Form 6-K NOMURA HOLDINGS INC For: May 11

Table of Contents

FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

Commission File Number: 1-15270

For the month of May 2022

NOMURA HOLDINGS, INC.

(Translation of registrant’s name into English)

13-1, Nihonbashi 1-chome

Chuo-ku, Tokyo 103-8645

Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Table of Contents

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NOMURA HOLDINGS, INC. | ||||||

| Date: May 11, 2022 | By: | /s/ Yoshifumi Kishida | ||||

| Yoshifumi Kishida | ||||||

| Senior Managing Director | ||||||

Table of Contents

[Translation of the Corporate Governance Report filed with the Tokyo Stock Exchange on May 10, 2022]

This document is a translation of the Japanese language original prepared solely for convenience of reference. In the event of any discrepancy between this translated document and the Japanese language original, the Japanese language original shall prevail.

| CORPORATE GOVERNANCE REPORT | Nomura Holdings, Inc. |

Last updated: May 10, 2022

Nomura Holdings, Inc.

Kentaro Okuda, Representative Executive Officer,

President and Group CEO

Contact: 81-3-5255-1000

Securities Code: 8604 (Tokyo Stock Exchange)

https://www.nomuraholdings.com/investor/

The status of the corporate governance of Nomura Holdings, Inc. (the “Company”) is as described below.

I Underlying Concept of Corporate Governance, Capital Structure, Corporate Attributes, and Other Fundamental Information

| • | 1. Underlying Concept |

The Company recognizes that enhancement of corporate governance is one of the most important issues in terms of achieving the management’s goal of enhancing corporate value by deepening society’s trust in the firm and increasing the satisfaction, beginning with clients, of stakeholders.

The Board of Directors, recognizing the perspectives of various stakeholders beginning with shareholders and clients, has established the “Nomura Holdings Corporate Governance Guidelines” (“the Guidelines”) with the aim of defining, and to contribute to realizing, a framework of effective corporate governance as a structure for transparent/fair and timely/decisive decision-making.

The full text of the Guidelines is available on the Company’s website.

https://www.nomuraholdings.com/company/cg/data/cg_guideline.pdf

[Reasons for Non-Compliance with the Principles of the Corporate Governance Code]

The Company has complied with all principles of the Corporate Governance Code.

[Disclosures in accordance with Each Principle of the Corporate Governance Code]

Disclosures in accordance with each principle of the Corporate Governance Code are as follows.

[Principle 1-4]

| (1) | Policy for Strategic Shareholdings |

Please refer to Article 26 “Basic Policy for Strategic Shareholdings” of the Guidelines.

| (2) | Assessment of the content of Strategic Shareholdings |

The Company, at the Strategic Shareholding Review Committee which is held once every half-year, on the basis of the Basic Holding Policy, by carrying out assessments of the purpose of the holding of strategic shareholdings and activities such as analyses and qualitative valuations of the returns in relation to required capital, examines factor such as the benefits and risks accompanying holdings.

In addition, the Board of Directors, concerning individual strategic shareholdings, will examine the content considered at the Strategic Shareholding Consideration Committee.

| (3) | Basic Policy regarding the Exercise of Voting Rights for Strategic Shareholdings |

Please refer to Article 27 “Basic Policy regarding the Exercise of Voting Rights for Strategic Shareholdings” of the Guidelines.

[Principle 1-7]

Please refer to Article 28 “Matters regarding Related-Party Transactions and Subsidiaries” of the Guidelines.

[Supplementary Principle 2-4-1]

[Approach to Ensure Diversity]

The Company established “Diversity and Inclusion Statement” for the purpose of promoting Nomura’s diversity management. Nomura Group, which operates its business globally, recognizes ensuring and enhancing the structure for human resource development is important, for each employee with various backgrounds/values such as nationality, ethnic origin, race, gender, age, religion, beliefs, social standing, gender preference, gender identity, disability or any other attribution, and career, to be able to utilize her/his capabilities, and have been promoting initiatives for this purpose. Nomura Group already has employees with diverse careers, backgrounds and values, as a result of these initiatives and appoints management positions by considering their abilities and performance, regardless of nationality or whether they are hired by mid-career (experienced) recruiting. Therefore, the Company does not intend to set specific targets in terms of promoting employees especially with these attributes in management. The Company will continue to respect the diversity of its employees and their different values, and make its efforts to builds a healthy work environment in which each and every employees can be successful in utilizing her or his capabilities.

1

Table of Contents

[Status of Voluntary and Measurable Goals for Ensuring Diversity, Approach to Human Resource Development, Internal Environmental Development, and Implementation Status to Ensure Diversity]

| (1) | Female employees |

The ratio of female managers in Nomura Group including overseas is 19% (FY2020/21), and in Japan, at Nomura Securities, as a major subsidiary, the ratio of female managers is 13% (as of April 1, 2021). In Japan, each group company sets its quantitative target and action plan as an action of plan for employers according to the Act on the Promotion of Female Participation and Career Advancement in the Workplace. Nomura Securities has set a quantitative target to have 20% of female representatives in managers, 10% in branch/department managers by 2025. In addition, the Company actively promotes initiatives to enrich the workplace for the female such as Pre- and Post-Natal Leave, Childcare Leave, Special Leave During and After Spouses’ or Partners’ Childbirth, the Work Location Change program for Area Type General Career employees and Leave for Spouse Overseas Transfers for the purpose of preventing turnover due to the life events.

| (2) | Overseas and mid-career employees |

The ratio of mid-career managers at Nomura Securities is over 27% (as of April 1, 2021). Among over 26,000 directors, officers, and employees, more than 10,000 individuals work in over 30 countries globally. In addition, in the overseas offices, the ratio of locally-hired managers (Managing Directors in the overseas offices) is over 90% (FY2020/21).

| (3) | Other matters |

For the information on the detailed of the Company’s initiatives, plan for human resource and internal environmental development, and status of ensuring diversity, please refer to “Others” in III.3. “Measures to Ensure Due Respect for the Stakeholders’ Standpoint” of this Report, “Diversity and Inclusion” and “ESG Data” on the Company’s website.

“Diversity and Inclusion”: https://www.nomuraholdings.com/sustainability/employee/di.html

“ESG Data”: https://www.nomuraholdings.com/sustainability/data/index.html

[Principle 2-6]

For the Company’s corporate pension fund, in order to realize payments such as the certain payment of pension benefits over the future and to realize investment management that makes the interests of participants/beneficiaries top priority, operations will be carried out by assigning qualified persons. Also for the selection of asset managers, it has been decided that selections constrained by the business relationship with the pension fund manager will not be carried out, and the policy is to take into consideration factors such as aspects of the Stewardship Code, such as the status of responses and initiatives, and policy in relation to ESG, as necessary. On the basis of these kinds of policies, monitoring of activities including the stewardship activities of asset managers will be implemented and initiatives will be undertaken to make sure that the corporate pension fund’s perform their roles as asset owners.

[Principle 3-1]

These items have been disclosed as follows.

| (1) | Management Philosophy and Management Strategies and Management Plans |

Management Philosophy: Please refer to the “Nomura Group Corporate Philosophy,” “Our Founder’s Principles,” and the “Nomura Group Code of Conduct” on the Company’s website.

https://www.nomuraholdings.com/company/basic/

Management Strategies and Management Plans: Please refer to the materials on the Company’s website “Presentations”

https://www.nomuraholdings.com/investor/presentation/

| (2) | Underlying Concept of Corporate Governance and Basic Policies |

Please refer to the Guidelines.

| (3) | Policies and Procedures to determine Compensation for Senior Executives and Directors |

Please refer to II.1. “Remuneration of Directors and Executive Officers” of this Report.

