosed form of proxy to vote your Common Shares. If you choose this option, you can give your voting instructions in any of the following ways:

Internet:

Go to www.tsxtrust.com/vote-proxy and follow the instructions. You will need to refer the Control

Number printed on your proxy voting form.

Mail:

Complete and return your proxy voting form in the envelope provided in your mailing package and

mail to:

TSX Trust Company

Proxy Department

P.O. Box 721

Agincourt, Ontario M1S 0A1

Telephone:

Call the toll-free number on the enclosed proxy form using a touchtone telephone and follow the voice instructions. Please have your Control Number ready to give your voting instructions on the telephone. This number is located on the bottom left of the enclosed proxy form. If your proxy form does not contain a Control Number, you will not be able to vote by telephone.

5

Email:

Scan both sides of your completed proxy form and send to email address:

www.proxyvote@tmx.com

Facsimile:

Complete your proxy form and fax both sides of the completed proxy form to TSX Trust

at (416) 368-2502 or toll-free from Canada or the United States at 1-866-781-3111.

You may also appoint another person to participate in the Meeting as proxyholder on your behalf and vote your Common Shares. If you choose this option, you must strike out the preprinted names and print that person’s name in the blank space provided on the back of the enclosed form of proxy, you may indicate how you want your Common Shares voted, and YOU MUST contact TSX Trust by going to TSX Trust’s website to complete and submit the electronic form at https://www.tsxtrust.com/control-number-request or by calling (866) 751-6315 (in North America) or (212) 235-5754 (outside North America)) no later than 4:00 p.m. (Toronto time) on June 14, 2022 and provide TSX Trust with the required information for your appointee so that TSX Trust may provide the appointee with a Control Number. This Control Number will allow your appointee to log in to and vote at the Meeting. Without a Control Number your proxyholder will only be able to log in to the Meeting as a guest and will not be able to vote. You may also appoint a second person to be your alternate proxyholder. Neither your proxyholder nor alternate proxyholder need be a Shareholder. The person you appoint must participate in the Meeting and vote on your behalf in order for your votes to be counted.

Unless you intend to participate in the Meeting and vote at the Meeting (see “How to Vote your Common Shares - Registered Shareholders - Voting at the Meeting” below), please remember that your proxy or voting instructions must be received no later than 4:00 p.m. (Toronto Time) on June 14, 2022.

Voting at the Meeting

If you are a Registered Shareholder and wish to vote at the Meeting, you do not need to complete or return your form of proxy. Registered Shareholders and their duly appointed proxyholders may vote at the Meeting by completing a ballot online during the Meeting, as further described below under “How to Participate in the Meeting”.

If you vote at the Meeting and had previously completed and returned your form of proxy, your proxy will be automatically revoked and any votes you cast in person on a poll at the Meeting will count.

Beneficial Shareholders

You are a Beneficial Shareholder if a nominee (i.e. your securities broker, clearing agency, financial institution, trustee or custodian or other intermediary) holds your Common Shares for you, or for someone else on your behalf.

Voting by Proxy

Your nominee may have sent to you the Notice of Meeting, including a voting instruction form or a blank proxy form signed by the nominee. You may provide your voting instructions by filling in the appropriate boxes. Please follow your nominee’s instructions for signing and returning the applicable materials. Sometimes you may be allowed to give your instructions by Internet or telephone.

If you are a Beneficial Shareholder and you did not receive a form of proxy or voting instruction form with a Control Number please contact your nominee.

6

Unless you intend to participate in the Meeting and vote at the Meeting (see “How to Vote your Common Shares - Beneficial Shareholders - Voting at the Meeting” below), please remember that your proxy or voting instructions must be received no later than 4:00 p.m. (Toronto Time) on June 14, 2022.

Voting at the Meeting

Only Registered Shareholders and their duly appointed proxyholders will be entitled to vote at the Meeting. Beneficial Shareholders who have not duly appointed themselves as proxyholder will not be able to vote at the Meeting but will be able to participate as guests. This is because the Corporation and our Transfer Agent, TSX Trust, do not have a record of the Beneficial Shareholders, and, as a result, will have no knowledge of their shareholdings or entitlement to vote unless they appoint themselves as proxyholder.

If you are a Beneficial Shareholder and wish to vote at the Meeting, you can request your nominee to appoint you as its proxyholder. Insert your own name as proxyholder on the voting instruction form or proxy form you received from your nominee and then follow your nominee’s instructions. YOU MUST contact TSX Trust by going to TSX Trust’s website at to complete and submit the electronic form or by 1-866-751-6315 (toll-free in North America) or 1-212-235-5754 (outside North America) by 4:00 p.m. (Toronto time) on June 14, 2022 (or, if the Meeting is adjourned or postponed, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time and date of the adjourned or postponed meeting), and provide TSX Trust with the required information for your chosen proxyholder so that TSX Trust may provide your proxyholder with a control number via email. This control number will allow your proxyholder to log in and vote at the meeting, by visiting https://virtual-meetings.tsxtrust.com/1330 and using meeting password oncolytics2022 (case sensitive). Without a control number your proxyholder will only be able to log in to the Meeting as a guest.

HOW TO PARTICIPATE IN THE MEETING

The Corporation is holding the Meeting in a virtual-only format, which will be conducted via live webcast. Shareholders will not be able to physically attend the Meeting in person.

Participating in the Meeting online enables Registered Shareholders and duly appointed proxyholders, including Beneficial Shareholders who have duly appointed themselves as proxyholder, to listen to the Meeting and to submit questions. Registered Shareholders and duly appointed proxyholders can also vote at the appropriate times during the Meeting.

Guests, including Beneficial Shareholders who have not duly appointed themselves as proxyholder, can log in to the Meeting as set out below. Guests can listen to the Meeting but are not able to vote.

Step 1: Log in online at https://virtual-meetings.tsxtrust.com/1330. We recommend that you log in at least one hour before the Meeting starts.

Step 2: Follow these instructions:

Registered Shareholders: Click “I have a control number” and then enter your control number and password oncolytics2022 (case sensitive). The control number located on the form of proxy or in the email notification you received from TSX is your control number. If you use your control number to log in to the Meeting, any vote you cast at the Meeting will revoke any proxy you previously submitted. If you do not wish revoke a previously submitted proxy, you should not vote during the Meeting.

Duly appointed proxyholders: Click “I have a control number” and then enter your control number and password oncolytics2022 (case sensitive). Proxyholders who have

7

been duly appointed and registered with TSX as described in this Circular will receive a control number by email from TSX after the proxy voting deadline has passed.

Guests (including Beneficial Shareholders who have not duly appointed themselves as proxyholder): Click “Guest” and then complete the online form.

If you attend the Meeting online, it is important that you are connected to the internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure connectivity for the duration of the Meeting. You should allow ample time to check into the Meeting online and complete the related procedure.

NOTICE TO SHAREHOLDERS IN THE UNITED STATES

Our solicitation of proxies is not subject to the requirements of Section 14(a) of the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), by virtue of an exemption applicable to proxy solicitations by “foreign private issuers” as defined in Rule 3b-4 under the U.S. Exchange Act. Accordingly, this Circular has been prepared in accordance with the applicable disclosure requirements in Canada. Residents of the U.S. should be aware that requirements are different than those of the U.S. applicable to proxy statements under the U.S. Exchange Act.

