Form 6-K NATIONAL GRID PLC For: May 19

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

Date: 19 May 2022

Commission File Number: 001-14958

NATIONAL GRID plc

(Registrant’s Name)

1-3 Strand

London WC2N 5EH, England

(Registrant’s Address)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

☒ Form 20-F ☐ Form 40-F

☒ Form 20-F ☐ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3- 2(b) under the Securities Exchange Act of 1934. ☐ Yes ☒ No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): n/a

Please see Exhibit 99.1 Announcement sent to the London Stock Exchange on 19 May 2022 — 'Full Year Results 2021/2022'

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

NATIONAL GRID plc | |||||||||||

| By: | /s/Ceri Jamond _______________________ | ||||||||||

| Ceri Jamond Senior Assistant Company Secretary | |||||||||||

Date: 19 May 2022

EXHIBIT INDEX

Exhibit No. | Description | ||||

Exhibit 99.1 Announcement sent to the London Stock Exchange on 19 May 2022 — 'Full Year Results 2021/2022' | |||||

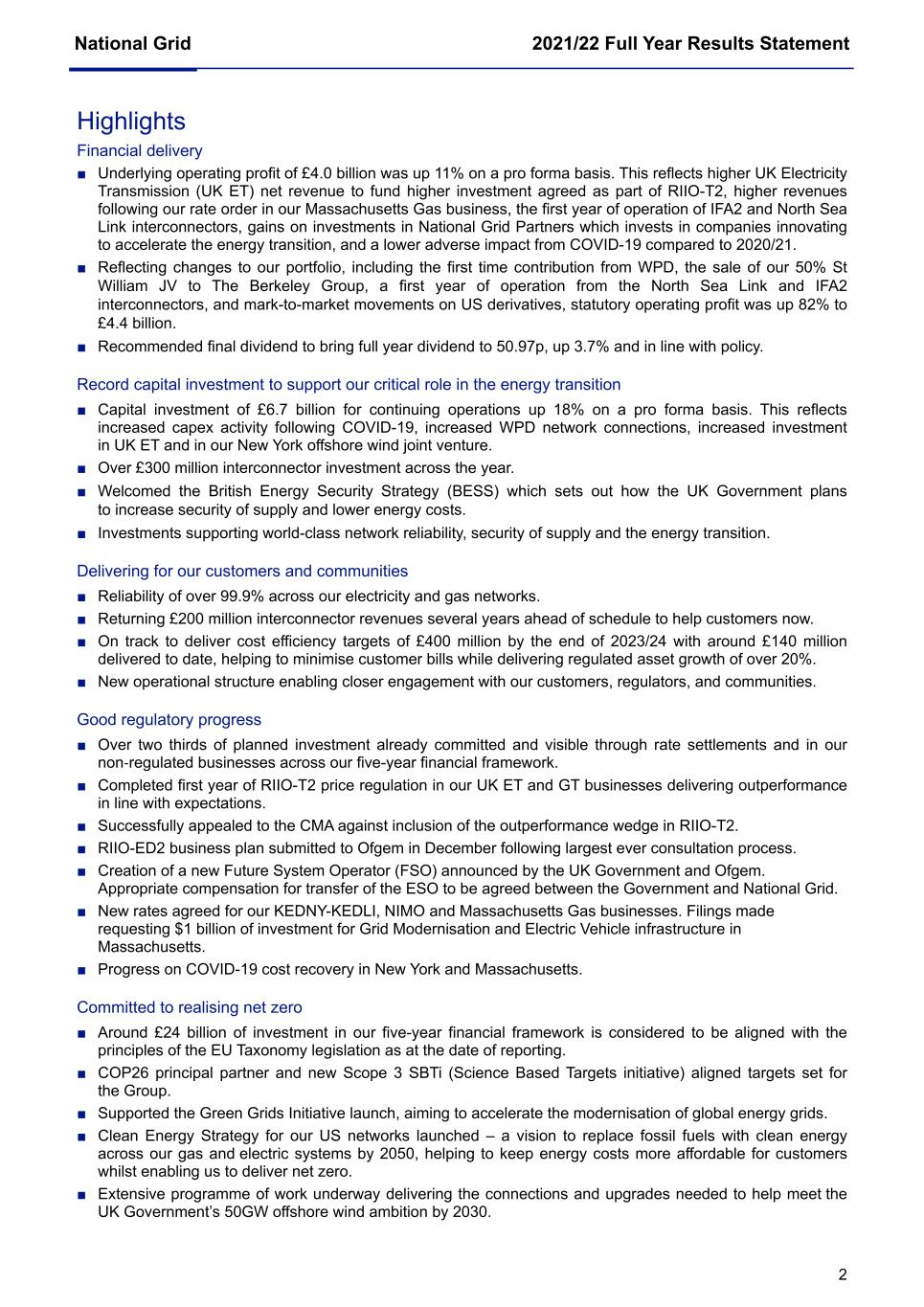

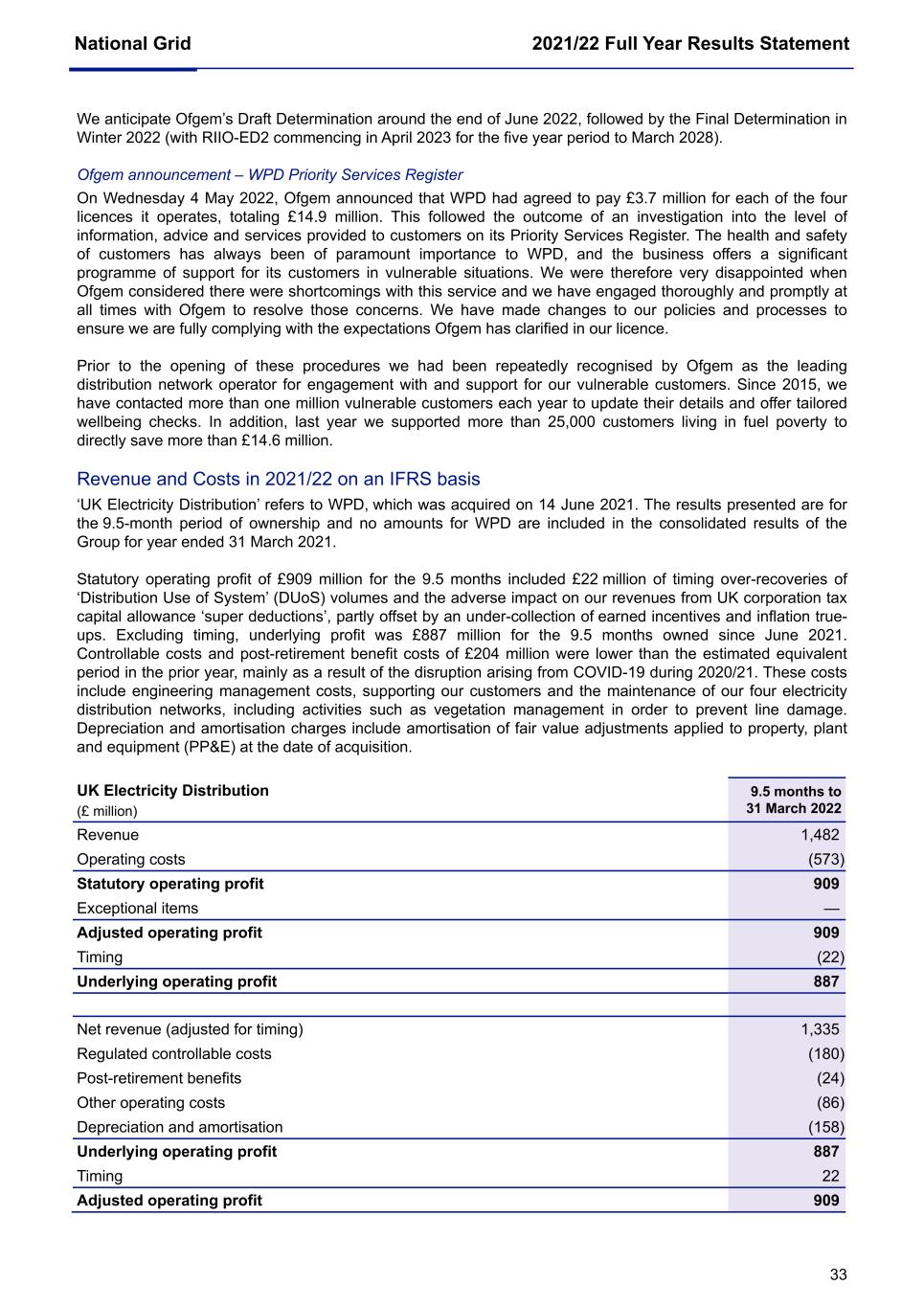

National Grid 2021/22 Full Year Results Statement 1 A record year of investment to enable the energy transition London | 19 May 2022: National Grid, a leading energy transmission and distribution company, today announces its Full Year results for the period ending 31 March 2022. John Pettigrew, Chief Executive, said: “The world has changed dramatically over the last year, with the tragic war in Ukraine, a global economic slowdown, and rapidly rising inflation. The UK and US communities we serve are facing significant cost of living challenges, at a time when further urgency is needed to address climate change. Against this backdrop, National Grid remains focused on positioning our business, through acquisitions and investment, to deliver net zero while continuing to safely ensure security of supply at the lowest possible cost to consumers. And our results today reflect the strength of this strategy. Our purchase of WPD has pivoted our business to a much greater focus on electricity infrastructure, putting us at the heart of delivering the energy transition. We’ve invested a record £6.7 billion in critical energy infrastructure, part of our five-year £30-35 billion investment programme. Over 70% of our five-year investment is aligned to EU taxonomy principles making us one of the FTSE's largest investors in the delivery of net zero. And we’ve made good progress on our £400 million cost efficiency programme, as we continue to focus on affordability for all of our customers.” Successful portfolio repositioning Last year, National Grid announced a strategic repositioning of its portfolio. Since then, we have: ■ Completed the £7.9 billion acquisition of Western Power Distribution (WPD), the UK’s largest distributor; ■ Obtained regulatory clearances and are awaiting the conclusion of the legal process for the sale of the Narragansett Electric Company (Rhode Island) which we expect to complete in Q1 2022/23; ■ Agreed the sale of a 60% stake in National Grid Gas to Macquarie Asset Management and British Columbia Investment Management Corporation, expected to complete in the third quarter of 2022/23 (continued to be held as a discontinued operation); and ■ Increased the focus on our core business following the sale of our 50% stake in the St William Homes joint venture to The Berkeley Group plc, for a cash consideration of £413 million. Financial Summary – Year ended 31 March Continuing operations only (not including UK Gas Transmission) Statutory results Underlying1 Actual Pro forma2 2022 2021 % change 2022 2021 2021 % change Operating profit (£m) 4,371 2,401 82% 3,992 2,688 3,608 11% Profit before tax (£m) 3,441 1,664 107% 3,059 1,889 2,626 16% Earnings per share (p) 60.6 37.0 64% 65.3 42.4 59.1 10% Dividend per share (p) 50.97 49.16 4% 50.97 49.16 49.16 4% Capital investment (£m) 6,739 4,843 39% 6,739 4,843 5,697 18% 3,599 million weighted average shares for 2021/22 (2020/21: 3,523 million). 1. ‘Underlying’ represents statutory results from continuing operations, but excluding exceptional items, remeasurements, major storm costs (when greater than $100m) and timing. These and a number of other terms and performance measures used in this document are not defined within accounting standards and may be applied differently by other organisations. We have provided definitions of these terms on page 91 and 92 and reconciliations of these measures on pages 91 to 106. These measures are not a substitute for IFRS measures, however the Group believes such information is useful in assessing the performance of the business on a comparable basis. 2. Pro forma underlying (continuing) 2020/21 figures are provided to help compare performance between reporting periods and include adjustments for an estimate of the underlying post-tax contribution from WPD for an equivalent 9.5 month period, as if we had owned that business in the prior year, including estimated incremental finance costs to acquire WPD. In addition, the current year beneficial earnings impact of not depreciating our Rhode Island business has also been applied in these comparative amounts. A reconciliation between these measures is provided on page 93. Exhibit 99.1

National Grid 2021/22 Full Year Results Statement 2 Highlights Financial delivery ■ Underlying operating profit of £4.0 billion was up 11% on a pro forma basis. This reflects higher UK Electricity Transmission (UK ET) net revenue to fund higher investment agreed as part of RIIO-T2, higher revenues following our rate order in our Massachusetts Gas business, the first year of operation of IFA2 and North Sea Link interconnectors, gains on investments in National Grid Partners which invests in companies innovating to accelerate the energy transition, and a lower adverse impact from COVID-19 compared to 2020/21. ■ Reflecting changes to our portfolio, including the first time contribution from WPD, the sale of our 50% St William JV to The Berkeley Group, a first year of operation from the North Sea Link and IFA2 interconnectors, and mark-to-market movements on US derivatives, statutory operating profit was up 82% to £4.4 billion. ■ Recommended final dividend to bring full year dividend to 50.97p, up 3.7% and in line with policy. Record capital investment to support our critical role in the energy transition ■ Capital investment of £6.7 billion for continuing operations up 18% on a pro forma basis. This reflects increased capex activity following COVID-19, increased WPD network connections, increased investment in UK ET and in our New York offshore wind joint venture. ■ Over £300 million interconnector investment across the year. ■ Welcomed the British Energy Security Strategy (BESS) which sets out how the UK Government plans to increase security of supply and lower energy costs. ■ Investments supporting world-class network reliability, security of supply and the energy transition. Delivering for our customers and communities ■ Reliability of over 99.9% across our electricity and gas networks. ■ Returning £200 million interconnector revenues several years ahead of schedule to help customers now. ■ On track to deliver cost efficiency targets of £400 million by the end of 2023/24 with around £140 million delivered to date, helping to minimise customer bills while delivering regulated asset growth of over 20%. ■ New operational structure enabling closer engagement with our customers, regulators, and communities. Good regulatory progress ■ Over two thirds of planned investment already committed and visible through rate settlements and in our non‑regulated businesses across our five-year financial framework. ■ Completed first year of RIIO-T2 price regulation in our UK ET and GT businesses delivering outperformance in line with expectations. ■ Successfully appealed to the CMA against inclusion of the outperformance wedge in RIIO-T2. ■ RIIO-ED2 business plan submitted to Ofgem in December following largest ever consultation process. ■ Creation of a new Future System Operator (FSO) announced by the UK Government and Ofgem. Appropriate compensation for transfer of the ESO to be agreed between the Government and National Grid. ■ New rates agreed for our KEDNY-KEDLI, NIMO and Massachusetts Gas businesses. Filings made requesting $1 billion of investment for Grid Modernisation and Electric Vehicle infrastructure in Massachusetts. ■ Progress on COVID-19 cost recovery in New York and Massachusetts. Committed to realising net zero ■ Around £24 billion of investment in our five-year financial framework is considered to be aligned with the principles of the EU Taxonomy legislation as at the date of reporting. ■ COP26 principal partner and new Scope 3 SBTi (Science Based Targets initiative) aligned targets set for the Group. ■ Supported the Green Grids Initiative launch, aiming to accelerate the modernisation of global energy grids. ■ Clean Energy Strategy for our US networks launched – a vision to replace fossil fuels with clean energy across our gas and electric systems by 2050, helping to keep energy costs more affordable for customers whilst enabling us to deliver net zero. ■ Extensive programme of work underway delivering the connections and upgrades needed to help meet the UK Government’s 50GW offshore wind ambition by 2030.

National Grid 2021/22 Full Year Results Statement 3 ■ Offshore wind venture with RWE successful in winning a seabed lease with New York Bight. ■ First year of IFA2 and North Sea Link interconnectors, saving more than 2 million tonnes of CO2 per annum. Financial Outlook and Guidance ■ Guidance includes WPD, assumes that the sale of the Narragansett Electric Company (Rhode Island) completes in Q1 of FY2022/23 and the sale of a 60% stake in National Grid Gas completes in the third quarter of this financial year. ■ Financial outlook over the five year period 2020/21 to 2025/26 remains unchanged: ■ Total cumulative capex of £30-£35 billion; ■ Asset Growth CAGR2 of 6-8% backed by strong balance sheet; ■ Driving underlying EPS CAGR of 5-7% from the 2020/21 EPS baseline of 54.2 pence per share1; ■ Credit metrics consistent with current Group rating; ■ Regulatory gearing to settle slightly above 70% once all three transactions are completed. ■ Following strong earnings growth in the first full year of the plan, we expect earnings for 2022/23 to be broadly flat on 2021/22, assuming an exchange rate of £1:$1.30. 1. Full-Year underlying EPS (2020/21) as reported on 20 May 2021. Prior year comparatives in this document have been restated for treatment of UK Gas Transmission as a discontinued operation. 2. Compound Annual Growth Rate.

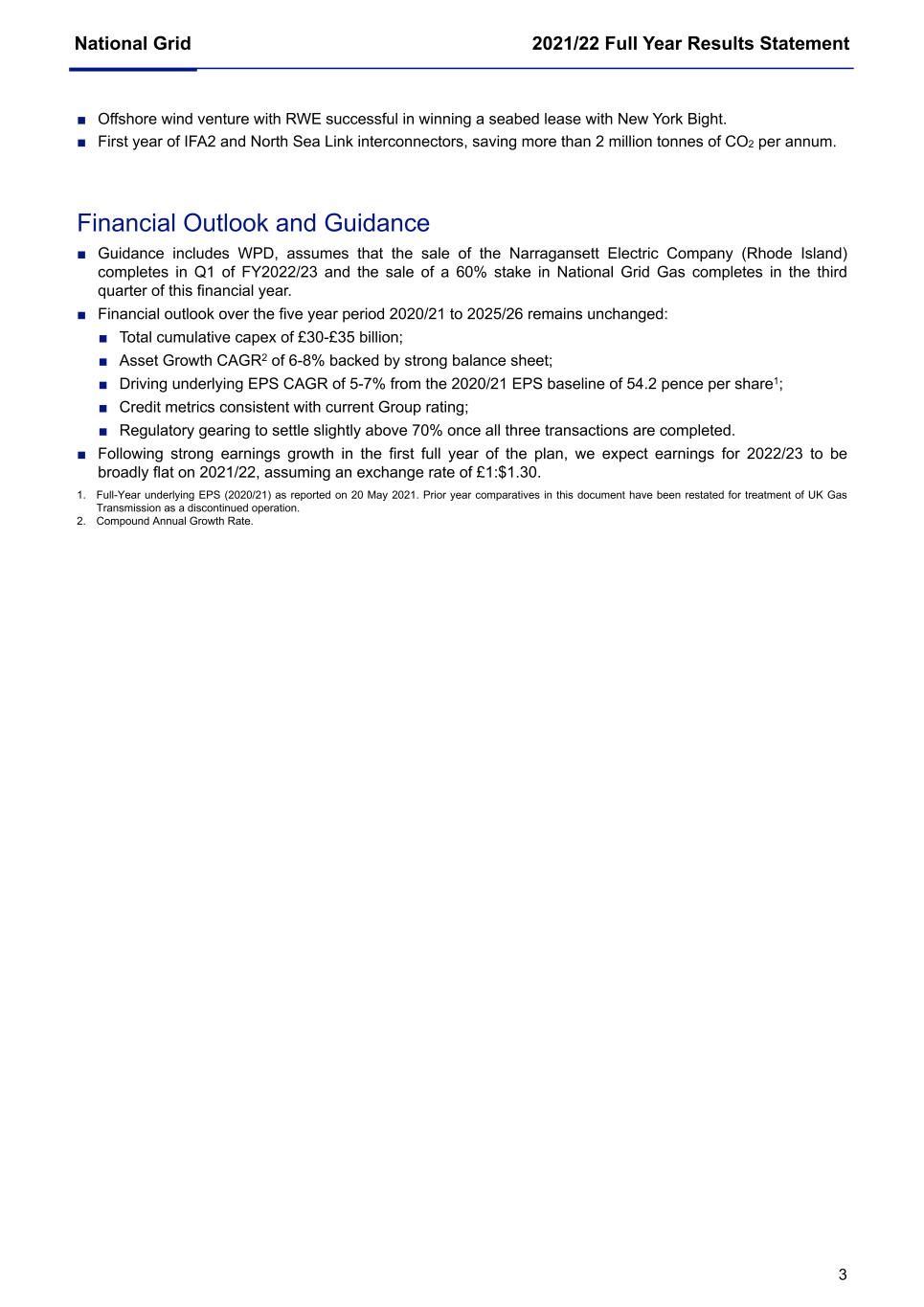

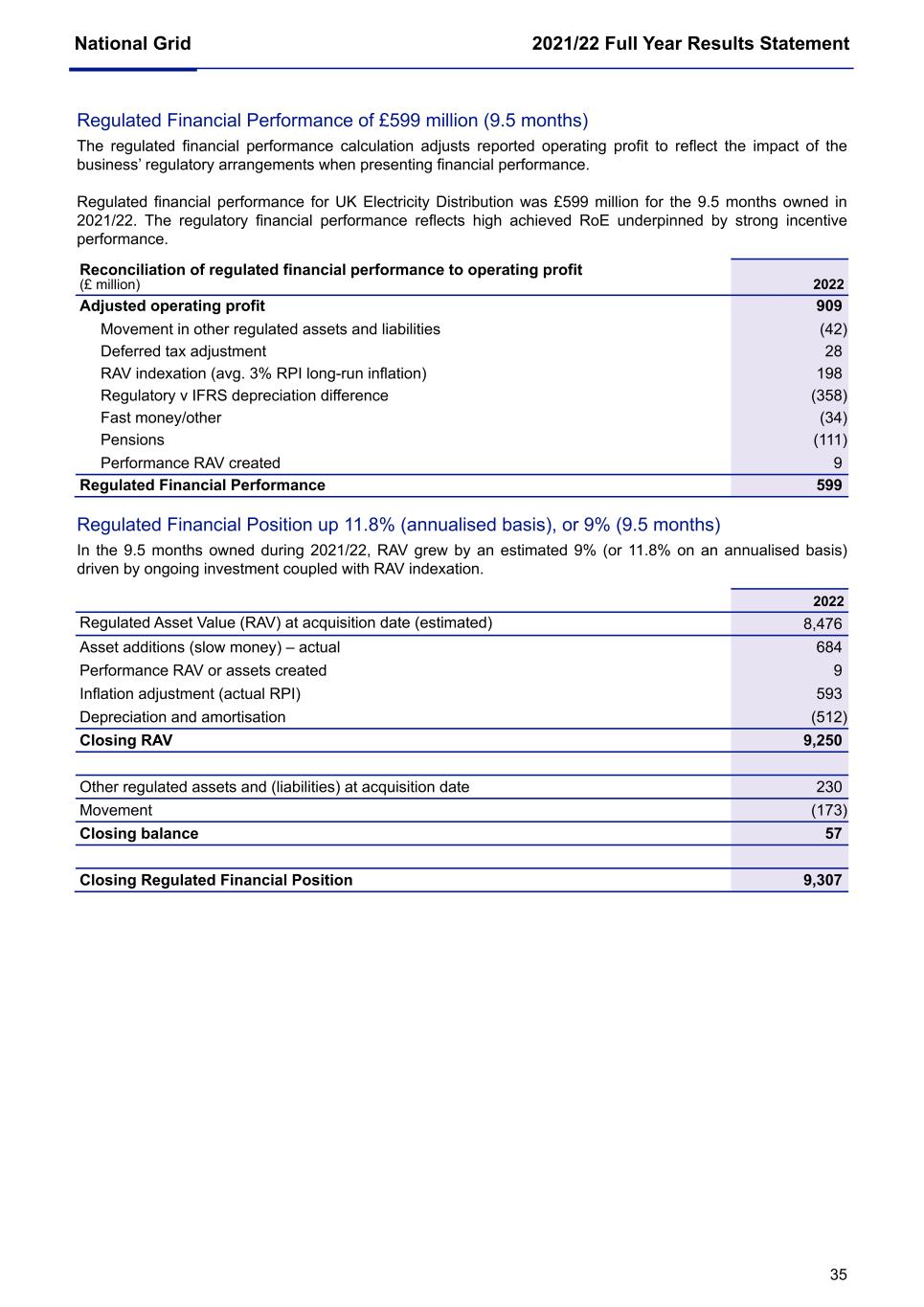

National Grid 2021/22 Full Year Results Statement 4 Operational Key Performance Indicators Year ended 31 March 2022 Actual Pro forma1 (£ million) 2022 20212 20212 change % Underlying operating profit (continuing): UK Electricity Transmission 1,152 1,052 1,052 10% UK Electricity Distribution 887 — 853 4% UK Electricity System Operator 54 70 70 (23%) New England 886 727 794 12% New York 706 722 722 (2%) NGV and Other 307 117 117 162% Underlying operating profit (continuing) 3,992 2,688 3,608 11% Capital investment (continuing): UK Electricity Transmission 1,195 984 984 21% UK Electricity Distribution 899 — 854 5% UK Electricity System Operator 108 88 88 23% New England 1,561 1,437 1,437 9% New York 1,960 1,738 1,738 13% NGV and Other 1,016 596 596 70% Capital investment (continuing) 6,739 4,843 5,697 18% RCF/Net debt 8.9 6.6 n/a 230bps As at 31 March Net debt (excludes businesses ‘held for sale’) (42,809) (28,546) 50% UK RAV – including UK Gas Transmission (£m) 31,593 20,876 51% US rate base (£m at constant currency) 22,178 20,687 7% Total Group RAV and rate base (£m) 53,771 41,563 29% NGV and Other businesses (£m) 5,226 4,920 6% Total (£m) 58,997 46,483 27% Regulated asset growth 8.7% 5.6% 310bps Group return on equity 11.4% 10.6% 80bps 1. Pro forma underlying (continuing) 2020/21 figures are provided to help compare performance between reporting periods and include adjustments for an estimate of the underlying post-tax contribution from WPD for an equivalent 9.5 month period, as if we had owned that business in the prior year, including estimated incremental finance costs to acquire WPD. In addition, the current year beneficial earnings impact of not depreciating our Rhode Island business has also been applied in these comparative amounts. A reconciliation between these measures is provided on page 93. 2. March 2021 opening balances restated for segmental changes and to correspond with 2020/21 regulatory filings and calculations. ESG Key Performance Indicators1 PwC assurance2 2022 2021 change Scope 1 & 2 greenhouse gas emissions (ktonnes CO2e) 7,465 6,943 8% Scope 3 greenhouse gas emissions (ktonnes CO2e) 30,088 28,948 4% Renewable energy connected to the UK Transmission Grid (MW) 1,869 360 n/a Renewable energy connected to the US Transmission and Distribution Grids (MW) 629 590 7% Group Lost Time Injury Frequency Rate (LTIFR) 0.13 0.10 0.03 Employee engagement index 81% 81% — Diversity % of the workforce 39% 38% 1% 1. Data does not include WPD, but does include National Grid Gas (NGG) and the Narragansett Electric Company (NECO). 2. In 2022, as represented by , we engaged PricewaterhouseCoopers LLP (PwC) to undertake a limited assurance engagement using the International Standard on Assurance Engagements (ISAE) 3000 (Revised): ‘Assurance Engagements Other Than Audits or Reviews of Historical Financial Information’ and ISAE 3410: ‘Assurance Engagements on Greenhouse Gas Statements’. Details of PwC’s full limited assurance opinion and National Grid’s Reporting Methodology are set out within National Grid’s Responsible Business Report.