The Company does not provide business-performance-based bonuses to Outside Directors. Further, the Company abolished retirement bonuses in 2001.

| (4) | Policies and Procedures to appoint/dismiss the senior management and nominate the directors candidates |

Please refer to Article 2 “Role of the Board of Directors,” Article 9 “Role and Composition of the Nomination Committee,” and Article 10 “Appointment/Dismissal of Officers such as the Group CEO and Succession Plan.”

| (5) | Explanations with respect to Individual Appointments/Dismissals and Nominations in the Appointment/Dismissal of the Senior Management and Nomination of Director Candidates |

For explanations for nominating director nominees including Directors concurrently serving as Representative Executive Officers, please refer to the “Reference Materials for the General Meeting of Shareholders” in the Notice of Convocation of the Annual General Meeting of Shareholders.

https://www.nomuraholdings.com/investor/shm/

2

Table of Contents

[Supplementary Principle 3-1-3]

| (1) | Initiatives Towards Sustainability |

At the Company, the Board of Directors has adopted the Guidelines, which set forth the Company’s basic sustainability policies. Further, deliberate and decide on basic sustainability policies and important strategies and plans, the Company has established the “Sustainability Committee” which the Group CEO chairs. The Sustainability Committee has, based on the opinions of the Board of Directors, established the Sustainability Statement, which sets forth the direction of our company’s sustainability activities and policies for responding to environmental and social risks. For the basic sustainability policies and initiatives, please refer to the Guidelines and materials on the Company’s website “Sustainability”.

https://www.nomuraholdings.com/sustainability/

| (2) | Investments in human capital and intellectual property, etc |

With regard to investments in human capital, Nomura Group considers human resources to be the source of its sustainable growth, and in order to realize the Company’s management vision, the Company are implementing a variety of initiatives, including recruitment, human resource development, and evaluation. For example, the Company is promoting digitization of training using IT as part of its efforts to strengthen group-wide knowledge management. The Company is also making further efforts to develop leaders by expanding the scope of employees. We have also introduced Digital IQ, an e-learning program for all global/group employees, as part of our efforts to develop digital human resources. In the highly competitive hiring environment for human resources such as talents for digital transformation, the Company is raising the level of its hiring activities and strengthening mid-career (experienced) hiring. For other matters, please refer to the materials on the Company’s website “Presentations”

| (3) | Information disclosure based on TCFD |

Please refer to the “Nomura TCFD Report” on the Company’s website “Annual Reports and SEC Filings”.

https://www.nomuraholdings.com/investor/library/index.html

[Supplementary Principle 4-1-1]

At the Company, the decision making authority for all matters, except for matters which must be referred to the Board of Directors, are delegated to the Executive Officers. For the reference matters of the Board of Directors, please refer to Article 10 of the Regulations of the Board of Directors.

https://www.nomuraholdings.com/company/cg/regulations.html

[Principle 4-9]

Please refer to II.1. “Matters relating to Independent Directors” in this Report.

[Supplementary Principle 4-11-1]

Please refer to Article 3 “Composition of the Board of Directors” of the Guidelines.

The Company’s Board of Directors, to carry out active discussions from various points of view, is made up of members with expertise in areas such as corporate management, international business, financial industry, placing outside directors who are experts in accounting/finance, legal systems/regulations, internal control including risk management, blockchain technology and who are diverse in terms of factors such as nationality, gender, and background. Specifically, the Board of Directors is made up of 12 directors, eight of whom are Outside Directors. Out of these members, four persons are non-Japanese directors and three persons are female directors.

[Supplementary Principle 4-11-2]

For concurrent positions held by directors, please refer to the “Reference Materials for the General Meeting of Shareholders” in the Notice of Convocation of the Annual General Meeting of Shareholders.

https://www.nomuraholdings.com/investor/shm/

[Supplementary Principle 4-11-3]

Please refer to Article 6 “Self-Evaluation” of the Guidelines. Further, the summary of the results of the analysis and evaluation of the effectiveness of the Board for the fiscal year ended March 31, 2022 are as follows:

< Concerning the Summary of the Results of the Analysis/Evaluation Regarding the Effectiveness of the Board of Directors during the Fiscal Year Ended March 31, 2022 (“FY 2022”)>

In the second half of FY 2022, the Company conducted a self-evaluation regarding the effectiveness of the Board of Directors during FY 2022.

As for the evaluation concerning the effectiveness of the Board of Directors, regarding the points below, each director has made an evaluation.

3

Table of Contents

| 1. | Composition and operation of the Board of Directors |

| (1) | Number of attendees at meetings of the Board of Directors, including Executive Officers and Senior Managing Directors |

| (2) | Composition of the members of the Board of Directors and the ratio of Outside Directors |

| (3) | Frequency of meetings |

| (4) | Meeting agenda and framework (number of matters to be resolved and matters to be reported; content; time allocation) |

| (5) | Management of the proceedings by the Chairman |

| 2. | Information provided to the Board of Directors (including materials for each meeting) |

| (1) | Quality, volume, and timing of information provided (pre-meeting briefing; support from the Office of Non-Executive Directors and Audit Committee, including various training programs; reporting of urgent matters, etc.) |

| 3. | The Board of Director’s involvement in management goals and strategies |

| (1) | Communication with executives from shareholders’ perspectives so that accountability of executives to the shareholders is secured |

| (2) | Discussion of management goals and strategies at the Board of Directors meetings based on the PDCA (plan-do-check-act) cycle |

| 4. | Management oversight functions of the Board of Directors |

| (1) | Monitoring of adequacy and progress with regard to various management benchmarks, such as financial statements, share price, ROE, and risk appetite, and appropriateness of the allocation of management resources |

| (2) | Assessment of discussions at the Strategic Shareholdings Consideration Committee with respect to each strategic shareholding |

| (3) | Analysis of the company’s performance from a long-term perspective |

| (4) | Effectiveness and adequacy of internal controls |

| (5) | The content and frequency of sustainability related reports and the level of involvement of the Board of Directors |

| 5. | Each Committee |

| (1) | Composition of the members of each Committee |

| (2) | Frequency and content of reports to the Board of Directors |

| (3) | Status of discussions at each Committee |

| 6. | Monitoring of dialogue with stakeholders |

| (1) | Sufficiency of information provided to stakeholders such as investors/rating agencies/regulatory authorities |

| (2) | Frequency and content of feedback to the Board of Directors on matters such as the opinions of investors/rating agencies |

| 7. | Meetings of the Outside Directors |

| (1) | Status of discussions at meetings of the Outside Directors |

| (2) | Status of cooperation from executives in relation to meetings of the Outside Directors |

In response to the Results of the Evaluation of the Effectiveness of the Board of Directors for the Fiscal Year Ended March 31, 2021, in FY 2022, 4 new outside directors were appointed, and the diversity of the Board of Directors improved substantially in terms of perspectives such as expertise, nationality, and gender. Further, by carrying out discussions regarding mid- to long-term strategy and direction at meetings of the outside directors, and by engaging in initiatives such as the expansion of the content of the reports to the Board of Directors concerning discussions at meetings of the Nomination/Compensation committees, initiatives to improve governance have continued to be carried out.

In addition, as part of initiatives to enhance risk management, the Board Risk Committee was newly established as a committee to discuss important management risks at the board level, independent from execution. We will focus on further strengthening our group’s risk management system by building a governance structure appropriate for a global financial institution. Five of the six members of the committee are outside directors, and an overseas outside director is appointed as chairman. At the meetings of the Board of Directors, we regularly discussed our efforts to enhance risk management and the status of progress.

In this year’s effectiveness evaluation, there were many opinions appreciating points such as the deepening of discussions concerning management strategy, reports regarding the reactions of stakeholders, and individual meetings with executive officers, and the evaluation of many of the points has improved.

4

Table of Contents

Based on the results of this year’s effectiveness evaluation, on the basis of the approach that what will be realized is the Board of Directors putting an emphasis on the monitoring of mid- to long-term strategy to further improve governance, discussions will be carried out at meetings of the Board of Directors regarding the appropriate state of the Board of Directors, and it has been decided that initiatives, including a review of operations such as time allocation and agenda setting, will be carried out for the further enhancement of the Board of Directors’ monitoring function.

Including on the basis of these initiatives, the Board of Directors’ evaluation is that the effectiveness of the Board of Directors is fully secured.

[Supplementary Principle 4-14-2]

Please refer to Article 18 “Training of Directors” of the Guidelines.

[Principle 5-1]

Please refer to Article 22 “Dialogue with Shareholders” of the Guidelines.