It may be difficult for you to enforce your rights and any claim you may have arising under U.S. federal securities laws, since we are located outside the U.S., and certain of the Corporation’s officers and directors are residents of a country other than the U.S. You may not be able to sue or effect service of process upon a non-U.S. entity or its officers or directors in a non-U.S. court for violations of U.S. securities laws. It may be difficult to compel a non-U.S. entity and its affiliates to subject themselves to a U.S. court’s judgment or to enforce a judgment obtained from a U.S. court against the Corporation.

NOTICE-AND-ACCESS

We have elected to use the notice-and-access provisions under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (the “Notice-and-Access Provisions”) for the Meeting in respect of mailings to beneficial Shareholders but not in respect of mailings to registered holders of our Common Shares (i.e. a Shareholder whose name appears on our records). The Notice-and-Access Provisions are a set of rules developed by the Canadian Securities Administrators that reduce the volume of materials which are mailed to shareholders by allowing a reporting issuer to post online an information circular in respect of a meeting of its shareholders and related materials.

We will be delivering proxy-related materials to non-objecting beneficial Shareholders directly with the assistance of Broadridge. We intend to pay for intermediaries to deliver proxy-related materials to objecting beneficial Shareholders.

A paper copy of the financial information in respect of our most recently completed financial year was mailed to those registered and beneficial Shareholders who previously requested to receive information.

PERSONS MAKING THE SOLICITATION

The solicitation is made on behalf of management of Oncolytics. The costs incurred in the preparation and mailing of this Circular and related materials will be borne by Oncolytics. In addition to solicitation by mail, proxies may be solicited by personal meetings, telephone or other means of communication and by directors, officers and employees of Oncolytics, who will not be specifically compensated for any such activity.

8

EXERCISE OF DISCRETION BY PROXY

The persons named in the form of proxy will vote the Common Shares in respect of which they are appointed in accordance with the direction of the Shareholders appointing them. In the absence of such direction, such Common Shares will be voted:

•FOR fixing the number of directors of the Corporation for the ensuing year at six (6);

•FOR the election of the directors referred to in this Circular; and

•FOR the appointment of EY LLP as the Corporation’s auditors to hold office until the next annual meeting of the Corporation with its remuneration to be fixed by the Board.

The form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice and with respect to other matters which may properly come before the Meeting. At the time of printing of this Circular, management knows of no such amendments, variations or other matters to come before the Meeting. However, if any other matters that are not now known to management should properly come before the Meeting, the proxy will be voted on such matters in accordance with the best judgment of the named proxyholders.

REVOCABILITY OF PROXY

Submitted proxies may be revoked at any time prior to exercising it. If you have given a proxy and attend the Meeting at which the proxy is to be used in person, you may revoke the proxy and vote in person instead. In addition to revocation in any other manner permitted by law, a proxy may be revoked by an instrument in writing executed by yourself (or your attorney authorized in writing) or, in the case of a Shareholder being a corporation, under the corporate seal or by a duly authorized officer or attorney. The proxy can be deposited either at the registered office of Oncolytics, being McCarthy Tétrault LLP, 4000, 421 – 7th Avenue S.W., Calgary, Alberta, T2P 4K9, Attention: Michael Bennett, at any time up to and including the last business day preceding the day of the Meeting at which the proxy is to be used, or with the chair of the Meeting on the day of the Meeting, at which point the proxy is revoked.

VOTING SHARES AND THE PRINCIPAL HOLDERS OF COMMON SHARES

Voting of Common Shares - General

The record date for the purpose of determining holders of Common Shares is May 2, 2022 (the “Record Date”). Shareholders of record on that date are entitled to receive notice of and attend the Meeting and vote at the Meeting on the basis of one vote for each Common Share held, except to the extent that: a registered Shareholder has transferred the ownership of any Common Shares subsequent to the Record Date; and the transferee of those Common Shares produces properly endorsed share certificates, or otherwise establishes that he or she owns the Common Shares and demands, not later than the day that is ten calendar days before the Meeting or any adjournment thereof, that his or her name be included on the Shareholder list before the Meeting, in which case the transferee shall be entitled to vote his or her Common Shares at the Meeting.

The Corporation is authorized to issue an unlimited number of Common Shares. As at April 29, 2022, there are 57,634,432 Common Shares issued and outstanding. At the Meeting, upon a show of hands, every Shareholder present in person or represented by proxy and entitled to vote shall have one vote. On a poll or ballot, every Shareholder present in person or by proxy has one vote for each Common Share of which such Shareholder is the registered holder.

When any Common Share is held jointly by several persons, any one of them may vote at the Meeting in person or by proxy in respect of such Common Share, but if more than one of them are present at the Meeting in person or by proxy and such joint owners of the proxy so present disagree as to any vote to be cast, the joint owner present or represented whose name appears first in the register of Shareholders maintained by TSX Trust is entitled to cast such vote.

9

Quorum for the Meeting

At the Meeting, a quorum shall consist of two persons present in person holding or representing by proxy not less than 5% of the votes attached to all outstanding Common Shares. If a quorum is not present at the Meeting within one half hour after the time fixed for the holding of the Meeting, it shall stand adjourned to such day being not less than 21 days later and to such place and time as may be determined by the Chairman of the Meeting. At such Meeting, the Shareholders present either in person or by proxy shall form a quorum.

Principal Holders of Common Shares

To the knowledge of the directors and executive officers of the Corporation, as at the date hereof, no persons or companies beneficially own, directly or indirectly, or exercise control or direction over, shares that carry more than 10% of the voting rights attached to the issued Common Shares.

BUSINESS OF THE MEETING

Item 1 - Consolidated Financial Statements and Auditors’ Report

The audited financial statements for the financial year ended December 31, 2021 of the Corporation together with the auditors’ report thereon have been delivered to the Shareholders. No formal action will be taken at the Meeting to approve the financial statements. If any Shareholder has questions respecting the December 31, 2021 financial statements, the questions may be brought forward at the Meeting.

Item 2 - Fixing the Number of Directors of the Corporation

The articles of the Corporation provide for a minimum of 3 directors and a maximum of 11 directors. There are currently six (6) directors. At the Meeting, Shareholders will vote, by ordinary resolution, to fix the number of directors of the Corporation at six (6). Approval of the ordinary resolution in respect of this matter requires the affirmative vote of a majority of the votes cast in respect thereof by the holders of Common Shares represented at the Meeting. It is the intention of the persons named in the accompanying form of proxy, if not expressly directed to the contrary in such form of proxy, to vote such proxies FOR the ordinary resolution to fix the number of directors at six (6).

Item 3 - Election of Directors

At the Meeting, six (6) directors are to be elected. If, prior to the Meeting, any vacancies occur in the slate of proposed nominees herein submitted, the persons named in the accompanying form of proxy intend to vote FOR the election of any substitute nominee or nominees recommended by management of the Corporation and FOR the remaining proposed nominees.

The term of office for each director of the Corporation is from the date of the Shareholders’ meeting at which he or she is elected until the next annual meeting of the Shareholders or until his or her successor is elected or appointed.

All of the nominees, other than James Parsons, are now members of the Board and have been since the dates indicated below. This is the first time Mr. Parsons has stood for nomination as a director of the Corporation. Mr. Kruimer, currently a director of the Corporation, will not be standing for re-election as a director at the Meeting. The term of each current director’s appointment will expire at the Meeting. It is the intention of the persons named in the accompanying form of proxy, if not expressly directed to the contrary in such form of proxy, to vote such proxies FOR the election of each of the nominees specified below as directors of the Corporation. Management of the Corporation does not contemplate that any of the nominees will be unable to serve as a director, but if that should occur for any reason at or prior to the Meeting, the persons named in the accompanying form of proxy reserve the right to vote for another nominee in their discretion.

