Form 6-K MorphoSys AG For: May 05

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

______________________

FORM 6-K

REPORT OF A FOREIGN ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For May 05, 2022

_______________Commission File Number 1-38455_______

MorphoSys AG

Semmelweisstrasse 7

82152 Planegg

Germany

(Address of principal executive offices)

______________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If ‘‘Yes’’ is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

MORPHOSYS AG (Registrant)

Date: May 05, 2022 By: /s/ i.A. Kristina Grötsch

Name: Kristina Grötsch

Title: Senior Specialist Investor Relations

By: /s/ i.A. Dr. Robert Mayer

Name: Dr. Robert Mayer

Title: Director Investor Relations

Media Release

Planegg/Munich, Germany, May 4, 2022

MorphoSys AG Reports First Quarter 2022 Financial Results

–Monjuvi® U.S. net product sales of US$ 18.7 million (€ 16.6 million) for the first quarter 2022, a 21% year-over-year growth

–NCCN® updated the designation of Monjuvi to preferred regimen in its Clinical Practice Guidelines in Oncology for B-cell Lymphoma

–Pipeline advances: enrollment progressing across three Phase 3 trials in myelofibrosis, first-line DLBCL, and FL/MZL

–€ 846.9 million in cash and other financial assets at March 31, 2022

Conference call and webcast (in English) tomorrow, May 5, 2022, at 2:00pm CEST (1pm GMT/8:00am EDT)

MorphoSys AG (FSE: MOR; NASDAQ: MOR) reports results for the first quarter 2022.

“Our clinical pipeline has never been stronger as it is today. We continue to see strong patient enrollment in our pivotal Phase 3 studies that are examining pelabresib and tafasitamab for some of the most difficult to treat blood cancers for which only limited treatment options are available,” said Jean-Paul Kress, M.D., Chief Executive Officer of MorphoSys. “Our cancer immunotherapy Monjuvi remains the market leader in second line relapsed or refractory diffuse large B-cell lymphoma new patient starts, and we expect its performance to sequentially increase in subsequent quarters this year. We remain confident in our late-stage pipeline and in delivering on our growth strategy.”

Tafasitamab Highlights:

Monjuvi (tafasitamab-cxix) U.S. net product sales of US$ 18.7 million (€ 16.6 million) for the first quarter 2022 (Q1 2021: US$ 15.5 million (€ 12.9 million)).

Minjuvi® Royalty revenue of € 0.7 million for sales outside of the U.S. in the first quarter 2022.

National Comprehensive Cancer Network® Clinical Practice Guideline update. On March 15, 2022, the National Comprehensive Cancer Network® updated the Clinical Practice Guidelines (NCCN Guidelines®) in Oncology for B-cell Lymphomas and the designation for Monjuvi (tafasitamab-cxix) in combination with lenalidomide is now a Preferred Regimen for second-line therapy in patients with Diffuse Large B-cell Lymphoma (DLBCL) who are not candidates for transplant.

Page 1

Minjuvi conditional approval in Switzerland. On March 22, 2022, MorphoSys and Incyte announced that the Swiss agency for therapeutic products (Swissmedic), has granted temporary approval for Minjuvi (tafasitamab) in combination with lenalidomide, followed by Minjuvi monotherapy, for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL), after at least one prior line of systemic therapy including an anti-CD20 antibody, who are not eligible for autologous stem cell transplant (ASCT). Incyte holds exclusive commercialization rights for Minjuvi in Switzerland.

Financial Results for the First Quarter of 2022 (IFRS):

Total revenues for the first quarter 2022 were € 41.5 million compared to € 47.2 million for the same period in 2021. Q1 2021 revenues benefited from € 16 million of milestone payments from GSK.

| in € million | Q1 2022 | Q4 2021 | Q1 2021 | Q-Q Δ | Y-Y Δ | |||||||||||||||||||||||||||

| Total revenues | 41.5 | 52.9 | 47.2 | (22) % | (12) % | |||||||||||||||||||||||||||

| Monjuvi product sales | 16.6 | 20.5 | 12.9 | (19) % | 29 % | |||||||||||||||||||||||||||

| Royalties | 19.0 | 23.2 | 11.6 | (18) % | 64 % | |||||||||||||||||||||||||||

| Licenses, milestones and other | 5.8 | 9.3 | 22.7 | (38) % | (74) % | |||||||||||||||||||||||||||

Cost of Sales: In the first quarter 2022, cost of sales was € 7.9 million compared to € 5.0 million for the comparable period in 2021.

Research and Development (R&D) Expenses: In the first quarter 2022, R&D expenses were € 65.0 million (Q1 2021: € 33.3 million). The increase in R&D expenses is primarily due to the inclusion of R&D expenses from Constellation and higher investment to support the advancement of clinical programs, especially the pivotal Phase 3 studies.

Selling, General and Administrative (SG&A) Expenses: Selling expenses in the first quarter 2022 were € 21.9 million (Q1 2021: € 28.2 million) and general and administrative (G&A) expenses amounted to € 14.6 million (Q1 2021: € 10.3 million). The year-over-year reduction in Selling expenses was driven by additional investments that were made in 2021, the first full year of the Monjuvi launch. The year-over-year increase in G&A expenses was primarily driven by the inclusion of Constellation and higher legal and professional fees.

Operating Loss: Operating loss amounted to € 68.0 million in the first quarter 2022 (Q1 2021: operating loss of € 29.6 million).

Consolidated Net Loss: For the first quarter 2022, consolidated net loss was € 122.7 million (Q1 2021: consolidated net loss of € 41.6 million).