National Grid 2021/22 Full Year Results Statement 5 Contacts Investor Relations Nick Ashworth +44 (0) 7814 355 590 Angela Broad +44 (0) 7825 351 918 Jon Clay +44 (0) 7899 928 247 James Flanagan +44 (0) 7970 778 952 Caroline Dawson +44 (0) 7789 273 241 Alex Bateman +44 (0) 7970 479 571 Media Molly Neal +44 (0) 7583 102 727 Danielle Dominey-Kent +44 (0) 7977 054 575 Brunswick Dan Roberts, Peter Hesse +44 (0) 207 404 5959 Management presentation and Q&A John Pettigrew (CEO) and Andy Agg (CFO) will host the results presentation at the London Stock Exchange, 10 Paternoster Square, London EC4M 7LS at 09:15 (BST) today. There will be a live webcast of the presentation available to view at nationalgrid.com/investors. Participants can ask a question via the webcast screen or via conference call (dial-in details below). A replay will be available soon after the event ends. For participants unable to join the webcast the presentation is available using the following details: UK dial-in numbers +44 (0) 203 936 2999 (Local) +44 (0) 800 640 6441 (Toll Free) US dial-in numbers +1 646 664 1960 (Local) All other locations +44 20 3936 2999 Access Code 038435 Press *1 to ask a question, *2 to withdraw a question, or *0 for operator assistance The Annual Report and Accounts 2021/22 (ARA) is expected to be publicly available on 7 June 2022. You can view or download the ARA from National Grid’s website at nationalgrid.com/investors Use of Alternative Performance Measures Throughout this release we use a number of alternative (or non-IFRS) and regulatory performance measures to provide users with a clearer picture of the regulated performance of the business. This is in line with how management monitor and manage the business day-to-day. Further detail and definitions for all alternative performance measures are provided on pages 91 to 106.

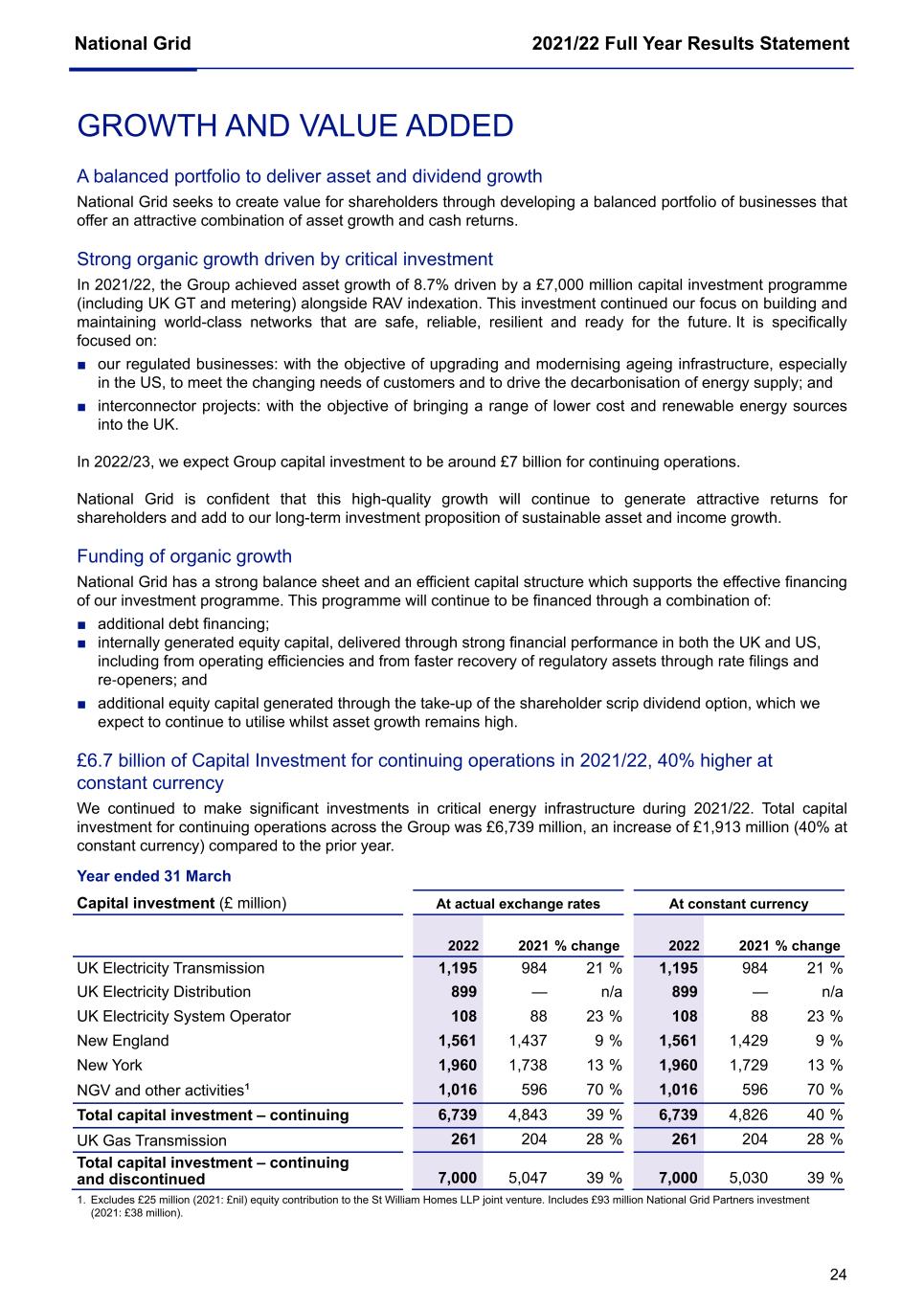

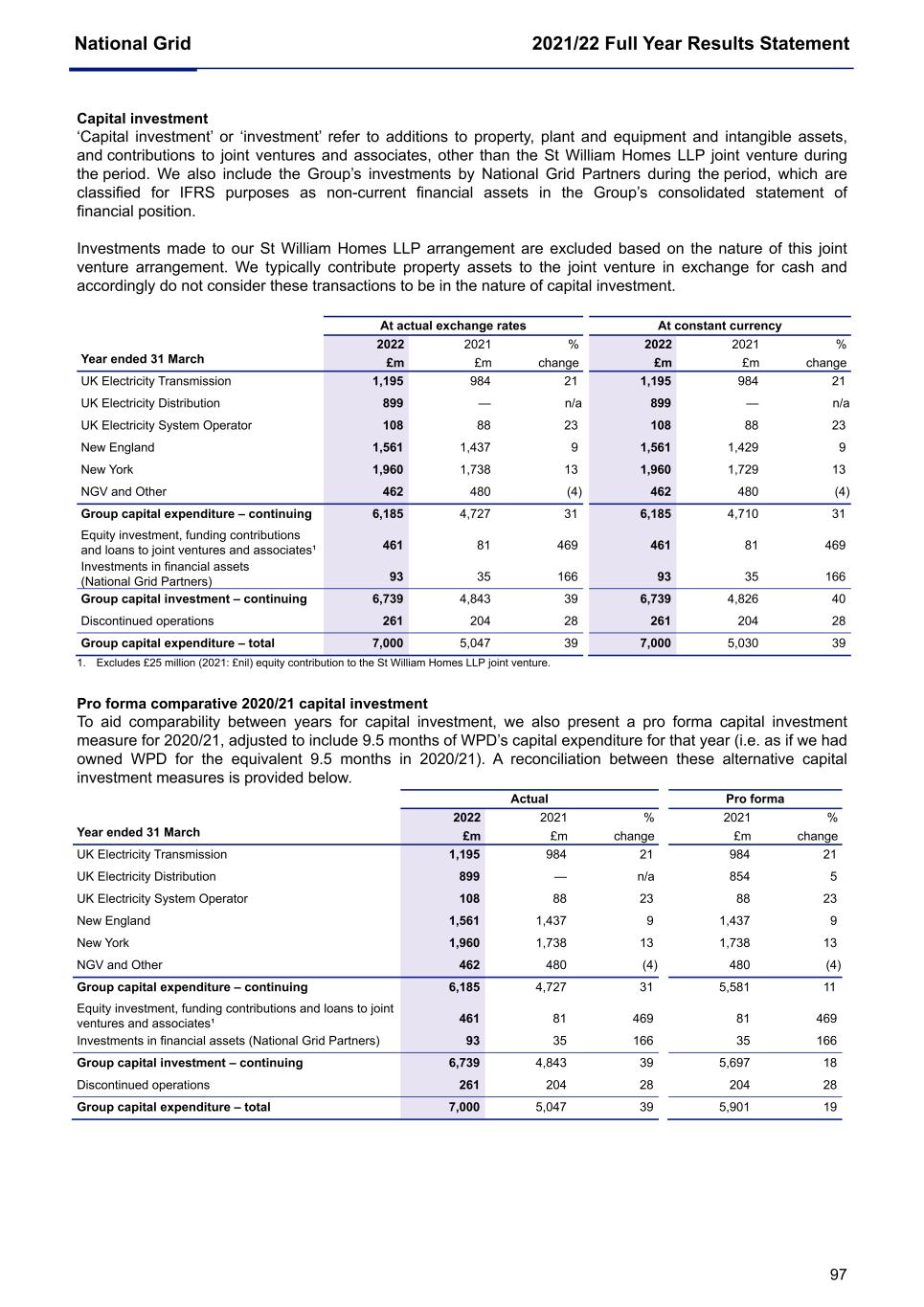

National Grid 2021/22 Full Year Results Statement 6 STRATEGIC OVERVIEW Good operational performance in a year of significant strategic change In 2021/22, National Grid delivered good operational performance with high levels of network reliability across all our service territories. During the year, we achieved a Lost Time Injury Frequency Rate (LTIFR)1 of 0.13, slightly above our industry leading Group target of 0.10. Our focus on safety has been unrelenting through the pandemic and our leading safety indicators performance remain strong. The slight increase in Group LTIFR was driven by a number of slips, trips and falls and minor incidents. We have continued to focus on our safety performance, and towards the end of the year we completed a full review of safety. We are using the outputs to inform our Group-wide priority actions to further improve our safety performance. A record year of investment: full-year financial performance (on a pro forma basis) The full-year financials provided in the following two paragraphs compare underlying performance on a pro forma basis (adjusted in 2020/21 to include an estimate of the underlying post-tax contribution from WPD for an equivalent 9.5 month period, as if we had owned that business in the prior year, including estimated incremental finance costs to acquire WPD; and the equivalent current year beneficial earnings impact of not depreciating our Rhode Island business applied to the comparative period). A full reconciliation can be found on page 93. Across the Group, capital investment for continuing operations increased by £1,059 million at constant currency to a record £6,739 million, an increase of 19% on the prior year (18% at actual exchange rates). This increase was principally due to higher UK ET capital spend on London Power Tunnels 2 (LPT2), the world’s first T-Pylon construction at Hinkley-Seabank, increased activities on Visual Impact Provision (VIP); higher spend on reinforcements and connections in UK Electricity Distribution (WPD); higher capital spend in New York and New England versus prior year when COVID-19 related work suspensions were in place; and the successful purchase of an offshore wind seabed lease in New York through National Grid Ventures (NGV). Underlying operating profit for continuing operations increased by £392 million at constant currency to £3,992 million, an increase of 11% on the prior year. This was principally driven by higher UK ET net revenue that funds higher investment levels; higher revenues following our rate order in our Massachusetts Gas business; the first year of operation of IFA2 and North Sea Link interconnectors; higher revenue from interconnector arbitrage; gains on investments in National Grid Partners which invests in companies innovating to accelerate the energy transition; and a lower adverse impact from COVID-19 compared to 2020/21. When combined with RAV indexation2, capital expenditure drove Group asset growth of 8.7%, slightly above the 6-8% Compound Annual Growth Rate (CAGR) we published as part of our five-year financial guidance in March 2021. Transforming our business – delivering for our customers This year has marked a significant strategic and structural shift for National Grid as we reach record levels of investment, enable the energy transition and deliver for our customers. The transactions we announced last year will be transformational for our business, providing clear visibility and certainty of investment that will help deliver the journey to net zero in the jurisdictions where we operate. When complete, the transactions will enhance our role in the energy transition, drive long-term shareholder value, and pivot our asset base towards 70% electricity, up from around 60% in 2021. Through our track record of delivery, and our drive for greater efficiencies and focus on digitalisation, our objective is to deliver a fair energy transition with affordability at the heart of our strategy and decision making. The recent rise in energy prices and increased focus on the cost of living has made this an even greater priority. This year, we have managed to keep bill rises minimised through new rate agreements; we have made good progress on our £400 million cost efficiency programme across the Group; and we have recently agreed the early return of £200 million of interconnector revenues to customers in the UK. We have continued to proactively support our communities with practical and financial support and we have realigned our organisational structure 1 Employee and contractor lost time injury frequency rate per 100,000 hours worked. 2 UK Transmission RAV indexed at CPIH in RIIO-T2; UK Electricity Distribution RAV indexed at RPI during RIIO-ED1.

National Grid 2021/22 Full Year Results Statement 7 to move us closer to customers to enhance the service we provide. Longer term, our Clean Energy Vision that we recently announced aims to deliver fossil free gas to our US customers by 2050, meaning that home heating costs could be 15-20% lower than under a high electrification approach, helping to keep energy costs more affordable for our customers whilst enabling us to deliver net zero. Repositioning our portfolio – enabling the energy transition We have made significant progress during the year on the transactions we announced in March 2021. Our £7.9 billion acquisition of Western Power Distribution (WPD), the UK’s largest electricity distribution network, completed in June and approval was received from the Competition and Markets Authority (CMA) in September. The acquisition, which creates our UK Electricity Distribution (UK ED) business, pivots us further towards electricity, places us at the centre of the energy transition and underpins the certainty of growth in the longer-term. The sale of the Narragansett Electric Company (Rhode Island) to PPL continues to make progress. We have obtained regulatory clearances and are awaiting the conclusion of the legal process for the sale of the business. We remain confident that the transaction will complete in the first quarter of 2022/23. In March 2022, we announced the sale of a 60% stake in National Grid Gas (NGG – UK Gas Transmission and Metering) to a consortium of long-term infrastructure investors comprised of Macquarie Asset Management and British Columbia Investment Management Corporation (BCI). The terms of the transaction imply an enterprise value for NGG of approximately £9.6 billion. On completion, National Grid will receive £2.2 billion in cash consideration, subject to customary completion adjustments. Following the transaction, we will own a 40% minority equity interest in NGG through a new holding company. In addition, we will receive approximately £2.0 billion from additional debt financing in NGG at completion. The transaction is subject to certain antitrust and regulatory conditions. Subject to these clearances, National Grid expects the transaction to complete in the third quarter of this financial year. National Grid has also entered into an option agreement with the consortium for the potential sale of our remaining 40% equity stake in NGG once the initial 60% stake sale completes. The option may be exercised by the consortium between 1 January 2023 and 30 June 2023. If the option is exercised, the consideration is expected to be paid in cash to National Grid on broadly similar terms to the transaction, subject to adjustment for dividends paid in the business at the time of exercise. In March 2022, we completed the sale of our 50% stake in the St William Homes LLP (St William) joint venture to The Berkeley Group plc, for a cash consideration of £413 million. This resulted in an exceptional gain on disposal of £228 million and a further exceptional gain from the release of £189 million of deferred income arising on historical site sales made to that joint venture. Alongside this sale, National Grid and The Berkeley Group entered into a series of sale and purchase agreements for a number of additional sites we own which are expected to complete over the period to 2025 for a total additional consideration of approximately £270 million. Deferred consideration of £230 million in respect of sites previously sold to St William will be payable by The Berkeley Group to National Grid over the period to 2031. The sale is in line with our existing plans to focus on our core business and demonstrates our ability to crystalise the value of our portfolio of non-operational land. Finally, in April 2022, the Department for Business, Energy and Industrial Strategy (BEIS) and Ofgem announced their joint decision to create a new Future System Operator (FSO) that builds on the track record and skills of the Electricity System Operator (ESO) whilst creating an impartial body with responsibilities across both the electricity and gas systems. The ESO will continue to work closely with all parties involved in the coming months to enable a smooth and successful transition. Appropriate compensation for transfer of the ESO will need to be agreed between the UK Government and National Grid.

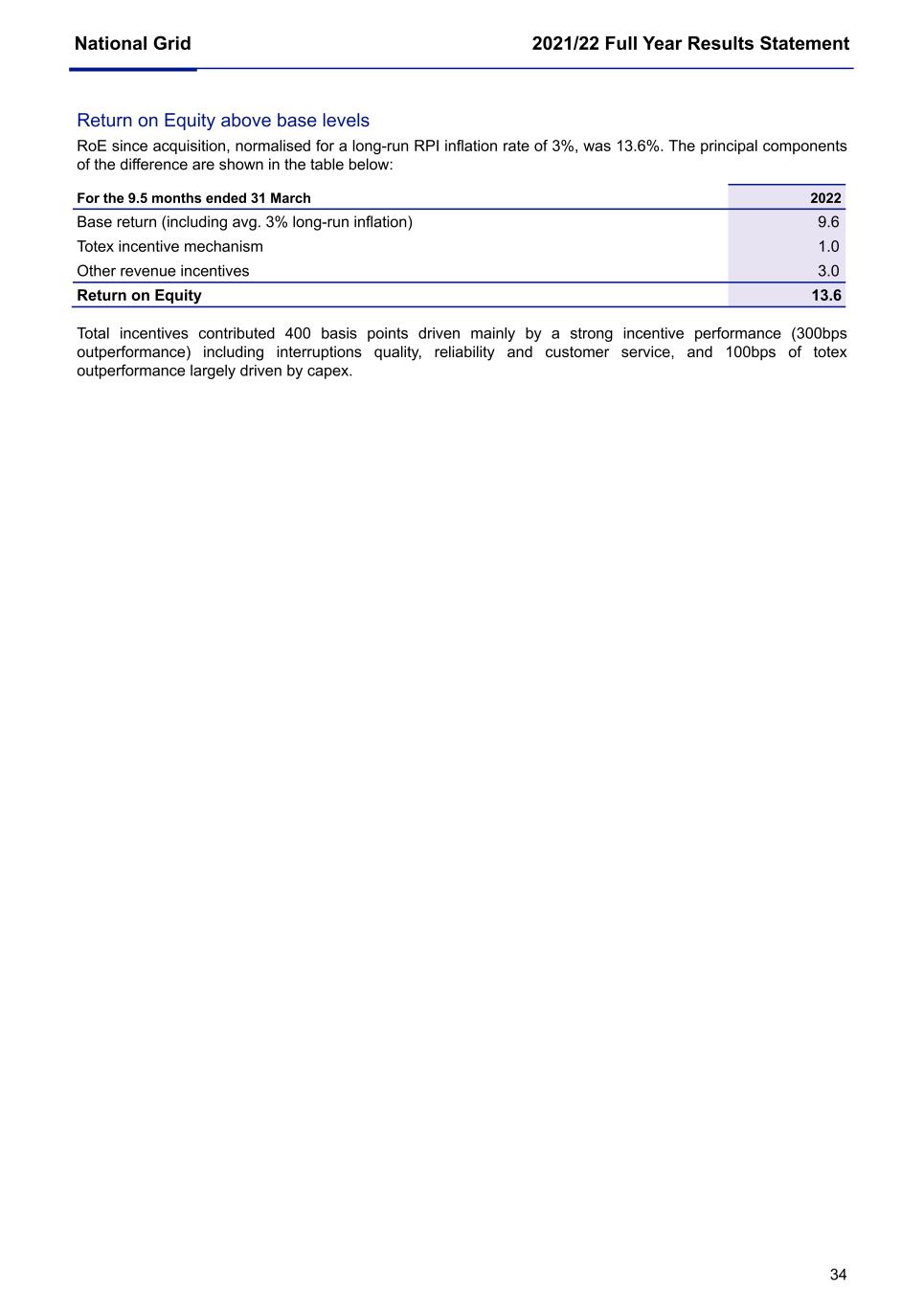

National Grid 2021/22 Full Year Results Statement 8 Our new operating model – bringing our business closer to customers, regulators and communities In April 2021, we moved to a new organisational structure that positions the Group strategically for the opportunities that net zero and the energy transition will bring. The business model is now based on seven business units, each of which are now run as end-to-end enterprises with financial responsibility with their executive teams, increasing the focus on efficient operational delivery. These units are UK Electricity Transmission, UK Electricity Distribution, UK Gas Transmission (treated as a discontinued operation), UK Electricity System Operator, New England, New York, and National Grid Ventures. This new structure enables us to be closer to our customers, our regulators, and our communities, with a best in class service in a locally-focused manner. In addition, it will drive decision making down to the local level making us a more agile business, helping to develop new processes and digital solutions. Together with our strong track record of delivering efficiently, our new operating model will deliver a step change in productivity improvements right across the business for the benefit of our customers and communities we serve. Progressing our Cost Efficiency Programme In November 2021, we announced our cost efficiency programme targeting at least £400 million savings3 per annum across the Group by the end of 3 years, even while our regulated assets continue to grow by over 20% over the same period. As we deliver this savings programme, as well as the new organisational structure, we expect to incur further implementation costs of around £100 million. In relation to the sale of our Rhode Island and UK Gas Transmission businesses, we expect to have further transaction and separation costs of around £95 million. Since the beginning of the programme, which includes some efficiency savings in 2020/21, we have delivered around £140 million of savings across the Group. These are across four main areas: 1. Process improvements – where we are reviewing work processes, particularly across the field workforce, to update and close out more jobs during the day which helps to increase productivity; 2. Organisation restructuring – where we are restructuring our management organisation allowing for greater decision making in the field; 3. Digital improvements – where we are increasing the use of drones rather than labour for network inspections, and utilising Vegetation Management software with satellite imagery to map the areas where vegetation poses a high risk to our networks; and 4. Supply chain and contract efficiencies – where we are identifying savings on contractor costs by prioritising internal resource more effectively, reducing expenditure on third party vendors, and reassessing the number of licenses we need to procure for various systems. We remain on track to deliver the £400 million savings target by the end of 2023/24. Regulatory Progress During the year, we made very good regulatory progress on our rate plans. Across the Group, over two thirds of our investment out to 2025/26 is now committed through rate settlements in our regulated businesses. This gives us good visibility for capital spend over the next five years as we invest to maintain network reliability and help enable the energy transition. Our final RIIO-ED2 Business Plan (UK ED) was submitted in December 2021 and proposed £6.7 billion investment between 2023 and 2028. This represents a 27% increase on annual average expenditure in RIIO- ED1, whilst maintaining affordability for our customers. The Business Plan was co-created with more than 25,000 stakeholders, with 96% of customers finding the plan fully acceptable. We anticipate Ofgem’s Draft Determination around the end of June 2022, followed by the Final Determination in Winter 2022. Across the Group, we achieved a Return on Equity (RoE) of 11.4% in 2021/22 up 80bps on the prior year driven by the acquisition of UK ED, and higher interconnector revenues in our National Grid Ventures non-regulated businesses. This was partially offset by a lower RIIO-T2 return in UK ET as well as higher interest costs. We completed the first year of the RIIO-T2 price regulation in our UK ET and GT businesses. For UK ET, we delivered an RoE of 7.7%, 140bps ahead of the baseline allowance as we completed projects started under the RIIO-T1 framework. For UK GT, we delivered an RoE of 7.8%, 120bps ahead of the baseline allowance. For UK 3 Not including UK Electricity Distribution

National Grid 2021/22 Full Year Results Statement 9 ED, in the penultimate year of RIIO-ED1, we delivered an RoE of 13.6%, 400bps ahead of the allowed return. The ESO also successfully completed the first year of its RIIO-T2 price control under its new bespoke regulatory funding framework. This allows recovery of all efficiently incurred costs as well as incentivisation of the ESO to deliver an ambitious business plan and value for money for consumers. In the US, New York achieved an RoE of 8.8%, or 99% of the allowed RoE; New England achieved an RoE of 8.3%, or 85% of the allowed RoE, slightly above our Half-Year guidance. During the year, we agreed rate settlements for our New York businesses, KEDNY-KEDLI and NIMO, and received a new rate order for our gas business in Massachusetts. We also filed for funding in Massachusetts to help modernise our electric grid network and made one of the largest US filings for EV charging infrastructure outside the state of California. We expect to hear the outcome of these filings in the second half of calendar year 2022. For further information on RoEs for each of our business entities, please refer to the Business Review section on pages 27 to 52. Delivering on our ESG commitments – progress through our Responsible Business Charter We have made good progress in the first full year of delivery against the commitments in our Responsible Business Charter. At our core, we are The Energy Transition Company and we are determined to successfully deliver the transition to net zero and do right by the communities we serve. In our role as a Principal Partner for COP26 in Glasgow, we launched a programme of events to raise public awareness of the progress and future change needed to fight climate change. In addition, we engaged widely to support the global diplomatic effort to build momentum for change, including our involvement in launching the UK and Indian governments’ new initiative, ‘Green Grid Initiative – One Sun One World One Grid’. Throughout COP26 we provided a clear message, which is that net zero is achievable, affordable and we need to accelerate action to reach net zero in line with International Energy Agency (IEA) milestone dates in the 2030s for electricity grids. To help map out our future actions we plan to publish our first Climate Transition Plan as part of this year’s Responsible Business Report (RBR). We are clear that energy needs to remain affordable through the transition in the long term, and to support our work in this we will publish our Fair Transition Statement this summer, an important step to set out and engage on the key challenges the transition presents to communities and customers. Within the year, we saw an increase in Group Scope 1 & 2 emissions. This was driven mainly by Scope 1 generation emissions exceeding projected levels through increased operating hours at our Long Island generation plant. The plant is contracted to the Long Island Power Authority (LIPA) and was required to replace shortfalls in off-island generation and transmission during the year. Our total Scope 3 emissions increased slightly on the prior year, driven principally by higher customer gas demand as pandemic-related restrictions were eased. However, looking forward, we now have an extensive programme of work committed to delivering the connections and network upgrades needed to help hit the UK Government’s 50GW by 2030 offshore wind ambition, and in New York our joint venture with RWE was successful in securing a new offshore wind seabed lease. We have also announced new partnerships with Hitachi, and with Cardiff and Manchester Universities, on projects to help remove SF6 gases from our networks. Across the Group, we have committed to a green car and light duty vehicle fleet across the Group by 2030. In New York, we launched our Project C for community programme which aims to provide additional funds and volunteering to ensure we play our part as a responsible member of the community. We are funding this growth in activity through the conversion of unclaimed shares and dividends. This has allowed us to inject an additional £5 million through the year into community and environmental causes to help support economic growth, diversity, opportunity and nature in the communities we serve. We are providing this support through workforce development programmes, grants for neighbourhood improvement, STEM education funding, and urban greening programmes such as community gardens and large-scale tree plantings. In the UK, the completion of our WPD acquisition brings a strong culture of commitment and action for customers and communities which we will fully incorporate into adjusted targets for next years’ RBR. Our wider actions to deliver a diverse workforce remain on course to hit our 2025 diversity commitments, and we will aim

National Grid 2021/22 Full Year Results Statement 10 to revise these commitments further to ensure we can hit our ambition to reflect the communities we serve in each region. Finally, the recent rise in energy prices, coupled with the wider cost of living crisis, pose a significant challenge. This is particularly acute in the UK where we have taken initial actions to support the important frontline work of Citizens Advice. Our first actions have been to provide financial support of £1 million to develop the systems and tools to provide advice and guidance to more people, and, separately, a further grant of £1 million to provide energy bill payment vouchers direct to those most in need. We will continue these levels of community support and take the actions needed to accelerate the path away from fossil fuels towards net zero, in terms of both energy efficiency and connection of low carbon supply sources. We demonstrated this in April through the announcement of our Clean Energy Vision in the US where we aim to fully decarbonise our electric and gas networks by 2050. Our Clean Energy Vision – decarbonising our networks, keeping energy affordable for customers On 19 April 2022, we announced our Clean Energy Vision, our plan to decrease our reliance on fossil fuels from our US gas and electric systems over time, enabling homes and businesses we serve to meet their heating needs without the use of fossil fuels by 2050. The announcement recognises our critical role in leading the clean energy transition for our customers and communities. We plan to achieve this goal through four pillars. Firstly, we will continue to provide programmes for our customers to accelerate weatherproofing and energy efficiency improvements to buildings, including deep retrofits and measures that reduce peak gas and electric demand; secondly, we will eliminate fossil fuels from our existing gas network no later than 2050 by delivering renewable natural gas and green hydrogen to our customers; thirdly, we will support our customers by providing them with strategies and tools to capture and maximise the benefits of pairing electric heat pumps with their gas appliances; finally, we will support cost- effective targeted electrification on our gas network, including piloting new solutions like networked geothermal. We acknowledge that Massachusetts and New York have ongoing public proceedings to help guide implementation of the critical plans needed to fight climate change. The Company is actively participating in those proceedings and will continue to engage in the public feedback sessions for our state climate action plans, highlighting the benefits of our fossil-free vision for all residents and businesses. Our vision, which will require legislative and regulatory changes to implement, proposes a hybrid approach that enables customers to have more affordable energy solutions and allows customers to retain choice in how to achieve net zero. Through this hybrid approach we estimate that home heating costs could be 15-20% lower than under a high or full electrification approach, helping to keep energy costs more affordable for our customers. In addition, it leverages existing infrastructure and requires less fossil gas generation, strengthens resiliency and reliability by decarbonising the gas system in parallel with the electric system, and it puts the skills of our existing workforce at the heart of the clean energy transition. Our roadmap to achieving these goals sets milestones out to 2050. We will work with regulators to ensure that support legislation and regulatory policies are in place by 2025. By 2030, we aim to serve 10-20% of customer gas demand with RNG whilst running community scale projects blending hydrogen into the system. By 2040, we aim to blend 20% green hydrogen and 30% Renewable Natural Gas (RNG) into the gas network, further laying foundations to supply 100% fossil-free gas to our customers by 2050. We anticipate that, by 2050, 50% of heating will be through heat pumps, 25% through fossil-free gas, and 25% through a hybrid of electric and fossil-free systems. Our vision is a more resilient and reliable solution for the states where we operate. A high electrification approach relies heavily on one system for power, transport, and heating. In addition, the weather characteristics of the Northeast make full-electrification less desirable, with a significant portion of the building stock categorised as ‘hard to electrify’. By decarbonising the gas system in parallel with the electric system, we can create a more resilient energy network. Our vision also supports equitable outcomes for disadvantaged communities. By avoiding large upfront investments, our vision enables all customers to have access to clean energy in the future.