10

The following table sets forth for all persons nominated by management for election as directors, their province/state and country of residence, the positions and offices with the Corporation now held by them, their present principal occupation and principal occupation for the preceding five years, the periods during which they have served as directors of the Corporation and the number of Common Shares of the Corporation beneficially owned, directly or indirectly, by each of them, or over which they exercise control or direction as of April 29, 2022.

| Name, Municipality of Residence and Date Appointed a Director | Present Principal Occupation and Principal Occupation for Preceding Five Years | Number of Common Shares beneficially owned and controlled(1) | ||||||

Deborah M. Brown, MBA, ICD.D(2)(3)(5) Ontario, Canada Director since November 2, 2017 | Ms. Brown leads Canadian Strategic Partnerships at Eversana, a leading provider of global commercial services to the life sciences industry. She held progressively senior roles at EMD Serono from 2000 to 2014, including Executive Vice President of Neuroimmunology for the company's U.S. operations, and President and Managing Director of the company's Canadian operations. In 2012, Ms. Brown was Chair of the National Pharmaceutical Organization (now Innovative Medicines Canada) and served on its Board of Directors from 2007 to 2014. She currently sits on the Boards of the HBSPCA, Oncolytics Biotech Inc, and Sernova Corp. Ms. Brown holds an MBA from Western University’s School of Business, an Hons B.Sc. from the University of Guelph, and has completed the Institute of Corporate Directors Designation (ICD.D). | 48,948 | ||||||

Matthew C. Coffey, Ph.D., MBA Alberta, Canada Director since May 11, 2011 | A co-founder of the Corporation, Dr. Coffey completed his doctorate degree in oncology at the University of Calgary with a focus on the oncolytic capabilities of the reovirus. The results of his research have been published in various respected scientific journals, including Science, Human Gene Therapy, and The EMBO Journal. Dr. Coffey took over as Chief Executive Officer in late 2016, prior to which he was Chief Operating Officer since December 2008. Since cofounding Oncolytics he has also held the positions of Chief Scientific Officer from December 2004 to December 2008, Vice-President of Product Development from July 1999 to December 2004 and Chief Financial Officer from September 1999 to May 2000. | 82,659 | ||||||

Angela Holtham,(2)(3) MBA, FCPA, FCMA, ICD.D Ontario, Canada Director since June 18, 2014 | Ms. Holtham held a number of financial positions over a 19-year career with the Canadian subsidiary of Nabisco Inc., rising to become Senior Vice President and Chief Financial Officer. In 2002, she joined Toronto, Ontario-based Hospital for Sick Children as Vice President, Finance and Chief Financial Officer, a position she held for eight years. Through her career she has participated in myriad initiatives ranging from traditional finance functions and operations oversight to intellectual property portfolio management and mergers and acquisitions. In more recent years she has held numerous governance roles on various Boards in both the publicly traded and not-for-profit sectors and held short term contract positions. Ms. Holtham is an FCPA, FCMA, holds an MBA from the University of Toronto - Rotman School of Management and has completed the Institute of Corporate Directors Designation (ICD.D). | 127,238 | ||||||

James T. Parsons Ontario, Canada Nominee | Life sciences industry consultant and director. Mr. Parsons was the Chief Financial Officer of Trillium Therapeutics Inc. (TSX / NASDAQ:TRIL) from August 2011 until its acquisition by Pfizer in November 2021. Mr. Parsons has been a director of Sernova Corp. (TSX: SVA) since 2012 and DiaMedica Therapeutics Inc.(NASDAQ:DMAC) since 2015. | Nil | ||||||

11

| Name, Municipality of Residence and Date Appointed a Director | Present Principal Occupation and Principal Occupation for Preceding Five Years | Number of Common Shares beneficially owned and controlled(1) | ||||||

Wayne Pisano, MBA(4)(5) Pennsylvania, U.S. Director since May 9, 2013 | Mr. Pisano has served as a Director/Chairman of several publicly traded companies in the US and Canada and has more than 30 years of experience as a pharmaceutical industry executive. He served as the president and CEO of VaxInnate, a privately held biotech company from January 2012 to November 2016. Mr. Pisano is the former president and CEO of Sanofi Pasteur, one of the largest vaccine companies in the world. He joined Sanofi Pasteur in 1997, assuming increasing levels of responsibility. He was promoted to President and CEO in 2007, the position he successfully held until his retirement in 2011. Prior to joining Sanofi Pasteur, he spent 11 years with Novartis (formerly Sandoz). He has a bachelor's degree in biology from St. John Fisher College, New York and an MBA from the University of Dayton, Ohio. | 189,941 | ||||||

Bernd R. Seizinger, M.D., Ph.D.(3)(6) New Jersey, U.S. and Munich, Germany Director since June 8, 2015 | Dr. Seizinger has been board member/chairman in multiple public and private biotech companies in the US and Europe. From 1998 to 2009, he served as President and Chief Executive Officer of GPC Biotech. He also served as Vice President of Oncology Drug Discovery and, in parallel, Vice President of Corporate and Academic Alliances at Bristol-Myers Squibb. Prior to his appointments in the biotechnology and pharmaceuticals sectors, Dr. Seizinger held professorships and senior staff appointments at Harvard Medical School, Princeton University and Massachusetts General Hospital. | 264,863 | ||||||

Notes:

(1)The information as to the number of Common Shares beneficially owned, not being within the knowledge of the Corporation, has been furnished by the respective nominees.

(2)Member of the Audit Committee. Ms. Holtham is Chair of this Committee.

(3)Member of the Compensation Committee. Ms. Brown is Chair of this Committee.

(4)Mr. Pisano, as Chair of the Board, serves as an ex-officio member of the Compensation, Audit and Science & Development Committees.

(5)Member of the Governance Committee. Mr. Pisano is Chair of this Committee.

(6)Member of the Science & Development Committee. Dr. Seizinger is the Chair of this Committee.

Majority Voting Policy

The Board has adopted a Majority Voting Policy which relates to the election of directors. This policy requires that any nominee for director who, on a ballot taken on the election of directors, has a greater number of votes withheld from voting than the number of votes received for his or her election shall tender his or her resignation to the Chair and to the President, subject to acceptance by the Board. The policy does not apply in circumstances involving contested director elections. The Board is required to consider the resignation, having regard to the best interests of the Corporation and all factors considered relevant and to: accept the resignation; maintain the director but address what the Board believes to be the underlying cause of the withhold votes; or reject the resignation. The Board is required to make its decision and announce it in a press release within 90 days of the annual meeting, including, if applicable, the reasons for rejecting a resignation offer. A director who is required to tender a resignation under the policy will not participate in the deliberations of the Board with respect to his or her resignation unless there are fewer than three directors who are not required to tender a resignation, in which event the entire Board will proceed in making the determination. To the extent that the Board accepts one or more director resignations, the Board will also determine whether to fill any vacancy prior to the next meeting of the shareholders.

Corporate Cease Trade Orders or Bankruptcies

None of the above proposed directors are, or within 10 years prior to the date of this Circular have been, a director, chief executive officer or chief financial officer of any company that, while such person was acting in that capacity, was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant issuer access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days.

12

None of the above proposed directors are, or within 10 years prior to the date of this Circular have been, a director, chief executive officer or chief financial officer of any company that was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant issuer access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.

Other than as described below, none of the above proposed directors are, or within 10 years prior to the date of this Circular have been, a director or executive officer of any company that, while acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

Mr. Seizinger was a non-executive independent director of Opsona Therapeutics Ltd., a private company formed under the laws of Ireland, which filed for a creditors’ voluntary liquidation under applicable Irish law in December 2018.

