Form 6-K Mynaric AG For: Jun 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF JUNE 2022

COMMISSION FILE NUMBER 001-41045

Mynaric AG

(Registrant’s name)

Dornierstraße 19

82205 Gilching

Germany

+49 (0) 8105 79990

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

CONTENTS

Explanatory Note

On June 3, 2022, Mynaric AG published the invitation to its annual shareholders meeting to be held on July 14, 2022. A copy of the invitation is furnished as Exhibit 99.1 hereto.

EXHIBIT INDEX

| Exhibit |

Description of Exhibit | |

| 99.1 | Invitation to Mynaric AG’s annual shareholders meeting to be held on July 14, 2022 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Mynaric AG | ||||

| By |

/s/ Stefan Berndt-von Bülow | |||

| Name: |

Stefan Berndt-von Bülow | |||

| Title: |

Chief Financial Officer | |||

| By |

/s/ Sven Meyer-Brunswick | |||

| Name: |

Sven Meyer-Brunswick | |||

| Title: |

Authorized Representative | |||

Date: June 3, 2022

Exhibit 99.1

Non-Binding Convenience Translation

Mynaric AG

Gilching, district of Starnberg

ISIN DE000A0JCY11

Unique identifier of the event: M0Y072022oHV

Invitation to the Annual General Meeting

We hereby invite our shareholders to the Annual General Meeting to be held

on July 14, 2022 at 13:00 hrs. (CEST)

as virtual meeting

without the physical presence of the shareholders or their proxies.

The Annual General Meeting will be broadcasted live on the internet for our shareholders and their proxies. Voting rights may only be exercised by electronical postal vote or by granting power of attorney to the voting representatives appointed by the Company. The place of the Annual General Meeting within the meaning of the German Stock Corporation Act is the registered office of the Company: Dornierstrasse 19, 82205 Gilching.

I.

Agenda of the Annual General Meeting

| 1. | Presentation of the adopted annual financial statements of the Company and the approved consolidated financial statements as of December 31, 2021, the management report for the Group and the report of the Supervisory Board for the financial year 2021 |

A resolution on this agenda item 1 is not provided for. Section 175 para. 1 sentence 1 of the German Stock Corporation Act (Aktiengesetz, “AktG”) only provides that the Management Board must convene the Annual General Meeting for the purpose of, amongst others, accepting the adopted annual financial statements and, in the case of a parent company, also the consolidated financial statements approved by the Supervisory Board and the Group management

report. Pursuant to section 175 para. 2, 176 para 1 sentence 1 AktG, the Management Board must make available to the Annual General Meeting, amongst others, the annual financial statements, the report of the Supervisory Board and, in the case of a parent company, also the consolidated financial statements, the Group management report and the report of the Supervisory Board.

All of the above documents will be available for inspection by shareholders from the day of convocation and during the Annual General Meeting via the Company’s website at http://www.mynaric.com/hv.

| 2. | Resolution on the discharge of the members of the Management Board for the financial year 2021 |

The Management Board and the Supervisory Board propose that the members of the Management Board be discharged for the financial year 2021.

| 3. | Resolution on the discharge of the members of the Supervisory Board for the financial year 2021 |

The Management Board and the Supervisory Board propose that the members of the Supervisory Board be discharged for the financial year 2021.

| 4. | Resolution on the election of the auditor of the annual financial statements and the consolidated financial statements for the financial year 2022 |

The Supervisory Board proposes the appointment of KPMG AG Wirtschaftsprüfungsgesellschaft, Klingelhöferstraße 18, 10785 Berlin, as auditor of the annual financial statements and the consolidated financial statements for the financial year 2022.

| 5. | By-elections to the Supervisory Board |

Pursuant to section 9 para. 1 of the Articles of Association in conjunction with sections 95 sentence 2, 96, para. 1, 101 para. 1 AktG, the Supervisory Board of the Company is composed of five members elected by the general meeting.

The previous member of the Supervisory Board Mr. Gerd Gruppe has resigned from his office as a member of the Supervisory Board of Mynaric AG with effect from October 5, 2021. Since October 13, 2021, Mr. Hans Königsmann is a member of the Supervisory Board of Mynaric AG in his place, who was appointed as a member of the Supervisory Board by way of court appointment for a limited term until the end of the Annual General Meeting of Mynaric AG on July 14, 2022, which is hereby convened.

-2-

Furthermore, the previous member of the Supervisory Board Mr. Thomas Hanke has resigned from his office as a member of the Supervisory Board of Mynaric AG with effect from June 24, 2021. Since July 30, 2021, Mr. Vincent Wobbe is a member of the Supervisory Board of Mynaric AG in his place, who was also appointed as a member of the Supervisory Board by way of court appointment for a limited term until the end of the Annual General Meeting of Mynaric AG on July 14, 2022, which is hereby convened

It is therefore intended to hold by-elections for the two Supervisory Board members Mr. Gerd Gruppe and Mr. Thomas Hanke who left the Supervisory Board prematurely.

By-elections are held in accordance with section 9 para. 4 sentence 1 of the Articles of Association of Mynaric AG for the remaining term of office of the departing member. It is therefore intended to elect Mr. Hans Königsmann as member of the Supervisory Board for the remaining term of office of Mr. Gruppe and to elect Mr. Vincent Wobbe as member of the Supervisory Board for the remaining term of office of Mr. Hanke. Mr. Gerd Gruppe and Mr. Thomas Hanke were each elected for a term of office until the end of the Annual General Meeting which resolves on the discharge of the Supervisory Board for the financial year 2022 (i.e., presumably until the end of the Annual General Meeting 2023).

The Supervisory Board proposes, that

| a. | Hans Königsmann, aerospace engineer, formerly Vice President of Flight Reliability at SpaceX, resident in Los Angeles/United States of America, be elected as member of the Supervisory Board as successor to Mr. Gerd Gruppe. |

| b. | Vincent Wobbe, Head of Public Markets Investments, Apeiron Investment Group, resident in London/United Kingdom, be elected as member of the Supervisory Board as successor to Mr. Thomas Hanke. |

The election shall in each case take effect from the end of the Annual General Meeting on July 14, 2022, which is hereby convened, and in accordance with the Articles of Association for the remainder of the term of office of the respective departing Supervisory Board member, i.e., in each case until the end of the Annual General Meeting which resolves on the discharge of the members of the Supervisory Board for the financial year 2022.

* * *

The proposed persons hold the following memberships on other statutory supervisory boards and in comparable domestic and foreign supervisory bodies of business enterprises:

-3-

| a. | Hans Königsmann: |

Memberships in other statutory supervisory boards: From June 1, 2022, member of the Supervisory Board of OHB SE, Bremen, Germany.

Memberships in comparable domestic and foreign supervisory bodies of business enterprises: None.

| b. | Vincent Wobbe: |

Memberships in other statutory supervisory boards: Member of the Supervisory Board of nextmarkets AG, Cologne, Germany.

Memberships in comparable domestic and foreign supervisory bodies of business enterprises: None.

Detailed curricula vitae of the proposed candidates are available on the Internet at http://www.mynaric.com/hv.

In accordance with the German Corporate Governance Code, the proposed candidates will ensure that they have sufficient time to perform their duties.

In the opinion of the Supervisory Board, the proposed candidates do not have any personal or business relationship with Mynaric AG or its group companies or the corporate bodies of Mynaric AG that is required to be disclosed in accordance with the German Corporate Governance Code, and there is no personal or business relationship with a shareholder with a material interest in Mynaric AG within the meaning of the German Corporate Governance Code that is required to be disclosed.

The proposed candidates as well as the Supervisory Board members not standing for re-election are familiar with the sector in which the Company operates. The aforementioned election proposals take into account the specific objectives resolved by the Supervisory Board for its composition and at the same time strive to fulfill the competence profile and diversity concept developed by the Supervisory Board for the entire body. The objectives for the composition, the competence profile and the diversity concept for the Supervisory Board, including the status of their respective implementation, are published in the corporate governance statement pursuant to sections 289f , 315d of the German Commercial Code (Handelsgesetzbuch, “HGB”) (including corporate governance report) of the Company for the financial year 2021 as part of the annual report.