National Grid 2021/22 Full Year Results Statement 11 Board changes Sir Peter Gershon stepped down from the Board with effect from 31 May 2021. Paula Rosput Reynolds, who joined the Board on 1 January 2021 as Non-executive Director and Chair Designate, assumed the position of Chair effective 31 May 2021. Nicola Shaw, UK Executive Director, and Paul Golby, Non-executive Director stepped down from the Board at the conclusion of the Company’s 2021 Annual General Meeting (AGM) on 26 July 2021. Nicola continued supporting the Company until the conclusion of the RIIO-T2 Competition and Markets Authority (CMA) appeal process. Lord Livingston Of Parkhead (Ian Livingston) was appointed as a Non-executive Director of the Board from 1 August 2021, joining the Remuneration Committee on appointment and the Audit & Risk Committee on 1 September 2021. Tony Wood and Martha B. Wyrsch were appointed as Non-executive Directors of the Board from 1 September 2021. On appointment, Tony joined the Safety & Sustainability and the People & Governance Committees and Martha joined the Remuneration and the Safety & Sustainability Committees. On 27 July 2021 we announced Committee membership changes following a review by the Board. The changes were effective from 1 September 2021. On 31 December 2021, Mark Williamson retired from the Board and on 1 January 2022, Thérèse Esperdy was appointed as the Senior Independent Director. In addition, Jonathan Dawson stepped down as Chair of the Remuneration Committee (however, remaining as a member of the Committee) and Ian Livingston became Chair of the Committee from 1 January 2022. On 19 January 2022, Anne E. Robinson was appointed as a Non-executive Director of the Board and a member of the Safety & Sustainability Committee.

National Grid 2021/22 Full Year Results Statement 12 FIVE-YEAR OUTLOOK Our five-year financial framework includes WPD and assumes that the sale of the Narragansett Electric Company (Rhode Island) completes in Q1 of 2022/23 and the sale of a 60% stake in National Grid Gas completes in the third quarter of this financial year. Capital investment and Group asset growth We expect to invest £30–£35 billion across our energy networks and adjacent businesses, in the UK and US, over the five-year period to 2025/26. Of this investment, around £24 billion is considered to be aligned with the principles of the EU Taxonomy legislation as at the date of reporting. In the UK, we expect around £8 billion of investment in Electricity Transmission for asset health and anticipatory system reinforcement to facilitate offshore generation and other new onshore system connections. We expect the WPD networks to invest around £5 billion over the five years to 2025/26 in asset replacement, reinforcement and new connections, facilitating the infrastructure for electric vehicles, heat pumps and directly connected generation. In our US businesses, we expect investment of around £17 billion over the five years to 2025/26. Over half of this will be safety related projects in our gas networks with the remainder in our electric networks such as for storm hardening, other net zero investments as well as further electric transmission investment. We expect NGV to invest £2–£3 billion over the five years to 2025/26 in completing the interconnector programme, the Isle of Grain Liquefied Natural Gas (LNG) capacity expansion, and US renewable generation. As we work through our proposed transactions, coupled with the sum of these investments, and the broad economic protection our businesses have against rising macroeconomic variables such as inflation, group asset growth is expected to be 6-8% CAGR through to 2025/26. Group gearing We expect regulatory gearing to settle slightly above 70% once all three of the transactions are completed. We remain committed to a strong, overall investment grade credit rating. Combined with the benefit of our hybrid debt, we expect gearing levels, and the other standard metrics we monitor, to sit within our current BBB+/Baa1 corporate rating band. Group earnings growth and dividend growth From 2020/21 through to 2025/26, we expect our CAGR in earnings per share to be in the 5–7 percent range from the baseline 54.2 pence per share1. This includes our long run average scrip uptake of 25% per annum, which will underpin our sustainable, progressive dividend policy into the future. Following strong earnings growth in the first full year of the plan, we expect earnings for 2022/23 to be broadly flat on 2021/22. We expect the future earnings through to 2025/26 to remain within our five-year framework. 1. Full-Year underlying EPS (2020/21) as reported on 20 May 2021. Prior year comparatives in this document have been restated for treatment of UK Gas Transmission as a discontinued operation.

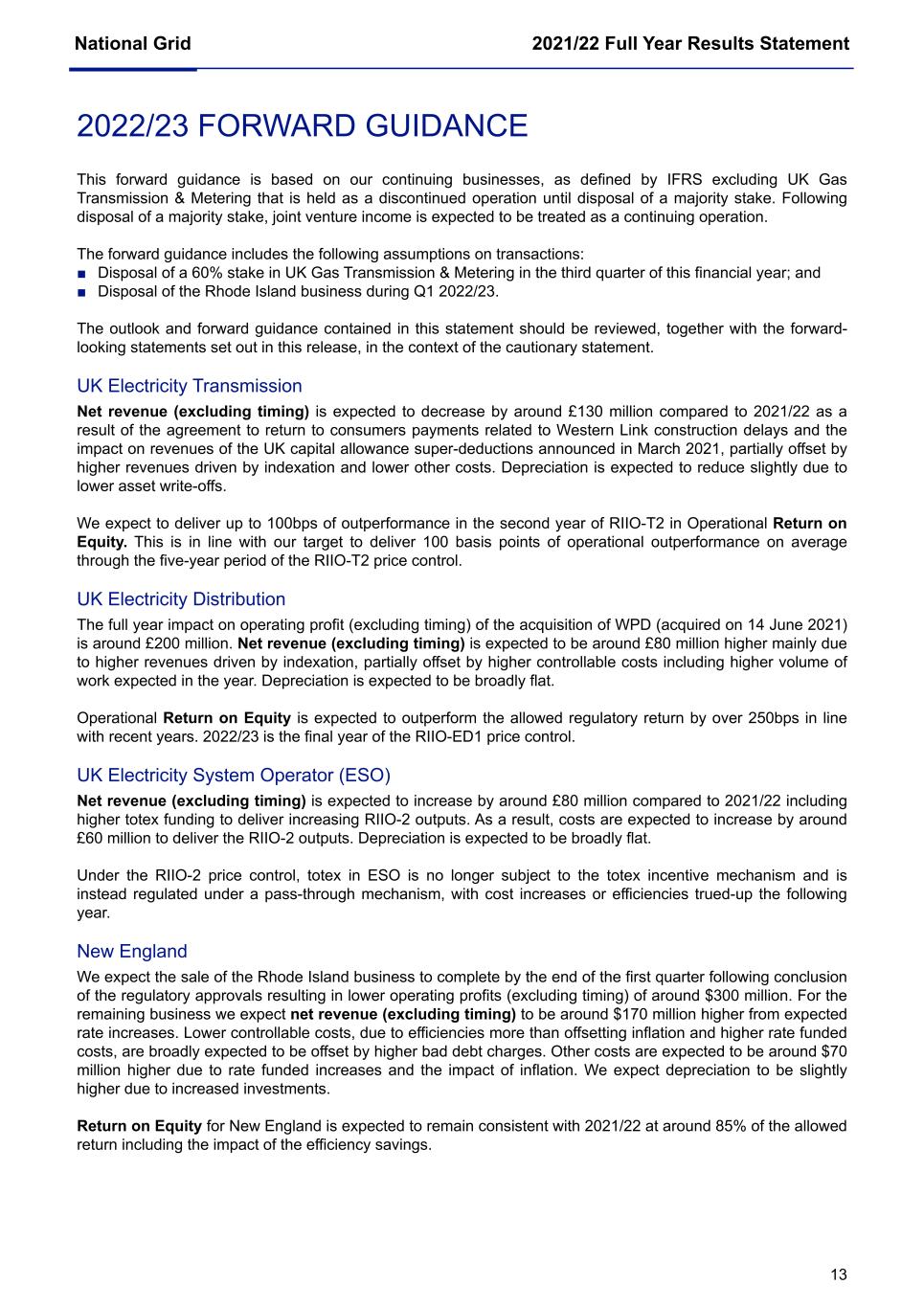

National Grid 2021/22 Full Year Results Statement 13 2022/23 FORWARD GUIDANCE This forward guidance is based on our continuing businesses, as defined by IFRS excluding UK Gas Transmission & Metering that is held as a discontinued operation until disposal of a majority stake. Following disposal of a majority stake, joint venture income is expected to be treated as a continuing operation. The forward guidance includes the following assumptions on transactions: ■ Disposal of a 60% stake in UK Gas Transmission & Metering in the third quarter of this financial year; and ■ Disposal of the Rhode Island business during Q1 2022/23. The outlook and forward guidance contained in this statement should be reviewed, together with the forward- looking statements set out in this release, in the context of the cautionary statement. UK Electricity Transmission Net revenue (excluding timing) is expected to decrease by around £130 million compared to 2021/22 as a result of the agreement to return to consumers payments related to Western Link construction delays and the impact on revenues of the UK capital allowance super-deductions announced in March 2021, partially offset by higher revenues driven by indexation and lower other costs. Depreciation is expected to reduce slightly due to lower asset write-offs. We expect to deliver up to 100bps of outperformance in the second year of RIIO-T2 in Operational Return on Equity. This is in line with our target to deliver 100 basis points of operational outperformance on average through the five-year period of the RIIO-T2 price control. UK Electricity Distribution The full year impact on operating profit (excluding timing) of the acquisition of WPD (acquired on 14 June 2021) is around £200 million. Net revenue (excluding timing) is expected to be around £80 million higher mainly due to higher revenues driven by indexation, partially offset by higher controllable costs including higher volume of work expected in the year. Depreciation is expected to be broadly flat. Operational Return on Equity is expected to outperform the allowed regulatory return by over 250bps in line with recent years. 2022/23 is the final year of the RIIO-ED1 price control. UK Electricity System Operator (ESO) Net revenue (excluding timing) is expected to increase by around £80 million compared to 2021/22 including higher totex funding to deliver increasing RIIO-2 outputs. As a result, costs are expected to increase by around £60 million to deliver the RIIO-2 outputs. Depreciation is expected to be broadly flat. Under the RIIO-2 price control, totex in ESO is no longer subject to the totex incentive mechanism and is instead regulated under a pass-through mechanism, with cost increases or efficiencies trued-up the following year. New England We expect the sale of the Rhode Island business to complete by the end of the first quarter following conclusion of the regulatory approvals resulting in lower operating profits (excluding timing) of around $300 million. For the remaining business we expect net revenue (excluding timing) to be around $170 million higher from expected rate increases. Lower controllable costs, due to efficiencies more than offsetting inflation and higher rate funded costs, are broadly expected to be offset by higher bad debt charges. Other costs are expected to be around $70 million higher due to rate funded increases and the impact of inflation. We expect depreciation to be slightly higher due to increased investments. Return on Equity for New England is expected to remain consistent with 2021/22 at around 85% of the allowed return including the impact of the efficiency savings.

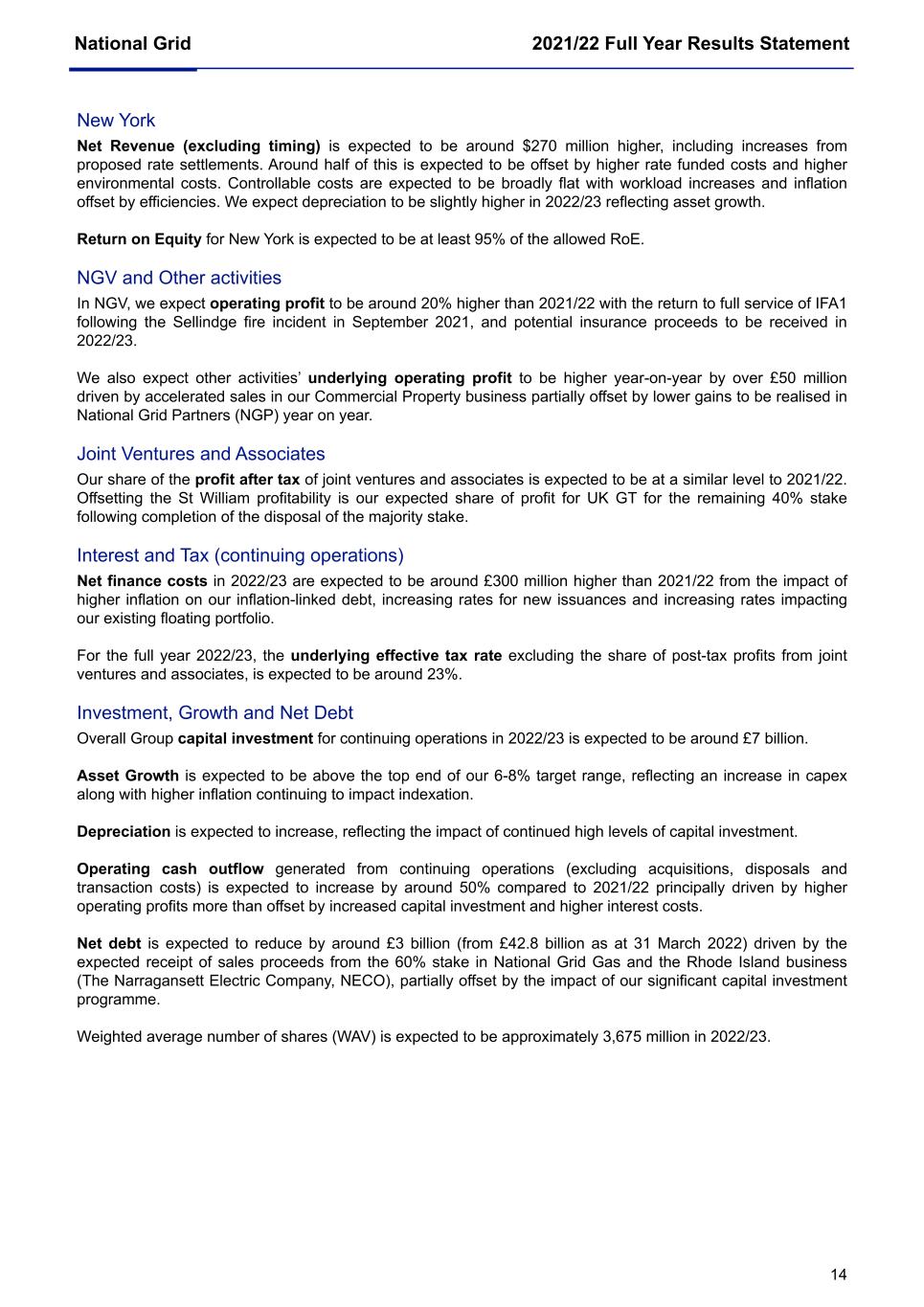

National Grid 2021/22 Full Year Results Statement 14 New York Net Revenue (excluding timing) is expected to be around $270 million higher, including increases from proposed rate settlements. Around half of this is expected to be offset by higher rate funded costs and higher environmental costs. Controllable costs are expected to be broadly flat with workload increases and inflation offset by efficiencies. We expect depreciation to be slightly higher in 2022/23 reflecting asset growth. Return on Equity for New York is expected to be at least 95% of the allowed RoE. NGV and Other activities In NGV, we expect operating profit to be around 20% higher than 2021/22 with the return to full service of IFA1 following the Sellindge fire incident in September 2021, and potential insurance proceeds to be received in 2022/23. We also expect other activities’ underlying operating profit to be higher year-on-year by over £50 million driven by accelerated sales in our Commercial Property business partially offset by lower gains to be realised in National Grid Partners (NGP) year on year. Joint Ventures and Associates Our share of the profit after tax of joint ventures and associates is expected to be at a similar level to 2021/22. Offsetting the St William profitability is our expected share of profit for UK GT for the remaining 40% stake following completion of the disposal of the majority stake. Interest and Tax (continuing operations) Net finance costs in 2022/23 are expected to be around £300 million higher than 2021/22 from the impact of higher inflation on our inflation-linked debt, increasing rates for new issuances and increasing rates impacting our existing floating portfolio. For the full year 2022/23, the underlying effective tax rate excluding the share of post-tax profits from joint ventures and associates, is expected to be around 23%. Investment, Growth and Net Debt Overall Group capital investment for continuing operations in 2022/23 is expected to be around £7 billion. Asset Growth is expected to be above the top end of our 6-8% target range, reflecting an increase in capex along with higher inflation continuing to impact indexation. Depreciation is expected to increase, reflecting the impact of continued high levels of capital investment. Operating cash outflow generated from continuing operations (excluding acquisitions, disposals and transaction costs) is expected to increase by around 50% compared to 2021/22 principally driven by higher operating profits more than offset by increased capital investment and higher interest costs. Net debt is expected to reduce by around £3 billion (from £42.8 billion as at 31 March 2022) driven by the expected receipt of sales proceeds from the 60% stake in National Grid Gas and the Rhode Island business (The Narragansett Electric Company, NECO), partially offset by the impact of our significant capital investment programme. Weighted average number of shares (WAV) is expected to be approximately 3,675 million in 2022/23.

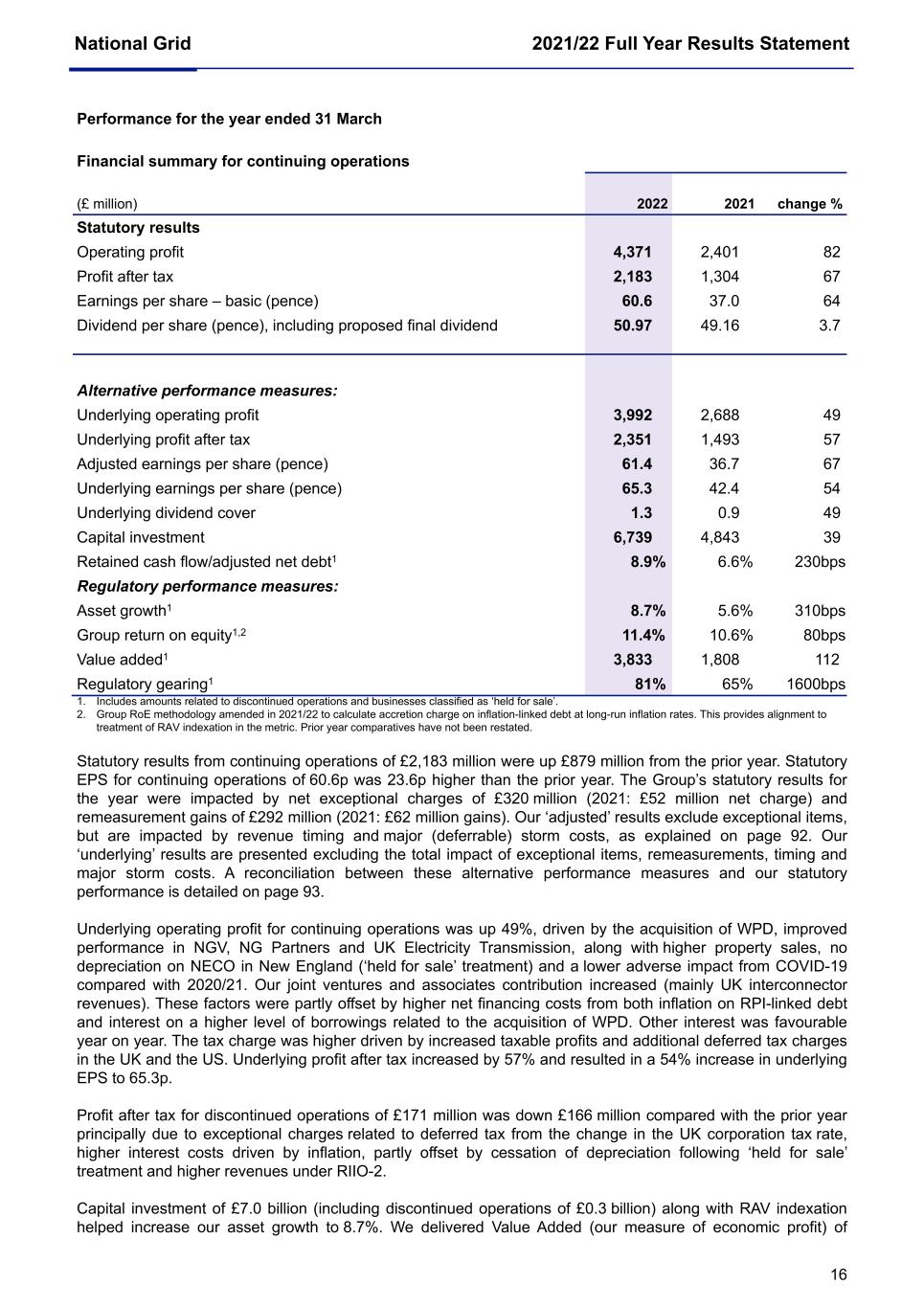

National Grid 2021/22 Full Year Results Statement 15 FINANCIAL REVIEW In managing the business, we focus on various non-IFRS measures which provide meaningful comparisons of performance between years, monitor the strength of the Group’s balance sheet as well as profitability and reflect the Group’s regulatory economic arrangements. Such alternative and regulatory performance measures are supplementary to, and should not be regarded as a substitute for, IFRS measures, which we refer to as statutory results. We explain the basis of these measures and, where practicable, reconcile these to statutory results in ‘Alternative performance measures/non-IFRS reconciliations’ on pages 91 to 106. Also, we distinguish between adjusted results, which exclude exceptional items and remeasurements, and underlying results, which further take account of: (i) volumetric and other revenue timing differences arising from our regulatory contracts, and (ii) major storm costs which are recoverable in future periods, where these are in excess of $100 million in the year, neither of which give rise to economic gains or losses. Performance against pro forma 2020/21 comparatives The following commentary compares our underlying 2021/22 results against our pro forma comparative 2020/21 results. Pro forma comparative 2020/21 figures are provided to help compare performance between reporting periods and include adjustments for: (i) an estimate of the underlying post-tax contribution from WPD for an equivalent 9.5 month period, as if we had owned that business in the prior year, including incremental finance costs to acquire WPD; and (ii) the equivalent of the current year beneficial earnings impact of not depreciating our Rhode Island business applied to the comparative period. A reconciliation between these measures is provided on page 93. Underlying operating profit for continuing operations (on a pro forma comparative basis) increased by 11% versus the prior year to £3,992 million. This was principally driven by higher UK Electricity Transmission (UK ET) net revenue that funds higher investment levels; the impact of higher revenues following our rate order in our Massachusetts Gas business; the first year of operation of IFA2 and North Sea Link; higher revenue from interconnector arbitrage; gains on investments in National Grid Partners and a lower adverse impact from COVID-19 compared to 2020/21. Net finance costs for continuing operations (on a pro forma comparative basis) were £33 million higher than the prior year at £1,081 million. This movement was driven by higher inflation on our RPI-linked debt and an increase in borrowings as a result of organic asset growth. These higher costs were partly offset by favourable year-on year other interest income, with benefits from interest on pension and OPEB liabilities, increased capitalised interest and higher levels of other interest income from US financial investments compared to 2020/21. The effective interest rate for continuing operations was 3.2%. The underlying effective tax rate (excluding joint ventures and associates) of 24.3% was higher than last year (on a pro forma comparative basis) primarily as a result of additional deferred tax charges in the UK for the change in the UK corporation tax rate and the unitary state deferred tax remeasurement which occurred as a result of the expected sale of Rhode Island in the US. Underlying earnings for continuing operations (on a pro forma comparative basis) increased to £2,350 million resulting in earnings per share of 65.3p; an increase of 10% against the prior year. Capital investment of £6,739 million was £1,042 million higher than 2020/21 (on a pro forma comparative basis). This reflects increased capex activity following COVID-19, increased WPD network connections, increased capex across UK Electricity Transmission and investment in our New York offshore joint wind venture. Unless stated otherwise, commentary that follows in this Financial Review provides information in respect of our results for statutory, adjusted and underlying results compared to our reported results in 2020/21, restated for the classification of the UK Gas Transmission business as a discontinued operation.