Page 2

Full Year 2022 Financial Guidance:

The Financial Guidance was initially provided on January 7, 2022 and reiterated on March 16, 2022 and on May 4, 2022.

| Amounts in million | 2022 Financial Guidance | 2022 Guidance Insights | ||||||

| Monjuvi U.S. Net Product Sales | US$ 110m to 135m | 100% of Monjuvi U.S. product sales are recorded on MorphoSys’ income statement and related profit/loss is split 50/50 between MorphoSys and Incyte. | ||||||

| Gross Margin for Monjuvi U.S. Net Product Sales | 75% to 80% | 100% of Monjuvi U.S. product cost of sales are recorded on MorphoSys’ income statement and related profit/loss is split 50/50 between MorphoSys and Incyte. | ||||||

| R&D expenses | € 300m to 325m | 2022 growth over 2021 will be driven primarily by investment in ongoing pivotal phase-3 studies, excluding transaction/restructuring/other charges related to Constellation acquisition recorded in 2021. | ||||||

| SG&A expenses | € 155m to 170m | 51% to 56% of mid-point of SG&A expenses represent Monjuvi U.S. selling costs of which 100% are recorded in MorphoSys’ income statement. Incyte reimburses MorphoSys for half of these selling expenses. For 2022, we anticipate a year-over-year decline in SG&A, excluding transaction/restructuring/other charges related to Constellation acquisition recorded in 2021. | ||||||

Additional information related to 2022 Financial Guidance:

•Tremfya® royalties will continue to be recorded as revenue without any cost of sales in MorphoSys’ income statement. These royalties, however, will not contribute any cash to MorphoSys as 100% of the royalties will be passed on to Royalty Pharma.

•MorphoSys anticipates receiving royalties for Minjuvi sales outside of the U.S. Guidance for these royalties is not being provided as MorphoSys does not receive any sales forecasts from its partner Incyte.

•MorphoSys does not anticipate any significant cash-accretive revenues from the achievement of milestones in 2022. Milestones for otilimab are passed on to Royalty Pharma. Milestones from all other programs remain with MorphoSys at 100%.

•MorphoSys anticipates sales of commercial and clinical supply of tafasitamab outside of the U.S. to its partner Incyte. Revenue from this supply is recorded in the “Licenses, milestones and other” category in MorphoSys’ income statement. These sales result in a zero gross profit/margin. As such, MorphoSys does not provide guidance for these sales.

•While R&D expense is anticipated to grow year-over-year due to investments in three pivotal studies, the growth is partially being offset by the consolidation of research/discovery activities.

Page 3

•SG&A expense guidance range reflects savings from synergies following the acquisition of Constellation and streamlined commercialization efforts.

Operational Outlook for 2022:

MorphoSys anticipates the following key development milestones in 2022:

•First proof-of-concept data from the ongoing clinical phase 2 study of CPI-0209 in solid tumors and blood cancer;

•Additional data from the phase 1/2 M-PLACE (proof-of-concept) study of felzartamab for the treatment of anti-PLA2R antibody positive membranous nephropathy (MN);

•First data from the phase 2 study (IGNAZ) to evaluate felzartamab in patients with immunoglobulin A nephropathy (IgAN);

•MorphoSys’ partner Roche expects a pivotal data readout of the GRADUATE 1 and GRADUATE 2 trials with gantenerumab in the second half of 2022. Roche initiated these phase 3 development programs for patients with Alzheimer’s disease in 2018.

Page 4

MorphoSys Group Key Figures (IFRS, end of the first quarter: March 31, 2022)

| in € million | Q1 2022 | Q1 2021 | Δ | |||||||||||||||||

| Revenues | 41.5 | 47.2 | (12) % | |||||||||||||||||

| Product Sales | 16.6 | 12.9 | 29 % | |||||||||||||||||

| Royalties | 19.0 | 11.6 | 64 % | |||||||||||||||||

| Licenses, milestones and other | 5.8 | 22.7 | (74) % | |||||||||||||||||

| Cost of Sales | (7.9) | (5.0) | 58 % | |||||||||||||||||

| Gross Profit | 33.6 | 42.1 | (20) % | |||||||||||||||||

| Total Operating Expenses | (101.5) | (71.7) | 42 % | |||||||||||||||||

| Research and Development | (65.0) | (33.3) | 95 % | |||||||||||||||||

| Selling | (21.9) | (28.2) | (22) % | |||||||||||||||||

| General and Administrative | (14.6) | (10.3) | 42 % | |||||||||||||||||

| Operating Profit / (Loss) | (68.0) | (29.6) | > 100% | |||||||||||||||||

| Other Income | 1.4 | 1.2 | 17 % | |||||||||||||||||

| Other Expenses | (3.7) | (2.0) | 85 % | |||||||||||||||||

| Finance Income | 10.6 | 13.9 | (24) % | |||||||||||||||||

| Finance Expenses | (62.8) | (39.7) | 58 % | |||||||||||||||||

| Income from Reversals of Impairment Losses / (Impairment Losses) on Financial Assets | (0.1) | 0.1 | > (100)% | |||||||||||||||||

| Income Tax Benefit / (Expenses) | 0.0 | 14.5 | > (100)% | |||||||||||||||||

| Consolidated Net Profit / (Loss) | (122.7) | (41.6) | > 100% | |||||||||||||||||

| Earnings per Share, Basic and Diluted | (3.59) | (1.27) | > 100% | |||||||||||||||||

| Cash and other financial assets (end of period) | 846.9 | 976.9 * | (13) % | |||||||||||||||||

*Value as of December 31, 2021

MorphoSys will hold its conference call and webcast tomorrow, May 5, 2022, to present the first quarter 2022 results and the outlook for 2022.

Dial-in number for the conference call (in English) at 2:00pm CEST; 1:00pm GMT; 8:00am EDT:

Germany: +49 69 201 744 220

For UK residents: +44 203 009 2470

For US residents: +1 877 423 0830

(All numbers reachable from any geography)

Participant PIN: 72430702#

Please dial in 10 minutes before the beginning of the conference.

A live webcast and slides will be made available at the Investors section under "Upcoming Events & Conferences" on MorphoSys' website, http://www.morphosys.com and after the call, a slide-synchronized audio replay of the conference will be available at the same location.

The statement for the first quarter 2022 (IFRS) are available for download at:

https://www.morphosys.com/en/investors/financial-information

Page 5

About MorphoSys

At MorphoSys, we are driven by our mission to give more life for people with cancer. As a global commercial-stage biopharmaceutical company, we use groundbreaking science and technologies to discover, develop, and deliver innovative cancer medicines to patients. MorphoSys is headquartered in Planegg, Germany, and has its U.S. operations anchored in Boston, Massachusetts. To learn more, visit us at www.morphosys.com and follow us on Twitter and LinkedIn.