-4-

| 6. | Resolution on the approval of the remuneration system for the Management Board |

The Supervisory Board proposes that the remuneration system as set out under section II adopted by the Supervisory Board for the members of the Management Board of Mynaric AG with effect from August 1, 2022 be approved.

| 7. | Resolution on the confirmation of the remuneration of the members of the Supervisory Board |

The Annual General Meeting on May 14, 2021 resolved under agenda item 6 c) on the remuneration of the members of the Supervisory Board (the “Resolution on Supervisory Board Remuneration”). The remuneration of the members of the Supervisory Board as determined in the Resolution on Supervisory Board Remuneration shall be confirmed unchanged. The wording of the Resolution on Supervisory Board Remuneration and the underlying remuneration system for the Supervisory Board with the disclosures pursuant to sections 113 para. 3 sentence 3, 87a para. 1 sentence 2 AktG is presented in section III below.

The Management Board and Supervisory Board propose that the remuneration of the members of the Supervisory Board set out in the Resolution on Supervisory Board Remuneration, which is based on the remuneration system described in section III below, be confirmed unchanged.

| 8. | Resolution on the approval of the remuneration report |

Pursuant to section 162 AktG, Management Board and Supervisory Board submit to the Annual General Meeting the remuneration report presented under section IV below, which was audited by the auditor of the Company, and propose that the remuneration report for the financial year 2021, be approved.

| 9. | Resolution on an amendment to the Articles of Association in para. 2 and para. 4 of section 9 (Composition and Term of Office) to make flexible the terms of office of Supervisory Board members and to adjust the majority requirements for by-elections to the Supervisory Board |

According to the current provision in section 9 para. 2 sentence 1 of the Articles of Association, the members of the Supervisory Board are elected for the time period until the end of the general meeting which resolves on their discharge for the fourth financial year after the beginning of their term of office, excluding he financial year in which the election takes places. In addition, by-elections pursuant to section 9 para. 4 sentence 1 of the Articles of Association are always held for the remaining term of office of the departed members. These provisions shall be made more flexible, in particular to allow elections for a shorter period than the aforementioned four-year

-5-

period and, in the case of by-elections, to enable the term of office for the subsequently elected members to be determined independently of the term of office of the predecessor.

In addition, under the current provision in section 9 para. 4 sentence 2 of the Articles of Association, the by-election of a member of the Supervisory Board who prematurely resigned from his office requires a qualified majority of three quarters of the votes cast if the by-election results in the departure of a replacement member who has stepped up. In the future, the simple majority of votes otherwise applicable to elections to the Supervisory Board shall be sufficient for such by-elections. The provision in section 9 para. 4 sentence 2 of the Articles of Association shall therefore be deleted without replacement.

The Management Board and Supervisory Board therefore propose that the following resolution be adopted:

Para. 2 and para. 4 of section 9 of the Articles of Association shall be amended and renewed as follows:

| a) | “(2) Unless a shorter period is specified by the general meeting at the time of the election, the members of the Supervisory Board shall be elected for the period until the end of the general meeting, which revolves on their discharge for the fourth financial year from the beginning of their term of office, not including the financial year in which the term of office begins. Re-election shall be possible.” |

| b) | “(4) If a Supervisory Board member is elected to replace a member who has resigned, his office shall continue for the remainder of the term of office of the member who has resigned, unless a different period is specified by the general meeting at the time of the election, which may however not exceed the maximum period permitted under paragraph 2 sentence 1.” |

| 10. | Resolution on the conversion of bearer shares to registered shares, the adjustment of conditional capital and authorized capital, and on corresponding amendments to the Articles of Association |

Currently, the Company’s share capital is divided into no-par value bearer shares (auf den Inhaber lautende Stückaktien). It is intended to convert the shares of Mynaric AG to registered shares (Namensaktien). Registered shares have advantages both in capital market communication and in direct shareholder communication. It is not intended to restrict the transferability of the shares.

-6-

In the course of the conversion to registered shares, it is also necessary to adjust capital authorizations and the rules for convening the general meeting.

The Management Board and the Supervisory Board propose that the following resolutions be adopted:

| a) | The no-par value bearer shares of the Company existing at the time the following amendments to the Articles of Association take effect shall be converted into registered shares while retaining the existing denomination (Stückelung). The Management Board shall be authorized to arrange for everything necessary and required for the conversion of the bearer shares into registered shares. |

| b) | Para. 2 of section 4 (Share Capital) of the Articles of Association is amended and reworded as follows: |

“(2) The shares are registered shares.”

| c) | The existing Authorized Capital 2021/I is governed by section 4 para. 3 of the Articles of Association. However, it is intended to propose to the Annual General Meeting of the Company on July 14, 2022, under agenda item 12 the cancellation of the existing Authorized Capital 2021/I and the creation of a new Authorized Capital (Authorized Capital 2022/I) for resolution (the “New Authorized Capital”) by way of a corresponding amendment to section 4 para. 3. |

If the New Authorized Capital is adopted by the Annual General Meeting on July 14, 2022 with the required majority, the authorized capital of the Company pursuant to section 4 para. 3 of the Articles of Association of the Company shall correspond in scope and form to the authorized capital of the Company pursuant to the revised section 4 para. 3 of the Articles of Association (Authorized Capital 2022/I) and shall – subject to a deviating resolution – read as set out under agenda item 12.

Otherwise, the authorized capital of the Company pursuant to section 4 para. 3 of the Articles of Association shall correspond in scope and form to the existing authorized capital pursuant to section 4 para. 3 of the Articles of Association in its currently applicable version (Authorized Capital 2021/I). In this case, however, in sentence 1 of section 4 para. 3 in its currently applicable version, the words “no-par value bearer shares” shall be replaced by the words “no-par value bearer or registered shares (auf den Inhaber oder den Namen lautende Stückaktien)”; for the rest, para. 3 of section 4 of the Articles of Association shall remain unaffected.

-7-

| d) | The resolution of the Annual General Meeting of the Company on June 12, 2020 under agenda item 8 on an authorization to issue convertible bonds and/or bonds with warrants and on the creation of a Conditional Capital 2020/II and the corresponding amendment to the Articles of Association, to the extent that it has not yet been utilized, shall be adjusted as follows: |

| - | In the authorization granted by the Annual General Meeting of the Company on June 12, 2020, under agenda item 8, lit. a) to issue convertible bonds and/or bonds with warrants, the sentence “In any case, the proportionate amount of the share capital of the no-par value bearer shares to be subscribed for per bond shall not exceed the nominal amount per bond.” shall be replaced by the sentence “In any case, the proportionate amount of the share capital of the no-par value bearer or registered shares to be subscribed for per bond shall not exceed the nominal amount per bond” with effect from the effective date of the amendment to the Articles of Association resolved under this lit. d) by its entry in the commercial register of the Company. In all other respects, the authorization shall remain unaffected. |

| - | Agenda item 8, lit. b), sentence 1 of the conditional capital increase resolved by the Annual General Meeting of the Company on June 12, 2020, shall be amended and reworded as follows with effect from the effective date of the amendment to the Articles of Association resolved under this lit. d) by its entry in the commercial register of the Company: |

“The share capital of the Company is conditionally increased by up to EUR 1,179,679.00 by issuing up to 1,179,679 new no-par value bearer or registered shares (auf den Inhaber oder den Namen lautende Stückaktien) (Conditional Capital 2020/II).”

In all other respects, the conditional capital increase resolved under agenda item 8, lit. b) by the Annual General Meeting of the Company on June 12, 2020 remains unchanged.

| - | Sentence 1 in para. 7 of section 4 (Share Capital) of the Articles of Association shall be amended and reworded as follows: |

“The share capital of the Company is conditionally increased by up to EUR 1,179,679.00 by issuing up to 1,179,679 new no-par value bearer or registered shares (auf den Inhaber oder den Namen lautende Stückaktien) (Conditional Capital 2020/II).”