Concerning other engagements regarding the Company’s corporate governance, including the items below, they have been published in places including this report, the Annual Securities Report, the Nomura Report, and the Company’s Homepage.

[Principle 2-3]

Please refer to Article 24 “Initiatives Towards Sustainability” of the Guidelines and “Environmental conservation initiatives and CSR activities” in III.3. “Measures to Ensure Due Respect for the Stakeholders’ Standpoint” of this Report.

[Principle 2-4]

Please refer to Article 23 “Nomura Group Corporate Philosophy and the Nomura Group Code of Conduct”, “Status of the Appointment of Female Directors and Officers” and “Diversity and Inclusion” in III.3. “Measures to Ensure Due Respect for the Stakeholders’ Standpoint” of this Report.

| • | 2. Capital Structure |

| Ratio of Shares held by Foreign Investors | Over 30% |

<Major Shareholders>

| Name |

Number of Shares | Percentage | ||||||

| The Master Trust Bank of Japan, Ltd. (Trust Account) |

253,651,000 | 8.27 | ||||||

| Custody Bank of Japan, Ltd. (Trust Account) |

134,376,000 | 4.38 | ||||||

| SMBC Nikko Securities Inc. |

72,001,000 | 2.35 | ||||||

| State Street Bank West Client-Treaty 505234 |

48,291,000 | 1.57 | ||||||

| Custody Bank of Japan, Ltd. (Trust Account 5) |

46,166,000 | 1.50 | ||||||

| Northern Trust Co. (AVFC) Re Silchester International Investors International Value Equity Trust |

45,178,000 | 1.47 | ||||||

| JP Morgan Securities Japan Co., Ltd. |

43,108,000 | 1.40 | ||||||

| Custody Bank of Japan, Ltd. (Trust Account 6) |

40,929,000 | 1.33 | ||||||

| Northern Trust Co. (AVFC) Re U.S. Tax Exempted Pension Funds |

40,182,000 | 1.31 | ||||||

| Custody Bank of Japan, Ltd. (Trust Account 7) |

40,103,000 | 1.30 | ||||||

| Controlling shareholder other than the parent company | None | |

| Parent company | None |

Supplementary Explanation

Information concerning major shareholders is as of March 31, 2021. Numbers of shares are rounded down to the nearest thousands.

The Company has 170,057 thousand shares of treasury stock as of March 31, 2021 which is not included in the major shareholders list above.

According to a statement on Schedule 13G (Amendment No.6) filed by BlackRock, Inc. with the SEC on January 29, 2021, BlackRock, Inc. owned 184,193 thousand shares, representing 5.70% of the issued shares of the Company’s common stock. However the Company has not confirmed the status of these shareholdings as of March 31, 2021.

According to a statement on Schedule 13G (Amendment No.1) filed by Sumitomo Mitsui Trust Holdings, Inc. with the SEC on February 5, 2021, Sumitomo Mitsui Trust Holdings, Inc. owned 217,569 thousand shares, representing 6.70% of the issued shares of the Company’s common stock. However the Company has not confirmed the status of these shareholdings as of March 31, 2021.

5

Table of Contents

| • | 3. Corporate Attributes |

| Listed exchanges and market section | Tokyo Prime, Nagoya Premier | |

| Fiscal year end | March | |

| Industry | Securities and Commodity Futures | |

| Number of employees (consolidated) | Over 1,000 | |

| Sales (consolidated) | Over 1 trillion yen | |

| Consolidated subsidiaries | Over 300 |

| • | 4. Guidelines Regarding Measures to Protect Minority Shareholders in the Event of Transactions with the Controlling Shareholder |

—

| • | 5. Other Special Conditions with Potentially Significant Effects on Corporate Governance |

Sugimura Warehouse Co., Ltd., which is a consolidated subsidiary of the Company, is listed on the Standard Market of the Tokyo Stock Exchange, and carries out operations mainly in the logistics business by performing services such as cargo storage, cargo handling, and freight car transportation. There is no competitive relationship with the businesses of the Company and the Company’s other consolidated subsidiaries.

Sugimura Warehouse Co., Ltd., through the expansion of businesses such as the logistics business which is in a business environment that is different from that of the Company’s main subsidiaries, contributes to the stabilization of the business performance of the Nomura Group, and the Company believes that maintaining the said company as a listed company will lead to things such as the said company (1) securing its name value and social credibility, (2) securing flexible financing methods, and (3) maintaining/improving the motivation of employees and securing talented personnel.

The Company respects the independence of Sugimura Warehouse Co., Ltd.’s management, and furthermore, Sugimura Warehouse Co., Ltd., for the purpose of shareholder value, is engaged in initiatives for the improvement of corporate value through independent management decisions, and while ensuring management’s efficiency/independence as a company with an audit and supervisory committee, the strengthening/enhancement of the corporate governance system is being sought.

Whereas, the Company, other than exercising its rights as a shareholder, within the scope necessary to address matters such as the Company’s financial results and laws/regulations/rules that include various filing/disclosure requirements, receives reports regarding important managerial matters from Sugimura Warehouse Co., Ltd. in a timely manner, and the status of the maintenance/operations of important matters starting with compliance are regularly confirmed with Sugimura Warehouse Co., Ltd.

II Organizations regarding Managerial Decision Making, Execution, Management and Status of Other Corporate Governance System

| • | 1. Organizational structure and management |

| Organizational structure | Company with Three Board Committees |

<Directors>

| Number of seats on the Board of Directors pursuant to the Company’s Articles of Incorporation |

20 | |

| Term of office of Directors pursuant to the Company’s Articles of Incorporation |

1 year | |

| Chairman of the meetings of the Board of Directors |

Chairman of the Board of Directors (kaicho) (except when concurrently serving as a president) | |

| Number of Directors in office |

12 |

<Outside Directors>

| Number of Outside Directors in office |

8 | |

| Number of Outside Directors qualifying as Independent Directors |

8 |

6

Table of Contents

Relationship with the Company (1)

| Name |

Attribution |

Relationship with the company (*) | ||||||||||||||||||||||

| a |

b |

c |

d |

e |

f |

g |

h |

i |

j |

k | ||||||||||||||

| Kazuhiko Ishimura |

External | |||||||||||||||||||||||

| Takahisa Takahara |

External | |||||||||||||||||||||||

| Noriaki Shimazaki |

External | |||||||||||||||||||||||

| Mari Sono |

CPA | |||||||||||||||||||||||

| Laura Simone Unger |

Other | |||||||||||||||||||||||

| Victor Chu |

External | |||||||||||||||||||||||

| J. Christopher Giancarlo |

Lawyer | |||||||||||||||||||||||

| Patricia Mosser |

Scholar | |||||||||||||||||||||||

| * | Choices concerning the relationship with the company. |

| * | For each item, “¡” in the event that “currently/recently” corresponds for the Outside Director and “r” in the event that “in the past” corresponds for the Outside Director. |

| * | For each item, “l” in the event that “currently/recently” corresponds for the close relative of an Outside Director and “p” in the event that “in the past” corresponds for the close relative of an Outside Director. |

| a - | Executive of the Listed Company or its subsidiary |

| b - | Executive or Non-Executive Director of the parent company of the Listed Company |

| c - | Executive of a fellow subsidiary of the Listed Company |

| d - | A legal or natural person whose major business partner is the Listed Company or an Executive of such a legal person |

| e - | Major business partner of the Listed Company or an Executive of such major business partner |

| f - | A consultant, accountant or legal expert receiving a large amount of compensation or other assets from the Listed Company, excluding director/officer compensation |

| g - | Major shareholder of the Listed Company (if such major shareholder is a legal entity, an Executive of such legal entity) |

| h - | Executive of a business partner of the Company (which does not fall under (d), (e) or (f) above) (applicable to the Director only) |

| i - | Executive of a company where there is a relationship of an Outside Director being mutually appointed (applicable to the Director only) |

| j - | Executive of an institution receiving a donation from the Listed Company (applicable to the Director only) |

| k - | Other |

7

Table of Contents

Relationship with the Company (2)

| Name |

Committees |

Supplementary description |

Reason for appointment (if designated as an Independent | |||||||||

|

*1 |

*2 |

*3 |

*4 | |||||||||

| Kazuhiko Ishimura |

☑ | ☑ | ☑ | Mr. Ishimura concurrently serves as President of the National Institute of Advanced Industrial Science and Technology, Outside Director of TDK Corporation, and Outside Director of IHI Corporation, etc. | <Reason for appointment as Outside Director> Mr. Ishimura has extensive experience with respect to corporate management and his achievements and insights have been evaluated highly. He has held a number of significant positions including Representative Director and President and CEO of Asahi Glass Co., Ltd. (currently AGC Inc.) and Chairman of the Board of Asahi Glass Co., Ltd. (currently AGC Inc.). The Company believes that he will play a full role as an Outside Director in determining important managerial matters and overseeing the business execution of the Company.