About Tafasitamab

Tafasitamab is a humanized Fc-modified cytolytic CD19 targeting monoclonal antibody. In 2010, MorphoSys licensed exclusive worldwide rights to develop and commercialize tafasitamab from Xencor, Inc. Tafasitamab incorporates an XmAb® engineered Fc domain, which mediates B-cell lysis through apoptosis and immune effector mechanism including Antibody-Dependent Cell-Mediated Cytotoxicity (ADCC) and Antibody-Dependent Cellular Phagocytosis (ADCP).

In the United States, Monjuvi® (tafasitamab-cxix) is approved by the U.S. Food and Drug Administration in combination with lenalidomide for the treatment of adult patients with relapsed or refractory DLBCL not otherwise specified, including DLBCL arising from low grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT). This indication is approved under accelerated approval based on overall response rate. Continued approval for this indication may be contingent upon verification and description of clinical benefit in a confirmatory trial(s).

In Europe, Minjuvi® (tafasitamab) received conditional marketing authorization in combination with lenalidomide, followed by Minjuvi monotherapy, for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) who are not eligible for autologous stem cell transplant (ASCT).

Tafasitamab is being clinically investigated as a therapeutic option in B-cell malignancies in several ongoing combination trials.

Monjuvi® and Minjuvi® are registered trademarks of MorphoSys AG. Tafasitamab is co-marketed by Incyte and MorphoSys under the brand name Monjuvi® in the U.S., and marketed by Incyte under the brand name Minjuvi® in the EU.

National Comprehensive Cancer Network®, NCCN®, NCCN Guidelines® are registered trademarks of NCCN.

Tremfya® is a registered trademark of Janssen Biotech, Inc

XmAb® is a registered trademark of Xencor, Inc.

Forward Looking Statements

This communication contains certain forward-looking statements concerning the MorphoSys group of companies. The forward-looking statements contained herein represent the judgment of MorphoSys as of the date of this release and involve known and unknown risks and uncertainties, which might cause the actual results, financial condition and liquidity, performance or achievements of MorphoSys, or industry results, to be materially different from any historic or future results, financial conditions and liquidity, performance or achievements expressed or implied by such forward-looking statements. In addition, even if MorphoSys' results, performance, financial condition and liquidity, and the development of the industry in which it operates are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. Among the factors that may result in differences are that MorphoSys' expectations may be incorrect, the inherent uncertainties associated with competitive developments, clinical trial and product development activities and regulatory

Page 6

approval requirements, MorphoSys' reliance on collaborations with third parties, estimating the commercial potential of its development programs and other risks indicated in the risk factors included in MorphoSys' Annual Report on Form 20-F and other filings with the U.S. Securities and Exchange Commission. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. MorphoSys expressly disclaims any obligation to update any such forward-looking statements in this document to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements, unless specifically required by law or regulation.

For more information, please contact:

Media Contacts: Thomas Biegi Vice President Tel.: +49 (0)89 / 899 27 26079 thomas.biegi@morphosys.com | Investor Contacts: Dr. Julia Neugebauer Senior Director Tel: +49 (0)89 / 899 27 179 julia.neugebauer@morphosys.com | ||||

Jeanette Bressi Director, US Communications Tel: +1 617 404 7816 jeanette.bressi@morphosys.com | Myles Clouston Senior Director Tel: +1 857 772 0240 myles.clouston@morphosys.com | ||||

Page 7

Q1 2022 Results & Business Update 5 May 2022

This communication contains certain forward-looking statements concerning the MorphoSys group of companies, including the expectations regarding Monjuvi's ability to treat patients with relapsed or refractory diffuse large B-cell lymphoma, the further clinical development of tafasitamab, including ongoing confirmatory trials, additional interactions with regulatory authorities and expectations regarding future regulatory filings and possible additional approvals for tafasitamab as well as the commercial performance of Monjuvi. The words "anticipate," "believe," "estimate," "expect," "intend," "may," "plan," "predict," "project," "would," "could," "potential," "possible," "hope" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The forward-looking statements contained herein represent the judgment of MorphoSys as of the date of this release and involve known and unknown risks and uncertainties, which might cause the actual results, financial condition and liquidity, performance or achievements of MorphoSys, or industry results, to be materially different from any historic or future results, financial conditions and liquidity, performance or achievements expressed or implied by such forward-looking statements. In addition, even if MorphoSys' results, performance, financial condition and liquidity, and the development of the industry in which it operates are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. Among the factors that may result in differences are MorphoSys' expectations regarding risks and uncertainties related to the impact of the COVID-19 pandemic to MorphoSys' business, operations, strategy, goals and anticipated milestones, including its ongoing and planned research activities, ability to conduct ongoing and planned clinical trials, clinical supply of current or future drug candidates, commercial supply of current or future approved products, and launching, marketing and selling current or future approved products, the global collaboration and license agreement for tafasitamab, the further clinical development of tafasitamab, including ongoing confirmatory trials, and MorphoSys' ability to obtain and maintain requisite regulatory approvals and to enroll patients in its planned clinical trials, additional interactions with regulatory authorities and expectations regarding future regulatory filings and possible additional approvals for tafasitamab as well as the commercial performance of Monjuvi, MorphoSys' reliance on collaborations with third parties, estimating the commercial potential of its development programs and other risks indicated in the risk factors included in MorphoSys' Annual Report on Form 20-F and other filings with the U.S. Securities and Exchange Commission. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. MorphoSys expressly disclaims any obligation to update any such forward-looking statements in this document to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements, unless specifically required by law or regulation. The compounds discussed in this slide presentation are investigational products being developed by MorphoSys and its partners and are not currently approved by the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA) or any other regulatory authority (except for tafasitamab/Monjuvi® and guselkumab/Tremfya®). There is no guarantee any investigational product will be approved by regulatory authorities. Monjuvi® is a registered trademark of MorphoSys AG. Tremfya® is a registered trademark of Janssen Biotech, Inc. Forward-Looking Statements © MorphoSys – Q1 2022 results 2