-8-

In all other respects, para. 7 of section 4 (Share Capital) of the Articles of Association remains unchanged.

| e) | In sentence 1 of para. 8 of section 4 (Share Capital) of the Articles of Association, the words “no-par value bearer shares” in the Authorized Capital 2021//II shall be replaced by the words “no-par value bearer or registered shares (auf den Inhaber oder den Namen lautende Stückaktien)”. In all other respects, para. 8 of section 4 (Share Capital) of the Articles of Association remains unchanged. |

| f) | Paras. 3 to 6 of section 16 (Place, Convening and Attendance) of the Articles of Association are amended and reworded as follows: |

| “(3) | Only those shareholders who are registered in the Company’s share register on the day of the general meeting and who have registered in good time prior to the general meeting shall be entitled to attend the general meeting and exercise their voting rights.” |

| (4) | (currently left blank) |

| (5) | The registration must be received by the Company no later than on the sixth day prior to the general meeting at the address specified for this purpose in the notice of convocation; the statutory provisions shall apply to the calculation of the deadline. The Management Board is entitled to stipulate a shorter registration period, to be measured in days, in the notice convening the general meeting; in this case, the shorter period stipulated by the Management Board shall be decisive for the receipt of the registration. Further shortening of the deadline on the basis of statutory provisions shall remain unaffected. |

| (6) | The notice convening the general meeting may provide further details on registration.” |

| 11. | Resolution on the cancellation of the Conditional Capital 2017 and a corresponding amendment to section 4 (Share Capital) of the Articles of Association |

The Conditional Capital 2017 in section 4 para. 4 of the Articles of Association of the Company was used to grant subscription rights to shares (stock options) to employees of the Company or of companies affiliated with the Company on the basis of the authorizations granted by the general meetings of the Company on September 8, 2017, and July 2, 2019. All stock options

-9-

granted hereunder have been fulfilled or expired in the meantime. The Conditional Capital 2017 is therefore no longer required.

The Management Board and Supervisory Board therefore propose that the following resolution be adopted:

| a) | The Conditional Capital 2017 shall be cancelled in full. |

| b) | Para. 4 of section 4 of the Articles of Association of the Company shall be repealed and reworded as follows: |

| “(4) | (currently left blank)” |

| 12. | Resolution on the cancellation of the existing authorized capital (Authorized Capital 2021/I), the creation of new authorized capital with the option to exclude subscription rights (Authorized Capital 2022/I) and a corresponding amendment to section 4 (Share Capital) of the Articles of Association |

The Management Board and the Supervisory Board propose that the following resolution be adopted:

| a) | The authorized capital set out in section 4 para. 3 of the Articles of Association (Authorized Capital 2021/I), insofar as it has not been utilized by that time, shall be cancelled with effect from the date on which the following new version of section 4 para. 3 of the Articles of Association is registered with the commercial register of the Company. |

| b) | A new authorized capital (Authorized Capital 2022/I) shall be created with the authorization to exclude subscription rights. Section 4 para. 3 of the Articles of Association shall be amended for this purpose and reworded as follows: |

| “(3) | The Management Board is authorized, with the consent of the Supervisory Board, to increase the share capital by up to EUR 2,154,680.00 on one or more occasions until and including July 13, 2027 by issuing up to 2,154,680 new no-par value bearer or registered shares (auf den Inhaber oder den Namen lautende Stückaktien) against contribution in cash and/or in kind (Authorized Capital 2022/I). |

The shareholders shall be granted subscription rights. The new shares may also be acquired by a credit institution to be determined by the Management Board or by an enterprise pursuing activities pursuant to section 53 para. 1 sentence 1 of the German Banking Act (Gesetz über das Kreditwesen, “KWG”) or

-10-

section 53b para 1 sentence 1 or para. 7 KWG (financial institution) or by a syndicate of such credit or financial institutions, with the obligation to offer them for subscription to the shareholders of the Company. However, the Management Board is authorized, with the consent of the Supervisory Board, to exclude the shareholders’ subscription rights on one or more occasions,

| (i) | to the extent necessary to avoid fractional amounts, |

| (ii) | in the event of a capital increase against contributions in kind, in particular in the context of business combinations or for the (also indirect) acquisition of companies, operations, parts of companies, equity interests or other assets or entitlements to the acquisition of assets, including claims against the Company or its Group companies, |

| (iii) | if a capital increase against cash contributions does not exceed 10% of the share capital either at the time this authorization becomes effective or – if this amount is lower – at the time this authorization is exercised, and the issue price of the new shares is not significantly lower than the stock market price (section 186 para. 3 sentence 4 of the German Stock Corporation Act (Aktiengesetz, “AktG”); when exercising this authorization with exclusion of subscription rights pursuant to section 186 para. 3 sentence 4 AktG, the exclusion of subscription rights on the basis of other authorizations in direct or corresponding application of section 186 para. 3 sentence 4 AktG shall be taken into account; the stock exchange price shall also be deemed to be the price of an American Depositary Share (“ADS”) listed on the New York Stock Exchange or on the NASDAQ stock exchange multiplied by the number of ADSs representing one share; if the Company’s share is listed on the Xetra system of the Frankfurt Stock Exchange (or a functionally comparable successor system replacing the Xetra system) and, at the same time, ADSs of the Company are listed on the New York Stock Exchange or on the NASDAQ Stock Exchange, the Company shall choose which of these stock exchange prices shall be decisive. |

The Management Board is authorized, with the consent of the Supervisory Board, to determine the further details of the capital increase and the terms and conditions of the issuance of shares; this also includes the determination of the dividend entitlement of the new shares, which, in derogation of section 60 para. 2 AktG, may also be determined for a financial year which has already expired if, at the time of

-11-

the issuance of the new shares, a resolution by the general meeting on the appropriation of profits for this financial year has not yet been adopted. The Supervisory Board is authorized to amend section 4 of the Articles of Association after the full or partial implementation of the capital increase in accordance with the respective utilization of the authorized capital and after expiry of the authorization period.”

| 13. | Resolution on the cancellation of the existing authorization of the Management Board to issue convertible bonds and/or bonds with warrants and the corresponding conditional capital (Conditional Capital 2021/I), the granting of a new authorization to issue convertible bonds and/or bonds with warrants with possible exclusion of subscription rights, on the creation of Conditional Capital 2022/I and the corresponding amendment to section 4 (Share Capital) of the Articles of Association |

The general meeting of the Company on May 14, 2021, resolved under agenda item 9, amongst others, to authorize the Management Board to issue convertible bonds and/or bonds with warrants and to create the corresponding Conditional Capital 2021. Until today, the authorization has not been made use of. The authorization and the Conditional Capital 2021 shall therefore be cancelled and replaced by a new authorization together with new conditional capital.

The Management Board and the Supervisory Board propose that the following resolution be adopted:

| a) | Cancellation of the existing authorization of the Management Board to issue convertible bonds and/or bonds with warrants and the corresponding Conditional Capital 2021/I and a corresponding amendment to section 4 (Share Capital) of the Articles of Association |

| (i) | The authorization of the Management Board to issue convertible bonds and/or bonds with warrants granted by resolution of the Annual General Meeting on May 14, 2021, under agenda item 9 (“Authorization 2021”) shall be repealed with effect from the date on which the authorization granted below under item 13 b) to issue convertible bonds and/or bonds with warrants becomes effective. |

| (ii) | Furthermore, the conditional capital created by resolution of the Annual General Meeting on May 14, 2021, under agenda item 9 (Conditional Capital 2021/I) shall be cancelled in full with effect from the date of cancellation of the Authorization 2021. |

-12-

| b) | Granting of a new authorization to the Management Board to issue convertible bonds and/or bonds with warrants with authorization to exclude subscription rights (Authorization 2022) and a corresponding amendment to the Articles of Association in section 4 (Share Capital) |

With effect from the date of registration of the below under item 13 c) provided new conditional capital, the following new authorization to issue convertible bonds and/or bonds with warrants with authorization to exclude subscription rights shall be granted:

The Management Board is authorized, with the consent of the Supervisory Board, to issue bearer convertible bonds and/or bonds with warrants in a total nominal amount of up to EUR 120,000,000.00 (hereinafter collectively referred to as “Bonds”) with a maximum term of 20 years on one or more occasions until and including July 13, 2027 and to grant the holders of the Bonds conversion or option rights to new shares in the Company with a pro rata amount of the share capital of up to a total of EUR 917,501.00 in accordance with the more detailed provisions of the conversion or option bond conditions. The Bonds may be issued once or several times, in whole or in part, and also simultaneously in different tranches.