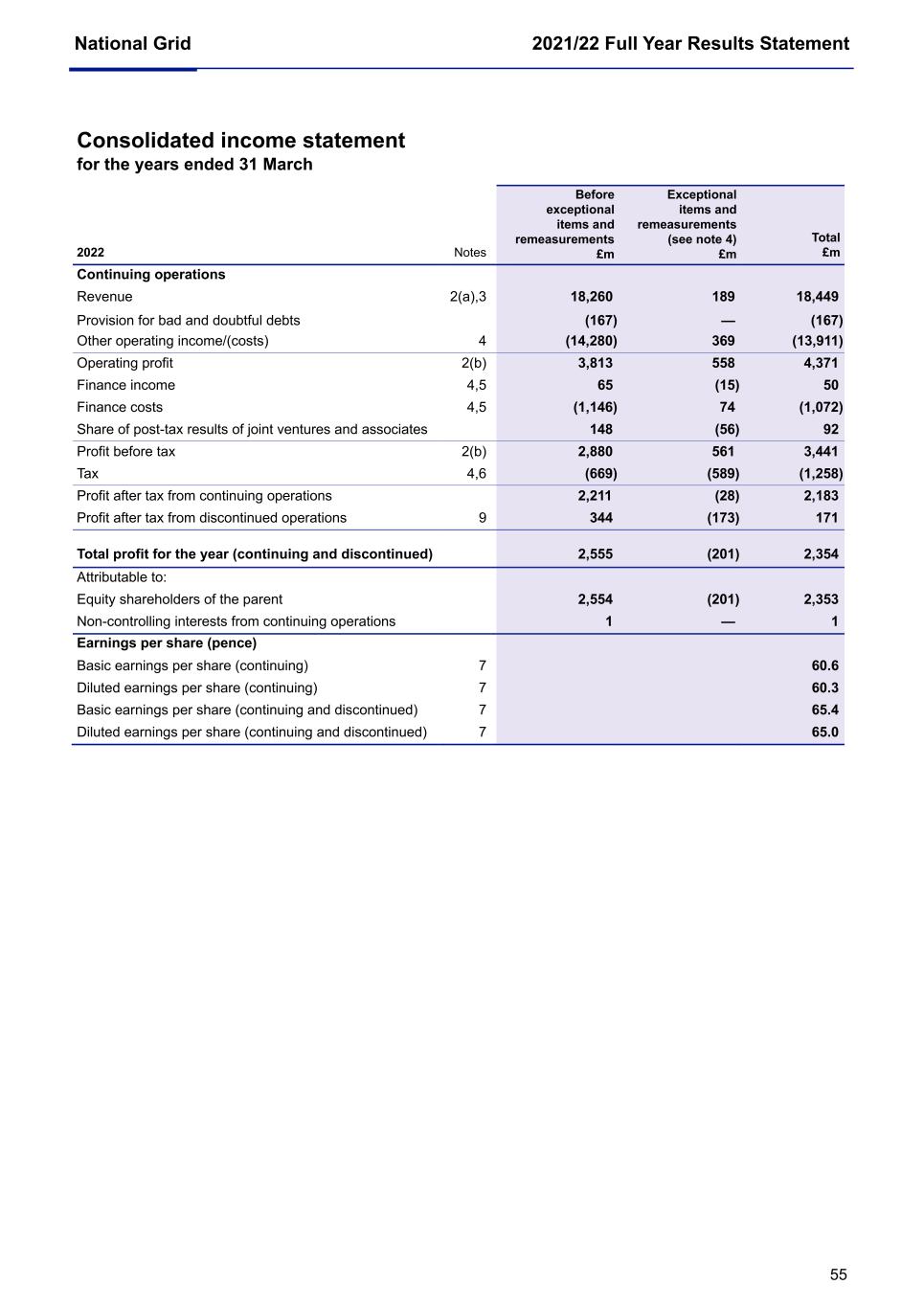

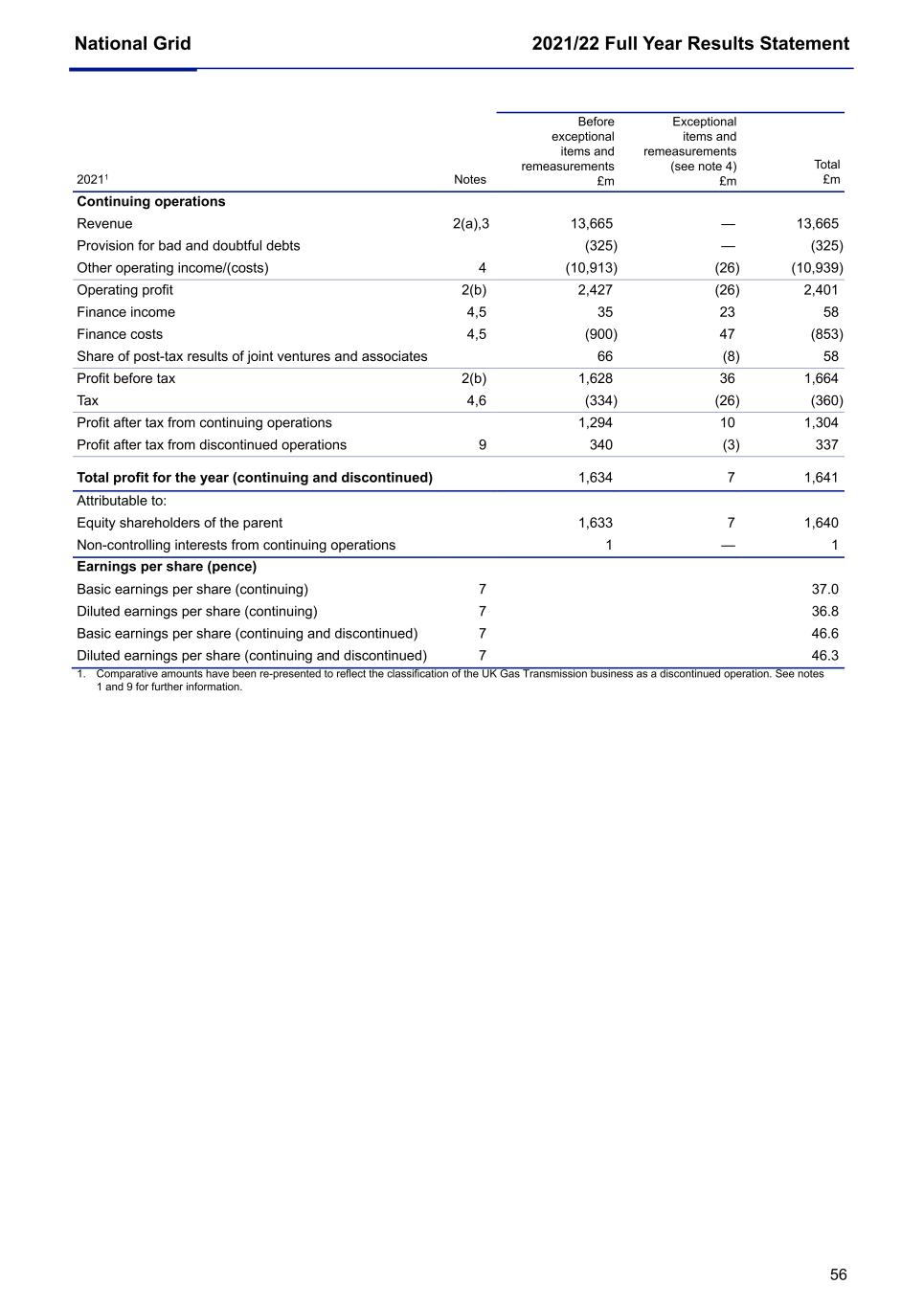

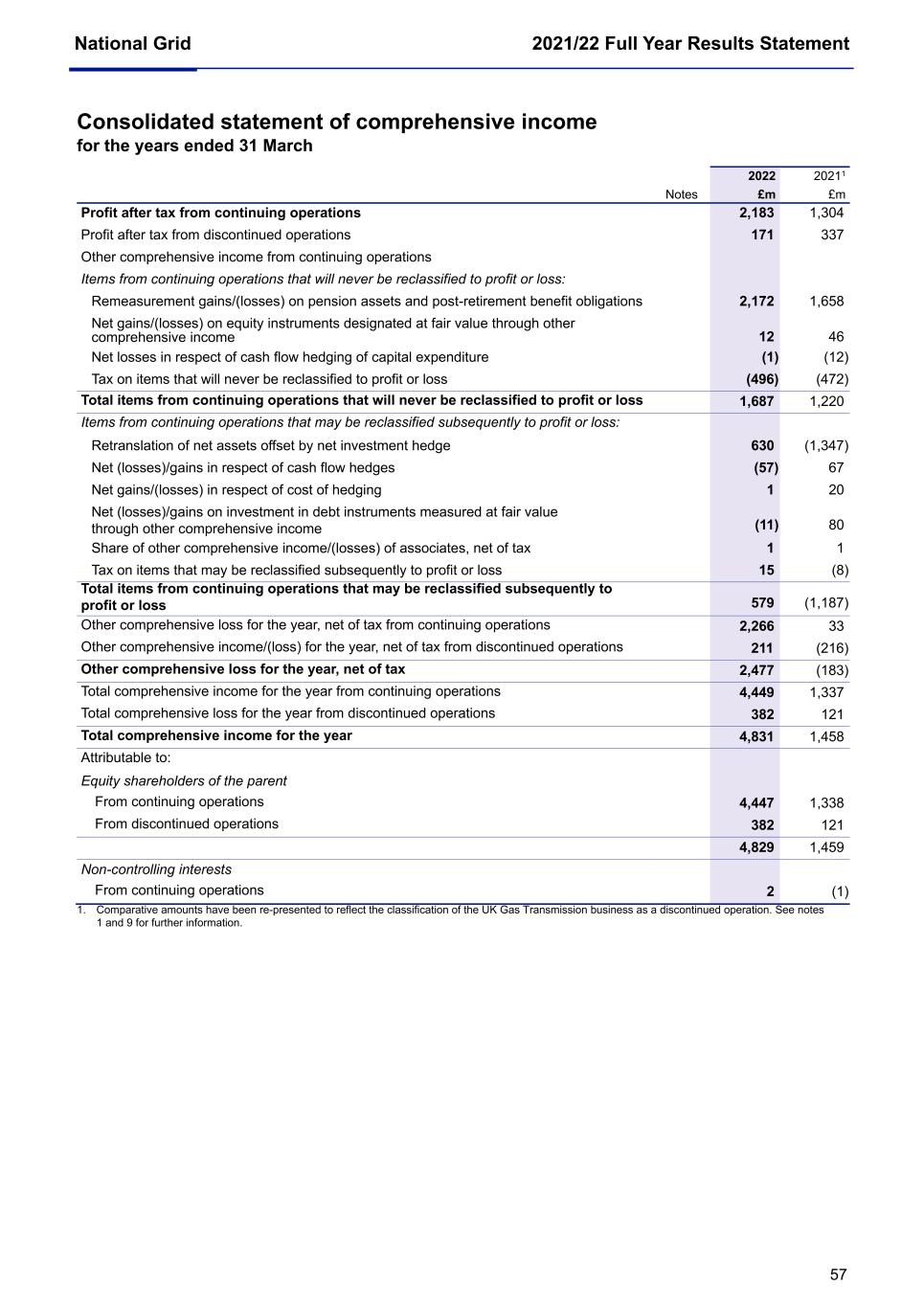

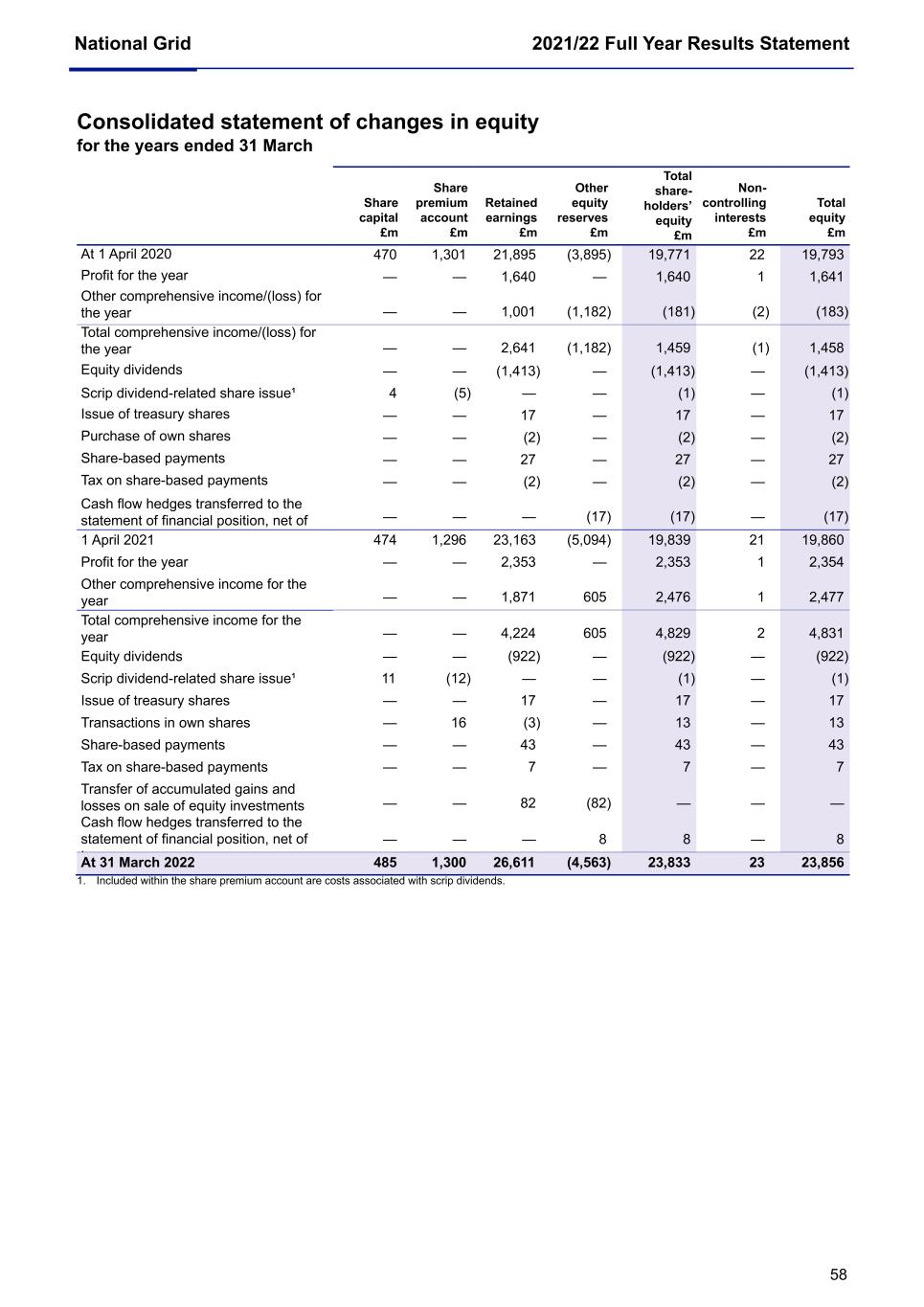

National Grid 2021/22 Full Year Results Statement 16 Performance for the year ended 31 March Financial summary for continuing operations (£ million) 2022 2021 change % Statutory results Operating profit 4,371 2,401 82 Profit after tax 2,183 1,304 67 Earnings per share – basic (pence) 60.6 37.0 64 Dividend per share (pence), including proposed final dividend 50.97 49.16 3.7 Alternative performance measures: Underlying operating profit 3,992 2,688 49 Underlying profit after tax 2,351 1,493 57 Adjusted earnings per share (pence) 61.4 36.7 67 Underlying earnings per share (pence) 65.3 42.4 54 Underlying dividend cover 1.3 0.9 49 Capital investment 6,739 4,843 39 Retained cash flow/adjusted net debt1 8.9% 6.6% 230bps Regulatory performance measures: Asset growth1 8.7% 5.6% 310bps Group return on equity1,2 11.4% 10.6% 80bps Value added1 3,833 1,808 112 Regulatory gearing1 81% 65% 1600bps 1. Includes amounts related to discontinued operations and businesses classified as ‘held for sale’. 2. Group RoE methodology amended in 2021/22 to calculate accretion charge on inflation-linked debt at long-run inflation rates. This provides alignment to treatment of RAV indexation in the metric. Prior year comparatives have not been restated. Statutory results from continuing operations of £2,183 million were up £879 million from the prior year. Statutory EPS for continuing operations of 60.6p was 23.6p higher than the prior year. The Group’s statutory results for the year were impacted by net exceptional charges of £320 million (2021: £52 million net charge) and remeasurement gains of £292 million (2021: £62 million gains). Our ‘adjusted’ results exclude exceptional items, but are impacted by revenue timing and major (deferrable) storm costs, as explained on page 92. Our ‘underlying’ results are presented excluding the total impact of exceptional items, remeasurements, timing and major storm costs. A reconciliation between these alternative performance measures and our statutory performance is detailed on page 93. Underlying operating profit for continuing operations was up 49%, driven by the acquisition of WPD, improved performance in NGV, NG Partners and UK Electricity Transmission, along with higher property sales, no depreciation on NECO in New England (‘held for sale’ treatment) and a lower adverse impact from COVID-19 compared with 2020/21. Our joint ventures and associates contribution increased (mainly UK interconnector revenues). These factors were partly offset by higher net financing costs from both inflation on RPI-linked debt and interest on a higher level of borrowings related to the acquisition of WPD. Other interest was favourable year on year. The tax charge was higher driven by increased taxable profits and additional deferred tax charges in the UK and the US. Underlying profit after tax increased by 57% and resulted in a 54% increase in underlying EPS to 65.3p. Profit after tax for discontinued operations of £171 million was down £166 million compared with the prior year principally due to exceptional charges related to deferred tax from the change in the UK corporation tax rate, higher interest costs driven by inflation, partly offset by cessation of depreciation following ‘held for sale’ treatment and higher revenues under RIIO-2. Capital investment of £7.0 billion (including discontinued operations of £0.3 billion) along with RAV indexation helped increase our asset growth to 8.7%. We delivered Value Added (our measure of economic profit) of

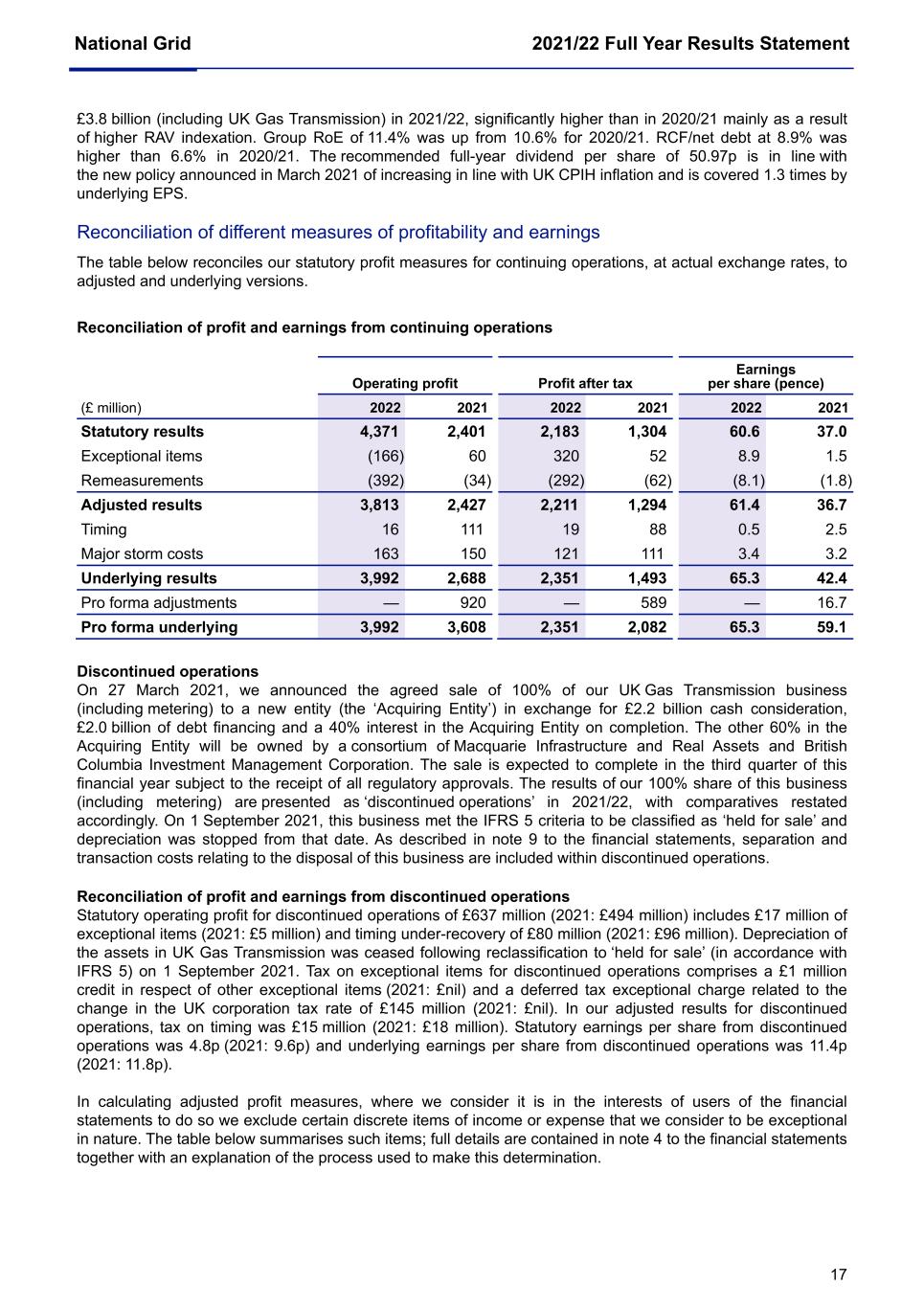

National Grid 2021/22 Full Year Results Statement 17 £3.8 billion (including UK Gas Transmission) in 2021/22, significantly higher than in 2020/21 mainly as a result of higher RAV indexation. Group RoE of 11.4% was up from 10.6% for 2020/21. RCF/net debt at 8.9% was higher than 6.6% in 2020/21. The recommended full-year dividend per share of 50.97p is in line with the new policy announced in March 2021 of increasing in line with UK CPIH inflation and is covered 1.3 times by underlying EPS. Reconciliation of different measures of profitability and earnings The table below reconciles our statutory profit measures for continuing operations, at actual exchange rates, to adjusted and underlying versions. Reconciliation of profit and earnings from continuing operations Operating profit Profit after tax Earnings per share (pence) (£ million) 2022 2021 2022 2021 2022 2021 Statutory results 4,371 2,401 2,183 1,304 60.6 37.0 Exceptional items (166) 60 320 52 8.9 1.5 Remeasurements (392) (34) (292) (62) (8.1) (1.8) Adjusted results 3,813 2,427 2,211 1,294 61.4 36.7 Timing 16 111 19 88 0.5 2.5 Major storm costs 163 150 121 111 3.4 3.2 Underlying results 3,992 2,688 2,351 1,493 65.3 42.4 Pro forma adjustments — 920 — 589 — 16.7 Pro forma underlying 3,992 3,608 2,351 2,082 65.3 59.1 Discontinued operations On 27 March 2021, we announced the agreed sale of 100% of our UK Gas Transmission business (including metering) to a new entity (the ‘Acquiring Entity’) in exchange for £2.2 billion cash consideration, £2.0 billion of debt financing and a 40% interest in the Acquiring Entity on completion. The other 60% in the Acquiring Entity will be owned by a consortium of Macquarie Infrastructure and Real Assets and British Columbia Investment Management Corporation. The sale is expected to complete in the third quarter of this financial year subject to the receipt of all regulatory approvals. The results of our 100% share of this business (including metering) are presented as ‘discontinued operations’ in 2021/22, with comparatives restated accordingly. On 1 September 2021, this business met the IFRS 5 criteria to be classified as ‘held for sale’ and depreciation was stopped from that date. As described in note 9 to the financial statements, separation and transaction costs relating to the disposal of this business are included within discontinued operations. Reconciliation of profit and earnings from discontinued operations Statutory operating profit for discontinued operations of £637 million (2021: £494 million) includes £17 million of exceptional items (2021: £5 million) and timing under-recovery of £80 million (2021: £96 million). Depreciation of the assets in UK Gas Transmission was ceased following reclassification to ‘held for sale’ (in accordance with IFRS 5) on 1 September 2021. Tax on exceptional items for discontinued operations comprises a £1 million credit in respect of other exceptional items (2021: £nil) and a deferred tax exceptional charge related to the change in the UK corporation tax rate of £145 million (2021: £nil). In our adjusted results for discontinued operations, tax on timing was £15 million (2021: £18 million). Statutory earnings per share from discontinued operations was 4.8p (2021: 9.6p) and underlying earnings per share from discontinued operations was 11.4p (2021: 11.8p). In calculating adjusted profit measures, where we consider it is in the interests of users of the financial statements to do so we exclude certain discrete items of income or expense that we consider to be exceptional in nature. The table below summarises such items; full details are contained in note 4 to the financial statements together with an explanation of the process used to make this determination.

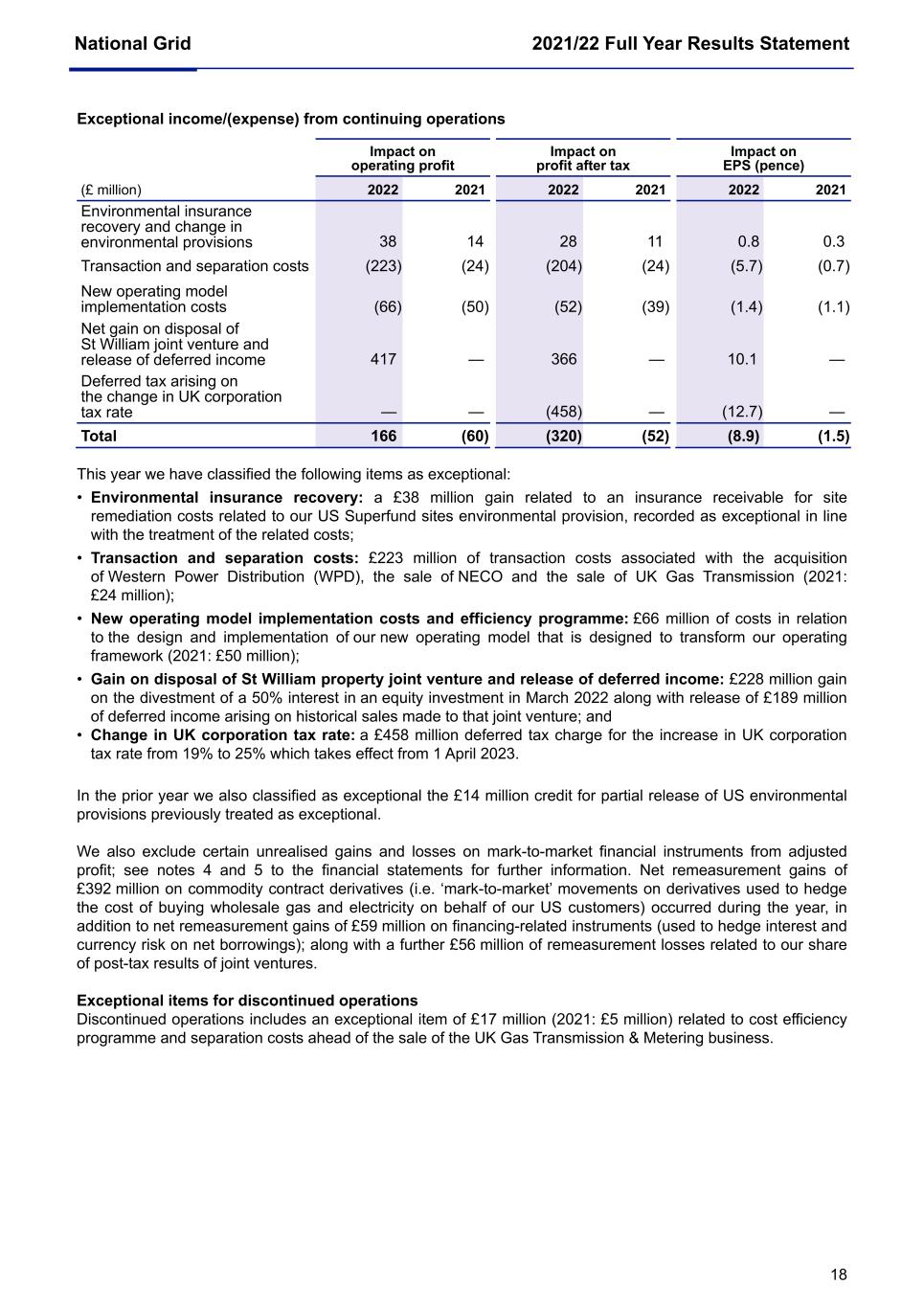

National Grid 2021/22 Full Year Results Statement 18 Exceptional income/(expense) from continuing operations Impact on operating profit Impact on profit after tax Impact on EPS (pence) (£ million) 2022 2021 2022 2021 2022 2021 Environmental insurance recovery and change in environmental provisions 38 14 28 11 0.8 0.3 Transaction and separation costs (223) (24) (204) (24) (5.7) (0.7) New operating model implementation costs (66) (50) (52) (39) (1.4) (1.1) Net gain on disposal of St William joint venture and release of deferred income 417 — 366 — 10.1 — Deferred tax arising on the change in UK corporation tax rate — — (458) — (12.7) — Total 166 (60) (320) (52) (8.9) (1.5) This year we have classified the following items as exceptional: • Environmental insurance recovery: a £38 million gain related to an insurance receivable for site remediation costs related to our US Superfund sites environmental provision, recorded as exceptional in line with the treatment of the related costs; • Transaction and separation costs: £223 million of transaction costs associated with the acquisition of Western Power Distribution (WPD), the sale of NECO and the sale of UK Gas Transmission (2021: £24 million); • New operating model implementation costs and efficiency programme: £66 million of costs in relation to the design and implementation of our new operating model that is designed to transform our operating framework (2021: £50 million); • Gain on disposal of St William property joint venture and release of deferred income: £228 million gain on the divestment of a 50% interest in an equity investment in March 2022 along with release of £189 million of deferred income arising on historical sales made to that joint venture; and • Change in UK corporation tax rate: a £458 million deferred tax charge for the increase in UK corporation tax rate from 19% to 25% which takes effect from 1 April 2023. In the prior year we also classified as exceptional the £14 million credit for partial release of US environmental provisions previously treated as exceptional. We also exclude certain unrealised gains and losses on mark-to-market financial instruments from adjusted profit; see notes 4 and 5 to the financial statements for further information. Net remeasurement gains of £392 million on commodity contract derivatives (i.e. ‘mark-to-market’ movements on derivatives used to hedge the cost of buying wholesale gas and electricity on behalf of our US customers) occurred during the year, in addition to net remeasurement gains of £59 million on financing-related instruments (used to hedge interest and currency risk on net borrowings); along with a further £56 million of remeasurement losses related to our share of post-tax results of joint ventures. Exceptional items for discontinued operations Discontinued operations includes an exceptional item of £17 million (2021: £5 million) related to cost efficiency programme and separation costs ahead of the sale of the UK Gas Transmission & Metering business.