Personal Bankruptcies

None of the above proposed directors have, within 10 years prior to the date of this Circular, become bankrupt, made a proposal under any bankruptcy or insolvency legislation, been subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold their assets.

Penalties and Sanctions

None of the above proposed directors have been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or have entered into a settlement agreement with a securities regulatory authority, or any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for the proposed director.

Item 4 - Appointment and Remuneration of the Auditors

The Corporation has requested that EY LLP, Chartered Accountants of Calgary, Alberta act as independent auditors for the Corporation subject to Shareholder approval. It is the intention of the persons named in the accompanying form of proxy, if not expressly directed to the contrary in such form of proxy, to vote such proxies FOR the ordinary resolution to appoint the firm of EY LLP, Chartered Accountants, as auditors of the Corporation to hold office until the close of the next annual meeting of Shareholders or until the firm of EY LLP, Chartered Accountants is removed from office or resigns as provided by law or by the Corporation’s by-laws, and to authorize the directors of the Corporation to fix the remuneration of EY LLP, Chartered Accountants, as auditors of the Corporation.

13

COMPENSATION DISCUSSION AND ANALYSIS

The Corporation has formed a compensation committee (the “Compensation Committee”) which consists of four outside, independent directors, Dr. Seizinger, Ms. Holtham, Ms. Brown, and Mr. Pisano, the Chair of the Board. Ms. Brown is the Chair of the Compensation Committee. No member of the Compensation Committee has been an employee officer of the Corporation or any of its affiliates.

The objectives of the Corporation’s compensation arrangements are: to attract and retain key personnel; to encourage commitment to the Corporation and its goals; to align executive interests with those of its shareholders; and to reward executives for performance in relation to overall corporate progress goals.

The key elements of the compensation program are the base salary, health benefits, and payments allocated to employees to be directed by them to their personal retirement accounts. Bonuses and the granting of Options (as defined herein) and Share Awards (as defined herein) are also part of the Corporation’s compensation program and are based on corporate performance. Part of corporate performance includes goals and objectives that are determined based on the strategic planning and budgeting process, which is conducted at least annually. The elements of the compensation plan are intended to reward performance, and the various elements are intended to provide a blend of short-term and long-term incentives to align the interests of management and the Shareholders.

In arriving at its recommendations for compensation, the Compensation Committee considers the long-term interests of the Corporation as well as its current stage of development and the economic environment within which it operates. The market for biotechnology companies in the development phase is challenging. Based on these factors, the Compensation Committee recognized the need to strike a balance between compensation to retain employees and resources expended to maintain operations. In the past, the Compensation Committee has engaged specialist consultants to assist in benchmarking its compensation practices and provide recommendations to the committee with respect to compensation for directors and senior management.

Following a review of the risks in the Corporation’s compensation policies and practices, the Compensation Committee found no risks that are reasonably likely to have a material adverse effect on the Corporation. The Compensation Committee’s role of approving the compensation policies and practices includes considering whether the compensation policies and practices could encourage a Named Executive Officer (as defined below) to take inappropriate or excessive risks.

Under the Corporation’s corporate trading policy, insiders (including Named Executive Officers and directors) are not permitted to hedge their position in Common Shares, Options, Share Awards, deferred share units, performance share units, debentures or other debt instruments by use of any financial instrument, which would include but is not limited to options, puts, calls, warrants or short sells, designed to benefit the holder from a change in the market value of the Common Shares of the Corporation.

For 2021, the following guidelines were employed by the Board in granting bonuses, Options and Share Awards to the Corporation’s executive and senior officers.

Annual Bonus, Option Grants and Share Award Grants

The Chief Executive Officer of the Corporation is eligible for a cash bonus of up to 50% of his base salary, the Chief Financial Officer and Chief Medical Officer are eligible for a cash bonus of up to 40% of their respective base salary, the President, Oncolytics Biotech (U.S.) Inc. is eligible for a cash bonus of up to 35% of his base salary and the Vice President, Product Development is eligible for a cash bonus of up to 30% of her respective base salary. In addition, when available, the officers are eligible for a combination of Option and Share Award grants. The amount of each grant is determined and approved by the Board with the actual bonus provided and the number of Options and Share Awards granted based upon the overall performance of the Corporation as assessed by the Compensation Committee and approved by the Board. The overall performance of the Corporation is determined by the annual goals and objectives

14

approved by the Board and includes specific objectives with respect to the clinical, manufacturing, and intellectual property plans in combination with financial goals. Previous grants are taken into account when considering new grants of Options and Share Awards.