Q&A Jean-Paul Kress, Sung Lee, Malte Peters, Joe Horvat Financial Results & Guidance Sung Lee, CFO Development Update Malte Peters, M.D., CR&DO Highlights Q1 2022 & Outlook Jean-Paul Kress, M.D., CEO 05 04 03 01 Agenda © MorphoSys – Q1 2022 results 3 Commercial Update Joe Horvat, General Manager, US02

Highlights Q1 2022 & Outlook 01 Jean-Paul Kress, M.D. CEO

Our Ambition is to Become a Leader in Hematology/Oncology © MorphoSys – Q1 2022 results 5 Relapsed/Refractory DLBCL Commercial Mid-Stage PELABRESIB CPI-0209 FELZARTAMAB Autoimmune (MN & IgAN) Basket trial Monjuvi® (tafasitamab-cxix) is approved under accelerated approval by the U.S. FDA in combination with lenalidomide for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT). MN: membranous nephropathy; IgAN: IgA nephropathy Aiming to have two commercial products by 2025 Expand into 1L DLBCL and beyond Change the standard of care in 1L myelofibrosis Phase 3 Development

2022 – Focus on Commercial and Clinical Development Execution © MorphoSys – Q1 2022 results 6 C O M M E R C I A L P R O G R E S S P I V O TA L T R I A L S + Monjuvi - 1L DLBCL - r/r FL & MZL + Pelabresib - 1L myelofibrosis + Pivotal readouts 2022: - Gantenerumab (Roche) - Otilimab (GSK) + Additional programs progressing: - Ianalumab (NVS) - Abelacimab (Anthos Therapeutics) - Setrusumab (Ultragenyx/Mereo) PA R T N E R E D P R O G R A M S + Liquidity position of € 846.9 million + Access to capital F I N A N C E S

Commercial Update 02 Joe Horvat General Manager, US

© MorphoSys – Q1 2022 results 8 >1,100 sites of care Leading market share by continued education to evolve prescribing patterns Supported by recent designation as a Preferred 2L Regimen by the NCCN guidelines Monjuvi Commercial Execution Continued uptake in DLBCL and building account momentum Q1 2022 U.S. Sales US$ 18.7MM +21 % Year over Year in 2L DLBCL new patient starts Increase patient persistence Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 <30% Academic>70% Community

Development Update 03 Malte Peters, M.D. CR&DO

Monjuvi® (tafasitamab-cxix) is approved under accelerated approval by the U.S. FDA in combination with lenalidomide for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT); r/r DLBCL: relapsed/refractory diffuse large B-cell lymphoma. r/r FL / MZL: relapsed/refractory Follicular Lymphoma or Marginal Zone Lymphoma; MN: membranous nephropathy; IgAN: IgA nephropathy) * trial sponsored by Xencor Accelerating our Innovation and Growth Strategy High potential mid- to late-stage pipeline © MorphoSys – Q1 2022 results 10 A S S E T P A R T N E R T A R G E T D I S E A S E A R E A P H A S E 1 P H A S E 2 P H A S E 3 M A R K E T Tafasitamab Incyte CD19 r/r DLBCL 1L DLBCL (frontMIND) r/r FL/MZL (inMIND) r/r DLBCL (with plamotamab)* Pelabresib BET 1L Myelofibrosis (MANIFEST-2) 1L/2L Myelofibrosis (MANIFEST) CPI – 0209 EZH2 Solid tumors/ Hematological malignancies Felzartamab CD38 MN (M-PLACE/New-PLACE) IgAN (IGNAZ) H e m a to lo g y /o n c o lo g y A u to - im m u n e

