Form 6-K NATIONAL STEEL CO For: Sep 30

Pursuant to Rule 13a-16 or 15d-16 of the

São Paulo, SP, Brazil

04538-132

under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

Table of Contents

| Company Information | |

| Capital Breakdown | 1 |

| Parent Company Financial Statements | |

| Balance Sheet – Assets | 2 |

| Balance Sheet – Liabilities | 3 |

| Statement of Income | 4 |

| Statement of Comprehensive Income | 5 |

| Statement of Cash Flows | 6 |

| Statement of Changes in Shareholders’ Equity | |

| 01/01/2022 to 09/30/2022 | 8 |

| 01/01/2021 to 09/30/2021 | 9 |

| Statement of Value Added | 10 |

| Consolidated Financial Statements | |

| Balance Sheet – Assets | 11 |

| Balance Sheet - Liabilities | 12 |

| Statement of Income | 13 |

| Statement of Comprehensive Income | 14 |

| Statement of Cash Flows | 15 |

| Statement of Changes in Shareholders’ Equity | |

| 01/01/2022 to 09/30/2022 | 17 |

| 01/01/2021 to 09/30/2021 | 18 |

| Statement of Value Added | 19 |

| Comments on the Company’s Consolidated Performance | 20 |

| Notes to the financial information | 44 |

| Comments on the Performance of Business Projections | 96 |

| Reports and Statements | |

| Unqualified Independent Auditors’ Review Report | 100 |

| Officers Statement on the Financial Statements | 102 |

| Officers Statement on Auditor’s Report | 103 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

Company Information / Capital Breakdown

|

Number of Shares (Units) |

Current Year 09/30/2022 |

|

| Paid-in Capital | ||

| Common | 1,326,093,947 | |

| Preferred | 0 | |

| Total | 1,326,093,947 | |

| Treasury Shares | ||

| Common | 0 | |

| Preferred | 0 | |

| Total | 0 |

| 1 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

|

Parent Company Financial Statements / Balance Sheet - Assets (BRL thousand) | |||

| Code | Description | Current Quarter 09/30/2022 | Previous Year 12/31/2021 |

| 1 | Total Assets | 61,135,432 | 61,933,890 |

| 1.01 | Current assets | 14,516,561 | 18,241,837 |

| 1.01.01 | Cash and cash equivalents | 2,764,344 | 3,885,265 |

| 1.01.02 | Financial investments | 1,339,364 | 2,426,457 |

| 1.01.02.01 | Financial investments measured a fair value through profit or loss | 1,288,977 | 2,383,059 |

| 1.01.02.01.03 | Financial investments measured a fair value through profit or loss – Usiminas’ shares | 1,288,977 | 2,383,059 |

| 1.01.02.03 | Financial investments at amortized cost | 50,387 | 43,398 |

| 1.01.03 | Trade receivables | 2,103,276 | 2,375,512 |

| 1.01.04 | Inventory | 6,955,768 | 7,508,183 |

| 1.01.06 | Recoverable taxes | 737,137 | 1,255,697 |

| 1.01.08 | Other current assets | 616,672 | 790,723 |

| 1.01.08.03 | Others | 616,672 | 790,723 |

| 1.01.08.03.02 | Prepaid expenses | 291,386 | 185,968 |

| 1.01.08.03.03 | Dividends receivable | 150,989 | 486,506 |

| 1.01.08.03.04 | Others | 174,297 | 118,249 |

| 1.02 | Non-current assets | 46,618,871 | 43,692,053 |

| 1.02.01 | Long-term assets | 10,658,113 | 9,982,573 |

| 1.02.01.03 | Financial investments at amortized cost | 136,167 | 132,523 |

| 1.02.01.07 | Deferred taxes assets | 4,097,191 | 4,843,653 |

| 1.02.01.10 | Other non-current assets | 6,424,755 | 5,006,397 |

| 1.02.01.10.03 | Recoverable taxes | 870,813 | 691,286 |

| 1.02.01.10.04 | Judicial deposits | 239,138 | 222,481 |

| 1.02.01.10.05 | Prepaid expenses | 85,914 | 109,583 |

| 1.02.01.10.06 | Receivable from related parties | 3,166,393 | 2,442,198 |

| 1.02.01.10.07 | Others | 2,062,497 | 1,540,849 |

| 1.02.02 | Investments | 28,192,190 | 26,140,909 |

| 1.02.02.01 | Equity interest | 28,051,447 | 25,998,331 |

| 1.02.02.02 | Investment Property | 140,743 | 142,578 |

| 1.02.03 | Property, plant and equipment | 7,716,629 | 7,508,842 |

| 1.02.03.01 | Property, plant and equipment in operation | 6,732,734 | 6,752,158 |

| 1.02.03.02 | Right of use in leases | 13,238 | 15,996 |

| 1.02.03.03 | Property, plant and equipment in progress | 970,657 | 740,688 |

| 1.02.04 | Intangible assets | 51,939 | 59,729 |

| 2 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Parent Company Financial Statements / Balance Sheet – Liabilities | |||

| (BRL thousand) | |||

| Code | Description | Current Quarter 09/30/2022 | Previous Year 12/31/2021 |

| 2 | Total Liabilities | 61,135,432 | 61,933,890 |

| 2.01 | Current liabilities | 14,366,065 | 16,202,230 |

| 2.01.01 | Payroll and related taxes | 190,675 | 133,595 |

| 2.01.02 | Trade payables | 4,006,546 | 4,710,811 |

| 2.01.03 | Tax payables | 221,344 | 761,868 |

| 2.01.04 | Borrowings and financing | 3,195,066 | 3,864,228 |

| 2.01.05 | Other payables | 6,722,401 | 6,696,157 |

| 2.01.05.02 | Others | 6,722,401 | 6,696,157 |

| 2.01.05.02.04 | Dividends and interests on shareholder´s equity | 455,002 | 1,125,359 |

| 2.01.05.02.05 | Advances from customers | 121,321 | 148,822 |

| 2.01.05.02.06 | Trade payables – Forfaiting and Drawee risk | 5,328,002 | 4,439,967 |

| 2.01.05.02.07 | Lease liabilities | 8,524 | 7,602 |

| 2.01.05.02.08 | Other payables | 809,552 | 974,407 |

| 2.01.06 | Provisions | 30,033 | 35,571 |

| 2.01.06.01 | Provision for tax, social security, labor and civil risks | 30,033 | 35,571 |

| 2.02 | Non-current liabilities | 25,656,852 | 25,416,662 |

| 2.02.01 | Borrowings and financing | 16,423,469 | 16,568,616 |

| 2.02.02 | Other payables | 253,453 | 319,859 |

| 2.02.02.02 | Others | 253,453 | 319,859 |

| 2.02.02.02.03 | Lease liabilities | 6,567 | 10,339 |

| 2.02.02.02.04 | Derivative financial instruments | 69,394 | 101,822 |

| 2.02.02.02.05 | Trade payables | 18,642 | 43,396 |

| 2.02.02.02.06 | Other payables | 158,850 | 164,302 |

| 2.02.04 | Provisions | 8,979,930 | 8,528,187 |

| 2.02.04.01 | Provision for tax, social security, labor and civil risks | 320,230 | 333,285 |

| 2.02.04.02 | Other provisions | 8,659,700 | 8,194,902 |

| 2.02.04.02.03 | Provision for environmental liabilities and decommissioning of assets | 167,382 | 159,254 |

| 2.02.04.02.04 | Pension and healthcare plan | 584,288 | 584,288 |

| 2.02.04.02.05 | Provision for losses on investments | 7,908,030 | 7,451,360 |

| 2.03 | Shareholders’ equity | 21,112,515 | 20,314,998 |

| 2.03.01 | Paid-up capital | 10,240,000 | 10,240,000 |

| 2.03.02 | Capital reserves | 32,720 | 32,720 |

| 2.03.04 | Earnings reserves | 9,697,708 | 10,092,888 |

| 2.03.04.01 | Legal reserve | 1,081,222 | 1,081,222 |

| 2.03.04.02 | Statutory reserve | 8,616,486 | 9,948,596 |

| 2.03.04.09 | Treasury shares | - | (936,930) |

| 2.03.05 | Accumulated earnings (losses) | 1,537,119 | - |

| 2.03.08 | Other comprehensive income | (395,032) | (50,610) |

| 3 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Parent Company Financial Statements / Statement of Income | |||||

| (BRL thousand) | |||||

| Code | Description | Current Quarter 07/01/2022 to 09/30/2022 | Year to date 01/01/2022 to 09/30/2022 | Same quarter previous year 07/01/2021 to 09/30/2021 | YTD previous year 01/01/2021 to 09/30/2021 |

| 3.01 | Revenues from sale of goods and rendering of services | 6,474,363 | 19,011,952 | 6,873,294 | 18,524,592 |

| 3.02 | Costs from sale of goods and rendering of services | (5,555,003) | (15,317,359) | (4,176,175) | (11,910,176) |

| 3.03 | Gross profit | 919,360 | 3,694,593 | 2,697,119 | 6,614,416 |

| 3.04 | Operating (expenses)/income | (616,628) | (83,999) | (312,976) | 5,334,820 |

| 3.04.01 | Selling expenses | (244,946) | (708,561) | (210,412) | (517,200) |

| 3.04.02 | General and administrative expenses | (59,809) | (170,135) | (54,251) | (171,726) |

| 3.04.04 | Other operating income | 164,627 | 202,219 | (14,452) | 2,650,650 |

| 3.04.05 | Other operating expenses | (772,796) | (1,524,625) | (166,188) | (720,986) |

| 3.04.06 | Equity in results of affiliated companies | 296,296 | 2,117,103 | 132,327 | 4,094,082 |

| 3.05 | Income before financial income (expenses) and taxes | 302,732 | 3,610,594 | 2,384,143 | 11,949,236 |

| 3.06 | Financial income (expenses) | (3,127) | (1,364,779) | (235,883) | 302,365 |

| 3.06.01 | Financial income | 116,663 | (605,214) | (361,353) | 1,014,750 |

| 3.06.02 | Financial expenses | (119,790) | (759,565) | 125,470 | (712,385) |

| 3.06.02.01 | Net exchange differences over financial instruments | 514,586 | 922,314 | 435,400 | 276,199 |