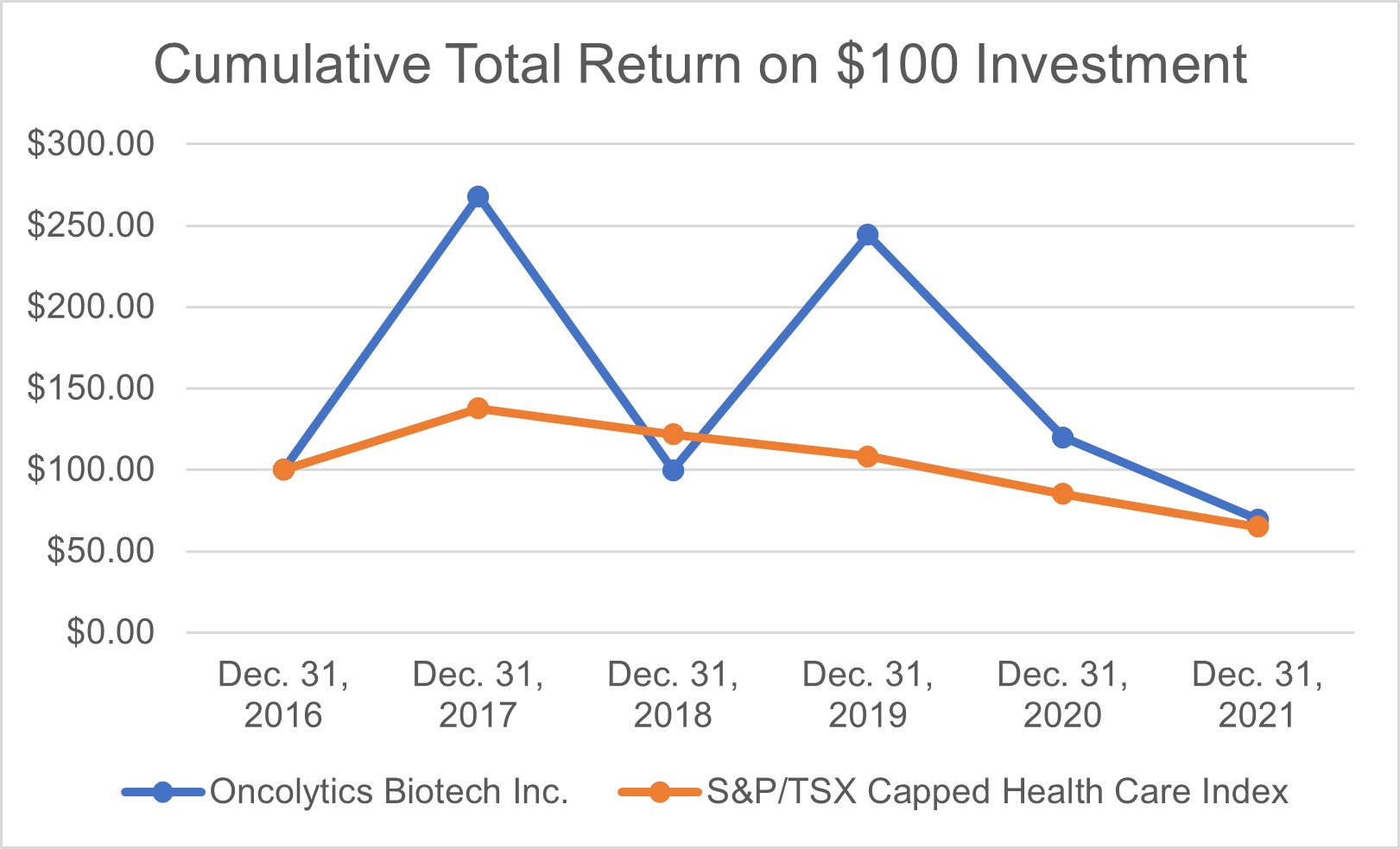

Performance Graph

The following graph and table compare the change in the cumulative total shareholder return on the Common Shares over the period from December 31, 2016 to December 31, 2021 (assuming a $100 investment was made on December 31, 2016) with the cumulative total return of the S&P/TSX Capped Health Care Index over the same period, assuming reinvestment of dividends.

As outlined in the compensation discussion and analysis, the Compensation Committee balances the various short-term and long-term objectives and provides bonuses and Options and Share Awards based on performance against these objectives. The movement in share price based upon one index is not considered wholly representative of the actions to be taken regarding compensation.

| Dec 31, 2016 | Dec 31, 2017 | Dec 31, 2018 | Dec 31, 2019 | Dec 31, 2020 | Dec 31, 2021 | |||||||||||||||

| S&P/TSX Capped Health Care Index | 100.00 | 267.92 | 99.70 | 244.29 | 119.96 | 69.51 | ||||||||||||||

| Oncolytics Biotech Inc. | 100.00 | 137.70 | 121.69 | 108.11 | 85.09 | 65.02 | ||||||||||||||

Compensation Governance

The Compensation Committee exercises general responsibility for the Corporation’s human resources and compensation policies and processes. Among other responsibilities, the Compensation Committee reviews and makes recommendations to the Board regarding the amount of regular and incentive compensation to be paid to the Chief Executive Officer and the amounts of regular and incentive compensation to be paid to certain designated executives after considering the Chief Executive Officer’s assessment of the performance of such executives.

Each member of the Compensation Committee is an independent director and is ineligible to participate in any of the Corporation’s executive officer compensation programs, other than the Stock Option Plan (as defined herein) and the Share Award Plan (as defined herein). Each member has extensive director and officer experience with various public and private companies in the design and implementation of executive compensation plans.

15

Compensation Advisors and Executive Compensation-Related Fees

The Compensation Committee, from time to time, engages external compensation advisors to assist in benchmarking its compensation practices and provide recommendations to the committee with respect to compensation for directors and officers. The Compensation Committee had retained Radford, An Aon Hewitt Corporation as a specialist consultant to assist with the benchmarking of officer and director compensation for 2021. The table below summarizes the fees billed by the specialist related to determining compensation for the Corporation’s directors and executives (“Executive Compensation Related Fees”) and the fees billed by the specialist related to other services (“All Other Fees”) for the financial years ended December 31, 2021 and 2020.

| Year ended | Executive Compensation-Related Fees $ | All Other Fees $ | ||||||

| December 31, 2021 | 34,473 | Nil | ||||||

| December 31, 2020 | 11,745(1) | Nil | ||||||

Note:

(1)Fees billed during the year-ended December 31, 2020 were in respect of the benchmarking of officer and director compensation for 2021.

Summary Compensation Table

The following table sets forth all compensation paid, payable, awarded, granted, given, or otherwise provided, directly or indirectly, by the Corporation, or a subsidiary of the Corporation, in Canadian dollars, to the individuals who were, at December 31, 2021, the Chief Executive Officer, the Chief Financial Officer and the next three most highly compensated executive officers whose total compensation was, individually, more than $150,000, and such other individuals as required under applicable securities laws (collectively, the “Named Executive Officers”) of the Corporation.

| Non-equity incentive plan compensation ($) | ||||||||||||||||||||||||||||||||

| Name and principal position | Year | Salary ($) | Share- based awards(1) ($) | Option- based Awards(1) ($) | Annual incentive plans ($) | Long-term incentive plans ($) | Pension value ($) | All other compensation(2) ($) | Total compensation ($) | |||||||||||||||||||||||

Dr. Matthew C. Coffey(3) | 2021 | 637,200 | N/A | 1,038,690 | 273,996 | N/A | N/A | 81,149 | 2,031,035 | |||||||||||||||||||||||

| President and Chief | 2020 | 540,750 | N/A | 631,970 | 243,000 | N/A | N/A | 73,657 | 1,489,377 | |||||||||||||||||||||||

| Executive Officer | 2019 | 525,000 | N/A | 157,239 | 212,625 | N/A | N/A | 69,813 | 964,677 | |||||||||||||||||||||||

| Kirk J. Look | 2021 | 473,800 | N/A | 425,741 | 162,987 | N/A | N/A | 67,669 | 1,130,197 | |||||||||||||||||||||||

| Chief Financial Officer | 2020 | 396,550 | N/A | 526,642 | 142,758 | N/A | N/A | 60,950 | 1,126,900 | |||||||||||||||||||||||

| 2019 | 385,000 | N/A | 112,314 | 124,740 | N/A | N/A | 59,013 | 681,067 | ||||||||||||||||||||||||

Dr. Thomas C. Heineman(4)(5) | 2021 | 519,798 | N/A | 346,592 | 134,108 | N/A | N/A | 42,940 | 1,043,438 | |||||||||||||||||||||||

| Chief Medical Officer | 2020 | 212,200 | N/A | 346,507 | 57,294 | N/A | N/A | 24,992 | 640,993 | |||||||||||||||||||||||

| 2019 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||

Andrew de Guttadauro(4) | 2021 | 409,373 | N/A | 267,443 | 123,221 | N/A | N/A | 26,342 | 826,379 | |||||||||||||||||||||||

| President, Oncolytics | 2020 | 381,960 | N/A | 421,314 | 85,941 | N/A | N/A | 14,247 | 903,462 | |||||||||||||||||||||||

| Biotech (U.S.) Inc. | 2019 | 377,886 | N/A | 89,851 | 76,522 | N/A | N/A | 13,646 | 557,905 | |||||||||||||||||||||||

| Allison Hagerman | 2021 | 380,500 | N/A | 176,987 | 98,169 | N/A | N/A | 59,221 | 714,877 | |||||||||||||||||||||||

| Vice President, | 2020 | 225,000 | N/A | 421,314 | 50,625 | N/A | N/A | 41,378 | 738,317 | |||||||||||||||||||||||

| Product Development | 2019 | 200,000 | N/A | 89,851 | 40,600 | N/A | N/A | 37,250 | 367,701 | |||||||||||||||||||||||

16

Notes:

(1)The value of share and option-based awards are based on the grant date assumptions as disclosed in note 10 "Share Based Payments" in the Corporation's 2021 audited consolidated financial statements.

(2)The dollar amounts set forth under this column are related to contributions to the officers' respective retirement savings plan and amounts provided for health care benefits by the Corporation.

(3)None of the compensation paid to Dr. Coffey related to his role as a director of the Corporation.

(4)U.S. Employees are paid salaries, bonuses and other compensation in U.S. Dollars. These amounts are presented in Canadian dollars and have been converted at a U.S./CDN exchange rate of $1.2678, $1.2732 and $1.2988 for the years 2021, 2020 and 2019, respectively.