The Bonds may be issued against cash and/or consideration in kind. The Bonds may, in addition to Euro, also be issued in the legal currency of an OECD country, subject to the limit of the corresponding Euro equivalent. For the total nominal amount limit of this authorization, in the case of an issuance in a foreign currency, the nominal amount of the Bonds on the day of the decision on their issuance shall be converted into Euro.

Bonds may also be issued by domestic or foreign companies which are dependent on the Company or which are directly or indirectly majority-owned by the Company; in this case, the Management Board shall be authorized, with the consent of the Supervisory Board, (i) to assume the guarantee for the repayment of the bonds on behalf of the issuing company, (ii) to grant shares in the Company to the holders or creditors of such Bonds in fulfilment of the conversion or option rights or conversion or option obligations specified in such Bonds, and (iii) to make all other declarations or take all other actions necessary for the successful issue of the Bonds.

Shareholders are generally entitled to a subscription right. The statutory subscription right may also be granted in such a way that the Bonds are acquired by one or more banks with the obligation to offer them to the shareholders for subscription. However, the Management Board is authorized, with the consent of the Supervisory Board, to exclude

-13-

in whole or in part the subscription rights of the Company’s shareholders to the Bonds with conversion or option rights to shares in the Company,

| ☐ | provided that the Bonds are issued against cash consideration and are structured in such a way that their issue price is not significantly lower than their theoretical market value calculated in accordance with recognized financial mathematical methods; however, this shall only apply to the extent that the shares to be issued to service the option and/or conversion rights and obligations thereby created do not exceed a total of 10% of the share capital, neither with regard to the time at which this authorization takes effect nor the time at which it is exercised. When exercising this authorization to exclude subscription rights in accordance with section 186 para. 3 sentence 4 AktG, the exclusion of subscription rights on the basis of other authorizations in accordance with section 186 para. 3 sentence 4AktG shall be taken into account in direct or corresponding application; |

| ☐ | provided that the Bonds are issued against contribution in kind, in particular for the purpose of acquiring companies, parts of companies, participations in companies, other assets or within the scope of mergers or for the purpose of acquiring receivables or rights, and the value of the contribution in kind is in reasonable proportion to the value of the Bond, whereby the theoretical market value of the Bond determined in accordance with recognized methods shall be decisive; |

| ☐ | in order to grant subscription rights to the holders of conversion/option rights to shares in the Company to compensate for dilution to the extent to which they would be entitled after exercising these rights; |

| ☐ | to exclude fractional amounts from shareholders’ subscription rights. |

If convertible bonds are issued, the holders of the convertible bonds shall be entitled to convert their convertible bonds into shares of the Company in accordance with the terms and conditions of the convertible bonds. The proportionate amount of the share capital represented by the shares to be issued upon conversion may not exceed the nominal amount of the convertible bonds. The conversion ratio is calculated by dividing the nominal amount of a convertible bond by the fixed conversion price for one share of the Company. The conversion ratio may also be calculated by dividing the issue price of a convertible bond, which is lower than the nominal amount, by the fixed conversion price for one share of the Company. It can be provided, that the conversion ratio is variable and the conversion price is set within a range to be determined depending on the development of the share

-14-

price during the term or during a specific period within the term. The conversion ratio may in any case be rounded up or down to a whole number; furthermore, an additional payment to be made in cash may be specified. In addition, provision may be made for fractional amounts to be combined and/or settled in cash.

If bonds with warrants are issued, one or more warrants shall be attached to each bond with warrant entitling the holder to subscribe for shares in the Company in accordance with the warrant terms and conditions to be determined by the Management Board. The proportionate amount of the share capital represented by the shares to be subscribed for per bond with warrant may not exceed the nominal amount of the bond with warrant.

The respective Bond terms and conditions may also establish a conversion obligation at the end of the term or at an earlier point in time. Finally, the terms and conditions of the Bonds may provide that, in the event of conversion or exercise of the option, the Company shall not grant shares of the Company to the conversion or option beneficiary, but shall pay the equivalent value in cash or a combination of cash and shares. Furthermore, the respective terms and conditions of the Bonds may stipulate that, in the event of conversion or exercise of the option, shares of the Company shall be granted from the Conditional Capital 2022/I to be created in connection with this authorization or also exclusively or, at the Company’s discretion, alternatively shares of the Company from authorized capital or an existing or to be acquired treasury shares of the Company or of companies dependent on the Company or in which the Company directly or indirectly holds a majority interest.

The conversion or option price to be determined for one share of the Company (subscription price) must, even in the case of a variable conversion ratio/conversion price, be either (a) at least 80% of the average closing price of the shares of the Company or the closing price, to be converted into amounts per share, of the right or certificate representing the share on the primary stock exchange on the ten trading days immediately prior to the date of the resolution by the Management Board on the issuance of the convertible bonds or bonds with warrants or (b) at least 80% of the average closing price of the shares of the Company or the closing price to be converted into amounts per share of the right or certificate representing the share on the primary stock exchange during the days, on which the subscription rights are traded on the primary stock exchange, with the exception of the last two days of trading in the subscription rights. Primary stock exchange within this meaning is the trading system with the highest total trading volume in shares of the Company or in rights or certificates representing such shares on the ten last days prior to the start of the trading period referred to in this agenda item 13 b) to (a) and (b) above, respectively, on which such trading system has been open for general stock exchange

-15-

trading. For periods in which the primary stock exchange is the Frankfurt Stock Exchange, the conversion or option price to be determined for one share of the Company, even in the case of a variable conversion ratio/conversion price, must either (a) be at least 80% of the average closing price of the shares of the Company in Xetra trading on the Frankfurt Stock Exchange (or a functionally comparable successor system replacing the Xetra system) on the ten trading days immediately prior to the date of the resolution by the Management Board on the issue of the convertible bonds or bonds with warrants or (b) at least 80% of the average closing price of the shares of the Company in Xetra trading on the Frankfurt Stock Exchange (or in a functionally comparable successor system taking the place of the Xetra system) on the days on which the subscription rights are traded on the Frankfurt Stock Exchange, with the exception of the last two days of trading in the subscription rights.

Sections 9 para. 1, 199 para. 2 AktG shall remain unaffected in any of the above cases.

If, during the term of a Bond, the economic value of the existing conversion or option rights is diluted and no subscription rights are granted as compensation, the conversion or option rights shall be adjusted in a value-preserving manner – notwithstanding the lowest issue amount pursuant to section 9 para 1 AktG – unless the adjustment is already mandatory by law. In any case, the pro rata amount of the share capital represented by the no-par value shares to be subscribed per Bond may not exceed the nominal amount per Bond.

Instead of an adjustment of the option or conversion price, the terms and conditions of the bonds with warrants or convertible bonds may also provide for the payment of a corresponding amount in cash by the Company upon exercise of the option or conversion right or upon fulfillment of the option or conversion obligation. The terms and conditions of the Bonds may also provide for an adjustment of the option or conversion rights or conversion obligations in the event of a capital reduction or other extraordinary measures or events.

The Management Board is authorized, with the consent of the Supervisory Board, to determine the further details of the issuance and creation of the convertible bonds and/or bonds with warrants, in particular the interest rate, issue price, term and denomination, conversion or option price and the conversion or option period, or, as the case may be, determines them in agreement with the bodies of the domestic or foreign company which is dependent on the Company or in which the Company directly or indirectly holds a majority interest and which issues the Bonds.