| 3.06.02.02 | Financial expenses | (634,376) | (1,681,879) | (309,930) | (988,584) |

| 3.07 | Income before income taxes | 299,605 | 2,245,815 | 2,148,260 | 12,251,601 |

| 3.08 | Income tax and social contribution | (166,214) | (708,696) | (998,723) | (896,278) |

| 3.09 | Net income from continued operations | 133,391 | 1,537,119 | 1,149,537 | 11,355,323 |

| 3.11 | Net income for the year | 133,391 | 1,537,119 | 1,149,537 | 11,355,323 |

| 3.99 | Earnings per share – (Reais / Share) | ||||

| 3.99.01 | Basic earnings per share | ||||

| 3.99.01.01 | Common shares | 0.10059 | 1.15804 | 0.83293 | 8.22781 |

| 3.99.02 | Diluted earnings per share | ||||

| 3.99.02.01 | Common shares | 0.10059 | 1.15804 | 0.83293 | 8.22781 |

| 4 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Parent Company Financial Statements / Statement of Comprehensive Income | |||||

| (BRL thousand) | |||||

| Code | Description | Current Quarter 07/01/2022 to 09/30/2022 | Year to date 01/01/2022 to 09/30/2022 | Same quarter previous year 07/01/2021 to 09/30/2021 | YTD previous year 01/01/2021 to 09/30/2021 |

| 4.01 | Net income for the year | 133,391 | 1,537,119 | 1,149,537 | 11,355,323 |

| 4.02 | Other comprehensive income | (286,479) | (569,348) | (921,415) | (144,162) |

| 4.02.01 | Actuarial gains over pension plan of subsidiaries, net of taxes | 12 | 68 | 28 | 77 |

| 4.02.02 | Reflex treasury shares acquired by subsidiary | - | - | (141,479) | (141,479) |

| 4.02.04 | Cumulative translation adjustments for the year | (128,842) | (714,813) | 174,408 | (18,060) |

| 4.02.06 | (Loss)/gain cash flow hedge accounting – “Platts”, net taxes, from investments in subsidiaries | (72,879) | (308,335) | (20,795) | 477 |

| 4.02.11 | (Loss)/gain cash flow hedge accounting, net of taxes | (493,872) | (376,400) | (998,799) | (302,649) |

| 4.02.13 | Cash flow hedge accounting reclassified to income upon realization, net of taxes | 409,102 | 830,132 | 65,222 | 317,472 |

| 4.03 | Comprehensive income for the year | (153,088) | 967,771 | 228,122 | 11,211,161 |

| 5 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Parent Company Financial Statements / Statements of Cash Flows – Indirect Method | |||

| (BRL thousand) | |||

| Code | Description | Year to date 01/01/2022 to 09/30/2022 | YTD previous year 01/01/2021 to 09/30/2021 |

| 6.01 | Net cash from operating activities | 4,348,079 | 6,761,807 |

| 6.01.01 | Cash from operations | 2,218,355 | 5,540,978 |

| 6.01.01.01 | Net income for the period | 1,537,106 | 11,355,323 |

| 6.01.01.02 | Financial charges in borrowing and financing raised | 895,963 | 524,453 |

| 6.01.01.03 | Financial charges in borrowing and financing granted | (133,367) | (42,093) |

| 6.01.01.04 | Charges on lease liabilities | 1,232 | 1,627 |

| 6.01.01.05 | Depreciation, amortization and depletion | 790,140 | 637,837 |

| 6.01.01.06 | Equity in results of affiliated companies | (2,117,103) | (4,094,082) |

| 6.01.01.07 | Deferred taxes assets | 512,722 | 469,233 |

| 6.01.01.08 | Provision for tax, social security, labor, civil and environmental risks | (18,593) | (61,032) |

| 6.01.01.09 | Monetary and exchange variations, net | 73,306 | 14,028 |

| 6.01.01.11 | Updated shares – Fair value through profit or loss | 1,122,058 | (185,944) |

| 6.01.01.12 | Write-off of property, plant and equipment and Intangible assets | 1,065 | - |

| 6.01.01.13 | Provision for environmental liabilities and decommissioning of assets | 8,128 | 31,281 |

| 6.01.01.14 | Accrued/(reversal) for consumption and services | 16,120 | 12,417 |

| 6.01.01.16 | Receivables by indemnity | (422,254) | - |

| 6.01.01.17 | Net gains on the sale of the shares of CSN Mineração | - | (2,472,497) |

| 6.01.01.18 | Net gains on the sale of the shares of Usiminas | - | (505,844) |

| 6.01.01.19 | Dividends USIMINAS | (105,732) | (176,512) |

| 6.01.01.20 | Others | 57,564 | 32,783 |

| 6.01.02 | Changes in assets and liabilities | 2,129,724 | 1,220,829 |

| 6.01.02.01 | Trade receivables - third parties | (309,915) | (962,073) |

| 6.01.02.02 | Trade receivables - related party | 491,084 | (939,599) |

| 6.01.02.03 | Inventory | 340,518 | (3,020,516) |

| 6.01.02.04 | Receivables related parties/dividends | 2,423,868 | 2,868,493 |

| 6.01.02.05 | Recoverable taxes | 339,033 | 549,554 |

| 6.01.02.06 | Judicial deposits | (16,657) | (16,390) |

| 6.01.02.09 | Trade payables | (730,571) | 102,195 |

| 6.01.02.10 | Trade payables – Forfaiting and Drawee risk | 888,035 | 2,835,533 |

| 6.01.02.11 | Payroll and related taxes | 57,080 | 61,800 |

| 6.01.02.12 | Tax payables | (477,746) | 366,116 |

| 6.01.02.13 | Payables to related parties | 66,498 | 22,957 |

| 6.01.02.15 | Interest paid | (719,792) | (599,523) |

| 6.01.02.17 | Interest received | 2,277 | - |

| 6.01.02.18 | Others | (223,988) | (47,718) |

| 6.02 | Capital reduction in investee | (3,878,010) | 2,629,974 |

| 6.02.01 | Investments / AFAC / Acquisitions of Shares | (2,747,830) | (1,048,117) |

| 6.02.02 | Purchase of property/intangible assets | (957,567) | (710,518) |

| 6 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| 6.02.06 | Net cash received from sale of CSN Mineração's shares | - | 3,164,612 |

| 6.02.07 | Intercompany loans granted | (165,658) | (145,892) |

| 6.02.09 | Intercompany loans received | 3,679 | (280) |

| 6.02.11 | Financial Investments, net of redemption | (10,634) | 1,370,169 |

| 6.03 | Net cash used in financing activities | (1,590,990) | (12,468,096) |

| 6.03.01 | Borrowings and financing raised | 1,912,203 | 190,903 |

| 6.03.02 | Transactions cost - Borrowings and financing | (5,216) | (9,863) |

| 6.03.03 | Borrowings and financing – related parties | 3,972,052 | 1,830,102 |

| 6.03.05 | Amortization of borrowings and financing | (3,523,998) | (4,265,560) |

| 6.03.06 | Amortization of borrowings and financing - related parties | (2,857,843) | (7,556,745) |

| 6.03.07 | Amortization of leases | (6,584) | (7,485) |

| 6.03.08 | Dividends and interest on shareholder’s equity | (673,129) | (2,649,448) |

| 6.03.10 | Share repurchase | (408,475) | - |

| 6.05 | Increase (decrease) in cash and cash equivalents | (1,120,921) | (3,076,315) |

| 6.05.01 | Cash and equivalents at the beginning of the year | 3,885,265 | 4,647,125 |

| 6.05.02 | Cash and equivalents at the end of the year | 2,764,344 | 1,570,810 |

| 7 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Parent Company Financial Statements / Statement of Changes in Equity - 01/01/2022 to 09/30/2022 | |||||||

| (BRL thousand) | |||||||

| Code | Description | Paid-up capital | Capital reserve, granted options and treasury shares | Earnings reserve | Retained earnings (accumulated losses) | Other comprehensive income | Shareholders’ equity |

| 5.01 | Opening balances | 10,240,000 | 32,720 | 10,092,888 | - | (50,610) | 20,314,998 |

| 5.04 | Capital transaction with shareholders | - | - | (395,180) | - | 224,926 | (170,254) |

| 5.04.04 | Treasury shares acquired | - | (395,180) | - | - | - | (395,180) |

| 5.04.08 | Reclassifications of treasury shares | - | (936,930) | 936,930 | - | - | - |

| 5.04.09 | Treasury shares canceled | - | 1,332,110 | (1,332,110) | - | - | - |

| 5.04.10 | (Loss) / gain on the percentage change in investments | - | - | - | - | 224,926 | 224,926 |

| 5.05 | Total comprehensive income | - | - | - | 1,537,119 | (569,348) | 967,771 |

| 5.05.01 | Net income for the period | - | - | - | 1,537,119 | - | 1,537,119 |

| 5.05.02 | Other comprehensive income | - | - | - | - | (569,348) | (569,348) |

| 5.05.02.04 | Cumulative translation adjustments for the year | - | - | - | - | (714,813) | (714,813) |

| 5.05.02.06 | Actuarial gains/(losses) on pension plan, net of taxes | - | - | - | - | 68 | 68 |

| 5.05.02.07 | (Loss) / gain on cash flow hedge accounting, net of taxes | - | - | - | - | 145,397 | 145,397 |

| 5.07 | Closing balance | 10,240,000 | 32,720 | 9,697,708 | 1,537,119 | (395,032) | 21,112,515 |

| 8 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Parent Company Financial Statements / Statement of Changes in Equity - 01/01/2021 to 09/30/2021 | |||||||

| (BRL thousand) | |||||||

| Code | Description | Paid-up capital | Capital reserve, granted options and treasury shares | Earnings reserve | Retained earnings (accumulated losses) | Other comprehensive income | Shareholders’ equity |

| 5.01 | Opening balances | 6,040,000 | 32,720 | 5,824,350 | - | (1,983,619) | 9,913,451 |

| 5.03 | Adjusted opening balances | 6,040,000 | 32,720 | 5,824,350 | - | (1,983,619) | 9,913,451 |

| 5.04 | Capital transaction with shareholders | - | - | - | (1,750,000) | 820,203 | (929,797) |