(5)Dr. Heineman was appointed as the Global Head of Clinical Development and Operations of Oncolytics Biotech (U.S.) effective August 3, 2020. He was then promoted to Chief Medical Officer of Oncolytics Biotech (U.S.) effective December 21, 2021.

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth for each Named Executive Officer all option-based and share-based awards outstanding at December 31, 2021.

| Option-based Awards | Share-based Awards | ||||||||||||||||||||||

| Name | Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the-money options(1) ($) | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested(2) ($) | Market or payout value of vested share-based awards not paid out or distributed ($) | ||||||||||||||||

| Dr. Matthew | 133,389 | 7.41 | 8-Mar-22 | Nil | Nil | Nil | Nil | ||||||||||||||||

| C. Coffey | 13,157 | 40.00 | 17-Dec-22 | Nil | |||||||||||||||||||

| 150,000 | 3.44 | 19-Nov-23 | Nil | ||||||||||||||||||||

| 25,263 | 16.53 | 11-Dec-23 | Nil | ||||||||||||||||||||

| 175,000 | 1.45 | 13-Dec-23 | 52,500 | ||||||||||||||||||||

| 300,000 | 3.17 | 11-Dec-24 | Nil | ||||||||||||||||||||

| 77,263 | 3.99 | 1-Dec-25 | Nil | ||||||||||||||||||||

| 65,000 | 2.08 | 10-Dec-25 | Nil | ||||||||||||||||||||

| 420,000 | 3.40 | 8-Mar-26 | Nil | ||||||||||||||||||||

| 42,105 | 2.66 | 16-Jan-27 | Nil | ||||||||||||||||||||

| Kirk J. Look | 59,705 | 7.41 | 8-Mar-22 | Nil | Nil | Nil | Nil | ||||||||||||||||

| 21,052 | 19.00 | 13-Nov-22 | Nil | ||||||||||||||||||||

| 4,210 | 40.00 | 17-Dec-22 | Nil | ||||||||||||||||||||

| 53,000 | 3.44 | 19-Nov-23 | Nil | ||||||||||||||||||||

| 16,842 | 16.53 | 11-Dec-23 | Nil | ||||||||||||||||||||

| 125,000 | 1.45 | 13-Dec-23 | 37,500 | ||||||||||||||||||||

| 250,000 | 3.17 | 11-Dec-24 | Nil | ||||||||||||||||||||

| 48,842 | 3.99 | 1-Dec-25 | Nil | ||||||||||||||||||||

| 55,000 | 2.08 | 10-Dec-25 | Nil | ||||||||||||||||||||

| 155,000 | 3.40 | 8-Mar-26 | Nil | ||||||||||||||||||||

| 31,578 | 2.66 | 16-Jan-27 | Nil | ||||||||||||||||||||

| Andrew de | 14,736 | 7.41 | 8-Mar-22 | Nil | Nil | Nil | Nil | ||||||||||||||||

| Guttadauro | 100,000 | 1.45 | 13-Dec-23 | 30,000 | |||||||||||||||||||

| 30,000 | 2.73 | 14-Dec-23 | Nil | ||||||||||||||||||||

| 200,000 | 3.17 | 11-Dec-24 | Nil | ||||||||||||||||||||

| 55,000 | 2.08 | 10-Dec-25 | Nil | ||||||||||||||||||||

| 85,000 | 3.40 | 8-Mar-26 | Nil | ||||||||||||||||||||

| 13,157 | 4.94 | 3-Jul-27 | Nil | ||||||||||||||||||||

| Dr. Thomas | 100,000 | 3.17 | 11-Dec-24 | Nil | Nil | Nil | Nil | ||||||||||||||||

| Heineman | 70,000 | 2.84 | 1-Aug-25 | Nil | |||||||||||||||||||

| 55,000 | 2.08 | 10-Dec-25 | Nil | ||||||||||||||||||||

| 120,000 | 3.40 | 8-Mar-26 | Nil | ||||||||||||||||||||

| Allison | 10,526 | 7.41 | 8-Mar-22 | Nil | Nil | Nil | Nil | ||||||||||||||||

| Hagerman | 526 | 20.24 | 12-Dec-22 | Nil | |||||||||||||||||||

| 2,105 | 16.53 | 11-Dec-23 | Nil | ||||||||||||||||||||

| 80,000 | 1.45 | 13-Dec-23 | 24,000 | ||||||||||||||||||||

| 30,000 | 2.73 | 14-Dec-23 | Nil | ||||||||||||||||||||

| 2,421 | 6.84 | 11-Dec-24 | Nil | ||||||||||||||||||||

| 200,000 | 3.17 | 11-Dec-24 | Nil | ||||||||||||||||||||

17

| Option-based Awards | Share-based Awards | ||||||||||||||||||||||

| 5,263 | 3.90 | 9-Dec-25 | Nil | ||||||||||||||||||||

| 55,000 | 2.08 | 10-Dec-25 | Nil | ||||||||||||||||||||

| 45,000 | 3.40 | 8-Mar-26 | Nil | ||||||||||||||||||||

| 7,894 | 2.66 | 28-Dec-26 | Nil | ||||||||||||||||||||

Notes:

(1)These amounts are calculated based on the difference between the closing price of the securities underlying the Options on the Toronto Stock Exchange (“TSX”) on December 31, 2021 ($1.75), and the exercise price of the Options.

(2)These amounts are calculated based on the closing price of the Common Shares on the TSX on December 31, 2021 ($1.75).

Value Vested or Earned During the Year

The following table sets forth for each Named Executive Officer the value vested or earned on all option-based awards, share-based awards, and non-equity incentive plan compensation during the financial year ending December 31, 2021.

| Name | Option-based awards – Value vested during the year ($) | Share-based awards – Value vested during the year ($) | Non-equity incentive plan compensation – Value earned during the year ($) | ||||||||

| Dr. Matthew C. Coffey | 34,416 | Nil | Nil | ||||||||

| Kirk J. Look | 24,583 | Nil | Nil | ||||||||

| Dr. Thomas Heineman | Nil | Nil | Nil | ||||||||

| Andrew de Guttadauro | 19,666 | Nil | Nil | ||||||||

| Allison Hagerman | 19,666 | Nil | Nil | ||||||||

The following table sets forth information concerning options exercised by Named Executive Officers during the financial year ending December 31, 2021.

| Name | Type of security | Number of securities exercised | Exercise price per security $ | Date of exercise | Closing price per security on date of exercise $ | Total $ | ||||||||||||||

| Allison Hagerman | Option-based awards | 10,000 | 1.45 | Feb. 24, 2021 | 4.80 | 33,500 | ||||||||||||||

18

DIRECTOR COMPENSATION

Director Compensation Table

The following table details the compensation received by each director of the Corporation in 2021 who is not a salaried employee of the Corporation.

| Name | Fees Earned ($)(1) | Share-Based Awards ($)(2) | Option-Based Awards ($)(2) | Non-Equity Incentive Plan Compensation ($) | Pension Value ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||

| Deborah Brown | 76,068 | Nil | 67,842 | Nil | N/A | Nil | 143,910 | ||||||||||||||||

| Angela Holtham | 82,407 | Nil | 67,842 | Nil | N/A | Nil | 150,249 | ||||||||||||||||

Leonard Kruimer(3) | 69,727 | Nil | 67,842 | Nil | N/A | Nil | 137,571 | ||||||||||||||||

| Wayne Pisano | 101,424 | Nil | 84,803 | Nil | N/A | Nil | 186,227 | ||||||||||||||||

William Rice(4) | 34,865 | Nil | 67,842 | Nil | N/A | Nil | 102,707 | ||||||||||||||||

| Bernd Seizinger | 76,068 | Nil | 67,842 | Nil | N/A | Nil | 143,910 | ||||||||||||||||

Notes:

(1)Directors are paid fees in U.S. Dollars. These amounts are presented in Canadian dollars and have been converted at a U.S./CDN exchange rate of $1.2678.