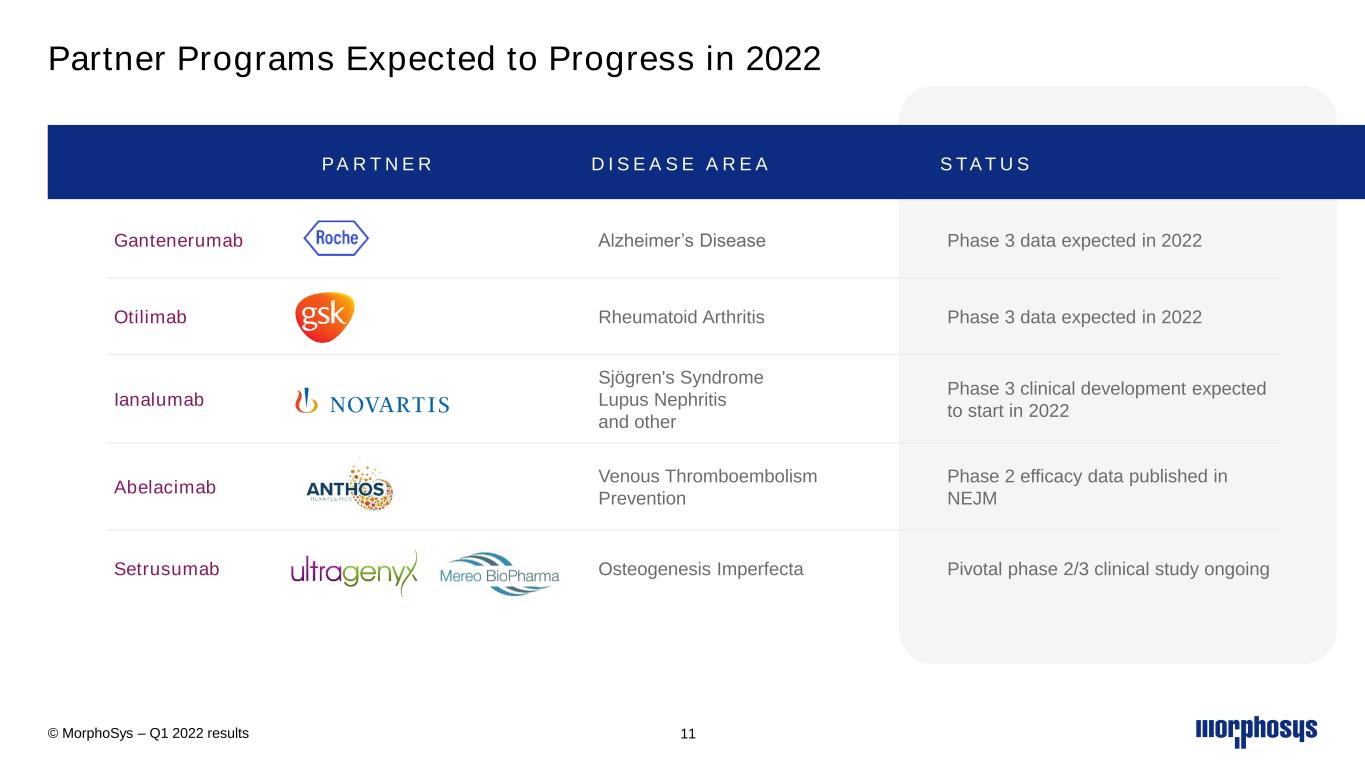

Partner Programs Expected to Progress in 2022 © MorphoSys – Q1 2022 results 11 PA R T N E R D I S E A S E A R E A S TAT U S Gantenerumab Alzheimer’s Disease Phase 3 data expected in 2022 Otilimab Rheumatoid Arthritis Phase 3 data expected in 2022 Ianalumab Sjögren's Syndrome Lupus Nephritis and other Phase 3 clinical development expected to start in 2022 Abelacimab Venous Thromboembolism Prevention Phase 2 efficacy data published in NEJM Setrusumab Osteogenesis Imperfecta Pivotal phase 2/3 clinical study ongoing

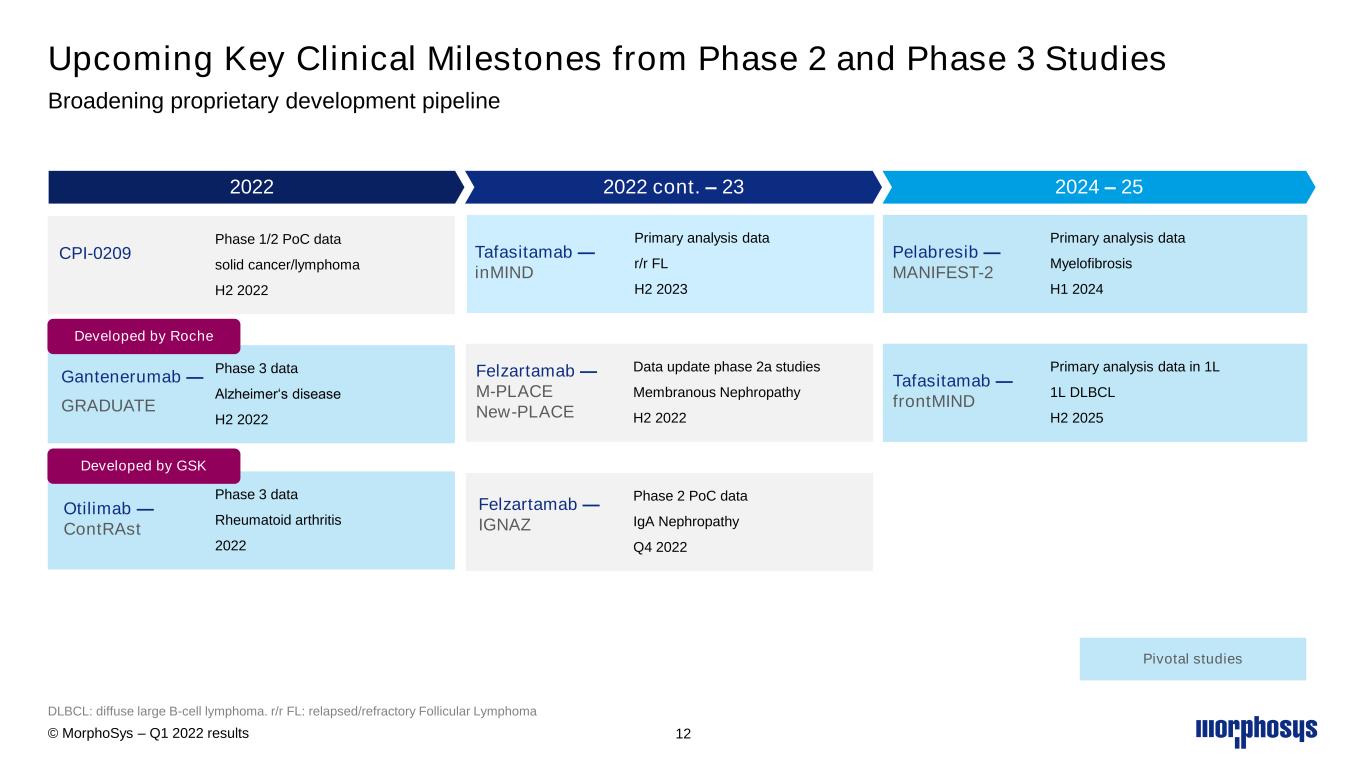

Upcoming Key Clinical Milestones from Phase 2 and Phase 3 Studies Broadening proprietary development pipeline DLBCL: diffuse large B-cell lymphoma. r/r FL: relapsed/refractory Follicular Lymphoma 2022 Phase 3 data Rheumatoid arthritis 2022 Otilimab — ContRAst Phase 3 data Alzheimer‘s disease H2 2022 Gantenerumab — GRADUATE Phase 1/2 PoC data solid cancer/lymphoma H2 2022 CPI-0209 2024 – 25 Primary analysis data Myelofibrosis H1 2024 Pelabresib — MANIFEST-2 Primary analysis data in 1L 1L DLBCL H2 2025 Tafasitamab — frontMIND Pivotal studies 2022 cont. – 23 Phase 2 PoC data IgA Nephropathy Q4 2022 Felzartamab — IGNAZ Primary analysis data r/r FL H2 2023 Tafasitamab — inMIND Data update phase 2a studies Membranous Nephropathy H2 2022 Felzartamab — M-PLACE New-PLACE Developed by Roche Developed by GSK © MorphoSys – Q1 2022 results 12