| 5.04.06 | Dividends | - | - | - | (1,750,000) | - | (1,750,000) |

| 5.04.08 | Net gain of transaction primary and secondary distribution shares of CSN Mineração | - | - | - | - | 829,486 | 829,486 |

| 5.04.09 | (Loss) / gain on the percentage change in investments | - | - | - | - | (9,283) | (9,283) |

| 5.05 | Total comprehensive income | - | - | - | 11,355,323 | (144,162) | 11,211,161 |

| 5.05.01 | Net income for the period | - | - | - | 11,355,323 | - | 11,355,323 |

| 5.05.02 | Other comprehensive income | - | - | - | - | (144,162) | (144,162) |

| 5.05.02.04 | Cumulative translation adjustments for the year | - | - | - | - | (18,060) | (18,060) |

| 5.05.02.06 | Actuarial gains/(losses) on pension plan, net of taxes | - | - | - | - | 77 | 77 |

| 5.05.02.07 | (Loss) / gain on cash flow hedge accounting, net of taxes | - | - | - | - | 15,300 | 15,300 |

| 5.05.02.08 | Treasury shares acquired by reflex subsidiary | - | - | - | - | (141,479) | (141,479) |

| 5.07 | Closing balance | 6,040,000 | 32,720 | 5,824,350 | 9,605,323 | (1,307,578) | 20,194,815 |

| 9 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Parent Company Financial Statements / Statement of Value Added | |||

| (BRL thousand) | |||

| Code | Description | Year to date 01/01/2022 to 09/30/2022 | YTD previous year 01/01/2021 to 09/30/2021 |

| 7.01 | Revenues | 23,123,457 | 26,239,778 |

| 7.01.01 | Sales of products and rendering of services | 22,921,627 | 22,911,052 |

| 7.01.02 | Other revenues | 192,161 | 3,329,657 |

| 7.01.04 | Allowance for (reversal of) doubtful debts | 9,669 | (931) |

| 7.02 | Raw materials acquired from third parties | (18,848,172) | (16,092,623) |

| 7.02.01 | Cost of sales and services | (16,960,170) | (14,498,351) |

| 7.02.02 | Materials, electric power, outsourcing and other | (1,759,286) | (1,532,883) |

| 7.02.03 | Impairment/recovery of assets | (128,716) | (61,389) |

| 7.03 | Gross value added | 4,275,285 | 10,147,155 |

| 7.04 | Retentions | (789,682) | (637,302) |

| 7.04.01 | Depreciation, amortization and depletion | (789,682) | (637,302) |

| 7.05 | Value added created | 3,485,603 | 9,509,853 |

| 7.06 | Value added received | 3,896,487 | 5,407,326 |

| 7.06.01 | Equity in results of affiliates companies | 2,117,103 | 4,094,082 |

| 7.06.02 | Financial income | 488,867 | 1,014,750 |

| 7.06.03 | Others | 1,290,517 | 298,494 |

| 7.07 | Value added for distribution | 7,382,090 | 14,917,179 |

| 7.08 | Value added distributed | 7,382,090 | 14,917,179 |

| 7.08.01 | Personnel | 938,908 | 947,787 |

| 7.08.01.01 | Salaries and wages | 724,544 | 710,181 |

| 7.08.01.02 | Benefits | 170,316 | 194,753 |

| 7.08.01.03 | Severance payment (FGTS) | 44,048 | 42,853 |

| 7.08.02 | Taxes, fees and contributions | 1,760,994 | 1,599,425 |

| 7.08.02.01 | Federal | 1,461,047 | 1,198,074 |

| 7.08.02.02 | State | 299,947 | 401,351 |

| 7.08.03 | Remuneration on third-party capital | 3,145,069 | 1,014,644 |

| 7.08.03.01 | Interest | 925,321 | 543,460 |

| 7.08.03.02 | Rental | 906 | 3,764 |

| 7.08.03.03 | Others | 2,218,842 | 467,420 |

| 7.08.03.03.01 | Other and passive exchange variations | 2,218,842 | 467,420 |

| 7.08.04 | Remuneration on Shareholders' capital | 1,537,119 | 11,355,323 |

| 7.08.04.02 | Dividends | - | 1,750,000 |

| 7.08.04.03 | Retained earnings (accumulated losses) | 1,537,119 | 9,605,323 |

| 10 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Consolidated Financial Statements / Balance Sheet - Assets | |||

| (BRL thousand) | |||

| Code | Description | Current Quarter 09/30/2022 | Previous Year 12/31/2021 |

| 1 | Total assets | 82,638,399 | 79,379,103 |

| 1.01 | Current assets | 31,118,220 | 34,972,354 |

| 1.01.01 | Cash and cash equivalents | 14,319,373 | 16,646,480 |

| 1.01.02 | Financial investments | 1,477,615 | 2,644,732 |

| 1.01.02.01 | Financial investments measured a fair value through profit or loss | 1,288,977 | 2,383,059 |

| 1.01.02.01.03 | Financial investments measured a fair value through profit or loss – Usiminas’ shares | 1,288,977 | 2,383,059 |

| 1.01.02.03 | Financial investments at amortized cost | 188,638 | 261,673 |

| 1.01.03 | Trade receivables | 2,733,706 | 2,597,838 |

| 1.01.04 | Inventory | 10,428,521 | 10,943,835 |

| 1.01.06 | Recoverable taxes | 1,365,088 | 1,655,349 |

| 1.01.08 | Other current assets | 793,917 | 484,120 |

| 1.01.08.03 | Others | 793,917 | 484,120 |

| 1.01.08.03.02 | Prepaid expenses | 497,077 | 225,036 |

| 1.01.08.03.03 | Dividends receivable | 61,924 | 76,878 |

| 1.01.08.03.05 | Others | 234,916 | 182,206 |

| 1.02 | Non-current assets | 51,520,179 | 44,406,749 |

| 1.02.01 | Long-term assets | 12,813,651 | 11,206,737 |

| 1.02.01.03 | Financial investments at amortized cost | 152,348 | 147,671 |

| 1.02.01.05 | Inventory | 948,234 | 656,193 |

| 1.02.01.07 | Deferred taxes assets | 5,072,047 | 5,072,092 |

| 1.02.01.10 | Other non-current assets | 6,641,022 | 5,330,781 |

| 1.02.01.10.03 | Recoverable taxes | 1,282,507 | 965,026 |

| 1.02.01.10.04 | Judicial deposits | 460,691 | 339,805 |

| 1.02.01.10.05 | Prepaid expenses | 116,403 | 133,614 |

| 1.02.01.10.06 | Receivable from related parties | 2,703,349 | 2,070,305 |

| 1.02.01.10.07 | Others | 2,078,072 | 1,822,031 |

| 1.02.02 | Investments | 5,674,022 | 4,011,828 |

| 1.02.02.01 | Equity interest | 5,514,175 | 3,849,647 |

| 1.02.02.02 | Investment Property | 159,847 | 162,181 |

| 1.02.03 | Property, plant and equipment | 25,347,190 | 21,531,134 |

| 1.02.03.01 | Property, plant and equipment in operation | 20,514,520 | 17,305,628 |

| 1.02.03.02 | Right of use in leases | 649,420 | 581,824 |

| 1.02.03.03 | Property, plant and equipment in progress | 4,183,250 | 3,643,682 |

| 1.02.04 | Intangible assets | 7,685,316 | 7,657,050 |

| 11 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Consolidated Financial Statements / Balance Sheet – Liabilities | |||

| (BRL thousand) | |||

| Code | Description | Current Quarter 09/30/2022 | Previous Year 12/31/2021 |

| 2 | Total Liabilities | 82,638,399 | 79,379,103 |

| 2.01 | Current liabilities | 21,388,059 | 24,541,616 |

| 2.01.01 | Payroll and related taxes | 493,587 | 328,443 |

| 2.01.02 | Trade payables | 6,259,680 | 6,446,999 |

| 2.01.03 | Tax payables | 1,161,575 | 3,308,614 |

| 2.01.04 | Borrowings and financing | 4,980,561 | 5,486,859 |

| 2.01.05 | Other payables | 8,434,029 | 8,904,654 |

| 2.01.05.02 | Others | 8,434,029 | 8,904,654 |

| 2.01.05.02.04 | Dividends and interests on shareholder´s equity | 454,520 | 1,206,870 |

| 2.01.05.02.05 | Advances from customers | 1,543,448 | 2,140,783 |

| 2.01.05.02.06 | Trade payables – Forfaiting and Drawee risk | 5,506,326 | 4,439,967 |

| 2.01.05.02.07 | Lease liabilities | 168,134 | 119,047 |

| 2.01.05.02.09 | Other payables | 761,601 | 997,987 |

| 2.01.06 | Provisions | 58,627 | 66,047 |

| 2.01.06.01 | Provision for tax, social security, labor and civil risks | 58,627 | 66,047 |

| 2.02 | Non-current liabilities | 37,459,826 | 31,463,098 |

| 2.02.01 | Borrowings and financing | 32,198,750 | 27,020,663 |

| 2.02.02 | Other payables | 2,411,121 | 1,948,164 |

| 2.02.02.02 | Others | 2,411,121 | 1,948,164 |

| 2.02.02.02.03 | Advances from customers | 1,081,494 | 947,896 |

| 2.02.02.02.04 | Lease liabilities | 525,108 | 492,504 |

| 2.02.02.02.05 | Derivative financial instruments | 90,928 | 101,822 |

| 2.02.02.02.06 | Trade payables | 40,188 | 98,625 |

| 2.02.02.02.07 | Other payables | 673,403 | 307,317 |

| 2.02.03 | Deferred taxes assets | 278,887 | 503,081 |

| 2.02.04 | Provisions | 2,571,068 | 1,991,190 |

| 2.02.04.01 | Provision for tax, social security, labor and civil risks | 1,037,622 | 508,305 |

| 2.02.04.02 | Other provisions | 1,533,446 | 1,482,885 |

| 2.02.04.02.03 | Provision for environmental liabilities and decommissioning of assets | 934,381 | 898,597 |