<Reason for designation as Independent Director> Mr. Ishimura satisfies the Independence Criteria for Outside Directors established by the Company. He is not considered to be in any situation where the degree of independence required by the Exchanges would be called in doubt, and hence he is unlikely to have conflicts of interest with general investors, and has been designated as an Independent Director. | |||||||

| Takahisa Takahara |

☑ | ☑ | ☑ | Mr. Takahara concurrently serves as Representative Director, President & CEO of Unicharm Corporation and Outside Director of Calbee, Inc., etc. | <Reason for appointment as Outside Director> Mr. Takahara has extensive experience with respect to corporate management and his achievements and insights have been evaluated highly. He concurrently serves significant positions including Representative Director, President & CEO of Unicharm. The Company believes that he will play a full role as an Outside Director in determining important managerial matters and overseeing the business execution of the Company.

<Reason for designation as Independent Director> Mr. Takahara satisfies the Independence Criteria for Outside Directors established by the Company. He is not considered to be in any situation where the degree of independence required by the Exchanges would be called in doubt, and hence he is unlikely to have conflicts of interest with general investors, and has been designated as an Independent Director. | |||||||

| Noriaki Shimazaki |

☑ | ☑ | Mr. Shimazaki concurrently serves as Director of Nomura Securities Co., Ltd. and Outside Director of Loginet Japan Co., Ltd., etc. | <Reason for appointment as Outside Director> Mr. Shimazaki has extensive experience with respect to corporate management and a high degree of expertise with regard to international accounting systems corresponding to a Sarbanes-Oxley Act of 2002 financial expert. He has held a number of significant positions including Representative Director and Executive Vice President of Sumitomo Corporation, Member of the Business Accounting Council of the Financial Services Agency, Trustee of IASC Foundation and Director of the Financial Accounting Standards Foundation, and such achievements and related insights have been evaluated highly both within and outside of the Company. The Company believes that he will play a full role as an Outside Director in determining important managerial matters and overseeing the business execution of the Company.

<Reason for designation as Independent Director> Mr. Shimazaki satisfies the Independence Criteria for Outside Directors established by the Company. He is not considered to be in any situation where the degree of independence required by the Exchanges would be called in doubt, and hence he is unlikely to have conflicts of interest with general investors, and has been designated as an Independent Director. | ||||||||

| 1 | Nomination Committee |

| 2 | Compensation Committee |

| 3 | Audit Committee |

| 4 | Independent Director |

8

Table of Contents

| Mari Sono | ☑ | ☑ | Although Ms. Sono was, in the past, a Senior Partner of Ernst & Young ShinNihon LLC (“E&Y”), the current corporate auditor of the Company, she has had no involvement whatsoever in E&Y’s management and financial policy since she retired from E&Y in August 2012. Moreover, during her tenure at E&Y, she was never involved in an accounting audit of the Company and also never belonged to the Financial Division that is responsible for accounting audits of financial institutions. | <Reason for appointment as Outside Director> Ms. Sono has a high degree of expertise with respect to corporate accounting based on many years of experience as a Certified Public Accountant and has held a number of significant positions including External Comprehensive Auditor, Tokyo, and Member of “Business Accounting Council,” Ministry of Finance. She is well versed in corporate accounting. She has also served as Commissioner of the Securities and Exchange Surveillance Commission after retiring from the Audit Firm. Her achievements and insights have been evaluated highly. The Company believes that she will play a full role as an Outside Director in determining important managerial matters and overseeing the business execution of the Company.

<Reason for designation as Independent Director> Ms. Sono satisfies the Independence Criteria for Outside Directors established by the Company. She is not considered to be in any situation where the degree of independence required by the Exchanges is called in doubt, and hence she is unlikely to have conflicts of interest with general investors, and has been designated as an Independent Director. | ||||||||

| Laura Simone Unger | ☑ | Ms. Unger concurrently serves as Independent Director of CIT Group Inc., Independent Director of Navient Corporation, Independent Director of Nomura Securities International, Inc., Independent Director of Nomura Holding America Inc., Independent Director of Nomura Securities International, Inc., and Independent Director of Nomura Global Financial Products Inc., etc. | <Reason for appointment as Outside Director> Ms. Unger is well-versed in finance-related legal systems/regulations and has held a number of significant positions including Commissioner and Acting Chairman of the U.S. Securities and Exchange Commission. She is well versed in financial laws and regulations. Her achievements and insights have been evaluated highly. The Company believes that she will play a full role as an Outside Director in determining important managerial matters and overseeing the business execution of the Company.

<Reason for designation as Independent Director> Ms. Unger satisfies the Independence Criteria for Outside Directors established by the Company. She is not considered to be in any situation where the degree of independence required by the Exchanges would be called in doubt, and hence she is unlikely to have conflicts of interest with general investors, and has been designated as an Independent Director. | |||||||||

9

Table of Contents

| Victor Chu | ☑ | Mr. Chu concurrently serves as Chairman and Chief Executive Officer of First Eastern Investment Group, Chair of Council, University College London, Co-Chair, International Business Council of the World Economic Forum and Independent Director of Airbus SE, etc. |

<Reason for appointment as Outside Director> Mr. Chu has extensive experience with respect to corporate management and the finance industry, and a high degree of expertise with regard to legal, regulatory and corporate governance. He established First Eastern Investment Group, an international investment company, and has served as its Chairman and CEO for many years. His past positions included key positions in Hong Kong financial circles such as the Hong Kong Stock Exchange and Securities and Futures Commission, Hong Kong. Such achievements and related insights have been evaluated highly both within and outside of the Company. The Company believes that he will play a full role as an Outside Director in determining important managerial matters and overseeing the business execution of the Company.

<Reason for designation as Independent Director> Mr. Chu satisfies the Independence Criteria for Outside Directors established by the Company. He is not considered to be in any situation where the degree of independence required by the Exchanges would be called in doubt, and hence he is unlikely to have conflicts of interest with general investors, and has been designated as an Independent Director. | |||||||||

| J. Christopher Giancarlo | ☑ | Mr. Giancarlo concurrently serves as Senior Counsel of Willkie Farr & Gallagher LLP, Independent Director of the American Financial Exchange, Chairman of Common Securitization Solutions LLC, Independent Director of BlockFi Inc., and Principal of Digital Dollar Project, etc. |

<Reason for appointment as Outside Director> Mr. Giancarlo is well-versed in finance-related legal systems/regulations and advanced technologies such as blockchain, and including the holding in the past of positions such as Executive Vice President of GFI Group Inc., a U.S. securities brokerage company, and Chairman of the U.S. Commodity Futures Trading Commission, such achievements and related insights have been evaluated highly both within and outside of the Company. The Company believes that he will play a full role as an Outside Director in determining important managerial matters and overseeing the business execution of the Company.

<Reason for designation as Independent Director> Mr. Giancarlo satisfies the Independence Criteria for Outside Directors established by the Company. He is not considered to be in any situation where the degree of independence required by the Exchanges would be called in doubt, and hence he is unlikely to have conflicts of interest with general investors, and has been designated as an Independent Director. | |||||||||

10

Table of Contents

| Patricia Mosser | ☑ | Ms. Mosser concurrently serves as Senior Research Scholar, Director of the MPA Program in Economic Policy Management, and Director of Central Banking and Financial Policy of Columbia University, School of International and Public Affairs, etc. | <Reason for appointment as Outside Director> Ms. Mosser has many years of experience as an economist and central banker. In addition to her current position of Senior Research Scholar and Director of Central Banking at Columbia’s School of International and Public Affairs, she has held past positions such as Deputy Director of the Office of Financial Research at U.S. Treasury Department and Senior Vice President of the Federal Reserve Bank of New York. Such achievements and related insights have been evaluated highly both within and outside of the Company. The Company believes that she will play a full role as an Outside Director in determining important managerial matters and overseeing the business execution of the Company.