Financial Results and Guidance 04 Sung Lee CFO

Monjuvi U.S. Product Sales and Minjuvi Royalty Revenue © MorphoSys – Q1 2022 results 14 5.0 17.1 15.5 18.0 22.0 23.6 18.7 0.1 0.7 0.7 0 6 13 19 25 Q3* '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21 Q4 '21 Q1 '22 Royalties from ex-U.S. Sales of Minjuvi U.S. Monjuvi Product Sales * partial quarter USD in million

Q1 2022: Profit or Loss Statement On March 31, 2022 MorphoSys’ liquidity position amounted to € 846.9 million (December 31, 2021: € 976.9 million) In € million Q1 2022 Q4 2021 Q1 2021 Q-Q Δ Y-Y Δ Revenues 41.5 52.9 47.2 (22)% (12)% Product Sales 16.6 20.5 12.9 (19)% 29% Royalties 19.0 23.2 11.6 (18)% 64% Licenses, Milestones and Other 5.8 9.3 22.7 (38)% (74)% Cost of Sales (7.9) (9.5) (5.0) (17)% 58% Gross Profit 33.6 43.4 42.1 (23)% (20)% R&D Expenses (65.0) (87.0) (33.3) (25)% 95% Selling Expenses (21.9) (32.5) (28.2) (33)% (22)% G&A Expenses (14.6) (18.2) (10.3) (20)% 42% Total Operating Expenses (101.5) (368.4)* (71.7) (72)% 42% Operating Profit / (Loss) (68.0) (325.0) (29.6) (79)% >100% Consolidated Net Profit / (Net Loss) (122.7) (381.0) (41.6) (68)% >100% Earnings per Share, basic and diluted (in €) (3.59) (11.16) (1.27) (68)% >100% © MorphoSys – Q1 2022 results 15 * Total operating expenses include impairment of goodwill of € 230.7 million

Financial Guidance FY2022 © MorphoSys – Q1 2022 results 16 Monjuvi U.S. Net Product Sales US$ 110m to 135m Gross Margin for Monjuvi U.S. Net Product Sales 75% to 80% R&D expenses € 300m to 325m SG&A expenses € 155m to 170m

Q&A 05 Malte Peters, M.D. CR&DO Jean-Paul Kress, M.D. CEO Sung Lee CFO Joe Horvat General Manager, U.S.

Thank you! www.morphosys.com

2022 Financial Guidance 2022 Guidance Insights Monjuvi U.S. Net Product Sales US$ 110m to 135m 100% of Monjuvi U.S. product sales are recorded on MorphoSys’ income statement and related profit/loss is split 50/50 between MorphoSys and Incyte. Gross Margin for Monjuvi U.S. Net Product Sales 75% to 80% 100% of Monjuvi U.S. product cost of sales is recorded on MorphoSys’ income statement and related profit/loss is split 50/50 between MorphoSys and Incyte. R&D expenses € 300m to 325m 2022 growth over 2021 will be driven primarily by investment in ongoing pivotal phase-3 studies, excluding transaction/restructuring/other charges related to Constellation acquisition recorded in 2021. SG&A expenses € 155m to 170m 51% to 56% of mid-point of SG&A expenses represents Monjuvi U.S. selling costs of which 100% are recorded in MorphoSys’ income statement. Incyte reimburses MorphoSys for half of these selling expenses. For 2022, we anticipate a year-over-year decline in SG&A, excluding transaction/restructuring/other charges related to Constellation acquisition recorded in 2021. Financial Guidance FY2022 Including 2022 Guidance Insights © MorphoSys – Q1 2022 results 19

Overview of Accounting for Co-Commercialization of Monjuvi in the U.S. 100% of Profit/Loss from Monjuvi co- commercialization is reflected on MorphoSys’ Income Statement 100% Monjuvi Net Product Sales 100% Monjuvi Cost of Sales Monjuvi Selling Expenses incurred by MorphoSys Monjuvi Selling Expenses incurred by Incyte MorphoSys Income Statement If result is a Loss: Incyte refunds MorphoSys 50% of Loss If result is a Profit: MorphoSys refunds Incyte 50% of Profit In c o m e S ta te m e n t B a la n c e S h e e t MorphoSys credits Cash and debits Financial Liability MorphoSys debits Cash and credits Financial Asset © MorphoSys – Q1 2022 results 20

Accounting for Royalty Pharma and Constellation Transactions Overview of major deal effects on consolidated financial statements Acquisition financing from Royalty Pharma (RP) ◼ MorphoSys owes the following future cash flows to RP: ▪ 100% of Tremfya royalties ▪ 80% of royalties and 100% of milestone payments for otilimab ▪ 60% of gantenerumab royalties ▪ 3% on future net sales of pelabresib and CPI-0209 ◼ RP financial liabilities are in the scope of IFRS 9 ◼ Initial recognition at fair value on July 15, 2021, subsequent measurement on a quarterly basis ◼ Subsequent measurement at amortized cost based on effective interest rate (EIR) method; EUR 1,271.2m as of March 31, 2022 presented as “Financial Liabilities from Future Payments to Royalty Pharma” on the balance sheet ◼ Cash transfers from licensees to RP (e.g., Tremfya royalties) reduce the financial liabilities ◼ Balance of financial liabilities can be affected by changes in the lifetime forecast for royalty/milestone/net sales streams ◼ Finance Income/Expense can be recognized quarterly due to: ▪ Application of interest charges ▪ Foreign exchange rate changes ▪ Changes in lifetime forecast ◼ Changes to the financial liabilities and/or recognition of finance income/expense have NO cash impact on MorphoSys © MorphoSys – Q1 2022 results 21