| 2.02.04.02.04 | Pension and healthcare plan | 599,065 | 584,288 |

| 2.03 | Shareholders’ equity | 23,790,514 | 23,374,389 |

| 2.03.01 | Paid-up capital | 10,240,000 | 10,240,000 |

| 2.03.02 | Capital reserves | 32,720 | 32,720 |

| 2.03.04 | Earnings reserves | 9,697,708 | 10,092,888 |

| 2.03.04.01 | Legal reserve | 1,081,222 | 1,081,222 |

| 2.03.04.02 | Statutory reserve | 8,616,486 | 9,948,596 |

| 2.03.04.09 | Treasury shares | - | (936,930) |

| 2.03.05 | Accumulated earnings (losses) | 1,537,119 | - |

| 2.03.08 | Other comprehensive income | (395,032) | (50,610) |

| 2.03.09 | Earnings attributable to the non-controlling interests | 2,677,999 | 3,059,391 |

| 12 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Consolidated Financial Statements / Statements of Income (BRL thousand ) | |||||

| Code | Description | Current Quarter 07/01/2022 to 09/30/2022 | Year to date 01/01/2022 to 09/30/2022 | Same quarter previous year 07/01/2021 to 09/30/2021 | YTD previous year 01/01/2021 to 09/30/2021 |

| 3.01 | Revenues from sale of goods and rendering of services | 10,897,049 | 33,232,837 | 10,246,173 | 37,551,074 |

| 3.02 | Costs from sale of goods and rendering of services | (8,358,934) | (23,206,660) | (5,941,522) | (19,231,398) |

| 3.03 | Gross profit | 2,538,115 | 10,026,177 | 4,304,651 | 18,319,676 |

| 3.04 | Operating (expenses)/income | (1,411,195) | (3,572,645) | (625,288) | (354,671) |

| 3.04.01 | Selling expenses | (647,943) | (1,595,871) | (603,615) | (1,706,395) |

| 3.04.02 | General and administrative expenses | (150,475) | (440,727) | (158,853) | (438,756) |

| 3.04.04 | Other operating income | 173,285 | 222,901 | 8,922 | 2,705,119 |

| 3.04.05 | Other operating expenses | (879,423) | (1,925,974) | 33,269 | (1,078,194) |

| 3.04.06 | Equity in results of affiliated companies | 93,361 | 167,026 | 94,989 | 163,555 |

| 3.05 | Income before financial income (expenses) and taxes | 1,126,920 | 6,453,532 | 3,679,363 | 17,965,005 |

| 3.06 | Financial income (expenses) | (318,494) | (2,333,743) | (943,426) | (1,483,984) |

| 3.06.01 | Financial income | 284,757 | (259,219) | (297,930) | 1,079,410 |

| 3.06.02 | Financial expenses | (603,251) | (2,074,524) | (645,496) | (2,563,394) |

| 3.06.02.01 | Net exchange differences over financial instruments | 479,862 | 987,446 | 247,882 | (138,476) |

| 3.06.02.02 | Financial expenses | (1,083,113) | (3,061,970) | (893,378) | (2,424,918) |

| 3.07 | Income before income taxes | 808,426 | 4,119,789 | 2,735,937 | 16,481,021 |

| 3.08 | Income tax and social contribution | (570,794) | (2,148,883) | (1,411,285) | (3,946,396) |

| 3.09 | Net income from continued operations | 237,632 | 1,970,906 | 1,324,652 | 12,534,625 |

| 3.11 | Consolidated net income for the year | 237,632 | 1,970,906 | 1,324,652 | 12,534,625 |

| 3.11.01 | Earnings attributable to the controlling interests | 133,391 | 1,537,119 | 1,149,537 | 11,355,323 |

| 3.11.02 | Earnings it attributable to the non-controlling interests | 104,241 | 433,787 | 175,115 | 1,179,302 |

| 3.99 | Earnings per share – (Reais / Share) | - | - | - | - |

| 3.99.01.01 | Basic Earnings Common shares | 0.10059 | 1.15804 | 0.83293 | 8.22781 |

| 3.99.02.01 | Diluted Earnings Common shares | 0.10059 | 1.15804 | 0.83293 | 8.22781 |

| 13 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Consolidated Financial Statements / Statement of Comprehensive Income | |||||

| (BRL thousand) | |||||

| Code | Description | Current Quarter 07/01/2022 to 09/30/2022 | Year to date 01/01/2022 to 09/30/2022 | Same quarter previous year 07/01/2021 to 09/30/2021 | YTD previous year 01/01/2021 to 09/30/2021 |

| 4.01 | Consolidated net income for the year | 237,632 | 1,970,906 | 1,324,652 | 12,534,625 |

| 4.02 | Other comprehensive income | (304,859) | (647,500) | (966,533) | (183,424) |

| 4.02.01 | Actuarial gains over pension plan of subsidiaries, net of taxes | (2) | 54 | 32 | 87 |

| 4.02.04 | Cumulative translation adjustments for the year | (128,842) | (714,813) | 174,408 | (18,060) |

| 4.02.06 | Treasury shares acquired by reflex subsidiary | - | - | (180,819) | (180,819) |

| 4.02.10 | (Loss)/gain cash flow hedge accounting, net of taxes | (493,872) | (376,400) | (998,799) | (302,649) |

| 4.02.13 | Cash flow hedge reclassified to income upon realization, net of taxes | 409,102 | 830,132 | 65,222 | 317,472 |

| 4.02.15 | Cash flow hedge - Platts, reclassified to income upon realization, net of taxes | 5,617 | (9,809) | (204,435) | 18,300 |

| 4.02.16 | (Loss)/gain cash flow hedge accounting – “Platts”, net taxes, from investments in subsidiaries | (96,862) | (376,664) | 177,858 | (17,755) |

| 4.03 | Consolidated comprehensive income for the year | (67,227) | 1,323,406 | 358,119 | 12,351,201 |

| 4.03.01 | Earnings attributable to the controlling interests | (153,088) | 967,771 | 228,122 | 11,211,161 |

| 4.03.02 | Earnings it attributable to the non-controlling interests | 85,861 | 355,635 | 129,997 | 1,140,040 |

| 14 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Consolidated Financial Statements / Statements of Cash Flows – Indirect Method | |||

| (BRL thousand) | |||

| Code | Description | Year to date 01/01/2022 to 09/30/2022 | YTD previous year 01/01/2021 to 09/30/2021 |

| 6.01 | Net cash from operating activities | 2,131,547 | 13,455,539 |

| 6.01.01 | Cash from operations | 6,203,015 | 13,144,258 |

| 6.01.01.01 | Earnings attributable to the controlling interests | 1,537,119 | 11,355,323 |

| 6.01.01.02 | Earnings attributable to the non-controlling interests | 433,787 | 1,179,302 |

| 6.01.01.03 | Financial charges in borrowing and financing raised | 1,786,561 | 1,580,062 |

| 6.01.01.04 | Financial charges in borrowing and financing granted | (111,221) | (36,869) |

| 6.01.01.05 | Charges on lease liabilities | 51,714 | 45,172 |

| 6.01.01.06 | Depreciation, amortization and depletion | 2,030,390 | 1,569,893 |

| 6.01.01.07 | Equity in results of affiliated companies | (167,026) | (163,555) |

| 6.01.01.08 | Deferred taxes assets | 584,923 | 286,915 |

| 6.01.01.09 | Provision for tax, social security, labor, civil and environmental risks | 35,191 | (47,479) |

| 6.01.01.10 | Monetary and exchange variations, net | (584,096) | 670,981 |

| 6.01.01.12 | Updated shares – Fair value through profit or loss | 1,122,058 | (185,944) |

| 6.01.01.13 | Write-off of property, plant and equipment and Intangible assets | 10,780 | 4,546 |

| 6.01.01.14 | Accrued/(reversal) for consumption and services | 6,030 | 1,808 |

| 6.01.01.15 | Provision for environmental liabilities and decommissioning of assets | 1,415 | 76,311 |

| 6.01.01.16 | Net gains on the sale of the shares of CSN Mineração | - | (2,472,497) |

| 6.01.01.17 | Net gains on the sale of the shares of Usiminas | - | (505,844) |

| 6.01.01.18 | Receivables by indemnity | (422,254) | - |

| 6.01.01.19 | Dividends USIMINAS | (105,763) | (179,215) |

| 6.01.01.20 | Others | (6,593) | (34,652) |

| 6.01.02 | Changes in assets and liabilities | (4,071,468) | 311,281 |

| 6.01.02.01 | Trade receivables - third parties | (642,845) | 1,322,434 |

| 6.01.02.02 | Trade receivables - related party | 61,236 | (68,362) |

| 6.01.02.03 | Inventory | 83,270 | (4,734,305) |

| 6.01.02.04 | Receivables related parties/dividends | 105,758 | - |

| 6.01.02.05 | Recoverable taxes | 195,917 | 529,495 |

| 6.01.02.06 | Judicial deposits | (25,763) | (33,531) |

| 6.01.02.07 | Trade payables | (729,251) | 1,292,726 |

| 6.01.02.08 | Trade payables – Forfaiting and Drawee risk | 1,066,359 | 2,835,533 |

| 6.01.02.09 | Payroll and related taxes | 138,538 | 114,411 |

| 6.01.02.10 | Tax payables | (2,330,376) | 1,442,686 |

| 6.01.02.11 | Payables to related parties | (33,610) | (44,825) |

| 6.01.02.12 | Advance from Minerals contracts | (681,373) | (481,431) |

| 6.01.02.13 | Advance from electric energy contracts | 701,157 | - |

| 6.01.02.14 | Interest paid | (1,631,139) | (1,702,971) |

| 6.01.02.17 | Receipt/Payment of Derivative Operations | 96,595 | (82,987) |

| 6.01.02.18 | Others | (445,941) | (77,592) |

| 6.02 | Net cash investment activities | (7,569,026) | 1,218,689 |

| 6.02.01 | Investments Acquisition of Shares | (430,012) | (150,994) |

| 6.02.02 | Purchase of property/intangible assets | (2,357,384) | (1,899,832) |

| 6.02.06 | Intercompany loans granted | (116,412) | (116,000) |

| 6.02.08 | Financial Investments, net of redemption | 68,358 | 1,157,637 |

| 15 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| 6.02.11 | Acquisition of Topázio Energética, Santa Ana and Brasil Central | (466,153) | - |

| 6.02.12 | Cash received from acquisition of investments -Topázio and Santa Ana | 6,486 | - |