-16-

| c) | Creation of a new conditional capital (Conditional Capital 2022/I) and a corresponding amendment to the Articles of Association in section 4 (Share Capital) |

| (i) | The share capital of the Company shall be conditionally increased by up to EUR 917,501.00 by issuing up to 917,501 new no-par value bearer or registered shares (Conditional Capital 2022/I). The conditional capital increase serves to grant shares to the holders of convertible bonds or bonds with warrants issued by the Company or a domestic or foreign company dependent on it or in which it directly or indirectly holds a majority interest on the basis of the authorization of the Annual General Meeting on July 14, 2022, until and including July 13, 2027. The conditional capital increase will only be implemented to the extent that the holders of such convertible bonds and/or bonds with warrants exercise their conversion or option rights or conversion obligations under such bonds are fulfilled, and to the extent that no other forms of settlement are used. The new shares shall participate in profits of the Company from the beginning of the financial year in which they are created; instead, the new shares shall carry profit participation rights from the beginning of the financial year preceding their issuance provided that the general meeting has not already resolved on the appropriation of the net retained profits for such financial year when the new shares are issued. The Management Board is authorized, with the consent of the Supervisory Board, to determine the further details of the implementation of the conditional capital increase. The Supervisory Board is authorized to amend the wording of the Articles of Association in accordance with the respective utilization of the conditional capital. |

| (ii) | Para. 9 of section 4 of the Articles of Association shall be reworded as follows: |

| “(9) | The share capital of the Company is conditionally increased by up to EUR 917,501.00 by issuing up to 917,501 new no-par value bearer or registered shares (auf den Inhaber oder den Namen lautende Stückaktien) (Conditional Capital 2022/I). The conditional capital serves to grant shares to the holders of convertible bonds or bonds with warrants issued by the Company or a domestic or foreign company dependent on it or in which it directly or indirectly holds a majority interest on the basis of the authorization of the Annual General Meeting on July 14, 2022, until and including July 13, 2027. The conditional capital increase will only be implemented to the extent that holders of such bonds exercise their conversion or option rights or conversion obligations under such bonds are fulfilled, and to the extent that no other forms of settlement are used. The new shares shall |

-17-

| participate in profits of the Company from the beginning of the financial year in which they are created; instead, the new shares shall carry profit participation rights from the beginning of the financial year preceding their issuance provided that the general meeting has not already resolved on the appropriation of the net retained profits for such financial year when the new shares are issued. The Management Board is authorized, with the consent of the Supervisory Board, to determine the further details of the implementation of the conditional capital increase. The Supervisory Board is authorized to amend the wording of the Articles of Association in accordance with the respective utilization of the conditional capital.” |

| 14. | Resolution on the granting of an authorization pursuant to section 71 para. 1 no. 8 AktG on the acquisition and on the use of treasury shares with possible exclusion of offer and subscription rights |

In order to be in a position to acquire treasury shares in the future, the Management Board shall be authorized to acquire treasury shares with the consent of the Supervisory Board.

The Management Board and the Supervisory Board propose that the following be resolved:

| a) | Creation of an acquisition authorization |

The Management Board is authorized until and including July 13, 2027, with the consent of the Supervisory Board, to acquire treasury shares in the Company up to a total of 10% of the share capital at the time the resolution is adopted by the Annual General Meeting or – if this value is lower – of the share capital of the Company at the time the authorization is exercised. The shares acquired on the basis of this authorization, together with other treasury shares of the Company held by the Company or attributable to it in accordance with sections 71d and 71e AktG, may at no time account for more than 10% of the Company’s share capital. The acquisition may also be carried out by dependent Group companies of the Company within the meaning of section 17 AktG or by third parties for its or their account.

This authorization may also be exercised by a Group company or by third parties for the account of the Company or a Group company. The authorization may be exercised for all legally permissible purposes, in particular in pursuit of one or more of the purposes set out under c) (1) to (5) below. Trading in treasury shares may not take place. The authorization may be exercised in whole or in part, in the latter case also on several occasions. The shares

-18-

may be acquired within the authorization period up to the maximum acquisition volume in partial tranches spread over different acquisition dates.

| b) | Method and manner of acquiring treasury shares |

The acquisition shall be effected in compliance with the principle of equal treatment (section 53a AktG) at the discretion of the Management Board (i) via the stock exchange or (ii) by means of a public purchase offer addressed to all shareholders or (iii) by means of a public invitation to shareholders to submit offers for sale (the acquisition pursuant to (ii) and (iii) hereinafter “Public Purchase Offer”).

| aa) | Acquisition via the stock exchange |

If the treasury shares are acquired via the stock exchange, the purchase price paid by the Company per no-par value share (excluding incidental acquisition costs) may not be more than 10% higher or lower than the volume-weighted average price of the Company’s shares in Xetra trading (or a functionally comparable successor system replacing it) on the Frankfurt Stock Exchange during the last five trading days prior to the date on which the obligation to acquire the shares is entered into.

| bb) | Acquisition of the shares by way of a Public Purchase Offer |

If the shares are acquired by way of a Public Purchase Offer, the Company may specify a fixed purchase price or a purchase price range per share (excluding incidental acquisition costs) within which it is willing to acquire shares. In the Public Purchase Offer, the Company may specify a period for the acceptance or submission of offers and the possibility and conditions for adjusting the purchase price range during the period in the event of not merely insignificant changes in the share price. In the event of a purchase price range, the purchase price shall be determined on the basis of the selling prices stated in the shareholders’ acceptance or tender declarations and the purchase volume determined by the Management Board after the end of the offer period.

| (1) | In the event of a public purchase offer by the Company, the purchase price offered or the purchase price range per share (excluding incidental costs) may not be more than 10% higher or lower than the volume-weighted average price of the Company’s shares in Xetra trading (or a functionally comparable successor system replacing Xetra) on the Frankfurt Stock Exchange during the last five trading days prior to the date of the public announcement of the offer. In the event of an adjustment of the |

-19-

| purchase price range by the Company, the last five stock exchange trading days prior to the public announcement of the adjustment shall be taken as a basis. |

| (2) | In the event of an invitation to shareholders to submit offers for sale, the purchase price (excluding incidental acquisition costs) per share of the Company determined on the basis of the offers submitted may not be more than 10% higher or lower than the volume-weighted average price of the Company’s shares in Xetra trading (or a functionally comparable successor system replacing it) on the Frankfurt Stock Exchange during the last five trading days prior to the date of publication of the invitation to submit offers for sale. |

The volume of the purchase offer or the invitation to sell may be limited. If the total number of shares tendered to the Company exceeds the total volume of the Company’s purchase offer or invitation to sell, consideration or acceptance shall be in proportion to the total volume of the purchase offer or invitation to sell in relation to the total number of shares tendered by the shareholders. In addition, provision may be made for preferential acceptance of small lots of up to 100 shares tendered per shareholder and for rounding in accordance with commercial principles in order to avoid fractional shares. Any further right of shareholders to tender shares is excluded in this respect. The Public Purchase Offer may provide for further conditions.

| c) | Authorization for use |

The Management Board is authorized, with the approval of the Supervisory Board, to use the treasury shares acquired on the basis of the above acquisition authorization for all legally permissible purposes. In addition to a sale on the stock exchange or by means of an offer to all shareholders, in each case in compliance with the principle of equal treatment (section 53a AktG), the Management Board is authorized, with the consent of the Supervisory Board, to use the treasury shares acquired on the basis of the above acquisition authorization also in the following manner:

| (1) | They may be offered for acquisition to and/or transferred to third parties against contributions in kind, in particular in connection with business combinations or the acquisition of companies, businesses, parts of businesses or equity interests in companies (including increases in existing shareholdings) as (partial) consideration. |

| (2) | They may be sold to third parties against payment in cash at a price (excluding incidental costs of realization) which is not significantly lower than the stock market |