1Q 2022 Income Statement w/o Incyte 50/50 U.S. Profit Share and Transfers to Royalty Pharma © MorphoSys – Q1 2022 results 22 We supplement the consolidated statement of profit or loss presented in our earnings release with additional information on certain income or expense effects. The consolidated statement of profit or loss as well as the additional information in the earnings call slide deck are prepared in accordance with International Financial Reporting Standards (IFRS). The additional information relates to the contracts with Incyte and Royalty Pharma, namely to the accounting for the US co-commercialization with Incyte and the financing provided by Royalty Pharma which resulted in financial liabilities for payments owed to Royalty Pharma in future periods. The related effects are presented in two separate columns for various lines item of the consolidated statement of profit or loss. We believe this more detailed information provides additional insights into the financial performance of MorphoSys Group. The information given is in addition to, not a substitute for, or superior to, the measures of financial performance prepared in accordance with IFRS. Legend 1) Incyte's share of Monjuvi US sales, accounted for at MOR being the principal for this business 2) Incyte's share of cost of sales related to Monjuvi US sales, accounted for at MOR 3) Incyte's portion of Monjuvi US selling expenses, charged to/accounted for at MOR 4) Valuation effects from Incyte financial liability/asset (actual and planning cash flow adjustments, fx effects, interest expense) 5) Tremfya royalty paid to Royalty Pharma from Q2 2021 onward 6) Valuation effects from Royalty Pharma financial liability (actual and planning cash flow adjustments incl. fx effects, interest expense) Euros in millions A B C A - B - C differences due to rounding IFRS Incyte Royalty Q1 2022 Collaboration Pharma Revenues 41.5 8.3 18.4 14.7 Monjuvi US product sales 16.6 8.3 1) 8.3 Royalties 19.0 18.4 5) 0.6 Other 5.8 5.8 Cost of Sales (7.9) (1.3) - (6.6) Cost of Sales US Monjuvi product sales (3.5) (1.3) 2) (2.2) Other (4.4) (4.4) Gross Profit 33.6 7.0 18.4 8.1 Gross Margin 80.9% 55.4% Total Operating Expenses: (101.5) (11.5) - (90.0) Research and Development (65.0) (65.0) Selling (21.9) (11.5) 3) (10.4) General and Administrative (14.6) (14.6) Impairment of Goodwill - - Operating Profit/(Loss) (68.0) (4.5) 18.4 (81.9) Operating Margin -164% -557% Other Income 1.4 1.4 Other Expenses (3.7) (3.7) Finance Income 10.6 6.8 4) - 6) 3.8 Finance Expenses (62.8) (27.4) 4) (31.1) 6) (4.3) Income from Reversals of Impairment Losses (0.1) (0.1) Income Tax Benefit / (Expenses) - - Consolidated Net Profit/(Loss) (122.7) (25.1) (12.7) (84.9) EPS, Basic and Diluted (3.59) (2.49) EPS, Basic - - EPS, Diluted - - Shares Used for EPS, Basic 34.15 34.15 Shares Used for EPS, Diluted

1Q 2021 Income Statement w/o Incyte 50/50 U.S. Profit Share and Transfers to Royalty Pharma © MorphoSys – Q1 2022 results 23 Euros in millions A B C A - B - C differences due to rounding IFRS Incyte Royalty Q1 2021 Collaboration Pharma Revenues 47.2 6.5 - 40.8 Monjuvi US product sales 12.9 6.5 1) 6.5 Royalties 11.6 5) 11.6 Other 22.7 22.7 Cost of Sales (5.0) (1.1) - (3.9) Cost of Sales US Monjuvi product sales (2.2) (1.1) 2) (1.1) Other (2.8) (2.8) Gross Profit 42.2 5.4 - 36.9 Gross Margin 89.4% 90.4% Total Operating Expenses: (71.8) (12.8) - (59.0) Research and Development (33.3) (33.3) Selling (28.2) (12.8) 3) (15.4) General and Administrative (10.3) (10.3) Operating Profit/(Loss) (29.6) (7.5) - (22.2) Operating Margin -63% -54% Other Income 1.2 1.2 Other Expenses (2.0) (2.0) Finance Income 13.9 2.4 4) 11.5 Finance Expenses (39.7) (34.9) 4) (4.8) Effects from Impairment on Financial Assets 0.1 0.1 Income Tax Benefit / (Expenses) 14.5 14.5 Consolidated Net Profit/(Loss) (41.6) (40.0) - (1.7) EPS, Basic and Diluted (1.27) (0.05) EPS, Basic - - EPS, Diluted - - Shares Used for EPS, Basic 32.76 32.76 Shares Used for EPS, Diluted We supplement the consolidated statement of profit or loss presented in our earnings release with additional information on certain income or expense effects. The consolidated statement of profit or loss as well as the additional information in the earnings call slide deck are prepared in accordance with International Financial Reporting Standards (IFRS). The additional information relates to the contracts with Incyte and Royalty Pharma, namely to the accounting for the US co-commercialization with Incyte and the financing provided by Royalty Pharma which resulted in financial liabilities for payments owed to Royalty Pharma in future periods. The related effects are presented in two separate columns for various lines item of the consolidated statement of profit or loss. We believe this more detailed information provides additional insights into the financial performance of MorphoSys Group. The information given is in addition to, not a substitute for, or superior to, the measures of financial performance prepared in accordance with IFRS. Legend 1) Incyte's share of Monjuvi US sales, accounted for at MOR being the principal for this business 2) Incyte's share of cost of sales related to Monjuvi US sales, accounted for at MOR 3) Incyte's portion of Monjuvi US selling expenses, charged to/accounted for at MOR 4) Valuation effects from Incyte financial liability/asset (actual and planning cash flow adjustments, fx effects, interest expense) 5) Tremfya royalty paid to Royalty Pharma from Q2 2021 onward