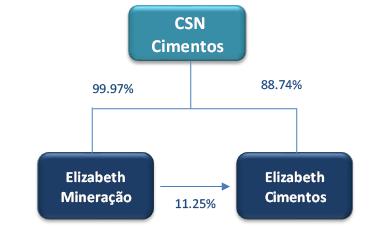

| 6.02.13 | Acquisition of CSN Cimentos Brasil | (4,770,354) | - |

| 6.02.14 | Cash received from acquisition of CSN Cimentos Brasil | 496,445 | - |

| 6.02.15 | Net cash received from sale of CSN Mineração's shares | - | 3,164,612 |

| 6.02.16 | Cash on Elizabeth´s consolidation | - | 54,768 |

| 6.02.17 | Escrow deposit for the acquisition of CSN Cimentos Brasil | - | (263,750) |

| 6.02.18 | Price paid in investiments of Elizabeth´s | - | (727,752) |

| 6.03 | Net cash used in financing activities | 3,079,058 | (9,356,140) |

| 6.03.01 | Borrowings and financing raised | 13,371,615 | 8,307,523 |

| 6.03.02 | Transaction cost - Borrowings and financings | (297,813) | (159,795) |

| 6.03.04 | Amortization of borrowings and financing | (8,211,226) | (15,334,408) |

| 6.03.06 | Amortization of leases | (106,934) | (81,696) |

| 6.03.07 | Dividends and interest on shareholder’s equity | (1,266,016) | (3,290,487) |

| 6.03.10 | Issuance of new CSN Mineração's shares | - | 1,347,862 |

| 6.03.11 | Share repurchase | (410,568) | (145,139) |

| 6.04 | Exchange rate on translating cash and cash equivalents | 31,314 | (7,569) |

| 6.05 | Increase (decrease) in cash and cash equivalents | (2,327,107) | 5,310,519 |

| 6.05.01 | Cash and equivalents at the beginning of the year | 16,646,480 | 9,944,586 |

| 6.05.02 | Cash and equivalents at the end of the year | 14,319,373 | 15,255,105 |

| 16 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Consolidated Financial Statements / Statements of Changes in Equity - 01/01/2022 to 09/30/2022 | |||||||||

| (BRL thousand) | |||||||||

| Code | Description | Paid-up capital | Capital reserve, granted options and treasury shares | Earnings reserve | Retained earnings (accumulated losses) | Other comprehensive income | Shareholders’ equity | Non-controlling interests | Shareholders’ equity |

| 5.01 | Opening balances | 10,240,000 | 32,720 | 10,092,888 | - | (50,610) | 20,314,998 | 3,059,391 | 23,374,389 |

| 5.04 | Capital transaction with shareholders | - | - | (395,180) | - | 224,926 | (170,254) | (737,027) | (907,281) |

| 5.04.04 | Treasury shares acquired | - | (395,180) | - | - | - | (395,180) | (1,638) | (396,818) |

| 5.04.07 | Interest on equity | - | - | - | - | - | - | (510,463) | (510,463) |

| 5.04.08 | Reclassifications of treasury shares | - | (936,930) | 936,930 | - | - | - | - | - |

| 5.04.09 | Treasury shares canceled | - | 1,332,110 | (1,332,110) | - | - | - | - | - |

| 5.04.10 | (Loss)/gain on the percentage change in investments | - | - | - | - | 224,926 | 224,926 | (224,926) | - |

| 5.05 | Total comprehensive income | - | - | - | 1,537,119 | (569,348) | 967,771 | 355,635 | 1,323,406 |

| 5.05.01 | Net income for the year | - | - | - | 1,537,119 | - | 1,537,119 | 433,787 | 1,970,906 |

| 5.05.02 | Other comprehensive income | - | - | - | - | (569,348) | (569,348) | (78,152) | (647,500) |

| 5.05.02.04 | Cumulative translation adjustments for the year | - | - | - | - | (714,813) | (714,813) | - | (714,813) |

| 5.05.02.06 | Actuarial gains/(losses) on pension plan, net of taxes | - | - | - | - | 68 | 68 | (14) | 54 |

| 5.05.02.07 | (Loss) / gain on cash flow hedge accounting, net of taxes | - | - | - | - | 145,397 | 145,397 | (78,138) | 67,259 |

| 5.07 | Closing balance | 10,240,000 | 32,720 | 9,697,708 | 1,537,119 | (395,032) | 21,112,515 | 2,677,999 | 23,790,514 |

| 17 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Consolidated Financial Statements / Statements of Changes in Equity - 01/01/2021 to 09/30/2021 | |||||||||

| (BRL thousand) | |||||||||

| Code | Description | Paid-up capital | Capital reserve, granted options and treasury shares | Earnings reserve | Retained earnings (accumulated losses) | Other comprehensive income | Shareholders’ equity | Non-controlling interests | Shareholders’ equity |

| 5.01 | Opening balances | 6,040,000 | 32,720 | 5,824,350 | - | (1,983,619) | 9,913,451 | 1,338,054 | 11,251,505 |

| 5.03 | Adjusted opening balances | 6,040,000 | 32,720 | 5,824,350 | - | (1,983,619) | 9,913,451 | 1,338,054 | 11,251,505 |

| 5.04 | Capital transaction with shareholders | - | - | - | (1,750,000) | 820,203 | (929,797) | 629,186 | (300,611) |

| 5.04.01 | Capital increase proposed | - | - | - | - | - | - | 294,900 | 294,900 |

| 5.04.06 | Dividends | - | - | - | (1,750,000) | - | (1,750,000) | (598,156) | (2,348,156) |

| 5.04.08 | Net gain of transaction primary and secondary distribution shares of CSN Mineração | - | - | - | - | 829,486 | 829,486 | 923,159 | 1,752,645 |

| 5.04.09 | (Loss)/gain on the percentage change in investments | - | - | - | - | (9,283) | (9,283) | 9,283 | - |

| 5.05 | Total comprehensive income | - | - | - | 11,355,323 | (144,162) | 11,211,161 | 1,140,040 | 12,351,201 |

| 5.05.01 | Net income for the year | - | - | - | 11,355,323 | - | 11,355,323 | 1,179,302 | 12,534,625 |

| 5.05.02 | Other comprehensive income | - | - | - | - | (144,162) | (144,162) | (39,262) | (183,424) |

| 5.05.02.04 | Cumulative translation adjustments for the year | - | - | - | - | (18,060) | (18,060) | - | (18,060) |

| 5.05.02.06 | Actuarial gains/(losses) on pension plan, net of taxes | - | - | - | - | 77 | 77 | 10 | 87 |

| 5.05.02.07 | (Loss) / gain on cash flow hedge accounting, net of taxes | - | - | - | - | 15,300 | 15,300 | 68 | 15,368 |

| 5.05.02.08 | Treasury shares acquired by reflex subsidiary | - | - | - | - | (141,479) | (141,479) | (39,340) | (180,819) |

| 5.07 | Closing balance | 6,040,000 | 32,720 | 5,824,350 | 9,605,323 | (1,307,578) | 20,194,815 | 3,107,280 | 23,302,095 |

| 18 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Consolidated Financial Statements / Statements of Value Added | ||||

| (BRL thousand) | ||||

| Code | Description | Year to date 01/01/2022 to 09/30/2022 | YTD previous year 01/01/2021 to 09/30/2021 | |

| 7.01 | Revenues | 38,199,932 | 45,957,315 | |

| 7.01.01 | Sales of products and rendering of services | 38,011,569 | 42,624,813 | |

| 7.01.02 | Other revenues | 184,418 | 3,331,827 | |

| 7.01.04 | Allowance for (reversal of) doubtful debts | 3,945 | 675 | |

| 7.02 | Raw materials acquired from third parties | (25,961,868) | (23,063,989) | |

| 7.02.01 | Cost of sales and services | (22,581,581) | (19,507,744) | |

| 7.02.02 | Materials, electric power, outsourcing and other | (3,233,884) | (3,423,080) | |

| 7.02.03 | Impairment/recovery of assets | (146,403) | (133,165) | |

| 7.03 | Gross value added | 12,238,064 | 22,893,326 | |

| 7.04 | Retentions | (2,024,965) | (1,565,822) | |

| 7.04.01 | Depreciation, amortization and depletion | (2,024,965) | (1,565,822) | |

| 7.05 | Value added created | 10,213,099 | 21,327,504 | |

| 7.06 | Value added received | 3,145,643 | 1,889,836 | |

| 7.06.01 | Equity in results of affiliated companies | 167,026 | 163,555 | |

| 7.06.02 | Financial income | 834,862 | 1,079,410 | |

| 7.06.03 | Others | 2,143,755 | 646,871 | |

| 7.07 | Value added for distribution | 13,358,742 | 23,217,340 | |

| 7.08 | Value added distributed | 13,358,742 | 23,217,340 | |

| 7.08.01 | Personnel | 2,017,649 | 1,747,915 | |

| 7.08.01.01 | Salaries and wages | 1,602,603 | 1,348,782 | |

| 7.08.01.02 | Benefits | 329,038 | 331,682 | |

| 7.08.01.03 | Severance payment (FGTS) | 86,008 | 67,451 | |

| 7.08.02 | Taxes, fees and contributions | 4,054,848 | 5,716,728 | |

| 7.08.02.01 | Federal | 3,350,011 | 4,881,018 | |

| 7.08.02.02 | State | 665,960 | 803,428 | |

| 7.08.02.03 | Municipal | 38,877 | 32,282 | |

| 7.08.03 | Remuneration on third-party capital | 5,315,339 | 3,218,072 | |

| 7.08.03.01 | Interest | 1,891,596 | 1,608,643 | |

| 7.08.03.02 | Rental | 2,979 | 7,809 | |

| 7.08.03.03 | Others | 3,420,764 | 1,601,620 | |

| 7.08.03.03.01 | Other and exchange losses | 3,420,764 | 1,601,620 | |

| 7.08.04 | Remuneration on Shareholders' capital | 1,970,906 | 12,534,625 | |

| 7.08.04.02 | Dividends | - | 1,750,000 | |

| 7.08.04.03 | Retained earnings (accumulated losses) | 1,537,119 | 9,605,323 | |

| 7.08.04.04 | Non-controlling interests in retained earnings | 433,787 | 1,179,302 | |

| 19 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| 20 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

São Paulo, October 31, 2022 - Companhia Siderúrgica Nacional ("CSN") (B3: CSNA3) (NYSE: SID) discloses its third quarter of 2022 (3Q22) financial results in Brazilian Reais, with all financial statements consolidated in accordance with accounting practices adopted in Brazil issued by the Accounting Pronouncements Committee ("CPC"), approved by the Brazilian Securities and Exchange Commission ("CVM") and the Federal Accounting Council ("CFC") and in accordance with international financial reporting standards (“IFRS”), issued by the International Accounting Standards Board (“IASB”).