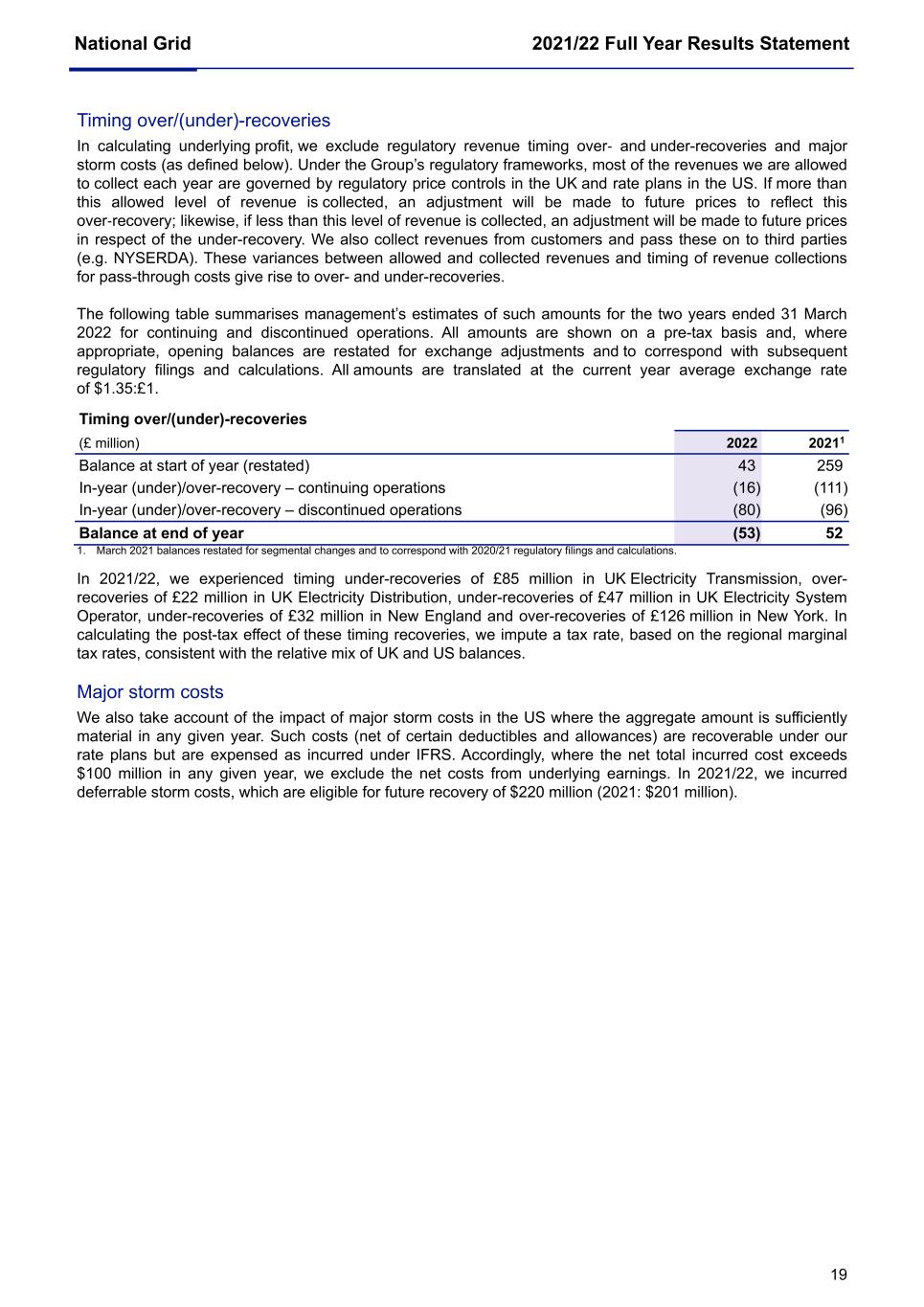

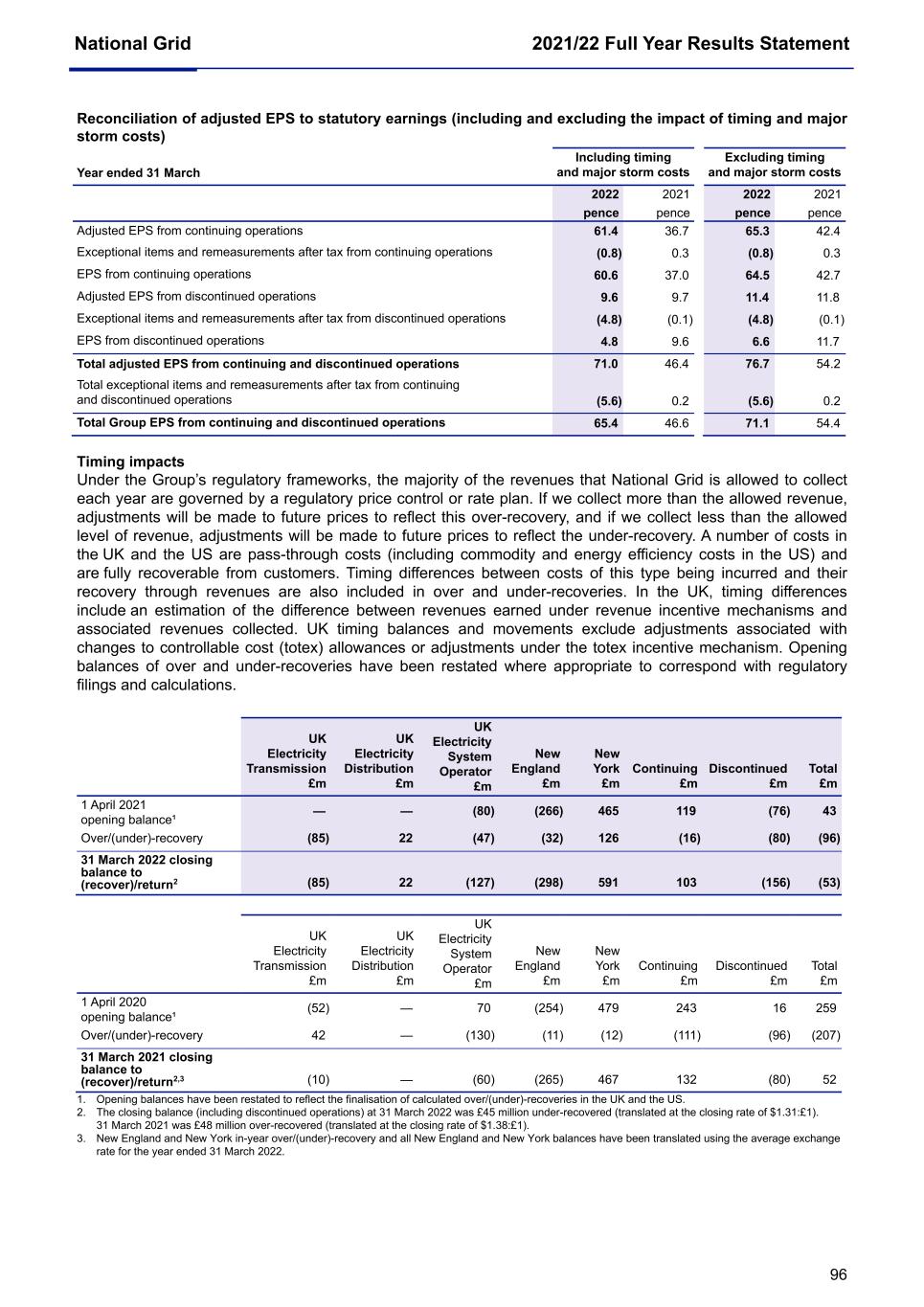

National Grid 2021/22 Full Year Results Statement 19 Timing over/(under)-recoveries In calculating underlying profit, we exclude regulatory revenue timing over‑ and under-recoveries and major storm costs (as defined below). Under the Group’s regulatory frameworks, most of the revenues we are allowed to collect each year are governed by regulatory price controls in the UK and rate plans in the US. If more than this allowed level of revenue is collected, an adjustment will be made to future prices to reflect this over‑recovery; likewise, if less than this level of revenue is collected, an adjustment will be made to future prices in respect of the under-recovery. We also collect revenues from customers and pass these on to third parties (e.g. NYSERDA). These variances between allowed and collected revenues and timing of revenue collections for pass-through costs give rise to over- and under-recoveries. The following table summarises management’s estimates of such amounts for the two years ended 31 March 2022 for continuing and discontinued operations. All amounts are shown on a pre-tax basis and, where appropriate, opening balances are restated for exchange adjustments and to correspond with subsequent regulatory filings and calculations. All amounts are translated at the current year average exchange rate of $1.35:£1. Timing over/(under)-recoveries (£ million) 2022 20211 Balance at start of year (restated) 43 259 In-year (under)/over-recovery – continuing operations (16) (111) In-year (under)/over-recovery – discontinued operations (80) (96) Balance at end of year (53) 52 1. March 2021 balances restated for segmental changes and to correspond with 2020/21 regulatory filings and calculations. In 2021/22, we experienced timing under-recoveries of £85 million in UK Electricity Transmission, over- recoveries of £22 million in UK Electricity Distribution, under-recoveries of £47 million in UK Electricity System Operator, under-recoveries of £32 million in New England and over-recoveries of £126 million in New York. In calculating the post-tax effect of these timing recoveries, we impute a tax rate, based on the regional marginal tax rates, consistent with the relative mix of UK and US balances. Major storm costs We also take account of the impact of major storm costs in the US where the aggregate amount is sufficiently material in any given year. Such costs (net of certain deductibles and allowances) are recoverable under our rate plans but are expensed as incurred under IFRS. Accordingly, where the net total incurred cost exceeds $100 million in any given year, we exclude the net costs from underlying earnings. In 2021/22, we incurred deferrable storm costs, which are eligible for future recovery of $220 million (2021: $201 million).