(2)The value of share based and option-based awards are based on the grant date assumptions as disclosed in note 10 “Share-Based Compensation” in the Corporation’s 2021 audited consolidated financial statements.

(3)Mr. Kruimer is not standing for re-election as a director at the Meeting.

(4)Dr. Rice ceased to be a director effective June 30, 2021.

The Board has approved the following compensation structure for the independent directors.

Annual Retainer

Each director receives a base retainer of U.S.$40,000. In addition to the base retainer directors are eligible to receive the following additional fees depending on committee involvement:

Additional Retainers (U.S.$):

| Board chair | $40,000 | ||||

| Audit Committee chair | $20,000 | ||||

| Governance & Compensation Committee chair | $10,000 | ||||

| Science & Development Committee Chair | $15,000 | ||||

| Non-chair member of the Audit Committee | $10,000 | ||||

| Non-chair member of the Governance, Compensation or Science & Development Committee | $5,000 | ||||

In addition to the combined retainer, the Corporation will grant 30,000 Options annually for Directors other than the Chair, and 37,500 Options annual for the Chair. These Options vest in their entirety one year following the grant date.

The Corporation also reimburses the directors for any reasonable expenses incurred by them while acting in their directors’ capacity. During the year ended December 31, 2021, total compensation of $864,574 was paid to the independent directors which consisted of fee payments of $440,561 and Option-based awards of $424,013.

19

Outstanding Share-Based Awards and Option Based Awards

The following table sets forth for each director, other than Named Executive Officers who are directors, all option-based awards (comprised of Options granted under the Stock Option Plan) and share-based awards (comprised of RSAs granted under the Share Award Plan) outstanding at December 31, 2021.

| Option-based Awards | Share-based Awards | |||||||||||||||||||||||||

| Name | Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the-money options(1) ($) | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested(2) ($) | Market or payout value of vested share-based awards not paid out or distributed ($) | |||||||||||||||||||

| Deborah Brown | 5,263 | 5.42 | Nov 7, 2027 | Nil | Nil | Nil | Nil | |||||||||||||||||||

| 30,000 | 3.40 | Mar 8, 2026 | Nil | |||||||||||||||||||||||

| Angela Holtham | 5,263 | 13.87 | June 18, 2024 | Nil | Nil | Nil | 5,499 | |||||||||||||||||||

| 30,000 | 3.40 | Mar 8, 2026 | Nil | |||||||||||||||||||||||

Leonard Kruimer(3) | 50,000 | 0.54 | Oct 2, 2024 | 60,500 | Nil | Nil | 39,015 | |||||||||||||||||||

| 30,000 | 3.40 | Mar 8, 2026 | Nil | |||||||||||||||||||||||

| Wayne Pisano | 5,263 | 27.46 | May 9, 2023 | Nil | Nil | Nil | 11,965 | |||||||||||||||||||

| 3,157 | 16.53 | Dec 11, 2023 | Nil | |||||||||||||||||||||||

| 37,500 | 3.40 | Mar 8, 2026 | Nil | |||||||||||||||||||||||

| Bernd Seizinger | 5,263 | 7.60 | June 8, 2025 | Nil | Nil | Nil | 14,502 | |||||||||||||||||||

| 30,000 | 3.40 | Mar 8, 2026 | Nil | |||||||||||||||||||||||

Notes:

(1)These amounts are calculated based on the difference between the closing price of the Common Shares on the TSX on December 31, 2021 ($1.75), and the exercise price of the options.

(2)These amounts are calculated based on the closing price of the Common Shares on the TSX on December 31, 2021 ($1.75).

(3)Mr. Kruimer is not standing for re-election as a director at the Meeting.

Value Vested or Earned During the Year

The following table sets forth for each director the value vested on all option-based awards (comprised of Options granted under the Stock Option Plan), share-based awards (comprised of RSAs granted under the Share Award Plan), value earned on non-equity incentive plan compensation during the financial year and ending December 31, 2021.

| Name | Option-based awards - Value vested during the year ($) | Share-based awards - Value vested during the year ($) | Non-equity incentive plan compensation - Value earned during the year ($) | ||||||||

| Deborah Brown | Nil | 20,335 | Nil | ||||||||

| Angela Holtham | Nil | 45,405 | Nil | ||||||||

Leonard Kruimer(1) | Nil | Nil | Nil | ||||||||

| Wayne Pisano | Nil | 74,890 | Nil | ||||||||

| William Rice | Nil | 20,335 | Nil | ||||||||

| Bernd Seizinger | Nil | 86,465 | Nil | ||||||||

Note:

(1)Mr. Kruimer is not standing for re-election as a director at the Meeting.

20

EQUITY COMPENSATION PLAN INFORMATION

Stock Option Plan

The following is a summary of the Corporation’s Stock Option Plan dated effective as of May 4, 2017.

The Corporation, with the approval of its Shareholders, has established the Stock Option Plan. The number of Common Shares reserved for issuance under the Stock Option Plan and all other security based compensation arrangements of the Corporation (including the Share Award Plan) in aggregate shall not exceed 10% of the total number of issued and outstanding Common Shares from time to time. As of April 29, 2022, there were 5,097,672 Common Shares issuable pursuant to outstanding Options; nil Common Shares issuable pursuant to outstanding PSAs; and 22,294 Common Shares issuable pursuant to outstanding RSAs, collectively representing approximately 8.9% of the total number of Common Shares issued and outstanding. Accordingly, an aggregate of 643,477 Common Shares, being approximately 1.1% of the outstanding Common Shares are unallocated and available for future grants of Options as of April 29, 2022.

Under the Stock Option Plan, the Board of Directors or the Compensation Committee may from time to time designate directors, officers, employees of, or consultants to, the Corporation or any subsidiary of the Corporation (such persons being “Eligible Persons”) to whom Options may be granted and the number of Options to be granted to each.

Options may be exercised at a price (the “Exercise Price”) which shall be fixed by the Board at the time the Option is granted. No Option can be granted with an Exercise Price at a discount to the market, which shall be the closing price of the Common Shares on the stock exchange upon which the Common Shares are listed on the first day preceding the date of grant on which at least one board lot of Common Shares traded on such exchange.

If any Option shall be exercised or shall expire or terminate for any reason without having been exercised in full, any Common Shares to which such Option relates shall be available for the purposes of the granting of Options under the Stock Option Plan.

The number of Shares that may be acquired under an Option granted to a participant under the Stock Option Plan shall be determined by the Board as at the time the Option is granted, provided that the aggregate number of Shares reserved for issuance to any one participant under the Stock Option Plan or any other security based compensation arrangement of the Corporation, shall not exceed five percent (5%) of the total number of issued and outstanding Common Shares (calculated on a non-diluted basis).

Without obtaining the approval of Shareholders in accordance with the rules of the TSX or the requirements of any other stock exchange on which the Common Shares are then listed, no Options shall be granted pursuant to the Stock Option Plan, if such grant together with grants pursuant to all other share compensation arrangements of the Corporation, could result, at any time, in:

(i) a number of Common Shares issuable pursuant to Options granted to insiders exceeding ten percent (10%) of the number of outstanding Common Shares at any time;

(ii) the issuance within a one year period to insiders, of a number of Common Shares exceeding ten percent (10%) of the number of outstanding Common Shares; or

(iii) the issuance to any one insider and such insider’s associates, within a one year period, of a number of Common Shares exceeding five percent (5%) of the number of outstanding Common Shares.