The comments address the Company's consolidated results in the third quarter of 2022 (3Q22) and the comparisons are in relation to the third quarter of 2021 (3Q21) and the second quarter of 2022 (2Q22). The price of the dollar was BRL 5.44 on 09/30/2021; BRL 5.24 on 06/30/2022 and BRL 5.41 on 09/30/2022.

Operational and financial highlights of 3Q22

| 21 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

Consolidated Table - Highlights

¹ Adjusted EBITDA is calculated from net income (loss), plus depreciation and amortization, taxes on income, net financial result, income from investment participation, income from other operating income/expenses and includes a proportional participation of 37.27% of the EBITDA of the joint subsidiary MRS Logística.

² Adjusted Ebitda Margin is calculated from Adjusted Ebitda divided by Management Net Revenue.

³ Adjusted Net Debt and Adjusted Cash/Availability consider 37.27% of MRS, in addition to not considering Forfaiting and Cashed Risk transactions.

Consolidated Results

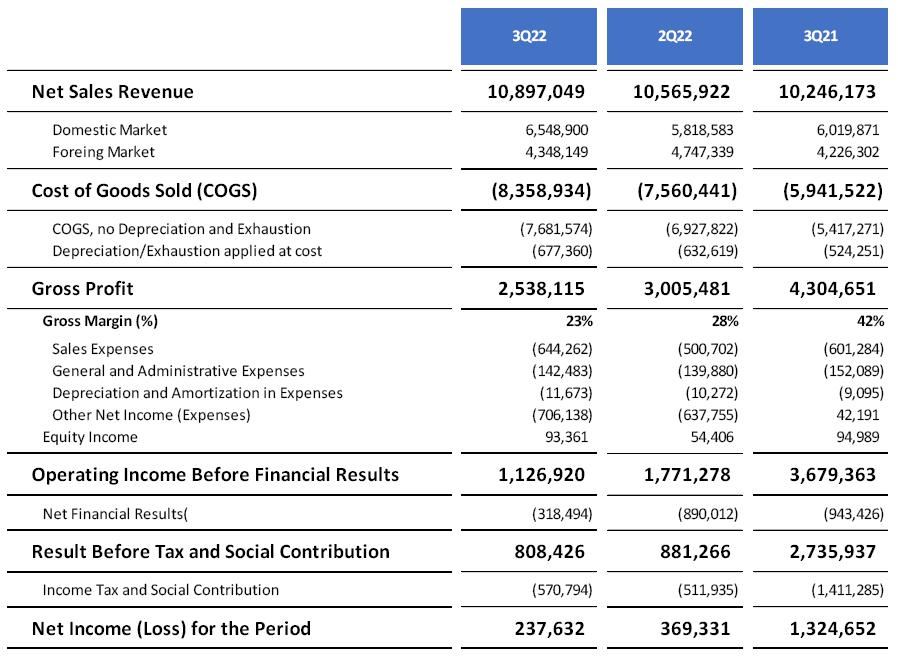

| · | Net revenue totaled BRL 10,897 million on 3Q22, which represents a 3.1% increase when compared to 2Q22. This result reflects the increased commercial activity and increased sales volume of the Company's main segments, but partially offset by lower prices of iron ore and steel products. |

| · | The cost of goods sold (COGS) totaled BRL 8,359 million in 3Q22, an increase of 10.5% compared to 2Q22, as a result of the continued high prices of some raw materials such as coke oven coal, in addition to higher costs with reducers in steel operations and greater mine movement. |

| · | The higher cost pressure negatively impacted the gross margin that attained 23.3% in 3Q22 and was 5.2 p.p. lower than that recorded in 2Q22. This performance mainly reflects the dynamics of the provisional prices in mining and the temporary impact of rising raw material costs, an effect that is already starting to decrease in 4Q22. |

| · | Sales, general and administrative expenses totaled for BRL 798 million in 3Q22, 22.6% higher than in the previous quarter, as a consequence of the increase in commercial activity through all segments in the period, but partially offset by lower prices with freight on the C3 route. |

| · | The group of other operating income and expenses was negative in BRL 707 million in 3Q22, mainly as a result of the cash flow hedge accounting operations that totaled BRL 418 million in the period. |

| · | The financial result was negative in BRL 318 million in 3Q22, which represents a 64.3% decline compared to the previous quarter, as a consequence of the normalization of financial expenses after a quarter with minimal changes in the value of Usiminas shares. |

| 22 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| · | The equity result was positive at BRL 94 million in 3Q22, a performance 74% higher than in the last quarter, as a consequence of the operational improvement in MRS results. |

| · | In 3Q22, the Company's Net Income was BRL 238 million, 35.5% lower than in the last quarter, highlighting the lower operating performance in the period due to the decline in international prices, which ended up compensating for the lower financial expenses presented in the quarter. |

Adjusted EBITDA

* The Company discloses its adjusted EBITDA excluding participation in investments and other operating income (expenses), understanding that it should not be considered in the calculation of recurring Operational Cash generation.

| · | In 3Q22, Adjusted EBITDA was BRL 2,714 million, with an Adjusted EBITDA Margin of 23.9%, 5.7 p.p. below that recorded last quarter. This reduction in profitability is a direct consequence of the cost pressure in the steel industry and the impact of iron ore and steel prices on international markets, which ended up compensating for the higher commercial activity recorded in the quarter. However, it is also important to highlight the temporary effect of this pressure since it is already possible to check an accommodation of costs and prices for the result at the end of the year. In addition, it is also worth noting the impact of the incorporation of LafargeHolcim in the cement segment, whose EBITDA increased by 58.4% in 3Q22, even considering only one month of operational result. |

| 23 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

Adjusted EBITDA (BRL MM) and Adjusted EBITDA Margin¹ (%)

¹ Adjusted EBITDA Margin is calculated from the division between Adjusted EBITDA and Adjusted Net Revenue, which considers 100% of the stakes in CSN Mineração's consolidation and 37.27% in MRS.

Adjusted Cash Flow¹

Adjusted Cash Flow in 3Q22 reached BRL 3,168 million, an increase of BRL 2,338 million compared to the previous quarter due to the combination of (i) efficient working capital management, (ii) seasonality in the payment of taxes, and (iii) lower impact of financial expenses. With this, the Company was able to mitigate the lowest operating results, presenting a reduction in accounts receivable and longer term with suppliers.

Adjusted Cash Flow¹ on 3Q22 (BRL MM)

¹ The concept of adjusted cash flow is calculated from adjusted Ebitda, subtracting Ebitda from Jointly Controlled Companies, CAPEX, IT, Financial Results and Changes in Assets and Liabilities², excluding the effect of the Glencore advance.

² Adjusted Working Capital is composed by the change in Net Working Capital, plus the change in accounts of long-term assets and liabilities and disregarding the net change in IT and SC.

Debt

As of 09/30/2022, consolidated net debt reached BRL 24,300 million, with the leverage indicator measured by the Net Debt/EBITDA ratio reaching 1.69x. This leverage increase is a consequence of the disbursement made in the period, with the payment for the acquisition of LafargeHolcim, in addition to the CSN Mineração’s 2nd Debentures Issuance. However, despite this greater need for financial disbursements, CSN maintained its policy of carrying a large amount of cash, which in this quarter reached approximately BRL 15.7 billion.

| 24 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

Debt (BRL Billion) and

Net Debt /Adjusted EBITDA (x)

¹ Net Debt / EBITDA: To calculate the debt, please consider the final dollar of each period and for net debt and EBITDA the average dollar of the period.

The Company remains very active in its goal of extending its debt amortization period, focusing on long-term operations and the local capital market. Among the main projects of 3Q22, the second issuance of CMIN’s Infrastructure debentures in the amount of BRL 1.4 billion, as well as operations to support the acquisition of LafargeHolcim's Brazilian assets, stand out. In addition, the Company has just completed its 12th issuance of institutional debentures, which will impact the 4Q22 result and focuses precisely on the extension of the average debt term.

Amortization Schedule (BRL Billion)

¹ IFRS: does not consider participation in MRS (37.27%).

² Gross Debt/Management Net considers participation in MRS (37.27%) and gross interest.

3 Medium term after completion of the Liability Management Plan.

Foreign Exchange Exposure

The accumulated net foreign exchange exposure in the consolidated balance sheet of 3Q22 was US$ 217 million, as shown in the table below, in line with the Company's policy of minimizing the impacts of exchange rate volatility on the result. The Hedge Accounting adopted by CSN correlates the projected dollar exports flow with future debt maturities in the same currency. Thus, the exchange variation of the dollar debt is temporarily recorded in the equity, being brought to the result when the dollar revenues from said exports occur.

| 25 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

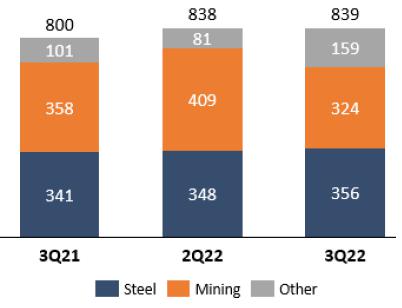

Investments

A total of BRL 839 million was invested in 3Q22, a stable performance compared to the previous quarter with the increase in investments in cement offsetting the delayed delivery of orders for expansion projects in the mining segment, which should present a higher concentration at the beginning of 2023.

Net Working Capital

Net Working Capital applied to the business totaled BRL 1,343 million in 3Q22, a 69% decrease when compared to 2Q22 as a result of the increase in the line of suppliers, due to the mix of purchases and longer negotiated terms, in addition to the drop in inventories.