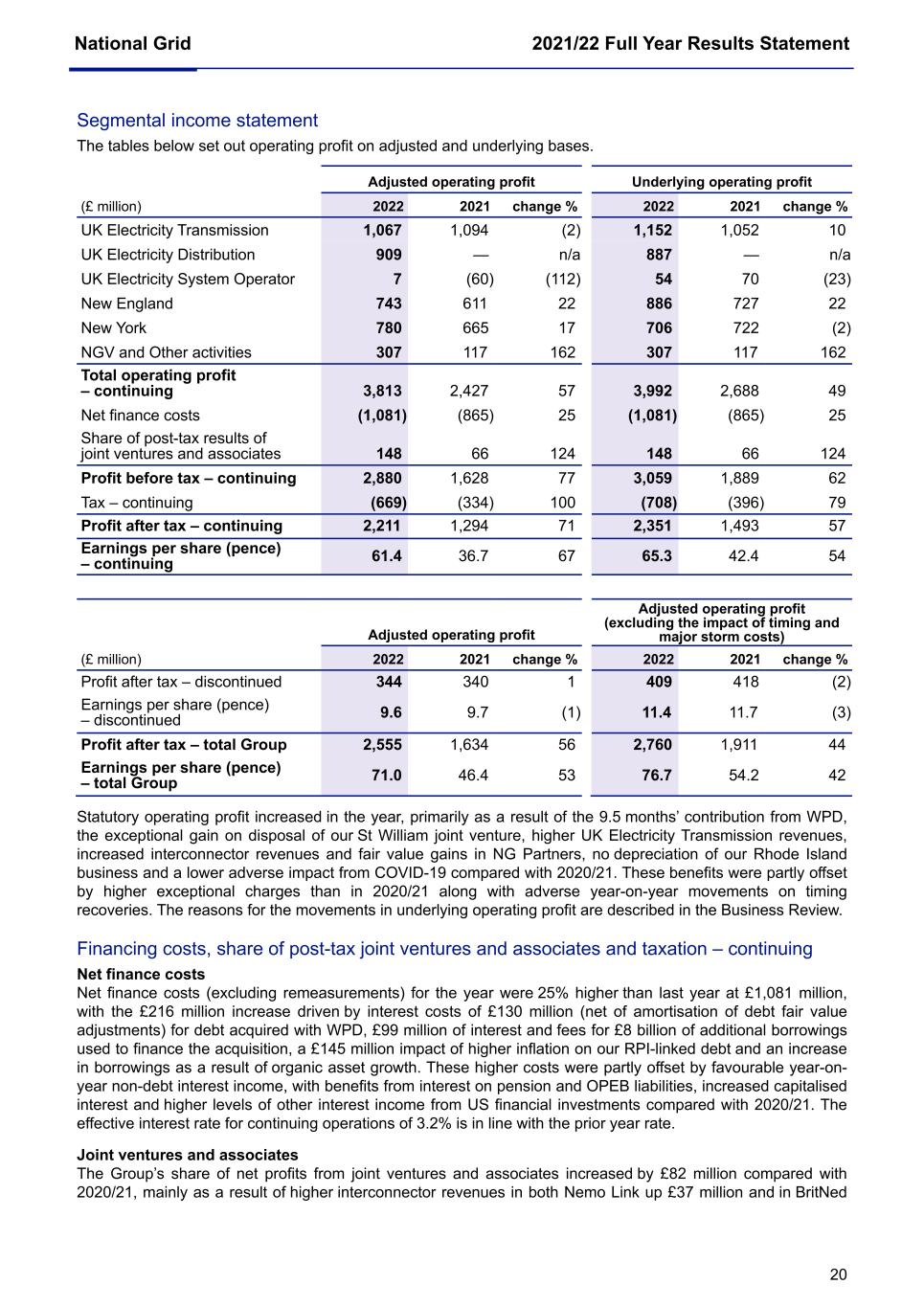

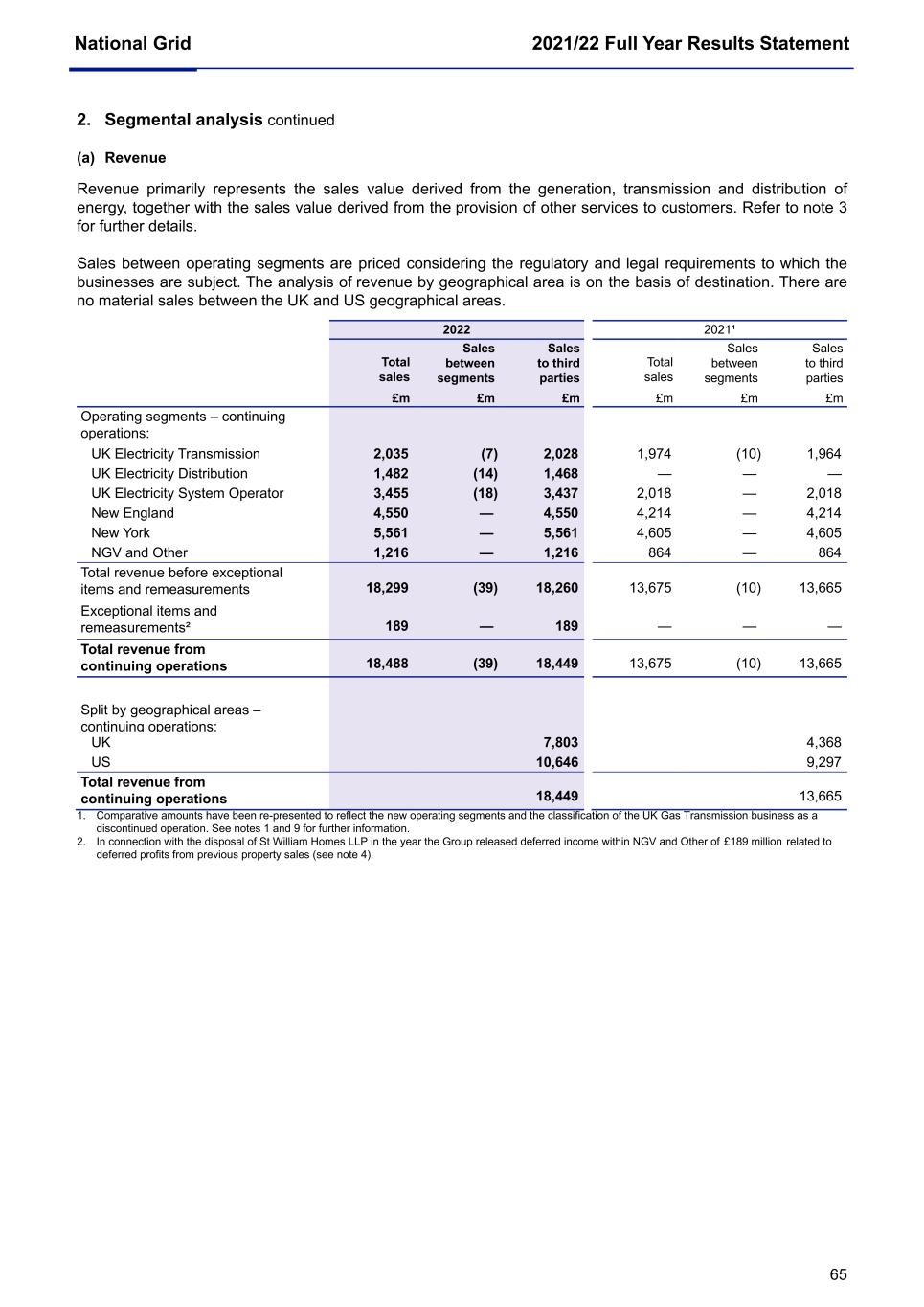

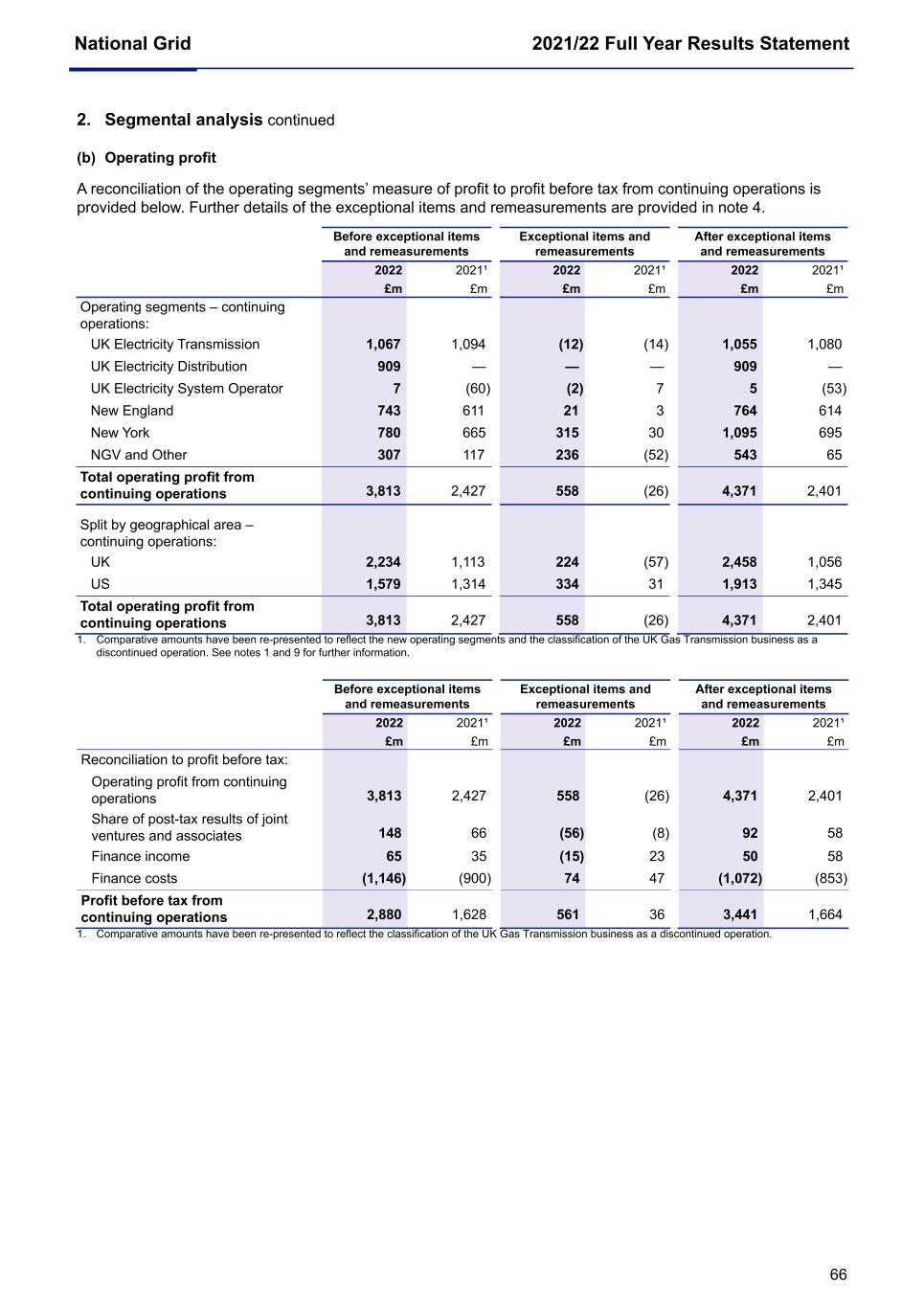

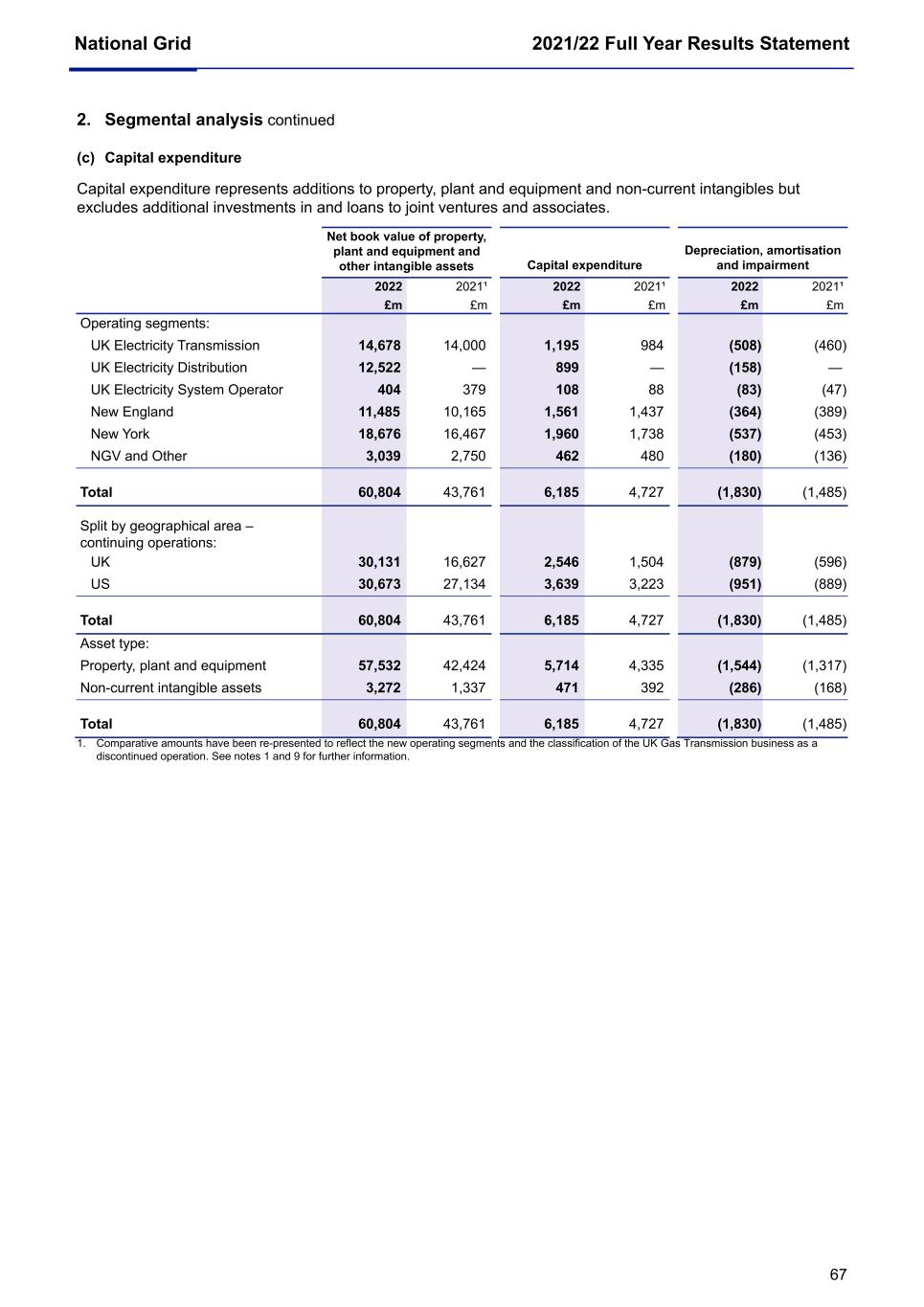

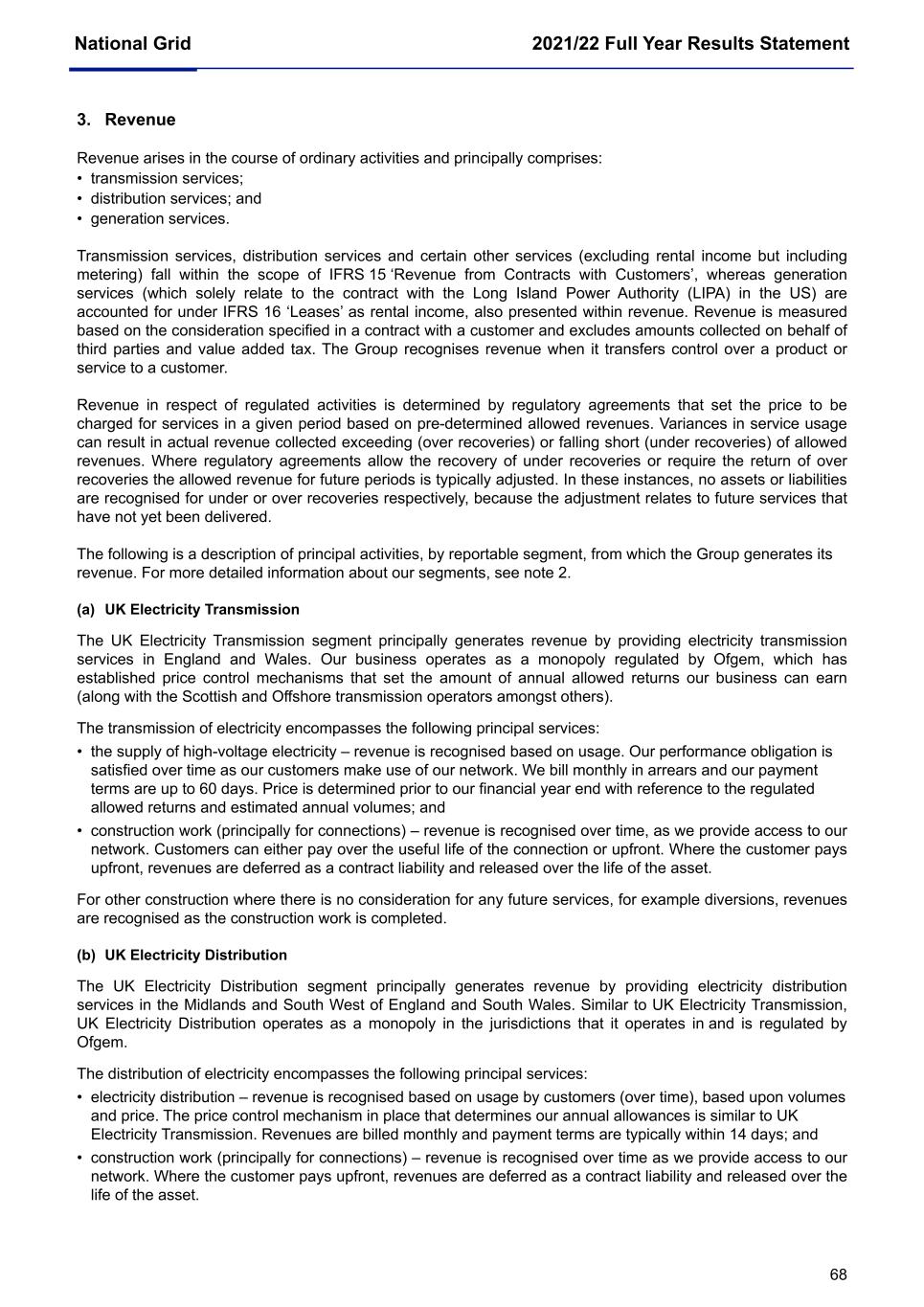

National Grid 2021/22 Full Year Results Statement 20 Segmental income statement The tables below set out operating profit on adjusted and underlying bases. Adjusted operating profit Underlying operating profit (£ million) 2022 2021 change % 2022 2021 change % UK Electricity Transmission 1,067 1,094 (2) 1,152 1,052 10 UK Electricity Distribution 909 — n/a 887 — n/a UK Electricity System Operator 7 (60) (112) 54 70 (23) New England 743 611 22 886 727 22 New York 780 665 17 706 722 (2) NGV and Other activities 307 117 162 307 117 162 Total operating profit – continuing 3,813 2,427 57 3,992 2,688 49 Net finance costs (1,081) (865) 25 (1,081) (865) 25 Share of post-tax results of joint ventures and associates 148 66 124 148 66 124 Profit before tax – continuing 2,880 1,628 77 3,059 1,889 62 Tax – continuing (669) (334) 100 (708) (396) 79 Profit after tax – continuing 2,211 1,294 71 2,351 1,493 57 Earnings per share (pence) – continuing 61.4 36.7 67 65.3 42.4 54 Adjusted operating profit Adjusted operating profit (excluding the impact of timing and major storm costs) (£ million) 2022 2021 change % 2022 2021 change % Profit after tax – discontinued 344 340 1 409 418 (2) Earnings per share (pence) – discontinued 9.6 9.7 (1) 11.4 11.7 (3) Profit after tax – total Group 2,555 1,634 56 2,760 1,911 44 Earnings per share (pence) – total Group 71.0 46.4 53 76.7 54.2 42 Statutory operating profit increased in the year, primarily as a result of the 9.5 months’ contribution from WPD, the exceptional gain on disposal of our St William joint venture, higher UK Electricity Transmission revenues, increased interconnector revenues and fair value gains in NG Partners, no depreciation of our Rhode Island business and a lower adverse impact from COVID-19 compared with 2020/21. These benefits were partly offset by higher exceptional charges than in 2020/21 along with adverse year-on-year movements on timing recoveries. The reasons for the movements in underlying operating profit are described in the Business Review. Financing costs, share of post-tax joint ventures and associates and taxation – continuing Net finance costs Net finance costs (excluding remeasurements) for the year were 25% higher than last year at £1,081 million, with the £216 million increase driven by interest costs of £130 million (net of amortisation of debt fair value adjustments) for debt acquired with WPD, £99 million of interest and fees for £8 billion of additional borrowings used to finance the acquisition, a £145 million impact of higher inflation on our RPI-linked debt and an increase in borrowings as a result of organic asset growth. These higher costs were partly offset by favourable year-on- year non-debt interest income, with benefits from interest on pension and OPEB liabilities, increased capitalised interest and higher levels of other interest income from US financial investments compared with 2020/21. The effective interest rate for continuing operations of 3.2% is in line with the prior year rate. Joint ventures and associates The Group’s share of net profits from joint ventures and associates increased by £82 million compared with 2020/21, mainly as a result of higher interconnector revenues in both Nemo Link up £37 million and in BritNed

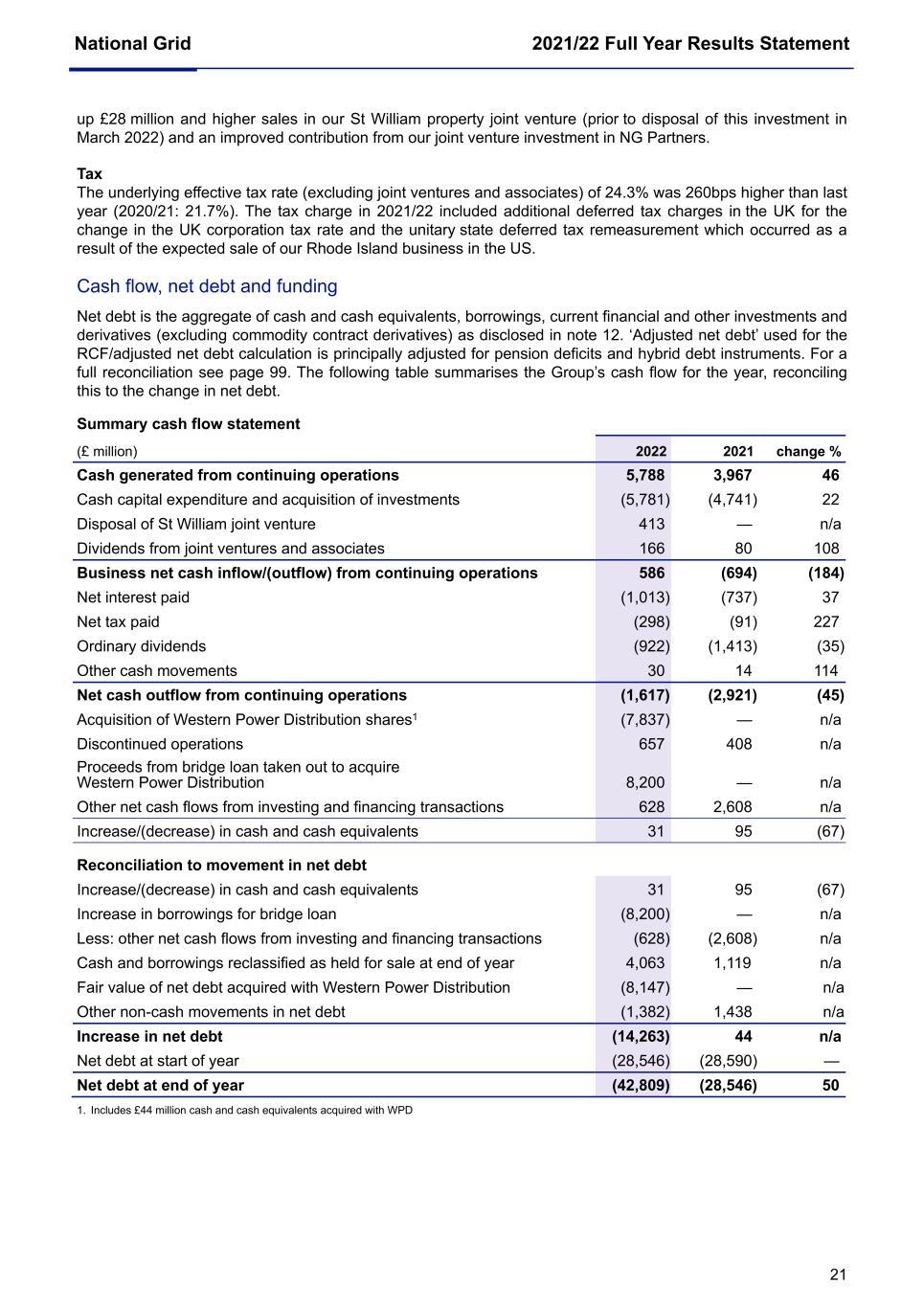

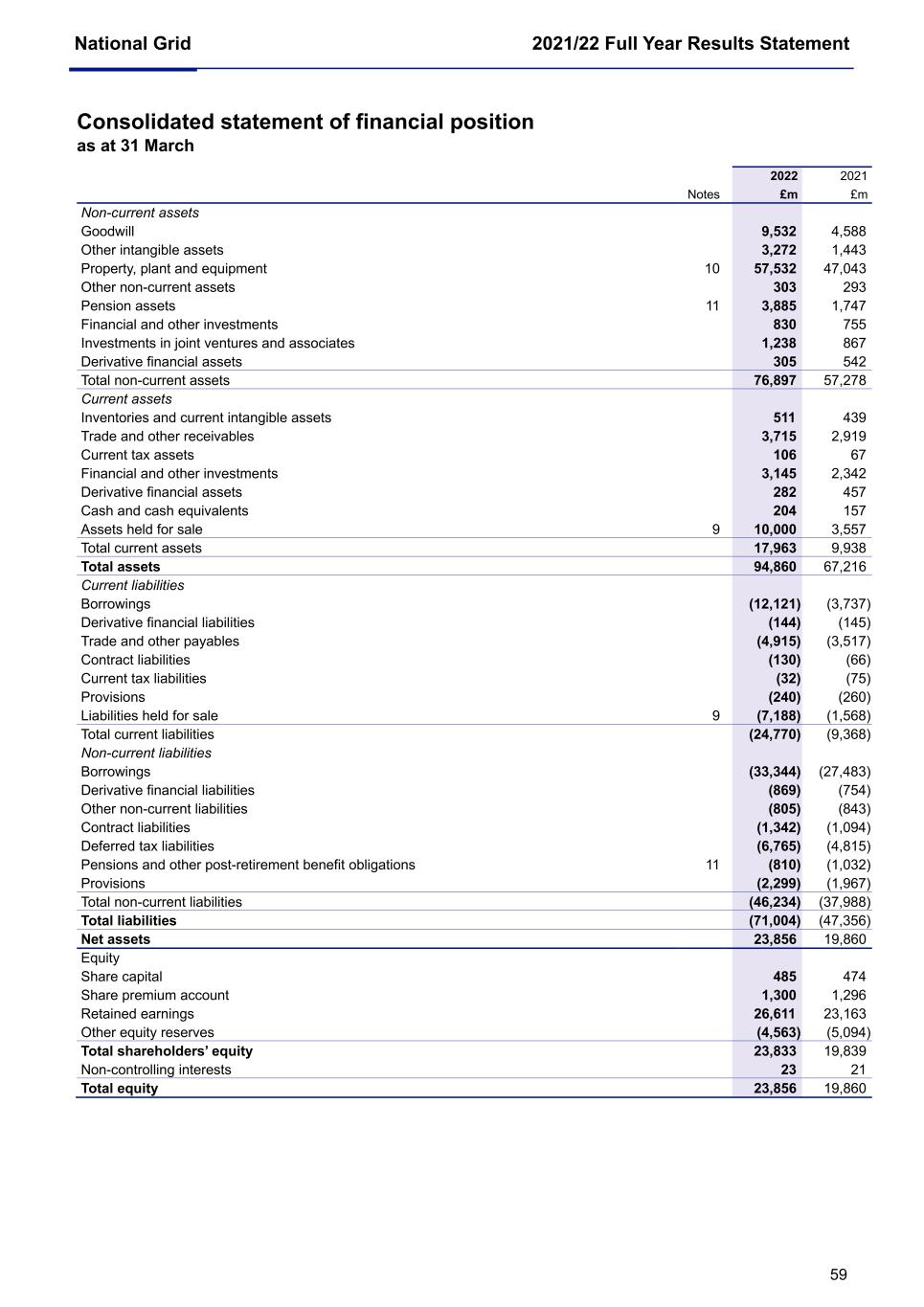

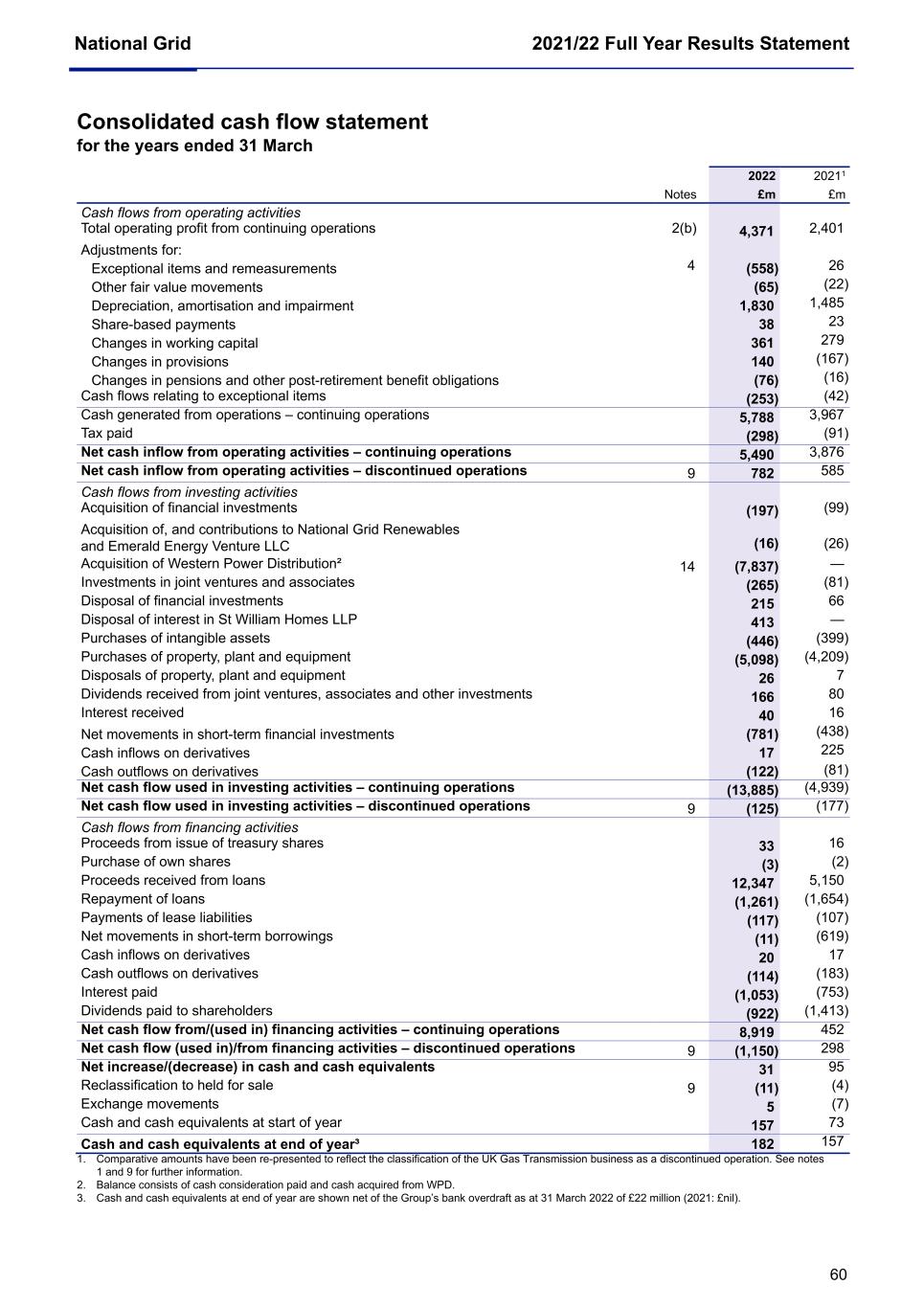

National Grid 2021/22 Full Year Results Statement 21 up £28 million and higher sales in our St William property joint venture (prior to disposal of this investment in March 2022) and an improved contribution from our joint venture investment in NG Partners. Tax The underlying effective tax rate (excluding joint ventures and associates) of 24.3% was 260bps higher than last year (2020/21: 21.7%). The tax charge in 2021/22 included additional deferred tax charges in the UK for the change in the UK corporation tax rate and the unitary state deferred tax remeasurement which occurred as a result of the expected sale of our Rhode Island business in the US. Cash flow, net debt and funding Net debt is the aggregate of cash and cash equivalents, borrowings, current financial and other investments and derivatives (excluding commodity contract derivatives) as disclosed in note 12. ‘Adjusted net debt’ used for the RCF/adjusted net debt calculation is principally adjusted for pension deficits and hybrid debt instruments. For a full reconciliation see page 99. The following table summarises the Group’s cash flow for the year, reconciling this to the change in net debt. Summary cash flow statement (£ million) 2022 2021 change % Cash generated from continuing operations 5,788 3,967 46 Cash capital expenditure and acquisition of investments (5,781) (4,741) 22 Disposal of St William joint venture 413 — n/a Dividends from joint ventures and associates 166 80 108 Business net cash inflow/(outflow) from continuing operations 586 (694) (184) Net interest paid (1,013) (737) 37 Net tax paid (298) (91) 227 Ordinary dividends (922) (1,413) (35) Other cash movements 30 14 114 Net cash outflow from continuing operations (1,617) (2,921) (45) Acquisition of Western Power Distribution shares1 (7,837) — n/a Discontinued operations 657 408 n/a Proceeds from bridge loan taken out to acquire Western Power Distribution 8,200 — n/a Other net cash flows from investing and financing transactions 628 2,608 n/a Increase/(decrease) in cash and cash equivalents 31 95 (67) Reconciliation to movement in net debt Increase/(decrease) in cash and cash equivalents 31 95 (67) Increase in borrowings for bridge loan (8,200) — n/a Less: other net cash flows from investing and financing transactions (628) (2,608) n/a Cash and borrowings reclassified as held for sale at end of year 4,063 1,119 n/a Fair value of net debt acquired with Western Power Distribution (8,147) — n/a Other non-cash movements in net debt (1,382) 1,438 n/a Increase in net debt (14,263) 44 n/a Net debt at start of year (28,546) (28,590) — Net debt at end of year (42,809) (28,546) 50 1. Includes £44 million cash and cash equivalents acquired with WPD