<Reason for designation as Independent Director> Ms. Mosser satisfies the Independence Criteria for Outside Directors established by the Company. She is not considered to be in any situation where the degree of independence required by the Exchanges would be called in doubt, and hence she is unlikely to have conflicts of interest with general investors, and has been designated as an Independent Director. |

<Committees>

Composition of each committee and attributes of the committee chairman

| Number of members |

Number of full-time members |

Number of Inside Directors |

Number of Outside Directors |

Attributes of the committee chairman |

||||||||||||||||

| Nomination Committee |

3 | 0 | 1 | 2 | Outside Director | |||||||||||||||

| Compensation Committee |

3 | 0 | 1 | 2 | Outside Director | |||||||||||||||

| Audit Committee |

3 | 1 | 1 | 2 | Outside Director | |||||||||||||||

<Executive Officers>

| Number of Executive Officers | 7 |

Concurrent positions

| Name |

Concurrently serving as a Director | |||||||||

| Authority to represent company |

Member of Nomination Committee |

Member of Compensation Committee |

Concurrent status as employee | |||||||

| Kentaro Okuda |

Yes | Yes | No | No | No | |||||

| Tomoyuki Teraguchi |

Yes | Yes | No | No | No | |||||

| Toshiyasu Iiyama |

No | No | No | No | No | |||||

| Takumi Kitamura |

No | No | No | No | No | |||||

| Sotaro Kato |

No | No | No | No | No | |||||

| Yosuke Inaida |

No | No | No | No | No | |||||

| Toru Otsuka |

No | No | No | No | No | |||||

11

Table of Contents

<Audit Structure>

Whether the Audit Committee is assisted by Directors/employees Yes

Matters relating to the independence of Directors and employees from Executive Officers

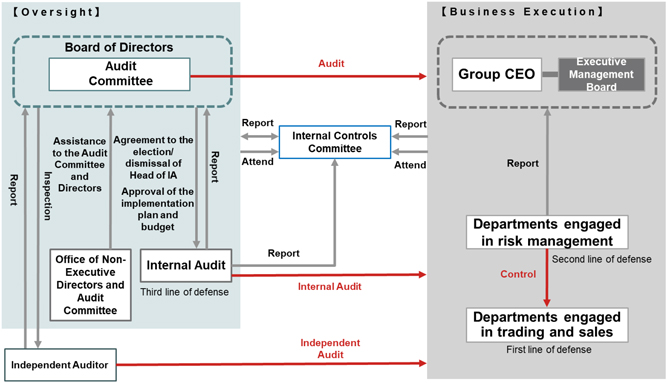

The Company has established the Office of Non-Executive Directors and Audit Committee as an organization to support Audit Committee and Directors’ execution of duties. The Audit Committee or an Audit Committee member elected by the Audit Committee performs personal evaluations of the staff employees working in the Office of Non-Executive Directors and Audit Committee, and grants consent for recruitments, transfers, and discipline of employees serving in the Office of Non-Executive Directors and Audit Committee. Further, non-executive full-time Directors may be appointed as a full-time Member of the Audit Committee or an Audit Mission Director in order to enhance the effectiveness of audit work.

Cooperation between the Audit Committee members, Independent Auditor, and the Internal Audit Division

Further, in order to ensure effective and adequate internal controls, the Group Internal Audit Department which is independent from the business execution functions and other similar audit sections placed in major affiliated subsidiaries conduct internal audits of the Nomura Group. To strengthen the independence of the internal audit sections from the business execution functions, implementation plans and formulation of the budget of the Internal Audit Division, as well as the election and dismissal of the Head of the Internal Audit Division require the consent of the Audit Committee, or a member of the Audit Committee designated by the Audit Committee.

In addition, the Audit Committee shall coordinate with Internal Audit Division through the activities such as concerning the modification of the implementation plan, additional audit procedures or improvement plan preparations, and receiving reports from the Senior Managing Director in charge of internal audits or Audit Committee Members, regarding the maintenance, operational status and implementation status of the internal audit structure, as well as the status of the internal audit.

Important matters in regard to internal controls including internal audit activities is deliberated at the Internal Controls Committee, which is chaired by Group CEO and includes a member of the Audit Committee, and the matters discussed at the Internal Controls Committee are also reported to the Board of Directors.

The Company has appointed Ernst & Young ShinNihon LLC as its Accounting Auditor. The Audit Committee has the authority to approve the accounting auditor’s annual audit plan, hear reports and explanations regarding the accounting audit from the accounting auditor at least once each quarter, exchange information from time to time with the accounting auditor, audit the method and result of the accounting auditor’s audits in view of the appropriateness thereof and examine the relevant financial statements, etc. In addition, audit fees to be paid to the accounting auditor are approved by the Audit Committee upon an explanation from the Financial Division. Furthermore, regarding services rendered by the accounting auditor and its affiliates’ to the Company and its subsidiaries and the fees to be paid, the Company has a procedure for deliberation and prior approval by the Audit Committee or prior approval and report to the next scheduled Audit Committee by a member of the Audit Committee designated by the Audit Committee upon the request of the Chief Financial Officer (CFO), pursuant to the U.S. Sarbanes-Oxley Act of 2002 and the relevant rules of the U.S. Securities and Exchange Commission.

<Independent Directors>

| Number of Independent Directors | 8 |

Matters relating to Independent Directors

The Company has designated all qualifying directors as Independent Directors.

The Company has established Independence Criteria for Outside Directors as follows:

“Independence Criteria for Outside Directors of Nomura Holdings, Inc.”

| 1. | The person, currently, or within the last three years, shall not correspond to a person listed below. |

| (1) | Person Related to the Company |

A person satisfying any of the following requirements shall be considered a Person Related to the Company:

| • | Executive (*1) of another company where any Executive of the Company serves as a director or officer of that company; |

| • | Major shareholder of the Company (directly or indirectly holding more than 10% of the voting rights) or Executive of such major shareholder; or |

| • | Partner of the Company’s accounting auditor or employee of such firm who works on the Company’s audit. |

| (2) | Executive of a Major Lender (*2) of the Company. |

| (3) | Executive of a Major Business Partner (*3) of the Company (including Partners, etc.). |

| (4) | A person receiving compensation from the Nomura Group of more than 10 million yen per year, excluding director/officer compensation. |

| (5) | A person executing the business of an institution receiving more than a Certain Amount of Donation (*4) from the Company. |

| 2. | The person’s spouse, relatives within the second degree of kinship or anyone who lives with the person shall not correspond to a person listed below (excluding persons in unimportant positions): |

| (1) | Executive of the Nomura Group; or |

| (2) | A person identified in any of subsections (1) ~ (5) in Section 1 above. |

(Notes)

| *1: | Executive shall mean Executive Directors (gyoumu shikkou torishimariyaku), Executive Officers (shikkouyaku) and important employees (jyuuyou na shiyounin), including Senior Managing Directors (shikkouyakuin), etc. |

| *2: | Major Lender shall mean a lender from whom the Company borrows an amount equal to or greater than 2% of the consolidated total assets of the Company. |

| *3: | Major Business Partner shall mean a business partner whose transactions with the Company exceed 2% of such business partner’s consolidated gross revenues in the last completed fiscal year. |

| *4: | Certain Amount of Donation shall mean a donation that exceeds 10 million yen per year that is greater than 2% of the donee institution’s gross revenues or ordinary income. |

—

12

Table of Contents

<Incentives and Remuneration>

| Implementation of Initiatives to offer Incentives to Directors and Executive Officers | Introduction of a performance-linked remuneration system, introduction of stock option plans and others |