The calculation of the Net Working Capital applied to the business does not take Glencore's advances, as shown in the following table:

| 26 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

¹ Other CCL Assets: Considers employees advances and other accounts receivable.

² Other CCL Liabilities: Considers other accounts payable, dividends payable, installment taxes and other provisions.

³ Inventories: Does not consider the effect of the provision for inventory losses. For the calculation of the SME, warehouse balances are not considered.

Closing of LafargeHolcim

On September 6, 2022, the Company completed the acquisition of 100% of the shares issued by LafargeHolcim Brasil and officially became the second largest cement producer in the Brazilian market, with an installed capacity of 16.3 Mton year, 172% higher than 2021. With the conclusion of this operation, the cement segment had one month of LafargeHolcim’s results in its 3Q22 numbers.

| 27 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

Results by Business Segments

| 28 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Result 3Q22 (BRL million) | Steel | Mining | Logistics (Port) | Logistics (Railway) | Energy | Cement | Corporate Expenses/Elimination | Consolidated |

| Net Revenue | 7,698 | 2,527 | 69 | 653 | 48 | 778 | (875) | 10,897 |

| Domestic Market | 5,655 | 437,50 | 69 | 653 | 48 | 778 | (1,091) | 6,549 |

| Foreign Market | 2,044 | 2,089 | 215 | 4,348 | ||||

| COGS | (6,426) | (1,800) | (54) | (397) | (53) | (501) | 873 | (8,359) |

| Gross profit | 1,272 | 727 | 14 | 256 | (5) | 276 | (3) | 2,538 |

| DGA/DVE | (334) | (63,49) | (7) | (37) | (10) | (100) | (248) | (798) |

| Depreciation | 313 | 253 | 9 | 108 | 4 | 82 | (78) | 689 |

| Proportional EBITDA of joint contr. | - | - | - | - | - | 285 | 285 | |

| Adjusted EBITDA | 1,251 | 916 | 16 | 327 | (10) | 257 | (44) | 2,714 |

| Result 2Q22 (BRL million) | Steel | Mining | Logistics (Port) | Logistics (Railway) | Energy | Cement | Corporate Expenses/Elimination | Consolidated |

| Net Revenue | 7,706 | 2,608 | 77 | 592 | 47 | 475 | (940) | 10,566 |

| Domestic Market | 5,248 | 411,20 | 77 | 592 | 47 | 475 | (1,032) | 5,819 |

| Foreign Market | 2,458 | 2,196 | - | - | - | - | 93 | 4,747 |

| COGS | (5,789) | (1,832) | (53) | (386) | (49) | (301) | 849 | (7,560) |

| Gross profit | 1,917 | 776 | 24 | 206 | (2) | 174 | (90) | 3,005 |

| DGA/DVE | (313) | (87,03) | (8) | (34) | (8) | (69) | (132) | (651) |

| Depreciation | 301 | 242 | 8 | 126 | 4 | 57 | (95) | 643 |

| Proportional EBITDA of joint contr. | - | - | - | - | - | 265 | 265 | |

| Adjusted EBITDA | 1,905 | 931 | 24 | 298 | (6) | 163 | (52) | 3,263 |

| Result 3Q21 (BRL million) | Steel | Mining | Logistics (Port) | Logistics (Railway) | Energy | Cement | Corporate Expenses/Elimination | Consolidated |

| Net Revenue | 7,627 | 2,804 | 70 | 508 | 66 | 387 | (1,216) | 10,246 |

| Domestic Market | 5,508 | 970,76 | 70 | 508 | 66 | 387 | (1,491) | 6,020 |

| Foreign Market | 2,118 | 1,833 | - | - | - | - | 275 | 4,226 |

| COGS | (4,736) | (1,883) | (53) | (325) | (38) | (229) | 1,322 | (5,942) |

| Gross profit | 2,891 | 920 | 17 | 183 | 29 | 159 | 106 | 4,305 |

| DGVA | (302) | (69,74) | (7) | (34) | (9) | (61) | (281) | (762) |

| Depreciation | 265 | 193 | 9 | 111 | 4 | 45 | (94) | 533 |

| Proportional EBITDA of joint contr. | - | - | - | - | - | 220 | 220 | |

| Adjusted EBITDA | 2,854 | 1,043 | 19 | 260 | 24 | 143 | (49) | 4,295 |

Steel Result

According to the World Steel Association (WSA), global crude steel production totaled 450.0 million tons (Mt) on 3Q22, representing a drop of 2.5% compared to the same period in 2021, also reflecting the effects of the conflict between Russia and Ukraine and its direct developments for the lowest volume of production in European countries. China produced 56.1% of the global volume (252.3 Mt), which corresponds to an increase of 3.1 p.p. in relation to the same period of 2021, mainly as a result of the September performance where it was possible to verify a seasonal return of demand and low inventories, in addition to the lower production observed in Europe. In the accumulated year-to-date, however, there is a 3.7% drop in the volume produced in China, reflecting the direct impact of production interruptions due to the Covid Zero Policy, in addition to the lower dynamism of the real estate market, which reduced the consumption of steel in China throughout 2022. Despite this situation, the Chinese government has sought to increase investment in infrastructure through economic stimulus that should keep demand at a satisfactory level by the end of this year. On the other hand, Brazil accrued a YTD production of 25.9 Mt, which corresponds to an annual reduction of 5.3%, as a result of the cost pressures faced by the industry, and a more difficult comparison basis due to the strong volumes seen last year.

Steel Production (thousand tons)

Regarding to CSN, plate production on 3Q22 totaled 1,027 Kton, a performance 15.4% higher than in the previous quarter. In turn, the production of flat laminates, our main market, reached 911 Kton, an increase of 18.7% compared to 2Q22, due to the normalization of the production process since the previous quarter was impacted by planned maintenances.

| 29 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

Sales Volume (Kton) - Steel

Total sales reached 1,160 Kton on the third quarter of 2022, a volume 18.2% higher than in the same period of last year. When analyzing the behavior in the different markets, it is perceived that domestic sales were the main responsible for this growth by adding 859 thousand tons of steel products, an increase of 18.7% compared to 2Q22, as a result of a very resilient demand and more competitive prices. In the foreign market, 3Q22 sales totaled 301 thousand tons and were 12% lower than those realized in 2Q22, as a consequence of a weaker sales volume verified in Europe, affecting the results of SWT and Lusosider. In the quarter, 22 Kton were exported directly and 279 Kton were sold by subsidiaries abroad, 62 Kton by LLC, 159 Kton by SWT and 58 Kton by Lusosider.

In relation to the total sales volume in 3Q22 compared to the previous quarter, the construction (+49%), distribution (+37%) and automotive (+9.5%) segments were the main positive highlights of the period and ended up compensating for the still uncertain period lived by the home appliances sector and industry, mainly in the State of São Paulo.

|

According to ANFAVEA (National Association of Motor Vehicle Manufacturers), the third quarter production registered 665,000 units, an increase of 12% compared to the last quarter and 32% compared to the same period of the previous year. The Association also projects a year growth of 4.1% in 2022, with a production of 2,340,000 vehicles’ units, which shows that the segment has already begun to overcome the difficulties faced in the last 2 years.

According to the Brazil Steel Institute (IABr) data, crude steel production in the third quarter was 8.407 Mton, a performance 10.6% lower than in the same period last year. Apparent Consumption was 5.9 Mton, a 10.1% retraction compared to 3Q21. In turn, the Steel Industry Confidence Indicator (ICIA) for September was 53.4 points, an increase of 8.0 p.p. compared to June and above the 50-point break line, indicating greater confidence for the next six months in the local market.

According to IBGE data, the production of home appliances (white line) for the months of July and August recorded a decline of 18.6% compared to the same period of last year. For this year, the white line market is expected to have a weaker performance after the strong sales volume seen in the sector in 2020 and 2021. |

|

| 30 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| · | Net revenue in Steel reached BRL 7,698 million in 3Q22, a stable performance compared to the previous quarter. As previously commented, the intense increase in commercial activity ended up being offset by the reduction in domestic price, generating this marginally lower revenue. In the sense, the average price of 3Q22 in the domestic market was 9% lower than that of 2Q22, a performance that accompanies the weaker dynamics of international prices. In turn, the price of the foreign market was 5.5% lower compared to last quarter, a performance driven by the economic slowdown in Europe. |

| · | The plate cost in 3Q22 reached BRL 4,133/t, representing a 6% decline compared to the previous quarter as a result of the higher dilution of fixed costs due to the higher production volume, despite the 7% increase in raw material costs and overall manufacturing costs (mainly natural gas). |

| · | The steel’s Adjusted EBITDA reached BRL 1,251 million in 3Q22 and was 34.3% lower than in 2Q22, with an EBITDA Margin of 16.3% (-8.5 p.p.). Despite the lower profitability and the higher cost pressure in production, the Company was able to sustain its margins at a very reasonable level and with a tendency to recover at the end of the year, as it is already possible to see a drop in the costs of the main raw materials. |

|

Adjusted EBITDA and Steel Margin (BRL MM and %) |

Mining Result

In 3Q22, concerns about the Chinese market and the sustainability of growth continued to dictate the pace of iron ore prices in the international market. The quarter in China was still marked by heat waves that led to a water crisis and increased the cost of energy. In addition, the continuous stoppages resulting from Covid Zero policy and the continuing crisis in the real estate market were other components that increased instability and mitigated the government's efforts to bring, through incentive packages and credit concessions, greater economic dynamism. In addition, the quarter was also marked by the ongoing conflict between Russia and Ukraine, by the maintenance of inflationary pressures and by the increase in interest rates that jointly helped to increase concerns about the global demand for iron ore. In the midst of this context, the price of iron ore underwent a greater adjustment at the beginning of the quarter, ending 3Q22 with an average of US$ 103.31/dmt (Platts, Fe62%, N. China), 25.1% lower than the 2Q22 (US$ 137.9/dmt), and 36.6% below 3Q21 (US$ 162.94/dmt).

| 31 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

In relation to sea freight, the BCI-C3 Route (Tubarão-Qingdao) presented an average of US$ 24.03/wmt in 3Q22, which represents a significant contraction of 21% in relation to the cost of the previous quarter, as a reflection of the normalization and better logistics organization of the transoceanic market, in addition to the lower pressure on fuel costs.