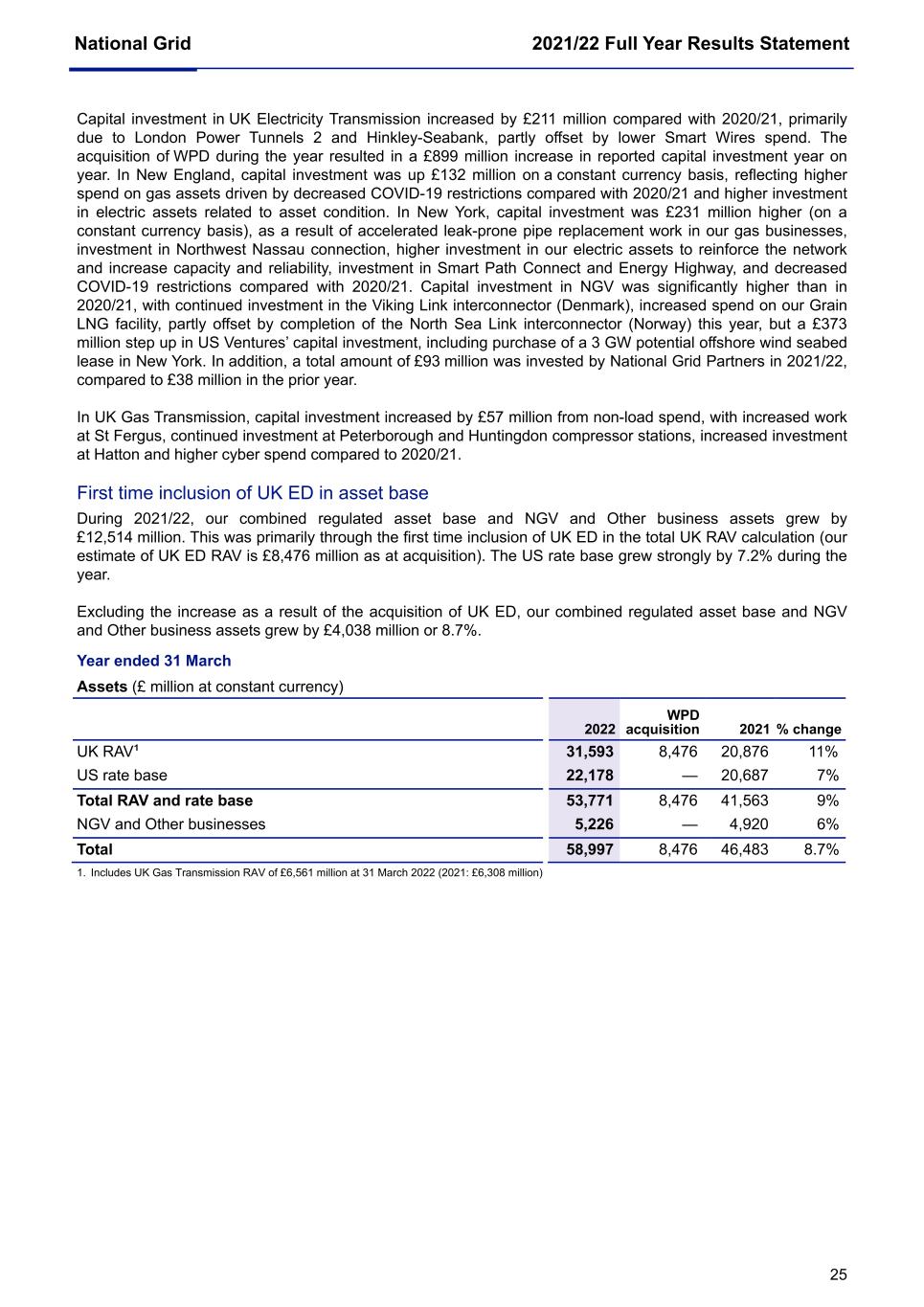

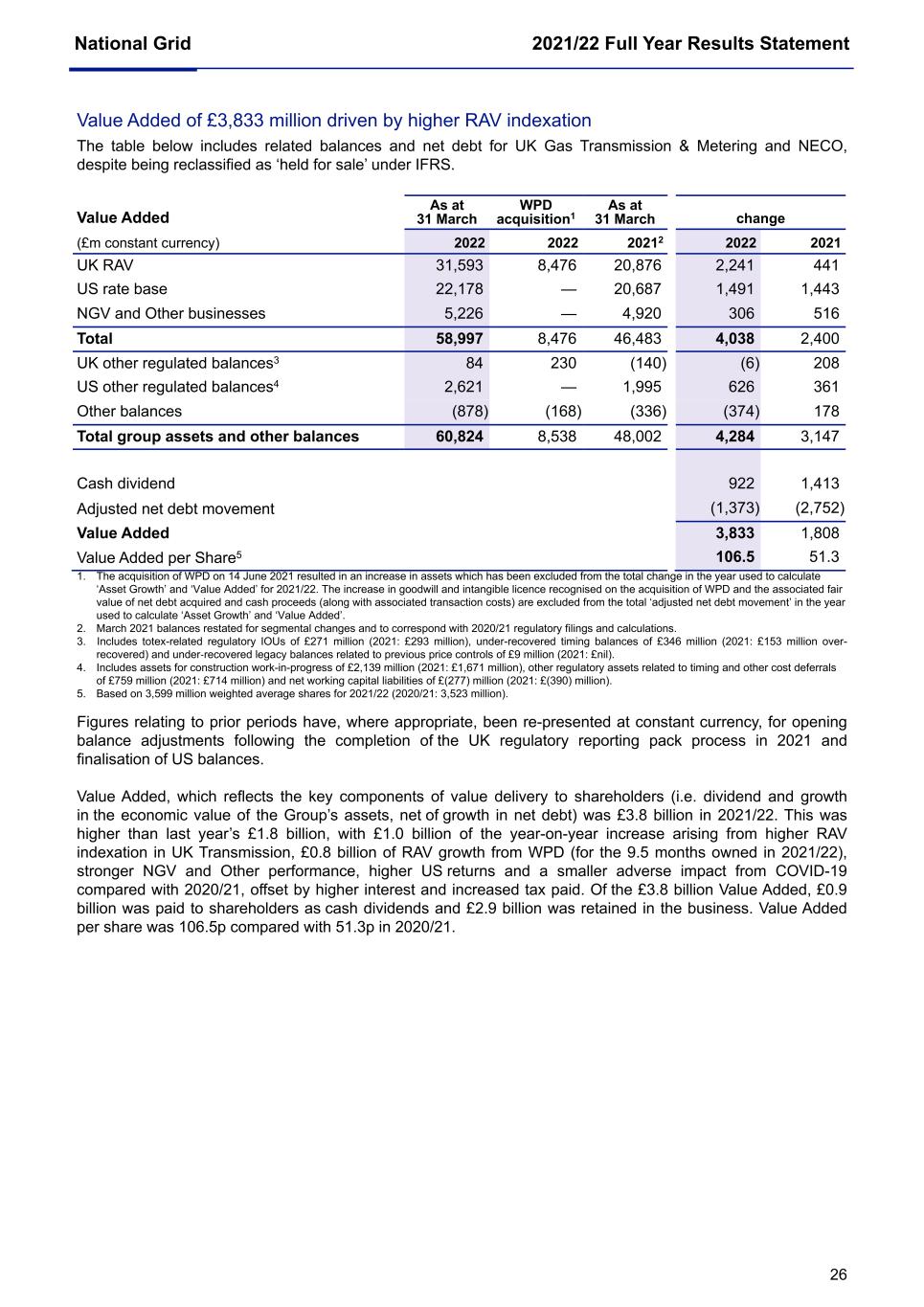

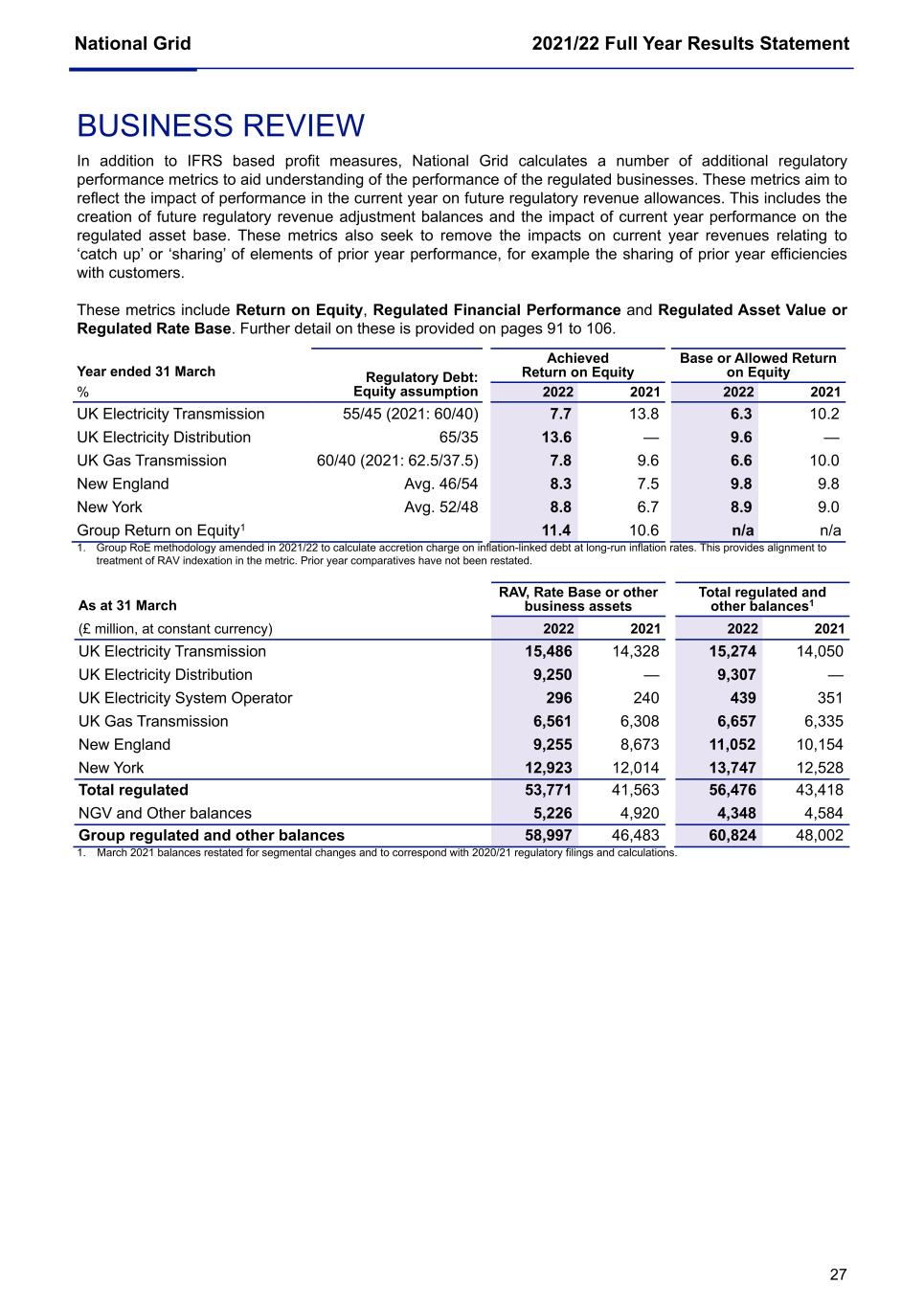

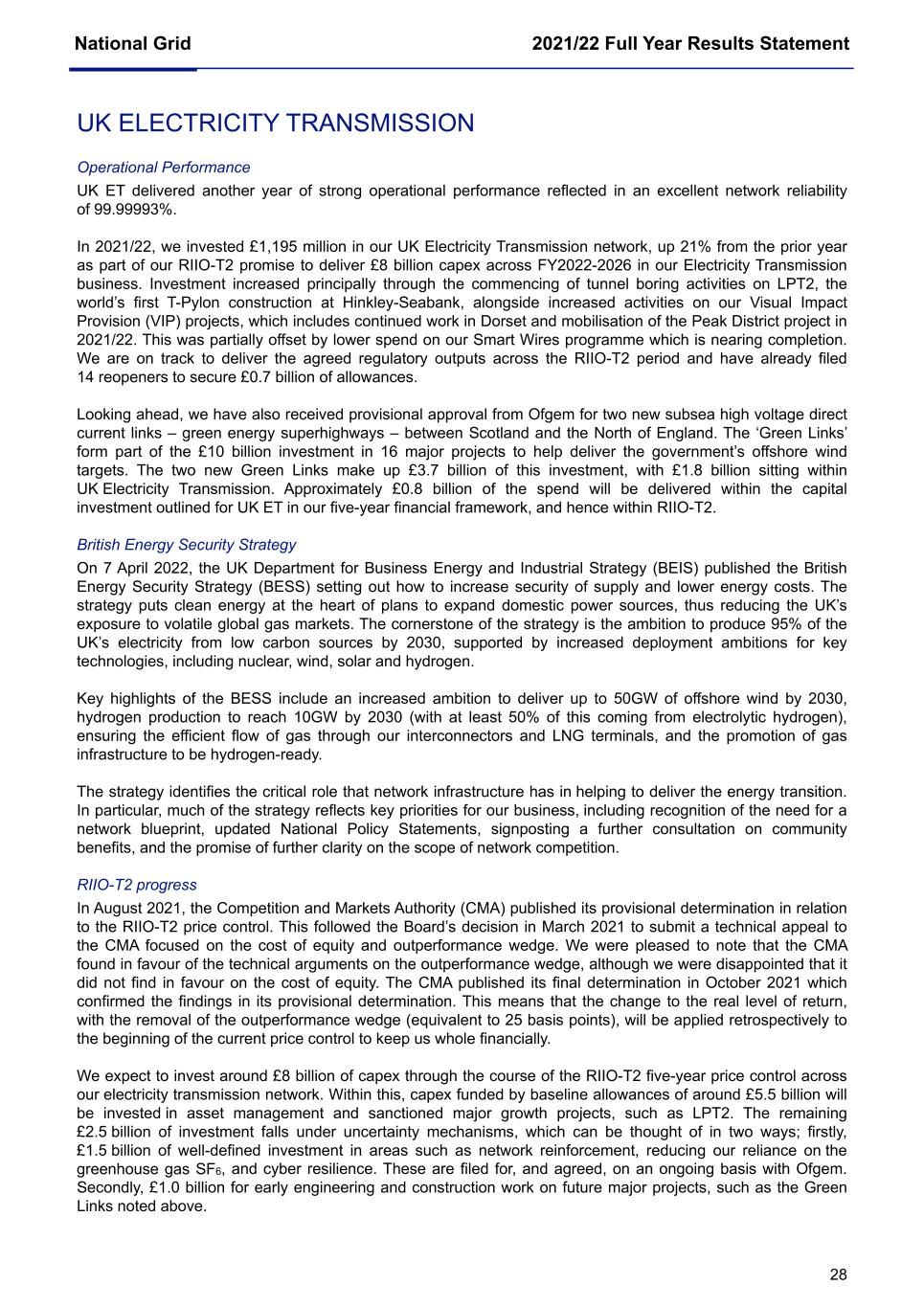

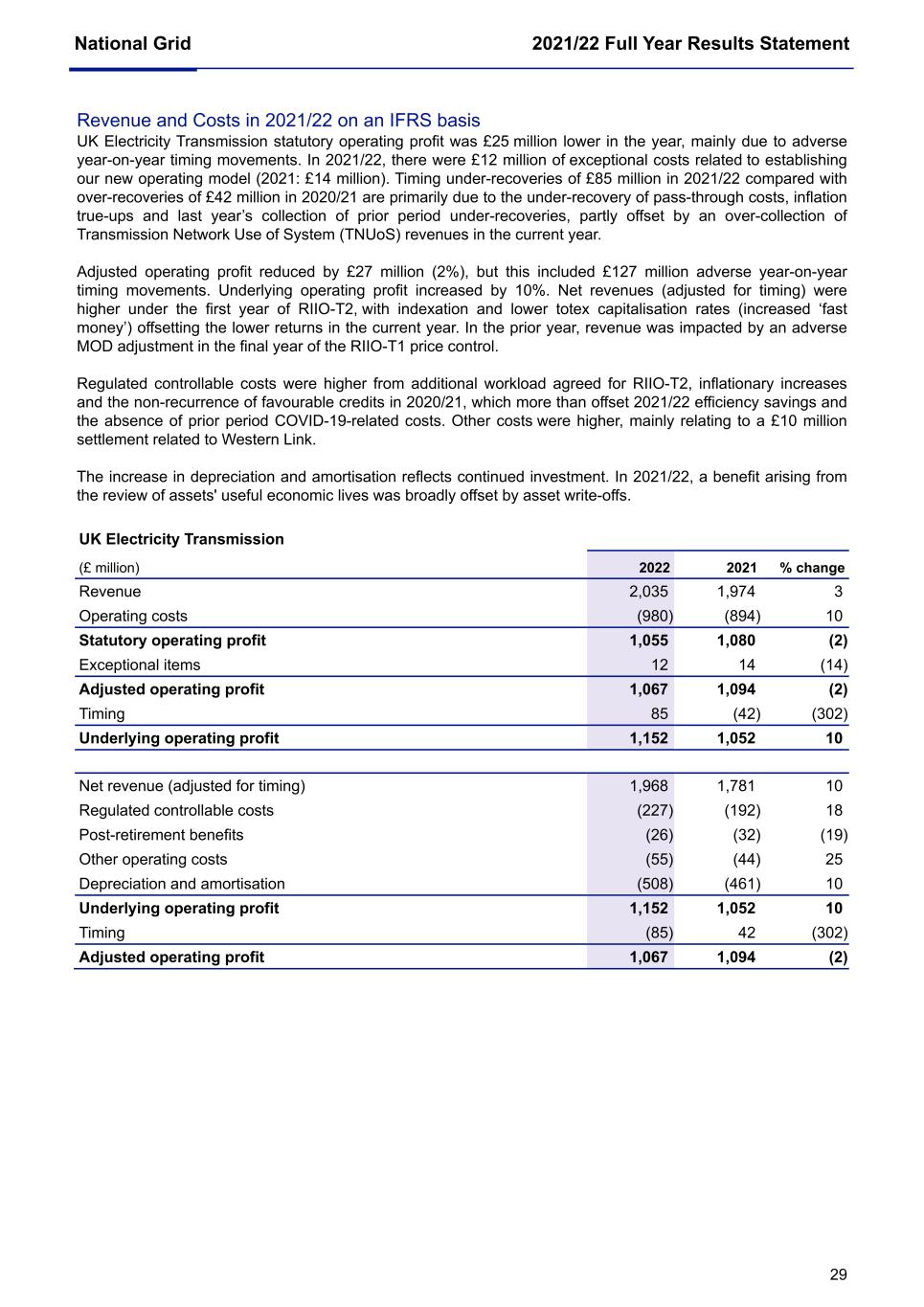

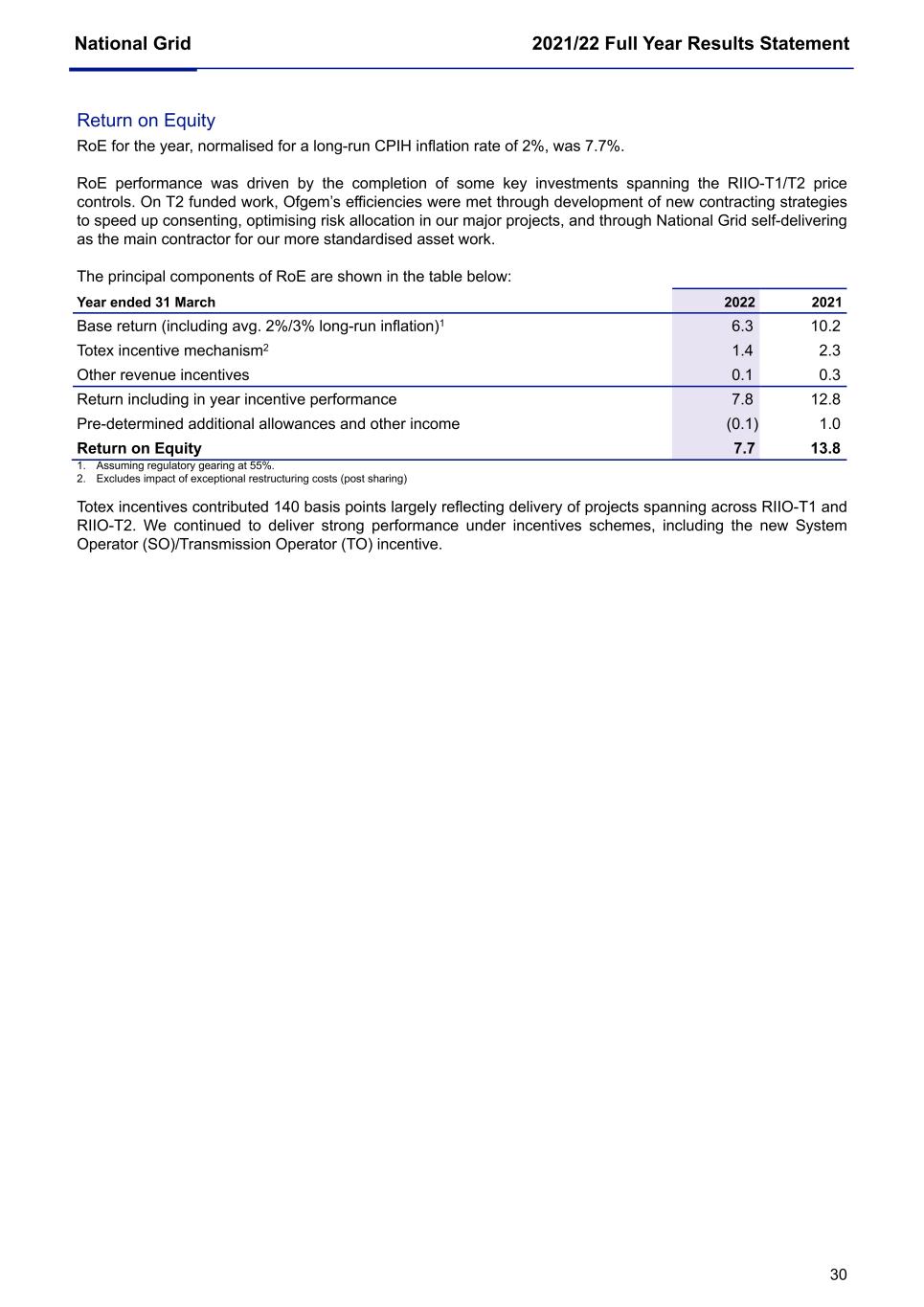

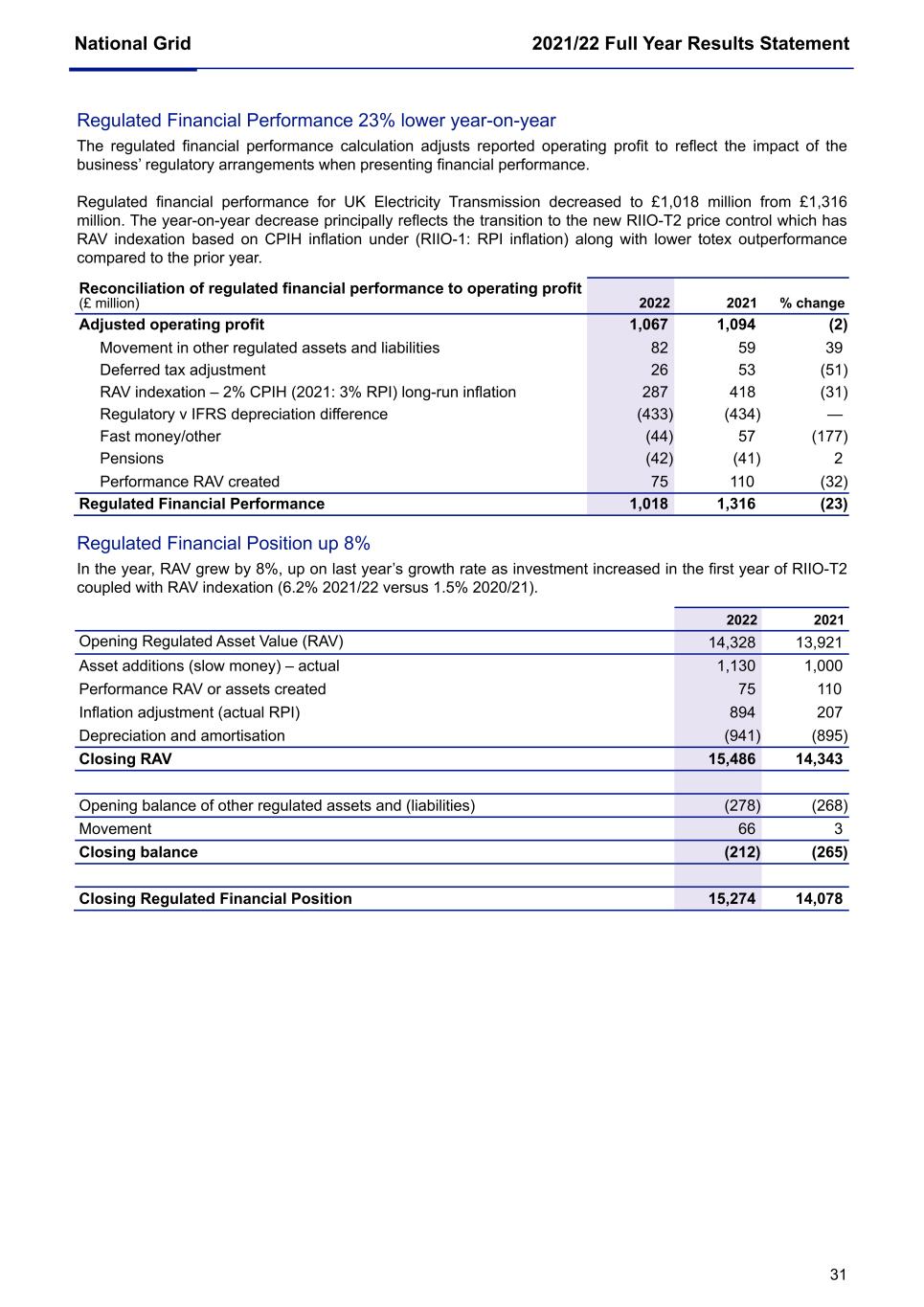

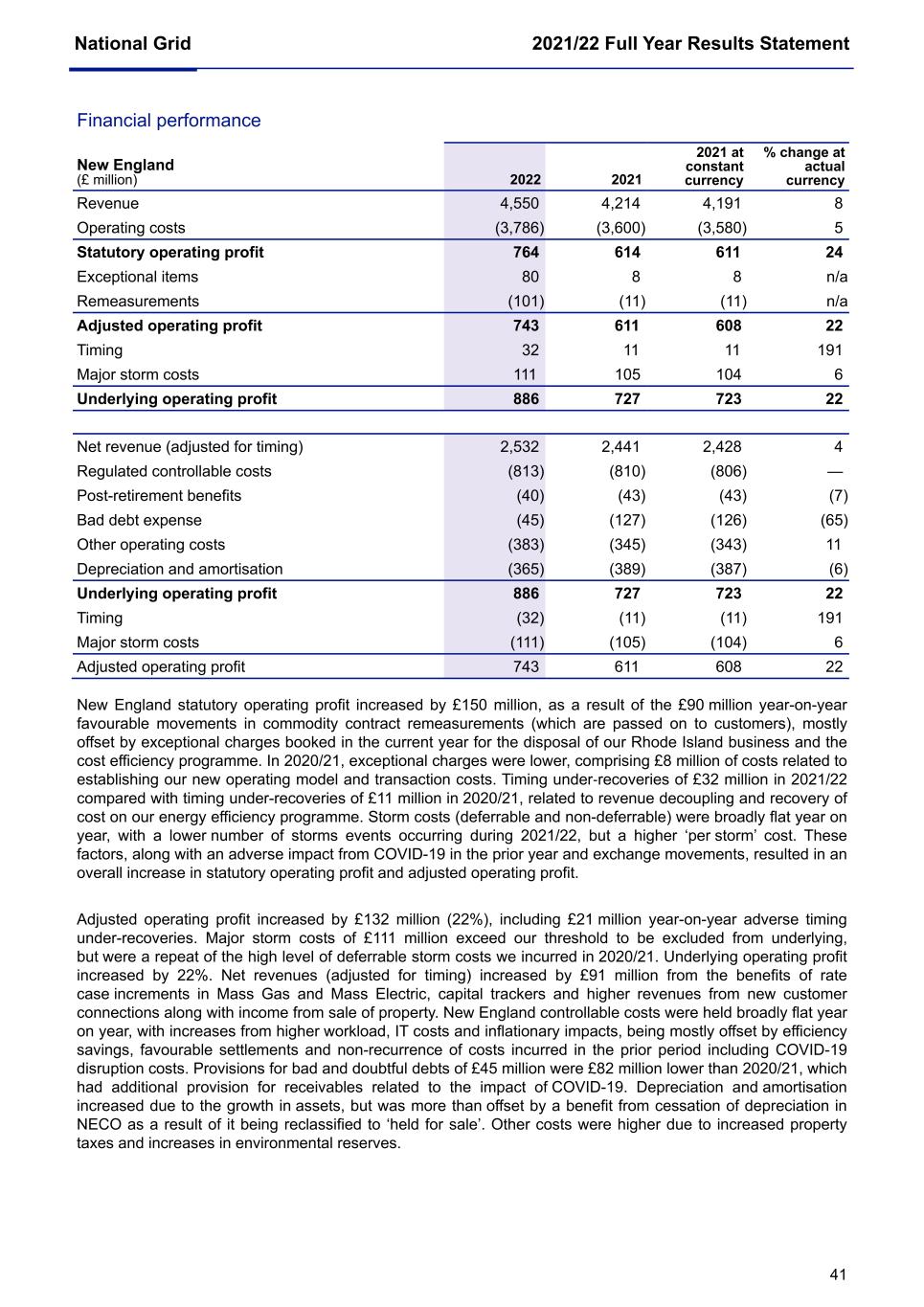

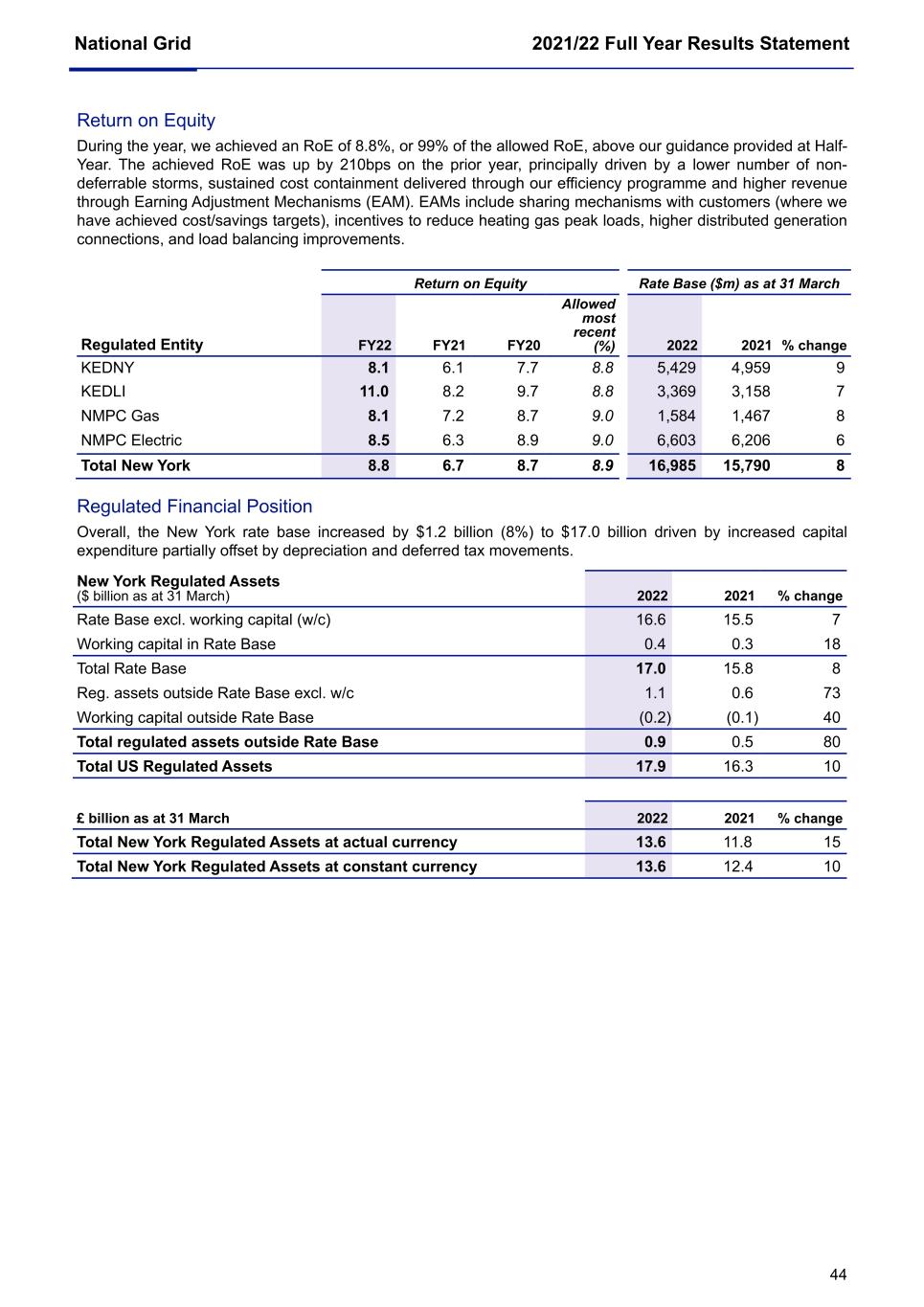

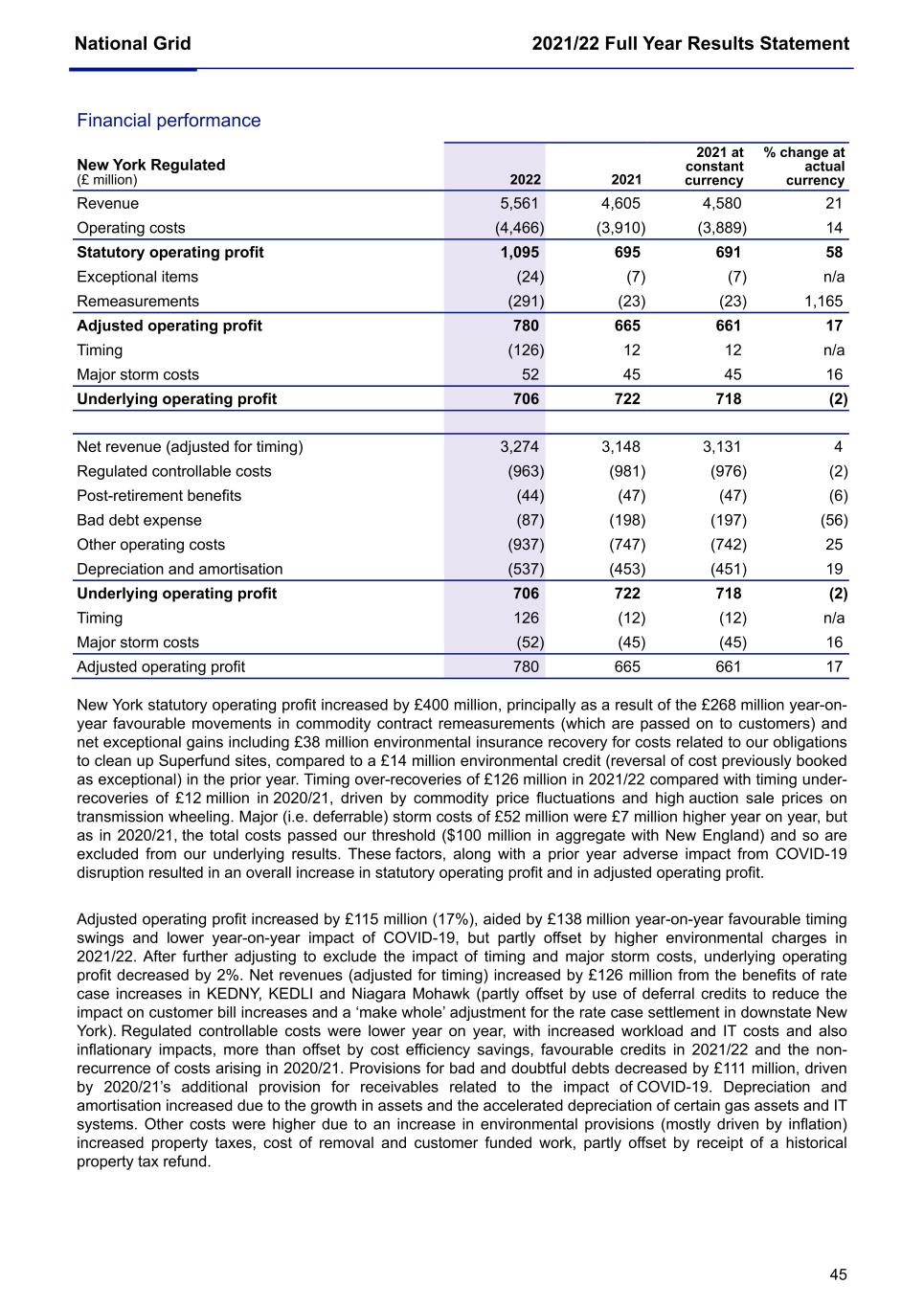

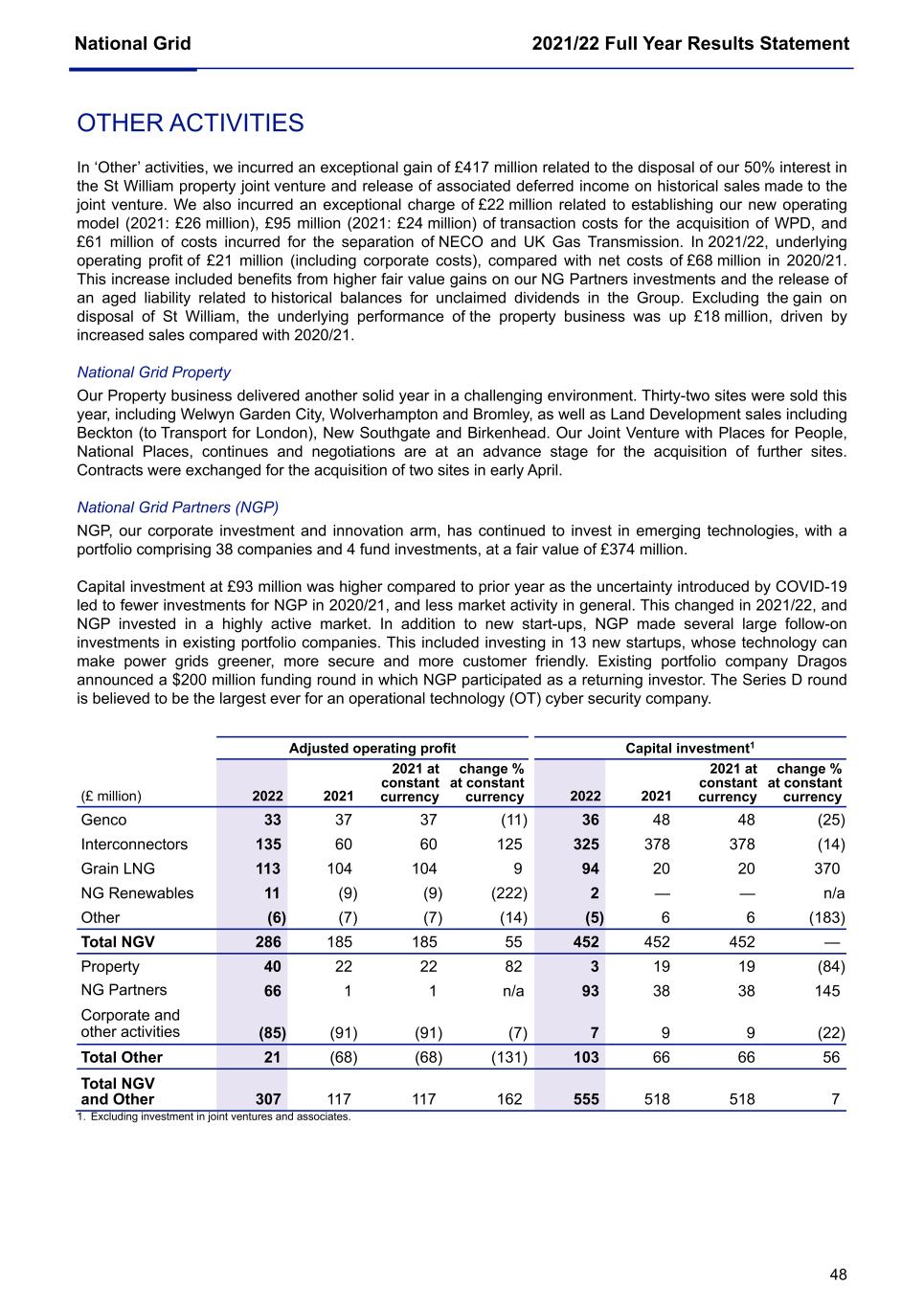

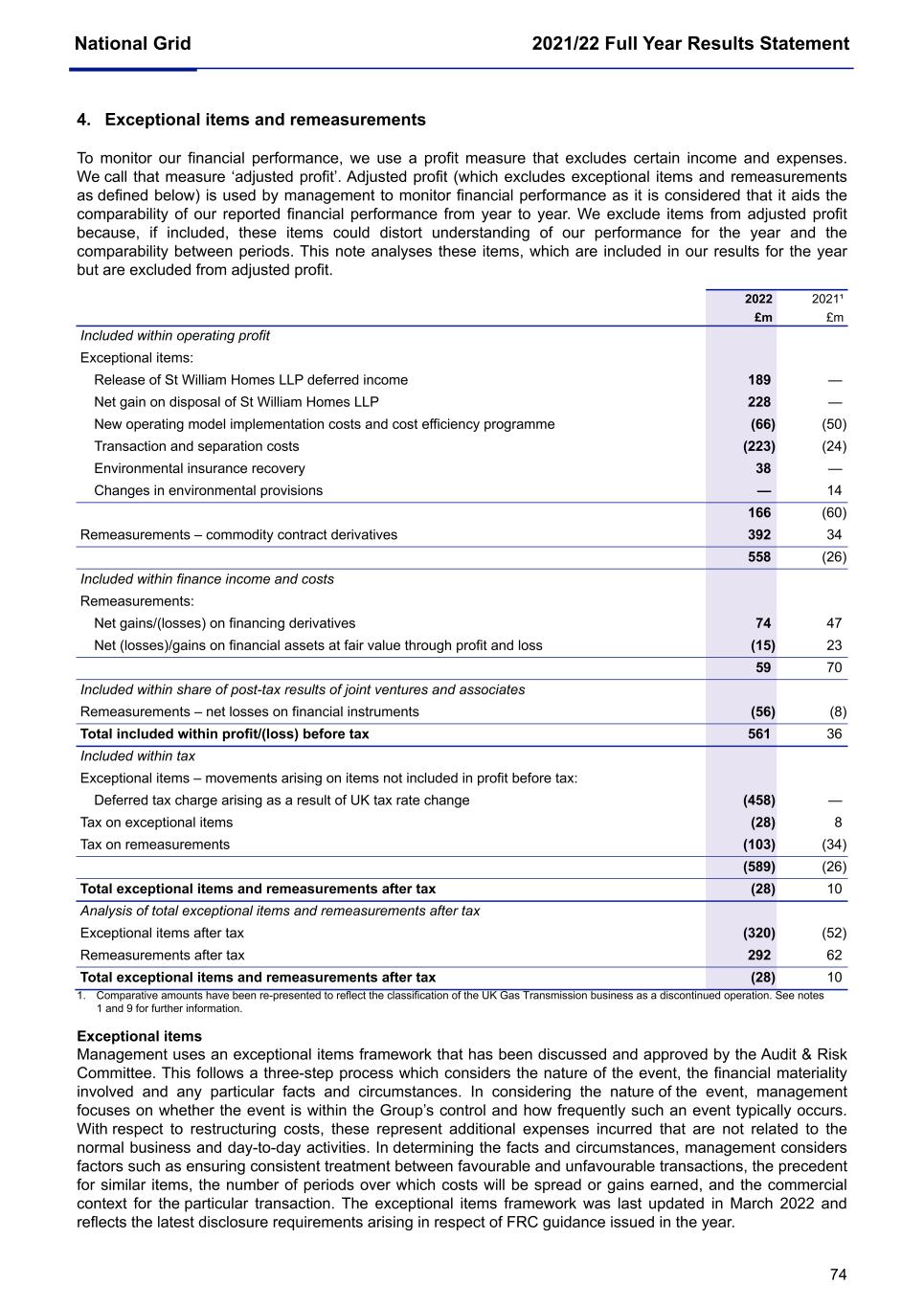

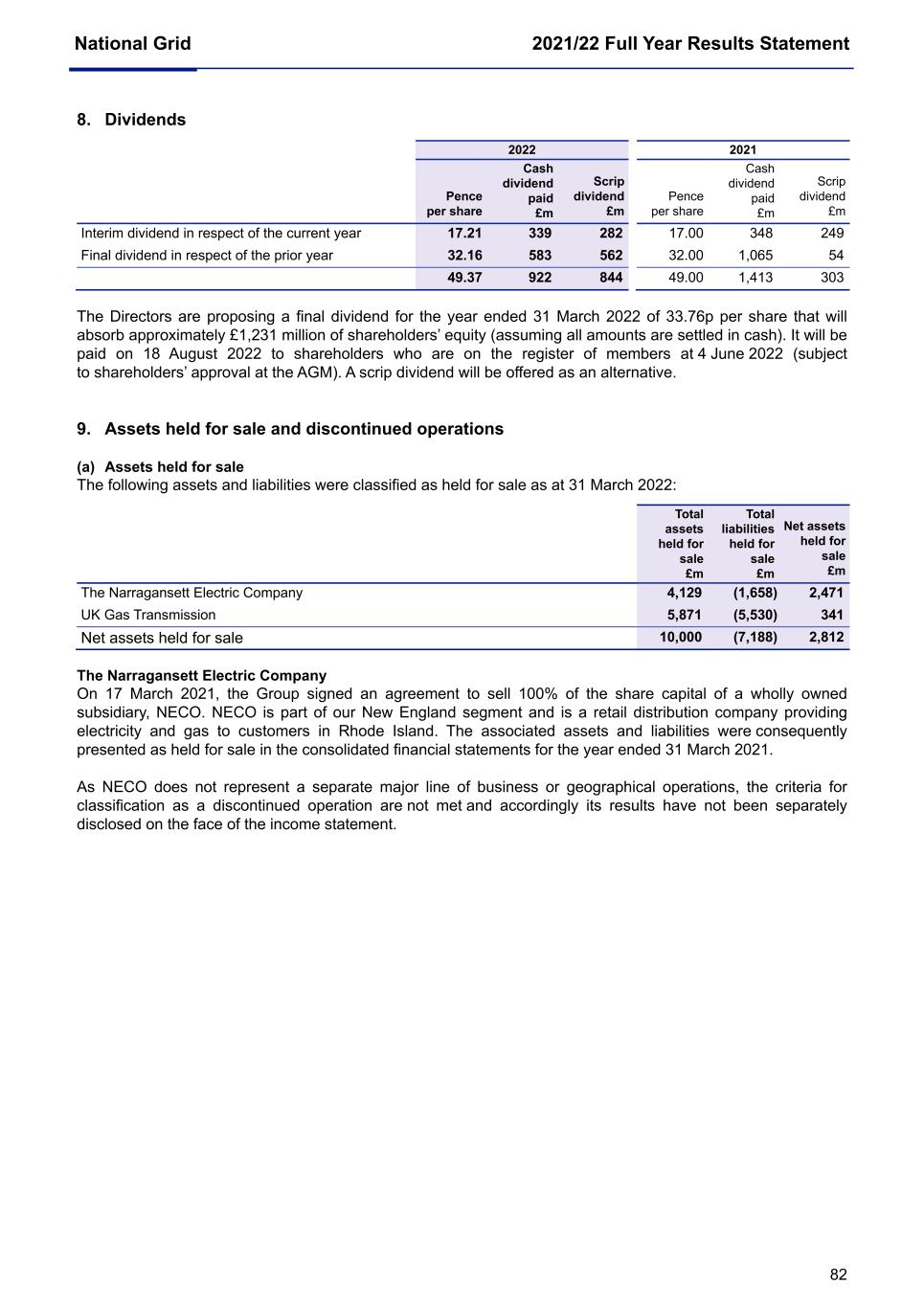

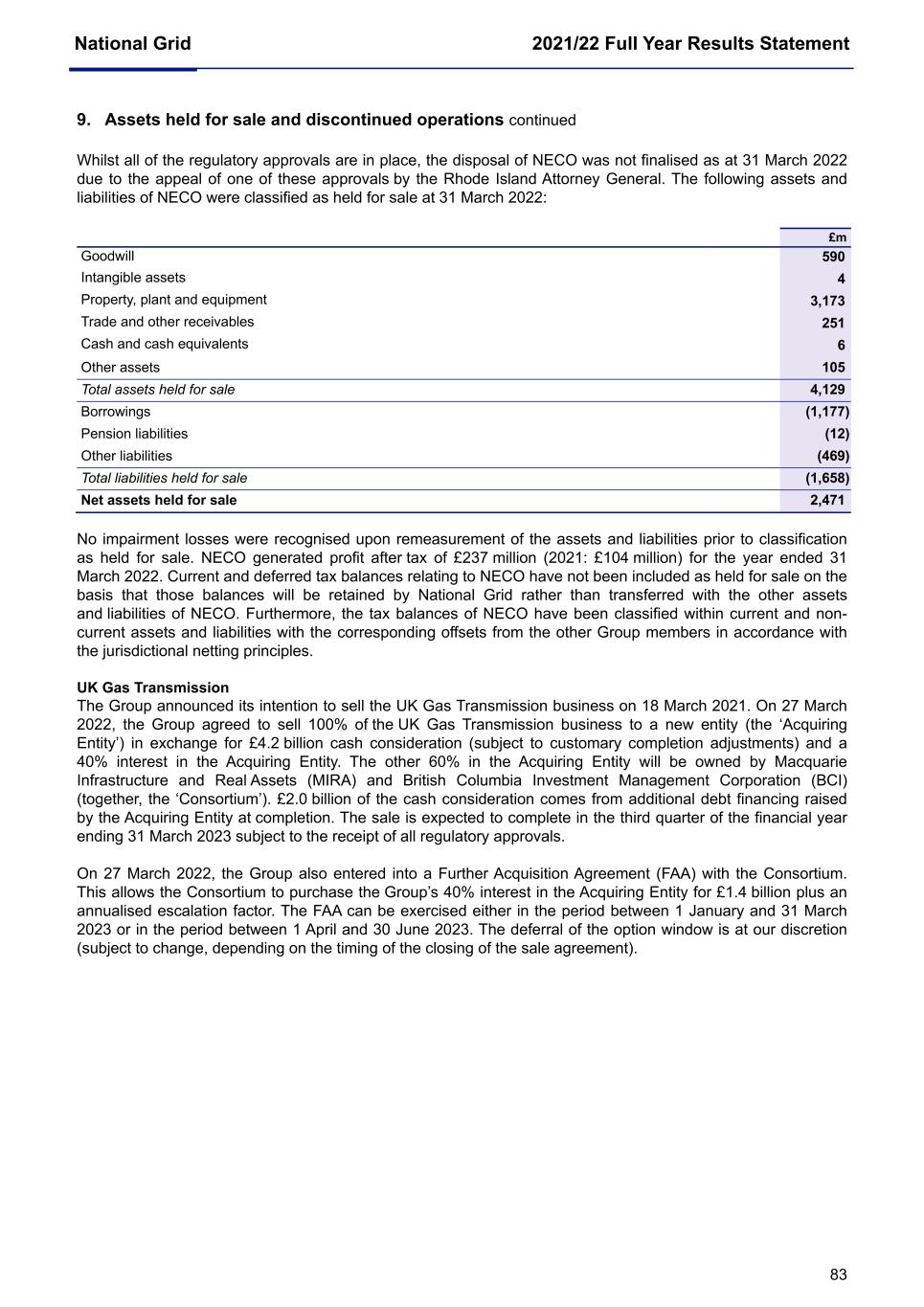

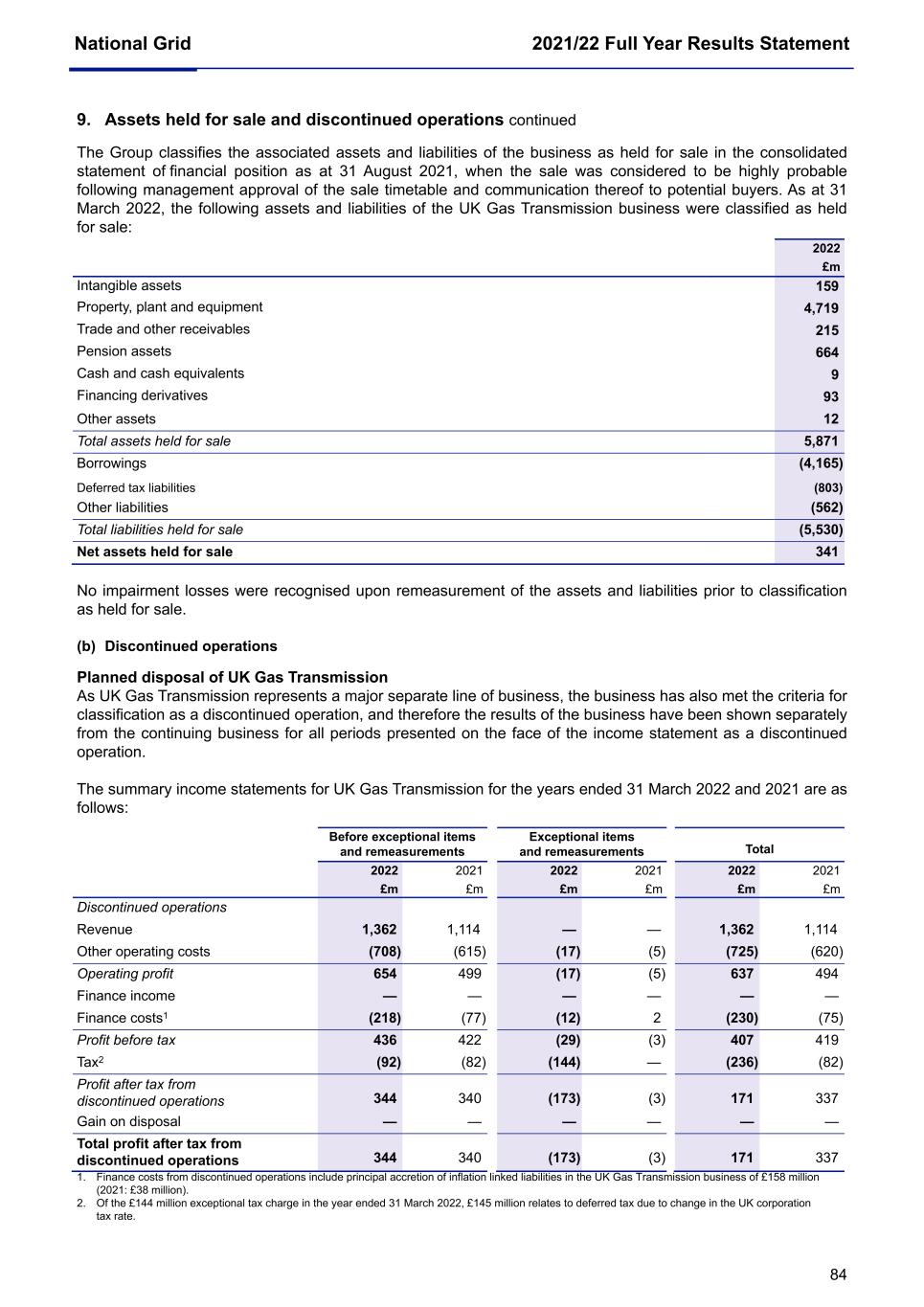

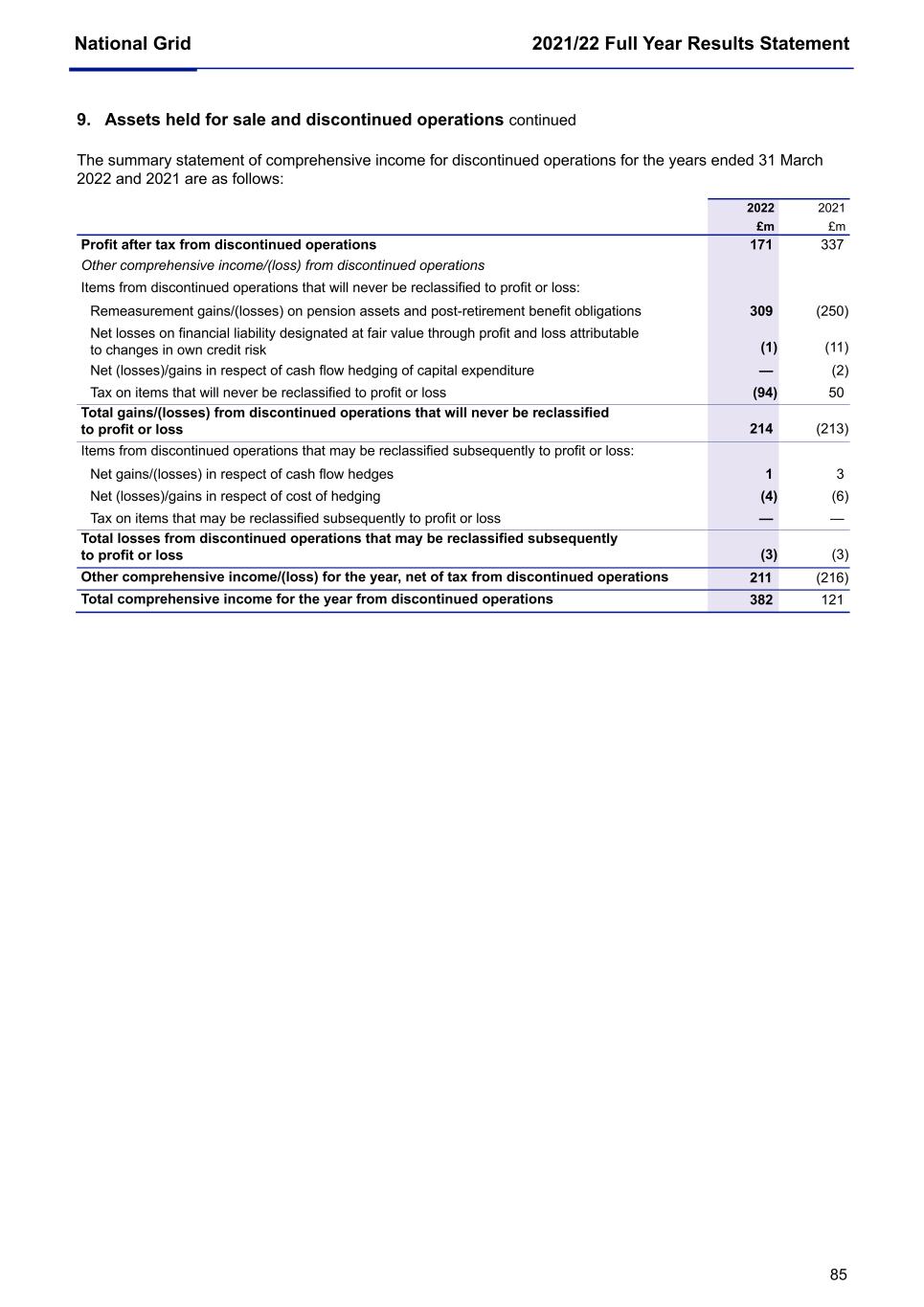

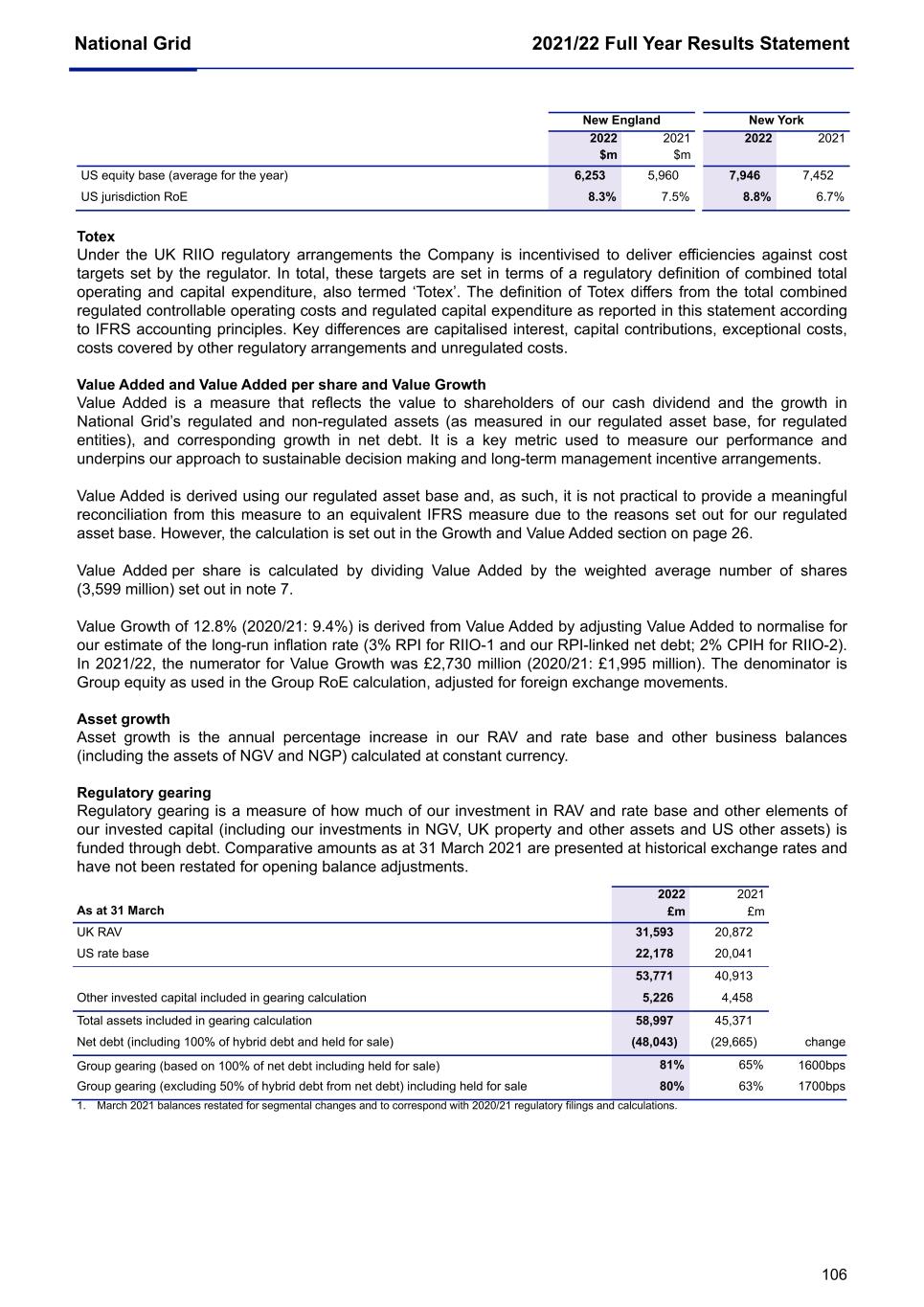

National Grid 2021/22 Full Year Results Statement 22 Cash flow generated from continuing operations was £5.8 billion, £1.8 billion higher than last year, mainly due to the contribution from WPD, lower adverse year on year timing under-recoveries, higher revenues compared to 2020/21, higher spend on provisions and exceptional charges, offset by favourable working capital inflows on payables. Cash expended on investment activities increased as a result of continued organic growth in our regulated and non-regulated businesses, the impact of acquiring WPD, partly offset by disposal of financial investments. The disposal of our St William investment in March 2022 generated £413 million of proceeds in the year. The cash acquisition of WPD in June 2021 for £7.9 billion increased net debt, along with a further £8.2 billion increase from the fair