Supplementary Explanation

Pursuant to the Compensation Policy of Nomura Group and Compensation Policy for Directors and Executive Officers (Please refer to II.1. “Remuneration of Directors and Executive Officers”) set by the Compensation Committee, the compensation of Directors and Executive Officers is composed of base salary, annual bonus and long-term incentive plans, and delivered through fixed and variable components. Depending on the level of payment, a portion of variable compensation may be deferred, and basically are non-cash bonus such as equity-linked compensation (RSU awards, NSU awards).

| (1) | Yearly Bonus as Performance-Linked Compensation |

Among the compensations for the Directors and the Executive Officers which is composed of the Base Salary, the Yearly Bonus and the Long-term Incentive Plan, the Company sets the Yearly Bonus as the Performance Linked Compensation. In relation to the Yearly Bonus, in principal, half of the amount of the Yearly Bonus of the Directors and Executive Officers is paid in cash and the remainder amount is paid by Nomura’s shares in multiple years - installments as Deferred Compensation the following year after the Fiscal Year onwards.

| (2) | Performance Indicator to be used for calculation of the Yearly Bonus |

The Nomura Group elects the Return On Equity (hereafter “ROE”), which is set out as the most important performance indicator for the Nomura Group, as the performance indicator to be used for calculation and determination of the Yearly Bonuses for the Directors and Executive Officers. The reason of the election of ROE is to be in line with the management vision and the business strategy of the Nomura Group.

| (3) | Calculation method of the Yearly Bonus |

<Outline of calculation method>

In calculating the Yearly Bonus for the Directors and the Executive Officers, a different calculation method is applied depending on the position.

<Specific calculation method by position>

| • | With respect to the President and the Group CEO, given the overall responsibility of business execution of the Nomura Group, the basic amount of the Yearly Bonus is calculated based on the level of achievement in actual value against the target value regarding ROE. In addition, Total Compensation (hereafter “TC”) , including the Base Salary and the Yearly Bonus, is determined by considering, as needed, qualitative evaluation etc. by the Compensation Committee. |

| • | With respect to the Executive Officers, same as the President and the Group CEO, given the responsibility of business execution for the Nomura Group, an individual ratio is applied to calculate their basic amounts of the Yearly Bonus. In addition, the Yearly Bonus and TC are determined by reflecting the qualitative evaluation etc. such as the performance and contribution for their responsible area. |

| • | With respect to the chairman of the Board of Directors, it is treated in the same matter as the Executive Officers. |

<Actual value regarding the performance indicator used for the calculation of the Yearly Bonus for FY 2021>

| • | Performance Indicator ROE |

| • | Target value 8.0% |

| • | Actual value for FY 2021 5.7% |

13

Table of Contents

| (4) | Yearly Bonus of Director of the audit committee member and Outside Directors |

With respect to the Director of the audit committee member is paid in cash only, to exclude equity-linkage of its compensation, so as to keep its independency from business execution. Also, Outside Directors are out of the scope of the Yearly Bonus.

| (5) | Matters relating to Non-Monetary Compensation (equity-linked compensation) |

The Company sets half of the amount of the Yearly Bonus of the Directors and Executive Officers. In principle, equity-linked compensation (Restricted Stock Unit (“RSU”), Notional Stock Unit (“NSU”)) that falls under the Non-Monetary Compensation is used for payment of the amount.

| (6) | Outline of current Deferred Compensation Awards. |

<RSU awards>

| • | Settled in Nomura’s common stock. |

| • | Graded vesting period is set as three years in principle. |

| • | It is introduced as the Deferred Compensation since the fiscal year ended March 31, 2018. |

In principle, it has been granted in May every year.

<NSU awards>

| • | Linked to the price of Nomura’s common stock and cash-settled. |

| • | Same as RSU awards, graded vesting period is set as three years in principle. |

| • | Following the introduction of RSU as a principle vehicle in 2,018 NSU awards are less commonly used in Nomura. |

Same as RSU awards, in principle, it has been granted in May every year.

As stated above, RSU awards have been introduced as a principle vehicle from the fiscal year ended as of March 31, 2018 and replaced with stock acquisition rights and other awards.

| (7) | Effect of payment of deferred compensation as equity-related compensation |

By providing deferred compensation as equity-linked compensation, the economic value of the compensation is linked to the stock price of Nomura, and a certain vesting period is set.

| • | Alignment of interests with shareholders. |

| • | Medium-term incentives (*) and retention by providing an opportunity for the economic value of Deferred Compensation at the time of grant to be increased by a rise in shares during a period of time from grant to vesting. |

| * | In line with the introduction of RSU, among the equity-linked compensation, as the principal vehicle for Deferred Compensation, in principle, Nomura’s common stock will be paid instead of cash over the three year deferral period from the fiscal year following the fiscal year in which the deferred compensation was granted. Since the number of shares to be paid is determined based on the Nomura’s share price at the time of grant, the increase in Nomura’s share price will increase the economic value of Deferred Compensation at the time of vest. Since the increase in share prices reflects the increase in corporate value, alignment of interest with that of shareholders, in addition to medium-term incentive effects for the Directors and Executive Officers, will be achieved. |

| • | Promotion of cross-divisional collaboration and cooperation by providing a common goal of increasing corporate value over the medium to long term. |

14

Table of Contents

| (8) | Clawback prescribed in Deferred Compensation |

Any voluntary resignation, material modification of the financial statements, material breach of Nomura’s internal policies and regulations etc.are subject to forfeiture, reduction or clawback (Conclusion of individual contracts including “clawback clause”).

Due to these benefits, the active use of Deferred Compensation is also recommended by regulators in the key jurisdictions in which we operate.

With respect to Deferred Compensation in Nomura, a deferral period is generally three or more years from the following fiscal year or later. This is in line with the “Principles for Sound Compensation Practices” issued by the Financial Stability Board which recommends, among other things, a deferral period of three or more years.

| Persons Eligible for Stock Options | Inside Directors, Executive Officers, employees, Directors/employees of subsidiaries |

Supplementary Explanation

The Company has two types of SAR plans to maintain incentives for high levels of performance and to recruit talented staff. The exercise price for SAR Plan A is determined based on the market price when issued, and the exercise price of SAR Plan B is 1 yen per share. Following the introduction of RSU awards instead of core deferral awards and all supplemental awards, no new SAR Plan B awards were granted in May 2018 in respect of the fiscal year ended March 31, 2018.

<Remuneration of Directors and Executive Officers>

| Disclosure of individual Director Remuneration | Disclosed in part | |

| Disclosure of individual Executive Officer Remuneration | Disclosed in part |

Supplementary Explanation

Information concerning compensation for Directors and Executive Officers is disclosed in the Yukashoken-hokokusho (“Annual Report”), Business Report, Form 20-F submitted to the SEC, Explanatory Document on the Status of Operation and Property and other documents – all of these documents can be accessed on the Company’s website. Individual compensation of certain Directors and Executive Officers is disclosed in the Annual Report in accordance with the Cabinet Office Ordinance on Disclosure of Corporate Affairs, etc.

| Whether there are any policies for the calculation of remuneration | Yes |

Amount of Remuneration or disclosure of the policy for the calculation of remuneration

<Compensation Policy of Nomura Group>

The “Compensation Policy of Nomura Group” is as follows:

Nomura Group is establishing its status firmly as a globally competitive financial services group. To support this, we recognize that our people are our most valuable asset. We have therefore developed our Compensation Policy for both executives and employees of Nomura Group to ensure we attract, retain, motivate and develop talent that enables us to achieve sustainable growth, realize a long-term increase in shareholder value, deliver client excellence, compete in a global market and enhance our reputation.