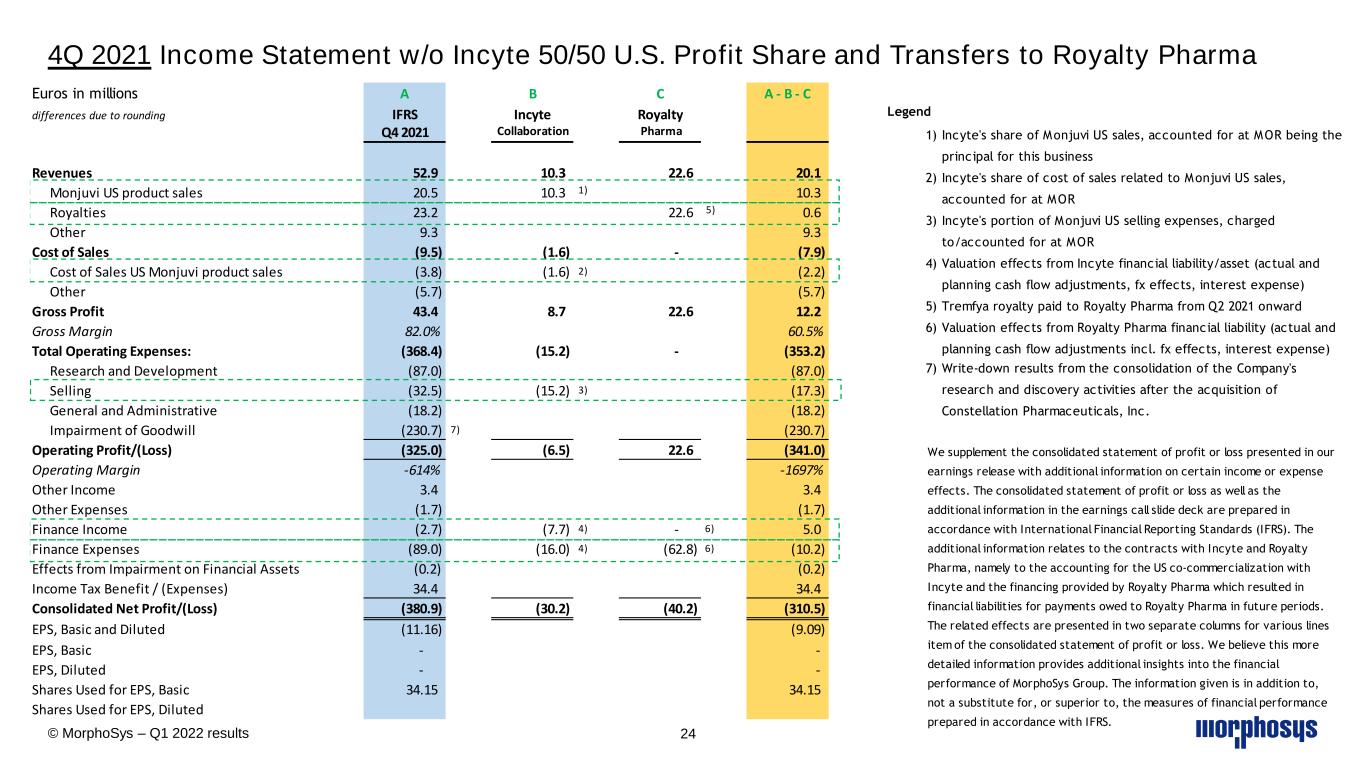

4Q 2021 Income Statement w/o Incyte 50/50 U.S. Profit Share and Transfers to Royalty Pharma © MorphoSys – Q1 2022 results 24 Euros in millions A B C A - B - C differences due to rounding IFRS Incyte Royalty Q4 2021 Collaboration Pharma Revenues 52.9 10.3 22.6 20.1 Monjuvi US product sales 20.5 10.3 1) 10.3 Royalties 23.2 22.6 5) 0.6 Other 9.3 9.3 Cost of Sales (9.5) (1.6) - (7.9) Cost of Sales US Monjuvi product sales (3.8) (1.6) 2) (2.2) Other (5.7) (5.7) Gross Profit 43.4 8.7 22.6 12.2 Gross Margin 82.0% 60.5% Total Operating Expenses: (368.4) (15.2) - (353.2) Research and Development (87.0) (87.0) Selling (32.5) (15.2) 3) (17.3) General and Administrative (18.2) (18.2) Impairment of Goodwill (230.7) 7) (230.7) Operating Profit/(Loss) (325.0) (6.5) 22.6 (341.0) Operating Margin -614% -1697% Other Income 3.4 3.4 Other Expenses (1.7) (1.7) Finance Income (2.7) (7.7) 4) - 6) 5.0 Finance Expenses (89.0) (16.0) 4) (62.8) 6) (10.2) Effects from Impairment on Financial Assets (0.2) (0.2) Income Tax Benefit / (Expenses) 34.4 34.4 Consolidated Net Profit/(Loss) (380.9) (30.2) (40.2) (310.5) EPS, Basic and Diluted (11.16) (9.09) EPS, Basic - - EPS, Diluted - - Shares Used for EPS, Basic 34.15 34.15 Shares Used for EPS, Diluted We supplement the consolidated statement of profit or loss presented in our earnings release with additional information on certain income or expense effects. The consolidated statement of profit or loss as well as the additional information in the earnings call slide deck are prepared in accordance with International Financial Reporting Standards (IFRS). The additional information relates to the contracts with Incyte and Royalty Pharma, namely to the accounting for the US co-commercialization with Incyte and the financing provided by Royalty Pharma which resulted in financial liabilities for payments owed to Royalty Pharma in future periods. The related effects are presented in two separate columns for various lines item of the consolidated statement of profit or loss. We believe this more detailed information provides additional insights into the financial performance of MorphoSys Group. The information given is in addition to, not a substitute for, or superior to, the measures of financial performance prepared in accordance with IFRS. Legend 1) Incyte's share of Monjuvi US sales, accounted for at MOR being the principal for this business 2) Incyte's share of cost of sales related to Monjuvi US sales, accounted for at MOR 3) Incyte's portion of Monjuvi US selling expenses, charged to/accounted for at MOR 4) Valuation effects from Incyte financial liability/asset (actual and planning cash flow adjustments, fx effects, interest expense) 5) Tremfya royalty paid to Royalty Pharma from Q2 2021 onward 6) Valuation effects from Royalty Pharma financial liability (actual and planning cash flow adjustments incl. fx effects, interest expense) 7) Write-down results from the consolidation of the Company's research and discovery activities after the acquisition of Constellation Pharmaceuticals, Inc.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Partslion Launches New Software to Streamline Access to Quality Car Parts

- Ibotta Announces Pricing of Initial Public Offering

- SkyWater Technology to Announce First Quarter Financial Results on May 8th, 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share