value of net debt acquired. Net interest paid increased as a result of the bridge loan taken out to finance the purchase of WPD, interest for borrowings acquired with WPD and increased base rates on borrowings. The Group made net tax payments of £298 million during 2021/22. The cash dividend of £922 million, reflected a higher scrip uptake of 48% (2021: 17%). Discontinued operations represents UK Gas Transmission & Metering which generated higher cash inflows in 2021/22, principally as a result of improved year on year performance and no pension deficit payments in 2021/22. Non-cash movements primarily reflect changes in the sterling-dollar exchange rate, accretions on index-linked debt, lease additions and other derivative fair value movements, offset by the amortisation of fair value adjustments on the debt acquired with WPD. Closing net debt of £42.8 billion excludes £1.2 billion of net debt in NECO and £4.1 billion of net debt in NG Gas plc which has been classified as ‘held for sale’ on 31 March 2022. The Board has considered the Group’s ability to finance normal operations as well as funding a significant capital programme, taking account of the disruption caused by the energy crisis. This includes stress-testing of the Group’s finances under a ‘reasonable worst case’ scenario, assessing the timing of the NECO and National Grid Gas plc transactions, and the further levers at the Board’s discretion to ensure our businesses are adequately financed. As a result, the Board has concluded that the Group will have adequate resources to do so.