-20-

| price of a share in the Company at the time of sale within the meaning of section 186 para. 3 sentence 4 AktG. |

| (3) | They may be used to service purchase obligations or purchase rights to shares in the Company arising from and in connection with convertible bonds or bonds with warrants or profit participation rights with conversion or option rights or conversion or option obligations issued by the Company or one of its Group companies. |

| (4) | They may be granted to employees of the Company or of a company affiliated with it within the meaning of sections 15 et seqq. AktG as well as members of the management of the Company or of a company affiliated with the Company within the meaning of sections 15 et seqq. AktG and/or be used to fulfill commitments to purchase or obligations to purchase shares of the Company which are held by employees of the Company or of a company affiliated with it within the meaning of sections 15 et seqq. AktG as well as members of the management of the Company or of a company affiliated with it within the meaning of sections 15 et seqq. AktG. In particular, they may also be used to service purchase obligations or purchase rights to shares in the Company entered into with employees or members of the management of the Company or of an enterprise affiliated with it within the meaning of sections 15 et seqq. AktG within the framework of employee stock option programs. Insofar as members of the Management Board of the Company are beneficiaries, this authorization applies to the Supervisory Board, which is also responsible for selecting the beneficiaries and determining the volume of shares to be granted to them in each case. |

| (5) | They may be redeemed and the share capital of the Company reduced by the portion of the share capital attributable to the retired shares without the redemption or its implementation requiring a further resolution by the general meeting. The redemption shall result in a capital reduction. In derogation of the foregoing, the Management Board may determine that the share capital shall remain unchanged upon redemption and that instead the redemption shall increase the proportion of the share capital represented by the remaining shares in accordance with section 8 para.3 AktG. In this case, the Management Board is authorized to adjust the number of non-par value shares in the Articles of Association. |

The aforementioned authorizations may be exercised in full or in several partial amounts and in pursuit of one or more purposes. The authorizations may also be exercised by dependent companies or companies majority-owned by the Company or by third parties

-21-

for the account of the Company or companies dependent on the Company or companies majority-owned by the Company.

Shareholders’ subscription rights to the Company’s treasury shares are excluded to the extent that these shares are used in accordance with the above authorizations under items (1) to (4). In addition, the Management Board may, with the approval of the Supervisory Board, exclude shareholders’ subscription rights for fractional amounts in the event of the sale of shares in connection with an offer for sale.

In total, the shares used on the basis of the authorizations under lit. c) (2) and (3) above, insofar as they are issued in direct or corresponding application of section 186 para. 3 sentence 4 AktG (with exclusion of subscription rights against cash contributions not significantly below the stock market price), may not exceed 10% of the share capital, either at the time of the resolution or – if this value is lower – at the time of exercise of this authorization. Shares issued or sold by direct or mutatis mutandis application of section 186 para. 3 sentence 4 AktG during the period of validity of this authorization up to this point in time shall be counted towards this limit. Shares issued or to be issued to service option or conversion rights or to fulfil option or conversion obligations shall also be counted towards this limit insofar as these bonds are issued during the effectiveness of this authorization under exclusion of the subscription right in accordance with section 186 para. 3 sentence 4 AktG.

| d) | American Depositary Shares |

To the extent legally permissible, the above authorization also includes certificates representing shares of the Company in the form of so-called American Depositary Shares of the Company (each individually an “ADS”, together “ADSs”). The Company’s share shall be replaced by the corresponding number of ADSs per share (currently four ADSs represent one share) and the holders of ADSs shall replace the shareholders. Insofar as the above authorization refers to the stock exchange price of the shares of the Company, this shall apply with regard to ADSs to the relevant price of the ADSs on the New York Stock Exchange or on the stock exchange NASDAQ.

-22-

| 15. | Resolution on a further authorization to grant subscription rights to members of the Management Board of the Company under a new stock option plan and creation of a new conditional capital (Conditional Capital 2022/II and corresponding amendment to section 4 (Share Capital) of the Articles of Association) |

In order to be able to continue to bind Management Board members of the Company to the Company by means of a variable remuneration component with a long-term incentive effect, under agenda item 15 it is intended to create the possibility of issuing subscription rights to shares of the Company to members of the Management Board of the Company under a stock option program which corresponds to the requirements of the remuneration system submitted for approval under agenda item 7 (the “Stock Option Program”).

The Management Board and the Supervisory Board propose that the following resolution be adopted:

| a) | Authorization to issue stock options with subscription rights to shares in the Company |

The Supervisory Board is authorized to grant subscription rights (stock options) for a total of up to 115,000 no-par value bearer or registered shares of the Company to members of the Management Board of the Company (“Beneficiaries”) on one or more occasions until and including July 13, 2027 (“Authorization Period”).

One stock option grants a subscription right to one share in the Company. The subscription rights of the shareholders are excluded. To the extent that stock options forfeit due to termination of employment with the Company or for other reasons during the Authorization Period, a corresponding number of stock options may be again granted to Beneficiaries. The subscription rights exercised may be fulfilled, at the Company’s discretion, either by utilizing the Conditional Capital 2022/II proposed for resolution or by treasury shares of the Company. In addition, the Company also has the right to settle in

-23-

cash. The grant of the stock options and the issuance of the subscription shares shall take place in accordance with the following provisions:

| (i) | Beneficiaries |

The group of beneficiaries includes the members of the Management Board of the Company.

| (ii) | Issue periods (acquisition periods) |

Stock options may be issued in tranches once a month in accordance with a stock option program to be launched once or repeatedly (each an “Issue Period”).

The relevant provisions shall be determined by the Supervisory Board of the Company (the “Terms and Conditions”). The “Grant Date” shall be the date on which the offer to grant stock options is received by the respective Beneficiary, irrespective of the date of acceptance of the offer. The offer may specify a later date as the Grant Date.

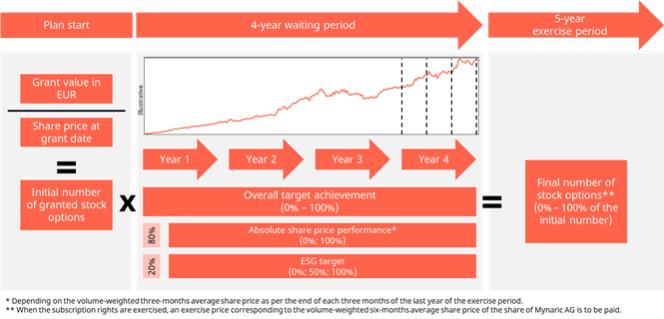

| (iii) | Waiting period |

Stock options may be exercised for the first time after expiry of the waiting period. The waiting period of a tranche of stock options begins in each case on the specified Grant Date and ends at the earliest at the end of the fourth anniversary after the Grant Date.

| (iv) | Performance targets |

Stock options may only be exercised if and to the extent that the performance targets as described below have been achieved:

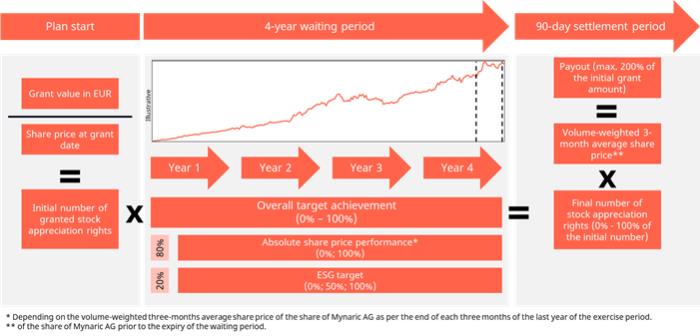

The performance targets are linked to the absolute share price performance of the Company’s shares and to the achievement of an Environment Social Governance target (“ESG target”) during the waiting period, whereby within the overall target achievement, the absolute share price performance is weighted with 80% and the ESG target with 20%.