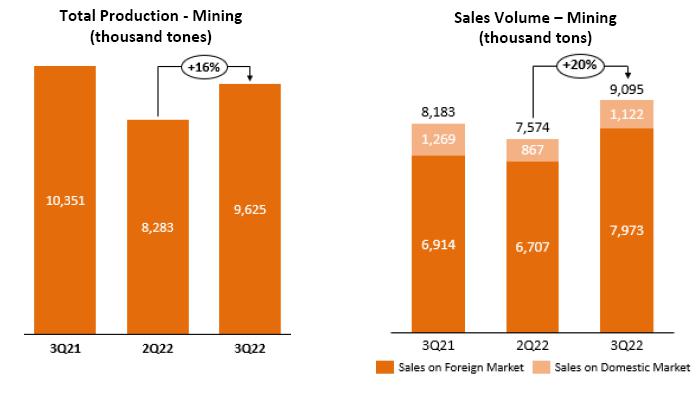

| · | Iron ore production totaled 9,625 thousand tons in 3Q22, representing an increase of 16% compared to 2Q22, as a result of the increase in the performance of projects integrated to the Central Plant and lower rainfall volume that allowed an improvement in production and efficiency in the Company's mines. |

| · | Sales volume reached 9,095 thousand tons in the 3Q22, a performance 20.1% higher than the previous quarter as a consequence of the higher volume produced and the drier period observed throughout the quarter, enabling an increase in port shipments. To contextualize this performance, the sales volume to the foreign market was 19% higher than in the previous quarter. |

| · | Net revenue totaled BRL 2,527 million in 3Q22 and was 3.1% lower than in the last quarter, as a result of a lower price realization that ended up offsetting the higher sales volume presented in the period. Unitary net revenue was US$ 53.23 per wet ton, a 25.8% decline against 2Q22, a performance that reflects not only the lower price of the benchmark index, but also the impact of the provisioned prices realization in the previous quarters given the high volatility presented in the period. These factors were partially offset by a better product mix with a higher share of own production in relation to third-party purchases, quality improvement and reduction in freight costs during the quarter. |

| · | In turn, the cost of products sold from mining totaled BRL 1,800 million in 3Q22, a 1.7% decline compared to the previous quarter, as a result of lower rail and port transport costs, in addition to the reduction in demurrage. On the other hand, C1 Cost reached US$ 19.4/t in 3Q22, and was 20% lower when compared to 2Q22, reflecting not only the lower logistics costs, but also the greater dilution of fixed costs due to the increase in the volume produced. |

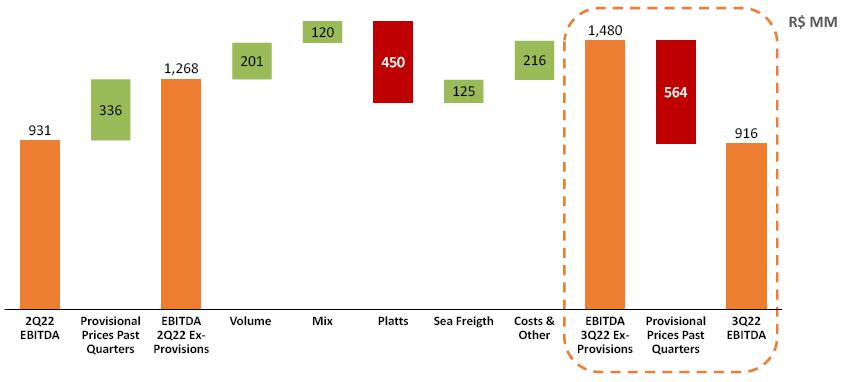

| · | Adjusted EBITDA reached BRL 916 million in 3Q22, with a quarterly EBITDA Margin of 36.3% or 0.5 p.p. lower than that recorded in 2Q22. This stability in the EBITDA Margin is a direct result of exogenous factors and high volatility in the price of iron ore throughout the year. On the other hand, when observing the decline in the cost of production and freight, there is a more optimistic outlook regarding the increase in profitability for the coming quarters. |

| 32 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

Cement Result

Throughout 3Q22, the cement segment maintained the strong dynamism presented in the previous quarter, packed by consumption-friendly movements, with the increase in Brazil aid, GDP growth and the decrease in inflationary impact. This combination of factors eventually offset higher interest rates and the slow recovery in wages, which make credit and new loans more difficult. According to the National Cement Industry Union (SNIC), cement sales reached 16.97 Mton in 3Q22, 6.7% higher than the previous quarter, but still 3.0% below the same period in 2021. In this context, the real estate market remains an important demand driver, but the segment has also seen a significant increase in sales directed to infrastructure projects. To corroborate this favorable environment, the Industrial Entrepreneur Confidence Index (ICEI), measured by the Brazilian Chamber of the Construction Industry (CBIC), presented values above 50 in all indicators, reaching 60.2 in October.

Regarding to CSN Cimentos, on September 6 the Company completed the acquisition process of LafargeHolcim, now called CSN Cimentos Brasil S.A., consolidating one month of the operating and financial results in the segment performance. Sales on 3Q22 totaled 1,890 Kton, a result 50% higher than the previous quarter, reflecting (i) the incorporation of part of Lafarge's sales in the quarter, and (ii) a positive performance in the other cement operations of the Company which also managed to overcome the strong dynamism observed in the previous quarter.

|

Sales Volume – Cements (thousand tones) |

* LafargeHolcim's operations were integrated in September 2022.

| 33 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| · | Net Revenue reached an all-time high of BRL 778 million in 3Q22, a performance 63.7% higher than last quarter, driven by the solid operating performance observed in the quarter, with increases in production, sales and prices applied in the period, in addition to the incorporation of LafargeHolcim's results. |

| · | In turn, unitary costs also rose in the quarter, as a result of the increase in the cost of imported coke and distribution freight, which is a result of the global increase in fuel costs. |

| · | Even so, Adjusted EBITDA in the segment increased 58.4% compared to the previous quarter, reaching BRL 257 million in 3Q22 and with an Adjusted EBITDA Margin of 33.1%, or 1.1 p.p. lower than that seen in 2Q22. This small loss of profitability, even considering cost pressures and integration expenses, reinforces the excellent moment CSN’s cement operation goes through, in addition to highlighting the strong operational improvement that LafargeHolcim's assets have shown since the acquisition was approved. |

Logistics Result

Rail Logistics: In 3Q22, net revenue reached BRL 653 million, with an Adjusted EBITDA of BRL 327 million and an Adjusted EBITDA Margin of 50%. Comparing to 2Q22, net revenue increased 10.3% due to the increased volume and prices of goods transported. In the same comparison line, Adjusted EBITDA was 9.8% higher.

Port Logistics: In 3Q22, 431,000 tons of steel products were shipped by Sepetiba Tecon, in addition to 12,000 containers, 32,000 tons of general cargo and 52,000 tons of bulk. Compared to the previous quarter, the Company had a change in its shipment mix, giving more relevance to the overall cargo volume, with a quarterly increase of 672%, against a 76% reduction in the bulk volume. In addition to this variation, the volume of steel products increased by 40% in the period. As a result, the net revenue of the port segment was 11.3% lower than in the last quarter, reaching BRL 69 million in 3Q22 and also impacting the Adjusted EBITDA for the period, which had a margin decrease of 7.8 p.p.

Energy Result

In 3Q22, the energy volume traded generated a net revenue of BRL 48 million, with a negative Adjusted EBITDA of BRL 10 million. Compared to the second quarter of 2022, the net revenue was practically stable, even with lower prices, while there was a small increase in the production cost, generating this negative EBITDA in the quarter.

| 34 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

Quarterly Financial Information – September 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

ESG - Environmental, Social & Governance

ESG COMMITMENTS - CSN GROUP

| AXIS | ESG Goals |

|

Natural Capital

|

Climate Change |

| ü Reduction of 10% of CO2 emissions per ton of crude steel by 2035, WSA (World Steel Association) methodology compared to 2018. | |

| ü Reduction of 20% of CO2 emissions per ton of crude steel by 2035, WSA (World Steel Association) methodology compared to 2018. | |

| ü Reduction of 28% of CO2 per ton of cement emissions by 2030, reaching 375 kgCO2e/t cement, CSI (Cement Sustainability Initiative) methodology. Equivalent to the target set in the CSI roadmap for the sector in 2050, base year 2020. | |

| ü Reduction of 30% in CO2 emissions aper ton of ore produced by 2035 (scopes 1 and 2), base year 2019. | |

| ü Net Zero by 2044 in the emissions of scopes 1 and 2 of CSN Mineração. | |

| Atmospheric Emissions | |

| ü Reduction of 40% of particulate matter emissions per ton of crude steel produced at UPV by 2030, base year 2019. | |

| Efficiency in Water Use and Effluent Management | |

| ü Reduce new water consumption for iron ore production by at least 10% per ton of ore produced by 2030 compared to the base year 2018. | |

|

Intellectual Capital

|

Innovation |

| ü Between 2020 and 2022, develop two new products/services on the ESG theme. | |

| ü By 2022, we will conduct six weeks of training in innovation, ESG and Venture Capital in the CSN Group units in relation to 2020. | |

| Governance, Ethics and Compliance | |

| ü Continuously increase our Compliance Index with the best governance practices provided for in CVM Resolution No. 80/2022 (considered "Practice" and "Partial practice"). | |

|

Human and Social Capital

|

Social Responsibility |

| ü By 2022, increase by 39% the care of children and adolescents by the Project Garoto Cidadão, by the CSN Foundation, in relation to 2020. | |

| Health and safety at work | |

| ü Continuously achieve the zero-fatality rate throughout the CSN Group (own and third parties). | |

| ü Reduce by 30% the frequency rate of accidents (CAF+SAF – own and third parties) by 2030 in the CSN Group compared to 2020 (factor of 1 million HHT). | |

| ü Reduce by 30% the number of days of sick leave by accident with own employees by 2030 compared to 2021. | |

| Dam Management and Mischaracterization | |

| ü Perform the complete mischaracterization of the dams built upstream of CSN Mineração by 2030. | |

| Diversity and Inclusion | |