The value of Option grants to each non-employee director shall not exceed $150,000 annually for any individual non-employee director (other than initial Option grants to new directors).

21

Options are generally granted for a term expiring on the tenth anniversary of the date of grant and typically either vest immediately or as to one-third on each of the first, second and third anniversary following the date of grant, as determined by the Board at the time the Option is granted. Options are not transferable or assignable except to the person or persons to whom the participant’s rights pass by the participant’s will or applicable law following the death or permanent disability of a participant. The Stock Option Plan provides that if the expiration date of an Option occurs during a “blackout period” or within five (5) business days after a blackout period, such expiration date shall be deemed to be extended to the date which is the tenth (10th) business day after the last day of the applicable blackout period.

Subject to any written agreement between the Corporation and a participant providing otherwise, if any participant shall cease to be an Eligible Person for any reason other than the termination for cause or the death or permanent disability of the participant, such participant’s Option will terminate immediately as to the then unvested portion thereof and at 5:00 p.m. (Calgary time) on the earlier of the date of the expiration of the applicable option period and the ninetieth (90th) day after the date such participant ceases to be an Eligible Person as to the then vested portion of the Option. If a participant ceases to be an Eligible Person as a result of the termination of such participant for cause, effective as of the date notice is given to the participant of such termination, all outstanding Options shall be terminated and all rights to receive Common Shares thereunder shall be forfeited by such participant, and the participant shall not be entitled to receive any Common Shares or other compensation in lieu thereof.

Subject to any written agreement between the Corporation and a participant providing otherwise, if in the event of the death or permanent disability of a participant, any Option previously granted to such participant shall be exercisable until the end of the applicable option period or until the expiration of 12 months after the date of death or permanent disability of such participant, whichever is earlier, and then only: (i) by the person or persons to whom the participant’s rights under the Option shall pass by the participant’s will or applicable law; (ii) to the extent that he or she was entitled to exercise the Option as at the date of the participant’s death or permanent disability.

Notwithstanding the foregoing, the Board may, at its sole discretion, extend the period during which any Options may be exercised, in the case of Options held by non-employee directors, by not more than one year, and in the case of Options held by other persons, by not more than three years, but in no case longer than the normal expiry of the Options.

In the event of a change of control of the Corporation (as such term is defined in the Stock Option Plan), all Options which have not otherwise vested in accordance with their terms shall immediately vest and be exercisable, notwithstanding the other terms of the Options or the Stock Option Plan for a period of time ending on the earlier of the expiry time of the Option and the ninetieth (90th) day following the change of control.

Subject to any required approval of the TSX and any other stock exchange on which the Common Shares are then listed, the Stock Option Plan and any Options granted thereunder may be amended, modified or terminated by the Board without approval of any participant or Shareholder (provided that no such amendment may be made that will materially prejudice the rights of any participant under any Option previously granted to the participant without consent by such participant). Such changes may include, without limitation:

(i) amending, modifying or terminating the Stock Option Plan with respect to all Common Shares in respect of Options which have not yet been granted thereunder;

(ii) making any amendment of a “housekeeping nature”;

(iii) changing the provisions relating to the manner of exercise of Options;

22

(iv) accelerating vesting or extending the expiration date of any Option (provided that such Option is not held by an insider), provided that the period during which an Option is exercisable does not exceed 10 years from the date the Option is granted;

(v) adding a cashless exercise feature, payable in cash or securities, whether or not providing for a full deduction of the number of underlying Common Shares from the Stock Option Plan reserve; and

(vi) making any addition to, deletion from or alteration of the provisions of the Stock Option Plan or any Option that are necessary to comply with applicable law, the rules of the TSX, or the requirements of any other exchange on which the Shares are then listed and to avoid unanticipated consequences deemed by the Board to be inconsistent with the purpose of the Stock Option Plan.

Notwithstanding the foregoing, Shareholder approval is required for any change to the Stock Option Plan or Options granted under it which:

(i)increases the number of Common Shares reserved for issuance under the Stock Option Plan;

(ii)extends eligibility to participate in the Stock Option Plan to persons other than Eligible Persons;

(iii)permits Options to be transferred, other than for normal estate settlement purposes or to an RRSP or similar plan;

(iv)permits awards other than Options to be made under the Stock Option Plan;

(v)extends the term of an Option beyond the maximum expiry date set out in the Stock Option Plan (except where an expiry date would have fallen within a blackout period;

(vi)reduces the exercise price of an Option, except for the purpose of maintaining Option value in connection with a conversion, change, reclassification, redivision, redesignation, subdivision or consolidation of shares or a reorganization, amalgamation, consolidation, merger, takeover bid or similar transaction involving the Corporation (for this purpose, cancellation or termination of an Option prior to its expiry date for the purpose of reissuing Options to the same Option-holder with a lower exercise price will be considered an amendment to reduce the exercise price of an Option);

(vii)changes the insider participation limitation at any time under the Stock Option Plan; or

(viii)amends the amending provision of the Stock Option Plan.

The Corporation’s annual burn rate under the Stock Option Plan was 3.42% for the year ending December 31, 2021, 4.51% for the year ending December 31, 2020 and 4.61% for the year ending December 31, 2019. For this purpose, the burn rate is calculated by dividing the total number of Options granted during the applicable fiscal year divided by the weighted average number of Common shares outstanding for the applicable fiscal year. The burn rate is subject to change, from time to time, based on the number of Options granted and the total number of Common Shares issued and outstanding.

Share Award Plan

The following is a summary of the Corporation’s Share Award Plan dated effective as of May 4, 2017.

The Corporation, with the approval of its Shareholders, has established the Share Award Plan. Under the Share Award Plan, the Board may, at such times and in such amounts as the Board may deem advisable in its sole and absolute discretion, issue PSAs to eligible employees, including officers, and RSAs to Eligible Persons. The number of Common Shares reserved for issuance under the Share Award Plan and all other security based compensation arrangements of the Corporation (including the Stock Option Plan) in aggregate shall not exceed 10% of the total number of issued and outstanding Common Shares from

23

time to time. As of April 29, 2022, there were 5,097,672 Common Shares issuable pursuant to outstanding Options; nil Common Shares issuable pursuant to outstanding PSAs; and 22,294 Common Shares issuable pursuant to outstanding RSAs, collectively representing approximately 8.9% of the total number of Common Shares issued and outstanding. Accordingly, an aggregate of 643,477 Common Shares, being approximately 1.1% of the outstanding Common Shares are unallocated and available for future grants of Share Awards as of April 29, 2022.

Subject to earlier vesting in accordance with the terms of the Share Award Plan and unless otherwise determined by the Board, Share Awards granted under the Share Award Plan vest on the third anniversary date of the date of grant. Upon vesting, each RSA is deemed to be redeemed for no further consideration for one Common Share (subject to adjustment for dividend equivalents) and each PSA is deemed to be redeemed for no further consideration for one Common Share (subject to adjustment for dividend equivalents) multiplied by the percentage (“Vesting Percentage”) of outstanding PSAs that will vest based upon the relative achievement of any performance-related measures or criteria as determined by the Board in its sole discretion, which may include the Corporation’s performance compared to identified operational or financial targets and the Corporation’s shareholder return.