Absolute share price development

The absolute share price performance target is linked to the development of the Company’s share price during the waiting period. To determine whether the

-24-

performance target has been achieved, the last year of the waiting period is divided into four quarters and the three-month volume-weighted average price of the Company’s share or the three-month volume-weighted average price, to be converted into amounts per share, of the right or certificate representing the share in the trading system with the highest total trading volume in shares of the Company or in rights or certificates representing such shares (in each case a “Relevant Closing Price”) is determined at the end of each quarter. The performance target is 100% achieved if at least one Relevant Closing Price is at least 50% above the exercise price. The relevant trading system shall be determined on the basis of the average trading volume in shares of the Company or in rights or certificates representing such shares during the relevant three months. If the absolute share price performance target is not achieved, the target achievement for this performance target shall be 0%. A target achievement above 100% is not possible.

ESG Target

The ESG target is composed of a diversity target and an employee engagement target as follows:

For the purpose of determining the achievement of the diversity target, the Supervisory Board determines the percentage of women within the Mynaric Group at the beginning of the waiting period. The diversity target is achieved if the percentage of women within the Mynaric Group at the end of the waiting period is 5 percentage points higher than the percentage of women determined at the beginning of the waiting period. If the share of women at the beginning of the waiting period is at least 30% or if a share of women within the Mynaric Group of at least 30% is achieved during the waiting period, the diversity target is achieved if the share of women within the Mynaric Group is still at least 30% at the end of the waiting period.

The employee engagement target is achieved if the employee satisfaction within the Mynaric Group, as determined by an external service provider, exceeds the employee engagement at the beginning of the waiting period by at least 5 percentage points. If the employee engagement at the beginning of the waiting period is at least 80% or if a employee engagement of at least 80% is achieved during the waiting period, the employee engagement target is achieved if the employee engagement is still 80% at the end of the waiting period.

-25-

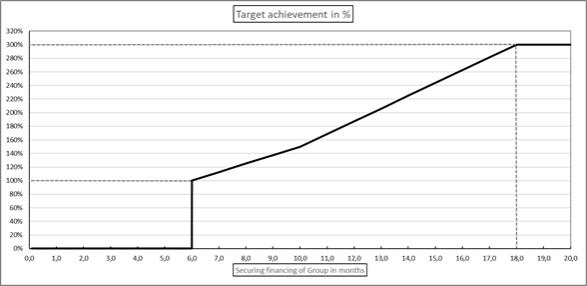

At the end of the waiting period, the Supervisory Board determines target achievement for the ESG target as follows: If none of the above targets has been achieved by the end of the waiting period, target achievement for the ESG target is 0%. If one of the above targets has been achieved, the target achievement for the ESG target is 50%. If both of the above targets are achieved, the target achievement for the ESG target is 100%. A target achievement of the ESG target above 100% is not possible.

For the overall target achievement, the achievement of the absolute share price performance target is weighted with 80% and the ESG target with 20%. The result forms the overall target achievement level (as a percentage), which (rounded down to the nearest whole number) determines the number of exercisable stock options.

| (v) | Exercisability of stock options |

Stock options are only exercisable if the waiting period has expired and to the extent the performance targets have been met. The stock options shall be settled in (treasury or new) shares of the Company, with each stock option entitling the Beneficiary to subscribe for one share, or, at the Company’s discretion, as a cash payment in the amount of the closing price of the Company’s share on the last trading day prior to the exercise date in the trading system with the highest total trading volume in shares of the Company or in rights or certificates representing such shares on the last ten days prior to the exercise date on which this trading system was open for general stock market trading.

| (vi) | Exercise periods and term |

The stock options may be exercised by the Beneficiaries within five years after the date on which the waiting period has expired (“Exercise Period”). The Exercise Period may be extended appropriately by the Supervisory Board of the Company if, due to statutory or internal company regulations, exercise is not possible at the end of the original Exercise Period. The term of the stock options ends upon expiry of the respective (possibly extended) Exercise Period. Stock options that have not

-26-

been exercised by the end of the respective Exercise Period shall forfeit without entitlement to compensation.

| (vii) | Exercise price |

Upon exercise of the stock options, an exercise price shall be paid for each share to be subscribed. The exercise price per share shall correspond to the volume-weighted six-month average price of the Company’s share on the day before the Grant Date or the volume-weighted six-month average price on the day before the Grant Date, to be converted into amounts per share, of the right or certificate representing the share in the trading system with the highest total trading volume in shares of the Company or in rights or certificates representing such shares on the ten days preceding the day before the issue period on which this trading system was open for general stock exchange trading. The minimum exercise price shall be at least equal to the lowest issue price within the meaning of section 9 para. 1 AktG.

| (viii) | Replacement rights of the Company |

The Company may settle exercised stock options by issuing new no-par value bearer or registered shares from the Conditional Capital 2022/II to be created for this purpose in accordance with the following. The Company is also entitled to deliver treasury shares in whole or in part instead of new shares. Furthermore, the Company is entitled, in whole or in part, instead of delivering (new or treasury) shares, to make a cash payment equal to the value of the shares to be delivered upon exercise of shares less the exercise price, whereby the amount of the cash payment per share corresponds to the closing price of the Company’s shares on the last trading day prior to the exercise date in the trading system with the highest total trading volume in shares of the Company or in rights or certificates representing such shares on the last ten days prior to the exercise date on which this trading system was open for general stock exchange trading. The decision as to which alternative shall be chosen by the Company in each individual case shall be made by the Supervisory Board of the Company.

| (ix) | Personal right |

The stock options are not legally transferable or pledgeable, but they are inheritable to the extent that they are vested. Likewise, a transfer for the fulfillment of legacies is permissible. The stock options may only be exercised by the

-27-

respective Beneficiary himself or his heirs or legatees. If stock options can no longer be exercised in accordance with the above provision, they shall expire without replacement or entitlement to compensation. The provision on the authorization to reissue expiring stock options to beneficiaries remains unaffected.

The Terms and Conditions may provide for stock options to be forfeited in whole or in part without replacement or entitlement to compensation if the service relationship of a Beneficiaries ends. Stock options that have lapsed as a result may be reissued. Special provisions may be included for the event of death, retirement, occupational disability and other special cases of departure, as well as in the event of a change of control and to meet statutory requirements. The decision on special provisions is the responsibility of the Supervisory Board.

| (x) | Anti-dilution |

The terms and conditions of the stock option program may contain customary anti-dilution clauses on the basis of which the economic value of the stock options is essentially secured in accordance with the provision in section 216 para. 3 AktG, in particular by taking into account any stock split, capital increases from company funds with the issue of new shares or other measures with comparable effects when determining the number of shares to be issued per stock option.

| (xi) | Profit share entitlement |

The new no-par value bearer shares shall carry dividend rights from the beginning of the financial year for which, at the time the subscription right is exercised, no resolution has yet been passed by the general meeting on the appropriation of the net retained profits.

| (xii) | Authorization to determine further details |

The further details of the granting and fulfillment of stock options for the issue of shares from Conditional Capital 2022/II and the further conditions of the stock option program shall be determined by the Supervisory Board of the Company.