Our Compensation Policy is based around six key themes:

| 1) | Align with Nomura Values and Strategies |

| • | Compensation is designed to support delivery against the broader strategic aims of the Group. |

| • | Levels and structures of compensation reflect the needs of each business line and allow the Group to effectively compete for key talent in the market. |

| • | We develop our staff to support the Nomura values. |

15

Table of Contents

| 2) | Reflect Firm, Division and Individual Performance |

| • | “Pay for Performance” is our fundamental principle to motivate and reward our key talent regardless of personal background. |

| • | We manage compensation on a firm-wide basis, taking into account the performance of the Group and supporting our ethos of sustainable growth, collaboration and client service. This enables us to manage strategic investments and still operate market-competitive compensation practices. |

| • | An individual’s compensation is determined by properly reflecting the Group, division and individual performance, ensuring that it is aligned with both the business strategy and market considerations. |

| • | Individual compensation award decisions are underpinned by valid and rigorous performance management processes and supporting systems. |

| 3) | Establish Appropriate Performance Measurement with a Focus on Risk |

| • | Compensation is not determined by reference solely to revenues. Risk-adjusted profits are being emphasized in Nomura’s management information and performance systems and processes. |

| • | In addition, qualitative factors such as cross-divisional collaboration, risk management, alignment with organizational values, and compliance are stressed when evaluating performance. |

| • | Performance measurement reflects the business needs, taking account of risk associated with each business. Such risk includes market, credit, operational, and liquidity risk among others. |

| • | In assessing and measuring risk for compensation, input and advice is received from the risk management and finance divisions. |

| 4) | Align Employee and Shareholder Interests |

| • | Compensation of Group executives and higher paid employees should reflect the achievement of targets which are in line with the creation of shareholder value. |

| • | For higher paid executives and employees, a part of their compensation is delivered in equity linked awards with appropriate vesting periods to ensure that their interests are closely aligned with those of shareholders. |

| 5) | Appropriate Compensation Structures |

| • | The compensation structure reflects our desire to grow and develop our talent. It is merit based, reflecting performance and is regularly reviewed to ensure its fairness. |

| • | For higher paid executives and employees, a significant portion of compensation is deferred, balancing short-term interests with longer-term stewardship of the Group. |

| • | Deferred compensation should be subject to forfeiture or “clawback” in the event of a material restatement of earnings or other significant harm to the business of Nomura. |

16

Table of Contents

| • | The percentage of deferral increases as an employee’s total compensation increases. A part of deferred compensation is delivered in mid/long-term incentive plans, such as equity linked awards with appropriate vesting periods. |

| • | Guarantees of bonus/compensation should be allowed only in limited circumstances such as new hiring or strategic business needs, and multi-year guarantees should not be used as a matter of course. |

| • | There should be no special or expensive retirement/severance guarantees for senior executives. |

| • | Nomura will respect all areas in which it operates and will seek to ensure pay structures reflect the needs of the organization as well as regulatory and government bodies. |

| 6) | Ensure Robust Governance and Control Processes |

| • | This Policy and any change hereof must be approved by Nomura Holdings’ Compensation Committee, a majority of which consists of non-executive outside directors. |

| • | The Compensation Committee of Nomura Holdings decides individual amounts as well as compensation policy for Directors and Executive Officers of Nomura Holdings, in line with this Policy. |

| • | Globally, we institute a review and authorization policy for senior or high-level contracts ensuring consistency with this Policy. This is administered by Human Resources, involves Finance, Risk Management and Regional Compensation Committees and is reviewed by the Executive Managing Board. |

| • | Compensation for employees of risk management and compliance functions is determined independently of other business divisions. |

| • | The Compensation Committee uses market and specialist advisory groups to advise on appropriate compensation structures and levels as necessary. |

<Compensation Policy for Directors and Executive Officers of Nomura Holdings, Inc.>

Compensation of Directors and Executive Officers is composed of base salary, cash bonus and long-term incentive plans.

| 1) | Base Salary |

| • | Base salary is determined based on factors such as professional background, career history, responsibilities and compensation standards of related business fields. |

| • | A portion of base salary may be paid in equity linked awards with appropriate vesting periods to ensure that medium to long-term interests of Directors and Executive Officers are closely aligned with those of shareholders. |

| 2) | Yearly Bonus |

| • | Yearly bonuses of Directors and Executive Officers are determined by taking into account both quantitative and qualitative factors. Quantitative factors include performance of the Group and the division. Qualitative factors include achievement of individual goals and subjective assessment of individual contribution. |

| • | Depending on the level of bonus payment, a portion of payment in cash may be deferred. In addition, a portion of deferred bonus may be paid in equity linked awards with appropriate vesting periods in lieu of cash to ensure that medium to long-term interests of Directors and Executive Officers are closely aligned with those of shareholders. Such deferred bonus may be unpaid or forfeited under specific circumstances. |

17

Table of Contents

| 3) | Long-term Incentive Plan |

| • | Long-term incentive plans may be awarded to Directors and Executive Officers, depending on their individual responsibilities and performance. |

| • | Payments under long-term incentive plans are made when a certain degree of achievements are accomplished. Payments are made in equity linked awards with appropriate vesting periods to ensure that medium to long-term interests of Directors and Executive Officers are closely aligned with those of shareholders. |

<The reasons why the Compensation Committee confirmed that the compensations in relation to FY 2021, to be paid for the Directors and Executive Officers is in line with the compensation policies.>

During FY 2021, the Compensation Committee was held 7 times and has been discussing as follows.

| • | April 24, 2020 (perfect attendance) Discussion: The yearly bonus of the previous fiscal year |

| • | May 8, 2020 (perfect attendance) Resolution: The yearly bonus of the previous fiscal year |

| • | June 24, 2020 (perfect attendance) Resolution: The appointment of the Director with the right to convoke the board of directors meetings and the Director who reports the executions of the committee’s duties to the board of the directors meetings, Resolution: The compensation policies, Resolution: Individual base salary of the Directors and Executive Officers, Discussion: Transformation of the determination process of the Directors and Executive Officers compensation (bonus). |

| • | August 25, 2020 (perfect attendance) Discussion: Transformation of the determination process of the Directors and Executive Officers compensation (bonus). |

| • | October 28, 2020 (perfect attendance) Discussion: Transformation of the determination process of the Directors and Executive Officers compensation (bonus). |

| • | December 3, 2020 (perfect attendance) Resolution: Transformation of the determination process of the Directors and Executive Officers compensation (bonus). |

| • | March 26, 2021 (perfect attendance) Resolution: Individual base salary of the Directors and Executive Officers, Discussion: The yearly bonuses of the Fiscal Year, Discussion: The determination process of the Directors and Executive Officers compensation (bonus). |

Through the discussions and the resolutions above, the Compensation Committee confirmed that the compensations for the Directors and the Executive Officers regarding the Fiscal Year are in line with relevant compensation policies and appropriate. Also, the outlines of the discussions have been reported to the Board of Directors meeting.

18

Table of Contents

<Support System for Outside Directors>

The Company has established the Office of Non-Executive Directors and Audit Committee as an organization to support the Audit Committee and Directors’ execution of duties. The Office of Non-Executive Directors and Audit Committee serve as a secretariat of the Audit Committee and support Directors to perform their duties, such as by periodic provision of information on the management to Outside Directors.

Not only briefings prior to meetings of the Board of Directors, the necessary explanations on important matters of the Company including business, business plan, financial status, and governance structures such as the internal controls systems, etc., are continuously provided to the Outside Directors.

In addition, the Outside Directors may, as necessary, request an explanation or report and/or request materials from Executive Officers and employees, and consult legal, accounting, or other outside experts at the Company’s expense.

<Status of persons who have retired from a position such as Representative Director and President>

Name, etc., of Nominating Counselors, Advisors, etc., who have formerly served as Representative Director and President, etc., of the Company

| Name |

Title/Positon |

Duties |

Work Form/ Conditions (Full-time/ Part-time, |

Date of Retirement as President etc. |

Term | |||||

| Nobuyuki Koga |

Honorary Advisor | (i) Engagement in social contribution activities such as holding office as an executive at industrial or public associations that are approved by the Company, and (ii) utilization of knowledge through holding office as outside executives in other companies that are approved by the Company. | Part-time Paid |

2020.6.23 | 1 year (The maximum entrustment period will last until March 31, 2025.) |

Total number of Nominating Counselors, Advisors, etc., who have formerly served as Representative Director and President, etc., of the Company: 1

Other Matters

NHI has established its Advisor Regulations by a resolution adopted by the Executive Management Board, and its content has also been reported to the Board of Directors. A summary of the Advisor Regulations is set forth below.

| • | Advisors shall never be involved in the business execution of and/or supervision within the Company. |

| • | The duties of Advisors are (i) engagement in social contribution activities such as holding office as an executive at industrial or public associations that are approved by the Company, and (ii) utilization of knowledge through holding office as outside executives in other companies that are approved by the Company. |

The treatments of advisors, including their compensation, shall be decided by consultation amongst the representative executive officers.

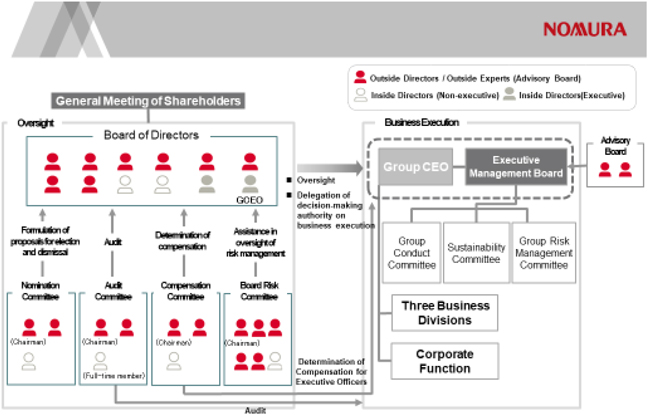

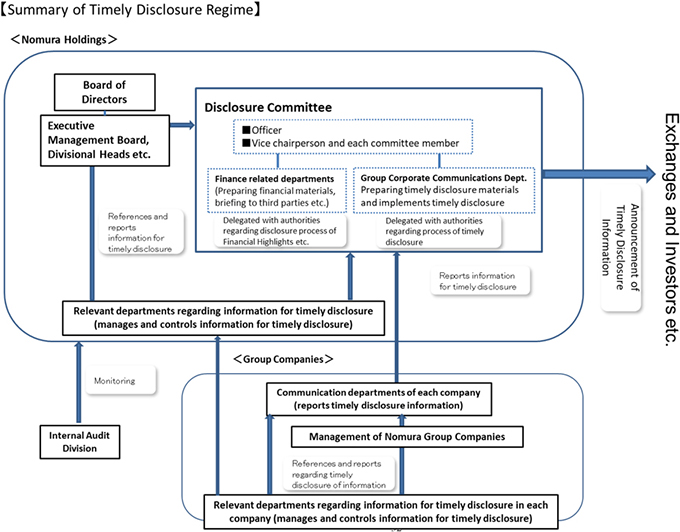

| • | 2. Matters Concerning Respective Decision-Making Functions for the Execution of Business, Audits, Supervision, Nominations, and Remuneration (Current Corporate Governance System) |

Business Execution Process

As a Company with Three Board Committees, the Board of Directors has, to the extent permitted by laws and regulations, delegated to the Executive Officers decision making authority for business execution functions to ensure that the Executive Officers can execute the Company’s business with speed and efficiency. Among the matters delegated to the Executive Officers by resolutions adopted by the Board of Directors, the most important matters of business must be decided upon deliberation by specific management bodies within the Company including the Executive Management Board, the Group Risk Management Committee, the Group Conduct Committee and the Internal Controls Committee. These management bodies are required to report to the Board of Directors on the status of their deliberations at least once every three months. The roles and members of each management body are outlined below.

| 1. | Executive Management Board |

This Board is chaired by the Group CEO Kentaro Okuda and also consists of the Representative Executive Officer and other persons designated by the Group CEO. The Executive Management Board deliberates and determines management strategies, business plans, budgets, allocation of management resources, and other important matters related to the management of the Nomura Group.

| 2. | Group Risk Management Committee |

This committee is chaired by the Group CEO Kentaro Okuda and also consists of one representative executive officer other than the Group CEO appointed by the Chairman, Chief Compliance Officer (CCO), the Chief Risk Officer (CRO), Chief Financial Officer (CFO), Divisional Heads (responsible for execution of business in each division) and other persons designated by the Chairman. The Executive Management Board has delegated authority to the Group Risk Management Committee to deliberate and determine important matters concerning enterprise risk management of the Nomura Group.

| 3. | Group Conduct Committee |

This committee is chaired by the Representative Executive Officer, Deputy President Tomoyuki Teraguchi, and also consists of the Chief Strategy Officer (CSO), Chief Compliance Officer (CCO) and Senior Managing Directors of each division. The Group Conduct Committee discusses the embeddedness of the Nomura Group Code of Conduct and management of compliance and conduct risk within Nomura Group.

19

Table of Contents

| 4. | Internal Controls Committee |

This committee is chaired by the Group CEO Kentaro Okuda, any person (s) designated by the Group CEO, an Audit Committee member elected by the Audit Committee, and a Director elected by the Board of Directors. The Internal Controls Committee deliberates upon principal matters related to the maintenance and assessment of internal controls with respect to the Nomura Group’s business, audit matters, and risk managements of the Nomura Group.

In order to further bolster the Company’s business execution framework for financial operations that are becoming increasingly sophisticated and specialized, the Company utilizes a system whereby the Executive Officers delegate a part of their authority for business execution decisions to Senior Managing Directors, who focus on individual business and operations.

In addition to the above, an “Advisory Board”, consisting of external leaders with extensive expertise, has been established as a consultative panel for the Executive Management Board to utilize outside opinions in planning the Company’s management strategies.

The Board of Directors and Committees

As an entity adopting the Company with Three Board Committees structure where management oversight and business execution functions are clearly separated, the Board of Directors and the Audit Committee (comprised of a majority of Outside Directors) perform the central role in management oversight functions within the Company. The Chair of the Board of Directors is held by a Director who is not concurrently serving as an Executive Officer, allowing the Board of Directors to better oversee the business conducted by the Executive Officers. Concerning each Committee, by having he chairman be an Outside Director, independence from business execution has been further clarified.

A summary of the Board of Directors and each Committee is as set out below.

| 1. | Board of Directors |

Aiming for transparent management under oversight with an emphasis on external perspective, the Company’s Board of Directors is comprised of twelve members: Koji Nagai, Kentaro Okuda, Tomoyuki Teraguchi, Shoji Ogawa, Kazuhiko Ishimura, Takahisa Takahara, Noriaki Shimazaki, Mari Sono, Laura Simone Unger, Victor Chu, J. Christopher Giancarlo and Patricia Mosser (including 8 Outside Directors). The Outside Directors, by applying their extensive experience and comprehensive knowledge, and through their activities at the Board of Directors and each of the Nomination, Audit and Compensation Committees, monitor management decisions on significant issues and business execution.

At meetings of the Board of Directors, activities such as the adoption of resolutions concerning matters such as financial results and budgets, reporting of the business environment and business execution of each division, and discussions regarding management strategies are carried out. Concerning information such as details about the number of times a meeting of the Board of Directors was held, the number of times that each director attended and summaries of discussions, please refer to the Company’s website or the section entitled “Reference Materials for the General Meeting of Shareholders” in the Notice of Convocation of the Annual General Meeting of Shareholders.

https://www.nomuraholdings.com/company/cg/committee.html

https://www.nomuraholdings.com/jp/investor/shm/index.html

| 2. | Nomination Committee |

This Committee is a statutory organ which determines the details of any proposals concerning the election and dismissal of Directors to be submitted to general meetings of shareholders. The three members of the Committee are elected by the Board of Directors. As for the Committee’s decisions, fixed nomination standards such as character/knowledge, corporate management experience, and expertise are established, and they are carried out based on such standards. In addition, the Committee establishes Independence Criteria for Outside Directors to maintain their independence from Nomura Group. The current members of this Committee are: Outside Directors Kazuhiko Ishimura, Takahisa Takahara and Koji Nagai, a Director not concurrently serving as an Executive Officer. This Committee is chaired by Kazuhiko Ishimura.

In addition, the Nomination Committee supervises discussions of a nature sought by the Group CEO based on factors such as the management environment and the succession plan which includes matters such as the business execution structure incorporating the point of view of successor development. Concerning information such as the number of times a meeting of the Committee was held and the status of attendance of each member, please refer to the “Reference Materials for the General Meeting of Shareholders” in the Notice of Convocation of the Annual General Meeting of Shareholders.

https://www.nomuraholdings.com/investor/shm/

| 3. | Audit Committee |