Further provisions include in particular the decision on the one-time or repeated issuance of tranches for the utilization of the authorization to grant stock options, as well as provisions on the implementation of the stock option program and the different tranches and the procedure for the allocation and exercise of stock options, the allocation of stock options to individual Beneficiaries, the

-28-

determination of the Grant Date within the respective Issue Period, and provisions on the exercisability or expiry in special cases, in particular in the event of Beneficiaries leaving the employment relationship, in the event of death or in the event of a change of control, the conclusion of an intercompany agreement or a delisting, for compliance with a maximum remuneration for members of the Management Board, for adjustment in the event of extraordinary developments and for the retention or reclaiming of stock options, as well as for compliance with statutory requirements

| (xiii) | Conditional Capital 2022/II |

The share capital of the Company shall be conditionally increased by up to EUR 115,000.00 by issuing up to 115,000 new no-par value bearer or registered shares (Conditional Capital 2022/II). The conditional capital increase serves exclusively to grant subscription rights to shares (stock options) to members of the Management Board of the Company granted on the basis of the authorization of the Annual General Meeting on July 14, 2022. The shares will be issued at the issue price specified in the above authorization. The conditional capital increase will only be implemented to the extent that subscription rights are exercised and the Company does not grant treasury shares or cash remuneration to fulfill the subscription rights. The new shares shall carry dividend rights from the beginning of the financial year for which, at the time the subscription right is exercised, no resolution has yet been passed by the general meeting on the appropriation of net retained profits. The Supervisory Board of the Company is authorized to determine the further details of the conditional capital increase and its implementation.

| b) | Amendment of the Articles of Association |

The following paragraph 11 is added to section 4 of the Articles of Association:

“(11) The share capital of the Company is conditionally increased by up to EUR 115,000.00 by issuing up to 115,000 new no-par value bearer or registered shares (auf den Inhaber oder den Namen lautende Stückaktien) (Conditional Capital 2022/II). The conditional capital increase serves exclusively to grant subscription rights to shares (stock options) to members of the Management Board of the Company granted on the basis of the authorization of the Annual General Meeting on July 14, 2022. The shares will be issued at the issue price specified in the authorization. The conditional capital increase will only be implemented to the extent that subscription rights are exercised and the Company does not grant treasury shares or a cash payment to fulfill the subscription

-29-

rights. The new shares shall carry dividend rights from the beginning of the financial year for which, at the time the subscription right is exercised, no resolution has yet been passed by the general meeting on the appropriation of net retained profits. The Supervisory Board of the Company is authorized to determine the further details of the conditional capital increase and its implementation. The Supervisory Board is also authorized to amend the wording of the Articles of Association in each case to reflect the issue of subscription shares. “

The Management Board and the Chairman of the Supervisory Board are authorized to register the Conditional Capital 2022/II and the corresponding amendment to the Articles of Association for registration with the commercial register independently of the other resolutions of the Annual General Meeting.

| 16. | Resolution on the creation of a new authorized capital with the option to exclude subscription rights (Authorized Capital 2022/II) and a corresponding amendment to section 4 (Share Capital) of the Articles of Association |

The Management Board intends, with the approval of the Supervisory Board, to adopt an additional Restricted Stock Unit Program as a long-term stock-based remuneration element for selected employees of the Company and its affiliates (the “Participants”) (the “RSUP”). The RSUP shall be substantially similar to the Restricted Stock Unit Program already in place at the Company.

An attractive and competitive remuneration program is an essential component in attracting and retaining highly qualified employees over the long term. Under the RSUP, the Company shall be able to grant participants so-called “restricted stock units” (“RSUs”) which, under certain conditions, grant the Participant a right to a cash payment, a transfer of shares in the Company or a combination of cash payment and shares in the Company, with the total amount of the Participant’s entitlement depending on the development of the Company’s share price. The Company has the option, at its sole discretion, to decide whether to fulfil the Participant’s claim by cash payment, in shares of the Company or by a combination of cash payment and shares of the Company. In order to enable the Company in this context to issue new shares and to fulfil the Participants’ payment claims when they become due, a new authorized capital (Authorized Capital 2022/II) shall be created. The Management Board and Supervisory Board therefore propose that the following resolution be adopted:

-30-

| a) | Creation of Authorized Capital 2022/II with exclusion of subscription rights |

The Management Board is authorized, with the consent of the Supervisory Board, to increase the share capital of the Company until and including July 13, 2027, by up to EUR 262,147.00 on one or several occasions by issuing up to 262,147 new no-par value bearer or registered shares against contribution in cash and/or in kind (Authorized Capital 2022/II).

The shareholders’ subscription rights are excluded. The Authorized Capital 2022/II serves to deliver shares of the Company to fulfil restricted stock units (RSUs) granted under the Company’s Restricted Stock Unit Program (RSUP) to selected employees of the Company and its affiliated companies in accordance with the RSUP in return for the contribution of the respective payment entitlements arising under the RSUs.

The issue amount of the new shares may be provided by contributions in cash and/or in kind, in particular also by the contribution of claims against the Company under the RSUP. The Management Board is authorized, with the consent of the Supervisory Board, to determine the further details of the capital increase and its implementation; this also includes the determination of the dividend entitlement of the new shares, which, in deviation from section 60 para. 2 AktG, may also be determined for a financial year that has already expired if, at the time of the issuance of the new shares, a resolution by the general meeting on the appropriation of profits for this financial year has not yet been adopted.

The Management Board is authorized, with the consent of the Supervisory Board, to determine the further details of the capital increase and the terms and conditions of the share issue. The Management Board is further authorized to issue the RSUs. The Supervisory Board is authorized to amend section 4 of the Articles of Association after full or partial implementation of the capital increase in accordance with the respective utilization of the authorized capital and after expiry of the Authorization Period.

| b) | Addition to section 4 of the Articles of Association |

The following new paragraph 12 is added to section 4 of the Articles of Association:

“(12) The Management Board is authorized, with the consent of the Supervisory Board, to increase the share capital of the Company in the period up to and including July 13, 2027 by up to EUR 262,147.00 on one or more occasions by issuing up to 262,147 new no-par

-31-

value bearer or registered shares (auf den Inhaber oder den Namen lautende Stückaktien) against contribution in cash and/or in kind (Authorized Capital 2022/II).

The shareholders’ subscription rights are excluded. The Authorized Capital 2022/II serves to deliver shares of the Company to fulfil restricted stock units (RSUs) granted under the Company’s Restricted Stock Unit Program (RSUP) to selected employees of the Company and its affiliated companies in accordance with the RSUP in return for the contribution of the respective payment claims arising under the RSUs. The issue price of the new shares may be paid in cash and/or in kind, in particular also by contributing claims against the Company under the RSUP. The Management Board is authorized, with the consent of the Supervisory Board, to determine the further details of the capital increase and its implementation; this also includes the determination of the dividend entitlement of the new shares, which, in deviation from section 60 para. 2 AktG, may also be determined for a financial year that has already expired if, at the time of the issuance of the new shares, a resolution by the general meeting on the appropriation of profits for this financial year has not yet been adopted.

The Management Board is authorized, with the consent of the Supervisory Board, to determine the further details of the capital increase and the terms and conditions of the share issuance. This authorization also already covers the issue of RSUs. The Supervisory Board is authorized to amend section 4 of the Articles of Association after full or partial implementation of the capital increase in accordance with the respective utilization of the authorized capital and after expiry of the authorization period.”

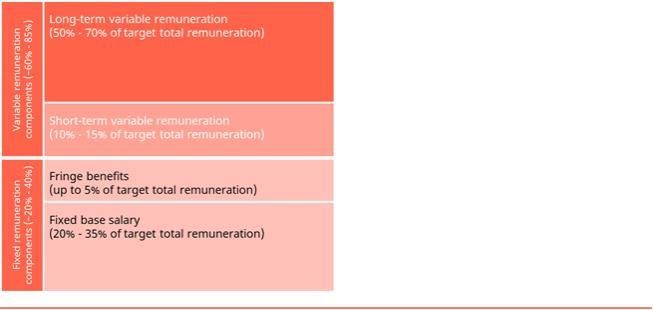

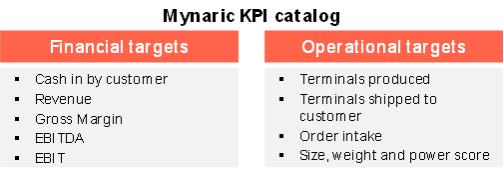

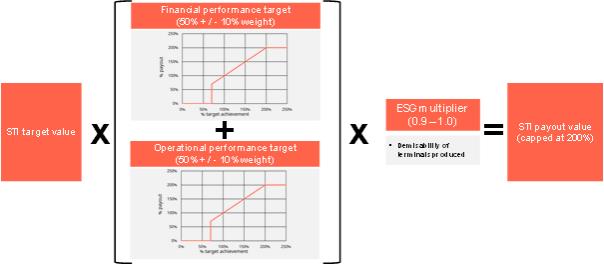

| c) | Application for registration with the commercial register |